UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934, FOR THE FISCAL YEAR ENDED DECEMBER 31, 2007 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

| | | | | | | | | | |

Commission file numbers: | | Barclays PLC | | 1-09246 | | |

| | | | | | Barclays Bank PLC | | 1-10257 | | |

BARCLAYS PLC

BARCLAYS BANK PLC

(Exact names of registrants as specified in their charters)

ENGLAND

(Jurisdictions of Incorporation)

1 CHURCHILL PLACE, LONDON, E14 5HP, ENGLAND

(Address of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

| | | Title of each class | | Name of each exchange on which registered |

| Barclays PLC | | 25p ordinary shares American Depositary Shares, each representing four 25p ordinary shares | | New York Stock Exchange* New York Stock Exchange |

| Barclays Bank PLC | | 7.4% Subordinated Notes 2009 | | New York Stock Exchange |

| | Callable Floating Rate Notes 2035 | | New York Stock Exchange |

| | Non-Cumulative Callable Dollar | | |

| | Preference Shares, Series 2 | | New York Stock Exchange* |

| | American Depositary Shares, Series | | |

| | 2, each representing one Non- | | |

| | Cumulative Callable Dollar | | |

| | Preference Share, Series 2 | | New York Stock Exchange |

| | Non-Cumulative Callable Dollar | | |

| | Preference Shares, Series 3 | | New York Stock Exchange* |

| | American Depositary Shares, Series | | |

| | 2, each representing one Non- | | |

| | Cumulative Callable Dollar | | |

| | Preference Share, Series 3 | | New York Stock Exchange |

| | Non-Cumulative Callable Dollar | | |

| | Preference Shares, Series 4 | | New York Stock Exchange* |

| | American Depositary Shares, Series | | |

| | 2, each representing one Non- | | |

| | Cumulative Callable Dollar | | |

| | Preference Share, Series 4 | | New York Stock Exchange |

| | iPathSM CBOE S&P 500 BuyWrite | | |

| | IndexSM | | American Stock Exchange |

| | iPath® Dow Jones – AIG Grains Total | | |

| | Return Sub-IndexSM ETN | | NYSE Arca |

| | iPath® Dow Jones – AIG Livestock | | |

| | Total Return Sub-IndexSM ETN | | NYSE Arca |

| | iPath® Dow Jones – AIG Nickel Total | | |

| | Return Sub-IndexSM ETN | | NYSE Arca |

| | iPath® Dow Jones – AIG Copper Total | | |

| | Return Sub-IndexSM ETN | | NYSE Arca |

| | iPath® Dow Jones – AIG Energy Total | | |

| | Return Sub-IndexSM ETN | | NYSE Arca |

| | iPath® Dow Jones – AIG Agriculture | | |

| | Total Return Sub-lndexSM ETN | | NYSE Arca |

| | iPath® Dow Jones – AIG Natural Gas | | |

| | Total Return Sub-IndexSM ETN | | NYSE Arca |

| | iPath® Dow Jones – AIG Industrial | | |

| | Metals Total Return Sub-IndexSM | | |

| | ETN | | NYSE Arca |

| | iPath® GBP/USD Exchange Rate | | |

| | ETN | | NYSE Arca |

| | iPath® Dow Jones – AIG Commodity | | |

| | Index Total ReturnSM ETN | | NYSE Arca |

| | iPath® EUR/USD Exchange Rate | | |

| | ETN | | NYSE Arca |

| | iPath® S&P GSCI™ Total Return | | |

| | Index ETN | | NYSE Arca |

| | iPath® MSCI India IndexSM ETN | | NYSE Arca |

| | iPath® S&P GSCI™ Crude Oil Total | | |

| | Return Index ETN | | NYSE Arca |

| | iPath® JPY/USD Exchange Rate ETN | | NYSE Arca |

| * | Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuers’ classes of capital or common stock as of the close of the period covered by the annual report.

| | | | |

| Barclays PLC | | 25p ordinary shares | | 6,534,698,021 |

| | £1 staff shares | | 875,000 |

| Barclays Bank PLC | | £1 ordinary shares | | 2,337,161,000 |

| | £1 preference shares | | 1,000 |

| | £100 preference shares | | 75,000 |

| | €100 preference shares | | 240,000 |

| | $0.25 preference shares | | 131,000,000 |

| | $100 preference shares | | 100,000 |

Indicate by check mark if each registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yesþ No¨

If this report is an annual or transition report, indicate by check mark if each registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes¨ Noþ

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports) and (2) have been subject to such filing requirements for the past 90 days.

Yesþ No¨

Indicate by check mark whether each registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Barclays PLC:

Large accelerated filerþ Accelerated filer¨ Non-accelerated flier¨

Barclays Bank PLC:

Large accelerated filer¨ Accelerated filer¨ Non-accelerated filerþ

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP¨ International Financial Reporting Standards as issued by the International Accounting Standards Boardþ Other¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17¨ Item 18¨

If this is an annual report, indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes¨ Noþ

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrants have fifed all documents and reports required to be filed by Section 12,13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes¨ No¨

Certain non-IFRS measures

In this document certain non-IFRS (International Financial Reporting Standards) measures, such as profit before business disposals, are reported. Barclays management believes that these non-IFRS measures provide valuable information to readers of its financal statements because they enable the reader to focus more directly on the underlying day-to-day performance of its businesses and provide more detail concerning the elements of performance which the managers of these businesses are most directly able to influence. They also reflect an important aspect of the way in which operating targets are defined and performance is monitored by Barclays management. However, any non-IFRS measures in this document are not a substitute for IFRS measures and readers should consider the IFRS measures as well.

Market and other data

This document contains information, including statistical data, about certain of Barclays markets and its competitive position. Except as otherwise indicated, this information is taken or derived from Datastream and other external sources. Barclays cannot guarantee the accuracy of information taken from external sources, or that, in respect of internal estimates, a third party using different methods would obtain the same estimates as Barclays.

Forward-looking statements

This document contains certain forward-looking statements within the meaning of Section 21E of the US Securities Exchange Act of 1934, as amended, and Section 27A of the US Securities Act of 1933, as amended, with respect to certain of the Group’s plans and its current goals and expectations relating to its future financial condition and performance. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements sometimes use words such as “aim”, “anticipate”, “target”, ‘expect”, “estimate”, “intend”, “plan”, “goal”, “believe”, or other words of similar meaning. Examples of forward-looking statements include, among others, statements regarding the Group’s future financial position, income growth, impairment charges, business strategy, projected levels of growth in the banking and financial markets, projected costs, estimates of capital expenditures, and plans and objectives for future operations. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances, including, but not limited to, UK domestic and global economic and business conditions, the effects of continued volatility in credit markets, market related risks such as changes in interest rates and exchange rates, the policies and actions of governmental and regulatory authorities, changes in legislation, the further development of standards and interpretations under IFRS applicable to past, current and future periods, evolving practices with regard to the interpretation and application of standards under IFRS, progress in the integration of Absa into the Group’s business and the achievement of synergy targets related to Absa, the outcome of pending and future litigation, the success of future acquisitions and other strategic transactions and the impact of competition – a number of which factors are beyond the Group’s control. As a result, the Group’s actual future results may differ materially from the plans, goals, and expectations set forth in the Group’s forward-looking statements.

Any forward-looking statements made by or on behalf of Barclays speak only as of the date they are made. Barclays does not undertake to update forward-looking statements to reflect any changes in Barclays expectations with regard thereto or any changes in events, conditions or circumstances on which any such statement is based. The reader should, however, consult any additional disclosures that Barclays has made or may make in documents it has filed or may file with the Securities and Exchange Commission, including the discussion of risk management in the document.

SEC Form 20-F cross reference information

SEC Form 20-F Cross Reference Information

| | | | |

Form 20-F item number | | | | Page reference in this document* |

| 1 | | Identity of Directors, Senior Management and Advisers | | |

| | | Not applicable | | |

| 2 | | Offer Statistics and Expected Timetable | | |

| | | Not applicable | | |

| 3 | | Key Information | | |

| | Risk factors | | 63 |

| | Currency of presentation | | 265 |

| | Financial data | | 6 |

| | | Dividends | | 267 |

| 4 | | Information on the Company | | |

| | Presentation of information | | 146 |

| | Glossary | | 266 |

| | Business description | | 8 |

| | Acquisitions | | 158 |

| | Financial review | | 3 |

| | Recent developments | | 159 |

| | Supervision and regulation | | 110 |

| | Note 23 Property, plant and equipment | | 181 |

| | Note 34 Contingent liabilities and commitments | | 200 |

| | Note 40 Principal subsidiaries | | 206 |

| | | Note 51 Segmental reporting | | 247 |

| 4A | | Unresolved staff comments | | |

| | | Not applicable | | |

| 5 | | Operating and Financial Review and Prospects | | |

| | Financial review | | 3 |

| | Capital adequacy | | 70 |

| | Liquidity management | | 91 |

| | Note 14 Derivative Financial Instruments | | 172 |

| | Note 46 Market Risk | | 218 |

| | Note 48 Liquidity Risk | | 240 |

| | | Note 50 Capital Management | | 246 |

| 6 | | Directors, Senior Management and Employees | | |

| | Board and Executive Committee | | 112 |

| | Directors’ report | | 114 |

| | Corporate governance report | | 117 |

| | Remuneration report | | 128 |

| | Accountability and Audit | | 143 |

| | Note 8 Staff costs | | 168 |

| | Note 30 Retirement benefit obligations | | 190 |

| | | Note 42 Related party transactions and Directors’ remuneration | | 208 |

| 7 | | Major Shareholders and Related Party Transactions | | |

| | Presentation of information | | 146 |

| | Directors’ report | | 114 |

| | Note 42 Related party transactions and Director’s remuneration | | 208 |

| | | Trading market for ordinary shares of Barclays PLC | | 267 |

8 | | Financial Information | | |

| | Financial statements | | 145 |

| | Note 1 Dividends per share –Barclays PLC | | 166 |

| | Note 35 Legal proceedings | | 201 |

| | Note 43 Events after the balance sheet date | | 212 |

| | | Dividends – Barclays PLC | | 267 |

| 9 | | The Offer and Listing | | |

| | Trading market for ordinary shares of Barclays PLC | | 267 |

| | | | |

Form 20-F item number | | | | Page reference in this document* |

| 10 | | Additional Information | | |

| | Memorandum and Articles of Association | | 269 |

| | Taxation | | 271 |

| | Exchange controls and other | | 273 |

| | limitations affecting security holders | | |

| | | Documents on display | | 273 |

| 11 | | Quantitative and qualitative disclosure about market risk | | |

| | Risk management Introduction | | 65 |

| | Credit risk management | | 74 |

| | Monitoring of Loans and advances | | 80 |

| | Allowances for impairment and other credit provisions | | 84 |

| | Potential credit risk loans | | 82 |

| | Loans and advances in non-local currencies | | 101 |

| | Market risk management | | 86 |

| | Derivatives | | 89 |

| | Capital adequacy | | 70 |

| | Liquidity management | | 91 |

| | | Note 14 Derivative financial instruments | | 172 |

| 12 | | Description of Securities Other than Equity Securities | | |

| | | Not applicable | | |

| 13 | | Defaults, Dividends Arrearages and Delinquencies | | |

| | | Not applicable | | |

| 14 | | Material Modifications to the Rights of Security Holders and Use of Proceeds | | |

| | | Not applicable | | |

| 15 | | Controls and Procedures | | |

| | Disclosure controls and procedures | | 144 |

| | Management’s report on internal control over financial reporting | | 143 |

| | Independent registered public accounting firm’s report | | 147 |

| | | Changes in internal control | | 144 |

| 16A | | Audit Committee Financial Expert | | 122 |

| 16B | | Code of Ethics | | Exhibit 11.1 |

| 16C | | Principal Accountant Fees and Services | | 122,169 |

| 16D | | Exemptions from the Listing Standards for Audit Committees | | |

| | | Not applicable | | |

| 16E | | Share Repurchase | | 197 |

| 17 | | Financial Statements | | |

| | | Not applicable | | |

| 18 | | Financial Statements | | |

| | Independent registered public accounting firm’s report for Barclays PLC | | 147 |

| | Independent registered public accounting firm report for Barlays Bank PLC | | 148 |

| | Accounting policies | | 149 |

| | Consolidated accounts Barclays PLC | | 149 |

| | Notes to accounts of Barclays PLC | | 166 |

| | Barclays Bank PLC data | | 250 |

| | | Notes to consolidated accounts of Barclays Bank PLC | | 254 |

| 19 | | Exhibits | | |

| | Included in documents as filed with the SEC | | |

| * | Where the response to an item of Form 20-F is presented over a number of pages, the page number indicates the page number on which the relevant response begins. |

| | |

Barclays Annual Report 2007 | | |

| |

| | |

Barclays Annual Report 2007 | | 1 |

| |

Glossary of terms

Absa definitions

“Absa Group Limited” refers to the consolidated results of the South African group of which the parent company is listed on the Johannesburg Stock Exchange (JSE Limited) in which Barclays owns a controlling stake.

“Absa” refers to the results for Absa Group Limited as consolidated into the results of Barclays PLC; translated into Sterling with adjustments for amortisation of intangible assets, certain head office adjustments, transfer pricing and minority interests.

“International Retail and Commercial Banking-Absa” is the portion of Absa’s results that is reported by Barclays within the International Retail and Commercial Banking business.

“Absa Capital” is the portion of Absa’s results that is reported by Barclays within the Barclays Capital business.

Other definitions

“Income” refers to total income net of insurance claims, unless otherwise specified.

“Profit before business disposals” represents profit before tax and disposal of subsidiaries, associates and joint ventures.

“Cost:income ratio” is defined as operating expenses compared to total income net of insurance claims.

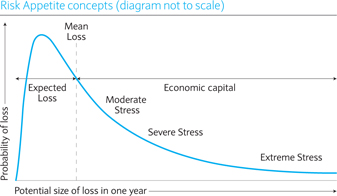

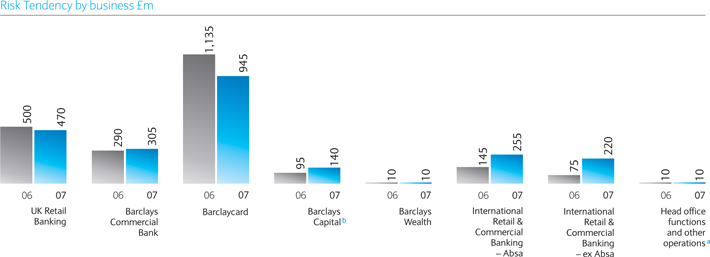

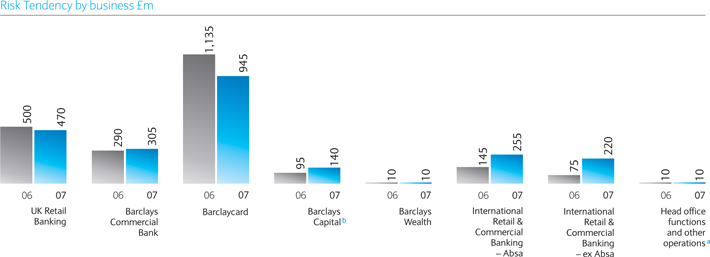

“Risk Tendency” is a statistical estimate of the average loss for each loan portfolio for a 12-month period, taking into account the size of the portfolio and its risk characteristics under current economic conditions, and is used to track the change in risk as the portfolio of loans changes over time. Further information on Risk Tendency is included under “Risk Management — Credit Risk Management”

“Daily Value at Risk (DVaR)” is an estimate of the potential loss which might arise from unfavourable market movements, if the current positions were to be held unchanged for one business day, measured to a confidence level of 98%.

| | |

| 2 | | Barclays Annual Report 2007 |

| |

| | |

Barclays Annual Report 2007 | | 3 |

| |

Financial review

Group Performance

Barclays delivered profit before tax of £7,076m. Earnings per share were 68.9p and we increased the full year dividend payout to 34p, a rise of 10%.

Income grew 7% to £23,000m. Growth was well spread by business, with strong contributions from International Retail and Commercial Banking, Barclays Global Investors and Barclays Wealth. Net income, after impairment charges, grew 4% and included net losses of £1,635m relating to credit market turbulence, net of £658m of gains arising from the fair valuation of notes issued by Barclays Capital and settlements on overdraft fees in relation to prior years of £116m in UK Retail Banking.

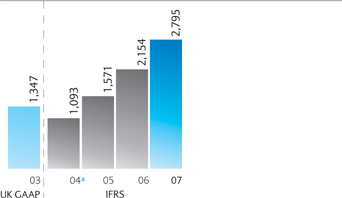

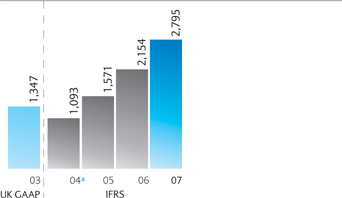

Impairment charges and other credit provisions rose 30% to £2,795m. Impairment charges relating to US sub-prime mortgages and other credit market exposures were £782m. Excluding these sub-prime related charges, impairment charges improved 7% to £2,013m. In UK Retail Banking and Barclaycard, impairment charges improved significantly, as a consequence of reductions in flows into delinquency and arrears balances in UK cards and unsecured loans. UK mortgage impairment charges remained negligible, with low levels of defaults, and the wholesale and corporate sector remained stable. The significant increase in impairment charges in International Retail and Commercial Banking was driven by very strong book growth.

Operating expenses increased 4% to £13,199m. We invested in growing the branch network and distribution channels in International Retail and Commercial Banking and in infrastructure development in Barclays Global Investors. Costs were lower in UK Banking and broadly flat in Barclays Capital. Gains from property disposals were £267m (2006: £432m). The Group cost:income ratio improved two percentage points to 57%.

Business Performance – Global Retail and Commercial Banking

In UK Bankingwe improved the cost:income ratio a further two percentage points to 48%, excluding settlements on overdraft fees in relation to prior years of £116m. On this basis we have delivered a cumulative eight percentage point improvement in the past three years, well ahead of our target of six percentage points.

UK Retail Bankingprofit before tax grew 9% to £1,282m. Income grew 2% excluding settlements on overdraft fees in relation to prior years of £116m, reflecting a very strong performance in Personal Customer Retail Savings and good performances in Current Accounts, Local Business and Home Finance, partially offset by lower income from loan protection insurance. Enhancements in product offering and continued improvements in processing capacity enabled a strong performance in mortgage origination, with a share of net new lending of 8%. Operating expenses were well controlled and improved 3%. Impairment charges improved 12% reflecting lower charges in unsecured consumer lending and Local Business. This was driven by improvements in the collection process which led to reduced flows into delinquency, lower levels of arrears and stable charge-offs. Mortgage impairment charges remained negligible.

| | |

| 4 | | Barclays Annual Report 2007 |

| |

Barclays Commercial Bankdelivered profit before tax of £1,371m. Profit before business disposals improved 5%. Income improved 7% driven by very strong growth in fees and commissions and steady growth in net interest income. Non-interest income increased to 32% of total income reflecting continuing focus on cross sales and efficient balance sheet utilisation. Operating expenses rose 6%, reflecting increased investment in product development and support, sales force capability and operational efficiency. Impairment charges increased £38m as a result of asset growth and higher charges in Larger Business.

Barclaycardprofit before tax increased to £540m, 18% ahead of the prior year. Steady income relative to 2006 reflected strong growth in Barclaycard International offset by a reduction in UK card extended credit balances as we re-positioned the UK business and reduced lower credit quality exposures including the sale of the Monument card portfolio. As a result, impairment charges improved 21%, reflecting more selective customer recruitment, client management and improved collections. Operating expenses increased 12%, driven by continued investment in Barclaycard International and the non-recurrence of a property gain included in the 2006 results. Barclaycard US continued to make good progress, and for the first time made a profit for the year.

International Retail and Commercial Bankingprofits declined 23% to £935m. Results in 2006 included a £247m profit on disposals and £41m post tax profit share from FirstCaribbean International Bank. 2007 results reflected a 12% decline in the average value of the Rand.

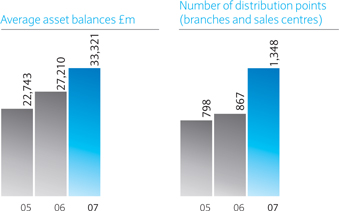

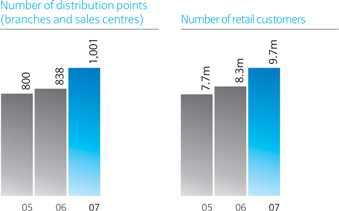

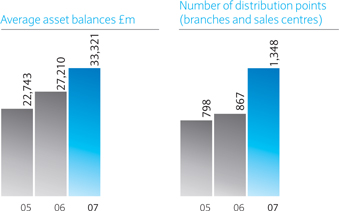

International Retail and Commercial Banking – excluding Absadelivered a profit before tax of £246m. Income rose 28% as we significantly increased the pace of organic growth across the business, with especially strong growth in Emerging Markets and Spain. Operating expenses grew 32% as we expanded the distribution footprint, opening 324 new branches and 157 new sales centres and also invested in rolling out a common technology platform and processes across the business. Impairment increased to £79m including very strong balance sheet growth and lower releases.

International Retail and Commercial Banking – AbsaSterling profit fell £9m to £689m after absorbing the 12% decline in the average value of the Rand. Retail loans and advances grew 22% and retail deposits grew 20%.

Business Performance – Investment Banking and Investment Management

Barclays Capitaldelivered a 5% increase in profit before tax to £2,335m. Net income was ahead of last year, reflecting very strong performances in most asset classes including interest rates, currencies, equity products and commodities. Results also included net losses arising from credit market turbulence of £1,635m net of gains from the fair valuation of issued notes of £658m. All geographies outside the US enjoyed significant growth in income and profits. Strong cost control led to operating expenses declining slightly year on year.

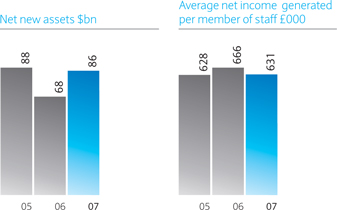

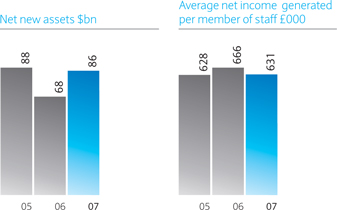

Barclays Global Investors(BGI) profit before tax increased 3% to £734m. Income grew 16%, driven by very strong growth in management fees and in securities lending revenues. Profit and income growth were both affected by the 8% depreciation in the average value of the US Dollar. BGI costs increased 25% as we continued to build our infrastructure across multiple products and platforms to support future growth.

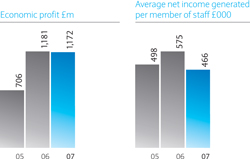

The cost:income ratio rose to 62%. Assets under management grew US$265bn to US$2.1 trillion, including net new assets of US$86bn.

Barclays Wealthprofit before tax rose 25% to £307m. Income growth of 11% was driven by increased client funds and greater transaction volumes. Costs were well controlled as business volumes rose and the cost:income ratio improved three percentage points to 76%. We continued to invest in client facing staff and infrastructure. Redress costs declined. Total client assets increased 14% to £133bn.

Head office functions and other operations

Head Office functions and other operationsloss before tax increased 65% to £428m reflecting higher inter-segment adjustments and lower gains from hedging activities.

Capital management

At 31st December 2007, our Basel I Tier 1 Capital ratio was 7.8% (2006: 7.7%). We started managing capital ratios under Basel II from 1st January 2008. Our Basel II Tier 1 Capital ratio was 7.6%. Our Equity Tier 1 ratio was 5.0% under Basel I (2006: 5.3%) and 5.1% under Basel II.

We have increased the proposed dividend payable to shareholders in respect of 2007 by 10%. We maintain our progressive approach to dividends, expecting dividend growth broadly to match earnings growth over time.

| | |

Barclays Annual Report 2007 | | 5 |

| |

Financial data

Consolidated income statement summary

For the year ended 31st December

| | | | | | | | | | | | |

| | | 2007 £m | | | 2006 £m | | | 2005 £m | | | 2004

£ma | |

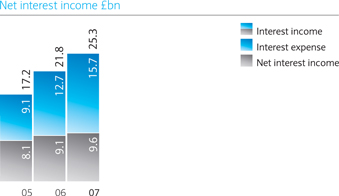

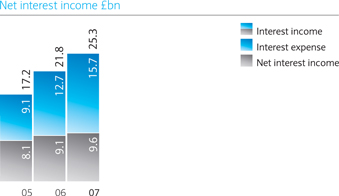

Net interest income | | 9,610 | | | 9,143 | | | 8,075 | | | 6,833 | |

Net fee and commission income | | 7,708 | | | 7,177 | | | 5,705 | | | 4,847 | |

Principal transactions | | 4,975 | | | 4,576 | | | 3,179 | | | 2,514 | |

Net premiums from insurance contracts | | 1,011 | | | 1,060 | | | 872 | | | 1,042 | |

Other income | | 188 | | | 214 | | | 147 | | | 131 | |

Total income | | 23,492 | | | 22,170 | | | 17,978 | | | 15,367 | |

Net claims and benefits incurred on insurance contracts | | (492 | ) | | (575 | ) | | (645 | ) | | (1,259 | ) |

Total income net of insurance claims | | 23,000 | | | 21,595 | | | 17,333 | | | 14,108 | |

Impairment charges and other credit provisions | | (2,795 | ) | | (2,154 | ) | | (1,571 | ) | | (1,093 | ) |

Net income | | 20,205 | | | 19,441 | | �� | 15,762 | | | 13,015 | |

Operating expenses | | (13,199 | ) | | (12,674 | ) | | (10,527 | ) | | (8,536 | ) |

Share of post-tax results of associates and joint ventures | | 42 | | | 46 | | | 45 | | | 56 | |

Profit before business disposals | | 7,048 | | | 6,813 | | | 5,280 | | | 4,535 | |

Profit on disposal of subsidiaries, associates and joint ventures | | 28 | | | 323 | | | – | | | 45 | |

Profit before tax | | 7,076 | | | 7,136 | | | 5,280 | | | 4,580 | |

Tax | | (1,981 | ) | | (1,941 | ) | | (1,439 | ) | | (1,279 | ) |

Profit after tax | | 5,095 | | | 5,195 | | | 3,841 | | | 3,301 | |

Profit attributable to minority interests | | 678 | | | 624 | | | 394 | | | 47 | |

Profit attributable to equity holders of the parent | | 4,417 | | | 4,571 | | | 3,447 | | | 3,254 | |

| | | 5,095 | | | 5,195 | | | 3,841 | | | 3,301 | |

| | | | |

| | | | | | | | | | | | |

Selected financial statistics | | | | | | | | | | | | |

Basic earnings per share | | 68.9p | | | 71.9p | | | 54.4p | | | 51.0p | |

Diluted earnings per share | | 66.7p | | | 69.8p | | | 52.6p | | | 49.8p | |

Dividends per ordinary share | | 34.0p | | | 31.0p | | | 26.6p | | | 24.0p | |

Dividend payout ratio | | 49.3% | | | 43.1% | | | 48.9% | | | 47.1% | |

Profit attributable to the equity holders of the parent as a percentage of: | | | | | | | | | | | | |

average shareholders’ equity | | 20.3% | | | 24.7% | | | 21.1% | | | 21.7% | |

average total assets | | 0.3% | | | 0.4% | | | 0.4% | | | 0.5% | |

| | | | |

Selected statistical measures | | | | | | | | | | | | |

Cost:income ratiob | | 57% | | | 59% | | | 61% | | | 61% | |

Average United States Dollar exchange rate used in preparing the accounts | | 2.00 | | | 1.84 | | | 1.82 | | | 1.83 | |

Average Euro exchange rate used in preparing the accounts | | 1.46 | | | 1.47 | | | 1.46 | | | 1.47 | |

Average Rand exchange rate used in preparing the accounts | | 14.11 | | | 12.47 | | | 11.57 | | | 11.83 | |

The financial information above is extracted from the published accounts for the last three years. This information should be read together with, and is qualified by reference to, the accounts and notes included in this report.

Note

| a | Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. |

| | |

| 6 | | Barclays Annual Report 2007 |

| |

Financial data

Consolidated balance sheet summary

As at 31st December

| | | | | | | | |

| | | 2007 £m | | 2006 £m | | 2005 £m | | 2004 £ma |

Assets | | | | | | | | |

Cash and other short-term funds | | 7,637 | | 9,753 | | 5,807 | | 3,525 |

Treasury bills and other eligible bills | | n/a | | n/a | | n/a | | 6,658 |

Trading portfolio and financial assets designated at fair value | | 341,171 | | 292,464 | | 251,820 | | n/a |

Derivative financial instruments | | 248,088 | | 138,353 | | 136,823 | | n/a |

Debt securities and equity shares | | n/a | | n/a | | n/a | | 141,710 |

Loans and advances to banks | | 40,120 | | 30,926 | | 31,105 | | 80,632 |

Loans and advances to customers | | 345,398 | | 282,300 | | 268,896 | | 262,409 |

Available for sale financial investments | | 43,072 | | 51,703 | | 53,497 | | n/a |

Reverse repurchase agreements and cash collateral on securities borrowed | | 183,075 | | 174,090 | | 160,398 | | n/a |

Other assets | | 18,800 | | 17,198 | | 16,011 | | 43,247 |

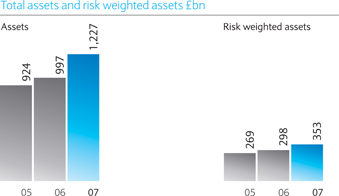

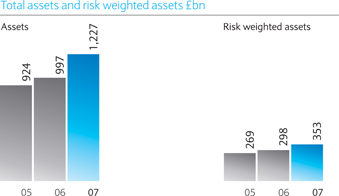

Total assets | | 1,227,361 | | 996,787 | | 924,357 | | 538,181 |

| | | | |

Liabilities | | | | | | | | |

Deposits and items in the course of collection due to banks | | 92,338 | | 81,783 | | 77,468 | | 112,229 |

Customer accounts | | 294,987 | | 256,754 | | 238,684 | | 217,492 |

Trading portfolio and financial liabilities designated at fair value | | 139,891 | | 125,861 | | 104,949 | | n/a |

Liabilities to customers under investment contracts | | 92,639 | | 84,637 | | 85,201 | | n/a |

Derivative financial instruments | | 248,288 | | 140,697 | | 137,971 | | n/a |

Debt securities in issue | | 120,228 | | 111,137 | | 103,328 | | 83,842 |

Repurchase agreements and cash collateral on securities lent | | 169,429 | | 136,956 | | 121,178 | | n/a |

Insurance contract liabilities, including unit-linked liabilities | | 3,903 | | 3,878 | | 3,767 | | 8,377 |

Subordinated liabilities | | 18,150 | | 13,786 | | 12,463 | | 12,277 |

Other liabilities | | 15,032 | | 13,908 | | 14,918 | | 87,200 |

Total liabilities | | 1,194,885 | | 969,397 | | 899,927 | | 521,417 |

Shareholders’ equity | | | | | | | | |

Shareholders’ equity excluding minority interests | | 23,291 | | 19,799 | | 17,426 | | 15,870 |

Minority interests | | 9,185 | | 7,591 | | 7,004 | | 894 |

Total shareholders’ equity | | 32,476 | | 27,390 | | 24,430 | | 16,764 |

Total liabilities and shareholders’ equity | | 1,227,361 | | 996,787 | | 924,357 | | 538,181 |

Risk weighted assets and capital ratiosb | | | | | | | | |

Risk weighted assets | | 353,476 | | 297,833 | | 269,148 | | |

Tier 1 ratio | | 7.8% | | 7.7% | | 7.0% | | |

Risk asset ratio | | 12.1% | | 11.7% | | 11.3% | | |

Selected financial statistics | | | | | | | | |

Net asset value per ordinary share | | 353p | | 303p | | 269p | | 246p |

Year-end United States Dollar exchange rate used in preparing the accounts | | 2.00 | | 1.96 | | 1.72 | | 1.92 |

Year-end Euro exchange rate used in preparing the accounts | | 1.36 | | 1.49 | | 1.46 | | 1.41 |

Year-end Rand exchange rate used in preparing the accounts | | 13.64 | | 13.71 | | 10.87 | | 10.86 |

The financial information above is extracted from the published accounts for the last three years. This information should be read together with, and is qualified by reference to, the accounts and Notes included in this report.

Notes

| a | Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. |

| b | Risk weighted assets and capital ratios are calculated on a Basel I basis. Capital ratios for 2004 based on IFRS are not available. As at 1st January 2005 the tier 1 ratio was 7.1% and the risk asset ratio was 11.8% reflecting the impact of IFRS including the adoption of IAS 32, IAS 39 and IFRS 4. |

| | |

Barclays Annual Report 2007 | | 7 |

| |

Financial review

Business description

The following section analyses the Group’s performance by business. For management and reporting purposes, Barclays is organised into the following business groupings:

Global Retail and Commercial Banking

| · | | UK Banking, comprising: |

| – | Barclays Commercial Bank (formerly UK Business Banking) |

| · | | International Retail and Commercial Banking, comprising |

| – | International Retail and Commercial Banking-excluding Absa |

| – | International Retail and Commercial Banking-Absa. |

Investment Banking and Investment Management

| · | | Barclays Global Investors |

Head office functions and other operations

UK Banking

UK Banking delivers banking solutions to Barclays UK retail and business banking customers. It offers a range of integrated products and services and access to the expertise of other Group businesses. Customers are served through a variety of channels comprising the branch network, automated teller machines, telephone banking, online banking and relationship managers. UK Banking is managed through two business areas, UK Retail Banking and Barclays Commercial Bank.

UK Retail Banking

UK Retail Banking comprises Personal Customers, Home Finance, Local Business, Consumer Lending and Barclays Financial Planning. This cluster of businesses aims to build broader and deeper relationships with its Personal and Local Business customers through providing a wide range of products and financial services. Personal Customers and Home Finance provide access to current account and savings products, Woolwich branded mortgages and general insurance. Consumer Lending provides unsecured loan and protection products and Barclays Financial Planning provides investment advice and products. Local Business provides banking services, including money transmission, to small businesses.

Barclays Commercial Bank

Barclays Commercial Bank provides banking services to organisations with an annual turnover of more than £1m. Customers are served via a network of relationship and industry sector specialists, which provides solutions constructed from a comprehensive suite of banking products, support, expertise and services, including specialist asset financing and leasing facilities. Customers are also offered access to the products and expertise of other businesses in the Barclays Group, particularly Barclays Capital, Barclaycard and Barclays Wealth.

Barclaycard

Barclaycard is a multi-brand credit card and consumer lending business which also processes card payments for retailers and merchants and issues credit and charge cards to corporate customers and the UK Government. It is one of Europe’s leading credit card businesses and has an increasing presence in the United States.

In the UK, Barclaycard comprises Barclaycard UK Cards, Barclaycard Partnerships (SkyCard, Thomas Cook, Argos and Solution Personal Finance), Barclays Partner Finance (formerly CFS) and FirstPlus.

Outside the UK, Barclaycard provides credit cards in the United States, Germany, Spain, Italy and Portugal. In the Nordic region, Barclaycard operates through Entercard, a joint venture with Swedbank.

Barclaycard works closely with other parts of the Group, including UK Retail Banking, Barclays Commercial Bank and International Retail and Commercial Banking, to leverage their distribution capabilities.

International Retail and Commercial Banking

International Retail and Commercial Banking provides banking services to Barclays personal and corporate customers outside the UK. The products and services offered to customers are tailored to meet the customer needs and the regulatory and commercial environments within each country. For reporting purposes, the operations are grouped into two components: International Retail and Commercial Banking-excluding Absa and International Retail and Commercial Banking-Absa. International Retail and Commercial Banking works closely with all other parts of the Group to leverage synergies from product and service propositions.

International Retail and Commercial Banking-excluding Absa

International Retail and Commercial Banking - excluding Absa provides a range of banking services to retail and corporate customers in Western Europe and Emerging Markets, including current accounts, savings, investments, mortgages and loans. Barclays Western Europe business includes Spain, Italy, France and Portugal. Emerging Markets includes operations in Africa, India and the Middle East.

International Retail and Commercial Banking-Absa

International Retail and Commercial Banking-Absa represents Barclays consolidation of Absa, excluding Absa Capital which is included as part of Barclays Capital. Absa Group Limited is one of South Africa’s largest financial services organisations serving personal, commercial and corporate customers predominantly in South Africa. International Retail and Commercial Banking-Absa serves retail customers through a variety of distribution channels and offers a full range of banking services, including current and deposit accounts, mortgages, instalment finance, credit cards, bancassurance products and wealth management services. It also offers customised business solutions for commercial and large corporate customers.

| | |

| 8 | | Barclays Annual Report 2007 |

| |

Barclays Capital

Barclays Capital is a leading global investment bank which provides large corporate, institutional and government clients with solutions to their financing and risk management needs.

Barclays Capital services a wide variety of client needs, from capital raising and managing foreign exchange, interest rate, equity and commodity risks, through to providing technical advice and expertise. Activities are organised into three principal areas: Rates, which includes fixed income, foreign exchange, commodities, emerging markets, money markets, prime services and equity products; Credit, which includes primary and secondary activities for loans and bonds for investment grade, high yield and emerging market credit, as well as hybrid capital products, asset based finance, mortgage backed securities, credit derivatives, structured capital markets and large asset leasing; and Private Equity. Barclays Capital includes Absa Capital, the investment banking business of Absa. Barclays Capital works closely with all other parts of the Group to leverage synergies from client relationships and product capabilities.

Barclays Global Investors

Barclays Global Investors (BGI) is one of the world’s largest asset managers and a leading global provider of investment management products and services.

BGI offers structured investment strategies such as indexing, global asset allocation and risk controlled active products including hedge funds and provides related investment services such as securities lending, cash management and portfolio transition services. In addition, BGI is the global leader in assets and products in the exchange traded funds business, with over 320 funds for institutions and individuals trading globally. BGI’s investment philosophy is founded on managing all dimensions of performance: a consistent focus on controlling risk, return and cost. BGI collaborates with the other Barclays businesses, particularly Barclays Capital and Barclays Wealth, to develop and market products and leverage capabilities to better serve the client base.

Barclays Wealth

Barclays Wealth serves high net worth affluent and intermediary clients worldwide, providing private banking, asset management, stockbroking, offshore banking, wealth structuring and financial planning services and manages the closed life assurance activities of Barclays and Woolwich in the UK.

Barclays Wealth works closely with all other parts of the Group to leverage synergies from client relationships and product capabilities.

Head office functions and other operations

Head office functions and other operations comprise:

| – | Head office and central support functions |

| – | Businesses in transition |

| – | Consolidation adjustments. |

Head office and central support functions comprises the following areas: Executive Management, Finance, Treasury, Corporate Affairs, Human Resources, Strategy and Planning, Internal Audit, Legal, Corporate Secretariat, Property, Tax, Compliance and Risk. Costs incurred wholly on behalf of the businesses are recharged to them.

Businesses in transition principally relate to certain lending portfolios that are centrally managed with the objective of maximising recovery from the assets.

Consolidation adjustments largely reflect the elimination of inter-segment transactions.

| | |

Barclays Annual Report 2007 | | 9 |

| |

Financial review

Analysis of results by business

| | | | | | | | | | | | | | | | | | | | | | | | |

Analysis of results by business For the year ended 31st December 2007 | |

| | | UK

Banking £m | | | Barclaycard £m | | | International

Retail and

Commercial

Banking £m | | | Barclays

Capital £m | | | Barclays

Global

Investors £m | | | Barclays

Wealth £m | | | Head office

functions

and other

operations £m | | | Group £m | |

| | | | | | | | |

| Net interest income | | 4,596 | | | 1,394 | | | 1,890 | | | 1,179 | | | (8 | ) | | 431 | | | 128 | | | 9,610 | |

| Net fee and commission income | | 1,932 | | | 1,080 | | | 1,210 | | | 1,235 | | | 1,936 | | | 739 | | | (424 | ) | | 7,708 | |

| Principal transactionsa | | 56 | | | 11 | | | 248 | | | 4,692 | | | (4 | ) | | 55 | | | (83 | ) | | 4,975 | |

| Net premiums from insurance contracts | | 252 | | | 40 | | | 372 | | | – | | | – | | | 195 | | | 152 | | | 1,011 | |

| Other income | | 58 | | | (26 | ) | | 87 | | | 13 | | | 2 | | | 19 | | | 35 | | | 188 | |

| | | | | | | | |

| Total income | | 6,894 | | | 2,499 | | | 3,807 | | | 7,119 | | | 1,926 | | | 1,439 | | | (192 | ) | | 23,492 | |

| Net claims and benefits incurred on insurance contracts | | (43 | ) | | (13 | ) | | (284 | ) | | – | | | – | | | (152 | ) | | – | | | (492 | ) |

| | | | | | | | |

| Total income, net of insurance claims | | 6,851 | | | 2,486 | | | 3,523 | | | 7,119 | | | 1,926 | | | 1,287 | | | (192 | ) | | 23,000 | |

| Impairment charges | | (849 | ) | | (838 | ) | | (252 | ) | | (846 | ) | | – | | | (7 | ) | | (3 | ) | | (2,795 | ) |

| | | | | | | | |

| Net income | | 6,002 | | | 1,648 | | | 3,271 | | | 6,273 | | | 1,926 | | | 1,280 | | | (195 | ) | | 20,205 | |

| Operating expenses | | (3,370 | ) | | (1,101 | ) | | (2,356 | ) | | (3,973 | ) | | (1,192 | ) | | (973 | ) | | (234 | ) | | (13,199 | ) |

| Share of post-tax results of associates and joint ventures | | 7 | | | (7 | ) | | 7 | | | 35 | | | – | | | – | | | – | | | 42 | |

| Profit before business disposals | | 2,639 | | | 540 | | | 922 | | | 2,335 | | | 734 | | | 307 | | | (429 | ) | | 7,048 | |

| Profit on disposal of subsidiaries, associates and joint ventures | | 14 | | | – | | | 13 | | | – | | | – | | | – | | | 1 | | | 28 | |

| | | | | | | | |

| Profit before tax | | 2,653 | | | 540 | | | 935 | | | 2,335 | | | 734 | | | 307 | | | (428 | ) | | 7,076 | |

| | | | | | | | |

| As at 31st December 2007 | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total assets | | 161,777 | | | 22,164 | | | 89,457 | | | 839,662 | | | 89,224 | | | 18,024 | | | 7,053 | | | 1,227,361 | |

| | | | | | | | |

| Total liabilities | | 166,988 | | | 1,559 | | | 48,809 | | | 811,516 | | | 87,101 | | | 43,988 | | | 34,924 | | | 1,194,885 | |

Note

| a | Principal transactions comprise net trading income and net investment income. |

| | |

| 10 | | Barclays Annual Report 2007 |

| |

Financial review

Analysis of results by business

Global Retail and Commercial Banking

UK Banking

Who we are

UK Banking comprises UK Retail Banking and Barclays Commercial Bank (formerly UK Business Banking).

What we do

UK Banking delivers banking solutions to Barclays retail and business banking customers in the United Kingdom. We offer a range of integrated products and services and access to the expertise of other Group businesses. Customers are served through a variety of channels comprising the branch network, automated teller machines, telephone banking, online banking and relationship managers.

Highlights

Performance

2007/06

UK Banking profit before tax increased 4% (£107m) to £2,653m (2006: £2,546m) driven principally by solid income growth. Results included gains from the sale and leaseback of properties and property sales of £232m (2006: £313m).

The cost:income ratio improved one percentage point to 49%. Excluding the impact of settlements on overdraft fees in relation to prior years (£116m), the cost:income ratio improved two percentage points to 48%, making eight percentage points of improvement from 2004 to 2007 compared to the target of six percentage points.

2006/05

UK Banking profit before tax increased 14% (£310m) to £2,546m (2005: £2,236m) driven principally by good income growth. Profit before business disposals grew 10% (£234m) to £2,470m (2005: £2,236m).

| | |

Barclays Annual Report 2007 | | 11 |

| |

| | | | | | | | | | | | | | | | |

| | | 2007 £m | | | | | 2006 £m | | | | | 2005 £m | |

| | | | | |

Income statement information | | | | | | | | | | | | | | | | |

| | | | | |

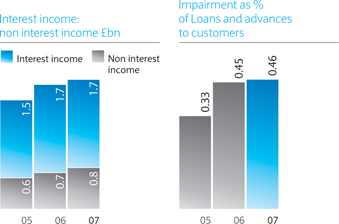

Net interest income | | | 4,596 | | | | | | 4,467 | | | | | | 4,213 | |

Net fee and commission income | | | 1,932 | | | | | | 1,874 | | | | | | 1,728 | |

Net trading income | | | 9 | | | | | | 2 | | | | | | – | |

Net investment income | | | 47 | | | | | | 28 | | | | | | 26 | |

Principal transactions | | | 56 | | | | | | 30 | | | | | | 26 | |

Net premiums from insurance contracts | | | 252 | | | | | | 342 | | | | | | 298 | |

Other income | | | 58 | | | | | | 63 | | | | | | 32 | |

| | | | | |

Total income | | | 6,894 | | | | | | 6,776 | | | | | | 6,297 | |

Net claims and benefits incurred on insurance contracts | | | (43 | ) | | | | | (35 | ) | | | | | (61 | ) |

| | | | | |

Total income, net of insurance claims | | | 6,851 | | | | | | 6,741 | | | | | | 6,236 | |

Impairment charges | | | (849 | ) | | | | | (887 | ) | | | | | (671 | ) |

| | | | | |

Net income | | | 6,002 | | | | | | 5,854 | | | | | | 5,565 | |

Operating expenses excluding amortisation of intangible assets | | | (3,358 | ) | | | | | (3,387 | ) | | | | | (3,323 | ) |

Amortisation of intangible assets | | | (12 | ) | | | | | (2 | ) | | | | | (3 | ) |

Operating expenses | | | (3,370 | ) | | | | | (3,389 | ) | | | | | (3,326 | ) �� |

Share of post-tax results of associates and joint ventures | | | 7 | | | | | | 5 | | | | | | (3 | ) |

Profit on disposal of subsidiaries, associates and joint ventures | | | 14 | | | | | | 76 | | | | | | – | |

| | | | | |

Profit before tax | | | 2,653 | | | | | | 2,546 | | | | | | 2,236 | |

| | | | | |

Balance sheet information | | | | | | | | | | | | | | | | |

| | | | | |

Loans and advances to customers | | £ | 145.3bn | | | | | £ | 131.0bn | | | | | £ | 125.5bn | |

Customer accounts | | £ | 147.9bn | | | | | £ | 139.7bn | | | | | £ | 127.2bn | |

Total assets | | £ | 161.8bn | | | | | £ | 147.6bn | | | | | £ | 138.0bn | |

| | | | | |

Selected statistical measures | | | | | | | | | | | | | | | | |

Cost:income ratioa | | | 49 | % | | | | | 50 | % | | | | | 53 | % |

| | | | | |

Risk Tendencya | | £ | 775m | | | | | £ | 790m | | | | | £ | 665m | |

Risk weighted assets | | £ | 99.8bn | | | | | £ | 93.0bn | | | | | £ | 87.9bn | |

| | |

| 12 | | Barclays Annual Report 2007 |

| |

Financial review

Analysis of results by business

Global Retail and Commercial Banking

UK Retail Banking

Who we are

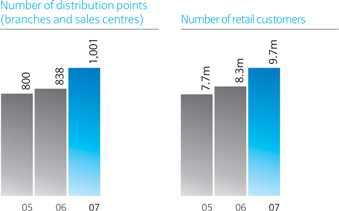

UK Retail Banking comprises Personal Customers, Home Finance, Local Business, Consumer Lending and Barclays Financial Planning. We have one of the largest branch networks in the UK with around 1,700 branches and an extensive network of cash machines.

What we do

Our cluster of businesses aims to build broader and deeper relationships with customers. Personal Customers and Home Finance provide a wide range of products and services to retail customers, including current accounts, savings and investment products, mortgages branded Woolwich and general insurance. Barclays Financial Planning provides banking, investment products and advice to affluent customers.

Local Business provides banking services to small businesses. UK Retail Banking is also a gateway to more specialised services from other parts of Barclays such as Barclays Stockbrokers.

Our business serves 15 million UK customers.

Highlights

Performance indicators

Performance

2007/06

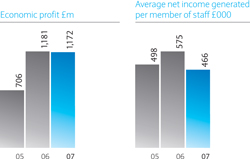

UK Retail Banking profit excluding tax increased 9% (£101m) to £1,282m (2006: £1,181m) due to reduced costs and a strong improvement in impairment.

Including the impact of settlements on overdraft fees from prior years (£116m), income decreased 1% (£49m) to £4,297m (2006: £4,346m). Income grew 2% (£67m) excluding the impact of settlements on overdraft fees in relation to prior years (£116m). This was driven by very strong growth in Personal Customer retail savings and good growth in Personal Customer current accounts, Home Finance and Local Business.

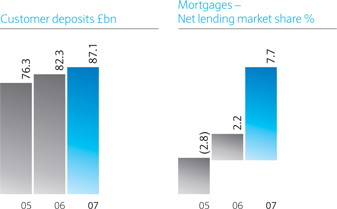

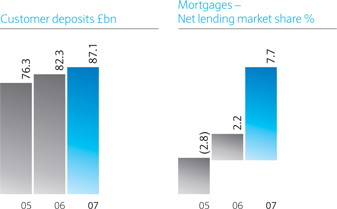

Net interest income increased 3% (£93m) to £2,858m (2006: £2,765m). Growth was driven by a higher contribution from deposits, through a combination of good balance sheet growth and an increased liability margin. Total average customer deposit balances increased 7% to £81.9bn (2006: £76.5bn), supported by the launch of new products.

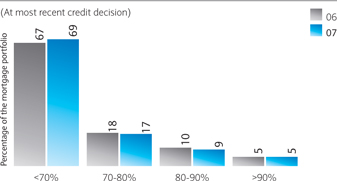

Mortgage volumes increased significantly, driven by an improved mix of longer term value products for customers, higher levels of retention and continuing improvements in processing capability. Mortgage balances were £69.8bn at the end of the period (2006: £61.7bn), an approximate market share of 6% (2006: 6%). Gross advances were 25% higher at £23.0bn (2006: £18.4bn). Net lending was £8.0bn (2006: £2.4bn), representing market share of 8% (2006: 2%). The average loan to value ratio of the residential mortgage book on a current valuation basis was 33%. The average loan to value ratio of new residential mortgage lending in 2007 was 54%. Consumer Lending balances decreased 4% to £7.9bn (2006: £8.2bn), reflecting the impact of tighter lending criteria.

Overall asset margins decreased as a result of the increased proportion of mortgages and contraction in unsecured loans.

Net fee and commission income reduced 4% (£49m) to £1,183m (2006: £1,232m). There was strong Current Account income growth in Personal Customers and good growth within Local Business. This was more than offset by settlements on overdraft fees.

Net premiums from insurance underwriting activities reduced 26% (£90m) to £252m (2006: £342m), as there continued to be lower customer take-up of loan protection insurance. Net claims and benefits on insurance contracts increased to £43m (2006: £35m).

Impairment charges decreased 12% (£76m) to £559m (2006: £635m) reflecting lower charges in unsecured Consumer Lending and Local Business. This was driven by improvements in the collection process which led to reduced flows into delinquency, lower levels of arrears and stable charge-offs. Mortgage impairment charges remained negligible.

Operating expenses reduced 3% (£69m) to £2,463m (2006: £2,532m), reflecting strong and active management of all expense lines, targeted processing improvements and back office consolidation. Gains from the sale of property were £193m (2006: £253m). Increased investment was focused on improving the overall customer experience through converting and improving the branch network; revitalising the product offering; increasing operational and process efficiency; and meeting regulatory requirements.

The cost:income ratio improved one percentage point to 57%. Excluding the impact of settlements on overdraft fees from prior years (£116m), the cost:income ratio improved two percentage points to 56%.

| | |

Barclays Annual Report 2007 | | 13 |

| |

| | | | | | | | | | | | | | | | |

| | | 2007 £m | | | | | 2006 £m | | | | | 2005 £m | |

Income statement information | | | | | | | | | | | | | | | | |

Net interest income | | | 2,858 | | | | | | 2,765 | | | | | | 2,677 | |

Net fee and commission income | | | 1,183 | | �� | | | | 1,232 | | | | | | 1,065 | |

Net premiums from insurance contracts | | | 252 | | | | | | 342 | | | | | | 372 | |

Other income | | | 47 | | | | | | 42 | | | | | | 24 | |

Total income | | | 4,340 | | | | | | 4,381 | | | | | | 4,138 | |

Net claims and benefits on insurance contracts | | | (43 | ) | | | | | (35 | ) | | | | | (61 | ) |

Total income net of insurance claims | | | 4,297 | | | | | | 4,346 | | | | | | 4,077 | |

Impairment charges | | | (559 | ) | | | | | (635 | ) | | | | | (494 | ) |

Net income | | | 3,738 | | | | | | 3,711 | | | | | | 3,583 | |

Operating expenses excluding amortisation of intangible assets | | | (2,455 | ) | | | | | (2,531 | ) | | | | | (2,501 | ) |

Amortisation of intangible assets | | | (8 | ) | | | | | (1 | ) | | | | | – | |

Operating expenses | | | (2,463 | ) | | | | | (2,532 | ) | | | | | (2,501 | ) |

Share of post-tax results of associates and joint ventures | | | 7 | | | | | | 2 | | | | | | (6 | ) |

Profit before tax | | | 1,282 | | | | | | 1,181 | | | | | | 1,076 | |

Balance sheet information | | | | | | | | | | | | | | | | |

Loans and advances to customers | | £ | 82.0bn | | | | | £ | 74.7bn | | | | | £ | 72.1bn | |

Customer accounts | | £ | 87.1bn | | | | | £ | 82.3bn | | | | | £ | 76.3bn | |

Total assets | | £ | 87.8bn | | | | | £ | 81.7bn | | | | | £ | 78.1bn | |

| | | | | |

Selected statistical measures | | | | | | | | | | | | | | | | |

Cost:income ratioa | | | 57 | % | | | | | 58 | % | | | | | 61 | % |

Risk Tendencya | | £ | 470m | | | | | £ | 500m | | | | | £ | 415m | |

Risk weighted assets | | £ | 46.0bn | | | | | £ | 43.0bn | | | | | £ | 40.8bn | |

2006/05

UK Retail Banking profit before tax increased 10% (£105m) to £1,181m (2005: £1,076m), driven by good income growth and well controlled costs. There has been substantial additional investment to transform the business.

Income increased 7% (£269m) to £4,346m (2005: £4,077m). Income growth was broadly based. There was strong income growth in Personal Customers retail savings, Local Business and UK Premier and good growth in Personal Customers current account income. Sales volumes increased, with a particularly strong performance from direct channels.

Net interest income increased 3% (£88m) to £2,765m (2005: £2,677m). Growth was driven by a higher contribution from deposits, through a combination of good balance sheet growth and a stable liability margin. Total average customer deposit balances increased 8% to £76.5bn (2005: £71.0bn), supported by new products. Growth of personal savings was above that of the market.

Mortgage volumes improved significantly, driven by a focus on improving capacity, customer service, value and promotion. UK residential mortgage balances ended the year at £61.7bn (2005: £59.6bn). Gross advances were 60% higher at £18.4bn (2005: £11.5bn), with a market share of 5% (2005: 4%). Net lending was £2.4bn, with performance improving during the year, leading to a market share of 4% in the second half of the year. The mortgage margin was reduced by changed assumptions used in the calculation of effective interest rates, a higher proportion of new mortgages and base rate changes. The new business spread was in line with the industry. The loan to value ratio within the residential mortgage book on a current valuation basis was 34% (2005: 35%).

There was good balance growth in non-mortgage loans, where Local Business average balances increased 9% and UK Premier average balances increased 25%.

Net fee and commission income increased 16% (£167m) to £1,232m (2005: £1,065m). There was strong current account income growth in Personal Customers and Local Business. UK Premier delivered strong growth reflecting higher income from banking services, mortgage sales and investment advice.

Net premiums from insurance underwriting activities decreased 8% (£30m) to £342m (2005: £372m). There continued to be lower customer take-up of loan protection insurance. Net claims and benefits on insurance contracts improved to £35m (2005: £61m).

Impairment charges increased 29% (£141m) to £635m (2005: £494m). The increase principally reflected balance growth and some deterioration in delinquency rates in the Local Business loan book. Losses from the mortgage portfolio remained negligible, with arrears at low levels.

Operating expenses were steady at £2,532m (2005: £2,501m). Gains from the sale and leaseback of property amounted to £253m (2005: nil). Investment in the business to improve customer service and deliver sustainable performance improvements was directed at upgrading distribution capabilities, including restructuring and improving the branch network. Further investment was focused on upgrading the contact centres, transforming the performance of the mortgage business, revitalising the retail product range to meet customers’ needs, improving core operations and processes and rationalising the number of operating sites. The level of investment reflected in operating expenses in 2006 was approximately double the level of 2005.

The cost:income ratio improved three percentage points to 58% (2005: 61%).

| | |

| 14 | | Barclays Annual Report 2007 |

| |

Financial review

Analysis of results by business

Global Retail and Commercial Banking

Barclays Commercial Bank

Who we are

Barclays Commercial Bank comprises 8,400 colleagues who serve 81,000 customers.

Earlier this year, we launched our new brand – Barclays Commercial Bank – to replace UK Business Banking. This new identity is much more than just a name change. Instead, it more accurately reflects our current capabilities and future aspirations, and it is scalable across markets. To complement the new identity, we also launched a clear customer proposition. It comprises three elements:

These encapsulate our capability to deliver distinctive service and solutions that meet our customers’ needs.

What we do

Barclays Commercial Bank provides banking services to organisations with an annual turnover of more than £1m. Customers are served via a network of relationship and industry sector specialists, which provides solutions constructed from a comprehensive suite of banking products, support, expertise and services, including specialist asset financing and leasing facilities.

We are a key component of the Barclays universal banking model, delivering income in partnership with all the constituent business units of the Barclays Group.

Highlights

Performance indicators

Performance

2007/06

Barclays Commercial Bank profit before tax increased £6m to £1,371m (2006: £1,365m) due to continued good income growth partially offset by lower gains from business disposals. Profit excluding profit on business disposals of £14m (2006: £76m) increased 5% to £1,357m (2006: £1,289m).

Income increased 7% (£159m) to £2,554m (2006: £2,395m). Non-interest income increased to 32% of total income (2006: 29%), reflecting continuing focus on cross sales and efficient balance sheet utilisation. There was very strong growth in net fee and commission income, which increased 17% (£107m) to £749m (2006: £642m) due to very strong performance in lending fees. There was also good growth in transaction related income, foreign exchange and derivatives transactions undertaken on behalf of clients.

Net interest income improved 2% (£36m) to £1,738m (2006: £1,702m). Average customer lendings increased 3% to £53.6bn (2006: £52.0bn). Average customer accounts grew 4% to £46.4bn (2006: £44.8bn).

Income from principal transactions primarily reflecting venture capital and other equity realisations increased 87% (£26m) to £56m (2006: £30m).

Impairment charges increased 15% (£38m) to £290m (2006: £252m), mainly due to a higher level of impairment losses in Larger Business as impairment trended towards risk tendency. There was a reduction in impairment levels in Medium Business due to a tightening of the lending criteria.

Operating expenses increased 6% (£50m) to £907m (2006: £857m). Operating expenses are net of gains of £39m (2006: £60m) on the sale of property. Growth in operating expenses was focused on continuing investment in operations, infrastructure, and new initiatives in product development and sales capability.

| | |

Barclays Annual Report 2007 | | 15 |

| |

| | | | | | | | | | | | | | | | |

| | | 2007 £m | | | | | 2006 £m | | | | | 2005 £m | |

| | | | | |

Income statement information | | | | | | | | | | | | | | | | |

Net interest income | | | 1,738 | | | | | | 1,702 | | | | | | 1,536 | |

Net fee and commission income | | | 749 | | | | | | 642 | | | | | | 589 | |

Net trading income | | | 9 | | | | | | 2 | | | | | | – | |

Net investment income | | | 47 | | | | | | 28 | | | | | | 17 | |

Principal transactions | | | 56 | | | | | | 30 | | | | | | 17 | |

Other income | | | 11 | | | | | | 21 | | | | | | 17 | |

| | | | | |

Total income | | | 2,554 | | | | | | 2,395 | | | | | | 2,159 | |

Impairment charges | | | (290 | ) | | | | | (252 | ) | | | | | (177 | ) |

| | | | | |

Net income | | | 2,264 | | | | | | 2,143 | | | | | | 1,982 | |

Operating expenses excluding amortisation of intangible assets | | | (903 | ) | | | | | (856 | ) | | | | | (822 | ) |

Amortisation of intangible assets | | | (4 | ) | | | | | (1 | ) | | | | | (3 | ) |

Operating expenses | | | (907 | ) | | | | | (857 | ) | | | | | (825 | ) |

Share of post-tax results of associates and joint ventures | | | – | | | | | | 3 | | | | | | 3 | |

Profit on disposal of subsidiaries, associates and joint ventures | | | 14 | | | | | | 76 | | | | | | – | |

| | | | | |

Profit before tax | | | 1,371 | | | | | | 1,365 | | | | | | 1,160 | |

| | | | | |

Balance sheet information | | | | | | | | | | | | | | | | |

Loans and advances to customers | | £ | 63.3bn | | | | | £ | 56.3bn | | | | | £ | 53.4bn | |

Customer accounts | | £ | 60.8bn | | | | | £ | 57.4bn | | | | | £ | 50.9bn | |

Total assets | | £ | 73.9bn | | | | | £ | 65.9bn | | | | | £ | 59.9bn | |

| | | | | |

Selected statistical measures | | | | | | | | | | | | | | | | |

Cost:income ratioa | | | 36 | % | | | | | 36 | % | | | | | 38 | % |

Risk Tendencya | | £ | 305m | | | | | £ | 290m | | | | | £ | 250m | |

Risk weighted assets | | £ | 53.8bn | | | | | £ | 50.0bn | | | | | £ | 47.1bn | |

2006/05

Barclays Commercial Bank profit before tax increased 18% (£205m) to £1,365m (2005: £1,160m), driven by continued strong income growth. Barclays Commercial Bank maintained its market share of primary customer relationships. The 2006 result included a £23m (2005: £13m) contribution from the full year consolidation of Iveco Finance, in which a 51% stake was acquired on 1st June 2005. Profit before business disposals increased 11% to £1,289m (2005: £1,160m).

Income increased 11% (£236m) to £2,395m (2005: £2,159m), driven by strong balance sheet growth. The uplift in income was broadly based across income categories.

Net interest income increased 11% (£166m) to £1,702m (2005: £1,536m) driven by strong balance sheet growth. There was strong growth in all business areas and in particular Larger Business. The lending margin improved slightly. Average customer accounts increased 11% to £44.8bn (2005: £40.5bn) with good growth across product categories. The deposit margin was stable.

Net fee and commission income increased 9% (£53m) to £642m

(2005: £589m). There was a strong rise in income from foreign exchange and derivatives business transacted through Barclays Capital on behalf of Barclays Commercial Bank customers.

Income from principal transactions was £30m (2005: £17m), primarily reflecting the profit realised on a number of equity investments.

As expected, impairment rates trended upwards during the year towards a more normalised level. Impairment increased 42% (£75m) to £252m (2005: £177m), with the increase mainly reflecting higher charges from Medium Business and balance growth. Impairment charges in Larger Business were stable.

Operating expenses increased 4% (£32m) to £857m (2005: £825m). Cost growth reflected higher volumes, increased expenditure on front line staff and the costs of Iveco Finance for a full year. Operating expenses included a credit of £60m on the sale and leaseback of property. Increased investment was focused on the acceleration of the rationalisation of operating sites and technology infrastructure.

The cost:income ratio improved two percentage points to 36% (2005: 38%).

Profit on disposals of subsidiaries, associates and joint ventures of £76m (2005: £nil) arose from the sales of interests in vehicle leasing and European vendor finance businesses.

| | |

| 16 | | Barclays Annual Report 2007 |

| |

Financial review

Analysis of results by business

Global Retail and Commercial Banking

Barclaycard

Who we are

We are a multi-brand international credit card and consumer lending business. Our credit card was the first to be launched in the UK in 1966 and is now one of the leading credit card businesses in Europe, with a fast growing business in the US.

What we do UK

Our activities include all Barclaycard branded credit cards, the FirstPlus secured lending business and the retail finance business Barclays Partner Finance. In addition to these activities, Barclaycard also operates partnership cards with leading brands including SkyCard and the Thomas Cook Credit Card. We continue to lead the UK market with the launch in 2007 of Barclaycard OnePulse, the UK’s first contactless card, and Barclaycard Breathe, the first card to donate a percentage of its profits to carbon reduction projects around the world.

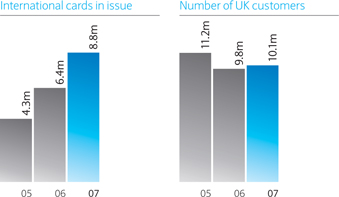

International

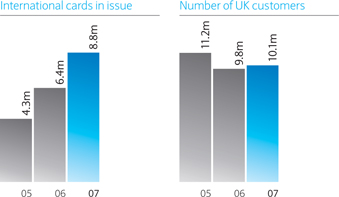

Barclaycard’s international presence is extensive. In 2007, 3 out of every 4 cards issued by Barclaycard were in markets outside the UK and we have 8.8m international cards in issue. We currently operate across Europe and the United States where we are the fastest growing credit card business. In Scandinavia we operate through Entercard, a joint venture with Swedbank.

Barclaycard Business

Barclaycard Business processes card payments for 93,000 retailers and merchants and issues credit and charge cards to corporate customers and the UK Government. It is Europe’s number one issuer of Visa Commercial Cards with over 137,000 corporate customers.

Highlights

Performance indicators

Performance

2007/06

Barclaycard profit before tax increased 18% (£82m) to £540m (2006: £458m), driven by strong international growth coupled with a significant improvement in UK impairment charges. Other income included a £27m loss on disposal of part of the Monument card portfolio. 2006 results reflected a property gain of £38m.

Income decreased 1% (£28m) to £2,486m (2006: £2,514m) reflecting strong growth in Barclaycard International, offset by a decline in UK Cards revenue resulting from a more cautious approach to lending in the UK and a £27m loss on disposal of part of the Monument card portfolio.

Net interest income increased 1% (£11m) to £1,394m (2006: £1,383m) due to strong organic growth in international average extended credit card balances, up 32% to £3.3bn and average secured consumer lending balances up 26% to £4.3bn, partially offset by lower UK average extended credit card balances which fell 14% to £6.9bn. Margins fell to 6.59% (2006: 7.13%) due to higher average base rates across core operating markets and a change in the product mix with an increased weighting to secured lending.

Net fee and commission income fell 2% (£26m) to £1,080m (2006: £1,106m) with growth in Barclaycard International offset by our actions in response to the Office of Fair Trading’s findings on late and overlimit fees in the UK which were implemented in August 2006.

Impairment charges improved 21% (£229m) to £838m (2006: £1,067m) reflecting reduced flows into delinquency, lower levels of arrears and lower charge-offs in UK Cards. We made changes to our impairment methodologies to standardise our approach and in anticipation of Basel II. The net positive impact of these changes in methodology was offset by an increase in impairment charges in Barclaycard International and secured consumer lending.

Operating expenses increased 12% (£120m) to £1,101m (2006: £981m). Excluding a property gain of £38m in 2006, operating expenses increased 8% (£82m) reflecting continued investment in expanding our businesses in Europe and the US. Costs in the UK businesses were broadly flat, with investment in new UK product innovations such as Barclaycard OnePulse being funded out of operating efficiencies.

Barclaycard International continued to gain momentum, delivering a profit before tax of £77m against a loss before tax of £36m in 2006. We concluded seven new credit card partnership deals across Western Europe. The Entercard joint venture continued to perform ahead of plan and entered the Danish market, extending its reach across the Scandinavian region. Barclaycard US was profitable, with very strong average balance growth and a number of new card partnerships including Lufthansa Airlines and Princess Cruise Lines.

| | |

Barclays Annual Report 2007 | | 17 |

| |

| | | | | | | | | | | | | | | | |

| | | 2007 £m | | | | | 2006 £m | | | | | 2005 £m | |

Income statement information | | | | | | | | | | | | | | | | |

Net interest income | | | 1,394 | | | | | | 1,383 | | | | | | 1,231 | |

Net fee and commission income | | | 1,080 | | | | | | 1,106 | | | | | | 1,065 | |

Net investment income | | | 11 | | | | | | 15 | | | | | | – | |

Net premiums from insurance contracts | | | 40 | | | | | | 18 | | | | | | 6 | |

Other income | | | (26 | ) | | | | | – | | | | | | – | |

Total income | | | 2,499 | | | | | | 2,522 | | | | | | 2,302 | |

Net claims and benefits incurred on insurance contracts | | | (13 | ) | | | | | (8 | ) | | | | | (3 | ) |

Total income net of insurance claims | | | 2,486 | | | | | | 2,514 | | | | | | 2,299 | |

Impairment charges | | | (838 | ) | | | | | (1,067 | ) | | | | | (753 | ) |

Net income | | | 1,648 | | | | | | 1,447 | | | | | | 1,546 | |

Operating expenses excluding amortisation of intangible assets | | | (1,073 | ) | | | | | (964 | ) | | | | | (891 | ) |

Amortisation of intangible assets | | | (28 | ) | | | | | (17 | ) | | | | | (17 | ) |

Operating expenses | | | (1,101 | ) | | | | | (981 | ) | | | | | (908 | ) |

Share of post-tax results of associates and joint ventures | | | (7 | ) | | | | | (8 | ) | | | | | 1 | |

Profit before tax | | | 540 | | | | | | 458 | | | | | | 639 | |

Balance sheet information | | | | | | | | | | | | | | | | |

Loans and advances to customers | | £ | 20.1bn | | | | | £ | 18.2bn | | | | | £ | 16.5bn | |

Total assets | | £ | 22.2bn | | | | | £ | 20.1bn | | | | | £ | 18.2bn | |

| | | | | |

Selected statistical measures | | | | | | | | | | | | | | | | |

Cost:income ratioa | | | 44 | % | | | | | 39 | % | | | | | 39 | % |

Risk Tendencya | | £ | 945m | | | | | £ | 1,135m | | | | | £ | 865m | |

Risk weighted assets | | £ | 19.9bn | | | | | £ | 17.0bn | | | | | £ | 13.6bn | |

2006/05

Barclaycard profit before tax decreased 28% (£181m) to £458m (2005: £639m) as good income growth was more than offset by higher impairment charges and increased costs from the continued development of international businesses.

Income increased 9% (£215m) to £2,514m (2005: £2,299m) reflecting very strong momentum in Barclaycard US and strong performances in Barclaycard Business, FirstPlus, SkyCard and continental European markets.

Net interest income increased 12% (£152m) to £1,383m (2005: £1,231m) due to strong growth in International average extended credit card balances up 39% to £2.5bn (2005: £1.8bn) and average secured consumer lending balances up 55% to £3.4bn (2005: £2.2bn), partly offset by UK average extended credit card balances down 7% to £8.0bn (2005: £8.6bn), reflecting the impact of tighter lending criteria.

Net fee and commission income increased 4% (£41m) to £1,106m (2005: £1,065m) as a result of increased contributions from Barclaycard International, SkyCard, FirstPlus and Barclaycard Business. Barclaycard reduced its late and overlimit fee charges in the UK on 1st August 2006 in response to the Office of Fair Trading’s findings.

Investment income of £15m (2005: £nil) represents the gain arising from the sale of part of the stake in MasterCard Inc, following its flotation.

Impairment charges increased 42% (£314m) to £1,067m (2005: £753m). The increase was driven by a rise in delinquent balances and increased numbers of bankruptcies and Individual Voluntary Arrangements. As a result of management action in 2005 and 2006 to tighten lending criteria and improve collection processes, the flows of new delinquencies reduced, and levels of arrears balances declined in the second half of 2006 in UK cards.

Operating expenses increased 8% (£73m) to £981m (2005: £908m). This included a £38m gain from the sale and leaseback of property. Excluding this item, underlying operating expenses increased 12% (£111m) to £1,019m. This was largely as a result of continued investment in Barclaycard International, particularly Barclaycard US, and the development of UK partnerships.

Barclaycard International continued its growth strategy in the continental European business delivering solid results. The Entercard joint venture, which is based in Scandinavia, performed ahead of plan. Barclaycard International loss before tax reduced to £36m (2005: loss £44m), including the loss before tax for Barclaycard US of £57m (2005: loss £60m). Barclaycard US continued to perform ahead of expectations, delivering very strong growth in balances and customer numbers and creating a number of new partnerships including US Airways, Barnes & Noble, Travelocity and Jo-Ann Stores.

Barclaycard UK customer numbers declined 1.4 million to 9.8 million (2005: 11.2 million). This reflected the closure of 1.5 million accounts that had been inactive.

| | |

| 18 | | Barclays Annual Report 2007 |

| |

Financial review

Analysis of results by business

Global Retail and Commercial Banking

International Retail and Commercial Banking

Who we are

Our business comprises: International Retail and Commercial Banking – excluding Absa and International Retail and Commercial Banking – Absa.

What we do

International Retail and Commercial Banking provides banking services to Barclays personal and corporate customers outside the UK. The products and services offered to customers are tailored to meet customer needs and the regulatory and commercial environments within each country.

Highlights

Performance 2007/06

International Retail and Commercial Banking profit before tax decreased £281m to £935m (2006: £1,216m). International Retail and Commercial Banking – excluding Absa profit before tax in 2006 included a £247m gain on the sale of associate FirstCaribbean International Bank and a £41m share of its post-tax results. Profit before tax in 2007 included gains from the sale and leaseback of property of £23m (2006: £55m). Very strong profit growth in Rand terms in International Retail and Commercial Banking – Absa was offset by a 12% decline in the average value of the Rand.