UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3010

Fidelity Advisor Series VII

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | July 31 |

| |

Date of reporting period: | January 31, 2005 |

Item 1. Reports to Stockholders

(fidelity_logo) (Registered_Trademark)

Fidelity Advisor

Focus Funds®

Class A, Class T, Class B and Class C

Biotechnology

Consumer Industries

Cyclical Industries

Developing Communications

Electronics

Financial Services

Health Care

Natural Resources

Technology

Telecommunications &

Utilities Growth

Semiannual Report

January 31, 2005

(2_fidelity_logos) (Registered_Trademark)

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity's web site at http://www.advisor.fidelity.com.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Advisor Biotechnology Fund

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2004 to January 31, 2005).

Actual Expenses

The first line of the table below for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning

Account Value

August 1, 2004 | Ending

Account Value

January 31, 2005 | Expenses Paid

During Period*

August 1, 2004

to January 31, 2005 |

Class A | | | |

Actual | $ 1,000.00 | $ 1,036.70 | $ 7.70 ** |

Hypothetical A | $ 1,000.00 | $ 1,017.64 | $ 7.63 ** |

Class T | | | |

Actual | $ 1,000.00 | $ 1,033.60 | $ 8.97 ** |

Hypothetical A | $ 1,000.00 | $ 1,016.38 | $ 8.89 ** |

Class B | | | |

Actual | $ 1,000.00 | $ 1,030.80 | $ 11.52 ** |

Hypothetical A | $ 1,000.00 | $ 1,013.86 | $ 11.42 ** |

Class C | | | |

Actual | $ 1,000.00 | $ 1,030.80 | $ 11.52 ** |

Hypothetical A | $ 1,000.00 | $ 1,013.86 | $ 11.42 ** |

Institutional Class | | | |

Actual | $ 1,000.00 | $ 1,036.30 | $ 6.01 ** |

Hypothetical A | $ 1,000.00 | $ 1,019.31 | $ 5.96 ** |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| Annualized

Expense Ratio |

Class A | 1.50% ** |

Class T | 1.75% ** |

Class B | 2.25% ** |

Class C | 2.25% ** |

Institutional Class | 1.17% ** |

Biotechnology

** If fees effective January 1, 2005 and changes to voluntary expense limitations effective February 1, 2005 had been in effect during the period, the annualized expense ratios and the expenses paid in the actual and hypothetical examples above would have been as follows:

| Annualized

Expense Ratio | Expenses Paid |

Class A | 1.40% | |

Actual | | $ 7.19 |

HypotheticalA | | $ 7.12 |

Class T | 1.65% | |

Actual | | $ 8.46 |

HypotheticalA | | $ 8.39 |

Class B | 2.15% | |

Actual | | $ 11.01 |

HypotheticalA | | $ 10.92 |

Class C | 2.15% | |

Actual | | $ 11.01 |

HypotheticalA | | $ 10.92 |

Institutional Class | 1.15% | |

Actual | | $ 5.90 |

HypotheticalA | | $ 5.85 |

A 5% return per year before expenses

Semiannual Report

Advisor Biotechnology Fund

Investment Summary

Top Ten Stocks as of January 31, 2005 |

| % of fund's

net assets |

Biogen Idec, Inc. | 11.0 |

Genentech, Inc. | 9.2 |

Celgene Corp. | 7.0 |

Elan Corp. PLC sponsored ADR | 6.0 |

MedImmune, Inc. | 5.5 |

Cephalon, Inc. | 5.2 |

Sepracor, Inc. | 4.8 |

Genzyme Corp. - General Division | 4.7 |

ImClone Systems, Inc. | 4.2 |

Gilead Sciences, Inc. | 4.0 |

| 61.6 |

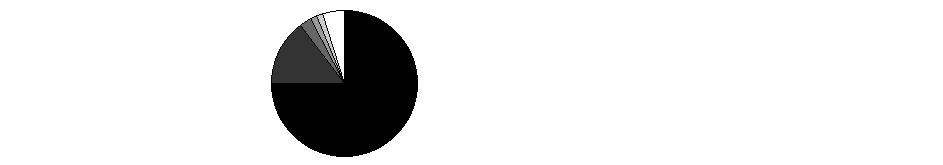

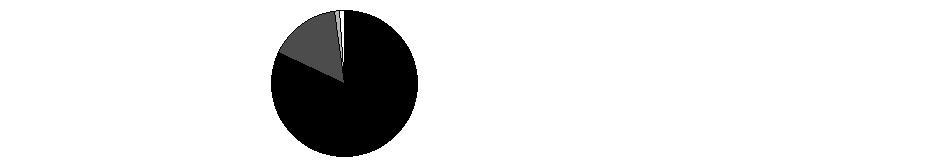

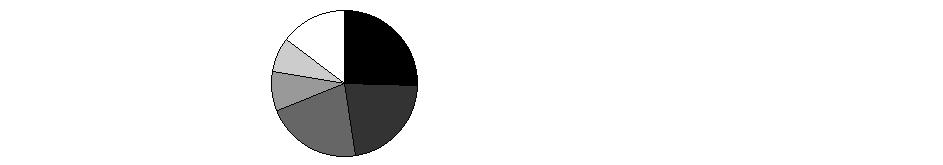

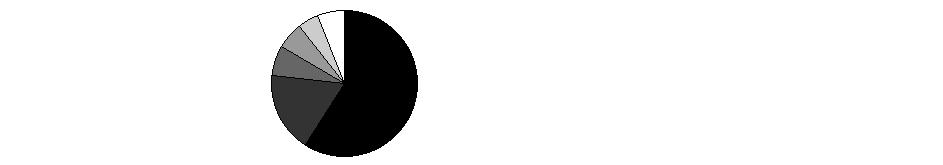

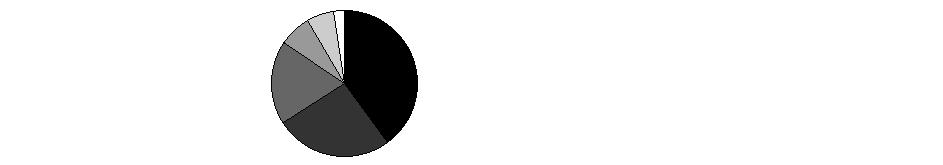

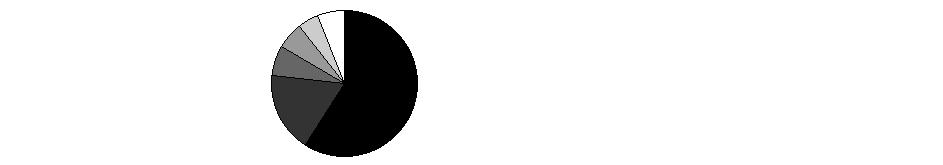

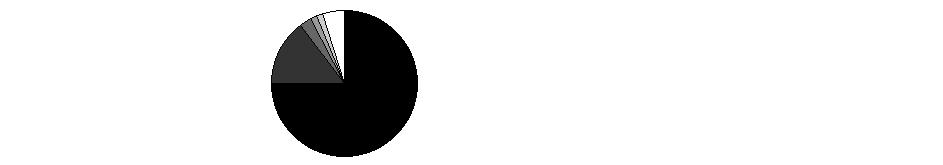

Top Industries as of January 31, 2005 |

% of fund's net assets |

| Biotechnology | 83.5% | |

| Pharmaceuticals | 16.0% | |

| Health Care Equipment & Supplies | 0.2% | |

| All Others * | 0.3% | |

* Includes short-term investments and net other assets. |

Biotechnology

Advisor Biotechnology Fund

Investments January 31, 2005 (Unaudited)

Showing Percentage of Net Assets

Common Stocks - 99.7% |

| Shares | | Value (Note 1) |

BIOTECHNOLOGY - 83.5% |

Actelion Ltd. (Reg.) (a) | 13,611 | | $ 1,291,325 |

Affymetrix, Inc. (a) | 41,300 | | 1,699,908 |

Alkermes, Inc. (a) | 71,240 | | 902,611 |

Amgen, Inc. (a) | 24,910 | | 1,550,398 |

Amylin Pharmaceuticals, Inc. (a) | 7,600 | | 170,316 |

Biogen Idec, Inc. (a) | 89,734 | | 5,829,120 |

Celgene Corp. (a) | 136,540 | | 3,733,004 |

Cephalon, Inc. (a) | 56,199 | | 2,764,991 |

Curis, Inc. (a) | 40,700 | | 174,603 |

Dendreon Corp. (a) | 38,800 | | 263,840 |

Dyax Corp. (a) | 4,200 | | 23,772 |

Enzon Pharmaceuticals, Inc. (a) | 25,200 | | 325,080 |

Genentech, Inc. (a) | 102,600 | | 4,895,046 |

Genta, Inc. (a) | 13,700 | | 21,372 |

Genzyme Corp. - General Division (a) | 42,620 | | 2,480,910 |

Gilead Sciences, Inc. (a) | 64,000 | | 2,118,400 |

Harvard Bioscience, Inc. (a) | 300 | | 1,248 |

ICOS Corp. (a) | 26,500 | | 663,295 |

ImClone Systems, Inc. (a) | 52,764 | | 2,213,450 |

ImmunoGen, Inc. (a) | 60,100 | | 418,897 |

Immunomedics, Inc. (a) | 8,600 | | 30,444 |

Invitrogen Corp. (a) | 30,550 | | 2,099,091 |

Ligand Pharmaceuticals, Inc. Class B (a) | 45,400 | | 472,614 |

Medarex, Inc. (a) | 27,590 | | 262,381 |

MedImmune, Inc. (a) | 123,100 | | 2,911,931 |

Millennium Pharmaceuticals, Inc. (a) | 206,771 | | 1,904,361 |

Neurocrine Biosciences, Inc. (a) | 19,300 | | 882,975 |

NPS Pharmaceuticals, Inc. (a) | 12,700 | | 209,550 |

Oscient Pharmaceuticals Corp. (a) | 2,600 | | 8,632 |

OSI Pharmaceuticals, Inc. (a) | 3,500 | | 227,850 |

Pharmion Corp. (a) | 16,004 | | 580,305 |

Protein Design Labs, Inc. (a) | 46,400 | | 935,888 |

Regeneron Pharmaceuticals, Inc. (a) | 23,622 | | 170,078 |

Seattle Genetics, Inc. (a) | 24,600 | | 145,632 |

Serologicals Corp. (a) | 25,000 | | 591,000 |

Tanox, Inc. (a) | 10,700 | | 127,009 |

Techne Corp. (a) | 18,310 | | 638,470 |

Telik, Inc. (a) | 7,300 | | 138,846 |

Transkaryotic Therapies, Inc. (a) | 12,440 | | 298,311 |

ViaCell, Inc. | 500 | | 5,490 |

XOMA Ltd. (a) | 49,300 | | 97,121 |

TOTAL BIOTECHNOLOGY | | 44,279,565 |

HEALTH CARE EQUIPMENT & SUPPLIES - 0.2% |

Cholestech Corp. (a) | 3,800 | | 47,728 |

Cyberonics, Inc. (a) | 1,300 | | 32,721 |

Epix Pharmaceuticals, Inc. (a) | 3,100 | | 29,915 |

IntraLase Corp. | 300 | | 6,900 |

TOTAL HEALTH CARE EQUIPMENT & SUPPLIES | | 117,264 |

|

| Shares | | Value (Note 1) |

PHARMACEUTICALS - 16.0% |

Cypress Bioscience, Inc. (a) | 2,600 | | $ 35,503 |

Elan Corp. PLC sponsored ADR (a) | 118,700 | | 3,196,591 |

Guilford Pharmaceuticals, Inc. (a) | 28,300 | | 137,397 |

Medicines Co. (a) | 16,900 | | 464,919 |

Merck KGaA | 15,926 | | 1,056,164 |

MGI Pharma, Inc. (a) | 40,800 | | 925,752 |

Sepracor, Inc. (a) | 44,896 | | 2,567,153 |

SkyePharma PLC (a) | 80,613 | | 97,928 |

TOTAL PHARMACEUTICALS | | 8,481,407 |

TOTAL COMMON STOCKS (Cost $50,343,248) | 52,878,236 |

Money Market Funds - 0.7% |

| | | |

Fidelity Cash Central Fund, 2.31% (b)

(Cost $369,125) | 369,125 | | 369,125 |

TOTAL INVESTMENT PORTFOLIO - 100.4% (Cost $50,712,373) | | 53,247,361 |

NET OTHER ASSETS - (0.4)% | | (221,155) |

NET ASSETS - 100% | $ 53,026,206 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

Other Information |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: |

United States of America | 89.4% |

Ireland | 6.0% |

Switzerland | 2.4% |

Germany | 2.0% |

Others (individually less than 1%) | 0.2% |

| 100.0% |

Income Tax Information |

At July 31, 2004, the fund had a capital loss carryforward of approximately $12,284,743 all of which will expire on July 31, 2011. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Advisor Biotechnology Fund

Financial Statements

Statement of Assets and Liabilities

| January 31, 2005 (Unaudited) |

Assets | | |

Investment in securities, at value (cost $50,712,373) - See accompanying schedule | | $ 53,247,361 |

Receivable for investments sold | | 268,946 |

Receivable for fund shares sold | | 54,387 |

Interest receivable | | 2,576 |

Prepaid expenses | | 202 |

Receivable from investment adviser for expense reductions | | 3,762 |

Other affiliated receivables | | 33 |

Other receivables | | 668 |

Total assets | | 53,577,935 |

Liabilities | | |

Payable for investments purchased | $ 217,933 | |

Payable for fund shares redeemed | 226,616 | |

Accrued management fee | 25,931 | |

Distribution fees payable | 32,246 | |

Other affiliated payables | 26,005 | |

Other payables and accrued expenses | 22,998 | |

Total liabilities | | 551,729 |

Net Assets | | $ 53,026,206 |

Net Assets consist of: | | |

Paid in capital | | $ 61,488,079 |

Accumulated net investment loss | | (527,268) |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (10,469,593) |

Net unrealized appreciation (depreciation) on investments | | 2,534,988 |

Net Assets | | $ 53,026,206 |

Calculation of Maximum Offering Price Class A:

Net Asset Value and redemption price per share ($10,189,643 ÷ 1,639,140 shares) | | $ 6.22 |

Maximum offering price per share (100/94.25 of $6.22) | | $ 6.60 |

Class T:

Net Asset Value and redemption price per share ($13,048,132 ÷ 2,121,521 shares) | | $ 6.15 |

Maximum offering price per share (100/96.50 of $6.15) | | $ 6.37 |

Class B:

Net Asset Value and offering price per share ($16,332,385 ÷ 2,712,505 shares) A | | $ 6.02 |

Class C:

Net Asset Value and offering price per share ($12,381,729 ÷ 2,055,988 shares) A | | $ 6.02 |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($1,074,317 ÷ 171,049 shares) | | $ 6.28 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

Statement of Operations

| Six months ended January 31, 2005 (Unaudited) |

Investment Income | | |

Interest | | $ 4,375 |

Security lending | | 4,687 |

Total income | | 9,062 |

| | |

Expenses | | |

Management fee | $ 156,960 | |

Transfer agent fees | 150,217 | |

Distribution fees | 195,583 | |

Accounting and security lending fees | 16,694 | |

Non-interested trustees' compensation | 162 | |

Custodian fees and expenses | 3,888 | |

Registration fees | 45,009 | |

Audit | 21,357 | |

Legal | 64 | |

Miscellaneous | 253 | |

Total expenses before reductions | 590,187 | |

Expense reductions | (53,857) | 536,330 |

Net investment income (loss) | | (527,268) |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities | 2,376,645 | |

Foreign currency transactions | 128 | |

Total net realized gain (loss) | | 2,376,773 |

Change in net unrealized appreciation (depreciation) on investment securities | | (103,473) |

Net gain (loss) | | 2,273,300 |

Net increase (decrease) in net assets resulting from operations | | $ 1,746,032 |

See accompanying notes which are an integral part of the financial statements.

Biotechnology

Statement of Changes in Net Assets

| Six months ended

January 31, 2005

(Unaudited) | Year ended

July 31,

2004 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ (527,268) | $ (954,269) |

Net realized gain (loss) | 2,376,773 | 2,867,187 |

Change in net unrealized appreciation (depreciation) | (103,473) | (2,278,403) |

Net increase (decrease) in net assets resulting from operations | 1,746,032 | (365,485) |

Share transactions - net increase (decrease) | (3,466,505) | 10,289,718 |

Redemption fees | 3,688 | 18,272 |

Total increase (decrease) in net assets | (1,716,785) | 9,942,505 |

| | |

Net Assets | | |

Beginning of period | 54,742,991 | 44,800,486 |

End of period (including accumulated net investment loss of $527,268 and 0, respectively) | $ 53,026,206 | $ 54,742,991 |

Financial Highlights - Class A

| Six months ended January 31, 2005 | Years ended July 31, |

| (Unaudited) | 2004 | 2003 | 2002 | 2001 F |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 6.00 | $ 5.94 | $ 4.39 | $ 7.09 | $ 10.00 |

Income from Investment Operations | | | | | |

Net investment income (loss) E | (.05) | (.09) | (.05) | (.07) | (.04) |

Net realized and unrealized gain (loss) | .27 | .15 | 1.60 | (2.64) | (2.88) |

Total from investment operations | .22 | .06 | 1.55 | (2.71) | (2.92) |

Redemption fees added to paid in capital E | - H | - H | - H | .01 | .01 |

Net asset value, end of period | $ 6.22 | $ 6.00 | $ 5.94 | $ 4.39 | $ 7.09 |

Total Return B, C, D | 3.67% | 1.01% | 35.31% | (38.08)% | (29.10)% |

Ratios to Average Net Assets G | | | | | |

Expenses before expense reductions | 1.66% A | 1.68% | 2.04% | 1.99% | 3.07% A |

Expenses net of voluntary waivers, if any | 1.50% A | 1.50% | 1.50% | 1.50% | 1.50% A |

Expenses net of all reductions | 1.50% A | 1.48% | 1.47% | 1.46% | 1.49% A |

Net investment income (loss) | (1.46)% A | (1.38)% | (1.11)% | (1.19)% | (.94)% A |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 10,190 | $ 10,197 | $ 7,718 | $ 4,657 | $ 4,232 |

Portfolio turnover rate | 22% A | 50% | 71% | 113% | 64% A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Total returns do not include the effect of the sales charges. E Calculated based on average shares outstanding during the period. F For the period December 27, 2000 (commencement of operations) to July 31, 2001. G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. H Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class T

| Six months ended January 31, 2005 | Years ended July 31, |

| (Unaudited) | 2004 | 2003 | 2002 | 2001 F |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 5.95 | $ 5.90 | $ 4.37 | $ 7.07 | $ 10.00 |

Income from Investment Operations | | | | | |

Net investment income (loss) E | (.05) | (.10) | (.06) | (.09) | (.05) |

Net realized and unrealized gain (loss) | .25 | .15 | 1.59 | (2.62) | (2.89) |

Total from investment operations | .20 | .05 | 1.53 | (2.71) | (2.94) |

Redemption fees added to paid in capital E | - H | - H | - H | .01 | .01 |

Net asset value, end of period | $ 6.15 | $ 5.95 | $ 5.90 | $ 4.37 | $ 7.07 |

Total Return B, C, D | 3.36% | .85% | 35.01% | (38.19)% | (29.30)% |

Ratios to Average Net Assets G | | | | | |

Expenses before expense reductions | 2.11% A | 2.10% | 2.39% | 2.27% | 3.29% A |

Expenses net of voluntary waivers, if any | 1.75% A | 1.75% | 1.75% | 1.75% | 1.75% A |

Expenses net of all reductions | 1.75% A | 1.73% | 1.72% | 1.72% | 1.74% A |

Net investment income (loss) | (1.71)% A | (1.63)% | (1.36)% | (1.45)% | (1.19)% A |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 13,048 | $ 13,367 | $ 10,281 | $ 6,861 | $ 7,721 |

Portfolio turnover rate | 22% A | 50% | 71% | 113% | 64% A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Total returns do not include the effect of the sales charges. E Calculated based on average shares outstanding during the period. F For the period December 27, 2000 (commencement of operations) to July 31, 2001. G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. H Amount represents less than $.01 per share. |

Financial Highlights - Class B

| Six months ended January 31, 2005 | Years ended July 31, |

| (Unaudited) | 2004 | 2003 | 2002 | 2001 F |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 5.84 | $ 5.82 | $ 4.33 | $ 7.05 | $ 10.00 |

Income from Investment Operations | | | | | |

Net investment income (loss) E | (.07) | (.13) | (.09) | (.12) | (.07) |

Net realized and unrealized gain (loss) | .25 | .15 | 1.58 | (2.61) | (2.89) |

Total from investment operations | .18 | .02 | 1.49 | (2.73) | (2.96) |

Redemption fees added to paid in capital E | - H | - H | - H | .01 | .01 |

Net asset value, end of period | $ 6.02 | $ 5.84 | $ 5.82 | $ 4.33 | $ 7.05 |

Total Return B, C, D | 3.08% | .34% | 34.41% | (38.58)% | (29.50)% |

Ratios to Average Net Assets G | | | | | |

Expenses before expense reductions | 2.46% A | 2.46% | 2.78% | 2.74% | 3.83% A |

Expenses net of voluntary waivers, if any | 2.25% A | 2.25% | 2.25% | 2.25% | 2.25% A |

Expenses net of all reductions | 2.25% A | 2.22% | 2.22% | 2.22% | 2.24% A |

Net investment income (loss) | (2.21)% A | (2.12)% | (1.86)% | (1.95)% | (1.69)% A |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 16,332 | $ 16,819 | $ 15,154 | $ 10,218 | $ 8,875 |

Portfolio turnover rate | 22% A | 50% | 71% | 113% | 64% A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Total returns do not include the effect of the contingent deferred sales charge. E Calculated based on average shares outstanding during the period. F For the period December 27, 2000 (commencement of operations) to July 31, 2001. G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. H Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Biotechnology

Financial Highlights - Class C

| Six months ended January 31, 2005 | Years ended July 31, |

| (Unaudited) | 2004 | 2003 | 2002 | 2001 F |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 5.84 | $ 5.82 | $ 4.33 | $ 7.05 | $ 10.00 |

Income from Investment Operations | | | | | |

Net investment income (loss) E | (.07) | (.13) | (.09) | (.12) | (.07) |

Net realized and unrealized gain (loss) | .25 | .15 | 1.58 | (2.61) | (2.89) |

Total from investment operations | .18 | .02 | 1.49 | (2.73) | (2.96) |

Redemption fees added to paid in capital E | - H | - H | - H | .01 | .01 |

Net asset value, end of period | $ 6.02 | $ 5.84 | $ 5.82 | $ 4.33 | $ 7.05 |

Total Return B, C, D | 3.08% | .34% | 34.41% | (38.58)% | (29.50)% |

Ratios to Average Net Assets G | | | | | |

Expenses before expense reductions | 2.29% A | 2.31% | 2.58% | 2.57% | 3.73% A |

Expenses net of voluntary waivers, if any | 2.25% A | 2.25% | 2.25% | 2.25% | 2.25% A |

Expenses net of all reductions | 2.25% A | 2.23% | 2.22% | 2.22% | 2.24% A |

Net investment income (loss) | (2.22)% A | (2.13)% | (1.86)% | (1.95)% | (1.69)% A |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 12,382 | $ 13,215 | $ 10,493 | $ 8,204 | $ 6,321 |

Portfolio turnover rate | 22% A | 50% | 71% | 113% | 64% A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Total returns do not include the effect of the contingent deferred sales charge. E Calculated based on average shares outstanding during the period. F For the period December 27, 2000 (commencement of operations) to July 31, 2001. G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. H Amount represents less than $.01 per share. |

Financial Highlights - Institutional Class

| Six months ended January 31, 2005 | Years ended July 31, |

| (Unaudited) | 2004 | 2003 | 2002 | 2001 E |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 6.06 | $ 5.97 | $ 4.40 | $ 7.09 | $ 10.00 |

Income from Investment Operations | | | | | |

Net investment income (loss) D | (.04) | (.06) | (.04) | (.06) | (.03) |

Net realized and unrealized gain (loss) | .26 | .15 | 1.61 | (2.64) | (2.89) |

Total from investment operations | .22 | .09 | 1.57 | (2.70) | (2.92) |

Redemption fees added to paid in capital D | - G | - G | - G | .01 | .01 |

Net asset value, end of period | $ 6.28 | $ 6.06 | $ 5.97 | $ 4.40 | $ 7.09 |

Total Return B, C | 3.63% | 1.51% | 35.68% | (37.94)% | (29.10)% |

Ratios to Average Net Assets F | | | | | |

Expenses before expense reductions | 1.17% A | 1.16% | 1.37% | 1.41% | 2.58% A |

Expenses net of voluntary waivers, if any | 1.17% A | 1.16% | 1.25% | 1.25% | 1.25% A |

Expenses net of all reductions | 1.17% A | 1.14% | 1.22% | 1.22% | 1.24% A |

Net investment income (loss) | (1.13)% A | (1.04)% | (.86)% | (.94)% | (.69)% A |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 1,074 | $ 1,146 | $ 1,153 | $ 857 | $ 911 |

Portfolio turnover rate | 22% A | 50% | 71% | 113% | 64% A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Calculated based on average shares outstanding during the period. E For the period December 27, 2000 (commencement of operations) to July 31, 2001. F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. G Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended January 31, 2005 (Unaudited)

1. Significant Accounting Policies.

Fidelity Advisor Biotechnology Fund (the fund) is a fund of Fidelity Advisor Series VII (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

The fund offers Class A, Class T, Class B, Class C, and Institutional Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the fund, and certain fund-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions also differ by class.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Net asset value per share (NAV calculation) is calculated as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Equity securities, including restricted securities, for which market quotations are available are valued at the last sale price or official closing price (closing bid price or last evaluated quote if no sale has occurred) on the primary market or exchange on which they trade. If prices are not readily available or do not accurately reflect fair value for a security, or if a security's value has been materially affected by events occurring after the close of the exchange or market on which the security is principally traded, that security may be valued by another method that the Board of Trustees believes accurately reflects fair value. A security's valuation may differ depending on the method used for determining value. Price movements in futures contracts and ADRs, market and trading trends, the bid/ask quotes of brokers and off-exchange institutional trading may be reviewed in the course of making a good faith determination of a security's fair value. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued on the basis of amortized cost. Investments in open-end investment companies are valued at their net asset value each business day.

Foreign Currency. The fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Income Tax Information and Distributions to Shareholders. Each year, the fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Biotechnology

1. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

Book-tax differences are primarily due to foreign currency transactions, market discount, net operating losses, capital loss carryforwards and losses deferred due to wash sales and excise tax regulations.

The federal tax cost of investments and unrealized appreciation (depreciation) as of period end were as follows:

Unrealized appreciation | $ 8,923,410 | |

Unrealized depreciation | (6,967,199) | |

Net unrealized appreciation (depreciation) | $ 1,956,211 | |

Cost for federal income tax purposes | $ 51,291,150 | |

Short-Term Trading (Redemption) Fees. Shares held in the fund less than 60 days are subject to a redemption fee equal to 1.00% of the proceeds of the redeemed shares. All redemption fees, including any estimated redemption fees paid by Fidelity Management & Research Company (FMR), are retained by the fund and accounted for as an addition to paid in capital.

2. Operating Policies.

Repurchase Agreements. FMR has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts. These accounts are then invested in repurchase agreements that are collateralized by U.S. Treasury or Government obligations. The fund may also invest directly with institutions, in repurchase agreements that are collateralized by commercial paper obligations and corporate obligations. Collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. Collateral is marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest).

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and U.S. government securities, aggregated $5,935,291 and $8,287,831, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the fund with investment management related services for which the fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the fund's average net assets and a group fee rate that averaged .27% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the period, the total annualized management fee rate was .57% of the fund's average net assets.

Distribution and Service Plan. In accordance with Rule 12b-1 of the 1940 Act, the fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of FMR, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the fund and providing shareholder support services. For the period, the Distribution and Service Fee rates and the total amounts paid to and retained by FDC were as follows:

| Distribution

Fee | Service

Fee | Paid to

FDC | Retained

by FDC |

Class A | 0% | .25% | $ 12,844 | $ - |

Class T | .25% | .25% | 33,758 | - |

Class B | .75% | .25% | 83,059 | 62,294 |

Class C | .75% | .25% | 65,922 | 14,103 |

| | | $ 195,583 | $ 76,397 |

Sales Load. FDC receives a front-end sales charge of up to 5.75% for selling Class A shares, and 3.50% for selling Class T shares, some of which is paid to financial intermediaries for selling shares of the fund. FDC receives the proceeds of contingent deferred sales charges levied on Class A, Class T, Class B, and Class C redemptions. These charges depend on the holding period. The deferred sales charges range from 5% to 1% for Class B, 1% for Class C, and .25% for certain purchases of Class A and Class T shares.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

4. Fees and Other Transactions with Affiliates - continued

Sales Load - continued

For the period, sales charge amounts retained by FDC were as follows:

| Retained

by FDC | |

Class A | $ 5,725 | |

Class T | 5,353 | |

Class B * | 31,194 | |

Class C * | 2,778 | |

| $ 45,050 | |

* When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of FMR, is the transfer, dividend disbursing and shareholder servicing agent for each class of the fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the fund. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, the total transfer agent fees paid by each class to FIIOC were as follows:

| Amount | % of

Average

Net Assets |

Class A | $ 26,657 | .52 * |

Class T | 48,629 | .72 * |

Class B | 46,988 | .57 * |

Class C | 26,421 | .40 * |

Institutional Class | 1,522 | .28 * |

| $ 150,217 | |

* Annualized

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, maintains the fund's accounting records. The accounting fee is based on the level of average net assets for the month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Central Funds. The fund may invest in affiliated Central Funds managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR. The Central Funds are open-end investment companies available only to investment companies and other accounts managed by FMR and its affiliates. The Central Funds seek preservation of capital and current income and do not pay a management fee. Income distributions earned by the fund are recorded as income in the accompanying financial statements and totaled $25,299 for the period.

Brokerage Commissions. The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $532 for the period.

5. Committed Line of Credit.

The fund participates with other funds managed by FMR in a $4.2 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The fund has agreed to pay commitment fees on its pro rata portion of the line of credit. During the period, there were no borrowings on this line of credit.

6. Security Lending.

The fund lends portfolio securities from time to time in order to earn additional income. The fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Cash collateral is invested in cash equivalents. At period end there were no security loans outstanding.

Biotechnology

7. Expense Reductions.

FMR voluntarily agreed to reimburse each class to the extent annual operating expenses exceeded certain levels of average net assets as noted in the table below. Some expenses, for example interest expense, are excluded from this reimbursement. Effective February 1, 2005 the expense limitation will be changed to 1.40%, 1.65%, 2.15%, 2.15% and 1.15% for Class A, T, B, C and Institutional, respectively.

| Expense

Limitations | Reimbursement

from adviser |

Class A | 1.50% | $ 8,339 |

Class T | 1.75% | 24,530 |

Class B | 2.25% | 17,328 |

Class C | 2.25% | 2,827 |

| | $ 53,024 |

Many of the brokers with whom FMR places trades on behalf of the fund provided services to the fund in addition to trade execution. These services included payments of certain expenses on behalf of the fund totaling $833 for the period.

8. Other.

The fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, the fund may also enter into contracts that provide general indemnifications. The fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the fund. The risk of material loss from such claims is considered remote.

9. Share Transactions.

Transactions for each class of shares were as follows:

| Shares | Dollars |

| Six months ended

January 31,

2005 | Year ended

July 31,

2004 | Six months ended

January 31,

2005 | Year ended

July 31,

2004 |

Class A | | | | |

Shares sold | 250,714 | 878,734 | $ 1,580,358 | $ 5,475,076 |

Shares redeemed | (309,952) | (480,064) | (1,916,205) | (2,905,863) |

Net increase (decrease) | (59,238) | 398,670 | $ (335,847) | $ 2,569,213 |

Class T | | | | |

Shares sold | 236,590 | 1,105,179 | $ 1,462,030 | $ 6,864,105 |

Shares redeemed | (362,412) | (601,131) | (2,233,120) | (3,678,218) |

Net increase (decrease) | (125,822) | 504,048 | $ (771,090) | $ 3,185,887 |

Class B | | | | |

Shares sold | 252,868 | 951,709 | $ 1,542,180 | $ 5,766,243 |

Shares redeemed | (421,600) | (675,608) | (2,528,698) | (4,063,659) |

Net increase (decrease) | (168,732) | 276,101 | $ (986,518) | $ 1,702,584 |

Class C | | | | |

Shares sold | 168,580 | 962,707 | $ 1,029,488 | $ 5,865,287 |

Shares redeemed | (375,896) | (502,895) | (2,288,950) | (3,048,910) |

Net increase (decrease) | (207,316) | 459,812 | $ (1,259,462) | $ 2,816,377 |

Institutional Class | | | | |

Shares sold | 14,266 | 64,860 | $ 90,015 | $ 427,262 |

Shares redeemed | (32,377) | (68,780) | (203,603) | (411,605) |

Net increase (decrease) | (18,111) | (3,920) | $ (113,588) | $ 15,657 |

Semiannual Report

Advisor Consumer Industries Fund

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2004 to January 31, 2005).

Actual Expenses

The first line of the table below for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning

Account Value

August 1, 2004 | Ending

Account Value

January 31, 2005 | Expenses Paid

During Period*

August 1, 2004

to January 31, 2005 |

Class A | | | |

Actual | $ 1,000.00 | $ 1,131.30 | $ 8.06** |

HypotheticalA | $ 1,000.00 | $ 1,017.64 | $ 7.63** |

Class T | | | |

Actual | $ 1,000.00 | $ 1,129.90 | $ 9.39** |

HypotheticalA | $ 1,000.00 | $ 1,016.38 | $ 8.89** |

Class B | | | |

Actual | $ 1,000.00 | $ 1,126.80 | $ 12.06** |

HypotheticalA | $ 1,000.00 | $ 1,013.86 | $ 11.42** |

Class C | | | |

Actual | $ 1,000.00 | $ 1,127.30 | $ 11.85** |

HypotheticalA | $ 1,000.00 | $ 1,014.06 | $ 11.22** |

Institutional Class | | | |

Actual | $ 1,000.00 | $ 1,132.70 | $ 6.72** |

HypotheticalA | $ 1,000.00 | $ 1,018.90 | $ 6.36** |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| Annualized

Expense Ratio |

Class A | 1.50%** |

Class T | 1.75%** |

Class B | 2.25%** |

Class C | 2.21%** |

Institutional Class | 1.25%** |

Consumer Industries

** If fees effective January 1, 2005 and changes to voluntary expense limitations effective February 1, 2005 had been in effect during the period, the annualized expense ratios and the expenses paid in the actual and hypothetical examples above would have been as follows:

| Annualized

Expense Ratio | Expenses Paid |

Class A | 1.40% | |

Actual | | $ 7.52 |

HypotheticalA | | $ 7.12 |

Class T | 1.65% | |

Actual | | $ 8.86 |

HypotheticalA | | $ 8.39 |

Class B | 2.15% | |

Actual | | $ 11.53 |

HypotheticalA | | $ 10.92 |

Class C | 2.15% | |

Actual | | $ 11.53 |

HypotheticalA | | $ 10.92 |

Institutional Class | 1.15% | |

Actual | | $ 6.18 |

HypotheticalA | | $ 5.85 |

A 5% return per year before expenses

Semiannual Report

Advisor Consumer Industries Fund

Investment Summary

Top Ten Stocks as of January 31, 2005 |

| % of fund's

net assets |

News Corp. Class A | 3.8 |

Procter & Gamble Co. | 3.5 |

Home Depot, Inc. | 3.3 |

McDonald's Corp. | 3.0 |

Wal-Mart Stores, Inc. | 2.9 |

Google, Inc. Class A (sub. vtg.) | 2.8 |

Omnicom Group, Inc. | 2.6 |

Walt Disney Co. | 2.6 |

Target Corp. | 2.5 |

Yahoo!, Inc. | 2.4 |

| 29.4 |

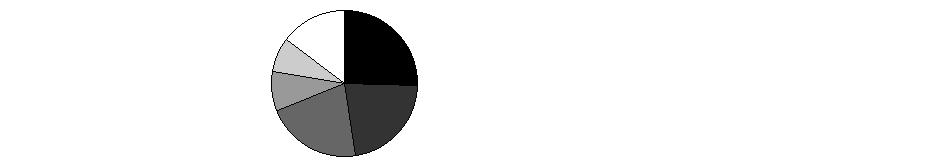

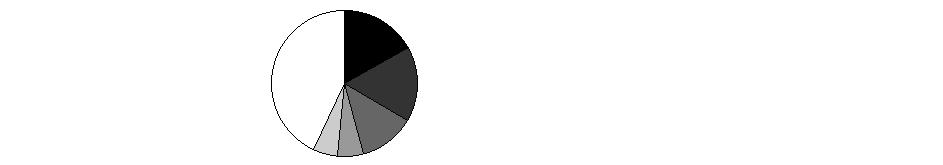

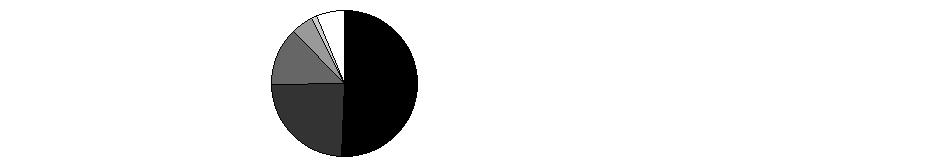

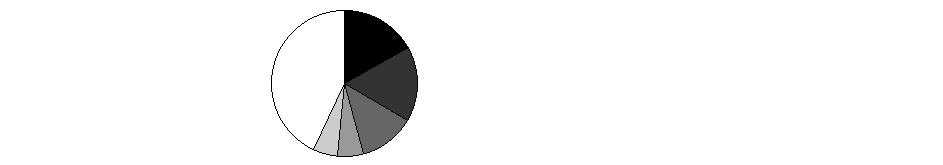

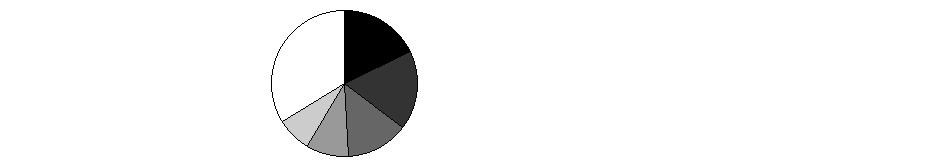

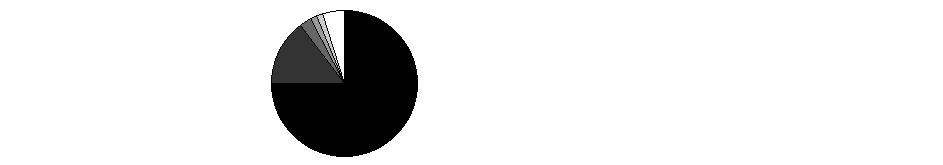

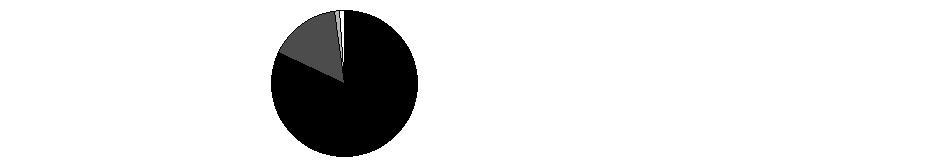

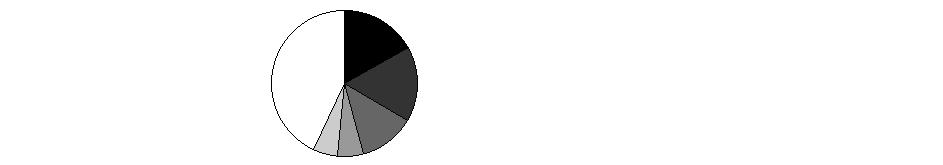

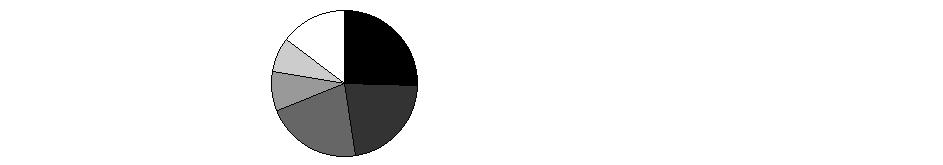

Top Industries as of January 31, 2005 |

% of fund's net assets |

| Media | 16.9% | |

| Hotels, Restaurants & Leisure | 16.6% | |

| Specialty Retail | 12.3% | |

| Food & Staples Retailing | 5.7% | |

| Internet Software & Services | 5.6% | |

| All Others * | 42.9% | |

* Includes short-term investments and net other assets. |

Consumer Industries

Advisor Consumer Industries Fund

Investments January 31, 2005 (Unaudited)

Showing Percentage of Net Assets

Common Stocks - 99.2% |

| Shares | | Value (Note 1) |

AUTOMOBILES - 1.5% |

Harley-Davidson, Inc. | 9,200 | | $ 553,012 |

Thor Industries, Inc. | 8,200 | | 283,310 |

TOTAL AUTOMOBILES | | 836,322 |

BEVERAGES - 3.1% |

PepsiCo, Inc. | 11,300 | | 606,810 |

The Coca-Cola Co. | 27,100 | | 1,124,379 |

TOTAL BEVERAGES | | 1,731,189 |

CHEMICALS - 0.6% |

Monsanto Co. | 6,200 | | 335,606 |

COMMERCIAL SERVICES & SUPPLIES - 3.6% |

Apollo Group, Inc. Class A (a) | 10,800 | | 844,452 |

Bright Horizons Family Solutions, Inc. (a) | 4,777 | | 279,932 |

Cendant Corp. | 20,700 | | 487,485 |

R.R. Donnelley & Sons Co. | 4,200 | | 140,490 |

Strayer Education, Inc. | 2,300 | | 246,905 |

TOTAL COMMERCIAL SERVICES & SUPPLIES | | 1,999,264 |

FOOD & STAPLES RETAILING - 5.7% |

Costco Wholesale Corp. | 13,700 | | 647,599 |

CVS Corp. | 9,500 | | 440,325 |

Safeway, Inc. (a) | 19,400 | | 365,690 |

Sysco Corp. | 200 | | 6,994 |

Wal-Mart Stores, Inc. | 30,880 | | 1,618,112 |

Whole Foods Market, Inc. | 900 | | 80,478 |

TOTAL FOOD & STAPLES RETAILING | | 3,159,198 |

FOOD PRODUCTS - 4.3% |

Bunge Ltd. | 10,900 | | 616,286 |

Dean Foods Co. (a) | 13,350 | | 470,321 |

Fresh Del Monte Produce, Inc. | 9,500 | | 303,335 |

Groupe Danone sponsored ADR | 6,100 | | 113,521 |

Hershey Foods Corp. | 200 | | 11,698 |

Smithfield Foods, Inc. (a) | 21,400 | | 647,778 |

SunOpta, Inc. (a) | 7,900 | | 56,144 |

The J.M. Smucker Co. | 4,000 | | 186,600 |

TOTAL FOOD PRODUCTS | | 2,405,683 |

HOTELS, RESTAURANTS & LEISURE - 16.6% |

Aristocrat Leisure Ltd. | 13,100 | | 111,134 |

Boyd Gaming Corp. | 200 | | 7,960 |

Brinker International, Inc. (a) | 9,700 | | 364,817 |

Buffalo Wild Wings, Inc. (a) | 16,700 | | 676,183 |

Caesars Entertainment, Inc. (a) | 10,100 | | 195,233 |

Carnival Corp. unit | 13,800 | | 794,880 |

CBRL Group, Inc. | 3,700 | | 152,107 |

Hilton Hotels Corp. | 14,100 | | 313,725 |

International Game Technology | 8,300 | | 259,790 |

|

| Shares | | Value (Note 1) |

International Speedway Corp. Class A | 1,600 | | $ 87,872 |

Kerzner International Ltd. (a) | 3,000 | | 180,990 |

Krispy Kreme Doughnuts, Inc. (a)(d) | 41,200 | | 361,736 |

Las Vegas Sands Corp. | 100 | | 4,340 |

McDonald's Corp. | 52,200 | | 1,690,758 |

MGM MIRAGE (a) | 5,700 | | 409,317 |

Outback Steakhouse, Inc. | 13,000 | | 598,650 |

Royal Caribbean Cruises Ltd. | 11,800 | | 625,400 |

Starbucks Corp. (a) | 4,800 | | 259,200 |

Starwood Hotels & Resorts Worldwide, Inc. unit | 15,600 | | 903,084 |

Station Casinos, Inc. | 1,800 | | 110,700 |

Wendy's International, Inc. | 13,840 | | 542,805 |

Wyndham International, Inc. Class A (a) | 262,500 | | 249,375 |

Yum! Brands, Inc. | 7,200 | | 333,720 |

TOTAL HOTELS, RESTAURANTS & LEISURE | | 9,233,776 |

HOUSEHOLD DURABLES - 0.4% |

Harman International Industries, Inc. | 1,700 | | 206,805 |

HOUSEHOLD PRODUCTS - 5.4% |

Colgate-Palmolive Co. | 16,500 | | 866,910 |

Kimberly-Clark Corp. | 2,900 | | 189,979 |

Procter & Gamble Co. | 36,470 | | 1,941,298 |

TOTAL HOUSEHOLD PRODUCTS | | 2,998,187 |

INDUSTRIAL CONGLOMERATES - 1.3% |

3M Co. | 5,400 | | 455,544 |

General Electric Co. | 7,800 | | 281,814 |

TOTAL INDUSTRIAL CONGLOMERATES | | 737,358 |

INTERNET & CATALOG RETAIL - 2.6% |

Amazon.com, Inc. (a) | 7,100 | | 306,862 |

eBay, Inc. (a) | 13,600 | | 1,108,400 |

TOTAL INTERNET & CATALOG RETAIL | | 1,415,262 |

INTERNET SOFTWARE & SERVICES - 5.6% |

Google, Inc. Class A (sub. vtg.) (d) | 8,100 | | 1,584,603 |

iVillage, Inc. (a) | 100 | | 601 |

Sina Corp. (a) | 6,100 | | 161,650 |

Sohu.com, Inc. (a) | 4,300 | | 67,467 |

Yahoo!, Inc. (a) | 37,170 | | 1,308,756 |

TOTAL INTERNET SOFTWARE & SERVICES | | 3,123,077 |

LEISURE EQUIPMENT & PRODUCTS - 4.5% |

Brunswick Corp. | 20,000 | | 922,400 |

MarineMax, Inc. (a) | 11,200 | | 352,352 |

Polaris Industries, Inc. | 10,800 | | 729,000 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

LEISURE EQUIPMENT & PRODUCTS - CONTINUED |

RC2 Corp. (a) | 2,700 | | $ 78,165 |

SCP Pool Corp. | 14,250 | | 423,510 |

TOTAL LEISURE EQUIPMENT & PRODUCTS | | 2,505,427 |

MEDIA - 16.9% |

E.W. Scripps Co. Class A | 9,800 | | 454,328 |

Fox Entertainment Group, Inc. Class A (a) | 18,000 | | 605,700 |

Gannett Co., Inc. | 5,080 | | 406,603 |

Harte-Hanks, Inc. | 4,400 | | 116,380 |

JC Decaux SA (a) | 31,700 | | 847,428 |

Lamar Advertising Co. Class A (a) | 13,220 | | 568,196 |

Liberty Media International, Inc. Class A (a) | 40 | | 1,811 |

McGraw-Hill Companies, Inc. | 3,200 | | 289,600 |

News Corp. Class A | 123,600 | | 2,101,201 |

Omnicom Group, Inc. | 16,900 | | 1,434,641 |

Radio One, Inc. Class D (non-vtg.) (a) | 2,100 | | 32,970 |

Reuters Group PLC sponsored ADR | 3,800 | | 170,734 |

SBS Broadcasting SA (a) | 3,900 | | 146,835 |

Spanish Broadcasting System, Inc. Class A (a) | 14,140 | | 145,289 |

Univision Communications, Inc. Class A (a) | 2,000 | | 54,620 |

Viacom, Inc. Class B (non-vtg.) | 45 | | 1,680 |

Walt Disney Co. | 49,600 | | 1,420,048 |

Washington Post Co. Class B | 600 | | 548,700 |

TOTAL MEDIA | | 9,346,764 |

MULTILINE RETAIL - 5.1% |

Big Lots, Inc. (a) | 8,700 | | 97,962 |

Family Dollar Stores, Inc. | 9,000 | | 301,050 |

Federated Department Stores, Inc. | 5,400 | | 306,720 |

JCPenney Co., Inc. | 7,400 | | 316,128 |

Neiman Marcus Group, Inc. Class A | 1,900 | | 127,110 |

Nordstrom, Inc. | 4,500 | | 217,125 |

Saks, Inc. | 3,200 | | 45,536 |

Target Corp. | 27,600 | | 1,401,252 |

TOTAL MULTILINE RETAIL | | 2,812,883 |

PAPER & FOREST PRODUCTS - 0.0% |

Neenah Paper, Inc. | 87 | | 2,774 |

|

| Shares | | Value (Note 1) |

PERSONAL PRODUCTS - 4.5% |

Alberto-Culver Co. | 11,600 | | $ 629,300 |

Avon Products, Inc. | 22,400 | | 945,728 |

Gillette Co. | 18,200 | | 923,104 |

TOTAL PERSONAL PRODUCTS | | 2,498,132 |

REAL ESTATE - 0.6% |

MeriStar Hospitality Corp. (a) | 24,700 | | 190,684 |

ZipRealty, Inc. | 8,700 | | 152,076 |

TOTAL REAL ESTATE | | 342,760 |

SOFTWARE - 0.7% |

Electronic Arts, Inc. (a) | 5,700 | | 366,738 |

SPECIALTY RETAIL - 12.3% |

Aeropostale, Inc. (a) | 4,400 | | 122,276 |

American Eagle Outfitters, Inc. | 19,900 | | 1,010,920 |

Best Buy Co., Inc. | 4,200 | | 225,918 |

Chico's FAS, Inc. (a) | 5,900 | | 310,812 |

Foot Locker, Inc. | 15,800 | | 425,336 |

Gap, Inc. | 5,600 | | 123,256 |

Home Depot, Inc. | 44,490 | | 1,835,657 |

Hot Topic, Inc. (a) | 4,350 | | 84,303 |

Limited Brands, Inc. | 1,663 | | 39,413 |

Lowe's Companies, Inc. | 14,600 | | 832,054 |

Office Depot, Inc. (a) | 15,900 | | 274,911 |

PETsMART, Inc. | 4,500 | | 136,035 |

Staples, Inc. | 14,700 | | 481,278 |

Steiner Leisure Ltd. (a) | 15,272 | | 473,722 |

Toys 'R' Us, Inc. (a) | 9,200 | | 197,340 |

Weight Watchers International, Inc. (a) | 2,500 | | 117,150 |

West Marine, Inc. (a) | 6,100 | | 144,021 |

TOTAL SPECIALTY RETAIL | | 6,834,402 |

TEXTILES, APPAREL & LUXURY GOODS - 3.9% |

Coach, Inc. (a) | 5,400 | | 302,940 |

Kenneth Cole Productions, Inc. Class A (sub. vtg.) | 3,200 | | 85,408 |

Liz Claiborne, Inc. | 10,500 | | 440,370 |

NIKE, Inc. Class B | 9,500 | | 822,985 |

Phoenix Footwear Group, Inc. (a) | 10,900 | | 66,490 |

Polo Ralph Lauren Corp. Class A | 7,600 | | 296,020 |

Quiksilver, Inc. (a) | 4,900 | | 146,363 |

TOTAL TEXTILES, APPAREL & LUXURY GOODS | | 2,160,576 |

TOTAL COMMON STOCKS (Cost $46,578,259) | 55,052,183 |

Money Market Funds - 1.5% |

| Shares | | Value (Note 1) |

Fidelity Cash Central Fund, 2.31% (b) | 367,394 | | $ 367,394 |

Fidelity Securities Lending Cash Central Fund, 2.29% (b)(c) | 464,250 | | 464,250 |

TOTAL MONEY MARKET FUNDS (Cost $831,644) | 831,644 |

TOTAL INVESTMENT PORTFOLIO - 100.7% (Cost $47,409,903) | | 55,883,827 |

NET OTHER ASSETS - (0.7)% | | (388,027) |

NET ASSETS - 100% | $ 55,495,800 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

(c) Includes investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Advisor Consumer Industries Fund

Financial Statements

Statement of Assets and Liabilities

| January 31, 2005 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $459,020) (cost $47,409,903) - See accompanying schedule | | $ 55,883,827 |

Receivable for investments sold | | 874,686 |

Receivable for fund shares sold | | 66,677 |

Dividends receivable | | 23,138 |

Interest receivable | | 1,142 |

Prepaid expenses | | 188 |

Other affiliated receivables | | 2 |

Other receivables | | 6,674 |

Total assets | | 56,856,334 |

| | |

Liabilities | | |

Payable for investments purchased | $ 715,164 | |

Payable for fund shares redeemed | 79,685 | |

Accrued management fee | 31,261 | |

Distribution fees payable | 30,294 | |

Other affiliated payables | 20,506 | |

Other payables and accrued expenses | 19,374 | |

Collateral on securities loaned, at value | 464,250 | |

Total liabilities | | 1,360,534 |

| | |

Net Assets | | $ 55,495,800 |

Net Assets consist of: | | |

Paid in capital | | $ 48,304,044 |

Accumulated net investment loss | | (234,386) |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (1,047,782) |

Net unrealized appreciation (depreciation) on investments | | 8,473,924 |

Net Assets | | $ 55,495,800 |

Calculation of Maximum Offering Price Class A:

Net Asset Value and redemption price per share ($12,960,910 ÷ 819,118 shares) | | $ 15.82 |

| | |

Maximum offering price per share (100/94.25 of $15.82) | | $ 16.79 |

Class T:

Net Asset Value and redemption price per share ($16,265,061 ÷ 1,047,111 shares) | | $ 15.53 |

| | |

Maximum offering price per share (100/96.50 of $15.53) | | $ 16.09 |

Class B:

Net Asset Value and offering price per share ($18,073,995 ÷ 1,212,641 shares) A | | $ 14.90 |

| | |

Class C:

Net Asset Value and offering price per share ($7,126,582 ÷ 477,413 shares) A | | $ 14.93 |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($1,069,252 ÷ 66,087 shares) | | $ 16.18 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

Statement of Operations

| Six months ended January 31, 2005 (Unaudited) |

| | |

Investment Income | | |

Dividends | | $ 250,801 |

Interest | | 9,646 |

Security lending | | 5,411 |

Total income | | 265,858 |

| | |

Expenses | | |

Management fee | $ 152,758 | |

Transfer agent fees | 112,630 | |

Distribution fees | 176,452 | |

Accounting and security lending fees | 15,717 | |

Non-interested trustees' compensation | 155 | |

Custodian fees and expenses | 3,301 | |

Registration fees | 31,646 | |

Audit | 20,292 | |

Legal | 62 | |

Miscellaneous | 1,254 | |

Total expenses before reductions | 514,267 | |

Expense reductions | (14,059) | 500,208 |

Net investment income (loss) | | (234,350) |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities | (940,539) | |

Foreign currency transactions | 568 | |

Total net realized gain (loss) | | (939,971) |

Change in net unrealized appreciation (depreciation) on investment securities | | 7,634,434 |

Net gain (loss) | | 6,694,463 |

Net increase (decrease) in net assets resulting from operations | | $ 6,460,113 |

See accompanying notes which are an integral part of the financial statements.

Consumer Industries

Statement of Changes in Net Assets

| Six months ended

January 31, 2005

(Unaudited) | Year ended

July 31,

2004 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ (234,350) | $ (483,848) |

Net realized gain (loss) | (939,971) | 5,966,105 |

Change in net unrealized appreciation (depreciation) | 7,634,434 | (3,103,656) |

Net increase (decrease) in net assets resulting from operations | 6,460,113 | 2,378,601 |

Distributions to shareholders from net realized gain | (1,957,777) | - |

Share transactions - net increase (decrease) | (1,619,170) | 3,962,592 |

Redemption fees | 869 | 7,430 |

Total increase (decrease) in net assets | 2,884,035 | 6,348,623 |

| | |

Net Assets | | |

Beginning of period | 52,611,765 | 46,263,142 |

End of period (including accumulated net investment loss of $234,386 and accumulated net investment loss of $36, respectively) | $ 55,495,800 | $ 52,611,765 |

Financial Highlights - Class A

| Six months ended

January 31, 2005 | Years ended July 31, |

| (Unaudited) | 2004 | 2003 | 2002 | 2001 | 2000 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 14.51 | $ 13.71 | $ 12.71 | $ 15.20 | $ 15.04 | $ 16.01 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | (.04) | (.07) | (.04) | (.05) | .01 | (.04) |

Net realized and unrealized gain (loss) | 1.88 | .87 | 1.04 | (2.09) | .15 | (.68) |

Total from investment operations | 1.84 | .80 | 1.00 | (2.14) | .16 | (.72) |

Distributions from net realized gain | (.53) | - | - | (.35) | - | (.20) |

Distributions in excess of net realized gain | - | - | - | - | - | (.06) |

Total distributions | (.53) | - | - | (.35) | - | (.26) |

Redemption fees added to paid in capital E | - G | - G | - G | - G | - G | .01 |

Net asset value, end of period | $ 15.82 | $ 14.51 | $ 13.71 | $ 12.71 | $ 15.20 | $ 15.04 |

Total Return B, C, D | 13.13% | 5.84% | 7.87% | (14.30)% | 1.06% | (4.48)% |

Ratios to Average Net Assets F | | | | | | |

Expenses before expense reductions | 1.51% A | 1.55% | 1.70% | 1.69% | 1.71% | 1.62% |

Expenses net of voluntary waivers, if any | 1.50% A | 1.50% | 1.53% | 1.50% | 1.50% | 1.50% |

Expenses net of all reductions | 1.47% A | 1.45% | 1.48% | 1.47% | 1.49% | 1.49% |

Net investment income (loss) | (.47)% A | (.50)% | (.33)% | (.36)% | .08% | (.24)% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 12,961 | $ 11,856 | $ 9,101 | $ 7,209 | $ 4,648 | $ 3,609 |

Portfolio turnover rate | 59% A | 152% | 88% | 136% | 77% | 69% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Total returns do not include the effect of the sales charges. E Calculated based on average shares outstanding during the period. F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. G Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class T

| Six months ended

January 31, 2005 | Years ended July 31, |

| (Unaudited) | 2004 | 2003 | 2002 | 2001 | 2000 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 14.27 | $ 13.51 | $ 12.57 | $ 15.06 | $ 14.93 | $ 15.93 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | (.05) | (.11) | (.07) | (.09) | (.02) | (.08) |

Net realized and unrealized gain (loss) | 1.84 | .87 | 1.01 | (2.05) | .15 | (.67) |

Total from investment operations | 1.79 | .76 | .94 | (2.14) | .13 | (.75) |

Distributions from net realized gain | (.53) | - | - | (.35) | - | (.20) |

Distributions in excess of net realized gain | - | - | - | - | - | (.06) |

Total distributions | (.53) | - | - | (.35) | - | (.26) |

Redemption fees added to paid in capital E | - G | - G | - G | - G | - G | .01 |

Net asset value, end of period | $ 15.53 | $ 14.27 | $ 13.51 | $ 12.57 | $ 15.06 | $ 14.93 |

Total Return B, C, D | 12.99% | 5.63% | 7.48% | (14.44)% | .87% | (4.69)% |

Ratios to Average Net Assets F | | | | | | |

Expenses before expense reductions | 1.79% A | 1.81% | 1.87% | 1.89% | 1.98% | 1.85% |

Expenses net of voluntary waivers, if any | 1.75% A | 1.75% | 1.78% | 1.75% | 1.75% | 1.75% |

Expenses net of all reductions | 1.72% A | 1.70% | 1.73% | 1.72% | 1.73% | 1.73% |

Net investment income (loss) | (.72)% A | (.74)% | (.58)% | (.61)% | (.17)% | (.49)% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 16,265 | $ 15,555 | $ 13,693 | $ 12,132 | $ 12,899 | $ 13,275 |

Portfolio turnover rate | 59% A | 152% | 88% | 136% | 77% | 69% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Total returns do not include the effect of the sales charges. E Calculated based on average shares outstanding during the period. F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. G Amount represents less than $.01 per share. |

Financial Highlights - Class B

| Six months ended

January 31, 2005 | Years ended July 31, |

| (Unaudited) | 2004 | 2003 | 2002 | 2001 | 2000 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 13.75 | $ 13.08 | $ 12.22 | $ 14.73 | $ 14.69 | $ 15.76 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | (.09) | (.18) | (.13) | (.15) | (.10) | (.15) |

Net realized and unrealized gain (loss) | 1.77 | .85 | .99 | (2.01) | .14 | (.67) |

Total from investment operations | 1.68 | .67 | .86 | (2.16) | .04 | (.82) |

Distributions from net realized gain | (.53) | - | - | (.35) | - | (.20) |

Distributions in excess of net realized gain | - | - | - | - | - | (.06) |

Total distributions | (.53) | - | - | (.35) | - | (.26) |

Redemption fees added to paid in capital E | - G | - G | - G | - G | - G | .01 |

Net asset value, end of period | $ 14.90 | $ 13.75 | $ 13.08 | $ 12.22 | $ 14.73 | $ 14.69 |

Total Return B, C, D | 12.68% | 5.12% | 7.04% | (14.91)% | .27% | (5.19)% |

Ratios to Average Net Assets F | | | | | | |

Expenses before expense reductions | 2.28% A | 2.29% | 2.37% | 2.39% | 2.51% | 2.41% |

Expenses net of voluntary waivers, if any | 2.25% A | 2.25% | 2.25% | 2.25% | 2.25% | 2.25% |

Expenses net of all reductions | 2.22% A | 2.20% | 2.19% | 2.22% | 2.24% | 2.24% |

Net investment income (loss) | (1.22)% A | (1.25)% | (1.05)% | (1.11)% | (.67)% | (.99)% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 18,074 | $ 17,302 | $ 15,944 | $ 13,807 | $ 13,483 | $ 9,021 |

Portfolio turnover rate | 59% A | 152% | 88% | 136% | 77% | 69% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Total returns do not include the effect of the contingent deferred sales charge. E Calculated based on average shares outstanding during the period. F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. G Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Consumer Industries

Financial Highlights - Class C

| Six months ended

January 31, 2005 | Years ended July 31, |

| (Unaudited) | 2004 | 2003 | 2002 | 2001 | 2000 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 13.77 | $ 13.10 | $ 12.24 | $ 14.75 | $ 14.71 | $ 15.78 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | (.08) | (.18) | (.13) | (.15) | (.10) | (.15) |

Net realized and unrealized gain (loss) | 1.77 | .85 | .99 | (2.01) | .14 | (.67) |

Total from investment operations | 1.69 | .67 | .86 | (2.16) | .04 | (.82) |

Distributions from net realized gain | (.53) | - | - | (.35) | - | (.20) |

Distributions in excess of net realized gain | - | - | - | - | - | (.06) |

Total distributions | (.53) | - | - | (.35) | - | (.26) |

Redemption fees added to paid in capital E | - G | - G | - G | - G | - G | .01 |

Net asset value, end of period | $ 14.93 | $ 13.77 | $ 13.10 | $ 12.24 | $ 14.75 | $ 14.71 |

Total Return B, C, D | 12.73% | 5.11% | 7.03% | (14.89)% | .27% | (5.19)% |

Ratios to Average Net Assets F | | | | | | |

Expenses before expense reductions | 2.21% A | 2.24% | 2.33% | 2.35% | 2.49% | 2.42% |

Expenses net of voluntary waivers, if any | 2.21% A | 2.24% | 2.25% | 2.25% | 2.25% | 2.25% |

Expenses net of all reductions | 2.18% A | 2.19% | 2.19% | 2.22% | 2.24% | 2.24% |

Net investment income (loss) | (1.18)% A | (1.24)% | (1.05)% | (1.11)% | (.67)% | (.99)% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 7,127 | $ 6,992 | $ 6,759 | $ 5,391 | $ 5,504 | $ 3,048 |

Portfolio turnover rate | 59% A | 152% | 88% | 136% | 77% | 69% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Total returns do not include the effect of the contingent deferred sales charge. E Calculated based on average shares outstanding during the period. FExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. GAmount represents less than $.01 per share. |

Financial Highlights - Institutional Class

| Six months ended

January 31, 2005 | Years ended July 31, |

| (Unaudited) | 2004 | 2003 | 2002 | 2001 | 2000 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 14.81 | $ 13.95 | $ 12.91 | $ 15.38 | $ 15.18 | $ 16.11 |

Income from Investment Operations | | | | | | |

Net investment income (loss) D | (.02) | (.04) | (.01) | (.02) | .05 | - F |

Net realized and unrealized gain (loss) | 1.92 | .90 | 1.05 | (2.10) | .15 | (.69) |