UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3010

Fidelity Advisor Series VII

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | July 31 |

| |

Date of reporting period: | January 31, 2008 |

Item 1. Reports to Stockholders

(Fidelity Investment logo)(registered trademark)

Fidelity Advisor

Focus Funds®

Class A, Class T, Class B and Class C

Biotechnology

Communications Equipment

Consumer Discretionary

Electronics

Energy

Financial Services

Health Care

Industrials

Technology

Utilities

Semiannual Report

January 31, 2008

(2_fidelity_logos) (Registered_Trademark)

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com (search for "proxy voting guidelines") or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com or http://www.advisor.fidelity.com, as applicable.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Chairman's Message

(Photograph of Edward C. Johnson 3d.)

Dear Shareholder:

Stocks got off to a poor start in 2008, while investment-grade bonds and money markets showed positive returns, once again underscoring the importance of a diversified portfolio. Financial markets are always unpredictable, but there are a number of time-tested principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies

indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third investment principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces unconstructive "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

Advisor Biotechnology Fund

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2007 to January 31, 2008).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning

Account Value

August 1, 2007 | Ending

Account Value

January 31, 2008 | Expenses Paid

During Period*

August 1, 2007

to January 31, 2008 |

Class A | | | |

Actual | $ 1,000.00 | $ 1,021.40 | $ 7.11 |

HypotheticalA | $ 1,000.00 | $ 1,018.10 | $ 7.10 |

Class T | | | |

Actual | $ 1,000.00 | $ 1,020.30 | $ 8.38 |

HypotheticalA | $ 1,000.00 | $ 1,016.84 | $ 8.36 |

Class B | | | |

Actual | $ 1,000.00 | $ 1,016.50 | $ 10.90 |

HypotheticalA | $ 1,000.00 | $ 1,014.33 | $ 10.89 |

Class C | | | |

Actual | $ 1,000.00 | $ 1,018.10 | $ 10.91 |

HypotheticalA | $ 1,000.00 | $ 1,014.33 | $ 10.89 |

Institutional Class | | | |

Actual | $ 1,000.00 | $ 1,023.90 | $ 5.55 |

HypotheticalA | $ 1,000.00 | $ 1,019.66 | $ 5.53 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

| Annualized

Expense Ratio |

Class A | 1.40% |

Class T | 1.65% |

Class B | 2.15% |

Class C | 2.15% |

Institutional Class | 1.09% |

Semiannual Report

Advisor Biotechnology Fund

Investment Changes

Top Ten Stocks as of January 31, 2008 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Genentech, Inc. | 10.9 | 6.0 |

Gilead Sciences, Inc. | 8.9 | 6.5 |

Biogen Idec, Inc. | 7.2 | 7.2 |

Celgene Corp. | 6.9 | 6.3 |

Cephalon, Inc. | 4.6 | 5.0 |

Alexion Pharmaceuticals, Inc. | 4.0 | 5.0 |

BioMarin Pharmaceutical, Inc. | 3.7 | 0.0 |

Elan Corp. PLC sponsored ADR | 3.4 | 2.4 |

United Therapeutics Corp. | 3.4 | 1.0 |

Auxilium Pharmaceuticals, Inc. | 3.2 | 1.5 |

| 56.2 | |

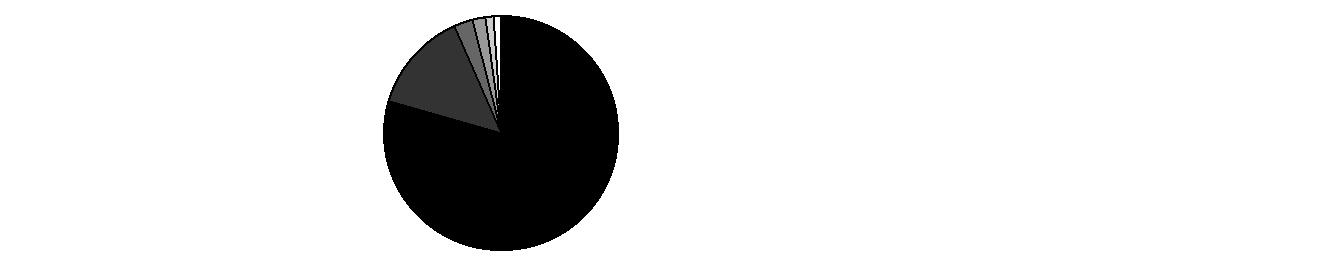

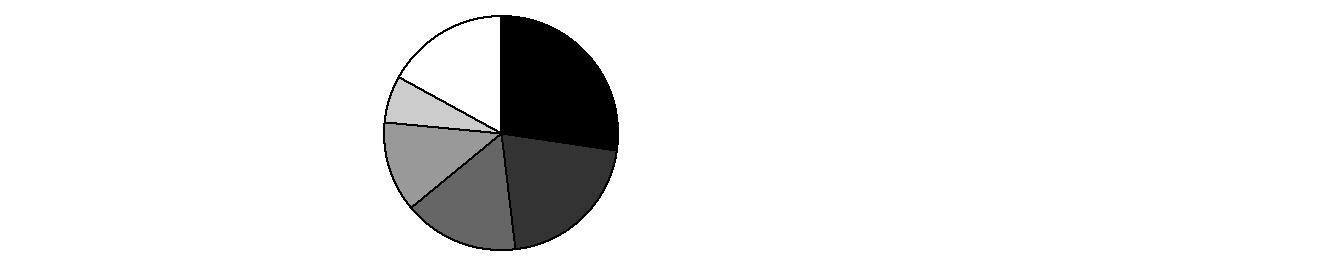

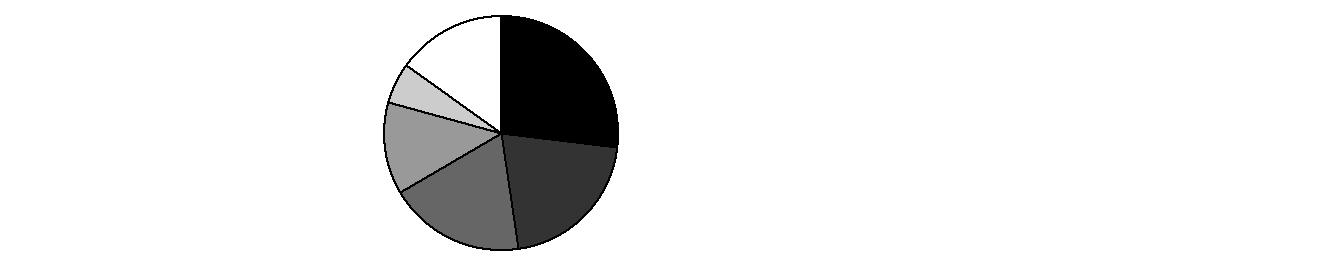

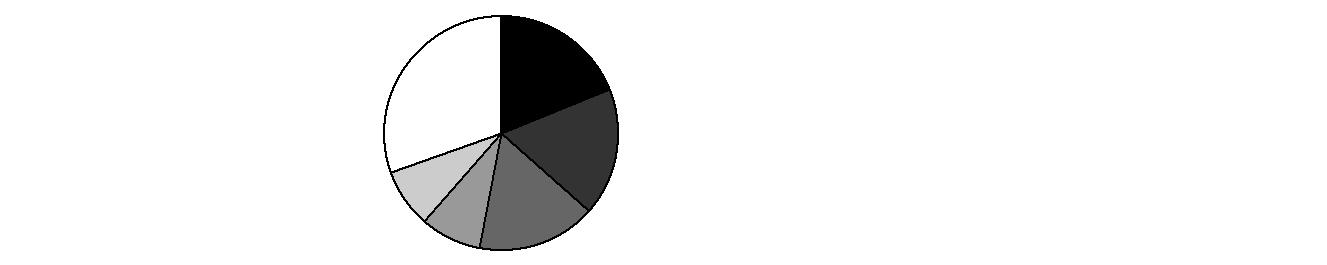

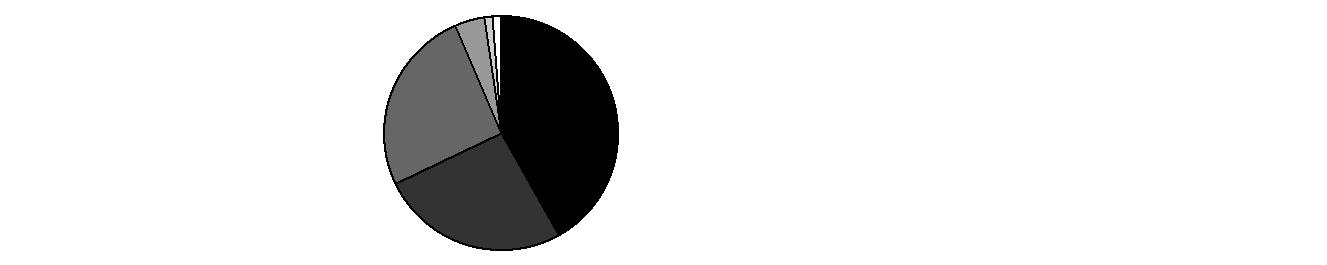

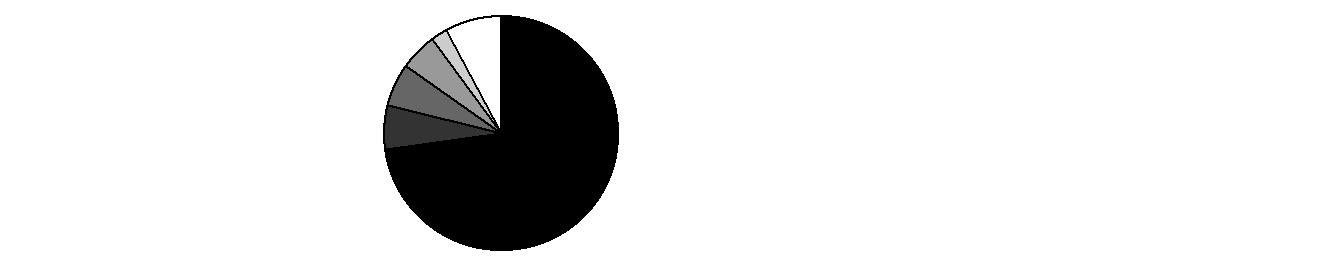

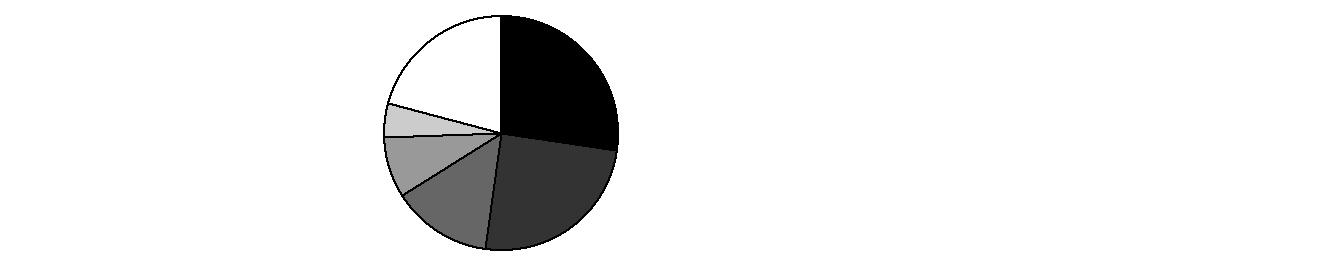

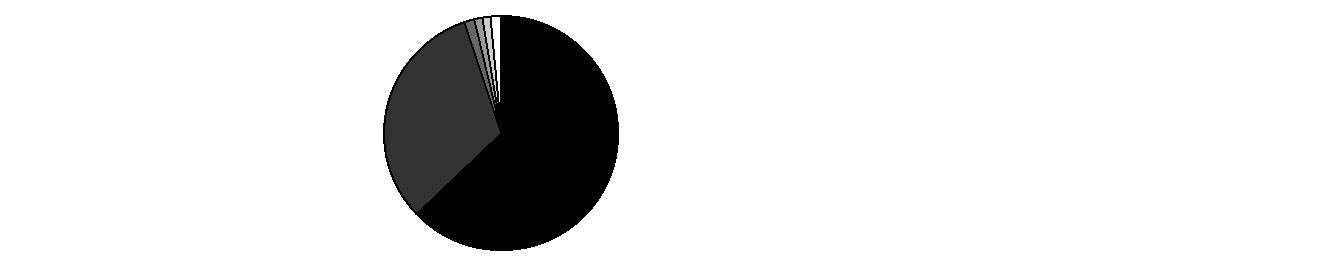

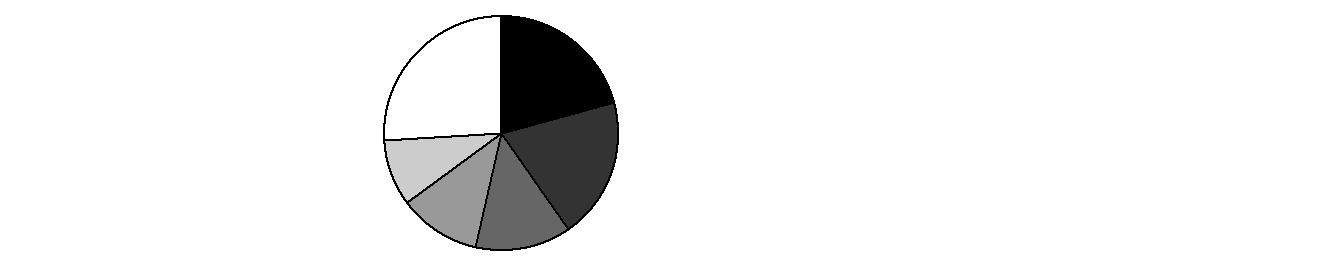

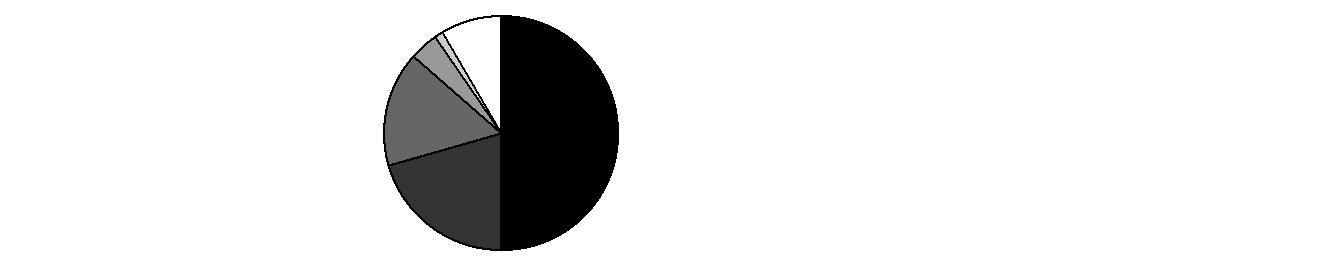

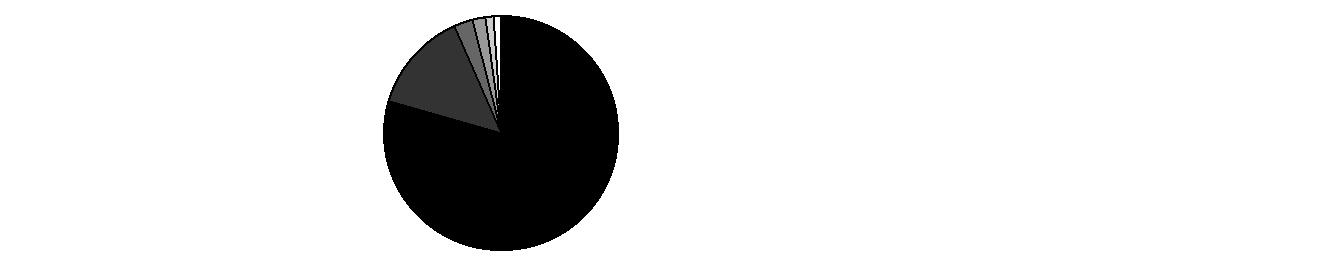

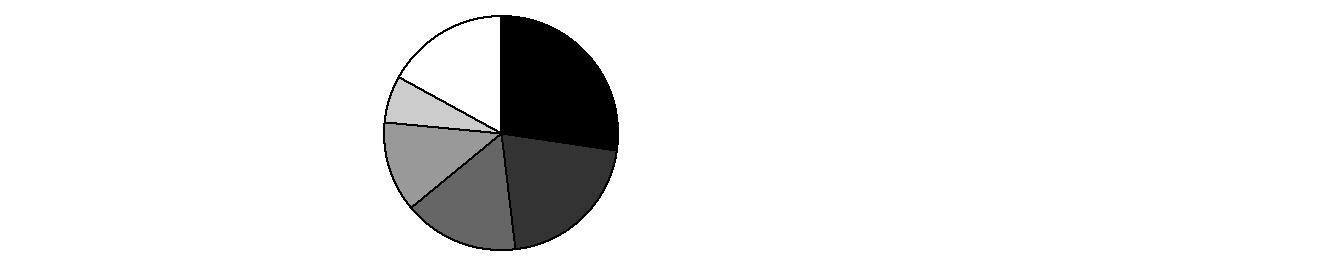

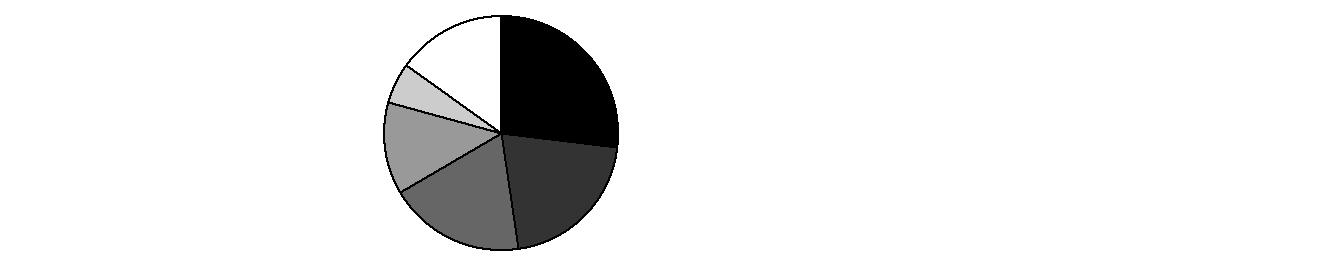

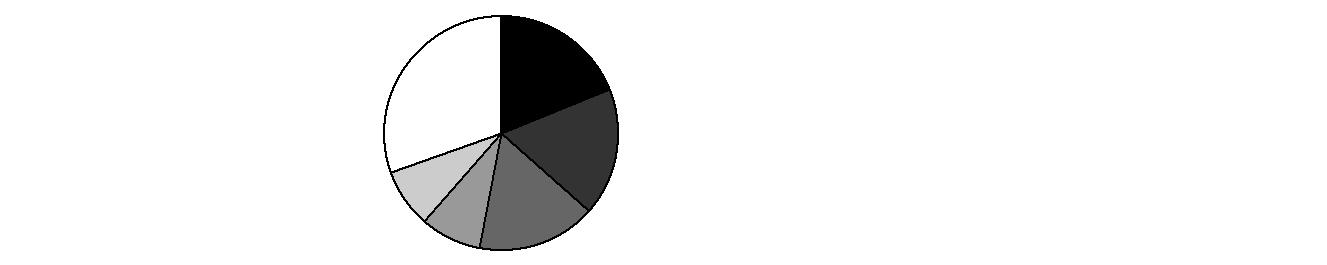

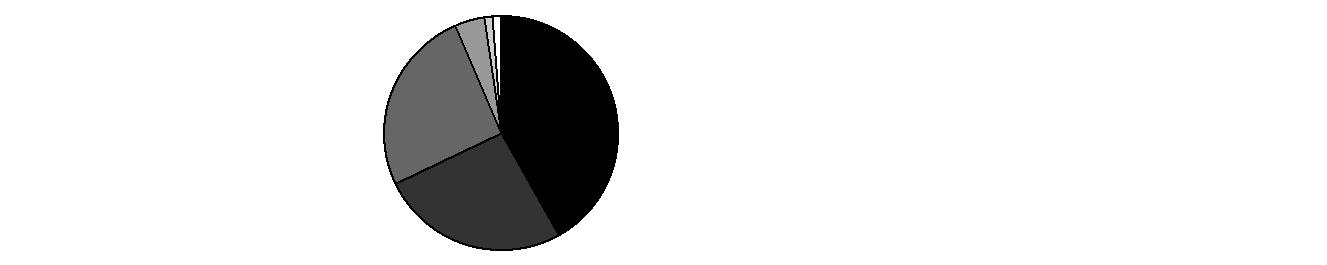

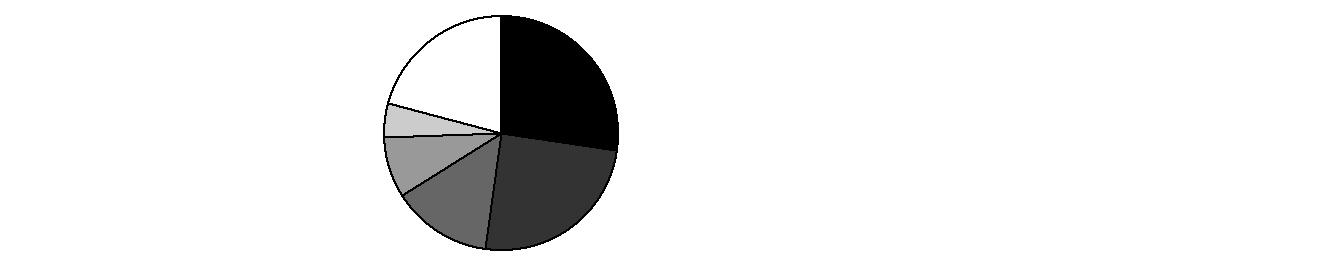

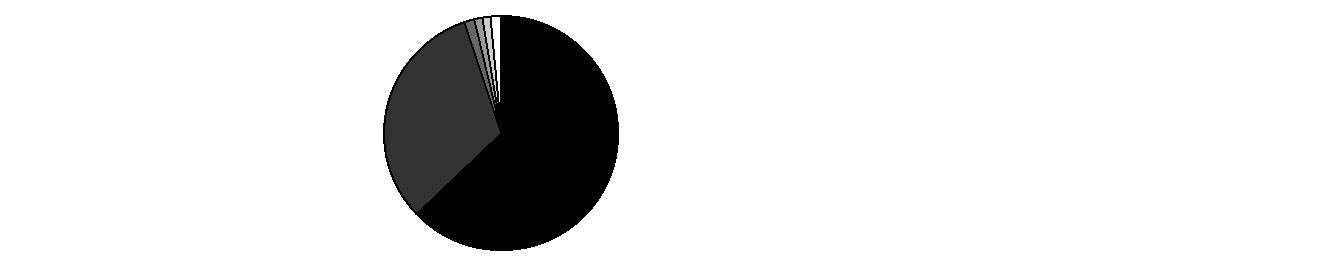

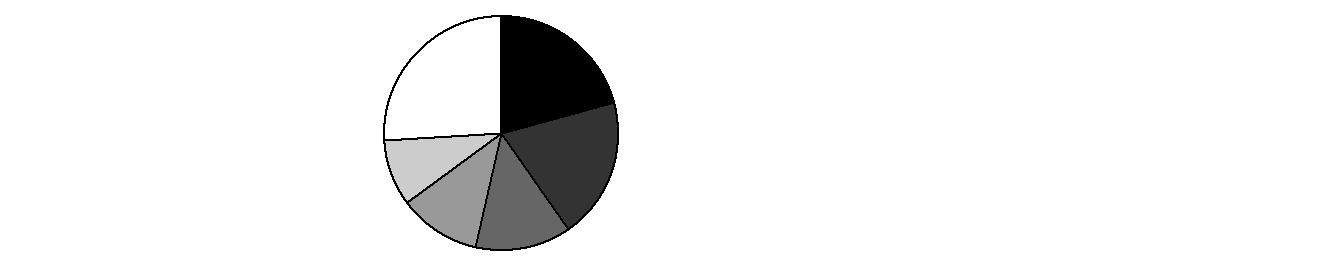

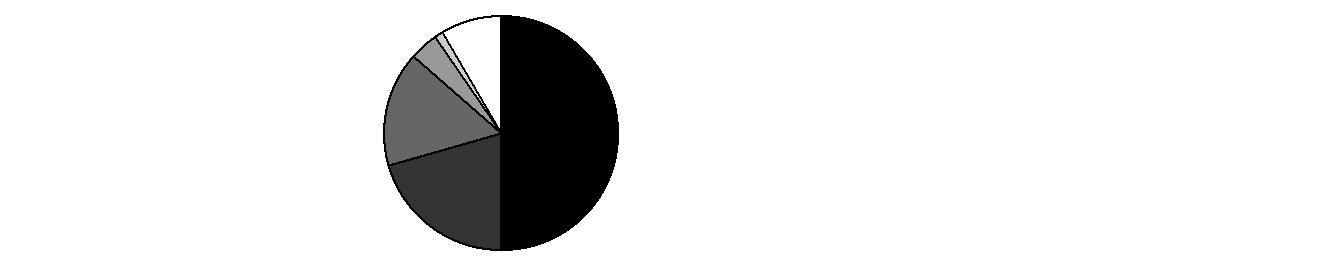

Top Industries (% of fund's net assets) |

As of January 31, 2008 |

| Biotechnology | 80.8% | |

| Pharmaceuticals | 14.2% | |

| Life Sciences Tools

& Services | 2.8% | |

| Health Care Equipment & Supplies | 1.8% | |

| Health Care Providers

& Services | 0.2% | |

| All Others* | 0.2% | |

|

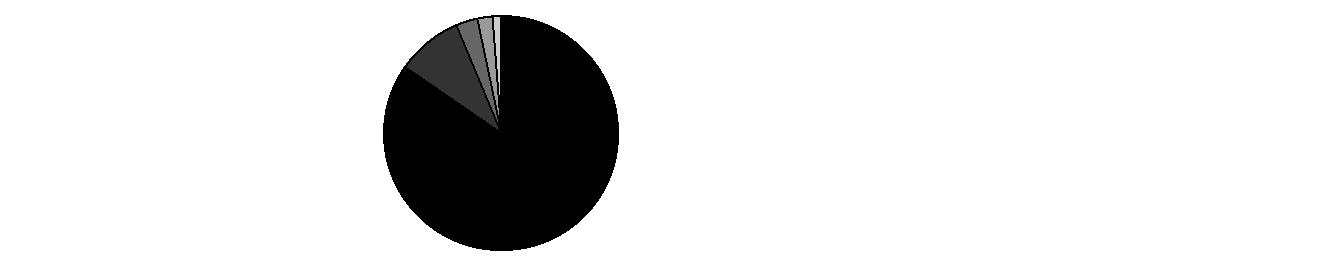

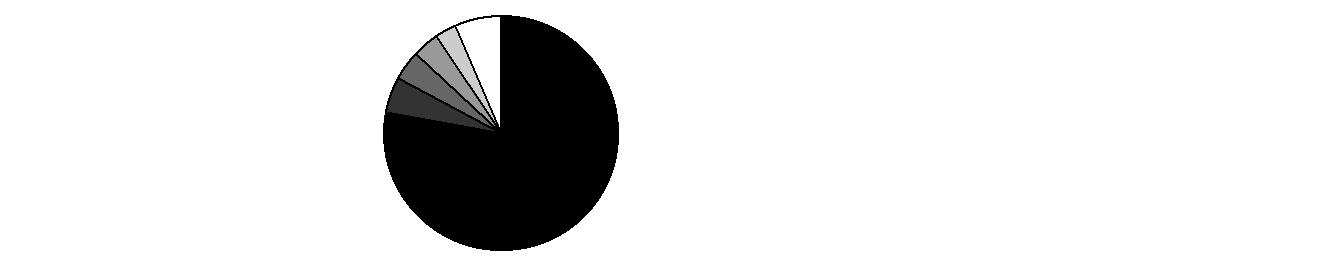

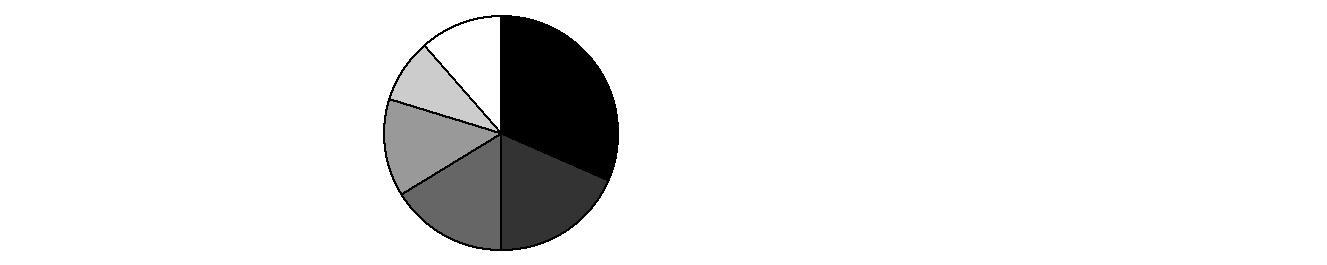

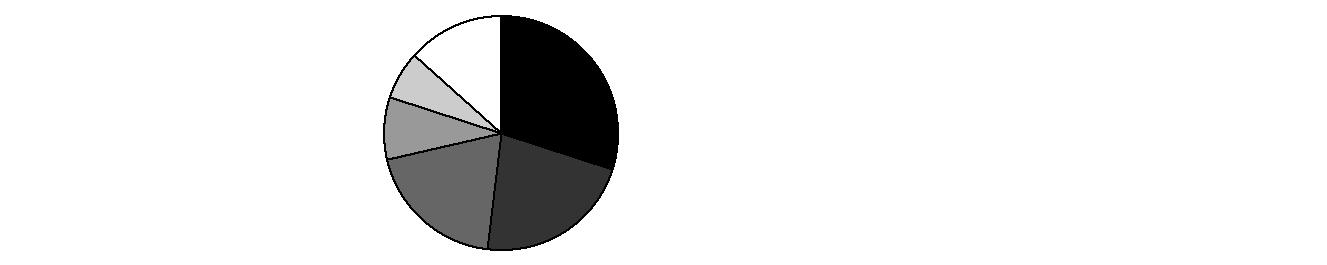

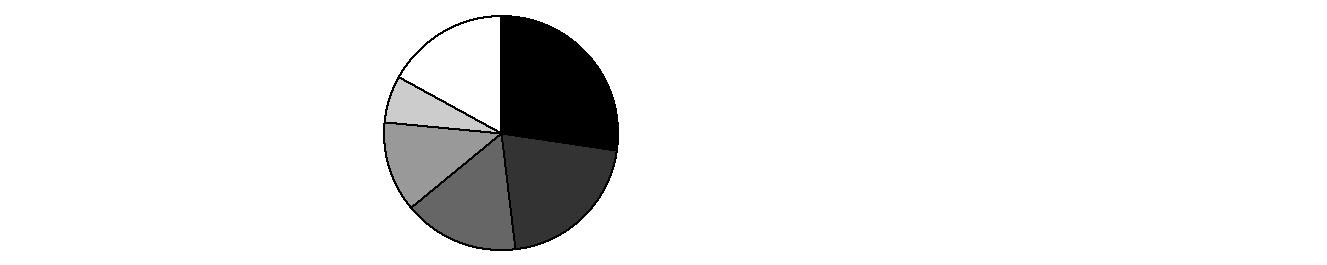

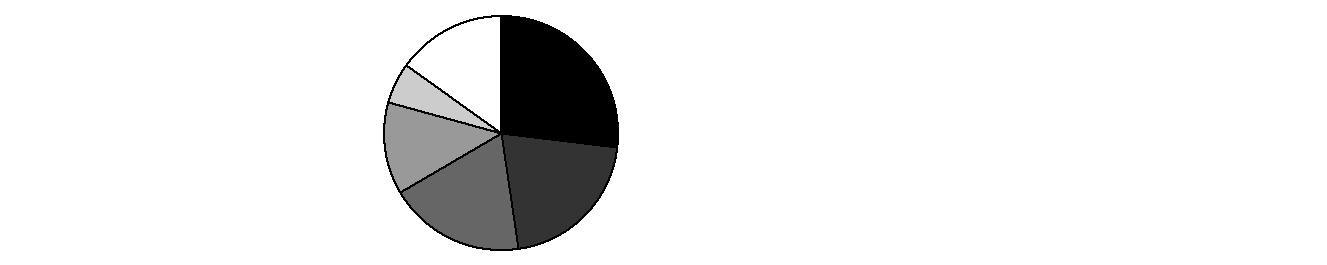

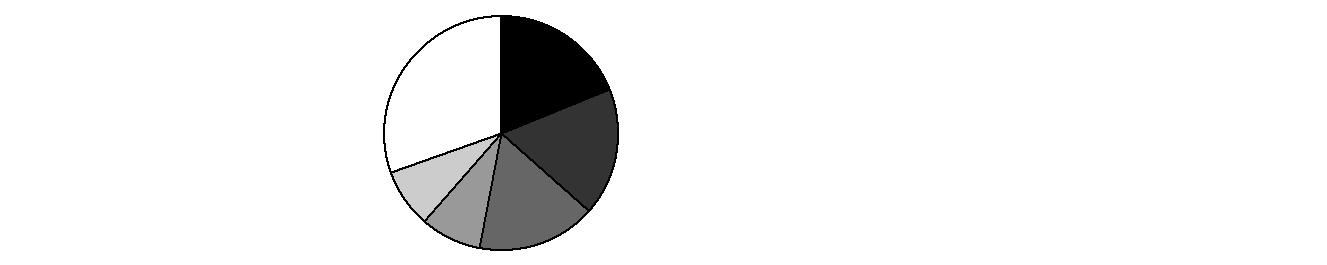

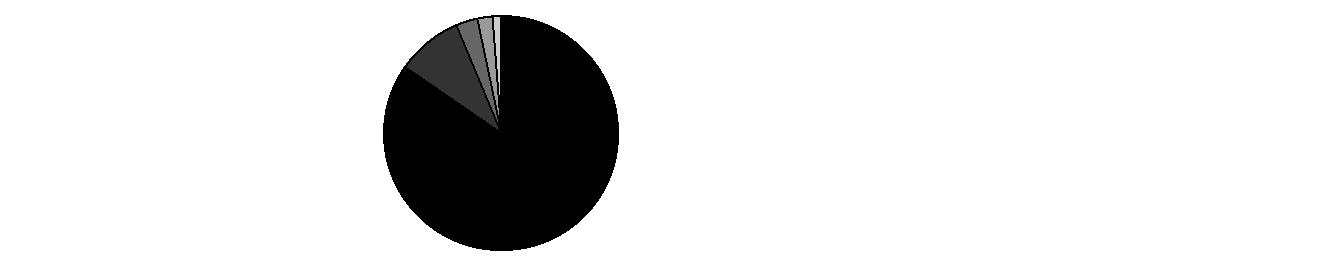

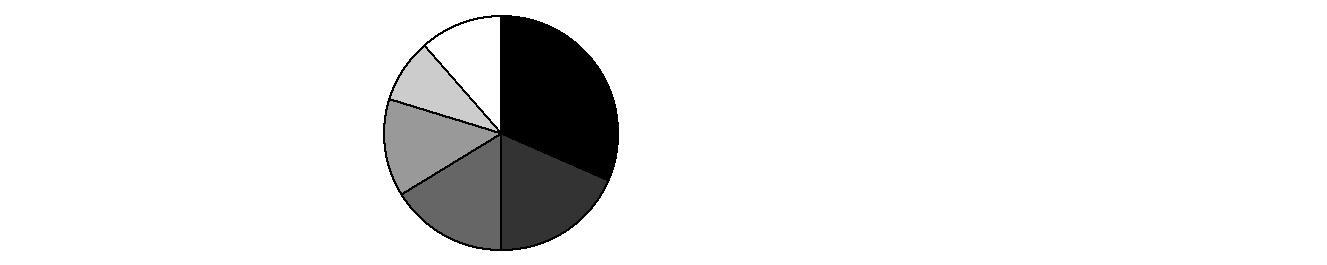

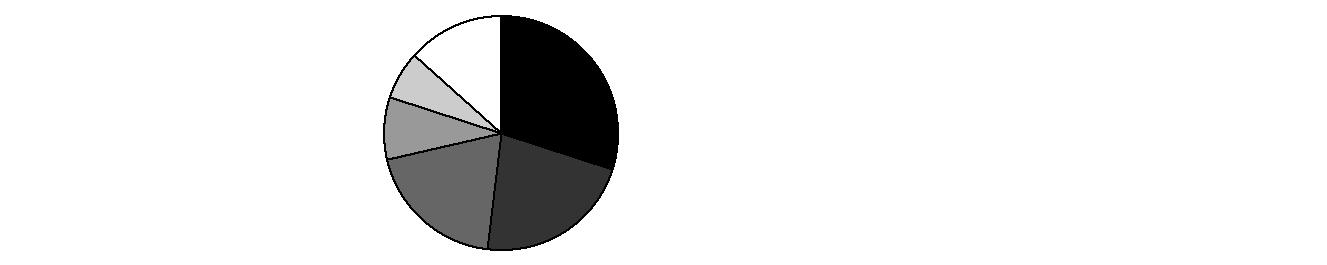

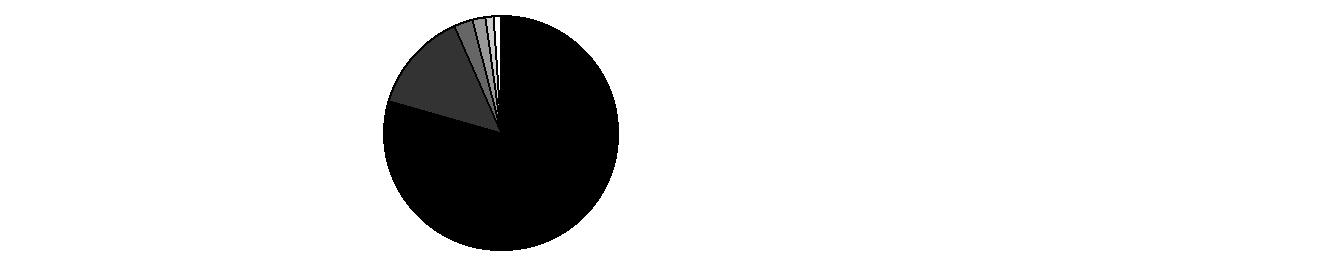

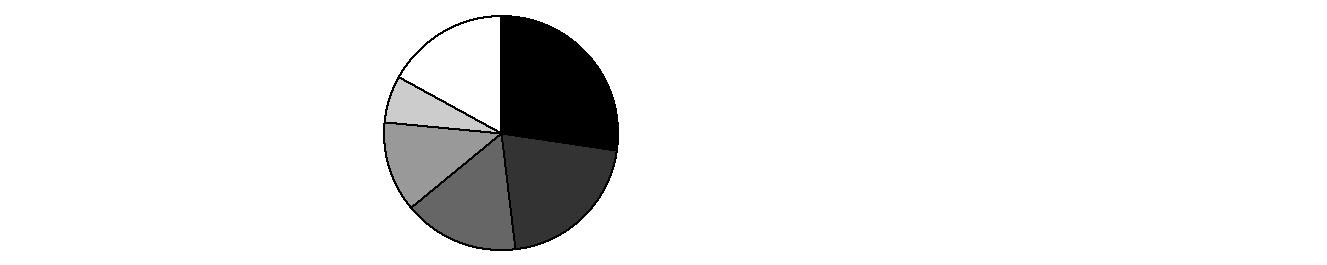

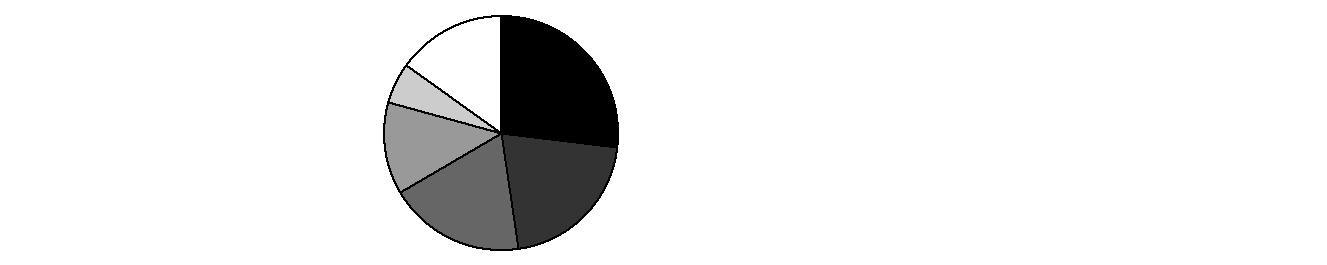

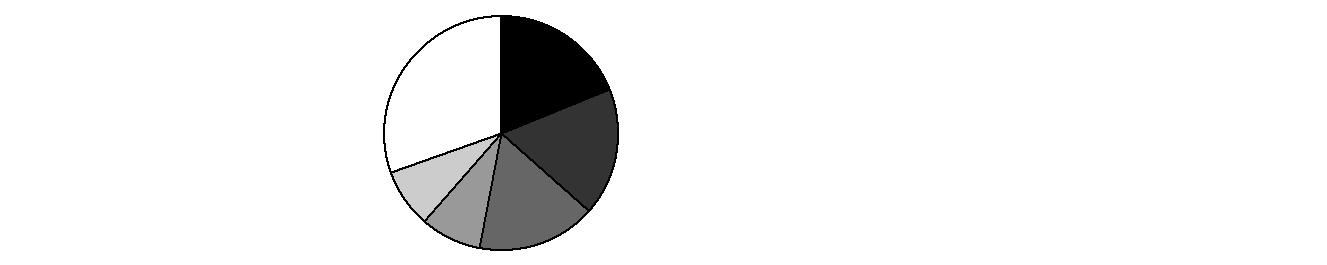

As of July 31, 2007 |

| Biotechnology | 85.6% | |

| Pharmaceuticals | 9.3% | |

| Life Sciences Tools

& Services | 3.0% | |

| Health Care Equipment & Supplies | 2.2% | |

| Health Care Providers

& Services | 0.2% | |

| All Others | (0.3)% (dagger) | |

* Includes short-term investments and net other assets. |

(dagger) Short-term investments and net other assets are not included in the pie chart. |

Biotechnology

Advisor Biotechnology Fund

Investments January 31, 2008 (Unaudited)

Showing Percentage of Net Assets

Common Stocks - 99.8% |

| Shares | | Value |

BIOTECHNOLOGY - 80.8% |

Biotechnology - 80.8% |

Acadia Pharmaceuticals, Inc. (a) | 31,774 | | $ 376,840 |

Acorda Therapeutics, Inc. (a) | 4,754 | | 120,561 |

Affymax, Inc. | 8,100 | | 162,486 |

Alexion Pharmaceuticals, Inc. (a) | 30,626 | | 2,000,490 |

Alkermes, Inc. (a) | 23,500 | | 313,020 |

Alnylam Pharmaceuticals, Inc. (a) | 8,500 | | 255,340 |

Amgen, Inc. (a) | 4,206 | | 195,958 |

Amylin Pharmaceuticals, Inc. (a) | 38,708 | | 1,147,692 |

Antigenics, Inc. unit (a)(c) | 452,000 | | 1,468,583 |

Arena Pharmaceuticals, Inc. (a) | 8,400 | | 60,816 |

Biogen Idec, Inc. (a) | 59,348 | | 3,617,261 |

BioMarin Pharmaceutical, Inc. (a) | 49,889 | | 1,848,886 |

Celgene Corp. (a) | 61,825 | | 3,469,001 |

Cephalon, Inc. (a) | 35,099 | | 2,303,547 |

Cepheid, Inc. (a) | 9,300 | | 284,022 |

Cougar Biotechnology, Inc. (a) | 13,800 | | 412,733 |

Cubist Pharmaceuticals, Inc. (a) | 9,915 | | 168,456 |

Dendreon Corp. (a) | 12,600 | | 77,994 |

Enzon Pharmaceuticals, Inc. (a) | 6,100 | | 51,057 |

Genentech, Inc. (a) | 78,311 | | 5,496,648 |

Genzyme Corp. (a) | 19,122 | | 1,494,002 |

Gilead Sciences, Inc. (a) | 98,960 | | 4,521,482 |

GTx, Inc. (a) | 10,700 | | 118,663 |

Halozyme Therapeutics, Inc. (a) | 6,310 | | 34,768 |

Human Genome Sciences, Inc. (a) | 21,777 | | 121,516 |

ImClone Systems, Inc. (a) | 9,800 | | 426,006 |

Incyte Corp. (a) | 34,395 | | 412,052 |

Indevus Pharmaceuticals, Inc. (a) | 26,057 | | 165,983 |

Isis Pharmaceuticals, Inc. (a) | 28,300 | | 441,480 |

LifeCell Corp. (a) | 3,500 | | 138,285 |

Ligand Pharmaceuticals, Inc. Class B | 10,400 | | 43,264 |

MannKind Corp. (a) | 17,108 | | 135,153 |

Martek Biosciences (a) | 4,300 | | 122,550 |

Medarex, Inc. (a) | 8,134 | | 81,259 |

Millennium Pharmaceuticals, Inc. (a) | 60,319 | | 915,039 |

Myriad Genetics, Inc. (a) | 14,605 | | 628,161 |

Neurochem, Inc. (a) | 1,300 | | 2,228 |

Omrix Biopharmaceuticals, Inc. (a) | 3,200 | | 74,432 |

ONYX Pharmaceuticals, Inc. (a) | 11,494 | | 546,310 |

OREXIGEN Therapeutics, Inc. | 11,126 | | 117,379 |

OSI Pharmaceuticals, Inc. (a) | 12,600 | | 502,488 |

PDL BioPharma, Inc. (a) | 34,500 | | 515,085 |

Pharmion Corp. (a) | 9,900 | | 682,605 |

Poniard Pharmaceuticals, Inc. (a) | 8,500 | | 44,370 |

Progenics Pharmaceuticals, Inc. (a) | 6,800 | | 111,112 |

Regeneron Pharmaceuticals, Inc. (a) | 18,391 | | 372,969 |

Rigel Pharmaceuticals, Inc. (a) | 10,035 | | 276,264 |

Sangamo Biosciences, Inc. (a) | 12,798 | | 146,537 |

Savient Pharmaceuticals, Inc. (a) | 14,505 | | 280,672 |

|

| Shares | | Value |

Theratechnologies, Inc. (a) | 6,300 | | $ 57,755 |

Theravance, Inc. (a) | 9,365 | | 184,771 |

United Therapeutics Corp. (a) | 20,203 | | 1,696,648 |

Vanda Pharmaceuticals, Inc. (a) | 63,239 | | 270,031 |

Vertex Pharmaceuticals, Inc. (a) | 60,400 | | 1,229,744 |

Zymogenetics, Inc. (a) | 12,795 | | 129,102 |

| | 40,871,556 |

HEALTH CARE EQUIPMENT & SUPPLIES - 1.8% |

Health Care Equipment - 1.8% |

Alsius Corp. (a) | 15,600 | | 55,848 |

Clinical Data, Inc. (a) | 6,747 | | 141,485 |

Quidel Corp. (a) | 43,600 | | 687,572 |

TomoTherapy, Inc. | 200 | | 2,962 |

| | 887,867 |

HEALTH CARE PROVIDERS & SERVICES - 0.2% |

Health Care Services - 0.2% |

Oracle Healthcare Acquisition Corp. unit (a) | 11,000 | | 89,760 |

LIFE SCIENCES TOOLS & SERVICES - 2.8% |

Life Sciences Tools & Services - 2.8% |

AMAG Pharmaceuticals, Inc. | 3,615 | | 186,389 |

Applera Corp. - Celera Genomics Group (a) | 14,100 | | 216,012 |

Exelixis, Inc. (a) | 41,700 | | 305,244 |

Medivation, Inc. (a) | 1,359 | | 21,744 |

QIAGEN NV (a) | 34,555 | | 704,922 |

| | 1,434,311 |

PHARMACEUTICALS - 14.2% |

Pharmaceuticals - 14.2% |

Akorn, Inc. (a) | 131,279 | | 984,593 |

Auxilium Pharmaceuticals, Inc. (a) | 47,658 | | 1,629,904 |

Biodel, Inc. | 69,770 | | 1,243,999 |

Catalyst Pharmaceutical Partners, Inc. (a) | 22,041 | | 74,499 |

Elan Corp. PLC sponsored ADR (a) | 67,400 | | 1,712,634 |

Jazz Pharmaceuticals, Inc. | 6,900 | | 90,390 |

Sepracor, Inc. (a) | 11,996 | | 338,767 |

ULURU, Inc. (a) | 2,100 | | 4,914 |

XenoPort, Inc. (a) | 18,000 | | 1,104,480 |

| | 7,184,180 |

TOTAL COMMON STOCKS (Cost $47,253,494) | 50,467,674 |

Money Market Funds - 1.2% |

| Shares | | Value |

Fidelity Cash Central Fund, 3.79% (b)

(Cost $570,865) | 570,865 | | $ 570,865 |

TOTAL INVESTMENT PORTFOLIO - 101.0% (Cost $47,824,359) | | 51,038,539 |

NET OTHER ASSETS - (1.0)% | | (481,230) |

NET ASSETS - 100% | $ 50,557,309 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. |

(c) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $1,468,583 or 2.9% of net assets. |

Additional information on each holding is as follows: |

Security | Acquisition Date | Acquisition Cost |

Antigenics, Inc. unit | 1/9/08 | $ 1,356,000 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 6,939 |

Fidelity Securities Lending Cash Central Fund | 5,335 |

Total | $ 12,274 |

See accompanying notes which are an integral part of the financial statements.

Biotechnology

Advisor Biotechnology Fund

Financial Statements

Statement of Assets and Liabilities

| January 31, 2008 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $47,253,494) | $ 50,467,674 | |

Fidelity Central Funds (cost $570,865) | 570,865 | |

Total Investments (cost $47,824,359) | | $ 51,038,539 |

Receivable for investments sold | | 1,061,773 |

Receivable for fund shares sold | | 56,096 |

Distributions receivable from Fidelity Central Funds | | 592 |

Prepaid expenses | | 163 |

Other receivables | | 123 |

Total assets | | 52,157,286 |

| | |

Liabilities | | |

Payable for investments purchased | $ 1,396,075 | |

Payable for fund shares redeemed | 108,582 | |

Accrued management fee | 27,878 | |

Distribution fees payable | 28,294 | |

Other affiliated payables | 15,154 | |

Other payables and accrued expenses | 23,994 | |

Total liabilities | | 1,599,977 |

| | |

Net Assets | | $ 50,557,309 |

Net Assets consist of: | | |

Paid in capital | | $ 51,602,322 |

Accumulated net investment loss | | (478,923) |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (3,780,270) |

Net unrealized appreciation (depreciation) on investments | | 3,214,180 |

Net Assets | | $ 50,557,309 |

Statement of Assets and Liabilities - continued

| January 31, 2008 (Unaudited) |

| | |

Calculation of Maximum Offering Price Class A:

Net Asset Value and redemption price per share ($13,238,927 ÷ 1,923,338 shares) | | $ 6.88 |

| | |

Maximum offering price per share (100/94.25 of $6.88) | | $ 7.30 |

Class T:

Net Asset Value and redemption price per share ($13,320,899 ÷ 1,973,076 shares) | | $ 6.75 |

| | |

Maximum offering price per share (100/96.50 of $6.75) | | $ 6.99 |

Class B:

Net Asset Value and offering price per share ($11,465,945 ÷ 1,765,637 shares) A | | $ 6.49 |

| | |

Class C:

Net Asset Value and offering price per share ($11,458,337 ÷ 1,764,098 shares)A | | $ 6.50 |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($1,073,201 ÷ 152,540 shares) | | $ 7.04 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Advisor Biotechnology Fund

Financial Statements - continued

Statement of Operations

| Six months ended January 31, 2008 (Unaudited) |

| | |

Investment Income | | |

Interest | | $ 87 |

Income from Fidelity Central Funds (including $5,335 from security lending) | | 12,274 |

Total income | | 12,361 |

| | |

Expenses | | |

Management fee | $ 151,327 | |

Transfer agent fees | 88,591 | |

Distribution fees | 178,921 | |

Accounting and security lending fees | 11,670 | |

Custodian fees and expenses | 5,990 | |

Independent trustees' compensation | 111 | |

Registration fees | 38,256 | |

Audit | 22,375 | |

Legal | 152 | |

Miscellaneous | 218 | |

Total expenses before reductions | 497,611 | |

Expense reductions | (6,327) | 491,284 |

Net investment income (loss) | | (478,923) |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | (828,422) | |

Foreign currency transactions | 287 | |

Total net realized gain (loss) | | (828,135) |

Change in net unrealized appreciation (depreciation) on investment securities | | 2,303,055 |

Net gain (loss) | | 1,474,920 |

Net increase (decrease) in net assets resulting from operations | | $ 995,997 |

Statement of Changes in Net Assets

| Six months ended

January 31, 2008

(Unaudited) | Year ended

July 31,

2007 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ (478,923) | $ (966,220) |

Net realized gain (loss) | (828,135) | 8,930,811 |

Change in net unrealized appreciation (depreciation) | 2,303,055 | (4,482,074) |

Net increase (decrease) in net assets resulting from operations | 995,997 | 3,482,517 |

Distributions to shareholders from net realized gain | (3,898,929) | - |

Share transactions - net increase (decrease) | 1,910,148 | (8,274,098) |

Redemption fees | 888 | 1,128 |

Total increase (decrease) in net assets | (991,896) | (4,790,453) |

| | |

Net Assets | | |

Beginning of period | 51,549,205 | 56,339,658 |

End of period (including accumulated net investment loss of $478,923 and $0, respectively) | $ 50,557,309 | $ 51,549,205 |

See accompanying notes which are an integral part of the financial statements.

Biotechnology

Financial Highlights - Class A

| Six months ended

January 31, 2008 | Years ended July 31, |

| (Unaudited) | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 7.23 | $ 6.81 | $ 6.80 | $ 6.00 | $ 5.94 | $ 4.39 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | (.05) | (.09) | (.09) | (.08) H | (.09) | (.05) |

Net realized and unrealized gain (loss) | .23 | .51 | .10 | .88 | .15 | 1.60 |

Total from investment operations | .18 | .42 | .01 | .80 | .06 | 1.55 |

Redemption fees added to paid in capital E, J | - | - | - | - | - | - |

Distributions from net realized gain | (.53) | - | - | - | - | - |

Net asset value, end of period | $ 6.88 | $ 7.23 | $ 6.81 | $ 6.80 | $ 6.00 | $ 5.94 |

Total Return B, C, D | 2.14% | 6.17% | .15% | 13.33% | 1.01% | 35.31% |

Ratios to Average Net Assets F, I | | | | | | |

Expenses before reductions | 1.40% A | 1.42% | 1.48% | 1.56% | 1.68% | 2.04% |

Expenses net of fee waivers, if any | 1.40% A | 1.40% | 1.40% | 1.45% | 1.50% | 1.50% |

Expenses net of all reductions | 1.40% A | 1.40% | 1.37% | 1.43% | 1.48% | 1.47% |

Net investment income (loss) | (1.35)% A | (1.25)% | (1.29)% | (1.36)% H | (1.38)% | (1.11)% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 13,239 | $ 13,081 | $ 12,539 | $ 11,022 | $ 10,197 | $ 7,718 |

Portfolio turnover rate G | 143% A | 120% | 62% | 30% | 50% | 71% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Total returns do not include the effect of the sales charges. E Calculated based on average shares outstanding during the period. F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. G Amount does not include the portfolio activity of any underlying Fidelity Central Funds. H Investment income per share reflects a special dividend which amounted to $.0004 per share. Excluding the special dividend, the ratio of net investment income (loss) to average net assets would have been (1.37)%. I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. J Amount represents less than $.01 per share. |

Financial Highlights - Class T

| Six months ended

January 31, 2008 | Years ended July 31, |

| (Unaudited) | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 7.11 | $ 6.71 | $ 6.72 | $ 5.95 | $ 5.90 | $ 4.37 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | (.06) | (.11) | (.11) | (.10) H | (.10) | (.06) |

Net realized and unrealized gain (loss) | .23 | .51 | .10 | .87 | .15 | 1.59 |

Total from investment operations | .17 | .40 | (.01) | .77 | .05 | 1.53 |

Redemption fees added to paid in capital E, J | - | - | - | - | - | - |

Distributions from net realized gain | (.53) | - | - | - | - | - |

Net asset value, end of period | $ 6.75 | $ 7.11 | $ 6.71 | $ 6.72 | $ 5.95 | $ 5.90 |

Total Return B, C, D | 2.03% | 5.96% | (.15)% | 12.94% | .85% | 35.01% |

Ratios to Average Net Assets F, I | | | | | | |

Expenses before reductions | 1.74% A | 1.75% | 1.79% | 1.93% | 2.10% | 2.39% |

Expenses net of fee waivers, if any | 1.65% A | 1.65% | 1.65% | 1.70% | 1.75% | 1.75% |

Expenses net of all reductions | 1.65% A | 1.65% | 1.62% | 1.68% | 1.73% | 1.72% |

Net investment income (loss) | (1.61)% A | (1.49)% | (1.54)% | (1.61)% H | (1.63)% | (1.36)% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 13,321 | $ 13,008 | $ 13,808 | $ 14,177 | $ 13,367 | $ 10,281 |

Portfolio turnover rate G | 143% A | 120% | 62% | 30% | 50% | 71% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Total returns do not include the effect of the sales charges. E Calculated based on average shares outstanding during the period. F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. G Amount does not include the portfolio activity of any underlying Fidelity Central Funds. H Investment income per share reflects a special dividend which amounted to $.0004 per share. Excluding the special dividend, the ratio of net investment income (loss) to average net assets would have been (1.61)%. I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. J Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class B

| Six months ended

January 31, 2008 | Years ended July 31, |

| (Unaudited) | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 6.88 | $ 6.52 | $ 6.56 | $ 5.84 | $ 5.82 | $ 4.33 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | (.07) | (.14) | (.14) | (.13) H | (.13) | (.09) |

Net realized and unrealized gain (loss) | .21 | .50 | .10 | .85 | .15 | 1.58 |

Total from investment operations | .14 | .36 | (.04) | .72 | .02 | 1.49 |

Redemption fees added to paid in capital E, J | - | - | - | - | - | - |

Distributions from net realized gain | (.53) | - | - | - | - | - |

Net asset value, end of period | $ 6.49 | $ 6.88 | $ 6.52 | $ 6.56 | $ 5.84 | $ 5.82 |

Total Return B, C, D | 1.65% | 5.52% | (.61)% | 12.33% | .34% | 34.41% |

Ratios to Average Net Assets F, I | | | | | | |

Expenses before reductions | 2.15% A | 2.17% | 2.23% | 2.33% | 2.46% | 2.78% |

Expenses net of fee waivers, if any | 2.15% A | 2.15% | 2.15% | 2.19% | 2.25% | 2.25% |

Expenses net of all reductions | 2.15% A | 2.15% | 2.12% | 2.18% | 2.22% | 2.22% |

Net investment income (loss) | (2.10)% A | (1.99)% | (2.04)% | (2.11)% H | (2.12)% | (1.86)% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 11,466 | $ 12,656 | $ 14,938 | $ 16,921 | $ 16,819 | $ 15,154 |

Portfolio turnover rate G | 143% A | 120% | 62% | 30% | 50% | 71% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Total returns do not include the effect of the contingent deferred sales charge. E Calculated based on average shares outstanding during the period. F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. G Amount does not include the portfolio activity of any underlying Fidelity Central Funds. H Investment income per share reflects a special dividend which amounted to $.0004 per share. Excluding the special dividend, the ratio of net investment income (loss) to average net assets would have been (2.11)%. I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. J Amount represents less than $.01 per share. |

Financial Highlights - Class C

| Six months ended

January 31, 2008 | Years ended July 31, |

| (Unaudited) | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 6.88 | $ 6.52 | $ 6.57 | $ 5.84 | $ 5.82 | $ 4.33 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | (.07) | (.14) | (.14) | (.13) H | (.13) | (.09) |

Net realized and unrealized gain (loss) | .22 | .50 | .09 | .86 | .15 | 1.58 |

Total from investment operations | .15 | .36 | (.05) | .73 | .02 | 1.49 |

Redemption fees added to paid in capital E, J | - | - | - | - | - | - |

Distributions from net realized gain | (.53) | - | - | - | - | - |

Net asset value, end of period | $ 6.50 | $ 6.88 | $ 6.52 | $ 6.57 | $ 5.84 | $ 5.82 |

Total Return B, C, D | 1.81% | 5.52% | (.76)% | 12.50% | .34% | 34.41% |

Ratios to Average Net Assets F, I | | | | | | |

Expenses before reductions | 2.15% A | 2.16% | 2.17% | 2.24% | 2.31% | 2.58% |

Expenses net of fee waivers, if any | 2.15% A | 2.15% | 2.15% | 2.19% | 2.25% | 2.25% |

Expenses net of all reductions | 2.15% A | 2.15% | 2.12% | 2.18% | 2.23% | 2.22% |

Net investment income (loss) | (2.11)% A | (1.99)% | (2.04)% | (2.11)% H | (2.13)% | (1.86)% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 11,458 | $ 11,813 | $ 13,787 | $ 12,538 | $ 13,215 | $ 10,493 |

Portfolio turnover rate G | 143% A | 120% | 62% | 30% | 50% | 71% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Total returns do not include the effect of the contingent deferred sales charge. E Calculated based on average shares outstanding during the period. F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. G Amount does not include the portfolio activity of any underlying Fidelity Central Funds. H Investment income per share reflects a special dividend which amounted to $.0004 per share. Excluding the special dividend, the ratio of net investment income (loss) to average net assets would have been (2.11)%. I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. J Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Biotechnology

Financial Highlights - Institutional Class

| Six months ended

January 31, 2008 | Years ended July 31, |

| (Unaudited) | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 7.37 | $ 6.91 | $ 6.89 | $ 6.06 | $ 5.97 | $ 4.40 |

Income from Investment Operations | | | | | | |

Net investment income (loss) D | (.04) | (.07) | (.07) | (.06) G | (.06) | (.04) |

Net realized and unrealized gain (loss) | .24 | .53 | .09 | .89 | .15 | 1.61 |

Total from investment operations | .20 | .46 | .02 | .83 | .09 | 1.57 |

Redemption fees added to paid in capital D, I | - | - | - | - | - | - |

Distributions from net realized gain | (.53) | - | - | - | - | - |

Net asset value, end of period | $ 7.04 | $ 7.37 | $ 6.91 | $ 6.89 | $ 6.06 | $ 5.97 |

Total Return B, C | 2.39% | 6.66% | .29% | 13.70% | 1.51% | 35.68% |

Ratios to Average Net Assets E, H | | | | | | |

Expenses before reductions | 1.09% A | 1.06% | 1.05% | 1.10% | 1.16% | 1.37% |

Expenses net of fee waivers, if any | 1.09% A | 1.06% | 1.05% | 1.10% | 1.16% | 1.25% |

Expenses net of all reductions | 1.09% A | 1.06% | 1.03% | 1.09% | 1.14% | 1.22% |

Net investment income (loss) | (1.04)% A | (.91)% | (.94)% | (1.02)% G | (1.04)% | (.86)% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 1,073 | $ 991 | $ 1,268 | $ 1,243 | $ 1,146 | $ 1,153 |

Portfolio turnover rate F | 143% A | 120% | 62% | 30% | 50% | 71% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Calculated based on average shares outstanding during the period. E Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. F Amount does not include the portfolio activity of any underlying Fidelity Central Funds. G Investment income per share reflects a special dividend which amounted to $.0004 per share. Excluding the special dividend, the ratio of net investment income (loss) to average net assets would have been (1.02)%. H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. I Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended January 31, 2008 (Unaudited)

1. Organization.

Fidelity Advisor Biotechnology Fund (the Fund) is a non-diversified fund of Fidelity Advisor Series VII (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

The Fund offers Class A, Class T, Class B, Class C, and Institutional Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions also differ by class.

2. Investments in Fidelity Central Funds.

The Fund may invest in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete list of holdings for each Fidelity Central Fund is available upon request or at the SEC's web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC's web site or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Investments are valued and net asset value (NAV) per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Wherever possible, the Fund uses independent pricing services approved by the Board of Trustees to value its investments.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value each business day. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. For example, when developments occur between the close of a market and the close of the NYSE that may materially affect the value of some or all of the securities, or when trading in a security is halted, those securities may be fair valued. Factors used in the determination of fair value may include monitoring news to identify significant market or security specific events such as changes in the value of U.S. securities markets, reviewing developments in foreign markets and evaluating the performance of ADRs, futures contracts and exchange-traded funds. Because the Fund's utilization of fair value pricing depends on market activity, the frequency with which fair value pricing is used cannot be predicted and may be utilized to a significant extent. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities.

Foreign Currency. The Fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Biotechnology

3. Significant Accounting Policies - continued

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV for processing shareholder transactions includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each Fund in the trust. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company by distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code and filing its U.S. federal tax return. As a result, no provision for income taxes is required. Effective with the beginning of the Fund's fiscal year the Fund adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainties in Income Taxes (FIN 48). FIN 48 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The implementation of FIN 48 did not result in any unrecognized tax benefits in the accompanying financial statements. Each of the Fund's federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, capital loss carryforwards, losses deferred due to wash sales and excise tax regulations.

The federal tax cost of investments and unrealized appreciation (depreciation) as of period end were as follows:

Unrealized appreciation | $ 7,184,827 | |

Unrealized depreciation | (4,337,216) | |

Net unrealized appreciation (depreciation) | $ 2,847,611 | |

Cost for federal income tax purposes | $ 48,190,928 | |

Short-Term Trading (Redemption) Fees. Shares held in the Fund less than 30 days are subject to a redemption fee equal to 0.75% of the proceeds of the redeemed shares. All redemption fees, including any estimated redemption fees paid by FMR, are retained by the Fund and accounted for as an addition to paid in capital.

New Accounting Pronouncement. In September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund's financial statement disclosures.

4. Operating Policies.

Repurchase Agreements. FMR has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the Fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The Fund may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non-government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The Fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $38,560,673 and $41,250,005, respectively.

6. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and a group fee rate that averaged .26% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the period, the total annualized management fee rate was .56% of the Fund's average net assets.

Distribution and Service Plan. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of FMR, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates and the total amounts paid to and retained by FDC were as follows:

| Distribution

Fee | Service

Fee | Paid to

FDC | Retained

by FDC |

Class A | 0% | .25% | $ 17,186 | $ 216 |

Class T | .25% | .25% | 34,778 | - |

Class B | .75% | .25% | 65,067 | 48,971 |

Class C | .75% | .25% | 61,890 | 8,269 |

| | | $ 178,921 | $ 57,456 |

Sales Load. FDC receives a front-end sales charge of up to 5.75% for selling Class A shares, and 3.50% for selling Class T shares, some of which is paid to financial intermediaries for selling shares of the Fund. FDC receives the proceeds of contingent deferred sales charges levied on Class A, Class T, Class B, and Class C redemptions. These charges depend on the holding period. The deferred sales charges range from 5% to 1% for Class B, 1% for Class C, 1.00% to .50% for certain purchases of Class A shares and .25% for certain purchases of Class T shares.

For the period, sales charge amounts retained by FDC were as follows:

| Retained

by FDC |

Class A | $ 4,220 |

Class T | 3,918 |

Class B* | 13,577 |

Class C* | 969 |

| $ 22,684 |

* When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of FMR, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, the total transfer agent fees paid by each class to FIIOC were as follows:

| Amount | % of

Average

Net Assets* |

Class A | $ 20,890 | .30 |

Class T | 27,448 | .39 |

Class B | 19,783 | .30 |

Class C | 18,878 | .31 |

Institutional Class | 1,592 | .24 |

| $ 88,591 | |

* Annualized

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for the month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Biotechnology

6. Fees and Other Transactions with Affiliates - continued

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $1,023 for the period.

7. Committed Line of Credit.

The Fund participates with other funds managed by FMR in a $4.2 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro rata portion of the line of credit, which amounted to $72 and is reflected in Miscellaneous Expense on the Statement of Operations. During the period, there were no borrowings on this line of credit.

8. Security Lending.

The Fund lends portfolio securities from time to time in order to earn additional income. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. At period end, there were no security loans outstanding. Security lending income represents the income earned on investing cash collateral, less fees and expenses associated with the loan, plus any premium payments that may be received on the loan of certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds.

9. Expense Reductions.

FMR voluntarily agreed to reimburse each class to the extent annual operating expenses exceeded certain levels of average net assets as noted in the table below. Some expenses, for example interest expense, including commitment fees, are excluded from this reimbursement.

The following classes were in reimbursement during the period:

| Expense

Limitations | Reimbursement

from adviser |

Class T | 1.65% | $ 6,204 |

Many of the brokers with whom FMR places trades on behalf of the Fund provided services to the Fund in addition to trade execution. These services included payments of certain expenses on behalf of the Fund totaling $123 for the period.

10. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

In December 2006, the Independent Trustees, with the assistance of independent counsel, completed an investigation regarding gifts, gratuities and business entertainment provided by certain brokers to certain individuals who were employed on FMR's domestic equity trading desk during the period 2002 to 2004. The Independent Trustees and FMR agreed that, despite the absence of proof that the Fidelity mutual funds experienced diminished execution quality as a result of the improper receipt of gifts and business entertainment, the conduct at issue was serious and was worthy of redress. Accordingly, the Independent Trustees requested, and FMR agreed to make a payment of $42 million plus accrued interest, which equaled approximately $7.3 million, to certain Fidelity mutual funds.

Subsequent to period end, the Trustees approved a method for allocating this payment among the funds and, in total, FMR paid the fund $6,156.

In a related administrative order dated March 5, 2008, the U.S. Securities and Exchange Commission ("SEC") announced a settlement with FMR and FMR Co., Inc. (an affiliate of FMR) involving the SEC's regulatory rules for investment advisers and the improper receipt of gifts, gratuities and business entertainment. Without admitting or denying the SEC's findings, FMR agreed to pay an $8 million civil penalty to the United States Treasury.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

11. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| Six months ended

January 31,

2008 | Year ended

July 31,

2007 |

From net realized gain | | |

Class A | $ 958,767 | $ - |

Class T | 975,567 | - |

Class B | 968,071 | - |

Class C | 911,566 | - |

Institutional Class | 84,958 | - |

Total | $ 3,898,929 | $ - |

12. Share Transactions.

Transactions for each class of shares were as follows:

| Shares | Dollars |

| Six months ended

January 31,

2008 | Year ended

July 31,

2007 | Six months ended

January 31,

2008 | Year ended

July 31,

2007 |

Class A | | | | |

Shares sold | 297,112 | 654,030 | $ 2,195,566 | $ 4,756,477 |

Reinvestment of distributions | 116,475 | - | 854,207 | - |

Shares redeemed | (298,354) | (687,789) | (2,203,206) | (5,067,147) |

Net increase (decrease) | 115,233 | (33,759) | $ 846,567 | $ (310,670) |

Class T | | | | |

Shares sold | 268,451 | 413,953 | $ 1,960,575 | $ 2,989,158 |

Reinvestment of distributions | 133,154 | - | 959,166 | - |

Shares redeemed | (257,075) | (643,045) | (1,884,963) | (4,647,999) |

Net increase (decrease) | 144,530 | (229,092) | $ 1,034,778 | $ (1,658,841) |

Class B | | | | |

Shares sold | 95,815 | 235,936 | $ 673,854 | $ 1,623,598 |

Reinvestment of distributions | 123,818 | - | 860,151 | - |

Shares redeemed | (294,189) | (686,826) | (2,039,831) | (4,815,046) |

Net increase (decrease) | (74,556) | (450,890) | $ (505,826) | $ (3,191,448) |

Class C | | | | |

Shares sold | 196,131 | 294,514 | $ 1,396,524 | $ 2,075,073 |

Reinvestment of distributions | 110,151 | - | 765,068 | - |

Shares redeemed | (259,392) | (691,341) | (1,807,430) | (4,822,276) |

Net increase (decrease) | 46,890 | (396,827) | $ 354,162 | $ (2,747,203) |

Institutional Class | | | | |

Shares sold | 111,194 | 40,455 | $ 858,271 | $ 308,779 |

Reinvestment of distributions | 6,538 | - | 48,898 | - |

Shares redeemed | (99,564) | (89,434) | (726,702) | (674,715) |

Net increase (decrease) | 18,168 | (48,979) | $ 180,467 | $ (365,936) |

Biotechnology

Advisor Communications Equipment Fund

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2007 to January 31, 2008).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning

Account Value

August 1, 2007 | Ending

Account Value

January 31, 2008 | Expenses Paid

During Period*

August 1, 2007

to January 31, 2008 |

Class A | | | |

Actual | $ 1,000.00 | $ 852.80 | $ 6.52 |

HypotheticalA | $ 1,000.00 | $ 1,018.10 | $ 7.10 |

Class T | | | |

Actual | $ 1,000.00 | $ 851.50 | $ 7.68 |

HypotheticalA | $ 1,000.00 | $ 1,016.84 | $ 8.36 |

Class B | | | |

Actual | $ 1,000.00 | $ 849.70 | $ 10.00 |

HypotheticalA | $ 1,000.00 | $ 1,014.33 | $ 10.89 |

Class C | | | |

Actual | $ 1,000.00 | $ 849.70 | $ 10.00 |

HypotheticalA | $ 1,000.00 | $ 1,014.33 | $ 10.89 |

Institutional Class | | | |

Actual | $ 1,000.00 | $ 853.10 | $ 5.36 |

HypotheticalA | $ 1,000.00 | $ 1,019.36 | $ 5.84 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

| Annualized

Expense Ratio |

Class A | 1.40% |

Class T | 1.65% |

Class B | 2.15% |

Class C | 2.15% |

Institutional Class | 1.15% |

Semiannual Report

Advisor Communications Equipment Fund

Investment Changes

Top Ten Stocks as of January 31, 2008 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Cisco Systems, Inc. | 15.4 | 6.6 |

Research In Motion Ltd. | 10.1 | 10.2 |

Comverse Technology, Inc. | 6.9 | 4.7 |

QUALCOMM, Inc. | 6.6 | 19.6 |

Corning, Inc. | 6.5 | 4.8 |

High Tech Computer Corp. | 4.7 | 0.0 |

Juniper Networks, Inc. | 4.1 | 5.8 |

Powerwave Technologies, Inc. | 3.5 | 4.4 |

F5 Networks, Inc. | 2.9 | 4.2 |

Sandvine Corp. (U.K.) | 2.8 | 3.0 |

| 63.5 | |

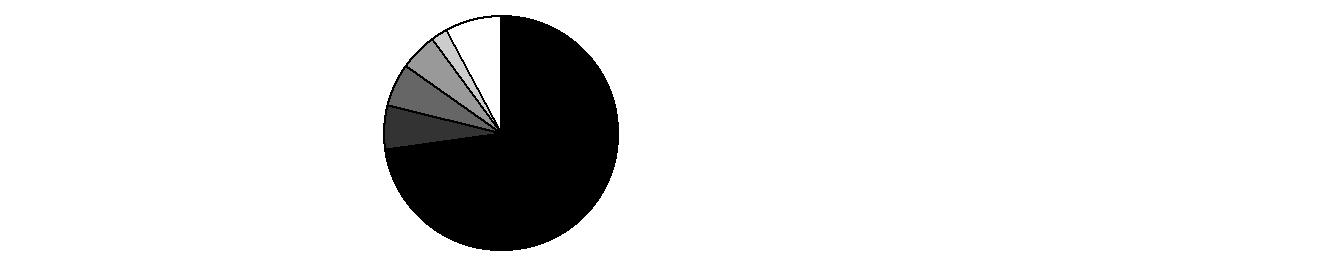

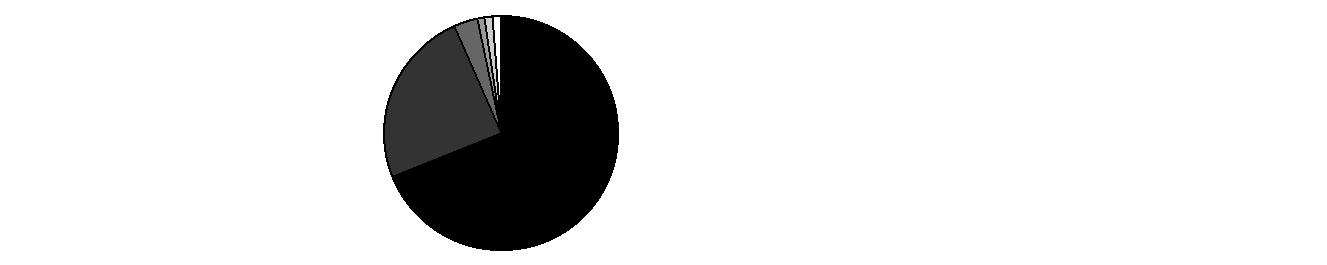

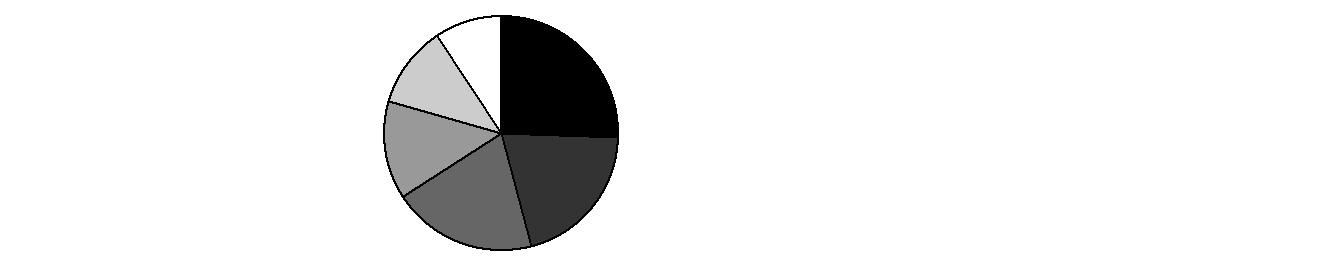

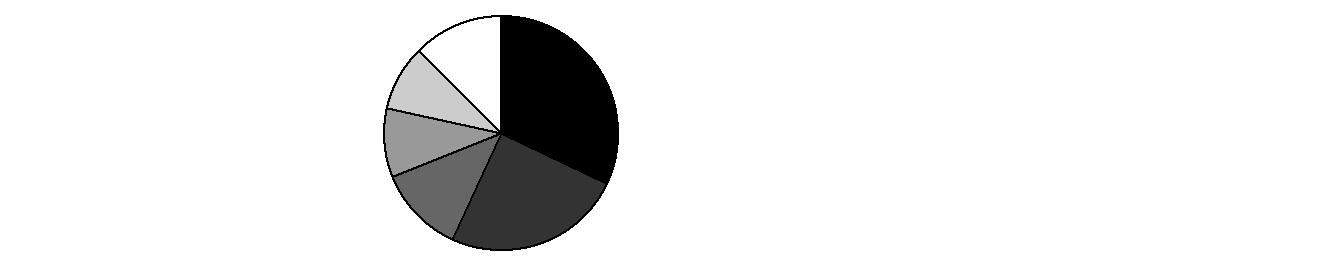

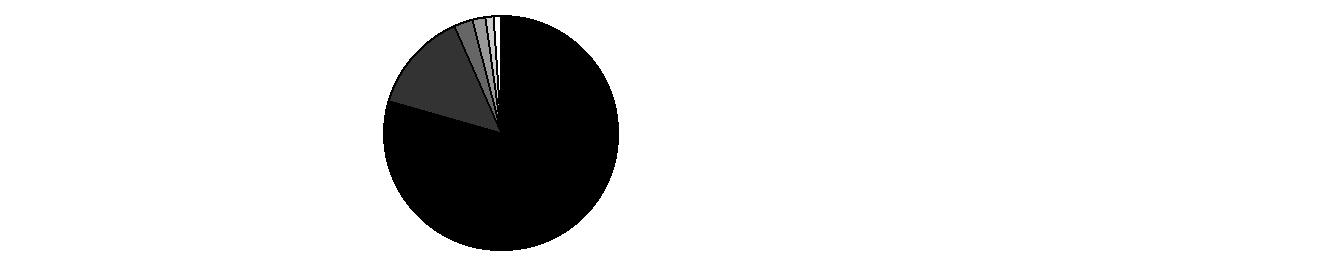

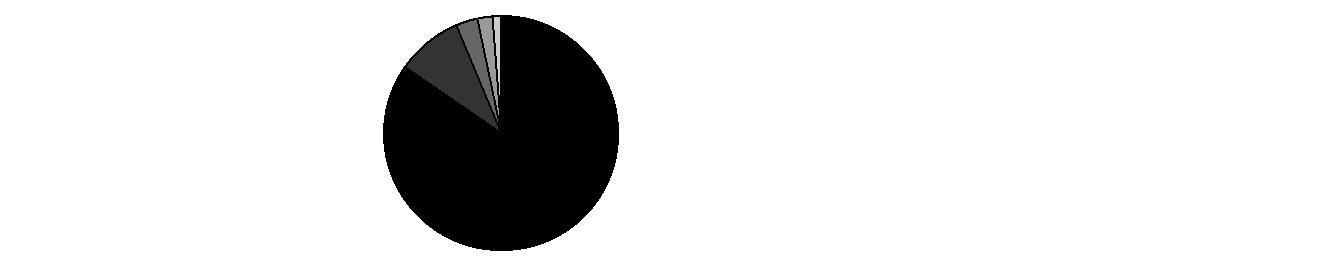

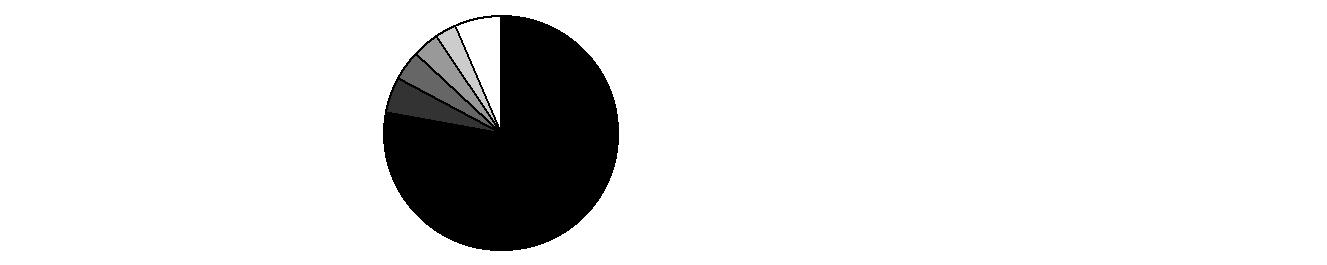

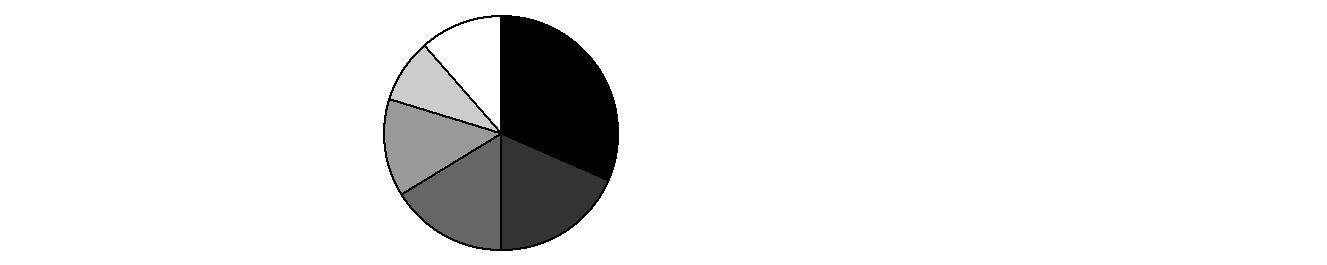

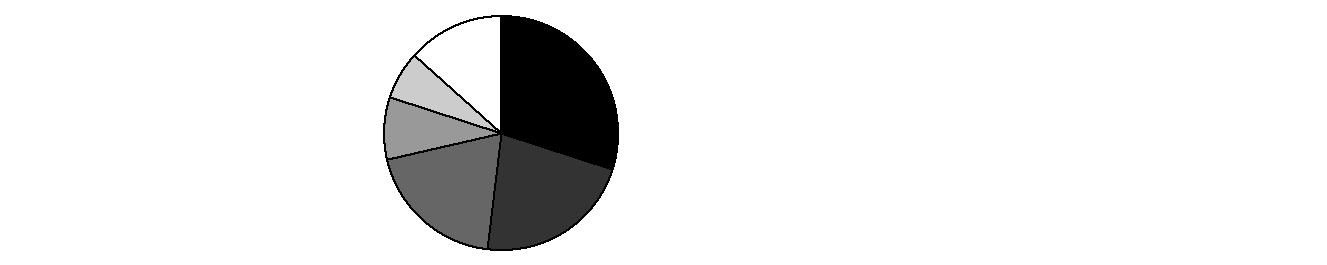

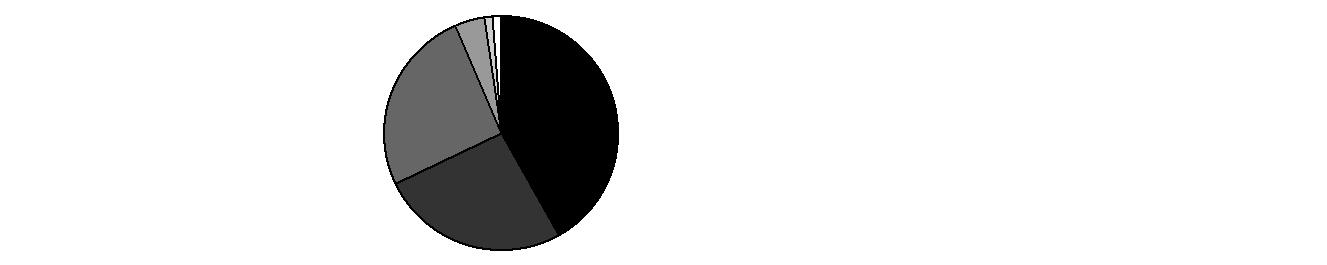

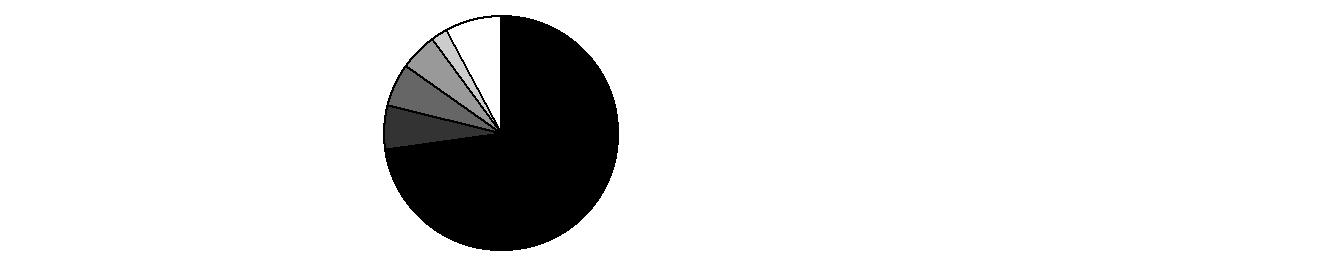

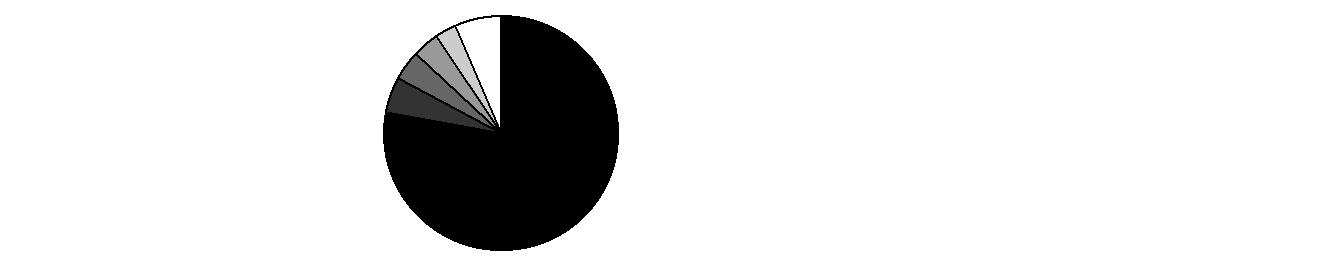

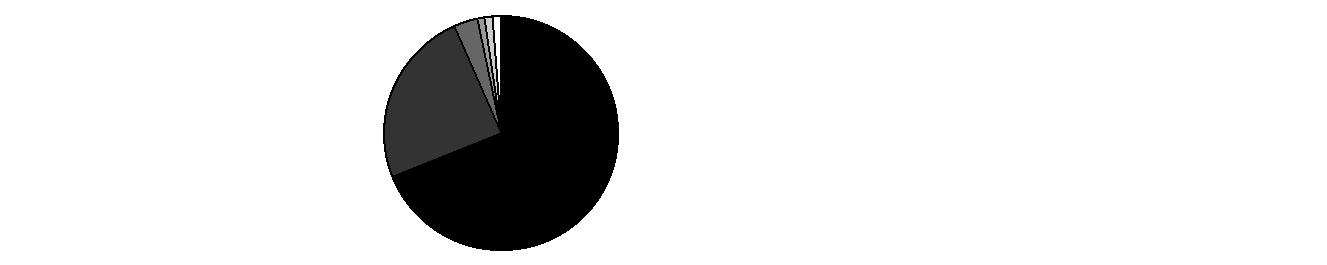

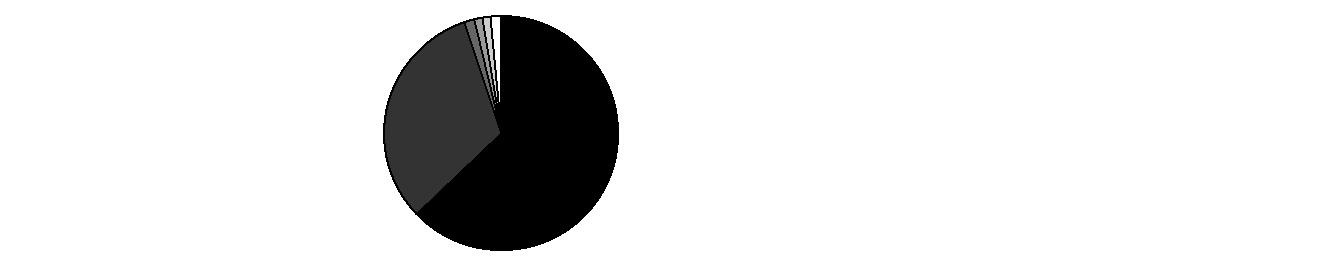

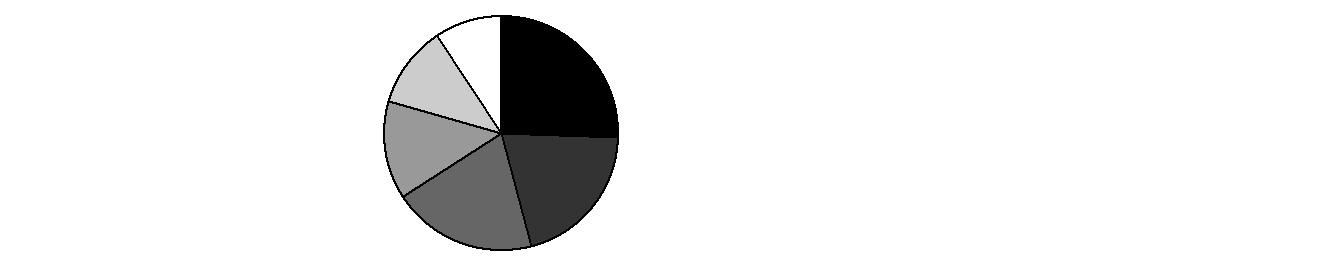

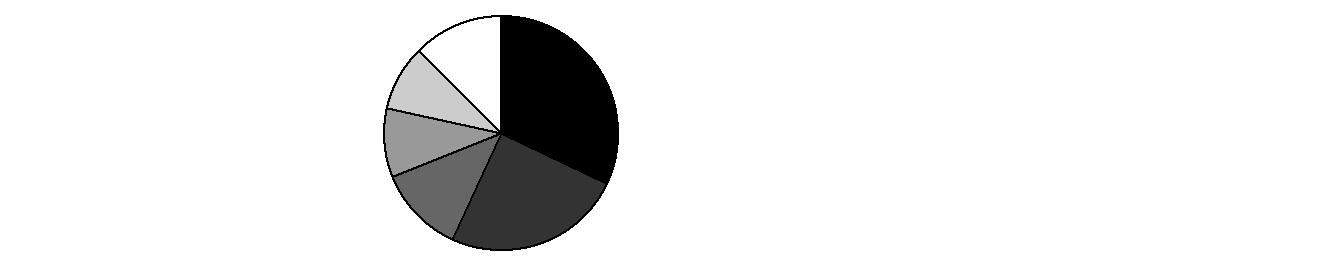

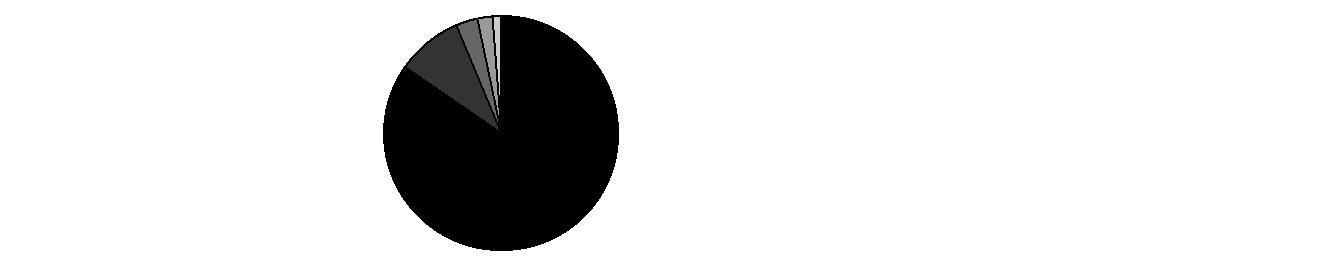

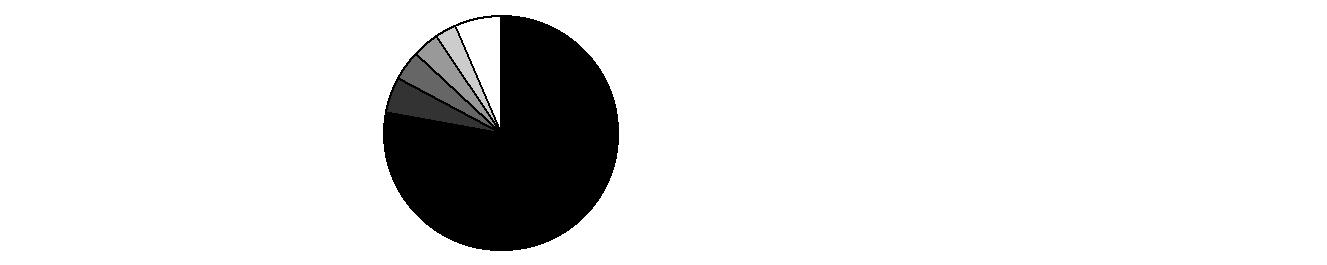

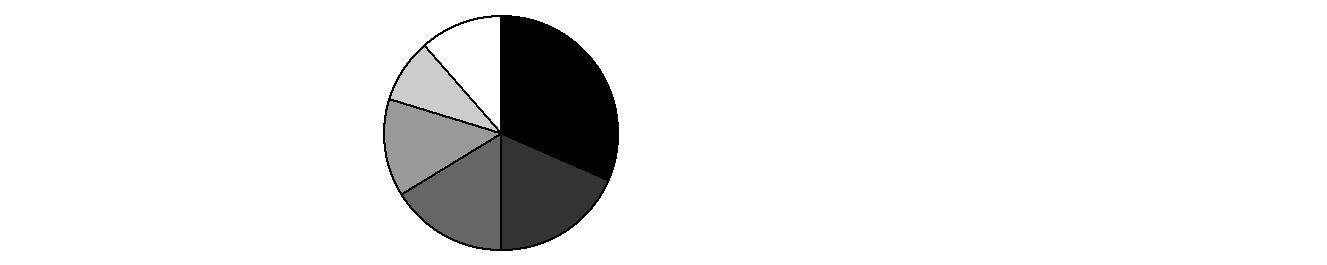

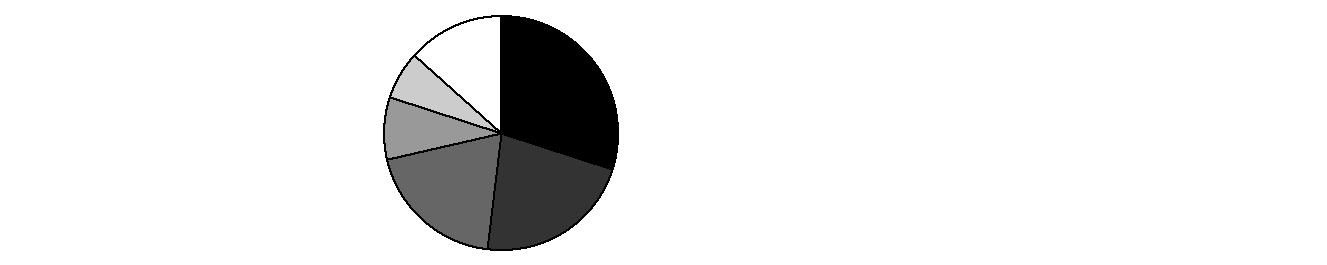

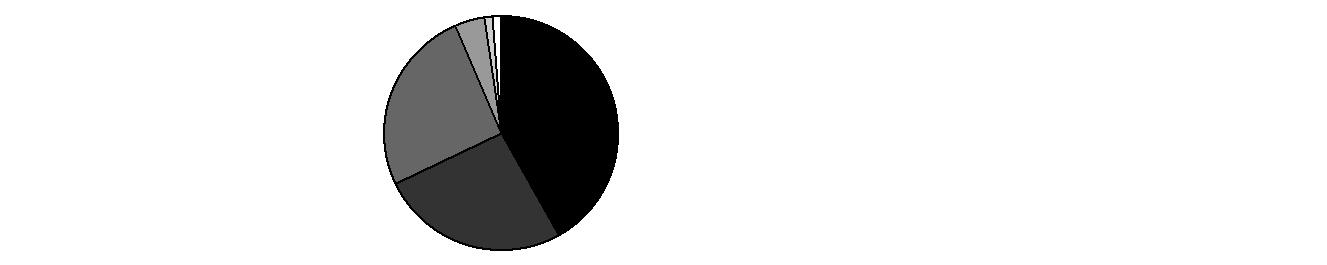

Top Industries (% of fund's net assets) |

As of January 31, 2008 |

| Communications Equipment | 72.9% | |

| Software | 6.1% | |

| Semiconductors & Semiconductor Equipment | 5.9% | |

| Computers & Peripherals | 5.1% | |

| Household Durables | 2.4% | |

| All Others* | 7.6% | |

|

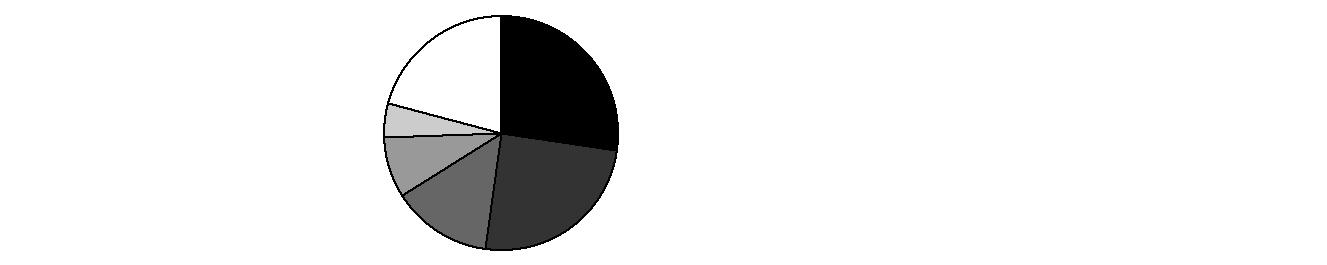

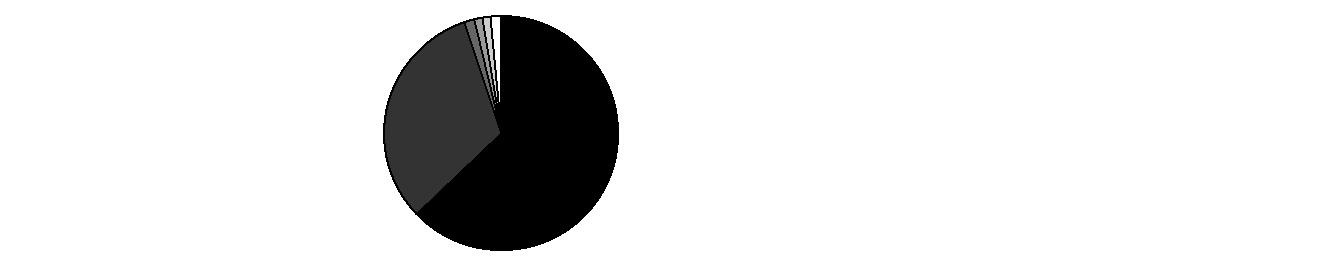

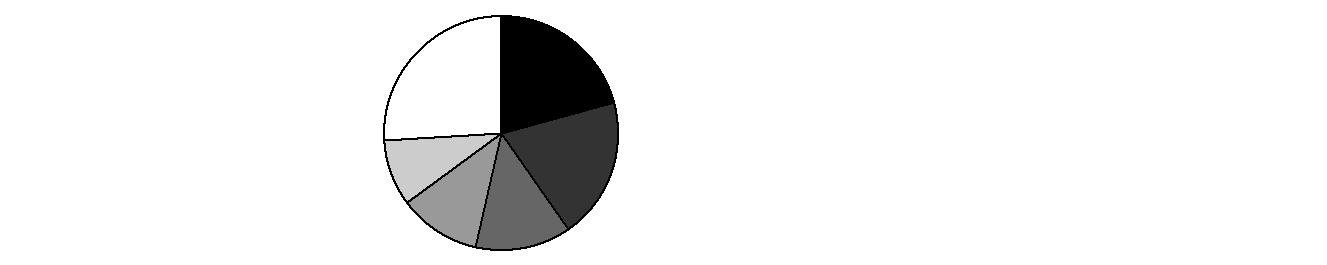

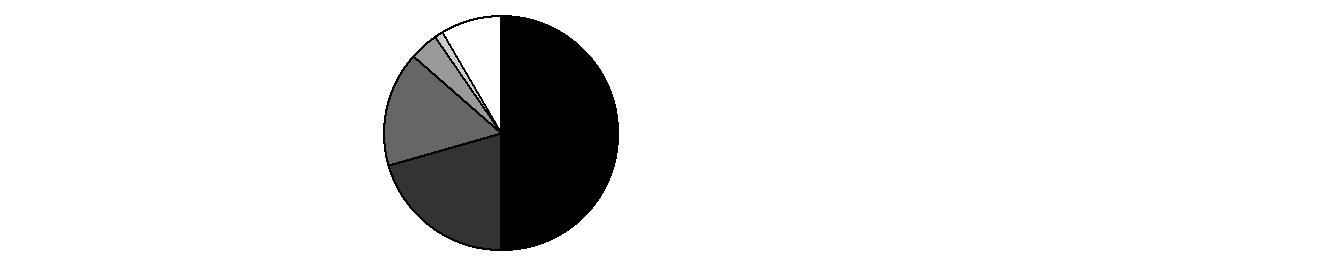

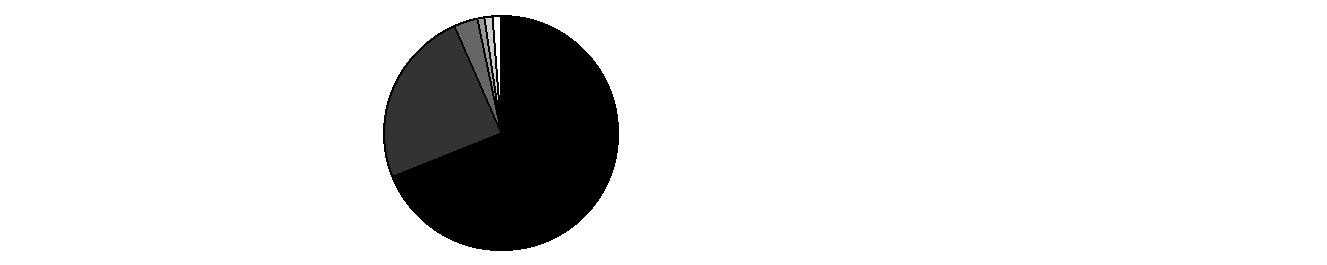

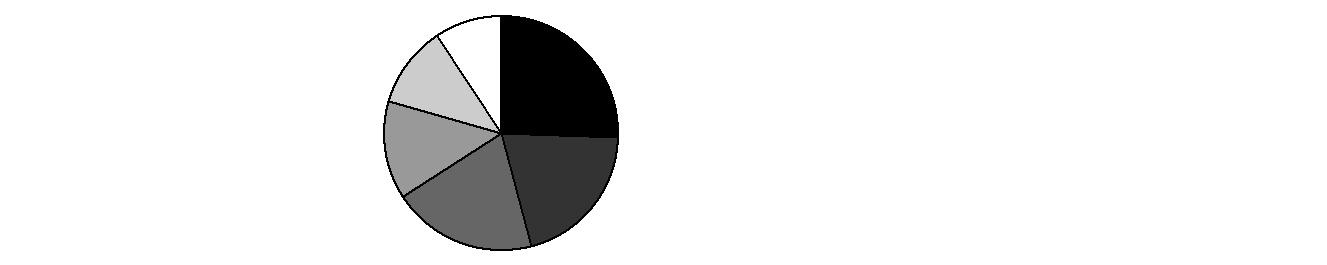

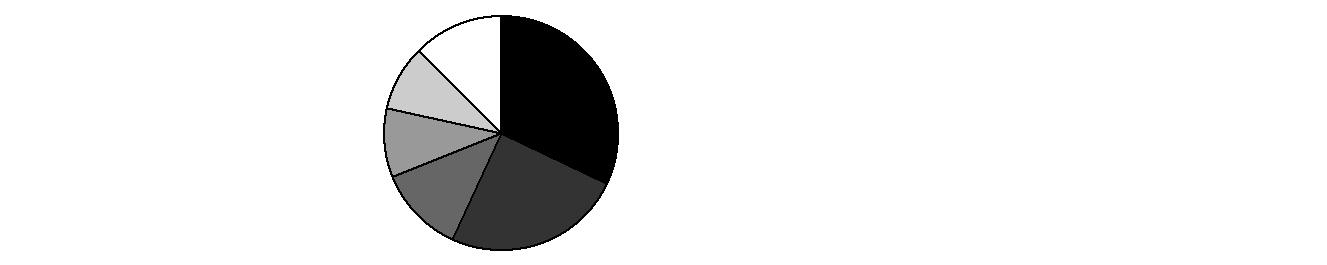

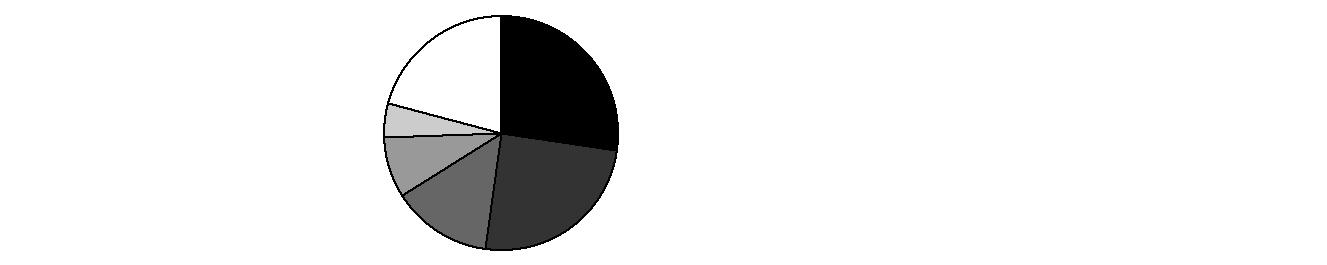

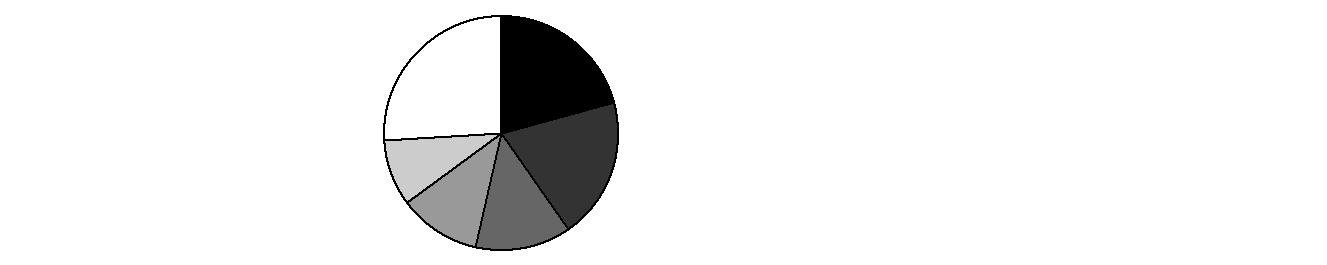

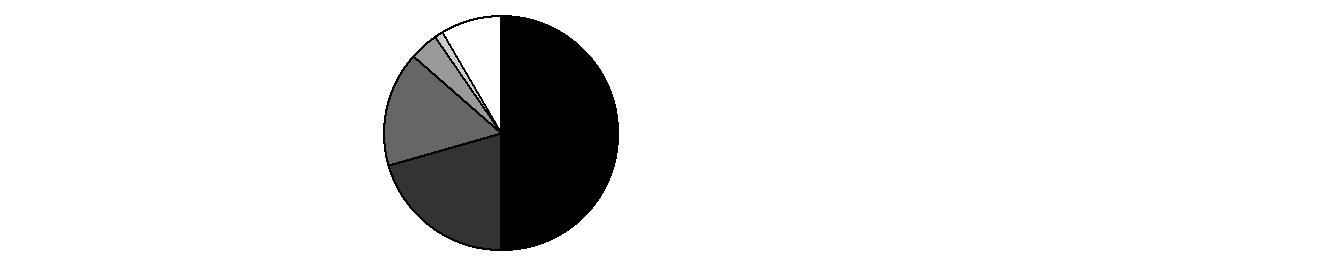

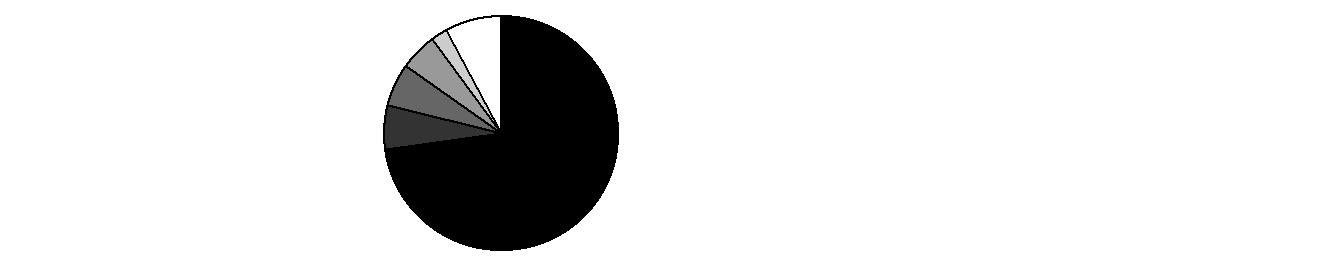

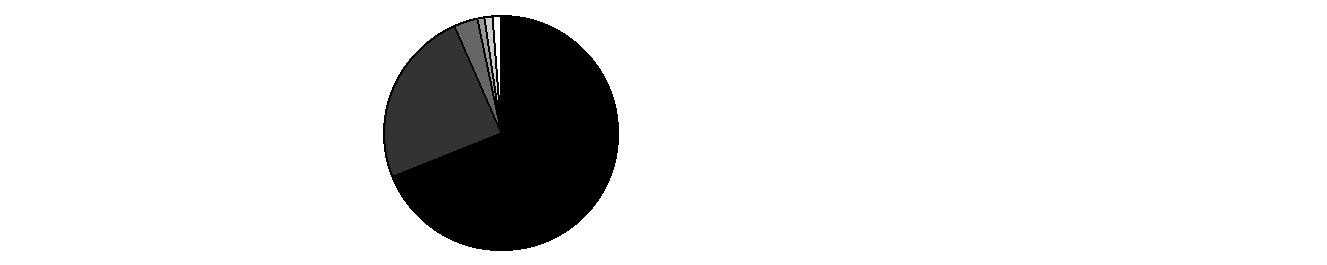

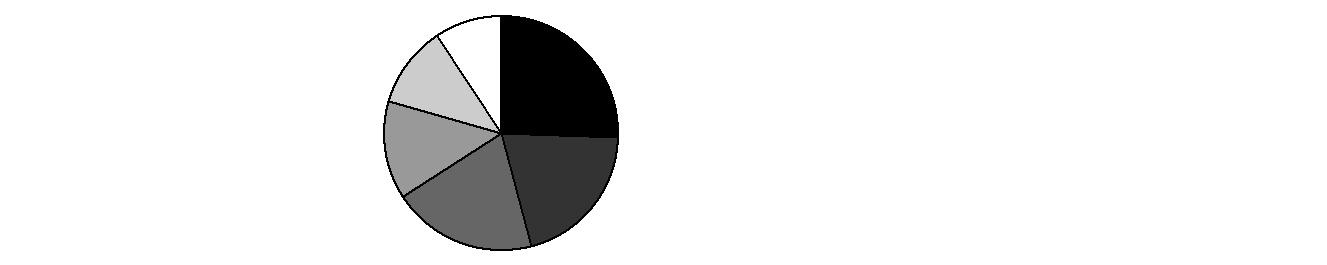

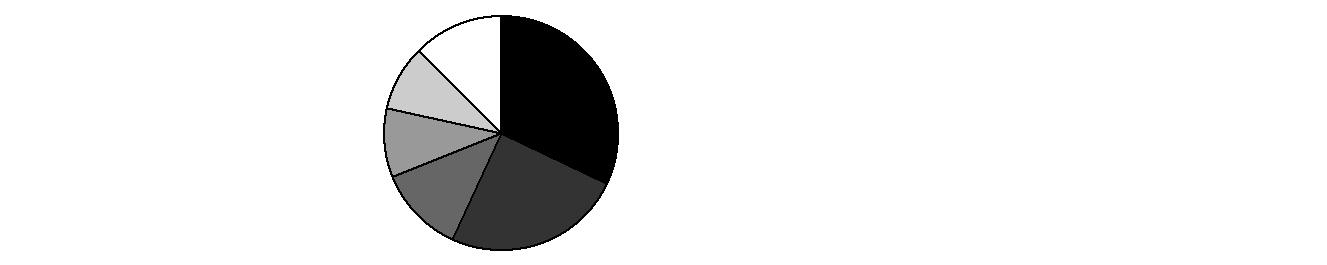

As of July 31, 2007 |

| Communications Equipment | 79.6% | |

| Software | 6.9% | |

| Semiconductors & Semiconductor Equipment | 6.2% | |

| Computers & Peripherals | 1.6% | |

| Household Durables | 1.5% | |

| All Others* | 4.2% | |

* Includes short-term investments and net other assets. |

Communications Equipment

Advisor Communications Equipment Fund

Investments January 31, 2008 (Unaudited)

Showing Percentage of Net Assets

Common Stocks - 93.8% |

| Shares | | Value |

COMMUNICATIONS EQUIPMENT - 72.7% |

Communications Equipment - 72.7% |

Acme Packet, Inc. (a) | 100 | | $ 962 |

ADC Telecommunications, Inc. (a) | 12,200 | | 180,438 |

Adtran, Inc. | 3,083 | | 64,157 |

ADVA AG Optical Networking (a) | 7,013 | | 24,062 |

Airvana, Inc. | 6,808 | | 35,606 |

Aruba Networks, Inc. | 100 | | 946 |

AudioCodes Ltd. (a) | 20,500 | | 96,145 |

Avanex Corp. (a) | 11,600 | | 11,020 |

Ceragon Networks Ltd. (a) | 100 | | 909 |

Cisco Systems, Inc. (a) | 47,669 | | 1,167,889 |

Comtech Group, Inc. (a) | 15,601 | | 167,867 |

Comverse Technology, Inc. (a) | 31,906 | | 521,663 |

Corning, Inc. | 20,600 | | 495,842 |

F5 Networks, Inc. (a) | 9,300 | | 218,829 |

Finisar Corp. (a) | 2,800 | | 4,480 |

Foundry Networks, Inc. (a) | 5,400 | | 74,520 |

Foxconn International Holdings Ltd. (a) | 2,000 | | 3,299 |

Harris Stratex Networks, Inc. Class A (a) | 15,495 | | 168,741 |

Infinera Corp. | 1,300 | | 13,247 |

Ixia (a) | 2,963 | | 21,926 |

Juniper Networks, Inc. (a) | 11,450 | | 310,868 |

Opnext, Inc. | 500 | | 2,580 |

Orckit Communications Ltd. (a) | 3,800 | | 28,500 |

Powerwave Technologies, Inc. (a) | 69,500 | | 264,100 |

QUALCOMM, Inc. | 11,800 | | 500,556 |

Research In Motion Ltd. (a) | 8,120 | | 762,306 |

Riverbed Technology, Inc. (a) | 2,300 | | 51,405 |

Sonus Networks, Inc. (a) | 34,204 | | 139,894 |

Starent Networks Corp. | 11,000 | | 135,960 |

Symmetricom, Inc. (a) | 8,145 | | 35,594 |

| | 5,504,311 |

COMPUTERS & PERIPHERALS - 5.1% |

Computer Hardware - 4.9% |

Compal Electronics, Inc. | 5,698 | | 4,905 |

Concurrent Computer Corp. (a) | 11,340 | | 9,526 |

High Tech Computer Corp. | 19,000 | | 358,183 |

NEC Corp. sponsored ADR | 90 | | 369 |

| | 372,983 |

Computer Storage & Peripherals - 0.2% |

SanDisk Corp. (a) | 610 | | 15,525 |

TOTAL COMPUTERS & PERIPHERALS | | 388,508 |

ELECTRONIC EQUIPMENT & INSTRUMENTS - 1.2% |

Electronic Equipment & Instruments - 1.0% |

Chi Mei Optoelectronics Corp. | 8,227 | | 9,699 |

|

| Shares | | Value |

HannStar Display Corp. (a) | 48,024 | | $ 18,040 |

Nippon Electric Glass Co. Ltd. | 3,000 | | 44,889 |

| | 72,628 |

Electronic Manufacturing Services - 0.2% |

Trimble Navigation Ltd. (a) | 600 | | 15,870 |

TOTAL ELECTRONIC EQUIPMENT & INSTRUMENTS | | 88,498 |

HOUSEHOLD DURABLES - 2.4% |

Consumer Electronics - 2.4% |

Tele Atlas NV (a) | 4,700 | | 185,227 |

INTERNET SOFTWARE & SERVICES - 0.4% |

Internet Software & Services - 0.4% |

RADVision Ltd. (a) | 3,050 | | 30,653 |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 5.9% |

Semiconductor Equipment - 0.8% |

EMCORE Corp. (a) | 4,600 | | 62,882 |

Semiconductors - 5.1% |

Actel Corp. (a) | 451 | | 5,371 |

AMIS Holdings, Inc. (a) | 5,900 | | 43,129 |

Applied Micro Circuits Corp. (a) | 2,758 | | 22,147 |

Broadcom Corp. Class A (a) | 1,300 | | 28,704 |

Conexant Systems, Inc. (a) | 12,800 | | 8,832 |

Cree, Inc. (a) | 1,100 | | 32,505 |

CSR PLC (a) | 2,000 | | 21,226 |

Exar Corp. (a) | 143 | | 1,174 |

Hittite Microwave Corp. (a) | 600 | | 23,892 |

Marvell Technology Group Ltd. (a) | 5,900 | | 70,033 |

Microsemi Corp. (a) | 449 | | 10,201 |

Mindspeed Technologies, Inc. (a) | 12,509 | | 10,220 |

MIPS Technologies, Inc. (a) | 1,398 | | 6,221 |

Pericom Semiconductor Corp. (a) | 1,700 | | 23,052 |

Pixelplus Co. Ltd. sponsored ADR (a) | 3,600 | | 2,160 |

PLX Technology, Inc. (a) | 1,400 | | 9,828 |

PMC-Sierra, Inc. (a) | 3,100 | | 14,539 |

Silicon Motion Technology Corp. sponsored ADR (a) | 1,800 | | 27,720 |

Silicon Storage Technology, Inc. (a) | 1,200 | | 3,408 |

Soitec SA (a) | 2,100 | | 18,530 |

Transmeta Corp. (a) | 290 | | 3,903 |

| | 386,795 |

TOTAL SEMICONDUCTORS & SEMICONDUCTOR

EQUIPMENT | | 449,677 |

SOFTWARE - 6.1% |

Application Software - 2.3% |

Smith Micro Software, Inc. (a) | 6,700 | | 50,451 |

Taleo Corp. Class A (a) | 100 | | 2,113 |

Ulticom, Inc. (a) | 17,598 | | 125,826 |

| | 178,390 |

Common Stocks - continued |

| Shares | | Value |

SOFTWARE - CONTINUED |

Home Entertainment Software - 1.0% |

Ubisoft Entertainment SA (a) | 800 | | $ 72,722 |

Systems Software - 2.8% |

Allot Communications Ltd. (a) | 300 | | 1,191 |

Sandvine Corp. (U.K.) (a) | 56,400 | | 207,839 |

| | 209,030 |

TOTAL SOFTWARE | | 460,142 |

TOTAL COMMON STOCKS (Cost $8,040,016) | 7,107,016 |

Convertible Bonds - 0.2% |

| Principal Amount | | |

COMMUNICATIONS EQUIPMENT - 0.2% |

Communications Equipment - 0.2% |

Ciena Corp. 0.25% 5/1/13

(Cost $20,000) | $ 20,000 | | 17,888 |

Money Market Funds - 6.4% |

| Shares | | |

Fidelity Cash Central Fund, 3.79% (b)

(Cost $481,822) | 481,822 | | 481,822 |

TOTAL INVESTMENT PORTFOLIO - 100.4% (Cost $8,541,838) | | 7,606,726 |

NET OTHER ASSETS - (0.4)% | | (31,948) |

NET ASSETS - 100% | $ 7,574,778 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 3,719 |

Other Information |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: |

United States of America | 73.7% |

Canada | 12.9% |

Taiwan | 5.6% |

Netherlands | 2.4% |

Israel | 2.1% |

France | 1.2% |

Others (individually less than 1%) | 2.1% |

| 100.0% |

Income Tax Information |

The fund intends to elect to defer to its fiscal year ending July 31, 2008 approximately $221,739 of losses recognized during the period November 1, 2006 to July 31, 2007. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Advisor Communications Equipment Fund

Financial Statements

Statement of Assets and Liabilities

| January 31, 2008 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $8,060,016) | $ 7,124,904 | |

Fidelity Central Funds (cost $481,822) | 481,822 | |

Total Investments (cost $8,541,838) | | $ 7,606,726 |

Receivable for investments sold | | 27,415 |

Dividends receivable | | 190 |

Interest receivable | | 12 |

Distributions receivable from Fidelity Central Funds | | 352 |

Prepaid expenses | | 32 |

Receivable from investment adviser for expense reductions | | 3,262 |

Other receivables | | 219 |

Total assets | | 7,638,208 |

| | |

Liabilities | | |

Payable for fund shares redeemed | $ 29,334 | |

Accrued management fee | 3,619 | |

Distribution fees payable | 3,964 | |

Other affiliated payables | 2,546 | |

Other payables and accrued expenses | 23,967 | |

Total liabilities | | 63,430 |

| | |

Net Assets | | $ 7,574,778 |

Net Assets consist of: | | |

Paid in capital | | $ 8,938,953 |

Accumulated net investment loss | | (73,133) |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (355,930) |

Net unrealized appreciation (depreciation) on investments | | (935,112) |

Net Assets | | $ 7,574,778 |

Statement of Assets and Liabilities - continued

| January 31, 2008 (Unaudited) |

| | |

Calculation of Maximum Offering Price Class A:

Net Asset Value and redemption price per share ($2,139,712 ÷ 268,285 shares) | | $ 7.98 |

| | |

Maximum offering price per share (100/94.25 of $7.98) | | $ 8.47 |

Class T:

Net Asset Value and redemption price per share ($2,183,189 ÷ 278,588 shares) | | $ 7.84 |

| | |

Maximum offering price per share (100/96.50 of $7.84) | | $ 8.12 |

Class B:

Net Asset Value and offering price per share ($1,669,961 ÷ 220,930 shares) A | | $ 7.56 |

| | |

Class C:

Net Asset Value and offering price per share ($1,314,984 ÷ 174,040 shares)A | | $ 7.56 |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($266,932 ÷ 32,862 shares) | | $ 8.12 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Communications Equipment

Statement of Operations

| Six months ended January 31, 2008 (Unaudited) |

| | |

Investment Income | | |

Dividends | | $ 10,279 |

Interest | | 81 |

Income from Fidelity Central Funds | | 3,719 |

Total income | | 14,079 |

| | |

Expenses | | |

Management fee | $ 27,592 | |

Transfer agent fees | 17,923 | |

Distribution fees | 30,052 | |

Accounting fees and expenses | 1,928 | |

Custodian fees and expenses | 1,286 | |

Independent trustees' compensation | 21 | |

Registration fees | 37,741 | |

Audit | 22,979 | |

Legal | 36 | |

Miscellaneous | 43 | |

Total expenses before reductions | 139,601 | |

Expense reductions | (52,389) | 87,212 |

Net investment income (loss) | | (73,133) |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | (15,903) | |

Foreign currency transactions | (38) | |

Total net realized gain (loss) | | (15,941) |

Change in net unrealized appreciation (depreciation) on investment securities | | (1,282,930) |

Net gain (loss) | | (1,298,871) |

Net increase (decrease) in net assets resulting from operations | | $ (1,372,004) |

Statement of Changes in Net Assets

| Six months ended

January 31, 2008

(Unaudited) | Year ended

July 31,

2007 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ (73,133) | $ (146,568) |

Net realized gain (loss) | (15,941) | 337,365 |

Change in net unrealized appreciation (depreciation) | (1,282,930) | 2,613,997 |

Net increase (decrease) in net assets resulting from operations | (1,372,004) | 2,804,794 |

Distributions to shareholders from net realized gain | (150,546) | - |

Share transactions - net increase (decrease) | (1,292,974) | (3,045,289) |

Redemption fees | 346 | 192 |

Total increase (decrease) in net assets | (2,815,178) | (240,303) |

| | |

Net Assets | | |

Beginning of period | 10,389,956 | 10,630,259 |

End of period (including accumulated net investment loss of $73,133 and $0, respectively) | $ 7,574,778 | $ 10,389,956 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class A

| Six months ended

January 31, 2008 | Years ended July 31, |

| (Unaudited) | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.49 | $ 7.29 | $ 7.70 | $ 6.53 | $ 5.57 | $ 3.96 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | (.05) | (.09) | (.09) | (.07) | (.09) | (.04) |