UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2018

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No.: 0-50231

Federal National Mortgage Association

(Exact name of registrant as specified in its charter)

Fannie Mae

| Federally chartered corporation | 52-0883107 | 3900 Wisconsin Avenue, NW Washington, DC 20016 | (800) 2FANNIE (800-232-6643) |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | (Address of principal executive offices, including zip code) | (Registrant’s telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Emerging growth company o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

As of March 31, 2018, there were 1,158,087,567 shares of common stock of the registrant outstanding.

TABLE OF CONTENTS

| Page | ||

| PART I—Financial Information | ||

| Item 1. | ||

| Item 2. | ||

| Retained Mortgage Portfolio | ||

| Item 3. | ||

| Item 4. | ||

| PART II—Other Information | ||

| Item 1. | ||

| Item 1A. | ||

| Item 2. | ||

| Item 3. | ||

| Item 4. | ||

| Item 5. | ||

| Item 6. | ||

| Fannie Mae First Quarter 2018 Form 10-Q | i | |

| MD&A | Introduction | ||

PART I—FINANCIAL INFORMATION

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

We have been under conservatorship, with the Federal Housing Finance Agency (“FHFA”) acting as conservator, since September 6, 2008. As conservator, FHFA succeeded to all rights, titles, powers and privileges of the company, and of any shareholder, officer or director of the company with respect to the company and its assets. The conservator has since provided for the exercise of certain functions by our Board of Directors. Our directors do not have any fiduciary duties to any person or entity except to the conservator and, accordingly, are not obligated to consider the interests of the company, the holders of our equity or debt securities, or the holders of Fannie Mae MBS unless specifically directed to do so by the conservator. | ||

| Our conservatorship has no specified termination date. We do not know when or how the conservatorship will terminate, what further changes to our business will be made during or following conservatorship, what form we will have and what ownership interest, if any, our current common and preferred stockholders will hold in us after the conservatorship is terminated or whether we will continue to exist following conservatorship. Congress continues to consider options for reform of the housing finance system, including Fannie Mae. As a result of our agreements with the U.S. Department of the Treasury (“Treasury”) and directives from our conservator, we are not permitted to retain more than $3.0 billion in capital reserves or to pay dividends or other distributions to stockholders other than Treasury. Our agreements with Treasury also include covenants that significantly restrict our business activities. For additional information on the conservatorship, the uncertainty of our future, our agreements with Treasury, and recent actions and statements relating to housing finance reform by the Administration, Congress and FHFA, see “Business—Conservatorship and Treasury Agreements,” “Business—Legislation and Regulation” and “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2017 (“2017 Form 10-K”) and “Legislation and Regulation” and “Risk Factors” in this report. | ||

You should read this Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) in conjunction with our unaudited condensed consolidated financial statements and related notes in this report and the more detailed information in our 2017 Form 10-K. You can find a “Glossary of Terms Used in This Report” in the MD&A of our 2017 Form 10-K.

This report contains forward-looking statements that are based on management’s current expectations and are subject to significant uncertainties and changes in circumstances. Please review “Forward-Looking Statements” for more information on these forward-looking statements. Our actual results may differ materially from those reflected in our forward-looking statements due to a variety of factors including, but not limited to, those discussed in “Risk Factors” and elsewhere in this report and in our 2017 Form 10-K.

| Introduction | ||||

Fannie Mae provides a stable source of liquidity to the mortgage market and increases the availability and affordability of housing in the United States. We operate in the secondary mortgage market, primarily working with lenders. We do not originate loans or lend money directly to consumers in the primary mortgage market. Instead, we securitize mortgage loans originated by lenders into Fannie Mae mortgage-backed securities that we guarantee (which we refer to as Fannie Mae MBS); purchase mortgage loans and mortgage-related securities, primarily for securitization and sale at a later date; and engage in other activities that increase the supply of affordable housing. Our common stock is traded in the OTCQB market and quoted under the ticker symbol “FNMA.”

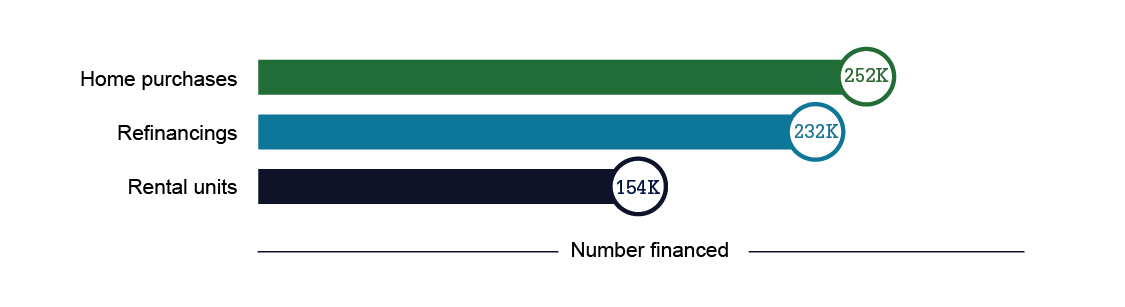

Through our single-family and multifamily business segments, we provided $124 billion in liquidity to the mortgage market in the first quarter of 2018, which enabled the financing of 638,000 home purchases, refinancings or rental units.

| Fannie Mae First Quarter 2018 Form 10-Q | 1 | |

| MD&A | Introduction | ||

Fannie Mae Provided $124 Billion in Liquidity in the First Quarter of 2018

| Executive Summary | ||||

Summary of Our Financial Performance

We recognized net income of $4.3 billion and comprehensive income of $3.9 billion in the first quarter of 2018 compared with comprehensive and net income of $2.8 billion in the first quarter of 2017.

The increase in our net income was primarily driven by the shift to fair value gains in the first quarter of 2018 from fair value losses in the first quarter of 2017. Fair value gains in the first quarter of 2018 were primarily driven by:

| • | increases in the fair value of our mortgage commitment derivatives due to rising interest rates; and |

| • | increases in the fair value of our risk management derivatives due to an increase in longer-term swap rates. |

See “MD&A—Consolidated Results of Operations” for more information on our financial results.

| Fannie Mae First Quarter 2018 Form 10-Q | 2 | |

| MD&A | Executive Summary | ||

Net Worth

Our net worth of $3.9 billion as of March 31, 2018 reflects our comprehensive income of $3.9 billion for the first quarter of 2018 and our receipt of $3.7 billion from Treasury during the quarter pursuant to the senior preferred stock purchase agreement to eliminate our net worth deficit as of December 31, 2017.

Financial Performance Outlook

We expect to remain profitable on an annual basis for the foreseeable future; however, certain factors could result in significant volatility in our financial results from quarter to quarter or year to year. We expect volatility from quarter to quarter in our financial results due to a number of factors, particularly changes in market conditions that result in fluctuations in the estimated fair value of the financial instruments that we mark to market through our earnings. Other factors that may result in volatility in our quarterly financial results include developments that affect our loss reserves, such as changes in interest rates, home prices or accounting standards, or events such as natural disasters.

The potential for significant volatility in our financial results could result in a net loss in a future quarter. We are permitted to retain up to $3.0 billion in capital reserves as a buffer in the event of a net loss in a future quarter. However, any net loss we experience in the future could be greater than the amount of our capital reserves, resulting in a net worth deficit for that quarter. See “Risk Factors” in our 2017 Form 10-K for a discussion of the risks associated with the limitations on our ability to rebuild our capital reserves, including factors that could result in a net loss or net worth deficit in a future quarter.

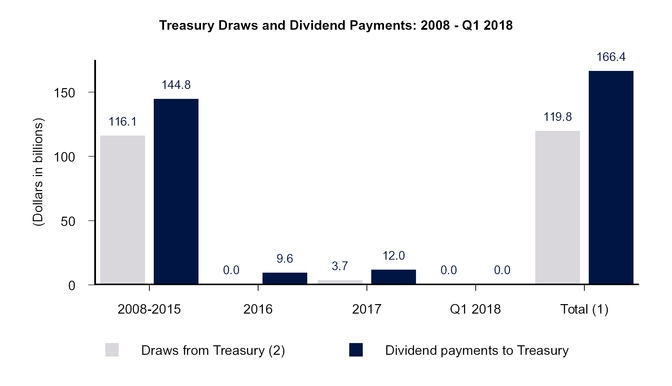

Treasury Draws and Dividend Payments

Treasury has made a commitment under a senior preferred stock purchase agreement to provide funding to us under certain circumstances if we have a net worth deficit. Pursuant to the senior preferred stock purchase agreement, we issued shares of senior preferred stock to Treasury in 2008. Acting as successor to the rights, titles, powers and privileges of the Board, the conservator has declared and directed us to pay dividends to Treasury on the senior preferred stock on a quarterly basis for every dividend period for which dividends were payable since we entered into conservatorship in 2008.

The chart below shows the funds we have drawn from Treasury pursuant to the senior preferred stock purchase agreement, as well as the dividend payments we have made to Treasury on the senior preferred stock, since entering into conservatorship. Because we had a net worth deficit of $3.7 billion as of December 31, 2017, we drew $3.7 billion from Treasury to eliminate this net worth deficit and no dividend was payable to Treasury for the first quarter of 2018.

| Fannie Mae First Quarter 2018 Form 10-Q | 3 | |

| MD&A | Executive Summary | ||

__________

(1) | Under the terms of the senior preferred stock purchase agreement, dividend payments we make to Treasury do not offset our prior draws of funds from Treasury, and we are not permitted to pay down draws we have made under the agreement except in limited circumstances. Amounts may not sum due to rounding. |

(2) | Treasury draws are shown in the period for which requested, not when the funds were received by us. Draw requests have been funded in the quarter following a net worth deficit. |

We expect to pay Treasury a dividend of $938 million for the second quarter of 2018 by June 30, 2018. The current dividend provisions of the senior preferred stock provide for quarterly dividends consisting of the amount, if any, by which our net worth as of the end of the immediately preceding fiscal quarter exceeds a $3.0 billion capital reserve amount. We refer to this as a “net worth sweep” dividend. As noted above, our net worth was $3.9 billion as of March 31, 2018.

If we experience a net worth deficit in a future quarter, we will be required to draw additional funds from Treasury under the senior preferred stock purchase agreement to avoid being placed into receivership. As of the date of this filing, the maximum amount of remaining funding under the agreement is $113.9 billion. If we were to draw additional funds from Treasury under the agreement in respect of a future period, the amount of remaining funding under the agreement would be reduced by the amount of our draw. Dividend payments we make to Treasury do not restore or increase the amount of funding available to us under the agreement. For a description of the terms of the senior preferred stock purchase agreement and the senior preferred stock, see “Business—Conservatorship and Treasury Agreements—Treasury Agreements” in our 2017 Form 10-K.

Although Treasury owns our senior preferred stock and a warrant to purchase 79.9% of our common stock, and has made a commitment under a senior preferred stock purchase agreement to provide us with funds to maintain a positive net worth under specified conditions, the U.S. government does not guarantee our securities or other obligations.

| Legislation and Regulation | ||||

The information in this section updates and supplements information regarding legislation and regulation affecting our business set forth in “Business—Legislation and Regulation” in our 2017 Form 10-K. Also see “Risk Factors” in this report and in our 2017 Form 10-K for discussions of risks relating to legislative and regulatory matters.

| Fannie Mae First Quarter 2018 Form 10-Q | 4 | |

| MD&A | Legislation and Regulation | ||

Housing Finance Reform

Congress continues to consider housing finance reform that could result in significant changes in our structure and role in the future. As a result, there continues to be significant uncertainty regarding the future of our company. See “Risk Factors” in our 2017 Form 10-K for a discussion of the risks to our business relating to the uncertain future of our company.

In February 2018, Treasury released its Strategic Plan 2018-2022, which includes an objective to support housing finance reform to resolve Fannie Mae’s and Freddie Mac’s conservatorships and prevent taxpayer bailouts of public and private mortgage finance entities, while promoting consumer choice within the mortgage market.

Single Security Initiative: New Uniform Mortgage-Backed Security Implementation Date

Since 2014, we, Freddie Mac and FHFA have been working on developing and implementing a uniform mortgage-backed security for Fannie Mae and Freddie Mac. In March 2018, FHFA announced that Fannie Mae and Freddie Mac will start issuing the new, common security—referred to as the Uniform Mortgage-Backed Security or UMBS—in place of their current offerings of TBA-eligible mortgage-backed securities on June 3, 2019. The new UMBS will be issued by Fannie Mae and Freddie Mac through their joint venture, Common Securitization Solutions, LLC (“CSS”), using the Common Securitization Platform (“CSP”). At that time, we plan to begin using CSS and the CSP to perform certain operational functions associated with issuing and managing these UMBS on our behalf, including data acceptance, issuance support, bond administration and the production of disclosures. See “Business—Legislation and Regulation—Housing Finance Reform—Conservator Developments and Strategic Goals” in our 2017 Form 10-K for more information on the expected features of the securities. See “Risk Factors” in this report and in our 2017 Form 10-K for a discussion of the risks to our business associated with the Single Security Initiative.

Housing Goals

2017 Housing Goals Performance

We are subject to housing goals, which establish specified requirements for our mortgage acquisitions relating to affordability or location. Our single-family performance is measured against the lower of benchmarks established by FHFA or goals-qualifying originations in the primary mortgage market. Multifamily goals are established as a number of units to be financed.

For 2017, we believe we met four of our five single-family benchmarks and all of our multifamily goals. We narrowly missed meeting the single-family very low-income families home purchase benchmark. Very low-income families are defined as those with income equal to or less than 50% of area median income. Final performance results will be determined and published by FHFA sometime after the release in the fall of 2018 of data reported by primary market originators under the Home Mortgage Disclosure Act. To determine whether we met our very low-income families home purchase goal, FHFA will compare our performance with that of the market. We will be in compliance with this goal if we meet the applicable market share measure for the goal.

2018 Single-Family Housing Goals: Low-Income Areas Home Purchase Goal Benchmark

Each year, FHFA sets the benchmark level for our acquisitions of single-family owner-occupied home purchase mortgage loans for families in low-income areas based on the benchmark level for the low-income areas home purchase subgoal (which is 14% for 2018), plus an adjustment factor reflecting an additional incremental share of mortgages for moderate-income families (defined as income equal to or less than 100% of area median income) in designated disaster areas. In April 2018, FHFA set the 2018 overall low-income areas home purchase benchmark goal at 18%.

See “Business—Legislation and Regulation—GSE Act and Other Regulation of Our Business—Housing Goals” in our 2017 Form 10-K for a more detailed discussion of our housing goals.

| Fannie Mae First Quarter 2018 Form 10-Q | 5 | |

| MD&A | Key Market Economic Indicators | ||

| Key Market Economic Indicators | ||||

The table below displays certain macroeconomic indicators that can significantly influence our business and financial results. We expect home prices on a national basis to continue to grow in 2018 at a similar rate as in 2017. We also expect significant regional variation in the timing and rate of home price growth.

| Selected Key Market Economic Indicators | ||||||||

| For the Three Months Ended | ||||||||

| March 31, 2018 | December 31, 2017 | March 31, 2017 | ||||||

| Growth in U.S. gross domestic product ("GDP"), annualized percentage change | 2.3 | % | 2.9 | % | 1.2 | % | ||

Home price change based on Fannie Mae national home price index(1) | 1.0 | 0.3 | 1.1 | |||||

| As of | ||||||||

| March 31, 2018 | December 31, 2017 | March 31, 2017 | ||||||

| U.S. unemployment rate | 4.1 | 4.1 | 4.5 | |||||

| 2-year swap rate | 2.58 | 2.08 | 1.62 | |||||

| 10-year swap rate | 2.79 | 2.40 | 2.38 | |||||

| 10-year Treasury rate | 2.74 | 2.41 | 2.40 | |||||

| 30-year Fannie Mae MBS par coupon rate | 3.46 | 3.00 | 3.13 | |||||

_______

(1) | Calculated internally using property data information on loans purchased by Fannie Mae, Freddie Mac and property data information obtained from other third-party data providers. Fannie Mae’s home price index is a weighted repeat transactions index, measuring average price changes in repeat transactions on the same properties. Fannie Mae’s home price index excludes prices on properties sold in foreclosure. The reported home price change reflects the percentage change in Fannie Mae’s home price index from the last day of the prior quarter to the applicable period end date. Fannie Mae’s home price estimates are based on preliminary data and are subject to change as additional data becomes available. |

See “Key Market Economic Indicators” in our 2017 Form 10-K for a description of how changes in GDP, unemployment rates, home prices and interest rates can affect our financial results.

| Fannie Mae First Quarter 2018 Form 10-Q | 6 | |

| MD&A | Consolidated Results of Operations | ||

| Consolidated Results of Operations | ||||

This section provides a discussion of our condensed consolidated results of operations and should be read together with our condensed consolidated financial statements, including the accompanying notes.

| Summary of Condensed Consolidated Results of Operations | |||||||||||

| For the Three Months | |||||||||||

| Ended March 31, | |||||||||||

| 2018 | 2017 | Variance | |||||||||

| (Dollars in millions) | |||||||||||

| Net interest income | $ | 5,232 | $ | 5,346 | $ | (114 | ) | ||||

| Fee and other income | 320 | 249 | 71 | ||||||||

| Net revenues | 5,552 | 5,595 | (43 | ) | |||||||

| Investment gains (losses), net | 250 | (9 | ) | 259 | |||||||

| Fair value gains (losses), net | 1,045 | (40 | ) | 1,085 | |||||||

| Administrative expenses | (750 | ) | (684 | ) | (66 | ) | |||||

| Credit-related income: | |||||||||||

| Benefit for credit losses | 217 | 396 | (179 | ) | |||||||

| Foreclosed property expense | (162 | ) | (217 | ) | 55 | ||||||

| Total credit-related income | 55 | 179 | (124 | ) | |||||||

| Temporary Payroll Tax Cut Continuation Act of 2011 (“TCCA”) fees | (557 | ) | (503 | ) | (54 | ) | |||||

| Other expenses, net | (203 | ) | (382 | ) | 179 | ||||||

| Income before federal income taxes | 5,392 | 4,156 | 1,236 | ||||||||

| Provision for federal income taxes | (1,131 | ) | (1,383 | ) | 252 | ||||||

| Net income | $ | 4,261 | $ | 2,773 | $ | 1,488 | |||||

| Other comprehensive income (loss) | (323 | ) | 6 | (329 | ) | ||||||

| Total comprehensive income | $ | 3,938 | $ | 2,779 | $ | 1,159 | |||||

Net Interest Income

We have two primary sources of net interest income:

| • | guaranty fees we receive for managing the credit risk on loans underlying Fannie Mae MBS held by third parties; and |

| • | the difference between interest income earned on the assets in our retained mortgage portfolio and the interest expense associated with the debt that funds those assets. |

The table below displays the components of our net interest income from our guaranty book of business and our retained mortgage portfolio.

| Components of Net Interest Income | ||||||||||||

| For the Three Months Ended March 31, | ||||||||||||

| 2018 | 2017 | Variance | ||||||||||

| (Dollars in millions) | ||||||||||||

Net interest income from retained mortgage portfolio(1) | $ | 1,078 | $ | 1,083 | $ | (5 | ) | |||||

| Net interest income from guaranty book of business: | ||||||||||||

| Base guaranty fee income, net of TCCA | 2,089 | 1,986 | 103 | |||||||||

Base guaranty fee income related to TCCA(2) | 557 | 503 | 54 | |||||||||

| Net amortization income | 1,508 | 1,774 | (266 | ) | ||||||||

| Total net interest income from guaranty book of business | 4,154 | 4,263 | (109 | ) | ||||||||

| Total net interest income | $ | 5,232 | $ | 5,346 | $ | (114 | ) | |||||

| Fannie Mae First Quarter 2018 Form 10-Q | 7 | |

| MD&A | Consolidated Results of Operations | ||

__________

(1) | Includes interest income from assets held in our other investments portfolio, as well as other assets used to generate lender liquidity. Also includes interest expense on outstanding Connecticut Avenue SecuritiesTM of $302 million and $208 million for the first quarter of 2018 and 2017, respectively. |

(2) | Revenues generated by the 10 basis point guaranty fee increase we implemented in 2012 pursuant to the TCCA, the incremental revenue from which is remitted to Treasury and not retained by us. |

Net interest income decreased in the first quarter of 2018 compared with the first quarter of 2017 primarily due to:

| • | A decline in net amortization income as a higher interest rate environment during the first quarter of 2018 slowed down loan prepayments, resulting in lower amortization of the cost basis adjustments on mortgage loans of consolidated trusts and related debt. |

| • | This decline was partially offset by an increase in base guaranty fee income as the size of our guaranty book of business increased and loans with higher base guaranty fees comprised a larger part of our guaranty book of business in the first quarter of 2018 than in the first quarter of 2017. |

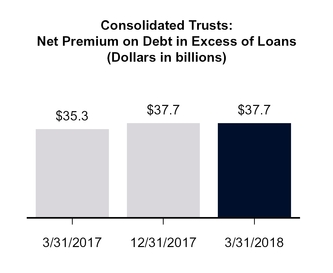

We initially recognize mortgage loans and debt of consolidated trusts in our consolidated balance sheet at fair value. We recognize the difference between the initial fair value and the carrying value of these mortgage loans and debt as cost basis adjustments in our consolidated balance sheet. We amortize cost basis adjustments, including premiums and discounts on mortgage loans and securities, as a yield adjustment over the contractual life of the loan or security as a component of net interest income.

The impact of net premiums and discounts on net interest income can vary:

| • | The net premium position of our consolidated debt will amortize as income over time. |

| • | The net discount position on our mortgage loans of Fannie Mae was primarily recorded upon the acquisition of credit-impaired loans. The extent to which we may record income in future periods as we amortize this discount will be based on the actual performance of the loans. |

The timing of when this amortization income is recognized in our consolidated statements of income can vary based on a number of factors, primarily interest rates. In a rising interest rate environment, our mortgage loans tend to prepay more slowly, which typically results in lower amortization income from cost basis adjustments. Conversely, in a declining interest rate environment, our mortgage loans tend to prepay faster, resulting in higher net amortization income from cost basis adjustments.

The following charts display information about the outstanding net premium and net discount positions on our debt of consolidated trusts and loans of Fannie Mae.

| Fannie Mae First Quarter 2018 Form 10-Q | 8 | |

| MD&A | Consolidated Results of Operations | ||

The table below displays an analysis of our net interest income, average balances, and related yields earned on assets and incurred on liabilities for the periods indicated. For most components of the average balances, we use a daily weighted average of amortized cost. When daily average balance information is not available, such as for mortgage loans, we use monthly averages.

| Analysis of Net Interest Income and Yield | |||||||||||||||||||||

| For the Three Months Ended March 31, | |||||||||||||||||||||

| 2018 | 2017 | ||||||||||||||||||||

| Average Balance | Interest Income/ Expense | Average Rates Earned/Paid | Average Balance | Interest Income/ Expense | Average Rates Earned/Paid | ||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||

| Mortgage loans of Fannie Mae | $ | 163,134 | $ | 1,736 | 4.26 | % | $ | 200,051 | $ | 2,093 | 4.18 | % | |||||||||

| Mortgage loans of consolidated trusts | 3,048,711 | 26,298 | 3.45 | 2,923,792 | 24,954 | 3.41 | |||||||||||||||

Total mortgage loans(1) | 3,211,845 | 28,034 | 3.49 | 3,123,843 | 27,047 | 3.46 | |||||||||||||||

| Mortgage-related securities | 10,531 | 100 | 3.80 | 15,394 | 142 | 3.69 | |||||||||||||||

Non-mortgage-related securities(2) | 51,707 | 207 | 1.60 | 55,994 | 101 | 0.72 | |||||||||||||||

| Federal funds sold and securities purchased under agreements to resell or similar arrangements | 37,389 | 142 | 1.52 | 40,586 | 66 | 0.65 | |||||||||||||||

| Advances to lenders | 3,844 | 31 | 3.23 | 4,506 | 28 | 2.49 | |||||||||||||||

| Total interest-earning assets | $ | 3,315,316 | $ | 28,514 | 3.44 | % | $ | 3,240,323 | $ | 27,384 | 3.38 | % | |||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||

| Short-term funding debt | $ | 31,242 | $ | (106 | ) | 1.36 | % | $ | 32,454 | $ | (43 | ) | 0.53 | % | |||||||

| Long-term funding debt | 214,397 | (1,158 | ) | 2.16 | 272,918 | (1,478 | ) | 2.17 | |||||||||||||

Connecticut Avenue SecuritiesTM (“CAS”) | 22,473 | (302 | ) | 5.38 | 16,873 | (208 | ) | 4.93 | |||||||||||||

| Total debt of Fannie Mae | 268,112 | (1,566 | ) | 2.34 | 322,245 | (1,729 | ) | 2.15 | |||||||||||||

| Debt securities of consolidated trusts held by third parties | 3,050,041 | (21,716 | ) | 2.85 | 2,925,290 | (20,309 | ) | 2.78 | |||||||||||||

| Total interest-bearing liabilities | $ | 3,318,153 | $ | (23,282 | ) | 2.81 | % | $ | 3,247,535 | $ | (22,038 | ) | 2.71 | % | |||||||

| Net interest income/net interest yield | $ | 5,232 | 0.63 | % | $ | 5,346 | 0.66 | % | |||||||||||||

__________

(1) | Average balance includes mortgage loans on nonaccrual status. Typically, interest income on nonaccrual mortgage loans is recognized when cash is received. Interest income not recognized for loans on nonaccrual status was $168 million for the first quarter of 2018, compared with $216 million for the first quarter of 2017. |

(2) | Includes cash equivalents. |

Investment Gains (Losses), Net

Investment gains (losses), net primarily consists of gains and losses recognized from the sale of available-for-sale (“AFS”) securities, sales of loans, gains and losses recognized on the consolidation and deconsolidation of securities, and lower of cost or fair value adjustments on held for sale (“HFS”) loans. The shift to investment gains in the first quarter of 2018 from investment losses in the first quarter of 2017 was primarily driven by gains on sales of AFS securities, as sales of AFS securities were higher during the first quarter of 2018 as compared with the first quarter of 2017.

| Fannie Mae First Quarter 2018 Form 10-Q | 9 | |

| MD&A | Consolidated Results of Operations | ||

Fair Value Gains (Losses), Net

The estimated fair value of our derivatives, trading securities and other financial instruments carried at fair value may fluctuate substantially from period to period because of changes in interest rates, the yield curve, mortgage and credit spreads and implied volatility, as well as activity related to these financial instruments. While the estimated fair value of our derivatives that serve to mitigate certain risk exposures may fluctuate, some of the financial instruments that generate these exposures are not recorded at fair value in our condensed consolidated financial statements.

The table below displays the components of our fair value gains and losses.

| Fair Value Gains (Losses), Net | |||||||

| For the Three Months Ended March 31, | |||||||

| 2018 | 2017 | ||||||

| (Dollars in millions) | |||||||

| Risk management derivatives fair value gains (losses) attributable to: | |||||||

| Net contractual interest expense accruals on interest rate swaps | $ | (215 | ) | $ | (255 | ) | |

| Net change in fair value during the period | 514 | 367 | |||||

| Total risk management derivatives fair value gains, net | 299 | 112 | |||||

| Mortgage commitment derivatives fair value gains (losses), net | 564 | (80 | ) | ||||

| Total derivatives fair value gains, net | 863 | 32 | |||||

| Trading securities gains, net | 98 | 68 | |||||

| CAS fair value losses, net | (8 | ) | (162 | ) | |||

| Other, net | 92 | 22 | |||||

| Fair value gains (losses), net | $ | 1,045 | $ | (40 | ) | ||

Fair value gains in the first quarter of 2018 were primarily driven by:

| • | increases in the fair value of our mortgage commitments due to gains on commitments to sell mortgage-related securities due to a decrease in prices as interest rates increased during the commitment periods; and |

| • | increases in the fair value of our pay-fixed risk management derivatives due to an increase in longer-term swap rates during the quarter. |

Fair value losses in the first quarter of 2017 were primarily due to losses on CAS reported at fair value resulting from tightening spreads between CAS yields and LIBOR during the period. These fair value losses in the first quarter of 2017 were partially offset by gains on risk management derivatives primarily due to increases in the fair value of our pay-fixed derivatives due to increases in longer-term swap rates during the period.

Credit-Related Income (Expense)

Credit-related income (expense) consists of our benefit (provision) for credit losses and foreclosed property expense.

| Fannie Mae First Quarter 2018 Form 10-Q | 10 | |

| MD&A | Consolidated Results of Operations | ||

Benefit for Credit Losses

The table below provides quantitative analysis of the drivers of our single-family benefit for credit losses for the periods presented. Many of the drivers that contribute to our benefit for credit losses overlap or are interdependent. The attribution shown below is based on internal allocation estimates. The table below also displays our multifamily benefit or provision for credit losses.

| Components of Benefit for Credit Losses | |||||||

| For the Three Months Ended March 31, | |||||||

| 2018 | 2017 | ||||||

| (Dollars in billions) | |||||||

| Benefit for credit losses: | |||||||

Changes in loan activity(1) | $ | (0.2 | ) | * | |||

| Redesignation of held for investment (“HFI”) loans to held for sale (“HFS”) loans | 0.2 | 0.1 | |||||

| Actual and forecasted home prices | 0.3 | 0.6 | |||||

| Actual and projected interest rates | (0.4 | ) | (0.2 | ) | |||

Other(2) | 0.3 | (0.1 | ) | ||||

| Single-family benefit for credit losses | 0.2 | 0.4 | |||||

| Multifamily benefit (provision) for credit losses | * | * | |||||

| Total benefit for credit losses | $ | 0.2 | $ | 0.4 | |||

_________

| * | Represents less than $50 million. |

(1) | Primarily consists of changes in the allowance due to loan delinquency, loan liquidations, new troubled debt restructurings, amortization of concessions granted to borrowers and the impact of FHFA’s Advisory Bulletin 2012-02, “Framework for Adversely Classifying Loans, Other Real Estate Owned, and Other Assets and Listing Assets for Special Mention” (the “Advisory Bulletin”). |

(2) | Primarily consists of model and assumption changes and changes in the reserve for guaranty losses that are not separately included in the other components. |

The primary factors that impacted our benefit for credit losses in the first quarter of 2018 were:

| • | An increase in actual and forecasted home prices, which contributed to the benefit for credit losses. Higher home prices decrease the likelihood that loans will default and reduce the amount of credit loss on loans that do default, which impacts our estimate of losses and ultimately reduces our loss reserves and provision for credit losses. |

| • | The redesignation of certain single-family loans from HFI to HFS during the quarter as we no longer intend to hold them for the foreseeable future or to maturity. Upon redesignation of these loans, we recorded the loans at the lower of cost or fair value with a charge-off to the allowance for loan losses. Amounts recorded in the allowance related to the loans exceeded the amounts charged off, which contributed to the benefit for credit losses. |

| • | The benefit for credit losses was partially offset by the impact of higher actual and projected mortgage interest rates. As mortgage interest rates rise, we expect a decrease in future prepayments on single-family individually impaired loans, including modified loans. Lower expected prepayments lengthen the expected lives of modified loans, which increases the impairment relating to concessions provided on these loans and results in an increase in the provision for credit losses. |

| • | The benefit for credit losses was also reduced by the impact of an increase in single-family loans classified as a troubled debt restructuring (“TDR”) in the areas affected by Hurricanes Harvey, Irma and Maria (collectively, “the hurricanes”). |

We recognized a benefit for credit losses in the first quarter of 2017 primarily due to an increase in actual and forecasted home prices.

| Fannie Mae First Quarter 2018 Form 10-Q | 11 | |

| MD&A | Consolidated Results of Operations | ||

Temporary Payroll Tax Cut Continuation Act of 2011 (“TCCA”) Fees

Pursuant to the TCCA, in 2012, FHFA directed us to increase our single-family guaranty fees by 10 basis points and remit this increase to Treasury. This TCCA-related revenue is included in “Net interest income” and the expense is recognized as “TCCA fees” in our condensed consolidated financial statements. TCCA fees increased in the first quarter of 2018 compared with the first quarter of 2017 as our book of business subject to the TCCA continued to grow. We expect the guaranty fees collected and expenses incurred under the TCCA to continue to increase.

Federal Income Taxes

The decrease in our provision for federal income taxes in the first quarter of 2018 as compared to the first quarter of 2017 was the result of the Tax Cuts and Jobs Act of 2017, which reduced the federal corporate income tax rate from 35% to 21% effective January 1, 2018. This decline in the federal corporate income tax rate was the primary driver of the reduction in our effective tax rate to 21.0% in the first quarter of 2018, compared with 33.3% for the same period in 2017.

Other Comprehensive Income (Loss)

The shift to other comprehensive loss in the first quarter of 2018 from other comprehensive income in the first quarter of 2017 was primarily driven by the reclassification of gains on AFS securities from other comprehensive income (loss) to investment gains (losses), net as a result of sales of AFS securities, which were higher during the first quarter of 2018 as compared with the first quarter of 2017.

| Fannie Mae First Quarter 2018 Form 10-Q | 12 | |

| MD&A | Consolidated Balance Sheet Analysis | ||

| Consolidated Balance Sheet Analysis | ||||

This section provides a discussion of our condensed consolidated balance sheets and should be read together with our condensed consolidated financial statements, including the accompanying notes.

| Summary of Condensed Consolidated Balance Sheets | |||||||||||

| As of | |||||||||||

| March 31, 2018 | December 31, 2017 | Variance | |||||||||

| (Dollars in millions) | |||||||||||

Assets | |||||||||||

| Cash and cash equivalents and federal funds sold and securities purchased under agreements to resell or similar arrangements | $ | 49,949 | $ | 51,580 | $ | (1,631 | ) | ||||

| Restricted cash | 27,112 | 28,150 | (1,038 | ) | |||||||

Investments in securities(1) | 43,985 | 39,522 | 4,463 | ||||||||

| Mortgage loans: | |||||||||||

| Of Fannie Mae | 158,632 | 167,793 | (9,161 | ) | |||||||

| Of consolidated trusts | 3,057,888 | 3,029,816 | 28,072 | ||||||||

| Allowance for loan losses | (18,734 | ) | (19,084 | ) | 350 | ||||||

| Mortgage loans, net of allowance for loan losses | 3,197,786 | 3,178,525 | 19,261 | ||||||||

| Deferred tax assets, net | 16,517 | 17,350 | (833 | ) | |||||||

| Other assets | 29,053 | 30,402 | (1,349 | ) | |||||||

| Total assets | $ | 3,364,402 | $ | 3,345,529 | $ | 18,873 | |||||

| Liabilities and equity (deficit) | |||||||||||

| Debt: | |||||||||||

| Of Fannie Mae | $ | 265,401 | $ | 276,752 | $ | (11,351 | ) | ||||

| Of consolidated trusts | 3,075,071 | 3,053,302 | 21,769 | ||||||||

| Other liabilities | 19,992 | 19,161 | 831 | ||||||||

| Total liabilities | 3,360,464 | 3,349,215 | 11,249 | ||||||||

| Fannie Mae stockholders’ equity (deficit): | |||||||||||

| Senior preferred stock | 120,836 | 117,149 | 3,687 | ||||||||

| Other net deficit | (116,898 | ) | (120,835 | ) | 3,937 | ||||||

| Total equity (deficit) | 3,938 | (3,686 | ) | 7,624 | |||||||

| Total liabilities and equity (deficit) | $ | 3,364,402 | $ | 3,345,529 | $ | 18,873 | |||||

__________

(1) | Includes $33.3 billion as of March 31, 2018 and $29.2 billion as of December 31, 2017 of non-mortgage-related securities. |

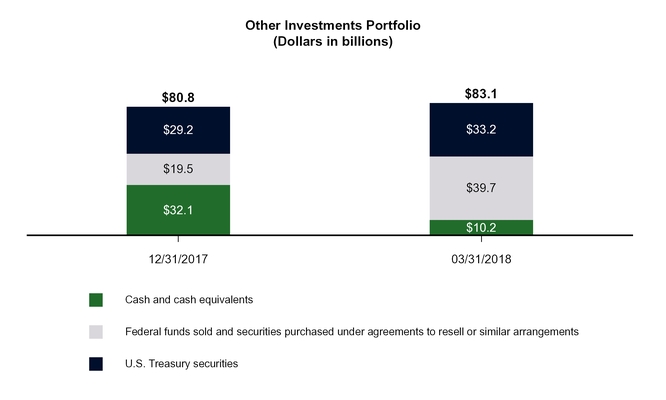

Other Investments Portfolio

Our other investments portfolio consists of cash and cash equivalents, securities purchased under agreements to resell or similar arrangements, and investments in U.S. Treasury securities. See “Liquidity and Capital Management—Liquidity Management—Other Investments Portfolio” for additional information on our other investments portfolio.

Restricted Cash

Restricted cash primarily includes unscheduled borrower payments received by servicers of loans backing consolidated trusts due to be remitted to the MBS certificateholders in the subsequent month. Our restricted cash decreased as of March 31, 2018 compared with the balance as of December 31, 2017 primarily as a result of a decrease in prepayments received on mortgage loans in March 2018 compared with prepayments received in December 2017.

| Fannie Mae First Quarter 2018 Form 10-Q | 13 | |

| MD&A | Consolidated Balance Sheet Analysis | ||

Investments in Securities

Our investments in securities are classified in our condensed consolidated balance sheets as either trading or available-for-sale and are measured at fair value. See “Note 5, Investments in Securities” for information on our investments in securities, including the composition of our trading and available-for-sale securities at amortized cost and fair value and the gross unrealized gains and losses related to our available-for-sale securities as of March 31, 2018 and December 31, 2017.

Mortgage Loans, Net of Allowance for Loan Losses

The mortgage loans reported in our condensed consolidated balance sheet are classified as either HFS or HFI and include loans owned by Fannie Mae and loans held in consolidated trusts.

Mortgage loans, net of allowance for loan losses increased as of March 31, 2018 compared with December 31, 2017 primarily driven by:

| • | an increase in mortgage loans due to acquisitions, partially offset by liquidations and sales; and |

| • | a decrease in our allowance for loan losses upon redesignation of single-family loans from HFI to HFS. |

For additional information on our mortgage loans, see “Note 3, Mortgage Loans,” and for additional information on changes in our allowance for loan losses, see “Note 4, Allowance for Loan Losses.”

Debt

Debt of Fannie Mae is the primary means of funding our mortgage purchases. Debt of consolidated trusts represents the amount of Fannie Mae MBS issued from consolidated trusts and held by third-party certificateholders. We provide a summary of the activity of the debt of Fannie Mae and a comparison of the mix between our outstanding short-term and long-term debt in “Liquidity and Capital Management—Liquidity Management—Debt Funding.” Also see “Note 7, Short-Term and Long-Term Debt” for additional information on our outstanding debt.

The decrease in debt of Fannie Mae from December 31, 2017 to March 31, 2018 was primarily driven by lower funding needs. The increase in debt of consolidated trusts from December 31, 2017 to March 31, 2018 was primarily driven by sales of Fannie Mae MBS, which are accounted for as issuances of debt of consolidated trusts in our condensed consolidated balance sheets, since the MBS certificate ownership is transferred from us to a third party.

Stockholders’ Equity (Deficit)

The shift from a net deficit of $3.7 billion as of December 31, 2017 to net equity of $3.9 billion as of March 31, 2018 was driven by:

| • | our receipt of $3.7 billion from Treasury during the first quarter of 2018 pursuant to the senior preferred stock purchase agreement, which eliminated our net worth deficit as of December 31, 2017; and |

| • | our comprehensive income of $3.9 billion for the first quarter of 2018. |

| Retained Mortgage Portfolio | ||||

Our retained mortgage portfolio consists of mortgage loans and mortgage-related securities that we own, including Fannie Mae MBS and non-Fannie Mae mortgage-related securities. Assets held by consolidated MBS trusts that back mortgage-related securities owned by third parties are not included in our retained mortgage portfolio. We primarily use our retained mortgage portfolio to provide liquidity to the mortgage market and support our loss mitigation activities. Previously, we also used our retained mortgage portfolio for investment purposes.

The chart below separates the instruments within our retained mortgage portfolio, measured by unpaid principal balance, into three categories based on each instrument’s use:

| • | Lender liquidity, which includes balances related to our whole loan conduit activity, supports our efforts to provide liquidity to the single-family and multifamily mortgage markets. |

| • | Loss mitigation supports our loss mitigation efforts through the purchase of delinquent loans from MBS trusts. |

| Fannie Mae First Quarter 2018 Form 10-Q | 14 | |

| MD&A | Retained Mortgage Portfolio | ||

| • | Other represents assets that were previously purchased for investment purposes. More than half of the balance of “Other” consisted of reverse mortgage loans and Fannie Mae-wrapped reverse mortgage securities as of March 31, 2018. We expect the amount of assets in “Other” will decline over time as they liquidate, mature or are sold. |

Retained Mortgage Portfolio (Dollars in billions) |

| Lender liquidity | Loss mitigation | Other | ||||||

| Fannie Mae First Quarter 2018 Form 10-Q | 15 | |

| MD&A | Retained Mortgage Portfolio | ||

The table below displays the components of our retained mortgage portfolio, measured by unpaid principal balance.

| Retained Mortgage Portfolio | |||||||||||

| As of | |||||||||||

| March 31, 2018 | December 31, 2017 | ||||||||||

| (Dollars in millions) | |||||||||||

| Single-family: | |||||||||||

Mortgage loans(1) | $ | 138,567 | $ | 146,316 | |||||||

| Reverse mortgages | 25,300 | 26,458 | |||||||||

| Mortgage-related securities: | |||||||||||

Agency securities(2) | 40,177 | 31,719 | |||||||||

| Fannie Mae-wrapped reverse mortgage securities | 6,570 | 6,689 | |||||||||

| Ginnie Mae reverse mortgage securities | 1,180 | 527 | |||||||||

Other Fannie Mae-wrapped securities(3) | 691 | 3,414 | |||||||||

Private-label and other securities(3) | 4,743 | 2,588 | |||||||||

Total single-family mortgage-related securities(4) | 53,361 | 44,937 | |||||||||

| Total single-family mortgage loans and mortgage-related securities | 217,228 | 217,711 | |||||||||

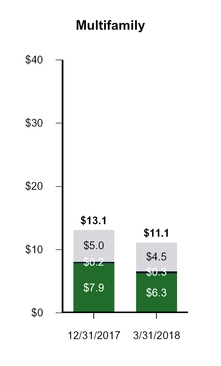

| Multifamily: | |||||||||||

Mortgage loans(5) | 4,246 | 4,591 | |||||||||

| Mortgage-related securities: | |||||||||||

Agency securities(2) | 6,330 | 7,860 | |||||||||

| Commercial mortgage-backed securities (“CMBS”) | 13 | 24 | |||||||||

| Mortgage revenue bonds | 470 | 597 | |||||||||

Total multifamily mortgage-related securities(6) | 6,813 | 8,481 | |||||||||

| Total multifamily mortgage loans and mortgage-related securities | 11,059 | 13,072 | |||||||||

| Total retained mortgage portfolio | $ | 228,287 | $ | 230,783 | |||||||

__________

(1) | Includes single-family loans classified as a TDR that were on accrual status of $82.7 billion and $86.3 billion as of March 31, 2018 and December 31, 2017, respectively, and single-family loans on nonaccrual status of $33.0 billion and $33.1 billion as of March 31, 2018 and December 31, 2017, respectively. |

(2) | Includes Fannie Mae, Freddie Mac and Ginnie Mae mortgage-related securities, excluding Fannie Mae-wrapped reverse mortgage securities, Ginnie Mae reverse mortgage securities and other Fannie Mae-wrapped securities. |

(3) | The increase in private-label and other securities and the corresponding decrease in other Fannie Mae-wrapped securities from December 31, 2017 to March 31, 2018 was due to the dissolution of a Fannie Mae-wrapped private-label securities trust during the period. |

(4) | The fair value of these single-family mortgage-related securities was $54.5 billion and $46.7 billion as of March 31, 2018 and December 31, 2017, respectively. |

(5) | Includes multifamily loans classified as a TDR that were on accrual status of $84 million as of March 31, 2018 and December 31, 2017, and multifamily loans on nonaccrual status of $182 million and $122 million as of March 31, 2018 and December 31, 2017, respectively. |

(6) | The fair value of these multifamily mortgage-related securities was $7.1 billion and $9.0 billion as of March 31, 2018 and December 31, 2017, respectively. |

The amount of mortgage assets that we may own is restricted by our senior preferred stock purchase agreement with Treasury, as described in “Business—Conservatorship and Treasury Agreements—Treasury Agreements” in our 2017 Form 10-K. Our retained mortgage portfolio is below the final $250 billion cap under the senior preferred stock purchase agreement that becomes effective on December 31, 2018. We expect the size of our retained mortgage portfolio will continue to decrease in 2018.

| Fannie Mae First Quarter 2018 Form 10-Q | 16 | |

| MD&A | Retained Mortgage Portfolio | ||

In support of our loss mitigation strategy, we purchased $5.2 billion of loans from our single-family MBS trusts in the first quarter of 2018, the substantial majority of which were delinquent. See “MD&A—Retained Mortgage Portfolio—Purchases of Loans from Our MBS Trusts” in our 2017 Form 10-K for more information relating to our purchases of loans from MBS trusts.

| Total Book of Business | ||||

The table below displays the composition of our total book of business based on unpaid principal balance. Our single-family book of business accounted for 91% of our total book of business as of March 31, 2018 and December 31, 2017. While our total book of business includes all of our mortgage-related assets, both on- and off-balance sheet, our guaranty book of business excludes non-Fannie Mae mortgage-related securities held in our retained mortgage portfolio for which we do not provide a guaranty.

| Composition of Total Book of Business | |||||||||||||||||||||||

| As of | |||||||||||||||||||||||

| March 31, 2018 | December 31, 2017 | ||||||||||||||||||||||

Single-Family | Multifamily | Total | Single-Family | Multifamily | Total | ||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||

Guaranty book of business(1) | $ | 2,944,620 | $ | 284,517 | $ | 3,229,137 | $ | 2,931,356 | $ | 280,502 | $ | 3,211,858 | |||||||||||

Non-Fannie Mae mortgage securities(2) | 7,350 | 483 | 7,833 | 4,005 | 621 | 4,626 | |||||||||||||||||

| Total book of business | $ | 2,951,970 | $ | 285,000 | $ | 3,236,970 | $ | 2,935,361 | $ | 281,123 | $ | 3,216,484 | |||||||||||

| Guaranty Book of Business Detail: | |||||||||||||||||||||||

Conventional guaranty book of business(3) | $ | 2,905,650 | $ | 283,272 | $ | 3,188,922 | $ | 2,890,908 | $ | 279,235 | $ | 3,170,143 | |||||||||||

Government guaranty book of business(4) | $ | 38,970 | $ | 1,245 | $ | 40,215 | $ | 40,448 | $ | 1,267 | $ | 41,715 | |||||||||||

__________

(1) | Includes other single-family Fannie Mae guarantees of $1.8 billion as of March 31, 2018 and December 31, 2017, and other multifamily Fannie Mae guarantees of $12.2 billion and $12.4 billion as of March 31, 2018 and December 31, 2017, respectively. The unpaid principal balance of resecuritized Fannie Mae MBS is included only once in the reported amount. |

(2) | Includes mortgage-related securities issued by Freddie Mac and Ginnie Mae, mortgage revenue bonds, Alt-A and subprime private-label securities, and CMBS. |

(3) | Refers to mortgage loans and mortgage-related securities that are not guaranteed or insured, in whole or in part, by the U.S. government or one of its agencies. |

(4) | Refers to mortgage loans and mortgage-related securities guaranteed or insured, in whole or in part, by the U.S. government or one of its agencies. |

The Federal Housing Enterprises Financial Safety and Soundness Act of 1992, as amended by the Federal Housing Finance Regulatory Reform Act of 2008 (together, the “GSE Act”), requires us to set aside each year an amount equal to 4.2 basis points for each dollar of the unpaid principal balance of our total new business purchases and to pay this amount to specified U.S. Department of Housing and Urban Development (“HUD”) and Treasury funds. New business purchases consist of single-family and multifamily whole mortgage loans purchased during the period and single-family and multifamily mortgage loans underlying Fannie Mae MBS issued during the period pursuant to lender swaps. In February 2018, we paid $239 million to the funds based on our new business purchases in 2017. Our new business purchases were $123.9 billion for the first three months of 2018. Accordingly, we recognized an expense of $52 million related to this obligation for the first three months of 2018. We expect to pay this amount, plus additional amounts to be accrued based on our new business purchases in the remaining nine months of 2018, to the funds on or before March 1, 2019. See “Business—Legislation and Regulation—GSE Act and Other Regulation of Our Business—Affordable Housing Allocations” in our 2017 Form 10-K for more information regarding this obligation.

| Fannie Mae First Quarter 2018 Form 10-Q | 17 | |

| MD&A | Business Segments | ||

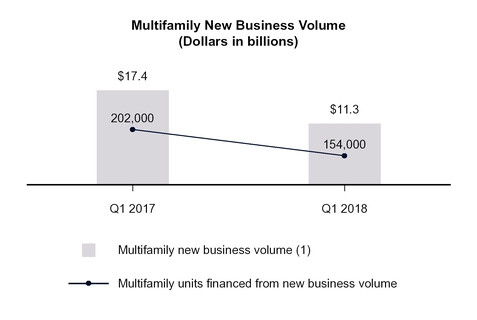

| Business Segments | ||||

We have two reportable business segments: Single-Family and Multifamily. This section describes each segment’s business and credit metrics, and financial results.

Single-Family Business

Single-Family Mortgage Market

Housing sales slightly declined in the first quarter of 2018 compared with the fourth quarter of 2017. Total existing home sales averaged 5.5 million units annualized in the first quarter of 2018, compared with 5.6 million units in the fourth quarter of 2017, according to data from the National Association of REALTORS®. According to the U.S. Census Bureau, new single-family home sales increased during the first quarter of 2018, averaging an annualized rate of 668,000 units, compared with 657,000 units in the fourth quarter of 2017.

The 30-year fixed mortgage rate averaged 4.44% during the first quarter of 2018, compared with 3.99% during the fourth quarter of 2017, according to Freddie Mac’s Primary Mortgage Market Survey®.

We forecast that total originations in the U.S. single-family mortgage market in 2018 will decrease from 2017 levels by approximately 8%, from an estimated $1.84 trillion in 2017 to $1.69 trillion in 2018, and that the amount of originations in the U.S. single-family mortgage market that are refinancings will decrease from an estimated $708 billion in 2017 to $498 billion in 2018.

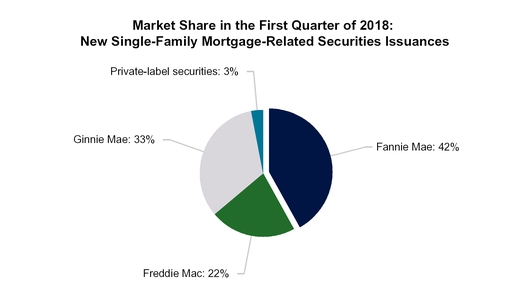

Single-Family Market Share

The chart below displays our market share of single-family mortgage-related securities issuances in the first quarter of 2018 as compared with that of our primary competitors for the issuance of single-family mortgage-related securities.

| • | We estimate our market share of single-family mortgage-related securities issuances was 42% in the first quarter of 2018, compared with 37% in the fourth quarter of 2017 and 39% in the first quarter of 2017. |

| Fannie Mae First Quarter 2018 Form 10-Q | 18 | |

| MD&A | Business Segments | ||

Single-Family Business Metrics

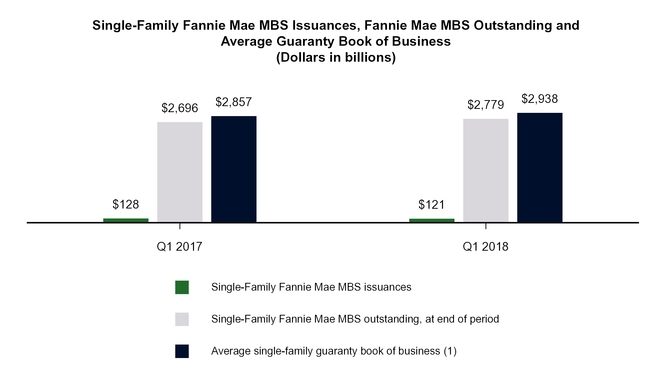

The charts and related discussion below present certain business metrics of our Single-Family business.

__________

(1) | Our single-family guaranty book of business consists of (a) single-family mortgage loans of Fannie Mae, (b) single-family mortgage loans underlying Fannie Mae MBS, and (c) other credit enhancements that we provide on single-family mortgage assets, such as long-term standby commitments. It excludes non-Fannie Mae single-family mortgage-related securities held in our retained mortgage portfolio for which we do not provide a guaranty. |

Although single-family Fannie Mae MBS issuances decreased in the first quarter of 2018 primarily as a result of lower refinancing activity during the quarter, single-family Fannie Mae MBS outstanding increased as of March 31, 2018, as liquidations slowed in the first quarter of 2018 driven by a decline in prepayments due to the rising interest rate environment.

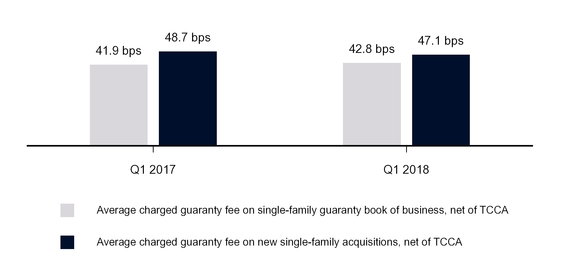

Average Charged Guaranty Fee on Single-Family Guaranty Book of Business and

Average Charged Guaranty Fee on New Single-Family Acquisitions(1)

| Fannie Mae First Quarter 2018 Form 10-Q | 19 | |

| MD&A | Business Segments | ||

__________

(1) | Calculated based on the average guaranty fee rate for our single-family guaranty arrangements during the period plus the recognition of any upfront cash payments over an estimated average life. Excludes the impact of a 10 basis point guaranty fee increase implemented in 2012 pursuant to the TCCA, the incremental revenue from which is remitted to Treasury and not retained by us. |

Our average charged guaranty fee on newly acquired single-family loans, net of TCCA, decreased from 48.7 bps in the first quarter of 2017 to 47.1 bps in the first quarter of 2018 primarily driven by increased competition.

Single-Family Business Financial Results

| Single-Family Business Financial Results | |||||||||||

| For the Three Months Ended March 31, | |||||||||||

| 2018 | 2017 | Variance | |||||||||

| (Dollars in millions) | |||||||||||

Net interest income(1) | $ | 4,561 | $ | 4,756 | $ | (195 | ) | ||||

| Fee and other income | 158 | 76 | 82 | ||||||||

| Net revenues | 4,719 | 4,832 | (113 | ) | |||||||

| Investment gains (losses), net | 242 | (50 | ) | 292 | |||||||

| Fair value gains (losses), net | 1,034 | (12 | ) | 1,046 | |||||||

| Administrative expenses | (643 | ) | (601 | ) | (42 | ) | |||||

Credit-related income(2) | 34 | 184 | (150 | ) | |||||||

TCCA fees(1) | (557 | ) | (503 | ) | (54 | ) | |||||

Other expenses, net(3) | (132 | ) | (256 | ) | 124 | ||||||

| Income before federal income taxes | 4,697 | 3,594 | 1,103 | ||||||||

| Provision for federal income taxes | (1,016 | ) | (1,252 | ) | 236 | ||||||

| Net income | $ | 3,681 | $ | 2,342 | $ | 1,339 | |||||

__________

(1) | Reflects the impact of a 10 basis point guaranty fee increase implemented in 2012 pursuant to the TCCA, the incremental revenue from which is remitted to Treasury. The resulting revenue is included in net interest income and the expense is recognized as “TCCA fees.” |

(2) | Consists of the benefit (provision) for credit losses and foreclosed property expense. |

(3) | Consists of gains (losses) from partnership investments, debt extinguishment (gains) losses, and other expenses. |

Net interest income

Single-family net interest income decreased in the first quarter of 2018 compared with the first quarter of 2017, primarily due to a decline in net amortization income, partially offset by an increase in single-family base guaranty fee income. The drivers of net interest income for the single-family segment for the first quarter of 2018 are consistent with the drivers of net interest income discussed in our condensed consolidated statements of operations and comprehensive income. See “Consolidated Results of Operations—Net Interest Income” for more information on the drivers of our net interest income.

Investment gains (losses), net

We recognized investment gains in the first quarter of 2018 compared with investment losses in the first quarter of 2017. Investment gains in the first quarter of 2018 were primarily driven by gains on sales of AFS securities, as sales of AFS securities were higher during the first quarter of 2018 as compared with the first quarter of 2017.

Fair value gains (losses), net

We recognized fair value gains in the first quarter of 2018, a shift from fair value losses recognized in the first quarter of 2017. The fair value gains and losses that are reported for the single-family segment are consistent with the fair value gains and losses reported in our condensed consolidated statements of operations and

| Fannie Mae First Quarter 2018 Form 10-Q | 20 | |

| MD&A | Business Segments | ||

comprehensive income. We discuss our fair value gains and losses in “Consolidated Results of Operations—Fair Value Gains (Losses), Net.”

Credit-related income

We recognized lower single-family credit-related income in the first quarter of 2018 compared with the first quarter of 2017. The credit-related income that is reported for the single-family segment is consistent with the credit-related income reported in our condensed consolidated statements of operations and comprehensive income. See “Consolidated Results of Operations—Credit-Related Income” for a discussion of the drivers of our credit-related income.

Single-Family Mortgage Credit Risk Management

This section updates our discussion of single-family mortgage credit risk management in our 2017 Form 10-K in “MD&A—Business Segments—Single-Family Business—Single-Family Mortgage Credit Risk Management.”

Single-Family Acquisition and Servicing Policies and Underwriting and Servicing Standards

For information on our underwriting and servicing standards, quality control process, repurchase requests, and representation and warranty framework, see “MD&A—Business Segments—Single-Family Business—Single-Family Mortgage Credit Risk Management—Single-Family Acquisition and Servicing Policies and Underwriting and Servicing Standards” in our 2017 Form 10-K. The discussion below updates some of that information.

Recent Changes

In July 2017, we implemented DU® Version 10.1, which included a change that enabled loans with debt-to-income ratios above 45% (up to 50%) to rely on DU’s comprehensive risk assessment, and removed specific policy rules that had previously set maximum loan-to-value (“LTV”) ratio and minimum reserves requirements for those loans. Due in part to our implementation of this change, the percentage of our non-Refi Plus single-family acquisitions associated with borrower debt-to-income ratios above 45% increased to 23% in the first quarter of 2018, compared with 7% in the first quarter of 2017. After assessing the loan profile of loans delivered to us since the DU Version 10.1 changes went into effect, we revised DU’s risk assessment to limit risk layering. Risk layering refers to the acquisition of loans with multiple higher-risk characteristics (such as high LTV ratio, credit profile with a history of delinquencies, debt-to-income ratio above 45% and no or low levels of reserves). We implemented these changes in March 2018 through DU Version 10.2. With DU Version 10.2, we expect fewer DU Approve recommendations on loans that have multiple higher-risk characteristics; however, we expect to continue to acquire a higher proportion of loans with debt-to-income ratios above 45% than we have in previous years.

Single-Family Portfolio Diversification and Monitoring

For information on key loan attributes, see “MD&A—Business Segments—Single-Family Business—Single-Family Mortgage Credit Risk Management—Single-Family Portfolio Diversification and Monitoring” in our 2017 Form 10-K. The table below displays our single-family conventional business volumes and our single-family conventional guaranty book of business, based on certain key risk characteristics that we use to evaluate the risk profile and credit quality of our single-family loans.

| Fannie Mae First Quarter 2018 Form 10-Q | 21 | |

| MD&A | Business Segments | ||

Risk Characteristics of Single-Family Conventional Business Volume and Guaranty Book of Business(1) | |||||||||||||||||||

Percent of Single-Family Conventional Business Volume at Acquisition(2) | Percent of Single-Family Conventional Guaranty Book of Business(3)(4) As of | ||||||||||||||||||

| For the Three Months Ended March 31, | |||||||||||||||||||

| 2018 | 2017 | March 31, 2018 | December 31, 2017 | ||||||||||||||||

Original LTV ratio:(5) | |||||||||||||||||||

| <= 60% | 18 | % | 22 | % | 20 | % | 20 | % | |||||||||||

| 60.01% to 70% | 13 | 14 | 14 | 14 | |||||||||||||||

| 70.01% to 80% | 38 | 38 | 38 | 38 | |||||||||||||||

| 80.01% to 90% | 12 | 11 | 11 | 11 | |||||||||||||||

| 90.01% to 95% | 13 | 11 | 10 | 10 | |||||||||||||||

| 95.01% to 100% | 6 | 4 | 4 | 4 | |||||||||||||||

| Greater than 100% | * | * | 3 | 3 | |||||||||||||||

| Total | 100 | % | 100 | % | 100 | % | 100 | % | |||||||||||

| Weighted average | 75 | % | 73 | % | 75 | % | 75 | % | |||||||||||

| Average loan amount | $ | 232,284 | $ | 221,405 | $ | 167,594 | $ | 166,643 | |||||||||||

Estimated mark-to-market LTV ratio:(6) | |||||||||||||||||||

| <= 60% | 52 | % | 52 | % | |||||||||||||||

| 60.01% to 70% | 18 | 18 | |||||||||||||||||

| 70.01% to 80% | 17 | 17 | |||||||||||||||||

| 80.01% to 90% | 8 | 8 | |||||||||||||||||

| 90.01% to 100% | 4 | 4 | |||||||||||||||||

| Greater than 100% | 1 | 1 | |||||||||||||||||

| Total | 100 | % | 100 | % | |||||||||||||||

| Weighted average | 58 | % | 58 | % | |||||||||||||||

| Product type: | |||||||||||||||||||

Fixed-rate:(7) | |||||||||||||||||||

| Long-term | 88 | % | 81 | % | 80 | % | 80 | % | |||||||||||

| Intermediate-term | 10 | 17 | 15 | 15 | |||||||||||||||

| Interest-only | — | — | * | * | |||||||||||||||

| Total fixed-rate | 98 | 98 | 95 | 95 | |||||||||||||||

| Adjustable-rate: | |||||||||||||||||||

| Interest-only | — | — | 1 | 1 | |||||||||||||||

| Other ARMs | 2 | 2 | 4 | 4 | |||||||||||||||

| Total adjustable-rate | 2 | 2 | 5 | 5 | |||||||||||||||

| Total | 100 | % | 100 | % | 100 | % | 100 | % | |||||||||||

| Number of property units: | |||||||||||||||||||

| 1 unit | 97 | % | 97 | % | 97 | % | 97 | % | |||||||||||

| 2-4 units | 3 | 3 | 3 | 3 | |||||||||||||||

| Total | 100 | % | 100 | % | 100 | % | 100 | % | |||||||||||

| Fannie Mae First Quarter 2018 Form 10-Q | 22 | |

| MD&A | Business Segments | ||

Percent of Single-Family Conventional Business Volume at Acquisition(2) | Percent of Single-Family Conventional Guaranty Book of Business(3)(4) As of | ||||||||||||||

| For the Three Months Ended March 31, | |||||||||||||||

| 2018 | 2017 | March 31, 2018 | December 31, 2017 | ||||||||||||

| Property type: | |||||||||||||||

| Single-family homes | 91 | % | 90 | % | 91 | % | 91 | % | |||||||

| Condo/Co-op | 9 | 10 | 9 | 9 | |||||||||||

| Total | 100 | % | 100 | % | 100 | % | 100 | % | |||||||

| Occupancy type: | |||||||||||||||

| Primary residence | 89 | % | 88 | % | 89 | % | 89 | % | |||||||

| Second/vacation home | 4 | 4 | 4 | 4 | |||||||||||

| Investor | 7 | 8 | 7 | 7 | |||||||||||

| Total | 100 | % | 100 | % | 100 | % | 100 | % | |||||||

| FICO credit score at origination: | |||||||||||||||

| < 620 | * | % | * | % | 2 | % | 2 | % | |||||||

| 620 to < 660 | 6 | 5 | 5 | 5 | |||||||||||

| 660 to < 700 | 14 | 13 | 12 | 12 | |||||||||||

| 700 to < 740 | 23 | 22 | 20 | 20 | |||||||||||

| >= 740 | 57 | 60 | 61 | 61 | |||||||||||

| Total | 100 | % | 100 | % | 100 | % | 100 | % | |||||||

| Weighted average | 743 | 746 | 745 | 745 | |||||||||||

Loan purpose: | |||||||||||||||

| Purchase | 53 | % | 44 | % | 39 | % | 39 | % | |||||||

| Cash-out refinance | 26 | 24 | 20 | 20 | |||||||||||

| Other refinance | 21 | 32 | 41 | 41 | |||||||||||

| Total | 100 | % | 100 | % | 100 | % | 100 | % | |||||||

Geographic concentration:(8) | |||||||||||||||

| Midwest | 13 | % | 13 | % | 15 | % | 15 | % | |||||||

| Northeast | 14 | 15 | 18 | 18 | |||||||||||

| Southeast | 22 | 22 | 22 | 22 | |||||||||||

| Southwest | 20 | 20 | 17 | 17 | |||||||||||

| West | 31 | 30 | 28 | 28 | |||||||||||

| Total | 100 | % | 100 | % | 100 | % | 100 | % | |||||||

| Origination year: | |||||||||||||||

| 2012 and prior | 34 | % | 36 | % | |||||||||||

| 2013 | 12 | 12 | |||||||||||||

| 2014 | 7 | 7 | |||||||||||||

| 2015 | 11 | 12 | |||||||||||||

| 2016 | 18 | 18 | |||||||||||||

| 2017 | 16 | 15 | |||||||||||||

| 2018 | 2 | — | |||||||||||||

| Total | 100 | % | 100 | % | |||||||||||

__________

| * | Represents less than 0.5% of single-family conventional business volume or book of business. |

| Fannie Mae First Quarter 2018 Form 10-Q | 23 | |

| MD&A | Business Segments | ||

(1) | Second lien mortgage loans held by third parties are not reflected in the original LTV or mark-to-market LTV ratios in this table. |

(2) | Calculated based on unpaid principal balance of single-family loans for each category at time of acquisition. |

(3) | Calculated based on the aggregate unpaid principal balance of single-family loans for each category divided by the aggregate unpaid principal balance of loans in our single-family conventional guaranty book of business as of the end of each period. |

(4) | Our single-family conventional guaranty book of business includes jumbo-conforming and high-balance loans that represented approximately 7% of our single-family conventional guaranty book of business as of March 31, 2018 and December 31, 2017. See “MD&A—Business Segments—Single-Family Business—Single-Family Mortgage Credit Risk Management—Single-Family Portfolio Diversification and Monitoring—Jumbo-Conforming and High-Balance Loans” in our 2017 Form 10-K for information on these loans. |

(5) | The original LTV ratio generally is based on the original unpaid principal balance of the loan divided by the appraised property value reported to us at the time of acquisition of the loan. Excludes loans for which this information is not readily available. |

(6) | The aggregate estimated mark-to-market LTV ratio is based on the unpaid principal balance of the loan as of the end of each reported period divided by the estimated current value of the property, which we calculate using an internal valuation model that estimates periodic changes in home value. Excludes loans for which this information is not readily available. |

(7) | Long-term fixed-rate consists of mortgage loans with maturities greater than 15 years, while intermediate-term fixed-rate loans have maturities equal to or less than 15 years. Loans with interest-only terms are included in the interest-only category regardless of their maturities. |

(8) | Midwest consists of IL, IN, IA, MI, MN, NE, ND, OH, SD and WI. Northeast consists of CT, DE, ME, MA, NH, NJ, NY, PA, PR, RI, VT and VI. Southeast consists of AL, DC, FL, GA, KY, MD, MS, NC, SC, TN, VA and WV. Southwest consists of AZ, AR, CO, KS, LA, MO, NM, OK, TX and UT. West consists of AK, CA, GU, HI, ID, MT, NV, OR, WA and WY. |

As shown in the table above, a greater proportion of our single-family loan acquisitions in the first quarter of 2018 had LTV ratios over 90% (from 15% in the first quarter of 2017 to 19% in the first quarter of 2018), and there was a decline in the weighted average FICO credit score of our single-family acquisitions in the first quarter of 2018 (from 746 in the first quarter of 2017 to 743 in the first quarter of 2018). We believe several factors drove these changes, including a decline in refinance volume and the changes to our eligibility standards implemented in DU Version 10.1 described above.

See “MD&A—Business Segments—Single-Family Business—Single-Family Mortgage Credit Risk Management—Single-Family Portfolio Diversification and Monitoring” in our 2017 Form 10-K for more information on the credit characteristics of loans in our guaranty book of business, including Home Affordable Refinance Program® (“HARP®”) and Refi PlusTM loans, jumbo-conforming and high-balance loans, reverse mortgages and mortgage products with rate resets.

| Fannie Mae First Quarter 2018 Form 10-Q | 24 | |

| MD&A | Business Segments | ||

Transfer of Mortgage Credit Risk

Single-Family Credit Enhancements

Our charter generally requires credit enhancement on any single-family conventional mortgage loan that we purchase or securitize if it has an LTV ratio over 80% at the time of purchase. We also enter into various other types of transactions in which we transfer mortgage credit risk to third parties. The table below displays information on the outstanding unpaid principal balance of our single-family loans, as well as the percentage of our total single-family conventional guaranty book of business measured by unpaid principal balance, that were covered by one or more forms of credit enhancement as of the dates specified. For a description of the types of credit enhancements specified in the table, see “MD&A—Business Segments—Single-Family Business—Single-Family Mortgage Credit Risk Management—Transfer of Mortgage Credit Risk” in our 2017 Form 10-K. For a discussion of our exposure to and management of the institutional counterparty credit risk associated with the providers of these credit enhancements see “Risk Management—Credit Risk Management—Institutional Counterparty Credit Risk Management” in our 2017 Form 10-K and “Note 11, Concentrations of Credit Risk” in this report.

| Single-Family Loans with Credit Enhancement | ||||||||||||||

| As of | ||||||||||||||

| March 31, 2018 | December 31, 2017 | |||||||||||||

| Unpaid Principal Balance | Percentage of Single-Family Conventional Guaranty Book of Business | Unpaid Principal Balance | Percentage of Single-Family Conventional Guaranty Book of Business | |||||||||||

| (Dollars in billions) | ||||||||||||||

| Primary mortgage insurance and other | $ | 583 | 20 | % | $ | 566 | 20 | % | ||||||

Connecticut Avenue SecuritiesTM (“CAS”) | 731 | 25 | 681 | 24 | ||||||||||

Credit Insurance Risk TransferTM (“CIRTTM”) | 193 | 7 | 181 | 6 | ||||||||||

| Lender risk sharing | 78 | 3 | 65 | 2 | ||||||||||

| Less: Loans covered by multiple credit enhancements | (362 | ) | (12 | ) | (335 | ) | (12 | ) | ||||||

| Total unpaid principal balance of single-family loans with credit enhancement | $ | 1,223 | 43 | % | $ | 1,158 | 40 | % | ||||||

Credit Risk Transfer Transactions

Our Single-Family business has developed risk-sharing capabilities to transfer portions of our single-family mortgage credit risk to the private market. Our primary method of achieving this objective has been through our CAS and CIRT transactions. In most of our credit risk transfer transactions, we transfer a small portion of the expected credit losses, and a significant portion of the losses we expect would be incurred in a stressed credit environment, such as a severe or prolonged economic downturn.

| Fannie Mae First Quarter 2018 Form 10-Q | 25 | |

| MD&A | Business Segments | ||

The table below displays the mortgage credit risk transferred to third parties and retained by Fannie Mae pursuant to our single-family credit risk transfer transactions.

| Single-Family Credit Risk Transfer Transactions | ||||||||||||||||

| Issuances from Inception to March 31, 2018 | ||||||||||||||||

(Dollars in billions) | ||||||||||||||||

| Senior | Fannie Mae(1) | Initial Reference Pool(4) | |||||||||||||

| $1,280 | ||||||||||||||||

| Mezzanine | Fannie Mae(1) | CIRT(2)(3) | CAS(2) | Lender Risk-Sharing(2) | ||||||||||||

| $2 | $6 | $28 | $1 | $1,327 | ||||||||||||

| First Loss | Fannie Mae(1) | CAS(2)(5) | Lender Risk-Sharing(2) | |||||||||||||

| $7 | $2 | $1 | ||||||||||||||

| Outstanding as of March 31, 2018 | ||||||||||||||||

(Dollars in billions) | ||||||||||||||||

| Senior | Fannie Mae(1) | Outstanding Reference Pool(4)(6) | |||||||||||||

| $956 | ||||||||||||||||

| Mezzanine | Fannie Mae(1) | CIRT(2)(3) | CAS(2) | Lender Risk-Sharing(2) | ||||||||||||

| $1 | $6 | $21 | $1 | $995 | ||||||||||||

| First Loss | Fannie Mae(1) | CAS(2)(5) | Lender Risk-Sharing(2) | |||||||||||||

| $7 | $2 | $1 | ||||||||||||||

__________

(1) | Credit risk retained by Fannie Mae in CAS, CIRT and lender risk-sharing transactions. Tranche sizes vary across programs. |

(2) | Credit risk transferred to third parties. Tranche sizes vary across programs. |

(3) | Includes mortgage pool insurance transactions covering loans with an unpaid principal balance of approximately $4 billion outstanding as of March 31, 2018. |

(4) | For CIRT and some lender risk-sharing transactions, “Reference Pool” reflects a pool of covered loans. |

(5) | For CAS transactions, “First Loss” represents all B tranche balances. |

(6) | For CAS and some lender risk-sharing transactions, represents outstanding reference pools, not the outstanding unpaid principal balance of the underlying loans, which was $1,002 billion as of March 31, 2018. |

During 2018, pursuant to our credit risk transfer transactions, we transferred a portion of the mortgage credit risk on single-family mortgages with an unpaid principal balance of $100 billion at the time of the transactions.

| • | For the quarter ended March 31, 2018, we paid approximately $200 million in interest expense, net of LIBOR, on our outstanding CAS and approximately $60 million in CIRT premiums. |

| Fannie Mae First Quarter 2018 Form 10-Q | 26 | |

| MD&A | Business Segments | ||

| • | Comparatively, we paid approximately $170 million in interest expense, net of LIBOR, on our outstanding CAS and approximately $38 million in CIRT premiums for the quarter ended March 31, 2017. |

These expenses increased from the first quarter of 2017 to the first quarter of 2018 as we continue to transfer credit risk on a larger portion of our single-family book of business.