U. S.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2918

DUPREE MUTUAL FUNDS

(Exact Name of Registrant as Specified in Charter)

125 South Mill Street, Vine Center, Suite 100

Lexington, Kentucky 40507

(Address of Principal Executive Offices) (Zip Code)

Allen E. Grimes, III

125 South Mill Street, Vine Center, Suite 100

Lexington, Kentucky 40507

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code (859) 254-7741

Date of fiscal year end: June 30, 2020

Date of reporting period: July 1, 2019 through June 30, 2020

Item 1. Report to Stockholders

June 30, 2020

ANNUAL REPORT

TO SHAREHOLDERS

Beginning January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund’s shareholder reports like this one will no longer be sent by mail, unless a request is made specifically to Dupree Mutual Funds or your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Dupree Mutual Funds website (www.dupree-funds.com); you will be notified by mail and provided with a website link to access the report each time a report is posted. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. If you prefer to receive shareholder reports and other communications electronically, you may update your mailing preferences with your financial intermediary, or enroll in e-delivery at www.dupree-funds.com (for accounts held directly with Dupree).

You may elect to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with Dupree, you may inform Dupree Mutual Funds that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800) 866-0614. Your election to receive reports in paper will apply to all funds held with Dupree Mutual Funds or through your financial intermediary.

ABOUT DUPREE MUTUAL FUNDS

In 1941, Dupree & Company, Inc. began business in Harlan, Kentucky as a small securities brokerage firm specializing in tax-exempt municipal bonds.

Over the years the firm, which in 1963 moved its offices to Lexington, Kentucky, grew to become a regional leader in public finance, helping to structure complex and innovative municipal bond financing for some of the largest public projects in the Commonwealth of Kentucky.

In 1979, Dupree & Company began what is now Dupree Mutual Funds with the Kentucky Tax-Free Income Series and became the Fund’s investment adviser. The Fund was one of the first single-state municipal bond funds in the country, and the first mutual fund to invest solely in Kentucky municipal bonds. Since then, several new offerings have been added to the Dupree Mutual Funds family:

Kentucky Tax-Free Short-to-Medium Series in 1987;

Intermediate Government Bond Series in 1992;

Tennessee Tax-Free Income Series in 1993;

Tennessee Tax-Free Short-to-Medium Series in 1994;

North Carolina Tax-Free Income Series in 1995;

North Carolina Tax-Free Short-to-Medium Series in 1995;

Alabama Tax-Free Income Series in 2000;

Mississippi Tax-Free Income Series in 2000; and

Taxable Municipal Bond Series in 2010.

Today, after more than 60 years in business, Dupree continues to be a pioneer in the industry. Our Kentucky, Tennessee, and Mississippi Series are currently the ONLY 100% “no-load” municipal bond funds available in those states. No-load means simply that shares of the funds are offered directly to investors with no front or back-end sales charges, as opposed to load funds, which are sold through brokerage firms or other institutions that typically carry sales charges.

At Dupree Mutual Funds, our goal is a simple one: to offer investors a high-quality, low-cost way to invest in municipal and government bonds while providing superior service to our shareholders. We encourage you to let us know how we’re doing.

TABLE OF CONTENTS

Management’s Discussion of Fund Performance: | Unaudited |

Twelve Months Ended June 30, 2020i

The investment objective of our tax-free municipal bond funds is to provide a high level of tax-free income derived from state-specific municipal bonds without incurring undue risk to principal. The investment objective of our government bond fund is to provide a high level of taxable income derived from securities of the U.S. government and its agencies without incurring undue risk to principal. Similarly, the investment objective of the taxable municipal bond fund is to provide a high level of taxable income derived from taxable municipal securities without incurring undue risk to principal.

This report covers the twelve month period from July 1, 2019 through June 30, 2020 (the “reporting period”). Economic activity increased at a moderate pace throughout the reporting period. Real gross domestic product (GDP) expanded at a 2.6 percent annual rate during the third quarter of 2019 and at an annual rate of 2.4 percent during the fourth quarter. Economic growth was derailed in early to mid-March with the emergence of a global pandemic caused by COVID-19. The economy contracted sharply during the first quarter of 2020 with real GDP decreasing at a 5.0 percent annual rate. Real GDP declined at a 32.9 percent annual rate in the second quarter of 2020 which was the most severe decline since 1947. Economic activity during the second quarter was disproportionately affected by the extended lockdown related to the pandemic.

The labor market experienced substantial upheaval during the reporting period. The national unemployment rate started out the reporting period at 3.7 percent and ended the reporting period at 11.1 percent. Wage growth increased as the unemployment rate spiked with average hourly earnings increasing at a 5.0 percent annualized rate in June. The increase in average hourly earnings largely reflected substantial job losses among lower-paid workers as a result of the COVID-19 pandemic and efforts to contain it.

Key measures of inflation remained stable during most of the reporting period but then declined sharply in the second quarter of 2020 with the onset of the COVID-19 pandemic. Weak demand and large price declines for some goods and services such as apparel, gasoline, air travel, and hotels contributed to the fall in prices. The Fed’s preferred inflation index, the personal consumption expenditure price index (PCE), increased 0.8 percent on a year-over-year basis through June, well below the Fed’s 2.0 percent target rate. The core PCE, which excludes food and energy prices, increased 0.9 percent on an annual basis through June. Measures of near-term and longer-run inflation expectations remained stable over the past twelve months.

The Federal Open Market Committee (FOMC) eased monetary policy during the reporting period by lowering the fed funds target rate by one-quarter percentage point at each of its meetings held in July, September, and October of 2019. The FOMC then lowered the fed funds target rate by one-half percentage point on March 3 in between meetings and subsequently by a full percentage point on March 15. The fed funds target rate range at the end of the reporting period was 0.00%-0.25%. The FOMC’s near-zero interest rate policy reflects the devastating effects of COVID-19 on economic activity, employment, and inflation and the heightened risks to the economic outlook.

To provide stability to the financial system and to support the flow of credit to households, the FOMC established 11 separate credit and liquidity facilities under section 13(3) of the Federal Reserve Act. These facilities support two primary goals—stabilizing short-term funding markets and providing more direct support for credit across the economy. One such facility is the Municipal Liquidity Facility (“MLF”), which is designed to help state and local governments manage cash flow pressures. The MLF permits the FOMC to purchase up to $500 billion of short-term debt directly from U.S. states, counties, cities, and certain multistate entities. Congress is also currently considering extending additional financial assistance to states and cities as part of an additional stimulus package.

Prior to the onset of the COVID-19 pandemic, most states and cities were enjoying strong fiscal conditions. Consecutive years of faster-than-expected revenue growth had led to budget surpluses and replenishment of rainy day funds in many jurisdictions. The onset of the COVID-19 pandemic and resulting recession abruptly changed this situation for the worse.

States rely on personal income taxes and sales taxes for roughly 75 percent of their general fund revenue. These revenue streams have been hit hard in light of stay-at-home orders, business closures, and rising unemployment claims. In just a short period of time, state fiscal conditions have experienced a dramatic deterioration. In this new fiscal environment, states are facing tough decisions such as spending reductions, instituting layoffs, furloughs, hiring freezes, drawing down rainy day reserve balances, and deferring large capital projects. Many states have enacted full-year budgets for fiscal 2021, but these may need to be adjusted given the uncertain revenue outlook and the possibility that future federal aid may be forthcoming.

The municipal bond market posted solid returns for the twelve month period under review. The Bloomberg Barclays Municipal Bond Index (“BBMBI”), which tracks investment grade municipal securities across all sectors and maturities, had a total return of 4.45 percent for the twelve month period ended June 30, 2020. Bonds with longer maturities (especially in the 12-17 year range) outperformed bonds with shorter maturities, and the highest-rated bonds (AAA and AA) generally outperformed lower-rated bonds.

i

A number of factors led to this solid performance during the reporting period. Bond prices rose (yields declined) as investors’ appetite for tax-exempt bonds increased. The boost in demand has been fueled in part by recent changes to the federal tax code (i.e., the impact from capping the state and local tax (SALT) deduction for higher-income earners) and also by investors’ flight to safe-haven assets. Favorable supply-and-demand dynamics (i.e., very firm demand coupled with lower supply) also supported municipal bond prices.

As of June 30, 2020, the BBMBI had a modified adjusted duration of 5.42 years, an average coupon of 4.58% and an average credit quality of AA2/AA3.

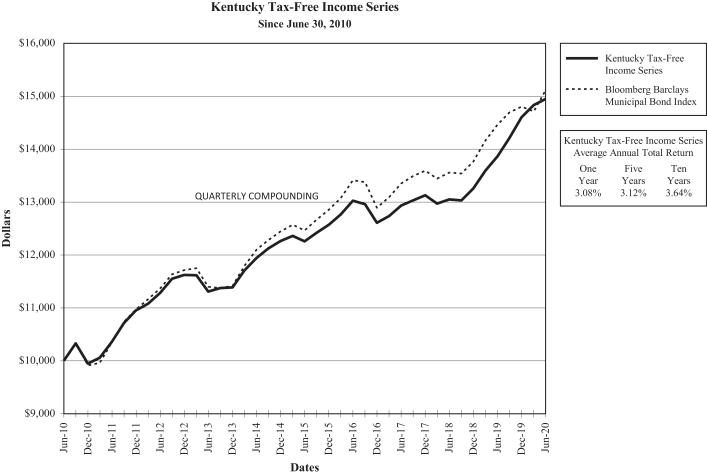

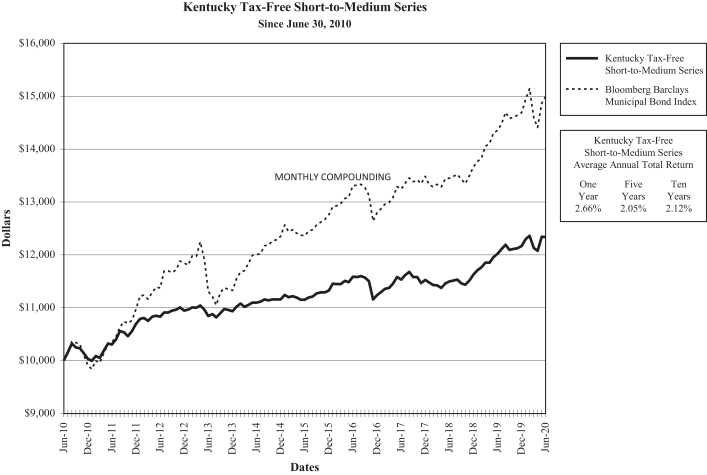

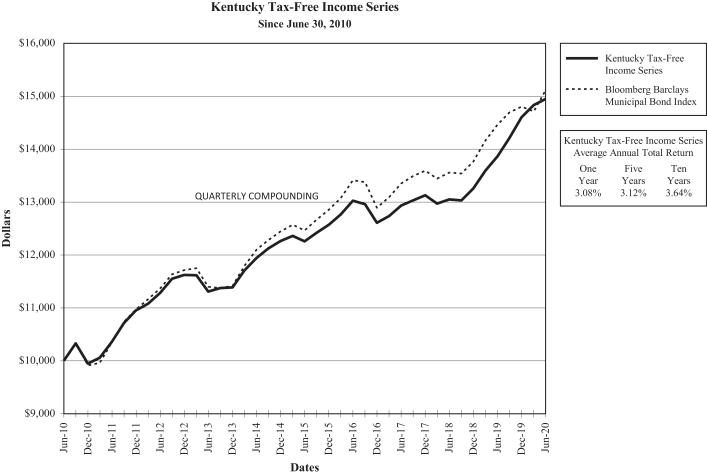

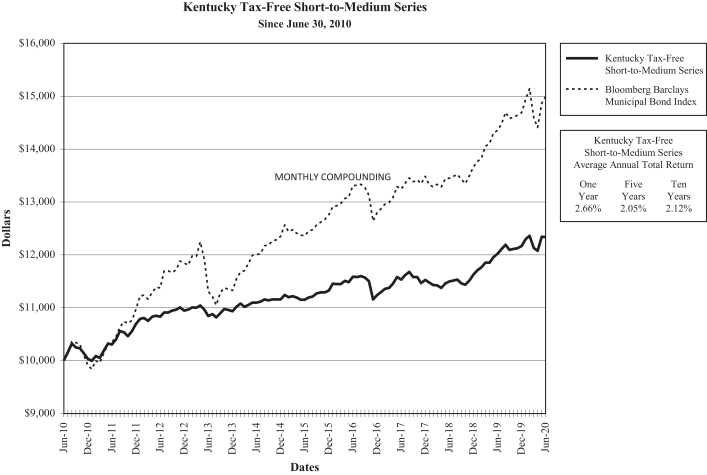

The Kentucky Tax-Free Income Series provided shareholders a total return of 3.08 percent for the twelve month period ended June 30, 2020. The Kentucky Tax-Free Short-to-Medium Series provided shareholders with a total return of 2.66 percent for the same time period. Both of the Kentucky funds had shorter durations and also held substantially more A-rated bonds than the BBMBI, thereby causing both to underperform the index during the reporting period.

Kentucky’s economy has continued to expand but at a relatively slow pace. The Commonwealth’s real GDP grew at an annualized rate of 1.1 percent in 2019 which was below the national average of 2.3 percent. Kentucky’s 2019 current-dollar GDP was $214.7 billion and ranked 28th in the United States. The Commonwealth ended FY20 with a balanced budget but anticipates a large shortfall for FY21. The state’s annual average unemployment rate at the end of June was 4.3 percent. In 2019, Kentucky had a per capita personal income of $44,017 which ranked 46th in the United States and was 78 percent of the national average, $56,663.

Kentucky’s appropriation supported debt was rated A1 by Moody’s and A- by Standard & Poor’s as of June 30, 2020. Kentucky had net tax-supported debt per capita of $2,278 as of calendar year-end 2019, which is substantially above the state net tax-supported debt median of $1,071 (Source: Moody’s Investors Services, State Government U.S.: Medians—State Debt Declined in 2019, But Likely to Grow in Coming Years”, May 12, 2020).

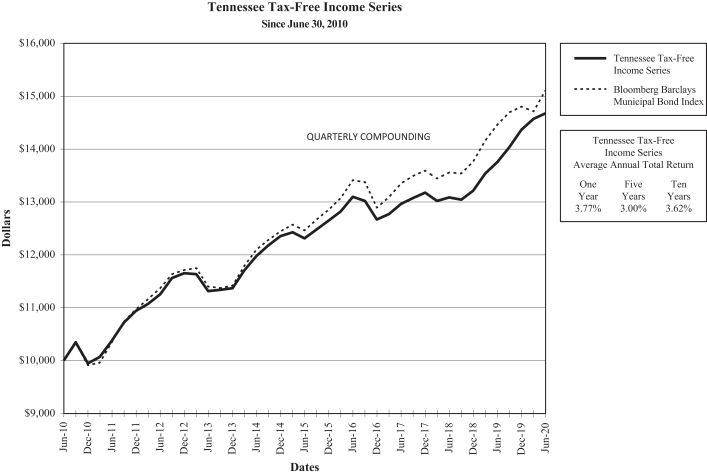

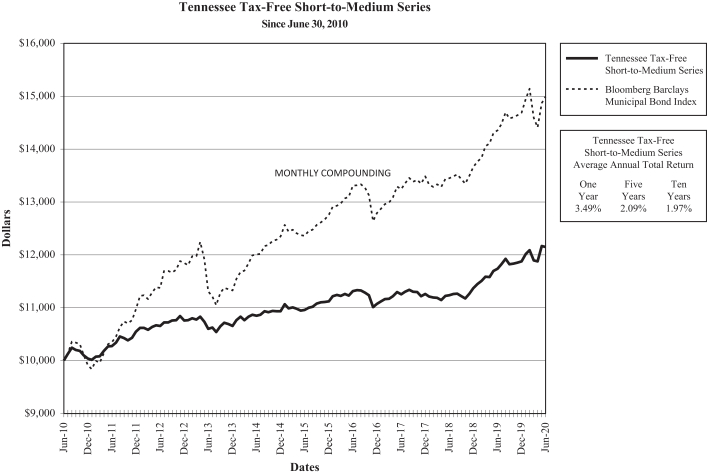

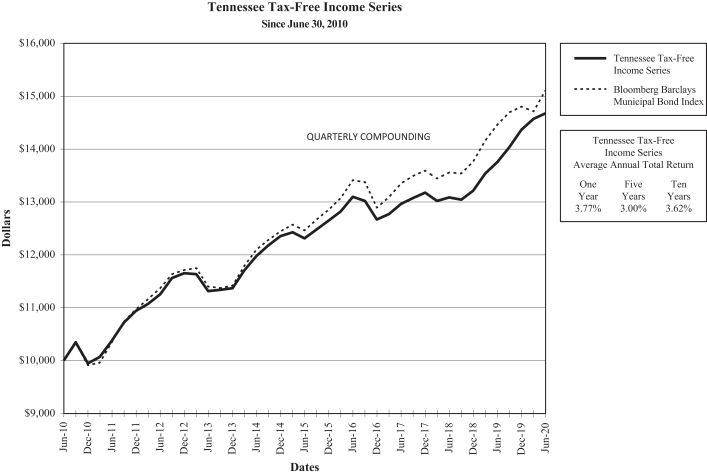

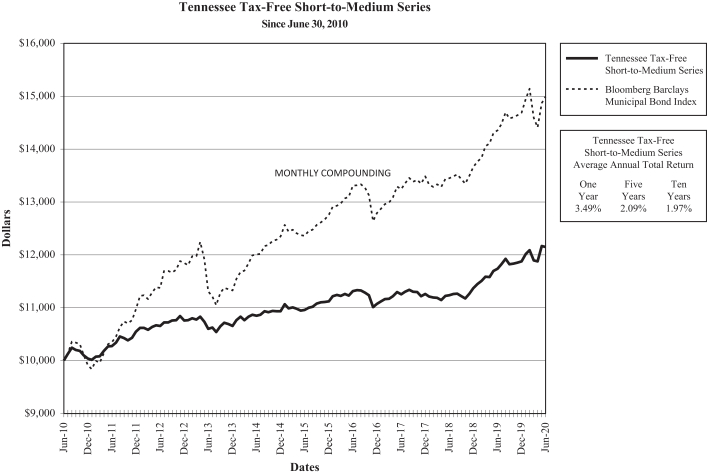

The Tennessee Tax-Free Income Series provided shareholders with a total return of 3.77 percent for the twelve month period ended June 30, 2020. The Tennessee Tax-Free Short-to-Medium Series provided a total return of 3.49 percent for the same time period. Both of the Tennessee funds had shorter durations and held fewer AAA-rated bonds than the BBMBI, thereby causing both to underperform the index during the reporting period.

Economic growth in Tennessee has mostly kept pace with the national average. In 2019, real GDP increased by 2.2 percent which was just below the national average of 2.3 percent. Tennessee’s current-dollar GDP in 2019 was $380.1 billion and ranked 18th in the United States. In 2019, the largest industry in Tennessee was finance, insurance, real estate, rental, and leasing which accounted for 17.0 percent of the state’s real GDP and had 2.9 percent real growth. The states’ second largest industry was professional and business services which accounted for 11.7 percent of the state’s GDP and had 6.5 percent real growth. Automobile manufacturing continues to be an important part of the state’s economy. The state’s annual average unemployment rate at the end of June was 9.7 percent. In 2019, the state had a per capita personal income of $48,761 which ranked 35th in the United States and was 86 percent of the national average, $56,663.

Tennessee relies on a combination of a state sales tax, corporate income taxes, franchise, and excise taxes for its revenue. Total state revenue collections through June (on an accrual basis June is the eleventh month in Tennessee’s 2019-2020 FY) were $298 million less than the budgeted estimate.

Tennessee’s general obligation (G.O.) bonds were rated Aaa by Moody’s and AAA by Standard & Poor’s as of June 30, 2020. Tennessee had net tax-supported debt per capita of $292 as of calendar year-end 2019, which is substantially below the state net tax-supported debt median of $1,071 (Source: Moody’s Investors Services, State Government U.S: “Medians—State Debt Declined in 2019, But Likely To Grow in Coming Years”, May 12, 2020).

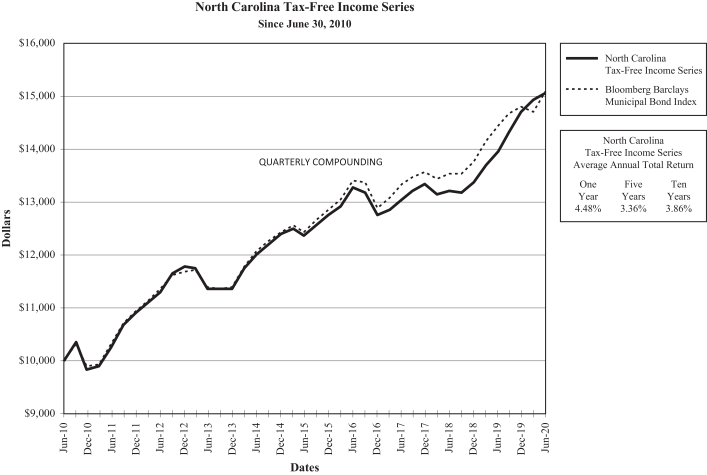

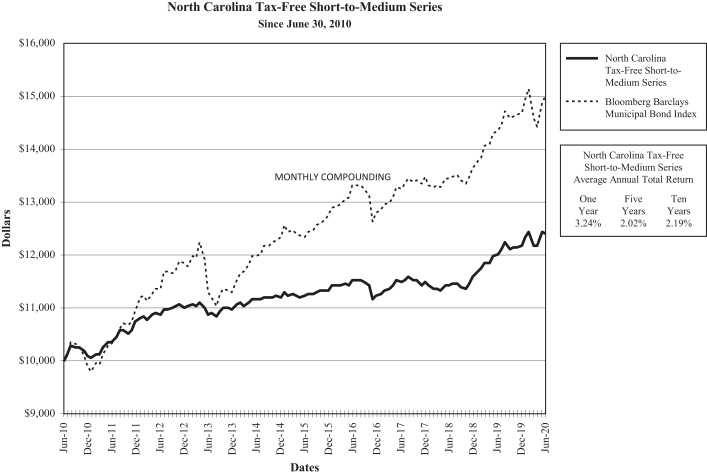

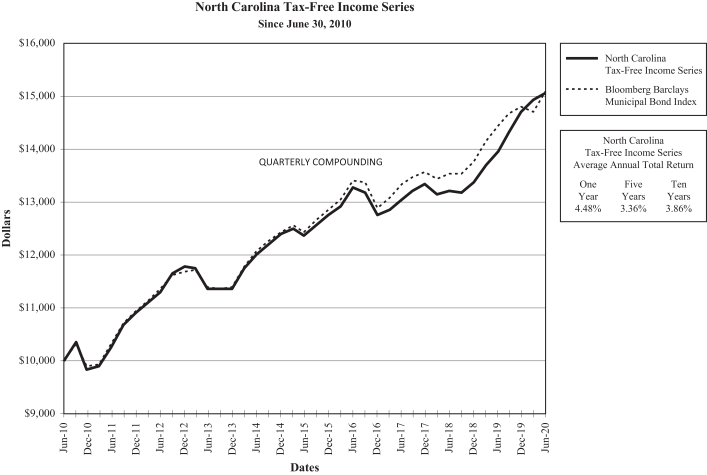

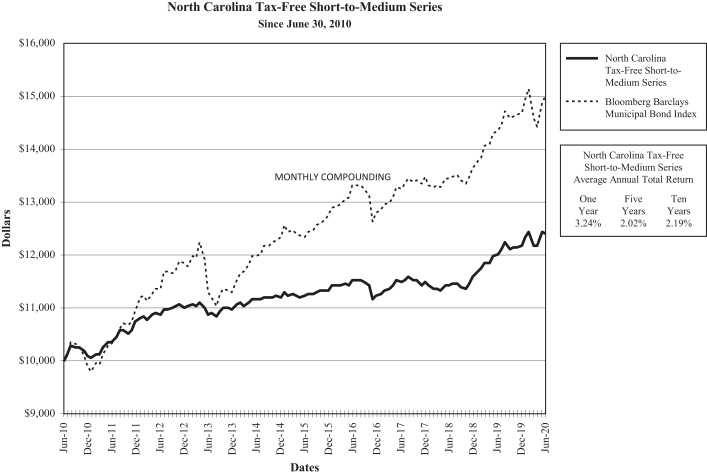

The North Carolina Tax-Free Income Series provided shareholders with a total return of 4.48 percent for the twelve month period ended June 30, 2020. The North Carolina Tax-Free Short-to-Medium Series provided shareholders with a total return of 3.24 percent for the same time period. The North Carolina Tax-Free Income Series performed in line with the index. The North Carolina Tax-Free Short-to-Medium Series had a shorter duration and held fewer AAA-rated issues than the BBMBI, thereby causing it to underperform the index during the reporting period.

North Carolina’s economy has continued to perform relatively well. In 2019, North Carolina real GDP grew 2.3 percent which was in line with the national average. North Carolina’s 2019 current-dollar GDP was $587.7 billion and ranked 12th in the United States. The state’s average annual unemployment rate at the end of June was 7.6 percent. In 2019, North Carolina had a per capita personal income of $47,803 which ranked 41st in the United States and was 84 percent of the national average, $56,663.

ii

North Carolina’s G.O. bonds were rated Aaa by Moody’s and AAA by Standard & Poor’s as of June 30, 2020. North Carolina had net tax-supported debt per capita of $586 as of calendar year-end 2019, which is below the state net tax-supported debt median of $1,071 (Source: Moody’s Investors Services, State Government—U.S.: “Medians—State Debt Declined in 2019, But Likely To Grow in Coming Years”, May 12, 2020).

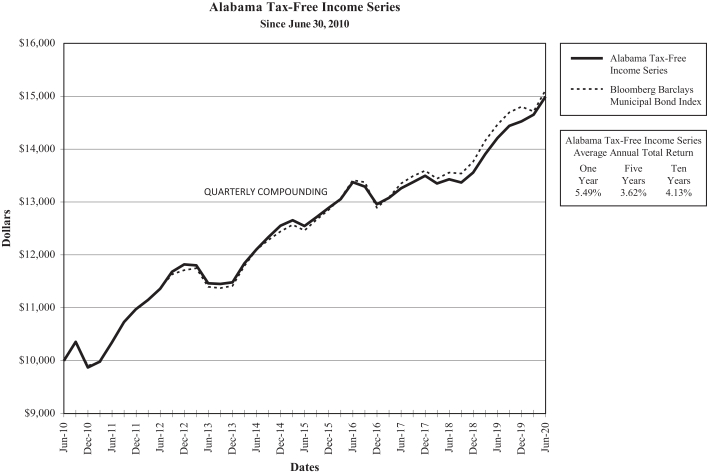

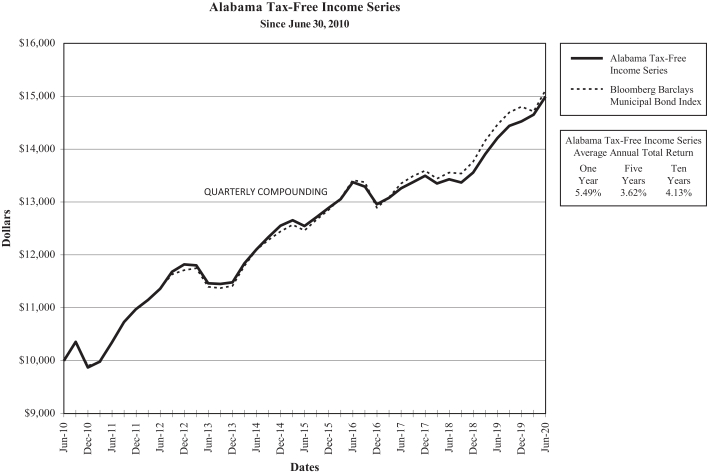

The Alabama Tax-Free Income Series provided shareholders with a total return of 5.49 percent for the twelve month period ended June 30, 2020. The fund held substantially more AA-rated and pre-refunded bonds than the BBMBI, thereby causing it to outperform the index during the reporting period.

Economic growth in Alabama has mostly kept pace with the national average. In 2019, Alabama’s real GDP grew 2.3 percent which was in line with the national average. Alabama’s 2019 current-dollar GDP was $231.0 billion which ranked 27th in the United States. Automotive manufacturing, aerospace, tourism, healthcare, biotechnology, and manufacturing continue to be the state’s main economic drivers. The state’s average annual unemployment rate at the end of June stood at 7.5 percent. In 2019, Alabama had a per capita personal income of $43,880 which ranked 48th in the United States and was 77 percent of the national average, $56,663.

Alabama’s G.O. bonds were rated Aa1 by Moody’s and AA by Standard & Poor’s as of June 30, 2020. Alabama had net tax-supported debt per capita of $822 as of calendar year-end 2020, which was lower than the state net tax-supported debt median of $1,071 (Source: Moody’s Investors Services, State Government U.S.: “Medians-State Debt Declined in 2019, But Likely To Grow in Coming Years”, May 12, 2020).

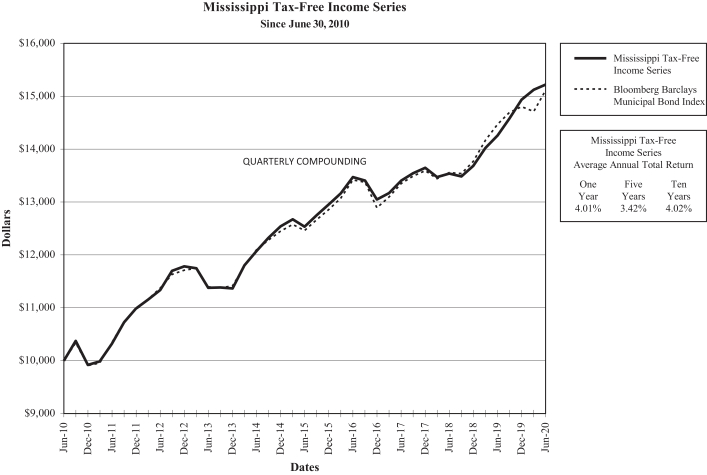

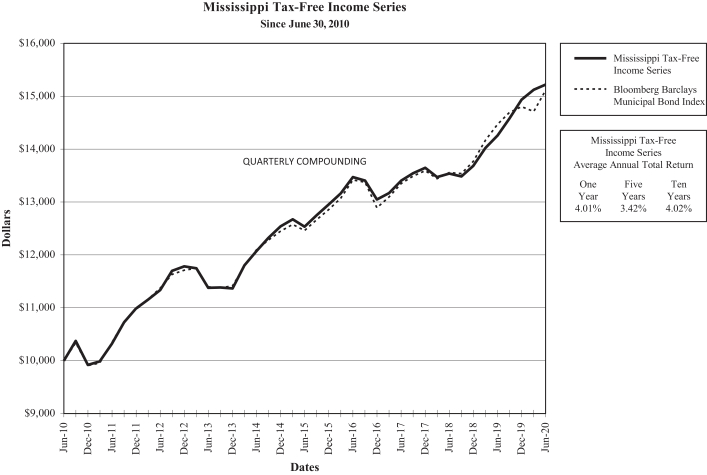

The Mississippi Tax-Free Income Series provided shareholders with a total return of 4.01 percent for the twelve month period ended June 30, 2020. The fund held fewer AAA-rated issues and had a shorter duration than the BBMBI, thereby causing it to underperform the index during the reporting period.

Mississippi’s economic recovery has continued to lag behind the nation. In 2019, Mississippi’s real GDP grew by 1.3 percent which was substantially below the national average of 2.3 percent. Mississippi’s 2019 current-dollar GDP was $118.7 billion and ranked 36th in the United States. The state’s average annual unemployment rate at the end of June was 8.7 percent. In 2019, Mississippi had a per capita personal income of $39,368 which ranked 50th in the United States and was 69 percent of the national average, $56,663.

The state’s G.O. bonds were rated Aa2 by Moody’s and AA by Standard & Poor’s as of June 30, 2020. Mississippi has net tax-supported debt per capita of $1,901 as of calendar year-end 2019, which is higher than the state net tax-supported debt median of $1,071 (Source: Moody’s Investors Services, State Government U.S.: “Medians-State Debt Declined in 2019, But Likely To Grow in Coming Years”, May 12, 2020).

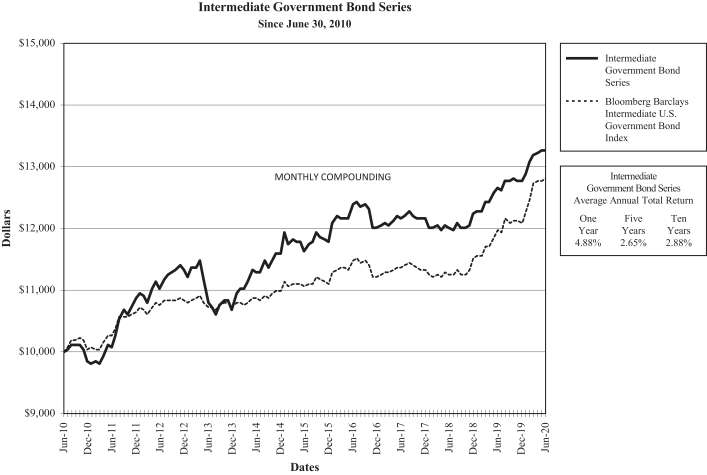

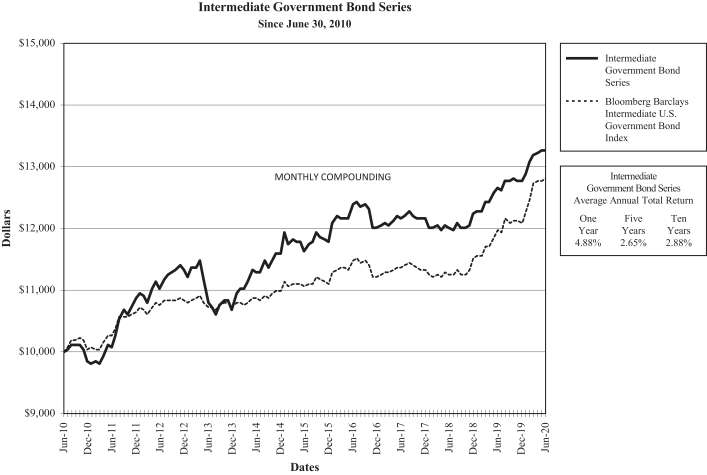

The Intermediate Government Bond Series provided shareholders with a total return of 4.88 percent for the twelve months ended June 30, 2020. The Bloomberg Barclays U.S. Intermediate Government Bond Index (“BBGBI”) had a total return of 7.01 percent for the twelve month period ended June 30, 2020. The Intermediate Government Bond Series had a shorter duration than the BBGBI (2.68 years compared to 3.84 years), thereby causing it to underperform the index during the reporting period.

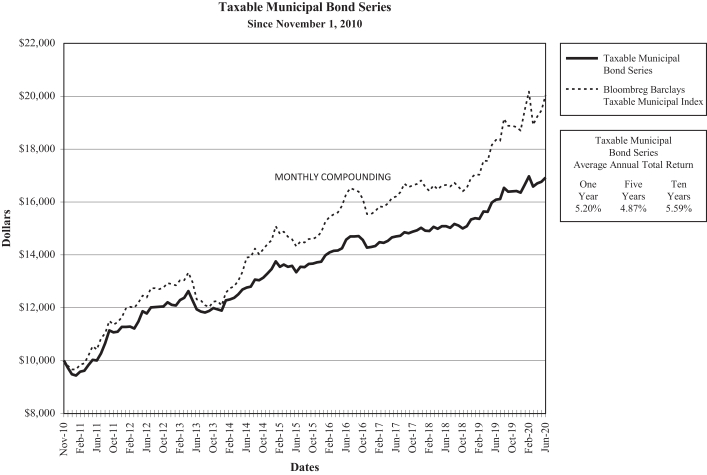

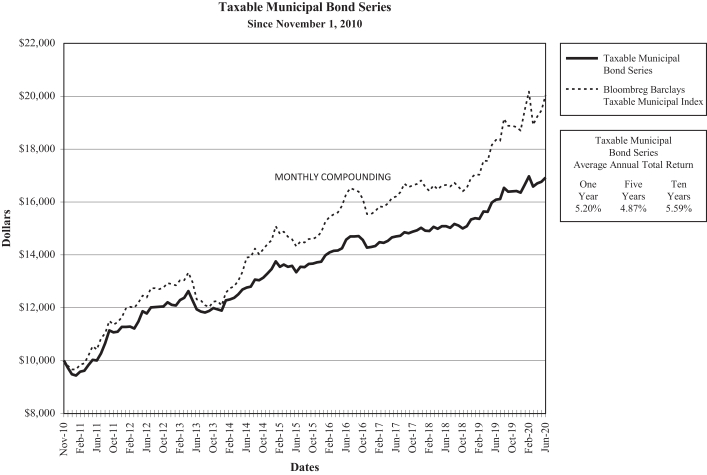

The Taxable Municipal Bond Series provided shareholders with a total return of 5.20 percent for the twelve month period ended June 30, 2020. The Bloomberg Barclays Municipal Bond Taxable Index (“BBTMI”) had a total return of 9.71 percent for the same time period. The Taxable Municipal Bond Series had a substantially shorter duration than the BBTMI (5.68 years compared to 10.07 years), thereby causing it to underperform the index during the reporting period.

Please note that index information is provided for reference only. No index can perfectly match the investments that make up a fund’s portfolio. In making investment decisions for our portfolios we do not attempt to track indices. The Bloomberg Barclays Municipal Bond index is national in scope and does not necessarily reflect the performance of state-specific municipal bond funds. Indices do not take into account any operating expenses or transaction costs. An investment cannot be made directly in an index.

i Data are from the Bureau of Economic Analysis, the U.S. Department of Labor Bureau of Labor Statistics, and various other sources management deems to be reliable. Some of the quoted data are preliminary in nature and may be subject to revision. Any opinions expressed herein are those of the funds’ portfolio management and are current as of June 30, 2020. They are not guarantees of performance or investment results and should not be taken as investment advice. Past performance is not a guarantee of future performance and you may lose money investing in the funds.

iii

The illustrations below provide each Fund’s sector allocation and

summarize key information about each Fund’s investments as of June 30, 2020. | Unaudited |

| | | | |

| |

Alabama Tax-Free Income Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 1.08% | |

Aa/AA | | | 91.46% | |

A | | | 3.88% | |

Not Rated | | | 3.58% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Prerefunded | | | 20.10% | |

School Improvement | | | 19.72% | |

Municipal Utility Revenue | | | 15.99% | |

Public Facilities | | | 15.95% | |

University Consolidated Education and Building Revenue | | | 12.48% | |

Refunding | | | 5.80% | |

Miscellaneous Public Improvement | | | 3.71% | |

Hospital and Healthcare Revenue | | | 2.33% | |

Turnpikes/Toll Road/Highway Revenue | | | 1.04% | |

Other Assets Less Liabilities | | | 2.88% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| |

Kentucky Tax-Free Short-to-Medium Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 0.41% | |

Aa/AA | | | 25.17% | |

A | | | 74.42% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

School Improvement | | | 22.83% | |

Miscellaneous Public Improvement | | | 20.35% | |

Public Facilities | | | 16.37% | |

Turnpikes/Toll Road/Highway Revenue | | | 9.50% | |

University Consolidated Education and Building Revenue | | | 7.34% | |

Hospital and Healthcare Revenue | | | 7.25% | |

Municipal Utility Revenue | | | 5.67% | |

Refunding | | | 4.06% | |

Prerefunded | | | 2.52% | |

Airport Revenue | | | 1.27% | |

Other Assets Less Liabilities | | | 2.84% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | |

| |

Kentucky Tax-Free Income Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aa/AA | | | 48.32% | |

A | | | 50.34% | |

Baa/BBB | | | 0.02% | |

Not Rated | | | 1.32% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Miscellaneous Public Improvement | | | 26.83% | |

School Improvement | | | 15.35% | |

University Consolidated Education and Building Revenue | | | 12.52% | |

Municipal Utility Revenue | | | 10.64% | |

Turnpikes/Toll Road/Highway Revenue | | | 7.59% | |

Hospital and Healthcare Revenue | | | 5.98% | |

Public Facilities | | | 5.76% | |

Refunding | | | 5.64% | |

Prerefunded | | | 3.68% | |

Airport Revenue | | | 1.26% | |

Ad Valorem Property | | | 0.14% | |

State and Local Mortgage/Housing Revenue | | | 0.11% | |

Other Assets Less Liabilities | | | 4.50% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

| |

Mississippi Tax-Free Income Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aa/AA | | | 88.38% | |

A | | | 11.62% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

University Consolidated Education and Building Revenue | | | 25.46% | |

Prerefunded | | | 25.09% | |

Municipal Utility Revenue | | | 10.59% | |

Turnpikes/Toll Road/Highway Revenue | | | 8.13% | |

Public Facilities | | | 7.21% | |

School Improvement | | | 5.48% | |

Refunding | | | 4.74% | |

Ad Valorem Property | | | 3.85% | |

Miscellaneous Public Improvement | | | 3.71% | |

Hospital and Healthcare Revenue | | | 1.85% | |

Other Assets Less Liabilities | | | 3.89% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

iv

The illustrations below provide each Fund’s sector allocation and

summarize key information about each Fund’s investments as of June 30, 2020. | Unaudited |

| | | | |

| |

North Carolina Tax-Free Income Series | |

| CREDIT QUALITY * | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 3.88% | |

Aa/AA | | | 79.33% | |

A | | | 16.79% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

University Consolidated Education and Building Revenue | | | 20.72% | |

School Improvement | | | 17.25% | |

Public Facilities | | | 14.30% | |

Municipal Utility Revenue | | | 9.50% | |

Prerefunded | | | 7.86% | |

Refunding | | | 7.86% | |

Hospital and Healthcare Revenue | | | 6.91% | |

Turnpikes/Toll Road/Highway Revenue | | | 4.57% | |

Miscellaneous Public Improvement | | | 3.51% | |

Airport Revenue | | | 3.10% | |

Lease Revenue | | | 1.08% | |

Escrowed to Maturity | | | 0.61% | |

Ad Valorem Property | | | 0.23% | |

Other Assets Less Liabilities | | | 2.50% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | |

| |

Tennessee Tax-Free Income Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 2.97% | |

Aa/AA | | | 79.77% | |

A | | | 15.90% | |

Not Rated | | | 1.36% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Municipal Utility Revenue | | | 35.58% | |

School Improvement | | | 11.70% | |

Public Facilities | | | 10.62% | |

University Consolidated Education and Building Revenue | | | 8.76% | |

Miscellaneous Public Improvement | | | 7.89% | |

Prerefunded | | | 7.37% | |

Hospital and Healthcare Revenue | | | 6.62% | |

Refunding | | | 5.40% | |

Airport Revenue | | | 2.60% | |

Industrial Revenue | | | 0.92% | |

State and Local Mortgage/Housing Revenue | | | 0.32% | |

Other Assets Less Liabilities | | | 2.22% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | |

| |

North Carolina Tax-Free Short-to-Medium Series | |

| CREDIT QUALITY * | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 2.32% | |

Aa/AA | | | 62.75% | |

A | | | 34.19% | |

Not Rated | | | 0.74% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

University Consolidated Education and Building Revenue | | | 24.50% | |

Refunding | | | 19.46% | |

Municipal Utility Revenue | | | 12.99% | |

School Improvement | | | 11.55% | |

Public Facilities | | | 8.52% | |

Hospital and Healthcare Revenue | | | 5.23% | |

Turnpikes/Toll Road/Highway Revenue | | | 3.92% | |

Prerefunded | | | 3.84% | |

Ad Valorem Property | | | 2.19% | |

Lease Revenue | | | 2.05% | |

Escrowed to Maturity | | | 1.84% | |

Miscellaneous Public Improvement | | | 1.09% | |

Other Assets Less Liabilities | | | 2.82% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| |

Tennessee Tax-Free Short-to-Medium Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aa/AA | | | 82.71% | |

A | | | 16.95% | |

Not Rated | | | 0.34% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Refunding | | | 25.88% | |

Public Facilities | | | 22.84% | |

Municipal Utility Revenue | | | 20.64% | |

School Improvement | | | 12.97% | |

University Consolidated Education and Building Revenue | | | 9.74% | |

Prerefunded | | | 1.94% | |

Airport Revenue | | | 1.64% | |

Miscellaneous Public Improvement | | | 0.61% | |

Other Assets Less Liabilities | | | 3.74% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

v

The illustrations below provide each Fund’s sector allocation and

summarize key information about each Fund’s investments as of June 30, 2020. | Unaudited |

| | | | |

| |

Intermediate Government Bond Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Federal Farm Credit Bank | | | 67.34% | |

Federal Home Loan Bank | | | 29.25% | |

Other Assets Less Liabilities | | | 3.41% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| |

Taxable Municipal Bond Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aa/AA | | | 93.79% | |

A | | | 6.21% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Municipal Utility Revenue | | | 23.53% | |

Prerefunded | | | 20.77% | |

Public Facilities | | | 12.57% | |

School Improvement | | | 10.79% | |

University Consolidated Education and Building Revenue | | | 5.93% | |

Miscellaneous Public Improvement | | | 5.13% | |

Hospital and Healthcare Revenue | | | 3.90% | |

Turnpikes/Toll Road/Highway Revenue | | | 3.23% | |

Marina/Port Authority Revenue | | | 2.27% | |

Refunding | | | 2.23% | |

Ad Valorem Property | | | 1.97% | |

Airport Revenue | | | 0.96% | |

Other Assets Less Liabilities | | | 6.72% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| * | Ratings by Moody’s Investors Services, Inc. unless noted otherwise. See Schedules of Portfolio Investments for individual bond ratings. |

vi

PERFORMANCE COMPARISON (Unaudited)

The following graphs compare the change in value of a $10,000 investment in each series of Dupree Mutual Funds with the change in value of a $10,000 investment in a comparable index. The comparisons are made over 10 years or since the inception of the series, if shorter than ten years. Results are for the fiscal years ended June 30.

PERFORMANCE DISCLOSURES

Past performance is not indicative of future results. The current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

The performance tables and the graphs above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

For performance data current to the most recent month-end call 800-866-0614 or visit our website at www.dupree-funds.com.

Notes on Graphs:

Results reflect reinvestment of all dividend and capital gain distributions. No index can perfectly match the investments that make up a fund’s portfolio. For each series, we have selected an index that we believe gives the most accurate picture of how the series performed during the reporting period. The investor should understand that an index is a mathematical hypothesis and does not reflect a real market situation. For example, the portfolio of each index is replaced with an entirely different portfolio each year without reflecting operating expenses or transaction costs, an impossibility in reality. On the other hand, the fund’s performance reflects not only these factors but management costs as well.

Please note that on August 24, 2016, Bloomberg LP completed its acquisition of Barclays Risk Analytics and Index Solutions Limited from Barclays Bank PLC and co-branded the indices as the Bloomberg Barclays Indices.

vii

viii

ix

x

xi

xii

xiii

xiv

xv

xvi

xvii

DUPREE MUTUAL FUNDS — ALABAMA TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds

June 30, 2020

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| PREREFUNDED BONDS | | | | | | | | | | | | | | | | | | |

| 20.10% of Net Assets | | | | | | | | | | | | | | | | | | |

Alabaster AL Board of Education Special Tax Warrants** | | | 5.000 | % | | | 09/01/2039 | | | A1 | | $ | 600,000 | | | $ | 714,006 | |

Auburn AL Waterworks Board Water Revenue | | | 5.000 | | | | 09/01/2036 | | | Aa2 | | | 250,000 | | | | 306,335 | |

Birmingham AL Waterworks | | | 5.000 | | | | 01/01/2026 | | | Aa2 | | | 80,000 | | | | 81,904 | |

Birmingham AL Waterworks** | | | 5.000 | | | | 01/01/2038 | | | Aa2 | | | 550,000 | | | | 614,111 | |

Birmingham AL Waterworks | | | 5.000 | | | | 01/01/2040 | | | Aa2 | | | 150,000 | | | | 180,761 | |

Decatur City AL Board of Education Special Tax | | | 5.000 | | | | 02/01/2040 | | | Aa2 | | | 225,000 | | | | 271,645 | |

Jasper AL Warrants | | | 5.000 | | | | 03/01/2031 | | | A2 | | | 250,000 | | | | 292,448 | |

Jasper AL Warrants | | | 5.000 | | | | 03/01/2032 | | | A2 | | | 450,000 | | | | 526,406 | |

Limestone County AL Water & Sewer Authority | | | 5.000 | | | | 12/01/2033 | | | AA-* | | | 300,000 | | | | 348,501 | |

Limestone County AL Water & Sewer Authority | | | 5.000 | | | | 12/01/2034 | | | AA-* | | | 250,000 | | | | 289,665 | |

Morgan County AL Board of Education Capital Outlay Warrants | | | 5.000 | | | | 03/01/2035 | | | NR | | | 155,000 | | | | 170,035 | |

Morgan County AL Board of Education Capital Outlay Warrants | | | 5.000 | | | | 03/01/2035 | | | NR | | | 245,000 | | | | 268,765 | |

Opelika AL Warrants | | | 5.000 | | | | 11/01/2031 | | | Aa2 | | | 150,000 | | | | 159,477 | |

Trussville AL Warrants | | | 5.000 | | | | 10/01/2039 | | | NR | | | 445,000 | | | | 511,399 | |

Tuscaloosa AL Warrants | | | 5.000 | | | | 01/01/2032 | | | Aa1 | | | 350,000 | | | | 406,742 | |

Tuscaloosa AL Warrants | | | 5.000 | | | | 07/01/2034 | | | Aa1 | | | 300,000 | | | | 355,533 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 5,497,733 | |

| SCHOOL IMPROVEMENT BONDS | | | | | | | | | | | | | | | | | | |

| 19.72% of Net Assets | | | | | | | | | | | | | | | | | | |

Cherokee County AL Board of Education Tax Warrants | | | 4.000 | | | | 12/01/2034 | | | A1 | | | 310,000 | | | | 357,560 | |

Elmore County AL Board of Education | | | 4.000 | | | | 08/01/2038 | | | Aa3 | | | 250,000 | | | | 291,350 | |

Etowah County AL Board of Education Capital Outlay Tax | | | 5.000 | | | | 09/01/2037 | | | A+* | | | 200,000 | | | | 216,134 | |

Jefferson County AL Board of Education Public School Warrants | | | 4.000 | | | | 02/01/2042 | | | A1 | | | 325,000 | | | | 361,100 | |

Jefferson County AL Public Schools | | | 4.000 | | | | 02/01/2038 | | | A1 | | | 165,000 | | | | 184,909 | |

Limestone County AL Board of Education | | | 5.000 | | | | 07/01/2033 | | | AA* | | | 255,000 | | | | 294,706 | |

Madison AL Board of Education Special Tax School Warrants | | | 4.000 | | | | 02/01/2040 | | | Aa3 | | | 400,000 | | | | 473,452 | |

Madison AL Board of Education Special Tax School Warrants | | | 4.000 | | | | 02/01/2041 | | | Aa3 | | | 370,000 | | | | 435,568 | |

Madison County AL Board of Education Capital Outlay** | | | 5.000 | | | | 09/01/2031 | | | Aa3 | | | 660,000 | | | | 798,263 | |

Marshall County AL Board of Education Special Tax School Warrants | | | 4.000 | | | | 03/01/2033 | | | A2 | | | 250,000 | | | | 280,230 | |

Morgan County AL Board of Education Capital Outlay Warrants | | | 5.000 | | | | 03/01/2035 | | | AA-* | | | 405,000 | | | | 439,239 | |

Shelby County AL Board of Education Capital Outlay Warrants** | | | 5.000 | | | | 02/01/2031 | | | Aa2 | | | 615,000 | | | | 630,104 | |

Troy AL Public Educational Building Authority | | | 5.250 | | | | 12/01/2036 | | | A2 | | | 30,000 | | | | 30,518 | |

Tuscaloosa County AL Board of Education Special Tax School Warrants | | | 5.000 | | | | 02/01/2036 | | | Aa3 | | | 250,000 | | | | 301,023 | |

Tuscaloosa County AL Board of Education Special Tax School Warrants | | | 5.000 | | | | 02/01/2037 | | | Aa3 | | | 250,000 | | | | 300,678 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 5,394,834 | |

| MUNICIPAL UTILITY REVENUE BONDS | | | | | | | | | | | | | | | | | | |

| 15.99% of Net Assets | | | | | | | | | | | | | | | | | | |

Athens AL Water & Sewer | | | 4.000 | | | | 05/01/2039 | | | A1 | | | 200,000 | | | | 230,724 | |

Athens AL Water & Sewer | | | 4.000 | | | | 05/01/2040 | | | A1 | | | 100,000 | | | | 114,697 | |

Berry AL Water & Sewer Revenue | | | 4.000 | | | | 09/01/2039 | | | AA* | | | 250,000 | | | | 271,013 | |

Birmingham AL Waterworks | | | 4.000 | | | | 01/01/2037 | | | Aa2 | | | 250,000 | | | | 283,773 | |

Birmingham AL Waterworks | | | 4.000 | | | | 01/01/2038 | | | Aa2 | | | 205,000 | | | | 231,888 | |

Birmingham AL Waterworks | | | 4.000 | | | | 01/01/2041 | | | Aa2 | | | 225,000 | | | | 252,313 | |

Chatom AL Industrial Board Gulf Opportunity Zone | | | 5.000 | | | | 08/01/2037 | | | A3 | | | 150,000 | | | | 150,501 | |

Cullman AL Utility Board Water Revenue | | | 4.750 | | | | 09/01/2037 | | | A1 | | | 400,000 | | | | 402,366 | |

Gadsden AL Waterworks & Sewer Board | | | 4.000 | | | | 06/01/2034 | | | A1 | | | 120,000 | | | | 136,915 | |

Jasper AL Waterworks & Sewer Board Utility Revenue | | | 5.000 | | | | 06/01/2030 | | | A+* | | | 455,000 | | | | 456,247 | |

Limestone County AL Water & Sewer Authority | | | 4.750 | | | | 12/01/2033 | | | AA* | | | 290,000 | | | | 346,298 | |

Limestone County AL Water & Sewer Authority | | | 4.750 | | | | 12/01/2035 | | | AA* | | | 400,000 | | | | 455,936 | |

Opelika AL Utilities Board | | | 4.000 | | | | 06/01/2039 | | | Aa3 | | | 250,000 | | | | 282,675 | |

Prattville AL Sewer Warrants | | | 4.000 | | | | 11/01/2042 | | | AA-* | | | 375,000 | | | | 422,655 | |

Tallassee AL Water Gas & Sewer Warrants | | | 5.125 | | | | 05/01/2036 | | | A2 | | | 10,000 | | | | 10,013 | |

West Morgan East Lawrence AL Water & Sewer | | | 4.750 | | | | 08/15/2030 | | | AA* | | | 75,000 | | | | 75,347 | |

West Morgan East Lawrence AL Water & Sewer | | | 4.850 | | | | 08/15/2035 | | | AA* | | | 250,000 | | | | 251,158 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 4,374,519 | |

The accompanying footnotes are an integral part of the financial statements.

1

DUPREE MUTUAL FUNDS — ALABAMA TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds

June 30, 2020

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| PUBLIC FACILITIES REVENUE BONDS | | | | | | | | | | | | | | | | | | |

| 15.95% of Net Assets | | | | | | | | | | | | | | | | | | |

Anniston AL Public Building Authority | | | 5.000 | % | | | 03/01/2032 | | | A2 | | $ | 400,000 | | | $ | 410,944 | |

Anniston AL Public Building Authority DHR Project | | | 5.250 | | | | 05/01/2030 | | | AA-* | | | 50,000 | | | | 50,115 | |

Anniston AL Public Building Authority DHR Project | | | 5.500 | | | | 05/01/2033 | | | AA-* | | | 200,000 | | | | 200,480 | |

Bessemer AL Public Educational Building Authority Revenue | | | 5.000 | | | | 07/01/2030 | | | AA* | | | 250,000 | | | | 250,695 | |

Birmingham Jefferson AL Civic Center Authority Revenue | | | 5.000 | | | | 05/01/2037 | | | Aa3 | | | 400,000 | | | | 489,548 | |

Birmingham Jefferson AL Civic Center Authority Revenue | | | 5.000 | | | | 05/01/2038 | | | Aa3 | | | 250,000 | | | | 302,325 | |

Boaz AL Warrants | | | 4.000 | | | | 02/01/2037 | | | AA* | | | 250,000 | | | | 287,115 | |

Bullock County AL Public Building Authority | | | 4.000 | | | | 10/01/2038 | | | AA-* | | | 500,000 | | | | 554,765 | |

Lowndes County AL Warrants | | | 5.250 | | | | 02/01/2037 | | | A2 | | | 250,000 | | | | 255,328 | |

Montgomery County AL Public Building Authority | | | 5.000 | | | | 03/01/2036 | | | Aa2 | | | 350,000 | | | | 432,927 | |

Phenix City AL Public Building Authority | | | 4.000 | | | | 10/01/2035 | | | AA-* | | | 100,000 | | | | 116,082 | |

Phenix City AL Public Building Authority | | | 4.000 | | | | 10/01/2037 | | | AA-* | | | 120,000 | | | | 140,843 | |

Trussville AL Warrants** | | | 5.000 | | | | 10/01/2039 | | | Aa2 | | | 775,000 | | | | 871,302 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 4,362,469 | |

| UNIVERSITY CONSOLIDATED EDUCATION AND BUILDING REVENUE BONDS | |

| 12.48% of Net Assets | | | | | | | | | | | | | | | | | | |

AL Community College System Gadsden State Community College | | | 5.000 | | | | 06/01/2038 | | | A1 | | | 325,000 | | | | 392,909 | |

Auburn University AL General Fee Revenue | | | 4.000 | | | | 06/01/2036 | | | Aa2 | | | 380,000 | | | | 429,472 | |

Troy University AL Facilities Revenue | | | 5.000 | | | | 11/01/2028 | | | A1 | | | 250,000 | | | | 293,218 | |

Troy University AL Facilities Revenue | | | 4.000 | | | | 11/01/2032 | | | A1 | | | 300,000 | | | | 344,052 | |

Troy University AL Facilities Revenue | | | 5.000 | | | | 11/01/2037 | | | A1 | | | 200,000 | | | | 241,504 | |

University of AL Birmingham | | | 5.000 | | | | 10/01/2037 | | | Aa2 | | | 225,000 | | | | 253,654 | |

University of AL Huntsville General Fee Revenue | | | 5.000 | | | | 09/01/2037 | | | Aa3 | | | 250,000 | | | | 307,265 | |

University of AL Huntsville General Fee Revenue | | | 5.000 | | | | 09/01/2038 | | | Aa3 | | | 500,000 | | | | 619,325 | |

University of AL Huntsville General Fee Revenue | | | 5.000 | | | | 09/01/2038 | | | Aa3 | | | 435,000 | | | | 532,891 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 3,414,290 | |

| REFUNDING BONDS | | | | | | | | | | | | | | | | | | |

| 5.80% of Net Assets | | | | | | | | | | | | | | | | | | |

Enterprise AL Warrants | | | 4.500 | | | | 11/01/2032 | | | Aa3 | | | 115,000 | | | | 124,604 | |

Montgomery AL Warrants | | | 5.000 | | | | 06/15/2035 | | | A1 | | | 500,000 | | | | 616,695 | |

Northport AL Warrants** | | | 5.000 | | | | 08/01/2040 | | | AA-* | | | 735,000 | | | | 844,456 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 1,585,755 | |

| MISCELLANEOUS PUBLIC IMPROVEMENT BONDS | | | | | | | | | | | | | | | | | | |

| 3.71% of Net Assets | | | | | | | | | | | | | | | | | | |

Birmingham AL Warrants | | | 4.000 | | | | 12/01/2035 | | | Aa3 | | | 250,000 | | | | 290,423 | |

Birmingham AL Warrants | | | 5.000 | | | | 12/01/2037 | | | Aa3 | | | 250,000 | | | | 311,302 | |

Madison AL Warrants | | | 5.000 | | | | 04/01/2035 | | | Aa2 | | | 350,000 | | | | 411,968 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 1,013,693 | |

| HOSPITAL AND HEALTHCARE REVENUE BONDS | | | | | | | | | | | | | | | | | | |

| 2.33% of Net Assets | | | | | | | | | | | | | | | | | | |

Chilton County AL Health Care Authority Chilton County Hospital** | | | 5.000 | | | | 11/01/2035 | | | AA-@ | | | 550,000 | | | | 636,119 | |

| | | | | | | | | | | | | | | | | | |

| TURNPIKES/TOLLROAD/HIGHWAY REVENUE BONDS | | | | | | | | | | | | | | | | | | |

| 1.04% of Net Assets | | | | | | | | | | | | | | | | | | |

AL Federal Aid Highway Finance Authority | | | 4.000 | | | | 06/01/2037 | | | Aa1 | | | 250,000 | | | | 285,748 | |

| | | | | | | | | | | | | | | | | | |

Total Investments 97.12% of Net Assets (cost $24,666,090) (See (a) below for further explanation) | | | | | | | | | $ | 26,565,160 | |

| | | | | | | | | | | | | | | | | | |

Other assets in excess of liabilities 2.88% | | | | | | | | | | | | | | | | | 788,836 | |

| | | | | | | | | | | | | | | | | | |

Net Assets 100% | | | | | | | | | | | | | | | | $ | 27,353,996 | |

| | | | | | | | | | | | | | | | | | |

| | # | | Ratings by Moody’s Investors Service unless noted otherwise. |

| | | | Bond ratings are unaudited and not covered by Report of Independent Registered Public Accounting Firm. |

| | | | All ratings are as of the date indicated and do not reflect subsequent changes. |

| | * | | Rated by Standard & Poor’s Corporation |

| | @ | | Rated by Fitch’s Investors Service |

The accompanying footnotes are an integral part of the financial statements.

2

DUPREE MUTUAL FUNDS — ALABAMA TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds

June 30, 2020

| | ** | | Security is segregated — see footnote 1(D) |

| (a) | | Cost for federal income tax purposes is $24,666,090 and net unrealized appreciation of investments is as follows: |

| | | | | | |

| | Unrealized appreciation | | $ | 1,899,250 | |

| | Unrealized depreciation | | | (180 | ) |

| | | | | | |

| | Net unrealized appreciation | | $ | 1,899,070 | |

| | | | | | |

Other Information

The following is a summary of the inputs used, as of June 30, 2020, involving the Fund’s investments in securities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements.

| | | | | | |

| | | Valuation Inputs | | Municipal Bonds | |

Level 1 | | Quoted Prices | | $ | — | |

Level 2 | | Other Significant Observable Inputs | | | 26,565,160 | |

Level 3 | | Significant Unobservable Inputs | | | — | |

| | | | | | |

| | | | $ | 26,565,160 | |

| | | | | | |

The accompanying footnotes are an integral part of the financial statements.

3

ALABAMA TAX-FREE INCOME SERIES

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2020

| | | | | | | | |

ASSETS: | | | | | | | | |

Investments in securities, at fair value (Cost: $24,666,090) | | | | | | $ | 26,565,160 | |

Cash | | | | | | | 595,131 | |

Interest receivable | | | | | | | 324,472 | |

| | | | | | | | |

Total assets | | | | | | | 27,484,763 | |

LIABILITIES: | | | | | | | | |

Payable for: | | | | | | | | |

Distributions to shareholders | | | 99,242 | | | | | |

Fund shares redeemed | | | 5,595 | | | | | |

Investment advisory fee | | | 5,581 | | | | | |

Transfer agent fee | | | 7,085 | | | | | |

Professional fees | | | 2,705 | | | | | |

Custodian expense | | | 2,334 | | | | | |

Trustees fees | | | 1,093 | | | | | |

Accrued expenses | | | 7,132 | | | | | |

| | | | | | | | |

Total liabilities | | | | | | | 130,767 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Capital | | | | | | | 25,526,330 | |

Total distributable earnings | | | | | | | 1,827,666 | |

| | | | | | | | |

Net assets at value | | | | | | $ | 27,353,996 | |

| | | | | | | | |

NET ASSET VALUE, offering price and redemption price per share

(2,140,551 shares outstanding; unlimited number of shares authorized; no par value) | | | | | | $ | 12.78 | |

| | | | | | | | |

STATEMENT OF OPERATIONS

For the year ended June 30, 2020

| | | | |

Net investment income: | | | | |

Interest income | | $ | 865,534 | |

| | | | |

Expenses: | | | | |

Investment advisory fee | | | 131,964 | |

Transfer agent fee | | | 37,671 | |

Custodian expense | | | 10,345 | |

Professional fees | | | 7,402 | |

Compliance fees | | | 7,221 | |

Pricing fees | | | 6,017 | |

Registration fees | | | 5,078 | |

Trustees fees | | | 3,064 | |

Other expenses | | | 6,737 | |

| �� | | | |

Total expenses | | | 215,499 | |

Fees waived by Adviser (Note 2) | | | (29,696 | ) |

Custodian expense reduction | | | (371 | ) |

| | | | |

Net expenses | | | 185,432 | |

| | | | |

Net investment income | | | 680,102 | |

| | | | |

Realized and unrealized gain on investments: | | | | |

Net realized loss gain | | | 18,246 | |

Net change in unrealized appreciation/(depreciation) | | | 680,806 | |

| | | | |

Net realized and unrealized gain on investments | | | 699,052 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 1,379,154 | |

| | | | |

The accompanying footnotes are an integral part of the financial statements.

4

ALABAMA TAX-FREE INCOME SERIES

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended June 30, 2020 and 2019

| | | | | | | | |

| | | 2020 | | | 2019 | |

Operations: | | | | | | | | |

Net investment income | | $ | 680,102 | | | $ | 707,873 | |

Net realized gain/(loss) on investments | | | 18,246 | | | | (25,778 | ) |

Net change in unrealized appreciation/(depreciation) | | | 680,806 | | | | 759,933 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 1,379,154 | | | | 1,442,028 | |

Total distributions (Note 6) | | | (680,102 | ) | | | (707,873 | ) |

Net Fund share transactions (Note 4) | | | 501,183 | | | | 164,601 | |

| | | | | | | | |

Total increase | | | 1,200,235 | | | | 898,756 | |

Net assets: | | | | | | | | |

Beginning of year | | | 26,153,761 | | | | 25,255,005 | |

| | | | | | | | |

End of year | | $ | 27,353,996 | | | $ | 26,153,761 | |

| | | | | | | | |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding: | | For the years ended June 30, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

Net asset value, beginning of year | | $ | 12.43 | | | $ | 12.08 | | | $ | 12.29 | | | $ | 12.77 | | | $ | 12.36 | |

| | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.33 | | | | 0.34 | | | | 0.36 | | | | 0.37 | | | | 0.39 | |

Net gains/(losses) on investments | | | 0.35 | | | | 0.35 | | | | (0.21 | ) | | | (0.48 | ) | | | 0.41 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.68 | | | | 0.69 | | | | 0.15 | | | | (0.11 | ) | | | 0.80 | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.33 | ) | | | (0.34 | ) | | | (0.36 | ) | | | (0.37 | ) | | | (0.39 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 12.78 | | | $ | 12.43 | | | $ | 12.08 | | | $ | 12.29 | | | $ | 12.77 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 5.49% | | | | 5.80% | | | | 1.24% | | | | (0.82 | )% | | | 6.61% | |

Net assets, end of year (in thousands) | | $ | 27,354 | | | $ | 26,154 | | | $ | 25,255 | | | $ | 26,555 | | | $ | 29,378 | |

Ratio of net expenses to average net assets (a) | | | 0.70% | | | | 0.70% | | | | 0.70% | | | | 0.70% | | | | 0.71% | |

Ratio of gross expenses to average net assets | | | 0.82% | | | | 0.84% | | | | 0.82% | | | | 0.78% | | | | 0.78% | |

Ratio of net investment income to average net assets | | | 2.58% | | | | 2.79% | | | | 2.96% | | | | 3.00% | | | | 3.14% | |

Portfolio turnover | | | 6.98% | | | | 16.54% | | | | 13.83% | | | | 6.95% | | | | 5.37% | |

| (a) | | Percentages are after expense waivers and reductions by the Adviser and Custodian. The Adviser and Custodian have agreed not to seek recovery of these waivers and reductions. |

The accompanying footnotes are an integral part of the financial statements.

5

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2020

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| MISCELLANEOUS PUBLIC IMPROVEMENT BONDS | | | | | | | | | | | | | | | | | | |

| 26.83% of Net Assets | |

| KY Association of Counties | | | 4.000 | % | | | 02/01/2028 | | | AA-* | | $ | 345,000 | | | $ | 412,359 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2029 | | | AA-* | | | 240,000 | | | | 291,180 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2030 | | | AA-* | | | 100,000 | | | | 100,356 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2032 | | | AA-* | | | 165,000 | | | | 165,597 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2033 | | | AA-* | | | 420,000 | | | | 475,885 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2034 | | | AA-* | | | 435,000 | | | | 490,998 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2035 | | | AA-* | | | 690,000 | | | | 793,486 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2035 | | | AA-* | | | 460,000 | | | | 517,518 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2035 | | | AA-* | | | 120,000 | | | | 120,419 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2037 | | | AA-* | | | 745,000 | | | | 853,331 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2038 | | | AA-* | | | 3,165,000 | | | | 3,610,854 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2039 | | | AA-* | | | 1,000,000 | | | | 1,137,090 | |

KY Bond Corporation Finance Program | | | 5.500 | | | | 02/01/2031 | | | AA-* | | | 1,115,000 | | | | 1,148,182 | |

KY State Property & Building #76 | | | 5.500 | | | | 08/01/2021 | | | A1 | | | 1,400,000 | | | | 1,465,842 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2031 | | | A2 | | | 2,110,000 | | | | 2,244,724 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2032 | | | A2 | | | 2,205,000 | | | | 2,328,877 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2033 | | | A2 | | | 2,310,000 | | | | 2,437,882 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2028 | | | A1 | | | 2,030,000 | | | | 2,225,509 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2029 | | | A1 | | | 4,130,000 | | | | 4,526,397 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2030 | | | A1 | | | 7,165,000 | | | | 7,833,710 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2031 | | | A1 | | | 4,910,000 | | | | 5,302,162 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2032 | | | A1 | | | 6,275,000 | | | | 6,844,080 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2033 | | | A1 | | | 4,870,000 | | | | 5,295,638 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2026 | | | A1 | | | 955,000 | | | | 1,096,369 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2028 | | | A1 | | | 2,670,000 | | | | 3,041,611 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2030 | | | A1 | | | 5,000,000 | | | | 5,598,500 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2031 | | | A1 | | | 8,290,000 | | | | 9,294,914 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2032 | | | A1 | | | 8,820,000 | | | | 9,898,157 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2033 | | | A1 | | | 5,270,000 | | | | 5,898,131 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2034 | | | A1 | | | 4,900,000 | | | | 5,437,040 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2029 | | | A1 | | | 4,200,000 | | | | 4,749,906 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2032 | | | A1 | | | 1,515,000 | | | | 1,700,194 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2033 | | | A1 | | | 1,000,000 | | | | 1,119,190 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2034 | | | A1 | | | 1,900,000 | | | | 2,108,240 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2035 | | | A1 | | | 3,680,000 | | | | 4,079,648 | |

KY State Property & Building #112 | | | 5.000 | | | | 11/01/2028 | | | A1 | | | 2,765,000 | | | | 3,209,833 | |

KY State Property & Building #112 | | | 5.000 | | | | 02/01/2035 | | | A1 | | | 8,325,000 | | | | 9,311,513 | |

KY State Property & Building #112 | | | 5.000 | | | | 02/01/2036 | | | A1 | | | 7,920,000 | | | | 8,845,451 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2030 | | | A1 | | | 2,500,000 | | | | 2,907,975 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2033 | | | A1 | | | 4,565,000 | | | | 5,236,283 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2034 | | | A1 | | | 13,975,000 | | | | 15,965,040 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2036 | | | A1 | | | 14,460,000 | | | | 16,432,919 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2037 | | | A1 | | | 5,000,000 | | | | 5,685,500 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2031 | | | A1 | | | 5,055,000 | | | | 5,830,690 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2032 | | | A1 | | | 3,680,000 | | | | 4,224,787 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2033 | | | A1 | | | 3,550,000 | | | | 4,065,993 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2034 | | | A1 | | | 5,825,000 | | | | 6,667,761 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2035 | | | A1 | | | 5,065,000 | | | | 5,790,967 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2036 | | | A1 | | | 5,275,000 | | | | 6,023,997 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2030 | | | A1 | | | 3,685,000 | | | | 4,362,672 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2034 | | | A1 | | | 725,000 | | | | 875,583 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2035 | | | A1 | | | 10,000,000 | | | | 11,560,800 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2036 | | | A1 | | | 10,000,000 | | | | 11,537,900 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2037 | | | A1 | | | 500,000 | | | | 576,515 | |

KY State Property & Building #122 | | | 5.000 | | | | 11/01/2031 | | | A1 | | | 790,000 | | | | 971,803 | |

KY State Property & Building #122 | | | 5.000 | | | | 11/01/2033 | | | A1 | | | 1,000,000 | | | | 1,169,000 | |

KY State Property & Building #122 | | | 4.000 | | | | 11/01/2035 | | | A1 | | | 1,000,000 | | | | 1,094,090 | |

The accompanying footnotes are an integral part of the financial statements.

6

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2020

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

KY State Property & Building #122 | | | 4.000 | % | | | 11/01/2037 | | | A1 | | $ | 675,000 | | | $ | 753,435 | |

KY State Property & Building #122 | | | 4.000 | | | | 11/01/2038 | | | A1 | | | 5,345,000 | | | | 5,798,042 | |

KY State Property & Building #122 | | | 4.000 | | | | 11/01/2039 | | | A1 | | | 9,655,000 | | | | 10,443,620 | |

Lexington Fayette Urban County Government | | | 5.000 | | | | 01/01/2028 | | | Aa2 | | | 820,000 | | | | 962,483 | |

Lexington Fayette Urban County Government | | | 5.000 | | | | 01/01/2029 | | | Aa2 | | | 345,000 | | | | 404,447 | |

Lexington Fayette Urban County Government | | | 5.000 | | | | 01/01/2033 | | | Aa2 | | | 1,685,000 | | | | 1,966,462 | |

Louisville & Jefferson County Visitors & Convention Commission | | | 4.000 | | | | 06/01/2034 | | | Aa3 | | | 3,720,000 | | | | 3,987,059 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 261,306,596 | |

| SCHOOL IMPROVEMENT BONDS | | | | | | | | | | | | | | | | | | |

| 15.35% of Net Assets | | | | | | | | | | | | | | | | | | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 08/01/2034 | | | A1 | | | 1,890,000 | | | | 2,103,268 | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 08/01/2035 | | | A1 | | | 2,215,000 | | | | 2,458,251 | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 08/01/2036 | | | A1 | | | 2,305,000 | | | | 2,551,174 | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 08/01/2037 | | | A1 | | | 2,395,000 | | | | 2,650,786 | |

Bullitt County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2035 | | | A1 | | | 1,820,000 | | | | 2,030,629 | |

Bullitt County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2036 | | | A1 | | | 2,985,000 | | | | 3,321,171 | |

Bullitt County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2037 | | | A1 | | | 3,075,000 | | | | 3,423,244 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 08/01/2028 | | | Aa3 | | | 1,330,000 | | | | 1,596,093 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 10/01/2028 | | | Aa3 | | | 1,375,000 | | | | 1,554,355 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 10/01/2029 | | | Aa3 | | | 3,660,000 | | | | 4,132,360 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 06/01/2031 | | | Aa3 | | | 3,705,000 | | | | 3,842,715 | |

Fayette County KY School District Finance Corporation | | | 4.750 | | | | 11/01/2031 | | | Aa3 | | | 1,730,000 | | | | 1,976,888 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 08/01/2032 | | | Aa3 | | | 10,600,000 | | | | 12,547,007 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 10/01/2032 | | | Aa3 | | | 3,615,000 | | | | 4,082,817 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 10/01/2033 | | | Aa3 | | | 4,385,000 | | | | 4,929,880 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 08/01/2034 | | | Aa3 | | | 8,750,000 | | | | 10,295,775 | |

Hardin County KY School District Finance Corporation | | | 4.000 | | | | 05/01/2030 | | | Aa3 | | | 635,000 | | | | 731,819 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 04/01/2030 | | | Aa3 | | | 975,000 | | | | 1,144,172 | |

Jefferson County KY School District Finance Corporation | | | 4.000 | | | | 05/01/2030 | | | Aa3 | | | 2,000,000 | | | | 2,211,700 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 04/01/2031 | | | Aa3 | | | 1,025,000 | | | | 1,199,742 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 05/01/2032 | | | Aa3 | | | 4,230,000 | | | | 4,839,374 | |

Jefferson County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2032 | | | Aa3 | | | 4,120,000 | | | | 4,671,297 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 05/01/2033 | | | Aa3 | | | 5,145,000 | | | | 5,875,796 | |

Jefferson County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2033 | | | Aa3 | | | 4,310,000 | | | | 4,865,947 | |

Jefferson County KY School District Finance Corporation | | | 4.750 | | | | 04/01/2034 | | | Aa3 | | | 1,165,000 | | | | 1,337,455 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 05/01/2034 | | | Aa3 | | | 5,405,000 | | | | 6,161,808 | |

Jefferson County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2034 | | | Aa3 | | | 3,500,000 | | | | 3,943,065 | |

Jefferson County KY School District Finance Corporation | | | 4.750 | | | | 04/01/2035 | | | Aa3 | | | 1,220,000 | | | | 1,393,972 | |

Jefferson County KY School District Finance Corporation | | | 4.250 | | | | 10/01/2037 | | | Aa3 | | | 2,110,000 | | | | 2,398,310 | |

Kenton County KY School District Finance Corporation | | | 4.000 | | | | 04/01/2036 | | | A1 | | | 1,210,000 | | | | 1,372,733 | |

Kenton County KY School District Finance Corporation | | | 4.000 | | | | 04/01/2037 | | | A1 | | | 1,255,000 | | | | 1,420,911 | |

Kenton County KY School District Finance Corporation | | | 4.000 | | | | 04/01/2038 | | | A1 | | | 1,300,000 | | | | 1,476,826 | |

Meade County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2036 | | | A1 | | | 2,215,000 | | | | 2,461,109 | |

Meade County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2037 | | | A1 | | | 2,255,000 | | | | 2,497,593 | |

Meade County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2038 | | | A1 | | | 2,400,000 | | | | 2,649,720 | |

Morgan County KY School District Finance Corporation | | | 4.000 | | | | 08/01/2029 | | | A1 | | | 960,000 | | | | 1,106,112 | |

Oldham County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2034 | | | A1 | | | 1,560,000 | | | | 1,731,818 | |

Scott County KY School District Finance Corporation | | | 4.500 | | | | 01/01/2025 | | | A1 | | | 4,890,000 | | | | 5,634,747 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 02/01/2029 | | | Aa3 | | | 5,040,000 | | | | 6,083,028 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2035 | | | Aa3 | | | 1,440,000 | | | | 1,613,678 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2035 | | | Aa3 | | | 2,235,000 | | | | 2,516,051 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2036 | | | Aa3 | | | 1,500,000 | | | | 1,675,560 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2037 | | | Aa3 | | | 2,415,000 | | | | 2,705,042 | |

Shelby County KY School District Finance Corporation | | | 4.000 | | | | 08/01/2037 | | | Aa3 | | | 6,240,000 | | | | 6,974,448 | |

Shelby County KY School District Finance Corporation | | | 4.000 | | | | 08/01/2038 | | | Aa3 | | | 3,000,000 | | | | 3,345,810 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 149,536,056 | |

The accompanying footnotes are an integral part of the financial statements.

7

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2020

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| UNIVERSITY CONSOLIDATED EDUCATION AND BUILDING REVENUE BONDS | | | | | | | | | | | |

| 12.52% of Net Assets | | | | | | | | | | | | | | | | | | |

Boyle County Centre College | | | 5.000 | % | | | 06/01/2037 | | | A3 | | $ | 2,865,000 | | | $ | 3,237,761 | |

KY Bond Development Corporation Educational Facilities Centre | | | 5.000 | | | | 06/01/2033 | | | A3 | | | 1,345,000 | | | | 1,562,137 | |

KY Bond Development Corporation Educational Facilities Centre | | | 5.000 | | | | 06/01/2034 | | | A3 | | | 1,605,000 | | | | 1,869,071 | |

KY Bond Development Corporation Educational Facilities Centre | | | 5.000 | | | | 06/01/2035 | | | A3 | | | 2,165,000 | | | | 2,509,495 | |

KY Bond Development Corporation Educational Facilities Centre | | | 5.000 | | | | 06/01/2036 | | | A3 | | | 2,835,000 | | | | 3,277,373 | |

KY Bond Development Corporation Educational Facilities Centre | | | 5.000 | | | | 06/01/2038 | | | A3 | | | 1,340,000 | | | | 1,542,930 | |

KY State Property & Building #114 | | | 5.000 | | | | 10/01/2032 | | | Aa3 | | | 2,795,000 | | | | 3,367,472 | |

KY State Property & Building #114 | | | 5.000 | | | | 10/01/2033 | | | Aa3 | | | 2,940,000 | | | | 3,540,230 | |

KY State Property & Building #114 | | | 5.000 | | | | 10/01/2034 | | | Aa3 | | | 3,090,000 | | | | 3,696,413 | |

KY State Property & Building #114 | | | 5.000 | | | | 10/01/2035 | | | Aa3 | | | 1,945,000 | | | | 2,307,665 | |

KY State Property & Building #116 | | | 5.000 | | | | 10/01/2035 | | | Aa3 | | | 4,165,000 | | | | 5,114,953 | |

KY State Property & Building #116 | | | 5.000 | | | | 10/01/2036 | | | Aa3 | | | 2,725,000 | | | | 3,319,486 | |

Murray State University | | | 5.000 | | | | 03/01/2032 | | | A1 | | | 2,220,000 | | | | 2,563,656 | |

University of Kentucky Certificate of Participation | | | 4.000 | | | | 05/01/2033 | | | Aa3 | | | 885,000 | | | | 1,041,796 | |

University of Kentucky Certificate of Participation | | | 4.000 | | | | 05/01/2034 | | | Aa3 | | | 1,020,000 | | | | 1,197,082 | |

University of Kentucky Certificate of Participation | | | 4.000 | | | | 05/01/2039 | | | Aa3 | | | 4,660,000 | | | | 5,366,503 | |

University of Kentucky Certificate of Participation | | | 4.000 | | | | 05/01/2044 | | | Aa3 | | | 3,755,000 | | | | 4,272,364 | |

University of Kentucky General Receipts | | | 5.000 | | | | 04/01/2030 | | | Aa2 | | | 5,490,000 | | | | 6,557,476 | |

University of Kentucky General Receipts | | | 5.000 | | | | 04/01/2036 | | | Aa2 | | | 6,390,000 | | | | 7,336,679 | |

University of Kentucky General Receipts | | | 4.000 | | | | 10/01/2036 | | | Aa2 | | | 16,160,000 | | | | 18,019,370 | |

University of Kentucky General Receipts | | | 5.000 | | | | 04/01/2037 | | | Aa2 | | | 7,180,000 | | | | 8,237,973 | |

University of Kentucky General Receipts | | | 5.000 | | | | 04/01/2038 | | | Aa2 | | | 7,395,000 | | | | 8,469,937 | |

University of Kentucky General Receipts | | | 4.000 | | | | 10/01/2038 | | | Aa2 | | | 10,855,000 | | | | 12,041,452 | |

University of Kentucky Higher Educational | | | 4.750 | | | | 04/01/2034 | | | Aa2 | | | 5,435,000 | | | | 6,271,936 | |

University of Louisville General Receipts | | | 5.000 | | | | 09/01/2030 | | | Baa1 | | | 440,000 | | | | 462,471 | |

University of Louisville General Receipts | | | 5.000 | | | | 09/01/2031 | | | Baa1 | | | 2,580,000 | | | | 2,712,689 | |

Western KY University | | | 4.000 | | | | 09/01/2034 | | | A1 | | | 575,000 | | | | 646,041 | |

Western KY University | | | 4.000 | | | | 09/01/2035 | | | A1 | | | 595,000 | | | | 667,037 | |

Western KY University | | | 4.000 | | | | 09/01/2036 | | | A1 | | | 620,000 | | | | 693,532 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 121,902,980 | |

| MUNICIPAL UTILITY REVENUE BONDS | | | | | | | | | | | | | | | | | | |

| 10.64% of Net Assets | | | | | | | | | | | | | | | | | | |

Campbell & Kenton County Sanitation District #1 | | | 4.000 | | | | 08/01/2032 | | | Aa2 | | | 6,100,000 | | | | 7,018,294 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2034 | | | AA* | | | 695,000 | | | | 795,393 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2035 | | | AA* | | | 725,000 | | | | 827,718 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2036 | | | AA* | | | 760,000 | | | | 863,831 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2037 | | | AA* | | | 800,000 | | | | 908,200 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2038 | | | AA* | | | 835,000 | | | | 946,022 | |

KY Rural Water Financing Corporation | | | 4.500 | | | | 02/01/2023 | | | A+* | | | 1,085,000 | | | | 1,191,363 | |

KY Rural Water Financing Corporation | | | 4.500 | | | | 02/01/2024 | | | A+* | | | 880,000 | | | | 969,135 | |

KY Rural Water Financing Corporation | | | 5.125 | | | | 02/01/2035 | | | A+* | | | 525,000 | | | | 526,071 | |

KY State Association of Counties Finance Corporation | | | 4.000 | | | | 02/01/2031 | | | AA-* | | | 405,000 | | | | 474,806 | |

KY State Association of Counties Finance Corporation | | | 4.000 | | | | 02/01/2033 | | | AA-* | | | 415,000 | | | | 481,060 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.000 | | | | 05/15/2030 | | | Aa3 | | | 3,120,000 | | | | 3,629,590 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2031 | | | Aa3 | | | 2,465,000 | | | | 2,741,499 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.000 | | | | 05/15/2033 | | | Aa3 | | | 1,000,000 | | | | 1,109,050 | |

Louisville & Jefferson County Metropolitan Sewer** | | | 5.000 | | | | 05/15/2034 | | | Aa3 | | | 27,730,000 | | | | 29,209,393 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.750 | | | | 05/15/2034 | | | Aa3 | | | 2,230,000 | | | | 2,536,759 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2034 | | | Aa3 | | | 4,595,000 | | | | 5,480,089 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.750 | | | | 05/15/2035 | | | Aa3 | | | 2,245,000 | | | | 2,545,673 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2035 | | | Aa3 | | | 4,825,000 | | | | 5,735,043 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.750 | | | | 05/15/2036 | | | Aa3 | | | 2,795,000 | | | | 3,165,533 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.000 | | | | 05/15/2037 | | | Aa3 | | | 10,000,000 | | | | 11,584,500 | |

Northern KY Water District | | | 5.000 | | | | 02/01/2026 | | | Aa2 | | | 1,000,000 | | | | 1,074,310 | |

Northern KY Water District | | | 5.000 | | | | 02/01/2027 | | | Aa2 | | | 4,315,000 | | | | 4,623,523 | |

Northern KY Water District | | | 5.000 | | | | 02/01/2033 | | | Aa2 | | | 3,580,000 | | | | 3,676,946 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2031 | | | A3 | | | 245,000 | | | | 280,202 | |

The accompanying footnotes are an integral part of the financial statements.

8

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2020

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

Owensboro KY Electric Light & Power | | | 4.000 | % | | | 01/01/2033 | | | A3 | | $ | 275,000 | | | $ | 310,349 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2034 | | | A3 | | | 305,000 | | | | 343,012 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2035 | | | A3 | | | 200,000 | | | | 223,760 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2036 | | | A3 | | | 325,000 | | | | 361,933 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2037 | | | A3 | | | 410,000 | | | | 455,539 | |

Owensboro KY Water Revenue | | | 4.000 | | | | 09/15/2034 | | | A1 | | | 2,075,000 | | | | 2,383,781 | |

Owensboro KY Water Revenue | | | 4.000 | | | | 09/15/2035 | | | A1 | | | 2,155,000 | | | | 2,470,966 | |

Owensboro KY Water Revenue | | | 4.000 | | | | 09/15/2037 | | | A1 | | | 1,950,000 | | | | 2,224,599 | |

Owensboro KY Water Revenue | | | 4.000 | | | | 09/15/2039 | | | A1 | | | 2,125,000 | | | | 2,411,981 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 103,579,923 | |

| TURNPIKES/TOLLROAD/HIGHWAY REVENUE BONDS | | | | | | | | | | | | | | | | | | |

| 7.59% of Net Assets | | | | | | | | | | | | | | | | | | |

KY Asset Liability Commission Federal Highway | | | 5.000 | | | | 09/01/2021 | | | A2 | | | 1,570,000 | | | | 1,582,136 | |

KY Asset Liability Commission Federal Highway | | | 5.000 | | | | 09/01/2022 | | | A2 | | | 3,500,000 | | | | 3,526,565 | |

KY Asset Liability Commission Federal Highway | | | 5.250 | | | | 09/01/2025 | | | A2 | | | 3,400,000 | | | | 3,869,098 | |

KY Asset Liability Commission Federal Highway | | | 5.000 | | | | 09/01/2027 | | | A2 | | | 9,760,000 | | | | 11,527,438 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2029 | | | Aa3 | | | 5,165,000 | | | | 5,352,645 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2029 | | | Aa3 | | | 7,235,000 | | | | 7,722,422 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2029 | | | Aa3 | | | 4,000,000 | | | | 4,705,280 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2030 | | | Aa3 | | | 1,845,000 | | | | 1,908,099 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2030 | | | Aa3 | | | 1,465,000 | | | | 1,560,093 | |

KY State Turnpike Economic Development Road Revenue** | | | 5.000 | | | | 07/01/2031 | | | Aa3 | | | 9,350,000 | | | | 9,972,242 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2032 | | | Aa3 | | | 1,315,000 | | | | 1,502,598 | |