Exhibit 99-1

December 2015 www.enzo.com December Investor Presentation – As Updated on December 21 st , 2015

1 DISCLAIMER Except for historical information, the matters discussed herein may be considered "forward - looking" statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . Such statements include declarations regarding the intent, belief, or current expectations of Enzo Biochem, Inc . (the Company) and its management, including those related to cash flow, gross margins, revenues, and expenses, and are dependent on a number of factors outside of the control of the company, including, inter alia, the markets for the Company’s products and services, costs of goods and services, other expenses, government regulations, litigations, and general business conditions . See Risk Factors in the Company’s Form 10 - K for the fiscal year ended July 31 , 2015 . Investors are cautioned that any such forward - looking statements are not guarantees of future performance and involve a number of risks and uncertainties that could materially affect actual results . The Company disclaims any obligations to update any forward - looking statement as a result of developments occurring after the date of this presentation .

2 Enzo Biochem, Inc . (the “Company”) has filed a definitive proxy statement with the U . S . Securities and Exchange Commission (the "SEC") with respect to its 2015 Annual Meeting of Shareholders and intends to file a definitive proxy statement as well . The definitive proxy statement and white proxy card has been mailed to shareholders of the Company . Enzo Biochem, Inc . , its directors and certain of its executive officers may be deemed to be participants in the solicitation of proxies from shareholders in connection with the matters to be considered at its 2015 Annual Meeting . ENZO BIOCHEM, INC . SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ ANY SUCH PROXY STATEMENT AND ACCOMPANYING PROXY CARD AS THEY WILL CONTAIN IMPORTANT INFORMATION . Information regarding the ownership of the Company’s directors and executive officers in the Company’s common stock, restricted stock and options is included in their SEC filings on Forms 3 , 4 and 5 , which can be found at the Company's website (www . enzo . com) in the section "Corporate — Investor Information . " More detailed information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the proxy statement and other materials to be filed with the SEC in connection with the Company’s 2015 Annual Meeting . Information can also be found in the Company’s Annual Report on Form 10 - K for the year ended July 31 , 2015 , filed with the SEC on October 13 , 2015 , as amended on November 27 , 2015 . Shareholders will be able to obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC for no charge at the SEC's website at www . sec . gov . Copies will also be available at no charge at the Company’s website at www . enzo . com or by writing to the Company at 527 Madison Avenue, New York, New York 10022 .

3 TABLE OF CONTENTS Page Executive Summary 4 Enzo Now 7 The Problems with Lone Star 27 Addressing Lone Star’s December 17 th Presentation to ISS 34 Additional Background on Lone Star 57 Enzo’s Leadership 84

December 2015 www.enzo.com Executive Summary 4

5 EXECUTIVE SUMMARY - ENZO x Executing on a corporate strategy which has positioned the company to thrive in the challenging MDx marketplace x The value of Enzo is beginning to be appreciated by the marketplace: delivering solid returns to shareholders – 3 - year TSR of 71.9%, 6 - month TSR of 86.0% (1) x Rapidly improving financial performance , including increasing revenue and expanding margins with superior, strategic, market - driven product pipeline x Efficiently h arvesting valuable IP estate , a testament to Enzo’s years of cutting edge scientific development and fiscal discipline x Engaged Board of Directors with diverse ideas and relevant experience to ensure Enzo achieves its full potential (1) Source: CapitalIQ as of November 24, 2015

6 EXECUTIVE SUMMARY – LONE STAR Aggressively reducing its Enzo ownership while simultaneously pursuing a proxy fight (see pages 30 - 31) Has not presented a single idea , plan, or alternative perspective on how Enzo can increase shareholder returns Has resorted to personal attacks on Enzo’s directors rather than engage in a debate about the best path to create value Put forward two highly - conflicted nominees whom are not qualified to serve on Enzo’s Board Aby smal t rack record of stewardship and performance in majority of portfolio companies where Lone Star pursued a campaign Lone Star

December 2015 www.enzo.com Enzo NOW 7

8 Enzo Is Positioned to Thrive NOW

9 WHY ENZO IS POSITIONED TO THRIVE NOW Why NOW? Molecular diagnostics market place is rapidly growing but economics are poor and will decline further for clinical labs The advent of open system platforms (<5 years) for labs creates opportunity for a vertically integrated technology development company to thrive Why ENZO? x Leading developer of molecular diagnostics x Strong IP Position x Comprehensive and thoughtful business strategy x Proven ability to deliver high quality products that do not require expensive systems to operate x Financial strength DESPITE BEING A MID - CAP COMPANY, WE BELIEVE THAT ENZO CAN THRIVE AND COMPETE AGAINST INDUSTRY GIANTS GIVEN ITS TECHNOLOGY PLATFORM AN D HIGH PERFORMING PRODUCTS THAT CAN DELIVER 30% - 50% SAVINGS TO THE MARK ET

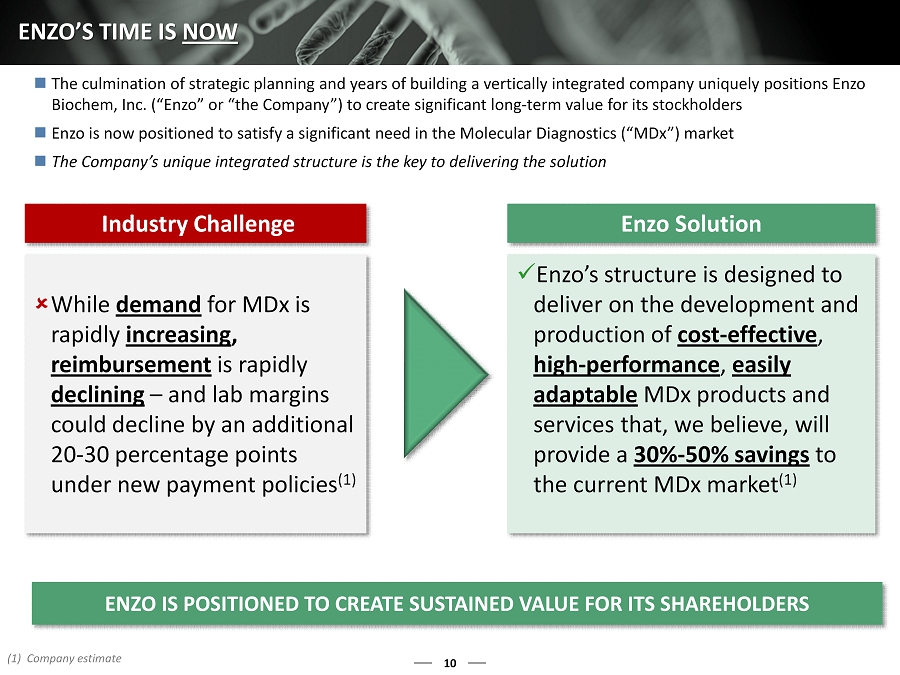

10 ENZO’S TIME IS NOW ENZO IS POSITIONED TO CREATE SUSTAINED VALUE FOR ITS SHAREHOLDER S Industry Challenge Enzo Solution While demand for MDx is rapidly increasing , reimbursement is rapidly declining – and lab margins could decline by an additional 20 - 30 percentage points under new payment policies (1) x Enzo’s structure is designed to deliver on the development and production of cost - effective , high - performance , easily adaptable MDx products and services that, we believe, will provide a 30% - 50% savings to the current MDx market (1) The culmination of strategic planning and years of building a vertically integrated company uniquely positions Enzo Biochem, Inc. (“Enzo” or “the Company”) to create significant long - term value for its stockholders Enzo is now positioned to satisfy a significant need in the Molecular Diagnostics (“MDx”) market The Company’s unique integrated structure is the key to delivering the solution (1) Company estimate

11 MD x MARKET GROWTH ($ in billions) In the span of 25 years, molecular diagnostics have burgeoned from a practically non - existent market of approximately $10 million in product sales to $ 5.2 billion worldwide in 2014 Estimated annual growth rate of 7.5% at least through 2018 Thousands of labs in the U.S. can be enabled with MDx technologies, but we believe that they lack key capability to capture the market Today’s MDx products are expensive Source: Enterprise Analysis Corporation “Molecular Diagnostics Update: Market Trends and Outlook,” 2014 Global MDx Sales 2012 – 2018E IF DEMAND FOR MD x TESTS IS GROWING SO FAST, WHY IS THE INDUSTRY UNDER PRESSURE? $4.6 $4.9 $5.2 $5.6 $6.0 $6.5 $7.1 $3 $4 $4 $5 $5 $6 $6 $7 $7 $8 2012 2013 2014 2015 2016 2017 2018

12 MD x MARKET CHALLENGES Demand for MDx is rapidly increasing, and we believe it is growing at 2x the rate of the overall diagnostic market (1) Despite growing demand, reimbursement for MDx tests is in long - term decline (1) MDx margins within labs could decline by another 20 - 30 percentage points under new payor guidelines (1) Meanwhile, we believe the costs for performing MDx tests are increasing (1) MDx product companies are not reducing the cost of the products to the clinical labs despite downward reimbursement pressure because closed systems are expensive to develop and produce ENZO BELIEVES IT CAN ADDRESS THIS CHALLENGE AND DELIVER TO ITS CUSTOMERS A 30% - 50% REDUCTION IN SAVINGS THROUGH ITS INTEGRATED SOLUTIONS MDx Market Margins are Under Intense Pressure (1) Company estimate

Increasing demand for MDx Tests. Aging population and efficacy of tests is expected to see MDx demand continue to grow (see slide 11) 13 MARKET PROBLEM EXPLAINED Clinical Labs Payors (Insurance & MEDICARE) Diagnostic Test Companies Despite increased d emand, payors are reducing reimbursemen t rates to Clinical Labs on MDx tests… …Which puts margin pressure on Clinical Labs whom make their profits on the difference they pay for tests from MDx Companies and the reimbursement rates from payors… $ … Which is beginning to put increased pricing pressure on Diagnostic Test Companies – setting - up a dynamic where the low cost provider wins MDx Tests Patients/Doctors Today Diagnostic Companies attempt to keep their position with labs secure by establishing “closed - system” (aka razor - razorblade ) test kits which thus - far has limited Clinical Labs ability to change to the lowest cost provider… THIS IS NOT A SUSTAINABLE DYNAMIC 2 3 4 1 Sample $

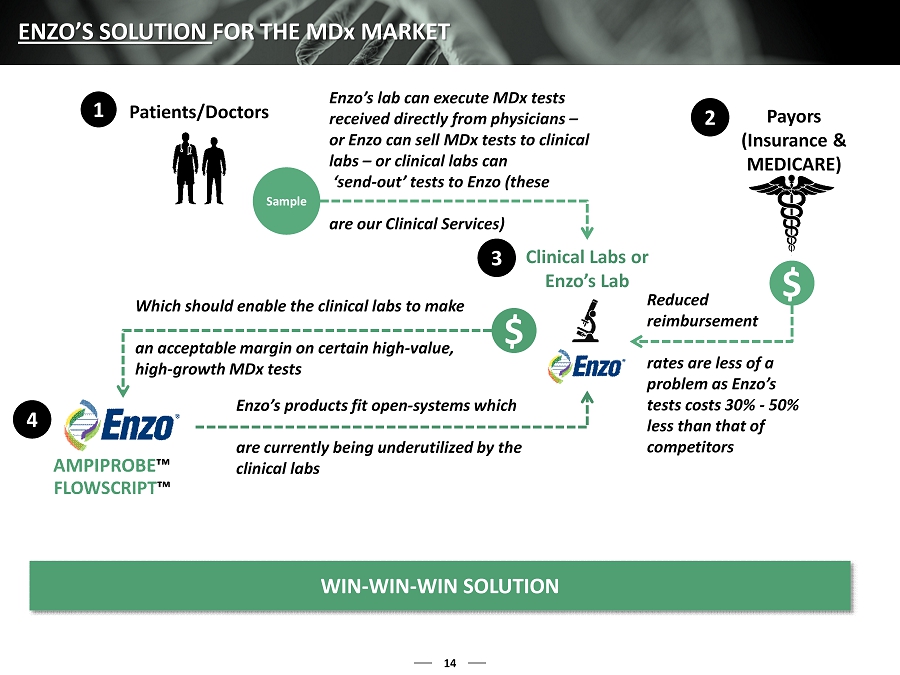

14 ENZO’S SOLUTION FOR THE MD x MARKET Clinical Labs or Enzo’s Lab Which should enable the clinical labs to make an acceptable margin on certain high - value, high - growth MDx tests $ Enzo’s products fit open - systems which are currently being underutilized by the clinical labs 3 4 WIN - WIN - WIN SOLUTION Reduced reimbursement rates are less of a problem as Enzo’s tests costs 30% - 50% less than that of competitors Payors (Insurance & MEDICARE) Enzo’s lab can execute MDx tests received directly from physicians – or Enzo can sell MDx tests to clinical labs – or clinical labs can ‘send - out’ tests to Enzo ( these are our Clinical Services) Patients/Doctors 2 1 Sample $

15 MARKET PROBLEM : CLOSED SYSTEMS Closed MDx System MDx Test “Company A” makes the MDx test “Company A” also makes the MDx closed s ystem that can only use “Company A’s ” MDx t est Closed - end systems are developed by MDx companies to perform MDx tests that only accept proprietary reagents In part because of the development costs of these systems, MDx companies attempt to lock in agreements with clinical labs for certain MDx tests, which has made the labs hostage to higher reagent prices and, thus, lower margins Closed Systems Explained WE BELIEVE BEING “STUCK” WITH CLOSED - END SYSTEMS IS A LARGE CONT RIBUTOR TO THE DECLINING MARGIN PRESSURE OF CLINICAL LABS

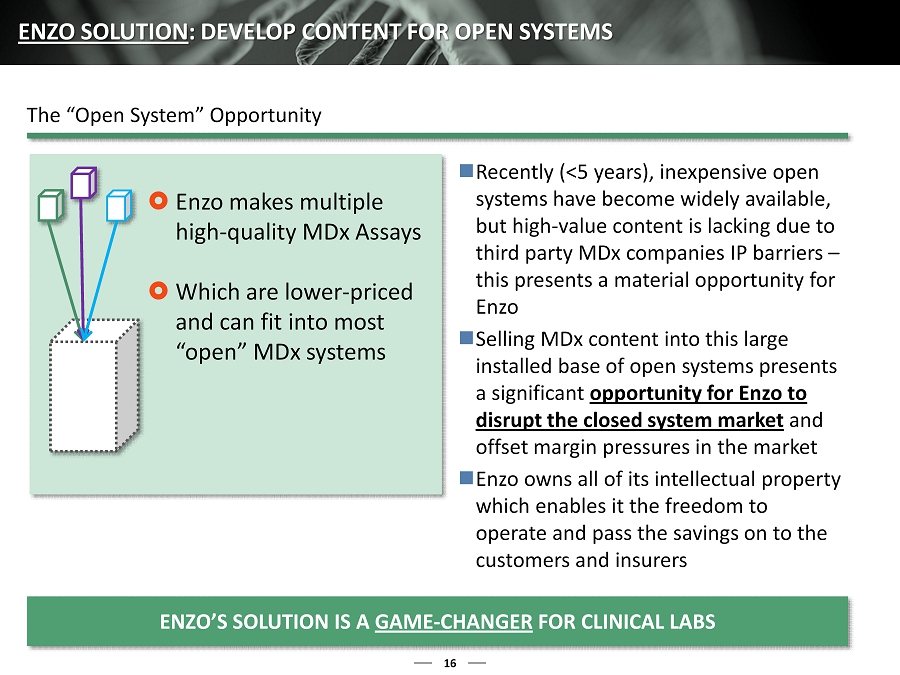

16 ENZO SOLUTION : DEVELOP CONTENT FOR OPEN SYSTEMS Enzo makes multiple high - quality MDx Assays Which are lower - priced and can fit into most “open ” MDx systems Recently (<5 years), inexpensive open systems have become widely available, but high - value content is lacking due to third party MDx companies IP barriers – this presents a material opportunity for Enzo Selling MDx content into this large installed base of open systems presents a significant opportunity for Enzo to disrupt the closed system market and offset margin pressures in the market Enzo owns all of its intellectual property which enables it the freedom to operate and pass the savings on to the customers and insurers ENZO’S SOLUTION IS A GAME - CHANGER FOR CLINICAL LABS The “Open System” Opportunity

17 MD x MARKET HAS MATERIAL INEFFICIENCIES Intellectual Property Biotech Innovation, Technology, and Test Platforms MDx Develop, Validate, and Manufacture Products Product Distribution, Sales, and Marketing Clinical Services $ $ $ $ Billing Payors Cost Cost Cost Cost Reimbursement Pressures The Multiple, Inefficient Layers of the MDx Market FRAGMENTED COMPANIES CURRENTLY IN THE MDX MARKET ADD COSTS AND COMPROMISES INNOVATION

18 ENZO’S VERTICAL INTEGRATION HAS MATERIAL ADVANTAGES Intellectual Property Biotech Innovation, Technology, and Test Platforms MDx Develop, Validate, and Manufacture Products Product Distribution, Sales, and Marketing Clinical Services $ $ $ $ Billing Payors Cost Cost Cost Cost Reimbursement Pressures Enzo’s Structure Lowers Costs and Promotes Innovatio n

Innovation & IP Technology Platform Manufacturing Technology Validation Products Services Biotech Competitors P P O O O O MDx Competitors Via Licenses P P P O Clinical Service Competitors O O O O O P P P P P P P 19 ENZO’S SOLUTION: VERTICAL INTEGRATION BIOTECH, MD x, AND CLINICAL SERVICES COMPANIES IN TODAY’S MARKET ENVIRONMENT LACK THE NECESSARY OPERATING STRUCTURE AND RESOURCES TO EFFECTIVELY MEET THE CHALLENGES OF THE MD x MARKET ( 1 ) Concept Commercialization Without an integrated vertical structure and associated resources, we believe the market incurs incremental licensing, high fixed overhead costs, and distributor costs that restrict the ability to operate in a low - cost, high - quality manner Unlike Enzo, we believe these companies are trapped in their singular limited structure that is neither adaptive to reimbursement challenges nor creates innovative technology products serving market participants (1) Company analysis

20 WHY ENZO BELIEVES IT CAN DELIVER 30% - 50% SAVINGS TO MARKET Average Gross Margin of Clinical Services Companies (1) ~30% Potential MDx Savings: Cumulative Royalty Relief Enzo owns all of its IP Intellectual property generation already paid for Lower Cost of Goods Enzo’s cumulative technological capability is the foundation Enzo’s robust product development pipeline emanates from a multiplicity of platforms with a low cost of product development for open systems No Capital Investment Enzo’s products do not require dedicated/expensive instrumentation 5% - 10% 10% - 20% 10% - 15% Anticipated Margin After Enzo Savings – 2016 55% - 75% Anticipated Margin After Enzo Savings – 2018 (After PAMA) (2) Even with further reimbursement erosion, we deliver cost relief to the market while maintaining healthy margins for Enzo 35% - 55% (1) Company estimates – average assumed segment lab gross margin (2) Assumes PAMA reimbursement rates are approximately 20 percentage points lower than 2016 levels HOW ENZO CAN DELIVER SIGNIFICANT SAVINGS TO ITS CUSTOMERS 1

21 “[Y] ou guys are doing a really good job. Getting AmpiProbe approved is a game changer .” Norman Hale, Stifel , 12/8/2015

22 JUST TWO OF ENZO’S PROPRIETARY PLATFORMS AMPIPROBE ™ FLOWSCRIPT ™ Less Sample x Allows paneling/reduced reaction volume/lower prep costs Multiplex Capability x Able to run up to 30 assays simultaneously Zero Background x After more than 60 cycles x Competitors have issues 100% Concordance x Existing FDA - approved PCR technologies Flexible, Adaptable & Universal x Any open/dedicated system Adaptive x Fits into laboratory workflow seamlessly Multiplex Capability x Simultaneous examinations of each cell in a sample Higher Efficiency x Designed to reduce hands - on time Consistent x Elimination of steps that can cause fluctuation in results Flexible, Adaptable & Universal x Work with virtually any flow cytometer with protocols that they are used to Compatible with High - Through Instrumentation x Scalability can reduce marginal cost Broad Applicability x Able to measure genomic activity, not just detect protein x Immune - mediated disorders, c ancer, infectious diseases, drug development Adaptive x Fits into laboratory workflow seamlessly

23 THE MARKET IS REWARDING ENZO’S PROGRESS 6 - Month Total Shareholder Return Note: Selected Lab Peers: GHDX, NEO, SQNM, SHL, NTRA, and VCYT (Median value used) Note: Selected Life Science Peers: AFFX, NSTG, EXQ, HBIO, and TECH (Median value used) Source: Capital IQ as of November 24, 2015 86.0% -40.0% -20.0% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% Enzo Biochem Inc. Lab Peers Life Science Peers All Peers

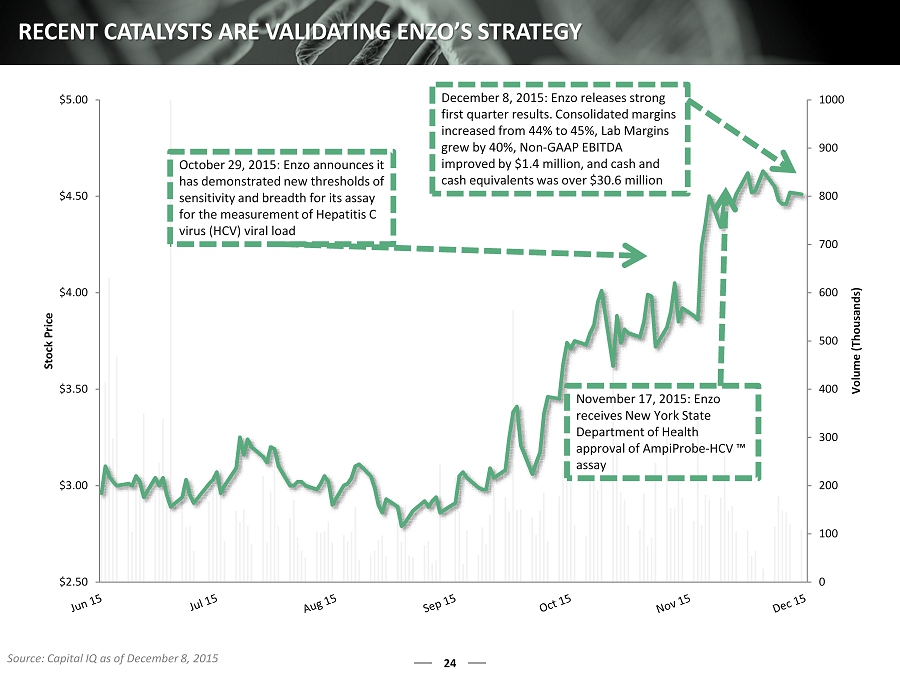

0 100 200 300 400 500 600 700 800 900 1000 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 Volume (Thousands) Stock Price October 29, 2015: Enzo announces it has demonstrated new thresholds of sensitivity and breadth for its assay for the measurement of Hepatitis C virus (HCV) viral load November 17, 2015: Enzo receives New York State Department of Health approval of AmpiProbe - HCV ™ assay 24 RECENT CATALYSTS ARE VALIDATING ENZO’S STRATEGY Source: Capital IQ as of December 8, 2015 December 8, 2015: Enzo releases strong first quarter results. Consolidated margins increased from 44% to 45%, Lab Margins grew by 40%, Non - GAAP EBITDA improved by $1.4 million, and cash and cash equivalents was over $30.6 million

25 ENZO RECENT RESULTS DEMONSTRATE THAT OUR STRATEGY IS WORKING $15,822 $17,090 $15,000 $15,500 $16,000 $16,500 $17,000 $17,500 Q1 2015 Q1 2016 Clinical Laboratory Services Revenue (in thousands) 36.0% 39.5% 34.0% 35.0% 36.0% 37.0% 38.0% 39.0% 40.0% Q1 2015 Q1 2016 Clinical Laboratory Services Gross Margin “FQ1 (Oct) represented a solid start to FY 2016 (July), particularly on the Clinical Lab side of the business, which once again posted strong revenue growth in the high single digits while continuing to expand gross margin by several hundred basis points.” Craig Hallum, December 8, 2015

26 SUMMARY The Company continually evaluates its own technologies and platforms and selects those to further advance based on the following criteria: Products that solve problems for clinical labs and have existing market opportunities Products that can be sold at 30% - 50% less than our competition (1) Products that could perform at or superior to market leaders’ products Medically relevant information Products that could fit into existing operations and do not disrupt lab workflows Products that result in greater margins for Enzo We have been able to design proprietary products and protocols that fit into current lab workflows without the need to utilize third - party intellectual property We save on licensing costs, and these savings can be passed along to our customers There is no need to “reinvent the wheel” once we decide on what test we want to develop Existing internally generated technologies and platforms allow us to efficiently mix and match capabilities in order to optimize the cost profile, performance, and user - friendly nature of any particular test Enzo can offer both products and services to the MDx market ENZO ADDRESSES THE CHALLENGES IN MD x MARKET THE TIME FOR ENZO IS NOW (1) Company estimate

December 2015 www.enzo.com The Problems with Lone Star 27

28 Lone Star: Complete lack of ideas for Enzo’s Business – thus resorting to disingenuous personal attacks and red herring critiques Rapidly selling their Enzo stock while waging a proxy fight ( see pages 30 - 31) WHY DOES LONE STAR THINK THIS IS OKAY? DO THEY CARE AT ALL ABOUT THEIR CREDIBILITY? THERE IS NO ROOM IN THE MARKETPLACE FOR THE TACTICS USED BY LONE STAR

29 LONE STAR VALUE’S LACK OF SPECIFICITY AND VALUE - ADD An investment manager called Lone Star Value Management LLC (“Lone Star”) with a 1.23% position in Enzo is currently seeking 40% representation on Enzo’s board (1) We believe Lone Star’s interests are not aligned with other shareholders – Lone Star has demonstrated a history of short - term trading in stocks in which it has been involved – Lone Star’s trading activity (in and out) of Enzo’s stock is the antithesis of long - term value creation ( see pages 30 - 31) We believe Lone Star’s nominees are not independent of one another and are not independent of Jeff Eberwein, the Founder and CEO of Lone Star – Mr. Eberwein operates in an insular circle with a web of interconnections to his Enzo nominees – John Climaco and Dimitrios Angelis became paid consultants and/or employees of his targeted companies We believe Lone Star and its nominees have no articulate plan for our business other than self - enrichment, jobs, stock trades, etc. – We provided Mr . Eberwein, Mr. Climaco, and Mr. Angelis with numerous opportunities to share their ideas for Enzo – and yet they never offered a single idea as to how they would create shareholder value any differently than the Company’s current plan – In fact, they were complimentary toward Enzo’s board and management – If elected to Enzo’s board , a majority of the independent directors would be controlled by Lone Star We believe Lone Star has a track record of destroying value for shareholders (2) – Lone Star’s failures overwhelmingly dwarf its successes – so much so that we can’t imagine why any shareholder would want to gamble on their involvement (1) Lone Star Value Investors LP (“Lone Star”) Schedule 14A, filed with SEC on December 2, 2015 (2) See pages 66 - 82

30 IS LONE STAR A SHAREHOLDER OR A TRADER? Common Stock 5,000 10/1/15 Common Stock 10,000 10/19/15 Common Stock (55,000) 10/30/15 Common Stock (5,000) 10/30/15 Common Stock (25,000) 11/2/15 Common Stock (5,000) 11/2/15 Common Stock (31,300) 11/4/15 Common Stock (2,236) 11/4/15 Common Stock (18,897) 11/5/15 Common Stock (2,591) 11/5/15 Common Stock (19,803) 11/6/15 Common Stock (173) 11/6/15 Common Stock (30,100) 11/18/15 Common Stock (5,000) 11/18/15 Common Stock (5,316) 11/19/15 Common Stock (1,784) 11/19/15 Common Stock (7,800) 11/20/15 Common Stock (5,000) 11/20/15 Common Stock (6,784) 11/23/15 Common Stock 1,784 11/30/15 Lone Star has been reducing the number of shares it owns in Enzo – since 10/30/2015, Lone Star has sold 226,784 shares and purchased only 1,784 What does this say about Lone Star’s commitment to create long - term value for shareholders? What does this say about Lone Star’s view of Enzo’s investment prospects at these levels? Should a “selling” shareholder have control of 67% of the board’s independent directors? ENZO’S MANAGEMENT TEAM AND BOARD NOMINEES ARE NOT SELLERS OF THE COMPANY’S STOCK AND ARE WORKING TO CREATE VALUE WELL IN EXCESS O F OUR CURRENT VALUATION, UNLIKE, WE BELIEVE, LONE STAR Source: Lone Star Schedule 14A, filed with SEC on December 2, 2015

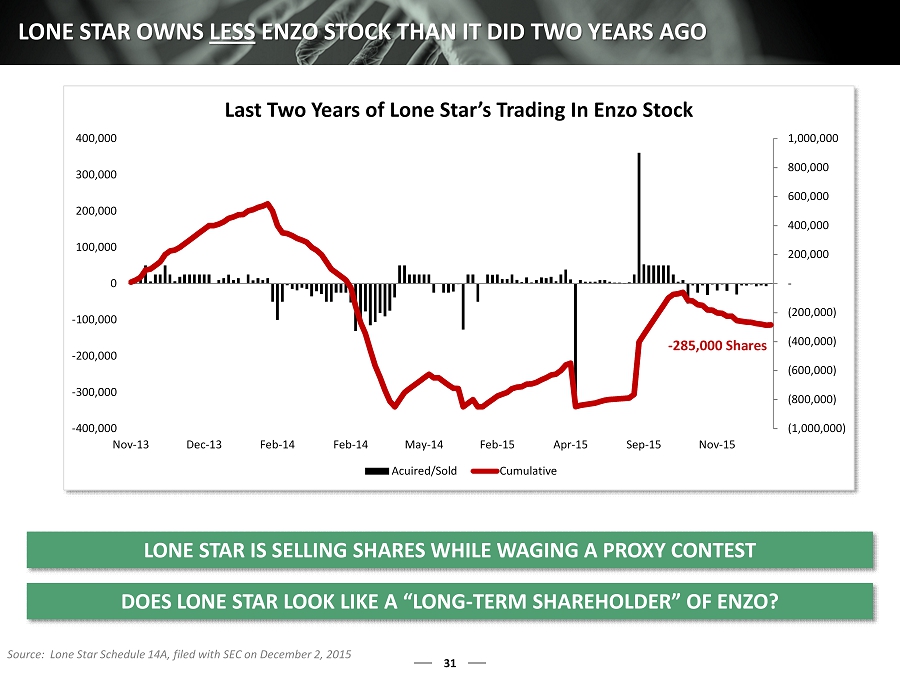

31 LONE STAR OWNS LESS ENZO STOCK THAN IT DID TWO YEARS AGO (1,000,000) (800,000) (600,000) (400,000) (200,000) - 200,000 400,000 600,000 800,000 1,000,000 -400,000 -300,000 -200,000 -100,000 0 100,000 200,000 300,000 400,000 Nov-13 Dec-13 Feb-14 Feb-14 May-14 Feb-15 Apr-15 Sep-15 Nov-15 Last Two Years of Lone Star’s Trading In Enzo Stock Acuired/Sold Cumulative LONE STAR IS SELLING SHARES WHILE WAGING A PROXY CONTEST - 285,000 Shares DOES LONE STAR LOOK LIKE A “LONG - TERM SHAREHOLDER” OF ENZO ? Source: Lone Star Schedule 14A, filed with SEC on December 2, 2015

32 ABYSMAL TRACK RECORD 125.9% 74.5% 56.2% - 8.1% - 11.5% - 20.0% - 21.8% - 26.9% - 34.2% - 35.3% - 38.9% - 47.06% - 54.1% - 56.8% - 64.1% - 83.1% - 87.0% - 91.1% - 99.8% - 99.9% -100.0% -50.0% 0.0% 50.0% 100.0% 150.0% LONE STAR’S TRACK RECORD, WE BELIEVE, SPEAKS FOR ITSELF Median = Negative 37.1% Source: FactSet (1) Represents Total Shareholder Return from campaign announcement until the end of Lone Star’s involvement (if Lone Star is still involved, end date is November 24, 2015 BANKRUPTCY BANKRUPTCY Total Shareholder Return (1) DELISTED

x A business model and operational structure that are positioned to address the imminent needs of the growing but challenged MDx industry x The ability to further leverage Enzo’s vertically integrated business structure to create value for shareholders x A board and management team with a deep understanding of the MDx marketplace and a proven track record of developing valuable biotech innovations , the value of which is now being harvested x An ownership culture in which directors and management do own shares of common stock – their interests are perfectly aligned with the interests of long - term shareholders 33 THE CHOICE FOR SHAREHOLDERS IS CLEAR! Disruption of Enzo’s current trajectory by an investor that openly admitted he “doesn’t understand our business” (1) A 67% change in independent directors by a 1.2% shareholder who has not put forth a single idea on how they would create value for shareholders An investor and nominees with innumerable interconnected relationships that appear to have an abysmal track record An investor who has bought 1,916,784 shares and sold 2,201,784 stock over the past two years – a shareholder that we believe trades in Enzo’s stock opportunistically (2) Lone Star (1) Lone Star discussion with the Company (2) Lone Star Value Investors Schedule 14A, filed with SEC on December 2, 2015

December 2015 www.enzo.com Addressing Lone Star’s December 17 th Presentation to ISS 34

35 HOW CAN LONE STAR LOOK ISS IN THE EYE AND SAY “WE ARE A LONG - TERM ENZO SHAREHOLDER”? LONE STAR IS ANYTHING BUT A LONG - TERM SHAREHOLDER OF ENZO Source: Lone Star Investor Presentation filed December 17, 2015 (1) Lone Star meeting with Company Lone Star has been aggressively selling Enzo’s stock! ( s ee pages 30 - 31) During our engagement it was immensely clear that Lone Star has absolutely nothing of value to offer the Company and Mr. Eberwein even admitted that “he does not understand our business” (1) If Lone Star had done any homework on this situation, they would quickly realize it is incredibly foolish to associate themselves with this resolved matter

36 LONE STAR ASSERTS THAT ENZO “LACKS EXECUTION” Developing and monetizing Enzo’s substantial IP portfolio is a direct result of execution of our strategic plan. Is L one Star suggesting their nominees have superior IP litigation experience to Enzo’s world class counsel who works on a contingency basis? How can Lone Star even assess our business if they “don’t understand” Enzo? (1) Our recent performance would suggest that we are executing very effectively on our strategic plan Obtaining product approvals is a direct result of execution of our strategic plan Source: Lone Star Investor Presentation filed December 17, 2015 (1) Lone Star meeting with Company

37 COULD LONE STAR’S LAWYER NOMINEES “ASSIST” WITH OUR IP LITIGATIO N? http://www.desmaraisllp.com/lawyers/john - m - desmarais Enzo has retained John Desmarais as its IP litigation counsel – with a 100% contingency arrangement Desmarais is one of the most successful IP litigators ever http://www.lifescienceslawgroup.com/dimitrios - j - angelis - executive - counsel/ THE NOTION THAT LONE STAR’S NOMINEES CAN ENHANCE ENZO’S IP LITIGATION EFFORTS IS PREPOSTEROUS AND WE BELIEVE LONE STAR IS MERELY GRASP ING AT STRAWS TO TRY AND FIND SOMETHING THEY CAN SAY REGARDING THEIR FECKLESS CAMPAIGN Enzo’s IP Litigator Lone Star Nominee – Dimitrios Angelis

Enzo has consistently been at the frontier of innovation, committed to investing in the development of disruptive technologies Having a wide range of applications, Enzo’s IP estate of patents (of which our CEO is co - inventor) has been regularly infringed upon, enriching a number of major companies over several years In light of patent infringement, Enzo is committed to protecting its formidable IP assets Investments in IP protection has generated substantial returns from both legal settlements and IP royalties 38 DOES ENZO APPEAR TO NEED THE HELP OF LONE STAR’S “IP EXPERTS?” 2011 - 16 Total Through 1 st Quarter of Fiscal 2016 Total Legal Fee Expense ($27.5) Legal Settlements, Net 34.4 IP Royalties 26.0 Net Gain 32.9 ($ in millions) $27.5 $60.4 $- $10 $20 $30 $40 $50 $60 $70 $80 Amount Spent Amount Received (1) Includes all legal expenses as reported DURING THE PAST FIVE YEARS , ENZO’S SETTLEMENT AND LICENSING REVENUE WAS TWICE AS LARGE AS THE COMPANY’S TOTAL LEGAL EXPENSE AND CONTRIBUTED TO THE COMPANY’S CASH RESERVES Total Legal Expenditures (1) vs. Return Through 1 st Quarter of Fiscal 2016 ($ in millions)

39 WHO IS LONE STAR? The assertion that Lone Star’s nominees are independent is laughable (see pages 61 - 65) Lone Star’s assertion that it has a “long term focus” is not substantiated by the facts (see page 31) Indeed Mr. Eberwein does have “extensive board experience” as he has sat on 11 different public boards (see page 62) . Does that seem like someone with a “long - term focus”? Should anyone be a Chairman of five public companies at one time while also running a hedge fund? Does this seem responsible? Lone Star’s track record is overwhelmingly negative with respect to creating value for shareholders (see pages 66 - 82) Source: Lone Star Investor Presentation filed December 17, 2015

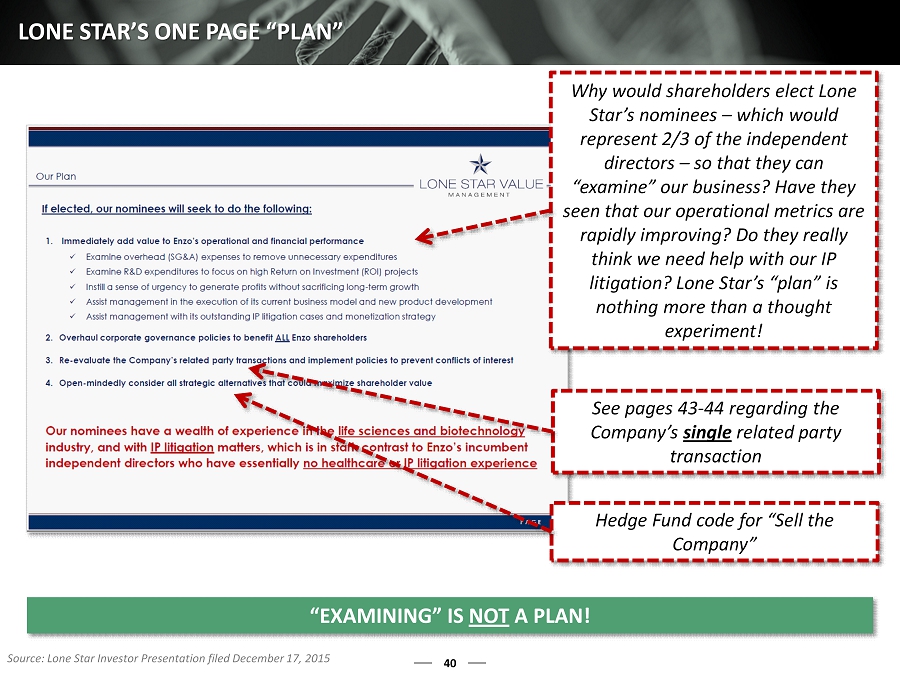

40 LONE STAR’S ONE PAGE “PLAN” “EXAMINING” IS NOT A PLAN! Why would shareholders elect Lone Star’s nominees – which would represent 2/3 of the independent directors – so that they can “examine” our business? Have they seen that our operational metrics are rapidly improving? Do they really think we need help with our IP litigation? Lone Star’s “plan” is nothing more than a thought experiment! Hedge Fund code for “Sell the Company” See pages 43 - 44 regarding the Company’s single related party transaction Source: Lone Star Investor Presentation filed December 17, 2015

41 LONE STAR NOMINEES HAVE NO PLAN Enzo acknowledges that the Company has yet to achieve its full potential We have been executing on a multi - year strategic plan to dramatically improve performance and create sustained value for shareholders Our strategy is beginning to bear the fruit of this effort, and the market is beginning to appreciate Enzo’s potential Despite Mr. Eberwein’s admission that he “ did not understand our business, ” we thoroughly interviewed and vetted Lone Star nominees and specifically requested they share ideas on how they can increase the value of Enzo In our meetings with Mr. Climaco and Mr. Angelis, they did not offer a single strategic suggestion for Enzo’s business In fact, both gentlemen had high praise for the accomplishments of the current Board Lone Star makes NO MENTION of any plan in their proxy LONE STAR IS SEEKING a 67% control of independent directors WITH NO IDEAS AND NO PLAN Source: Lone Star Schedule 14A, filed with SEC on December 2, 2015 (1) Lone Star discussion with the Company The single “plan” page presented to ISS combined with aggressive selling of Enzo stock makes us wonder if Lone Star is taking its investment in Enzo seriously

42 “SETTLEMENT OFFER” ENZO REFUSES TO “SETTLE” WITH NOMINEES WHO HAVE ZERO IDEAS AND AN ABYSMAL TRACK RECORD ▪ It would have been remarkably easy for us to have simply expanded the Board and add a Lone Star nominee to avoid the expense and distraction of a contested election ▪ However , we obviously have genuine and serious concerns about Lone Star and its nominees ▪ After thorough examination of their record and after meeting with each nominee – we could not agree to “just add one” ▪ We take our fiduciary responsibility to our shareholders very seriously and could not in good conscience accept either of Lone Star’s nominees simply because it was the easy thing to do Source: Lone Star Investor Presentation filed December 17, 2015

43 “RELATED PARTY TRANSACTIONS” THIS SINGLE RELATED PARTY TRANSACTION IS NOT A “NON - ISSUE” IT IS IN FACT AN EXCELLENT ARRANGEMENT FOR ENZO SHAREHOLDERS Lone Star’s attempt to depict the Company’s clinical lab lease as somehow unfair or enriching the management team at the expense of shareholders, we believe, demonstrates either (1) a complete misunderstanding of the facts, or (2) a further attempt to potentially mislead shareholders HOW WOULD LONE STAR SUGGEST IMPROVING THIS STRUCTURE? Source: Lone Star Investor Presentation filed December 17, 2015

44 “RELATED PARTY TRANSACTIONS” In its preliminary proxy statement, Lone Star expresses concerns regarding the Company’s “ related - party transactions” Although Lone Star repeatedly states "transactions ” to suggest that there are multiple, there is, in fact, a single related - party transaction which has been in place for 25 years and is unquestionably beneficial for Enzo’s shareholders The one and only related - party transaction that Lone Star is concerned with is the Company’s lease of its clinical lab in Farmingdale, NY We believe this criticism is not only disingenuous, but it also demonstrates a complete lack of knowledge of Enzo and the lab industry In 1990, Enzo was experiencing financial challenges and was in dire need of an expanded laboratory facility in order to grow its business. To address this challenge, an LLC supported by the founders of the Company acquired a property in Long Island and immediately structured a market - rate lease for the Company Lone Star questions “why Enzo did not purchase the facility outright from the beginning ” Quite simply, Enzo did not have the capital at such time; f urthermore, this is a question of capital allocation – Would shareholders really want an emerging B iotech Company to use its capital to acquire real estate? Not only could Enzo not have just “purchased the facility outright,” they also did not have the financial profile to secure a lease from an independent party Since that time , all of the rent increases for the lab have been associated with significant square footage expansions, increases in real estate tax rates (nnn lease), and regional cost of living adjustments At inception, the facility was ~25,000 square feet and today is ~43,000 square feet Significant adjustments and annual variability in Long Island real estate tax rates, which are a simple pass - through and standard for nnn leases The independent members of the Board have retained CB Richard Ellis to review all lease renewals to ensure that the rates and terms are fair and customary Finally, moving locations for a clinical lab is extraordinarily challenging, both logistically and financially The stability provided by the current structure is tremendously favorable and has given the Company the latitude to sustainably grow and innovate Source: Lone Star Schedule 14A, filed with SEC on December 2, 2015

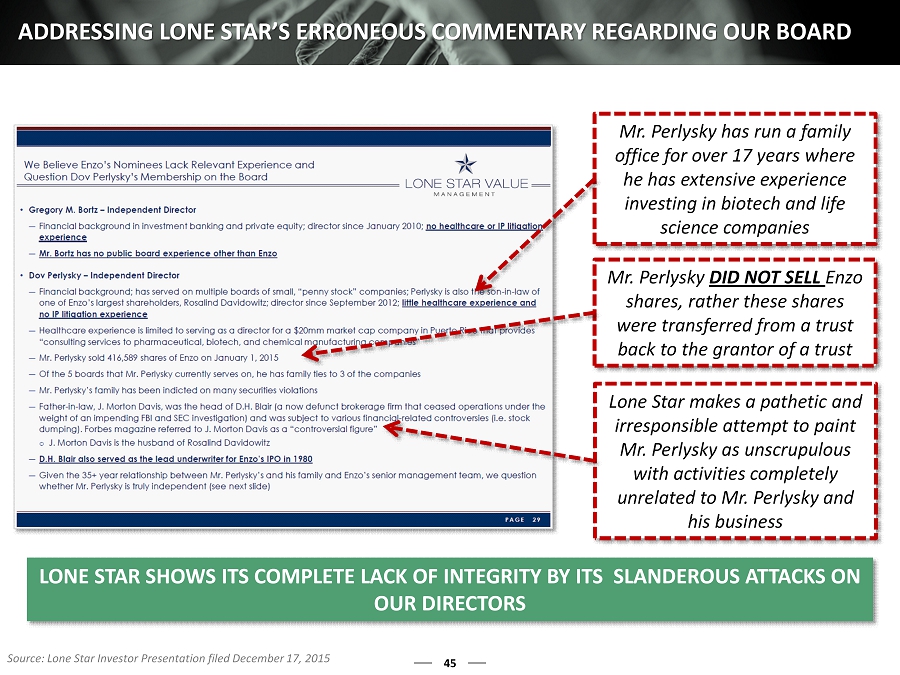

45 ADDRESSING LONE STAR’S ERRONEOUS COMMENTARY REGARDING OUR BOARD LONE STAR SHOWS ITS COMPLETE LACK OF INTEGRITY BY ITS SLANDEROU S ATTACKS ON OUR DIRECTORS Mr. Perlysky has run a family office for over 17 years where he has extensive experience investing in biotech and life science companies Source: Lone Star Investor Presentation filed December 17, 2015 Mr. Perlysky DID NOT SELL Enzo shares, rather these shares were transferred from a trust back to the grantor of a trust Lone Star makes a pathetic and irresponsible attempt to paint Mr. Perlysky as unscrupulous with activities completely unrelated to Mr. Perlysky and his business

46 LONE STAR IS DRAGGING FAMILY MEMBERS INTO ITS PROXY FIGHT • This slide that Lone Star put forward to ISS is an attempt to tie Mr. Perlysky to certain members of his wife’s family in another effort to characterize Mr. Perlysky as somehow immoral or involved in criminal activity. This is absolutely ridiculous. • Does Lone Star have any REAL ISSUES or REAL IDEAS? BECAUSE LONE STAR HAS NO IDEAS FOR ENZO’S BUSINESS – THEY HAVE RESORTED TO DISINGENUOUS PERSONAL ATTACKS Source: Lone Star Investor Presentation filed December 17, 2015

47 OUR BOARD HAS AN EXCELLENT TRACK RECORD • The original investors joining Mr. Perlysky into the company paid $0.50/share . A later financing was done at $0.72 share. The company now trades at $ 1.00 per share. The company went from $ 147 thousand to $ 22 million in stockholder equity and currently has close to $ 15 million cash on hand • News Communications is a closely held company whose shares have recently sold for $148.00 • Non - filer due to it being a closely held company – we expect solid returns • Mr . Perlysky was instrumental in refinancing and turning Oak Tree around • Mr. Perlysky is a director of Engex , a closed - end mutual fund which holds a significant position in Enzo stock • Although Mr. Perlysky is a director – he has no control over the composition of Engex’s portfolio – however – the one thing Mr. Perlysky could do – was join the board of an Engex portfolio company to help that Company create value • Since joining the Enzo Board, ENZ has appreciated approximately 100 % while Engex share price has increased approximately 150% and the NAV has almost tripled • Mr. Perlysky is a founding investor in Highlands State Bank. The Bank grew from $0 - $ 300 million in assets and now has four branches. The stock price has appreciated 60% since the 2008 banking crisis . Since joining the board, Stockholder equity is up from $ 8.7 million to over $ 24 million and the share price is up from $7.50 to $8.00 • Due to the 2012 Jobs Act, the company does not have enough shareholders to require an SEC filing. Therefore the company files a quarterly call report with the FDIC, Shareholder Annual Reports, and quarterly press releases Source: Lone Star Investor Presentation filed December 17, 2015

48 DIRECTOR QUALIFICATIONS Mr. Bortz has made a career out of helping companies maximize their potential and improve operating performance – it is his primary expertise Mr. Bortz been a director of Enzo since 2010 Mr. Perlysky is an engaged investor who regularly works with portfolio companies to improve performance – it is his primary expertise Enzo is NOT in restructuring and its recent performance has been excellent Mr. Perlysky has extensive M&A experience as both a director and lead investor Enzo has retained a premier IP litigation firm and the results of the litigation have been phenomenal Source: Lone Star Investor Presentation filed December 17, 2015

49 Enzo does not need another lawyer OTI was not a success under Mr. Angelis (see page 50) Why was Mr. Angelis tenure at Wockhardt and Osteotech so short? LONE STAR NOMINEE: DIMITRIOS ANGELIS Source: Lone Star Investor Presentation filed December 17, 2015 All three of Mr. Angelis’ public boards have been with Mr. Eberwein (see page 62)

50 LONE STAR NOMINEE: DIMITRIOS ANGELIS Mr. Angelis is currently on the boards of Digirad (with Mr. Eberwein and Mr. Climaco) and Ameri100 Mr. Angelis’ most recent full - time position was serving as CEO of On Track Innovations (where Mr. Eberwein, Mr. Gillman, and Mr. Singh were all on the Board), and during his tenure saw approximately a 20% decrease in value Mr. Angelis has been on three public company boards – all of which Jeff Eberwein has also been a director We wonder if Mr. Angelis is essentially a proxy for Mr. Eberwein and whether Mr. Angelis feels obligated to do Lone Star’s bidding, losing any sense of “independence” Mr. Angelis Tenure at OTI Mr. Angelis’ principal background is that of a lawyer If elected to the Enzo Board, Mr. Angelis will be replacing a valuable contributor to the Company’s strategy and recent success Finally, we believe that Mr. Angelis’ nomination by Lone Star represents yet another example of what we believe is poor judgement by Mr. Eberwein who appears to have simply chosen a close “ally” rather than a director with the unique skills to add value to Enzo and its shareholders Source: FactSet

51 LONE STAR NOMINEE: JOHN CLIMACO Is a director at Perma - Fix and then pivoted to become a full - time employee See Infusystems case study (page 73 - 74) Digirad is now a customer of Perma - Fix and Digirad is now a shareholder of Perma - Fix. Does that seem appropriate? Digirad made an unsolicited bid for PDI. Is that a coincidence? Axial was a money - losing venture Eberwein, Climaco , and Angelis are ALL on the board of Digirad . Source: Lone Star Investor Presentation filed December 17, 2015

52 LONE STAR NOMINEE: JOHN CLIMACO If Mr. Climaco was so proud of his accomplishments at Alco, why did he leave these details out of his list of “public board experience” when he presented Enzo’s nominating committee with his resume? (See page 55) Source: Lone Star Investor Presentation filed December 17, 2015 Enzo is NOT in a difficult financial position given its improving results and strong balance sheet

53 LONE STAR NOMINEE: JOHN CLIMACO Enzo’s management team has known Mr. Climaco for approximately three years We were first introduced to Mr. Climaco when he approached Enzo in an effort to explore channels of distribution for his Axial Biotech product, which we turned down after being entirely unimpressed with both Mr. Climaco and Axial’s product Mr . Climaco was the Founder, President, and CEO of Axial Biotech, which was founded in 2003 and funded for ~$25.3 million and sold for ~$ 4.4 million to Transgenomic – a loss of approximately 80% (1) We have been unable to determine if this product has made any profit for its current owner, nor did Mr. Climaco provide this information Mr. Eberwein claims that Mr. Climaco would make a good candidate because of his “nine years as a CEO of a company involved in clinical lab services” (2) Based on the failures of Axial Biotech, we have to question both Mr. Eberwein’s judgment and Mr. Climaco’s relevant experience In spite of this, Lone Star offered to have Enzo simply accept Mr. Climaco to the Board as part of a proposed settlement agreement It would have been remarkably easy for us to have simply expanded the Board and added Mr. Climaco to avoid the expense and distraction of a contested election. However , we obviously have genuine and serious concerns about Mr. Climaco after thorough examination of his record Additionally, when asked by Enzo to furnish his resume in advance of a meeting with the nominating committee of our Board, Mr. Climaco presented a list of his “Public Board Experience” Omitted from Mr. Climaco’s list of previous public board experience was ALCO Stores , which ended up in Chapter 11 bankruptcy during his directorship MR. CLIMACO IS OBVIOUSLY NOT AN ACCEPTABLE CANDIDATE FOR ENZO, A ND HIS UNIMPRESSIVE AND MISLEADING TRACK RECORD DOES NOT INSPIRE CONFID ENCE THAT HE COULD ADD ANY TRUE VALUE TO THE ENZO BOARD (1) Capital IQ (2) Lone Star Schedule 14A, filed with SEC on December 2, 2015

54 We are concerned that a Lone Star nominee failed to disclose significant facts in his background and only disclosed them upon questioning by our Nominating and Governance Committee

55 JOHN CLIMACO CASE STUDY: ALCO STORES (100%) -120.0% -100.0% -80.0% -60.0% -40.0% -20.0% 0.0% February 18, 2014: Concerned ALCO Stockholders (“CAS”) announced its intent to nominate board candidates in ALCO’s 2014 election August 29, 2014: ALCO announced the completion of its annual meeting where all seven nominees of CAS, including John Climaco, were elected to replace the board October 12, 2014: ALCO files for BANKRUPTCY Source: FactSet (1) Concerned ALCO Stockholders press release, April 3, 2014 April 3, 2014 : “CAS is a group dedicated to maximizing stockholder value and improving corporate governance at ALCO” (1)

56 LONE STAR’S “CONCLUSION” Enzo’s stock is up more than 70% in the last three years and 55% in the last three months WHAT PLAN? Source: Lone Star Investor Presentation filed December 17, 2015 HOW CAN LONE STAR ASSERT THEY HAVE A “BETTER PLAN” WHEN THEY DON’T HAVE ANY PLAN

December 2015 www.enzo.com Additional Background on Lone Star 57

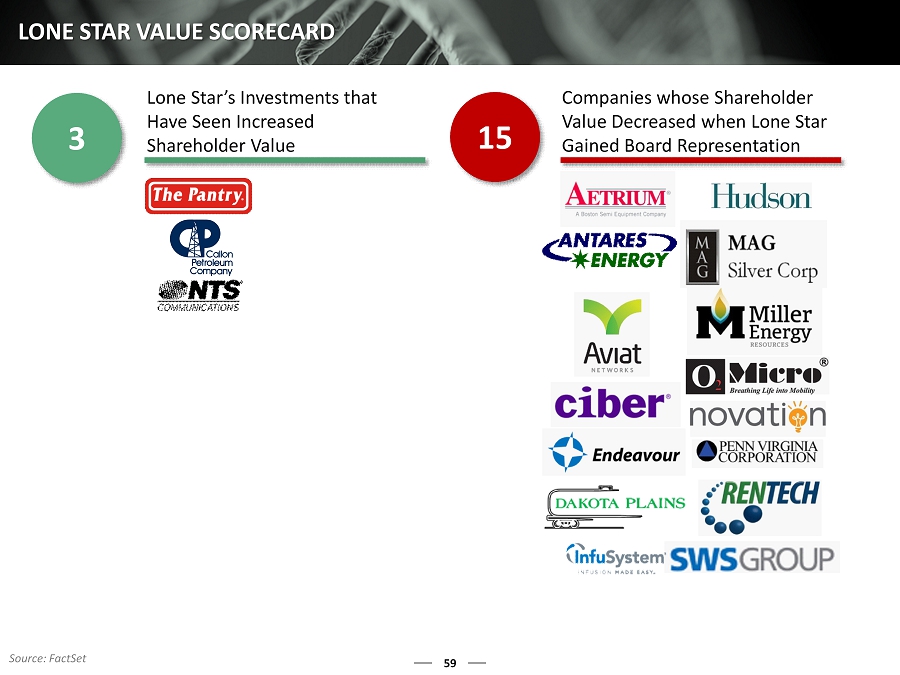

58 We believe that Mr. Eberwein’s track record as an activist investor and corporate director appears to be quite poor S ince starting his activist fund in 2012, Mr. Eberwein has been one of the most activist investors in the U.S., routinely targeting smaller - cap companies in diverse industries and repeatedly putting forward an unimpressive cast of related nominees for consideration Although Mr. Eberwein appears to have been successful as a serial short - term activist by achieving settlements at many companies and has himself sat on 11 public boards , closer examination indicates an overwhelming and disturbing pattern of value destruction, as discussed in the following pages We believe that Mr. Eberwein anticipated Enzo would join his rapidly growing list of “success stories”; however, Enzo has worked too hard and come too far to passively allow Mr. Eberwein or his “independent” nominees to disrupt the Company’s current trajectory Enzo has analyzed Mr. Eberwein’s “strategy,” or lack thereof, and has determined that his platform provides no benefit for shareholders We respect the input of shareholders, which is why Dov Perlysky, who Mr. Eberwein wants to replace, currently sits on our board LONE STAR’S POOR TRACK RECORD EXAMINING THE POOR TRACK RECORD OF LONE STAR AND ITS NOMINEES, COMBINED WITH A COMPLETE LACK OF ANY PLAN , WHY WOULD SHAREHOLDERS WANT THEM ON THE ENZO BOARD? Note: Includes situations in which Eberwein or Lone Star made a public disclosure of activist intents. Excludes: 13D filings in which no specific activism initiative was disclosed (e.g., Crossroads Systems, Digirad), M&A activism that is campaigns against an announced transaction (e .g., Nabi Biopharmaceuticals), situations that are ongoing (e.g., Edgewater Technology), and situations that lasted less than one month (e .g., Lucas Energy)

Lone Star’s Investments that Have Seen Increased Shareholder Value 59 LONE STAR VALUE SCORECARD Companies whose Shareholder Value Decreased when Lone Star Gained Board Representation 15 3 Source: FactSet

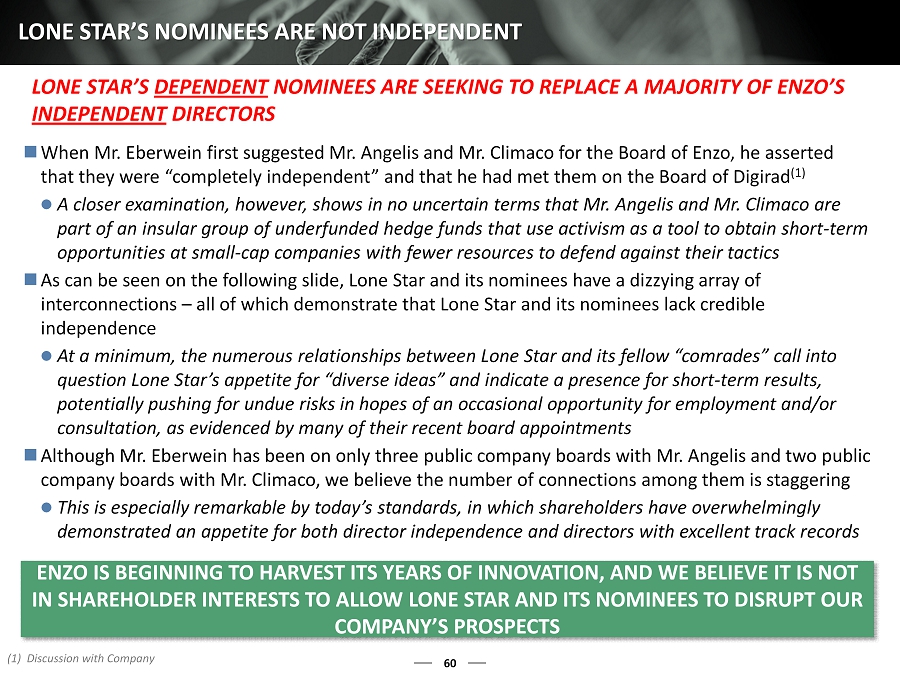

60 LONE STAR’S NOMINEES ARE NOT INDEPENDENT When Mr. Eberwein first suggested Mr. Angelis and Mr. Climaco for the Board of Enzo, he asserted that they were “completely independent” and that he had met them on the Board of Digirad (1) A closer examination, however, shows in no uncertain terms that Mr. Angelis and Mr. Climaco are part of an insular group of underfunded hedge funds that use activism as a tool to obtain short - term opportunities at small - cap c ompanies with fewer resources to defend against their tactics As can be seen on the following slide, Lone Star and its nominees have a dizzying array of interconnections – all of which demonstrate that Lone Star and its nominees lack credible independence At a minimum, the numerous relationships between Lone Star and its fellow “comrades” call into question Lone Star’s appetite for “diverse ideas” and indicate a presence for short - term results, potentially pushing for undue risks in hopes of an occasional opportunity for employment and/or consultation, as evidenced by many of their recent board appointments Although Mr. Eberwein has been on only three public company boards with Mr. Angelis and two public company boards with Mr. Climaco, we believe the number of connections among them is staggering This is especially remarkable by today’s standards, in which shareholders have overwhelmingly demonstrated an appetite for both director independence and directors with excellent track records ENZO IS BEGINNING TO HARVEST ITS YEARS OF INNOVATION, AND WE BEL IEVE IT IS NOT IN SHAREHOLDER INTERESTS TO ALLOW LONE STAR AND ITS NOMINEES TO DISRUPT OUR COMPANY’S PROSPECTS (1) Discussion with Company LONE STAR’S DEPENDENT NOMINEES ARE SEEKING TO REPLACE A MAJORITY OF ENZO’S INDEPENDENT DIRECTORS

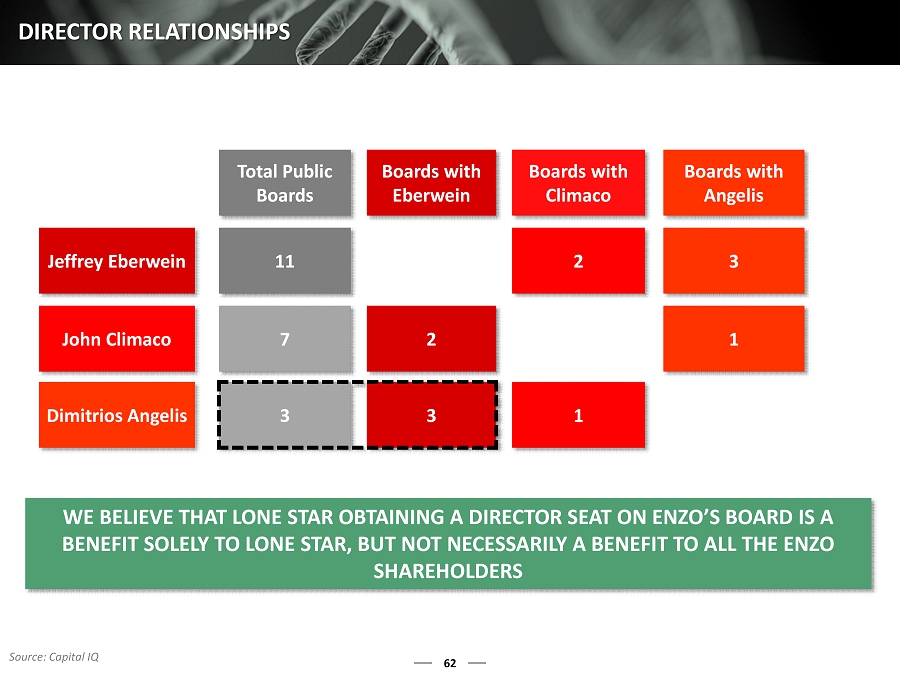

61 INDEPENDENT DIRECTORS? Jeff Eberwein Dimitrios Angelis John Climaco Chuck Gillman Dilip Singh Supporter Largest Shareholder Largest Shareholder Richard Coleman Jr. Boston Avenue Capital, LLC Proponent Source: FactSet BANKRUPT (Climaco is EVP of parent company)

62 DIRECTOR RELATIONSHIPS WE BELIEVE THAT LONE STAR OBTAINING A DIRECTOR SEAT ON ENZO’S BO ARD IS A BENEFIT SOLELY TO LONE STAR, BUT NOT NECESSARILY A BENEFIT TO AL L THE ENZO SHAREHOLDERS Total Public Boards Boards with Eberwein Boards with Climaco Boards with Angelis Jeffrey Eberwein 11 2 3 John Climaco 7 2 1 Dimitrios Angelis 3 3 1 Source: Capital IQ

63 LACK OF INDEPENDENCE: DIGIRAD’S FAILED BID FOR PDI In October 2013, John Climaco joined the Board of PDI, Inc. On October 29, 2014, John Climaco resigned from PDI’s Board of Directors On October 29, 2014, the same day as Climaco’s resignation , Digirad, where Mr. Eberwein is a director, sent a letter to PDI expressing its willingness to acquire PDI John Climaco was also on the Digirad Board of Directors at the time, and on the same day he left PDI’s Board, Digirad attempted to acquire PDI On October 29, 2014, the PDI Board declined Digirad’s offer, claiming it “does not consider PDI for sale and does not view [Digirad’s] letter to be a meaningful offer” On October 31, 2014, Digirad sent a letter to PDI questioning whether the PDI Board was acting in the best interest of shareholders Digirad claimed PDI was “showing its disregard for stockholder rights and stockholder value by refusing to consider a potentially significant value - enhancing transaction” Digirad also claimed that this was an “unacceptable response for a board that has presided over such a tremendous destruction of stockholder value” Climaco was on the Board of PDI during this period of “tremendous destruction,” yet he was also part of the Digirad Board that was attacking the PDI Board’s performance – we question Mr. Climaco’s independence in these interactions It is important to note that Chuck Gillman (also a member of the Digirad Board along with Eberwein, Climaco, and Angelis) is the founder of Boston Avenue Capital, a business partner with Heartland Advisors, the largest shareholder of PDI, Inc. Dimitrios Angelis was named to the Digirad Board in July of 2015 WE ARE CONCERNED THAT CLIMACO , EBERWEIN, AND GILLMAN ARE CERTAINLY NOT “INDEPENDENT DIRECTORS” Source: FactSet

64 WHAT’S GOING ON AT DIGIRAD ? On July 24, 2015, the Company’s majority - owned Polish subsidiary, Perma - Fix Medical and Digirad Corporation, a Delaware corporation (“ Digirad ”), Nasdaq: DRAD, entered into a multi - year Tc - 99m Supplier Agreement (the “Supplier Agreement”) and a Series F Stock Subscription Agreement (the “Subscription Agreement”), (together, the “ Digirad Agreements”). The Supplier Agreement is effective upon the completion of the Subscription Agreement. Perma - Fix Medical was formed to develop and commercialize a new process to produce Technetium - 99 (“Tc - 99m”), the most widely used medical isotope in the world. Pursuant to the terms of the Digirad Agreements, Digirad purchased 71,429 shares of Perma - Fix Medical’s restricted Series F Stock for an aggregate purchase price of $1,000,000 . Under Polish law, issuance of shares requires approval of the shares by the Polish court which is expected to occur in the third quarter of 2015. In the event that the shares are not approved by the Polish co urt within 120 days from the date of payment by Digirad to Perma - Fix Medical of the $1,000,000 purchase price on July 24, 2015, Perma - Fix Medical and Digirad have agreed that Perma - Fix Medical will return the $1,000,000 to Digirad and the Digirad Agreements shall terminate. The 71,429 share investment made by Digirad , when completed, will constitute approximately 5.4% of the outstanding common shares of Perma - Fix Medical. Upon issuance of the 71,429 shares to Digirad , the Company’s ownership interest in Perma - Fix Medical would be diluted from approximately 64.0% to approximately 60.5%. The Supplier Agreement provides, among other things, that upon Perma - Fix Medical’s commercialization of certain Tc99m generators, Digirad will purchase agreed upon quantities of Tc - 99m for its nuclear imaging operations either directly or in conjunction with its preferre d nuclear pharmacy supplier and Perma - Fix Medical will supply Digirad , or its preferred nuclear pharmacy supplier, with Tc - 99m at a preferred pricing, subject to certain conditions. Mr. Climaco is a Director of the Company and Executive Vice - President of Perma - Fix Medical. Mr. Climaco is also a Director of Digirad . Mr. Climaco abstained in connection with the Board’s approval of the above transactions with Digirad . Permiafix DEF 14A, 8/13/2015 (emphasis added) EBERWEIN, CLIMACO , AND ANGELIS ALL SIT ON THE BOARD OF DIGIRAD WHY IS DIGIRAD ACQUIRING STOCK IN PERMAFIX WHERE CLIMACO IS A DIRECTOR AND EMPLOYEE?

65 DIGIRAD AND PERMAFIX NOW PERMAFIX HAS A SLIDE ON DIGIRAD IN ITS INVESTOR PRESENTATION, WHY? Source: Perma - Fix Medical Investor Presentation, June 2015

66 JEFFREY EBERWEIN CASE STUDY: AETRIUM -80.0% -60.0% -40.0% -20.0% 0.0% 20.0% 40.0% 60.0% 80.0% August 14, 2012: Jeffrey Eberwein and Archer Advisors LLC filed a joint Schedule 13D (Concerned Aetrium Shareholders (“CAS”)) reporting a 16.7 % stake in the Company November 29, 2012: CAS filed a lawsuit claiming that Aetrium violated shareholder rights by changing the quorum rule and the rules for adjourning a shareholder meeting December 20, 2012: CAS issued a press release announcing that the judge ruled in favor of Aetrium and the meeting results would be considered final February 1, 2013: Aetrium and CAS reached a settlement agreement which would allow 5 members of CAS to join the board March 13, 2013: Three more CAS nominees (including Eberwein) were added to the Board (54.1%) Source: FactSet

67 LONE STAR CASE STUDY: ANTARES “The Board of Directors believe Lone Star Value Management brought nothing of merit to Antares and the lack of veracity of their statements was clearly demonstrated by the failure of Jeffrey Eberwein to attend the General Meeting he imposed upon Shareholders at which he and his group’s proposals all failed and were rejected by Shareholders .” Antares Energy Limited Annual Report, March 31, 2015 -100.0% -80.0% -60.0% -40.0% -20.0% 0.0% 20.0% 40.0% 60.0% May 14, 2014: Lone Star, a 5.3% holder in Antares Energy, announced its intention to call an extraordinary general meeting to elect five new directors to the B oard July 22, 2014: At the special meeting called by Lone Star, shareholders voted in favor of the company October 8, 2014 : Antares sold Northern Star and Big Star on 9/7/2015 for $253.9 million, and the stock ceased trading after 10/8/2015 (20.0%) Source: FactSet

68 LONE STAR CASE STUDY: AVIAT -50.00% -40.00% -30.00% -20.00% -10.00% 0.00% 10.00% 20.00% October 6, 2014: Lone Star issues a press release and disclosed its intent to nominate six candidates for election to Aviat’s board at the 2014 annual meeting January 12, 2015: Aviat announced the reaching of an agreement with Steel Partners and Lone Star. Under the agreement, the company appointed two Steel Partners nominees and two Lone Star nominees to the Board (47.1%) Source: FactSet

69 LONE STAR CASE STUDY: CIBER -45.0% -40.0% -35.0% -30.0% -25.0% -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% February 27, 2014: Lone Star submitted formal notice to nominate three candidates to CIBER’s Board at the 2015 annual meeting April 20, 2014: CIBER announced the nomination of a new independent director and incumbent Lone Star candidate Richard Coleman. The company also decreased the size of its B oard from nine to eight directors (26.9%) Source: FactSet

-90.00% -80.00% -70.00% -60.00% -50.00% -40.00% -30.00% -20.00% -10.00% 0.00% 10.00% 70 LONE STAR CASE STUDY: DAKOTA PLAINS HOLDINGS December 15, 2014: Lone Star, a 7.3% holder, urged the company’s B oard to use a Master Limited Partnership for the Pioneer transloading business and to initiate a review of strategic alternatives February 12, 2015: The company announced the addition of a new strategy c ommittee to evaluate strategic alternatives and named two independent directors to the Board July 23, 2014: Lone Star’s director of research is appointed to the Dakota Plains Board (83.1%) Source: FactSet

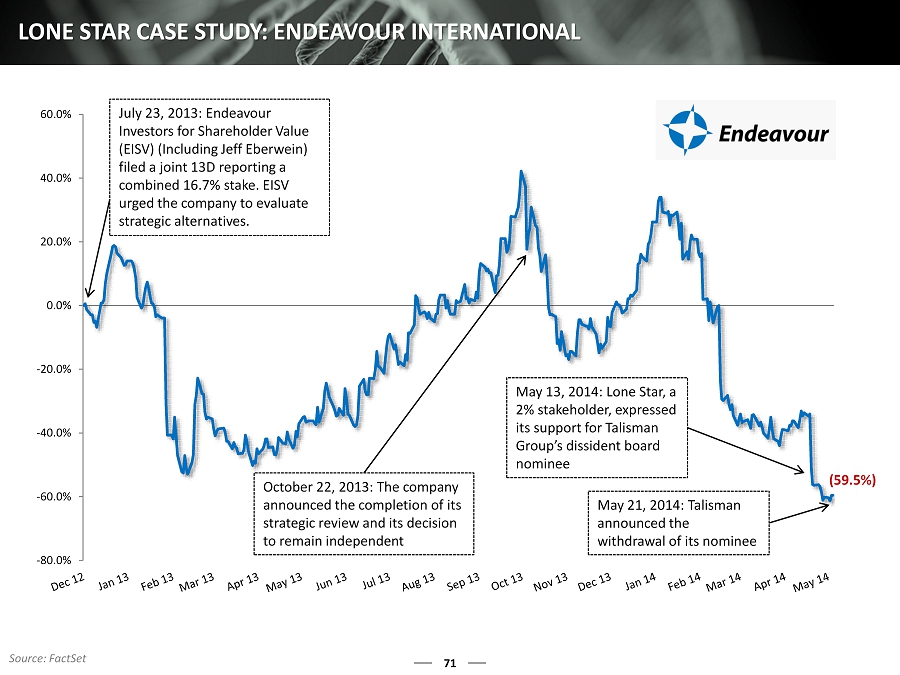

-80.0% -60.0% -40.0% -20.0% 0.0% 20.0% 40.0% 60.0% 71 LONE STAR CASE STUDY: ENDEAVOUR INTERNATIONAL July 23, 2013: Endeavour Investors for Shareholder Value (EISV) (Including Jeff Eberwein) filed a joint 13D reporting a combined 16.7% stake. EISV urged the company to evaluate strategic alternatives. October 22, 2013: The company announced the completion of its strategic review and its decision to remain independent May 13, 2014: Lone Star, a 2% stakeholder, expressed its support for Talisman Group’s dissident board nominee May 21, 2014: Talisman announced the withdrawal of its nominee (59.5%) Source: FactSet

- 64.1% -80.0% -60.0% -40.0% -20.0% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 72 JOHN CLIMACO CASE STUDY: ESSEX RENTAL CORP. February 26, 2015: Casey Capital LLC filed Schedule 13D June 5, 2015: Essex announced the Board’s decision to accept the nomination of John Keddie and John Climaco to the board Source: FactSet December 9, 2015: Essex announces intent to delist and deregister common stock

73 INFUSYSTEM CASE STUDY A COMPANY FOUNDED BY CHUCK GILLMAN AND SUPPORTED BY JEFFREY EBER WEIN ENTERED A SETTLEMENT WITH INFUSYSTEM TO PLACE CHUCK GILLMAN, JOHN CLIMACO, AND DILIP SINGH ON THE BOARD On January 18, 2012, Meson Capital Partners, Kleinheinz Capital Partners, and Boston Avenue Capital filed a preliminary proxy statement seeking the support to call a special meeting to replace InfuSystem’s entire board Reasons for the proxy battle included poor stock performance and high compensation paid to executives On February 24, 2012, Jeffrey Eberwein expressed support for the campaign of the “Kleinheinz Dissident Group” to replace the InfuSystem Board of Directors Boston Avenue Capital, founded by Chuck Gillman, was part of the Kleinheinz Group supported by Eberwein The Dissident group called for special meeting to replace the InfuSystem Board with a slate that, according to Eberwein, “has the right experience based on the successful performance of several investments in which certain members of the Dissident group have been involved” On February 6, 2012, InfuSystem released a statement claiming the dissident nominees “ have not articulated any plans or proposals for InfuSystem or provided any information as to what actions they might undertake if they were to seize control of InfuSystem” Eberwein, Climaco, and Gillman campaigned for board seats based on past investment experience, placing no emphasis on industry expertise or tangible management plans On February 27, 2012, Glass Lewis recommended that shareholders reject the dissident’s effort to call special meeting, statin g “the Company’s policies provide for adequate procedures to allow shareholders to nominate their own director candidates for election at an annual meeting ” On February 27, 2012, the Kleinheinz Dissident Group delivered a request to call special meeting after obtaining 50.19% of vo tes On April 24, 2012, InfuSystem announced that it had reached a settlement with the Kleinheinz Group John Climaco, Chuck Gillman, and Dilip Singh were named to the B oard, and Dilip Singh became the interim CEO Dilip Singh is the Chairman of On Track Innovations, where Eberwein and Angelis are ex - board members Source: FactSet

- 11.52% -30.00% -25.00% -20.00% -15.00% -10.00% -5.00% 0.00% 5.00% 10.00% 15.00% 20.00% 74 INFUSYSTEM CASE STUDY (CONT.) 68.64% -40.00% -20.00% 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 120.00% 140.00% 160.00% 180.00% Stock Performance with Climaco on Board Stock Performance after Climaco Left the Board January 24, 2012: Meson Capital, Kleinheinz Capital, and Boston Capital launch campaign to replace entire Board April 24, 2012: Through a settlement, Chuck Gillman, John Climaco, and Dilip Singh appointed to Board, and Singh is named interim CEO March 14, 2013: Eric Steen replaces Dilip Singh as CEO April 4, 2013: John Climaco steps down from Board Source: FactSet

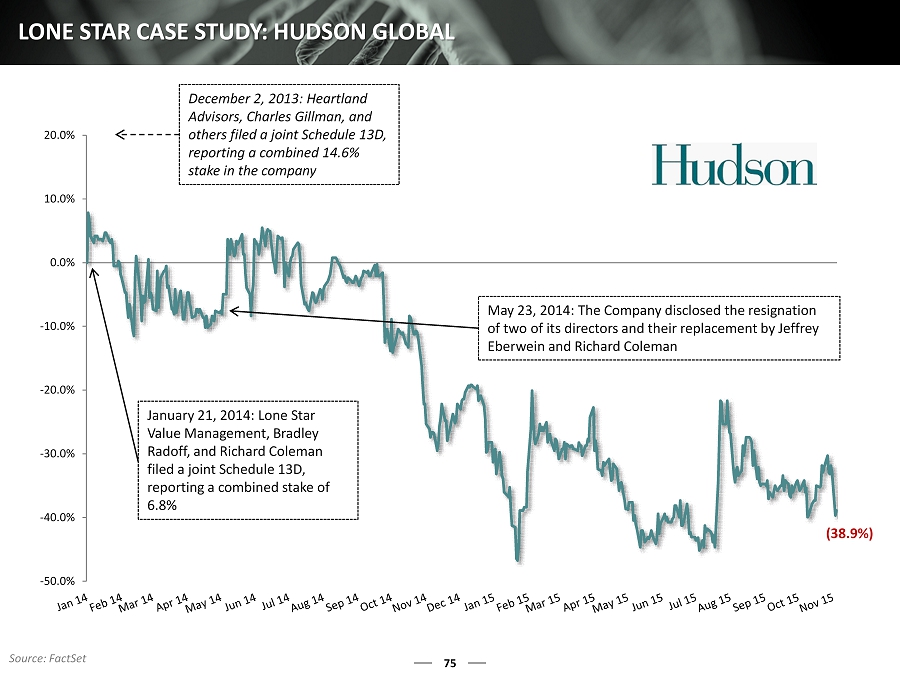

75 LONE STAR CASE STUDY: HUDSON GLOBAL -50.0% -40.0% -30.0% -20.0% -10.0% 0.0% 10.0% 20.0% January 21, 2014: Lone Star Value Management, Bradley Radoff, and Richard Coleman filed a joint Schedule 13D, reporting a combined stake of 6.8% December 2, 2013: Heartland Advisors, Charles Gillman, and others filed a joint Schedule 13D, reporting a combined 14.6% stake in the company May 23, 2014: The Company disclosed the resignation of two of its directors and their replacement by Jeffrey Eberwein and Richard Coleman (38.9%) Source: FactSet

76 EBERWEIN CASE STUDY: MAG SILVER -60.0% -50.0% -40.0% -30.0% -20.0% -10.0% 0.0% 10.0% 20.0% 30.0% 40.0% April 3, 2012: Mason Hill Advisors filed a Schedule 13D, reporting an 8.5% stake in the Company and that it had engaged in strategic alternatives discussions with the company June 29, 2012: Jeffrey Eberwein, Charles Gillman, and CCM Opportunistic Advisors joined Mason Hill and filed a joint 13D, expressing concerns September 5, 2012: The company announced a settlement agreement with the dissident group and appointed two dissident nominees to the Board (34.2%) Source: FactSet

-120.0% -100.0% -80.0% -60.0% -40.0% -20.0% 0.0% 77 LONE STAR CASE STUDY: MILLER ENERGY December 17, 2013: Concerned Miller Shareholders (CMS), led by Bristol Capital Advisors and Lone Star, 4.7% holders, disclosed the nomination of 10 board members at Miller’s 2014 annual meeting March 31, 2014: The company reached an agreement with CMS and agreed to nominate Lone Star nominee governor Bill Richardson to the Board September 16, 2015: Bill Richardson resigns from the Board October 1, 2015: Miller Energy files for BANKRUPTCY (99.8%) Source: FactSet

78 LONE STAR CASE STUDY: NOVATION -60.00% -40.00% -20.00% 0.00% 20.00% 40.00% 60.00% 80.00% April 22. 2015: Novation Companies announced in a press release a settlement agreement with Lone Star. Per the agreement, the company would appoint Jeffrey Eberwein and Robert G. Pearse to the Board. The company also agreed to declassify the Board at the 2016 annual meeting (35.3%) Source: FactSet

79 LONE STAR CASE STUDY: O2MICRO -30.0% -20.0% -10.0% 0.0% 10.0% 20.0% 30.0% 40.0% November 25, 2014: Lone Star filed a Schedule 13D, reporting a stake of 5.6% in O2Micro. It proposed that the company streamline operations, repurchase shares/issue a dividend, liquidate long - term equity investments, and license its IP to maximize shareholder value February 2, 2015: Lone Star sent a letter to stockholders noting its concern over O2Micro’s “abysmal” stock performance and poor revenue and cost management measures. It noted that a change in the Board was necessary (21.8%) Source: FactSet

80 LONE STAR CASE STUDY: PENN VIRGINIA CORPORATION -100.0% -90.0% -80.0% -70.0% -60.0% -50.0% -40.0% -30.0% -20.0% -10.0% 0.0% June 26, 2015: Lone Star, a 2.8% holder owning 1.975 million shares of Penn Virginia stock, issued a press release suggesting the company assesses strategic alternatives September 30, 2015: According to its 13F, Lone Star’s position in Penn Virginia fell to 700,000 shares October 29, 2015: The company disclosed the resignation of H. Baird Whitehead as President and CEO and the appointment of Edward B. Cloues II as interim CEO (91.1%) Source: FactSet

81 LONE STAR CASE STUDY: RENTECH -100.0% -80.0% -60.0% -40.0% -20.0% 0.0% 20.0% 40.0% January 13, 2014: The Concerned Rentech Shareholders Group (Engaged Capital and Lone Star Value Management) (CRS) announced the nomination of four directors to the Board of Rentech March 20, 2014: CRS filed a preliminary consent statement to call a special meeting in order to amend Rentech’s charter to add a provision requiring majority shareholder approval for any equity issuance of more than 4.9% of outstanding shares April 10, 2014: The company announced a settlement with CRS, whereby CRS would approve an additional director to the Board (who would also be appointed to the Finance Committee) (87.0%) Source: FactSet

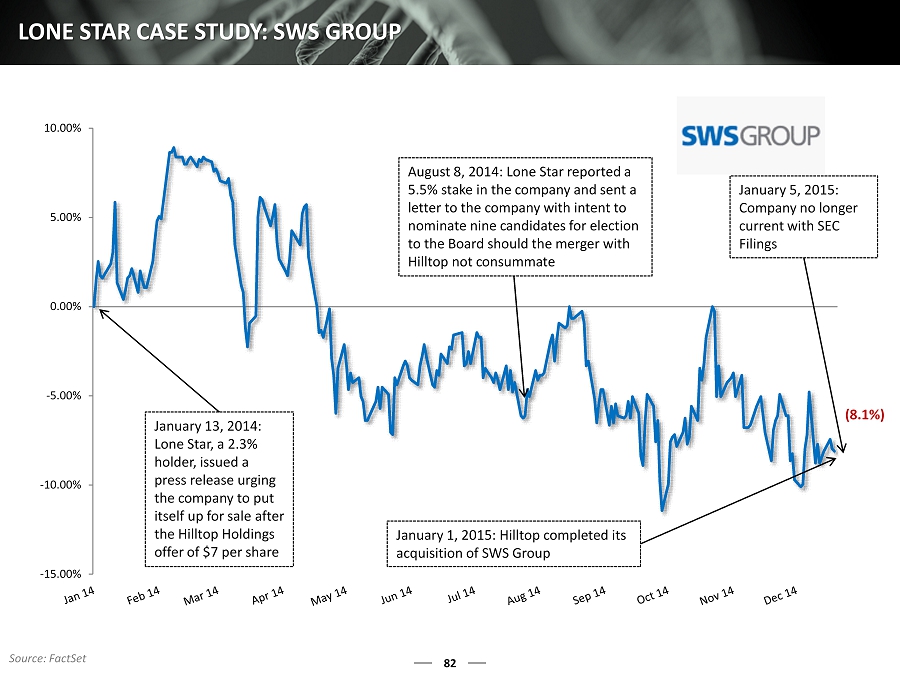

82 LONE STAR CASE STUDY: SWS GROUP -15.00% -10.00% -5.00% 0.00% 5.00% 10.00% January 13, 2014: Lone Star, a 2.3% holder, issued a press release urging the company to put itself up for sale after the Hilltop Holdings offer of $7 per share August 8, 2014: Lone Star reported a 5.5% stake in the company and sent a letter to the company with intent to nominate nine candidates for election to the Board should the merger with Hilltop not consummate January 1, 2015: Hilltop completed its acquisition of SWS Group (8.1%) Source: FactSet January 5, 2015: Company no longer current with SEC Filings

x A business model and operational structure that are positioned to address the imminent needs of the growing but challenged MDx industry x The ability to further leverage Enzo’s vertically integrated business structure to create value for shareholders x A board and management team with a deep understanding of the MDx marketplace and a proven track record of developing valuable biotech innovations , the value of which is now being harvested x An ownership culture in which directors and management do own shares of common stock – their interests are perfectly aligned with the interests of long - term shareholders 83 THE CHOICE FOR SHAREHOLDERS IS CLEAR! Disruption of Enzo’s current trajectory by an investor that openly admits he “doesn’t understand our business” (1) A 67% change in independent directors by a 1.2% shareholder who has not put forth a single idea on how they would create value for shareholders An investor and nominees with innumerable interconnected relationships that appear to have an abysmal track record An investor who has bought 1,916,784 shares and sold 2,201,784 stock over the past two years – a shareholder that we believe trades in Enzo’s stock opportunistically (2) Lone Star (1) Lone Star discussion with the Company (2) Lone Star Value Investors Schedule 14A, filed with SEC on December 2, 2015

December 2015 www.enzo.com Enzo’s Leadership 84

85 ELAZAR RABBANI, Ph . D . , is an Enzo Biochem founder and has served as the Company’s Chairman of the Board and Chief Executive Officer since its inception in 1976 and Secretary since November 25 , 2009 . Dr . Rabbani has authored numerous scientific publications in the field of molecular biology, in particular, nucleic acid labeling and detection . He is also the lead inventor of most of the Company’s pioneering patents covering a wide range of technologies and products . Dr . Rabbani received his Bachelor of Arts degree from New York University in Chemistry and his Ph . D . in Biochemistry from Columbia University . BARRY W . WEINER , President, Chief Financial Officer, Principal Accounting Officer, and Director and a founder of Enzo Biochem . He has served as the Company’s President since 1996 , and previously held the position of Executive Vice President . Before his employment with Enzo Biochem, he worked in several managerial and marketing positions at the Colgate Palmolive Company . Mr . Weiner is a member of the New York Biotechnology Association . He received his Bachelor of Arts degree in Economics from New York University and his Master of Business Administration in Finance from Boston University . JAMES M . O’BRIEN , Executive Vice President, Finance, joined Enzo Biochem, Inc . in February 2014 and is responsible for leading and managing all activities for the company’s corporate and business u nit financial functions . Mr . O’Brien has held leadership positions for corporate and business u nit budgeting and forecasting, SEC reporting , internal controls, and accounting o perations for large and small multinational public companies in pharmaceutical , consumer products, and manufacturing industries . From 2010 to 2013 , Mr . O’Brien was Vice President and Corporate Controller for Actavis, PLC (formally Watson Pharmaceuticals ), a global specialty pharmaceutical company . From 1998 to 2010 , Mr . O’Brien held senior - level f inance leadership roles at Nycomed US, Aptuit, Inc . , Purdue Pharma LLP, and Bristol Myers Squibb Company . From 1988 to 1998 , Mr . O’Brien was with PricewaterhouseCoopers LLP . He received his Bachelor of Arts degree from George Washington University and his Master of Business Administration from Fordham University . Mr . O’Brien is a Certified Public Accountant . DAVID C . GOLDBERG , Vice President of Corporate Development for Enzo Biochem, Inc . , has been employed with the Company since 1985 . He also held several other executive positions within Enzo Biochem . In addition, Mr . Goldberg held management and marketing positions with DuPont - NEN and Gallard Schlesinger Industries before joining the Company . He received his Master of Science degree in Microbiology from Rutgers University and his Master of Business Administration in Finance from New York University . EXPERIENCED MANAGEMENT TEAM

86 DIETER SCHAPFEL, M . D . , Chief Medical Director for Enzo Clinical Labs, has been employed with the Company since 2012 , initially as a consulting pathologist . Dr . Schapfel served as Medical Director of Pathology at Southside Hospital – North Shore/Long Island Jewish Health System from 2006 to 2012 . Dr . Schapfel served as a staff pathologist at Huntington Hospital from January 2004 to June 2006 . Dr . Schapfel served as Director of Pathology and Medical Affairs and the College of American Pathologists Director of Pathology, Dublin, Ireland and Farmingdale , NY for Icon Laboratories from February 2002 to October 2003 . Dr . Schapfel is a graduate of the State University of New York at Stony Brook, College of Medicine, where he also served his residency . He is a diplomat of the American Board of Pathology with certification in Anatomic and Clinical Pathology and is also a diplomat of The National Board of Medical Examiners . EXPERIENCED MANAGEMENT TEAM (CONT.)

87 Mr . Bortz is an Independent Director of Enzo Biochem, Inc. He co - founded CREO and leads its investment management business. With over 19 years of experience in developing and managing investments for high - net - worth individuals, families, and institutions, Mr. Bortz has generated sizeable returns for private equity and hedge fund investors focusing on distressed , asset - intensive companies in the middle market and public companies trading at a discount to their intrinsic value. Prior to CREO, Mr. Bortz served as a Senior V ice P resident at Lehman Brothers, focused on business and professional services investment banking. During his tenure at Lehman Brothers, Mr. Bortz led transactions in a multitude of business and professional services sub - sectors, including the security, staffing, human capital management, facilities services, consulting services, marketing services, and business process outsourcing sectors. Previously, Mr. Bortz served as a Vice P resident in investment banking at Credit Suisse, focusing on providing a full suite of investment banking services to mid - and large - cap companies in the Western United States. Prior to that, Mr. Bortz served as a Senior M anager in the business assurance practice at Ernst & Young. Mr. Bortz graduated from the University of Cape Town with a B achelor of Business S cience degree. He is qualified as a Chartered Accountant in South Africa as well as in England and Wales . GREGORY M. BORTZ “When I stepped onto the Enzo Board in 2010, I found that the management team was committed to improving all aspects of the business. The Company welcomed my advice around improving operations and at my suggestion undertook a robust cost - cutting initiative . As we see in the recent results, these initiatives are having a meaningful impact on the gross margins of the Company. By combining improved operations with our innovative MDx solutions, I believe the Company is wonderfully positioned to create robust value for shareholders” Greg Bortz, Enzo Director

88 DOV PERLYSKY Mr . Perlysky is an Independent Director of Enzo Biochem , Inc .. He is also an Independent Director at Highlands Bancorp, Inc . , Independent Director at Pharma - Bio Serv , Inc . , and Managing Member at Nesher LLC . He is on the Board of Directors at Enzo Biochem , Inc .; Oak Tree Educational Partners, Inc . , a provider of vocational training courses with a better than 95 % placement rate ; Highlands Bancorp, Inc . and Highlands State Bank, a New Jersey community bank that he helped found, which currently has four branches ; News Communications, Inc . , publisher of The Hill newspaper in Washington D . C . with the largest circulation of any Capitol Hill newspaper ; Pharma - Bio Serv , Inc . , a regulatory compliance consulting company serving eight of the 10 largest pharmaceutical and medical device companies in the world with offices in four countries ; and Engex , Inc . , a closed - end mutual fund . Mr . Perlysky was previously employed as Vice President of The Private Client Group at Laidlaw Global Securities . Prior to that, he was a highly trained information technology specialist for both Anixter and IBM Corp . Mr . Perlysky received his undergraduate degree from the University of Illinois and a Master of Management degree from the Kellogg School of Management at Northwestern University . “It’s a very exciting time to be associated with Enzo. The current management team has the full support of the independent directors, and we are very pleased at the recent progress the Company has made to bring its game - changing platforms and products to the MDx marketplace. Enzo operates in a complicated business, which has required patience from all stakeholders. Fortunately, we have arrived at the point where Enzo is beginning to harvest its years of creativity and hard work.” Dov Perlysky, Enzo Director

89 BERNARD L. KASTEN, M.D Dr Kasten has been a Director of Enzo BioChem Inc . since January 2008 . He presently is Enzo’s Lead Independent Director . He was Chairman of the Board of Cleveland Biolabs , Inc . (CBLI : NASDAQ) August 2006 to 2014 . From 1996 to 2004 , Dr . Kasten served at Quest Diagnostics Incorporated (DGX : NYSE) as Chief Laboratory Officer, Vice President of Business Development for Science and Medicine and most recently as Vice President of Medical Affairs of its MedPlus Inc . subsidiary . Dr . Kasten served as a Director of SIGA Technologies (SIGA : NASDAQ) from May 2003 to December 2006 , and as SIGA's Chief Executive Officer from July 2004 through April 2006 . Since 2007 Dr . Kasten has been the Director and Chairman of GeneLink Inc . and Chairman of the Board of Riggs Heinrich Media Inc . / iMirus since 2005 . Dr . Kasten is a graduate of the Ohio State University College of Medicine . His residency was served at the University of Miami, Florida and fellowships at the National Institutes of Health Clinical Center and National Cancer Institute, Bethesda, Maryland . He is a diplomat of the American Board of Pathology with Certification in Anatomic and Clinical Pathology and Sub - specialty Certification in Medical Microbiology .

90 CONTACT INFORMATION Bruce H. Goldfarb/Patrick J. McHugh/Michael Fein (212) 297 - 0720 / (877 ) 629 - 6356 info@okapipartners.com Shareholders