Filed Pursuant to Rule 424(b)(2)

Registration No. 333-265158

|  | Pricing Supplement dated August 1, 2022 to the Prospectus dated May 23, 2022 and the Prospectus Supplement dated June 27, 2022 |

$100,000,000 iPath® Silver ETN

This pricing supplement relates to the iPath® Silver Exchange-Traded Notes (the “ETNs”) that Barclays Bank PLC may issue from time to time. The return of the ETNs is linked to the performance of the Barclays Silver 3 Month Index Total Return (the “Index”). The Index is calculated on a total return basis and is intended to reflect (1) the performance of a rolling position in specified silver futures contracts that will become the first liquid nearby futures contracts three months in the future in accordance with a specified schedule and (2) the return that corresponds to the weekly announced interest rate for specified 3-month U.S. Treasury bills. The ETNs do not guarantee any return of principal at or prior to maturity and do not pay any interest during their term. Instead, you will receive a cash payment in U.S. dollars at maturity or upon early redemption based on the performance of the Index.

You may lose all or a substantial portion of your investment within a single day if you invest in the ETNs. Any payment on the ETNs at or prior to maturity, including any repayment of principal, is not guaranteed by any third party and is subject to both the creditworthiness of Barclays Bank PLC and to the exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority. If Barclays Bank PLC were to default on its payment obligations or become subject to the exercise of any U.K. Bail-in Power (or any other resolution measure) by the relevant U.K. resolution authority, you might not receive any amounts owed to you under the ETNs. See “Consent to U.K. Bail-in Power” and “Risk Factors” in this pricing supplement and “Risk Factors” in the accompanying prospectus supplement for more information.

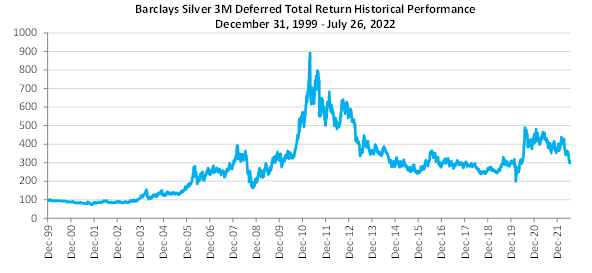

THE ETNS OFFER EXPOSURE TO FUTURES CONTRACTS AND NOT DIRECT EXPOSURE TO SILVER OR ITS SPOT PRICES. THESE FUTURES CONTRACTS WILL NOT TRACK THE PERFORMANCE OF SILVER. In addition, the nature of the futures market for silver has historically resulted in a cost to maintain a rolling position in the futures contracts underlying the Index. As a result, the level of the Index, which tracks a rolling position in specified futures contracts, may experience significant declines as a result of these costs, known as roll costs, especially over a longer period. The price of silver will perform differently than the Index and, in certain cases, may have positive performance during periods where the Index is experiencing negative performance. In turn, an investment in the ETNs may experience a significant decline in value over time, the risk of which increases the longer that the ETNs are held. For more information, see “Risk Factors” beginning on page PS-12 of this pricing supplement and the historical performance of the Index presented below in this pricing supplement.

The ETNs may not be suitable for all investors and should be used only by investors with the sophistication and knowledge necessary to understand the risks inherent in the Index, the futures contracts that the Index tracks and investments in silver as an asset class generally. Investors should consult with their broker or financial advisor when making an investment decision and to evaluate their investment in the ETNs and should actively manage and monitor their investments in the ETNs throughout each trading day.

If we were to price the ETNs for initial sale to the public as of the inception date, our hypothetical estimated value of the ETNs at the time of such initial pricing would be $25.00 per ETN. See “Pricing Supplement Summary—What Are the ETNs and How Do They Work?” and “Risk Factors—Risks Relating to Conflicts of Interest and Hedging” for additional information about inherent costs in the ETNs that are borne by holders of the ETNs. In addition, see “Risk Factors” beginning on page PS-12 of this pricing supplement for risks relating to an investment in the ETNs.

The principal terms of the ETNs are as follows:

Issuer: Barclays Bank PLC

Series: Global Medium-Term Notes, Series A

Principal Amount per ETN: $25

Inception and Issue Dates: The ETNs were first sold on October 7, 2019 (the “inception date”) and first issued on October 9, 2019 (the “issue date”).

Maturity Date: October 6, 2049

Secondary Market: We have listed the ETNs on the NYSE Arca exchange (“NYSE Arca”) under the ticker symbol “SBUG.” To the extent an active secondary market in the ETNs exists, we expect that investors will purchase and sell the ETNs primarily in this secondary market. We are not required to maintain any listing of the ETNs on NYSE Arca or any other securities exchange.

CUSIP Number: 06747D700

ISIN: US06747D7003

Index: The return on the ETNs is linked to the performance of the Index. The Index is calculated on a total return basis and is intended to reflect (1) the performance of a rolling position in specified silver futures contracts that will become the first liquid nearby futures contracts three months in the future in accordance with a specified schedule and (2) the return that corresponds to the weekly announced interest rate for specified 3-month U.S. Treasury bills. The Index is maintained and calculated by Barclays Bank PLC (in such capacity, the “index sponsor”). The closing level of the Index will be calculated on each index business day and is reported by Bloomberg L.P. or a successor via the facilities of the Consolidated Tape Association under the ticker symbol “BCC2SI3T.”

Consent to U.K. Bail-in Power: Notwithstanding and to the exclusion of any other term of the ETNs or any other agreements, arrangements or understandings between Barclays Bank PLC and any holder or beneficial owner of the ETNs, by acquiring the ETNs, each holder and beneficial owner of the ETNs acknowledges, accepts, agrees to be bound by, and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority. See “Consent to U.K. Bail-in Power” on page PS-22 of this pricing supplement.

Payment at Maturity

Payment at Maturity: If you hold your ETNs to maturity, you will receive a cash payment per ETN at maturity in U.S. dollars equal to the closing indicative value on the final valuation date.

Closing Indicative Value: The closing indicative value for each ETN on the initial valuation date was equal to $25. On each subsequent calendar day until maturity or early redemption, the closing indicative value for each ETN will equal (1) the closing indicative value on the immediately preceding calendar day times (2) the daily index factor on such calendar day (or, if such day is not an index business day, one). If the ETNs undergo a split or reverse split, the closing indicative value will be adjusted accordingly.

The closing indicative value is not the market price of the ETNs in any secondary market and is not intended as a price or quotation, or as an offer or solicitation for the purchase or sale of the ETNs or as a recommendation to transact in the ETNs at the stated price. The market price of the ETNs at any time may vary significantly from the closing indicative value.

Daily Index Factor: The daily index factor for each ETN on any index business day will equal (1) the closing level of the Index on such index business day divided by (2) the closing level of the Index on the immediately preceding index business day.

Business Day: A business day means a Monday, Tuesday, Wednesday, Thursday or Friday that is not a day on which banking institutions in New York City generally are authorized or obligated by law, regulation or executive order to close.

Trading Day: A trading day with respect to the ETNs is a day that is an index business day and a business day and a day on which trading is generally conducted on NYSE Arca, in each case as determined by the calculation agent in its sole discretion.

Valuation Date: A valuation date means each trading day from October 7, 2019 to October 1, 2049, inclusive, subject to postponement due to the occurrence of a market disruption event, such postponement not to exceed five scheduled trading days. We refer to October 7, 2019 as the “initial valuation date” and October 1, 2049 as the “final valuation date” for the ETNs.

Index Business Day: An index business day is a day on which the Index is calculated and published by the index sponsor.

Intraday Indicative Value: The intraday indicative value is intended to provide an approximation of the effect that changes in the level of the Index during the current trading day would have on closing indicative value of the ETNs from the previous day. Intraday indicative value differs from closing indicative value because intraday indicative value is based on the most recent Index level published by the index sponsor, which reflects the most recent reported prices for the index components, rather than the daily index factor for the immediately preceding calendar day.

The intraday indicative value is not the market price of the ETNs in any secondary market and is not intended as a price or quotation, or as an offer or solicitation for the purchase or sale of the ETNs or as a recommendation to transact in the ETNs at the stated price. Because the intraday indicative value is based on the intraday Index levels, it will reflect any lags, disruptions or suspensions that affect the Index. The market price of the ETNs at any time may vary significantly from the intraday indicative value due to, among other things, imbalances of supply and demand for the ETNs (including as a result of any decision of ours to issue, stop issuing or resume issuing additional ETNs), futures contracts included in the Index and/or other derivatives related to the Index or the ETNs; any trading disruptions, suspension or limitations to any of the forgoing; lack of liquidity; severe volatility; transaction costs; credit considerations; and bid-offer spreads. A premium or discount market price over the intraday indicative value can also arise as a result of mismatches of trading hours between the ETNs and the futures contracts included in the Index, actions (or failure to take action) by the index sponsor and the relevant exchange of the futures contracts included in the Index and technical or human errors by service providers, market participants and others.

Early Redemption

Holder Redemption: Subject to the notification requirements set forth under “Specific Terms of the ETNs—Holder Redemption Procedures” in this pricing supplement, and if we have not delivered notice of our intention to exercise our right to redeem the ETNs, you may redeem your ETNs on any redemption date during the term of the ETNs. If you redeem your ETNs, you will receive a cash payment in U.S. dollars per ETN on such date in an amount equal to the closing indicative value on the applicable valuation date. You must redeem at least 5,000 ETNs at one time in order to exercise your right to redeem your ETNs on any redemption date. If you hold fewer than 5,000 ETNs or fewer than 5,000 ETNs are outstanding, you will not be able to exercise your right to redeem your ETNs. We may from time to time, in our sole discretion, reduce this minimum redemption amount on a consistent basis for all holders of the ETNs.

Issuer Redemption: We may redeem the ETNs (in whole but not in part) at our sole discretion on any business day from and including the issue date to and including the maturity date. To exercise our right to redeem, we must deliver notice to the holders of the ETNs not less than ten calendar days prior to the redemption date on which we intend to redeem the ETNs. If we redeem the ETNs, you will receive a cash payment in U.S. dollars per ETN on the corresponding redemption date in an amount equal to the closing indicative value on the valuation date specified by us in such notice.

Redemption Date: In the case of holder redemption, the redemption date is the second business day following the applicable valuation date (which must be earlier than the final valuation date) specified in your notice of holder redemption. Accordingly, the final redemption date will be the second business day following the valuation date that is immediately prior to the final valuation date. In the case of issuer redemption, the redemption date for the ETNs is the fifth business day after the valuation date specified by us in the issuer redemption notice, which will in no event be later than the maturity date.

Sale to Public

We sold a portion of the ETNs on the inception date at 100% of the principal amount through Barclays Capital Inc., our affiliate, as principal in the initial distribution. Following the inception date, the remainder of the ETNs will be offered and sold from time to time through Barclays Capital Inc., as agent. Sales of the ETNs by us after the inception date will be made at market prices prevailing at the time of sale, at prices related to market prices or at negotiated prices. However, we are under no obligation to issue or sell ETNs at any time. If we limit, restrict or stop sales of ETNs, or if we subsequently resume sales of ETNs, the liquidity and trading price of the ETNs in the secondary market could be materially and adversely affected. Barclays Capital Inc. will not receive an agent’s commission in connection with sales of the ETNs. Please see “Supplemental Plan of Distribution” in this pricing supplement for more information.

We may use this pricing supplement in the initial sale of the ETNs. In addition, Barclays Capital Inc. or another of our affiliates may use this pricing supplement in market-making transactions in any ETNs after the initial sale of ETNs. Unless we or our agent

informs you otherwise in the confirmation of sale or in a notice delivered at the same time as the confirmation of sale, this pricing supplement is being used in a market-making transaction.

The ETNs are not deposit liabilities of Barclays Bank PLC and are not insured by the United States Federal Deposit Insurance Corporation or any other governmental agency of the United States, the United Kingdom or any other jurisdiction.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these ETNs or determined that this pricing supplement is truthful or complete. Any representation to the contrary is a criminal offense.

Pricing Supplement dated August 1, 2022

Issued in denominations of $25

TABLE OF CONTENTS

-i-

The following is a summary of terms of the iPath® Silver Exchange-Traded Notes (the “ETNs”) linked to the performance of the Barclays Silver 3 Month Index Total Return (the “Index”) that Barclays Bank PLC may issue from time to time, as well as a discussion of risks and other considerations you should take into account when deciding whether to invest in the ETNs. The information in this section is qualified in its entirety by the more detailed explanations set forth elsewhere in this pricing supplement and the accompanying prospectus and prospectus supplement. References to the “prospectus” mean our accompanying prospectus, dated May 23, 2022, and references to the “prospectus supplement” mean our accompanying prospectus supplement, dated June 27, 2022, which supplements the prospectus. See “—Additional Documents Related to the Offering of the ETNs” below.

We may, without your consent, create and issue additional securities having the same terms and conditions as the ETNs. We may consolidate the additional securities to form a single class with the outstanding ETNs. We may, but are not required to, offer and sell ETNs after the inception date through Barclays Capital Inc., our affiliate, as agent. We may impose a requirement to purchase a particular minimum amount of ETNs from our inventory in a single purchase, though we may waive this requirement with respect to any purchase at any time in our sole discretion. In addition, we may offer to sell ETNs from our inventory at a price that is greater or less than the prevailing intraday indicative value or the prevailing market price at the time such sale is made. However, we are under no obligation to sell additional ETNs at any time, and if we do sell additional ETNs, we may limit such sales and stop selling additional ETNs at any time.

Any limitation or suspension on the issuance or sale of the ETNs may materially and adversely affect the price and liquidity of the ETNs in the secondary market. Alternatively, the decrease in supply may cause an imbalance in the market supply and demand, which may cause the ETNs to trade at a premium over their indicative value. Any premium may be reduced or eliminated at any time. Paying a premium purchase price over the indicative value of the ETNs could lead to significant losses in the event you sell your ETNs at a time when such premium is no longer present in the marketplace or if we redeem the

ETNs. Investors should consult their financial advisors before purchasing or selling the ETNs, especially ETNs trading at a premium over their indicative value.

This section summarizes the following aspects of the ETNs:

| · | What are the ETNs and how do they work? |

| · | How do you redeem your ETNs? |

| · | What are some of the risks of the ETNs? |

| · | Is this the right investment for you? |

| · | What are the tax consequences? |

What Are the ETNs and How Do They Work?

The ETNs are medium-term notes that are senior unsecured debt obligations of Barclays Bank PLC. The ETNs will be issued in denominations of $25. The return on the ETNs is linked to the performance of the Index.

We have listed the ETNs on NYSE Arca. If an active secondary market in the ETNs exists, we expect that investors will purchase and sell the ETNs primarily in the secondary market.

THE ETNS OFFER EXPOSURE TO FUTURES CONTRACTS AND NOT DIRECT EXPOSURE TO SILVER OR ITS SPOT PRICES. THESE FUTURES CONTRACTS WILL NOT TRACK THE PERFORMANCE OF SILVER. In addition, the nature of the futures market for silver has historically resulted in a cost to maintain a rolling position in the futures contracts underlying the Index. As a result, the level of the Index, which tracks a rolling position in specified futures contracts, may experience significant declines as a result of these costs, known as roll costs, especially over a longer period. The price of silver will perform differently than the Index and, in certain cases, may have positive performance during periods where the Index is experiencing negative performance. In turn, an investment in the ETNs may experience a significant decline in value over time, the risk of which increases the longer that the ETNs are held. For more information, see “Risk Factors” beginning on page PS-12 of this pricing supplement and the historical performance of the Index presented below in this pricing supplement.

The ETNs may not be suitable for all investors and should be used only by

PS-1

investors with the sophistication and knowledge necessary to understand the risks inherent in the Index, the futures contracts that the Index tracks and investments in silver as an asset class generally. Investors should consult with their broker or financial advisor when making an investment decision and to evaluate their investment in the ETNs and should actively manage and monitor their investments in the ETNs throughout each trading day.

The Index

The Index is calculated on a total return basis and is intended to reflect (1) the performance of a rolling position in specified silver futures contracts (the “Index Components”) that will become the first liquid nearby futures contracts three months in the future in accordance with a specified schedule and (2) the return that corresponds to the weekly announced interest rate for specified 3-month U.S. Treasury bills. The Index is maintained and calculated by Barclays Bank PLC (in such capacity, the “index sponsor”). The closing level of the Index will be calculated on each index business day and is reported by Bloomberg L.P. or a successor via the facilities of the Consolidated Tape Association under the ticker symbol “BCC2SI3T.”

Understanding the Value of the ETNs

The “principal amount” is $25.00 per ETN, which is the initial offering price at which the ETNs were sold on the inception date.

The “closing indicative value” is the value of the ETNs calculated by us on a daily basis and is used to determine the payment at maturity or upon early redemption. The calculation of the closing indicative value on any valuation date following the initial valuation date is based on the closing indicative value for the immediately preceding calendar day. As a result, the closing indicative value differs from the intraday indicative value or the trading price of the ETNs. The closing indicative value for each ETN on the initial valuation date was equal to $25. On each subsequent calendar day until maturity or early redemption, the closing indicative value for each ETN will equal (1) the closing indicative value on the immediately preceding calendar day times (2) the daily index factor on such calendar day (or, if such day is not an index business day, one). If the ETNs undergo a split or reverse split, the closing indicative value will be adjusted accordingly.

The “intraday indicative value” is intended to provide an approximation of the effect that changes in the level of the Index during the current trading day would have on the closing indicative value of the ETNs from the previous day. Intraday indicative value differs from closing indicative value because intraday indicative value is based on the most recent Index level published by the index sponsor, which reflects the most recent reported prices for the Index Components, rather than the daily index factor for the immediately preceding calendar day.

The intraday indicative value is not the market price of the ETNs in any secondary market and is not intended as a price or quotation, or as an offer or solicitation for the purchase or sale of the ETNs or as a recommendation to transact in the ETNs at the stated price. Because the intraday indicative value is based on the intraday Index levels, it will reflect any lags, disruptions or suspensions that affect the Index. The market price of the ETNs at any time may vary significantly from the intraday indicative value due to, among other things, imbalances of supply and demand for the ETNs (including as a result of any decision of ours to issue, stop issuing or resume issuing additional ETNs) futures contracts included in the Index and/or other derivatives related to the Index or the ETNs; any trading disruptions, suspension or limitations to any of the forgoing; lack of liquidity; severe volatility; transaction costs; credit considerations and bid-offer spreads. A premium or discount market price over the intraday indicative value can also arise as a result of mismatches of trading hours between the ETNs and the futures contracts included in the Index, actions (or failure to take action) by the index sponsor and the relevant exchange of the futures contracts included in the Index and technical or human errors by service providers, market participants and others.

The intraday indicative value is calculated and published every 15 seconds on each trading day from approximately 9:30 a.m. to approximately 4:15 p.m., New York City time by ICE Data Indices, LLC or a successor under the ticker symbol SBUG.IV. The daily settlement price of each futures contract underlying the Index is determined at or prior to approximately 1:30 p.m. New York City time on each trading day. However, because of a time lag in the publication

PS-2

of the daily settlement price, the closing level of the Index, which is based on the daily settlement price, is typically not published until after 4:00 p.m., New York City time. The index sponsor suspends real-time calculation of the intraday level of the Index following the initial determination of the daily settlement price (subject to adjustment to reflect any late settlement of relevant futures contracts), even though the futures contracts underlying the Index might continue to trade on their markets. As a result, the intraday indicative value (which reflects the most recently published intraday level of the Index) will not reflect any trading in the futures contracts underlying the Index that might take place during this time period. Therefore, during this time period, the intraday indicative value is likely to differ from the value of the ETNs that would be determined if real-time trading data of the futures contracts were used in the calculation. As a result, we expect that the trading price of the ETNs is likely to diverge from the intraday indicative value during this time period, particularly if there is a significant price movement in the futures contracts during this time period.

The ETNs trade on the NYSE Arca exchange from approximately 9:30 a.m. to 4:00 p.m., New York City time. The ETNs may also trade during after-hours trading. Therefore, during after-hours trading, the last-published intraday indicative value is likely to differ from any value of the ETNs determined based on real-time trading data of the futures contracts, particularly if there is a significant price movement in the futures contracts during this time period. It is possible that the value of the ETNs could undergo a rapid and substantial decline outside of ordinary market trading hours. You may not be able to accurately assess the value of the ETNs relative to the trading price during after-hours trading, including any premium or discount thereto, when there is no recent intraday indicative value available.

If you sell your ETNs on the secondary market, you will receive the “trading price” for your ETNs, which may be substantially above or below the principal amount, closing indicative value and/or the intraday indicative value because the trading price reflects investor supply and demand for the ETNs. In addition, if you purchase your ETNs at a price which reflects a premium over the closing indicative value, you may experience a significant loss if you sell or redeem your ETNs at a time when such premium

is no longer present in the market place or if we exercise our right to redeem the ETNs. Furthermore, if you sell your ETNs at a price which reflects a discount below the intraday indicative value, you may experience a significant loss.

For more information regarding the intraday indicative value, see “Valuation of the ETNs—Intraday Indicative Value” in this pricing supplement.

The ETN performance is linked to the performance of the Index. There is no minimum limit to the level of the Index. Moreover, the ETNs are not principal protected. Therefore, you could lose up to your entire investment in the ETNs.

The costs incurred by the Issuer and its affiliates in order to provide the exposure under the ETNs and compensation received by the Issuer and its affiliates for providing the ETNs are borne by holders of the ETNs. Please see “Risk Factors—Risks Relating to Conflicts of Interest and Hedging” for additional information.

How Do You Redeem Your ETNs?

If we have not delivered notice of our intention to exercise our right to redeem the ETNs, you may, subject to the minimum redemption amount, elect to redeem your ETNs on any redemption date. To redeem your ETNs, you must instruct your broker or other person through whom you hold your ETNs to take the following steps:

| · | deliver a notice of holder redemption, in proper form, which is attached as Annex A, to us via email by no later than 4:00 p.m., New York City time, on the business day prior to the applicable valuation date. If we receive your notice by the time specified in the preceding sentence, we will respond by sending you a form of confirmation of holder redemption, which is attached as Annex B; |

| · | deliver the signed confirmation of holder redemption to us via email in the specified form by 5:00 p.m., New York City time, on the same day. We or our affiliate must acknowledge receipt in order for your confirmation to be effective; |

| · | instruct your Depository Trust Company (“DTC”) custodian to book a delivery vs. payment trade with respect to your ETNs on |

PS-3

the valuation date at a price per ETN equal to the applicable closing indicative value, facing Barclays DTC 229; and

| · | cause your DTC custodian to deliver the trade as booked for settlement via DTC at or prior to 10:00 a.m., New York City time, on the applicable redemption date (the second business day following the applicable valuation date). |

Different brokerage firms may have different deadlines for accepting instructions from their customers. Accordingly, you should consult the brokerage firm through which you own your interest in the ETNs in respect of such deadlines. If we do not receive your notice of holder redemption by 4:00 p.m., New York City time, or your confirmation of holder redemption by 5:00 p.m., New York City time, on the business day prior to the applicable valuation date, your notice will not be effective and we will not redeem your ETNs on the applicable redemption date. Any redemption instructions for which we (or our affiliate) receive a valid confirmation in accordance with the procedures described above will be irrevocable.

The redemption value is determined according to a formula which relies upon the closing indicative value and will be calculated on a valuation date that will occur after the redemption notice is submitted. It is not possible to publicly disclose, or for you to determine, the precise redemption value prior to your election to redeem. The redemption value may be below the most recent intraday indicative value or closing indicative value of your ETNs at the time when you submit your redemption notice.

What Are Some of the Risks of the ETNs?

An investment in the ETNs involves risks. Some of these risks are summarized here, but we urge you to read the more detailed explanation of risks in “Risk Factors” in this pricing supplement.

| · | Commodity Market Risk — The return on the ETNs is linked to the performance of the Index which, in turn, is linked to the prices of the futures contracts on silver that comprise the Index. The prices of such futures contracts may change unpredictably, affecting the level of the Index and, consequently, the value of your ETNs in unforeseeable ways. |

| · | Uncertain Principal Repayment — There is no minimum limit to the level of the Index. Moreover, the ETNs are not principal protected. Therefore, a decrease in the level of the Index could cause you to lose up to your entire investment in the ETNs. If the level of the Index decreases, you will receive less than the amount you invested in the ETNs at maturity or upon early redemption. |

| · | Credit of Issuer — The ETNs are unsecured and unsubordinated debt obligations of the Issuer, Barclays Bank PLC, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the ETNs, including any repayment of principal, is subject to the ability of Barclays Bank PLC to satisfy its obligations as they come due and is not guaranteed by any third party. As a result, the actual and perceived creditworthiness of Barclays Bank PLC may affect the market value of the ETNs and, in the event Barclays Bank PLC were to default on its obligations, you might not receive any amount owed to you under the terms of the ETNs. |

| · | Issuer Redemption — Subject to the procedures described in this pricing supplement, we have the right to redeem or “call” the ETNs (in whole but not in part) at our sole discretion without your consent on any business day from and including the issue date to and including the maturity date. |

| · | Limited or Lack of Portfolio Diversification — The Index Components are concentrated in one commodity. Your investment may therefore carry risks similar to a concentrated securities investment in one industry or sector. |

| · | No Interest Payments — You will not receive any periodic interest payments on the ETNs. |

| · | A Trading Market for the ETNs May Not Exist — Although we have listed the ETNs on NYSE Arca, a trading market for the ETNs may not exist at any time. Even if there is a secondary market for the ETNs, whether as a result of any listing of the ETNs or on an over-the-counter basis, it may not provide enough liquidity to trade or sell your ETNs easily. Certain affiliates of Barclays Bank PLC intend to engage in limited purchase and resale transactions. If they do, |

PS-4

however, they are not required to do so and may stop at any time. We are not required to maintain any listing of the ETNs on NYSE Arca or any other securities exchange and may cause the ETNs to be de-listed at our discretion.

Is This the Right Investment for You?

The ETNs may be a suitable investment for you if:

| · | You do not seek a guaranteed return of principal and you are willing to risk losing up to your entire investment in the ETNs; |

| · | You intend to regularly monitor your investment in the ETNs to ensure that it remains consistent with your market views and investment strategies; |

| · | You do not seek current income from your investment; |

| · | You seek an investment with a return linked to the performance of the Index; |

| · | You are willing to accept the risk of fluctuations in the prices of the futures contracts on silver that compose the Index; |

| · | You are willing to accept the risks of an investment linked to the Index, which tracks a rolling position in futures contracts on silver, and in particular risks associated with roll costs reflected in the level of the Index; |

| · | You believe the level of the Index will not decrease; |

| · | You are willing to hold securities that are subject to the issuer redemption right on or after the issue date; and |

| · | You are willing and able to assume the credit risk of Barclays Bank PLC, as issuer of the ETNs, for all payments under the ETNs and understand that if Barclays Bank PLC were to default on its payment obligations or become subject to the exercise of any U.K. Bail-in Power, you might not receive any amounts due to you under the ETNs, including any repayment of principal. |

The ETNs may not be a suitable investment for you if:

| · | You seek a guaranteed return of principal and you are not willing to risk losing up to your entire investment in the ETNs; |

| · | You seek current income from your investment; |

| · | You do not intend to regularly monitor your investment in the ETNs to ensure that it remains consistent with your market views and investment strategies; |

| · | You are not willing to be exposed to fluctuations in the prices of futures contracts on silver that compose the Index; |

| · | You are not willing to accept the risks of an investment linked to the Index, which tracks a rolling position in futures contracts on silver, and in particular risks associated with roll costs reflected in the level of the Index; |

| · | You believe the level of the Index will decrease; |

| · | You are not willing to hold securities that are subject to the issuer redemption right on or after the issue date; |

| · | You prefer the lower risk and therefore accept the potentially lower returns of fixed income investments with comparable maturities and credit ratings; or |

| · | You are unwilling or unable to assume the credit risk of Barclays Bank PLC, as issuer of the ETNs, for all payments under the ETNs or you are not willing to be exposed to the risk that if Barclays Bank PLC were to default on its payment obligations or become subject to the exercise of any U.K. Bail-in Power, you might not receive any amounts due to you under the ETNs, including any repayment of principal. |

What Are the Tax Consequences?

Absent a change in law or an administrative or judicial ruling to the contrary, in the opinion of our special tax counsel, Davis Polk & Wardwell LLP, the ETNs should be treated for U.S. federal income tax purposes as prepaid forward contracts with respect to the Index that are not debt instruments, as discussed further in the section below entitled “Material U.S. Federal Income Tax Considerations.” If the ETNs are so treated, you should generally recognize capital gain or loss upon the sale, exchange, early redemption or maturity of your ETNs in an amount equal to the difference between the amount you receive at such time and your tax basis in the ETNs.

However, the U.S. federal income tax

PS-5

consequences of your investment in the ETNs are uncertain. It is possible that the Internal Revenue Service (the “IRS”) may assert an alternative treatment. Because of this uncertainty, we urge you to consult your own tax advisor as to the tax consequences of your investment in the ETNs.

For a more complete discussion of the U.S. federal income tax consequences of your investment in the ETNs, including possible alternative treatments for the ETNs, see “Material U.S. Federal Income Tax Considerations” in this pricing supplement.

Additional Documents Related to the Offering of the ETNs

You should read this pricing supplement together with the prospectus dated May 23, 2022, as supplemented by the prospectus supplement dated June 27, 2022 relating to our Global Medium-Term Notes, Series A, of which these ETNs are a part. This pricing supplement, together with the documents listed below, contains the terms of the ETNs and supersedes all prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth under “Risk Factors” in the prospectus supplement and this pricing supplement, as the ETNs involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the ETNs.

You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| · | Prospectus dated May 23, 2022: |

http://www.sec.gov/Archives/edgar/data/312070/

000119312522157585/d337542df3asr.htm

| · | Prospectus Supplement dated June 27, 2022: |

http://www.sec.gov/Archives/edgar/data/0000312070/

000095010322011301/dp169388_424b2-prosupp.htm

Our SEC file number is 1-10257. As used in this pricing supplement, “we,” “us” and “our” refer to Barclays Bank PLC.

Conflicts of Interest

Barclays Capital Inc. is an affiliate of Barclays Bank PLC and, as such, has a “conflict of interest” in this offering within the meaning of Rule 5121 of Financial Industry Regulatory Authority, Inc. (“FINRA”). Consequently, this offering is being conducted in compliance with the provisions of FINRA Rule 5121 (or any successor rule thereto). In addition, Barclays Capital Inc. will not sell the ETNs to a discretionary account without specific written approval from the account holder. For more information, please refer to “Plan of Distribution (Conflicts of Interest)—Conflicts of Interest” in the accompanying prospectus supplement.

PS-6

| Hypothetical Examples |

The following examples show how the ETNs would perform in hypothetical circumstances, assuming a starting level of 100.000.

The hypothetical examples in this section do not take into account the effects of applicable taxes. The after-tax return you receive on your ETNs will depend on the U.S. tax treatment of your ETNs and on your particular circumstances. Accordingly, the after-tax rate of return of your ETNs could be different than the after-tax return of a direct investment in the Index components or the Index.

Figures for year 30 are as of the final valuation date, and figures for each year prior to year 30 represent the hypothetical amount that would be paid upon early redemption at each anniversary of the issue date, assuming that the relevant valuation date for each early redemption occurs on each anniversary of the inception date.

These hypothetical examples are provided for illustrative purposes only. Past performance of the Index and the hypothetical performance of the ETNs are not indicative of the future results of the Index or the ETNs. The actual performance of the Index and the ETNs will vary, perhaps significantly, from the examples illustrated below.

PS-7

| A | B | C | D |

| Year | Index Level | Annualized Index Return | Closing Indicative Value (CIV) |

| A | B | C | (C+1) × Previous CIV |

| 0 | 100.0000 | - | $25.0000 |

| 1 | 103.0000 | 3.00% | $25.7500 |

| 2 | 106.0900 | 3.00% | $26.5225 |

| 3 | 109.2727 | 3.00% | $27.3182 |

| 4 | 112.5509 | 3.00% | $28.1377 |

| 5 | 115.9274 | 3.00% | $28.9819 |

| 6 | 119.4052 | 3.00% | $29.8513 |

| 7 | 122.9874 | 3.00% | $30.7468 |

| 8 | 126.6770 | 3.00% | $31.6693 |

| 9 | 130.4773 | 3.00% | $32.6193 |

| 10 | 134.3916 | 3.00% | $33.5979 |

| 11 | 138.4234 | 3.00% | $34.6058 |

| 12 | 142.5761 | 3.00% | $35.6440 |

| 13 | 146.8534 | 3.00% | $36.7133 |

| 14 | 151.2590 | 3.00% | $37.8147 |

| 15 | 155.7967 | 3.00% | $38.9492 |

| 16 | 160.4706 | 3.00% | $40.1177 |

| 17 | 165.2848 | 3.00% | $41.3212 |

| 18 | 170.2433 | 3.00% | $42.5608 |

| 19 | 175.3506 | 3.00% | $43.8377 |

| 20 | 180.6111 | 3.00% | $45.1528 |

| 21 | 186.0295 | 3.00% | $46.5074 |

| 22 | 191.6103 | 3.00% | $47.9026 |

| 23 | 197.3587 | 3.00% | $49.3397 |

| 24 | 203.2794 | 3.00% | $50.8199 |

| 25 | 209.3778 | 3.00% | $52.3444 |

| 26 | 215.6591 | 3.00% | $53.9148 |

| 27 | 222.1289 | 3.00% | $55.5322 |

| 28 | 228.7928 | 3.00% | $57.1982 |

| 29 | 235.6566 | 3.00% | $58.9141 |

| 30 | 242.7262 | 3.00% | $60.6816 |

| Annualized Index Return | 3.00% | |||

| Annualized ETN Return | 3.00% |

PS-8

Hypothetical Examples

A | B | C | D |

| Year | Index Level | Annualized Index Return | Closing Indicative Value (CIV) |

| A | B | C | (C+1) × Previous CIV |

| 0 | 100.0000 | - | $25.0000 |

| 1 | 100.4000 | 0.40% | $25.1000 |

| 2 | 100.8016 | 0.40% | $25.2004 |

| 3 | 101.2048 | 0.40% | $25.3012 |

| 4 | 101.6096 | 0.40% | $25.4024 |

| 5 | 102.0161 | 0.40% | $25.5040 |

| 6 | 102.4241 | 0.40% | $25.6060 |

| 7 | 102.8338 | 0.40% | $25.7085 |

| 8 | 103.2452 | 0.40% | $25.8113 |

| 9 | 103.6581 | 0.40% | $25.9145 |

| 10 | 104.0728 | 0.40% | $26.0182 |

| 11 | 104.4891 | 0.40% | $26.1223 |

| 12 | 104.9070 | 0.40% | $26.2268 |

| 13 | 105.3266 | 0.40% | $26.3317 |

| 14 | 105.7480 | 0.40% | $26.4370 |

| 15 | 106.1709 | 0.40% | $26.5427 |

| 16 | 106.5956 | 0.40% | $26.6489 |

| 17 | 107.0220 | 0.40% | $26.7555 |

| 18 | 107.4501 | 0.40% | $26.8625 |

| 19 | 107.8799 | 0.40% | $26.9700 |

| 20 | 108.3114 | 0.40% | $27.0779 |

| 21 | 108.7447 | 0.40% | $27.1862 |

| 22 | 109.1796 | 0.40% | $27.2949 |

| 23 | 109.6164 | 0.40% | $27.4041 |

| 24 | 110.0548 | 0.40% | $27.5137 |

| 25 | 110.4950 | 0.40% | $27.6238 |

| 26 | 110.9370 | 0.40% | $27.7343 |

| 27 | 111.3808 | 0.40% | $27.8452 |

| 28 | 111.8263 | 0.40% | $27.9566 |

| 29 | 112.2736 | 0.40% | $28.0684 |

| 30 | 112.7227 | 0.40% | $28.1807 |

| Annualized Index Return | 0.40% | |||

| Annualized ETN Return | 0.40% |

PS-9

Hypothetical Examples

| A | B | C | D |

| Year | Index Level | Annualized Index Return | Closing Indicative Value (CIV) |

| A | B | C | (C+1) × Previous CIV |

| 0 | 100.0000 | - | $25.0000 |

| 1 | 97.0000 | -3.00% | $24.2500 |

| 2 | 94.0900 | -3.00% | $23.5225 |

| 3 | 91.2673 | -3.00% | $22.8168 |

| 4 | 88.5293 | -3.00% | $22.1323 |

| 5 | 85.8734 | -3.00% | $21.4684 |

| 6 | 83.2972 | -3.00% | $20.8243 |

| 7 | 80.7983 | -3.00% | $20.1996 |

| 8 | 78.3743 | -3.00% | $19.5936 |

| 9 | 76.0231 | -3.00% | $19.0058 |

| 10 | 73.7424 | -3.00% | $18.4356 |

| 11 | 71.5301 | -3.00% | $17.8825 |

| 12 | 69.3842 | -3.00% | $17.3461 |

| 13 | 67.3027 | -3.00% | $16.8257 |

| 14 | 65.2836 | -3.00% | $16.3209 |

| 15 | 63.3251 | -3.00% | $15.8313 |

| 16 | 61.4254 | -3.00% | $15.3563 |

| 17 | 59.5826 | -3.00% | $14.8957 |

| 18 | 57.7951 | -3.00% | $14.4488 |

| 19 | 56.0613 | -3.00% | $14.0153 |

| 20 | 54.3794 | -3.00% | $13.5949 |

| 21 | 52.7481 | -3.00% | $13.1870 |

| 22 | 51.1656 | -3.00% | $12.7914 |

| 23 | 49.6306 | -3.00% | $12.4077 |

| 24 | 48.1417 | -3.00% | $12.0354 |

| 25 | 46.6975 | -3.00% | $11.6744 |

| 26 | 45.2965 | -3.00% | $11.3241 |

| 27 | 43.9377 | -3.00% | $10.9844 |

| 28 | 42.6195 | -3.00% | $10.6549 |

| 29 | 41.3409 | -3.00% | $10.3352 |

| 30 | 40.1007 | -3.00% | $10.0252 |

| Annualized Index Return | -3.00% | |||

| Annualized ETN Return | -3.00% |

PS-10

Hypothetical Examples

| A | B | C | D |

| Year | Index Level | Annualized Index Return | Closing Indicative Value (CIV) |

| A | B | C | (C+1) × Previous CIV |

| 0 | 100.0000 | - | $25.0000 |

| 1 | 99.6000 | -0.40% | $24.9000 |

| 2 | 99.2016 | -0.40% | $24.8004 |

| 3 | 98.8048 | -0.40% | $24.7012 |

| 4 | 98.4096 | -0.40% | $24.6024 |

| 5 | 98.0159 | -0.40% | $24.5040 |

| 6 | 97.6239 | -0.40% | $24.4060 |

| 7 | 97.2334 | -0.40% | $24.3083 |

| 8 | 96.8444 | -0.40% | $24.2111 |

| 9 | 96.4571 | -0.40% | $24.1143 |

| 10 | 96.0712 | -0.40% | $24.0178 |

| 11 | 95.6870 | -0.40% | $23.9217 |

| 12 | 95.3042 | -0.40% | $23.8261 |

| 13 | 94.9230 | -0.40% | $23.7307 |

| 14 | 94.5433 | -0.40% | $23.6358 |

| 15 | 94.1651 | -0.40% | $23.5413 |

| 16 | 93.7885 | -0.40% | $23.4471 |

| 17 | 93.4133 | -0.40% | $23.3533 |

| 18 | 93.0397 | -0.40% | $23.2599 |

| 19 | 92.6675 | -0.40% | $23.1669 |

| 20 | 92.2968 | -0.40% | $23.0742 |

| 21 | 91.9276 | -0.40% | $22.9819 |

| 22 | 91.5599 | -0.40% | $22.8900 |

| 23 | 91.1937 | -0.40% | $22.7984 |

| 24 | 90.8289 | -0.40% | $22.7072 |

| 25 | 90.4656 | -0.40% | $22.6164 |

| 26 | 90.1037 | -0.40% | $22.5259 |

| 27 | 89.7433 | -0.40% | $22.4358 |

| 28 | 89.3843 | -0.40% | $22.3461 |

| 29 | 89.0268 | -0.40% | $22.2567 |

| 30 | 88.6707 | -0.40% | $22.1677 |

| Annualized Index Return | -0.40% | |||

| Annualized ETN Return | -0.40% |

PS-11

The ETNs are senior unsecured debt obligations of Barclays Bank PLC and are not secured debt. The ETNs are riskier than ordinary unsecured debt securities. The return on the ETNs is linked to the performance of the Index. Investing in the ETNs is not equivalent to investing directly in the Index or the Index Components. See “The Index” in this pricing supplement for more information.

The ETNs may not be suitable for all investors and should be used only by investors with the sophistication and knowledge necessary to understand the risks inherent in the Index, the futures contracts that the Index tracks and investments in silver as an asset class generally. Investors should consult with their broker or financial advisor when making an investment decision and to evaluate their investment in the ETNs and should actively manage and monitor their investments in the ETNs throughout each trading day.

You may lose all or a substantial portion of your investment within a single day if you invest in the ETNs.

This section describes the most significant risks relating to an investment in the ETNs. We urge you to read the following information about these risks, together with the other information in this pricing supplement and the accompanying prospectus and prospectus supplement, before investing in the ETNs.

You should also consider the tax consequences of investing in the ETNs, significant aspects of which are uncertain. See “Material U.S. Federal Income Tax Considerations” in this pricing supplement.

Risks Relating to the ETNs Generally

The ETNs Do Not Guarantee Any Return of Principal, and You May Lose Some or All of Your Investment

The ETN performance is linked to the performance of the Index. There is no minimum limit to the level of the Index. Moreover, the ETNs are not principal protected. Therefore, a decrease in the level of the Index could cause you to lose up to your entire investment in the ETNs. You may lose all or a substantial portion of your investment within a single day if you invest in the ETNs.

If the level of the Index decreases, you will receive less than the amount you invested in the ETNs at maturity or upon early redemption.

We May Redeem the ETNs at Any Time on or after the Issue Date

We have the right to redeem or “call” the ETNs (in whole but not in part) at our sole discretion without your consent on any business day from and including the issue date to and including the maturity date. If we elect to redeem the ETNs, we will deliver written notice of such election to redeem to the holders of the ETNs not less than ten calendar days prior to the redemption date on which we intend to redeem the ETNs. In this scenario, the ETNs will be redeemed on the fifth business day following the valuation date specified by us in the issuer redemption notice, but in no event later than the maturity date.

If we exercise our right to redeem the ETNs, the payment you receive may be less than the payment that you would have otherwise been entitled to receive at maturity and may be less than the secondary market trading price of the ETNs. Also, you may not be able to reinvest any amounts received on the redemption date in a comparable investment. Our right to redeem the ETNs may also adversely impact your ability to sell your ETNs, and/or the price at which you may be able to sell your ETNs, particularly after delivery of the issuer redemption notice.

You Will Not Benefit from Any Increase in the Level of the Index If Such Increase Is Not Reflected in the Level of the Index on the Applicable Valuation Date

If the Index does not increase between the date you purchased the ETNs and the applicable valuation date (including the final valuation date), we will pay you less than the amount you invested in the ETNs at maturity or upon early redemption. This will be true even if the level of the Index as of some date or dates prior to the applicable valuation date would have been sufficiently high to provide the ETNs with a valuation equal to or greater than the amount you invested in the ETNs.

You Will Not Receive Interest Payments on the ETNs or Have Rights in Respect of Any of the Index Components

You will not receive any periodic interest payments on your ETNs. As an owner of the ETNs, you will not have rights that investors in the Index Components may have. Your ETNs

PS-12

will be paid in cash, and you will have no right to receive delivery of any Index Components or the commodity underlying the Index Components. In addition, the return on your ETNs will not reflect the return you would have realized if you had actually owned the Index Components and held such investment for a similar period.

If a Market Disruption Event Has Occurred or Exists on a Valuation Date, the Calculation Agent Can Postpone the Determination of, as Applicable, the Closing Indicative Value or the Maturity Date or a Redemption Date

The determination of the value of the ETNs on a valuation date, including the final valuation date, may be postponed if the calculation agent determines that a market disruption event has occurred or is continuing on such valuation date. In no event, however, will a valuation date for the ETNs be postponed by more than five scheduled trading days. As a result, the maturity date or a redemption date for the ETNs could also be postponed to the fifth business day following such valuation date, as postponed. If a valuation date is postponed until the fifth scheduled trading day following the scheduled valuation date but a market disruption event occurs or is continuing on such day, that day will nevertheless be the valuation date and the calculation agent will make a good faith estimate in its sole discretion of the level of the Index for such day. See “Specific Terms of the ETNs—Market Disruption Events” in this pricing supplement.

Postponement of a Valuation Date May Result in a Reduced Amount Payable at Maturity or Upon Early Redemption

As the payment at maturity or upon early redemption is a function of, among other things, the applicable change in Index level on the final valuation date or applicable valuation date, as the case may be, the postponement of any valuation date may result in the application of a different applicable change in Index level and, accordingly, decrease the payment you receive at maturity or upon early redemption.

Risks Relating to the Issuer

The ETNs Are Subject to the Credit Risk of the Issuer, Barclays Bank PLC

The ETNs are senior unsecured debt obligations of the issuer, Barclays Bank PLC, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the ETNs depends on the ability of Barclays Bank PLC to

satisfy its obligations as they come due and are not guaranteed by a third party. As a result, the actual and perceived creditworthiness of Barclays Bank PLC may affect the market value of the ETNs and, in the event Barclays Bank PLC were to default on its obligations, you may not receive the amounts owed to you under the terms of the ETNs.

You May Lose Some or All of Your Investment If Any U.K. Bail-in Power Is Exercised by the Relevant U.K. Resolution Authority

Notwithstanding and to the exclusion of any other term of the ETNs or any other agreements, arrangements or understandings between Barclays Bank PLC and any holder or beneficial owner of the ETNs, by acquiring the ETNs, each holder and beneficial owner of the ETNs acknowledges, accepts, agrees to be bound by, and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority as set forth under “Consent to U.K. Bail-in Power” in this pricing supplement. Accordingly, any U.K. Bail-in Power may be exercised in such a manner as to result in you and other holders and beneficial owners of the ETNs losing all or a part of the value of your investment in the ETNs or receiving a different security from the ETNs, which may be worth significantly less than the ETNs and which may have significantly fewer protections than those typically afforded to debt securities. Moreover, the relevant U.K. resolution authority may exercise the U.K. Bail-in Power without providing any advance notice to, or requiring the consent of, the holders and beneficial owners of the ETNs. The exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority with respect to the ETNs will not be a default or an event of default and the Trustee (as defined herein) will not be liable for any action that the Trustee takes, or abstains from taking, in either case, in accordance with the exercise of the U.K. Bail-in Power by the relevant U.K. resolution authority with respect to the ETNs. See “Consent to U.K. Bail-in Power” in this pricing supplement as well as “U.K. Bail-in Power,” “Risk Factors—Risks Relating to the Securities Generally—Regulatory action in the event a bank or investment firm in the Group is failing or likely to fail could materially adversely affect the value of the securities” and “Risk Factors—Risks Relating to the Securities Generally—Under the terms of the securities, you have agreed to be bound by the exercise of any U.K. Bail-in Power by the relevant U.K. resolution

PS-13

authority” in the accompanying prospectus supplement.

Risks Relating to the Index

Future Prices of the Index Components That Are Different Relative to Their Current Prices May Result in a Reduced Amount Payable at Maturity or Upon Early Redemption

The Index is composed of commodity futures contracts rather than physical commodities. Unlike equities, which typically entitle the holder to a continuing stake in a corporation, futures contracts normally specify a certain date for delivery of the underlying asset or for settlement in cash based on the level of the underlying asset. As the futures contracts that comprise the Index approach expiration, they are replaced by similar contracts that have a later expiration. The Index Components are rolled in certain specified months into futures contracts that will become the first liquid nearby futures contracts three months in the future under the methodology governing the Index. Thus, for example, a futures contract held in September may specify an expiration in March of the following year. As time passes, the contract expiring in March will be replaced by a contract for delivery in May of the following year. This process is referred to as “rolling.” If the market for these futures contracts is (putting aside other considerations) in “contango,” which means that the prices are higher in the distant delivery months than in the nearer delivery months, the sale of the March contract would take place at a price that is lower than the price of the contract expiring in May, thereby creating a negative “roll yield.” Assuming spot prices remain steady, a futures contract in a contango market will generally tend to lose value over time. The futures markets for silver included in the Index have traded in “contango” markets during certain periods in the past. The presence of contango in the futures markets for silver could result in negative roll yields, which could adversely affect the level of the Index and, accordingly, decrease the payment you receive at maturity or upon early redemption.

The ETNs Offer Exposure to Futures Contracts and Not Direct Exposure to Physical Silver

The ETNs offer investors exposure to the price of futures contracts on silver and not to the spot price of silver or any other physical commodities. The price of a futures contract reflects the market price of a commodity to be delivered at a

specified future point in time, whereas the spot price of a commodity reflects the immediate delivery value of the commodity. A variety of factors can lead to a disparity between the expected future price of a commodity and the spot price at a given point in time, such as the cost of storing the commodity for the term of the futures contract, interest charges to finance the purchase of the commodity and expectations concerning supply and demand for the commodity. The price movement of a futures contract is typically correlated with the movements of the spot price of the reference commodity, but the correlation is generally imperfect and price moves in the spot market may not be reflected in the futures market (and vice versa). Accordingly, the ETNs may underperform a similar investment that reflects the return on physical silver.

Concentration Risks Associated with the Index May Adversely Affect the Market Price of the ETNs

Because the ETNs are linked to the Index, which maintains a rolling position in silver futures contracts, the Index is and generally will be less diversified than other funds, investment portfolios or indices investing in or tracking a broader range of products and, therefore, could experience greater volatility. You should be aware, in particular, that other commodities indices may be more diversified in terms of both the number of and variety of commodity futures contracts than the Index. An investment in the ETNs may therefore carry risks similar to a concentrated securities investment in one industry or sector.

The Performance of the Index Will Differ From That of an Index That Tracks Liquid Nearby Silver Futures Contracts

The Index tracks the performance of specified silver futures contracts that will become the first liquid nearby futures contracts three months in the future in accordance with a specified schedule. There can be no assurance that the longer-dated futures contracts used in the Index will cause the Index to outperform an index that tracks liquid nearby silver futures contracts, and the performance of the Index could be materially worse than the performance of an index that tracks liquid nearby silver futures contracts.

At any time when the market for a commodity futures contract is in “backwardation”, which means that the prices are lower in the distant delivery months than in the nearer delivery

PS-14

months, longer-dated futures contracts are likely to underperform shorter-dated futures contracts on the same commodities. This is because the effects of backwardation are often more pronounced on shorter-dated futures contracts than on longer-dated futures contracts because of the near-term supply-demand imbalance that drives the backwardation. In that market condition, as the delivery months of a shorter-dated futures contract and a longer-dated futures contract become nearer, the settlement price of the shorter-dated futures contract would increase more rapidly than the price of the longer-dated futures contract, and the shorter-dated futures contract would therefore outperform the longer-dated futures contract.

In addition, a significant increase in the settlement price of shorter-dated futures contracts may occur, for example, as a result of a sudden increase in demand for, or an interruption in supply of, the underlying commodity—for example, as a result of supply shortages caused by cartel activity, labor disruptions, accidents affecting production infrastructure or other events. If the factors driving the increase in the price of shorter-dated futures contracts are expected to be temporary, longer-dated futures prices may increase by a smaller amount or not at all.

Furthermore, the market for longer-dated futures contracts may be less liquid than the market for shorter-dated futures contracts. This may result in greater volatility, and less favorable performance, for the longer-dated futures contracts than for the shorter-dated futures contracts.

Prices of the Index Components May Change Unpredictably, Affecting the Level of the Index and the Value of Your Securities in Unforeseeable Ways

Trading in futures contracts on silver, including trading in the Index Components, is speculative and can be extremely volatile. Market prices of the Index Components may fluctuate rapidly based on numerous factors, including: changes in supply and demand relationships (whether actual, perceived, anticipated, unanticipated or unrealized); weather; agriculture; trade; fiscal, monetary and exchange control programs; domestic and foreign political and economic events and policies; disease; pestilence; technological developments; changes in interest rates, whether through governmental action or market movements; and monetary and other

governmental policies, action and inaction. These factors may affect the level of the Index and the value of your ETNs in varying ways, and different factors may cause the prices of the Index Components, and the volatilities of their prices, to move in unexpected directions at unexpected rates.

Supply of and Demand for Silver Tends to be Particularly Concentrated, So Prices Are Likely to Be Volatile

The prices of physical commodities, including silver, can fluctuate widely due to supply and demand disruptions in major producing or consuming regions. In particular, recent growth in industrial production and gross domestic product has made China and other developing nations oversized users of commodities and has increased the extent to which certain commodities rely on those markets. Political, economic and other developments that affect those countries may affect the value of silver and, thus, the level of the Index and the ETNs linked to the Index. Because silver may be produced in a limited number of countries and may be controlled by a small number of producers, political, economic and supply related events in such countries or with such producers could have a disproportionate impact on the prices of silver and the value of your ETNs.

The ETNs May Be Subject to Certain Risks Specific to Silver as a Commodity

Silver is a precious metal. Consequently, in addition to factors affecting commodities generally that are described above, the Index may be subject to a number of additional factors specific to silver that might cause price volatility. These may include, among others:

| · | disruptions in the supply chain, from mining to storage to smelting or refining; |

| · | adjustments to inventory; |

| · | domestic and international monetary policies; |

| · | variations in production costs, including storage, labor and energy costs; |

| · | changes in industrial, government and consumer demand, both in individual consuming nations and internationally; |

| · | precious metal leasing rates; |

| · | currency exchange rates; |

PS-15

| · | level of economic growth and inflation; and |

| · | degree to which consumers, governments, corporate and financial institutions hold physical silver as a safe haven asset (hoarding) which may be caused by a banking crisis/recovery, a rapid change in the value of other assets (both financial and physical) or changes in the level of inflation or geopolitical tension. |

These factors interrelate in complex ways, and the effect of one factor on the level of the Index, and the market value of the ETNs, may offset or enhance the effect of another factor.

Historical Levels of the Index or Any Index Component Should Not Be Taken as an Indication of the Future Performance of the Index during the Term of the ETNs

It is impossible to predict whether the level of the Index will fall or rise. The actual performance of the Index or any Index Component over the term of the ETNs, as well as the amount payable at maturity or upon early redemption, may bear little relation to the historical level of the Index or the Index Components, which in most cases have been highly volatile.

The ETNs Will Be Subject to Significant Movements in Underlying Futures Markets Outside of the Hours During Which the ETNs are Traded on NYSE Arca

The futures markets on which the Index Components are traded are open for trading during significant periods of time when the ETNs are not traded on NYSE Arca. Significant price movements may take place in the underlying futures markets during hours when the ETNs are not traded on NYSE Arca, and those movements may be reflected in the market value of the ETNs when trading of the ETNs commences on NYSE Arca.

Changes in Law or Regulation Relating to Commodities Futures Contracts May Adversely Affect the Market Value of the ETNs and the Amounts Payable on Your ETNs

Commodity futures contracts, such as the Index Components, are subject to legal and regulatory regimes that impose significant regulatory requirements on the trading of such instruments, and on market participants. The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) regulatory scheme (including the rulemaking authority granted to the

Commodity Futures Trading Commission (“CFTC”)) extended and expanded this regime. In particular, for example, while position limits currently exist with respect to futures contracts on physical commodities, the CFTC’s proposed rules under Dodd-Frank would create a more extensive and restrictive set of position limits. It is currently unclear whether the proposed position limit rules will be adopted. However, if adopted as proposed, the rules could adversely affect the cost and liquidity of futures contracts and the market value of the ETNs. Similarly, other regulatory organizations (such as the European Securities and Markets Authority) have proposed, and in the future may propose, further reforms similar to those enacted by the Dodd-Frank Act or other legislation which could have an adverse impact on the liquidity and depth of the commodities, futures and derivatives markets. Any of these changes in laws or regulations may have a material adverse effect on the market value of the ETNs and any amounts payable or property deliverable on the ETNs.

The Index Has Very Limited Performance History

The Index was launched on September 26, 2019. Because the Index is of recent origin and limited historical performance data exists with respect to it, your investment in the ETNs may involve a greater risk than investing in alternate securities linked to one or more indices with an established record of performance. A longer history of actual performance may have been helpful in providing more reliable information on which to assess the validity of the proprietary methodology that the Index makes use of as the basis for an investment decision.

Changes in the Treasury Bill Rate of Interest May Affect the Level of the Index and Your ETNs

Because the return on your ETNs is linked to the closing level of the Index in U.S. dollars, and the calculation of the closing level of the Index is linked, in part, to the Treasury Bill rate of interest that could be earned on cash collateral invested in specified Treasury Bills, changes in the Treasury Bill rate of interest may affect the amount payable on your ETNs at maturity or upon early redemption and, therefore, the market value of your ETNs. Assuming the trading prices of the Index Components remain constant, an increase in the Treasury Bill rate of interest will increase the level of the Index and, therefore, the

PS-16

value of your ETNs. A decrease in the Treasury Bill rate of interest will adversely impact the level of the Index and, therefore, the value of your ETNs. See “The Index—Calculation of the Index.”

Suspension or Disruptions of Market Trading in Silver and Related Futures May Adversely Affect the Value of Your ETNs

The silver futures markets are subject to temporary distortions or other disruptions due to various factors, including the lack of liquidity in the markets, the participation of speculators and government regulation and intervention. In addition, some futures exchanges (including COMEX) have regulations that limit the amount of fluctuation in some futures contract prices that may occur during a single business day. These limits are generally referred to as “daily price fluctuation limits” and the maximum or minimum price of a contract on any given day as a result of these limits is referred to as a “limit price.” Once the limit price has been reached in a particular contract, no trades may be made at a price beyond the limit, or trading may be limited for a set period of time. Limit prices have the effect of precluding trading in a particular contract or forcing the liquidation of contracts at potentially disadvantageous times or prices. These circumstances could adversely affect the level of the Index and therefore, the value of your ETNs.

As Index Sponsor, Barclays Bank PLC Will Have the Authority to Make Determinations That Could Materially Affect the ETNs in Various Ways and Create Conflicts of Interest

Barclays Bank PLC is the index sponsor. The index sponsor is responsible for the composition, calculation and maintenance of the Index. As discussed in “The Index—Modifications to the Index” in this pricing supplement, the index sponsor has the discretion in a number of circumstances to make judgments and take actions in connection with the composition, calculation and maintenance of the Index, and any such judgments or actions may adversely affect the value of the ETNs.

The role played by the index sponsor, and the exercise of the kinds of discretion described above and in “The Index—Modifications to the Index” could present it with significant conflicts of interest in light of the fact that Barclays Bank PLC is the issuer of the ETNs. The index sponsor has no obligation to take the needs of any buyer,

seller or holder of the ETNs into consideration at any time.

The Policies of the Index Sponsor and Changes That Affect the Composition and Valuation of the Index or the Index Components Could Affect the Amount Payable on Your ETNs and Their Market Value

The policies of the index sponsor concerning the calculation of the level of the Index, additions, deletions or substitutions of Index Components and the manner in which changes affecting the Index Components are reflected in the Index could affect the level of the Index and, therefore, the amount payable on the ETNs at maturity or upon early redemption and the market value of the ETNs prior to maturity.

The mechanisms included in the Index and the related Index Components may be changed from time to time in accordance with the Index’s methodology. The index sponsor may also discontinue or suspend calculation or publication of the Index, in which case it may become difficult to determine the market level of the Index. Any such changes could adversely affect the value of your ETNs.

Risks Relating to Liquidity and the Secondary Market

The Estimated Value of the ETNs Is Not a Prediction of the Prices at Which the ETNs May Trade in the Secondary Market, If Any Such Market Exists, and Such Secondary Market Prices, If Any, May Be Lower Than the Principal Amount of the ETNs and May Be Lower Than Such Estimated Value of the ETNs

The estimated value of the ETNs will not be a prediction of the prices at which the ETNs may be redeemed or at which the ETNs may trade in secondary market transactions, if any such market exists, including on NYSE Arca. The price at which you may be able to sell the ETNs in the secondary market at any time will be influenced by many factors that cannot be predicted, such as market conditions, and any bid and ask spread for similar sized trades, and may be substantially less than our estimated value of the ETNs at the time of pricing as of the inception date. For more information regarding additional factors that may influence the market value of the ETNs, please see the risk factor “—The Market Value of the ETNs May Be Influenced by Many Unpredictable Factors.”

PS-17

The Market Value of the ETNs May Be Influenced by Many Unpredictable Factors, Including Volatile Silver Prices

The market value of your ETNs may fluctuate between the date you purchase them and the applicable valuation date. You may also sustain a significant loss if you sell your ETNs in the secondary market. We expect that generally the value of the Index Components will affect the Index and thus the market value of the ETNs and the payment you receive at maturity or upon early redemption, more than any other factor. Several other factors, many of which are beyond our control, and many of which could themselves affect the prices of the Index Components, will influence the market value of the ETNs and the payment you receive at maturity or upon early redemption, including the following:

| · | prevailing spot price for silver, prices of the Index Components, and prevailing market prices of options on the Index or any other financial instruments related to the Index; |

| · | supply and demand for the ETNs, including inventory positions with Barclays Capital Inc. or any market maker and any decision we may make not to issue additional ETNs or to cease or suspend sales of ETNs from inventory; |

| · | the level of contango or backwardation in the markets for the relevant silver futures contracts and the roll costs associated with maintaining a rolling position in such futures contracts; |

| · | the time remaining to maturity of the ETNs; |

| · | prevailing Treasury Bill rate of interest and the general interest rate environment; |

| · | the volatility of the Index, the market prices of the Index Components and the price of silver; |

| · | economic, financial, political, regulatory, geographical or judicial events that affect the level of the Index or the market price of the Index Components; |

| · | the perceived creditworthiness of Barclays Bank PLC; or |

| · | supply and demand in the listed and over-the-counter commodity derivative markets. |

These factors interrelate in complex ways, and the effect of one factor on the market value of

your ETNs may offset or enhance the effect of another factor.

There May Not Be an Active Trading Market in the ETNs; Sales in the Secondary Market May Result in Significant Losses

Although we have listed the ETNs on NYSE Arca, there can be no assurance that a secondary market for the ETNs will exist at any time. Even if there is a secondary market for the ETNs, whether as a result of any listing of the ETNs or on an over-the-counter basis, it may not provide enough liquidity for you to trade or sell your ETNs easily. In addition, although certain affiliates of Barclays Bank PLC may engage in limited purchase and resale transactions in the ETNs, they are not required to do so. If they decide to engage in such transactions, they may stop at any time. We are not required to maintain any listing of the ETNs on NYSE Arca or any other securities exchange and may cause the ETNs to be de-listed at our discretion.

The Liquidity of the Market for the ETNs May Vary Materially Over Time

As stated on the cover of this pricing supplement, we sold a portion of the ETNs on the inception date, and the remainder of the ETNs may be offered and sold from time to time through Barclays Capital Inc., our affiliate, as agent. Also, the number of ETNs outstanding or held by persons other than our affiliates could be reduced at any time due to holder redemptions of the ETNs. Accordingly, the liquidity of the market for the ETNs could vary materially over the term of the ETNs. While you may elect to redeem your ETNs prior to maturity, holder redemption is subject to the conditions and procedures described elsewhere in this pricing supplement, including the condition that you must redeem at least 5,000 ETNs at one time in order to exercise your right to redeem your ETNs on any redemption date.

The ETNs May Trade at a Substantial Premium to or Discount from the Closing Indicative Value and/or the Intraday Indicative Value