UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-02201

Cutwater Select Income Fund

(Exact name of registrant as specified in charter)

113 King Street

Armonk, NY 10504

(Address of principal executive offices) (Zip code)

Clifford D. Corso

113 King Street

Armonk, NY 10504

(Name and address of agent for service)

Registrant’s telephone number, including area code: 914-273-4545

Date of fiscal year end: March 31

Date of reporting period: March 31, 2014

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

CUTWATER SELECT INCOME FUND SHAREHOLDER LETTER – 03/31/14

April 15, 2014

DEAR SHAREHOLDERS:

As investors have responded to quickening global growth and the accommodative monetary policies of the U.S. Federal Reserve and other central banks over the last six months, the market for risk assets has been strong. U.S. Treasury securities, on the other hand, have been somewhat volatile. Since the beginning of the year, U.S. Treasuries have rallied in response to geopolitical tensions (e.g. Russia’s annexation of Crimea and China’s modest economic slowdown) and domestic stock market volatility. As a result, the 10-year Treasury yield declined from a recent peak of 3.03 percent on December 3, 2013 down to 2.72 percent on March 31, 2014.

At its December meeting, the U.S. Federal Reserve announced an initial reduction in a key part of its accommodative monetary policy, known as Quantitative Easing (“QE”). The announcement called for a “tapering” of monthly asset purchases by $10 billion, beginning in January 2014. The new Federal Reserve Chair, Janet Yellen, has since continued the $10 billion reduction in QE at each subsequent meeting. The market now expects QE to be finished by the end of 2014. The Federal Reserve is likely to continue its accommodative policy stance, however, and has indicated it needs to see further evidence of the U.S. economy strengthening, particularly in the labor market, before it would raise the federal funds rate. It is widely believed that a rate rise is unlikely before mid-2015. Risk assets have benefited from a decline in uncertainty as Congress was able to agree on an extension of the U.S. debt ceiling and the transition to the new Federal Reserve Chair was smooth. During this period the European Central Bank maintained its stimulative monetary policies while closely monitoring the risk of deflation to determine if further policy action is needed to spur economic growth. Japan’s economy is responding positively to its Central Bank’s accommodative monetary policies as growth and inflation have increased. Financial markets in most Emerging Markets have also rebounded during the period as many central banks have raised local interest rates to address weakened currencies and inflation concerns.

We believe that global economic data are supportive of our forecast that we are in the fourth phase of our multi-year forecast: the Self-Sustaining Recovery phase. Indeed, U.S. consumers are benefiting from improving household balance sheets and the recovering job market, and consumer confidence and retail sales continue to grow. We believe the business sector will profit from more confident consumers, increased capital investment, and growing world GDP, which the IMF expects to grow 3.6 percent in 2014 (versus 3.0 percent in 2013). With China growing near 7.5 percent and the U.S. ticking upwards beyond 2.5 percent, Japan benefiting from accommodative economic policies, and Europe forecast to grow 1.6 percent, we now have over 70 percent of world GDP stable or growing. Given our belief in an improving economy, we see several implications for investors going forward. We expect interest rates to rise, reflecting real GDP growth and inflation over time. We also expect that credit spreads may compress moderately as investors continue to search for yield and corporate fundamentals are supported by an economy that continues on its checkmark-like recovery.

In the U.S. sources of economic growth are broadening, consistent with our self-sustaining recovery thesis. Fourth quarter U.S. GDP growth was 2.6 percent, down from the third quarter level due to the U.S. government shutdown during the period. We anticipate GDP growth for the first quarter of 2014 to be depressed primarily due to the severe winter weather but also anticipate a rebound during the balance of the year. Consumer confidence has improved alongside consumers’ balance sheets, reflecting elevated stock prices and recovery in home values. Income growth has been improving since the second half of 2013, reflecting the slow decline in the unemployment rate to the 6.7 percent rate at the end of the first quarter and is supportive of growth in consumer spending. Ongoing geopolitical concerns and the upcoming mid-term elections in the U.S. may contribute to future periods of market volatility.

1

The corporate sector continues to exhibit solid fundamentals as managements have focused on reducing costs and maintaining financial flexibility. Cash flow and earnings comparisons have generally held up well, although we have seen softness in certain sectors. Capital expenditure growth has been muted but given record high corporate cash balances, improving capacity utilization, and the need to replace older infrastructure, we believe capital expenditures will increase. Strong corporate fundamentals notwithstanding, we will remain vigilant as corporations add leverage to enhance shareholder returns at the expense of creditors. We must also watch out for debt-financed mergers and acquisitions. We closely monitor our holdings for these credit-adverse risks. On balance, we remain constructive on the corporate segment of the fixed income market, including leveraged finance, where we expect default rates to remain low. Indeed, Moody’s is forecasting that the global speculative-grade default rate will increase only slightly from 2.3 percent currently to 2.6 percent in March 2015, still substantially below the long-term average default rate.

As of March 31, 2014, the Fund had a Net Asset Value (NAV) of $21.10 per share. This represents a 3.4 percent increase from $20.40 per share at September 30, 2013. On March 31, 2014, the Fund’s closing price on the New York Stock Exchange was $19.42 per share, representing a 7.96 percent discount to NAV per share, compared with a 12.79 percent discount as of September 30, 2013. The market trading discount was at 9.23 percent as of market close on April 15, 2014.

One of the primary objectives of the Fund is to maintain a high level of income. On March 12, 2014 the Board of Trustees declared a dividend payment of $0.265 per share payable May 1, 2014 to shareholders of record on April 4, 2014. On an annualized basis, including the pending dividend, the Fund has paid a total of $1.06 per share in dividends, representing a 5.56 percent dividend yield based on the market price on April 15, 2014 of $19.07 per share. The dividend is evaluated on a quarterly basis and is based on the income generation capability of the portfolio.

Total Return-Percentage Change (Annualized for periods longer than 1 year)

In Net Asset Value Per Share with All Distributions Reinvested1

| | | | | | | | | | | | | | | | | | | | |

| | | 6 Months

to

03/31/14 | | | 1 Year

to

03/31/14 | | | 3 Years

to

03/31/14 | | | 5 Years

to

03/31/14 | | | 10 Years

to

03/31/14 | |

Cutwater Select Income Fund | | | 6.44 | % | | | 3.70 | % | | | 7.77 | % | | | 12.91 | % | | | 5.93 | %2 |

Barclays U.S. Credit Index3 | | | 3.86 | % | | | 1.02 | % | | | 5.80 | % | | | 8.90 | % | | | 5.20 | % |

1 – This is historical information and should not be construed as indicative of any likely future performance.

2 – Source: BNY Mellon for all periods except 10-year returns, which are from Lipper Inc.

3 – Comprised primarily of US investment grade corporate bonds (Fund’s Benchmark).

The Fund’s performance for the 5- and 10-year historical periods (shown above) reflects the 4.79 percent dilution of net asset value resulting from the rights offering in the third quarter of 2009. After adjusting for the impact of the rights offerings, we estimate the 5-year annualized return to be 13.99 percent and the 10-year annualized return to be 6.92 percent. The returns noted in the table above are actual returns as calculated by BNY Mellon and Lipper and do not adjust for dilution from the rights offerings.

Despite volatility in U.S. Treasury yields, all major fixed income sectors exhibited positive returns for the six-month period ended March 31, 2014. The Fund’s returns for the period benefited from the allocations to investment grade and high yield corporate securities and select structured credit securities as spreads tightened in corporate and other non-government fixed income securities. For the six-month period ended March 31, 2014, the Fund outperformed its benchmark by 2.58 percent. We believe spreads may compress moderately from current levels but spreads are approaching cyclical tight levels.

2

Yield represents the major component of return in most fixed income portfolios. Given this Fund’s emphasis on income and the dividend, we generally will not have material exposure to low yielding U.S. Treasuries and will maintain meaningful exposure to corporate bonds. When it comes to management of credit risk, we try to look through periods of volatility to focus on an investment’s long term creditworthiness to assess whether it will provide an attractive yield to the Fund over time.

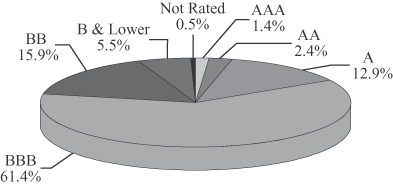

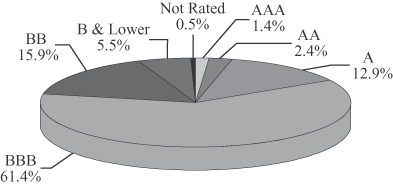

The Fund’s performance will continue to be subject to trends in long-term interest rates and to corporate yield spreads. Consistent with our investment discipline, we continue to emphasize diversification and risk management within the bounds of income stability. The pie chart below summarizes the portfolio quality of the Fund’s assets as of March 31, 2014:

Percent of Total Investment (Lower of S&P and Moody’s Ratings)

We would like to remind shareholders of the opportunities presented by the Fund’s dividend reinvestment plan referred to in the Shareholder Information section of this report. The dividend reinvestment plan affords shareholders a price advantage by allowing them to purchase shares at Net Asset Value (NAV) or market price, whichever is lower. This means that the reinvestment price is at market price when the Fund is trading at a discount to Net Asset Value, as is currently the situation, or at NAV per share when market trading is at a premium to that value. To participate in the plan, please contact BNY Mellon Investment Servicing (US) Inc. the Fund’s Transfer Agent and Dividend Paying Agent, at 1-866-333-6685. The Fund’s investment adviser, Cutwater Investment Services Corp., may be reached at 866-766-3030.

Cliff Corso

President

Mr. Corso’s comments reflect the investment adviser’s views generally regarding the market and the economy, and are compiled from the investment adviser’s research. These comments reflect opinions as of the date written and are subject to change at any time.

3

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and

Board of Directors of the

Cutwater Select Income Fund

We have audited the accompanying statement of assets and liabilities of Cutwater Select Income Fund, including the schedule of investments, as of March 31, 2014, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2014 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Cutwater Select Income Fund as of March 31, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

May 12, 2014

4

SCHEDULE OF INVESTMENTS March 31, 2014

| | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | Principal

Amount (000’s) | | | Value

(Note 1) | |

CORPORATE DEBT SECURITIES (82.73%) | | | | | | | | | | |

AUTOMOTIVE (1.31%) | | | | | | | | | | |

Ford Holdings LLC, 9.30%, 03/01/30 | | Baa3/BBB- | | $ | 1,000 | | | $ | 1,425,470 | |

Ford Motor Co., Sr. Unsec. Notes, 8.90%, 01/15/32 | | Baa3/BBB- | | | 500 | | | | 678,954 | |

Ford Motor Credit Co. LLC, Sr. Unsec. Notes, 5.875%, 08/02/21 | | Baa3/BBB- | | | 750 | | | | 862,976 | |

| | | | | | | | | | |

| | | | | | | | | 2,967,400 | |

| | | | | | | | | | |

CHEMICALS (3.01%) | | | | | | | | | | |

Braskem Finance, Ltd., Co Gty., 7.00%, 05/07/20, 144A | | Baa3/BBB- | | | 500 | | | | 542,500 | |

Braskem Finance, Ltd., Co Gty., 5.375%, 05/02/22, 144A | | Baa3/BBB- | | | 750 | | | | 731,250 | |

Dow Chemical Co., Sr. Unsec. Notes, 8.55%, 05/15/19 | | Baa2/BBB | | | 500 | | | | 640,223 | |

Incitec Pivot Finance LLC, Co. Gty., 6.00%, 12/10/19, 144A | | Baa3/BBB | | | 405 | | | | 447,288 | |

Sinochem Overseas Capital Co., Ltd., Co. Gty., 4.50%, 11/12/20, 144A | | Baa1/BBB+ | | | 500 | | | | 516,383 | |

Sinochem Overseas Capital Co., Ltd., Co. Gty., 6.30%, 11/12/40, 144A | | Baa1/BBB+ | | | 1,500 | | | | 1,621,082 | |

Union Carbide Corp., Sr. Unsec. Notes, 7.75%, 10/01/96 | | Baa2/BBB | | | 2,000 | | | | 2,309,982 | |

| | | | | | | | | | |

| | | | | | | | | 6,808,708 | |

| | | | | | | | | | |

DIVERSIFIED FINANCIAL SERVICES (13.56%) | | | | | | | | | | |

Akbank TAS, Sr. Unsec. Notes, 6.50%, 03/09/18, 144A | | Baa2/NA | | | 1,000 | | | | 1,069,000 | |

Ally Financial, Inc., Co. Gty., 7.50%, 09/15/20 | | B1/BB | | | 315 | | | | 374,456 | |

Bank of America Corp., Sr. Unsec. Notes, 5.625%, 07/01/20 | | Baa2/A- | | | 190 | | | | 216,210 | |

Bank of America Corp., Sr. Unsec. Notes, 5.875%, 01/05/21 | | Baa2/A- | | | 500 | | | | 576,895 | |

BNP Paribas SA, Jr. Sub. Notes, 5.186%, 06/29/15, 144A(b),(c) | | Ba1/BBB | | | 1,000 | | | | 1,026,250 | |

CDP Financial, Inc., Co. Gtd., 4.40%, 11/25/19, 144A | | Aaa/AAA | | | 400 | | | | 441,284 | |

Chase Capital II, Ltd. Gtd., Series B, 0.738%, 02/01/27(b),(d) | | Baa2/BBB | | | 70 | | | | 58,450 | |

Citigroup, Inc., Sr. Unsec. Notes, 8.50%, 05/22/19 | | Baa2/A- | | | 595 | | | | 758,078 | |

Citigroup, Inc., Sr. Unsec. Notes, 8.125%, 07/15/39 | | Baa2/A- | | | 125 | | | | 180,788 | |

CoBank ACB, Sub. Notes, 7.875%, 04/16/18, 144A | | NA/A- | | | 500 | | | | 598,702 | |

Deutsche Bank AG, Sub. Notes, 4.296%, 05/24/28(b),(d) | | Baa3/BBB | | | 1,750 | | | | 1,648,932 | |

Discover Financial Services, Sr. Unsec. Notes, 10.25%, 07/15/19 | | Ba1/BBB- | | | 200 | | | | 252,962 | |

Farmers Exchange Capital, Sub. Notes, 7.20%, 07/15/48, 144A | | Baa2/A- | | | 3,000 | | | | 3,618,870 | |

General Electric Capital Corp., Jr. Sub. Notes, Series A, 7.125%, 06/15/22(b),(c) | | Baa1/AA- | | | 3,500 | | | | 3,990,000 | |

General Electric Capital Corp., Sr. Unsec. Notes, 6.875%, 01/10/39 | | A1/AA+ | | | 1,000 | | | | 1,316,941 | |

Goodman Funding Pty, Ltd., Co. Gty., 6.375%, 04/15/21, 144A | | Baa2/BBB | | | 1,050 | | | | 1,186,831 | |

HSBC USA Capital Funding LP, Bank Gtd., 10.176%, 06/30/30, 144A(b),(c) | | Baa2/BBB+ | | | 2,180 | | | | 3,139,200 | |

HSBC USA Trust II, Bank Gtd., 8.38%, 05/15/27, 144A(d) | | NA/BBB+ | | | 2,500 | | | | 2,542,002 | |

JPMorgan Chase & Co., Sr. Unsec. Notes, 4.40%, 07/22/20 | | A3/A | | | 175 | | | | 188,639 | |

JPMorgan Chase & Co., Sr. Unsec. Notes, 4.35%, 08/15/21 | | A3/A | | | 105 | | | | 112,549 | |

Merrill Lynch & Co., Inc., Sr. Unsec. Notes, 6.875%, 04/25/18 | | Baa2/A- | | | 1,000 | | | | 1,179,310 | |

Morgan Stanley, Sr. Unsec. Notes, 6.25%, 08/28/17 | | Baa2/A- | | | 300 | | | | 343,344 | |

Santander US Debt SA Unipersonal, Bank Gtd., 3.724%, 01/20/15, 144A | | Baa1/BBB | | | 100 | | | | 101,907 | |

UBS AG Stamford CT, Sub. Notes, 7.625%, 08/17/22 | | NR/BBB- | | | 2,000 | | | | 2,345,772 | |

Wachovia Capital Trust III, Ltd. Gtd., 5.57%, 05/05/14(b),(c) | | Baa3/BBB+ | | | 3,500 | | | | 3,364,375 | |

| | | | | | | | | | |

| | | | | | | | | 30,631,747 | |

| | | | | | | | | | |

ENERGY (16.40%) | | | | | | | | | | |

APT Pipelines, Ltd., Co. Gty., 3.875%, 10/11/22, 144A | | Baa2/BBB | | | 2,000 | | | | 1,925,424 | |

BG Energy Capital PLC, Co. Gty., 6.50%, 11/30/72(b),(d) | | Baa1/BBB | | | 3,250 | | | | 3,562,000 | |

Burlington Resources, Inc., Co. Gty., 9.125%, 10/01/21 | �� | A1/A | | | 850 | | | | 1,157,794 | |

Citgo Petroleum Corp., Sr. Sec. Notes, 11.50%, 07/01/17, 144A(d) | | B1/BB- | | | 1,000 | | | | 1,075,000 | |

CMS Panhandle Holding Co., Sr. Unsec. Notes, 7.00%, 07/15/29 | | Baa3/BBB- | | | 1,000 | | | | 1,066,459 | |

DCP Midstream LLC, Jr. Sub. Notes, 5.85%, 05/21/43, 144A(b),(d) | | Baa3/BB | | | 1,940 | | | | 1,823,600 | |

EL Paso Corp., Sr. Sec. Notes, 8.05%, 10/15/30 | | Ba2/BB | | | 1,000 | | | | 1,065,718 | |

Enterprise Products Operating LLC, Co. Gty., Series B, 7.034%, 01/15/68(b),(d) | | Baa2/BBB- | | | 1,000 | | | | 1,132,500 | |

EQT Corp., Sr. Unsec. Notes, 4.875%, 11/15/21 | | Baa3/BBB | | | 1,455 | | | | 1,538,370 | |

The accompanying notes are an integral part of these financial statements.

5

SCHEDULE OF INVESTMENTS — continued

| | | | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | | Principal

Amount (000’s) | | | Value

(Note 1) | |

ENERGY (Continued) | | | | | | | | | | | | |

Florida Gas Transmission Co. LLC, Sr. Unsec. Notes, 9.19%, 11/01/24, 144A | | | Baa2/BBB | | | $ | 110 | | | $ | 139,896 | |

Gibson Energy Inc, Sr. Unsec. Notes, 6.75%, 07/15/21, 144A(d) | | | Ba3/BB | | | | 1,350 | | | | 1,447,875 | |

IFM US Colonial Pipeline 2 LLC, Sr. Sec. Notes, 6.45%, 05/01/21, 144A(d) | | | NA/BBB- | | | | 1,000 | | | | 1,062,579 | |

KazMunayGas National Co., Sr. Unsec. Notes, 11.75%, 01/23/15, 144A | | | Baa3/BBB- | | | | 500 | | | | 536,250 | |

KazMunayGas National Co., Sr. Unsec. Notes, 6.375%, 04/09/21, 144A | | | Baa3/BBB- | | | | 500 | | | | 545,000 | |

Linn Energy LLC/Linn Energy Finance Corp., Co. Gty., 7.25%, 11/01/19, 144A(d) | | | B1/B+ | | | | 500 | | | | 521,250 | |

Lukoil International Finance BV, Co. Gty., 6.125%, 11/09/20, 144A | | | Baa2/BBB | | | | 1,000 | | | | 1,035,000 | |

Motiva Enterprises LLC, Sr. Unsec. Notes, 5.75%, 01/15/20, 144A | | | A2/BBB+ | | | | 64 | | | | 72,618 | |

Motiva Enterprises LLC, Sr. Unsec. Notes, 6.85%, 01/15/40, 144A | | | A2/BBB+ | | | | 124 | | | | 159,039 | |

Nabors Industries, Inc., Co. Gty., 9.25%, 01/15/19 | | | Baa2/BBB | | | | 625 | | | | 776,926 | |

Petroleos Mexicanos, Co. Gty., 8.00%, 05/03/19 | | | Baa1/BBB+ | | | | 250 | | | | 305,000 | |

Petroleos Mexicanos, Co. Gty., 6.00%, 03/05/20 | | | Baa1/BBB+ | | | | 750 | | | | 844,688 | |

Petroleum Co. of Trinidad & Tobago, Ltd., Sr. Unsec. Notes, 9.75%, 08/14/19, 144A | | | Baa3/BBB | | | | 500 | | | | 623,750 | |

Pride International, Inc., Co. Gty., 8.50%, 06/15/19 | | | Baa1/BBB+ | | | | 500 | | | | 631,416 | |

Pride International, Inc., Co. Gty., 6.875%, 08/15/20 | | | Baa1/BBB+ | | | | 500 | | | | 596,892 | |

Reliance Holdings USA, Inc., Co. Gty., 5.40%, 02/14/22, 144A | | | Baa2/BBB+ | | | | 1,250 | | | | 1,309,039 | |

Samson Investment Co., Co. Gty., 10.75%, 02/15/20, 144A(d) | | | B3/CCC+ | | | | 1,000 | | | | 1,090,000 | |

SEACOR Holdings, Inc., Sr. Unsec. Notes, 7.375%, 10/01/19 | | | Ba3/BB- | | | | 1,000 | | | | 1,125,000 | |

Shell International Finance BV, Co. Gty., 4.30%, 09/22/19 | | | Aa1/AA | | | | 1,000 | | | | 1,103,773 | |

Transocean, Inc., Co. Gty., 7.50%, 04/15/31 | | | Baa3/BBB- | | | | 500 | | | | 577,211 | |

Valero Energy Corp., Co. Gty., 9.375%, 03/15/19 | | | Baa2/BBB | | | | 124 | | | | 161,361 | |

Valero Energy Corp., Co. Gty., 8.75%, 06/15/30 | | | Baa2/BBB | | | | 1,000 | | | | 1,338,128 | |

Valero Energy Corp., Co. Gty., 10.50%, 03/15/39 | | | Baa2/BBB | | | | 500 | | | | 784,058 | |

Weatherford International, Ltd. Bermuda, Co. Gty., 6.75%, 09/15/40 | | | Baa2/BBB- | | | | 2,000 | | | | 2,328,840 | |

Western Atlas, Inc., Sr. Unsec. Notes, 8.55%, 06/15/24 | | | A2/A | | | | 2,539 | | | | 3,492,283 | |

Williams Cos., Inc., Sr. Unsec. Notes, 8.75%, 03/15/32 | | | Baa3/BBB- | | | | 81 | | | | 97,647 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 37,052,384 | |

| | | | | | | | | | | | |

FOOD AND BEVERAGE (0.26%) | | | | | | | | | | | | |

Anheuser-Busch InBev Worldwide, Inc., Co. Gty., 7.75%, 01/15/19 | | | A2/A | | | | 325 | | | | 402,590 | |

Anheuser-Busch InBev Worldwide, Inc., Co. Gty., 8.20%, 01/15/39 | | | A2/A | | | | 27 | | | | 40,980 | |

Bunge Ltd. Finance Corp., Co. Gty., 8.50%, 06/15/19 | | | Baa2/BBB- | | | | 125 | | | | 154,257 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 597,827 | |

| | | | | | | | | | | | |

HEALTHCARE (0.35%) | | | | | | | | | | | | |

Fresenius Medical Care US Finance, Inc., Co. Gty., 5.75%, 02/15/21, 144A | | | Ba2/BB+ | | | | 750 | | | | 797,812 | |

| | | | | | | | | | | | |

INDUSTRIAL (4.48%) | | | | | | | | | | | | |

ADT Corp., Sr. Unsec. Notes, 6.25%, 10/15/21, 144A | | | Ba2/BB- | | | | 1,000 | | | | 1,027,500 | |

Alcoa, Inc., Sr. Unsec. Notes, 6.15%, 08/15/20 | | | Ba1/BBB- | | | | 640 | | | | 697,430 | |

Alcoa, Inc., Sr. Unsec. Notes, 5.95%, 02/01/37 | | | Ba1/BBB- | | | | 244 | | | | 236,403 | |

Altria Group, Inc., Co. Gty., 9.70%, 11/10/18 | | | Baa1/BBB+ | | | | 317 | | | | 416,099 | |

ArcelorMittal, Sr. Unsec. Notes, 6.75%, 02/25/22 | | | Ba1/BB+ | | | | 1,200 | | | | 1,317,000 | |

ArcelorMittal, Sr. Unsec. Notes, 7.50%, 10/15/39 | | | Ba1/BB+ | | | | 405 | | | | 418,669 | |

Arrow Electronics, Inc., Sr. Unsec. Notes, 6.00%, 04/01/20 | | | Baa3/BBB- | | | | 500 | | | | 551,949 | |

Holcim US Finance Sarl & Cie SCS, Co. Gty., 6.00%, 12/30/19, 144A | | | Baa2/BBB | | | | 1,000 | | | | 1,138,348 | |

Ingersoll-Rand Global Holding Co., Ltd., Co. Gty., 6.875%, 08/15/18 | | | Baa2/BBB | | | | 185 | | | | 217,427 | |

Meccanica Holdings USA, Inc., Co. Gty., 6.25%, 07/15/19, 144A | | | Ba1/BB+ | | | | 129 | | | | 138,514 | |

Northrop Grumman Space & Mission Systems Corp., Co. Gty., 7.75%, 06/01/29 | | | Baa1/BBB+ | | | | 500 | | | | 623,244 | |

Samarco Mineracao SA, Sr. Unsec. Notes, 5.75%, 10/24/23, 144A | | | NA/BBB- | | | | 2,200 | | | | 2,213,750 | |

Waste Management, Inc., Co. Gty., 7.125%, 12/15/17 | | | Baa3/A- | | | | 500 | | | | 586,459 | |

Worthington Industries, Inc., Sr. Unsec. Notes, 6.50%, 04/15/20 | | | Baa3/BBB | | | | 500 | | | | 534,307 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 10,117,099 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

6

SCHEDULE OF INVESTMENTS — continued

| | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | Principal

Amount (000’s) | | | Value

(Note 1) | |

INSURANCE (8.23%) | | | | | | | | | | |

AIG SunAmerica, Inc., Sr. Unsec. Notes, 8.125%, 04/28/23 | | Baa1/A- | | $ | 1,800 | | | $ | 2,268,486 | |

Allstate Corp., Jr. Sub. Notes, 6.50%, 05/15/57(b),(d) | | Baa1/BBB | | | 2,200 | | | | 2,334,420 | |

American International Group, Inc., Jr. Sub. Debs., 8.175%, 05/15/58(b),(d) | | Baa2/BBB | | | 2,500 | | | | 3,284,375 | |

Guardian Life Insurance Co. of America, Sub. Notes, 7.375%, 09/30/39, 144A | | A1/AA- | | | 108 | | | | 147,139 | |

Liberty Mutual Group, Inc., Co. Gty., 7.00%, 03/15/37, 144A(b),(d) | | Baa3/BB | | | 500 | | | | 522,500 | |

Liberty Mutual Group, Inc., Co. Gty., 10.75%, 06/15/58, 144A(b),(d) | | Baa3/BB | | | 1,000 | | | | 1,500,000 | |

Liberty Mutual Group, Inc., Sr. Unsec. Notes, 7.00%, 03/15/34, 144A | | Baa2/BBB- | | | 250 | | | | 301,726 | |

Lincoln National Corp., Jr. Sub. Notes, 6.05%, 04/20/67(b),(d) | | Baa3/BBB | | | 500 | | | | 496,875 | |

Massachusetts Mutual Life Insurance Co., Sub. Notes, 8.875%, 06/01/39, 144A | | A1/AA- | | | 500 | | | | 760,395 | |

MetLife Capital Trust X, Jr. Sub. Notes, 9.25%, 04/08/38, 144A(d) | | Baa2/BBB | | | 500 | | | | 655,000 | |

MetLife, Inc., Jr. Sub. Notes, 10.75%, 08/01/39(d) | | Baa2/BBB | | | 1,000 | | | | 1,515,000 | |

Nationwide Mutual Insurance Co., Sub. Notes, 9.375%, 08/15/39, 144A | | A3/A- | | | 215 | | | | 316,187 | |

New York Life Insurance Co., Sub. Notes, 6.75%, 11/15/39, 144A | | Aa2/AA- | | | 103 | | | | 134,140 | |

Prudential Financial, Inc., Jr. Sub. Notes, 8.875%, 06/15/38(b),(d) | | Baa2/BBB+ | | | 1,000 | | | | 1,225,000 | |

Prudential Financial, Inc., Jr. Sub. Notes, 5.875%, 09/15/42(b),(d) | | Baa2/BBB+ | | | 2,500 | | | | 2,609,375 | |

Travelers Cos., Inc., Jr. Sub. Notes, 6.25%, 03/15/37(b),(d) | | A3/NR | | | 500 | | | | 535,000 | |

| | | | | | | | | | |

| | | | | | | | | 18,605,618 | |

| | | | | | | | | | |

MEDIA (8.18%) | | | | | | | | | | |

CBS Corp., Co. Gty., 8.875%, 05/15/19 | | Baa2/BBB | | | 350 | | | | 448,730 | |

Comcast Corp., Co. Gty., 7.05%, 03/15/33 | | A3/A- | | | 2,000 | | | | 2,598,380 | |

COX Communications, Inc., Sr. Unsec. Notes, 6.80%, 08/01/28 | | Baa2/BBB | | | 1,500 | | | | 1,726,297 | |

Cox Enterprises, Inc., Sr. Unsec. Notes, 7.375%, 07/15/27, 144A | | Baa2/BBB | | | 500 | | | | 596,691 | |

Grupo Televisa SAB, Sr. Unsec. Notes, 6.625%, 01/15/40 | | Baa1/BBB+ | | | 159 | | | | 182,127 | |

Harcourt General, Inc., Sr. Unsec. Notes, 8.875%, 06/01/22 | | WR/BBB+ | | | 2,000 | | | | 2,413,280 | |

Myriad International Holding BV, Co. Gty., 6.375%, 07/28/17, 144A | | Baa3/NA | | | 100 | | | | 110,500 | |

Nara Cable Funding, Ltd., Sr. Sec. Notes, 8.875%, 12/01/18, 144A(d) | | B1/B+ | | | 1,200 | | | | 1,306,500 | |

News America Holdings, Inc., Co. Gty., 7.90%, 12/01/95 | | Baa1/BBB+ | | | 1,400 | | | | 1,721,747 | |

Time Warner Entertainment Co., LP, Co. Gty., 8.375%, 07/15/33 | | Baa2/BBB | | | 1,360 | | | | 1,874,197 | |

Time Warner, Inc., Co. Gty., 9.15%, 02/01/23 | | Baa2/BBB | | | 3,000 | | | | 4,092,462 | |

VTR Finance BV, 6.875%, 01/15/24, 144A(d) | | B1/B+ | | | 1,365 | | | | 1,419,600 | |

World Color Press, Inc., Escrow Notes, —%, 12/01/43 | | NA/NA | | | 1,000 | | | | — | |

| | | | | | | | | | |

| | | | | | | | | 18,490,511 | |

| | | | | | | | | | |

MINING (3.44%) | | | | | | | | | | |

Anglo American Capital PLC, Co. Gty., 9.375%, 04/08/19, 144A | | Baa2/BBB | | | 500 | | | | 639,955 | |

Coeur d’Alene Mines Corp., Co. Gty., 7.875%, 02/01/21(d) | | B3/B+ | | | 750 | | | | 753,750 | |

FMG Resources August 2006 Property Ltd., Co. Gty., 6.875%, 04/01/22, 144A(d) | | Ba2/BB- | | | 1,200 | | | | 1,293,000 | |

Freeport-McMoran Corp., Co. Gty., 9.50%, 06/01/31 | | Baa2/BBB | | | 250 | | | | 325,421 | |

Newcrest Finance Property, Ltd., Co. Gty., 4.45%, 11/15/21, 144A | | Baa3/BBB- | | | 1,500 | | | | 1,342,922 | |

Rio Tinto Finance USA, Ltd., Co. Gty., 9.00%, 05/01/19 | | A3/A- | | | 85 | | | | 110,570 | |

Teck Resources, Ltd., Co. Gty., 6.00%, 08/15/40(d) | | Baa2/BBB | | | 1,000 | | | | 999,118 | |

Teck Resources, Ltd., Co. Gty., 5.20%, 03/01/42(d) | | Baa2/BBB | | | 1,415 | | | | 1,280,874 | |

Xstrata Canada Financial Corp., Co. Gty., 4.95%, 11/15/21, 144A | | Baa2/BBB | | | 1,000 | | | | 1,033,626 | |

| | | | | | | | | | |

| | | | | | | | | 7,779,236 | |

| | | | | | | | | | |

PAPER (2.04%) | | | | | | | | | | |

Celulosa Arauco y Constitucion SA, Sr. Unsec. Notes, 4.75%, 01/11/22(d) | | Baa3/BBB- | | | 1,085 | | | | 1,090,221 | |

Smurfit Kappa Treasury Funding, Ltd., Sr. Sec. Notes, 7.50%, 11/20/25 | | Ba2/BB+ | | | 2,000 | | | | 2,260,000 | |

Westvaco Corp., Co. Gty., 8.20%, 01/15/30 | | Baa3/BBB | | | 1,000 | | | | 1,248,677 | |

| | | | | | | | | | |

| | | | | | | | | 4,598,898 | |

| | | | | | | | | | |

REAL ESTATE INVESTMENT TRUST (REIT) (1.96%) | | | | | | | | | | |

Biomed Realty LP, Co. Gty., 6.125%, 04/15/20(d) | | Baa3/BBB- | | | 350 | | | | 393,271 | |

Duke Realty LP, Co. Gty., 6.50%, 01/15/18 | | Baa2/BBB | | | 500 | | | | 571,523 | |

The accompanying notes are an integral part of these financial statements.

7

SCHEDULE OF INVESTMENTS — continued

| | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | Principal

Amount (000’s) | | | Value

(Note 1) | |

REAL ESTATE INVESTMENT TRUST (REIT) (Continued) | | | | | | | | | | |

Duke Realty LP, Co. Gty., 8.25%, 08/15/19 | | Baa2/BBB | | $ | 500 | | | $ | 619,078 | |

Health Care REIT, Inc., Sr. Unsec. Notes, 5.25%, 01/15/22(d) | | Baa2/BBB | | | 1,500 | | | | 1,652,241 | |

WEA Finance, LLC, Co. Gty., 7.125%, 04/15/18, 144A | | A2/A- | | | 500 | | | | 594,295 | |

WEA Finance, LLC, Co. Gty., 6.75%, 09/02/19, 144A | | A2/A- | | | 500 | | | | 601,044 | |

| | | | | | | | | | |

| | | | | | | | | 4,431,452 | |

| | | | | | | | | | |

RETAIL & RESTAURANT (0.08%) | | | | | | | | | | |

Limited Brands, Inc., Co. Gty., 8.50%, 06/15/19 | | Ba1/BB+ | | | 150 | | | | 181,500 | |

| | | | | | | | | | |

TECHNOLOGY (0.35%) | | | | | | | | | | |

Corning, Inc., Sr. Unsec. Notes, 5.75%, 08/15/40 | | A3/A- | | | 60 | | | | 69,402 | |

Mantech International Corp., Co. Gty., 7.25%, 04/15/18(d) | | Ba2/BB+ | | | 100 | | | | 103,775 | |

NCR Escrow Corp., Sr. Unsec. Notes, 5.875%, 12/15/21, 144A(d) | | Ba3/BB | | | 580 | | | | 610,450 | |

| | | | | | | | | | |

| | | | | | | | | 783,627 | |

| | | | | | | | | | |

TELECOMMUNICATIONS (9.39%) | | | | | | | | | | |

Centel Capital Corp., Co. Gty., 9.00%, 10/15/19 | | Baa3/BBB- | | | 1,000 | | | | 1,191,704 | |

Deutsche Telekom International Finance BV, Co. Gty., 8.75%, 06/15/30 | | Baa1/BBB+ | | | 2,000 | | | | 2,886,336 | |

Digicel, Ltd., Sr. Unsec. Notes, 6.00%, 04/15/21, 144A(d) | | B1/NA | | | 500 | | | | 511,250 | |

Frontier Communications Corp., Sr. Unsec. Notes, 8.125%, 10/01/18 | | Ba2/BB- | | | 500 | | | | 583,750 | |

Frontier Communications Corp., Sr. Unsec. Notes, 9.00%, 08/15/31 | | Ba2/BB- | | | 500 | | | | 511,250 | |

GTE Corp., Co. Gty., 6.94%, 04/15/28 | | Baa2/BBB+ | | | 1,500 | | | | 1,803,715 | |

Hearst-Argyle Television, Inc., Sr. Unsec. Notes, 7.00%, 01/15/18 | | WR/NR | | | 1,000 | | | | 1,002,500 | |

Qwest Corp., Sr. Unsec. Notes, 7.20%, 11/10/26(d) | | Baa3/BBB- | | | 1,000 | | | | 1,007,211 | |

Qwest Corp., Sr. Unsec. Notes, 6.875%, 09/15/33(d) | | Baa3/BBB- | | | 1,100 | | | | 1,084,757 | |

Qwest Corp., Sr. Unsec. Notes, 7.25%, 10/15/35(d) | | Baa3/BBB- | | | 500 | | | | 505,582 | |

Sprint Capital Corp., Co. Gty., 6.875%, 11/15/28 | | B1/BB- | | | 1,500 | | | | 1,455,000 | |

Sprint Capital Corp., Co. Gty., 8.75%, 03/15/32 | | B1/BB- | | | 1,000 | | | | 1,100,000 | |

T-Mobile USA, Inc., Co. Gty., 6.25%, 04/01/21(d) | | Ba3/BB | | | 935 | | | | 988,763 | |

T-Mobile USA, Inc., Co. Gty., 6.625%, 04/01/23(d) | | Ba3/BB | | | 1,325 | | | | 1,404,500 | |

T-Mobile USA, Inc., Co. Gty., 6.125%, 01/15/22(d) | | Ba3/BB | | | 60 | | | | 62,850 | |

T-Mobile USA, Inc., Co. Gty., 6.50%, 01/15/24(d) | | Ba3/BB | | | 60 | | | | 62,850 | |

Telecom Italia Capital SA, Co. Gty., 6.999%, 06/04/18 | | Ba1/BB+ | | | 1,000 | | | | 1,133,750 | |

Telecom Italia Capital SA, Co. Gty., 6.00%, 09/30/34 | | Ba1/BB+ | | | 1,000 | | | | 932,500 | |

Telecom Italia Capital SA, Co. Gty., 7.20%, 07/18/36 | | Ba1/BB+ | | | 250 | | | | 254,375 | |

Trilogy International Partners LLC/Trilogy International Finance, Inc., Sr. Sec. Notes, 10.25%, 08/15/16, 144A(d) | | Caa1/CCC | | | 100 | | | | 102,750 | |

Verizon Communications, Inc., Sr. Unsec. Notes, 7.75%, 12/01/30 | | Baa1/BBB+ | | | 1,646 | | | | 2,176,723 | |

Windstream Corp, Co. Gty., 7.75%, 10/01/21(d) | | B1/B | | | 425 | | | | 456,875 | |

| | | | | | | | | | |

| | | | | | | | | 21,218,991 | |

| | | | | | | | | | |

TRANSPORTATION (5.32%) | | | | | | | | | | |

American Airlines, Pass Through Certs., Series 2013-2, Class B, 5.60%, 07/15/20, 144A | | NA/BB+ | | | 2,436 | | | | 2,539,644 | |

BNSF Funding Trust I, Co. Gty., 6.613%, 12/15/55(b),(d) | | Baa2/BBB | | | 250 | | | | 276,250 | |

British Airways PLC, Pass Through Certs., 5.625%, 06/20/20, 144A | | Ba1/BBB | | | 1,400 | | | | 1,498,000 | |

Continental Airlines, Pass Through Certs., Series 1999-1, Class B, 6.795%, 08/02/18 | | Ba1/BB | | | 225 | | | | 237,431 | |

Continental Airlines, Pass Through Certs., Series 2000-1, Class A1, 8.048%, 11/01/20 | | Baa2/BBB | | | 813 | | | | 937,487 | |

Continental Airlines, Pass Through Certs., Series 2000-2, Class A2, 7.707%, 04/02/21 | | Baa3/BBB- | | | 1,174 | | | | 1,341,143 | |

Delta Air Lines, Pass Through Certs, Series 1993, Class A2, 10.50%, 04/30/16(e) | | WR/NR | | | 342 | | | | 68,495 | |

ERAC USA Finance, Co., Co. Gty., 7.00%, 10/15/37, 144A | | Baa1/BBB+ | | | 1,500 | | | | 1,886,493 | |

Federal Express Corp., Pass Through Certs, Series 1996, Class B2, 7.84%, 01/30/18(d) | | A3/BBB | | | 864 | | | | 984,617 | |

Stena AB, Sr. Unsec. Notes, 7.00%, 02/01/24, 144A | | B2/BB | | | 1,705 | | | | 1,734,838 | |

United Airlines 2013-1 Class B Pass Through Trust, 5.375%, 08/15/21 | | NA/BB+ | | | 500 | | | | 516,250 | |

| | | | | | | | | | |

| | | | | | | | | 12,020,648 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

8

SCHEDULE OF INVESTMENTS — continued

| | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | Principal

Amount (000’s) | | | Value

(Note 1) | |

UTILITIES (4.37%) | | | | | | | | | | |

Avista Corp., 5.95%, 06/01/18 | | A2/A- | | $ | 500 | | | $ | 569,204 | |

DPL, Inc., Sr. Unsec. Notes, 7.25%, 10/15/21(d) | | Ba2/BB | | | 1,000 | | | | 1,032,500 | |

Duquesne Light Holdings, Inc., Sr. Unsec. Notes, 6.40%, 09/15/20, 144A | | Baa3/BBB- | | | 1,000 | | | | 1,164,147 | |

Electricite de France SA, Sub., 5.25%, 01/29/23, 144A(b),(c) | | A3/BBB+ | | | 2,000 | | | | 2,003,000 | |

Hydro-Quebec, 8.25%, 04/15/26 | | Aa2/A+ | | | 1,550 | | | | 2,133,859 | |

MidAmerican Funding LLC, Sr. Sec. Notes, 6.927%, 03/01/29 | | A2/BBB+ | | | 500 | | | | 622,403 | |

NextEra Energy Capital Holding, Inc., Co. Gty., Series D, 7.30%, 09/01/67(b),(d) | | Baa2/BBB | | | 500 | | | | 551,250 | |

Ohio Power Co., Sr. Unsec. Notes, 6.00%, 06/01/16 | | Baa1/BBB | | | 500 | | | | 552,967 | |

Ohio Power Co., Sr. Unsec. Notes, 5.375%, 10/01/21 | | Baa1/BBB | | | 1,000 | | | | 1,154,398 | |

Toledo Edison Co., 7.25%, 05/01/20 | | Baa1/BBB | | | 80 | | | | 94,802 | |

| | | | | | | | | | |

| | | | | | | | | 9,878,530 | |

| | | | | | | | | | |

TOTAL CORPORATE DEBT SECURITIES (Cost of $164,892,984) | | | | | | | | | 186,961,988 | |

| | | | | | | | | | |

ASSET BACKED SECURITIES (2.49%) | | | | | | | | | | |

ALM Loan Funding, Series 2012-7A, Class A2, 2.537%, 10/19/24, 144A(b) | | NR/AA | | | 2,000 | | | | 1,993,280 | |

Credit-Based Asset Servicing and Securitization LLC, Series 2006-SC1, Class A, 0.424%, 05/25/36, 144A(b) | | A3/AAA | | | 40 | | | | 37,573 | |

Dryden XXIV Senior Loan Fund Notes, Class A, CLO, 1.666%, 11/15/23, 144A(b) | | Aaa/AAA | | | 2,500 | | | | 2,500,775 | |

Option One Mortgage Loan Trust, Series 2007-FXD2, Class 2A1, 5.90%, 03/25/37(f) | | A2/AA | | | 57 | | | | 54,799 | |

Renaissance Home Equity Loan Trust, Series 2006-3, Class AF2, 5.58%, 11/25/36(f) | | Ca/CCC | | | 155 | | | | 93,039 | |

Small Business Administration Participation Certificates, Series 2010-20F, Class 1, 3.88%, 06/01/30 | | Aaa/AA+ | | | 257 | | | | 269,862 | |

Sonic Capital LLC, Series 2011-1A, Class A2, 5.438%, 05/20/41, 144A | | Baa2/BBB | | | 644 | | | | 687,685 | |

| | | | | | | | | | |

TOTAL ASSET BACKED SECURITIES (Cost of $5,645,032) | | | | | | | | | 5,637,013 | |

| | | | | | | | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (7.19%) | | | | | | | | | | |

CGBAM Commerical Mortgage Trust 2013-BREH, 3.005%, 05/15/30, 144A(b) | | Baa3/NA | | | 1,790 | | | | 1,798,669 | |

Citigroup/Deutsche Bank Commercial Mortgage Trust, Series 2006-CD2, Class AM, 5.349%, 01/15/46(b) | | Baa2/A- | | | 2,500 | | | | 2,674,875 | |

Developers Diversified Realty Corp., Series 2009-DDR1, Class C,

6.223%, 10/14/22, 144A | | A1/AA+ | | | 2,000 | | | | 2,038,630 | |

Hilton USA Trust, Series 2013-HLT, Class CFX, 3.714%, 11/05/30, 144A | | A3/A- | | | 1,400 | | | | 1,418,070 | |

Irvine Core Office Trust, Series 2013-IRV, Class C, 3.174%, 05/15/48, 144A(b) | | NA/A | | | 735 | | | | 677,905 | |

Ml-CFC Commercial Mortgage Trust 2006-3, 5.485%, 07/12/46(b) | | Ba2/NA | | | 1,000 | | | | 995,445 | |

Morgan Stanley Bank of America Merrill Lynch Trust, Series 2012-CKSV, Class C, 4.293%, 10/15/30, 144A(b) | | NA/A | | | 2,710 | | | | 2,500,628 | |

Morgan Stanley Capital I Trust, Series 2006-HQ10, Class AM, 5.36%, 11/12/41 | | A2/NA | | | 2,000 | | | | 2,187,770 | |

Morgan Stanley Reremic Trust, Series 2009-GG10, Class A4B,

5.819%, 08/12/45, 144A(b) | | Baa2/NA | | | 210 | | | | 231,097 | |

Spirit Master Funding LLC, Series 2006-1A, Class A, 5.76%, 03/20/24, 144A | | Baa2/BB+ | | | 1,646 | | | | 1,715,445 | |

| | | | | | | | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(Cost of $16,498,724) | | | | | | | | | 16,238,534 | |

| | | | | | | | | | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES (0.68%) | | | | | | | | | | |

FHLMC Pool # 170128, 11.50%, 06/01/15 | | Aaa/AA+ | | | — | | | | 331 | |

FHLMC Pool # 360019, 10.50%, 12/01/17 | | Aaa/AA+ | | | 1 | | | | 1,091 | |

FHLMC Pool # A15675, 6.00%, 11/01/33 | | Aaa/AA+ | | | 305 | | | | 343,105 | |

FHLMC Pool # G00182, 9.00%, 09/01/22 | | Aaa/AA+ | | | 1 | | | | 593 | |

FNMA Pool # 124012, 12.50%, 10/01/15 | | Aaa/AA+ | | | 1 | | | | 1,096 | |

FNMA Pool # 303022, 8.00%, 09/01/24 | | Aaa/AA+ | | | 14 | | | | 16,459 | |

FNMA Pool # 303136, 8.00%, 01/01/25 | | Aaa/AA+ | | | 6 | | | | 6,880 | |

FNMA Pool # 55192, 10.50%, 09/01/17 | | Aaa/AA+ | | | 3 | | | | 3,650 | |

FNMA Pool # 58991, 11.00%, 02/01/18 | | Aaa/AA+ | | | 3 | | | | 2,642 | |

FNMA Pool # 754791, 6.50%, 12/01/33 | | Aaa/AA+ | | | 547 | | | | 614,251 | |

The accompanying notes are an integral part of these financial statements.

9

SCHEDULE OF INVESTMENTS — continued

| | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | Principal

Amount (000’s) | | | Value

(Note 1) | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | | | |

FNMA Pool # 763852, 5.50%, 02/01/34 | | Aaa/AA+ | | $ | 350 | | | $ | 389,198 | |

FNMA Pool # 889554, 6.00%, 04/01/38 | | Aaa/AA+ | | | 86 | | | | 95,773 | |

GNSF Pool # 194228, 9.50%, 11/15/20 | | Aaa/AA+ | | | 16 | | | | 16,633 | |

GNSF Pool # 307527, 9.00%, 06/15/21 | | Aaa/AA+ | | | 15 | | | | 17,145 | |

GNSF Pool # 417239, 7.00%, 02/15/26 | | Aaa/AA+ | | | 16 | | | | 17,278 | |

GNSF Pool # 780374, 7.50%, 12/15/23 | | Aaa/AA+ | | | 9 | | | | 10,356 | |

| | | | | | | | | | |

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES

(Cost of $1,257,069) | | | | | | | | | 1,536,481 | |

| | | | | | | | | | |

MUNICIPAL BONDS (2.35%) | | | | | | | | | | |

Commonwealth of Puerto Rico, Series A, GO, 8.00%, 07/01/35 | | Ba2/BB+ | | | 2,100 | | | | 1,959,594 | |

Municipal Electric Authority of Georgia, Build America Bonds-Taxable-Plant Vogle Units 3&4, Series J, Revenue Bond, 6.637%, 04/01/57 | | A2/A+ | | | 175 | | | | 198,196 | |

San Francisco City & County Public Utilities Commission, Water Revenue, Build America Bonds, 6.00%, 11/01/40 | | Aa3/AA- | | | 145 | | | | 173,094 | |

State of California, Build America Bonds, GO, 7.625%, 03/01/40 | | A1/A | | | 1,500 | | | | 2,093,805 | |

State of Illinois, Build America Bonds, GO, 7.35%, 07/01/35 | | A3/A- | | | 755 | | | | 881,349 | |

| | | | | | | | | | |

TOTAL MUNICIPAL BONDS (Cost of $4,645,174) | | | | | | | | | 5,306,038 | |

| | | | | | | | | | |

| | | | | Shares | | | | |

COMMON STOCK (0.02%) | | | | | | | | | | |

MEDIA (0.02%) | | | | | | | | | | |

Quad Graphics, Inc. | | | | | 1,617 | | | | 37,919 | |

| | | | | | | | | | |

TOTAL COMMON STOCK (Cost of $74,496) | | | | | | | | | 37,919 | |

| | | | | | | | | | |

PREFERRED STOCK (1.38%) | | | | | | | | | | |

CoBank ACB, Series F, 6.250%, 144A | | | | | 20,000 | | | | 2,023,750 | |

Federal Home Loan Mortgage Corp, Series Z, 0.000%(g),(h) | | | | | 53,779 | | | | 591,569 | |

US BANCORP, Series A, 3.500% | | | | | 615 | | | | 497,990 | |

| | | | | | | | | | |

TOTAL PREFERRED STOCK (Cost of $3,868,939) | | | | | | | | | 3,113,309 | |

| | | | | | | | | | |

TOTAL INVESTMENTS (96.84%) | | | | | | | | | | |

(Cost $196,882,418) | | | | | | | | | 218,831,282 | |

| | | | | | | | | | |

OTHER ASSETS AND LIABILITIES (3.16%) | | | | | | | | | 7,148,072 | |

| | | | | | | | | | |

NET ASSETS (100.00%) | | | | | | | | $ | 225,979,354 | |

| | | | | | | | | | |

| (a) | Ratings for debt securities are unaudited. All ratings are as of March 31, 2014 and may have changed subsequently. |

| (b) | Variable rate security. Rate disclosed is as of March 31, 2014. |

| (c) | Security is perpetual. Date shown is next call date. |

| (d) | This security is callable. |

| (e) | Investment was in default as of March 31, 2014 |

| (f) | Multi-Step Coupon. Rate disclosed is as of March 31, 2014. |

| (g) | Non-income producing security. |

| (h) | Dividend was discontinued as of September 7, 2008. |

| 144A | Securities were purchased pursuant to Rule, 144A under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. At March 31, 2014, these securities amounted to $79,214,092 or 35.05% of net assets. |

The accompanying notes are an integral part of these financial statements.

10

SCHEDULE OF INVESTMENTS — continued

Legend

Certs. - Certificates

CLO - Collateralized Loan Obligation

Co. Gty. - Company Guaranty

Debs. - Debentures

FHLMC - Federal Home Loan Mortgage Corp.

FNMA - Federal National Mortgage Association

GNSF - Government National Mortgage Association (Single Family)

GO - General Obligation

Gtd. - Guaranteed

Jr. - Junior

LLC - Limited Liability Company

Ltd. - Limited

NA - Not Available

NR - Not Rated

REIT - Real Estate Investment trust

Sec. - Secured

Sr. - Senior

Sub. - Subordinated

Unsec. - Unsecured

WR - Withdrawn Rating

The accompanying notes are an integral part of these financial statements.

11

STATEMENT OF ASSETS AND LIABILITIES

March 31, 2014

| | | | |

Assets: | | | | |

Investment in securities, at value (amortized cost $196,882,418) (Note 1) | | $ | 218,831,282 | |

Cash | | | 3,898,474 | |

Receivables for investments sold | | | 124 | |

Interest receivable | | | 3,416,066 | |

Dividend receivable | | | 36,631 | |

Prepaid expenses | | | 22,861 | |

| | | | |

TOTAL ASSETS | | | 226,205,438 | |

| | | | |

Liabilities: | | | | |

Payable to Investment Adviser | | | 85,265 | |

Accrued expenses payable | | | 140,819 | |

| | | | |

TOTAL LIABILITIES | | | 226,084 | |

| | | | |

Net assets: (equivalent to $21.10 per share based on 10,708,597 shares of capital stock outstanding) | | $ | 225,979,354 | |

| | | | |

NET ASSETS consisted of: | | | | |

Par value | | $ | 107,086 | |

Capital paid-in | | | 217,372,775 | |

Accumulated net investment income | | | 449,538 | |

Accumulated net realized loss on investments | | | (13,898,909 | ) |

Net unrealized appreciation on investments | | | 21,948,864 | |

| | | | |

| | $ | 225,979,354 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

12

STATEMENT OF OPERATIONS

For the year ended March 31, 2014

| | | | | | | | |

Investment Income: | | | | | | | | |

Interest | | | $ | 12,811,931 | |

Dividends | | | | 148,764 | |

| | | | | | | | |

Total Investment Income | | | | 12,960,695 | |

| | | | | | | | |

Expenses: | | | | | | | | |

Investment advisory fees (Note 4) | | $ | 988,557 | | | | | |

Administration fees | | | 191,176 | | | | | |

Transfer agent fees | | | 42,876 | | | | | |

Trustees’ fees (Note 4) | | | 93,534 | | | | | |

Audit fees | | | 20,300 | | | | | |

Legal fees and expenses | | | 126,058 | | | | | |

Reports to shareholders | | | 77,620 | | | | | |

Custodian fees | | | 22,607 | | | | | |

Insurance | | | 36,033 | | | | | |

NYSE fee | | | 24,451 | | | | | |

Miscellaneous | | | 48,853 | | | | | |

| | | | | | | | |

Total Expenses | | | | 1,672,065 | |

| | | | | | | | |

Net Investment Income | | | | 11,288,630 | |

| | | | | | | | |

Realized and unrealized gain (loss) on investments: | | | | | | | | |

Net realized gain from security transactions | | | | 3,370,286 | |

| | | | | | | | |

Unrealized appreciation (depreciation) of investments: | | | | | | | | |

Beginning of the period | | | 29,885,365 | | | | | |

End of the period | | | 21,948,864 | | | | | |

| | | | | | | | |

Change in unrealized (depreciation) of investments | | | | (7,936,501 | ) |

| | | | | | | | |

Net realized and unrealized loss on investments | | | | (4,566,215 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | $ | 6,722,415 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

13

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year ended

March 31, 2014 | | | Year ended

March 31, 2013 | |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 11,288,630 | | | $ | 11,333,464 | |

Net realized gain from security transactions (Note 2) | | | 3,370,286 | | | | 4,596,190 | |

Change in unrealized appreciation (depreciation) of investments and warrants | | | (7,936,501 | ) | | | 7,946,703 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 6,722,415 | | | | 23,876,357 | |

| | | | | | | | |

Distributions: | | | | | | | | |

Distributions to shareholders from net investment income | | | (11,351,114 | ) | | | (11,592,057 | ) |

| | | | | | | | |

Increase (decrease) in net assets | | | (4,628,699 | ) | | | 12,284,300 | |

Net Assets: | | | | | | | | |

Beginning of period | | | 230,608,053 | | | | 218,323,753 | |

| | | | | | | | |

End of period | | $ | 225,979,354 | | | $ | 230,608,053 | |

| | | | | | | | |

Accumulated net investment income/(loss) | | $ | 449,538 | | | $ | 383,805 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

14

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of capital stock outstanding throughout each year presented.

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended March 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 21.53 | | | $ | 20.39 | | | $ | 20.01 | | | $ | 19.10 | | | $ | 15.63 | |

| | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 1.05 | | | | 1.06 | | | | 1.08 | | | | 1.14 | (1) | | | 1.19 | |

Net realized and unrealized gain (loss) on investments | | | (0.42 | ) | | | 1.16 | | | | 0.45 | | | | 0.92 | | | | 4.31 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.63 | | | | 2.22 | | | | 1.53 | | | | 2.06 | | | | 5.50 | |

| | | | | | | | | | | | | | | | | | | | |

Capital share transaction: | | | | | | | | | | | | | | | | | | | | |

Dilution of the net asset value from rights offering (Note 6) | | | — | | | | — | | | | — | | | | — | | | | (0.88 | ) |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (1.06 | ) | | | (1.08 | ) | | | (1.15 | ) | | | (1.15 | ) | | | (1.15 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.06 | ) | | | (1.08 | ) | | | (1.15 | ) | | | (1.15 | ) | | | (1.15 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 21.10 | | | $ | 21.53 | | | $ | 20.39 | | | $ | 20.01 | | | $ | 19.10 | |

| | | | | | | | | | | | | | | | | | | | |

Per share market price, end of year | | $ | 19.42 | | | $ | 20.06 | | | $ | 19.74 | | | $ | 18.03 | | | $ | 17.12 | |

| | | | | | | | | | | | | | | | | | | | |

Total Investment Return(2) | | | | | | | | | | | | | | | | | | | | |

Based on market value | | | 2.44 | % | | | 7.24 | % | | | 16.37 | % | | | 12.23 | % | | | 33.60 | % |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000’s) | | | 225,979 | | | | 230,608 | | | | 218,324 | | | | 214,266 | | | | 125,253 | |

Ratio of expenses to average net assets | | | 0.75 | % | | | 0.74 | % | | | 0.74 | % | | | 0.79 | % | | | 0.85 | % |

Ratio of net investment income to average net assets | | | 5.08 | % | | | 5.03 | % | | | 5.37 | % | | | 5.76 | % | | | 6.16 | % |

Portfolio turnover rate | | | 16.10 | % | | | 20.39 | % | | | 19.60 | % | | | 19.91 | % | | | 15.40 | % |

Number of shares outstanding at the end of the year (in 000’s) | | | 10,709 | | | | 10,709 | | | | 10,709 | | | | 10,709 | | | | 6,559 | |

| (1) | The selected per share data was calculated using the average shares outstanding method. |

| (2) | Total investment return is calculated assuming a purchase of common shares at the market price on the first day and a sale at the market price on the last day of the period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions. The total investment return, if for less than a full year, is not annualized. Past performance is not a guarantee of future results. |

The accompanying notes are an integral part of these financial statements.

15

NOTES TO FINANCIAL STATEMENTS

Note 1 – Significant Accounting Policies – The Cutwater Select Income Fund (the “Fund”), a Delaware statutory trust, is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as a diversified closed-end, management investment company. The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements. The policies are in conformity with generally accepted accounting principles within the United States of America (“GAAP”).

| A. | Security Valuation – In valuing the Fund’s net assets, all securities for which representative market quotations are available will be valued at the last quoted sales price on the security’s principal exchange on the day of valuation. If there are no sales of the relevant security on such day, the security will be valued at the bid price at the time of computation. For securities traded in the over-the-counter market, including listed debt and preferred securities, whose primary market is believed to be over-the-counter, the Fund uses recognized industry pricing services – approved by the Board and unaffiliated with the Adviser - and uses broker quotes provided by market makers of securities not valued by these and other recognized pricing sources. |

In the event that market quotations are not readily available, or when such quotations are deemed not to reflect current market value, the securities will be valued at their respective fair value as determined in good faith by the Adviser pursuant to certain procedures and reporting requirements established by the Board of Trustees. The Adviser considers all relevant facts that are reasonably available when determining the fair value of a security, including but not limited to the last sale price or initial purchase price (if a when issued security) and subsequently adjusting the value based on changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves are utilized. At March 31, 2014, there were no securities valued using fair value procedures.

Fair Value Measurements – The Fund has adopted authoritative fair value accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| | |

• Level 1 – | | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| |

• Level 2 – | | Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| |

• Level 3 – | | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

16

NOTES TO FINANCIAL STATEMENTS — continued

Following is a description of the valuation techniques applied to the Fund’s major categories of assets measured at fair value on a recurring basis as of March 31, 2014.

| | | | | | | | | | | | | | | | |

| | | Total Market

Value at

03/31/14 | | | Level 1

Quoted Price | | | Level 2

Significant Observable

Inputs | | | Level 3

Significant Unobservable

Inputs | |

CORPORATE DEBT SECURITIES | | $ | 186,961,988 | | | $ | — | | | $ | 186,961,988 | | | $ | — | |

ASSET BACKED SECURITIES | | | 5,637,013 | | | | — | | | | 5,637,013 | | | | — | |

COMMERCIAL MORTGAGE-BACKED SECURITIES | | | 16,238,534 | | | | — | | | | 16,238,534 | | | | — | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES | | | 1,536,481 | | | | — | | | | 1,536,481 | | | | — | |

MUNICIPAL BONDS | | | 5,306,038 | | | | — | | | | 5,306,038 | | | | — | |

COMMON STOCK* | | | 37,919 | | | | 37,919 | | | | — | | | | — | |

PREFERRED STOCK | | | 3,113,309 | | | | 3,113,309 | | | | — | | | | — | |

TOTAL INVESTMENTS | | $ | 218,831,282 | | | $ | 3,151,228 | | | $ | 215,680,054 | | | $ | — | |

| * | See schedule of Investments for industry breakout. |

At the end of each calendar quarter, management evaluates the Level 1, 2 and 3 assets and liabilities for changes in liquidity, including but not limited to: whether a broker is willing to execute at the quoted price, the depth and consistency of prices from third party services, and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates Level 1 and 2 assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges. Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Fund’s investments may fluctuate from period to period. Additionally, the fair value of investments may differ significantly from the values that would have been used had a ready market existed for such investments and may differ materially from the values the Fund may ultimately realize. Further, such investments may be subject to legal and other restrictions on resale or otherwise less liquid than publicly traded securities. Pursuant to Fund policy, transfers between levels are considered to have occurred at the beginning of the reporting period. For the year ended March 31, 2014, there were no transfers between Level 1, Level 2 and Level 3 for the Fund.

Level 3 investments are categorized as Level 3 with values derived utilizing prices from prior transactions or third party pricing information without adjustment (broker quotes, pricing services and net asset values). A significant change in third party pricing information could result in a significantly lower or higher value in such Level 3 investments. Rights are valued at zero as of March 31, 2014 and are included in the Level 3 investments.

When-Issued Securities – The Fund may enter into commitments to purchase securities on a forward or when-issued basis. When-issued securities are securities purchased for delivery beyond the normal settlement date at a stated price and yield. In the Fund’s case, these securities are subject to settlement within 45 days of the purchase date. The interest rate realized on these securities is fixed as of the purchase date. The Fund does not pay for such securities prior to the settlement date and no interest accrues to the Fund before settlement. These securities are subject to market fluctuation due to changes in market interest rates. The Fund will enter into these commitments with the intent of buying the security but may dispose of such security prior to settlement. At the time the commitment is entered into, the Fund will establish and maintain a segregated account in an amount sufficient to cover the obligation under the when-issued contract. At the

17

NOTES TO FINANCIAL STATEMENTS — continued

time the Fund makes the commitment to purchase securities on a when-issued basis, it will record the transaction and thereafter reflect the value of such security purchased in determining its NAV. At the time of delivery of the security, its value may be more or less than the fixed purchase price.

| B. | Determination of Gains or Losses on Sale of Securities – Gains or losses on the sale of securities are calculated for financial reporting purposes and for federal tax purposes using the identified cost basis. The identified cost basis for financial reporting purposes differs from that used for federal tax purposes in that the amortized cost of the securities sold is used for financial reporting purposes and the original cost of the securities sold is used for federal tax purposes, except for those instances where tax regulations require the use of amortized cost. |

| C. | Federal Income Taxes – It is the Fund’s policy to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required. |

| | Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years (tax years March 31, 2011-2013) or expected to be taken on the Fund’s 2014 tax return, and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue. |

| D. | Other – Security transactions are accounted for on the trade date. Interest income is accrued daily. Premiums and discounts are amortized using the interest method. Paydown gains and losses on mortgage-backed and asset-backed securities are presented as an adjustment to interest income. Dividend income and distributions to shareholders are recorded on the ex-dividend date. |

| E. | Distributions to Shareholders and Book/Tax Differences – Distributions of net investment income will be made quarterly. Distributions of any net realized capital gains will be made annually. Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatments for amortization of market premium and accretion of market discount. |

| | In order to reflect permanent book/tax differences that occurred during the fiscal year ended March 31, 2014, the following capital accounts were adjusted for the following amounts: |

| | | | | | | | | | |

Undistributed

Net Investment Income | | Net Realized

Gain | | Accumulated

Paid-In

Capital |

| $128,217 | | | $ | (128,217 | ) | | | $ | — | |

| | Distributions during the fiscal years ended March 31, 2014 and 2013 were characterized as follows for tax purposes: |

| | | | | | | | |

| | | Ordinary Income | | Return of Capital | | Capital Gain | | Total Distribution |

FY 2014 | | $11,351,114 | | $ — | | $ — | | $11,351,114 |

FY 2013 | | $11,592,057 | | $ — | | $ — | | $11,592,057 |

18

NOTES TO FINANCIAL STATEMENTS — continued

| | At March 31, 2014, the components of distributable earnings on a tax basis were as follows: |

| | | | | | | | |

Total* | | Accumulated

Ordinary Income | | Capital Loss

Carryforward and Other | | Late Year Losses

Deferred | | Net Unrealized

Appreciation |

$8,499,493 | | $1,289,606 | | $(13,840,511) | | $ — | | $21,050,398 |

| | | | | | | | | |

| | * | Temporary differences include book amortization and book accretion. |

| | The Regulated Investment Company Modernization Act of 2010 (the “Act”) was enacted on December 22, 2010. The Act makes changes to several tax rules impacting the Fund. In general, the provisions of the Act are in effect for the Fund’s fiscal year ended March 31, 2012. Although the Act provides several benefits, including the unlimited carryover of future capital losses, there may be a greater likelihood that all or a portion of the Fund’s pre-enactment capital loss carryovers may expire without being utilized due to the fact that post-enactment capital losses must be utilized before pre-enactment capital loss carryovers may be utilized. Under the Act, new capital losses may now be carried forward indefinitely, and retain the character of the original loss as compared with pre-enactment law, where capital losses could be carried forward for up to eight years, and carried forward as short-term capital losses, irrespective of the character of the original loss. |

| | As of March 31, 2014, the capital loss carryovers available to offset possible future capital gains and the expiration dates from pre-enactment taxable years were as follows: |

| | | | |

Amount | | Expiration Date | |

$ 3,483,590 | | | 2016 | |

10,295,168 | | | 2017 | |

61,753 | | | 2018 | |

| | There were no post-enactment capital loss carryovers as of March 31, 2014. |

| | Capital loss carryforwards are subject to usage limitations. During the year ended March 31, 2014, capital loss carryforwards in the amount of $3,137,222 were utilized and $0 were expired off and cannot be used going forward. |

| | Under current laws, certain capital losses realized after October 31 and certain ordinary losses realized after December 31 may be deferred and treated as occurring on the first day of the following fiscal year. For the year ended March 31, 2014, the Fund did not elect to defer losses. |

| | At March 31, 2014, the following table shows for federal tax purposes the aggregate cost of investments, the net unrealized appreciation of those investments, the aggregate gross unrealized appreciation of all securities with an excess of market value over tax cost and the aggregate gross unrealized depreciation of all securities with an excess of tax cost over market value: |

| | | | | | | | | | | | |

Aggregate

Tax Cost | | Net Unrealized

Appreciation | | | Gross Unrealized

Appreciation | | | Gross Unrealized

(Depreciation) | |

| $197,780,884 | | $ | 21,050,398 | | | $ | 24,295,470 | | | $ | (3,245,072 | ) |

| | The difference between book basis and tax-basis unrealized appreciation is attributable primarily to the differing treatments for wash sales, amortization of market premium and accretion of market discount. |

19

NOTES TO FINANCIAL STATEMENTS — continued

| F. | Use of Estimates in the Preparation of Financial Statements – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that may affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. |

Note 2 – Portfolio Transactions – The following is a summary of the security transactions, other than short-term investments, for the year ended March 31, 2014:

| | | | | | | | |

| | | Cost of

Purchases | | | Proceeds from Sales

or Maturities | |

U.S. Government Securities | | $ | 198,813 | | | $ | 5,743,348 | |

Other Investment Securities | | $ | 35,080,272 | | | $ | 31,800,026 | |

Note 3 – Capital Stock – At March 31, 2014, there were an unlimited number of shares of beneficial interest ($0.01 par value) authorized, with 10,708,597 shares issued and outstanding.

Note 4 – Investment Advisory Contract, Accounting and Administration and Trustee Compensation – Cutwater Investor Services Corp. (“Cutwater”) serves as Investment Adviser to the Fund. Cutwater is entitled to a fee at the annual rate of 0.50% on the first $100 million of the Fund’s month end net assets and 0.40% on the Fund’s month-end net assets in excess of $100 million.

BNY Mellon Investment Servicing (US) Inc. (“BNY Mellon”), a member of The Bank of New York Mellon Corporation, provides accounting and administrative services to the Fund.

The Trustees of the Fund receive an annual retainer, meeting fees and out of pocket expenses for meetings attended. The aggregate remuneration paid to the Trustees by the Fund during the year ended March 31, 2014 was $93,534. Certain officers of the Fund are also directors, officers and/or employees of the investment adviser. None of the Fund’s officers receives compensation from the Fund. As of March 31, 2014, there were no amounts due to the Trustees.

Note 5 – Dividend and Distribution Reinvestment – In accordance with the terms of the Automatic Dividend Investment Plan (the “Plan”), for shareholders who so elect, dividends and distributions are made in the form of previously unissued Fund shares at the net asset value if on the Friday preceding the payment date (the “Valuation Date”) the closing New York Stock Exchange price per share, plus the brokerage commissions applicable to one such share equals or exceeds the net asset value per share. However, if the net asset value is less than 95% of the market price on the Valuation Date, the shares issued will be valued at 95% of the market price. If the net asset value per share exceeds market price plus commissions, the dividend or distribution proceeds are used to purchase Fund shares on the open market for participants in the Plan. During the year ended March 31, 2014 the Fund issued no shares under this Plan.

Note 6 – Rights Offering – On August 7, 2009 the Fund completed its transferable rights offering. In accordance with the terms of the rights offering described in the Fund’s prospectus an additional 1,650,893 shares were issued at a subscription price of $15.77 per share, making the gross proceeds raised by the offering $26,034,583, before offering-related expenses. Dealer/manager fees of $976,297 and offering costs of approximately $550,332 were deducted from the gross proceeds making the net proceeds available for investment by the Fund $24,507,954. The dilution impact of the offering was $0.88 per share or 4.79% of the $18.34 net asset value per share on August 7, 2009, the expiration and pricing date of the offering.

Note 7 – Subsequent Event – Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued, and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

20

SHAREHOLDER INFORMATION (Unaudited)

ADDITIONAL INFORMATION REGARDING THE FUND’S TRUSTEES AND OFFICERS

| | | | | | | | | | |

Name, Address and Age | | Position Held

With Fund | | Principal Occupation

During the Past 5 Years | | Number of

Funds Overseen

By Trustee | | Term of Office and Length

of Time Served | | Other

Directorships

Held by Trustee |

| | | | | |

W. Thacher Brown* 113 King Street Armonk, NY 10504 Born: December 1947 | | Trustee | | Retired; Former President of MBIA Asset Management LLC from July 1998 to September 2004; and Former President of 1838 Investment Advisors, LLC from July 1988 to May 2004. | | 1 | | Shall serve until the next annual meeting or until his successor is qualified. Trustee since 1988. | | None. |

| | | | | |

Ellen D. Harvey 113 King Street Armonk, NY 10504 Born: February 1954 | | Trustee | | Consultant with Lindsay Criswell LLC beginning July 2008. Principal with the Vanguard Group from January 2008 to June 2008; and Senior Vice President with Mercantile Safe-Deposit & Trust from February 2003 to October 2007. | | 1 | | Shall serve until the next annual meeting or until her successor is qualified. Trustee since 2010. | | Director, Aetos Capital Funds (3 portfolios). |

| | | | | |

Gautam Khanna* 113 King Street Armonk, NY 10504 Born: October 1969 | | Trustee/

Vice

President | | Officer of Cutwater Investor Services Corp. | | 1 | | Shall serve as Trustee until the next annual meeting or until his successor is qualified. Trustee since 2014. Shall serve as Officer until death, resignation, or removal. Officer since 2006. | | None. |

| | | | | |

Thomas E. Spock 113 King Street Armonk, NY 10504 Born: May 1956 | | Trustee | | Partner at Scalar Media Partners, LLC since June 2008. | | 1 | | Shall serve until the next annual meeting or until his successor is qualified. Trustee since 2013. | | None. |

| | | | | |

Suzanne P. Welsh 113 King Street Armonk, NY 10504 Born: March 1953 | | Trustee | | Vice President for Finance and Treasurer, Swarthmore College since 2002. | | 1 | | Shall serve until the next annual meeting or until her successor is qualified. Trustee since 2008. | | None. |

21

SHAREHOLDER INFORMATION (Unaudited) — continued

ADDITIONAL INFORMATION REGARDING THE FUND’S TRUSTEES AND OFFICERS

| | | | | | | | | | |

Name, Address and Age | | Position Held

With Fund | | Principal Occupation

During the Past 5 Years | | Number of

Funds Overseen

By Trustee | | Term of Office and Length

of Time Served | | Other

Directorships

Held by

Trustee |

| | | | | |

Clifford D. Corso* Cutwater 113 King Street Armonk, NY 10504 Born: October 1961 | | President | | Chief Executive Officer and Chief Investment Officer, Cutwater Investor Services Corp.; Managing Director and Chief Investment Officer, MBIA Insurance Corporation; officer of other affiliated entities of Cutwater Investor Services Corp. | | N/A. | | Shall serve until death, resignation, or removal. Officer since 2005. | | N/A. |

| | | | | |

Joseph L. Sevely* Cutwater 113 King Street Armonk, NY 10504 Born: January 1960 | | Treasurer | | Director of Cutwater Investor Services Corp.; Director and officer of other affiliated entities of Cutwater Investor Services Corp. | | N/A. | | Shall serve until death, resignation, or removal. Officer since 2010. | | N/A. |

| | | | | |

Thomas E. Stabile* Cutwater 113 King Street Armonk, NY 10504 Born: March 1974 | | Assistant

Treasurer | | Officer of Cutwater Investor Services Corp. | | N/A. | | Shall serve until death, resignation, or removal. Officer since 2010. | | N/A. |

| | | | | |

Leonard I. Chubinsky* Cutwater 113 King Street Armonk, NY 10504 Born: December 1948 | | Secretary | | Senior Corporate Counsel of Cutwater Investor Services Corp. and certain of its affiliates. | | N/A. | | Shall serve until death, resignation, or removal. Officer since 2005. | | N/A. |

| | | | | |

Michelle Houck* Cutwater 113 King Street Armonk, NY 10504 Born: January 1971 | | Vice

President/

Chief

Compliance

Officer | | Assistant General Counsel, Compliance Officer and Principal with Pzena Investment Management. | | N/A. | | Shall serve until death, resignation, or removal. Officer since 2011. | | N/A. |

22

SHAREHOLDER INFORMATION (Unaudited) — continued

ADDITIONAL INFORMATION REGARDING THE FUND’S TRUSTEES AND OFFICERS

| | | | | | | | | | |

Name, Address and Age | | Position Held

With Fund | | Principal Occupation During the Past 5 Years | | Number of

Funds Overseen

By Trustee | | Term of Office and Length

of Time Served | | Other

Directorships

Held by

Trustee |

| | | | | |

Robert T. Claiborne* Cutwater 113 King Street Armonk, NY 10504 Born: August 1955 | | Vice

President | | Officer of

Cutwater Investor

Services Corp. | | N/A. | | Shall serve until death, resignation, or removal. Officer since 2006. | | N/A. |

| * | Denotes a trustee/officer who is an “interested person” of the Fund as defined under the provisions of the Investment Company Act of 1940. Mr. Brown is an “interested person” because he has an interest in MBIA Inc., the parent of the Fund’s Investment Adviser. Messrs. Corso, Sevely, Stabile, Chubinsky, Claiborne, Khanna and Ms. Houck are “interested persons” by virtue of being employees of the Fund’s Investment Adviser. |

HOW TO GET INFORMATION REGARDING PROXIES

The Fund has adopted the Adviser’s proxy voting policies and procedures to govern the voting of proxies relating to the voting securities of the Fund. You may obtain a copy of these proxy voting procedures, without charge, by calling (800) 765-6242 or on the Securities and Exchange Commission website at www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available, without charge, by calling (800) 765-6242 or on the SEC’s website at www.sec.gov.

QUARTERLY STATEMENT OF INVESTMENTS