Filed Pursuant to Rule 424(b)(2)

Registration No. 333-265158

| | Pricing Supplement dated August 1, 2022 to the Prospectus dated May 23, 2022 and the Prospectus Supplement dated June 27, 2022 |

$150,000,000*

iPath® Shiller CAPETM ETNs

This pricing supplement relates to the iPath® Shiller CAPETM Exchange Traded Notes (the “ETNs”) that Barclays Bank PLC may issue from time to time. Effective on March 2, 2020, the name of the ETNs was changed from Barclays ETN+ Shiller CAPETM Exchange Traded Notes to iPath® Shiller CAPETM Exchange Traded Notes. The terms of the ETNs and their ticker symbol remain the same after the name change. The return of the ETNs is linked to the performance of the Shiller Barclays CAPETM US Core Sector Index (the “Index”). The ETNs do not guarantee any return of principal at or prior to maturity and do not pay any interest during their term. Instead, you will receive a cash payment in U.S. dollars at maturity or upon early redemption based on the performance of the Index less an investor fee.

You may lose some or all of your investment if you invest in the ETNs. Any payment on the ETNs at or prior to maturity, including any repayment of principal, is subject to the creditworthiness of Barclays Bank PLC and is not guaranteed by any third party. See “Risk Factors” beginning on page PS-12 of this pricing supplement for risks relating to an investment in the ETNs.

Because the investor fee reduces the amount of your return at maturity or upon early redemption, the level of the underlying Index will need to increase significantly in order for you to receive at least the principal amount of your investment at maturity or upon early redemption. If the increase in the level of the Index is insufficient to offset the negative effect of the investor fee, or the level of that Index decreases, you will receive less than the principal amount of your investment at maturity or upon early redemption.

The principal terms of the ETNs are as follows:

Issuer: Barclays Bank PLC

Series: Global Medium-Term Notes, Series A

Principal Amount per ETN: $5. The principal amount was $50 per ETN from, and including, the inception date to, but excluding, June 4, 2021, the effective date of the 10 for 1 split of the ETNs.

Inception and Issue Dates: The ETNs were first sold on October 10, 2012 (the “inception date”) and were first issued on October 15, 2012 (the “issue date”).

Maturity Date: October 12, 2022

Secondary Market: We have listed the ETNs on the NYSE Arca exchange (“NYSE Arca”) under the ticker symbol “CAPD”.** To the extent that an active secondary market in the ETNs exists, we expect that investors will purchase and sell the ETNs primarily in this secondary market. We are not required to maintain any listing of the ETNs on NYSE Arca or any other securities exchange.

CUSIP Number: 06742A669

ISIN: US06742A6698

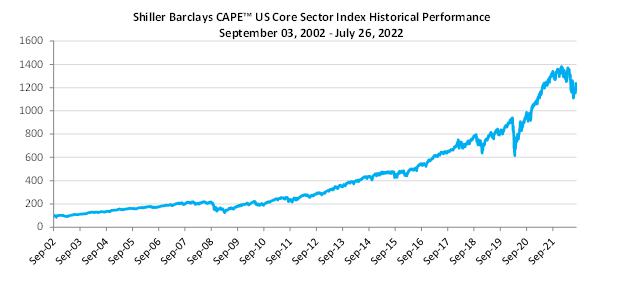

Underlying Index: The return on the ETNs is linked to the performance of the Index. The Index seeks to provide a notional long exposure to the top four relatively undervalued US equity sectors that also exhibit relatively strong price momentum. The Index incorporates the CAPE (Cyclically Adjusted Price Earnings) ratio to assess equity market valuations of 10 sectors (the “Sector Universe”) on a monthly basis and to identify the relatively undervalued sectors represented in the S&P 500® Index (the “S&P 500”). The S&P 500® is intended to provide an indication of the pattern of stock price movement in the U.S. equities market. The Index then selects the top four undervalued sectors that possess relatively stronger price momentum over the past twelve months and allocates an equally weighted notional long position in the total return version of the S&P Select Sector Indices (each, a “Sector Index” and collectively, the “Sector Indices”) corresponding to the selected sectors. Each Sector Index is comprised of equity securities of all companies included in the S&P 500® that are classified as members of the relevant sectors represented by such Sector Index generally according to the Global Industry Classification Standard (“GICS”). We refer herein to the Sector Indices represented in the Index at any given time collectively as the “Index Constituents”. The Index Constituents are calculated, maintained and published by S&P Dow Jones Indices LLC (“S&P Dow Jones Indices” or the “sector index sponsor”).

The Index was created by Barclays Bank PLC, which is the owner of the intellectual property and licensing rights relating to the Index. The Index is administered and published by Barclays Index Administration (the “index sponsor”), a distinct function within the Investment Bank of Barclays Bank PLC. The index sponsor has appointed a third-party index calculation agent (the “index calculation agent”), currently Bloomberg Index Services Limited (formerly known as Barclays Risk Analytics and Index Solutions Limited), to calculate and maintain the Index. While the index sponsor is responsible for the operation of the Index, among other things, certain aspects have thus been outsourced to the index calculation agent. The level of the Index is reported on Bloomberg page “BXIICCST <Index>”.

Prior to October 1, 2018, the Sector Universe consisted of nine sectors. As of October 1, 2018, the index sponsor implemented changes to the Index to include an additional sector to the Sector Universe named the Communication

| * | 2,000,000 ETNs, principal amount $50 per ETN, were issued on October 15, 2012 and an additional 1,000,000 ETNs, principal amount $50 per ETN were issued on January 11, 2021. On May 19, 2021, Barclays Bank PLC announced a 10 for 1 split of the ETNs, effective June 4, 2021. Following the split, 30,000,000 ETNs, principal amount $5 per ETN, were outstanding. |

| ** | Prior to February 24, 2022, the ticker symbol for the ETNs was “CAPE”. |

Services sector, which expanded the Sector Universe to ten sectors. These changes to the Sector Universe were made as a result of changes to the classification of the Global Industry Classification Standard (“GICS”) made by Standard & Poor’s and MSCI Inc. on September 21, 2018. The new Communication Services sector was formed based on the re-classification of companies from both the Technology sector and Consumer Discretionary sector. For more information, please see “The Index—Changes to the Index” in this pricing supplement.

Payment at Maturity: If you hold your ETNs to maturity, you will receive a cash payment per ETN at maturity in U.S. dollars equal to the closing indicative value on the final valuation date.

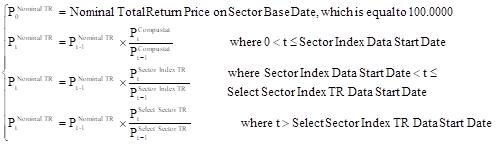

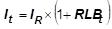

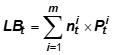

Closing Indicative Value: The closing indicative value for each ETN on any given calendar day will be calculated in the following manner. The closing indicative value on the initial valuation date was $50. On each subsequent calendar day until maturity or early redemption, the closing indicative value will equal (1) the closing indicative value on the immediately preceding calendar day times (2) the daily index factor on such calendar day (or, if such day is not an index business day, one) minus (3) the investor fee on such calendar day. An “index business day” is a day which is a New York Stock Exchange trading day and a NASDAQ Exchange trading day. If the ETNs undergo a split or reverse split, the closing indicative value will be adjusted accordingly.

Barclays Bank PLC implemented a 10 for 1 split of the ETNs, effective at the open of trading on June 4, 2021. For the purpose of calculating the closing indicative value on June 4, 2021, the effective date of the split, the “closing indicative value on the immediately preceding calendar day” in the above formula was adjusted to $20.4651, which is equal to the closing indicative value of $204.6514 on June 3, 2021 divided by 10.

The closing indicative value is not the market price of the ETNs in any secondary market and is not intended as a price or quotation, or as an offer or solicitation for the purchase or sale of the ETNs or as a recommendation to transact in the ETNs at the stated price. The market price of the ETNs at any time may vary significantly from the closing indicative value.

Daily Index Factor: The daily index factor on any index business day will equal (1) the closing level of the Index on such index business day divided by (2) the closing level of the Index on the immediately preceding index business day.

Investor Fee: The investor fee per ETN on the initial valuation date was zero. On each subsequent calendar day until maturity or early redemption, the investor fee will be equal to (1) 0.45% times (2) the closing indicative value on the immediately preceding calendar day times (3) the daily index factor on that day (or, if such day is not an index business day, one) divided by (4) 365. Because the investor fee is calculated and subtracted from the closing indicative value on a daily basis, the net effect of the fee accumulates over time and is subtracted at the rate of 0.45% per year, which we refer to as the “investor fee rate”. The investor fee reduces the daily return of the ETNs. Because the net effect of the investor fee is a fixed percentage of the value of each ETN, the aggregate effect of the investor fee will increase or decrease in a manner directly proportional to the value of each ETN and the amount of ETNs that are held, as applicable.

Barclays Bank PLC implemented a 10 for 1 split of the ETNs, effective at the open of trading on June 4, 2021. For the purpose of calculating the investor fee on June 4, 2021, the effective date of the split, the “closing indicative value on the immediately preceding calendar day” in the above formula was adjusted to $20.4651, which is equal to the closing indicative value of $204.6514 on June 3, 2021 divided by 10.

Intraday Indicative Value: The intraday indicative value is intended to provide an approximation of the effect that changes in the level of the Index during the current trading day would have on the closing indicative value of the ETNs from the previous day. Intraday indicative value differs from closing indicative value in two important respects. First, intraday indicative value is based on the most recent Index level published by the index sponsor, which reflects the most recent reported sales prices for the Index components, rather than the closing indicative value for the immediately preceding calendar day. Second, the intraday indicative value only reflects the investor fee at the close of business on the preceding calendar day, but does not include any adjustment for the investor fee accruing during the course of the current day.

The intraday indicative value is not the market price of the ETNs in any secondary market and is not intended as a price or quotation, or as an offer or solicitation for the purchase or sale of the ETNs or as a recommendation to transact in the ETNs at the stated price. Because the intraday indicative value is based on the intraday Index levels, it will reflect any lags, disruptions or suspensions that affect the Index. The market price of the ETNs at any time may vary significantly from the intraday indicative value due to, among other things, imbalances of supply and demand for the ETNs (including as a result of any decision of ours to issue, stop issuing or resume issuing additional ETNs), stocks included in the Index and/or other derivatives related to the Index or the ETNs; any trading disruptions, suspension or limitations to any of the forgoing; lack of liquidity; severe volatility; transaction costs; credit considerations; and bid-offer spreads. A premium or discount market price over the intraday indicative value can also arise as a result of actions (or failure to take action) by the index sponsor or the sector index sponsor, the relevant exchanges of the stocks included in the Index and NYSE Arca and technical or human errors by service providers, market participants and others.

Business Day: A business day means a Monday, Tuesday, Wednesday, Thursday or Friday that is neither a day on which banking institutions in New York City or London, as applicable, generally are authorized or obligated by law, regulation, or executive order to close.

Trading Day: A trading day with respect to the ETNs is a day on which (1) it is a business day in New York City, (2) trading is generally conducted on the NYSE Arca and (3) trading is generally conducted on the markets on which the equity securities underlying the Index Constituents are traded, in each case as determined by the calculation agent in its sole discretion.

Valuation Date: A valuation date means each index business day from October 10, 2012 to October 4, 2022, inclusive (subject to the occurrence of a market disruption event), or, if such date is not a trading day, the next succeeding trading

day, not to exceed five business days. We refer to October 10, 2012 as the “initial valuation date” and October 4, 2022 as the “final valuation date”.

Early Redemption

Holder Redemption: Subject to the notification requirements set forth under “Specific Terms of the ETNs—Early Redemption Procedures” in this pricing supplement, you may redeem your ETNs on any redemption date during the term of the ETNs. If you redeem your ETNs, you will receive a cash payment in U.S. dollars per ETN equal to the closing indicative value on the applicable valuation date. You must redeem at least 25,000 ETNs at one time in order to exercise your right to redeem your ETNs on any redemption date. If you hold fewer than 25,000 ETNs or fewer than 25,000 ETNs are outstanding, you will not be able to exercise your right to redeem your ETNs.

Issuer Redemption: We may redeem the ETNs (in whole but not in part) at our sole discretion on any trading day on or after the inception date until and including maturity. To exercise our right to redeem, we must deliver notice to the holders of the ETNs not less than ten calendar days prior to the redemption date specified by us in such notice. If we redeem the ETNs, you will receive a cash payment in U.S. dollars per ETN in an amount equal to the closing indicative value on the applicable valuation date.

Redemption Date: In the case of holder redemption, effective as of August 31, 2017, a redemption date is the second business day following each valuation date (other than the final valuation date). The final redemption date will be the second business day following the valuation date that is immediately prior to the final valuation date. In the case of issuer redemption, the redemption date for the ETNs is the date specified by us in the issuer redemption notice, which will in no event be prior to the tenth calendar day following the date on which we deliver such notice.

Sale to Public: We sold a portion of the ETNs on the inception date at 100% of the principal amount through Barclays Capital Inc., our affiliate, as principal in the initial distribution. The remainder of the ETNs will be offered and sold from time to time through Barclays Capital Inc., as agent. Sales of the ETNs by us after the inception date will be made at market prices prevailing at the time of sale, at prices related to market prices or at negotiated prices. However, we are under no obligation to issue or sell ETNs at any time. If we limit, restrict or stop sales of ETNs, or if we subsequently resume sales of ETNs, the liquidity and trading price of the ETNs in the secondary market could be materially and adversely affected. Barclays Capital Inc. will not receive an agent’s commission in connection with sales of the ETNs. Please see “Supplemental Plan of Distribution” in this pricing supplement for more information.

We may use this pricing supplement in the initial sale of the ETNs. In addition, Barclays Capital Inc. or another of our affiliates may use this pricing supplement in market-making transactions in any ETNs after the initial sale of ETNs. Unless we or our agent informs you otherwise in the confirmation of sale or in a notice delivered at the same time as the confirmation of sale, this pricing supplement is being used in a market-making transaction.

The ETNs are not deposit liabilities of Barclays Bank PLC and are not insured by the United States Federal Deposit Insurance Corporation or any other governmental agency of the United States, the United Kingdom or any other jurisdiction.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these ETNs or determined that this pricing supplement is truthful or complete. Any representation to the contrary is a criminal offense.

Pricing Supplement dated August 1, 2022

Issued in denominations of $5

TABLE OF CONTENTS

PRICING SUPPLEMENT SUMMARY

The following is a summary of terms of the iPath® Shiller CAPETM Exchange Traded Notes (the “ETNs”) linked to the performance of the Shiller Barclays CAPETM US Core Sector Index (the “Index”), as well as a discussion of risks and other considerations you should take into account when deciding whether to invest in the ETNs. The information in this section is qualified in its entirety by the more detailed explanations set forth elsewhere in this pricing supplement and the accompanying prospectus and prospectus supplement. References to the “prospectus” mean our accompanying prospectus, dated May 23, 2022, and references to the “prospectus supplement” mean our accompanying prospectus supplement, dated June 27, 2022, which supplements the prospectus. See “—Additional Documents Related to the Offering of the ETNs” below.

We may, without your consent, create and issue additional securities having the same terms and conditions as the ETNs. We may consolidate the additional securities to form a single class with the outstanding ETNs. We may, but are not required to, offer and sell ETNs after the inception date through Barclays Capital Inc., our affiliate, as agent. We may impose a requirement to purchase a particular minimum amount of ETNs from our inventory in a single purchase, though we may waive this requirement with respect to any purchase at any time in our sole discretion. In addition, we may offer to sell ETNs from our inventory at a price that is greater or less than the prevailing intraday indicative value or the prevailing market price at the time such sale is made. However, we are under no obligation to sell additional ETNs at any time, and if we do sell additional ETNs, we may limit such sales and stop selling additional ETNs at any time.

Any limitation or suspension on the issuance or sale of the ETNs may materially and adversely affect the price and liquidity of the ETNs in the secondary market. Alternatively, the decrease in supply may cause an imbalance in the market supply and demand, which may cause the ETNs to trade at a premium over their indicative value. Any premium may be reduced or eliminated at any time. Paying a premium purchase price over the indicative value of the ETNs could lead to significant losses in the event you sell your ETNs at a time when such premium is no longer present

in the marketplace or if we redeem the ETNs. Investors should consult their financial advisors before purchasing or selling the ETNs, especially ETNs trading at a premium over their indicative value.

This section summarizes the following aspects of the ETNs:

| · | What are the ETNs and how do they work? |

| · | How do you redeem your ETNs? |

| · | What are some of the risks of the ETNs? |

| · | Is this the right investment for you? |

| · | What are the tax consequences? |

What Are the ETNs and How Do They Work?

The ETNs are medium-term notes that are senior unsecured debt obligations of Barclays Bank PLC. The ETNs were issued in denominations of $50 from, and including, the inception date to, but excluding, June 4, 2021, the effective date of the 10 for 1 split of the ETNs. Beginning on June 4, 2021, the ETNs will be issued, if any, in denominations of $5. The return on the ETNs is linked to the performance of the Index.

Payment at Maturity or Upon Holder Redemption or Issuer Redemption

If you or we have not previously redeemed your ETNs, you will receive a cash payment in U.S. dollars at maturity per ETN equal to the closing indicative value on the final valuation date. Prior to maturity, you may, subject to certain restrictions, redeem your ETNs on any redemption date during the term of the ETNs, provided that you present at least 25,000 ETNs for redemption, or your broker or other financial intermediary (such as a bank or other financial institution not required to register as a broker-dealer to engage in securities transactions) bundles your ETNs for redemption with those of other investors to reach this minimum. If you choose to redeem your ETNs on a redemption date, you will receive a cash payment in U.S. dollars per ETN on such date equal to the closing indicative value on the applicable valuation date.

Prior to maturity, we may redeem the ETNs (in whole but not in part) at our sole discretion on any trading day on or after the inception date until and including maturity. If we elect to redeem the ETNs, we will deliver written notice of such election to

redeem to the holders of the ETNs not less than ten calendar days prior to the redemption date specified by us in such notice. If we redeem the ETNs, you will receive a cash payment in U.S. dollars per ETN in an amount equal to the closing indicative value on the applicable valuation date.

We have listed the ETNs on NYSE Arca. If an active secondary market in the ETNs exists, we expect that investors will purchase and sell the ETNs primarily in the secondary market.

The Index

The Index seeks to provide a notional long exposure to the top four relatively undervalued US equity sectors (each, a “Sector”) that also exhibit relatively strong price momentum. The Index incorporates the CAPE (Cyclically Adjusted Price Earnings) ratio to assess equity market valuations of the Sector Universe on a monthly basis and to identify the relatively undervalued sectors represented in the S&P 500®. The Index then selects the top four undervalued sectors that possess relatively stronger price momentum over the past twelve months and allocates an equally weighted notional long position in the total return version of the Sector Indices corresponding to the selected sectors.

The S&P 500® is intended to provide an indication of the pattern of stock price movement in the U.S. equities market. We refer herein to the Sector Indices represented in the Index at any given time collectively as the “Index Constituents”. The Index Constituents are calculated, maintained and published by S&P Dow Jones Indices LLC (“S&P Dow Jones Indices” or the “index component sponsor”).

The Index is administered and published by Barclays Index Administration (the “index sponsor”), a distinct function within the Investment Bank of Barclays Bank PLC. The index sponsor has appointed a third-party index calculation agent (the “index calculation agent”), currently Bloomberg Index Services Limited (formerly known as Barclays Risk Analytics and Index Solutions Limited), to calculate and maintain the Index. While the index sponsor is responsible for the operation of the Index, among other things, certain aspects have thus been outsourced to the index calculation agent. The level of the Index is reported on Bloomberg page “BXIICCST <Index>”.

Prior to October 1, 2018, the Sector Universe consisted of nine sectors. As of October 1, 2018,

the index sponsor implemented changes to the Index to include an additional sector to the Sector Universe named the Communication Services sector, which expanded the Sector Universe to ten sectors. These changes to the Sector Universe were made as a result of changes to the classification of the GICS made by Standard & Poor’s and MSCI Inc. on September 21, 2018. The new Communication Services sector was formed based on the re-classification of companies from both the Technology sector and Consumer Discretionary sector. For more information, please see “The Index—Changes to the Index” in this pricing supplement.

Inception, Issuance and Maturity

The ETNs were first sold on October 10, 2012, which we refer to as the “inception date”. The ETNs were first issued on October 15, 2012, and will be due on October 12, 2022.

Understanding the Value of the ETNs

The “principal amount” is $5 per ETN. The principal amount was $50 per ETN from, and including, the inception date to, but excluding, June 4, 2021, the effective date of the 10 for 1 split of the ETNs.

The “closing indicative value” for each ETN is the value of the ETNs calculated by us on a daily basis and is used to determine the payment at maturity or upon early redemption. The calculation of the closing indicative value on any valuation date is based on the closing indicative value for the immediately preceding calendar day. As a result, the closing indicative value differs from the intraday indicative value or the trading price of the ETNs. The closing indicative value on the initial valuation date was $50. On each subsequent calendar day until maturity or early redemption, the closing indicative value for each ETN will equal (1) the closing indicative value on the immediately preceding calendar day times (2) the daily index factor on such calendar day (or, if such day is not an index business day, one) minus (3) the investor fee on such calendar day. If the ETNs undergo any splits or reverse splits, the closing indicative value will be adjusted accordingly.

Barclays Bank PLC implemented a 10 for 1 split of the ETNs, effective at the open of trading on June 4, 2021. For the purpose of calculating the closing indicative value on June 4, 2021, the effective date of the split, the “closing indicative value on the immediately preceding calendar day” in the above

formula was adjusted to $20.4651, which is equal to the closing indicative value of $204.6514 on June 3, 2021 divided by 10.

The “intraday indicative value” is intended to provide an approximation of the effect that changes in the level of the Index during the current trading day would have on the closing indicative value of the ETNs from the previous day. Intraday indicative value differs from closing indicative value in two important respects. First, intraday indicative value is based on the most recent Index level published by the index sponsor, which reflects the most recent reported sales prices for the Index components, rather than the closing indicative value for the immediately preceding calendar day. Second, the intraday indicative value only reflects the investor fee at the close of business on the preceding calendar day, but does not include any adjustment for the investor fee accruing during the course of the current day.

The intraday indicative value is not the market price of the ETNs in any secondary market and is not intended as a price or quotation, or as an offer or solicitation for the purchase or sale of the ETNs or as a recommendation to transact in the ETNs at the stated price. Because the intraday indicative value is based on the intraday Index levels, it will reflect any lags, disruptions or suspensions that affect the Index. The market price of the ETNs at any time may vary significantly from the intraday indicative value due to, among other things, imbalances of supply and demand for the ETNs (including as a result of any decision of ours to issue, stop issuing or resume issuing additional ETNs), stocks included in the Index and/or other derivatives related to the Index or the ETNs; any trading disruptions, suspension or limitations to any of the forgoing; lack of liquidity; severe volatility; transaction costs; credit considerations; and bid-offer spreads. A premium or discount market price over the intraday indicative value can also arise as a result of actions (or failure to take action) by the index sponsor or the sector index sponsor, the relevant exchanges of the stocks included in the Index and NYSE Arca and technical or human errors by service providers, market participants and others.

The intraday indicative value of the ETNs is calculated and published every 15 seconds on each trading day from approximately 9:30 a.m. to

approximately 4:15 p.m., New York City time by NYSE Euronext (NYSE), or a successor, under the following ticker symbol:

| ETNs | Ticker Symbol |

| iPath® Shiller CAPETM ETN | CAPD.IV |

For more information regarding the intraday indicative value see “Valuation of the ETNs—Intraday Indicative Value” in this pricing supplement.

The intraday indicative value will not be updated to reflect any trading in the stocks included in the Index that might take place after 4:15 p.m. The ETNs trade on the NYSE Arca from approximately 9:30 a.m. to 4:00 p.m., New York City time. The ETNs may also trade during after-hours trading. Therefore, during after-hours trading after 4:15 p.m., the last-published intraday indicative value is likely to differ from any value of the ETNs determined based on real-time trading data of the stocks included in the Index, particularly if there is a significant price movement in the stocks included in the Index during this time period. It is possible that the value of the ETNs could undergo a rapid and substantial decline outside of ordinary market trading hours. You may not be able to accurately assess the value of the ETNs relative to the trading price during after-hours trading, including any premium or discount thereto, when there is no recent intraday indicative value available.

If you sell your ETNs on the secondary market you will receive the “trading price” for your ETNs, which may be substantially above or below the principal amount, closing indicative value and/or intraday indicative value because the trading price reflects investor supply and demand for the ETNs. In addition, if you purchase your ETNs at a price which reflects a premium over the closing indicative value, you may experience a significant loss if you sell or redeem your ETNs at a time when such premium is no longer present in the market place or if we exercise our right to redeem the ETNs. Furthermore, if you sell your ETNs at a price which reflects a discount below the intraday indicative value, you may experience a significant loss.

The ETN performance is linked to the performance of the Index less an investor fee. There is no minimum limit to the level of the Index. Moreover, the ETNs are not principal protected. Therefore, a decrease in the level of

the Index could cause you to lose up to your entire investment in the ETNs.

Furthermore, because the investor fee reduces the amount of your return at maturity or upon early redemption, the level of the underlying Index will need to increase significantly in order for you to receive at least the principal amount of your investment at maturity or upon early redemption. If the increase in the level of the Index is insufficient to offset the negative effect of the investor fee, or the level of that Index decreases, you will receive less than the principal amount of your investment at maturity or upon early redemption.

How Do You Redeem Your ETNs?

To redeem your ETNs, you must instruct your broker or other person through whom you hold your ETNs to take the following steps:

| · | deliver a notice of redemption, which is attached as Annex A, to us via facsimile or email by no later than 4:00 p.m., New York City time, on the business day prior to the applicable valuation date. If we receive your notice by the time specified in the preceding sentence, we will respond by sending you a form of confirmation of redemption, which is attached as Annex B; |

| · | deliver the signed confirmation of redemption to us via facsimile or email in the specified form by 5:00 p.m., New York City time, on the same day. We or our affiliate must acknowledge receipt in order for your confirmation to be effective; |

| · | instruct your Depository Trust Company (“DTC”) custodian to book a delivery vs. payment trade with respect to your ETNs on the valuation date at a price per ETN equal to the applicable daily closing indicative value, facing Barclays DTC 229; and |

| · | cause your DTC custodian to deliver the trade as booked for settlement via DTC at or prior to 10:00 a.m., New York City time, on the applicable redemption date (the second business day following the valuation date). |

Different brokerage firms may have different deadlines for accepting instructions from their customers. Accordingly, you should consult the brokerage firm through which you own your interest in the ETNs in respect of such deadlines. If we do

not receive your notice of redemption by 4:00 p.m., New York City time, or your confirmation of redemption by 5:00 p.m., New York City time, on the business day prior to the applicable valuation date, your notice will not be effective and we will not redeem your ETNs on the applicable redemption date. Any redemption instructions for which we (or our affiliate) receive a valid confirmation in accordance with the procedures described above will be irrevocable.

The redemption value is determined according to a formula which relies upon the closing indicative value and will be calculated on a valuation date that will occur after the redemption notice is submitted. It is not possible to publicly disclose, or for you to determine, the precise redemption value prior to your election to redeem. The redemption value may be below the most recent intraday indicative value or closing indicative value of your ETNs at the time when you submit your redemption notice.

What Are Some of the Risks of the ETNs?

An investment in the ETNs involves risks. Some of these risks are summarized here, but we urge you to read the more detailed explanation of risks in “Risk Factors” in this pricing supplement.

| · | Uncertain Principal Repayment – If the level of the Index decreases or does not increase sufficiently to offset any negative effect of the investor fee, you may receive less than your original investment in the ETNs at maturity or upon early redemption. |

| · | Credit of Issuer — The ETNs are unsecured and unsubordinated debt obligations of the Issuer, Barclays Bank PLC, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the ETNs, including any repayment of principal, is subject to the ability of Barclays Bank PLC to satisfy its obligations as they come due and is not guaranteed by any third party. As a result, the actual and perceived creditworthiness of Barclays Bank PLC may affect the market value of the ETNs and, in the event Barclays Bank PLC were to default on its obligations, you might not receive any amount owed to you under the terms of the ETNs. |

| · | Issuer Redemption – Subject to the procedures described in this pricing |

supplement, we have the right to redeem or “call” the ETNs (in whole but not in part) at our sole discretion without your consent on any trading day on or after the inception date until and including maturity.

| · | Market and Volatility Risk – The return on the ETNs is linked to the performance of the Index which, in turn, is comprised of the total return versions of the Sector Indices, each of which is comprised of equity securities included in the S&P 500®. Equity security prices may change unpredictably and, as a result, affect the level of the Index and, consequently, the value of your ETNs in unforeseeable ways. |

| · | Conflicts of Interest with the Index Sponsor – Barclays Index Administration, a distinct function within the Investment Bank of Barclays Bank PLC, is the index sponsor. The index sponsor may administer and publish the level of the Index and make determinations in respect of the Index in its role of administering and publishing, the Index. These activities may present the index sponsor with significant conflicts of interest in light of the fact that its affiliate, Barclays Bank PLC, is the issuer of the ETNs. The index sponsor has no obligation to take the needs of any buyer, seller or holder of the ETNs into consideration at any time. |

| · | No Interest Payments – You will not receive any periodic interest payments on the ETNs. |

| · | A Trading Market for the ETNs May Not Exist – Although we have listed the ETNs on NYSE Arca, a trading market for the ETNs may not exist at any time. Even if there is a secondary market for the ETNs, whether as a result of any listing of the ETNs or on an over-the-counter basis, it may not provide enough liquidity to trade or sell your ETNs easily. In addition, although certain affiliates of Barclays Bank PLC intend to engage in limited purchase and resale transactions in the ETNs, they are not required to do so, and if they decide to engage in such transactions, they may stop at any time. We are not required to maintain any listing of the ETNs on NYSE Arca or any other securities exchange and may cause the ETNs to be de-listed at our discretion. |

Is This the Right Investment for You?

The ETNs may be a suitable investment for you if:

| · | You do not seek a guaranteed return of principal and you are willing to risk losing up to your entire investment in the ETNs. You may lose all or a substantial portion of your investment if you invest in the ETNs. |

| · | You believe the value of the Index will increase by an amount sufficient to offset the investor fee during the term of the ETNs. |

| · | You do not seek current income from your investment. |

| · | You seek an investment with a return linked to the performance of the Index. |

| · | You are willing to accept the risk of market fluctuations in general and fluctuations in the performance of the Index and any of the Sector Indices that comprise the Index specifically. |

| · | You are willing to hold securities that are subject to the issuer redemption right on or after the inception date; and |

| · | You are willing and able to assume the credit risk of Barclays Bank PLC, as issuer of the ETNs, for all payments under the ETNs and understand that if Barclays Bank PLC were to default on its payment obligations, you might not receive any amounts due to you under the ETNs, including any repayment of principal. |

The ETNs may not be a suitable investment for you if:

| · | You seek a guaranteed return of principal and you are not willing to risk losing up to your entire investment in the ETNs; |

| · | You seek current income from your investment; |

| · | You believe the level of the Index will decrease or will not increase by an amount sufficient to offset the investor fee during the term of the ETNs. |

| · | You are not willing to be exposed to market fluctuations in general and fluctuations in the performance of the Index and any of the Sector Indices that comprise the Index specifically. |

| · | You are not willing to hold securities that are subject to the issuer redemption right on or after the inception date. |

| · | You prefer the lower risk and therefore accept the potentially lower returns of fixed income investments with comparable maturities and credit ratings. |

| · | You are unwilling or unable to assume the credit risk of Barclays Bank PLC, as issuer of the ETNs, for all payments under the ETNs or you are not willing to be exposed to the risk that if Barclays Bank PLC were to default on its payment obligations, you might not receive any amounts due to you under the ETNs, including any repayment of principal. |

What Are the Tax Consequences?

You should review carefully the section below entitled “Material U.S. Federal Income Tax Consequences.” As discussed further in that section, based on current market conditions, in the opinion of our special tax counsel, the ETNs should be treated for U.S. federal income tax purposes as prepaid forward contracts with respect to the Index that are not debt instruments. Assuming this treatment is respected, gain or loss on your ETNs should be treated as long-term capital gain or loss if you are treated as holding your ETNs for more than a year, whether or not you are an initial purchaser of ETNs at the original issue price. However, the Internal Revenue Service (the “IRS”) or a court might not respect this treatment, in which case the timing and character of any income or loss on the ETNs could be materially and adversely affected.

In addition, in 2007 the U.S. Treasury Department and the IRS released a notice requesting comments on the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments. The notice focuses in particular on whether to require investors in these instruments to accrue income over the term of their investment. It also asks for comments on a number of related topics, including the character of income or loss with respect to these instruments; the relevance of factors such as the exchange-traded status of the instruments and the nature of the underlying property to which the instruments are linked; the degree, if any, to which income (including any mandated accruals) realized by non-U.S. investors should be subject to withholding tax; and whether these instruments are or should be subject to the

“constructive ownership” regime, which very generally can operate to recharacterize certain long-term capital gain as ordinary income and impose a notional interest charge. While the notice requests comments on appropriate transition rules and effective dates, any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the ETNs, possibly with retroactive effect.

Non-U.S. investors should also note that a 30% withholding tax may be imposed on “dividend equivalents” deemed paid to them under Section 871(m) of the Internal Revenue Code of 1986, as amended (the “Code”), after December 31, 2019 under certain circumstances (even if no cash is actually paid to them), as further discussed below under “Material U.S. Federal Income Tax Consequences—Section 871(m) Withholding.”

You should consult your tax advisor regarding the U.S. federal income tax consequences of an investment in the ETNs, including possible alternative treatments, the possible consequences of the changes to the Index and the issues presented by the 2007 notice.

Additional Documents Related to the Offering of the ETNs

You should read this pricing supplement together with the prospectus dated May 23, 2022, as supplemented by the prospectus supplement dated June 27, 2022 relating to our Global Medium-Term Notes, Series A, of which these ETNs are a part. This pricing supplement, together with the documents listed below, contains the terms of the ETNs and supersedes all prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth under “Risk Factors” in the prospectus supplement and this pricing supplement, as the ETNs involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the ETNs.

You may access these documents on the SEC website at www.sec.gov as follows (or if such

Conflicts of Interest

Barclays Capital Inc. is an affiliate of Barclays Bank PLC and, as such, has a “conflict of interest” in this offering within the meaning of Rule 5121 of Financial Industry Regulatory Authority, Inc. (“FINRA”). Consequently, this offering is being conducted in compliance with the provisions of FINRA Rule 5121 (or any successor rule thereto). In addition, Barclays Capital Inc. will not sell the ETNs to a discretionary account without specific written approval from the account holder. For more information, please refer to “Plan of Distribution (Conflicts of Interest)—Conflicts of Interest” in the accompanying prospectus supplement.

Hypothetical Examples

The following examples show how the ETNs would perform in hypothetical circumstances, assuming a starting level for the Index of 1,000.00. We have included two examples in which the Index has increased by approximately 34.39% at maturity (reflecting an annualized Index return of 3.00%), an examples in which the Index has decreased by approximately 26.26% at maturity (reflecting an annualized Index return of -3.00%), and an example in which the Index has increased by approximately 2.53% (reflecting an annualized Index return of 0.25%). These examples highlight the effect of the investor fee in different circumstances. The level of the investor fee will be dependent upon the path taken by the Index to arrive at its ending level. The figures in these examples have been rounded for convenience. Figures for year 10 are as of the final valuation date, and given the indicated assumptions, a holder will receive payment at maturity in the indicated amount, according to the formula indicated in this pricing supplement.

The hypothetical examples in this section do not take into account the effects of applicable taxes. The after-tax return you receive on your ETNs will depend on the U.S. tax treatment of your ETNs and on your particular circumstances. Accordingly, the after-tax rate of return of your ETNs could be different than the after-tax return of a direct investment in the Index Constituents or the Index.

These hypothetical examples are provided for illustrative purposes only. Past performance of the Index and the hypothetical performance of the ETNs are not indicative of the future results of the Index or the ETNs. The actual performance of the Index and the ETNs will vary, perhaps significantly, from the examples illustrated below.

Assumptions:

Investor Fee Rate | Days in Year | Principal Amount | Starting Index Level |

| 0.45% | 365 | $50.00 | 1,000.00 |

| A | B | C | D | E | F |

Year | Index Level | Index Annual Percentage Change | Yearly Fee | Investor Fee | Closing Indicative Value |

| 0 | 1,000.00 | | $0.00 | $0.00 | $50.00 |

| 1 | 1,030.00 | 3.00% | $0.23 | $0.23 | $51.28 |

| 2 | 1,060.90 | 3.00% | $0.23 | $0.46 | $52.58 |

| 3 | 1,092.73 | 3.00% | $0.24 | $0.69 | $53.92 |

| 4 | 1,125.51 | 3.00% | $0.24 | $0.94 | $55.30 |

| 5 | 1,159.27 | 3.00% | $0.25 | $1.18 | $56.71 |

| 6 | 1,194.05 | 3.00% | $0.26 | $1.44 | $58.15 |

| 7 | 1,229.87 | 3.00% | $0.26 | $1.70 | $59.64 |

| 8 | 1,266.77 | 3.00% | $0.27 | $1.97 | $61.16 |

| 9 | 1,304.77 | 3.00% | $0.28 | $2.24 | $62.72 |

| 10 | 1,343.92 | 3.00% | $0.28 | $2.53 | $64.32 |

| | | | | |

| | | Total Index Return | 34.39% | |

| | | Annualized Index Return | 3.00% | |

| | | Annualized ETN Total Return | 2.55% | |

Hypothetical Examples

| A | B | C | D | E | F |

Year | Index Level | Index Annual Percentage Change | Yearly Fee | Investor Fee | Closing Indicative Value |

| 0 | 1,000.00 | | $0.00 | $0.00 | $50.00 |

| 1 | 1,080.00 | 8.00% | $0.23 | $0.23 | $53.78 |

| 2 | 1,166.40 | 8.00% | $0.24 | $0.47 | $57.84 |

| 3 | 1,259.71 | 8.00% | $0.26 | $0.73 | $62.20 |

| 4 | 1,360.49 | 8.00% | $0.28 | $1.01 | $66.90 |

| 5 | 1,469.33 | 8.00% | $0.30 | $1.31 | $71.95 |

| 6 | 1,439.94 | -2.00% | $0.32 | $1.63 | $70.19 |

| 7 | 1,411.14 | -2.00% | $0.32 | $1.95 | $68.47 |

| 8 | 1,385.18 | -1.84% | $0.31 | $2.26 | $66.90 |

| 9 | 1,371.33 | -1.00% | $0.30 | $2.56 | $65.93 |

| 10 | 1,343.90 | -2.00% | $0.30 | $2.85 | $64.31 |

| | | | | |

| | | Total Index Return | 34.39% | |

| | | Annualized Index Return | 3.00% | |

| | | Annualized ETN Total Return | 2.55% | |

Hypothetical Examples

| A | B | C | D | E | F |

Year | Index Level | Index Annual Percentage Change | Yearly Fee | Investor Fee | Closing Indicative Value |

| 0 | 1,000.00 | | $0.00 | $0.00 | $50.00 |

| 1 | 970.00 | -3.00% | $0.23 | $0.23 | $48.28 |

| 2 | 940.90 | -3.00% | $0.22 | $0.44 | $46.61 |

| 3 | 912.67 | -3.00% | $0.21 | $0.65 | $45.00 |

| 4 | 885.29 | -3.00% | $0.20 | $0.85 | $43.45 |

| 5 | 858.73 | -3.00% | $0.20 | $1.05 | $41.95 |

| 6 | 832.97 | -3.00% | $0.19 | $1.24 | $40.50 |

| 7 | 807.98 | -3.00% | $0.18 | $1.42 | $39.11 |

| 8 | 783.74 | -3.00% | $0.18 | $1.60 | $37.76 |

| 9 | 760.23 | -3.00% | $0.17 | $1.77 | $36.45 |

| 10 | 737.42 | -3.00% | $0.16 | $1.93 | $35.20 |

| | | | | |

| | | Total Index Return | -26.26% | |

| | | Annualized Index Return | -3.00% | |

| | | Annualized ETN Total Return | -3.45% | |

Hypothetical Examples

| A | B | C | D | E | F |

Year | Index Level | Index Annual Percentage Change | Yearly Fee | Investor Fee | Closing Indicative Value |

| 0 | 1,000.00 | | $0.00 | $0.00 | $50.00 |

| 1 | 1,002.50 | 0.25% | $0.23 | $0.23 | $49.90 |

| 2 | 1,005.01 | 0.25% | $0.22 | $0.45 | $49.80 |

| 3 | 1,007.52 | 0.25% | $0.22 | $0.67 | $49.70 |

| 4 | 1,010.04 | 0.25% | $0.22 | $0.90 | $49.60 |

| 5 | 1,012.56 | 0.25% | $0.22 | $1.12 | $49.50 |

| 6 | 1,015.09 | 0.25% | $0.22 | $1.34 | $49.40 |

| 7 | 1,017.63 | 0.25% | $0.22 | $1.57 | $49.30 |

| 8 | 1,020.18 | 0.25% | $0.22 | $1.79 | $49.21 |

| 9 | 1,022.73 | 0.25% | $0.22 | $2.01 | $49.11 |

| 10 | 1,025.28 | 0.25% | $0.22 | $2.23 | $49.01 |

| | | | | |

| | | Total Index Return | 2.53% | |

| | | Annualized Index Return | 0.25% | |

| | | Annualized ETN Total Return | -0.20% | |

RISK FACTORS

The ETNs are senior unsecured debt obligations of Barclays Bank PLC and are not secured debt. The ETNs are riskier than ordinary unsecured debt securities. The return on the ETNs is linked to the performance of the Index. Investing in the ETNs is not equivalent to investing directly in the Index, the Index Constituents or the equity securities underlying the Index Constituents. See “The Index” as well as the Index-specific sections in this pricing supplement for more information.

This section describes the most significant risks relating to an investment in the ETNs. We urge you to read the following information about these risks, together with the other information in this pricing supplement and the accompanying prospectus and prospectus supplement, before investing in the ETNs.

You should also consider the tax consequences of investing in the ETNs, significant aspects of which are uncertain. See “Material U.S. Federal Income Tax Considerations” in this pricing supplement.

Risks Relating to the ETNs Generally

The ETNs Do Not Guarantee Any Return of Principal, and You May Lose Some or All of Your Investment

The ETN performance is linked to the performance of the Index less an investor fee. There is no minimum limit to the level of the Index. Moreover, the ETNs are not principal protected. Therefore, a decrease in the level of the Index could cause you to lose up to your entire investment in the ETNs. You may lose all or a substantial portion of your investment if you invest in the ETNs.

Furthermore, because the investor fee reduces the amount of your return at maturity or upon early redemption, the level of the Index will need to increase significantly in order for you to receive at least the amount you invested in the ETNs at maturity or upon early redemption. If the increase in the level of the Index is insufficient to offset the negative effect of the investor fee, or if the Index level decreases, you will receive less than the amount you invested in the ETNs at maturity or upon early redemption.

We May Redeem the ETNs at Any Time on or after the Inception Date

We have the right to redeem or “call” the ETNs (in whole but not in part) at our sole discretion without your consent on any trading day on or

after the inception date until and including maturity. If we elect to redeem the ETNs, we will deliver written notice of such election to redeem to the holders of the ETNs not less than ten calendar days prior to the redemption date specified by us in such notice. In this scenario, the ETNs will be redeemed on the date specified by us in the issuer redemption notice, but in no event prior to the tenth calendar day following the date on which we deliver such notice.

If we exercise our right to redeem the ETNs, the payment you receive may be less than the payment that you would have otherwise been entitled to receive at maturity and may be less than the secondary market trading price of the ETNs. Also, you may not be able to reinvest any amounts received on the redemption date in a comparable investment. Our right to redeem the ETNs may also adversely impact your ability to sell your ETNs, and/or the price at which you may be able to sell your ETNs, following delivery of the issuer redemption notice.

You Will Not Benefit from Any Increase in the Level of the Index if Such Increase Is Not Reflected in the Index on the Applicable Valuation Date

If the positive effect of any increase in the level of the Index is insufficient to offset the negative effect of the investor fee between the inception date and the applicable valuation date (including the final valuation date), we will pay you less than the amount you invested in the ETNs at maturity or upon early redemption. This will be true even if the level of the Index as of some date or dates prior to the applicable valuation date would have been sufficiently high to offset the negative effect of the investor fee.

You Will Not Receive Interest Payments on the ETNs or Have Rights in Respect of Any of the Equity Securities Included in the Index Constituents

You will not receive any periodic interest payments on your ETNs. As an owner of the ETNs, you will not have rights that investors in the equity securities included in the Index Constituents may have. Your ETNs will be paid in cash, and you will have no right to receive delivery of any equity securities comprising the S&P 500® or the Index Constituents or of any dividends or distributions relating to such securities.

Owning the ETNs is Not the Same As Owning the Index Constituents or a Security Directly Linked to the Performance of the Index

The return on your ETNs will not reflect the return you would have realized if you had actually owned the Index Constituents or a security directly linked to the performance of the Index and held such investment for a similar period. Any return on your ETNs includes the negative effect of the accrued investor fee. Furthermore, if the level of the Index increases during the term of the ETNs, the market value of the ETNs may not increase by the same amount or may even decline.

Even If the Level of the Index at Maturity or Upon Early Redemption Is Greater than it Was on the Inception Date, You May Receive Less than the Principal Amount of Your ETNs Due To the Investor Fee

Since the investor fee reduces the amount of your return at maturity or upon early redemption, the Index will need to increase significantly in order for you to receive at least the principal amount of your investment at maturity or upon early redemption. Because the investor fee is calculated and subtracted from the closing indicative value on a daily basis, the net effect of the fee accumulates over time and is subtracted at the rate of 0.45% per year. Therefore, if the Index level does not increase or the increase in the level of the Index is insufficient to offset the negative effect of the investor fee or the level of the Index decreases, you will receive less than the principal amount of your investment at maturity or upon early redemption.

If a Market Disruption Event Has Occurred or Exists on a Valuation Date, the Calculation Agent Can Postpone the Determination of, as Applicable, the Closing Indicative Value or the Maturity Date or a Redemption Date

The determination of the value of the ETNs on a valuation date, including the final valuation date, may be postponed if the calculation agent determines that a market disruption event or force majeure event has occurred or is continuing on such valuation date. In no event, however, will a valuation date for the ETNs be postponed by more than five trading days. As a result, the maturity date or a redemption date could also be postponed, although not by more than five trading days. If a valuation date is postponed until the fifth trading day following the scheduled valuation date but a market disruption event occurs or is continuing on such day, that day will nevertheless be the valuation date and the calculation agent

will make a good faith estimate in its sole discretion of the level of the Index for such day. See “Specific Terms of the ETNs—Postponement of Valuation Dates” in this pricing supplement.

Risks Relating to the Issuer

The ETNs Are Subject to the Credit Risk of the Issuer, Barclays Bank PLC

The ETNs are senior unsecured debt obligations of the issuer, Barclays Bank PLC, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the ETNs depends on the ability of Barclays Bank PLC to satisfy its obligations as they come due and are not guaranteed by a third party. As a result, the actual and perceived creditworthiness of Barclays Bank PLC may affect the market value of the ETNs and, in the event Barclays Bank PLC were to default on its obligations, you may not receive the amounts owed to you under the terms of the ETNs.

Risks Relating to the Index

The Value of the Index Will Depend Upon the Success of the Index in Dynamically Allocating Among the Sector Indices

The Index seeks to provide investors with exposure to different sectors by dynamically allocating among the Sector Indices. Each month, the Index selects four Sectors for inclusion in the Index based upon their Relative CAPE Indicator and a price momentum factor, each as described under “The Index” below. The four selected Sectors, represented by corresponding Sector Indices, are included as the Index Constituents in the Index and are equally weighted to comprise 25% of the notional long position of the Index.

There can be no assurance, however, that a notional investment in sectors with a lower Relative CAPE Indicator and higher price momentum will increase or perform better than sectors with a higher Relative CAPE Indicator and a lower price momentum. It is possible that the Sector Indices selected at any time for inclusion in the Index will decrease and cause the level of the Index to fall. Additionally, the Sector Indices included in the Index may underperform and produce lower returns than an investment in a diversified portfolio of assets or a different combination of Sector Indices. Accordingly, there is no assurance that the Index will outperform any alternative index that might be employed in respect of the sectors or a diversified portfolio.

The Value of the Index Will Depend Upon the Performance of the Index Constituents Included in the Index

While the Index is designed to provide exposure to four Sectors, each represented by a Sector Index, the level of the Index will continue to depend, in large part, on the performance of the Sector Indices that comprise the Index Constituents over the term of your ETNs. Even if the Index is successful in dynamically allocating among the sectors, the value of the Index may fall as a result of a decline in the level of the Index Constituents.

Changes to the Index Methodology May Adversely Affect the Value of Your Investment in the ETNs

Prior to October 1, 2018, the Sector Universe consisted of nine sectors. As of October 1, 2018, the index sponsor implemented changes to the Index to include an additional sector to the Sector Universe named the Communication Services sector, which expanded the Sector Universe to ten sectors. For more information, please see “The Index—Changes to the Index” in this pricing supplement. This change may adversely affect the performance of the Index and the value of the ETNs, as future performance of the Index may be lower than its performance would have been if it had not been amended. Moreover, the performance of the Index prior to October 1, 2018 does not reflect this change, and the Index has limited operating history under the revised methodology.

The Index Allocates to the Sector Indices in Accordance with Pre-Defined Weightings That May Not Be Optimal

The four Sector Indices selected for inclusion in the Index on a monthly basis will comprise 100% of the Index. The four Sector Indices selected as the Index Constituents are equally weighted notional long positions (i.e., a weight of 25% in each Sector Index). Therefore, even if the Index is optimal in allocating to the sectors that will offer positive returns over the term of the ETNs, the pre-defined weightings among the Sector Indices as specified herein may not be the most optimal allocations at any given moment over the term of your ETNs. Therefore, there is no assurance that the weightings determined by the Index will outperform any alternative Index or investment that might reflect different weighting of the Index Constituents.

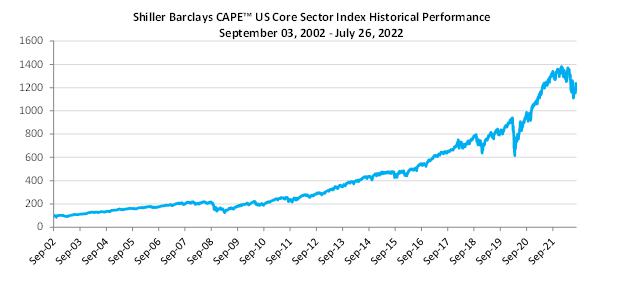

Historical Levels of the Index Should Not Be Taken as an Indication of the Future

Performance of the Index During the Term of the ETNs

It is impossible to predict whether the level of the Index will rise or fall. The actual performance of the Index over the term of the ETNs, as well as the amount payable at maturity or upon early redemption, may bear little relation to the historical level of the Index.

The Index Sponsor, a Distinct Function Within Barclays Bank PLC, Will Have the Authority To Make Determinations That Could Materially Affect the ETNs in Various Ways and Create Conflicts of Interest

Barclays Bank PLC is the owner of the intellectual property and licensing rights relating to the Index, and Barclays Index Administration, a distinct function within the Investment Bank of Barclays Bank PLC, is the index sponsor. The index sponsor is responsible for the composition, calculation and maintenance of the Index. As discussed under “The Index—Modifications to the Index” in this pricing supplement, the index sponsor has the discretion in a number of circumstances, including upon the occurrence of an index market disruption event or force majeure event, to make judgments and take actions in connection with the composition, calculation and maintenance of the Index, and any such judgments or actions may adversely affect the value of the ETNs.

The role played by the index sponsor and the exercise of the kinds of discretion described above and in the section entitled “The Index―Modifications to the Index” in this pricing supplement could present it with significant conflicts of interest in light of the fact that Barclays Bank PLC, the issuer of the ETNs, is its parent company and the owner of the Index. The index sponsor has no obligation to take the needs of any buyer, seller or holder of the ETNs into consideration at any time.

In addition, the Index or the Index Constituents could be adversely affected by the promulgation of new laws or regulations or by the reinterpretation of existing laws or regulations (including, without limitation, those relating to taxes and duties on the Index) by one or more governments, governmental agencies or instrumentalities, courts or other official bodies. Any of these events could adversely affect the Index or the Index Constituents and, correspondingly, could adversely affect the value of the ETNs.

The Policies of the Index Sponsor and the Sector Index Sponsor and Changes That

Affect the Composition and Valuation of the Index and the Index Constituents Could Affect the Amount Payable on Your ETNs and Their Market Value

The policies of the index sponsor, Barclays Index Administration, a distinct function within the Investment Bank of Barclays Bank PLC, concerning the calculation of the level of the Index and the policies of the sector index sponsor concerning the calculation of the value of the Index Constituents, and any additions, deletions or substitutions of underlying assets and the manner in which changes affecting the underlying assets are reflected in the Index Constituents, could affect the level of the Index and, therefore, the amount payable on the ETNs at maturity or upon early redemption and the market value of the ETNs prior to maturity. Additionally, the sector index sponsor may discontinue or suspend dissemination of the Index Constituents. Any of these actions could adversely affect the value of your ETNs. The index sponsor and sector index sponsor have no obligation to consider your interests in calculating or revising the Index or the Index Constituents.

If events such as these occur, or if the level of the Index is not available or cannot be calculated because of a market disruption event or for any other reason, the calculation agent may be required to make a good faith estimate in its sole discretion of the level of the Index. The circumstances in which the calculation agent will be required to make such a determination are described more fully below under “The Index—Modifications to the Index”.

Risks Relating to Liquidity and the Secondary Market

The Market Value of the ETNs May Be Influenced by Many Unpredictable Factors

The market value of the ETNs may fluctuate between the date you purchase them and the applicable valuation date. You may also sustain a significant loss if you sell the ETNs in the secondary market. We expect that generally the value of the Index Constituents and Index will affect the market value of the ETNs and the payment you receive at maturity or upon early redemption, more than any other factor. Several other factors, many of which are beyond our control, will influence the market value of the ETNs and the payment you receive at maturity or upon early redemption, including the following:

| · | prevailing market prices and forward volatility levels of the stock markets on which the equity securities included in the Index |

Constituents are listed or traded, the equity securities included in the Index Constituents, and prevailing market prices of options on the Index, any of the Index Constituents or any of the equity securities included in the Index Constituents or any other financial instruments related to the Index, any of the Index Constituents or any of the equity securities included in the Index Constituents;

| · | supply and demand for the ETNs, including inventory positions with Barclays Capital Inc. or any market maker and any decision we may make not to issue additional ETNs or to cease or suspend sales of ETNs from inventory; |

| · | the time remaining to the maturity of the ETNs; |

| · | economic, financial, political, regulatory, geographical or judicial events that affect the level of the underlying Index or the market price or forward volatility of the stock markets on which the equity securities included in the Index Constituents are listed or traded, the equity securities included in Index Constituents, and the Index or Index Constituents; |

| · | the perceived creditworthiness of Barclays Bank PLC; |

| · | supply and demand in the listed and over-the-counter equity derivative markets; or |

| · | supply and demand as well as hedging activities in the equity-linked structured product markets. |

These factors interrelate in complex ways, and the effect of one factor on the market value of your ETNs may offset or enhance the effect of another factor.

There May Not Be an Active Trading Market in the ETNs; Sales in the Secondary Market May Result in Significant Losses

Although we have listed the ETNs on NYSE Arca, there can be no assurance that a secondary market for the ETNs will exist at any time. Even if there is a secondary market for the ETNs, whether as a result of any listing of the ETNs or on an over-the-counter basis, it may not provide enough liquidity for you to trade or sell your ETNs easily. In addition, although certain affiliates of Barclays Bank PLC may engage in limited purchase and resale transactions in the ETNs,

they are not required to do so. If they decide to engage in such transactions, they may stop at any time. We are not required to maintain any listing of the ETNs on NYSE Arca or any other securities exchange and may cause the ETNs to be de-listed at our discretion.

The Liquidity of the Market for the ETNs May Vary Materially Over Time

As stated on the cover of this pricing supplement, we sold a portion of the ETNs on the inception date, and the remainder of the ETNs will be offered and sold from time to time through Barclays Capital Inc., our affiliate, as agent. Also, the number of ETNs outstanding or held by persons other than our affiliates could be reduced at any time due to early redemptions of the ETNs. Accordingly, the liquidity of the market for the ETNs could vary materially over the term of the ETNs. While you may elect to redeem your ETNs prior to maturity, early redemption is subject to the conditions and procedures described elsewhere in this pricing supplement, including the condition that you must redeem at least 25,000 ETNs at one time in order to exercise your right to redeem your ETNs on any redemption date.

The ETNs May Trade at a Substantial Premium to or Discount from the Closing Indicative Value and/or the Intraday Indicative Value

The ETNs may trade at a substantial premium to or discount from the closing indicative value and/or the intraday indicative value. The closing indicative value is the value of the ETNs calculated by us on a daily basis and is used to determine the payment at maturity or upon early redemption. The intraday indicative value is meant to approximate on an intraday basis the component of the ETN’s value that is attributable to the Index and is provided for reference purposes only. In contrast, the market price of the ETNs at any time is the price at which you may be able to sell your ETNs in the secondary market at that time, if one exists.

If you sell your ETNs on the secondary market, you will receive the market price for your ETNs, which may be substantially above or below the closing indicative value and/or the intraday indicative value due to, among other things, imbalances of supply and demand for the ETNs (including as a result of any decision of ours to issue, stop issuing or resume issuing additional ETNs), stocks included in the Index and/or other derivatives related to the Index or the ETNs; any trading disruptions; suspension or limitations to any of the forgoing; lack of liquidity; severe

volatility; transaction costs; credit considerations; and bid-offer spreads. A premium or discount market price over the intraday indicative value can also arise as a result of actions (or failure to take action) by the index sponsor or the sector index sponsor, the relevant exchanges of the stocks included in the Index and NYSE Arca and technical or human errors by service providers, market participants and others. In addition, paying a premium purchase price over the intraday indicative value could lead to significant losses if you sell your ETNs at a time when such premium is no longer present in the market place or if we exercise our right to redeem the ETNs. Furthermore, if you sell your ETNs at a price which reflects a discount below the intraday indicative value, you may experience a significant loss.

The intraday indicative value for the ETNs is calculated and published every 15 seconds on each trading day from approximately 9:30 a.m. to approximately 4:15 p.m., New York City time. The intraday indicative value will not be updated to reflect any trading in the stocks included in the Index that might take place after 4:15 p.m. The ETNs trade on the NYSE Arca from approximately 9:30 a.m. to 4:00 p.m., New York City time. The ETNs may also trade during after-hours trading. Therefore, during after-hours trading after 4:15 p.m., the last-published intraday indicative value is likely to differ from any value of the ETNs determined based on real-time trading data of the stocks included in the Index, particularly if there is a significant price movement in the stocks included in the Index during this time period. It is possible that the value of the ETNs could undergo a rapid and substantial decline outside of ordinary market trading hours. You may not be able to accurately assess the value of the ETNs relative to the trading price during after-hours trading, including any premium or discount thereto, when there is no recent intraday indicative value available.

We Have No Obligation to Issue Additional ETNs, and We May Cease or Suspend Sales of the ETNs

As further described in the accompanying prospectus supplement under “Summary—Medium-Term Notes—Amounts That We May Issue” on page S-3 and “Summary—Medium-Term Notes—Reissuances or Reopened Issues” on page S-3, we have the right, but not the obligation, to issue additional ETNs once the initial distribution is complete. We also reserve the right to cease or suspend sales of the ETNs from inventory held at any time after the inception date.

Any limitation or suspension on the issuance or sale of the ETNs may materially and adversely affect the price and liquidity of the ETNs in the secondary market. Alternatively, the decrease in supply may cause an imbalance in the market supply and demand, which may cause the ETNs to trade at a premium over their indicative value. Any premium may be reduced or eliminated at any time. Paying a premium purchase price over the indicative value of the ETNs could lead to significant losses in the event you sell your ETNs at a time when such premium is no longer present in the marketplace or if we redeem the ETNs at our discretion. Investors should consult their financial advisors before purchasing or selling the ETNs, especially ETNs trading at a premium over their indicative value.

Changes in Our Credit Ratings May Affect the Market Value of the ETNs

Our credit ratings are an assessment of our ability to pay our obligations, including those on the ETNs. Consequently, actual or anticipated changes in our credit ratings may affect the market value of your ETNs. However, because the return on your ETNs is dependent upon certain factors in addition to our ability to pay our obligations on your ETNs, an improvement in our credit ratings will not reduce the other investment risks related to your ETNs.

There Are Restrictions on the Minimum Number of ETNs You May Redeem and on the Dates on Which You May Redeem Them

You must redeem at least 25,000 ETNs at one time in order to exercise your right to redeem your ETNs on a redemption date. Accordingly, if you hold fewer than 25,000 ETNs or fewer than 25,000 ETNs are outstanding, you will not be able to purchase enough ETNs to meet the minimum size requirement in order to exercise your early repurchase right. The unavailability of the repurchase right can result in the ETNs trading in the secondary market at a discount below their closing indicative value and/or intraday indicative value. The number of ETNs outstanding or held by persons other than our affiliates could be reduced at any time due to early repurchase of the ETNs or due to our or our affiliates’ purchases of ETNs in the secondary market. A suspension of additional issuances of the ETNs could result in a significant reduction in the number of outstanding ETNs if investors subsequently exercise their right to have the ETNs repurchased by us.

You may only redeem your ETNs on a redemption date if we receive a notice of

redemption from you by no later than 4:00 p.m., New York City time, and a confirmation of redemption by no later than 5:00 p.m., New York City time, on the business day prior to the applicable valuation date. If we do not receive your notice of redemption by 4:00 p.m., New York City time, or your confirmation of redemption by 5:00 p.m., New York City time, on the business day prior to the applicable valuation date, your notice will not be effective and we will not redeem your ETNs on the applicable redemption date. Your notice of redemption and confirmation of redemption will not be effective until we confirm receipt. See “Specific Terms of the ETNs—Early Redemption Procedures” in this pricing supplement for more information.

There May Be Restrictions on Your Ability to Purchase Additional ETNs From Us

We may, but are not required to, offer and sell ETNs after the inception date through Barclays Capital Inc., our affiliate, as agent. We may impose a requirement to purchase a particular minimum amount of ETNs from our inventory in a single purchase, though we may waive this requirement with respect to any purchase at any time in our sole discretion. In addition, we may offer to sell ETNs from our inventory at a price that is greater or less than the intraday indicative value or the prevailing market price at the time such sale is made. However, we are under no obligation to issue or sell additional ETNs at any time, and if we do issue or sell additional ETNs, we may limit such sales and stop selling additional ETNs at any time. Any limitations or restrictions that we place on the sale of the ETNs from inventory, and the price at which we sell the ETNs from inventory, may impact supply and demand for the ETNs and may impact the liquidity and price of the ETNs in the secondary market. See “Specific Terms of the ETNs—Further Issuances” and “Supplemental Plan of Distribution” in this pricing supplement for more information.

Risks Relating to Conflicts of Interest and Hedging

There Are Potential Conflicts of Interest Between You and the Calculation Agent

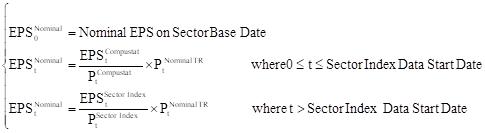

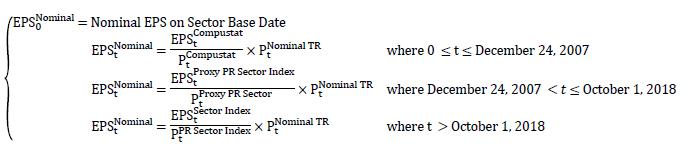

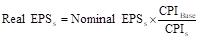

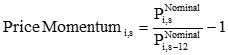

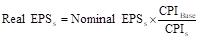

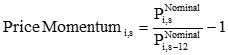

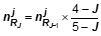

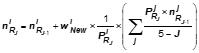

Currently, Barclays Bank PLC serves as the calculation agent. The calculation agent will, among other things, determine the amount of the return paid out to you on the ETNs at maturity or upon early redemption. For a more detailed description of the calculation agent’s role see “Specific Terms of the ETNs—Role of Calculation Agent” in this pricing supplement.