UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

811-03074

(Investment Company Act file number)

Northeast Investors Growth Fund

(Exact name of registrant as specified in charter)

100 High Street

Boston, MA 02110

Boston, MA 02110

(Address of principal executive offices) (Zip code)

(617) 523-3588

(Registrant's telephone number, including area code)

Robert Kane

100 High Street

Boston, MA 02110

100 High Street

Boston, MA 02110

(Name and address of agent for service)

December 31

Date of fiscal year end

January 1, 2016 - December 31, 2016

Date of reporting period

Form N-CSR is to be used by management investment companies to file reports with the Commission, not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1 - Reports to Stockholders

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Portfolio Update | 3 |

| Disclosure of Fund Expenses | 7 |

| Schedule of Investments | 8 |

| Statement of Assets and Liabilities | 12 |

| Statement of Operations | 13 |

| Statements of Changes in Net Assets | 14 |

| Financial Highlights | 16 |

| Notes to Financial Statements | 18 |

| Report of Independent Registered Public Accounting Firm | 23 |

| Additional Information | 24 |

| Trustees & Officers | 25 |

| Northeast Investors Growth Fund | Shareholder Letter |

Dear Fellow Shareholders:

It is with deep sadness that we announce the death of our dear friend and firm President, William A. Oates, Jr., on February 14th. Billy served as President of Northeast Management & Research, Inc. as well as President and portfolio manager of Northeast Investors Growth Fund since the Fund’s inception in 1980. His long and courageous battle with multiple myeloma only began to deter his routine in the past two months, and was unknown to many around him until very recently. Billy’s interests were varied and many, and he gave back in service to former schools and local organizations. He leaves behind his wife of 48 years, three daughters and six grandchildren. We are all fortunate to have known Billy.

Turning to our annual summary, historical levels of volatility returned to equity markets in 2016 after multiple years of linear positive performance. January was the worst beginning month on record and domestic large cap equities were down 12% until mid‐February. Uncertain Federal Reserve rate projections, Chinese currency devaluation and collapsing oil prices spiked demand for safe haven assets amid growing global recession fears. Strong equity correlations began to fade as sector divergence grew. While equities recovered swiftly on the back of corrective actions for commodity prices and increased transparency on global currency management, 2016 soon became known as the year populism took over.

Pollsters and strategists missed their marks on both the United Kingdom’s vote to leave the European Union and on our own U.S. presidential election. Beyond just the result of the votes, the market reactions after each were even further than predicted. While the pound declined meaningfully, developed equities recovered from a brief setback after Brexit and marched higher upon Donald Trump’s surprise victory. The strong finish to the year for U.S. equities propelled the benchmarks to new record highs. Though better than many of our peer funds and closer in line to the large cap growth index, the Northeast Investors Growth Fund gained +4.39% compared to the benchmark S&P 500 +11.96%.

With interest rates moving sharply lower in the first half of the year, higher‐yielding names and sectors like Utilities, Telecom and Real Estate saw heavy buying. A reassessment of higher beta growth stocks also took hold as prior year winners in Information Technology and Health Care sold off. The sharp rebound in energy prices and later interest rates hurt our Fund being underweight in the Energy and Financials areas. Underperformance was due to both sector allocation and individual security selection.

Our biggest individual detractors occurred in the Health Care sector where we maintained an overweight allocation throughout the year. Biotechs Alkermes (down 50% before sold) and Bristol Myers (down 14% for year) both had late stage drug trial failures and declined sharply, while Gilead (‐28%) is “a product of its own success” as it faces a shrinking Hepatitis C population due to its proprietary cure. Longtime Fund winner CVS (‐18%) was not immune to the broad health care struggles surrounding the drug pricing pressures directed toward all involved parties. There seemed to be temporary relief of this rhetoric upon Hillary Clinton’s defeat, but it now looks as though President Trump is targeting the same.

Outside of Health Care, other Fund holdings such as Manhattan Associates (‐20%) and Nike (‐18%) reversed very strong 2015 performances. While the economy showed further improvement across the labor market and wages last year, broad retail did not benefit as expected to the detriment of both companies. Lastly, while not negative on the year, numerous outsize Fund positions were flat on the year holding back our relative comparison. Growing fear around subscriber losses and reduced ESPN profitability tempered Walt Disney (+1%). And both Alphabet (+2%) and Visa (+1%) did not participate in the third quarter tech rally, but we remain optimistic around each’s long-term prospects.

Annual Report | December 31, 2016 | 1 |

| Northeast Investors Growth Fund | Shareholder Letter |

Though relatively underweight to the sector, we received our best performance from our Financials names. First Republic (+41%), Goldman Sachs (+35%), JP Morgan (+35%) and Bank of America (+33%) all rallied sharply beginning late summer as interest rates moved materially higher amid improved growth metrics and business confidence. The presidential election result, whereby investors bet the president‐elect would roll back financial regulations enacted after the recent recession, spurred these companies even further. Union Pacific (+36%) made up much of what was lost in a terrible 2015 as rails and transportation stocks benefitted from renewed growth and talk of a potential stimulus package. And Akamai (+27%) continues to fend off competition and decreasing content delivery prices through its growing security and performance analytics segments.

Perhaps the only thing that can be said for certain this year is there is a lot more uncertainty. A Federal Reserve intent on hiking rates further, a novice presidential administration ushering in a new way of doing business in Washington, potential corporate tax reform and major elections in Europe later this year are just a few of the topics that will likely dominate investors’ focus throughout 2017. The good news is the recent market volatility has provided more attractive price dislocations among both current and potential Fund holdings, so we remain nimble to capitalize where possible. Our own economy and labor market appear on strong enough footing to withstand any temporary gyrations caused by these macro events.

As always, we welcome and encourage you to contact us with any questions, concerns or comments. Please call us directly at 617‐523‐3588 or visit our website, www.northeastinvestorsgrowthfund.com, where you can view the Fund’s closing price, composition, and historical performance. If you follow your investments online, the ticker symbol for the Fund is NTHFX.

Those of us to whom Billy entrusted the Fund’s management are deeply saddened by this loss but will endeavor to manage the Fund with the same level of enthusiasm and attentiveness as he did. Our lines of communication are always open to our most important partners – you our fellow shareholders. We continue to appreciate your support.

Nancy M. Mulligan

February, 2017

| 2 | www.northeastinvestorsgrowthfund.com |

| Northeast Investors Growth Fund | Portfolio Update |

December 31, 2016 (Unaudited)

Average Annual Total Return (For the Period Ended December 31, 2016)

| 1 Year | 5 Year | 10 Year | Expense Ratio | |

| Northeast Investors Growth Fund | 4.39%* | 10.26% | 4.14% | 1.30%** |

S&P 500® Total Return Index | 11.96% | 14.66% | 6.95% |

| * | Excludes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported to the market may differ from the net asset value for financial reporting purposes. |

| ** | As stated in the Fund’s most recent prospectus. |

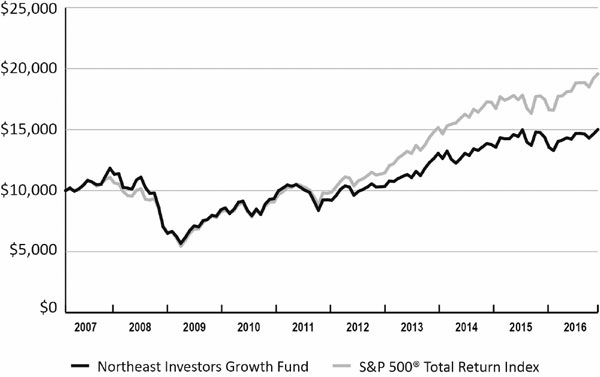

Performance Graph

The following graph compares the cumulative total shareholder return on the Northeast Investors Growth Fund shares to the cumulative total return on the S&P 500® Total Return Index, assuming an investment of $10,000 in both at their closing prices on December 31, 2006 and reinvestment of dividends and capital gains. The graph does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Keep in mind that past performance does not guarantee future returns, and an investment in the Fund is not guaranteed. For management’s discussion of the Fund’s performance for the year ended December 31, 2016, including strategies and market conditions which influenced such performance, see the Shareholder Letter.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| Northeast Investors Growth Fund | $11,390 | $6,651 | $8,582 | $9,988 | $9,205 | $10,348 | $13,050 | $13,763 | $14,371 | $15,001 |

S&P 500® Total Return Index | $10,549 | $6,646 | $8,405 | $9,671 | $9,876 | $11,456 | $15,166 | $17,243 | $17,481 | $19,572 |

Annual Report | December 31, 2016 | 3 |

| Northeast Investors Growth Fund | Portfolio Update |

December 31, 2016 (Unaudited)

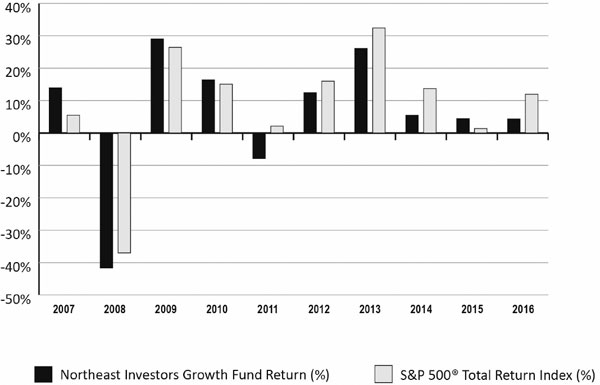

Returns and Per Share Data

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| Net Asset Value | 20.19 | 11.74 | 15.15 | 17.60 | 16.22 | 16.67 | 17.26 | 16.58 | 15.30 | 15.10* |

| Dividend Dist. | 0.04 | 0.05 | 0.00 | 0.03 | 0.00 | 0.10 | 0.08 | 0.00 | 0.04 | 0.04 |

| Capital Gains Dist. | 2.60 | 0.00 | 0.00 | 0.00 | 0.00 | 1.47 | 3.60 | 1.64 | 1.98 | 0.84 |

| Northeast Investors Growth Fund Return (%) | 13.90 | ‐41.61 | 29.05 | 16.38 | ‐7.84 | 12.42 | 26.11 | 5.47 | 4.41 | 4.39 |

S&P 500® Total Return Index (%) | 5.49 | ‐37.00 | 26.46 | 15.06 | 2.11 | 16.00 | 32.39 | 13.69 | 1.38 | 11.96 |

| * | Excludes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported to the market may differ from the net asset value for financial reporting purposes. |

| 4 | www.northeastinvestorsgrowthfund.com |

| Northeast Investors Growth Fund | Portfolio Update |

December 31, 2016 (Unaudited)

Ten Largest Investment Holdings

| Market Value | Percent of Net Assets | |||||||

| Alphabet, Inc., Class A | $ | 2,852,820 | 5.49 | % | ||||

| Facebook, Inc., Class A | 2,427,555 | 4.67 | % | |||||

| Amazon.com, Inc. | 2,324,597 | 4.48 | % | |||||

| Apple, Inc. | 2,200,580 | 4.24 | % | |||||

| Goldman Sachs Group, Inc. | 1,963,490 | 3.78 | % | |||||

| Microsoft Corp. | 1,628,068 | 3.14 | % | |||||

| Honeywell International, Inc. | 1,610,315 | 3.10 | % | |||||

| Exxon Mobil Corp. | 1,606,628 | 3.09 | % | |||||

| Visa, Inc., Class A | 1,560,400 | 3.00 | % | |||||

| Celgene Corp. | 1,389,000 | 2.67 | % | |||||

Summary of Sector Weightings as a Percentage of Net Assets

| Percent of Net Assets | |||

| Financial | 22.09% | ||

| Consumer, Non‐Cyclical | 19.75% | ||

| Communications | 19.03% | ||

| Industrial | 12.09% | ||

| Technology | 11.06% | ||

| Consumer, Cyclical | 8.90% | ||

| Energy | 6.70% | ||

| Cash, Cash Equivalents, & Other Net Assets | 0.38% | ||

| Total | 100.00% | ||

Annual Report | December 31, 2016 | 5 |

| Northeast Investors Growth Fund | Portfolio Update |

December 31, 2016 (Unaudited)

Summary of Net Assets by Industry

| Market Value | Percent of Net Assets | |||||||

| Common Stocks | ||||||||

| Aerospace/Defense | $ | 920,808 | 1.77 | % | ||||

| Apparel | 630,292 | 1.21 | % | |||||

| Banks | 6,650,194 | 12.81 | % | |||||

| Beverages | 868,429 | 1.67 | % | |||||

| Biotechnology | 2,363,509 | 4.55 | % | |||||

| Computers | 3,030,396 | 5.84 | % | |||||

| Cosmetics/Personal Care | 958,512 | 1.85 | % | |||||

| Diversified Financial Services | 2,839,353 | 5.47 | % | |||||

| Electronics | 1,610,315 | 3.10 | % | |||||

| Food | 817,889 | 1.58 | % | |||||

| Healthcare‐Products | 606,730 | 1.17 | % | |||||

| Household Products/Wares | 792,132 | 1.53 | % | |||||

| Insurance | 977,880 | 1.88 | % | |||||

| Internet | 7,604,972 | 14.64 | % | |||||

| Media | 969,246 | 1.87 | % | |||||

| Miscellaneous Manufacturing | 2,650,058 | 5.10 | % | |||||

| Oil & Gas | 2,890,361 | 5.56 | % | |||||

| Oil & Gas Services | 293,825 | 0.57 | % | |||||

| Pharmaceuticals | 3,843,690 | 7.40 | % | |||||

| Pipelines | 298,224 | 0.57 | % | |||||

| Real Estate Investment Trusts | 1,003,960 | 1.93 | % | |||||

| Retail | 3,992,796 | 7.69 | % | |||||

| Semiconductors | 470,448 | 0.91 | % | |||||

| Software | 2,237,913 | 4.31 | % | |||||

| Telecommunications | 1,309,018 | 2.52 | % | |||||

| Transportation | 1,099,008 | 2.12 | % | |||||

| Total Common Stocks | 51,729,957 | 99.62 | % | |||||

| Other Assets in Excess of Liabilities | 199,367 | 0.38 | % | |||||

| Total Net Assets | 51,929,324 | 100.00 | % | |||||

| 6 | www.northeastinvestorsgrowthfund.com |

| Northeast Investors Growth Fund | Disclosure of Fund Expenses |

December 31, 2016 (Unaudited)

As a shareholder of the Northeast Investors Growth Fund (the “Fund”), you will incur ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on July 1, 2016 and held until December 31, 2016.

Actual Expenses. The first line of each table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The expenses shown in the table are meant to highlight ongoing Fund costs. Therefore, the second line of each table below is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Net Expense Ratios | Beginning Account Value July 1, 2016 | Ending Account Value December 31, 2016 | Expenses Paid During Period(a) | |

| Northeast Investors Growth Fund | ||||

| Actual Return | 1.45% | $1,000.00 | $1,054.90 | $7.49 |

| Hypothetical Return (5% return before expenses) | 1.45% | $1,000.00 | $1,017.85 | $7.35 |

| (a) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), divided by 366. |

Annual Report | December 31, 2016 | 7 |

| Northeast Investors Growth Fund | Schedule of Investments |

December 31, 2016

| Description | Shares | $ Value | ||||||

| COMMON STOCKS ‐ 99.62% | ||||||||

| Communications ‐ 19.03% | ||||||||

| Internet ‐ 14.64% | ||||||||

Alphabet, Inc., Class A(a) | 3,600 | $ | 2,852,820 | |||||

Amazon.com, Inc.(a) | 3,100 | 2,324,597 | ||||||

Facebook, Inc., Class A(a) | 21,100 | 2,427,555 | ||||||

| 7,604,972 | ||||||||

| Media ‐ 1.87% | ||||||||

| Walt Disney Co. | 9,300 | 969,246 | ||||||

| Telecommunications ‐ 2.52% | ||||||||

| AT&T, Inc. | 17,600 | 748,528 | ||||||

| Verizon Communications, Inc. | 10,500 | 560,490 | ||||||

| 1,309,018 | ||||||||

| Total Communications | 9,883,236 | |||||||

| Consumer, Cyclical ‐ 8.90% | ||||||||

| Apparel ‐ 1.21% | ||||||||

| NIKE, Inc., Class B | 12,400 | 630,292 | ||||||

| Retail ‐ 7.69% | ||||||||

| Costco Wholesale Corp. | 6,300 | 1,008,693 | ||||||

| CVS Health Corp. | 10,500 | 828,555 | ||||||

| Lowe's Cos., Inc. | 14,200 | 1,009,904 | ||||||

| McDonald's Corp. | 3,300 | 401,676 | ||||||

| Starbucks Corp. | 13,400 | 743,968 | ||||||

| 3,992,796 | ||||||||

| Total Consumer, Cyclical | 4,623,088 | |||||||

| Consumer, Non‐Cyclical ‐ 19.75% | ||||||||

| Beverages ‐ 1.67% | ||||||||

| PepsiCo, Inc. | 8,300 | 868,429 | ||||||

| Biotechnology ‐ 4.55% | ||||||||

| Amgen, Inc. | 2,600 | 380,146 | ||||||

Celgene Corp.(a) | 12,000 | 1,389,000 | ||||||

| Gilead Sciences, Inc. | 8,300 | 594,363 | ||||||

| 2,363,509 | ||||||||

| Cosmetics/Personal Care ‐ 1.85% | ||||||||

| Procter & Gamble Co. | 11,400 | 958,512 | ||||||

See accompanying notes which are an integral part of these financial statements.

| 8 | www.northeastinvestorsgrowthfund.com |

| Northeast Investors Growth Fund | Schedule of Investments |

December 31, 2016

| Description | Shares | $ Value | ||||||

| Consumer, Non‐Cyclical ‐ 19.75% (continued) | ||||||||

| Food ‐ 1.58% | ||||||||

| Mondelez International, Inc., Class A | 18,450 | $ | 817,888 | |||||

| Healthcare‐Products ‐ 1.17% | ||||||||

| Thermo Fisher Scientific, Inc. | 4,300 | 606,730 | ||||||

| Household Products/Wares ‐ 1.53% | ||||||||

| Clorox Co. | 6,600 | 792,132 | ||||||

| Pharmaceuticals ‐ 7.40% | ||||||||

| Bristol‐Myers Squibb Co. | 21,100 | 1,233,084 | ||||||

| Johnson & Johnson | 11,640 | 1,341,044 | ||||||

| Merck & Co., Inc. | 11,800 | 694,666 | ||||||

| Pfizer, Inc. | 17,700 | 574,896 | ||||||

| 3,843,690 | ||||||||

| Total Consumer, Non‐Cyclical | 10,250,890 | |||||||

| Energy ‐ 6.70% | ||||||||

| Oil & Gas ‐ 5.56% | ||||||||

| Chevron Corp. | 8,000 | 941,600 | ||||||

| Exxon Mobil Corp. | 17,800 | 1,606,628 | ||||||

| Pioneer Natural Resources Co. | 1,900 | 342,133 | ||||||

| 2,890,361 | ||||||||

| Oil & Gas Services ‐ 0.57% | ||||||||

| Schlumberger Ltd. | 3,500 | 293,825 | ||||||

| Pipelines ‐ 0.57% | ||||||||

| Kinder Morgan, Inc. | 14,400 | 298,224 | ||||||

| Total Energy | 3,482,410 | |||||||

| Financial ‐ 22.09% | ||||||||

| Banks ‐ 12.81% | ||||||||

| Bank of America Corp. | 34,500 | 762,450 | ||||||

| Citigroup, Inc. | 9,400 | 558,642 | ||||||

| First Republic Bank | 11,900 | 1,096,466 | ||||||

| Goldman Sachs Group, Inc. | 8,200 | 1,963,490 | ||||||

| JPMorgan Chase & Co. | 13,300 | 1,147,657 | ||||||

| Wells Fargo & Co. | 20,350 | 1,121,489 | ||||||

| 6,650,194 | ||||||||

See accompanying notes which are an integral part of these financial statements.

| Annual Report | December 31, 2016 | 9 |

| Northeast Investors Growth Fund | Schedule of Investments |

December 31, 2016

| Description | Shares | $ Value | ||||||

| Financial ‐ 22.09% (continued) | ||||||||

| Diversified Financial Services ‐ 5.47% | ||||||||

| BlackRock, Inc. | 1,950 | $ | 742,053 | |||||

| MasterCard, Inc., Class A | 5,200 | 536,900 | ||||||

| Visa, Inc., Class A | 20,000 | 1,560,400 | ||||||

| 2,839,353 | ||||||||

| Insurance ‐ 1.88% | ||||||||

Berkshire Hathaway, Inc., Class B(a) | 6,000 | 977,880 | ||||||

| Real Estate Investment Trusts ‐ 1.93% | ||||||||

| American Tower Corp. | 9,500 | 1,003,960 | ||||||

| Total Financial | 11,471,387 | |||||||

| Industrial ‐ 12.09% | ||||||||

| Aerospace/Defense ‐ 1.77% | ||||||||

| United Technologies Corp. | 8,400 | 920,808 | ||||||

| Electronics ‐ 3.10% | ||||||||

| Honeywell International, Inc. | 13,900 | 1,610,315 | ||||||

| Miscellaneous Manufacturing ‐ 5.10% | ||||||||

| 3M Co. | 5,800 | 1,035,706 | ||||||

| Danaher Corp. | 5,800 | 451,472 | ||||||

| General Electric Co. | 36,800 | 1,162,880 | ||||||

| 2,650,058 | ||||||||

| Transportation ‐ 2.12% | ||||||||

| Union Pacific Corp. | 10,600 | 1,099,008 | ||||||

| Total Industrial | 6,280,189 | |||||||

| Technology ‐ 11.06% | ||||||||

| Computers ‐ 5.84% | ||||||||

| Accenture PLC, Class A | 3,400 | 398,242 | ||||||

| Apple, Inc. | 19,000 | 2,200,580 | ||||||

| International Business Machines Corp. | 2,600 | 431,574 | ||||||

| 3,030,396 | ||||||||

| Semiconductors ‐ 0.91% | ||||||||

NXP Semiconductors N.V.(a) | 4,800 | 470,448 | ||||||

| Software ‐ 4.31% | ||||||||

Manhattan Associates, Inc.(a) | 11,500 | 609,845 | ||||||

See accompanying notes which are an integral part of these financial statements.

| 10 | www.northeastinvestorsgrowthfund.com |

| Northeast Investors Growth Fund | Schedule of Investments |

December 31, 2016

| Description | Shares | $ Value | ||||||

| Technology ‐ 11.06% (continued) | ||||||||

| Software ‐ 4.31% (continued) | ||||||||

| Microsoft Corp. | 26,200 | $ | 1,628,068 | |||||

| 2,237,913 | ||||||||

| Total Technology | 5,738,757 | |||||||

Total Common Stocks (Cost $39,344,799) | 51,729,957 | |||||||

Total Investments ‐ 99.62% (Cost $39,344,799) | 51,729,957 | |||||||

| Other Assets in Excess of Liabilities ‐ 0.38% | 199,367 | |||||||

| Total Net Assets ‐ 100.00% | $ | 51,929,324 | ||||||

| (a) | Non-income producing security. Includes securities which did not pay at least one dividend in the year preceding the date of this statement. |

See accompanying notes which are an integral part of these financial statements.

| Annual Report | December 31, 2016 | 11 |

| Northeast Investors Growth Fund | Statement of Assets and Liabilities |

December 31, 2016

| ASSETS: | ||||

| Investments, at market value (Cost $39,344,799) | $ | 51,729,957 | ||

| Cash | 289,872 | |||

| Dividends receivable | 49,409 | |||

| Receivable for shares sold | 50 | |||

| Other assets | 8,698 | |||

| Total Assets | 52,077,986 | |||

| LIABILITIES: | ||||

| Accrued audit and tax expense | 51,650 | |||

| Accrued investment advisory fee | 30,710 | |||

| Payable for shares redeemed | 22,496 | |||

| Accrued administration fees | 9,136 | |||

| Accrued printing fees | 5,746 | |||

| Accrued legal fees | 4,807 | |||

| Accrued insurance | 3,854 | |||

| Accrued other expenses | 20,263 | |||

| Total Liabilities | 148,662 | |||

| NET ASSETS | $ | 51,929,324 | ||

| NET ASSETS CONSISTS OF: | ||||

| Paid‐in capital | $ | 39,460,887 | ||

| Accumulated net realized gain | 83,279 | |||

| Net unrealized appreciation | 12,385,158 | |||

| NET ASSETS | $ | 51,929,324 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | 3,441,358 | |||

| Net Asset Value, offering and redemption price per share | $ | 15.09 | ||

See accompanying notes which are an integral part of these financial statements.

| 12 | www.northeastinvestorsgrowthfund.com |

| Northeast Investors Growth Fund | Statement of Operations |

For the Year Ended December 31, 2016

| INVESTMENT INCOME: | ||||

| Dividends | $ | 897,412 | ||

| Total Investment Income | 897,412 | |||

| EXPENSES: | ||||

| Investment advisory fee (Note D) | 367,581 | |||

| Administrative fees (Note C) | 103,254 | |||

| Transfer agent fees (Note C) | 94,284 | |||

| Audit and tax fees | 51,908 | |||

| Legal fees | 35,251 | |||

| Registration and filing fees | 31,537 | |||

| Trustee fees | 30,000 | |||

| Insurance | 19,353 | |||

| Printing fees | 10,731 | |||

| Custodian fees | 9,124 | |||

| Miscellaneous fees | 11,939 | |||

| Total Expenses | 764,962 | |||

| Net Investment Income | 132,450 | |||

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | ||||

| Net realized gain on investment transactions | 2,331,899 | |||

| Net change in unrealized depreciation on investments | (333,915 | ) | ||

| Net Gain on Investments | 1,997,984 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 2,130,434 | ||

See accompanying notes which are an integral part of these financial statements.

| Annual Report | December 31, 2016 | 13 |

| Northeast Investors Growth Fund | Statements of Changes in Net Assets |

| Year Ended December 31, 2016 | Year Ended December 31, 2015 | |||||||

| INCREASE IN NET ASSETS FROM OPERATIONS: | ||||||||

| Net investment income | $ | 132,450 | $ | 136,308 | ||||

| Net realized gain | 2,331,899 | 7,504,907 | ||||||

| Net change in unrealized depreciation | (333,915 | ) | (4,754,826 | ) | ||||

| Net Increase in Net Assets Resulting from Operations | 2,130,434 | 2,886,389 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||

| From net investment income | (126,228 | ) | (140,797 | ) | ||||

| From net realized gains on investments | (2,782,423 | ) | (6,728,832 | ) | ||||

| Net Decrease in Net Assets from Distributions | (2,908,651 | ) | (6,869,629 | ) | ||||

| FUND SHARE TRANSACTIONS: | ||||||||

| Proceeds from sale of shares | 1,549,903 | 2,446,581 | ||||||

| Reinvestment of distributions | 2,635,048 | 6,090,965 | ||||||

| Cost of shares redeemed | (9,070,418 | ) | (12,942,348 | ) | ||||

| Net Decrease in Net Assets from Fund Share Transactions | (4,885,467 | ) | (4,404,802 | ) | ||||

| Net Decrease in Net Assets | (5,663,684 | ) | (8,388,042 | ) | ||||

| NET ASSETS: | ||||||||

| Beginning of year | 57,593,008 | 65,981,050 | ||||||

| End of year* | $ | 51,929,324 | $ | 57,593,008 | ||||

| *Includes accumulated undistributed net investment income: | $ | – | $ | – | ||||

See accompanying notes which are an integral part of these financial statements.

| 14 | www.northeastinvestorsgrowthfund.com |

Page Intentionally Left Blank

Northeast Investors Growth Fund

| NET ASSET VALUE, BEGINNING OF year |

| INVESTMENT OPERATIONS: |

Net investment income/(loss)(a) |

| Net realized and unrealized gain on investments |

| Total from Investment Operations |

| LESS DISTRIBUTIONS TO SHAREHOLDERS |

| From net investment income |

| From net realized gains |

| Total Distributions |

| NET ASSET VALUE, END OF year |

TOTAL RETURN(b) |

| RATIOS AND SUPPLEMENTAL DATA: |

| Net assets, end of year (in 000s) |

| Ratio to average daily net assets: |

| Expenses |

| Net investment income/(loss) |

| PORTFOLIO TURNOVER RATE |

| (a) | Average share method used to calculate per share data. |

| (b) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

See accompanying notes which are an integral part of these financial statements.

| 16 | www.northeastinvestorsgrowthfund.com |

| Financial Highlights |

| For a share outstanding through the years presented |

Year Ended December 31, 2016 | Year Ended December 31, 2015 | Year Ended December 31, 2014 | Year Ended December 31, 2013 | Year Ended December 31, 2012 | |||||||||||||

| $ | 15.30 | $ | 16.58 | $ | 17.26 | $ | 16.67 | $ | 16.22 | ||||||||

| 0.04 | 0.04 | (0.05 | ) | 0.04 | 0.08 | ||||||||||||

| 0.63 | 0.70 | 1.01 | 4.23 | 1.94 | |||||||||||||

| 0.67 | 0.74 | 0.96 | 4.27 | 2.02 | |||||||||||||

| (0.04 | ) | (0.04 | ) | – | (0.08 | ) | (0.10 | ) | |||||||||

| (0.84 | ) | (1.98 | ) | (1.64 | ) | (3.60 | ) | (1.47 | ) | ||||||||

| (0.88 | ) | (2.02 | ) | (1.64 | ) | (3.68 | ) | (1.57 | ) | ||||||||

| $ | 15.09 | $ | 15.30 | $ | 16.58 | $ | 17.26 | $ | 16.67 | ||||||||

| 4.32 | % | 4.41 | % | 5.47 | % | 26.11 | % | 12.42 | % | ||||||||

| $51,929 | $ | 57,593 | $ | 65,981 | $ | 76,054 | $ | 73,016 | |||||||||

| 1.43 | % | 1.30 | % | 1.25 | % | 1.23 | % | 1.38 | % | ||||||||

| 0.25 | % | 0.22 | % | (0.29 | )% | 0.22 | % | 0.44 | % | ||||||||

| 20 | % | 28 | % | 58 | % | 82 | % | 36 | % | ||||||||

| Annual Report | December 31, 2016 | 17 |

| Northeast Investors Growth Fund | Notes to Financial Statements |

December 31, 2016

NOTE A–ORGANIZATION

Northeast Investors Growth Fund (the “Fund”) is a diversified, no‐load, open‐end, series‐type management investment company registered under the Investment Company Act of 1940, as amended. The Fund presently consists of one portfolio and is organized as a Massachusetts business trust.

The Fund’s objective is to produce long‐term capital appreciation for its shareholders. The Fund maintains a flexible investment policy which primarily targets common stocks of large domestic companies. The Fund emphasizes well‐known companies which it believes to have strong management, solid financial fundamentals and which are established leaders in their industries. The Fund generally invests in companies with market capitalizations in excess of $10 billion.

NOTE B–SIGNIFICANT ACCOUNTING POLICIES

The Fund is considered an investment company for financial reporting purposes under accounting principles generally accepted in the United States of America (“U.S. GAAP”). Significant accounting policies of the Fund, which are in conformity with U.S. GAAP are as follows:

Use of Estimates: The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Valuation of Investments: Investments in securities traded on national securities exchanges are valued based upon closing prices on the exchanges or last sales price. Securities traded in the over‐the‐counter market and listed securities with no sales on the date of valuation are valued at closing bid prices. Other short‐term investments, when held by the Fund, are valued at cost plus earned discount or interest which approximates market value.

Securities and other assets for which market quotations are not readily available or are deemed unreliable (including restricted securities, if any) are valued at their fair value as determined in good faith under consistently applied procedures approved by the Board of Trustees. Methodologies and factors used to determine fair value of securities may include, but are not limited to, contractual restrictions, information of any recent sales, the analysis of the company’s financial statements, quotations or evaluated prices from broker‐dealers and/or pricing services and information obtained from analysts. The Fund may use fair value pricing for foreign securities if a material event occurs that may effect the price of a security after the close of the foreign market or exchange (or on days the foreign market is closed) but before the Fund prices its portfolio, generally at 4:00 p.m. EST. Fair value pricing may also be used for securities acquired as a result of corporate restructurings or reorganizations as reliable market quotations for such issues may not be readily available. At December 31, 2016, there were no securities priced at fair value as determined in good faith.

Investment Transactions: Investment transactions are accounted for as of trade date. Realized gains and losses on investment transactions are determined on the identified cost basis.

| 18 | www.northeastinvestorsgrowthfund.com |

| Northeast Investors Growth Fund | Notes to Financial Statements |

December 31, 2016

Investment Income: Interest income is recognized on an accrual basis. Dividend income is recorded on the ex‐dividend date, net of applicable withholding taxes.

Federal Income Taxes: No provision for federal income taxes is necessary since the Fund has elected to qualify under subchapter M of the Internal Revenue Code of 1986, as amended, and its policy is to distribute substantially all of its taxable income, including net realized capital gains, within the prescribed time periods.

As of December 31, 2016, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognized interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the six months ended, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for tax years 2013 through 2016.

Dividends and Distributions to Shareholders: Income and capital gain distributions are determined in accordance with income tax regulations which may differ from U.S. GAAP. Permanent book and tax differences relating to shareholder distributions will result in reclassifications to paid‐in capital. The Fund’s distributions and dividend income are recorded on the ex‐dividend date.

Indemnification: In the normal course of business, the Fund may enter into contracts that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote.

Net Asset Value: In determining the net asset value per share, rounding adjustments are made for fractions of a cent to the next higher cent.

Concentration of Credit Risk: The Fund places its cash with one banking institution, which is insured by Federal Deposit Insurance Corporation (FDIC). The FDIC limit is $250,000. At various times throughout the period, the amount on deposit may exceed the FDIC limit and subject the Fund to a credit risk. The Fund does not believe that such deposits are subject to any unusual risk associated with investment activities.

Subsequent Events: In accordance with U.S. GAAP, management has evaluated subsequent events through the date these financial statements were issued. All subsequent events determined to be relevant and material to these financial statements as a whole have been accordingly disclosed.

NOTE C–FUND ADMINISTRATION, ACCOUNTING, TRANSFER AGENCY, SHAREHOLDER SERVICING AND OTHER AGREEMENTS

ALPS Fund Services, Inc. (“ALPS”) serves as Fund administrator for which it is compensated by the Fund. ALPS also serves as fund accountant, transfer agent and shareholder servicing agent. ALPS carries out all functions related to the maintenance of shareholder accounts, acquisition and redemption of shares and mailings to shareholders. ALPS also determines the Fund’s Net Asset Value.

Union Bank serves as custodian of portfolio securities and other assets.

| Annual Report | December 31, 2016 | 19 |

| Northeast Investors Growth Fund | Notes to Financial Statements |

December 31, 2016

NOTE D–INVESTMENT ADVISORY AND SERVICE CONTRACT

Northeast Management & Research Company, Inc. (“NMR”) provides the Fund with the services of a Chief Compliance Officer and anti‐money laundering officer. The Fund has an investment advisory and service contract with NMR (the “Advisor”). Under the contract, the Fund pays the Advisor an annual fee at a maximum rate of 1.00% of the first $10,000,000 of the Fund’s average daily net assets, 3/4 of 1.00% of the next $20,000,000 and 1/2 of 1.00% of the average daily net assets in excess of $30,000,000, in monthly installments on the basis of the average daily net assets during the month preceding payment.

Under the Fund’s Investment Advisory Agreement (the “Agreement”), personnel of the Advisor provide the Fund with advice and assistance in the choice of investments and the execution of securities transactions, and otherwise maintain the Fund’s organization. Compensation to officers of the Fund or Advisor for services rendered to the Fund or to the Advisor are paid by the Advisor. Messrs. John C. Emery, Michael Baldwin, and F. Washington Jarvis, the Fund's disinterested Trustees, are not officers or directors of the Advisor. The compensation of all disinterested Trustees of the Fund is borne by the Fund.

The Independent Trustees receive a quarterly retainer of $2,500. The Independent Trustees are also reimbursed for all reasonable out‐of‐pocket expenses relating to attendance at meetings and for meeting‐related expenses.

NOTE E–PURCHASES AND SALES OF INVESTMENTS

The cost of purchases and proceeds from sales of investments, other than short‐term securities, aggregated $10,426,468 and $17,508,094, respectively, for the year ended December 31, 2016.

NOTE F–FUND SHARE TRANSACTIONS

Transactions in shares of beneficial interest for the periods ended were as follows:

| 12/31/2016 | 12/31/2015 | |||||||

| Shares sold | 102,834 | 140,977 | ||||||

| Shares reinvested | 172,677 | 396,032 | ||||||

| Shares redeemed | (599,499 | ) | (753,248 | ) | ||||

| Net decrease in shares outstanding | (323,988 | ) | (216,239 | ) | ||||

NOTE G–TAX BASIS INFORMATION

For the year ended December 31, 2016, the following reclassifications, which had no impact on results of operations or net assets, were recorded to reflect tax character:

| Paid‐in Capital | $ | 216,868 | ||

| Accumulated Net Investment Income | (6,222 | ) | ||

| Accumulated Net Realized Gain on Investments | (210,646 | ) |

| 20 | www.northeastinvestorsgrowthfund.com |

| Northeast Investors Growth Fund | Notes to Financial Statements |

December 31, 2016

The tax character of distributions paid for the years ended December 31, 2016 and December 31, 2015 were as follows:

| Distributions Paid From: | 2016 | |||

| Ordinary Income | $ | 126,228 | ||

| Long Term Capital Gains | 2,782,423 | |||

| Total | $ | 2,908,651 | ||

| Distributions Paid From: | 2015 | |||

| Ordinary Income | $ | 136,308 | ||

| Long Term Capital Gains | 6,733,321 | |||

| Total | $ | 6,869,629 | ||

As of December 31, 2016 the components of distributable earnings on a tax basis were as follows:

| Accumulated net realized gain on investments | $ | 134,941 | ||

| Net unrealized appreciation on investments | 12,333,496 | |||

| Total accumulated earnings ‐ net | $ | 12,468,437 |

At December 31, 2016 the Fund’s aggregate security unrealized gains and losses based on cost for U.S. federal income tax purposes was as follows:

| Cost of investments for income tax purposes | $ | 39,396,461 | ||

| Aggregate gross appreciation | $ | 12,504,804 | ||

| Aggregate gross depreciation | (171,308 | ) | ||

| Net unrealized appreciation | $ | 12,333,496 |

NOTE H–FAIR VALUE MEASUREMENTS

Accounting Standards Codification 820 (“ASC 820”), “Fair Value Measurements and Disclosures” established a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The various inputs that may be used to determine the value of the Fund’s investments are summarized in the following fair value hierarchy:

| Level 1 ‐ | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 ‐ | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or input other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 ‐ | Significant unobservable prices or inputs (including a Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

| Annual Report | December 31, 2016 | 21 |

| Northeast Investors Growth Fund | Notes to Financial Statements |

December 31, 2016

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Fund to measure fair value during the year ended December 31, 2016, maximized the use of observable inputs and minimized the use of unobservable inputs.

The following table summarizes the Fund’s investments as of December 31, 2016, based on the inputs used to value them.

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Common Stocks | $ | 51,729,957 | $ | – | $ | – | $ | 51,729,957 | ||||||||

| TOTAL | $ | 51,729,957 | $ | – | $ | – | $ | 51,729,957 | ||||||||

For the year ended December 31, 2016, there have been no significant changes to the Fund’s fair value methodologies. Additionally, there were no transfers into or out of assigned levels during the year ended December 31, 2016. It is the Fund’s policy to recognize transfers at the end of the reporting period.

For the year ended December 31, 2016, the Fund did not have significant unobservable inputs (Level 3) used in determining fair value.

NOTE I–NEW ACCOUNTING GUIDANCE

In October 2016, the Securities and Exchange Commission (SEC) issued a new rule, Investment Company Reporting Modernization, which, among other provisions, amends Regulation S‐X to require standardized, enhanced disclosures, particularly related to derivatives, in investment company financial statements. Compliance with the guidance is required for financial statements filed with the SEC on or after August 1, 2017. Management is currently assessing the impact of this rule to the Fund’s financial statements and other filings and does not expect any impact to the Fund’s net assets or results of operations.

NOTE J–SUBSEQUENT EVENTS

In accordance with U.S. GAAP, management has evaluated subsequent events through the date on which these financial statements were issued and reports the following: William A. Oates, Jr. no longer serves as the President and a portfolio manager of the Fund or as a Trustee on the Fund’s Board as a result of his death on February 14, 2017. On February 16, 2017, the Fund’s Board appointed Nancy M. Mulligan as the Fund’s President and a Trustee on, and the chairman of, the Board. Also on February 16, 2017, the Fund’s Board, including all the Trustees who are not “interested persons” (within the meaning of the Investment Company Act of 1940) of the Fund, approved a new investment advisory agreement with Northeast Management & Research Company, Inc. (the “Adviser”). The terms of the new investment advisory agreement are the same as the terms of the Fund’s previous investment advisory agreement with the Adviser (including the same rate at which the investment advisory fee is calculated), except that the new investment advisory agreement is dated February 16, 2017 and will terminate on July 14, 2017. The previously investment advisory agreement terminated by its terms in accordance with the requirements of the Investment Company Act of 1940 upon the death of Mr. Oates, who was a controlling person of the Adviser.

| 22 | www.northeastinvestorsgrowthfund.com |

| Northeast Investors Growth Fund | Report of Independent Registered Public Accounting Firm |

Board of Directors and Shareholders

Northeast Investors Growth Fund

We have audited the accompanying statement of assets and liabilities of Northeast Investors Growth Fund (a Massachusetts trust) (the “Fund”), including the schedule of investments, as of December 31, 2016, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2016, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Northeast Investors Growth Fund as of December 31, 2016, and the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended in conformity with accounting principles generally accepted in the United States of America.

New York, New York

February 24, 2017

February 24, 2017

| Annual Report | December 31, 2016 | 23 |

| Northeast Investors Growth Fund | Additional Information |

December 31, 2016 (Unaudited)

1. PROXY VOTING POLICIES AND VOTING RECORD

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll‐free 1‐855‐755‐6344, on the Fund’s website at www.northeastinvestorsgrowthfund.com or on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12‐month period ended June 30th is available without charge upon request by calling toll‐free 1‐855‐755‐6344, or on the SEC’s website at http://www.sec.gov.

2. QUARTERLY PORTFOLIO HOLDINGS

The Fund files a complete listing of portfolio holdings with the SEC as of the first and third quarters of each fiscal year on Form N‐Q. The filings are available upon request by calling 1‐855‐755‐6344. Furthermore, you may obtain a copy of the filing on the SEC’s website at http://www.sec.gov. The Fund’s Form N‐Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1‐800‐SEC‐0330.

3. TAX INFORMATION

The Fund designates the following for federal income tax purposes for distributions made during the calendar year ended December 31, 2016:

| Fund | Dividends Received Deduction | Qualified Dividend Income | ||||||

| Northeast Investors Growth Fund | 100% | 100% | ||||||

The Fund will notify shareholders in early 2017 of amounts paid to them by the Fund, if any, during the calendar year 2016.

Pursuant to Section 852(b)(3) of the Internal Revenue Code, Northeast Investors Growth Fund designated $2,782,423 as long‐term capital gain dividends.

| 24 | www.northeastinvestorsgrowthfund.com |

| Northeast Investors Growth Fund | Trustees & Officers |

December 31, 2016 (Unaudited)

The Trustees of the Fund are Nancy M. Mulligan, John C. Emery, Michael Baldwin, and F. Washington Jarvis. Under Massachusetts law, the Trustees are generally responsible for overseeing the operation and management of the Fund. The table below provides certain information about the Fund’s Trustees and Officers. The mailing address for the Trustees and Officers of the Fund is 100 High Street, Suite 1000, Boston, MA 02110‐2301.

| Name/Age/Service* | Position | Principal Occupation(s) and Other Directorships During the Past Five Years |

| Interested Trustees*** and Fund Officers | ||

Nancy M. Mulligan**† Age: 49 Years of Service: 0 | Trustee and President | Trustee and President of Northeast Investors Growth Fund; President and Director of Northeast Investment Management, Inc.; President and Director of Northeast Management & Research Co., Inc. |

Robert B. Minturn Age: 77 Years of Service: 36 | Clerk; Vice President; Chief Legal Officer | Officer of Northeast Investors Growth Fund; Officer of Northeast Investors Trust (until December 2014), Director and Officer of Northeast Investment Management, Inc. (until June 2015) |

John F. Francini, Jr Age: 48 Years of Service: 9 | Chief Financial Officer | Officer of Northeast Investors Growth Fund; Director and Officer of Northeast Investment Management, Inc. and Northeast Management & Research Co., Inc. |

Richard G. Manoogian Age: 53 Years of Service: 5 | Chief Compliance Officer | Chief Compliance Officer of Northeast Investors Growth Fund; Director and Chief Compliance Officer of Northeast Investment Management, Inc.; Chief Compliance Officer of Northeast Management & Research Co., Inc. |

Robert M. Kane Age: 41 Years of Service: 16 | Vice President | Officer of Northeast Investors Growth Fund (Chief Compliance Officer until Feb 2012); Officer of Northeast Investment Management, Inc. |

| * | The Trustees serve until their resignation or the appointment of a successor and the officers serve at the pleasure of the Trustees. |

| ** | Ms. Mulligan is an interested Trustee because of her affiliation with the Fund’s investment adviser. |

| *** | None of the Trustees are directors or Trustees of any other affiliated or unaffiliated registered investment companies nor do they hold directorships in other public companies. |

| † | Ms. Mulligan was appointed as a Trustee and President on February 16, 2017. Please see the paragraph captioned “Subsequent Events” in Note J of these Financial Statements. |

| Independent Trustees*** | ||

Michael Baldwin Age: 76 Years of Service: 17 | Trustee | Partner, Baldwin Brothers, Registered Investment Advisor |

John C. Emery Age: 86 Years of Service: 36 | Trustee | Counsel, Law Firm of Sullivan & Worcester LLP; President of Boston Investment Company |

F. Washington Jarvis Age: 77 Years of Service: 13 | Trustee | Director, ELM Program, Yale Divinity School; Headmaster Emeritus, Roxbury Latin School |

| *** | None of the Trustees are directors or Trustees of any other affiliated or unaffiliated registered investment companies nor do they hold directorships in other public companies. |

| Annual Report | December 31, 2016 | 25 |

| TRUSTEES Nancy M. Mulligan Michael Baldwin John C. Emery F. Washington Jarvis OFFICERS Nancy M. Mulligan, President Robert B. Minturn, Vice President, Clerk & Chief Legal Officer John F. Francini, Jr., Vice President & Chief Financial Officer Richard G. Manoogian, Vice President & Chief Compliance Officer Robert M. Kane, Vice President INVESTMENT ADVISOR Northeast Management & Research Company, Inc. 100 High Street Boston, Massachusetts 02110 CUSTODIAN Union Bank 350 California Street, 6th Floor San Francisco, CA 94104 LEGAL COUNSEL Wilmer Cutler Pickering Hale and Dorr LLP 60 State Street Boston, Massachusetts 02109 TRANSFER AGENT ALPS Fund Services, Inc. 1290 Broadway Suite 1100 Denver, Colorado 80203 INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Grant Thornton LLP 757 Third Avenue New York, NY 10017 |

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus. Past performance is not predictive of future results. You may lose money by investing in the Fund. The information in this letter should not be construed as a recommendation to purchase or sell a particular security, and there is no assurance the securities described remain part of the Fund’s portfolio today.

Shares of the Fund are sold to investors at net asset value by Northeast Investors Growth Fund 100 High Street Boston, Massachusetts 02110 855-755-NEIG (6344) www.northeastinvestorsgrowthfund.com Must be preceded or accompanied by a prospectus. |  |

Item 2. Code of Ethics

The registrant has adopted a code of ethics that applies to the registrant's principal executive officer and principal financial officer. A copy of the code of ethics is filed as an Exhibit to registrant's Report on this Form N-CSR for its fiscal year ended December 31, 2016. The registrant has not granted any waivers from any provisions of the code of ethics during the covered period.

Item 3. Audit Committee Financial Expert.

The registrant does not have an Audit Committee Financial Expert. Although the members of the registrant's Audit Committee have a variety of business and investment experience, none of them has been determined to meet the technical qualifications required in order to meet the definition of an Audit Committee Financial Expert under this Item. The registrant's trustee who is considered to be an “interested person” as defined in Section 2(a)(19) under the Investment Company of 1940, as amended, does possess such qualifications, but it has been determined that the Audit Committee should consist entirely of independent trustees. The Audit Committee, under its charter, has the ability to retain independent advisers if it deems it necessary or appropriate without the need to seek approval from the management of the Fund.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees. The aggregate fees billed for the registrant's fiscal years ended December 31, 2016 and December 31, 2015 for professional services rendered by the registrant's principal accountant for audit of its annual financial statements or services that are normally provided by such accountant in connection with statutory and regulatory filings were $45,000, and $40,000 respectively.

(b) Audit-Related Fees. The aggregate fees billed for the registrant's fiscal year ended December 31, 2016 and December 31, 2015 for assurance and related services by the registrant's principal accountant reasonably related to the performance of audit of the registrant's financial statements and not reported under Paragraph (a) of this Item were $0 and 0 respectively. Such services consisted of a report of the Fund's transfer agent internal controls pursuant to rule 17AD-13, semi-annual report review and a report on the Fund's anti-money laundering controls and policies.

(c) Tax Fees. The aggregate fees billed in the registrant's fiscal years ended December 31, 2016 and December 31, 2015 for professional services rendered by the registrant's principal accountant for tax matters were $4,650 and $4,000 respectively. Such services consisted of the preparation of the registrant's federal income and excise tax returns.

(d) All Other Fees. During the fiscal years ended December 31, 2016 and 2015 the aggregate fees billed for other services rendered by the registrant's principal accountant were $0 and $0.

(e) It is the registrant's policy that all audit and non-audit services provided by the registrant's principal accountant be approved in advance by the Audit Committee, and all of the services described in Paragraphs (a) - (d) of this item were so approved.

(f) The percentage of hours expended on the principal accountant's engagement to audit the registrant's financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant's full-time, permanent employees was zero percent (0% ).

(g) No non-audit services were provided by the registrant's principal accountant to the registrant's investment adviser. There is no entity affiliated with registrant's investment adviser that provides ongoing services to the registrant.

(h) Not applicable to the registrant.

Item 5. Audit Committee of Listed Registrants.

Not applicable to the registrant.

Item 6. Schedule of Investments

| (a) | Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the Reports to Stockholders filed under Item 1 of Form N-CSR. |

| (b) | Not applicable. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to the registrant.

Item 8. Portfolio Manager of Closed-End Management Investment Companies

Not applicable to the registrant.

Item 9. Purchase of Equity Securities by Closed-End Management Company and Affiliated Purchasers

Not applicable to the registrant.

Item 10. Submission of Matters to a Vote of Security Holders.

No material changes have been made with respect to procedures by which shareholders may recommend nominees for trustee during the covered period.

Item 11. Controls and Procedures.

| (a) | The registrant's principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)). |

| (b) | No changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d)) occurred during the registrant's second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a)(1) | Code of ethics, or any amendment thereto, that is the subject of disclosure required by Item 2 is attached hereto. |

| (a)(2) | Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto Exhibits 99.302(i) CERT. |

| (a)(3) | Not applicable. |

| (b) | Certifications pursuant to Rule 30a-2(b) under the 1940 Act and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto Exhibit 99.906CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Northeast Investors Growth Fund | ||

| By: | /s/ Nancy M. Mulligan | |

| Nancy M. Mulligan | ||

| President | ||

| (principal executive officer) | ||

| Date: | March 1, 2017 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Nancy M. Mulligan | |

| Nancy M. Mulligan | ||

| President | ||

| (principal executive officer) | ||

| Date: | March 1, 2017 |

| By: | /s/ John F. Francini, Jr. | |

| John F. Francini, Jr. | ||

| Chief Financial Officer | ||

| (principal financial officer) | ||

| Date: | March 1, 2017 |