UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | (X) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, 2010

or

| | ( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 0-20269

DUCKWALL-ALCO STORES, INC.

(Exact name of registrant as specified in its charter)

| Kansas | 48-0201080 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

401 Cottage Street Abilene, Kansas | 67410-2832 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number including area code: (785) 263-3350

Securities registered pursuant to Section 12(b) of the Act:

NONE

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.0001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes_____ No __X_

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes___ No _X__

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No _____

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes _____ No _____

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “accelerated filer", "large accelerated filer” and "smaller reporting company" in Rule 12b-2 of the Exchange Act. Large accelerated filer [ ] Accelerated filer [X] Non-accelerated filer (Do not check if a smaller reporting company) [ ] Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ____ No __X__

The aggregate market value of the 3,797,947 shares of Common Stock, par value $.0001 per share, of the registrant held by non-affiliates of the registrant is $64,868,935 on August 2, 2009, based on a closing sale price of $17.08. As of April 15, 2010, there were 3,826,852 shares of Common Stock outstanding.

Documents incorporated by reference: portions of the Registrant's Proxy Statement for the 2010 Annual Meeting of Stockholders are incorporated by reference in Part I and III hereof.

DUCKWALL-ALCO FISCAL 2010 FORM 10-K

| TABLE OF CONTENTS | | | |

| | | | | | |

| PART I | | |

| | Item 1. | | Business | 3 | |

| | Item 1A. | | Risk Factors | 6 | |

| | Item 1B. | | Unresolved Staff Comments | 8 | |

| | Item 2. | | Properties | 8 | |

| | Item 3. | | Legal Proceedings | 8 | |

| | Item 4. | | Reserved | 8 | |

| | | |

| PART II | | |

| | Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 9 | |

| | Item 6. | | Selected Financial Data | 11 | |

| | Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | 12 | |

| | Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | 22 | |

| | Item 8. | | Financial Statements and Supplementary Data | 23 | |

| | Item 9. | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 38 | |

| | Item 9A. | | Controls and Procedures | 39 | |

| | Item 9B. | | Other Information | 40 | |

| | | |

| PART III | | |

| | Item 10. | | Directors and Executive Officers of the Registrant | 40 | |

| | Item 11. | | Executive Compensation | 41 | |

| | Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 41 | |

| | Item 13. | | Certain Relationships and Related Transactions | 41 | |

| | Item 14. | | Principal Accountant Fees and Services | 41 | |

| | | |

| PART IV | | |

| | Item 15. | | Exhibits and Financial Statement Schedules | 41 | |

| | | |

| Signatures | 43 | |

| | | |

| | | |

PART I

ITEM 1. BUSINESS

History

Duckwall-ALCO Stores, Inc., (the “Company” or “Registrant”), was founded as a general merchandising operation in 1901 in Abilene, Kansas by A. L. Duckwall. From its founding until 1968, the Company conducted its retail operations as small variety or “dime” stores. In 1968, the Company followed an emerging trend to broad line retailing when it opened its first ALCO store. The Company's overall business strategy involves identifying and opening stores in towns that will provide the Company with the highest return on investment. This strategy includes opening ALCO stores. As of January 31, 2010, the Company operates 258 stores located in the central United States, consisting of 209 ALCO stores and 49 Duckwall stores.

The Company was incorporated on July 2, 1915 under the laws of Kansas. The Company's executive offices are located at 401 Cottage Street, Abilene, Kansas 67410-2832, and its telephone number is (785) 263-3350.

General

The Company is a regional retailer operating 258 stores in 23 states in the central United States. The Company's strategy is to target smaller markets not served by other regional or national broad line retail chains and to provide the most convenient access to retail shopping within each market. The Company's ALCO stores offer a broad line of merchandise consisting of approximately 35,000 items, including automotive, candy, crafts, domestics, electronics, fabrics, furniture, hardware, health and beauty aids, housewares, jewelry, ladies', men's and children's apparel and shoes, pre-recorded music and video, sporting goods, seasonal items, stationery and toys. The Company's smaller Duckwall stores offer a more limited selection of similar merchandise.

Of the Company's 209 ALCO stores, more than 70% operate in primary markets that do not have another broad line retailer. The ALCO stores account for approximately 96% of the Company's net sales. The current ALCO store averages approximately 21,000 square feet of selling space. The Company's store expansion program is primarily directed toward opening stores with a design prototype of approximately 21,000 square feet of selling space.

All of the Company's stores are serviced by the Company's 352,000 square foot distribution center in Abilene, Kansas.

For fiscal 2010, 2009 and 2008, the percentage of sales by product category were as follows:

| | | | | | | | | | |

| | | Percentage of Sales | |

| | | 2010 | | | 2009 | | | 2008 | |

| Merchandise Category: | | | | | | | | | |

| Consumables and commodities | | | 34 | % | | | 32 | % | | | 34 | % |

| Hardlines | | | 33 | % | | | 33 | % | | | 34 | % |

| Apparel and accessories | | | 17 | % | | | 19 | % | | | 19 | % |

| Home furnishings and décor | | | 16 | % | | | 16 | % | | | 13 | % |

| Total | | | 100 | % | | | 100 | % | | | 100 | % |

Business Strategy

The Company intends to focus on executing a business strategy that includes the following key components:

Markets: The Company intends to open ALCO stores primarily in towns with populations of typically less than 5,000 that are in trade areas with populations of less than 16,000 where: (1) there is no direct competition from national or regional broad line retailers; (2) economic and demographic criteria indicate the market is able to commercially support a broad line retailer; and (3) the opening of an ALCO store would significantly reduce the likelihood of the entry into such market by another broad line retailer. This key component of the Company's strategy has guided the Company in both its opening of new stores and in its closing of existing stores.

Market Selection: The Company utilizes a detailed process to analyze under-served markets which includes examining factors such as distance from competition, trade area, demographics, retail sales levels, existence and stability of major employers, location of county government, disposable income, and distance from the Company’s distribution center. Markets that are determined to be sizable enough to support an ALCO and that have no direct competition from another broad line retailer are examined closely and eventually selected or passed over by the Company's experienced management team.

Store Expansion: The Company's expansion program is designed primarily around the prototype Class 21 Store. This prototype details shelf space, merchandise presentation, store items to be offered, parking, storage requirements, as well as other store design considerations. The 21,000 square feet of selling space is large enough to permit a full line of the Company's merchandise, while minimizing capital expenditures, labor costs and general overhead costs. The Company will also consider opportunities in acceptable markets to open ALCO stores in available space in buildings already constructed.

Advertising and Promotion: The Company utilizes full-color photography advertising circulars of eight to 20 pages distributed through newspaper insertion or, in the case of inadequate newspaper coverage, through direct mail. During fiscal 2010, these circulars were distributed 47 times in ALCO markets. In its Duckwall markets, the Company discontinued advertising in fiscal 2008. The Company’s marketing program is designed to create awareness and recognition of its competitive pricing on a comprehensive merchandise selection for the whole family. During fiscal 2011, the Company will distribute approximately 45 circulars in ALCO markets.

Store Environment: The Company's stores are open, clean, bright and offer a pleasant atmosphere with disciplined product presentation, attractive displays and efficient check-out procedures. The Company endeavors to staff its stores with courteous, highly motivated, knowledgeable store associates in order to provide a convenient, friendly and enjoyable shopping experience.

Store Development

The Company expects to open less than 10 ALCO stores during fiscal year 2011. During fiscal 2010, the Company opened one ALCO store. No ALCO stores were closed and one Duckwall store was closed, resulting in a year end total of 258 stores. The Company's strategy regarding store development is to increase sales and profitability at existing stores by continually refining the merchandising mix and improving operating efficiencies and through new store openings in the Company's targeted base of under-served markets in the central United States. The following table summarizes the Company's store development during the past three fiscal years:

| | | | | | | | | | | | | | | | | | | |

| | | 2010 | | | 2009 | | | 2008 | |

| | | ALCO | | | Duckwall | | | ALCO | | | Duckwall | | | ALCO | | | Duckwall | |

| Stores Opened | | | 1 | | | | - | | | | 15 | | | | - | | | | 18 | | | | - | |

| Stores Closed | | | - | | | | 1 | | | | 11 | | | | 8 | | | | 3 | | | | 9 | |

| Net New Stores | | | 1 | | | | (1) | | | | 4 | | | | (8) | | | | 15 | | | | (9) | |

As of January 31, 2010, the Company owned three ALCO locations and one Duckwall location, and leased 206 ALCO locations and 48 Duckwall locations. The Company's present intention is to lease all new stores; however, the Company may own some of the ALCO locations. The investment to open a new prototype ALCO store that is leased is approximately $1.0 million for the equipment and inventory.

Store Environment and Merchandising

The Company manages its stores to attractively and conveniently display a full line of merchandise within the confines of the stores' available square footage. Corporate merchandising direction is provided to each store to ensure a consistent company-wide store presentation. To facilitate long-term merchandising planning, the Company divides its merchandise into three core categories driven by the Company's customer profile: primary, secondary, and convenience. The primary core receives management's primary focus, with a wide assortment of merchandise being placed in the most accessible locations within the stores and receiving significant promotional consideration. The secondary core consists of categories of merchandise for which the Company maintains a strong assortment that is easily and readily identifiable by its customers. The convenience core consists of categories of merchandise for which ALCO will maintain convenient (but limited) assortments, focusing on key items that are in keeping with customers' expectations for a broad line retail store. Secondary and convenience cores include merchandise that the Company feels is important to carry, as the target customer expects to find them within a broad line retail store and they ensure a high level of customer traffic. The Company continually evaluates and ranks all product lines, shifting product classifications when necessary to reflect the changing demand for products.

Purchasing

Procurement and merchandising of products is directed by the Executive Vice President - Chief Operating Officer. The Company employs nineteen merchandise buyers. Buyers are assisted by a management information system that provides them with current price, volume information and on-hand quantities by SKU (stock keeping unit), thus allowing them to react quickly with buying and pricing adjustments dictated by customer buying patterns.

The Company purchases its merchandise from approximately 1,700 suppliers. The Company generally does not utilize long-term supply contracts. Only one supplier accounted for approximately 5% of the Company's total purchases in fiscal 2010 and competing brand name and private label products are available from other suppliers at competitive prices. The Company believes that its relationships with its suppliers are good and that the loss of any one or more of its suppliers would not have a material adverse effect on the Company.

Pricing

The Company's pricing strategy, with its promotional activities, is designed to bring consistent value to the customer. In fiscal 2011, promotions on various items will be offered approximately 45 times through advertising circulars.

Distribution and Transportation

The Company operates a 352,000 square foot distribution center in Abilene, Kansas, from which it services all stores. The distribution center is responsible for distributing approximately 80% of the Company's merchandise, with the balance being delivered directly to the Company's stores by its vendors. The distribution center maintains an integrated management information system, allowing the Company to utilize such cost cutting efficiencies as perpetual inventories, safety programs, and employee productivity software.

Management Information Systems

The Company has made a significant investment in the purchase and implementation of industry standard technology with the intent to lower costs, improve customer service, improve associate productivity, provide necessary controls and enhance general business planning and execution. In general, the Company's merchandising systems are designed to integrate the key retailing functions of seasonal merchandise planning, purchase order management, merchandise distribution, sales information and inventory maintenance and replenishment. All of the Company's ALCO stores have POS computer terminals that capture sales information and transmit to the Company's data processing facilities where it is used to drive mana gement, financial, and supply chain functions.

The Company has committed significant efforts towards establishing a technical infrastructure, and a core of operational systems, that will support the Company’s future needs. The Company will continue to maintain and leverage this core of systems, plus adding industry leading business area specific solutions to meet business objectives. The Company has established an integrated infrastructure of data, processes, and technology that provides the necessary business and regulatory controls, while positioning for future growth and efficiency. The Company is aligned on the need to use technology to enhance customer service, support fact based decision making, improve associate productivity and drive business functionality and efficiency.

Financial Information About Segments

The Company derives 100% of its revenue through the sale of merchandise in the United States. See Item 8. Financial Statements & Supplemental Data, Note 13, for more information.

Store Locations

As of January 31, 2010, the Company operated 209 ALCO stores in 23 states located in smaller communities in the central United States. The ALCO stores average approximately 21,000 square feet of selling space, with an additional 5,000 square feet utilized for merchandise processing, temporary storage and administration. The Company also operates 49 Duckwall stores in 9 states. The geographic distribution of the Company's stores is as follows:

| Duckwall Stores | | ALCO Stores | |

| | | | | | | | | | | | |

| Colorado | | | 4 | | Arizona | | | 8 | | Montana | | | 1 | |

| Iowa | | | 3 | | Arkansas | | | 4 | | Nebraska | | | 16 | |

| Kansas | | | 20 | | Colorado | | | 13 | | New Mexico | | | 8 | |

| Nebraska | | | 6 | | Florida | | | 1 | | North Dakota | | | 10 | |

| New Mexico | | | 1 | | Georgia | | | 3 | | Ohio | | | 4 | |

| North Dakota | | | 1 | | Idaho | | | 5 | | Oklahoma | | | 9 | |

| Oklahoma | | | 5 | | Illinois | | | 10 | | South Dakota | | | 11 | |

| South Dakota | | | 1 | | Indiana | | | 14 | | Texas | | | 28 | |

| Texas | | | 8 | | Iowa | | | 9 | | Utah | | | 6 | |

| | | | | | Kansas | | | 26 | | Wisconsin | | | 1 | |

| | | | | | Minnesota | | | 12 | | Wyoming | | | 3 | |

| | | | | | Missouri | | | 7 | | | | | | |

Competition

While the broad line retail business in general is highly competitive, the Company's business strategy is to locate its ALCO stores in smaller markets where there is no direct competition with larger national or regional broad line retail chains, and where it is believed no such competition is likely to develop. Accordingly, the Company's primary method of competing is to offer its customers a conveniently located store with a wide range of merchandise at value prices in a primary trade area population under 16,000 that does not have a large national or regional broad line retail store. The Company believes that trade area size is a significant deterrent to larger national and regional broad line retail chains. Duckwall stores are located in very small markets, and like the ALCO stores, emphasize the convenience of location to the primary customer base.

In the broad line retail business in general, price, merchandise selection, merchandise quality, advertising and customer service are all important aspects of competing. The Company encounters direct competition with national broad line retail stores in approximately 23% of its ALCO markets, and another 6% of the ALCO stores are in direct competition with regional broad line retail stores. The competing national broad line retailers are generally larger than the Company and the stores of such competitors in the Company's markets are substantially larger, have a somewhat wider selection of merchandise and are very price competitive in some lines of merchandise. Where there are no national or regional broad line retail stores directly competing with the Company's ALCO stores, the Company's custome rs nevertheless shop at broad line retail stores and other retailers located in regional trade centers, and to that extent the Company competes with such broad line stores and retailers. The Company also competes for retail sales with other entities, such as specialty retailers, mass merchandisers, dollar stores and the internet. In the 114 markets in which the Company operates a Class 18 Store, approximately 18,000 square feet, only 14 markets have direct competition from a national or regional broad line retailer. The Company competes with dollar stores in approximately 85 percent of its ALCO stores and approximately 40 percent of its Duckwall stores.

Employees

As of January 31, 2010, the Company employed approximately 4,150 people. Of these employees, approximately 480 were employed in the store support center and distribution center in Abilene, Kansas, and 3,670 in the store locations. Additional employees are hired on a seasonal basis, most of whom are sales personnel. The Company offers a broad range of company-paid benefits to our employees, including a 401(k) plan, medical and dental plans, short-term and long-term disability insurance, paid vacation and merchandise discounts. Eligibility for and the level of these benefits varies depending on the employees' full-time or part-time status and/or length of service. There is no collective bargaining agreement for any of the Company's employees. The Company considers its relations with its employees to be excellent.

Seasonality

The Company, like that of most retailers, is subject to seasonal influences. The Company’s highest sales levels occur in the fourth quarter of its fiscal year, which includes the Christmas holiday selling season. For more information on seasonality, see “Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operation – Seasonality and Quarterly Results.”

Trademarks and Service Marks

The names “Duckwall” and “ALCO” are registered service marks of the Company. The Company considers these marks and the accompanying name recognition to be valuable to the business.

Available Information

The Company files reports with the Securities and Exchange Commission (“SEC”), including Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other reports as required. The public may read and copy any materials the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The Company is an electronic filer and the SEC maintains an Internet site at www.sec.gov that contains the reports, proxy and information statements, and other information filed electronically.

The Company’s internet website is www.ALCOstores.com. Through the “Investors” portion of this website, the Company makes available, free of charge, our proxy statements, Annual Reports on Form 10-K, and any amendments to those reports as soon as reasonably practicable after such material has been filed with, or furnished to, the Securities and Exchange Commission.

Charters of our Board of Directors’ Audit Committee and Compensation Committee; and Code of Business Conduct and Ethics for Directors and Senior Officers as well as for Associates have also been posted on our website, under the caption “Investors - Corporate Governance.”

Information contained on the Company’s website is not part of this Annual Report on Form 10-K. The materials listed above will be provided without charge to any stockholder submitting a written request to the Company’s Secretary at 401 Cottage, Abilene, Kansas 67410-2832.

ITEM 1A. RISK FACTORS

Our business is subject to a variety of risks, most of which are beyond our control.

We are highly susceptible to the state of macroeconomic conditions and consumer confidence in the United States.

All of our stores are located within the United States, making our results highly dependent on U.S. consumer confidence and the health of the U.S. economy. In addition, a significant portion of our total sales is derived from stores located in these states: Kansas, Texas and Nebraska, resulting in further dependence on local economic conditions in these states. Deterioration in macroeconomic conditions and consumer confidence could negatively affect our business in many ways, including slowing sales growth or reduction in overall sales, and reducing gross margins.

We may be forced to lower prices to effectively compete, which would adversely affect our financial results.

The Company operates in the broad line retail business, which is highly competitive. Although the Company prefers markets that don’t have direct competition from national or regional broad line retail stores, competition still exists. Even in non-competitive markets, the Company’s customers shop at broad line retail stores and other retailers located in regional trade centers. The Company also competes for retail sales with other entities, such as specialty retailers, mass merchandisers, dollar stores and the internet. This competitive environment subjects the Company to the risk of reduced profitability because the Company may be forced to lower its prices, resulting in lower margins, in order to maintain its competitive position.

If we cannot effectively open new stores, our ability to improve our financial results will be adversely affected.

The growth in the Company’s sales and operating net income depends to a substantial degree on its expansion program. This expansion strategy is dependent upon the Company’s ability to open and operate new stores effectively, efficiently and on a profitable basis. The Company prefers to locate its ALCO stores in smaller retail markets where no competing broad line retail store is located within the primary trade area. The Company’s ability to open new stores timely and to expand into additional market areas depends in part on the following factors: availability of store locations, the ability to hire and train new store personnel, the ability to react to consumer needs and trends on a timely basis, and the availability of sufficient capital for expansion.

If we are unable to access the capital markets or obtain bank credit, our growth plans, liquidity and results of operations could suffer.

Disruptions in the capital and credit markets, as have been experienced during fiscal 2010, could adversely affect the ability of lenders to meet their commitments. Our access to funds under the credit facility is dependent on the ability of the banks that are parties to the facility to meet their funding commitments. Those banks may not be able to meet their funding commitments to us if they experience shortages of capital and liquidity or if they experience excessive volumes of borrowing requests within a short period of time.

Constrained capital markets could threaten our liquidity and capital resources. Longer term disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives, or failures of significant financial institutions could adversely affect our access to liquidity needed for our business. Any disruption could require us to take measures to conserve cash until the markets stabilize or until alternative credit arrangements or other funding for our business needs can be arranged. Such measures could include deferring capital expenditures and reducing other discretionary uses of cash. We believe operating cash flows and current credit facilities will be adequate to fund our working capital requirements, scheduled debt repayments and to support the development of our sho rt-term and long-term operating strategies.

If we cannot effectively implement or use information technology, our financial results and operations would be adversely affected.

If we cannot effectively implement technology upgrades, it could have a material impact on the Company’s results of operations. The Company depends on information systems to process transactions, manage inventory, purchase, sell and ship goods on a timely basis. Any material disruption or slowdown of our systems could cause information to be lost or delayed which could have a negative effect on our business.

Changes in federal, state or local laws and regulations, or our failure to comply with such laws and regulations, could increase our expenses and expose us to legal risks.

Our business is subject to a wide array of laws and regulations. Significant legislative changes that impact our relationship with our workforce (none of which is represented by unions as of the end of fiscal 2010) could increase our expenses and adversely affect our operations. Examples of possible legislative changes impacting our relationship with our workforce include changes to minimum wage requirements and health care mandates. In addition, certain aspects of our business, such as credit card operations, are more heavily regulated than other areas. Changes in the regulatory environmental regarding topics such as banking and consumer credit, privacy and information security, product safety or environmental protection, among others, could cause our expenses to in crease. In addition, if we fail to comply with applicable laws and regulations, particularly wage and hour laws, we could be subject to legal risk, including governmental enforcement action and class action civil litigation, which could adversely affect our results of operations.

A failure to design, implement or maintain an adequate system of internal controls could adversely affect our ability to manage our business or detect fraud.

The Company is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting for external purposes in accordance with U.S. generally accepted accounting principles (GAAP). Internal control over financial reporting includes: maintaining records that in reasonable detail accurately and fairly reflect our transactions; providing reasonable assurance that transactions are recorded as necessary for preparation of the financial statements; providing reasonable assurance that our receipts and expenditures of our assets are made in accordance with management authorization; and providing reasonable assurance that unauthorized acquisition, use or disposition of o ur assets that could have a material effect on the financial statements would be prevented or detected on a timely basis. Because of its inherent limitations, internal control over financial reporting is not intended to provide absolute assurance that a misstatement of our financial statements would be prevented or detected. Any failure to maintain an effective system of internal control over financial reporting could limit our ability to report our financial results accurately and timely or to detect and prevent fraud. The Company continues to refine and test its internal control over financial reporting processes.

Our results are subject to seasonal variations.

Quarterly results of operations have historically fluctuated as a result of retail consumers purchasing patterns, with the highest quarter in terms of sales and profitability being the fourth quarter. Quarterly results of operations will likely continue to fluctuate significantly as a result of such patterns and may fluctuate due to the timing of new store openings.

Our stock price may be volatile.

No assurance can be given that operating results will not vary from quarter to quarter, and any fluctuations in quarterly operating results may result in volatility in the Company’s stock price.

We are dependent on key personnel.

The development of the Company’s business is largely dependent on the efforts of its current management team headed by Richard E. Wilson and four other executive officers. The loss of the services of one or more of these officers could have a material adverse effect on the Company.

We are exposed to interest rate risks.

The Company is subject to market risk from exposure to changes in interest rates based on its financing requirements. Changes in interest rates could have a negative impact on the Company’s profitability.

If we fail to anticipate and respond quickly to changing consumer preferences, our sales, gross margin and profitability could suffer.

A substantial part of our business is dependent on our ability to make trend-right decisions in apparel, home décor, seasonal offerings and other merchandise. Failure to accurately predict constantly changing consumer tastes, preferences, spending patterns and other lifestyles decisions could lead to lost sales, increased markdowns on inventory and adversely affect our results of operations.

Interruptions in our supply chain could adversely affect our results.

We are dependent on our vendors to supply merchandise in a timely and efficient manner. If a vendor fails to deliver on its commitments, whether due to financial difficulties or other reasons, we could experience merchandise shortages that could lead to lost sales. In addition, a large portion of our merchandise is sourced, directly or indirectly, from outside the United States, with China as our single largest source. Political or financial instability, trade restrictions, tariffs, currency exchange rates, the outbreak of pandemics, labor unrest, transport capacity and costs, port security or other events that could slow port activities and impact foreign trade are beyond our control and could disrupt our supply of merchandise and adversely affect our results of operations.

Lack of availability of suitable locations in which to build new stores could slow our growth, and difficulty in executing plans for new stores, expansions and remodels could increase our costs and capital requirements.

Our future growth is dependent, in part, on our ability to build new stores and expand and remodel existing stores in a manner that achieves appropriate returns on our capital investment. We compete with other retailers and businesses for suitable locations for our stores. In addition, for many sites we are dependent on a third party developer's ability to acquire land, obtain financing and secure the necessary zoning changes and permits for a larger project, of which our store may be one component. Turmoil in the financial markets has made it difficult for third party developers to obtain financing for new projects. Local land use and other regulations applicable to the types of stores we desire to construct may affect our ability to find suitable locations and also influence the c ost of constructing, expanding and remodeling our stores.

Product safety concerns could adversely affect our sales and results of operations.

If our merchandise offerings, including food, drug and children’s products, do not meet applicable safety standards or our guests’ expectations regarding safety, we could experience lost sales, experience increased costs and be exposed to legal and reputational risk. All of our vendors must comply with applicable product safety laws, and we are dependent on them to ensure that the products we buy comply with all safety standards. Events that give rise to actual, potential or perceived product safety concerns, including food or drug contamination, could expose us to governmental enforcement action or private litigation and result in costly product recalls and other liabilities. In addition, negative customer perceptions regarding the safety of the products we sell could cause our custom ers to seek alternative sources for their needs, resulting in lost sales. In those circumstances, it may be difficult and costly for us to regain the confidence of our customers.

If we fail to protect the security of personal information about our customer, we could be subject to costly government enforcement actions or private litigation and our reputation could suffer.

The nature of our experience involves the receipt and storage of personal information about our customers. If we experience a data security breach, we could be exposed to governmental enforcement actions and private litigation. In addition, our customers could lose confidence in our ability to protect their personal information, which could cause them to discontinue usage of our credit card products or stop shopping at our stores altogether. Such events could lead to lost future sales and adversely affect our results of operations.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

The Company owns facilities in Abilene, Kansas that consist of a store support center (approximately 35,000 square feet), the Distribution Center (approximately 352,000 square feet) and additional warehouse space adjacent to the store support center (approximately 95,500 square feet).

Three of the ALCO stores and one of the Duckwall stores operate in buildings owned by the Company. The remainder of the stores operate in properties leased by the Company. As of January 31, 2010, such ALCO leases account for approximately 4,300,000 square feet of lease space, which expire as follows: approximately 454,000 square feet (10.6%) expire between February 1, 2010 and January 30, 2011; approximately 387,000 square feet (9.0%) expire between January 31, 2011 and January 29, 2012; and approximately 643,000 square feet (15.0%) expire between January 30, 2012 and February 3, 2013. The remainder of the leases expire through 2031. All Duckwall store leases have terms remaining of 42 months or less. The majority of the leases that are about to expire have renewal options with lease terms that are the same as the existing l ease.

Other than routine litigation from time to time in the ordinary course of business, the Company is not a party to any material litigation.

PART II

| ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Common Stock of the Company is quoted on the NASDAQ National Market tier of The NASDAQ Stock Market under the symbol “DUCK”. The following table sets forth the range of high and low bid information for the Company's Common Stock for each quarter of fiscal 2010 and 2009.

| Fiscal 2010 | | High | | | Low | |

| First quarter | | $ | 11.34 | | | $ | 7.77 | |

| Second quarter | | $ | 19.14 | | | $ | 11.35 | |

| Third quarter | | $ | 18.21 | | | $ | 15.89 | |

| Fourth quarter | | $ | 17.60 | | | $ | 11.85 | |

| | | | | | | | | |

| Fiscal 2009 | | High | | | Low | |

| First quarter | | $ | 23.88 | | | $ | 10.55 | |

| Second quarter | | $ | 16.05 | | | $ | 9.04 | |

| Third quarter | | $ | 16.29 | | | $ | 10.51 | |

| Fourth quarter | | $ | 13.15 | | | $ | 7.52 | |

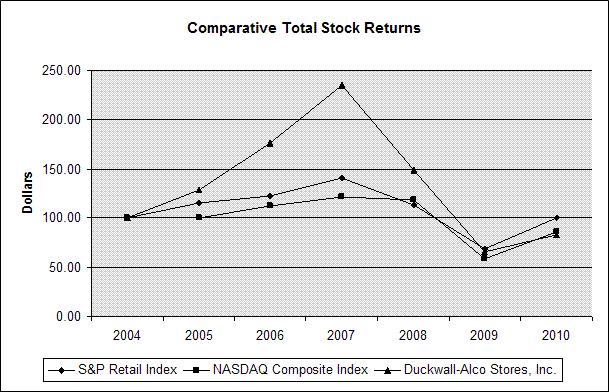

The following graph compares the cumulative total return of the Company, the NASDAQ Composite Index, and the S&P Retail Index (assuming dividends reinvested at the end of each subsequent fiscal year). The graph assumes $100 was invested on February 2, 2004 in Duckwall-ALCO Stores, Inc. Common Stock, the NASDAQ Composite Index, and the S&P Retail Index.

| | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| NASDAQ Composite Index | | | 100.00 | | | | 99.91 | | | | 112.72 | | | | 121.28 | | | | 118.40 | | | | 59.00 | | | | 85.89 | |

| S&P Retail Index | | | 100.00 | | | | 115.41 | | | | 122.43 | | | | 140.37 | | | | 113.09 | | | | 69.07 | | | | 100.06 | |

| Duckwall-ALCO Stores, Inc. | | | 100.00 | | | | 128.21 | | | | 176.07 | | | | 234.40 | | | | 148.61 | | | | 65.33 | | | | 82.98 | |

Based upon the data reflected in the table, at January 31, 2010, a $100 investment in the Company's Common Stock in 2004 would have a total return value of $82.98, as compared to $85.89 for the Composite NASDAQ Index and $100.06 for the S&P Retail Index.

There can be no assurances that the Company's stock performance will continue into the future with the same or similar trends depicted in the graph above. The Company does not make or endorse any predictions as to future stock performance. We did not sell any equity securities during fiscal 2010 which were not registered under the Securities Act.

As of April 15, 2010, there were approximately 1,200 holders of record of the Common Stock of the Company. The Company has not paid cash dividends on its Common Stock during the last five fiscal years. The terms of the Security Agreement, dated as of February 10, 2010, between the Company and Bank of America allow for the payment of dividends unless certain loan covenants are triggered, which did not occur in fiscal 2010 and are not expected to occur during fiscal 2011.

Company Repurchases of Common Stock

| | | | | | | | | | | | Maximum Number | |

| | | | | | | | | Total Number of | | | (or Approximate Dollar | |

| | | | | | | | | shares (or Units) | | | Value) of Shares (or | |

| | | Total Number Of | | | | | | Purchased as Part | | | Units) that May Yet | |

| | | Shares (or Units) | | | Average Price Paid | | | of Publicly Announced | | | Be Purchased Under | |

| Period | | Purchased | | | per Share (or Unit) | | | Plans or Programs | | | the Plans or Programs | |

| First Quarter | | | - | | | | - | | | | - | | | | 174,466 | |

| Second Quarter | | | - | | | | - | | | | - | | | | 174,466 | |

| Third Quarter | | | - | | | | - | | | | - | | | | 174,466 | |

| | | | | | | | | | | | | | | | | |

| Fourth Quarter: | | | | | | | | | | | | | | | | |

| 11/02/09 - 11/29/09 | | | - | | | | - | | | | - | | | | 174,466 | |

| 11/30/09 - 01/03/10 | | | - | | | | - | | | | - | | | | 174,466 | |

| 01/04/10 - 01/31/10 | | | - | | | | - | | | | - | | | | 174,466 | |

| | | | - | | | | | | | | - | | | | 174,466 | |

| | | | | | | | | | | | | | | | | |

| As of January 31, 2010 | | | 25,534 | | | $ | 15.16 | | | | 25,534 | | | | 174,466 | |

| | | | | | | | | | | | | | | | | |

On July 1, 2008, the Company entered into a Stock Purchase Agreement with Lawrence J. Zigerelli as part his starting employment at the Company. Mr. Zigerelli purchased 10,000 shares of the Company’s common stock. The purchase price was $9.05 which was the closing price of the stock on the NASDAQ Global Market on the date of the agreement. The agreement was executed in reliance upon the exemption from securities registration afforded by Section 4(2) of the Securities Act. The proceeds of this transaction were used by the Company for general purposes.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

The Company did not sell any equity securities during fiscal 2010 that were not registered under the Securities Act.

Securities Authorized For Issuance Under Equity Compensation Plans

See the information provided in the “Equity Compensation Plan Information” section of the Proxy Statement for our Annual Meeting of Stockholders on or about June 3, 2010, which information is incorporated herein by reference.

ITEM 6. SELECTED FINANCIAL DATA

SELECTED CONSOLIDATED FINANCIAL DATA

(dollars in thousands, except per share and store data)

| | | Fiscal Year Ended | |

| | | 52 Weeks | | | 52 Weeks | | | 53 Weeks | | | 52 Weeks | | | 52 Weeks | |

| | | January 31, | | | February 1, | | | February 3, | | | January 28, | | | January 29, | |

| Statement of Operations Data | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Net sales | | $ | 488,691 | | | | 489,753 | | | | 481,475 | | | | 446,575 | | | | 408,272 | |

| Cost of sales | | | 330,179 | | | | 335,934 | | | | 329,195 | | | | 304,653 | | | | 277,060 | |

| Gross margin | | | 158,512 | | | | 153,819 | | | | 152,280 | | | | 141,922 | | | | 131,212 | |

| | | | | | | | | | | | | | | | | | | | | |

| Selling, general and administrative (1) | | | 141,208 | | | | 147,735 | | | | 138,250 | | | | 123,564 | | | | 117,115 | |

| Depreciation and amortization (2) | | | 9,983 | | | | 9,302 | | | | 9,463 | | | | 6,512 | | | | 5,632 | |

| Operating income (loss) from continuing operations | | | 7,321 | | | | (3,218 | ) | | | 4,567 | | | | 11,846 | | | | 8,465 | |

| Interest expense | | | 2,149 | | | | 1,867 | | | | 3,382 | | | | 2,729 | | | | 1,272 | |

| Earnings (loss) from continuing operations before | | | | | | | | | | | | | | | | | | | | |

| income taxes | | | 5,172 | | | | (5,085 | ) | | | 1,185 | | | | 9,117 | | | | 7,193 | |

| Income tax expense (benefit) | | | 2,135 | | | | (2,080 | ) | | | 394 | | | | 3,213 | | | | 2,188 | |

| Earnings (loss) from continuing operations | | | 3,037 | | | | (3,005 | ) | | | 790 | | | | 5,904 | | | | 5,005 | |

| Loss from discontinued operations, net | | | | | | | | | | | | | | | | | | | | |

| of income tax benefit | | | (42 | ) | | | (1,971 | ) | | | (1,015 | ) | | | (200 | ) | | | (3,056 | ) |

| Net earnings (loss) (1)(2) | | $ | 2,995 | | | | (4,976 | ) | | | (224 | ) | | | 5,704 | | | | 1,949 | |

| | | | | | | | | | | | | | | | | | | | | |

| Per Share Information | | | | | | | | | | | | | | | | | | | | |

| Earnings (loss) per share - basic | | | | | | | | | | | | | | | | | | | | |

| Earnings (loss) from continuing operations | | $ | 0.80 | | | | (0.79 | ) | | | 0.21 | | | | 1.56 | | | | 1.23 | |

| Discontinued operations | | | (0.01 | ) | | | (0.52 | ) | | | (0.27 | ) | | | (0.05 | ) | | | (0.75 | ) |

| Net earnings (loss) | | $ | 0.79 | | | | (1.31 | ) | | | (0.06 | ) | | | 1.51 | | | | 0.48 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Earnings (loss) per share - diluted | | | | | | | | | | | | | | | | | | | | |

| Earnings (loss) from continuing operations | | $ | 0.78 | | | | (0.79 | ) | | | 0.21 | | | | 1.54 | | | | 1.22 | |

| Discontinued operations | | | (0.01 | ) | | | (0.52 | ) | | | (0.27 | ) | | | (0.05 | ) | | | (0.74 | ) |

| Net earnings (loss) | | $ | 0.77 | | | | (1.31 | ) | | | (0.06 | ) | | | 1.49 | | | | 0.48 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 3,797,947 | | | | 3,809,109 | | | | 3,807,033 | | | | 3,792,202 | | | | 4,083,798 | |

| Diluted | | | 3,879,656 | | | | 3,809,109 | | | | 3,807,033 | | | | 3,828,928 | | | | 4,117,922 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating Data | | | | | | | | | | | | | | | | | | | | |

| Stores open at year-end | | | 258 | | | | 257 | | | | 242 | | | | 224 | | | | 218 | |

| Stores in non-competitive markets at year-end (3) | | | 199 | | | | 199 | | | | 185 | | | | 170 | | | | 168 | |

| Same-same stores at year-end (4) | | | 257 | | | | 224 | | | | 218 | | | | 214 | | | | 208 | |

| | | | | | | | | | | | | | | | | | | | | |

| Percentage of total stores in non-competitive | | | | | | | | | | | | | | | | | | | | |

| markets (3) | | | 77.1 | % | | | 77.4 | % | | | 76.4 | % | | | 75.9 | % | | | 77.1 | % |

| Percentage of net sales from stores in | | | | | | | | | | | | | | | | | | | | |

| non-competitive markets, excluding fuel (3)(5) | | | 82.6 | % | | | 83.0 | % | | | 81.8 | % | | | 82.3 | % | | | 82.6 | % |

| Same-store sales increase (decrease) for all stores, | | | | | | | | | | | | | | | | | | | | |

| excluding fuel (4) | | | (0.7 | )% | | | (5.1 | )% | | | 1.8 | % | | | 4.9 | % | | | 3.4 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Data | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 194,808 | | | | 208,775 | | | | 185,386 | | | | 195,420 | | | | 178,992 | |

| Total debt (includes capital lease | | | | | | | | | | | | | | | | | | | | |

| obligation and current maturities) | | | 40,992 | | | | 49,841 | | | | 33,013 | | | | 29,988 | | | | 26,240 | |

| Stockholders' equity | | $ | 105,733 | | | | 102,040 | | | | 107,172 | | | | 106,060 | | | | 102,147 | |

| (1) | Included in selling, general and administrative expenses is $757 of share-based compensation in fiscal 2010, $186 in fiscal 2009, $1.1 million in fiscal 2008, respectively. No expense was recorded for share-based compensation in earlier years. |

| | |

| (2) | An asset impairment charge is included in depreciation and amortization of $831 for fiscal 2010, $1.3 million for fiscal 2009, $2.1 million for fiscal 2008 and $130 for fiscal 2007, respectively. For fiscal 2009, $299 of the impairment is attributable to writing down the carrying value on property held for sale. |

| | |

| (3) | “Non-competitive” markets refer to those markets where there is not a national or regional broad line retail store located in the primary market served by the Company. The Company's stores in such non-competitive markets nevertheless face competition from various sources. See Item 1 “Business-Competition”. |

| | |

| (4) | Percentages, as adjusted to a comparable 52 week year, reflect the increase or decrease based upon a comparison of the applicable fiscal year with the immediately preceding fiscal year for stores open during the entirety of both years. For fiscal 2008, sales were reduced by the week 53 amount. |

| | |

| (5) | In fiscal 2010, the Company began including stores as same-stores in their fourteenth fiscal period of operation. |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

Overview

Economic conditions: The current economic slowdown has caused disruptions and significant volatility in financial markets, increased rates of mortgage loan default and personal bankruptcy, and declining consumer and business confidence, which has led to decreased customer traffic and reduced levels of consumer spending, particularly on discretionary items. This decline in consumer and business confidence and the decreased levels of customer traffic and consumer spending have negatively impacted our business. We cannot predict how long the current economically challenging conditions will persist and how such conditions might affect us and our cust omers. Decreased customer traffic and reduced consumer spending, particularly on discretionary items, would, however, over an extended period of time negatively affect our financial condition, operating performance, revenues and income.

Operations. The Company is a regional broad line retailer operating in 23 states in the central United States.

The Company’s fiscal year ends on the Sunday closest to January 31. Fiscal years 2010 and 2009 consisted of 52 weeks and fiscal year 2008 consisted of 53 weeks, respectively. For purposes of this management's discussion and analysis of financial condition and results of operations, the financial numbers are presented in thousands.

Strategy. The Company’s overall business strategy involves identifying and opening stores in locations that will provide the Company with the highest return on investment. The Company prefers markets that do not have direct competition from national or regional broad line retail stores. The Company also competes for retail sales with other entities, such as mail order companies, specialty retailers, stores, manufacturer’s outlets and the internet.

The Company uses a variety of broad-based targeted marketing and advertising strategies to reach consumers. These strategies include full-color photography advertising circulars of eight to 20 pages distributed through newspaper insertion or, in the case of inadequate newspaper coverage, through direct mail. During fiscal 2010, these circulars were distributed 47 times in ALCO markets. For fiscal 2011, the Company currently intends to distribute these circulars a similar number of times in the ALCO markets. The Company also uses in-store marketing. The Company’s merchandising and marketing teams work together to present the products in an engaging and innovative manner, which is coordinated so that it is consistent with the current print advertisements. The Company regularly changes its banners and in-store promotions, which are advertised throughout the year, to attract consumers to visit the stores, to generate strong customer frequency and to increase average sales per customer. Net marketing and promotion costs represented approximately 1.0%, 0.8% and 0.9% of net sales in fiscal years 2010, 2009 and 2008. Management believes it has developed a comprehensive marketing strategy that will increase customer traffic and same-store sales. The Company continues to operate as a high low retailer and has included in many of its marketing vehicles cross departmental products. For example, the Company has used an Elder Care page with over-the-counter products, “as seen on TV” items, and dry meals—all targeting customers who have reached retirement age. The Company believes that by providing the breadth of these key items to this tar geted audience we can serve our customers’ needs more efficiently and garner a greater share of the purchases made by this demographic. The Company’s ALCO stores offer a broad line of merchandise consisting of approximately 35,000 items, including automotive, candy, crafts, domestics, electronics, fabrics, furniture, hardware, health and beauty aids, housewares, jewelry, ladies’, men’s and children’s apparel and shoes, pre-recorded music and video, sporting goods, seasonal items, stationery and toys. The Company’s smaller Duckwall stores offer a more limited selection of similar merchandise. The Company is constantly evaluating the appropriate mix of merchandise to improve sales and gross margin performance. Corporate merchandising is provided to each store to ensure a consistent company-wide store presentation. To facilitate long-term merchandising plann ing, the Company divides its merchandise into three core categories: primary, secondary, and convenience. The primary core receives management’s primary focus, with a wide assortment of merchandise being placed in the most accessible locations within the stores and receiving significant promotional consideration. The secondary core consists of categories of merchandise for which the Company maintains a strong assortment that is easily and readily identifiable by its customers. The convenience core consists of categories of merchandise for which the Company maintains convenient (but limited) assortments, focusing on key items that are in keeping with customers’ expectations for a broad line retail store. Secondary and convenience cores include merchandise that the Company feels is important to carry, as the target customer expects to find them within a broad line retail store and they ensure a high level of customer traffic. The Company contin ually evaluates and ranks all product lines, shifting product classifications when necessary to reflect the changing demand for products. In addition, the Company’s merchandising systems are designed to integrate the key retailing functions of seasonal merchandise planning, purchase order management, merchandise distribution, sales information and inventory maintenance and replenishment. All of the Company’s ALCO stores have point-of-service computer terminals that capture sales information and transmit such information to the Company’s data processing facilities where it is used to drive management, financial, and supply chain functions.

Recent Events.

| · | The Company completed its store transformation project during fiscal 2010. The store transformation project involved two principal components: improving work processes and shrink reduction. Improving work processes principally involved industrial engineering of work flow, stocking, cleanliness, and the efficient use of labor within our stores. Shrink reduction principally involved improving paperwork processing and vendor receipts and returns processes, cashier monitoring, manager override monitoring, reducing customer and employee theft, and enhancing physical security. During fiscal 2010, the Company achieved store level labor and benefit savings improvement of approximately $4.2 million. In addition, for fiscal 2010, the Company experienced an approximate $1.4 million decrease in gross margin due to shrink increase. Increases in shrink are contrary to the desired result of our store transformation project. In order to address the increase in shrink that we experienced, the Company has implemented a Company-wide Shrink Awareness Program to devote additional efforts to improving paperwork processing, the vendor receipts and returns processes, cashier monitoring, and manager override monitoring, reducing customer and employee theft, and enhancing physical security. |

| · | On January 29, 2010 the Company received a United States Securities and Exchange Commission Comment Letter regarding the Company's Annual Report on Form 10-K for the Year Ended February 1, 2009, Filed on April 17, 2009, File No. 0-20269, and Related Filings. The Company completed and provided its response to the Comment Letter on March 5, 2010. The Company received a follow-up Comment Letter on March 18, 2010. The Company responded to the follow-up letter on April 1, 2010. On April 13, 2010, the Company received notification from the United States Securities and Exchange Commission that they had completed their review of the Company's responses and had no further comments. |

| · | On February 10, 2010, the Company closed on an Amended and Restated Credit Agreement (the "Facility") with Bank of America, N.A. and Wells Fargo Retail Finance, LLC. The $120 million Facility has a term of four years and replaces the Company's previous revolving credit facility which was in the amount of $105 million. |

| · | Richard E. Wilson joined the Company on February 15, 2010 to become the President-Chief Executive Officer |

| · | Lawrence J. Zigerelli, President – Chief Executive Officer resigned from the Company on February 19, 2010 |

| · | James M. Spencer, Senior Vice President - Store Operations resigned from the Company on February 26, 2010 |

| · | James Worth, Director, resigned from the Board of Directors on March 2, 2010 |

| · | On March 18, 2010, the Company filed Form S-8 with the Securities and Exchange Commission registering the shares of the Company's Non-Qualified Stock Option Agreement and the Company's Incentive Stock Option Plan. |

| · | Lawrence J. Zigerelli exercised his vested options for 27,500 shares on March 19, 2010. Of which, 25,000 were vested under the Incentive Stock Option Plan and 2,500 were vested under the Non-Qualified Stock Option Agreement. |

| · | James M. Spencer elected net exercise for vested options, receiving 1,405 shares on March 19, 2010 under the Incentive Stock Option Plan |

| · | The Company has closed four Duckwall Stores during the first quarter of fiscal 2011. They were located in underperforming markets and were at the end of their lease term. |

Key Items in Fiscal 2010.

The Company measures itself against a number of financial metrics to assess its performance. Some of the important financial items during fiscal 2010 were:

| · | Net sales decreased 0.2% to $488.7 million. Same-store sales decreased 0.7%, excluding the Company's two fuel centers, compared to the prior year. |

| · | Gross margin increased to 32.4% of sales, compared to 31.4% in the prior year. Excluding the prior year first quarter $1.3 million inventory review initiative charge, fiscal 2009 gross margin is 31.7%. |

| · | Selling, general and administrative (SG&A) expenses were 28.9% of sales, compared to 30.2% in the prior year. Excluding the prior year executive and staff severance along with the current and prior year store transformation project expenses, preopening costs and share-based compensation, fiscal 2010 and fiscal 2009 SG&A expenses, as a percent of sales, were 28.3% and 28.9%, respectively. |

| · | Net earnings per diluted share was $0.79, compared to a loss of ($1.31) per diluted share in the prior year. |

| · | Return on average equity was 2.9%, compared to (4.8%) in the prior year. |

Gross margin percentage is a key measure of the Company's ability to maximize profit on the purchase and subsequent sale of merchandise, while minimizing promotional and clearance markdowns, shrinkage, damage and returns. Gross margin percentage is defined as sales less cost of sales, expressed as a percentage of sales.

Selling, general and administrative expenses are a measure of the Company’s ability to manage and control its expenses to purchase, distribute and sell merchandise.

Earnings (loss) per share ("EPS") is an indicator of the returns generated for the Company's stockholders. EPS from continuing operations was $0.78 per diluted share for fiscal 2010, compared to ($0.79) per diluted share for the prior fiscal year. Return on average equity is a measure of how much income was produced on the average equity of the Company.

Results of Operations. The following table sets forth, for the fiscal years indicated, the components of the Company's consolidated statements of operations expressed as a percentage of net sales:

| | | Fiscal Year Ended | |

| | | 52 Weeks | | | 52 Weeks | | | 53 Weeks | |

| | | January 31, | | | February 1, | | | February 3, | |

| | | 2010 | | | 2009 | | | 2008 | |

| Net sales | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| Cost of sales | | | 67.6 | | | | 68.6 | | | | 68.4 | |

| Gross margin | | | 32.4 | | | | 31.4 | | | | 31.6 | |

| Selling, general and administrative | | | 28.9 | | | | 30.2 | | | | 28.7 | |

| Depreciation and amortization | | | 2.0 | | | | 1.9 | | | | 2.0 | |

| Total operating expenses | | | 30.9 | | | | 32.1 | | | | 30.7 | |

| Operating income (loss) from continuing operations | | | 1.5 | | | | (0.7 | ) | | | 0.9 | |

| Interest expense | | | 0.4 | | | | 0.4 | | | | 0.7 | |

Earnings (loss) from continuing operations before income taxes | | | 1.1 | | | | (1.1 | ) | | | 0.2 | |

| Income tax expense (benefit) | | | 0.4 | | | | (0.4 | ) | | | 0.1 | |

| Earnings (loss) from continuing operations | | | 0.7 | | | | (0.7 | ) | | | 0.1 | |

| Loss from discontinued operations, net of income tax benefit | | | 0.0 | | | | (0.4 | ) | | | (0.2 | ) |

| Net earnings (loss) | | | 0.7 | % | | | (1.1 | ) % | | | (0.1 | )% |

Critical Accounting Policies

Our analysis of operations and financial condition is based on our consolidated financial statements, prepared in accordance with U.S. GAAP. Preparation of these consolidated financial statements requires us to make estimates and assumptions affecting the reported amounts of assets and liabilities at the date of the financial statements, reported amounts of revenues and expenses during the reporting period and related disclosures of contingent assets and liabilities. In the Notes to Consolidated Financial Statements, we describe our significant accounting policies used in preparing the consolidated financial statements. Our estimates are evaluated on an ongoing basis and are drawn from historical experience and other assumptions that we believe to be reasonable under the circumstances. Actual results could differ from these estimates. The following items in our consolidated financial statements require significant estimation or judgment:

Inventory: As discussed in Note 1(d) to the Consolidated Financial Statements, inventories are stated at the lower of cost or net realizable value with cost determined using the last-in, first-out “LIFO” method. Merchandise inventories in our stores are valued by the retail method. The retail method is widely used in the retail industry due to its practicality. Under the retail method, cost is determined by applying a calculated cost-to-retail ratio across groupings of similar items, known as departments. As a result, the retail method results in an averaging of inventory costs across similar items within a department. The cost-to-retail ratio is applied to ending inventory at its current owned retail valuation to determine the cost of ending inventory on a depa rtment basis. Current owned retail represents the retail price for which merchandise is offered for sale on a regular basis reduced for any permanent or clearance markdowns. Use of the retail method does not eliminate the use of management judgments and estimates, including markdowns and shrinkage, which significantly impact the ending inventory valuation at cost and the resulting gross margins. The Company continually evaluates product categories to determine if markdown action is appropriate, or if a markdown reserve should be established. As markdowns are taken as a reduction of the retail value of inventories, the Company recognizes the retail method results in valuing inventories at lower of cost or market. Management believes that the retail method provides an inventory valuation which reasonably approximates cost and results in carrying inventory at the lower of cost or market. For LIFO, the Company determines lower of cost or market by pool.

Insurance: The Company retains significant deductibles on its insurance policies for workers compensation, general liability, medical claims and prescriptions. Due to the fact that it often takes more than one year to determine the actual costs, these costs are estimated based on the Company’s historical loss experience and estimates from the insurance carriers and consultants. The Company completes an actuarial evaluation of its loss experience twice each year. In between actuarial evaluations, management monitors the cost and number of claims and compares those results to historical amounts. The Company’s actuarial method is the fully developed method. The Company records its reserves on an undiscounted basis. The Company’s prior estimates have varied fr om actual results due to differences related to actual claims versus estimated ultimate loss calculations. Current and future estimates could be affected by changes in those same assumptions and are reasonably likely to occur.

Consideration received from vendors: Cost of sales and SG&A expenses are partially offset by various forms of consideration received from our vendors. This “vendor income” is earned for a variety of vendor-sponsored programs, such as volume rebates, markdown allowances, promotions, warehouse cost reimbursement and advertising. Consideration received, to the extent that it reimburses specific, incremental and identifiable costs incurred to date, is recorded in selling, general and administrative expenses in the same period as the associated expenses are incurred. Reimbursements received that are in excess of specific, incremental and identifiable costs incurred to date are recognized as a reduction to the cost of the merchandise pur chased and are reflected in costs of sales as the merchandise is sold. The Company establishes a receivable for the vendor income that is earned but not yet received. Based on provisions of the agreements in place, this receivable is computed by estimating when the Company has completed its performance and the amount has been earned. The majority of year-end receivables associated with these activities are collected within the following fiscal quarter.

Analysis of long-lived assets for impairment: The Company reviews assets for impairment at the lowest level for which there are identifiable cash flows, usually at the store level. The carrying amount of assets is compared with the expected undiscounted future cash flows to be generated by those assets over their estimated remaining economic lives. If the undiscounted cash flows are less than the carrying amount of the asset, the asset is written down to fair value. Factors that could result in an impairment review include, but are not limited to, a current period cash flow loss combined with a history of cash flow losses or a projection that demonstrates continuing losses associated with the use of a long-lived asset, or signific ant changes in a manner of use of the assets due to business strategies or competitive environment. Additionally, when a commitment is made to close a store in a period beyond the quarter in which the closure commitment is made, it is reviewed for impairment and depreciable lives are adjusted. The impairment evaluation is based on the estimated cash flows from continuing use until the expected disposal date plus the expected terminal value. Actual results could vary from management estimates.

Income Taxes: The Company adopted Accounting Standards Codification (ASC) Topic 740, on January 29, 2007. ASC Topic 740 prescribes a recognition threshold and a measurement standard for the financial statement recognition and measurement of tax positions taken or expected to be taken in a tax return. The recognition and measurement of tax benefits is often highly judgmental. Determinations regarding the recognition and measurement of a tax benefit can change as additional developments occur relative to the issue. Accordingly, the Company’s future results may include favorable or unfavorable adjustments to our liability for uncertain tax positions.

The Company records valuation allowances against our deferred tax assets, when necessary. Realization of deferred tax assets (such as net operating loss carryforwards) is dependent on future taxable earnings and is therefore uncertain. The Company will assess the likelihood that our deferred tax assets in each of the jurisdictions in which it operates will be recovered from future taxable income. Deferred tax assets are reduced by a valuation allowance to recognize the extent to which, more likely than not, the future tax benefits will not be realized.

Share-Based Compensation: The Company has a share-based compensation plan, which includes non-qualified stock options and nonvested share awards. See Note 1(q), Summary of Significant Accounting Policies, and Note 10, Share-based Compensation, to the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K, for a complete discussion of our stock-based compensation programs. We determine the fair value of our non-qualified stock option awards at the date of grant using option-pricing models. We determi ne the fair value of our share awards at the date of grant using generally accepted valuation techniques. Management reviews its assumptions and the valuations to determine the fair value of share-based compensation awards.

Customer Loyalty Program: The Company has a customer loyalty program which allows members to earn points for each purchase completed at any of our stores. Points earned enable members to receive a certificate that may be redeemed on future purchases at our stores. The value of points earned by our customer loyalty program members is included in accrued liabilities, based on the value of points that are projected to be redeemed, and recorded as a reduction in revenue at the time the points are redeemed.

Fiscal 2010 Compared to Fiscal 2009

Net sales for fiscal 2010 decreased $1.1 million or 0.2% to $488.7 million compared to $489.8 million for fiscal 2009. During fiscal 2010, the Company opened one ALCO store. No ALCO stores were closed and one Duckwall store was closed, resulting in a year end total of 258 stores. Net sales from same-stores decreased by $3.3 million or 0.7%, excluding the two fuel centers, in fiscal 2010 compared to fiscal 2009. Fuel sales decreased $4.7 million, in fiscal 2010 compared to fiscal 2009. Sales from non same-stores increased $7.3 million, in fiscal 2010 compared to fiscal 2009.

Gross margin for fiscal 2010 increased $4.7 million, or 3.1%, to $158.5 million compared to $153.8 million in fiscal 2009. As a percentage of net sales, gross margin increased to 32.4% in fiscal 2010 compared to 31.4% in fiscal 2009. Fiscal 2010 gross margin was positively impacted by reduced markdowns of $3.4 million, increased non same-store margin of $2.4 million and reduced freight expense of $1.7 million offset by increased shri nk of $1.4 million and reduced new store allowances of $1.1 million. The decline in markdowns was the result of an inventory position more representative of customer demands in fiscal 2010 when compared to fiscal 2009. Reduced miles driven and a lower per mile freight rate allowed for less freight expense in fiscal 2010 when compared to fiscal 2009. The increase in shrink is contrary to the desired result of our store transformation project. In order to address the increase in shrink that we experienced, the Company has implemented a Company-wide Shrink Awareness Program to devote additional efforts to improving paperwork processing, the vendor receipts and returns processes, cashier monitoring, and manager override monitoring, reducing customer and employee theft, and enhancing physical security. The decline in new store allowances was due to reduced store opens in fiscal 2010 com pared to fiscal 2009. Fiscal 2009 cost of sales included a $1.3 million inventory review initiative charge. Excluding this charge from fiscal 2009, gross margin is 31.7%.

Selling, general and administrative expenses decreased $6.5 million or 4.4% to $141.2 million in fiscal 2010 compared to $147.7 million in fiscal 2009. As a percentage of net sales, selling, general and administrative expenses were 28.9% in fiscal 2010 and 30.2% in fiscal 2009. The decrease in SG&A expenses is attributable to reduced severance charges of $1.9 million, preopening store costs of $1.7 million, point-of-sale hardware lease expense of $1.7 million and store level labor and benefits of $1.7 million offset by increased real property rent expense of $1.2 million and advertising costs of $797. Excluding share-b ased compensation, preopening store costs, store transformation project costs and executive and staff severance (Adjusted SG&A expenses) were 28.3% and 28.9%, as percentage of net sales, fiscal 2010 and 2009, respectively.

Depreciation and amortization expense increased $681 or 7.3% to $10.0 million in fiscal 2010 compared to $9.3 million in fiscal 2009. The increase is attributable to depreciation from stores opened in fiscal 2010 and 2009.

Operating income (loss) from continuing operations increased $10.5 million, or 327.5%, to $7.3 million in fiscal 2010 compared to ($3.2) million in fiscal 2009. Operating income (loss) from continuing operations as a percentage of net sales was 1.5% in fiscal 2010 compared to (0.7)% in fiscal 2009. Operating income (loss) from continuing operations was positively impacted by reduced markdowns of $3.4 million, increased non same-store margin of $2.4 million, reduced freight expense of $1.7 million, reduced severance charges of $1.9 million, preopening store costs of $1.7 million, point-of-sale hardware lease expense of $1.7 million and store level labor and benefits of $1.7 million offset by increased shrink of $1.4 million, increased real property rent expense of $1.2 million, reduced new store allowances of $1.1 million and advertising costs of $797.

Interest expense increased $282 or 15.1% to $2.1 million in fiscal 2010 compared to $1.9 million in fiscal 2009. The increase in interest expense was due to increased average borrowings to fund capital expenditures or other programs.

Income tax expense (benefit) on continuing operations was $2.1 million in fiscal 2010 compared to ($2.1) million in fiscal 2009. The Company's effective tax rate was 41.3% in fiscal 2010 and 40.9% in fiscal 2009. The effective tax rate is higher in fiscal 2010 due to the impact of permanent book and tax differences offset by a slight decrease in the Company's state effective tax rates.

Loss from discontinued operations, net of income tax benefit was $42 in fiscal 2010, compared to $2.0 million in fiscal 2009. One Duckwall store was closed during fiscal 2010. Three Duckwall stores and 14 ALCO stores were closed during fiscal 2009. The three Duckwall stores that were closed in fiscal 2009 were replaced by an ALCO store and are therefore shown in continuing operations. Results of all other closed stores are included in discontinued operations.

Fiscal 2009 Compared to Fiscal 2008

Net sales for fiscal 2009 increased $8.3 million or 1.7% to $489.8 million compared to $481.5 million for fiscal 2008. During fiscal 2009, the Company opened fifteen ALCO stores, of which four were in markets previously occupied by a Duckwall store. Eleven ALCO stores were closed and four Duckwall stores were closed, resulting in a year end total of 258 stores. Net sales for all stores open the full year in both fiscal 2009 and 2008 (same-stores), decreased by $22.6 million or 5.1%, excluding the two fuel centers, in fiscal 2009 compared to fiscal 2008, as adjusted for 52 week comparability. Fuel sales decreased $1.2 million, in fiscal 2009 compared to fiscal 2008. Sales from non same-stores increased $43.3 million, in fiscal 2009 compared to fiscal 2008.