DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from January 1, 2020 through December 31, 2020, as provided by Leigh N. Todd, CFA, Erik A. Swords and Matthew Jenkin, Primary Portfolio Managers

Market and Fund Performance Overview

For the 12-month period ended December 31, 2020, the BNY Mellon Large Cap Securities Fund, Inc. produced a total return of 26.56%.1 In comparison, the S&P 500® Index (the “Index”), the fund’s benchmark, provided a total return of 18.40% for the same period.2

Equity markets experienced volatility due to the COVID-19 pandemic but rebounded in the second half of the reporting period. The fund outperformed the Index largely due to favorable security selections in most of the 11 market sectors.

The Fund’s Investment Approach

The fund seeks long-term capital growth consistent with the preservation of capital. Current income is a secondary goal. To pursue these goals, the fund primarily invests in common stocks issued by U.S. companies. The fund may invest up to 20% of its assets in foreign securities. In choosing stocks, we focus on large-capitalization, U.S. companies with strong positions in their industries and catalysts that can trigger a price increase. We use fundamental analysis to create a broadly diversified portfolio composed of a blend of growth stocks, value stocks and stocks that exhibit characteristics of both investment styles. We attempt to measure a security’s intrinsic value by analyzing “real” data (company financials, economic outlook, etc.) and other factors (management, industry conditions, competition, etc.) and select stocks based on their value, growth and financial profiles.

Stocks Recover as the Economy Rebounds

Prior to the reporting period, stocks were supported by three rate cuts by the Federal Reserve (the “Fed”) late in 2019, by steady economic data and an announcement of a “Phase One” U.S.-China trade agreement. Stocks also benefited from the approval of a new U.S.-Mexico-Canada Trade Agreement, potentially reducing trade uncertainty with America’s neighbors.

However, early in 2020, markets experienced a sharp correction, amid growing concerns about COVID-19 in China, erasing gains that occurred late in 2019 and early in 2020. In response, the Fed reduced the federal funds rate by 50 basis points early in March 2020, bringing the target rate down to 1.00–1.25%. The Fed made another cut in mid-March 2020, bringing the federal funds rate target to 0.00-0.25%. In addition, the Fed and other central banks initiated various programs to ease liquidity concerns in certain markets.

Congress also acted quickly, passing the $2 trillion Coronavirus Aid, Relief and Economic Security (CARES) Act. This legislation provided payments to qualified citizens and included the Paycheck Protection Program that enabled small businesses to keep their workers employed or hire them back. It also allowed businesses to use these funds to cover overhead costs.

In the second quarter of 2020, the economy began to show signs of recovery. Retail sales rebounded, and the outlook for manufacturing also improved. Job creation surged, beating economists’ expectations, and markets began to rebound as relief programs took effect, government shutdowns began to ease and hope for a COVID-19 vaccine or effective therapy took hold.

Late in the reporting period, markets benefited from the announcement that COVID-19 vaccines would be available within a few months. Uncertainty surrounding the November 2020 election also eased, and investors began to factor the likelihood of additional stimulus and infrastructure spending into their calculations. With the end of the pandemic in view and continued economic rebound likely, investors began to shift away from growth-oriented stocks and into value-oriented stocks.

2

Stock Selection Benefited Fund Performance

The fund’s performance was driven by strong stock selection across seven of 11 sectors. In the information technology sector, many companies benefited from social distancing and work-from-home policies, which have accelerated the digital transformation of the economy that was already occurring. In the software industry, ServiceNow, salesforce.com, Microsoft and Adobe were the primary positive contributors. In the semiconductor industry, NVIDIA and Applied Materials were the leading contributors. Other advantageous holdings included PayPal Holdings and Apple. In the consumer discretionary sector, Amazon.com, McDonald’s, hardware chain Lowe’s and VF, a clothing manufacturer, were beneficial, and in the industrial sector, Trane Technologies, a manufacturer of heating and air conditioning systems, Roper Technologies, a conglomerate, and Cummins, a maker of engines and power generation systems, were the most favorable selections. Other beneficial holdings included Walmart, Costco, Alphabet (parent of Google) and Facebook. In the financial sector, the fund’s position in Goldman Sachs Group also contributed positively to returns.

On a less positive note, stock selections in the health care and energy sectors detracted from performance. In the health care sector, positions in the medical equipment industry, including Boston Scientific and Becton Dickinson, detracted from returns. In the energy sector, the fund’s position in Helmerich & Payne, an oilfield services provider, hampered performance, as demand for oil declined.

Positioned for Continued Digital Transformation

COVID-19 accelerated a long-term trend toward digital transformation of the global economy across all industries, and we expect this trend to continue as the pandemic winds down. We also anticipate that this shift will not replace more traditional consumer and business behaviors but will supplement them. Ongoing investment in mobility and remote work technologies is likely to mean greater spending, as the global economy recovers.

Companies that fail to make use of the available technologies are likely to struggle retaining their customers as well as growing new customers and may ultimately be left behind. So, in the long term, we believe companies will learn from the pandemic and more fully embrace digital transformation.

January 15, 2021

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment returns fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 Source: Lipper Inc. — The S&P 500® Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Investors cannot invest directly in any index.

Please note: the position in any security highlighted with italicized typeface was sold during the reporting period.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The fund may, but is not required to, use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries.

3

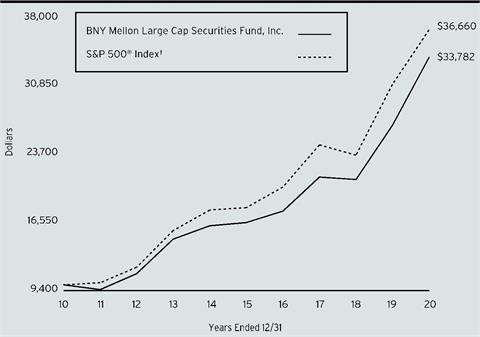

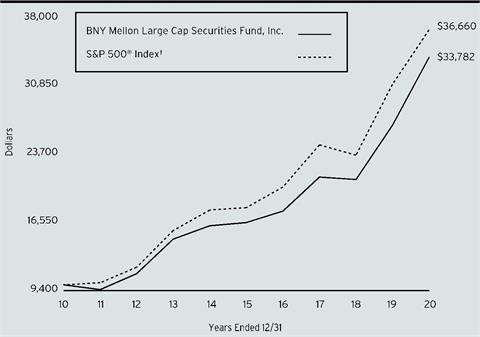

FUND PERFORMANCE (Unaudited)

Comparison of change in value of a $10,000 investment in shares of BNY Mellon Large Cap Securities Fund, Inc. with a hypothetical investment of $10,000 in the S&P 500® Index (the “Index”)

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical investment of $10,000 made in shares of BNY Mellon Large Cap Securities Fund, Inc. on 12/31/10 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses. The Index is widely regarded as the best single gauge of large-cap U.S. equities. The Index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

| | | | |

Average Annual Total Returns as of 12/31/2020 | |

| 1 Year | 5 Years | 10 Years |

Fund | 26.56% | 15.40% | 12.95% |

S&P 500® Index | 18.40% | 15.21% | 13.87% |

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Large Cap Securities Fund, Inc. from July 1, 2020 to December 31, 2020. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | |

Expenses and Value of a $1,000 Investment | |

Assume actual returns for the six months ended December 31, 2020 | |

| | | |

| | | |

Expense paid per $1,000† | $3.92 | |

Ending value (after expenses) | $1,228.40 | |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | |

Expenses and Value of a $1,000 Investment | |

Assuming a hypothetical 5% annualized return for the six months ended December 31, 2020 | |

| | | |

| | | |

Expense paid per $1,000† | $3.56 | |

Ending value (after expenses) | $1,021.62 | |

†Expenses are equal to the fund’s annualized expense ratio of .70%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

5

STATEMENT OF INVESTMENTS

December 31, 2020

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.4% | | | | | |

Banks - 5.2% | | | | | |

JPMorgan Chase & Co. | | | | 310,798 | | 39,493,102 | |

The PNC Financial Services Group | | | | 149,533 | | 22,280,417 | |

U.S. Bancorp | | | | 396,118 | | 18,455,138 | |

| | | | | 80,228,657 | |

Capital Goods - 9.3% | | | | | |

AMETEK | | | | 196,651 | | 23,782,972 | |

Ingersoll Rand | | | | 787,183 | a | 35,864,057 | |

Rockwell Automation | | | | 78,051 | | 19,575,971 | |

Roper Technologies | | | | 69,537 | | 29,976,705 | |

Trane Technologies | | | | 233,884 | | 33,950,601 | |

| | | | | 143,150,306 | |

Consumer Durables & Apparel - 1.3% | | | | | |

VF | | | | 232,392 | | 19,848,601 | |

Diversified Financials - 3.3% | | | | | |

BlackRock | | | | 38,406 | | 27,711,465 | |

The Goldman Sachs Group | | | | 88,561 | | 23,354,421 | |

| | | | | 51,065,886 | |

Energy - 2.7% | | | | | |

Hess | | | | 501,637 | | 26,481,417 | |

Valero Energy | | | | 266,019 | | 15,048,695 | |

| | | | | 41,530,112 | |

Food & Staples Retailing - 1.9% | | | | | |

Walmart | | | | 198,951 | | 28,678,787 | |

Food, Beverage & Tobacco - 2.5% | | | | | |

PepsiCo | | | | 261,886 | | 38,837,694 | |

Health Care Equipment & Services - 6.3% | | | | | |

Danaher | | | | 137,647 | | 30,576,905 | |

Humana | | | | 48,928 | | 20,073,691 | |

Intuitive Surgical | | | | 26,336 | a | 21,545,482 | |

Medtronic | | | | 217,836 | | 25,517,309 | |

| | | | | 97,713,387 | |

Insurance - 2.6% | | | | | |

Chubb | | | | 126,588 | | 19,484,425 | |

The Progressive | | | | 214,176 | | 21,177,723 | |

| | | | | 40,662,148 | |

Materials - 2.0% | | | | | |

FMC | | | | 264,680 | | 30,419,672 | |

Media & Entertainment - 7.4% | | | | | |

Alphabet, Cl. C | | | | 40,105 | a | 70,259,147 | |

Facebook, Cl. A | | | | 163,813 | a | 44,747,159 | |

| | | | | 115,006,306 | |

6

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.4% (continued) | | | | | |

Pharmaceuticals Biotechnology & Life Sciences - 8.7% | | | | | |

AbbVie | | | | 280,528 | | 30,058,575 | |

Biogen | | | | 45,421 | a | 11,121,786 | |

Eli Lilly & Co. | | | | 174,577 | | 29,475,581 | |

Seagen | | | | 118,748 | a | 20,797,525 | |

Vertex Pharmaceuticals | | | | 87,080 | a | 20,580,487 | |

Zoetis | | | | 139,142 | | 23,028,001 | |

| | | | | 135,061,955 | |

Retailing - 11.1% | | | | | |

Amazon.com | | | | 31,836 | a | 103,687,623 | |

Booking Holdings | | | | 9,967 | a | 22,199,200 | |

Lowe's | | | | 140,745 | | 22,590,980 | |

The TJX Companies | | | | 340,929 | | 23,282,041 | |

| | | | | 171,759,844 | |

Semiconductors & Semiconductor Equipment - 6.0% | | | | | |

Applied Materials | | | | 297,429 | | 25,668,123 | |

NVIDIA | | | | 71,691 | | 37,437,040 | |

Qualcomm | | | | 192,439 | | 29,316,157 | |

| | | | | 92,421,320 | |

Software & Services - 15.7% | | | | | |

Microsoft | | | | 465,203 | | 103,470,451 | |

PayPal Holdings | | | | 193,162 | a | 45,238,540 | |

salesforce.com | | | | 136,669 | a | 30,412,953 | |

ServiceNow | | | | 60,750 | a | 33,438,623 | |

Visa, Cl. A | | | | 138,066 | b | 30,199,176 | |

| | | | | 242,759,743 | |

Technology Hardware & Equipment - 8.2% | | | | | |

Apple | | | | 958,724 | | 127,213,088 | |

Transportation - 2.2% | | | | | |

Union Pacific | | | | 162,968 | | 33,933,197 | |

Utilities - 3.0% | | | | | |

NextEra Energy | | | | 416,872 | | 32,161,675 | |

PPL | | | | 525,105 | | 14,807,961 | |

| | | | | 46,969,636 | |

Total Common Stocks (cost $883,543,665) | | | | 1,537,260,339 | |

7

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | 1-Day

Yield (%) | | Shares | | Value ($) | |

Investment Companies - .6% | | | | | |

Registered Investment Companies - .6% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost $9,086,100) | | 0.09 | | 9,086,100 | c | 9,086,100 | |

Total Investments (cost $892,629,765) | | 100.0% | | 1,546,346,439 | |

Liabilities, Less Cash and Receivables | | (.0%) | | (278,310) | |

Net Assets | | 100.0% | | 1,546,068,129 | |

aNon-income producing security.

bSecurity, or portion thereof, on loan. At December 31, 2020, the value of the fund’s securities on loan was $29,897,110 and the value of the collateral was $30,445,373, consisting of U.S. Government & Agency securities.

cInvestment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Information Technology | 29.9 |

Health Care | 15.1 |

Consumer Discretionary | 12.4 |

Industrials | 11.4 |

Financials | 11.1 |

Communication Services | 7.4 |

Consumer Staples | 4.4 |

Utilities | 3.0 |

Energy | 2.7 |

Materials | 2.0 |

Investment Companies | .6 |

| | 100.0 |

† Based on net assets.

See notes to financial statements.

8

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

| | | | | | | |

Investment Companies | Value

12/31/19($) | Purchases($)† | Sales($) | Value

12/31/20($) | Net

Assets(%) | Dividends/

Distributions($) |

Registered Investment Companies: | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares | 14,709,175 | 131,239,393 | (136,862,468) | 9,086,100 | .6 | 46,686 |

† Includes reinvested dividends/distributions.

See notes to financial statements.

9

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2020

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $29,897,110)—Note 1(c): | | | |

Unaffiliated issuers | 883,543,665 | | 1,537,260,339 | |

Affiliated issuers | | 9,086,100 | | 9,086,100 | |

Dividends and securities lending income receivable | | 1,172,819 | |

Receivable for shares of Common Stock subscribed | | 15,072 | |

Prepaid expenses | | | | | 32,097 | |

| | | | | 1,547,566,427 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(b) | | 891,919 | |

Payable for shares of Common Stock redeemed | | 505,183 | |

Directors’ fees and expenses payable | | 7,893 | |

Other accrued expenses | | | | | 93,303 | |

| | | | | 1,498,298 | |

Net Assets ($) | | | 1,546,068,129 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 856,015,397 | |

Total distributable earnings (loss) | | | | | 690,052,732 | |

Net Assets ($) | | | 1,546,068,129 | |

| | | | | |

Shares Outstanding | | |

(500 million shares of $1 par value Common Stock authorized) | 104,897,562 | |

Net Asset Value Per Share ($) | | 14.74 | |

| | | | |

See notes to financial statements. | | | | |

10

STATEMENT OF OPERATIONS

Year Ended December 31, 2020

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends: | |

Unaffiliated issuers | | | 18,348,224 | |

Affiliated issuers | | | 45,174 | |

Interest | | | 129,661 | |

Income from securities lending—Note 1(c) | | | 42,926 | |

Total Income | | | 18,565,985 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 8,734,235 | |

Shareholder servicing costs—Note 3(b) | | | 446,294 | |

Professional fees | | | 120,253 | |

Directors’ fees and expenses—Note 3(c) | | | 98,561 | |

Prospectus and shareholders’ reports | | | 55,048 | |

Loan commitment fees—Note 2 | | | 53,183 | |

Registration fees | | | 36,708 | |

Custodian fees—Note 3(b) | | | 20,853 | |

Chief Compliance Officer fees—Note 3(b) | | | 13,982 | |

Miscellaneous | | | 20,016 | |

Total Expenses | | | 9,599,133 | |

Investment Income—Net | | | 8,966,852 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions | 113,749,452 | |

Net realized gain (loss) on forward foreign currency exchange contracts | (1) | |

Capital gain distributions from affiliated issuers | 1,512 | |

Net Realized Gain (Loss) | | | 113,750,963 | |

Net change in unrealized appreciation (depreciation) on investments | 206,565,495 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 320,316,458 | |

Net Increase in Net Assets Resulting from Operations | | 329,283,310 | |

| | | | | | |

See notes to financial statements. | | | | | |

11

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended December 31, |

| | | | 2020 | | 2019 | |

Operations ($): | | | | | | | | |

Investment income—net | | | 8,966,852 | | | | 15,402,877 | |

Net realized gain (loss) on investments | | 113,750,963 | | | | 61,392,248 | |

Net change in unrealized appreciation

(depreciation) on investments | | 206,565,495 | | | | 219,130,530 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 329,283,310 | | | | 295,925,655 | |

Distributions ($): | |

Distributions to shareholders | | | (93,212,040) | | | | (86,364,343) | |

Capital Stock Transactions ($): | |

Net proceeds from shares sold | | | 6,353,026 | | | | 5,522,770 | |

Distributions reinvested | | | 85,130,582 | | | | 78,678,888 | |

Cost of shares redeemed | | | (97,031,498) | | | | (110,309,035) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | (5,547,890) | | | | (26,107,377) | |

Total Increase (Decrease) in Net Assets | 230,523,380 | | | | 183,453,935 | |

Net Assets ($): | |

Beginning of Period | | | 1,315,544,749 | | | | 1,132,090,814 | |

End of Period | | | 1,546,068,129 | | | | 1,315,544,749 | |

Capital Share Transactions (Shares): | |

Shares sold | | | 484,802 | | | | 457,302 | |

Shares issued for distributions reinvested | | | 6,128,006 | | | | 6,494,026 | |

Shares redeemed | | | (7,559,244) | | | | (9,274,685) | |

Net Increase (Decrease) in Shares Outstanding | (946,436) | | | | (2,323,357) | |

| | | | | | | | | |

See notes to financial statements. | | | | | | | | |

12

FINANCIAL HIGHLIGHTS

The following table describes the performance for the fiscal periods indicated. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. These figures have been derived from the fund’s financial statements.

| | | | | | | | | |

| | | |

| | Year Ended December 31, |

| | 2020 | 2019 | 2018 | 2017 | 2016 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 12.43 | 10.47 | 11.55 | 10.54 | 10.68 |

Investment Operations: | | | | | | |

Investment income—neta | | .09 | .15 | .11 | .09 | .11 |

Net realized and unrealized

gain (loss) on investments | | 3.15 | 2.65 | (.24) | 1.97 | .67 |

Total from Investment Operations | | 3.24 | 2.80 | (.13) | 2.06 | .78 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.09) | (.15) | (.12) | (.10) | (.11) |

Dividends from net realized

gain on investments | | (.84) | (.69) | (.83) | (.95) | (.81) |

Total Distributions | | (.93) | (.84) | (.95) | (1.05) | (.92) |

Net asset value,

end of period | | 14.74 | 12.43 | 10.47 | 11.55 | 10.54 |

Total Return (%) | | 26.56 | 27.06 | (1.20) | 20.12 | 7.23 |

Ratios/Supplemental Data (%): |

Ratio of total expenses

to average net assets | | .71 | .72 | .71 | .75 | .76 |

Ratio of net investment

income to average

net assets | | .67 | 1.23 | .98 | .82 | 1.01 |

Portfolio Turnover Rate | | 44.24 | 27.73 | 32.16 | 40.41 | 68.83 |

Net Assets, end of period

($ x 1,000) | | 1,546,068 | 1,315,545 | 1,132,091 | 1,232,034 | 1,118,858 |

a Based on average shares outstanding.

See notes to financial statements.

13

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon Large Cap Securities Fund, Inc. (the “fund”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), is a diversified open-end management investment company. The fund’s investment objective is to seek long-term capital growth consistent with the preservation of capital. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares, which are sold to the public without a sales charge.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

14

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in equity securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant American Depository Receipts and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for

15

NOTES TO FINANCIAL STATEMENTS (continued)

example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the fund’s Board of Directors (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

The following is a summary of the inputs used as of December 31, 2020 in valuing the fund’s investments:

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | | Level 3-Significant Unobservable Inputs | Total | |

Assets ($) | | |

Investments In Securities:† | | |

Equity Securities - Common Stocks | 1,537,260,339 | - | | - | 1,537,260,339 | |

Investment Companies | 9,086,100 | - | | - | 9,086,100 | |

† See Statement of Investments for additional detailed categorizations, if any.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments

16

resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of the Adviser, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Adviser, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, The Bank of New York Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending transactions are on an overnight and continuous basis. During the period ended December 31, 2020, The Bank of New York Mellon earned $8,185 from the lending of the fund’s portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by the Adviser are considered “affiliated” under the Act.

(e) Risk: Certain events particular to the industries in which the fund’s investments conduct their operations, as well as general economic, political and public health conditions, may have a significant negative impact on the investee’s operations and profitability. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different

17

NOTES TO FINANCIAL STATEMENTS (continued)

country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies worldwide. Recent examples include pandemic risks related to COVID-19 and aggressive measures taken world-wide in response by governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines of large populations, and by businesses, including changes to operations and reducing staff. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

(f) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from investment income-net are normally declared and paid quarterly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended December 31, 2020, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended December 31, 2020, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended December 31, 2020 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At December 31, 2020, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $512,671,

18

undistributed capital gains $35,820,859 and unrealized appreciation $653,719,202.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2020 and December 31, 2019 were as follows: ordinary income $9,110,641 and $16,115,266, and long-term capital gains $84,101,399 and $70,249,077, respectively.

NOTE 2—Bank Lines of Credit:

The fund participates with other long-term open-end funds managed by the Adviser in a $823.5 million unsecured credit facility led by Citibank, N.A. (the “Citibank Credit Facility”) and a $300 million unsecured credit facility provided by The Bank of New York Mellon (the “BNYM Credit Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions (each, a “Facility”). The Citibank Credit Facility is available in two tranches: (i) Tranche A is in an amount equal to $688.5 million and is available to all long-term open-ended funds, including the fund, and (ii) Tranche B is an amount equal to $135 million and is available only to BNY Mellon Floating Rate Income Fund, a series of BNY Mellon Investment Funds IV, Inc. Prior to September 30, 2020, the Citibank Credit Facility was $927 million with Tranche A available in an amount equal to $747 million and Tranche B available in an amount equal to $180 million. Prior to March 11, 2020, the Citibank Credit Facility was $1.030 billion with Tranche A available in an amount equal to $830 million and Tranche B available in an amount equal to $200 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for Tranche A of the Citibank Credit Facility and the BNYM Credit Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended December 31, 2020, the fund did not borrow under the Facilities.

NOTE 3—Management Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement (the “Agreement”) with the Adviser, the management fee is payable monthly, based on the following annual percentages of the value of the fund’s average daily net assets: .65% of the first $1.5 billion; .625% of the next $500 million; .60% of the next $500 million; and .55% over $2.5 billion. The effective management fee rate during the period ended December 31, 2020 was .65%.

The Agreement also provides for an expense reimbursement from the Adviser should the fund’s aggregate expenses (excluding taxes and brokerage commissions) exceed 1% of the value of the fund’s average daily

19

NOTES TO FINANCIAL STATEMENTS (continued)

net assets for any full fiscal year. During the period ended December 31, 2020, there was no reduction in expenses pursuant to the Agreement.

(b) The fund has an arrangement with the transfer agent whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency fees. For financial reporting purposes, the fund includes net earnings credits, if any, as shareholder servicing costs in the Statement of Operations.

The fund has an arrangement with the custodian whereby the fund will receive interest income or be charged an overdraft fees when cash balances are maintained. For financial reporting purposes, the fund includes this interest income and overdraft fees, if any, as interest income in the Statement of Operations.

The fund compensates BNY Mellon Transfer, Inc., a wholly-owned subsidiary of the Adviser, under a transfer agency agreement for providing transfer agency and cash management services inclusive of earnings credits, if any, for the fund. The majority of transfer agency fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended December 31, 2020, the fund was charged $287,258 for transfer agency services, inclusive of earnings credit, if any. These fees are included in Shareholder servicing costs in the Statement of Operations.

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended December 31, 2020, the fund was charged $20,853 pursuant to the custody agreement.

During the period ended December 31, 2020, the fund was charged $13,982 for services performed by the Chief Compliance Officer and his staff. These fees are included in Chief Compliance Officer fees in the Statement of Operations.

The components of “Due to BNY Mellon Investment Adviser, Inc. and affiliates” in the Statement of Assets and Liabilities consist of: management fees of $826,651, custodian fees of $6,965, Chief Compliance Officer fees of $2,903 and transfer agency fees of $55,400.

(c) Each Board member also serves as a Board member of other funds in the BNY Mellon Family of Funds complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

20

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and forward foreign currency exchange contracts (“forward contracts”), during the period ended December 31, 2020, amounted to $590,094,159 and $674,177,451, respectively.

Derivatives: A derivative is a financial instrument whose performance is derived from the performance of another asset. The fund enters into International Swaps and Derivatives Association, Inc. Master Agreements or similar agreements (collectively, “Master Agreements”) with its OTC derivative contract counterparties in order to, among other things, reduce its credit risk to counterparties. Master Agreements include provisions for general obligations, representations, collateral and events of default or termination. Under a Master Agreement, the fund may offset with the counterparty certain derivative financial instruments’ payables and/or receivables with collateral held and/or posted and create one single net payment in the event of default or termination.

Each type of derivative instrument that was held by the fund during the period ended December 31, 2020 is discussed below.

Forward Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle foreign currency transactions or as a part of its investment strategy. When executing forward contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward contracts, the fund incurs a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed. The fund realizes a gain if the value of the contract decreases between those dates. With respect to purchases of forward contracts, the fund incurs a loss if the value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed. The fund realizes a gain if the value of the contract increases between those dates. Any realized or unrealized gains or losses which occurred during the period are reflected in the Statement of Operations. The fund is exposed to foreign currency risk as a result of changes in value of underlying financial instruments. The fund is also exposed to credit risk associated with counterparty nonperformance on these forward contracts, which is generally limited to the unrealized gain on each open contract. This risk may be mitigated by Master Agreements, if any, between the fund and the counterparty and the posting of collateral, if any, by the counterparty to the fund to cover the fund’s exposure to the

21

NOTES TO FINANCIAL STATEMENTS (continued)

counterparty. At December 31, 2020, there were no forward contracts outstanding.

The following summarizes the average market value of derivatives outstanding during the period ended December 31, 2020:

| | | |

| | Average Market Value ($) |

Forward contracts | | 59 |

| | |

At December 31, 2020, the cost of investments for federal income tax purposes was $892,629,765; accordingly, accumulated net unrealized appreciation on investments was $653,716,674, consisting of $658,021,239 gross unrealized appreciation and $4,304,565 gross unrealized depreciation.

NOTE 5—Subsequent Event:

On February 10, 2021, BNY Mellon Investment Management announced its intention to realign several of its investment firms. As a result of this realignment, which is scheduled to occur, subject to regulatory requirements, in the third quarter of 2021 (the “Effective Date”), portfolio managers responsible for managing the fund’s investments who are employees of Mellon Investments Corporation (“Mellon”) in a dual employment arrangement with the Adviser, will become employees of Newton Investment Management North America, LLC (“Newton”), which, like Mellon, will be an affiliate of the Adviser, and will no longer be employees of Mellon. Consequently, effective as of the Effective Date and subject to the approval of the fund’s board, the Adviser will engage Newton to serve as the fund’s sub-adviser, pursuant to a sub-investment advisory agreement between the Adviser and Newton. As the fund’s sub-adviser, Newton will provide the day-to-day management of the fund’s investments, subject to the Adviser’s supervision and approval. It is currently anticipated that the fund’s portfolio managers who are responsible for the day-to-day management of the fund’s investments will continue to manage the fund’s investments as of the Effective Date. It is also currently anticipated that there will be no material changes to the fund’s investment objective, strategies or policies, no reduction in the nature or level of services provided to the fund, and no increase in the management fee payable by the fund as a result of the engagement of Newton as the fund’s sub-adviser. The Adviser (and not the fund) will pay Newton for its sub-advisory services.

22

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Directors of BNY Mellon Large Cap Securities Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of BNY Mellon Large Cap Securities Fund, Inc. (the “Fund”), including the statements of investments and investments in affiliated issuers, as of December 31, 2020, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund at December 31, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of the Fund’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2020, by correspondence with the custodian and others or by other appropriate auditing procedures where replies from others were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies in the BNY Mellon Family of Funds since at least 1957, but we are unable to determine the specific year.

New York, New York

February 25, 2021

23

IMPORTANT TAX INFORMATION (Unaudited)

In accordance with federal tax law, the fund hereby reports 100% of the ordinary dividends paid during the fiscal year ended December 31, 2020 as qualifying for the corporate dividends received deduction. For the fiscal year ended December 31, 2020, certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $9,110,641 represents the maximum amount that may be considered qualified dividend income. Shareholders will receive notification in early 2021 of the percentage applicable to the preparation of their 2020 income tax returns. Also, the fund hereby reports $.0597 per share as a long-term capital gain distribution paid on March 31, 2020 and the fund also reports $.7764 per share as a long-term capital gain distribution paid on December 18, 2020.

24

INFORMATION ABOUT THE RENEWAL OF THE FUND’S MANAGEMENT AGREEMENT (Unaudited)

At a meeting of the fund’s Board of Directors held on July 21-22, 2020, the Board considered the renewal of the fund’s Management Agreement pursuant to which the Adviser provides the fund with investment advisory and administrative services (the “Agreement”). The Board members, a majority of whom are not “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of the Adviser. In considering the renewal of the Agreement, the Board considered several factors that it believed to be relevant, including those discussed below. The Board did not identify any one factor as dispositive, and each Board member may have attributed different weights to the factors considered.

Analysis of Nature, Extent, and Quality of Services Provided to the Fund. The Board considered information provided to it at the meeting and in previous presentations from representatives of the Adviser regarding the nature, extent, and quality of the services provided to funds in the BNY Mellon fund complex, including the fund. The Adviser provided the number of open accounts in the fund, the fund’s asset size and the allocation of fund assets among distribution channels. The Adviser also had previously provided information regarding the diverse intermediary relationships and distribution channels of funds in the BNY Mellon fund complex (such as retail direct or intermediary, in which intermediaries typically are paid by the fund and/or the Adviser) and the Adviser’s corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each intermediary or distribution channel, as applicable to the fund.

The Board also considered research support available to, and portfolio management capabilities of, the fund’s portfolio management personnel and that the Adviser also provides oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Board also considered the Adviser’s extensive administrative, accounting and compliance infrastructures. The Board also considered portfolio management’s brokerage policies and practices (including policies and practices regarding soft dollars) and the standards applied in seeking best execution.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. The Board reviewed reports prepared by Broadridge Financial Solutions, Inc. (“Broadridge”), an independent provider of investment company data based on classifications provided by Thomson Reuters Lipper, which included information comparing (1) the fund’s performance with the performance of a group of other retail no-load large-cap core funds selected by Broadridge as comparable to the fund (the “Performance Group”) and with a broader group of funds consisting of all retail and institutional large-cap core funds (the “Performance Universe”), all for various periods ended May 31, 2020, and (2) the fund’s actual and contractual management fees and total expenses with those of the same group of funds in the Performance Group (the

25

INFORMATION ABOUT THE RENEWAL OF THE FUND’S MANAGEMENT AGREEMENT (Unaudited) (continued)

“Expense Group”) and with a broader group of all retail no-load large-cap core funds, excluding outliers (the “Expense Universe”), the information for which was derived in part from fund financial statements available to Broadridge as of the date of its analysis. The Adviser previously had furnished the Board with a description of the methodology Broadridge used to select the Performance Group and Performance Universe and the Expense Group and Expense Universe.

Performance Comparisons. Representatives of the Adviser stated that the usefulness of performance comparisons may be affected by a number of factors, including different investment limitations and policies that may be applicable to the fund and comparison funds and the end date selected. The Board discussed with representatives of the Adviser the results of the comparisons and considered that the fund’s total return performance was above the Performance Group and the Performance Universe medians for all periods except the ten-year period when performance was at the Performance Group median. The Adviser also provided a comparison of the fund’s calendar year total returns to the returns of the fund’s benchmark index.

Management Fee and Expense Ratio Comparisons. The Board reviewed and considered the contractual management fee rate payable by the fund to the Adviser in light of the nature, extent and quality of the management services provided by the Adviser. In addition, the Board reviewed and considered the actual management fee rate paid by the fund over the fund’s last fiscal year. The Board also reviewed the range of actual and contractual management fees and total expenses as a percentage of average net assets of the Expense Group and Expense Universe funds and discussed the results of the comparisons. The Board considered that the fund’s contractual management fee was equal to the Expense Group median contractual management fee, the fund’s actual management fee was higher than the Expense Group median and equal to the Expense Universe median actual management fee and the fund’s total expenses were approximately equal to the Expense Group median and lower than the Expense Universe median total expenses.

Representatives of the Adviser reviewed with the Board the management or investment advisory fees paid by funds advised or administered by the Adviser that are in the same Lipper category as the fund (the “Similar Funds”), and explained the nature of the Similar Funds. They discussed differences in fees paid and the relationship of the fees paid in light of any differences in the services provided and other relevant factors. The Board considered the relevance of the fee information provided for the Similar Funds to evaluate the appropriateness of the fund’s management fee. Representatives of the Adviser noted that there were no separate accounts and/or other types of client portfolios advised by the Adviser that are considered to have similar investment strategies and policies as the fund.

Analysis of Profitability and Economies of Scale. Representatives of the Adviser reviewed the expenses allocated and profit received by the Adviser and its affiliates and the resulting profitability percentage for managing the fund and the aggregate profitability percentage to the Adviser and its affiliates for managing the funds in the BNY Mellon fund complex, and the method used to determine the expenses and profit.

26

The Board concluded that the profitability results were not excessive, given the services rendered and service levels provided by the Adviser and its affiliates. The Board also had been provided with information prepared by an independent consulting firm regarding the Adviser’s approach to allocating costs to, and determining the profitability of, individual funds and the entire BNY Mellon fund complex. The consulting firm also had analyzed where any economies of scale might emerge in connection with the management of a fund.

The Board considered, on the advice of its counsel, the profitability analysis (1) as part of its evaluation of whether the fees under the Agreement, considered in relation to the mix of services provided by the Adviser, including the nature, extent and quality of such services, supported the renewal of the Agreement and (2) in light of the relevant circumstances for the fund and the extent to which economies of scale would be realized if the fund grows and whether fee levels reflect these economies of scale for the benefit of fund shareholders. Representatives of the Adviser stated that a discussion of economies of scale is predicated on a fund having achieved a substantial size with increasing assets and that, if a fund’s assets had been stable or decreasing, the possibility that the Adviser may have realized any economies of scale would be less. Representatives of the Adviser also stated that, as a result of shared and allocated costs among funds in the BNY Mellon fund complex, the extent of economies of scale could depend substantially on the level of assets in the complex as a whole, so that increases and decreases in complex-wide assets can affect potential economies of scale in a manner that is disproportionate to, or even in the opposite direction from, changes in the fund’s asset level. The Board also considered potential benefits to the Adviser from acting as investment adviser and took into consideration the soft dollar arrangements in effect for trading the fund’s investments.

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to the renewal of the Agreement. Based on the discussions and considerations as described above, the Board concluded and determined as follows.

· The Board concluded that the nature, extent and quality of the services provided by the Adviser are adequate and appropriate.

· The Board was satisfied with the fund’s performance.

· The Board concluded that the fee paid to the Adviser continued to be appropriate under the circumstances and in light of the factors and the totality of the services provided as discussed above.

· The Board determined that the economies of scale which may accrue to the Adviser and its affiliates in connection with the management of the fund had been adequately considered by the Adviser in connection with the fee rate charged to the fund pursuant to the Agreement and that, to the extent in the future it were determined that material economies of scale had not been shared with the fund, the Board would seek to have those economies of scale shared with the fund.

27

INFORMATION ABOUT THE RENEWAL OF THE FUND’S MANAGEMENT AGREEMENT (Unaudited) (continued)

In evaluating the Agreement, the Board considered these conclusions and determinations and also relied on its previous knowledge, gained through meetings and other interactions with the Adviser and its affiliates, of the Adviser and the services provided to the fund by the Adviser. The Board also relied on information received on a routine and regular basis throughout the year relating to the operations of the fund and the investment management and other services provided under the Agreement, including information on the investment performance of the fund in comparison to similar mutual funds and benchmark performance indices; general market outlook as applicable to the fund; and compliance reports. In addition, the Board’s consideration of the contractual fee arrangements for the fund had the benefit of a number of years of reviews of the Agreement for the fund, or substantially similar agreements for other BNY Mellon funds that the Board oversees, during which lengthy discussions took place between the Board and representatives of the Adviser. Certain aspects of the arrangements may receive greater scrutiny in some years than in others, and the Board’s conclusions may be based, in part, on their consideration of the fund’s arrangements, or substantially similar arrangements for other BNY Mellon funds that the Board oversees, in prior years. The Board determined to renew the Agreement.

28

BOARD MEMBERS INFORMATION (Unaudited)

INDEPENDENT BOARD MEMBERS

Joseph S. DiMartino (77)

Chairman of the Board (1995)

Principal Occupation During Past 5 Years:

· Director and Trustee of funds in the BNY Mellon Family of Funds and certain other entities (as described in the fund’s Statement of Additional Information) (1995-Present)

Other Public Company Board Memberships During Past 5 Years:

· CBIZ, Inc., a public company providing professional business services, products and solutions, Director (1997-Present)

No. of Portfolios for which Board Member Serves: 109

———————

Francine J. Bovich (69)

Board Member (2015)

Principal Occupation During Past 5 Years:

· Trustee, The Bradley Trusts, private trust funds (2011-Present)

Other Public Company Board Membership During Past 5 Years:

· Annaly Capital Management, Inc., a real estate investment trust, Director (2014-Present)

No. of Portfolios for which Board Member Serves: 66

———————

J. Charles Cardona (65)

Board Member (2014)

Principal Occupation During Past 5 Years:

· BNY Mellon Liquidity Funds, Director (2004-Present) and Chairman (since 2019)

· President and Director of the Manager (2008-2016)

· Chief Executive Officer of Dreyfus Cash Investment Strategies, a division of the Adviser (2009-2016)

· Chairman (2013 – 2016) Director (2005-2016) and Executive Vice President (2006-2015) of the MBSC Securities Corporation (“MBSC”)

Other Public Company Board Memberships During Past 5 Years:

· BNY Mellon ETF Trust, Chairman and Trustee (2020-Present)

No. of Portfolios for which Board Member Serves: 38

———————

29

BOARD MEMBERS INFORMATION (Unaudited) (continued)

INDEPENDENT BOARD MEMBERS (continued)

Andrew J. Donohue (70)

Board Member (2019)

Principal Occupation During Past 5 Years:

· Of Counsel, Shearman & Sterling LLP (2017-2019)

· Chief of Staff to the Chair of the SEC (2015-2017)

· Managing Director and Investment Company General Counsel of Goldman Sachs (2012-2015)

· Attorney, Solo Law Practice (2019-Present)

Other Public Company Board Memberships During Past 5 Years:

· Oppenheimer Funds (58 funds), Director (2017-2019)

No. of Portfolios for which Board Member Serves: 52

———————

Isabel P. Dunst (73)

Board Member (2014)

Principal Occupation During Past 5 Years:

· Senior Counsel, Hogan Lovells LLP, a law firm, Senior Counsel (2018-2019); Of Counsel (2015-2018); Partner (1990-2014)

· Member of the Board of Governors, Hebrew Union College Jewish Institute of Religion (2015-Present)

· Board Member, Bend the ARC, a civil rights organization, (2016-Present)

No. of Portfolios for which Board Member Serves: 30

———————

Nathan Leventhal (77)

Board Member (2009)

Principal Occupation During Past 5 Years:

· President Emeritus of Lincoln Center for the Performing Arts (2001-Present)

· President of the Palm Beach Opera (2016-Present)

Other Public Company Board Membership During Past 5 Years:

· Movado Group, Inc., a public company that designs sources, markets and distributes watches Director (2003-Present)

No. of Portfolios for which Board Member Serves: 44

———————

30

Robin A. Melvin (57)

Board Member (2014)

Principal Occupation During Past 5 Years:

· Co-Chair, Mentor Illinois, a non-profit organization dedicated to increasing the quality of mentoring services in Illinois (2014 - 2020); Board member, Mentor Illinois (2013-2020)

· Trustee, Westover School, a private girls' boarding school in Middlebury, Connecticut (2019-Present)

No. of Portfolios for which Board Member Serves: 87

———————

Roslyn M. Watson (71)

Board Member (2014)

Principal Occupation During Past 5 Years:

· Principal, Watson Ventures, Inc., a real estate investment company (1993-Present)

Other Public Company Board Membership During Past 5 Years:

· American Express Bank, FSB, Director (1993-2018)

No. of Portfolios for which Board Member Serves: 52

———————

Benaree Pratt Wiley (73)

Board Member (2009)

Principal Occupation During Past 5 Years:

· Principal, The Wiley Group, a firm specializing in strategy and business development (2005-Present)

Other Public Company Board Membership During Past 5 Years:

· CBIZ, Inc., a public company providing professional business services, products and solutions, Director (2008-Present)

· Blue Cross Blue Shield of Massachusetts, Director (2004-Present)

No. of Portfolios for which Board Member Serves: 70

———————

31

BOARD MEMBERS INFORMATION (Unaudited) (continued)

INTERESTED BOARD MEMBER

Gordon J. Davis (79)

Board Member (2012)

Principal Occupation During Past 5 Years:

· Partner in the law firm of Venable LLP (2012-Present)

No. of Portfolios for which Board Member Serves: 48

Gordon J. Davis is deemed to be an “interested person” (as defined under the Act) of the fund as a result of his affiliation with Venable LLP, which provides legal services to the fund.

———————

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80. The address of the Board Members and Officers is c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street, New York, New York 10286. Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from the Adviser free of charge by calling this toll free number: 1-800-373-9387.

Clifford L. Alexander, Jr., Emeritus Board Member

Whitney I. Gerard, Emeritus Board Member

George L. Perry, Emeritus Board Member

32

OFFICERS OF THE FUND (Unaudited)

DAVID DIPETRILLO, President since January 2021.

Head of North America Product, BNY Mellon Investment Management since January 2018, Director of Product Strategy, BNY Mellon Investment Management from January 2016 to December 2017; Head of US Retail Product and Channel Marketing, BNY Mellon Investment Management from January 2014 to December 2015. He is an officer of 62 investment companies (comprised of 117 portfolios) managed by the Adviser or an affiliate of the Adviser. He is 42 years old and has been an employee of BNY Mellon since 2005.

JAMES WINDELS, Treasurer since November 2001.

Director-BNY Mellon Fund Administration, and an officer of 63 investment companies (comprised of 140 portfolios) managed by the Adviser or an affiliate of the Adviser. He is 62 years old and has been an employee of the Adviser since April 1985.

BENNETT A. MACDOUGALL, Chief Legal Officer since October 2015.

Chief Legal Officer of the Adviser and Associate General Counsel and Managing Director of BNY Mellon since June 2015; Director and Associate General Counsel of Deutsche Bank–Asset & Wealth Management Division from June 2005 to June 2015, and as Chief Legal Officer of Deutsche Investment Management Americas Inc. from June 2012 to May 2015. He is an officer of 63 investment companies (comprised of 140 portfolios) managed by the Adviser or an affiliate of the Adviser. He is 49 years old and has been an employee of the Adviser since June 2015.

JAMES BITETTO, Vice President since August 2005 and Secretary since February 2018.

Senior Managing Counsel of BNY Mellon since December 2019; Managing Counsel of BNY Mellon from April 2014 to December 2019; Secretary of the Adviser, and an officer of 63 investment companies (comprised of 140 portfolios) managed by the Adviser or an affiliate of the Adviser. He is 54 years old and has been an employee of the Adviser since December 1996.

DEIRDRE CUNNANE, Vice President and Assistant Secretary since March 2019.

Counsel of BNY Mellon since August 2018; Senior Regulatory Specialist at BNY Mellon Investment Management Services from February 2016 to August 2018; Trustee Associate at BNY Mellon Trust Company (Ireland) Limited from August 2013 to February 2016. She is an officer of 63 investment companies (comprised of 140 portfolios) managed by the Adviser or an affiliate of the Adviser. She is 30 years old and has been an employee of the Adviser since August 2018.

SARAH S. KELLEHER, Vice President and Assistant Secretary since April 2014.

Managing Counsel of BNY Mellon since December 2017, Senior Counsel of BNY Mellon from March 2013 to December 2017. She is an officer of 63 investment companies (comprised of 140 portfolios) managed by the Adviser or an affiliate of the Adviser. She is 45 years old and has been an employee of the Adviser since March 2013.

JEFF PRUSNOFSKY, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 63 investment companies (comprised of 140 portfolios) managed by the Adviser or an affiliate of the Adviser. He is 55 years old and has been an employee of the Adviser since October 1990.

AMANDA QUINN, Vice President and Assistant Secretary since March 2020.

Counsel of BNY Mellon since June 2019; Regulatory Administration Manager at BNY Mellon Investment Management Services from September 2018 to May 2019; Senior Regulatory Specialist at BNY Mellon Investment Management Services from April 2015 to August 2018. She is an officer of 63 investment companies (comprised of 140 portfolios) managed by the Adviser or an affiliate of the Adviser. She is 35 years old and has been an employee of the Adviser since June 2019.

PETER M. SULLIVAN, Vice President and Assistant Secretary since March 2019.

Senior Managing Counsel of BNY Mellon since December 2020; Managing Counsel of BNY Mellon from March 2009 to December 2020, and an officer of 63 investment companies (comprised of 140 portfolios) managed by the the Adviser or an affiliate of the the Adviser. He is 52 years old and has been an employee of BNY Mellon since April 2004.

33

OFFICERS OF THE FUND (Unaudited) (continued)

NATALYA ZELENSKY, Vice President and Assistant Secretary since March 2017.

Managing Counsel of BNY Mellon since December 2019; Counsel of BNY Mellon from May 2016 to December 2019; Assistant Secretary of the Adviser since 2018; Attorney at Wildermuth Endowment Strategy Fund/Wildermuth Advisory, LLC from November 2015 to May 2016 and Assistant General Counsel at RCS Advisory Services from July 2014 to November 2015. She is an officer of 63 investment companies (comprised of 140 portfolios) managed by the Adviser or an affiliate of the Adviser. She is 35 years old and has been an employee of the Adviser since May 2016.

GAVIN C. REILLY, Assistant Treasurer since December 2005.

Tax Manager-BNY Mellon Fund Administration, and an officer of 63 investment companies (comprised of 140 portfolios) managed by the Adviser or an affiliate of the Adviser. He is 52 years old and has been an employee of the Adviser since April 1991.

ROBERT S. ROBOL, Assistant Treasurer since August 2005.

Senior Accounting Manager-BNY Mellon Fund Administration, and an officer of 63 investment companies (comprised of 141 portfolios) managed by the Adviser or an affiliate of the Adviser. He is 56 years old and has been an employee of the Adviser since October 1988.

ROBERT SALVIOLO, Assistant Treasurer since July 2007.

Senior Accounting Manager–BNY Mellon Fund Administration, and an officer of 63 investment companies (comprised of 140 portfolios) managed by the Adviser or an affiliate of the Adviser. He is 53 years old and has been an employee of the Adviser since June 1989.

ROBERT SVAGNA, Assistant Treasurer since December 2002.

Senior Accounting Manager–BNY Mellon Fund Administration, and an officer of 63 investment companies (comprised of 140 portfolios) managed by the Adviser or an affiliate of the Adviser. He is 53 years old and has been an employee of the Adviser since November 1990.

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Adviser, the BNY Mellon Family of Funds and BNY Mellon Funds Trust (62 investment companies, comprised of 132 portfolios). He is 63 years old and has served in various capacities with the Adviser since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

CARIDAD M. CAROSELLA, Anti-Money Laundering Compliance Officer since January 2016.

Anti-Money Laundering Compliance Officer of the BNY Mellon Family of Funds and BNY Mellon Funds Trust since January 2016; from May 2015 to December 2015, Interim Anti-Money Laundering Compliance Officer of the BNY Mellon Family of Funds and BNY Mellon Funds Trust and the Distributor; from January 2012 to May 2015, AML Surveillance Officer of the Distributor. She is an officer of 56 investment companies (comprised of 133 portfolios) managed by the Adviser or an affiliate of the Adviser. She is 52 years old and has been an employee of the Distributor since 1997.

34

This page intentionally left blank.

35

This page intentionally left blank.

36

This page intentionally left blank.

37

BNY Mellon Large Cap Securities Fund, Inc.

240 Greenwich Street

New York, NY 10286

Adviser

BNY Mellon Investment Adviser, Inc.

240 Greenwich Street

New York, NY 10286

Custodian

The Bank of New York Mellon

240 Greenwich Street

New York, NY 10286

Transfer Agent &

Dividend Disbursing Agent