UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party Other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement.

[ ] Confidential, for Use of the Commission Only (as Permitted by Rule

14a-6(e)(2)).

[ X] Definitive Proxy Statement.

[ ] Definitive Additional Materials.

[ ] Soliciting Material Pursuant to Section

240.14a-12.

LASERCARD CORPORATION

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule, or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

LASERCARD CORPORATION

1875 N. Shoreline Blvd.

Mountain View, California 94043

NOTICE OF 2008 Annual Meeting of Stockholders

Friday, September 19, 2008

9:00 a.m. Pacific Time

To the Stockholders:

The 2008 Annual Meeting of Stockholders of LaserCard Corporation (the “Company”) will be held in the California Conference Rooms at Pillsbury Winthrop Shaw Pittman LLP, 2475 Hanover Street, Palo Alto, California, 94304, on Friday, September 19, 2008, at 9:00 a.m. Pacific time, for the following purposes:

1. to elect directors;

2. to ratify the selection of SingerLewak as the Company’s independent registered public accounting firm for the fiscal year ended March 31, 2009; and

3. to transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on Monday, July 21, 2008 are entitled to notice of and to vote at this meeting and at any continuation, adjournment, or postponement thereof.

| | By Order of the Board of Directors | |

| | | |

| | | |

| | /s/ STEVEN G. LARSON | |

| | Secretary | |

Mountain View, California

July 28, 2008

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to Be Held on September 19, 2008.

Our Proxy Statement for our 2008 Annual Meeting of Stockholders, along with the proxy card, our Annual Report to Stockholders for the fiscal year March 31, 2008 and our Annual Report on Form 10-K are available on our website at www.lasercard.com.

TABLE OF CONTENTS

Page

| GENERAL | 1 |

| | |

| PROPOSAL 1: ELECTION OF DIRECTORS | 3 |

| | |

| INFORMATION RELATING TO OUR BOARD OF DIRECTORS AND ITS COMMITTEES | 3 |

| | |

PROPOSAL 2: RATIFICATION OF THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 11 |

| | |

| EXECUTIVE COMPENSATION | 12 |

| | |

| MISCELLANEOUS MATTERS | 25 |

| | |

| STOCKHOLDER MEETING MATTERS | 26 |

| | |

| AVAILABILITY OF FORM 10-K | 27 |

Notice of Availability

We are taking advantage of the SEC’s proxy rules which permit us to send our stockholders whose shares are registered in the name of a bank brokerage firm, or other nominee (“street name stockholders”) a paper Notice of Availability concerning internet availability of proxy materials for our annual stockholders meeting. This enables us to provide our stockholders with the information they need in a cost-effective and environmentally-friendly or “green” manner by avoiding the printing of unnecessary and/or unwanted materials. In accordance with these rules, instead of mailing a printed copy of our proxy materials to each street name stockholder, we may now furnish proxy materials to our stockholders on the Internet. The Notice of Availability instructs you how to access and review our proxy materials on-line and how to vote by Internet. The Notice of Availability also instructs you how to request by email or by telephone that an electronic copy of our proxy materials and annual report be sent to you by email or that a paper copy be sent to you by regular mail.

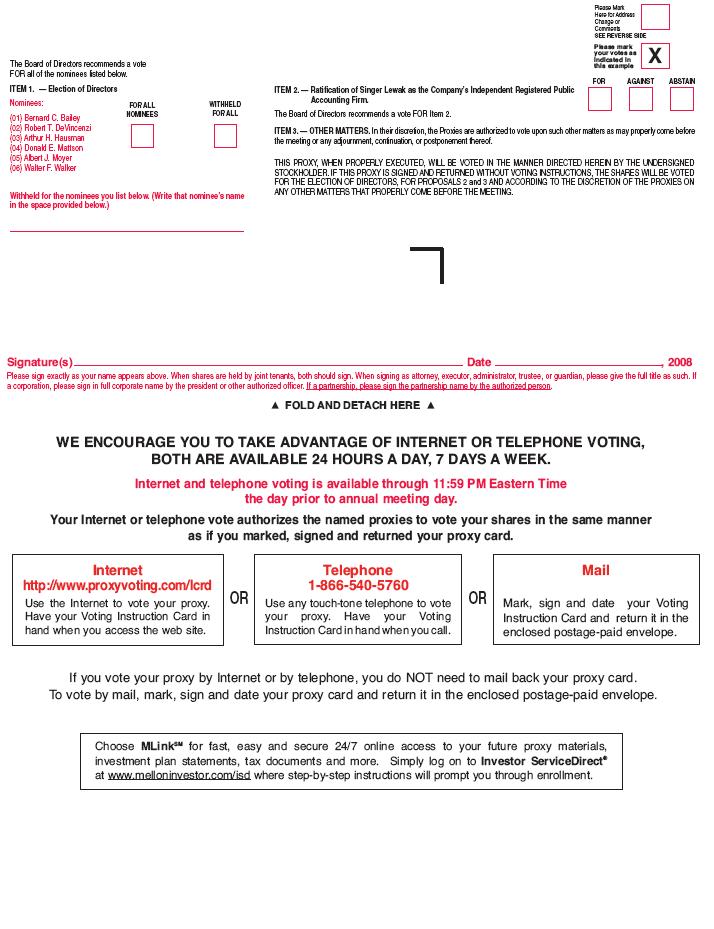

Voting Shares Held in Your Own Name

If your shares are held directly in your name on our stock records maintained by our transfer agent, BNY Mellon Shareowner Services, you are a “registered stockholder.” Under California law, applicable to us because our principal executive offices are in California, we are required to send registered stockholders an annual report by mail. We are therefore sending registered stockholders a proxy card, proxy statement, and annual report. Your proxy card contains a control number. You may vote by Internet by following the instructions on the proxy card. If you wish to vote by telephone, then you may do so by calling 1-866-540-5760 toll free from the US or Canada. You will need to have the control number contained on your proxy card. You may also vote by completing and signing your card and mailing it to us in the enclosed return envelope (postage free if mailed in the United States). Whether or not you plan to attend the meeting, we would request that you vote your shares. If you attend the meeting, and so desire, you may withdraw any proxy you have submitted and vote in person.

Voting Shares Held in “Street Name”

If you are a street name stockholder, you are receiving a Notice of Availability from your broker or the broker’s agent which contains a control number. You may vote by Internet or by telephone by following the instructions on the Notice of Availability. You will need to have the control number contained on your Notice of Availability in order to vote.

If you request a paper copy of these proxy materials, then you will also receive a voting instruction form from your broker or bank or their agent, asking you how your shares should be voted. Please either vote your shares as instructed per that form by internet or, if available from your broker or bank, by telephone, or else please complete the form and return it in the envelope provided by the broker or bank or their agent; no postage is necessary if mailed in the United States.

Whether or not you plan to attend the meeting, we would request that you vote your shares. Street name stockholders may attend the 2008 Annual Meeting and vote in person by contacting the broker or bank in whose name the shares are registered, or their agent, to obtain a broker’s proxy showing the number of shares you owned beneficially on the record date. You must bring the broker’s proxy to the annual meeting in order to vote in person.

Voting Deadline

If you are voting by internet or by telephone, you must vote by 11:59 p.m. East Coast time on September 18, 2008.

LASERCARD CORPORATION

1875 N. Shoreline Blvd.,

Mountain View, California 94043

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held September 19, 2008

GENERAL

The enclosed proxy is solicited on behalf of the Board of Directors of LaserCard Corporation, a Delaware corporation (the “Company”), for use at the 2008 Annual Meeting of Stockholders of the Company, to be held in the California Conference Rooms at Pillsbury Winthrop Shaw Pittman LLP, 2475 Hanover Street, Palo Alto, California, 94304, at 9:00 a.m. Pacific time on Friday, September 19, 2008. Only stockholders of record on Monday, July 21, 2008, will be entitled to vote. At the close of business on that date, the Company had outstanding 12,012,376 shares of common stock.

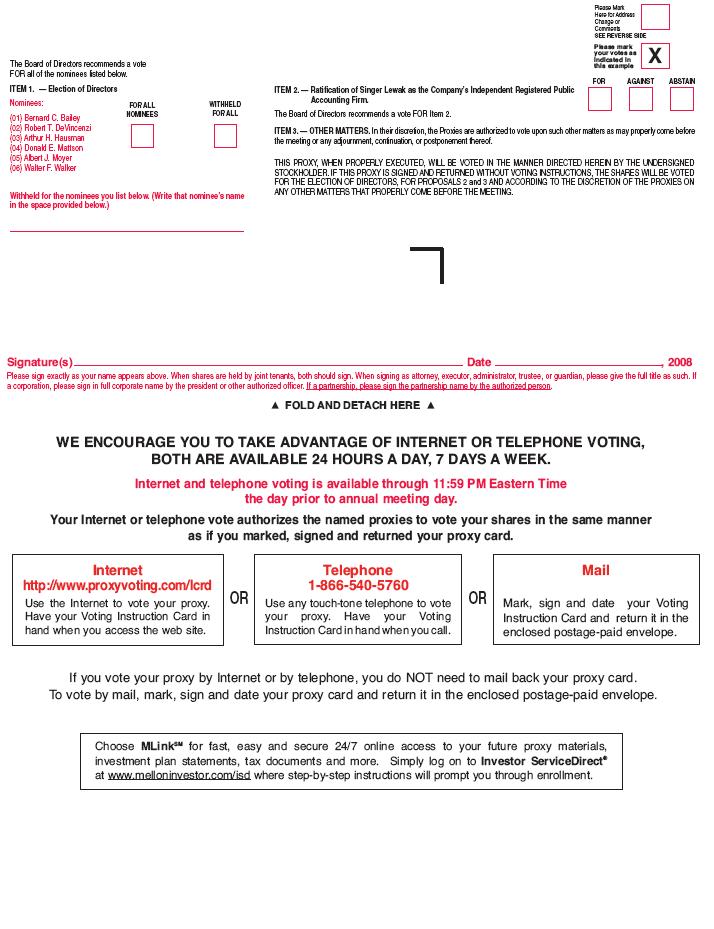

Stockholders are entitled to one vote for each share held. All duly executed proxy cards received prior to the meeting will be voted at the annual meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares represented by proxies will be voted as follows:

● FOR the election of the Board’s nominees as directors as set forth in this Proxy Statement; and

● FOR the ratification of SingerLewak as the Company’s independent registered public accounting firm as set forth in this Proxy Statement.

In addition, if other matters come before the annual meeting, the persons named in the accompanying form of proxy will vote in accordance with their best judgment with respect to such matters. Any stockholder giving a proxy in the form accompanying this Proxy Statement has the power to revoke the proxy prior to its exercise. A proxy may be revoked by filing with the Secretary of the Company, prior to the meeting, either an instrument revoking it or a duly executed proxy bearing a later date; by duly executing a proxy bearing a later date which is presented at the meeting; or by attending the meeting and electing to vote in person by ballot.

The required quorum for the transaction of business at the annual meeting is a majority of the shares entitled to vote, represented in person or by proxy. Shares that are duly voted “FOR,” “AGAINST,” or “ABSTAIN” on any matter are treated as being present at the meeting for purposes of establishing a quorum.

The Company intends to count abstentions with respect to any proposal as present or represented and entitled to vote on that proposal and thus have the same effect as negative votes. The Company intends to count broker non-votes (which typically occur when shares held by brokers or nominees for beneficial owners are not voted on a particular matter due to the absence of instructions as to the particular matter from the beneficial owners and the absence of the authority for the broker or nominee to vote such shares as to such matter absent such instructions) for the purpose of establishing the presence or absence of a quorum for the transaction of business, but not as votes cast with respect to any proposal that may come before the meeting. That is, although they count for purposes of determining a quorum, shares which are not voted as to a matter, besides abstentions, such as broker non-votes or under other circumstances in which proxy authority is defective or has been withheld, are not deemed to be present or represented for the purposes of determining whether stockholder approval of that matter has been obtained. Broker non-votes would to this extent have no effect on the outcome of the election of directors or the vote on any proposal requiring a majority of shares present or in person represented by proxy at the meeting.

This Proxy Statement is being filed with SEC on July 28, 2008, and a Notice of Availability regarding this Proxy Statement will be mailed on or about August 7, 2008, to stockholders of record on July 21, 2008.

PROPOSAL 1: ELECTION OF DIRECTORS

Nominees

The Company’s By-Laws currently provide for a Board of Directors with seven authorized directors. The Company currently has seven directors; however, upon the resignation of Dan Maydan on September 19, 2008, the authorized number of directors will be fixed as six. All directors are elected annually and serve a one-year term until the next annual meeting of stockholders and until their successors are duly elected and qualified or until their earlier resignation or removal.

The following six persons were nominated by the Company’s Board of Directors upon recommendation of its Nominating and Corporate Governance Committee for election as directors: Bernard C. Bailey, Robert T. DeVincenzi, Arthur H. Hausman, Donald E. Mattson, Albert J. Moyer, and Walter F. Walker. Certain biographical information about the nominees and Dr. Maydan is set forth in the Security Ownership by Directors and Executive Officers table on pages 7, 8 and 9.

As explained above, all proxies solicited hereby will be voted for the election of the six nominees unless authority to vote for one or more nominees is withheld in accordance with the instructions on the proxy card. If any nominee is unable or declines to serve as director at the time of the annual meeting, an event not now anticipated, proxies will be voted for any nominee designated by the Board of Directors to fill the vacancy.

The Board of Directors recommends a vote FOR election of the Company’s nominees.

Required Vote for Approval of Proposal 1

The election of each nominee to the Board of Directors will require the affirmative vote of the holders of a plurality of the shares of the Company’s common stock present in person or represented by proxy at the meeting. The six nominees for director who receive the most votes cast in their favor will be elected to serve as directors. With respect to the election of directors, stockholders may (1) vote “FOR” all six nominees, (2) “WITHHOLD” authority to vote for all such nominees, or (3) “WITHHOLD” authority to vote for any individual nominee or nominees, but vote for all other nominees. Because directors are elected by a plurality of the votes cast, broker non-votes and shares for which authority to vote has been withheld will have no effect on the outcome of the election.

INFORMATION RELATING TO OUR BOARD OF DIRECTORS AND ITS COMMITTEES

Determination of Independence

The Board of Directors has determined that all of its current members and nominees other than Mr. DeVincenzi are “independent” as defined by applicable listing standards of The Nasdaq Stock Market and SEC rules. In order to separate the role of CEO from Board leadership, Mr. Bailey serves as Chairman of the Board and Mr. Mattson serves as Vice Chairman of the Board.

Board Meetings and Committees

The Board of Directors held seven meetings during fiscal year ended March 31, 2008. The Board has standing Audit, Compensation, Corporate Strategy, and Nominating and Corporate Governance Committees. During fiscal year 2008, the Audit Committee held six meetings, the Compensation Committee held nine meetings, the Corporate Strategy Committee held four meetings, and the Nominating and Corporate Governance Committee held three meetings. All directors attended in person or telephonically at least 75% of the meetings of the Board of Directors and of the committees on which such directors serve. At the end of each regularly scheduled meeting, the outside independent members of the Board of Directors meet without any employee directors (currently Mr. DeVincenzi) present.

The Audit Committee is generally responsible for oversight on matters relating to financial accounting and reporting, internal controls, auditing, legal and regulatory compliance activities, and other matters as the Board of Directors deems appropriate. The Audit Committee’s role is limited to this oversight; it is not the duty of the Audit Committee to plan or conduct audits or to determine whether the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Rather the Company’s management is responsible for preparing the Company’s financial statements and the Company’s independent registered public accounting firm (“independent accountants”) is responsible for auditing those financial statements. The Audit Committee has the sole authority to appoint, retain, compensate, evaluate, and, where appropriate, replace the Company’s independent accountants. In addition, the Audit Committee has the sole authority to approve all auditing services and non-audit services to be provided to the Company and its subsidiaries by the independent accountants in advance of the provision of these services. The Audit Committee also approves the fees and terms of all non-audit services provided by the independent accountants and evaluates their independence. The Audit Committee currently is composed of four outside directors, namely Mr. Moyer, Chairman, and Messrs. Hausman, Mattson, and Walker, each of whom the Company believes to be qualified and “independent” as defined by The Nasdaq® Stock Market listing requirements.

The Audit Committee of our Board of Directors contains at least one “audit committee financial expert.” The name of the Audit Committee financial expert is Albert J. Moyer and the Board of Directors has determined that he is “independent” as that term is defined Item 7(d)(3)(iv) of Section 14A of the Securities and Exchange Act, as amended (the “Exchange Act”).

The Compensation Committee currently is composed of four outside independent directors, namely Mr. Hausman, Chairman, and Mr. Bailey, Dr. Maydan, and Mr. Moyer. Mr. Bailey ceased his membership on the Compensation Committee during the time period from April 1 through June 6, 2008, when he was serving as interim chief executive officer of the Company. Following the annual meeting Dr. Maydan will no longer serve on the Compensation Committee. The Compensation Committee is responsible for approving the compensation of executive officers and of any other senior managers and key employees with respect to whose compensation the Chief Executive Officer seeks Compensation Committee input, and overseeing the Company’s 2004 Equity Incentive Compensation Plan and Employee Stock Purchase Plan except that the Compensation Committee shall recommend to the independent directors for their approval the compensation of the Chief Executive Officer.

Under its charter adopted by the Board of Directors, the Compensation Committee is responsible, on behalf of the Board, for reviewing and approving compensation programs, policies, and plans designed to motivate personnel to achieve Company objectives. One of the key responsibilities of the Compensation Committee is to recommend to the independent directors for their approval the compensation of the Chief Executive Officer (the “CEO”), taking into account his evaluation by the Board of Directors. Other responsibilities include: review and approve recommendations from the CEO for the compensation of officers, other senior managers, and key employees; review and approve recommendations regarding stock option grants for specific employees as provided under existing Company plans; and review and approve the concept and design of management incentive plans and programs for Company officers, other senior managers, and key employees. An additional responsibility of the Compensation Committee is to review and approve recommendations regarding changes in compensation of non-employee directors.

The Corporate Strategy Committee currently is composed of the CEO and three outside independent directors, namely Mr. Bailey, Chairman, and Messrs. DeVincenzi, Mattson and Moyer. The Corporate Strategy Committee participates with management to develop the Company’s strategic plan, including merger and acquisition strategy. The Corporate Strategy Committee then oversees management’s development of plans to implement the strategy; participates with management in the review and evaluation of individual merger and acquisition candidates and investment opportunities; and reviews and monitors progress, execution, and implementation of the strategy.

The Nominating and Corporate Governance Committee is responsible for recommending to the Board of Directors nominees for director, and reviewing and making recommendations to the Board of Directors with respect to candidates for director proposed by stockholders. The Nominating and Corporate Governance Committee also periodically reviews and may recommend changes in the Company’s governance practices. The Nominating and Corporate Governance Committee currently is composed of three outside independent directors, namely, Mr. Walker, Chairman, and Mr. Mattson and Dr. Maydan. Following the annual meeting Dr. Maydan will no longer serve on the Nominating and Corporate Governance Committee.

All four committees of the Board have written charters that have been approved by the Company’s Board of Directors. Copies of these charters are available on the Company’s website (www.lasercard.com).

Compensation Committee Interlocks And Insider Participation

No member of the Compensation Committee is a former or current officer or employee of the Company except for Mr. Bailey who was not an employee of the Company but who served as interim chief executive officer of the Company from April 1, 2008, through June 6, 2008. During fiscal 2008, none of the Company’s executive officers served on the board of directors of any entities whose directors or officers serve on the Company’s Compensation Committee.

Certain Relationships And Related Transactions

The Company’s Code of Ethics and Business Conduct requires disclosure to the Chief Financial or Executive Officer of any proposed transaction in which a related person, such as an employee, officer, director, or 5% stockholder, or their immediate family members, has a material interest. If such proposed transaction is material to the Company then the Audit Committee would determine whether to authorize the transaction taking into account such factors as the nature of the proposed transaction and the related person’s interest and whether the transaction is just and reasonable as to the Company. For the most significant transactions, for example those involving more than $120,000 and involving an executive officer or board member, then the full Board of Directors would make this determination rather than the Audit Committee. The Audit Committee or Board of Directors, as the case may be, may determine to ratify interested person transactions that have already been undertaken.

Since October 21, 2001, the Company contracted with Wexler & Walker Public Policy Associates, a unit of Hill and Knowlton, Inc., (“Wexler)” to be lobbyists on behalf of the Company. The Chairman of Wexler is Robert S. Walker, a brother of director Walter F. Walker. The contract has been extended through fiscal year 2009 on the same terms and conditions with a new monthly retainer of $15,000 and reimbursement of related expenses. The Company paid Wexler $161,000 during fiscal 2008, $116,000 during fiscal 2007, and $142,082 during fiscal 2006. As of March 31, 2008, $50,000 was due to Wexler.

Directors Nominations

The Board of Directors nominates directors for election at each annual meeting of stockholders and elects new directors to fill vacancies when they arise. The Nominating and Corporate Governance Committee has the responsibility to identify, evaluate, recruit and recommend qualified candidates to the Board of Directors for nomination or election.

The Board of Directors has as an objective that its membership be composed of experienced and dedicated individuals with diversity of backgrounds, perspectives and skills. The Nominating and Governance Committee will select candidates for director based on their character, judgment, diversity of experience, business acumen, and ability to act on behalf of all stockholders. The Nominating and Corporate Governance Committee believes that nominees for director should have experience, such as experience in management or accounting and finance, or industry and technology knowledge, that may be useful to the Company and the Board, high personal and professional ethics, and the willingness and ability to devote sufficient time to effectively carry out his or her duties as a director. The Nominating and Corporate Governance Committee believes it appropriate for at least one member of the Board to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and for a majority of the members of the Board to meet the definition of “independent director” under the rules of The Nasdaq Stock Market. While the Nominating and Corporate Governance Committee also believes it appropriate for certain key members of the Company’s management to participate as members of the Board, it also believes it is better corporate governance for a corporation the size of the Company to have the CEO be the only management team board member.

Prior to each annual meeting of stockholders, the Nominating and Corporate Governance Committee identifies nominees first by evaluating the current directors whose term will expire at the annual meeting and who are willing to continue in service. These candidates are evaluated based on the criteria described above, including as demonstrated by the candidate’s prior service as a director, and the needs of the Board with respect to the particular talents and experience of its directors. In the event that a director does not wish to continue in service, the Nominating and Corporate Governance Committee determines not to re-nominate the Director, or a vacancy is created on the Board as a result of a resignation, an increase in the size of the board or other event, the Committee will consider various candidates for Board membership, including those suggested by the Committee members, by other Board members, by any executive search firm engaged by the Committee and by stockholders. Once identified, candidates are initially interviewed by the Chairman of the Nominating and Corporate Governance Committee and our Chief Executive Officer, and then by all members of the Nominating and Corporate Governance Committee and at least one additional officer of the Company and the Chairman of the Board.

The Nominating Committee does not currently use the services of a third party consultant to assist in the identification or evaluation of potential director candidates. However, it may engage a third party to provide for such services in the future.

The Nominating Committee will consider nominees proposed timely by the stockholders based on the same criteria it uses for all director candidates. Any stockholder who wishes to recommend a prospective nominee for the Board of Directors for the Nominating Committee’s consideration may do so by giving timely notice of the candidate’s name and qualifications in writing to the Secretary of the Company, 1875 North Shoreline Boulevard, Mountain View, CA 94043 and by otherwise complying with the procedures set forth in Section 2.13(b) of the Company’s bylaws. See “Stockholder Proposals and Board Nominations for the 2008 Annual Meeting.”

Board of Directors Interaction with Stockholders

The Company provides for a process for stockholders to communicate with the Board of Directors. Stockholders may send written communications to the attention of the Board of Directors, a specific Board member, or a specific committee, in care of LaserCard Corporation, Attention: Steven Larson, 1875 N. Shoreline Blvd., Mountain View, California 94043. You must include your name and address in the written communication and indicate whether you are a stockholder of the Company. Mr. Larson will review any communication received from a stockholder, and all material communications from stockholders will be forwarded to the appropriate director or directors or committee of the Board based on the subject matter.

Board Attendance at Annual Meetings

Although the Company does not have a formal policy regarding Board attendance at annual meetings of stockholders, all Board members are expected to attend. Five members of the Board attended the 2007 annual meeting that was held on September 21, 2007.

Director Compensation

(a) Fiscal 2008 through September 30, 2008

During the first portion of fiscal year 2008, each non-employee director received an annual fee of $21,000 for serving as a director, the standard fee in effect since October 1, 2005. The Chairman of the Board received an additional $19,000.

The Chairman of each committee was paid an additional $10,000, $5,000, and $2,000 per year for serving on the Audit, Compensation, and Nominating and Corporate Governance Committees, respectively. Audit Committee members were paid an additional $5,000 per year. In addition, the Chairman and members of the Corporate Strategy Committee received fees at the annual rate of $20,000 and $5,000, respectively, payable monthly, for serving on the committee. All retainer fees were prorated over 12 months.

The Company also paid each member no more than $7,500, $2,000, and $1,000 per year for meeting attendance on the Audit, Compensation, and Nominating and Corporate Governance Committees, respectively. Fees for meeting attendance were paid per meeting. Reasonable out-of-pocket expenses incurred by directors for performing services for the Company were also reimbursed.

(b) October 1, 2008, Forward

At its board of directors meeting held on September 21, 2007, the Board approved changes to its outside director cash compensation. The Chairman of the Board will receive an annual retainer of $75,000 for his or her services: other outside directors will receive an annual retainer of $28,500 plus an annual retainer for serving on a committee or as committee chairman as shown below. All annual retainers are payable one-twelfth each month. There are no longer board or board committee meeting attendance fees although the board could approve meeting fees on a case by case basis in the future if the board or a committee of the board was required to have an unusually large number of meetings due to then extant circumstances.

Audit Committee: Chairman—$15,000 and Member—$5,000

Compensation Committee: Chairman—$7,000 and Member—$2,000

Corporate Strategy: Chairman—$20,000 and Member—$5,000

Nominating and Corporate Governance: Chairman—$4,000 and Member—$1,000

Subsequently, with the planned retirement of our former CEO, Richard Haddock, at the end of November 2008, the board of directors appointed Mr. Bailey as Chairman of the Board and Mr. Mattson as Vice Chairman of the Board and due to their increased roles, determined that they should each receive a flat monthly fee for their services in all capacities (that is, in lieu of the compensation described above) of $12,500 and $6,250, respectively.

The Company’s 2004 Equity Incentive Compensation Plan provides for the automatic grant of an option to purchase up to 15,000 shares of the Company's common stock on the date any person first becomes a director. These grants to newly elected directors become exercisable in cumulative increments of one-fourth (1/4) each at the end of 12 months, 24 months, 36 months and 48 months from the date of grant. The 2004 Equity Incentive Compensation Plan further provides that on the date of the Company's annual meeting, each non-employee director who has been a director of the Company for the preceding six-month period and who is re-elected at the annual meeting, is automatically granted an option to purchase up to 6,000 shares of the Company's common stock. The option share grants to the re-elected directors vest over the next year in twelve equal monthly advance installments. The exercise price for options granted to newly elected directors and re-elected directors is the fair market value of the Company's common stock on the date of grant. In addition, the Company’s 2004 Equity Incentive Compensation Plan was amended in September, 2007, to provide that each re-elected director who had served the requisite time period would receive an award of up to 2,000 restricted shares vesting in one installment eleven months after the date of the award. Analogously, such plan was amended to provide that each newly elected director would receive an award of up to 5,000 restricted shares vesting in four equal installments on the date eleven months after grant and on the following three annual anniversaries of such date.

Non-Executive Director Compensation Table for Fiscal Year 2008

The following chart shows the compensation earned by or paid to each non-employee directors for their service in fiscal year 2008.

| | Fees Earned or Paid in Cash ($)(1) | | | | Option Awards ($)(3)(4)(5) | | |

| | | | | | | | | |

| Bernard C. Bailey | | 83,417 | | 20,800 | | 39,239 | | 143,456 |

| Arthur H. Hausman | | 41,500 | | 20,800 | | 34,544 | | 96,845 |

| Donald E. Mattson | | 69,500 | | 20,800 | | 53,723 | | 144,023 |

| Dan Maydan | | 32,000 | | 20,800 | | 34,545 | | 87,345 |

| Albert J. Moyer | | 45,125 | | 20,800 | | 60,175 | | 126,100 |

| Walter F. Walker | | 37,123 | | 20,800 | | 34,545 | | 92,468 |

(1) The amounts listed under “Fees Earned or Paid in Cash” are based on fees earned by or paid to our non-employee directors which include the standard Board and Committee member and chairman retainers and meeting fees described under “Director Compensation” immediately preceding this table. The amounts listed do not include reimbursement of expenses in attending the meetings.

(2) Represents the number of shares awarded times the $10.40 average of the high and low trading prices of our stock on their date of grant of September 21, 2007.

(3) Represents the amount of the total fair value of option awards granted in fiscal year 2008 and prior years recognized as stock-based compensation expense for financial statement reporting purposes for the fiscal year ended March 31, 2008, in accordance with SFAS No. 123(R), Share-Based Payment. Please see a discussion of all assumptions used in the valuation of these awards in Note 2, subpart (23) to our consolidated financial statements, which are included in Part II Item 8 of our Annual Report on Form 10-K for the fiscal year ended March 31, 2008.

(4) Each director was granted 6,000 options under the 2004 Equity Incentive Plan on September 23, 2007. The grant date fair value of each option computed in accordance with SFAS 123R is $72,360 for each director.

(5) The number of options held at fiscal year end by each of the directors is as follows: Mr. Bailey—21,000; Mr. Hausman—54,000; Mr. Maydan—30,000; Mr. Mattson—33,000; Mr. Moyer—33,000; and Mr. Walker—61,000.

Security Ownership of Directors and Executive Officers

The table below and on the following page contains information as of July 21, 2008, respecting the number of shares and percentage of the Company’s common stock beneficially owned by each of the Company’s seven directors, by each named executive officer of the Company as shown in the table under “Executive Compensation—Summary Compensation Table” below, and by all executive officers and directors as a group. The address of each beneficial owner listed in the table is c/o LaserCard Corporation, 1875 N. Shoreline Blvd., Mountain View, California 94043. Applicable percentages are based on 12,012,376 shares outstanding on July 21, 2008.

| | | Director | Common | Percentage |

| Name, Principal Occupation, and Other Directorships | Age | Since | Shares(1) | of Class(2) |

| | | | | |

| BERNARD C. BAILEY, Director | 55 | 2006 | 21,750 (3) | 0.2% |

| Business consultant. Formerly, CEO and Director | | | | |

| Viisage Technology, Inc. (identity solutions for | | | | |

| security credentials) from August 2002 through August | | | | |

| 2006. Previously, from January 2001through August | | | | |

2002, Mr. Bailey served as the Chief Operating Officer of | | | | |

| Art Technology Group (software). Between April 1984 and | | | | |

| January 2001, Mr. Bailey served in various capacities at IBM | | | | |

| Corporation, including several executive positions. A graduate | | | | |

of the U.S. Naval Academy, Mr. Bailey served for eight years | | | | |

| as an officer in the US Navy. Mr. Bailey is a director of Telos | | | | |

| Corp.(information technology solutions and services) since | | | | |

| October, 2006. He is also a director of Spectrum Control, Inc. | | | | |

| (electronic components) since April, 2008. | | | | |

| | | | | |

| ROBERT T. DEVINCENZI, Director and Executive Officer | 49 | 2008 | 28,000 (4) | 0.2% |

| President and Chief Executive Officer (since June 2008). | | | | |

| Previously Senior Vice President of Corporate Development | | | | |

| of Solectron Inc. (electronics manufacturing) from January 2005 | | | | |

| to December 2007. Former President | | | | |

| and Chief Executive Officer of Inkra Networks Inc. (Internet Protocol | | | | |

| Network Equipment) from January 2004 to January 2005) and Ignis Optics Inc. | | | | |

| (fiber-optic transceiver packaging) from January 2003 to January 2004). | | | | |

| From 2000 to 2003, Mr. DeVincenzi was Senior Vice President | | | | |

| of Ditech Communications which acquired Atmosphere | | | | |

| Networks Inc., where he was Vice President of Global Sales, | | | | |

| Service and Field Marketing from 1999 to 2000. | | | | |

| ARTHUR H. HAUSMAN, Director | 84 | 1981 | 76,392(5) | 0.6% |

| Private investor. Retired Chairman, President and Chief | | | | |

| Executive Officer of Ampex Corporation (manufacturer of professional | | | | |

| audio-video systems, data/memory products and magnetic tape). | | | | |

| Director of CalAmp Corp. (direct broadcast satellite | | | | |

| products). | | | | |

| | | | | |

| DONALD E. MATTSON, Director | 76 | 2005 | 31,250(6) | 0.3% |

| Private investor. Retired Senior Vice President and Chief | | | | |

| Operating Officer of InVision Technologies, an explosives | | | | |

| detection systems manufacturer, until its acquisition by GE | | | | |

(November 2000 to January 2005). | | | | |

| | | | | |

| DAN MAYDAN, Director | 72 | 1998 | 32,000(7) | 0.3% |

| Retired. Retired President of Applied Materials, Inc. (semiconductor | | | | |

| manufacturing equipment) from January 1994 through April 2003. | | | | |

| Director of Electronics for Imaging, Inc. (printing solutions), Infera | | | | |

| (optical transmission equipment) and numerous private companies. | | | | |

| Member of Board of Trustees of PAMF (Palo Alto Medical Foundation) | | | | |

| since 2003 and Board of Governors of Technion (Israel Institute of | | | | |

| Technology). Member of the National Academy of Engineering. | | | | |

| | | | | |

| ALBERT J. MOYER, Director | 64 | 2005 | 31,250(8) | 0.3% |

| Private investor. Retired Executive Vice President and Chief Financial | | | | |

| Officer of QAD Inc. (a publicly held software company and | | | | |

| subsequently served as consultant to QAD). Previously Director of | | | | |

| QAD, Inc. from 2000 – 2005. Director of Collectors’ Universe, Inc. | | | | |

| (collectibles markets), CalAmp Corp. (direct broadcast satellite | | | | |

| products) and Virco Manufacturing Corp. (education furniture). | | | | |

| | | | | |

| WALTER F. WALKER, Director | 54 | 1999 | 164,041(9) | 1.4% |

| Principal, Manager of Hana Road Partners LP, an investment | | | | |

| management fund, Private Investor (November 2006 to present). | | | | |

| Previously President (September 1994 to October, 2007) of | | | | |

| The Basketball Club of Seattle, LLC, which owns the Seattle Sonics & | | | | |

| Storm Basketball teams (NBA and WNBA basketball). Formerly, was | | | | |

| President (in 1994) of Walker Capital, Inc. (money management firm) and | | | | |

| Vice President (from 1987 to 1994) of Goldman Sachs & Co. (investment | | | | |

| banking firm). Director of Advanced Digital Information Corporation | | | | |

| (archival and backup data-storage peripherals). Member of the Institute of | | | | |

| Chartered Financial Analysts (CFAs). | | | | |

| | | | | |

| CHRISTOPHER J. DYBALL, Executive Officer | 57 | 2001 | 251,866(10) | 2.1% |

| Chief Operating Officer (since November 2004). Formerly | | | | |

| President from November 2004 through September 2005, Co-Chief | | | | |

| Executive Officer from August 2003 through November 2004 and | | | | |

| Executive Vice President from 1992 through November 2003. | | | | |

| | | | | |

| STEVEN G. LARSON, Executive Officer | 58 | | 232,878(11) | 1.9% |

| Vice President of Finance, Treasurer and Secretary since 1987. | | | | |

| | | | | |

| STEPHEN D. PRICE-FRANCIS, Executive Officer | 61 | | 69,248(12) | 0.6% |

| Vice President of Marketing (since May, 2008). Previously | | | | |

| Vice President of Business Development (since November 2004) | | | | |

| of LaserCard Corporation. Previously Vice President of Business | | | | |

| Development of LaserCard Systems Corporation since 1999. | | | | |

| Past president, Advanced Card Technology Association of Canada | | | | |

| (ACT Canada). | | | | |

| | | | | |

| All executive officers and directors as a group (the 10 persons | | | | |

| named above) | | | 938,975(13) | 7.4% |

| (1) | To the Company’s knowledge, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws, where applicable, and the information contained in the footnotes to this table. |

| | |

| (2) | For purposes of computing the percentage of outstanding shares held by each person or group of persons named above on a given date, shares which such person or group has the right to acquire within 60 days after such date are deemed to be outstanding, but are not deemed to be outstanding for the purposes of computing the percentage ownership of any other person. |

| | |

| (3) | Includes 9,750 shares purchasable by exercise of option within 60 days. Includes 2,000 restricted shares subject to repurchase by the Company if service as a director terminates on or before August 20, 2008. |

| | |

| (4) | Includes 20,000 restricted shares granted on June 2, 2008, which while unvested are subject to repurchase by the Company if service as an employee terminates. Restricted stock awards vest in cumulative increments of one-fourth (1/4) each at the end of 12 months, 24 months, 36 months, and 48 months from date granted. |

| | |

| (5) | Includes 54,000 shares purchasable by exercise of option within 60 days. Includes 2,000 restricted shares subject to repurchase by the Company if service as a director terminates on or before August 20, 2008. |

| | |

| (6) | Includes 31,250 shares purchasable by exercise of option within 60 days. Includes 2,000 restricted shares subject to repurchase by the Company if service as a director terminates on or before August 20, 2008. |

| | |

| (7) | Includes 30,000 shares purchasable by exercise of option within 60 days. Includes 2,000 restricted shares subject to repurchase by the Company if service as a director terminates on or before August 20, 2008. |

| | |

| (8) | Includes 29,250 shares purchasable by exercise of option within 60 days. Includes 2,000 restricted shares subject to repurchase by the Company if service as a director terminates on or before August 20, 2008. |

| | |

| (9) | Includes 61,000 shares purchasable by exercise of option within 60 days. Includes 2,000 restricted shares subject to repurchase by the Company if service as a director terminates on or before August 20, 2008. Does not include 1,000 shares owned by Mr. Walker's wife, as to which shares Mr. Walker disclaims any beneficial ownership. |

| | |

| (10) | Includes 223,520 shares purchasable by exercise of option within 60 days. Includes 7,500 restricted shares granted on September 21, 2008, which while unvested are subject to repurchase by the Company if service as an employee terminates. Restricted stock awards vest in cumulative increments of one-fourth (1/4) each at the end of 12 months, 24 months, 36 months, and 48 months from date granted. |

| | |

| (11) | Includes 215,404 shares purchasable by exercise of option within 60 days. Includes 7,500 restricted shares granted on September 21, 2008, which while unvested are subject to repurchase by the Company if service as an employee terminates. Restricted stock awards vest in cumulative increments of one-fourth (1/4) each at the end of 12 months, 24 months, 36 months, and 48 months from date granted. |

| | |

| (12) | Includes 62,180 shares purchasable by exercise of options within 60 days. Includes 2,500 restricted shares granted on September 21, 2008, which while unvested are subject to repurchase by the Company if service as an employee terminates. Restricted stock awards vest in cumulative increments of one-fourth (1/4) each at the end of 12 months, 24 months, 36 months, and 48 months from date granted. |

| | |

| (13) | Includes 684,354 shares purchasable by exercise of option within 60 days. Includes 47,500 restricted shares granted on September 21, 2008, which are subject to repurchase if services as an employee or director, as the case may be, terminates. |

It is anticipated that each director and each executive officer will continue in his position, although there is no understanding or arrangement to that effect. Each director holds office until the next annual meeting of stockholders and until such director’s successor is elected and qualified or until such director’s earlier resignation or removal. Each executive officer serves at the pleasure of the Board of directors. Each executive officer holds office until such officer’s successor is elected and qualified or until such officer’s earlier resignation or removal. There are no family relationships among any directors or executive officers of the Company.

PROPOSAL 2:RATIFICATION OF THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Subject to ratification by the stockholders, the Board of Directors has appointed SingerLewak (“SL”) as the Company’s independent registered public accounting firm (“independent accountants”) to audit the financial statements of the Company for the current fiscal year. During the Company’s two most recent fiscal years (which ended March 31, 2007, and 2008, respectively), and during the subsequent period from April 1, 2008, through June 10, 2008, neither the Company nor anyone of its behalf has consulted with SL regarding any of the matters referenced in Item 304(a)(2) of Regulation S-K.

SL was appointed as independent accountants in June 2008, to replace Odenberg Ullakko Muranishi & Co. LLP (“OUM”) who was dismissed by the Company as its independent registered public accounting firm and who had audited the Company’s financial statements beginning with fiscal 2005. No report on the financial statements prepared by OUM for either of the Company’s last two fiscal years contained an adverse opinion or a disclaimer of opinion, or was qualified or modified as to uncertainty, audit scope, or accounting principles. During the Company’s two most recent fiscal years (which ended March 31, 2007, and 2008, respectively) and during the subsequent interim period beginning April 1, 2008, through June 9, 2008, there were no disagreements with OUM on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement, if not resolved to the satisfaction of OUM, would have caused OUM to make reference to the subject matter of such disagreements in connection with its report. In addition, no reportable events, as defined in Item 304(a)(1)(v) of Regulation S-K, occurred within such time period.

Representatives of the firm of SL are expected to be present at the Annual Meeting and will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions. Representatives of OUM are not expected to be present.

Stockholder ratification of the selection of SL as the Company’s independent registered public accounting firm is not required by the Company’s By-Laws or otherwise. The Board of Directors is submitting the selection of SL to the stockholders for ratification as a matter of good corporate practice. In the event the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm if the Audit Committee is unable to reach a mutually satisfactory agreement with SL at any time subsequently during the year if the Audit Committee determines that such a change could be in the best interests of the Company and its stockholders.

The Board of Directors recommends a vote FOR the above proposal.

Required Vote for Approval of Proposal 2

Approval of the above proposal related to the ratification of the Company’s independent registered public accounting firm will require the affirmative vote of the holders of a majority of the shares of the Company’s common stock present in person or represented by proxy at the meeting. Stockholders may (1) vote “FOR,” (2) vote “AGAINST,” or (3) “ABSTAIN” from voting on Proposal 2. Broker non-votes are not considered to be votes cast and therefore will have no effect on the outcome of this proposal.

Compensation Discussion and Analysis

Compensation Philosophy. The Company's compensation practices for its named executive officers are intended to provide total compensation opportunities that are competitive with the pay practices of similar, high-technology companies. The goal of these compensation practices is to enable the Company to attract, retain and motivate superior performing officers and to align their compensation with the Company’s business objectives and performance, thereby providing incentives for management to strive to increase stockholder value and contribute to the long-term success of the Company. Consistent with these goals, the Company’s compensation programs for named executive officers include a mix of base salary, cash bonuses, and equity awards which to date have consisted of stock options. Each element is considered independently of the others so that the decision as to one element does not affect the decision as to the other elements. Base salary is intended to provide assured cash compensation. Bonus is intended to provide cash compensation linked to Company short-term performance. Stock options are used primarily to link executive incentives and the creation of stockholder value. This mix of compensation elements is intended to place a significant portion of compensation at risk and emphasizes performance. The Company utilizes a similar compensation program for its other key exempt employees.

In March 2006, the Compensation Committee engaged J. Richard & Associates to assist the Compensation Committee in the evaluation of appropriate cash and equity compensation for executive management in fiscal 2007. J. Richard & Associates prepared a competitive compensation analysis by comparing the company’s executive officer compensation with combined, or blended, compensation data of the Radford Executive Survey and a public company peer group as reported in proxy statements and other public filings. The peer group, consisting of ten companies of relatively similar size and profile to the Company, was established in consultation with management and was approved by the Compensation Committee. The peer group companies were Activcard Corp, Cambridge Display Technology, Inc., Digimarc Corporation, Discovery Partners International, Inc., I.D. Systems, Inc., OSI Systems Inc., RAE Systems, Inc., Rimage Corporation, Universal Display Corporation, and Viisage Corporation, Inc.

The Compensation Committee considered the competitive analysis and the CEO’s recommendations for fiscal 2007 executive officer compensation and requested certain additional data and modifications be made to the competitive analysis and recommendations. The Compensation Committee and independent directors subsequently approved modified proposals for fiscal 2007 base salaries, bonus plan, and equity awards in the form of stock options for the named executive officers. The Compensation Committee for fiscal 2008 determined that it did not need another competitive analysis and, as further described below, retained base salaries at their fiscal 2007 level and adopted a similarly structured bonus plan, deferring until the annual stockholders meeting the determination of equity awards. The Compensation Committee for fiscal 2009 determined that it did not need another competitive analysis and, as further described below, retained base salaries at their fiscal 2008 level and is in the process of structuring a bonus plan and determining appropriate equity awards.

Base Salary. After a decrease in annual base salaries in fiscal 2006 with the implementation of a bonus plan, the annual base salaries paid to the Company's four executive officers were increased an average of 3.2% during fiscal 2007 and then kept at the same level for fiscal 2008 and fiscal 2009. The fiscal 2007 adjustments included a 12.9% increase in the base salary for one officer and a 9.4% decrease in the base salary of another officer due to the competitive compensation analysis described above and taking into account their relative levels of responsibility. The Compensation Committee annually reviews and recommends to the independent directors the base salary level for the CEO, based on industry practice, competitive factors, prior experience, technical and administrative ability, position and responsibility, corporate performance, individual contribution, recommendations of executive management, in-depth knowledge of the Company and its technology and similar factors. The Committee annually discusses with the CEO his similar analysis of the base salary of the other named executive officers in deciding whether to approve the CEO’s recommendation of the salaries of the other named executive officers. Consistent with the Company’s current size, the Committee believes current executive salaries are comparable to the average salaries offered by competitive companies. The determination of annual salary is effective at the start of each fiscal year but sometimes is not made until during the first fiscal quarter.

Bonus Compensation. Prior to fiscal 2006, cash bonuses were occasionally awarded to executive officers and management employees based upon criteria such as pre-tax, pre-bonus Company earnings and licensing revenues, with various adjustments; however, no bonuses were awarded to executive officers for fiscal 2003, 2004 and 2005. Beginning in fiscal 2006, the Company each year has established a bonus plan that provides for bonuses to be awarded to the named executive officers and other key management employees based on specific goals achieved by the Company and the level of contribution to achievement of the goals by the individual named executive officers and key employees. The Company’s performance objectives include operating, strategic and financial goals considered critical to the Company’s short and long term goals. Bonuses for a fiscal year are paid during the first fiscal quarter of the following year once the determination of their amounts can be made based upon Company performance; there is no provision for recalculating them should there be a restatement of the Company’s financial statements. The bonus plan for each fiscal year is typically put in place during the first fiscal quarter.

While the percentages vary from year to year, the bonus plan for fiscal 2007 provided for bonuses based on 100% achievement of target goal levels as a function of base salaries for fiscal 2007, as follows: the CEO had a target bonus of 70%, the COO and CFO had target bonuses of 50%, and the Vice President of Business Development had a target bonus of 45%. For fiscal 2008, these target bonuses were adjusted to 59%, 44%, 44%, and 16%, respectively of base pay. Thus, for the Company’s named executive officers, the bonus plan links a substantial portion of their cash compensation to the achievement of Company performance objectives. The bonus plan for fiscal 2008 was designed such that bonus opportunity when combined with base salary created total cash compensation which was comparable to the average cash compensation of the surveyed companies against which the Company competes in hiring and retaining executive officers and other key employees.

Bonus awards depend on the extent to which Company performance objectives are achieved. The Company’s performance objectives vary from year to year and include operating, strategic and financial goals considered critical to the Company’s short and long term goals. For fiscal 2007, the bonus plan provided that bonuses were a function of the Company’s revenue achievement (30%) and pre-tax after bonus earnings (30%) relative to the annual operating plan; the individual officer's accomplishment of certain management by objectives or MBOs (20%); and board discretion (20%). For fiscal 2008, the earnings percentage was increased to 35% and the revenue percentage was decreased to 25%. For fiscal 2007, the bonuses could range from zero to 150% of target based on Company performance while for fiscal 2008 the range is zero to 200% of target. In fiscal 2007, if the revenue and earnings component combined were less than target, then the MBO and discretionary components would be based on target; provided that the revenue achievement and MBO components also required the Company to be profitable. In fiscal 2008, if earnings are less than those in the annual operating plan, then the MBO and discretionary components are each to be allocated based on a maximum payment consisting of 20% of the target bonus while if the earnings are in excess of those in the annual operating plan, the MBO and discretionary components are each to allocated based upon an increased maximum payment which may not exceed 40% of the target bonus. During fiscal 2007 and 2008, because the Company was not profitable, the only bonus that could have been paid was the 20% board discretionary portion and the board determined not to pay any bonuses for fiscal 2007 or 2008 to the named executive officers (although a $50,000 pool was established for other key employees) other to Mr. Haddock under his retirement arrangements. Mr. Haddock received a $50,000 bonus under the bonus plan and a separate $50,000 bonus outside the plan for performance in recognition of his role in obtaining the original GIG agreements in 2004 and in managing the relationship to date and its transition to Prevent. The Company has not yet adopted a bonus for fiscal 2009 due to the transition to a new chief executive officer but presently plans to put in place such a plan.

Since fiscal 2006, the bonus plan has been formulaic other than the MBO and discretionary components and while the Board retains discretion to alter the formulae and payout, the Board would not do so absent exigent circumstances so discretionary alterations have not been made. The bonus plan is shown in the Summary Compensation and Grant of Plan-Based Award Tables above in two components. The portion that is formulaic is considered non-equity incentive plan compensation while the portion that is discretionary is considered bonus.

Equity Awards. The purpose of the Company’s 2004 Equity Incentive Compensation Plan is to attract and retain talented executive and other participating employees and to align their personal financial interests with those of the Company’s stockholders. By historically granting options with an exercise price equal to market price of Company stock at the date of grant, the Company ensures that executive officers will not obtain value unless there is appreciation in the Company’s stock. The options are a retention tool since they are generally granted with a term of seven years (decreased in fiscal 2007 from ten years) and vest over a four-year period. This approach is designed to focus key employees on sustainable growth of the Company and the creation of stockholder value over the long term. During fiscal 2004 and 2005 no options were granted to the named executive officers. The decision was made in fiscal 2006 that option grants should be a major component of the compensation package of the named executive officers. Therefore, in fiscal 2006, and to a lesser extend in fiscal 2007 and 2008, the Company granted options which were larger than it would otherwise have granted had the named executive officers possessed substantial unvested options from prior grants. In recruiting its new CEO during June, 2008, the Company granted for the first time as part of the equity package a market price option which would vest when the Company’s stock price exceed specified targets for twenty consecutive trading days.

Equity awards, historically in the form of stock options, are a major component of the compensation package of executive management. The named executive officers are generally granted options at the first Compensation Committee meeting following commencement of employment. Annual supplemental grants in fiscal 2006 and 2007 were determined proximate to the start of the fiscal year at the first board meeting following the Company’s earnings release for the prior fiscal year but in fiscal 2008, the annual supplemental awards, which may be in the form of options and/or restricted stock or unit grants, were considered on or close to the date of the annual stockholders meeting. In fiscal 2008, the Company for the first time made restricted stock awards to its named executive officers and accordingly reduced the number of options granted to them. In addition, while the Committee retains the discretion to grant the named executive officers additional equity awards at other times based upon superlative performance, the Committee has not done for the past several years. In recommending individual equity awards, the Committee considers individual performance, overall contribution to the Company, retention, the number of unvested stock awards held, the total number of shares of stock to be subjected to equity awards to be granted that year, and the associated SFAS 123(R) expense. In recommending individual stock options, the Committee in the past has not considered salary or bonus or gains made from prior option exercises. In determining the size of the equity pool for annual supplemental equity awards in any given year, the Committee considers overall stockholder dilution, FAS 123R expense, and Company performance. In granting options, the Committee for decades has used the average of the high and low trading prices on the date of grant as the exercise price, rather than the closing trading price, as the Committee believes that such average is a more reliable measure of the fair market value of Company stock on the grant date and is in accordance with the valuation methods described in Section 20.2031-2 of the Treasury Regulations. The Committee is in the process of determining amounts and timing of awards for the fiscal 2009.

Executives generally are able to exercise their vested options at any time but may only sell the resulting stock during non-black-out periods or under a 10b5-1 plan. The Company does not currently have any stock ownership requirement for its executive officers and directors but may consider such a requirement in the future.

Other. Other elements of executive officer compensation, all of which are available to either to all employees or to all exempt employees on the same basis, consist of participation in the employee stock purchase plan and Company match under its 401(k) plan, and Company-paid premiums on medical and life insurance and long-term disability policies. During fiscal 2007, all automobile-related benefits for the named executive officers were terminated and the CEO was given the 1997 vintage car which the Company had owned and been providing him usage of.

Tax Considerations. Cash payments, including salary and bonuses, are taxed at ordinary income rates when actually or constructively received. The Company currently grants incentive options to employees for the first $100,000 of options that become exercisable in a calendar year as permitted by the tax code and otherwise grants non-statutory options. Upon grant of either a non-statutory stock option or an incentive stock option, there is no tax consequence for the Company or the optionee. Upon any exercise of a non-statutory stock option, the employee is taxed at ordinary income rates and the Company receives a compensation expense deduction based on the spread between the then current fair market value of Company stock and the option exercise price. Upon any subsequent sale of the stock, the optionee is taxed at capital gains rates on any appreciation or depreciation since the date of exercise, which capital gain or loss is short-term or long-term depending on whether the stock has been held for a year or more. Upon any exercise of an incentive stock option, the employee is taxed in the same manner as for a non-statutory stock option if the employee sells the stock either less than one year after exercise of the option or less than two years after grant of the option, or otherwise fails to meet certain requirements. If the employee meets these holding periods and requirements, then there is no tax at ordinary income rates due on exercise and the Company does not receive a compensation expense deduction; however, the spread that would have been taxable to the employee had the option instead been a non-statutory option is classified as alternative minimum taxable income for the year of exercise which could result in alternative minimum tax for the employee. On any subsequent sale of the stock, the employee is taxed at long-term capital gains rates on any appreciation or depreciation since the date of grant.

The Company generally intends to qualify executive compensation for deductibility without limitation under section 162(m) of the Internal Revenue Code. Section 162(m) provides that, for purposes of the regular income tax and the alternative minimum tax, the otherwise allowable deduction for compensation paid or accrued with respect to a covered employee of a publicly-held corporation (other than certain exempt performance-based compensation) is limited to no more than $1 million per year. The Company does not expect that the non-exempt compensation to be paid to any of our executive officers for fiscal 2008 or 2009 as calculated for purposes of section 162(m) will exceed the $1 million limit.

Severance and Change of Control Arrangements. The Company has arrangements with all of its named executive officers who are currently employees to provide them with severance pay if they are terminated without cause or resign for good reason. In addition, if their employment is so terminated following a change of control, they receive accelerated vesting of a portion of their outstanding options. These arrangements are described above under “Executive Compensation--Severance Contracts and Change of Control Agreements”. The Committee believed that it was important to provide its named executive officers with the incentive to remain employed with the Company or its successor following a change in control so that the acquirer could transition appropriately and more readily obtain the full value of the Company’s assets which would benefit Company stockholders. Therefore, the Company did not grant benefits simply in the event of a change in control.

Report of the Compensation Committee of the Board of Directors on Executive Compensation

The following report of the Compensation Committee does not constitute solicitation material, and shall not be deemed filed or incorporated by reference into any other filing by the Company under the Securities Act of 1933, or the Securities Exchange Act of 1934.

The Compensation Committee has reviewed and discussed the above Compensation Discussion and Analysis with the Company’s management. Based on this review and these discussions, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s annual report on Form 10-K and proxy statement on Schedule 14A.

Compensation Committee

Arthur H. Hausman (Chairman)

Dan Maydan

Albert J. Moyer

Fiscal 2008 Summary Compensation Table

The Summary Compensation table below discloses the total compensation awarded to, earned by, or paid to the chief executive officer, the chief financial officer, and each of the other two persons who have served as the Company's executive officers for the fiscal year ended March 31, 2008, who are referred to below as our named executive officers, for services rendered in all capacities to the Company and its subsidiaries.

| Name and Principal Position | | Year | | Salary ($) | | | Bonus Awards ($) | | | Stock Awards (1)($) | | | Option Awards (1)($) | | | All Other Compensation ($) | | | Total Compensation ($) | |

| | | | | | | | | | | | | | | | | | | | | | |

| Richard M. Haddock (2) | | 2007 | | $ | 350,002 | | | | -- | | | | -- | | | $ | 209,277 | | | $ | 28,449 | (3) | | | $ | 587,728 | |

| President and Chief Executive Officer | | 2008 | | $ | 350,002 | | | $ | 100,000 | | | $ | 130,000 | | | $ | 217,931 | | | $ | 29,028 | (4) | | | $ | 826,961 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Christopher J. Dyball | | 2007 | | $ | 305,011 | | | | -- | | | | -- | | | $ | 163,452 | | | $ | 26,450 | (5) | | | $ | 494,913 | |

| Chief Operating Officer | | 2008 | | $ | 305,011 | | | | -- | | | $ | 78,000 | | | $ | 187,999 | | | $ | 25,909 | (6) | | | $ | 596,219 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Steven G. Larson | | 2007 | | $ | 265,013 | | | | -- | | | | -- | | | $ | 123,076 | | | $ | 19,541 | (7) | | | $ | 407,630 | |

| Vice President, Finance and Chief Financial Officer | | 2008 | | $ | 265,013 | | | | -- | | | $ | 78,000 | | | $ | 153,807 | | | $ | 21,273 | (8) | | | $ | 518,093 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stephen Price-Francis | | 2007 | | $ | 192,005 | | | | -- | | | | -- | | | $ | 79,309 | | | $ | 23,665 | (9) | | | $ | 294,979 | |

| Vice President, Business Development | | 2008 | | $ | 192,374 | | | | -- | | | $ | 26,000 | | | $ | 98,288 | | | $ | 23,375 | (10) | | | $ | 340,037 | |

(1) Represents the amount of the total fair value of option awards or stock awards granted in fiscal year 2008 and prior years recognized as stock-based compensation expense for financial statement reporting purposes for the fiscal year ended March 31, 2008 in accordance with SFAS No. 123(R), Share-Based Payment. Please see a discussion of all assumptions used in the valuation of these awards in Note 2, subpart (23) to our consolidated financial statements, which are included in Part II Item 8 of our Annual Report on Form 10-K for the fiscal year ended March 31, 2008.

(2) Effective March 31, 2008, Mr. Haddock retired and resign as the Company’s President and Chief Executive Officer.

(3) Consists of the following amounts paid for by us: (i) $5,029 for Company’s matching contribution on behalf of the individual in the Company’s 401(k) plan, (ii) $10,660 for Employee Stock Purchase Plan discount; (iii) $10,702 for group insurance premiums; (iv) $1,194 for group term life insurance premium, and (vi) $864 for long-term disability insurance premium.

(4) Consists of the following amounts paid for by us: (i) $5,029 for Company's matching contribution on behalf of the individual in the Company's 401(k) plan, (ii) $11,003 for Employee Stock Purchase Plan discount; (iii) $10,872 for group insurance premiums; (iv) $1,260 for group term life insurance premium, and (vi) $864 for long-term disability insurance premium.

(5) Consists of the following amounts paid for by us: (i) $4,592 for Company’s matching contribution on behalf of the individual in the Company’s 401(k) plan, (ii) $9,186 for Employee Stock Purchase Plan discount; (iii) $10,702 for group insurance premium; (iv) $1,106 for group term life insurance premium, and (v) $864 for long-term disability insurance premium.

(6) Consists of the following amounts paid for by us: (i) $4,624 for Company's matching contribution on behalf of the individual in the Company's 401(k) plan, (ii) $8,447 for Employee Stock Purchase Plan discount; (iii) $10,873 for group insurance premium; (iv) $1,101 for group term life insurance premium, and (v) $864 for long-term disability insurance premium.

(7) Consists of the following amounts paid for by us: (i) $3,981 for Company’s matching contribution on behalf of the individual in the Company’s 401(k) plan, (ii) $7,897 for Employee Stock Purchase Plan discount; (iii) $5,895 for group insurance premium; (iv) $904 for group term life insurance premium, and (v) $864 for long-term disability insurance premium.

(8) Consists of the following amounts paid for by us: (i) $4,025 for Company's matching contribution on behalf of the individual in the Company's 401(k) plan, (ii) $7,339 for Employee Stock Purchase Plan discount; (iii) $8,087 for group insurance premium; (iv) $958 for group term life insurance premium, and (v) $864 for long-term disability insurance premium.

(9) Consists of the following amounts paid for by us: (i) $2,869 for Company’s matching contribution on behalf of the individual in the Company’s 401(k) plan, (ii) $3,403 for Employee Stock Purchase Plan discount; (iii) $15,916 for group insurance premium; (iv) $641 for group term life insurance premium, and (v) $836 for long-term disability insurance premium.

(10) Consists of the following amounts paid for by us: (i) $2,912 for Company's matching contribution on behalf of the individual in the Company's 401(k) plan, (ii) $3,552 for Employee Stock Purchase Plan discount; (iii) $15,352 for group insurance premium; (iv) $695 for group term life insurance premium, and (v) $864 for long-term disability insurance premium.

Fiscal Year 2008 Grants of Plan-Based Awards Table

The following table shows information regarding payments to named executive officers under our non-equity incentive compensation plan for the fiscal year ended March 31, 2008, and regarding stock option awards we granted to the named executive officers during the fiscal year ended March 31, 2008. The options granted to our named executive officers in fiscal year 2008 were granted under our 2004 Equity Incentive Compensation Plan. In addition, the table below shows estimated possible payouts under the formulaic portion of our fiscal 2008 bonus plan, whereas any actual such payouts would have been shown under the Fiscal 2008 Summary Compensation Table.

| | | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards | | | | | | | | | | | | | | | | |

| Name | Grant Date | | Minimum ($) | | | Target ($) | | | Maximum ($) | | | All Other Stock Awards: Number of Shares or Units (#) (2) | | | All Other Option Awards: Number of Securities Underlying Options (#) (3) | | | Exercise Price of Option Awards ($/sh) (4) | | | Closing Price on Option Grant Date ($/sh) | | | Grant Date Fair Value of Stock and Option Awards ($) (1) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Richard M. Haddock | | | $ | - | | | $ | 245,000 | | | $ | 367,500 | | | | | | | | | | | | | | | | |

| | 9/21/2007 | | | | | | | | | | | | | | | 12,500 | | | | 50,000 | | | $ | 10.40 | | | $ | 10.78 | | | $ | 130,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Christopher J. Dyball | | | $ | - | | | $ | 152,500 | | | $ | 228,750 | | | | | | | | | | | | | | | | | | | | | |

| | 9/21/2007 | | | | | | | | | | | | | | | 7,500 | | | | 30,000 | | | $ | 10.40 | | | $ | 10.78 | | | $ | 78,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Steven G. Larson | | | $ | - | | | $ | 132,500 | | | $ | 198,750 | | | | | | | | | | | | | | | | | | | | | |

| | 9/21/2007 | | | | | | | | | | | | | | | 7,500 | | | | 30,000 | | | $ | 10.40 | | | $ | 10.78 | | | $ | 78,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stephen Price-Francis | | | $ | - | | | $ | 86,400 | | | $ | 129,600 | | | | | | | | | | | | | | | | | | | | | |

| | 9/21/2007 | | | | | | | | | | | | | | | 2,500 | | | | 10,000 | | | $ | 10.40 | | | $ | 10.78 | | | $ | 26,000 | |

(1) Represents the total grant date of stock option awards granted to our named executive officers during fiscal year 2008. The fair value of these awards was determined in accordance with SFAS 123(R), Share-Based Payment. The assumptions used to calculate the grant date fair value of these awards are set forth in the Note 2, subpart (23) to our consolidated financial statements, which are included in Part II Item 8 of the Annual Report on Form 10-K for the fiscal year ended March 31, 2008.

(2) Consists of awards of restricted stock, the unvested portion of which would be forfeited upon employment termination. The vesting schedule is that 25% vests on each of the first four anniversaries of the award date.

(3) Consists of options awarded which are exercisable over a four-year period, with 25% exercisable one year from the date of grant and the balance exercisable in quarterly installments thereafter.

(4) In granting options, the Company for decades has used the average of the high and low trading prices on the date of grant as the exercise price, rather than the closing trading price, as the Company believes that such average is a more reliable measure of the fair market value of Company stock on the grant date and is in accordance with the valuation methods described in Section 20.2031-2 of the Treasury Regulations.

Outstanding Equity Awards At Fiscal Year-End 2008

The following table sets forth information regarding the outstanding equity awards held by our named executive officers as of March 31, 2008:

| | | | | | | | | | | | | | | | | | | | |

| Name | Grant Date | | Number of Securities Underlying Exercisable Options (#) (1)) | | | Number of Securities Underlying Unexercisable Options (#) | | | | Option Exercise Price ($) | | | Option Expiration Date | | Number of shares or units of stock that have not vested (#) | | | Market value of shares or units of stock that have not vested ($) | |

| | | | | | | | | | | | | | | | | | | | |

| Richard M. Haddock | 6/2/1998 | | | 5,000 | | | | 0 | | | | $ | 14.75 | | | 6/2/2008 | | | | | | |