UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-15760

Hardinge Inc.

(Exact name of registrant as specified in its charter)

|

| | |

| New York | | 16-0470200 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

One Hardinge Drive Elmira, NY | | 14902 |

| (Address of principal executive offices) | | (Zip Code) |

(607) 734-2281

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12(g) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | NASDAQ Global Select Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. oYes ýNo

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. oYes ýNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ýYes oNo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ýYes oNo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | |

Large accelerated filer o | | Accelerated filer x |

Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). oYes ýNo

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2016 was $103.4 million, based on the closing price of common stock on the NASDAQ Global Select Market on June 30, 2016.

As of February 28, 2017 there were 12,902,366 shares of common stock of the registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Hardinge Inc.’s Proxy Statement for its 2017 Annual Meeting of Shareholders to be filed with the Commission are incorporated by reference to Part III of this Form 10-K.

HARDINGE INC. AND SUBSIDIARIES

TABLE OF CONTENTS

PART I

Item 1. Business.

General

Hardinge Inc.'s principal executive office is located within Chemung County at One Hardinge Drive, Elmira, New York 14902-1507. Unless otherwise mentioned or unless the context requires otherwise, all references to "Hardinge," "we," "us," "our," "the Company" or similar references mean Hardinge Inc. and its subsidiaries.

Our website, www.hardinge.com, provides links to all of the Company's filings with the Securities and Exchange Commission. A copy of this annual report on Form 10-K and our other annual, quarterly, current reports, and amendments thereto filed with SEC are available on the website or can be obtained free of charge by contacting the Investor Relations Department at our principal executive office. Alternatively, such reports may be accessed at the Internet address of the SEC, which is www.sec.gov, or at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information about the operation of the SEC's Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

We are a global designer, manufacturer and distributor of machine tools, specializing in precision computer numerically controlled metalcutting machines and workholding technology solutions. The Company has the following direct and indirect wholly owned subsidiaries:

|

| | |

| North America: | | |

| Canadian Hardinge Machine Tools, Ltd. | | Toronto, Canada |

| Forkardt Inc. | | Traverse City, Michigan |

| Hardinge Technology Systems, Inc. | | Elmira, New York |

| Hardinge Grinding Group | | Elgin, Illinois |

| Europe: | | |

| Forkardt Deutschland GmbH | | Reutlingen, Germany |

| Forkardt SAS | | Noisy le Sec, France |

| Hardinge GmbH | | Krefeld, Germany |

| Hardinge Holdings GmbH | | St. Gallen, Switzerland |

| Hardinge Holdings B.V. | | Amsterdam, Netherlands |

| Hardinge Machine Tools B.V. | | Raamsdonksveer, Netherlands |

| Jones & Shipman Hardinge Limited | | Leicester, England |

| Jones & Shipman SARL | | Bron, France |

| L. Kellenberger & Co., AG | | St. Gallen, Switzerland |

| Asia and Other: | | |

| Forkardt India LLP | | Hyderabad, India |

| Forkardt Precision Machinery (Shanghai) Co., Ltd. | | Shanghai, People's Republic of China |

| Hardinge China Limited | | Hong Kong, People's Republic of China |

| Hardinge Machine (Shanghai) Co., Ltd. | | Shanghai, People's Republic of China |

| Hardinge Machine Tools B.V., Taiwan Branch | | Nan Tou City, Taiwan, Republic of China |

| Hardinge Precision Machinery (Jiaxing) Company, Limited | | Jiaxing, People's Republic of China |

| Hardinge Taiwan Precision Machinery Limited | | Nan Tou City, Taiwan, Republic of China |

We have manufacturing facilities located in China, Switzerland, Taiwan, Germany, France, India, the United Kingdom ("U.K.") and the United States ("U.S."). We manufacture the majority of the products we sell.

Products

We supply high precision computer controlled metalcutting turning machines, grinding machines, machining centers, and repair parts related to those machines. The Company also engineers and supplies high precision, standard and specialty workholding devices, and other machine tool accessories. We believe our products are known for accuracy, reliability, durability and value.

Segments

The Company has two unique business segments: Metalcutting Machine Solutions ("MMS") and Aftermarket Tooling and Accessories ("ATA").

Metalcutting Machine Solutions (MMS)

This segment includes operations related to grinding, turning, and milling, as discussed below, and related repair parts. The products are considered to be capital goods with sales prices ranging from approximately forty thousand dollars for some standard products to approximately two million dollars for specialized grinding machines or other specialty built turnkey systems of multiple machines. Sales are subject to economic cycles and, because they are most often purchased to add manufacturing capacity, the cycles can be severe with customers delaying purchases during down cycles and then aggressively requiring machine deliveries during up cycles. Machines are purchased to a lesser extent during down cycles, as customers are looking for productivity improvements or they have new products that require new machining capabilities.

We have been a manufacturer of industrial-use high precision and general precision turning machine tools since 1890. Turning machines, or lathes, are power-driven machines used to remove material from either bar stock or a rough-formed part by moving multiple cutting tools against the surface of a part rotating at very high speeds in a spindle mechanism. The multi-directional movement of the cutting tools allows the part to be shaped to the desired dimensions. On parts produced by our machines, those dimensions are often measured in millionths of an inch. We consider Hardinge to be a leader in the field of producing machines capable of consistently and cost-effectively producing parts to very close dimensions.

Grinding is a machining process in which a part's surface is shaped to closer tolerances with a rotating abrasive wheel or tool. Grinding machines can be used to finish parts of various shapes and sizes. The grinding machines of our Kellenberger subsidiary are used to grind the inside and outside diameters of cylindrical parts. Such grinding machines are typically used to provide a more exact finish on a part that has been partially completed on a lathe. The Kellenberger grinding machines are generally purchased by the same type of customers as other Hardinge equipment and further our ability to be a primary source for our customers.

Our Kellenberger precision grinding technology is complemented by our Hauser, Tschudin, Usach, and Voumard grinding brands. Hauser machines are jig grinders used to make demanding contour components, primarily for tool and mold-making applications. Tschudin product technology is focused on the specialized grinding of cylindrical parts when the customer requires high volume production. Our Tschudin machines are generally equipped with automatic loading and unloading mechanisms for the part being machined. These loading and unloading mechanisms significantly reduce machine operator involvement in the production process. Usach and Voumard machines are high quality internal diameter cylindrical grinding systems used in production and job shop environments.

Machining centers are designed to remove material from stationary, prismatic, or box-like parts of various shapes with rotating tools that are capable of milling, drilling, tapping, reaming and routing. Machining centers have mechanisms that automatically change tools based on commands from an integrated computer control without the assistance of an operator. Machining centers are generally purchased by the same customers who purchase other Hardinge equipment. We supply a broad line of machining centers under our Bridgeport brand name addressing a range of sizes, speeds, and powers.

Our machines generally use commands from an integrated computer to control the movement of cutting tools, grinding wheels, part positioning, and in the case of turning and grinding machines, the rotation speeds of the part being shaped. The computer control enables the operator to program operations such as part rotation, tooling selection, and tooling movement for a specific part and then stores that program in memory for future use. The machines are able to produce parts while left unattended when connected to automatic bar-feeding, robotics equipment, or other material handling devices designed to supply raw materials and remove machined parts from the machine.

New products are critical to our growth plans. We gain access to new products through internal product development, acquisitions, joint ventures, license agreements, and partnerships. Products are introduced each year to broaden our product

offering, to take advantage of new technologies available to us, and to replace older models nearing the end of their respective product life cycles. These technologies generally allow our machines to run at higher speeds and with more power, thus increasing their efficiency. Customers routinely replace old machines with newer machines that can produce parts faster and with less time to set up the machine when converting from one type of part to another. Generally, our machines can be used to produce parts from all of the standard ferrous and non-ferrous metals, as well as plastics, composites, and exotic materials.

We focus on products and solutions for companies making parts from hard to machine materials with hard to sustain close tolerances and hard to achieve surface finishes that may be hard to hold in the machine. We believe that with our high precision and super precision lathes, our grinding machines, and our rugged machining centers, combined with our accessory products and our technical expertise, we are uniquely qualified to be the supplier of choice for customers manufacturing to demanding specifications.

Multiple options are available on many of our machines, which allows customers to customize their machines to their specific operating performance and cost objectives. We produce machines for stock with popular option combinations for immediate delivery, as well as design and produce machines to specific customer requirements. In addition to our machines, we provide the necessary tooling, accessories, and support services to assist customers in maximizing their return on investment.

The sale of repair parts is important to our business. Certain parts on machines wear out, fail, or need to be replaced due to misuse over time. Customers will buy parts from us throughout the life of the machine, which typically extends over many years. There are thousands of machines in operation in the world for which we provide those repair parts and in many cases the parts are available exclusively from us.

We offer various warranties on our equipment and consider post-sale support to be a critical element of our business. Warranties on machines typically extend for twelve months after purchase. Services provided include operation and maintenance training, in-field maintenance, and in-field repair. We offer these post sales support services on a paid basis throughout the life of the machine. In territories covered by distributors, this support and service is offered through the distributor.

Aftermarket Tooling and Accessories (ATA)

This segment includes products that are purchased by manufacturers throughout the lives of their machines. The selling prices of these units are relatively low per piece with prices ranging from forty dollars on high volume collets to two hundred thousand dollars or more for specialty chucks. While considered to be consumable, these products are more durable in nature, with replacement due to wear over time. Our products are used on all types and brands of machine tools, not limited to our own. Sales levels are affected by manufacturing cycles, but not as severely as capital goods lines. While customers may not purchase high cost machines during a down cycle, their factories are operating with their existing equipment and therefore accessories are still needed as they wear out or they are needed for a change in production requirements.

The two primary product groups in ATA are collets and chucks. Collets are cone-shaped metal sleeves used for holding circular or rod-like pieces in a lathe or other machine that provide effective part holding and accurate part location during machining operations. Chucks are a specialized clamping device used to hold an object with radial symmetry, especially a cylindrical object. It is most commonly used to hold a rotating work piece. Some of our specialty chucks can also hold irregularly shaped objects that lack radial symmetry. While our products are known for accuracy and durability, they are consumable in nature.

We offer an extensive line of workholding and toolholding solutions that are available in tens of thousands of shapes and sizes to meet unique customer application needs. These solutions can be used on virtually all types and brands of metalcutting machines, as well as non-traditional uses in many industrial applications. The Company continues to explore opportunities to expand this business organically and through acquisitions.

Sales, Markets and Distribution

We sell our products in most of the industrialized countries of the world through a combination of distributors, agents, and manufacturers' representatives. In certain areas of China, France, Germany, India, North America, and the United Kingdom, we have also used a direct sales force for portions of our product lines. Generally, our distributors have an exclusive right to sell our products in a defined geographic area. Our distributors operate as independent businesses and purchase products from us at discounted prices for their customers, while agents and representatives sell products on our behalf and receive commissions on sales. Our discount schedule is adjusted to reflect the level of pre and post sales support offered by our distributors. Our direct sales personnel earn a fixed salary plus commission. Sales through distributors are made only on standard commercial open account terms or through letters of credit. Distributors generally take title to products upon shipment from our facilities and do not have any special return privileges.

Our standard ATA products are sold through direct telephone orders and via our web site at www.shophardinge.com. Custom or special solutions are sold through direct sales and agents. In most cases, we are able to package and ship in-stock tooling, accessories, and repair parts within 24 hours of receiving orders. We can package and ship items with heavy demand within a few hours. In other parts of the world, these products are sold on either a direct sales basis or through distributor arrangements.

We promote our products through advertising in trade publications, web presences, email newsletters, and participation in industry trade shows. In addition, we market our non-machine products and capabilities through the publication of general catalogs and other targeted catalogs, which we distribute to existing and prospective customers. We have a considerable presence on the internet at www.hardinge.com and www.forkardt.com, where customers can obtain information about our products and place orders for accessories, tooling, knee mill products and repair parts.

A substantial portion of our end use customers are small and medium-sized independent job shops, which in turn sell machined parts to their industrial customers. Industries directly and indirectly served by us include aerospace, automotive, computer, communications, consumer-electronics, construction equipment, defense, energy, farm equipment, medical equipment, recreational equipment, and transportation.

No single customer or related group of customers accounted for more than 5% of our consolidated sales in 2016 or 2015. While valuing our relationship with each customer, we do not believe that the loss of any single customer, or any few customers, would have an adverse material effect on our business.

Competitive Conditions

In our industry, the barriers to entry for competition vary based on the level of product performance required. For the products with the highest performance in terms of accuracy and productivity, the barriers are generally technical in nature. For basic products, often the barriers are not technical; they are tied to product availability, competitive price position, and an effective distribution model that offers the pre and post sales support required by customers. Another significant barrier in the global machine tool industry is the high level of working capital that is required to operate the business.

We compete in various sectors of the machine tool market within the products of turning, milling, grinding, tooling and accessories. We compete with multiple companies in each market sector we serve. The primary competitive factors in the marketplace for our machine tools are reliability, price, delivery time, service, and technological characteristics. Our management considers our segment of the industry to be extremely competitive. There are many manufacturers of machine tools in the world. They can be categorized by the size of material their products can machine and the precision level their products can achieve. For our high precision, multi-tasking turning and milling equipment, competition comes primarily from companies such as DMG Mori Seiki, Mazak, and Okuma. Competition in our more standard turning and milling equipment comes, in part, from those companies as well as Doosan, which is based in South Korea, and Haas, which is based in the U.S., as well as many Taiwanese companies. Our internal and outer diameter (ID/OD) cylindrical grinding machines compete primarily with products manufactured by Studer, a Swiss company, as well as Toyoda and Shigiya, which are based in Japan. Our Hauser jig grinding machines compete primarily with products manufactured by Moore Tool, which is based in the U.S., and some Japanese suppliers. Our surface grinding machines compete with products manufactured by Okamoto in Japan and Chevalier in Taiwan. Our ATA products compete with many products manufactured by smaller companies.

The overall number of our competitors providing product solutions serving our target markets may increase. Also, the overall composition of companies with which we compete may change as we broaden our product offerings and the geographic markets we serve. As we expand into new market areas, we will face competition not only from our existing competitors but from other competitors as well, including existing companies with strong technological, marketing and sales positions in those markets. In addition, several of our competitors may have greater resources, including financial, technical, and engineering resources, than we do.

Sources and Availability of Components

Our machines within the MMS segment are produced around the world. We produce certain of our lathes, knee mills, and related products at our Elmira, New York plant. The Kellenberger and Voumard grinding machines and related products are manufactured at our St. Gallen, Switzerland plant and Hauser and Tschudin products are produced at our Biel, Switzerland facility. The Jones & Shipman grinding machines are manufactured at our Leicester, England plant. The Usach grinding machines are manufactured at our Elgin, Illinois plant. We produce machining centers and lathes at our Hardinge Taiwan facility in Nan Tou, Taiwan and our Hardinge Precision Machinery (Jiaxing) Company, Ltd. facility in Jiaxing, China. The Company's Forkardt and Hardinge branded ATA segment products and solutions are engineered and produced in our plants located in Traverse City, Michigan, Elmira, New York, Reutlingen, Germany, Noisy le Sec, France, Hyderabad, India and Shanghai, China. We manufacture products from various raw materials, including cast iron, sheet metal, and bar steel. We purchase a number of components, sub-assemblies and assemblies from outside suppliers, including the computer and electronic components for our computer controlled lathes, grinding machines, and machining centers. There are multiple suppliers for virtually all of our raw material, components, sub-assemblies and assemblies and historically, we have not experienced a serious supply interruption. However, in 2011, because of the increase in demand driven by early 2011 worldwide order activity, producers of bearings, ball screws, and linear guides had difficulty meeting the rise in demand. Similar demand increase in the future could impact our production schedules.

A major component of our computer controlled machines is the computer and related electronics package. We purchase these components from Fanuc Limited, a Japanese electronics company, Heidenhain, a German control supplier, Mitsubishi Electric, a Japanese electronics company, or from Siemens, another German control manufacturer. While we believe that design changes could be made to our machines to allow sourcing from several other existing suppliers, and we occasionally do so for special orders, a disruption in the supply of the computer controls from one of our suppliers could cause us to experience a substantial disruption of our operations, depending on the circumstances at the time. We purchase parts from these suppliers under normal trade terms. There are no agreements with these suppliers to purchase minimum volumes per year.

Research and Development

Our ongoing research and development program involves creating new products, modifying existing products to meet market demands, and redesigning existing products, both to add new functionality and to reduce the cost of manufacturing. Our research and development departments throughout the world are staffed with experienced design engineers with varying levels of education, ranging from technical to doctoral degrees.

The worldwide cost of research and development, all of which has been charged to operating expense, amounted to $13.5 million, $14.1 million and $13.9 million, in 2016, 2015 and 2014, respectively.

Patents

Although we hold several patents with respect to certain of our products, we do not believe that our business is dependent to any material extent upon any single patent or group of patents.

Seasonal Trends and Working Capital Requirements

Hardinge's business and that of the machine tool industry in general, is cyclical. It is not subject to significant seasonal trends. However, our quarterly results are subject to fluctuation based on the timing of our shipments of machine tools, which are largely dependent upon customer delivery requirements. Given that a large percentage of our sales are from Asia, the impact of plant shutdowns in that region by us and our customers due to the celebration of the Lunar New Year holiday may impact the first quarter sales, income from operations, and net income, and result in the first quarter being the lowest quarter of the year.

The ability to deliver products within a short period of time is an important competitive criterion. We must have inventory on hand to meet customers' delivery expectations, which for standard machines typically range from immediate to eight weeks delivery. Meeting this requirement is especially difficult with some of our products, where delivery is extended due to time associated with shipping on ocean-going vessels, depending on the location of the customer. This creates a need to have inventory of finished machines available in our major markets to serve our customers in a timely manner.

We deliver many of our machine products within one to two months after the order. Some orders, especially multiple machine orders, are delivered on a turnkey basis with the machine or group of machines configured to make certain parts for the customer. This type of order often includes the addition of material handling equipment, tooling and specific programming. In those cases, the customer usually observes and inspects the parts being made on the machine at our facility before shipment so the timing of the sale is dependent upon the customer's schedule and acceptance. Lead time for these types of orders, especially grinding machines, can range from six to eight months. Therefore, sales from quarter-to-quarter can vary depending upon the timing of customers' acceptances and the significance of those orders.

We feel it is important, where practical, to provide readily available accessories and replacement parts for the machines we sell and we carry inventory at levels sufficient to meet these customer requirements.

Governmental Regulations

We believe that our current operations and our current uses of property, plant and equipment conform in all material respects to applicable laws and regulations in the various countries in which we conduct business.

Governmental Contracts

No material portion of our business is subject to government contracts.

Environmental Matters

Our operations are subject to extensive federal, state, local and foreign laws and regulations relating to environmental matters. Certain environmental laws can impose joint and several liability for releases or threatened releases of hazardous substances upon certain statutorily defined parties regardless of fault or the lawfulness of the original activity or disposal. Hazardous substances and adverse environmental effects have been identified with respect to real property we own and on adjacent parcels of real property.

In particular, our Elmira, NY manufacturing facility is located within the Kentucky Avenue Wellfield on the National Priorities List of hazardous waste sites designated for cleanup by the United States Environmental Protection Agency ("EPA") because of groundwater contamination. The Kentucky Avenue Wellfield Site (the "Site") encompasses an area which includes sections of the Town of Horseheads and the Village of Elmira Heights in Chemung County, NY. In February 2006, the Company received a Special Notice Concerning a Remedial Investigation/Feasibility Study ("RI/FS") for the Koppers Pond (the "Pond") portion of the Site. The EPA documented the release and threatened release of hazardous substances into the environment at the Site, including releases into and in the vicinity of the Pond. The hazardous substances, including metals and polychlorinated biphenyls, have been detected in sediments in the Pond.

Until receipt of this Special Notice in February 2006, the Company had never been named as a potentially responsible party ("PRP") at the Site nor had the Company received any requests for information from the EPA concerning the Site. Environmental sampling on our property within this Site under supervision of regulatory authorities had identified off-site sources for such groundwater contamination and sediment contamination in the Pond, and found no evidence that our operations or property have contributed or are contributing to the contamination. We have notified all appropriate insurance carriers and are actively cooperating with them, but whether coverage will be available has not yet been determined and possible insurance recovery cannot be estimated with any degree of certainty at this time.

A substantial portion of the Pond is located on our property. The Company, along with Beazer East, Inc., the Village of Horseheads, the Town of Horseheads, the County of Chemung, CBS Corporation and Toshiba America, Inc., (collectively, the "PRP's"), agreed to voluntarily participate in the RI/FS by signing an Administrative Settlement Agreement and Order of Consent on September 29, 2006. On September 29, 2006, the Director of Emergency and Remedial Response Division of the EPA, Region II, approved and executed the Agreement on behalf of the EPA. The PRP's also signed a PRP Member Agreement, agreeing to share the costs associated with the RI/FS study on a per capita basis.

The EPA approved the RI/FS Work Plan in May of 2008. In July of 2012 the PRP's submitted a Remedial Investigation (RI) to respond to EPA issues raised in the initial draft RI. In January 2016, the PRP's submitted a draft Feasibility Study (FS), also to respond to issues raised by the EPA about previous drafts of the FS. In July 2016, the EPA announced its proposed remediation plan based on an alternative put forth in a July 2016 Woodruff & Curran FS with an estimated total clean-up phase cost of $1.9 million. The preferred remedy consists of the placement of a continuous six-inch thick soil and sand cap, including a geotextile membrane to act as a demarcation layer, over Koppers Pond. The preferred remedy includes long-term monitoring and institutional controls. After a public comment period the EPA concluded this RI phase of its process documented in a letter in December 2016.

The Company has recorded a reserve of $0.3 million for its estimated related liability, assuming all of the PRP's would continue to share costs equally in the clean-up phase of the project. Based on our understanding including discussions with our experts, it is possible that the PRP's may change and/or the relative split of costs may be different for this final phase of the project. However, this will not be known for quite some time, and this ongoing estimate of “7 split equally” is viewed as the best possible estimate at the moment. This reserve is reported in Accrued expenses on the Consolidated Balance Sheets.

We believe, based upon information currently available that, except as described in the preceding paragraphs, we will not have material liabilities for environmental remediation. Though the foregoing reflects the Company's current assessment as it relates to environmental remediation obligations, it is possible that future remedial requirements or changes in the enforcement of existing laws and regulations, which are subject to extensive regulatory discretion, will result in material liabilities to the Company.

Employees

As of December 31, 2016, Hardinge Inc. employed 1,451 persons, 463 of whom were located in the United States. Management believes that relations with our employees are good.

Foreign Operations and Export Sales

Information related to foreign and domestic operations and sales is included in Note 18. "Segment Information" to the Consolidated Financial Statements contained in this Annual Report. Our strategy has been to diversify our sales and operations geographically so that the impact of economic trends in different regions can be balanced.

The risks associated with conducting business on an international basis are discussed further in Item 1A. "Risk Factors".

Item 1A. Risk Factors.

Risk Factors That May Impact Future Results

Current and potential shareholders should carefully consider the risks described below. These are the risks and uncertainties we believe are most important for shareholders to consider. Additional risks and uncertainties not presently known to us, which we currently deem immaterial or which are similar to those faced by other companies in our industry or business in general, may also impair our business operations. Any of these factors, many of which are beyond our control, could materially adversely affect our business, financial condition, operating results, cash flow, and stock price.

Risks Relating to Our Industry

Changes in general economic conditions and the cyclical nature of our business could harm our operating results.

Our business is cyclical in nature, following the strength and weakness of the manufacturing economies in the geographic markets we serve. As a result of this cyclicality, we have experienced, and in the future we can be expected to experience, significant fluctuations in sales and operating income, which may affect our business, operating results, financial condition and the market price of our common shares.

The following factors, among others, significantly influence demand for our products:

| |

| • | Fluctuations in capacity at both original equipment manufacturers and job shops; |

| |

| • | The availability of skilled machinists; |

| |

| • | The need to replace machines that have reached the end of their useful life; |

| |

| • | The need to replace older machines with new technology that increases productivity, reduces general manufacturing costs, and machines parts in a new way; |

| |

| • | The evolution of end-use products requiring machining to more specific tolerances; |

| |

| • | Our customers' use of new materials requiring machining by different processes; |

| |

| • | General economic and manufacturing industry expansions and contractions; and |

| |

| • | Changes in manufacturing capabilities in developing regions. |

Our business is highly competitive, and increased competition could reduce our sales, earnings and profitability.

The markets in which our machines and other products are sold are extremely competitive and highly fragmented. In marketing our products, we compete primarily with other businesses on quality, reliability, price, value, delivery time, service, and technological characteristics. We compete with a number of U.S., European, and Asian competitors, many of which are larger, have greater financial and other resources, and are supported by governmental or financial institution subsidies. Increased competition could force us to lower our prices or to offer additional product features or services at a higher cost to us, which could reduce our earnings.

The greater financial resources or the lower amount of debt of certain of our competitors may enable them to commit larger amounts of capital in response to changing market conditions. Certain competitors may also have the ability to develop product innovations that could put us at a disadvantage. If we are unable to compete successfully against other manufacturers in our marketplace, we could lose customers, and our sales may decline. There can also be no assurance that customers will continue to regard our products favorably, that we will be able to develop new products that appeal to customers, that we will be able to improve or maintain our profit margins on sales to our customers, or that we will be able to continue to compete successfully in our core markets. While we believe our product lines compete effectively in their markets, we may not continue to do so.

Our competitive position and prospects for growth may be diminished if we are unable to develop and introduce new and enhanced products on a timely basis that are accepted in the market.

The machine tool industry is subject to technological change, rapidly evolving industry standards, changing customer requirements, and improvements in and expansion of product offerings, especially with respect to computer-controlled products. Our ability to anticipate changes in technology, industry standards, customer requirements and product offerings by competitors, and to develop and introduce new and enhanced products on a timely basis that are accepted in the market, will be significant factors in our ability to compete and grow. Moreover, if technologies or standards used in our products become obsolete or fail to gain widespread commercial acceptance, our business would be materially adversely affected. Developments by our competitors or others may render our products or technologies obsolete or noncompetitive. Failure to effectively introduce new products or product enhancements on a timely basis could materially adversely affect our business, operating results, and financial condition.

Risks Relating to Our Operations

Our business, financial condition, and results of operations could be adversely affected by the political and economic conditions of the countries in which we conduct business and other factors related to our international operations.

We manufacture a substantial portion of our products overseas and sell our products throughout the world. In 2016, approximately 71% of our products were manufactured in countries outside of North America and approximately 68% of our products were sold in countries outside of North America. In addition, a majority of our employees are located outside of the United States. Multiple factors relating to our international operations and to particular countries in which we operate could have a material adverse effect on our business, financial condition, results of operations, and cash flows. These factors include:

| |

| • | A prolonged world-wide economic downturn or economic uncertainty in our principal international markets including Asia and Europe; |

| |

| • | Changes in political, regulatory, legal, or economic conditions; |

| |

| • | Restrictive governmental actions, such as restrictions on the transfer or repatriation of funds and foreign investments and trade protection measures, including export duties and quotas, customs duties and tariffs, or trade barriers erected by either the United States or other countries where we do business; |

| |

| • | Disruptions of capital and trading markets; |

| |

| • | Changes in import or export licensing requirements; |

| |

| • | Civil disturbances or political instability; |

| |

| • | Geopolitical turmoil, including terrorism or war; |

| |

| • | Currency restrictions and exchange rate fluctuations; |

| |

| • | Changes in labor standards; |

| |

| • | Limitations on our ability under local laws to protect our intellectual property; |

| |

| • | Nationalization and expropriation; and |

| |

| • | Changes in domestic and foreign tax laws. |

Prices of some raw materials, especially steel and iron, fluctuate, which can adversely affect our sales, costs, and profitability.

We manufacture products with a relatively high iron casting or steel content, commodities for which worldwide prices fluctuate. The availability of, and prices for, these and other raw materials are subject to volatility due to worldwide supply and demand forces, speculative actions, inventory levels, exchange rates, production costs, and anticipated or perceived shortages. In some cases, raw material cost increases can be passed on to customers in the form of price increases; in other cases, they cannot. If raw material prices increase and we are not able to charge our customers higher prices to compensate, it would adversely affect our business, results of operations and financial condition.

We rely on a limited number of suppliers to obtain certain components, sub-assemblies, assemblies and products. Delays in deliveries from or the loss of any of these suppliers may cause us to incur additional costs, result in delays in manufacturing and delivering our products or cause us to carry excess or obsolete inventory.

Some components, sub-assemblies, or assemblies we use in the manufacturing of our products are purchased from a limited number of suppliers. Our purchases from these suppliers are generally not made pursuant to long-term contracts and are subject to additional risks associated with purchasing products internationally, including risks associated with potential import restrictions and exchange rate fluctuations, as well as changes in tax laws, tariffs, and freight rates. Although we believe that our relationships with these suppliers are good, there can be no assurance that we will be able to obtain these products from these suppliers on satisfactory terms indefinitely.

We believe that design changes could be made to our machines to allow sourcing of components, sub-assemblies, assemblies or products from several other suppliers; however, a disruption in the supply from any of our suppliers could cause us to experience a material adverse effect on our operations.

We rely in part on independent distributors and the loss of these distributors could adversely affect our business.

In addition to our direct sales force, we depend on the services of independent distributors and agents to sell our products and provide service and aftermarket support to our customers. We maintain an extensive distributor and agent network worldwide. In 2016, approximately 30% of our sales were through distributors. No distributor accounted for more than 5% of our consolidated sales in 2016. Rather than serving as passive conduits for delivery of product, many of our distributors are active participants in the sale and support of our products. Many of the distributors with whom we transact business offer competitive products and services to our customers. In addition, the distribution agreements we have are typically cancelable by the distributor after a relatively short notice period. The loss of a substantial number of our distributors or an increase in the distributors' sales of our competitors' products to our customers could reduce our sales and profits.

If we are unable to attract and retain skilled employees to work at our manufacturing facilities our operations and growth prospects would be adversely impacted.

We conduct substantially all of our manufacturing operations in less densely populated urban areas which, in many cases, may represent a relatively small market for skilled labor force. Our continued success depends on our ability to attract and retain a skilled labor force at these locations. If we are not able to attract and retain the personnel we require, we may be unable to develop, manufacture, and market our products, or to expand our operations in a manner that best exploits market opportunities and capitalizes on our investment in our business. Failure to achieve these objectives would materially adversely affect our business, operating results and financial condition.

We could face potential product liability claims relating to products we manufacture, which could result in commitments of significant time and expense to defend these claims and to pay material amounts in damages or settlement.

We face a business risk of exposure to product liability claims in the event that the use of our products is alleged to have resulted in injury or other adverse effects. We currently maintain product liability insurance coverage; however, such insurance does not cover all types of damages that could be assessed against us in a product liability claim and the coverage

amounts are subject to certain limitations under the applicable policies. We may not be able to obtain product liability insurance on acceptable terms in the future. Product liability claims can be expensive to defend and can divert the attention of management and other personnel for long periods of time, regardless of the ultimate outcome. An unsuccessful product liability defense could have a material adverse effect on our business, financial condition, results of operations or prospects. In addition, we believe our business depends on the strong brand reputation we have developed. In the event that our reputation is damaged, we may face difficulty in maintaining our pricing positions with respect to some of our products, which would reduce our sales and profitability.

We are subject to environmental laws that could impose significant costs on us and the failure to comply with such laws could subject us to sanctions and material fines and expenses.

Our operations are subject to extensive federal, state, local and foreign laws and regulations relating to environmental matters. Certain environmental laws can impose joint and several liability for releases or threatened releases of hazardous substances upon certain statutorily defined parties regardless of fault or the lawfulness of the original activity or disposal. Hazardous substances and adverse environmental effects have been identified with respect to real property we own and on adjacent parcels of real property.

We believe, based upon information currently available that, except with respect to the environmental matter concerning the Kentucky Avenue Wellfield Site as described in Part I Item 1. "Business - Environmental Matters", we will not have material liabilities for environmental remediation. Though the foregoing reflects the Company's current assessment as it relates to environmental remediation obligations, it is possible that future remedial requirements or changes in the enforcement of existing laws and regulations, which are subject to extensive regulatory discretion, will result in material liabilities to the Company.

We may be adversely affected by attacks on information technology systems as well as other cybersecurity risks and business disruptions.

Our business may be impacted by disruptions to our own or third party information technology systems, which may result from attacks on or failures of such infrastructure. Cybersecurity risks are evolving and include, but are not limited to, attacks on our information technology systems and attacks on the information technology systems of third parties in attempts to gain unauthorized access to our confidential or other proprietary information or information relating to our employees, customers and other third parties. Cybersecurity risks may also include attacks targeting the security, integrity and/or reliability of the hardware, software and information installed, stored or transmitted in our products, including after the purchase of those products and when they are incorporated into our customers’ facilities and/or infrastructure. Such attacks could potentially result in disruptions to systems, unauthorized release of confidential or otherwise protected information and corruption of data. We believe that we have adopted appropriate measures to mitigate potential risks to our technology, products, services and operations from these potential attacks. However, given the unpredictability of the timing, nature and scope of such attacks or other disruptions, we could potentially be subject to production downtimes, operational delays, other damaging effects on our operations or our ability to provide products and services to our customers, the unintended release of confidential or otherwise protected information, misappropriation, destruction or corruption of data, security breaches, other improper use of our or third party systems, networks or products, financial losses from remedial actions, loss of business or potential liability, and/or damage to our reputation, any of which could have a material adverse effect on our operating results.

Risks Relating to Our Customers

Our customers' activity levels and spending for our products and services have been impacted by global economic conditions, especially deterioration in the credit markets.

For many of our customers, the purchase of our machines represents a significant capital expenditure. For others, the purchase of our machines is a part of a larger improvement or expansion of manufacturing capability. For all, the purchase represents a long term commitment of capital raised by incurrence of debt, issuance of equity or use of cash flow from operations.

We rely on estimated forecasts of our customers' needs and inaccuracies in such forecasts could adversely affect our business.

We generally sell our products pursuant to individual purchase orders instead of long-term purchase commitments. Therefore, we rely on estimated demand forecasts, based upon input from our customers and the general economic environment, to determine how much material to purchase and product to manufacture. Because our sales are based on purchase orders, our customers may cancel, delay, or otherwise modify their purchase commitments with little or no consequence to them and with little or no notice to us. For these reasons, we generally have limited visibility regarding our customers' actual product needs. The quantities or timing required by our customers for our products could vary significantly. Whether in response to changes affecting the industry or a customer's specific business pressures, any cancellation, delay, or other modification in our customers' orders could significantly reduce our revenue, causing our operating results to fluctuate from period to period and make it more difficult for us to predict our revenue. In the event of a cancellation or reduction of a customer order, we may not have enough time to reduce inventory purchases or our workforce to minimize the effect of the lost revenue on our business. Order cancellations typically average approximately 2% of sales. Cancellations could vary significantly during times of global economic uncertainty.

Major changes in the economic situation of our customer base could require us to write off significant portion of our receivables from customers.

In difficult economic periods, our customers lose work and find it difficult if not impossible to pay for products purchased from us. Although appropriate credit reviews are done at the time of sale, rapidly changing economic conditions can have sudden impacts on customers' ability to pay. We run the risk of bad debt with customers on open account. If we write off significant parts of our customer accounts receivable because of unforeseen changes in their business condition, it would adversely affect our results of operations, financial condition, and cash flows.

Risks Relating to Our Securities

Anti-takeover provisions in our charter documents and under New York law may discourage a third party from acquiring us.

Certain provisions of our certificate of incorporation and bylaws may have the effect of discouraging a third party from making a proposal to acquire us and, as a result, may inhibit a change in control of the Company under circumstances that could give the shareholders the opportunity to realize a premium over the then-prevailing market price of our common shares. These include:

Staggered Board of Directors. Our certificate of incorporation and bylaws provide that our Board of Directors, currently consisting of nine members, is divided into three classes of directors, with each class consisting of three directors, and with the classes serving staggered three-year terms. This classification of the directors has the effect of making it more difficult for shareholders, including those holding a majority of our outstanding shares, to force an immediate change in the composition of our Board of Directors.

Removal of Directors and Filling of Vacancies. Our certificate of incorporation provides that a member of our Board of Directors may be removed only for cause and upon the affirmative vote of the holders of 75% of the securities entitled to vote at an election of directors. Newly created directorships and Board of Director vacancies resulting from retirement, death, removal or other causes may be filled only by a majority vote of the then remaining directors. Accordingly, it is more difficult for shareholders, including those holding a majority of our outstanding shares, to force an immediate change in the composition of our Board of Directors.

Supermajority Voting Provisions for Certain Business Combinations. Our certificate of incorporation requires the affirmative vote of at least 75% of all of the securities entitled to vote and at least 75% of shareholders who are not Major Shareholders (defined as 10% beneficial holders) in order to effect certain mergers, sales of assets or other business combinations involving the Company. These provisions could have the effect of delaying, deferring or preventing a change of control of the Company.

In addition, as a New York corporation we are subject to provisions of the New York Business Corporation Law which may make it more difficult for a third party to acquire and exercise control over us pursuant to a tender offer or request or invitation for tenders. These provisions could have the effect of deterring or delaying changes in incumbent management, proxy contests or changes in control.

Our certificate of incorporation authorizes the issuance of shares of blank check preferred stock.

Our certificate of incorporation provides that our Board of Directors is authorized to issue from time to time, without further stockholder approval, up to 2,000,000 shares of preferred stock (the Board of Directors has already designated 250,000 of such shares of preferred stock as Series A Preferred Stock) in one or more series and to fix and designate the rights, preferences, privileges and restrictions of the preferred stock, including dividend rights, conversion rights, voting rights, redemption rights and terms of redemption and liquidation preferences. Such shares of preferred stock could have preferences over our common stock with respect to dividends and liquidation rights. Our issuance of preferred stock may have the effect of delaying or preventing a change in control. Our issuance of preferred stock could decrease the amount of earnings and assets available for distribution to the holders of common stock or could adversely affect the rights and powers, including voting rights, of the holders of common stock. The issuance of preferred stock could have the effect of decreasing the market price of our common stock.

Our shareholders may experience further dilution as a result of future equity offerings or issuances.

In order to raise additional capital or pursue strategic transactions, we may in the future offer, issue or sell additional shares of our common stock or other equity securities. Our shareholders may experience significant dilution as a result of future equity offerings or issuances. Investors purchasing shares or other securities in the future could have rights superior to existing shareholders.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Pertinent information concerning the principal properties of the Company and its subsidiaries is as follows:

Owned Properties:

|

| | | | |

| Location | | Type of Facility | | Acreage (Land) Square Footage (Building) |

| Horseheads, New York | | Manufacturing, Engineering, Turnkey Systems, Marketing, Sales, Demonstration, Service, and Administration | | 80 acres 515,000 sq. ft. |

| Jiaxing, China | | Manufacturing, Engineering, Demonstration, and Administration (Buildings and improvements are owned by the Company; land is under 50-year lease expiring in November 2060) | | 7 acres 223,179 sq. ft |

| St. Gallen, Switzerland | | Manufacturing, Engineering, Turnkey Systems, Marketing, Sales, Demonstration, Service, and Administration | | 8 acres 162,924 sq. ft. |

| Nan Tou City, Taiwan | | Manufacturing, Engineering, Marketing, Sales, Demonstration, Service, and Administration | | 3 acres 123,204 sq. ft. |

| Romanshorn, Switzerland | | Manufacturing | | 2 acres 42,324 sq. ft. |

| Biel, Switzerland | | Manufacturing, Engineering, Service, and Turnkey Systems | | 4 acres 41,500 sq. ft. |

| Traverse City, Michigan | | Manufacturing, Engineering, Marketing, Sales, Service, and Administration | | 2.4 acres 38,800 sq. ft. |

Leased Properties:

|

| | | | | | |

| Location | | Type of Facility | | Square Footage | | Lease Expiration Date |

| Leicester, England | | Manufacturing, Sales, Marketing, Engineering, Turnkey Systems, Demonstration, Service, and Administration | | 55,000 sq. ft. | | 3/31/19 |

| Reutlingen, Germany | | Manufacturing, Engineering, Marketing, Sales, Service, and Administration | | 39,547 sq. ft. | | 8/31/19 |

| Shanghai, China | | Marketing, Engineering, Turnkey Systems, Sales, Service, Demonstration, and Administration | | 38,820 sq. ft. | | 5/31/18 |

| Elgin, Illinois | | Manufacturing, Sales, Marketing, Engineering, Turnkey Systems, Demonstration, Service, and Administration | | 34,000 sq. ft. | | 12/31/17 |

| Krefeld, Germany | | Sales, Turnkey Systems, Service, Demonstration, and Administration | | 14,402 sq. ft. | | 3/31/20 |

| Hyderabad, India | | Manufacturing, Engineering, Marketing, Sales, Service, and Administration | | 10,000 sq. ft. | | 9/30/18 |

| Biel, Switzerland | | Manufacturing, Sales, Engineering, Turnkey Systems, Service, and Administration | | 7,995 sq. ft. | | 6/30/17 |

| Noisy le Sec, France | | Manufacturing, Engineering, Marketing, Sales, Administration, and Service | | 7,320 sq. ft. | | 12/31/19 |

| St. Gallen, Switzerland | | Manufacturing | | 7,136 sq. ft. | | 12/31/19 |

| Shanghai, China | | Sales, Service, Engineering, and Administration | | 6,949 sq. ft. | | 10/31/17 |

| Bron, France | | Marketing, Sales, Administration, and Service | | 2,680 sq. ft. | | 4/1/23 |

Item 3. Legal Proceedings.

The Company is from time to time involved in routine litigation incidental to its operations. None of the litigation in which we are currently involved, individually or in the aggregate, is anticipated to be material to our financial condition, results of operations, or cash flows.

Item 4. Mine Safety Disclosures.

Not Applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The following table reflects the highest and lowest values at which our common stock traded in each quarter of the last two years. Our common stock trades on the NASDAQ Global Select Market under the symbol "HDNG". The table also includes dividends per share, by quarter:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | 2016 | | 2015 |

| | High | | Low | | Dividends | | High | | Low | | Dividends |

| Quarter Ended | |

| | |

| | |

| | |

| | |

| | |

|

| March 31, | $ | 12.60 |

| | $ | 12.45 |

| | $ | 0.02 |

| | $ | 12.05 |

| | $ | 10.78 |

| | $ | 0.02 |

|

| June 30, | 10.21 |

| | 9.96 |

| | 0.02 |

| | 11.69 |

| | 9.38 |

| | 0.02 |

|

| September 30, | 11.23 |

| | 10.53 |

| | 0.02 |

| | 10.83 |

| | 8.13 |

| | 0.02 |

|

| December 31, | 11.24 |

| | 10.85 |

| | 0.02 |

| | 10.15 |

| | 7.97 |

| | 0.02 |

|

At February 28, 2017, there were 218 shareholders of record of our common stock.

Issuer Purchases of Equity Securities

None.

Performance Graph

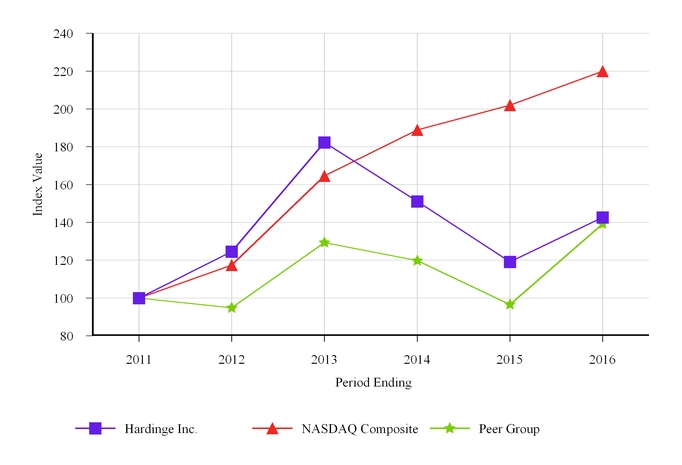

The graph below compares the five-year cumulative total return for Hardinge Inc. common stock with the comparable returns for the NASDAQ Stock Market (U.S.) Index and a group of 14 peer issuers. The companies included in our peer group were selected based on comparability to Hardinge with respect to market capitalization, sales, manufactured products and international presence. Our peer group includes Altra Holding, Inc., Cohu, Inc., Columbus McKinnon Corporation, Dynamic Materials Corporation, Electro Scientific Industries Inc., Global Power Equipment Group Inc., Hurco Companies Inc., Kadant Inc., Nanometrics Inc., NN, Inc., Rudolph Technologies, Inc., Sifco Industries Inc., Transcat Inc., and Twin Disc Inc. We removed Newport Corp. from the peer group as it is no longer a publicly traded company. Cumulative total return represents the change in stock price and the amount of dividends received during the indicated period, assuming reinvestment of dividends. The graph assumes an investment of $100 on December 31, 2011. The stock performance shown in the graph is included in response to SEC requirements and is not intended to forecast or to be indicative of future performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Hardinge Inc., the NASDAQ Composite Index,

and a Peer Group

____________________

*$100 invested on 12/31/11 in stock or index, including reinvestment of dividends.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal year ended December 31, | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | | 2016 |

| Hardinge Inc. | $ | 100.00 |

| | $ | 124.52 |

| | $ | 182.32 |

| | $ | 151.15 |

| | $ | 119.09 |

| | $ | 142.69 |

|

| NASDAQ Composite | 100.00 |

| | 117.45 |

| | 164.57 |

| | 188.84 |

| | 201.98 |

| | 219.89 |

|

| Peer Group | 100.00 |

| | 94.78 |

| | 129.30 |

| | 119.72 |

| | 96.57 |

| | 139.25 |

|

Item 6. Selected Financial Data.

The following selected financial data is derived from the audited consolidated financial statements of the Company. The data should be read in conjunction with the audited consolidated financial statements, related notes and other information included herein (amounts in thousands except per share data):

|

| | | | | | | | | | | | | | | | | | | |

| | 2016 | | 2015 | | 2014 | | 2013 | | 2012 |

| STATEMENT OF OPERATIONS DATA: | |

| | |

| | |

| | |

| | |

|

| Sales | $ | 292,013 |

| | $ | 315,249 |

| | $ | 311,633 |

| | $ | 329,459 |

| | $ | 334,413 |

|

| Cost of sales | 194,486 |

| | 210,711 |

| | 210,851 |

| | 223,760 |

| | 225,286 |

|

| Gross profit | 97,527 |

| | 104,538 |

| | 100,782 |

| | 105,699 |

| | 109,127 |

|

| Selling, general and administrative expenses | 79,647 |

| | 81,271 |

| | 81,045 |

| | 79,533 |

| | 76,196 |

|

Research & development(1) | 13,514 |

| | 14,140 |

| | 13,904 |

| | 12,460 |

| | 12,290 |

|

Restructuring charges(2) | 661 |

| | 3,558 |

| | — |

| | — |

| | — |

|

Impairment charges(3) | — |

| | — |

| | 5,766 |

| | 6,239 |

| | — |

|

| Other expense, net | 310 |

| | 632 |

| | 514 |

| | 471 |

| | 559 |

|

| Operating income (loss) | 3,395 |

| | 4,937 |

| | (447 | ) | | 6,996 |

| | 20,082 |

|

| Interest expense, net | 328 |

| | 499 |

| | 678 |

| | 1,064 |

| | 741 |

|

Income (loss) from continuing operations before income taxes | 3,067 |

| | 4,438 |

| | (1,125 | ) | | 5,932 |

| | 19,341 |

|

| Income taxes | 1,843 |

| | 1,828 |

| | 1,233 |

| | 1,537 |

| | 1,486 |

|

| Income (loss) from continuing operations | 1,224 |

| | 2,610 |

| | (2,358 | ) | | 4,395 |

| | 17,855 |

|

Gain from disposal of discontinued operation, and income from discontinued operations, net of tax(4) | — |

| | — |

| | 218 |

| | 5,532 |

| | — |

|

| Net income (loss) | $ | 1,224 |

| | $ | 2,610 |

| | $ | (2,140 | ) | | $ | 9,927 |

| | $ | 17,855 |

|

| PER SHARE DATA: | |

| | |

| | |

| | |

| | |

|

| Basic earnings (loss) per share: | | | | | | | | | |

| Continuing operations | $ | 0.10 |

| | $ | 0.20 |

| | $ | (0.19 | ) | | $ | 0.37 |

| | $ | 1.53 |

|

| Discontinued operations | — |

| | — |

| | 0.02 |

| | 0.47 |

| | — |

|

| Basic earnings (loss) per share | $ | 0.10 |

| | $ | 0.20 |

| | $ | (0.17 | ) |

| $ | 0.84 |

| | $ | 1.53 |

|

| Weighted average basic shares outstanding | 12,824 |

| | 12,776 |

| | 12,661 |

| | 11,801 |

| | 11,557 |

|

| | | | | | | | | | |

| Diluted earnings (loss) per share: | | | | | | | | | |

| Continuing operations | $ | 0.09 |

| | $ | 0.20 |

| | $ | (0.19 | ) | | $ | 0.37 |

| | $ | 1.53 |

|

| Discontinued operations | — |

| | — |

| | 0.02 |

| | 0.46 |

| | — |

|

| Diluted earnings (loss) per share | $ | 0.09 |

| | $ | 0.20 |

| | $ | (0.17 | ) | | $ | 0.83 |

| | $ | 1.53 |

|

| Weighted average diluted shares outstanding | 12,909 |

| | 12,872 |

| | 12,661 |

| | 11,891 |

| | 11,596 |

|

| | |

| | |

| | |

| | |

| | |

|

| Cash dividends declared per share | $ | 0.08 |

| | $ | 0.08 |

| | $ | 0.08 |

| | $ | 0.08 |

| | $ | 0.08 |

|

| BALANCE SHEET DATA: | |

| | |

| | |

| | |

| | |

|

| Working capital | $ | 127,848 |

| | $ | 129,310 |

| | $ | 134,338 |

| | $ | 136,931 |

| | $ | 128,069 |

|

| Total assets | 297,550 |

| | 310,938 |

| | 311,084 |

| | 343,861 |

| | 325,628 |

|

| Total debt | 6,596 |

| | 11,606 |

| | 15,989 |

| | 26,314 |

| | 19,963 |

|

| Shareholders' equity | 155,941 |

| | 161,105 |

| | 169,596 |

| | 203,788 |

| | 161,207 |

|

____________________

| |

(1) | In 2016, we reclassified Research & development expenses from Cost of sales to Operating expenses for all years presented. |

| |

(2) | On August 4, 2015, the Company's Board of Directors approved a strategic restructuring program with the goals of streamlining the Company's cost structure, increasing operational efficiencies and improving shareholder returns, which was completed in 2016. |

| |

(3) | 2014 and 2013 results include non-cash charges of $5.8 million and $6.2 million, respectively, for impairment of goodwill and other intangible assets. $5.8 million and $5.1 million in 2014 and 2013, respectively, was related to the impairment in the value of goodwill and the trade name associated with the purchase of Usach, and $1.1 million in 2013 was related to the impairment of the Forkardt trade name as a result of the Forkardt Swiss business divestiture. |

| |

(4) | On December 31, 2013, the Company divested its Forkardt Operations in Switzerland for CHF 5.6 million, net of cash sold ($6.3 million equivalent), resulting in a gain of $4.9 million. In March 2014, the Company recognized $0.2 million of additional consideration as a result of final working capital adjustments. |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Overview. We supply high precision computer controlled metalcutting turning machines, grinding machines, vertical machining centers, and repair parts related to those machines. The Company also engineers and supplies high precision, standard and specialty workholding devices, and other machine tool accessories. We believe our products are known for accuracy, reliability, durability and value. We are geographically diversified with manufacturing facilities in China, France, Germany, India, Switzerland, Taiwan, the United States (“U.S.”), and the United Kingdom (“U.K.”), with sales to most industrialized countries. Approximately 68% of our 2016 sales were to customers outside of North America, 71% of our 2016 products sold were manufactured outside of North America, and 68% of our employees in 2016 were employed outside of North America.

Metrics on machine tool market activity monitored by our management include world machine tool shipments, as reported annually by Gardner Publications in the Metalworking Insiders Report, and metal-cutting machine orders, as reported by the Association of Manufacturing Technology, the primary industry group for U.S. machine tool manufacturers. Other closely followed U.S. market indicators are tracked to determine activity levels in U.S. manufacturing plants that are prospective customers for our products. One such measurement is the Purchasing Managers Index, as reported by the Institute for Supply Management. Another measurement is capacity utilization of U.S. manufacturing plants, as reported by the Federal Reserve Board. Similar information regarding machine tool shipments and economic indicators in foreign countries is published by trade associations, government agencies, and economic services in those countries.

Non-machine sales, which include collets, chucks, accessories, repair parts and service revenue, accounted for approximately 33% of overall sales in 2016 and are an important part of our business due to an installed base of thousands of machines, and the growing needs demanded by specialty workholding applications. In the past, sales of these products and services have not fluctuated on a year-to-year basis as significantly as the sales of our machines have from time to time, but demand for these products and services typically track the direction of the related machine metrics.

Other key performance indicators are geographic distribution of net sales (“sales”), gross profit as a percent of sales, income from operations, working capital changes, and debt level trends. In an industry where constant product technology development has led to an average model life of three to five years, effectiveness of technological innovation and development of new products are also key performance indicators.

We are exposed to financial market risk resulting from changes in interest and foreign currency rates. Global economic conditions and related disruptions within the financial markets have also increased our exposure to the possible liquidity and credit risks of our counterparties. We believe we have sufficient liquidity to fund our foreseeable business needs, including cash and cash equivalents, cash flows from operations, our bank financing arrangements, and equity financing arrangements.

We monitor the third-party depository institutions that hold our cash and cash equivalents. Our emphasis is primarily on safety of principal. Our cash and cash equivalents are diversified among counterparties to minimize exposure to any one of these entities.

We are subject to credit risks relating to the ability of counterparties of hedging transactions to meet their contractual payment obligations. The risks related to creditworthiness and non-performance has been considered in the fair value measurements of our foreign currency forward exchange contracts.

We expect that some of our customers and vendors may experience difficulty in maintaining the liquidity required to buy inventory or raw materials. We continue to monitor our customers’ financial condition in order to mitigate the risk associated with our ability to collect on our accounts receivable.

Foreign currency exchange rate changes can be significant to reported results for several reasons. Our primary competitors, particularly for the most technologically advanced products, are now largely manufacturers in Japan, Germany, Switzerland, Korea, and Taiwan, which causes the worldwide valuation of their respective currencies to be central to

competitive pricing in all of our markets. The major functional currencies of our subsidiaries are the British Pound Sterling (“GBP”), Chinese Renminbi (“CNY”), Euro (“EUR”), New Taiwanese Dollar (“TWD”), and Swiss Franc (“CHF”). Under US GAAP, results of foreign subsidiaries are translated into U.S. Dollars (“USD”) at the average exchange rate during the periods presented. Period-to-period changes in the exchange rate between their local currency and the USD may affect comparative data significantly. We also purchase computer controls and other components from suppliers throughout the world, with purchase costs reflecting currency changes.

Results of Operations

Presented below is summarized selected financial data for the years ended December 31, 2016 and 2015 (in thousands):

|

| | | | | | | | | | | | | | | | | | | | |

| | 2016 | | % of Sales | | 2015 | | % of Sales | | $

Change | | %

Change |

| Sales | $ | 292,013 |

| |

|

| | $ | 315,249 |

| | | | $ | (23,236 | ) | | (7.4 | )% |

| Gross profit | 97,527 |

| | 33.4 | % | | 104,538 |

| | 33.2 | % | | (7,011 | ) | | (6.7 | )% |

| Selling, general and administrative expenses | 79,647 |

| | 27.3 | % | | 81,271 |

| | 25.8 | % | | (1,624 | ) | | (2.0 | )% |

| Research & Development | 13,514 |

| | 4.6 | % | | 14,140 |

| | 4.5 | % | | (626 | ) | | (4.4 | )% |

| Restructuring Charges | 661 |

| | 0.2 | % | | 3,558 |

| | 1.1 | % | | (2,897 | ) | | (81.4 | )% |

| Other expense, net | 310 |

| | 0.1 | % | | 632 |

| | 0.2 | % | | (322 | ) | | (50.9 | )% |

| Operating Income | 3,395 |

| | 1.2 | % | | 4,937 |

| | 1.6 | % | | (1,542 | ) | | (31.2 | )% |

| Interest expense, net | 328 |

| |

|

| | 499 |

| |

|

| | (171 | ) | |

|

|

| Income before income taxes | 3,067 |

| | 1.1 | % | | 4,438 |

| | 1.4 | % | | (1,371 | ) | | (30.9 | )% |

| Income taxes | 1,843 |

| |

|

| | 1,828 |

| |

|

| | 15 |

| |

|

|

| Net income | $ | 1,224 |

| | 0.4 | % | | $ | 2,610 |

| | 0.8 | % | | $ | (1,386 | ) | | (53.1 | )% |

Sales. The table below summarizes sales by each corresponding geographical region for the year ended December 31, 2016 compared to the year ended December 31, 2015 (in thousands):

|

| | | | | | | | | | | | | | | | | | | | |

| | 2016 | | 2015 | | Change |

| | $ | | % | | $ | | % | | $ | | % |

| Sales to customers in: |

| North America | $ | 92,668 |

| | 31.7 | % | | $ | 108,470 |

| | 34.4 | % | | $ | (15,802 | ) | | (14.6 | )% |

| Europe | 91,382 |

| | 31.3 | % | | 97,269 |

| | 30.9 | % | | (5,887 | ) | | (6.1 | )% |

| Asia | 107,963 |

| | 37.0 | % | | 109,510 |

| | 34.7 | % | | (1,547 | ) | | (1.4 | )% |

| Total | $ | 292,013 |

| | 100.0 | % | | $ | 315,249 |

| | 100.0 | % | | $ | (23,236 | ) | | (7.4 | )% |

Sales for the year ended December 31, 2016 were $292.0 million, a decrease of $23.2 million, or 7.4% when compared to the prior year. Global demand for machine tools and accessories continued to be weak in 2016, especially in North America and Europe, which drove the year over year decline. In Asia, we have been able to maintain stable sales volume levels in the primary customer segments that we serve. Unfavorable foreign currency translation had an impact of approximately $6.9 million, primarily in Asia. Excluding the impact of foreign currency translation, sales would have decreased $16.3 million or 5.2% over the prior year.

North America sales were $92.7 million and $108.5 million, respectively, for the years ended December 31, 2016 and 2015, a decrease of $15.8 million, or 14.6%. The current year decrease reflects industrial market weakness with MMS down 22.4%, and ATA down 3.6% from respective prior year sales in the region.

Europe sales were $91.4 million and $97.3 million for the years ended December 31, 2016 and 2015, respectively, a decrease of $5.9 million, or 6.1%. This decline reflects industrial market weakness with MMS down 4.3%, and ATA down 15.3% from respective prior year sales in the region. The ATA decline is primarily attributed to the restructuring of our operations in this region. Unfavorable foreign currency translation impacted sales by approximately $2.0 million. Excluding the impact of foreign currency translation, sales would have decreased $3.9 million, or 4.0% versus the prior year.