- DHR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Danaher (DHR) DEF 14ADefinitive proxy

Filed: 31 Mar 17, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

DANAHER CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

DANAHER CORPORATION

2200 Pennsylvania Avenue, N.W., Suite 800W

Washington, D.C. 20037-1701

March 31, 2017

By order of the Board of Directors,

JAMES F. O’REILLY

Vice President, Associate General Counsel and Secretary

Review Your Proxy Statement and Vote in One of Four Ways:

| VIA THE INTERNET Visit the website listed on your proxy card or voting instruction form |  | BY MAIL Sign, date and return your proxy card or voting instruction form in the enclosed envelope | |||

| BY TELEPHONE Call the telephone number on your proxy card or voting instruction form |  | BY MOBILE DEVICE Scan the QR code included with your proxy card or voting instruction form | |||

Please refer to the enclosed proxy materials or the information forwarded by your bank, broker, trustee or other intermediary to see which voting methods are available to you.

2017 ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENTTABLE OF CONTENTS

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on May 9, 2017. This Proxy Statement and the accompanying Annual Report are available free of charge at:http://investors.danaher.com/annual-report-and-proxy.

To assist you in reviewing the proposals to be acted upon at our 2017 Annual Meeting, below is summary information regarding the meeting, each proposal to be voted upon at the meeting and Danaher Corporation’s (“Danaher” or the “Company”) business performance, corporate governance and executive compensation. The following description is only a summary. For more information about these topics, please review Danaher’s Annual Report on Form 10-K for the year ended December 31, 2016 and the complete Proxy Statement.

2017 Annual Meeting of Shareholders

DATE AND TIME: May 9, 2017, 3:00 p.m. local time

PLACE: Park Hyatt Washington, 1201 24th Street, NW, Washington, D.C.

RECORD DATE: March 13, 2017

Voting Matters

| PROPOSAL | DESCRIPTION | BOARD RECOMMENDATION | ||||||

Proposal 1: Election of directors (page 1) | We are asking our shareholders to elect each of the twelve directors identified below to serve until the 2018 Annual Meeting of shareholders. | ü FOR each nominee | ||||||

Proposal 2: Ratification of the appointment of the independent registered public accounting firm (page 19) | We are asking our shareholders to ratify our Audit Committee’s selection of Ernst & Young LLP (“E&Y”) to act as the independent registered public accounting firm for Danaher for 2017. Although our shareholders are not required to approve the selection of E&Y, our Board believes that it is advisable to give our shareholders an opportunity to ratify this selection. | ü FOR | ||||||

| Proposal 3: Approval of certain amendments to Danaher’s 2007 Stock Incentive Plan and the material terms of the performance goals under the plan (page 53) | We are asking our shareholders to approve certain amendments to Danaher’s 2007 Stock Incentive Plan and the material terms of the performance goals under the plan so that we can continue to use the plan to grant compensation awards, on a basis that is tax-deductible under Section 162(m) (“Section 162(m)”) of the Internal Revenue Code (the “Code”) as appropriate, to attract, retain and reward employees and directors and closely align their interests with those of the Company’s shareholders. | ü FOR | ||||||

| Proposal 4: Approval of certain amendments to Danaher’s 2007 Executive Incentive Compensation Plan and the material terms of the performance goals under the plan (page 62) | We are asking our shareholders to approve certain amendments to Danaher’s 2007 Executive Incentive Compensation Plan and the material terms of the performance goals under the plan so that we can continue to use the plan to grant incentive compensation, on a basis that is tax-deductible under Section 162(m) as appropriate, to attract, retain and reward executive officers and closely align their interests with those of the Company’s shareholders. | ü FOR | ||||||

Proposal 5: Advisory vote to approve named executive officer compensation (page 64) | We are asking our shareholders to cast a non-binding, advisory vote on the compensation of the executive officers named in the Summary Compensation Table (the “named executive officers”). In evaluating this year’s “say on pay” proposal, we recommend that you review our Compensation Discussion and Analysis, which explains how and why the Compensation Committee of our Board arrived at its executive compensation actions and decisions for 2016. | ü FOR

| ||||||

| DANAHER 2017 PROXY STATEMENT i | ||

| PROPOSAL | DESCRIPTION | BOARD RECOMMENDATION | ||||||

| Proposal 6: Advisory vote relating to frequency of future advisory votes on named executive officer compensation (page 65) | We are asking our shareholders to cast a non-binding, advisory vote on the frequency of future shareholder advisory votes on the Company’s named executive officer compensation. The voting choices are every one, two or three years, or abstain. | ü FOR Every ONE Year | ||||||

Proposal 7: Shareholder Proposal (page 66) | You are being asked to consider a shareholder proposal requesting that Danaher adopt and report on goals to reduce greenhouse gas emissions. | O AGAINST | ||||||

Please see the sections titled “General Information About the Meeting” and “Other Information” beginning on page 68 for important information about the proxy materials, voting, the Annual Meeting, Company documents, communications and the deadlines to submit shareholder proposals and director nominations for next year’s annual meeting of shareholders.

Business Highlights

2016 Performance

2016 was a transformative year for Danaher as we:

| • | successfully completed the spin-off (“Separation”) of Fortive Corporation (“Fortive”), consisting of our former Test & Measurement segment, Industrial Technologies segment (excluding the product identification businesses) and retail/commercial petroleum business; |

| • | consummated our $4.0 billion acquisition of Cepheid, a leading global molecular diagnostics company; and |

| • | continued the integration of our 2015, $13.6 billion acquisition of Pall Corporation, a leading global provider of filtration, separation and purification solutions. |

Following the Separation, Danaher is better positioned to sharpen its strategic focus and concentrate its investment capital on its science and technology-oriented businesses, as illustrated by the recent acquisition of Cepheid. Cepheid is a highly complementary addition to Danaher’s Diagnostics segment, significantly expands Danaher’s recurring revenue base and provides a strong foundation for Danaher to grow in the molecular diagnostics segment both organically and through future acquisitions.

Even as we invested in Danaher’s future growth, we continued to deliver strong operational and financial performance despite tepid growth or declines in certain of the end-markets we serve. Specifically, during 2016, Danaher:

| • | deployed over $4.9 billion across eight strategic acquisitions (including the strategically critical acquisition of Cepheid); |

| • | returned over $400 million to shareholders through cash dividends; and |

| • | continued to grow our business on a year-over-year basis: |

DANAHER 2015-2016 YEAR-OVER-YEAR GROWTH FROM CONTINUING OPERATIONS

| ii DANAHER 2017 PROXY STATEMENT | ||

Long-Term Performance

We believe a long-term performance period most accurately compares relative performance within our peer group, because over shorter periods performance comparisons may be skewed by the easier performance baselines of peer companies that have experienced periods of underperformance in the past.

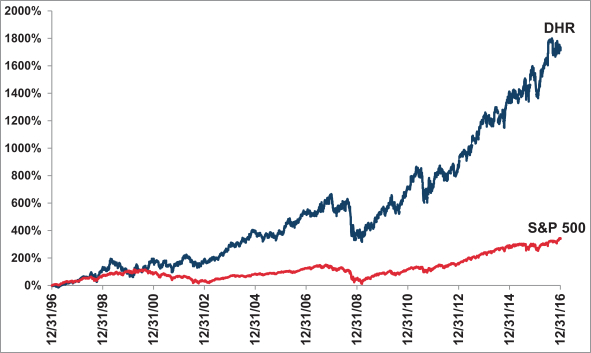

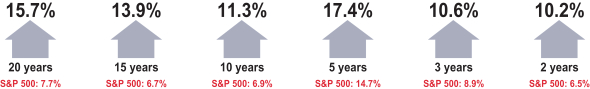

Danaher has not experienced a sustained period of underperformance over the last twenty years, and we believe the consistency of our performance over the last twenty years is unmatched within our peer group. Danaher ranks number one in its peer group over the past twenty years based on compounded average annual shareholder return, and is the only company in its peer group whose total shareholder return (“TSR”) outperformed the S&P 500 Index: |  |

| • | over every rolling 3-year period from 1997-2016; and |

| • | by more than 600 basis points over every rolling 3-year period from 2007-2016. |

Danaher’s compounded, average annual shareholder return has outperformed the S&P 500 Index over each of the last two-, three, five-, ten-, fifteen- and twenty-year periods:

| DANAHER 2017 PROXY STATEMENT iii | ||

Corporate Governance Highlights

Our Board of Directors recognizes that Danaher’s success over the long-term requires a robust framework of corporate governance that serves the best interests of all our shareholders. Below are highlights of our corporate governance framework.

☑ Board refreshment remains a key area of focus for us, as evidenced by the fact that 25% of our directors have less than three years’ tenure, including two directors with less than one year of tenure.

☑ Our Amended and Restated By-Laws (“Bylaws”) provide for proxy access by shareholders.

☑ Our Chairman and CEO positions are separate.

☑ Our Board has established a Lead Independent Director position.

☑ All of our directors are elected annually.

☑ In uncontested elections, our directors must be elected by a majority of the votes cast, and an incumbent director who fails to receive such a majority automatically tenders his or her resignation.

☑ Our shareholders have the right to act by written consent.

☑ Shareholders owning 25% or more of our outstanding shares may call a special meeting of shareholders.

☑ We have never had a shareholder rights plan.

☑ We have no supermajority voting requirements in our Certificate of Incorporation or Bylaws.

☑ All members of our Audit, Compensation and Nominating and Governance Committees are independent as defined by the New York Stock Exchange listing standards and applicable Securities and Exchange Commission (“SEC”) rules.

☑ Danaher (including its subsidiaries during the period we have owned them) has made no political contributions since at least 2012 and has no intention of contributing any Danaher funds or assets for political purposes, and we disclose our political expenditures policy on our public website.

Below is an overview of each of the director nominees you are being asked to elect at the 2017 Annual Meeting.

| NAME | DIRECTOR SINCE | PRIMARY OCCUPATION | COMMITTEE MEMBERSHIPS | OTHER BOARDS | ||||||||

| Donald J. Ehrlich* | 1985 | Former President and CEO, Schwab Corp. | A, C (Chair); Lead | 0 | ||||||||

| Linda Hefner Filler* | 2005 | President of Retail Products and Chief Merchandising Officer, Walgreen Co. | N (Chair) | 0 | ||||||||

| Thomas P. Joyce, Jr. | 2014 | President and Chief Executive Officer, Danaher Corporation | F, E | 0 | ||||||||

| Robert J. Hugin* | 2016 | Executive Chairman of the Board of Directors, Celgene Corporation | C | 2 | ||||||||

| Teri List-Stoll* | 2011 | Executive Vice President and Chief Financial Officer, Gap Inc. | A | 1 | ||||||||

| Walter G. Lohr, Jr.* | 1983 | Retired partner, Hogan Lovells | C, F, N | 0 | ||||||||

| Mitchell P. Rales | 1983 | Chairman of the Executive Committee, Danaher Corporation | F (Chair), E (Chair) | 2 | ||||||||

| Steven M. Rales | 1983 | Chairman of the Board, Danaher Corporation | F, E | 1 | ||||||||

| John T. Schwieters* | 2003 | Principal, Perseus Realty, LLC | A (Chair), N | 0 | ||||||||

| Alan G. Spoon* | 1999 | Partner Emeritus, Polaris Partners | C | 4 | ||||||||

| Raymond C. Stevens, Ph.D.* | 2017 | Provost Professor of Biological Sciences and Chemistry, and Director of The Bridge Institute, at the University of Southern California | — | 0 | ||||||||

| Elias A. Zerhouni, M.D.* | 2009 | President, Global Research & Development, Sanofi S.A. | N | 0 | ||||||||

| * | Independent director |

| A | Audit Committee |

| C | Compensation Committee |

| E | Executive Committee |

| F | Finance Committee |

| N | Nominating & Governance Committee |

| iv DANAHER 2017 PROXY STATEMENT | ||

Executive Compensation Highlights

Overview of Executive Compensation Program

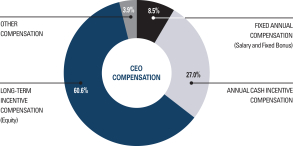

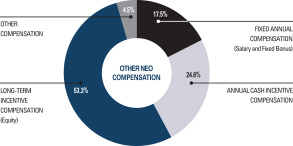

As discussed in detail under “Compensation Discussion and Analysis,” with the goal of building long-term value for our shareholders, we have developed an executive compensation program designed to:

| • | attract and retain executives with the leadership skills, attributes and experience necessary to succeed in an enterprise with Danaher’s size, diversity and global footprint; |

| • | motivate executives to demonstrate exceptional personal performance and perform consistently at or above the levels that we expect, over the long-term and through a range of economic cycles; and |

| • | link compensation to the achievement of corporate goals that we believe best correlate with the creation of long-term shareholder value. |

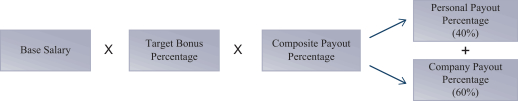

To achieve these objectives our compensation program combines annual and long-term components, cash and equity, and fixed and variable elements, with a bias toward long-term equity awards tied closely to shareholder returns and subject to significant vesting and/or holding periods. Our executive compensation program rewards our executive officers when they build long-term shareholder value, achieve annual business goals and maintain long-term careers with Danaher.

Compensation Governance

Our Compensation Committee also recognizes that the success of our executive compensation program over the long-term requires a robust framework of compensation governance. As a result, the Committee regularly reviews external executive compensation practices and trends and incorporates best practices into our executive compensation program:

| WHAT WE DO | WHAT WE DON’T DO | |||||||||||||

| Five-year vesting requirement for equity awards (or in the case of PSUs, three-year vesting and a further two-year holding period) |  | No tax gross-up provisions (except as applicable to management employees generally such as relocation policy) | |||||||||||

| Incentive compensation programs feature multiple, different performance measures aligned with business strategy |  | No dividend/dividend equivalents paid on unvested equity awards | |||||||||||

| Rigorous clawback policy that is triggered even in the absence of wrongdoing |  | No “single trigger” change of control benefits | |||||||||||

| Minimum vesting requirements for equity awards per the Company’s stock plan |  | No active defined benefit pension program since 2003 | |||||||||||

| Stock ownership requirements for all executive officers |  | No hedging of Danaher securities permitted | |||||||||||

| Limited perquisites and the presence of a cap on CEO/CFO personal aircraft usage |  | No long-term incentive compensation is denominated or paid in cash | |||||||||||

| Independent compensation consultant that performs no other services for the Company |  | No above-market returns on deferred compensation plans | |||||||||||

| DANAHER 2017 PROXY STATEMENT v | ||

Named Executive Officers 2016 Compensation

The following table sets forth the 2016 compensation of our named executive officers. Please see pages 37-39 for information regarding 2015 and 2014 compensation, as well as footnotes.

NAME AND PRINCIPAL POSITION | SALARY | BONUS | STOCK AWARDS | OPTION AWARDS | NON-EQUITY PLAN | CHANGE IN PENSION | ALL OTHER COMPENSATION | TOTAL | ||||||||||||||||||||||||||||

Thomas P. Joyce, Jr., President and CEO | $ | 1,100,000 | 0 | $ | 4,095,424 | $ | 3,762,923 | $ | 3,500,000 | $ | 11,867 | $ | 498,587 | $ | 12,968,801 | |||||||||||||||||||||

Daniel L. Comas, Executive Vice President and CFO | $ | 862,357 | 0 | $ | 1,830,931 | $ | 1,682,232 | $ | 1,666,505 | $ | 9,196 | $ | 271,662 | $ | 6,322,883 | |||||||||||||||||||||

William K. Daniel II, Executive Vice President | $ | 730,144 | 0 | $ | 1,589,854 | $ | 1,460,842 | $ | 1,337,989 | 0 | $ | 110,968 | $ | 5,229,797 | ||||||||||||||||||||||

Brian W. Ellis, Senior Vice President – General Counsel | $ | 500,000 | $ | 325,000 | $ | 981,721 | $ | 885,558 | $ | 643,000 | 0 | $ | 372,075 | $ | 3,707,354 | |||||||||||||||||||||

Angela S. Lalor, Senior Vice President – Human Resources | $ | 603,986 | $ | 300,000 | $ | 867,250 | $ | 796,901 | $ | 1,013,851 | 0 | $ | 91,318 | $ | 3,673,306 | |||||||||||||||||||||

James A. Lico, Former Executive Vice President | $ | 422,717 | 0 | $ | 2,167,938 | $ | 1,992,280 | $ | 715,063 | $ | 10,907 | $ | 173,670 | $ | 5,482,575 | |||||||||||||||||||||

| vi DANAHER 2017 PROXY STATEMENT | ||

PROPOSAL 1 — ELECTION OF DIRECTORS OF DANAHER

The Board has fixed the number of directors at twelve and our entire Board is elected annually. We are seeking your support for the election of the twelve candidates that the Board has nominated to serve on the Board of Directors (each of whom currently serves as a director of the Company), to serve until the 2018 Annual Meeting of shareholders and until his or her successor is duly elected and qualified. We believe these nominees have qualifications consistent with our position as a large, global and diversified science and technology company. We also believe these nominees have the experience and perspective to guide Danaher as we expand our business in high-growth geographies and high-growth market segments,

identify, consummate and integrate appropriate acquisitions, develop innovative and differentiated new products and services, adjust to rapidly changing technologies, business cycles and competition and address the demands of an increasingly regulated environment.

Proxies cannot be voted for a greater number of persons than the twelve nominees named in this Proxy Statement. In the event a nominee declines or is unable to serve, the proxies may be voted in the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why this will occur.

2017 Director Nominees

DONALD J. EHRLICH

| LINDA HEFNER FILLER

| |||||||

AGE 79 DIRECTOR SINCE: 1985

| AGE 56 DIRECTOR SINCE: 2005

| |||||||

Mr. Ehrlich served as President and Chief Executive Officer of Schwab Corp., a manufacturer of fire-protective safes, files, cabinets and vault doors, from January 2003 until his retirement in July 2008, and has also served on the boards of private and non-profit organizations.

Mr. Ehrlich also founded and served as the chairman and chief executive officer of an NYSE-listed publicly-traded manufacturing company, and has founded and served as CEO of two privately held manufacturing companies. As an entrepreneur and business leader who began his career on the factory floor, has been awarded over fifteen patents and worked his way to leadership of an NYSE-listed publicly-traded company, Mr. Ehrlich has a broad understanding of the strategic challenges and opportunities facing a publicly-traded company such as Danaher. He also has a broad, functional skill-set in the areas of engineering, finance, capital allocation and executive compensation. | Ms. Hefner Filler has served as President of Retail Products and Chief Merchandising Officer of Walgreen Co., a national drugstore chain, since January 2015. From March 2013 until June 2014, Ms. Hefner Filler served as President, North America of Claire’s Stores, Inc., a specialty retailer; from May 2007 to June 2012, as Executive Vice President of Wal-Mart Stores Inc., an operator of retail stores and warehouse clubs, and from April 2009 to June 2012 also as Chief Merchandising Officer for Sam’s Club, a division of Wal-Mart; and from May 2004 through December 2006, as Executive Vice President—Global Strategy for Kraft Foods Inc., a food and beverage company.

Ms. Hefner Filler has served in senior management roles with leading retail and consumer goods companies, with general management responsibilities and responsibilities in the areas of marketing, branding and merchandising. Understanding and responding to the needs of our customers is fundamental to Danaher’s business strategy, and Ms. Hefner Filler’s keen marketing and branding insights have been a valuable resource to Danaher’s Board. Her prior leadership experiences with large public companies have given her valuable perspective for matters of global portfolio strategy and capital allocation as well as global business practices.

| |||||||

| DANAHER 2017 PROXY STATEMENT 1 | ||

Proposal 1 — Election of Directors of Danaher

|

ROBERT J. HUGIN

| THOMAS P. JOYCE, JR.

| |||||||

| AGE 62 DIRECTOR SINCE: 2016 | AGE 56 DIRECTOR SINCE: 2014

| |||||||

Mr. Hugin has served as Executive Chairman of the board of directors of Celgene Corp., a global biopharmaceutical company, since March 2016. Since joining Celgene in 1999, he has served in a series of progressively more responsible leadership positions including serving as Chairman of the Board from 2011 to March 2016 and as Chief Executive Officer from June 2010 until March 2016. Prior to joining Celgene, Mr. Hugin served as a Managing Director at J.P. Morgan & Co. Inc., which he joined in 1985. From 1976 to 1983, Mr. Hugin served as a United States Marine Corps infantry officer. Mr. Hugin is also a director of The Medicines Company. Mr. Hugin was originally proposed to the Nominating and Governance Committee for election as a director by a third party recruiting firm.

Mr. Hugin’s extensive biopharmaceutical leadership experience gives him unique insights into the strategic opportunities and challenges facing companies that serve the medical and life sciences industries, which are key areas of focus for Danaher. Mr. Hugin has also served as Chairman of the board of directors of the Pharmaceutical Research and Manufacturers of America (PhRMA) and is a member of the board of trustees of Princeton University, through which he has gained valuable knowledge of regulatory, legal and legislative issues affecting the industries we serve.

| Mr. Joyce has served as Danaher’s President and Chief Executive Officer since September 2014. Mr. Joyce joined Danaher in 1989 and served in leadership positions in a variety of different functions and businesses before his promotion to President and Chief Executive Officer. His broad operating and functional experience and in-depth knowledge of Danaher’s businesses and of the Danaher Business System are particularly valuable to the Board given the complex, diverse nature of Danaher’s portfolio. | |||||||

TERI LIST-STOLL

| WALTER G. LOHR, JR.

| |||||||

AGE 54 DIRECTOR SINCE: 2011

| AGE 73 DIRECTOR SINCE: 1983 | |||||||

Ms. List-Stoll has served as Executive Vice President and Chief Financial Officer of Gap Inc., a global clothing retailer, since January 2017. Prior to joining Gap, she served as Executive Vice President and Chief Financial Officer of Dick’s Sporting Goods, Inc., a sporting goods retailer, from August 2015 to August 2016, and with Kraft Foods Group, Inc., a food and beverage company, as Advisor from March 2015 to May 2015, as Executive Vice President and Chief Financial Officer from December 2013 to February 2015 and as Senior Vice President of Finance from September 2013 to December 2013. From 1994 to September 2013, Ms. List-Stoll served in a series of progressively more responsible positions in the accounting and finance organization of The Procter & Gamble Company, a consumer goods company, most recently as Senior Vice President and Treasurer. Prior to joining Procter & Gamble, Ms. List-Stoll was employed by the accounting firm of Deloitte & Touche for almost ten years. Ms. List-Stoll is a member of the board of directors of Microsoft Corporation.

Ms. List-Stoll’s experience dealing with complex finance and accounting matters for Gap, Dick’s, Kraft and Procter & Gamble have given her an appreciation for and understanding of the similarly complex finance and accounting matters that Danaher faces. In addition, through her leadership roles with large, global companies she has insight into the business practices that are critical to the success of a large, growing public company such as Danaher.

| Mr. Lohr was a partner of Hogan Lovells, a global law firm, for over five years until retiring in June 2012 and has also served on the boards of private and non-profit organizations.

Prior to his tenure at Hogan Lovells, Mr. Lohr served as assistant attorney general for the State of Maryland. He has extensive experience advising companies in a broad range of transactional matters, including mergers and acquisitions, contests for corporate control and securities offerings. His extensive knowledge of the legal strategies, issues and dynamics that pertain to mergers and acquisitions and capital raising has been a critical resource for Danaher given the importance of its acquisition program. | |||||||

| 2 DANAHER 2017 PROXY STATEMENT | ||

Proposal 1 — Election of Directors of Danaher

|

MITCHELL P. RALES

| STEVEN M. RALES

| |||||||

AGE 60 DIRECTOR SINCE: 1983

| AGE 65 DIRECTOR SINCE: 1983 | |||||||

Mr. Rales is a co-founder of Danaher and has served as Chairman of the Executive Committee of Danaher since 1984. He was also President of the Company from 1984 to 1990. Mr. Rales is also a member of the board of directors of each of Colfax Corporation and Fortive Corporation, and is a brother of Steven M. Rales.

The strategic vision and leadership of Mr. Rales and his brother, Steven Rales, helped create the Danaher Business System and have guided Danaher down a path of consistent, profitable growth that continues today. In addition, as a result of his substantial ownership stake in Danaher, he is well-positioned to understand, articulate and advocate for the rights and interests of the Company’s shareholders.

| Mr. Rales is a co-founder of Danaher and has served as Danaher’s Chairman of the Board since 1984. He was also CEO of the Company from 1984 to 1990. Mr. Rales is also a member of the board of directors of Fortive Corporation, and is a brother of Mitchell P. Rales.

The strategic vision and leadership of Mr. Rales and his brother, Mitchell Rales, helped create the Danaher Business System and have guided Danaher down a path of consistent, profitable growth that continues today. In addition, as a result of his substantial ownership stake in Danaher, he is well-positioned to understand, articulate and advocate for the rights and interests of the Company’s shareholders.

| |||||||

JOHN T. SCHWIETERS

| ALAN G. SPOON

| |||||||

AGE 77 DIRECTOR SINCE: 2003

| AGE 66 DIRECTOR SINCE: 1999 | |||||||

Mr. Schwieters has served as Principal of Perseus Realty, LLC, a real estate investment and development firm, since July 2013. He also served as a Senior Executive of Perseus, LLC, a merchant bank and private equity fund management company, from May 2012 to June 2016 and as Senior Advisor from March 2009 to May 2012. Within the past five years Mr. Schwieters has served as a director of Smithfield Foods, Inc. and Choice Hotels International, Inc.

In addition to his roles with Perseus, Mr. Schwieters led the Mid-Atlantic region of one of the world’s largest accounting firms after previously leading that firm’s tax practice in the Mid-Atlantic region, and has served on the boards and chaired the audit committees of several NYSE-listed public companies. He brings to Danaher extensive knowledge and experience in the areas of public accounting, tax accounting and finance, which are areas of critical importance to Danaher as a large, global and complex public company.

| Mr. Spoon has served as Partner Emeritus of Polaris Partners, a company that invests in private technology and life science firms, since January 2015. Mr. Spoon has been a partner at Polaris since May 2000, and served as Managing General Partner from 2000 to 2010. Mr. Spoon is also a member of the board of directors of each of Fortive Corporation, IAC/InterActiveCorp., Match Group, Inc. and Cable One, Inc.

In addition to his leadership role at Polaris Partners, Mr. Spoon previously served as president, chief operating officer and chief financial officer of one of the country’s largest, publicly-traded education and media companies, and has served on the boards of numerous public and private companies. His public company leadership experience gives him insight into business strategy, leadership and executive compensation and his public company and private equity experience give him insight into technology and life science trends, acquisition strategy and financing, each of which represents an area of key strategic opportunity for the Company.

| |||||||

| DANAHER 2017 PROXY STATEMENT 3 | ||

Proposal 1 — Election of Directors of Danaher

|

RAYMOND C. STEVENS, PH.D.

| ELIAS A. ZERHOUNI, M.D.

| |||||||

AGE 53 DIRECTOR SINCE: 2017

| AGE 65 DIRECTOR SINCE: 2009 | |||||||

Professor Stevens has served as Provost Professor of Biological Sciences and Chemistry, and Director of The Bridge Institute, at the University of Southern California, a private research university, since July 2014. From 1999 until July 2014, he served as Professor of Molecular Biology and Chemistry with The Scripps Research Institute, a non-profit research organization. Professor Stevens is also Founding Director of the iHuman Institute at ShanghaiTech University, and has launched multiple biotechnology companies focused on drug discovery. Professor Stevens was originally proposed to the Nominating and Governance Committee for election as a director by one of the Company’s management directors.

Professor Stevens is considered among the world’s most influential biomedical scientists in molecular research. A pioneer in human cellular behavior research, he has been involved in the creation of therapeutic molecules that led to breakthrough drugs aimed at curing influenza, childhood diseases, neuromuscular disorders and diabetes. Professor Stevens’ insights in the area of molecular research, as well as his experience bringing industry and academia together to advance drug development, are highly beneficial to Danaher given our strategic focus on the development of research tools used to understand the causes of disease, identify new therapies and test new drugs and vaccines.

| Dr. Zerhouni has served as President, Global Research & Development, for Sanofi S.A., a global pharmaceutical company, since January 2011. From 2008 until 2011, he provided advisory and consulting services to various non-profit and other organizations as Chairman and President of Zerhouni Holdings. From 2002 to 2008, Dr. Zerhouni served as director of the National Institutes of Health, and from 1996 to 2002, he served as Chair of the Russell H. Morgan Department of Radiology and Radiological Sciences, Vice Dean for Research and Executive Vice Dean of the Johns Hopkins School of Medicine.

Dr. Zerhouni, a physician, scientist and world-renowned leader in radiology research, is widely viewed as one of the leading authorities in the United States on emerging trends and issues in medicine and medical care. These insights, as well as his deep, technical knowledge of the research and clinical applications of medical technologies, are of considerable importance given Danaher’s strategic focus in the medical technologies markets. Dr. Zerhouni’s government experience also gives him a strong understanding of how government agencies work, and his experience growing up in North Africa, together with the global nature of the issues he faced at NIH and his role at France-based Sanofi, give him a global perspective that is valuable to Danaher.

| |||||||

The Board of Directors recommends a vote FOR each of the foregoing nominees.

| 4 DANAHER 2017 PROXY STATEMENT | ||

Proposal 1 — Election of Directors of Danaher

|

Board Selection and Refreshment

Director Selection.The Board and its Nominating and Governance Committee believe that it is important that our directors demonstrate:

| • | personal and professional integrity and character; |

| • | prominence and reputation in his or her profession; |

| • | skills, knowledge and expertise (including business or other relevant experience) that in aggregate are useful and appropriate in overseeing and providing strategic direction with respect to Danaher’s business and serving the long-term interests of Danaher’s shareholders; |

| • | the capacity and desire to represent the interests of the shareholders as a whole; and |

| • | availability to devote sufficient time to the affairs of Danaher. |

The Nominating and Governance Committee is responsible for recommending to the Board a slate of nominees for election at each annual meeting of shareholders. Nominees may be suggested by directors, members of management, shareholders or, in some cases, by a third-party search firm. The Committee considers a wide range of factors when assessing potential director nominees. This includes consideration of the current composition of the Board, any perceived need for one or more particular areas of expertise, the balance of management and independent directors, the need for committee-specific expertise, the evaluations of other prospective nominees and the qualifications of each potential nominee relative to the attributes, skills and experience described above. The Board does not have a formal or informal policy with respect to diversity but believes that the Board, taken as a whole, should embody a diverse set of skills, knowledge, experiences and backgrounds appropriate in light of the Company’s needs, and in this regard also subjectively takes into consideration the diversity (with respect to race, gender and national origin) of the Board when considering director nominees. The Board does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors.

A shareholder who wishes to recommend a prospective nominee for the Board should notify the Nominating and Governance Committee in writing using the procedures described below under “Other Information – Communications with the Board of Directors” with whatever supporting material the shareholder considers appropriate. If a prospective nominee has been identified other than in connection with a director search process initiated by the Committee, the Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. The Committee’s determination of whether to conduct a full evaluation is based primarily on the Committee’s view as to whether a new or additional Board member is necessary or appropriate at such time, the likelihood that the prospective nominee can satisfy the evaluation factors described above and any other factors as the Committee may deem appropriate. The Committee takes into account whatever information is provided to the Committee with the recommendation of the prospective candidate and any additional inquiries the Committee may in its discretion conduct or have conducted with respect to such prospective nominee.

The graph below illustrates the diverse set of skills, knowledge, experiences and backgrounds represented on our Board:

SCIENCE, TECHNOLOGY & HEALTHCARE | 5 | |||||||||||||||||||||||||||||||

GOVERNMENT | 1 | |||||||||||||||||||||||||||||||

PUBLIC COMPANY CEO AND/OR PRESIDENT | 6 | |||||||||||||||||||||||||||||||

FINANCE AND ACCOUNTING | 4 | |||||||||||||||||||||||||||||||

MANUFACTURING | 4 | |||||||||||||||||||||||||||||||

INTERNATIONAL | 2 | |||||||||||||||||||||||||||||||

M&A / STRATEGIC DEVELOPMENT | 6 | |||||||||||||||||||||||||||||||

BRANDING AND MARKETING | 1 | |||||||||||||||||||||||||||||||

LEGAL | 1 | |||||||||||||||||||||||||||||||

Board Refreshment

As part of its process for identifying and evaluating directors and director nominees and ensuring an appropriate range of backgrounds and expertise, our Board actively considers Board refreshment. Supported by the Nominating and Governance Committee, the Board

| DANAHER 2017 PROXY STATEMENT 5 | ||

Proposal 1 — Election of Directors of Danaher

|

seeks to thoughtfully balance the knowledge and experience that comes from longer-term Board service with the fresh ideas, energy and new domain expertise that can come from adding new directors. As evidence of this focus on refreshment, 25% of our directors have less than three years’ tenure, including two directors with less than one year of tenure.

Proxy Access

Our Bylaws permit a shareholder, or a group of up to twenty shareholders, owning three percent or more of the Company’s outstanding shares of Common Stock continuously for at least three years to nominate and include in the Company’s annual meeting proxy materials a number of director nominees up to the greater of (1) two, or (2) twenty percent of the Board, provided that the shareholder(s) and nominee(s) satisfy the requirements specified in the Bylaws.

Majority Voting Standard

Our Bylaws provide for majority voting in uncontested director elections, and our Board has adopted a director resignation policy. Under the policy, our Board will not appoint or nominate for election to the Board any person who has not tendered in advance an irrevocable resignation effective in such circumstances where the individual does not receive a majority of the votes cast in an uncontested election and such resignation is accepted by the Board. If an incumbent director is not elected by a majority of the votes cast in an uncontested election, our Nominating and Governance Committee will submit for prompt consideration by the Board a recommendation whether to accept or reject the director’s resignation. The Board expects the director whose resignation is under consideration to abstain from participating in any decision regarding that resignation.

At any meeting of shareholders for which the Secretary of the Company receives a notice that a shareholder has nominated a person for election to the Board of Directors in compliance with the Company’s Bylaws and such nomination has not been withdrawn on or before the tenth day before the Company first mails its notice of meeting to the Company’s shareholders, the directors will be elected by a plurality of the votes cast (which means that the nominees who receive the most affirmative votes would be elected to serve as directors).

| 6 DANAHER 2017 PROXY STATEMENT | ||

Corporate Governance Overview

Our Board of Directors recognizes that Danaher’s success over the long-term requires a robust framework of corporate governance that serves the best interests of all our shareholders. Below are highlights of our corporate governance framework, and additional details follow in the sections below.

☑ Board refreshment remains a key area of focus for us, as evidenced by the fact that 25% of our directors have less than three years’ tenure, including two directors with less than one year of tenure.

☑ Our Amended and Restated By-Laws (“Bylaws”) provide for proxy access by shareholders.

☑ Our Chairman and CEO positions are separate.

☑ Our Board has established a Lead Independent Director position.

☑ All of our directors are elected annually.

☑ In uncontested elections, our directors must be elected by a majority of the votes cast, and an incumbent director who fails to receive such a majority automatically tenders his or her resignation |

☑ Our shareholders have the right to act by written consent.

☑ Shareholders owning 25% or more of our outstanding shares may call a special meeting of shareholders.

☑ We have never had a shareholder rights plan.

☑ We have no supermajority voting requirements in our Certificate of Incorporation or Bylaws.

☑ All members of our Audit, Compensation and Nominating and Governance Committees are independent as defined by the New York Stock Exchange listing standards and applicable SEC rules.

☑ Danaher (including its subsidiaries during the period we have owned them) has made no political contributions since at least 2012 and has no intention of contributing any Danaher funds or assets for political purposes, and we disclose our political expenditures policy on our public website.

|

Board Leadership Structure and Risk Oversight

Board Leadership Structure

The Board has separated the positions of Chairman and CEO because it believes that, at this time, this structure best enables the Board to ensure that Danaher’s business and affairs are managed effectively and in the best interests of shareholders. This is particularly the case in light of the fact that the Company’s Chairman is Steven Rales, a co-founder of the Company who owns approximately 6.2 percent of the Company’s outstanding shares, served as CEO of the company from 1984 to 1990 and continues to serve as an executive officer of the company. As a result of his substantial ownership stake in the Company, the Board believes that Mr. Rales is uniquely able to understand, articulate and advocate for the rights and interests of the Company’s shareholders. Moreover, Mr. Rales uses his management experience with the Company and Board tenure to help ensure that the non-management directors have a keen understanding of the Company’s business as well as the strategic and other risks and opportunities that the Company faces. This enables the Board to more effectively provide insight and direction to, and exercise oversight of, the Company’s President and CEO and the rest of the management team responsible for the Company’s day-to-day business (including with respect to oversight of risk management).

Because Mr. Rales is not independent within the meaning of the NYSE listing standards, our Corporate Governance Guidelines require the appointment of a “Lead Independent Director” and Mr. Ehrlich has been appointed as our Lead Independent Director. As the Lead Independent Director, Mr. Ehrlich:

| • | presides at all meetings of the Board at which the Chairman of the Board and the Chair of the Executive Committee are not present, including the executive sessions of non-management directors; |

| • | has the authority to call meetings of the independent directors; |

| • | acts as a liaison as necessary between the independent directors and the management directors; and |

| • | advises with respect to the Board’s agenda. |

| DANAHER 2017 PROXY STATEMENT 7 | ||

Corporate Governance

|

Risk Oversight

The Board’s role in risk oversight at the Company is consistent with the Company’s leadership structure, with management having day-to-day responsibility for assessing and managing the Company’s risk exposure and the Board and its committees overseeing those efforts, with particular emphasis on the most significant risks facing the Company. Each committee reports to the full Board on a regular basis, including as appropriate with respect to the committee’s risk oversight activities. On an annual basis, the Company’s Risk Committee (consisting of members of senior management) inventories, assesses and prioritizes the most significant risks facing the Company as well as related mitigation efforts and provides a report to the Board. With respect to the manner in which the Board’s risk oversight function impacts the Board’s leadership structure, as described above our Board believes that Mr. Rales’ management experience and tenure help the Board to more effectively exercise its risk oversight function.

| BOARD/COMMITTEE | PRIMARY AREAS OF RISK OVERSIGHT | |

| Full Board | Risks associated with Danaher’s strategic plan, acquisition and capital allocation program, capital structure, liquidity, organizational structure and other significant risks, and overall risk assessment and risk management policies.

| |

| Audit Committee | Major financial risk exposures, significant legal, compliance, reputational and cyber security risks and overall risk assessment and risk management policies.

| |

Compensation Committee

| Risks associated with compensation policies and practices, including incentive compensation. | |

Nominating and Governance Committee

| Risks related to corporate governance, effectiveness of Board and committee oversight and review of director candidates, conflicts of interest and director independence. | |

Succession Planning

With the support of our Nominating and Governance Committee, our Board maintains and annually reviews both a long-term succession plan and emergency succession plan for the CEO position. The Board holds a formal talent review and succession planning session annually, which includes a review of potential successors for the CEO position and other executive positions, as well as current development needs for potential successors.

Board of Directors and Committees of the Board

General

The Board met seven times during 2016. All directors attended at least 75% of the aggregate of the total number of meetings of the Board and of all committees of the Board on which they served (during the period they so served) during 2016. Danaher typically schedules a Board meeting in conjunction with each annual meeting of shareholders and as a general matter expects that the members of the Board will attend the annual meeting. All of the ten directors serving at the time attended the Company’s annual meeting in May 2016.

The membership of each of the Board’s committees as of March 13, 2017 is set forth to the right. While each of the Committees is authorized to delegate its powers to sub-committees, none of the Committee did do so during 2016. The Audit, Compensation and Nominating and Governance Committees report to the Board on their actions and recommendations at each regularly scheduled Board meeting.

| NAME OF DIRECTOR | AUDIT | COMPENSATION | NOMINATING AND GOVERNANCE | EXECUTIVE | FINANCE | |||||||||||||||

Donald J. Ehrlich | X | Chair | ||||||||||||||||||

Linda Hefner Filler | Chair | |||||||||||||||||||

Robert J. Hugin | X | |||||||||||||||||||

Thomas P. Joyce, Jr. | X | X | ||||||||||||||||||

Walter G. Lohr, Jr. | X | X | X | |||||||||||||||||

Teri List-Stoll | X | |||||||||||||||||||

Mitchell P. Rales | Chair | Chair | ||||||||||||||||||

Steven M. Rales | X | X | ||||||||||||||||||

John T. Schwieters | Chair | X | ||||||||||||||||||

Raymond C. Stevens, Ph.D. | ||||||||||||||||||||

Alan G. Spoon | X | |||||||||||||||||||

Elias A. Zerhouni, M.D. | X | |||||||||||||||||||

Audit Committee

The Audit Committee met ten times during 2016. The Audit Committee prepares a report as required by the SEC to be included in this Proxy Statement and assists the Board in overseeing:

| • | the quality and integrity of Danaher’s financial statements; |

| • | the effectiveness of Danaher’s internal control over financial reporting; |

| 8 DANAHER 2017 PROXY STATEMENT | ||

Corporate Governance

|

| • | the qualifications, independence and performance of Danaher’s independent auditors; |

| • | the performance of Danaher’s internal audit function; |

| • | Danaher’s compliance with legal and regulatory requirements; |

| • | the risks described above under “-Risk Oversight”; and |

| • | the Company’s swaps and derivatives transactions and related policies and procedures. |

The Board has determined that each of the members of the Audit Committee is independent for purposes of Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (“Securities Exchange Act”) and the NYSE listing standards, qualifies as an audit committee financial expert as that term is defined in Item 407(d)(5) of Regulation S-K under the Securities Exchange Act and is financially literate within the meaning of the NYSE listing standards. The Committee typically meets in executive session, without the presence of management, at its regularly scheduled meetings.

Compensation Committee

The Compensation Committee met nine times during 2016. The Compensation Committee discharges the Board’s responsibilities relating to compensation of our executive officers, including evaluating the performance of, and approving the compensation paid to, our executive officers. The Committee also:

| • | reviews and discusses with Company management the Compensation Discussion and Analysis and recommends to the Board the inclusion of the Compensation Discussion and Analysis in the annual meeting proxy statement; |

| • | reviews and makes recommendations to the Board with respect to the adoption, amendment and termination of all executive incentive compensation plans and all equity compensation plans, and exercises all authority of the Board (and all responsibilities assigned by such plans to the Committee) with respect to the administration of such plans; |

| • | monitors compliance by directors and executive officers with the Company’s stock ownership requirements; |

| • | assists the Board in overseeing the risks described above under “-Risk Oversight”; |

| • | prepares a report as required by the SEC to be included in the annual meeting proxy statement; and |

| • | considers factors relating to independence and conflicts of interests in connection with the compensation consultants that provide advice to the Committee. |

Each member of the Compensation Committee is an “outside director” for purposes of Section 162(m), a “non-employee director” for purposes of Rule 16b-3 under the Securities Exchange Act and, based on the determination of the Board, independent under the NYSE listing standards and under Rule 10C-1 under the Securities Exchange Act.

Management Role in Supporting the Compensation Committee

Our Senior Vice President-Human Resources, Vice President-Compensation and Secretary generally attend, and from time-to-time our CEO attends, the Compensation Committee meetings. In particular, our CEO:

| • | provides background regarding the interrelationship between our business objectives and executive compensation matters and advises on the alignment of incentive plan performance measures with our overall strategy; |

| • | participates in the Committee’s discussions regarding the performance and compensation of the other executive officers and provides recommendations to the Committee regarding all significant elements of compensation paid to such officers, their annual, personal performance objectives and his evaluation of their performance (the Committee gives considerable weight to our CEO’s evaluation of and recommendations with respect to the other executive officers because of his direct knowledge of each such officer’s performance and contributions); and |

| • | provides feedback regarding the companies that he believes Danaher competes with in the marketplace and for executive talent. |

Our human resources and legal departments also assist the Committee Chair in scheduling and setting the agendas for the Committee’s meetings, prepare meeting materials and provide the Committee with data relating to executive compensation as requested by the Committee. The Committee typically meets in executive session, without the presence of management, at its regularly scheduled meetings.

Independent Compensation Consultant Role in Supporting the Compensation Committee

Under the terms of its charter, the Committee has the authority to engage the services of outside advisors and experts to assist the Committee. The Committee has engaged Frederic W. Cook & Co., Inc. (“FW Cook”) as the Committee’s independent compensation

| DANAHER 2017 PROXY STATEMENT 9 | ||

Corporate Governance

|

consultant since 2008. The Committee engages FW Cook because it is considered one of the premier independent compensation consulting firms in the country and has never provided any services to the Company other than the compensation-related services provided to or at the direction of the Compensation Committee and the Nominating and Governance Committee. FW Cook takes its direction solely from the Committee (and with respect to matters relating to the non-management director compensation program, the Nominating and Governance Committee). FW Cook’s primary responsibilities in 2016 were to:

| • | provide advice and data in connection with the structuring of the executive compensation and equity compensation programs of both Danaher and Fortive and the compensation levels for the Company’s and Fortive’s executive officers and directors compared to their respective peers; |

| • | assess the Company’s executive compensation program in the context of compensation governance best practices; |

| • | update the Committee regarding legislative and regulatory initiatives and other trends in the area of executive compensation; |

| • | provide data regarding the share dilution and compensation costs attributable to the Company’s equity compensation program; and |

| • | advise regarding the Company’s executive compensation public disclosures. |

The Committee does not place any material limitations on the scope of the feedback provided by FW Cook. In the course of discharging its responsibilities, FW Cook may from time to time and with the Committee’s consent, request from management information regarding compensation amounts and practices, the interrelationship between our business objectives and executive compensation matters, the nature of the Company’s executive officer responsibilities and other business information. The Committee has considered whether the compensation consultant work performed for or at the direction of the Compensation Committee and the Nominating and Governance Committee raises any conflict of interest, taking into account the factors listed in Securities Exchange Act Rule 10C-1(b)(4), and has concluded that such work does not create any conflict of interest.

Nominating and Governance Committee

The Nominating and Governance Committee met five times in 2016. The Nominating and Governance Committee:

| • | assists the Board in identifying individuals qualified to become Board members; |

| • | proposes to the Board a slate of directors for election by Danaher’s shareholders at each annual meeting; |

| • | makes recommendations to the Board regarding the membership of the Board’s committees; |

| • | makes recommendations to the Board regarding matters of corporate governance; |

| • | oversees the operation of Danaher’s Corporate Governance Guidelines and facilitates the annual review of the performance of the Board and its committees; |

| • | assists the Board in CEO succession planning; |

| • | assists the Board in overseeing the risks described above under “-Risk Oversight” |

| • | reviews and makes recommendations to the Board regarding non-management director compensation; and |

| • | administers Danaher’s Related Person Transactions Policy. |

The Board has determined that all of the members of the Nominating and Governance Committee are independent within the meaning of the NYSE listing standards.

Finance Committee

The Finance Committee did not meet in 2016. The Finance Committee approves business acquisitions, investments and divestitures up to the levels of authority delegated to it by the Board.

Executive Committee

The Executive Committee met five times in 2016. The Executive Committee exercises between meetings of the Board such powers and authority in the management of the business and affairs of the Company as are specifically delegated to it by the Board from time to time.

Corporate Governance Guidelines, Committee Charters and Standards of Conduct

As part of its ongoing commitment to good corporate governance, our Board of Directors has codified its corporate governance practices into a set of Corporate Governance Guidelines and has also adopted written charters for each of the committees of the Board. Danaher has also adopted a code of business conduct and ethics for directors, officers (including our principal executive officer,

| 10 DANAHER 2017 PROXY STATEMENT | ||

Corporate Governance

|

principal financial officer and principal accounting officer) and employees, known as the Standards of Conduct. The Corporate Governance Guidelines, charters of each of the Audit, Compensation and Nominating and Governance Committees and Standards of Conduct are available in the “Investors – Corporate Governance” section of our website at http://www.danaher.com.

Corporate Social Responsibility

Corporate social responsibility is deeply ingrained in our culture and work, and has been for decades. We are a science and technology innovator committed to solving customers’ most complex challenges, and improving quality of life around the world. We are also placing a greater emphasis on complementing our external performance with internal initiatives that help ensure supportive, diverse and inclusive work environments worldwide—places where our associates can be themselves, engage deeply with their work and seize opportunities to realize their own potential through professional development. More information about Danaher’s corporate social responsibility efforts is included in our 2016/2017 Corporate Social Responsibility Report available in the “Investors – Corporate Governance” section of our website at http://www.danaher.com.

| DANAHER 2017 PROXY STATEMENT 11 | ||

Director Compensation Program

Director Compensation Philosophy

We use a combination of cash and equity-based compensation to attract and retain qualified candidates to serve on the Board. In setting director compensation, the Board and the Nominating and Governance Committee are guided by the following principles:

| • | compensation should fairly pay directors for work required in a company of our size and scope, and differentiate among directors where appropriate to reflect different levels of work and responsibilities; |

| • | a significant portion of the total compensation should be paid in stock-based awards to align directors’ interests with the long-term interests of our shareholders; and |

| • | the structure of the compensation program should be simple and transparent. |

Process for Setting Director Compensation

The Nominating and Governance Committee is responsible for reviewing and making recommendations to the Board regarding non-management director compensation (although the Board makes the final determination regarding the amounts and type of non-management director compensation). Since 2011, the Committee has engaged FW Cook, the Board’s independent compensation consultant, to prepare regular reports on market non-management director compensation practices and evaluate our program in light of the results of such reports. The Committee anticipates reviewing, and seeking advice from FW Cook regarding, the Company’s non-management director compensation at least every other year or more often as needed.

In addition, included in the proposed 2007 Stock Incentive Plan amendments set forth in Proposal 3 is a limit on the cash and equity compensation that may be paid to a non-management director each year. Under the proposed terms, an annual limit of $800,000 per calendar year applies to the sum of all cash and equity-based awards (calculated based on the grant date fair value of such awards for financial reporting purposes) granted to each non-management director for services as a member of the Board (plus an additional limit of $500,000 per calendar year with respect to any non-executive Board chair or vice chair). Please see “Proposal 3—Approval of Amendments to the Danaher Corporation 2007 Stock Incentive Plan and Material Terms of the Plan’s Performance Goals” for more information regarding this and other terms of the proposed amendments.

Director Compensation Structure

Effective as of January 1, 2017, each non-management director receives:

| • | An annual cash retainer of $115,000, paid in four, equal installments following each quarter of service. |

| • | If a director attends more than twenty (20) Board and Board committee meetings in aggregate during a calendar year, a cash meeting fee of $2,000 for each Board and committee meeting attended during such year in excess of such threshold, paid in aggregate following completion of such year. |

| • | An annual equity award with a target award value of $165,000, divided equally between options and RSUs. The options are fully vested as of the grant date. The RSUs vest upon the earlier of (1) the first anniversary of the grant date, or (2) the date of, and immediately prior to, the next annual meeting of Danaher’s shareholders following the grant date, but the underlying shares are not issued until the earlier of the director’s death or the first day of the seventh month following the director’s retirement from the Board. |

| • | Reimbursement for Danaher-related out-of-pocket expenses, including travel expenses. |

In addition, the lead independent director receives an annual cash retainer of $30,000, the chair of the Audit Committee receives an annual cash retainer of $25,000, the chair of the Compensation Committee receives an annual cash retainer of $20,000 and the chair of the Nominating and Governance Committee receives an annual cash retainer of $15,000, in each case paid in four, equal installments following each quarter of service.

Directors’ Deferred Compensation Plan

Each non-management director can elect to defer all or part of the cash director fees that he or she receives with respect to a particular year under the Non-Employee Directors’ Deferred Compensation Plan, which is a sub-plan under the 2007 Stock Incentive Plan. Amounts deferred under the plan are converted into a particular number of phantom shares of Danaher Common Stock, calculated based on the closing price of Danaher’s Common Stock on the date that such quarterly fees would otherwise have been paid. A director may elect to have his or her plan balance distributed upon cessation of Board service, or one, two, three, four or five years after cessation of Board service. All distributions from the plan are in the form of shares of Danaher Common Stock.

| 12 DANAHER 2017 PROXY STATEMENT | ||

Director Compensation

|

Director Stock Ownership Requirements

Our Board has adopted stock ownership requirements for non-management directors. Under the requirements, each non-management director (within five years of his or her initial election or appointment) is required to beneficially own Danaher shares with a market value of at least five times his or her annual cash retainer (excluding the additional cash retainers paid to the committee chairs and the Lead Independent Director). Once a director has acquired a number of shares that satisfies such ownership multiple, such number of shares then becomes such director’s minimum ownership requirement (even if his or her retainer increases or the fair market value of such shares subsequently declines). Under the policy, beneficial ownership includes RSUs held by the director, shares in which the director or his or her spouse or child has a direct or indirect interest and phantom shares of Danaher Common Stock in the Non-Employee Directors’ Deferred Compensation Plan, but does not include shares subject to unexercised stock options or pledged shares. Each Danaher director is in compliance with the policy.

Anti-Pledging/Hedging Policy

In 2013 Danaher’s Board adopted a policy that prohibits any director or executive officer from pledging as security under any obligation any shares of Danaher Common Stock that he or she directly or indirectly owns and controls. The Board exempted from the policy shares of Danaher Common Stock that were already pledged as of the time the policy was adopted, but pledged shares of Danaher Common Stock do not count toward stock ownership requirements and the pledging of any additional shares is prohibited. Certain shares of Common Stock owned by Messrs. Steven and Mitchell Rales were exempted from the policy because such shares have been pledged for decades, to secure lines of credit that reduce the need to sell shares for liquidity purposes. Messrs. Steven and Mitchell Rales acquired these shares in cash purchase transactions between 1983 and 1988, and did not receive them as compensation or purchase them from Danaher. Notwithstanding that these shares are exempted from Danaher’s policy, as part of its risk oversight function the Audit Committee of Danaher’s Board regularly reviews these share pledges to assess whether such pledging poses an undue risk to the Company. The Committee has concluded that the existing pledge arrangements do not pose an undue risk to the Company, based in particular on its consideration of the following factors:

| • | the degree of overcollateralization (i.e., the amount by which the market value of the shares pledged as collateral exceeds the amount of secured indebtedness), which the Committee believes is a key factor in assessing the degree of risk posed by the pledging arrangements; |

| • | the number of shares and percentage of total outstanding shares pledged; and |

| • | the 15% reduction since 2013 in the number of shares pledged by Messrs. Steven Rales and Mitchell Rales. |

Danaher policy also prohibits Danaher directors and employees (including executive officers) from engaging in any transactions involving a derivative of a Danaher security, including hedging transactions.

Director Summary Compensation Table

The table below summarizes the compensation paid by Danaher to the non-management directors for the year ended December 31, 2016. Each of Steven Rales, Mitchell Rales and Thomas P. Joyce, Jr. serves as a director and executive officer of Danaher but does not receive any additional compensation for services provided as a director. Neither Steven Rales nor Mitchell Rales is a named executive officer. Details regarding the 2016 executive compensation provided to each of Steven Rales and Mitchell Rales is set forth under “Director Independence and Related Person Transactions.”

| NAME | FEES EARNED OR PAID IN CASH ($) | STOCK AWARDS ($)(1) | OPTION AWARDS ($)(1) | TOTAL ($) | ||||||||||||

Donald J. Ehrlich(2) | $ | 163,000 | $ | 76,970 | $ | 67,068 | $ | 307,038 | ||||||||

Linda Hefner Filler(2)(3) | 0 | $ | 201,970 | $ | 67,068 | $ | 269,038 | |||||||||

Robert J. Hugin(2)(4) | $ | 51,978 | $ | 76,970 | $ | 67,068 | $ | 196,016 | ||||||||

Teri List-Stoll(2)(3) | 0 | $ | 186,970 | $ | 67,068 | $ | 254,038 | |||||||||

Walter G. Lohr, Jr.(2) | $ | 110,000 | $ | 76,970 | $ | 67,068 | $ | 254,038 | ||||||||

John T. Schwieters(2) | $ | 139,000 | $ | 76,970 | $ | 67,068 | $ | 283,038 | ||||||||

Alan G. Spoon(2)(3) | 0 | $ | 186,970 | $ | 67,068 | $ | 254,038 | |||||||||

Raymond C. Stevens, Ph.D.(5) | 0 | 0 | 0 | 0 | ||||||||||||

Elias A. Zerhouni, M.D. (2)(3) | 0 | $ | 186,970 | $ | 67,068 | $ | 254,038 | |||||||||

| (1) | The amounts reflected in these columns represent the aggregate grant date fair value of the applicable award computed in accordance with FASB ASC Topic 718. With respect to stock awards, the grant date fair value under FASB ASC Topic 718 is calculated based on the number of shares of |

| DANAHER 2017 PROXY STATEMENT 13 | ||

Director Compensation

|

| Common Stock underlying the award, times the closing price of the Danaher Common Stock on the date of grant. With respect to stock options, the grant date fair value under FASB ASC Topic 718 has been calculated using the Black-Scholes option pricing model, based on the following assumptions (and assuming no forfeitures): an 8.0 year option life, a risk-free interest rate of 1.48%; a stock price volatility rate of 24.84%; and a dividend yield of 0.67% per share. |

| (2) | The table below sets forth as to each non-management director the aggregate number of unvested RSUs and aggregate number of stock options outstanding as of December 31, 2016 (other than for Professor Stevens, who was not appointed to Danaher’s Board until February 2017). All of the stock options set forth in the table below are fully vested. The RSUs set forth in the table below vest in accordance with the terms described above. As discussed in further detail in “Compensation Discussion and Analysis—Treatment of Equity-Based Compensation Upon Fortive Separation,” the share amounts set forth below reflect adjustments as applicable pursuant to the anti-dilution provisions of the 2007 Plan to account for the Fortive Separation and preserve the intrinsic value of each award. |

| NAME OF DIRECTOR | AGGREGATE NUMBER OF DANAHER STOCK OPTIONS OWNED AS OF DECEMBER 31, 2016 | AGGREGATE NUMBER OF UNVESTED DANAHER RSUS OWNED AS OF DECEMBER 31, 2016 | ||||||

Donald J. Ehrlich | 64,478 | 970 | ||||||

Linda Hefner Filler | 64,478 | 970 | ||||||

Robert J. Hugin | 2,930 | 970 | ||||||

Teri List-Stoll | 17,380 | 970 | ||||||

Walter G. Lohr, Jr. | 64,478 | 970 | ||||||

John T. Schwieters | 64,478 | 970 | ||||||

Alan G. Spoon | 53,900 | 970 | ||||||

Elias A. Zerhouni, M.D. | 32,744 | 970 | ||||||

| (3) | Each of Mss. Hefner Filler and List-Stoll, Mr. Spoon and Dr. Zerhouni deferred 100% of his or her 2016 cash director fees into phantom shares of Danaher Common Stock under the Non-Employee Directors’ Deferred Compensation Plan and pursuant to such deferrals received a total of 1,492 shares, 1,313 shares, 1,313 shares and 1,313 shares, respectively. Since these phantom shares are accounted for under FASB ASC Topic 718, they are reported under the “Stock Awards” column in the table above. |

| (4) | Mr. Hugin was appointed to the Board in July 2016. |

| (5) | Professor Stevens was appointed to the Board in February 2017. |

| 14 DANAHER 2017 PROXY STATEMENT | ||

DIRECTOR INDEPENDENCE AND RELATED PERSON TRANSACTIONS

Director Independence

At least a majority of the Board must qualify as independent within the meaning of the listing standards of the NYSE. The Board has affirmatively determined that Mss. Hefner Filler and List-Stoll, Messrs. Ehrlich, Hugin, Lohr, Schwieters and Spoon, Professor Stevens and Dr. Zerhouni are independent within the meaning of the listing standards of the NYSE. The Board concluded that none of the independent directors possesses any of the bright-line relationships set forth in the listing standards of the NYSE that prevent independence, or except as discussed below, any other relationship with Danaher other than Board membership.

In making its determination with respect to the independence of the directors identified above as independent, the Board considered that in 2016, the Company and its subsidiaries sold products and/or services to and purchased products and/or services from organizations with whom Danaher directors are employed. In each case, the amount of sales and the amount purchases in 2016 were less than 0.4% of the annual revenues of such other organization and of Danaher’s 2016 revenues and the transactions were conducted in the ordinary course of business, on commercial terms and on an arms’-length basis.

Danaher’s non-management directors (all of whom are, as noted above, independent within the meaning of the listing standards of the NYSE) meet in executive session following the Board’s regularly-scheduled meetings. The sessions are chaired by the Lead Independent Director.

Certain Relationships and Related Transactions

Policy

Under Danaher’s written Related Person Transactions Policy, the Nominating and Governance Committee of the Board is required to review and if appropriate approve all related person transactions, prior to consummation whenever practicable. If advance approval of a related person transaction is not practicable under the circumstances or if Danaher management becomes aware of a related person transaction that has not been previously approved or ratified, the transaction is submitted to the Committee at the Committee’s next meeting. The Committee is required to review and consider all relevant information available to it about each related person transaction, and a transaction is considered approved or ratified under the policy if the Committee authorizes it according to the terms of the policy after full disclosure of the related person’s interests in the transaction. Related person transactions of an ongoing nature are reviewed annually by the Committee. The definition of “related person transactions” for purposes of the policy covers the transactions that are required to be disclosed under Item 404(a) of Regulation S-K under the Securities Exchange Act.

Relationships and Transactions

Based on a Schedule 13G/A filed by FMR LLC with the SEC on February 11, 2016, as of December 31, 2015, FMR LLC and certain of its affiliates beneficially owned more than 5% of Danaher’s Common Stock. Certain affiliates of FMR LLC provide services to us in connection with the administration of our stock plans (including the Non-Employee Directors’ Deferred Compensation Plan), the Danaher Corporation & Subsidiaries Savings Plan (the “401(k) Plan”), the Danaher Corporation & Subsidiaries Retirement and Savings Plan (collectively with the 401(k) Plan, the “Savings Plans”) and EDIP. We paid these entities an aggregate of approximately $285,000 for these services for 2016. In addition, Fidelity Management Trust Company serves as trustee and custodian of the Danaher stock and certain other accounts included in our Savings Plans and receives fees from plan participants for these services, and FMR LLC and its affiliates also receive investment management fees from each Fidelity mutual fund offered under the Savings Plans based on a percentage of the plan assets invested in such mutual fund. Based on a Schedule 13G/A filed by FMR LLC with the SEC on February 14, 2017, as of December 31, 2016, FMR LLC and its affiliates no longer beneficially own more than 5% of Danaher’s Common Stock.

For their service as executive officers, each of Steven Rales and Mitchell Rales received a salary of $419,000 and 401(k) Plan contributions of $18,830 during 2016 and is entitled to participate in all of the benefits made generally available to salaried employees as well as all perquisites made generally available to Danaher’s executive officers. The Rales’ do not receive cash incentive compensation or equity awards. In 2016, Danaher provided tax and accounting services to the Rales’ at a cost of approximately $240,000 in the form of one full-time employee (plus health and welfare benefits for the employee), allowed the Rales’ to make personal use of designated Danaher office space at a cost of approximately $440,000 and provided Mr. Steven Rales with a personal car and parking at a cost of $3,708. The incremental cost to the Company of the perquisites set forth above is based on the Company’s out-of-pocket costs with respect to such fees. Separately, in 2016, Steven Rales and Mitchell Rales paid Danaher approximately $70,000 for providing benefits for, and as reimbursement for paying a portion of the salaries of, two persons who provide services to the Rales’.

Steven Rales and Mitchell Rales collectively own more than 10% of the equity of Colfax Corporation, a publicly traded manufacturing and engineering company that provides gas- and fluid-handling and fabrication technology products and services. Certain of our subsidiaries sell products and services to, and/or purchase products and services from, Colfax from time to time in the ordinary course of business and on an arms’-length basis. In 2016, our subsidiaries sold approximately $610,000 of products to, and purchased approximately $25,000 of products

| DANAHER 2017 PROXY STATEMENT 15 | ||

Director Independence and Related Person Transactions

|