2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K |

| | |

| (Mark One) |

| ý | | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2011 |

| OR |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

____________________________________________________________________________

Commission file number 1-815

E. I. DU PONT DE NEMOURS AND COMPANY

(Exact name of registrant as specified in its charter)

|

| | |

DELAWARE (State or Other Jurisdiction of Incorporation or Organization) | | 51-0014090 (I.R.S. Employer Identification No.) |

1007 Market Street

Wilmington, Delaware 19898

(Address of principal executive offices)

Registrant's telephone number, including area code: 302-774-1000

Securities registered pursuant to Section 12(b) of the Act

(Each class is registered on the New York Stock Exchange, Inc.):

Title of Each Class

__________________________________________________

Common Stock ($.30 par value)

Preferred Stock

(without par value-cumulative)

$4.50 Series

$3.50 Series

No securities are registered pursuant to Section 12(g) of the Act.

_____________________________________________________

Indicate by check mark whether the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ý No o

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of voting stock held by nonaffiliates of the registrant (excludes outstanding shares beneficially owned by directors and officers and treasury shares) as of June 30, 2011, was approximately $50.3 billion.

As of January 31, 2012, 932,253,000 shares (excludes 87,041,000 shares of treasury stock) of the company's common stock, $0.30 par value, were outstanding.

Documents Incorporated by Reference

(Specific pages incorporated are indicated under the applicable Item herein):

|

| | |

| | | Incorporated By Reference In Part No. |

| The company's Proxy Statement in connection with the Annual Meeting of Stockholders to be held on April 25, 2012 | | III |

E. I. du Pont de Nemours and Company

Form 10-K

Table of Contents

The terms "DuPont" or the "company" as used herein refer to E. I. du Pont de Nemours and Company and its consolidated subsidiaries, or to E. I. du Pont de Nemours and Company, as the context may indicate.

Note on Incorporation by Reference

Information pertaining to certain Items in Part III of this report is incorporated by reference to portions of the company's definitive 2012 Annual Meeting Proxy Statement to be filed within 120 days after the end of the year covered by this Annual Report on Form 10-K, pursuant to Regulation 14A (the Proxy).

Part I

ITEM 1. BUSINESS

DuPont was founded in 1802 and was incorporated in Delaware in 1915. DuPont brings world-class science and engineering to the global marketplace in the form of innovative products, materials and services. The company believes that by collaborating with customers, governments, non-governmental organizations and thought leaders it can help find solutions to such global challenges as providing enough healthy food for people everywhere, decreasing dependence on fossil fuels, and protecting life and the environment. Total worldwide employment at December 31, 2011, was approximately 70,000 people. The company has operations in more than 90 countries worldwide and about 65 percent of consolidated net sales are made to customers outside the United States of America (U.S.).

Subsidiaries and affiliates of DuPont conduct manufacturing, seed production or selling activities and some are distributors of products manufactured by the company. As a science and technology based company, DuPont competes on a variety of factors such as product quality and performance or specifications, continuity of supply, price, customer service and breadth of product line, depending on the characteristics of the particular market involved and the product or service provided. Most products are marketed primarily through DuPont's sales force, although in some regions, more emphasis is placed on sales through distributors. The company utilizes numerous suppliers as well as internal sources to supply a wide range of raw materials, energy, supplies, services and equipment. To ensure availability, the company maintains multiple sources for fuels and many raw materials, including hydrocarbon feedstocks. Large volume purchases are generally procured under competitively priced supply contracts.

In 2011, DuPont acquired Danisco A/S (Danisco), a global enzyme and specialty food ingredients company. This acquisition was valued at $6.4 billion, plus net debt assumed of $0.6 billion.

Business Segments

The company consists of 14 businesses which are aggregated into nine reportable segments based on similar economic characteristics, the nature of the products and production processes, end-use markets, channels of distribution and regulatory environment. The company's reportable segments are Agriculture, Electronics & Communications, Industrial Biosciences, Nutrition & Health, Performance Chemicals, Performance Coatings, Performance Materials, Safety & Protection and Pharmaceuticals. The company includes certain embryonic businesses not included in the reportable segments, such as pre-commercial programs, and nonaligned businesses in Other.

Agriculture

Agriculture businesses, Pioneer Hi-Bred International, Inc. (Pioneer) and DuPont Crop Protection, leverage the company's technology, customer relationships and industry knowledge to improve the quantity, quality and safety of the global food supply and the global production agriculture industry. Land available for worldwide agricultural production is increasingly limited so production growth will need to be achieved principally through improving crop yields and productivity rather than through increases in planted area. The segment's businesses deliver a broad portfolio of products and services that are specifically targeted to achieve gains in crop yields and productivity, including Pioneer® brand seed products and well-established brands of insecticides, fungicides and herbicides. Research and development focuses on leveraging technology to increase grower productivity and enhance the value of grains and soy through improved seed traits, superior seed germplasm and effective use of insecticides, herbicides and fungicides. Agriculture accounted for approximately 50 percent of the company's total research and development expense in 2011.

Sales of the company's products in the segment are affected by seasonal cropping and weather patterns. Sales and earnings performance in the Agriculture segment are strongest in the first half of the year reflecting the northern hemisphere planting season. The segment generally operates at a loss during the third and fourth quarters of the year. As a result of the seasonal nature of its business, Agriculture's inventory is at its highest level at the end of the calendar year and is sold down in the first and second quarters. Trade receivables in the Agriculture segment are at a low point at year-end and increase through the selling season to peak at the end of the second quarter.

Pioneer is a world leader in developing, producing and marketing corn hybrid and soybean varieties which improve the productivity and profitability of its customers. Additionally, Pioneer sells canola, sunflower, sorghum, inoculants, wheat and rice. As the world's population grows and the middle class expands, the need for crops for animal feed, food, biofuels and industrial uses continues to increase. The business competes with other seed and plant biotechnology companies. Pioneer seed sales amounted to 16 percent, 17 percent and 18 percent of the company's total consolidated net sales for the years ended December 31, 2011, 2010 and 2009, respectively.

Part I

ITEM 1. BUSINESS, continued

Pioneer's research and development focuses on integrating high yielding germplasm with value added proprietary and/or licensed native and biotechnology traits with local environment and service expertise. Pioneer uniquely develops integrated products for specific regional application based on local product advancement and testing of the product concepts. Research and development in this arena requires long-term commitment of resources, extensive regulatory efforts and collaborations, partnerships and business arrangements to successfully bring products to market. Pioneer licenses biotechnology traits from third parties as a normal course of business. To protect its investment, the business employs the use of patents covering germplasm and native and biotechnology traits in accordance with country laws.

Pioneer is actively pursuing the development of innovations for corn hybrid, soybean varieties, canola, sunflower, wheat and rice based on market assessments of the most valuable opportunities. In corn hybrids, programs include innovations for drought and nitrogen efficiency, insect protection and herbicide tolerance. In soybean varieties, programs include products with high oleic content, multiple herbicide tolerance and insect protection.

Pioneer has seed production facilities located throughout the world. Seed production is performed directly by the business or contracted with independent growers and conditioners. Pioneer's ability to produce seeds primarily depends upon weather conditions and availability of reliable contract growers.

Pioneer markets and sells seed product primarily under the Pioneer® brand but also sells and distributes products utilizing additional brand names. Pioneer promotes its products through multiple marketing channels around the world. In the corn and soybean markets of the U.S. Corn Belt, Pioneer® brand products are sold through a specialized force of independent sales representatives. Outside of North America Pioneer's products are marketed through a network of subsidiaries, joint ventures and independent producer-distributors.

DuPont Crop Protection serves the global production agriculture industry with crop protection products for field crops such as wheat, corn, soybean and rice; specialty crops such as fruit, nut, vine and vegetables; and non-crop segments, including forestry and land management. Principal crop protection products are weed control, disease control and insect control products. Crop Protection products are marketed and sold to growers and other end users through a network of wholesale distributors and crop input retailers. The sales growth of the business' insect control portfolio is led by DuPontTM Rynaxypyr® insecticide, a product registered for sale in over 80 countries and sold under four key brands for use across a broad range of core agricultural crops.

The major commodities, raw materials and supplies for the Agriculture segment include: corn and soybean seeds, benzene and carbamic acid related intermediates, copper, insect control products, natural gas, soybeans and sulfonamides.

Agriculture segment sales outside the U.S. accounted for 54 percent of the segment's total sales in 2011.

Electronics & Communications

Electronics & Communications (E&C) is a leading supplier of differentiated materials and systems for photovoltaics, consumer electronics, displays and advanced printing that enable superior performance and lower total cost of ownership for customers. The segment leverages DuPont's strong materials and technology base to target attractive growth opportunities in photovoltaic materials, circuit and semiconductor fabrication and packaging materials, display materials, packaging graphics, and ink-jet printing. In the growing photovoltaics market, E&C continues to be a leading supplier of metalization pastes and backsheet materials for use in solar cells and modules. In 2011, the segment completed the acquisition of Innovalight, Inc., a company specializing in advanced silicon inks and process technologies that increase the efficiency of crystalline silicon solar cells. The acquisition further strengthens the segment's position as a leader in materials for the solar energy market, enabling a broader and more integrated photovoltaic materials and technology offering from the business. The segment completed a $295 million expansion to support the DuPontTM Tedlar® polyvinyl fluoride films business. This included a $120 million investment in capacity expansion to produce the raw materials that make the film, which was completed in 2010, and a multi-phase $175 million investment of high-performance Tedlar® PV2001 series oriented film production completed in 2011. Tedlar® films serve as the critical component of photovoltaic module backsheets, providing long-term durability and performance in all weather conditions.

In the displays market, E&C continues to be a leading materials supplier for plasma displays. In 2011, the segment signed a technology licensing agreement with a leading Asian manufacturer of active matrix organic light emitting diode (AMOLED) display products that will enable solution-process technology developed by the manufacturer to be used in the segment's production of large AMOLED television displays.

Part I

ITEM 1. BUSINESS, continued

The segment is expanding its broad portfolio of materials for semiconductor fabrication and packaging, as well as innovative materials for circuit applications, to address critical needs of electronic component and device manufacturers. In packaging graphics, E&C is a leading supplier of flexographic printing systems, including Cyrel® photopolymer plates. The segment is investing in new products such as Cyrel® FAST Round to strengthen its market leadership position in advanced printing markets. The segment is also expanding its leadership position in black-pigmented inks and developing new color-pigmented inks for network printing applications.

The major commodities, raw materials and supplies for E&C include: block co-polymers, copper, hydroxylamine, oxydianiline, polyester film, precious metals, difluoroethane and pyromellitic dianhydride.

E&C segment sales outside the U.S. accounted for 86 percent of the segment's total sales in 2011.

Industrial Biosciences

Industrial Biosciences is comprised of Danisco's enzyme business acquired in 2011, as well as the DuPontTM Sorona® renewably sourced polymer and BioPDOTM 1,3 propanediol businesses, previously reported in Other. Industrial Biosciences leverages DuPont's unique combination of biotechnology, chemical, materials science and process engineering capabilities to deliver customer-driven, superior-performing, sustainable solutions. Industrial Biosciences is a leader in developing and manufacturing a wide range of enzymes, which are biocatalysts that enable chemical reactions, on a large scale. The segment's enzymes add value and functionality to a broad range of products and processes such as animal nutrition, detergents, food manufacturing, ethanol production and industrial applications resulting in cost and process benefits, better product performance and improved environmental outcomes.

The segment includes a joint venture with Tate & Lyle PLC, DuPont Tate and Lyle Bio Products LLC, to produce BioPDOTM using a proprietary fermentation and purification process. BioPDOTM is the key building block for DuPontTM Sorona®, which is used primarily in carpet and apparel fibers.

The major commodities, raw materials and supplies for the Industrial Biosciences segment include: grain products, such as dextrose and glucose, glucoamylase, purified terephthalic acid and glycols.

Industrial Biosciences segment sales outside the U.S. accounted for 53 percent of the segment's total sales in 2011.

Nutrition & Health

Nutrition & Health is comprised of Danisco's world leading specialty food ingredients business and Solae, a majority-owned venture with Bunge Limited, which is a world leader in developing soy based technologies. The segment is the premier provider of innovative solutions for specialty food ingredients, health and safety. The segment's products, which include cultures, emulsifiers, gums, natural sweeteners and soy-based food ingredients, hold leading market positions based on industry leading innovation, relevant product portfolio and close-partnering with the world's food manufacturers. Nutrition & Health serves various end markets within the food industry including meat, dairy, beverages and bakery segments. Nutrition & Health has research, production and distribution operations around the world.

Nutrition & Health products are marketed and sold under a variety of brand names and are distributed primarily through its direct route to market. The direct route to market focuses on strong customer collaborations and insights with multinational customers and regional customers alike.

The major commodities, raw materials and supplies for the Nutrition & Health segment include: soybean, oils and fats, grain products, locust bean gum, glycerin, seaweed, acetyls, sugar, yeast and citrus peels.

Nutrition & Health segment sales outside the U.S. accounted for 69 percent of the segment's total sales in 2011.

Performance Chemicals

Performance Chemicals businesses, DuPont Titanium Technologies and DuPont Chemicals and Fluoroproducts, deliver customized solutions with a wide range of industrial and specialty chemical products for markets including plastics and coatings, textiles, mining, pulp and paper, water treatment and healthcare.

DuPont Titanium Technologies is the world's largest manufacturer of titanium dioxide, and is dedicated to creating greater value for the coatings, paper, plastics, specialties and minerals markets through service, brand and product. The business' main products include its broad line of DuPontTM Ti-Pure® titanium dioxide products. In 2011, the business announced a global expansion to

Part I

ITEM 1. BUSINESS, continued

support increased customer demand for titanium dioxide, including a $500 million investment in new production facilities at the company's Altamira, Mexico site scheduled for completion in 2014. In addition, the business is investing in facility upgrades to improve productivity at its other global manufacturing sites over the next three years.

DuPont Chemicals and Fluoroproducts is a leading global manufacturer of industrial and specialty fluorochemicals, fluoropolymers and performance chemicals. The business' broad line of products that include refrigerants, lubricants, propellants, solvents, fire extinguishants and electronic gases, cover a wide range of industries and markets. Key brands include DuPont™ Teflon®, Capstone®, Dymel®, OpteonTM yf, Isceon®, Suva®, Vertrel®, Zyron®, Vazo® and Virkon®.

The major commodities, raw materials and supplies for the Performance Chemicals segment include: ammonia, benzene, chlorine, chloroform, fluorspar, hydrofluoric acid, industrial gases, methanol, natural gas, perchloroethylene, sulfur, petroleum coke and titanium ore.

Performance Chemicals segment sales outside the U.S. accounted for 60 percent of the segment's total sales in 2011.

Performance Coatings

Performance Coatings is one of the world's leading motor vehicle coatings suppliers. Products offered include high performance liquid and powder coatings for motor vehicle original equipment manufacturers (OEMs), the motor vehicle after-market, and general industrial applications, such as coatings for heavy equipment, pipes and appliances and electrical insulation. After-market coatings products are marketed using the DuPontTM Standox®, Spies Hecker®, Cromax Pro® and Nason® brand names. Standox®, Spies Hecker® and Cromax Pro® are focused on the high-end motor vehicle after-markets, while Nason® is primarily focused on economy coating applications. The segment has several large customers, primarily in the motor vehicle OEM industry supply chain. The company has long-standing relationships with these customers and they are considered to be important to the segments' operating results.

The major commodities, raw materials and supplies for the Performance Coatings segment include: isocyanates, pigments, resins and solvents.

Performance Coatings segment sales outside the U.S. accounted for 75 percent of the segment's total sales in 2011.

Performance Materials

Performance Materials businesses, Performance Polymers and Packaging & Industrial Polymers, provide productive, higher performance polymers, elastomers, films, parts, and systems and solutions which improve the uniqueness, functionality and profitability of its customers' offerings. The key markets served by the segment include the automotive OEM and associated after-market industries, as well as electrical, packaging, construction, oil, electronics, photovoltaics, aerospace, chemical processing and consumer durable goods. The segment has several large customers, primarily in the motor vehicle OEM industry supply chain. The company has long-standing relationships with these customers and they are considered to be important to the segments' operating results.

Performance Polymers delivers a broad range of polymer-based high performance materials in its product portfolio, including elastomers and thermoplastic and thermoset engineering polymers which are used by customers to fabricate components for mechanical, chemical and electrical systems. The main products include: DuPontTM Zytel® nylon resins, Delrin® acetal resins, Hytrel® polyester thermoplastic elastomer resins, Tynex® filaments, Vespel® parts and shapes, Vamac® ethylene acrylic elastomer, Kalrez® perfluoroelastomer and Viton® fluoroelastomers. Performance Polymers also includes the DuPont Teijin Films joint venture, whose primary products are Mylar® and Melinex® polyester films.

Packaging & Industrial Polymers specializes in resins and films used in packaging and industrial polymer applications, sealants and adhesives, sporting goods, and interlayers for laminated safety glass. Key brands include: DuPontTM Surlyn® ionomer resins, Bynel® coextrudable adhesive resins, Elvax® EVA resins, SentryGlas®, Butacite® laminate interlayers and Elvaloy® copolymer resins.

The major commodities, raw materials and supplies for the Performance Materials segment include: acrylic monomers, adipic acid, butadiene, butanediol, dimethyl terephthalate, ethane, fiberglass, hexamethylenediamine, methanol, natural gas and purified terephthalic acid.

Performance Materials segment sales outside the U.S. accounted for 68 percent of the segment's total sales in 2011.

Part I

ITEM 1. BUSINESS, continued

Safety & Protection

Safety & Protection businesses, Protection Technologies, Sustainable Solutions and Building Innovations, satisfy the growing global needs of businesses, governments and consumers for solutions that make life safer, healthier and more secure. By uniting market-driven science with the strength of highly regarded brands, the segment delivers products and services to a large number of markets, including construction, transportation, communications, industrial chemicals, oil and gas, electric utilities, automotive, manufacturing, defense, homeland security and safety consulting.

Protection Technologies is focused on finding solutions to protect people and the environment. With products like DuPont™ Kevlar® high strength material, Nomex® thermal resistant material and Tyvek® protective material, the business continues to hold strong positions in life protection markets and meet the continued demand for body armor and personal protective gear for the military, law enforcement personnel, firefighters and other first responders, as well as for workers in the oil and gas industry around the world. In 2011, the business announced the start up of its $500 million Cooper River Kevlar® facility near Charleston, South Carolina. The Cooper River Kevlar® plant uses state-of-the-art technology that will allow the business to meet increased customer demand for advanced protective materials in emerging industries around the world by expanding its portfolio of science-based innovations and boosting productivity. Commercial supply began at the end of 2011.

Sustainable Solutions continues to help organizations worldwide reduce workplace injuries and fatalities while improving operating costs, productivity and quality. Sustainable Solutions is a leader in the safety consulting field, selling training products, as well as consulting services. Additionally, Sustainable Solutions is dedicated to clean air, clean fuel and clean water with offerings that help reduce sulfur and other emissions, formulate cleaner fuels, or dispose of liquid waste. Its goal is to help maintain business continuity and environmental compliance for companies in the refining and petrochemical industries, as well as for government entities. In 2010, the business completed the acquisition of MECS, Inc. (MECS), which is a leading global provider of process technology, proprietary specialty equipment and technical services to the sulfuric acid industry.

Building Innovations is committed to the building science behind increasing the performance of building systems, helping reduce operating costs and creating more sustainable structures. The business is a market leader of solid surfaces through its DuPont™ Corian® and Montelli® lines of products which offer durable and versatile materials for residential and commercial purposes. Other products such as DuPont™ Tyvek® and Typar® offer leading solutions for the protection and energy efficiency of buildings.

The major commodities, raw materials and supplies for the Safety & Protection segment include: alumina hydroxide, benzene, high density polyethylene, isophthaloyl chloride, metaphenylenediamine, methyl methacrylate, paraphenylenediamine, polyester fiber, terephthaloyl chloride and wood pulp.

Safety & Protection segment sales outside the U.S. accounted for 63 percent of the segment's total sales in 2011.

Pharmaceuticals

On October 1, 2001, DuPont Pharmaceuticals was sold to the Bristol-Myers Squibb Company. DuPont retained its interest in Cozaar® (losartan potassium) and Hyzaar® (losartan potassium with hydrochlorothiazide), which are used in the treatment of hypertension. DuPont has exclusively licensed worldwide marketing and manufacturing rights for Cozaar® and Hyzaar® to Merck & Co., Inc. (Merck).

Pharmaceuticals' Cozaar®/Hyzaar® income is the sum of two parts: income related to a share of the profits from North American sales and certain markets in Europe, and royalty income derived from worldwide contract net sales linked to the exclusivity term in a particular country. Patents and exclusivity started to expire in prior years and the U.S. exclusivity for Cozaar® ended in April 2010. The worldwide agreement terminates when the following conditions are met: (i) the Canadian exclusivity ends (which occurred in January 2012), and (ii) North American sales fall below a certain level, which could occur by year end 2012. The company experienced its first significant step-down in income from Cozaar®/Hyzaar® in 2010 and expects a continued step-down to zero when the contract ends. In general, management expects a traditional earnings and cash decline for a drug going off patent in the pharmaceutical industry to continue until the contract ends.

Backlog

In general, the company does not manufacture its products against a backlog of orders and does not consider backlog to be a significant indicator of the level of future sales activity. Production and inventory levels are based on the level of incoming orders as well as projections of future demand. Therefore, the company believes that backlog information is not material to understanding its overall business and should not be considered a reliable indicator of the company's ability to achieve any particular level of revenue or financial performance.

Part I

ITEM 1. BUSINESS, continued

Intellectual Property

DuPont believes that its intellectual property estate provides it with an important competitive advantage. It has an established global network of attorneys, as well as branding, advertising and licensing professionals, to procure, maintain, protect, enhance and gain value from this estate.

The company has a large portfolio of and is licensed under various patents. These definite-lived patents cover many products, processes and product uses. These patents protect many aspects of the company's significant research programs and the goods and services it sells. The actual protection afforded by these patents varies from country to country and depends upon the scope of coverage of each individual patent as well as the availability of legal remedies in each country. DuPont owns about 19,000 worldwide patents and is awaiting action on about 18,000 worldwide patent applications. In 2011, the company was granted 910 U.S. patents, the highest number for a single year in the company's history, and about 2,100 international patents. DuPont's rights under its patents and licenses, as well as the products made and sold under them, are important to the company as a whole, and to varying degrees, important to each reportable segment.

Trade secrets are an important element of the company's intellectual property. Many of the processes used to make DuPont products are kept as trade secrets which, from time to time, may be licensed to third parties. DuPont vigilantly protects all of its intellectual property including its trade secrets. When the company discovers that its trade secrets have been unlawfully taken, it reports the matter to governmental authorities for investigation and potential criminal action, as appropriate. In addition, the company takes measures to mitigate any potential impact, which may include civil actions seeking redress, restitution and/or damages based on loss to the company and/or unjust enrichment.

Ownership of and access to intellectual property rights, particularly those relating to biotechnology and germplasm, will continue to be important to Pioneer and its competitors. The environment in which Pioneer competes is characterized by the use among competitors of intellectual property rights, including patent lawsuits, to gain advantage in commercial markets. In support of its business, Pioneer continues to build a large collection of intellectual property rights related to biotechnology and germplasm and to license technology from others, including competitors. Pioneer endeavors to obtain such licenses on commercially reasonable terms.

The company has about 2,450 unique trademarks for its products and services and approximately 22,500 registrations for these trademarks worldwide. Ownership rights in trademarks do not expire if the trademarks are continued in use and properly protected. The company has many trademarks that have significant recognition at the consumer retail level and/or business to business level.

Research and Development

The company conducts research at either dedicated research facilities or manufacturing plants. There are twelve major research locations in the U.S. & Canada, with the highest concentration of facilities being located in the Wilmington, Delaware area. Reflecting the company's global interests, five major research locations are located in both the Asia Pacific and Europe, Middle East and Africa (EMEA) regions. One major location is also located in Latin America.

The objectives of the company's research and development programs are to create new technologies, processes and business opportunities in relevant fields, as well as to improve existing products and processes. Each segment of the company funds research and development activities that support its business mission. The company is expanding its offerings addressing safety, environment, energy and climate challenges in the global marketplace by developing and commercializing renewable, bio-based materials; advanced biofuels; energy-efficient technologies; enhanced safety and protection products; and alternative energy products and technologies. The goals are tied directly to business growth, including increasing food production, increasing renewable sources for energy and raw materials, and providing greater safety and protection for people and the environment. All research and development activities are administered by senior research and development management to ensure consistency with the business and corporate strategy. The future of the company is not dependent upon the outcome of any single research program.

Additional information with respect to research and development, including the amount incurred during each of the last three fiscal years, is included in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, on page 19 of this report.

Part I

ITEM 1. BUSINESS, continued

Environmental Matters

Information related to environmental matters is included in several areas of this report: (1) Environmental Proceedings beginning on page 12, (2) Management's Discussion and Analysis of Financial Condition and Results of Operations beginning on pages 29, 33-34 and (3) Notes 1 and 15 to the Consolidated Financial Statements.

Available Information

The company is subject to the reporting requirements under the Securities Exchange Act of 1934. Consequently, the company is required to file reports and information with the Securities and Exchange Commission (SEC), including reports on the following forms: annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934.

The public may read and copy any materials the company files with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

The company's annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are also accessible on the company's website at http://www.dupont.com by clicking on the tab labeled "Investor Center", then on "Key Financials & Filings" and then on "SEC Filings." These reports are made available, without charge, as soon as is reasonably practicable after the company files or furnishes them electronically with the SEC.

Executive Officers of the Registrant

Information related to the company's Executive Officers is included in Item 10, Directors, Executive Officers and Corporate Governance, beginning on page 38 of this report.

ITEM 1A. RISK FACTORS

The company's operations could be affected by various risks, many of which are beyond its control. Based on current information, the company believes that the following identifies the most significant risk factors that could affect its businesses. Past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.

Price increases for energy and raw materials could have a significant impact on the company's ability to sustain and grow earnings.

The company's manufacturing processes consume significant amounts of energy and raw materials, the costs of which are subject to worldwide supply and demand as well as other factors beyond the control of the company. Significant variations in the cost of energy, which primarily reflect market prices for oil and natural gas and raw materials affect the company's operating results from period to period. Legislation to address climate change by reducing greenhouse gas emissions and establishing a price on carbon could create increases in energy costs and price volatility. When possible, the company purchases raw materials through negotiated long-term contracts to minimize the impact of price fluctuations. Additionally, the company enters into over-the-counter and exchange traded derivative commodity instruments to hedge its exposure to price fluctuations on certain raw material purchases. The company takes actions to offset the effects of higher energy and raw material costs through selling price increases, productivity improvements and cost reduction programs. Success in offsetting higher raw material costs with price increases is largely influenced by competitive and economic conditions and could vary significantly depending on the market served. If the company is not able to fully offset the effects of higher energy and raw material costs, it could have a significant impact on the company's financial results.

Failure to develop and market new products and manage product life cycles could impact the company's competitive position and have an adverse effect on the company's financial results.

Operating results are largely dependent on the company's assessment and management of its portfolio of current, new and developing products and services and its ability to bring those products and services to market. The company plans to grow earnings by focusing on developing markets and solutions to meet increasing demand for food productivity, decrease dependency on fossil fuels and protect people, assets and the environment. This ability could be adversely affected by difficulties or delays in product development such as the inability to identify viable new products, successfully complete research and development, obtain relevant regulatory approvals, obtain intellectual property protection, or gain market acceptance of new products and services. Because of the lengthy development process, technological challenges and intense competition, there can be no assurance that any of the

Part I

ITEM 1A. RISK FACTORS, continued

products the company is currently developing, or could begin to develop in the future, will achieve substantial commercial success. Sales of the company's new products could replace sales of some of its current products, offsetting the benefit of even a successful product introduction.

The company's results of operations could be adversely affected by litigation and other commitments and contingencies.

The company faces risks arising from various unasserted and asserted litigation matters, including, but not limited to, product liability, patent infringement, antitrust claims, and claims for third party property damage or personal injury stemming from alleged environmental torts. The company has noted a nationwide trend in purported class actions against chemical manufacturers generally seeking relief such as medical monitoring, property damages, off-site remediation and punitive damages arising from alleged environmental torts without claiming present personal injuries. The company also has noted a trend in public and private nuisance suits being filed on behalf of states, counties, cities and utilities alleging harm to the general public. Various factors or developments can lead to changes in current estimates of liabilities such as a final adverse judgment, significant settlement or changes in applicable law. A future adverse ruling or unfavorable development could result in future charges that could have a material adverse effect on the company. An adverse outcome in any one or more of these matters could be material to the company's financial results.

In the ordinary course of business, the company may make certain commitments, including representations, warranties and indemnities relating to current and past operations, including those related to divested businesses and issue guarantees of third party obligations. If the company were required to make payments as a result, they could exceed the amounts accrued, thereby adversely affecting the company's results of operations.

The company's business, including its results of operations and reputation, could be adversely affected by process safety and product stewardship issues.

Failure to appropriately manage safety, human health, product liability and environmental risks associated with the company's products, product life cycles and production processes could adversely impact employees, communities, stakeholders, the company's reputation and its results of operations. Public perception of the risks associated with the company's products and production processes could impact product acceptance and influence the regulatory environment in which the company operates. While the company has procedures and controls to manage process safety risks, issues could be created by events outside of its control including natural disasters, severe weather events and acts of sabotage.

As a result of the company's current and past operations, including operations related to divested businesses, the company could incur significant environmental liabilities.

The company is subject to various laws and regulations around the world governing the environment, including the discharge of pollutants and the management and disposal of hazardous substances. As a result of its operations, including its past operations and operations of divested businesses, the company could incur substantial costs, including remediation and restoration costs. The costs of complying with complex environmental laws and regulations, as well as internal voluntary programs, are significant and will continue to be so for the foreseeable future. The ultimate costs under environmental laws and the timing of these costs are difficult to predict. The company's accruals for such costs and liabilities may not be adequate because the estimates on which the accruals are based depend on a number of factors including the nature of the matter, the complexity of the site, site geology, the nature and extent of contamination, the type of remedy, the outcome of discussions with regulatory agencies and other Potentially Responsible Parties (PRPs) at multi-party sites and the number and financial viability of other PRPs.

Market acceptance, government policies, rules or regulations and competition could affect the company's ability to generate sales from genetically modified products.

The company is using biotechnology to create and improve products, particularly in its Agriculture segment. The use of biotechnology to characterize the genetic and performance characteristics of Pioneer seeds provides Pioneer with competitive advantages in the development of new products, and in the most effective placement of those products on customer acres. In addition, the company uses biotechnology to enhance the performance of its seed products through the addition of specific transgenes. The company's ability to generate sales from such products could be affected by market acceptance of genetically modified products as well as governmental policies, laws and regulations that affect the development, manufacture and distribution of products, including the testing and planting of seeds containing biotechnology traits and the import of commodity grain grown from those seeds.

The company competes with major global companies that have strong intellectual property estates supporting the use of biotechnology to enhance products, particularly in the agricultural products and production markets. Speed in discovering and protecting new technologies and bringing products based on them to market is a significant competitive advantage. Failure to predict and respond effectively to this competition could cause the company's existing or candidate products to become less

Part I

ITEM 1A. RISK FACTORS, continued

competitive, adversely affecting sales.

Changes in government policies and laws could adversely affect the company's financial results.

Sales outside the U.S. constitute approximately 65 percent of the company's 2011 revenue. The company anticipates that international sales will continue to represent a substantial portion of its total sales and that continued growth and profitability will require further international expansion, particularly in developing markets. Sales from developing markets represent 34 percent of the company's revenue in 2011 and the company's growth plans include focusing on expanding its presence in developing markets. The company's financial results could be affected by changes in trade, monetary and fiscal policies, laws and regulations, or other activities of U.S. and non-U.S. governments, agencies and similar organizations. These conditions include, but are not limited to, changes in a country's or region's economic or political conditions, trade regulations affecting production, pricing and marketing of products, local labor conditions and regulations, reduced protection of intellectual property rights in some countries, changes in the regulatory or legal environment, restrictions on currency exchange activities, burdensome taxes and tariffs and other trade barriers. International risks and uncertainties, including changing social and economic conditions as well as terrorism, political hostilities and war, could lead to reduced sales and profitability.

Economic factors, including inflation, deflation and fluctuations in currency exchange rates, interest rates and commodity prices could affect the company's financial results.

The company is exposed to fluctuations in currency exchange rates, interest rates and commodity prices. Because the company has significant international operations, there are a large number of currency transactions that result from international sales, purchases, investments and borrowings. The company actively manages currency exposures that are associated with net monetary asset positions, committed currency purchases and sales, foreign currency- denominated revenues and other assets and liabilities created in the normal course of business. Failure to successfully manage these risks could have an adverse impact on the company's financial position, results of operations and cash flows.

Conditions in the global economy and global capital markets may adversely affect the company's results of operations, financial condition, and cash flows.

The company's business and operating results may in the future be adversely affected by global economic conditions, including instability in credit markets, declining consumer and business confidence, fluctuating commodity prices, volatile exchange rates, and other challenges that could affect the global economy. The company's customers may experience deterioration of their businesses, cash flow shortages, and difficulty obtaining financing. As a result, existing or potential customers may delay or cancel plans to purchase products and may not be able to fulfill their obligations in a timely fashion. Further, suppliers could experience similar conditions, which could impact their ability to fulfill their obligations to the company. Adversity within capital markets may impact future return on pension assets, thus resulting in greater future pension costs that impact the company's results. Future weakness in the global economy could adversely affect the company's results of operations, financial condition and cash flows in future periods.

The company's results of operations and financial condition could be seriously impacted by business disruptions and security threats.

Business disruptions, including supply disruptions, increasing costs for energy, temporary plant and/or power outages and information technology system and network disruptions, could seriously harm the company's operations as well as the operations of its customers and suppliers. Like many other multinational organizations, the company faces security threats to its facilities, data and information technology infrastructure. Although it is impossible to predict the occurrences or consequences of business disruptions or security threats, they could result in reduced demand for the company's products, make it difficult or impossible for the company to deliver products to its customers or to receive raw materials from suppliers, and create delays and inefficiencies in the supply chain. The company actively manages the risks within its control that could lead to business disruptions or security breaches in order to mitigate any potential impact from business disruptions regardless of cause including acts of sabotage, terrorism or war, weather events and natural disasters. Despite these efforts, the impact from business disruptions and security breaches could significantly increase the cost of doing business or otherwise adversely impact the company's financial performance.

Inability to protect and enforce the company's intellectual property rights could adversely affect the company's financial results.

Intellectual property rights, including patents, plant variety protection, trade secrets, confidential information, trademarks, tradenames and other forms of trade dress, are important to the company's business. The company endeavors to protect its intellectual property rights in jurisdictions in which its products are produced or used and in jurisdictions into which its products are imported. However, the company may be unable to obtain protection for its intellectual property in key jurisdictions. The company has designed and implemented internal controls to restrict access to and distribution of its intellectual property. Despite these

Part I

ITEM 1A. RISK FACTORS, continued

precautions, the company's intellectual property is vulnerable to unauthorized access through cyber-attacks, theft, and other security breaches. When unauthorized access and use or counterfeit products are discovered, the company reports such situations to governmental authorities for investigation, as appropriate, and takes measures to mitigate any potential impact.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

The company's corporate headquarters are located in Wilmington, Delaware. The company's manufacturing, processing, marketing and research and development facilities, as well as regional purchasing offices and distribution centers are located throughout the world.

Information regarding research and development facilities is incorporated by reference to Item 1, Business-Research and Development. Additional information with respect to the company's property, plant and equipment and leases is contained in Notes 9, 15 and 20 to the Consolidated Financial Statements.

The company has investments in property, plant and equipment related to global manufacturing operations. Collectively there are over 300 principal sites in total. The number of sites used by their applicable segment(s) by major geographic area around the world is as follows:

|

| | | | | | | | | | | | | | | | | | |

| | Number of Sites |

| | Agriculture | Electronics & Communications | Industrial Biosciences | Nutrition & Health | Performance Chemicals | Performance Coatings | Performance Materials | Safety & Protection | Total 1 |

| Asia Pacific | 17 |

| 11 |

| 1 |

| 9 |

| 6 |

| 3 |

| 19 |

| 7 |

| 73 |

|

| EMEA | 17 |

| 4 |

| 7 |

| 20 |

| 4 |

| 8 |

| 12 |

| 5 |

| 77 |

|

| Latin America | 15 |

| — |

| 1 |

| 7 |

| 1 |

| 3 |

| 1 |

| 1 |

| 29 |

|

| U.S. & Canada | 56 |

| 18 |

| 4 |

| 14 |

| 29 |

| 5 |

| 20 |

| 10 |

| 156 |

|

| | 105 |

| 33 |

| 13 |

| 50 |

| 40 |

| 19 |

| 52 |

| 23 |

| 335 |

|

| |

1. | Sites that are used by multiple segments are included more than once in the figures above. |

The company's plants and equipment are well maintained and in good operating condition. The company believes it has sufficient capacity to meet demand in 2012. Properties are primarily owned by the company; however, certain properties are leased. No title examination of the properties has been made for the purpose of this report and certain properties are shared with other tenants under long-term leases.

DuPont recognizes that the security and safety of its operations are critical to its employees, community and, indeed, to the future of the company. As such, the company has merged chemical site security into its safety core value where it serves as an integral part of its long standing safety culture. Physical security measures have been combined with process safety measures (including the use of inherently safer technology), administrative procedures and emergency response preparedness into an integrated security plan. The company has conducted vulnerability assessments at operating facilities in the U.S. and high priority sites worldwide and identified and implemented appropriate measures to protect these facilities from physical and cyber attacks. DuPont is partnering with carriers, including railroad, shipping and trucking companies, to secure chemicals in transit.

ITEM 3. LEGAL PROCEEDINGS

The company is subject to various litigation matters, including, but not limited to, product liability, patent infringement, antitrust claims, and claims for third party property damage or personal injury stemming from alleged environmental torts. Information regarding certain of these matters is set forth below and in Note 15 to the Consolidated Financial Statements.

Litigation

PFOA: Environmental and Litigation Proceedings

For purposes of this report, the term PFOA means collectively perfluorooctanoic acid and its salts, including the ammonium salt and does not distinguish between the two forms. Information related to this matter is included in Note 15 to the Consolidated Financial Statements under the heading PFOA.

Environmental Proceedings

Belle Plant, West Virginia

The U.S. Environmental Protection Agency (EPA) is investigating three chemical releases at DuPont's Belle facility in West Virginia which occurred in January 2010. One of the releases involved the death of a DuPont employee after exposure to phosgene.

Chambers Works Plant, Deepwater, New Jersey

In 2010, the government initiated an enforcement action alleging that the facility violated recordkeeping requirements of certain provisions of the Clean Air Act (CAA) and the Federal Clean Air Act Regulations (FCAR) governing Leak Detection and Reporting and that it failed to report emissions of a compound from Chambers Works' waste water treatment facility under the Emergency Planning and Community Right-to-Know Act. The alleged non-compliance was identified by EPA in 2007 and 2009 following separate environmental audits. DuPont is in settlement negotiations with EPA and the Department of Justice (DOJ).

Yerkes Plant, Buffalo, New York

The government alleges that the facility violated recordkeeping requirements of certain provisions of the CAA and the FCAR governing Leak Detection and Reporting and that it failed to accurately report emissions under the Emergency Planning and Community Right-to-Know Act. The alleged non-compliance was identified by EPA in 2006 and 2010 following separate environmental audits. DuPont is in settlement negotiations with EPA and DOJ.

LaPorte Plant, LaPorte, Texas

EPA conducted a multimedia inspection at the LaPorte facility in January of 2008. DuPont, EPA and DOJ began discussions in the fall of 2011 relating primarily to the management of certain materials in the facility's wastewater treatment system. These negotiations continue.

ITEM 4. MINE SAFETY DISCLOSURES

Information regarding mine safety and other regulatory actions at the company's surface mine in Starke, Florida is included in Exhibit 95 to this report.

Part II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market for Registrant's Common Equity and Related Stockholder Matters

The company's common stock is listed on the New York Stock Exchange, Inc. (symbol DD) and certain non-U.S. exchanges. The number of record holders of common stock was approximately 77,000 at January 31, 2012.

Holders of the company's common stock are entitled to receive dividends when they are declared by the Board of Directors. While it is not a guarantee of future conduct, the company has continuously paid a quarterly dividend since the fourth quarter 1904. Dividends on common stock and preferred stock are usually declared in January, April, July and October. When dividends on common stock are declared, they are usually paid mid March, June, September and December. Preferred dividends are paid on or about the 25th of January, April, July and October. The Stock Transfer Agent and Registrar is Computershare Trust Company, N.A.

The company's quarterly high and low trading stock prices and dividends per common share for 2011 and 2010 are shown below.

|

| | | | | | | | | |

| | Market Prices | |

| 2011 | High | Low | Per Share Dividend Declared |

| Fourth Quarter | $ | 49.92 |

| $ | 37.10 |

| $ | 0.41 |

|

| Third Quarter | 56.20 |

| 39.94 |

| 0.41 |

|

| Second Quarter | 57.00 |

| 48.64 |

| 0.41 |

|

| First Quarter | 56.19 |

| 47.22 |

| 0.41 |

|

| | | | |

| 2010 | |

| |

| |

|

| Fourth Quarter | $ | 50.17 |

| $ | 44.21 |

| $ | 0.41 |

|

| Third Quarter | 45.87 |

| 33.73 |

| 0.41 |

|

| Second Quarter | 41.45 |

| 33.66 |

| 0.41 |

|

| First Quarter | 39.04 |

| 31.88 |

| 0.41 |

|

Issuer Purchases of Equity Securities

There were no purchases of the company's common stock during the three months ended December 31, 2011.

Part II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES, continued

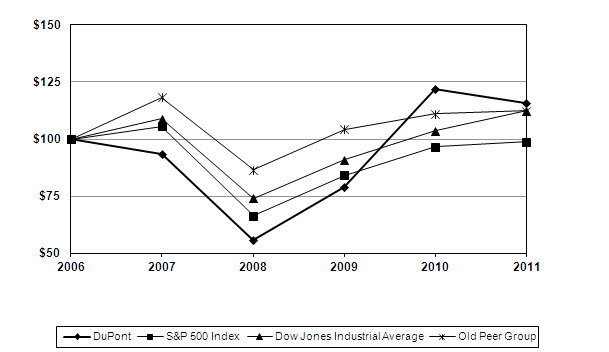

Stock Performance Graph

The following graph presents the cumulative five-year total return for the company's common stock compared with the S&P 500 Stock Index and the Dow Jones Industrial Average. For 2011, the company replaced its self-constructed peer group with the Dow Jones Industrial Average. The total return for the company's old peer group consisting of 3M Company; Abbott Laboratories; Air Products & Chemicals, Inc.; Baxter International Inc.; The Boeing Company; Caterpillar Inc.; Eastman Kodak Company; Emerson Electric Co.; Hewlett-Packard Company; Honeywell International Inc.; Ingersoll-Rand plc; Johnson & Johnson; Johnson Controls, Inc.; Kimberly-Clark Corporation; Merck & Co. Inc.; Monsanto Company; Motorola Inc.; The Procter & Gamble Company; and United Technologies Corporation has also been included.

Stock Performance Graph

|

| | | | | | | | | | | | | | | | | | |

| | 12/31/2006 | 12/31/2007 | 12/31/2008 | 12/31/2009 | 12/31/2010 | 12/31/2011 |

| DuPont | $ | 100 |

| $ | 93 |

| $ | 56 |

| $ | 79 |

| $ | 122 |

| $ | 116 |

|

| S&P 500 Index | 100 |

| 105 |

| 66 |

| 84 |

| 97 |

| 99 |

|

| Dow Jones Industrial Average | 100 |

| 109 |

| 74 |

| 91 |

| 104 |

| 112 |

|

| Old Peer Group | 100 |

| 118 |

| 87 |

| 104 |

| 111 |

| 112 |

|

The graph assumes that the values of DuPont Common Stock, the S&P 500 Stock Index, the Dow Jones Industrial Average and the old peer group of companies were each $100 on December 31, 2006 and that all dividends were reinvested. The old peer group is weighted by market capitalization.

Part II

ITEM 6. SELECTED FINANCIAL DATA

|

| | | | | | | | | | | | | | | |

| (Dollars in millions, except per share) | 2011 | 2010 | 2009 | 2008 | 2007 |

| Summary of operations | | |

| |

| |

| |

|

| Net sales | $ | 37,961 |

| $ | 31,505 |

| $ | 26,109 |

| $ | 30,529 |

| $ | 29,378 |

|

| Income before income taxes | $ | 4,282 |

| $ | 3,711 |

| $ | 2,184 |

| $ | 2,391 |

| $ | 3,743 |

|

| Provision for income taxes | $ | 772 |

| $ | 659 |

| $ | 415 |

| $ | 381 |

| $ | 748 |

|

| Net income attributable to DuPont | $ | 3,474 |

| $ | 3,031 |

| $ | 1,755 |

| $ | 2,007 |

| $ | 2,988 |

|

| Basic earnings per share of common stock | $ | 3.73 |

| $ | 3.32 |

| $ | 1.93 |

| $ | 2.21 |

| $ | 3.25 |

|

| Diluted earnings per share of common stock | $ | 3.68 |

| $ | 3.28 |

| $ | 1.92 |

| $ | 2.20 |

| $ | 3.22 |

|

| Financial position at year-end | | |

| |

| |

| |

|

| Working capital | $ | 6,873 |

| $ | 9,670 |

| $ | 7,898 |

| $ | 5,601 |

| $ | 4,619 |

|

| Total assets | $ | 48,492 |

| $ | 40,410 |

| $ | 38,185 |

| $ | 36,209 |

| $ | 34,131 |

|

| Borrowings and capital lease obligations | | |

| |

| |

| |

|

| Short-term | $ | 817 |

| $ | 133 |

| $ | 1,506 |

| $ | 2,012 |

| $ | 1,370 |

|

| Long-term | $ | 11,736 |

| $ | 10,137 |

| $ | 9,528 |

| $ | 7,638 |

| $ | 5,955 |

|

| Total equity | $ | 9,062 |

| $ | 9,743 |

| $ | 7,651 |

| $ | 7,552 |

| $ | 11,578 |

|

| General | | |

| |

| |

| |

|

| For the year | | |

| |

| |

| |

|

Purchases of property, plant & equipment and investments in affiliates | $ | 1,910 |

| $ | 1,608 |

| $ | 1,432 |

| $ | 2,033 |

| $ | 1,698 |

|

| Depreciation | $ | 1,283 |

| $ | 1,204 |

| $ | 1,251 |

| $ | 1,169 |

| $ | 1,158 |

|

| Research and development expense | $ | 1,956 |

| $ | 1,651 |

| $ | 1,378 |

| $ | 1,393 |

| $ | 1,338 |

|

| Average number of common shares outstanding (millions) | | |

| |

| |

| |

|

| Basic | 928 |

| 909 |

| 904 |

| 902 |

| 917 |

|

| Diluted | 941 |

| 922 |

| 909 |

| 907 |

| 925 |

|

| Dividends per common share | $ | 1.64 |

| $ | 1.64 |

| $ | 1.64 |

| $ | 1.64 |

| $ | 1.52 |

|

| At year-end | | |

| |

| |

| |

|

| Employees (thousands) | 70 |

| 60 |

| 58 |

| 60 |

| 60 |

|

| Closing stock price | $ | 45.78 |

| $ | 49.88 |

| $ | 33.67 |

| $ | 25.30 |

| $ | 44.09 |

|

| Common stockholders of record (thousands) | 78 |

| 81 |

| 85 |

| 88 |

| 92 |

|

Part II

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

CAUTIONARY STATEMENTS ABOUT FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements which may be identified by their use of words like “plans,” “expects,” “will,” “anticipates,” "believes," “intends,” “projects,” “estimates” or other words of similar meaning. All statements that address expectations or projections about the future, including statements about the company's strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, outcome of contingencies, such as litigation and environmental matters, expenditures and financial results, are forward-looking statements.

Forward-looking statements are based on certain assumptions and expectations of future events which may not be accurate or realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company's control. Some of the important factors that could cause the company's actual results to differ materially from those projected in any such forward-looking statements are:

| |

| • | Fluctuations in energy and raw material prices; |

| |

| • | Failure to develop and market new products and optimally manage product life cycles; |

| |

| • | Outcome of significant litigation and environmental matters, including those related to divested businesses; |

| |

| • | Failure to appropriately manage process safety and product stewardship issues; |

| |

| • | Effect of changes in tax, environmental and other laws and regulations or political conditions in the U.S. and other countries in which the company operates; |

| |

| • | Conditions in the global economy and global capital markets, including economic factors, such as inflation, deflation and fluctuations in currency exchange rates, interest rates and commodity prices, as well as regulatory requirements; |

| |

| • | Impact of business disruptions, including supply disruptions, and security threats, regardless of cause, including acts of sabotage, terrorism or war, weather events and natural disasters; |

| |

| • | Inability to protect and enforce the company's intellectual property rights; and |

| |

| • | Successful integration of acquired businesses and completion of divestitures of underperforming or non-strategic assets or businesses. |

For some of the important factors that could cause the company's actual results to differ materially from those projected in any such forward-looking statements, see the Risk Factors discussion set forth under Part I, Item 1A beginning on page 8.

Overview

Vision DuPont's vision is to be the world's most dynamic science company, creating sustainable solutions essential to a better, safer and healthier life for people everywhere. The company is committed to growing shareholder and societal value while reducing its environmental footprint in the value chains in which it operates, over the long-term.

Strategy The company's strategy for growth is to apply its science and technology to address three challenges driven by global population growth: feeding the world, reducing our dependence on fossil fuels and keeping people and the environment safe. Critical areas for the company's growth are innovation, differential management and productivity. Applying science to deliver innovative solutions and new products in the marketplace generates shareholder value and profitable growth. Differential management is a disciplined process to prioritize and allocate resources across businesses and geographies aligned with growth opportunities. The company continues to achieve fixed cost, working capital and variable cost productivity through disciplined business processes called DuPont Integrated Business Management (DIBM) and DuPont Production System (DPS). DIBM focuses on the business supply chain to maximize efficiency and optimize working capital, while DPS focuses on productivity outcomes to eliminate operational inefficiencies and improve lead time, cycle time and quality.

Goals The company's long-term plan includes compound annual growth targets of 7 percent for sales and 12 percent for earnings per share. In 2011, sales were up 20 percent with strong contributions across most segments with earnings per share increasing 12 percent. Sales in developing markets, which include China, India, and the countries located in Latin America, Eastern and Central Europe, Middle East, Africa, and Southeast Asia, are targeted to make up 40 percent of the company's sales by 2015, a 6 percentage point increase from 2011. In 2011, sales of new products introduced in the last four years were in line with the company's long-term target of 30 percent of total sales. Additionally, the company exceeded its 2011 goals for fixed cost and working capital productivity. The company remains on-track to exceed its three-year 2010-2012 plan of $1 billion fixed cost productivity actions and has already exceeded its three-year 2010-2012 plan of $1 billion working capital productivity. The company is committed to maintain a strong balance sheet and to return excess cash to shareholders unless there is a compelling opportunity to invest for growth.

Part II

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS, continued

Analysis of Operations

Acquisition of Danisco In 2011, the company acquired Danisco in a transaction valued at $6.4 billion, plus net debt assumed of $0.6 billion. As part of this acquisition, DuPont incurred $85 million in transaction related costs during 2011, which were recorded in costs of goods sold and other operating charges. In 2011, the businesses acquired from Danisco contributed net sales of $1.7 billion and net income attributable to DuPont of $(7) million, which excludes $30 million after-tax ($39 million pre-tax) of additional interest expense related to the debt issued to finance the acquisition. Danisco's contributions included a $125 million after-tax ($175 million pre-tax) charge related to the fair value step-up of inventories acquired and sold during 2011.

In 2011, the company initiated a series of actions to achieve the expected cost and revenue synergies associated with the Danisco acquisition. As part of these actions, the company incurred restructuring charges totaling $53 million. Additionally, the company expects to incur about $50 million of other costs to achieve synergies through 2013, including operating enhancements, consulting fees and relocation related costs, which will be expensed as incurred. These actions are expected to produce pre-tax annual cost savings of at least $130 million beginning in 2012, a full year ahead of the original schedule.

See Note 2 to the Consolidated Financial Statements for additional information.

|

| | | | | | | | | |

| (Dollars in millions) | 2011 | 2010 | 2009 |

| NET SALES | $ | 37,961 |

| $ | 31,505 |

| $ | 26,109 |

|

2011 versus 2010 The table below shows a regional breakdown of 2011 consolidated net sales based on location of customers and percentage variances from prior year:

|

| | | | | | | | | | | | | |

| | Percent Change Due to: |

| (Dollars in billions) | 2011 Net Sales | Percent Change vs. 2010 | Local Price | Currency Effect | Volume | Portfolio |

| Worldwide | $ | 38.0 |

| 20 |

| 11 |

| 2 |

| 1 |

| 6 |

|

| U.S. & Canada | 14.3 |

| 16 |

| 10 |

| — |

| 1 |

| 5 |

|

| Europe, Middle East and Africa (EMEA) | 10.0 |

| 23 |

| 10 |

| 4 |

| — |

| 9 |

|

| Asia Pacific | 8.9 |

| 22 |

| 16 |

| 3 |

| (3 | ) | 6 |

|

| Latin America | 4.8 |

| 29 |

| 13 |

| 2 |

| 10 |

| 4 |

|

Sales increased 20 percent, principally reflecting higher local selling prices and the sales added from businesses acquired from Danisco. Local selling prices were significantly higher for titanium dioxide, seeds, fluoroproducts and electronic products, with the latter reflecting pass through pricing for higher precious metals costs. Worldwide sales volume increased 1 percent as strong volume growth in Agriculture was largely offset by declines in Electronic & Communications, Performance Chemicals and Performance Materials. The declines occurred primarily during the fourth quarter, resulting from destocking in photovoltaics, polymer and industrial supply chains, as well as weaker demand for company products supplying consumer electronics and construction. Volume growth in Latin America was driven by Agriculture, Safety & Protection and Performance Coatings. Sales in developing markets of $13.0 billion improved 27 percent from 2010, and the percentage of total company sales in these markets increased to 34 percent from 32 percent in 2010.

Part II

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS, continued

2010 versus 2009 The table below shows a regional breakdown of 2010 consolidated net sales based on location of customers and percentage variances from 2009:

|

| | | | | | | | | | | | | |

| | Percent Change Due to: |

| (Dollars in billions) | 2010 Net Sales | Percent Change vs. 2009 | Local Price | Currency Effect | Volume | Portfolio |

| Worldwide | $ | 31.5 |

| 21 |

| 5 |

| — |

| 17 |

| (1 | ) |

| U.S. & Canada | 12.4 |

| 17 |

| 5 |

| 1 |

| 12 |

| (1 | ) |

| EMEA | 8.1 |

| 14 |

| 4 |

| (3 | ) | 13 |

| — |

|

| Asia Pacific | 7.3 |

| 40 |

| 6 |

| 2 |

| 33 |

| (1 | ) |

| Latin America | 3.7 |

| 17 |

| 4 |

| 2 |

| 13 |

| (2 | ) |

Sales increased 21 percent, due principally to higher volume as demand recovered in most markets from prior-year levels that were depressed from a global economic recession. Volume was higher across all segments, with the largest dollar increases in Performance Materials, Performance Chemicals, and Electronics & Communications. Volume grew double digits in all regions, led by a rebound in demand in the Asia Pacific region. Sales in developing markets of $10.2 billion improved 27 percent from 2009, and the percentage of total company sales in these markets increased to 32 percent from 31 percent in 2009.

|

| | | | | | | | | |

| (Dollars in millions) | 2011 | 2010 | 2009 |

| OTHER INCOME, NET | $ | 758 |

| $ | 1,228 |

| $ | 1,219 |

|

2011 versus 2010 The $470 million decrease was largely attributable to a $201 million reduction of Cozaar®/Hyzaar® income, an increase of $150 million in net pre-tax exchange losses, the absence of a benefit of $59 million recorded in 2010 related to accrued interest associated with settlements of income tax contingencies related to prior years, the absence of $41 million in insurance recoveries and a $37 million decrease in net gains on sales of assets.

2010 versus 2009 Other income, net, was essentially flat compared to 2009, despite a decrease of $549 million of Cozaar®/Hyzaar® income due to the expiration of certain patents. Offsetting the reduction of Cozaar®/Hyzaar® income was a decrease in net pre-tax exchange losses of $192 million combined with higher income from equity affiliates of $93 million, an increase in net gains on sales of assets of $64 million, a benefit of $59 million in 2010 related to accrued interest associated with settlements of income tax contingencies related to prior years, an increase in insurance recoveries of $41 million and a $31 million combined benefit from an acquisition and an early termination of a supply agreement.

Additional information related to the company's other income, net is included in Note 3 to the Consolidated Financial Statements.

|

| | | | | | | | | |

| (Dollars in millions) | 2011 | 2010 | 2009 |

| COST OF GOODS SOLD AND OTHER OPERATING CHARGES | $ | 27,814 |

| $ | 23,146 |

| $ | 19,708 |

|

| As a percent of net sales | 73 | % | 73 | % | 75 | % |

2011 versus 2010 Cost of goods sold and other operating charges (COGS) increased 20 percent. COGS as a percentage of net sales was 73 percent, unchanged from prior year, as selling price increases of $3.6 billion were offset by $2.0 billion of inflation in raw material, energy and freight costs, and $0.7 billion of higher plant operating costs, including capacity expansions. 2011 COGS also included $175 million of additional costs related to the fair value step-up of inventory acquired from Danisco, $85 million of Danisco transaction related fees and $175 million for charges related to Imprelis® herbicide claims.

2010 versus 2009 COGS increased 17 percent, while COGS as a percent of net sales decreased 2 percentage points from 2009. The improvement principally reflects increased manufacturing utilization and higher selling prices that more than offset increases in raw material costs. Higher selling prices increased sales $1.3 billion, while raw material, energy and freight costs, adjusted for volume and currency, were up 6 percent, or $0.7 billion.

Part II

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS, continued

|

| | | | | | | | | |

| (Dollars in millions) | 2011 | 2010 | 2009 |

| SELLING, GENERAL AND ADMINISTRATIVE EXPENSES | $ | 4,170 |

| $ | 3,669 |

| $ | 3,440 |

|

| As a percent of net sales | 11 | % | 12 | % | 13 | % |