Exhibit 99.1

Income statement

for the year ended 30 June

| | | | 2019 | | 2018 | | 2017 | |

| | Note | | Rm | | Rm | | Rm | |

Turnover | | 2 | | 203 576 | | 181 461 | | 172 407 | |

Materials, energy and consumables used | | 3 | | (90 589 | ) | (76 606 | ) | (71 436 | ) |

Selling and distribution costs | | | | (7 836 | ) | (7 060 | ) | (6 405 | ) |

Maintenance expenditure | | | | (10 227 | ) | (9 163 | ) | (8 654 | ) |

Employee-related expenditure | | 4 | | (29 928 | ) | (27 468 | ) | (24 417 | ) |

Exploration expenditure and feasibility costs | | | | (663 | ) | (352 | ) | (491 | ) |

Depreciation and amortisation | | | | (17 968 | ) | (16 425 | ) | (16 204 | ) |

Other expenses and income | | | | (19 097 | ) | (15 316 | ) | (12 550 | ) |

Translation gains/(losses) | | 5 | | 604 | | (11 | ) | (1 201 | ) |

Other operating expenses and income | | 6 | | (19 701 | ) | (15 305 | ) | (11 349 | ) |

Equity accounted profits, net of tax | | 20 | | 1 074 | | 1 443 | | 1 071 | |

Operating profit before remeasurement items and Sasol Khanyisa share-based payment | | | | 28 342 | | 30 514 | | 33 321 | |

Remeasurement items | | 9 | | (18 645 | ) | (9 901 | ) | (1 616 | ) |

Sasol Khanyisa share-based payment* | | 35 | | — | | (2 866 | ) | — | |

Earnings before interest and tax (EBIT) | | | | 9 697 | | 17 747 | | 31 705 | |

Finance income | | 7 | | 787 | | 1 716 | | 1 568 | |

Finance costs | | 7 | | (1 253 | ) | (3 759 | ) | (3 265 | ) |

Earnings before tax | | | | 9 231 | | 15 704 | | 30 008 | |

Taxation | | 12 | | (3 157 | ) | (5 558 | ) | (8 495 | ) |

Earnings for the year | | | | 6 074 | | 10 146 | | 21 513 | |

Attributable to | | | | | | | | | |

Owners of Sasol Limited | | | | 4 298 | | 8 729 | | 20 374 | |

Non-controlling interests in subsidiaries | | | | 1 776 | | 1 417 | | 1 139 | |

| | | | 6 074 | | 10 146 | | 21 513 | |

| | | | Rand | | Rand | | Rand | |

Per share information | | | | | | | | | |

Basic earnings per share | | 8 | | 6,97 | | 14,26 | | 33,36 | |

Diluted earnings per share | | 8 | | 6,93 | | 14,18 | | 33,27 | |

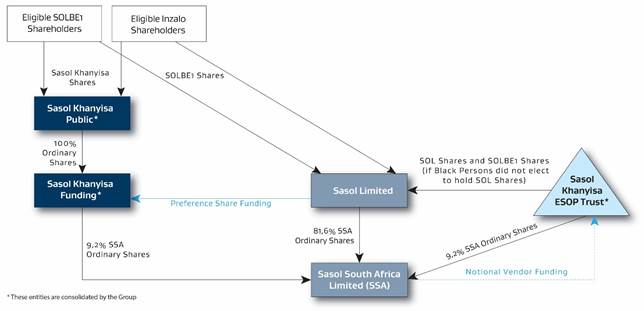

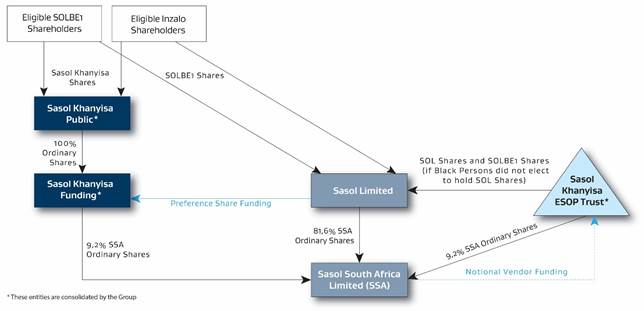

* | 2018 relates to the implementation of Sasol Khanyisa in relation to SOLBE1, Inzalo Public, Inzalo Groups and Khanyisa Public participants. |

| |

| The notes on pages 7 to 98 are an integral part of these Consolidated Financial Statements. |

Sasol Annual Financial Statements 2019

1

Sasol Limited Group

Statement of comprehensive income

for the year ended 30 June

| | 2019 | | 2018 | | 2017 | |

| | Rm | | Rm | | Rm | |

Earnings for the year | | 6 074 | | 10 146 | | 21 513 | |

Other comprehensive income, net of tax | | | | | | | |

Items that can be subsequently reclassified to the income statement | | 1 353 | | 6 068 | | (8 931 | ) |

Effect of translation of foreign operations | | 1 533 | | 5 237 | | (10 074 | ) |

Effect of cash flow hedges* | | (287 | ) | 1 233 | | 1 821 | |

Fair value of investments available-for-sale | | — | | 13 | | 11 | |

Tax on items that can be subsequently reclassified to the income statement** | | 107 | | (415 | ) | (689 | ) |

Items that cannot be subsequently reclassified to the income statement | | (265 | ) | (54 | ) | 743 | |

Remeasurement on post-retirement benefit obligation*** | | (531 | ) | (80 | ) | 1 114 | |

Fair value of investments through other comprehensive income | | 136 | | — | | — | |

Tax on items that cannot be subsequently reclassified to the income statement | | 130 | | 26 | | (371 | ) |

| | | | | | | |

Total comprehensive income for the year | | 7 162 | | 16 160 | | 13 325 | |

Attributable to | | | | | | | |

Owners of Sasol Limited | | 5 377 | | 14 727 | | 12 234 | |

Non-controlling interests in subsidiaries | | 1 785 | | 1 433 | | 1 091 | |

| | 7 162 | | 16 160 | | 13 325 | |

* | These amounts include the loss of R1 400 million (2018 – R286 million; 2017 – R302 million) on the revaluation of the cash flow hedge pertaining to the interest rate swap and a gain of R1 115 million relating to the reclassification of the swap to profit and loss on termination of the hedge relationship. |

| |

** | The amount is mainly on the cash flow hedge. |

| |

*** | Includes the effect of a loss/(gain) of R58 million (2018 – R1 051 million; 2017 – (R105 million)) relating to the movement in the asset limitation, as well as a loss/(gain) of R83 million (2018 – R1 million; 2017 – R50 million) on reimbursive rights related to post-retirement benefits, recognised in long-term receivables. |

| |

| The notes on pages 7 to 98 are an integral part of these Consolidated Financial Statements. |

2

Statement of financial position

at 30 June

| | | | 2019 | | 2018 | |

| | Note | | Rm | | Rm | |

Assets | | | | | | | |

Property, plant and equipment | | 17 | | 233 549 | | 167 457 | |

Assets under construction | | 18 | | 127 764 | | 165 361 | |

Goodwill and other intangible assets | | | | 3 357 | | 2 687 | |

Equity accounted investments | | 20 | | 9 866 | | 10 991 | |

Other long-term investments | | | | 1 248 | | 951 | |

Post-retirement benefit assets | | 33 | | 1 274 | | 1 498 | |

Long-term receivables and prepaid expenses | | 19 | | 6 317 | | 4 646 | |

Long-term financial assets | | 40 | | 15 | | 291 | |

Deferred tax assets | | 14 | | 8 563 | | 4 096 | |

Non-current assets | | | | 391 953 | | 357 978 | |

Assets in disposal groups held for sale | | 11 | | 2 554 | | 113 | |

Short-term investments | | | | — | | 85 | |

Inventories | | 23 | | 29 646 | | 29 364 | |

Tax receivable | | 13 | | 730 | | 3 302 | |

Trade and other receivables | | 24 | | 28 578 | | 29 729 | |

Short-term financial assets | | 40 | | 630 | | 1 536 | |

Cash and cash equivalents | | 27 | | 15 877 | | 17 128 | |

Current assets | | | | 78 015 | | 81 257 | |

Total assets | | | | 469 968 | | 439 235 | |

Equity and liabilities | | | | | | | |

Shareholders’ equity | | | | 219 910 | | 222 985 | |

Non-controlling interests | | | | 5 885 | | 5 623 | |

Total equity | | | | 225 795 | | 228 608 | |

Long-term debt | | 16 | | 127 350 | | 89 411 | |

Finance leases | | 16 | | 7 445 | | 7 280 | |

Long-term provisions | | 31 | | 17 622 | | 15 160 | |

Post-retirement benefit obligations | | 33 | | 12 708 | | 11 900 | |

Long-term deferred income | | | | 924 | | 879 | |

Long-term financial liabilities | | 40 | | 1 440 | | 133 | |

Deferred tax liabilities | | 14 | | 27 586 | | 25 908 | |

Non-current liabilities | | | | 195 075 | | 150 671 | |

Liabilities in disposal groups held for sale | | 11 | | 488 | | 36 | |

Short-term debt | | 16 | | 3 783 | | 14 709 | |

Short-term provisions | | 32 | | 3 289 | | 3 508 | |

Tax payable | | 13 | | 1 039 | | 2 318 | |

Trade and other payables | | 25 | | 39 466 | | 37 150 | |

Short-term deferred income | | | | 210 | | 220 | |

Short-term financial liabilities | | 40 | | 765 | | 1 926 | |

Bank overdraft | | 27 | | 58 | | 89 | |

Current liabilities | | | | 49 098 | | 59 956 | |

Total equity and liabilities | | | | 469 968 | | 439 235 | |

The notes on pages 7 to 98 are an integral part of these Consolidated Financial Statements. |

3

Statement of changes in equity

for the year ended 30 June

| | Share

capital | | Share

repurchase

programme | | Share-

based

payment

reserve | | Investment

fair value | |

| | Note 15 | | Note 15 | | Note 35 | | reserve | |

| | Rm | | Rm | | Rm | | Rm | |

Balance at 30 June 2016 | | 29 282 | | (2 641 | ) | (13 582 | ) | 26 | |

Share-based payment expense | | — | | — | | 463 | | — | |

Long-term incentive scheme converted to equity-settled* | | — | | — | | 645 | | — | |

Long-term incentives vested and settled | | — | | — | | (51 | ) | — | |

Total comprehensive income for the year | | — | | — | | — | | 7 | |

profit | | — | | — | | — | | — | |

other comprehensive income for the year | | — | | — | | — | | 7 | |

Dividends paid | | — | | — | | — | | — | |

Balance at 30 June 2017 | | 29 282 | | (2 641 | ) | (12 525 | ) | 33 | |

Transactions with non-controlling shareholders | | — | | — | | — | | — | |

Movement in share-based payment reserve | | — | | — | | 989 | | — | |

Share-based payment expense | | — | | — | | 823 | | — | |

Deferred tax | | — | | — | | 166 | | — | |

Unwind of Sasol Inzalo transaction | | (12 698 | ) | — | | 6 999 | | — | |

Repurchase of shares | | (12 698 | ) | — | | 12 698 | | — | |

Share-based payment reserve to retained earnings | | — | | — | | (5 699 | ) | — | |

Long-term incentives vested and settled | | — | | — | | (605 | ) | — | |

Implementation of Sasol Khanyisa transaction | | 1 832 | | — | | 1 121 | | — | |

Share-based payment expense | | — | | — | | 2 953 | | — | |

Shares issued to Sasol Khanyisa Employee Trust | | 1 832 | | — | | (1 832 | ) | — | |

Repurchase of shares | | (2 641 | ) | 2 641 | | — | | — | |

Total comprehensive income for the year | | — | | — | | — | | 10 | |

profit | | — | | — | | — | | — | |

other comprehensive income for the year | | — | | — | | — | | 10 | |

Dividends paid | | — | | — | | — | | — | |

Balance at 30 June 2018 | | 15 775 | | — | | (4 021 | ) | 43 | |

Disposal of business | | — | | — | | — | | — | |

Movement in share-based payment reserve | | — | | — | | 1 552 | | — | |

Share-based payment expense | | — | | — | | 707 | | — | |

Sasol Khanyisa transaction | | — | | — | | 952 | | — | |

Deferred tax | | — | | — | | (107 | ) | — | |

Unwind of Sasol Inzalo transaction | | (5 887 | ) | — | | 3 452 | | — | |

Repurchase of shares | | (5 887 | ) | — | | 5 887 | | — | |

Final distribution to Sasol Inzalo Public | | — | | — | | — | | — | |

Share-based payment reserve to retained earnings | | — | | — | | (2 435 | ) | — | |

Long-term incentives vested and settled | | — | | — | | (573 | ) | — | |

Total comprehensive income for the year | | — | | — | | — | | 89 | |

profit | | — | | — | | — | | — | |

other comprehensive income for the year | | — | | — | | — | | 89 | |

Dividends paid | | — | | — | | — | | — | |

Balance at 30 June 2019 | | 9 888 | | — | | 410 | | 132 | |

* | Refer to note 35 for further detail on the conversion of the long-term incentive scheme. |

| |

The notes on pages 7 to 98 are an integral part of these Consolidated Financial Statements. |

4

Foreign

currency

translation

reserve | | Cash flow

hedge

accounting

reserve | | Remeasurement

on post-

retirement

benefits | | Retained

earnings | | Shareholders’

equity | | Non-

controlling

interests | | Total

equity | |

Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | |

33 316 | | (1 788 | ) | (2 533 | ) | 164 917 | | 206 997 | | 5 421 | | 212 418 | |

— | | — | | — | | — | | 463 | | — | | 463 | |

— | | — | | — | | — | | 645 | | — | | 645 | |

— | | — | | — | | 51 | | — | | — | | — | |

(10 031 | ) | 1 141 | | 743 | | 20 374 | | 12 234 | | 1 091 | | 13 325 | |

— | | — | | — | | 20 374 | | 20 374 | | 1 139 | | 21 513 | |

(10 031 | ) | 1 141 | | 743 | | — | | (8 140 | ) | (48 | ) | (8 188 | ) |

— | | — | | — | | (8 628 | ) | (8 628 | ) | (989 | ) | (9 617 | ) |

23 285 | | (647 | ) | (1 790 | ) | 176 714 | | 211 711 | | 5 523 | | 217 234 | |

— | | — | | — | | — | | — | | (51 | ) | (51 | ) |

— | | — | | — | | — | | 989 | | — | | 989 | |

— | | — | | — | | — | | 823 | | — | | 823 | |

— | | — | | — | | — | | 166 | | — | | 166 | |

— | | — | | — | | 6 256 | | 557 | | (557 | ) | — | |

— | | — | | — | | 557 | | 557 | | (557 | ) | — | |

— | | — | | — | | 5 699 | | — | | — | | — | |

— | | — | | — | | 605 | | — | | — | | — | |

— | | — | | — | | — | | 2 953 | | — | | 2 953 | |

— | | — | | — | | — | | 2 953 | | — | | 2 953 | |

— | | — | | — | | — | | — | | — | | — | |

— | | — | | — | | — | | — | | — | | — | |

5 215 | | 827 | | (54 | ) | 8 729 | | 14 727 | | 1 433 | | 16 160 | |

— | | — | | — | | 8 729 | | 8 729 | | 1 417 | | 10 146 | |

5 215 | | 827 | | (54 | ) | — | | 5 998 | | 16 | | 6 014 | |

— | | — | | — | | (7 952 | ) | (7 952 | ) | (725 | ) | (8 677 | ) |

28 500 | | 180 | | (1 844 | ) | 184 352 | | 222 985 | | 5 623 | | 228 608 | |

(52 | ) | — | | — | | — | | (52 | ) | — | | (52 | ) |

— | | — | | — | | — | | 1 552 | | — | | 1 552 | |

— | | — | | — | | — | | 707 | | — | | 707 | |

— | | — | | — | | — | | 952 | | — | | 952 | |

— | | — | | — | | — | | (107 | ) | — | | (107 | ) |

— | | — | | — | | 1 063 | | (1 372 | ) | — | | (1 372 | ) |

— | | — | | — | | — | | — | | — | | — | |

— | | — | | — | | (1 372 | ) | (1 372 | ) | — | | (1 372 | ) |

— | | — | | — | | 2 435 | | — | | — | | — | |

— | | — | | — | | 573 | | — | | — | | — | |

1 530 | | (180 | ) | (360 | ) | 4 298 | | 5 377 | | 1 785 | | 7 162 | |

— | | — | | — | | 4 298 | | 4 298 | | 1 776 | | 6 074 | |

1 530 | | (180 | ) | (360 | ) | — | | 1 079 | | 9 | | 1 088 | |

— | | — | | — | | (8 580 | ) | (8 580 | ) | (1 523 | ) | (10 103 | ) |

29 978 | | — | | (2 204 | ) | 181 706 | | 219 910 | | 5 885 | | 225 795 | |

5

Statement of cash flows

for the year ended 30 June

| | | | 2019 | | 2018 | | 2017 | |

| | Note | | Rm | | Rm | | Rm | |

Cash receipts from customers | | | | 203 613 | | 178 672 | | 172 061 | |

Cash paid to suppliers and employees | | | | (152 215 | ) | (135 795 | ) | (127 992 | ) |

Cash generated by operating activities | | 28 | | 51 398 | | 42 877 | | 44 069 | |

Dividends received from equity accounted investments | | 20 | | 1 506 | | 1 702 | | 1 539 | |

Finance income received | | 7 | | 682 | | 1 565 | | 1 464 | |

Finance costs paid* | | 7 | | (6 222 | ) | (4 797 | ) | (3 612 | ) |

Tax paid | | 13 | | (3 946 | ) | (7 041 | ) | (6 352 | ) |

Cash available from operating activities | | | | 43 418 | | 34 306 | | 37 108 | |

Dividends paid | | 30 | | (9 952 | ) | (7 952 | ) | (8 628 | ) |

Dividends paid to non-controlling shareholders in subsidiaries | | | | (1 523 | ) | (725 | ) | (989 | ) |

Cash retained from operating activities | | | | 31 943 | | 25 629 | | 27 491 | |

Additions to non-current assets | | | | (56 734 | ) | (55 891 | ) | (56 812 | ) |

additions to property, plant and equipment | | 17 | | (1 229 | ) | (714 | ) | (390 | ) |

additions to assets under construction | | 18 | | (54 552 | ) | (52 635 | ) | (59 892 | ) |

additions to other intangible assets | | | | (19 | ) | (35 | ) | (61 | ) |

(decrease)/increase in capital project related payables | | | | (934 | ) | (2 507 | ) | 3 531 | |

Net cash movements in equity accounted investments | | | | 66 | | (164 | ) | (444 | ) |

Proceeds on disposals and scrappings | | 10 | | 567 | | 2 316 | | 788 | |

Net cash disposed of on disposal of businesses | | 10 | | — | | (36 | ) | — | |

Purchase of investments | | | | (222 | ) | (124 | ) | (96 | ) |

Proceeds from sale of investments | | | | 142 | | 114 | | 28 | |

Increase in long-term receivables | | | | (231 | ) | (194 | ) | (141 | ) |

Cash used in investing activities | | | | (56 412 | ) | (53 979 | ) | (56 677 | ) |

Proceeds from long-term debt | | 16 | | 93 884 | | 24 961 | | 9 277 | |

Repayment of long-term debt | | 16 | | (70 000 | ) | (9 199 | ) | (2 364 | ) |

Proceeds from short-term debt | | | | 977 | | 1 957 | | 4 033 | |

Repayment of short-term debt | | | | (1 730 | ) | (2 607 | ) | (1 410 | ) |

Cash generated by financing activities | | | | 23 131 | | 15 112 | | 9 536 | |

Translation effects on cash and cash equivalents | | | | 162 | | 954 | | (3 207 | ) |

Decrease in cash and cash equivalents | | | | (1 176 | ) | (12 284 | ) | (22 857 | ) |

Cash and cash equivalents at the beginning of year | | | | 17 039 | | 29 323 | | 52 180 | |

Reclassification to disposal groups held for sale | | | | (44 | ) | — | | — | |

Cash and cash equivalents at the end of the year | | 27 | | 15 819 | | 17 039 | | 29 323 | |

* | Included in finance costs paid is amounts capitalised to assets under construction. Refer note 18. |

| |

The notes on pages 7 to 98 are an integral part of these Consolidated Financial Statements. |

6

Notes to the financial statements

The Annual Financial Statements outlined below, provide a full overview of our financial results, in the context of our strategy, while enabling more effective analysis of the group’s performance.

Segment information | 8 |

| |

Statement of compliance | 14 |

| |

Earnings generated from operations | 16 |

| |

Operating activities | |

Turnover | 17 |

Materials, energy and consumables used | 18 |

Employee-related expenditure | 18 |

Translation gains/(losses) | 19 |

Other operating expenses and income | 20 |

Net finance costs | 20 |

Earnings and dividends per share | 21 |

| |

Once-off items | |

Remeasurement items affecting operating profit | 23 |

Disposals and scrapping | 28 |

Disposal groups held for sale | 29 |

| |

Taxation | |

Taxation | 31 |

Tax paid | 34 |

Deferred tax | 34 |

| |

Sources of capital | 37 |

| |

Equity | |

Share capital | 38 |

| |

Funding activities and facilities | |

Long-term debt and finance leases | 39 |

| |

Capital allocation and utilisation | 43 |

| |

Investing activities | |

Property, plant and equipment | 44 |

Assets under construction | 48 |

Long-term receivables and prepaid expenses | 52 |

Equity accounted investments | 52 |

Interest in joint operations | 56 |

Interest in significant operating subsidiaries | 57 |

| |

Working capital | |

Inventories | 59 |

Trade and other receivables | 59 |

Trade and other payables | 61 |

Decrease/(increase) in working capital | 61 |

| |

Cash management | |

Cash and cash equivalents | 62 |

Cash generated by operating activities | 63 |

Cash flow from operations | 63 |

Dividends paid | 63 |

| |

Provisions and reserves | 64 |

| |

Provisions | |

Long-term provisions | 65 |

Short-term provisions | 67 |

Post-retirement benefit obligations | 67 |

Cash-settled share-based payment provision | 74 |

| |

Reserves | |

Share-based payment reserve | 76 |

| |

Other disclosures | 81 |

| |

Contingent liabilities | 82 |

Leases and other commitments | 83 |

Related party transactions | 84 |

Subsequent events | 85 |

Financial risk management and financial Instruments | 86 |

7

Segment information

| | Mining | | Exploration

and Production

International | | Energy | | Base Chemicals*** | | Performance

Chemicals*** | |

| | 2019 | | 2018 | | 2019 | | 2018 | | 2019 | | 2018 | | 2019 | | 2018 | | 2019 | | 2018 | |

| | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | |

Statement of financial position | | | | | | | | | | | | | | | | | | | | | |

Non-current assets | | 26 485 | | 25 197 | | 13 542 | | 14 217 | | 67 325 | | 64 526 | | 141 160 | | 124 826 | | 126 949 | | 116 945 | |

Current assets | | 1 809 | | 2 547 | | 2 475 | | 2 339 | | 19 727 | | 20 657 | | 19 478 | | 15 714 | | 25 007 | | 26 335 | |

| | | | | | | | | | | | | | | | | | | | | |

Non-current liabilities | | 1 701 | | 1 629 | | 6 782 | | 5 684 | | 11 561 | | 11 616 | | 10 612 | | 38 749 | | 11 763 | | 36 538 | |

Current liabilities | | 2 601 | | 2 801 | | 1 685 | | 2 371 | | 13 160 | | 11 462 | | 10 234 | | 9 883 | | 12 462 | | 12 584 | |

| | Mining | | Exploration and Production

International | | Energy | |

| | 2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | |

| | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | |

Income statement | | | | | | | | | | | | | | | | | | | |

External turnover | | 3 222 | | 3 446 | | 2 946 | | 1 815 | | 1 610 | | 1 750 | | 82 977 | | 69 110 | | 64 254 | |

Total turnover | | 20 876 | | 19 797 | | 18 962 | | 5 184 | | 4 198 | | 4 084 | | 83 803 | | 69 773 | | 64 772 | |

Intersegmental turnover | | (17 654 | ) | (16 351 | ) | (16 016 | ) | (3 369 | ) | (2 588 | ) | (2 334 | ) | (826 | ) | (663 | ) | (518 | ) |

Earnings before interest and tax | | 4 701 | | 5 244 | | 3 725 | | (889 | ) | (3 683 | ) | 585 | | 16 566 | | 14 081 | | 11 218 | |

Earnings attributable to owners of Sasol Limited | | 3 021 | | 3 336 | | 2 266 | | (1 800 | ) | (4 168 | ) | 47 | | 11 970 | | 8 558 | | 6 395 | |

Effect of remeasurement items* | | 45 | | 34 | | 6 | | 1 976 | | 4 241 | | (6 | ) | 247 | | 971 | | 1 844 | |

Depreciation and amortisation | | 1 805 | | 1 677 | | 1 905 | | 1 582 | | 1 465 | | 2 053 | | 5 331 | | 4 817 | | 4 496 | |

| | | | | | | | | | | | | | | | | | | |

Statement of cash flows | | | | | | | | | | | | | | | | | | | |

Cash flow from operations | | 7 025 | | 6 877 | | 5 401 | | 2 528 | | 2 665 | | 1 726 | | 23 247 | | 17 158 | | 17 996 | |

Additions to non-current assets** | | 2 912 | | 3 729 | | 2 839 | | 1 086 | | 2 525 | | 2 600 | | 7 484 | | 6 650 | | 6 781 | |

| | | | | | | | | | | | | | | | | | | |

Other disclosures | | | | | | | | | | | | | | | | | | | |

Capital commitments* | | 2 372 | | 2 640 | | 3 099 | | 19 795 | | 18 811 | | 19 431 | | 10 390 | | 10 320 | | 10 327 | |

* | Excludes equity accounted investments. |

| |

** | Includes capital accruals. |

| |

*** | The comparative financial results have been restated for the transfer of the Phenolics, Ammonia and Specialty Gases businesses from Performance Chemicals to Base Chemicals. The restatements were performed to align with the current strategy and to best reflect the basis in which the Chief Operating Decision Maker reviews and makes decisions. |

8

Group Functions | | Total | | Deferred tax assets

and liabilities | | Net tax

receivable/

payable | | Post-retirement

benefit assets | | Total per statement

of financial position | |

2019 | | 2018 | | 2019 | | 2018 | | 2019 | | 2018 | | 2019 | | 2018 | | 2019 | | 2018 | | 2019 | | 2018 | |

Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | |

| | | | | | | | | | | | | | | | | | | | | | | |

6 655 | | 6 673 | | 382 116 | | 352 384 | | 8 563 | | 4 096 | | — | | — | | 1 274 | | 1 498 | | 391 953 | | 357 978 | |

8 789 | | 10 363 | | 77 285 | | 77 955 | | — | | — | | 730 | | 3 302 | | — | | — | | 78 015 | | 81 257 | |

| | | | | | | | | | | | | | | | | | | | | | | |

125 070 | | 30 547 | | 167 489 | | 124 763 | | 27 586 | | 25 908 | | — | | — | | — | | — | | 195 075 | | 150 671 | |

7 917 | | 18 537 | | 48 059 | | 57 638 | | — | | — | | 1 039 | | 2 318 | | — | | — | | 49 098 | | 59 956 | |

Base Chemicals*** | | Performance Chemicals*** | | Group Functions | | Total | |

2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | |

Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | |

| | | | | | | | | | | | | | | | | | | | | | | |

48 113 | | 43 269 | | 41 582 | | 67 389 | | 63 986 | | 61 359 | | 60 | | 40 | | 516 | | 203 576 | | 181 461 | | 172 407 | |

48 813 | | 43 951 | | 42 288 | | 68 296 | | 64 887 | | 62 185 | | 78 | | 52 | | 516 | | 227 050 | | 202 658 | | 192 807 | |

(700 | ) | (682 | ) | (706 | ) | (907 | ) | (901 | ) | (826 | ) | (18 | ) | (12 | ) | — | | (23 474 | ) | (21 197 | ) | (20 400 | ) |

(1 431 | ) | 918 | | 6 888 | | (7 040 | ) | 7 853 | | 8 737 | | (2 210 | ) | (6 666 | ) | 552 | | 9 697 | | 17 747 | | 31 705 | |

1 622 | | 2 075 | | 5 899 | | (3 516 | ) | 7 434 | | 7 124 | | (6 999 | ) | (8 506 | ) | (1 357 | ) | 4 298 | | 8 729 | | 20 374 | |

3 190 | | 4 512 | | (374 | ) | 13 182 | | 103 | | 136 | | 5 | | 40 | | 10 | | 18 645 | | 9 901 | | 1 616 | |

4 788 | | 4 422 | | 4 050 | | 3 739 | | 3 299 | | 2 965 | | 723 | | 745 | | 735 | | 17 968 | | 16 425 | | 16 204 | |

| | | | | | | | | | | | | | | | | | | | | | | |

6 343 | | 9 017 | | 11 476 | | 9 743 | | 12 303 | | 12 272 | | 102 | | (1 382 | ) | (2 635 | ) | 48 988 | | 46 638 | | 46 236 | |

23 065 | | 20 299 | | 24 182 | | 20 403 | | 19 384 | | 23 055 | | 850 | | 797 | | 886 | | 55 800 | | 53 384 | | 60 343 | |

| | | | | | | | | | | | | | | | | | | | | | | |

16 504 | | 21 125 | | 30 375 | | 10 434 | | 16 432 | | 26 743 | | 600 | | 599 | | 761 | | 60 095 | | 69 927 | | 90 736 | |

9

Geographic segment information

| | Mining | | Exploration and Production

International | | Energy | |

| | 2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | |

External turnover* | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | |

· South Africa | | — | | — | | — | | — | | — | | — | | 77 345 | | 65 827 | | 60 814 | |

· Rest of Africa | | — | | — | | — | | 652 | | 341 | | 355 | | 4 665 | | 3 282 | | 3 438 | |

· Europe | | 2 819 | | 2 691 | | 2 040 | | 924 | | 985 | | 835 | | 967 | | 1 | | 2 | |

· North America | | — | | — | | — | | 239 | | 284 | | 560 | | — | | — | | — | |

· South America | | — | | — | | — | | — | | — | | — | | — | | — | | — | |

· Asia, Australasia and Middle East | | 403 | | 755 | | 906 | | — | | — | | — | | — | | — | | — | |

Total operations | | 3 222 | | 3 446 | | 2 946 | | 1 815 | | 1 610 | | 1 750 | | 82 977 | | 69 110 | | 64 254 | |

* | The analysis of turnover is based on the location of the customer. |

| |

** | The comparative financial results have been restated for the transfer of the Phenolics, Ammonia and Specialty Gases businesses from Performance Chemicals to Base Chemicals. The restatements were performed to align with the current strategy and to best reflect the basis in which the Chief Operating Decision Maker reviews and makes decision. |

| | Mining | | Exploration and Production

International | | Energy | |

Earnings before interest | | 2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | |

and tax* | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | |

· South Africa | | 3 273 | | 3 796 | | 2 775 | | 1 458 | | 1 008 | | 1 307 | | 15 243 | | 13 064 | | 12 248 | |

· Rest of Africa | | — | | — | | — | | 164 | | (1 282 | ) | 707 | | 259 | | 926 | | (85 | ) |

· Europe | | 1 249 | | 1 131 | | 658 | | 223 | | 194 | | (503 | ) | 14 | | — | | (47 | ) |

· North America | | — | | — | | — | | (2 739 | ) | (3 595 | ) | (728 | ) | — | | (1 010 | ) | (1 756 | ) |

· South America | | — | | — | | — | | — | | — | | — | | — | | — | | — | |

· Asia, Australasia and Middle East | | 179 | | 317 | | 292 | | 5 | | (8 | ) | (198 | ) | 1 050 | | 1 101 | | 858 | |

Total operations | | 4 701 | | 5 244 | | 3 725 | | (889 | ) | (3 683 | ) | 585 | | 16 566 | | 14 081 | | 11 218 | |

* | Includes equity accounted profits/(losses) remeasurement items and once-off share-based payment expenses. |

| |

** | The comparative financial results have been restated for the transfer of the Phenolics, Ammonia and Specialty Gases businesses from Performance Chemicals to Base Chemicals. The restatements were performed to align with the current strategy and to best reflect the basis in which the Chief Operating Decision Maker reviews and makes decision. |

Non-current assets

| | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Rm | | Rm | | Rm | |

· South Africa | | 147 688 | | 143 493 | | 139 398 | |

· Rest of Africa | | 19 323 | | 18 443 | | 17 856 | |

· Europe | | 15 944 | | 15 389 | | 13 925 | |

· North America | | 189 560 | | 165 742 | | 125 983 | |

· South America | | 1 | | 1 | | 1 | |

· Asia, Australasia and Middle East | | 9 600 | | 9 316 | | 10 118 | |

Total operations | | 382 116 | | 352 384 | | 307 281 | |

Deferred tax asset | | 8 563 | | 4 096 | | 3 082 | |

Post-retirement benefit assets | | 1 274 | | 1 498 | | 622 | |

Total non-current assets | | 391 953 | | 357 978 | | 310 985 | |

10

Base Chemicals** | | Performance Chemicals** | | Group Functions | | Total | |

2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | |

Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | |

22 561 | | 21 336 | | 19 891 | | 1 049 | | 1 297 | | 1 292 | | — | | — | | — | | 100 955 | | 88 460 | | 81 997 | |

2 573 | | 2 142 | | 2 751 | | 900 | | 790 | | 786 | | 24 | | — | | 34 | | 8 814 | | 6 555 | | 7 364 | |

7 324 | | 7 037 | | 5 922 | | 33 168 | | 33 008 | | 29 261 | | — | | — | | — | | 45 202 | | 43 722 | | 38 060 | |

8 039 | | 5 894 | | 3 228 | | 19 459 | | 16 926 | | 19 375 | | — | | — | | — | | 27 737 | | 23 104 | | 23 163 | |

584 | | 513 | | 396 | | 1 501 | | 1 415 | | 1 669 | | — | | — | | — | | 2 085 | | 1 928 | | 2 065 | |

7 032 | | 6 347 | | 9 394 | | 11 312 | | 10 550 | | 8 976 | | 36 | | 40 | | 482 | | 18 783 | | 17 692 | | 19 758 | |

48 113 | | 43 269 | | 41 582 | | 67 389 | | 63 986 | | 61 359 | | 60 | | 40 | | 516 | | 203 576 | | 181 461 | | 172 407 | |

Base Chemicals** | | Performance Chemicals** | | Group Functions | | Total | |

2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | | 2019 | | 2018 | | 2017 | |

Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | | Rm | |

(843 | ) | (3 213 | ) | 2 899 | | 449 | | 1 547 | | 1 340 | | (1 004 | ) | (7 617 | ) | (125 | ) | 18 576 | | 8 585 | | 20 444 | |

120 | | 416 | | 220 | | 189 | | 22 | | 86 | | (25 | ) | 553 | | 26 | | 707 | | 635 | | 954 | |

526 | | 812 | | 734 | | 2 754 | | 3 530 | | 2 984 | | 251 | | 345 | | 84 | | 5 017 | | 6 012 | | 3 910 | |

(1 724 | ) | 430 | | 1 221 | | (11 844 | ) | 1 809 | | 3 049 | | (1 436 | ) | 50 | | 85 | | (17 743 | ) | (2 316 | ) | 1 871 | |

7 | | 141 | | 100 | | 111 | | 138 | | 160 | | — | | — | | — | | 118 | | 279 | | 260 | |

483 | | 2 332 | | 1 714 | | 1 301 | | 807 | | 1 118 | | 4 | | 3 | | 482 | | 3 022 | | 4 552 | | 4 266 | |

(1 431 | ) | 918 | | 6 888 | | (7 040 | ) | 7 853 | | 8 737 | | (2 210 | ) | (6 666 | ) | 552 | | 9 697 | | 17 747 | | 31 705 | |

11

Reporting segments

The group has six main reportable segments that reflects the structure used by the Joint Presidents and Chief Executive Officers to make key operating decisions and assess performance. The group’s reportable segments are operating segments that are differentiated by the activities that each undertakes and the products they manufacture and market (referred to as business segments). The group evaluates the performance of its reportable segments based on earnings before interest and tax (EBIT).

The operating model structure reflects how the results are reported to the Chief Operating Decision Maker (CODM). The CODM for Sasol are the Joint Presidents and Chief Executive Officers.

Operating business units

Mining

Mining is responsible for securing coal feedstock for the Southern African value chain, mainly for gasification, but also to generate electricity and steam. Coal is sold for gasification and utility purposes to Secunda Synfuels, for utility purposes to Sasolburg Operations; and to third parties in the export market.

Mining sells coal under both long- and short-term contracts at a price determinable from the agreements. Turnover is recognised upon delivery of the coal to the customer, which, in accordance with the related contract terms is the point at which the control passes to the customer. Prices are fixed or determinable and collectability is probable.

The date of delivery related to Mining is determined in accordance with the contractual agreements entered into with customers. These are summarised as follows:

Delivery terms | | Control passes to the customer |

Free on Board | | At the point in time when the coal is loaded onto the vessel at Richards Bay Coal Terminal; the customer is responsible for shipping and handling costs. |

The related costs of sales are recognised in the same period as the supply of the coal and include any shipping and handling costs incurred. All inter-segment sales are conducted at market related prices.

Exploration and Production International

Exploration and Production International (E&PI) develops and manages the group’s upstream interests in oil and gas exploration and production in Mozambique, South Africa, Canada and Gabon.

E&PI sells Mozambican gas under long-term contracts to both Sasol and external customers, condensate on short-term contracts and Canadian gas into the market at spot prices. Oil is sold to customers under annual contracts. Turnover is recognised upon delivery to the customer, which, in accordance with the related contract terms is the point at which control passes to the customer. Prices are determinable from the agreements and on the open market.

Delivery terms | | Control passes to the customer |

On-delivery | | At the point in time when the: |

| | · Gas reaches the inlet coupling of the customer’s pipeline. |

| | · Condensate is loaded onto the customer’s truck. |

| | These are the points when the customer controls the gas or condensate, or directs the use of it. The customer is responsible for transportation and handling costs. |

Strategic business units

Performance Chemicals

Performance Chemicals markets commodity and differentiated performance chemicals. The key product lines are organics, waxes and advanced materials. These are produced in various Sasol production facilities around the world.

Base Chemicals

Base Chemicals markets commodity chemicals based on the group’s upstream Fischer-Tropsch, ethylene, propylene and ammonia value chains. The key product lines are polymers, solvents and ammonia-based explosives and fertilisers. These are produced in various Sasol production facilities around the world.

The Base and Performance Chemicals businesses sell the majority of their products under contracts at prices determinable from such agreements. Turnover is recognised upon delivery which, in accordance with the related contract terms, is the point at which control transfer to the customer. Prices are determinable and collectability is probable.

12

The point of delivery is determined in accordance with the contractual agreements entered into with customers which are as follows:

Delivery terms | | Control passes to the customer: |

Ex-tank sales | | At the point in time when products are loaded into the customer’s vehicle or unloaded from the seller’s storage tanks. |

Ex-works | | At the point in time when products are loaded into the customer’s vehicle or unloaded at the seller’s premises. |

Carriage Paid To (CPT); Cost Insurance Freight (CIF); Carriage and Insurance Paid (CIP); and Cost Freight Railage (CFR) | | Products — CPT: At the point in time when the product is delivered to a specified location or main carrier. |

| Products — CIF, CIP and CFR: At the point in time when the products are loaded into the transport vehicle. |

| Carriage, freight and insurance: Over the period of transporting the products to the customer’s nominated place — where the seller is responsible for carriage, freight and insurance costs, which are included in the contract. |

Free on Board | | At the point in time when products are loaded into the transport vehicle; the customer is responsible for shipping and handling costs. |

Delivered at Place | | At the point in time when products are delivered to and signed for by the customer. |

Consignment Sales | | As and when products are consumed by the customer. |

Energy

Energy is responsible for the sales and marketing of liquid fuels, pipeline gas and electricity. In South Africa, Energy sells approximately nine billion liters of liquid fuels annually, blended from fuel components produced by the Secunda Synfuels operations, crude oil refined at Natref, as well as some products purchased from other refiners. Energy markets approximately 55 billion standard cubic feet (bscf) of natural and methane-rich gas a year.

Energy sells liquid fuel products under both short- and long-term agreements for both retail sales and commercial sales, including sales to other oil companies. The prices for retail sales are regulated and fixed by South African law. For commercial sales and sales to other oil companies, the prices are fixed and determinable according to the specific contract, with periodic price adjustments.

Turnover for the supply of fuel is based on measurement through a flow-meter into customers’ tanks. Turnover is derived from the sale of goods produced by the operating facilities and is recognised when, in accordance with the related contract terms, control passes to the customer. Prices are fixed or determinable and collectability is probable. Shipping and handling costs are included in turnover when billed to customers in conjunction with the sale of the products. Turnover is also derived from the rendering of engineering services to external partners in joint ventures upon the proof of completion of the service.

Gas is sold under long-term contracts at a price determinable from the supply agreements in accordance with the pricing methodology used by the National Energy Regulator of South Africa (NERSA). Gas analysis and tests of the specifications and content are performed prior to delivery.

Turnover is recognised under the following arrangements:

Service/good | | Delivery terms | | Control passes to the customer: |

Sale of fuel | | On-delivery | | At the point in time when the fuel is delivered onto the rail tank car, road tank truck or into the customer pipeline. |

| | Free Carrier | | At the point in time when the goods are unloaded to the port of shipment; Sasol is not responsible for the freight and insurance. |

| | Carriage Paid To | | Products: At the point in time when the product is delivered to a specified location or main carrier.

Freight: Over the period of transporting the goods to the customer’s nominated place — where the seller is responsible for freight costs, which are included in the contract. |

Sale of gas | | On-delivery | | At the point in time when the gas has reached the inlet coupling of the customer’s pipeline. |

Sale of electricity | | On-delivery | | At the point in time when the electricity passes through the supply points to the customer’s transmission line. |

The Energy business also develops, implements and manages the group’s international business ventures based on Sasol’s proprietary gas-to-liquids (GTL) technology. Sasol holds 49% in ORYX GTL in Qatar, and an indirect 10% share in Escravos GTL in Nigeria.

Group Functions

Group Functions includes head office and centralised treasury operations.

13

1 Statement of compliance

The consolidated financial statements are prepared in compliance with International Financial Reporting Standards (IFRS) and Interpretations of those standards, as issued by the International Accounting Standards Board, the SAICA Financial Reporting Guides as issued by the Accounting Practices Committee, Financial Reporting Pronouncements as issued by the Financial Reporting Standards Council, the JSE Listings Requirements and the South African Companies Act, 2008. The consolidated financial statements were approved for issue by the Board of Directors on 28 October 2019 and will be presented to shareholders at the Annual General Meeting on 27 November 2019.

Basis of preparation of financial results

The consolidated financial statements are prepared using the historic cost convention except that, certain items, including derivative instruments, liabilities for cash-settled share-based payment schemes, financial assets at fair value through profit or loss and financial assets designated at fair value through other comprehensive income, are stated at fair value. The consolidated financial results are presented in rand, which is Sasol Limited’s functional and presentation currency, rounded to the nearest million.

The consolidated financial statements are prepared on the going concern basis.

The comparative figures are reclassified or restated as necessary to afford a proper and more meaningful comparison of results as set out in the affected notes to the financial statements.

Certain additional disclosure has been provided in respect of the current year, as described on page 163 “Pro-forma financial information”. To the extent practicable, comparative information has also been provided.

Accounting policies

The accounting policies applied in the preparation of these consolidated financial statements are in terms of IFRS and are consistent with those applied in the consolidated annual financial statements for the year ended 30 June 2018, except for the adoption of IFRS 9 ‘Financial Instruments’, IFRS 15 ‘Revenue from Contracts with Customers’ and an amendment to IAS 23 ‘Borrowing Costs’ with effect from 1 July 2018. Both IFRS 9 and IFRS 15 were adopted using the modified transition approach, where the comparative financial information is not restated as permitted by the standard. The amendment to IAS 23 is applied prospectively. These accounting policies are consistently applied throughout the group.

Accounting standards, interpretations and amendments to published accounting standards

IFRS 9 ‘Financial Instruments’

IFRS 9 provides a single classification and measurement approach for financial assets that reflects the business model in which they are managed and their cash flow characteristics. The group’s financial assets are classified as measured at amortised cost, fair value through profit or loss, or fair value through other comprehensive income. The group elected to recognise the fair value gains and losses on its current equity investments through other comprehensive income as they are held for long-term strategic purpose. Due to the limited unlisted investments held, this change in measurement basis from amortised cost to fair value had an insignificant effect on Sasol’s accounting, and therefore no transition adjustment is presented.

For financial liabilities the existing classification and measurement requirements of IAS 39 will remain the same.

Impairments of financial assets classified as measured at amortised cost are recognised on an expected loss basis which incorporates forward-looking information when assessing credit risk, with the expected losses recognised in profit or loss. The effect of the change was inconsequential due to the stringent debtor management policies currently applied by Sasol, and therefore no transition adjustment is presented. Refer to note 40 for the expected credit loss calculation.

The adoption of IFRS 9 did not have a significant impact on the group’s accounting policies relating to financial assets and financial liabilities.

The IFRS 9 hedge accounting requirements are not effective for the group until the International Accounting Standards Board’s macro hedging project is finalised.

IFRS 15 ‘Revenue from contracts with customers’

Under IFRS 15, revenue from contracts with customers is recognised when a performance obligation is satisfied by transferring promised goods or services to customers. Goods or services are transferred when the customer obtains control of the goods or services. The transfer of control of Sasol’s energy and chemical products usually coincides with title passing to the customer and the customer taking physical possession, with the group’s performance obligations primarily satisfied at a point in time. Amounts of revenue recognised relating to performance obligations over time are not significant. The accounting for revenue under IFRS 15 therefore represents an inconsequential change from the group’s previous practice for recognising revenue from sales with customers, and therefore no transition adjustment is presented.

An analysis of revenue from contracts with customers by product is presented on note 2. Amounts presented for comparative periods include revenues determined in accordance with the group’s previous accounting policies, but the differences are inconsequential.

14

1 Statement of compliance continued

IAS 23 ‘Borrowing Costs’

The amendment to IAS 23 clarifies that if any specific borrowing remains outstanding after the related asset is ready for its intended use or sale, that borrowing becomes part of the funds that an entity borrows generally when calculating the capitalisation rate on general borrowings. Previously, if any specific borrowing remained outstanding after the related asset was ready for its intended use or sale, Sasol recognised the finance costs related to this borrowing in profit and loss.

The adoption of the amendment has been applied prospectively from 1 July 2018 and had a material impact on the group’s earnings for the period as Sasol has a large number of projects to which borrowing costs are capitalised. The impact of applying the amendment for the period ended 30 June 2019 is:

| | Results

excluding

amendment | | Adjustment

on IAS 23

amendment | | Results

after

amendments | |

| | Rm | | Rm | | Rm | |

Non-current assets | | | | | | | |

Property, plant, equipment and assets under construction | | 358 135 | | 1 998 | | 360 133 | |

Income statement | | | | | | | |

Finance costs | | (3 251 | ) | 1 998 | | (1 253 | ) |

Accounting standards, interpretations and amendments not yet effective

IFRS 16 ‘Leases’ (Effective for the group from 1 July 2019)

IFRS 16 introduces a single lease accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value. A lessee is required to recognise a right of use asset representing its right to use the underlying leased asset and a lease liability representing its obligation to make lease payments. The finance charge to unwind the lease liability and depreciation of the leased asset are recognised in the income statement based on the implied interest rate and contract terms respectively.

This standard does not apply to leases to explore for or use minerals, oils, natural gas and similar non-regenerative resources, including the intangible right to explore for those natural resources and rights to use the land in which those natural resources are contained.

Previously, the group planned to adopt the standard from 1 July 2019 on a full retrospective basis and was in the process of completing this adoption method. However, with the new standard indirectly impacting the accounting of a number of other business areas, including the valuation of inventory and the value-in-use of cash generating units, the group decided from a cost/benefit perspective that it would be preferable to apply the modified retrospective approach as applied by almost all of our peers. This approach allow the cumulative effect of initially applying the standard to be recognised at the date of initial application, with no restatement of comparative financial information required.

The identification and classification of leases and the analysis of the effect on the group’s consolidated financial statements have largely been completed. A new software program has been introduced to manage and measure leases going forward and the results from the solution, used to determine the impact disclosed below, is currently being assessed. Accounting policies and processes have been updated and the impact on key performance indicators and financial metrics have been quantified.

The adoption of the standard will have a material effect on the group’s financial statements, significantly increasing the group’s recognised assets and liabilities. Upon adoption, the most significant impact will be the present value of the operating lease commitments as per note 37, which are not currently recognised on the statement of financial position and provides an indication of the magnitude of assets and liabilities that will be recognised on the statement of financial position on adoption. We expect an increase in the depreciation expense and also in cash flows from operating activities as the lease payments will be reflected as financing outflows in our cash flow statement.

The discount rates applied on operating leases in determining the lease liabilities recognised are based on the incremental borrowing rates as appropriate for each lease considering factors such as the lessee country of operation, lease term, nature of asset and commencement date. Currently across the group, the incremental borrowing rates applicable to the significant portion of the undiscounted lease cash flows range from 8,2% – 11,5% (South Africa), 0,9% –3,6% (Eurasia) and 3,7% –5,6% (United States).

Based on the group’s current assessment, the impact on 2020 is expected to be as follows:

· Between R8,4 billion and R9,0 billion of additional lease liabilities would be recognised in the statement of financial position and a corresponding right-of-use asset of between R8,4 billion and R9,0 billion at 1 July 2019.

· Net income before interest and tax would increase between zero and R0,4 billion and interest expense increased by between R0,3 billion and R0,6 billion, the net results having an immaterial impact on earnings. Depreciation would increase by between R1,4 billion and R1,7 billion.

· The additional lease liabilities are expected to add approximately 5% on gearing.

15

SASOL LIMITED GROUP

EARNINGS GENERATED FROM OPERATIONS

Page | | |

| | |

17 Operating Activities | | |

| | |

· Turnover | | |

· Material, energy and consumables used | | |

· Employee-related expenditure | | |

· Translation gains/(losses) | | |

· Other operating expenses and income | | |

· Net finance costs | | |

· Earnings and dividends per share | | |

| | |

23 Once-off items | | |

| | |

· Remeasurement items affecting operating profit | | |

· Disposals and scrapping | | |

· Disposal groups held for sale | | |

| | |

31 Taxation | | |

| | |

· Taxation | | |

· Tax paid | | |

· Deferred tax | | |

16

Operating activities

2 Turnover

| | 2019 | | 2018* | | 2017* | |

for the year ended 30 June | | Rm | | Rm | | Rm | |

Revenue by major product line | | | | | | | |

Base Chemicals | | 48 113 | | 43 262 | | 41 573 | |

Polymers | | 25 864 | | 22 332 | | 22 206 | |

Solvents | | 13 178 | | 12 948 | | 11 619 | |

Fertilisers and explosives | | 4 718 | | 4 145 | | 4 021 | |

Other base chemicals** | | 4 353 | | 3 837 | | 3 727 | |

Performance Chemicals | | 67 228 | | 63 916 | | 61 322 | |

Organics | | 51 405 | | 49 005 | | 47 122 | |

Waxes | | 8 474 | | 8 456 | | 8 197 | |

Advanced materials | | 7 349 | | 6 455 | | 6 003 | |

Upstream, Energy and Other | | | | | | | |

Coal | | 3 222 | | 3 446 | | 2 946 | |

Liquid fuels and crude oil*** | | 75 819 | | 62 555 | | 57 640 | |

Gas (methane rich and natural gas) and condensate*** | | 5 986 | | 5 411 | | 5 625 | |

Other (Technology, refinery services)**** | | 2 308 | | 1 933 | | 2 418 | |

Revenue from contracts with customers | | 202 676 | | 180 523 | | 171 524 | |

Revenue from other contracts (franchise rentals, use of fuel tanks and fuel storage) | | 900 | | 938 | | 883 | |

| | 203 576 | | 181 461 | | 172 407 | |

* | Sale of goods (2018 – R178 463 million; 2017 – R169 115 million), services rendered (2018 – R1 612 million; 2017 – R1 549 million) and other trading income (2018 – R1 386 million; 2017 – R1 743 million). |

| |

** | Phenolics, Ammonia and Speciality Gases. |

| |

*** | Relate to the Exploration and Production International and Energy segments. |

| |

**** | Other includes revenue in relation to different insignificant performance obligations mainly for the Energy and Performance Chemicals segments. |

Accounting policies:

IFRS 15 applicable in 2019:

Revenue from contracts with customers is recognised when the control of goods or services has transferred to the customer through the satisfaction of a performance obligation. Group performance obligations are satisfied at a point in time and over time, however the group mainly satisfies its performance obligations at a point in time.

Revenue recognised reflects the consideration that the group expects to be entitled to for each distinct performance obligation after deducting indirect taxes, rebates and trade discounts and consists primarily of the sale of oil, natural gas and chemical products, services rendered, license fees and royalties. The group allocates revenue based on stand-alone selling price.

The group enters into exchange agreements with the same counterparties for the purchase and sale of inventory that are entered into in contemplation of one another. When the items exchanged are similar in nature, these transactions are combined and accounted for as a single exchange transaction. The exchange is recognised at the carrying amount of the inventory transferred.

Revenue from arrangements that are not considered contracts with customers, mainly pertaining to franchise rentals, use of fuel tanks and fuel storage, is presented as revenue from other contracts.

The period between the transfer of the goods and services to the customer and the payment by the customer does not exceed 12 months and the group does not adjust for time value of money.

For further information on revenue recognition, refer to Segment information on pages 12 to 13.

17

2 Turnover continued

IAS 18 applicable to prior periods:

Revenue is recognised at the fair value of the consideration received or receivable net of indirect taxes, rebates and trade discounts and consists primarily of the sale of products, services rendered, licence fees and royalties.

Revenue is recognised when the following criteria are met:

· evidence of an arrangement exists;

· delivery has occurred or services have been rendered and the significant risks and rewards of ownership have been transferred to the purchaser;

· transaction costs can be reliably measured;

· the selling price is fixed or determinable; and

· collectability is reasonably assured.

The timing of revenue recognition is as follows. Revenue from:

· the sale of products is recognised when the group has substantially transferred all the risks and rewards of ownership and no longer retains continuing managerial involvement associated with ownership or effective control;

· services rendered is based on the stage of completion of the transaction, based on the proportion that costs incurred to date bear to the total cost of the project; and

· licence fees and royalties are recognised on an accrual basis.

The group enters into exchange agreements with the same counterparties for the purchase and sale of inventory that are entered into in contemplation of one another. When the items exchanged are similar in nature, these transactions are combined and accounted for as a single exchange transaction. The exchange is recognised at the carrying amount of the inventory transferred.

3 Materials, energy and consumables used

| | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Rm | | Rm | | Rm | |

Cost of raw materials | | 79 774 | | 66 928 | | 63 291 | |

Cost of energy and other consumables used in production process | | 10 815 | | 9 678 | | 8 145 | |

| | 90 589 | | 76 606 | | 71 436 | |

Costs relating to items that are consumed in the manufacturing process, including changes in inventories and distribution costs up until the point of sale.

4 Employee-related expenditure

| | | | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Note | | Rm | | Rm | | Rm | |

Analysis of employee costs | | | | | | | | | |

Labour | | | | 30 706 | | 28 448 | | 26 646 | |

salaries, wages and other employee-related expenditure | | | | 28 665 | | 26 388 | | 24 814 | |

post-retirement benefits | | | | 2 041 | | 2 060 | | 1 832 | |

Share-based payment expenses | | | | 1 219 | | 1 565 | | 226 | |

equity-settled | | 35 | | 1 659 | | 910 | | 463 | |

cash-settled | | 34 | | (440 | ) | 655 | | (237 | ) |

Total employee-related expenditure | | | | 31 925 | | 30 013 | | 26 872 | |

Costs capitalised to projects | | | | (1 997 | ) | (2 545 | ) | (2 455 | ) |

Per income statement | | | | 29 928 | | 27 468 | | 24 417 | |

18

4 Employee-related expenditures continued

The total number of permanent and non-permanent employees, in approved positions, including the group’s share of employees within joint operation entities and excluding contractors, joint ventures’ and associates’ employees, is analysed below:

| | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Number | | Number | | Number | |

Permanent employees | | 31 112 | | 31 020 | | 30 600 | |

Non-permanent employees | | 317 | | 250 | | 300 | |

| | 31 429 | | 31 270 | | 30 900 | |

The number of employees by area of employment is analysed as follows:

| | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Number | | Number | | Number | |

Business segmentation | | | | | | | |

· Mining | | 7 402 | | 7 471 | | 7 483 | |

· Exploration and Production International | | 419 | | 430 | | 416 | |

· Energy | | 5 118 | | 5 069 | | 5 008 | |

· Base Chemicals | | 8 090 | | 7 724 | | 7 438 | |

· Performance Chemicals | | 5 667 | | 5 600 | | 5 435 | |

· Group Functions | | 4 733 | | 4 976 | | 5 120 | |

Total operations* | | 31 429 | | 31 270 | | 30 900 | |

* | Increase mainly due to LCCP. |

Accounting policies:

Remuneration of employees is charged to the income statement, except where it is capitalised to projects in line with the accounting policy for assets under construction.

Short-term employee benefits

Short-term employee benefits includes salaries, wages and costs of temporary employees, paid vacation leave, sick leave and incentive bonuses.

Long-term employee benefits

Long-term employee benefits are those benefits that are expected to be wholly settled more than 12 months after the end of the annual reporting period, in which the services have been rendered and are discounted to their present value.

Post-retirement benefits

Further information on these benefits is provided in Note 33, and include defined benefit contribution plans, as well as defined benefit plans.

5 Translation gains/(losses)

| | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Rm | | Rm | | Rm | |

Arising from | | | | | | | |

Trade and other receivables | | 98 | | 132 | | (909 | ) |

Trade and other payables | | (372 | ) | (354 | ) | 237 | |

Foreign currency loans | | 965 | | (103 | ) | 313 | |

Other | | (87 | ) | 314 | | (842 | ) |

| | 604 | | (11 | ) | (1 201 | ) |

Business segmentation | | | | | | | |

· Mining | | (19 | ) | (18 | ) | (19 | ) |

· Exploration and Production International | | (79 | ) | 289 | | 337 | |

· Energy | | (337 | ) | (45 | ) | (299 | ) |

· Base Chemicals | | (124 | ) | (5 | ) | (394 | ) |

· Performance Chemicals | | 51 | | 45 | | (299 | ) |

· Group Functions | | 1 112 | | (277 | ) | (527 | ) |

Total operations | | 604 | | (11 | ) | (1 201 | ) |

Differences arising on the translation of monetary assets and liabilities into functional currency.

19

6 Other operating expenses and income

| | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Rm | | Rm | | Rm | |

Rentals | | 1 845 | | 1 497 | | 1 367 | |

Insurance | | 514 | | 432 | | 511 | |

Computer costs | | 2 155 | | 2 042 | | 1 991 | |

Hired labour | | 786 | | 838 | | 878 | |

Audit remuneration | | 97 | | 88 | | 89 | |

Derivative losses/(gains) (including foreign exchange contracts)(1) | | 2 465 | | 3 927 | | (635 | ) |

Professional fees | | 2 226 | | 1 971 | | 1 383 | |

Enablement of digital and continuous improvement initiatives | | 454 | | 409 | | 17 | |

Other | | 1 772 | | 1 562 | | 1 366 | |

Changes in rehabilitation provisions | | 1 096 | | (804 | ) | 472 | |

Other expenses(2) | | 9 880 | | 6 724 | | 6 981 | |

Other operating income | | (1 363 | ) | (1 410 | ) | (1 688 | ) |

| | 19 701 | | 15 305 | | 11 349 | |

(1) | Relates mainly to the group’s hedging activities which includes a loss of R1,5 billion on the reclassification of the interest rate swap to profit and loss on termination of the hedge relationship, refer note 40. |

| |

(2) | Increase relates mainly to growth cost relating to the LCCP and high-density polyethyline (HDPE) plants that have reached beneficial operation. |

7 Net finance costs

| | | | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Note | | Rm | | Rm | | Rm | |

Finance income | | | | | | | | | |

Dividends received from investments | | | | 42 | | 520 | | 59 | |

Notional interest received | | | | — | | 5 | | 1 | |

Interest received on | | | | 745 | | 1 191 | | 1 508 | |

other long-term investments | | | | 27 | | 32 | | 36 | |

loans and receivables | | | | 334 | | 359 | | 349 | |

cash and cash equivalents | | | | 384 | | 800 | | 1 123 | |

Per income statement | | | | 787 | | 1 716 | | 1 568 | |

Less: notional interest | | | | — | | (5 | ) | (1 | ) |

Less: interest received on tax | | | | (105 | ) | (146 | ) | (103 | ) |

Per the statement of cash flows | | | | 682 | | 1 565 | | 1 464 | |

Finance costs | | | | | | | | | |

Debt | | | | 6 088 | | 4 166 | | 3 463 | |

debt | | | | 6 044 | | 3 880 | | 3 162 | |

interest rate swap — net settlements | | | | 44 | | 286 | | 301 | |

Preference share dividends | | | | 116 | | 963 | | 989 | |

Finance leases (refer note 16) | | | | 871 | | 483 | | 86 | |

Other(1) | | | | (462 | ) | 291 | | 378 | |

| | | | 6 613 | | 5 903 | | 4 916 | |

Amortisation of loan costs | | 16 | | 725 | | 462 | | 279 | |

Notional interest | | 31 | | 857 | | 962 | | 834 | |

Total finance costs | | | | 8 195 | | 7 327 | | 6 029 | |

Amounts capitalised to assets under construction(2) | | 18 | | (6 942 | ) | (3 568 | ) | (2 764 | ) |

Per income statement | | | | 1 253 | | 3 759 | | 3 265 | |

Total finance costs before amortisation of loan costs and notional interest | | | | 6 613 | | 5 903 | | 4 916 | |

Add: modification gain | | | | 109 | | — | | — | |

Less: interest accrued on long-term debt | | 16 | | (1 025 | ) | (878 | ) | (956 | ) |

Less: interest reversed/(accrued) on tax payable(1) | | | | 525 | | (228 | ) | (348 | ) |

Per the statement of cash flows | | | | 6 222 | | 4 797 | | 3 612 | |

(1) | Interest (reversed)/accrued on tax payable relates mainly to our tax litigation claim. Refer to note 12. |

(2) | Finance costs capitalised increased due to higher assets under construction and the adoption of the amendment of IAS23 ‘Borrowing Costs’ on 1 July 2018, which resulted in higher capitalisation of costs. |

20

8 Earnings and dividends per share

| | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Rand | | Rand | | Rand | |

Attributable to owners of Sasol Limited | | | | | | | |

Basic earnings per share | | 6,97 | | 14,26 | | 33,36 | |

Headline earnings per share | | 30,72 | | 27,44 | | 35,15 | |

Diluted earnings per share | | 6,93 | | 14,18 | | 33,27 | |

Diluted headline earnings per share | | 30,54 | | 27,27 | | 35,05 | |

Dividends per share | | 5,90 | | 12,90 | | 12,60 | |

interim | | 5,90 | | 5,00 | | 4,80 | |

final* | | — | | 7,90 | | 7,80 | |

* | Declared subsequent to 30 June and has been presented for information purposes only. |

Earnings per share (EPS)

Earnings per share is derived by dividing attributable earnings by the weighted average number of shares, after taking the long-term incentives (LTIs), the Sasol Inzalo and Sasol Khanyisa share transactions into account. Appropriate adjustments are made in calculating diluted, headline and diluted headline earnings per share.

for the year ended 30 June | | | | 2019 | | 2018 | | 2017 | |

Weighted average number of shares | | million | | 616,6 | | 612,2 | | 610,7 | |

Earnings attributable to owners of Sasol Limited | | Rm | | 4 298 | | 8 729 | | 20 374 | |

Basic earnings per share | | Rand | | 6,97 | | 14,26 | | 33,36 | |

Headline earnings per share (HEPS)

| | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | million | | million | | million | |

Weighted average number of shares | | 616,6 | | 612,2 | | 610,7 | |

| | | | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Note | | Rm | | Rm | | Rm | |

Headline earnings is determined as follows: | | | | | | | | | |

Earnings attributable to owners of Sasol Limited | | | | 4 298 | | 8 729 | | 20 374 | |

Adjusted for: | | | | | | | | | |

Effect of remeasurement items for subsidiaries and joint operations, net of tax | | 9 | | 14 628 | | 8 058 | | 1 077 | |

gross remeasurement items | | | | 18 645 | | 9 901 | | 1 616 | |

tax effect and non-controlling interest effect | | | | (4 017 | ) | (1 843 | ) | (539 | ) |

Effect of remeasurement items for equity accounted investments | | 9 | | 15 | | 11 | | 14 | |

Headline earnings | | | | 18 941 | | 16 798 | | 21 465 | |

| | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Rand | | Rand | | Rand | |

Headline earnings attributable to owners of Sasol Limited | | | | | | | |

Headline earnings per share | | 30,72 | | 27,44 | | 35,15 | |

21

8 Earnings and dividends per share continued

Diluted earnings per share (DEPS) and diluted headline earnings per share (DHEPS)

DEPS and DHEPS are calculated considering the potential dilution that could occur if all of the group’s long-term incentives (LTIs) had vested, if all outstanding share options were exercised and the effect of all dilutive potential ordinary shares resulting from the Sasol Inzalo and Sasol Khanyisa Tier 1 share transactions.

The number of shares outstanding is adjusted to show the potential dilution if the LTI’s and Sasol Khanyisa Tier 1 were settled in Sasol Limited shares.

The Sasol Inzalo share transaction is anti-dilutive for EPS and HEPS in 2019, 2018 and 2017.

The Sasol Khanyisa Tier 2 and Khanyisa Public are anti-dilutive for EPS and HEPS in 2019 and 2018.

| | Number of shares | |

| | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | million | | million | | million | |

Weighted average number of shares | | 616,6 | | 612,2 | | 610,7 | |

Potential dilutive effect of long-term incentive scheme* | | 2,9 | | 3,7 | | 1,7 | |

Potential dilutive effect of Sasol Khanyisa Tier 1 | | 0,8 | | — | | — | |

Diluted weighted average number of shares for DEPS and DHEPS | | 620,3 | | 615,9 | | 612,4 | |

* | On 25 November 2016, the cash-settled LTI scheme was converted to an equity-settled share scheme. |

| | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Rm | | Rm | | Rm | |

Diluted earnings is determined as follows: | | | | | | | |

Earnings attributable to owners of Sasol Limited | | 4 298 | | 8 729 | | 20 374 | |

Diluted earnings attributable to owners of Sasol Limited | | 4 298 | | 8 729 | | 20 374 | |

Diluted headline earnings is determined as follows: | | | | | | | |

Headline earnings attributable to owners of Sasol Limited | | 18 941 | | 16 798 | | 21 465 | |

Diluted headline earnings attributable to owners of Sasol Limited | | 18 941 | | 16 798 | | 21 465 | |

| | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Rand | | Rand | | Rand | |

Diluted earnings per share | | 6,93 | | 14,18 | | 33,27 | |

Diluted headline earnings per share | | 30,54 | | 27,27 | | 35,05 | |

22

Once-off items

9 Remeasurement items affecting operating profit

| | | | 2019 | | 2018 | | 2017 | |

for the year ended 30 June | | Note | | Rm | | Rm | | Rm | |

Effect of remeasurement items for subsidiaries and joint operations | | | | | | | | | |

Impairment of | | | | 18 451 | | 9 115 | | 2 477 | |

property, plant and equipment | | 17 | | 14 161 | | 7 623 | | 415 | |

assets under construction | | 18 | | 4 272 | | 1 492 | | 1 942 | |

goodwill and other intangible assets | | | | 11 | | — | | 120 | |

other assets | | | | 7 | | — | | — | |

Reversal of impairment of | | | | (949 | ) | (354 | ) | (1 136 | ) |

property, plant and equipment | | 17 | | (650 | ) | — | | (272 | ) |

assets under construction | | 18 | | (299 | ) | (14 | ) | (849 | ) |

goodwill and other intangible assets | | | | — | | (56 | ) | — | |

equity accounted investments | | | | — | | (269 | ) | (15 | ) |

other assets | | | | — | | (15 | ) | — | |

Fair value write down — assets held for sale | | | | — | | — | | 64 | |

Loss/(profit) on | | 10 | | 1 109 | | 828 | | 211 | |

disposal of property, plant and equipment | | | | (32 | ) | (3 | ) | (25 | ) |

disposal of goodwill and other intangible assets | | | | — | | 11 | | 4 | |

disposal of other assets | | | | — | | (1 | ) | — | |

disposal of businesses | | | | (267 | ) | (833 | ) | (51 | ) |

scrapping of property, plant and equipment | | | | 556 | | 454 | | 183 | |

disposal and scrapping of assets under construction | | | | 852 | | 1 200 | | 100 | |

Write-off of unsuccessful exploration wells | | 18 | | 34 | | 312 | | — | |

Remeasurement items per income statement | | | | 18 645 | | 9 901 | | 1 616 | |

Tax effect | | | | (4 012 | ) | (1 834 | ) | (532 | ) |

Non-controlling interest effect | | | | (5 | ) | (9 | ) | (7 | ) |

Total remeasurement items for subsidiaries and joint operations, net of tax | | | | 14 628 | | 8 058 | | 1 077 | |

Effect of remeasurement items for equity accounted investments | | | | 15 | | 11 | | 14 | |

Total remeasurement items for the group, net of tax | | | | 14 643 | | 8 069 | | 1 091 | |

Impairment/reversal of impairments

The group’s non-financial assets, other than inventories and deferred tax assets, are assessed for impairment at each reporting date or whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Recoverable amounts are estimated for individual assets or, where an individual asset cannot generate cash inflows independently, the recoverable amount is determined for the larger cash generating unit to which it belongs.

Impairment calculations

The recoverable amount of the assets assessed for impairment is determined based on the higher of the fair value less costs to sell or value-in-use calculations. Key assumptions relating to this valuation include the discount rate and cash flows. Future cash flows are estimated based on financial budgets covering a five year period and extrapolated over the useful life of the assets to reflect the long term plans for the group using the estimated growth rate for the specific business or project. Where reliable cash flow projections are available for a period longer than five years, those budgeted cash flows are used in the impairment calculation. The estimated future cash flows and discount rate are post-tax, based on the assessment of current risks applicable to the specific entity and country in which it operates. Discounting post-tax cash flows at a post-tax discount rate yields the same results as discount pre-tax cash flows at a pre-tax discount rate, assuming there are no significant temporary tax differences.

23

9 Remeasurement items affecting operating profit continued

Main assumptions used for impairment calculations

| | | | 2019 | | 2018 | | 2017 | |

Long-term average crude oil price (Brent) (nominal)* | | US$/bbl | | 71,17 | | 73,91 | | 74,29 | |

Long-term average gas price (Henry Hub), excluding margins (real)* | | US$/mmbtu | | 3,44 | | 3,49 | | 3,69 | |

Long-term average ethane price (nominal)* | | US$c/gal | | 39,04 | | 37,42 | | 44,27 | |

Long-term average ammonia price* | | Rand/ton | | 4 258,54 | | 5 807,46 | | 6 392,85 | |

Long-term average exchange rate* | | Rand/US$ | | 14,29 | | 13,57 | | 14,71 | |

* | Assumptions are provided on a long-term average basis. Oil price, ammonia price and exchange rate assumptions are calculated based on a five year period, while the ethane price is based on a ten year period. The Henry Hub gas price is calculated until 2041, linked to the plant’s useful life. |

| | | | South

Africa | | United

States of

America | | Europe | | Canada | |

| | | | % | | % | | % | | % | |

Growth rate — long-term Producer Price Index | | 2019 | | 5,50 | | 2,00 | | 2,00 | | 2,00 | |

Weighted average cost of capital* | | 2019 | | 13,12 | | 7,18 | | 7,18 – 9,48 | | 7,18 | |

Discount rate — risk adjusted | | 2019 | | 13,12 | | 7,18 | | 7,18 – 9,48 | | 10,00 | |

Growth rate — long-term Producer Price Index | | 2018 | | 5,50 | | 2,00 | | 2,00 | | 2,00 | |

Weighted average cost of capital* | | 2018 | | 12,71 | | 7,56 | | 7,68 – 9,35 | | 7,68 | |

Discount rate — risk adjusted | | 2018 | | 12,71 | | 7,56 | | 7,68 – 9,35 | | 10,00 | |

Growth rate — long-term Producer Price Index | | 2017 | | 5,50 | | 2,00 | | 2,00 | | 2,00 | |

Weighted average cost of capital* | | 2017 | | 12,50 | | 6,60 | | 6,60 – 8,22 | | 6,60 | |

Discount rate — risk adjusted | | 2017 | | 12,50 | | 6,60 | | 6,60 – 8,22 | | 9,50 – 9,80 | |

* | Calculated using spot market factors on 30 June. |

Areas of judgement:

Management determines the expected performance of the assets based on past performance and its expectations of market developments. The weighted average growth rates used are consistent with the increase in the geographic segment long-term Producer Price Index. Estimations are based on a number of key assumptions such as volume, price and product mix which will create a basis for future growth and gross margin. These assumptions are set in relation to historic figures and external reports. If necessary, these cash flows are then adjusted to take into account any changes in assumptions or operating conditions that have been identified subsequent to the preparation of the budgets.

The weighted average cost of capital rate (WACC) is derived from a pricing model. The variables used in the model are established on the basis of management judgement and current market conditions. Management judgement is also applied in estimating future cash flows and defining of cash-generating units. These values are sensitive to the cash flows projected for the periods for which detailed forecasts are not available and to the assumptions regarding the long-term sustainability of the cash flows thereafter.

Determining as to whether, and by how much, cost incurred on a project is abnormal and needs to be scrapped involves judgement. The factors considered by management include the scale and complexity of the project, the technology being applied and guidance from experts in terms of what constitute abnormal wastage on the project.

24

9 Remeasurement items affecting operating profit continued

Significant impairment (reversals of impairment) of assets in 2019

| | | | Property,

plant and

equipment | | Assets

under

con-

struction | | Goodwill

and other

intangible

assets | | Other | | Total | |

| | Business | | 2019 | | 2019 | | 2019 | | 2019 | | 2019 | |

Cash-generating unit (CGU) | | segmentation | | Rm | | Rm | | Rm | | Rm | | Rm | |

Tetramerization value chain (LCCP) | | Performance Chemicals | | 3 929 | | 3 474 | | — | | — | | 7 403 | |

Ethylene Oxide/Ethylene Glycol value chain (LCCP) | | Performance Chemicals | | 4 662 | | 798 | | — | | — | | 5 460 | |

Ammonia value chain | | Base Chemicals | | 3 347 | | — | | — | | — | | 3 347 | |

Sasol Canada — Shale gas assets | | Exploration and Production International | | 1 947 | | — | | — | | — | | 1 947 | |

Chlor Vinyls value chain | | Base Chemicals | | (650 | ) | (299 | ) | — | | — | | (949 | ) |

High Purity Alumina assets | | Performance Chemicals | | 205 | | — | | — | | — | | 205 | |

Sasol Wilmar Alcohol Industries | | Performance Chemicals | | 65 | | — | | 11 | | 7 | | 83 | |

Other | | Various | | 6 | | — | | — | | — | | 6 | |

| | | | 13 511 | | 3 973 | | 11 | | 7 | | 17 502 | |

Performance Chemicals — Tetramerization and Ethylene Oxide/Ethylene Glycol (EO/EG) value chains