U. S.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-2918

DUPREE MUTUAL FUNDS

(Exact Name of Registrant as Specified in Charter)

125 South Mill Street, Vine Center, Suite 100

Lexington, Kentucky 40507

(Address of Principal Executive Offices) (Zip Code)

Allen E. Grimes, III

125 South Mill Street, Vine Center, Suite 100

Lexington, Kentucky 40507

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code (859)254-7741

Date of fiscal year end: June 30, 2019

Date of reporting period: July 1, 2018 through June 30, 2019

Item 1. Report to Stockholders

June 30, 2019

ANNUAL REPORT

TO SHAREHOLDERS

Beginning January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund’s shareholder reports like this one will no longer be sent by mail, unless a request is made specifically to Dupree Mutual Funds or your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Dupree Mutual Funds website (www.dupree-funds.com); you will be notified by mail and provided with a website link to access the report each time a report is posted. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. If you prefer to receive shareholder reports and other communications electronically, you may update your mailing preferences with your financial intermediary, or enroll ine-delivery at www.dupree-funds.com (for accounts held directly with Dupree).

You may elect to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with Dupree, you may inform Dupree Mutual Funds that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800)866-0614. Your election to receive reports in paper will apply to all funds held with Dupree Mutual Funds or through your financial intermediary.

ABOUT DUPREE MUTUAL FUNDS

In 1941, Dupree & Company, Inc. began business in Harlan, Kentucky as a small securities brokerage firm specializing intax-exempt municipal bonds.

Over the years the firm, which in 1963 moved its offices to Lexington, Kentucky, grew to become a regional leader in public finance, helping to structure complex and innovative municipal bond financing for some of the largest public projects in the Commonwealth of Kentucky.

In 1979, Dupree & Company began what is now Dupree Mutual Funds with the KentuckyTax-Free Income Series and became the Fund’s investment adviser. The Fund was one of the first single-state municipal bond funds in the country, and the first mutual fund to invest solely in Kentucky municipal bonds. Since then, several new offerings have been added to the Dupree Mutual Funds family:

KentuckyTax-FreeShort-to-Medium Series in 1987;

Intermediate Government Bond Series in 1992;

TennesseeTax-Free Income Series in 1993;

TennesseeTax-FreeShort-to-Medium Series in 1994;

North CarolinaTax-Free Income Series in 1995;

North CarolinaTax-FreeShort-to-Medium Series in 1995;

AlabamaTax-Free Income Series in 2000;

MississippiTax-Free Income Series in 2000; and

Taxable Municipal Bond Series in 2010.

Today, after more than 60 years in business, Dupree continues to be a pioneer in the industry. Our Kentucky, Tennessee, and Mississippi Series are currently the ONLY 100%“no-load” municipal bond funds available in those states.No-load means simply that shares of the funds are offered directly to investors with no front orback-end sales charges, as opposed to load funds, which are sold through brokerage firms or other institutions that typically carry sales charges.

At Dupree Mutual Funds, our goal is a simple one: to offer investors a high-quality,low-cost way to invest in municipal and government bonds while providing superior service to our shareholders. We encourage you to let us know how we’re doing.

TABLE OF CONTENTS

Management’s Discussion of Fund Performance: | Unaudited |

Twelve Months Ended June 30, 2019i

The investment objective of ourtax-free municipal bond funds is to provide a high level oftax-free income derived from state-specific municipal bonds without incurring undue risk to principal. The investment objective of our government bond fund is to provide a high level of taxable income derived from securities of the U.S. government and its agencies without incurring undue risk to principal. Similarly, the investment objective of the taxable municipal bond fund is to provide a high level of taxable income derived from taxable municipal securities without incurring undue risk to principal.

This report covers the twelve month period from July 1, 2018 through June 30, 2019 (the “reporting period”). Economic activity increased at a moderate pace throughout the reporting period. Real gross domestic product (GDP) expanded at 2.9% annual rate during the third quarter of 2018. Economic growth slowed significantly during the fourth quarter of 2018 with real GDP increasing at a 1.1% annual rate. The pace of economic growth then picked back up during the first quarter of 2019 with real GDP increasing at a 3.1% annual rate. Economic activity slowed in the second quarter of 2019 with real GDP increasing at a 2.1% annual rate (advance estimate). The current economic expansion is now in its 11th year.

The labor market remained tight during the reporting period. The national unemployment rate was 3.7% in June which is close to a50-year low. The labor force participation rate remained relatively stable and stood at 62.9% at the end of June. Wage growth has continued to be modest with average hourly earnings increasing at a 3.1% annualized rate in June.

Key measures of inflation continued to be subdued during the reporting period. The Fed’s preferred inflation index, the personal consumption expenditure price index (PCE), increased 1.4% on a year-over-year basis through June which is well below the Fed’s 2% target rate. The core PCE, which excludes food and energy prices, increased 1.6% on an annual basis through June. Measures of near-term andlonger-run inflation expectations remained stable over the past twelve months.

The Federal Open Market Committee (FOMC) continued to tighten monetary policy during the first half of the reporting period by raising the fed funds target rate byone-quarter point at both its September 26 and December 19, 2018 meetings. During the second half of the reporting period, the FOMC left the fed funds target rate unchanged at2.25-2.50 percent.

At its January, March, and May meetings, the FOMC emphasized that it would be “patient” in determining what future adjustments to the federal funds rate might be appropriate. However, at its June meeting, the FOMC abruptly changed course by abandoning the use of the term “patient” and noting that persistently low inflation pressures and uncertainties about the economic outlook (i.e., trade tensions and concerns about the strength of the global economy) would likely require the FOMC to take some action to sustain the expansion. The FOMC’s change in its policy stance was sudden and fairly dramatic and appears to have marked the end of the interest rate tightening cycle.

Credit quality in thetax-exempt sector has remained strong as state fiscal conditions have continued to improve. According to data compiled by the National Association of State Budget Officers (“NASBO”), following strong gains in April tax collections, most states ended fiscal 2019 with year-over-year revenue growth. Notably, in fiscal 2019, no states reported makingmid-year budget reductions due to a revenue shortfall. Improving fiscal conditions have allowed many states to strengthen their reserve balances or “rainy day” funds.

Medicaid spending continues to be a significant line item for state budgets. According to NASBO, Medicaid spending from all fund sources is estimated to grow 5.3% percent in fiscal 2019 compared to a 5.2% growth rate in fiscal 2018. For states that expanded Medicaid, the state share is gradually set to increase to 10% by 2020 which could lead to additional budgetary pressures.

The municipal bond market posted strong returns for the twelve month period under review. The Bloomberg Barclays Municipal Bond Index (“BBMBI”), which tracks investment grade municipal securities across all sectors and maturities, had a total return of 6.71% for the twelve month period ended June 30, 2019. Within the reporting period, municipal bonds posted the highest returns (+2.89%) during the first quarter of 2019, followed closely by a strong second quarter performance (+2.13%). Longer-dated bonds generally outperformed shorter-dated bonds, and lower-rated bonds generally outperformed higher-rated bonds.

A number of factors led to the strong performance during the reporting period. Bond prices rose (yields declined) as investors’ appetite fortax-exempt bonds increased. The boost in demand was fueled in part by recent changes to the federal tax code (i.e., the impact from capping the state and local (SALT) deduction for higher-income earners) and also by investors’ flight to safe-haven assets during a period which witnessed increased trade tensions and heightened geopolitical risks. Favorablesupply-and-demand dynamics (i.e., very strong demand coupled with lower supply) also created a powerful tailwind for municipal bonds. A favorable macroeconomic environment, namely, moderate economic growth and low inflation levels, also helped support municipal bond prices during the reporting period.

i

As of June 30, 2019, the BBMBI had a modified adjusted duration of 5.50 years, an average coupon of 4.65% and an average credit quality of AA2/AA3.

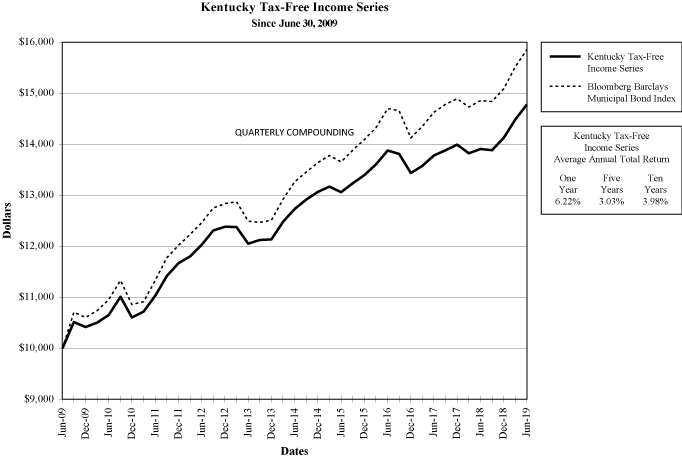

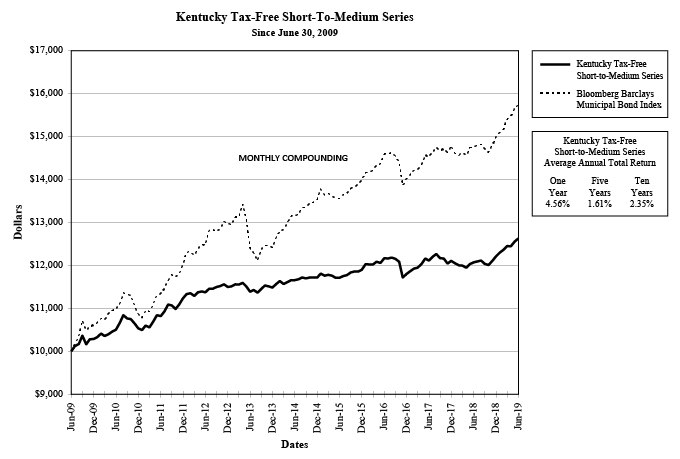

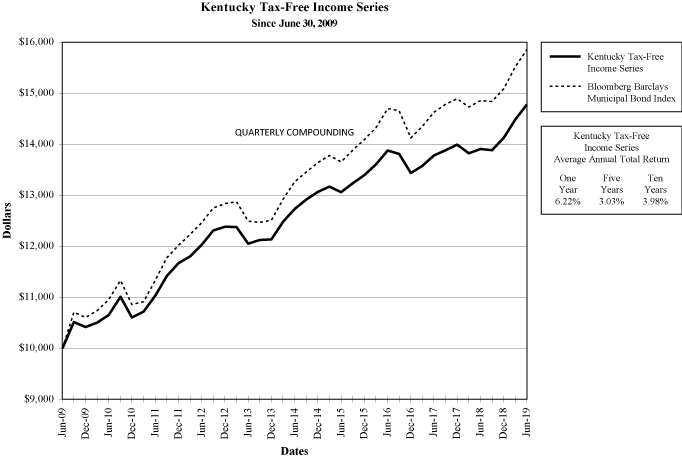

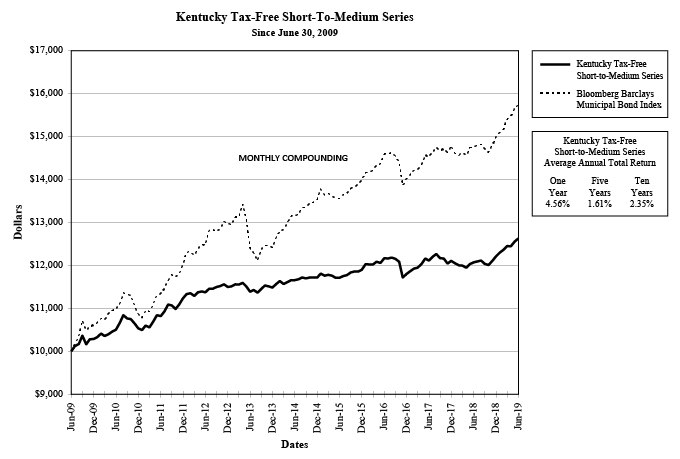

TheKentuckyTax-Free Income Seriesprovided shareholders a total return of 6.22% for the twelve month period ended June 30, 2019. TheKentuckyTax-FreeShort-to-Medium Seriesprovided shareholders with a total return of 4.56% for the same time period. Both of the Kentucky funds had shorter durations and held fewer lower-rated issues (e.g., hospitals and special tax bonds) than the BBMBI, thereby causing both to underperform the index during the reporting period.

Kentucky’s economy has continued to expand but at a relatively slow pace. The Commonwealth’s real GDP grew at an annualized rate of 1.4% in 2018 which was below the national average of 2.9%. Kentucky’s 2018 current-dollar GDP was $208.3 billion and ranked 28th in the United States. The Commonwealth’s tax collections have continued to strengthen with final FY19 General Fund revenues increasing 5.1% over FY18 collections. The Commonwealth ended FY19 with a $194.5 million budget surplus. The state’s annual average unemployment rate at the end of June was 4.1%. In 2018, Kentucky had a per capita personal income of $41,779 which was well below the national average of $53,712.

Kentucky’s appropriation supported debt was rated A1 by Moody’s andA- by Standard & Poor’s as of June 30, 2019. Kentucky had nettax-supported debt per capita of $1,932 as of calendaryear-end 2018, which is substantially above the state nettax-supported debt median of $1,068 (Source: Moody’s Investors Services, “State Government — US: Medians-Flat Debt Total Signals Cautious Borrowing, Despite Infrastructure Needs”, June 3, 2019).

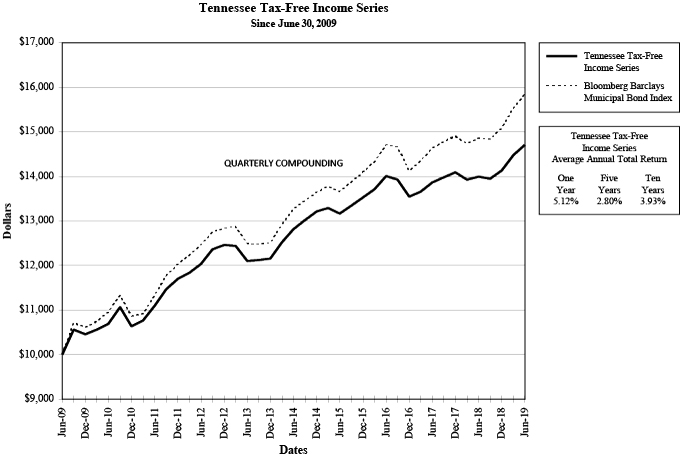

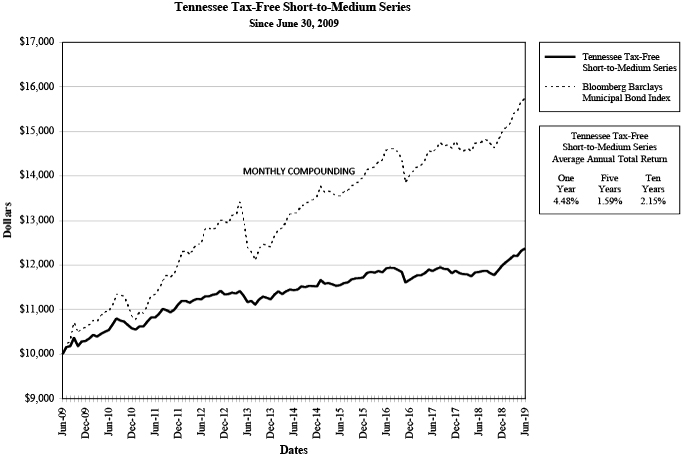

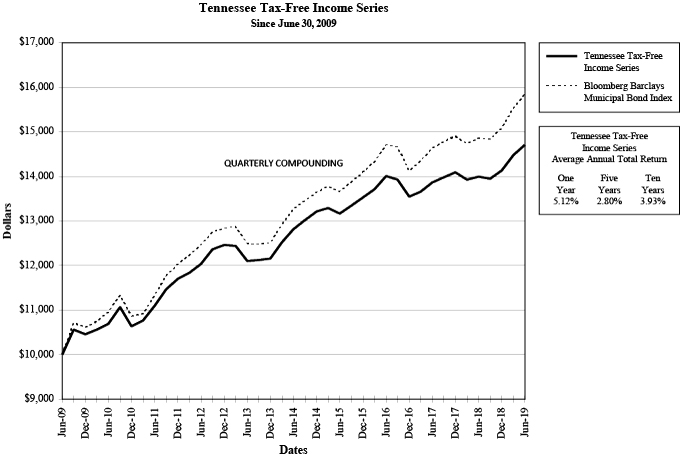

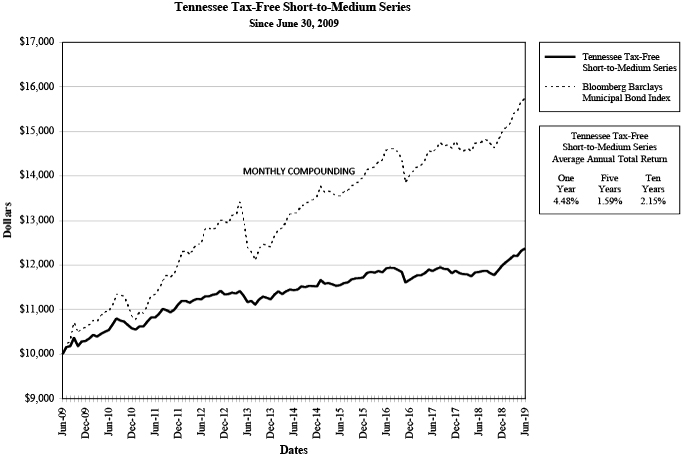

TheTennesseeTax-Free Income Series provided shareholders with a total return of 5.12% for the twelve month period ended June 30, 2019. TheTennesseeTax-FreeShort-to-Medium Series provided a total return of 4.48% for the same time period. Both of the Tennessee funds had shorter durations and held fewer lower-rated issues than the BBMBI, thereby causing both to underperform the index during the reporting period.

Economic growth in Tennessee has continued to outpace the national average. In 2018, real GDP increased by 3.0% which was just above the national average. Tennessee’s current-dollar GDP in 2018 was $365.6 billion and ranked 19th in the United States. Finance, insurance, real estate, rental, and leasing are the largest industries in the state and collectively in 2018 accounted for 16.4% of the state’s real GDP. The largest contributor to real GDP growth was professional and business services followed by durable goods manufacturing. Automobile manufacturing continues to be an important part of the state’s economy. The state’s annual average unemployment rate at the end of June was 3.4%. In 2018, the state had a per capita personal income of $47,179 which was below the national average of $53,712.

Tennessee relies on a combination of a state sales tax, corporate income taxes, franchise, and excise taxes for its revenue. Total state revenue collections through June (on an accrual basis June is the eleventh month in Tennessee’s 2018-2019 FY) were $649.2 million more than the budgeted estimate.

Tennessee’s general obligation (G.O.) bonds were rated Aaa by Moody’s and AAA by Standard & Poor’s as of June 30, 2019. Tennessee had nettax-supported debt per capita of $305 as of calendaryear-end 2018, which is substantially below the state nettax-supported debt median of $1,068 (Source: Moody’s Investors Services,“State Government — US: Medians-Flat Debt Total Signals Cautious Borrowing, Despite Infrastructure Needs”,June 3, 2019).

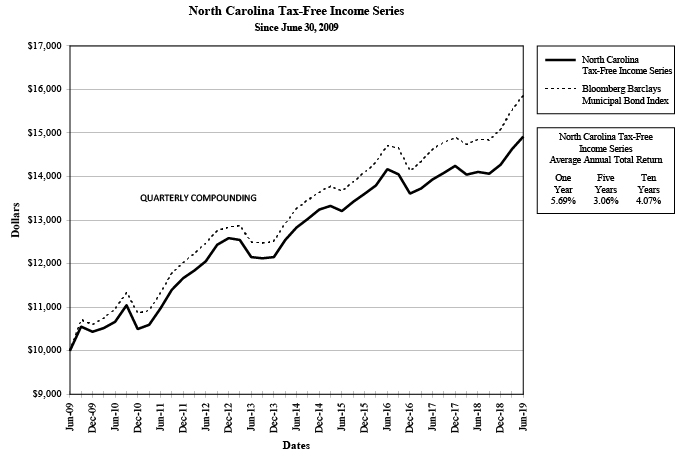

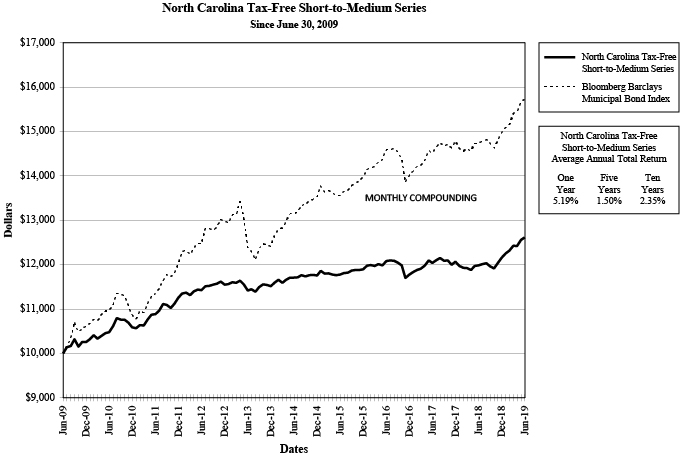

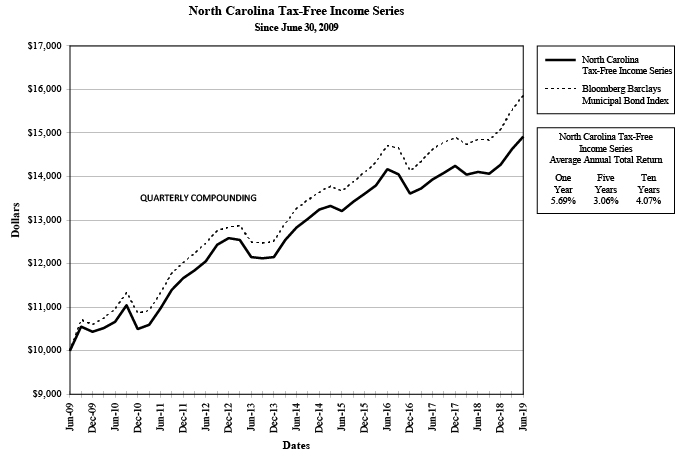

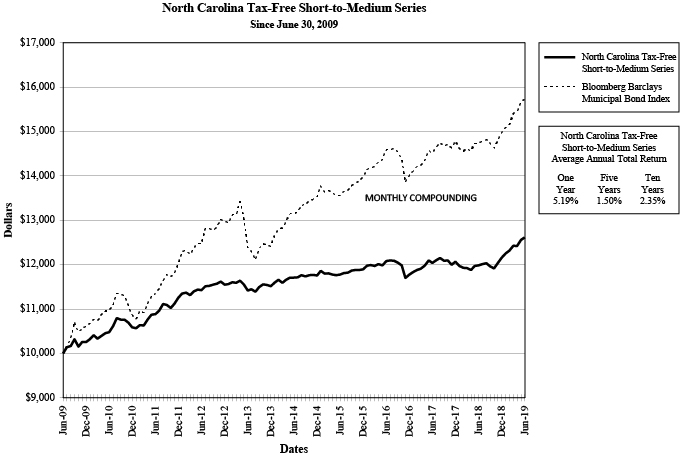

TheNorth CarolinaTax-Free Income Series provided shareholders with a total return of 5.69% for the twelve month period ended June 30, 2019. TheNorth CarolinaTax-FreeShort-to-Medium Series provided shareholders with a total return of 5.19% for the same time period. Both of the North Carolina funds had shorter durations and held fewer lower-rated issues than the BBMBI, thereby causing both to underperform the index during the reporting period.

North Carolina’s economy continued to perform well during the2019-19 fiscal year. In 2018, North Carolina real GDP grew 2.9% which was in line with the national average. North Carolina’s 2018 current-dollar GDP was $565.8 billion and ranked 11th in the United States. The state closed out FY 2019 with a substantial budget surplus estimated to be around $643.3 million. The state’s average annual unemployment rate at the end of June was 4.1%. In 2018, North Carolina had a per capita personal income of $45,834 which was below the national average of $53,712.

North Carolina’s G.O. bonds were rated Aaa by Moody’s and AAA by Standard & Poor’s as of June 30, 2019. North Carolina had nettax-supported debt per capita of $531 as of calendaryear-end 2018, which is below the state nettax-supported debt median of $1,068 (Source: Moody’s Investors Services, “State Government — US: Medians-Flat Debt Total Signals Cautious Borrowing, Despite Infrastructure Needs”,June 3, 2019).

ii

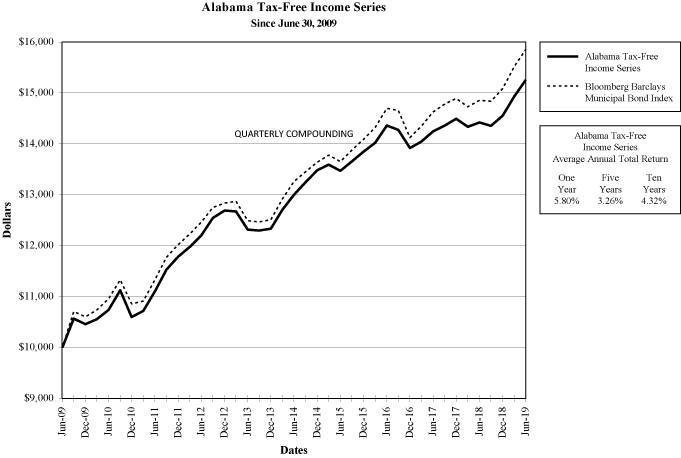

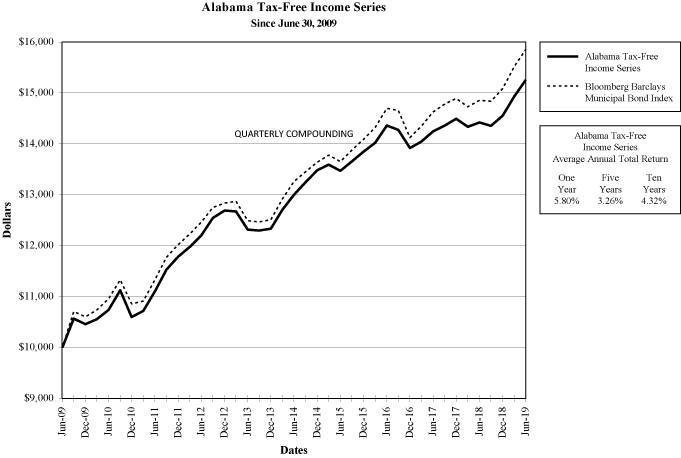

TheAlabamaTax-Free Income Series provided shareholders with a total return of 5.80% for the twelve month period ended June 30, 2019. The fund held fewer lower-rated issues and had a shorter duration than the BBMBI, thereby causing it to underperform the index during the reporting period.

Economic growth in Alabama has continued to fall short of the national average. In 2018, Alabama’s real GDP grew 2.0%. Alabama’s 2018 current-dollar GDP was $221.1 billion which ranked 27th in the United States. Automotive manufacturing, aerospace, tourism, healthcare, biotechnology, and manufacturing continue to be the state’s main economic drivers. The state’s average annual unemployment rate at the end of June stood at 3.5%. In 2018, Alabama had a per capita personal income of $42,334, which was below the national average of $53,712.

Alabama’s G.O. bonds were rated Aa1 by Moody’s and AA by Standard & Poor’s as of June 30, 2019. Alabama had nettax-supported debt per capita of $877 as of calendaryear-end 2018, which was lower than the state nettax-supported debt median of $1,068 (Source: Moody’s Investors Services, “State Government — US: Medians-Flat Debt Total Signals Cautious Borrowing, Despite Infrastructure Needs”, June 3, 2019).

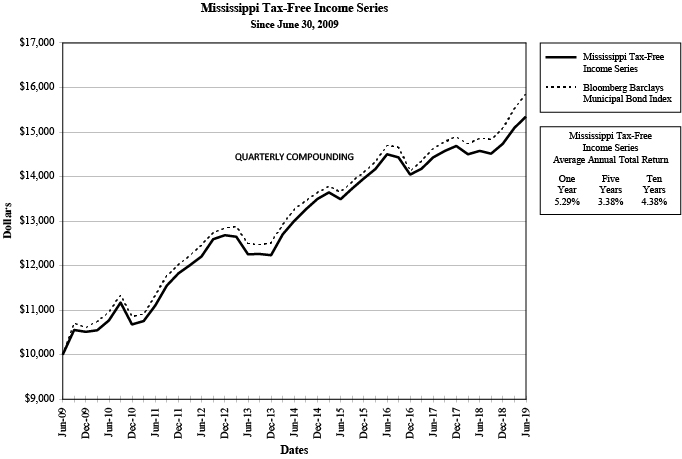

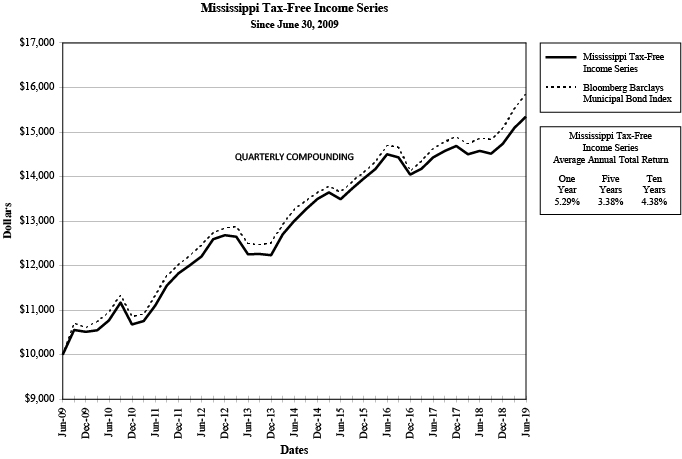

TheMississippiTax-Free Income Series provided shareholders with a total return of 5.29% for the twelve month period ended June 30, 2019. The fund held less lower-rated issues and had a shorter duration than the BBMBI, thereby causing it to underperform the index during the reporting period.

Mississippi’s economic recovery has continued to lag behind the nation. In 2018, Mississippi’s real GDP grew by 1.0% which was substantially below the national average. Mississippi’s 2018 current-dollar GDP was $114.1 billion and ranked 36th in the United States. The state’s average annual unemployment rate at the end of June was 5.0%. In 2018, Mississippi had a per capita personal income of $37,994 which was below the national average of $53,712.

The state’s G.O. bonds were rated Aa2 by Moody’s and AA by Standard & Poor’s as of June 30, 2019. Mississippi has nettax-supported debt per capita of $1,782 as of calendaryear-end 2018, which is higher than the state nettax-supported debt median of $1,068 (Source: Moody’s Investors Services,State Government — US: Medians-Flat Debt Total Signals Cautious Borrowing, Despite Infrastructure Needs”,June 3, 2019).

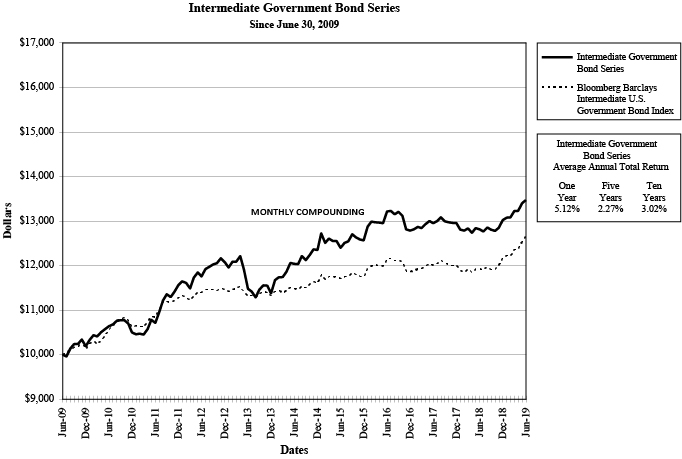

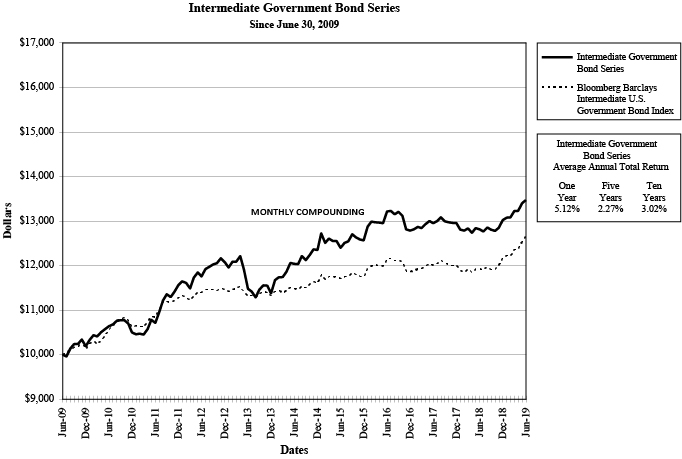

TheIntermediate Government Bond Series provided shareholders with a total return of 5.12% for the twelve months ended June 30, 2019. The Bloomberg Barclays U.S. Intermediate Government Bond Index (“BBGBI”) had a total return of 6.15% for the twelve month period ended June 30, 2019. The fund had a shorter duration than the BBGBI (2.97 years compared to 3.77 years), thereby causing it to underperform the index during the reporting period.

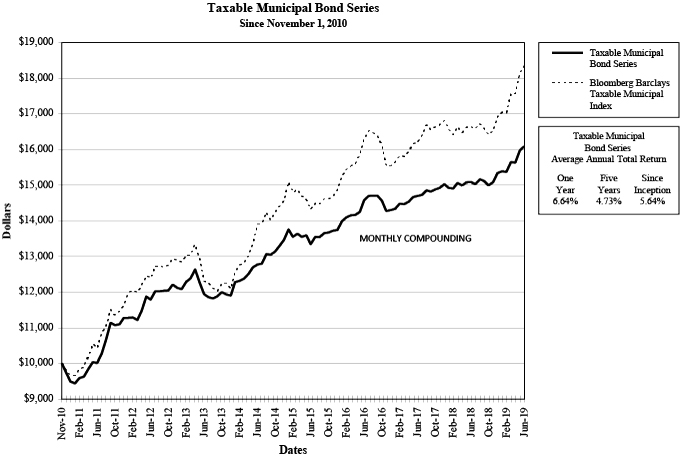

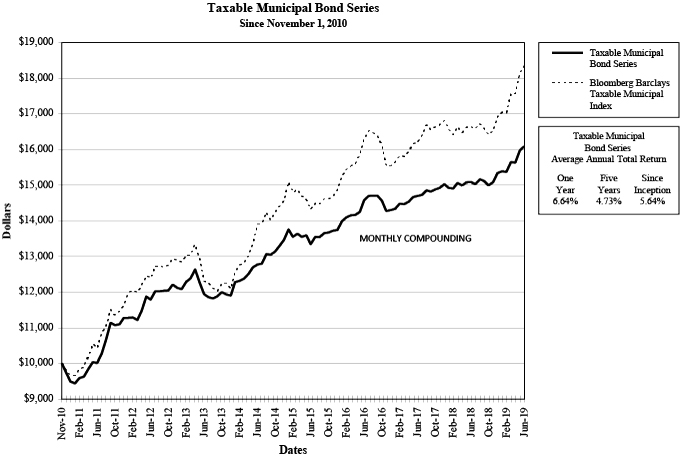

TheTaxable Municipal Bond Seriesprovided shareholders witha total return of 6.64% for the twelve month period ended June 30, 2019. The Bloomberg Barclays Municipal Bond Taxable Index (“BBTMI”) had a total return of 10.26% for the same time period. The Taxable Municipal Bond Series had a shorter duration than the BBTMI (4.87 years compared to 9.04 years), thereby causing it to underperform the index during the reporting period.

Please note that index information is provided for reference only. No index can perfectly match the investments that make up a fund’s portfolio. In making investment decisions for our portfolios we do not attempt to track indices. The Bloomberg Barclays Municipal Bond index is national in scope and does not necessarily reflect the performance of state-specific municipal bond funds. Indices do not take into account any operating expenses or transaction costs. An investment cannot be made directly in an index.

i Data are from the Bureau of Economic Analysis, the U.S. Department of Labor Bureau of Labor Statistics, and various other sources management deems to be reliable. Some of the quoted data are preliminary in nature and may be subject to revision. Any opinions expressed herein are those of the funds’ portfolio management and are current as of June 30, 2019. They are not guarantees of performance or investment results and should not be taken as investment advice. Past performance is not a guarantee of future performance and you may lose money investing in the funds.

iii

The illustrations below provide each Fund’s sector allocation and

summarize key information about each Fund’s investments as of June 30, 2019. | Unaudited |

| | | | |

| |

AlabamaTax-Free Income Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 1.08% | |

Aa/AA | | | 84.91% | |

A | | | 6.92% | |

B | | | 2.32% | |

Not Rated | | | 4.77% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

School Improvement | | | 21.26% | |

Municipal Utility Revenue | | | 20.98% | |

Public Facilities | | | 16.73% | |

University Consolidated Education and Building Revenue | | | 12.77% | |

Prerefunded | | | 9.13% | |

Refunding | | | 7.46% | |

Miscellaneous Public Improvement | | | 6.63% | |

Hospital and Healthcare Revenue | | | 2.28% | |

Turnpikes/Toll Road/Highway Revenue | | | 1.06% | |

Other Assets Less Liabilities | | | 1.70% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| |

KentuckyTax-Free Income Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 0.47 | % |

Aa/AA | | | 46.98 | % |

A | | | 50.85 | % |

Baa/BBB | | | 0.02 | % |

Not Rated | | | 1.68 | % |

| | | | | |

| | | | 100.00 | % |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Miscellaneous Public Improvement | | | 28.47 | % |

School Improvement | | | 14.97 | % |

University Consolidated Education and Building Revenue | | | 12.96 | % |

Municipal Utility Revenue | | | 10.85 | % |

Turnpikes/Toll Road/Highway Revenue | | | 7.95 | % |

Refunding | | | 6.69 | % |

Public Facilities | | | 5.94 | % |

Prerefunded | | | 5.39 | % |

Hospital and Healthcare Revenue | | | 5.26 | % |

Airport Revenue | | | 1.38 | % |

Ad Valorem Property | | | 0.13 | % |

State and Local Mortgage/Housing Revenue | | | 0.12 | % |

Other liabilities in excess of assets | | | (0.11 | )% |

| | | | | |

| | | | 100.00 | % |

| | | | | |

| | | | | |

| | | | |

| |

KentuckyTax-FreeShort-to-Medium Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 0.35% | |

Aa/AA | | | 27.15% | |

A | | | 72.50% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Miscellaneous Public Improvement | | | 22.31% | |

School Improvement | | | 19.64% | |

Public Facilities | | | 13.59% | |

Turnpikes/Toll Road/Highway Revenue | | | 12.60% | |

Refunding | | | 8.09% | |

Hospital and Healthcare Revenue | | | 6.46% | |

University Consolidated Education and Building Revenue | | | 6.36% | |

Municipal Utility Revenue | | | 4.74% | |

Prerefunded | | | 3.65% | |

Airport Revenue | | | 1.09% | |

Other Assets Less Liabilities | | | 1.47% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | |

| |

MississippiTax-Free Income Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aa/AA | | | 85.93% | |

A | | | 14.07% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Prerefunded | | | 34.08% | |

University Consolidated Education and Building Revenue | | | 20.79% | |

Municipal Utility Revenue | | | 12.39% | |

Turnpikes/Toll Road/Highway Revenue | | | 8.74% | |

Public Facilities | | | 8.41% | |

School Improvements | | | 6.48% | |

Refunding | | | 4.94% | |

Hospital and Healthcare Revenue | | | 2.62% | |

Miscellaneous Public Improvement | | | 0.87% | |

Other Assets Less Liabilities | | | 0.68% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

iv

The illustrations below provide each Fund’s sector allocation and

summarize key information about each Fund’s investments as of June 30, 2019. | Unaudited |

| | | | |

| |

North CarolinaTax-Free Income Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 3.17% | |

Aa/AA | | | 78.24% | |

A | | | 18.38% | |

Not Rated | | | 0.21% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

University Consolidated Education and Building Revenue | | | 19.68% | |

School Improvement | | | 14.64% | |

Public Facilities | | | 10.89% | |

Refunding | | | 10.42% | |

Municipal Utility Revenue | | | 10.35% | |

Hospital and Healthcare Revenue | | | 9.25% | |

Prerefunded | | | 8.30% | |

Airport Revenue | | | 4.64% | |

Turnpikes/Toll Road/Highway Revenue | | | 4.32% | |

Miscellaneous Public Improvement | | | 4.20% | |

Lease Revenue | | | 1.18% | |

Escrowed to Maturity | | | 0.70% | |

Other Assets Less Liabilities | | | 1.43% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | |

| |

North CarolinaTax-FreeShort-to-Medium Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 3.62% | |

Aa/AA | | | 67.66% | |

A | | | 28.22% | |

Not Rated | | | 0.50% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Refunding | | | 23.05% | |

University Consolidated Education and Building Revenue | | | 18.51% | |

Municipal Utility Revenue | | | 15.73% | |

School Improvement | | | 15.20% | |

Public Facilities | | | 7.19% | |

Hospital and Healthcare Revenue | | | 5.24% | |

Turnpikes/Toll Road/Highway Revenue | | | 4.10% | |

Escrowed to Maturity | | | 2.65% | |

Prerefunded | | | 2.10% | |

Miscellaneous Public Improvement | | | 2.05% | |

Ad Valorem Property | | | 1.48% | |

Lease Revenue | | | 1.37% | |

Other Assets Less Liabilities | | | 1.33% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | |

| |

TennesseeTax-Free Income Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 3.87% | |

Aa/AA | | | 79.70% | |

A | | | 14.94% | |

Not Rated | | | 1.49% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Municipal Utility Revenue | | | 32.77% | |

Public Facilities | | | 11.68% | |

University Consolidated Education and Building Revenue | | | 10.01% | |

Hospital and Healthcare Revenue | | | 9.48% | |

School Improvement | | | 9.23% | |

Prerefunded | | | 8.73% | |

Miscellaneous Public Improvement | | | 7.72% | |

Refunding | | | 5.73% | |

Airport Revenue | | | 2.44% | |

Industrial Revenue | | | 0.87% | |

State and Local Mortgage/Housing Revenue | | | 0.45% | |

Other Assets Less Liabilities | | | 0.89% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | |

| |

TennesseeTax-FreeShort-to-Medium Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aa/AA | | | 77.98% | |

A | | | 15.93% | |

Baa/BBB | | | 3.76% | |

Not Rated | | | 2.33% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Refunding | | | 24.86% | |

Public Facilities | | | 20.96% | |

Municipal Utility Revenue | | | 17.71% | |

School Improvement | | | 11.69% | |

University Consolidated Education and Building Revenue | | | 8.88% | |

Miscellaneous Public Improvement | | | 4.82% | |

Prerefunded | | | 3.79% | |

Hospital and Healthcare Revenue | | | 3.68% | |

Airport Revenue | | | 1.51% | |

Other Assets Less Liabilities | | | 2.10% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

v

The illustrations below provide each Fund’s sector allocation and

summarize key information about each Fund’s investments as of June 30, 2019. | Unaudited |

| | | | |

| |

Intermediate Government Bond Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 100.00% | |

| | | | | |

| | | | | |

| | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Federal Farm Credit Bank | | | 62.35% | |

Federal Home Loan Bank | | | 35.08% | |

Other Assets Less Liabilities | | | 2.57% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| |

Taxable Municipal Bond Series | |

| CREDIT QUALITY* | | % of Net Assets

at Fair Value | |

Aa/AA | | | 90.11% | |

A | | | 9.89% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Public Facilities | | | 34.08% | |

Municipal Utility Revenue | | | 23.61% | |

School Improvement | | | 12.42% | |

Miscellaneous Public Improvements | | | 9.90% | |

University Consolidated Education and Building Revenue | | | 4.50% | |

Turnpikes/Toll Road/Highway Revenue | | | 4.34% | |

Hospital and Healthcare Revenue | | | 4.27% | |

Marina/Port Authority Revenue | | | 2.40% | |

Airport Revenue | | | 1.04% | |

Other Assets Less Liabilities | | | 3.44% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| * | Ratings by Moody’s Investors Services, Inc. unless noted otherwise. See Schedules of Portfolio Investments for individual bond ratings. |

vi

PERFORMANCE COMPARISON (Unaudited)

The following graphs compare the change in value of a $10,000 investment in each series of Dupree Mutual Funds with the change in value of a $10,000 investment in a comparable index. The comparisons are made over 10 years or since the inception of the series, if shorter than ten years. Results are for the fiscal years ended June 30.

PERFORMANCE DISCLOSURES

Past performance is not indicative of future results. The current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

The performance tables and the graphs above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

For performance data current to the most recentmonth-end call800-866-0614 or visit our website atwww.dupree-funds.com.

Notes on Graphs:

Results reflect reinvestment of all dividend and capital gain distributions. No index can perfectly match the investments that make up a fund’s portfolio. For each series, we have selected an index that we believe gives the most accurate picture of how the series performed during the reporting period. The investor should understand that an index is a mathematical hypothesis and does not reflect a real market situation. For example, the portfolio of each index is replaced with an entirely different portfolio each year without reflecting operating expenses or transaction costs, an impossibility in reality. On the other hand, the fund’s performance reflects not only these factors but management costs as well.

Please note that on August 24, 2016, Bloomberg LP completed its acquisition of Barclays Risk Analytics and Index Solutions Limited from Barclays Bank PLC andco-branded the indices as the Bloomberg Barclays Indices.

vii

viii

ix

x

xi

xii

xiii

xiv

xv

xvi

xvii

DUPREE MUTUAL FUNDS — ALABAMATAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds

June 30, 2019

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| SCHOOL IMPROVEMENT BONDS | |

| 21.26% of Net Assets | | | | | | | | | | | | | | | | | | |

Alabaster AL Board of Education Special Tax Warrants** | | | 5.000 | % | | | 09/01/2039 | | | A1 | | $ | 600,000 | | | $ | 681,730 | |

Cherokee County AL Board of Education Tax Warrants | | | 4.000 | | | | 12/01/2034 | | | A1 | | | 310,000 | | | | 343,062 | |

Decatur City AL Board of Education Special Tax | | | 5.000 | | | | 02/01/2040 | | | Aa2 | | | 225,000 | | | | 256,068 | |

Etowah County AL Board of Education Capital Outlay Tax | | | 5.000 | | | | 09/01/2037 | | | A+* | | | 200,000 | | | | 217,848 | |

Jasper AL Warrants | | | 5.000 | | | | 03/01/2032 | | | A2 | | | 450,000 | | | | 510,170 | |

Jefferson County AL Board of Education Public School Warrants | | | 4.000 | | | | 02/01/2042 | | | A1 | | | 325,000 | | | | 344,890 | |

Limestone County AL Board of Education | | | 5.000 | | | | 07/01/2033 | | | AA* | | | 255,000 | | | | 290,894 | |

Madison County AL Board of Education Capital Outlay** | | | 5.000 | | | | 09/01/2031 | | | Aa3 | | | 660,000 | | | | 773,230 | |

Marshall County AL Board of Education Special Tax School Warrants | | | 4.000 | | | | 03/01/2033 | | | A2 | | | 250,000 | | | | 273,238 | |

Morgan County AL Board of Education Capital Outlay Warrants | | | 5.000 | | | | 03/01/2035 | | | AA-* | | | 405,000 | | | | 441,879 | |

Opelika AL Warrants | | | 5.000 | | | | 11/01/2031 | | | Aa2 | | | 150,000 | | | | 161,313 | |

Shelby County AL Board of Education Capital Outlay Warrants** | | | 5.000 | | | | 02/01/2031 | | | Aa2 | | | 615,000 | | | | 647,521 | |

Troy AL Public Educational Building Authority | | | 5.250 | | | | 12/01/2036 | | | A2 | | | 30,000 | | | | 31,363 | |

Tuscaloosa County AL Board of Education Special Tax School Warrants | | | 5.000 | | | | 02/01/2036 | | | Aa3 | | | 250,000 | | | | 294,860 | |

Tuscaloosa County AL Board of Education Special Tax School Warrants | | | 5.000 | | | | 02/01/2037 | | | Aa3 | | | 250,000 | | | | 293,535 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 5,561,601 | |

| MUNICIPAL UTILITY REVENUE BONDS | |

| 20.98% of Net Assets | |

Auburn AL Waterworks Board Water Revenue | | | 5.000 | | | | 09/01/2036 | | | Aa2 | | | 250,000 | | | | 292,248 | |

Birmingham AL Waterworks | | | 5.000 | | | | 01/01/2026 | | | Aa2 | | | 80,000 | | | | 84,234 | |

Birmingham AL Waterworks | | | 4.000 | | | | 01/01/2037 | | | Aa2 | | | 250,000 | | | | 273,913 | |

Birmingham AL Waterworks** | | | 5.000 | | | | 01/01/2038 | | | Aa2 | | | 550,000 | | | | 607,011 | |

Birmingham AL Waterworks | | | 4.000 | | | | 01/01/2038 | | | Aa2 | | | 205,000 | | | | 223,438 | |

Birmingham AL Waterworks | | | 5.000 | | | | 01/01/2040 | | | Aa2 | | | 150,000 | | | | 170,841 | |

Birmingham AL Waterworks | | | 4.000 | | | | 01/01/2041 | | | Aa2 | | | 225,000 | | | | 243,011 | |

Chatom AL Industrial Board Gulf Opportunity Zone | | | 5.000 | | | | 08/01/2037 | | | A3 | | | 150,000 | | | | 154,998 | |

Cullman AL Utility Board Water Revenue | | | 4.750 | | | | 09/01/2037 | | | A1 | | | 400,000 | | | | 412,748 | |

Gadsden AL Waterworks & Sewer Board | | | 4.000 | | | | 06/01/2034 | | | A1 | | | 120,000 | | | | 131,494 | |

Jasper AL Waterworks and Sewer Board Utility Revenue | | | 5.000 | | | | 06/01/2030 | | | A+* | | | 455,000 | | | | 468,122 | |

Limestone County AL Water & Sewer Authority | | | 5.000 | | | | 12/01/2033 | | | A* | | | 300,000 | | | | 341,268 | |

Limestone County AL Water & Sewer Authority | | | 4.750 | | | | 12/01/2033 | | | AA* | | | 290,000 | | | | 336,093 | |

Limestone County AL Water & Sewer Authority | | | 5.000 | | | | 12/01/2034 | | | A* | | | 250,000 | | | | 281,833 | |

Limestone County AL Water & Sewer Authority | | | 4.750 | | | | 12/01/2035 | | | AA* | | | 400,000 | | | | 446,032 | |

Opelika AL Utilities Board | | | 4.000 | | | | 06/01/2039 | | | Aa3 | | | 250,000 | | | | 269,710 | |

Prattville AL Sewer Warrants | | | 4.000 | | | | 11/01/2042 | | | AA-* | | | 375,000 | | | | 403,054 | |

Tallassee AL Water Gas & Sewer Warrants | | | 5.125 | | | | 05/01/2036 | | | A2 | | | 10,000 | | | | 10,265 | |

West Morgan East Lawrence AL Water & Sewer | | | 4.750 | | | | 08/15/2030 | | | AA* | | | 75,000 | | | | 77,558 | |

West Morgan East Lawrence AL Water & Sewer | | | 4.850 | | | | 08/15/2035 | | | AA* | | | 250,000 | | | | 258,205 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 5,486,076 | |

| PUBLIC FACILITIES REVENUE BONDS | |

| 16.73% of Net Assets | |

Anniston AL Public Building Authority | | | 5.000 | | | | 03/01/2032 | | | A2 | | | 400,000 | | | | 421,288 | |

Anniston AL Public Building Authority DHR Project | | | 5.250 | | | | 05/01/2030 | | | AA-* | | | 50,000 | | | | 51,506 | |

Anniston AL Public Building Authority DHR Project | | | 5.500 | | | | 05/01/2033 | | | AA-* | | | 200,000 | | | | 206,456 | |

Bessemer AL Public Educational Building Authority Revenue | | | 5.000 | | | | 07/01/2030 | | | AA* | | | 250,000 | | | | 258,213 | |

Birmingham Jefferson AL Civic Center Authority Revenue | | | 5.000 | | | | 05/01/2037 | | | Aa3 | | | 400,000 | | | | 473,648 | |

Birmingham Jefferson AL Civic Center Authority Revenue | | | 5.000 | | | | 05/01/2038 | | | Aa3 | | | 250,000 | | | | 295,380 | |

Boaz AL Warrants | | | 4.000 | | | | 02/01/2037 | | | AA* | | | 250,000 | | | | 273,363 | |

Bullock County AL Public Building Authority | | | 4.000 | | | | 10/01/2038 | | | AA-* | | | 500,000 | | | | 538,805 | |

Lowndes County AL Warrants | | | 5.250 | | | | 02/01/2037 | | | A2 | | | 250,000 | | | | 261,215 | |

Montgomery AL Warrants | | | 5.000 | | | | 02/01/2030 | | | A1 | | | 300,000 | | | | 305,835 | |

Montgomery County AL Public Building Authority | | | 5.000 | | | | 03/01/2036 | | | Aa2 | | | 350,000 | | | | 422,608 | |

Trussville AL Warrants** | | | 5.000 | | | | 10/01/2039 | | | Aa2 | | | 775,000 | | | | 867,076 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 4,375,393 | |

The accompanying notes are an integral part of the financial statements.

1

DUPREE MUTUAL FUNDS — ALABAMATAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds

June 30, 2019

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| UNIVERSITY CONSOLIDATED EDUCATION AND BUILDING REVENUE BONDS | |

| 12.77% of Net Assets | |

AL Community College System Gadsden State Community College | | | 5.000 | % | | | 06/01/2038 | | | A1 | | $ | 325,000 | | | $ | 385,830 | |

Auburn University AL General Fee Revenue | | | 4.000 | | | | 06/01/2036 | | | Aa2 | | | 380,000 | | | | 418,574 | |

Troy University AL Facilities Revenue | | | 5.000 | | | | 11/01/2028 | | | A1 | | | 250,000 | | | | 291,900 | |

Troy University AL Facilities Revenue | | | 4.000 | | | | 11/01/2032 | | | A1 | | | 300,000 | | | | 332,970 | |

Troy University AL Facilities Revenue | | | 5.000 | | | | 11/01/2037 | | | A1 | | | 200,000 | | | | 237,762 | |

University of AL Birmingham | | | 5.000 | | | | 10/01/2037 | | | Aa2 | | | 225,000 | | | | 254,381 | |

University of AL General Fee Revenue University of AL Huntsville | | | 5.000 | | | | 09/01/2037 | | | Aa3 | | | 250,000 | | | | 299,110 | |

University of AL Huntsville | | | 5.000 | | | | 09/01/2038 | | | Aa3 | | | 500,000 | | | | 601,445 | |

University of AL Huntsville General Fee Revenue | | | 5.000 | | | | 09/01/2038 | | | Aa3 | | | 435,000 | | | | 518,950 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 3,340,922 | |

| PREREFUNDED BONDS | | | | | | | | | | | | | | | | | | |

| 9.13% of Net Assets | | | | | | | | | | | | | | | | | | |

Auburn University AL General Fee Revenue | | | 5.000 | | | | 06/01/2036 | | | Aa2 | | | 150,000 | | | | 160,487 | |

Birmingham AL Waterworks Board Water Revenue | | | 4.750 | | | | 01/01/2036 | | | Aa2 | | | 215,000 | | | | 226,144 | |

Fort Payne AL Waterworks Board Water Revenue | | | 4.750 | | | | 07/01/2034 | | | AA-* | | | 100,000 | | | | 100,028 | |

Morgan County AL Board of Education Capital Outlay Warrants | | | 5.000 | | | | 03/01/2035 | | | NR | | | 155,000 | | | | 172,173 | |

Morgan County AL Board of Education Capital Outlay Warrants | | | 5.000 | | | | 03/01/2035 | | | NR | | | 490,000 | | | | 544,287 | |

Opelika AL Water Board Revenue | | | 5.250 | | | | 06/01/2036 | | | Aa3 | | | 70,000 | | | | 72,553 | |

Opelika AL Water Board Revenue | | | 5.000 | | | | 06/01/2037 | | | Aa3 | | | 250,000 | | | | 253,863 | |

Phenix City AL Water & Sewer | | | 5.000 | | | | 08/15/2034 | | | A3 | | | 75,000 | | | | 75,360 | |

Tallassee AL Water Gas & Sewer Warrants | | | 5.125 | | | | 05/01/2036 | | | A2 | | | 65,000 | | | | 67,018 | |

Troy AL Public Educational Building Authority | | | 5.250 | | | | 12/01/2036 | | | A2 | | | 195,000 | | | | 205,667 | |

Trussville AL Warrants | | | 5.000 | | | | 10/01/2039 | | | NR | | | 445,000 | | | | 510,790 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 2,388,370 | |

| REFUNDING BONDS | |

| 7.46% of Net Assets | |

Enterprise AL Warrants | | | 4.500 | | | | 11/01/2032 | | | Aa3 | | | 115,000 | | | | 123,744 | |

Montgomery AL Warrants | | | 5.000 | | | | 06/15/2035 | | | A1 | | | 500,000 | | | | 598,190 | |

Northport AL Warrants** | | | 5.000 | | | | 08/01/2040 | | | AA-* | | | 735,000 | | | | 830,579 | |

Tuscaloosa AL Warrants | | | 5.000 | | | | 01/01/2032 | | | Aa1 | | | 350,000 | | | | 399,105 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 1,951,618 | |

| MISCELLANEOUS PUBLIC IMPROVEMENT BONDS | |

| 6.63% of Net Assets | |

AL Incentives Financing Authority Special Obligation | | | 5.000 | | | | 09/01/2029 | | | A* | | | 125,000 | | | | 125,790 | |

Birmingham AL Warrants | | | 4.000 | | | | 12/01/2035 | | | Aa3 | | | 250,000 | | | | 274,370 | |

Birmingham AL Warrants | | | 5.000 | | | | 12/01/2037 | | | Aa3 | | | 250,000 | | | | 300,380 | |

Jasper AL Warrants | | | 5.000 | | | | 03/01/2031 | | | A2 | | | 250,000 | | | | 283,785 | |

Madison AL Warrants | | | 5.000 | | | | 04/01/2035 | | | Aa2 | | | 350,000 | | | | 405,181 | |

Tuscaloosa AL Warrants | | | 5.000 | | | | 07/01/2034 | | | Aa1 | | | 300,000 | | | | 343,611 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 1,733,117 | |

| HOSPITAL AND HEALTHCARE REVENUE BONDS | |

| 2.28% of Net Assets | |

Chilton County AL Health Care Authority Chilton County Hospital** | | | 5.000 | | | | 11/01/2035 | | | B@ | | | 550,000 | | | | 596,530 | |

| | | | | | | | | | | | | | | | | | |

| TURNPIKES/TOLLROAD/HIGHWAY REVENUE BONDS | |

| 1.06% of Net Assets | |

AL Federal Aid Highway Finance Authority | | | 4.000 | | | | 06/01/2037 | | | Aa1 | | | 250,000 | | | | 276,785 | |

| | | | | | | | | | | | | | | | | | |

Total Investments 98.30% of Net Assets (cost $24,492,148) (See (a) below for further explanation) | | | $ | 25,710,412 | |

| | | | | | | | | | | | | | | | | | |

Other assets in excess of liabilities 1.70% | | | | | | | | | | | | | | | | | 443,349 | |

| | | | | | | | | | | | | | | | | | |

Net Assets 100% | | | | | | | | | | | | | | | | $ | 26,153,761 | |

| | | | | | | | | | | | | | | | | | |

| | # | | Ratings by Moody’s Investors Service, Inc. unless noted otherwise. |

| | | | Bond ratings are unaudited and not covered by Report of Independent Registered Public Accounting Firm. |

| | | | All ratings are as of the date indicated and do not reflect subsequent changes. |

| | * | | Rated by S & P Global Ratings |

The accompanying notes are an integral part of the financial statements.

2

DUPREE MUTUAL FUNDS — ALABAMATAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds

June 30, 2019

| | @ | | Rated by Fitch Ratings, Inc. |

| | ** | | Security is segregated — see footnote 1(D) |

| (a) | | Cost for federal income tax purposes is $24,492,148 and net unrealized appreciation of investments is as follows: |

| | | | | | |

| | Unrealized appreciation | | $ | 1,245,174 | |

| | Unrealized depreciation | | | (26,910 | ) |

| | | | | | |

| | Net unrealized appreciation | | $ | 1,218,264 | |

| | | | | | |

Other Information

The following is a summary of the inputs used, as of June 30, 2019, involving the Fund’s investments in securities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements.

| | | | | | |

| | | Valuation Inputs | | Municipal Bonds | |

Level 1 | | Quoted Prices | | $ | — | |

Level 2 | | Other Significant Observable Inputs | | | 25,710,412 | |

Level 3 | | Significant Unobservable Inputs | | | — | |

| | | | | | |

| | | | $ | 25,710,412 | |

| | | | | | |

The accompanying notes are an integral part of the financial statements.

3

ALABAMATAX-FREE INCOME SERIES

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2019

| | | | | | | | |

ASSETS: | | | | | | | | |

Investments in securities, at fair value (Cost: $24,492,148) | | | | | | $ | 25,710,412 | |

Cash | | | | | | | 261,688 | |

Interest receivable | | | | | | | 316,381 | |

| | | | | | | | |

Total assets | | | | | | | 26,288,481 | |

LIABILITIES: | | | | | | | | |

Payable for: | | | | | | | | |

Distributions to shareholders | | | 93,648 | | | | | |

Fund shares redeemed | | | 8,820 | | | | | |

Investment advisory fee | | | 4,722 | | | | | |

Transfer agent fee | | | 6,984 | | | | | |

Accrued expenses | | | 20,546 | | | | | |

| | | | | | | | |

Total liabilities | | | | | | | 134,720 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Capital | | | | | | | 25,025,147 | |

Total distributable earnings | | | | | | | 1,128,614 | |

| | | | | | | | |

Net assets at value | | | | | | $ | 26,153,761 | |

| | | | | | | | |

NET ASSET VALUE, offering price and redemption price per share

(2,103,399 shares outstanding; unlimited number of shares authorized; no par value) | | | | | | $ | 12.43 | |

| | | | | | | | |

STATEMENT OF OPERATIONS

For the year ended June 30, 2019

| | | | |

Net investment income: | | | | |

Interest income | | $ | 885,392 | |

| | | | |

Expenses: | | | | |

Investment advisory fee | | | 126,762 | |

Transfer agent fee | | | 36,423 | |

Custodian expense | | | 10,851 | |

Professional fees | | | 7,202 | |

Pricing fees | | | 6,001 | |

Trustees fees | | | 4,281 | |

Other expenses | | | 20,222 | |

| | | | |

Total expenses | | | 211,742 | |

Fees waived by Adviser (Note 2) | | | (33,805 | ) |

Custodian expense reduction | | | (418 | ) |

| | | | |

Net expenses | | | 177,519 | |

| | | | |

Net investment income | | | 707,873 | |

| | | | |

Realized and unrealized gain/(loss) on investments: | | | | |

Net realized loss | | | (25,778 | ) |

Net change in unrealized appreciation/depreciation | | | 759,933 | |

| | | | |

Net realized and unrealized gain on investments | | | 734,155 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 1,442,028 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

4

ALABAMATAX-FREE INCOME SERIES

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended June 30, 2019 and 2018

| | | | | | | | |

| | | 2019 | | | 2018(1) | |

Operations: | | | | | | | | |

Net investment income | | $ | 707,873 | | | $ | 772,453 | |

Net realized loss on investments | | | (25,778 | ) | | | (29,010 | ) |

Net change in unrealized appreciation/depreciation | | | 759,933 | | | | (421,512 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 1,442,028 | | | | 321,931 | |

Total distributions (Note 6) | | | (707,873 | ) | | | (772,453 | ) |

Net Fund share transactions (Note 4) | | | 164,601 | | | | (849,482 | ) |

| | | | | | | | |

Total increase/(decrease) | | | 898,756 | | | | (1,300,004 | ) |

Net assets: | | | | | | | | |

Beginning of year | | | 25,255,005 | | | | 26,555,009 | |

| | | | | | | | |

End of year | | $ | 26,153,761 | | | $ | 25,255,005 | |

| | | | | | | | |

| (1) | | The presentation of Total distributions has been updated to reflect the changes prescribed in amendments to RegulationS-X, effective November 5, 2018. For the year ended June 30, 2018, distributions from net investment income were $772,453. As of June 30, 2018, accumulated net investment income was $0. |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding: | | For the years ended June 30, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of year | | | $12.08 | | | | $12.29 | | | | $12.77 | | | | $12.36 | | | | $12.32 | |

| | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.34 | | | | 0.36 | | | | 0.37 | | | | 0.39 | | | | 0.41 | |

Net gains/(losses) on investments | | | 0.35 | | | | (0.21 | ) | | | (0.48 | ) | | | 0.41 | | | | 0.04 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.69 | | | | 0.15 | | | | (0.11 | ) | | | 0.80 | | | | 0.45 | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.34 | ) | | | (0.36 | ) | | | (0.37 | ) | | | (0.39 | ) | | | (0.41 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | | $12.43 | | | | $12.08 | | | | $12.29 | | | | $12.77 | | | | $12.36 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 5.80% | | | | 1.24% | | | | (0.82 | )% | | | 6.61% | | | | 3.64% | |

Net assets, end of year (in thousands) | | | $26,154 | | | | $25,255 | | | | $26,555 | | | | $29,378 | | | | $25,511 | |

Ratio of net expenses to average net assets (a) | | | 0.70% | | | | 0.70% | | | | 0.70% | | | | 0.71% | | | | 0.71% | |

Ratio of gross expenses to average net assets | | | 0.84% | | | | 0.82% | | | | 0.78% | | | | 0.78% | | | | 0.79% | |

Ratio of net investment income to average net assets | | | 2.79% | | | | 2.96% | | | | 3.00% | | | | 3.14% | | | | 3.26% | |

Portfolio turnover | | | 16.54% | | | | 13.83% | | | | 6.95% | | | | 5.37% | | | | 9.65% | |

| (a) | | Percentages are after expense waivers and reductions by the Adviser and Custodian. The Adviser and Custodian have agreed not to seek recovery of these waivers and reductions. |

The accompanying notes are an integral part of the financial statements.

5

DUPREE MUTUAL FUNDS — KENTUCKYTAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2019

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| MISCELLANEOUS PUBLIC IMPROVEMENT BONDS | |

| 28.47% of Net Assets | |

KY Association of Counties | | | 4.000 | % | | | 02/01/2033 | | | AA-* | | $ | 420,000 | | | $ | 461,849 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2034 | | | AA-* | | | 435,000 | | | | 476,564 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2035 | | | AA-* | | | 690,000 | | | | 758,917 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2035 | | | AA-* | | | 460,000 | | | | 502,076 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2037 | | | AA-* | | | 745,000 | | | | 814,620 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2038 | | | AA-* | | | 3,165,000 | | | | 3,450,641 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2039 | | | AA-* | | | 1,000,000 | | | | 1,089,460 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2030 | | | AA-* | | | 100,000 | | | | 103,486 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2032 | | | AA-* | | | 165,000 | | | | 170,698 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2035 | | | AA-* | | | 120,000 | | | | 124,144 | |

KY Bond Corporation Finance Program | | | 5.500 | | | | 02/01/2031 | | | AA-* | | | 1,115,000 | | | | 1,183,416 | |

KY State Property & Building #76 | | | 5.500 | | | | 08/01/2021 | | | A1 | | | 1,400,000 | | | | 1,517,891 | |

KY State Property & Building #98 | | | 5.000 | | | | 08/01/2021 | | | A1 | | | 2,505,000 | | | | 2,600,942 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2026 | | | A1 | | | 2,000,000 | | | | 2,134,600 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2027 | | | A1 | | | 1,710,000 | | | | 1,823,989 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2028 | | | A1 | | | 4,000,000 | | | | 4,265,800 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2029 | | | A1 | | | 2,500,000 | | | | 2,665,050 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2030 | | | A1 | | | 9,980,000 | | | | 10,609,234 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2031 | | | A1 | | | 5,100,000 | | | | 5,422,626 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2031 | | | A2 | | | 2,110,000 | | | | 2,309,395 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2032 | | | A2 | | | 2,205,000 | | | | 2,413,373 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2033 | | | A2 | | | 2,310,000 | | | | 2,524,784 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2028 | | | A1 | | | 2,030,000 | | | | 2,287,079 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2029 | | | A1 | | | 4,130,000 | | | | 4,633,241 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2030 | | | A1 | | | 7,165,000 | | | | 8,031,822 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2031 | | | A1 | | | 4,910,000 | | | | 5,499,740 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2032 | | | A1 | | | 6,275,000 | | | | 7,020,533 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2033 | | | A1 | | | 4,870,000 | | | | 5,442,274 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2026 | | | A1 | | | 955,000 | | | | 1,122,125 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2028 | | | A1 | | | 2,670,000 | | | | 3,113,861 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2030 | | | A1 | | | 5,000,000 | | | | 5,787,800 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2031 | | | A1 | | | 8,290,000 | | | | 9,560,443 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2032 | | | A1 | | | 8,820,000 | | | | 10,122,979 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2033 | | | A1 | | | 5,270,000 | | | | 6,032,464 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2034 | | | A1 | | | 4,900,000 | | | | 5,594,036 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2029 | | | A1 | | | 4,200,000 | | | | 4,887,750 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2032 | | | A1 | | | 1,515,000 | | | | 1,738,811 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2033 | | | A1 | | | 1,000,000 | | | | 1,145,290 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2034 | | | A1 | | | 1,900,000 | | | | 2,167,957 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2035 | | | A1 | | | 3,030,000 | | | | 3,455,503 | |

KY State Property & Building #112 | | | 5.000 | | | | 11/01/2028 | | | A1 | | | 2,500,000 | | | | 2,973,975 | |

KY State Property & Building #112 | | | 5.000 | | | | 02/01/2035 | | | A1 | | | 8,325,000 | | | | 9,560,597 | |

KY State Property & Building #112 | | | 5.000 | | | | 02/01/2036 | | | A1 | | | 7,920,000 | | | | 9,079,963 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2030 | | | A1 | | | 2,500,000 | | | | 2,969,225 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2033 | | | A1 | | | 4,565,000 | | | | 5,365,153 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2034 | | | A1 | | | 13,975,000 | | | | 16,359,974 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2036 | | | A1 | | | 14,460,000 | | | | 16,828,259 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2037 | | | A1 | | | 5,000,000 | | | | 5,826,550 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2031 | | | A1 | | | 5,055,000 | | | | 5,997,151 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2032 | | | A1 | | | 3,680,000 | | | | 4,360,101 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2033 | | | A1 | | | 3,550,000 | | | | 4,189,391 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2034 | | | A1 | | | 5,825,000 | | | | 6,842,336 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2035 | | | A1 | | | 5,065,000 | | | | 5,937,852 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2036 | | | A1 | | | 5,275,000 | | | | 6,175,865 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2030 | | | A1 | | | 3,685,000 | | | | 4,457,118 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2034 | | | A1 | | | 725,000 | | | | 868,594 | |

The accompanying notes are an integral part of the financial statements.

6

DUPREE MUTUAL FUNDS — KENTUCKYTAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2019

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

KY State Property & Building #119 | | | 5.000 | % | | | 05/01/2035 | | | A1 | | $ | 10,000,000 | | | $ | 11,875,800 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2036 | | | A1 | | | 10,000,000 | | | | 11,841,200 | |

Lexington Fayette Urban County Government | | | 5.000 | | | | 01/01/2028 | | | Aa2 | | | 820,000 | | | | 961,712 | |

Lexington Fayette Urban County Government | | | 5.000 | | | | 01/01/2029 | | | Aa2 | | | 345,000 | | | | 404,030 | |

Lexington Fayette Urban County Government | | | 5.000 | | | | 01/01/2033 | | | Aa2 | | | 1,685,000 | | | | 1,947,422 | |

Louisville & Jefferson County Visitors & Convention Commission | | | 4.000 | | | | 06/01/2032 | | | A2 | | | 1,825,000 | | | | 1,994,415 | |

Louisville & Jefferson County Visitors & Convention Commission | | | 4.000 | | | | 06/01/2034 | | | A2 | | | 3,720,000 | | | | 4,038,209 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 275,922,155 | |

| SCHOOL IMPROVEMENT BONDS | |

| 14.97% of Net Assets | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 08/01/2034 | | | A1 | | | 1,890,000 | | | | 2,059,042 | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 08/01/2035 | | | A1 | | | 2,215,000 | | | | 2,405,623 | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 08/01/2036 | | | A1 | | | 2,305,000 | | | | 2,495,624 | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 08/01/2037 | | | A1 | | | 2,395,000 | | | | 2,586,648 | |

Bullitt County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2035 | | | A1 | | | 1,820,000 | | | | 1,981,216 | |

Bullitt County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2036 | | | A1 | | | 2,985,000 | | | | 3,239,143 | |

Bullitt County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2037 | | | A1 | | | 3,075,000 | | | | 3,330,471 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 08/01/2028 | | | Aa3 | | | 1,330,000 | | | | 1,569,440 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 10/01/2028 | | | Aa3 | | | 1,375,000 | | | | 1,553,351 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 10/01/2029 | | | Aa3 | | | 3,660,000 | | | | 4,125,113 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 06/01/2031 | | | Aa3 | | | 3,705,000 | | | | 3,929,745 | |

Fayette County KY School District Finance Corporation | | | 4.750 | | | | 11/01/2031 | | | Aa3 | | | 1,730,000 | | | | 1,949,278 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 08/01/2032 | | | Aa3 | | | 10,600,000 | | | | 12,316,034 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 10/01/2032 | | | Aa3 | | | 3,615,000 | | | | 4,061,778 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 10/01/2033 | | | Aa3 | | | 4,385,000 | | | | 4,923,127 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 08/01/2034 | | | Aa3 | | | 8,750,000 | | | | 10,139,500 | |

Hardin County KY School District Finance Corporation | | | 4.000 | | | | 05/01/2030 | | | Aa3 | | | 635,000 | | | | 703,383 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 04/01/2030 | | | Aa3 | | | 975,000 | | | | 1,137,357 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 04/01/2031 | | | Aa3 | | | 1,025,000 | | | | 1,191,440 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 05/01/2032 | | | Aa3 | | | 4,230,000 | | | | 4,814,798 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 05/01/2033 | | | Aa3 | | | 5,145,000 | | | | 5,830,880 | |

Jefferson County KY School District Finance Corporation | | | 4.750 | | | | 04/01/2034 | | | Aa3 | | | 1,165,000 | | | | 1,308,714 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 05/01/2034 | | | Aa3 | | | 5,405,000 | | | | 6,122,892 | |

Jefferson County KY School District Finance Corporation | | | 4.750 | | | | 04/01/2035 | | | Aa3 | | | 1,220,000 | | | | 1,368,413 | |

Jefferson County KY School District Finance Corporation | | | 4.250 | | | | 10/01/2037 | | | Aa3 | | | 2,110,000 | | | | 2,334,441 | |

Jefferson County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2032 | | | Aa3 | | | 2,500,000 | | | | 2,762,175 | |

Jefferson County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2033 | | | Aa3 | | | 4,310,000 | | | | 4,756,171 | |

Jefferson County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2034 | | | Aa3 | | | 3,500,000 | | | | 3,845,905 | |

Jefferson County KY School District Finance Corporation | | | 4.000 | | | | 05/01/2030 | | | Aa3 | | | 2,000,000 | | | | 2,174,020 | |

Kenton County KY School District Finance Corporation | | | 4.000 | | | | 04/01/2036 | | | A1 | | | 1,210,000 | | | | 1,331,920 | |

Kenton County KY School District Finance Corporation | | | 4.000 | | | | 04/01/2037 | | | A1 | | | 1,255,000 | | | | 1,377,350 | |

Kenton County KY School District Finance Corporation | | | 4.000 | | | | 04/01/2038 | | | A1 | | | 1,300,000 | | | | 1,422,499 | |

Meade County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2036 | | | A1 | | | 2,215,000 | | | | 2,414,727 | |

Meade County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2037 | | | A1 | | | 2,255,000 | | | | 2,446,404 | |

Meade County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2038 | | | A1 | | | 2,400,000 | | | | 2,594,256 | |

Morgan County KY School District Finance Corporation | | | 4.000 | | | | 08/01/2029 | | | A1 | | | 960,000 | | | | 1,085,155 | |

Oldham County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2034 | | | A1 | | | 1,560,000 | | | | 1,697,108 | |

Scott County KY School District Finance Corporation | | | 4.500 | | | | 01/01/2025 | | | A1 | | | 4,890,000 | | | | 5,551,959 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 02/01/2029 | | | Aa3 | | | 5,040,000 | | | | 5,901,336 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2035 | | | Aa3 | | | 1,440,000 | | | | 1,572,710 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2035 | | | Aa3 | | | 2,235,000 | | | | 2,440,687 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2036 | | | Aa3 | | | 1,500,000 | | | | 1,632,270 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2037 | | | Aa3 | | | 2,415,000 | | | | 2,622,255 | |

Shelby County KY School District Finance Corporation | | | 4.000 | | | | 08/01/2037 | | | Aa3 | | | 6,240,000 | | | | 6,768,652 | |

Shelby County KY School District Finance Corporation | | | 4.000 | | | | 08/01/2038 | | | Aa3 | | | 3,000,000 | | | | 3,246,090 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 145,121,100 | |

The accompanying notes are an integral part of the financial statements.

7

DUPREE MUTUAL FUNDS — KENTUCKYTAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2019

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| UNIVERSITY CONSOLIDATED EDUCATION AND BUILDING REVENUE BONDS | |

| 12.96% of Net Assets | |

Boyle County Centre College | | | 5.000 | % | | | 06/01/2037 | | | A3 | | $ | 2,865,000 | | | $ | 3,332,253 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 5.000 | | | | 06/01/2038 | | | A3 | | | 1,340,000 | | | | 1,570,199 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 5.000 | | | | 06/01/2035 | | | A3 | | | 2,165,000 | | | | 2,563,209 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 5.000 | | | | 06/01/2036 | | | A3 | | | 2,835,000 | | | | 3,341,643 | |

KY Bond Development Corporation Educational Facility Lancaster Centre | | | 5.000 | | | | 06/01/2033 | | | A3 | | | 1,345,000 | | | | 1,602,971 | |

KY Bond Development Corporation Educational Facility Lancaster Centre | | | 5.000 | | | | 06/01/2034 | | | A3 | | | 1,605,000 | | | | 1,894,606 | |

KY State Property & Building #114 | | | 5.000 | | | | 10/01/2032 | | | Aa3 | | | 2,795,000 | | | | 3,298,771 | |

KY State Property & Building #114 | | | 5.000 | | | | 10/01/2033 | | | Aa3 | | | 2,940,000 | | | | 3,454,853 | |

KY State Property & Building #114 | | | 5.000 | | | | 10/01/2034 | | | Aa3 | | | 3,090,000 | | | | 3,624,385 | |

KY State Property & Building #114 | | | 5.000 | | | | 10/01/2035 | | | Aa3 | | | 1,945,000 | | | | 2,278,548 | |

KY State Property & Building #116 | | | 5.000 | | | | 10/01/2035 | | | Aa3 | | | 4,165,000 | | | | 4,968,262 | |

KY State Property & Building #116 | | | 5.000 | | | | 10/01/2036 | | | Aa3 | | | 2,725,000 | | | | 3,241,578 | |

Murray State University | | | 5.000 | | | | 03/01/2032 | | | A1 | | | 2,220,000 | | | | 2,571,692 | |

University of Kentucky Certificate of Participation** | | | 4.000 | | | | 05/01/2033 | | | Aa3 | | | 885,000 | | | | 991,952 | |

University of Kentucky Certificate of Participation** | | | 4.000 | | | | 05/01/2034 | | | Aa3 | | | 1,020,000 | | | | 1,137,637 | |

University of Kentucky Certificate of Participation** | | | 4.000 | | | | 05/01/2044 | | | Aa3 | | | 2,755,000 | | | | 2,985,730 | |

University of Kentucky Certificate of Participation** | | | 4.000 | | | | 05/01/2039 | | | Aa3 | | | 4,660,000 | | | | 5,108,572 | |

University of Kentucky General Receipts | | | 5.000 | | | | 04/01/2030 | | | Aa2 | | | 5,490,000 | | | | 6,473,039 | |

University of Kentucky General Receipts | | | 5.000 | | | | 04/01/2036 | | | Aa2 | | | 4,820,000 | | | | 5,527,335 | |

University of Kentucky General Receipts | | | 4.000 | | | | 10/01/2036 | | | Aa2 | | | 16,160,000 | | | | 17,732,044 | |

University of Kentucky General Receipts | | | 5.000 | | | | 04/01/2037 | | | Aa2 | | | 7,180,000 | | | | 8,230,147 | |

University of Kentucky General Receipts | | | 5.000 | | | | 04/01/2038 | | | Aa2 | | | 7,395,000 | | | | 8,462,025 | |

University of Kentucky General Receipts | | | 4.000 | | | | 10/01/2038 | | | Aa2 | | | 10,855,000 | | | | 11,861,367 | |

University of Kentucky Higher Educational | | | 4.750 | | | | 04/01/2034 | | | Aa2 | | | 5,435,000 | | | | 6,212,151 | |

University of Louisville | | | 4.500 | | | | 03/01/2035 | | | A1 | | | 5,600,000 | | | | 6,307,784 | |

University of Louisville General Receipts | | | 5.000 | | | | 09/01/2030 | | | A3 | | | 440,000 | | | | 469,792 | |

University of Louisville General Receipts | | | 5.000 | | | | 09/01/2031 | | | A3 | | | 2,580,000 | | | | 2,754,124 | |

Western KY University | | | 5.000 | | | | 05/01/2032 | | | A1 | | | 1,500,000 | | | | 1,627,575 | |

Western KY University | | | 4.000 | | | | 09/01/2034 | | | A1 | | | 575,000 | | | | 627,756 | |

Western KY University | | | 4.000 | | | | 09/01/2035 | | | A1 | | | 595,000 | | | | 647,152 | |

Western KY University | | | 4.000 | | | | 09/01/2036 | | | A1 | | | 620,000 | | | | 672,657 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 125,571,809 | |

| MUNICIPAL UTILITY REVENUE BONDS | |

| 10.85% of Net Assets | |

Campbell & Kenton County Sanitation District #1 | | | 4.000 | | | | 08/01/2032 | | | Aa3 | | | 6,100,000 | | | | 6,766,486 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2034 | | | AA* | | | 695,000 | | | | 780,610 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2035 | | | AA* | | | 725,000 | | | | 813,131 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2036 | | | AA* | | | 760,000 | | | | 850,736 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2037 | | | AA* | | | 800,000 | | | | 893,352 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2038 | | | AA* | | | 835,000 | | | | 930,641 | |

KY Rural Water Financing Corporation | | | 5.375 | | | | 02/01/2020 | | | A+* | | | 65,000 | | | | 65,172 | |

KY Rural Water Financing Corporation | | | 4.500 | | | | 02/01/2023 | | | A+* | | | 1,085,000 | | | | 1,192,393 | |

KY Rural Water Financing Corporation | | | 4.500 | | | | 02/01/2024 | | | A+* | | | 880,000 | | | | 965,483 | |

KY Rural Water Financing Corporation | | | 5.125 | | | | 02/01/2035 | | | A+* | | | 525,000 | | | | 535,406 | |

KY State Association of Counties Finance Corporation | | | 4.000 | | | | 02/01/2031 | | | AA-* | | | 405,000 | | | | 455,366 | |

KY State Association of Counties Finance Corporation | | | 4.000 | | | | 02/01/2033 | | | AA-* | | | 415,000 | | | | 462,854 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2021 | | | Aa3 | | | 1,175,000 | | | | 1,191,744 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2023 | | | Aa3 | | | 1,020,000 | | | | 1,034,617 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.000 | | | | 05/15/2030 | | | Aa3 | | | 3,120,000 | | | | 3,518,736 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2031 | | | Aa3 | | | 2,465,000 | | | | 2,773,125 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.000 | | | | 05/15/2033 | | | Aa3 | | | 1,000,000 | | | | 1,089,260 | |

The accompanying notes are an integral part of the financial statements.

8

DUPREE MUTUAL FUNDS — KENTUCKYTAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2019

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

Louisville & Jefferson County Metropolitan Sewer** | | | 5.000 | % | | | 05/15/2034 | | | Aa3 | | $ | 27,730,000 | | | $ | 29,869,092 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.750 | | | | 05/15/2034 | | | Aa3 | | | 2,230,000 | | | | 2,521,840 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2034 | | | Aa3 | | | 4,595,000 | | | | 5,401,744 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.750 | | | | 05/15/2035 | | | Aa3 | | | 2,245,000 | | | | 2,532,719 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2035 | | | Aa3 | | | 4,825,000 | | | | 5,662,668 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.750 | | | | 05/15/2036 | | | Aa3 | | | 2,795,000 | | | | 3,147,170 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.000 | | | | 05/15/2037 | | | Aa3 | | | 10,000,000 | | | | 11,120,400 | |

Northern KY Water District | | | 5.000 | | | | 02/01/2026 | | | Aa3 | | | 1,000,000 | | | | 1,087,290 | |

Northern KY Water District | | | 5.000 | | | | 02/01/2027 | | | Aa3 | | | 4,315,000 | | | | 4,699,725 | |

Northern KY Water District | | | 5.000 | | | | 02/01/2033 | | | Aa3 | | | 3,580,000 | | | | 3,766,411 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2031 | | | A3 | | | 245,000 | | | | 268,961 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2033 | | | A3 | | | 275,000 | | | | 299,734 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2034 | | | A3 | | | 305,000 | | | | 331,352 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2035 | | | A3 | | | 200,000 | | | | 215,868 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2036 | | | A3 | | | 325,000 | | | | 349,876 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2037 | | | A3 | | | 410,000 | | | | 439,377 | |

Owensboro KY Water Revenue | | | 4.000 | | | | 09/15/2034 | | | A1 | | | 2,075,000 | | | | 2,285,322 | |

Owensboro KY Water Revenue | | | 4.000 | | | | 09/15/2035 | | | A1 | | | 2,155,000 | | | | 2,366,750 | |

Owensboro KY Water Revenue | | | 4.000 | | | | 09/15/2037 | | | A1 | | | 1,950,000 | | | | 2,138,585 | |

Owensboro KY Water Revenue | | | 4.000 | | | | 09/15/2039 | | | A1 | | | 2,125,000 | | | | 2,317,396 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 105,141,392 | |

| TURNPIKES/TOLLROAD/HIGHWAY REVENUE BONDS | |

| 7.95% of Net Assets | |

KY Asset Liability Commission Federal Highway | | | 5.250 | | | | 09/01/2019 | | | A2 | | | 1,765,000 | | | | 1,776,702 | |

KY Asset Liability Commission Federal Highway | | | 5.000 | | | | 09/01/2021 | | | A2 | | | 1,570,000 | | | | 1,633,161 | |

KY Asset Liability Commission Federal Highway | | | 5.000 | | | | 09/01/2022 | | | A2 | | | 3,500,000 | | | | 3,642,485 | |

KY Asset Liability Commission Federal Highway | | | 5.250 | | | | 09/01/2025 | | | A2 | | | 3,400,000 | | | | 3,884,398 | |

KY Asset Liability Commission Federal Highway | | | 5.000 | | | | 09/01/2027 | | | A2 | | | 9,760,000 | | | | 11,533,490 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2029 | | | Aa3 | | | 5,165,000 | | | | 5,493,804 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2029 | | | Aa3 | | | 7,235,000 | | | | 7,912,196 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2029 | | | Aa3 | | | 4,000,000 | | | | 4,746,560 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2030 | | | Aa3 | | | 1,845,000 | | | | 1,961,696 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2030 | | | Aa3 | | | 1,465,000 | | | | 1,598,974 | |

KY State Turnpike Economic Development Road Revenue** | | | 5.000 | | | | 07/01/2031 | | | Aa3 | | | 9,350,000 | | | | 10,202,252 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2032 | | | Aa3 | | | 1,315,000 | | | | 1,525,979 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2032 | | | Aa3 | | | 1,765,000 | | | | 2,110,305 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2032 | | | Aa3 | | | 8,755,000 | | | | 9,553,018 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2033 | | | Aa3 | | | 5,000,000 | | | | 5,593,450 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2034 | | | Aa3 | | | 2,370,000 | | | | 2,782,001 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2036 | | | Aa3 | | | 400,000 | | | | 473,760 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2037 | | | Aa3 | | | 500,000 | | | | 590,610 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 77,014,841 | |

| REFUNDING BONDS | |

| 6.69% of Net Assets | |

KY State Property & Building #80 | | | 5.250 | | | | 05/01/2020 | | | A1 | | | 1,000,000 | | | | 1,032,510 | |