UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03480

Fidelity Oxford Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | July 31 |

|

|

Date of reporting period: | January 31, 2023 |

Item 1.

Reports to Stockholders

Fidelity® SAI Inflation-Focused Fund

Semi-Annual Report

January 31, 2023

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-3455 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

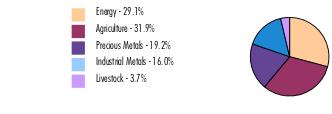

The information in the following tables is based on the Fund's commodity-linked investments and excludes short-term investment-grade debt securities, cash and cash equivalents.

| Commodity Sector Diversification as of January 31, 2023* |

| |

|

|

| * The Fund does not invest directly in physical commodities. |

| Commodity Instruments as of January 31, 2023* |

| |

|

Showing Percentage of Net Assets

| U.S. Treasury Inflation-Protected Obligations - 96.4% |

| | | Principal Amount (a) | Value ($) |

| U.S. Treasury Inflation-Indexed Bonds: | | | |

| 1.75% 1/15/28 | | 32,426,203 | 32,980,356 |

| 2% 1/15/26 (b) | | 35,666,287 | 35,892,990 |

| 2.375% 1/15/25 (b) | | 55,260,047 | 55,522,032 |

| 2.375% 1/15/27 (b) | | 34,472,381 | 35,572,676 |

| U.S. Treasury Inflation-Indexed Notes: | | | |

| U.S. Treasury Notes 1.625% 10/15/27 | | 86,331,510 | 87,497,492 |

| 0.125% 7/15/24 (b) | | 88,690,758 | 86,117,908 |

| 0.125% 10/15/24 (b) | | 79,125,630 | 76,596,616 |

| 0.125% 4/15/25 (b) | | 64,809,011 | 62,150,054 |

| 0.125% 10/15/25 (b) | | 78,829,596 | 75,621,263 |

| 0.125% 4/15/26 (b) | | 60,915,905 | 57,887,001 |

| 0.125% 7/15/26 (b) | | 74,613,751 | 71,144,315 |

| 0.125% 10/15/26 (b) | | 84,263,336 | 80,146,762 |

| 0.125% 4/15/27 (b) | | 86,074,413 | 81,320,982 |

| 0.25% 1/15/25 (b) | | 81,091,484 | 78,243,942 |

| 0.375% 7/15/23 | | 102,576,508 | 102,021,985 |

| 0.375% 7/15/25 (b) | | 88,938,813 | 86,050,179 |

| 0.375% 1/15/27 (b) | | 69,477,468 | 66,414,300 |

| 0.375% 7/15/27 | | 76,605,366 | 73,337,855 |

| 0.5% 4/15/24 (b) | | 54,857,659 | 53,493,906 |

| 0.5% 1/15/28 | | 78,255,576 | 74,928,895 |

| 0.625% 4/15/23 (b) | | 91,199,629 | 90,842,127 |

| 0.625% 1/15/24 | | 97,688,263 | 95,787,198 |

| 0.625% 1/15/26 (b) | | 74,867,579 | 72,444,090 |

| TOTAL U.S. TREASURY INFLATION-PROTECTED OBLIGATIONS (Cost $1,714,394,945) | | | 1,632,014,924 |

| | | | |

| Money Market Funds - 8.3% |

| | | Shares | Value ($) |

Fidelity Cash Central Fund 4.38% (c) (Cost $141,504,206) | | 141,475,911 | 141,504,206 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 104.7% (Cost $1,855,899,151) | 1,773,519,130 |

NET OTHER ASSETS (LIABILITIES) - (4.7)% | (80,131,779) |

| NET ASSETS - 100.0% | 1,693,387,351 |

| | |

| Futures Contracts |

| | Number of contracts | Expiration Date | Notional Amount ($) | Value ($) | Unrealized Appreciation/ (Depreciation) ($) |

| Purchased | | | | | |

| | | | | | |

| Commodity Futures Contracts | | | | | |

| CBOT Corn Contracts (United States) | 1,426 | Jul 2023 | 47,432,325 | (342,902) | (342,902) |

| CBOT Corn Contracts (United States) | 1,308 | May 2023 | 44,308,500 | 198,019 | 198,019 |

| CBOT Corn Contracts (United States) | 452 | Sep 2023 | 13,684,300 | 47,004 | 47,004 |

| CBOT HRW Wheat Contracts (United States) | 229 | Sep 2023 | 9,884,213 | (427,257) | (427,257) |

| CBOT HRW Wheat Contracts (United States) | 73 | Jul 2023 | 2,815,063 | 70,722 | 70,722 |

| CBOT HRW Wheat Contracts (United States) | 400 | Sep 2023 | 15,555,000 | (1,453,910) | (1,453,910) |

| CBOT KC HRW Wheat Contracts (United States) | 770 | May 2023 | 33,562,375 | 791,330 | 791,330 |

| CBOT Soybean Contracts (United States) | 598 | May 2023 | 45,754,475 | 801,907 | 801,907 |

| CBOT Soybean Contracts (United States) | 696 | May 2023 | 32,607,600 | 1,006,828 | 1,006,828 |

| CBOT Soybean Contracts (United States) | 453 | May 2023 | 16,984,782 | 371,716 | 371,716 |

| CBOT Soybean Contracts (United States) | 556 | Jul 2023 | 42,221,250 | (22,507) | (22,507) |

| CBOT Soybean Contracts (United States) | 726 | Dec 2023 | 26,462,700 | 1,171,536 | 1,171,536 |

| CBOT Soybean Contracts (United States) | 289 | Nov 2023 | 19,695,350 | (177,319) | (177,319) |

| CBOT Soybean Meal Contracts (United States) | 165 | Jul 2023 | 7,528,950 | (6,382) | (6,382) |

| CBOT Soybean Meal Contracts (United States) | 681 | Dec 2023 | 26,851,830 | (1,164,700) | (1,164,700) |

| CBOT Soybean Oil Contracts (United States) | 219 | Jul 2023 | 8,187,534 | 113,558 | 113,558 |

| CBOT Wheat Contracts (United States) | 376 | May 2023 | 14,485,400 | (10,125) | (10,125) |

| CME Lean Hogs Contracts (United States) | 295 | Apr 2023 | 10,198,150 | (479,521) | (479,521) |

| CME Lean Hogs Contracts (United States) | 245 | Aug 2023 | 10,182,200 | (13,940) | (13,940) |

| CME Live Cattle Contracts (United States) | 647 | Apr 2023 | 42,190,870 | 972,715 | 972,715 |

| COMEX Copper Contracts (United States) | 575 | May 2023 | 60,899,688 | (49,555) | (49,555) |

| COMEX Copper Contracts (United States) | 291 | Jul 2023 | 30,791,438 | 2,795,112 | 2,795,112 |

| COMEX Gold 100 oz. Contracts (United States) | 1,287 | Apr 2023 | 250,142,170 | 4,748,724 | 4,748,724 |

| COMEX Silver Contracts (United States) | 624 | Mar 2023 | 74,334,000 | 7,795,672 | 7,795,672 |

| ICE Brent Crude Contracts (United Kingdom) | 1,653 | Mar 2023 | 140,951,110 | 4,546,982 | 4,546,982 |

| ICE Coffee 'C' Contracts (United States) | 781 | May 2023 | 53,215,388 | 4,323,139 | 4,323,139 |

| ICE Cotton No. 2 Contracts (United States) | 115 | Jul 2023 | 5,028,950 | (3,228) | (3,228) |

| ICE Cotton No. 2 Contracts (United States) | 276 | Dec 2023 | 11,794,860 | 970,107 | 970,107 |

| ICE Low Sulphur Gasoil Contracts (United States) | 687 | May 2023 | 58,549,575 | (1,148,635) | (1,148,635) |

| ICE Sugar No. 11 Contracts (United States) | 2,565 | Apr 2023 | 58,720,032 | 5,013,886 | 5,013,886 |

| LME Aluminum Contracts (United Kingdom) | 560 | May 2023 | 37,135,000 | 147,965 | 147,965 |

| LME Aluminum Contracts (United Kingdom) | 380 | Jul 2023 | 25,412,500 | 1,677,271 | 1,677,271 |

| LME Lead Contracts (United Kingdom) | 183 | May 2023 | 9,787,069 | (109,443) | (109,443) |

| LME Lead Contracts (United Kingdom) | 92 | Jul 2023 | 4,930,625 | 23,246 | 23,246 |

| LME Nickel Contracts (United Kingdom) | 178 | May 2023 | 32,465,064 | 711,119 | 711,119 |

| LME Nickel Contracts (United Kingdom) | 89 | Jul 2023 | 16,317,438 | 643,007 | 643,007 |

| LME Zinc Contracts (United Kingdom) | 413 | May 2023 | 34,970,775 | (581,141) | (581,141) |

| LME Zinc Contracts (United Kingdom) | 211 | Jul 2023 | 17,787,300 | 986,363 | 986,363 |

| NYMEX Gasoline RBOB Contracts (United States) | 260 | Aug 2023 | 27,470,352 | 2,723,805 | 2,723,805 |

| NYMEX Natural Gas Contracts (United States) | 1,377 | Feb 2023 | 37,592,100 | (31,620,279) | (31,620,279) |

| NYMEX Natural Gas Contracts (United States) | 1,734 | Apr 2023 | 50,077,920 | (14,314,572) | (14,314,572) |

| NYMEX Natural Gas Contracts (United States) | 267 | Jun 2023 | 8,768,280 | (3,050,019) | (3,050,019) |

| NYMEX NY Harbor ULSD Contracts (United States) | 389 | Apr 2023 | 48,267,353 | (748,708) | (748,708) |

| NYMEX WTI Crude Oil Contracts (United States) | 1,286 | Apr 2023 | 102,416,420 | (990,364) | (990,364) |

| NYMEX WTI Crude Oil Contracts (United States) | 250 | Aug 2023 | 19,565,000 | 43,211 | 43,211 |

| | | | | | |

| TOTAL FUTURES CONTRACTS | | | | | (14,019,563) |

| The notional amount of futures purchased as a percentage of Net Assets is 100.0% |

For the period, the average monthly notional amount at value for futures contracts in the aggregate was $2,936,929,733.

Legend

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $158,137,476. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.38% | 740,451,255 | 2,286,428,147 | 2,885,375,196 | 3,185,190 | - | - | 141,504,206 | 0.3% |

| Total | 740,451,255 | 2,286,428,147 | 2,885,375,196 | 3,185,190 | - | - | 141,504,206 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Consolidated Statement of Operations, if applicable.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Consolidated Subsidiary

| Fund | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain /loss ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) |

| Geode SAI Inflation-Focused Cayman Ltd. | 752,525,291 | 286,999,806 | 345,000,309 | - | (91,066,622) | (271,184,260) | 332,273,906 |

Investment Valuation

The following is a summary of the inputs used, as of January 31, 2023, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Consolidated Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| U.S. Government and Government Agency Obligations | 1,632,014,924 | - | 1,632,014,924 | - |

|

| Money Market Funds | 141,504,206 | 141,504,206 | - | - |

| Total Investments in Securities: | 1,773,519,130 | 141,504,206 | 1,632,014,924 | - |

Derivative Instruments: | | | | |

|

| Assets | | | | |

Futures Contracts | 42,694,944 | 42,694,944 | - | - |

| Total Assets | 42,694,944 | 42,694,944 | - | - |

|

| Liabilities | | | | |

Futures Contracts | (56,714,507) | (56,714,507) | - | - |

| Total Liabilities | (56,714,507) | (56,714,507) | - | - |

| Total Derivative Instruments: | (14,019,563) | (14,019,563) | - | - |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of January 31, 2023. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Consolidated Financial Statements.

Primary Risk Exposure / Derivative Type | Value |

| Asset ($) | Liability ($) |

| Commodity Risk | | |

Futures Contracts (a) | 42,694,944 | (56,714,507) |

| Total Commodity Risk | 42,694,944 | (56,714,507) |

| Total Value of Derivatives | 42,694,944 | (56,714,507) |

(a)Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Consolidated Schedule of Investments. In the Consolidated Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in Total accumulated earnings (loss).

| Consolidated Statement of Assets and Liabilities |

| | | | January 31, 2023 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $1,714,394,945) | $ | 1,632,014,924 | | |

Fidelity Central Funds (cost $141,504,206) | | 141,504,206 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $1,855,899,151) | | | $ | 1,773,519,130 |

| Receivable for investments sold | | | | 6,422,585 |

| Receivable for fund shares sold | | | | 1,399,975 |

| Interest receivable | | | | 1,110,807 |

| Distributions receivable from Fidelity Central Funds | | | | 379,781 |

| Receivable for daily variation margin on futures contracts | | | | 27,593,529 |

| Prepaid expenses | | | | 3,046 |

Total assets | | | | 1,810,428,853 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 115,448,848 | | |

| Payable for fund shares redeemed | | 947,391 | | |

| Accrued management fee | | 616,653 | | |

| Other payables and accrued expenses | | 28,610 | | |

| Total Liabilities | | | | 117,041,502 |

| Net Assets | | | $ | 1,693,387,351 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 2,286,399,914 |

| Total accumulated earnings (loss) | | | | (593,012,563) |

| Net Assets | | | $ | 1,693,387,351 |

Net Asset Value , offering price and redemption price per share ($1,693,387,351 ÷ 173,648,265 shares) | | | $ | 9.75 |

| Consolidated Statement of Operations |

| | | | Six months ended January 31, 2023 (Unaudited) |

| Investment Income | | | | |

| Interest | | | $ | 39,291,789 |

| Income from Fidelity Central Funds | | | | 3,185,190 |

| Total Income | | | | 42,476,979 |

| Expenses | | | | |

| Management fee | $ | 5,848,060 | | |

| Custodian fees and expenses | | 487 | | |

| Independent trustees' fees and expenses | | 6,480 | | |

| Registration fees | | 75,275 | | |

| Audit | | 33,857 | | |

| Subsidiary directors' fees | | 7,500 | | |

| Legal | | 2,729 | | |

| Miscellaneous | | 9,347 | | |

| Total expenses before reductions | | 5,983,735 | | |

| Expense reductions | | (655) | | |

| Total expenses after reductions | | | | 5,983,080 |

| Net Investment income (loss) | | | | 36,493,899 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (131,900,947) | | |

| Futures contracts | | (388,702,397) | | |

| Total net realized gain (loss) | | | | (520,603,344) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated Issuers | | 653,582 | | |

| Futures contracts | | 35,043,601 | | |

| Total change in net unrealized appreciation (depreciation) | | | | 35,697,183 |

| Net gain (loss) | | | | (484,906,161) |

| Net increase (decrease) in net assets resulting from operations | | | $ | (448,412,262) |

| Consolidated Statement of Changes in Net Assets |

| |

| | Six months ended January 31, 2023 (Unaudited) | | Year ended July 31, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 36,493,899 | $ | 121,779,402 |

| Net realized gain (loss) | | (520,603,344) | | 282,120,919 |

| Change in net unrealized appreciation (depreciation) | | 35,697,183 | | (203,802,392) |

| Net increase (decrease) in net assets resulting from operations | | (448,412,262) | | 200,097,929 |

| Distributions to shareholders | | (367,599,443) | | (391,904,775) |

| Share transactions | | | | |

| Proceeds from sales of shares | | 427,537,561 | | 4,044,713,803 |

| Reinvestment of distributions | | 340,697,420 | | 390,754,524 |

| Cost of shares redeemed | | (2,169,250,184) | | (2,101,467,399) |

Net increase (decrease) in net assets resulting from share transactions | | (1,401,015,203) | | 2,334,000,928 |

| Total increase (decrease) in net assets | | (2,217,026,908) | | 2,142,194,082 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 3,910,414,259 | | 1,768,220,177 |

| End of period | $ | 1,693,387,351 | $ | 3,910,414,259 |

| | | | | |

| Other Information | | | | |

| Shares | | | | |

| Sold | | 40,321,719 | | 337,344,722 |

| Issued in reinvestment of distributions | | 32,306,339 | | 37,373,675 |

| Redeemed | | (216,355,529) | | (191,156,828) |

| Net increase (decrease) | | (143,727,471) | | 183,561,569 |

| | | | | |

Consolidated Financial Highlights

| Fidelity® SAI Inflation-Focused Fund |

| |

| | Six months ended (Unaudited) January 31, 2023 | | Years ended July 31, 2022 | | 2021 | | 2020 | | 2019 A |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 12.32 | $ | 13.21 | $ | 9.31 | $ | 10.34 | $ | 10.00 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) B,C | | .12 | | .89 | | .50 | | .12 | | .21 |

| Net realized and unrealized gain (loss) | | (1.45) | | 1.81 | | 3.72 | | (.93) | | .14 |

| Total from investment operations | | (1.33) | | 2.70 | | 4.22 | | (.81) | | .35 |

| Distributions from net investment income | | (1.22) | | (3.54) | | (.32) | | (.20) | | (.01) D |

| Distributions from net realized gain | | (.01) | | (.05) | | - | | (.02) | | - |

| Total distributions | | (1.24) E | | (3.59) | | (.32) | | (.22) | | (.01) |

| Net asset value, end of period | $ | 9.75 | $ | 12.32 | $ | 13.21 | $ | 9.31 | $ | 10.34 |

Total Return F,G | | (11.45)% | | 27.48% | | 46.61% | | (8.05)% | | 3.50% |

Ratios to Average Net Assets C,H,I | | | | | | | | | | |

| Expenses before reductions | | .38% J | | .40% | | .40% | | .41% | | .52% J |

| Expenses net of fee waivers, if any | | .38% J | | .40% | | .40% | | .41% | | .50% J |

| Expenses net of all reductions | | .38% J | | .40% | | .40% | | .41% | | .50% J |

| Net investment income (loss) | | 2.33% J | | 7.18% | | 4.15% | | 1.18% | | 3.38% J |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 1,693,387 | $ | 3,910,414 | $ | 1,768,220 | $ | 32,230 | $ | 1,230,762 |

Portfolio turnover rate K | | 23% J | | 135% | | 101% | | 40% | | 21% J |

A For the period December 20, 2018 (commencement of operations) through July 31, 2019.

B Calculated based on average shares outstanding during the period.

C Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

D The amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

E Total distributions per share do not sum due to rounding.

F Total returns for periods of less than one year are not annualized.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

J Annualized.

K Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

For the period ended January 31, 2023

1. Organization.

Fidelity SAI Inflation-Focused Fund (the Fund) is a fund of Fidelity Oxford Street Trust (the Trust) and is authorized to issue an unlimited number of shares. Shares are offered exclusively to certain clients of Strategic Advisers LLC or its affiliates. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust.

2. Consolidated Subsidiary.

The Funds included in the table below hold certain commodity-related investments through a wholly owned subsidiary (the "Subsidiary"). As of period end, the investments in the Subsidiaries, were as follows:

| | Subsidiary Name | $ Amount | % of Fund's Net Assets |

| Fidelity SAI Inflation-Focused Fund | Geode SAI Inflation-Focused Cayman Ltd. | 332,273,906 | 19.6 |

The financial statements have been consolidated to include the Subsidiary accounts where applicable. Accordingly, all inter-company transactions and balances have been eliminated.

3. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by FMR and its affiliates. The Consolidated Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio A |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

4. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies . The consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the consolidated financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the consolidated financial statements were issued have been evaluated in the preparation of the consolidated financial statements. The Fund's Consolidated Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has designated the Fund's investment adviser as the valuation designee responsible for the fair valuation function and performing fair value determinations as needed. The investment adviser has established a Fair Value Committee (the Committee) to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Committee. In accordance with these fair valuation policies and procedures, which have been approved by the Board, the Fund attempts to obtain prices from one or more third party pricing services or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with the policies and procedures. Factors used in determining fair value vary by investment type and may include market or investment specific events, transaction data, estimated cash flows, and market observations of comparable investments. The frequency that the fair valuation procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee manages the Fund's fair valuation practices and maintains the fair valuation policies and procedures. The Fund's investment adviser reports to the Board information regarding the fair valuation process and related material matters.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing services or from brokers who make markets in such securities. U.S. government and government agency obligations are valued by pricing services who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing services. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Futures contracts are valued at the settlement price or official closing price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in commodities are valued at their last traded price prior to 4:00 p.m. Eastern time each business day and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of January 31, 2023 is included at the end of the Fund's Consolidated Schedule of Investments.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. For Treasury Inflation-Protected Securities (TIPS) the principal amount is adjusted daily to keep pace with inflation. Interest is accrued based on the adjusted principal amount. The adjustments to principal due to inflation are reflected as increases or decreases to Interest in the accompanying Statement of Operations. Such adjustments may result in negative Interest and may have a significant impact on the Fund's distributions.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying consolidated financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds. Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

The Subsidiary is classified as a controlled foreign corporation under Subchapter N of the Internal Revenue Code. Therefore, the Fund is required to increase its taxable income by its share of the Subsidiary's income. Net investment losses of the Subsidiary cannot be deducted by the Fund in the current period nor carried forward to offset taxable income in future periods.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the consolidated financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to futures contracts, market discount, deemed dividend distribution, controlled foreign corporations, and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $51,790,292 |

| Gross unrealized depreciation | (145,213,239) |

| Net unrealized appreciation (depreciation) | $(93,422,947) |

| Tax cost | $1,852,922,514 |

Due to large subscriptions and redemptions in the current and prior periods, the Fund is subject to annual limits on its use of some of its unrealized capital losses to offset capital gains in future periods. If those capital losses are realized and the limitation prevents the Fund from using any of those capital losses in the future period, those capital losses will be available to offset capital gains in subsequent periods.

5. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objectives allow for various types of derivative instruments, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

Derivatives were primarily used to increase returns, to gain exposure to certain types of assets and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the objectives may not be achieved.

Derivatives were used to increase or decrease exposure to the following risk:

| Commodity Risk | Commodity risk is the risk that the value of a commodity will fluctuate as a result of changes in market prices. |

Funds are also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that a fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to a fund. Derivative counterparty credit risk is managed through formal evaluation of the creditworthiness of all potential counterparties. Exchange-traded futures contracts are not covered by the ISDA Master Agreement; however counterparty credit risk related to exchange-traded futures contracts may be mitigated by the protection provided by the exchange's clearinghouse. A summary of derivatives inclusive of potential netting arrangements is presented at the end of the Consolidated Schedule of Investments.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Consolidated Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. Futures contracts were used to manage exposure to the commodities market.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin on futures contracts in the Consolidated Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on futures contracts during the period is presented in the Consolidated Statement of Operations.

Any open futures contracts at period end are presented in the Consolidated Schedule of Investments under the caption "Futures Contracts". The notional amount at value reflects each contract's exposure to the underlying instrument or index at period end. Any securities deposited to meet initial margin requirements are identified in the Consolidated Schedule of Investments. Any cash deposited to meet initial margin requirements is presented as segregated cash with brokers for derivative instruments in the Consolidated Statement of Assets and Liabilities.

6. Fees and Other Transactions with Affiliates.

Management Fee and Administration Agreement. Geode Capital Management, LLC (the investment adviser) provides the Fund with investment management services for which the Fund pays a monthly management fee that is based on an annual rate of .38% of the Fund's average net assets.

Fidelity Management & Research Company LLC (FMR) provides administrative services to the Fund and the investment adviser pays for these services.

The investment adviser also provides investment management services to the Subsidiary. The Subsidiary does not pay the investment adviser a fee for these services. The Subsidiary pays certain other expenses including custody and directors' fees.

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Any interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note. During the period, there were no interfund trades.

7. Committed Line of Credit.

Certain Funds participate with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The participating funds have agreed to pay commitment fees on their pro-rata portion of the line of credit, which are reflected in Miscellaneous expenses on the Consolidated Statement of Operations, and are listed below. During the period, there were no borrowings on this line of credit.

| | Amount |

| Fidelity SAI Inflation-Focused Fund | $4,530 |

8. Expense Reductions.

Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses by $655.

9. Other.

A fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, a fund may also enter into contracts that provide general indemnifications. A fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against a fund. The risk of material loss from such claims is considered remote.

10. Risk and Uncertainties.

Many factors affect a fund's performance. Developments that disrupt global economies and financial markets, such as pandemics, epidemics, outbreaks of infectious diseases, war, terrorism, and environmental disasters, may significantly affect a fund's investment performance. The effects of these developments to a fund will be impacted by the types of securities in which a fund invests, the financial condition, industry, economic sector, and geographic location of an issuer, and a fund's level of investment in the securities of that issuer.

As a shareholder, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments or redemption proceeds, as applicable and (2) ongoing costs, which generally include management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2022 to January 31, 2023). |

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class/Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. If any fund is a shareholder of any underlying mutual funds or exchange-traded funds (ETFs) (the Underlying Funds), such fund indirectly bears its proportional share of the expenses of the Underlying Funds in addition to the direct expenses incurred presented in the table. These fees and expenses are not included in the annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. If any fund is a shareholder of any Underlying Funds, such fund indirectly bears its proportional share of the expenses of the Underlying Funds in addition to the direct expenses as presented in the table. These fees and expenses are not included in the annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | Annualized Expense Ratio- A | | Beginning Account Value August 1, 2022 | | Ending Account Value January 31, 2023 | | Expenses Paid During Period- C August 1, 2022 to January 31, 2023 |

| | | | | | | | | | |

| Fidelity® SAI Inflation-Focused Fund | | | | .38% | | | | | | |

| Actual | | | | | | $ 1,000 | | $ 885.50 | | $ 1.81 |

Hypothetical- B | | | | | | $ 1,000 | | $ 1,023.29 | | $ 1.94 |

| |

A Annualized expense ratio reflects expenses net of applicable fee waivers.

B 5% return per year before expenses

C Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/ 365 (to reflect the one-half year period). The fees and expenses of any Underlying Funds are not included in each annualized expense ratio.

Board Approval of Investment Advisory Contracts and Management Fees

Fidelity SAI Inflation-Focused Fund

Each year, the Board of Trustees, including the Independent Trustees (together, the Board), votes on the renewal of the management contract (the Advisory Contract) with Geode Capital Management, LLC (Geode) and the administration agreement with Fidelity Management & Research Company LLC (FMR) for the fund. The Board, assisted by the advice of fund counsel and Independent Trustees' counsel, requests and considers a broad range of information relevant to the renewal of the Advisory Contract and administration agreement throughout the year.

The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and considers factors that are relevant to its annual consideration of the renewal of the fund's Advisory Contract and administration agreement, including the services and support provided to the fund and its shareholders. The Board has established four standing committees (Committees) - Operations, Audit, Fair Valuation, and Governance and Nominating - each composed of and chaired by Independent Trustees with varying backgrounds, to which the Board has assigned specific subject matter responsibilities in order to enhance effective decision-making by the Board. The Operations Committee, of which all the Independent Trustees are members, meets regularly throughout the year and requests, receives and considers, among other matters, information related to the annual consideration of the renewal of the fund's Advisory Contracts before making its recommendation to the Board. The Board also meets as needed to review matters specifically related to the Board's annual consideration of the renewal of the Advisory Contract and administration agreement. Members of the Board may also meet from time to time with trustees of other Fidelity funds through joint ad hoc committees to discuss certain matters relevant to all of the Fidelity funds.

At its September 2022 meeting, the Board unanimously determined to renew the fund's Advisory Contract and administration agreement. In reaching its determination, the Board considered all factors it believed relevant, including (i) the nature, extent, and quality of the services provided to the fund and its shareholders (including the investment performance of the fund); (ii) the competitiveness relative to peer funds of the fund's management fee and total expense ratio; (iii) the total costs of the services provided by and the profits realized by Geode from its relationships with the fund; and (iv) the extent to which, if any, economies of scale exist and are realized as the fund grows, and whether any economies of scale are appropriately shared with fund shareholders.

In considering whether to renew the Advisory Contract for the fund, the Board reached a determination, with the assistance of fund counsel and Independent Trustees' counsel and through the exercise of its business judgment, that the renewal of the Advisory Contract was in the best interests of the fund and its shareholders and that the compensation payable under the Advisory Contract was fair and reasonable. The Board's decision to renew the Advisory Contract was not based on any single factor, but rather was based on a comprehensive consideration of all the information provided to the Board at its meetings throughout the year. The Board, in reaching its determination to renew the Advisory Contract, was aware that shareholders of the fund have a broad range of investment choices available to them, including a wide choice among funds offered by Fidelity's competitors, and that the fund's shareholders, who have the opportunity to review and weigh the disclosure provided by the fund in its prospectus and other public disclosures, have chosen to invest in this fund, which is part of the Fidelity family of funds.

Nature, Extent, and Quality of Services Provided. The Board considered staffing as it relates to the fund, including the backgrounds of investment personnel of Geode, and also considered the fund's investment objective, strategies, and related investment philosophy. The Independent Trustees also had discussions with senior management of Geode. The Board considered the structure of the investment personnel compensation program and whether this structure provides appropriate incentives to act in the best interests of the fund. Additionally, the Board considered the portfolio managers' investments, if any, in the funds that they manage. The Board also considered the steps Fidelity had taken to ensure the continued provision of high quality services to the Fidelity funds throughout the COVID-19 pandemic, including the expansion of staff in client facing positions to maintain service levels in periods of high volumes and volatility.

Resources Dedicated to Investment Management and Support Services. The Board reviewed the general qualifications and capabilities of Geode's investment staff, including its size, education, experience, and resources, as well as Geode's approach to recruiting, training, managing, and compensating investment personnel. The Board considered that Geode's investment professionals have extensive resources, tools, and capabilities so as to provide competitive investment results over time, and that those professionals also have access to sophisticated tools that permit them to assess portfolio construction and risk and performance attribution characteristics continuously. The Board also noted the extensive resources devoted by Fidelity to providing non-advisory services to the fund. The Board considered that Geode has established a Geode Fair Valuation Committee and undertaken compliance-related efforts in connection with Geode's designation as the fund's "valuation designee" pursuant to Rule 2a-5 under the Investment Company Act. Additionally, in its deliberations, the Board considered Geode's trading, risk management, compliance, and technology and operations capabilities and resources, which are integral parts of the investment management process.

Shareholder and Administrative Services. The Board considered (i) the nature, extent, quality, and cost of administrative and shareholder services performed by Fidelity under separate agreements covering administration, transfer agency, pricing and bookkeeping, and securities lending services for the fund; (ii) the nature and extent of the supervision of third party service providers, principally custodians, subcustodians, and pricing vendors; and (iii) the resources devoted to, and the record of compliance with, the fund's compliance policies and procedures.

The Board noted that the growth of fund assets over time across the complex allows Fidelity to reinvest in the development of services designed to enhance the value and convenience of the Fidelity funds as investment vehicles. These services include 24-hour access to account information and market information over the Internet and through telephone representatives, investor education materials and asset allocation tools. The Board also considered that it reviews customer service metrics such as telephone response times, continuity of services on the website and metrics addressing services at Fidelity Investor Centers.

Investment in a Large Fund Family. The Board considered the benefits to shareholders of investing in a Fidelity fund, including the benefits of investing in a fund that is part of a large family of funds offering a variety of investment disciplines and providing a large variety of mutual fund investor services. The Board noted that Fidelity had taken, or had made recommendations to the Board that resulted in the Fidelity funds taking, a number of actions over the previous year that benefited particular funds, including: (i) continuing to dedicate additional resources to Fidelity's investment research process, which includes meetings with management of issuers of securities in which the funds invest; (ii) continuing efforts to enhance Fidelity's global research capabilities; (iii) launching new funds, ETFs, and share classes with innovative structures, strategies and pricing and making other enhancements to meet investor needs; (iv) broadening eligibility requirements for certain funds and share classes; (v) reducing management fees and total expenses for certain funds and classes; (vi) lowering expenses for certain existing funds and classes by implementing or lowering expense caps; (vii) rationalizing product lines and gaining increased efficiencies from fund mergers and liquidations; (viii) continuing to develop, acquire and implement systems and technology to improve services to the funds and shareholders, strengthen information security, and increase efficiency; and (ix) continuing to implement enhancements to further strengthen Fidelity's product line to increase investors' probability of success in achieving their investment goals, including their retirement income goals.

Investment Performance. The Board considered whether the fund has operated in accordance with its investment objective, as well as its record of compliance with its investment restrictions and its performance history.

The Board took into account discussions with senior management of Geode about fund investment performance. In this regard the Board noted that as part of regularly scheduled fund reviews and other reports to the Board on fund performance, the Board considers annualized return information for the fund for different time periods, measured against an appropriate securities market index (benchmark index). The Board also receives and considers information about performance attribution. In its evaluation of fund investment performance at meetings throughout the year, the Board gave particular attention to information indicating underperformance of certain Fidelity funds for specific time periods and discussed with Fidelity the reasons for such underperformance.

In addition to reviewing absolute and relative fund performance, the Independent Trustees periodically consider the appropriateness of fund performance metrics in evaluating the results achieved. In general, the Independent Trustees believe that fund performance should be evaluated based on gross performance (before fees and expenses but after transaction costs) compared to appropriate benchmark indices, over appropriate time periods that may include full market cycles, taking into account relevant factors including the following: general market conditions; expectations for interest rate levels and credit conditions; issuer-specific information including credit quality; and fund cash flows and other factors. The Independent Trustees generally give greater weight to fund performance over longer time periods than over shorter time periods. Depending on the circumstances, the Independent Trustees may be satisfied with a fund's performance notwithstanding that it lags its benchmark index for certain periods.

The Independent Trustees recognize that shareholders evaluate performance on a net basis over their own holding periods, for which one-, three-, and five-year periods are often used as a proxy. For this reason, the performance information reviewed by the Board also included net cumulative calendar year total return information for the fund and an appropriate benchmark index for the most recent one- and three-year periods. No performance peer group information was considered by the Board as Fidelity advised the Board that competitor funds have different and/or broader investment mandates compared with the fund's more specialized strategies. The Independent Trustees recognize that shareholders who are not investing through a tax-advantaged retirement account also consider tax consequences in evaluating performance.

Based on its review, the Board concluded that the nature, extent, and quality of services provided to the fund under the Advisory Contract should continue to benefit the shareholders of the fund.

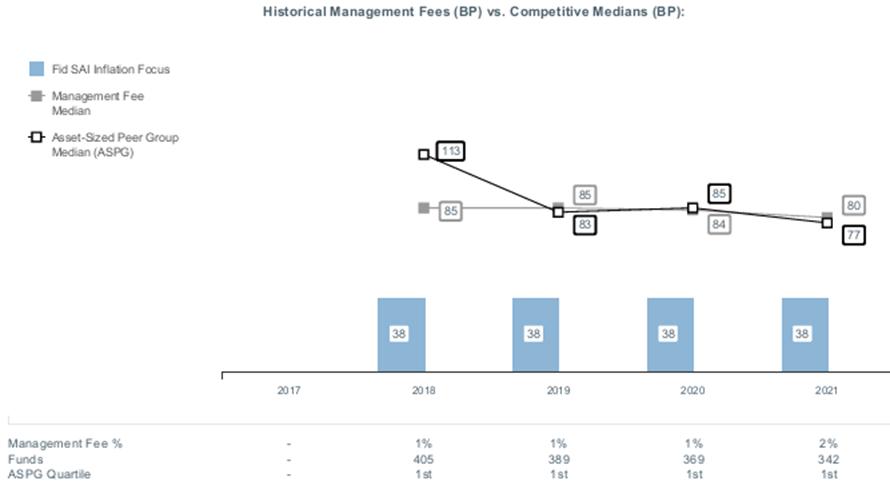

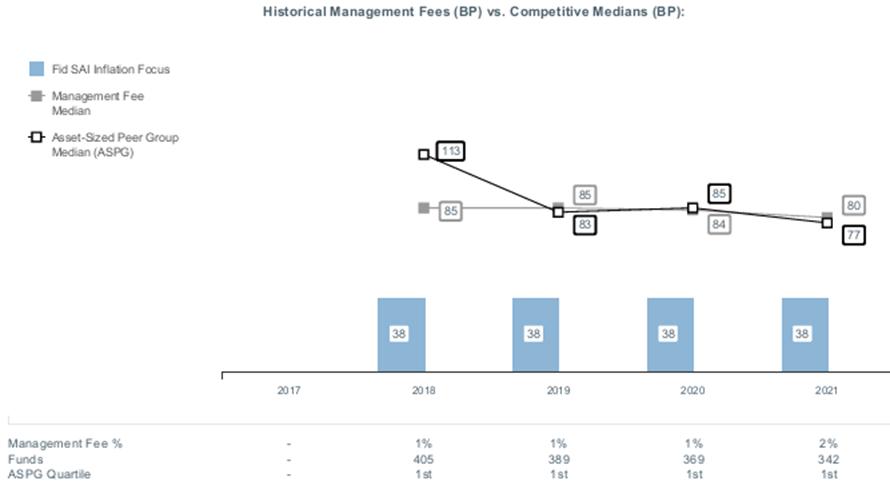

Competitiveness of Management Fee and Total Expense Ratio. The Board considered the fund's management fee and total expense ratio compared to selected groups of competitive funds and classes (referred to as "mapped groups" below) for the purpose of facilitating the Trustees' competitive analysis of management fees and total expenses. Fidelity creates "mapped groups" by combining similar investment objective categories (as classified by Lipper) that have comparable investment mandates. Combining funds with similar investment objective categories aids the Board's comparison of management fees and total expense ratios by broadening the competitive group used for such comparison.

Management Fee. The Board considered two proprietary management fee comparisons for the 12-month (or shorter) periods shown in basis points (BP) in the chart below. The group of Lipper funds used by the Board for management fee comparisons is referred to below as the "Total Mapped Group." The Total Mapped Group comparison focuses on a fund's standing in terms of gross management fees before expense reimbursements or caps relative to the total universe of funds with comparable investment mandates, regardless of whether their management fee structures also are comparable. Funds with comparable investment mandates offer exposure to similar types of securities. Funds with comparable management fee structures have similar management fee contractual arrangements (e.g., flat rate charged for advisory services, all-inclusive fee rate, etc.). "TMG %" represents the percentage of funds in the Total Mapped Group that had management fees that were lower than the fund's. For example, a hypothetical TMG % of 20% would mean that 80% of the funds in the Total Mapped Group had higher, and 20% had lower, management fees than the fund. The fund's actual TMG %s and the number of funds in the Total Mapped Group are in the chart below. The "Asset-Sized Peer Group" (ASPG) comparison focuses on a fund's standing relative to a subset of non-Fidelity funds within the Total Mapped Group that are similar in size and management fee structure. For example, if a fund is in the first quartile of the ASPG, the fund's management fee ranks in the least expensive or lowest 25% of funds in the ASPG. The ASPG represents at least 15% of the funds in the Total Mapped Group with comparable asset size and management fee structures, subject to a minimum of 50 funds (or all funds in the Total Mapped Group if fewer than 50). Additional information, such as the ASPG quartile in which the fund's management fee rate ranked, is also included in the chart and was considered by the Board.

The Board noted that the fund's management fee rate ranked below the median of its Total Mapped Group and below the median of its ASPG for 2021.

Based on its review, the Board concluded that the fund's management fee is fair and reasonable in light of the services that the fund receives and the other factors considered.

Total Expense Ratio . In its review of the fund's total expense ratio, the Board considered the fund's management fee rate as well as other fund expenses, such as custodial, legal, and audit fees. The fund is compared to those funds and classes in the Total Mapped Group (used by the Board for management fee comparisons) that have a similar sales load structure. The Board also considered a total expense ASPG comparison, which focuses on the total expenses of the fund relative to a subset of non-Fidelity funds within the similar sales load structure group that are similar in size and management fee structure. The total expense ASPG is limited to 15 larger and 15 smaller classes of different funds, where possible. The total expense ASPG comparison excludes performance adjustments and fund-paid 12b-1 fees to eliminate variability in expenses relating to these items.

The Board noted that the fund's total net expense ratio ranked below the similar sales load structure group competitive median for 2021 and below the ASPG competitive median for 2021.

The Board further considered that FMR has contractually agreed to reimburse the fund to the extent that total operating expenses, with certain exceptions, as a percentage of its average net assets, exceed 0.50% through November 30, 2023.

Fees Charged to Other Geode and Fidelity Clients . The Board also considered information, including fee rates, about management services provided by Geode to other clients, if any, in the same strategy as the fund. The Board also considered Fidelity fee structures and other information with respect to clients of Fidelity, such as other funds advised or subadvised by Fidelity, pension plan clients, and other institutional clients with similar mandates. The Board noted that a joint ad hoc committee created by it and the boards of other Fidelity funds periodically reviews and compares Fidelity's institutional investment advisory business with its business of providing services to the Fidelity funds and also noted the most recent findings of the committee. The Board noted that the committee's review included a consideration of the differences in services provided, fees charged, and costs incurred, as well as competition in the markets serving the different categories of clients.

Based on its review of total expense ratios and fees charged to other Fidelity clients, the Board concluded that the fund's total expense ratio was reasonable in light of the services that the fund and its shareholders receive and the other factors considered.

Costs of the Services and Profitability. The Board considered the revenues earned and the expenses incurred by Geode in managing the fund and Fidelity in conducting the business of developing, marketing, distributing, administering and servicing the fund and servicing the fund's shareholders. The Board also considered the level of Fidelity's profits in respect of all the Fidelity funds.

On an annual basis, Geode presents to the Board information about the profitability of its relationship with the fund. In addition, Fidelity calculates profitability information for each Fidelity fund, as well as aggregate profitability information for groups of Fidelity funds and all Fidelity funds, using a series of detailed revenue and cost allocation methodologies which originate with the books and records of Fidelity on which Fidelity's audited financial statements are based. The Audit Committee of the Board reviews any significant changes from the prior year's methodologies and the full Board approves such changes.

A public accounting firm has been engaged annually by the Board as part of the Board's assessment of Fidelity's profitability analysis. The engagement includes the review and assessment of the methodologies used by Fidelity in determining the revenues and expenses attributable to Fidelity's mutual fund business, and completion of agreed-upon procedures in respect of the mathematical accuracy of certain fund profitability information and its conformity to established allocation methodologies. After considering the reports issued under the engagement and information provided by Fidelity, the Board concluded that while other allocation methods may also be reasonable, Fidelity's profitability methodologies are reasonable in all material respects.

The Board also reviewed Fidelity's and Geode's non-fund businesses and potential indirect benefits such businesses may have received as a result of their association with Fidelity's mutual fund business (i.e., fall-out benefits) as well as cases where Fidelity's and Geode's affiliates may benefit from the funds' business. The Board considered areas where potential indirect benefits to the Fidelity funds from their relationships with Fidelity may exist. The Board's consideration of these matters was informed by the findings of a joint ad hoc committee created by it and the boards of other Fidelity funds to evaluate potential fall-out benefits.

The Board considered the costs of the services provided by and the profits realized by Geode and Fidelity in connection with the operation of the fund and was satisfied that the profitability was not excessive.

Economies of Scale. The Board considered whether there have been economies of scale in respect of the management and/or servicing of the fund and other Fidelity funds, whether the Fidelity funds (including the fund) have appropriately benefited from any such economies of scale, and whether there is potential for realization of any further economies of scale. The Board considered the extent to which the fund will benefit from economies of scale as assets grow through increased services to the fund, through waivers or reimbursements, or through fee or expense ratio reductions. The Board also noted that a committee (the Economies of Scale Committee) created by it and the boards of other Fidelity funds periodically analyzes whether Fidelity attains economies of scale in respect of the management and servicing of the Fidelity funds, whether the Fidelity funds have appropriately benefited from such economies of scale, and whether there is potential for realization of any further economies of scale.

The Board concluded, taking into account the analysis of the Economies of Scale Committee, that economies of scale, if any, are being appropriately shared between fund shareholders and Fidelity.

Additional Information Requested by the Board. In order to develop fully the factual basis for consideration of the Fidelity funds' advisory contracts, the Board requested and received additional information on certain topics, including: (i) Fidelity's fund profitability methodology, profitability trends for certain funds, the allocation of various costs to different funds, and the impact of certain factors on fund profitability results; (ii) portfolio manager changes that have occurred during the past year and the amount of the investment that each portfolio manager has made in the Fidelity fund(s) that he or she manages; (iii) the extent to which current market conditions have affected retention and recruitment of personnel; (iv) the arrangements with and compensation paid to certain fund sub-advisers on behalf of the Fidelity funds and the treatment of such compensation within Fidelity's fund profitability methodology; (v) the terms of the funds' various management fee structures, including the basic group fee and the terms of Fidelity's voluntary expense limitation arrangements; (vi) Fidelity's transfer agent, pricing and bookkeeping fees, expense and service structures for different funds and classes relative to competitive trends; (vii) the impact on fund profitability of recent industry trends, such as the growth in passively managed funds and the changes in flows for different types of funds; (viii) the types of management fee and total expense comparisons provided, and the challenges and limitations associated with such information; and (ix) explanations regarding the relative total expense ratios and management fees of certain funds and classes, total expense and management fee competitive trends, and methodologies for total expense and management fee competitive comparisons. In addition, the Board considered its discussions with Geode and Fidelity regarding Geode's and Fidelity's efforts to maintain the continuous investment and shareholder services necessary for the funds during the current pandemic and economic circumstances.

Based on its evaluation of all of the conclusions noted above, and after considering all factors it believed relevant, the Board concluded that the advisory fee arrangements are fair and reasonable and that the fund's Advisory Contract should be renewed.

The Securities and Exchange Commission adopted Rule 22e-4 under the Investment Company Act of 1940 (the Liquidity Rule) to promote effective liquidity risk management throughout the open-end investment company industry, thereby reducing the risk that funds will be unable to meet their redemption obligations and mitigating dilution of the interests of fund shareholders.

The Fund has adopted and implemented a liquidity risk management program (the Program) reasonably designed to assess and manage the Fund's liquidity risk and to comply with the requirements of the Liquidity Rule. The Fund's Board of Trustees (the Board) has designated the Fund's investment adviser as administrator of the Program. The Fidelity advisers have established a Liquidity Risk Management Committee (the LRM Committee) to manage the Program for each of the Fidelity Funds. The LRM Committee monitors the adequacy and effectiveness of implementation of the Program and on a periodic basis assesses each Fund's liquidity risk based on a variety of factors including (1) the Fund's investment strategy, (2) portfolio liquidity and cash flow projections during normal and reasonably foreseeable stressed conditions, (3) shareholder redemptions, (4) borrowings and other funding sources and (5) certain factors specific to ETFs including the effect of the Fund's prices and spreads, market participants, and basket compositions on the overall liquidity of the Fund's portfolio, as applicable.

In accordance with the Program, each of the Fund's portfolio investments is classified into one of four defined liquidity categories based on a determination of a reasonable expectation for how long it would take to convert the investment to cash (or sell or dispose of the investment) without significantly changing its market value.

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

Liquidity classification determinations take into account a variety of factors including various market, trading and investment-specific considerations, as well as market depth, and generally utilize analysis from a third-party liquidity metrics service.

The Liquidity Rule places a 15% limit on a fund's illiquid investments and requires funds that do not primarily hold assets that are highly liquid investments to determine and maintain a minimum percentage of the fund's net assets to be invested in highly liquid investments (highly liquid investment minimum or HLIM). The Program includes provisions reasonably designed to comply with the 15% limit on illiquid investments and for determining, periodically reviewing and complying with the HLIM requirement as applicable.

At a recent meeting of the Fund's Board of Trustees, the LRM Committee provided a written report to the Board pertaining to the operation, adequacy, and effectiveness of the Program for the period December 1, 2021 through November 30, 2022. The report concluded that the Program is operating effectively and is reasonably designed to assess and manage the Fund's liquidity risk.

1.9892163.104

IFF-SANN-0423

Fidelity® Commodity Strategy Fund

Semi-Annual Report

January 31, 2023

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

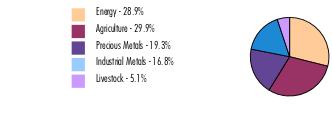

The information in the following tables is based on the Fund's commodity-linked investments and excludes short-term investment-grade debt securities, cash and cash equivalents.

| Commodity Sector Diversification as of January 31, 2023* |

| |

|

|

| * The Fund does not invest directly in physical commodities. |

| Commodity Instruments as of January 31, 2023* |

| |

|

Showing Percentage of Net Assets

| Money Market Funds - 90.3% |

| | | Shares | Value ($) |

Fidelity Cash Central Fund 4.38% (a) (Cost $57,434,152) | | 57,422,668 | 57,434,152 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 90.3% (Cost $57,434,152) | 57,434,152 |

NET OTHER ASSETS (LIABILITIES) - 9.7% | 6,168,641 |

| NET ASSETS - 100.0% | 63,602,793 |

| | |

| Futures Contracts |

| | Number of contracts | Expiration Date | Notional Amount ($) | Value ($) | Unrealized Appreciation/ (Depreciation) ($) |

| Purchased | | | | | |

| | | | | | |

| Commodity Futures Contracts | | | | | |

| CBOT Corn Contracts (United States) | 103 | Mar 2023 | 3,500,713 | 57,780 | 57,780 |

| CBOT KC HRW Wheat Contracts (United States) | 26 | Mar 2023 | 1,142,375 | (70,146) | (70,146) |

| CBOT Soybean Contracts (United States) | 45 | Mar 2023 | 2,178,900 | 150,413 | 150,413 |

| CBOT Soybean Contracts (United States) | 47 | Mar 2023 | 3,614,300 | 159,281 | 159,281 |

| CBOT Soybean Oil Contracts (United States) | 53 | Mar 2023 | 1,982,094 | 66,644 | 66,644 |

| CBOT Wheat Contracts (United States) | 46 | Mar 2023 | 1,750,875 | (175,005) | (175,005) |

| CME Lean Hogs Contracts (United States) | 33 | Apr 2023 | 1,140,810 | (23,308) | (23,308) |

| CME Live Cattle Contracts (United States) | 32 | Apr 2023 | 2,086,720 | 23,727 | 23,727 |

| COMEX Copper Contracts (United States) | 33 | Mar 2023 | 3,488,100 | 452,324 | 452,324 |

| COMEX Gold 100 oz. Contracts (United States) | 49 | Apr 2023 | 9,523,640 | 207,048 | 207,048 |

| COMEX Silver Contracts (United States) | 23 | Mar 2023 | 2,739,875 | 274,340 | 274,340 |

| ICE Brent Crude Contracts (United Kingdom) | 56 | Mar 2023 | 4,775,120 | 192,714 | 192,714 |

| ICE Coffee 'C' Contracts (United States) | 30 | Mar 2023 | 2,044,688 | 257,609 | 257,609 |

| ICE Cotton No. 2 Contracts (United States) | 22 | Mar 2023 | 948,420 | 18,112 | 18,112 |

| ICE Low Sulphur Gasoil Contracts (United States) | 20 | Mar 2023 | 1,812,000 | 224,104 | 224,104 |

| ICE Sugar No. 11 Contracts (United States) | 74 | Feb 2023 | 1,803,469 | 324,331 | 324,331 |

| LME Aluminum Contracts (United Kingdom) | 44 | Mar 2023 | 2,891,350 | 192,586 | 192,586 |

| LME Lead Contracts (United Kingdom) | 10 | Mar 2023 | 533,188 | (18,736) | (18,736) |

| LME Nickel Contracts (United Kingdom) | 10 | Mar 2023 | 1,814,760 | 74,412 | 74,412 |

| NYMEX Gasoline RBOB Contracts (United States) | 14 | Feb 2023 | 1,509,925 | 278,153 | 278,153 |