Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 | |

DANAHER CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

Table of Contents

DANAHER CORPORATION

2200 Pennsylvania Avenue, N.W., Suite 800W

Washington, D.C. 20037-1701

| Notice of 2016 Annual Meeting of Shareholders | ||

| When: | May 10, 2016 at 3:00 p.m., local time. | |

| Where: | Park Hyatt Washington, 1201 24th Street, NW, Washington, D.C. | |

| Items of Business: | 1. To elect the ten directors named in the attached proxy statement to hold office until the 2017 annual meeting of shareholders and until their successors are elected and qualified.

2. To ratify the selection of Ernst & Young LLP as Danaher’s independent registered public accounting firm for the year ending December 31, 2016.

3. To approve on an advisory basis the Company’s named executive officer compensation.

4. To act upon a shareholder proposal requesting that Danaher issue a report disclosing its political expenditure policies and direct and indirect political expenditures.

5. To act upon a shareholder proposal requesting that Danaher amend its governing documents to reduce the percentage of shares required for shareholders to call a special meeting of shareholders from 25% to 15%.

6. To consider and act upon such other business as may properly come before the meeting or any adjournment thereof. | |

| Who Can Vote: | Shareholders of Danaher common stock at the close of business on March 14, 2016. | |

| Attending the Meeting: | Shareholders who wish to attend the meeting in person should review the instructions set forth in the attached proxy statement under “Annual Meeting Admission.” | |

| Date of Mailing: | The date of mailing of this Proxy Statement is on or about April 1, 2016. | |

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. Most shareholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card. Please refer to the attached proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 10, 2016. This Proxy Statement and the accompanying annual report are available at:http://www.danaher.com/proxy.

By Order of the Board of Directors,

JAMES F. O’REILLY

Secretary

April 1, 2016

Table of Contents

2016 ANNUAL MEETING OF SHAREHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

i

Table of Contents

To assist you in reviewing the proposals to be acted upon at our 2016 Annual Meeting, below is summary information regarding the meeting, Danaher Corporation’s business performance, corporate governance and executive compensation and each proposal to be voted upon at the meeting. The following description is only a summary. For more information about these topics, please review the Annual Report on Form 10-K of Danaher Corporation (“Danaher”) and the complete Proxy Statement.

2016 ANNUAL MEETING OF SHAREHOLDERS

Date and time: May 10, 2016, 3:00 p.m. local time

Place: Park Hyatt Washington, 1201 24th Street, NW, Washington, D.C.

Record date: March 14, 2016

BUSINESS HIGHLIGHTS

2015 Performance

2015 was a transformative year for Danaher, as we consummated our $13.6 billion acquisition of Pall Corporation, a leading global provider of filtration, separation and purification solutions, and announced plans to separate into two, publicly traded companies in 2016. Pall is a highly complementary addition to Danaher’s Life Sciences platform, significantly expands Danaher’s recurring revenue base and provides a strong foundation for Danaher to grow in the filtration segment both organically and through acquisition. In the third quarter of 2016, Danaher intends to separate into a science and technology growth company that will retain the Danaher name (“New Danaher”) and a diversified industrial growth company named Fortive Corporation that will consist of the businesses that currently constitute Danaher’s Test & Measurement segment, Industrial Technologies segment (other than its Product Identification platform) and Retail/Commercial Petroleum platform. Danaher’s Board determined that our shareholders would be best served by Danaher’s separation into two, more focused companies, which will provide each company access to the capital necessary to pursue organic and inorganic growth opportunities and also allow investors to more effectively value each respective business. The separation is expected to occur through a tax-free, pro rata spin-off of Fortive to Danaher shareholders (the “Separation”), with Thomas P. Joyce, Jr. continuing to serve as President and CEO of New Danaher and James A. Lico serving as President and CEO of Fortive.

In 2015, while preparing for the Separation and against the backdrop of slowing growth in industrial segments and certain high-growth markets, Danaher continued to deliver strong operational and financial performance and used its healthy financial position to continue investing robustly in growth opportunities. During 2015, Danaher:

| • | deployed over $14.3 billion across twelve strategic acquisitions, including the transformational, $13.6 billion acquisition of Pall Corporation; |

| • | split-off Danaher’s $760 million communications business in an exchange offer in which shareholders tendered approximately $2.3 billion of Danaher shares to Danaher in consideration for the communications business, which was then immediately merged with NetScout Systems, Inc.; |

| • | achieved a 2015 operating profit margin of 16.9%, even while integrating Pall and investing in the upcoming Separation; and |

| • | increased Danaher’s regular quarterly dividend amount by 35% and returned over $375 million to shareholders through cash dividends. |

1

Table of Contents

Danaher’s 2015 and prior year growth investments yielded tangible year-over-year improvements in 2015:

Danaher 2014-2015 Year-Over-Year Growth from Continuing Operations

Our commitment to continue investing in future growth and our generation of the cash flow to fund such investments has positioned us to grow our business on a profitable and sustainable basis.

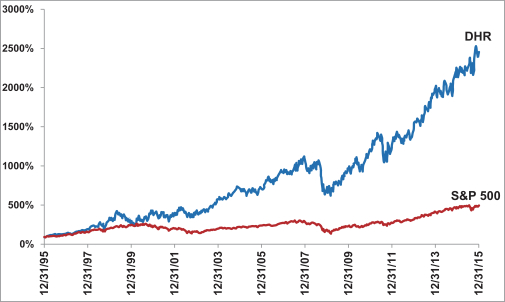

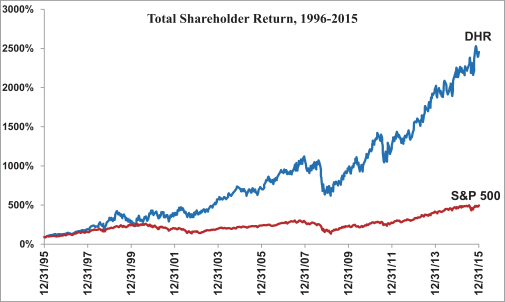

Long-Term Performance

Over the last twenty years, Danaher’s compounded, |  | |

| has not experienced a sustained period of underperformance over the last twenty years, and we believe the consistency of our performance over the last twenty years is unmatched within our peer group: | ||

| • | Danaher is the only company in its peer group whose total shareholder return (“TSR”) outperformed the S&P 500 Index over every rolling 3-year period from 1996-2015. |

| • | Danaher is the only company in its peer group whose TSR outperformed the S&P 500 Index by more than 750 basis points over every rolling 3-year period from 2006-2015. |

| • | Danaher is one of only two companies in its peer group whose TSR outperformed the S&P 500 Index in 15 of the 20 years in the period 1996-2015. |

| • | Danaher’s compounded, average annual shareholder return has outperformed the compounded, average annual shareholder return of the S&P 500 Index over each of the last one, two-, three-, five-, ten-, fifteen- and twenty-year periods: |

Danaher Compounded, Average Annual Shareholder Returns, 1996-2015

2

Table of Contents

| • | The graph below compares Danaher’s TSR to the TSR of the S&P 500 Index over the last twenty years: |

Total Shareholder Return, 1996-2015

CORPORATE GOVERNANCE HIGHLIGHTS

Our Board of Directors recognizes that Danaher’s success over the long-term requires a robust framework of corporate governance that serves the best interests of all our shareholders. Below are highlights of our corporate governance framework.

| • | Our Chairman and CEO positions are separate. |

| • | Our Board has established a robust Lead Independent Director position, elected by the independent directors. |

| • | All of our directors are elected annually. |

| • | In uncontested elections, our directors must be elected by a majority of the votes cast, and an incumbent director who fails to receive such a majority automatically tenders his or her resignation per the terms of the conditional, irrevocable tender of resignation each director signs before joining the Board. |

| • | All members of our Audit, Compensation and Nominating and Governance Committees are independent as defined by the New York Stock Exchange listing standards and applicable SEC rules. |

| • | Our shareholders have the right to act by written consent. |

| • | Shareholders owning 25% or more of our outstanding shares may call a special meeting of shareholders. |

| • | We have never had a shareholder rights plan. |

| • | We have no supermajority voting requirements in our Certificate of Incorporation or Bylaws. |

| • | Danaher and its subsidiaries have made no political expenditures since at least 2012 and have no intention of contributing any Danaher funds or assets for political purposes, and we disclose our political expenditures policy on our public website. |

3

Table of Contents

Below is an overview of each of the director nominees you are being asked to elect at the 2016 Annual Meeting.

| NAME | DIRECTOR SINCE | PRIMARY OCCUPATION | COMMITTEE MEMBERSHIPS | |||||

Donald J. Ehrlich* | 1985 | Former President and CEO, Schwab Corp. | A, C (Chair); Lead | |||||

Linda Hefner Filler* | 2005 | President of Retail Products and Chief Merchandising Officer, Walgreen Co. | N (Chair) | |||||

Thomas P. Joyce, Jr. | 2014 | President and Chief Executive Officer, Danaher Corporation | F | |||||

Teri List-Stoll* | 2011 | Executive Vice President, Chief Financial Officer, Dick’s Sporting Goods, Inc. | A | |||||

Walter G. Lohr, Jr.* | 1983 | Retired partner, Hogan Lovells | C, F, N | |||||

Mitchell P. Rales | 1983 | Chairman of the Executive Committee, Danaher Corporation | F (Chair) | |||||

Steven M. Rales | 1983 | Chairman of the Board, Danaher Corporation | F | |||||

John T. Schwieters* | 2003 | Senior Executive, Perseus LLC, and Principal, Perseus Realty, LLC | A (Chair), N | |||||

Alan G. Spoon* | 1999 | Partner Emeritus, Polaris Partners | C | |||||

Elias A. Zerhouni, M.D.* | 2009 | President, Global Research & Development, Sanofi-Aventis | N | |||||

* Independent director A Audit Committee C Compensation Committee | F Finance Committee N Nominating and Governance Committee | |||

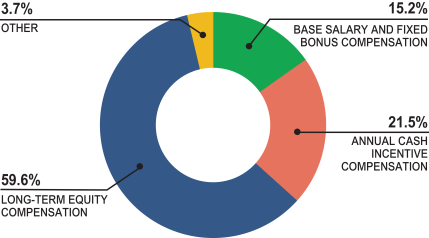

EXECUTIVE COMPENSATION HIGHLIGHTS

Overview of Executive Compensation Program

As discussed in detail under the heading “Executive Compensation – Compensation Discussion and Analysis,” our executive compensation program is designed to attract and retain executives with the leadership skills, attributes and experience necessary to succeed in an enterprise with Danaher’s size, diversity and global footprint; motivate executives to demonstrate exceptional personal performance and perform consistently over the long-term at or above the levels that we expect; and link compensation to the achievement of corporate goals that we believe best correlate with the creation of long-term shareholder value. We believe our executive compensation program has been highly effective in achieving these objectives, both in 2015 and historically, as evidenced by the business highlights noted above.

Our executive compensation program operates within a strong framework of compensation governance. Our Compensation Committee regularly reviews external executive compensation practices and trends and in recent periods has revised Danaher’s executive compensation policies and practices in the following ways to more closely align with recognized best practices and more strongly support our financial and strategic objectives:

| • | In 2015, the Committee introduced into the Company’s executive equity compensation program performance stock units (“PSUs”) that vest based on the Company’s TSR ranking relative to the S&P |

4

Table of Contents

500 Index over a three-year performance period. The PSUs are strongly aligned with long-term shareholder value: |

| ¡ | PSU payout at the target level requires a Company relative TSR ranking of 55%; |

| ¡ | PSUs that vest are subject to an additional two-year holding period following the three-year performance period; and |

| ¡ | PSU payout is capped at 100% of target if the Company’s TSR for the performance period is negative, regardless of how strong the Company’s performance is on a relative basis. |

| • | Since 2014, the Company’s executive annual cash incentive compensation program incorporates target metrics related to earnings, cash flow and (except for 2016 due to the Separation) capital efficiency, key financial indicators that hold our executive officers closely accountable for Company financial performance. |

These more recent changes complement the following compensation governance practices that have been a hallmark of Danaher’s program.

| • | The Compensation Committee has eliminated tax reimbursement and gross-up provisions in our executive compensation program (except under any policy applicable to management employees generally such as a relocation policy) and limited the amount of our CEO’s and CFO’s personal aircraft usage perquisite. |

| • | The Compensation Committee has implemented a rigorous compensation recoupment policy that is triggered even in the absence of wrongdoing. |

| • | Our stock options and RSUs have typically vested over five years (and our newly-introduced PSUs are similarly subject to three-year vesting and a further two-year holding period), which periods are longer than typical for our peer group. |

| • | None of our executive officers has a right to compensation triggered solely by a change of control. |

| • | Our executive officers have no pension program (apart from a small cash balance plan that operated in lieu of a 401(k) plan from 1997- 2003). |

| • | We require executive officers to maintain robust stock ownership levels and prohibit hedging against the economic risk of such ownership. |

| • | None of our named executive officer long-term incentive compensation is denominated or paid in cash. |

| • | The Compensation Committee’s compensation consultant has never provided services to the Company other than the compensation-related services provided to the Compensation Committee and the Nominating and Governance Committee. |

5

Table of Contents

2015 Compensation Summary

Named Executive Officers 2015 Compensation

The following table sets forth the 2015 compensation of our President and Chief Executive Officer, Executive Vice President and Chief Financial Officer, our three other most highly compensated executive officers who were serving as executive officers as of December 31, 2015 and one highly compensated former executive officer who was no longer serving as an executive officer as of December 31, 2015. Please see pages 42-44 for information regarding 2014 and 2013 compensation, as well as footnotes.

NAME AND PRINCIPAL POSITION | SALARY | BONUS | STOCK AWARDS | OPTION AWARDS | NON-EQUITY PLAN | CHANGE IN PENSION | ALL OTHER COMPENSATION | TOTAL | ||||||||

| Thomas P. Joyce, Jr., President and CEO | $1,000,000 | 0 | $3,473,408 | $3,048,142 | $2,600,000 | $4,392 | $469,606 | $10,595,548 | ||||||||

Daniel L. Comas, Executive Vice President and CFO | $821,400 | 0 | $1,786,736 | $1,567,665 | $1,402,541 | $2,773 | $265,398 | $5,846,513 | ||||||||

William K. Daniel II, Executive Vice President | $682,500 | 0 | $1,538,272 | $1,350,063 | $1,076,644 | 0 | $106,580 | $4,754,059 | ||||||||

James A. Lico, Executive Vice President | $701,200 | 0 | $1,588,304 | $1,393,534 | $1,123,673 | $2,937 | $167,668 | $4,977,316 | ||||||||

Angela S. Lalor, Senior Vice President – Human Resources | $575,300 | $300,000 | $794,576 | $560,024 | $823,945 | 0 | $99,240 | $3,153,085 | ||||||||

Mark A. Beck, Former Executive Vice President | $617,188 | $250,000 | $1,240,624 | $1,088,745 | 0 | 0 | $91,500 | $3,288,057 |

6

Table of Contents

VOTING MATTERS

| PROPOSAL | DESCRIPTION | BOARD RECOMMENDATION | ||

Item 1: Election of Directors (page 14) | We are asking our shareholders to elect each of the ten directors identified above to serve until the 2017 Annual Meeting of shareholders. | FOR each nominee | ||

Item 2: Ratification of the Appointment of the Independent Registered Public Accounting Firm (page 69) | We are asking our shareholders to ratify our Audit Committee’s selection of Ernst & Young LLP (“E&Y”) to act as the independent registered public accounting firm for Danaher for 2016. Although our shareholders are not required to approve the selection of E&Y, our Board believes that it is advisable to give our shareholders an opportunity to ratify this selection. | FOR | ||

Item 3: Advisory Vote to Approve Named Executive Officer Compensation (page 71) | We are asking our shareholders to cast a non-binding, advisory vote on our executive compensation program. In evaluating this year’s “say on pay” proposal, we recommend that you review our CD&A, which explains how and why the Compensation Committee of our Board arrived at its executive compensation actions and decisions for 2015. | FOR | ||

Item 4: Shareholder Proposal (page 73) | You are being asked to consider a shareholder proposal requesting that Danaher issue a report disclosing its political expenditure policies and direct and indirect political expenditures. | AGAINST | ||

Item 5: Shareholder Proposal (page 74) | You are being asked to consider a shareholder proposal requesting that Danaher’s Board of Directors amend its governing documents to reduce the percentage of shares required for shareholders to call a special meeting of shareholders from 25% to 15%. | AGAINST |

7

Table of Contents

DANAHER CORPORATION

2200 Pennsylvania Avenue, N.W., Suite 800W

Washington, D.C. 20037-1701

2016 ANNUAL MEETING OF SHAREHOLDERS

MAY 10, 2016

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (“Board”) of Danaher Corporation, a Delaware corporation (“Danaher”), of proxies for use at the 2016 Annual Meeting of Shareholders (“Annual Meeting”) to be held at the Park Hyatt Washington, 1201 24th Street, NW, Washington, D.C., on May 10, 2016 at 3:00 p.m., local time, and at any and all postponements or adjournments thereof. Danaher’s principal address is 2200 Pennsylvania Avenue, N.W., Suite 800W, Washington, D.C. 20037-1701. The date of mailing of this Proxy Statement is on or about April 1, 2016.

The purpose of the meeting is to: elect the ten directors named in this proxy statement to hold office until the 2017 Annual Meeting of Shareholders and until their successors are elected and qualified; ratify the selection of Ernst & Young LLP as Danaher’s independent registered public accounting firm for the year ending December 31, 2016; approve on an advisory basis the Company’s named executive officer compensation; act upon a shareholder proposal requesting that Danaher issue a report disclosing its political expenditure policies and direct and indirect political expenditures, if properly presented at the meeting; act upon a shareholder proposal requesting that Danaher amend its governing documents to reduce the percentage of shares required for shareholders to call a special meeting of shareholders from 25% to 15%, if properly presented at the meeting; and consider and act upon such other business as may properly come before the meeting or any adjournment thereof.

Please be prepared to present photo identification for admittance. If you are a shareholder of record or hold your shares through the Danaher Corporation & Subsidiaries Savings Plan (the “401(k) Plan”) or the Danaher Corporation & Subsidiaries Retirement and Savings Plan (collectively with the 401(k) Plan, the “Savings Plans”), your name will be verified against the list of shareholders of record or plan participants on the record date prior to your being admitted to the Annual Meeting. If you are not a shareholder of record or a Savings Plan participant but hold shares through a broker, bank or nominee (i.e., in street name), you should also be prepared to provide proof of beneficial ownership as of the record date, such as a recent brokerage account statement showing your ownership, a copy of the voting instruction card provided by your broker, bank or nominee, or other similar evidence of ownership.

Outstanding Stock and Voting Rights

In accordance with Danaher’s Amended and Restated Bylaws, the Board has fixed the close of business on March 14, 2016 as the record date for determining the shareholders entitled to notice of, and to vote at, the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to vote. The only outstanding securities of Danaher entitled to vote at the Annual Meeting are shares of Common Stock, $.01 par value. Each outstanding share of Danaher Common Stock entitles the holder to one vote on each directorship and other matter brought before the Annual Meeting. As of the close of business on March 14, 2016, 688,089,244 shares of Danaher Common Stock were outstanding, excluding shares held by or for the account of Danaher.

8

Table of Contents

The proxies being solicited hereby are being solicited by Danaher’s Board. The total expense of the solicitation will be borne by Danaher, including reimbursement paid to banks, brokerage firms and other nominees for their reasonable expenses in forwarding material regarding the Annual Meeting to beneficial owners. Solicitation of proxies may be made personally or by mail, telephone, internet, e-mail or facsimile by officers and other management employees of Danaher, who will receive no additional compensation for their services. We have retained Georgeson Shareholder Communications, Inc. to aid in the solicitation of proxies. For these services, we expect to pay Georgeson a fee of less than $15,000 and reimburse it for certain out-of-pocket disbursements and expenses.

Proxies will be voted as specified in the shareholder’s proxy. If you sign your proxy card with no further instructions, your shares will be voted (1) FOR each of the nominees named herein as directors, (2) FOR ratification of the selection of Ernst & Young LLP as Danaher’s independent registered public accounting firm for the year ending December 31, 2016, (3) FOR approval of the Company’s named executive officer compensation, (4) AGAINST the shareholder proposal requesting that Danaher issue a report disclosing its political expenditure policies and direct and indirect political expenditures, (5) AGAINST the shareholder proposal requesting that Danaher amend its governing documents to reduce the percentage of shares required for shareholders to call a special meeting of shareholders from 25% to 15%, and (6) in the discretion of the proxy holders on any other matter that properly comes before the meeting or any adjournment thereof. The Board has selected Steven Rales and Mitchell Rales to act as proxies with full power of substitution.

Voting Requirements With Respect to Each of the Proposals Described in this Proxy Statement

Quorum. The quorum necessary to conduct business at the Annual Meeting consists of a majority of the issued and outstanding shares of Danaher Common Stock entitled to vote at the Annual Meeting as of the record date. Abstentions and broker non-votes will be counted as present in determining whether the quorum requirement is satisfied.

Broker Non-Votes. Under New York Stock Exchange (“NYSE”) rules, if your broker holds your shares in its name and does not receive voting instructions from you, your broker has discretion to vote those shares on Proposal 2, which is considered a “routine” matter. However, on “non-routine” matters such as Proposals 1 and 3-5, your broker must receive voting instructions from you, as it does not have discretionary voting power for these particular items. Therefore, if you are a beneficial owner and do not provide your broker with voting instructions, your shares may constitute broker non-votes with respect to Proposals 1 and 3-5. Broker non-votes will not affect the required vote with respect to Proposals 1 and 3-5 (and will not affect the attainment of a quorum since the broker has discretion to vote on Proposal 2 and these votes will be counted toward establishing a quorum).

Approval Requirements. If a quorum is present, the vote required under the Company’s Amended and Restated Bylaws to approve each of the proposals is as follows. All votes will be counted by the inspector of election appointed for the meeting.

| • | With respect to Proposal 1, the election of directors, you may vote “for” or “against” any or all director nominees or you may abstain as to any or all director nominees. In uncontested elections of directors, such as this election, a nominee is elected by a majority of the votes cast by the shares present in person or represented by proxy and entitled to vote. A “majority of the votes cast” means that the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that nominee. A vote to abstain is not treated as a vote “for” or “against,” and thus will have no effect on the outcome of the vote. Under our director resignation policy, our Board will not appoint or nominate for election to the Board any person who has not tendered in advance an irrevocable resignation effective in such circumstances where the individual does not receive a majority of the votes cast in an uncontested election and such resignation is accepted by the Board. If an incumbent director is not elected by a |

9

Table of Contents

majority of the votes cast in an uncontested election, our Nominating and Governance Committee will submit for prompt consideration by the Board a recommendation whether to accept or reject the director’s resignation. The Board expects the director whose resignation is under consideration to abstain from participating in any decision regarding that resignation. |

| • | With respect to Proposals 2-5, the affirmative vote of a majority of the shares of Danaher Common Stock represented in person or by proxy and entitled to vote on the proposal is required for approval. For these proposals, abstentions are counted for purposes of determining the minimum number of affirmative votes required for approval and, accordingly, have the effect of a vote against the proposal. |

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered theregistered holder of those shares. As theregistered shareholder, you can ensure your shares are voted at the Annual Meeting by submitting your instructions by telephone, over the internet, by completing, signing, dating and returning the enclosed proxy card in the envelope provided, or by attending the Annual Meeting and voting your shares at the meeting. Telephone and internet voting for registered shareholders will be available 24 hours a day, up until 11:59 p.m., Central time on May 9, 2016. You may obtain directions to the Annual Meeting in order to vote in person by calling Danaher’s Investor Relations department at 202-828-0850.

Most Danaher shareholders hold their shares through a broker, bank or another nominee, rather than registered directly in their name. In that case, you are considered thebeneficial owner of shares held in street name, and the proxy materials are being forwarded to you by your broker, bank or other nominee, together with a voting instruction card. As thebeneficial owner, you are entitled to direct the voting of your shares by your intermediary. Brokers, banks and other nominees typically offer telephonic or electronic means by which thebeneficial owners of shares held by them can submit voting instructions, in addition to the traditional mailed voting instruction cards.

If you participate in the Danaher Stock Fund through either of the Savings Plans, your proxy will also serve as a voting instruction for Fidelity Management Trust Company (“Fidelity”), the trustee of the Savings Plans, with respect to shares of Common Stock attributable to your Savings Plan account as of the record date. Fidelity will vote your Savings Plan shares as of the record date in the manner directed by you. If Fidelity does not receive voting instructions from you by May 6, 2016, Fidelity will not vote your Savings Plan shares on any of the proposals brought at the Annual Meeting.

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of Danaher a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke your proxy or vote at the meeting, you must follow the instructions provided to you by the record holder and/or obtain from the record holder a proxy issued in your name. Attendance at the meeting will not, by itself, revoke a proxy.

We are permitted to send a single set of our proxy statement and annual report to shareholders who share the same last name and address. This procedure is called “householding” and is intended to reduce our printing and postage costs. We will promptly deliver a separate copy of our annual report and proxy statement to you if you contact us at Danaher Corporation, Attn: Investor Relations, 2200 Pennsylvania Avenue, N.W., Suite 800W, Washington, D.C. 20037-1701; telephone us at 202-828-0850; or email us atinvestor.relations@danaher.com. In addition, if you want to receive separate copies of the proxy statement or

10

Table of Contents

annual report in the future; if you and another shareholder sharing an address would like to request delivery of a single copy of the proxy statement or annual report at such address in the future; or if you would like to make a permanent election to receive either printed or electronic copies of the proxy materials and annual report in the future, you may contact us at the same address, telephone number or email address. If you hold your shares through a broker or other intermediary and would like additional copies of our proxy statement or annual report or would like to request householding, please contact your broker or other intermediary.

BENEFICIAL OWNERSHIP OF DANAHER COMMON STOCK BY

DIRECTORS, OFFICERS AND PRINCIPAL SHAREHOLDERS

The following table sets forth as of March 14, 2016 (unless otherwise indicated) the number of shares and percentage of Danaher Common Stock beneficially owned by (1) each person who owns of record or is known to Danaher to beneficially own more than five percent of Danaher’s Common Stock, (2) each of Danaher’s directors and nominees for director and each of the executive officers named in the Summary Compensation Table (the “named executive officers”), and (3) all executive officers and directors of Danaher as a group. Except as otherwise indicated and subject to community property laws where applicable, each person or entity included in the table below has sole voting and investment power with respect to the shares beneficially owned by that person or entity. Under applicable SEC rules, the definition of beneficial ownership for purposes of this table includes shares over which a person or entity has sole or shared voting or investment power, whether or not the person or entity has any economic interest in the shares, and also includes shares as to which the person has the right to acquire beneficial ownership within 60 days of March 14, 2016.

Name | Number of Shares Beneficially Owned (1) | Percent of Class (1) | ||

Donald J. Ehrlich | 162,950 (2) | * | ||

Linda Hefner Filler | 67,464 (3) | * | ||

Thomas P. Joyce, Jr. | 555,030 (4) | * | ||

Teri List-Stoll | 13,360 (5) | * | ||

Walter G. Lohr, Jr. | 657,452 (6) | * | ||

Mitchell P. Rales | 40,112,698 (7) | 5.8% | ||

Steven M. Rales | 43,143,925 (8) | 6.3% | ||

John T. Schwieters | 62,552 (9) | * | ||

Alan G. Spoon | 83,896 (10) | * | ||

Elias A. Zerhouni, M.D. | 30,050 (11) | * | ||

Daniel L. Comas | 575,407 (12) | * | ||

William K. Daniel II | 373,241 (13) | * | ||

Angela S. Lalor | 48,971 (14) | * | ||

James A. Lico | 510,617 (15) | * | ||

Mark A. Beck | 0 | - | ||

T. Rowe Price Associates, Inc. | 79,440,338 (16) | 11.5% | ||

FMR LLC | 39,633,681 (17) | 5.8% | ||

All current executive officers and | ||||

directors as a group | ||||

(18 persons) | 86,835,082 (18) | 12.6% |

| (1) | Balances credited to each executive officer’s account under the Amended and Restated Danaher Corporation Executive Deferred Incentive Program (the “EDIP”) which are vested or are scheduled to vest within 60 days of March 14, 2016, are included in the table. For purposes of the table, the number of shares of Danaher Common Stock attributable to a person’s EDIP account is equal to (1) the person’s outstanding EDIP balance as of March 14, 2016 (to the extent such balance is vested or will become vested within 60 days of March 14, 2016), divided by (2) the closing price of Danaher Common Stock |

11

Table of Contents

| as reported on the NYSE on March 14, 2016 ($91.48 per share). In addition, for purposes of the table, the number of shares attributable to each executive officer’s 401(k) Plan account is equal to (a) the officer’s balance, as of March 14, 2016, in the Danaher stock fund included in the executive officer’s 401(k) Plan account (the “401(k) Danaher Stock Fund”), divided by (b) the closing price of Danaher Common Stock as reported on the NYSE on March 14, 2016. The 401(k) Danaher Stock Fund consists of a unitized pool of Danaher Common Stock and cash. The table also includes shares that may be acquired upon exercise of options that are exercisable within 60 days of March 14, 2016 or upon vesting of RSUs that vest within 60 days of March 14, 2016. |

| (2) | Includes options to acquire 46,550 shares, 4,000 shares owned by Mr. Ehrlich’s spouse and 48,000 other shares owned indirectly. Mr. Ehrlich disclaims beneficial ownership of the shares held by his spouse. |

| (3) | Includes options to acquire 54,550 shares. |

| (4) | Includes options to acquire 438,900 shares, 2,243 shares attributable to Mr. Joyce’s 401(k) account and 99,153 shares attributable to Mr. Joyce’s EDIP account. |

| (5) | Includes options to acquire 10,930 shares. |

| (6) | Includes options to acquire 54,550 shares, 48,246 shares held by a charitable foundation of which Mr. Lohr is president, 106,656 shares held by Mr. Lohr as trustee of trusts for his children and 448,000 other shares held indirectly. Mr. Lohr disclaims beneficial ownership of the shares held by the charitable foundation and the shares held in trust for his children. |

| (7) | Includes 34,000,000 shares owned by limited liability companies of which Mr. Rales is the sole member, 136,409 shares attributable to Mr. Rales’ 401(k) Plan account and 2,468,580 other shares owned indirectly. The shares held by the limited liability companies are pledged to secure lines of credit with certain banks and each of these entities and Mr. Rales is in compliance with these lines of credit; the number of pledged shares has decreased by approximately 6% compared to the number of pledged shares disclosed in the Company’s 2015 proxy statement. The business address of Mitchell Rales, and of each of the limited liability companies, is 2200 Pennsylvania Avenue, N.W., Suite 800W, Washington, D.C. 20037-1701. |

| (8) | Includes 34,000,000 shares owned by limited liability companies of which Mr. Rales is the sole member, 12,185 shares attributable to Mr. Rales’ 401(k) Plan account and 117,000 shares owned by a charitable foundation of which Mr. Rales is a director. Mr. Rales disclaims beneficial ownership of those shares held by the charitable foundation. The shares held by the limited liability companies are pledged to secure lines of credit with certain banks and each of these entities and Mr. Rales is in compliance with these lines of credit; the number of pledged shares has decreased by approximately 6% compared to the number of pledged shares disclosed in the Company’s 2015 proxy statement. The business address of Steven Rales, and of each of the limited liability companies, is 2200 Pennsylvania Avenue, N.W., Suite 800W, Washington, D.C. 20037-1701. |

| (9) | Includes options to acquire 54,550 shares. |

| (10) | Includes options to acquire 38,550 shares. |

| (11) | Includes options to acquire 22,550 shares and 7,500 shares held indirectly. |

| (12) | Includes options to acquire 457,760 shares, 6,650 shares attributable to Mr. Comas’ 401(k) account, 30,339 shares attributable to Mr. Comas’ EDIP account, 4,528 shares held by Mr. Comas’ spouse and 38,804 shares held by a trust as to which Mr. Comas’ spouse is trustee. Mr. Comas disclaims beneficial ownership of the shares held by his spouse and by the trust. |

12

Table of Contents

| (13) | Includes options to acquire 297,555 shares and 20,157 shares attributable to Mr. Daniel’s EDIP account. |

| (14) | Includes options to acquire 20,482 shares and 13,917 shares attributable to Ms. Lalor’s EDIP account. |

| (15) | Includes options to acquire 424,260 shares, 10,078 shares attributable to Mr. Lico’s 401(k) account and 57,324 shares attributable to Mr. Lico’s EDIP account. |

| (16) | The amount shown and the following information is derived from a Schedule 13G filed February 11, 2016 by T. Rowe Price Associates, Inc. (“Price Associates”), which sets forth Price Associates’ beneficial ownership as of December 31, 2015. According to the Schedule 13G, Price Associates has sole voting power over 26,097,139 shares and sole dispositive power over 79,423,338 shares. These shares are owned by various individual and institutional investors for which Price Associates serves as an investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, as amended (“Securities Exchange Act”), Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. The address of Price Associates is 100 E. Pratt Street, Baltimore, Maryland 21202. |

| (17) | The amount shown and the following information is derived from a Schedule 13G filed February 12, 2016 by FMR LLC and Abigail P. Johnson, which sets forth their respective beneficial ownership as of December 31, 2015. According to the Schedule 13G, FMR LLC has sole voting power over 4,075,334 shares and FMR LLC and Abigail P. Johnson have sole dispositive power over 39,633,681 shares. The address of FMR LLC is 245 Summer Street, Boston, Massachusetts 02210. |

| (18) | Includes options to acquire 2,280,959 shares, 167,578 shares attributable to executive officers’ 401(k) accounts and 286,158 shares attributable to executive officers’ EDIP accounts. |

| * | Represents less than 1% of the outstanding Danaher Common Stock. |

13

Table of Contents

ELECTION OF DIRECTORS OF DANAHER

Danaher’s Amended and Restated Bylaws provide that the number of directors is determined by the Board, and the Board has fixed the number of directors at ten. Danaher’s Certificate of Incorporation provides for the annual election of directors. At the 2016 Annual Meeting, shareholders will be asked to elect each of the ten directors identified below (each of whom has been nominated by the Board and currently serves as a director of the Company) to serve until the 2017 Annual Meeting of shareholders and until his or her successor is duly elected and qualified. Proxies cannot be voted for a greater number of persons than the ten nominees named in this Proxy Statement.

We have set forth below information relating to each nominee for election as director, including: his or her principal occupation and any board memberships at other public companies during the past five years; the other experience, qualifications, attributes or skills that led the Board to conclude that he or she should continue to serve as a director of Danaher; the year in which he or she became a director; and age. Please see “Corporate Governance – Board of Directors and Committees of the Board – Nominating and Governance Committee” for a further discussion of the Board’s process for nominating Board candidates. In the event a nominee declines or is unable to serve, the proxies may be voted in the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why this will occur.

Donald J. Ehrlich Age 78 | Mr. Ehrlich has served on Danaher’s Board of Directors since 1985. He served as President and Chief Executive Officer of Schwab Corp., a manufacturer of fire-protective safes, files, cabinets and vault doors, from January 2003 until his retirement in July 2008, and has also served on the boards of private and non-profit organizations.

Mr. Ehrlich also founded and served as the chairman and chief executive officer of an NYSE-listed publicly-traded manufacturing company, and has also founded and served as CEO of two privately held manufacturing companies. As an entrepreneur and business leader who began his career on the factory floor, has been awarded over fifteen patents and worked his way to leadership of an NYSE-listed publicly-traded company, Mr. Ehrlich has a broad understanding of the strategic challenges and opportunities facing a publicly-traded company such as Danaher. He also has a broad, functional skill-set in the areas of engineering, finance, capital allocation and executive compensation.

| |

Linda Hefner Filler Age 56 | Ms. Hefner Filler has served on Danaher’s Board of Directors since 2005. She has served as President of Retail Products and Chief Merchandising Officer of Walgreen Co., a national drugstore chain, since January 2015. From March 2013 until June 2014, Ms. Hefner Filler served as President, North America of Claire’s Stores, Inc., a specialty retailer; from May 2007 to June 2012, as Executive Vice President of Wal-Mart Stores Inc., an operator of retail stores and warehouse clubs, and from April 2009 to June 2012 also as Chief Merchandising Officer for Sam’s Club, a division of Wal-Mart; and from May 2004 through December 2006, as Executive Vice President - Global Strategy for Kraft Foods Inc., a food and beverage company.

|

14

Table of Contents

Ms. Hefner Filler has served in senior management roles with leading retail and consumer goods companies, with general management responsibilities and responsibilities in the areas of marketing, branding and merchandising. Understanding and responding to the needs of our customers is fundamental to Danaher’s business strategy, and Ms. Hefner Filler’s keen marketing and branding insights have been a valuable resource to Danaher’s Board. Her prior leadership experiences with large public companies have given her valuable perspective for matters of global portfolio strategy and capital allocation as well as global business practices.

| ||

Thomas P. Joyce, Jr. Age 55 | Mr. Joyce has served on Danaher’s Board of Directors and as Danaher’s President and Chief Executive Officer since September 2014.

Mr. Joyce joined Danaher in 1989 and served in leadership positions in a variety of different functions and businesses before his promotion to President and Chief Executive Officer. His broad operating and functional experience and in-depth knowledge of Danaher’s businesses and of the Danaher Business System are particularly valuable to the Board given the complex, diverse nature of Danaher’s portfolio.

| |

Teri List-Stoll Age 53 | Ms. List-Stoll has served on Danaher’s Board of Directors since September 2011. She has served as Executive Vice President, Chief Financial Officer of Dick’s Sporting Goods, Inc., a sporting goods retailer, since August 2015. Prior to joining Dick’s, she served with Kraft Foods Group, Inc., a food and beverage company, as Advisor from March 2015 to May 2015, as Executive Vice President and Chief Financial Officer from December 2013 to February 2015 and as Senior Vice President of Finance from September 2013 to December 2013. From 1994 to September 2013, Ms. List-Stoll served in a series of progressively more responsible positions in the accounting and finance organization of The Procter & Gamble Company, a consumer goods company, most recently as Senior Vice President and Treasurer. Prior to joining Procter & Gamble, Ms. List-Stoll was employed by the accounting firm of Deloitte & Touche for almost ten years. Ms. List-Stoll is a member of the board of directors of Microsoft Corporation.

Ms. List-Stoll has overseen the finance and accounting function for a leading retail company and a leading consumer goods company. Her experience dealing with complex finance and accounting matters for Dick’s, Kraft and Procter & Gamble have given her an appreciation for and understanding of the similarly complex finance and accounting matters that Danaher faces. In addition, through her leadership roles with large, global companies she has insight into the business practices that are critical to the success of a large, growing public company such as Danaher.

| |

Walter G. Lohr, Jr. Age 72 | Mr. Lohr has served on Danaher’s Board of Directors since 1983. He was a partner of Hogan Lovells, a global law firm, for over five years until retiring in June 2012 and has also served on the boards of private and non-profit organizations.

|

15

Table of Contents

Prior to his tenure at Hogan Lovells, Mr. Lohr served as assistant attorney general for the State of Maryland. He has extensive experience advising companies in a broad range of transactional matters, including mergers and acquisitions, contests for corporate control and securities offerings. His extensive knowledge of the legal strategies, issues and dynamics that pertain to mergers and acquisitions and capital raising have been a critical resource for Danaher given the importance of its acquisition program.

| ||

Mitchell P. Rales Age 59 | Mr. Rales is a co-founder of Danaher and has served on Danaher’s Board of Directors since 1983, serving as Chairman of the Executive Committee of Danaher since 1984. He was also President of the Company from 1984 to 1990. In addition, for more than the past five years he has been a principal in private and public business entities in the manufacturing area. Mr. Rales is also a member of the board of directors of Colfax Corporation, and is a brother of Steven M. Rales.

The strategic vision and leadership of Mr. Rales and his brother, Steven Rales, helped create the Danaher Business System and have guided Danaher down a path of consistent, profitable growth that continues today. In addition, as a result of his substantial ownership stake in Danaher, he is well-positioned to understand, articulate and advocate for the rights and interests of the Company’s shareholders.

| |

Steven M. Rales Age 64 | Mr. Rales is a co-founder of Danaher and has served on Danaher’s Board of Directors since 1983, serving as Danaher’s Chairman of the Board since 1984. He was also CEO of the Company from 1984 to 1990. Mr. Rales is a brother of Mitchell P. Rales.

The strategic vision and leadership of Mr. Rales and his brother, Mitchell Rales, helped create the Danaher Business System and have guided Danaher down a path of consistent, profitable growth that continues today. In addition, as a result of his substantial ownership stake in Danaher, he is well-positioned to understand, articulate and advocate for the rights and interests of the Company’s shareholders.

| |

John T. Schwieters Age 76 | Mr. Schwieters has served on Danaher’s Board of Directors since 2003. He has been a Senior Executive of Perseus, LLC, a merchant bank and private equity fund management company, since May 2012 after serving as Senior Advisor from March 2009 to May 2012 and as Vice Chairman from April 2000 to March 2009, and has also served as Principal of Perseus Realty, LLC, a real estate investment and development firm, since July 2013. Within the past five years Mr. Schwieters has served as a director of Smithfield Foods, Inc. and Choice Hotels International, Inc. In addition to his roles with Perseus, Mr. Schwieters led the Mid-Atlantic region of one of the world’s largest accounting firms after previously leading that firm’s tax practice in the Mid-Atlantic region, and has served on the boards and chaired the audit committees of several NYSE-listed public companies. He brings to Danaher extensive knowledge and experience in the areas of public accounting, tax accounting and finance, which are areas of critical importance to Danaher as a large, global and complex public company.

|

16

Table of Contents

Alan G. Spoon Age 64 | Mr. Spoon has served on Danaher’s Board of Directors since 1999. He has served as Partner Emeritus of Polaris Partners, a company that invests in private technology and life science firms, since January 2015. Mr. Spoon has been a partner at Polaris since May 2000, and served as Managing General Partner from 2000 to 2010. Mr. Spoon is also a member of the board of directors of each of IAC/InterActiveCorp., Match Group, Inc. and Cable One, Inc.

In addition to his leadership role at Polaris Partners, Mr. Spoon previously served as president, chief operating officer and chief financial officer of one of the country’s largest, publicly-traded education and media companies, and has served on the boards of numerous public and private companies. His public company leadership experience gives him insight into business strategy, leadership and executive compensation and his public company and private equity experience give him insight into technology and life science trends, acquisition strategy and financing, each of which represents an area of key strategic opportunity for the Company.

| |

Elias A. Zerhouni, M.D. Age 64 | Dr. Zerhouni has served on Danaher’s Board of Directors since 2009. Dr. Zerhouni has served as President, Global Research & Development, for Sanofi-Aventis, a global pharmaceutical company, since January 2011. From 1996 to 2002, Dr. Zerhouni served as Chair of the Russell H. Morgan Department of Radiology and Radiological Sciences, Vice Dean for Research and Executive Vice Dean of the Johns Hopkins School of Medicine. From 2002 to November 2008, Dr. Zerhouni served as director of the National Institutes of Health (“NIH”), and from November 2008 to December 2010 he provided advisory and consulting services to various non-profit and other organizations as Chairman and President of Zerhouni Holdings.

Dr. Zerhouni, a physician, scientist and world-renowned leader in radiology research, is widely viewed as one of the leading authorities in the United States on emerging trends and issues in medicine and medical care. These insights, as well as his deep, technical knowledge of the research and clinical applications of medical technologies, are of considerable importance given Danaher’s strategic expansion in the medical technologies markets. Dr. Zerhouni’s government experience also gives him a strong understanding of how government agencies work, and his experience growing up in North Africa, together with the global nature of the issues he faced at NIH, give him a global perspective that is valuable to Danaher.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE

FOREGOING NOMINEES.

17

Table of Contents

Our Board of Directors recognizes that Danaher’s success over the long-term requires a robust framework of corporate governance that serves the best interests of all our shareholders. Below are highlights of our corporate governance framework, and additional details follow in the sections below.

| • | Our Chairman and CEO positions are separate. |

| • | Our Board has established a robust Lead Independent Director position, elected by the independent directors. |

| • | All of our directors are elected annually. |

| • | In uncontested elections, our directors must be elected by a majority of the votes cast, and an incumbent director who fails to receive such a majority automatically tenders his or her resignation per the terms of the conditional, irrevocable tender of resignation each director signs before joining the Board. |

| • | All members of our Audit, Compensation and Nominating and Governance Committees are independent as defined by the New York Stock Exchange listing standards and applicable SEC rules. |

| • | Our shareholders have the right to act by written consent. |

| • | Shareholders owning 25% or more of our outstanding shares may call a special meeting of shareholders. |

| • | We have never had a shareholder rights plan. |

| • | We have no supermajority voting requirements in our Certificate of Incorporation or Bylaws. |

| • | Danaher and its subsidiaries have made no political expenditures since at least 2012 and have no intention of contributing any Danaher funds or assets for political purposes, and we disclose our political expenditures policy on our public website. |

Corporate Governance Guidelines, Committee Charters and Standards of Conduct

As part of its ongoing commitment to good corporate governance, our Board of Directors has codified its corporate governance practices into a set of Corporate Governance Guidelines and has also adopted written charters for each of the Audit Committee, the Compensation Committee and the Nominating and Governance Committee of the Board. Danaher has also adopted a code of business conduct and ethics for directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees, known as the Standards of Conduct. The Corporate Governance Guidelines, committee charters and Standards of Conduct referenced above are each available in the “Investor – Corporate Governance” section of our website at http://www.danaher.com.

Board Leadership Structure and Risk Oversight

Board Leadership Structure. The Board has separated the positions of Chairman and CEO because it believes that, at this time, this structure best enables the Board to ensure that Danaher’s business and affairs are managed effectively and in the best interests of shareholders. This is particularly the case in light of the fact that the Company’s Chairman is Steven Rales, a co-founder of the Company who owns approximately 6.3 percent of the Company’s outstanding shares, served as CEO of the company from 1984 to 1990 and continues to serve as an executive officer of the company. As a result of his substantial ownership stake in the Company, the Board believes that Mr. Rales is uniquely able to understand, articulate and advocate for the rights and interests of the Company’s shareholders. Moreover, Mr. Rales uses his management experience with the Company and Board tenure to help ensure that the non-management directors have a keen understanding of the Company’s business as well as the strategic and other risks and opportunities that the Company faces. This enables the Board to more effectively provide insight and direction to, and exercise oversight of, the Company’s President and CEO and the rest of the management team responsible for the Company’s day-to-day business (including with respect to oversight of risk management).

18

Table of Contents

Because Mr. Rales is not independent within the meaning of the NYSE listing standards, our Corporate Governance Guidelines require the appointment of a “Lead Independent Director.” Our independent directors have appointed Mr. Ehrlich as our Lead Independent Director. As the Lead Independent Director, Mr. Ehrlich:

| • | presides at all meetings of the Board at which the Chairman of the Board and the Chair of the Executive Committee are not present, including the executive sessions of non-management directors; |

| • | has the authority to call meetings of the independent directors; |

| • | acts as a liaison as necessary between the independent directors and the management directors; and |

| • | advises with respect to the Board’s agenda. |

Risk Oversight. The Board’s role in risk oversight at the Company is consistent with the Company’s leadership structure, with management having day-to-day responsibility for assessing and managing the Company’s risk exposure and the Board and its committees overseeing those efforts, with particular emphasis on the most significant risks facing the Company. The Board oversees the Company’s risk management processes directly and through its committees. In general, the Board oversees the management of risks inherent in the operation of the Company’s businesses, the implementation of its strategic plan, its acquisition and capital allocation program, its capital structure and liquidity and its organizational structure, and also oversees the Company’s risk assessment and risk management policies. Each of the Board’s committees also oversees the management of Company risks that fall within the committee’s areas of responsibility. The Audit Committee oversees risks related to financial controls and legal and compliance risks and also assists the Board in overseeing the Company’s risk assessment and risk management policies; the Nominating and Governance Committee oversees corporate governance risks; and the Compensation Committee considers the impact of the Company’s compensation programs on the Company’s risk profile. Each committee reports to the full Board on a regular basis, including as appropriate with respect to the committee’s risk oversight activities. In addition, since risk issues often overlap, committees from time to time request that the full Board discuss particular risks. On an annual basis, the Company’s Risk Committee (consisting of members of senior management) inventories, assesses and prioritizes the most significant risks facing the Company as well as related mitigation efforts and provides a report to the Board. With respect to the manner in which the Board’s risk oversight function impacts the Board’s leadership structure, as described above our Board believes that Mr. Rales’ management experience and tenure help the Board to more effectively exercise its risk oversight function.

At least a majority of the Board must qualify as independent within the meaning of the listing standards of the NYSE. The Board has affirmatively determined that other than Messrs. Steven Rales, Mitchell Rales and Thomas P. Joyce, Jr., each of whom is an executive officer of Danaher, all of the remaining seven members of the Board, consisting of Mss. Hefner Filler and List-Stoll, Messrs. Ehrlich, Lohr, Schwieters and Spoon and Dr. Zerhouni, are independent within the meaning of the listing standards of the NYSE. The Board concluded that none of the independent directors possesses any of the bright-line relationships set forth in the listing standards of the NYSE that prevent independence, or except as discussed below, any other relationship with Danaher other than Board membership.

In making its determination with respect to the independence of the directors identified above as independent, the Board considered the following transactions. In 2015, the Company and its subsidiaries sold products to Kraft Foods Group, Inc., where Ms. List-Stoll served as an officer; sold products to and purchased products from Dick’s Sporting Goods, Inc., where Ms. List-Stoll serves as an officer; sold products to and purchased products from Sanofi-Aventis, where Dr. Zerhouni serves as an officer; sold products to and purchased products from Walgreen Co., where Ms. Hefner Filler serves as an officer; and sold products to Wabash National Corp., where an immediate family member of Mr. Ehrlich serves as an officer. In each case, the amount of sales and purchases in 2015 were less than 0.15% of the 2015 revenues of such other company and of Danaher’s 2015 revenues. In all of the cases described above, the sales and purchases were made in the ordinary course of business, on commercial terms and on an arms’-length basis and the director had no role in the decision-making

19

Table of Contents

with respect to such transactions, and in each case the Board determined that such transactions do not create a material relationship between the director and Danaher and do not affect the director’s independence.

Danaher’s non-management directors (all of whom are independent within the meaning of the listing standards of the NYSE) meet in executive session following the Board’s regularly-scheduled meetings. The sessions are chaired by the Lead Independent Director.

Board of Directors and Committees of the Board

General. The Board met eight times during 2015. All directors attended at least 75% of the aggregate of the total number of meetings of the Board and of all committees of the Board on which they served (during the period they so served) during 2015. Danaher typically schedules a Board meeting in conjunction with each annual meeting of shareholders and as a general matter expects that the members of the Board will attend the annual meeting. All of the ten directors serving at the time attended the Company’s annual meeting in May 2015.

The membership of each of the Audit, Compensation, Nominating and Governance and Finance committees as of March 14, 2016 is set forth below.

| NAME OF DIRECTOR | AUDIT | COMPENSATION | NOMINATING AND GOVERNANCE | FINANCE | ||||

Donald J. Ehrlich | X | X* | ||||||

Linda Hefner Filler | X* | |||||||

Thomas P. Joyce, Jr. | X | |||||||

Walter G. Lohr, Jr. | X | X | X | |||||

Teri List-Stoll | X | |||||||

Mitchell P. Rales | X* | |||||||

Steven M. Rales | X | |||||||

John T. Schwieters | X* | X | ||||||

Alan G. Spoon | X | |||||||

Elias A. Zerhouni, M.D. | X |

X = committee member; * = Chair

Audit Committee. The Audit Committee met nine times during 2015. The Audit Committee assists the Board in overseeing:

| • | the quality and integrity of Danaher’s financial statements; |

| • | the effectiveness of Danaher’s internal control over financial reporting; |

| • | the qualifications, independence and performance of Danaher’s independent auditors; |

| • | the performance of Danaher’s internal audit function; |

| • | Danaher’s compliance with legal and regulatory requirements; |

| • | the Company’s risk assessment and risk management policies; and |

| • | the Company’s swaps and derivatives transactions and related policies and procedures. |

The Committee also prepares a report as required by the SEC to be included in this proxy statement. The Committee reports to the Board on its actions and recommendations at each regularly scheduled Board meeting. The Board has determined that each of the members of the Audit Committee is independent for purposes of Rule 10A-3(b)(1) under the Securities Exchange Act and the NYSE listing standards, qualifies as an audit committee financial expert as that term is defined in Item 407(d)(5) of Regulation S-K and is financially literate within the meaning of the NYSE listing standards.

20

Table of Contents

Compensation Committee. The Compensation Committee met seven times during 2015. The Compensation Committee discharges the Board’s responsibilities relating to compensation of our executive officers, including evaluating the performance of, and approving the compensation paid to, our executive officers. The Committee also:

| • | reviews and discusses with Company management the Compensation Discussion & Analysis (“CD&A”) and recommends to the Board the inclusion of the CD&A in the annual meeting proxy statement; |

| • | reviews and makes recommendations to the Board with respect to the adoption, amendment and termination of all executive incentive compensation plans and all equity compensation plans, and exercises all authority of the Board (and all responsibilities assigned by such plans to the Committee) with respect to the administration of such plans; |

| • | monitors compliance by directors and executive officers with the Company’s stock ownership requirements; |

| • | considers the impact of the Company’s compensation programs on the Company’s risk profile; |

| • | prepares a report as required by the SEC to be included in this proxy statement; and |

| • | considers factors relating to independence and conflicts of interests in connection with the compensation consultant, counsel and other outside advisors that provide advice to the Committee. |

Each member of the Compensation Committee is an “outside director” for purposes of Section 162(m) (“Section 162(m)”) of the Internal Revenue Code (the “Code”), a “non-employee director” for purposes of Rule 16b-3 under the Securities Exchange Act and, based on the determination of the Board, independent under the NYSE listing standards and under Rule 10C-1 under the Securities Exchange Act. While the Committee’s charter authorizes it to delegate its powers to sub-committees, the Committee did not do so during 2015. The Committee reports to the Board on its actions and recommendations at each regularly scheduled Board meeting. The Chair of the Committee works with our Senior Vice President-Human Resources and our Secretary to schedule the Committee’s meetings and set the agenda for each meeting. Our Senior Vice President-Human Resources, Vice President-Compensation and Secretary generally attend, and from time-to-time our CEO attends, the Committee meetings and support the Committee in preparing meeting materials and taking meeting minutes. In particular, our CEO provides background regarding the interrelationship between our business objectives and executive compensation matters and advises on the alignment of incentive plan performance measures with our overall strategy; participates in the Committee’s discussions regarding the performance and compensation of the other executive officers and provides recommendations to the Committee regarding all significant elements of compensation paid to such officers, their annual, personal performance objectives and his evaluation of their performance; and provides feedback regarding the companies that he believes Danaher competes with in the marketplace and for executive talent. The Committee gives considerable weight to our CEO’s evaluation of and recommendations with respect to the other executive officers because of his direct knowledge of each such officer’s performance and contributions. Danaher’s human resources department also provides the Committee with such data relating to executive compensation as requested by the Committee. The Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting.

Under the terms of its charter, the Committee has the authority to engage the services of outside advisors and experts to assist the Committee. The Committee has engaged Frederic W. Cook & Co., Inc. (“F.W. Cook”) as the Committee’s independent compensation consultant since 2008. The Committee engages F.W. Cook because it is considered one of the premier independent compensation consulting firms in the country and has never provided any services to the Company other than the compensation-related services provided to or at the direction of the Compensation Committee and the Nominating and Governance Committee. F.W. Cook takes its direction solely from the Committee (and with respect to matters relating to the non-management director compensation program, the Nominating and Governance Committee). F.W. Cook’s primary responsibilities in 2015 were to provide advice and data in connection with the structuring of the executive compensation and equity compensation programs of both Danaher as well as the business Danaher anticipates spinning off in the

21

Table of Contents

third quarter of 2016, Fortive Corporation, the compensation levels for the Company’s executive officers compared to executive compensation levels at the Company’s peers, the compensation levels for the Company’s directors compared to director compensation levels at the Company’s peers, the compensation levels for Fortive’s anticipated executive officers compared to executive compensation levels at Fortive’s peers, and the compensation levels and practices for Fortive’s directors compared to director compensation levels and practices at Fortive’s peers; assess the Company’s executive compensation program in the context of corporate governance best practices; update the Committee regarding legislative and regulatory initiatives and other trends in the area of executive compensation; provide data regarding the share dilution and compensation costs attributable to the Company’s equity compensation program; and advise regarding the Company’s executive compensation public disclosures. The Committee does not place any material limitations on the scope of the feedback provided by F.W. Cook. In the course of discharging its responsibilities, F.W. Cook may from time to time and with the Committee’s consent, request from management certain information regarding compensation amounts and practices, the interrelationship between our business objectives and executive compensation matters, the nature of the Company’s executive officer responsibilities and other business information.

The Committee has considered whether the work performed by F.W. Cook for or at the direction of the Compensation Committee and the Nominating and Governance Committee raises any conflict of interest, taking into account the factors listed in Securities Exchange Act Rule 10C-1(b)(4), and has concluded that such work does not create any conflict of interest.

Nominating and Governance Committee. The Nominating and Governance Committee met three times in 2015. The Nominating and Governance Committee:

| • | assists the Board in identifying individuals qualified to become Board members; |

| • | proposes to the Board a slate of directors for election by Danaher’s shareholders at each annual meeting; |

| • | makes recommendations to the Board regarding the membership of the Board’s committees; |

| • | makes recommendations to the Board regarding matters of corporate governance; |

| • | facilitates the annual review of the performance of the Board and its committees; |

| • | oversees the operation of Danaher’s Corporate Governance Guidelines; |

| • | assists the Board in CEO succession planning; |

| • | reviews and makes recommendations to the Board regarding non-management director compensation; and |

| • | administers Danaher’s Related Person Transactions Policy. |

The Board has determined that all of the members of the Nominating and Governance Committee are independent within the meaning of the NYSE listing standards.

The Nominating and Governance Committee from time-to-time engages an executive search firm to help identify, evaluate and provide background information regarding director candidates, and also considers candidates for Board membership suggested by Board members, management and shareholders. A shareholder who wishes to recommend a prospective nominee for the Board should notify the Nominating and Governance Committee in writing using the procedures described below under “– Communications with the Board of Directors” with whatever supporting material the shareholder considers appropriate. If a prospective nominee has been identified other than in connection with a director search process initiated by the Committee, the Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. The Committee’s determination of whether to conduct a full evaluation is based primarily on the Committee’s view as to whether a new or additional Board member is necessary or appropriate at such time, and the likelihood that the prospective nominee can satisfy the evaluation factors described below and any such other factors as the Committee may deem appropriate. The Committee takes into account whatever information is provided to the Committee with the

22

Table of Contents

recommendation of the prospective candidate and any additional inquiries the Committee may in its discretion conduct or have conducted with respect to such prospective nominee. If the Committee determines that any such prospective nominee warrants additional consideration, or if the Committee has initiated a director search process and has identified one or more prospective nominees, the Committee will evaluate such prospective nominees against the standards and qualifications set out in Danaher’s Corporate Governance Guidelines, including:

| • | personal and professional integrity and character; |

| • | prominence and reputation in the prospective nominee’s profession; |

| • | skills, knowledge and expertise (including business or other relevant experience) useful and appropriate in overseeing and providing strategic direction with respect to Danaher’s business; |

| • | the extent to which the interplay of the prospective nominee’s skills, knowledge, experience and background with that of the other Board members will help build a Board that is effective in collectively meeting Danaher’s strategic needs and serving the long-term interests of the shareholders; |

| • | the capacity and desire to represent the interests of the shareholders as a whole; and |

| • | availability to devote sufficient time to the affairs of Danaher. |

The Committee also considers such other factors as it may deem relevant and appropriate, including the current composition of the Board, any perceived need for one or more particular areas of expertise, the balance of management and independent directors, the need for committee-specific expertise and the evaluations of other prospective nominees. The Board does not have a formal or informal policy with respect to diversity but believes that the Board, taken as a whole, should embody a diverse set of skills, knowledge, experiences and backgrounds appropriate in light of the Company’s needs, and in this regard also subjectively takes into consideration the diversity (with respect to race, gender and national origin) of the Board when considering director nominees. The Board does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors.

If the Committee determines that a prospective nominee warrants further consideration, one or more members of the Committee (and other members of the Board as appropriate) will interview the prospective nominee. After completing this evaluation and interview process, if the Committee deems it appropriate it will recommend that the Board appoint one or more candidates to the Board or nominate one or more such candidates for election to the Board.

The Committee also reviews and makes recommendations to the Board regarding non-management director compensation (although the Board makes the final determination regarding the amounts and type of non-management director compensation). In connection with its periodic evaluations of non-management director compensation, the Committee reviews the compensation practices for non-management directors within Danaher’s peer group. For a description of the annual compensation paid to each non-management director, please see “Director Compensation.”

Finance Committee. The Finance Committee met five times in 2015. The Finance Committee approves business acquisitions, investments and divestitures up to the levels of authority delegated to it by the Board.