UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to Section 240.14a-12 |

DODGE & COX FUNDS

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

[Form of Shareholder Letter]

DODGE & COX FUNDS

Dodge & Cox Stock Fund

Dodge & Cox International Stock Fund

Dodge & Cox Balanced Fund

Dodge & Cox Income Fund

Dodge & Cox Global Stock Fund

March 5, 2014

Dear Shareholder:

I am writing to inform you of the upcoming SPECIAL MEETING of SHAREHOLDERS (the “Meeting”) of the Dodge & Cox Funds to be held on April 23, 2014, beginning at 10:00 a.m. Pacific Time. At the Meeting, you will be asked to vote on important proposals affecting each of the above-named Funds. In addition to electing Trustees to the Board of Trustees, you will be asked to remove or amend several fundamental investment restrictions of the Funds that Dodge & Cox and the Board of Trustees believe are outdated and unnecessary. As discussed in the Proxy Statement accompanying this letter, Dodge & Cox and the Board of Trustees believe that these proposals are in the Funds’ and your best interest. These proposals are not expected to materially affect the way your Fund is managed.

I am sure that you, like most people, lead a busy life and are tempted to put this proxy aside for another day. Please don’t. When shareholders do not return their proxies, additional expenses are incurred to pay for follow-up mailings and telephone calls.Please review the accompanying Proxy Statement and vote on the internet, by phone, or by mail today. If you hold shares in more than one Fund, you will receive a separate proxy card for each Fund you hold. Please be sure to vote each proxy card regardless of how many you receive.

The Board of Trustees of your Fund has unanimously approved these proposals and recommends a vote “FOR” each proposal. If you have any questions regarding the issues to be voted on or need assistance in completing your proxy card, please contact our proxy solicitor, D.F. King & Co., Inc., at 800-967-7858.

Thank you for your time in considering these important proposals. Thank you for investing with the Dodge & Cox Funds and for your continuing support.

|

| Sincerely, |

|

|

| Kenneth E. Olivier |

| Chairman of the Board of Trustees |

DODGE & COX FUNDS

Dodge & Cox Stock Fund

Dodge & Cox International Stock Fund

Dodge & Cox Balanced Fund

Dodge & Cox Income Fund

Dodge & Cox Global Stock Fund

A.P. Giannini Memorial Auditorium

555 California Street

San Francisco, CA

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

to be held on Wednesday, April 23, 2014

Notice is hereby given that Dodge & Cox Funds (the “Trust”) will hold a special meeting (the “Meeting”) of shareholders of the Dodge & Cox Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Balanced Fund, Dodge & Cox Income Fund, and Dodge & Cox Global Stock Fund, each a series of the Trust (each, a “Fund,” collectively, the “Funds”), on Wednesday, April 23, 2014, beginning at 10:00 AM Pacific Time in the A.P. Giannini Memorial Auditorium, 555 California Street, San Francisco, CA.

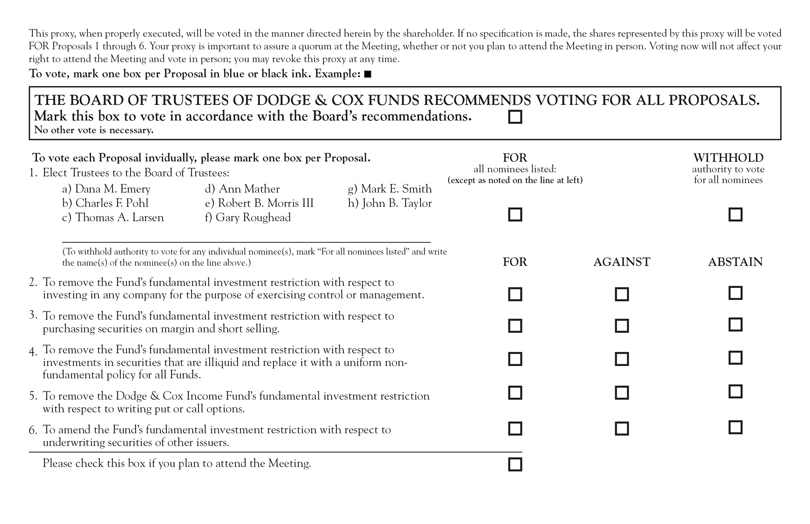

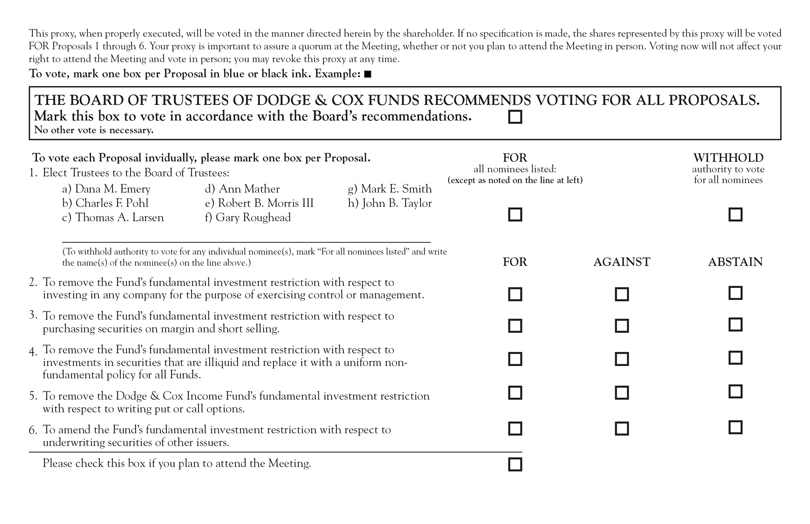

During the Meeting, shareholders of each of the Funds will vote on the following Proposals:

| | |

| Proposal 1: | | Elect Trustees to the Board of Trustees. |

| |

| Proposal 2: | | Remove each Fund’s fundamental investment restriction with respect to investing in any company for the purpose of exercising control or management. |

| |

| Proposal 3: | | Remove each Fund’s fundamental investment restriction with respect to purchasing securities on margin and short selling. |

| |

| Proposal 4: | | Remove each Fund’s fundamental investment restriction with respect to investments in securities that are illiquid and replace it with a uniform non-fundamental policy for all Funds. |

| |

| Proposal 5: | | Remove the Dodge & Cox Income Fund’s fundamental investment restriction with respect to writing put or call options. |

| |

| Proposal 6: | | Amend each Fund’s fundamental investment restriction with respect to underwriting securities of other issuers. |

| |

| Proposal 7: | | Transact such other business as may properly come before the Meeting or any adjournment thereof. |

The attached Proxy Statement provides additional information about this Meeting. Shareholders of record of a Fund as of the close of business on February 14, 2014 are entitled to vote at the Meeting and any adjournment(s) or postponement(s) thereof. Each share of the Funds is entitled to one vote, and a proportionate fractional vote for each fractional share held, with respect to each Proposal that is applicable to that Fund.

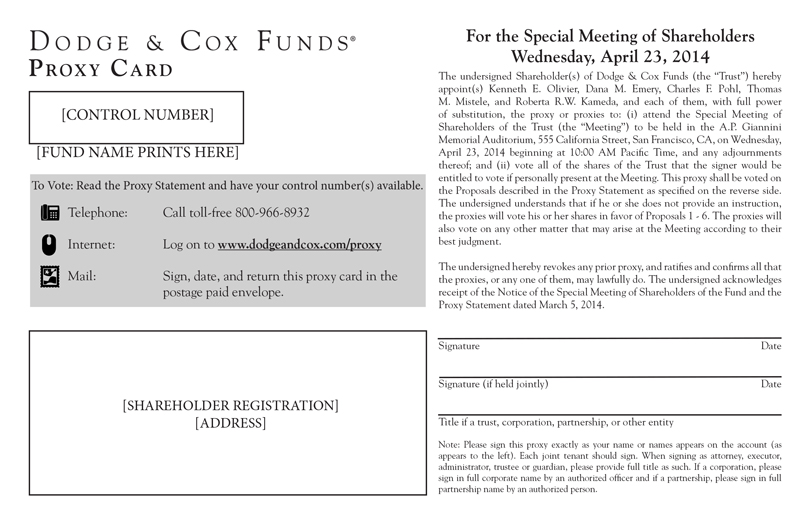

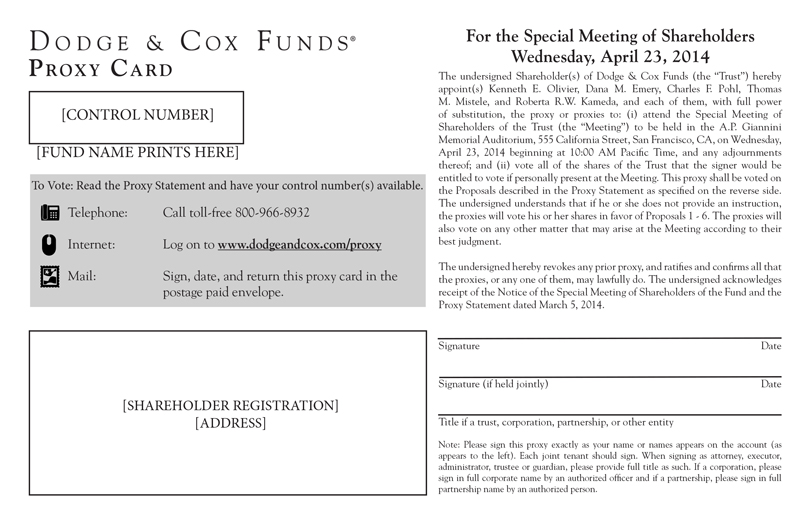

Whether or not you plan to attend the Meeting in person, please vote your shares. To vote by mail, please complete, date, and sign the enclosed proxy card(s) and return it in the self-addressed, postage-paid envelope. You may also vote by telephone or internet, as follows:

| | |

To vote by telephone: | | To vote by internet: |

(1) Read the Proxy Statement and have your proxy card(s) at hand. | | (1) Read the Proxy Statement and have your proxy card(s) at hand. |

(2) Call the toll-free number that appears on your proxy card(s). | | (2) Go to the internet address that appears on your proxy card(s). |

(3) Follow the simple instructions. | | (3) Follow the simple instructions. |

We encourage you to vote by telephone or internet using the control number that appears on the enclosed proxy card(s). Voting by telephone or internet will reduce the time and costs associated with this proxy solicitation. Whichever method of voting you choose, please read the enclosed Proxy Statement carefully before you vote. Voting now will not affect your right to attend the Meeting and vote in person. You may revoke your proxy at any time by executing a proxy bearing a later date or by attending and voting at the Meeting, though attending the meeting in person will not by itself revoke a previously tendered proxy.

The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting or any adjournments or postponements thereof.

If the necessary quorum to transact business or the vote required to approve a Proposal is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting with respect to that Proposal in accordance with applicable law to permit further solicitation of proxies.

If you attend the Meeting in person, you will be asked to present picture identification to be admitted. If your Dodge & Cox Funds shares are held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and your name will not appear on the Funds’ list of shareholders. If your Dodge & Cox Funds shares are held in street name and you wish to attend the Meeting in person, you should also bring with you a letter or account statement showing that you were the beneficial owner of the shares on the record date. Please note that the use of cameras, mobile phones, or other electronic devices to record or broadcast the Meeting is not permitted. Dodge & Cox reserves the right to inspect any persons or items prior to admission to the Meeting.

PLEASE RESPOND—WE ASK THAT YOU VOTE PROMPTLY IN ORDER TO AVOID THE ADDITIONAL EXPENSE OF FURTHER SOLICITATION.

YOUR VOTE IS IMPORTANT.

|

| By Order of the Board of Trustees, |

|

|

|

| Thomas M. Mistele |

| Secretary |

March 5, 2014

DODGE & COX FUNDS

Dodge & Cox Stock Fund

Dodge & Cox International Stock Fund

Dodge & Cox Balanced Fund

Dodge & Cox Income Fund

Dodge & Cox Global Stock Fund

SPECIAL MEETING OF SHAREHOLDERS

to be held on Wednesday, April 23, 2014

PROXY STATEMENT

GENERAL

This document is a proxy statement (the “Proxy Statement”). This Proxy Statement and enclosed proxy card(s) are being furnished to shareholders of each of the Dodge & Cox Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Balanced Fund, Dodge & Cox Income Fund, and Dodge & Cox Global Stock Fund (each a series of Dodge & Cox Funds) (each, a “Fund,” and collectively, the “Funds”) in connection with six Proposals. This Proxy Statement sets forth concisely the information that shareholders should know in order to evaluate the Proposals.

The Board of Trustees (the “Board,” the members of which are referred to herein as “Trustees”) of Dodge & Cox Funds (the “Trust”), is soliciting proxies from shareholders on behalf of each Fund, for use at the Meeting of Shareholders of each of the Funds, to be held in the A.P. Giannini Memorial Auditorium, 555 California Street, San Francisco, CA at 10:00 AM Pacific Time, on Wednesday, April 23, 2014, and at any and all adjournments thereof (each, a “Meeting”).

The Board has fixed the close of business on February 14, 2014, as the record date for determination of shareholders entitled to notice of and to vote at the Meeting (the “Record Date”). You are entitled to vote at the Meeting and any adjournment(s) or postponement(s) with respect to a Fund if you owned shares of that Fund at the close of business on the Record Date.

This Proxy Statement, the Notice of Meeting, and the proxy card(s) are first being mailed to shareholders on or about March 5, 2014.

At a Board meeting held on December 17, 2013, the Board unanimously approved and recommended that you vote FOR all the Proposals.

It is important for you to vote on the issues described in this Proxy Statement. We recommend that you read this Proxy Statement in its entirety to help you decide how to vote on the Proposals.

The following Proposals will be considered and acted upon at the Meeting:

Under the Investment Company Act of 1940, as amended (the “1940 Act”), a Fund’s “fundamental” investment restrictions may be changed only with shareholder approval.

With regard to Proposal 1, shareholders of each Fund will vote collectively as a single class on the election of each nominee to the Board of Trustees. The election of each nominee to the Board of Trustees must be approved by a plurality of the votes cast at the Meeting at which a quorum is present. With regard to Proposals 2 through 4 and 6, if a Proposal is approved by shareholders of one Fund and disapproved by shareholders of another Fund, the Proposal may be implemented for the Fund that approved the Proposal but will not be implemented for any Fund that did not approve the Proposal. Proposals 2 through 6 require the affirmative vote of a majority of each Fund’s outstanding voting securities (as defined in the 1940 Act) for the Proposal to pass with respect to that Fund, which, for these purposes, is the vote of: (1) 67% or more of the voting securities entitled to vote on the Proposal that are present at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy; or (2) more than 50% of the outstanding voting securities entitled to vote on the Proposal, whichever is less.

This Proxy Statement should be kept for future reference. The most recent Annual Report and Semi-Annual Report of the Funds, including financial statements, have been mailed previously to shareholders. If you would like to receive an additional copy of the Annual Report free of charge, or copies of any subsequent shareholder report, visit the Funds’ web site at www.dodgeandcox.com, contact the Trust at Dodge & Cox Funds, c/o Boston Financial Data Services, P.O. Box 8422, Boston, MA 02266-8422, or call 800-621-3979. Shareholder reports will be sent by first class mail within three business days of the receipt of the request.

2

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” PROPOSALS 1 THROUGH 6.

PROPOSAL 1: ALL FUNDS

APPROVAL TO ELECT TRUSTEES TO THE BOARD OF TRUSTEES.

The purpose of this Proposal is to elect eight nominees to the Board of Trustees of the Trust, two of whom do not currently serve as Trustees. Mmes. Dana M. Emery and Ann Mather and Messrs. Thomas A. Larsen, Robert B. Morris III, Gary Roughead, and John B. Taylor currently serve as Trustees. Messrs. Charles F. Pohl and Mark E. Smith do not currently serve as Trustees.

At the Meeting, Trustees of the Trust are to be elected, each to serve for a term of indefinite duration and until his or her successor is duly elected and qualifies, or until his or her earlier resignation or removal (as provided in the Trust’s Trust Instrument) or death. It is the intention of the persons named as proxies in the enclosed proxy card to vote the shares covered thereby for the election of the Trustee nominees named below, unless the proxy contains contrary instructions.

The nominees for election to the Board of Trustees are Mmes. Emery and Mather and Messrs. Larsen, Morris, Pohl, Roughead, Smith, and Taylor. Each of the nominees was recommended for nomination by the Nominating Committee of the Board of Trustees. Each of Ms. Mather and Messrs. Larsen, Morris, Roughead, Smith, and Taylor is not an “interested person” of the Trust, as that term is defined in Section 2(a)(19) of the 1940 Act (“Independent Trustees”).

Currently, Mr. Kenneth E. Olivier is Chairman of the Board of Trustees, and Messrs. John A. Gunn and L. Dale Crandall are Trustees of the Trust. Messrs. Olivier, Gunn, and Crandall are expected to retire upon election of the new trustees and, consequently, have not been proposed for election to the Board of Trustees at the Meeting.

Each of the nominees has consented to serve as a Trustee. The Board of Trustees knows of no reason why any of the nominees will be unable to serve, but in the event any nominee is unable to serve or for good cause will not serve, the proxies received indicating a vote in favor of such nominee will be voted for a substitute nominee as the Board of Trustees may recommend.

3

Nominees

Basic information concerning the nominees is set forth below. Unless otherwise indicated, the address of all persons below is 555 California Street, San Francisco, CA 94104. Each Trustee will oversee all five Funds in the Dodge & Cox Funds complex.

| | | | |

Name, (Age), Position with

the Trust, and Length of

Time Served | | Principal Occupation(s) During Past 5 Years | | Other Public Company

and Investment

Company Directorships

Held by Trustee During

the Past 5 Years |

|

Interested Nominees1 |

Charles F. Pohl (56) Chair-elect Senior Vice President since 2008 Officer since 2004 | | Chairman (since 2013), Co- President (2011-2013), Senior Vice President (until 2011), and Director of Dodge & Cox; Chief Investment Officer, Portfolio Manager, Investment Analyst, and member of the Investment Policy Committee (“IPC”), Global Stock Investment Policy Committee (“GSIPC”), International Investment Policy Committee (“IIPC”), and Fixed Income Investment Policy Committee (“FIIPC”). Mr. Pohl joined Dodge & Cox in 1984. | | None |

|

Dana M. Emery (52) President-elect Senior Vice President since 2008 Trustee since 1993 | | Chief Executive Officer (since 2013), President (since 2011), Executive Vice President (2011), and Director of Dodge & Cox; Director of Fixed Income, Portfolio Manager and member of FIIPC. Ms. Emery joined Dodge & Cox in 1983. | | None |

|

| 1 | Each “Interested Nominee” is an “interested person” of the Trust (as that term is defined in the 1940 Act) because of his or her affiliation with Dodge & Cox. |

4

| | | | |

Name, (Age), Position with

the Trust, and Length of

Time Served | | Principal Occupation(s) During Past 5 Years | | Other Public Company and Investment Company Directorships Held by Trustee During the Past 5 Years |

|

Independent Nominees | | |

Thomas A. Larsen (64) Trustee since 2002 | | Mr. Larsen has been Senior Counsel of Arnold & Porter LLP (a law firm) since 2013, prior to which he was a Partner. He previously was a Director of Howard, Rice, Nemerovski, Canady, Falk & Rabkin (a law firm) from 1977 to 2011, where he also served as Chair of the Real Estate and Private Client Services Groups. Mr. Larsen previously worked in the Office of the General Counsel of the Environmental Protection Agency. Mr. Larsen has served in leadership positions on advisory and trustee boards for many charitable, educational, and nonprofit organizations, as well as a private company. | | None |

|

Ann Mather (54) Trustee since 2011 | | Ms. Mather has served as the Chief Financial Officer or in other executive financial management positions with numerous public and private companies, including Polo Ralph Lauren, Buena Vista International, Inc., and, most recently, Pixar Animation Studios where she was CFO from 1999 to 2004. Ms. Mather has also served on a variety of public and private company boards, including as chair of the audit committee for several public company boards. | | Ms. Mather is a current Director of Google, Inc. (internet information services); Glu Mobile, Inc. (multimedia software); Netflix, Inc. (video services); Shutterfly, Inc. (internet photography services/publishing); and Solazyme Inc. (renewable oils). She formerly served as a Director of Central European Media Enterprises, Ltd. (vertically integrated media services) (until 2009) and MoneyGram International, Inc. (business services)(2010-13). |

|

Robert B. Morris III (61) Trustee since 2011 | | Mr. Morris most recently has served as an adviser to various financial services firms. During his career in the financial services industry, Mr. Morris worked with many leading firms, including Wells Fargo, Montgomery Securities, Prudential-Bache Securities, and Goldman Sachs, where he was a partner and managing director. Mr. Morris has served on advisory and trustee boards for many charitable, educational, and nonprofit organizations. | | None |

|

5

| | | | |

Name, (Age), Position with

the Trust, and Length of

Time Served | | Principal Occupation(s) During Past 5 Years | | Other Public Company and Investment Company Directorships Held by Trustee During the Past 5 Years |

|

Mark E. Smith (62) No current position with the Trust | | Mr. Smith served as a consultant from 2012 to 2013 at Brown Brothers Harriman, a privately-held financial institution, and at Loomis Sayles & Company, L.P., an investment manager. Prior to 2012, Mr. Smith served as Executive Vice President, Managing Director-Fixed Income at Loomis Sayles & Company, L.P. | | None |

|

John B. Taylor (67) Trustee since 2005 (and 1998-2001) | | Mr. Taylor has been a Professor of Economics at Stanford University since 1984 and a Senior Fellow at the Hoover Institution since 1996. He has served in numerous government positions, including, most recently, Under Secretary for International Affairs at the United States Treasury from 2001 to 2005. Previous government positions include service as a Director of the Overseas Private Investment Corporation, on the Advisory Panel of the Congressional Budget Office, and both a Member and Senior Staff Economist of the President’s Council of Economic Advisers. Mr. Taylor is actively involved in many economics professional societies. | | None |

|

Gary Roughead (62) Trustee Admiral Roughead was appointed to the Board of Trustees on December 17, 2013. | | Admiral Roughead (Ret.) has served since 2011 as the Annenberg Distinguished Visiting Fellow at the Hoover Institution at Stanford University. Admiral Roughead is a member of the Arctic Security Initiative (Chair), Task Force on Energy Policy, Military History Working Group and Foreign Policy Working Group at the Hoover Institution. From 1973 to 2011, Admiral Roughead served in the U.S. Navy. From 2007 to 2011, Admiral Roughead was the Chief of Naval Operations. During that period, Admiral Roughead was a Senior Officer in the U.S. Navy, Naval Advisor to the President and Secretary of Defense and a Member of the Joint Chiefs of Staff. | | Admiral Roughead is a current Director of Northrop Grumman Corp. (global security) |

|

6

Qualifications of Nominees; Leadership Structure and Risk Oversight Function

Each Fund is governed by the Board of Trustees of the Trust, which meets regularly to review a wide variety of matters affecting the Funds. The Trustees’ primary responsibility is oversight of the management of each Fund for the benefit of its shareholders, not day-to-day management. The Trustees set broad policies for the Funds; monitor Fund operations, service providers, regulatory compliance, performance, and costs; and nominate and select new Trustees. The Trustees also elect the Funds’ Officers and are responsible for performing various duties imposed on them by the 1940 Act, the laws of Delaware, and other laws. Dodge & Cox manages the day-to-day operations of the Funds under the direction of the Board of Trustees. The Board met 5 times during the fiscal year ended December 31, 2013.

Kenneth E. Olivier, an “interested” Trustee, currently serves as Chairman of the Board of Trustees. Following the Meeting and upon his election, Charles F. Pohl will serve as Chairman of the Board of Trustees. The Independent Trustees of the Funds have designated a Lead Independent Trustee, who functions as a spokesperson and principal point of contact for the Independent Trustees. The Lead Independent Trustee is responsible for coordinating the activities of the Independent Trustees, including calling and presiding at regular executive sessions of the Independent Trustees, developing the agenda of each Board meeting together with the Chairman, and representing the Independent Trustees in discussions with Dodge & Cox management. John B. Taylor currently serves as Lead Independent Trustee. The Funds’ Board has determined that its leadership and committee structure is appropriate because it sets the proper tone for the relationship between the Funds, on the one hand, and Dodge & Cox and the Funds’ other principal service providers, on the other, and facilitates the exercise of the Board’s independent judgment in evaluating and managing the relationships. In addition, the structure efficiently allocates responsibility among committees and the full Board.

Like other mutual funds, each of the Dodge & Cox Funds is subject to a variety of risks, including, among others, investment, valuation, compliance, and operational risks. Dodge & Cox and other service providers have primary responsibility for the Funds’ risk management on a day-to-day basis as part of their overall responsibilities. Dodge & Cox is also primarily responsible for managing investment risk and its own operational risks as part of its day-to-day investment management responsibilities. Dodge & Cox and the Funds’ Chief Compliance Officer (who reports directly to the Board’s Independent Trustees) assist the Board in overseeing the significant investment policies of the Funds and monitor the various compliance policies and procedures approved by the Board as part of its oversight responsibilities.

In discharging its oversight responsibilities, the Board of Trustees considers risk management issues throughout the year by reviewing regular reports prepared by Dodge & Cox and the Funds’ Chief Compliance Officer, as well as special written and oral reports or presentations provided on a variety of relevant issues, as needed. For example, Dodge & Cox reports to the Board quarterly on the investment performance of the Funds, the financial performance of the Funds, and overall market and economic conditions. Dodge & Cox also provides regular updates on legal and regulatory

7

developments that may affect the Funds. The Funds’ Chief Compliance Officer provides regular presentations to the Board at its quarterly meetings. The Funds’ Chief Compliance Officer also provides an annual report to the Board concerning, among other things, (i) any material compliance matters relating to the Funds, Dodge & Cox, and the Funds’ other key service providers; (ii) various risks identified as part of the Funds’ compliance program assessments; and (iii) any material recommended changes to policies and procedures. The Funds’ Chief Compliance Officer also meets regularly in executive session with the Independent Trustees and communicates any significant compliance-related issues and regulatory developments to the Audit and Compliance Committee between Board meetings.

In addressing issues regarding the Funds’ risk management between meetings, representatives of Dodge & Cox communicate with the Lead Independent Trustee and/or the Chairman of the Audit and Compliance Committee and other Independent Trustees. As appropriate, the Trustees confer among themselves, or with Dodge & Cox, the Funds’ Chief Compliance Officer, and independent legal counsel, to identify and review risk management issues that may be placed on the full Board’s agenda.

The Board also relies on its committees to administer the Board’s oversight function. The Audit and Compliance Committee, which is composed of all the Independent Trustees, provides oversight of financial and compliance risks and controls. The Audit and Compliance Committee assists the Board at various times throughout the year in reviewing with Dodge & Cox and the Funds’ independent auditors matters relating to financial accounting and reporting, systems of internal controls, and the Funds’ annual audit process. Ann Mather serves as Chairman of the Audit and Compliance Committee. The Valuation Committee reviews and makes recommendations concerning the fair valuation of portfolio securities and the Funds’ valuation procedures in general. Robert B. Morris serves as Chairman of the Valuation Committee. These and the Board’s other committees present reports to the Board that may prompt further discussion of issues concerning the oversight of the Funds’ risk management. The Board may also discuss particular risks that are not addressed in the committee process.

In addition to the committees discussed above, there are other committees upon which the Board relies when reviewing matters affecting the Funds. The Contract Review Committee considers the renewal of the Investment Management Agreements between the Funds and Dodge & Cox and such other material contracts as the Board and the Committee deem appropriate. Thomas A. Larsen serves as Chairman of the Contract Review Committee. The Governance Committee proposes members of the committees of the Board, evaluates and recommends to the Board the compensation of Trustees, and evaluates the performance of the Board as necessary. John B. Taylor serves as Chairman of the Governance Committee. The Nominating Committee determines such standards or qualifications for nominees to serve as Trustees on the Board, if any, as the Committee deems appropriate, identifies possible candidates to become members of the Board, considers and evaluates such candidates, and recommends Trustee nominees for the Board’s approval. John B. Taylor serves as Chairman of the Nominating Committee. For more information on the Board’s committees, please see the subsection below titled “Standing Committees of the Trust.”

8

All of the Trustees bring to the Board a wealth of executive leadership experience. The Board and its Nominating and Governance Committees select Independent Trustees with a view toward constituting a Board that, as a body, possesses the qualifications, skills, attributes, and experience to appropriately oversee the actions of the Funds’ service providers, decide upon matters of general policy, and represent the long-term interests of Fund shareholders. While the Nominating and Governance Committees have not adopted a specific policy on diversity in identifying nominees, they consider the qualifications, skills, attributes, and experience of the current Board members of the Funds, with a view toward maintaining a Board that is diverse in viewpoint, experience, education, and skills.

The Funds seek Independent Trustees who have high ethical standards and the highest levels of integrity and commitment, who have inquiring and independent minds, mature judgment, good communication skills, and other complementary personal qualifications and skills that enable them to function effectively in the context of the Funds’ Board and committee structure and who have the ability and willingness to dedicate sufficient time to effectively fulfill their duties and responsibilities. The business acumen, experience, and objective thinking of the Trustees are considered invaluable assets for Dodge & Cox management and the Funds.

The Independent Trustees collectively have a significant record of accomplishments in governance, business, not-for-profit organizations, government and military service, academia, law, accounting, or other professions. Although no single list could identify all the experience upon which the Funds’ Independent Trustees draw in connection with their service, the table above summarizes key experience for each Independent Trustee. These references to the qualifications, attributes, and skills of the Trustees are pursuant to the disclosure requirements of the U.S. Securities and Exchange Commission, and shall not be deemed to impose any greater responsibility or liability on any Trustee or the Board as a whole. Notwithstanding the qualifications listed above, none of the Independent Trustees is considered an “expert” within the meaning of the federal securities laws with respect to information in the Funds’ registration statement.

Interested Trustees have similar qualifications, skills, and attributes as the Independent Trustees. Interested Trustees are senior executive officers of Dodge & Cox. This management role with the Funds’ investment manager also permits them to make a significant contribution to the Funds’ Board.

Nominee Ownership of Fund Shares

The following table sets forth information describing the dollar range of shares in the Funds beneficially owned by each nominee and the aggregate dollar range of shares beneficially own by them in the Funds in the aggregate as of December 31, 2013, unless otherwise noted.

9

| | | | | | |

| Name of Trustee | | Dollar Range of Equity Securities in the Funds | | | | Aggregate Dollar Range of Equity Securities in

all Registered

Investment Companies

Overseen by Trustee in Family of

Investment Companies |

|

Interested Trustees | | | | |

| Charles F. Pohl1 | | Dodge & Cox Stock Fund Dodge & Cox Global Stock Fund Dodge & Cox International Stock Fund Dodge & Cox Balanced Fund Dodge & Cox Income Fund | | Over $100,000 Over $100,000 Over $100,000 Over $100,000 Over $100,000 | | Over $100,000 |

| Dana M. Emery | | Dodge & Cox Stock Fund Dodge & Cox Global Stock Fund Dodge & Cox International Stock Fund Dodge & Cox Balanced Fund Dodge & Cox Income Fund | | Over $100,000 Over $100,000 Over $100,000 Over $100,000 Over $100,000 | | Over $100,000 |

Independent Trustees | | | | |

| Thomas A. Larsen | | Dodge & Cox Stock Fund Dodge & Cox Global Stock Fund Dodge & Cox International Stock Fund Dodge & Cox Balanced Fund Dodge & Cox Income Fund | | Over $100,000 Over $100,000 Over $100,000 None Over $100,000 | | Over $100,000 |

| Ann Mather | | Dodge & Cox Stock Fund Dodge & Cox Global Stock Fund Dodge & Cox International Stock Fund Dodge & Cox Balanced Fund Dodge & Cox Income Fund | | $10,001-$50,000 $10,001-$50,000 $10,001-$50,000 $10,001-$50,000 $10,001-$50,000 | | Over $100,000 |

| Robert B. Morris | | Dodge & Cox Stock Fund Dodge & Cox Global Stock Fund Dodge & Cox International Stock Fund Dodge & Cox Balanced Fund Dodge & Cox Income Fund | | Over $100,000 Over $100,000 Over $100,000 Over $100,000 None | | Over $100,000 |

| Gary Roughead2 | | Dodge & Cox Stock Fund Dodge & Cox Global Stock Fund Dodge & Cox International Stock Fund Dodge & Cox Balanced Fund Dodge & Cox Income Fund | | $10,001-$50,000 $10,001-$50,000 None $10,001-$50,000 None | | $10,001-$50,000 |

Mark E. Smith1 | | Dodge & Cox Stock Fund Dodge & Cox Global Stock Fund Dodge & Cox International Stock Fund Dodge & Cox Balanced Fund Dodge & Cox Income Fund | | Over $100,000 None None None None | | Over $100,000 |

| John B. Taylor | | Dodge & Cox Stock Fund Dodge & Cox Global Stock Fund Dodge & Cox International Stock Fund Dodge & Cox Balanced Fund Dodge & Cox Income Fund | | Over $100,000 None Over $100,000 None Over $100,000 | | Over $100,000 |

| 1 | Proposed to join Board. |

| 2 | Joined Board on December 17, 2013; holdings are as of February 15, 2014. |

10

As of December 31, 2013, no Trustee or nominee for election to the Board of Trustees owned more than 1% of the outstanding shares of a Fund. As of December 31, 2013, the Trustees and Officers as a group owned less than 1% of the outstanding shares of Dodge & Cox Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Balanced Fund, and Dodge & Cox Income Fund. As of December 31, 2013, the Trustees and Officers as a group owned 1.6% of the outstanding shares of Dodge & Cox Global Stock Fund.

Ownership of Certain Entities

As of December 31, 2013, no Independent Trustee nominee or his immediate family members own securities, beneficially or of record, in Dodge & Cox or a person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with Dodge & Cox.

Compensation Table

The following table shows compensation paid by the Trust to Independent Trustee nominees for the fiscal year ended December 31, 2013. The Trust does not pay any other remuneration to its Officers or Trustees, and has no bonus, profit-sharing, pension, or retirement plan.

| | | | |

Independent Trustee | | Total Compensation from Funds and the Dodge& Cox Funds Complex paid to Trustees for Year Ended December 31, 2013 | |

Thomas A. Larsen | | $ | 210,000 | |

Ann Mather | | $ | 200,000 | |

Robert B. Morris | | $ | 225,000 | |

John B. Taylor | | $ | 210,000 | |

Gary Roughead | | | N/A | 3 |

| 3 | Joined Board on December 17, 2013. |

11

Standing Committees of the Trust

The Board of Trustees has the five standing committees listed below:

| | | | | | |

| Committee | | Functions | | Members | | Number of

Meetings Held

During the Last

Fiscal Year |

|

| Audit and Compliance Committee | | Oversee the accounting and financial reporting processes of the Trust and each Fund and its internal controls and, as the Committee deems appropriate, inquire into the internal controls of certain third-party service providers; oversee the quality and integrity of the Funds’ financial statements and the independent audit thereof; oversee, or, as appropriate, assist Board of Trustees’ oversight of, the Funds’ compliance with legal and regulatory requirements that relate to the Funds’ accounting and financial reporting, internal controls and independent audits; approve prior to appointment the engagement of the Funds’ independent auditors and, in connection therewith, review and evaluate the qualifications, independence and performance of the Funds’ independent auditors; and act as a liaison between the Funds’ independent auditors and Chief Compliance Officer and the Board. | | L. Dale Crandall Thomas A. Larsen Ann Mather (Chairman) Robert B. Morris Gary Roughead John B. Taylor | | 2 |

| | | |

| Contract Review Committee | | Consider the renewal of the Investment Management Agreements between the Funds and Dodge & Cox pursuant to Section 15(c) of the 1940 Act and such other material contracts as the Board and Committee deem appropriate. | | L. Dale Crandall Thomas A. Larsen (Chairman) Ann Mather Robert B. Morris Gary Roughead John B. Taylor | | 2 |

| Governance Committee | | Nominate proposed members of committees of the Board; evaluate and recommend to the Board the compensation of Trustees and Trustee expense reimbursement policies; and evaluate the performance of the Board as deemed necessary. | | L. Dale Crandall Thomas A. Larsen Ann Mather Robert B. Morris Gary Roughead John B. Taylor (Chairman) | | 4 |

| | | |

| Nominating Committee | | Determine such standards or qualifications for nominees to serve as Trustees, if any, as the Committee deems appropriate; identify possible candidates to become members of the Board in the event that a Trustee position is vacated or created and/or in contemplation of a shareholders’ meeting at which one or more Trustees is to be elected; and consider and evaluate such candidates and recommend Trustee nominees for the Board’s approval. | | L. Dale Crandall Thomas A. Larsen Ann Mather Robert B. Morris Gary Roughead John B. Taylor (Chairman) | | 7 |

12

| | | | | | |

| Committee | | Functions | | Members | | Number of

Meetings Held

During the Last

Fiscal Year |

|

| Valuation Committee | | Review and approve the Funds’ valuation procedures; provide oversight for pricing of securities and calculation of net asset value; review “fair valuations”; and review determinations of liquidity of the Funds’ securities. | | L. Dale Crandall Thomas A. Larsen Ann Mather Robert B. Morris (Chairman) Gary Roughead John B. Taylor | | 1 |

The Nominating Committee has a charter, which is attached asExhibit B.

The Nominating Committee will consider shareholder recommendations for Trustee nominees. Shareholders may send recommendations to the Secretary at Dodge & Cox Funds, c/o Dodge & Cox, 555 California Street, 40th Floor, San Francisco, CA 94104.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS OF EACH FUND VOTE “FOR” THE ELECTION OF TRUSTEES TO THE BOARD OF TRUSTEES IN THIS PROPOSAL 1.

A NOTE REGARDING PROPOSALS 2 THROUGH 6

With regard to Proposals 2 through 6, Dodge & Cox and the Board each notes that many of the current fundamental investment restrictions of the Funds were initially drafted many (in some cases over forty) years ago. Now, such restrictions may be outdated, may unnecessarily restrict the flexibility of each Fund in pursuing its investment objectives and strategies, or may present unnecessary compliance obligations. Accordingly, Dodge & Cox and the Board recommend taking this opportunity to address Proposals 2 through 6. It should also be noted that in 2007, each Fund’s shareholders approved amendments to a different set of fundamental investment restrictions, which Dodge & Cox and the Board also proposed out of a concern that such fundamental investment restrictions were outdated and unnecessary. The passage of Proposals 2 through 6 would complete the modernization of the Fund’s fundamental investment restrictions.

Dodge & Cox and the Board do not propose or anticipate any material change in the management of the Funds as a result of the removal or amendment of the fundamental investment restrictions in Proposals 2 through 6, but such changes may allow the Funds added flexibility in the future in pursuing their investment objectives and strategies. Furthermore, passage of Proposals 2 through 6 will allow the Funds to avoid the costs, including potential opportunity costs, associated with arranging a future shareholder meeting to address Proposals 2 through 6 should Dodge & Cox and the Board in the future decide to make material changes to the management of the Funds. Any material changes to the management of the Funds in the future will require consideration by the Board and disclosure in the relevant Fund’s prospectus or statement of additional information, as appropriate.

13

PROPOSAL 2: ALL FUNDS

APPROVAL TO REMOVE EACH FUND’S FUNDAMENTAL INVESTMENT RESTRICTION WITH RESPECT TO INVESTING IN ANY COMPANY FOR THE PURPOSE OF EXERCISING CONTROL OR MANAGEMENT

The Board recommends that shareholders of each Fund approve the removal of the Fund’s fundamental investment restriction with respect to investing in any company for the purpose of exercising control or management.

| | | | |

Applicable Fund | | Current Fundamental Policy/

Restriction | | Proposed New Fundamental Policy/ Restriction |

All Funds | | Each Fund may not invest in any company for the purpose of exercising control or management. | | It is proposed that this restriction be removed. |

In making their recommendations to the shareholders of each Fund to remove this restriction, Dodge & Cox and the Board note that the investment restriction regarding investing in a company for the purpose of exercising control or management of the company was based on the requirements previously imposed by state “Blue Sky” regulators as a condition to registration. Under the National Securities Markets Improvement Act of 1996, state securities regulators are no longer permitted to impose substantive investment restrictions of this nature on mutual funds. This restriction is not required by the 1940 Act and Dodge & Cox and the Board believe that it is in the best interest of the Funds to remove unnecessary fundamental investment restrictions.

Effects of Removing the Current Restriction

Because there are other practical and legal impediments to exercising control or management of another company and in light of the Funds’ investment approach, Dodge & Cox and the Board do not propose or anticipate any material change in the management of the Funds as a result of the proposed removal of the fundamental investment restriction. The removal may simplify the Funds’ compliance requirements and may provide Dodge & Cox with added flexibility in the future to invest the Funds’ assets, consistent with applicable law and the Funds’ investment objectives and policies. In addition, removal of the restriction may facilitate communications between Dodge & Cox and the management of portfolio companies that may be in the best interests of Fund shareholders.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS OF EACH FUND VOTE “FOR” THE REMOVAL OF THE FUNDAMENTAL INVESTMENT RESTRICTION IN THIS PROPOSAL 2.

14

PROPOSAL 3: ALL FUNDS

APPROVAL TO REMOVE EACH FUND’S FUNDAMENTAL INVESTMENT RESTRICTION WITH RESPECT TO PURCHASING SECURITIES ON MARGIN AND SHORT SELLING

The Board recommends that shareholders of each Fund approve the removal of the Fund’s fundamental investment restriction with respect to purchasing securities on margin or selling securities short.

| | | | |

Applicable Fund | | Current Fundamental Policy/

Restriction | | Proposed New Fundamental Policy/ Restriction |

All Funds | | Each Fund may not purchase securities on margin or sell short. | | It is proposed that this restriction be removed. |

In making their recommendations to the shareholders of each Fund to remove this restriction, Dodge & Cox and the Board note that the 1940 Act does not require funds to have a fundamental or non-fundamental investment policy/restriction with respect to purchasing securities on margin or engaging in short sales of securities, and Dodge & Cox and the Board believe that it is in the best interest of the Funds to remove unnecessary fundamental investment restrictions. Both Dodge & Cox and the Board believe that the current fundamental investment restriction is unduly restrictive and may result in unnecessary confusion with respect to the ability of the Funds’ to invest in certain types of securities or to engage in certain activities.

Effects of Removing the Current Restriction

The 1940 Act generally allows a fund to engage in short sales of securities, consistent with applicable law and the fund’s investment objectives and policies. If the current investment restriction is removed, each Fund will be able to engage in short sales of securities, consistent with applicable law and the Funds’ investment objectives and policies. Although neither Dodge & Cox nor the Board proposes or anticipates any material change in the management of the Funds as a result of the proposed removal of the fundamental investment restriction, the proposed removal of the current investment restriction may afford the Funds’ added flexibility in the future in pursuing their investment objectives and strategies and may avoid unnecessary confusion regarding the permissible investments and activities of the Funds. Similarly, Dodge & Cox and the Board do not propose or anticipate any material change in the management of the Funds as a result of the proposed change in policy with respect to purchasing securities on margin, but this change may allow for added flexibility in the future should the Securities and Exchange Commission (“SEC”) or its staff ever adopt or update rules or guidance regarding the use of margin accounts by registered investment companies. Any material changes to the management of the Funds in the future will require consideration by the Board and disclosure in the relevant Fund’s prospectus or statement of additional information, as appropriate.

15

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS OF EACH FUND VOTE “FOR” THE REMOVAL OF THE FUNDAMENTAL INVESTMENT RESTRICTION IN THIS PROPOSAL 3.

PROPOSAL 4: ALL FUNDS

APPROVAL TO REMOVE EACH FUND’S FUNDAMENTAL INVESTMENT RESTRICTION WITH RESPECT TO INVESTMENTS IN SECURITIES THAT ARE ILLIQUID AND REPLACE IT WITH A UNIFORM NON-FUNDAMENTAL POLICY FOR ALL FUNDS

The Board recommends that shareholders of each Fund approve the removal of its fundamental investment restriction with respect to investments in securities that are illiquid.

| | | | |

Applicable Fund | | Current Fundamental Policy/

Restriction | | New Non-Fundamental Policy/

Restriction (if Fundamental Restriction Is

Removed) |

| All Funds | | Each Fund may not purchase any security if as a result a Fund would then have more than 15% (10% for the Dodge & Cox Income Fund) of its total assets invested in securities which are illiquid, including repurchase agreements not maturing in seven days or less and securities restricted as to disposition under federal securities laws. | | It is proposed that this restriction be changed to the following non-fundamental investment restriction for the Funds: Each Fund may not purchase any security if as a result a Fund would then have more than 15% of its net assets invested in securities that are illiquid, including repurchase agreements not maturing in seven days or less and securities restricted as to disposition under federal securities laws. |

Dodge & Cox Income Fund | | | | It is proposed that the non-fundamental investment restriction apply equally to all Funds and that the separate 10% asset limit for the Dodge & Cox Income Fund be removed. |

In making their recommendations to the shareholders of each Fund to change this restriction from fundamental to non-fundamental, Dodge & Cox and the Board note that the 1940 Act does not require funds to have a fundamental investment policy/restriction with respect to investments in securities that are illiquid, and Dodge & Cox and the Board believe that it is in the best interest of the Funds to remove unnecessary fundamental investment restrictions. According to current guidance from the staff of the SEC, a fund, other than a money market fund, may not invest more than 15% of its

16

net assets in illiquid securities. Following the removal of the fundamental investment restriction, the Funds will continue to comply with this SEC staff guidance.

With respect to the Proposal to apply the new non-fundamental investment restriction equally to all Funds and to remove the separate 10% limit for the Dodge & Cox Income Fund, both Dodge & Cox and the Board believe that there is no current rationale for maintaining a separate, lower restriction for the Income Fund. Both Dodge & Cox and the Board believe that it is appropriate and consistent with applicable SEC staff guidance to apply the non-fundamental investment restriction equally to all Funds and to remove the separate, lower restriction for the Dodge & Cox Income Fund.

Effect of Removing the Current Restrictions

Because the Funds will continue to comply with the relevant guidance from the SEC staff regarding investments in illiquid securities following the removal of the fundamental investment restriction, Dodge & Cox and the Board do not propose or anticipate any material change in the management of the Funds as a result of the proposed amendment of the current investment restriction. Changing the investment restriction from a fundamental investment restriction to a non-fundamental investment restriction will afford the Funds added flexibility in the future to respond to regulatory changes without delay and without the expense of holding a shareholder meeting. Furthermore, removing the separate limit for the Dodge & Cox Income Fund may afford the Fund added flexibility in the future in pursuing its investment objectives and strategies and may simplify the Fund’s compliance requirements by applying the non-fundamental investment restriction equally to all Funds. Any material changes to the management of the Funds in the future will require consideration by the Board and disclosure in the relevant Fund’s prospectus or statement of additional information, as appropriate.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS OF EACH FUND VOTE “FOR” THE REMOVAL OF THE FUNDAMENTAL INVESTMENT RESTRICTION AND THE DODGE & COX INCOME FUND’S SEPARATE FUNDAMENTAL INVESTMENT RESTRICTION IN THIS PROPOSAL 4.

17

PROPOSAL 5: DODGE & COX INCOME FUND

APPROVAL TO REMOVE THE DODGE & COX INCOME FUND’S FUNDAMENTAL INVESTMENT RESTRICTION WITH RESPECT TO WRITING PUT OR CALL OPTIONS

The Board recommends that shareholders of the Dodge & Cox Income Fund approve the removal of the Fund’s fundamental investment restriction with respect to writing put or call options.

| | | | |

Applicable Fund | | Current Fundamental Policy/

Restriction | | Proposed New Fundamental

Policy/Restriction |

Dodge & Cox

Income Fund | | The Dodge & Cox Income Fund will not write put or call options. | | It is proposed that this restriction be removed. |

In making their recommendations to the shareholders of the Dodge & Cox Income Fund to remove this restriction, Dodge & Cox and the Board note that the 1940 Act does not require funds to have a fundamental or non-fundamental investment policy/restriction with respect to writing put or call options, Dodge & Cox and the Board note that the other Funds are not subject to such a requirement, and Dodge & Cox and the Board believe that it is in the best interest of the Fund to remove unnecessary fundamental investment restrictions.

Effects of Removing the Current Restriction

The 1940 Act generally allows a fund to write put or call options, consistent with applicable law and the fund’s investment objectives and policies. If the current investment restriction is removed, the Dodge & Cox Income Fund will be able to write put and call options, consistent with applicable law and the Fund’s investment objectives and policies. Although neither Dodge & Cox nor the Board proposes or anticipates any material change in the management of the Fund as a result of the proposed removal of the current investment restriction, Dodge & Cox and the Board believe that it may afford the Dodge & Cox Income Fund added flexibility in the future in pursuing its investment objectives and strategies, including the ability to use put and call options both for hedging positions and for the purpose of taking an investment position. Any material changes to the management of the Funds in the future will require consideration by the Board and disclosure in the relevant Fund’s prospectus or statement of additional information, as appropriate.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS OF THE DODGE & COX INCOME FUND VOTE “FOR” THE REMOVAL OF THE FUND’S FUNDAMENTAL INVESTMENT RESTRICTION IN THIS PROPOSAL 5.

18

PROPOSAL 6: ALL FUNDS

APPROVAL TO AMEND EACH FUND’S FUNDAMENTAL INVESTMENT RESTRICTION WITH RESPECT TO UNDERWRITING SECURITIES OF OTHER ISSUERS

The Board recommends that shareholders of each Fund approve a change to its fundamental investment restriction regarding underwriting securities of other issuers. The current policy/restriction applicable to each Fund would be removed from the Fund’s fundamental investment restrictions and replaced with the proposed policy/restriction, as shown below.

| | | | |

Applicable Fund | | Current Fundamental Policy/

Restriction | | Proposed New Fundamental Policy/

Restriction |

| All Funds | | Each Fund may not underwrite securities of other issuers, except insofar as a Fund may be deemed an underwriter under the Securities Act of 1933, as amended, in selling portfolio securities. | | Each Fund may not underwrite securities of other issuers, except as permitted under, or to the extent not prohibited by, the 1940 Act, and rules thereunder as interpreted or modified by regulatory authority having jurisdiction from time to time, and any applicable exemptive relief. |

In making their recommendations to the shareholders of each Fund to amend this fundamental investment restriction, Dodge & Cox and the Board note that Section 13(a)(2) of the 1940 Act requires a registered investment company to disclose as a fundamental policy, among other things, its policy on underwriting securities issued by other persons, and that Item 16 of SEC Form N-1A requires that a registrant disclose its policy with respect to underwriting securities of other issuers. It is proposed that the Funds’ adopt a more flexible fundamental investment restriction to clarify the permissible exceptions to the general prohibition on underwriting securities of other issuers.

Effect of Amending the Current Restriction

Because the Funds will continue to comply with applicable law and the Funds’ investment objectives and policies following the amendment of the investment restriction, neither Dodge & Cox nor the Board proposes or anticipates any material change in the management of the Funds as a result of the proposed amendment of the current fundamental investment restriction. However, amending the investment restriction would provide a clearer policy and may afford the Funds added flexibility in the future to engage in certain investment activities and to respond to legal and/or regulatory changes without delay and without the expense of holding a shareholder meeting. Any material changes to the management of the Funds in the future will require consideration by the Board and disclosure in the relevant Fund’s prospectus or statement of additional information, as appropriate.

19

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS OF EACH FUND VOTE “FOR” THE AMENDMENT TO THE FUNDAMENTAL INVESTMENT RESTRICTION IN THIS PROPOSAL 6.

OTHER MATTERS

The Board is not aware of any matters that will be presented for action at the Meeting other than the matters set forth herein. Should any other matters requiring a vote of shareholders arise, the proxy in the accompanying form will confer upon the person or persons entitled to vote the shares represented by such proxy the discretionary authority to vote the shares as to any such other matters in accordance with their best judgment in the interest of the Trust and each Fund, as applicable.

ADDITIONAL INFORMATION

SHAREHOLDER PROPOSALS

The Trust does not hold regular annual shareholders’ meetings. Shareholders wishing to submit proposals for consideration for inclusion in a proxy statement for a subsequent shareholders’ meeting of the Trust (if any) should send their written proposals to the Secretary of the Trust at Dodge & Cox Funds, c/o Dodge & Cox, 555 California Street, 40th Floor, San Francisco, CA 94104. Proposals must be received a reasonable time before the date of a meeting of shareholders to be considered for inclusion in the proxy materials for that meeting. Timely submission of a proposal does not, however, guarantee that the proposal will be included. A shareholder who wishes to make a proposal at the next meeting of shareholders without including the proposal in the Trust’s proxy statement must notify the Secretary of the Trust in writing of such proposal within a reasonable time prior to the date of the meeting. If a shareholder fails to give timely notice, then the persons named as proxies in the proxies solicited by the Board for the next meeting of shareholders may exercise discretionary voting power with respect to any such proposal.

SHAREHOLDER COMMUNICATIONS WITH THE BOARD

Shareholders may address correspondence that relates to any Fund, to the Board as a whole, or to individual members and send such correspondence to the Board or to the Trustee, c/o Dodge & Cox, 555 California Street, 40th Floor, San Francisco, CA 94104, Attention: Secretary. Upon receipt, all such shareholder correspondence will be directed to the appropriate Trustee or officer for review and consideration.

VOTING INFORMATION

Each share of a Fund is entitled to one vote on Proposals affecting that Fund, and a fractional share is entitled to a proportionate share of one vote. Any shareholder giving a proxy has the power to revoke it by executing a proxy bearing a later date or by attending and voting at the meeting. All properly executed proxies received in time for

20

the Meeting will be voted as specified in the proxy or, if no specification is made, in favor of the Proposal referred to in the Proxy Statement.

Quorum

The presence at any meeting, in person or by proxy, of the holders of one-third of the shares of each Fund entitled to be cast shall be necessary and sufficient to constitute a quorum for the transaction of business with respect to that Fund.

Shares represented by proxy over which broker-dealers have discretionary voting power, shares represented by proxy that represent “broker non-votes” (i.e.,shares heldby brokers or nominees that neither have received instructions from the beneficial owner or other persons entitled to vote nor have discretionary power to vote on a particular matter), and shares whose proxies reflect an abstention on any item will all be counted as shares present and entitled to vote for purposes of determining whether the required quorum of shares exists.

Holders of record of the shares of each Fund at the close of business on February 14, 2014, as to any matter on which they are entitled to vote, will be entitled to vote on all business at the Meeting with respect to the Fund. As of February 14, 2014, the following numbers of shares of each Fund were outstanding:

| | | | |

| Fund | | Number of Shares Outstanding | |

Dodge & Cox Stock Fund | | | 321,548,969 | |

Dodge & Cox International Stock Fund | | | 1,272,667,648 | |

Dodge & Cox Balanced Fund | | | 145,680,962 | |

Dodge & Cox Income Fund | | | 1,833,951,796 | |

Dodge & Cox Global Stock Fund | | | 368,050,483 | |

Voting Requirement

Passage of Proposal 1 requires a plurality of the total votes validly cast in person or by proxy at the Meeting. The votes of each Fund will be counted together with respect to the election of the Trustees.

Passage of Proposals 2 through 6 requires the affirmative vote of a majority of each Fund’s outstanding voting securities (as defined in the 1940 Act) for the Proposal to pass with respect to that Fund, which, for these purposes, is the vote of: (1) 67% or more of the voting securities entitled to vote on the Proposal that are present at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy; or (2) more than 50% of the outstanding voting securities entitled to vote on the Proposal, whichever is less.

Adjournment

In the event that a quorum to transact business is not present, the vote required to approve any Proposal is not obtained at the Meeting, or such other reason as determined by the Chairman of the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting in accordance with applicable law to permit further solicitation of proxies. An adjournment may be proposed on a per

21

Proposal and/or per Fund basis. If the proposed adjournment relates to a Proposal on which Funds are voting individually, any such adjournment with respect to a particular Fund will require the affirmative vote of the holders of a majority of that Fund’s shares present in person or by proxy and entitled to vote at the Meeting. In the absence of a quorum, the persons named as proxies will vote all shares represented by proxy and entitled to vote in favor of such adjournment. If a quorum is present but insufficient votes have been received to approve a Proposal, the persons named as proxies will vote in favor of such adjournment with respect to any Proposal those proxies which they are entitled to vote in favor of that Proposal and will vote against any such adjournment with respect to any Proposal those proxies required to be voted against that Proposal, provided that broker non-votes will be disregarded for this purpose.

Effect of Abstentions and Broker Non-Votes

For purposes of determining the presence of a quorum for transacting business at the Meeting, executed proxies marked as abstentions and broker “non-votes” will be treated as shares that are present for quorum purposes but which have not been voted. Accordingly, abstentions and broker non-votes will have no effect on Proposal 1, for which the required vote is a plurality of the votes cast. Abstentions and broker non-votes will effectively be a vote “against” Proposals 2 through 6, for which the required vote is a majority of each Fund’s outstanding voting securities (as defined in the 1940 Act) for the Proposal to pass with respect to that Fund, which, for these purposes, is the vote of: (1) 67% or more of the voting securities entitled to vote on the Proposal that are present at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy; or (2) more than 50% of the outstanding voting securities entitled to vote on the Proposal, whichever is less. Abstentions and broker non-votes will be disregarded for purposes of voting on adjournment. Accordingly, shareholders are urged to forward their voting instructions promptly.

OWNERSHIP OF THE FUNDS

Exhibit A sets forth the beneficial owners of more than 5% of each Fund’s shares. To the best of the Trust’s knowledge, as of December 31, 2013, no person owned beneficially more than 5% of outstanding shares of any Fund, except as stated inExhibit A.

As of December 31, 2013, no Trustee or nominee for election to the Board of Trustees owned more than 1% of the outstanding shares of a Fund. As of December 31, 2013, the Trustees and Officers as a group owned less than 1% of the outstanding shares of Dodge & Cox Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Balanced Fund, and Dodge & Cox Income Fund. As of December 31, 2013, the Trustees and Officers as a group owned 1.6% of the outstanding shares of Dodge & Cox Global Stock Fund.

22

TRUSTEES AND OFFICERS OF THE TRUST

Exhibit C lists (1) the name, address, position, principal occupation(s) during the past five years, number of Funds overseen, and other directorships held during the past five years of the current Trustees of the Trust not being proposed for election at the Meeting, and (2) the name, address, position, and principal occupation(s) during the past five years of the Officers of the Trust.

COST AND METHOD OF PROXY SOLICITATION

The Trust will pay the cost of preparing, printing, and mailing the enclosed proxy card(s) and Proxy Statement and all other costs incurred in connection with the solicitation of proxies, including any additional solicitation made by letter, internet, telephone, or other means. The solicitation of proxies will be largely by mail, but may include telephonic, electronic, or oral communication by Officers and service providers of the Trust, who will not be paid for these services, and/or by D.F. King & Co., Inc., a professional proxy solicitor retained by the Trust for an estimated fee of $1.9 Million, plus out-of-pocket expenses. Banks, brokerage houses, nominees, and other fiduciaries will be requested to forward the proxy soliciting materials to the beneficial owners and obtain authorization for the execution of proxies. The Trust may reimburse brokers, banks and other fiduciaries for postage and reasonable expenses incurred by them in the forwarding of proxy material to beneficial owners.

SERVICE PROVIDERS

Investment Manager

Dodge & Cox, a California corporation, has served as investment manager to the Funds and their predecessors since inception. Dodge & Cox is one of the oldest professional investment management firms in the United States, having acted continuously as investment managers since 1930. Dodge & Cox is located at 555 California Street, 40th Floor, San Francisco, CA 94104. Dodge & Cox has the authority to manage the Funds in accordance with the investment objectives, policies, and restrictions of the Funds and subject to general supervision of the Board. It also provides the Funds with ongoing management supervision, administration, and policy direction.

Principal Underwriter

The Trust distributes the shares of the Funds and does not have a principal underwriter.

Custodian and Transfer Agent

State Street Bank and Trust Company, P.O. Box 8422, Boston, MA 02266-8422(800-621-3979), and its global custody network act as custodian of all cash and securities of the Funds and receives and disburses cash and securities for the account of the Funds. Boston Financial Data Services, P.O. Box 8422, Boston, MA 02266-8422 (800-621-3979), acts as transfer and dividend disbursing agent for the Funds.

23

Independent Registered Public Accounting Firm

Information related to the Funds’ Independent Registered Public Accounting Firm is set out inExhibit D.

FINANCIAL STATEMENTS

Audited financial statements for the Trust appear in its Annual Report.

If you would like a copy of the most recent Annual Report or Semi-Annual Report free of charge, visit the Funds’ web site at www.dodgeandcox.com, call 800-621-3979, or write the Trust at Dodge & Cox Funds, c/o Boston Financial Data Services, P.O. Box 8422, Boston, MA 02266-8422.

|

| By Order of the Board of Trustees, |

|

|

|

| Thomas M. Mistele |

| Secretary |

March 5, 2014

Please complete, date, and sign the enclosed proxy card(s) and return it promptly in the enclosed reply envelope. NO POSTAGE IS REQUIRED if mailed in the United States.

24

INDEX OF EXHIBITS

| | |

| EXHIBIT A | | BENEFICIAL OWNERS OF TRUST SHARES |

| EXHIBIT B | | NOMINATING COMMITTEE CHARTER |

| EXHIBIT C | | TRUSTEES AND OFFICERS OF THE TRUST |

| EXHIBIT D | | INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

EXHIBIT A

BENEFICIAL OWNERS OF TRUST SHARES

As of December 31, 2013, the following persons owned of record or beneficially 5% or more of the following Funds:

Dodge & Cox Stock Fund

| | | | | | | | |

Name and Address of Shareholder | | Shares Beneficially Owned | | | Percent of Fund | |

National Financial Services 200 Seaport Boulevard Boston, MA 02210 | | | 71,289,802 | | | | 21.9 | % |

| | |

The Charles Schwab Corporation 211 Main Street San Francisco, CA 94105 | | | 36,795,789 | | | | 11.3 | % |

Dodge & Cox International Stock Fund

| | | | | | | | |

Name and Address of Shareholder | | Shares Beneficially Owned | | | Percent of Fund | |

National Financial Services 200 Seaport Boulevard Boston, MA 02210 | | | 244,720,309 | | | | 19.6 | % |

| | |

The Charles Schwab Corporation 211 Main Street San Francisco, CA 94105 | | | 116,414,088 | | | | 9.3 | % |

Dodge & Cox Balanced Fund

| | | | | | | | |

Name and Address of Shareholder | | Shares Beneficially Owned | | | Percent of Fund | |

National Financial Services 200 Seaport Boulevard Boston, MA 02210 | | | 31,054,063 | | | | 21.2 | % |

| | |

The Charles Schwab Corporation 211 Main Street San Francisco, CA 94105 | | | 18,663,683 | | | | 12.7 | % |

A-1

Dodge & Cox Income Fund

| | | | | | | | |

Name and Address of Shareholder | | Shares Beneficially Owned | | | Percent of Fund | |

National Financial Services 200 Seaport Boulevard Boston, MA 02210 | | | 312,076,172 | | | | 17.1 | % |

| | |

The Charles Schwab Corporation 211 Main Street San Francisco, CA 94105 | | | 196,010,021 | | | | 10.8 | % |

| | |

Edward Jones 12555 Manchester Road Saint Louis, MO 63131 | | | 170,323,646 | | | | 9.3 | % |

Dodge & Cox Global Stock Fund

| | | | | | | | |

Name and Address of Shareholder | | Shares Beneficially Owned | | | Percent of Fund | |

National Financial Services 200 Seaport Boulevard Boston, MA 02210 | | | 60,011,014 | | | | 17.6 | % |

| | |

The Charles Schwab Corporation 211 Main Street San Francisco, CA 94105 | | | 41,801,259 | | | | 12.2 | % |

The Trust knows of no other person who owns beneficially or of record more than 5% of the outstanding shares of a Fund.

A-2

EXHIBIT B

NOMINATING COMMITTEE CHARTER

DODGE & COX FUNDS

Dodge & Cox Stock Fund

Dodge & Cox International Stock Fund

Dodge & Cox Balanced Fund

Dodge & Cox Income Fund

Dodge & Cox Global Stock Fund

December 14, 2010

The Board of Trustees (the “Board”) of the Dodge & Cox Funds (the “Trust”) has adopted this Charter to govern the activities of the Nominating Committee (the “Committee”) of the Board.

| I. | Statement of Purposes and Responsibilities of the Committee |

The Committee is responsible for (i) determining such standards or qualifications for nominees to serve as Trustees on the Board, if any, as the Committee deems appropriate, (ii) identifying possible candidates to become members of the Board in the event that a Trustee position is vacated or created and/or in contemplation of a shareholders’ meeting at which one or more Trustees is to be elected, and (iii) considering and evaluating such candidates and recommending Trustee nominees for the Board’s approval.

| II. | Organization and Governance of the Committee |

The Committee shall consist of at least three members appointed by the Board upon the recommendation of the Governance Committee. No member of the Committee shall be an “interested person” of the Trust, as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”).

One or more members of the Committee may be designated by the Board as the Committee’s chair or co-chair, as the case may be. The Committee may delegate any portion of it authority or responsibilities to a sub-committee of one or more members.

The Committee will not have regularly scheduled meetings. Committee meetings shall be held as and when the Committee or the Board determines necessary or appropriate in accordance with the Trust’s By-Laws. The Chair of the Trustees, the chair or vice-chair of the Committee or a majority of the members of the Committee are authorized to call a meeting of the Committee and send notice thereof or direct that such notice be sent.

A majority of the members of the Committee shall constitute a quorum for the transaction of business at any meeting of the Committee. The action of a majority of the members of the Committee present at a meeting at which a quorum is present shall

B-1

be the action of the Committee. The Committee may also take action by written consent of a majority of the Committee members. The Committee may meet by means of a telephone conference circuit or similar communications equipment by means of which all persons participating in the meeting can hear each other.

The Chairperson of the Committee shall serve for a term of three years from the date of his or her respective appointment, at which time the Board or the Committee shall consider whether to select a new Chairperson to be appointed.

| III. | Duties and Responsibilities of the Committee |

The duties and responsibilities of the Committee include:

(a) Nomination

| | 1. | To determine such standards or qualifications for Trustees nominees, if any, as the Committee deems appropriate. |

| | 2. | To identify potential candidates to become members of the Board in the event that a Trustee position is vacated or created and/or in contemplation of a shareholders’ meeting at which one or more Trustees is to be elected. The Committee may consider candidates recommended by one or more of the following sources: (i) the Trust’s current Trustees, (ii) the Trust’s officers, (iii) the Trust’s investment manager, (iv) the Fund’s shareholders (see 4. below) and (v) any other source the Committee deems to be appropriate. |

| | 3. | To consider and evaluate candidates identified in 2. above and recommend Trustee nominees for the Board’s approval. In considering and evaluating candidates, the Committee may take into account a wide variety of factors, including (but not limited to): (i) availability and commitment of a candidate to attend meetings and perform his or her responsibilities on the Board, (ii) educational background, (iii) an assessment of the candidate’s ability, judgment and expertise, (iv) the percentage of the Board represented by Independent Trustees and whether a candidate would qualify as an Independent Trustee under the 1940 Act, and (v) such other factors as the Committee deems appropriate. |

| | 4. | To consider and evaluate nominee candidates properly submitted by shareholders on the same basis as it considers and evaluates candidates recommended by other sources.Appendix A to this Charter, as it may be amended from time to time by the Committee, sets forth procedures that must be followed by shareholders to properly submit a nominee candidate to the Committee (recommendations not properly submitted in accordance withAppendix A will not be considered by the Committee). For the avoidance of doubt, the Committee shall not be obligated to convene solely as a result of the submission by a shareholder of a recommendation for a Trustee nominee for the Committee’s consideration. |

B-2

(b) General

| | 1. | To make such other recommendations and reports to the Board within the scope of the Committee’s functions. |

| | 2. | To discharge any other duties or responsibilities delegated to the Committee by the Board from time to time. |

B-3

Appendix A

Procedures for Shareholders to Submit Nominee Candidates

Adopted September 10, 2007

A shareholder must follow the following procedures in order to properly submit a recommendation for a Trustee nominee for the Committee’s consideration:

| 1. | The shareholder must submit any such recommendation in writing to the Trust, to the attention of the Secretary, at the address of the principal executive offices of the Trust. |

| 2. | The shareholder recommendation must include: |

| | (i) | a statement in writing setting forth (a) the name, date of birth, business address and residence address of the person recommended by the shareholder (the “candidate”); and (b) whether the recommending shareholder believes that the candidate is or will be an “interested person” of the Trust (as defined in the 1940 Act) and, if not an “interested person,” information regarding the candidate that will be sufficient for the Trust to make such determination and, if applicable, similar information regarding whether the candidate would satisfy the standards for independence of a Board member under listing standards of the New York Stock Exchange or other applicable securities exchange. |

| | (ii) | the written and manually signed consent of the candidate to be named as a nominee and to serve as a Trustee if elected; |

| | (iii) | the recommending shareholder’s name as it appears on the Trust’s books and the number of all shares of the Trust owned beneficially and of record by the recommending shareholder (as evidenced to the Committee’s satisfaction by a recent brokerage or account statement); and |