UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| |

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2017

OR

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No.: 0-50231

Federal National Mortgage Association

(Exact name of registrant as specified in its charter)

Fannie Mae

|

| |

| Federally chartered corporation | 52-0883107 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

3900 Wisconsin Avenue, NW Washington, DC | 20016 (Zip Code) |

| (Address of principal executive offices) | |

Registrant’s telephone number, including area code: (800) 2FANNIE (800-232-6643)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| |

Large accelerated filer þ | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Emerging growth company o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

As of June 30, 2017, there were 1,158,087,567 shares of common stock of the registrant outstanding.

TABLE OF CONTENTS

|

| | |

| | | Page |

| PART I—Financial Information | |

| Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Note 14—Fair Value | |

| | | |

| | | |

| Item 2. | | |

| | | |

| | | |

| | Legislation and Regulation | |

| | | |

| | | |

| | Retained Mortgage Portfolio | |

| | Mortgage Credit Book of Business | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 3. | | |

| Item 4. | | |

| PART II—Other Information | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | i |

MD&A TABLE REFERENCE

|

| | |

| Table | Description | Page |

| 1 | Summary of Condensed Consolidated Results of Operations | 13 |

| 2 | Analysis of Net Interest Income and Yield | 14 |

| 3 | Rate/Volume Analysis of Changes in Net Interest Income | 16 |

| 4 | Fair Value Losses, Net | 17 |

| 5 | Changes in Combined Loss Reserves | 18 |

| 6 | Troubled Debt Restructurings and Nonaccrual Loans | 19 |

| 7 | Credit Loss Performance Metrics | 20 |

| 8 | Credit Loss Concentration Analysis | 21 |

| 9 | Summary of Condensed Consolidated Balance Sheets | 22 |

| 10 | Summary of Mortgage-Related Securities at Fair Value | 23 |

| 11 | Retained Mortgage Portfolio | 24 |

| 12 | Retained Mortgage Portfolio Profile | 25 |

| 13 | Composition of Mortgage Credit Book of Business | 26 |

| 14 | Single-Family Business Key Performance Data | 28 |

| 15 | Single-Family Business Financial Results | 29 |

| 16 | Representation and Warranty Status of Single-Family Conventional Loans Acquired in 2013-2017 | 31 |

| 17 | Single-Family Credit Risk Transfer Transactions | 32 |

| 18 | Selected Credit Characteristics of Single-Family Conventional Guaranty Book of Business, by Acquisition Period | 34 |

| 19 | Risk Characteristics of Single-Family Conventional Business Volume and Guaranty Book of Business | 35 |

| 20 | Delinquency Status and Activity of Single-Family Conventional Loans | 38 |

| 21 | Single-Family Conventional Seriously Delinquent Loan Concentration Analysis | 39 |

| 22 | Statistics on Single-Family Loan Workouts | 40 |

| 23 | Single-Family Foreclosed Properties | 41 |

| 24 | Multifamily Business Key Performance Data | 43 |

| 25 | Multifamily Business Financial Results | 44 |

| 26 | Multifamily Guaranty Book of Business Key Risk Characteristics | 45 |

| 27 | Activity in Debt of Fannie Mae | 47 |

| 28 | Outstanding Short-Term Borrowings and Long-Term Debt | 49 |

| 29 | Cash and Other Investments Portfolio | 50 |

| 30 | Mortgage Insurance Coverage | 54 |

| 31 | Interest Rate Sensitivity of Net Portfolio to Changes in Interest Rate Level and Slope of Yield Curve | 59 |

| 32 | Derivative Impact on Interest Rate Risk (50 Basis Points) | 59 |

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | ii |

PART I—FINANCIAL INFORMATION

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

| | |

| | | |

| | We have been under conservatorship, with the Federal Housing Finance Agency (“FHFA”) acting as conservator, since September 6, 2008. As conservator, FHFA succeeded to all rights, titles, powers and privileges of the company, and of any shareholder, officer or director of the company with respect to the company and its assets. The conservator has since delegated specified authorities to our Board of Directors and has delegated to management the authority to conduct our day-to-day operations. Our directors do not have any fiduciary duties to any person or entity except to the conservator and, accordingly, are not obligated to consider the interests of the company, the holders of our equity or debt securities or the holders of Fannie Mae MBS unless specifically directed to do so by the conservator. We describe the rights and powers of the conservator, key provisions of our agreements with the U.S. Department of the Treasury (“Treasury”), and their impact on shareholders in our annual report on Form 10-K for the year ended December 31, 2016 (“2016 Form 10-K”) in “Business—Conservatorship and Treasury Agreements.” | |

| | | |

You should read this Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) in conjunction with our unaudited condensed consolidated financial statements and related notes in this report and the more detailed information in our 2016 Form 10-K.

This report contains forward-looking statements that are based on management’s current expectations and are subject to significant uncertainties and changes in circumstances. Please review “Forward-Looking Statements” for more information on the forward-looking statements in this report. Our actual results may differ materially from those reflected in our forward-looking statements due to a variety of factors including, but not limited to, those discussed in “Risk Factors” and elsewhere in this report and in our 2016 Form 10-K.

You can find a “Glossary of Terms Used in This Report” in the MD&A of our 2016 Form 10-K.

Fannie Mae is a government-sponsored enterprise (“GSE”) chartered by Congress. We serve as a stable source of liquidity for purchases of homes and financing of multifamily rental housing, as well as for refinancing existing mortgages. Our role in the market enables qualified borrowers to have reliable access to affordable mortgage credit, including a variety of conforming mortgage products such as the prepayable 30-year fixed-rate mortgage that protects homeowners from fluctuations in interest rates.

We operate in the secondary mortgage market. We support the liquidity and stability of the U.S. mortgage market primarily by securitizing mortgage loans originated by lenders into Fannie Mae mortgage-backed securities that we guarantee, which we refer to as Fannie Mae MBS. We also purchase mortgage loans and mortgage-related securities, primarily for securitization and sale at a later date. We use the term “acquire” in this report to refer to both our securitizations and our purchases of mortgage-related assets. We do not originate loans or lend money directly to consumers in the primary mortgage market.

We remain in conservatorship and our conservatorship has no specified termination date. We do not know when or how the conservatorship will terminate, what further changes to our business will be made during or following conservatorship, what form we will have and what ownership interest, if any, our current common and preferred stockholders will hold in us after the conservatorship is terminated, or whether we will continue to exist following conservatorship. In addition, as a result of our agreements with Treasury and directives from our conservator, we are not permitted to retain our net worth (other than a limited amount that will decrease to zero in 2018), rebuild our capital position or pay dividends or other distributions to stockholders other than Treasury. Our senior preferred stock purchase agreement with Treasury also includes covenants that significantly restrict our business activities. Congress continues to consider options for reform of the housing finance system, including the GSEs. We cannot predict the prospects for the enactment, timing or final content of housing finance reform legislation or actions the Administration or FHFA may take with respect to housing finance reform. We provide additional information on the uncertainty of our future, the conservatorship, the provisions of our agreements with Treasury, their impact on our business, and recent actions and statements relating to housing finance reform by the Administration, Congress and FHFA in “Business—Conservatorship and Treasury Agreements,” “Business—

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 1 |

Legislation and Regulation—Housing Finance Reform” and “Risk Factors” in our 2016 Form 10-K and in “Legislation and Regulation” and “Risk Factors” in our quarterly report on Form 10-Q for the quarter ended March 31, 2017 (“First Quarter 2017 Form 10-Q”) and in this report.

Although Treasury owns our senior preferred stock and a warrant to purchase 79.9% of our common stock, and has made a commitment under a senior preferred stock purchase agreement to provide us with funds to maintain a positive net worth under specified conditions, the U.S. government does not guarantee our securities or other obligations.

Our common stock is traded in the over-the-counter market and quoted on the OTC Bulletin Board under the symbol “FNMA.” Our debt securities are actively traded in the over-the-counter market.

Summary of Our Financial Performance

Quarterly Results

We recognized comprehensive income of $3.1 billion in the second quarter of 2017, consisting of net income of $3.2 billion, partially offset by other comprehensive loss of $83 million. In comparison, we recognized comprehensive income of $2.9 billion in the second quarter of 2016, consisting of net income of $2.9 billion, partially offset by other comprehensive loss of $77 million. The increase in our net income in the second quarter of 2017 compared with the second quarter of 2016 was primarily driven by lower fair value losses, partially offset by lower credit-related income and lower net interest income.

Year-to-Date Results

We recognized comprehensive income of $5.9 billion in the first half of 2017, consisting of net income of $6.0 billion, partially offset by other comprehensive loss of $77 million. In comparison, we recognized comprehensive income of $3.8 billion in the first half of 2016, consisting of net income of $4.1 billion, partially offset by other comprehensive loss of $277 million. The increase in our net income in the first half of 2017 compared with the first half of 2016 was primarily driven by lower fair value losses, partially offset by lower credit-related income.

The table below highlights our financial results and key performance data. The performance measures shown below are discussed in later sections of the MD&A. See “MD&A—Consolidated Results of Operations” for more information on our financial results.

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 2 |

Financial Results and Key Performance Data

|

| | | | |

| | Second Quarter | First Half |

| | 2017 | 2016 | 2017 | 2016 |

Comprehensive income | $3.1 billion | $2.9 billion | $5.9 billion | $3.8 billion |

| Net income | 3.2 billion | 2.9 billion | 6.0 billion | 4.1 billion |

Net interest income Net interest income in the second quarter and first half of 2017 was primarily derived from guaranty fees from our guaranty book of business and remained relatively flat compared with the second quarter and first half of 2016. We receive guaranty fee income as compensation for managing the credit risk on loans underlying Fannie Mae MBS held by third parties. | 5.0 billion | 5.3 billion | 10.3 billion | 10.1 billion |

Net fair value losses Fair value losses in the second quarter and first half of 2017 were primarily driven by decreases in the fair value of our risk management derivatives due to declines in longer-term swap rates during the second quarter and by decreases in the fair value of our mortgage commitments due to an increase in prices as interest rates decreased during the commitment periods. We recognized additional fair value losses in the second quarter and first half of 2017 on Connecticut Avenue SecuritiesTM (“CAS”) debt reported at fair value resulting from tightening spreads between CAS debt yields and LIBOR during the periods. Fair value losses in the second quarter and first half of 2016 were primarily due to losses on our risk management derivatives resulting from declines in longer-term swap rates. | 0.7 billion | 1.7 billion | 0.7 billion | 4.5 billion |

Credit-related income Credit-related income in the second quarter and first half of 2017 was primarily driven by an increase in actual and forecasted home prices and the redesignation of loans from held for investment (“HFI”) to held for sale (“HFS”). Credit-related income in the second quarter and first half of 2016 was primarily attributable to an increase in home prices and a decline in actual and projected mortgage interest rates in the period. | 1.2 billion | 1.5 billion | 1.4 billion | 2.4 billion |

Retained mortgage portfolio as of period end | 255.8 billion | 316.3 billion | 255.8 billion | 316.3 billion |

Single-family guaranty book of business as of period end | 2.9 trillion | 2.8 trillion | 2.9 trillion | 2.8 trillion |

Net worth as of period end | 3.7 billion | 4.1 billion | 3.7 billion | 4.1 billion |

Capital reserve amount applicable to quarterly dividend payment to Treasury | 600 million | 1.2 billion | 600 million | 1.2 billion |

Dividends paid to Treasury in the period | 2.8 billion | 919 million | 8.3 billion | 3.8 billion |

We expect volatility from period to period in our financial results from a number of factors, particularly changes in market conditions that result in fluctuations in the estimated fair value of the financial instruments that we mark to market through our earnings. These instruments include derivatives and certain securities whose estimated fair value may fluctuate substantially from period to period because of changes in interest rates, the yield curve, mortgage and credit spreads, and implied volatility, as well as activity related to these financial instruments. We use derivatives to manage the interest rate risk exposure of our net portfolio, which consists of our retained mortgage portfolio, cash and other investments portfolio, and outstanding debt of Fannie Mae. Some of these

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 3 |

financial instruments in our net portfolio are not recorded at fair value in our condensed consolidated financial statements, and as a result we may experience accounting gains or losses due to changes in interest rates or other market conditions that may not be indicative of the economic interest rate risk exposure of our net portfolio. See “Risk Management—Market Risk Management, Including Interest Rate Risk Management” for more information. In addition, our credit-related income or expense can vary substantially from period to period based on a number of factors such as changes in actual and expected home prices, fluctuations in interest rates, borrower payment behavior, the types and volume of our loss mitigation activities, the volume of foreclosures completed, and redesignations of loans from HFI to HFS.

Our Strategy and Business Objectives

Our vision is to be America’s most valued housing partner and to provide liquidity, access to credit and affordability in all U.S. housing markets at all times, while effectively managing and reducing risk to our business, taxpayers and the housing finance system. In support of this vision, we are focused on:

| |

| • | advancing a sustainable and reliable business model that reduces risk to the housing finance system and taxpayers; |

| |

| • | providing reliable, large-scale access to affordable mortgage credit for qualified borrowers and helping struggling homeowners; and |

| |

| • | serving customer needs by building a company that is efficient, innovative and continuously improving. |

Advancing a sustainable and reliable business model that reduces risk to the housing finance system and taxpayers

We have significantly changed our business model since we entered conservatorship in 2008 and our business continues to evolve. We have strengthened our underwriting and eligibility standards and transitioned from a portfolio-focused business to a guaranty-focused business. In addition, we are transferring an increasing portion of the credit risk on our guaranty book of business. These changes have transformed our business model and reduced certain risks of our business as compared with our business prior to entering conservatorship.

Our business also continues to evolve as a result of our many other efforts to build a safer and sustainable housing finance system and to pursue the strategic goals identified by our conservator. See “Business—Legislation and Regulation—Housing Finance Reform—Conservator Developments and Strategic Goals” in our 2016 Form 10-K for a discussion of some of these efforts and FHFA’s strategic goals for our conservatorship.

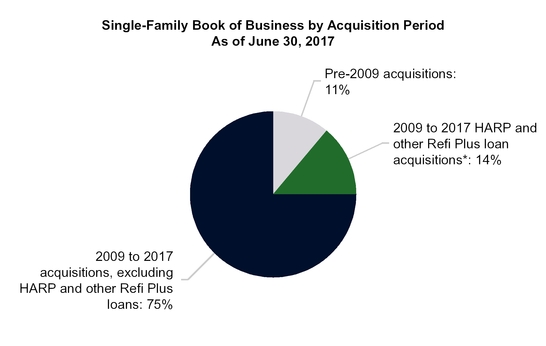

Stronger underwriting and eligibility standards

We strengthened our underwriting and eligibility standards for loans we acquired beginning in late 2008 and 2009. These changes improved the credit quality of our single-family guaranty book of business and contributed to improvement in our credit performance. As of June 30, 2017, 89% of our single-family conventional guaranty book of business consisted of loans acquired since 2009. Our single-family serious delinquency rate has decreased each quarter since the first quarter of 2010 and was 1.01% as of June 30, 2017.

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 4 |

__________

| |

| * | We have acquired HARP loans and other Refi Plus loans under our Refi PlusTM initiative since 2009. Our Refi Plus initiative offers refinancing flexibility to eligible borrowers who are current on their loans and whose loans are owned or guaranteed by us and meet certain additional criteria. HARP loans, which have loan-to-value (“LTV”) ratios at origination greater than 80%, refers to loans we have acquired pursuant to the Home Affordable Refinance Program® (“HARP®”). Other Refi Plus loans, which have LTV ratios at origination of 80% or less, refers to loans we have acquired under our Refi Plus initiative other than HARP loans. Loans we acquire under Refi Plus and HARP are refinancings of loans that were originated prior to June 2009. |

See “Business Segments—Single-Family Business” for information on our recent single-family acquisitions and the credit performance of our single-family mortgage loans.

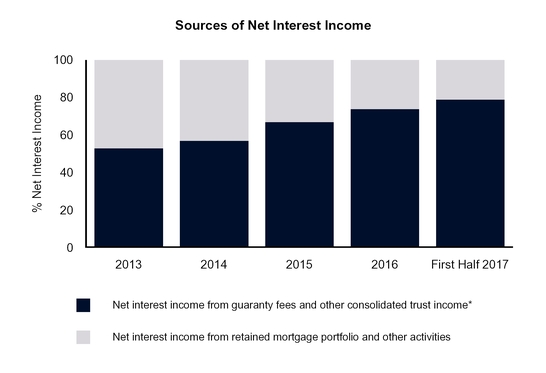

Transition to a guaranty-focused business

We have two primary sources of revenues: (1) the guaranty fees we receive for managing the credit risk on loans underlying Fannie Mae MBS held by third parties; and (2) the difference between interest income earned on the assets in our retained mortgage portfolio and the interest expense associated with the debt that funds those assets. Our retained mortgage portfolio refers to the mortgage-related assets we own (which excludes the portion of assets held by consolidated MBS trusts that back mortgage-related securities owned by third parties).

As shown in the chart below, in recent periods, an increasing portion of our net interest income has been derived from guaranty fees, rather than from our retained mortgage portfolio assets. This shift has been driven by both the guaranty fee increases we implemented in 2012 and the reduction of our retained mortgage portfolio in accordance with the requirements of our senior preferred stock purchase agreement with Treasury and direction from FHFA. More than 75% of our net interest income for the first half of 2017 was derived from the loans underlying our Fannie Mae MBS in consolidated trusts, which primarily generate income through guaranty fees. We expect that guaranty fees will continue to account for an increasing portion of our net interest income.

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 5 |

__________

| |

| * | Guaranty fee income reflects the impact of a 10 basis point guaranty fee increase implemented in 2012 pursuant to the Temporary Payroll Tax Cut Continuation Act of 2011, the incremental revenue from which is remitted to Treasury and not retained by us. |

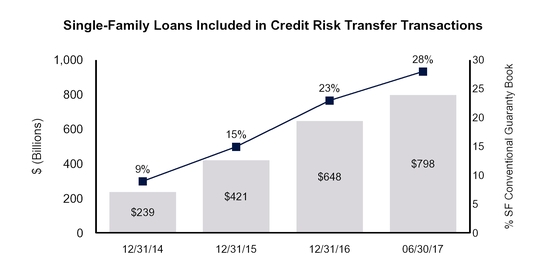

Transferring a portion of the mortgage credit risk on our single-family book of business

In late 2013, we began entering into credit risk transfer transactions with the goal of transferring, to the extent economically sensible, a portion of the mortgage credit risk on some of the recently acquired loans in our single-family book of business in order to reduce the economic risk to us and to taxpayers of future borrower defaults. Our primary method of achieving this objective has been through our CAS and Credit Insurance Risk TransferTM (“CIRTTM”) transactions. In these transactions, we transfer to investors a portion of the mortgage credit risk associated with losses on a reference pool of mortgage loans and in exchange we pay investors a premium that effectively reduces the guaranty fee income we retain on the loans. As of June 30, 2017, $798 billion in outstanding unpaid principal balance of our single-family loans, or 28% of the loans in our single-family conventional guaranty book of business measured by unpaid principal balance, were included in a reference pool for a credit risk transfer transaction. Over time, we expect that a larger portion of our single-family conventional guaranty book of business will be covered by credit risk transfer transactions.

The chart below shows as of the dates specified the total outstanding unpaid principal balance of our single-family loans, as well as the percentage of our total single-family conventional guaranty book of business measured by unpaid principal balance, that were included in a reference pool for a credit risk transfer transaction.

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 6 |

The risk in force of these transactions, which refers to the maximum amount of losses that could be absorbed by credit risk transfer investors, was approximately $25 billion as of June 30, 2017. For further discussion of our credit risk transfer transactions, including more detailed information on the portion of the credit risk of these loans we have transferred, see “Business Segments—Single-Family Business—Single-Family Mortgage Credit Risk Management—Transfer of Mortgage Credit Risk: Single-Family Credit Risk Transfer Transactions.”

Providing reliable, large-scale access to affordable mortgage credit for qualified borrowers and helping struggling homeowners

We continued to provide reliable, large-scale access to affordable mortgage credit to the U.S. housing market and to help struggling homeowners in the second quarter of 2017:

| |

| • | We provided approximately $135 billion in liquidity to the mortgage market in the second quarter of 2017 through our purchases of loans and guarantees of loans and securities. This liquidity enabled borrowers to complete approximately 222,000 mortgage refinancings and approximately 316,000 home purchases, and provided financing for approximately 162,000 units of multifamily housing. |

| |

| • | We provided approximately 27,000 loan workouts in the second quarter of 2017 to help homeowners stay in their homes or otherwise avoid foreclosure. |

| |

| • | We helped borrowers refinance loans, including through our Refi PlusTM initiative, which offers refinancing flexibility to eligible borrowers who are current on their loans, whose loans are owned or guaranteed by us and who meet certain additional criteria. We acquired approximately 24,000 Refi Plus loans in the second quarter of 2017. Refinancings delivered to us through Refi Plus in the second quarter of 2017 reduced borrowers’ monthly mortgage payments by an average of $176. |

| |

| • | We support affordability in the multifamily rental market. This has become more challenging in recent years as rent growth has outpaced wage growth, making units at many income levels less affordable than in prior years. Approximately 90% of the multifamily units we financed in the second quarter of 2017 were affordable to families earning at or below 120% of the median income in their area, providing support for both workforce housing and affordable housing. |

Serving customer needs by building a company that is efficient, innovative and continuously improving

We are committed to providing our lender customers with the products, services and tools they need to serve the housing market more effectively and efficiently, as well as continuing to improve our business processes. For information on enhancements we have recently made or are currently working on, see “Business—Executive Summary—Our Strategy and Business Objectives” in our 2016 Form 10-K.

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 7 |

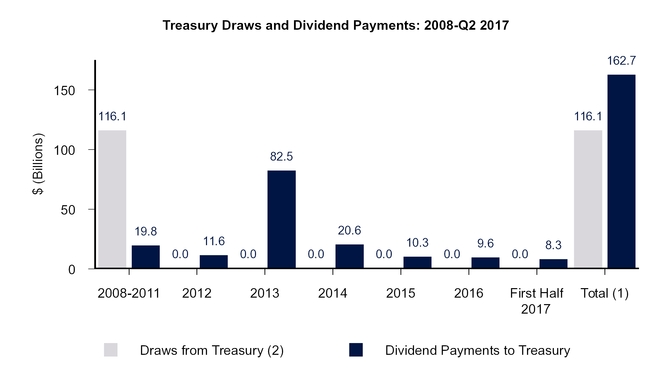

Treasury Draws and Dividend Payments

Treasury has made a commitment under a senior preferred stock purchase agreement to provide funding to us under certain circumstances if we have a net worth deficit. Acting as successor to the rights, titles, powers and privileges of the Board, the conservator has declared and directed us to pay dividends to Treasury on the senior preferred stock on a quarterly basis since we entered into conservatorship in 2008.

The chart below shows the funds we have drawn from Treasury pursuant to the senior preferred stock purchase agreement, as well as the dividend payments we have made to Treasury on the senior preferred stock, since entering into conservatorship.

__________

| |

(1) | Under the terms of the senior preferred stock purchase agreement, dividend payments we make to Treasury do not offset our prior draws of funds from Treasury, and we are not permitted to pay down draws we have made under the agreement except in limited circumstances. Accordingly, the current aggregate liquidation preference of the senior preferred stock is $117.1 billion, due to the initial $1.0 billion liquidation preference of the senior preferred stock (for which we did not receive cash proceeds) and the $116.1 billion we have drawn from Treasury. Amounts may not sum due to rounding. |

| |

(2) | Treasury draws are shown in the period for which requested, not when the funds were received by us. We have not requested a draw for any period since 2012. |

The dividend provisions of the senior preferred stock provide for quarterly dividends consisting of the amount, if any, by which our net worth as of the end of the immediately preceding fiscal quarter exceeds an applicable capital reserve amount. This capital reserve amount is $600 million for each quarter of 2017 and will decrease to zero in 2018. These are referred to as “net worth sweep” dividend provisions. As a result of these provisions, we will pay Treasury a dividend of $3.1 billion for the third quarter of 2017 by September 30, 2017, calculated based on our net worth of $3.7 billion as of June 30, 2017, less the current capital reserve amount of $600 million, if our conservator declares a dividend in this amount before September 30, 2017. To the extent that these quarterly dividends are not paid, they will accumulate and be added to the liquidation preference of the senior preferred stock. This would not affect the amount of available funding from Treasury under the senior preferred stock purchase agreement.

If we experience a net worth deficit in a future quarter, we will be required to draw additional funds from Treasury under the senior preferred stock purchase agreement in order to avoid being placed into receivership. As of the date of this filing, the maximum amount of remaining funding under the agreement is $117.6 billion. If we were to draw additional funds from Treasury under the agreement in a future period, the amount of remaining funding

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 8 |

under the agreement would be reduced by the amount of our draw. Dividend payments we make to Treasury do not restore or increase the amount of funding available to us under the agreement. For a description of the terms of the senior preferred stock purchase agreement and the senior preferred stock, see “Business—Conservatorship and Treasury Agreements—Treasury Agreements” in our 2016 Form 10-K. See “Risk Factors” in our 2016 Form 10-K for a discussion of the risks associated with our limited and declining capital reserves, and “Outlook” in this report for our current expectations about our future financial results.

On May 11, 2017, the Director of FHFA testified before the U.S. Senate Committee on Banking, Housing and Urban Affairs that a draw by Fannie Mae or Freddie Mac could erode investor confidence, which could affect liquidity and increase the cost of mortgage credit for borrowers. To avoid a draw, the Director indicated that FHFA has the authority to withhold dividend payments without the consent of Treasury, but that his first option would be to work with the Secretary of the Treasury. He further stated that any action FHFA may take to avoid additional draws would not be intended to influence the outcome of housing finance reform or as a step toward “recap and release,” which refers to proposals by some investors to recapitalize Fannie Mae and Freddie Mac with private capital and release them from conservatorship. On May 18, 2017, the Secretary of the Treasury testified before the same committee and stated that it was Treasury’s expectation that dividends should be paid per the terms of the senior preferred stock purchase agreement.

As described in “Legal Proceedings” and “Note 15, Commitments and Contingencies,” several lawsuits have been filed by preferred and common stockholders of Fannie Mae and Freddie Mac against one or more of the United States, Treasury and FHFA challenging actions taken by the defendants relating to the senior preferred stock purchase agreements and the conservatorships of Fannie Mae and Freddie Mac, including challenges to the net worth sweep dividend provisions of the senior preferred stock. We are also a party to some of those lawsuits. We cannot predict the course or the outcome of these lawsuits, or the actions the U.S. government (including Treasury or FHFA) may take in response to any ruling or finding in any of these lawsuits.

2017 Market Share

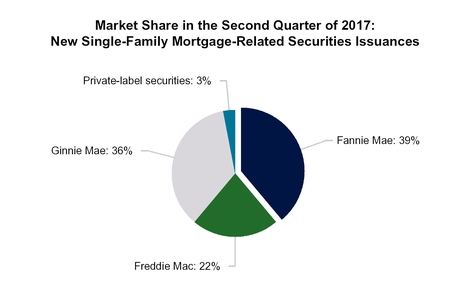

We were the largest issuer of single-family mortgage-related securities in the secondary market in the second quarter of 2017. Our estimated market share of new single-family mortgage-related securities issuances was 39% in both the first and second quarter of 2017, compared with 38% in the second quarter of 2016. The chart below shows our market share of single-family mortgage-related securities issuances in the second quarter of 2017 compared with that of our primary competitors.

We remained a continuous source of liquidity in the multifamily market in the second quarter of 2017. We owned or guaranteed approximately 20% of the outstanding debt on multifamily properties as of March 31, 2017 (the latest date for which information is available).

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 9 |

Outlook

In this section, we present a number of estimates and expectations regarding our future performance, as well as future home prices. These estimates and expectations are forward-looking statements based on our current assumptions regarding numerous factors. See “Forward-Looking Statements” and “Risk Factors” in this report and in our 2016 Form 10-K for discussions of factors that could cause actual results to differ materially from our current estimates and expectations. Due to the large size of our guaranty book of business, even small changes in these factors could have a significant impact on our financial results for a particular period.

Financial Results. We continued to be profitable in the second quarter of 2017, with net income of $3.2 billion. We expect to remain profitable on an annual basis for the foreseeable future; however, certain factors, such as changes in interest rates or home prices, could result in significant volatility in our financial results from quarter to quarter or year to year. Our future financial results also will be affected by a number of other factors, including: our guaranty fee rates; the volume of single-family mortgage originations in the future; the size, composition and quality of our retained mortgage portfolio and guaranty book of business; and economic and housing market conditions. Although we expect to remain profitable on an annual basis for the foreseeable future, due to our limited and declining capital reserves (which decrease to zero in 2018) and the potential for significant volatility in our financial results, we could experience a net worth deficit in a future quarter. If we experience a net worth deficit in a future quarter, we will be required to draw additional funds from Treasury under the senior preferred stock purchase agreement to avoid being placed into receivership.

Our expectations for our future financial results do not take into account the impact on our business of potential future legislative or regulatory changes, which could have a material impact on our financial results, particularly the enactment of housing finance reform legislation, corporate income tax reform legislation and changes in accounting standards. For example, the current Administration proposes reducing the U.S. corporate income tax rate. Under applicable accounting standards, a significant reduction in the U.S. corporate income tax rate would require that we record a substantial reduction in the value of our deferred tax assets in the quarter in which the legislation is enacted. Thus, if legislation significantly lowering the U.S. corporate income tax rate is enacted, we expect to incur a significant net loss and net worth deficit for the quarter in which the legislation is enacted and we could potentially incur a net loss for that year. As noted above, if we experience a net worth deficit in a future quarter, we will be required to draw additional funds from Treasury under the senior preferred stock purchase agreement in order to avoid being placed into receivership.

See “Risk Factors” in our 2016 Form 10-K and in this report for discussions of the risks associated with our limited and declining capital reserves and the potential impact of legislative and regulatory actions.

Revenues. We have two primary sources of revenues: (1) the guaranty fees we receive for managing the credit risk on loans underlying Fannie Mae MBS held by third parties; and (2) the difference between interest income earned on the assets in our retained mortgage portfolio and the interest expense associated with the debt that funds those assets.

Our guaranty fee revenues consist of two primary components: (1) the base guaranty fees that we receive over the life of the loan; and (2) upfront fees we receive at loan acquisition which are amortized over the contractual life of the loan. When mortgage loans prepay faster due to a lower interest rate environment, we typically have higher amortization income. Conversely, when mortgage loans prepay more slowly due to a higher interest rate environment, we typically have lower amortization income. Our guaranty fee revenues increased in recent years primarily driven by: (1) loans with higher base guaranty fees comprising a larger part of our guaranty book of business; and (2) an increase in amortization income as a lower interest rate environment during portions of these years increased prepayments on mortgage loans. We expect loans with lower guaranty fees to continue to liquidate from our book of business and be replaced with new loans that typically have higher guaranty fees, which will contribute to increasing guaranty fee revenues; however, the impact of this trend on our guaranty fee revenues could be offset by lower amortization income if interest rates remain at higher levels and result in lower prepayments on mortgage loans. Accordingly, our guaranty fee revenues may remain relatively flat in the near term.

We expect the size of our retained mortgage portfolio to continue to decrease each year to meet the requirements of our senior preferred stock purchase agreement with Treasury and FHFA’s additional portfolio cap, which we describe in “Business—Conservatorship and Treasury Agreements—Treasury Agreements” in our 2016 Form 10-K. These decreases in our retained mortgage portfolio will continue to negatively impact our net interest income and net revenues.

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 10 |

Factors that may affect our future revenues include: changes to guaranty fee pricing we may make in the future and their impact on our competitive environment and guaranty fee revenues; economic and housing market conditions, including changes in interest rates and home prices; the size, composition and quality of our guaranty book of business; the life of the loans in our guaranty book of business; the size, composition and quality of our retained mortgage portfolio; our market share; and legislative and regulatory changes.

Home Prices. Based on our home price index, we estimate that home prices on a national basis increased by 2.6% in the second quarter of 2017 and by 3.7% in the first half of 2017. We expect the rate of home price appreciation on a national basis in 2017 will be similar to the estimated 5.8% home price appreciation rate in 2016. We also expect significant regional variation in the timing and rate of home price growth.

Credit Losses. Our credit losses, which include our charge-offs, net of recoveries, reflect our realization of losses on our loans. Our credit losses were $1.8 billion for the first half of 2017, down from $2.4 billion for the first half of 2016. We expect our credit losses for 2017 to be lower than for 2016; however, we expect a significantly smaller decline in credit losses for 2017 than the $7.0 billion decline for 2016. See “Consolidated Results of Operations—Credit-Related Income (Expense)—Credit Loss Performance Metrics” for a discussion of our credit losses for the second quarter and first half of 2017 and 2016.

Loss Reserves. Our allowance for loan losses was $20.4 billion as of June 30, 2017, down from $23.5 billion as of December 31, 2016. Our loss reserves declined in recent years and are expected to decline further in 2017. For a discussion of the factors that contributed to the decline in our loss reserves in the second quarter and first half of 2017, see “Consolidated Results of Operations—Credit-Related Income (Expense)” and “Consolidated Balance Sheet Analysis—Mortgage Loans and Allowance for Loan Losses.”

|

| | | | |

| Legislation and Regulation |

The information in this section updates and supplements information regarding legislation and regulation affecting our business set forth in “Business—Legislation and Regulation” in our 2016 Form 10-K and in “MD&A—Legislation and Regulation” in our First Quarter 2017 Form 10-Q. Also see “Risk Factors” in this report and in our 2016 Form 10-K for discussions of risks relating to legislative and regulatory matters.

Housing Finance Reform

Congress continues to consider housing finance reform that could result in significant changes in our structure and role in the future. As a result, there continues to be significant uncertainty regarding the future of our company. See “Risk Factors” for a discussion of the risks to our business relating to the uncertain future of our company.

Treasury Report on Financial System

In June 2017, in response to an executive order, the Secretary of the Treasury released a report titled “A Financial System That Creates Economic Opportunities: Banks and Credit Unions” recommending changes to financial services regulations. The report does not cover housing finance reform; however, the report makes a number of recommendations relating to regulations affecting the mortgage industry, including regulations relating to mortgage loan origination, mortgage loan servicing and private sector secondary mortgage market activities. The report also makes recommendations relating to bank capital and liquidity standards that, if implemented, could affect demand for our debt and MBS securities. Many of the report’s recommendations could be completed through regulatory actions, and do not require legislation.

Conservatorship Capital Framework

We have worked with FHFA and Freddie Mac on an aligned risk measurement framework for evaluating Fannie Mae and Freddie Mac business decisions and performance during conservatorship. FHFA has directed Fannie Mae and Freddie Mac to implement these conservatorship capital framework standards. The framework includes specific requirements relating to risk and modeled returns on our new acquisitions. We will be required to submit quarterly reports to FHFA relating to the framework’s requirements starting later this year. We continuously review our business decisions as they relate to existing and prospective capital framework standards and at this time expect the conservatorship capital framework to result in limited change to our business decision making.

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 11 |

|

| | |

| | MD&A | Legislation and Regulation |

Duty to Serve Plan

In May 2017, FHFA published our proposed duty to serve underserved markets plan and requested public input on the plan by July 10, 2017. The proposed plan describes specific activities and objectives we propose to undertake from 2018 to 2020 to fulfill our duty to serve obligations in each underserved market—manufactured housing, affordable housing preservation and rural markets. The final plan must receive a non-objection letter from FHFA. Under the current timetable set forth by FHFA, we anticipate our first duty to serve underserved markets plan will become effective in 2018.

Proposed Housing Goals for 2018-2020

In June 2017, FHFA published a proposed rule that would establish new single-family and multifamily housing goals for Fannie Mae and Freddie Mac for 2018 through 2020. Comments on the proposed rule are due in September 2017. FHFA will issue a final rule after considering the comments received on the proposed rule.

Proposed Single-Family Housing Goals

Under FHFA’s proposed rule, FHFA would continue to evaluate our performance against the single-family housing goals using a two-part approach that compares the goals-qualifying share of our single-family mortgage acquisitions against both a benchmark level and a market level. To meet a single-family housing goal or subgoal, the percentage of our mortgage acquisitions that meet each goal or subgoal must meet or exceed either the benchmark level set in advance by FHFA or the market level for that year. The market level is determined retrospectively each year based on actual goals-qualifying originations in the primary mortgage market as measured by FHFA based on Home Mortgage Disclosure Act data for that year. Typically, this data is made available in September.

FHFA has proposed the following single-family home purchase and refinance housing goal benchmarks for 2018 through 2020. A home purchase mortgage may be counted toward more than one home purchase benchmark.

| |

| • | Low-Income Families Home Purchase Benchmark: At least 24% of our acquisitions of single-family owner-occupied purchase money mortgage loans must be affordable to low-income families (defined as income not in excess of 80% of area median income). This is the same benchmark currently applicable for 2017. |

| |

| • | Very Low-Income Families Home Purchase Benchmark: At least 6% of our acquisitions of single-family owner-occupied purchase money mortgage loans must be affordable to very low-income families (defined as income not greater than 50% of area median income). This is the same benchmark currently applicable for 2017. |

| |

| • | Low-Income Areas Home Purchase Goal Benchmark: The benchmark level for our acquisitions of single-family owner-occupied purchase money mortgage loans for families in low-income areas is set annually by notice from FHFA, based on the benchmark level for the low-income areas home purchase subgoal (below), plus an adjustment factor reflecting the additional incremental share of mortgages for moderate-income families (defined as income not in excess of 100% of area median income) in designated disaster areas. |

| |

| • | Low-Income Areas Home Purchase Subgoal Benchmark: At least 15% of our acquisitions of single-family owner-occupied purchase money mortgage loans must be affordable to families in low-income census tracts or to moderate-income families in high-minority census tracts. This is an increase from the benchmark of 14% currently applicable for 2017. |

| |

| • | Low-Income Families Refinancing Benchmark: At least 21% of our acquisitions of single-family owner-occupied refinance mortgage loans must be affordable to low-income families. This is the same benchmark currently applicable for 2017. |

Proposed Multifamily Housing Goals

FHFA has proposed the following multifamily goals and subgoals for 2018 through 2020.

| |

| • | Low-Income Families Goal: At least 315,000 multifamily units per year financed by us must be affordable to low-income families. This is an increase from the goal of 300,000 units currently applicable for 2017. |

| |

| • | Very Low-Income Families Subgoal: At least 60,000 multifamily units per year financed by us must be affordable to very low-income families. This is the same subgoal currently applicable for 2017. |

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 12 |

|

| | |

| | MD&A | Legislation and Regulation |

| |

| • | Small Affordable Multifamily Properties Subgoal: At least 10,000 multifamily units per year financed by us must be affordable to low-income families in small multifamily rental properties (5 to 50 units). This is the same subgoal currently applicable for 2017. |

There is no market-based alternative measurement for the multifamily goal or subgoals.

|

| | | | |

| Consolidated Results of Operations |

This section provides a discussion of our condensed consolidated results of operations and should be read together with our condensed consolidated financial statements, including the accompanying notes.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Table 1: Summary of Condensed Consolidated Results of Operations |

| | For the Three Months | | For the Six Months |

| | Ended June 30, | | Ended June 30, |

| | 2017 | | 2016 | | Variance | | 2017 | | 2016 | | Variance |

| | (Dollars in millions) |

| Net interest income | $ | 5,002 |

| | $ | 5,286 |

| | $ | (284 | ) | | $ | 10,348 |

| | $ | 10,055 |

| | $ | 293 |

|

| Fee and other income | 353 |

| | 174 |

| | 179 |

| | 602 |

| | 377 |

| | 225 |

|

| Net revenues | 5,355 |

| | 5,460 |

| | (105 | ) | | 10,950 |

| | 10,432 |

| | 518 |

|

| Investment gains, net | 385 |

| | 398 |

| | (13 | ) | | 376 |

| | 467 |

| | (91 | ) |

| Fair value losses, net | (691 | ) | | (1,667 | ) | | 976 |

| | (731 | ) | | (4,480 | ) | | 3,749 |

|

| Administrative expenses | (686 | ) | | (678 | ) | | (8 | ) | | (1,370 | ) | | (1,366 | ) | | (4 | ) |

| Credit-related income: | | | | | | | | | | | |

| Benefit for credit losses | 1,267 |

| | 1,601 |

| | (334 | ) | | 1,663 |

| | 2,785 |

| | (1,122 | ) |

| Foreclosed property expense | (34 | ) | | (63 | ) | | 29 |

| | (251 | ) | | (397 | ) | | 146 |

|

| Total credit-related income | 1,233 |

| | 1,538 |

| | (305 | ) | | 1,412 |

| | 2,388 |

| | (976 | ) |

| Temporary Payroll Tax Cut Continuation Act of 2011 (“TCCA”) fees | (518 | ) | | (453 | ) | | (65 | ) | | (1,021 | ) | | (893 | ) | | (128 | ) |

| Other expenses, net | (291 | ) | | (254 | ) | | (37 | ) | | (673 | ) | | (518 | ) | | (155 | ) |

| Income before federal income taxes | 4,787 |

| | 4,344 |

| | 443 |

| | 8,943 |

| | 6,030 |

| | 2,913 |

|

| Provision for federal income taxes | (1,587 | ) | | (1,398 | ) | | (189 | ) | | (2,970 | ) | | (1,948 | ) | | (1,022 | ) |

| Net income | $ | 3,200 |

| | $ | 2,946 |

| | $ | 254 |

| | $ | 5,973 |

| | $ | 4,082 |

| | $ | 1,891 |

|

| Total comprehensive income | $ | 3,117 |

| | $ | 2,869 |

| | $ | 248 |

| | $ | 5,896 |

| | $ | 3,805 |

| | $ | 2,091 |

|

Net Interest Income

We have two primary sources of net interest income: (1) the guaranty fees we receive for managing the credit risk on loans underlying Fannie Mae MBS held by third parties; and (2) the difference between interest income earned on the assets in our retained mortgage portfolio and the interest expense associated with the debt that funds those assets.

Guaranty fees consist of two primary components: (1) base guaranty fees that we receive over the life of the loan; and (2) upfront fees that we receive at the time of loan acquisition, primarily related to single-family loan level pricing adjustments and other fees we receive from lenders, which are amortized over the contractual life of the loan. Guaranty fees include revenues generated by the 10 basis point increase in guaranty fees we implemented in 2012 pursuant to the TCCA, the incremental revenue from which is remitted to Treasury and not retained by us. We recognize almost all of our guaranty fee revenue in net interest income due to the consolidation of the substantial majority of loans underlying our Fannie Mae MBS in consolidated trusts on our balance sheet. Those guaranty fees are the primary component of the difference between the interest income on loans in consolidated trusts and the interest expense on the debt of consolidated trusts.

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 13 |

|

| | |

| | MD&A | Consolidated Results of Operations |

Table 2 displays an analysis of our net interest income, average balances, and related yields earned on assets and incurred on liabilities. For most components of the average balances, we use a daily weighted average of amortized cost. When daily average balance information is not available, such as for mortgage loans, we use monthly averages. Table 3 displays the change in our net interest income between periods and the extent to which that variance is attributable to: (1) changes in the volume of our interest-earning assets and interest-bearing liabilities or (2) changes in the interest rates of these assets and liabilities.

|

| | | | | | | | | | | | | | | | | | | | | |

| Table 2: Analysis of Net Interest Income and Yield |

| | For the Three Months Ended June 30, |

| | 2017 | | 2016 |

| | Average

Balance | | Interest

Income/

Expense | | Average

Rates

Earned/Paid | | Average

Balance | | Interest

Income/

Expense | | Average

Rates

Earned/Paid |

| | (Dollars in millions) |

| Interest-earning assets: | | | | | | | | | | | |

| Mortgage loans of Fannie Mae | $ | 190,255 |

| | $ | 1,978 |

| | 4.16 | % | | $ | 232,722 |

| | $ | 2,390 |

| | 4.11 | % |

| Mortgage loans of consolidated trusts | 2,951,028 |

| | 25,033 |

| | 3.39 |

| | 2,822,502 |

| | 23,866 |

| | 3.38 |

|

Total mortgage loans(1) | 3,141,283 |

| | 27,011 |

| | 3.44 |

| | 3,055,224 |

| | 26,256 |

| | 3.44 |

|

| Mortgage-related securities, net | 13,860 |

| | 127 |

| | 3.64 |

| | 23,060 |

| | 241 |

| | 4.18 |

|

Non-mortgage-related securities(2) | 54,542 |

| | 140 |

| | 1.02 |

| | 53,217 |

| | 57 |

| | 0.42 |

|

Other(3) | 41,344 |

| | 115 |

| | 1.10 |

| | 26,781 |

| | 46 |

| | 0.68 |

|

| Total interest-earning assets | $ | 3,251,029 |

| | $ | 27,393 |

| | 3.37 | % | | $ | 3,158,282 |

| | $ | 26,600 |

| | 3.37 | % |

| Interest-bearing liabilities: | | | | | | | | | | | |

| Short-term funding debt | $ | 30,320 |

| | $ | 56 |

| | 0.73 | % | | $ | 56,132 |

| | $ | 56 |

| | 0.40 | % |

| Long-term funding debt | 281,987 |

| | 1,629 |

| | 2.31 |

| | 303,397 |

| | 1,736 |

| | 2.29 |

|

| Total funding debt | 312,307 |

| | 1,685 |

| | 2.16 |

| | 359,529 |

| | 1,792 |

| | 1.99 |

|

| Debt securities of consolidated trusts held by third parties | 2,949,510 |

| | 20,706 |

| | 2.81 |

| | 2,819,018 |

| | 19,522 |

| | 2.77 |

|

| Total interest-bearing liabilities | $ | 3,261,817 |

| | $ | 22,391 |

| | 2.75 | % | | $ | 3,178,547 |

| | $ | 21,314 |

| | 2.68 | % |

| Net interest income/net interest yield | | | $ | 5,002 |

| | 0.62 | % | | | | $ | 5,286 |

| | 0.67 | % |

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 14 |

|

| | |

| | MD&A | Consolidated Results of Operations |

|

| | | | | | | | | | | | | | | | | | | | | |

| | For the Six Months Ended June 30, |

| | 2017 | | 2016 |

| | Average

Balance | | Interest

Income/

Expense | | Average

Rates

Earned/Paid | | Average

Balance | | Interest

Income/

Expense | | Average

Rates

Earned/Paid |

| | (Dollars in millions) |

| Interest-earning assets: | | | | | | | | | | | |

| Mortgage loans of Fannie Mae | $ | 195,302 |

| | $ | 4,071 |

| | 4.17 | % | | $ | 235,338 |

| | $ | 4,725 |

| | 4.02 | % |

| Mortgage loans of consolidated trusts | 2,937,007 |

| | 49,987 |

| | 3.40 |

| | 2,820,153 |

| | 48,492 |

| | 3.44 |

|

Total mortgage loans(1) | 3,132,309 |

| | 54,058 |

| | 3.45 |

| | 3,055,491 |

| | 53,217 |

| | 3.48 |

|

| Total mortgage-related securities, net | 14,627 |

| | 269 |

| | 3.66 |

| | 24,821 |

| | 510 |

| | 4.11 |

|

Non-mortgage-related securities(2) | 55,264 |

| | 241 |

| | 0.87 |

| | 51,737 |

| | 111 |

| | 0.43 |

|

Other(3) | 43,207 |

| | 209 |

| | 0.96 |

| | 27,260 |

| | 94 |

| | 0.68 |

|

| Total interest-earning assets | $ | 3,245,407 |

| | $ | 54,777 |

| | 3.38 | % | | $ | 3,159,309 |

| | $ | 53,932 |

| | 3.41 | % |

| Interest-bearing liabilities: | | | | | | | | | | | |

| Short-term funding debt | $ | 31,381 |

| | $ | 99 |

| | 0.63 | % | | $ | 58,109 |

| | $ | 106 |

| | 0.36 | % |

| Long-term funding debt | 285,894 |

| | 3,315 |

| | 2.32 |

| | 311,170 |

| | 3,590 |

| | 2.31 |

|

| Total funding debt | 317,275 |

| | 3,414 |

| | 2.15 |

| | 369,279 |

| | 3,696 |

| | 2.00 |

|

| Total debt securities of consolidated trusts held by third parties | 2,937,399 |

| | 41,015 |

| | 2.79 |

| | 2,809,727 |

| | 40,181 |

| | 2.86 |

|

| Total interest-bearing liabilities | $ | 3,254,674 |

| | $ | 44,429 |

| | 2.73 | % | | $ | 3,179,006 |

| | $ | 43,877 |

| | 2.76 | % |

| Net interest income/net interest yield | | | $ | 10,348 |

| | 0.64 | % | | | | $ | 10,055 |

| | 0.64 | % |

|

| | | | | |

| | As of June 30, |

| | 2017 | | 2016 |

| Selected benchmark interest rates | | | |

| 3-month LIBOR | 1.30 | % | | 0.65 | % |

| 2-year swap rate | 1.62 |

| | 0.73 |

|

| 5-year swap rate | 1.96 |

| | 0.98 |

|

| 10-year swap rate | 2.28 |

| | 1.36 |

|

| 30-year Fannie Mae MBS par coupon rate | 3.03 |

| | 2.31 |

|

__________

| |

(1) | Average balance includes mortgage loans on nonaccrual status. Typically, interest income on nonaccrual mortgage loans is recognized when cash is received. Interest income not recognized for loans on nonaccrual status was $186 million and $402 million, respectively, for the second quarter and first half of 2017, compared with $321 million and $659 million, respectively, for the second quarter and first half of 2016. |

| |

(2) | Includes cash equivalents. |

| |

(3) | Consists of federal funds sold and securities purchased under agreements to resell or similar arrangements and advances to lenders. |

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 15 |

|

| | |

| | MD&A | Consolidated Results of Operations |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Table 3: Rate/Volume Analysis of Changes in Net Interest Income | | | | | | |

| For the Three Months Ended | | For the Six Months Ended |

| June 30, 2017 vs. 2016 | | June 30, 2017 vs. 2016 |

| Total | | Variance Due to:(1) | | Total | | Variance Due to:(1) |

| Variance | | Volume | | Rate | | Variance | | Volume | | Rate |

| | (Dollars in millions) |

| Interest income: | | | | | | | | | | | |

| Mortgage loans of Fannie Mae | $ | (412 | ) | | $ | (441 | ) | | $ | 29 |

| | $ | (654 | ) | | $ | (829 | ) | | $ | 175 |

|

| Mortgage loans of consolidated trusts | 1,167 |

| | 1,090 |

| | 77 |

| | 1,495 |

| | 1,993 |

| | (498 | ) |

| Total mortgage loans | 755 |

| | 649 |

| | 106 |

| | 841 |

| | 1,164 |

| | (323 | ) |

| Mortgage-related securities, net | (114 | ) | | (87 | ) | | (27 | ) | | (241 | ) | | (193 | ) | | (48 | ) |

Non-mortgage-related securities(2) | 83 |

| | 1 |

| | 82 |

| | 130 |

| | 8 |

| | 122 |

|

Other(3) | 69 |

| | 22 |

| | 47 |

| | 115 |

| | 53 |

| | 62 |

|

| Total interest income | $ | 793 |

| | $ | 585 |

| | $ | 208 |

| | $ | 845 |

| | $ | 1,032 |

| | $ | (187 | ) |

| Interest expense: | | | | | | | | | | | |

| Short-term funding debt | — |

| | (33 | ) | | 33 |

| | (7 | ) | | (63 | ) | | 56 |

|

| Long-term funding debt | (107 | ) | | (124 | ) | | 17 |

| | (275 | ) | | (293 | ) | | 18 |

|

| Total funding debt | (107 | ) | | (157 | ) | | 50 |

| | (282 | ) | | (356 | ) | | 74 |

|

| Debt securities of consolidated trusts held by third parties | 1,184 |

| | 923 |

| | 261 |

| | 834 |

| | 1,862 |

| | (1,028 | ) |

| Total interest expense | $ | 1,077 |

| | $ | 766 |

| | $ | 311 |

| | $ | 552 |

| | $ | 1,506 |

| | $ | (954 | ) |

| Net interest income | $ | (284 | ) | | $ | (181 | ) | | $ | (103 | ) | | $ | 293 |

| | $ | (474 | ) | | $ | 767 |

|

__________

| |

(1) | Combined rate/volume variances are allocated to rate and volume based on the relative size of each variance. |

| |

(2) | Includes cash equivalents. |

| |

(3) | Consists of federal funds sold and securities purchased under agreements to resell or similar arrangements and advances to lenders. |

Net interest income and net interest yield decreased in the second quarter of 2017 compared with the second quarter of 2016 due to a decline in the average balance of our retained mortgage portfolio as we continued to reduce this portfolio pursuant to the requirements of our senior preferred stock purchase agreement with Treasury and FHFA’s additional portfolio cap. The decrease in net interest income was partially offset by a slight increase in guaranty fee income driven by (1) loans with higher base guaranty fees comprising a larger part of our guaranty book of business in the second quarter of 2017 compared with the second quarter of 2016; almost entirely offset by (2) a decrease in the amortization of upfront fees driven by lower prepayments on mortgage loans and liquidations of MBS debt of consolidated trusts, which reduced the amortization of cost basis adjustments on the loans and related debt.

Net interest income increased in the first half of 2017 compared with the first half of 2016 due to an increase in guaranty fee income driven by: (1) an increase in amortization income in the first half of 2017 due to activity related to increased prepayments on mortgage loans and liquidations of MBS debt of consolidated trusts, which accelerated the amortization of cost basis adjustments on the loans and related debt; and (2) loans with higher base guaranty fees comprising a larger part of our guaranty book of business in the first half of 2017 compared with the first half of 2016. The increase in net interest income due to higher guaranty fee income was partially offset by a decline in the average balance of our retained mortgage portfolio as we continued to reduce this portfolio. See “Retained Mortgage Portfolio” for information about our retained mortgage portfolio.

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 16 |

|

| | |

| | MD&A | Consolidated Results of Operations |

Fair Value Losses, Net

The estimated fair value of our derivatives and trading securities may fluctuate substantially from period to period because of changes in interest rates, credit spreads and interest rate volatility, as well as activity related to these financial instruments. While the estimated fair value of our derivatives that serve to mitigate certain risk exposures may fluctuate, some of the financial instruments that generate these exposures are not recorded at fair value in our condensed consolidated financial statements.

Table 4 displays the components of our fair value gains and losses.

|

| | | | | | | | | | | | | | | |

| Table 4: Fair Value Losses, Net |

| | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| | (Dollars in millions) |

| Risk management derivatives fair value gains (losses) attributable to: | | | | | | | |

| Net contractual interest expense accruals on interest rate swaps | $ | (224 | ) | | $ | (291 | ) | | $ | (479 | ) | | $ | (560 | ) |

| Net change in fair value during the period | (78 | ) | | (899 | ) | | 289 |

| | (3,001 | ) |

| Total risk management derivatives fair value losses, net | (302 | ) | | (1,190 | ) | | (190 | ) | | (3,561 | ) |

| Mortgage commitment derivatives fair value losses, net | (192 | ) | | (367 | ) | | (272 | ) | | (729 | ) |

| Total derivatives fair value losses, net | (494 | ) | | (1,557 | ) | | (462 | ) | | (4,290 | ) |

| Trading securities gains, net | 18 |

| | 22 |

| | 86 |

| | 50 |

|

CAS debt fair value losses, net(1) | (169 | ) | | (168 | ) | | (331 | ) | | (228 | ) |

Other, net(2) | (46 | ) | | 36 |

| | (24 | ) | | (12 | ) |

| Fair value losses, net | $ | (691 | ) | | $ | (1,667 | ) | | $ | (731 | ) | | $ | (4,480 | ) |

| |

(1) | Consists of fair value losses on CAS debt reported at fair value. |

| |

(2) | Consists of fair value gains and losses on non-CAS debt and mortgage loans. |

Fair value losses in the second quarter and first half of 2017 were primarily driven by:

| |

| • | decreases in the fair value of our pay-fixed risk management derivatives due to declines in longer-term swap rates during the second quarter; |

| |

| • | decreases in the fair value of our mortgage commitments due to losses on commitments to sell mortgage-related securities due to an increase in prices as interest rates decreased during the commitment periods; and |

| |

| • | fair value losses on CAS debt reported at fair value resulting from tightening spreads between CAS debt yields and LIBOR during the periods. |

Fair value losses in the second quarter and first half of 2016 were primarily due to losses on risk management derivatives resulting from decreases in the fair value of our pay-fixed derivatives due to declines in longer-term swap rates during the second quarter and first half of 2016.

Credit-Related Income (Expense)

We refer to our benefit (provision) for loan losses and benefit (provision) for guaranty losses collectively as our “benefit (provision) for credit losses.” Credit-related income (expense) consists of our benefit (provision) for credit losses and foreclosed property income (expense).

Provision (Benefit) for Credit Losses

Our combined loss reserves provide for an estimate of credit losses incurred in our guaranty book of business, including concessions we granted borrowers upon modification of their loans. We establish our combined loss reserves through our provision for credit losses for losses that we believe have been incurred and will eventually be realized over time in our financial statements. When we reduce our combined loss reserves, we recognize a benefit for credit losses. When we determine that a loan is uncollectible, typically upon foreclosure or other liquidation event (such as a deed-in-lieu of foreclosure or a short sale), we recognize a charge-off against our

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 17 |

|

| | |

| | MD&A | Consolidated Results of Operations |

combined loss reserves. For a subset of delinquent single-family loans, we charge off the portion of the loans that is deemed uncollectible prior to foreclosure when the loans have been delinquent for a specified length of time and meet specified mark-to-market LTV ratios. We also recognize a charge-off upon the redesignation of loans from HFI to HFS. If the amounts charged off upon redesignation exceed the allowance related to the loans, we record a provision for credit losses. If the amounts charged off are less than the allowance related to the loans, we recognize a benefit for credit losses. We record recoveries of previously charged-off amounts as a reduction to charge-offs.

Table 5 displays the changes in the combined loss reserves, which consists of the allowance for loan losses and the reserve for guaranty losses.

|

| | | | | | | | | | | | | | | |

| Table 5: Changes in Combined Loss Reserves |

| | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| | (Dollars in millions) |

| Changes in combined loss reserves: | | | | | | | |

| Beginning balance | $ | 22,526 |

| | $ | 26,332 |

| | $ | 23,835 |

| | $ | 28,590 |

|

| Benefit for credit losses | (1,267 | ) | | (1,601 | ) | | (1,663 | ) | | (2,785 | ) |

| Charge-offs | (704 | ) | | (828 | ) | | (1,766 | ) | | (2,131 | ) |

| Recoveries | 179 |

| | 164 |

| | 298 |

| | 329 |

|

| Other | 8 |

| | 22 |

| | 38 |

| | 86 |

|

| Ending balance | $ | 20,742 |

| | $ | 24,089 |

| | $ | 20,742 |

| | $ | 24,089 |

|

|

| | | | | | | | | | | | | | | | | |

| | As of |

| | June 30, | | | December 31, | |

| | 2017 | | | 2016 | |

| | (Dollars in millions) |

| Allocation of combined loss reserves: | | | | | |

| Balance at end of each period attributable to: | | | | | |

| Single-family | $ | 20,553 |

| | | $ | 23,639 |

| |

| Multifamily | 189 |

| | | 196 |

| |

| Total | $ | 20,742 |

| | | $ | 23,835 |

| |

| Single-family and multifamily combined loss reserves as a percentage of applicable guaranty book of business: | | | | | |

| Single-family | 0.72 |

| % | | 0.83 |

| % |

| Multifamily | 0.07 |

| | | 0.08 |

| |

| Combined loss reserves as a percentage of: | | | | | |

| Total guaranty book of business | 0.66 |

| % | | 0.77 |

| % |

| Recorded investment in nonaccrual loans | 55.06 |

| | | 53.62 |

| |

The amount of our provision or benefit for credit losses may vary from period to period based on a number of factors, such as changes in actual and expected home prices, fluctuations in interest rates, borrower payment behavior, the types and volumes of our loss mitigation activities, the volume of foreclosures completed, and redesignations of loans from HFI to HFS. In addition, our provision or benefit for credit losses and our combined loss reserves can be impacted by updates to the models, assumptions and data used in determining our allowance for loan losses.

The following factors contributed to our benefit for credit losses in the second quarter and first half of 2017:

| |

| • | Actual and forecasted home prices increased in the period. Higher home prices decrease the likelihood that loans will default and reduce the amount of credit loss on loans that do default, which impacts our estimate of losses and ultimately reduces our combined loss reserves and provision for credit losses. |

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 18 |

|

| | |

| | MD&A | Consolidated Results of Operations |

| |

| • | We redesignated certain reperforming and nonperforming single-family loans from HFI to HFS during the period as we no longer intend to hold them to maturity. Upon redesignation of these loans, we recorded the loans at the lower of cost or fair value via a charge-off to the allowance for loan losses. Amounts recorded in the allowance related to the loans exceeded the amount charged off, contributing to the benefit for credit losses. |

The following factors contributed to our benefit for credit losses in the second quarter and first half of 2016:

| |

| • | Home prices, including distressed property valuations, increased during the second quarter and first half of 2016. |

| |

| • | Actual and projected mortgage interest rates declined during the second quarter and first half of 2016. As mortgage interest rates decline, we expect an increase in future prepayments on single-family individually impaired loans, including modified loans. Higher expected prepayments shorten the expected lives of modified loans, which decreases the impairment relating to concessions provided on these loans and results in a decrease in the provision for credit losses. |

We discuss our expectations regarding our future loss reserves in “Executive Summary—Outlook—Loss Reserves.”

Troubled Debt Restructurings and Nonaccrual Loans

Table 6 displays the composition of loans restructured in a troubled debt restructuring (“TDR”) that are on accrual status and loans on nonaccrual status. The table includes our recorded investment in HFI and HFS mortgage loans. For information on the impact of TDRs and other individually impaired loans on our allowance for loan losses, see “Note 3, Mortgage Loans.”

|

| | | | | | | | | | | |

| Table 6: Troubled Debt Restructurings and Nonaccrual Loans |

| | As of |

| | June 30,

2017 | | December 31, 2016 |

| | (Dollars in millions) |

| TDRs on accrual status: | | | | | | | |

| Single-family | | $ | 123,183 |

| | | | $ | 127,353 |

| |

| Multifamily | | 95 |

| | | | 141 |

| |

| Total TDRs on accrual status | | $ | 123,278 |

| | | | $ | 127,494 |

| |

| Nonaccrual loans: | | | | | | | |

| Single-family | | $ | 37,331 |

| | | | $ | 44,047 |

| |

| Multifamily | | 341 |

| | | | 403 |

| |

| Total nonaccrual loans | | $ | 37,672 |

| | | | $ | 44,450 |

| |

Accruing on-balance sheet loans past due 90 days or more(1) | | $ | 304 |

| | | | $ | 402 |

| |

|

| | | | | | | | | | | |

| | For the Six Months |

| | | Ended June 30, | |

| | | 2017 | | | | 2016 | |

| | | (Dollars in millions) | |

| Interest related to on-balance sheet TDRs and nonaccrual loans: | | | | | | | |

Interest income forgone(2) | | $ | 1,781 |

| | | | $ | 2,345 |

| |

Interest income recognized for the period(3) | | 2,886 |

| | | | 3,103 |

| |

__________

| |

(1) | Includes loans that, as of the end of each period, are 90 days or more past due and continuing to accrue interest. The majority of these amounts consists of loans insured or guaranteed by the U.S. government and loans for which we have recourse against the seller in the event of a default. |

| |

(2) | Represents the amount of interest income we did not recognize, but would have recognized during the period for nonaccrual loans and TDRs on accrual status as of the end of each period had the loans performed according to their original contractual terms. |

| |

(3) | Represents interest income recognized during the period, including the amortization of any deferred cost basis adjustments, for loans classified as either nonaccrual loans or TDRs on accrual status as of the end of each period. Includes primarily amounts accrued while the loans were performing and cash payments received on nonaccrual loans. |

|

| | |

| Fannie Mae Second Quarter 2017 Form 10-Q | 19 |

|

| | |

| | MD&A | Consolidated Results of Operations |

Credit Loss Performance Metrics

Our credit-related income (expense) should be considered in conjunction with our credit loss performance metrics. Our credit loss performance metrics, however, are not defined terms within generally accepted accounting principles (“GAAP”) and may not be calculated in the same manner as similarly titled measures reported by other companies. Because management does not view changes in the fair value of our mortgage loans as credit losses, we adjust our credit loss performance metrics for the impact associated with our acquisition of credit-impaired loans from unconsolidated MBS trusts. We also exclude interest forgone on nonaccrual loans and TDRs, other-than-temporary impairment losses resulting from deterioration in the credit quality of our mortgage-related securities and accretion of interest income on acquired credit-impaired loans from credit losses. We believe that credit loss performance metrics may be useful to investors as the losses are presented as a percentage of our book of business and have historically been used by analysts, investors and other companies within the financial services industry. Moreover, by presenting credit losses with and without the effect of fair value losses associated with the acquisition of credit-impaired loans, investors are able to evaluate our credit performance on a more consistent basis among periods. Table 7 displays the components of our credit loss performance metrics as well as our single-family and multifamily initial charge-off severity rates.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 7: Credit Loss Performance Metrics |

| | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| | Amount | | Ratio(1) | | Amount | | Ratio(1) | | Amount | | Ratio(1) | | Amount | | Ratio(1) |

| | (Dollars in millions) |

| Charge-offs, net of recoveries | $ | 525 |

| | 6.7 | bps | | $ | 664 |

| | 8.8 | bps | | $ | 1,468 |

| | 9.4 | bps | | $ | 1,802 |

| | 11.8 | bps |

| Foreclosed property expense | 34 |