UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Zachary Tackett, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end December 31

Date of reporting period: January 1, 2024 – December 31, 2024

ITEM 1. REPORT TO SHAREHOLDERS.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended (“Act”), is attached hereto.

Lisanti Small Cap Growth Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about the Lisanti Small Cap Growth Fund for the period of January 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://lisantismallcap.com/investing-in-the-fund. You can also request this information by contacting us at (800) 441-7031.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Lisanti Small Cap Growth Fund | $154 | 1.35% |

|---|

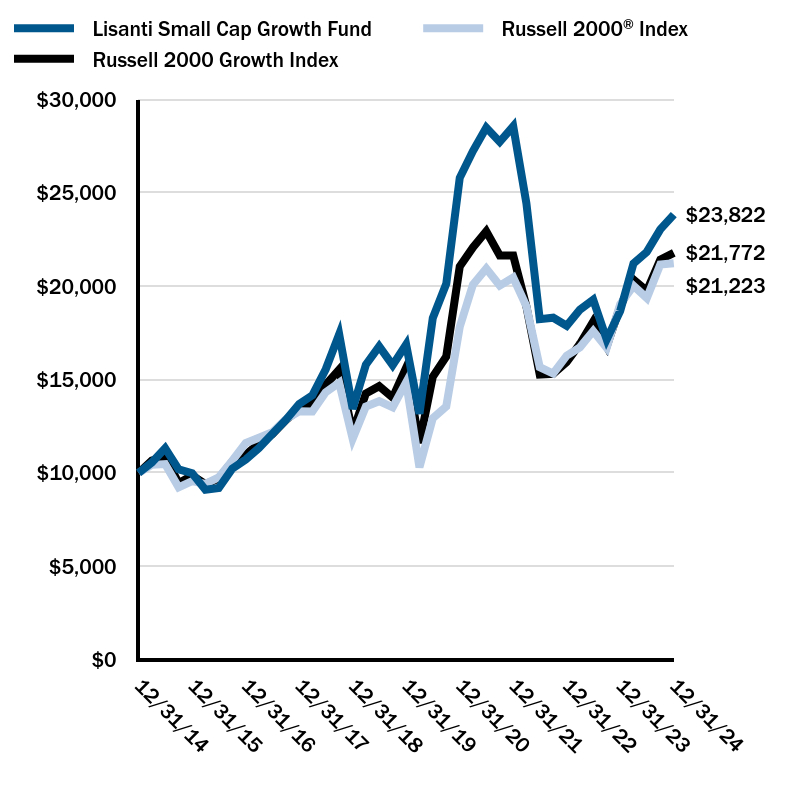

Total Return Based on a $10,000 Investment

| Date | Lisanti Small Cap Growth Fund | Russell 2000® Index | Russell 2000 Growth Index |

|---|

| 12/31/14 | $10,000 | $10,000 | $10,000 |

|---|

| 03/31/15 | $10,561 | $10,432 | $10,663 |

|---|

| 06/30/15 | $11,324 | $10,475 | $10,874 |

|---|

| 09/30/15 | $10,192 | $9,227 | $9,453 |

|---|

| 12/31/15 | $9,982 | $9,559 | $9,862 |

|---|

| 03/31/16 | $9,105 | $9,413 | $9,400 |

|---|

| 06/30/16 | $9,189 | $9,770 | $9,705 |

|---|

| 09/30/16 | $10,229 | $10,654 | $10,600 |

|---|

| 12/31/16 | $10,713 | $11,595 | $10,978 |

|---|

| 03/31/17 | $11,331 | $11,881 | $11,565 |

|---|

| 06/30/17 | $12,085 | $12,174 | $12,073 |

|---|

| 09/30/17 | $12,834 | $12,864 | $12,823 |

|---|

| 12/31/17 | $13,689 | $13,294 | $13,411 |

|---|

| 03/31/18 | $14,155 | $13,283 | $13,720 |

|---|

| 06/30/18 | $15,545 | $14,312 | $14,712 |

|---|

| 09/30/18 | $17,416 | $14,824 | $15,525 |

|---|

| 12/31/18 | $13,430 | $11,830 | $12,163 |

|---|

| 03/31/19 | $15,788 | $13,555 | $14,248 |

|---|

| 06/30/19 | $16,774 | $13,839 | $14,640 |

|---|

| 09/30/19 | $15,765 | $13,507 | $14,029 |

|---|

| 12/31/19 | $16,871 | $14,849 | $15,628 |

|---|

| 03/31/20 | $13,165 | $10,303 | $11,601 |

|---|

| 06/30/20 | $18,290 | $12,922 | $15,149 |

|---|

| 09/30/20 | $20,120 | $13,559 | $16,234 |

|---|

| 12/31/20 | $25,788 | $17,813 | $21,040 |

|---|

| 03/31/21 | $27,221 | $20,075 | $22,066 |

|---|

| 06/30/21 | $28,478 | $20,937 | $22,930 |

|---|

| 09/30/21 | $27,712 | $20,024 | $21,634 |

|---|

| 12/31/21 | $28,543 | $20,453 | $21,636 |

|---|

| 03/31/22 | $24,430 | $18,914 | $18,904 |

|---|

| 06/30/22 | $18,226 | $15,661 | $15,264 |

|---|

| 09/30/22 | $18,303 | $15,319 | $15,301 |

|---|

| 12/31/22 | $17,875 | $16,273 | $15,933 |

|---|

| 03/31/23 | $18,733 | $16,718 | $16,901 |

|---|

| 06/30/23 | $19,263 | $17,589 | $18,093 |

|---|

| 09/30/23 | $17,142 | $16,687 | $16,769 |

|---|

| 12/31/23 | $18,654 | $19,028 | $18,906 |

|---|

| 03/31/24 | $21,204 | $20,013 | $20,340 |

|---|

| 06/30/24 | $21,825 | $19,357 | $19,746 |

|---|

| 09/30/24 | $23,032 | $21,152 | $21,407 |

|---|

| 12/31/24 | $23,822 | $21,223 | $21,772 |

|---|

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years. Effective May 1, 2024, the Fund changed its primary benchmark from the Russell 2000 Growth Index to the Russell 2000 Index due to regulatory requirements. The Fund retained the Russell 2000 Growth Index as a secondary benchmark because the Russell 2000 Growth Index more closely aligns with the Fund’s investment strategies and investment restrictions.

How did the Fund perform in the last year?

Performance of the Fund in 2024 was driven by individual stock selection. The Fund’s investment process focuses on companies that have individual, idiosyncratic drivers of growth and are showing or on the path to show strong operating leverage. This focus was the main driver of performance. At the sector level, the Information Technology, Consumer Discretionary and Industrials sectors contributed to the Fund’s performance; the Fund was overweight all three sectors, which also was a positive contributor to performance. The Financials and Communications Services sectors detracted from performance. The Financials sector underperformed because the Fund was underweight banks, and Communications Services sector underperformed due to stock selection. Our top three contributors were Super Micro Computer, Inc; Q2 Holdings, Inc., and FTAI Aviation LTD; our bottom three detractors were Harmonic Inc., Magnite, Inc., and Apellis Pharmaceuticals, Inc.

During the year ended December 31, 2024, the Fund’s use of current investment strategies did not cause the Fund’s performance to deviate materially from the manager’s expectations.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Lisanti Small Cap Growth Fund | 27.71% | 7.14% | 9.07% |

|---|

Russell 2000® Index | 11.54% | 7.40% | 7.82% |

|---|

| Russell 2000 Growth Index | 15.15% | 6.86% | 8.09% |

|---|

| Total Net Assets | $27,641,429 |

|---|

| # of Portfolio Holdings | 89 |

|---|

| Portfolio Turnover Rate | 223% |

|---|

| Investment Advisory Fees (Net of fees waived) | $60,281 |

|---|

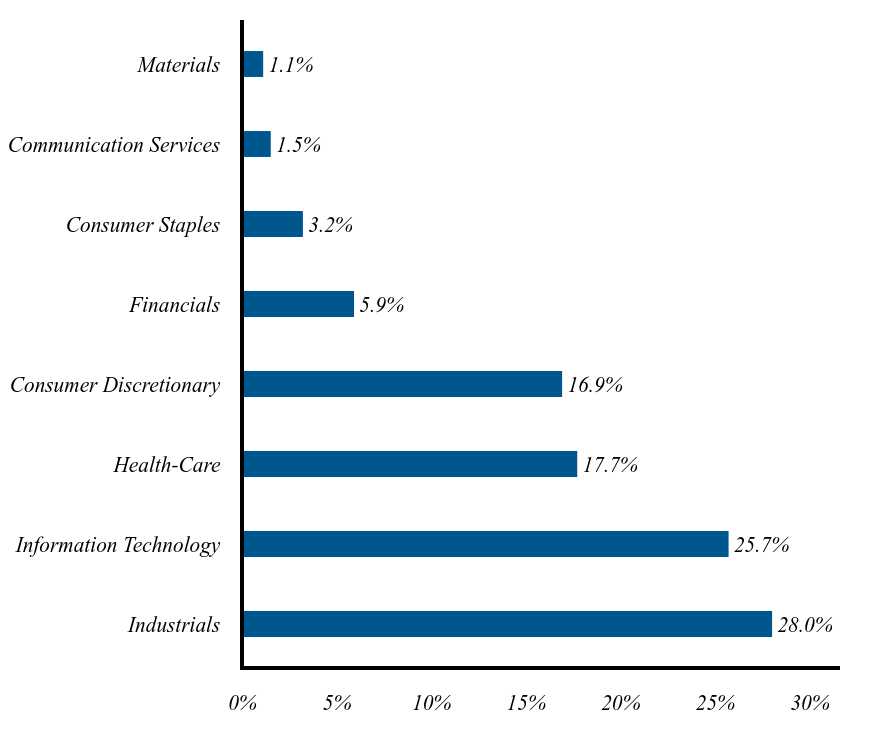

Sector Weightings

(% total investments)*

| Value | Value |

|---|

| Industrials | 28.0% |

| Information Technology | 25.7% |

| Health-Care | 17.7% |

| Consumer Discretionary | 16.9% |

| Financials | 5.9% |

| Consumer Staples | 3.2% |

| Communication Services | 1.5% |

| Materials | 1.1% |

* excluding cash equivalents

Top Ten Holdings

(% total investments)*

| Q2 Holdings, Inc. | 2.54% |

| Astera Labs, Inc. | 2.51% |

| Construction Partners, Inc., Class A | 2.47% |

| Xometry, Inc., Class A | 2.24% |

| RH | 2.01% |

| Freshpet, Inc. | 1.87% |

| Comfort Systems USA, Inc. | 1.86% |

| Warby Parker, Inc. | 1.83% |

| Boot Barn Holdings, Inc. | 1.79% |

| Kornit Digital, Ltd. | 1.72% |

* excluding cash equivalents

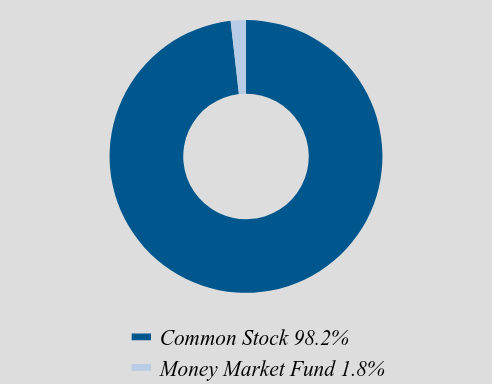

Asset Class Weightings

(% total investments)

| Value | Value |

|---|

| Common Stock | 98.2% |

| Money Market Fund | 1.8% |

Lisanti Small Cap Growth Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the fund?

If you wish to view additional information about the Fund; including but not limited to its prospectus, holdings, financial information, and proxy information, please visit https://lisantismallcap.com/investing-in-the-fund or scan the QR code.

(b) Not applicable.

ITEM 2. CODE OF ETHICS.

(a) As of the end of the period covered by this report, Forum Funds (the “Registrant”) has adopted a code of ethics, which applies to its Principal Executive Officer and Principal Financial Officer (the “Code of Ethics”).

(c) There have been no amendments to the Registrant’s Code of Ethics during the period covered by this report.

(d) There have been no waivers to the Registrant’s Code of Ethics during the period covered by this report.

(e) Not applicable.

(f)(1) A copy of the Code of Ethics is being filed under Item 19(a)(1) hereto.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

(a)(1) The Board of Trustees has determined that the Registrant has an audit committee financial expert, as defined in Item 3 of Form N-CSR, serving on its audit committee.

(a)(2) The audit committee financial expert, Mr. Mark Moyer, is a non-“interested” Trustee (as defined in Item 3(a)(2) of Form N-CSR.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees - The aggregate fees billed for each of the last two fiscal years (the “Reporting Periods”) for professional services rendered by the Registrant’s principal accountant for the audit of the Registrant’s annual financial statements, or services that are normally provided by the principal accountant in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $14,200 in 2023 and $15,200 in 2024.

(b) Audit-Related Fees – The aggregate fees billed in the Reporting Periods for assurance and related services rendered by the principal accountant that were reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this Item 4 were $0 in 2023 and $0 in 2024.

(c) Tax Fees - The aggregate fees billed in the Reporting Periods for professional services rendered by the principal accountant to the Registrant for tax compliance, tax advice and tax planning were $3,200 in 2023 and $3,300 in 2024. These services consisted of review or preparation of U.S. federal, state, local and excise tax returns.

(d) All Other Fees - The aggregate fees billed in the Reporting Periods for products and services provided by the principal accountant to the Registrant, other than the services reported in paragraphs (a) through (c) of this Item, were $0 in 2023 and $0 in 2024.

(e)(1) The Audit Committee reviews and approves in advance all audit and “permissible non-audit services” (as that term is defined by the rules and regulations of the U.S. Securities and Exchange Commission) to be rendered to a series of the Registrant (each, a “Series”). In addition, the Audit Committee reviews and approves in advance all “permissible non-audit services” to be provided to an investment adviser (not including any sub-adviser) of a Series, or an affiliate of such investment adviser, that is controlling, controlled by or under common control with the investment adviser and provides on-going services to the Registrant (“Affiliate”), by the Series’ principal accountant if the engagement relates directly to the operations and financial reporting of the Series. The Audit Committee considers whether fees paid by a Series’ investment adviser or an Affiliate to the Series’ principal accountant for audit and permissible non-audit services are consistent with the principal accountant’s independence.

(e)(2) No services included in (b) - (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable

(g) The aggregate non-audit fees billed by the principal accountant for services rendered to the Registrant for the Reporting Periods were $0 in 2023 and $0 in 2024. There were no fees billed in either of the Reporting Periods for non-audit services rendered by the principal accountant to the Registrant’s investment adviser or any Affiliate.

(h) During the Reporting Period, the Registrant's principal accountant provided no non-audit services to the investment advisers or any entity controlling, controlled by or under common control with the investment advisers to the series of the Registrant to which this report relates.

(i) Not applicable. The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

(j) Not applicable. The Registrant is not a “foreign issuer,” as defined in 17 CFR 240.3b-4.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. INVESTMENTS.

(a) Included as part of financial statements filed under Item 7(a).

(b) Not applicable.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

(a)

Lisanti

Small

Cap

Growth

Fund

Annual

Financials

and

Other

Information

December

31,

2024

Schedule

of

Investments

1

Statement

of

Assets

and

Liabilities

3

Statement

of

Operations

4

Statements

of

Change

in

Net

Assets

5

Financial

Highlights

6

Notes

to

Financial

Statements

7

Report

of

Independent

Registered

Public

Accounting

Firm

13

Other

Information

(Unaudited)

15

Lisanti

Small

Cap

Growth

Fund

SCHEDULE

OF

INVESTMENTS

December

31,

2024

See

Notes

to

Financial

Statements.

Shares

Security

Description

Value

Common

Stock

-

98.4%

Communication

Services

-

1.5%

14,330

Magnite,

Inc.

(a)

$

228,133

7,480

QuinStreet,

Inc.

(a)

172,564

400,697

Consumer

Discretionary

-

16.7%

1,540

Abercrombie

&

Fitch

Co.

(a)

230,184

3,200

Boot

Barn

Holdings,

Inc.

(a)

485,824

630

Duolingo,

Inc.

(a)

204,265

2,795

Modine

Manufacturing

Co.

(a)

324,024

14,650

Newell

Brands,

Inc.

145,914

3,490

Ollie's

Bargain

Outlet

Holdings,

Inc.

(a)

382,958

4,365

Planet

Fitness,

Inc.,

Class A

(a)

431,567

7,270

Revolve

Group,

Inc.

(a)

243,472

1,390

RH

(a)

547,090

2,190

Shake

Shack,

Inc.,

Class A

(a)

284,262

4,850

Sweetgreen,

Inc.,

Class A

(a)

155,491

2,185

Texas

Roadhouse,

Inc.

394,240

20,615

Warby

Parker,

Inc.

(a)

499,089

12,620

Wolverine

World

Wide,

Inc.

280,164

4,608,544

Consumer

Staples

-

3.1%

2,830

elf

Beauty,

Inc.

(a)

355,307

3,440

Freshpet,

Inc.

(a)

509,498

864,805

Financials

-

5.8%

1,025

Evercore,

Inc.,

Class A

284,120

5,615

NBT

Bancorp,

Inc.

268,172

820

Piper

Sandler

Cos.

245,959

18,225

Remitly

Global,

Inc.

(a)

411,338

2,855

Skyward

Specialty

Insurance

Group,

Inc.

(a)

144,292

2,660

The

Bancorp,

Inc.

(a)

139,996

1,330

Western

Alliance

Bancorp.

111,108

1,604,985

Health-Care

-

17.4%

9,600

ADMA

Biologics,

Inc.

(a)

164,640

2,285

ANI

Pharmaceuticals,

Inc.

(a)

126,315

25,895

BrightSpring

Health

Services,

Inc.

(a)

440,992

3,960

Castle

Biosciences,

Inc.

(a)

105,534

6,610

Corcept

Therapeutics,

Inc.

(a)

333,078

5,360

Crinetics

Pharmaceuticals,

Inc.

(a)

274,057

4,905

Dyne

Therapeutics,

Inc.

(a)

115,562

5,790

GeneDx

Holdings

Corp.

(a)

445,019

2,050

Glaukos

Corp.

(a)

307,377

5,055

Inari

Medical,

Inc.

(a)

258,058

4,730

Intra-Cellular

Therapies,

Inc.

(a)

395,050

2,470

Ligand

Pharmaceuticals,

Inc.

(a)

264,660

Shares

Security

Description

Value

Health-Care

-

17.4%

(continued)

4,405

PROCEPT

BioRobotics

Corp.

(a)

$

354,691

3,860

RadNet,

Inc.

(a)

269,582

7,745

Tandem

Diabetes

Care,

Inc.

(a)

278,975

8,275

Tarsus

Pharmaceuticals,

Inc.

(a)

458,187

2,155

Vericel

Corp.

(a)

118,331

2,710

Viking

Therapeutics,

Inc.

(a)

109,050

4,819,158

Industrials

-

27.6%

1,105

AAON,

Inc.

130,036

620

Applied

Industrial

Technologies,

Inc.

148,471

2,035

Chart

Industries,

Inc.

(a)

388,359

1,155

Clean

Harbors,

Inc.

(a)

265,812

1,190

Comfort

Systems

USA,

Inc.

504,631

7,610

Construction

Partners,

Inc.,

Class A

(a)

673,181

1,640

Dycom

Industries,

Inc.

(a)

285,458

3,280

Federal

Signal

Corp.

303,039

2,919

Fluor

Corp.

(a)

143,965

1,080

FTAI

Aviation,

Ltd.

155,563

3,085

JBT

Marel

Corp.

392,104

5,100

Knight-Swift

Transportation

Holdings,

Inc.

270,504

15,085

Kornit

Digital,

Ltd.

(a)

466,881

13,015

Kratos

Defense

&

Security

Solutions,

Inc.

(a)

343,336

3,305

Loar

Holdings,

Inc.

(a)

244,273

3,040

MasTec,

Inc.

(a)

413,866

595

Saia,

Inc.

(a)

271,159

4,455

Standardaero,

Inc.

(a)

110,306

1,790

Sterling

Infrastructure,

Inc.

(a)

301,526

3,735

Tecnoglass,

Inc.

296,260

5,580

The

AZEK

Co.,

Inc.

(a)

264,883

5,305

UL

Solutions,

Inc.,

Class A

264,613

4,000

VSE

Corp.

380,400

14,280

Xometry,

Inc.,

Class A

(a)

609,185

7,627,811

Information

Technology

-

25.2%

1,055

Agilysys,

Inc.

(a)

138,954

10,625

Alkami

Technology,

Inc.

(a)

389,725

5,145

Astera

Labs,

Inc.

(a)

681,455

11,260

AvePoint,

Inc.

(a)

185,903

2,740

Commvault

Systems,

Inc.

(a)

413,493

9,795

Confluent,

Inc.,

Class A

(a)

273,868

5,550

Credo

Technology

Group

Holding,

Ltd.

(a)

373,016

23,415

Extreme

Networks,

Inc.

(a)

391,967

12,085

Freshworks,

Inc.

(a)

195,414

Lisanti

Small

Cap

Growth

Fund

SCHEDULE

OF

INVESTMENTS

December

31,

2024

See

Notes

to

Financial

Statements.

The

following

is

a

summary

of

the

inputs

used

to

value

the

Fund's investments

as

of

December

31,

2024.

The

inputs

or

methodology

used

for

valuing

securities

are

not

necessarily

an

indication

of

the

risks

associated

with

investing

in

those

securities.

For

more

information

on

valuation

inputs,

and

their

aggregation

into

the

levels

used

in

the

table

below,

please

refer

to

the

Security

Valuation

section

in

Note

2

of

the

accompanying

Notes

to

Financial

Statements.

The

Level

1

value

displayed

in

this

table

is

Common

Stock

and

a

Money

Market

Fund.

Refer

to

this

Schedule

of

Investments

for

a

further

breakout

of

each

security

by

industry.

Shares

Security

Description

Value

Information

Technology

-

25.2%

(continued)

845

Guidewire

Software,

Inc.

(a)

$

142,450

990

Impinj,

Inc.

(a)

143,807

1,265

Itron,

Inc.

(a)

137,354

8,615

Klaviyo,

Inc.,

Class A

(a)

355,283

5,385

Lumentum

Holdings,

Inc.

(a)

452,071

2,140

MACOM

Technology

Solutions

Holdings,

Inc.

(a)

278,007

6,340

PAR

Technology

Corp.

(a)

460,728

6,850

Q2

Holdings,

Inc.

(a)

689,453

7,210

Semtech

Corp.

(a)

445,939

2,080

SiTime

Corp.

(a)

446,222

21,325

Zeta

Global

Holdings

Corp.,

Class A

(a)

383,637

6,978,746

Materials

-

1.1%

1,730

Carpenter

Technology

Corp.

293,598

Total

Common

Stock

(Cost

$22,825,171)

27,198,344

Shares

Security

Description

Value

Money

Market

Fund

-

1.8%

495,824

First

American

Treasury

Obligations

Fund,

Class X,

4.37%

(b)

(Cost

$495,824)

495,824

Investments,

at

value

-

100.2%

(Cost

$23,320,995)

$

27,694,168

Other

Assets

&

Liabilities,

Net

-

(0.2)%

(52,739)

Net

Assets

-

100.0%

$

27,641,429

(a)

Non-income

producing

security.

(b)

Dividend

yield

changes

daily

to

reflect

current

market

conditions.

Rate

was

the

quoted

yield

as

of

December

31,

2024.

Valuation

Inputs

Investments

in

Securities

Level

1

-

Quoted

Prices

$

27,694,168

Level

2

-

Other

Significant

Observable

Inputs

–

Level

3

-

Significant

Unobservable

Inputs

–

Total

$

27,694,168

PORTFOLIO

HOLDINGS

(Unaudited)

%

of

Total

Investments

Communication

Services

1.5%

Consumer

Discretionary

16.6%

Consumer

Staples

3.1%

Financials

5.8%

Health-Care

17.4%

Industrials

27.5%

Information

Technology

25.2%

Materials

1.1%

Money

Market

Fund

1.8%

100.0%

Lisanti

Small

Cap

Growth

Fund

STATEMENT

OF

ASSETS

AND

LIABILITIES

December

31,

2024

See

Notes

to

Financial

Statements.

ASSETS

Investments,

at

value

(Cost

$23,320,995)

$

27,694,168

Receivables:

Fund

shares

sold

14,893

Dividends

2,416

Prepaid

expenses

13,737

Total

Assets

27,725,214

LIABILITIES

Payables:

Fund

shares

redeemed

17,023

Accrued

Liabilities:

Investment

adviser

fees

10,909

Fund

services

fees

8,140

Other

expenses

47,713

Total

Liabilities

83,785

NET

ASSETS

$

27,641,429

COMPONENTS

OF

NET

ASSETS

Paid-in

capital

$

47,137,587

Accumulated

loss

(19,496,158)

NET

ASSETS

$

27,641,429

SHARES

OF

BENEFICIAL

INTEREST

AT

NO

PAR

VALUE

(UNLIMITED

SHARES

AUTHORIZED)

1,309,147

NET

ASSET

VALUE,

OFFERING

AND

REDEMPTION

PRICE

PER

SHARE

$

21.11

Lisanti

Small

Cap

Growth

Fund

STATEMENT

OF

OPERATIONS

YEAR

ENDED

DECEMBER

31,

2024

See

Notes

to

Financial

Statements.

INVESTMENT

INCOME

Dividend

income

(Net

of

foreign

withholding

taxes

of

$1,066)

$

87,649

Total

Investment

Income

87,649

EXPENSES

Investment

adviser

fees

259,054

Fund

services

fees

207,713

Shareholder

service

fees

54,538

Custodian

fees

7,435

Registration

fees

22,879

Professional

fees

48,916

Trustees'

fees

and

expenses

7,694

Other

expenses

68,620

Total

Expenses

676,849

Fees

waived

(309,591)

Net

Expenses

367,258

NET

INVESTMENT

LOSS

(279,609)

NET

REALIZED

AND

UNREALIZED

GAIN

(LOSS)

Net

realized

gain

on

investments

6,783,097

Net

change

in

unrealized

appreciation

(depreciation)

on

investments

118,175

NET

REALIZED

AND

UNREALIZED

GAIN

6,901,272

INCREASE

IN

NET

ASSETS

RESULTING

FROM

OPERATIONS

$

6,621,663

Lisanti

Small

Cap

Growth

Fund

STATEMENTS

OF

CHANGES

IN

NET

ASSETS

See

Notes

to

Financial

Statements.

For

the

Years

Ended

December

31,

2024

2023

OPERATIONS

Net

investment

loss

$

(279,609)

$

(564,747)

Net

realized

gain

6,783,097

978,903

Net

change

in

unrealized

appreciation

(depreciation)

118,175

986,988

Increase

in

Net

Assets

Resulting

from

Operations

6,621,663

1,401,144

CAPITAL

SHARE

TRANSACTIONS

Sale

of

shares

5,587,412

12,474,244

Redemption

of

shares

(15,399,659)

(43,517,859)

Decrease

in

Net

Assets

from

Capital

Share

Transactions

(9,812,247)

(31,043,615)

Decrease

in

Net

Assets

(3,190,584)

(29,642,471)

NET

ASSETS

Beginning

of

Year

30,832,013

60,474,484

End

of

Year

$

27,641,429

$

30,832,013

SHARE

TRANSACTIONS

Sale

of

shares

288,225

774,563

Redemption

of

shares

(843,774)

(2,728,467)

Decrease

in

Shares

(555,549)

(1,953,904)

Lisanti

Small

Cap

Growth

Fund

FINANCIAL

HIGHLIGHTS

See

Notes

to

Financial

Statements.

These

financial

highlights

reflect

selected

data

for

a

share

outstanding

throughout

each

year

.

For

the

Years

Ended

December

31,

2024

2023

2022

2021

2020

NET

ASSET

VALUE,

Beginning

of

Year

$

16.53

$

15.84

$

25.95

$

30.96

$

21.76

INVESTMENT

OPERATIONS

Net

investment

loss

(a)

(0.20)

(0.17)

(0.17)

(0.38)

(0.28)

Net

realized

and

unrealized

gain

(loss)

4.78

0.86

(9.51)

3.32

11.66

Total

from

Investment

Operations

4.58

0.69

(9.68)

2.94

11.38

DISTRIBUTIONS

TO

SHAREHOLDERS

FROM

Net

realized

gain

–

–

(0.43)

(7.95)

(2.18)

Total

Distributions

to

Shareholders

–

–

(0.43)

(7.95)

(2.18)

REDEMPTION

FEES(a)

–

–

0.00(b)

0.00(b)

0.00(b)

NET

ASSET

VALUE,

End

of

Year

$

21.11

$

16.53

$

15.84

$

25.95

$

30.96

TOTAL

RETURN

27.71%

4.36%

(37.37)%

10.69%

52.85%

RATIOS/SUPPLEMENTARY

DATA

Net

Assets

at

End

of

Year

(000s

omitted)

$

27,641

$

30,832

$

60,474

$

105,111

$

82,925

Ratios

to

Average

Net

Assets:

Net

investment

loss

(1.03)%

(1.05)%

(0.91)%

(1.14)%

(1.17)%

Net

expenses

1.35%

1.35%

1.35%

1.35%

1.35%

Gross

expenses

(c)

2.48%

1.88%

1.67%

1.61%

1.78%

PORTFOLIO

TURNOVER

RATE

223%

475%

347%

264%

314%

footertext

(a)

Calculated

based

on

average

shares

outstanding

during

each

year.

(b)

Less

than

$0.01

per

share.

(c)

Reflects

the

expense

ratio

excluding

any

waivers

and/or

reimbursements.

Expense

waivers

and/or

reimbursements

would

decrease

the

total

return

had

such

reductions

not

occurred.

Lisanti

Small

Cap

Growth

Fund

NOTES

TO

FINANCIAL

STATEMENTS

December

31,

2024

Note

1.

Organization

The

Lisanti

Small

Cap

Growth

Fund

(the

“Fund”)

is

a

diversified

portfolio

of

Forum

Funds

(the

“Trust”).

The

Trust

is

a

Delaware

statutory

trust

that

is

registered

as

an

open-end,

management

investment

company

under

the

Investment

Company

Act

of

1940,

as

amended

(the

“Act”).

Under

its

Trust

Instrument,

the

Trust

is

authorized

to

issue

an

unlimited

number

of

the

Fund’s

shares

of

beneficial

interest

without

par

value.

The

Fund

commenced

operations

on

February

27,

2004.

The

Fund

seeks

maximum

capital

appreciation.

The

Fund

included

herein

is

deemed

to

be

an

individual

reporting

segment

and

is

not

part

of

a

consolidated

reporting

entity.

The

objective

and

strategy

of

the

Fund

is

used

by

the

Adviser,

as

defined

in

Note

3,

to

make

investment

decisions,

and

the

results

of

the

operations,

as

shown

on

the

Statement

of

Operations

and

the

financial

highlights

for

the

Fund

is

the

information

utilized

for

the

day-to-day

management

of

the

Fund.

The

Fund

is

party

to

the

expense

agreements

as

disclosed

in

the

Notes

to

the

Financial

Statements

and

there

are

no

resources

allocated

to

the

Fund

based

on

performance

measurements.

Due

to

the

significance

of

oversight

and

their

role,

the

Adviser

is

deemed

to

be

the

Chief

Operating

Decision

Maker.

Note

2.

Summary

of

Significant

Accounting

Policies

The

Fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

under

Financial

Accounting

Standards

Board

Accounting

Standards

Codification

Topic

946,

“Financial

Services

–

Investment

Companies.”

These

financial

statements

are

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(“GAAP”),

which

require

management

to

make

estimates

and

assumptions

that

affect

the

reported

amounts

of

assets

and

liabilities,

the

disclosure

of

contingent

liabilities

at

the

date

of

the

financial

statements,

and

the

reported

amounts

of

increases

and

decreases

in

net

assets

from

operations

during

the

fiscal

year.

Actual

amounts

could

differ

from

those

estimates.

The

following

summarizes

the

significant

accounting

policies

of

the

Fund:

Security

Valuation

–

Securities

are

recorded

at

fair

value

using

last

quoted

trade

or

official

closing

price

from

the

principal

exchange

where

the

security

is

traded,

as

provided

by

independent

pricing

services

on

each

Fund

business

day.

In

the

absence

of

a

last

trade,

securities

are

valued

at

the

mean

of

the

last

bid

and

ask

price

provided

by

the

pricing

service.

Shares

of

non-exchange

traded

open-end

mutual

funds

are

valued

at

net

asset

value

per

share

(“NAV”).

Short-term

investments

that

mature

in

sixty

days

or

less

may

be

recorded

at

amortized

cost,

which

approximates

fair

value.

Pursuant

to

Rule

2a-5

under

the

Investment

Company

Act,

the

Trust’s

Board

of

Trustees

(the

“Board”)

has

designated

the

Adviser

as

the

Fund’s

valuation

designee

to

perform

any

fair

value

determinations

for

securities

and

other

assets

held

by

the

Fund.

The

Adviser

is

subject

to

the

oversight

of

the

Board

and

certain

reporting

and

other

requirements

intended

to

provide

the

Board

the

information

needed

to

oversee

the

Adviser’s

fair

value

determinations.

The

Adviser

is

responsible

for

determining

the

fair

value

of

investments

for

which

market

quotations

are

not

readily

available

in

accordance

with

policies

and

procedures

that

have

been

approved

by

the

Board.

Under

these

procedures,

the

Adviser

convenes

on

a

regular

and

ad

hoc

basis

to

review

such

investments

and

considers

a

number

of

factors,

including

valuation

methodologies

Lisanti

Small

Cap

Growth

Fund

NOTES

TO

FINANCIAL

STATEMENTS

December

31,

2024

and

significant

unobservable

inputs,

when

arriving

at

fair

value.

The

Board

has

approved

the

Adviser’s

fair

valuation

procedures

as

a

part

of

the

Fund’s

compliance

program

and

will

review

any

changes

made

to

the

procedures.

The

Adviser

provides

fair

valuation

inputs.

In

determining

fair

valuations,

inputs

may

include

market-based

analytics

that

may

consider

related

or

comparable

assets

or

liabilities,

recent

transactions,

market

multiples,

book

values

and

other

relevant

investment

information.

Adviser

inputs

may

include

an

income-based

approach

in

which

the

anticipated

future

cash

flows

of

the

investment

are

discounted

in

determining

fair

value.

Discounts

may

also

be

applied

based

on

the

nature

or

duration

of

any

restrictions

on

the

disposition

of

the

investments.

The

Adviser

performs

regular

reviews

of

valuation

methodologies,

key

inputs

and

assumptions,

disposition

analysis

and

market

activity.

Fair

valuation

is

based

on

subjective

factors

and,

as

a

result,

the

fair

value

of

an

investment

may

differ

from

the

security’s

market

price

and

may

not

be

the

price

at

which

the

asset

may

be

sold.

Fair

valuation

could

result

in

a

different

NAV

than

a

NAV

determined

by

using

market

quotes.

GAAP

has

a

three-tier

fair

value

hierarchy.

The

basis

of

the

tiers

is

dependent

upon

the

level

of

various

“inputs”

used

to

determine

the

value

of

the

Fund’s

investments.

These

inputs

are

summarized

in

the

three

broad

levels

listed

below:

Level

1

-

Quoted

prices

in

active

markets

for

identical

assets

and

liabilities.

Level

2

-

Prices

determined

using

significant

other

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

prepayment

speeds,

credit

risk,

etc.).

Short-term

securities

are

valued

at

amortized

cost,

which

approximates

market

value,

are

categorized

as

Level

2

in

the

hierarchy.

Municipal

securities,

long-term

U.S.

government

obligations

and

corporate

debt

securities

are

valued

in

accordance

with

the

evaluated

price

supplied

by

a

pricing

service

and

generally

categorized

as

Level

2

in

the

hierarchy.

Other

securities

that

are

categorized

as

Level

2

in

the

hierarchy

include,

but

are

not

limited

to,

warrants

that

do

not

trade

on

an

exchange,

securities

valued

at

the

mean

between

the

last

reported

bid

and

ask

quotation

and

international

equity

securities

valued

by

an

independent

third

party

with

adjustments

for

changes

in

value

between

the

time

that

the

securities’

respective

local

market

closes

and

the

close

of

the

U.S.

market.

Level

3

-

Significant

unobservable

inputs

(including

the

Fund’s

own

assumptions

in

determining

the

fair

value

of

investments).

The

aggregate

value

by

input

level,

as

of

December

31,

2024,

for

the

Fund’s

investments

is

included

in

the

Fund’s

Schedule

of

Investments.

Security

Transactions,

Investment

Income

and

Realized

Gain

and

Loss

–

Investment

transactions

are

accounted

for

on

the

trade

date.

Dividend

income

is

recorded

on

the

ex-dividend

date.

Foreign

dividend

income

is

recorded

on

the

ex-dividend

date

or

as

soon

as

possible

after

determining

the

existence

of

a

dividend

declaration

after

exercising

reasonable

due

diligence.

Income

and

capital

gains

on

some

foreign

Lisanti

Small

Cap

Growth

Fund

NOTES

TO

FINANCIAL

STATEMENTS

December

31,

2024

securities

may

be

subject

to

foreign

withholding

taxes,

which

are

accrued

as

applicable.

Interest

income

is

recorded

on

an

accrual

basis.

Premium

is

amortized

to

the

next

call

date

above

par,

and

discount

is

accreted

to

maturity

using

the

effective

interest

method

and

included

in

interest

income.

Identified

cost

of

investments

sold

is

used

to

determine

the

gain

and

loss

for

both

financial

statement

and

federal

income

tax

purposes.

Distributions

to

Shareholders

–

Distributions

to

shareholders

of

net

investment

income,

if

any,

are

declared

and

paid

quarterly.

Distributions

to

shareholders

of

net

capital

gains

and

foreign

currency

gains,

if

any,

are

declared

and

paid

at

least

annually.

Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date.

Distributions

are

based

on

amounts

calculated

in

accordance

with

applicable

federal

income

tax

regulations,

which

may

differ

from

GAAP.

These

differences

are

due

primarily

to

differing

treatments

of

income

and

gain

on

various

investment

securities

held

by

the

Fund,

timing

differences

and

differing

characterizations

of

distributions

made

by

the

Fund.

Federal

Taxes

–

The

Fund

intends

to

continue

to

qualify

each

year

as

a

regulated

investment

company

under

Subchapter

M

of

Chapter

1,

Subtitle

A,

of

the

Internal

Revenue

Code

of

1986,

as

amended

(“Code”),

and

to

distribute

all

of

its

taxable

income

to

shareholders.

In

addition,

by

distributing

in

each

calendar

year

substantially

all

of

its

net

investment

income

and

capital

gains,

if

any,

the

Fund

will

not

be

subject

to

a

federal

excise

tax.

Therefore,

no

federal

income

or

excise

tax

provision

is

required.

The

Fund

recognizes

interest

and

penalties,

if

any,

related

to

unrecognized

tax

benefits

as

income

tax

expense

in

the

Statement

of

Operations.

During

the

year,

the

Fund

did

not

incur

any

interest

or

penalties.

The

Fund

files

a

U.S.

federal

income

and

excise

tax

return

as

required.

The

Fund’s

federal

income

tax

returns

are

subject

to

examination

by

the

Internal

Revenue

Service

for

a

period

of

three

years

after

they

are

filed.

As

of

December

31,

2024,

there

are

no

uncertain

tax

positions

that

would

require

financial

statement

recognition,

de-recognition

or

disclosure.

Income

and

Expense

Allocation

–

The

Trust

accounts

separately

for

the

assets,

liabilities

and

operations

of

each

of

its

investment

portfolios.

Expenses

that

are

directly

attributable

to

more

than

one

investment

portfolio

are

allocated

among

the

respective

investment

portfolios

in

an

equitable

manner.

Commitments

and

Contingencies

–

In

the

normal

course

of

business,

the

Fund

enters

into

contracts

that

provide

general

indemnifications

by

the

Fund

to

the

counterparty

to

the

contract.

The

Fund’s

maximum

exposure

under

these

arrangements

is

dependent

on

future

claims

that

may

be

made

against

the

Fund

and,

therefore,

cannot

be

estimated;

however,

based

on

experience,

the

risk

of

loss

from

such

claims

is

considered

remote.

The

Fund

has

determined

that

none

of

these

arrangements

requires

disclosure

on

the

Fund’s

Statement

of

Assets

and

Liabilities.

Note

3.

Fees

and

Expenses

Investment

Adviser

–

Lisanti

Capital

Growth,

LLC

(the

“Adviser”)

is

the

investment

adviser

to

the

Fund.

Pursuant

to

an

investment

advisory

agreement,

the

Adviser

receives

an

advisory

fee,

payable

monthly,

from

the

Fund

at

an

annual

rate

of

0.95%

of

the

Fund’s

average

daily

net

assets.

Lisanti

Small

Cap

Growth

Fund

NOTES

TO

FINANCIAL

STATEMENTS

December

31,

2024

Shareholder

Service

Plan

–

The

Trust

has

adopted

a

shareholder

service

plan

for

the

Fund

under

which

the

Fund

may

reimburse

the

Fund’s

administrator

for

amounts

paid

by

the

administrator

for

providing

shareholder

service

activities

that

are

not

otherwise

provided

by

the

transfer

agent.

The

Fund’s

administrator

may

make

such

payments

to

various

financial

institutions,

including

the

Adviser,

that

provide

shareholder

servicing

to

their

customers

invested

in

the

Fund

in

amounts

of

up

to

0.25%

annually

of

the

average

daily

net

assets

of

the

Fund.

Distribution

–

Foreside

Fund

Services,

LLC,

a

wholly

owned

subsidiary

of

Foreside

Financial

Group,

LLC

(d/b/a

ACA

Group)

(the

“Distributor”),

acts

as

the

agent

of

the

Trust

in

connection

with

the

continuous

offering

of

shares

of

the

Fund.

The

Fund

does

not

have

a

distribution

(12b-1)

plan;

accordingly,

the

Distributor

does

not

receive

compensation

from

the

Fund

for

its

distribution

services.

The

Adviser

compensates

the

Distributor

directly

for

its

services.

The

Distributor

is

not

affiliated

with

the

Adviser

or

Atlantic

Fund

Administration,

LLC,

a

wholly

owned

subsidiary

of

Apex

US

Holdings

LLC

(d/b/a

Apex

Fund

Services)

(“Apex”)

or

their

affiliates.

Other

Service

Providers

–

Apex

provides

fund

accounting,

fund

administration,

compliance

and

transfer

agency

services

to

the

Fund.

The

fees

related

to

these

services

are

included

in

Fund

services

fees

within

the

Statement

of

Operations.

Apex

also

provides

certain

shareholder

report

production

and

EDGAR

conversion

and

filing

services.

Pursuant

to

an

Apex

Services

Agreement,

the

Fund

pays

Apex

customary

fees

for

its

services.

Apex

provides

a

Principal

Executive

Officer,

a

Principal

Financial

Officer,

a

Chief

Compliance

Officer

and

an

Anti-Money

Laundering

Officer

to

the

Fund,

as

well

as

certain

additional

compliance

support

functions.

Trustees

and

Officers

–

Each

Independent

Trustee’s

annual

retainer

is

$45,000

($55,000

for

the

Chairman).

The

Audit

Committee

Chairman

receives

an

additional

$2,000

annually.

Effective

January

1,

2025,

each

Independent

Trustee’s

annual

retainer

is

$60,000

($70,000

for

the

Chairman),

and

the

Audit

Committee

Chairman

receives

an

additional

$5,000

annually.

The

Trustees

and

the

Chairman

may

receive

additional

fees

for

special

Board

meetings.

Each

Trustee

is

also

reimbursed

for

all

reasonable

out-of-pocket

expenses

incurred

in

connection

with

his

or

her

duties

as

a

Trustee,

including

travel

and

related

expenses

incurred

in

attending

Board

meetings.

The

amount

of

Trustees’

fees

attributable

to

the

Fund

is

disclosed

in

the

Statement

of

Operations.

Certain

officers

of

the

Trust

are

also

officers

or

employees

of

the

above

named

service

providers,

and

during

their

terms

of

office

received

no

compensation

from

the

Fund.

Note

4.

Fees

Waived

The

Adviser

has

contractually

agreed

to

waive

its

fee

and/or

reimburse

expenses

to

limit

total

annual

fund

operating

expenses

(excluding

all

taxes,

interest,

portfolio

transaction

expenses,

proxy

expenses,

and

extraordinary

expenses)

to

1.35%

through

April

30,

2025.

(“Expense

Cap”)

The

Expense

Cap

may

only

be

raised

or

eliminated

with

the

consent

of

the

Board.

Other

Fund

service

providers

have

agreed

to

waive

a

portion

of

their

fees

and

such

waivers

may

be

changed

or

elimated

with

the

approval

of

the

Board.

For

the

year

ended

December

31,

2024

,

fees

waived

were

as

follows:

Lisanti

Small

Cap

Growth

Fund

NOTES

TO

FINANCIAL

STATEMENTS

December

31,

2024

The

adviser

may

be

reimbursed

by

the

Fund

for

fees

waived

and

expenses

reimbursed

by

the

adviser

if

such

payment

is

made

within

three

years

of

the

fee

waiver

or

expense

reimbursement,

and

does

not

cause

the

Total

Annual

Fund

Operating

Expenses

After

Fee

Waiver

and/or

Expense

Reimbursement

to

exceed

the

lesser

of

(i)

the

then-current

expense

cap,

or

(ii)

the

expense

cap

in

place

at

the

time

the

fees/expenses

were

waived/reimbursed.

As

of

December

31,

2024,

$678,863

is

subject

to

recapture

by

the

adviser.

Other

waivers

are

not

eligible

for

recoupment.

Note

5.

Security

Transactions

The

cost

of

purchases

and

proceeds

from

sales

of

investment

securities

(including

maturities),

other

than

short-term

investments

during

the

year

ended

December

31,

2024,

totaled

$60,164,291

and

$70,721,557,

respectively.

Note

6.

Federal

Income

Tax

As

of

December

31,

2024

,

the

cost

of

investments

for

federal

income

tax

purposes

is

$23,589,014

and

the

components

of

net

unrealized

appreciation

consists

of:

As

of

December

31,

2024,

distributable

earnings

on

a

tax

basis

were

as

follows:

The

difference

between

components

of

distributable

earnings

on

a

tax

basis

and

the

amounts

reflected

in

the

Statement

of

Assets

and

Liabilities

are

primarily

due

to

wash

sales,

return

of

capital

on

equity

securities

and

PFICs.

For

the

year

ended

December

31,

2024,

the

Fund

had

$23,879,658

in

short

term

capital

loss

carry

forwards

that

have

no

expiration

date.

On

the

Statement

of

Assets

and

Liabilities,

as

a

result

of

permanent

book

to

tax

differences,

certain

amounts

have

been

reclassified

for

the

year

ended

December

31,

2024.

The

following

reclassification

was

the

result

Investment

Adviser

Fees

Waived

Other

Waivers

Total

Fees

Waived

and

Expenses

Reimbursed

$

198,773

$

110,818

$

309,591

Gross

Unrealized

Appreciation

$

4,886,291

Gross

Unrealized

Depreciation

(781,137)

Net

Unrealized

Appreciation

$

4,105,154

Undistributed

Ordinary

Income

$

278,346

Capital

and

Other

Losses

(23,879,658)

Net

Unrealized

Appreciation

4,105,154

Total

$

(19,496,158)

Lisanti

Small

Cap

Growth

Fund

NOTES

TO

FINANCIAL

STATEMENTS

December

31,

2024

of

prior

year

adjustments

and

has

no

impact

on

the

net

assets

of

the

Fund.

Note

7.

Subsequent

Events

Subsequent

events

occurring

after

the

date

of

this

report

through

the

date

these

financial

statements

were

issued

have

been

evaluated

for

potential

impact,

and

the

Fund

has

had

no

such

events.

Accumulated

Loss

$

8,172

Paid-in-Capital

(8,172)

REPORT

OF

INDEPENDENT

REGISTERED

PUBLIC

ACCOUNTING

FIRM

To

the

Shareholders

of

Lisanti

Small

Cap

Growth

Fund

and

the

Board

of

Trustees

of

Forum

Funds

Opinion

on

the

Financial

Statements

We

have

audited

the

accompanying

statement

of

assets

and

liabilities,

including

the

schedule

of

investments,

of

Lisanti

Small

Cap

Growth

Fund

(the

“Fund”),

a

series

of

Forum

Funds,

as

of

December

31,

2024,

the

related

statement

of

operations

for

the

year

then

ended,

the

statements

of

changes

in

net

assets

and

the

financial

highlights

for

each

of

the

two

years

in

the

period

then

ended,

and

the

related

notes

(collectively

referred

to

as

the

“financial

statements”).

In

our

opinion,

the

financial

statements

present

fairly,

in

all

material

respects,

the

financial

position

of

the

Fund

as

of

December

31,

2024,

the

results

of

its

operations

for

the

year

then

ended,

and

the

changes

in

net

assets

and

the

financial

highlights

for

each

of

the

two

years

in

the

period

then

ended,

in

conformity

with

accounting

principles

generally

accepted

in

the

United

States

of

America.

The

Fund’s

financial

highlights

for

the

years

ended

December

31,

2022,

and

prior,

were

audited

by

other

auditors

whose

report

dated

February

24,

2023,

expressed

an

unqualified

opinion

on

those

financial

highlights.

Basis

for

Opinion

These

financial

statements

are

the

responsibility

of

the

Fund’s

management.

Our

responsibility

is

to

express

an

opinion

on

the

Fund’s

financial

statements

based

on

our

audits.

We

are

a

public

accounting

firm

registered

with

the

Public

Company

Accounting

Oversight

Board

(United

States)

(“PCAOB”)

and

are

required

to

be

independent

with

respect

to

the

Fund

in

accordance

with

the

U.S.

federal

securities

laws

and

the

applicable

rules

and

regulations

of

the

Securities

and

Exchange

Commission

and

the

PCAOB.

We

conducted

our

audits

in

accordance

with

the

standards

of

the

PCAOB.

Those

standards

require

that

we

plan

and

perform

the

audit

to

obtain

reasonable

assurance

about

whether

the

financial

statements

are

free

of

material

misstatement

whether

due

to

error

or

fraud.

REPORT

OF

INDEPENDENT

REGISTERED

PUBLIC

ACCOUNTING

FIRM

Our

audits

included

performing

procedures

to

assess

the

risks

of

material

misstatement

of

the

financial

statements,

whether

due

to

error

or

fraud,

and

performing

procedures

that

respond

to

those

risks.

Such

procedures

included

examining,

on

a

test

basis,

evidence

regarding

the

amounts

and

disclosures

in

the

financial

statements.

Our

procedures

included

confirmation

of

securities

owned

as

of

December

31,

2024,

by

correspondence

with

the

custodian.

Our

audits

also

included

evaluating

the

accounting

principles

used

and

significant

estimates

made

by

management,

as

well

as

evaluating

the

overall

presentation

of

the

financial

statements.

We

believe

that

our

audits

provide

a

reasonable

basis

for

our

opinion.

We

have

served

as

the

Fund’s

auditor

since

2023.

COHEN

&

COMPANY,

LTD

Philadelphia,

Pennsylvania

February

18,

2025

Lisanti

Small

Cap

Growth

Fund

OTHER

INFORMATION

(UNAUDITED)

December

31,

2024

Changes

in

and

Disagreements

with

Accountants

(Item

8

of

Form

N-CSR)

N/A

Proxy

Disclosure

(Item

9

of

Form

N-CSR)

N/A

Remuneration

Paid

to

Directors,

Officers,

and

Others

(Item

10

of

Form

N-CSR)

Please

see

financial

statements

in

Item

7.

Statement

Regarding

the

Basis

for

the

Board’s

Approval

of

Investment

Advisory

Contract

(Item

11

of

Form

N-CSR)

Investment

Advisory

Agreement

Approval

At

the

September

20,

2024

Board

meeting,

the

Board,

including

the

Independent

Trustees,

considered

the

approval

of

the

continuance

of

the

investment

advisory

agreement

between

the

Adviser

and

the

Trust

pertaining

to

the

Fund.

In

preparation

for

its

deliberations,

the

Board

requested

and

reviewed

written

responses

from

the

Adviser

to

a

due

diligence

questionnaire

circulated

on

the

Board's

behalf

concerning

the

services

provided

by

the

Adviser.

The

Board

also

discussed

the

materials

with

Fund

counsel

and,

as

necessary,

with

the

Trust's

administrator.

During

its

deliberations,

the

Board

received

an

oral

presentation

from

the

Adviser

and

was

assisted

by

the

advice

of

independent

Trustee

counsel.

At

the

Meeting,

the

Board

reviewed,

among

other

matters:

(i)

the

nature,

extent

and

quality

of

the

services

provided

to

the

Fund

by

the

Adviser,

including

information

on

the

investment

performance

of

the

Fund

and

the

Adviser;

(ii)

the

costs

of

the

services

provided

and

profitability

to

the

Adviser

of

its

relationship

with

the

Fund;

(iii)

the

advisory

fee

and

total

expense

ratio

of

the

Fund

as

compared

to

those

of

a

relevant

peer

group

of

funds;

(iv)

the

extent

to

which

economies

of

scale

may

be

realized

as

the

Fund

grows

and

whether

the

advisory

fee

enables

the

Fund's

investors

to

share

in

the

benefits

of

economies

of

scale;

and

(v)

other

benefits

received

by

the

Adviser

from

its

relationship

with

the

Fund.

The

Board

recognized

that

the

evaluation

process

with

respect

to

the

Adviser

was

an

ongoing

one

and,

in

this

regard,

the

Board

considered

information

provided

by

the

Adviser

at

regularly

scheduled

meetings

during

the

past

year.

Nature,

Extent

and

Quality

of

Services

Based

on

written

materials

received,

a

presentation

from

a

senior

representative

of

the

Adviser

and

a

discussion

with

the

Adviser

about

the

Adviser’s

personnel,

operations

and

financial

condition,

the

Board

considered

the

quality

of

services

provided

by

the

Adviser

under

the

Advisory

Agreement.

In

this

regard,

the

Board

considered

information

regarding

the

experience,

qualifications

and

professional

background

of

the

portfolio

manager

and

other

personnel

at

the

Adviser

providing

services

to

the

Fund,

as

well

as

the

Lisanti

Small

Cap

Growth

Fund

OTHER

INFORMATION

(UNAUDITED)

December

31,

2024

investment

philosophy

and

decision-making

process

of

the

Adviser

and

the

capability

and

integrity

of

the

Adviser’s

senior

management

and

staff.

The

Board

considered

also

the

adequacy

of

the

Adviser’s

resources.

The

Board

noted

the

Adviser’s

representations

that

the

firm

is

in

stable

financial

condition

and

has

the

operational

capability

and

the

necessary

staffing

and

experience

to

continue

providing

high-quality

investment

advisory

services

to

the

Fund.

Based

on

the

presentation

and

the

materials

provided

by

the

Adviser

in

connection

with

the

Board’s

consideration

of

the

renewal

of

the

Advisory

Agreement,

among

other

relevant

factors,

the

Board

concluded

that,

overall,

it

was

satisfied

with

the

nature,

extent

and

quality

of

services

to

be

provided

to

the

Fund

under

the

Advisory

Agreement.

Performance

In

connection

with

a

presentation

by

the

Adviser

regarding