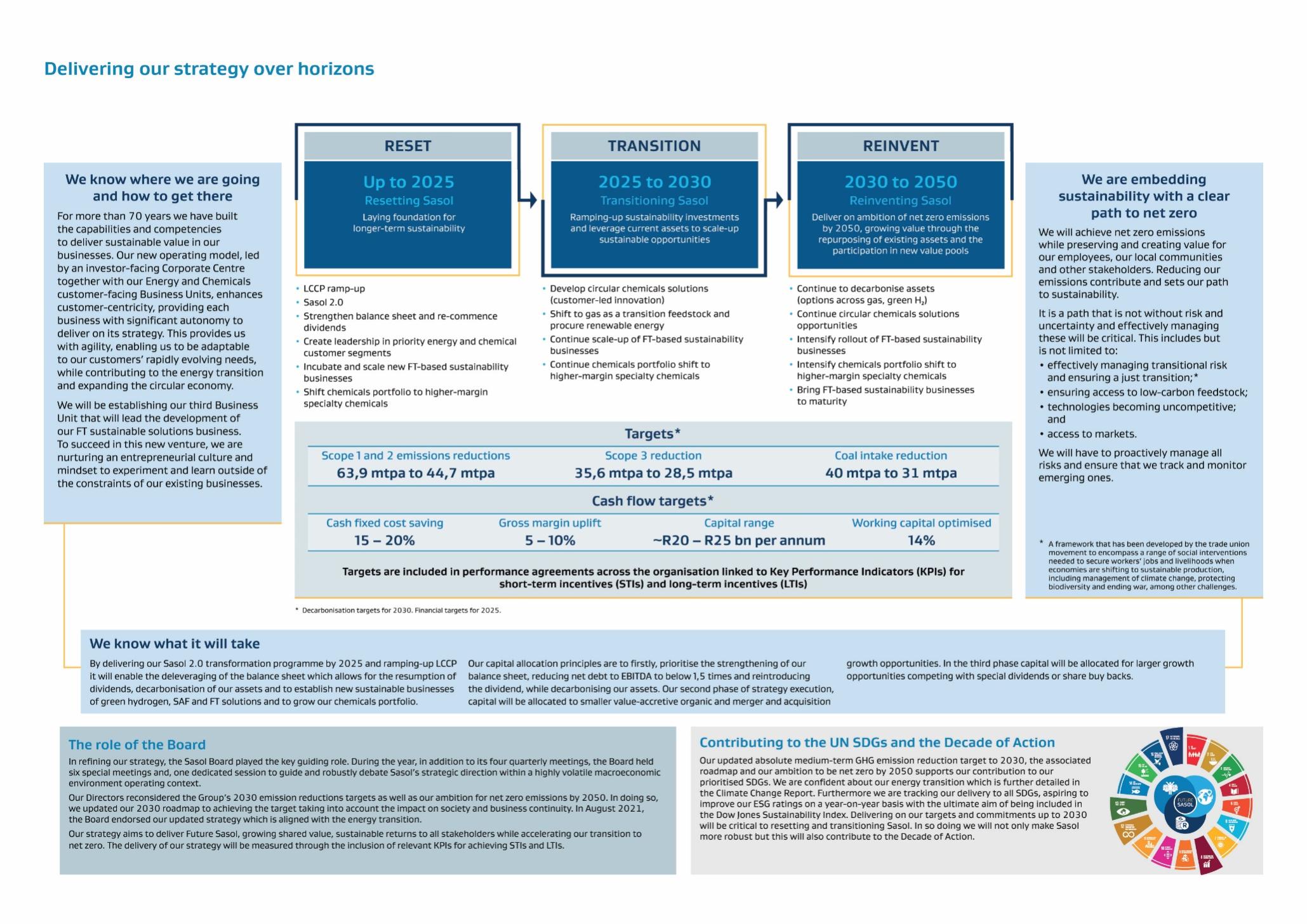

| 1 2 3 4 5 6 Delivering our strategy over horizons sustainability with a clear while preserving and creating value for to sustainability. uncertainty and effectively managing is not limited to: and ensuring a just transition;* • technologies becoming uncompetitive; risks and ensure that we track and monitor available on our website, www.sasol.com union including management of climate change, protecting FUTURE improve our ESG ratings on a year-on-year basis with the ultimate aim of being included in will be critical to resetting and transitioning Sasol. In so doing we will not only make Sasol Sasol Integrated Report 2021 NELC12 D:20210915215650+02'00'9/15/2021 12:56:50 AM --------------------------------------------Delete section indicator NELC12 D:20210915215700+02'00'9/15/2021 12:57:00 AM --------------------------------------------Delete page number and report name NELC12 D:20210915215718+02'00'9/15/2021 12:57:18 AM --------------------------------------------Delete symbols and reference sentence NELC12 D:20210915215736+02'00'9/15/2021 12:57:36 AM --------------------------------------------Delete symbol and reference sentence NELC12 D:20210915215754+02'00'9/15/2021 12:57:54 AM --------------------------------------------Delete symbols and reference sentence NELC12 D:20210915215815+02'00'9/15/2021 12:58:15 AM --------------------------------------------Delete symbol and reference sentence NELC12 D:20210915215831+02'00'9/15/2021 12:58:31 AM --------------------------------------------Delete symbol and reference sentence NELC12 D:20210915215848+02'00'9/15/2021 12:58:48 AM --------------------------------------------Delete symbol and reference sentence 14 Contributing to the UN SDGs and the Decade of Action Our updated absolute medium-term GHG emission reduction target to 2030, the associated roadmap and our ambition to be net zero by 2050 supports our contribution to our prioritised SDGs. We are confident about our energy transition which is further detailed in the Climate Change Report. Furthermore we are tracking our delivery to all SDGs, aspiring to the Dow Jones Sustainability Index. Delivering on our targets and commitments up to 2030 more robust but this will also contribute to the Decade of Action. CCR SR For more detail refer to our Climate Change Report and Sustainability Report available on our website, www.sasol.com The role of the Board In refining our strategy, the Sasol Board played the key guiding role. During the year, in addition to its four quarterly meetings, the Board held six special meetings and, one dedicated session to guide and robustly debate Sasol’s strategic direction within a highly volatile macroeconomic environment operating context. Our Directors reconsidered the Group’s 2030 emission reductions targets as well as our ambition for net zero emissions by 2050. In doing so, we updated our 2030 roadmap to achieving the target taking into account the impact on society and business continuity. In August 2021, the Board endorsed our updated strategy which is aligned with the energy transition. Our strategy aims to deliver Future Sasol, growing shared value, sustainable returns to all stakeholders while accelerating our transition to net zero. The delivery of our strategy will be measured through the inclusion of relevant KPIs for achieving STIs and LTIs. IR For more detail refer to pages 31 – 35. We know where we are going and how to get there For more than 70 years we have built the capabilities and competencies to deliver sustainable value in our businesses. Our new operating model, led by an investor-facing Corporate Centre together with our Energy and Chemicals customer-facing Business Units, enhances customer-centricity, providing each business with significant autonomy to deliver on its strategy. This provides us with agility, enabling us to be adaptable to our customers’ rapidly evolving needs, while contributing to the energy transition and expanding the circular economy. We will be establishing our third Business Unit that will lead the development of our FT sustainable solutions business. To succeed in this new venture, we are nurturing an entrepreneurial culture and mindset to experiment and learn outside of the constraints of our existing businesses. IR For more detail refer to pages 4 and 10. • LCCP ramp-up • Develop circular chemicals solutions• Continue to decarbonise assets • Sasol 2.0 (customer-led innovation) (options across gas, green H2) • Strengthen balance sheet and re-commence • Shift to gas as a transition feedstock and • Continue circular chemicals solutions dividends procure renewable energy opportunities • Create leadership in priority energy and chemical • Continue scale-up of FT-based sustainability• Intensify rollout of FT-based sustainability customer segments businesses businesses • Incubate and scale new FT-based sustainability• Continue chemicals portfolio shift to • Intensify chemicals portfolio shift to businesses higher-margin specialty chemicals higher-margin specialty chemicals • Shift chemicals portfolio to higher-margin• Bring FT-based sustainability businesses specialty chemicals to maturity We are embedding path to net zero We will achieve net zero emissions our employees, our local communities and other stakeholders. Reducing our emissions contribute and sets our path It is a path that is not without risk and these will be critical. This includes but • effectively managing transitional risk • ensuring access to low-carbon feedstock; and • access to markets. We will have to proactively manage all emerging ones. IR For more detail refer to pages 4 and 10. CCR For more detail refer to our Climate Change Report, and specifically page 3 and 25 on just transition, * A framework that has been developed by the trade movement to encompass a range of social intervention needed to secure workers’ jobs and livelihoods when economies are shifting to sustainable production, biodiversity and ending war, among other challenges. s * Decarbonisation targets for 2030. Financial targets for 2025. We know what it will take By delivering our Sasol 2.0 transformation programme by 2025 and ramping-up LCCP Our capital allocation principles are to firstly, prioritise the strengthening of our growth opportunities. In the third phase capital will be allocated for larger growth it will enable the deleveraging of the balance sheet which allows for the resumption of balance sheet, reducing net debt to EBITDA to below 1,5 times and reintroducing opportunities competing with special dividends or share buy backs. dividends, decarbonisation of our assets and to establish new sustainable businesses the dividend, while decarbonising our assets. Our second phase of strategy execution, IR For more detail refer to page 44 for capital allocation principles. of green hydrogen, SAF and FT solutions and to grow our chemicals portfolio. capital will be allocated to smaller value-accretive organic and merger and acquisition Targets* Cash flow targets* Targets are included in performance agreements across the organisation linked to Key Performance Indicators (KPIs) for short-term incentives (STIs) and long-term incentives (LTIs) Cash fixed cost saving Gross margin uplift Capital range Working capital optimised 15 – 20% 5 – 10%~R20 – R25 bn per annum 14% Scope 1 and 2 emissions reductions Scope 3 reduction Coal intake reduction 63,9 mtpa to 44,7 mtpa 35,6 mtpa to 28,5 mtpa 40 mtpa to 31 mtpa TRANSITION 2025 to 2030 Transitioning Sasol Ramping-up sustainability investments and leverage current assets to scale-up sustainable opportunities REINVENT 2030 to 2050 Reinventing Sasol Deliver on ambition of net zero emissions by 2050, growing value through the repurposing of existing assets and the participation in new value pools RESET Up to 2025 Resetting Sasol Laying foundation for longer-term sustainability |