UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3010

Fidelity Advisor Series VII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | July 31 |

|

|

Date of reporting period: | July 31, 2014 |

Item 1. Reports to Stockholders

Fidelity Advisor

Focus Funds®

Class A, Class T, Class B and Class C

Fidelity Advisor® Biotechnology Fund

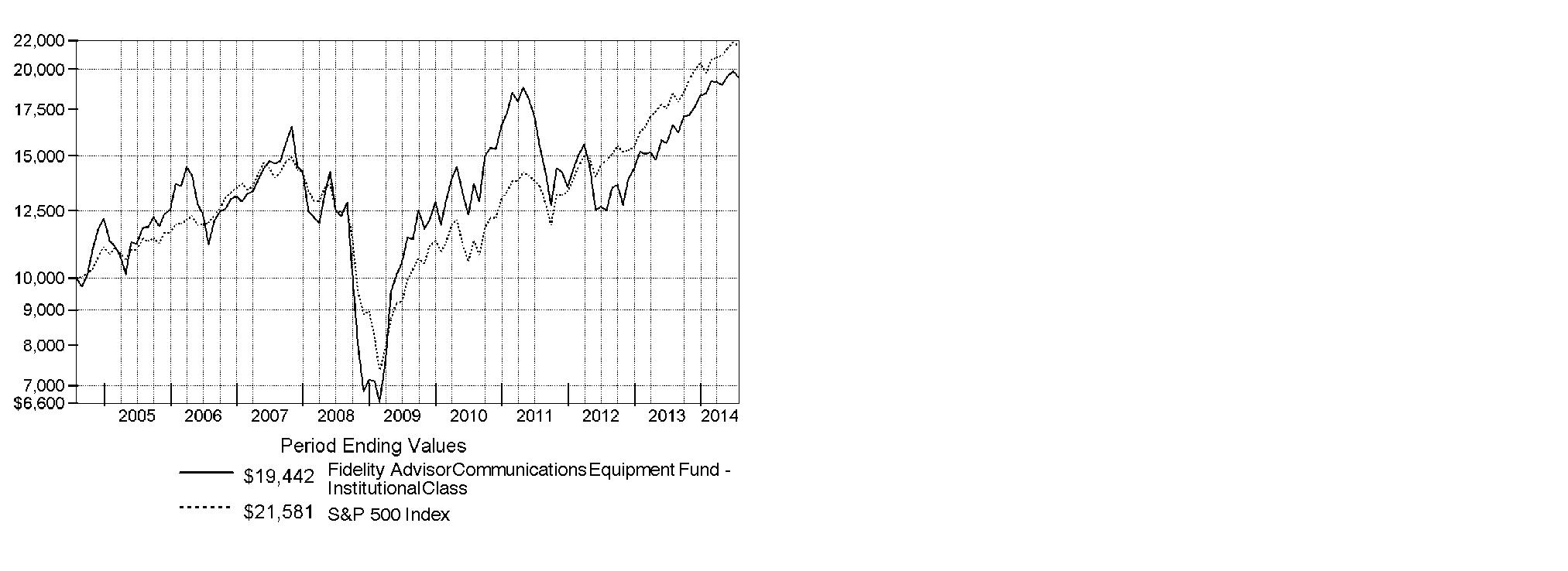

Fidelity Advisor Communications Equipment Fund

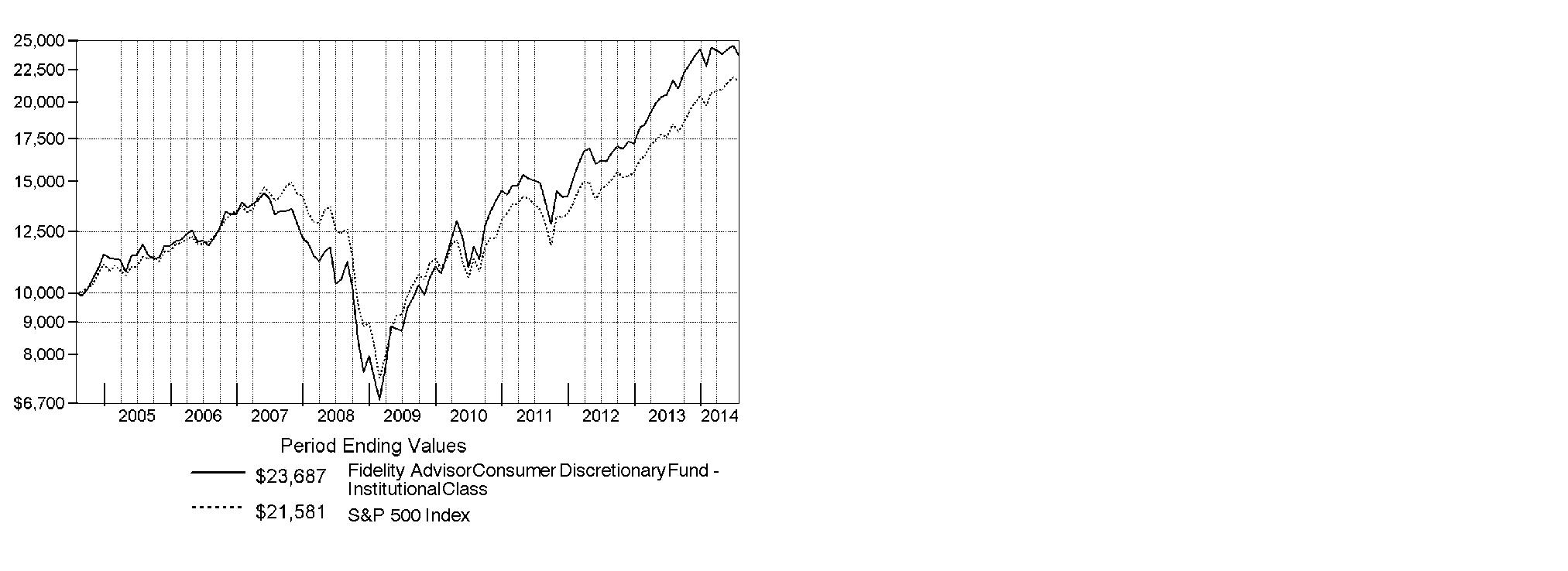

Fidelity Advisor Consumer Discretionary Fund

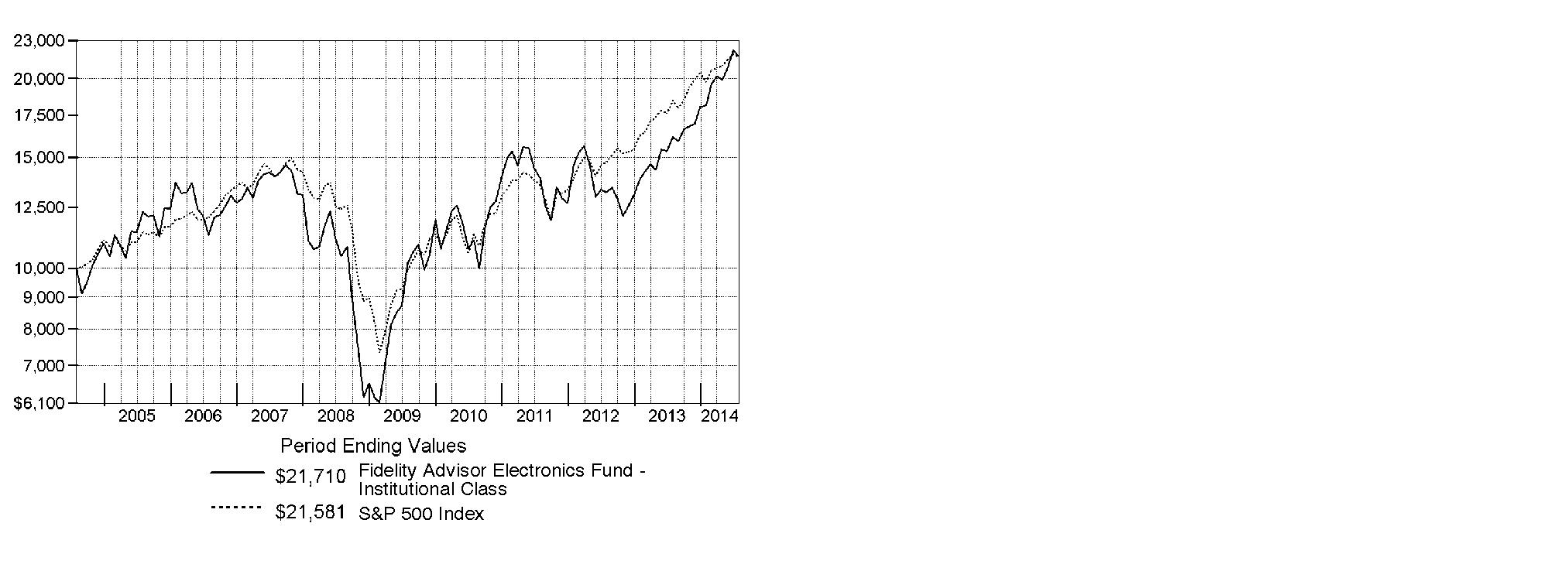

Fidelity Advisor Electronics Fund

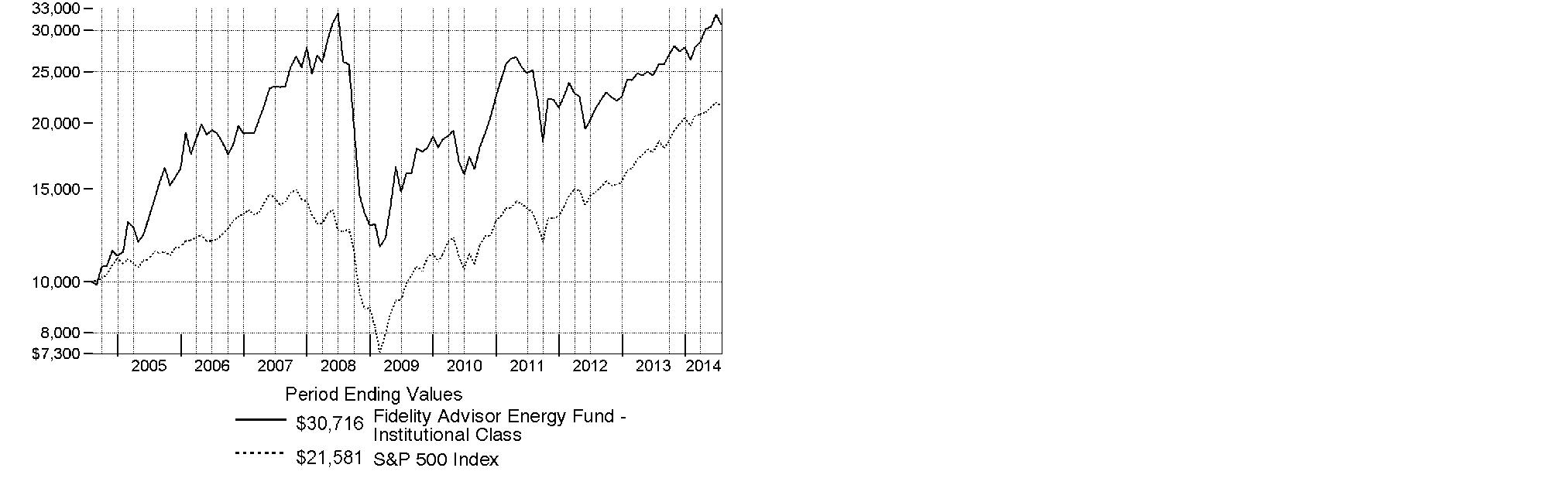

Fidelity Advisor Energy Fund

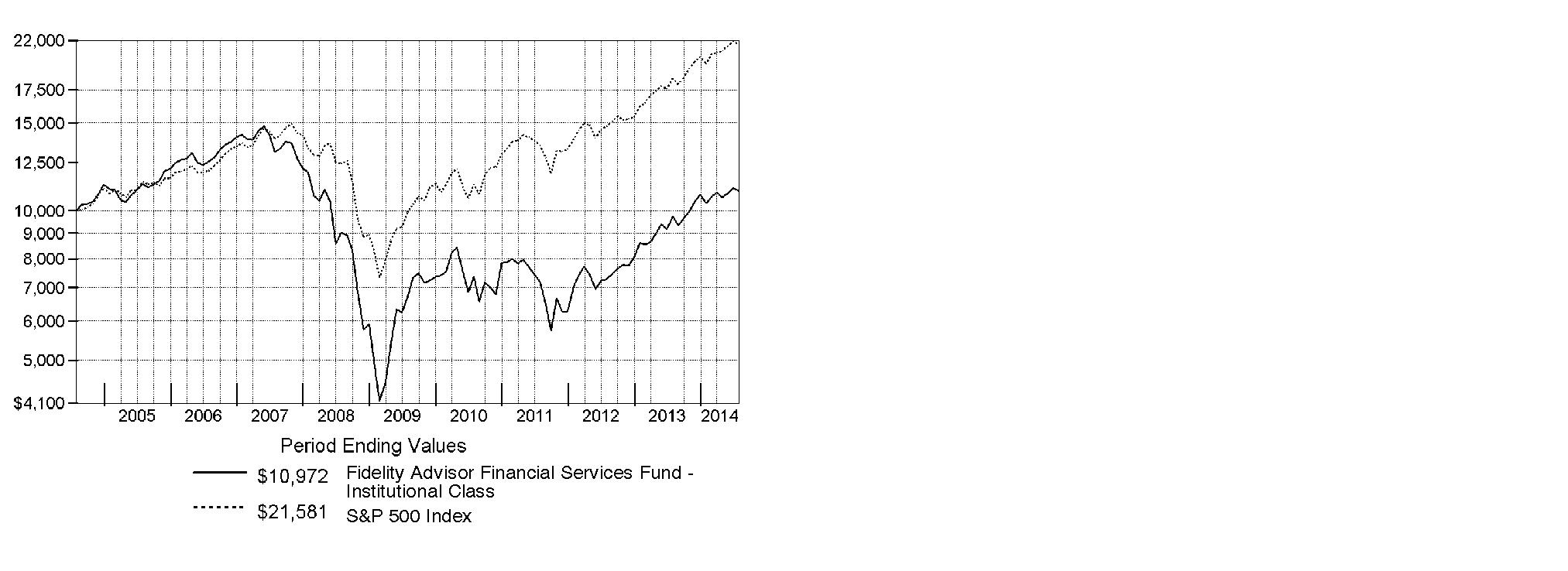

Fidelity Advisor Financial Services Fund

Fidelity Advisor Health Care Fund

Fidelity Advisor Industrials Fund

Fidelity Advisor Technology Fund

Fidelity Advisor Utilities Fund

Annual Report

July 31, 2014

(Fidelity Cover Art)

Contents

Fidelity Advisor® | Performance | |

Management's Discussion of Fund Performance | ||

| Shareholder Expense Example | |

Investment Changes | ||

| Investments | |

| Financial Statements | |

| Notes to the Financial Statements | |

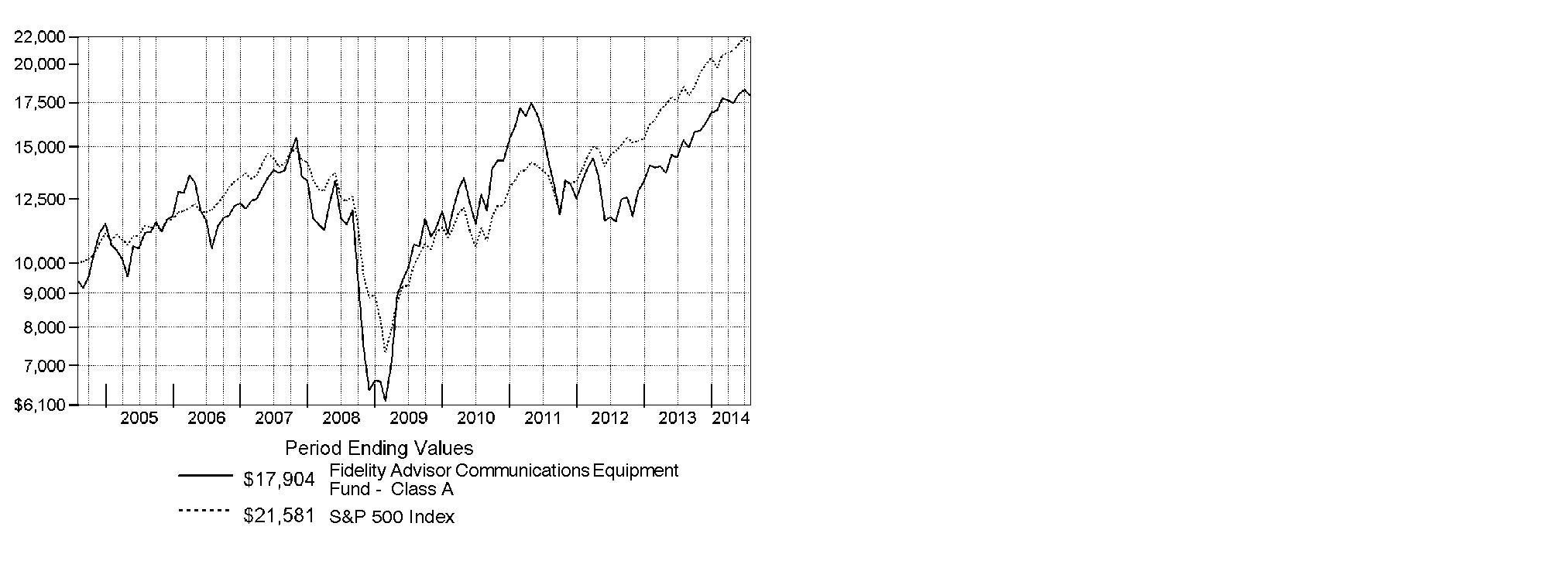

Fidelity Advisor | Performance | |

Management's Discussion of Fund Performance | ||

| Shareholder Expense Example | |

Investment Changes | ||

| Investments | |

| Financial Statements | |

| Notes to the Financial Statements | |

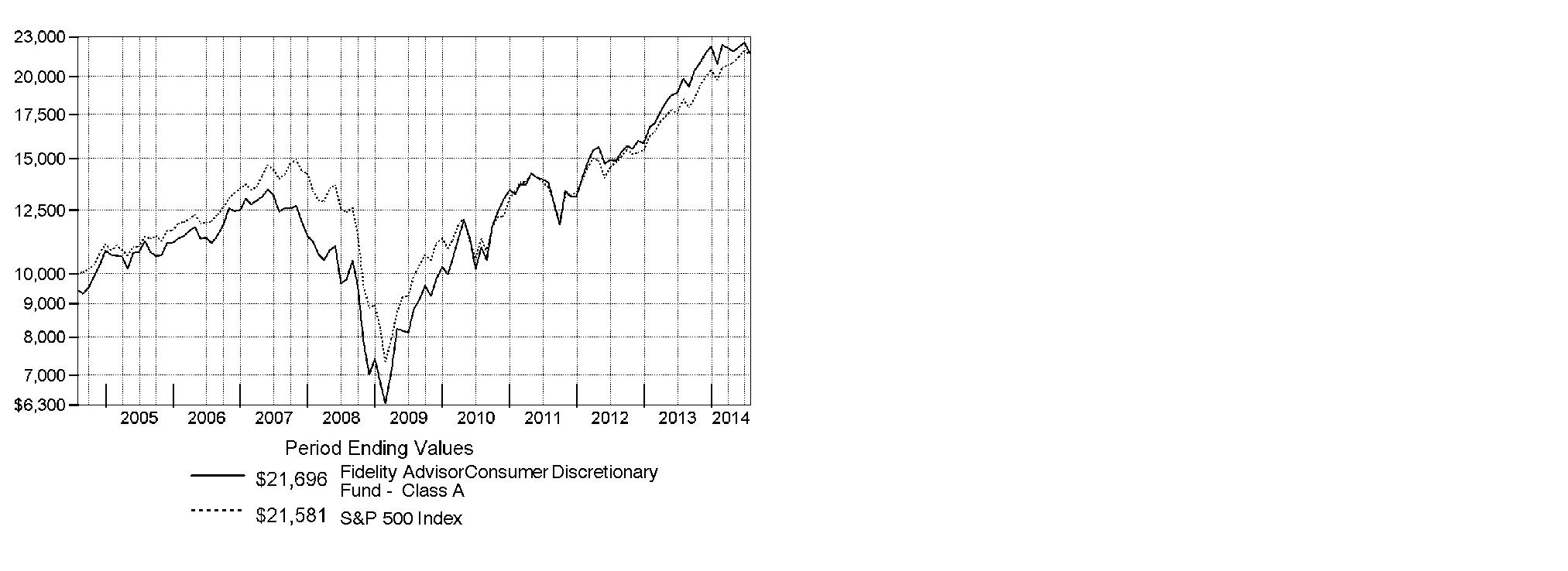

Fidelity Advisor | Performance | |

Management's Discussion of Fund Performance | ||

| Shareholder Expense Example | |

Investment Changes | ||

| Investments | |

| Financial Statements | |

| Notes to the Financial Statements | |

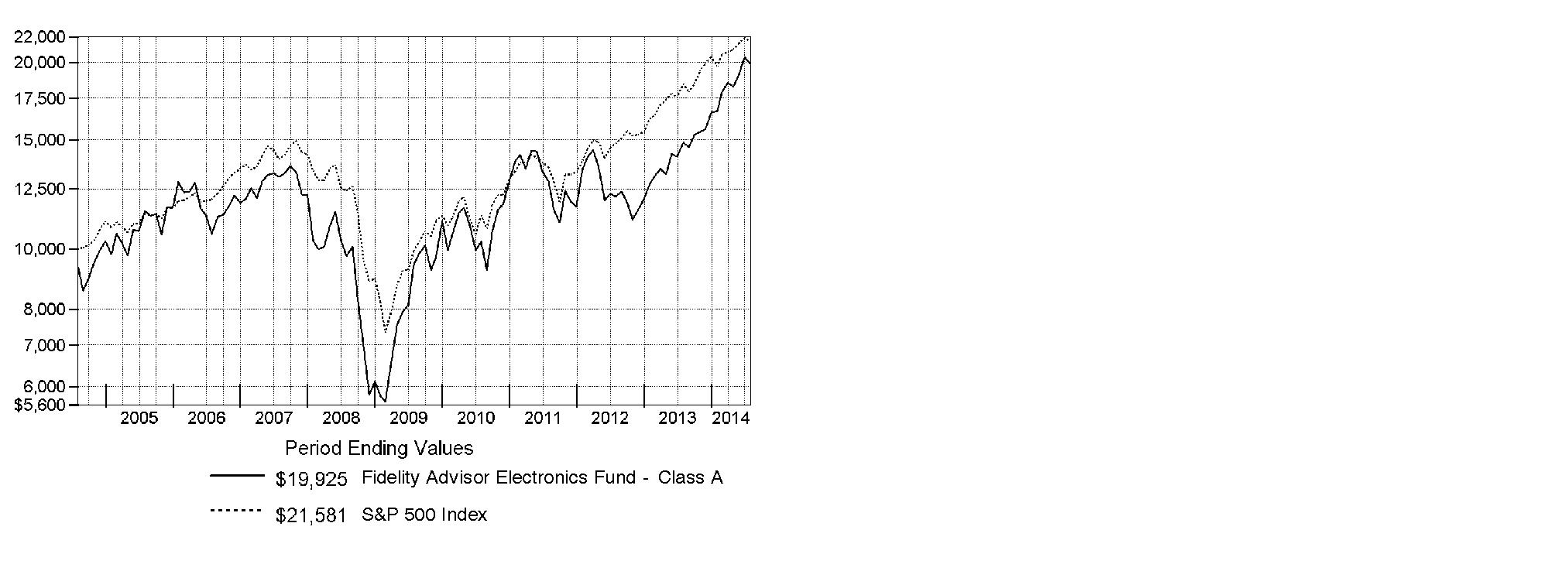

Fidelity Advisor Electronics Fund | Performance | |

| Management's Discussion of Fund Performance | |

| Shareholder Expense Example | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

| Notes to the Financial Statements | |

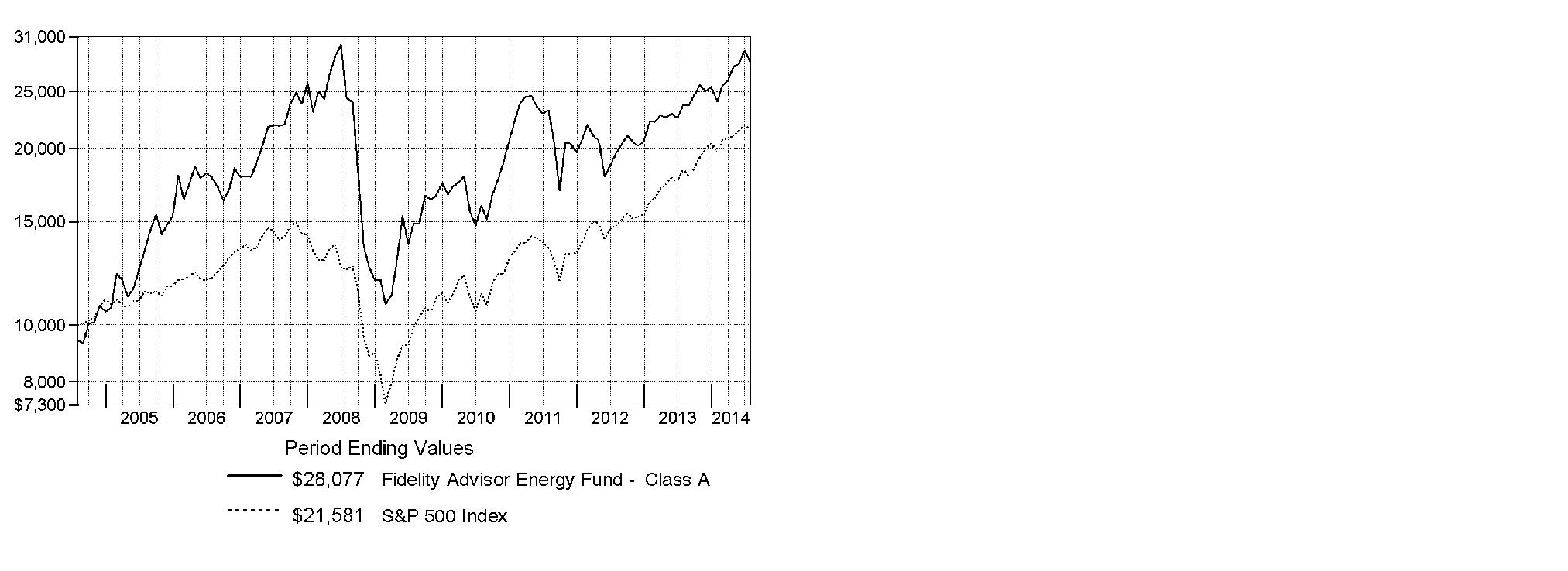

Fidelity Advisor Energy Fund | Performance | |

| Management's Discussion of Fund Performance | |

| Shareholder Expense Example | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

| Notes to the Financial Statements | |

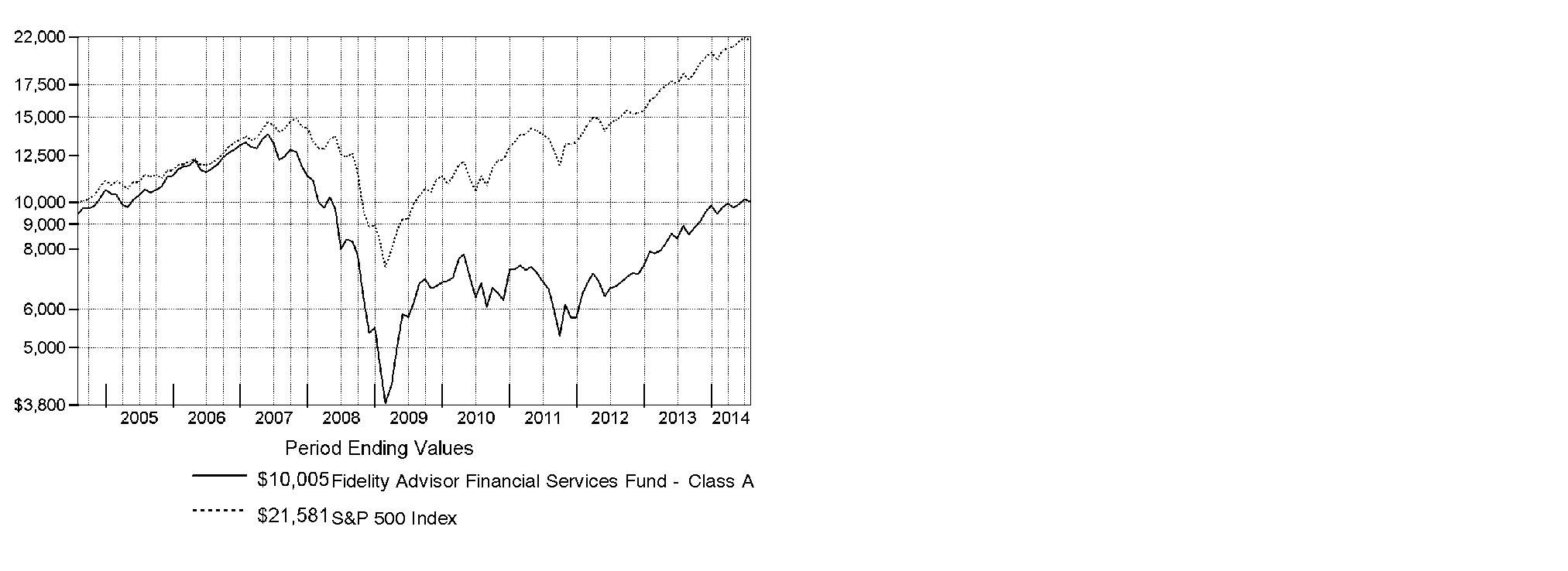

Fidelity Advisor Financial | Performance | |

Management's Discussion of Fund Performance | ||

| Shareholder Expense Example | |

Investment Changes | ||

| Investments | |

| Financial Statements | |

| Notes to the Financial Statements | |

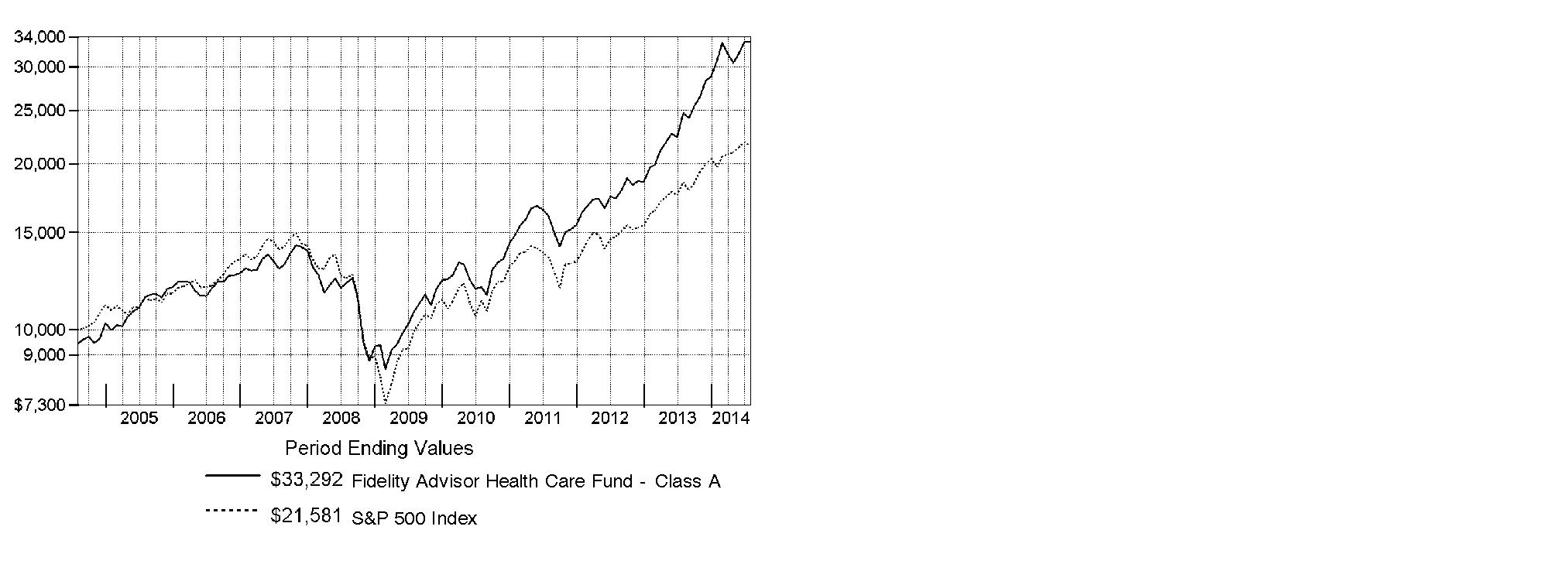

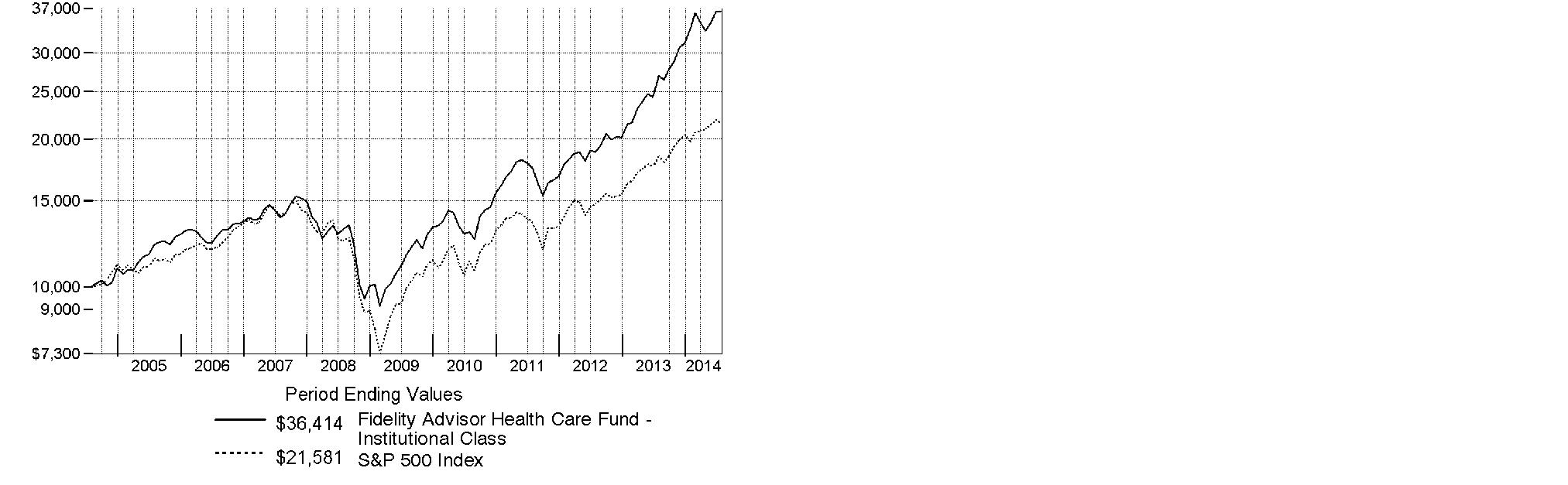

Fidelity Advisor Health Care Fund | Performance | |

| Management's Discussion of Fund Performance | |

| Shareholder Expense Example | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

| Notes to the Financial Statements | |

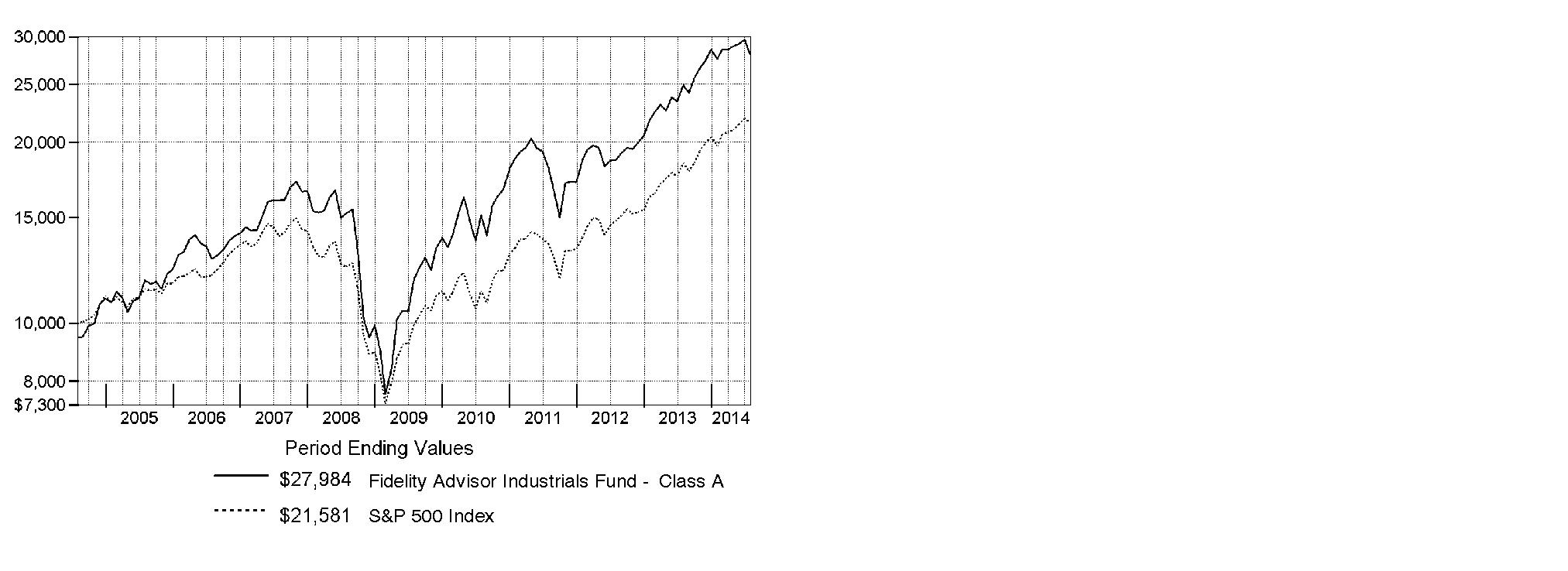

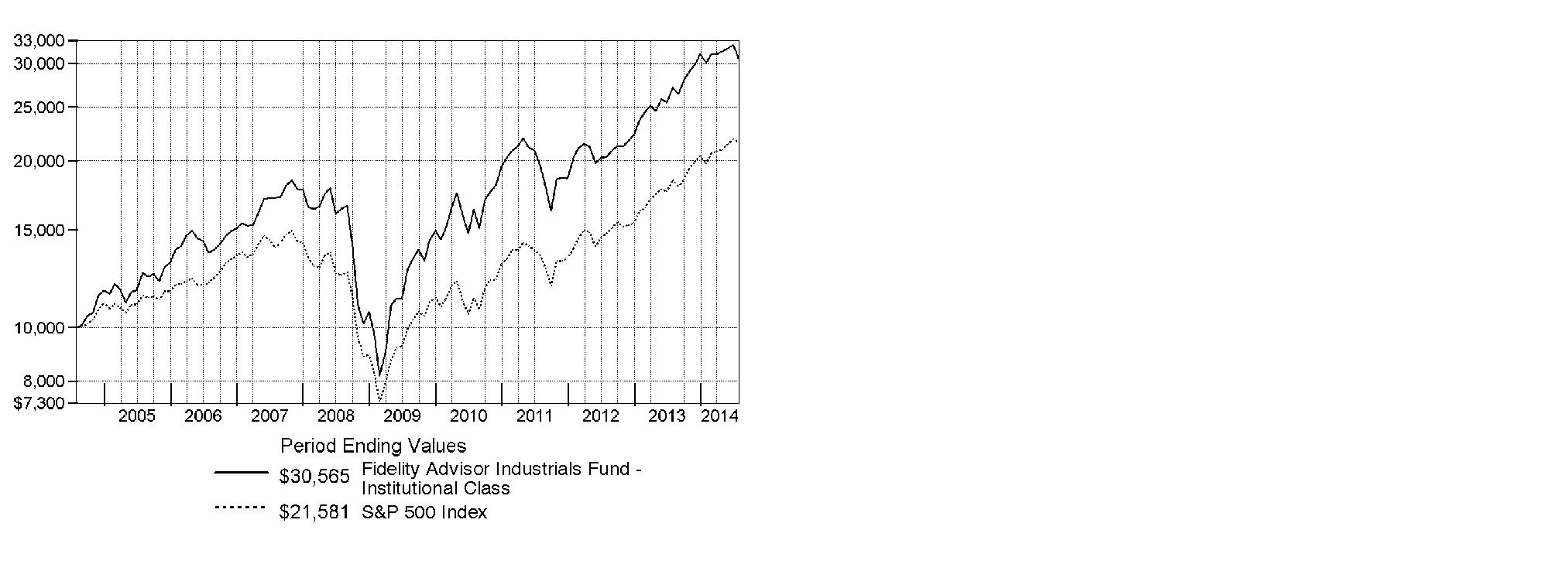

Fidelity Advisor Industrials Fund | Performance | |

| Management's Discussion of Fund Performance | |

| Shareholder Expense Example | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

| Notes to the Financial Statements | |

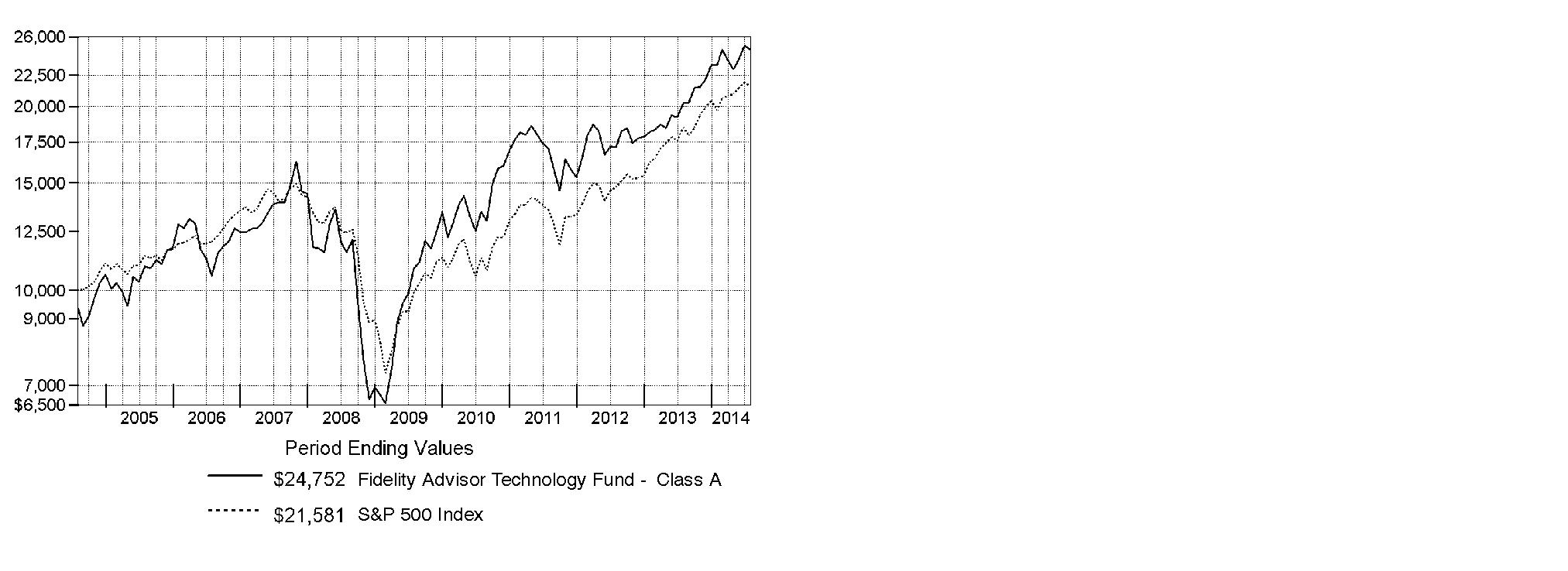

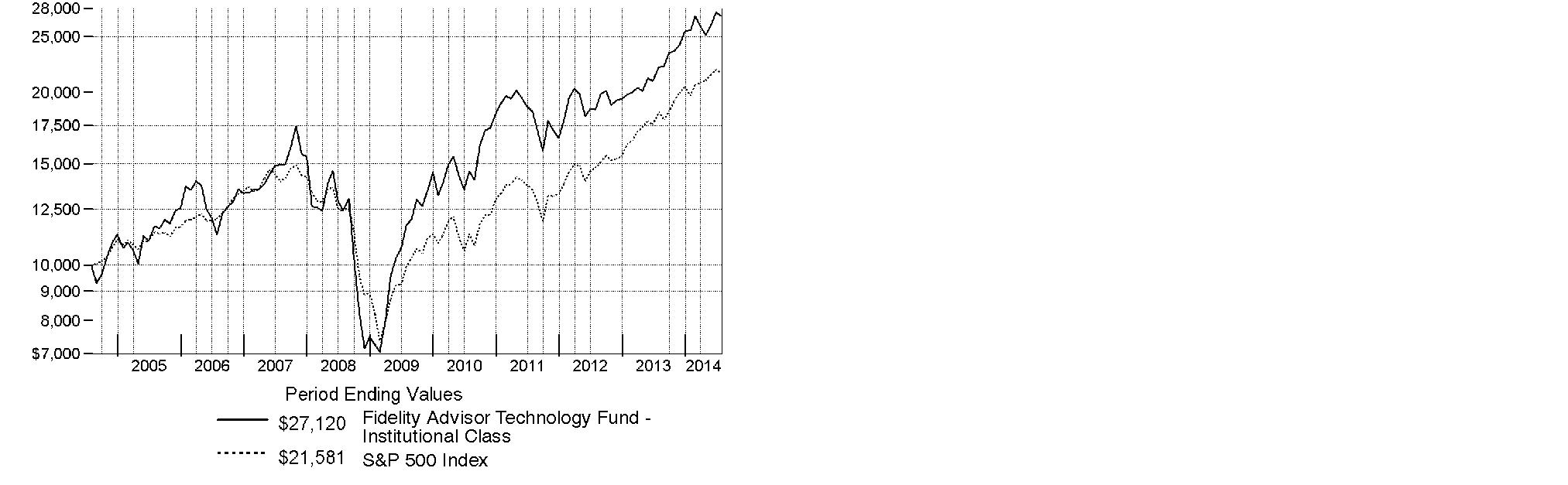

Fidelity Advisor Technology Fund | Performance | |

| Management's Discussion of Fund Performance | |

| Shareholder Expense Example | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

| Notes to the Financial Statements | |

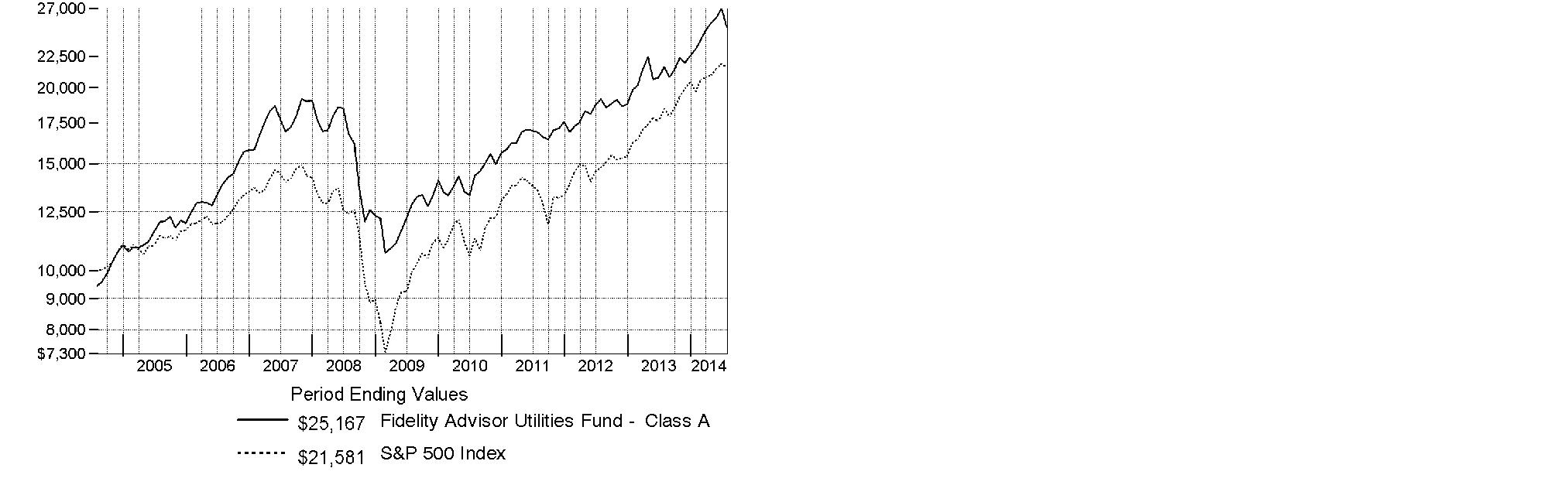

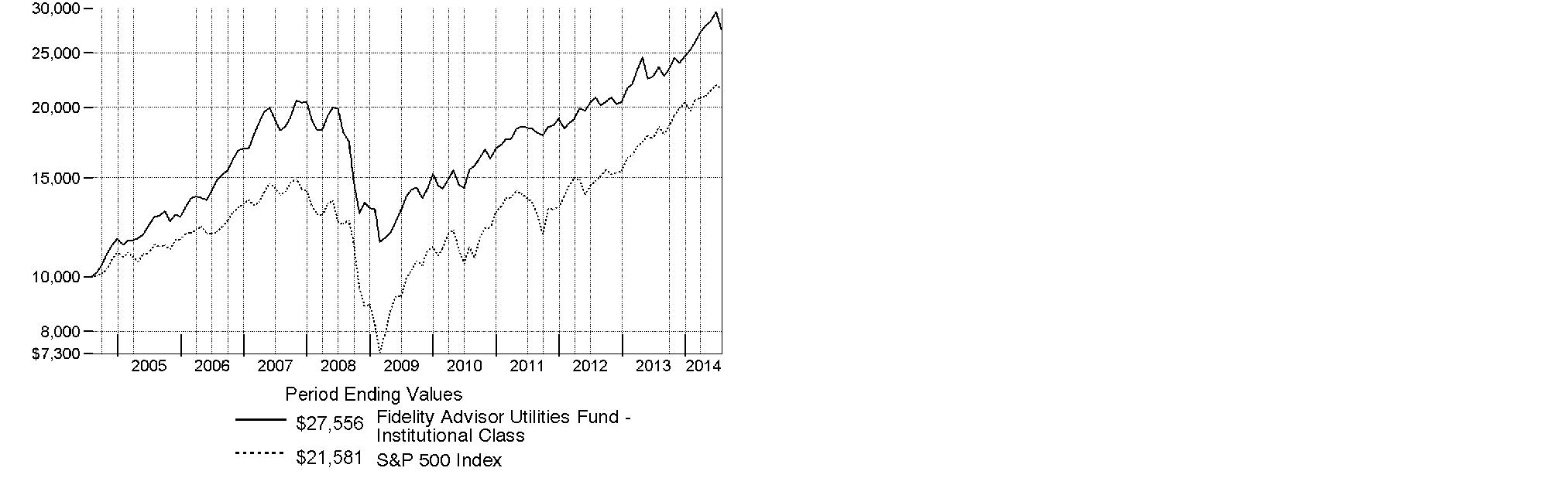

Fidelity Advisor Utilities Fund | Performance | |

| Management's Discussion of Fund Performance | |

| Shareholder Expense Example | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

| Notes to the Financial Statements | |

Report of Independent Registered Public Accounting Firm |

| |

Trustees and Officers |

| |

Distributions |

| |

Board Approval of Investment Advisory Contracts and Management Fees |

|

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2014 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Fidelity Advisor® Biotechnology Fund - Class A, T, B, and C

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow. Returns reflect the conversion of Class B shares to Class A shares after a maximum of seven years.

Average Annual Total Returns

Periods ended July 31, 2014 | Past 1 | Past 5 | Past 10 years |

Class A (incl. 5.75% sales charge) | 10.63% | 23.83% | 13.71% |

Class T (incl. 3.50% sales charge) | 12.85% | 24.04% | 13.66% |

Class B (incl. contingent deferred sales charge) A | 11.42% | 24.19% | 13.77% |

Class C (incl. contingent deferred sales charge) B | 15.54% | 24.40% | 13.53% |

A Class B shares' contingent deferred sales charges included in the past one year, past five years, and past ten years total return figures are 5%, 2%, and 0%, respectively.

B Class C shares' contingent deferred sales charges included in the past one year, past five years, and past ten years total return figures are 1%, 0%, and 0%, respectively.

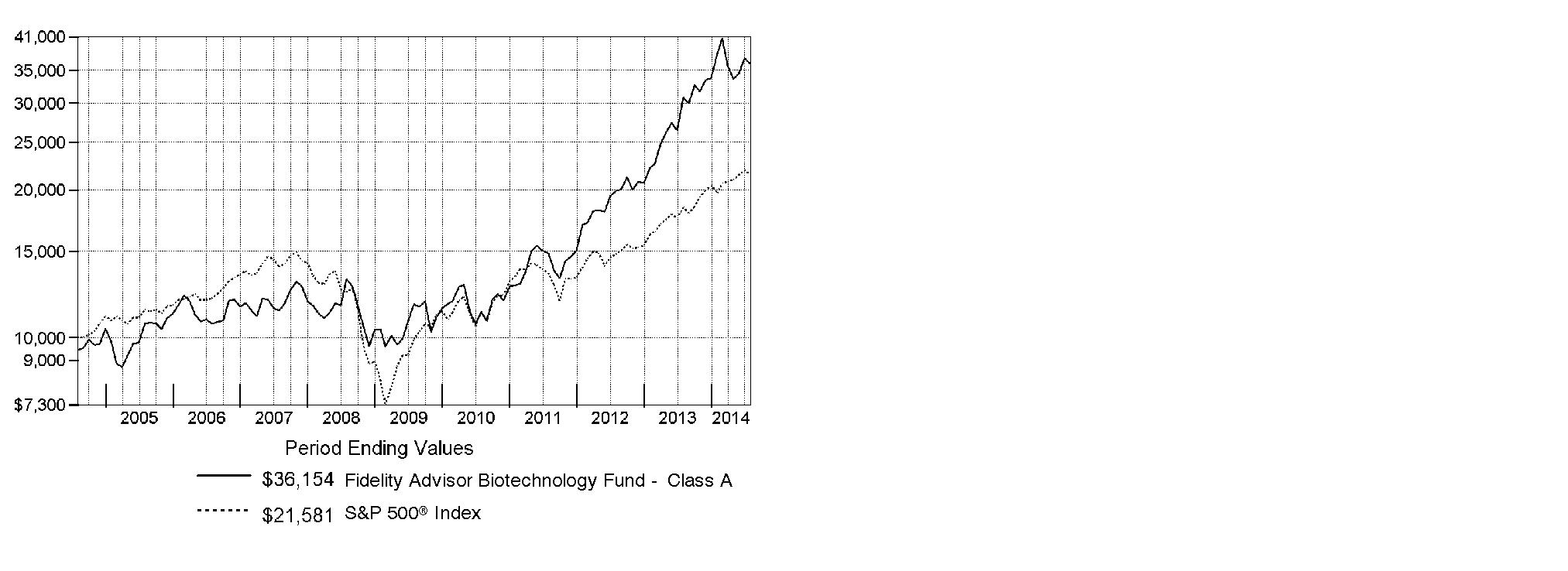

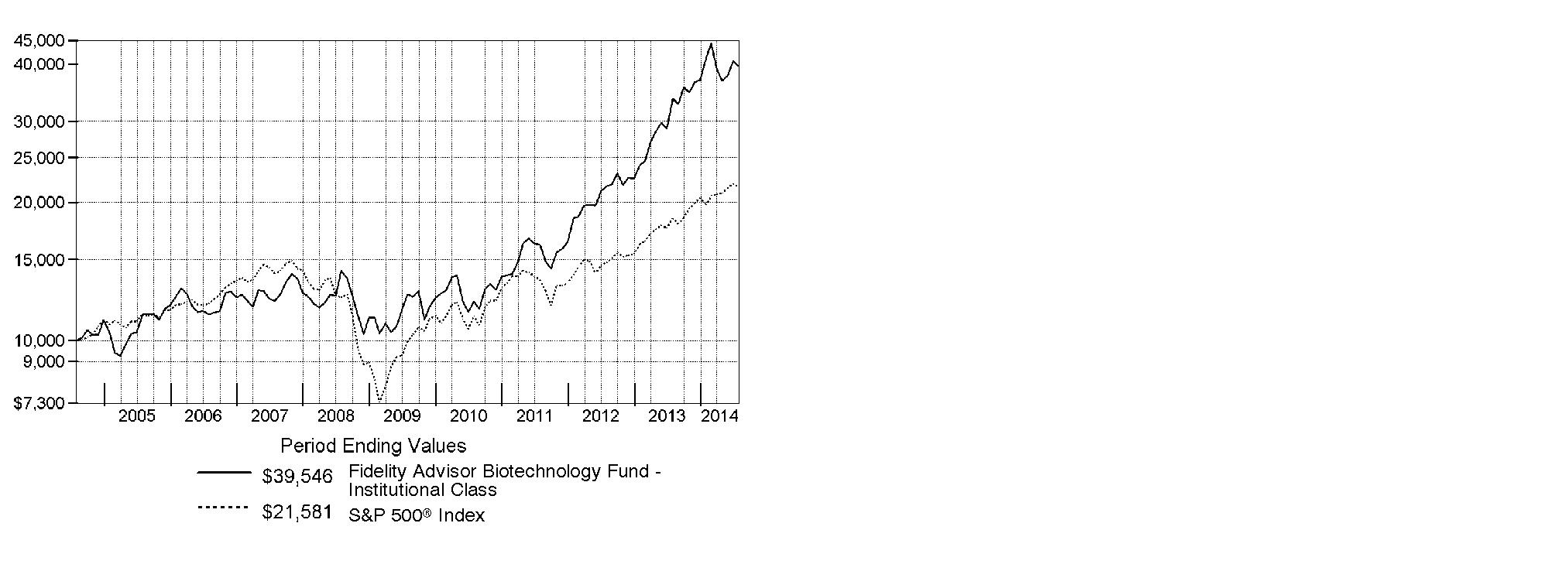

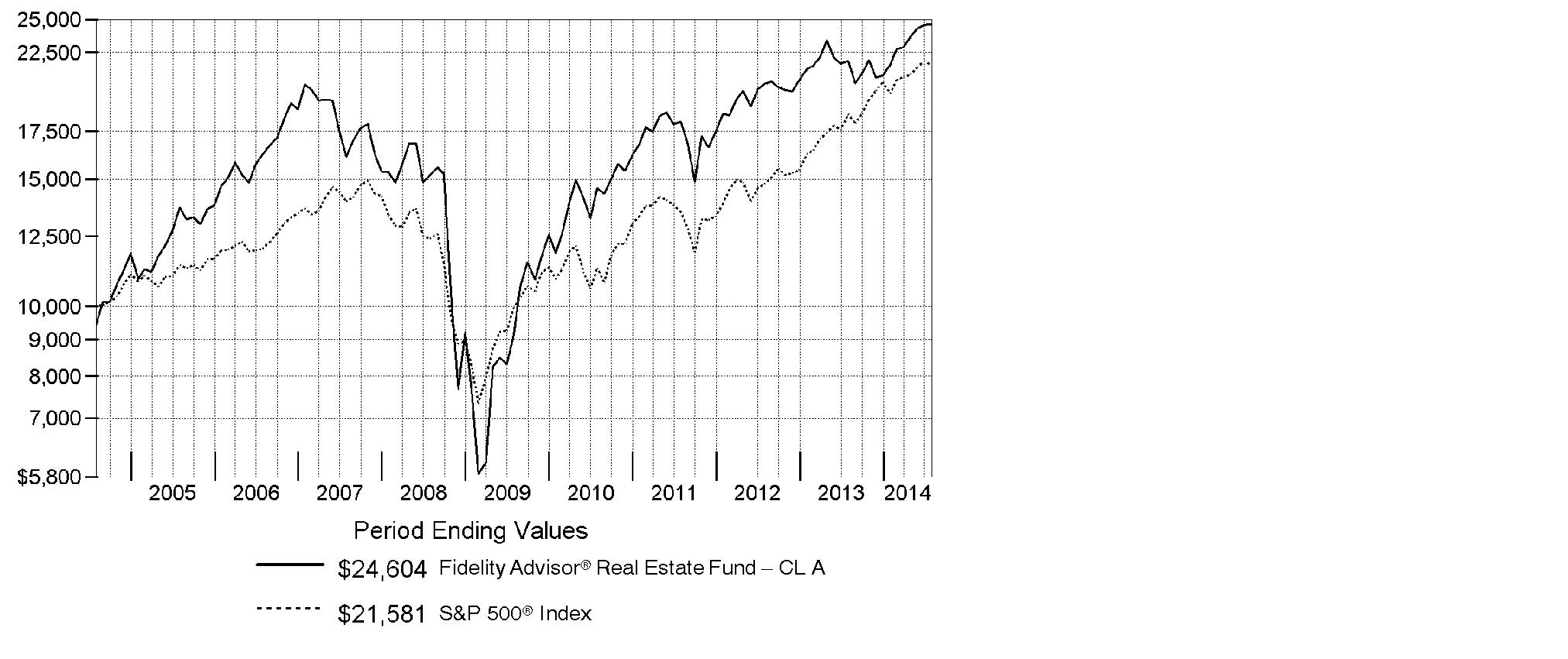

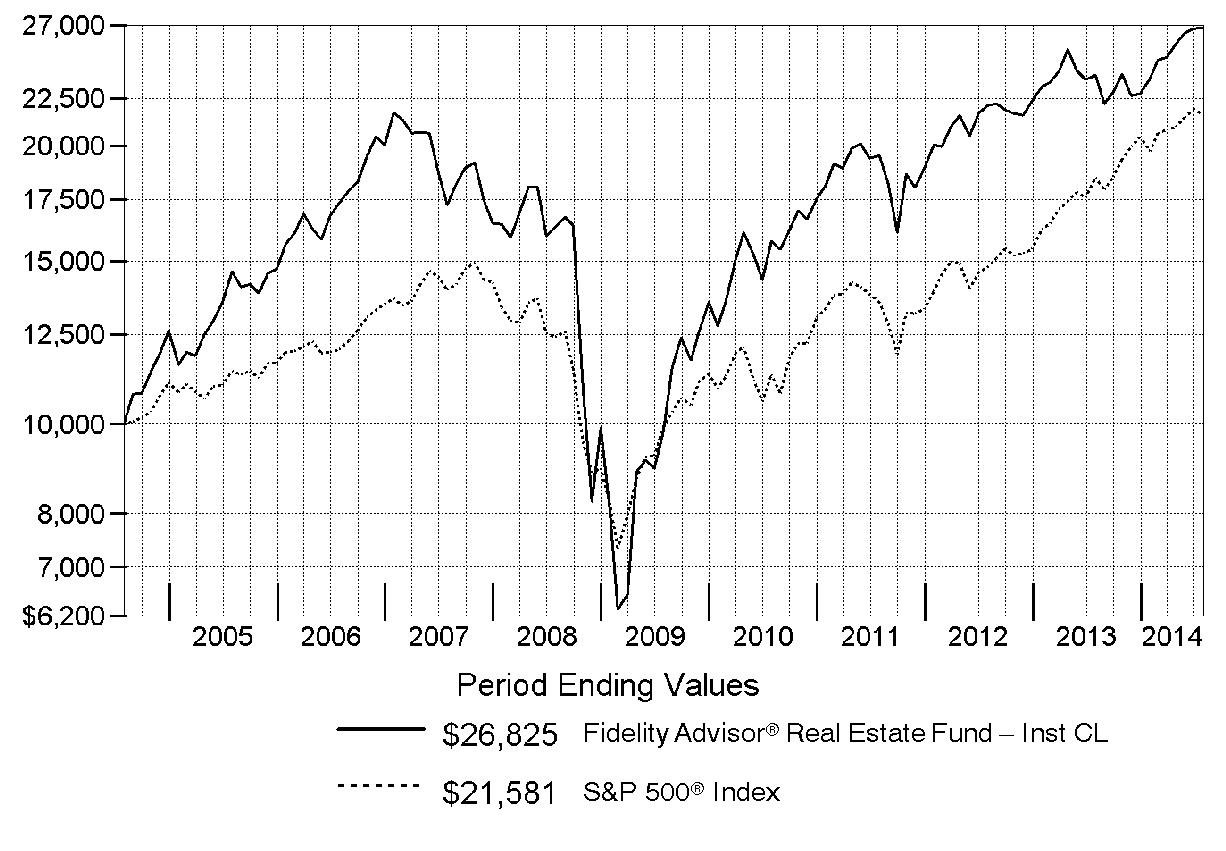

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Biotechnology Fund - Class A on July 31, 2004, and the current 5.75% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Annual Report

Fidelity Advisor Biotechnology Fund

Management's Discussion of Fund Performance

Market Recap: U.S. stocks overcame a slowing economy early in 2014 to post a strong gain for the 12-month period ending July 31, 2014, supported by corporate profits and continued low interest rates. The S&P 500® Index rose 16.94%, reaching an all-time high near period end. The technology-heavy Nasdaq Composite Index® gained 22.00%. The Russell 2000® Index returned 8.56%, reflecting the relatively lackluster performance of small-cap stocks. Information technology (+28%) was the top-performing sector within the S&P 500®, driven by strong semiconductor and computer hardware sales. Materials (+23%) gained amid higher prices for many commodity products. Health care (+21%) rose, driven by gains in pharmaceuticals, biotechnology & life sciences companies. Energy stocks (+19%) advanced in the latter part of the period amid healthy U.S. output and the threat of supply disruptions in Iraq. Conversely, most defensive sectors, including consumer staples, utilities and telecommunication services, lagged the broader market. Volatility remained tame throughout most of the period, with markets supported by declining unemployment, near-record profit margins for companies, muted cost inflation and fairly low corporate debt levels. Geopolitical tension remained a concern at period end, with conflict in Ukraine and strained relations between Russia and the West posing a potential threat to global growth.

Comments from Rajiv Kaul, Portfolio Manager of Fidelity Advisor® Biotechnology Fund: For the year, the fund's Class A, Class T, Class B and Class C shares returned 17.38%, 16.95%, 16.42% and 16.54%, respectively (excluding sales charges), lagging the 24.79% advance of the MSCI U.S. IMI Biotechnology 25-50 Index but about in line with the S&P 500®. Favorable product stories and investors' preference for companies with earnings growth that was less dependent on the broader U.S. economy spurred solid performance in biotechnology stocks. A large overweighting in Aegerion Pharmaceuticals made this stock by far the fund's biggest detractor versus the MSCI index. In November 2013, the company received a warning letter from the U.S. Food and Drug Administration about its marketing of JUXTAPID®, Aegerion's oral treatment for a rare but potentially fatal disease that causes high cholesterol. I viewed this development as only a temporary setback for the stock, so I significantly increased our stake as the shares declined. A number of other key detractors were strong-performing large-cap index components in which the fund was underweighted: Gilead Sciences, Celgene and Amgen. Gilead was easily the fund's largest holding, with an average weighting of roughly 15% of net assets, so our exposure here was significant but less than the benchmark's. In Amgen's case, I significantly reduced our stake to free up cash for investing in smaller-cap stocks that I thought were undervalued. Conversely, the top relative contributor by a wide margin was Intercept Pharmaceuticals. This stock rocketed higher in January, after the firm announced that a clinical trial of obeticholic acid, a treatment for a common fatty liver disease, was stopped early because the drug was clearly effective. Pacira Pharmaceuticals also contributed to relative performance. This stock rose fairly steadily during the period, as sales of EXPAREL®, the firm's injectable non-opioid pain reliever for post-surgical patients, steadily gained traction. Pacira was an out-of-benchmark position. I'll also mention Puma Biotechnology, which saw the value of its shares more than triple in July, after positive phase three results from testing neratinib as a treatment for women suffering from a form of early-stage breast cancer.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Fidelity Advisor Biotechnology Fund

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (February 1, 2014 to July 31, 2014).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Annualized | Beginning | Ending | Expenses Paid |

Class A | 1.07% |

|

|

|

Actual |

| $ 1,000.00 | $ 956.40 | $ 5.19 |

HypotheticalA |

| $ 1,000.00 | $ 1,019.49 | $ 5.36 |

Class T | 1.40% |

|

|

|

Actual |

| $ 1,000.00 | $ 954.70 | $ 6.79 |

HypotheticalA |

| $ 1,000.00 | $ 1,017.85 | $ 7.00 |

Class B | 1.87% |

|

|

|

Actual |

| $ 1,000.00 | $ 952.40 | $ 9.05 |

HypotheticalA |

| $ 1,000.00 | $ 1,015.52 | $ 9.35 |

Class C | 1.82% |

|

|

|

Actual |

| $ 1,000.00 | $ 952.50 | $ 8.81 |

HypotheticalA |

| $ 1,000.00 | $ 1,015.77 | $ 9.10 |

Institutional Class | .80% |

|

|

|

Actual |

| $ 1,000.00 | $ 957.80 | $ 3.88 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.83 | $ 4.01 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Annual Report

Fidelity Advisor Biotechnology Fund

Investment Changes (Unaudited)

Top Ten Stocks as of July 31, 2014 | ||

| % of fund's | % of fund's net assets |

Gilead Sciences, Inc. | 15.3 | 14.3 |

Celgene Corp. | 6.1 | 5.9 |

Vertex Pharmaceuticals, Inc. | 5.5 | 3.2 |

Biogen Idec, Inc. | 3.7 | 7.7 |

Amgen, Inc. | 3.4 | 9.2 |

Alexion Pharmaceuticals, Inc. | 3.4 | 4.5 |

Regeneron Pharmaceuticals, Inc. | 3.3 | 3.2 |

Puma Biotechnology, Inc. | 3.0 | 1.4 |

Intercept Pharmaceuticals, Inc. | 2.6 | 3.6 |

InterMune, Inc. | 2.3 | 0.5 |

| 48.6 | |

Top Industries (% of fund's net assets) | |||

As of July 31, 2014 | |||

| Biotechnology | 94.8% |

|

| Pharmaceuticals | 5.1% |

|

| Life Sciences Tools & Services | 0.0%† |

|

| Personal Products | 0.0%† |

|

| Health Care Equipment & Supplies | 0.0%† |

|

| All Others* | 0.1% |

|

As of January 31, 2014 | |||

| Biotechnology | 93.6% |

|

| Pharmaceuticals | 3.1% |

|

| Health Care Providers & Services | 0.3% |

|

| Life Sciences Tools & Services | 0.0%† |

|

| Health Care Equipment & Supplies | 0.0%† |

|

| All Others* | 3.0% |

|

* Includes short-term investments and net other assets (liabilities). |

† Amount represents less than 0.1%. |

Annual Report

Fidelity Advisor Biotechnology Fund

Investments July 31, 2014

Showing Percentage of Net Assets

Common Stocks - 99.5% | |||

Shares | Value | ||

BIOTECHNOLOGY - 94.5% | |||

Biotechnology - 94.5% | |||

ACADIA Pharmaceuticals, Inc. (a)(d) | 417,586 | $ 8,464,468 | |

Acceleron Pharma, Inc. | 504,023 | 14,929,161 | |

Achillion Pharmaceuticals, Inc. (a)(d) | 985,172 | 6,748,428 | |

Acorda Therapeutics, Inc. (a) | 613,487 | 17,956,764 | |

Actelion Ltd. | 59,339 | 7,176,183 | |

Adamas Pharmaceuticals, Inc. | 215,821 | 3,433,712 | |

ADMA Biologics, Inc. | 50,300 | 497,970 | |

Aegerion Pharmaceuticals, Inc. (a) | 436,143 | 14,658,766 | |

Agenus, Inc. (a) | 9,425 | 31,103 | |

Agenus, Inc. warrants 1/9/18 (a) | 452,000 | 25,954 | |

Agios Pharmaceuticals, Inc. | 17,087 | 688,606 | |

Akebia Therapeutics, Inc. (a)(d) | 101,100 | 2,238,354 | |

Alder Biopharmaceuticals, Inc. | 115,442 | 1,949,815 | |

Aldeyra Therapeutics, Inc. (e) | 278,295 | 993,513 | |

Alexion Pharmaceuticals, Inc. (a) | 322,999 | 51,353,611 | |

Alkermes PLC (a) | 308,256 | 13,181,027 | |

Alnylam Pharmaceuticals, Inc. (a) | 184,161 | 9,953,902 | |

AMAG Pharmaceuticals, Inc. (a)(d) | 118,935 | 2,270,469 | |

Ambit Biosciences Corp. (a) | 14,910 | 83,049 | |

Amgen, Inc. | 408,817 | 52,079,198 | |

Anacor Pharmaceuticals, Inc. (a)(d) | 246,113 | 4,097,781 | |

Applied Genetic Technologies Corp. | 99,465 | 1,591,440 | |

Ardelyx, Inc. | 232,350 | 3,359,781 | |

Arena Pharmaceuticals, Inc. (a)(d) | 6,328 | 29,299 | |

ARIAD Pharmaceuticals, Inc. (a)(d) | 1,170,695 | 6,743,203 | |

ArQule, Inc. (a) | 950 | 1,292 | |

Array BioPharma, Inc. (a) | 498,104 | 1,992,416 | |

Arrowhead Research Corp. (a) | 553,155 | 6,997,411 | |

Asterias Biotherapeutics, Inc. (a) | 115,914 | 260,807 | |

Auspex Pharmaceuticals, Inc. | 131,243 | 2,389,935 | |

Avalanche Biotechnologies, Inc. (a) | 24,604 | 688,666 | |

BioCryst Pharmaceuticals, Inc. (a) | 168,200 | 2,105,864 | |

Biogen Idec, Inc. (a) | 168,590 | 56,374,810 | |

BioMarin Pharmaceutical, Inc. (a) | 475,338 | 29,385,395 | |

Bionovo, Inc. warrants 2/2/16 (a) | 56,850 | 1 | |

Bluebird Bio, Inc. (a) | 23,249 | 776,517 | |

Cara Therapeutics, Inc. | 184,735 | 2,355,371 | |

Catalyst Pharmaceutical Partners, Inc.: | |||

warrants 5/2/17 (a) | 8,557 | 8,628 | |

warrants 5/30/17 (a) | 17,900 | 22,600 | |

Celgene Corp. (a) | 1,064,361 | 92,759,061 | |

Cell Therapeutics, Inc. warrants 7/6/16 (a) | 46,404 | 932 | |

Celldex Therapeutics, Inc. (a)(d) | 413,902 | 5,417,977 | |

Cellectar Biosciences, Inc. (a) | 6,880 | 48,160 | |

Cepheid, Inc. (a) | 51,400 | 1,934,696 | |

Cerulean Pharma, Inc. | 530,000 | 2,135,900 | |

Chimerix, Inc. (a) | 130,682 | 2,969,095 | |

Clovis Oncology, Inc. (a)(d) | 140,534 | 5,122,464 | |

CTI BioPharma Corp. (a)(d) | 464,007 | 1,201,778 | |

Cubist Pharmaceuticals, Inc. | 262,881 | 16,009,453 | |

| |||

Shares | Value | ||

Cytokinetics, Inc. (a) | 67,916 | $ 287,285 | |

Cytokinetics, Inc. warrants 6/25/17 (a) | 244,500 | 1,315 | |

Dendreon Corp. (a)(d) | 327,540 | 678,008 | |

Dicerna Pharmaceuticals, Inc. (d) | 45,606 | 685,002 | |

Durata Therapeutics, Inc. (a)(d) | 129,737 | 1,668,418 | |

Dyax Corp. (a) | 1,096,505 | 10,329,077 | |

Dynavax Technologies Corp. (a) | 5,369 | 7,946 | |

Eleven Biotherapeutics, Inc. (d) | 123,940 | 1,359,622 | |

Emergent BioSolutions, Inc. (a) | 146,555 | 3,224,210 | |

Enanta Pharmaceuticals, Inc. (a)(d) | 140,822 | 5,296,315 | |

Epizyme, Inc. (a)(d) | 647,371 | 20,275,660 | |

Esperion Therapeutics, Inc. (a)(d) | 10,708 | 153,446 | |

Exact Sciences Corp. (a)(d) | 183,159 | 2,859,112 | |

Exelixis, Inc. (a)(d) | 263,845 | 1,065,934 | |

Fate Therapeutics, Inc. | 145,502 | 877,377 | |

Fibrocell Science, Inc. (a) | 279,800 | 937,330 | |

Foundation Medicine, Inc. | 159,200 | 3,585,184 | |

Genmab A/S (a) | 113,500 | 4,551,659 | |

Genocea Biosciences, Inc. (d) | 97,179 | 1,691,886 | |

Genomic Health, Inc. (a) | 54,120 | 1,378,978 | |

Geron Corp. (a)(d) | 2,782,517 | 6,691,953 | |

Gilead Sciences, Inc. (a) | 2,554,512 | 233,865,568 | |

Halozyme Therapeutics, Inc. (a)(d) | 410,617 | 3,999,410 | |

Heron Therapeutics, Inc. (a)(d) | 65,145 | 572,625 | |

Hyperion Therapeutics, Inc. (a)(d) | 291,271 | 6,632,241 | |

Ignyta, Inc. (a)(d) | 237,700 | 1,930,124 | |

Immune Design Corp. (a) | 140,400 | 1,684,800 | |

ImmunoGen, Inc. (a)(d) | 184,438 | 1,988,242 | |

Immunomedics, Inc. (a)(d) | 575,159 | 1,863,515 | |

Incyte Corp. (a) | 450,174 | 21,414,777 | |

Infinity Pharmaceuticals, Inc. (a) | 185,334 | 1,684,686 | |

Insys Therapeutics, Inc. (a)(d) | 166,692 | 4,505,685 | |

Intercept Pharmaceuticals, Inc. (a) | 168,060 | 39,050,422 | |

InterMune, Inc. (a) | 804,065 | 35,274,332 | |

Intrexon Corp. (d) | 109,008 | 2,407,987 | |

Ironwood Pharmaceuticals, Inc. Class A (a) | 670,651 | 9,925,635 | |

Isis Pharmaceuticals, Inc. (a)(d) | 355,594 | 11,019,858 | |

KaloBios Pharmaceuticals, Inc. (a) | 165,702 | 273,408 | |

Karyopharm Therapeutics, Inc. (d) | 475,382 | 16,491,002 | |

Keryx Biopharmaceuticals, Inc. (a)(d) | 453,112 | 6,819,336 | |

Kindred Biosciences, Inc. | 191,920 | 2,924,861 | |

Kite Pharma, Inc. | 120,180 | 2,824,230 | |

KYTHERA Biopharmaceuticals, Inc. (a)(d) | 219,330 | 7,365,101 | |

La Jolla Pharmaceutical Co. (a)(d) | 189,944 | 1,850,055 | |

Lexicon Pharmaceuticals, Inc. (a) | 1,437,492 | 2,113,113 | |

Ligand Pharmaceuticals, Inc. Class B (a) | 156,285 | 7,684,533 | |

Lion Biotechnologies, Inc. (a) | 89,246 | 638,109 | |

Macrogenics, Inc. | 461,857 | 9,375,697 | |

MannKind Corp. (a)(d) | 1,151,662 | 9,627,894 | |

Medivation, Inc. (a) | 408,359 | 30,312,489 | |

Merrimack Pharmaceuticals, Inc. (a) | 60,200 | 355,782 | |

MiMedx Group, Inc. (a)(d) | 250,413 | 1,730,354 | |

Common Stocks - continued | |||

Shares | Value | ||

BIOTECHNOLOGY - CONTINUED | |||

Biotechnology - continued | |||

Minerva Neurosciences, Inc. | 228,600 | $ 1,442,466 | |

Mirati Therapeutics, Inc. (a) | 25,300 | 459,701 | |

Momenta Pharmaceuticals, Inc. (a) | 121,037 | 1,287,834 | |

Myriad Genetics, Inc. (a)(d) | 234,057 | 8,449,458 | |

Neurocrine Biosciences, Inc. (a) | 624,728 | 8,483,806 | |

NewLink Genetics Corp. (a)(d) | 252,479 | 5,347,505 | |

Novavax, Inc. (a)(d) | 2,301,331 | 9,964,763 | |

Novelos Therapeutics, Inc. warrants 12/6/16 (a) | 137,600 | 1 | |

NPS Pharmaceuticals, Inc. (a) | 439,525 | 12,280,329 | |

OncoMed Pharmaceuticals, Inc. (d) | 120,434 | 2,600,170 | |

Ophthotech Corp. (d) | 624,137 | 24,378,791 | |

Opko Health, Inc. (a)(d) | 791,951 | 6,985,008 | |

Oragenics, Inc. (a) | 250,308 | 438,039 | |

Orexigen Therapeutics, Inc. (a)(d) | 1,349,072 | 6,731,869 | |

Organovo Holdings, Inc. (a)(d) | 244,983 | 1,854,521 | |

Osiris Therapeutics, Inc. (a) | 203,971 | 3,018,771 | |

OvaScience, Inc. (a)(d) | 96,100 | 942,741 | |

PDL BioPharma, Inc. (d) | 99,788 | 936,011 | |

Pharmacyclics, Inc. (a) | 185,133 | 22,297,419 | |

PolyMedix, Inc. (a) | 7,142 | 143 | |

PolyMedix, Inc. warrants 4/10/16 (a) | 163,833 | 2 | |

Portola Pharmaceuticals, Inc. (a) | 248,117 | 6,237,661 | |

Progenics Pharmaceuticals, Inc. (a) | 607,944 | 2,905,972 | |

Prosensa Holding BV (a)(d) | 112,766 | 1,113,000 | |

Protalix BioTherapeutics, Inc. (a)(d) | 90,943 | 299,202 | |

Prothena Corp. PLC (a) | 54,500 | 946,120 | |

PTC Therapeutics, Inc. (a) | 233,912 | 6,179,955 | |

Puma Biotechnology, Inc. (a) | 203,549 | 45,130,884 | |

Raptor Pharmaceutical Corp. (a)(d) | 228,373 | 1,966,292 | |

Receptos, Inc. (a) | 229,010 | 9,483,304 | |

Regeneron Pharmaceuticals, Inc. (a) | 158,080 | 49,988,058 | |

Regulus Therapeutics, Inc. (a)(d) | 186,217 | 1,189,927 | |

Repligen Corp. (a) | 228,585 | 4,793,427 | |

Rigel Pharmaceuticals, Inc. (a) | 416,077 | 1,360,572 | |

Sage Therapeutics, Inc. (a) | 226,646 | 6,395,950 | |

Sage Therapeutics, Inc. | 25,896 | 657,707 | |

Sangamo Biosciences, Inc. (a)(d) | 982,368 | 11,670,532 | |

Sarepta Therapeutics, Inc. (a)(d) | 160,901 | 3,433,627 | |

Seattle Genetics, Inc. (a)(d) | 196,850 | 6,929,120 | |

Sophiris Bio, Inc. (a) | 141,653 | 368,298 | |

Sorrento Therapeutics, Inc. (a) | 45,800 | 249,152 | |

Spectrum Pharmaceuticals, Inc. (a) | 338,247 | 2,381,259 | |

Stemline Therapeutics, Inc. (a)(d) | 292,993 | 3,753,240 | |

Sunesis Pharmaceuticals, Inc. (a) | 443,217 | 2,916,368 | |

Synageva BioPharma Corp. (a)(d) | 168,200 | 11,506,562 | |

Synergy Pharmaceuticals, Inc. (a)(d) | 242,484 | 885,067 | |

Synergy Pharmaceuticals, Inc. warrants 11/14/16 (a) | 20,600 | 21,630 | |

| |||

Shares | Value | ||

Synta Pharmaceuticals Corp. (a)(d) | 471,286 | $ 1,861,580 | |

Synthetic Biologics, Inc. (a) | 100 | 175 | |

TESARO, Inc. (a) | 153,779 | 4,422,684 | |

Threshold Pharmaceuticals, Inc. (a) | 92,584 | 389,779 | |

Threshold Pharmaceuticals, Inc. warrants 3/16/16 (a) | 35,146 | 67,297 | |

Ultragenyx Pharmaceutical, Inc. | 71,735 | 3,134,820 | |

uniQure B.V. | 63,432 | 648,275 | |

United Therapeutics Corp. (a) | 152,594 | 13,876,898 | |

Verastem, Inc. (a) | 202,208 | 1,494,317 | |

Versartis, Inc. (a)(d) | 211,002 | 4,304,441 | |

Versartis, Inc. | 97,274 | 1,785,951 | |

Vertex Pharmaceuticals, Inc. (a) | 951,126 | 84,564,613 | |

Vical, Inc. (a) | 659,862 | 864,419 | |

Vital Therapies, Inc. | 180,500 | 4,133,450 | |

Xencor, Inc. | 187,673 | 1,812,921 | |

XOMA Corp. (a) | 709,143 | 2,751,475 | |

Zafgen, Inc. (d) | 891,452 | 15,600,410 | |

Zafgen, Inc. | 129,125 | 2,033,719 | |

ZIOPHARM Oncology, Inc. (a)(d) | 59,779 | 187,108 | |

| 1,445,902,940 | ||

HEALTH CARE EQUIPMENT & SUPPLIES - 0.0% | |||

Health Care Equipment - 0.0% | |||

Alsius Corp. (a) | 14,200 | 0 | |

InVivo Therapeutics Holdings Corp. (a) | 98,300 | 90,436 | |

| 90,436 | ||

LIFE SCIENCES TOOLS & SERVICES - 0.0% | |||

Life Sciences Tools & Services - 0.0% | |||

BG Medicine, Inc. (a)(d) | 75,570 | 71,792 | |

ChromaDex, Inc. (a) | 143,866 | 192,780 | |

Transgenomic, Inc. (a) | 16,258 | 64,056 | |

Transgenomic, Inc. warrants 2/3/17 (a) | 81,000 | 1 | |

| 328,629 | ||

PERSONAL PRODUCTS - 0.0% | |||

Personal Products - 0.0% | |||

MYOS Corp. (a) | 6,666 | 91,991 | |

PHARMACEUTICALS - 5.0% | |||

Pharmaceuticals - 5.0% | |||

AcelRx Pharmaceuticals, Inc. (a)(d) | 52,410 | 364,774 | |

Achaogen, Inc. (a) | 141,215 | 1,526,534 | |

ALK-Abello A/S | 1,500 | 216,318 | |

Aradigm Corp. (a) | 8,241 | 69,505 | |

Aradigm Corp. (a) | 545 | 4,633 | |

Auxilium Pharmaceuticals, Inc. (a)(d) | 200,238 | 4,008,765 | |

AVANIR Pharmaceuticals Class A (a) | 1,482,487 | 7,723,757 | |

ContraVir Pharmaceuticals, Inc. (a)(d) | 23,908 | 30,124 | |

Egalet Corp. (d) | 196,663 | 2,379,622 | |

Endocyte, Inc. (a) | 1,544 | 10,244 | |

Horizon Pharma, Inc. (a)(d) | 811,450 | 6,897,325 | |

Common Stocks - continued | |||

Shares | Value | ||

PHARMACEUTICALS - CONTINUED | |||

Pharmaceuticals - continued | |||

Horizon Pharma, Inc. warrants 9/25/17 (a) | 55,250 | $ 226,964 | |

Intra-Cellular Therapies, Inc. (d) | 225,154 | 3,262,481 | |

Jazz Pharmaceuticals PLC (a) | 70,620 | 9,867,733 | |

NeurogesX, Inc. (a) | 187,202 | 880 | |

Pacira Pharmaceuticals, Inc. (a) | 152,160 | 13,998,720 | |

Parnell Pharmaceuticals Holdings Ltd. | 123,569 | 768,599 | |

Perrigo Co. PLC | 49 | 7,372 | |

Relypsa, Inc. | 182,613 | 4,128,880 | |

Repros Therapeutics, Inc. (a)(d) | 211,800 | 2,969,436 | |

TherapeuticsMD, Inc. (a)(d) | 818,700 | 3,798,768 | |

Theravance Biopharma, Inc. (a)(d) | 44,290 | 1,241,449 | |

Theravance, Inc. (a)(d) | 249,076 | 5,404,949 | |

Zogenix, Inc. (a) | 1,284,991 | 1,696,188 | |

Zogenix, Inc. warrants 7/27/17 (a) | 32,985 | 0 | |

ZS Pharma, Inc. | 191,186 | 5,355,120 | |

| 75,959,140 | ||

TOTAL COMMON STOCKS (Cost $1,192,632,509) |

| ||

Preferred Stocks - 0.4% | |||

|

|

|

|

Convertible Preferred Stocks - 0.4% | |||

BIOTECHNOLOGY - 0.3% | |||

Biotechnology - 0.3% | |||

Avalanche Biotechnologies, Inc. Series B (f) | 89,832 | 2,262,958 | |

ProQR Therapeutics BV (f) | 2,337 | 1,643,477 | |

| 3,906,435 | ||

PHARMACEUTICALS - 0.1% | |||

Pharmaceuticals - 0.1% | |||

aTyr Pharma, Inc. 8.00% (a)(f) | 282,494 | 714,427 | |

Kolltan Pharmaceuticals, Inc. Series D (f) | 1,610,391 | 1,610,391 | |

| 2,324,818 | ||

TOTAL CONVERTIBLE PREFERRED STOCKS | 6,231,253 | ||

Nonconvertible Preferred Stocks - 0.0% | |||

BIOTECHNOLOGY - 0.0% | |||

Biotechnology - 0.0% | |||

Moderna LLC Series D, 8.00% (f) | 26,918 | 574,161 | |

| |||

Shares | Value | ||

PHARMACEUTICALS - 0.0% | |||

Pharmaceuticals - 0.0% | |||

Equilibrate Asia Therapeutics Series D (a)(f) | 299,320 | $ 4,885 | |

Equilibrate Worldwide Therapeutics Series D (a)(f) | 299,320 | 12,024 | |

Neuropathic Worldwide Therapeutics Series D (a)(f) | 299,320 | 2,254 | |

Oculus Worldwide Therapeutics Series D (a)(f) | 299,320 | 3,756 | |

Orchestrate U.S. Therapeutics, Inc. Series D (a)(f) | 299,320 | 5,259 | |

Orchestrate Worldwide Therapeutics Series D (a)(f) | 299,320 | 9,393 | |

| 37,571 | ||

TOTAL NONCONVERTIBLE PREFERRED STOCKS | 611,732 | ||

TOTAL PREFERRED STOCKS (Cost $5,308,379) |

| ||

Money Market Funds - 8.4% | |||

|

|

|

|

Fidelity Cash Central Fund, 0.11% (b) | 6,633,107 | 6,633,107 | |

Fidelity Securities Lending Cash Central Fund, 0.11% (b)(c) | 121,475,612 | 121,475,612 | |

TOTAL MONEY MARKET FUNDS (Cost $128,108,719) |

| ||

TOTAL INVESTMENT PORTFOLIO - 108.3% (Cost $1,326,049,607) | 1,657,324,840 | ||

NET OTHER ASSETS (LIABILITIES) - (8.3)% | (126,798,273) | ||

NET ASSETS - 100% | $ 1,530,526,567 | ||

Legend |

(a) Non-income producing |

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Affiliated company |

(f) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $6,842,985 or 0.4% of net assets. |

Additional information on each restricted holding is as follows: |

Security | Acquisition Date | Acquisition Cost |

aTyr Pharma, Inc. 8.00% | 4/8/13 - 5/17/13 | $ 714,427 |

Avalanche Biotechnologies, Inc. Series B | 4/17/14 | $ 676,435 |

Equilibrate Asia Therapeutics Series D | 5/17/13 | $ 4,885 |

Equilibrate Worldwide Therapeutics Series D | 5/17/13 | $ 12,024 |

Kolltan Pharmaceuticals, Inc. Series D | 3/13/14 | $ 1,610,391 |

Moderna LLC Series D, 8.00% | 11/6/13 | $ 574,161 |

Neuropathic Worldwide Therapeutics Series D | 5/17/13 | $ 2,254 |

Oculus Worldwide Therapeutics Series D | 5/17/13 | $ 3,756 |

Orchestrate U.S. Therapeutics, Inc. Series D | 5/17/13 | $ 5,259 |

Orchestrate Worldwide Therapeutics Series D | 5/17/13 | $ 9,393 |

ProQR Therapeutics BV | 4/17/14 | $ 1,695,394 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 12,703 |

Fidelity Securities Lending Cash Central Fund | 2,336,849 |

Total | $ 2,349,552 |

Other Affiliated Issuers |

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows: |

Affiliate | Value, | Purchases | Sales | Dividend | Value, |

Aldeyra Therapeutics, Inc. | $ - | $ 2,219,341 | $ - | $ - | $ 993,513 |

Other Information |

The following is a summary of the inputs used, as of July 31, 2014, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: | ||||

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | ||||

Common Stocks | $ 1,522,373,136 | $ 1,517,542,064 | $ 4,831,072 | $ - |

Preferred Stocks | 6,842,985 | - | 2,262,958 | 4,580,027 |

Money Market Funds | 128,108,719 | 128,108,719 | - | - |

Total Investments in Securities: | $ 1,657,324,840 | $ 1,645,650,783 | $ 7,094,030 | $ 4,580,027 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Advisor Biotechnology Fund

Financial Statements

Statement of Assets and Liabilities

| July 31, 2014 | |

|

|

|

Assets | ||

Investment in securities, at value (including securities loaned of $113,523,863) - See accompanying schedule: Unaffiliated issuers (cost $1,195,721,547) | $ 1,528,222,608 |

|

Fidelity Central Funds (cost $128,108,719) | 128,108,719 |

|

Other affiliated issuers (cost $2,219,341) | 993,513 |

|

Total Investments (cost $1,326,049,607) |

| $ 1,657,324,840 |

Receivable for investments sold | 2,417,358 | |

Receivable for fund shares sold | 4,396,165 | |

Distributions receivable from Fidelity Central Funds | 397,907 | |

Other receivables | 2,321 | |

Total assets | 1,664,538,591 | |

|

|

|

Liabilities | ||

Payable for investments purchased | $ 7,112,941 | |

Payable for fund shares redeemed | 3,836,805 | |

Accrued management fee | 704,864 | |

Distribution and service plan fees payable | 473,542 | |

Other affiliated payables | 299,092 | |

Other payables and accrued expenses | 109,168 | |

Collateral on securities loaned, at value | 121,475,612 | |

Total liabilities | 134,012,024 | |

|

|

|

Net Assets | $ 1,530,526,567 | |

Net Assets consist of: |

| |

Paid in capital | $ 1,197,814,678 | |

Accumulated net investment loss | (6,816,483) | |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 8,253,139 | |

Net unrealized appreciation (depreciation) on investments | 331,275,233 | |

Net Assets | $ 1,530,526,567 | |

Statement of Assets and Liabilities - continued

| July 31, 2014 | |

|

|

|

Calculation of Maximum Offering Price Class A: | $ 20.19 | |

|

|

|

Maximum offering price per share (100/94.25 of $20.19) | $ 21.42 | |

Class T: | $ 19.39 | |

|

|

|

Maximum offering price per share (100/96.50 of $19.39) | $ 20.09 | |

Class B: | $ 18.01 | |

|

|

|

Class C: | $ 18.04 | |

|

|

|

Institutional Class: | $ 21.10 | |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Advisor Biotechnology Fund

Financial Statements - continued

Statement of Operations

| Year ended July 31, 2014 | |

|

|

|

Investment Income |

|

|

Dividends |

| $ 2,482,457 |

Interest |

| 2,977 |

Income from Fidelity Central Funds (including $2,336,849 from security lending) |

| 2,349,552 |

Total income |

| 4,834,986 |

|

|

|

Expenses | ||

Management fee | $ 6,811,384 | |

Transfer agent fees | 2,583,031 | |

Distribution and service plan fees | 4,548,469 | |

Accounting and security lending fees | 411,556 | |

Custodian fees and expenses | 59,779 | |

Independent trustees' compensation | 27,881 | |

Registration fees | 237,578 | |

Audit | 46,947 | |

Legal | 12,413 | |

Interest | 1,541 | |

Miscellaneous | 10,548 | |

Total expenses before reductions | 14,751,127 | |

Expense reductions | (34,011) | 14,717,116 |

Net investment income (loss) | (9,882,130) | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Unaffiliated issuers | 15,834,775 | |

Foreign currency transactions | 918 | |

Total net realized gain (loss) |

| 15,835,693 |

Change in net unrealized appreciation (depreciation) on investment securities | 126,643,560 | |

Net gain (loss) | 142,479,253 | |

Net increase (decrease) in net assets resulting from operations | $ 132,597,123 | |

Statement of Changes in Net Assets

| Year ended | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ (9,882,130) | $ (2,400,307) |

Net realized gain (loss) | 15,835,693 | (3,418,106) |

Change in net unrealized appreciation (depreciation) | 126,643,560 | 172,587,152 |

Net increase (decrease) in net assets resulting from operations | 132,597,123 | 166,768,739 |

Distributions to shareholders from net realized gain | (3,083,051) | (10,422,000) |

Share transactions - net increase (decrease) | 713,552,409 | 368,981,342 |

Redemption fees | 133,198 | 20,216 |

Total increase (decrease) in net assets | 843,199,679 | 525,348,297 |

|

|

|

Net Assets | ||

Beginning of period | 687,326,888 | 161,978,591 |

End of period (including accumulated net investment loss of $6,816,483 and accumulated net investment loss of $1,831,365, respectively) | $ 1,530,526,567 | $ 687,326,888 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class A

Years ended July 31, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 17.25 | $ 11.79 | $ 8.81 | $ 6.67 | $ 6.94 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) C | (.13) | (.09) | (.07) | (.07) F | (.08) G |

Net realized and unrealized gain (loss) | 3.12 | 6.24 | 3.05 | 2.21 | (.19) |

Total from investment operations | 2.99 | 6.15 | 2.98 | 2.14 | (.27) |

Distributions from net realized gain | (.05) | (.69) | - | - | - |

Redemption fees added to paid in capital C, I | - | - | - | - | - |

Net asset value, end of period | $ 20.19 | $ 17.25 | $ 11.79 | $ 8.81 | $ 6.67 |

Total ReturnA, B | 17.38% | 54.94% | 33.83% | 32.08% | (3.89)% |

Ratios to Average Net Assets D, H |

|

|

|

|

|

Expenses before reductions | 1.08% | 1.15% | 1.27% | 1.35% | 1.39% |

Expenses net of fee waivers, if any | 1.08% | 1.15% | 1.27% | 1.35% | 1.39% |

Expenses net of all reductions | 1.08% | 1.14% | 1.27% | 1.34% | 1.38% |

Net investment income (loss) | (.68)% | (.63)% | (.73)% | (.91)% F | (1.15)% G |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 602,625 | $ 286,695 | $ 68,993 | $ 30,639 | $ 20,154 |

Portfolio turnover rateE | 50% | 22% | 82% | 99% | 130% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (1.04)%.

G Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (1.29)%.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

Financial Highlights - Class T

Years ended July 31, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 16.63 | $ 11.42 | $ 8.56 | $ 6.50 | $ 6.78 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) C | (.19) | (.12) | (.10) | (.09) F | (.09) G |

Net realized and unrealized gain (loss) | 3.00 | 6.02 | 2.96 | 2.15 | (.19) |

Total from investment operations | 2.81 | 5.90 | 2.86 | 2.06 | (.28) |

Distributions from net realized gain | (.05) | (.69) | - | - | - |

Redemption fees added to paid in capital C, I | - | - | - | - | - |

Net asset value, end of period | $ 19.39 | $ 16.63 | $ 11.42 | $ 8.56 | $ 6.50 |

Total ReturnA, B | 16.95% | 54.50% | 33.41% | 31.69% | (4.13)% |

Ratios to Average Net Assets D, H |

|

|

|

|

|

Expenses before reductions | 1.41% | 1.46% | 1.56% | 1.64% | 1.69% |

Expenses net of fee waivers, if any | 1.41% | 1.46% | 1.56% | 1.64% | 1.65% |

Expenses net of all reductions | 1.40% | 1.46% | 1.56% | 1.64% | 1.64% |

Net investment income (loss) | (1.01)% | (.94)% | (1.02)% | (1.21)% F | (1.41)% G |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 95,945 | $ 67,887 | $ 28,154 | $ 16,454 | $ 11,684 |

Portfolio turnover rateE | 50% | 22% | 82% | 99% | 130% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (1.34)%.

G Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (1.55)%.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class B

Years ended July 31, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 15.52 | $ 10.75 | $ 8.09 | $ 6.17 | $ 6.47 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) C | (.26) | (.17) | (.13) | (.12) F | (.12) G |

Net realized and unrealized gain (loss) | 2.80 | 5.63 | 2.79 | 2.04 | (.18) |

Total from investment operations | 2.54 | 5.46 | 2.66 | 1.92 | (.30) |

Distributions from net realized gain | (.05) | (.69) | - | - | - |

Redemption fees added to paid in capital C, I | - | - | - | - | - |

Net asset value, end of period | $ 18.01 | $ 15.52 | $ 10.75 | $ 8.09 | $ 6.17 |

Total ReturnA, B | 16.42% | 53.76% | 32.88% | 31.12% | (4.64)% |

Ratios to Average Net Assets D, H |

|

|

|

|

|

Expenses before reductions | 1.89% | 1.94% | 2.03% | 2.10% | 2.14% |

Expenses net of fee waivers, if any | 1.89% | 1.94% | 2.03% | 2.10% | 2.14% |

Expenses net of all reductions | 1.88% | 1.94% | 2.02% | 2.09% | 2.13% |

Net investment income (loss) | (1.49)% | (1.42)% | (1.49)% | (1.66)% F | (1.90)% G |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 6,101 | $ 8,136 | $ 6,349 | $ 5,849 | $ 6,297 |

Portfolio turnover rateE | 50% | 22% | 82% | 99% | 130% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (1.79)%.

G Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (2.04)%.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

Financial Highlights - Class C

Years ended July 31, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 15.53 | $ 10.76 | $ 8.10 | $ 6.18 | $ 6.47 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) C | (.25) | (.17) | (.13) | (.12) F | (.12) G |

Net realized and unrealized gain (loss) | 2.81 | 5.63 | 2.79 | 2.04 | (.17) |

Total from investment operations | 2.56 | 5.46 | 2.66 | 1.92 | (.29) |

Distributions from net realized gain | (.05) | (.69) | - | - | - |

Redemption fees added to paid in capital C, I | - | - | - | - | - |

Net asset value, end of period | $ 18.04 | $ 15.53 | $ 10.76 | $ 8.10 | $ 6.18 |

Total ReturnA, B | 16.54% | 53.71% | 32.84% | 31.07% | (4.48)% |

Ratios to Average Net Assets D, H |

|

|

|

|

|

Expenses before reductions | 1.83% | 1.88% | 2.01% | 2.10% | 2.14% |

Expenses net of fee waivers, if any | 1.83% | 1.88% | 2.01% | 2.10% | 2.14% |

Expenses net of all reductions | 1.83% | 1.87% | 2.01% | 2.09% | 2.13% |

Net investment income (loss) | (1.43)% | (1.36)% | (1.47)% | (1.66)% F | (1.90)% G |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 359,967 | $ 146,684 | $ 31,710 | $ 15,787 | $ 11,421 |

Portfolio turnover rateE | 50% | 22% | 82% | 99% | 130% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (1.79)%.

G Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (2.04)%.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Institutional Class

Years ended July 31, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 17.97 | $ 12.22 | $ 9.10 | $ 6.87 | $ 7.12 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) B | (.08) | (.05) | (.04) | (.05) E | (.06) F |

Net realized and unrealized gain (loss) | 3.26 | 6.49 | 3.16 | 2.28 | (.19) |

Total from investment operations | 3.18 | 6.44 | 3.12 | 2.23 | (.25) |

Distributions from net realized gain | (.05) | (.69) | - | - | - |

Redemption fees added to paid in capital B, H | - | - | - | - | - |

Net asset value, end of period | $ 21.10 | $ 17.97 | $ 12.22 | $ 9.10 | $ 6.87 |

Total ReturnA | 17.74% | 55.39% | 34.29% | 32.46% | (3.51)% |

Ratios to Average Net Assets C, G |

|

|

|

|

|

Expenses before reductions | .81% | .85% | .95% | 1.04% | 1.07% |

Expenses net of fee waivers, if any | .81% | .85% | .95% | 1.04% | 1.07% |

Expenses net of all reductions | .80% | .84% | .94% | 1.03% | 1.06% |

Net investment income (loss) | (.41)% | (.32)% | (.40)% | (.60)% E | (.83)% F |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 465,889 | $ 177,926 | $ 26,772 | $ 5,903 | $ 3,008 |

Portfolio turnover rateD | 50% | 22% | 82% | 99% | 130% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.73)%.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.97)%.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended July 31, 2014

1. Organization.

Fidelity Advisor Biotechnology Fund (the Fund) is a non-diversified fund of Fidelity Advisor Series VII (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class T, Class C and Institutional Class shares, each of which, along with Class B shares, has equal rights as to assets and voting privileges. Class B shares are closed to new accounts and additional purchases, except for exchanges and reinvestments. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. In accordance with valuation policies and procedures approved by the Board of Trustees (the Board), the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Fidelity SelectCo, LLC (SelectCo) Fair Value Committee (the Committee), in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and is responsible for approving and reporting to the Board all fair value determinations.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Annual Report

3. Significant Accounting Policies - continued

Investment Valuation - continued

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of July 31, 2014, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Subsequent to ex-dividend date the Fund determines the components of these distributions, based upon receipt of tax filings or other correspondence relating to the underlying investment. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of July 31, 2014, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), partnerships, net operating losses, capital loss carryforwards and losses deferred due to wash sales and excise tax regulations.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 448,874,092 |

Gross unrealized depreciation | (123,618,223) |

Net unrealized appreciation (depreciation) on securities | $ 325,255,869 |

|

|

Tax Cost | $ 1,332,068,971 |

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The tax-based components of distributable earnings as of period end were as follows:

Undistributed long-term capital gain | $ 14,272,505 |

Net unrealized appreciation (depreciation) on securities and other investments | $ 325,255,869 |

The tax character of distributions paid was as follows:

| July 31, 2014 | July 31, 2013 |

Long-term Capital Gains | $ 3,083,051 | $ 10,422,000 |

Short-Term Trading (Redemption) Fees. Shares held by investors in the Fund less than 30 days may have been subject to a redemption fee equal to .75% of the NAV of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $1,320,090,617 and $610,606,472, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. Effective August 1, 2013, SelectCo replaced Fidelity Management & Research Company (FMR), an affiliate of SelectCo, as investment adviser to the Fund. The investment adviser and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and an annualized group fee rate that averaged .25% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR and the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annual management fee rate was .55% of the Fund's average net assets.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| Distribution | Service | Total Fees | Retained |

Class A | -% | .25% | $ 1,277,012 | $ 34,881 |

Class T | .25% | .25% | 434,339 | 2,886 |

Class B | .75% | .25% | 77,485 | 58,326 |

Class C | .75% | .25% | 2,759,633 | 1,738,659 |

|

|

| $ 4,548,469 | $ 1,834,752 |

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class T shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class T, Class B and Class C redemptions. The deferred sales charges range from 5.00% to 1.00% for Class B shares, 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class T shares.

Annual Report

5. Fees and Other Transactions with Affiliates - continued

Sales Load - continued

For the period, sales charge amounts retained by FDC were as follows:

| Retained |

Class A | $ 1,085,516 |

Class T | 76,720 |

Class B* | 13,831 |

Class C* | 127,045 |

| $ 1,303,112 |

* When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| Amount | % of |

Class A | $ 1,070,342 | .21 |

Class T | 248,578 | .29 |

Class B | 20,560 | .27 |

Class C | 575,016 | .21 |

Institutional Class | 668,535 | .19 |

| $ 2,583,031 |

|

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $26,947 for the period.

Interfund Lending Program. Pursuant to an Exemptive Order issued by the SEC, the Fund, along with other registered investment companies having management contracts with FMR or other affiliated entities of FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the funds to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. The Fund's activity in this program during the period for which loans were outstanding was as follows:

Borrower or Lender | Average Loan | Weighted Average | Interest |

Borrower | $ 6,730,048 | .32% | $ 1,236 |

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $1,946 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, which prior to August 1, 2013 included Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit

Annual Report

Notes to Financial Statements - continued

7. Security Lending - continued