Annual Meeting of Shareholders C. John Wilder Hal Hickey Executive Chairman Chief Executive Officer May 23, 2016 Exhibit 99.1

EXCO Overview: Three Concentrated Resource Positions Operating Area Overview 1 Core Basins 2 Net Production3 13-16; Mmcfe/d 3 As of Dec. 31, ‘15. The Total Proved Reserves as of Dec. 31, ‘15 were prepared in accordance with the rules and regulations of the SEC. The reserves were prepared using reference prices of $2.59 per Mmbtu for natural gas and $50.28 per Bbl for oil, in each case adjusted for geographical and historical differentials. Net production excludes production from divested assets. Appalachia South Texas East Texas / North Louisiana East Texas And North Louisiana Net Acres/%HBP 1 97,600/96% Q1 ‘16 Operated Rigs 2 Q1 ‘16 Net Production (Mmcfe/d) 214 Year End Proved Reserves (Bcfe)2 726 South Texas Net Acres/% HBP1 65,800/81% Q1 ‘16 Operated Rigs 0 Q1 ‘16 Net Production (Boe/d) 6,500 Year End Proved Reserves (Bcfe)2 129 Appalachia And Other Net Acres/% HBP1 272,800/87% Q1 ‘16 Operated Rigs 0 Q1 ‘16 Net Production (Mmcfe/d) 42 Year End Proved Reserves (Bcfe)2 52 Total Net Acres/% HBP1 436,200/88% Q1 ‘16 Operated Rigs 2 Q1 ‘16 Net Production (Mmcfe/d) 295 Year End Proved Reserves (Bcfe)2 907

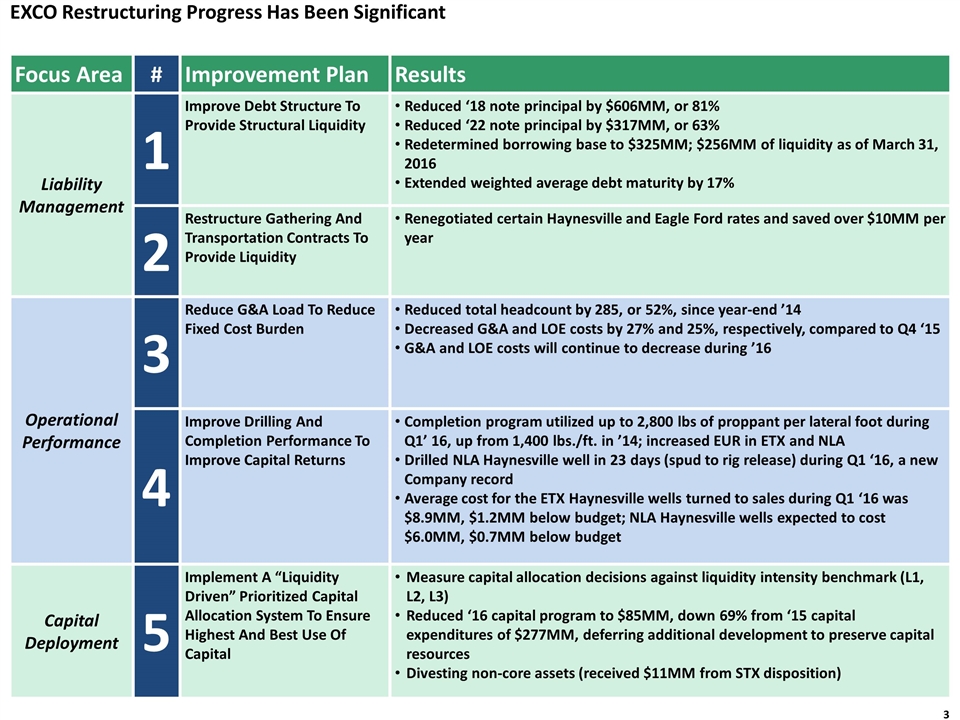

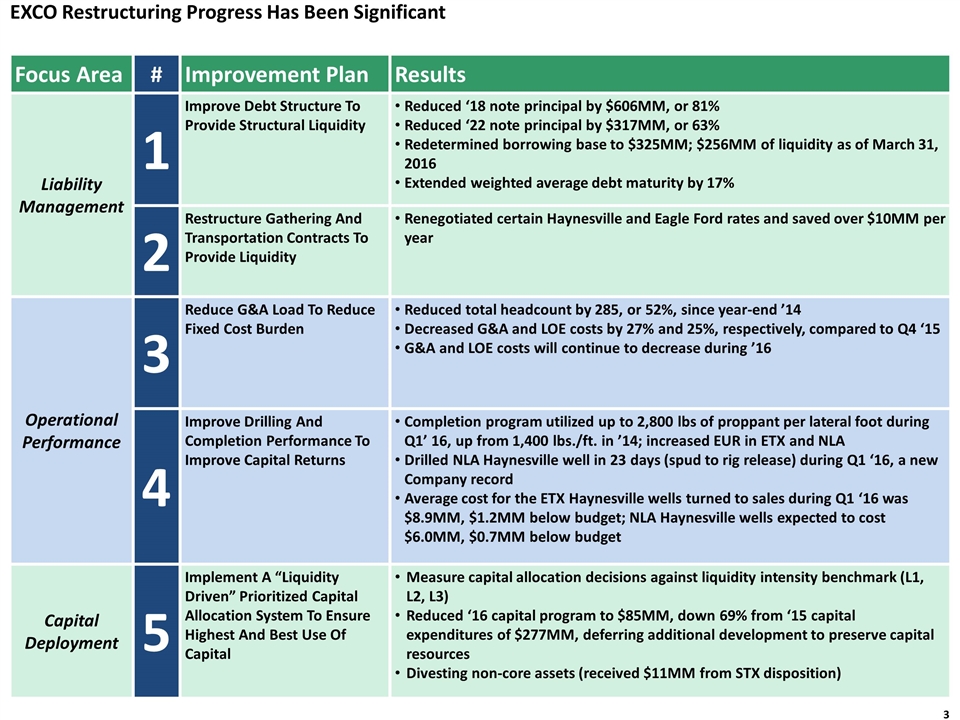

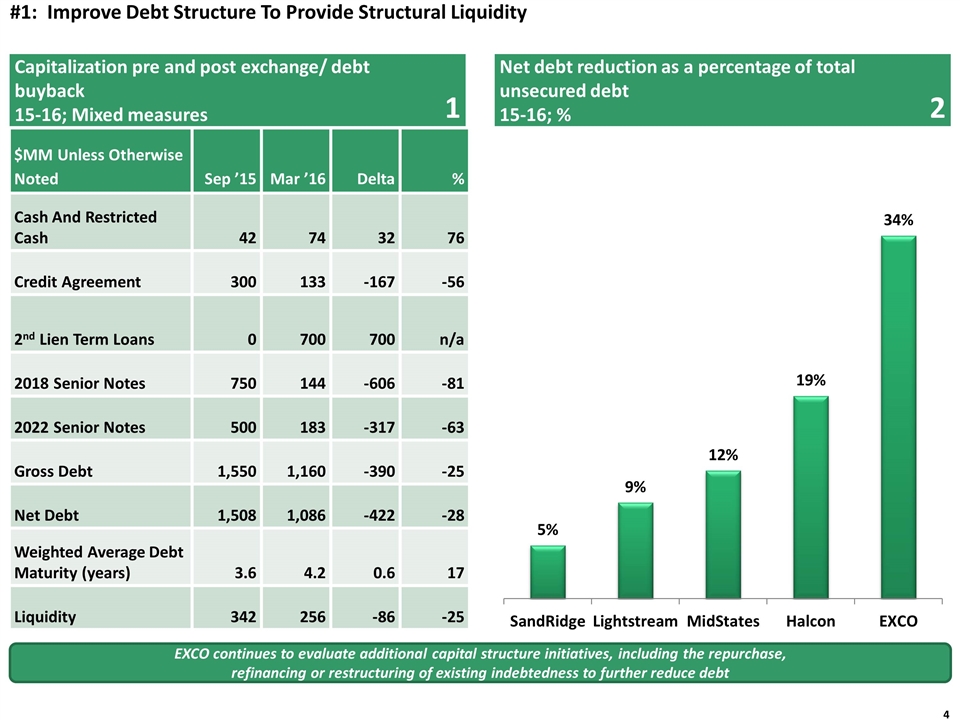

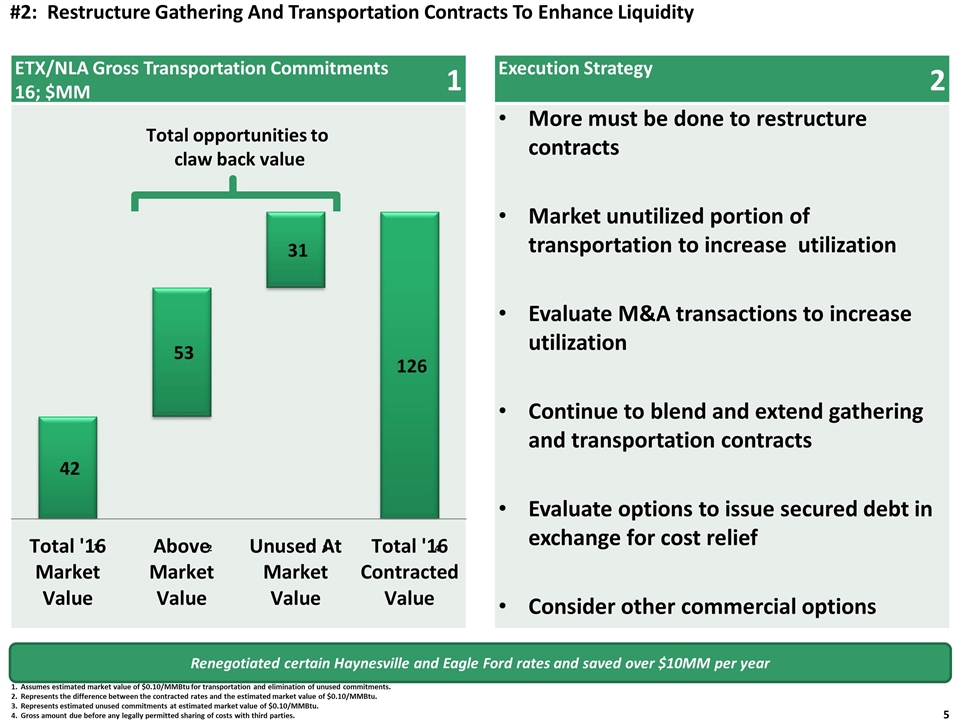

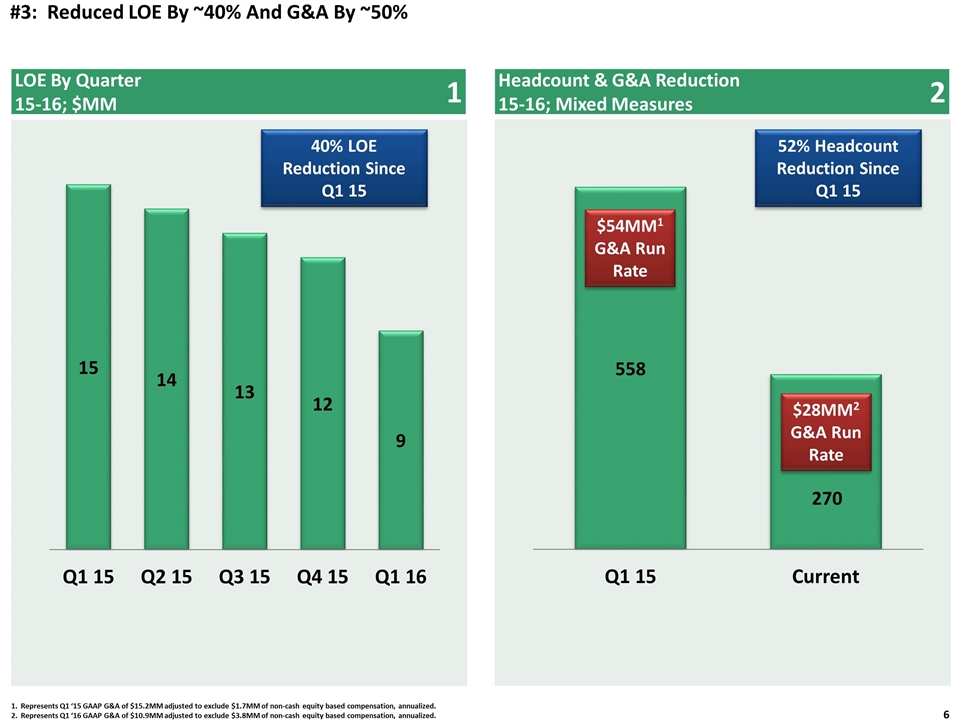

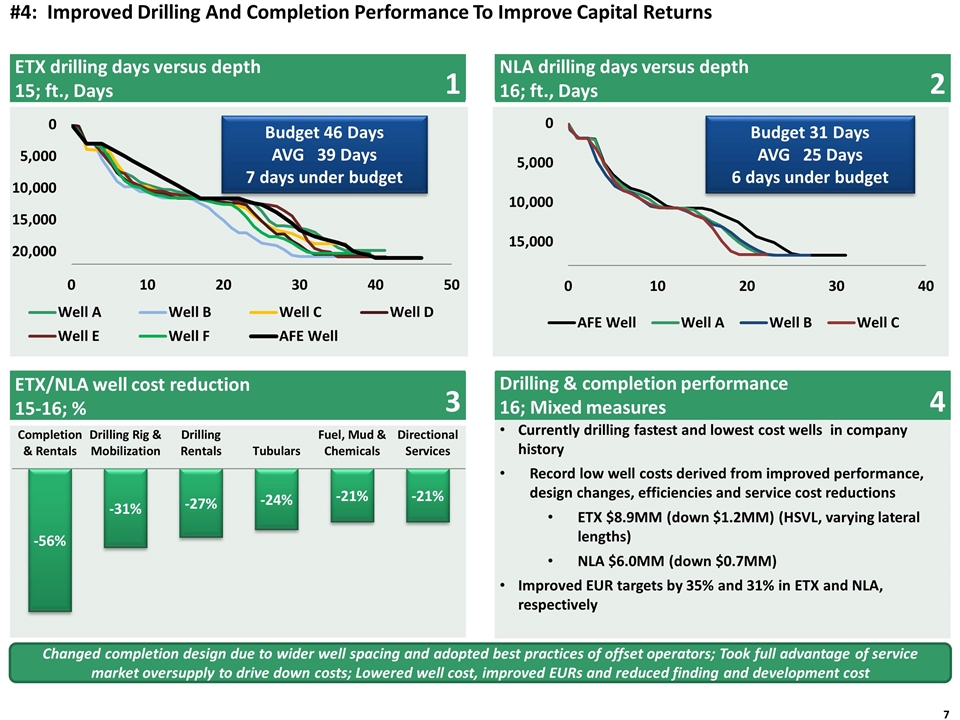

Focus Area # Improvement Plan Results Liability Management 1 Improve Debt Structure To Provide Structural Liquidity Reduced ‘18 note principal by $606MM, or 81% Reduced ‘22 note principal by $317MM, or 63% Redetermined borrowing base to $325MM; $256MM of liquidity as of March 31, 2016 Extended weighted average debt maturity by 17% 2 Restructure Gathering And Transportation Contracts To Provide Liquidity Renegotiated certain Haynesville and Eagle Ford rates and saved over $10MM per year Operational Performance 3 Reduce G&A Load To Reduce Fixed Cost Burden Reduced total headcount by 285, or 52%, since year-end ’14 Decreased G&A and LOE costs by 27% and 25%, respectively, compared to Q4 ‘15 G&A and LOE costs will continue to decrease during ’16 4 Improve Drilling And Completion Performance To Improve Capital Returns Completion program utilized up to 2,800 lbs of proppant per lateral foot during Q1’ 16, up from 1,400 lbs./ft. in ’14; increased EUR in ETX and NLA Drilled NLA Haynesville well in 23 days (spud to rig release) during Q1 ‘16, a new Company record Average cost for the ETX Haynesville wells turned to sales during Q1 ‘16 was $8.9MM, $1.2MM below budget; NLA Haynesville wells expected to cost $6.0MM, $0.7MM below budget Capital Deployment 5 Implement A “Liquidity Driven” Prioritized Capital Allocation System To Ensure Highest And Best Use Of Capital Measure capital allocation decisions against liquidity intensity benchmark (L1, L2, L3) Reduced ‘16 capital program to $85MM, down 69% from ‘15 capital expenditures of $277MM, deferring additional development to preserve capital resources Divesting non-core assets (received $11MM from STX disposition) EXCO Restructuring Progress Has Been Significant

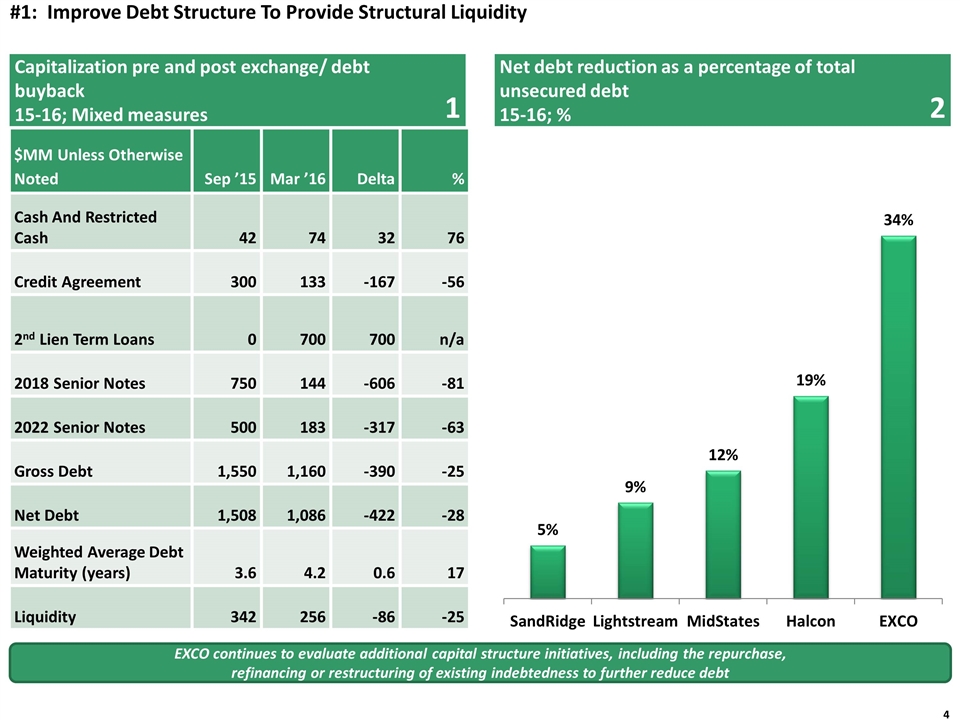

Capitalization pre and post exchange/ debt buyback 15-16; Mixed measures 1 Net debt reduction as a percentage of total unsecured debt 15-16; % 2 $MM Unless Otherwise Noted Sep ’15 Mar ’16 Delta % Cash And Restricted Cash 42 74 32 76 Credit Agreement 300 133 -167 -56 2nd Lien Term Loans 0 700 700 n/a 2018 Senior Notes 750 144 -606 -81 2022 Senior Notes 500 183 -317 -63 Gross Debt 1,550 1,160 -390 -25 Net Debt 1,508 1,086 -422 -28 Weighted Average Debt Maturity (years) 3.6 4.2 0.6 17 Liquidity 342 256 -86 -25 EXCO continues to evaluate additional capital structure initiatives, including the repurchase, refinancing or restructuring of existing indebtedness to further reduce debt #1: Improve Debt Structure To Provide Structural Liquidity

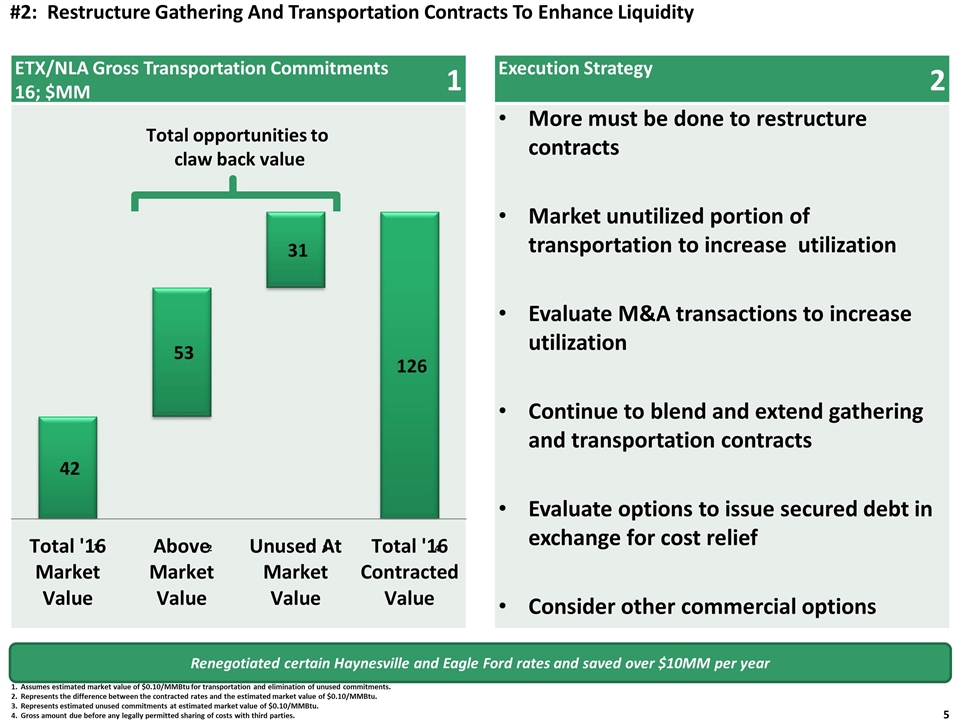

ETX/NLA Gross Transportation Commitments 16; $MM 1 Execution Strategy 2 More must be done to restructure contracts Market unutilized portion of transportation to increase utilization Evaluate M&A transactions to increase utilization Continue to blend and extend gathering and transportation contracts Evaluate options to issue secured debt in exchange for cost relief Consider other commercial options Assumes estimated market value of $0.10/MMBtu for transportation and elimination of unused commitments. Represents the difference between the contracted rates and the estimated market value of $0.10/MMBtu. Represents estimated unused commitments at estimated market value of $0.10/MMBtu. Gross amount due before any legally permitted sharing of costs with third parties. 1 2 3 4 Renegotiated certain Haynesville and Eagle Ford rates and saved over $10MM per year #2: Restructure Gathering And Transportation Contracts To Enhance Liquidity

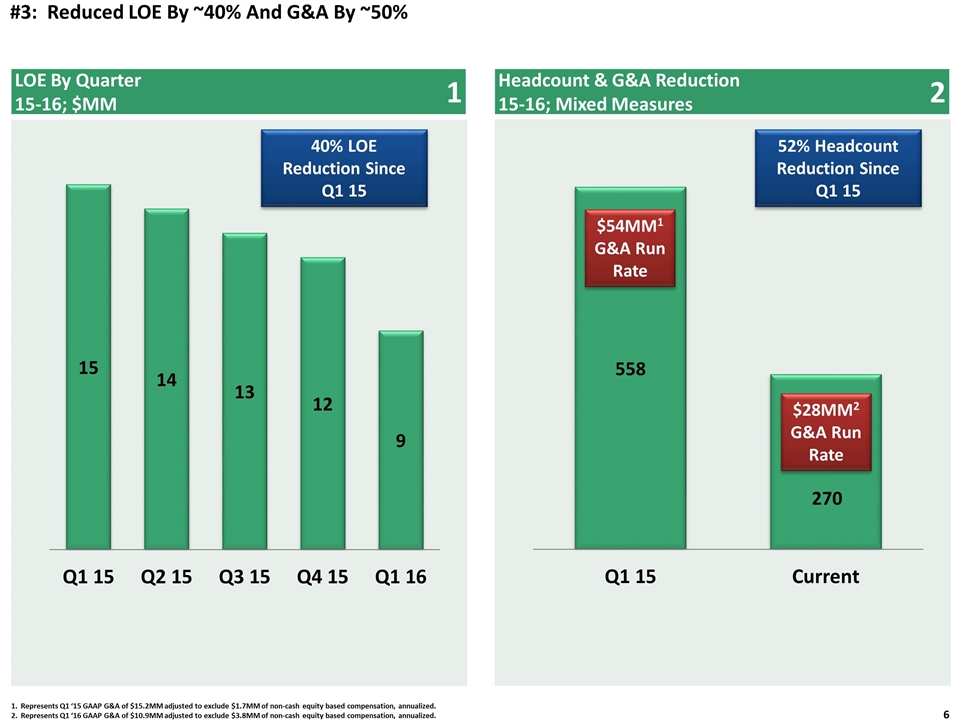

LOE By Quarter 15-16; $MM 1 Headcount & G&A Reduction 15-16; Mixed Measures 2 #3: Reduced LOE By ~40% And G&A By ~50% 40% LOE Reduction Since Q1 15 52% Headcount Reduction Since Q1 15 $54MM1 G&A Run Rate $28MM2 G&A Run Rate Represents Q1 ‘15 GAAP G&A of $15.2MM adjusted to exclude $1.7MM of non-cash equity based compensation, annualized. Represents Q1 ‘16 GAAP G&A of $10.9MM adjusted to exclude $3.8MM of non-cash equity based compensation, annualized.

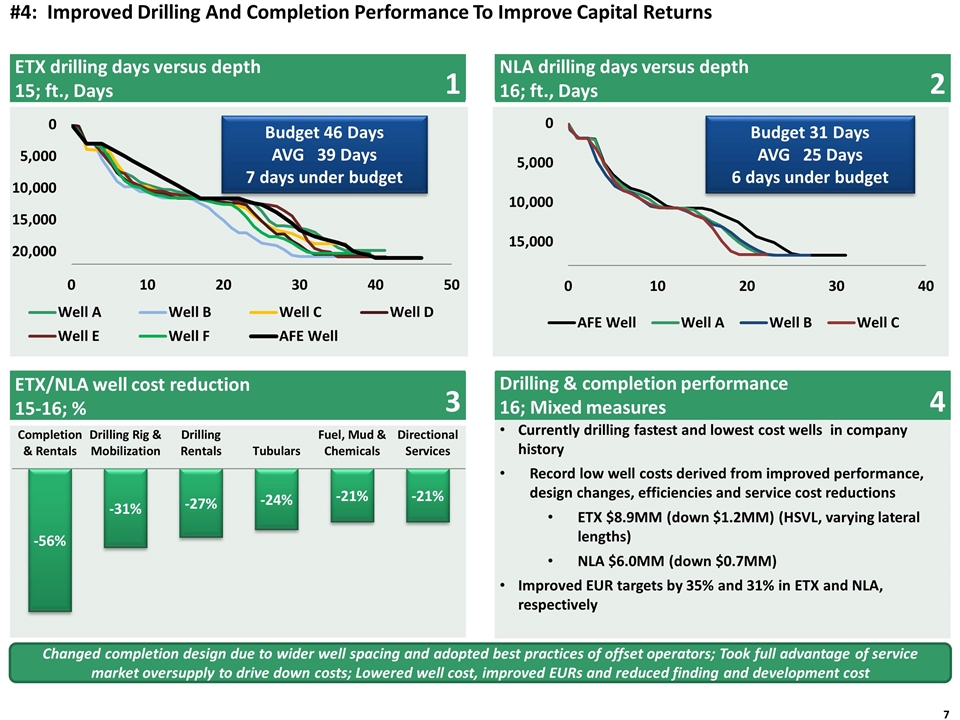

ETX drilling days versus depth 15; ft., Days 1 NLA drilling days versus depth 16; ft., Days 2 ETX/NLA well cost reduction 15-16; % 3 Drilling & completion performance 16; Mixed measures 4 Currently drilling fastest and lowest cost wells in company history Record low well costs derived from improved performance, design changes, efficiencies and service cost reductions ETX $8.9MM (down $1.2MM) (HSVL, varying lateral lengths) NLA $6.0MM (down $0.7MM) Improved EUR targets by 35% and 31% in ETX and NLA, respectively Changed completion design due to wider well spacing and adopted best practices of offset operators; Took full advantage of service market oversupply to drive down costs; Lowered well cost, improved EURs and reduced finding and development cost Budget 46 Days AVG 39 Days 7 days under budget Budget 31 Days AVG 25 Days 6 days under budget #4: Improved Drilling And Completion Performance To Improve Capital Returns

Capital Program Overview 16; Mixed Measures 1 Capital Budget By Type 16; $MM 2 Development Capital Spending By Area 16; # 3 Category Descriptions Reduced ‘16 Program Announced additional reduction in ‘16 capital program on March 30 Elected to defer additional development to preserve capital resources and give time to work with midstream ‘16 capital budget of $85 million, represents a reduction of $192 million, or 69%, compared to ‘15 capital expenditures of $277 million ‘16 Development Activity Currently plan to drill 7 gross wells and complete 15 gross wells in ‘16, with development activities focused on natural gas drilling and completion activities in the Haynesville and Bossier shales in NLA and ETX No ‘16 development activity planned in STX or Appalachia Area Gross Spuds Net Spuds Gross Completions Net Completions ETX 1 0.3 9 3.9 NLA 6 5.5 6 5.5 Total 7 5.8 15 9.4 Category Drilling and Completion 66 Field Operations and Non-Operated 5 Land 4 Capitalized Costs 10 Total 85 EXCO is focused on preserving its capital resources for future growth and, based on current natural gas prices and time to work with midstream providers, the Company has decided to significantly reduce its drilling activity in ‘16 #5: Implement A “Liquidity Driven” Prioritized Capital Allocation System To Ensure Highest And Best Use of Capital