Use these links to rapidly review the document

TABLE OF CONTENTS

Item 17. FINANCIAL STATEMENTS

Table of Contents

As filed with the Securities and Exchange Commission on 28 October 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| | |

o |

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934—for the year ended 30 June 2019 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

o |

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-31615

Sasol Limited

(Exact name of registrant as Specified in its Charter)

Republic of South Africa

(Jurisdiction of Incorporation or Organisation)

Sasol Place, 50 Katherine Street, Sandton, 2196

South Africa

(Address of Principal Executive Offices)

Paul Victor, Chief Financial Officer, Tel. No. +27 10 344 7896, Email paul.victor@sasol.com

Sasol Place, 50 Katherine Street, Sandton, 2196, South Africa

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

|---|

| American Depositary Shares | | SSL | | New York Stock Exchange |

| Ordinary Shares of no par value* | | SSL | | New York Stock Exchange |

| 4,50% Notes due 2022 issued by Sasol Financing International Limited | | SOLJAS | | New York Stock Exchange |

| 5,875% Notes due 2024 issued by Sasol Financing USA LLC | | SOLJL | | New York Stock Exchange |

| 6,50% Notes due 2028 issued by Sasol Financing USA LLC | | SOLJL | | New York Stock Exchange |

- *

- Listed on the New York Stock Exchange not for trading or quotation purposes, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission.

Securities registered pursuant to Section 12(g) of the Act:None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report:

624 696 971 Sasol ordinary shares of no par value

6 331 347 Sasol BEE ordinary shares of no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232 405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of "large accelerated filer," "accelerated filer," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o | | Emerging growth company o |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. o

- †

- The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

| U.S. GAAP o | | International Financial Reporting Standards as issued

by the International Accounting Standards Board ý | | Other o |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Table of Contents

TABLE OF CONTENTS

| | | | | | |

| |

| | Page | |

|---|

ITEM 1. | | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | | | 6 | |

ITEM 2. | | OFFER STATISTICS AND EXPECTED TIMETABLE | | | 6 | |

ITEM 3. | | KEY INFORMATION | | | 6 | |

ITEM 4. | | INFORMATION ON THE COMPANY | | | 33 | |

ITEM 4A. | | UNRESOLVED STAFF COMMENTS | | | 62 | |

ITEM 5. | | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | | | 62 | |

ITEM 6. | | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | | | 76 | |

ITEM 7. | | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | | | 77 | |

ITEM 8. | | FINANCIAL INFORMATION | | | 78 | |

ITEM 9. | | THE OFFER AND LISTING | | | 79 | |

ITEM 10. | | ADDITIONAL INFORMATION | | | 79 | |

ITEM 11. | | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | | 93 | |

ITEM 12. | | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | | | 95 | |

ITEM 13. | | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | | | 96 | |

ITEM 14. | | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | | | 96 | |

ITEM 15. | | CONTROLS AND PROCEDURES | | | 96 | |

ITEM 16A. | | AUDIT COMMITTEE FINANCIAL EXPERT | | | 99 | |

ITEM 16B. | | CODE OF ETHICS | | | 99 | |

ITEM 16C. | | PRINCIPAL ACCOUNTANT FEES AND SERVICES | | | 100 | |

ITEM 16D. | | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | | | 101 | |

ITEM 16E. | | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | | | 101 | |

ITEM 16F. | | CHANGE IN REGISTRANT'S CERTIFYING ACCOUNTANT | | | 101 | |

ITEM 16G. | | CORPORATE GOVERNANCE | | | 101 | |

ITEM 16H. | | MINE SAFETY DISCLOSURE | | | 101 | |

ITEM 17. | | FINANCIAL STATEMENTS | | | 101 | |

ITEM 18. | | FINANCIAL STATEMENTS | | | 102 | |

ITEM 19. | | EXHIBITS | | | H-1 | |

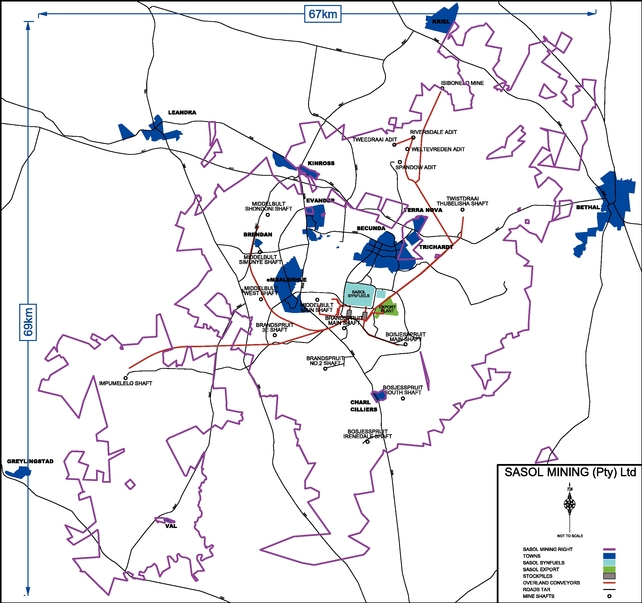

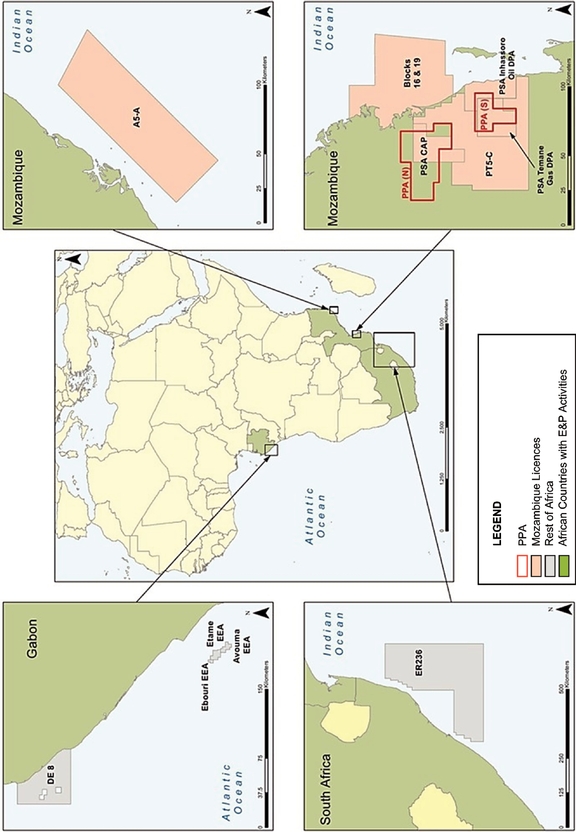

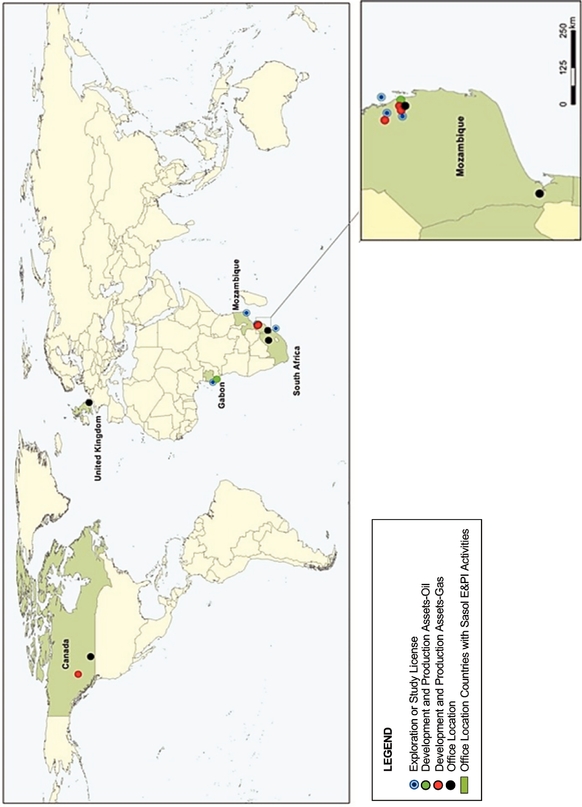

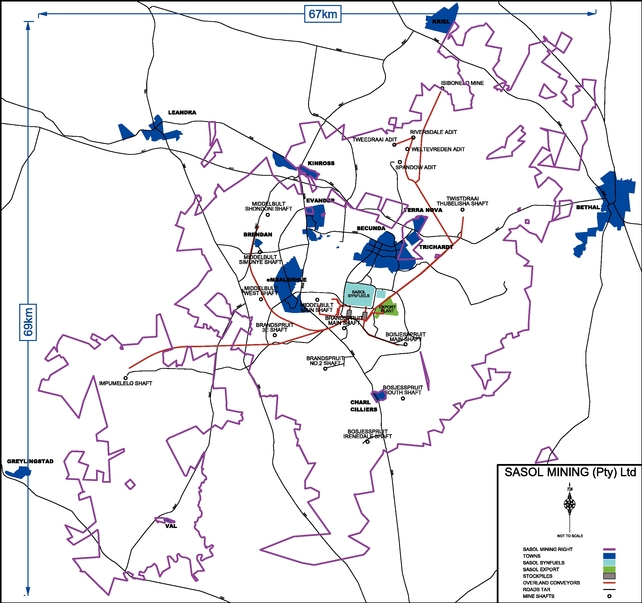

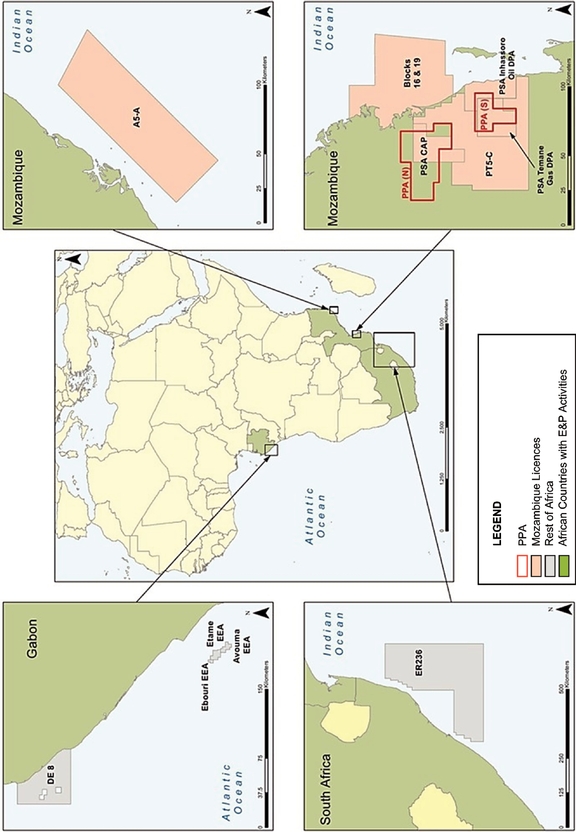

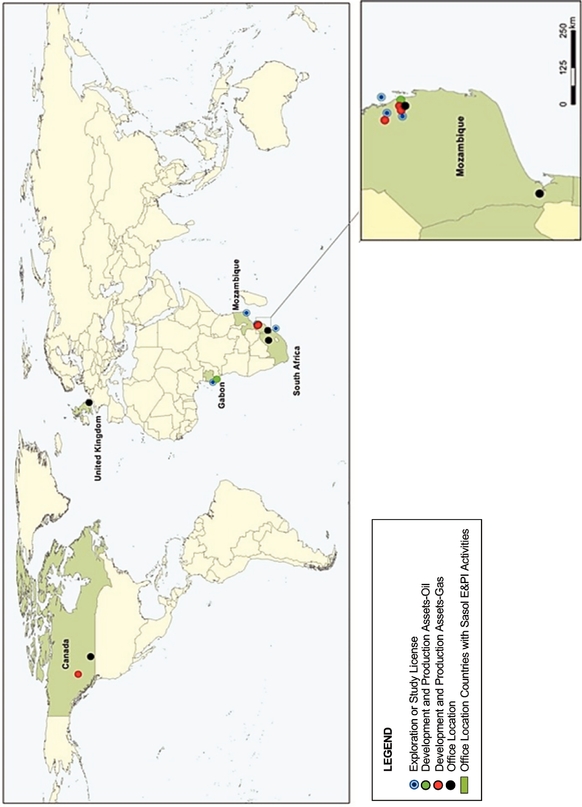

LOCATION MAPS | | | M-1 | |

1

Table of Contents

PRESENTATION OF INFORMATION

We are incorporated in the Republic of South Africa as a public company under South African company law. Our audited consolidated financial statements are prepared in accordance with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board (IASB).

As used in this Form 20-F:

- •

- "rand" or "R" means the currency of the Republic of South Africa;

- •

- "US dollars", "dollars", "US$" or "$" means the currency of the United States (US);

- •

- "euro", "EUR" or "€" means the common currency of the member states of the European Monetary Union; and

- •

- "CAD" means Canadian dollar, the currency of Canada.

We present our financial information in rand, which is our reporting currency. Solely for your convenience, this Form 20-F contains translations of certain rand amounts into US dollars at specified rates as at and for the year ended 30 June 2019. These rand amounts do not represent actual US dollar amounts, nor could they necessarily have been converted into US dollars at the rates indicated.

All references in this Form 20-F to "years" refer to the financial years ended on 30 June. Any reference to a calendar year is prefaced by the word "calendar".

Besides applying barrels (b or bbl) and standard cubic feet (scf) for reporting oil and gas reserves and production, Sasol applies the Système International (SI) metric measures for all global operations. A ton, or tonne, denotes one metric ton equivalent to 1 000 kilograms (kg). Sasol's reference to metric tons should not be confused with an imperial ton equivalent to 2 240 pounds (or about 1 016 kg). Barrels per day, or bpd, or bbl/d, is used to refer to our oil and gas production.

In addition, in line with a South African convention under the auspices of the South

African Bureau of Standards (SABS), the information presented herein is displayed using the decimal comma (e.g., 3,5) instead of the more familiar decimal point (e.g., 3.5) used in the UK, US and elsewhere. Similarly, a hard space is used to distinguish thousands in numeric figures (e.g., 2 500) instead of a comma (e.g., 2,500).

All references to the "group", "us", "we", "our", "company", or "Sasol" in this Form 20-F are to Sasol Limited, its group of subsidiaries and its interests in associates, joint arrangements and structured entities. All references in this Form 20-F are to Sasol Limited or the companies comprising the group, as the context may require. All references to "(Pty) Ltd" refers to Proprietary Limited, a form of corporation in South Africa which restricts the right of transfer of its shares and prohibits the public offering of its shares.

All references in this Form 20-F to "South Africa" and "the government" are to the Republic of South Africa and its government. All references to the "JSE" are to the JSE Limited or Johannesburg Stock Exchange, the securities exchange of our primary listing. All references to "SARB" refer to the South African Reserve Bank. All references to "PPI" and "CPI" refer to the South African Producer Price Index and Consumer Price Index, respectively, which are measures of inflation in South Africa. All references to "GTL" and "CTL" refer to our gas-to-liquids and coal-to-liquids processes, respectively.

Unless otherwise stated, presentation of financial information in this annual report on Form 20-F will be in terms of IFRS. Our discussion of business segment results follows the basis used by the Joint Presidents and Chief Executive Officers (the company's chief operating decision makers) for segmental financial decisions, resource allocation and performance assessment, which forms the accounting basis for segmental reporting, that is disclosed to the investing and reporting public.

"Financial Review" means the Chief Financial Officer's Finance Overview included in Exhibit 99.3.

2

Table of Contents

"Headline earnings per share (HEPS)" refers to disclosure made in terms of the JSE listing requirements.

"Core headline earnings per share (CHEPS)" refers to a disclosure based on HEPS above, calculated by adjusting headline earnings with once-off items, period close adjustments and depreciation and amortisation of capital projects (exceeding four billion rand) which have reached beneficial operation and are still ramping up and share-based payments on implementation of Broad-Based Black Economic Empowerment (B-BBEE) transactions. Period close adjustments in relation to the valuation of our derivatives at period end are to remove volatility from earnings as these instruments are valued using forward curves and other market factors at the reporting

date and could vary from period to period. We believe core headline earnings is a useful measure of the group's sustainable operating performance. However, this is not a defined term under IFRS, should not be viewed as a substitute for earnings for the year or earnings per share and may not be comparable with similarly titled measures reported by other companies. The aforementioned adjustments are the responsibility of the directors of Sasol. The adjustments have been prepared for illustrative purposes only and due to their nature, core headline earnings may not necessarily be indicative of Sasol's financial position, changes in equity, results of operations or cash flows.

"EBIT" refers to earnings before interest and tax.

3

Table of Contents

FORWARD-LOOKING STATEMENTS

We may from time to time make written or oral forward-looking statements, including in this Form 20-F, in other filings with the US Securities and Exchange Commission, in reports to shareholders and in other communications. These statements may relate to analyses and other information which are based on forecasts of future results and estimates of amounts not yet determinable. These statements may also relate to our future prospects, developments and business strategies. Examples of such forward-looking statements include, but are not limited to:

- •

- the capital cost of our projects, including the Lake Charles Chemicals Project (including material, engineering and construction cost) and the timing of project milestones;

- •

- our ability to obtain financing to meet the funding requirements of our capital investment programme, as well as to fund our ongoing business activities and to pay dividends;

- •

- changes in the demand for and international prices of crude oil, gas, petroleum and chemical products and changes in foreign currency exchange rates;

- •

- statements regarding our future results of operations and financial condition and regarding future economic performance including cost-containment and cash-conservation programmes;

- •

- statements regarding recent and proposed accounting pronouncements and their impact on our future results of operations and financial condition;

- •

- statements of our business strategy, business performance outlook, plans, objectives or goals, including those related to products or services;

- •

- statements regarding future competition, volume growth and changes in market share in the industries and markets for our products;

- •

- statements regarding our existing or anticipated investments (including the Lake

Charles Chemicals Project, Mozambique exploration and development activities, the GTL joint ventures in Qatar and Nigeria, chemical projects and joint arrangements in North America and other investments), acquisitions of new businesses or the disposal of existing businesses, including estimates or projections of internal rates of return (IRR) and future profitability;

- •

- statements regarding our estimated oil, gas and coal reserves;

- •

- statements regarding the probable future outcome of litigation and regulatory proceedings and the future development in legal and regulatory matters including statements regarding our ability to comply with future laws and regulations;

- •

- statements regarding future fluctuations in refining margins and crude oil, natural gas and petroleum product prices;

- •

- statements regarding the demand, pricing and cyclicality of oil, gas and petrochemical product prices;

- •

- statements regarding changes in the fuel and gas pricing mechanisms in South Africa and their effects on prices, our operating results and profitability;

- •

- statements regarding future fluctuations in exchange and interest rates and changes in credit ratings;

- •

- statements regarding total shareholder return;

- •

- statements regarding our growth and expansion plans;

- •

- statements regarding our current or future products and anticipated customer demand for these products;

- •

- statements regarding acts of war, terrorism or other events that may adversely affect the group's operations or that of key stakeholders to the group;

- •

- statements and assumptions relating to macro-economics;

4

Table of Contents

- •

- statements regarding tax litigation and assessments; and

- •

- statements of assumptions underlying such statements.

Words such as "believe", "anticipate", "expect", "intend", "seek", "will", "plan", "could", "may", "endeavour", "target", "forecast" and "project" and similar expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and there are risks that the predictions, forecasts, projections and other forward-looking statements will not be achieved. If one or more of these risks materialise, or should underlying assumptions prove incorrect, our actual results may differ materially from those anticipated in such forward-looking statements. You should understand that a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. These factors include among others, and without limitation:

- •

- the outcome in pending and developing regulatory matters and the effect of changes in regulation and government policy;

- •

- the political, social and fiscal regime and economic conditions and developments in the world, especially in those countries in which we operate;

- •

- the outcome of legal proceedings including tax litigation and assessments;

- •

- our ability to maintain key customer relations in important markets;

- •

- our ability to improve results despite increased levels of competition;

- •

- our ability to exploit our oil, gas and coal reserves as anticipated;

- •

- the continuation of substantial growth in significant developing markets;

- •

- the ability to benefit from our capital investment programme;

- •

- the accuracy of our assumptions in assessing the economic viability of our large capital projects and growth in significant developing areas of our business;

- •

- the ability to gain access to sufficient competitively priced gas, oil and coal reserves and other commodities;

- •

- the impact of environmental legislation and regulation on our operations and access to natural resources;

- •

- our success in continuing technological innovation;

- •

- the success of our B-BBEE ownership transaction;

- •

- our ability to maintain sustainable earnings despite fluctuations in oil, gas and commodity prices, foreign currency exchange rates and interest rates;

- •

- our ability to attract and retain sufficient skilled employees;

- •

- the risk of completing major projects like, for instance, our Lake Charles Chemicals Project (LCCP) within budget and schedule; and

- •

- our success at managing the foregoing risks.

The foregoing list of important factors is not exhaustive; when relying on forward-looking statements to make investment decisions, you should carefully consider the foregoing factors and other uncertainties and events, and you should not place undue reliance on forward-looking statements. Forward-looking statements apply only as of the date on which they are made and we do not undertake any obligation to update or revise any of them, whether as a result of new information, future events or otherwise. See "Item 3.D—Risk factors"

5

Table of Contents

ENFORCEABILITY OF CERTAIN CIVIL LIABILITIES

We are a public company incorporated under the company law of South Africa. Most of our directors and officers reside outside the US, principally in South Africa. You may not be able, therefore, to effect service of process within the US upon those directors and officers with respect to matters arising under the federal securities laws of the US.

In addition, most of our assets and the assets of most of our directors and officers are located outside the US. As a result, you may not be able to enforce against us or our directors and officers judgements obtained in US courts predicated on the civil liability provisions of the federal securities laws of the US.

There are additional factors to be considered under South African law in respect of the enforceability, in South Africa (in original actions or in actions for enforcement of judgements of US courts) of liabilities predicated on the US federal securities laws. These additional factors include, but are not necessarily limited to:

- •

- South African public policy considerations;

- •

- South African legislation regulating the applicability and extent of damages and/or penalties that may be payable by a party;

- •

- the applicable rules under the relevant South African legislation which regulate the recognition and enforcement of foreign judgements in South Africa; and

- •

- the South African courts' inherent jurisdiction to intervene in any matter which such courts may determine warrants the courts' intervention (despite any agreement amongst the parties to (i) have any certificate or document being conclusive proof of any factor, or (ii) oust the courts' jurisdiction).

Based on the foregoing, there is no certainty as to the enforceability in South Africa (in original actions or in actions for enforcement of judgements of US courts) of liabilities predicated on the US federal securities laws.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

3.A Selected financial data

The following information should be read in conjunction with "Item 5—Operating and financial review and prospects" and the consolidated financial statements, the accompanying notes and other financial information included elsewhere in this annual report on Form 20-F.

The financial data set forth below for the years ended as at 30 June 2019 and 2018 and for each of the years in the three-year period ended 30 June 2019 has been derived from and should be read in conjunction with our audited consolidated financial statements included in Item 18.

Financial data as at 30 June 2017, 2016 and 2015, and for the years ended 30 June 2016 and 2015 have been derived from the group's previously published audited consolidated financial statements, which are not included in this document.

The audited consolidated financial statements from which the selected consolidated financial

6

Table of Contents

data set forth below have been derived were prepared in accordance with IFRS.

| | | | | | | | | | | | | | | | |

| | 30 June

2019(1) | | 30 June

2018(1) | | 30 June

2017(1) | | 30 June

2016(1) | | 30 June

2015(1) | |

|---|

| | (Rand in millions)

(except per share information and weighted

average shares in issue)

| |

|---|

Income Statement data: | | | | | | | | | | | | | | | | |

Turnover | | | 203 576 | | | 181 461 | | | 172 407 | | | 172 942 | | | 185 266 | |

Earnings before interest and tax | | | 9 697 | | | 17 747 | | | 31 705 | | | 24 239 | | | 46 549 | |

Earnings attributable to owners of Sasol Limited | | | 4 298 | | | 8 729 | | | 20 374 | | | 13 225 | | | 29 716 | |

Statement of Financial Position data: | | | | | | | | | | | | | | | | |

Total assets | | | 469 968 | | | 439 235 | | | 398 939 | | | 390 714 | | | 323 599 | |

Total equity | | | 225 795 | | | 228 608 | | | 217 234 | | | 212 418 | | | 196 483 | |

Total liabilities | | | 244 173 | | | 210 627 | | | 181 705 | | | 178 296 | | | 127 116 | |

Share capital(2) | | | 9 888 | | | 15 775 | | | 29 282 | | | 29 282 | | | 29 228 | |

Per share information (rand): | | | | | | | | | | | | | | | | |

Basic earnings per share | | | 6,97 | | | 14,26 | | | 33,36 | | | 21,66 | | | 48,71 | |

Diluted earnings per share | | | 6,93 | | | 14,18 | | | 33,27 | | | 21,66 | | | 48,70 | |

Dividends per share(3) | | | 5,90 | | | 12,90 | | | 12,60 | | | 14,80 | | | 18,50 | |

Weighted average shares in issue (in millions): | | | | | | | | | | | | | | | | |

Average shares outstanding—basic(4) | | | 616,6 | | | 612,2 | | | 610,7 | | | 610,7 | | | 610,1 | |

Average shares outstanding—diluted(5) | | | 620,3 | | | 615,9 | | | 612,4 | | | 610,7 | | | 610,2 | |

- (1)

- From 1 July 2018 the group has applied IFRS 15 'Revenue from Contracts with Customers' using the modified retrospective approach, by recognising the cumulative effect of initially applying IFRS 15 as an adjustment to the opening balance of equity. For the comparative financial years, 2015 to 2018, the principles of the previous revenue standard, IAS 18 'Revenue', were applied.

- (2)

- For information regarding the share repurchases and cancellations please refer to "Item 18—Financial Statements—Note 15 Share capital".

- (3)

- The total dividend includes the interim and final dividend. Dividends per share in dollars are as follows: $0,42 for 30 June 2019, $0,97 for 30 June 2018, $0,95 for 30 June 2017, $1,03 for 30 June 2016 and $1,43 for 30 June 2015.

- (4)

- Increase in basic average shares outstanding is due to shares issued as long-term incentives (LTIs) to employees.

- (5)

- The number of shares outstanding is adjusted to show the potential dilution if the LTIs and Sasol Khanyisa Tier 1 were settled in Sasol Limited shares. The Sasol Khanyisa Tier 2 and Khanyisa Public schemes are anti-dilutive in 2019.

3.B Capitalisation and indebtedness

Not applicable.

3.C Reasons for the offer and use of proceeds

Not applicable.

3.D Risk factors

Our large projects are subject to schedule delays and cost overruns, and we may face constraints in financing our existing projects or new business opportunities, which could render our projects unviable or less profitable than planned

We are progressing with the construction of our Lake Charles Chemicals Project (LCCP) in the US and indications are that the cost of the project will remain within the updated market guidance of US$12,6 - 12,9 billion. As at the end of June 2019, engineering, equipment fabrication and procurement were substantially complete and construction progress had reached 94% completion and overall the project completion is 98% with capital expenditure amounting to US$11,8 billion. During the financial year, we achieved first steam production in August 2018, followed by beneficial operation of our linear low density polyethylene (LLDPE) unit in February 2019, the ethylene oxide/ethylene glycol (EO/EG) unit in May 2019 and the ethane cracker in August 2019. The cracker remains stable at approximately 50% - 60% of design capacity, limited by operating issues with the acetylene removal system. A two to three week planned shutdown to replace the acetylene reactor catalyst is expected to address these issues. Normal production ramp up will occur after the acetylene reactor issues are resolved. These units, combined with the utilities that support them, comprise approximately 65% of LCCP's total capital cost. The progressive commissioning and start-up of the remainder of the derivative units is ongoing, with our low-density polyethylene (LDPE) facility anticipated to reach beneficial operation during the remainder of calendar year 2019 and our Ziegler alcohol, ethoxylates and Guerbet alcohol facilities completed shortly thereafter, to bring the LCCP to full completion during the remainder of 2020. Progress on the LCCP units is reviewed and considered internally and by third party consultants regularly, with past reviews identifying increased scope and slower construction and commissioning ramp-down curves as units reached start-up. As the start-up of the remaining units continues, we will update guidance in the event we confirm a materially different view of unit startup and/or cost.

7

Table of Contents

In Mozambique, Phase 1 and Phase 2 drilling activities in the Production Sharing Agreement (PSA) licence area have been completed. In total, 11 wells were drilled comprising of seven oil wells and four gas wells. We forecast recoverable volumes of light oil to be around the low end of the range presented in the field development plan, 8MMbbl compared to the midpoint of 55MMbbl. This has required a review of the development programme. While Phase 1 gas results confirmed gas resources cover for the planned Central Termica Temane (CTT), formerly Mozambique Gas to Power Project (MGtP), Phase 2 appraisal drilling results however indicate gas volumes to be at the lower end of our initial estimates. We plan to submit a revised field development plan encompassing an integrated oil, gas and LPG development for the whole licence area in 2020.

The development of these projects involve capital-intensive processes carried out over long durations. It requires us to commit significant capital expenditure and allocate considerable management resources in utilising our existing experience and know-how.

Projects like the LCCP and PSA are subject to the risk of delays and cost overruns inherent in any large construction project, including as a result of:

- •

- shortages or unforeseen increases in the cost of equipment, labour and raw materials;

- •

- unforeseen design and engineering problems, contributing to or causing late additions and/or increases to scope;

- •

- unforeseen construction problems;

- •

- unforeseen failure of mechanical parts or equipment;

- •

- unforeseen technical challenges on start-up causing delays in beneficial operations being achieved;

- •

- inadequate phasing of activities;

- •

- labour disputes;

- •

- inadequate workforce planning or productivity of workforce;

- •

- inadequate change management practices;

- •

- natural disasters and adverse weather conditions, including excessive winds, higher-than-expected rainfall patterns, tornadoes, cyclones and hurricanes;

- •

- failure or delay of third-party service providers; and

- •

- regulatory approvals and compliance obligations, including changes to regulations, such as environmental regulations, and/or identification of changes to project scope necessary to ensure safety, process safety, and environmental compliance.

In addition, significant variations in the assumptions we make in assessing the viability of our projects, including those relating to commodity prices and the prices for our products, exchange rates, import tariffs, interest rates, discount rates (due to change in country risk premium) and the demand for our products, may adversely affect the profitability or even the viability of our investments.

As the LCCP capital investment is particularly material to Sasol, any further cost overruns or adverse changes in assumptions affecting the viability of the project could have a material adverse effect on our business, cash flows, financial condition and prospects. We have updated the LCCP economics with the latest view of long-term market assumptions obtained from independent market consultants. Due to the uncertainty and volatility in the market, the views from the independent market consultants differ significantly from period to period. Views provided also differ on ethane price assumptions in the long term. This divergence in views makes it more difficult to accurately evaluate the project economics and increases the risk that the assumptions underlying our assessment of the viability of the project may prove incorrect.

Our operating cash flow and credit facilities may be insufficient to meet our capital expenditure plans and requirements, depending on the timing and cost of development of our existing projects and any further projects we may pursue, as well as our operating performance and the utilisation of our credit facilities. As a result, new sources of capital may be needed to meet the

8

Table of Contents

funding requirements of these projects and to fund ongoing business activities. Our ability to raise and service significant new sources of capital will be a function of macro-economic conditions, our credit rating, our gearing and other risk metrics, the condition of the financial markets, future prices for the products we sell, the prospects for our industry, our operational performance and operating cash flow and debt position, among other factors.

In the event of unanticipated operating or financial challenges, any dislocation in financial markets, any downgrade of our credit ratings by ratings agencies or new funding limitations, our ability to pursue new business opportunities, invest in existing and new projects, fund our ongoing business activities and retire or service outstanding debt and pay dividends, could be constrained, any of which could have a material adverse effect on our business, operating results, cash flows and financial condition.

Fluctuations in crude oil, natural gas, ethane and petroleum product prices and refining margins may adversely affect our business, operating results, cash flows and financial condition

Market prices for crude oil, natural gas, ethane and petroleum products fluctuate as they are subject to local and international supply and demand fundamentals and other factors over which we have no control. Worldwide supply conditions and the price levels of crude oil may be significantly influenced by general economic conditions; industry inventory levels; technology advancements; production quotas or other actions that might be imposed by international associations that control the production of a significant proportion of the worldwide supply of crude oil; weather-related damage and disruptions; competing fuel prices and geopolitical risks, including warfare; especially in the Middle East, North Africa and West Africa.

During 2019, the dated Brent crude oil price averaged US$68,63/bbl and fluctuated between a high of US$86,16/bbl and a low of US$50,21/bbl. This compares to an average dated Brent crude oil price of US$63,62/bbl during 2018, when it fluctuated between a high of US$80,29/bbl and a low of US$46,53/bbl.

A substantial proportion of our turnover is derived from sales of petroleum, natural/piped gas and petrochemical products, prices for which have fluctuated widely in recent years and are affected by crude oil prices, the price and availability of substitute fuels, changes in product inventory, product specifications and other factors.

The South African government controls and/or regulates certain fuel prices. The pump price of petrol is regulated at an absolute level. Furthermore, maximum price regulation applies to the refinery gate price of liquefied petroleum gas (LPG) and the sale of unpacked illuminating paraffin. South African liquid fuels are valued using the "Basic Fuel Price" (BFP) mechanism. BFP is a formula-driven price that considers, amongst others, the international prices of refined products (petrol, diesel, jet fuel and illuminating paraffin), the rand/US dollar exchange rate and the logistical cost of transporting liquid fuels to South Africa. The BFP is then used as a component in the regulated prices that are published by the government on a monthly basis. Piped gas prices are regulated through the approval of maximum piped gas prices by the National Energy Regulator of South Africa (NERSA) from time to time.

Through our equity participation in the National Petroleum Refiners of South Africa (Pty) Ltd (Natref) crude oil refinery, we are exposed to fluctuations in refinery margins resulting from fluctuations in international crude oil and petroleum product prices. We are also exposed to changes in absolute levels of international petroleum product prices through our synthetic fuel operations.

Prolonged periods of low crude oil, natural gas and petroleum prices could also result in projects being delayed or cancelled, as well as the impairment of certain assets. In North America, softer ethylene and global mono-ethylene glycol prices and an increase in the capital cost of our LCCP in Louisiana, US, resulted in the impairment of our Tetramerization and EO/EG cash generating units (CGU) by R7,4 billion (US$ 526 million) and R5,5 billion (US$ 388 million), respectively in 2019. Our shale gas assets in Canada were impaired by a further R1,9 billion (CAD181 million) as at 30 June 2019

9

Table of Contents

to a carrying value of R22 million (CAD2 million). The total cumulative impairments recognised between 2014 and 2018 on our Canadian shale gas assets were R19,3 billion (CAD1,8 billion), mainly due to the declining gas prices. The valuation of the ammonia value chain in Southern Africa in 2019 was negatively impacted by softer international ammonia sales prices and higher gas feedstock prices. This resulted in an impairment of R3,3 billion.

We use derivative financial instruments to partially protect us against day-to-day and longer-term fluctuations in US dollar oil, export coal and ethane prices. The oil price affects the profitability of both our energy and chemical products. See "Item 11—Quantitative and qualitative disclosures about market risk". While the use of these instruments may provide some protection against fluctuations in crude oil prices, it does not protect us against longer-term fluctuations in crude oil prices or differing trends between crude oil and petroleum product prices.

We are unable to accurately forecast fluctuations in crude oil, ethane, natural/piped gas and petroleum products prices. Fluctuations in any of these may have a material adverse effect on our business, operating results, cash flows and financial condition. Refer "Item 5A—Operating results" for the impact of the crude oil prices on the results of our operations.

Fluctuations in exchange rates may adversely affect our business, operating results, cash flows and financial condition

The rand is the principal functional currency of our operations and we report our results in rand. However, a significant majority of our turnover is impacted by the US dollar and the price of most petroleum and chemical products is based on global commodity and benchmark prices which are quoted in US dollars.

Further, as explained above, the components of the BFP are US dollar-denominated and converted to rand, which impacts the price at which we sell fuel in South Africa.

A significant part of our capital expenditure and borrowings are US dollar-denominated, as

they relate to investments outside South Africa or constitutes materials, engineering and construction costs imported into South Africa. Fluctuations in the rand/US dollar exchange rate impacts our gearing and estimated capital expenditure.

We also generate turnover and incur operating costs in euro and other currencies.

Fluctuations in the exchange rates of the rand against the US dollar, euro and other currencies impact the comparability of our financial statements between periods due to the effects of translating the functional currencies of our foreign subsidiaries into rand at different exchange rates.

Accordingly, fluctuations in exchange rates between the rand and US dollar, and/or euro may have a material effect on our business, operating results, cash flows and financial condition.

During 2019, the rand/US dollar exchange rate averaged R14,20, fluctuating between a high of R15,44 and a low of R13,11. This compares to an average exchange rate of R12,85 during 2018, when it fluctuated between a high of R14,48 and a low of R11,55. At 30 June 2019 the closing rand/US dollar exchange rate was R14,08 as compared to R13,73 at 30 June 2018.

The rand exchange rate is affected by various international and South African economic and political factors. Subsequent to 30 June 2019, the rand has on average weakened against the US dollar and the euro, closing at R14,63 and R16,21, respectively, on 25 October 2019. In general, a weakening of the rand would have a positive effect on our operating results. Conversely, strengthening of the rand would have an adverse effect on our operating results, cash flows and financial condition. However, given the significance of our foreign currency denominated long-term debt a weaker rand against the US dollar has a negative impact on our gearing. Refer to "Item 5.A—Operating results" for further information regarding the effect of exchange rate fluctuations on our results of operations. We engage in hedging activities which partially protects the balance sheet and our earnings against fluctuations in the rand exchange rate. While the use of these instruments may provide some protection against fluctuations in the rand exchange rate, it does not protect us against a

10

Table of Contents

longer term strong rand/US dollar exchange rate. Refer to "Item 11—Quantitative and qualitative disclosures about market risk".

Although the exchange rate of the rand is primarily market-determined, its value at any time may not be an accurate reflection of its underlying value, due to the potential effect of, among other factors, exchange controls. For more information regarding exchange controls in South Africa see "Item 10.D—Exchange controls".

Cyclicality in petrochemical product prices and demand may adversely affect our business, operating results, cash flows and financial condition

The demand for chemicals, especially products such as polymers, solvents, surfactants and fertilisers is cyclical. Typically, higher demand during peaks in the industry business cycle leads producers to increase their production capacity. Although peaks in the business cycle have been characterised by increased EBIT margins in the past, such peaks have led to overcapacity with supply exceeding demand growth. Low periods during the industry business cycle are characterised by excess capacity, which can depress EBIT margins. Currently, shorter term factors including the current US/China trade dispute, 'Brexit' the scheduled withdrawal of the United Kingdom from the European Union, business and consumer confidence trends as well as other geo-political tensions pose significant risks to demand. Supply is currently largely affected by the US-China trade tensions and the capacity overbuild taking place in China. Consequently, forecasting the timing of the industry business cycle, and prices for chemical products during downturns in the cycle, remain difficult and a deterioration in overall conditions may have a material adverse effect on our business, operating results, cash flows and financial condition.

Our access to and cost of funding is affected by our credit rating, which in turn is affected by the sovereign credit rating of the Republic of South Africa

Our credit rating may be affected by our ability to maintain our outstanding debt and

financial ratios at levels acceptable to the credit ratings agencies; our business prospects; the sovereign credit rating of the Republic of South Africa and other factors, some of which are outside our control. The credit rating assigned by the ratings agencies is dependent on a number of factors, including the gearing levels of the group. In assessing these gearing levels, performance guarantees which have been issued by Sasol are taken into account as potential future exposure, which may impact the liquidity of the group. Our credit rating has been affected by movements in the sovereign credit rating of the Republic of South Africa.

Any future adverse rating actions or downgrade of the South African sovereign credit rating may have an adverse effect on our credit rating, which could negatively impact our ability to borrow money and could increase the cost of debt finance.

Failure to comply with any debt covenant could have an adverse impact on our financial position and results and/or liquidity

Our principal credit facilities contain restrictive covenants. These covenants limit, among other things, encumbrances on assets of Sasol and its subsidiaries, the ability of our subsidiaries to incur debt and the ability of Sasol and its subsidiaries to dispose of assets in certain circumstances. These restrictive and financial covenants could limit our operating and financial flexibility. Failure to comply with any covenant would enable the lenders to accelerate repayment obligations or may result in unfavourable changes to the credit facilities. Moreover, Sasol's credit facilities have standard provisions whereby certain events relating to other borrowers within the Group could, under certain circumstances, lead to acceleration of debt repayment under the credit facilities and the acceleration of debt repayment under the group's credit facilities and other borrowings under these cross-acceleration clauses could create liquidity pressures. In addition, the mere market perception of a potential breach of any financial covenant could have a negative impact on our ability to refinance indebtedness or the terms on which this could be achieved.

11

Table of Contents

We identified a material weakness in our internal control over financial reporting as of 30 June 2019, which we are still in the process of remediating. If we are unable to remediate this material weakness, or if we experience additional material weaknesses or other deficiencies in the future or otherwise fail to maintain an effective system of internal controls, we may not be able to accurately and timely report our financial results, which could cause shareholders to lose confidence in our financial and other public reporting, and adversely affect our share price

Our management is responsible for establishing and maintaining adequate internal control over financial reporting and for evaluating and reporting on the effectiveness of our system of internal control. As disclosed below under Item 15. Controls and Procedures, during 2019, management identified a material weakness in internal control over financial reporting with respect to the capital cost estimation process implemented in connection with the LCCP which resulted from the aggregation of a series of individual control and project related control environment deficiencies. As a result, management concluded that our internal control over financial reporting was not effective as of 30 June 2019. While we are currently implementing remedial measures, there can be no assurance that our efforts will be successful. The material weakness cannot be considered remediated until the remedial controls operate for a sufficient period of time and management has time to conclude, through testing, that these controls are operating effectively. As a result of the material weakness described above, our management also concluded that our disclosure controls and procedures were not effective as of 30 June 2019.

We cannot be certain that any remedial measures we are currently in the process of implementing, or our internal control over financial reporting more generally, will ensure that we design, implement and maintain adequate controls over our financial processes and reporting in the future. Our failure to implement our remediation plan referred to above, or to implement newly required or improved controls or adapt our controls, or difficulties encountered in their operation, or difficulties in the assimilation

of acquired businesses into our control system, could prevent us from meeting our financial reporting obligations, including filing our periodic reports with the SEC on a timely basis and maintaining compliance with applicable NYSE listing requirements, or result in a restatement of previously disclosed financial statements.

The material weakness identified during 2019 resulted in a revision of capital commitments as at 30 June 2018. If other currently undetected material weaknesses in our internal controls exist, it could result in material misstatements in our financial statements requiring us to restate previously issued financial statements. In addition, material weaknesses, and any resulting restatements, could cause investors to lose confidence in our reported financial information, and could subject us to regulatory scrutiny and to litigation from shareholders, which could have a material adverse effect on our business and the price of our ordinary shares or ADSs. Furthermore, the remediation of any such material weaknesses could require additional remedial measures including additional personnel, which could be costly and time-consuming. If we do not maintain adequate financial and management personnel, processes and controls, we may not be able to manage our business effectively or accurately report our financial performance on a timely basis, which could cause a decline in our share price and adversely affect our results of operations and financial condition. Failure to comply with the Sarbanes-Oxley Act of 2002 could potentially subject us to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

Certain of the factors identified as resulting in the material weakness discussed above, in particular, that certain persons within the LCCP project management team responsible for the management of the Company reported inaccurate capital cost projections to senior executives and the board, may also constitute a reportable irregularity in accordance with the South African Auditing Profession Act 26 of 2005, on the basis that such persons may not have acted with the necessary care, skill and diligence required, which failure has caused, or is likely to cause material financial loss to the entity or stakeholders in its dealings with the entity, or, alternatively, this

12

Table of Contents

activity may have constituted a material breach of fiduciary duties by such persons. As a result of this activity, the Company removed all work responsibilities and initiated disciplinary action against one individual and negotiated the separation of three additional individuals, and took other remedial actions. Management believe that actions taken effectively remediate the activities that gave rise to a reportable irregularity. PricewaterhouseCoopers Incorporated (PwC) reported a reportable irregularity to the Independent Regulatory Board for Auditors in South Africa and concluded that these matters have been remediated and are no longer continuing.

Our ability to respond to climate change could negatively impact our growth strategies, reduce supply/demand for our products, increase our operational costs, reduce our competitiveness, negatively impact our stakeholder relations and affect our future legal licence to operate

Key manufacturing processes in South Africa, especially coal gasification and combustion, result in relatively high carbon dioxide emissions. Sasol is committed to reducing its overall impact on the environment, while developing and implementing an appropriate climate change management response to enable the long-term resilience of the company's strategy and business operations. Sasol's ability to develop and implement an appropriate climate change mitigation response poses a significant transitional risk for our business in South Africa. This is heightened by the necessity to appropriately address increasing societal pressures and shifts away from carbon intensive processes and products, as well as meeting new and anticipated policy and legislative requirements including carbon tax, budgets and reduction targets. It is particularly challenging in South Africa where access to lower carbon energies is limited and related infrastructure is under-developed.

A carbon tax was implemented in South Africa from 1 June 2019, which will significantly increase the operational costs of our South African operations post 2022. For the first phase to 2022, several transitional tax-free allowances are provided. The headline carbon tax is R120 per ton of CO2e (carbon dioxide equivalent) before

tax-free allowances, for emissions above the tax-free thresholds. At the same time the South African government is developing carbon budgets. Currently, there is uncertainty on how the mandatory carbon budget will be implemented and aligned to the carbon tax. The future risk that Sasol faces is how much the group will need to pay for either the carbon tax or possible penalties for exceeding the carbon budgets for the subsequent phases from 2023 onwards should the scale of mitigation not be possible in the timeframe required. Sasol's current carbon tax liability pre-tax is approximately R800 million to R1 billion per annum pre-tax in 2020, escalating at CPI + 2 percentage points until 2022. Considering South Africa's developmental challenges, the structure of its economy and the fact that the carbon tax design is not aligned with the carbon budget system, Sasol is supportive of carbon pricing but believes that alternative mechanisms could achieve the outcome sought by the proposed stand-alone carbon tax. In this instance, the alignment of the carbon budget with the carbon tax offers an efficient and effective solution for the South African economy to still grow while transitioning to a lower carbon economy. We continue to work to advocate for such a solution and actively engage with government and various stakeholders to appropriately manage these challenges that balance the need for economic development, job creation, energy security and greenhouse gas (GHG) emission reductions. Whilst we are not supportive of the Carbon Tax Act in its current form, Sasol is adhering to the Act and is participating in the relevant government process to develop the operating rules for the tax.

The group sees a lower carbon emission world representing changes to energy demand, regulations and commodity consumption patterns (also seen in externally validated data). Companies that do not respond to these possible realities could find parts of their portfolios, or potentially their entire business model, becoming less robust over time. Through our scenario analysis, Sasol visualises the potential areas where our business might be less robust to further changes in demand patterns, regulations or technology changes. This enables proactive mitigation action to be taken so that our

13

Table of Contents

operations (and our overall value chain) remain robust, as the world transitions to a lower carbon future. Given future uncertainty, Sasol has used a rigorous process to develop a set of scenarios based on an understanding of global and national energy system fundamentals, including government policy and carbon risk. There are, however, risks associated with accuracy, completeness and correctness of various assumptions that are used as inputs to scenario analysis work undertaken, including scenarios developed to test resilience to climate change threats. Should these assumptions prove to be inaccurate, incomplete or incorrect this could potentially significantly impact our resilience. In addition, scenarios by their very nature are inherently risky as it relates to limited ability to predict future outcomes.

Sasol's preliminary 2030 analysis of the Paris Agreement focuses our attention on reducing the use of coal to produce electricity as an immediate and critical mitigation opportunity for reducing emissions and will form part of a broader initiative to remain resilient. Sasol's foundation business portfolio in South Africa is sensitive to climate related risks if further reductions are not undertaken.

Further, climate change poses a significant risk for both our South African and global business as it relates to potential physical impacts including change of weather patterns, water scarcity and extreme weather events such as, hurricanes, tornadoes, flooding and sea level rise. In this regard, work is underway to develop an adaptation strategy for the identified key priority regions such as the US Gulf Coast, Mozambique, and South African operations (Secunda and Sasolburg). Ongoing monitoring efforts accordingly also guide our interventions to improve our maintenance, asset integrity processes and response procedures. While we are in the process of implementing an emission reduction framework based on the three pillars of reducing our emissions, transforming our coal-based operations and shifting our portfolio to a lower-carbon business, this framework may not be adequate to enable us to fully comply with any current or future regulations over GHG emissions.

Our international operations are less carbon-intensive and have been operating for some time in a more mature GHG regulatory regime. However, enhanced focus on issues concerning environmental quality and climate change may result not only in a more complex regulatory environment, but also additional legal risk, to the extent that damages relating to climate change and other air quality impacts are brought into judicial systems around the world. In addition our permits and operational licences are subject to public comment and/or input from stakeholders in certain of the jurisdictions in which we operate and there is an emerging trend by activists to use the public comment period to challenge a company's response to climate change.

Our coal, synthetic oil, natural oil and natural gas reserve estimates may be materially different from quantities that we eventually recover

Our reported coal, synthetic oil, natural oil and gas reserves are estimated quantities based on applicable reporting regulations that, under present conditions, have the potential to be economically mined, processed, produced, delivered to market and sold.

There are numerous uncertainties inherent in estimating quantities of reserves and in projecting future rates of production, including factors that are beyond our control. The accuracy of any reserve estimate is a function of the quality of available data, engineering and geological interpretation, costs to develop and produce, and market prices for related products.

Reserve estimates are adjusted from time to time to reflect improved recovery and extensions, and also revised from time to time based on improved data acquired from actual production experience and other factors, including resource extensions and new discoveries. In addition, regulatory changes, market prices, increased production costs and other factors may result in a revision to estimated reserves. Revised estimates may have a material adverse effect on our business, operating results, cash flows and financial condition. See "Item 4.D—Property, plants and equipment".

14

Table of Contents

We may be unable to access, discover, appraise and develop new coal, synthetic oil, natural oil and natural gas resources at a rate that is adequate to sustain our business and/or enable growth

Competition for suitable opportunities, increasing technical difficulty, stringent regulatory and environmental standards, large capital requirements and existing capital commitments may negatively affect our ability to access, discover, appraise and develop new resources in a timely manner, which could adversely impact our ability to support and sustain our current business operations. We acquire certain of these feedstocks through long term supply agreements and if the price levels at which replacement agreements are put into place are less favourable when such long term supply agreements come to an end it could adversely affect our business, cash flows and financial condition.

Our future growth could also be impacted by these factors, potentially leading to a material adverse effect on our business, operating results, cash flows and financial condition.

We may not achieve projected benefits of acquisitions or divestments

We may pursue acquisitions or divestments. With any such transaction, there is the risk that any benefits or synergies identified at the time of acquisition may not be achieved as a result of changing or inappropriate assumptions or materially different market conditions, or other factors. Furthermore, we could be found liable, regardless of extensive due diligence reviews, for past acts or omissions of the acquired business without any adequate right of redress.

In addition, delays in the sale of assets, or reductions in value realisable, may arise due to changing market conditions. Failure to achieve expected values from the sale of assets, or delays in expected receipt or delivery of funds may result in higher debt levels, the underperformance of those businesses and the loss of key personnel.

There are country-specific risks relating to the countries in which we operate that could adversely affect our business, operating results, cash flows and financial condition

Several of our subsidiaries, joint arrangements and associates operate in countries and regions that are subject to significantly differing political, social, economic and market conditions. See "Item 4.B—Business overview" for a description of the extent of our activities in the main countries and regions in which we operate. Although we are a South African-domiciled company and the majority of our operations are located in South Africa, we also have significant energy businesses in other African countries, chemical businesses in Europe, the US, the Middle East and Asia, a joint venture GTL facility in Qatar, joint operations in the US and Canada and a 10% indirect economic interest in the Escravos GTL (EGTL) project in Nigeria, which is an upstream joint venture between Chevron Nigeria Limited (CNL) and Nigerian National Petroleum Corporation (NNPC).

Particular aspects of country-specific risks that may have a material adverse impact on our business, operating results, cash flows and financial condition include:

(a) Political and socioeconomic issues

i. Political, social and economic uncertainty

We have invested, or are in the process of investing in, significant operations in Southern African, Western African, European, North American, Asian and Middle Eastern countries that have in the past, to a greater or lesser extent, experienced political, social and economic uncertainty.

South Africa faces ongoing challenges in improving the country's long-term growth potential and weak public sector revenue growth, stabilising debt levels and addressing weaknesses at state-owned enterprises and other institutions. These factors continue to pose a risk to South Africa's sovereign credit rating outlook. In Mozambique, there has been an improvement in economic conditions. However, very high levels of public sector debt, insufficient governance, accountability and transparency, the need to

15

Table of Contents

strengthen institutions, security concerns and extreme weather events are expected to remain significant risks to the sovereign credit and operational outlook for the foreseeable future.

At a global level, the trade dispute between the US and China, the evolution of the Brexit process, geo-political tensions and conflicts, potential financial vulnerabilities that have been built up over years due to low-to-zero interest rates, abrupt shifts in financial conditions and weakening economic growth can also all have an influence on the macro-economic outlook in the countries in which we operate.

Other countries in which we operate could from time-to-time face sovereign rating risks, which may impact our counterparties' ability to access funding and honour commitments.

Government policies, laws and regulations in countries in which we operate, or plan to operate, may change in the future. Governments in those countries have in the past and may in the future pursue policies of resource nationalisation and market intervention, including through protectionism like import tariffs and subsidies. The impact of such changes on our ability to deliver on planned projects cannot be determined with any degree of certainty and such changes may therefore have an adverse effect on our operations and financial results.

Sasol's strategic objective to progressively grow a resilient oil-based portfolio in selected West African countries, inherently carries frontier basin exploration and new country entry risks, offset by potential high reward through unlocking of new exploration plays. Sasol manages the associated exploration and new country risks through building a balanced portfolio of exploration and production assets, rigorously ensuring compliance with all corporate and legislative governance requirements, and following its internal technical and business quality assurance processes.

In all countries, our operations are required to comply with local procurement, employment equity, equity participation, corporate social responsibility and other regulations that are

designed to address country-specific social and economic transformation and local content issues. Should we not meet or are perceived to not be meeting country-specific transformation or local content requirements or regulations, our ability to sustainably deliver on our business objectives may be impacted.

In South Africa, there are various transformation initiatives with which we are required to comply since Sasol operates in more than one sector of the economy. The broad risks that we face should we not comply with these transformation initiatives include the inability to obtain licences to operate in certain sectors such as mining and liquid fuels, limited ability to successfully tender for government and public entity business and potential loss of customers (as private sector customers increasingly require their suppliers to have a minimum B-BBEE rating).

The 2018 Mining Charter was published for implementation on 27 September 2018. On 19 December 2018 certain amendments were published in the Government Gazette which provided that existing mining right holders must implement the 2018 Mining Charter from 1 March 2019. Although the 2018 Mining Charter is an improvement on the 2017 draft, the Minerals Council commenced with a judicial review of certain aspects of the 2018 Mining Charter. Sasol Mining will monitor the outcome of this process which may either result in the status quo being retained or certain amendments being made to the 2018 Mining Charter that may address the Minerals Council's concerns. For more information refer to "Item 3.D—Risk Factors—South African mining legislation may have an adverse effect on our mineral rights".

The revised Codes of Good Practice for Broad-Based Black Economic Empowerment (B-BBEE) (the Revised Codes), which came into effect on 1 May 2015, provide a standard framework for the measurement of B-BBEE across all sectors of the economy, other than sectors that have their own sectorial transformation charters (e.g. the mining and liquid fuels industries). The Revised Codes provide more stringent targets, which negatively impacted on Sasol's B-BBEE contributor status. The liquid fuels industry is currently developing the

16

Table of Contents

"Petroleum and Liquid Fuels Sector Charter" (PLFSC) which will regulate B-BBEE in the liquid fuels and gas sector. While it is too early to assess the impact of the PLFSC, the PLFSC will be required to set industry-specific targets that cannot be more lenient than those in the Revised Codes.

Since our September 2017 announcement of plans to unwind the Sasol Inzalo B-BBEE transaction and introduce the Sasol Khanyisa B-BBEE transaction, we placed specific management focus on engaging with trade unions on issues pertaining to employee share ownership levels. Two of the five Sasol trade unions, Solidarity and CEPPWAWU, declared disputes relating individually to Sasol Khanyisa and the unwind of Sasol Inzalo which, if not resolved, might result in industrial action, which could adversely affect our operations and could give rise to costs which would impact earnings. In the case of the Solidarity trade union, the Sasol Khanyisa dispute is similar to disputes the trade union has with three other large employers in South Africa. The President of the Labour Court requested the various employers to prepare a stated case in order to allow the Labour Court to give guidance in this regard. It is therefore not a Sasol only matter in South Africa and affects other large companies as well. The Sasol Inzalo dispute lodged by the CEPPWAWU trade union has lost its momentum and it is no longer regarded as a major threat to Sasol. The time frame within which the matter was to be continued has become stale.

On 6 May 2019, Sasol received a statement of claim filed by the trade union Solidarity with the Labour Court in Johannesburg, alleging that the Sasol Khanyisa Employee Share Option Plan (ESOP) element of the Sasol Khanyisa transaction is discriminatory as it does not include white employees in South Africa and employees working for Sasol outside South Africa. This litigation is ongoing and we are unable at this time to assess the potential effect the ultimate outcome of the matter may have on the Sasol Khanyisa B-BBEE transaction. In addition, the Department of Mineral Resources and Energy may not recognise the ownership component of Sasol Khanyisa in which case we may be unable to fully comply with the 2018 Mining Charter requirements related to

new or amended licence applications, or the B-BBEE Commissioner may not recognise that the vendor financing mechanism allows us to be allocated points on Enterprise Supplier Development. Although Sasol Mining has applied for recognition of the Sasol Khanyisa ESOP to meet the ownership requirements contained in the 2018 Mining Charter, the Department of Mineral Resources and Energy has not yet formally responded to the request. The litigation instituted by Solidarity is of importance since the Department of Mineral Resources and Energy might be awaiting the outcome thereof before a final decision will be taken in respect of Sasol Khanyisa. At this stage all applications submitted prior to the 2018 Mining Charter becoming effective are being processed based on Sasol Mining's historic ownership level.

We expect that the long-term benefits of Sasol Khanyisa to the company and South Africa should outweigh any possible adverse effects, such as dilution to existing shareholders, but we cannot assure you that future implications of compliance with these requirements or with any newly imposed conditions will not have a material adverse effect on our shareholders or business, operating results, cash flows and financial condition. See "Item 4.B—Empowerment of historically disadvantaged South Africans".

Value creation, if any, to the majority of the Khanyisa shareholders at the conclusion of the transaction is exposed to the inherent business risks of Sasol South Africa during the empowerment period. This could potentially have an impact on dividend distributions to those Khanyisa shareholders that are required to settle funding obligations or otherwise negatively impact the valuation of the Sasol South Africa business on conclusion of the transaction.

The majority of our employees worldwide belong to trade unions. These employees comprise mainly of general workers, artisans and technical operators. While Sasol believes its labour relations are currently stable, the South African labour market remains volatile and can be characterised by major industrial action in key sectors of the economy especially during wage negotiations.

17

Table of Contents

In Sasol South Africa, only the industrial chemicals sector is scheduled for wage negotiations during 2019. The petroleum sector is covered by a three-year wage agreement effective 1 July 2018 to 30 June 2021.

Sasol Mining concluded a three-year wage agreement with all five of its participating trade unions in August 2017 valid until June 2020, paving the way for stable labour relations over the duration of three years.

Although we have positive relationships with our employees and their unions, significant labour disruptions could occur in the future and our labour costs could increase significantly in the future.

(b) Fiscal and monetary policies

Macro-economic factors, such as higher inflation and interest rates, could adversely impact our ability to contain costs and/or ensure cost-effective debt financing in the countries in which we operate.

Our sustainability and competitiveness is influenced by our ability to optimise our cost base. As we are unable to control the price at which our products are sold, an increase in inflation in countries in which we operate may result in significantly higher future operational costs.

South African consumer price inflation averaged 4,6% in 2019, from 4,5% in 2018. During the year, inflation was impacted mainly by muted food price increases, electricity tariff hikes and higher fuel prices. Despite relatively stable inflation, the South African Reserve Bank decided to hike the policy interest rate by 25 basis points to 6,75%, citing potential upside inflationary pressures emanating from tightening global financial conditions, exchange rate weakness, higher wage growth, global oil price trends and possible above-inflation target electricity and water tariff adjustments as reasons for the decision. The policy interest rate was maintained at 6,75% for the rest of 2019.

South Africa's economic outlook remains constrained as policy uncertainty, weak levels of business and consumer confidence, and a generally weaker global outlook weigh on the

country's growth prospects. Ongoing economic weakness and subdued inflation already prompted the Reserve Bank to cut the policy interest rate by 25 basis points to 6,50% in July 2019.

The exchange rate remains a key risk to the inflation outlook. Global financial conditions, trade disputes, emerging market sentiment swings and domestic political and policy developments are likely to contribute to ongoing currency volatility.

The already weakening global growth outlook is clouded by the US and China trade dispute, while the Brexit process, weak euro area growth prospects and heightened geo-political tensions could result in even weaker than currently expected global growth. South African policy uncertainty, potential electricity supply constraints, limited fiscal space and low confidence levels are likely to constrain the country's near-term growth prospects. Against this background, Sasol's product sales in key markets are likely to remain under pressure for the foreseeable future.

(c) Legal and regulatory

South African law provides for exchange control regulations which apply to transactions involving South African residents, including both natural persons and legal entities. These regulations may restrict the export of capital from South Africa, including foreign investments. The regulations may also affect our ability to borrow funds from non-South African sources for use in South Africa, including the repayment of these borrowings from South Africa and, in some cases, our ability to guarantee the obligations of our subsidiaries with regard to these funds. These restrictions may affect the manner in which we finance our transactions outside South Africa and the geographic distribution of our debt. See "Item 10.D—Exchange controls" and "Item 5.B—Liquidity and capital resources". We may also be impacted by new exchange control regulations affecting our operations in Gabon. See "Item 4.B—Business overview—Regulation—Safety, health and environment—Regions in which Sasol operates and their applicable legislation—Gabon".

18

Table of Contents

We operate in multiple tax jurisdictions globally and are subject to both local and international tax laws and regulations. Although we aim to fully comply with tax laws in all the countries in which we operate, tax is a highly complex area leading to the risk of unexpected tax uncertainties. Tax laws are changing regularly and their interpretation may potentially result in ambiguities and uncertainties, in particular in the areas of international taxation and transfer pricing. Where the tax law is not clear, we interpret our tax obligations in a responsible way, with the support of legal and tax advisors as deemed appropriate. Tax authorities and courts may arrive at different interpretations to those taken by Sasol, which may lead to substantial increases in tax payments. Although we believe we have adequate systems, processes and people in place to assist us with complying with all applicable tax laws and regulations, the outcomes of certain tax disputes and assessments may have a material adverse effect on our business, operating results, cash flows and financial position.

We could also be exposed to significant fines and penalties and to enforcement measures, including, but not limited to, tax assessments, despite our best efforts at compliance. In response to tax assessments or similar tax deficiency notices in particular jurisdictions, we may be required to pay the full amount of the tax assessed (including stated penalties and interest charges) or post security for such amounts notwithstanding that we may contest the assessment and related amounts.

In particular, two of our subsidiaries, Sasol Oil (Pty) Ltd ("Sasol Oil") and Sasol Financing International (SFI), have received assessments in relation to international business activities. The litigation in respect of the Sasol Oil matter has been resolved with Sasol no longer exposed to a potential liability and the litigation proceedings relating to the assessments in respect of SFI are still ongoing.

For more information regarding pending tax disputes and assessments see "Item 4.B—Business overview—Legal proceedings and other contingencies".

Any of these risks may materially and adversely affect our business, results of operations, cash flows and financial condition.