As filed with the Securities and Exchange Commission on March 2, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2019 – December 31, 2019

ITEM 1. REPORT TO STOCKHOLDERS.

LISANTI SMALL CAP GROWTH FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

DECEMBER 31, 2019

Dear Shareholder,

The equity markets continued to deliver very strong returns in the second half of 2019, following the rebound they saw in the first half of the year. All aspects of the U.S. equity market participated: the Russell 1000 Index, which is an index of the 1000 largest capitalization stocks in the United States, increased 10.59%, returning 32.59% for the full year, while the Russell 2000 Index, which is an index of the 2000 smallest capitalization stocks in the United States, increased 7.30%, returning 26.53% for the full year. The second half of 2019 saw Growth stocks maintain its leadership over Value stocks in the larger capitalization issues; the Russell 1000 Growth Index, which is an index of the 1000 largest market capitalization stocks with the highest growth rate in the United States increased 12.27%, versus the Russell 1000 Value Index which returned 8.86%. In the smaller capitalization universe that situation was reversed in the second half of 2019, with the Russell 2000 Value Index (which is an index of the 2000 smallest capitalization stocks in the United States with the lowest valuation, low price to book, etc.) returning 7.87% versus the Russell 2000 Growth Index returning 6.75%. For the year, however, the Russell 2000 Growth Index edged out the Russell 2000 Value Index, returning 28.48% versus 23.01%. The Lisanti Small Cap Growth Fund underperformed its benchmark, the Russell 2000 Growth Index, returning 25.62% versus 28.48% for the benchmark.

The shift from growth to value that occurred during the month of September was noted for the speed and strength of the shift. The style rotation was the biggest since September of 2008, with the Russell 2000 Growth Index declining 0.82% and the Russell 2000 Value index increasing 5.13% in September. The best performing sectors during the month of September were Materials and Processing, followed by Producer Durables and Real Estate; Health-Care declined significantly (almost 5%) during the month, due to fears over potential changes to the system after the 2020 election. The largest quintile by market capitalization declined significantly, although year to date it has been the strongest contributor to the Index’s return. This in part reflects the fairly large inflows seen into small cap exchange-traded funds (“ETFs”) in September; when this occurs, lower capitalization and lower quality stocks in the index tend to outperform1, these factors do not favor our investment process.

This rotation was based in part on valuation, since growth was significantly more expensive than value relative to historical measures over the past five years or more. However, we think it also reflects the fact that the earnings slowdown we have seen has been disproportionately centered on a few sectors in the economy that have been pressured by the economic slowdown in the rest of the world, and also from trade pressures. Many of those sectors began to lap the start of the slowdown in the fall; as investors became more certain about a cessation of hostilities on trade, these issues began to outperform.

The fourth quarter of 2019 was extremely unusual in that the performance of the Russell 2000 Growth Index in the quarter was driven by only two sectors out of 24—BioPharma and Health-Care Equipment/Services. This was extremely unusual — according to Furey Research partners, this has not occurred since the index

| 1 | Source: FactSet, FTSE Russell, Jefferies |

LISANTI SMALL CAP GROWTH FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

DECEMBER 31, 2019

started trading almost 30 years ago. The main driver of the portfolio’s underperformance in the quarter was relative to the Russell 2000 Growth Index’s strong outperformance of Biotechnology/BioPharma stocks. For the quarter (specifically, the months of November and December) the drivers of outperformance were the most speculative stocks in that sector. What do we mean by that? Specifically, it was the smallest stocks, those below $1.0 billion in market capitalization and those with market capitalization of $500 million to $1.0 billion; stocks with little or no sales, and stocks with no products in Phase II or higher. While we invest in biotechnology stocks, as you know, we have tended to focus on companies with platform technologies, and with several products, at least one of which is past Phase II. The move in the biopharma stocks in the fourth quarter was responsible for 375 basis points of the Index’s outperformance, according to our Bloomberg attribution reports.

The move in the biopharma stocks was driven in part by M&A. Although most of the announced acquisitions focused on the larger capitalization companies in the biopharma sector, the smaller companies that had similar products moved very sharply in response to the robust takeout valuations seen for the acquired companies. While we realize there is a difference between a company with an established product and product pipeline and a company just entering a Phase I trial, and believe that a lot of the move was due to ETFs or “day traders”, we also believe there are some fundamental factors that will be supportive of the sector. It seemed clear to us that this fourth quarter marked a bit of a realization by large pharmaceutical companies that they do not have the skills for success in the next decade of drug development. They do not have the people that understand biotechnology and are good at developing targeted therapies; nor are they able to hire them; nor, even if they could develop them or hire them, could they catch the companies that have a 5-10 year head start on them. We believe the Health-Care market will increasingly move to molecularly based, targeted therapies for all sorts of health-care issues, as they are much gentler on the body and truly targeted, and therefore more effective. Thus, we believe that there will be continuous interest on the part of larger companies in acquiring companies with valuable technology. We also believe that part of the move was due to valuation disparity. The medical device/medical technology sector has performed strongly for a number of years; as a result, the valuation disparity between med-tech and biotechnology appear likely the widest we have seen it. We think that valuation gap may narrow over the coming years, as many of these newer biotechnology drugs that address very large markets become successful commercial products. We will continue to invest in biotechnology because we believe it is an increasingly valuable sector that will drive growth. (It is also almost 14% of the Russell 2000 Growth Index). We believe that our process of identifying companies with strong management teams, proprietary technology, and platform opportunities that appear likely to deliver multiple drugs over time, is a sound one that has added value, regardless of whether biopharma stocks are in or out of favor in the stock market.

Given these unusual events, we would not be surprised if one were to ask “what is going on here?” We do believe that the rise of ETFs and high frequency trading has had an impact on smaller capitalization stocks, and increased their volatility, particularly over a short term time frame. Over the longer term, however, we believe the basic tenets of successful small cap growth investing still apply, which is to identify companies that have unique characteristics (new products and services, sharp management teams, etc.) that could

LISANTI SMALL CAP GROWTH FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

DECEMBER 31, 2019

enable them to grow at above average rates; if the company can execute and grow at an above average rate for some period of time, we have observed that above average returns usually follow.

Although the second half of 2019 provided a bit more volatility than investors might have expected, given the first half of 2019, to us the critical point was that the market “broadened out”—i.e., more individual smaller capitalization stocks began to outperform. They outperformed, by and large, because they met or exceeded investors’ expectations in terms of earnings and revenue growth. The third quarter of 2019, which was the last earnings period to be reported, saw a very high number of smaller companies “beat expectations”—we estimate about 70%. This has not happened in a number of years, and we take it as a bullish sign for this part of the market, particularly given an economic backdrop that remains constructive.

For the back half of 2019, our biggest contributors to performance were the Information Technology and Communications Services sectors. While we continued to be invested in the high growth Software as a Service (SaaS) stocks, we saw opportunities in semiconductors and semiconductor capital equipment companies in the summer, as our research indicated that the slowdown (caused in part by trade issues with China) was fading and that 2020 could potentially be a period of strong growth. We believe both those industries could show strong growth for a number of years. The companies we speak with believe that the advent of the 5G wireless network, and the increasing focus on Artificial Intelligence (AI) could create demand for semiconductors that is significantly greater than that created in the early 1990s, as we entered the personal computer era. If their belief proves accurate, then there is not enough semiconductor manufacturing capacity in the world. Meeting that demand could create years of opportunity. The industry (both semiconductors and semiconductor capital equipment) has also consolidated, which should improve the profitability of the remaining companies as the industry returns to growth.

Our biggest detractors in the second half of 2019 were Health-Care and Industrials. Health-Care was by far the largest detractor; this was primarily due to biopharma, which we discussed earlier in this letter. Our industrial holdings suffered from being tied to Boeing; as Boeing’s issues with the Max737 worsened, these stocks came under pressure. As we look to 2020, we have deliberately broadened our focus in the industrial space, to include clean technologies, pollution control services, business services such as consulting, etc. We believe this broadening of focus has the potential to benefit our investors.

It is said that “bull markets always climb a wall of worry”; if we add the uncertainties around impeachment to the uncertainties around trade, to the uncertainties around the election, to the uncertainties around Brexit, to the issues in the Middle East, we appear to have a fairly large “wall of worry” for investors to climb. The professional investment world seems to be divided between those who expect an “earnings recession” and those who see earnings growth accelerating. Our own personal view is that the economy remains very constructive: consumer confidence is high; unemployment is low; housing appears to be picking up; the Federal Reserve appears set to keep interest rates low for the foreseeable future, and if trade tensions between the United States and China do not accelerate further, global growth may pick up. The consensus numbers, according to Jefferies, call for smaller companies to see earnings growth that is faster than that of larger companies as we move through 2020. We believe that backdrop could be a very positive one

LISANTI SMALL CAP GROWTH FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

DECEMBER 31, 2019

for investors in small cap growth stocks. We believe the story of the 2020 stock market may be broader participation on the part of many individual issues. We believe that secular trends will still dominate—for instance, we do not believe that we can make a strong investment case for your average small bank suddenly returning to strong earnings growth, or a specialty retailer that is poorly positioned for an omni-channel world suddenly seeing an acceleration in sales and earnings—but it may mean there are more opportunities for stock pickers in 2020 than there might have been in 2019. While there are sure to be issues that we did not anticipate (and probably at least one correction or two), we do believe that this backdrop will be, by and large, positive for smaller companies.

We continue to be impressed by the amount of innovation we see, across all industries, among smaller companies, and the increasing speed with which it is overtaking traditional companies in these industries. This innovation can be exceedingly disruptive—for instance, we see a number of newer financial companies offer services similar to those the banks offer, but in a non-bank format. This makes it much easier and quicker to get a loan, to pay bills, etc., and we believe these companies are creating a challenge for the smaller banks. We also see the move to the cloud as disruptive to traditional client/server software companies—the environment is so multi-faceted that it requires a completely different architecture. Given the cost advantages of moving to the cloud for corporations, as well as the convenience, we believe that the transition to cloud or hybrid cloud structures will happen much more quickly than the move from mainframes to client/server architecture did. We believe as these transitions ripple through the economy, they may be disruptive, as economic growth may not be evenly distributed across sectors, and there will be winners and losers in these change curves.

As we look to the end of 2019 and into 2020, we see an economic and political backdrop that is far more nuanced than it was even a few months ago. However, we do not see a domestic recession at this point. We continue to believe the environment will be “confusing” as the cyclical and secular trends intersect, and we see a clear dichotomy between larger capitalization stocks and the smaller, more domestically focused and more secularly well positioned companies. The Tax Reform Act was of significant benefit to many of the smaller public companies, as they tend to be among the highest corporate tax payers. We believe that this benefit will be both short term (reflecting the reduction in the actual tax rate) as well as long term, as many of the companies will, we believe, reinvest some of those benefits in their businesses to accelerate growth. However, the specter of a trade war has created a more nuanced economic backdrop, and the extent to which this escalates and its final impact is difficult to forecast. From our conversations with the managements of smaller companies, it may impact certain industries more than others. For those who rely on parts from China, it could require a restructuring of the supply chain. While the impact may be far less on smaller companies than on larger companies, there will likely still be some impact. While investor fear at this point over these issue seems quite high, it remains to be seen if the fears will translate into reality. Again, we think a more nuanced investment backdrop points towards more dispersion among returns from individual stocks, which we believe could make 2020 (once again) a stock picker’s market. As you know, our process is focused on identifying those companies whose returns are being driven by secular, structural, and transformative changes. We continue to remain prudent by focusing on reducing the volatility and earnings variability in the portfolio and on companies that are able to grow sales and earnings as a result

LISANTI SMALL CAP GROWTH FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

DECEMBER 31, 2019

of secular trends, structural changes where management is consolidating an industry or improving efficiency and stocks that are trading at a reasonable multiple to earnings growth.

Sincerely,

Mary Lisanti, CFA

President & Portfolio Manager

IMPORTANT RISKS AND DISCLOSURES

An investment in the Fund is subject to risk, including the possible loss of principal amount invested. The Fund invests in smaller companies, which carry greater risk than is associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock. The Fund’s investments in growth securities may be more sensitive to company earnings and more volatile than the market in general. Investments in technology companies are vulnerable to factors affecting that sector, such as dependency on consumer and business acceptance as new technology evolves. Investments in the Industrial sector can be significantly affected by business cycle fluctuations, worldwide economy growth, government and corporate spending and others. Investments in Health-Care companies may be affected by government regulations and government health-care programs, changes in the cost of medical products and services, limited product lines, product liability claims, and patent protection, among other factors.

Basis points, otherwise known as bps or "bips," are a unit of measure used in finance to describe the percentage change in the value or rate of a financial instrument. One basis point is equivalent to 0.01% (1/100th of a percent) or 0.0001 in decimal form.

The views in this report were those of the Fund manager as of December 31, 2019, and may not necessarily reflect her views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding the Fund’s investment methodology and do not constitute investment advice. Although the Fund manager believes she has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. All current and future holdings of the Fund are subject to risk and are subject to change.

LISANTI SMALL CAP GROWTH FUND

PERFORMANCE CHART AND ANALYSIS (Unaudited)

DECEMBER 31, 2019

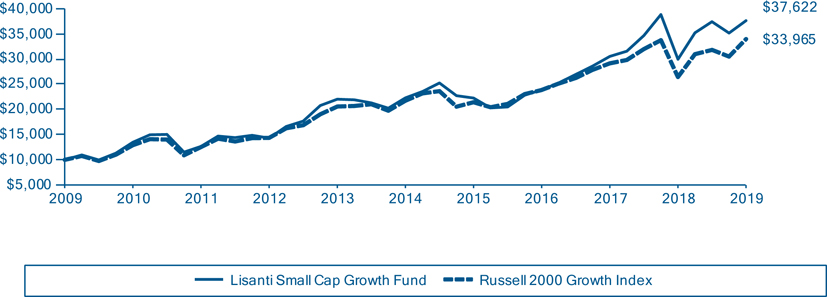

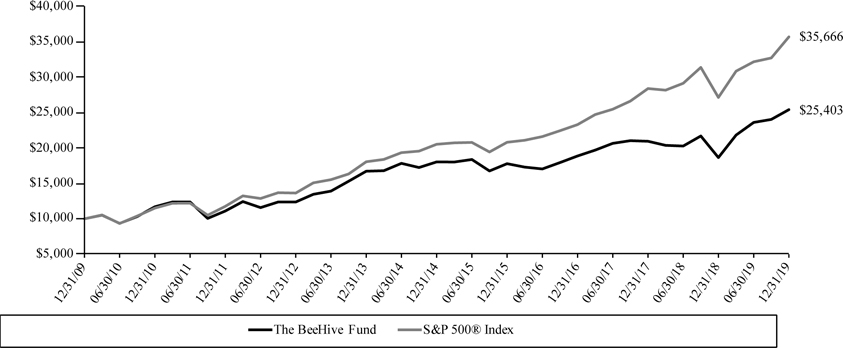

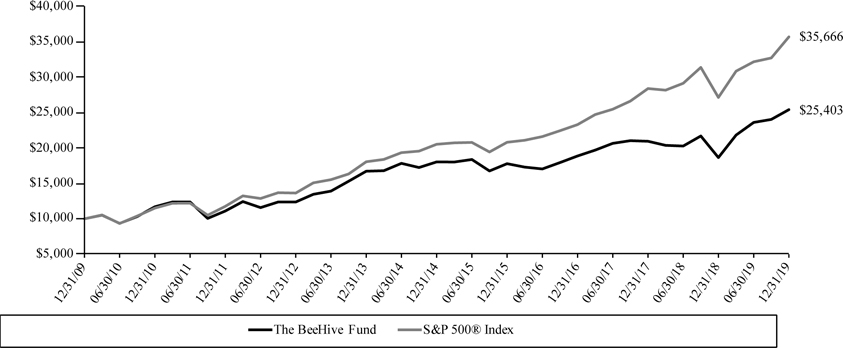

The following chart reflects the change in the value of a hypothetical $10,000 investment, including reinvested dividends and distributions, in the Lisanti Small Cap Growth Fund (the “Fund”) compared with the performance of the benchmark, Russell 2000 Growth Index (“Russell 2000 Growth”), over the past ten fiscal years. The Russell 2000 Growth, the Fund‘s primary performance benchmark, measures the performance of those Russell 2000 Growth companies with higher price-to-value ratios and higher forecasted growth values. The total return of the index includes the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the index does not include expenses. The Fund is professionally managed, while the index is unmanaged and is not available for investment.

Comparison of Change in Value of a $10,000 Investment

Lisanti Small Cap Growth Fund vs. Russell 2000 Growth Index

| Average Annual Total Returns | | | |

| Periods Ended December 31, 2019 | One Year | Five Year | Ten Year |

| Lisanti Small Cap Growth Fund | 25.62% | 11.03% | 14.17% |

| Russell 2000 Growth Index | 28.48% | 9.34% | 13.01% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratio (gross) is 2.32%. However, the Fund’s adviser has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, proxy expenses, and extraordinary expenses) to 1.35%, through April 30, 2020 (the “Expense Cap”). The Expense Cap may be raised or eliminated only with the consent of the Board of Trustees. The adviser may be reimbursed by the Fund for fees waived and expenses reimbursed by the adviser pursuant to the Expense Cap if such payment is made within three years of the fee waiver or expense reimbursement and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current Expense Cap and (ii) the Expense Cap in place at the time the fees/expenses were waived/reimbursed. Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement will increase if exclusions from the Expense Cap apply. Shares redeemed or exchanged within 30 days of purchase will be charged a 1.00% redemption fee. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (800) 441-7031.

LISANTI SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2019

| Shares | | | Security Description | | Value | |

| Common Stock - 97.8% | | | | |

| Communication Services - 1.6% | | | | |

| | 6,160 | | | Cardlytics, Inc. (a) | | $ | 387,218 | |

| | 12,320 | | | EverQuote, Inc. (a) | | | 423,192 | |

| | | | | | | | 810,410 | |

| Consumer Discretionary - 18.9% | | | | |

| | 21,905 | | | Boot Barn Holdings, Inc. (a) | | | 975,430 | |

| | 12,110 | | | Callaway Golf Co. | | | 256,732 | |

| | 17,100 | | | Chegg, Inc. (a) | | | 648,261 | |

| | 24,115 | | | Crocs, Inc. (a) | | | 1,010,177 | |

| | 23,305 | | | KB Home | | | 798,662 | |

| | 5,460 | | | Lithia Motors, Inc., Class A | | | 802,620 | |

| | 7,885 | | | Papa John's International, Inc. | | | 497,938 | |

| | 10,795 | | | Planet Fitness, Inc., Class A (a) | | | 806,171 | |

| | 2,745 | | | RH (a) | | | 586,057 | |

| | 14,845 | | | Skyline Champion Corp. (a) | | | 470,587 | |

| | 9,080 | | | TopBuild Corp. (a) | | | 935,966 | |

| | 4,975 | | | Visteon Corp. (a) | | | 430,785 | |

| | 18,505 | | | Winnebago Industries, Inc. | | | 980,395 | |

| | 11,400 | | | YETI Holdings, Inc. (a) | | | 396,492 | |

| | | | | | | | 9,596,273 | |

| Consumer Staples - 1.6% | | | | |

| | 13,890 | | | Freshpet, Inc. (a) | | | 820,760 | |

| Energy - 1.1% | | | | |

| | 13,420 | | | World Fuel Services Corp. | | | 582,696 | |

| Financial Services - 1.0% | | | | |

| | 4,928 | | | Kinsale Capital Group, Inc. | | | 500,980 | |

| Financials - 3.7% | | | | |

| | 15,355 | | | Ameris Bancorp | | | 653,202 | |

| | 3,730 | | | eHealth, Inc. (a) | | | 358,378 | |

| | 20,240 | | | First Financial Bankshares, Inc. | | | 710,424 | |

| | 2,705 | | | Palomar Holdings, Inc. (a) | | | 136,576 | |

| | | | | | | | 1,858,580 | |

| Health-Care - 20.0% | | | | |

| | 14,410 | | | ACADIA Pharmaceuticals, Inc. (a) | | | 616,460 | |

| | 18,620 | | | Aimmune Therapeutics, Inc. (a) | | | 623,211 | |

| | 6,395 | | | AMN Healthcare Services, Inc. (a) | | | 398,472 | |

| | 30,310 | | | Horizon Therapeutics PLC (a) | | | 1,097,222 | |

| | 7,065 | | | Inogen, Inc. (a) | | | 482,751 | |

| | 6,730 | | | LHC Group, Inc. (a) | | | 927,125 | |

| | 8,245 | | | Natera, Inc. (a) | | | 277,774 | |

| | 5,575 | | | Nevro Corp. (a) | | | 655,286 | |

| | 10,170 | | | NuVasive, Inc. (a) | | | 786,548 | |

| | 12,660 | | | Pacira BioSciences, Inc. (a) | | | 573,498 | |

| | 2,955 | | | Penumbra, Inc. (a) | | | 485,418 | |

| | 7,990 | | | Repligen Corp. (a) | | | 739,075 | |

| | 5,475 | | | Shockwave Medical, Inc. (a) | | | 240,462 | |

| | 5,125 | | | Tactile Systems Technology, Inc. (a) | | | 345,989 | |

| Shares | | | Security Description | | Value | |

| Health-Care - 20.0% (continued) | | | | |

| | 8,285 | | | Tandem Diabetes Care, Inc. (a) | | $ | 493,869 | |

| | 9,940 | | | Teladoc Health, Inc. (a) | | | 832,177 | |

| | 19,160 | | | Veracyte, Inc. (a) | | | 534,947 | |

| | | | | | | | 10,110,284 | |

| Health-Care Biotechnology - 1.6% | | | | |

| | 1,850 | | | Arrowhead Pharmaceuticals, Inc. (a) | | | 117,345 | |

| | 2,720 | | | Biohaven Pharmaceutical Holding Co., Ltd. (a) | | | 148,077 | |

| | 1,715 | | | CRISPR Therapeutics AG (a) | | | 104,452 | |

| | 19,810 | | | Karyopharm Therapeutics, Inc. (a) | | | 379,758 | |

| | 2,210 | | | Rocket Pharmaceuticals, Inc. (a) | | | 50,300 | |

| | | | | | | | 799,932 | |

| Health-Care Equipment - 0.4% | | | | |

| | 1,330 | | | Insulet Corp. (a) | | | 227,696 | |

| Health-Care Life Sciences Tools - 0.3% | | | | |

| | 5,245 | | | NeoGenomics, Inc. (a) | | | 153,416 | |

| Health-Care Services - 2.6% | | | | |

| | 2,449 | | | Addus HomeCare Corp. (a) | | | 238,092 | |

| | 6,610 | | | Amedisys, Inc. (a) | | | 1,103,341 | |

| | | | | | | | 1,341,433 | |

| Health-Care Supplies - 2.0% | | | | |

| | 6,120 | | | SI-BONE, Inc. (a) | | | 131,580 | |

| | 24,350 | | | STAAR Surgical Co. (a) | | | 856,390 | |

| | | | | | | | 987,970 | |

| Health-Care Technology - 1.2% | | | | |

| | 8,360 | | | Inspire Medical Systems, Inc. (a) | | | 620,396 | |

| Industrials - 11.8% | | | | |

| | 24,525 | | | Builders FirstSource, Inc. (a) | | | 623,180 | |

| | 17,300 | | | Casella Waste Systems, Inc. (a) | | | 796,319 | |

| | 4,405 | | | Clean Harbors, Inc. (a) | | | 377,729 | |

| | 13,360 | | | Generac Holdings, Inc. (a) | | | 1,343,882 | |

| | 5,500 | | | Huron Consulting Group, Inc. (a) | | | 377,960 | |

| | 24,055 | | | Kornit Digital, Ltd. (a) | | | 823,403 | |

| | 11,070 | | | MasTec, Inc. (a) | | | 710,251 | |

| | 2,015 | | | RBC Bearings, Inc. (a) | | | 319,055 | |

| | 4,035 | | | Trex Co., Inc. (a) | | | 362,666 | |

| | 1,970 | | | Woodward, Inc. | | | 233,327 | |

| | | | | | | | 5,967,772 | |

| Information Technology - 8.6% | | | | |

| | 3,430 | | | Avalara, Inc. (a) | | | 251,247 | |

| | 4,065 | | | Bill.Com Holdings, Inc. (a) | | | 154,673 | |

| | 9,395 | | | Enphase Energy, Inc. (a) | | | 245,491 | |

| | 5,885 | | | Fabrinet (a) | | | 381,583 | |

| | 6,520 | | | Lumentum Holdings, Inc. (a) | | | 517,036 | |

| | 19,000 | | | MACOM Technology Solutions Holdings, Inc. (a) | | | 505,400 | |

See Notes to Financial Statements.

LISANTI SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2019

| Shares | | | Security Description | | Value | |

| Information Technology - 8.6% (continued) | | | | |

| | 6,100 | | | ManTech International Corp., Class A | | $ | 487,268 | |

| | 5,485 | | | Paylocity Holding Corp. (a) | | | 662,698 | |

| | 7,570 | | | Silicon Motion Technology Corp., ADR | | | 383,875 | |

| | 2,640 | | | SolarEdge Technologies, Inc. (a) | | | 251,038 | |

| | 21,155 | | | Ultra Clean Holdings, Inc. (a) | | | 496,508 | |

| | | | | | | | 4,336,817 | |

| Materials - 1.2% | | | | |

| | 26,485 | | | Summit Materials, Inc., Class A (a) | | | 632,992 | |

| Real Estate - 1.0% | | | | |

| | 12,020 | | | First Industrial Realty Trust, Inc. REIT | | | 498,950 | |

| Technology - 19.2% | | | | |

| | 6,045 | | | ACI Worldwide, Inc. (a) | | | 229,015 | |

| | 10,055 | | | Advanced Energy Industries, Inc. (a) | | | 715,916 | |

| | 4,835 | | | Anaplan, Inc. (a) | | | 253,354 | |

| | 12,530 | | | Five9, Inc. (a) | | | 821,717 | |

| | 34,290 | | | FormFactor, Inc. (a) | | | 890,511 | |

| | 11,370 | | | Inphi Corp. (a) | | | 841,607 | |

| | 13,305 | | | Itron, Inc. (a) | | | 1,116,955 | |

| | 26,745 | | | Lattice Semiconductor Corp. (a) | | | 511,899 | |

| | 8,080 | | | Methode Electronics, Inc. | | | 317,948 | |

| | 6,495 | | | MKS Instruments, Inc. | | | 714,515 | |

| | 22,235 | | | Perficient, Inc. (a) | | | 1,024,366 | |

| | 2,100 | | | Q2 Holdings, Inc. (a) | | | 170,268 | |

| | 9,125 | | | Rapid7, Inc. (a) | | | 511,183 | |

| | 2,970 | | | The Trade Desk, Inc., Class A (a) | | | 771,547 | |

| | 53,985 | | | Viavi Solutions, Inc. (a) | | | 809,775 | |

| | | | | | | | 9,700,576 | |

| Total Common Stock (Cost $44,053,682) | | | 49,547,933 | |

| Investments, at value - 97.8% (Cost $44,053,682) | | $ | 49,547,933 | |

| Other Assets & Liabilities, Net - 2.2% | | | 1,089,559 | |

| Net Assets - 100.0% | | $ | 50,637,492 | |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| (a) | Non-income producing security. |

The following is a summary of the inputs used to value the Fund's investments as of December 31, 2019.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| Valuation Inputs | | Investments in Securities | |

| Level 1 - Quoted Prices | | $ | 49,547,933 | |

| Level 2 - Other Significant Observable Inputs | | | – | |

| Level 3 - Significant Unobservable Inputs | | | – | |

| Total | | $ | 49,547,933 | |

The Level 1 value displayed in this table is Common Stock. Refer to this Schedule of Investments for a further breakout of each security by industry.

| PORTFOLIO HOLDINGS (Unaudited) | | | |

| % of Total Investments | | | |

| Communication Services | | | 1.6 | % |

| Consumer Discretionary | | | 19.4 | % |

| Consumer Staples | | | 1.7 | % |

| Energy | | | 1.2 | % |

| Financial Services | | | 1.0 | % |

| Financials | | | 3.7 | % |

| Health-Care | | | 20.4 | % |

| Health-Care Biotechnology | | | 1.6 | % |

| Health-Care Equipment | | | 0.5 | % |

| Health-Care Life Sciences Tools | | | 0.3 | % |

| Health-Care Services | | | 2.7 | % |

| Health-Care Supplies | | | 2.0 | % |

| Health-Care Technology | | | 1.2 | % |

| Industrials | | | 12.0 | % |

| Information Technology | | | 8.8 | % |

| Materials | | | 1.3 | % |

| Real Estate | | | 1.0 | % |

| Technology | | | 19.6 | % |

| | | | 100.0 | % |

See Notes to Financial Statements.

LISANTI SMALL CAP GROWTH FUND

STATEMENT OF ASSETS AND LIABILITIES

DECEMBER 31, 2019

| ASSETS | | | |

| Investments, at value (Cost $44,053,682) | | $ | 49,547,933 | |

| Cash | | | 847,076 | |

| Receivables: | | | | |

| Fund shares sold | | | 297,330 | |

| Dividends and interest | | | 9,503 | |

| Prepaid expenses | | | 11,021 | |

| Total Assets | | | 50,712,863 | |

| | | | | |

| LIABILITIES | | | | |

| Payables: | | | | |

| Fund shares redeemed | | | 3,151 | |

| Accrued Liabilities: | | | | |

| Investment adviser fees | | | 23,487 | |

| Fund services fees | | | 9,176 | |

| Other expenses | | | 39,557 | |

| Total Liabilities | | | 75,371 | |

| | | | | |

| NET ASSETS | | $ | 50,637,492 | |

| | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| Paid-in capital | | $ | 45,450,234 | |

| Distributable earnings | | | 5,187,258 | |

| NET ASSETS | | $ | 50,637,492 | |

| | | | | |

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | 2,326,956 | |

| | | | | |

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE* | | $ | 21.76 | |

| * | Shares redeemed or exchanged within 30 days of purchase are charged a 1.00% redemption fee. |

See Notes to Financial Statements.

LISANTI SMALL CAP GROWTH FUND

STATEMENT OF OPERATIONS

YEAR ENDED DECEMBER 31, 2019

| INVESTMENT INCOME | | | |

| Dividend income | | $ | 55,668 | |

| Interest income | | | 10,106 | |

| Total Investment Income | | | 65,774 | |

| | | | | |

| EXPENSES | | | | |

| Investment adviser fees | | | 418,830 | |

| Fund services fees | | | 228,735 | |

| Shareholder service fees | | | 110,218 | |

| Custodian fees | | | 5,328 | |

| Registration fees | | | 29,599 | |

| Professional fees | | | 35,434 | |

| Trustees' fees and expenses | | | 4,090 | |

| Other expenses | | | 40,723 | |

| Total Expenses | | | 872,957 | |

| Fees waived | | | (277,778 | ) |

| Net Expenses | | | 595,179 | |

| | | | | |

| NET INVESTMENT LOSS | | | (529,405 | ) |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN | | | | |

| Net realized gain on investments | | | 2,271,514 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 7,315,554 | |

| NET REALIZED AND UNREALIZED GAIN | | | 9,587,068 | |

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 9,057,663 | |

See Notes to Financial Statements.

LISANTI SMALL CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the Years Ended December 31, | |

| | | 2019 | | | 2018 | |

| OPERATIONS | | | | | | |

| Net investment loss | | $ | (529,405 | ) | | $ | (294,230 | ) |

| Net realized gain | | | 2,271,514 | | | | 827,143 | |

| Net change in unrealized appreciation (depreciation) | | | 7,315,554 | | | | (4,171,325 | ) |

| Increase (Decrease) in Net Assets Resulting from Operations | | | 9,057,663 | | | | (3,638,412 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total Distributions Paid | | | (1,076,692 | ) | | | (1,490,131 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Sale of shares | | | 14,463,091 | | | | 29,042,321 | |

| Reinvestment of distributions | | | 998,703 | | | | 1,422,005 | |

| Redemption of shares | | | (6,607,821 | ) | | | (5,455,798 | ) |

| Redemption fees | | | 1,741 | | | | 1,423 | |

| Increase in Net Assets from Capital Share Transactions | | | 8,855,714 | | | | 25,009,951 | |

| Increase in Net Assets | | | 16,836,685 | | | | 19,881,408 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Year | | | 33,800,807 | | | | 13,919,399 | |

| End of Year | | $ | 50,637,492 | | | $ | 33,800,807 | |

| | | | | | | | | |

| SHARE TRANSACTIONS | | | | | | | | |

| Sale of shares | | | 683,112 | | | | 1,385,122 | |

| Reinvestment of distributions | | | 46,734 | | | | 77,199 | |

| Redemption of shares | | | (311,546 | ) | | | (293,500 | ) |

| Increase in Shares | | | 418,300 | | | | 1,168,821 | |

See Notes to Financial Statements.

LISANTI SMALL CAP GROWTH FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each year.

| | | For the Years Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| NET ASSET VALUE, Beginning of Year | | $ | 17.71 | | | $ | 18.81 | | | $ | 18.74 | | | $ | 17.75 | | | $ | 18.73 | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment loss (a) | | | (0.25 | ) | | | (0.21 | ) | | | (0.33 | ) | | | (0.25 | ) | | | (0.32 | ) |

| Net realized and unrealized gain (loss) | | | 4.78 | | | | (0.12 | ) | | | 5.43 | | | | 1.55 | | | | 0.28 | (b) |

| Total from Investment Operations | | | 4.53 | | | | (0.33 | ) | | | 5.10 | | | | 1.30 | | | | (0.04 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | | | |

| Net realized gain | | | (0.48 | ) | | | (0.77 | ) | | | (5.03 | ) | | | (0.31 | ) | | | (0.94 | ) |

| Total Distributions to Shareholders | | | (0.48 | ) | | | (0.77 | ) | | | (5.03 | ) | | | (0.31 | ) | | | (0.94 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| REDEMPTION FEES(a) | | | 0.00 | (c) | | | 0.00 | (c) | | | 0.00 | (c) | | | 0.00 | (c) | | | 0.00 | (c) |

| NET ASSET VALUE, End of Year | | $ | 21.76 | | | $ | 17.71 | | | $ | 18.81 | | | $ | 18.74 | | | $ | 17.75 | |

| TOTAL RETURN | | | 25.62 | % | | | (1.90 | )% | | | 27.78 | % | | | 7.32 | % | | | (0.18 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (000s omitted) | | $ | 50,637 | | | $ | 33,801 | | | $ | 13,919 | | | $ | 24,022 | | | $ | 32,809 | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (1.20 | )% | | | (1.02 | )% | | | (1.61 | )% | | | (1.49 | )% | | | (1.65 | )% |

| Net expenses | | | 1.35 | % | | | 1.37 | % | | | 1.80 | % | | | 1.80 | % | | | 1.80 | % |

| Gross expenses (d) | | | 1.98 | % | | | 2.32 | % | | | 3.15 | % | | | 2.48 | % | | | 2.26 | % |

| PORTFOLIO TURNOVER RATE | | | 252 | % | | | 220 | % | | | 294 | % | | | 268 | % | | | 196 | % |

| (a) | Calculated based on average shares outstanding during each year. |

| (b) | Per share amount does not accord with the amount reported in the Statement of Operations due to the timing of Fund share sales and the amount per share of realized and unrealized gains and losses at such times. |

| (c) | Less than $0.01 per share. |

| (d) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements.

LISANTI SMALL CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2019

Note 1. Organization

The Lisanti Small Cap Growth Fund (the “Fund”) is a diversified portfolio of Forum Funds (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940, as amended (the “Act”). Under its Trust Instrument, the Trust is authorized to issue an unlimited number of the Fund’s shares of beneficial interest without par value. The Fund commenced operations on February 27, 2004. The Fund seeks maximum capital appreciation. Prior to February 1, 2018, the Fund was named Dinosaur Lisanti Small Cap Growth Fund.

Note 2. Summary of Significant Accounting Policies

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services – Investment Companies.” These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the fiscal year. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation – Securities are valued at market prices using the last quoted trade or official closing price from the principal exchange where the security is traded, as provided by independent pricing services on each Fund business day. In the absence of a last trade, securities are valued at the mean of the last bid and ask price provided by the pricing service. Shares of non-exchange traded open-end mutual funds are valued at net asset value (“NAV”). Short-term investments that mature in sixty days or less may be valued at amortized cost.

The Fund values its investments at fair value pursuant to procedures adopted by the Trust’s Board of Trustees if (1) market quotations are not readily available or (2) the Adviser, as defined in Note 4, believes that the values available are unreliable. The Trust’s Valuation Committee, as defined in the Fund’s registration statement, performs certain functions as they relate to the administration and oversight of the Fund’s valuation procedures. Under these procedures, the Valuation Committee convenes on a regular and ad hoc basis to review such investments and considers a number of factors, including valuation methodologies and significant unobservable inputs, when arriving at fair value.

The Valuation Committee may work with the Adviser to provide valuation inputs. In determining fair valuations, inputs may include market-based analytics that may consider related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant investment information. Adviser inputs may include an income-based approach in which the anticipated future cash flows of the investment are discounted in determining fair value. Discounts may also be applied based on the nature or duration of any restrictions on the disposition of the investments. The Valuation Committee performs regular reviews of valuation methodologies, key inputs and assumptions, disposition analysis and market activity.

LISANTI SMALL CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2019

Fair valuation is based on subjective factors and, as a result, the fair value price of an investment may differ from the security’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different NAV than a NAV determined by using market quotes.

GAAP has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various “inputs” used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 - Quoted prices in active markets for identical assets and liabilities.

Level 2 - Prices determined using significant other observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Short-term securities with maturities of sixty days or less are valued at amortized cost, which approximates market value, and are categorized as Level 2 in the hierarchy. Municipal securities, long-term U.S. government obligations and corporate debt securities are valued in accordance with the evaluated price supplied by a pricing service and generally categorized as Level 2 in the hierarchy. Other securities that are categorized as Level 2 in the hierarchy include, but are not limited to, warrants that do not trade on an exchange, securities valued at the mean between the last reported bid and ask quotation and international equity securities valued by an independent third party with adjustments for changes in value between the time of the securities’ respective local market closes and the close of the U.S. market.

Level 3 - Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The aggregate value by input level, as of December 31, 2019, for the Fund’s investments is included in the Fund’s Schedule of Investments.

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after determining the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded on an accrual basis. Premium is amortized and discount is accreted using the effective interest method. Identified cost of investments sold is used to determine the gain and loss for both financial statement and federal income tax purposes.

Distributions to Shareholders – Distributions to shareholders of net investment income, if any, are declared and paid quarterly. Distributions to shareholders of net capital gains and foreign currency gains, if any, are declared and paid at least annually. Distributions to shareholders are recorded on the ex-dividend date. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain

LISANTI SMALL CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2019

on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund.

Federal Taxes – The Fund intends to continue to qualify each year as a regulated investment company under Subchapter M of Chapter 1, Subtitle A, of the Internal Revenue Code of 1986, as amended (“Code”), and to distribute all of its taxable income to shareholders. In addition, by distributing in each calendar year substantially all of its net investment income and capital gains, if any, the Fund will not be subject to a federal excise tax. Therefore, no federal income or excise tax provision is required. The Fund files a U.S. federal income and excise tax return as required. The Fund’s federal income tax returns are subject to examination by the Internal Revenue Service for a period of three fiscal years after they are filed. As of December 31, 2019, there are no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

Commitments and Contingencies – In the normal course of business, the Fund enters into contracts that provide general indemnifications by the Fund to the counterparty to the contract. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote. The Fund has determined that none of these arrangements requires disclosure on the Fund’s balance sheet.

Redemption Fees – A shareholder who redeems or exchanges shares within 30 days of purchase will incur a redemption fee of 1.00% of the current NAV of shares redeemed or exchanged, subject to certain limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to the Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. The Fund reserves the right to modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee. Redemption fees incurred for the Fund, if any, are reflected on the Statements of Changes in Net Assets.

Note 3. Cash – Concentration in Uninsured Account

For cash management purposes, the Fund may concentrate cash with the Fund’s custodian. This typically results in cash balances exceeding the Federal Deposit Insurance Corporation (“FDIC”) insurance limits. As of December 31, 2019, the Fund had $597,076 at MUFG Union Bank, N.A. that exceeded the FDIC insurance limit.

LISANTI SMALL CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2019

Note 4. Fees and Expenses

Investment Adviser – Lisanti Capital Growth, LLC (the “Adviser”) is the investment adviser to the Fund. Pursuant to an investment advisory agreement, the Adviser receives an advisory fee, payable monthly, from the Fund at an annual rate of 0.95% of the Fund’s average daily net assets.

Shareholder Service Plan – The Trust has adopted a shareholder service plan for the Fund under which the Fund may reimburse the Fund’s administrator for amounts paid by the administrator for providing shareholder service activities that are not otherwise provided by the transfer agent. The Fund’s administrator may make such payments to various financial institutions, including the Adviser, that provide shareholder servicing to their customers invested in the Fund in amounts of up to 0.25% annually of the average daily net assets of the Fund.

Distribution – Foreside Fund Services, LLC serves as the Fund’s distributor (the “Distributor”). The Fund does not have a distribution (12b-1) plan; accordingly, the Distributor does not receive compensation from the Fund for its distribution services. The Adviser compensates the Distributor directly for its services. The Distributor is not affiliated with the Adviser or Atlantic Fund Administration, LLC, a wholly owned subsidiary of Apex US Holdings, LLC (d/b/a Apex Fund Services) (“Apex”) or their affiliates.

Other Service Providers – Apex provides fund accounting, fund administration, compliance and transfer agency services to the Fund. The fees related to these services are included in Fund services fees within the Statement of Operations. Apex also provides certain shareholder report production and EDGAR conversion and filing services. Pursuant to an Apex services agreement, the Fund pays Apex customary fees for its services. Apex provides a Principal Executive Officer, a Principal Financial Officer, a Chief Compliance Officer and an Anti-Money Laundering Officer to the Fund, as well as certain additional compliance support functions.

Trustees and Officers – Each Independent Trustee’s annual retainer is $31,000 ($41,000 for the Chairman), and the Audit Committee Chairman receives an additional $2,000 annually. The Trustees and Chairman may receive additional fees for special Board meetings. Each Trustee is also reimbursed for all reasonable out-of-pocket expenses incurred in connection with his or her duties as a Trustee, including travel and related expenses incurred in attending Board meetings. The amount of Trustees’ fees attributable to the Fund is disclosed in the Statement of Operations. Certain officers of the Trust are also officers or employees of the above named service providers, and during their terms of office received no compensation from the Fund.

Note 5. Fees Waived

The Adviser has contractually agreed to waive its fee and/or reimburse expenses to limit total annual fund operating expenses (excluding all taxes, interest, portfolio transaction expenses, proxy expenses, and extraordinary expenses) to 1.35% through April 30, 2020. Other Fund service providers have voluntarily agreed to waive a portion of their fees. The contractual waivers may only be raised or eliminated with the consent of the Board and voluntary fee waivers may be reduced or eliminated at any time. For the year ended December 31, 2019, fees waived were as follows:

LISANTI SMALL CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2019

| Investment Adviser Fees Waived | | | Other Waivers | | | Total Fees Waived | |

| $ | 150,797 | | | $ | 126,981 | | | $ | 277,778 | |

The Adviser may be reimbursed by the Fund for fees waived and expenses reimbursed by the Adviser pursuant to the Expense Cap if such payment is made within three years of the fee waiver or expense reimbursement, and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap and (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. As of December 31, 2019 $430,107 is subject to recapture by the Adviser.

Note 6. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments during the year ended December 31, 2019, totaled $114,055,555 and $106,939,450, respectively.

Note 7. Federal Income Tax

As of December 31, 2019, the cost of investments for federal income tax purposes is $44,385,546 and the components of net unrealized appreciation consists of:

| Gross Unrealized Appreciation | | $ | 5,566,786 | |

| Gross Unrealized Depreciation | | | (404,399 | ) |

| Net Unrealized Appreciation | | $ | 5,162,387 | |

Distributions paid during the fiscal years ended as noted were characterized for tax purposes as follows:

| | | 2019 | | | 2018 | |

| Ordinary Income | | $ | – | | | $ | 403,951 | |

| Long-Term Capital Gain | | | 1,076,692 | | | | 1,086,180 | |

| | | $ | 1,076,692 | | | $ | 1,490,131 | |

As of December 31, 2019, distributable earnings on a tax basis were as follows:

| Undistributed Ordinary Income | | $ | 1,052 | |

| Undistributed Long-Term Gain | | | 23,820 | |

| Capital and Other Losses | | | (1 | ) |

| Net Unrealized Appreciation | | | 5,162,387 | |

| Total | | $ | 5,187,258 | |

The difference between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales.

LISANTI SMALL CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2019

For tax purposes, the current year post October loss was $1 (realized during the period November 1, 2019 through December 31, 2019). This loss will be recognized for tax purposes on the first business day of the Fund’s next fiscal year, January 1, 2020.

Note 8. Subsequent Events

Subsequent events occurring after the date of this report through the date these financial statements were issued have been evaluated for potential impact, and the Fund has had no such events.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Forum Funds

and the Shareholders of Lisanti Small Cap Growth Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Lisanti Small Cap Growth Fund, a series of shares of beneficial interest in Forum Funds (the “Fund”), including the schedule of investments, as of December 31, 2019, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2019, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2019 by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the Forum Funds since 2008.

Philadelphia, Pennsylvania

February 26, 2020

LISANTI SMALL CAP GROWTH FUND

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2019

Investment Advisory Agreement Approval

At the September 13, 2019 Board meeting, the Board, including the Independent Trustees, considered the continuance of the investment advisory agreement between the Adviser and the Trust pertaining to the Fund (the “Advisory Agreement”). In preparation for its deliberations, the Board requested and reviewed written responses from the Adviser to a due diligence questionnaire circulated on the Board's behalf concerning the services provided by the Adviser. The Board also discussed the materials with Fund counsel and, as necessary, with the Trust's administrator. During its deliberations, the Board received an oral presentation from the Adviser, and was assisted by the advice of Trustee counsel.

At the meeting, the Board reviewed, among other matters: (1) the nature, extent and quality of the services provided to the Fund by the Adviser, including information on the investment performance of the Fund and the Adviser; (2) the costs of the services provided and profitability to the Adviser of its relationship with the Fund; (3) the advisory fee and total expense ratio of the Fund compared to a relevant peer group of funds; (4) the extent to which economies of scale may be realized as the Fund grows and whether the advisory fee enables the Fund's investors to share in the benefits of economies of scale; and (5) other benefits received by the Adviser from its relationship with the Fund.

Nature, Extent and Quality of Services

Based on written materials received, a presentation from a senior representative of the Adviser and a discussion with the Adviser about the Adviser’s personnel, operations and financial condition, the Board considered the quality of services provided by the Adviser under the Advisory Agreement. In this regard, the Board considered information regarding the experience, qualifications and professional background of the portfolio manager and other personnel at the Adviser with principal responsibility for the Fund, as well as the investment philosophy and decision-making process of those professionals and the capability and integrity of the Adviser’s senior management and staff.

The Board considered also the adequacy of the Adviser’s resources. The Board noted the Adviser’s representation that the firm is in stable financial condition and that the Adviser has the operational capability and the necessary staffing and experience to continue providing high-quality investment advisory services to the Fund for the foreseeable future. Based on the presentation and the materials provided by the Adviser in connection with the Board’s consideration of the renewal of the Advisory Agreement, the Board concluded that, overall, it was satisfied with the nature, extent and quality of services to be provided to the Fund under the Advisory Agreement.

Performance

In connection with a presentation by the Adviser regarding its approach to managing the Fund, the Board considered the historical performance of the Fund, including the performance of the Fund compared to its primary benchmark index and an independent peer group of funds identified by Broadridge Financial Solutions, Inc. (“Broadridge”) believed to have characteristics similar to the Fund. The Board observed

LISANTI SMALL CAP GROWTH FUND

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2019

that the Fund outperformed the Russell 2000 Growth Index, the Fund’s primary benchmark index, for the one-three-, five-, and 10-year periods ended June 30, 2019. The Board also observed that, based on the information provided by Broadridge, the Fund outperformed the median of its Broadridge peers over the one-, three-, and five-year periods ended June 30, 2019. The Board noted the Adviser’s representation that stock selection, namely with respect to growth stocks, coupled with the Fund’s bias toward small market capitalization stocks, were the primary drivers of outperformance for the Fund relative to the index and Broadridge peers. Based on the foregoing and other applicable considerations, the Board determined that the Fund and its shareholders could benefit from the Adviser’s continued management of the Fund.

Compensation

The Board evaluated the Adviser’s compensation for providing advisory services to the Fund and analyzed comparative information on actual advisory fee rates and actual total expense ratios of the Fund compared to those of its Broadridge peer group. The Board observed that the Adviser’s actual advisory fee rate for the Fund was lower than the median of the Broadridge peer group. The Board also observed that, although the Adviser’s actual total expense ratio for the Fund was higher than the median of the Broadridge peer group the Adviser had implemented reductions in the contractual advisory fee rate and expense cap for the Fund in 2018. Based on the foregoing and other applicable considerations, the Board concluded that the Adviser’s advisory fee rate charged to the Fund was fair and reasonable.

Cost of Services and Profitability

The Board evaluated information provided by the Adviser regarding the costs of services and its profitability with respect to the Fund. In this regard, the Board considered the Adviser’s resources devoted to the Fund, as well as the information provided by the Adviser regarding the costs and profitability of its Fund activities. The Board noted the Adviser’s representation that it did not maintain separately identifiable profit and loss information for the Fund relative to its other advisory businesses. The Board also noted the Adviser’s representation that the Adviser was subsidizing the Fund’s operations by forgoing a portion of its advisory fee. Based on these and other applicable considerations, including financial statements from the Adviser indicating its profitability and expenses from overall operations, the Board concluded that the Adviser’s costs of services and profits attributable to management of the Fund were reasonable in the context of all factors considered.

Economies of Scale

The Board evaluated whether the Fund would benefit from any economies of scale. In this respect, the Board considered the Fund’s fee structure, asset size, and net expense ratio. The Board noted the relatively small size of the Fund and the Adviser’s representation that the Fund could benefit from economies of scale as assets grow but that the Adviser had determined that breakpoints were not appropriate at this time, particularly in light of the reductions to the contractual management fee and expense cap in 2018. Based on the foregoing information and other applicable considerations, the Board concluded that the asset level

LISANTI SMALL CAP GROWTH FUND

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2019

of the Fund was not consistent with the existence of economies of scale such that economies of scale were not a material factor in approving the Advisory Agreement.

Other Benefits

The Board noted the Adviser’s representation that it would be receiving a benefit arising from the use of soft dollars in connection with Fund trades for the acquisition of research that would benefit not only the Fund, but potentially other clients of the Adviser. The Board concluded that the other benefits received were not a material factor in approving the Advisory Agreement.

Conclusion

The Board did not identify any single factor as being of paramount importance, and different Trustees may have given different weight to different factors. The Board reviewed a memorandum from Fund counsel discussing the legal standards applicable to its consideration of the Advisory Agreement. Based on its review, including consideration of each of the factors referenced above, the Board determined, in the exercise of its reasonable business judgment, that the advisory arrangement, as outlined in the Advisory Agreement, was fair and reasonable in light of the services performed or to be performed, expenses incurred or to be incurred and such other matters as the Board considered relevant.

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund’s portfolio is available, without charge and upon request, by calling (800) 441-7031 and on the U.S. Securities and Exchange Commission's (the "SEC") website at www.sec.gov. The Fund’s proxy voting record for the most recent twelve-month period ended June 30 is available, without charge and upon request, by calling (800) 441-7031 and on the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. These filings are available, without charge and upon request on the SEC’s website at www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees, and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

LISANTI SMALL CAP GROWTH FUND

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2019

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2019 through December 31, 2019.

Actual Expenses – The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees and exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs had been included, your costs would have been higher.

| | | Beginning Account Value July 1, 2019 | | | Ending Account Value December 31, 2019 | | | Expenses Paid During Period* | | | Annualized Expense Ratio* | |

| Actual | | $ | 1,000.00 | | | $ | 1,005.81 | | | $ | 6.83 | | | | 1.35 | % |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.40 | | | $ | 6.87 | | | | 1.35 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184) divided by 365 to reflect the half-year period. |

Trustees and Officers of the Trust

The Board is responsible for oversight of the management of the Trust’s business affairs and of the exercise of all the Trust’s powers except those reserved for the shareholders. The following table provides information about each Trustee and certain officers of the Trust. Each Trustee and officer holds office until the person resigns, is removed, or is replaced. Unless otherwise noted, the persons have held their principal occupations for more than five years. The address for all Trustees and officers is Three Canal Plaza, Suite 600, Portland,

LISANTI SMALL CAP GROWTH FUND

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2019

Maine 04101. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available, without charge and upon request, by calling (800) 441-7031.

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Series in Fund Complex Overseen By Trustee | Other Directorships Held By Trustee During Past Five Years |

| Independent Trustees |

David Tucker

Born: 1958 | Trustee; Chairman of the Board | Since 2011 and Chairman since 2018 | Director, Blue Sky Experience (a charitable endeavor) since 2008; Senior Vice President & General Counsel, American Century Companies (an investment management firm) 1998-2008. | 1 | Trustee, Forum

Funds II and U.S.

Global Investors

Funds |

| Mark D. Moyer Born: 1959 | Trustee; Chairman of the Audit Committee | Since 2018 | Chief Financial Officer, Freedom House (a NGO advocating political freedom and democracy) since 2017; independent consultant providing interim CFO services, principally to non-profit organizations, 2011-2017; Chief Financial Officer, Institute of International Education (a NGO administering international educational exchange programs), 2008-2011; Chief Financial Officer and Chief Restructuring Officer, Ziff Davis Media Inc. (an integrated media company), 2005-2008; Adjunct Professor of Accounting, Fairfield University from 2009-2012. | 1 | Trustee, Forum

Funds II and U.S.

Global Investors

Funds |

Jennifer Brown-Strabley Born: 1964 | Trustee | Since 2018 | Principal, Portland Global Advisors (a registered investment adviser), 1996-2010. | 1 | Trustee, Forum

Funds II and U.S.

Global Investors

Funds |

| Interested Trustees(1) |

| Jessica Chase Born: 1970 | Trustee | Since 2018 | Director, Apex Fund Services since 2019; Senior Vice President, Atlantic Fund Services 2008-2019. | 1 | Trustee, Forum

Funds II and U.S.

Global Investors

Funds |

| (1) | Jessica Chase is currently an interested person of the Trust, as defined in the 1940 Act, due to her affiliation with Apex Fund Services and her role as President of the Trust. Apex Fund Services is a wholly owned subsidiary of Apex US Holdings LLC. |

LISANTI SMALL CAP GROWTH FUND

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2019

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past 5 Years |

| Officers |

Jessica Chase

Born: 1970 | President; Principal Executive Officer | Since 2015 | Director, Apex Fund Services since 2019. Senior Vice President, Atlantic Fund Services 2008-2019. |

Karen Shaw

Born: 1972 | Treasurer; Principal Financial Officer | Since 2008 | Senior Vice President, Apex Fund Services since 2019; Senior Vice President, Atlantic Fund Services 2008-2019. |

Zachary Tackett

Born: 1988 | Vice President; Secretary and Anti-Money Laundering Compliance Officer | Since 2014 | Counsel, Apex Fund Services since 2019; Counsel, Atlantic Fund Services 2014-2019. |

| Michael J. McKeen Born: 1971 | Vice President | Since 2009 | Senior Vice President, Apex Fund Services since 2019; Senior Vice President, Atlantic Fund Services 2008-2019. |

| Timothy Bowden Born: 1969 | Vice President | Since 2009 | Manager, Apex Fund Services since 2019; Manager, Atlantic Fund Services 2008-2019. |

Geoffrey Ney

Born: 1975 | Vice President | Since 2013 | Manager, Apex Fund Services since 2019; Manager, Atlantic Fund Services 2013-2019. |

Todd Proulx

Born: 1978 | Vice President | Since 2013 | Manager, Apex Fund Services since 2019; Manager, Atlantic Fund Services 2013-2019. |

Carlyn Edgar

Born: 1963 | Vice President | Since 2008 | Senior Vice President, Apex Fund Services since 2019; Senior Vice President, Atlantic Fund Services 2008-2019; Chief Compliance Officer, 2008-2016. |

Dennis Mason

Born: 1967 | Chief Compliance Officer | Since 2016 | Fund Compliance Officer, Apex Fund Services since 2019; Fund Compliance Officer, Atlantic Fund Services 2013-2019. |

Annual Report

DECEMBER 31, 2019

TABLE OF CONTENTS

| A Message to Our Shareholders (Unaudited) | 1 |

| Performance Chart and Analysis (Unaudited) | 7 |

| Schedule of Investments | 8 |

| Statement of Assets and Liabilities | 10 |

| Statement of Operations | 11 |

| Statements of Changes in Net Assets | 12 |

| Financial Highlights | 13 |

| Notes to Financial Statements | 14 |

| Report of Independent Registered Public Accounting Firm | 20 |

| Additional Information (Unaudited) | 21 |

POLARIS GLOBAL VALUE FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

DECEMBER 31, 2019

Dear Fellow Shareholder,

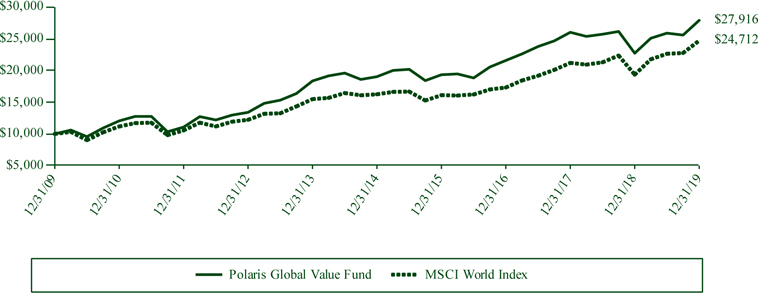

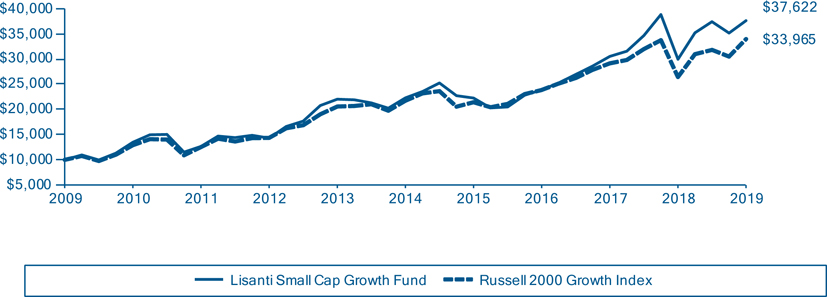

Global markets closed the decade on a bullish note, with fourth-quarter gains marking a year of unexpected strength given the considerable trade headwinds faced. A combination of low interest rates, continued resilience of the U.S. consumer, and strong election results in the U.K. fueled higher equity prices. In a continued high-growth market, the Polaris Global Value Fund (the “Fund”) gained 22.79% for the year, while the MSCI World Index (the “benchmark”) returned 27.67%.

The Fund outperformed in the fourth quarter, but lagged the MSCI World benchmark in the prior three quarters. Much of this was attributable to the Fund’s underweight in the U.S. market, which continued to outpace most non-U.S. markets. The Fund was overweight and outperformed in the vast majority of other countries, including European developed regions of the U.K., Germany and the Nordic countries of Sweden, Norway and Finland. At the sector level, contributions came from financials, consumer discretionary, information technology (IT) and industrials. The Fund’s holdings in communications services, utilities and energy posted absolute positive gains, but underperformed the sector benchmarks.

The longest-running bull market in history celebrated its 10-year anniversary in 2019. Although such market dynamics do not typically favor disciplined value managers, we were gratified to outperform the MSCI World Index for the 10-year period. The Fund was up 10.81% vs. 9.47% for the Index over this 10-year period. Disciplined stock picking, focusing on attractively priced companies with good free cash flow, stands at the core of this long-term success.

| | 2019 | Annualized As of December 31, 2019 |

| | YTD | Q IV | Q III | Q II | Q I | 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs | 15 Yrs | 20 Yrs | ITD* |

| Polaris Global Value Fund | 22.79% | 9.09% | -1.16% | 3.17% | 10.38% | 22.79% | 8.96% | 7.96% | 10.81% | 6.82% | 8.26% | 9.45% |

| MSCI World Index net dividends reinvested | 27.67% | 8.56% | 0.53% | 4.00% | 12.48% | 27.67% | 12.57% | 8.74% | 9.47% | 6.92% | 4.50% | 6.80% |

| * | Inception-to-date (Inception 7/31/1989) |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Returns for more than one year are annualized. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. For the most recent month end performance, please call (888) 263-5594. As stated in the current prospectus, the Fund’s total annual operating expense ratio is 1.23%. The Fund’s annual operating expense ratio has been reduced to 0.99%, through April 30, 2020, due to the Adviser’s contractual agreement to waive its fee and/or reimburse expenses to limit total Annual Fund Operating Expenses. Shares redeemed or exchanged within 180 days of purchase will be charged at 1.00% fee. Fund performance returns shown do not reflect fees; if reflected, the returns would have been lower. Short-term performance is not a good indication of the Fund's future performance, and an investment should not be made based solely on returns.

2019 PERFORMANCE ANALYSIS: