UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Zachary Tackett, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end December 31

Date of reporting period: January 1, 2024 – June 30, 2024

ITEM 1. REPORT TO SHAREHOLDERS.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended (“Act”), is attached hereto.

Lisanti Small Cap Growth Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Lisanti Small Cap Growth Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at https://lisantismallcap.com/investing-in-the-fund. You can also request this information by contacting us at (800) 441-7031.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Lisanti Small Cap Growth Fund | $72 | 1.34% |

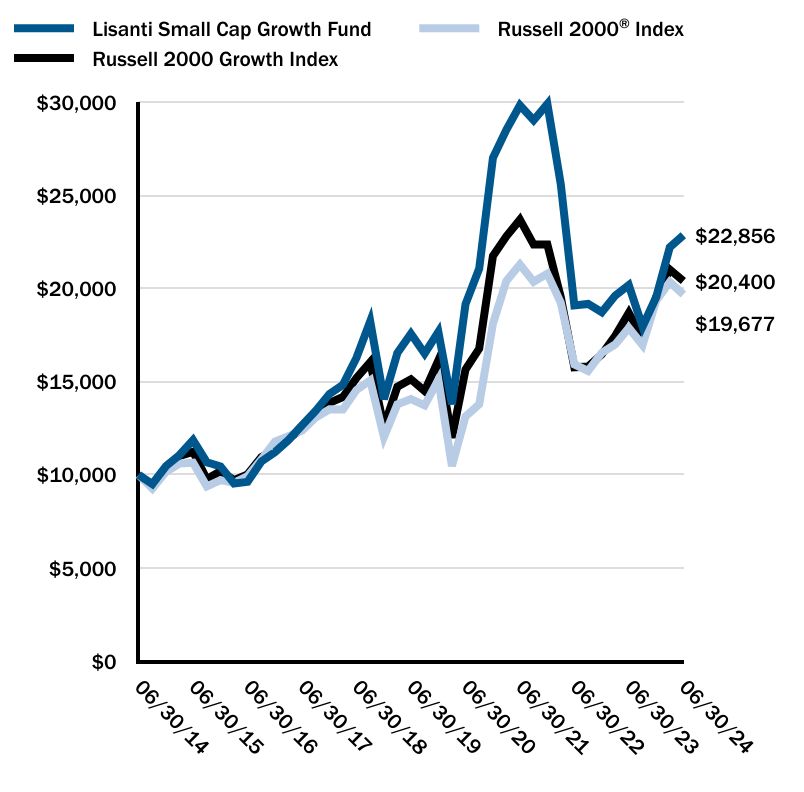

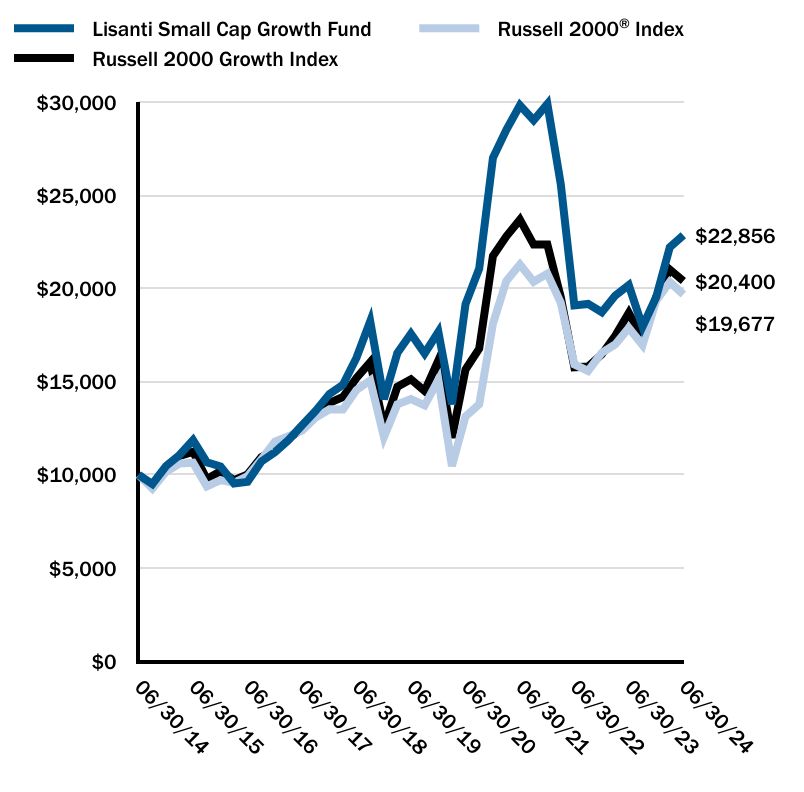

Total Return Based on a $10,000 Investment

| Date | Lisanti Small Cap Growth Fund | Russell 2000® Index | Russell 2000 Growth Index |

|---|

| 06/30/14 | $10,000 | $10,000 | $10,000 |

| 09/30/14 | $9,507 | $9,264 | $9,387 |

| 12/31/14 | $10,473 | $10,165 | $10,331 |

| 03/31/15 | $11,060 | $10,604 | $11,016 |

| 06/30/15 | $11,859 | $10,649 | $11,234 |

| 09/30/15 | $10,674 | $9,379 | $9,767 |

| 12/31/15 | $10,454 | $9,717 | $10,189 |

| 03/31/16 | $9,535 | $9,569 | $9,711 |

| 06/30/16 | $9,623 | $9,932 | $10,026 |

| 09/30/16 | $10,713 | $10,830 | $10,951 |

| 12/31/16 | $11,219 | $11,787 | $11,342 |

| 03/31/17 | $11,866 | $12,078 | $11,948 |

| 06/30/17 | $12,656 | $12,375 | $12,473 |

| 09/30/17 | $13,441 | $13,077 | $13,248 |

| 12/31/17 | $14,336 | $13,513 | $13,856 |

| 03/31/18 | $14,824 | $13,502 | $14,174 |

| 06/30/18 | $16,280 | $14,549 | $15,200 |

| 09/30/18 | $18,239 | $15,069 | $16,039 |

| 12/31/18 | $14,064 | $12,025 | $12,566 |

| 03/31/19 | $16,534 | $13,779 | $14,721 |

| 06/30/19 | $17,567 | $14,067 | $15,125 |

| 09/30/19 | $16,510 | $13,730 | $14,494 |

| 12/31/19 | $17,669 | $15,094 | $16,145 |

| 03/31/20 | $13,787 | $10,473 | $11,986 |

| 06/30/20 | $19,155 | $13,135 | $15,651 |

| 09/30/20 | $21,071 | $13,783 | $16,772 |

| 12/31/20 | $27,007 | $18,107 | $21,737 |

| 03/31/21 | $28,507 | $20,407 | $22,797 |

| 06/30/21 | $29,824 | $21,283 | $23,690 |

| 09/30/21 | $29,022 | $20,355 | $22,351 |

| 12/31/21 | $29,892 | $20,791 | $22,353 |

| 03/31/22 | $25,584 | $19,226 | $19,530 |

| 06/30/22 | $19,087 | $15,920 | $15,770 |

| 09/30/22 | $19,168 | $15,572 | $15,808 |

| 12/31/22 | $18,720 | $16,542 | $16,461 |

| 03/31/23 | $19,618 | $16,995 | $17,461 |

| 06/30/23 | $20,174 | $17,879 | $18,692 |

| 09/30/23 | $17,952 | $16,962 | $17,324 |

| 12/31/23 | $19,536 | $19,342 | $19,533 |

| 03/31/24 | $22,206 | $20,344 | $21,014 |

| 06/30/24 | $22,856 | $19,677 | $20,400 |

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years. Effective May 1, 2024, the Fund changed its primary benchmark from the Russell 2000 Growth Index to the Russell 2000 Index due to regulatory requirements. The Fund retained the Russell 2000 Growth Index as a secondary benchmark because the Russell 2000 Growth Index more closely aligns with the Fund’s investment strategies and investment restrictions.

How did the Fund perform in the last six months?

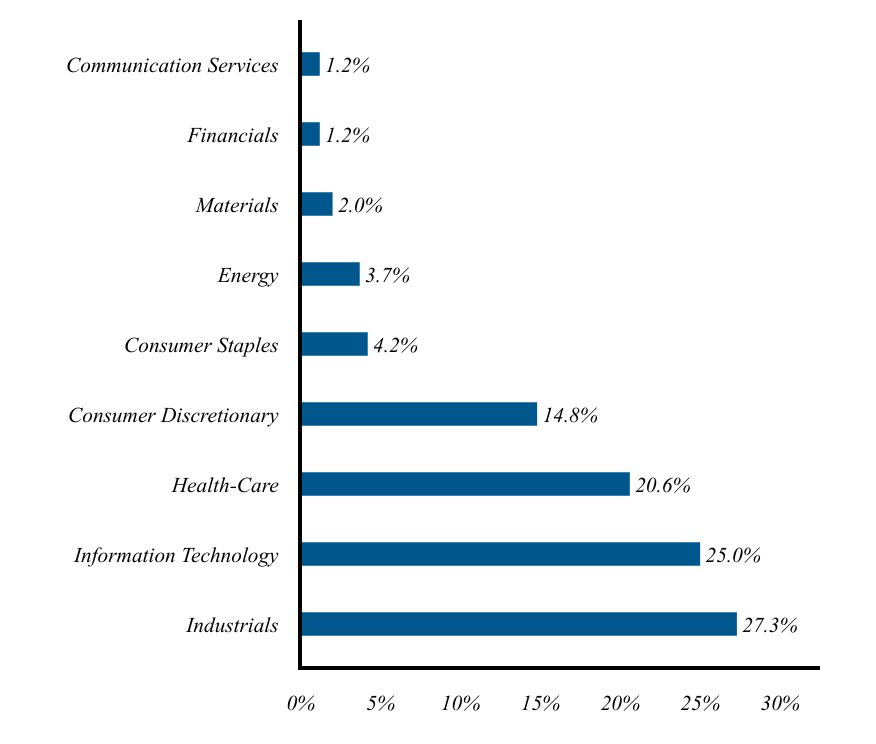

Performance of the Fund in the first half of 2024 was driven by individual stock selection. The Fund’s investment process focuses on companies that have individual, idiosyncratic drivers of growth and are showing or on the path to show strong operating leverage. The Consumer Discretionary, Healthcare and Industrials sectors were the greatest contributors to outperformance, while Financials and Communications Services detracted modestly from performance. The focus in Consumer Discretionary was on companies that have transformed their business models to adapt to the new environment, and that offer a very strong value proposition to a more discerning and disciplined consumer, such as Modine Manufacturing, Abercrombie & Fitch and Freshpet. In Healthcare, the Fund benefited from companies with very strong growth profiles that offer innovative therapies and/or devices to solve significant medical challenges, such as Viking Therapeutics, TransMedics Group, and PROCEPT BioRobotics. In Industrials, the team focused on companies that solved critical issues, such as FTAI Aviation, which provides parts to the aerospace industry.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Lisanti Small Cap Growth Fund | 13.30% | 5.41% | 8.62% |

Russell 2000® Index | 10.06% | 6.94% | 7.00% |

| Russell 2000 Growth Index | 9.14% | 6.17% | 7.39% |

| Total Net Assets | $26,328,534 |

| # of Portfolio Holdings | 88 |

| Portfolio Turnover Rate | 101% |

| Investment Advisory Fees (Net of fees waived) | $34,675 |

Sector Weightings

(% total investments)*

| Value | Value |

|---|

| Industrials | 27.3% |

| Information Technology | 25.0% |

| Health-Care | 20.6% |

| Consumer Discretionary | 14.8% |

| Consumer Staples | 4.2% |

| Energy | 3.7% |

| Materials | 2.0% |

| Financials | 1.2% |

| Communication Services | 1.2% |

* excluding cash equivalents

Top Ten Holdings

(% of investments)*

| FTAI Aviation, Ltd. | 2.70% |

| Q2 Holdings, Inc. | 2.43% |

| Freshpet, Inc. | 2.37% |

| PROCEPT BioRobotics Corp. | 2.25% |

| Ollie's Bargain Outlet Holdings, Inc. | 2.19% |

| Federal Signal Corp. | 1.98% |

| TransMedics Group, Inc. | 1.90% |

| FormFactor, Inc. | 1.86% |

| Credo Technology Group Holding, Ltd. | 1.81% |

| SPX Technologies, Inc. | 1.81% |

* excluding cash equivalents

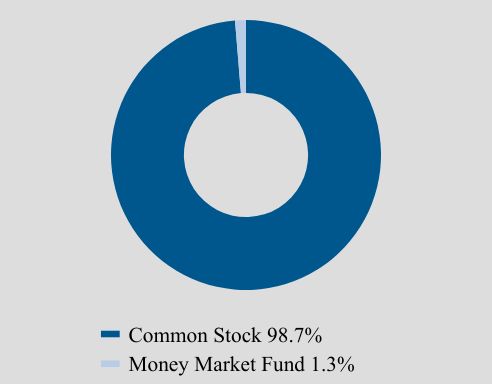

Asset Class Weightings

(% total investments)

| Value | Value |

|---|

| Common Stock | 98.7% |

| Money Market Fund | 1.3% |

Lisanti Small Cap Growth Fund

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the fund?

The Fund is distributed by Foreside Fund Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (dba ACA Group). If you wish to view additional information about the Fund; including but not limited to its prospectus, holdings, financial information, and proxy information, please visit https://lisantismallcap.com/investing-in-the-fund or scan the QR code.

(b) Not applicable.

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. INVESTMENTS.

(a) Included as part of financial statements filed under Item 7(a).

(b) Not applicable.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

(a)

Lisanti

Small

Cap

Growth

Fund

Semi

Annual

Financials

and

Other

Information

June

30,

2024

(Unaudited)

Lisanti

Small

Cap

Growth

Fund

SCHEDULE

OF

INVESTMENTS

June

30,

2024

See

Notes

to

Financial

Statements.

Shares

Security

Description

Value

Common

Stock

-

99.6%

Communication

Services

-

1.2%

23,150

Magnite,

Inc.

(a)

$

307,663

Consumer

Discretionary

-

14.7%

1,790

Abercrombie

&

Fitch

Co.

(a)

318,334

22,550

Arhaus,

Inc.

381,997

3,110

Boot

Barn

Holdings,

Inc.

(a)

400,972

14,790

Bowlero

Corp.

214,307

1,905

Crocs,

Inc.

(a)

278,016

615

Duolingo,

Inc.

(a)

128,332

3,380

Light

&

Wonder,

Inc.

(a)

354,495

2,885

Modine

Manufacturing

Co.

(a)

289,048

5,845

Ollie's

Bargain

Outlet

Holdings,

Inc.

(a)

573,804

5,255

On

Holding

AG,

Class A

(a)

203,894

3,545

Smith

Douglas

Homes

Corp.

(a)

82,882

12,145

Sweetgreen,

Inc.,

Class A

(a)

366,050

640

Wingstop,

Inc.

270,502

3,862,633

Consumer

Staples

-

4.2%

4,090

BellRing

Brands,

Inc.

(a)

233,703

1,185

elf

Beauty,

Inc.

(a)

249,703

4,800

Freshpet,

Inc.

(a)

621,072

1,104,478

Energy

-

3.7%

10,490

TechnipFMC

PLC

274,314

50,875

Transocean,

Ltd.

(a)

272,181

3,525

Weatherford

International

PLC

(a)

431,636

978,131

Financials

-

1.2%

8,605

Skyward

Specialty

Insurance

Group,

Inc.

(a)

311,329

Health-Care

-

20.5%

4,125

ANI

Pharmaceuticals,

Inc.

(a)

262,680

1,575

Apellis

Pharmaceuticals,

Inc.

(a)

60,417

6,030

BioLife

Solutions,

Inc.

(a)

129,223

7,895

Castle

Biosciences,

Inc.

(a)

171,874

5,085

Corcept

Therapeutics,

Inc.

(a)

165,212

6,005

Crinetics

Pharmaceuticals,

Inc.

(a)

268,964

2,430

Cytokinetics,

Inc.

(a)

131,657

8,590

Dyne

Therapeutics,

Inc.

(a)

303,141

2,905

Glaukos

Corp.

(a)

343,807

1,520

HealthEquity,

Inc.

(a)

131,024

4,675

Inari

Medical,

Inc.

(a)

225,101

5,135

Intra-Cellular

Therapies,

Inc.

(a)

351,696

4,865

Lantheus

Holdings,

Inc.

(a)

390,611

8,655

Pacira

BioSciences,

Inc.

(a)

247,620

9,650

PROCEPT

BioRobotics

Corp.

(a)

589,518

7,310

RxSight,

Inc.

(a)

439,843

Shares

Security

Description

Value

Health-Care

-

20.5%

(continued)

9,750

Tandem

Diabetes

Care,

Inc.

(a)

$

392,827

3,310

TransMedics

Group,

Inc.

(a)

498,552

335

Vaxcyte,

Inc.

(a)

25,296

3,110

Vericel

Corp.

(a)

142,687

2,520

Viking

Therapeutics,

Inc.

(a)

133,585

5,405,335

Industrials

-

27.2%

1,570

AeroVironment,

Inc.

(a)

285,991

5,770

Ameresco,

Inc.,

Class A

(a)

166,234

5,075

American

Superconductor

Corp.

(a)

118,704

2,185

Applied

Industrial

Technologies,

Inc.

423,890

2,165

Chart

Industries,

Inc.

(a)

312,496

1,990

Clean

Harbors,

Inc.

(a)

450,038

1,435

Comfort

Systems

USA,

Inc.

436,412

6,005

Construction

Partners,

Inc.,

Class A

(a)

331,536

5,525

Enerpac

Tool

Group

Corp.

210,944

6,195

Federal

Signal

Corp.

518,336

6,190

Fluor

Corp.

(a)

269,575

6,850

FTAI

Aviation,

Ltd.

707,126

2,210

Kirby

Corp.

(a)

264,603

1,950

MasTec,

Inc.

(a)

208,631

5,575

Montrose

Environmental

Group,

Inc.

(a)

248,422

3,935

NEXTracker,

Inc.,

Class A

(a)

184,473

3,040

Parsons

Corp.

(a)

248,702

3,340

SPX

Technologies,

Inc.

(a)

474,748

2,115

Sterling

Infrastructure,

Inc.

(a)

250,289

8,785

The

AZEK

Co.,

Inc.

(a)

370,112

7,200

UL

Solutions,

Inc.,

Class A

303,768

4,300

VSE

Corp.

379,604

7,164,634

Information

Technology

-

24.9%

10,325

Alkami

Technology,

Inc.

(a)

294,056

1,410

Astera

Labs,

Inc.

(a)

85,319

3,100

Camtek,

Ltd./Israel

388,244

4,845

Coherent

Corp.

(a)

351,069

3,855

CommVault

Systems,

Inc.

(a)

468,652

14,900

Credo

Technology

Group

Holding,

Ltd.

(a)

475,906

1,200

CyberArk

Software,

Ltd.

(a)

328,104

9,800

Extreme

Networks,

Inc.

(a)

131,810

1,160

Fabrinet

(a)

283,956

8,055

FormFactor,

Inc.

(a)

487,569

985

Guidewire

Software,

Inc.

(a)

135,822

2,060

Impinj,

Inc.

(a)

322,946

3,670

Itron,

Inc.

(a)

363,183

Lisanti

Small

Cap

Growth

Fund

SCHEDULE

OF

INVESTMENTS

June

30,

2024

See

Notes

to

Financial

Statements.

The

following

is

a

summary

of

the

inputs

used

to

value

the

Fund's investments

as

of

June

30,

2024.

The

inputs

or

methodology

used

for

valuing

securities

are

not

necessarily

an

indication

of

the

risks

associated

with

investing

in

those

securities.

For

more

information

on

valuation

inputs,

and

their

aggregation

into

the

levels

used

in

the

table

below,

please

refer

to

the

Security

Valuation

section

in

Note

2

of

the

accompanying

Notes

to

Financial

Statements.

The

Level

1

value

displayed

in

this

table

is

Common

Stock

and

a

Money

Market

Fund.

Refer

to

this

Schedule

of

Investments

for

a

further

breakout

of

each

security

by

industry.

Shares

Security

Description

Value

Information

Technology

-

24.9%

(continued)

3,330

MACOM

Technology

Solutions

Holdings,

Inc.

(a)

$

371,195

2,570

Napco

Security

Technologies,

Inc.

133,512

1,940

Onto

Innovation,

Inc.

(a)

425,947

10,545

Q2

Holdings,

Inc.

(a)

636,180

3,625

Semtech

Corp.

(a)

108,315

2,040

SiTime

Corp.

(a)

253,735

2,860

Varonis

Systems,

Inc.

(a)

137,194

7,965

Veeco

Instruments,

Inc.

(a)

372,045

6,554,759

Materials

-

2.0%

2,390

Carpenter

Technology

Corp.

261,896

3,805

Knife

River

Corp.

(a)

266,883

528,779

Total

Common

Stock

(Cost

$21,171,191)

26,217,741

Shares

Security

Description

Value

Money

Market

Fund

-

1.3%

347,850

First

American

Treasury

Obligations

Fund,

Class X,

5.21%

(b)

(Cost

$347,850)

347,850

Investments,

at

value

-

100.9%

(Cost

$21,519,041)

$

26,565,591

Other

Assets

&

Liabilities,

Net

-

(0.9)%

(237,057)

Net

Assets

-

100.0%

$

26,328,534

(a)

Non-income

producing

security.

(b)

Dividend

yield

changes

daily

to

reflect

current

market

conditions.

Rate

was

the

quoted

yield

as

of

June

30,

2024.

Valuation

Inputs

Investments

in

Securities

Level

1

-

Quoted

Prices

$

26,565,591

Level

2

-

Other

Significant

Observable

Inputs

–

Level

3

-

Significant

Unobservable

Inputs

–

Total

$

26,565,591

PORTFOLIO

HOLDINGS

%

of

Total

Investments

Communication

Services

1.2%

Consumer

Discretionary

14.5%

Consumer

Staples

4.1%

Energy

3.7%

Financials

1.2%

Health-Care

20.3%

Industrials

27.0%

Information

Technology

24.7%

Materials

2.0%

Money

Market

Fund

1.3%

100.0%

Lisanti

Small

Cap

Growth

Fund

STATEMENT

OF

ASSETS

AND

LIABILITIES

June

30,

2024

See

Notes

to

Financial

Statements.

ASSETS

Investments,

at

value

(Cost

$21,519,041)

$

26,565,591

Receivables:

Fund

shares

sold

2,497

Dividends

2,044

Prepaid

expenses

17,096

Total

Assets

26,587,228

LIABILITIES

Payables:

Investment

securities

purchased

161,632

Fund

shares

redeemed

55,083

Accrued

Liabilities:

Investment

adviser

fees

6,015

Fund

services

fees

14,111

Other

expenses

21,853

Total

Liabilities

258,694

NET

ASSETS

$

26,328,534

COMPONENTS

OF

NET

ASSETS

Paid-in

capital

$

47,907,072

Accumulated

loss

(21,578,538)

NET

ASSETS

$

26,328,534

SHARES

OF

BENEFICIAL

INTEREST

AT

NO

PAR

VALUE

(UNLIMITED

SHARES

AUTHORIZED)

1,361,428

NET

ASSET

VALUE,

OFFERING

AND

REDEMPTION

PRICE

PER

SHARE*

$

19.34

Lisanti

Small

Cap

Growth

Fund

STATEMENT

OF

OPERATIONS

SIX

MONTHS

ENDED

JUNE

30,

2024

See

Notes

to

Financial

Statements.

INVESTMENT

INCOME

Dividend

income

(Net

of

foreign

withholding

taxes

of

$1,066)

$

47,967

Total

Investment

Income

47,967

EXPENSES

Investment

adviser

fees

133,639

Fund

services

fees

96,063

Shareholder

service

fees

28,135

Custodian

fees

3,558

Registration

fees

10,569

Professional

fees

22,308

Trustees'

fees

and

expenses

3,499

Other

expenses

31,974

Total

Expenses

329,745

Fees

waived

(140,290)

Net

Expenses

189,455

NET

INVESTMENT

LOSS

(141,488)

NET

REALIZED

AND

UNREALIZED

GAIN

(LOSS)

Net

realized

gain

on

investments

3,897,391

Net

change

in

unrealized

appreciation

(depreciation)

on

investments

791,552

NET

REALIZED

AND

UNREALIZED

GAIN

4,688,943

INCREASE

IN

NET

ASSETS

RESULTING

FROM

OPERATIONS

$

4,547,455

Lisanti

Small

Cap

Growth

Fund

STATEMENTS

OF

CHANGES

IN

NET

ASSETS

See

Notes

to

Financial

Statements.

For

the

Six

Months

Ended

June

30,

2024

For

the

Year

Ended

December

31,

2023

OPERATIONS

Net

investment

loss

$

(141,488)

$

(564,747)

Net

realized

gain

3,897,391

978,903

Net

change

in

unrealized

appreciation

(depreciation)

791,552

986,988

Increase

in

Net

Assets

Resulting

from

Operations

4,547,455

1,401,144

CAPITAL

SHARE

TRANSACTIONS

Sale

of

shares

2,376,198

12,474,244

Redemption

of

shares

(11,427,132)

(43,517,859)

Decrease

in

Net

Assets

from

Capital

Share

Transactions

(9,050,934)

(31,043,615)

Decrease

in

Net

Assets

(4,503,479)

(29,642,471)

NET

ASSETS

Beginning

of

Period

30,832,013

60,474,484

End

of

Period

$

26,328,534

$

30,832,013

SHARE

TRANSACTIONS

Sale

of

shares

140,417

774,563

Redemption

of

shares

(643,685)

(2,728,467)

Decrease

in

Shares

(503,268)

(1,953,904)

Lisanti

Small

Cap

Growth

Fund

FINANCIAL

HIGHLIGHTS

See

Notes

to

Financial

Statements.

These

financial

highlights

reflect

selected

data

for

a

share

outstanding

throughout

each

period

.

For

the

Six

Months

Ended

June

30,

2024

For

the

Years

Ended

December

31,

2023

2022

2021

2020

2019

NET

ASSET

VALUE,

Beginning

of

Period

$

16.53

$

15.84

$

25.95

$

30.96

$

21.76

$

17.71

INVESTMENT

OPERATIONS

Net

investment

loss

(a)

(0.09)

(0.17)

(0.17)

(0.38)

(0.28)

(0.25)

Net

realized

and

unrealized

gain

(loss)

2.90

0.86

(9.51)

3.32

11.66

4.78

Total

from

Investment

Operations

2.81

0.69

(9.68)

2.94

11.38

4.53

DISTRIBUTIONS

TO

SHAREHOLDERS

FROM

Net

realized

gain

–

–

(0.43)

(7.95)

(2.18)

(0.48)

Total

Distributions

to

Shareholders

–

–

(0.43)

(7.95)

(2.18)

(0.48)

REDEMPTION

FEES(a)

–

–

0.00(b)

0.00(b)

0.00(b)

0.00(b)

NET

ASSET

VALUE,

End

of

Period

$

19.34

$

16.53

$

15.84

$

25.95

$

30.96

$

21.76

TOTAL

RETURN

17.00%(c)

4.36%

(37.37)%

10.69%

52.85%

25.62%

RATIOS/SUPPLEMENTARY

DATA

Net

Assets

at

End

of

Period

(000s

omitted)

$

26,329

$

30,832

$

60,474

$

105,111

$

82,925

$

50,637

Ratios

to

Average

Net

Assets:

Net

investment

loss

(1.00)%(d)

(1.05)%

(0.91)%

(1.14)%

(1.17)%

(1.20)%

Net

expenses

1.34%(d)

1.35%

1.34%

1.35%

1.35%

1.35%

Gross

expenses

(e)

2.34%(d)

1.88%

1.67%

1.61%

1.78%

1.98%

PORTFOLIO

TURNOVER

RATE

101%(c)

475%

347%

264%

314%

252%

footertext

(a)

Calculated

based

on

average

shares

outstanding

during

each

period.

(b)

Less

than

$0.01

per

share.

(c)

Not

annualized.

(d)

Annualized.

(e)

Reflects

the

expense

ratio

excluding

any

waivers

and/or

reimbursements.

Lisanti

Small

Cap

Growth

Fund

NOTES

TO

FINANCIAL

STATEMENTS

June

30,

2024

Note

1.

Organization

The

Lisanti

Small

Cap

Growth

Fund

(the

“Fund”)

is

a

diversified

portfolio

of

Forum

Funds

(the

“Trust”).

The

Trust

is

a

Delaware

statutory

trust

that

is

registered

as

an

open-end,

management

investment

company

under

the

Investment

Company

Act

of

1940,

as

amended

(the

“Act”).

Under

its

Trust

Instrument,

the

Trust

is

authorized

to

issue

an

unlimited

number

of

the

Fund’s

shares

of

beneficial

interest

without

par

value.

The

Fund

commenced

operations

on

February

27,

2004.

The

Fund

seeks

maximum

capital

appreciation.

Note

2.

Summary

of

Significant

Accounting

Policies

The

Fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

under

Financial

Accounting

Standards

Board

Accounting

Standards

Codification

Topic

946,

“Financial

Services

–

Investment

Companies.”

These

financial

statements

are

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(“GAAP”),

which

require

management

to

make

estimates

and

assumptions

that

affect

the

reported

amounts

of

assets

and

liabilities,

the

disclosure

of

contingent

liabilities

at

the

date

of

the

financial

statements,

and

the

reported

amounts

of

increases

and

decreases

in

net

assets

from

operations

during

the

fiscal

period.

Actual

amounts

could

differ

from

those

estimates.

The

following

summarizes

the

significant

accounting

policies

of

the

Fund:

Security

Valuation

–

Securities

are

valued

at

market

prices

using

the

last

quoted

trade

or

official

closing

price

from

the

principal

exchange

where

the

security

is

traded,

as

provided

by

independent

pricing

services

on

each

Fund

business

day.

In

the

absence

of

a

last

trade,

securities

are

valued

at

the

mean

of

the

last

bid

and

ask

price

provided

by

the

pricing

service.

Shares

of

non-exchange

traded

open-end

mutual

funds

are

valued

at

net

asset

value

(“NAV”).

Short-term

investments

that

mature

in

sixty

days

or

less

may

be

valued

at

amortized

cost.

Pursuant

to

Rule

2a-5

under

the

Investment

Company

Act,

the

Trust’s

Board

of

Trustees

(the

“Board”)

has

designated

the

Adviser,

as

defined

in

Note

3,

as

the

Fund’s

valuation

designee

to

perform

any

fair

value

determinations

for

securities

and

other

assets

held

by

the

Fund.

The

Adviser

is

subject

to

the

oversight

of

the

Board

and

certain

reporting

and

other

requirements

intended

to

provide

the

Board

the

information

needed

to

oversee

the

Adviser’s

fair

value

determinations.

The

Adviser

is

responsible

for

determining

the

fair

value

of

investments

for

which

market

quotations

are

not

readily

available

in

accordance

with

policies

and

procedures

that

have

been

approved

by

the

Board.

Under

these

procedures,

the

Adviser

convenes

on

a

regular

and

ad

hoc

basis

to

review

such

investments

and

considers

a

number

of

factors,

including

valuation

methodologies

and

significant

unobservable

inputs,

when

arriving

at

fair

value.

The

Board

has

approved

the

Adviser’s

fair

valuation

procedures

as

a

part

of

the

Fund’s

compliance

program

and

will

review

any

changes

made

to

the

procedures.

The

Adviser

provides

fair

valuation

inputs.

In

determining

fair

valuations,

inputs

may

include

market-based

analytics

that

may

consider

related

or

comparable

assets

or

liabilities,

recent

transactions,

market

multiples,

book

values

and

other

relevant

investment

information.

Adviser

inputs

may

include

an

income-based

approach

in

which

the

anticipated

future

cash

flows

of

the

investment

are

discounted

in

determining

fair

value.

Lisanti

Small

Cap

Growth

Fund

NOTES

TO

FINANCIAL

STATEMENTS

June

30,

2024

Discounts

may

also

be

applied

based

on

the

nature

or

duration

of

any

restrictions

on

the

disposition

of

the

investments.

The

Adviser

performs

regular

reviews

of

valuation

methodologies,

key

inputs

and

assumptions,

disposition

analysis

and

market

activity.

Fair

valuation

is

based

on

subjective

factors

and,

as

a

result,

the

fair

value

price

of

an

investment

may

differ

from

the

security’s

market

price

and

may

not

be

the

price

at

which

the

asset

may

be

sold.

Fair

valuation

could

result

in

a

different

NAV

than

a

NAV

determined

by

using

market

quotes.

GAAP

has

a

three-tier

fair

value

hierarchy.

The

basis

of

the

tiers

is

dependent

upon

the

various

“inputs”

used

to

determine

the

value

of

the

Fund’s

investments.

These

inputs

are

summarized

in

the

three

broad

levels

listed

below:

Level

1

-

Quoted

prices

in

active

markets

for

identical

assets

and

liabilities.

Level

2

-

Prices

determined

using

significant

other

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

prepayment

speeds,

credit

risk,

etc.).

Short-term

securities

with

maturities

of

sixty

days

or

less

are

valued

at

amortized

cost,

which

approximates

market

value,

and

are

categorized

as

Level

2

in

the

hierarchy.

Municipal

securities,

long-term

U.S.

government

obligations

and

corporate

debt

securities

are

valued

in

accordance

with

the

evaluated

price

supplied

by

a

pricing

service

and

generally

categorized

as

Level

2

in

the

hierarchy.

Other

securities

that

are

categorized

as

Level

2

in

the

hierarchy

include,

but

are

not

limited

to,

warrants

that

do

not

trade

on

an

exchange,

securities

valued

at

the

mean

between

the

last

reported

bid

and

ask

quotation

and

international

equity

securities

valued

by

an

independent

third

party

with

adjustments

for

changes

in

value

between

the

time

that

the

securities’

respective

local

market

closes

and

the

close

of

the

U.S.

market.

Level

3

-

Significant

unobservable

inputs

(including

the

Fund’s

own

assumptions

in

determining

the

fair

value

of

investments).

The

aggregate

value

by

input

level,

as

of

June

30,

2024,

for

the

Fund’s

investments

is

included

in

the

Fund’s

Schedule

of

Investments.

Security

Transactions,

Investment

Income

and

Realized

Gain

and

Loss

–

Investment

transactions

are

accounted

for

on

the

trade

date.

Dividend

income

is

recorded

on

the

ex-dividend

date.

Foreign

dividend

income

is

recorded

on

the

ex-dividend

date

or

as

soon

as

possible

after

determining

the

existence

of

a

dividend

declaration

after

exercising

reasonable

due

diligence.

Income

and

capital

gains

on

some

foreign

securities

may

be

subject

to

foreign

withholding

taxes,

which

are

accrued

as

applicable.

Interest

income

is

recorded

on

an

accrual

basis.

Premium

is

amortized

to

the

next

call

date

above

par,

and

discount

is

accreted

to

maturity

using

the

effective

interest

method.

Identified

cost

of

investments

sold

is

used

to

determine

the

gain

and

loss

for

both

financial

statement

and

federal

income

tax

purposes.

Distributions

to

Shareholders

–

Distributions

to

shareholders

of

net

investment

income,

if

any,

are

declared

and

paid

quarterly.

Distributions

to

shareholders

of

net

capital

gains

and

foreign

currency

gains,

if

any,

are

Lisanti

Small

Cap

Growth

Fund

NOTES

TO

FINANCIAL

STATEMENTS

June

30,

2024

declared

and

paid

at

least

annually.

Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date.

Distributions

are

based

on

amounts

calculated

in

accordance

with

applicable

federal

income

tax

regulations,

which

may

differ

from

GAAP.

These

differences

are

due

primarily

to

differing

treatments

of

income

and

gain

on

various

investment

securities

held

by

the

Fund,

timing

differences

and

differing

characterizations

of

distributions

made

by

the

Fund.

Federal

Taxes

–

The

Fund

intends

to

continue

to

qualify

each

year

as

a

regulated

investment

company

under

Subchapter

M

of

Chapter

1,

Subtitle

A,

of

the

Internal

Revenue

Code

of

1986,

as

amended

(“Code”),

and

to

distribute

all

of

its

taxable

income

to

shareholders.

In

addition,

by

distributing

in

each

calendar

year

substantially

all

of

its

net

investment

income

and

capital

gains,

if

any,

the

Fund

will

not

be

subject

to

a

federal

excise

tax.

Therefore,

no

federal

income

or

excise

tax

provision

is

required.

The

Fund

recognizes

interest

and

penalties,

if

any,

related

to

unrecognized

tax

benefits

as

income

tax

expense

in

the

Statement

of

Operations.

During

the

period,

the

Fund

did

not

incur

any

interest

or

penalties.

The

Fund

files

a

U.S.

federal

income

and

excise

tax

return

as

required.

The

Fund’s

federal

income

tax

returns

are

subject

to

examination

by

the

Internal

Revenue

Service

for

a

period

of

three

years

after

they

are

filed.

As

of

June

30,

2024,

there

are

no

uncertain

tax

positions

that

would

require

financial

statement

recognition,

de-recognition

or

disclosure.

Income

and

Expense

Allocation

–

The

Trust

accounts

separately

for

the

assets,

liabilities

and

operations

of

each

of

its

investment

portfolios.

Expenses

that

are

directly

attributable

to

more

than

one

investment

portfolio

are

allocated

among

the

respective

investment

portfolios

in

an

equitable

manner.

Commitments

and

Contingencies

–

In

the

normal

course

of

business,

the

Fund

enters

into

contracts

that

provide

general

indemnifications

by

the

Fund

to

the

counterpary

to

the

contract.

The

Fund’s

maximum

exposure

under

these

arrangements

is

dependent

on

future

claims

that

may

be

made

against

the

Fund

and,

therefore,

cannot

be

estimated;

however,

based

on

experience,

the

risk

of

loss

from

such

claims

is

considered

remote.

The

Fund

has

determined

that

none

of

these

arrangements

requires

disclosure

on

the

Fund’s

statement

of

assets

and

liabilities.

Note

3.

Fees

and

Expenses

Investment

Adviser

–

Lisanti

Capital

Growth,

LLC

(the

“Adviser”)

is

the

investment

adviser

to

the

Fund.

Pursuant

to

an

investment

advisory

agreement,

the

Adviser

receives

an

advisory

fee,

payable

monthly,

from

the

Fund

at

an

annual

rate

of

0.95%

of

the

Fund’s

average

daily

net

assets.

Shareholder

Service

Plan

–

The

Trust

has

adopted

a

shareholder

service

plan

for

the

Fund

under

which

the

Fund

may

reimburse

the

Fund’s

administrator

for

amounts

paid

by

the

administrator

for

providing

shareholder

service

activities

that

are

not

otherwise

provided

by

the

transfer

agent.

The

Fund’s

administrator

may

make

such

payments

to

various

financial

institutions,

including

the

Adviser,

that

provide

shareholder

servicing

to

their

customers

invested

in

the

Fund

in

amounts

of

up

to

0.25%

annually

of

the

average

daily

net

assets

of

the

Fund.

Lisanti

Small

Cap

Growth

Fund

NOTES

TO

FINANCIAL

STATEMENTS

June

30,

2024

Distribution

–

Foreside

Fund

Services,

LLC,

a

wholly

owned

subsidiary

of

Foreside

Financial

Group,

LLC

(d/b/a

ACA

Group)

(the

“Distributor”),

acts

as

the

agent

of

the

Trust

in

connection

with

the

continuous

offering

of

shares

of

the

Fund.

The

Fund

does

not

have

a

distribution

(12b-1)

plan;

accordingly,

the

Distributor

does

not

receive

compensation

from

the

Fund

for

its

distribution

services.

The

Adviser

compensates

the

Distributor

directly

for

its

services.

The

Distributor

is

not

affiliated

with

the

Adviser

or

Atlantic

Fund

Administration,

LLC,

a

wholly

owned

subsidiary

of

Apex

US

Holdings

LLC

(d/b/a

Apex

Fund

Services)

(“Apex”)

or

their

affiliates.

Other

Service

Providers

–

Apex

provides

fund

accounting,

fund

administration,

compliance

and

transfer

agency

services

to

the

Fund.

The

fees

related

to

these

services

are

included

in

Fund

services

fees

within

the

Statement

of

Operations.

Apex

also

provides

certain

shareholder

report

production

and

EDGAR

conversion

and

filing

services.

Pursuant

to

an

Apex

Services

Agreement,

the

Fund

pays

Apex

customary

fees

for

its

services.

Apex

provides

a

Principal

Executive

Officer,

a

Principal

Financial

Officer,

a

Chief

Compliance

Officer

and

an

Anti-Money

Laundering

Officer

to

the

Fund,

as

well

as

certain

additional

compliance

support

functions.

Trustees

and

Officers

–

Each

Independent

Trustee’s

annual

retainer

is

$45,000

($55,000

for

the

Chairman).

The

Audit

Committee

Chairman

receives

an

additional

$2,000

annually.

The

Trustees

and

the

Chairman

may

receive

additional

fees

for

special

Board

meetings.

Each

Trustee

is

also

reimbursed

for

all

reasonable

out-

of-pocket

expenses

incurred

in

connection

with

his

or

her

duties

as

a

Trustee,

including

travel

and

related

expenses

incurred

in

attending

Board

meetings.

The

amount

of

Trustees’

fees

attributable

to

the

Fund

is

disclosed

in

the

Statement

of

Operations.

Certain

officers

of

the

Trust

are

also

officers

or

employees

of

the

above

named

service

providers,

and

during

their

terms

of

office

received

no

compensation

from

the

Fund.

Note

4.

Fees

Waived

The

Adviser

has

contractually

agreed

to

waive

its

fee

and/or

reimburse

expenses

to

limit

total

annual

fund

operating

expenses

(excluding

all

taxes,

interest,

portfolio

transaction

expenses,

proxy

expenses,

and

extraordinary

expenses)

to

1.35%

through

April

30,

2025.

(“Expense

Cap”)

The

Expense

Cap

may

only

be

raised

or

eliminated

with

the

consent

of

the

Board.

Other

Fund

service

providers

have

agreed

to

waive

a

portion

of

their

fees

and

such

waivers

may

be

changed

or

elimated

with

the

approval

of

the

Board.

For

the

period

ended

June

30,

2024

,

fees

waived

were

as

follows:

The

Adviser

may

be

reimbursed

by

the

Fund

for

fees

waived

and

expenses

reimbursed

by

the

Adviser

if

such

payment

is

made

within

three

years

of

the

fee

waiver

or

expense

reimbursement,

and

does

not

cause

the

Total

Annual

Fund

Operating

Expenses

After

Fee

Waiver

and/or

Expense

Reimbursement

to

exceed

the

lesser

of

(i)

the

then-current

expense

cap,

or

(ii)

the

expense

cap

in

place

at

the

time

the

fees/expenses

were

waived/reimbursed.

As

of

June

30,

2024,

$657,140

is

subject

to

recapture

by

the

Adviser.

Other

waivers

are

not

eligible

for

recoupment.

Investment

Adviser

Fees

Waived

Other

Waivers

Total

Fees

Waived

and

Expenses

Reimbursed

$

98,964

$

41,326

$

140,290

Lisanti

Small

Cap

Growth

Fund

NOTES

TO

FINANCIAL

STATEMENTS

June

30,

2024

Note

5.

Security

Transactions

The

cost

of

purchases

and

proceeds

from

sales

of

investment

securities

(including

maturities),

other

than

short-term

investments

during

the

period

ended

June

30,

2024,

totaled

$28,163,704

and

$37,494,545,

respectively.

Note

6.

Federal

Income

Tax

As

of

June

30,

2024

,

the

cost

of

investments

for

federal

income

tax

purposes

is

substantially

the

same

as

for

financial

statement

purposes

and

the

components

of

net

unrealized

appreciation

consists

of:

As

of

December

31,

2023,

distributable

earnings

on

a

tax

basis

were

as

follows:

The

difference

between

components

of

distributable

earnings

on

a

tax

basis

and

the

amounts

reflected

in

the

Statement

of

Assets

and

Liabilities

are

primarily

due

to

wash

sales

and

PFICs.

For

the

year

ended

December

31,

2023,

the

Fund

had

$29,717,615

in

short

term

capital

loss

carry

forwards

that

have

no

expiration

date.

Note

7.

Subsequent

Events

Subsequent

events

occurring

after

the

date

of

this

report

through

the

date

these

financial

statements

were

issued

have

been

evaluated

for

potential

impact,

and

the

Fund

has

had

no

such

events.

Gross

Unrealized

Appreciation

$

5,362,737

Gross

Unrealized

Depreciation

(316,187)

Net

Unrealized

Appreciation

$

5,046,550

Capital

and

Other

Losses

$

(29,717,615)

Net

Unrealized

Appreciation

3,591,622

Total

$

(26,125,993)

Lisanti

Small

Cap

Growth

Fund

ADDITIONAL

INFORMATION

June

30,

2024

Changes

in

and

Disagreements

with

Accountants

(Item

8

of

Form

N-CSR)

N/A

Proxy

Disclosure

(Item

9

of

Form

N-CSR)

N/A

Remuneration

Paid

to

Directors,

Officers,

and

Others

(Item

10

of

Form

N-CSR)

Please

see

financial

statements

in

Item

7.

Statement

Regarding

the

Basis

for

the

Board’s

Approval

of

Investment

Advisory

Contract

(Item

11

of

Form

N-CSR)

N/A

Lisanti

Small

Cap

Growth

Fund

P.O.

Box

588

Portland,

ME

04112

(800)

441-7031

www.lisantismallcap.com

Investment

Adviser

Lisanti

Capital

Growth,

LLC

777

Third

Avenue,

14th

Floor

New

York,

NY

10017

Distributor

Foreside

Fund

Services,

LLC

Three

Canal

Plaza

Suite

100

Portland,

ME

04101

www.foreside.com

This

report

is

submitted

for

the

general

information

of

the

shareholders

of

the

Fund.

It

is

not

authorized

for

distribution

to

prospective

investors

unless

preceded

or

accompanied

by

an

effective

prospectus,

which

includes

information

regarding

the

Fund’s

risks,

objectives,

fees

and

expenses,

experience

of

its

management

and

other

information.

228

-

SAR

-

0624

.

(b) Included as part of financial statements filed under Item 7(a).

ITEM 8. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PROXY DISCLOSURES FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 10. REMUNERATION PAID TO DIRECTORS, OFFICERS, AND OTHERS OF OPEN-END MANAGEMENT INVESTMENT COMPANIES.

Included as part of financial statements filed under Item 7(a).

ITEM 11. STATEMENT REGARDING BASIS FOR APPROVAL OF INVESTMENT ADVISORY CONTRACT.

Not Applicable.

ITEM 12. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 13. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 14. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 15. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

The Registrant does not accept nominees to the Board of Trustees from shareholders.

ITEM 16. CONTROLS AND PROCEDURES

(a) The Registrant’s Principal Executive Officer and Principal Financial Officer have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act are effective, based on their evaluation of the controls and procedures required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as of a date within 90 days of the filing date of this report.

(b) There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the Reporting Period that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

ITEM 17. DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 18. RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION.

Not applicable.

ITEM 19. EXHIBITS.

(a)(1) Not applicable

(a)(2) Not applicable.

(a)(4) Not applicable.

(a)(5) Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Registrant Forum Funds

| By: | /s/ Zachary Tackett | |

| | Zachary Tackett, Principal Executive Officer | |

| | | |

| Date: | August 21, 2024 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By: | /s/ Zachary Tackett | |

| | Zachary Tackett, Principal Executive Officer | |

| | | |

| Date: | August 21, 2024 | |

| By: | /s/ Karen Shaw | |

| | Karen Shaw, Principal Financial Officer | |

| | | |

| Date: | August 21, 2024 | |