UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Zachary Tackett, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end December 31

Date of reporting period: January 1, 2024 – June 30, 2024

ITEM 1. REPORT TO SHAREHOLDERS.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended (“Act”), is attached hereto.

Semi-Annual Shareholder Report - June 30, 2024

Polaris Global Value Fund

This semi-annual shareholder report contains important information about the Polaris Global Value Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at https://polarisfunds.com/resources/. You can also request this information by contacting us at (888) 263-5594.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Polaris Global Value Fund | $50 | 0.99% |

How did the Fund perform in the last six months?

The Fund had positive absolute returns in nine of 11 sectors; however, an underweight in a heated information technology (IT) sector weighed on results, as did lackluster results in communication services and real estate. Top contributors included financials and industrials, while the Fund outperformed the World Index in materials, consumer staples and utilities. Geographically, the Fund had double-digit gains from out-of-benchmark allocations in South Korea, China and Chile, while beating the World Index in Germany, Switzerland and Singapore. The Fund was underweight and underperformed in a heated U.S. market (artificial intelligence momentum drove U.S. averages), with Canada, Norway, Japan and Italy as other detractors.

Financials contributed most, largely due to positive absolute performance in a heavily-overweight sector. Double-digit gains from Allison Transmission Holding, General Dynamics and two Japanese trading companies boosted industrial sector results. In IT, SK Hynix gained in excess of 50% for the semi-annual period, continuing to dominate in high-bandwidth memory (HBM), while noting good price momentum in traditional dynamic random-access memory (DRAM) and NAND markets. Energy transition applications, AI, and automation demand increasing copper resources amidst limited supply. As a result, copper prices have been on an upward trajectory since the end of 2023; Lundin Mining Corp. and Antofagasta PLC were direct beneficiaries.

Detractors included two banks, Webster Financial Corp. and Toronto-Dominion Bank, the latter of which faced an anti-money-laundering investigation. Teleperformance declined on renewed concerns that generative AI will disrupt the French call center’s business. Fellow French company VINCI SA, the concessions and construction company, trended down 25%; we can ascertain no reason for the decline other than geopolitical risk in the country. OpenText Corp. declined on slow software implementation due to delays from customers assessing their use of AI. Guidance was lowered and quarterly earnings fell short of expectations.

United Therapeutics Corp.

Allison Transmission Holdings, Inc.

Magna International, Inc.

Sally Beauty Holdings, Inc.

Total Return Based on a $10,000 Investment

| Date | Polaris Global Value Fund | MSCI World Index |

|---|

| 06/30/14 | $10,000 | $10,000 |

| 09/30/14 | $9,487 | $9,784 |

| 12/31/14 | $9,714 | $9,883 |

| 03/31/15 | $10,215 | $10,112 |

| 06/30/15 | $10,303 | $10,143 |

| 09/30/15 | $9,396 | $9,286 |

| 12/31/15 | $9,864 | $9,797 |

| 03/31/16 | $9,934 | $9,763 |

| 06/30/16 | $9,608 | $9,861 |

| 09/30/16 | $10,489 | $10,341 |

| 12/31/16 | $11,015 | $10,533 |

| 03/31/17 | $11,539 | $11,204 |

| 06/30/17 | $12,139 | $11,655 |

| 09/30/17 | $12,593 | $12,219 |

| 12/31/17 | $13,285 | $12,892 |

| 03/31/18 | $12,954 | $12,727 |

| 06/30/18 | $13,126 | $12,948 |

| 09/30/18 | $13,352 | $13,592 |

| 12/31/18 | $11,603 | $11,769 |

| 03/31/19 | $12,807 | $13,238 |

| 06/30/19 | $13,214 | $13,767 |

| 09/30/19 | $13,060 | $13,841 |

| 12/31/19 | $14,248 | $15,025 |

| 03/31/20 | $9,725 | $11,862 |

| 06/30/20 | $11,539 | $14,159 |

| 09/30/20 | $12,043 | $15,281 |

| 12/31/20 | $15,196 | $17,415 |

| 03/31/21 | $16,850 | $18,272 |

| 06/30/21 | $17,304 | $19,687 |

| 09/30/21 | $17,122 | $19,685 |

| 12/31/21 | $17,535 | $21,214 |

| 03/31/22 | $16,725 | $20,121 |

| 06/30/22 | $14,562 | $16,864 |

| 09/30/22 | $13,214 | $15,821 |

| 12/31/22 | $15,428 | $17,366 |

| 03/31/23 | $15,862 | $18,708 |

| 06/30/23 | $16,132 | $19,986 |

| 09/30/23 | $15,772 | $19,294 |

| 12/31/23 | $17,707 | $21,496 |

| 03/31/24 | $18,754 | $23,405 |

| 06/30/24 | $18,571 | $24,021 |

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Polaris Global Value Fund | 15.12% | 7.04% | 6.39% |

| MSCI World Index | 20.19% | 11.78% | 9.16% |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $422,383,916 |

| # of Portfolio Holdings | 94 |

| Portfolio Turnover Rate | 8% |

| Investment Advisory Fees (Net of fees waived) | $1,643,523 |

Top Ten Holdings

(% of investments)*

| SK Hynix, Inc. | 2.24% |

| Microsoft Corp. | 1.81% |

| United Therapeutics Corp. | 1.75% |

| Allison Transmission Holdings, Inc. | 1.71% |

| Williams Cos., Inc. | 1.69% |

| Crocs, Inc. | 1.67% |

| Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen, Class R | 1.62% |

| General Dynamics Corp. | 1.57% |

| Linde PLC | 1.52% |

| Smurfit Kappa Group PLC | 1.50% |

* excluding cash equivalents

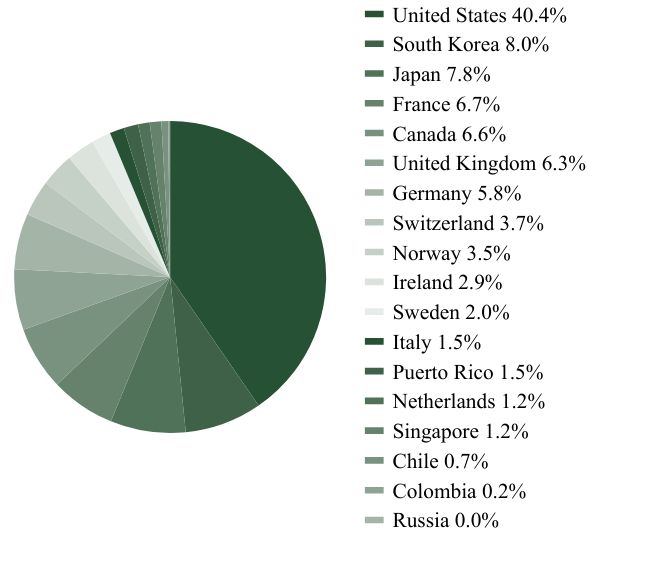

Country Weightings

(% total investments)*

| Value | Value |

|---|

| United States | 40.4% |

| South Korea | 8.0% |

| Japan | 7.8% |

| France | 6.7% |

| Canada | 6.6% |

| United Kingdom | 6.3% |

| Germany | 5.8% |

| Switzerland | 3.7% |

| Norway | 3.5% |

| Ireland | 2.9% |

| Sweden | 2.0% |

| Italy | 1.5% |

| Puerto Rico | 1.5% |

| Netherlands | 1.2% |

| Singapore | 1.2% |

| Chile | 0.7% |

| Colombia | 0.2% |

| Russia | 0.0% |

* excluding cash equivalents

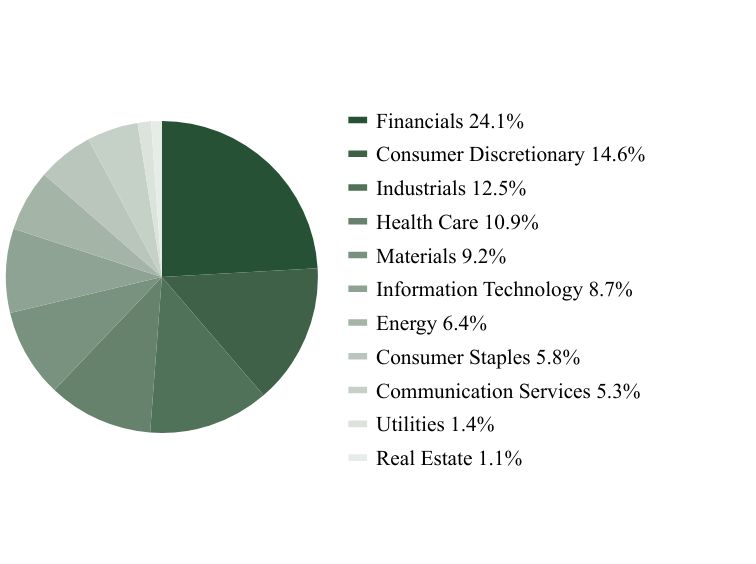

Sector Weightings

(% total investments)*

| Value | Value |

|---|

| Financials | 24.1% |

| Consumer Discretionary | 14.6% |

| Industrials | 12.5% |

| Health Care | 10.9% |

| Materials | 9.2% |

| Information Technology | 8.7% |

| Energy | 6.4% |

| Consumer Staples | 5.8% |

| Communication Services | 5.3% |

| Utilities | 1.4% |

| Real Estate | 1.1% |

* excluding cash equivalents

The Fund is distributed by Foreside Fund Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (dba ACA Group). Additional information is available by scanning the QR code or at https://polarisfunds.com/resources/, including its:

prospectus

financial information

holdings

proxy information

Semi-Annual Shareholder Report - June 30, 2024

(b) Not applicable.

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. INVESTMENTS.

(a) Included as part of financial statements filed under Item 7(a).

(b) Not applicable.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

(a)

Semi-Annual

Financials

and

Other

Information

JUNE

30,

2024

(

Unaudited

)

Schedule

of

Investments

1

Statement

of

Assets

and

Liabilities

4

Statement

of

Operations

5

Statements

of

Changes

in

Net

Assets

6

Financial

Highlights

7

Notes

to

Financial

Statements

8

Other

Information

15

Polaris

Global

Value

Fund

SCHEDULE

OF

INVESTMENTS

JUNE

30,

2024

See

Notes

to

Financial

Statements.

Shares

Security

Description

Value

Common

Stock

-

99.3%

Canada

-

6.6%

47,620

Canadian

Tire

Corp.,

Ltd.,

Class A

$

4,724,929

436,400

Lundin

Mining

Corp.

4,858,281

92,304

Magna

International,

Inc.

3,868,800

125,937

Methanex

Corp.

6,080,289

129,600

OpenText

Corp.

3,891,647

79,611

Toronto-Dominion

Bank

4,376,117

27,800,063

Chile

-

0.7%

115,000

Antofagasta

PLC

3,067,337

Colombia

-

0.2%

13,700

Tecnoglass,

Inc.

(a)

687,466

France

-

6.6%

153,100

Cie

Generale

des

Etablissements

Michelin

SCA

5,920,686

46,807

IPSOS

SA

2,952,538

56,776

Publicis

Groupe

SA

6,042,730

35,300

Teleperformance

SE

3,717,700

77,200

TotalEnergies

SE

5,153,281

39,553

Vinci

SA

4,167,308

27,954,243

Germany

-

5.8%

135,400

Daimler

Truck

Holding

AG

5,389,899

189,548

Deutsche

Telekom

AG

4,766,358

167,400

flatexDEGIRO

AG

2,375,422

19,700

Hannover

Rueck

SE

4,993,831

13,600

Muenchener

Rueckversicherungs-

Gesellschaft

AG

in

Muenchen,

Class R

6,801,821

24,327,331

Ireland

-

2.9%

1,036,300

Greencore

Group

PLC

(b)

2,179,817

33,900

Jazz

Pharmaceuticals

PLC

(b)

3,618,147

141,352

Smurfit

Kappa

Group

PLC

6,297,449

12,095,413

Italy

-

1.5%

300,400

Eni

SpA

4,617,876

4,371,673

TREVI

-

Finanziaria

Industriale

SpA

(b)

1,608,214

6,226,090

Japan

-

7.8%

355,100

Daicel

Corp.

3,404,449

45,500

Daito

Trust

Construction

Co.,

Ltd.

4,690,270

119,000

ITOCHU

Corp.

5,809,099

166,400

KDDI

Corp.

4,399,687

283,700

Marubeni

Corp.

5,246,748

57,100

Sony

Group

Corp.

4,840,848

Shares

Security

Description

Value

Japan

-

7.8%

(continued)

172,200

Takeda

Pharmaceutical

Co.,

Ltd.

$

4,465,277

32,856,378

Netherlands

-

1.2%

177,200

Koninklijke

Ahold

Delhaize

NV

5,235,821

Norway

-

3.5%

244,996

DNB

Bank

ASA

4,811,807

329,537

SpareBank

1

SR-Bank

ASA

4,030,864

158,654

Sparebanken

Vest

1,864,857

135,700

Yara

International

ASA

3,909,461

14,616,989

Puerto

Rico

-

1.4%

69,600

Popular,

Inc.

6,154,728

Russia

-

0.0%

3,148,600

Alrosa

PJSC

(c)

367

Singapore

-

1.2%

225,050

United

Overseas

Bank,

Ltd.

5,199,717

South

Korea

-

7.9%

26,700

F&F

Co.,

Ltd./New

1,210,374

61,100

Kia

Corp.

5,739,361

70,500

LG

Electronics,

Inc.

5,679,949

95,274

Samsung

Electronics

Co.,

Ltd.

5,640,996

166,800

Shinhan

Financial

Group

Co.,

Ltd.

5,834,668

54,700

SK

Hynix,

Inc.

9,398,147

33,503,495

Sweden

-

2.0%

119,300

Duni

AB,

Class A

1,143,587

100,203

Loomis

AB

2,609,305

240,300

SKF

AB,

Class B

4,824,591

8,577,483

Switzerland

-

3.7%

2,953

Barry

Callebaut

AG

4,811,834

20,544

Chubb,

Ltd.

5,240,364

49,400

Novartis

AG

5,287,771

10,840

Sandoz

Group

AG

392,602

15,732,571

United

Kingdom

-

6.2%

155,921

Bellway

PLC

4,998,447

292,716

Inchcape

PLC

2,752,965

14,513

Linde

PLC

6,368,450

235,510

Mondi

PLC

4,520,697

45,528

Next

PLC

5,200,391

146,000

Nomad

Foods,

Ltd.

2,406,080

26,247,030

Polaris

Global

Value

Fund

SCHEDULE

OF

INVESTMENTS

JUNE

30,

2024

See

Notes

to

Financial

Statements.

The

following

is

a

summary

of

the

inputs

used

to

value

the

Fund's investments

as

of

June

30,

2024.

The

inputs

or

methodology

used

for

valuing

securities

are

not

necessarily

an

indication

of

the

risks

associated

with

investing

in

those

securities.

For

more

information

on

valuation

inputs,

and

their

aggregation

into

the

levels

used

in

the

table

below,

please

refer

to

the

Security

Valuation

section

in

Note

2

of

the

accompanying

Notes

to

Financial

Statements.

Shares

Security

Description

Value

United

States

-

40.1%

30,451

AbbVie,

Inc.

$

5,222,956

94,500

Allison

Transmission

Holdings,

Inc.

7,172,550

35,000

Arrow

Electronics,

Inc.

(b)

4,226,600

14,200

Cambridge

Bancorp

979,800

36,100

Capital

One

Financial

Corp.

4,998,045

48,176

Crocs,

Inc.

(b)

7,030,806

47,400

Cullen/Frost

Bankers,

Inc.

4,817,262

55,600

CVS

Health

Corp.

3,283,736

62,335

Dime

Community

Bancshares,

Inc.

1,271,634

11,100

Elevance

Health,

Inc.

6,014,646

22,767

General

Dynamics

Corp.

6,605,617

63,000

Gilead

Sciences,

Inc.

4,322,430

45,100

Ingredion,

Inc.

5,172,970

108,963

International

Bancshares

Corp.

6,233,773

28,400

JPMorgan

Chase

&

Co.

5,744,184

105,000

LKQ

Corp.

4,366,950

25,800

M&T

Bank

Corp.

3,905,088

33,282

Marathon

Petroleum

Corp.

5,773,761

17,000

Microsoft

Corp.

7,598,150

44,900

MKS

Instruments,

Inc.

5,863,042

84,576

NextEra

Energy,

Inc.

5,988,827

61,800

Northern

Trust

Corp.

5,189,964

227,722

NOV,

Inc.

4,328,995

46,600

Premier

Financial

Corp.

953,436

351,529

Sally

Beauty

Holdings,

Inc.

(b)

3,771,906

38,100

Science

Applications

International

Corp.

4,478,655

245,800

SLM

Corp.

5,110,182

121,300

The

Carlyle

Group,

Inc.

4,870,195

143,700

The

Interpublic

Group

of

Cos.,

Inc.

4,180,233

81,200

Tyson

Foods,

Inc.,

Class A

4,639,768

23,000

United

Therapeutics

Corp.

(b)

7,326,650

10,868

UnitedHealth

Group,

Inc.

(a)

5,534,638

120,438

Webster

Financial

Corp.

5,249,892

166,700

Williams

Cos.,

Inc.

7,084,750

169,312,091

Total

Common

Stock

(Cost

$312,503,761)

419,594,613

Shares

Security

Description

Exercise

Price

Exp.

Date

Value

Warrants

-

0.0%

10,863

TREVI

-

Finanziaria

Industriale

SpA

(b)

(Cost

$1,001,311)

$

1.30

05/05/25

19,777

Shares

Security

Description

Value

Money

Market

Fund

-

0.6%

2,444,594

Northern

Institutional

Treasury

Portfolio

Premier

Shares,

5.15%

(d)

(Cost

$2,444,594)

$

2,444,594

Investments,

at

value

-

99.9%

(Cost

$315,949,666)

$

422,058,984

Total

Written

Options

-

0.0%

(Premiums

Received

$(140,333))

(142,075)

Other

Assets

&

Liabilities,

Net

-

0.1%

467,007

Net

Assets

-

100.0%

$

422,383,916

PJSC

Public

Joint

Stock

Company

PLC

Public

Limited

Company

(a)

Subject

to

call

option

written

by

the

Fund.

(b)

Non-income

producing

security.

(c)

Security

fair

valued

in

accordance

with

procedures

adopted

by

the

Board

of

Trustees.

At

the

period

end,

the

value

of

these

securities

amounted

to

$367

or

0.0%

of

net

assets.

(d)

Dividend

yield

changes

daily

to

reflect

current

market

conditions.

Rate

was

the

quoted

yield

as

of

June

30,

2024.

Contracts

Security

Description

Strike

Price

Exp.

Date

Notional

Contract

Value

Value

Written

Options

-

0.0%

Call

Options

Written

-

0.0%

(100)

Tecnoglass,

Inc.

$

65.00

07/24

$

501,800

$

(1,000)

(45)

UnitedHealth

Group,

Inc.

$

520.00

08/24

2,291,670

(60,075)

(45)

UnitedHealth

Group,

Inc.

$

520.00

09/24

2,291,670

(81,000)

Total

Call

Options

Written

(Premiums

Received

$(140,333))

(142,075)

Total

Written

Options

-

0.0%

(Premiums

Received

$(140,333))

$

(142,075)

Polaris

Global

Value

Fund

SCHEDULE

OF

INVESTMENTS

JUNE

30,

2024

See

Notes

to

Financial

Statements.

The

following

is

a

reconciliation

of

Level

3

investments

for

which

significant

unobservable

inputs

were

used

to

determine

fair

value.

Level

1

Level

2

Level

3

Total

Assets

Investments

at

Value

Common

Stock

Canada

$

27,800,063

$

–

$

–

$

27,800,063

Chile

3,067,337

–

–

3,067,337

Colombia

687,466

–

–

687,466

France

27,954,243

–

–

27,954,243

Germany

24,327,331

–

–

24,327,331

Ireland

12,095,413

–

–

12,095,413

Italy

6,226,090

–

–

6,226,090

Japan

32,856,378

–

–

32,856,378

Netherlands

5,235,821

–

–

5,235,821

Norway

14,616,989

–

–

14,616,989

Puerto

Rico

6,154,728

–

–

6,154,728

Russia

–

–

367

367

Singapore

5,199,717

–

–

5,199,717

South

Korea

33,503,495

–

–

33,503,495

Sweden

8,577,483

–

–

8,577,483

Switzerland

15,732,571

–

–

15,732,571

United

Kingdom

26,247,030

–

–

26,247,030

United

States

169,312,091

–

–

169,312,091

Warrants

19,777

–

–

19,777

Money

Market

Fund

2,444,594

–

–

2,444,594

Investments

at

Value

$

422,058,617

$

–

$

367

$

422,058,984

Total

Assets

$

422,058,617

$

–

$

367

$

422,058,984

Liabilities

Other

Financial

Instruments*

Written

Options

(142,075)

–

–

(142,075)

Total

Liabilities

$

(142,075)

$

–

$

–

$

(142,075)

Common

Stock

Balance

as

of

12/31/23

$

353

Change

in

Unrealized

Appreciation/(Depreciation)

14

Balance

as

of

6/30/24

$

367

Net

change

in

unrealized

depreciation

from

investments

held

as

of

6/30/24

$

14

PORTFOLIO

HOLDINGS

%

of

Total

Investments

Communication

Services

5.3%

Consumer

Discretionary

14.5%

Consumer

Staples

5.8%

Energy

6.4%

Financials

23.9%

Health

Care

10.8%

Industrials

12.4%

Information

Technology

8.7%

Materials

9.1%

Real

Estate

1.1%

Utilities

1.4%

Warrants

0.0%

Money

Market

Fund

0.6%

Written

Options

0.0%

100.0%

Polaris

Global

Value

Fund

STATEMENT

OF

ASSETS

AND

LIABILITIES

JUNE

30,

2024

See

Notes

to

Financial

Statements.

*

Shares

redeemed

or

exchanged

within

180

days

of

purchase

are

charged

a

1.00%

redemption

fee.

ASSETS

Investments,

at

value

(Cost

$315,949,666)

$

422,058,984

Foreign

currency

(Cost

$389)

389

Receivables:

Fund

shares

sold

100

Dividends

897,871

Prepaid

expenses

30,771

Total

Assets

422,988,115

LIABILITIES

Call

options

written,

at

value

(Premiums

received

$140,333)

142,075

Payables:

Fund

shares

redeemed

97,758

Accrued

Liabilities:

Investment

adviser

fees

273,479

Fund

services

fees

40,390

Other

expenses

50,497

Total

Liabilities

604,199

NET

ASSETS

$

422,383,916

COMPONENTS

OF

NET

ASSETS

Paid-in

capital

$

301,214,698

Distributable

Earnings

121,169,218

NET

ASSETS

$

422,383,916

SHARES

OF

BENEFICIAL

INTEREST

AT

NO

PAR

VALUE

(UNLIMITED

SHARES

AUTHORIZED)

13,013,780

NET

ASSET

VALUE,

OFFERING

AND

REDEMPTION

PRICE

PER

SHARE*

$

32.46

Polaris

Global

Value

Fund

STATEMENT

OF

OPERATIONS

SIX

MONTHS

ENDED

JUNE

30,

2024

See

Notes

to

Financial

Statements.

INVESTMENT

INCOME

Dividend

income

(Net

of

foreign

withholding

taxes

of

$654,323)

$

7,062,785

Total

Investment

Income

7,062,785

EXPENSES

Investment

adviser

fees

2,092,673

Fund

services

fees

258,816

Custodian

fees

30,575

Registration

fees

12,865

Professional

fees

38,905

Trustees'

fees

and

expenses

10,144

Other

expenses

103,482

Total

Expenses

2,547,460

Fees

waived

(475,720)

Net

Expenses

2,071,740

NET

INVESTMENT

INCOME

4,991,045

NET

REALIZED

AND

UNREALIZED

GAIN

(LOSS)

Net

realized

gain

(loss)

on:

Investments

11,619,771

Foreign

currency

transactions

(32,219)

Written

options

208,367

Net

realized

gain

11,795,919

Net

change

in

unrealized

appreciation

(depreciation)

on:

Investments

3,163,109

Foreign

currency

translations

(25,357)

Written

options

(1,742)

Net

change

in

unrealized

appreciation

(depreciation)

3,136,010

NET

REALIZED

AND

UNREALIZED

GAIN

14,931,929

INCREASE

IN

NET

ASSETS

RESULTING

FROM

OPERATIONS

$

19,922,974

Polaris

Global

Value

Fund

STATEMENTS

OF

CHANGES

IN

NET

ASSETS

See

Notes

to

Financial

Statements.

For

the

Six

Months

Ended

June

30,

2024

For

the

Year

Ended

December

31,

2023

OPERATIONS

Net

investment

income

$

4,991,045

$

6,797,237

Net

realized

gain

11,795,919

8,747,877

Net

change

in

unrealized

appreciation

(depreciation)

3,136,010

39,074,455

Increase

in

Net

Assets

Resulting

from

Operations

19,922,974

54,619,569

DISTRIBUTIONS

TO

SHAREHOLDERS

Total

Distributions

Paid

–

(6,875,779)

CAPITAL

SHARE

TRANSACTIONS

Sale

of

shares

1,157,884

8,920,743

Reinvestment

of

distributions

–

6,534,905

Redemption

of

shares

(14,370,437)

(39,617,690)

Redemption

fees

16,905

4,775

Decrease

in

Net

Assets

from

Capital

Share

Transactions

(13,195,648)

(24,157,267)

Increase

in

Net

Assets

6,727,326

23,586,523

NET

ASSETS

Beginning

of

Period

415,656,590

392,070,067

End

of

Period

$

422,383,916

$

415,656,590

SHARE

TRANSACTIONS

Sale

of

shares

36,660

314,141

Reinvestment

of

distributions

–

211,144

Redemption

of

shares

(454,317)

(1,392,511)

Decrease

in

Shares

(417,657)

(867,226)

Polaris

Global

Value

Fund

FINANCIAL

HIGHLIGHTS

See

Notes

to

Financial

Statements.

These

financial

highlights

reflect

selected

data

for

a

share

outstanding

throughout

each

period

.

For

the

Six

Months

Ended

June

30,

2024

For

the

Years

Ended

December

31,

2023

2022

2021

2020

2019

NET

ASSET

VALUE,

Beginning

of

Period

$

30.95

$

27.42

$

32.26

$

29.12

$

27.72

$

23.41

INVESTMENT

OPERATIONS

Net

investment

income

(a)

0.38

0.49

0.50

0.48

0.32

0.62

Net

realized

and

unrealized

gain

(loss)

1.13

3.56

(4.37)

3.97

1.53

4.72

Total

from

Investment

Operations

1.51

4.05

(3.87)

4.45

1.85

5.34

DISTRIBUTIONS

TO

SHAREHOLDERS

FROM

Net

investment

income

–

(0.52)

(0.43)

(0.50)

(0.34)

(0.68)

Net

realized

gain

–

–

(0.54)

(0.81)

(0.11)

(0.35)

Total

Distributions

to

Shareholders

–

(0.52)

(0.97)

(1.31)

(0.45)

(1.03)

REDEMPTION

FEES(a)

0.00(b)

0.00(b)

0.00(b)

0.00(b)

0.00(b)

0.00(b)

NET

ASSET

VALUE,

End

of

Period

$

32.46

$

30.95

$

27.42

$

32.26

$

29.12

$

27.72

TOTAL

RETURN

4.88%(c)

14.77%

(12.01)%

15.36%

6.68%

22.79%

RATIOS/SUPPLEMENTARY

DATA

Net

Assets

at

End

of

Period

(000s

omitted)

$

422,384

$

415,657

$

392,070

$

492,795

$

450,739

$

468,882

Ratios

to

Average

Net

Assets:

Net

investment

income

2.38%(d)

1.72%

1.74%

1.47%

1.34%

2.35%

Net

expenses

0.99%(d)

0.99%

0.99%

0.99%

0.99%

0.99%

Gross

expenses

(e)

1.21%(d)

1.22%

1.23%

1.21%

1.24%

1.23%

PORTFOLIO

TURNOVER

RATE

8%(c)

14%

19%

19%

57%

10%

(a)

Calculated

based

on

average

shares

outstanding

during

each

period.

(b)

Less

than

$0.01

per

share.

(c)

Not

annualized.

(d)

Annualized.

(e)

Reflects

the

expense

ratio

excluding

any

waivers

and/or

reimbursements.

Polaris

Global

Value

Fund

NOTES

TO

FINANCIAL

STATEMENTS

JUNE

30,

2024

Note

1.

Organization

The

Polaris

Global

Value

Fund

(the

“Fund”)

is

a

diversified

portfolio

of

Forum

Funds

(the

“Trust”).

The

Trust

is

a

Delaware

statutory

trust

that

is

registered

as

an

open-end,

management

investment

company

under

the

Investment

Company

Act

of

1940,

as

amended

(the

“Act”).

Under

its

Trust

Instrument,

the

Trust

is

authorized

to

issue

an

unlimited

number

of

the

Fund’s

shares

of

beneficial

interest

without

par

value.

The

Fund

commenced

operations

June

1,

1998

after

it

acquired

the

net

assets

of

Global

Value

Limited

Partnership

(the

“Partnership”),

in

exchange

for

Fund

shares.

The

Partnership

commenced

operations

on

July

31,

1989.

The

Fund

seeks

capital

appreciation.

Note

2.

Summary

of

Significant

Accounting

Policies

The

Fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

under

Financial

Accounting

Standards

Board

Accounting

Standards

Codification

Topic

946,

“Financial

Services

–

Investment

Companies.”

These

financial

statements

are

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(“GAAP”),

which

require

management

to

make

estimates

and

assumptions

that

affect

the

reported

amounts

of

assets

and

liabilities,

the

disclosure

of

contingent

liabilities

at

the

date

of

the

financial

statements,

and

the

reported

amounts

of

increases

and

decreases

in

net

assets

from

operations

during

the

fiscal

period.

Actual

amounts

could

differ

from

those

estimates.

The

following

summarizes

the

significant

accounting

policies

of

the

Fund:

Security

Valuation

–

Securities

are

valued

at

market

prices

using

the

last

quoted

trade

or

official

closing

price

from

the

principal

exchange

where

the

security

is

traded,

as

provided

by

independent

pricing

services

on

each

Fund

business

day.

In

the

absence

of

a

last

trade,

securities

are

valued

at

the

mean

of

the

last

bid

and

ask

price

provided

by

the

pricing

service.

Forward

currency

contracts

are

generally

valued

based

on

interpolation

of

forward

curve

data

points

obtained

from

major

banking

institutions

that

deal

in

foreign

currencies

and

currency

dealers.

Shares

of

non-exchange

traded

open-end

mutual

funds

are

valued

at

net

asset

value

per

share

(“NAV”).

Short-term

investments

that

mature

in

sixty

days

or

less

may

be

valued

at

amortized

cost.

Pursuant

to

Rule

2a-5

under

the

Investment

Company

Act,

the

Trust’s

Board

of

Trustees

(the

“Board”)

has

designated

the

Adviser,

as

defined

in

Note

3,

as

the

Fund’s

valuation

designee

to

perform

any

fair

value

determinations

for

securities

and

other

assets

held

by

the

Fund.

The

Adviser

is

subject

to

the

oversight

of

the

Board

and

certain

reporting

and

other

requirements

intended

to

provide

the

Board

the

information

needed

to

oversee

the

Adviser’s

fair

value

determinations.

The

Adviser

is

responsible

for

determining

the

fair

value

of

investments

for

which

market

quotations

are

not

readily

available

in

accordance

with

policies

and

procedures

that

have

been

approved

by

the

Board.

Under

these

procedures,

the

Adviser

convenes

on

a

regular

and

ad

hoc

basis

to

review

such

investments

and

considers

a

number

of

factors,

including

valuation

methodologies

and

significant

unobservable

inputs,

when

arriving

at

fair

value.

The

Board

has

approved

the

Adviser’s

fair

valuation

procedures

as

a

part

of

the

Fund’s

compliance

program

and

will

review

any

changes

made

to

the

procedures.

The

Adviser

provides

fair

valuation

inputs.

In

determining

fair

valuations,

inputs

may

include

market-based

analytics

that

may

consider

related

or

comparable

assets

or

liabilities,

recent

transactions,

market

multiples,

book

values

and

other

relevant

investment

information.

Adviser

inputs

may

include

an

income-based

approach

in

which

the

anticipated

future

cash

flows

of

the

investment

are

discounted

in

determining

fair

value.

Discounts

may

also

be

applied

based

on

the

nature

or

duration

Polaris

Global

Value

Fund

NOTES

TO

FINANCIAL

STATEMENTS

JUNE

30,

2024

of

any

restrictions

on

the

disposition

of

the

investments.

The

Adviser

performs

regular

reviews

of

valuation

methodologies,

key

inputs

and

assumptions,

disposition

analysis

and

market

activity.

Fair

valuation

is

based

on

subjective

factors

and,

as

a

result,

the

fair

value

price

of

an

investment

may

differ

from

the

security’s

market

price

and

may

not

be

the

price

at

which

the

asset

may

be

sold.

Fair

valuation

could

result

in

a

different

NAV

than

a

NAV

determined

by

using

market

quotes.

GAAP

has

a

three-tier

fair

value

hierarchy.

The

basis

of

the

tiers

is

dependent

upon

the

various

“inputs”

used

to

determine

the

value

of

the

Fund’s

investments.

These

inputs

are

summarized

in

the

three

broad

levels

listed

below:

Level

1

-

Quoted

prices

in

active

markets

for

identical

assets

and

liabilities.

Level

2

-

Prices

determined

using

significant

other

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

prepayment

speeds,

credit

risk,

etc.).

Short-term

securities

with

maturities

of

sixty

days

or

less

are

valued

at

amortized

cost,

which

approximates

market

value,

and

are

categorized

as

Level

2

in

the

hierarchy.

Municipal

securities,

long-term

U.S.

government

obligations

and

corporate

debt

securities

are

valued

in

accordance

with

the

evaluated

price

supplied

by

a

pricing

service

and

generally

categorized

as

Level

2

in

the

hierarchy.

Other

securities

that

are

categorized

as

Level

2

in

the

hierarchy

include,

but

are

not

limited

to,

warrants

that

do

not

trade

on

an

exchange,

securities

valued

at

the

mean

between

the

last

reported

bid

and

ask

quotation

and

international

equity

securities

valued

by

an

independent

third

party

with

adjustments

for

changes

in

value

between

the

time

of

the

securities’

respective

local

market

closes

and

the

close

of

the

U.S.

market.

Level

3

-

Significant

unobservable

inputs

(including

the

Fund’s

own

assumptions

in

determining

the

fair

value

of

investments).

The

aggregate

value

by

input

level,

as

of

June

30,

2024,

for

the

Fund’s

investments

is

included

at

the

end

of

the

Fund’s

Schedule

of

Investments.

Security

Transactions,

Investment

Income

and

Realized

Gain

and

Loss

–

Investment

transactions

are

accounted

for

on

the

trade

date.

Dividend

income

is

recorded

on

the

ex-dividend

date.

Non-cash

dividend

income

is

recorded

at

the

fair

market

value

of

the

securities

received.

Foreign

dividend

income

is

recorded

on

the

ex-dividend

date

or

as

soon

as

possible

after

determining

the

existence

of

a

dividend

declaration

after

exercising

reasonable

due

diligence.

Income

and

capital

gains

on

some

foreign

securities

may

be

subject

to

foreign

withholding

taxes,

which

are

accrued

as

applicable.

Interest

income

is

recorded

on

an

accrual

basis.

Premium

is

amortized

to

the

next

call

date

above

par,

and

discount

is

accreted

to

maturity

using

the

effective

interest

method.

Identified

cost

of

investments

sold

is

used

to

determine

the

gain

and

loss

for

both

financial

statement

and

federal

income

tax

purposes.

Written

Options

–

When

a

fund

writes

an

option,

an

amount

equal

to

the

premium

received

by

the

fund

is

recorded

as

a

liability

and

is

subsequently

adjusted

to

the

current

value

of

the

option

written.

Premiums

received

from

writing

options

that

expire

unexercised

are

treated

by

the

fund

on

the

expiration

date

as

realized

gain

from

written

options.

The

difference

between

the

premium

and

the

amount

paid

on

effecting

a

closing

purchase

transaction,

including

brokerage

commissions,

is

also

treated

as

a

realized

gain,

or

if

the

premium

is

less

than

the

amount

paid

for

the

closing

purchase

transaction,

as

a

realized

loss.

If

a

call

option

is

exercised,

the

premium

is

added

to

the

proceeds

from

the

sale

of

the

underlying

security

in

Polaris

Global

Value

Fund

NOTES

TO

FINANCIAL

STATEMENTS

JUNE

30,

2024

determining

whether

the

fund

has

realized

a

gain

or

loss.

If

a

put

option

is

exercised,

the

premium

reduces

the

cost

basis

of

the

securities

purchased

by

the

fund.

The

fund,

as

writer

of

an

option,

bears

the

market

risk

of

an

unfavorable

change

in

the

price

of

the

security

underlying

the

written

option.

Written

options

are

non-income

producing

securities.

The

values

of

each

individual

written

option

outstanding

as

of

June

30,

2024,

if

any,

are

disclosed

in

the

Fund’s

Schedule

of

Investments.

Purchased

Options

–

When

a

fund

purchases

an

option,

an

amount

equal

to

the

premium

paid

by

the

fund

is

recorded

as

an

investment

and

is

subsequently

adjusted

to

the

current

value

of

the

option

purchased.

If

an

option

expires

on

the

stipulated

expiration

date

or

if

the

fund

enters

into

a

closing

sale

transaction,

a

gain

or

loss

is

realized.

If

a

call

option

is

exercised,

the

cost

of

the

security

acquired

is

increased

by

the

premium

paid

for

the

call.

If

a

put

option

is

exercised,

a

gain

or

loss

is

realized

from

the

sale

of

the

underlying

security,

and

the

proceeds

from

such

sale

are

decreased

by

the

premium

originally

paid.

Purchased

options

are

non-income

producing

securities.

The

values

of

each

individual

purchased

option

outstanding

as

of

June

30,

2024,

if

any,

are

disclosed

in

the

Fund’s

Schedule

of

Investments.

Foreign

Currency

Translations

–

Foreign

currency

amounts

are

translated

into

U.S.

dollars

as

follows:

(1)

assets

and

liabilities

at

the

rate

of

exchange

at

the

end

of

the

respective

period;

and

(2)

purchases

and

sales

of

securities

and

income

and

expenses

at

the

rate

of

exchange

prevailing

on

the

dates

of

such

transactions.

The

portion

of

the

results

of

operations

arising

from

changes

in

the

exchange

rates

and

the

portion

due

to

fluctuations

arising

from

changes

in

the

market

prices

of

securities

are

not

isolated.

Such

fluctuations

are

included

with

the

net

realized

and

unrealized

gain

or

loss

on

investments.

Foreign

Currency

Transactions

–

The

Fund

may

enter

into

transactions

to

purchase

or

sell

foreign

currency

contracts

and

options

on

foreign

currency.

Forward

currency

contracts

are

agreements

to

exchange

one

currency

for

another

at

a

future

date

and

at

a

specified

price.

A

fund

may

use

forward

currency

contracts

to

facilitate

transactions

in

foreign

securities,

to

manage

a

fund’s

foreign

currency

exposure

and

to

protect

the

U.S.

dollar

value

of

its

underlying

portfolio

securities

against

the

effect

of

possible

adverse

movements

in

foreign

exchange

rates.

These

contracts

are

intrinsically

valued

daily

based

on

forward

rates,

and

a

fund’s

net

equity

therein,

representing

unrealized

gain

or

loss

on

the

contracts

as

measured

by

the

difference

between

the

forward

foreign

exchange

rates

at

the

dates

of

entry

into

the

contracts

and

the

forward

rates

at

the

reporting

date,

is

recorded

as

a

component

of

NAV.

These

instruments

involve

market

risk,

credit

risk,

or

both

kinds

of

risks,

in

excess

of

the

amount

recognized

in

the

Statement

of

Assets

and

Liabilities.

Risks

arise

from

the

possible

inability

of

counterparties

to

meet

the

terms

of

their

contracts

and

from

movement

in

currency

and

securities

values

and

interest

rates.

Due

to

the

risks

associated

with

these

transactions,

a

fund

could

incur

losses

up

to

the

entire

contract

amount,

which

may

exceed

the

net

unrealized

value

included

in

its

NAV.

Distributions

to

Shareholders

–

The

Fund

declares

any

dividends

from

net

investment

income

and

pays

them

annually.

Any

net

capital

gains

and

foreign

currency

gains

realized

by

the

Fund

are

distributed

at

least

annually.

Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date.

Distributions

are

based

on

amounts

calculated

in

accordance

with

applicable

federal

income

tax

regulations,

which

may

differ

from

GAAP.

These

differences

are

due

primarily

to

differing

Polaris

Global

Value

Fund

NOTES

TO

FINANCIAL

STATEMENTS

JUNE

30,

2024

treatments

of

income

and

gain

on

various

investment

securities

held

by

the

Fund,

timing

differences

and

differing

characterizations

of

distributions

made

by

the

Fund.

Federal

Taxes

–

The

Fund

intends

to

continue

to

qualify

each

year

as

a

regulated

investment

company

under

Subchapter

M

of

Chapter

1,

Subtitle

A,

of

the

Internal

Revenue

Code

of

1986,

as

amended

(“Code”),

and

to

distribute

all

of

its

taxable

income

to

shareholders.

In

addition,

by

distributing

in

each

calendar

year

substantially

all

of

its

net

investment

income

and

capital

gains,

if

any,

the

Fund

will

not

be

subject

to

a

federal

excise

tax.

Therefore,

no

federal

income

or

excise

tax

provision

is

required.

The

Fund

recognizes

interest

and

penalties,

if

any,

related

to

unrecognized

tax

benefits

as

income

tax

expense

in

the

Statement

of

Operations.

During

the

period,

the

Fund

did

not

incur

any

interest

or

penalties.

The

Fund

files

a

U.S.

federal

income

and

excise

tax

return

as

required.

The

Fund’s

federal

income

tax

returns

are

subject

to

examination

by

the

Internal

Revenue

Service

for

a

period

of

three

fiscal

years

after

they

are

filed.

As

of

June

30,

2024,

there

are

no

uncertain

tax

positions

that

would

require

financial

statement

recognition,

de-recognition

or

disclosure.

Income

and

Expense

Allocation

–

The

Trust

accounts

separately

for

the

assets,

liabilities

and

operations

of

each

of

its

investment

portfolios.

Expenses

that

are

directly

attributable

to

more

than

one

investment

portfolio

are

allocated

among

the

respective

investment

portfolios

in

an

equitable

manner.

Redemption

Fees

–

A

shareholder

who

redeems

or

exchanges

shares

within

180

days

of

purchase

will

incur

a

redemption

fee

of

1.00%

of

the

current

NAV

of

shares

redeemed

or

exchanged,

subject

to

certain

limitations.

The

fee

is

charged

for

the

benefit

of

the

remaining

shareholders

and

will

be

paid

to

the

Fund

to

help

offset

transaction

costs.

The

fee

is

accounted

for

as

an

addition

to

paid-in

capital.

The

Fund

reserves

the

right

to

modify

the

terms

of

or

terminate

the

fee

at

any

time.

There

are

limited

exceptions

to

the

imposition

of

the

redemption

fee.

Redemption

fees

incurred

for

the

Fund,

if

any,

are

reflected

on

the

Statements

of

Changes

in

Net

Assets.

Commitments

and

Contingencies

–

In

the

normal

course

of

business,

the

Fund

enters

into

contracts

that

provide

general

indemnifications

by

the

Fund

to

the

counterparty

to

the

contract.

The

Fund’s

maximum

exposure

under

these

arrangements

is

dependent

on

future

claims

that

may

be

made

against

the

Fund

and,

therefore,

cannot

be

estimated;

however,

based

on

experience,

the

risk

of

loss

from

such

claims

is

considered

remote.

The

Fund

has

determined

that

none

of

these

arrangements

requires

disclosure

on

the

Fund’s

statement

of

assets

and

liabilities.

Note

3.

Fees

and

Expenses

Investment

Adviser

–

Polaris

Capital

Management,

LLC

(the

“Adviser”)

is

the

investment

adviser

to

the

Fund.

Pursuant

to

an

investment

advisory

agreement,

the

Adviser

receives

an

advisory

fee,

payable

monthly,

from

the

Fund

at

an

annual

rate

of

1.00%

of

the

Fund’s

average

daily

net

assets.

Distribution

–

Foreside

Fund

Services,

LLC,

a

wholly

owned

subsidiary

of

Foreside

Financial

Group,

LLC

(d/b/a

ACA

Group)

(the

“Distributor”),

acts

as

the

agent

of

the

Trust

in

connection

with

the

continuous

offering

of

shares

of

the

Fund.

The

Fund

does

not

have

a

distribution

(12b-1)

plan;

accordingly,

the

Distributor

does

not

receive

compensation

from

the

Fund

for

its

distribution

services.

The

Adviser

compensates

the

Distributor

directly

for

its

services.

The

Distributor

is

not

Polaris

Global

Value

Fund

NOTES

TO

FINANCIAL

STATEMENTS

JUNE

30,

2024

affiliated

with

the

Adviser

or

Atlantic

Fund

Administration,

LLC,

a

wholly

owned

subsidiary

of

Apex

US

Holdings

LLC

(d/b/a

Apex

Fund

Services)

(“Apex”)

or

their

affiliates.

Other

Service

Providers

–

Apex

provides

fund

accounting,

fund

administration,

compliance

and

transfer

agency

services

to

the

Fund.

The

fees

related

to

these

services

are

included

in

Fund

services

fees

within

the

Statement

of

Operations.

Apex

also

provides

certain

shareholder

report

production

and

EDGAR

conversion

and

filing

services.

Pursuant

to

an

Apex

Services

Agreement,

the

Fund

pays

Apex

customary

fees

for

its

services.

Apex

provides

a

Principal

Executive

Officer,

a

Principal

Financial

Officer,

a

Chief

Compliance

Officer

and

an

Anti-Money

Laundering

Officer

to

the

Fund,

as

well

as

certain

additional

compliance

support

functions.

Trustees

and

Officers

–

Each

Independent

Trustee’s

annual

retainer

is

$45,000

($55,000

for

the

Chairman).

The

Audit

Committee

Chairman

receives

an

additional

$2,000

annually.

The

Trustees

and

the

Chairman

may

receive

additional

fees

for

special

Board

meetings.

Each

Trustee

is

also

reimbursed

for

all

reasonable

out-of-pocket

expenses

incurred

in

connection

with

his

or

her

duties

as

a

Trustee,

including

travel

and

related

expenses

incurred

in

attending

Board

meetings.

The

amount

of

Trustees’

fees

attributable

to

the

Fund

is

disclosed

in

the

Statement

of

Operations.

Certain

officers

of

the

Trust

are

also

officers

or

employees

of

the

above

named

service

providers,

and

during

their

terms

of

office

received

no

compensation

from

the

Fund.

Note

4.

Fees

Waived

The

Adviser

has

contractually

agreed

to

waive

its

fee

and/or

reimburse

Fund

expenses

to

limit

Total

Annual

Fund

Operating

Expenses

After

Fee

Waiver

and/or

Expense

Reimbursement

(excluding

all

taxes,

interest,

portfolio

transaction

expenses,

dividend

and

interest

expense

on

short

sales,

acquired

fund

fees

and

expenses,

proxy

expenses

and

extraordinary

expenses)

to

0.99%,

through

at

least

April

30,

2025

(“Expense

Cap”).

The

Expense

Cap

may

only

be

raised

or

eliminated

with

the

consent

of

the

Board

of

Trustees.

Other

Fund

service

providers

have

agreed

to

waive

a

portion

of

their

fees

and

such

waivers

may

be

changed

or

eliminated

with

the

approval

of

the

Board

of

Trustees

of

the

Trust.

For

the

period

ended

June

30,

2024,

fees

waived

were

as

follows:

The

Adviser

may

be

reimbursed

by

the

Fund

for

fees

waived

and

expenses

reimbursed

by

the

Adviser

pursuant

to

the

Expense

Cap

if

such

payment

is

made

within

three

years

of

the

fee

waiver

or

expense

reimbursement,

and

does

not

cause

the

Total

Annual

Fund

Operating

Expenses

After

Fee

Waiver

and/or

Expense

Reimbursement

to

exceed

the

lesser

of

(i)

the

then-current

expense

cap,

or

(ii)

the

expense

cap

in

place

at

the

time

the

fees/expenses

were

waived/reimbursed.

As

of

June

30,

2024,

$2,781,168

is

subject

to

recapture

by

the

Adviser.

Other

waivers

are

not

eligible

for

recoupment.

Note

5.

Security

Transactions

The

cost

of

purchases

and

proceeds

from

sales

of

investment

securities

(including

maturities),

other

than

short-term

investments

during

the

period

ended

June

30,

2024,

were

$33,190,262

and

$41,559,655,

respectively.

Investment

Adviser

Fees

Waived

Other

Waivers

Total

Fees

Waived

$

449,150

$

26,570

$

475,720

Polaris

Global

Value

Fund

NOTES

TO

FINANCIAL

STATEMENTS

JUNE

30,

2024

Note

6.

Summary

of

Derivative

Activity

The

volume

of

open

derivative

positions

may

vary

on

a

daily

basis

as

the

Fund

transacts

derivative

contracts

in

order

to

achieve

the

exposure

desired

by

the

Adviser.

Premiums

received

on

purchased

and

written

options

for

the

period

ended

June

30,

2024,

for

any

derivative

type

that

was

held

during

the

period

is

as

follows:

The

Fund’s

use

of

derivatives

during

the

period

ended

June

30,

2024,

was

limited

to

written

options.

Following

is

a

summary

of

the

effects

of

derivatives

on

the

Statement

of

Asset

and

Liabilities

as

of

June

30,

2024:

Realized

and

unrealized

gains

and

losses

on

derivative

contracts

during

the

period

ended

June

30,

2024,

by

the

Fund

are

recorded

in

the

following

locations

on

the

Statement

of

Operations:

Asset

(Liability)

amounts

shown

in

the

table

below

represent

amounts

for

derivative

related

investments

at

June

30,

2024.

These

amounts

may

be

collateralized

by

cash

and

financial

instruments.

Written

Options

$

(348,700)

Location:

Equity

Risk

Liability

derivatives:

Call

options

written

$

(142,075)

Location:

Equity

Contracts

Net

realized

gain

(loss)

on:

Written

options

$

208,367

Total

net

realized

gain

(loss)

$

208,367

Net

change

in

unrealized

appreciation

(depreciation)

on:

Written

options

$

(1,742)

Total

net

change

in

unrealized

appreciation

(depreciation)

$

(1,742)

Gross

Asset

(Liability)

as

Presented

in

the

Statement

of

Assets

and

Liabilities

Financial

Instruments

(Received)

Pledged*

Cash

Collateral

(Received)

Pledged*

Net

Amount

Polaris

Global

Value

Fund

Liabilities:

Over-the-counter

derivatives**

$

(142,075)

$

142,075

$

–

$

–

*

The

actual

financial

instruments

and

cash

collateral

(received)

pledged

may

be

in

excess

of

the

amounts

shown

in

the

table.

The

table

only

reflects

collateral

amounts

up

to

the

amount

of

the

financial

instrument

disclosed

on

the

Statement

of

Assets

and

Liabilities

**

Over-the-counter

derivatives

may

consist

of

written

options

contracts.

The

amounts

disclosed

above

represent

the

exposure

to

one

or

more

counterparties.

For

further

detail

on

individual

derivative

contracts

and

the

corresponding

unrealized

appreciation

(depreciation),

see

the

Schedule

of

Call

and

Put

Options

Written.

Polaris

Global

Value

Fund

NOTES

TO

FINANCIAL

STATEMENTS

JUNE

30,

2024

Note

7.

Federal

Income

Tax

As

of

June

30,

2024,

the

cost

of

investments

for

federal

income

tax

purposes

is

substantially

the

same

as

for

financial

statement

purposes and

the

components

of

net

unrealized appreciation were

as

follows:

As

of

December

31,

2023,

distributable

earnings

on

a

tax

basis

were

as

follows:

The

difference

between

components

of

distributable

earnings

on

a

tax

basis

and

the

amounts

reflected

in

the

Statement

of

Assets

and

Liabilities

are

primarily

due

to

passive

foreign

investment

company

transactions,

wash

sales,

and

return

of

capital

on

equity

securities.

During

the

year

ended

December

31,

2023,

the

Fund

utilized

$8,642,753

of

capital

loss

carryforwards

to

offset

capital

gains.

As

of

December

31,

2023,

the

Fund

had

$1,726,731

of

available

short-term

capital

loss

carryforwards

that

have

no

expiration

date.

Note

8.

Subsequent

Events

Subsequent

events

occurring

after

the

date

of

this

report

through

the

date

these

financial

statements

were

issued

have

been

evaluated

for

potential

impact,

and

the

Fund

has

had

no

such

events.

Gross

Unrealized

Appreciation

$

134,025,268

Gross

Unrealized

Depreciation

(27,917,692)

Net