UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-02958

T. Rowe Price International Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

October 31, 2024

This annual shareholder report contains important information about Japan Fund (the "fund") for the period of November 1, 2023 to October 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Japan Fund - Investor Class | $121 | 1.13% |

What drove fund performance during the past 12 months?

Japanese stocks posted solid gains in the year ended October 31, 2024. For much of the period, yen weakness boosted the profit outlooks for Japan’s export-oriented companies. The Bank of Japan raised interest rates twice, in March and July, but there was uncertainty about the pace of further monetary policy normalization given market volatility, global economic developments, and domestic political instability.

Versus the TOPIX Index Net, the leading contributor to relative performance was stock selection in the machinery sector. Shares of IHI Corporation soared as markets rewarded the industrial conglomerate's solid growth, driven by its civil aero engines and defense equipment segment. Stock choices in commercial and wholesale trade also added value.

On the negative side, the leading detractor from relative performance was the information technology and services sector due to stock selection and an underweight position. SHIFT was a major laggard. The provider of software testing services struggled amid a slowdown in demand and the lower utilization of consultants and engineers. Stock choices in energy resources also weighed on performance.

The fund invests in Japanese companies across the market capitalization spectrum in a wide range of sectors, with a focus on opportunities where there is potential upside relative to the risks priced in the market (asymmetric risk-reward). We continued to closely manage the fund’s sector allocations and style exposures. With sector and style more neutralized relative to the benchmark, our focus was on stock selection, guided by our belief that improving governance will drive shareholder returns for many Japanese businesses.

How has the fund performed?

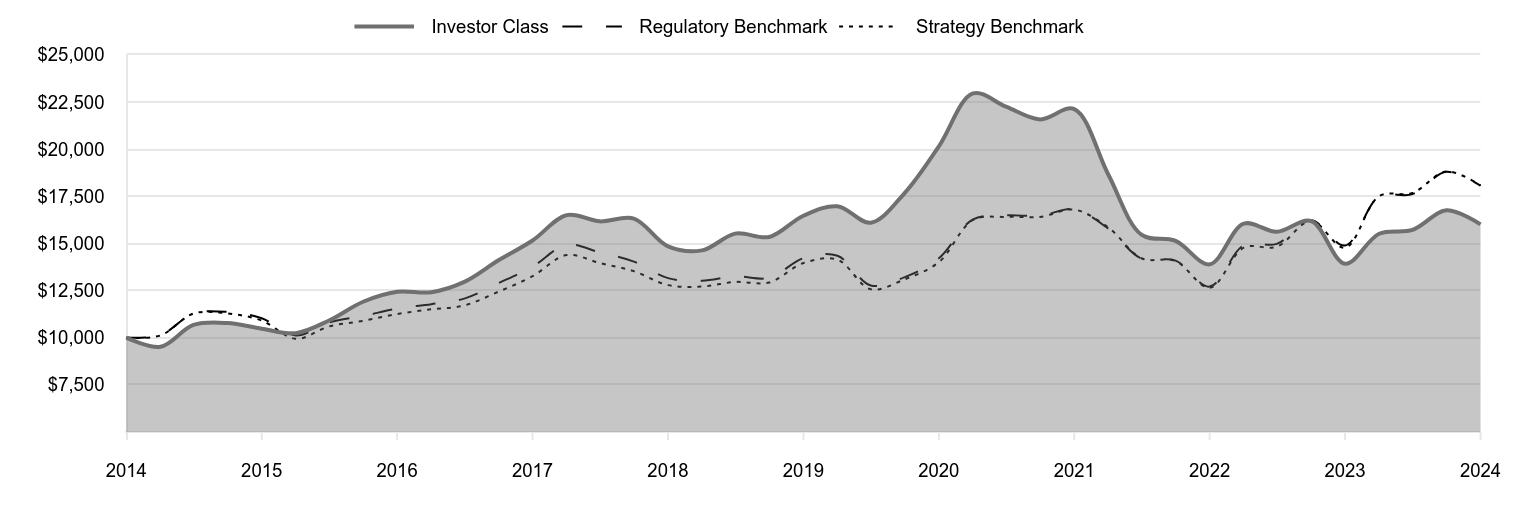

Cumulative Returns of a Hypothetical $10,000 Investment as of October 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

| 2015 | 9,519 | 10,138 | 10,118 |

| 2015 | 10,676 | 11,278 | 11,282 |

| 2015 | 10,776 | 11,367 | 11,286 |

| 2015 | 10,475 | 11,029 | 10,907 |

| 2016 | 10,239 | 10,118 | 9,942 |

| 2016 | 10,910 | 10,809 | 10,597 |

| 2016 | 11,906 | 11,149 | 10,892 |

| 2016 | 12,435 | 11,538 | 11,255 |

| 2017 | 12,414 | 11,778 | 11,503 |

| 2017 | 12,960 | 12,071 | 11,710 |

| 2017 | 14,103 | 12,889 | 12,437 |

| 2017 | 15,154 | 13,767 | 13,259 |

| 2018 | 16,499 | 14,925 | 14,381 |

| 2018 | 16,167 | 14,522 | 13,957 |

| 2018 | 16,312 | 14,029 | 13,526 |

| 2018 | 14,838 | 13,156 | 12,786 |

| 2019 | 14,627 | 13,015 | 12,710 |

| 2019 | 15,518 | 13,252 | 12,955 |

| 2019 | 15,340 | 13,173 | 12,926 |

| 2019 | 16,466 | 14,211 | 13,958 |

| 2020 | 16,966 | 14,342 | 14,134 |

| 2020 | 16,092 | 12,770 | 12,566 |

| 2020 | 17,681 | 13,213 | 13,097 |

| 2020 | 20,143 | 14,210 | 14,004 |

| 2021 | 22,948 | 16,271 | 16,240 |

| 2021 | 22,249 | 16,482 | 16,407 |

| 2021 | 21,573 | 16,468 | 16,404 |

| 2021 | 22,121 | 16,802 | 16,788 |

| 2022 | 18,638 | 15,775 | 15,838 |

| 2022 | 15,460 | 14,195 | 14,210 |

| 2022 | 15,129 | 14,084 | 14,061 |

| 2022 | 13,889 | 12,709 | 12,646 |

| 2023 | 16,043 | 14,898 | 14,772 |

| 2023 | 15,611 | 14,974 | 14,822 |

| 2023 | 16,187 | 16,226 | 16,190 |

| 2023 | 13,920 | 14,886 | 14,769 |

| 2024 | 15,511 | 17,484 | 17,506 |

| 2024 | 15,711 | 17,608 | 17,672 |

| 2024 | 16,752 | 18,791 | 18,813 |

| 2024 | 16,005 | 18,054 | 18,067 |

202411-4029887, 202412-3916166

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Japan Fund (Investor Class) | 14.98% | -0.57% | 4.82% |

| TOPIX Index Net (Regulatory Benchmark) | 21.29 | 4.90 | 6.09 |

| MSCI Japan Index Net (Strategy Benchmark) | 22.33 | 5.30 | 6.09 |

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$272,064

- Number of Portfolio Holdings77

- Investment Advisory Fees Paid (000s)$1,818

- Portfolio Turnover Rate67.6%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Electric Appliances & Precision Instruments | 21.0% |

| IT & Services & Others | 12.7 |

| Commercial & Wholesale Trade | 8.5 |

| Banks | 7.3 |

| Financials Ex-Banks | 7.2 |

| Machinery | 6.6 |

| Raw Materials & Chemicals | 5.9 |

| Automobiles & Transportation Equipment | 5.2 |

| Pharmaceutical | 4.5 |

| Other | 21.1 |

Top Ten Holdings (as a % of Net Assets)

| Sony Group | 5.2% |

| ITOCHU | 5.1 |

| Mitsubishi UFJ Financial Group | 4.7 |

| Hitachi | 4.4 |

| Recruit Holdings | 3.5 |

| Tokio Marine Holdings | 3.3 |

| Nintendo | 3.0 |

| Seven & i Holdings | 2.9 |

| Inpex | 2.8 |

| ORIX | 2.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Tokyo Stock Exchange and MSCI do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Japan Fund

Investor Class (PRJPX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

October 31, 2024

This annual shareholder report contains important information about Japan Fund (the "fund") for the period of November 1, 2023 to October 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Japan Fund - I Class | $90 | 0.84% |

What drove fund performance during the past 12 months?

Japanese stocks posted solid gains in the year ended October 31, 2024. For much of the period, yen weakness boosted the profit outlooks for Japan’s export-oriented companies. The Bank of Japan raised interest rates twice, in March and July, but there was uncertainty about the pace of further monetary policy normalization given market volatility, global economic developments, and domestic political instability.

Versus the TOPIX Index Net, the leading contributor to relative performance was stock selection in the machinery sector. Shares of IHI Corporation soared as markets rewarded the industrial conglomerate's solid growth, driven by its civil aero engines and defense equipment segment. Stock choices in commercial and wholesale trade also added value.

On the negative side, the leading detractor from relative performance was the information technology and services sector due to stock selection and an underweight position. SHIFT was a major laggard. The provider of software testing services struggled amid a slowdown in demand and the lower utilization of consultants and engineers. Stock choices in energy resources also weighed on performance.

The fund invests in Japanese companies across the market capitalization spectrum in a wide range of sectors, with a focus on opportunities where there is potential upside relative to the risks priced in the market (asymmetric risk-reward). We continued to closely manage the fund’s sector allocations and style exposures. With sector and style more neutralized relative to the benchmark, our focus was on stock selection, guided by our belief that improving governance will drive shareholder returns for many Japanese businesses.

How has the fund performed?

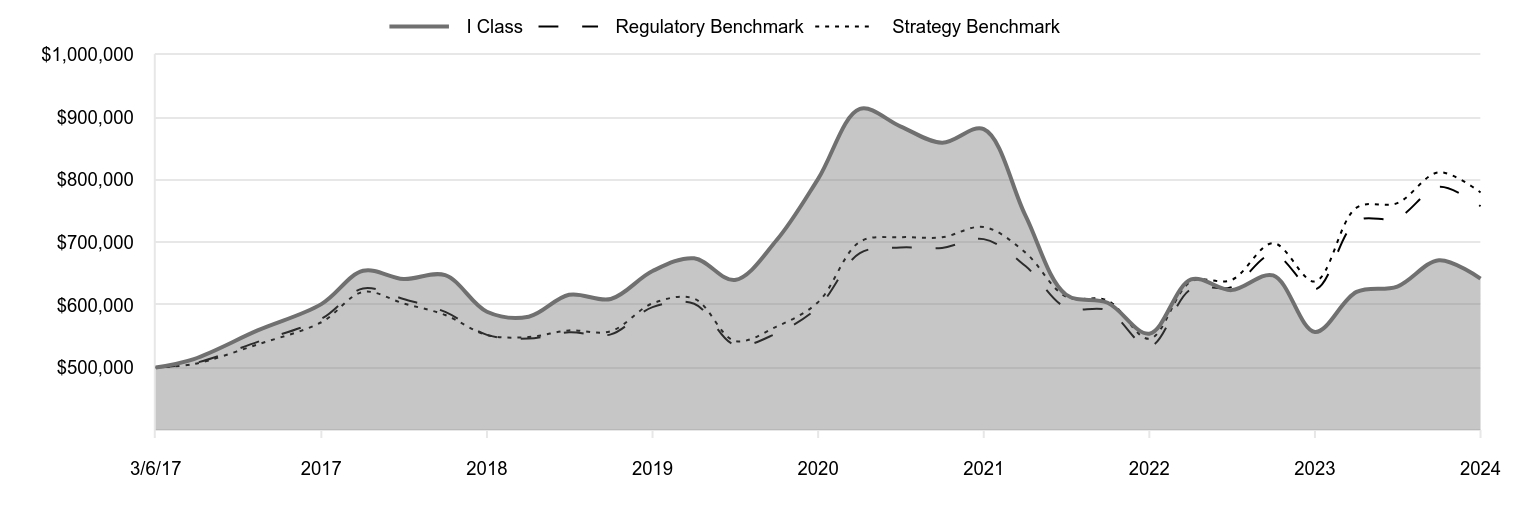

Cumulative Returns of a Hypothetical $500,000 Investment as of October 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 3/6/17 | 500,000 | 500,000 | 500,000 |

| 4/30/17 | 513,469 | 506,618 | 505,449 |

| 7/31/17 | 559,184 | 540,927 | 536,822 |

| 10/31/17 | 601,224 | 577,783 | 572,280 |

| 1/31/18 | 654,545 | 626,395 | 620,706 |

| 4/30/18 | 641,371 | 609,482 | 602,443 |

| 7/31/18 | 647,546 | 588,785 | 583,806 |

| 10/31/18 | 589,090 | 552,134 | 551,898 |

| 1/31/19 | 581,191 | 546,228 | 548,605 |

| 4/30/19 | 616,160 | 556,190 | 559,175 |

| 7/31/19 | 609,520 | 552,874 | 557,906 |

| 10/31/19 | 654,227 | 596,434 | 602,457 |

| 1/31/20 | 674,505 | 601,949 | 610,059 |

| 4/30/20 | 639,811 | 535,969 | 542,390 |

| 7/31/20 | 703,342 | 554,551 | 565,309 |

| 10/31/20 | 801,567 | 596,386 | 604,474 |

| 1/31/21 | 913,374 | 682,897 | 700,966 |

| 4/30/21 | 885,612 | 691,762 | 708,188 |

| 7/31/21 | 859,238 | 691,151 | 708,039 |

| 10/31/21 | 880,985 | 705,174 | 724,627 |

| 1/31/22 | 742,786 | 662,074 | 683,616 |

| 4/30/22 | 616,625 | 595,741 | 613,362 |

| 7/31/22 | 603,422 | 591,107 | 606,925 |

| 10/31/22 | 554,034 | 533,395 | 545,860 |

| 1/31/23 | 640,878 | 625,281 | 637,583 |

| 4/30/23 | 623,642 | 628,453 | 639,748 |

| 7/31/23 | 647,146 | 680,997 | 698,813 |

| 10/31/23 | 556,786 | 624,749 | 637,495 |

| 1/31/24 | 620,805 | 733,800 | 755,599 |

| 4/30/24 | 629,331 | 738,994 | 762,792 |

| 7/31/24 | 671,428 | 788,671 | 812,022 |

| 10/31/24 | 642,120 | 757,731 | 779,832 |

202411-4029887, 202412-3916166

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 3/6/17 |

|---|

| Japan Fund (I Class) | 15.33% | -0.37% | 3.32% |

| TOPIX Index Net (Regulatory Benchmark) | 21.29 | 4.90 | 5.58 |

| MSCI Japan Index Net (Strategy Benchmark) | 22.33 | 5.30 | 5.98 |

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$272,064

- Number of Portfolio Holdings77

- Investment Advisory Fees Paid (000s)$1,818

- Portfolio Turnover Rate67.6%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Electric Appliances & Precision Instruments | 21.0% |

| IT & Services & Others | 12.7 |

| Commercial & Wholesale Trade | 8.5 |

| Banks | 7.3 |

| Financials Ex-Banks | 7.2 |

| Machinery | 6.6 |

| Raw Materials & Chemicals | 5.9 |

| Automobiles & Transportation Equipment | 5.2 |

| Pharmaceutical | 4.5 |

| Other | 21.1 |

Top Ten Holdings (as a % of Net Assets)

| Sony Group | 5.2% |

| ITOCHU | 5.1 |

| Mitsubishi UFJ Financial Group | 4.7 |

| Hitachi | 4.4 |

| Recruit Holdings | 3.5 |

| Tokio Marine Holdings | 3.3 |

| Nintendo | 3.0 |

| Seven & i Holdings | 2.9 |

| Inpex | 2.8 |

| ORIX | 2.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Tokyo Stock Exchange and MSCI do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Japan Fund

I Class (RJAIX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

October 31, 2024

This annual shareholder report contains important information about Japan Fund (the "fund") for the period of November 1, 2023 to October 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Japan Fund - Z Class | $0 | 0.00% |

What drove fund performance during the past 12 months?

Japanese stocks posted solid gains in the year ended October 31, 2024. For much of the period, yen weakness boosted the profit outlooks for Japan’s export-oriented companies. The Bank of Japan raised interest rates twice, in March and July, but there was uncertainty about the pace of further monetary policy normalization given market volatility, global economic developments, and domestic political instability.

Versus the TOPIX Index Net, the leading contributor to relative performance was stock selection in the machinery sector. Shares of IHI Corporation soared as markets rewarded the industrial conglomerate's solid growth, driven by its civil aero engines and defense equipment segment. Stock choices in commercial and wholesale trade also added value.

On the negative side, the leading detractor from relative performance was the information technology and services sector due to stock selection and an underweight position. SHIFT was a major laggard. The provider of software testing services struggled amid a slowdown in demand and the lower utilization of consultants and engineers. Stock choices in energy resources also weighed on performance.

The fund invests in Japanese companies across the market capitalization spectrum in a wide range of sectors, with a focus on opportunities where there is potential upside relative to the risks priced in the market (asymmetric risk-reward). We continued to closely manage the fund’s sector allocations and style exposures. With sector and style more neutralized relative to the benchmark, our focus was on stock selection, guided by our belief that improving governance will drive shareholder returns for many Japanese businesses.

How has the fund performed?

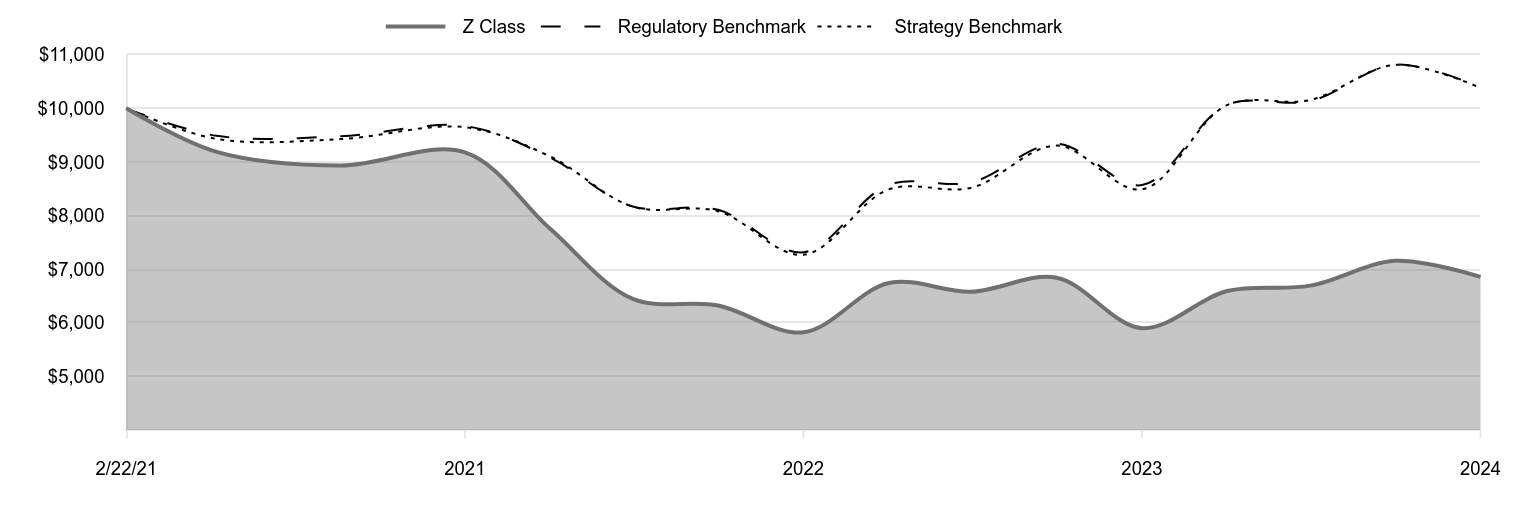

Cumulative Returns of a Hypothetical $10,000 Investment as of October 31, 2024

| Z Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2/22/21 | 10,000 | 10,000 | 10,000 |

| 4/30/21 | 9,188 | 9,487 | 9,429 |

| 7/31/21 | 8,934 | 9,479 | 9,427 |

| 10/31/21 | 9,179 | 9,671 | 9,648 |

| 1/31/22 | 7,754 | 9,080 | 9,102 |

| 4/30/22 | 6,447 | 8,170 | 8,167 |

| 7/31/22 | 6,324 | 8,107 | 8,081 |

| 10/31/22 | 5,822 | 7,315 | 7,268 |

| 1/31/23 | 6,742 | 8,576 | 8,489 |

| 4/30/23 | 6,578 | 8,619 | 8,518 |

| 7/31/23 | 6,841 | 9,340 | 9,305 |

| 10/31/23 | 5,900 | 8,568 | 8,488 |

| 1/31/24 | 6,592 | 10,064 | 10,061 |

| 4/30/24 | 6,693 | 10,135 | 10,156 |

| 7/31/24 | 7,156 | 10,816 | 10,812 |

| 10/31/24 | 6,857 | 10,392 | 10,383 |

202411-4029887, 202412-3916166

Average Annual Total Returns

| | 1 Year | Since Inception 2/22/21 |

|---|

| Japan Fund (Z Class) | 16.23% | -9.72% |

| TOPIX Index Net (Regulatory Benchmark) | 21.29 | 1.05 |

| MSCI Japan Index Net (Strategy Benchmark) | 22.33 | 1.02 |

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$272,064

- Number of Portfolio Holdings77

- Investment Advisory Fees Paid (000s)$1,818

- Portfolio Turnover Rate67.6%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Electric Appliances & Precision Instruments | 21.0% |

| IT & Services & Others | 12.7 |

| Commercial & Wholesale Trade | 8.5 |

| Banks | 7.3 |

| Financials Ex-Banks | 7.2 |

| Machinery | 6.6 |

| Raw Materials & Chemicals | 5.9 |

| Automobiles & Transportation Equipment | 5.2 |

| Pharmaceutical | 4.5 |

| Other | 21.1 |

Top Ten Holdings (as a % of Net Assets)

| Sony Group | 5.2% |

| ITOCHU | 5.1 |

| Mitsubishi UFJ Financial Group | 4.7 |

| Hitachi | 4.4 |

| Recruit Holdings | 3.5 |

| Tokio Marine Holdings | 3.3 |

| Nintendo | 3.0 |

| Seven & i Holdings | 2.9 |

| Inpex | 2.8 |

| ORIX | 2.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Tokyo Stock Exchange and MSCI do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Japan Fund

Z Class (TRZJX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | | | |

| | | 2024 | | | 2023 | | | | |

Audit Fees | | $ | 26,450 | | | $ | 25,925 | | | | | |

Audit-Related Fees | | | - | | | | - | | | | | |

Tax Fees | | | - | | | | - | | | | | |

All Other Fees | | | - | | | | - | | | | | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $846,000 and $1,584,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

PRJPX

Japan

Fund

RJAIX

Japan

Fund–

.

I Class

TRZJX

Japan

Fund–

.

Z Class

For

a

share

outstanding

throughout

each

period

Investor

Class

..

Year

..

..

Ended

.

10/31/24

10/31/23

10/31/22

10/31/21

10/31/20

NET

ASSET

VALUE

Beginning

of

period

$

10.62

$

11.32

$

18.99

$

17.75

$

14.77

Investment

activities

Net

investment

income

(1)(2)

0.09

0.07

0.06

0.05

0.09

Net

realized

and

unrealized

gain/loss

1.49

0.03

(3)

(6.81)

1.71

3.17

Total

from

investment

activities

1.58

0.10

(6.75)

1.76

3.26

Distributions

Net

investment

income

(0.20)

—

(0.03)

(0.08)

(0.15)

Net

realized

gain

—

(0.80)

(0.89)

(0.44)

(0.13)

Total

distributions

(0.20)

(0.80)

(0.92)

(0.52)

(0.28)

NET

ASSET

VALUE

End

of

period

$

12.00

$

10.62

$

11.32

$

18.99

$

17.75

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

10/31/24

10/31/23

10/31/22

10/31/21

10/31/20

Ratios/Supplemental

Data

Total

return

(2)(4)

14.98%

0.22%

(37.21)%

9.82%

22.33%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1.13%

1.08%

1.05%

0.96%

0.96%

Net

expenses

after

waivers/

payments

by

Price

Associates

1.13%

1.08%

1.05%

0.96%

0.96%

Net

investment

income

0.76%

0.61%

0.42%

0.25%

0.59%

Portfolio

turnover

rate

67.6%

124.4%

35.7%

26.9%

38.6%

Net

assets,

end

of

period

(in

thousands)

$155,352

$192,404

$264,666

$624,641

$690,468

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

The

amount

presented

is

inconsistent

with

the

fund's

aggregate

gains

and

losses

because

of

the

timing

of

sales

and

redemptions

of

fund

shares

in

relation

to

fluctuating

market

values

for

the

investment

portfolio.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

10/31/24

10/31/23

10/31/22

10/31/21

10/31/20

NET

ASSET

VALUE

Beginning

of

period

$

10.66

$

11.33

$

19.04

$

17.79

$

14.78

Investment

activities

Net

investment

income

(1)(2)

0.13

0.10

0.09

0.09

0.14

Net

realized

and

unrealized

gain/loss

1.49

0.03

(3)

(6.82)

1.69

3.15

Total

from

investment

activities

1.62

0.13

(6.73)

1.78

3.29

Distributions

Net

investment

income

(0.23)

—

(0.09)

(0.09)

(0.15)

Net

realized

gain

—

(0.80)

(0.89)

(0.44)

(0.13)

Total

distributions

(0.23)

(0.80)

(0.98)

(0.53)

(0.28)

NET

ASSET

VALUE

End

of

period

$

12.05

$

10.66

$

11.33

$

19.04

$

17.79

Ratios/Supplemental

Data

Total

return

(2)(4)

15.33%

0.50%

(37.11)%

9.91%

22.52%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.95%

0.90%

0.90%

0.85%

0.84%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.84%

0.85%

0.87%

0.85%

0.84%

Net

investment

income

1.07%

0.85%

0.61%

0.44%

0.91%

Portfolio

turnover

rate

67.6%

124.4%

35.7%

26.9%

38.6%

Net

assets,

end

of

period

(in

thousands)

$62,901

$144,227

$78,107

$248,968

$246,231

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

The

amount

presented

is

inconsistent

with

the

fund's

aggregate

gains

and

losses

because

of

the

timing

of

sales

and

redemptions

of

fund

shares

in

relation

to

fluctuating

market

values

for

the

investment

portfolio.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Z

Class

(1)

..

Year

..

..

Ended

.

2/22/21

(1)

Through

10/31/21

10/31/24

10/31/23

10/31/22

NET

ASSET

VALUE

Beginning

of

period

$

10.78

$

11.36

$

19.11

$

20.82

Investment

activities

Net

investment

income

(2)(3)

0.22

0.20

0.21

0.24

Net

realized

and

unrealized

gain/loss

1.50

0.02

(4)

(6.81)

(1.95)

(4)

Total

from

investment

activities

1.72

0.22

(6.60)

(1.71)

Distributions

Net

investment

income

(0.34)

—

(0.26)

—

Net

realized

gain

—

(0.80)

(0.89)

—

Total

distributions

(0.34)

(0.80)

(1.15)

—

NET

ASSET

VALUE

End

of

period

$

12.16

$

10.78

$

11.36

$

19.11

Ratios/Supplemental

Data

Total

return

(3)(5)

16.23%

1.34%

(36.57)%

(8.21)%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.91%

0.88%

0.89%

0.84%

(6)

Net

expenses

after

waivers/payments

by

Price

Associates

0.00%

0.02%

0.03%

0.01%

(6)

Net

investment

income

1.87%

1.71%

1.52%

1.81%

(6)

Portfolio

turnover

rate

67.6%

124.4%

35.7%

26.9%

Net

assets,

end

of

period

(in

thousands)

$53,811

$65,812

$75,352

$142,074

0%

0%

0%

0%

(1)

Inception

date

(2)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

The

amount

presented

is

inconsistent

with

the

fund's

aggregate

gains

and

losses

because

of

the

timing

of

sales

and

redemptions

of

fund

shares

in

relation

to

fluctuating

market

values

for

the

investment

portfolio.

(5)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

(6)

Annualized

T.

ROWE

PRICE

Japan

Fund

October

31,

2024

Shares

$

Value

(Cost

and

value

in

$000s)

‡

JAPAN

97.0%

COMMON

STOCKS

96.2%

AUTOMOBILES

&

TRANSPORTATION

EQUIPMENT

5.2%

Rubber

Products

1.4%

Toyo

Tire

261,000

3,703

3,703

Transportation

Equipment

3.8%

Isuzu

Motors

214,700

2,777

Toyota

Industries

45,600

3,161

Toyota

Motor

259,500

4,471

10,409

Total

Automobiles

&

Transportation

Equipment

14,112

BANKS

7.3%

Banks

7.3%

Mitsubishi

UFJ

Financial

Group

1,215,500

12,812

Resona

Holdings

895,200

5,906

Tokyo

Kiraboshi

Financial

Group

38,100

1,025

Total

Banks

19,743

COMMERCIAL

&

WHOLESALE

TRADE

8.5%

Wholesale

Trade

8.5%

Daiwabo

Holdings

129,800

2,336

Hanwa

117,000

3,877

ITOCHU

279,800

13,841

Toyota

Tsusho

172,700

2,936

Total

Commercial

&

Wholesale

Trade

22,990

CONSTRUCTION

&

MATERIALS

4.3%

Construction

0.8%

Shimizu

324,100

2,147

2,147

Glass

&

Ceramics

Products

3.5%

Niterra

105,900

3,001

Taiheiyo

Cement

199,900

4,355

Tokai

Carbon (1)

382,700

2,160

9,516

Total

Construction

&

Materials

11,663

Shares

$

Value

(Cost

and

value

in

$000s)

ELECTRIC

APPLIANCES

&

PRECISION

INSTRUMENTS

21.0%

Electric

Appliances

18.5%

Hamamatsu

Photonics

178,600

2,361

Hitachi

473,100

11,887

Horiba

44,600

2,742

Idec

90,400

1,457

Keyence

8,700

3,927

Konica

Minolta

650,100

2,714

Mitsubishi

Electric

231,000

4,064

Renesas

Electronics

422,500

5,661

Sony

Group

799,000

14,060

Tokyo

Electron

10,200

1,501

50,374

Precision

Instruments

2.5%

Nakanishi

85,600

1,456

Olympus

199,700

3,515

Tokyo

Seimitsu

32,000

1,722

6,693

Total

Electric

Appliances

&

Precision

Instruments

57,067

ELECTRIC

POWER

&

GAS

0.5%

Electric

Power

&

Gas

0.5%

METAWATER

125,300

1,450

Total

Electric

Power

&

Gas

1,450

ENERGY

RESOURCES

2.8%

Mining

2.8%

Inpex

579,500

7,639

Total

Energy

Resources

7,639

FINANCIALS

EX-BANKS

7.2%

Insurance

3.3%

Tokio

Marine

Holdings

252,600

9,098

9,098

Other

Financing

Business

3.9%

Aiful

1,828,700

3,843

ORIX

320,800

6,759

10,602

Total

Financials

Ex-Banks

19,700

Shares

$

Value

(Cost

and

value

in

$000s)

FOODS

1.0%

Foods

1.0%

Suntory

Beverage

&

Food

83,100

2,803

Total

Foods

2,803

IT

&

SERVICES

&

OTHERS

11.9%

Information

&

Communication

1.5%

Hikari

Tsushin

12,300

2,483

TIS

61,200

1,526

4,009

Other

Products

3.5%

Nintendo

152,900

8,076

Yamaha

190,300

1,537

9,613

Services

6.9%

Daiei

Kankyo

124,700

2,572

Kyoritsu

Maintenance

29,800

478

Persol

Holdings

1,007,900

1,693

Recruit

Holdings

157,600

9,624

Resorttrust

108,700

1,975

Round

One

228,200

1,444

TRYT (1)

428,200

1,047

18,833

Total

IT

&

Services

&

Others

32,455

MACHINERY

6.6%

Machinery

6.6%

IHI

61,800

3,290

Komatsu

145,500

3,766

Miura

227,000

5,301

Modec

93,000

2,025

Sega

Sammy

Holdings

123,700

2,328

Takeuchi

Manufacturing

42,400

1,321

Total

Machinery

18,031

PHARMACEUTICAL

4.5%

Pharmaceutical

4.5%

Astellas

Pharma

351,400

4,114

Eiken

Chemical

96,300

1,559

Takeda

Pharmaceutical

237,000

6,613

Total

Pharmaceutical

12,286

Shares

$

Value

(Cost

and

value

in

$000s)

RAW

MATERIALS

&

CHEMICALS

5.9%

Chemicals

5.2%

Daicel

98,600

870

Dexerials

82,700

1,263

Fuso

Chemical

38,000

927

Mitsui

Chemicals (1)

60,900

1,391

Nifco

111,500

2,590

Nippon

Soda

173,500

2,890

Nissan

Chemical

25,600

865

Shin-Etsu

Chemical

93,300

3,419

14,215

Pulp

And

Paper

0.7%

Rengo

288,500

1,747

1,747

Total

Raw

Materials

&

Chemicals

15,962

REAL

ESTATE

3.2%

Real

Estate

3.2%

Mitsubishi

Estate

343,500

5,079

Nomura

Real

Estate

Holdings

108,600

2,674

Open

House

Group

24,300

896

Total

Real

Estate

8,649

RETAIL

TRADE

4.5%

Retail

Trade

4.5%

Nextage (1)

249,800

2,398

Seven

&

i

Holdings

539,200

7,764

Takashimaya

273,700

2,167

Total

Retail

Trade

12,329

STEEL

&

NONFERROUS

METALS

1.3%

Iron

&

Steel

1.3%

Nippon

Steel

172,700

3,456

Total

Steel

&

Nonferrous

Metals

3,456

TRANSPORTATION

&

LOGISTICS

0.5%

Land

Transportation

0.5%

Sankyu

38,700

1,344

Total

Transportation

&

Logistics

1,344

Total

Common

Stocks

261,679

Shares

$

Value

(Cost

and

value

in

$000s)

CONVERTIBLE

PREFERRED

STOCKS

0.8%

IT

&

SERVICES

&

OTHERS

0.8%

Information

&

Communication

0.8%

Andpad,

Series

D,

Acquisition

Date:

7/21/22,

Cost

$726 (2)(3)(4)

17,240

618

Datax,

Series

E,

Acquisition

Date:

7/14/21,

Cost

$4,542 (2)(3)(4)

11,236

1,278

Finc

Technologies,

Series

E,

Acquisition

Date:

12/18/19,

Cost

$3,650 (2)(3)(4)

232,019

492

Total

IT

&

Services

&

Others

2,388

Total

Convertible

Preferred

Stocks

2,388

Total

Japan

(Cost

$243,311)

264,067

SHORT-TERM

INVESTMENTS 2.2%

MONEY

MARKET

FUNDS

2.2%

T.

Rowe

Price

Government

Reserve

Fund,

4.86% (5)

(6)

5,881,851

5,882

Total

Short-Term

Investments

(Cost

$5,882)

5,882

SECURITIES

LENDING

COLLATERAL 0.5%

INVESTMENTS

IN

A

POOLED

ACCOUNT

THROUGH

SECURITIES

LENDING

PROGRAM

WITH

JPMORGAN

CHASE

BANK 0.5%

Money

Market

Funds 0.5%

T.

Rowe

Price

Government

Reserve

Fund,

4.86% (5)

(6)

1,322,100

1,322

Total

Investments

in

a

Pooled

Account

through

Securities

Lending

Program

with

JPMorgan

Chase

Bank

1,322

Total

Securities

Lending

Collateral

(Cost

$1,322)

1,322

Total

Investments

in

Securities

99.7%

of

Net

Assets

(Cost

$250,515)

$

271,271

‡

Country

classifications

are

generally

based

on

MSCI

categories

or

another

unaffiliated

third

party

data

provider;

Shares

are

denominated

in

the

currency

of

the

country

presented

unless

otherwise

noted.

(1)

See

Note

4

.

All

or

a

portion

of

this

security

is

on

loan

at

October

31,

2024.

(2)

See

Note

2.

Level

3

in

fair

value

hierarchy.

(3)

Security

cannot

be

offered

for

public

resale

without

first

being

registered

under

the

Securities

Act

of

1933

and

related

rules

("restricted

security").

Acquisition

date

represents

the

day

on

which

an

enforceable

right

to

acquire

such

security

is

obtained

and

is

presented

along

with

related

cost

in

the

security

description.

The

fund

may

have

registration

rights

for

certain

restricted

securities.

Any

costs

related

to

such

registration

are

generally

borne

by

the

issuer.

The

aggregate

value

of

restricted

securities

(excluding

144A

holdings)

at

period

end

amounts

to

$2,388

and

represents

0.9%

of

net

assets.

(4)

Non-income

producing

(5)

Seven-day

yield

(6)

Affiliated

Companies

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

AFFILIATED

COMPANIES

($000s)

The

fund

may

invest

in

certain

securities

that

are

considered

affiliated

companies.

As

defined

by

the

1940

Act,

an

affiliated

company

is

one

in

which

the

fund

owns

5%

or

more

of

the

outstanding

voting

securities,

or

a

company

that

is

under

common

ownership

or

control.

The

following

securities

were

considered

affiliated

companies

for

all

or

some

portion

of

the

year

ended

October

31,

2024.

Net

realized

gain

(loss),

investment

income,

change

in

net

unrealized

gain/loss,

and

purchase

and

sales

cost

reflect

all

activity

for

the

period

then

ended.

Affiliate

Net

Realized

Gain

(Loss)

Change

in

Net

Unrealized

Gain/Loss

Investment

Income

T.

Rowe

Price

Government

Reserve

Fund,

4.86%

$

—

$

—

$

197++

Totals

$

—#

$

—

$

197+

Supplementary

Investment

Schedule

Affiliate

Value

10/31/23

Purchase

Cost

Sales

Cost

Value

10/31/24

T.

Rowe

Price

Government

Reserve

Fund,

4.86%

$

3,617

¤

¤

$

7,204

Total

$

7,204^

#

Capital

gain

distributions

from

underlying

Price

funds

represented

$0

of

the

net

realized

gain

(loss).

++

Excludes

earnings

on

securities

lending

collateral,

which

are

subject

to

rebates

and

fees

as

described

in

Note

4

.

+

Investment

income

comprised

$197

of

dividend

income

and

$0

of

interest

income.

¤

Purchase

and

sale

information

not

shown

for

cash

management

funds.

^

The

cost

basis

of

investments

in

affiliated

companies

was

$7,204.

T.

ROWE

PRICE

Japan

Fund

October

31,

2024

Statement

of

Assets

and

Liabilities

($000s,

except

shares

and

per

share

amounts)

Assets

Investments

in

securities,

at

value

(cost

$250,515)

$

271,271

Dividends

receivable

2,280

Receivable

for

shares

sold

172

Foreign

currency

(cost

$23)

23

Due

from

affiliates

3

Other

assets

170

Total

assets

273,919

Liabilities

Obligation

to

return

securities

lending

collateral

1,322

Investment

management

fees

payable

187

Payable

for

investment

securities

purchased

170

Payable

for

shares

redeemed

112

Other

liabilities

64

Total

liabilities

1,855

Commitments

and

Contingent

Liabilities

(note

7

)

NET

ASSETS

$

272,064

T.

ROWE

PRICE

Japan

Fund

October

31,

2024

Statement

of

Assets

and

Liabilities

($000s,

except

shares

and

per

share

amounts)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Net

Assets

Consist

of:

Total

distributable

earnings

(loss)

$

30,477

Paid-in

capital

applicable

to

22,595,907

shares

of

$0.01

par

value

capital

stock

outstanding;

18,000,000,000

shares

of

the

Corporation

authorized

241,587

NET

ASSETS

$

272,064

NET

ASSET

VALUE

PER

SHARE

Investor

Class

(Net

assets:

$155,352;

Shares

outstanding:

12,949,356)

$

12.00

I

Class

(Net

assets:

$62,901;

Shares

outstanding:

5,221,169)

$

12.05

Z

Class

(Net

assets:

$53,811;

Shares

outstanding:

4,425,382)

$

12.16

Year

Ended

10/31/24

Investment

Income

(Loss)

Income

Dividend

(net

of

foreign

taxes

of

$628)

$

5,847

Securities

lending

50

Other

1

Total

income

5,898

Expenses

Investment

management

2,450

Shareholder

servicing

Investor

Class

$

386

I

Class

25

411

Prospectus

and

shareholder

reports

Investor

Class

26

I

Class

4

Z

Class

2

32

Custody

and

accounting

255

Registration

54

Legal

and

audit

40

Directors

1

Miscellaneous

28

Waived

/

paid

by

Price

Associates

(632)

Total

expenses

2,639

Net

investment

income

3,259

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

Ended

10/31/24

Realized

and

Unrealized

Gain

/

Loss

–

Net

realized

gain

(loss)

Securities

24,319

Futures

(346)

Foreign

currency

transactions

174

Net

realized

gain

24,147

Change

in

net

unrealized

gain

/

loss

Securities

22,693

Other

assets

and

liabilities

denominated

in

foreign

currencies

(101)

Change

in

net

unrealized

gain

/

loss

22,592

Net

realized

and

unrealized

gain

/

loss

46,739

INCREASE

IN

NET

ASSETS

FROM

OPERATIONS

$

49,998

Statement

of

Changes

in

Net

Assets

Year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Ended

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10/31/24

10/31/23

Increase

(Decrease)

in

Net

Assets

Operations

Net

investment

income

$

3,259

$

3,806

Net

realized

gain

(loss)

24,147

(2,990)

Change

in

net

unrealized

gain

/

loss

22,592

(2,238)

Increase

(decrease)

in

net

assets

from

operations

49,998

(1,422)

Distributions

to

shareholders

Net

earnings

Investor

Class

(3,342)

(17,193)

I

Class

(1,245)

(5,366)

Z

Class

(2,059)

(5,202)

Decrease

in

net

assets

from

distributions

(6,646)

(27,761)

Capital

share

transactions

*

Shares

sold

Investor

Class

27,690

37,514

I

Class

9,764

122,894

Z

Class

149

1,133

Distributions

reinvested

Investor

Class

3,147

16,365

I

Class

1,112

4,815

Z

Class

2,059

5,202

Shares

redeemed

Investor

Class

(92,776)

(116,772)

I

Class

(102,588)

(45,054)

Z

Class

(22,288)

(12,596)

Increase

(decrease)

in

net

assets

from

capital

share

transactions

(173,731)

13,501

Statement

of

Changes

in

Net

Assets

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Ended

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10/31/24

10/31/23

Net

Assets

Decrease

during

period

(130,379)

(15,682)

Beginning

of

period

402,443

418,125

End

of

period

$

272,064

$

402,443

*Share

information

(000s)

Shares

sold

Investor

Class

2,339

3,170

I

Class

821

10,083

Z

Class

15

90

Distributions

reinvested

Investor

Class

279

1,392

I

Class

98

409

Z

Class

182

440

Shares

redeemed

Investor

Class

(7,790)

(9,828)

I

Class

(9,230)

(3,853)

Z

Class

(1,877)

(1,059)

Increase

(decrease)

in

shares

outstanding

(15,163)

844

NOTES

TO

FINANCIAL

STATEMENTS

T.

Rowe

Price

International

Funds,

Inc. (the

corporation) is

registered

under

the

Investment

Company

Act

of

1940

(the

1940

Act).

The

Japan

Fund

(the

fund)

is a

diversified, open-end

management

investment

company

established

by

the

corporation. The

fund

seeks long-term

growth

of

capital

through

investments

in

common

stocks

of

companies

located

(or

with

primary

operations)

in

Japan.

The

fund

has three classes

of

shares:

the

Japan

Fund

(Investor

Class),

the

Japan

Fund–I

Class

(I

Class)

and

the

Japan

Fund–Z

Class

(Z

Class).

I

Class

shares

require

a

$500,000

initial

investment

minimum,

although

the

minimum

generally

is

waived

or

reduced

for

financial

intermediaries,

eligible

retirement

plans,

and

certain

other

accounts.

The

Z

Class

is

only

available

to

funds

advised

by

T.

Rowe

Price

Associates,

Inc.

and

its

affiliates

and

other

clients

that

are

subject

to

a

contractual

fee

for

investment

management

services. Each

class

has

exclusive

voting

rights

on

matters

related

solely

to

that

class;

separate

voting

rights

on

matters

that

relate

to

all

classes;

and,

in

all

other

respects,

the

same

rights

and

obligations

as

the

other

classes.

NOTE

1

-

SIGNIFICANT

ACCOUNTING

POLICIES

Basis

of

Preparation

The fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

in

the

Financial

Accounting

Standards

Board

(FASB)

Accounting

Standards

Codification

Topic

946

(ASC

946).

The

accompanying

financial

statements

were

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(GAAP),

including,

but

not

limited

to,

ASC

946.

GAAP

requires

the

use

of

estimates

made

by

management.

Management

believes

that

estimates

and

valuations

are

appropriate;

however,

actual

results

may

differ

from

those

estimates,

and

the

valuations

reflected

in

the

accompanying

financial

statements

may

differ

from

the

value

ultimately

realized

upon

sale

or

maturity.

Investment

Transactions,

Investment

Income,

and

Distributions

Investment

transactions

are

accounted

for

on

the

trade

date

basis.

Income

and

expenses

are

recorded

on

the

accrual

basis.

Realized

gains

and

losses

are

reported

on

the

identified

cost

basis. Income

tax-related

interest

and

penalties,

if

incurred,

are

recorded

as

income

tax

expense. Dividends

received

from other

investment

companies are

reflected

as

dividend income;

capital

gain

distributions

are

reflected

as

realized

gain/loss. Dividend

income and

capital

gain

distributions

are

recorded

on

the

ex-dividend

date. Non-cash

dividends,

if

any,

are

recorded

at

the

fair

market

value

of

the

asset

received. Proceeds

from

litigation

payments,

if

any,

are

included

in

either

net

realized

gain

(loss)

or

change

in

net

unrealized

gain/loss

from

securities. Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date. Income

distributions,

if

any,

are

declared

and

paid

by

each

class annually. A

capital

gain

distribution,

if

any, may

also

be

declared

and

paid

by

the

fund

annually.

Currency

Translation

Assets,

including

investments,

and

liabilities

denominated

in

foreign

currencies

are

translated

into

U.S.

dollar

values

each

day

at

the

prevailing

exchange

rate,

using

the

mean

of

the

bid

and

asked

prices

of

such

currencies

against

U.S.

dollars

as

provided

by

an

outside

pricing

service.

Purchases

and

sales

of

securities,

income,

and

expenses

are

translated

into

U.S.

dollars

at

the

prevailing

exchange

rate

on

the

respective

date

of

such

transaction.

The

effect

of

changes

in

foreign

currency

exchange

rates

on

realized

and

unrealized

security

gains

and

losses

is

not

bifurcated

from

the

portion

attributable

to

changes

in

market

prices.

Class

Accounting

Shareholder

servicing,

prospectus,

and

shareholder

report

expenses

incurred

by

each

class

are

charged

directly

to

the

class

to

which

they

relate.

Expenses

common

to

all

classes,

investment

income,

and

realized

and

unrealized

gains

and

losses

are

allocated

to

the

classes

based

upon

the

relative

daily

net

assets

of

each

class.

Capital

Transactions

Each

investor’s

interest

in

the

net

assets

of the

fund

is

represented

by

fund

shares. The

fund’s

net

asset

value

(NAV)

per

share

is

computed

at

the

close

of

the

New

York

Stock

Exchange

(NYSE),

normally

4

p.m.

Eastern

time,

each

day

the

NYSE

is

open

for

business.

However,

the

NAV

per

share

may

be

calculated

at

a

time

other

than

the

normal

close

of

the

NYSE

if

trading

on

the

NYSE

is

restricted,

if

the

NYSE

closes

earlier,

or

as

may

be

permitted

by

the

SEC.

Purchases

and

redemptions

of

fund

shares

are

transacted

at

the

next-computed

NAV

per

share,

after

receipt

of

the

transaction

order

by

T.

Rowe

Price

Associates,

Inc.,

or

its

agents.

New

Accounting

Guidance

In

November

2023,

the

FASB

issued

Accounting

Standards

Update

(ASU),

ASU

2023-07,

Segment

Reporting

(Topic

280)

–

Improvements

to

Reportable

Segment

Disclosures,

which

improves

reportable

segment

disclosure

requirements,

primarily

through

enhanced

disclosures

about

segment

expenses.

In

addition,

the

ASU

clarifies

that

a

public

entity

with

a

single

reportable

segment

provide

all

disclosures

required

by

the

ASU

and

all

existing

segment

disclosures

in

Topic

280.

The

amendments

under

this

ASU

are

effective

for

fiscal

years

beginning

after

December

15,

2023.

Management

expects

that

adoption

of

the

guidance

will

not

have

a

material

impact

on

the

fund’s

financial

statements.

Indemnification

In

the

normal

course

of

business, the

fund

may

provide

indemnification

in

connection

with

its

officers

and

directors,

service

providers,

and/or

private

company

investments. The

fund’s

maximum

exposure

under

these

arrangements

is

unknown;

however,

the

risk

of

material

loss

is

currently

considered

to

be

remote.

NOTE

2

-

VALUATION

Fair

Value

The

fund’s

financial

instruments

are

valued

at

the

close

of

the

NYSE

and

are

reported

at

fair

value,

which

GAAP

defines

as

the

price

that

would

be

received

to

sell

an

asset

or

paid

to

transfer

a

liability

in

an

orderly

transaction

between

market

participants

at

the

measurement

date. The fund’s

Board

of

Directors

(the

Board)

has

designated

T.

Rowe

Price

Associates,

Inc.

as

the

fund’s

valuation

designee

(Valuation

Designee).

Subject

to

oversight

by

the

Board,

the

Valuation

Designee

performs

the

following

functions

in

performing

fair

value

determinations:

assesses

and

manages

valuation

risks;

establishes

and

applies

fair

value

methodologies;

tests

fair

value

methodologies;

and

evaluates

pricing

vendors

and

pricing

agents.

The

duties

and

responsibilities

of

the

Valuation

Designee

are

performed

by

its

Valuation

Committee. The

Valuation

Designee provides

periodic

reporting

to

the

Board

on

valuation

matters.

Various

valuation

techniques

and

inputs

are

used

to

determine

the

fair

value

of

financial

instruments.

GAAP

establishes

the

following

fair

value

hierarchy

that

categorizes

the

inputs

used

to

measure

fair

value:

Level

1

–

quoted

prices

(unadjusted)

in

active

markets

for

identical

financial

instruments

that

the

fund

can

access

at

the

reporting

date

Level

2

–

inputs

other

than

Level

1

quoted

prices

that

are

observable,

either

directly

or

indirectly

(including,

but

not

limited

to,

quoted

prices

for

similar

financial

instruments

in

active

markets,

quoted

prices

for

identical

or

similar

financial

instruments

in

inactive

markets,

interest

rates

and

yield

curves,

implied

volatilities,

and

credit

spreads)

Level

3

–

unobservable

inputs

(including

the Valuation

Designee’s assumptions

in

determining

fair

value)

Observable

inputs

are

developed

using

market

data,

such

as

publicly

available

information

about

actual

events

or

transactions,

and

reflect

the

assumptions

that

market

participants

would

use

to

price

the

financial

instrument.

Unobservable

inputs

are

those

for

which

market

data

are

not

available

and

are

developed

using

the

best

information

available

about

the

assumptions

that

market

participants

would

use

to

price

the

financial

instrument.

GAAP

requires

valuation

techniques

to

maximize

the

use

of

relevant

observable

inputs

and

minimize

the

use

of

unobservable

inputs.

When

multiple

inputs

are

used

to

derive

fair

value,

the

financial

instrument

is

assigned

to

the

level

within

the

fair

value

hierarchy

based

on

the

lowest-level

input

that

is

significant

to

the

fair

value

of

the

financial

instrument.

Input

levels

are

not

necessarily

an

indication

of

the

risk

or

liquidity