As filed with the Securities and Exchange Commission on August 11, 2006

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party Other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement.

[ ] Confidential, for Use of the Commission Only (as Permitted by Rule

14a-6(e)(2)).

[ X] Definitive Proxy Statement.

[ ] Definitive Additional Materials.

[ ] Soliciting Material Pursuant to Section

240.14a-12.

LASERCARD CORPORATION

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, schedule, or registration statement no.:

(3) Filing party:

(4) Date filed:

LASERCARD CORPORATION

1875 N. Shoreline Blvd.

Mountain View, California 94043

NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS

Friday, September 22, 2006

2:00 p.m. Pacific Time

To the Stockholders:

The 2006 Annual Meeting of Stockholders of LaserCard Corporation (the “Company”) will be held in the Cyprus Room at Crowne Plaza Cabana Palo Alto, 4290 El Camino Real, Palo Alto, California, 94306, on Friday, September 22, 2006, at 2:00 p.m. Pacific time, for the following purposes:

1. to elect directors;

2. to ratify the selection of Odenberg Ullakko Muranishi & Co. LLP as the Company’s independent registered public accounting firm for the fiscal year ended March 31, 2007;

3. to approve an amendment to the 2004 Equity Incentive Compensation Plan to increase the number of shares reserved for issuance thereunder by 575,000;

4. to transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on Wednesday, July 26, 2006 are entitled to notice of and to vote at this meeting and at any continuation, adjournment, or postponement thereof.

| | By Order of the Board of Directors |

| | /s/ STEPHEN M. WURZBURG |

| | Secretary |

Mountain View, California

August 11, 2006

TABLE OF CONTENTS

| | Page |

| GENERAL | 1 |

| | |

| PROPOSAL 1: ELECTION OF DIRECTORS | 3 |

| | |

| PROPOSAL 2: RATIFICATION OF THE COMPANY’S INDEPENDENT AUDITORS | 8 |

| | |

PROPOSAL 3: APPROVAL OF AN AMENDMENT TO THE 2004 EQUITY INCENTIVE COMPENSATION PLAN TO INCREASE THE NUMBER OF SHARES RESERVED FOR ISSUANCE THEREUNDER BY 575,000 | 8 |

| | |

| EXECUTIVE COMPENSATION AND RELATED PARTY TRANSACTIONS | 14 |

| | |

| STOCK PERFORMANCE GRAPH | 16 |

| | |

| EQUITY COMPENSATION PLAN INFORMATION | 18 |

| | |

| COMPENSATION COMMITTEE REPORT ON FISCAL 2006 EXECUTIVE COMPENSATION | 18 |

| | |

| AUDIT COMMITTEE REPORT AND OTHER OUTSIDE ACCOUNTANT-RELATED MATTERS | 20 |

| | |

| MISCELLANEOUS MATTERS | 22 |

| | |

| OTHER MATTERS AND TIMELY PROPOSALS FOR THE 2006 ANNUAL MEETING | 23 |

| | |

| STOCKHOLDER PROPOSALS AND BOARD NOMINATIONS FOR THE 2007 ANNUAL MEETING | 23 |

| | |

| AVAILABILITY OF FORM 10-K | 24 |

| | |

| APPENDIX A NOMINATING AND CORPORATE GOVERNANCE COMMITTEE CHARTER | 25 |

| | |

| APPENDIX B AUDIT COMMITTEE CHARTER | 27 |

Voting Shares Held in Your Own Name

If your shares are held directly in your name on the company’s stock records maintained by its transfer agent, Mellon Investor Services LLC, you are receiving a LaserCard Corporation proxy card on which to vote. Whether or not you plan to attend the meeting, please sign and return the proxy card in the enclosed envelope as promptly as possible. Postage is not needed if the envelope is mailed in the United States. If you attend the meeting, and so desire, you may withdraw your proxy and vote in person.

If you live in the United States or Canada, you may submit your proxy by following the Vote by Telephone instructions on the proxy card. If you have Internet access, you may submit your proxy from any location in the world by following the Vote by Internet instructions on the proxy card.

Voting Shares Held in “Street Name”

If your shares are held by your broker (“street name”) on the company’s stock records, you are receiving a voting instruction form from your broker or the broker’s agent, asking you how your shares should be voted. Please complete the form and return it in the envelope provided by the broker or agent; no postage is necessary if mailed in the United States.

A number of brokers and banks participate in a program, provided through ADP Investor Communication Services, that offers telephone and Internet voting options to “street name” stockholders. Please check your voting instruction form to determine if you can use these voting methods.

“Street name” stockholders may attend the 2006 Annual Meeting and vote in person by contacting the broker or agent in whose name the shares are registered, to obtain a broker’s proxy showing the number of shares you owned beneficially on July 26, 2006. You must bring the broker’s proxy to the annual meeting in order to vote in person.

LASERCARD CORPORATION

1875 N. Shoreline Blvd.,

Mountain View, California 94043

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held September 22, 2006

GENERAL

The enclosed proxy is solicited on behalf of the Board of Directors of LaserCard Corporation, a Delaware corporation (the “Company”), for use at the 2006 Annual Meeting of Stockholders of the Company, to be held in the Cyprus Room at Crowne Plaza Cabana Palo Alto, 4290 El Camino Real, Palo Alto, California, 94306, at 2:00 p.m. Pacific time on Friday, September 22, 2006. Only stockholders of record on Wednesday, July 26, 2006, will be entitled to vote. At the close of business on that date, the Company had outstanding 11,810,360 shares of common stock.

Stockholders are entitled to one vote for each share held. All duly executed proxy cards received prior to the meeting will be voted at the annual meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares represented by proxies will be voted as follows:

● FOR the election of the Board’s nominees as directors as set forth in this Proxy Statement;

● FOR the ratification of Odenberg Ullakko Muranishi & Co. LLP as the Company’s independent registered public accounting firm as set forth in this Proxy Statement;

● FOR the amendment to the 2004 Equity Incentive Compensation Plan to increase the shares reserved for issuance thereunder by 575,000 as set forth in this Proxy Statement;

In addition, if other matters come before the annual meeting, the persons named in the accompanying form of proxy will vote in accordance with their best judgment with respect to such matters. Any stockholder giving a proxy in the form accompanying this Proxy Statement has the power to revoke the proxy prior to its exercise. A proxy may be revoked by filing with the Secretary of the Company, prior to the meeting, either an instrument revoking it or a duly executed proxy bearing a later date; by duly executing a proxy bearing a later date which is presented at the meeting; or by attending the meeting and electing to vote in person by ballot.

The required quorum for the transaction of business at the annual meeting is a majority of the shares entitled to vote, represented in person or by proxy. Shares that are duly voted “FOR,” “AGAINST,” or “ABSTAIN” on any matter are treated as being present at the meeting for purposes of establishing a quorum.

The Company intends to count abstentions with respect to any proposal as present or represented and entitled to vote on that proposal and thus have the same effect as negative votes. The Company intends to count broker non-votes (which typically occur when shares held by brokers or nominees for beneficial owners are not voted on a particular matter due to the absence of instructions as to the particular matter from the beneficial owners and the absence of the authority for the broker or nominee to vote such shares as to such matter absent such instructions) for the purpose of establishing the presence or absence of a quorum for the transaction of business, but not as votes cast with respect to any proposal that may come before the meeting. That is, although they count for purposes of determining a quorum, shares which are not voted as to a matter, besides abstentions, such as broker non-votes or under other circumstances in which proxy authority is defective or has been withheld, are not deemed to be present or represented for the purposes of determining whether stockholder approval of that matter has been obtained. Broker non-votes would to this extent have no effect on the outcome of the election of directors or the vote on any proposal requiring a majority of shares present or in person represented by proxy at the meeting. Many brokers are subject to rules which prohibit them from voting on proposals such as Proposal 3 relating to equity compensation plans unless they receive specific instructions from the

beneficial owner to vote on such matters but such rules do not prohibit them to vote in the election of directors and on proposals such as Proposal 2 related to ratification of our independent registered public accounting firm in the absence of such instructions if and as they choose.

This Proxy Statement is being mailed on or about August 14, 2006, to stockholders of record on July 26, 2006.

PROPOSAL 1: ELECTION OF DIRECTORS

Nominees

The Company’s By-Laws currently provide for a Board of Directors with seven authorized directors and the Company currently has seven directors. All directors are elected annually and serve a one-year term until the next annual meeting of stockholders and until their successors are duly elected and qualified or until their earlier resignation or removal.

The following seven persons were nominated by the Company’s Board of Directors upon recommendation of its Nominating and Corporate Governance Committee for election as directors: Bernard C. Bailey, Richard M. Haddock, Arthur H. Hausman, Donald E. Mattson, Dan Maydan, Albert J. Moyer, and Walter F. Walker. Christopher J. Dyball, currently a Company director and its Chief Operating Officer, did not seek re-nomination as a director so that the board size could remain seven (7) and Mr. Bailey, who has valuable industry experience, could be added as director. Mr. Bailey, who has been the CEO of Viisage Technology, Inc. (identity solutions for security credentials) for the past four years, has announced that he will be stepping down as CEO in connection with its planned merger with Identix. Dr. Dyball’s decision not to seek re-nomination also allows the Board of Directors to have only one employee director which the Board of Directors believes is better corporate governance. Dr. Dyball will remain a Company employee and its Chief Operating Officer. Certain biographical information about the nominees is set forth in the Security Ownership by Directors and Executive Officers table on pages 5, 6 and 7. The Board of Directors has determined that all of its current members and nominees other than Dr. Dyball and Mr. Haddock are “independent” as defined by applicable listing standards of The Nasdaq Stock Market and SEC rules. In order to separate the role of CEO and Chairman of the Board, Mr. Mattson was elected as Chairman of the Board.

As explained above, all proxies solicited hereby will be voted for the election of the seven nominees unless authority to vote for one or more nominees is withheld in accordance with the instructions on the proxy card. If any nominee is unable or declines to serve as director at the time of the annual meeting, an event not now anticipated, proxies will be voted for any nominee designated by the Board of Directors to fill the vacancy.

Board Meetings and Committees

The Board of Directors held eight meetings during fiscal year ended March 31, 2006. The Board has standing Audit, Compensation, and Nominating and Corporate Governance Committees. During fiscal year 2006, the Audit Committee held eight meetings, the Compensation Committee held six meetings, and the Nominating and Corporate Governance Committee held one meeting. All directors attended in person or telephonically at least 75% of the meetings of the Board of Directors and of the committees on which such directors serve. At the end of each regularly scheduled meeting, the outside independent members of the Board of Directors meet without the employee directors (currently Dr. Dyball and Mr. Haddock) present.

The Audit Committee is generally responsible for oversight on matters relating to financial accounting and reporting, internal controls, auditing, legal and regulatory compliance activities, and other matters as the Board of Directors deems appropriate. The Audit Committee’s role is limited to this oversight; it is not the duty of the Audit Committee to plan or conduct audits or to determine whether the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Rather the Company’s management is responsible for preparing the Company’s financial statements and the Company’s independent registered public accounting firm (“independent accountants”) is responsible for auditing those financial statements. The Audit Committee has the sole authority to appoint, retain, compensate, evaluate, and, where appropriate, replace the Company’s independent accountants. In addition, the Audit Committee has the sole authority to approve all auditing services and non-audit services to be provided to the Company and its subsidiaries by the independent accountants in advance of the provision of these services. The Audit Committee also approves the fees and terms of all non-audit services provided by the independent accountants and evaluates their independence. The Audit Committee currently is composed of four outside directors, namely Mr. Moyer, Chairman, and Messrs. Hausman, Mattson, and Walker, each of whom the Company believes to be qualified and “independent” as defined by The Nasdaq® Stock Market listing requirements.

The Audit Committee of our Board of Directors contains at least one “audit committee financial expert.” The name of the Audit Committee financial expert is Albert J. Moyer and the Board of Directors has determined that he is “independent” as that term is defined Item 7(d)(3)(iv) of Section 14A of the Securities and Exchange Act, as amended (the “Exchange Act”).

The Compensation Committee currently is composed of three outside independent directors, namely Mr. Hausman, Dr. Maydan, and Mr. Moyer. The Compensation Committee is responsible for approving the compensation of executive officers and of any other senior managers and key employees with respect to whose compensation the Chief Executive Officer seeks Compensation Committee input, and overseeing the Company’s 2004 Equity Incentive Compensation Plan (the “Incentive Plan”) and Employee Stock Purchase Plan except that the Compensation Committee shall recommend to the independent directors for their approval the compensation of the Chief Executive Officer.

The Nominating and Corporate Governance Committee is responsible for recommending to the Board of Directors nominees for director, and reviewing and making recommendations to the Board of Directors with respect to candidates for director proposed by stockholders. The Nominating and Corporate Governance Committee also periodically reviews and may recommend changes in the Company’s governance practices. The Nominating and Corporate Governance Committee currently is composed of three outside independent directors, namely, Mr. Walker, Mr. Mattson, and Dr. Maydan. The Nominating and Corporate Governance Committee has a written charter that has been approved by the Company’s Board of Directors. A copy of his charter is included as Appendix A to this Proxy Statement and is available on the Company’s website.

Directors Nominations

The Board of Directors nominates directors for election at each annual meeting of stockholders and elects new directors to fill vacancies when they arise. The Nominating and Corporate Governance Committee has the responsibility to identify, evaluate, recruit and recommend qualified candidates to the Board of Directors for nomination or election.

The Board of Directors has as an objective that its membership be composed of experienced and dedicated individuals with diversity of backgrounds, perspectives and skills. The Nominating and Governance Committee will select candidates for director based on their character, judgment, diversity of experience, business acumen, and ability to act on behalf of all stockholders. The Nominating and Corporate Governance Committee believes that nominees for director should have experience, such as experience in management or accounting and finance, or industry and technology knowledge, that may be useful to the Company and the Board, high personal and professional ethics, and the willingness and ability to devote sufficient time to effectively carry out his or her duties as a director. The Nominating and Corporate Governance Committee believes it appropriate for at least one member of the Board to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and for a majority of the members of the Board to meet the definition of “independent director” under the rules of The Nasdaq Stock Market. While the Nominating and Corporate Governance Committee also believes it appropriate for certain key members of the Company’s management to participate as members of the Board, it also believes it is better corporate governance for a corporation the size of the Company to have the CEO be the only management team board member.

Prior to each annual meeting of stockholders, the Nominating and Corporate Governance Committee identifies nominees first by evaluating the current directors whose term will expire at the annual meeting and who are willing to continue in service. These candidates are evaluated based on the criteria described above, including as demonstrated by the candidate’s prior service as a director, and the needs of the Board with respect to the particular talents and experience of its directors. In the event that a director does not wish to continue in service, the Nominating and Corporate Governance Committee determines not to re-nominate the Director, or a vacancy is created on the Board as a result of a resignation, an increase in the size of the board or other event, the Committee will consider various candidates for Board membership, including those suggested by the Committee members, by other Board members, by any executive search firm engaged by the Committee and by stockholders. Once identified, candidates are initially interviewed by the Chairman of the Nominating and Corporate Governance Committee and our Chief Executive Officer, and then by all members of the Nominating and Corporate Governance Committee and at least one additional officer of the Company and the Chairman of the Board.

The Nominating Committee will consider nominees proposed timely by the stockholders. Any stockholder who wishes to recommend a prospective nominee for the Board of Directors for the Nominating Committee’s consideration may do so by giving timely notice of the candidate’s name and qualifications in writing to the Secretary of the Company, 1875 North Shoreline Boulevard, Mountain View, CA 94043 and by otherwise complying with the procedures set forth in Section 2.13(b) of the Company’s bylaws. See “Stockholder Proposals and Board Nominations for the 2007 Annual Meeting.”

Board of Directors Interaction with Stockholders

The Company provides for a process for stockholders to communicate with the Board of Directors. Stockholders may send written communications to the attention of the Board of Directors, a specific Board member, or a specific committee, in care of LaserCard Corporation, Attention: Steven Larson, 1875 N. Shoreline Blvd., Mountain View, California 94043. You must include your name and address in the written communication and indicate whether you are a stockholder of the Company. Mr. Larson will review any communication received from a stockholder, and all material communications from stockholders will be forwarded to the appropriate director or directors or committee of the Board based on the subject matter.

Board Attendance at Annual Meetings

Although the Company does not have a formal policy regarding Board attendance at annual meetings of stockholders, all Board members are expected to attend. All members of the Board, except one, attended the 2005 annual meeting that was held on September 23, 2005.

Director Compensation

During fiscal year 2006, each non-employee director received an annual fee of $21,000 for serving as a director, the standard fee in effect since October 1, 2005. The Chairman of the Board received an additional $19,000.

The Chairman of each committee is paid an additional $10,000, $5,000, and $2,000 per year for serving on the Audit, Compensation, and Nominating and Corporate Governance Committees, respectively. Audit Committee members are paid an additional $5,000 per year. All retainer fees were prorated over 12 months.

The Company also pays each member no more than $7,500, $2,000, and $1,000 per year for meeting attendance on the Audit, Compensation, and Nominating and Corporate Governance Committees, respectively. Fees for meeting attendance were paid per meeting. Reasonable out-of-pocket expenses incurred by directors for performing services for the Company were also reimbursed.

The Company's 2004 Equity Incentive Compensation Plan provides for the automatic grant of an option to purchase 15,000 shares of the Company's common stock on the date any person first becomes a director. These grants to newly elected directors become exercisable in cumulative increments of one-fourth (1/4) each at the end of 12 months, 24 months, 36 months and 48 months from the date of grant. The 2004 Equity Incentive Compensation Plan further provides that on the date of the Company's annual meeting, each non-employee director who has been a director of the Company for the preceding six-month period and who is re-elected at the annual meeting, is automatically granted an option to purchase 6,000 shares of the Company's common stock. The option share grants to the re-elected directors in the past had been exercisable in full at the time of grant; starting with the upcoming annual meeting, they will instead vest over the next year in twelve equal monthly advance installments due to an amendment to the 2004 Equity Incentive Compensation Plan recently adopted by the Board of Directors. The exercise price for options granted to newly elected directors and re-elected directors is the fair market value of the Company's common stock on the date of grant.

Security Ownership of Directors and Executive Officers

The table below and on the following page contains information as of July 31, 2006, respecting the number of shares and percentage of the Company’s common stock beneficially owned by each of the Company’s seven directors, by the new nominee for director, by each named executive officer of the Company, and by all executive officers and directors as a group. The address of each beneficial owner listed in the table is c/o LaserCard Corporation, 1875 N. Shoreline Blvd., Mountain View, California 94043. Applicable percentages are based on 11,809,298 shares outstanding on July 31, 2006.

SECURITY OWNERSHIP BY DIRECTORS, DIRECTOR NOMINEES, AND EXECUTIVE OFFICERS

| Name, Principal Occupation, and Other Directorships | | Age | | Director Since | | Common Shares(1) | | Percentage of Class(2) |

| | | | | | | | | |

ARTHUR H. HAUSMAN, Director Private investor. Retired Chairman, President and Chief Executive Officer of Ampex Corporation (manufacturer of professional audio-video systems, data/memory products and magnetic tape). Director of CalAmp Corp. (direct broadcast satellite product). | | | 82 | | | 1981 | | | 74,392(5) | | | 0.6 |

| | | | | | | | | | | | | |

DONALD E. MATTSON, Director Private investor. Retired Senior Vice President and Chief Operating Officer of InVision Technologies, an explosives detection systems manufacturer, until its acquisition by GE (November 2000 to January 2005). | | | 73 | | | 2005 | | | 9,750(7) | | | 0.1 |

| | | | | | | | | | | | | |

DAN MAYDAN, Director Retired. Retired President of Applied Materials, Inc. .(semiconductor manufacturing equipment) from January 1994 through April 2003. Director of Electronics for Imaging, Inc. (printing solutions) and numerous private companies. Member of Board of Trustees of PAMF (Palo Alto Medical Foundation) since 2003 and Board of Governors of Technion (Israel Institute of Technology). Member of the National Academy of Engineering. | | | 70 | | | 1998 | | | 33,000(8) | | | 0.3% |

| | | | | | | | | | | | | |

ALBERT J. MOYER, Director Private investor. Retired Executive Vice President and Chief Financial Officer of QAD Inc. (a publicly held software company and subsequently served as consultant to QAD). Previously Director of QAD, Inc. from 2000 - 2005. Director of Collectors’ Universe (collectibles markets), Inc., CalAmp Corp. (direct broadcast satellite products) and Virco Manufacturing Corp. (education furniture). | | | 62 | | | 2005 | | | 9,750(9) | | | 0.1% |

| | | | | | | | | | | | | |

WALTER F. WALKER, Director President, CEO and Director (since 2001) of The Basketball Club of Seattle, LLC, which owns the Seattle Sonics & Storm Basketball teams (NBA and WNBA basketball); formerly President (since 1994) of Seattle SuperSonics NBA basketball team. Previously, was President (in 1994) of Walker Capital, Inc. (money management firm) and Vice President (from 1987 to 1994) of Goldman Sachs & Co. (investment banking firm). Director of Advanced Digital Information Corporation (archival and backup data-storage peripherals). Member of the Institute of Chartered Financial Analysts (CFAs) | | | 51 | | | 1999 | | | 121,539(11) | | | 1.0% |

| | | | | | | | | | | | | |

BERNARD C. BAILEY, Nominee for Director Chief Executive Officer and Director, Viisage Technology, Inc. (identity solutions for security credentials) since August 2002. Previously, from January 2001 through August 2002, Mr. Bailey served as the Chief Operating Officer of Art Technology Group (software). Between April 1984 and January 2001, Mr. Bailey served in various capacities at IBM Corporation, including several executive positions. A graduate of the U.S. Naval Academy, Mr. Bailey served for eight years as an officer in the US Navy. | | | 52 | | | N/A | | | 0 | | | 0% |

| | | | | | | | | | | | | |

CHRISTOPHER J. DYBALL, Director and Executive Officer Chief Operating Officer (since November 2004). Formerly President from November 2004 through September 2005, Co-Chief Executive Officer from August 2003 through November 2004 and Executive Vice President from 1992 through November 2003. | | | 55 | | | 2001 | | | 248,908(3) | | | 2.1% |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

RICHARD M. HADDOCK, Director and Executive Officer Chief Executive Officer (since November 2004) and President (since September 2005). Previously Co-Chief Executive Officer from August 2003 through November 2004 and President and Chief Operating Officer from 1997 through November 2003. | | | 54 | | | 2001 | | | 285,597(4) | | | 2.4% |

| | | | | | | | | | | | | |

STEVEN G. LARSON, Executive Officer Vice President of Finance and Treasurer since 1987. | | | 56 | | | | | | 182,825(6) | | | 1.5% |

| | | | | | | | | | | | | |

STEPHEN D. PRICE-FRANCIS, Executive Officer Vice President of Business Development (since November 2004) of LaserCard Corporation. Previously Director of Business Development of LaserCard Corporation. Previously Director of Business Development since 1999. Director of North American Security Products Organization; Past president, Advanced Card Technology Association of Canada (ACT Canada). | | | 59 | | | | | | 29,421(10) | | | 0.3% |

| | | | | | | | | | | | | |

All executive officers and directors as a group (the 9 persons named above) | | | | | | | | | 996,380(12) | | | 7.9% |

| (1) | To the Company’s knowledge, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws, where applicable, and the information contained in the footnotes to this table. |

| (2) | For purposes of computing the percentage of outstanding shares held by each person or group of persons named above on a given date, shares which such person or group has the right to acquire within 60 days after such date are deemed to be outstanding, but are not deemed to be outstanding for the purposes of computing the percentage ownership of any other person. |

| (3) | Includes 223,659 shares purchasable by exercise of option within 60 days. |

| (4) | Includes 259,750 shares purchasable by exercise of option within 60 days. |

| (5) | Includes 54,000 shares purchasable by exercise of option within 60 days. |

| (6) | Includes 170,727 shares purchasable by exercise of option within 60 days. |

| (7) | Includes 9,750 shares purchasable by exercise of option within 60 days. |

| (8) | Includes 33,000 shares purchasable by exercise of option within 60 days. |

| (9) | Includes 9,750 shares purchasable by exercise of option within 60 days. |

| (10) | Includes 27,212 shares purchasable by exercise of options within 60 days. |

| (11) | Includes 49,000 shares purchasable by exercise of option within 60 days. Does not include 1,000 shares owned by Mr. Walker's wife, as to which shares Mr. Walker disclaims any beneficial ownership. |

| (12) | Includes 836,848 shares purchasable by exercise of option within 60 days. |

It is anticipated that each director (other than Dr. Dyball) and each executive officer will continue in his position, although there is no understanding or arrangement to that effect. Each director holds office until the next annual meeting of stockholders and until such director’s successor is elected and qualified or until such director’s earlier resignation or removal. Each executive officer serves at the pleasure of the Board of directors. Each executive officer holds office until such officer’s successor is elected and qualified or until such officer’s earlier resignation or removal. There are no family relationships among any directors or executive officers of the Company.

Required Vote for Approval of Proposal 1 and Recommendation

The election of each nominee to the Board of Directors will require the affirmative vote of the holders of a plurality of the shares of the Company’s common stock present in person or represented by proxy at the meeting. The seven nominees for director who receive the most votes cast in their favor will be elected to serve as directors. With respect to the election of directors, stockholders may (1) vote “FOR” all seven nominees, (2) ”WITHHOLD” authority to vote for all such nominees, or (3) ”WITHHOLD” authority to vote for any individual nominee or nominees, but vote for all other nominees. Because directors are elected by a plurality of the votes cast, broker non-votes and shares for which authority to vote has been withheld will have no effect on the outcome of the election.

The Board of Directors recommends a vote FOR election of the Company’s nominees.

PROPOSAL 2: RATIFICATION OF THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Subject to ratification by the stockholders, the Board of Directors has appointed Odenberg Ullakko Muranishi & Co. LLP (“OUM”) as the Company’s independent registered public accounting firm (“independent accountants”) to audit the financial statements of the Company for the current fiscal year. OUM audited the Company’s financial statements for fiscal years 2006 and 2005.

Representatives of the firm of OUM are expected to be present at the Annual Meeting and will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of OUM as the Company’s independent accountants is not required by the Company’s By-Laws or otherwise. The Board of Directors is submitting the selection of OUM to the stockholders for ratification as a matter of good corporate practice. In the event the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change could be in the best interests of the Company and its stockholders.

Required Vote for Approval of Proposal 2 and Recommendation

Approval of the above proposal related to the ratification of the Company’s independent registered public accounting firm will require the affirmative vote of the holders of a majority of the shares of the Company’s common stock present in person or represented by proxy at the meeting and voting on the proposal. Stockholders may (1) vote “FOR,” (2) vote “AGAINST,” or (3) “ABSTAIN” from voting on Proposal 2. Broker non-votes are not considered to be votes cast and therefore will have no effect on the outcome of this proposal.

The Board of Directors recommends a vote FOR approval of Proposal 2.

| PROPOSAL 3: | APPROVAL OF AN AMENDMENT TO THE 2004 EQUITY INCENTIVE COMPENSATION PLAN TO INCREASE THE NUMBER OF SHARES RESERVED FOR ISSUANCE THEREUNDER BY 575,000 |

The Board of Directors recommends stockholder approval of an amendment to the 2004 Equity Incentive Compensation Plan (the “Incentive Plan”) to increase the total number of shares reserved for issuance thereunder by 575,000, from 937,359 shares to 1,512,359 shares. The 575,000 share increase would be added to the 119,210 shares that remained available for stock option grants as of July 31, 2006. The 575,000 shares increase represents approximately 5% of the Company’s 11,810,360 total outstanding shares as of the record date of July 26, 2006.

The Board of Directors believes that it is in the best interests of the Company to be able to continue to create equity incentives to attract and retain top quality employees and consultants, including officers and directors, and to provide these persons with an incentive to enhance stockholder returns.

The Board of Directors recommends a vote FOR election of the above proposal.

Summary of the Incentive Plan

Set forth below is a summary of the Incentive Plan, which is qualified in its entirety by the specific language of the Incentive Plan. A copy of the Incentive Plan is included as Appendix C to this proxy statement as filed electronically via EDGAR with the Securities and Exchange Commission. Alternatively, copy of the Incentive Plan is available without charge upon stockholder request to: Steven G. Larson, Vice President of Finance, LaserCard Corporation, 1875 N. Shoreline Blvd., Mountain View, California 94043.

Description of the Incentive Plan

The Incentive Plan provides for the grant of restricted share awards, options, stock units and stock appreciation rights, any of which may or may not require the satisfaction of performance objectives, with respect to shares of our Common Stock to directors, officers, employees and consultants of the Company and our subsidiaries. The Incentive Plan may be administered by the Compensation Committee of the Board of Directors (the “Committee”), which has complete discretion to select the participants and to establish the terms and conditions of each award, subject to the provisions of the Incentive Plan. Options granted under the Incentive Plan may be “incentive stock options” as deemed in Section 422 of the Internal Revenue Code of 1986, as amended, or the Code, or nonqualified options. As of July 31, 2006, approximately 185 employees were eligible to be considered for the grant of options under the Incentive Plan.

The Board of Directors believes that the granting of equity compensation awards is necessary to attract the highest quality personnel as well as to reward and thereby retain existing key personnel. Moreover, the attraction and retention of such personnel is essential to our continued progress, which ultimately is in the interests of our stockholders.

Shares Subject to the Incentive Plan

As of July 31, 2006, a total of 937,359 shares of Common Stock have been reserved for issuance under the Incentive Plan, including 300,000 shares newly reserved when the Incentive Plan was adopted at the Company’s 2004 annual meeting, plus an aggregate of 235,234 shares that remained available for future grants under the prior Stock Option Plan (the “Prior Plan”) as of the Company’s 2004 annual meeting, plus an aggregate of 87,125 shares which were then subject to options outstanding under the Prior Plan but which have lapsed subsequently, plus 315,000 shares newly reserved at the Company’s 2005 annual meeting. Upon stockholder approval of this proposal, an additional 575,000 shares will be reserved for issuance under the Incentive Plan, for an aggregate of 1,512,359 shares. Any shares granted as options or stock appreciation rights are counted against this limit as one share for every one share granted. Any shares granted as awards other than options or stock appreciation rights are counted against this limit as two shares for every one share granted.

If any award granted under the Incentive Plan is forfeited or expires for any reason, then the shares subject to that award will once again be available for additional awards. Further, if in the future any outstanding option under the Prior Plan expires or terminates for any reason without having been exercised in full, then the unpurchased shares subject to that option will be available for additional awards under the Incentive Plan.

As of July 31, 2006, (i) the number of shares subject to outstanding options, (ii) the range of exercise prices for these options, (iii) the weighted average per share exercise price, (iv) the weighted-average remaining life in years, (v) the number of shares issued upon exercise of options and (vi) the number of shares available for future grant under (A) the Incentive Plan and (B) all our equity compensation plans (including the Incentive Plan but excluding the Employee Stock Purchase Plan), whether or not approved by our stockholders, were as follows:

| | | | Shares Subject to Outstanding Options | | | Range of Exercise Prices | | | Weighted- Average Per Share Price | | | Weighted- Average Remaining Life in Years | | | Number of Shares Issued Upon Exercise | | | Number of Shares Available for Further Grant | |

| | | | | | | | | | | | | | | | | | | | |

| Incentive Plan | | | 766,804 | | | $6.05 to $22.46 | | | $11.19 | | | 5.3 | | | 766,804 | | | 118,484 | |

| | | | | | | | | | | | | | | | | | | | |

| All Plans | | | 2,278,443 | | | $6.05 to $22.75 | | | $12.95 | | | | | | 2,278,443 | | | 119,210 | |

Because option grants under the Incentive Plan are subject to the discretion of the Committee, subsequent awards under the Incentive Plan for the current year are indeterminable except that on September 22, 2006, assuming that the amendment to the Incentive Plan is approved and the following individuals are either elected as director or continue in office, as the case may be, each of the five re-elected outside directors would receive 6,000 options; Bernard Bailey, the newly elected director, would receive 15,000 options; and the executive officers would be granted an aggregate of 47,500 shares (18,750 for Mr. Haddock, 12,500 for Dr. Dyball, 10,000 for Mr. Larson, and 6,250 for Mr. Price-Francis). Future option exercise prices under the Incentive Plan are also indeterminable because the prices will be based upon the fair market value of the Common Stock on the date of grant. During the fiscal year ended March 31, 2006, the following persons or groups had in total, received options to purchase shares of Common Stock under the Incentive Plan as follows, each with an exercise price per share equal to the fair market value of the Company’s Common Stock the date of the grant:

Name | | Number of Shares | |

| Arthur H. Hausman | | 6,000 | |

| Donald E. Mattson | | 6,000 | |

| Dan Maydan | | 6,000 | |

| Albert J. Moyer | | 6,000 | |

| Walter F. Walker | | 6,000 | |

| Christopher J. Dyball | | 65,000 | |

| Richard M. Haddock | | 75,000 | |

| Steven G. Larson | | 45,000 | |

| Stephen D. Price-Francis | | 35,000 | |

| All current executive officers as a group (4 persons) | | 220,000 | |

| All current outside directors as a group (5 persons) | | 30,000 | |

| All employees, including all current officers who are not executive officers | | 218,800 | |

None of the executive officers and outside directors received options under the Prior Plan during the fiscal year ended March 31, 2006.

Stock Options and Stock Appreciation Rights

A stock option is the right to purchase a certain number of shares of stock, at a certain exercise price, in the future. A stock appreciation right is the right to receive the net of the market price of a share of stock and the exercise price of the right, either in cash or in stock, in the future.

The exercise price of incentive stock options may not be less than 100% of the fair market value of the Common Stock as of the date of grant (110% of the fair market value if the grant is to an employee who owns more than 10% of the total combined voting power of all classes of our capital stock). The Code currently limits to $100,000 the aggregate value of Common Stock for which incentive stock options may first become exercisable in any calendar year under the Incentive Plan or any other option plan adopted by the Company. Nonstatutory stock options may be granted under the Incentive Plan at an exercise price of not less than 100% of the fair market value of the Common Stock on the date of grant. Nonstatutory stock options also may be granted without regard to any restriction on the amount of Common Stock to which the option may first become exercisable in any calendar year. Repricing, or reducing the exercise price of a stock option or stock appreciation right is not permitted without stockholder approval. On August 1, 2006, the closing price for the Common Stock on The Nasdaq Stock Market was $12.29 per share.

Subject to the limitations contained in the Incentive Plan, options granted under the Incentive Plan will become exercisable at such times and in such installments as the Committee shall provide in the terms of each individual stock option agreement. The Committee must also provide in the terms of each stock option agreement when the option expires and becomes unexercisable. Any options that were not exercisable on the date of termination of employment immediately terminate at that time. Any options that are exercisable on the date of termination will remain exercisable only in accordance with the option agreement. Options granted under the Incentive Plan may not be exercised more than 10 years after the date of grant (five years after the date of grant if the grant is an incentive stock option to an employee who owns more than 10% of the total combined voting power of all classes of our capital stock).

Non-Employee Director Options

The Incentive Plan provides for the automatic grant of an option to purchase 15,000 shares of the Company’s common stock on the date a person who is not a Company employee or consultant first becomes an outside director. These grants to newly elected outside directors become exercisable in cumulative increments of one-fourth (1/4) each at the end of 12 months, 24 months, 36 months, and 48 months from the date of grant. The Incentive Plan further provides that on the date of the Company’s annual meeting each outside director who has been a director of the Company for the preceding six-month period and who is re-elected at the annual meeting, be automatically granted an option to purchase 6,000 shares of the Company’s common stock. The option share grants to the re-elected outside directors in the past had been exercisable in full at the time of grant; starting with the upcoming annual meeting, they will instead vest over the next year in twelve equal monthly advance installments due to an amendment to the Incentive Plan recently adopted by the Board of Directors. The exercise price for options granted to newly elected outside directors and re-elected outside directors is the fair market value of the Company’s common stock on the date of grant. As of March 31, 2006, 66,000 shares are subject to outstanding options granted to non-employee directors under the Incentive Plan.

Restricted Share Awards and Stock Units

Restricted stock is a share award that may be conditioned upon continued employment or the achievement of performance objectives. The terms of any restricted share award under the Incentive Plan will be set forth in a restricted stock agreement to be entered into between the Company and each grantee. The Committee will determine the terms and conditions of any restricted stock agreements, which need not be identical. Shares may be awarded under the Incentive Plan in consideration of services rendered prior to the award, without a cash payment by the grantee.

Under the Incentive Plan, the Committee may also grant stock units that give recipients the right to acquire a specified number of shares of stock, or the equivalent value in cash, at a future date upon the attainment of certain conditions established by the Committee. No cash consideration is required of the recipient. Recipients of stock units do not have voting or dividend rights, but may be credited with dividend equivalent compensation.

Section 162(m)

So that awards may qualify under Section 162(m) of the Code, which permits performance-based compensation meeting the requirements established by the Internal Revenue Service to be excluded from the limitation on deductibility of compensation in excess of $1 million paid to certain specified senior executives, the Incentive Plan limits the number of shares that may be subject to awards to individual participants to no more than 100,000 shares in any twelve-month period except that this limit is increased to 200,000 shares during the first year that a participant is hired or retained.

Awards may, but need not, include performance criteria that satisfy Section 162(m) of the Code. To the extent that awards are intended to qualify as “performance-based compensation” under Section 162(m), the performance criteria will be one of the following criteria, either individually, alternatively or in any combination, applied to either the Company as a whole or to a business unit or subsidiary, either individually, alternatively, or in any combination, and measured either annually or cumulatively over a period of years, on an absolute basis or relative to a pre-established target, to previous years’ results or to a designated comparison group, in each case as specified by the Committee in the award:

· Cash flow | · Earnings per share |

· Earnings before interest, taxes and amortization | · Return on equity |

· Total stockholder return | · Share price performance |

· Return on capital | · Return on assets or net assets |

· Revenue | · Income or net income |

· Operating income or net operating income | · Operating profit or net operating profit |

· Operating margin or profit margin | · Return on operating revenue |

· Return on invested capital | · Market segment shares |

· Sales | · Customer satisfaction |

To the extent that an award under the Incentive Plan is designated as a “performance award,” but is not intended to qualify as performance-based compensation under Section 162(m), the performance criteria can include the achievement of strategic objectives as determined by the Committee.

Notwithstanding satisfaction or completion of any performance criteria described above, to the extent specified at the time of grant of an award, the number of shares of Common Stock, stock options or other benefits granted, issued, retainable and/or vested under an award upon satisfaction of the performance criteria may be reduced by the Committee on the basis of such further considerations as the Committee in its sole discretion determines. However, in no event may the Committee increase the amount payable upon satisfaction or completion of the performance criteria to a person subject to the Section 162(m) limitations.

Administration

The Committee, which is made up entirely of independent directors, will administer the Incentive Plan. The Committee will select employees and consultants, including officers and directors, who receive awards, determine the number of shares covered thereby, and, subject to the terms and limitations expressly set forth in the Incentive Plan, establish the terms, conditions and other provisions of the awards. The Committee may interpret the Incentive Plan and establish, amend and rescind any rules relating to the Incentive Plan. The Committee may delegate to a secondary committee of directors the ability to grant awards and take certain other actions with respect to participants who are not executive officers, and may delegate certain administrative or ministerial functions under the Incentive Plan to an officer or officers.

Amendment to or Termination of the Incentive Plan

The Board of Directors may at any time amend, alter, suspend or terminate the Incentive Plan. No amendment, alteration, suspension or termination of the Plan will impair the rights of any party, unless mutually agreed otherwise between the party and the Committee. Termination of the Incentive Plan will not affect the Committee’s ability to exercise the powers granted to it under the Incentive Plan with respect to awards granted under the Incentive Plan prior to the date of such termination. The Incentive Plan is effective until August 9, 2014, that is ten years from the date of its approval by the Board of Directors, unless sooner terminated.

Since the 2004 Plan was adopted, the board has adopted amendments providing that (1) the number of available shares in the 2004 Plan be reduced by the number of shares covered by a stock appreciation right which is settled in shares and by the number shares covered by an option for which there is a net exercise (rather than the number of shares actually issued), (2) the number of shares available in the Plan be reduced by the twice the number of restricted shares awarded, (3) that restricted stock grants have at least one-year vesting if they also include performance conditions and vesting over at least three years if they do not include performance conditions, (4) eliminating a provision that could have been read to allow outstanding stock options to be cancelled or modified in exchange for a stock award, and (5) amending the vesting of the 6,000 share follow-on options granted to board members upon their re-election so that the vesting is delayed to be in twelve monthly advance installments with the first on their date of grant instead of being fully-vested at grant.

Adjustments

In the event of a stock dividend, recapitalization, stock split, combination of shares, extraordinary dividend of cash or assets, reorganization, or exchange of our Common Stock or any similar event affecting our Common Stock, the Committee shall adjust the number and kind of shares available for grant under the Incentive Plan, and subject to the various limitations set forth in the Incentive Plan, the number and kind of shares subject to outstanding awards under the Incentive Plan, and the exercise or settlement price of outstanding stock options and of other awards.

The impact of a merger or other reorganization of the Company on outstanding stock options, stock appreciation rights, restricted share awards and stock units granted under the Incentive Plan shall be specified in the agreement relating to the merger or reorganization, subject to the limitations and restrictions set forth in the Incentive Plan. Such agreement shall provide for the continuation of outstanding awards if we are the surviving corporation, assumption of outstanding awards by the surviving corporation, substitution by the surviving corporation of its own awards for outstanding awards under the Incentive Plan, accelerated expiration of outstanding awards which may or may not be accompanied by accelerated vesting, or settlement of outstanding awards in cash. The Company’s current guidelines with respect to the impact of a merger or other reorganization of the Company are specified below under the heading “Employment Contracts, Termination of Employment and Change in Control Agreements.” The Incentive Plan also provides in the event of a merger or other reorganization of the Company for the accelerated vesting in full of the automatic 15,000 and 6,000 share grants to outside directors.

Certain Federal Income Tax Consequences

Incentive stock options granted under the Incentive Plan will be afforded favorable federal income tax treatment under the Code. If an option is treated as an incentive stock option, the optionee will recognize no income upon grant or exercise of the option unless the alternative minimum tax rules apply. Upon an optionee’s sale of the shares (assuming that the sale occurs more than two years after grant of the option and more than one year after exercise of the option), any gain will be taxed to the optionee as long-term capital gain. If the optionee disposes of the shares prior to the expiration of either of the above holding periods, then the optionee will recognize ordinary income in an amount generally measured as the difference between the exercise price and the lower of the fair market value of the shares at the exercise date or the sale price of the shares. Any gain recognized on such a premature sale of the shares in excess of the amount treated as ordinary income will be characterized as capital gain.

All other options granted under the Incentive Plan will be nonstatutory stock options and will not qualify for any special tax benefits to the optionee. An optionee will not recognize any taxable income at the time he or she is granted a nonstatutory stock option. However, upon exercise of the nonstatutory stock option, the optionee will recognize ordinary income for federal income tax purposes in an amount generally measured as the excess of the then fair market value of each share over its exercise price. Upon an optionee’s resale of such shares, any difference between the sale price and the fair market value of such shares on the date of exercise will be treated as capital gain or loss and will generally qualify for long term capital gain or loss treatment if the shares have been held for more than one year. The Code provides for reduced tax rates for long term capital gains based on the taxpayer’s income and the length of the taxpayer’s holding period.

The recipient of a restricted share award will generally recognize ordinary compensation income when such shares are no longer subject to a substantial risk of forfeiture, based on the excess of the value of the shares at that time over the price, if any, paid for such shares. However, if the recipient makes a timely election under the Code to be subject to tax upon the receipt of the shares, the recipient will recognize ordinary compensation income at that time equal to the fair market value of the shares over the price paid, if any, and no further ordinary compensation income will be recognized when the shares vest.

In the case of an exercise of a stock appreciation right or an award of stock units, the recipient will generally recognize ordinary income in an amount equal to any cash received and the fair market value of any shares received on the date of payment or delivery.

The Company is generally entitled to a deduction for Federal income tax purposes equal to the amount of ordinary compensation income recognized by the recipient of an award at the time such income is recognized.

The foregoing does not purport to be a complete summary of the federal income tax considerations that may be relevant to holders of options or restricted shares, or to the Company. It also does not reflect provisions of the income tax laws of any municipality, state or foreign country in which an optionee may reside, nor does it reflect the tax consequences of an optionee’s death.

Required Vote for Approval of Proposal 3 and Recommendation

Approval of the above proposal related to the approval of amendment of the 2004 Incentive Plan to increase the number of shares by 575,000 will require the affirmative vote of the holders of a majority of the shares of the Company’s common stock present in person or represented by proxy at the meeting voting on the proposal. Stockholders may (1) vote “FOR,” (2) vote “AGAINST,” or (3) ”ABSTAIN” from voting on Proposal 3. Broker non-votes are not considered to be votes cast and therefore will have no effect on the outcome of this proposal.

The Board of Directors recommends a vote FOR approval of Proposal 3.

EXECUTIVE COMPENSATION AND RELATED PARTY TRANSACTIONS

Compensation of Executive Officers

The Summary Compensation table below discloses the total compensation awarded to, earned by, or paid to each of the four persons who have served as the Company's executive officers for the three fiscal years ended March 31, 2006, for services rendered in all capacities to the Company and its subsidiaries.

SUMMARY COMPENSATION TABLE

| | | | | Annual Compensation | | Long-Term Compensation | | | |

| | | Fiscal | | | | | | Securities Underlying | | All Other | |

| Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Option Grants (#) | | Compensation(1) | |

| Richard M. Haddock | | 2006 | | $332,690 | | $241,713 | | 75,000 | | $4,583 | |

| President & Chief Executive Officer | | 2005 | | 363,352 | | — | | — | | 3,423 | |

| (since November 30, 2004) | | 2004 | | 318,176 | | — | | — | | — | |

| | | | | | | | | | | | | | | | | |

| Christopher J. Dyball | | 2006 | | $323,821 | | $182,918 | | 65,000 | | $4,542 | |

| Chief Operating Officer | | 2005 | | 364,475 | | — | | — | | 3,423 | |

| (since November 30, 2004) | | 2004 | | 314,408 | | — | | — | | — | |

| | | | | | | | | | | | | | | | | |

| Steven G. Larson | | 2006 | | $256,598 | | $137,842 | | 45,000 | | $3,857 | |

| Vice President of Finance | | 2005 | | 265,453 | | — | | — | | 3,293 | |

| and Treasurer | | 2004 | | 250,150 | | — | | — | | — | |

| | | | | | | | | | | | | | | | |

| Steven D. Price-Francis | | 2006 | | $163,998 | | $96,685 | | 35,000 | | $2,443 | |

| Vice President of | | 2005 | | 46,444 | | — | | — | | 697 | |

| Business Development (2) | | | | | | | | | | | | | | | | |

| (1) | Represents the Company’s matching contribution on behalf of these individuals in the Company’s 401(k) Plan. |

| (2) | Stephen D. Price-Francis was named Vice President, Business Development of LaserCard Corporation on December 2, 2004. His compensation shown is since that date. |

Stock Option Grants to Executive Officers

The stock option table below discloses the total stock options granted to the Company's four executive officers during the fiscal year ended March 31, 2006.

STOCK OPTION GRANTS TO EXECUTIVE OFFICERS

| | | Individual Grants | | | | |

| | | Number of | | Percent of Total | | | | | | | | |

| | | Securities | | Options Granted to | | | | | | Potential Realizable Value at Assumed |

| | | Underlying Options | | Employees in Fiscal | | Exercise or Base | | | | Annual Rates of Stock Price |

| Name | | Granted | | Year (2) | | Price/Share | | Expiration Date | | Appreciation for Option Term (1) |

| | | | | | | | | | | 5% | | 10% |

| Richard Haddock | | 75,000 | | 16.0% (3) | | $6.045 | | 5/24/2015 | | $285,125 | | $722,563 |

| Christopher Dyball | | 65,000 | | 13.9% (3) | | $6.045 | | 5/24/2015 | | $247,109 | | $626,221 |

| Steven Larson | | 45,000 | | 9.6% (3) | | $6.045 | | 5/24/2015 | | $171,075 | | $433,538 |

| Stephen Price-Francis | | 35,000 | | 7.5% (3) | | $6.045 | | 5/24/2015 | | $133,058 | | $337,196 |

| | | | | | | | | | | | | |

(1) These columns show the hypothetical gains that could be realized from exercise of the granted options based on an assumed annual appreciation rate of the market price of our stock of 5% and 10% over the ten-year term of the options. Potential realizable value is disclosed in response to SEC rules that require such disclosure for illustration only and does not reflect our estimate of future stock price appreciation. Annual compounding results in total appreciation of 62.9% (at 5% per year) and 159.4% (at 10% per year). If the price of our common stock were to increase at such rates from the closing price at our 2006 fiscal year-end, which was $22.50 per share, over the next ten years, the resulting stock prices at 5% and 10% appreciation would by $36.65 and $58.36, respectively. The values disclosed are not intended to be, and should not be, interpreted by stockholders as representations or projections of the future value of the Company's stock or of the stock price.

(2) Percent of total options granted calculated using fiscal year 2006 option grants of 468,800.

(3) These options are exercisable over a four year period, with 25% exercisable one year from the date of grant and the balance exercisable in quarterly installments thereafter.

Aggregated Option Exercises and Options Held by Executive Officers

The following table sets forth the value of options exercised by the Company's executive officers during the fiscal year ended March 31, 2006 and remaining options held at fiscal year end.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

| Shares Acquired on Exercise | Value Realized | Number of Securities Underlying Unexercised Options at Fiscal Year-End (#) | Value of Unexercised In-the-Money Options at Fiscal Year-End ($)(2) |

| Name | (#) | ($)(1) | Exercisable | Unexercisable | Exercisable | Unexercisable |

| Richard Haddock | 5,000 | $25,550 | 228,500 | 87,500 | $1,990,840 | $1,290,500 |

| Christopher Dyball | — | — | 235,200 | 77,500 | $2,094,576 | $1,126,400 |

| Steven Larson | 10,190 | $88,602 | 150,727 | 53,750 | $1,278,916 | $780,275 |

| Stephen Price-Francis | — | — | 22,462 | 36,688 | $227,361 | $586,959 |

______________________

| (1) | Market value of underlying securities (based on the fair market value of the Company's common stock on The Nasdaq Stock Market) at the time of their exercise, minus the exercise price. |

| (2) | Market value of securities underlying in-the-money options at fiscal year end (based on $22.455 per share, the average of the high and low market prices of the Company's common stock on The Nasdaq Stock Market on the last day of the Company’s fiscal year) minus the exercise price. |

Compensation Committee Interlocks and Insider Participation

During fiscal 2006, none of the Company’s executive officers served on the board of directors of any entities whose directors or officers serve on the Company’s Compensation Committee.

The Compensation Committee currently is composed of three outside directors, Mr. Hausman, Dr. Maydan, and Mr. Moyer. The Compensation Committee is responsible for approving the salaries of executive officers (including the Chief Executive Officer), and the salaries of certain other employees, and overseeing the Company’s Prior and Incentive Plans and Employee Stock Purchase Plan.

Certain Relationships and Related Transactions

Since October 21, 2001, the Company contracted with Wexler & Walker Public Policy Associates, a unit of Hill and Knowlton, Inc., (“Wexler”) to be lobbyists on behalf of the Company. The Chairman of Wexler is Robert S. Walker, a brother of director Walter F. Walker. In October 2002, the agreement was extended for the period October 1, 2002 through September 2003 or until terminated upon seven days’ notice. The extended agreement provides for a monthly retainer of $10,000 and there have been multiple purchase orders, the most recent of which has remaining services through September 2006 in the aggregate amount of $61,000. In addition, additional services are separately billed under purchase orders, the most recent of which was for the period from March 2006 through July 2006 in the aggregate amount of $25,000. The Company paid Wexler $142,082 during fiscal year 2006, $206,000 during fiscal year 2005, and $151,000 during fiscal year 2004. As of March 31, 2006, $10,012 was due to Wexler.

Employment Contracts, Termination of Employment, and Change in Control Arrangements

None of the Company’s executive officers has an employment or severance arrangement with the Company although the Company is in the process of negotiating such agreements with its officers. If such agreements are consummated prior to the annual meeting, they will be described in a Current Report on Form 8-K. Under the terms of the Prior and Incentive Plans, the Board of Directors and/or Compensation Committee retains discretion, subject to certain limits, to modify the terms of outstanding options. In the event of a merger or sale of assets or like event, the Board of Directors is empowered to make appropriate adjustments to options granted previously under the Incentive Plan and Stock Option Plan. The Board of Directors has adopted guidelines specifying the following as adjustments that it would consider appropriate upon the occurrence of such an event:

| ● | permitting optionees no less than 30 days to exercise the vested portion of their options; |

| ● | having the successor corporation either (a) issue to optionees replacement options for the unvested portions of options, or else (b) pay deferred compensation on the spread between the value of Company stock upon the occurrence of such event and the option exercise price at the time such unvested portion would have vested; and |

| ● | providing for vesting of 100% of the unvested portion for optionees employed by the Company for at least two years prior to such event if their employment is terminated within one year of such event by the successor corporation other than by resignation or for acts of moral turpitude. |

The Incentive Plan also provides in the event of a merger or other reorganization of the Company for the accelerated vesting n full of the automatic 15,000 and 6,000 share grants to outside directors.

STOCK PERFORMANCE GRAPH

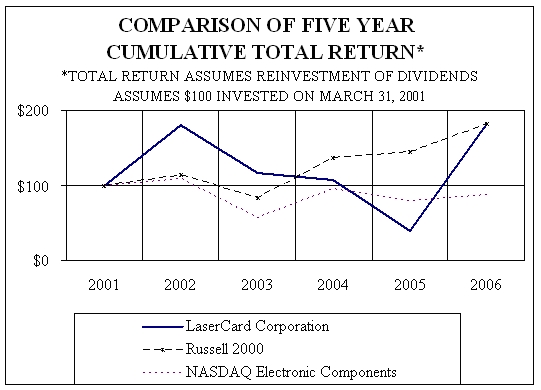

In the following stock performance graph, the cumulative total return on investment for the Company’s common stock over the past five fiscal years is compared with the Russell 2000 Stock Index (“Russell 2000”) and the University of Chicago Center for Research in Security Prices (CRSP) Total Return Index for the Nasdaq Stock Market Electronic Components industry group (“Nasdaq Electronic Components”). The Russell 2000 is a benchmark index for small capitalization stocks. The Nasdaq Electronic Components index is used because the majority of the Company’s revenues currently are derived from the sale of optical recording media (optical memory cards). The chart assumes that the value of the investment in the Company and each index was $100 on March 31, 2001, and that any dividends were reinvested.

The stock performance graph was plotted using the following data:

| | | Fiscal Year Ended March 31, | |

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | |

| LaserCard Corporation | | $ | 100.00 | | $ | 180.79 | | $ | 116.56 | | $ | 107.07 | | $ | 40.03 | | $ | 180.87 | |

| Russell 2000 | | | 100.00 | | | 113.98 | | | 83.25 | | | 136.39 | | | 143.77 | | | 180.93 | |

| CRSP Nasdaq Electronic Components | | | 100.00 | | | 108.62 | | | 56.50 | | | 95.49 | | | 79.70 | | | 87.97 | |

PAST RESULTS ARE NOT AN INDICATOR OF FUTURE INVESTMENT RETURNS.

Pursuant to Securities and Exchange Commission regulations, this chart is not “soliciting material”, is not deemed filed with the Securities and Exchange Commission, and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934.

EQUITY COMPENSATION PLAN INFORMATION

The table below shows information as of March 31, 2006, with respect to equity compensation plans under which equity securities of the Company are authorized for issuance. The Company’s equity compensation plans, consisting of the Company’s prior Stock Option Plan, 2004 Equity Incentive Compensation Plan, and Employee Stock Purchase Plan, are approved by security holders.

Plan Category | | Number of Securities to Be Issued upon Exercise of Outstanding Options, Warrants and Rights | | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | | Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) |

| | | (a) | | (b) | | (c) |

| Equity compensation plans approved by security holders | | 1,943,673 | | $12.20 | | 483,276 (1) |

| | | | | | | |

| Equity compensation plans not approved by security holders (Nasdaq exemption Rule No. 4350(i)(1)(A)) | | 135,824 (2) | | $13.81 | | — |

___________

| (1) | Includes 61,517 shares reserved as of March 31, 2006 for future purchases by employees through payroll deductions under the Company’s Employee Stock Purchase Plan, which is available to all regular employees who work a minimum of 30 hours per week and who have completed six months of employment with the Company and 421,759 shares under the 2004 Equity Incentive Compensation Plan. |

| (2) | Includes options to purchase 120,000 shares of common stock granted to six key employees of the acquired German subsidiaries and warrants to purchase 15,824 shares of common stock granted to the placement agent in our December 2003 private placement. See Notes 6 and 9 of Notes to Financial Statements for a description of our equity compensation plans that do not require the approval of and have not been approved by our stockholders. Excludes warrants outstanding as of March 31, 2006, to purchase 158,233 shares of common stock issued to investors in our December 2003 private placement. |

COMPENSATION COMMITTEE REPORT ON FISCAL 2006 EXECUTIVE COMPENSATION

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, that might incorporate future filings, including this Form 10-K, in whole or in part, the following Compensation Committee Report shall not be incorporated by reference into any such filings, nor shall it be deemed to be soliciting material or deemed filed with the Securities and Exchange Commission under the Securities Act of 1933 or under the Securities Exchange Act of 1934.

Committee Independence. The Board of Directors has established Compensation Committee which is composed entirely of outside directors who are not officers or employees of the Company and who are independent. The Committee reports to the Board of Directors on its activities. The current members of the Committee are Arthur H. Hausman (Chairman), Dan Maydan, and Albert J. Moyer. Under its charter adopted by the Board of Directors, the Committee is responsible, on behalf of the Board, for reviewing and approving compensation programs, policies, and plans designed to motivate personnel to achieve Company objectives. One of the key responsibilities of the Committee is to recommend to the independent directors for their approval the compensation of the Chief Executive Officer (the “CEO”), taking into account his evaluation by the Board of Directors. Other responsibilities include: review and approve recommendations from the CEO for the compensation of officers, other senior managers, and key employees; review and approve recommendations regarding stock option grants for specific employees as provided under existing Company plans; and review and approve the concept and design of management incentive plans and programs for Company officers, other senior managers, and key employees. An additional responsibility of the Committee is to review and approve recommendations regarding changes in compensation of non-employee directors.

Compensation Philosophy. The Company's compensation practices are intended to provide total compensation opportunities that are competitive with the pay practices of similar, high-technology companies. The goal of these compensation practices is to enable the Company to attract, retain and motivate superior performing officers and employees and to align compensation with the Company’s business objectives and performance. This is accomplished through a combination of base salary, cash bonuses and stock options. The Company believes that its compensation philosophy closely aligns employee interests with those of its stockholders and provides incentives for management to strive to increase stockholder value and contribute to the long-term success of the Company.

Base Salary. The annual base salaries paid to the Company's four executive officers were decreased during fiscal 2006 as the Company instituted the bonus plan described below designed to be a meaningful element of executive officer compensation if the performance of the Company and individual officer merited. The Compensation Committee annually reviews and recommends to the independent directors the base salary level for the CEO, based on industry practice, competitive factors, prior experience, technical and administrative ability, position and responsibility, corporate performance, individual contribution, recommendations of executive management, in-depth knowledge of the Company and its technology and similar factors. The Committee annually discusses with the CEO his similar analysis of the base salary of the other executive officers in deciding whether to approve the CEO’s recommendation of the salaries of the other executive officers. Consistent with the Company’s current size, the Committee believes current executive salaries are comparable to the average salaries offered by competitive companies.

Bonus Compensation. In the past, cash bonuses were occasionally awarded to executive officers and management employees based upon criteria such as pre-tax, pre-bonus Company earnings and licensing revenues, with various adjustments. No bonuses were awarded to executive officers for fiscal 2003, 2004 and 2005. In fiscal 2006, the Company established a bonus plan that provides for bonuses to be awarded to executive officers and key employees based on specific goals achieved by the Company and the level of contribution to achievement of the goals by the executive officers and key employees. The Company’s performance objectives include operating, strategic and financial goals considered critical to the Company’s short and long term goals. The bonus plan is designed such that bonuses when combined with salaries create total compensation which is comparable to the average compensation of successful companies against which the Company competes in hiring and retaining key employees.

Stock Option Grants. Stock options are granted to a broad range of the Company's employees, including executive officers and outside directors receive automatic option grants. These awards are made to recruit, retain and motivate the employees and outside directors and to align their personal financial interests with those of the Company’s stockholders. Eligible employees are generally granted options upon commencement of employment and are considered for additional options periodically thereafter. In recommending stock options the Committee considers individual performance, overall contribution to the Company, retention, the number of unvested stock options and the total number of stock options to be granted. Options are generally granted with an exercise price equal to the market price of the Common Stock on the date of grant and generally vest over a four-year period. This approach is designed to focus key employees on sustainable growth of the Company and the creation of stockholder value over the long term. During fiscal 2004 and 2005 no options were granted to the executive officers. The decision was made in fiscal 2006 that option grants should be a major component of the compensation package of executive officers. Therefore, in fiscal 2006, the Company granted options which were larger than it would otherwise have granted had the executive officers possessed substantial unvested options from prior grants.