UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | | | |

Filed by the Registrant ☒ | | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

DODGE & COX FUNDS

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

DODGE & COX FUNDS

Dodge & Cox Stock Fund

Dodge & Cox International Stock Fund

Dodge & Cox Emerging Markets Stock Fund

Dodge & Cox Global Stock Fund

Dodge & Cox Balanced Fund

Dodge & Cox Income Fund

Dodge & Cox Global Bond Fund

August 23, 2024

Dear Shareholder:

A Special Meeting of Shareholders (the “meeting”) of the Dodge & Cox Funds will be held on Thursday, October 24, 2024, beginning at 10:00 a.m. Pacific Time. The meeting will be held virtually in an audio format only, which means you can join the meeting live by telephone. At the meeting, shareholders of the Dodge & Cox Funds will be asked to vote on two important proposals.

The first proposal is the election of Trustees to the Board of Trustees. The second proposal is an amendment to the investment objective of the Dodge & Cox Balanced Fund. All shareholders are eligible to vote on the first proposal. Only shareholders of the Balanced Fund are eligible to vote on the second proposal.

The Board of Trustees has unanimously approved these proposals and recommends a vote “FOR” each proposal. As discussed in more detail in the Proxy Statement accompanying this letter, Dodge & Cox and the Board of Trustees believe that these proposals are in the best interests of both the Funds and you, as a shareholder. These proposals are not expected to materially affect the way your Fund is managed.

Please review the accompanying Proxy Statement and cast your vote. Voting in a timely manner will help us reduce the expenses the Funds would otherwise incur for follow-up mailings and telephone calls.

| | |

Cast Your Vote |

| |

| | Vote Online. Visit the website shown on your proxy ballot, or scan the QR code on your proxy ballot, enter the voting control number, and follow the online instructions; OR |

| |

| | Vote by Phone. Call the number on your proxy ballot, enter the voting control number, and follow the recorded instructions; OR |

| |

| | Vote by Mail. Complete the proxy card(s) and return the signed card(s) in the postage-paid envelope |

More information is available on our website at Dodgeandcox.com/FundsProxy. To attend the virtual meeting, you must be a shareholder on the record date (August 15, 2024).

If you have any questions regarding the issues to be voted on or need assistance in completing your proxy card, please call 833-812-4594 to speak to a Proxy Specialist.

Thank you for considering these important proposals. We appreciate your continued confidence in the Dodge & Cox Funds.

|

| Sincerely, |

|

/s/ Dana M. Emery |

Dana M. Emery |

Chair of Dodge & Cox Funds Board of Trustees |

Chair and CEO of Dodge & Cox |

DODGE & COX FUNDS

Dodge & Cox Stock Fund

Dodge & Cox International Stock Fund

Dodge & Cox Emerging Markets Stock Fund

Dodge & Cox Global Stock Fund

Dodge & Cox Balanced Fund

Dodge & Cox Income Fund

Dodge & Cox Global Bond Fund

Meeting via Audioconference

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

to be held on October 24, 2024

Notice is hereby given that Dodge & Cox Funds (the “Trust”) will hold a special meeting via audioconference (the “Meeting”) of shareholders of the Dodge & Cox Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Emerging Markets Stock Fund, Dodge & Cox Global Stock Fund, Dodge & Cox Balanced Fund, Dodge & Cox Income Fund, and Dodge & Cox Global Bond Fund, each a series of the Trust (each, a “Fund,” collectively, the “Funds”), on October 24, 2024, beginning at 10:00 a.m. Pacific Time. Details about how to vote and attend the Meeting are available in the “Voting Information” section of the attached Proxy Statement.

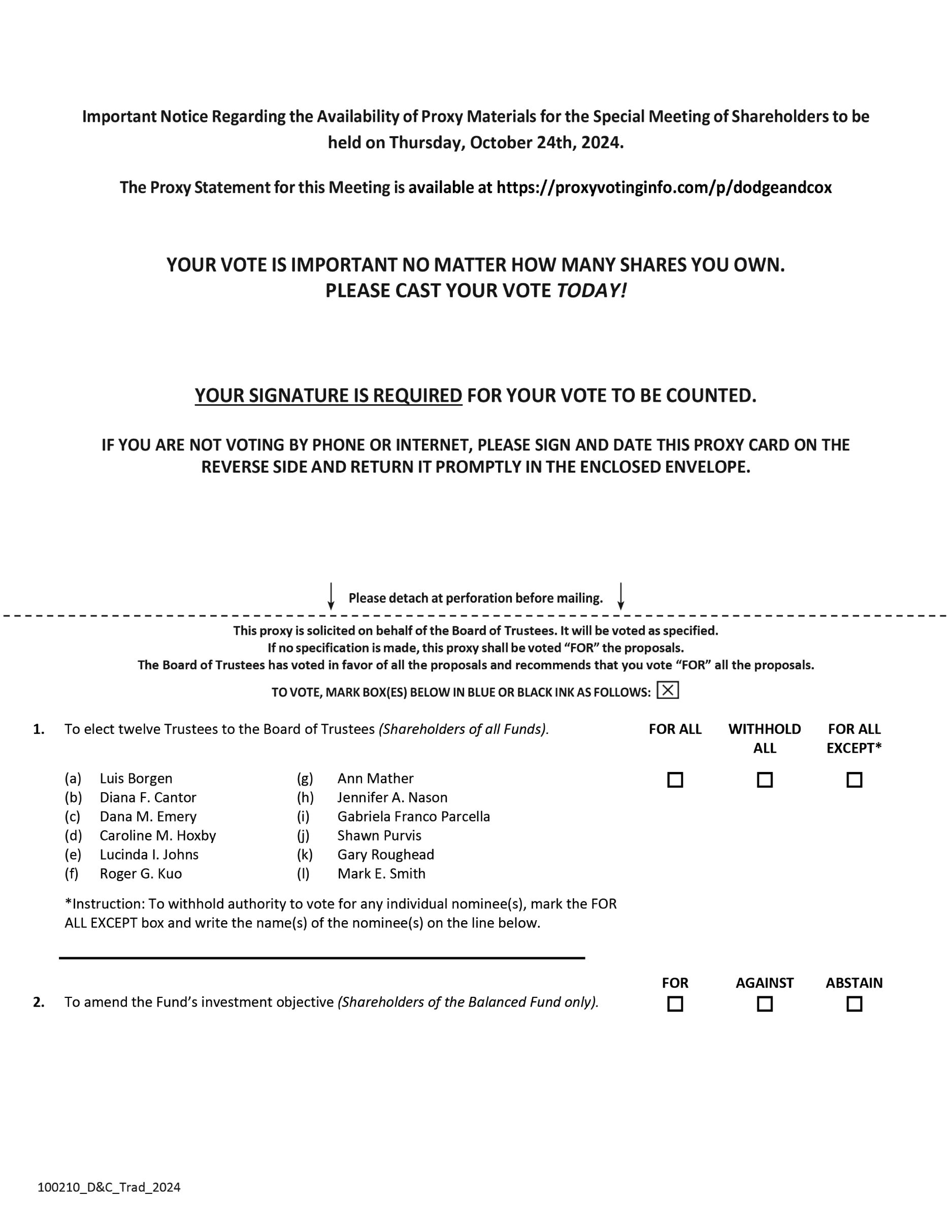

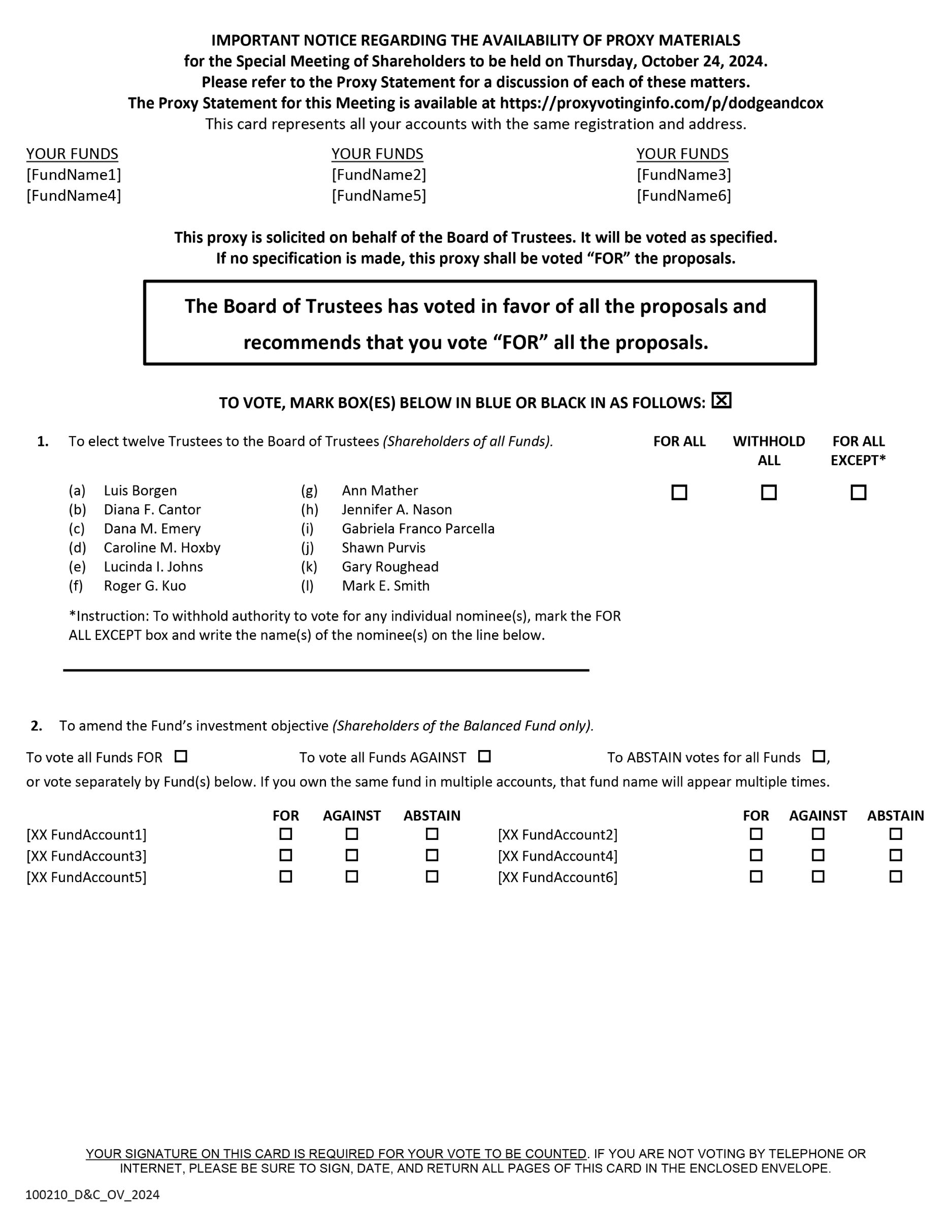

During the Meeting, shareholders of all Funds will vote on Proposal 1:

| | Proposal 1: | Elect Trustees to the Board of Trustees. |

In addition, shareholders of the Balanced Fund will vote on Proposal 2:

| | Proposal 2: | Amend the investment objective of the Dodge & Cox Balanced Fund. |

The attached Proxy Statement provides additional information about this Meeting. Shareholders of record of a Fund as of the close of business on August 15, 2024 (the “Record Date”) are entitled to vote at the Meeting and any adjournment(s) or postponement(s) thereof. Each share of the Funds is entitled to one vote, and a proportionate fractional vote for each fractional share held, with respect to each Proposal that is applicable to that Fund.

Whether or not you plan to attend the Meeting, please vote your shares. To vote by mail, please complete, date, and sign the enclosed proxy card(s) and return it in the self-addressed, postage-paid envelope. You may also vote by telephone or by internet, as follows:

| | | | |

To vote by telephone: | | | | To vote by internet: |

(1) Read the Proxy Statement and have your proxy card(s) at hand. | | | | (1) Read the Proxy Statement and have your proxy card(s) at hand. |

(2) Call the toll-free number that appears on your proxy card(s). | | | | (2) Go to the website address that appears on your proxy card(s) or scan the QR code. |

(3) Follow the simple instructions. | | | | (3) Follow the simple instructions. |

We encourage you to vote by telephone or by internet using the control number that appears on the enclosed proxy card(s). Voting by telephone or by internet will reduce the time and costs associated with this proxy solicitation. Whichever method of voting you choose, please read the enclosed Proxy Statement carefully before you vote. Voting now will not affect your right to attend the Meeting via audioconference and vote at the Meeting. You may revoke your proxy at any time by executing a proxy bearing a later date or by attending and voting at the Meeting, though attending the meeting will not by itself revoke a previously tendered proxy.

The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting or any adjournment(s) or postponement(s) thereof.

If the necessary quorum to transact business or the vote required to approve a Proposal is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting with respect to that Proposal in accordance with applicable law to permit further solicitation of proxies.

The Meeting will be conducted exclusively via audioconference. Any shareholder wishing to participate in the Meeting telephonically can do so. If you were a record holder of the Fund shares as of the Record Date, please send an e-mail to the Fund’s proxy solicitor, Morrow Sodali Fund Solutions (“MSFS”), at msfs-meetinginfo@morrowsodali.com no later than 2:00pm ET on October 23rd, 2024 to register to attend. Please include the Fund’s name(s) in the subject line and provide your name and address in the body of the e-mail. MSFS will then e-mail you the credentials to the audioconference and instructions for voting during the Meeting. If you held Fund shares through an intermediary, such as a broker-dealer, as of the Record Date, and you want to participate in the Meeting, please e-mail MSFS at msfs-meetinginfo@morrowsodali.com no later than 2:00pm ET on October 23rd, 2024 to register to attend. Please include the Fund’s name(s) in the subject line and provide your name, address and proof of ownership as of the Record Date from your intermediary. Please be aware that if you wish to vote at the Meeting, you must first obtain a legal proxy from your intermediary reflecting the Fund’s name(s), the number of Fund shares you held as of the Record Date and your name and e-mail address. You may forward an email from your intermediary containing the legal proxy or e-mail an image of the legal proxy to MSFS at msfs-meetinginfo@morrowsodali.com and put “Legal Proxy” in the subject line. MSFS will then provide you with the credentials for the audioconference and instructions for voting during the Meeting. The audioconference credentials will only be active for the date and time of the Meeting. If you have any questions prior to the Meeting, please call MSFS at 833-812-4594.

Please note that the use of electronic devices or any other method to record or broadcast the Meeting is not permitted.

PLEASE RESPOND—WE ASK THAT YOU VOTE PROMPTLY IN ORDER TO

AVOID THE ADDITIONAL EXPENSE OF FURTHER SOLICITATION.

YOUR VOTE IS IMPORTANT.

|

By Order of the Board of Trustees, |

|

/s/ Roberta R.W. Kameda |

| Roberta R.W. Kameda |

Secretary |

August 23, 2024

DODGE & COX FUNDS

Dodge & Cox Stock Fund

Dodge & Cox International Stock Fund

Dodge & Cox Emerging Markets Stock Fund

Dodge & Cox Global Stock Fund

Dodge & Cox Balanced Fund

Dodge & Cox Income Fund

Dodge & Cox Global Bond Fund

SPECIAL MEETING OF SHAREHOLDERS

to be held on October 24, 2024

PROXY STATEMENT

GENERAL

This document is a proxy statement (the “Proxy Statement”). This Proxy Statement and enclosed proxy card(s) are being furnished to shareholders of each of the Dodge & Cox Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Emerging Markets Stock Fund, Dodge & Cox Global Stock Fund, Dodge & Cox Balanced Fund, Dodge & Cox Income Fund and Dodge & Cox Global Bond Fund (each a series of Dodge & Cox Funds (the “Trust”)) (each, a “Fund,” and collectively, the “Funds”) in connection with two Proposals. This Proxy Statement sets forth the information that shareholders should know in order to evaluate the Proposals.

The Board of Trustees (the “Board,” the members of which are referred to herein as “Trustees”) of Dodge & Cox Funds (the “Trust”) is soliciting proxies from shareholders on behalf of each Fund, for use at the Meeting of Shareholders of each of the Funds, to be held via audioconference at 10:00 a.m. Pacific Time, on October 24, 2024, and at any adjournment(s) or postponement(s) thereof (each, a “Meeting”).

The Board has fixed the close of business on August 15, 2024, as the record date for determination of shareholders entitled to notice of and to vote at the Meeting (the “Record Date”). You are entitled to vote at the Meeting and any adjournment(s) or postponement(s) thereof with respect to a Fund if you owned shares of that Fund at the close of business on the Record Date.

This Proxy Statement, the Notice of Meeting, and the proxy card(s) are first being mailed to shareholders on or about August 23, 2024.

At a Board meeting held on June 3, 2024, the Board unanimously approved and recommended that you vote FOR all the Proposals.

It is important for you to vote on the issues described in this Proxy Statement. We recommend that you read this Proxy Statement in its entirety to help you decide how to vote on the Proposals.

The following Proposals will be considered and acted upon at the Meeting:

With regard to Proposal 1, shareholders of each Fund will vote collectively as a single class on the election of each nominee to the Board of Trustees. The election of each nominee to the Board of Trustees must be approved by a plurality of the votes cast at the Meeting at which a quorum is present. Proposal 2 requires the affirmative vote of a majority of the Balanced Fund’s outstanding voting securities, as defined in the Investment Company Act of 1940, as amended (the “1940 Act”) for the Proposal to pass, which, for these purposes, is the vote of: (1) 67% or more of the voting securities entitled to vote on the Proposal that are present at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy; or (2) more than 50% of the outstanding voting securities entitled to vote on the Proposal, whichever is less.

This Proxy Statement should be kept for future reference. The most recent Annual Report and Semi-Annual Report of the Funds, including financial statements, have been previously made available to shareholders. If you would like to receive an additional copy of the Annual Report free of charge, or copies of any subsequent shareholder report, visit the Funds’ website at www.dodgeandcox.com, contact the Trust at Dodge & Cox Funds, P.O. Box 219502 Kansas City, MO 64121-9502 or call 800-621-3979. Shareholder reports will be sent by first class mail within three business days of the receipt of the request.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” PROPOSALS 1 AND 2.

PROPOSAL 1: ALL FUNDS

APPROVAL TO ELECT TRUSTEES TO THE BOARD OF TRUSTEES.

The purpose of this Proposal is to elect twelve nominees to the Board of Trustees of the Trust, four of whom do not currently serve as Trustees. Mses. Dana M. Emery, Caroline M. Hoxby, Ann Mather, Gabriela Franco Parcella and Shawn Purvis and Messrs. Luis Borgen, Mark E. Smith and Admiral Gary Roughead currently serve as Trustees. None of Diana F. Cantor, Lucinda I. Johns, Roger G. Kuo or Jennifer Nason currently serve as Trustees.

At the Meeting, Trustees of the Trust are to be elected, each to serve for a term of indefinite duration and until his or her successor is duly elected and qualifies, or until his or her earlier resignation or removal (as provided in the Trust’s Amended and Restated Trust Instrument) or death. It is the intention of the persons named as proxies in the enclosed proxy card to vote the shares covered thereby for the election of the Trustee nominees named below, unless the proxy contains contrary instructions.

The nominees for election to the Board of Trustees are Mses. Cantor, Emery, Hoxby, Johns, Mather, Nason, Parcella and Purvis and Messrs. Borgen, Kuo, Smith, and Admiral Roughead. Each of the nominees was recommended for nomination by the Nominating Committee of the Board of Trustees. Each of Mses. Cantor, Hoxby, Mather, Nason1, Parcella and Purvis and Messrs. Borgen, Smith, and Admiral Roughead is not an “interested person” of the Trust, as that term is defined in Section 2(a)(19) of the 1940 Act (collectively, the “Independent Trustees”). If elected, it is expected that Ms. Nason would be seated as a Trustee on or about February 1, 2025, while the other nominees would be seated as Trustees immediately following the Meeting.

| 1 | As a result of her current employment with J.P. Morgan Securities, and the Trust’s use of J.P. Morgan Securities as a broker, Ms. Nason may be deemed to be an “interested person” of the Trust, as that term is defined in Section 2(a)(19) of the 1940 Act, at the time of the Meeting. If elected, it is expected that Ms. Nason will be seated as a Trustee on or about February 1, 2025, at which time Ms. Nason will no longer be an “interested person” of the Trust. For the purpose of this Proxy Statement, Ms. Nason is a nominee to serve as an Independent Trustee. |

2

Currently, Messrs. Thomas A. Larsen and Charles F. Pohl are Trustees of the Trust. If the nominees are successfully elected to the Board of Trustees at the Meeting, Mr. Pohl is expected to retire following the Meeting and Mr. Larsen is expected to retire on December 31, 2024, and consequently they have not been proposed for election to the Board of Trustees at the Meeting.

Each of the nominees has consented to serve as a Trustee. The Board of Trustees knows of no reason why any of the nominees will be unable to serve, but in the event any nominee is unable to serve or for good cause will not serve, the proxies received indicating a vote in favor of such nominee will be voted for a substitute nominee as the Board of Trustees may recommend.

Nominees

Certain information concerning the nominees, as of March 31, 2024, is set forth below. Unless otherwise indicated, the address of all persons below is 555 California Street, San Francisco, 40th Floor, CA 94104. Each Trustee will oversee all seven of the Dodge & Cox Funds.

| | | | |

Name, (Age), Position with the Trust, and Length of Time Served | | Principal Occupation(s)

During Past 5 Years | | Other Public Company

and Investment

Company Directorships

Held by Trustee During

the Past 5 Years |

| Interested Nominees1 | | | | |

Dana M. Emery (62) Chair (since 2022) President (since 2014) Trustee (since 1993) | | Chair (since 2022), Chief Executive Officer, and Director of Dodge & Cox; President (until 2022); Co-Director of Fixed Income (until 2020), Director of Fixed Income (until 2019); member of U.S. Fixed Income Investment Committee (USFIIC) and Global Fixed Income Investment Committee (GFIIC). | | None |

| | |

Roger G. Kuo (52) Senior Vice President (since 2022) Trustee (Nominee) | | President (since 2022); Senior Vice President (until 2022) and Director (since 2016) of Dodge & Cox; Research Analyst and member of International Equity Investment Committee (IEIC) and Global Equity Investment Committee (GEIC). | | None |

| | |

Lucinda I. Johns (50) Vice President (since 2012) Trustee (Nominee) | | Senior Vice President and Director of Dodge & Cox (since 2022); Director of Fixed Income (since January 2024); Associate Director of Fixed Income (until 2023), Research Analyst, and member of U.S. Fixed Income Investment Committee (USFIIC), Global Fixed Income Investment Committee (GFIIC), and Balanced Fund Investment Committee (BFIC). | | None |

3

| | | | |

Name, (Age), Position with the Trust, and Length of Time Served | | Principal Occupation(s)

During Past 5 Years | | Other Public Company

and Investment

Company Directorships

Held by Trustee During

the Past 5 Years |

| Independent Nominees | | |

Luis Borgen (54) Trustee (since 2022) | | Mr. Borgen is currently an independent member of the Board of Directors of Synopsys, Carter’s, and Eastern Bankshares. From 2019 to April 2022, he served as Chief Financial Officer (CFO) of athenahealth and played a key role in the company’s sale to Hellman & Friedman and Bain Capital. Over the preceding decade, he served as CFO of various publicly-traded companies, including DaVita and DAVIDsTEA. Earlier in his career, he spent 13 years in increasingly senior finance roles at Staples, culminating as Senior Vice President and CFO for the U.S. Retail business. Mr. Borgen began his career in the U.S. Air Force, where he attained the rank of Captain. | | Current Director of Synopsys, Inc. (semiconductor technology); Carter’s Inc. (omni channel retailer); and Eastern Bankshares Inc. (regional bank). |

| | |

Diana F. Cantor (66) Trustee (Nominee) | | Investment Committee Member and Member Board of Managers, Alternative Investment Management, LLC (since 2010); Senior Adviser, AKF Consulting Group (since 2014). | | Current Director of Domino’s Pizza, Inc. (food industry); VICI Properties Inc. (real estate); Universal Corporation (agri-business). |

| | |

Caroline M. Hoxby (57) Trustee (since 2017) | | Ms. Hoxby has been a Professor of Economics at Stanford University since 2007 and a Director of the Economics of Education Program for the National Bureau of Economic Research since 2001. She is also a Senior Fellow of the Hoover Institution and the Stanford Institute for Economic Policy Research. | | None |

4

| | | | |

Name, (Age), Position with the Trust, and Length of Time Served | | Principal Occupation(s)

During Past 5 Years | | Other Public Company

and Investment

Company Directorships

Held by Trustee During

the Past 5 Years |

Ann Mather (63) Trustee (since 2011) | | Ms. Mather has served as the Chief Financial Officer or in other executive financial management positions with numerous public and private companies, including Polo Ralph Lauren, Buena Vista International, Inc., and, most recently, Pixar Animation Studios where she was CFO from 1999 to 2004. Ms. Mather has also served on a variety of public and private company boards, including as chair of the audit committee for several public company boards. | | Current Director of Netflix, Inc. (internet television); Blend (software company); and Bumble (online dating). |

| | |

Jennifer Nason (63) Trustee (Nominee) | | Global Chairman of Investment Banking, J.P. Morgan. | | Current Director of Rio Tinto (mining). |

| | |

Gabriela Franco Parcella (55) Trustee (since 2020) | | Ms. Parcella is President (since 2020) of Merlone Geier Management and Executive Managing Director (since 2018) of the private equity real estate firm Merlone Geier Partners. Previously, she was Chairman, President & CEO of Mellon Capital, serving in those roles over the last seven years of her 20-year tenure at the firm. Ms. Parcella also previously served as an Independent Director and Chair of the Nominating and Corporate Governance Committee of Terreno Realty Corporation and currently serves as a trustee on the boards of several educational and non-profit organizations. | | None |

| | |

Shawn Purvis (51) Trustee (since 2022) | | Ms. Purvis is President and CEO of QinetiQ US (since 2022), part of QinetiQ Group plc. Previously, Ms. Purvis served in senior leadership roles over the course of a decade at Northrop Grumman (2012-2022), culminating as Corporate Vice President and President of Enterprise Services. Earlier in her career, she held management roles at SAIC and Lockheed Martin. | | None |

5

| | | | |

Name, (Age), Position with the Trust, and Length of Time Served | | Principal Occupation(s)

During Past 5 Years | | Other Public Company

and Investment

Company Directorships

Held by Trustee During

the Past 5 Years |

Gary Roughead (72) Trustee (since 2013) | | Admiral Roughead (Ret.) serves as a Trustee of Johns Hopkins University and serves on the board of the Johns Hopkins Applied Physics Laboratory; and has served since 2012 as the Robert and Marion Oster Distinguished Military Fellow at the Hoover Institution at Stanford University. Admiral Roughead is a member of the Arctic Security Initiative (Chair), Task Force on Energy Policy, Military History Working Group, and Foreign Policy Working Group at the Hoover Institution. From 1973 to 2011, Admiral Roughead served in the U.S. Navy. From 2007 to 2011, Admiral Roughead was the Chief of Naval Operations. During that period, Admiral Roughead was a Senior Officer in the U.S. Navy, Naval Advisor to the President and Secretary of Defense and a Member of the Joint Chiefs of Staff. | | Current Director, Northrop Grumman Corp. (global security); and Maersk Line, Limited (shipping and transportation). |

| | |

Mark E. Smith (73) Trustee (since 2014) | | Mr. Smith served as a consultant from 2012 to 2013 at Brown Brothers Harriman, an investment management company, and at Loomis Sayles & Company, L.P., an investment manager. From 2003 to 2011, Mr. Smith served as Executive Vice President, Managing Director-Fixed Income at Loomis Sayles & Company, L.P. | | None |

| 1 | Each “Interested Nominee” is an “interested person” of the Trust (as that term is defined in the 1940 Act) because of his or her affiliation with Dodge & Cox. |

6

Current Trustees not being Nominated

Certain information concerning the Trustees of the Trust not proposed for election at the Meeting, as of March 31, 2024, is set forth below. The address for each of the individuals listed below is 555 California Street, 40th Floor, San Francisco, CA 94104. Each Trustee oversees all seven Funds in the Dodge & Cox Funds complex.

| | | | |

Name, (Age), Position with the Trust, and Length of Time Served | | Principal Occupation(s)

During Past 5 Years | | Other Public Company

and Investment

Company Directorships

Held by Trustee During

the Past 5 Years |

Thomas A. Larsen (74) Trustee (since 2002) | | Mr. Larsen most recently served as Senior Counsel of the law firm of Arnold & Porter until 2018, prior to which he was a Partner. He previously was a Director of Howard, Rice, Nemerovski, Canady, Falk & Rabkin (a law firm) from 1977 to 2011, where he also served as Chair of the Real Estate and Private Client Services Groups. Mr. Larsen previously worked in the Office of the General Counsel of the Environmental Protection Agency. Mr. Larsen has served in leadership positions on advisory and trustee boards for many charitable, educational, and nonprofit organizations, as well as a private company. | | None |

| | |

Charles F. Pohl (66) Trustee (since 2014) | | Chair and Director of Dodge & Cox (until 2022); Chief Investment Officer (until 2022) and member of U.S. Equity Investment Committee (USEIC) and Emerging Markets Equity Investment Committee (EMEIC) (until 2022); member of Global Equity Investment Committee (GEIC) (until May 2021), International Equity Investment Committee (IEIC) (until 2021), and; U.S. Fixed Income Investment Committee (USFIIC) (until 2019). | | None |

7

Qualifications of Nominees; Leadership Structure and Risk Oversight Function

Each Fund is governed by the Board of Trustees of the Trust, which meets regularly to review a wide variety of matters affecting the Funds. The Trustees’ primary responsibility is oversight of the management of each Fund for the benefit of its shareholders. The Trustees approve certain agreements and policies for the Funds; monitor Fund operations, service providers, regulatory compliance, performance, and costs; and nominate and select new Trustees. The Trustees also elect the Funds’ Officers and are responsible for performing various duties imposed on them by applicable law, including the 1940 Act and the laws of the State of Delaware. Dodge & Cox manages the day-to-day operations of the Funds under the direction of the Board of Trustees. The Board met four times during the fiscal year ended December 31, 2023. Dana M. Emery, an “interested” Trustee, serves as Chair of the Board of Trustees of the Trust. The Independent Trustees of the Funds have designated a Lead Independent Trustee, who functions as a spokesperson and principal point of contact for the Independent Trustees. The Lead Independent Trustee is responsible for coordinating the activities of the Independent Trustees, including calling and presiding at regular executive sessions of the Independent Trustees, developing the agenda of each Board meeting together with the Chair, representing the Independent Trustees in discussions with Dodge & Cox management, and facilitating communication among the Funds’ Independent Trustees. Admiral Gary Roughead currently serves as Lead Independent Trustee. The Funds’ Board has determined that its leadership and committee structure is appropriate because it sets the proper tone for the relationship between the Funds, on the one hand, and Dodge & Cox and the Funds’ other principal service providers, on the other, and facilitates the exercise of the Board’s independent judgment in evaluating and managing the relationships. In addition, the structure efficiently allocates responsibility among committees and the full Board.

Like other mutual funds, each of the Dodge & Cox Funds is subject to a variety of risks, including, among others, investment, valuation, compliance, and operational risks. Dodge & Cox and other service providers have primary responsibility for the Funds’ risk management on a day-to-day basis as part of their overall responsibilities. Dodge & Cox is also primarily responsible for managing investment risk and its own operational risks as part of its day-to-day investment management responsibilities. Dodge & Cox and the Funds’ Chief Compliance Officer (who reports directly to the Board) assist the Board in overseeing the significant investment policies of the Funds and monitor the various compliance policies and procedures approved by the Board as part of its oversight responsibilities.

In discharging its oversight responsibilities, the Board of Trustees considers risk management matters throughout the year by reviewing regular reports prepared by Dodge & Cox and the Funds’ Chief Compliance Officer, as well as special written reports or presentations provided on a variety of relevant issues, as needed. For example, Dodge & Cox reports to the Board quarterly on the investment performance of the Funds, the financial performance of the Funds, and overall market and economic conditions. Dodge & Cox also provides regular updates on legal and regulatory developments that may affect the Funds. The Funds’ Chief Compliance Officer provides regular presentations to the Board at its quarterly meetings. The Funds’ Chief Compliance Officer also provides an annual report to the Board concerning, among other things, (i) any material compliance matters relating to the Funds, Dodge & Cox, and the Funds’ other key service providers; (ii) various risks identified as part of the Funds’ compliance program assessments; and (iii) any material recommended changes to policies and procedures. The Funds’ Chief Compliance Officer also meets regularly in executive session with the Independent Trustees and communicates any significant compliance-related issues and regulatory developments to the Audit and Compliance Committee between Board meetings.

In addressing issues regarding the Funds’ risk management between meetings, representatives of Dodge & Cox communicate with the Lead Independent Trustee and/or the Chairperson of the

8

Audit and Compliance Committee and other Independent Trustees. As appropriate, the Trustees confer among themselves, or with Dodge & Cox, the Funds’ Chief Compliance Officer, and independent legal counsel to the Independent Trustees, to identify and review risk management issues that may be placed on the Board’s agenda.

The Board also relies on its committees to administer the Board’s oversight function. The Audit and Compliance Committee, which is composed of all Independent Trustees, oversees management of financial and compliance risks and controls. The Audit and Compliance Committee assists the Board at various times throughout the year in reviewing with Dodge & Cox and the Funds’ independent auditors matters relating to financial accounting and reporting, systems of internal controls, and the Funds’ annual audit process. Gabriela Franco Parcella serves as Chair of the Audit and Compliance Committee. The Valuation Committee reviews and makes recommendations concerning the fair valuation of portfolio securities and the Funds’ valuation policies in general. Caroline M. Hoxby serves as Chair of the Valuation Committee. These and the Board’s other committees present reports to the Board that may prompt further discussion of issues concerning the oversight of the Funds’ risk management. The Board may also discuss particular risks that are not addressed in the committee process.

In addition to the committees discussed above, there are other committees upon which the Board relies when reviewing matters affecting the Funds. The Contract Review Committee considers the renewal of the Investment Management Agreements between the Funds and Dodge & Cox and such other material contracts as the Board and the Committee deem appropriate. Mark E. Smith and Gabriela Franco Parcella serve as Co-Chairs of the Contract Review Committee. The Governance Committee proposes members of the committees of the Board, evaluates and recommends to the Board the compensation of Trustees, and evaluates the performance of the Board as necessary. Thomas A. Larsen serves as Chair of the Governance Committee. The Nominating Committee determines such standards or qualifications for nominees to serve as Trustees on the Board, if any, as the Committee deems appropriate, identifies possible candidates to become members of the Board, considers and evaluates such candidates, and recommends Trustee nominees for the Board’s approval. Ann Mather serves as Chair of the Nominating Committee. For more information on the Board’s committees, please see the subsection below titled “Standing Committees of the Trust.”

All of the Trustees bring to the Board a wealth of executive leadership experience. The Board and its Nominating and Governance Committees select Independent Trustees with a view toward constituting a Board that, as a body, possesses the qualifications, skills, attributes, and experience to appropriately oversee the actions of the Funds’ service providers, decide upon matters of general policy, and represent the long-term interests of Fund shareholders. In doing so, they consider the qualifications, skills, attributes, and experience of the current Board members of the Funds, with a view toward maintaining a Board that is diverse in viewpoint, experience, education, and skills.

The Funds seek Independent Trustees who have high ethical standards and the highest levels of integrity and commitment, who have inquiring and independent minds, mature judgment, good communication skills, and other complementary personal qualifications and skills that enable them to function effectively in the context of the Funds’ Board and committee structure and who have the ability and willingness to dedicate sufficient time to effectively fulfill their duties and responsibilities. The business acumen, experience, and objective thinking of the Trustees are considered invaluable assets for Dodge & Cox management and the Funds.

The Independent Trustees collectively have a significant record of accomplishments in governance, business, not-for-profit organizations, government and military service, academia,

9

law, accounting, and other professions. Although no single list could identify all the experience upon which the Funds’ Independent Trustees draw in connection with their service, the table above summarizes key experience for each Independent Trustee. These references to the qualifications, attributes, and skills of the Trustees are pursuant to the disclosure requirements of the U.S. Securities and Exchange Commission, and shall not be deemed to impose any greater responsibility or liability on any Trustee or the Board as a whole. Notwithstanding the qualifications listed above, none of the Independent Trustees is considered an “expert” within the meaning of the federal securities laws with respect to information in the Funds’ registration statement.

Interested Trustees have similar qualifications, skills, and attributes as the Independent Trustees. Interested Trustees are current or former senior executive officers of Dodge & Cox. This management experience with the Funds’ investment adviser also permits them to make a significant contribution to the Funds’ Board.

Standing Committees of the Trust

The Board of Trustees has the five standing committees listed below. No Interested Trustee serves on any of these standing committees.

| | | | | | |

Committee | | Functions | | Members | | Number of

Meetings Held

During the Last

Fiscal Year |

| Audit and Compliance Committee | | Oversee the accounting and financial reporting processes of the Trust and each of its series and its internal controls and, as the Committee deems appropriate, inquire into the internal controls of certain third-party service providers; oversee the quality and integrity of the Funds’ financial statements and the independent audit thereof; oversee, or, as appropriate, assist Board of Trustees’ oversight of, the Funds’ compliance with legal and regulatory requirements that relate to the Funds’ accounting and financial reporting, internal controls and independent audits; approve prior to appointment the engagement of the Funds’ independent auditors and, in connection therewith, to review and evaluate the qualifications, independence and performance of the Funds’ independent auditors; and act as a liaison between the Funds’ independent auditors and Chief Compliance Officer and the Board. | | Luis Borgen Caroline M. Hoxby Thomas A. Larsen Ann Mather Gabriela Franco Parcella (Chair) Shawn Purvis Gary Roughead Mark E. Smith | | 2 |

10

| | | | | | |

Committee | | Functions | | Members | | Number of

Meetings Held

During the Last

Fiscal Year |

Contract Review Committee | | Consider the renewal of the Investment Management Agreements between the Funds and Dodge & Cox pursuant to Section 15(c) of the 1940 Act and such other material contracts as the Board and Committee deem appropriate. | | Luis Borgen Caroline M. Hoxby Thomas A. Larsen Ann Mather Gabriela Franco Parcella (Co-Chair) Shawn Purvis Gary Roughead Mark E. Smith (Co-Chair) | | 2 |

| | | |

Governance Committee | | Nominate proposed members of committees of the Board; evaluate and recommend to the Board the compensation of Trustees and Trustee expense reimbursement policies; and evaluate the performance of the Board as deemed necessary. | | Luis Borgen Caroline M. Hoxby Thomas A. Larsen (Chair) Ann Mather Gabriela Franco Parcella Shawn Purvis Gary Roughead Mark E. Smith | | 4 |

| | | |

Nominating Committee | | Determine such standards or qualifications for nominees to serve as Trustees, if any, as the Committee deems appropriate; identify possible candidates to become members of the Board in the event that a Trustee position is vacated or created and/or in contemplation of a shareholders’ meeting at which one or more Trustees is to be elected; and consider and evaluate such candidates and recommend Trustee nominees for the Board’s approval. | | Luis Borgen Caroline M. Hoxby Thomas A. Larsen Ann Mather (Chair) Gabriela Franco Parcella Gary Roughead Shawn Purvis Mark E. Smith | | 2 |

| | | |

Valuation Committee | | Review and approve the Funds’ valuation policies; provide oversight for pricing of securities and calculation of net asset value; review “fair valuations” and determinations of liquidity of the Funds’ securities. | | Luis Borgen Caroline M. Hoxby (Chair) Thomas A. Larsen Ann Mather Gabriela Franco Parcella Shawn Purvis Gary Roughead Mark E. Smith | | 2 |

No Trustee nominee attended fewer than seventy-five percent of the meetings held the Board or by any Committee of which he or she was a member while he or she was a Trustee during the fiscal year ended December 31, 2023.

The Nominating Committee has a charter, which is attached as Exhibit B.

The Audit and Compliance Committee has a charter, which is attached as Exhibit E.

The Governance Committee has a charter, which is attached as Exhibit F.

11

Nominee Ownership of Fund Shares

The following table sets forth information describing the dollar ranges of shares in the Funds beneficially owned by each nominee and the dollar ranges of shares in the Funds beneficially owned by each nominee in the aggregate as of March 31, 2024, unless otherwise noted.

| | | | | | |

Name of Trustee | | Fund Name | | Dollar Range of Equity Securities in the Fund | | Aggregate Dollar Range of

Equity Securities in all

Registered Investment

Companies Overseen by

Trustee in Family of

Investment Companies |

| Interested Trustees | | | | |

| Dana M. Emery | | Dodge & Cox Stock Fund | | Over $100,000 | | Over $100,000 |

| | Dodge & Cox International Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Emerging Markets Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Global Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Balanced Fund | | Over $100,000 | | |

| | Dodge & Cox Income Fund | | Over $100,000 | | |

| | Dodge & Cox Global Bond Fund | | Over $100,000 | | |

| | | |

| Roger G. Kuo1 | | Dodge & Cox Stock Fund | | Over $100,000 | | Over $100,000 |

| | Dodge & Cox International Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Emerging Markets Stock Fund | | None | | |

| | Dodge & Cox Global Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Balanced Fund | | Over $100,000 | | |

| | Dodge & Cox Income Fund | | None | | |

| | Dodge & Cox Global Bond Fund | | None | | |

| | | |

| Lucinda I. Johns1 | | Dodge & Cox Stock Fund | | Over $100,000 | | Over $100,000 |

| | Dodge & Cox International Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Emerging Markets Stock Fund | | None | | |

| | Dodge & Cox Global Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Balanced Fund | | Over $100,000 | | |

| | Dodge & Cox Income Fund | | Over $100,000 | | |

| | Dodge & Cox Global Bond Fund | | Over $100,000 | | |

Independent Trustees | | | | |

| Luis Borgen | | Dodge & Cox Stock Fund | | None | | None |

| | Dodge & Cox International Stock Fund | | None | | |

12

| | | | | | |

Name of Trustee | | Fund Name | | Dollar Range of Equity Securities in the Fund | | Aggregate Dollar Range of

Equity Securities in all

Registered Investment

Companies Overseen by

Trustee in Family of

Investment Companies |

| | Dodge & Cox Emerging Markets Stock Fund | | None | | |

| | Dodge & Cox Global Stock Fund | | None | | |

| | Dodge & Cox Balanced Fund | | None | | |

| | Dodge & Cox Income Fund | | None | | |

| | Dodge & Cox Global Bond Fund | | None | | |

| | | |

Diana F. Cantor 1 | | Dodge & Cox Stock Fund | | None | | None |

| | Dodge & Cox International Stock Fund | | None | | |

| | Dodge & Cox Emerging Markets Stock Fund | | None | | |

| | Dodge & Cox Global Stock Fund | | None | | |

| | Dodge & Cox Balanced Fund | | None | | |

| | Dodge & Cox Income Fund | | None | | |

| | Dodge & Cox Global Bond Fund | | None | | |

| | | |

| Caroline M. Hoxby | | Dodge & Cox Stock Fund | | Over $100,000 | | Over $100,000 |

| | Dodge & Cox International Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Emerging Markets Stock Fund | | None | | |

| | Dodge & Cox Global Stock Fund | | None | | |

| | Dodge & Cox Balanced Fund | | None | | |

| | Dodge & Cox Income Fund | | None | | |

| | Dodge & Cox Global Bond Fund | | None | | |

| | | |

Ann Mather | | Dodge & Cox Stock Fund | | None | | Over $100,000 |

| | Dodge & Cox International Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Emerging Markets Stock Fund | | None | | |

| | Dodge & Cox Global Stock Fund | | None | | |

| | Dodge & Cox Balanced Fund | | $1-10,000 | | |

| | Dodge & Cox Income Fund | | None | | |

| | Dodge & Cox Global Bond Fund | | None | | |

13

| | | | | | |

Name of Trustee | | Fund Name | | Dollar Range of Equity Securities in the Fund | | Aggregate Dollar Range of

Equity Securities in all

Registered Investment

Companies Overseen by

Trustee in Family of

Investment Companies |

Jennifer Nason1 | | Dodge & Cox Stock Fund | | None | | None |

| | Dodge & Cox International Stock Fund | | None | | |

| | Dodge & Cox Emerging Markets Stock Fund | | None | | |

| | Dodge & Cox Global Stock Fund | | None | | |

| | Dodge & Cox Balanced Fund | | None | | |

| | Dodge & Cox Income Fund | | None | | |

| | Dodge & Cox Global Bond Fund | | None | | |

| | | |

| Gabriela Franco Parcella | | Dodge & Cox Stock Fund | | Over $100,000 | | Over $100,000 |

| | Dodge & Cox International Stock Fund | | None | | |

| | Dodge & Cox Emerging Markets Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Global Stock Fund | | $10,001-50,000 | | |

| | Dodge & Cox Balanced Fund | | None | | |

| | Dodge & Cox Income Fund | | $10,001-50,000 | | |

| | Dodge & Cox Global Bond Fund | | $50,001-100,000 | | |

| | | |

Shawn Purvis | | Dodge & Cox Stock Fund | | None | | None |

| | Dodge & Cox International Stock Fund | | None | | |

| | Dodge & Cox Emerging Markets Stock Fund | | None | | |

| | Dodge & Cox Global Stock Fund | | None | | |

| | Dodge & Cox Balanced Fund | | None | | |

| | Dodge & Cox Income Fund | | None | | |

| | Dodge & Cox Global Bond Fund | | None | | |

| | | |

Gary Roughead | | Dodge & Cox Stock Fund | | Over $100,000 | | Over $100,000 |

| | Dodge & Cox International Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Emerging Markets Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Global Stock Fund | | $50,001-100,000 | | |

| | Dodge & Cox Balanced Fund | | Over $100,000 | | |

| | Dodge & Cox Income Fund | | Over $100,000 | | |

| | Dodge & Cox Global Bond Fund | | $50,001-100,000 | | |

14

| | | | | | |

Name of Trustee | | Fund Name | | Dollar Range of Equity Securities in the Fund | | Aggregate Dollar Range of

Equity Securities in all

Registered Investment

Companies Overseen by

Trustee in Family of

Investment Companies |

Mark E. Smith | | Dodge & Cox Stock Fund | | Over $100,000 | | Over $100,000 |

| | Dodge & Cox International Stock Fund | | None | | |

| | Dodge & Cox Emerging Markets Stock Fund | | None | | |

| | Dodge & Cox Global Stock Fund | | None | | |

| | Dodge & Cox Balanced Fund | | None | | |

| | Dodge & Cox Income Fund | | None | | |

| | Dodge & Cox Global Bond Fund | | None | | |

| (1) | Proposed to join Board. |

The following table sets forth information describing the dollar ranges of shares in the Funds beneficially owned by each Trustee who is not proposed for election at the Meeting in the aggregate as of March 31, 2024, unless otherwise noted.

| | | | | | |

Current Trustees not being Nominated | | | | | | |

Thomas A. Larsen | | Dodge & Cox Stock Fund | | Over $100,000 | | Over $100,000 |

| | Dodge & Cox Global Stock Fund | | Over $100,000 | | |

| | Dodge & Cox International Stock Fund | | $10,001-$50,000 | | |

| | Dodge & Cox Emerging Markets Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Balanced Fund | | None | | |

| | Dodge & Cox Income Fund | | Over $100,000 | | |

| | Dodge & Cox Global Bond Fund | | Over $100,000 | | |

| | | |

Charles F. Pohl | | Dodge & Cox Stock Fund | | Over $100,000 | | Over $100,000 |

| | Dodge & Cox Global Stock Fund | | Over $100,000 | | |

| | Dodge & Cox International Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Emerging Markets Stock Fund | | Over $100,000 | | |

| | Dodge & Cox Balanced Fund | | None | | |

| | Dodge & Cox Income Fund | | None | | |

| | Dodge & Cox Global Bond Fund | | Over $100,000 | | |

15

As of March 31, 2024, other than the specific instances noted directly below, no Trustee or nominee for election to the Board of Trustees owned more than 1% of the outstanding shares any class of a Fund. As of March 31, 2024, Ms. Emery, a current Interested Trustee and nominee for election to the Board of Trustees as an Interested Trustee, beneficially owned 3.9% of the shares of the Dodge & Cox Emerging Markets Stock Fund, as well as 1.5% of the outstanding Class I shares and 2.1% of the Class X shares of the Global Bond Fund. As of March 31, 2024, the Trustees and Officers as a group owned less than 1% of each of the outstanding Class I and Class X shares of Dodge & Cox Stock Fund, Dodge & Cox International Stock Fund, and Dodge & Cox Income Fund. As of March 31, 2024, the Trustees and Officers as a group beneficially owned: less than 1% of the outstanding Class I shares and 2.0% of the outstanding Class X shares of Dodge & Cox Balanced Fund; 21.8% of the outstanding shares of Dodge & Cox Emerging Markets Stock Fund; 1.7% of the outstanding Class I shares and 7.2% of the outstanding Class X shares of Dodge & Cox Global Bond Fund; and less than 1% of the outstanding Class I shares and 6.3% of the outstanding Class X shares of Dodge & Cox Global Stock Fund.

Ownership of Certain Entities

As of March 31, 2024, no Independent Trustee nominee or his or her immediate family members own securities, beneficially or of record, in Dodge & Cox or a person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with Dodge & Cox.

Compensation Table

The following table shows compensation paid by the Trust to the Independent Trustees for the fiscal year ended 2023. The Trust does not pay any other remuneration to its Officers or Trustees, and has no bonus, profit-sharing, pension, or retirement plan.

| | | | |

Independent Trustees | | Total Compensation from the Dodge

& Cox Funds Complex paid to Trustees for Year Ended

December 31, 20231 | |

| | | | |

Luis Borgen | | $ | 350,000 | |

Caroline M. Hoxby | | $ | 365,000 | |

Ann Mather | | $ | 355,000 | |

Gabriela Franco Parcella | | $ | 375,000 | |

Shawn Purvis | | $ | 350,000 | |

Gary Roughead | | $ | 375,000 | |

Mark E. Smith | | $ | 365,000 | |

| (1) | For the year ended December 31, 2023, each Independent Trustee was paid $350,000 for his or her services as an Independent Trustee. Any additional compensation above this amount represents payments to Independent Trustees who performed additional services to the Funds as Lead Independent Trustee and/or as Chair or Co-Chair of one or more Committees, as applicable. |

| | | | |

Current Independent Trustee not being Nominated | | Total Compensation from the Dodge

& Cox Funds Complex paid to Trustees for Year Ended

December 31, 2023 | |

| | | | |

Thomas A. Larsen | | $ | 365,000 | |

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS OF EACH FUND VOTE “FOR” THE ELECTION OF TRUSTEES TO THE BOARD OF TRUSTEES IN THIS PROPOSAL 1.

16

PROPOSAL 2: DODGE & COX BALANCED FUND

APPROVAL TO AMEND THE INVESTMENT OBJECTIVE OF THE DODGE & COX BALANCED FUND

The Balanced Fund’s current investment objective is as follows:

“The Fund seeks regular income, conservation of principal, and an opportunity for long-term growth of principal and income.”

The Board proposes that the Balanced Fund’s investment objective be changed to the following:

“The Fund seeks income and long-term capital appreciation.”

Under the Investment Company Act of 1940, as amended (the “1940 Act”), the investment objective of the Dodge & Cox Balanced Fund (the “Balanced Fund”) may be changed only with shareholder approval.

Dodge & Cox believes that it is in the interest of the Balanced Fund’s shareholders to approve a simpler and more general investment objective. Dodge & Cox notes that the Balanced Fund’s inception date was June 26, 1931, and over time the term “conservation of principal” has come to be more typically associated with funds that invest in the highest quality, short-term instruments, such as money market or short-term bond Funds. Accordingly, Dodge & Cox recommends removing that reference from the Fund’s objective. This change will not affect the Fund’s investment strategies, investment portfolio, or principal risks and will not result in an increase in the management fee payable by the Balanced Fund to Dodge & Cox. If approved by shareholders, the Balanced Fund’s investment objective will continue to be a fundamental policy of the Balanced Fund that may not be changed without shareholder approval.

The Board, upon recommendation by Dodge & Cox, believes that it is in the interests of the Balanced Fund’s shareholders to approve a more general investment objective to provide the Fund with more long-term flexibility.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS OF THE FUND VOTE “FOR” THE PROPOSAL TO AMEND THE INVESTMENT OBJECTIVE OF THE DODGE & COX BALANCED FUND IN THIS PROPOSAL 2.

OTHER MATTERS

The Board is not aware of any matters that will be presented for action at the Meeting other than the matters set forth herein. Should any other matters requiring a vote of shareholders arise, the proxy in the accompanying form will confer upon the person or persons entitled to vote the shares represented by such proxy the discretionary authority to vote the shares as to any such other matters in accordance with their best judgment in the interest of the Trust and each Fund, as applicable.

ADDITIONAL INFORMATION

SHAREHOLDER PROPOSALS

The Trust does not hold regular annual shareholders’ meetings. Shareholders wishing to submit proposals for consideration for inclusion in a proxy statement for a subsequent

17

shareholders’ meeting of the Trust (if any) should send their written proposals to the Secretary of the Trust at Dodge & Cox Funds, c/o Dodge & Cox, 555 California Street, 40th Floor, San Francisco, CA 94104. Proposals must be received a reasonable time before the date of a meeting of shareholders to be considered for inclusion in the proxy materials for that meeting. The mere submission of a proposal does not, however, guarantee that the proposal will be included.

In accordance with the Nominating Committee’s charter, which is attached as Exhibit B, the Nominating Committee will consider shareholder recommendations for Trustee nominees. Shareholders may send recommendations to the Secretary of the Trust at Dodge & Cox Funds, c/o Dodge & Cox, 555 California Street, 40th Floor, San Francisco, CA 94104. Trustee nominations must be received a reasonable time before the date of a meeting of shareholders to be considered for inclusion in the proxy materials for that meeting. The Nominating Committee has adopted specific procedures for considering the recommendation of Trustee nominees by shareholders. Please see the procedures described in Appendix A of Exhibit B below.

SHAREHOLDER COMMUNICATIONS WITH THE BOARD

Shareholders may direct correspondence related to any Fund, the Board as a whole, or individual Board members to the principal executive office of the Trust. Please address such correspondence as follows: c/o Dodge & Cox, 555 California Street, 40th Floor, San Francisco, CA 94104, Attention: Secretary.

Upon receipt, all shareholder correspondence will be directed to the appropriate Trustee or officer for review and consideration.

VOTING INFORMATION

Each share of a Fund is entitled to one vote on Proposals affecting that Fund, and a fractional share is entitled to a proportionate share of one vote. Any shareholder giving a proxy has the power to revoke it by executing a proxy bearing a later date or by attending and voting at the meeting. All properly executed proxies received in time for the Meeting will be voted as specified in the proxy or, if no specification is made, in favor of the Proposal referred to in the Proxy Statement.

The Meeting will be conducted exclusively via audioconference. Any shareholder wishing to participate in the Meeting telephonically can do so. If you were a record holder of the Fund shares as of the Record Date, please send an e-mail to the Fund’s proxy solicitor, Morrow Sodali Fund Solutions (“MSFS”), at msfs-meetinginfo@morrowsodali.com no later than 2:00pm ET on October 23rd, 2024 to register to attend. Please include the Fund’s name(s) in the subject line and provide your name and address in the body of the e-mail. MSFS will then e-mail you the credentials to the audioconference and instructions for voting during the Meeting. If you held Fund shares through an intermediary, such as a broker-dealer, as of the Record Date, and you want to participate in the Meeting, please e-mail MSFS at msfs-meetinginfo@morrowsodali.com no later than 2:00pm ET on October 23rd, 2024 to register to attend. Please include the Fund’s name(s) in the subject line and provide your name, address and proof of ownership as of the Record Date from your intermediary. Please be aware that if you wish to vote at the Meeting, you must first obtain a legal proxy from your intermediary reflecting the Fund’s name(s), the number of Fund shares you held as of the Record Date and your name and e-mail address. You may forward an email from your intermediary containing the legal proxy or e-mail an image of the legal proxy to MSFS at msfs-meetinginfo@morrowsodali.com and put “Legal Proxy” in the subject line. MSFS will then provide you with the credentials for the audioconference and instructions for voting during the Meeting. The audioconference credentials will only be active for the date and time of the Meeting. If you have any questions prior to the Meeting, please call MSFS at 833-812-4594.

18

Quorum

With respect to Proposal 1, the presence at any meeting, by audioconference or by proxy, of the holders of one-third of the shares of the Trust entitled to be cast shall be necessary and sufficient to constitute a quorum for the transaction of business. With respect to Proposal 2, the presence at any meeting, by audioconference or by proxy, of the holders of one-third of the shares of the Dodge & Cox Balanced Fund entitled to be cast shall be necessary and sufficient to constitute a quorum for the transaction of business.

Shares represented by proxy over which broker-dealers have discretionary voting power, shares represented by proxy that represent “broker non-votes” (i.e., shares held by brokers or nominees that neither have received instructions from the beneficial owner or other persons entitled to vote nor have discretionary power to vote on a particular matter), and shares whose proxies reflect an abstention on any item will all be counted as shares present and entitled to vote for purposes of determining whether the required quorum of shares exists.

Holders of record of the shares of each Fund at the close of business on the Record Date, August 15, 2024, as to any matter on which they are entitled to vote, will be entitled to vote on all business at the Meeting with respect to each Fund. As of August 15, 2024, the following number of shares of each Fund were outstanding:

| | | | | | | | | | | | |

Fund | | Number of Shares

Outstanding

Class I | | | Number of Shares

Outstanding

Class X | | | Total Number of

Shares Outstanding | |

Dodge & Cox Stock Fund | | | 253,123,370.258 | | | | 170,090,284.564 | | | | 423,213,654.822 | |

Dodge & Cox International Stock Fund | | | 764,792,475.401 | | | | 169,867,333.410 | | | | 934,659,808.811 | |

Dodge & Cox Emerging Markets Stock Fund | | | N/A | | | | N/A | | | | 38,035,539.905 | |

Dodge & Cox Global Stock Fund | | | 654,090,491.299 | | | | 54,514,225.198 | | | | 708,604,716.497 | |

Dodge & Cox Balanced Fund | | | 115,241,054.092 | | | | 21,570,174.760 | | | | 136,811,228.852 | |

Dodge & Cox Income Fund | | | 5,412,948,001.675 | | | | 1,121,653,129.777 | | | | 6,534,601,131.452 | |

Dodge & Cox Global Bond Fund | | | 256,392,937.502 | | | | 22,940,633.623 | | | | 279,333,571.125 | |

Voting Requirement

Passage of Proposal 1 requires a plurality of the total votes validly cast by audioconference or by proxy at the Meeting. The votes of each Fund will be counted together with respect to the election of the Trustees. Passage of Proposal 2 requires the affirmative vote of a majority of the Dodge & Cox Balanced Fund’s outstanding voting securities (as defined in the 1940 Act) for Proposal 2 to pass with respect to the Fund, which, for these purposes, is the vote of: (1) 67% or more of the voting securities entitled to vote on Proposal 2 that are present at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy; or (2) more than 50% of the outstanding voting securities entitled to vote on Proposal 2, whichever is less.

Adjournment

In the event that a quorum to transact business is not present, the vote required to approve any Proposal is not obtained at the Meeting, or such other reason as determined by the Chair of the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting in accordance with applicable law to permit further solicitation of proxies. An adjournment may be proposed on a per Proposal and/or per Fund basis. If the proposed adjournment relates to Proposal 2, any such adjournment will require the affirmative vote of the holders of a majority of the

19

Balanced Fund’s shares present by audioconference or by proxy and entitled to vote at the Meeting. In the absence of a quorum, the persons named as proxies will vote all shares represented by proxy and entitled to vote in favor of such adjournment. If a quorum is present but insufficient votes have been received to approve a Proposal, the persons named as proxies will vote in favor of such adjournment with respect to any Proposal those proxies which they are entitled to vote in favor of that Proposal and will vote against any such adjournment with respect to any Proposal those proxies required to be voted against that Proposal, provided that broker non-votes will be disregarded for this purpose.

Effect of Abstentions and Broker Non-Votes

For purposes of determining the presence of a quorum for transacting business at the Meeting, executed proxies marked as abstentions and broker “non-votes” will be treated as shares that are present for quorum purposes, but which have not been voted. Accordingly, abstentions and broker non-votes will have no effect on Proposal 1, for which the required vote is a plurality of the votes cast. Abstentions and broker non-votes will effectively be a vote “against” Proposal 2, for which the required vote is a majority of the Balanced Fund’s outstanding voting securities (as defined in the 1940 Act) for Proposal 2 to pass, which, for these purposes, is the vote of: (1) 67% or more of the voting securities entitled to vote on Proposal 2 that are present at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy; or (2) more than 50% of the outstanding voting securities entitled to vote on Proposal 2, whichever is less. Abstentions and broker non-votes will be disregarded for purposes of voting on adjournment. Accordingly, shareholders are urged to forward their voting instructions promptly.

OWNERSHIP OF THE FUNDS

Exhibit A sets forth the beneficial and record owners of more than 5% of each Fund’s shares. To the best of the Trust’s knowledge, as of March 31, 2024, no person owned beneficially more than 5% of outstanding shares of any Fund, except as stated in Exhibit A.

OFFICERS OF THE TRUST

Exhibit C lists the name, age, position(s) with the Trust, length of time served, and principal occupation(s) during the past 5 years of the Officers of the Trust.

COST AND METHOD OF PROXY SOLICITATION

The Trust will pay the cost of preparing, printing, and mailing the enclosed proxy card(s) and Proxy Statement and all other costs incurred in connection with the solicitation of proxies, including any additional solicitation made by mail, internet, telephone, or other means. The solicitation of proxies will be largely by mail, but may include telephonic, electronic, or oral communication by Officers and service providers of the Trust, who will not be paid for these services, and/or by MSFS, a professional proxy solicitor retained by the Trust for an estimated fee of approximately $1.4 million, plus out-of-pocket expenses. Banks, brokerage houses, nominees, custodians and other fiduciaries will be requested to forward the proxy soliciting materials to the beneficial owners and obtain authorization for the execution of proxies. The Trust may reimburse banks, brokerage houses, nominees, custodians and other fiduciaries for postage and reasonable expenses incurred by them in the forwarding of proxy material to beneficial owners.

20

SERVICE PROVIDERS

Investment Manager

Dodge & Cox, 555 California Street, 40th Floor, San Francisco, CA 94104, a California corporation, is employed by the Trust as manager and investment adviser of the Funds, subject to the direction of the Board of Trustees. Dodge & Cox is one of the oldest professional investment management firms in the United States, having acted continuously as investment managers since 1930, and has served as manager and investment adviser for the Funds since each Fund’s inception.

Dodge & Cox is not engaged in the brokerage business nor in the business of dealing in or selling securities. Its activities are devoted to investment research and the supervision of investment accounts for individuals, trustees, corporations, pension and profit-sharing funds, public entities, and charitable institutions.

Principal Underwriter

Foreside Fund Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (d/b/a ACA Group) (“Foreside”), a wholly owned subsidiary of Foreside Distributors, LLC, is a member of the Financial Industry Regulatory Authority (“FINRA”) and is located at Three Canal Plaza, Third Floor, Portland, Maine 04101. Foreside serves as the Funds’ principal underwriter under a Distribution Agreement with the Trust (the “Distribution Agreement”). Dodge & Cox is responsible for paying any fees and expenses incurred by the Trust under the Distribution Agreement, and the Funds are not responsible for covering any such fees or expenses. Under the terms of the Distribution Agreement, Foreside acts as the agent of the Trust in connection with the continuous offering of shares of the Funds, and Foreside has no obligation to sell any specific quantity of Fund shares. Foreside continually distributes shares of the Funds on a commercially reasonable efforts basis. Foreside is not affiliated with Dodge & Cox. Foreside and its officers have no role in determining the investment policies or which securities are to be purchased or sold by the Trust. The Funds do not pay any brokerage commissions to Foreside.

Custodian and Transfer Agent

State Street Bank and Trust Company, One Congress Street, Suite 1, Boston, Massachusetts 02114-2016, at its offices of its branches and agencies throughout the world, acts as custodian of all cash and securities of the Funds and serves as fund accounting agent for the Funds. As Foreign Custody Manager for the Funds, the bank selects and monitors foreign sub-custodian banks, selects and evaluates non-compulsory foreign depositaries, and furnishes information relevant to the selection of compulsory depositaries. SS&C GIDS, P.O. Box 219502, Kansas City, MO 64121-9502 acts as transfer and dividend disbursing agent for the Funds.

Independent Registered Public Accounting Firm

Information related to the Funds’ Independent Registered Public Accounting Firm is set out in Exhibit D.

FINANCIAL STATEMENTS

Audited financial statements for the Trust appear in its Annual Report.

If you would like a copy of the most recent Annual Report or Semi-Annual Report free of charge, visit the Funds’ website at www.dodgeandcox.com, call 800-621-3979, or write the Trust at Dodge & Cox Funds, P.O. Box 219502, Kansas City, MO 64121-9502.

21

|

| By Order of the Board of Trustees, |

|

/s/ Roberta R.W. Kameda |

| Roberta R.W. Kameda |

| Secretary |

August 23, 2024

Please complete, date, and sign the enclosed proxy card(s) and return it promptly in the enclosed reply envelope. NO POSTAGE IS REQUIRED if mailed in the United States.

22

INDEX OF EXHIBITS

| | |

| EXHIBIT A | | BENEFICIAL AND RECORD OWNERS OF TRUST SHARES |

| EXHIBIT B | | NOMINATING COMMITTEE CHARTER |

| EXHIBIT C | | OFFICERS OF THE TRUST |

| EXHIBIT D | | INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| EXHIBIT E | | AUDIT AND COMPLIANCE COMMITTEE CHARTER |

| EXHIBIT F | | GOVERNANCE COMMITTEE CHARTER |

EXHIBIT A

BENEFICIAL AND RECORD OWNERS OF TRUST SHARES

The following table sets forth the beneficial and record owners of more than 5% of each Fund’s shares. To the best of the Trust’s knowledge, as of March 31, 2024, no person owned beneficially more than 5% of outstanding shares of any Fund, except as stated below.

| | | | | | | | |

Name/Address | | Fund - Class | | Nature of Ownership | | Number of Shares

Owned | | Percent of

Class |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox Stock Fund Class I | | Of Record | | 52,832,566.7800 | | 20.24% |

| | | | |

The Charles Schwab Corporation,

211 Main Street,

San Francisco, CA 94105 | | Dodge & Cox Stock Fund Class I | | Of Record | | 44,964,718.1250 | | 17.23% |

| | | | |

Edward D Jones & Co

12555 Manchester Road,

Saint Louis, MO 63131-371 | | Dodge & Cox Stock Fund Class I | | Of Record | | 16,778,400.4220 | | 6.43% |

| | | | |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox Stock Fund Class X | | Of Record | | 56,178,966.3830 | | 34.20% |

| | | | |

Bank of America, N.A.

P.O. Box 843869 Dallas,

TX 75284-3869 | | Dodge & Cox Stock Fund Class X | | Of Record | | 17,509,556.8580 | | 10.66% |

| | | | |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox Global Stock Fund Class I | | Of Record | | 186,205,000.4250 | | 27.64% |

| | | | |

The Charles Schwab Corporation,

211 Main Street,

San Francisco, CA 94105 | | Dodge & Cox Global Stock Fund Class I | | Of Record | | 110,594,580.7620 | | 16.42% |

| | | | |

Principal Financial

One Freedom Valley Drive,

Oaks, PA 19456 | | Dodge & Cox Global Stock Fund Class I | | Of Record | | 72,035,910.7280 | | 10.69% |

| | | | |

US Bank N.A.,

1555 North Rivercenter Drive Milwaukee,

WI 53212-3958 | | Dodge & Cox Global Stock Fund Class I | | Of Record | | 47,374,355.2320 | | 7.03% |

| | | | | | | | |

Name/Address | | Fund - Class | | Nature of Ownership | | Number of Shares

Owned | | Percent of

Class |

TIAA Trust, N.A.,

8500 Andrew Carnegie Boulevard, Charlotte,

NC 28262-8500 | | Dodge & Cox Global Stock Fund Class X | | Of Record | | 16,171,495.1710 | | 33.91% |

| | | | |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox Global Stock Fund Class X | | Of Record | | 13,454,111.1800 | | 28.22% |

MAC & CO.

500 Grant St. Room 151-1010

Pittsburgh, PA 15219-2502 | | Dodge & Cox Global Stock Fund Class X | | Of Record | | 12,933,879.1120 | | 27.13% |

| | | | |

The Charles Schwab Corporation,

211 Main Street,

San Francisco, CA 94105 | | Dodge & Cox Global Stock Fund Class X | | Of Record | | 3,056,615.2500 | | 6.41% |

| | | | |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox International Stock Fund Class I | | Of Record | | 168,420,094.9950 | | 21.04% |

| | | | |

The Charles Schwab Corporation,

211 Main Street,

San Francisco, CA 94105 | | Dodge & Cox International Stock Fund Class I | | Of Record | | 153,975,246.6410 | | 19.24% |

| | | | |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox International Stock Fund Class X | | Of Record | | 60,626,175.0120 | | 37.54% |

| | | | |

The Charles Schwab Corporation,

211 Main Street,

San Francisco, CA 94105 | | Dodge & Cox International Stock Fund Class X | | Of Record | | 11,095,144.1590 | | 6.87% |

| | | | |

The Charles Schwab Corporation,

211 Main Street,

San Francisco, CA 94105 | | Dodge & Cox Emerging Markets Stock Fund | | Of Record | | 12,332,032.0040 | | 33.12% |

| | | | |

BMO Wealth Management.

1 Freedom Valley Drive,

Oaks, PA 19456 | | Dodge & Cox Emerging Markets Stock Fund | | Of Record | | 7,678,474.7130 | | 20.62% |

| | | | |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox Emerging Markets Stock Fund | | Of Record | | 4,799,004.0070 | | 12.89% |

2

| | | | | | | | |

Name/Address | | Fund - Class | | Nature of Ownership | | Number of Shares

Owned | | Percent of

Class |

Charles F. Pohl

555 California St. 40th Floor

San Francisco, CA 94104 | | Dodge & Cox Emerging Markets Stock Fund | | Beneficial | | 4,081,160.202 | | 10.95% |

| | | | |

The Charles Schwab Corporation,

211 Main Street,

San Francisco, CA 94105 | | Dodge & Cox Balanced Fund Class I | | Of Record | | 24,267,333.1490 | | 20.62% |

| | | | |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox Balanced Fund Class I | | Of Record | | 18,890,775.7270 | | 16.05% |

| | | | |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox Balanced Fund Class X | | Of Record | | 7,221,987.6080 | | 34.71% |

| | | | |

T. Rowe Price

PO BOX 78446

Atlanta, GA 30357 | | Dodge & Cox Balanced Fund Class X | | Of Record | | 4,529,424.6180 | | 21.77% |

Empower Trust Company

8525 East Orchard Road,

Greenwood Village,

CO 80111-5002 | | Dodge & Cox Balanced Fund Class X | | Of Record | | 2,439,511.5180 | | 11.72% |

| | | | |

The Charles Schwab Corporation,

211 Main Street,

San Francisco, CA 94105 | | Dodge & Cox Balanced Fund Class X | | Of Record | | 1,943,603.3190 | | 9.34% |

| | | | |

The Charles Schwab Corporation,

211 Main Street,

San Francisco, CA 94105 | | Dodge & Cox Income Fund Class I | | Of Record | | 1,033,323,363.326 | | 20.12% |

| | | | |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox Income Fund Class I | | Of Record | | 844,098,773.9120 | | 16.43% |

| | | | |

Pershing, LLC

1 Pershing Plaza,

Jersey City, NJ 07399-0002 | | Dodge & Cox Income Fund Class I | | Of Record | | 379,152,744.4870 | | 7.38% |

| | | | |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox Income Fund Class X | | Of Record | | 347,983,192.4120 | | 38.18% |

| | | | |

The Charles Schwab Corporation,

211 Main Street,

San Francisco, CA 94105 | | Dodge & Cox Income Fund Class X | | Of Record | | 82,450,198.3230 | | 9.05% |

3

| | | | | | | | |

Name/Address | | Fund - Class | | Nature of Ownership | | Number of Shares

Owned | | Percent of

Class |

Vanguard Fiduciary Trust, Co.

PO Box 2600

Valley Forge, PA 19482-2600 | | Dodge & Cox Income Fund Class X | | Of Record | | 50,502,134.4610 | | 5.54% |

| | | | |

The Charles Schwab Corporation,

211 Main Street,

San Francisco, CA 94105 | | Dodge & Cox Global Bond Fund Class I | | Of Record | | 82,263,116.1520 | | 34.48% |

| | | | |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox Global Bond Fund Class I | | Of Record | | 47,344,225.1120 | | 19.84% |

| | | | |

Pershing, LLC.

1 Pershing Plaza,

Jersey City, NJ 07399-0002 | | Dodge & Cox Global Bond Fund Class I | | Of Record | | 15,220,920.6940 | | 6.38% |

| | | | |

UBS Wealth Management USA

1000 Harbor Boulevard,

Weehawken, NJ 07086 | | Dodge & Cox Global Bond Fund Class I | | Of Record | | 13,086,515.9080 | | 5.48% |

| | | | |

The Charles Schwab Corporation,

211 Main Street,

San Francisco, CA 94105 | | Dodge & Cox Global Bond Fund Class X | | Of Record | | 3,775,148.8570 | | 22.85% |

| | | | |

State Street Bank and Trust Co.

1 Heritage Drive,

Quincy, MA 02171-2105 | | Dodge & Cox Global Bond Fund Class X | | Of Record | | 2,850,383.4550 | | 17.25% |

TIAA Trust, N.A.,

8500 Andrew Carnegie

Boulevard, Charlotte,

NC 28262-8500 | | Dodge & Cox Global Bond Fund Class X | | Of Record | | 2,839,581.7310 | | 17.18% |

| | | | |

National Financial Services,

499 Washington Boulevard,

Jersey City, NJ 07310 | | Dodge & Cox Global Bond Fund Class X | | Of Record | | 1,966,422.8620 | | 11.90% |

| | | | |

Empower Trust Company

8515 East Orchard Road,

Greenwood Village,

CO 80111 | | Dodge & Cox Global Bond Fund Class X | | Of Record | | 846,321.6310 | | 5.12% |

4

EXHIBIT B

NOMINATING COMMITTEE CHARTER

DODGE & COX FUNDS

Dodge & Cox Stock Fund

Dodge & Cox International Stock Fund

Dodge & Cox Emerging Markets Stock Fund

Dodge & Cox Global Stock Fund

Dodge & Cox Balanced Fund

Dodge & Cox Income Fund

Dodge & Cox Global Bond Fund

September 22, 2021

The Board of Trustees (the “Board”) of the Dodge & Cox Funds (the “Trust”) has adopted this Charter to govern the activities of the Nominating Committee (the “Committee”) of the Board.

| I. | Role and Responsibilities of the Committee |

The Committee is responsible for (i) determining such standards or qualifications for nominees to serve as Trustees on the Board, if any, as the Committee deems appropriate, (ii) identifying possible candidates to become members of the Board in the event that a Trustee position is vacated or created and/or in contemplation of a shareholders’ meeting at which one or more Trustees is to be elected, and (iii) considering and evaluating such candidates and recommending Trustee nominees for the Board’s approval.

| II. | Organization and Governance of the Committee |

The Committee shall consist of at least three members appointed by the Board upon the recommendation of the Governance Committee.

The Board may replace members of the Committee for any reason. The Board may designate a chair of the Committee. In the absence of such designation, the Committee may elect its own Chair (Trust Bylaws, Article V, Section 1).