UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | Registration statement pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 |

or

| þ | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, for the fiscal year ended December 31, 2006 |

or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

or

| ¨ | Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

| | | | | | | | | | |

Commission file numbers: | | Barclays PLC | | 1-09246 | | |

| | | | | | Barclays Bank PLC | | 1-10257 | | |

BARCLAYS PLC

BARCLAYS BANK PLC

(Exact names of registrants as specified in their charters)

ENGLAND

(Jurisdictions of incorporation)

1 CHURCHILL PLACE, LONDON, E14 5HP, ENGLAND

(Address of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

| | | Title of each class | | Name of each exchange on which registered |

| Barclays PLC | | 25p ordinary shares | | New York Stock Exchange* |

| | American Depositary Shares, each representing four 25p ordinary shares | | New York Stock Exchange |

| | |

| Barclays Bank PLC | | 7.4% Subordinated Notes 2009 | | New York Stock Exchange |

| | Callable Floating Rate Notes 2035 | | New York Stock Exchange |

| | Non-Cumulative Callable Dollar Preference Shares, Series 2 | | New York Stock Exchange* |

| | American Depositary Shares, Series 2, each representing one Non-Cumulative Callable Dollar Preference Share, Series 2 | | New York Stock Exchange |

| | iPathSM Exchange Traded Notes Linked to GSCI® Total Return Index | | New York Stock Exchange |

| | iPathSM Exchange Traded Notes Linked to Dow Jones – AIG Commodity Index Total ReturnSM | | New York Stock Exchange |

| | iPathSM Exchange Traded Notes Linked to Goldman Sachs Crude Oil Total Return Index | | New York Stock Exchange |

| | iPathSM MSCI India IndexSM ETN | | New York Stock Exchange |

| * | Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuers’ classes of capital or common stock as of the close of the period covered by the annual report.

| | | | |

| Barclays PLC | | 25p ordinary shares | | 6,534,698,021 |

| | £1 staff shares | | 875,000 |

| Barclays Bank PLC | | £1 ordinary shares | | 2,329,960,515 |

| | £1 preference shares | | 1,000 |

| | £100 preference shares | | 75,000 |

| | €100 preference shares | | 240,000 |

| | $0.25 preference shares | | 30,000,000 |

| | $100 preference shares | | 100,000 |

Indicate by check mark if each registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yesþ No¨

If this report is an annual or transition report, indicate by check mark if each registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes¨ Noþ

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports) and (2) have been subject to such filing requirements for the past 90 days.

Yesþ No¨

Indicate by check mark whether each registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filerþ Accelerated filer¨ Non-accelerated filer¨

Indicate by check mark which financial statement item the registrants have elected to follow.

Item 17¨ Item 18þ

If this is an annual report, indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrants have filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ¨ No ¨

In this document certain non-IFRS (International Financial Reporting Standards) measures, such as profit before business disposals, are reported. Barclays management believes that these non-IFRS measures provide valuable information to readers of its financial statements because they enable the reader to focus more directly on the underlying day-to-day performance of its businesses and provide more detail concerning the elements of performance which the managers of these businesses are most directly able to influence. They also reflect an important aspect of the way in which operating targets are defined and performance is monitored by Barclays management.

This document contains information, including statistical data, about certain of Barclays markets and its competitive position. Except as otherwise indicated, this information is taken or derived from Datastream and other external sources. Barclays cannot guarantee the accuracy of information taken from external sources, or that, in respect of internal estimates, a third party using different methods would obtain the same estimates as Barclays.

Forward-looking statements

This document contains certain forward-looking statements within the meaning of Section 21E of the US Securities Exchange Act of 1934, as amended, and Section 27A of the US Securities Act of 1933, as amended, with respect to certain of the Group’s plans and its current goals and expectations relating to its future financial condition and performance. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements sometimes use words such as ‘aim’, ‘anticipate’, ‘target’, ‘expect’, ‘estimate’, ‘intend’, ‘plan’, ‘goal’, ‘believe’, or other words of similar meaning. Examples of forward-looking statements include, among others, statements regarding the Group’s future financial position, income growth, impairment charges, business strategy, projected levels of growth in the banking and financial markets, projected costs, estimates of capital expenditures, and plans and objectives for future operations.

By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances, including, but not limited to, the further development of standards and interpretations under International Financial Reporting Standards (IFRS) applicable to past, current and future periods, evolving practices with regard to the interpretation and application of standards under IFRS, as well as UK domestic and global economic and business conditions, market related risks such as changes in interest rates and exchange rates, the policies and actions of governmental and regulatory authorities, changes in legislation, progress in the integration of Absa into the Group’s business and the achievement of synergy targets related to Absa, the outcome of pending and future litigation, the success of future acquisitions and other strategic transactions and the impact of competition – a number of which factors are beyond the Group’s control. As a result, the Group’s actual future results may differ materially from the plans, goals, and expectations set forth in the Group’s forward-looking statements. Any forward-looking statements made by or on behalf of Barclays speak only as of the date they are made. Barclays does not undertake to update forward-looking statements to reflect any changes in Barclays expectations with regard thereto or any changes in events, conditions or circumstances on which any such statement is based. The reader should, however, consult any additional disclosures that Barclays has made or may make in documents it has filed or may file with the SEC.

| | |

Barclays PLC Annual Report 2006 | | 1 |

| |

Absa Definitions

‘Absa Group Limited’ refers to the consolidated results of the South African group of which the parent company is listed on the Johannesburg Stock Exchange in which Barclays owns a controlling stake.

‘Absa’ refers to the results for Absa Group Limited as consolidated into the results of Barclays PLC; translated into Sterling with adjustments for amortisation of intangible assets, certain Head office adjustments, transfer pricing and minority interests.

‘International Retail and Commercial Banking – Absa’ is the portion of Absa’s results that is reported by Barclays within the International Retail and Commercial Banking business.

Barclays acquired a controlling stake in Absa Group Limited on 27th July 2005. Therefore, unless otherwise indicated, 2005 comparatives reflect results from that date and are not directly comparable to 2006.

‘Absa Capital’ is the portion of Absa’s results that is reported by Barclays within the Barclays Capital business.

Glossary of terms

The cost:income ratio is defined as operating expenses compared to total income net of insurance claims.

The cost:net income ratio is defined as operating expenses compared to total income net of insurance claims less impairment charges.

‘Income’ refers to total income net of insurance claims, unless otherwise specified.

‘Profit before business disposals’ represents profit before tax and disposal of subsidiaries, associates and joint ventures.

Group reporting changes

Barclays announced on 16th June 2006 the impact of certain changes in Group structure and reporting on the 2005 and 2004 results.

Barclays realigned a number of reportable business segments based on the reorganisation of certain portfolios better to reflect the type of client served, the nature of the products offered and the associated risks and rewards. The Group’s policy for the internal cost of funding and the segmental disclosure of risk weighted assets was also revised with effect from 1st January 2006. The reclassifications had no impact on the Group Income Statement or Balance sheet.

| | |

| 2 | | Barclays PLC Annual Report 2006 |

| |

| | |

Barclays PLC Annual Report 2006 | | 3 |

| |

Financial data

Consolidated income statement summary – IFRS

For the year ended 31st December

| | | | | | | | | |

| | | 2006 £m | | | 2005 £m | | | 2004(a) £m | |

Continuing operations | | | | | | | | | |

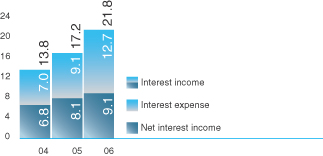

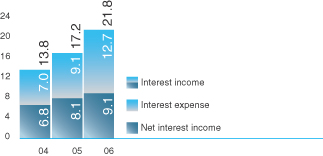

Net interest income | | 9,143 | | | 8,075 | | | 6,833 | |

Net fee and commission income | | 7,177 | | | 5,705 | | | 4,847 | |

Principal transactions | | 4,576 | | | 3,179 | | | 2,514 | |

Net premiums from insurance contracts | | 1,060 | | | 872 | | | 1,042 | |

Other income | | 214 | | | 147 | | | 131 | |

| | | |

Total income | | 22,170 | | | 17,978 | | | 15,367 | |

Net claims and benefits paid on insurance contracts | | (575 | ) | | (645 | ) | | (1,259 | ) |

| | | |

Total income net of insurance claims | | 21,595 | | | 17,333 | | | 14,108 | |

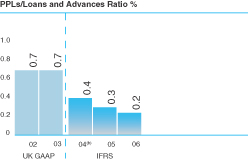

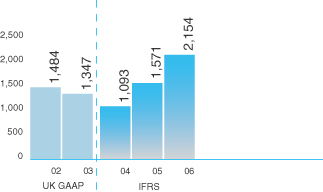

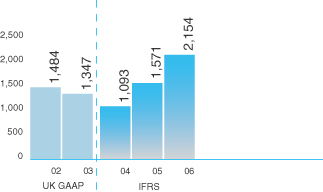

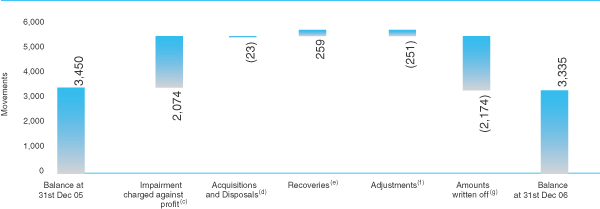

Impairment charges | | (2,154 | ) | | (1,571 | ) | | (1,093 | ) |

| | | |

Net income | | 19,441 | | | 15,762 | | | 13,015 | |

Operating expenses | | (12,674 | ) | | (10,527 | ) | | (8,536 | ) |

Share of post-tax results of associates and joint ventures | | 46 | | | 45 | | | 56 | |

Profit on disposal of subsidiaries, associates and joint ventures | | 323 | | | – | | | 45 | |

| | | |

Profit before tax | | 7,136 | | | 5,280 | | | 4,580 | |

Tax | | (1,941 | ) | | (1,439 | ) | | (1,279 | ) |

| | | |

Profit after tax | | 5,195 | | | 3,841 | | | 3,301 | |

| | | |

Profit attributable to minority interests | | 624 | | | 394 | | | 47 | |

Profit attributable to equity holders of the parent | | 4,571 | | | 3,447 | | | 3,254 | |

| | | |

| | | 5,195 | | | 3,841 | | | 3,301 | |

| | | | | | |

Selected financial statistics | | | | | | |

| | | |

Basic earnings per share | | 71.9p | | 54.4p | | 51.0p |

Diluted earnings per share | | 69.8p | | 52.6p | | 49.8p |

Dividends per ordinary share | | 31.0p | | 26.6p | | 24.0p |

Dividend payout ratio | | 43.1% | | 48.9% | | 47.1% |

Profit attributable to the equity holders of the parent as a percentage of: | | | | | | |

average shareholders’ equity | | 24.7% | | 21.1% | | 21.7% |

average total assets | | 0.4% | | 0.4% | | 0.5% |

| | | |

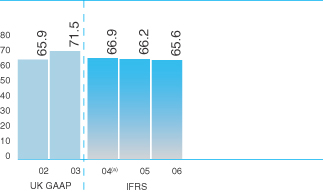

Cost:income ratio | | 59% | | 61% | | 61% |

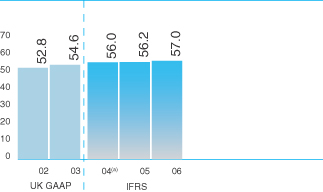

Cost:net income ratio | | 65% | | 67% | | 66% |

Average United States Dollar exchange rate used in preparing the accounts | | 1.84 | | 1.82 | | 1.83 |

Average Euro exchange rate used in preparing the accounts | | 1.47 | | 1.46 | | 1.47 |

Average Rand exchange rate used in preparing the accounts | | 12.47 | | 11.57 | | 11.83 |

The financial information above is extracted from the published accounts for the last two years. This information should be read together with, and is qualified by reference to, the accounts and Notes included in this report.

Note

| (a) | Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. |

| | |

| 4 | | Barclays PLC Annual Report 2006 |

| |

Consolidated profit and loss account summary – UK GAAP

For the year ended 31st December

| | | | | | |

| | | 2003 £m | | | 2002 £m | |

Interest receivable | | 12,427 | | | 12,044 | |

Interest payable | | (5,823 | ) | | (5,839 | ) |

Net interest income | | 6,604 | | | 6,205 | |

Fees and commissions receivable | | 4,896 | | | 4,454 | |

Less: fees and commissions payable | | (633 | ) | | (529 | ) |

Dealing profits | | 1,054 | | | 833 | |

Other operating income | | 490 | | | 364 | |

Operating income | | 12,411 | | | 11,327 | |

Administration expenses – staff costs | | (4,295 | ) | | (3,755 | ) |

Administration expenses – other | | (2,404 | ) | | (2,312 | ) |

Depreciation | | (289 | ) | | (303 | ) |

Goodwill amortisation | | (265 | ) | | (254 | ) |

Operating expenses | | (7,253 | ) | | (6,624 | ) |

Operating profit before provisions | | 5,158 | | | 4,703 | |

Provisions for bad and doubtful debts | | (1,347 | ) | | (1,484 | ) |

Provisions for contingent liabilities and commitments | | 1 | | | (1 | ) |

Provisions | | (1,346 | ) | | (1,485 | ) |

Operating profit | | 3,812 | | | 3,218 | |

Profit/(loss) from joint ventures | | 1 | | | (5 | ) |

Profit/(loss) from associates | | 28 | | | (5 | ) |

Exceptional items | | 4 | | | (3 | ) |

Profit on ordinary activities before tax | | 3,845 | | | 3,205 | |

Tax on profit on ordinary activities | | (1,076 | ) | | (955 | ) |

Profit on ordinary activities after tax | | 2,769 | | | 2,250 | |

Minority interests (including non-equity interests) | | (25 | ) | | (20 | ) |

Profit for the financial year attributable to the members of Barclays PLC | | 2,744 | | | 2,230 | |

Dividends | | (1,340 | ) | | (1,206 | ) |

Profit retained for the financial year | | 1,404 | | | 1,024 | |

Selected financial statistics | | | | | | |

Basic earnings per share | | 42.3p | | | 33.7p | |

Diluted earnings per share | | 42.1p | | | 33.4p | |

Dividends per ordinary share | | 20.50p | | | 18.35p | |

Dividend payout ratio | | 48.5% | | | 54.5% | |

Attributable profit as a percentage of: | | | | | | |

average shareholders’ funds | | 17.0% | | | 14.7% | |

average total assets | | 0.6% | | | 0.5% | |

Average United States Dollar exchange rate used in preparing the accounts | | 1.64 | | | 1.50 | |

Average Euro exchange rate used in preparing the accounts | | 1.45 | | | 1.59 | |

The financial information shown here is extracted from the published UK GAAP accounts for the years 2002 and 2003.

| | |

Barclays PLC Annual Report 2006 | | 5 |

| |

Financial data

Consolidated balance sheet summary – IFRS

As at 31st December

| | | | | | |

| | | 2006 £m | | 2005 £m | | 2004(a) £m |

Assets | | | | | | |

Cash and other short-term funds | | 9,753 | | 5,807 | | 3,525 |

Treasury bills and other eligible bills | | n/a | | n/a | | 6,658 |

Trading and financial assets designated at fair value | | 292,464 | | 251,820 | | n/a |

Derivative financial instruments | | 138,353 | | 136,823 | | n/a |

Debt securities and equity shares | | n/a | | n/a | | 141,710 |

Loans and advances to banks | | 30,926 | | 31,105 | | 80,632 |

Loans and advances to customers | | 282,300 | | 268,896 | | 262,409 |

Available for sale investments | | 51,703 | | 53,497 | | n/a |

Reverse repurchase agreements and cash collateral on securities borrowed | | 174,090 | | 160,398 | | n/a |

Property, plant and equipment | | 2,492 | | 2,754 | | 2,282 |

Other assets | | 14,706 | | 13,257 | | 40,965 |

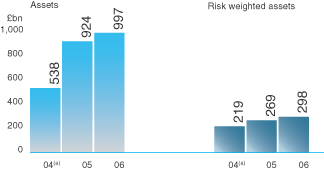

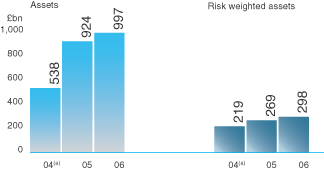

Total assets | | 996,787 | | 924,357 | | 538,181 |

| | | |

Liabilities | | | | | | |

Deposits and items in the course of collection due to banks | | 81,783 | | 77,468 | | 112,229 |

Customer accounts | | 256,754 | | 238,684 | | 217,492 |

Trading and financial liabilities designated at fair value | | 125,861 | | 104,949 | | n/a |

Liabilities to customers under investment contracts | | 84,637 | | 85,201 | | n/a |

Derivative financial instruments | | 140,697 | | 137,971 | | n/a |

Debt securities in issue | | 111,137 | | 103,328 | | 83,842 |

Repurchase agreements and cash collateral on securities lent | | 136,956 | | 121,178 | | n/a |

Insurance contract liabilities, including unit-linked liabilities | | 3,878 | | 3,767 | | 8,377 |

Subordinated liabilities | | 13,786 | | 12,463 | | 12,277 |

Other liabilities | | 13,908 | | 14,918 | | 87,200 |

Total liabilities | | 969,397 | | 899,927 | | 521,417 |

Shareholders’ equity | | | | | | |

Shareholders’ equity excluding minority interests | | 19,799 | | 17,426 | | 15,870 |

Minority interests | | 7,591 | | 7,004 | | 894 |

Total shareholders’ equity | | 27,390 | | 24,430 | | 16,764 |

Total liabilities and shareholders’ equity | | 996,787 | | 924,357 | | 538,181 |

| | | |

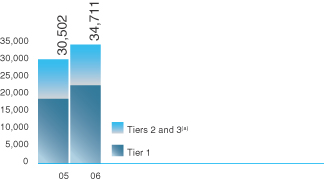

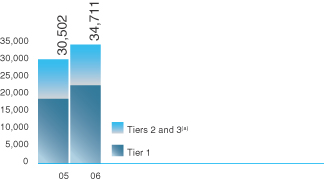

Risk weighted assets and capital ratios | | | | | | |

Risk weighted assets | | 297,833 | | 269,148 | | 218,601 |

Tier 1 ratio(b) | | 7.7% | | 7.0% | | 7.6% |

Risk asset ratio(b) | | 11.7% | | 11.3% | | 11.5% |

Selected financial statistics | | | | | | |

Net asset value per ordinary share | | 303p | | 269p | | 246p |

Year-end United States Dollar exchange rate used in preparing the accounts | | 1.96 | | 1.72 | | 1.92 |

Year-end Euro exchange rate used in preparing the accounts | | 1.49 | | 1.46 | | 1.41 |

Year-end Rand exchange rate used in preparing the accounts | | 13.71 | | 10.87 | | 10.86 |

Note 60 to the accounts provides a reconciliation of profit attributable to equity holders of the parent and shareholders’ equity between the amounts calculated under IFRS and US GAAP.

The financial information above is extracted from the published accounts for the last two years. This information should be read together with, and is qualified by reference to, the accounts and Notes included in this report.

Notes

| (a) | Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. |

| (b) | Capital ratios for 2004 are based on UK GAAP and have not been restated as these remain as reported to the Financial Services Authority (FSA). As at 1st January 2005 the tier 1 ratio was 7.1% and the risk asset ratio was 11.8% reflecting the impact of IFRS including the adoption of IAS 32, IAS 39 and IFRS 4. |

| | |

| 6 | | Barclays PLC Annual Report 2006 |

| |

Consolidated balance sheet summary – UK GAAP

As at 31st December

| | | | |

| | | 2003 £m | | 2002 £m |

Assets | | | | |

Loans and advances to banks and customers | | 288,743 | | 260,572 |

Other assets | | 139,818 | | 129,136 |

| | |

| | 428,561 | | 389,708 |

Infrastructure | | 6,624 | | 6,015 |

| | |

| | 435,185 | | 395,723 |

Retail life-fund assets attributable to policyholders | | 8,077 | | 7,284 |

| | |

Total assets | | 443,262 | | 403,007 |

| | |

Liabilities | | | | |

Deposits by banks, customer accounts and debt securities in issue | | 328,529 | | 304,817 |

Other liabilities | | 77,660 | | 64,067 |

| | |

| | | 406,189 | | 368,884 |

| | |

Capital resources | | | | |

Undated loan capital | | 6,310 | | 6,678 |

Dated loan capital | | 6,029 | | 4,859 |

| | |

Total subordinated liabilities | | 12,339 | | 11,537 |

| | |

Minority interests | | 283 | | 156 |

Shareholders’ equity excluding minority interests | | 16,374 | | 15,146 |

| | |

Total shareholders’ equity | | 16,657 | | 15,302 |

| | |

Total capital resources | | 28,996 | | 26,839 |

| | |

| | 435,185 | | 395,723 |

Retail life-fund liabilities attributable to policyholders | | 8,077 | | 7,284 |

| | |

Total liabilities and shareholders’ equity | | 443,262 | | 403,007 |

| | |

Risk weighted assets and capital ratios | | | | |

Risk weighted assets | | 188,997 | | 172,748 |

Tier 1 ratio | | 7.9% | | 8.2% |

Risk asset ratio | | 12.8% | | 12.8% |

Selected financial statistics | | | | |

Net asset value per ordinary share | | 250p | | 230p |

Year-end United States Dollar exchange rate used in preparing the accounts | | 1.78 | | 1.61 |

Year-end Euro exchange rate used in preparing the accounts | | 1.41 | | 1.54 |

The financial information shown here is extracted from the UK GAAP published accounts for the years 2002 and 2003.

| | |

Barclays PLC Annual Report 2006 | | 7 |

| |

Intentionally Left Blank

| | |

| 8 | | Barclays PLC Annual Report 2006 |

| |

| | |

Barclays PLC Annual Report 2006 | | 9 |

| |

Financial review

Business description

The following section analyses the Group’s performance by business. For management and reporting purposes, Barclays is organised into the following business groupings:

Global Retail and Commercial Banking

| · | | UK Banking, comprising: |

| · | | International Retail and Commercial Banking, comprising |

| – | International Retail and Commercial Banking-excluding Absa |

| – | International Retail and Commercial Banking-Absa, first included with effect from 27th July 2005 |

Investment Banking and Investment Management

| · | | Barclays Global Investors |

| · | | Barclays Wealth-closed life assurance activities |

Head office functions and other operations

UK Banking

UK Banking delivers banking solutions to Barclays UK retail and business banking customers. It offers a range of integrated products and services and access to the expertise of other Group businesses. Customers are served through a variety of channels comprising the branch network, automated teller machines, telephone banking, online banking and relationship managers. UK Banking is managed through two business areas, UK Retail Banking and UK Business Banking.

UK Retail Banking

UK Retail Banking comprises Personal Customers, Home Finance, UK Premier and Local Business (formerly Small Business). This cluster of businesses aims to build broader and deeper relationships with customers. Personal Customers and Home Finance provide a wide range of products and services to retail customers, including current accounts, savings and investment products, mortgages branded Woolwich and general insurance. UK Premier provides banking, investment products and advice to affluent customers. Local Business provides banking services to small businesses.

UK Business Banking

UK Business Banking provides relationship banking to Barclays larger and medium business customers in the UK. Customers are served by a network of relationship and industry sector specialist managers who provide local access to an extensive range of products and services, as well as offering business information and support. Customers are also offered access to the products and expertise of other businesses in the Group, particularly Barclays Capital and Barclaycard. UK Business Banking provides asset financing and leasing solutions through a specialist business.

Barclaycard

Barclaycard is a multi-brand credit card and consumer loans business which also processes card payments for retailers and merchants and issues credit and charge cards to corporate customers and the UK Government. It is one of Europe’s leading credit card businesses and has an increasing presence in the United States.

In the UK, Barclaycard comprises Barclaycard, SkyCard and Monument branded credit cards, Barclays branded loans and FirstPlus secured lending. Barclaycard also manages card operations on behalf of Solution Personal Finance.

Outside the UK, Barclaycard provides credit cards in the United States, Germany, Spain, Italy, Portugal and Africa. In the Nordic region, Barclaycard operates through Entercard, a joint venture with FöreningsSparbanken (Swedbank).

Barclaycard works closely with other parts of the Group, including UK Retail Banking, UK Business Banking and International Retail and Commercial Banking, to leverage their distribution capabilities.

International Retail and Commercial Banking

International Retail and Commercial Banking provides Barclays personal and corporate customers outside the UK with banking services. The products and services offered to customers are tailored to meet the regulatory and commercial environments within each country. For reporting purposes from 2005, the operations have been grouped into two components: International Retail and Commercial Banking-excluding Absa and International Retail and Commercial Banking-Absa.

International Retail and Commercial Banking works closely with all other parts of the Group to leverage synergies from product and service propositions.

International Retail and Commercial Banking-excluding Absa

International Retail and Commercial Banking-excluding Absa provides a range of banking services, including current accounts, savings, investments, mortgages and loans to personal and corporate customers across Spain, Portugal, France, Italy, Africa and the Middle East.

International Retail and Commercial Banking-Absa

International Retail and Commercial Banking-Absa represents Barclays consolidation of Absa, excluding Absa Capital which is included as part of Barclays Capital. Absa Group Limited is one of South Africa’s largest financial services organisations serving personal, commercial and corporate customers predominantly in South Africa. International Retail and Commercial Banking-Absa serves retail customers through a variety of distribution channels and offers a full range of banking services, including current and deposit accounts, mortgages, instalment finance, credit cards, bancassurance products and wealth management services; it also offers customised business solutions for commercial and large corporate customers.

| | |

| 10 | | Barclays PLC Annual Report 2006 |

| |

Barclays Capital

Barclays Capital is a leading global investment bank which provides large corporate, institutional and government clients with solutions to their financing and risk management needs.

Barclays Capital services a wide variety of client needs, from capital raising and managing foreign exchange, interest rate, equity and commodity risks, through to providing technical advice and expertise. Activities are organised into three principal areas: Rates, which includes fixed income, foreign exchange, commodities, emerging markets, money markets, sales, trading and research, prime services and equity products; Credit, which includes primary and secondary activities for loans and bonds for investment grade, high yield and emerging market credit, as well as hybrid capital products, asset based finance, commercial mortgage backed securities, credit derivatives, structured capital markets and large asset leasing; and Private Equity. Barclays Capital includes Absa Capital, the investment banking business of Absa. Barclays Capital works closely with all other parts of the Group to leverage synergies from client relationships and product capabilities.

Barclays Global Investors

Barclays Global Investors (BGI) is one of the world’s largest asset managers and a leading global provider of investment management products and services.

BGI offers structured investment strategies such as indexing, global asset allocation and risk controlled active products including hedge funds and provides related investment services such as securities lending, cash management and portfolio transition services. In addition, BGI is the global leader in assets and products in the exchange traded funds business, with over 190 funds for institutions and individuals trading in fifteen markets globally. BGI’s investment philosophy is founded on managing all dimensions of performance: a consistent focus on controlling risk, return and cost. BGI collaborates with the other Barclays businesses, particularly Barclays Capital and Barclays Wealth, to develop and market products and leverage capabilities to better serve the client base.

Barclays Wealth

Barclays Wealth serves affluent, high net worth and intermediary clients worldwide, providing private banking, asset management, stockbroking, offshore banking, wealth structuring and financial planning services.

Barclays Wealth works closely with all other parts of the Group to leverage synergies from client relationships and product capabilities.

Barclays Wealth-closed life assurance activities

Barclays Wealth-closed life assurance activities comprise the closed life assurance businesses of Barclays and Woolwich in the UK.

Head office functions and other operations

Head office functions and other operations comprise:

| – | Head office and central support functions |

| – | Businesses in transition |

| – | Consolidation adjustments. |

Head office and central support functions comprise the following areas: Executive management, Finance, Treasury, Corporate Affairs, Human Resources, Strategy and Planning, Internal Audit, Legal, Corporate Secretariat, Property, Tax, Compliance and Risk. Costs incurred wholly on behalf of the businesses are recharged to them.

Businesses in transition principally relate to certain lending portfolios that are centrally managed with the objective of maximising recovery from the assets.

Consolidation adjustments largely reflect the elimination of inter-segment transactions.

| | |

Barclays PLC Annual Report 2006 | | 11 |

| |

Financial review

Group financial performance

The Group’s profit before tax in 2006 increased 35% (£1,856m) to £7,136m (2005: £5,280m). Income increased 25% (£4,262m) to £21,595m (2005: £17,333m) whilst operating expenses rose 20% (£2,147m) to £12,674m (2005: £10,527m). Impairment charges rose 37% (£583m) to £2,154 (2005: £1,571m).

Earnings per share rose 32% to 71.9p (2005: 54.4p), diluted earnings per share rose 33% to 69.8p (2005: 52.6p). Dividends per share rose 17% to 31p (2005: 26.6p). Return on average shareholders’ funds was 25% (2005: 21%).

Business performance

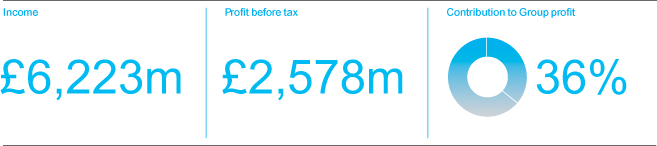

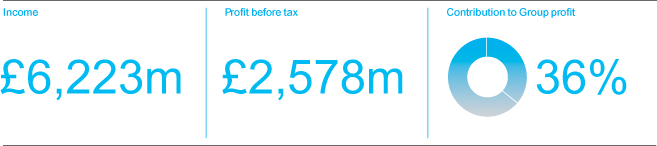

InUK Bankingstrong growth in income enabled us to increase our profit before tax 17% to £2,578m. The improvement in the cost:income ratio was four percentage points in headline terms to 52% (2005: 56%).

UK Retail Bankingdelivered a 17% profit before tax increase to £1,213m. This was driven by broadly based income growth of 7%, with particularly strong performances in savings, Local Business and UK Premier and good growth in current accounts. Our mortgage market share and processing capacity also increased strongly leading to a net market share of 4% for the second half of the year. We doubled investment across the business. We focused on upgrading distribution capabilities, transforming the performance of the mortgage business, revitalising product offerings, and improving core operations and processes. The additional investment substantially offset the impact of property gains, leading to broadly flat costs. In 2007 we expect to make further significant investment, including the restructuring of the branch network and the migration of Woolwich customers.

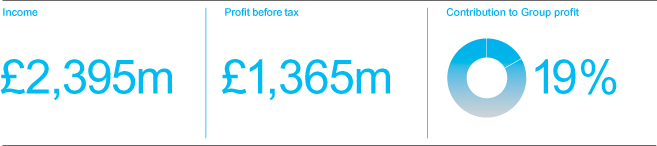

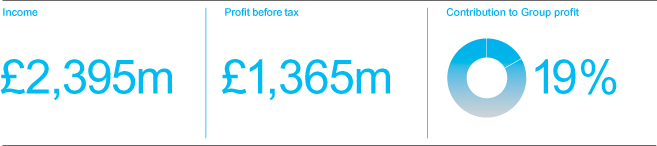

UK Business Bankingdelivered very strong growth in profit before tax of 18% to £1,365m. Strong growth in loans and deposits drove income growth of 11%. Profit before business disposals grew 11%. UK Business Banking maintained its competitive position and also funded significant investment in improving its infrastructure and customer service.

AtBarclaycardprofit before tax fell 40% to £382m. Good income growth of 8%, driven by very strong momentum in Barclaycard International, was more than offset by a further rise in impairment charges, principally in the UK lending portfolios, and by higher costs, mainly as a result of continued investment in Barclaycard US. In the UK, high debt levels and changing attitudes to bankruptcy and debt default contributed to increased impairment charges. As the consumer lending market in the UK changes, Barclaycard is repositioning its business to achieve sustainable, profitable growth. Higher borrowing by UK consumers, lower disposable household incomes and a tougher regulatory environment have seen Barclaycard take a number of actions. The business focused on tighter lending criteria and improved collections throughout 2006 and, as a consequence, believes we have passed the worst in Barclaycard UK impairment in the second half of 2006. There has also been a review of some partnership businesses and lending to higher risk customers. An operational review is also under way, to improve efficiency and enhance Barclaycard’s ability to provide the best service to customers, wherever they are in the world.

We continued to invest in Barclaycard US. Since we bought the business in December 2004, outstandings have grown from US$1.4bn to US$4.0bn, and cards in issue have increased from 1.1 million to 4.2 million. Income grew 73% in 2006. Barclaycard US is on track to become profitable in 2007.

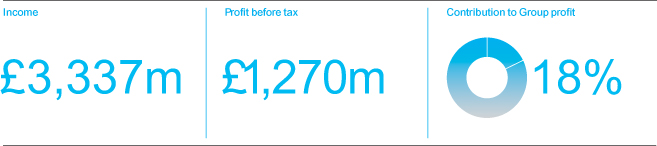

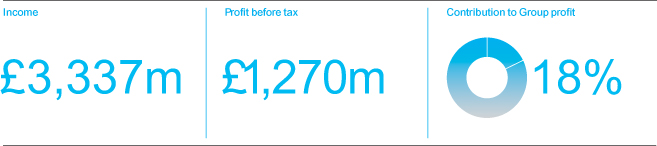

International Retail and Commercial Bankingachieved a step change in profitability to £1,270m (2005: £633m), reflecting the inclusion of Absa for a full year, the impact of corporate development activity and growth in key geographies.

International Retail and Commercial Banking – excluding Absaachieved a profit before tax of £572m (2005: £335m), including a gain of £247m from the disposal of our interest in FirstCaribbean International Bank. Excluding this gain, profit before tax was £325m (2005: £335m). Good organic growth in the businesses across continental Europe was offset by incremental investment in distribution capacity and technology across the businesses in 2006. We expect to double the rate of investment in infrastructure and distribution in 2007.

International Retail and Commercial Banking – Absacontributed £698m profit before tax in the first full year of ownership and is performing well ahead of our acquisition business case. Absa Group Limited achieved year on year growth in profit before tax of 24% in Rand terms, reflecting very strong growth in mortgages, credit cards and commercial property finance. The benefits of Barclays ownership are evident in 46% attributable earnings growth in both Absa Card and Absa Capital (reported in Barclays Capital), with total synergy benefits well ahead of plan.

Barclays Capitalproduced an outstanding performance with profit before tax rising 55% to £2,216m. Income growth of 39% was driven by doing more business with new and existing clients and was broadly based across asset classes and geographies. Growth was particularly strong in areas where we have invested in recent years, including commodities, equity products and credit derivatives. Profit growth was accompanied by improvements in productivity: income and profits grew significantly faster than Daily Value at Risk, risk weighted assets, economic capital, regulatory capital and costs. The ratio of compensation costs to net income improved two percentage points to 49% and the cost:net income ratio improved three percentage points to 64%. We continued to invest for future growth, increasing headcount 3,300 including 1,300 from the acquisition of HomEq, a US mortgage servicing business.

Barclays Global Investorsdelivered excellent results, with profit before tax up 32% to £714m. Income growth of 26% was attributable to increased management fees, particularly in the iShares and active businesses. Assets under management grew US$301bn to US$1.8trn, including net new assets of US$68bn, reflecting very strong inflows in iShares and active assets. The cost:income ratio improved two percentage points to 57%.

| | |

| 12 | | Barclays PLC Annual Report 2006 |

| |

Barclays Wealthprofit before tax rose 28% to £213m.

This reflected broadly based income growth and favourable market conditions, partially offset by a significant increase in investment in people and infrastructure to build a platform for future growth. Total client assets increased 19% to £93bn. The cost:income ratio improved three percentage points to 79%.

InHead office functions and other operationsthe loss before tax decreased £64m to £259m, reflecting the Head office relocation costs incurred in 2005.

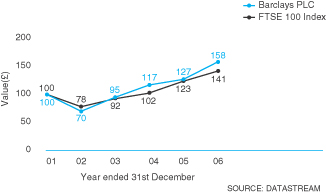

Goals

Barclays primary focus is to deliver superior value to its shareholders.

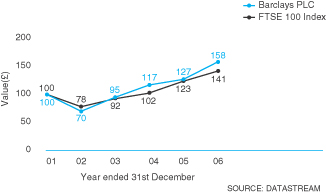

The primary goal remains to achieve top quartile total shareholder return (TSR) relative to a peer group of 11 other UK and international financial services institutions. TSR is defined as the value created for shareholders through share price appreciation, plus reinvested dividend payments. In 2004, we announced a new performance cycle TSR goal for the 2004 to 2007 period.

The TSR peer group is reviewed annually to ensure it aligns with our business mix and the direction and scale of our ambition. The peer group for 2006 was: ABN Amro, BBVA, BNP Paribas, Citigroup, Deutsche Bank, HBOS, HSBC, JP Morgan Chase, Lloyds TSB, Royal Bank of Scotland and UBS. For 2007 the peer group is unchanged.

For the first three years of the new goal period, from 31st December 2003 to 31st December 2006, Barclays was positioned sixth within its peer group, which is second quartile TSR performance.

| | |

Barclays PLC Annual Report 2006 | | 13 |

| |

Intentionally Left Blank

| | |

| 14 | | Barclays PLC Annual Report 2006 |

| |

Overview

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Analysis of results by business For the year ended 31st December 2006 | |

| | | UK

Banking

£m | | | Barclaycard

£m | | | International

Retail and

Commercial

Banking £m | | | Barclays

Capital

£m | | | Barclays

Global

Investors

£m | | | Barclays

Wealth

£m | | | Barclays

Wealth

– closed life

assurance

activities

£m | | | Head office

functions

and other

operations

£m | | | Group

£m | |

| | | | | | | | | |

Net interest income | | 4,035 | | | 1,843 | | | 1,659 | | | 1,158 | | | 10 | | | 366 | | | (8 | ) | | 80 | | | 9,143 | |

Net fee and commission income | | 1,861 | | | 1,054 | | | 1,303 | | | 952 | | | 1,651 | | | 665 | | | 50 | | | (359 | ) | | 7,177 | |

Principal transactions(a) | | 30 | | | 15 | | | 194 | | | 4,135 | | | 4 | | | – | | | 156 | | | 42 | | | 4,576 | |

| Net premiums from insurance contracts | | 269 | | | 33 | | | 351 | | | – | | | – | | | – | | | 210 | | | 197 | | | 1,060 | |

Other income | | 63 | | | – | | | 74 | | | 22 | | | – | | | 5 | | | 11 | | | 39 | | | 214 | |

| | | | | | | | | |

Total income | | 6,258 | | | 2,945 | | | 3,581 | | | 6,267 | | | 1,665 | | | 1,036 | | | 419 | | | (1 | ) | | 22,170 | |

| Net claims and benefits on insurance contracts | | (35 | ) | | (8 | ) | | (244 | ) | | – | | | – | | | – | | | (288 | ) | | – | | | (575 | ) |

| | | | | | | | | |

| Total income, net of insurance claims | | 6,223 | | | 2,937 | | | 3,337 | | | 6,267 | | | 1,665 | | | 1,036 | | | 131 | | | (1 | ) | | 21,595 | |

Impairment charges | | (461 | ) | | (1,493 | ) | | (167 | ) | | (42 | ) | | – | | | (2 | ) | | – | | | 11 | | | (2,154 | ) |

| | | | | | | | | |

Net income | | 5,762 | | | 1,444 | | | 3,170 | | | 6,225 | | | 1,665 | | | 1,034 | | | 131 | | | 10 | | | 19,441 | |

Operating expenses | | (3,265 | ) | | (1,054 | ) | | (2,196 | ) | | (4,009 | ) | | (951 | ) | | (821 | ) | | (109 | ) | | (269 | ) | | (12,674 | ) |

| Share of post-tax results of associates and joint ventures | | 5 | | | (8 | ) | | 49 | | | – | | | – | | | – | | | – | | | – | | | 46 | |

| Profit on disposal of subsidiaries, associates and joint ventures | | 76 | | | – | | | 247 | | | – | | | – | | | – | | | – | | | – | | | 323 | |

| | | | | | | | | |

Profit before tax | | 2,578 | | | 382 | | | 1,270 | | | 2,216 | | | 714 | | | 213 | | | 22 | | | (259 | ) | | 7,136 | |

| | | | | | | | | |

As at 31st December 2006 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Total assets | | 139,902 | | | 27,628 | | | 68,848 | | | 657,922 | | | 80,515 | | | 7,285 | | | 7,605 | | | 7,082 | | | 996,787 | |

| | | | | | | | | |

Total liabilities | | 159,503 | | | 1,909 | | | 37,567 | | | 632,208 | | | 79,366 | | | 26,817 | | | 7,499 | | | 24,528 | | | 969,397 | |

Note

| (a) | Principal transactions comprise net trading income and net investment income. |

| | |

Barclays PLC Annual Report 2006 | | 15 |

| |

Financial review

Analysis of results by business

UK Banking

UK Banking delivers banking solutions to Barclays UK retail and business banking customers. It offers a range of integrated products and services and access to the expertise of other Group businesses. Customers are served through a variety of channels comprising the branch network, automated teller machines, telephone banking, online banking and relationship managers. UK Banking is managed through two business areas, UK Retail Banking and UK Business Banking.

| | | | | | | | | | | | | | | | |

| | | 2006 £m | | | | | 2005 £m | | | | | 2004(a) £m | |

| | | | | |

Net interest income | | | 4,035 | | | | | | 3,744 | | | | | | 3,348 | |

Net fee and commission income | | | 1,861 | | | | | | 1,720 | | | | | | 1,855 | |

Net trading income | | | 2 | | | | | | – | | | | | | – | |

Net investment income | | | 28 | | | | | | 26 | | | | | | – | |

Principal transactions | | | 30 | | | | | | 26 | | | | | | – | |

Net premiums from insurance contracts | | | 269 | | | | | | 280 | | | | | | 249 | |

Other income | | | 63 | | | | | | 33 | | | | | | 43 | |

| | | | | |

Total income | | | 6,258 | | | | | | 5,803 | | | | | | 5,495 | |

Net claims and benefits on insurance contracts | | | (35 | ) | | | | | (58 | ) | | | | | (46 | ) |

| | | | | |

Total income, net of insurance claims | | | 6,223 | | | | | | 5,745 | | | | | | 5,449 | |

Impairment charges | | | (461 | ) | | | | | (327 | ) | | | | | (188 | ) |

| | | | | |

Net income | | | 5,762 | | | | | | 5,418 | | | | | | 5,261 | |

Operating expenses excluding amortisation of intangible assets | | | (3,263 | ) | | | | | (3,212 | ) | | | | | (3,220 | ) |

Amortisation of intangible assets | | | (2 | ) | | | | | (3 | ) | | | | | (2 | ) |

Operating expenses | | | (3,265 | ) | | | | | (3,215 | ) | | | | | (3,222 | ) |

Share of post-tax results of associates and joint ventures | | | 5 | | | | | | (3 | ) | | | | | 5 | |

Profit on disposal of subsidiaries, associates and joint ventures | | | 76 | | | | | | – | | | | | | 42 | |

| | | | | |

Profit before tax | | | 2,578 | | | | | | 2,200 | | | | | | 2,086 | |

| | | | | |

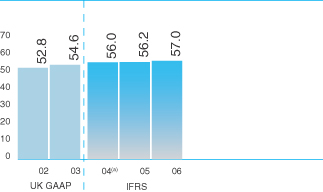

Cost:income ratio | | | 52 | % | | | | | 56 | % | | | | | 59 | % |

Cost:net income ratio | | | 57 | % | | | | | 59 | % | | | | | 61 | % |

| | | | | |

Risk Tendency | | £ | 515m | | | | | £ | 430m | | | | | £ | 360m | |

| | | | | |

| | | | 2006 | | | | | | 2005 | | | | | | 2004 | |

| | | | | |

Loans and advances to customers | | £ | 123.9bn | | | | | £ | 118.2bn | | | | | £ | 106.7bn | |

Customer accounts | | £ | 142.4bn | | | | | £ | 129.7bn | | | | | £ | 111.1bn | |

Total assets | | £ | 139.9bn | | | | | £ | 130.3bn | | | | | £ | 114.9bn | |

Risk weighted assets | | £ | 84.9bn | | | | | £ | 79.9bn | | | | | £ | 80.5bn | |

Note

| (a) | Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. |

| | |

| 16 | | Barclays PLC Annual Report 2006 |

| |

2006/05

UK Banking profit before tax increased 17% (£378m) to £2,578m (2005: £2,200m) driven principally by good income growth. Profit before business disposals of £76m grew 14% (£302m) to £2,502m (2005: £2,200m).

2005/04

UK Banking profit before tax in 2005 increased 5% (£114m) to £2,200m (2004: £2,086m) driven by good income growth and strong cost management.

The cost:income ratio improved by three percentage points to 56% (2004: 59%).

| | |

Barclays PLC Annual Report 2006 | | 17 |

| |

Financial review

Analysis of results by business

UK Retail Banking

UK Retail Banking comprises Personal Customers, Home Finance, UK Premier and Local Business (formerly Small Business). This cluster of businesses aims to build broader and deeper relationships with customers. Personal Customers and Home Finance provide a wide range of products and services to retail customers, including current accounts, savings and investment products, mortgages branded Woolwich and general insurance. UK Premier provides banking, investment products and advice to affluent customers. Local Business provides banking services to small businesses.

| | | | | | | | | | | | | | | | |

| | | 2006 £m | | | | | 2005 £m | | | | | 2004(a) £m | |

Net interest income | | | 2,333 | | | | | | 2,208 | | | | | | 2,107 | |

Net fee and commission income | | | 1,219 | | | | | | 1,131 | | | | | | 1,149 | |

Net trading income | | | – | | | | | | – | | | | | | – | |

Net investment income | | | – | | | | | | 9 | | | | | | – | |

Principal transactions | | | – | | | | | | 9 | | | | | | – | |

Net premiums from insurance contracts | | | 269 | | | | | | 280 | | | | | | 249 | |

Other income | | | 42 | | | | | | 16 | | | | | | 29 | |

Total income | | | 3,863 | | | | | | 3,644 | | | | | | 3,534 | |

Net claims and benefits on insurance contracts | | | (35 | ) | | | | | (58 | ) | | | | | (46 | ) |

Total income net of insurance claims | | | 3,828 | | | | | | 3,586 | | | | | | 3,488 | |

Impairment charges | | | (209 | ) | | | | | (150 | ) | | | | | (69 | ) |

Net income | | | 3,619 | | | | | | 3,436 | | | | | | 3,419 | |

Operating expenses excluding amortisation of intangible assets | | | (2,407 | ) | | | | | (2,390 | ) | | | | | (2,461 | ) |

Amortisation of intangible assets | | | (1 | ) | | | | | – | | | | | | – | |

Operating expenses | | | (2,408 | ) | | | | | (2,390 | ) | | | | | (2,461 | ) |

Share of post-tax results of associates and joint ventures | | | 2 | | | | | | (6 | ) | | | | | 2 | |

Profit on disposal of subsidiaries, associates and joint ventures | | | – | | | | | | – | | | | | | 42 | |

Profit before tax | | | 1,213 | | | | | | 1,040 | | | | | | 1,002 | |

| | | | | |

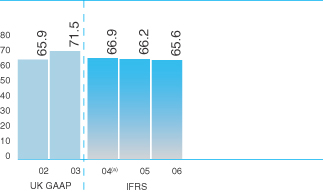

Cost:income ratio | | | 63% | | | | | | 67% | | | | | | 71% | |

Cost:net income ratio | | | 67% | | | | | | 70% | | | | | | 72% | |

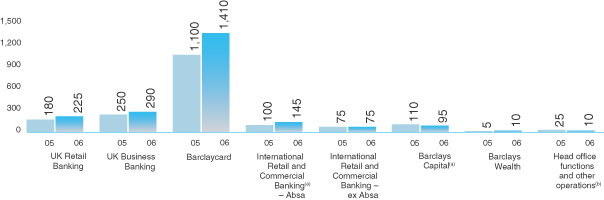

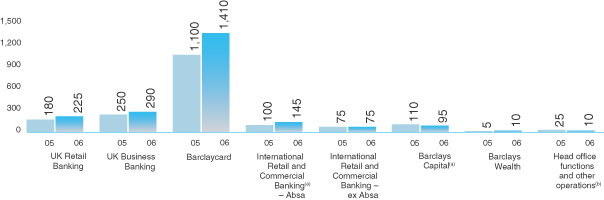

Risk Tendency | | £ | 225m | | | | | £ | 180m | | | | | £ | 160m | |

| | | | | |

| | | | 2006 | | | | | | 2005 | | | | | | 2004 | |

Loans and advances to customers | | £ | 67.6bn | | | | | £ | 64.8bn | | | | | £ | 66.7bn | |

Customer accounts | | £ | 85.0bn | | | | | £ | 78.8bn | | | | | £ | 73.6bn | |

Total assets | | £ | 74.0bn | | | | | £ | 70.4bn | | | | | £ | 72.7bn | |

Risk weighted assets | | £ | 34.9bn | | | | | £ | 32.8bn | | | | | £ | 38.2bn | |

Note

| (a) | Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. |

| | |

| 18 | | Barclays PLC Annual Report 2006 |

| |

2006/05

UK Retail Banking profit before tax increased 17% (£173m) to £1,213m (2005: £1,040m), driven by good income growth and well controlled costs. There has been substantial additional investment to transform the business.

Income increased 7% (£242m) to £3,828m (2005: £3,586m). Income growth was broadly based. There was strong income growth in Personal Customers retail savings, Local Business and UK Premier and good growth in Personal Customers current account income. Sales volumes increased, with a particularly strong performance from direct channels.

Net interest income increased 6% (£125m) to £2,333m (2005: £2,208m). Growth was driven by a higher contribution from deposits, through a combination of good balance sheet growth and a stable liability margin. Total average customer deposit balances increased 8% to £79.2bn (2005: £73.5bn), supported by new products. Growth of personal savings was above that of the market.

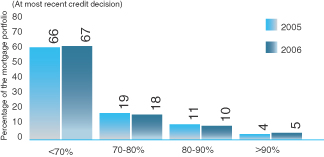

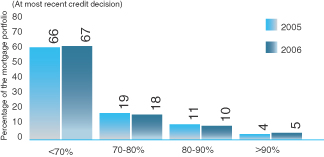

Mortgage volumes improved significantly, driven by a focus on improving capacity, customer service, value and promotion. UK residential mortgage balances ended the year at £61.9bn (2005: £59.6bn). Gross advances were 60% higher at £18.4bn (2005: £11.5bn), with a market share of 5% (2005: 4%). Net lending was £2.4bn, with performance improving during the year, leading to a market share of 4% in the second half of the year. The mortgage margin was reduced by changed assumptions used in the calculation of effective interest rates, a higher proportion of new mortgages and base rate changes. The new business spread was in line with the industry. The loan to value ratio within the residential mortgage book on a current valuation basis was 34% (2005: 35%).

There was good balance growth in non-mortgage loans, where Local Business average balances increased 9% and UK Premier average balances increased 25%.

Net fee and commission income increased 8% (£88m) to £1,219m (2005: £1,131m). There was strong current account income growth in Personal Customers and Local Business. UK Premier delivered strong growth reflecting higher income from banking services, mortgage sales and investment advice.

Net premiums from insurance underwriting activities decreased 4% (£11m) to £269m (2005: £280m). There continued to be lower customer take-up of loan protection insurance. Net claims and benefits on insurance contracts improved to £35m (2005: £58m). Other income increased £26m to £42m (2005: £16m), principally representing the benefit from reinsurance.

Impairment charges increased 39% (£59m) to £209m (2005: £150m). The increase principally reflected balance growth and some deterioration in delinquency rates in the Local Business loan book. Losses from the mortgage portfolio remained negligible, with arrears at low levels.

Operating expenses were steady at £2,408m (2005: £2,390m). Substantially all of the gains from the sale and leaseback of property of £253m have been reinvested in the business to improve customer service and deliver sustainable performance improvements. Around half of the incremental investment was directed at upgrading distribution capabilities, including restructuring and improving the branch network. Further investment was focused on upgrading the contact centres, transforming the performance of the mortgage business, revitalising the retail product range to meet customers’ needs, improving core operations and processes and rationalising the number of operating sites. The level of investment reflected in operating expenses in 2006 was approximately double the level of 2005.

The cost:income ratio improved four percentage points to 63% (2005: 67%).

2005/04

Profit before tax increased 4% (£38m) in 2005 to £1,040m (2004: £1,002m). Profit before tax increased 8% excluding the impact of £42m profit on business disposals in 2004.

Income increased 3% (£98m) to £3,586m (2004: £3,488m). There was good growth in Personal Customer current accounts, Local Business and UK Premier, whilst income from Personal Customers retail savings was weaker. The application of IAS 32 and IAS 39 from 1st January 2005 resulted in the reclassification of certain lending related fees from net fee and commission income to net interest income.

Net interest income increased 5% (£101m) to £2,208m (2004: £2,107m). Growth was driven by higher contributions from Home Finance and Local Business, partly offset by some margin pressure on savings and deposits.

UK residential mortgage balances ended the period at £59.6bn (2004: £61.7bn). Total average customer deposit balances increased 5% to £73.5bn (2004: £69.7bn).

Net fee and commission income decreased 2% (£18m) to £1,131m (2004: £1,149m) with lending related fees impacted by the application of IAS 32 and IAS 39 from 1st January 2005.

Income from principal transactions was £9m (2004: £nil) representing the gain on the sale of the investment in Gresham, an insurance underwriting business.

Net premiums from insurance underwriting activities increased 12% (£31m) to £280m (2004: £249m). In 2004 there was a provision relating to the early termination of contracts. Excluding this provision, there was a slight underlying reduction in net premiums.

Impairment charges increased 117% (£81m) to £150m (2004: £69m). Excluding UK mortgage releases of £10m (2004: £40m), impairment charges increased 47%, reflecting some deterioration in the delinquencies experience and balance growth in overdrafts and Local Business.

Operating expenses decreased 3% (£71m) to £2,390m (2004: £2,461m). The cost:income ratio improved four percentage points to 67% (2004: 71%).

| | |

Barclays PLC Annual Report 2006 | | 19 |

| |

Financial review

Analysis of results by business

UK Business Banking

UK Business Banking provides relationship banking to Barclays larger and medium business customers in the UK. Customers are served by a network of relationship and industry sector specialist managers who provide local access to an extensive range of products and services, as well as offering business information and support. Customers are also offered access to the products and expertise of other businesses in the Group, particularly Barclays Capital and Barclaycard. UK Business Banking provides asset financing and leasing solutions through a specialist business.

| | | | | | | | | | | | | | | | |

| | | 2006 £m | | | | | 2005 £m | | | | | 2004(a) £m | |

Net interest income | | | 1,702 | | | | | | 1,536 | | | | | | 1,241 | |

Net fee and commission income | | | 642 | | | | | | 589 | | | | | | 706 | |

Net trading income | | | 2 | | | | | | – | | | | | | – | |

Net investment income | | | 28 | | | | | | 17 | | | | | | – | |

Principal transactions | | | 30 | | | | | | 17 | | | | | | – | |

Other income | | | 21 | | | | | | 17 | | | | | | 14 | |

Total income | | | 2,395 | | | | | | 2,159 | | | | | | 1,961 | |

Impairment charges | | | (252 | ) | | | | | (177 | ) | | | | | (119 | ) |

Net income | | | 2,143 | | | | | | 1,982 | | | | | | 1,842 | |

Operating expenses excluding amortisation of intangible assets | | | (856 | ) | | | | | (822 | ) | | | | | (759 | ) |

Amortisation of intangible assets | | | (1 | ) | | | | | (3 | ) | | | | | (2 | ) |

Operating expenses | | | (857 | ) | | | | | (825 | ) | | | | | (761 | ) |

Share of post-tax results of associates and joint ventures | | | 3 | | | | | | 3 | | | | | | 3 | |

Profit on disposal of subsidiaries, associates and joint ventures | | | 76 | | | | | | – | | | | | | – | |

Profit before tax | | | 1,365 | | | | | | 1,160 | | | | | | 1,084 | |

Cost:income ratio | | | 36% | | | | | | 38% | | | | | | 39% | |

Cost:net income ratio | | | 40% | | | | | | 42% | | | | | | 41% | |

Risk Tendency | | £ | 290m | | | | | £ | 250m | | | | | £ | 200m | |

| | | | | |

| | | | 2006 | | | | | | 2005 | | | | | | 2004 | |

Loans and advances to customers | | £ | 56.3bn | | | | | £ | 53.4bn | | | | | £ | 40.0bn | |

Customer accounts | | £ | 57.4bn | | | | | £ | 50.9bn | | | | | £ | 37.5bn | |

Total assets | | £ | 65.9bn | | | | | £ | 59.9bn | | | | | £ | 42.2bn | |

Risk weighted assets | | £ | 50.0bn | | | | | £ | 47.1bn | | | | | £ | 42.3bn | |

Note

| (a) | Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. |

| | |

| 20 | | Barclays PLC Annual Report 2006 |

| |

2006/05

UK Business Banking profit before tax increased 18% (£205m) to £1,365m (2005: £1,160m), driven by continued strong income growth. UK Business Banking maintained its market share of primary customer relationships. The 2006 result included a £23m (2005: £13m) contribution from a full year consolidation of Iveco Finance, in which a 51% stake was acquired on 1st June 2005, and a £76m (2005: £nil) contribution from business disposals. Profit before business disposals of £76m increased 11% to £1,289m (2005: £1,160m).

Income increased 11% (£236m) to £2,395m (2005: £2,159m), driven by strong balance sheet growth. The uplift in income was broadly based across income categories.

Net interest income increased 11% (£166m) to £1,702m (2005: £1,536m) driven by strong balance sheet growth. There was strong growth in all business areas and in particular Larger Business. The lending margin improved slightly. Average deposit balances increased 11% to £44.8bn (2005: £40.5bn) with good growth across product categories. The deposit margin was stable.

Net fee and commission income increased 9% (£53m) to £642m (2005: £589m). There was a strong rise in income from foreign exchange and derivatives business transacted through Barclays Capital on behalf of Business Banking customers.

Income from principal transactions was £30m (2005: £17m), primarily reflecting the profit realised on a number of equity investments.

As expected, impairment rates trended upwards during the year towards a more normalised level. Impairment increased 42% (£75m) to £252m (2005: £177m), with the increase mainly reflecting higher charges from Medium Business and balance growth. Impairment charges in Larger Business were stable.

Operating expenses increased 4% (£32m) to £857m (2005: £825m). Cost growth reflected higher volumes, increased expenditure on front line staff and the costs of Iveco Finance for a full year. Operating expenses included a gain of £60m on the sale and leaseback of property, of which approximately half was reinvested in the business, including costs relating to the acceleration of the rationalisation of operating sites and technology infrastructure.

The cost:income ratio improved two percentage points to 36% (2005: 38%).

Profit on disposals of subsidiaries, associates and joint ventures of £76m (2005: £nil) arose from the sales of interests in vehicle leasing and European vendor finance businesses.

2005/04

Profit before tax increased 7% (76m) to £1,160m (2004: £1,084m), driven by strong income growth.

Both Larger Business and Medium Business performed well.

Income increased 10% (£198m) to £2,159m (2004: £1,961m), driven by strong balance sheet growth. The application of IAS 32 and IAS 39 from 1st January 2005 resulted in the reclassification of certain lending related fees from net fee and commission income to net interest income. Excluding the impact of IAS 32 and IAS 39, both net interest income and net fee and commission income continued to grow.

Impairment charges increased 49% (£58m) to £177m (2004: £119m). Excluding the impact of a £57m recovery in 2004, the impairment charge was broadly stable.

Operating expenses increased 8% (£64m) to £825m (2004: £761m), reflecting volume growth, increased expenditure on frontline staff and the costs of Iveco Finance since acquisition.

The cost:income ratio improved one percentage point to 38% (2004: 39%).

| | |

Barclays PLC Annual Report 2006 | | 21 |

| |

Financial review

Analysis of results by business

Barclaycard

Barclaycard is a multi-brand credit card and consumer loans business which also processes card payments for retailers and merchants and issues credit and charge cards to corporate customers and the UK Government. It is one of Europe’s leading credit card businesses and has an increasing presence in the United States.

In the UK, Barclaycard comprises Barclaycard, SkyCard and Monument branded credit cards, Barclays branded loans and FirstPlus secured lending. Barclaycard also manages card operations on behalf of Solution Personal Finance.

Outside the UK, Barclaycard provides credit cards in the United States, Germany, Spain, Italy, Portugal and Africa. In the Nordic region, Barclaycard operates through Entercard, a joint venture with FöreningsSparbanken (Swedbank).

Barclaycard works closely with other parts of the Group, including UK Retail Banking, UK Business Banking and International Retail and Commercial Banking, to leverage their distribution capabilities.

| | | | | | | | | | | | | | | | |

| | | 2006 £m | | | | | 2005 £m | | | | | 2004(a) £m | |

| | | | | |

Net interest income | | | 1,843 | | | | | | 1,726 | | | | | | 1,587 | |

Net fee and commission income | | | 1,054 | | | | | | 972 | | | | | | 790 | |

Net investment income | | | 15 | | | | | | – | | | | | | – | |

Net premiums from insurance contracts | | | 33 | | | | | | 24 | | | | | | 22 | |

Total income | | | 2,945 | | | | | | 2,722 | | | | | | 2,399 | |

Net claims and benefits on insurance contracts | | | (8 | ) | | | | | (7 | ) | | | | | (5 | ) |

Total income net of insurance claims | | | 2,937 | | | | | | 2,715 | | | | | | 2,394 | |

Impairment charges | | | (1,493 | ) | | | | | (1,098 | ) | | | | | (761 | ) |

Net income | | | 1,444 | | | | | | 1,617 | | | | | | 1,633 | |

Operating expenses excluding amortisation of intangible assets | | | (1,037 | ) | | | | | (961 | ) | | | | | (804 | ) |

Amortisation of intangible assets | | | (17 | ) | | | | | (17 | ) | | | | | (3 | ) |

Operating expenses | | | (1,054 | ) | | | | | (978 | ) | | | | | (807 | ) |

Share of post-tax results of associates and joint ventures | | | (8 | ) | | | | | 1 | | | | | | 4 | |

Profit before tax | | | 382 | | | | | | 640 | | | | | | 830 | |

Cost:income ratio | | | 36% | | | | | | 36% | | | | | | 34% | |

Cost:net income ratio | | | 73% | | | | | | 60% | | | | | | 49% | |

Risk Tendency | | £ | 1,410m | | | | | £ | 1,100m | | | | | £ | 860m | |

| | | | | |

| | | | 2006 | | | | | | 2005 | | | | | | 2004 | |

Loans and advances to customers | | | £25.5bn | | | | | | £24.0bn | | �� | | | £ | 22.3bn | |

Total assets | | | £27.6bn | | | | | | £25.8bn | | | | | £ | 23.4bn | |

Risk weighted assets | | | £25.2bn | | | | | | £21.8bn | | | | | £ | 20.2bn | |

Note

| (a) | Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. |

| | |

| 22 | | Barclays PLC Annual Report 2006 |

| |

2006/05

Barclaycard profit before tax decreased 40% (£258m) to £382m (2005: £640m) as good income growth was more than offset by higher impairment charges and increased costs from the continued development of international businesses.

Income increased 8% (£222m) to £2,937m (2005: £2,715m). Growth was driven by very strong momentum in the United States and by strong performances in Barclaycard Business, FirstPlus, SkyCard and continental European markets.

Net interest income increased 7% (£117m) to £1,843m (2005: £1,726m). UK average extended credit card balances fell 7% to £8.0bn (2005: £8.6bn), reflecting the impact of tighter lending criteria. UK average consumer lending balances increased 16% to £11.9bn (2005: £10.3bn) driven by secured lending in FirstPlus. International average extended credit card balances rose 39% to £2.5bn (2005: £1.8bn).

Net fee and commission income increased 8% (£82m) to £1,054m (2005: £972m) as a result of increased contributions from Barclaycard International, SkyCard, FirstPlus and Barclaycard Business. Barclaycard reduced its late and overlimit fee charges in the UK on 1st August 2006 in response to the Office of Fair Trading’s findings.

Investment income of £15m (2005: £nil) represents the gain arising from the sale of part of the stake in MasterCard Inc, following its flotation.

Impairment charges increased 36% (£395m) to £1,493m (2005: £1,098m). The increase was driven by a rise in delinquent balances and increased numbers of bankruptcies and Individual Voluntary Arrangements. As a result of management action in 2005 and 2006 to tighten lending criteria and improve collection processes, the flows of new delinquencies reduced, and levels of arrears balances declined in the second half of 2006 in UK cards and unsecured loans.

Operating expenses increased 8% (£76m) to £1,054m (2005: £978m). This included a £38m gain from the sale and leaseback of property. Excluding this item, operating expenses increased 12% (£114m) to £1,092m. This was largely as a result of continued investment in Barclaycard International, particularly Barclaycard US, and the development of UK partnerships.

Barclaycard International continued its growth strategy in the continental European business delivering solid results. The Entercard joint venture, which is based in Scandinavia, performed ahead of plan. Barclaycard International loss before tax reduced to £30m (2005: loss £37m), including the loss before tax for Barclaycard US of £56m (2005: loss £59m). Barclaycard US continued to perform ahead of expectations, delivering very strong growth in balances and customer numbers and creating a number of new partnerships including US Airways, Barnes & Noble, Travelocity and Jo-Ann Stores.

Barclaycard UK customer numbers declined 1.4 million to 9.8 million (2005: 11.2 million). This reflected the closure of 1.5 million accounts that had been inactive.

2005/04

Barclaycard profit before tax decreased 23% (£190m) to £640m (2004: £830m). Excluding Barclaycard US loss before tax of £59m, profit before tax fell 16% (£131m) to £699m.

Income increased 13% (£321m) to £2,715m (2004: £2,394m) driven by good performances across the diversified UK cards and loans businesses and Barclaycard Business, and by very strong momentum in international cards. Excluding Barclaycard US income of £117m, income increased 9%.

Net interest income increased 9% (£139m) to £1,726m (2004: £1,587m) as a result of growth in average balances.

UK average extended credit balances rose 5% to £8.6bn (2004: £8.2bn) and international average extended credit balances doubled to £1.8bn (2004: £0.9bn). Excluding Barclaycard US average extended credit balances of £0.9bn, international average extended credit balances increased 26%.

Net fee and commission income increased 23% (£182m) to £972m (2004: £790m) as a result of the inclusion of Barclaycard US and increased contributions from Barclaycard Business and FirstPlus. Excluding the impact of IAS 32 and IAS 39, net fee and commission income increased 16%.

Impairment charges increased 44% (£337m) to £1,098m (2004: £761m). The increase was driven by a rise in delinquent balances, lower rates of recovery from customers, the inclusion of Barclaycard US, and an increase in the size of the average loan book. Excluding Barclaycard US impairment charges of £53m, impairment charges increased 38%.

Operating expenses rose 21% (£171m) to £978m (2004: £807m), mostly as a result of the inclusion of Barclaycard US. Excluding Barclaycard US operating expenses of £111m, operating expenses rose 7% reflecting continued investment in the UK and continental European card businesses and the development of the UK Partnerships business.

Barclaycard International performed strongly, with Germany and Spain delivering excellent results. The loss before tax for Barclaycard International was £37m (2004: loss of £6m). Excluding Barclaycard US, Barclaycard International profit before tax was £22m (2004: £8m), with income ahead 22%. The loss before tax for Barclaycard US was £59m (2004: loss of £2m).

| | |

Barclays PLC Annual Report 2006 | | 23 |

| |

Financial review

Analysis of results by business

International Retail and Commercial Banking

International Retail and Commercial Banking provides Barclays personal and corporate customers outside the UK with banking services.

The products and services offered to customers are tailored to meet the regulatory and commercial environments within each country. For reporting purposes from 2005, the operations have been grouped into two components: International Retail and Commercial Banking – excluding Absa and International Retail and Commercial Banking – Absa.

International Retail and Commercial Banking works closely with all other parts of the Group to leverage synergies from product and service propositions.

| | | | | | | | | | | | | | | | |

| | | 2006

£m | | | | | 2005

£m | | | | | 2004(a)

£m | |

Net interest income | | | 1,659 | | | | | | 1,050 | | | | | | 529 | |

Net fee and commission income | | | 1,303 | | | | | | 705 | | | | | | 288 | |

Net trading income | | | 6 | | | | | | 3 | | | | | | – | |

Net investment income | | | 188 | | | | | | 143 | | | | | | 135 | |

Principal transactions | | | 194 | | | | | | 146 | | | | | | 135 | |

Net premiums from insurance contracts | | | 351 | | | | | | 227 | | | | | | 300 | |

Other income | | | 74 | | | | | | 60 | | | | | | 25 | |

Total income | | | 3,581 | | | | | | 2,188 | | | | | | 1,277 | |

Net claims and benefits on insurance contracts | | | (244 | ) | | | | | (205 | ) | | | | | (390 | ) |

Total income net of insurance claims | | | 3,337 | | | | | | 1,983 | | | | | | 887 | |

Impairment charges | | | (167 | ) | | | | | (32 | ) | | | | | (31 | ) |

Net income | | | 3,170 | | | | | | 1,951 | | | | | | 856 | |

Operating expenses excluding amortisation of intangible assets | | | (2,111 | ) | | | | | (1,317 | ) | | | | | (616 | ) |

Amortisation of intangible assets | | | (85 | ) | | | | | (47 | ) | | | | | (1 | ) |

Operating expenses | | | (2,196 | ) | | | | | (1,364 | ) | | | | | (617 | ) |

Share of post-tax results of associates and joint ventures | | | 49 | | | | | | 46 | | | | | | 49 | |

Profit on disposal of subsidiaries, associates and joint ventures | | | 247 | | | | | | – | | | | | | – | |

Profit before tax | | | 1,270 | | | | | | 633 | | | | | | 288 | |

Cost:income ratio | | | 66% | | | | | | 69% | | | | | | 70% | |

Cost:net income ratio | | | 69% | | | | | | 70% | | | | | | 72% | |

Risk Tendency | | £ | 220m | | | | | £ | 175m | | | | | £ | 65m | |

| | | | | |

| | | 2006 | | | | | | 2005 | | | | | | 2004 | |

Loans and advances to customers | | £ | 53.5bn | | | | | £ | 49.3bn | | | | | £ | 20.7bn | |

Customer accounts | | £ | 22.5bn | | | | | £ | 22.6bn | | | | | £ | 10.1bn | |

Total assets | | £ | 68.9bn | | | | | £ | 63.6bn | | | | | £ | 28.5bn | |

Risk weighted assets | | £ | 41.1bn | | | | | £ | 41.2bn | | | | | £ | 19.3bn | |

Note

| (a) | Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. |

| | |

| 24 | | Barclays PLC Annual Report 2006 |

| |

2006/05

International Retail and Commercial Banking profit before tax increased £637m to £1,270m (2005: £633m). The increase reflected the inclusion of a full year’s profit before tax from International Retail and Commercial Banking – Absa of £698m (2005(a): £298m) and a profit of £247m on the disposal of Barclays interest in FirstCaribbean International Bank.

2005/04

International Retail and Commercial Banking profit before tax increased £345m to £633m (2004: £288m). The increase reflected the inclusion of profit before tax from International Retail and Commercial Banking –Absa of £298m(a)and strong organic growth in Africa and Europe.

From 1st January 2005, following the application of IAS 39 and IFRS 4, life assurance products are divided into investment contracts and insurance contracts. Investment income from assets backing insurance contracts, and the corresponding movement in investment contract liabilities, has been presented on a net basis in other income.

In addition, these standards have impacted the reporting of net claims and benefits paid.

Note

(a) For 2005, this reflects the period from 27th July until 31st December 2005.

| | |

Barclays PLC Annual Report 2006 | | 25 |

| |

Financial review

Analysis of results by business

International Retail and Commercial Banking – excluding Absa

International Retail and Commercial Banking – excluding Absa provides a range of banking services, including current accounts, savings, investments, mortgages and loans to personal and corporate customers across Spain, Portugal, France, Italy, Africa and the Middle East.

| | | | | | | | | | | | | | | | |

| | | 2006 £m | | | | | 2005 £m | | | | | 2004(a) £m | |

Net interest income | | | 610 | | | | | | 562 | | | | | | 529 | |

Net fee and commission income | | | 448 | | | | | | 377 | | | | | | 288 | |

Net trading income | | | 17 | | | | | | 31 | | | | | | – | |

Net investment income | | | 66 | | | | | | 88 | | | | | | 135 | |

Principal transactions | | | 83 | | | | | | 119 | | | | | | 135 | |

Net premiums from insurance contracts | | | 111 | | | | | | 129 | | | | | | 300 | |

Other income | | | 20 | | | | | | 23 | | | | | | 25 | |

Total income | | | 1,272 | | | | | | 1,210 | | | | | | 1,277 | |

Net claims and benefits on insurance contracts | | | (138 | ) | | | | | (161 | ) | | | | | (390 | ) |

Total income net of insurance claims | | | 1,134 | | | | | | 1,049 | | | | | | 887 | |

Impairment charges | | | (41 | ) | | | | | (13 | ) | | | | | (31 | ) |

Net income | | | 1,093 | | | | | | 1,036 | | | | | | 856 | |

Operating expenses excluding amortisation of intangible assets | | | (799 | ) | | | | | (734 | ) | | | | | (616 | ) |

Amortisation of intangible assets | | | (9 | ) | | | | | (6 | ) | | | | | (1 | ) |

Operating expenses | | | (808 | ) | | | | | (740 | ) | | | | | (617 | ) |

Share of post-tax results of associates and joint ventures | | | 40 | | | | | | 39 | | | | | | 49 | |

Profit on disposal of subsidiaries, associates and joint ventures | | | 247 | | | | | | – | | | | | | – | |

Profit before tax | | | 572 | | | | | | 335 | | | | | | 288 | |

Cost:income ratio | | | 71% | | | | | | 71% | | | | | | 70% | |

Cost:net income ratio | | | 74% | | | | | | 71% | | | | | | 72% | |

| | | | | |

Risk Tendency | | £ | 75m | | | | | £ | 75m | | | | | £ | 65m | |

| | | | | |

| | | | 2006 | | | | | | 2005 | | | | | | 2004 | |

| | | | | |

Loans and advances to customers | | £ | 29.3bn | | | | | £ | 25.4bn | | | | | £ | 20.7bn | |

Customer accounts | | £ | 11.4bn | | | | | £ | 10.4bn | | | | | £ | 10.1bn | |

Total assets | | £ | 38.5bn | | | | | £ | 34.2bn | | | | | £ | 28.5bn | |

Risk weighted assets | | £ | 20.4bn | | | | | £ | 20.4bn | | | | | £ | 19.3bn | |

Note

| (a) | Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. |

| | |

| 26 | | Barclays PLC Annual Report 2006 |

| |

2006/05

International Retail and Commercial Banking – excluding Absa profit before tax increased 71% (£237m) to £572m (2005: £335m), including a gain on the disposal of the interest in FirstCaribbean International Bank of £247m. Profit before business disposals was £325m (2005: £335m). This reflected good growth in continental Europe offset by a decline in profits in Africa caused by higher impairment, and increased costs reflecting a step change in the rate of organic investment in the business.

Income increased 8% (£85m) to £1,134m (2005: £1,049m). Excluding gains from asset sales of £31m in 2005, income increased 11% (£116m) to £1,134m (2005: £1,018m).

Net interest income increased 9% (£48m) to £610m (2005: £562m), reflecting strong balance sheet growth in continental Europe, Africa and the Middle East, and the development of the corporate business in Spain.

Total average customer loans increased 20% to £27.4bn (2005: £22.9bn). Mortgage balance growth in continental Europe was particularly strong, with average Euro balances up 22%. There was a modest decline in lending margins partly driven by a greater share of mortgage assets as a proportion of the total book in continental Europe. Average customer deposits increased 17% to £10.8bn (2005: £9.2bn), with deposit margins stable.