UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

R ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 28, 2013

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to ________.

Commission File Number 0-2585

The Dixie Group, Inc.

(Exact name of registrant as specified in its charter)

| Tennessee | 62-0183370 | |

| (State or other jurisdiction of incorporation of organization) | (I.R.S. Employer Identification No.) | |

| 104 Nowlin Lane, Suite 101, Chattanooga, TN 37421 | (423) 510-7000 | |

| (Address of principal executive offices and zip code) | (Registrant's telephone number, including area code) | |

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of Class | Name of each exchange on which registered | |

| Common Stock, $3.00 par value | NASDAQ Stock Market, LLC | |

| Securities registered pursuant to Section 12(g) of the Act: | ||

| Title of class | ||

| None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes R No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. o Yes R No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. R Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). R Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer R Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes R No

The aggregate market value of the Common Stock held by non-affiliates of the registrant on June 28, 2013 (the last business day of the registrant's most recently completed fiscal second quarter) was $88,645,594. The aggregate market value was computed by reference to the closing price of the Common Stock on such date. In making this calculation, the registrant has assumed, without admitting for any purpose, that all executive officers, directors, and holders of more than 10% of a class of outstanding Common Stock, and no other persons, are affiliates. No market exists for the shares of Class B Common Stock, which is neither registered under Section 12 of the Act nor subject to Section 15(d) of the Act.

Indicate the number of shares outstanding of each of the registrant's classes of Common Stock as of the latest practicable date.

| Class | Outstanding as of February 28, 2014 | |||

| Common Stock, $3.00 Par Value | 12,453,166 | shares | ||

| Class B Common Stock, $3.00 Par Value | 866,875 | shares | ||

| Class C Common Stock, $3.00 Par Value | 0 | shares | ||

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the following document are incorporated by reference:

Proxy Statement of the registrant for annual meeting of shareholders to be held April 29, 2014 (Part III).

THE DIXIE GROUP, INC.

Index to Annual Report

on Form 10-K for

Year Ended December 28, 2013

| PART I | Page | |

| Item 1. | ||

| Item 1A. | ||

| Item 1B. | ||

| Item 2. | ||

| Item 3. | ||

| Item 4. | ||

| PART II | ||

| Item 5. | ||

| Item 6. | ||

| Item 7. | ||

| Item 7A. | ||

| Item 8. | ||

| Item 9. | ||

| Item 9A. | ||

| Item 9B. | ||

| PART III | ||

| Item 10. | ||

| Item 11. | ||

| Item 12. | ||

| Item 13. | ||

| Item 14. | ||

| PART IV | ||

| Item 15. | ||

FORWARD-LOOKING INFORMATION

This Report contains statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include the use of terms or phrases such as "expects," "estimates," "projects," "believes," "anticipates," "intends," and similar terms and phrases. Such forward-looking statements relate to, among other matters, our future financial performance, business prospects, growth strategies or liquidity. The following important factors may affect our future results and could cause those results to differ materially from our historical results; these factors include, in addition to those "Risk Factors" detailed in Item 1A of this report, and described elsewhere in this document, the cost and availability of capital, raw material and transportation costs related to petroleum price levels, the cost and availability of energy supplies, the loss of a significant customer or group of customers, materially adverse changes in economic conditions generally in carpet, rug and floorcovering markets we serve and other risks detailed from time to time in our filings with the Securities and Exchange Commission.

Part I.

| Item 1. | BUSINESS |

General

Our business consists principally of marketing, manufacturing and selling carpet and rugs to high-end residential and commercial customers through our various sales forces and brands. A small portion of our manufacturing capacity is used to provide carpet and yarn related services to other manufacturers.

From 1920 until 1993 we were exclusively in the textile business. We sold our textile assets and began acquiring floorcovering businesses in 1993. We focus exclusively on the upper-end of the soft floorcovering market where we believe we have strong brands and competitive advantages with our style and design capabilities and customer relationships.

Our business is concentrated in areas of the soft floorcovering markets where innovative styling, design, color, quality and service, as well as limited distribution, are welcomed and rewarded. Our Fabrica, Masland, and Dixie Home brands have a significant presence in the high-end residential soft floorcovering markets. Our Masland Contract brand and Avant, a brand launched in 2013, participate in the upper end specified commercial marketplace. Dixie International sells all of our brands outside of the North American market. Our brands are well known, highly regarded and complementary; by being differentiated, we offer meaningful alternatives to the discriminating customer.

We have one line of business, carpet and rug manufacturing.

Our Brands

Fabrica, markets and manufactures luxurious residential carpet and custom rugs, at selling prices that we believe are approximately five times the average for the residential soft floorcovering industry. Its primary customers are interior decorators and designers, selected retailers and furniture stores, luxury home builders and manufacturers of luxury motor coaches and yachts. Fabrica is among the leading premium brands in the domestic marketplace and is known for styling innovation and unique colors and patterns. The Carousel line of products was acquired in 2013 and added to our Fabrica line of products. The Carousel line of products consists of made-to-order, hand-crafted, extremely high quality carpets and area rugs in natural fibers, primarily wool, with a wide variety of patterns and textures manufactured by machine, hand weaving and hand-hooked techniques. Fabrica is viewed by the trade as the premier quality brand for very high-end carpet and enjoys an established reputation as a styling trendsetter and a market leader in providing both custom and designer products to the very high-end residential sector.

Masland Residential, founded in 1866, markets and manufactures design-driven specialty carpets and rugs for the high-end residential marketplace. Its residential and commercial broadloom carpet products are marketed at selling prices that we believe are over three times the average for the residential soft floorcovering industry. Its products are marketed through the interior design community, as well as to consumers through specialty floorcovering retailers. Masland Residential has strong brand recognition within the upper-end residential market. Masland Residential competes through innovative styling, color, product design, quality and service.

Dixie Home provides stylishly designed, differentiated products that offer affordable fashion to residential consumers. Dixie Home markets an array of tufted broadloom residential and commercial carpet to selected retailers and home centers under the Dixie Home and private label brands. Its objective is to make the Dixie Home brand the choice for styling, service and quality in the more moderately priced sector of the high-end broadloom residential carpet market. Its products are marketed at selling prices which we believe average two times the soft floorcovering industry's average selling price.

Masland Contract markets and manufactures broadloom and modular carpet tile for the specified commercial marketplace. Its commercial products are marketed to the architectural and specified design community and directly to commercial end users, as well as to consumers through specialty floorcovering retailers. Masland Contract has strong brand recognition within the upper-end contract market, and competes through innovative styling, color, patterns, quality and service.

Avant Contract, a new commercial business launched in 2013, is designed to focus on the corporate office market through multi-line sales agents. These agents carry a broad array of products for the corporate interiors market and will exclusively offer Avant as their soft floorcovering offering. Its modular carpet tile and broadloom product offerings are designed for the interior designer in the upper-end of the contract market who appreciates sophisticated texture, color and patterns with excellent service.

Industry

The carpet and rug industry has two primary markets, residential and commercial, with the residential market making up the largest portion of the industry's sales. A substantial portion of industry shipments is made in response to replacement demand. Residential products consist of broadloom carpets and rugs in a broad range of styles, colors and textures. Commercial products consist primarily of broadloom carpet and modular carpet tile for a variety of institutional applications such as office buildings, restaurant chains, schools and other commercial establishments. The carpet industry also manufactures carpet for the automotive, recreational vehicle, small boat and other industries.

The Carpet and Rug Institute (the "CRI") is the national trade association representing carpet and rug manufacturers. Information compiled by the CRI suggests that the domestic carpet and rug industry is comprised of fewer than 100 manufacturers, with a significant majority of the industry's production concentrated in a limited number of manufacturers focused on the lower end of the price curve. We believe that this industry focus provides us with opportunities to capitalize on our competitive strengths in selected markets where innovative styling, design, product differentiation, focused service and limited distribution add value.

Competition

The floorcovering industry is highly competitive. We compete with other carpet and rug manufacturers and other types of floorcoverings. We believe our products are among the leaders in styling and design in the high-end residential and high-end commercial carpet markets. However, a number of manufacturers produce competitive products and some of these manufacturers have greater financial resources than we do.

We believe the principal competitive factors in our primary soft floorcovering markets are styling, color, product design, quality and service. In the high-end residential and high-end commercial markets, carpet competes with various other types of floorcoverings. Nevertheless, we believe we have competitive advantages in several areas. We have an attractive portfolio of brands that we believe are well known, highly regarded by customers and complementary; by being differentiated, we offer meaningful alternatives to the discriminating customer. We believe our investment in new yarns , such as Stainmaster's® TruSoft™ and PetProtect™, and innovative tufting and dyeing technologies, strengthens our ability to offer product differentiation to our customers. In addition, we have established longstanding relationships with key suppliers in our industry and customers in most of our markets. Finally, our reputation for innovative design excellence and our experienced management team enhance our competitive position. See "Risk Factors" in Item 1A of this report.

Backlog

Sales order backlog is not material to understanding our business, due to relatively short lead times for order fulfillment in the markets for the vast majority of our products.

Trademarks

Our floorcovering businesses own a variety of trademarks under which our products are marketed. Among such trademarks, the names "Fabrica", "Masland", "Dixie Home", “Masland Contract” and "Avant" are of greatest importance to our business. We believe that we have taken adequate steps to protect our interest in all significant trademarks.

Customer and Product Concentration

As a percentage of our net sales, one customer, Lowe's, a mass merchant, accounted for approximately 13% in 2013, 9% in 2012 and 12% in 2011. No other customer was more than 10 percent of our sales during the periods presented. During 2013, sales to our top ten customers accounted for 20% percent of our sales and our top 20 customers accounted for 23% percent of our sales. We do not make a material amount of sales in foreign countries.

We do not have any single class of products that accounts for more than 10 percent of our sales. However, sales of our floorcovering products may be classified by significant end-user markets into which we sell, and such information for the past three years is summarized as follows:

| 2013 | 2012 | 2011 | ||||||

| Residential floorcovering products | 74 | % | 75 | % | 71 | % | ||

| Commercial floorcovering products | 26 | % | 25 | % | 29 | % | ||

Seasonality

Our sales historically have normally reached their lowest level in the first quarter (approximately 23% of our annual sales), with the remaining sales being distributed relatively equally between the second, third and fourth quarters. Working capital requirements have normally reached their highest levels in the second and third quarters of the year.

Environmental

Our operations are subject to federal, state and local laws and regulations relating to the generation, storage, handling, emission, transportation and discharge of materials into the environment. The costs of complying with environmental protection laws and regulations have not had a material adverse impact on our financial condition or results of operations in the past and are not expected to have a material adverse impact in the future. See "Risk Factors” in Item 1A of this report.

Raw Materials

Our primary raw material is yarn. Nylon is the primary yarn we utilize and, to a lesser extent, polyester and wool yarn is used. Additionally, we utilize polypropylene carpet backing, latex, dyes and chemicals, and man-made topical applications in the construction of our products. Our synthetic yarns are purchased primarily from domestic fiber suppliers and wool is purchased from a number of domestic and international sources. Our other raw materials are purchased primarily from domestic suppliers. Where possible, we pass raw material price increases through to our customers; however, there can be no assurance that price increases can be passed through to customers and that increases in raw material prices will not have an adverse effect on our profitability. See "Risk Factors” in Item 1A of this report. We purchase a significant portion of our primary raw material (nylon yarn) from one supplier. We believe there are other sources of nylon yarn; however, an unanticipated termination or interruption of our supply arrangements could adversely affect our supplies of raw materials and could have a material effect on our operations. See "Risk Factors” in Item 1A of this report.

Utilities

We use electricity as our principal energy source, with oil or natural gas used in some facilities for finishing operations as well as heating. We have not experienced any material problem in obtaining adequate supplies of electricity, natural gas or oil. Energy shortages of extended duration could have an adverse effect on our operations, and price volatility could negatively impact future earnings. See "Risk Factors” in Item 1A of this report.

Working Capital

We are required to maintain significant levels of inventory in order to provide the enhanced service levels demanded by the nature of our business and our customers, and to ensure timely delivery of our products. Consistent and dependable sources of liquidity are required to maintain such inventory levels. Failure to maintain appropriate levels of inventory could materially adversely affect our relationships with our customers and adversely affect our business. See "Risk Factors” in Item 1A of this report.

Employment Level

At December 28, 2013, we employed 1,423 associates in our operations.

Available Information

Our internet address is www.thedixiegroup.com. We make the following reports filed by us with the Securities and Exchange Commission available, free of charge, on our website under the heading "Investor Relations":

| 1. | annual reports on Form 10-K; |

| 2. | quarterly reports on Form 10-Q; |

| 3. | current reports on Form 8-K; and |

| 4. | amendments to the foregoing reports. |

The contents of our website are not a part of this report.

Item 1A. RISK FACTORS

In addition to the other information provided in this Report, the following risk factors should be considered when evaluating the results of our operations, future prospects and an investment in shares of our Common Stock. Any of these factors could cause our actual financial results to differ materially from our historical results, and could give rise to events that might have a material adverse effect on our business, financial condition and results of operations.

The floor covering industry is sensitive to changes in general economic conditions and a decline in residential or commercial construction activity or corporate remodeling and refurbishment could have a material adverse effect on our business.

The floor covering industry, in which the Company participates, is highly dependent on general economic conditions, such as consumer confidence and income, corporate and government spending, interest rate levels, availability of credit and demand for housing. The Company derives a majority of its sales from the replacement segment of the market. Therefore, economic

changes that result in a significant or prolonged decline in spending for remodeling and replacement activities could have a material adverse effect on the Company’s business and results of operations.

The floor covering industry is highly dependent on construction activity, including new construction, which is cyclical in nature and recently experienced a downturn. The downturn in the U.S. and global economies, along with the residential and commercial markets in such economies, negatively impacted the floor covering industry and the Company’s business. Although the impact of a decline in new construction activity is typically accompanied by an increase in remodeling and replacement activity, these activities lagged during the downturn. Although the difficult economic conditions have improved, there may be additional downturns that could cause the industry to deteriorate in the foreseeable future. A significant or prolonged decline in residential or commercial construction activity could have a material adverse effect on the Company’s business and results of operations.

We have significant levels of sales in certain channels of distribution and reduction in sales through these channels could adversely affect our business.

A significant amount of our sales are generated through certain retail and mass merchant channels of distribution. Because we depend on such certain channels of distribution, a significant reduction of sales through these channels could adversely affect our business.

We have significant levels of indebtedness that could result in negative consequences to us.

We have a significant amount of indebtedness relative to our equity. Insufficient cash flow, profitability or the value of our assets securing our loans could materially adversely affect our ability to generate sufficient funds to satisfy the terms of our senior loan agreements and other debt obligations. Additionally, the inability to access debt or equity markets at competitive rates in sufficient amounts to satisfy our obligations could adversely impact our business.

Uncertainty in the credit market or downturns in the economy and our business could affect our overall availability and cost of credit.

Uncertainty in the credit markets could affect the overall availability and cost of credit. Despite recent improvement in overall economic conditions, market conditions could impact our ability to obtain financing in the future, including any financing necessary to refinance existing indebtedness, and the cost and terms of it, remains uncertain. These and other economic factors could have a material adverse effect on demand for our products and on its financial condition and operating results.

We face intense competition in our industry, which could decrease demand for our products and could have a material adverse effect on our profitability.

The floor covering industry is highly competitive. We face competition from a number of domestic manufacturers and independent distributors of floor covering products and, in certain product areas, foreign manufacturers. Significant consolidation within the floor covering industry has caused a number of our existing and potential competitors to grow significantly larger and have greater access to resources and capital than we do. Maintaining our competitive position may require us to make substantial additional investments in our product development efforts, manufacturing facilities, distribution network and sales and marketing activities. These additional investments may be limited by our access to capital, as well as restrictions set forth in our credit facilities. Competitive pressures may also result in decreased demand for our products and in the loss of market share. In addition, we face, and will continue to face, pressure on sales prices of our products from competitors. As a result of any of these factors, there could be a material adverse effect on our sales and profitability.

If we are unable to anticipate consumer preferences and successfully develop and introduce new, innovative and updated products, we may not be able to maintain or increase our net revenues and profitability.

Our success depends on our ability to identify and originate product trends as well as to anticipate and react to changing consumer demands in a timely manner. All of our products are subject to changing consumer preferences that cannot be predicted with certainty. In addition, long lead times for certain of our products may make it hard for us to quickly respond to changes in consumer demands. Our new products may not receive consumer acceptance as consumer preferences could shift rapidly to different types of flooring products or away from these types of products altogether, and our future success depends in part on our ability to anticipate and respond to these changes. Failure to anticipate and respond in a timely manner to changing consumer preferences could lead to, among other things, lower sales and excess inventory levels, which could have a material adverse effect on our financial condition.

Raw material prices may increase and the inability to pass any such increases to our customers could materially adversely affect our business, results of operations and financial condition.

The prices of raw materials and fuel-related costs vary significantly with market conditions. In particular, our business requires the purchase of large volumes of nylon and polyester yarn, as well as wool yarns, synthetic backing, latex, and dyes. Increases in the cost of these raw materials could materially adversely affect our business, results of operations and financial condition if

we are unable to pass these increases through to our customers. Although we generally attempt to pass on increases in raw material, energy and fuel-related costs to our customers, our ability to do so is dependent upon the rate and magnitude of any increase, competitive pressures and market conditions for our products. There have been in the past, and may be in the future, periods of time during which increases in these costs cannot be recovered. During such periods of time, our business may be materially adversely affected.

Unanticipated termination or interruption of our arrangements with third-party suppliers of nylon yarn could have a material adverse effect on us.

Nylon yarn is the principal raw material used in our floor covering products. A significant portion of such yarn is purchased from one supplier. Our yarn supplier is on the of the leading fiber suppliers within the industry and is the exclusive supplier of certain innovative branded fiber technology upon which we rely. We believe our offerings of this innovative fiber technology contribute materially to the competiveness of our products. While we believe there are other sources of nylon yarns, an unanticipated termination or interruption of our current supply of nylon yarn could have a material adverse effect on our ability to supply our product to our customers and have a material adverse impact on our competitiveness if we are unable to replace our nylon supplier with another supplier that can offer similar innovative fiber products. An extended interruption in the supply of these or other raw materials or sourced products used in the Company’s business or in the supply of suitable substitute materials or products would disrupt the Company’s operations, which could have a material adverse effect on the Company’s business.

We may experience certain risks associated with acquisitions, joint ventures and strategic investments.

We have recently embarked on several strategic and tactical initiatives, including acquisitions and investment in new products, to strengthen our future and to enable us to return to sustained growth and profitability. Growth through acquisitions involves risks, many of which may continue to affect us after the acquisition. An acquired company may not achieve the levels of revenue, profitability and production that we expect. The combination of an acquired company’s business with ours involves risks. Reported earnings may not meet expectations because of goodwill and intangible asset impairment, other asset impairments, increased interest costs and issuance of additional securities or debt as a result of these acquisitions. We may also face challenges in consolidating functions and integrating our organizations, procedures, operations and product lines in a timely and efficient manner.

The diversion of management attention and any difficulties encountered in the transition and integration process could have a material adverse effect on our revenues, level of expenses and operating results. Failure to successfully manage and integrate an acquisition with our existing operations could lead to the potential loss of customers of the acquired business, the potential loss of employees who may be vital to the new operations, the potential loss of business opportunities or other adverse consequences that could have a material adverse effect on our business, financial condition and results of operations. Even if integration occurs successfully, failure of the acquisition to achieve levels of anticipated sales growth, profitability or productivity, or otherwise perform as expected, may have a material adverse effect on our business, financial condition and results of operations.

We are subject to various environmental, safety and health regulatory governance that may subject us to costs, liabilities and other obligations, which could have a material adverse effect on our business, results of operations and financial condition.

We are subject to various environmental, safety and health and other regulations that may subject us to costs, liabilities and other obligations which could have a material adverse effect on our business. The applicable requirements under these laws are subject to amendment, to the imposition of new or additional requirements and to changing interpretations of agencies or courts. We could incur material expenditures to comply with new or existing regulations, including fines and penalties and increased costs of its operations. Additionally, future laws, ordinances or regulations could give rise to additional compliance or remediation costs that could have a material adverse effect on our business, results of operations and financial condition.

Various federal, state and local environmental laws govern the use of our current and former facilities. These laws govern such matters as:

• | Discharge to air and water; |

• | Handling and disposal of solid and hazardous substances and waste, and |

• | Remediation of contamination from releases of hazardous substances in our facilities and off-site disposal locations. |

Our operations also are governed by laws relating to workplace safety and worker health, which, among other things, establish noise standards and regulate the use of hazardous materials and chemicals in the workplace. We have taken, and will continue to take, steps to comply with these laws. If we fail to comply with present or future environmental or safety regulations, we could be subject to future liabilities. However, we cannot ensure that complying with these environmental or health and safety laws and requirements will not adversely affect our business, results of operations and financial condition.

We may be exposed to litigation, claims and other legal proceedings in the ordinary course of business relating to our products or business, which could have a material adverse effect on our business, results of operations and financial condition.

In the ordinary course of business, we are subject to a variety of work-related and product-related claims, lawsuits and legal proceedings, including those relating to product liability, product warranty, product recall, personal injury, and other matters that are inherently subject to many uncertainties regarding the possibility of a loss our business. Such matters could have a material adverse effect on our business, results of operations and financial condition if we are unable to successfully defend against or resolve these matters or if our insurance coverage is insufficient to satisfy any judgments against us or settlements relating to these matters. Although we have product liability insurance, the policies may not provide coverage for certain claims against us or may not be sufficient to cover all possible liabilities. Further, we may not be able to maintain insurance at commercially acceptable premium levels. Additionally, adverse publicity arising from claims made against us, even if the claims are not successful, could adversely affect our reputation or the reputation and sales of our products.

Our business operations could suffer significant losses from natural disasters, catastrophes, fire or other unexpected events.

Many of our business activities involve substantial investments in manufacturing facilities and many products are produced at a limited number of locations. These facilities could be materially damaged by natural disasters, such as floods, tornadoes, hurricanes and earthquakes, or by fire or other unexpected events. We could incur uninsured losses and liabilities arising from such events, including damage to our reputation, and/or suffer material losses in operational capacity, which could have a material adverse impact on our business, financial condition and results of operations.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

| Item 2. | PROPERTIES |

The following table lists our facilities according to location, type of operation and approximate total floor space as of February 28, 2014:

| Location | Type of Operation | Approximate Square Feet | |||

| Administrative: | |||||

| Dalton, GA* | Administrative | 16,000 | |||

| Saraland, AL | Administrative | 29,000 | |||

| Santa Ana, CA | Administrative | 4,000 | |||

| Chattanooga, TN* | Administrative | 3,500 | |||

| Calhoun, GA | Administrative | 10,600 | |||

| Total Administrative | 63,100 | ||||

| Manufacturing and Distribution: | |||||

| Atmore, AL | Carpet Manufacturing, Distribution | 610,000 | |||

| Saraland, AL | Carpet Tile Manufacturing, Distribution | 384,000 | |||

| Saraland, AL* | Samples and Rug Manufacturing, Distribution | 132,000 | |||

| Roanoke, AL | Carpet Yarn Processing | 204,000 | |||

| Santa Ana, CA | Carpet and Rug Manufacturing, Distribution | 200,000 | |||

| Calhoun, GA * | Carpet Wool Manufacturing | 99,000 | |||

| Calhoun, GA | Carpet Dyeing & Processing | 193,300 | |||

| Chatsworth, GA * | Samples and Distribution | 79,600 | |||

| Eton, GA | Carpet Manufacturing, Distribution | 408,000 | |||

| Total Manufacturing and Distribution | 2,309,900 | ||||

| * Leased properties | TOTAL | 2,373,000 | |||

In addition to the facilities listed above, we lease a small amount of office space in various locations. In addition, during 2013, we entered into a lease for a 292,000 square feet distribution facility which will commence on May 1, 2014.

In our opinion, our manufacturing facilities are well maintained and our machinery is efficient and competitive. Operations of our facilities generally vary between 120 and 168 hours per week. Substantially all of our owned properties are subject to mortgages, which secure the outstanding borrowings under our senior credit facilities.

| Item 3. | LEGAL PROCEEDINGS |

At December 28, 2013, the Company was a plaintiff in a lawsuit against a former raw material supplier. In its lawsuit, the Company alleges that the former supplier sold defective materials to the Company over a period of time, which, when applied to certain of the Company’s products, caused those products to become defective and unmerchantable in the ordinary course of the Company’s business. On January 31, 2014, the Company and the supplier settled the Company's claim for $400 thousand.

| Item 4. | MINE SAFETY DISCLOSURES |

Not applicable.

Pursuant to instruction G of Form 10-K the following is included as an unnumbered item to PART I.

EXECUTIVE OFFICERS OF THE REGISTRANT

The names, ages, positions and offices held by the executive officers of the registrant as of February 28, 2014, are listed below along with their business experience during the past five years.

| Name, Age and Position | Business Experience During Past Five Years | |

Daniel K. Frierson, 72 Chairman of the Board, and Chief Executive Officer, Director | Director since 1973, Chairman of the Board since 1987 and Chief Executive Officer since 1980. He is the Chairman of the Company's Executive Committee and Retirement Plans Committee. He serves as Director of Astec Industries, Inc. headquartered in Chattanooga, Tennessee; and Louisiana-Pacific Corporation headquartered in Nashville, Tennessee. | |

D. Kennedy Frierson, Jr., 47 Vice President and Chief Operating Officer | Director since 2012 and Vice President and Chief Operating Officer since August 2009. Vice President and President Masland Residential from February 2006 to July 2009. President Masland Residential from December 2005 to January 2006. Executive Vice President and General Manager, Dixie Home, 2003 to 2005. Business Unit Manager, Bretlin, 2002 to 2003. | |

Jon A. Faulkner, 53 Vice President and Chief Financial Officer | Vice President and Chief Financial Officer since October 2009. Vice President of Planning and Development from February 2002 to September 2009. Executive Vice President of Sales and Marketing for Steward, Inc. from 1997 to 2002. | |

Paul B. Comiskey, 62 Vice President and President, Dixie Residential | Vice President and President of Dixie Residential since August 2009. Vice President and President, Dixie Home from February 2007 to July 2009. President, Dixie Home from December 2006 to January 2007. Senior Vice President of Residential Sales, Mohawk Industries, Inc. from 1998 to 2006. Executive Vice President of Sales and Marketing for World Carpets from 1996 to 1998. | |

V. Lee Martin, 62 Vice President and President, Masland Contract | President, Masland Contract since August 2012 and Vice President since February 2013. President, Step 2 Surfaces, LLC from 2011 to August 2012. Corporate Vice President, Sales and Marketing, for J & J Industries from 1994 to 2011. | |

W. Derek Davis, 63 Vice President, Human Resources | Vice President of Human Resources since January 1991. Corporate Employee Relations Director, 1988 to 1991. | |

D. Eugene Lasater, 63 Controller | Controller since 1988. | |

Starr T. Klein, 71 Secretary | Secretary since November 1992. Assistant Secretary, 1987 to 1992. | |

The executive officers of the registrant are generally elected annually by the Board of Directors at its first meeting held after each annual meeting of our shareholders.

Part II.

| Item 5. | MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our Common Stock trades on the NASDAQ Global Market under the symbol DXYN. No market exists for our Class B Common Stock.

As of February 28, 2014, the total number of holders of our Common Stock was approximately 2,350 including an estimated 1,900 shareholders who hold our Common Stock in nominee names, but excluding approximately 580 participants in our 401(k) plan who may direct the voting of the shares allocated to their accounts. The total number of holders of our Class B Common Stock was 12.

Recent Sales of Unregistered Securities

None.

Issuer Purchases of Equity Securities

The following table provides information regarding our repurchases of shares of our Common Stock during the three months ended December 28, 2013:

| Fiscal Month Ending | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) | Maximum Number (or approximate dollar value) of Shares That May Yet Be Purchased Under Plans or Programs | ||||||||||

| November 2, 2013 | — | $ | — | — | ||||||||||

| November 30, 2013 | — | — | — | |||||||||||

| December 28, 2013 | — | — | — | |||||||||||

| Three Fiscal Months Ended December 28, 2013 | — | $ | — | — | $ | 4,268,461 | ||||||||

| (1) | On August 8, 2007, we announced a program to repurchase up to $10 million of our Common Stock. |

Quarterly Financial Data, Dividends and Price Range of Common Stock

Following are quarterly financial data, dividends and price range of Common Stock for the four quarterly periods in the years ended December 28, 2013 and December 29, 2012. Due to rounding, the totals of the quarterly information for each of the years reflected below may not necessarily equal the annual totals. The discussion of restrictions on payment of dividends is included in Note 9 to the Consolidated Financial Statements included herein.

| THE DIXIE GROUP, INC. | ||||||||||||||||

| QUARTERLY FINANCIAL DATA, DIVIDENDS AND PRICE RANGE OF COMMON STOCK | ||||||||||||||||

| (unaudited) (dollars in thousands, except per share data) | ||||||||||||||||

| 2013 | 1ST | 2ND | 3RD | 4TH | ||||||||||||

| Net sales | $ | 75,440 | $ | 83,617 | $ | 90,210 | $ | 95,799 | ||||||||

| Gross profit | 18,412 | 22,302 | 22,100 | 22,825 | ||||||||||||

| Operating income | 1,677 | 3,271 | 1,830 | 1,813 | ||||||||||||

| Income from continuing operations | 651 | 1,677 | 1,432 | 1,598 | ||||||||||||

| Loss from discontinued operations | (15 | ) | (32 | ) | (20 | ) | (1 | ) | ||||||||

| Net income | $ | 636 | $ | 1,645 | $ | 1,412 | $ | 1,597 | ||||||||

| Basic earnings per share: | ||||||||||||||||

| Continuing operations | $ | 0.05 | $ | 0.13 | $ | 0.11 | $ | 0.12 | ||||||||

| Discontinued operations | — | — | — | — | ||||||||||||

| Net income | $ | 0.05 | $ | 0.13 | $ | 0.11 | $ | 0.12 | ||||||||

| Diluted earnings per share: | ||||||||||||||||

| Continuing operations | $ | 0.05 | $ | 0.13 | $ | 0.11 | $ | 0.12 | ||||||||

| Discontinued operations | — | — | — | — | ||||||||||||

| Net income | $ | 0.05 | $ | 0.13 | $ | 0.11 | $ | 0.12 | ||||||||

| Common Stock Prices: | ||||||||||||||||

| High | $ | 5.93 | $ | 9.38 | $ | 12.05 | $ | 13.85 | ||||||||

| Low | 3.24 | 5.30 | 7.43 | 9.15 | ||||||||||||

| 2012 | 1ST | 2ND | 3RD | 4TH | ||||||||||||

| Net sales | $ | 62,851 | $ | 66,566 | $ | 65,822 | $ | 71,134 | ||||||||

| Gross profit | 15,703 | 15,719 | 16,557 | 17,395 | ||||||||||||

| Operating income (loss) | 620 | (40 | ) | 820 | 415 | |||||||||||

| Income (loss) from continuing operations | (104 | ) | (404 | ) | 269 | (413 | ) | |||||||||

| Loss from discontinued operations | (77 | ) | (29 | ) | (167 | ) | (2 | ) | ||||||||

| Net income (loss) | $ | (181 | ) | $ | (433 | ) | $ | 102 | $ | (415 | ) | |||||

| Basic earnings (loss) per share: | ||||||||||||||||

| Continuing operations | $ | (0.01 | ) | $ | (0.03 | ) | $ | 0.02 | $ | (0.03 | ) | |||||

| Discontinued operations | — | — | (0.01 | ) | — | |||||||||||

| Net income (loss) | $ | (0.01 | ) | $ | (0.03 | ) | $ | 0.01 | $ | (0.03 | ) | |||||

| Diluted earnings (loss) per share: | ||||||||||||||||

| Continuing operations | $ | (0.01 | ) | $ | (0.03 | ) | $ | 0.02 | $ | (0.03 | ) | |||||

| Discontinued operations | — | — | (0.01 | ) | — | |||||||||||

| Net income (loss) | $ | (0.01 | ) | $ | (0.03 | ) | $ | 0.01 | $ | (0.03 | ) | |||||

| Common Stock Prices: | ||||||||||||||||

| High | $ | 4.79 | $ | 4.25 | $ | 3.90 | $ | 4.38 | ||||||||

| Low | 2.83 | 3.20 | 3.02 | 2.95 | ||||||||||||

Shareholder Return Performance Presentation

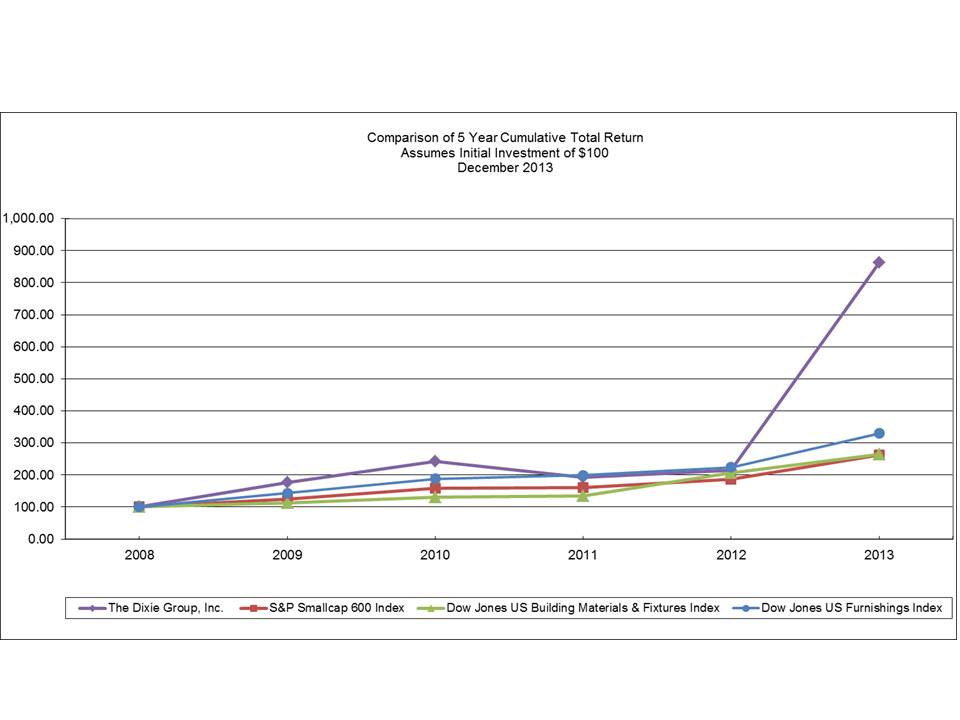

We compare our performance to two different industry indexes published by Dow Jones, Inc. The first of these is the Dow Jones Furnishings Index, which is composed of publicly traded companies classified by Dow Jones in the furnishings industry. The second is the Dow Jones Building Materials & Fixtures Index, which is composed of publicly traded companies classified by Dow Jones in the building materials and fixtures industry.

In accordance with SEC rules, set forth below is a line graph comparing the yearly change in the cumulative total shareholder return on our Common Stock against the total return of the Standard & Poor's 600 Stock Index, plus both the Dow Jones Furnishings Index and the Dow Jones Building Materials & Fixtures Index, in each case for the five year period ended December 28, 2013. The comparison assumes that $100.00 was invested on December 27, 2008, in our Common Stock, the S&P 600 Index, and each of the two Peer Groups, and assumes the reinvestment of dividends.

The foregoing shareholder performance presentation shall not be deemed "soliciting material" or to be "filed" with the Commission subject to Regulation 14A, or subject to the liabilities of Section 18 of the Exchange Act.

| Item 6. | SELECTED FINANCIAL DATA |

| The Dixie Group, Inc. | ||||||||||||||||||||

| Historical Summary | ||||||||||||||||||||

| (dollars in thousands, except share and per share data) | ||||||||||||||||||||

| FISCAL YEARS | 2013 | 2012 | 2011 (1) | 2010 (2) | 2009 (3) | |||||||||||||||

| OPERATIONS | ||||||||||||||||||||

| Net sales | $ | 345,066 | $ | 266,372 | $ | 270,110 | $ | 231,322 | $ | 203,480 | ||||||||||

| Gross profit | 85,639 | 65,372 | 65,506 | 56,651 | 52,106 | |||||||||||||||

| Operating income (loss) | 8,591 | 1,815 | 5,668 | (2,570 | ) | (45,389 | ) | |||||||||||||

| Income (loss) from continuing operations before taxes | 4,715 | (1,054 | ) | 1,956 | (6,977 | ) | (50,729 | ) | ||||||||||||

| Income tax provision (benefit) | (643 | ) | (401 | ) | 684 | (2,604 | ) | (8,870 | ) | |||||||||||

| Income (loss) from continuing operations | 5,358 | (653 | ) | 1,272 | (4,373 | ) | (41,859 | ) | ||||||||||||

| Depreciation and amortization | 10,262 | 9,396 | 9,649 | 11,575 | 13,504 | |||||||||||||||

| Dividends | — | — | — | — | — | |||||||||||||||

| Capital expenditures | 11,438 | 3,386 | 6,740 | 1,771 | 2,436 | |||||||||||||||

| Assets purchased under capital leases | 1,865 | 666 | 14 | 127 | — | |||||||||||||||

| FINANCIAL POSITION | ||||||||||||||||||||

| Total assets | $ | 248,866 | $ | 201,770 | $ | 182,943 | $ | 180,929 | $ | 181,944 | ||||||||||

| Working capital | 95,679 | 76,958 | 66,417 | 56,496 | 52,616 | |||||||||||||||

| Long-term debt | 101,759 | 80,166 | 65,357 | 58,070 | 59,349 | |||||||||||||||

| Stockholders' equity | 70,771 | 64,046 | 64,385 | 62,430 | 66,349 | |||||||||||||||

| PER SHARE | ||||||||||||||||||||

| Income (loss) from continuing operations: | ||||||||||||||||||||

| Basic | $ | 0.40 | $ | (0.05 | ) | $ | 0.10 | $ | (0.35 | ) | $ | (3.39 | ) | |||||||

| Diluted | 0.40 | (0.05 | ) | 0.10 | (0.35 | ) | (3.39 | ) | ||||||||||||

| Dividends: | ||||||||||||||||||||

| Common Stock | — | — | — | — | — | |||||||||||||||

| Class B Common Stock | — | — | — | — | — | |||||||||||||||

| Book value | 5.32 | 4.88 | 4.99 | 4.86 | 5.20 | |||||||||||||||

| GENERAL | ||||||||||||||||||||

| Weighted-average common shares outstanding: | ||||||||||||||||||||

| Basic | 12,736,835 | 12,637,657 | 12,585,396 | 12,524,358 | 12,330,648 | |||||||||||||||

| Diluted | 12,851,917 | 12,637,657 | 12,623,054 | 12,524,358 | 12,330,648 | |||||||||||||||

| Number of shareholders (4) | 2,350 | 1,800 | 1,750 | 1,750 | 1,860 | |||||||||||||||

| Number of associates | 1,423 | 1,200 | 1,171 | 1,150 | 1,050 | |||||||||||||||

| (1) | Includes income of $563, or $356 net of tax, for facility consolidation and severance in 2011. |

| (2) | Includes expenses of $1,556, or $1,008 net of tax, for facility consolidation and severance costs in 2010. |

| (3) | Includes expenses of $36,956, or $32,055 net of tax, for the impairment of goodwill and long-lived assets and facility consolidation and severance costs in 2009. |

| (4) | The approximate number of record holders of our Common Stock for 2009 through 2013 includes Management's estimate of shareholders who held our Common Stock in nominee names as follows: 2009 - 1,300 shareholders; 2010 - 1,250 shareholders; 2011 - 1,250 shareholders; 2012 - 1,255 shareholders; 2013 - 1,900 shareholders. |

| Item 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis should be read in conjunction with our consolidated financial statements and related notes appearing elsewhere in this report.

OVERVIEW

Publicly reported information has reflected improved factors in the economy in the United States that have positively affected the carpet industry beginning in the latter half of 2012 throughout 2013 with continuing improvement anticipated in 2014. These factors include an increase in new and existing home sales, residential remodeling and an increase in residential and commercial investment as a percentage of the United States Gross Domestic Product. We believe our business, driven more by resale and remodeling of existing homes and commercial facilities, has been positively affected by this overall market improvement during these periods. While our business was more deeply affected by the economic crisis as it reached the higher end markets where our business is concentrated, we believe our position in the upper end of the markets has permitted us to benefit from improved conditions and will allow us to take advantage of further anticipated growth in the upper end markets. Our residential and commercial sales growth rate for 2013 compared with 2012 was significantly above that of the industry.

During 2013 and 2012, we embarked upon several strategic and tactical initiatives that we believe will permit us to strengthen our future and allow us to return to sustained growth and profitability, although certain of these actions negatively impacted our results in 2013 and 2012. These items, further discussed below, include the investment in the development of certain new products, the acquisition of a continuous dyeing facility in North Georgia, the acquisition of certain rug manufacturing equipment and related business, realignment of certain of our broadloom tufting technologies from Atmore, Alabama into our North Georgia Eton facility, an opportunistic purchase of certain products from an industry competitor to incorporate into our product line and changes in both manufacturing and commercial business management during 2012. During 2013, we expanded our yarn processing capabilities at our Roanoke, Alabama yarn processing facility to support our growth with internal supply and lessen our dependence on externally supplied yarn requirements and acquired a wool manufacturing facility in Calhoun, Georgia that will permit us to enhance our wool processing capabilities and related product offerings. In addition, during 2013 we acquired certain dyeing technology we did not previously have that will further enhance our ability to provide a broader array of differentiated products.

We have taken advantage of several opportunities to invest in products we believe will further differentiate us from the competition. We have access to two new yarn systems that have been limited in distribution and, we believe, will provide exceptional softness and colorfastness qualities. In addition, we have developed a new “permaset process” for wool which we believe will allow our designer customers the broadest possible choice of colorations. As a result, during 2012 we invested at an increased rate in sampling initiatives related to these product offerings as compared to the same periods in the prior year. During 2013, we have seen positive market acceptance for the products associated with these investments.

During 2012, we relocated certain of our tufting technologies from our manufacturing facility in Atmore, Alabama to our facility in Eton, Georgia to achieve a more favorable cost structure for the products and markets served from those technologies. The tufting realignment was completed during 2012. This realignment resulted in incremental operating costs of approximately $926 thousand during 2012. This realignment positively affected our costs, manufacturing capabilities and costs structure during 2013.

On November 2, 2012, we acquired a continuous carpet dyeing facility in Calhoun, Georgia. The acquisition of this dyeing operation has allowed us to transition certain of our products from our beck dyeing operation in Atmore, Alabama and from other third party commission continuous dyeing operations located in North Georgia. This has allowed us to achieve significant cost reductions in the dyeing process and and the capacity to support future growth. The purchase price of this acquisition consisted of a $5.5 million, seller financed note, a cash payment of $239 thousand and $823 thousand representing the fair value of a five year, below market agreement to process certain of the seller's products on a commission basis during this period as we ramp up the dyeing of our products. In conjunction with the acquisition of these assets, we are in the process of assessing all of our dyeing and ancillary assets to determine whether and to what extent further rationalization of assets would be advisable.

On November 28, 2012, we acquired certain specialized wool rug tufting equipment and the associated business for total consideration valued at $2.6 million, consisting of $958 thousand of cash paid, $471 thousand representing the fair value of cash to be paid in equal installments over a three-year period and $1.1 million representing the fair value of contingent consideration over a three-year period. We were the major consumer of products produced by the seller on the equipment. The acquisition has allowed us to reduce our cost by permitting us to produce the goods in-house. Additionally, this has allowed us to support what we believe to be good growth potential in markets we currently serve and provide access to other markets.

Additionally, during 2012, we made a change in our manufacturing management in connection with the realignment and relocation of our tufting equipment. We also brought in new leadership for our commercial business in an effort to strengthen our performance in our commercial sector. These actions resulted in incremental costs of approximately $600 thousand in 2012.

We believe the management changes have positively affected our commercial business in terms of sales growth, manufacturing cost improvements and return on investment.

On June 30, 2013, we completed the acquisition of Robertex Associates, Inc., a high-end manufacturer of specialty wool floorcovering products marketed under the names of “Robertex” and “Carousel”. This acquisition will allow us to strengthen our position in our wool product line where we have seen strong growth, although these products appeal to a more select and discriminating customer base. The purchase price of the acquisition was approximately $6.0 million, plus additional consideration contingent upon growth in gross margins of selected products for five years subsequent to the acquisition. In order to appropriately support the increased wool business, we are realigning certain manufacturing equipment in this facility and infrastructure across our Company related to wool products. As our wool production capabilities are being expanded and enhanced, we are developing new products and investing in increased product sampling for these products. Until such time that all of these actions have been completed and products are in the field, there will be a negative effect on our results.

Subsequent to our 2013 year end, on January 20, 2014, our Board of Directors approved a 2014 Warehousing/Distribution/Manufacturing Restructuring Plan intended to align our warehousing, distribution and manufacturing to support our growth and manufacturing strategy. The plan is intended to create a better cost structure and improve distribution capabilities and customer service. The key element and first major step of this plan is the leasing and occupancy of a 292,000 square foot finished goods warehouse, cut-order and distribution facility in Adairsville, Georgia; such lease and occupancy to commence as of May 1, 2014.

We expect the plan to be substantially completed in the second quarter of the fiscal year ending December 26, 2015. We currently expect the implementation of this plan will result in total restructuring expenses of approximately $2.4 million, with approximately $1.3 million of such expenses during the fiscal year ending December 27, 2014 and approximately $1.1 million of such expenses during the fiscal year ending December 26, 2015, primarily consisting of moving and relocation expenses, information technology expenses and expenses relating to conversion and realignment of equipment.

We remain optimistic about conditions that affect the higher-end residential markets we serve and continue to address initiatives in our commercial offerings related to our products, manufacturing processes and distribution alternatives.

RESULTS OF OPERATIONS

Our discussion and analysis of financial condition and results of operations is based on our Consolidated Financial Statements that were prepared in accordance with U. S. generally accepted accounting principles.

Each of our 2013 and 2012 quarterly fiscal periods contained 13 operating weeks. Our first quarter of 2011 contained 14 operating weeks while our second through fourth quarters of 2011 contained 13 operating weeks; therefore, 2013 and 2012 contained 52 operating weeks compared with 53 operating weeks in 2011. Discussions below related to percentage changes in net sales in 2012 compared with 2011 have been adjusted to reflect the comparable number of weeks and are qualified with the term “net sales as adjusted”. We believe "net sales as adjusted" will assist our financial statement users in understanding the rate of growth in our business in the comparative periods. (See reconciliation of net sales to net sales as adjusted in the table below.)

Reconciliation of Net Sales to Net Sales as Adjusted

| Fiscal Year Ended | Percent Increase (Decrease) | ||||||||||||||||

| December 28, 2013 | December 29, 2012 | December 31, 2011 | 2013 vs. 2012 | 2012 vs. 2011 | |||||||||||||

| Net sales as reported | $ | 345,066 | $ | 266,372 | $ | 270,110 | 29.5 | % | (1.4 | )% | |||||||

| Adjustment to net sales: | |||||||||||||||||

| Impact of shipping weeks | — | — | (4,711 | ) | |||||||||||||

| Net sales as adjusted | $ | 345,066 | $ | 266,372 | $ | 265,399 | 29.5 | % | 0.4 | % | |||||||

The following table sets forth certain elements of our continuing operations as a percentage of net sales for the periods indicated:

| Fiscal Year Ended | ||||||||

| December 28, 2013 | December 29, 2012 | December 31, 2011 | ||||||

| Net sales | 100.0 | % | 100.0 | % | 100.0 | % | ||

| Cost of sales | 75.2 | % | 75.5 | % | 75.7 | % | ||

| Gross profit | 24.8 | % | 24.5 | % | 24.3 | % | ||

| Selling and administrative expenses | 22.2 | % | 23.8 | % | 22.5 | % | ||

| Other operating (income) expense, net | 0.1 | % | — | % | (0.1 | )% | ||

| Facility consolidation and severance expense, net | — | % | — | % | (0.2 | )% | ||

| Operating income | 2.5 | % | 0.7 | % | 2.1 | % | ||

Fiscal Year Ended December 28, 2013 Compared with Fiscal Year Ended December 29, 2012

Net Sales. Net sales for the year ended December 28, 2013 were $345.1 million compared with $266.4 million in the year-earlier period, an increase of 29.5% for the year-over-year comparison. The carpet industry reported a percentage increase in the mid- single digits in net sales in 2013 compared with 2012. Our 2013 year-over-year carpet sales comparison reflected an increase of 28.9% in net sales. Sales of residential carpet are up 28.5% and sales of commercial carpet increased 30.1%. Revenue from carpet yarn processing and carpet dyeing and finishing services increased $4.1 million in 2013 compared with 2012. We believe our residential and commercial sales were positively affected primarily as a result of the introduction of new products and the expansion of our wool products.

Cost of Sales. Cost of sales, as a percentage of net sales, was basically unchanged in 2013 compared with 2012. Cost of sales in 2013 included approximately $5.1 million of costs associated with acquisitions in late 2012 and 2013 as well as certain process realignment and expansion initiatives undertaken during 2013. Cost of sales in 2012 included incremental costs of approximately $1.4 million related to tufting equipment relocations and costs related to the transition of products from our beck dyeing operations to our continuous dyeing operations acquired in the fourth quarter of 2012.

Gross Profit. Gross profit increased $20.3 million in 2013 compared with 2012. The increase in gross profit was primarily attributable to higher sales. Gross profit in 2013 and 2012 was negatively affected by the incremental costs discussed above related to costs of sales.

Selling and Administrative Expenses. Selling and administrative expenses were $76.6 million in 2013 compared with $63.5 million in 2012, a decline of 1.6 percentage points as a percentage of sales in 2013 compared with 2012. Selling and administrative costs in 2013 included approximately $1.8 million of sampling costs incurred to incorporate the new wool products associated with the Robertex acquisition and our launch of a new tile product line. 2012 included $1.7 million related to investment in the development and sampling of new product initiatives, $409 thousand for incremental costs related to the two acquisitions and $600 thousand of costs related to management changes.

Other Operating (Income) Expense, Net. Net other operating (income) expense was $494 thousand in 2013 compared with $68 thousand in 2012. The change in 2013 was due to the disposal of certain manufacturing assets taken out of service, losses on currency valuations and settlement of a claim against a supplier.

Operating Income. Operating income was $8.6 million in 2013 compared with operating income of $1.8 million in 2012. The increase in 2013 was primarily a result of the increased level of sales in 2013, less the variable selling expenses associated with the sales increase.

Interest Expense. Interest expense increased $610 thousand in 2013 principally due to higher levels of debt to support our growth, including an increase in debt related to business acquisitions in late 2012 and during mid-2013.

Other (Income) Expense, Net. Other (income) expense, net was an expense of $26 thousand in 2013 compared to income of $277 thousand in 2012. The change was primarily the result of a $187 thousand gain recognized on the sale of a non-operating asset in 2012.

Income Tax Provision (Benefit). Our income tax provision was a benefit of $643 thousand in 2013 on positive earnings primarily as a result of the reversal of $1.2 million of previously established reserves for state income tax loss and tax credit carryforwards. The reversal of the reserves was based on a number of factors including current and future earnings assumptions by taxing jurisdiction. Additionally, 2013 included certain tax credits of approximately $520 thousand related to the years 2009 - 2011 determined to be available for utilization and $304 thousand of 2012 research and development tax credits that could not be recognized until the extension of the credit was approved by Congress in 2013. Our effective income tax benefit rate was 38.0% in 2012. The effective tax rate varied from statutory rates in 2012 primarily as a result of adjustments to

estimates used in the 2011 estimated tax calculations versus amounts used in the subsequent tax return filing for the 2011 period, net of the effects of permanent differences on the lower level of pre-tax earnings in the 2012 tax calculations.

Net Income (Loss). Continuing operations reflected income of $5.4 million, or $0.40 per diluted share in 2013, compared with a loss from continuing operations of $653 thousand, or $0.05 per diluted share in 2012. Our discontinued operations reflected a loss of $68 thousand, or $0.01 per diluted share in 2013, compared with a loss of $274 thousand, or $0.02 per diluted share in 2012. Including discontinued operations, our net income was $5.3 million, or $0.39 per diluted share, in 2013 compared with a net loss of $927 thousand, or $0.07 per diluted share, in 2012.

Fiscal Year Ended December 29, 2012 Compared with Fiscal Year Ended December 31, 2011

Net Sales. Net sales for the year ended December 29, 2012 were $266.4 million compared with $270.1 million in the year-earlier period, a decrease of 1.4% for the year-over-year comparison. Net sales in 2012 reflected an increase of 0.4% compared with 2011 on a "net sales as adjusted" basis. The carpet industry reported a percentage increase in the low single digits in net sales in 2012. Our 2012 year-over-year carpet sales comparison reflected a decrease of 1.8% in net sales, or 0.1% on a "net sales as adjusted" basis. Sales of residential carpet are up 2.5%, or 4.3% on a "net sales as adjusted" basis and sales of commercial carpet declined 12.7%, or 11.1% on a "net sales as adjusted" basis. Revenue from carpet yarn processing and carpet dyeing and finishing services increased $1.1 million in 2012 compared with 2011.

Cost of Sales. Cost of sales, as a percentage of net sales, was basically unchanged; a decrease of 0.2 percentage points in 2012 compared with 2011. Cost of sales included costs of approximately $926 thousand in 2012 related to tufting equipment relocations. Other manufacturing efficiencies and cost improvements more than offset these relocation costs.

Gross Profit. Gross profit was basically unchanged in both total dollars and as a percentage of net sales in 2012 compared with 2011. Gross profit on lower sales in 2012 was affected by costs of approximately $926 thousand incurred in 2012 related to tufting equipment relocations. However, we experienced more favorable product mix in our residential products in 2012 compared with 2011.

Selling and Administrative Expenses. Selling and administrative expenses reflected an increase of $2.8 million, or 1.3 percentage points as a percentage of sales in 2012 compared with 2011. The increase is primarily a result of an increase of $1.7 million related to investment in the development and sampling of new product initiatives, $409 thousand for costs related to the two acquisitions and $600 thousand of costs related to management changes.

Other Operating (Income) Expense, Net. Net other operating expense was $68 thousand in 2012 compared with net other operating income of $266 thousand in 2011. The change was due to a settlement gain of $492 thousand recognized in 2011 related to a company-owned insurance policy, net of a decrease in certain retirement related expenses of $170 thousand in 2012 compared with 2011.

Facility Consolidation and Severance (Benefit) Expense, Net. Facility consolidation and severance expenses reflected a cost reduction of $563 thousand in 2011. The gain in 2011 was a result of the favorable settlement of a lease obligation in 2011 compared with the amount previously reserved under our restructuring plan.

Operating Income (Loss). Operating income was $1.8 million in 2012 compared with operating income of $5.7 million in 2011. The decrease in 2012 was primarily a result of the higher selling and administrative expenses and gains in 2011 related to the facilities consolidation and company-owned life insurance of $563 thousand and $492 thousand, respectively.

Interest Expense. Interest expense decreased $324 thousand in 2012 principally due to lower interest rates in 2012 compared with 2011.

Other (Income) Expense, Net. Other income was $277 thousand in 2012 compared with income of $75 thousand in 2011, an improvement of $202 thousand. The change was primarily the result of a gain recognized on the sale of a non-operating asset in 2012.

Refinancing Expenses. Expenses of $317 thousand were recorded in the third quarter of 2011 related to refinancing our senior credit and term loan facility and included the costs associated with the extinguishment or modification of existing debt and the addition of new debt arrangements.

Income Tax Provision (Benefit). Our effective income tax benefit rate was 38.0% in 2012, compared with an effective income tax provision rate of 35.0% in 2011. The effective tax rate varied from statutory rates in 2012 primarily as a result of adjustments to estimates used in the 2011 estimated tax calculations versus amounts used in the subsequent tax return filing for the 2011 period, net of the effects of permanent differences on the lower level of pre-tax earnings in the 2012 tax calculations.

Net Income (Loss). Continuing operations reflected a loss of $653 thousand, or $0.05 per diluted share in 2012, compared with income from continuing operations of $1.3 million, or $0.10 per diluted share in 2011. Our discontinued operations reflected a loss of $274 thousand, or $0.02 per diluted share in 2012, compared with a loss of $286 thousand, or $0.02 per diluted share in

2011. Including discontinued operations, our net loss was $927 thousand, or $0.07 per diluted share, in 2012 compared with net income of $986 thousand, or $0.08 per diluted share, in 2011.

LIQUIDITY AND CAPITAL RESOURCES

We believe our operating cash flows, credit availability under our senior loan and security agreement and other sources of financing are adequate to finance our normal foreseeable liquidity requirements. However, deterioration in our markets or significant additional cash expenditures above our normal liquidity requirements could require supplemental financing or other funding sources. There can be no assurance that such supplemental financing or other sources of funding can be obtained or will be obtained on terms favorable to us.

Cash Sources and Uses. During the year ended December 28, 2013, cash provided from financing activities was $19.2 million. $5.9 million was used to fund our operating activities, $11.4 million to invest in property, plant and equipment and $2.2 million cash paid in business combination. Working capital increased $18.7 million in 2013, including an increase in inventories of $21.4 million to support higher levels of business activity and an increase of $11.6 million in accounts receivable primarily related to the higher level of sales. Additionally, other current assets increased approximately $2.0 million as a result of deposits related to equipment financing arrangements and the current portion of deferred tax assets. Accounts payable increased $6.8 million in 2013 compared with 2012 primarily as a result raw material purchases associated with the increased levels of business and accrued expenses increased $7.1 million primarily as a result of significant growth in our business during 2013. Additionally, the current portion of debt reflected an increase of $2.2 million as of the 2013 balance sheet date compared with the 2012 comparative period related to increases in funded debt levels outside of our revolving facility.

Capital expenditures, excluding assets acquired under business acquisitions, were $13.3 million in 2013; $11.4 million through funded debt and $1.9 million of equipment acquired under capital leases, $4.1 million in 2012 and $6.8 million in 2011. Depreciation and amortization were $10.3 million in 2013, $9.4 million in 2012 and $9.6 million in 2011. A significant portion of capital expenditures in 2013 were directed toward expanding manufacturing capabilities while capital expenditures in 2012 and 2011 were directed to a greater degree toward new and more efficient manufacturing capabilities and, to a lesser extent in each year, computer software enhancements. We expect capital expenditures to be approximately $16 million in 2014, while depreciation and amortization are expected to be approximately $12 million. Planned capital expenditures in 2014 are primarily directed toward both new manufacturing equipment and an expansion and realignment of our warehousing, cut order, distribution and certain manufacturing processes.

Senior Credit Facility. On September 14, 2011, we entered into a five-year, secured revolving credit facility (the "senior credit facility"). The senior credit facility provided for a maximum of $90.0 million of revolving credit, subject to borrowing base availability, including limited amounts of credit in the form of letters of credit and swingline loans. The borrowing base was equal to specified percentages of our eligible accounts receivable, inventories and fixed assets less reserves established, from time to time, by the administrative agent under the senior credit facility. We can use the proceeds of the senior credit facility for general corporate purposes, including financing acquisitions and refinancing other indebtedness.

At our election, revolving loans under the senior credit facility bore interest at annual rates equal to either (a) LIBOR for 1, 2 or 3 month periods, as selected by us, plus an applicable margin of either 2.00% or 2.25%, or (b) the higher of the prime rate, the Federal Funds rate plus 0.5%, or a daily LIBOR rate, plus an applicable margin of either 1.00% or 1.50%. The applicable margin was determined based on availability under the senior credit facility with margins increasing as availability decreases. We also paid an unused line fee on the average amount by which the aggregate commitments exceed utilization of the senior credit facility equal to 0.375% per annum.

The senior credit facility included certain affirmative and negative covenants that imposed restrictions on our financial and business operations, including limitations on debt, liens, investments, fundamental changes in our business, asset dispositions, dividends and other similar restricted payments, transactions with affiliates, payments and modifications of certain existing debt, future negative pledges, and changes in the nature of our business. We were also required to maintain a fixed charge coverage ratio of 1.1 to 1.0 during any period that borrowing availability was less than $10.0 million.

Amended Senior Credit Facility. As amended, our senior credit facility ("amended senior credit facility") provides for a maximum of $130.0 million of revolving credit, subject to borrowing base availability. The borrowing base is currently equal to specified percentages of our eligible accounts receivable, inventories, fixed assets and real property less reserves established, from time to time, by the administrative agent under the facility. In addition, the term of the facility was extended to August 1, 2018.

At our election, revolving loans under the amended senior credit facility bear interest at annual rates equal to either (a) LIBOR for 1, 2 or 3 month periods, as selected by us, plus an applicable margin of either 1.50%, 1.75% or 2.00%, or (b) the higher of the prime rate, the Federal Funds rate plus 0.5%, or a daily LIBOR rate plus 1.00%, plus an applicable margin of either 0.50%, 0.75% or 1.00%. The applicable margin is determined based on availability under the amended senior credit facility with margins increasing as availability decreases. We continue to pay an unused line fee on the average amount by which the aggregate commitments exceed utilization of the senior credit facility equal to 0.375% per annum.

The amended senior credit facility continues to include certain affirmative and negative covenants that impose restrictions on our financial and business operations. The amended senior credit facility requires that we maintain a fixed charge coverage ratio of 1.1 to 1.0 during any period that borrowing availability is less than $14.4 million. At December 28, 2013, we were in compliance with the amended senior credit facility's covenants.

Average Interest Rates and Availability. The weighted-average interest rate on borrowings outstanding under the amended senior credit facility was 2.66% at December 28, 2013 and 3.59% at December 29, 2012. As of December 28, 2013, the unused borrowing availability under the amended senior credit facility was $32.6 million.

Mortgage Note Payable. On April 1, 2013, we terminated our five-year $11.1 million mortgage loan which had a balance of $9.8 million. The mortgage loan was secured by our Susan Street real estate and liens secondary to the senior credit facility. The mortgage loan was scheduled to mature on September 13, 2016. Prior to the termination, the mortgage loan bore interest at a variable rate equal to one month LIBOR plus 3.00% and was payable in equal monthly installments of principal of $61 thousand, plus interest calculated on the declining balance of the mortgage loan, with a final payment of $7.4 million due on maturity.

Obligation to Development Authority of Gordon County. On November 2, 2012, we signed a 6% seller-financed note of $5.5 million with Lineage PCR, Inc. (“Lineage”) related to the acquisition of the continuous carpet dyeing facility in Calhoun, Georgia. Effective December 28, 2012 through a series of agreements between us, the Development Authority of Gordon County, Georgia (the “Authority”) and Lineage, obligations with identical payment terms as the original note to Lineage are now payment obligations to the Authority. These transactions were consummated in order to provide us with a tax abatement to the related real estate and equipment at this facility. The tax abatement plan provides for abatement for certain components of the real and personal property taxes for up to ten years. At any time, we have the option to pay off the obligation, plus a nominal amount. The debt to the Authority bears interest at 6% and is payable in equal monthly installments of principal and interest of $106 thousand over 57 months.