UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(X) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 28, 2007

or

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 0-20269

DUCKWALL-ALCO STORES, INC.

(Exact name of registrant as specified in its charter)

| Kansas | 48-0201080 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

401 Cottage Street Abilene, Kansas | 67410-2832 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number including area code: (785) 263-3350

Securities registered pursuant to Section 12(b) of the Act:

NONE

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.0001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes_____ No __X_

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes___ No _X__

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No _____

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. Large accelerated filer [ ] Accelerated filer [X] Non-accelerated filer [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ____ No __X__

The aggregate market value of the 3,792,515 shares of Common Stock, par value $.0001 per share, of the registrant held by non-affiliates of the registrant is $134,330,881 on August 1, 2006, based on a closing sale price of $35.42. As of April 23, 2007, there were 3,804,216 shares of Common Stock outstanding.

Documents incorporated by reference: portions of the Registrant's Proxy Statement for the 2007 Annual Meeting of Stockholders are incorporated by reference in Part III hereof.

DUCKWALL-ALCO FISCAL 2007 FORM 10-K

TABLE OF CONTENTS | | | |

| | | | | | |

PART I | | |

| | Item 1. | | Business. | | 3 |

| | Item 1A. | | Risk Factors. | | 6 |

| | Item 1B. | | Unresolved Staff Comments. | | 7 |

| | Item 2. | | Properties. | | 7 |

| | Item 3. | | Legal Proceedings. | | 7 |

| | Item 4. | | Submission of Matters to a Vote of Security Holders. | | 7 |

| | Item 4A. | | Executive Officers. | | 7 |

| | | |

PART II | | |

| | Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | | 8 |

| | Item 6. | | Selected Financial Data. | | 10 |

| | Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations. | | 11 |

| | Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk. | | 18 |

| | Item 8. | | Financial Statements and Supplementary Data. | | 19 |

| | Item 9. | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. | | 35 |

| | Item 9A. | | Controls and Procedures. | | 36 |

| | Item 9B. | | Other Information. | | 38 |

| | | |

PART III | | |

| | Item 10. | | Directors, Executive Officers and Corporate Governance. | | 38 |

| | Item 11. | | Executive Compensation. | | 39 |

| | Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | | 39 |

| | Item 13. | | Certain Relationships and Related Transactions, and Director Independence. | | 39 |

| | Item 14. | | Principal Accountant Fees and Services. | | 39 |

| | | |

PART IV | | |

| | Item 15. | | Exhibits and Financial Statement Schedules. | | 39 |

| | | |

| Signatures | | 41 |

| | | |

| | | |

PART I

ITEM 1. BUSINESS

History

Duckwall-ALCO Stores, Inc., (the “Company” or “Registrant”), was founded as a general merchandising operation in 1901 in Abilene, Kansas by A. L. Duckwall. From its founding until 1968, the Company conducted its retail operations as small variety or “dime” stores. In 1968, the Company followed an emerging trend to discount retailing when it opened its first ALCO discount store. The Company's overall business strategy involves identifying and opening stores in towns that will provide the Company with the highest return on investment. Although the Company prefers markets that don’t have direct competition from national or regional full-line discount stores, its strategy does not preclude it from entering competitive markets. This strategy includes opening ALCO discount stores. As of January 28, 2007, the Company operates 256 retail stores located in the central United States, consisting of 189 ALCO retail discount stores and 67 Duckwall variety stores.

The Company was incorporated on July 2, 1915 under the laws of Kansas. The Company's executive offices are located at 401 Cottage Street, Abilene, Kansas 67410-2832, and its telephone number is (785) 263-3350.

General

The Company is a regional retailer operating 256 stores in 21 states in the central United States. The Company's strategy is to target smaller markets not served by other regional or national full-line retail discount chains and to provide the most convenient access to retail shopping within each market. The Company's ALCO discount stores offer a full line of merchandise consisting of approximately 35,000 items, including automotive, candy, crafts, domestics, electronics, fabrics, furniture, hardware, health and beauty aids, housewares, jewelry, ladies', men's and children's apparel and shoes, pre-recorded music and video, sporting goods, seasonal items, stationery and toys. The Company's smaller Duckwall variety stores offer a more limited selection of similar merchandise.

Of the Company's 189 ALCO discount stores, 155 stores are located in communities that do not have another full-line discounter. The ALCO discount stores account for 94% of the Company's net sales. The current ALCO store averages 20,300 square feet of selling space. However, the Company's store expansion program is primarily directed toward opening stores with a design prototype of approximately 21,500 square feet of selling space. Based on the Company’s experience, the design of the Class 20 Stores produces the greatest return on investment for newly opened stores.

All of the Company's discount and variety stores are serviced by the Company's 352,000 square foot distribution center in Abilene, Kansas.

For 2007 and 2006, the percentage of sales by product category were as follows:

| | | Percentage of Sales |

| | | | 2007 | | | 2006 | |

| Merchandise Category: | | | | | | | |

| Consumables and commodities | | | 30 | % | | 30 | % |

| Electronics, entertainment, sporting goods, toys and outdoor living | | | 25 | % | | 25 | % |

| Apparel and accessories | | | 20 | % | | 19 | % |

| Home furnishings and decor | | | 14 | % | | 15 | % |

| Other | | | 11 | % | | 11 | % |

| | | | | | | | |

| Total | | | 100 | % | | 100 | % |

Business Strategy

The Company intends to focus on executing a business strategy that includes the following key components:

Markets: The Company intends to open ALCO stores primarily in towns with populations of typically less than 5,000 that are in trade areas with populations of less than 16,000 where: (1) there is no direct competition from national or regional full-line discount retailers; (2) economic and demographic criteria indicate the market is able to commercially support a discount retailer; and (3) the opening of an ALCO store would significantly reduce the likelihood of the entry into such market by another full-line discount retailer. This key component of the Company's strategy has guided the Company in both its opening of new stores and in its closing of existing stores.

Market Selection: The Company utilizes a detailed process to analyze under-served markets which includes examining factors such as distance from competition, trade area, demographics, retail sales levels, existence and stability of major employers, location of county government, disposable income, and distance from the Company’s distribution center. Markets that are determined to be sizable enough to support an ALCO and that have no direct competition from another full-line discount retailer are examined closely and eventually selected or passed over by the Company's experienced management team.

Store Expansion: The Company's expansion program is designed primarily around the prototype Class 20 Store. This prototype details shelf space, merchandise presentation, store items to be offered, parking, storage requirements, as well as other store design considerations. The 21,500 square feet of selling space is large enough to permit a full line of the Company's merchandise, while minimizing capital expenditures, labor costs and general overhead costs. The Company will also consider opportunities in acceptable markets to open ALCO stores in available space in buildings already constructed.

Technology: The Company went live on the human resources/payroll and financial systems during fiscal 2006. The Company went live on the Point-of-Sale (POS) system in the third quarter of fiscal 2007. Financial Planning, Performance Analysis, and Merchandise Allocation systems went live in the second quarter of fiscal 2007. The Company is conducting a review of its logistics. This could result in the determination that the Company will need to consider a new integrated Warehouse Management System.

Advertising and Promotion: The Company utilizes full-color photography advertising circulars of eight to 24 pages distributed through newspaper insertion or, in the case of inadequate newspaper coverage, through direct mail. During fiscal 2007, these circulars were distributed 40 times in ALCO markets. In its Duckwall markets, the Company distributed a full-color, four page insert 11 times during fiscal 2007. The Company’s marketing program is designed to create awareness and recognition of its competitive pricing on a comprehensive merchandise selection for the whole family. During fiscal 2008, the Company will distribute approximately 42 circulars in ALCO markets and will discontinue advertising in Duckwall markets.

Store Environment: The Company's stores are open, clean, bright and offer a pleasant atmosphere with disciplined product presentation, attractive displays and efficient check-out procedures. The Company endeavors to staff its stores with courteous, highly motivated, knowledgeable store associates in order to provide a convenient, friendly and enjoyable shopping experience.

Store Development

The Company expects to open approximately 25 ALCO stores during fiscal year 2008. The Company's strategy regarding store development is to increase sales and profitability at existing stores by continually refining the merchandising mix and improving operating efficiencies, and through new store openings in the Company's targeted base of under-served markets in the central United States. The following table summarizes the Company's store development during the past three fiscal years:

| | | 2007 | | 2006 | | 2005 | |

| | | | ALCO | | | Duckwall | | | ALCO | | | Duckwall | | | ALCO | | | Duckwall | |

| Stores Opened | | | 7 | | | - | | | 7 | | | 1 | | | 8 | | | - | |

| Stores Closed | | | 1 | | | 1 | | | 10 | | | 13 | | | 2 | | | 6 | |

| Net New Stores | | | 6 | | | (1) | | | (3) | | | (12) | | | 6 | | | (6) | |

As of January 28, 2007, the Company owned three ALCO and one Duckwall location, and leased 186 ALCO and 66 Duckwall locations. The Company's present intention is to lease all new stores; however, the company may own some of the ALCO locations. The estimated investment to open a new prototype ALCO store that is leased is approximately $800,000 for the equipment and inventory.

Store Environment and Merchandising

The Company manages its stores to attractively and conveniently display a full line of merchandise within the confines of the stores' available square footage. Corporate merchandising direction is provided to each store to ensure a consistent company-wide store presentation. To facilitate long-term merchandising planning, the Company divides its merchandise into three core categories driven by the Company's customer profile: primary, secondary, and convenience. The primary core receives management's primary focus, with a wide assortment of merchandise being placed in the most accessible locations within the stores and receiving significant promotional consideration. The secondary core consists of categories of merchandise for which the Company maintains a strong assortment that is easily and readily identifiable by its customers. The convenience core consists of categories of merchandise for which ALCO will maintain convenient (but limited) assortments, focusing on key items that are in keeping with customers' expectations for a discount store. Secondary and convenience cores include merchandise that the Company feels is important to carry, as the target customer expects to find them within a discount store and they ensure a high level of customer traffic. The Company continually evaluates and ranks all product lines, shifting product classifications when necessary to reflect the changing demand for products.

Purchasing

Procurement and merchandising of products is directed by a staff of two Vice President - Divisional Merchandise Managers and one Assistant Vice President Divisional Merchandise Manager who are each responsible for specific product categories. The Company employs twenty merchandise buyers and two assistant buyers who each report to a Divisional Merchandise Manager. Buyers are assisted by a management information system that provides them with current price and volume information by SKU, thus allowing them to react quickly with buying and pricing adjustments dictated by customer buying patterns.

The Company purchases its merchandise from approximately 2,200 suppliers. The Company generally does not utilize long-term supply contracts. Only one supplier accounted for more than 5% of the Company's total purchases in fiscal 2007 and competing brand name and private label products are available from other suppliers at competitive prices. The Company believes that its relationships with its suppliers are good and that the loss of any one or more of its suppliers would not have a material adverse effect on the Company.

Pricing

Merchandise pricing is done at the corporate level with the impact significantly different depending upon the level of competition in the market. This pricing strategy, with its promotional activities, is designed to bring consistent value to the customer. In fiscal 2008, promotions on various items will be offered approximately 42 times through advertising circulars.

Distribution and Transportation

The Company operates a 352,000 square foot distribution center in Abilene, Kansas, from which it services all stores. The distribution center is responsible for distributing approximately 80% of the Company's merchandise, with the balance being delivered directly to the Company's stores by its vendors. The distribution center maintains an integrated management information system, allowing the Company to utilize such cost cutting efficiencies as perpetual inventories, safety programs, and employee productivity software. As stated previously, the Company is considering an upgrade to the system.

Effective January 1, 2006, the Company contracted with Werner Enterprises, Inc. to be its dedicated transportation provider. Werner will sublease the Subsidiary’s equipment which includes five tractors and 23 trailers until such equipment leases expire.

Management Information Systems

The Company has committed significant resources to the purchase and application of available computer hardware and software to its discount retailing operations with the intent to lower costs, improve customer service and enhance general business planning. In general, the Company's merchandising systems are designed to integrate the key retailing functions of seasonal merchandise planning, purchase order management, merchandise distribution, sales information and inventory maintenance and replenishment. All of the Company's ALCO discount stores have POS computer terminals that record certain sales data in a format that can be transmitted nightly to the Company's data processing facility where it is used to produce daily and weekly management reports. During the last four fiscal years, the Company has devoted resources to development of systems that have improved information available to management and improved specific operational efficiencies.

Approximately 2,000 of the Company's merchandise suppliers currently participate in the Company's electronic data interchange (“EDI”) system, which makes it possible for the Company to place purchase orders electronically. A number of these suppliers are able to utilize additional EDI functions, including transmitting invoices and advance shipment notices to the Company and receiving sales history from the Company. Refer to the section above: Business Strategy: Technology, for additional discussion on the Company’s planned technology upgrades.

Store Locations

As of January 28, 2007, the Company operated 189 ALCO stores in 21 states located in smaller communities in the central United States. The ALCO stores average approximately 20,800 square feet of selling space, with an additional 5,000 square feet utilized for merchandise processing, temporary storage and administration. The Company also operates 67 Duckwall stores in 10 states. The geographic distribution of the Company's stores is as follows:

| Duckwall Stores | | ALCO Stores |

| | | | | | | | |

| Arkansas | 1 | | Arizona | 9 | | Montana | 1 |

| Colorado | 5 | | Arkansas | 5 | | Nebraska | 16 |

| Iowa | 4 | | Colorado | 12 | | New Mexico | 8 |

| Kansas | 27 | | Idaho | 3 | | North Dakota | 7 |

| Nebraska | 7 | | Illinois | 7 | | Ohio | 5 |

| New Mexico | 1 | | Indiana | 13 | | Oklahoma | 8 |

| North Dakota | 2 | | Iowa | 10 | | South Dakota | 9 |

| Oklahoma | 9 | | Kansas | 26 | | Texas | 26 |

| South Dakota | 2 | | Minnesota | 8 | | Utah | 6 |

| Texas | 9 | | Missouri | 6 | | Wisconsin | 1 |

| | | | | | | Wyoming | 3 |

Competition

While the discount retail business in general is highly competitive, the Company's business strategy is to locate its ALCO discount stores in smaller markets where there is no direct competition with larger national or regional full-line discount chains, and where it is believed no such competition is likely to develop. Accordingly, the Company's primary method of competing is to offer its customers a conveniently located store with a wide range of merchandise at discount prices in a primary trade area population under 16,000 that does not have a large national or regional full-line discount store. The Company believes that trade area size is a significant deterrent to larger national and regional full-line discount chains. Duckwall variety stores are located in very small markets, and like the ALCO stores, emphasize the convenience of location to the primary customer base.

In the discount retail business in general, price, merchandise selection, merchandise quality, advertising and customer service are all important aspects of competing. The Company encounters direct competition with national full-line discount stores in 26 of its ALCO markets, and another eight ALCO stores are in direct competition with regional full-line discount stores. The competing regional and national full-line discount retailers are generally larger than the Company and the stores of such competitors in the Company's markets are substantially larger, have a somewhat wider selection of merchandise and are very price competitive in some lines of merchandise. Where there are no national or regional full-line discount retail stores directly competing with the Company's ALCO stores, the Company's customers nevertheless shop at retail discount stores and other retailers located in regional trade centers, and to that extent the Company competes with such discount stores and retailers. The Company also competes for retail sales with mail order companies, specialty retailers, mass merchandisers, dollar stores, manufacturer’s outlets, and the internet. In the 123 markets in which the Company operates a Class 18 Store, only 12 markets have direct competition from a national or regional full-line discount retailer. The Company competes with dollar stores in 87 percent of its ALCO stores and approximately 40 percent of its Duckwall stores.

Employees

As of January 28, 2007, the Company employed approximately 4,800 people. Of these employees, approximately 490 were employed in the general office and distribution center in Abilene Kansas, 4,310 in the store locations. Additional employees are hired on a seasonal basis, most of whom are sales personnel. We offer a broad range of company-paid benefits to our employees, including a 401(k) plan, medical and dental plans, short-term and long-term disability insurance, paid vacation and merchandise discounts. Eligibility for and the level of these benefits varies depending on the employees' full-time or part-time status and/or length of service. There is no collective bargaining agent for any of the Company's employees. The Company considers its relations with its employees to be excellent.

ITEM 1A. RISK FACTORS

The Company encourages investors to carefully consider the risks described below and other information contained in this document when considering an investment decision with respect to he Company’s securities. Additional risks and uncertainties not presently known to management, or that management currently deems immaterial, may also impair the Company’s business operations. Any of the events discussed in the risk factors below may occur. If one or more of these events do occur, business, results of operations or financial condition could be materially adversely affected. In that instance, the trading price of the Company’s securities could decline, and investors might lose part or all of their investment.

Economic Conditions

Similar to other retail businesses, the Company’s operations may be affected adversely by general economic conditions and events which result in reduced consumer spending in the markets served by its stores. Also, smaller communities where the Company’s stores are located may be dependent upon a few large employers or may be significantly affected by economic conditions in the industry upon which the community relies for its economic viability, such as the agricultural industry. This may make the Company’s stores more vulnerable to a downturn in a particular segment of the economy than the Company’s competitors, which operate in markets which are larger metropolitan areas where the local economy is more diverse.

Competition

The Company operates in the discount retail business, which is highly competitive. Although the Company prefers markets that don’t have direct competition from national or regional full-line discount stores, competition still exists. Even in non-competitive markets, the Company’s customers shop at retail discount stores and other retailers located in regional trade centers. The Company also competes for retail sales with other entities, such as mail order companies, specialty retailers, mass merchandisers, dollar stores, manufacturer’s outlets, and the internet. This competitive environment subjects the Company to the risk of reduced profitability because the Company may be forced to lower its prices, resulting in lower margins, in order to maintain its competitive position.

Store Expansion

The growth in the Company’s sales and operating net income depends to a substantial degree on its expansion program. This expansion strategy is dependent upon the Company’s ability the open and operate new stores effectively, efficiently, and on a profitable basis. The Company prefers to locate its ALCO stores in smaller retail markets where no competing full-line discount retail store is located within the primary trade area. The Company’s ability to timely open new stores and to expand into additional market areas depends in part on the following factors: availability of store locations, the ability to hire and train new store personnel, the ability to react to consumer needs and trends on a timely basis, and the availability of sufficient capital for expansion.

Information Technology

The Company completed its rollout of the new POS in its ALCO stores in the fourth quarter of fiscal 2007. The Company’s ability to train employees on the new POS software and to utilize technology upgrades could have a material impact on the Company’s results of operations.

Government Regulation

The Company is subject to numerous federal, state and local government laws and regulations, including those relating to the development, construction and operation of the Company’s stores. The Company is also subject to laws governing its relationship with employees, including minimum wage requirements, laws and regulations relating to overtime, working and safety conditions, and citizenship requirements. Material increases in the cost of compliance with any applicable law or regulation and similar matters could materially and adversely affect the Company.

Internal Control

The Company continues to refine and test its internal control processes. The Company created an Internal Audit Department in the fourth quarter of fiscal 2007. The inability of the Company to correct deficiencies could adversely affect the Company.

Quarterly Fluctuations

Quarterly results of operations have historically fluctuated as a result of retail consumers purchasing patterns, with the highest quarter in terms of sales and profitability being the fourth quarter. Quarterly results of operations will likely continue to fluctuate significantly as a result of such patterns and may fluctuate due to the timing of new store openings.

Stock Price

No assurance can be given that operating results will not vary from quarter to quarter, and any fluctuations in quarterly operating results may result in volatility in the Company’s stock price.

Dependence on Officers

The development of the Company’s business is largely dependent on the efforts of its current management team headed by Bruce C. Dale and eight other executive officers. The loss of the services of one or more of these officers could have a material adverse effect on the Company.

Interest Rate Risk

The Company is subject to market risk from exposure to changes in interest rates based on its financing requirements. Changes in interest rates could have a negative impact on the Company’s profitability.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES.

The Company owns facilities in Abilene, Kansas that consist of a general office (approximately 35,000 square feet), the Distribution Center (approximately 352,000 square feet) and additional warehouse space adjacent to the general office.

Three of the ALCO stores and one of the Duckwall stores operate in buildings owned by the Company. The remainder of the stores operate in properties leased by the Company. As of January 28, 2007, such ALCO leases account for approximately 4,700,000 square feet of lease space, which expire as follows: approximately 652,668 square feet (14.0%) expire between January 28, 2007 and February 3, 2008; approximately 689,542 square feet (14.8%) expire between February 3, 2008 and February 1, 2009; and approximately 578,648 square feet (12.4%) expire between February 1, 2009 and January 31, 2010. The remainder of the leases expire through 2021. All Duckwall store leases have terms remaining of fifty months or less. The majority of the leases that are about to expire have renewal options with lease terms that are the same as the existing lease.

ITEM 3. LEGAL PROCEEDINGS.

Other than routine litigation from time to time in the ordinary course of business, the Company is not a party to any material litigation.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No matters were submitted to a vote of the stockholders of the Company during the fourth quarter of the fiscal year ended January 28, 2007.

ITEM 4A. Executive Officers.

The following table sets forth the names, ages, positions and certain other information regarding the executive officers of the Company as of April 23, 2007.

Name | Age | Position |

| | | |

| Bruce C. Dale | 59 | President and Chief Executive Officer |

| James E. Schoenbeck | 63 | Senior Vice President |

| John R. Sturdivant | 62 | Senior Vice President |

| Tom L. Canfield, Jr. | 53 | Senior Vice President |

| Anthony C. Corradi | 46 | Senior Vice President |

| Michael S Marcus | 52 | Vice President - Finance and Treasurer |

| Michael J. Gawin | 55 | Vice President - Divisional Merchandise Manager - Softlines |

| Robert E. Swartz, Jr. | 50 | Vice President - Divisional Merchandise Manager - Hardlines |

| Virginia A. Meyer | 63 | Vice President - Marketing |

Except as set forth below, all of the executive officers have been associated with the Company in their present position or other capacity for more than the past five years. There are no family relationships among the executive officers of the Company.

Bruce C. Dale has served as President and Chief Executive Officer of the Company since March 28, 2005. From 2003 to 2004, Mr. Dale was President and CEO of Franks Nursery and Crafts, Inc. From 1993 to 2003, Mr. Dale was with Michaels Stores, Inc., where he served for eight of those years as president of Aaron Brothers Art & Framing. Mr. Dale has approximately 37 years of experience in the retail industry.

James E. Schoenbeck has served as Senior Vice President of Real Estate and Travel since 2005. From 1988 to 2005, Mr. Schoenbeck served as Senior Vice President - Operations and Advertising. From 1975 to 1988, Mr. Schoenbeck served in various capacities with the Company. Mr. Schoenbeck has approximately 32 years of experience in the retail industry.

John R. Sturdivant has served as Senior Vice President - Stores since February 13, 2006. For more than five years prior to that, he served as Regional Vice President of Jo-Ann Stores, Inc. Mr. Sturdivant has approximately 44 years experience in the retail industry.

Tom L. Canfield, Jr. has served as Senior Vice President - Logistics and Administration since 2006. From 1973 to 2006, Mr. Canfield served in various capacities with the Company. Mr. Canfield has approximately 34 years of experience in the retail industry.

Anthony C. Corradi has served as Senior Vice President - Chief Technology Officer since 2007. Mr. Corradi served as Vice President - Chief Technology Officer since 2005. For five years prior to that, he was an independent consultant. Mr. Corradi has approximately 24 years experience in the retail technology industry.

Michael S. Marcus has served as Vice President - Finance and Treasurer since 2006. From 2004 to 2006, Mr. Marcus served in various capacities with the Company. From 1997 to 2003, Mr. Marcus served as Vice President and Chief Financial Officer of Weiner’s Stores, Inc. Mr. Marcus has approximately 18 years experience in the retail industry.

Michael J. Gawin has served as Vice President - Divisional Merchandise Manager since 1997. For more than five years prior to that, he served as Divisional Merchandise Manager for Shopko Stores, Inc. Mr. Gawin has approximately 34 years experience in the retail industry.

Robert E. Swartz, Jr. has served as Vice President - Divisional Merchandise Manger since 2000. From 1978 to 2000, Mr. Swartz served in various capacities with the Company. Mr. Swartz has approximately 29 years experience in the retail industry.

Virginia A. Meyer has served as Vice President - Marketing since 2007. From 2002 to 2007, Ms. Meyer served as Director of Marketing and Advertising. For more than five years prior to that, she served as Vice President - Marketing with Cato Corporation. Ms. Meyer has approximately 37 years experience in the retail industry.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

The Common Stock of the Company is quoted on the NASDAQ National Market tier of The NASDAQ Stock Market under the symbol “DUCK”. The following table sets forth the range of high and low bid information for the Company's Common Stock for each quarter of fiscal 2007 and 2006.

Fiscal 2007 | | | | High | | Low |

| First quarter | | | | $26.70 | | $22.34 |

| Second quarter | | | | $34.93 | | $25.40 |

| Third quarter | | | | $38.54 | | $33.65 |

| Fourth quarter | | | | $42.06 | | $33.77 |

| | | | | | | |

Fiscal 2006 | | | | High | | Low |

| First quarter | | | | $19.79 | | $16.79 |

| Second quarter | | | | $23.90 | | $18.55 |

| Third quarter | | | | $24.50 | | $21.10 |

| Fourth quarter | | | | $25.59 | | $20.02 |

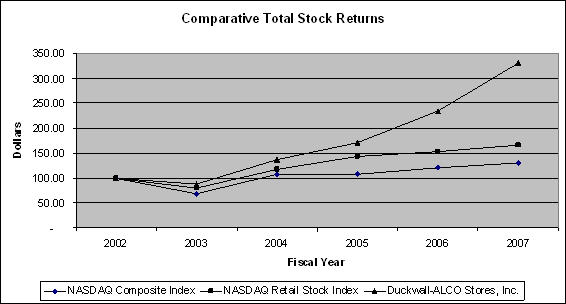

The following graph compares the cumulative total return of the Company, the NASDAQ Stock Market Index, and the NASDAQ Retail Trade Stocks Index (assuming dividends reinvested at the end of each subsequent fiscal year). The graph assumes $100 was invested on January 31, 2002 in Duckwall-ALCO Stores, Inc. Common Stock, the NASDAQ Stock Market Index, and the NASDAQ Retail Trade Stocks Index.

| | Period Ending at Fiscal Year End |

| Index | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 |

| Duckwall-ALCO Stores, Inc. | 100.00 | 87.76 | 136.94 | 17.0.95 | 233.93 | 330.74 |

| NASDAQ Composite Index | 100.00 | 68.91 | 107.25 | 107.45 | 120.87 | 129.66 |

| NASDAQ Retail Stock Index | 100.00 | 80.38 | 117.85 | 142.58 | 152.52 | 166.46 |

| | | | | | | |

Based upon the data reflected in the table, a $100 investment in the Company's Common Stock would have a total return value of $330.74 at January 28, 2007, as compared to $129.66 for the Composite NASDAQ Index and $166.46 for the NASDAQ Retail Stock Index.

No Recent Dividend Payments; Restrictions on Payment of Dividends

As of April 23, 2007, there were approximately 1,216 holders of record of the Common Stock of the Company. The Company has not paid cash dividends on its Common Stock during the last five fiscal years and it has no plans to commence paying cash dividends on the Common Stock. The terms of the Loan and Security Agreement, dated as of April 15, 2002, between the Company and Bank of America (formerly Fleet Retail Finance Inc.) allow for the payment of dividends unless certain loan covenants are triggered, which are not expected to occur during fiscal 2008.

Company Repurchases of Common Stock

As shown in the following table, the Company did not repurchase any shares of the Common Stock during the three months ended January 28, 2007

| | | | | Maximum Number |

| | | | Total Number of | (or Approximate Dollar |

| | | | shares (or Units) | Value) of Shares (or |

| | Total Number Of | | Purchased as Part | Units) that May Yet |

| | Shares (or Units) | Average Price Paid | of Publicly Announced | Be Purchased Under |

Period | Purchased | per Share (or Unit) | Plans or Programs | the Plans or Programs |

| November 1 - November 30, 2006 | - | | | 196,663 |

| December 1 - December 31, 2006 | - | | | 196,663 |

| January 1 - January 31, 2007 | | | | 196,663 |

| | (a) | On March 23, 2006, the Board of Directors approved a new plan authorizing the repurchase an additional 200,000 shares of the Company’s common stock, of which 3,337 shares have been repurchased at an average cost of $30.46. As of January 28, 2007, 196,663 shares remain available to be repurchased |

ITEM 6. SELECTED FINANCIAL DATA.

SELECTED CONSOLIDATED FINANCIAL DATA

(Dollars in thousands, except per share and store data)

The selected consolidated financial data presented below for, and as of the end of, each of the last five fiscal years under the captions Statements of Operations Data and Balance Sheet Data have been derived from the audited consolidated financial statements of the Company. This data should be read in conjunction with “Management's Discussion and Analysis of Financial Condition and Results of Operations” (Item 7) and the consolidated financial statements, related notes, and other financial information included herein (Item 8).

| | | Fiscal Year Ended |

| | | | January 28, | | | January 29, | | | January 30, | | | February 1, | | | February 2, | |

Statement of Operations Data | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Net sales | | $ | 475,255 | | | 433,319 | | | 407,420 | | | 396,517 | | | 370,300 | |

| Cost of sales | | | 324,885 | | | 295,488 | | | 272,245 | | | 264,073 | | | 245,885 | |

| Gross margin | | | 150,370 | | | 137,831 | | | 135,175 | | | 132,444 | | | 124,415 | |

| | | | | | | | | | | | | | | | | |

| Selling, general and administrative expenses | | | 132,165 | | | 124,208 | | | 121,154 | | | 116,308 | | | 108,428 | |

| Depreciation and amortization | | | 6,795 | | | 5,940 | | | 6,407 | | | 6,807 | | | 6,459 | |

| Income from continuing operations | | | 11,410 | | | 7,683 | | | 7,614 | | | 9,329 | | | 9,528 | |

| Interest expense | | | 2,730 | | | 1,272 | | | 1,230 | | | 1,386 | | | 1,609 | |

| Earnings from continuing operations before | | | | | | | | | | | | | | | | |

| income taxes and discontinued operations | | | 8,680 | | | 6,411 | | | 6,384 | | | 7,943 | | | 7,919 | |

| Income tax expense | | | 3,046 | | | 1,754 | | | 2,192 | | | 2,403 | | | 2,904 | |

| Earning from continuing operations before | | | | | | | | | | | | | | | | |

| discontinued operations | | | 5,634 | | | 4,657 | | | 4,192 | | | 5,540 | | | 5,015 | |

| (Loss) income from discontinued operations, net | | | | | | | | | | | | | | | | |

| of income tax | | | 70 | | | (2,708 | ) | | (269 | ) | | 973 | | | 339 | |

| Net earnings (1) | | $ | 5,704 | | | 1,949 | | | 3,923 | | | 6,513 | | | 5,354 | |

| | | | | | | | | | | | | | | | | |

| Per Share Information | | | | | | | | | | | | | | | | |

| Earnings per share - basic: | | | | | | | | | | | | | | | | |

| Earnings before discontinued operations | | $ | 1.49 | | | 1.14 | | | 0.95 | | | 1.30 | | | 1.18 | |

| Discontinued operations | | | 0.01 | | | (0.66 | ) | | (0.06 | ) | | 0.23 | | | 0.08 | |

| Net earnings | | $ | 1.50 | | | 0.48 | | | 0.89 | | | 1.53 | | | 1.26 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Earnings (loss) per share - diluted | | | | | | | | | | | | | | | | |

| Earnings (loss) before discontinued operations | | $ | 1.48 | | | 1.13 | | | 0.94 | | | 1.27 | | | 1.15 | |

| Discontinued operations | | | 0.01 | | | (0.66 | ) | | (0.06 | ) | | 0.23 | | | 0.08 | |

| Net earnings | | $ | 1.49 | | | 0.47 | | | 0.88 | | | 1.50 | | | 1.23 | |

| | | | | | | | | | | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | | | | | | | | | |

| Basic | | | 3,792,202 | | | 4,083,798 | | | 4,391,538 | | | 4,243,441 | | | 4,235,911 | |

| Diluted | | | 3,828,928 | | | 4,117,922 | | | 4,464,416 | | | 4,343,381 | | | 4,355,653 | |

| | | | | | | | | | | | | | | | | |

Operating Data | | | | | | | | | | | | | | | | |

| Stores open at year-end | | | 256 | | | 251 | | | 266 | | | 264 | | | 264 | |

| Stores in non-competitive markets at year-end (2) | | | 222 | | | 222 | | | 231 | | | 230 | | | 229 | |

| | | | | | | | | | | | | | | | | |

| Percentage of total stores in non-competitive | | | | | | | | | | | | | | | | |

| markets (2) | | | 86.72 | % | | 88.45 | % | | 86.84 | % | | 87.12 | % | | 86.74 | % |

| Net Sales of stores in non-competitive markets(2) | | $ | 404,196 | | $ | 381,863 | | $ | 366,637 | | $ | 363,634 | | $ | 334,811 | |

| Percentage of net sales from stores in | | | | | | | | | | | | | | | | |

| non-competitive markets (2) | | | 85.05 | % | | 87.78 | % | | 84.59 | % | | 83.99 | % | | 81.53 | % |

| Comparable stores sales increase for all stores (3) | | | 6.02 | % | | 3.12 | % | | 0.13 | % | | 0.98 | % | | -0.05 | % |

| Comparable stores sales increase for stores in | | | | | | | | | | | | | | | | |

| non-competitive markets (2)(3) | | | 6.43 | % | | 3.67 | % | | 0.78 | % | | 2.09 | % | | 2.94 | % |

| | | | | | | | | | | | | | | | | |

Balance Sheet Data | | | | | | | | | | | | | | | | |

| Total Assets | | $ | 195,420 | | $ | 178,922 | | $ | 163,118 | | $ | 167,493 | | $ | 169,900 | |

| Total Debt (includes capital lease | | | | | | | | | | | | | | | | |

| obligation and current maturities) | | | 29,988 | | | 26,240 | | | 8,605 | | | 10,876 | | | 24,611 | |

| Stockholders' equity | | | 106,060 | | | 102,147 | | | 114,676 | | | 109,193 | | | 102,110 | |

| (1) | Effective January 29, 2006, the Company adopted SFAS no 123(R), Share-Based Payments. Included in selling, general and administrative expenses is $821 of stock compensation expense in fiscal 2007. No expense was recorded for stock compensation in earlier years. |

| (2) | “Non-competitive” markets refer to those markets where there is not a national or regional full-line discount store located in the primary market served by the Company. The Company's stores in such non-competitive markets nevertheless face competition from various sources. See Item 1 “Business-Competition”. |

| (3) | Percentages, as adjusted to a comparable 52 week year, reflect the increase or decrease based upon a comparison of the applicable fiscal year with the immediately preceding fiscal year for stores open during the entirety of both years. |

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.

Overview

Operations. The Company is a regional discount retailer operating in 21 states in the central United States.

The Company’s fiscal year ends on the Sunday closest to January 31. Fiscal 2007, 2006 and 2005 each consisted of 52 weeks. For purposes of this management's discussion and analysis of financial condition and results of operations, the financial numbers are presented in thousands.

Strategy. The Company's overall business strategy involves identifying and opening stores in towns that will provide the Company with the highest return on investment. Although the Company prefers markets that don’t have direct competition from national or regional full-line discount stores, its strategy does not preclude it from entering competitive markets. Even in non-competitive markets, competition still exists, as the Company's customers still shop at retail discount stores and other retailers located in regional trade centers. The Company also competes for retail sales with other entities, such as mail order companies, specialty retailers, mass merchandisers, dollar stores, manufacturer's outlets, and the internet.

The Company is constantly evaluating the appropriate mix of merchandise to improve sales and gross margin performance. The Company uses centralized purchasing, merchandising, pricing and warehousing to obtain volume discounts, improve efficiencies and achieve consistency among stores and the best overall results. The Company utilizes information obtained from its POS system and regular input from its store associates to determine its merchandise offerings.

The Company, when appropriate, implements new merchandising and marketing initiatives in an effort to increase customer traffic and same-store sales. The Company is changing its focus from consumable products that carry a lower margin to higher margin soft goods. This includes more fashion apparel that will appeal to a broad base of customers. The Company is also adding new items to its assortments and has made changes to its advertising program that reduces the number of items advertised, but increases the frequency of the advertising.

Recent Events. During fiscal 2007, the Company purchased and retired 3,337 shares of the Company’s Common Stock for an average price of $30.46. All shares repurchased were retired. On March 23, 2006, the Board of Directors approved a plan to repurchase 200,000 shares of the Company’s common stock. There are 196,663 shares remaining under this plan.

The Company completed the rollout of its new POS system in the fourth quarter of fiscal 2007.

The Company entered into an agreement with Radio Shack to carry Radio Shack branded products. This merchandise was incorporated into the product mix in nine stores locations during fiscal 2007.

On September 26, 2006, the Company announced its first store that would carry Bass Pro Shops® branded products. An additional store carrying these items was added in the first quarter of fiscal 2008.

Items Impacting Specific Periods. The Company had items impacting specific periods. The Company analyzed its income tax liability account based on current information, and determined it was over-accrued with respect to certain tax matters arising in prior years. During the fourth quarter of fiscal 2006 the Company reversed this over-accrual of approximately $371. The Company completes an actuarial analysis of its self-insurance liabilities twice a year. In the third quarter of fiscal 2005, the Company increased its self-insurance reserves by $463 as a result of the actuarial analysis indicating higher than previously estimated claim activity. In the second quarter of fiscal 2006, the Company decreased its self-insurance reserves by $901 as a result of lower than estimated claim activity. In fiscal 2007 there was not a significant change in the self-insurance reserves. In the fourth quarter of fiscal 2007, the Company recorded $795 in income due to a decrease in its LIFO reserve. During the fourth quarter of fiscal 2007 the Company experienced store physical inventory shrinkage $795 higher than expected.

Key Items in Fiscal 2007. The Company measures itself against a number of financial metrics to assess its performance. Some of the important financial items during fiscal 2007 were:

| | · | Net sales increased 9.7% to $475,255. Same store sales increased 6.0% compared to the prior year. |

| | · | Gross margin decreased to 31.6% of sales, compared to 31.8% in the prior year. |

| | · | Selling, general and administrative expenses were 27.8% of sales, compared to 28.7% in the prior year. |

| | · | Earnings per share was $1.49, compared to earnings of $0.47 per share in the prior year. |

| | · | Return on average equity was 5.5%, compared to 1.8% in the prior year. |

Same store sales growth is a measure which may indicate whether existing stores are maintaining their market share. Other factors, such as the overall economy, may also affect same store sales. The Company defines same stores as those stores that were open as of the first day of the prior fiscal year and remain open at the end of the reporting period (this may also be referred to as comparable stores).

Gross margin percentage is a key measure of the Company's ability to maximize profit on the purchase and subsequent sale of merchandise, while minimizing promotional and clearance markdowns, shrinkage, damage, and returns. Gross margin percentage is defined as sales less cost of sales, expressed as a percentage of sales.

Selling, general and administrative expenses are a measure of the Company’s ability to manage and control its expenses to purchase, distribute and sell merchandise.

Earnings per share ("EPS") growth is an indicator of the returns generated for the Company's stockholders. EPS from continuing operations was $1.48 per diluted share for fiscal 2007, compared to $1.13 per diluted share for the prior fiscal year. Return on average equity is a measure of how much income was produced on the average equity of the Company.

Results of Operations. The following table sets forth, for the fiscal years indicated, the components of the Company's consolidated statements of operations expressed as a percentage of net sales:

| | | Fiscal Year Ended | |

| | | | January 28, | | | January 29, | | | January 30, | |

| | | | 2007 | | | 2006 | | | 2005 | |

| Net sales | | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Cost of sales | | | 68.4 | | | 68.2 | | | 66.8 | |

| Gross margin | | | 31.6 | | | 31.8 | | | 33.2 | |

| Selling, general and administrative expenses | | | 27.8 | | | 28.7 | | | 29.7 | |

| Depreciation and amortization | | | 1.4 | | | 1.4 | | | 1.6 | |

| Total operating expenses | | | 29.2 | | | 30.1 | | | 31.3 | |

| Income from continuing operations | | | 2.4 | | | 1.7 | | | 1.9 | |

| Interest expense | | | 0.6 | | | 0.3 | | | 0.3 | |

| Earnings from continuing operations before income | | | | | | | | | | |

| taxes and discontinued operations | | | 1.8 | | | 1.4 | | | 1.6 | |

| Income tax expense | | | 0.6 | | | 0.4 | | | 0.5 | |

| Earnings from continuing operations before discontinued operations | | | 1.2 | | | 1.0 | | | 1.1 | |

| (Loss) income from discontinued operations, net of income tax | | | 0.0 | | | (0.6 | ) | | (0.1 | ) |

| Net earnings | | | 1.2 | % | | 0.4 | % | | 1.0 | % |

Critical Accounting Policies

Our analysis of operations and financial condition is based on our consolidated financial statements, prepared in accordance with U.S. generally accepted accounting principles (GAAP). Preparation of these consolidated financial statements requires us to make estimates and assumptions affecting the reported amounts of assets and liabilities at the date of the financial statements, reported amounts of revenues and expenses during the reporting period and related disclosures of contingent assets and liabilities. In the Notes to Consolidated Financial Statements, we describe our significant accounting policies used in preparing the consolidated financial statements. Our estimates are evaluated on an ongoing basis and are drawn from historical experience and other assumptions that we believe to be reasonable under the circumstances. Actual results could differ under different assumptions or conditions. The following items in our consolidated financial statements require significant estimation or judgment:

Inventory: As discussed in Note 1(d) to the Consolidated Financial Statements, inventories are stated at the lower of cost or net realizable value with cost determined using the last-in, first-out (LIFO) method. The retail inventory method (“RIM”) used by the Company is an averaging method that has been widely used in the retail industry. This method calculates a cost to retail ratio that is applied to the retail value of inventory to calculate cost inventory and the resulting gross margin. Use of the RIM does not eliminate the use of management judgments and estimates, including markdowns and shrinkage, which significantly impact the ending inventory valuation at cost and the resulting gross margins. The Company continually evaluates product categories to determine if markdown action is appropriate, or if a markdown reserve should be established. The Company recognizes that the use of the RIM will result in valuing inventories at lower of cost or market if markdowns are currently taken as a reduction of the retail value of inventories. As of January 28, 2007 and January 29, 2006, the Company had recorded markdowns that had not been taken and which served to reduce inventories to lower of cost or market by approximately $354 and $597, respectively. Management believes that the RIM provides an inventory valuation which reasonably approximates cost and results in carrying inventory at the lower of cost or market. For LIFO, the Company determines lower of cost or market by pool. The Company has historically accrued its shrink reserve based on a three-year average shrink percentage at each of its store locations. Historically the three-year average has appropriately recorded estimated shrinkage on a monthly basis. At the end of fiscal 2007, the Company determined that this reserve was not sufficient due to the shrink results for the last month of fiscal 2007. The stores inventoried in January 2007 experienced $795 more shrink at cost, than had previously been reserved. A 0.5% increase in this percentage would increase the recorded reserve by $257.

Insurance: The Company retains significant deductibles on its insurance policies for workers compensation, general liability and medical claims. Due to the fact that it takes more than one year to determine the actual costs, these costs are estimated based on the Company’s historical loss experience and estimates from the insurance carriers and consultants. The Company completes an actuarial evaluation of its loss experience twice each year. In between actuarial evaluations, management monitors the cost and number of claims and compares those results to historical amounts. The Company’s actuarial method is the fully developed method. This method includes a loss conversion factor that includes administrative, legal and claims handling expenses. The Company records its reserves on an undiscounted basis. The Company’s prior estimates have varied based on changes in assumptions related to actual claims versus estimated ultimate loss calculations. Current and future estimates could be affected by changes in those same assumptions and are reasonably likely to occur. A 1% increase in the loss development factor would increase the recorded liability by $75.

Income Taxes: The Company’s tax provision and establishment of reserves for potential tax liabilities involves the use of estimates and judgment. The Company has identified exposures for which they have established a reserve, such as differences in interpretation of tax laws at the federal, state, and local units of government. In the ordinary course of business, the Company analyzes its income accounts. During fiscal 2006, the Company determined that it was overaccrued with respect to certain matters arising in prior years. The Company reversed such overaccrual of approximately $371 during fiscal 2006.

Share-Based Payments: Effective January 30, 2006, the Company adopted Statement of Financial Accounting Standards No. 123 "Share-Based Payment" ("SFAS 123(R)") and began recognizing compensation expense for its share-based payments based on the fair value of the awards. Share-based payments consist of stock option grants. SFAS 123(R) requires share-based compensation expense recognized since January 30, 2006 to be based on the following: a) grant date fair value estimated in accordance with the original provisions of SFAS 123 for unvested options granted prior to the adoption date and b) grant date fair value estimated in accordance with the provisions of SFAS 123(R) for all share-based payments granted subsequent to the adoption date. For Executives and Directors, the Company estimates forfeitures will not occur. This is due to the fact that, historically, the Company does not experience material turnover of these two classes. Any turnover in these classes could have a significant impact on the stock option expense for the Company. For non-Executives, the Company estimates a higher forfeiture rate. An actual turnover rate, lower or higher than historical trends, and changes in estimated forfeiture rates would impact the stock option expense recorded by the Company.

Fiscal 2007 Compared to Fiscal 2006

Net sales for fiscal 2007 increased $42.0 million or 9.7% to $475.3 million compared to $433.3 million for fiscal 2006. During fiscal 2007, the Company opened seven ALCO stores. One ALCO was closed and one Duckwall store was closed and replaced by an ALCO store, resulting in a year end total of 256 stores. Net sales for all stores open the full year in both fiscal 2007 and 2006 (same stores), increased by $25.6 million or 6.0% in fiscal 2007 compared to fiscal 2006. The average sale for fiscal 2007 increased 7.2% compared to fiscal 2006. The Company had four of its merchandise departments experience greater than 15% increase in sales for fiscal 2007 when compared to fiscal 2006.

Gross margin for fiscal 2007 increased $12.6 million, or 9.1%, to $150.4 million compared to $137.8 million in fiscal 2006. As a percentage of net sales, gross margin decreased to 31.6% in fiscal 2007 compared to 31.8% in fiscal 2006. Fiscal 2007 gross margin was positively impacted by a LIFO reserve reductions and increased vendor participation support, offset by a reduction in warehouse swell, additional shrinkage reserve and increased transportation costs.

Selling, general and administrative expenses increased $8.0 million or 6.4% to $132.2 million in fiscal 2007 compared to $124.2 million in fiscal 2006. As a percentage of net sales, selling, general and administrative expenses were 27.8% in fiscal 2007 and 28.7% in fiscal 2006. The decrease in selling, general and administrative expenses as a percentage of net sales was due in part to an increase in vendor participation in CO-OP advertising, offset by increased payroll, increase in expenses related to stock options, increase in credit card fees, increase in advertising, professional services and software maintenance fees associated with rollout of IT initiative and increase in utilities and new store rents.

Depreciation and amortization expense increased $860 or 14.5% to $6.8 million in fiscal 2007 compared to $5.9 million in fiscal 2006. The increase in depreciation and amortization expense was attributable to a full year’s depreciation on capitalized software which was purchased in the fourth quarter of fiscal 2006.

Income from continuing operations increased $3.7 million, or 48.1%, to $11.4 million in fiscal 2007 compared to $7.7 million in fiscal 2006. Income from continuing operations as a percentage of net sales was 2.4% in fiscal 2007 compared to 1.8% in fiscal 2006. The increase in gross margin, as described above, had the largest impact on the increased income from continuing operations.

Interest expense increased $1.4 million or 107.7%, to $2.7 million in fiscal 2007 compared to $1.3 million in fiscal 2006. The increase in interest expense was attributable to increased borrowings by the Company during fiscal 2007 compared to fiscal 2006. Interest expense may increase if interest rates continue to rise or if the Company expands its borrowing to fund capital expenditures or other programs.

Income taxes on continuing operations were $3.0 million in fiscal 2007 compared to $1.8 million in fiscal 2006. The Company's effective tax rate was 35.1% in fiscal 2007 and 27.4% in fiscal 2006. The effective tax rate is higher due to permanent tax differences relating to stock compensation expense and reversal of over-accrual of approximately $371 during the fourth quarter of 2006.

Income from discontinued operations, net of income taxes was $70 in fiscal 2007, compared to a loss of $2.7 million in fiscal 2006.

Fiscal 2006 Compared to Fiscal 2005

Fiscal 2006 included a number of one-time costs and markdowns associated with the implementation of programs focused on improving long-term performance. The Company has outlined a number of initiatives that address the poor performance of each of the key performance measures, with the goal of improving performance in each area over the long term.

Net sales for fiscal 2006 increased $25.9 million or 6.4% to $433.3 million compared to $407.4 million for fiscal 2005. During fiscal 2006, the Company opened seven ALCO and one Duckwall stores. Ten ALCO and thirteen Duckwall stores were closed, resulting in a year end total of 251 stores. Net sales for all stores open the full year in both fiscal 2006 and 2005 (same stores), increased by $12.6 million or 3.1% in fiscal 2006 compared to fiscal 2005. During the second quarter of fiscal 2006, the Company began a process of eliminating seasonal carryover and distressed inventory. Markdowns that were taken to eliminate this inventory were completed in the third quarter, and affected gross margin as discussed below. A number of factors contributed to the same store sales growth, including liquidation of distressed inventory discussed above, as well as expanded store operating hours, better in-stock position and new product offerings.

Gross margin for fiscal 2006 increased $2.6 million, or 2.0%, to $137.8 million compared to $135.2 million in fiscal 2005. As a percentage of net sales, gross margin decreased to 31.8% in fiscal 2006 compared to 33.2% in fiscal 2005. This decrease in the gross margin percentage was attributable to higher markdowns resulting from the Company’s efforts to reduce its seasonal inventory carryover. The impact of the additional markdowns was $6.6 million at cost, which reduced the gross margin percentage by 1.5%. Other factors affecting margin included higher transportation costs, offset in part by an improved mix of sales and higher markup on purchases.

Selling, general and administrative expenses increased $3.0 million or 2.5% to $124.2 million in fiscal 2006 compared to $121.2 million in fiscal 2005. As a percentage of net sales, selling, general and administrative expenses were 28.7% in fiscal 2006 and 29.7% in fiscal 2005. Non-comparable stores accounted for $3.9 million of this increase. Other SG&A expense categories were subject to inflationary pressures, but those increases were offset by the Company’s cost containment initiatives.

Depreciation and amortization expense decreased $468 or 7.3 % to $5.9 million in fiscal 2006 compared to $6.4 million in fiscal 2005. The decrease in depreciation and amortization expense was attributable to store fixtures and equipment becoming fully depreciated in the current fiscal year on a large number of ALCO stores that were opened in fiscal years 1997 and 1998.

Income from continuing operations increased $69, or 0.9%, to $7.7 million in fiscal 2006 compared to $7.6 million in fiscal 2005. Income from continuing operations as a percentage of net sales was 1.8% in fiscal 2006 compared to 1.9% in fiscal 2005. The reduction in gross margin as described above had the largest impact on the reduced income from continuing operations.

Interest expense increased $43, or 3.5%, to $1.3 million in fiscal 2006 compared to $1.2 million in fiscal 2005. The increase in interest expense was attributable to increased borrowings by the Company during fiscal 2006 compared to fiscal 2005. Interest expense may increase if interest rates continue to rise or if the Company expands its borrowing to fund capital expenditures or other programs.

Income taxes on continuing operations were $1.8 million in fiscal 2006 compared to $2.2 million in fiscal 2005. The Company's effective tax rate was 27.4% in fiscal 2006 and 34.3% in fiscal 2005. The rate was lower in fiscal 2006 because, during the fourth quarter of fiscal 2006, the Company, based on current information, analyzed its income tax liability account and determined that it was over-accrued with respect to certain matters arising in prior years. The Company reversed such over-accrual of $371 during fiscal 2006.

Loss from discontinued operations, net of income taxes was $2.7 million in fiscal 2006, compared to a loss of $270 in fiscal 2005.

SG&A Detail; Certain Financial Matters

The Company has included EBITDA, a non-GAAP performance measure, as part of its disclosure as a means to enhance its communications with stockholders. Certain stockholders have specifically requested this information as a means of comparing the Company to other retailers that disclose similar non-GAAP performance measures. Further, management utilizes this measure in internal evaluation; review of performance and to compare the Company’s financial measure to that of its peers. EBITDA differs from the most comparable GAAP financial measure (earnings from continuing operations before discontinued operations) in that it does not include non-cash items. As a result, it may not reflect important aspects of the results of the Company’s operations.

| | | For the Year Ended |

SG&A Expenses Breakout | | | January 28, 2007 | | | January 29, 2006 | |

| General Office | | | 17,869 | | | 16,668 | |

| Distribution Center | | | 8,742 | | | 8,319 | |

| SPD Truck Lines | | | - | | | 1,128 | |

| 401K/Profit Sharing | | | 478 | | | - | |

| Asset Impairment | | | 130 | | | - | |

| Comparable Stores SG&A | | | 101,481 | | | 96,870 | |

| Non Comp Stores SG&A # | | | 2,644 | | | 1,223 | |

| Stock Option Expense | | | 821 | | | - | |

| Final SG&A | | | 132,165 | | | 124,208 | |

| | | | | | | | |

| Return on Average Equity (ROE)**** | | | 5.48 | % | | 1.80 | % |

| | | | | | | | |

| Net Sales | | $ | 475,255 | | $ | 433,319 | |

| SG&A as % of Sales | | | 27.81 | % | | 28.66 | % |

| | | | | | | | |

| SG&A per average selling square foot | | $ | 32.12 | | $ | 31.14 | |

| | | | | | | | |

| EBITDA** | | $ | 19,026 | | $ | 13,623 | |

| EBITDA per average selling square foot*** | | $ | 4.62 | | $ | 3.42 | |

| | | | | | | | |

| Sales per average selling square feet* | | | | | | | |

| ALCO | | $ | 118.45 | | $ | 111.15 | |

| Duckwall | | $ | 85.15 | | $ | 82.84 | |

| Total | | $ | 115.49 | | $ | 108.64 | |

| | | | | | | | |

| Average Selling Square Feet* | | | 4,115 | | | 3,989 | |

| Average Square Feet % Change | | | 3.1 | % | | 3.3 | % |

| | | | | | | | |

| Total Stores Operating beginning of Period | | | 251 | | | 266 | |

| Total Stores Operating end of Period | | | 256 | | | 251 | |

| | | | | | | | |

| Supplemental Data: | | | | | | | |

| Same Store Sales Change | | | 6.0 | % | | 3.1 | % |

| Total customer count change | | | 1.9 | % | | 2.3 | % |

| Average sale per ticket change | | | 7.6 | % | | 3.8 | % |

| | | | | | | | |

| Average annualized New Store Sale | | | | | | | |

| performance on prototype Stores | | $ | 2,357 | | | | |

| Incremental expenses related to IT initiative | | $ | 749 | | | | |

| | | | | | | | |

| * Average selling square feet is (beginning square feet plus ending square feet) divided by 2. | | | |

| ** EBITDA is earnings from continuing operations before interest, taxes, depreciation and amortization, and stock option expense. |

| *** EBITDA per selling square foot is a non-GAAP financial measure and is calculated as EBITDA divided by selling square feet. |

| **** Return on average equity (ROE) is calculated as Net Earnings divided by average stockholders' equity. | | | |

| Average Stockholders' Equity is calculated as (beginning of period stockholders' equity plus end of period |

| stockholders' equity) divided by 2 | | | | | | | |

| # Non Comp Stores are those stores opened in Fiscal 2006 & Fiscal 2007. | | | | | | | |

Fiscal 2007 Compared to Fiscal 2006

General Office expenses for fiscal 2007 increased $1,201, or 7.2%. The majority of the increase was related to professional fees related to Sarbanes-Oxley, stock options expense and incremental IT expenses.

Distribution center expenses increased $423, or 5.1%.

SPD Truck Line expenses did not exist in fiscal 2007 and were replaced with contract transportation expenses which are capitalized into inventory and included in cost of goods sold.

Comparable store SG&A expenses increased $4,611, or 4.8%. Utilities, credit card fees, and advertising accounted for the majority of this increase.

Non Comparable Stores SG&A expenses increased $1,421. The Company opened seven new stores during the year.

Reconciliation and Explanation of Non-GAAP Financial Measures

The following table shows the reconciliation of EBITDA and EBITDA per selling square foot to the earnings (loss) from continuing operations, the most directly comparable financial measure calculated and presented in accordance with GAAP:

| | | 2007 | | 2006 | |

| | | | | | |

| Earnings from continuing operations | | $ | 5,634 | | | 4,657 | |

| Plus interest | | | 2,730 | | | 1,272 | |

| Plus taxes | | | 3,046 | | | 1,754 | |

| Plus depreciation and amortization | | | 6,795 | | | 5,940 | |

| Plus stock option expense | | | 821 | | | - | |

| =EBITDA | | $ | 19,026 | | | 13,623 | |

| | | | | | | | |

| | | | | | | | |

| Earnings from continuing operations per square foot | | | 1.37 | | | 1.17 | |

| Plus interest per square foot | | | 0.66 | | | 0.32 | |

| Plus taxes per square foot | | | 0.74 | | | 0.44 | |

| Plus depreciation and amortization per square foot | | | 1.65 | | | 1.49 | |

| Plus stock option expense per square foot | | | 0.20 | | | - | |

| =EBITDA per selling square foot | | $ | 4.62 | | | 3.42 | |

Seasonality and Quarterly Results

The following table sets forth the Company's net sales, gross margin, income from operations, and net earnings during each quarter of fiscal 2007 and 2006.

| | | First | | Second | | Third | | Fourth | |

| | Quarter | | Quarter | | Quarter | | Quarter(1)(2) | |

| | | | | | | | | | |

| Fiscal 2007 | | | | | | | | | | | | | |

| Net sales | | $ | 108.8 | | | 120.3 | | | 110.1 | | | 136.1 | |

| Gross margin | | | 32.4 | | | 36.1 | | | 34.3 | | | 47.5 | |

| Earnings from continuing operations | | | 0.3 | | | 1.4 | | | (0.5 | ) | | 4.2 | |

| Net Earnings (loss) | | | 0.5 | | | 1.4 | | | (0.6 | ) | | 4.4 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Fiscal 2006 | | | | | | | | | | | | | |

| Net sales | | $ | 98.0 | | | 108.3 | | | 100.7 | | | 126.7 | |

| Gross margin | | | 30.4 | | | 32.6 | | | 32.5 | | | 42.3 | |

| Earnings from continuing operations | | | (1.2 | ) | | 0.7 | | | (0.1 | ) | | 5.1 | |

| Net Earnings (loss) | | | (2.7 | ) | | (0.3 | ) | | (0.1 | ) | | 5.2 | |

| | (1) | In fiscal 2007, an increase in shrinkage of $795 in the fourth quarter negatively impacted gross margin. A LIFO, lower or cost or market adjustment of $795 positively impacted gross margin. A shrinkage reserve of $300 negatively impacted gross margin. |

| | (2) | In fiscal 2006, the reduction in shrinkage related to a warehouse inventory adjustment contributed $1.3 million to the gross margin. A reversal of an over-accrual of income taxes of $371 positively impacted net earnings. |

See Note 10 of Notes to Consolidated Financial Statements for quarterly earnings per share information.

The Company’s business is subject to seasonal fluctuations. The Company’s highest sales levels occur in the fourth quarter of its fiscal year which includes the Christmas holiday selling season. The Company's results of operations in any one quarter are not necessarily indicative of the results of operations that can be expected for any other quarter or for the full fiscal year. The Company's results of operations may also fluctuate from quarter to quarter as a result of the amount and timing of sales contributed by new stores and the integration of the new stores into the operations of the Company, as well as other factors. The addition of a large number of new stores can, therefore, significantly affect the quarterly results of operations.

Inflation

Management does not believe that its merchandising operations have been materially affected by inflation over the past few years. The Company will continue to monitor costs, take advantage of vendor incentive programs, selectively buy from competitive vendors and adjust merchandise prices based on market conditions.

The Company’s operating expenses have been impacted by increases in insurance expenses, as well as competitive pressures in wages in selected markets. See additional discussion of wages in the “Government Regulation” section.

The increase in the price of oil adversely affects the Company’s transportation costs, both on inbound shipments to the Company’s distribution center, and on outbound shipments of merchandise to the stores. The Company also believes the higher retail price of gasoline adversely affects the amount of discretionary spending dollars our customers have to spend at our stores.

Liquidity and Capital Resources

At the end of fiscal 2007, working capital (defined as current assets less current liabilities) was $106.4 million compared to $90.6 million at the end of fiscal 2006 and $95.4 million at the end of fiscal 2005.

The Company's primary sources of funds are cash flow from operations, borrowings under its revolving loan credit facility, vendor trade credit financing and lease financing. In fiscal 2007 the Company completed a sale-leaseback of a number of its owned stores. The proceeds from this transaction amounted to $12.6 million. No sale-leaseback transactions were completed in fiscal 2006. In fiscal 2005 the Company received proceeds from sale-leaseback transactions of $1.7 million.

Cash (used in) provided by operating activities aggregated ($4.0) million, $12.0 million, and $5.5 million, in fiscal 2007, 2006 and 2005, respectively. The decrease in cash provided in fiscal 2007 relative to fiscal 2006 and fiscal 2005 resulted primarily from an increase in merchandise inventory. In addition to the seven new locations, the Company maintained a strategic program to remain in stock at all times.

The Company uses its revolving loan credit facility and vendor trade credit financing to fund the build up of inventories periodically during the year for its peak selling seasons and to meet other short-term cash requirements. The revolving loan credit facility provides up to $70 million of financing in the form of notes payable and letters of credit. The loan agreement expires in April 2010. The revolving loan note payable and letter of credit balance at January 28, 2007 was $24.4 million, resulting in an available line of credit at that date of $45.6 million. Loan advances are secured by a security interest in the Company’s inventory. The loan agreement contains various restrictions that are applicable when outstanding borrowings exceed $42.5 million. Short-term trade credit represents a significant source of financing for inventory to the Company. Trade credit arises from the willingness of the Company's vendors to grant payment terms for inventory purchases.

In fiscal 2007, the Company had net cash borrowings of $4.0 million on its revolving credit facility, made cash payments of $2.1 million to reduce its capital lease obligations, and repurchased $2.0 million of Company stock. The Company received $113 in proceeds from the exercise of outstanding stock options. In fiscal 2006, the Company had net cash borrowings on its revolving credit facility of $13.0 million and made cash payments of $1.1 million to reduce its long-term debt and capital lease obligations, and repurchased $13.0 million of Company stock. The Company received $423 in proceeds from the exercise of outstanding stock options. In fiscal 2005, the Company made net cash payments on its revolving credit facility of $935 and made cash payments of $1.3 million to reduce its long-term debt and capital lease obligations, and repurchased $80 of Company stock. The Company received $1.3 million in proceeds from the exercise of outstanding stock options. The Company executed operating leases for 15 additional stores during the three year period ending in fiscal 2007. The Company’s long-range plan assumes growth in the number of stores and, in accordance with this plan, seven new ALCO stores were opened in fiscal 2007, seven new ALCO and one new Duckwall stores were opened in fiscal 2006 and approximately 25 new ALCO stores are expected to be opened in fiscal 2008. The Company believes that with the $70 million line of credit, sufficient capital is available to fund the Company’s planned expansion.

Cash used for acquisition of property and equipment in fiscal 2007, 2006 and 2005 totaled $7.6 million, $11.1 million, and $6.5 million, respectively. A sale-leaseback transaction of several store buildings was completed in fiscal 2007 in the amount of $12.6 million and $1.6 from the sale of other assets. In fiscal 2005, the company owned surplus land was sold for $315 and the Company completed a sale-leaseback transaction for $1.7 million. Anticipated cash payments for acquisition of property and equipment in fiscal 2008, principally for fixtures and equipment, are $13.0 million. The net cash provided by investing activities was $6.5 million in fiscal 2007. The net cash used in investing activities in fiscal 2006 and 2005 was $11.1 million and $4.6 million, respectively.

On March 23, 2006, the Board of Directors approved a new plan authorizing the repurchase of 200,000 shares of the Company’s common stock, of which 3,337 shares have been repurchased at an average cost of $30.46. As of January 28, 2007, 196,663 shares remain available to be repurchased.

The following table summarizes the Company’s significant contractual obligations payable as of January 28, 2007 (in thousands):

| | | | | | | | | | | | |

| | | Payments due by Period | |

| | | | | Less than | | 1 - 3 | | 4 - 5 | | After | |

| Contractual Obligations | | | Total | | | 1 year | | | years | | | years | | | 5 years | |

| | | | | | | | | | | | | | | | | |

| Revolving Loan Credit Facility (1) | | $ | 21,077 | | | - | | | 21,077 | | | - | | | - | |