UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3010

Fidelity Advisor Series VII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | July 31 |

|

|

Date of reporting period: | July 31, 2015 |

Item 1.

Reports to Stockholders

Fidelity Advisor Focus Funds® Fidelity Advisor® Biotechnology Fund Fidelity Advisor® Communications Equipment Fund Fidelity Advisor® Consumer Discretionary Fund Fidelity Advisor® Electronics Fund Fidelity Advisor® Energy Fund Fidelity Advisor® Financial Services Fund Fidelity Advisor® Health Care Fund Fidelity Advisor® Industrials Fund Fidelity Advisor® Technology Fund Fidelity Advisor® Utilities Fund Annual Report July 31, 2015 |

|

Contents

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2015 FMR LLC. All rights reserved.

Fidelity Advisor® Biotechnology Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year.

The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred.

How a fund did yesterday is no guarantee of how it will do tomorrow.

Returns reflect the conversion of Class B shares to Class A shares after a maximum of seven years.

Average Annual Total Returns

| For the periods ended July 31, 2015 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl. 5.75% sales charge) | 50.48% | 37.06% | 17.68% |

| Class T (incl. 3.50% sales charge) | 53.60% | 37.28% | 17.62% |

| Class B (incl. contingent deferred sales charge) | 53.42% | 37.53% | 17.76% |

| Class C (incl. contingent deferred sales charge) | 57.43% | 37.65% | 17.48% |

Class B shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 5%, 2% and 0%, respectively.

Class C shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

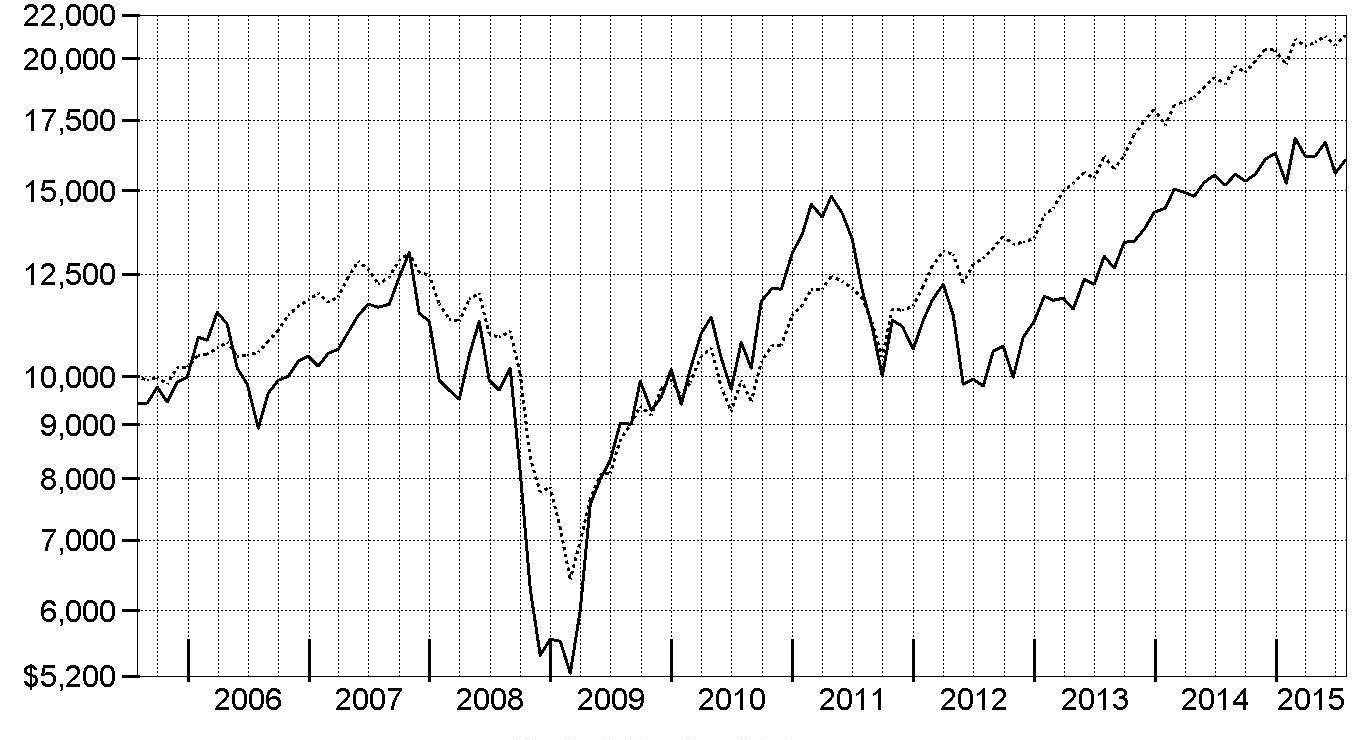

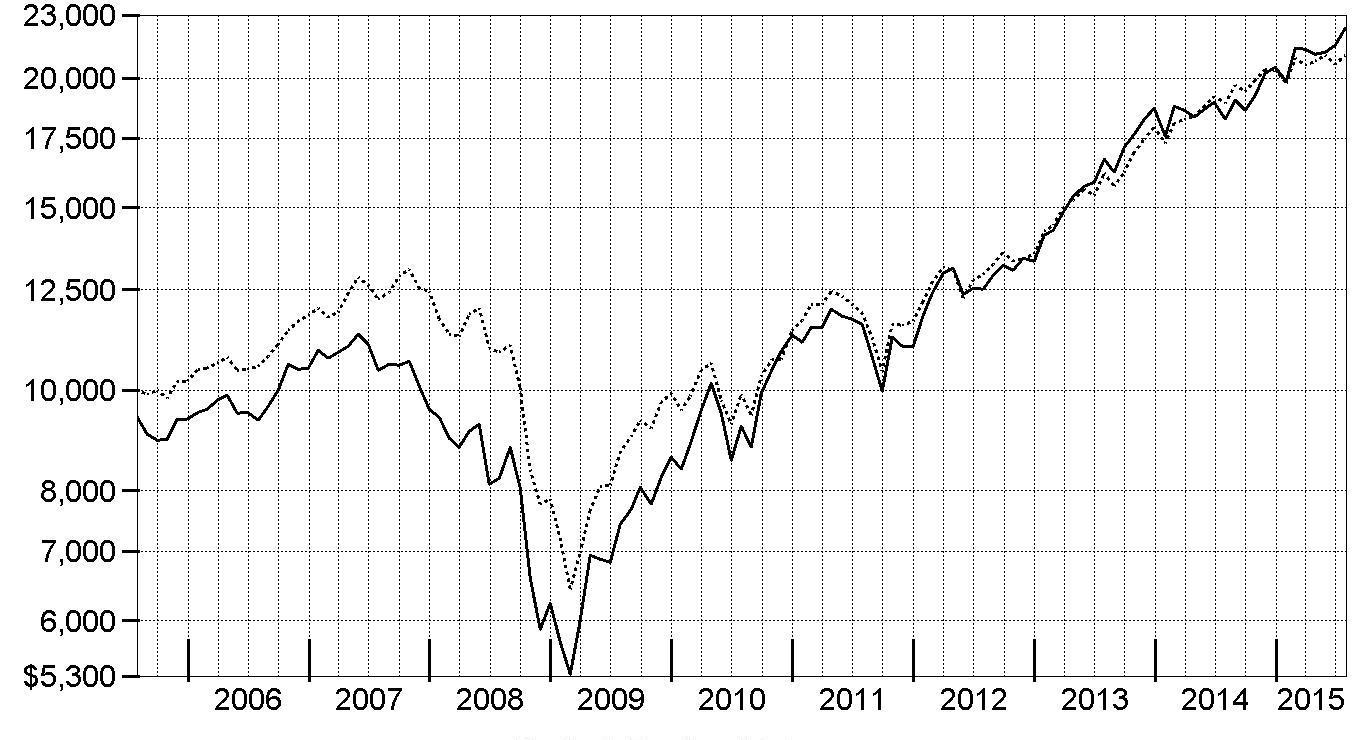

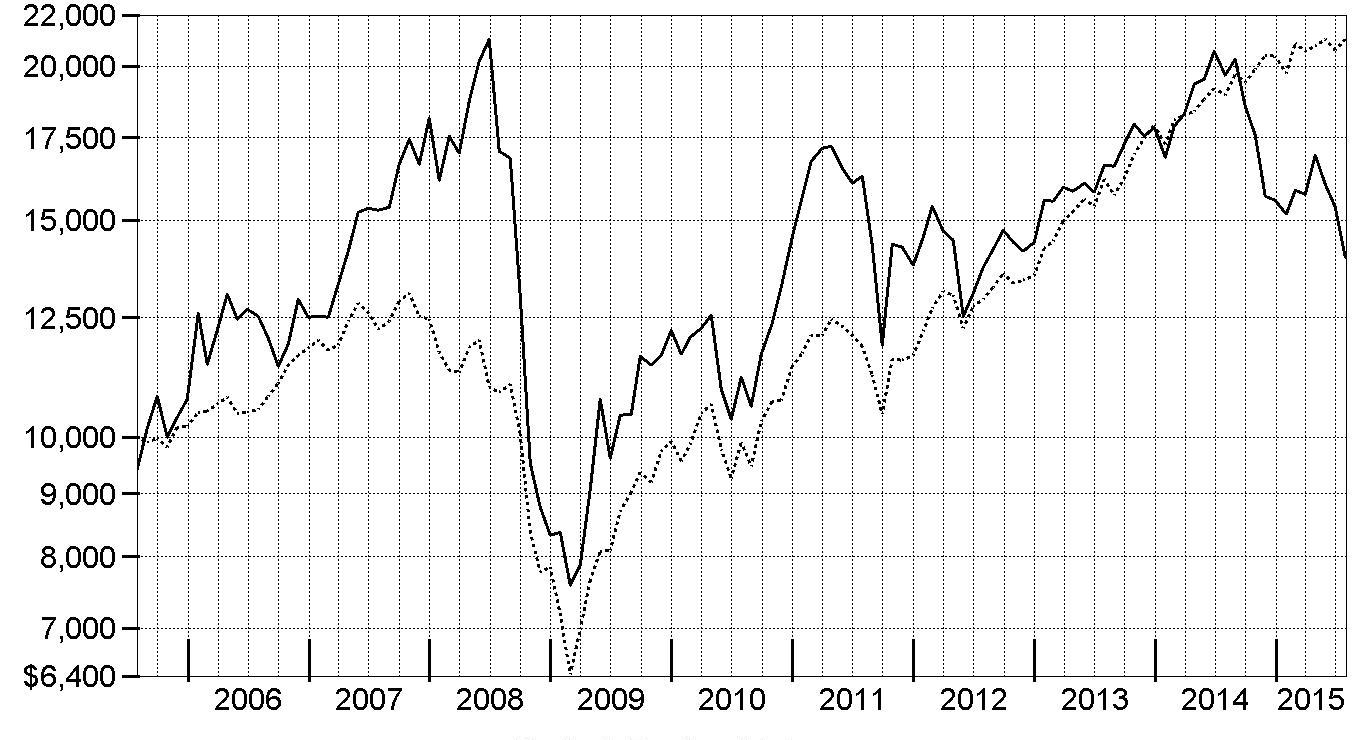

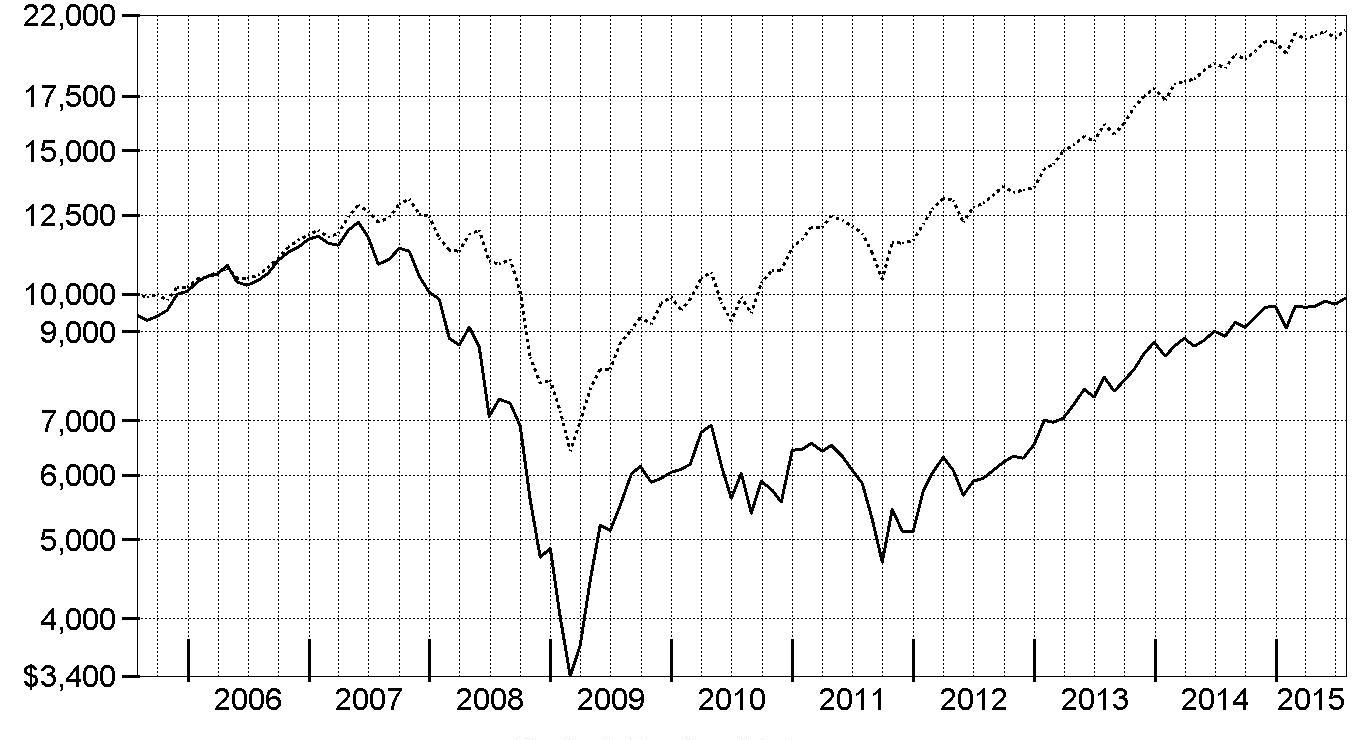

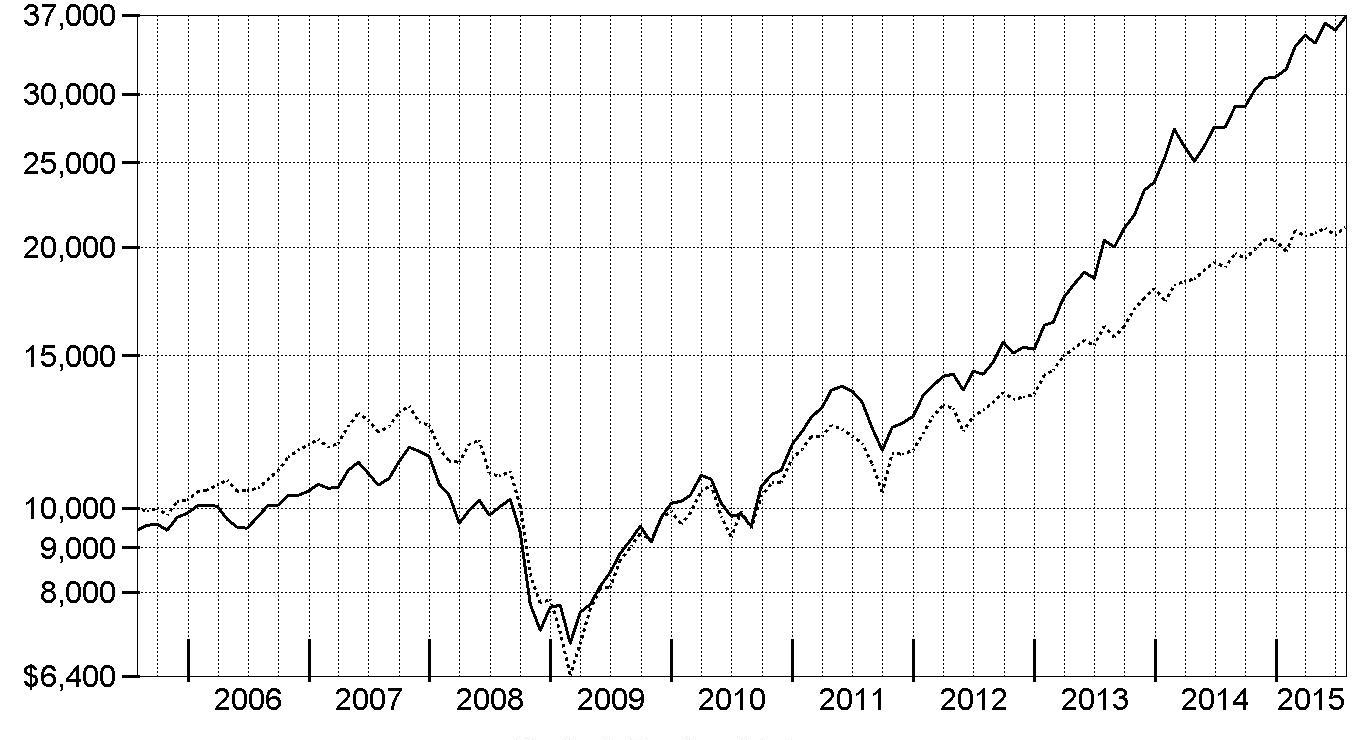

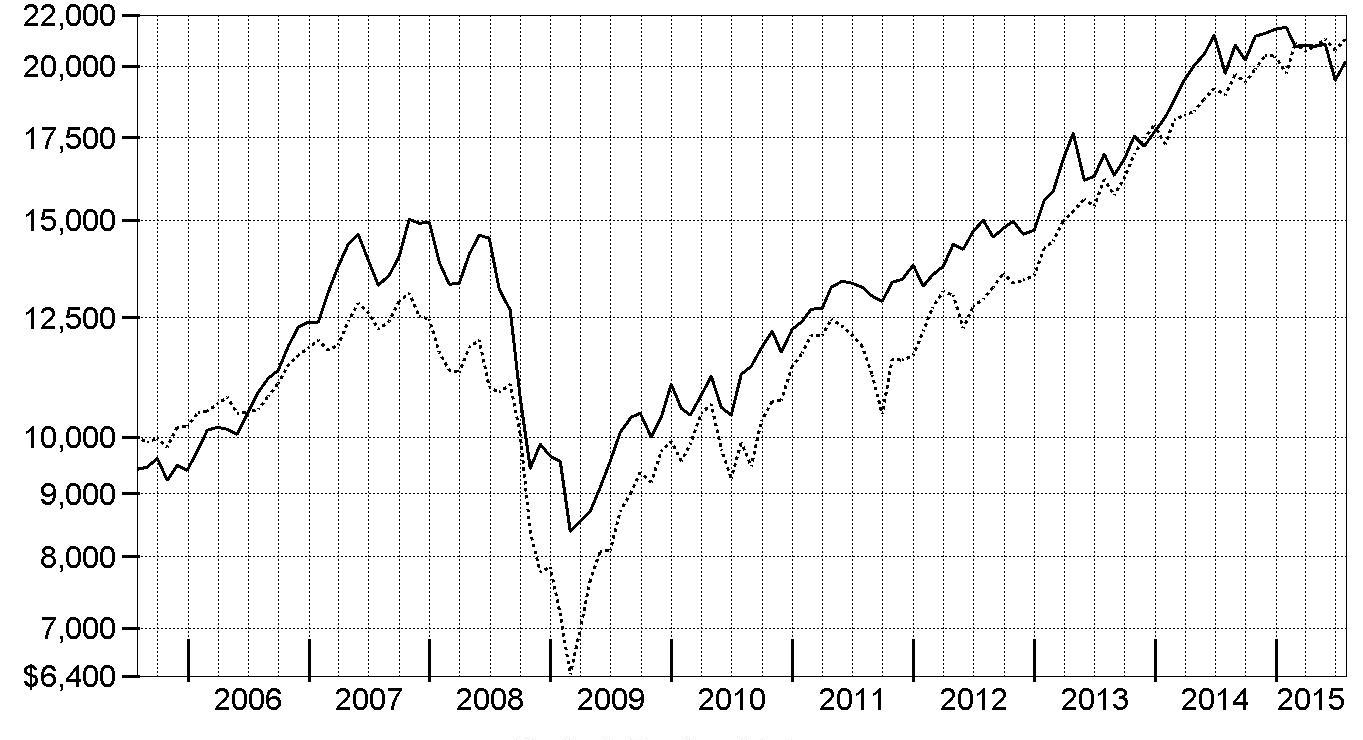

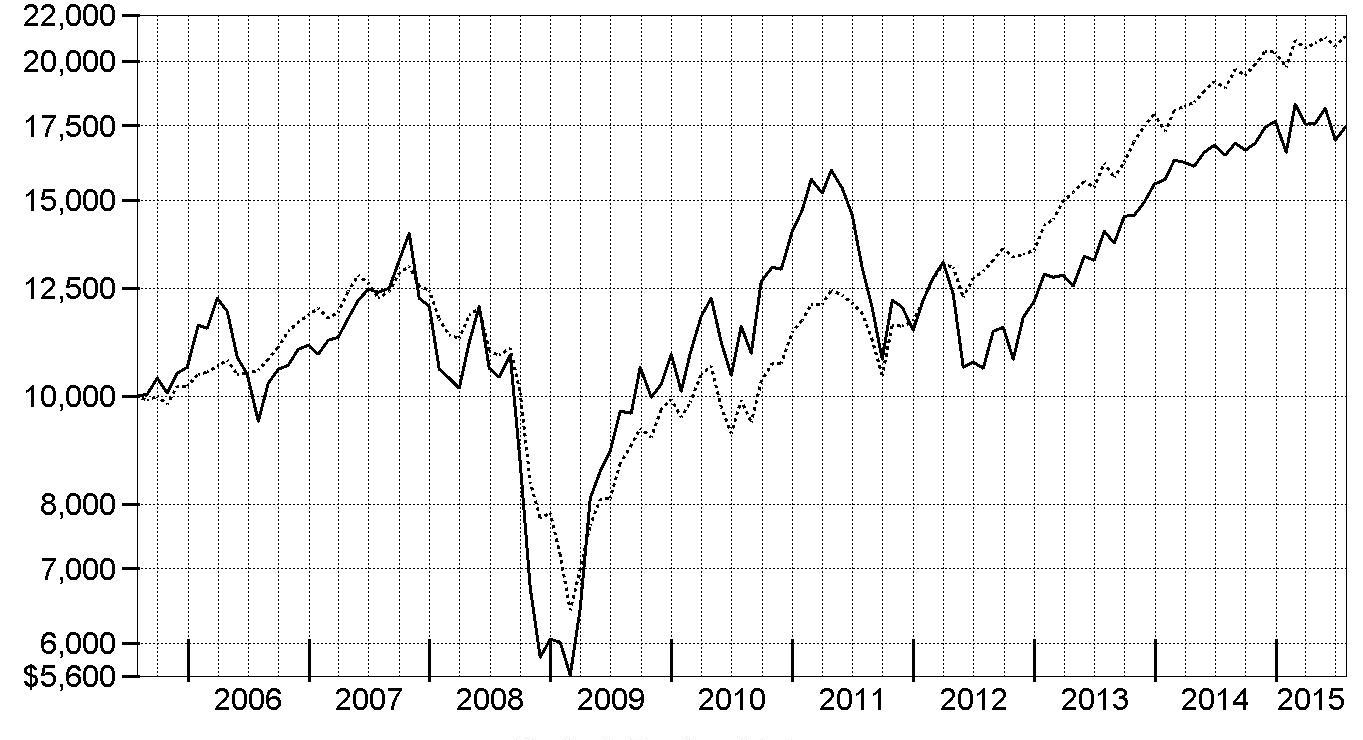

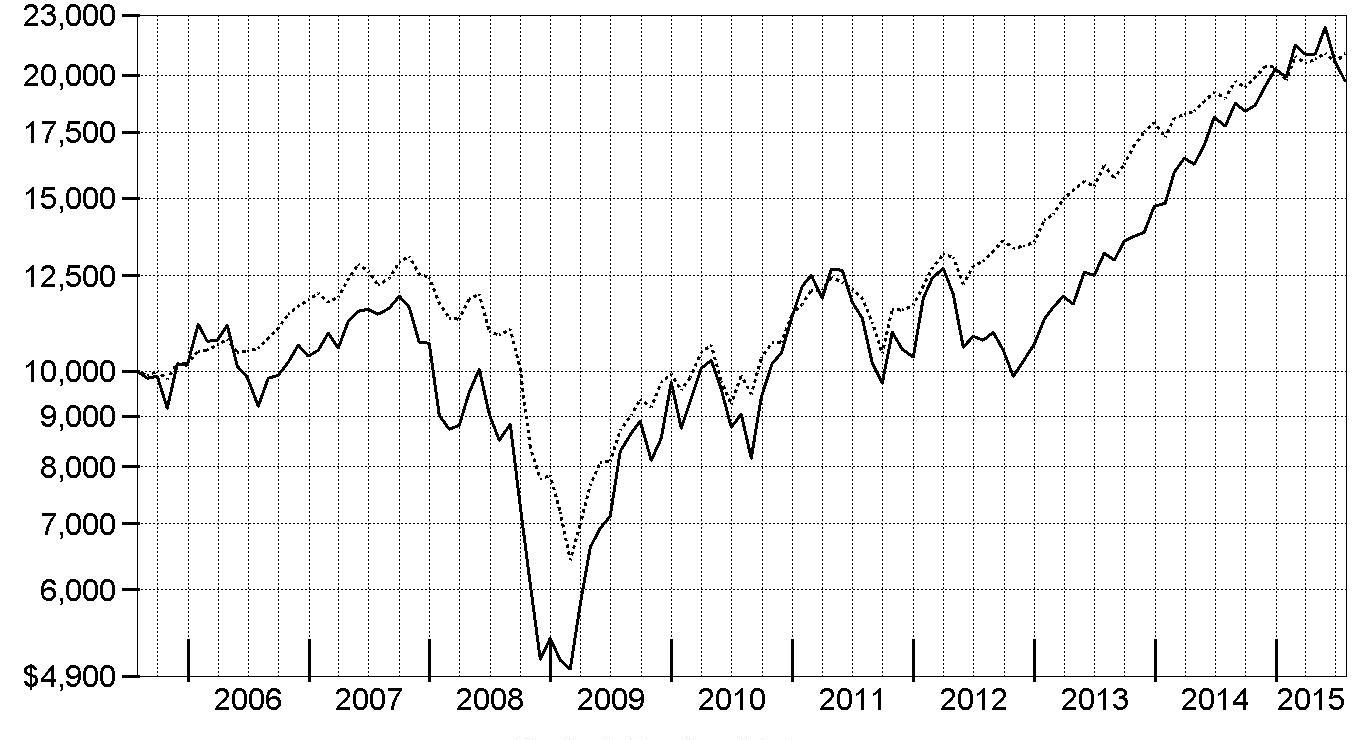

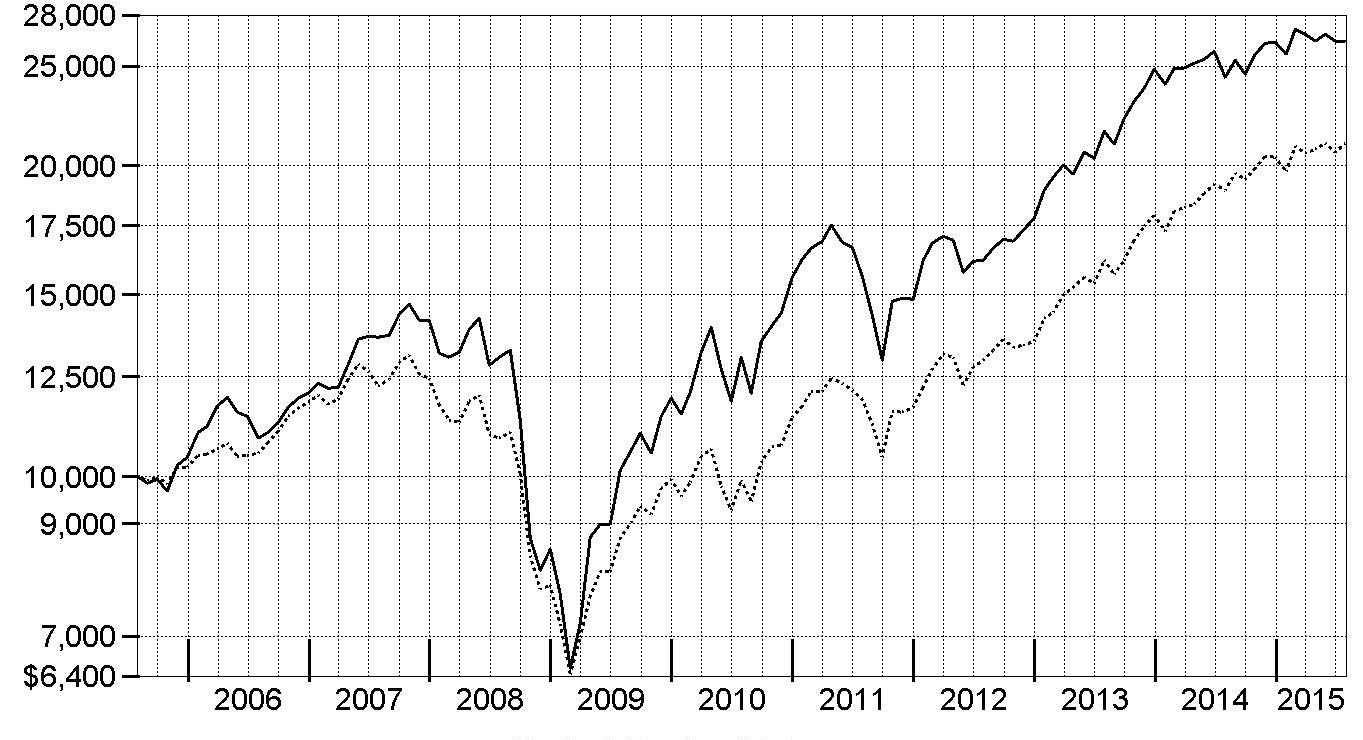

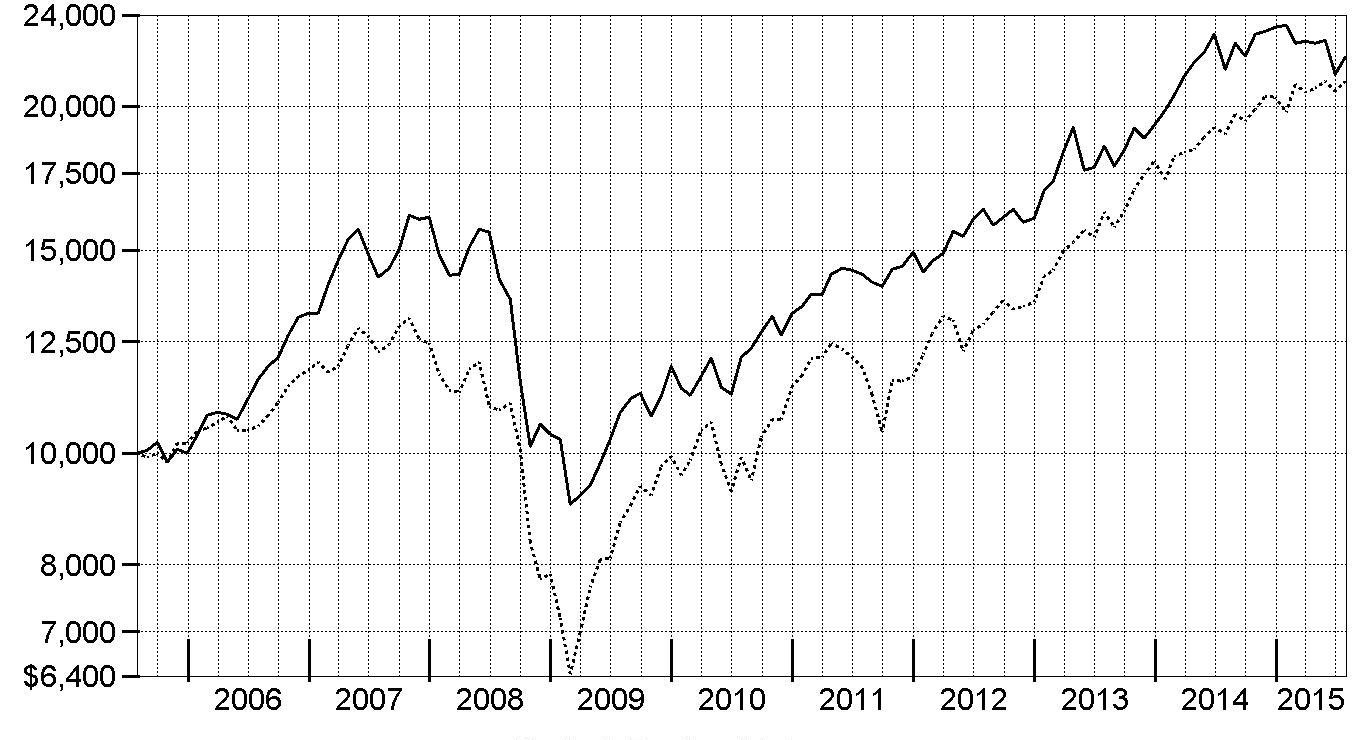

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Biotechnology Fund - Class A on July 31, 2005, and the current 5.75% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

| Period Ending Values | ||

| $50,932 | Fidelity Advisor® Biotechnology Fund - Class A | |

| $21,043 | S&P 500® Index | |

Fidelity Advisor® Biotechnology Fund

Management's Discussion of Fund Performance

Market Recap: The U.S. equity market gained strongly for the 12 months ending July 31, 2015 as stocks recovered from volatility in late 2014 and early 2015, supported by a still-positive economic backdrop. The S&P 500® Index returned 11.21%, with growth stocks in the index far outpacing value-oriented names on prospects for continued U.S. economic growth. As a result, the growth-oriented Nasdaq Composite Index® rose 18.71%, outpacing the broader S&P 500®, as well as the 12.03% advance of the smaller-cap Russell 2000® Index. Within the S&P 500®, seven of 10 sectors notched a gain, with significant performance variation. Health care (+27%) led the way, aided by merger activity. Consumer discretionary (+24%) benefited from spending linked to a seven-year low in unemployment. Strong first halves for consumer staples and the real estate segment of the financials sector yielded above-market returns (19% and 12%, respectively) for the full-year period. Conversely, energy (-26%) significantly lagged, due to a roughly 55% decline for U.S. crude-oil prices. Materials (-4%) also lost ground. At period end, investors remained focused on the slowing rate of U.S. earnings growth, the possible effect of a relatively stronger U.S. dollar on exports and inflation, and whether an economic slowdown in China would create ripples for the global economy.Comments from Portfolio Manager Rajiv Kaul: For the year, the fund's share classes handily outpaced the 51.91% return of the MSCI U.S. IMI Biotechnology 25/50 Index and the broadly based S&P 500®. (For specific class-level results, please see the Performance section of this report.) The fund's robust performance attracted steady inflows of capital, which I put to work in a variety of names. Versus the MSCI index, the fund was aided mainly by stock selection – specifically, investors' enthusiasm for small- and mid-cap biotech shares, which I tend to favor over large-caps for their more-robust growth prospects. Our top relative contributor was a large overweighting in mid-cap holding Anacor Pharmaceuticals, whose share price exploded higher in the final month of the period after the company reported positive results from two key Phase III studies on crisaborole, a non-steroidal ointment for patients with mild-to-moderate dermatitis. Several of the fund's top relative contributors were large-cap benchmark names I underweighted that failed to keep pace with the MSCI index: Biogen, Gilead Sciences and Amgen. Conversely, a large underweighting in bluebird bio curbed our relative results, in view of this index component's roughly 397% return. An overweighting in Epizyme also hampered our relative performance.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.Fidelity Advisor® Biotechnology Fund

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2015

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Gilead Sciences, Inc. | 8.8 | 11.3 |

| Biogen, Inc. | 6.9 | 7.1 |

| Celgene Corp. | 6.0 | 7.3 |

| Regeneron Pharmaceuticals, Inc. | 5.4 | 4.1 |

| Alexion Pharmaceuticals, Inc. | 5.4 | 4.7 |

| BioMarin Pharmaceutical, Inc. | 4.9 | 2.7 |

| Vertex Pharmaceuticals, Inc. | 3.6 | 4.0 |

| Anacor Pharmaceuticals, Inc. | 2.3 | 0.4 |

| Incyte Corp. | 2.2 | 1.8 |

| Radius Health, Inc. | 1.9 | 1.1 |

| 47.4 |

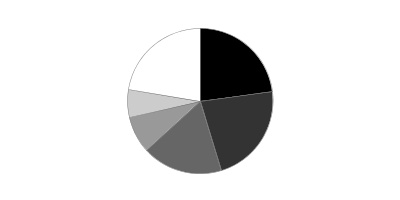

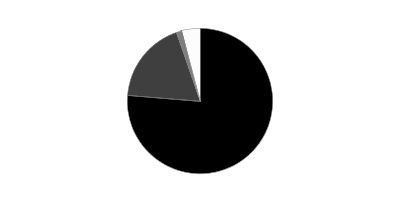

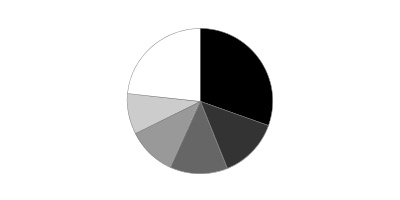

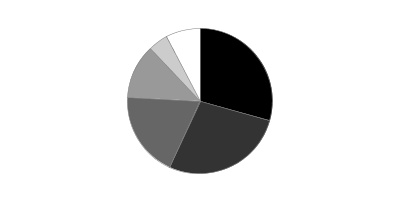

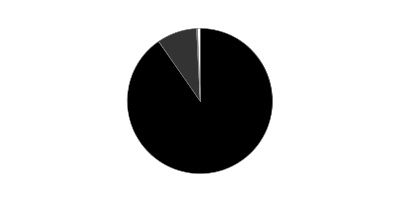

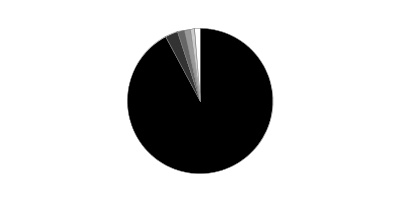

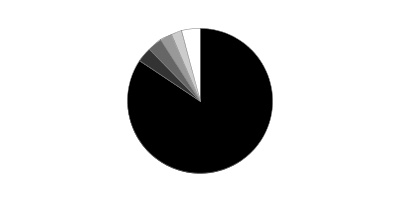

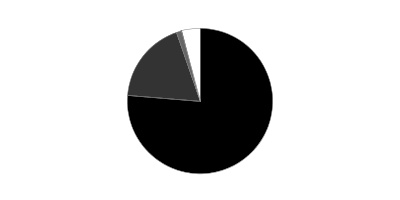

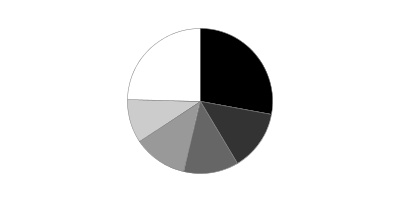

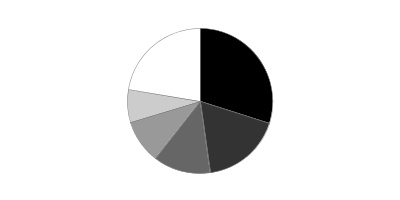

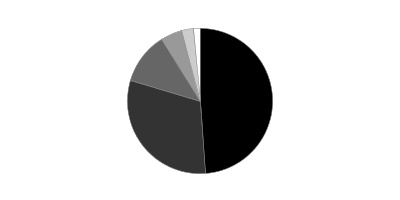

Top Industries (% of fund's net assets)

| As of July 31, 2015 | ||

| Biotechnology | 90.4% | |

| Pharmaceuticals | 8.8% | |

| Health Care Equipment & Supplies | 0.2% | |

| Life Sciences Tools & Services | 0.1% | |

| Capital Markets | 0.0% | |

| All Others* | 0.5% | |

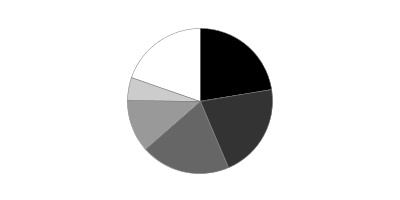

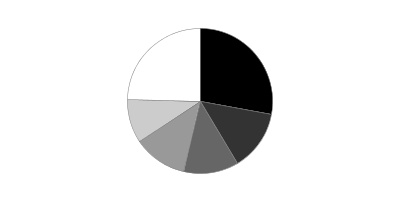

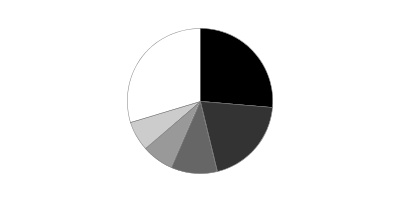

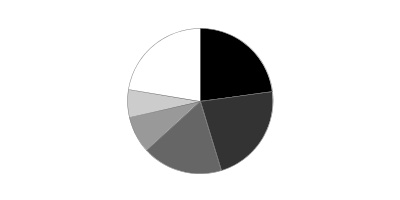

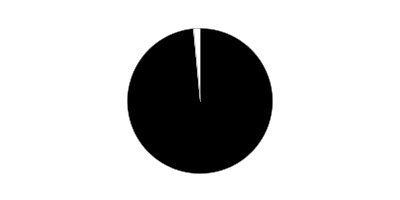

| As of January 31, 2015 | ||

| Biotechnology | 94.2% | |

| Pharmaceuticals | 5.2% | |

| Health Care Equipment & Supplies | 0.1% | |

| Life Sciences Tools & Services | 0.0% | |

| Personal Products | 0.0% | |

| All Others* | 0.5% | |

* Includes short-term investments and net other assets (liabilities).

Fidelity Advisor® Biotechnology Fund

Investments July 31, 2015

Showing Percentage of Net Assets

| Common Stocks - 98.1% | |||

| Shares | Value | ||

| Biotechnology - 89.7% | |||

| Biotechnology - 89.7% | |||

| ACADIA Pharmaceuticals, Inc. (a)(b) | 439,886 | $21,470,836 | |

| Acceleron Pharma, Inc. (a) | 534,157 | 15,298,256 | |

| Achillion Pharmaceuticals, Inc. (a)(b) | 1,640,172 | 13,974,265 | |

| Acorda Therapeutics, Inc. (a) | 665,253 | 22,858,093 | |

| Actelion Ltd. | 102,247 | 15,120,663 | |

| Adamas Pharmaceuticals, Inc. (a) | 891,152 | 22,064,924 | |

| Adaptimmune Therapeutics PLC sponsored ADR (b) | 560,777 | 8,439,694 | |

| ADMA Biologics, Inc. (a) | 50,300 | 468,796 | |

| Aduro Biotech, Inc. (b) | 87,388 | 2,291,313 | |

| Aduro Biotech, Inc. | 345,762 | 8,159,292 | |

| Aegerion Pharmaceuticals, Inc. (a)(b)(c) | 1,437,389 | 27,497,252 | |

| Affimed NV | 46,150 | 757,322 | |

| Agenus, Inc. (a) | 487,360 | 4,162,054 | |

| Agenus, Inc. warrants 1/9/18 (a) | 452,000 | 66,557 | |

| Agios Pharmaceuticals, Inc. (a) | 41,571 | 4,580,293 | |

| Akebia Therapeutics, Inc. (a) | 321,877 | 3,025,644 | |

| Alder Biopharmaceuticals, Inc. (a) | 526,313 | 24,431,449 | |

| Aldeyra Therapeutics, Inc. (a) | 478,895 | 4,252,588 | |

| Alexion Pharmaceuticals, Inc. (a) | 1,125,715 | 222,261,170 | |

| Alkermes PLC (a) | 347,441 | 24,327,819 | |

| Alnylam Pharmaceuticals, Inc. (a) | 208,735 | 26,599,101 | |

| AMAG Pharmaceuticals, Inc. (a)(b) | 815,018 | 52,079,650 | |

| Amarin Corp. PLC ADR (a)(b) | 706,803 | 1,597,375 | |

| Amgen, Inc. | 387,830 | 68,486,900 | |

| Amicus Therapeutics, Inc. (a) | 768,570 | 13,211,718 | |

| Anacor Pharmaceuticals, Inc. (a) | 625,028 | 93,247,927 | |

| Applied Genetic Technologies Corp. (a)(b) | 210,996 | 3,894,986 | |

| Ardelyx, Inc. (a) | 769,395 | 15,172,469 | |

| ARIAD Pharmaceuticals, Inc. (a)(b) | 815,995 | 6,658,519 | |

| Array BioPharma, Inc. (a) | 378,104 | 2,196,784 | |

| Ascendis Pharma A/S ADR | 35,700 | 715,071 | |

| Asterias Biotherapeutics, Inc. (a)(b) | 115,938 | 570,415 | |

| Atara Biotherapeutics, Inc. (b) | 290,699 | 16,319,842 | |

| aTyr Pharma, Inc. (a) | 45,620 | 855,375 | |

| aTyr Pharma, Inc. | 55,238 | 932,141 | |

| Avalanche Biotechnologies, Inc. (a) | 125,129 | 1,841,899 | |

| Baxalta, Inc. | 37,900 | 1,244,257 | |

| BioCryst Pharmaceuticals, Inc. (a) | 326,300 | 5,051,124 | |

| Biogen, Inc. (a) | 888,906 | 283,365,455 | |

| BioMarin Pharmaceutical, Inc. (a) | 1,375,020 | 201,124,175 | |

| Bionovo, Inc. warrants 2/2/16 (a) | 56,850 | 1 | |

| BioTime, Inc. warrants 10/1/18 (a) | 2 | 2 | |

| bluebird bio, Inc. (a) | 33,549 | 5,563,431 | |

| Blueprint Medicines Corp. | 102,288 | 2,763,822 | |

| Calithera Biosciences, Inc. (b) | 497,158 | 3,678,969 | |

| Cara Therapeutics, Inc. (a) | 273,227 | 5,822,467 | |

| Catabasis Pharmaceuticals, Inc. | 138,100 | 1,795,300 | |

| Catalyst Pharmaceutical Partners, Inc.: | |||

| warrants 5/2/17 (a) | 8,557 | 31,409 | |

| warrants 5/30/17 (a) | 17,900 | 70,184 | |

| Celgene Corp. (a) | 1,889,799 | 248,036,119 | |

| Cell Therapeutics, Inc. warrants 7/6/16 (a) | 46,404 | 0 | |

| Celldex Therapeutics, Inc. (a)(b) | 539,120 | 12,696,276 | |

| Cellectis SA sponsored ADR | 40,000 | 1,420,400 | |

| Cepheid, Inc. (a) | 51,400 | 2,857,326 | |

| Cerulean Pharma, Inc. (a) | 1,310,113 | 5,292,857 | |

| Chiasma, Inc. | 325,192 | 6,898,298 | |

| Chiasma, Inc. | 29,500 | 695,315 | |

| Chiasma, Inc. warrants (a) | 81,298 | 1,184,016 | |

| Chimerix, Inc. (a) | 280,086 | 15,051,822 | |

| Cidara Therapeutics, Inc. | 19,000 | 265,620 | |

| Cidara Therapeutics, Inc. Series B | 223,967 | 2,817,953 | |

| Clovis Oncology, Inc. (a) | 201,132 | 16,981,575 | |

| CTI BioPharma Corp. (a)(b) | 1,758,315 | 3,252,883 | |

| Cytokinetics, Inc. (a) | 67,916 | 433,983 | |

| Cytokinetics, Inc. warrants 6/25/17 (a) | 244,500 | 90,798 | |

| DBV Technologies SA sponsored ADR (a) | 258,000 | 11,246,220 | |

| Dicerna Pharmaceuticals, Inc. (a) | 125,106 | 1,528,795 | |

| Dyax Corp. (a) | 1,872,832 | 46,090,396 | |

| Eleven Biotherapeutics, Inc. (a)(b) | 140,279 | 388,573 | |

| Emergent BioSolutions, Inc. (a) | 146,555 | 4,811,401 | |

| Enanta Pharmaceuticals, Inc. (a)(b) | 140,822 | 7,132,634 | |

| Epirus Biopharmaceuticals, Inc. (a)(b) | 254,100 | 1,649,109 | |

| Epizyme, Inc. (a)(b) | 2,060,493 | 45,969,599 | |

| Esperion Therapeutics, Inc. (a)(b) | 389,646 | 24,158,052 | |

| Exact Sciences Corp. (a)(b) | 364,159 | 8,765,307 | |

| Exelixis, Inc. (a)(b) | 1,013,812 | 5,809,143 | |

| Fate Therapeutics, Inc. (a)(b) | 198,704 | 1,402,850 | |

| Fibrocell Science, Inc. (a) | 279,800 | 1,824,296 | |

| FibroGen, Inc. (b) | 74,322 | 1,727,987 | |

| Forward Pharma A/S sponsored ADR | 23,100 | 749,826 | |

| Foundation Medicine, Inc. (a) | 159,200 | 3,230,964 | |

| Galapagos Genomics NV sponsored ADR | 253,629 | 15,382,599 | |

| Genmab A/S (a) | 387,749 | 36,493,151 | |

| Genocea Biosciences, Inc. (a) | 159,921 | 2,078,973 | |

| Genomic Health, Inc. (a) | 54,120 | 1,465,570 | |

| Geron Corp. (a)(b) | 4,752,575 | 19,247,929 | |

| Gilead Sciences, Inc. | 3,072,903 | 362,172,343 | |

| Halozyme Therapeutics, Inc. (a)(b) | 839,755 | 19,599,882 | |

| Heron Therapeutics, Inc. (a) | 403,200 | 13,039,488 | |

| Histogenics Corp. (b)(c) | 672,534 | 4,284,042 | |

| Ignyta, Inc. (a) | 629,000 | 8,717,940 | |

| Immune Design Corp. (a) | 268,300 | 5,194,288 | |

| ImmunoGen, Inc. (a)(b) | 1,104,927 | 19,910,785 | |

| Immunomedics, Inc. (a)(b) | 1,111,071 | 2,277,696 | |

| Incyte Corp. (a) | 882,941 | 92,073,087 | |

| Infinity Pharmaceuticals, Inc. (a) | 287,434 | 2,512,173 | |

| Insys Therapeutics, Inc. (a)(b) | 585,194 | 26,286,914 | |

| Intercept Pharmaceuticals, Inc. (a)(b) | 174,460 | 46,024,293 | |

| Intrexon Corp. (a)(b) | 182,908 | 11,934,747 | |

| Ironwood Pharmaceuticals, Inc. Class A (a) | 670,651 | 7,008,303 | |

| Isis Pharmaceuticals, Inc. (a) | 366,994 | 20,158,980 | |

| JHL Biotech, Inc. (d) | 234,770 | 878,040 | |

| Juno Therapeutics, Inc. | 73,900 | 3,615,188 | |

| Juno Therapeutics, Inc. (e) | 214,673 | 10,501,803 | |

| Karyopharm Therapeutics, Inc. (a) | 650,766 | 13,353,718 | |

| Keryx Biopharmaceuticals, Inc. (a)(b) | 673,542 | 5,374,865 | |

| Kite Pharma, Inc. (a)(b) | 654,920 | 47,658,528 | |

| La Jolla Pharmaceutical Co. (a) | 268,300 | 8,156,320 | |

| Lexicon Pharmaceuticals, Inc. (a)(b) | 785,970 | 6,633,587 | |

| Ligand Pharmaceuticals, Inc. Class B (a)(b) | 110,425 | 11,954,611 | |

| Lion Biotechnologies, Inc. (a) | 369,046 | 3,159,034 | |

| Macrocure Ltd. | 4,000 | 53,960 | |

| Macrogenics, Inc. (a) | 511,457 | 19,230,783 | |

| MannKind Corp. (a)(b) | 1,151,662 | 4,940,630 | |

| Medivation, Inc. (a) | 535,177 | 56,370,193 | |

| Merrimack Pharmaceuticals, Inc. (a) | 60,200 | 608,020 | |

| MiMedx Group, Inc. (a)(b) | 250,413 | 2,686,931 | |

| Minerva Neurosciences, Inc. (b) | 921,974 | 5,255,252 | |

| Momenta Pharmaceuticals, Inc. (a) | 121,037 | 2,631,344 | |

| Myriad Genetics, Inc. (a)(b) | 195,057 | 6,655,345 | |

| Neurocrine Biosciences, Inc. (a) | 624,728 | 31,311,367 | |

| NewLink Genetics Corp. (a) | 252,479 | 13,166,780 | |

| Nivalis Therapeutics, Inc. | 18,600 | 315,642 | |

| Novavax, Inc. (a) | 2,465,631 | 29,735,510 | |

| Novelos Therapeutics, Inc. warrants 12/6/16 (a) | 137,600 | 80 | |

| OncoMed Pharmaceuticals, Inc. (a) | 125,932 | 2,876,287 | |

| Ophthotech Corp. (a) | 674,737 | 45,672,948 | |

| Opko Health, Inc. (a)(b) | 586,151 | 9,595,292 | |

| Oragenics, Inc. (a) | 250,308 | 655,807 | |

| Orexigen Therapeutics, Inc. (a)(b) | 1,765,996 | 7,063,984 | |

| Organovo Holdings, Inc. (a)(b) | 194,083 | 656,001 | |

| Osiris Therapeutics, Inc. (a) | 203,971 | 4,350,701 | |

| OvaScience, Inc. (a)(b) | 193,445 | 5,513,183 | |

| PolyMedix, Inc. warrants 4/10/16 (a) | 163,833 | 2 | |

| Portola Pharmaceuticals, Inc. (a) | 475,082 | 23,488,054 | |

| Progenics Pharmaceuticals, Inc. (a)(b) | 793,543 | 6,872,082 | |

| ProNai Therapeutics, Inc. | 199,883 | 5,476,794 | |

| ProQR Therapeutics BV (a) | 249,416 | 4,035,551 | |

| Proteon Therapeutics, Inc. (b) | 137,500 | 2,376,000 | |

| Prothena Corp. PLC (a) | 113,234 | 7,470,047 | |

| PTC Therapeutics, Inc. (a) | 313,245 | 16,041,276 | |

| Puma Biotechnology, Inc. (a)(b) | 291,758 | 26,433,275 | |

| Radius Health, Inc. (a)(b) | 975,562 | 76,406,016 | |

| Raptor Pharmaceutical Corp. (a)(b) | 625,173 | 8,902,464 | |

| Receptos, Inc. (a) | 57,870 | 13,186,258 | |

| Regeneron Pharmaceuticals, Inc. (a) | 405,563 | 224,544,011 | |

| Regulus Therapeutics, Inc. (a) | 254,763 | 2,089,057 | |

| Repligen Corp. (a) | 361,227 | 12,646,557 | |

| Retrophin, Inc. (a)(b) | 71,300 | 2,263,062 | |

| Rigel Pharmaceuticals, Inc. (a) | 643,465 | 1,917,526 | |

| Sage Therapeutics, Inc. (b) | 262,168 | 17,921,804 | |

| Sangamo Biosciences, Inc. (a) | 682,052 | 6,240,776 | |

| Sarepta Therapeutics, Inc. (a)(b) | 371,104 | 11,845,640 | |

| Seattle Genetics, Inc. (a)(b) | 196,850 | 9,423,210 | |

| Seres Therapeutics, Inc. | 237,191 | 8,977,679 | |

| Seres Therapeutics, Inc. | 352,270 | 12,000,078 | |

| Sophiris Bio, Inc. (a) | 141,653 | 123,181 | |

| Sorrento Therapeutics, Inc. (a) | 7,400 | 153,772 | |

| Spark Therapeutics, Inc. (b) | 269,670 | 16,568,525 | |

| Spectrum Pharmaceuticals, Inc. (a) | 338,247 | 2,338,978 | |

| Stemline Therapeutics, Inc. (a)(b) | 348,093 | 3,735,038 | |

| Sunesis Pharmaceuticals, Inc. (a)(b) | 830,240 | 1,158,185 | |

| Synta Pharmaceuticals Corp. (a) | 471,286 | 999,126 | |

| TESARO, Inc. (a) | 391,937 | 22,732,346 | |

| TG Therapeutics, Inc. (a)(b) | 1,273,655 | 22,225,280 | |

| Threshold Pharmaceuticals, Inc. (a) | 26,804 | 115,793 | |

| Threshold Pharmaceuticals, Inc. warrants 3/16/16 (a) | 35,146 | 66,462 | |

| Tokai Pharmaceuticals, Inc. (b) | 91,000 | 1,186,640 | |

| Ultragenyx Pharmaceutical, Inc. (a) | 365,327 | 44,178,994 | |

| uniQure B.V. (a) | 158,829 | 4,089,847 | |

| United Therapeutics Corp. (a) | 142,294 | 24,098,912 | |

| Verastem, Inc. (a)(b) | 331,008 | 2,416,358 | |

| Versartis, Inc. (a) | 351,776 | 6,367,146 | |

| Vertex Pharmaceuticals, Inc. (a) | 1,089,676 | 147,106,260 | |

| Vical, Inc. (a) | 659,862 | 424,951 | |

| Vitae Pharmaceuticals, Inc. (b) | 1,091,502 | 11,035,085 | |

| Vital Therapies, Inc. (a)(b) | 218,579 | 3,545,351 | |

| Xencor, Inc. (a) | 464,569 | 10,401,700 | |

| Xenon Pharmaceuticals, Inc. | 102,215 | 1,113,121 | |

| XOMA Corp. (a)(b) | 1,918,701 | 1,401,803 | |

| Zafgen, Inc. (a)(b) | 1,306,751 | 49,617,335 | |

| ZIOPHARM Oncology, Inc. (a)(b) | 29,667 | 396,351 | |

| 3,699,508,117 | |||

| Capital Markets - 0.0% | |||

| Asset Management & Custody Banks - 0.0% | |||

| RPI International Holdings LP (d) | 12,210 | 1,719,168 | |

| Health Care Equipment & Supplies - 0.1% | |||

| Health Care Equipment - 0.1% | |||

| Bellerophon Therapeutics, Inc. | 227,700 | 790,119 | |

| Vermillion, Inc. (a)(b) | 1,165,400 | 2,330,800 | |

| Zosano Pharma Corp. | 172,100 | 1,344,101 | |

| 4,465,020 | |||

| Life Sciences Tools & Services - 0.1% | |||

| Life Sciences Tools & Services - 0.1% | |||

| NantKwest, Inc. | 83,700 | 2,561,220 | |

| Transgenomic, Inc. (a) | 13,500 | 20,520 | |

| Transgenomic, Inc. warrants 2/3/17 (a) | 81,000 | 43 | |

| 2,581,783 | |||

| Personal Products - 0.0% | |||

| Personal Products - 0.0% | |||

| MYOS Corp. (a) | 6,666 | 21,198 | |

| Pharmaceuticals - 8.2% | |||

| Pharmaceuticals - 8.2% | |||

| Achaogen, Inc. (a) | 141,215 | 1,018,160 | |

| Adimab LLC unit (d)(f) | 398,401 | 7,378,324 | |

| Aradigm Corp. (a) | 8,786 | 65,192 | |

| Auris Medical Holding AG (a) | 261,667 | 1,355,435 | |

| Biodel, Inc. (a)(b) | 718,800 | 740,364 | |

| Carbylan Therapeutics, Inc. | 699,867 | 4,836,081 | |

| Cempra, Inc. (a) | 187,800 | 7,861,308 | |

| Collegium Pharmaceutical, Inc. | 81,700 | 1,636,451 | |

| Dermira, Inc. (e) | 162,931 | 3,678,982 | |

| Dermira, Inc. | 449,300 | 10,145,194 | |

| Egalet Corp. (a)(b) | 489,678 | 5,675,368 | |

| Eisai Co. Ltd. | 342,900 | 22,397,027 | |

| Endo Health Solutions, Inc. (a) | 58,774 | 5,145,076 | |

| Flex Pharma, Inc. | 22,600 | 352,334 | |

| GW Pharmaceuticals PLC ADR (a)(b) | 346,424 | 39,669,012 | |

| Horizon Pharma PLC (a) | 1,745,938 | 64,337,815 | |

| Intra-Cellular Therapies, Inc. (a) | 253,854 | 7,387,151 | |

| Jazz Pharmaceuticals PLC (a) | 250,087 | 48,076,725 | |

| Kura Oncology, Inc. | 325,932 | 2,059,890 | |

| Nektar Therapeutics (a)(b) | 277,332 | 3,497,157 | |

| NeurogesX, Inc. (a) | 150,000 | 900 | |

| Ocular Therapeutix, Inc. | 196,271 | 4,531,897 | |

| Pacira Pharmaceuticals, Inc. (a) | 152,160 | 10,106,467 | |

| Paratek Pharmaceuticals, Inc. (a) | 683,303 | 17,191,903 | |

| Parnell Pharmaceuticals Holdings Ltd. (a) | 123,569 | 594,367 | |

| Repros Therapeutics, Inc. (a)(b) | 1,213,840 | 8,982,416 | |

| SCYNEXIS, Inc. (a) | 111,900 | 889,605 | |

| Sun Pharmaceutical Industries Ltd. (a) | 181,199 | 2,328,837 | |

| Tetraphase Pharmaceuticals, Inc. (a) | 378,131 | 17,980,129 | |

| TherapeuticsMD, Inc. (a) | 918,373 | 7,154,126 | |

| XenoPort, Inc. (a) | 478,008 | 3,489,458 | |

| Zogenix, Inc. (a)(b) | 560,316 | 10,819,702 | |

| Zogenix, Inc. warrants 7/27/17 (a) | 32,985 | 9,657 | |

| ZS Pharma, Inc. (a) | 259,204 | 15,482,255 | |

| 336,874,765 | |||

| TOTAL COMMON STOCKS | |||

| (Cost $2,842,483,596) | 4,045,170,051 | ||

| Preferred Stocks - 1.4% | |||

| Convertible Preferred Stocks - 1.4% | |||

| Biotechnology - 0.7% | |||

| Biotechnology - 0.7% | |||

| 23andMe, Inc. Series E (d) | 341,730 | 3,700,003 | |

| Aimmune Therapeutics, Inc. Series B (d) | 349,360 | 6,623,865 | |

| CytomX Therapeutics, Inc. Series D (d) | 4,092,403 | 607,075 | |

| Gensight Biologics Series B (d) | 191,500 | 584,675 | |

| Immunocore Ltd. Series A (d) | 17,149 | 3,238,594 | |

| Jounce Therapeutics, Inc. Series B (d) | 1,591,779 | 3,597,421 | |

| Moderna LLC Series E (d) | 54,410 | 3,355,465 | |

| Pronutria Biosciences, Inc. Series C (d) | 341,857 | 3,445,919 | |

| RaNA Therapeutics LLC Series B (d) | 1,310,353 | 1,415,181 | |

| Twist Bioscience Corp. Series C (d) | 1,866,791 | 2,799,998 | |

| 29,368,196 | |||

| Health Care Equipment & Supplies - 0.1% | |||

| Health Care Supplies - 0.1% | |||

| Novocure Ltd. Series J (d) | 26,307 | 3,629,051 | |

| Pharmaceuticals - 0.6% | |||

| Pharmaceuticals - 0.6% | |||

| Afferent Pharmaceuticals, Inc. Series C (d) | 1,915,787 | 4,699,998 | |

| Global Blood Therapeutics, Inc. Series B (d) | 1,814,085 | 9,324,397 | |

| Kolltan Pharmaceuticals, Inc. Series D (a)(d) | 1,610,391 | 1,610,391 | |

| MyoKardia, Inc. Series B (d) | 1,781,076 | 4,800,000 | |

| Syros Pharmaceuticals, Inc. Series B, 6.00% (d) | 163,994 | 515,942 | |

| Voyager Therapeutics, Inc. Series B (d) | 1,200,000 | 3,600,000 | |

| 24,550,728 | |||

| TOTAL CONVERTIBLE PREFERRED STOCKS | 57,547,975 | ||

| Nonconvertible Preferred Stocks - 0.0% | |||

| Biotechnology - 0.0% | |||

| Biotechnology - 0.0% | |||

| Moderna LLC Series D, 8.00% (a)(d) | 26,918 | 1,660,033 | |

| TOTAL PREFERRED STOCKS | |||

| (Cost $49,323,372) | 59,208,008 | ||

| Money Market Funds - 7.7% | |||

| Fidelity Cash Central Fund, 0.17% (g) | 30,057,446 | 30,057,446 | |

| Fidelity Securities Lending Cash Central Fund, 0.18% (g)(h) | 286,288,233 | 286,288,233 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $316,345,679) | 316,345,679 | ||

| TOTAL INVESTMENT PORTFOLIO - 107.2% | |||

| (Cost $3,208,152,647) | 4,420,723,738 | ||

| NET OTHER ASSETS (LIABILITIES) - (7.2)% | (295,543,483) | ||

| NET ASSETS - 100% | $4,125,180,255 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Affiliated company

(d) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $69,183,540 or 1.7% of net assets.

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $14,180,785 or 0.3% of net assets.

(f) Investment is owned by an entity that is treated as a corporation for U.S. tax purposes and is wholly-owned by the Fund.

(g) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(h) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost |

| 23andMe, Inc. Series E | 6/18/15 | $3,700,003 |

| Adimab LLC unit | 9/17/14 - 6/5/15 | $6,416,091 |

| Afferent Pharmaceuticals, Inc. Series C | 7/1/15 | $4,700,000 |

| Aimmune Therapeutics, Inc. Series B | 2/26/15 | $2,620,200 |

| CytomX Therapeutics, Inc. Series D | 6/12/15 | $607,075 |

| Gensight Biologics Series B | 7/2/15 | $590,265 |

| Global Blood Therapeutics, Inc. Series B | 12/22/14 | $4,535,213 |

| Immunocore Ltd. Series A | 7/27/15 | $3,227,085 |

| JHL Biotech, Inc. | 4/14/15 | $878,040 |

| Jounce Therapeutics, Inc. Series B | 4/17/15 | $3,597,421 |

| Kolltan Pharmaceuticals, Inc. Series D | 3/13/14 | $1,610,391 |

| Moderna LLC Series D, 8.00% | 11/6/13 | $574,161 |

| Moderna LLC Series E | 12/18/14 | $3,355,465 |

| MyoKardia, Inc. Series B | 4/20/15 | $4,800,000 |

| Novocure Ltd. Series J | 6/1/15 | $3,629,051 |

| Pronutria Biosciences, Inc. Series C | 1/30/15 | $3,445,919 |

| RaNA Therapeutics LLC Series B | 7/17/15 | $1,415,181 |

| RPI International Holdings LP | 5/21/15 | $1,439,559 |

| Syros Pharmaceuticals, Inc. Series B, 6.00% | 10/9/14 | $515,942 |

| Twist Bioscience Corp. Series C | 5/29/15 | $2,800,000 |

| Voyager Therapeutics, Inc. Series B | 4/10/15 | $3,600,000 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $33,479 |

| Fidelity Securities Lending Cash Central Fund | 4,375,447 |

| Total | $4,408,926 |

Other Affiliated Issuers

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows:

| Affiliate | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value, end of period |

| Aegerion Pharmaceuticals, Inc. | $14,658,766 | $26,915,448 | $-- | $-- | $27,497,252 |

| Aldeyra Therapeutics, Inc. | 993,513 | 1,504,500 | -- | -- | -- |

| Histogenics Corp. | -- | 7,408,337 | -- | -- | 4,284,042 |

| Repros Therapeutics, Inc. | 2,969,436 | 10,793,250 | -- | -- | -- |

| Vitae Pharmaceuticals, Inc. | -- | 13,496,238 | -- | -- | -- |

| Total | $18,621,715 | $60,117,773 | $-- | $-- | $31,781,294 |

Investment Valuation

The following is a summary of the inputs used, as of July 31, 2015, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Common Stocks | $4,045,170,051 | $4,000,807,658 | $31,142,955 | $13,219,438 |

| Preferred Stocks | 59,208,008 | -- | -- | 59,208,008 |

| Money Market Funds | 316,345,679 | 316,345,679 | -- | -- |

| Total Investments in Securities: | $4,420,723,738 | $4,317,153,337 | $31,142,955 | $72,427,446 |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value:

| Investments in Securities: | |

| Other Investments in Securities | |

| Beginning Balance | $-- |

| Total Realized Gain (Loss) | (73,792) |

| Total Unrealized Gain (Loss) | 2,499,647 |

| Cost of Purchases | 10,793,583 |

| Proceeds of Sales | -- |

| Amortization/Accretion | -- |

| Transfers in to Level 3 | -- |

| Transfers out of Level 3 | -- |

| Ending Balance | $13,219,438 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at July 31, 2015 | $2,425,855 |

| Preferred Stocks | |

| Beginning Balance | $4,580,027 |

| Total Realized Gain (Loss) | (37,571) |

| Total Unrealized Gain (Loss) | 9,936,555 |

| Cost of Purchases | 47,138,818 |

| Proceeds of Sales | (2,409,821) |

| Amortization/Accretion | -- |

| Transfers in to Level 3 | -- |

| Transfers out of Level 3 | -- |

| Ending Balance | $59,208,008 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at July 31, 2015 | $9,884,638 |

The information used in the above reconciliations represent fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor® Biotechnology Fund

Financial Statements

Statement of Assets and Liabilities

| July 31, 2015 | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $282,809,554) — See accompanying schedule: Unaffiliated issuers (cost $2,841,026,638) | $4,072,596,765 | |

| Fidelity Central Funds (cost $316,345,679) | 316,345,679 | |

| Other affiliated issuers (cost $50,780,330) | 31,781,294 | |

| Total Investments (cost $3,208,152,647) | $4,420,723,738 | |

| Cash | 18,331 | |

| Foreign currency held at value (cost $3,238,596) | 3,238,596 | |

| Receivable for investments sold | 16,679,600 | |

| Receivable for fund shares sold | 19,882,119 | |

| Distributions receivable from Fidelity Central Funds | 449,549 | |

| Other receivables | 21,759 | |

| Total assets | 4,461,013,692 | |

| Liabilities | ||

| Payable for investments purchased | $42,505,382 | |

| Payable for fund shares redeemed | 3,122,814 | |

| Accrued management fee | 1,835,035 | |

| Distribution and service plan fees payable | 1,181,168 | |

| Other affiliated payables | 650,799 | |

| Other payables and accrued expenses | 250,006 | |

| Collateral on securities loaned, at value | 286,288,233 | |

| Total liabilities | 335,833,437 | |

| Net Assets | $4,125,180,255 | |

| Net Assets consist of: | ||

| Paid in capital | $2,735,740,642 | |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 176,868,522 | |

| Net unrealized appreciation (depreciation) on investments | 1,212,571,091 | |

| Net Assets | $4,125,180,255 | |

| Calculation of Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($1,560,528,108 ÷ 49,657,414 shares) | $31.43 | |

| Maximum offering price per share (100/94.25 of $31.43) | $33.35 | |

| Class T: | ||

| Net Asset Value and redemption price per share ($196,393,228 ÷ 6,533,001 shares) | $30.06 | |

| Maximum offering price per share (100/96.50 of $30.06) | $31.15 | |

| Class B: | ||

| Net Asset Value and offering price per share ($8,097,965 ÷ 292,071 shares)(a) | $27.73 | |

| Class C: | ||

| Net Asset Value and offering price per share ($956,494,535 ÷ 34,425,841 shares)(a) | $27.78 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($1,403,666,419 ÷ 42,595,280 shares) | $32.95 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Year ended July 31, 2015 | ||

| Investment Income | ||

| Dividends | $3,283,311 | |

| Income from Fidelity Central Funds (including $4,375,447 from security lending) | 4,408,926 | |

| Total income | 7,692,237 | |

| Expenses | ||

| Management fee | $14,470,394 | |

| Transfer agent fees | 4,982,034 | |

| Distribution and service plan fees | 9,417,806 | |

| Accounting and security lending fees | 807,688 | |

| Custodian fees and expenses | 76,442 | |

| Independent trustees' compensation | 41,710 | |

| Registration fees | 411,171 | |

| Audit | 50,757 | |

| Legal | 25,848 | |

| Miscellaneous | 19,628 | |

| Total expenses before reductions | 30,303,478 | |

| Expense reductions | (106,911) | 30,196,567 |

| Net investment income (loss) | (22,504,330) | |

| Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 265,574,762 | |

| Foreign currency transactions | (44,901) | |

| Total net realized gain (loss) | 265,529,861 | |

| Change in net unrealized appreciation (depreciation) on investment securities | 881,295,858 | |

| Net gain (loss) | 1,146,825,719 | |

| Net increase (decrease) in net assets resulting from operations | $1,124,321,389 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Year ended July 31, 2015 | Year ended July 31, 2014 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $(22,504,330) | $(9,882,130) |

| Net realized gain (loss) | 265,529,861 | 15,835,693 |

| Change in net unrealized appreciation (depreciation) | 881,295,858 | 126,643,560 |

| Net increase (decrease) in net assets resulting from operations | 1,124,321,389 | 132,597,123 |

| Distributions to shareholders from net investment income | (69,565) | – |

| Distributions to shareholders from net realized gain | (51,362,234) | (3,083,051) |

| Total distributions | (51,431,799) | (3,083,051) |

| Share transactions - net increase (decrease) | 1,521,666,795 | 713,552,409 |

| Redemption fees | 97,303 | 133,198 |

| Total increase (decrease) in net assets | 2,594,653,688 | 843,199,679 |

| Net Assets | ||

| Beginning of period | 1,530,526,567 | 687,326,888 |

| End of period (including undistributed net investment income of $0 and accumulated net investment loss of $6,816,483, respectively) | $4,125,180,255 | $1,530,526,567 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Biotechnology Fund Class A

| Years ended July 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $20.19 | $17.25 | $11.79 | $8.81 | $6.67 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | (.20) | (.13) | (.09) | (.07) | (.07)B |

| Net realized and unrealized gain (loss) | 12.04 | 3.12 | 6.24 | 3.05 | 2.21 |

| Total from investment operations | 11.84 | 2.99 | 6.15 | 2.98 | 2.14 |

| Distributions from net realized gain | (.60) | (.05) | (.69) | – | – |

| Redemption fees added to paid in capitalA,C | – | – | – | – | – |

| Net asset value, end of period | $31.43 | $20.19 | $17.25 | $11.79 | $8.81 |

| Total ReturnD,E | 59.66% | 17.38% | 54.94% | 33.83% | 32.08% |

| Ratios to Average Net AssetsF,G | |||||

| Expenses before reductions | 1.04% | 1.08% | 1.15% | 1.27% | 1.35% |

| Expenses net of fee waivers, if any | 1.04% | 1.08% | 1.15% | 1.27% | 1.35% |

| Expenses net of all reductions | 1.04% | 1.08% | 1.14% | 1.27% | 1.34% |

| Net investment income (loss) | (.75)% | (.68)% | (.63)% | (.73)% | (.91)%B |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $1,560,528 | $602,625 | $286,695 | $68,993 | $30,639 |

| Portfolio turnover rateH | 26% | 50% | 22% | 82% | 99% |

A Calculated based on average shares outstanding during the period.

B Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (1.04) %.

C Amount represents less than $.01 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Biotechnology Fund Class T

| Years ended July 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $19.39 | $16.63 | $11.42 | $8.56 | $6.50 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | (.27) | (.19) | (.12) | (.10) | (.09)B |

| Net realized and unrealized gain (loss) | 11.54 | 3.00 | 6.02 | 2.96 | 2.15 |

| Total from investment operations | 11.27 | 2.81 | 5.90 | 2.86 | 2.06 |

| Distributions from net realized gain | (.60) | (.05) | (.69) | – | – |

| Redemption fees added to paid in capitalA,C | – | – | – | – | – |

| Net asset value, end of period | $30.06 | $19.39 | $16.63 | $11.42 | $8.56 |

| Total ReturnD,E | 59.17% | 16.95% | 54.50% | 33.41% | 31.69% |

| Ratios to Average Net AssetsF,G | |||||

| Expenses before reductions | 1.35% | 1.41% | 1.46% | 1.56% | 1.64% |

| Expenses net of fee waivers, if any | 1.35% | 1.41% | 1.46% | 1.56% | 1.64% |

| Expenses net of all reductions | 1.34% | 1.40% | 1.46% | 1.56% | 1.64% |

| Net investment income (loss) | (1.05)% | (1.01)% | (.94)% | (1.02)% | (1.21)%B |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $196,393 | $95,945 | $67,887 | $28,154 | $16,454 |

| Portfolio turnover rateH | 26% | 50% | 22% | 82% | 99% |

A Calculated based on average shares outstanding during the period.

B Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (1.34) %.

C Amount represents less than $.01 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Biotechnology Fund Class B

| Years ended July 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $18.01 | $15.52 | $10.75 | $8.09 | $6.17 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | (.35) | (.26) | (.17) | (.13) | (.12)B |

| Net realized and unrealized gain (loss) | 10.67 | 2.80 | 5.63 | 2.79 | 2.04 |

| Total from investment operations | 10.32 | 2.54 | 5.46 | 2.66 | 1.92 |

| Distributions from net realized gain | (.60) | (.05) | (.69) | – | – |

| Redemption fees added to paid in capital A,C | – | – | – | – | – |

| Net asset value, end of period | $27.73 | $18.01 | $15.52 | $10.75 | $8.09 |

| Total ReturnD,E | 58.42% | 16.42% | 53.76% | 32.88% | 31.12% |

| Ratios to Average Net AssetsF,G | |||||

| Expenses before reductions | 1.83% | 1.89% | 1.94% | 2.03% | 2.10% |

| Expenses net of fee waivers, if any | 1.83% | 1.89% | 1.94% | 2.03% | 2.10% |

| Expenses net of all reductions | 1.82% | 1.88% | 1.94% | 2.02% | 2.09% |

| Net investment income (loss) | (1.53)% | (1.49)% | (1.42)% | (1.49)% | (1.66)%B |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $8,098 | $6,101 | $8,136 | $6,349 | $5,849 |

| Portfolio turnover rateH | 26% | 50% | 22% | 82% | 99% |

A Calculated based on average shares outstanding during the period.

B Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (1.79) %.

C Amount represents less than $.01 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the contingent deferred sales charge.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Biotechnology Fund Class C

| Years ended July 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $18.04 | $15.53 | $10.76 | $8.10 | $6.18 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | (.35) | (.25) | (.17) | (.13) | (.12)B |

| Net realized and unrealized gain (loss) | 10.69 | 2.81 | 5.63 | 2.79 | 2.04 |

| Total from investment operations | 10.34 | 2.56 | 5.46 | 2.66 | 1.92 |

| Distributions from net realized gain | (.60) | (.05) | (.69) | – | – |

| Redemption fees added to paid in capital A,C | – | – | – | – | – |

| Net asset value, end of period | $27.78 | $18.04 | $15.53 | $10.76 | $8.10 |

| Total ReturnD,E | 58.43% | 16.54% | 53.71% | 32.84% | 31.07% |

| Ratios to Average Net AssetsF,G | |||||

| Expenses before reductions | 1.79% | 1.83% | 1.88% | 2.01% | 2.10% |

| Expenses net of fee waivers, if any | 1.79% | 1.83% | 1.88% | 2.01% | 2.10% |

| Expenses net of all reductions | 1.79% | 1.83% | 1.87% | 2.01% | 2.09% |

| Net investment income (loss) | (1.49)% | (1.43)% | (1.36)% | (1.47)% | (1.66)%B |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $956,495 | $359,967 | $146,684 | $31,710 | $15,787 |

| Portfolio turnover rateH | 26% | 50% | 22% | 82% | 99% |

A Calculated based on average shares outstanding during the period.

B Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (1.79) %.

C Amount represents less than $.01 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the contingent deferred sales charge.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Biotechnology Fund Class I

| Years ended July 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $21.10 | $17.97 | $12.22 | $9.10 | $6.87 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | (.14) | (.08) | (.05) | (.04) | (.05)B |

| Net realized and unrealized gain (loss) | 12.60 | 3.26 | 6.49 | 3.16 | 2.28 |

| Total from investment operations | 12.46 | 3.18 | 6.44 | 3.12 | 2.23 |

| Distributions from investment income | –C | – | – | – | – |

| Distributions from net realized gain | (.60) | (.05) | (.69) | – | – |

| Total distributions | (.61)D | (.05) | (.69) | – | – |

| Redemption fees added to paid in capitalA,C | – | – | – | – | – |

| Net asset value, end of period | $32.95 | $21.10 | $17.97 | $12.22 | $9.10 |

| Total ReturnE | 60.00% | 17.74% | 55.39% | 34.29% | 32.46% |

| Ratios to Average Net AssetsF,G | |||||

| Expenses before reductions | .78% | .81% | .85% | .95% | 1.04% |

| Expenses net of fee waivers, if any | .78% | .81% | .85% | .95% | 1.04% |

| Expenses net of all reductions | .77% | .80% | .84% | .94% | 1.03% |

| Net investment income (loss) | (.48)% | (.41)% | (.32)% | (.40)% | (.60)%B |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $1,403,666 | $465,889 | $177,926 | $26,772 | $5,903 |

| Portfolio turnover rateH | 26% | 50% | 22% | 82% | 99% |

A Calculated based on average shares outstanding during the period.

B Investment income per share reflects a large, non-recurring dividend which amounted to $.01 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.73) %.

C Amount represents less than $.01 per share.

D Total distributions of $.61 per share is comprised of distributions from net investment income of $.003 and distributions from net realized gain of $.604 per share.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended July 31, 2015

1. Organization.

Fidelity Advisor Biotechnology Fund (the Fund) is a non-diversified fund of Fidelity Advisor Series VII (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class T, Class C and Class I (formerly Institutional Class) shares, each of which, along with Class B shares, has equal rights as to assets and voting privileges. Class B shares are closed to new accounts and additional purchases, except for exchanges and reinvestments. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fidelity SelectCo, LLC (SelectCo) Fair Value Committee (the Committee). In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy. Equity securities, including restricted securities, for which observable inputs are not available are valued using alternate valuation approaches, including the market approach and the income approach and are categorized as Level 3 in the hierarchy. The market approach generally consists of using comparable market transactions while the income approach generally consists of using the net present value of estimated future cash flows, adjusted as appropriate for liquidity, credit, market and/or other risk factors.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

The following provides information on Level 3 securities held by the Fund that were valued at period end based on unobservable inputs. These amounts exclude valuations provided by a broker.

| Asset Type | Fair Value at 07/31/15 | Valuation Technique(s) | Unobservable Input | Amount or Range/Weighted Average | Impact to Valuation from an Increase in Input* |

| Equities | $ 72,427,446 | Black scholes | Discount for lack of marketability | 10.0% | Decrease |

| Discount cash flow | Discount rate | 8.0% | Decrease | ||

| Discount rate | Discount for lack of marketability | 10.0% | Decrease | ||

| Last transaction price | Transaction price | $0.15-$137.95/$27.68 | Increase | ||

| Registration statement | Discount rate | 10.0% | Decrease |

* Represents the expected directional change in the fair value of the Level 3 investments that would result from an increase in the corresponding input. A decrease to the unobservable input would have the opposite effect. Significant changes in these inputs could result in significantly higher or lower fair value measurements.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of July 31, 2015, as well as a roll forward of Level 3 investments, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Subsequent to ex-dividend date the Fund determines the components of these distributions, based upon receipt of tax filings or other correspondence relating to the underlying investment. During the period, dividend income has been increased $415,705 with a corresponding decrease to net unrealized appreciation (depreciation) as a result of a change in the prior period estimate, which had no impact on the total net assets or total return of the Fund. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of July 31, 2015, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), partnerships, net operating losses and losses deferred due to wash sales and excise tax regulations.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

| Gross unrealized appreciation | $1,391,318,986 |

| Gross unrealized depreciation | (190,969,871) |

| Net unrealized appreciation (depreciation) on securities | $1,200,349,115 |

| Tax Cost | $3,220,374,623 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $ 41,636,838 |

| Undistributed long-term capital gain | $ 147,453,662 |

| Net unrealized appreciation (depreciation) on securities and other investments | $1,200,349,115 |

The tax character of distributions paid was as follows:

| July 31, 2015 | July 31, 2014 | |

| Ordinary Income | $69,565 | $– |

| Long-term Capital Gains | 51,362,234 | 3,083,051 |

| Total | $51,431,799 | $ 3,083,051 |

Short-Term Trading (Redemption) Fees. Shares held by investors in the Fund less than 30 days may have been subject to a redemption fee equal to .75% of the NAV of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $2,114,556,562 and $686,266,912, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity SelectCo, LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and an annualized group fee rate that averaged .25% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by Fidelity Management & Research Company (FMR) and the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annual management fee rate was .55% of the Fund's average net assets.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| Distribution Fee | Service Fee | Total Fees | Retained by FDC | |

| Class A | -% | .25% | $2,497,966 | $59,669 |

| Class T | .25% | .25% | 714,048 | 2,248 |

| Class B | .75% | .25% | 72,711 | 54,539 |

| Class C | .75% | .25% | 6,133,081 | 2,675,253 |

| $9,417,806 | $2,791,709 |

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class T shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class T, Class B, and Class C redemptions. The deferred sales charges range from 5.00% to 1.00% for Class B shares, 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class T shares.

For the period, sales charge amounts retained by FDC were as follows:

| Retained by FDC | |

| Class A | $2,094,492 |

| Class T | 128,052 |

| Class B* | 3,865 |

| Class C* | 142,139 |

| $2,368,548 |

* When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| Amount | % of Class-Level Average Net Assets | |

| Class A | $1,895,518 | .19 |

| Class T | 351,986 | .25 |

| Class B | 16,532 | .23 |

| Class C | 1,168,975 | .19 |

| Class I | 1,549,023 | .18 |

| $ 4,982,034 |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $58,735 for the period.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $3,449 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds.

8. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $58,478 for the period.

In addition, during the period the investment adviser reimbursed/waived a portion of fund-level operating expenses in the amount of $14,520 and a portion of class-level operating expenses as follows:

| Amount | |

| Class A | $13,398 |

| Class T | 2,003 |

| Class B | 155 |

| Class C | 7,791 |

| Class I | 10,566 |

| $33,913 |

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| Years ended July 31, | 2015 | 2014 |

| From net investment income | ||

| Class I | $69,565 | $– |

| Total | $69,565 | $– |

| From net realized gain | ||

| Class A | $19,162,759 | $1,291,021 |

| Class T | 3,137,062 | 234,772 |

| Class B | 191,809 | 24,488 |

| Class C | 13,249,824 | 722,216 |

| Class I | 15,620,780 | 810,554 |

| Total | $51,362,234 | $3,083,051 |

10. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between funds:

| Shares | Shares | Dollars | Dollars | |

| Years ended July 31, | 2015 | 2014 | 2015 | 2014 |

| Class A | ||||

| Shares sold | 28,734,829 | 26,291,422 | $782,311,246 | $513,888,215 |

| Reinvestment of distributions | 750,777 | 64,680 | 17,834,437 | 1,162,299 |

| Shares redeemed | (9,674,834) | (13,129,582) | (251,598,976) | (254,303,314) |

| Net increase (decrease) | 19,810,772 | 13,226,520 | $548,546,707 | $260,747,200 |

| Class T | ||||

| Shares sold | 2,609,939 | 2,490,442 | $67,425,583 | $47,007,190 |

| Reinvestment of distributions | 134,415 | 13,197 | 3,058,643 | 228,306 |

| Shares redeemed | (1,158,298) | (1,639,876) | (29,041,801) | (30,470,117) |

| Net increase (decrease) | 1,586,056 | 863,763 | $41,442,425 | $16,765,379 |

| Class B | ||||

| Shares sold | 83,752 | 92,681 | $1,983,767 | $1,623,597 |

| Reinvestment of distributions | 8,590 | 1,384 | 180,710 | 22,292 |

| Shares redeemed | (138,999) | (279,647) | (3,242,788) | (4,810,522) |