SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO.___)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| | | |

| [ ] | | Preliminary Proxy Statement |

|

|

|

|

| [X] | | Definitive Proxy Statement |

|

|

|

|

| [ ] | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

|

| [ ] | | Definitive Additional Materials |

|

|

|

|

| [ ] | | Soliciting Material Pursuant to sec. 240.14a-11(c) or sec. 240.14a-12 |

Genentech, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| [X] | Fee not required. |

|

|

|

|

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

| | | (1) | | Title of each class of securities to which transaction applies:

|

|

|

|

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

|

|

|

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

|

|

|

|

| | | (5) | | Total fee paid:

|

|

|

|

|

| [ ] | | Fee paid previously with preliminary materials. |

|

|

|

|

| [ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

| | | (1) | | Amount Previously Paid:

|

|

|

|

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

|

|

|

|

| | | (3) | | Filing Party:

|

|

|

|

|

| | | (4) | | Date Filed:

|

TABLE OF CONTENTS

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on April 11, 2002

To the Stockholders of Genentech, Inc.:

The Annual Meeting of Stockholders of Genentech, Inc. will be held on Thursday, April 11, 2002, at 10:00 a.m. local time, at the Westin Hotel, 1 Old Bayshore Highway, Millbrae, California, for the following purposes, as more fully described in the Proxy Statement accompanying this Notice:

| |

| | 1. To elect all of the members of the Board of Directors for a one year term or until such directors’ successors are elected and qualified. |

| |

| | 2. To approve the amended and restated 1999 Stock Plan under which 63,000,000 shares have been reserved for issuance in order to qualify the plan as “performance-based” within the meaning of 162(m) of the Internal Revenue Code. |

| |

| | 3. To approve the ratification of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2002. |

| |

| | 4. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

Only holders of record of common stock of Genentech at the close of business on February 11, 2002 are entitled to notice of the Annual Meeting. This Notice and the accompanying proxy materials are sent to you by order of the Board of Directors.

| |

| | STEPHEN G. JUELSGAARD, |

| | Secretary |

South San Francisco, California

March 12, 2002

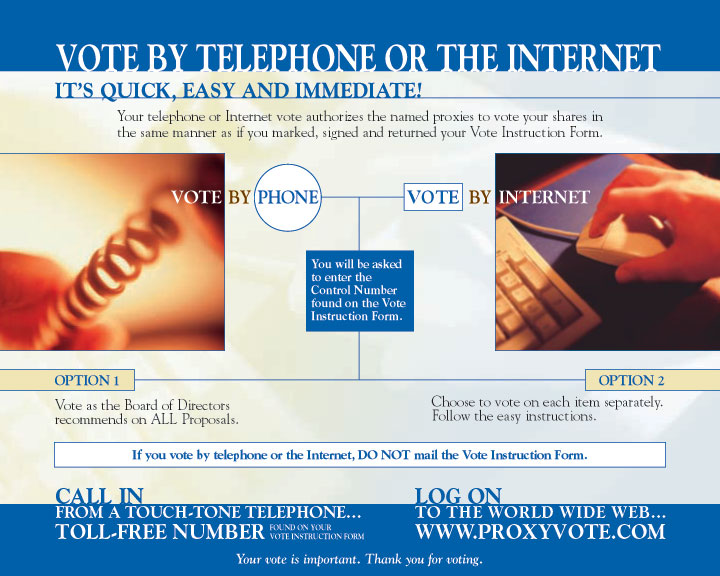

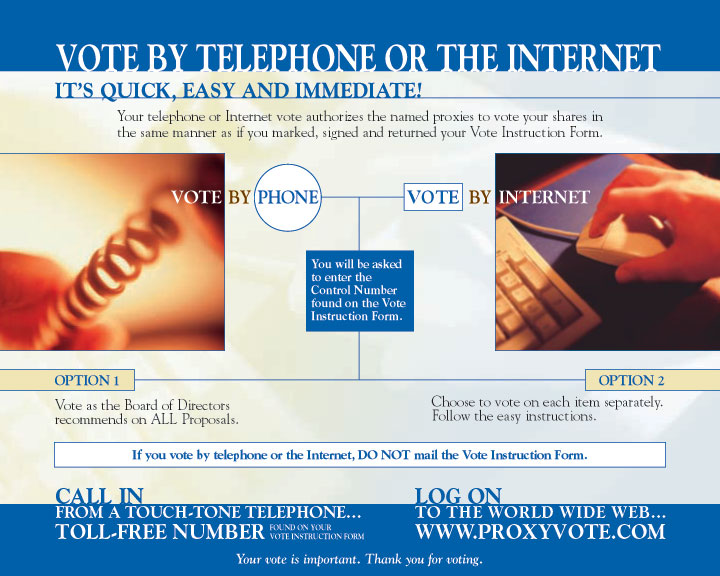

YOUR VOTE IS IMPORTANT. THERE ARE THREE WAYS TO VOTE:

| | | |

| | • | By Internet, | |

| | • | By telephone, or |

| | • | Sign, date and return your proxy card in the enclosed envelope as soon as possible. |

OUR ANNUAL MEETING WILL ALSO BE WEBCAST ATwww.gene.com

AT 10:00 A.M. PACIFIC DAYLIGHT TIME ON APRIL 11, 2002.

GENENTECH, INC.

PROXY STATEMENT

General

These proxy materials are being sent to you at the request of the Board of Directors of Genentech, Inc. (“Genentech,” “we,” “us,” “our” or the “Company”) to encourage you to vote your shares at the Annual Meeting of Stockholders to be held on April 11, 2002 or at any adjournment or postponement of the Annual Meeting. This Proxy Statement contains information on matters that will be presented at the Annual Meeting and is provided to assist you in voting your shares. We commenced mailing this Proxy Statement and the Proxy Card to the Company’s stockholders entitled to vote at the Annual Meeting on March 12, 2002.

Who Can Vote

Holders of Genentech common stock at the close of business on February 11, 2002 are entitled to vote at the Annual Meeting. As of that date, 526,300,038 shares of Genentech common stock were outstanding. Each share of common stock is entitled to one vote on each matter brought before the Annual Meeting. In this Proxy Statement, “common stock” refers to Genentech’s common stock, par value $.02 per share, and “special common stock” refers to Genentech’s callable putable common stock, par value $.02 per share.

How to Vote

Even if you plan to attend the Annual Meeting, you are encouraged to vote by proxy. You may vote by proxy in one of the following ways:

| | |

| | • | By Internet at the address listed on the Proxy Card. |

| |

| | • | By telephone using the toll-free number listed on the Proxy Card. |

| |

| | • | By returning the enclosed Proxy Card (signed and dated) in the envelope provided. |

When you vote by proxy, your shares will be voted according to your instructions. If you sign your Proxy Card but do not specify how you want your shares to be voted, they will be voted as the Board of Directors recommends. You can change or revoke your proxy by Internet or telephone at any time before the Annual Meeting in accordance with the instructions on the enclosed Proxy Card. You may also revoke it by attending the Annual Meeting and voting in person. If you would like to revoke your proxy by mail, please file a notice of revocation or an executed Proxy Card bearing a later date with the Secretary of Genentech, at the principal executive offices of Genentech, 1 DNA Way, South San Francisco, California 94080-4990.

Required Vote

In order to carry on business at the Annual Meeting, we must have a quorum. A quorum requires the presence, in person or by proxy, of the holders of a majority of the shares entitled to vote at the Annual Meeting. We will count abstentions and broker nonvotes as present for purposes of determining a quorum. A plurality of the votes cast is required for the election of the directors. The affirmative vote of holders of a majority of the shares present in person or by proxy at the Annual Meeting is required for the approval of the amended and restated 1999 Stock Plan and the ratification of Ernst & Young LLP as the Company’s independent auditors. We will count abstentions in the number of votes cast on the proposals presented to the stockholders, and they will have the same effect as negative votes, but broker nonvotes will not be counted for purposes of determining whether a proposal has been approved. All votes will be tabulated by the inspector of elections appointed for the Annual Meeting who will separately tabulate affirmative and negative votes, abstentions and broker nonvotes.

Solicitations of Proxies

We will pay all costs relating to the solicitations of proxies. We will also reimburse brokers, custodians, nominees, fiduciaries and other entities representing beneficial owners of common stock for reasonable expenses in forwarding proxy materials to the beneficial owners. Proxies may be solicited by directors, officers and other employees of the Company personally, by mail, telephone or other electronic means, but we will not pay those directors, officers or employees for those services.

Proxy Statement Proposals

At each Annual Meeting, stockholders will be asked to elect directors to serve on the Board of Directors and to ratify the appointment of our independent auditors for the year. Other proposals may be submitted by the Board of Directors or stockholders to be included in the proxy statement. To be considered for inclusion in the 2003 Annual Meeting proxy statement and the form of proxy card relating to that meeting, stockholder proposals must be received by the Secretary of the Company no later than November 12, 2002.

RELATIONSHIP WITH ROCHE

History of Ownership

On June 30, 1999, we redeemed all of our special common stock held by stockholders other than Roche Holdings, Inc. (“Roche”) at $20.625 per share in cash and retired all of the shares of special common stock including those held by Roche. As a result, Roche’s percentage ownership of our outstanding equity increased from approximately 65% to 100% and our then existing governance agreement terminated, except for provisions relating to indemnification and stock options, warrants and convertible securities.

Offerings of, and Notes Exchangeable for, our Common Stock

On July 23, 1999, Roche completed a public offering of 88 million shares of our common stock. In connection with that offering, we amended our Certificate of Incorporation and bylaws and entered into an affiliation agreement with Roche as described below. On October 26, 1999, Roche completed a public offering of 80 million shares of our common stock. Upon completion of that offering, Roche’s percentage ownership of our outstanding common stock decreased to 66.4%. On January 19, 2000, Roche completed an offering of zero-coupon notes which are exchangeable for an aggregate of 13,034,618 shares of our common stock held by Roche. On March 29, 2000, Roche completed a public offering of 34.6 million shares of our common stock, decreasing its ownership of our outstanding common stock to 58.9%.

Arrangements between Genentech and Roche

As a result of the redemption of the special common stock, the then existing governance agreement between Genentech and Roche terminated, except for provisions relating to indemnification and stock options, warrants and convertible securities. Subsequently, we entered into an affiliation agreement with Roche that enabled our current management to conduct our business and operations as we had done in the past while at the same time reflecting Roche’s ownership in us. The affiliation agreement is for the exclusive benefit of Roche and can be amended at any time by Roche and us. We have amended our bylaws in order to maintain certain proportional representation rights of Roche under the bylaws with respect to membership on our Board of Directors and Board committees to the extent that we do not make repurchases of our common stock as provided by the affiliation agreement.

Our Amended and Restated Certificate of Incorporation provides that the provisions in our bylaws described below under “— Composition of Board of Directors,” “— Roche’s Right to Proportional Representation,” “— Membership of Committees” and “— Nomination of Directors” may be repealed or amended only by a 60% vote of our stockholders, except for Roche’s right to nominate a number of directors proportional to Roche’s ownership interest rounded down to the next whole number until Roche’s ownership interest is less than 5%, which may be repealed or amended only by a 90% vote of our stockholders. The

2

provisions of the affiliation agreement described below under “— Roche Approval Required for Certain Actions” and “— Licensing and Marketing Arrangements” terminate upon Roche owning less than 40% of our stock.

For purposes of the following provisions, an independent director is a director who is not:

| | |

| | • | one of our officers; or |

| |

| | • | an employee, director, principal stockholder or partner of Roche or any affiliate of Roche or an entity that was dependent upon Roche for more than 10% of its revenues or earnings in its most recent fiscal year. |

| |

| | Composition of Board of Directors |

Our Board consists of six members, all of whom are nominated by the Nominations Committee of the Board: two nominees of Roche, one executive officer of Genentech and up to three independent directors. Directors are elected to serve one year terms or until their successors are elected and qualified. At all times our Board will include at least two independent directors and one executive officer of Genentech.

| |

| | Roche’s Right to Proportional Representation |

We have agreed that upon Roche’s request, Roche will be entitled to representation on our Board proportional to its ownership interest in our common stock. Roche will be entitled to have the number of Roche designated directors equal to the percentage of our common stock owned by Roche times the total number of directors, rounded up to the next whole number if Roche’s ownership interest is greater than 50% and rounded down if Roche’s ownership percentage is less than or equal to 50%. Upon Roche’s request, we will immediately take action to cause the size of our Board to be increased and to cause our Board to fill the vacancies by electing Roche nominees in order to achieve Roche’s proportional representation. If Roche’s ownership interest of common stock drops below 40%, Roche will cause its directors to resign to the extent its representation is in excess of its proportional ownership interest. The number of directors who are required to resign upon such event shall be rounded up to the next whole number. Roche shall thereafter be entitled to nominate a number of directors which is proportional to Roche’s ownership interest rounded down to the next whole number, until Roche’s ownership interest is less than 5%.

We have five standing committees of the Board: an Audit Committee, a Compensation Committee, a Corporate Governance Committee, an Executive Committee and a Nominations Committee and Roche is entitled upon request to its proportional representation on each committee. However, New York Stock Exchange rules require that no Roche director be a member of the Audit Committee. Roche’s committee members may designate another Roche director to serve as their alternates on any committee.

The Nominations Committee shall at all times have three members. At anytime that Roche owns 80% or more of the total voting power of our stock, the Nominations Committee shall include two nominees of Roche and one of the independent directors. At any time that Roche owns less than 80% of the total voting power of our stock, the Nominations Committee shall include a number of nominees of Roche that is equal to the percentage owned by Roche of the total voting power of our common stock times three, rounded up to the next whole number if Roche’s total voting power is greater than 50% and rounded down to the next whole number if Roche’s total voting power is less than or equal to 50%,provided that Roche shall at no time have more than two nominees.

The nomination of any person for director requires the approval of a majority of the members of the Nominations Committee.

3

| |

| | Roche Approval Required for Certain Actions |

Without the prior approval of the Roche directors, we have agreed not to approve:

| | |

| | • | any acquisition that would constitute a substantial portion of our business or assets; |

| |

| | • | any sale, lease, license, transfer or other disposal of all or a substantial portion of our business or assets other than in the ordinary course of our business; |

| |

| | • | any issuance of capital stock except (1) issuances of capital stock pursuant to employee incentive plans not exceeding 5% of our voting stock, (2) issuances of capital stock upon the exercise, conversion or exchange of any of our outstanding capital stock, and (3) other issuances of capital stock not exceeding 5% of our voting stock in any 24 month period; and |

| |

| | • | any repurchase or redemption of our capital stock other than redemption required by the terms of any security and purchases made at fair market value in connection with any of our deferred compensation plans. |

For purposes of the first and second bullet points in this paragraph, unless a majority of the Board of Directors have made a contrary determination in good faith, a “substantial portion of our business or assets” shall mean a portion of our business or assets accounting for 10% or more of our and our consolidated subsidiaries’ consolidated total assets, contribution to net income or revenues.

Following a request by Roche for proportional representation on the Board, until the Roche designees take office as directors we may not take any action other than in the ordinary course of business without the consent of Roche.

| |

| | Licensing and Marketing Arrangements |

We have a licensing and marketing agreement with F. Hoffmann-La Roche Ltd (“Hoffmann-La Roche”) and its affiliates granting it an option to license to use and sell products in non-U.S. markets. The major provisions of that agreement include the following:

| | |

| | • | Hoffmann-La Roche’s option expires in 2015; |

| |

| | • | Hoffmann-La Roche may exercise its option to license our products upon the occurrence of any of the following: (1) our decision to file an Investigational New Drug application, or IND, for a product, (2) completion of a Phase II trial for a product or (3) if Hoffmann-La Roche previously paid us a fee of $10 million to extend its option on a product, completion of a Phase III trial for that product; |

| |

| | • | if Hoffmann-La Roche exercises its option to license a product, it has agreed to reimburse Genentech for development costs as follows: (1) if exercise occurs at the time an IND is filed, Hoffmann-La Roche will pay 50% of development costs incurred prior to the filing and 50% of development costs subsequently incurred, (2) if exercise occurs at the completion of a Phase II trial, Hoffmann-La Roche will pay 50% of development costs incurred through completion of the trial and 75% of development costs subsequently incurred, (3) if the exercise occurs at the completion of a Phase III trial, Hoffmann-La Roche will pay 50% of development costs incurred through completion of the trial and 75% of development costs subsequently incurred, and $5 million of the option extension fee paid by Hoffmann-La Roche to preserve its right to exercise its option at the completion of a Phase III trial will be credited against the total development costs payable to Genentech upon the exercise of the option; |

| |

| | • | we agreed, in general, to manufacture for and supply to Hoffmann-La Roche its clinical requirements of our products at cost, and its commercial requirements at cost plus a margin of 20%; however, Hoffmann-La Roche will have the right to manufacture our products under certain circumstances; |

| |

| | • | Hoffmann-La Roche has agreed to pay, for each product for which Hoffmann-La Roche exercises its option upon either a decision to file an IND with the U.S. Food and Drug Administration, or FDA, or completion of the Phase II trials, a royalty of 12.5% on the first $100 million on its aggregate sales of |

4

| | |

| | | that product and thereafter a royalty of 15% on its aggregate sales of that product in excess of $100 million until the later in each country of the expiration of our last relevant patent or 25 years from the first commercial introduction of that product; and |

| |

| | • | Hoffmann-La Roche will pay, for each product for which Hoffmann-La Roche exercises its option after completion of the Phase III trials, a royalty of 15% on its sales of that product until the later in each country of the expiration of our relevant patent or 25 years from the first commercial introduction of that product; however, $5 million of any option extension fee paid by Hoffmann-La Roche will be credited against royalties payable to us in the first calendar year of sales by Hoffmann-La Roche in which aggregate sales of the product exceed $100 million. |

We have agreed that, upon Roche’s request, we will file one or more registration statements under the Securities Act of 1933 in order to permit Roche to offer and sell shares of our common stock. We have agreed to use our best efforts to facilitate the registration and offering of those shares designated for sale by Roche.

We have the right to postpone the filing or effectiveness of a registration statement for a period of up to 60 days in any 12-month period if:

| | |

| | • | in the reasonable good faith judgment of our Board, fulfillment of our obligations would require us to make disclosures that would be detrimental to Genentech and premature; or |

| |

| | • | we have filed a registration statement with respect to securities to be distributed in an underwritten public offering and we have been advised by the lead or managing underwriter that an offering by Roche would materially and adversely affect the distribution of our securities. |

Generally, we will pay all expenses incident to the performance of our obligations with respect to the registration of Roche’s shares of our common stock except that Roche has agreed to pay certain expenses to be directly incurred by Roche, including underwriting fees, discounts and commissions and counsel fees. In addition, we are only required to pay for two registrations within a 12-month period. We and Roche each have agreed to customary indemnification and contribution provisions with respect to liability incurred in connection with these registrations.

If Roche and its affiliates sell their majority ownership of shares of our common stock to a successor, Roche has agreed that it will cause the successor to purchase all shares of our common stock not held by Roche:

| | |

| | • | if the consideration is composed entirely of either cash or equity traded on a U.S. national securities exchange, with consideration in the same form and amounts per share as received by Roche and its affiliates; and |

| |

| | • | in any other case, with consideration either in the same form and amounts per share as received by Roche and its affiliates or with consideration that has a value per share not less than the weighted average value per share received by Roche and its affiliates as determined by an investment bank of nationally recognized standing appointed by a committee of independent directors. |

Roche has agreed to cause the buyer to agree to be bound by the obligations described in the preceding paragraph as well as the obligations described under “— Business Combinations with Roche” and “— Compulsory Acquisitions” below. We have agreed that the buyer shall be entitled to succeed to Roche’s rights described under “— Roche’s Right to Proportional Representation.”

5

| |

| | Business Combinations with Roche |

Roche has agreed that as a condition to any merger of Genentech with Roche or its affiliates or the sale of substantially all of our assets to Roche or its affiliates, that either:

| | |

| | • | the merger or sale must be authorized by the favorable vote at any meeting of a majority of the shares of common stock not owned by Roche, provided that no person or group shall be entitled to cast more than 5% of the votes cast at the meeting; or |

| |

| | • | in the event such a favorable vote is not obtained, the value of the consideration to be received by the holders of our common stock, other than Roche, shall be equal to or greater than the average of the means of the ranges of fair values for the common stock as determined by two investment banks of nationally recognized standing appointed by a committee of independent directors. |

Roche has agreed that it will not sell any shares of our common stock in the 90 days immediately preceding any proposal by Roche for a merger with us.

Roche also agreed that in the event of any merger of Genentech with Roche or its affiliates or sale of substantially all of our assets to Roche or its affiliates, each unvested option then outstanding under our stock option plan will:

| | |

| | • | be accelerated so that each option shall become exercisable immediately prior to the consummation of the transaction for the full number of shares of common stock covered by the option; |

| |

| | • | become exchangeable upon the consummation of the transaction for deferred cash compensation, which vests on the same schedule as the shares of the common stock covered by the option, having a value equal to the product of (A) the number of shares covered by the option and (B) the amount which Roche, in its reasonable judgment, considers to be equivalent in value to the consideration per share received by holders of shares of common stock other than Roche in the transaction, minus the exercise price per share under the option; or |

| |

| | • | be canceled in exchange for a replacement option to purchase stock of the surviving corporation in the transaction with the terms of the option to provide value equivalent, as determined by Roche in its reasonable discretion, to that of the canceled option. |

If Roche owns more than 90% of our common stock for more than two months, Roche has agreed to, as soon as reasonably practicable, effect a merger of Genentech with Roche or an affiliate of Roche.

The merger shall be conditioned on the vote or the valuation described under the first two bullets of “— Business Combinations with Roche” above.

Roche’s Ability to Maintain its Percentage Ownership Interest in Our Stock

The affiliation agreement provides, among other things, that we will establish a stock repurchase program designed to maintain Roche’s percentage ownership interest in our common stock. The affiliation agreement provides that we will repurchase a sufficient number of shares pursuant to this program such that, with respect to any issuance of common stock by us in the future, the percentage of our common stock owned by Roche immediately after such issuance will be no lower than Roche’s lowest percentage ownership of our common stock at any time after the offering of common stock occurring in July 1999 but prior to the time of such issuance, except that we may issue shares up to an amount that would cause Roche’s lowest percentage ownership to be decreased up to 2% below the “Minimum Percentage.” The Minimum Percentage equals a fraction (expressed as a percentage) where the numerator is the lowest number of shares of our common stock owned by Roche since the July 1999 offering (to be adjusted in the future for dispositions of shares of our common stock by Roche), and the denominator is 509,194,352 which is the number of shares of our common stock outstanding at the time of the July 1999 offering adjusted for the two-for-one splits of our common stock in November 1999 and October 2000. Each of the numerator and denominator are to be adjusted in the future

6

for stock splits or stock combinations. As long as Roche’s percentage ownership is greater than 50%, prior to issuing any shares, the affiliation agreement provides that we will repurchase a sufficient number of shares of our common stock such that, immediately after its issuance of shares, Roche’s percentage ownership will be greater than 50%. The affiliation agreement also provides that, upon Roche’s request, we will repurchase shares of our common stock to increase Roche’s ownership to the Minimum Percentage. Roche currently owns approximately 58% of our common stock. The obligations of this stock repurchase program terminate upon Roche owning less than 40% of our stock.

Furthermore, Roche has (i) a continuing option (which is assignable by Roche to any of its affiliates) to buy from us, prior to the occurrence of any event that could result in a decrease in the percentage of common stock owned by Roche and its affiliates, a sufficient amount of common stock to ensure that Roche and its affiliates maintain the percentage ownership of our common stock owned by them, and (ii) a continuing option (which is assignable by Roche to any of its affiliates) to buy from us 80% of any class of stock issued by us other than common stock, in each case with a price per share equal to either the average of the last sale price on each of the five immediately preceding trading days on a U.S. national securities exchange on which the shares are traded or, if the sale prices are unavailable, the value of the shares determined in accordance with procedures reasonably satisfactory to Roche and us.

Tax Sharing Agreement

From the redemption of our special common stock in June 1999 until Roche completed its public offering of our common stock in October 1999, we were included in Roche’s U.S. consolidated federal income tax group and included with Roche and/or one or more Roche subsidiaries in consolidated or combined income tax groups for certain state and local tax jurisdictions. Accordingly, we entered into a tax sharing agreement with Roche. Pursuant to the tax sharing agreement, we and Roche are to make payments such that the net amount paid by us on account of consolidated or combined income taxes is determined as if we had filed separate, stand-alone federal, state and local income tax returns as the common parent of an affiliated group of corporations filing consolidated or combined federal, state and local returns.

Effective upon the consummation of the public offering in October 1999, we ceased to be a member of the consolidated federal income tax group (and certain consolidated or combined state or local income tax groups) of which Roche is the common parent. Accordingly, our tax sharing agreement with Roche now pertains only to the state and local tax returns in which we will be consolidated or combined with Roche. We will continue to calculate our tax liability or refund with Roche for these state and local jurisdictions as if we were a stand-alone entity.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The table below shows, as of December 31, 2001, information relating to stockholders known by us to be the beneficial owners of more than five percent of any class of Genentech’s voting securities, based on Securities and Exchange Commission filings made pursuant to Section 13(d) and Section 13(g) of the Securities Exchange Act of 1934:

| | | | | | | | | | | | | | |

| | Number | | | | Percent |

| Name and Address of Beneficial Owner | | of Shares | | Class | | of Class |

| |

| |

| |

|

| Roche Holdings, Inc. | | | 306,594,352 | | | | Common Stock | | | | 58.03 | % |

| | One Commerce Center, Suite 1050 | | | | | | | | | | | | |

| | 1201 N. Orange Street | | | | | | | | | | | | |

| | Wilmington, DE 19801 | | | | | | | | | | | | |

7

PROPOSAL 1 — ELECTION OF DIRECTORS

NOMINEES FOR DIRECTOR

The Company’s Board currently consists of two Roche directors, Franz B. Humer and Jonathan K.C. Knowles, three independent directors, Herbert W. Boyer, Charles A. Sanders and Sir Mark Richmond, and one Genentech employee, Arthur D. Levinson, who is also the chairman of the Board. The Board has proposed the election of each of these individuals at the Annual Meeting for a one year term expiring on the date of the Annual Meeting in 2003 or until a director’s successor has been elected or appointed. The persons named in the enclosed Proxy Card intend to vote the proxy for the election of each of the six nominees unless you indicate otherwise.

We expect each nominee for election as a director to be able to serve if elected. If any nominee is not able to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for any other person the Board of Directors may select.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE FOR EACH NOMINEE

The table below shows the name and age (as of the date of the Annual Meeting) of each of the directors, their current principal occupations, any positions and offices held by each with Genentech in addition to their position as a director, and the period during which each has served as a director of Genentech.

| | | | | | | | | | | |

| | | | | | Served as |

| Name | | Age | | Principal Occupation/Position Held | | Director Since |

| |

| |

| |

|

| Herbert W. Boyer, Ph.D. | | | 65 | | | Director of Genentech | | | 1976 | |

| Franz B. Humer | | | 55 | | | Chairman and Chief Executive Officer, The Roche Group | | | 1995 | |

| Jonathan K.C. Knowles, Ph.D. | | | 54 | | | Head of Global Pharmaceutical Research, The Roche Group | | | 1998 | |

| Arthur D. Levinson, Ph.D. | | | 52 | | | Chairman, President and Chief Executive Officer of Genentech | | | 1995 | |

| Sir Mark Richmond, Ph.D. | | | 71 | | | Director of Genentech | | | 1999 | |

| Charles A. Sanders, M.D. | | | 70 | | | Director of Genentech | | | 1999 | |

Dr. Boyer, a founder of Genentech, had been a director of Genentech since 1976 when he resigned from the Board in June 1999 in connection with the redemption of our special common stock. He was reelected to the Board in September 1999. Dr. Boyer is a consultant to Genentech. He served as a Vice President of Genentech from 1976 to 1991. Dr. Boyer, a Professor of Biochemistry at the University of California at San Francisco from 1976 to 1991, demonstrated the usefulness of recombinant DNA technology to produce medicines economically, which laid the groundwork for Genentech’s development. Dr. Boyer has received numerous awards for his research, including the National Medal of Science from President Bush in 1990, the National Medal of Technology in 1989 and the Albert Lasker Basic Medical Research Award in 1980. He is an elected member of the National Academy of Sciences and a Fellow in the American Academy of Arts and Sciences. In 2001, Dr. Boyer was elected to the National Inventors Hall of Fame. In addition, Dr. Boyer serves as Chairman of the Board of Directors of Allergan, Inc. and a member of the Boards of Directors of IDEC Pharmaceuticals Corporation and Sangamo BioSciences, Inc.

Dr. Humer was elected a director of Genentech in the spring of 1995. He joined The Roche Group in 1995 as the Head of its Pharmaceuticals Division, and became Chief Executive Officer of The Roche Group in 1998 and Chairman of the Board of Directors of The Roche Group in April 2001. Prior to joining The Roche Group, Dr. Humer was an Executive Director and Chief Operating Officer of Glaxo Holdings, a United Kingdom public limited company. Pursuant to the affiliation agreement, Dr. Humer is a designee of Roche.

Dr. Knowles was elected a director of Genentech in February 1998. He joined The Roche Group as Head of Global Pharmaceutical Research in September 1997. In January 1998, he became a member of the

8

Executive Committee of The Roche Group. Prior to joining The Roche Group, Dr. Knowles served as the Director of Research for Europe of Glaxo from 1995 to 1997 and served as the Director of the Geneva Institute of Glaxo from 1989 to 1995. Pursuant to the affiliation agreement, Dr. Knowles is a designee of Roche.

Dr. Levinson was appointed Chairman of the Board of Directors in September 1999 and was elected President and Chief Executive Officer and a director of the Company in July 1995. Since joining the Company in 1980, Dr. Levinson has been a Senior Scientist, Staff Scientist and the Director of the Company’s Cell Genetics Department. Dr. Levinson was appointed Vice President of Research Technology in April 1989, Vice President of Research in May 1990 and Senior Vice President in January 1993. Dr. Levinson was formerly on the editorial boards of “Molecular Biology and Medicine” and “Molecular and Cellular Biology,” and is active in the American Society of Microbiology, the New York Academy of Sciences, the American Association for the Advancement of Science, and the American Society for Biochemistry and Molecular Biology. From 1977 to 1980, Dr. Levinson was a Postdoctoral Fellow in the Department of Microbiology at the University of California, San Francisco. In 1977, Dr. Levinson received his Ph.D. in Biochemistry from Princeton University. Dr. Levinson also serves as a member of the Board of Directors of Apple Computer, Inc.

Dr. Richmond was elected a director of Genentech in August 1999. He was a senior research fellow at the School of Public Policy, University College London from February 1996 to February 2002. Previously, he held positions as science advisor at Glaxo Wellcome plc from 1995 to February 1996, as Group Head of Research at Glaxo plc from 1993 to 1995, as chairman of the Science and Engineering Council, London, from 1990 to 1993, as vice chancellor at the University of Manchester from 1981 to 1990, and professor and head of the Department of Bacteriology at the University of Bristol from 1968 to 1981. Dr. Richmond is currently a member of the Scientific Advisory Committee of the Institute for Biotechnology, ETH, Zurich, a member of the Scientific Advisory Board of the SPP-Biotechnology, Swiss National Foundation and a member of the Boards of Directors of Targeted Genetics Corporation and OSI Pharmaceuticals, Inc.

Dr. Sanders was elected a director of Genentech in August 1999. He served as Chief Executive Officer of Glaxo Inc. from 1989 to 1994, and was the Chairman of the Board of Glaxo Inc. from 1992 to 1995. He also has served on the Board of Directors of Glaxo plc. Previously, he held a number of positions at Squibb Corporation, a multinational pharmaceutical corporation, including Vice Chairman, Chief Executive Officer of the Science and Technology Group and Chairman of the Science and Technology Committee on the Board. Dr. Sanders is a member of the Boards of Directors of Scios Inc., Genaera Corporation, Vertex Pharmaceuticals, Edgewater, Inc., Trimeris, Inc., Biopure Corporation, Pharmacopeia, Inc. and Cephalon, Inc.

COMMITTEES AND MEETINGS

During 2001, the Board of Directors held four meetings, the Audit Committee held seven meetings, the Compensation Committee held four meetings, the Corporate Governance Committee held three meetings, the Executive Committee did not meet and the Nominations Committee held one meeting. All directors who served on the Board throughout the year attended at least 75% of the aggregate number of meetings of the Board and of the committees on which the directors serve. None of the members of the Audit, Compensation, Corporate Governance or Nominations Committees were an officer or employee of the Company. We summarize below the functions of the various committees and identify the directors who served on each committee.

9

| | | |

| Name of Committee | | |

| and Members | | Functions of the Committee |

| |

|

Audit Committee

Herbert W. Boyer

Mark Richmond

Charles A. Sanders | | • Recommends the independent auditors to the Board

• Meets with the Company’s independent auditors to review and discuss the Company’s financial statements, quarterly reporting process, inventory and receivable reserve policies, tax compliance and strategy, investment policy and risk management programs, and scope of audit activities

• Reviews the reports of the independent auditors and accompanying management letter on the scope and results of their work

• Reviews the independent auditors’ recommendations concerning the Company’s financial practices and procedures |

| |

Compensation Committee

Herbert W. Boyer

Franz B. Humer

Jonathan K.C. Knowles

Mark Richmond

Charles A. Sanders | | • Administers the Company’s stock option plans, the stock purchase plan and other corporate benefits programs

• Reviews and approves the Company’s annual bonus plan, annual stock option grants, corporate benefits strategy, compensation philosophy and executive officer compensation

• Recommends to the Board candidates for election as executive officers of the Company |

| |

Corporate Governance

Committee

Jonathan K.C. Knowles

Mark Richmond | | • Reviews the Company’s policies relating to sales and marketing activities, investor relations, corporate communications, government relations, human resources, legal and regulatory affairs, compliance with laws and regulations, and Board of Directors and Board committee effectiveness |

| |

Executive Committee

Herbert W. Boyer

Franz B. Humer

Arthur D. Levinson | | • Established to act when the full Board of Directors is unavailable

• Has the authority of the Board in the management of the business and affairs of the Company, except those powers that cannot be delegated by the Board of Directors by law |

| |

Nominations Committee

Herbert W. Boyer

Franz B. Humer

Jonathan K.C. Knowles | | • Identifies, reviews and recommends potential nominees to the Board of Directors

• Recommends to the Board candidates for election as executive officers of the Company |

PROPOSAL 2 — APPROVAL OF AMENDED AND RESTATED

1999 STOCK PLAN FOR CERTAIN CIRCUMSTANCES

We are asking our stockholders to approve the amended and restated 1999 Stock Plan (the “Plan”), under which a total of 63,000,000 shares of common stock have been reserved for issuance, so that the Company can receive a federal income tax deduction under the Plan in connection with options exercised by the Company’s five most highly compensated executive officers after stockholder approval. If the stockholders approve the amended and restated Plan, it will permit the Company to receive a federal income tax deduction for compensation paid under the Plan when those options are exercised by those individuals. Our Board of Directors previously approved the Plan. The affirmative vote of holders of a majority of the shares present in person or by proxy at the Annual Meeting is required for the approval of this proposal. Our five most highly compensated executive officers and directors have an interest in this proposal.

As of December 31, 2001, approximately 43,377,723 shares were subject to outstanding awards granted under the Plan, and approximately 14,500,000 shares remained available for any new awards to be granted in the future. The Board of Directors believes that the approval of the Plan solely for the purpose stated above provides the Company with an important benefit of being eligible to receive a federal income tax deduction in connection with options exercised by the Company’s five most highly compensated executive officers.

10

Description of the Amended and Restated 1999 Stock Plan

The following paragraphs provide a summary of the principal features of the Plan and its operation. The Plan is attached as Appendix A to this Proxy Statement, and the following summary is qualified in its entirety by reference to Appendix A.

The Plan permits the grant of stock options and stock purchase rights (each, an “Award”). The Plan is intended to increase incentives and to encourage share ownership on the part of eligible employees, non-employee directors and consultants who provide significant services to us. The Plan also is intended to further our growth and profitability.

| |

| | Administration of the Plan |

The Plan is administered by the Compensation Committee of our Board of Directors (the “Committee”). Subject to the terms of the Plan, the Committee has the sole discretion to select the employees, non-employee directors and consultants who will receive Awards, determine the terms and conditions of Awards (for example, the exercise price and vesting schedule), and interpret the provisions of the Plan and outstanding Awards. The Committee may delegate any part of its authority and powers under the Plan to one or more directors and/or officers of the Company.

If an Award expires or is cancelled without having been fully exercised or vested, the unvested or cancelled Shares generally will be returned to the available pool of Shares reserved for issuance under the Plan. Also, if we experience a stock dividend, reorganization or other change in our capital structure, our Board of Directors has discretion to adjust the number of Shares available for issuance under the Plan, the outstanding Awards, and the per-person limits on options, all as appropriate to reflect the stock dividend or other change.

| |

| Eligibility to Receive Awards |

The Committee selects the employees, non-employee directors and consultants who will be granted Awards under the Plan. The actual number of individuals who will receive an Award under the Plan cannot be determined in advance because the Committee has discretion to select the participants.

A stock option is the right to acquire shares of the Company’s common stock (“Shares”) at a fixed exercise price for a fixed period of time. Under the Plan, the Committee may grant nonqualified stock options and/or incentive stock options. The number of Shares covered by each option will be determined by the Committee, but during any fiscal year of the Company, no participant may be granted options covering more than 2,000,000 Shares or 3,000,000 Shares in the year of first hire. The exercise price of the Shares subject to each option is set by the Committee but for incentive stock options and options intended to qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code, the exercise price cannot be less than 100% of the fair market value (on the date of grant) of the Shares covered by the option. An exception may be made for any options that the Company grants in substitution for options held by employees of companies that the Company acquires (in which case the exercise price preserves the economic value of the employee’s cancelled option from his or her former employer). The aggregate fair market value of the Shares (determined on the grant date) covered by incentive stock options which first become exercisable by any participant during any calendar year also may not exceed $100,000.

An option granted under the Plan cannot be exercised until it becomes vested unless otherwise approved by the Company. The Committee establishes the vesting schedule of each option at the time of grant. Options granted under the Plan expire at the times established by the Committee, but in no event later than 10 years after the grant date.

The exercise price of each option granted under the Plan must be paid in full in cash at the time of exercise. The Committee also may permit payment through the tender of Shares that are already owned by

11

the participant, or by any other means that the Committee determines to be consistent with the purpose of the Plan. Any taxes required to be withheld must be paid by the participant at the time of exercise.

Stock purchase rights generally are the same as options. Stock purchase rights may be granted alone or in combination with an option. Each right allows the participant to purchase shares at a price determined by the Committee. Shares purchased may be subject to a vesting schedule or right of repurchase by the Company, all as determined by the Committee.

| |

| Awards to be Granted to Certain Individuals and Groups |

The number of Awards that an employee, non-employee director or consultant may receive under the Plan is in the discretion of the Committee and therefore cannot be determined in advance. To date, only stock options have been granted under the Plan. The table below shows the aggregate number of Shares subject to options granted under the Plan during the last fiscal year and the average per Share exercise price of such options as follows:

| | | | | | | | | |

| | Number of | | Average Per Share |

| Name of Individual or Group | | Options Granted | | Exercise Price |

| |

| |

|

| Arthur D. Levinson | | | 360,000 | | | $ | 41.80 | |

| Myrtle S. Potter | | | 225,000 | (1) | | $ | 43.70 | (1) |

| Susan D. Desmond-Hellmann | | | 225,000 | | | $ | 41.80 | |

| Louis J. Lavigne, Jr | | | 160,000 | | | $ | 41.80 | |

| Stephen G. Juelsgaard | | | 160,000 | | | $ | 41.80 | |

| All executive officers, as a group | | | 2,256,600 | | | $ | 42.53 | |

| All directors who are not executive officers, as a group | | | 30,000 | | | $ | 52.50 | |

| All employees who are not executive officers, as a group | | | 8,454,089 | | | $ | 42.56 | |

| |

| (1) | 150,000 of the options have an exercise price of $41.80 and 75,000 of the options have an exercise price of $47.50. The exercise price of $43.70 in theAverage Per Share Exercise Price column above was calculated as a weighted average. |

| |

| Limited Transferability of Awards |

Awards granted under the Plan generally may not be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, other than by will or by the applicable laws of descent and distribution, unless the Committee determines otherwise.

| |

| Amendment and Termination of the Plan |

The Board generally may amend or terminate the Plan at any time and for any reason.

Federal Tax Aspects

The following paragraphs are a summary of the general federal income tax consequences to U.S. taxpayers and the Company of Awards granted under the Plan. Tax consequences for any particular individual may be different.

| |

| Nonqualified Stock Options |

No taxable income is reportable when a nonqualified stock option is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the excess of the fair market value (on the exercise date) of the Shares purchased over the exercise price of the option. Any additional gain or loss recognized upon any later disposition of the Shares will be capital gain or loss.

12

Taxable income is not generally recognized on the grant or exercise of an incentive stock option (unless the alternative minimum tax rules apply). The difference between the sale price and the option price on the sale of Shares exercised and held for a period of at least two years after the grant date and one year after the issuance date will be long-term capital gain or loss. If the participant exercises the option and then later sells or otherwise disposes of the Shares before the end of the two or one-year holding periods described above, then the participant will generally have ordinary income at the time of the sale equal to the fair market value of the Shares on the exercise date (or the sale price, if less) minus the exercise price of the option.

Stock purchase rights generally are taxed in the same manner as nonqualified stock options. However, when a stock purchase right is exercised, the participant typically receives “restricted” stock (that is, stock that is subject to a vesting schedule). At the time of purchase, restricted stock is subject to a “substantial risk of forfeiture” within the meaning of Section 83 of the Internal Revenue Code. As a result, the participant will not recognize ordinary income at the time of purchase. Instead, the participant will recognize ordinary income on the dates when the stock ceases to be subject to a substantial risk of forfeiture. The stock typically will cease to be subject to a substantial risk of forfeiture when it is no longer subject to the Company’s right to repurchase the stock upon the purchaser’s termination of employment with the Company. The participant will recognize ordinary income measured as the difference between the purchase price and the fair market value of the stock on the date the stock is no longer subject to a substantial risk of forfeiture. The participant may accelerate to the date of purchase his or her recognition of ordinary income, if any, and the beginning of any capital gain holding period by timely filing an election pursuant to Section 83(b) of the Internal Revenue Code.

Tax Effect for the Company

The Company generally will be entitled to a tax deduction in connection with an Award under the Plan in an amount equal to the ordinary income realized by a participant and at the time the participant recognizes such income (for example, the exercise of a nonqualified stock option). Special rules limit the deductibility of compensation paid to our Chief Executive Officer and to each of our four most highly compensated executive officers. Under Section 162(m) of the Internal Revenue Code, the annual compensation paid to any of these specified executives will be deductible only to the extent that it does not exceed $1 million. However, the Company can preserve the deductibility of certain compensation in excess of $1 million if the conditions of Section 162(m) are met. These conditions include stockholder approval of the Plan, setting limits on the number of Awards that any individual may receive and for Awards other than stock options, establishing performance criteria that must be met before the Award actually will vest or be paid. The Plan has been designed to permit the Committee to grant options that qualify as performance-based for purposes of satisfying the conditions of Section 162(m), thereby permitting the Company to continue to receive a federal income tax deduction in connection with the exercise of those options.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE FOR APPROVAL OF PROPOSAL 2

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act requires the Company’s directors, officers and persons owning more than 10% of any class of the Company’s equity securities (collectively, “Reporting Persons”) to file reports of holdings and transactions in the Company’s equity securities with the Securities and Exchange Commission and the New York Stock Exchange. The Reporting Persons are required to furnish the Company with copies of all Section 16(a) reports they file. We believe that all Forms 3, 4 and 5 required to be filed by its Reporting Persons were filed on time during 2001.

13

SECURITY OWNERSHIP OF MANAGEMENT

The table below shows the beneficial ownership of shares of common stock of the Company as of December 31, 2001, unless otherwise noted, held by (i) each of Genentech’s directors, (ii) Genentech’s Chief Executive Officer, (iii) each of Genentech’s four other most highly compensated executive officers (together with Genentech’s Chief Executive Officer, the “Named Executive Officers”), and (iv) all of Genentech’s directors and executive officers as a group. Unless otherwise indicated, each person has sole voting and investment power, other than the powers that may be shared with the person’s spouse under applicable law.

AMOUNT AND NATURE OF BENEFICIAL OWNERSHIP

| | | | | | | | | |

| | |

| | Genentech Common Stock |

| |

|

| | | | Percent of |

| Name of Beneficial Owner | | Shares | | Class |

| |

| |

|

| Herbert W. Boyer | | | 30,050(1 | ) | | | * | |

| Susan D. Desmond-Hellmann | | | 733,091(2 | ) | | | * | |

| Franz B. Humer | | | 0(3 | ) | | | * | |

| Stephen G. Juelsgaard | | | 505,776(4 | ) | | | * | |

| Jonathan K. C. Knowles | | | 0(3 | ) | | | * | |

| Louis J. Lavigne, Jr. | | | 691,262(5 | ) | | | * | |

| Arthur D. Levinson | | | 1,793,992(6 | ) | | | * | |

| Myrtle S. Potter | | | 88,211(7 | ) | | | * | |

| Sir Mark Richmond | | | 20,500(8 | ) | | | * | |

| Charles A. Sanders | | | 21,500(9 | ) | | | * | |

| All Directors and Executive Officers as a Group (33 persons) | | | 5,886,119(10 | ) | | | 1.11 | % |

Asterisk (*) indicates that the amount beneficially owned is less than one percent (1%) of the outstanding shares of common stock of the Company.

| |

| (1) | Includes stock options exercisable on December 31, 2001 or exercisable by March 1, 2002 to purchase 9,250 shares of common stock. |

| |

| (2) | Includes stock options exercisable on December 31, 2001 or exercisable by March 1, 2002 to purchase 732,048 shares of common stock. |

| |

| (3) | As of December 31, 2001, Roche owned 306,594,352 shares of common stock, representing 58.03% of the class. Pursuant to the affiliation agreement, Roche has appointed Drs. Humer and Knowles as its representatives on Genentech’s Board of Directors. |

| |

| (4) | Includes stock options exercisable on December 31, 2001 or exercisable by March 1, 2002 to purchase 504,334 shares of common stock. |

| |

| (5) | Includes stock options exercisable on December 31, 2001 or exercisable by March 1, 2002 to purchase 689,820 shares of common stock. |

| |

| (6) | Includes stock options exercisable on December 31, 2001 or exercisable by March 1, 2002 to purchase 1,791,899 shares of common stock. |

| |

| (7) | Includes stock options exercisable on December 31, 2001 or exercisable by March 1, 2002 to purchase 87,500 shares of common stock. |

| |

| (8) | Includes stock options exercisable on December 31, 2001 or exercisable by March 1, 2002 to purchase 20,500 shares of common stock. |

| |

| (9) | Includes stock options exercisable on December 31, 2001 or exercisable by March 1, 2002 to purchase 20,500 shares of common stock. |

| |

| (10) | Includes stock options held by 23 other current executive officers, exercisable on December 31, 2001 or exercisable by March 1, 2002 to purchase 1,968,027 shares of common stock. This amount excludes the shares of an officer who resigned from the Company in January 2002 and includes the shares of an individual who was appointed an officer in February 2002. |

14

EXECUTIVE COMPENSATION

COMPENSATION OF DIRECTORS

Each of the non-employee directors of Genentech is paid an annual retainer fee of $30,000. In addition, each of the non-employee directors receives a total of $1,500 for each Board meeting at which the director was present in person and a total of $500 for each Board meeting at which the director was present by telephone. As an employee of Genentech, Dr. Levinson is not paid for his services as a director. All directors are reimbursed for expenses incurred in connection with their service on the Board. Dr. Boyer also serves as a consultant to Genentech and received compensation in the amount of $20,000 for his services as a consultant in 2001.

Under the Plan, each non-Roche and non-employee Board member (an “Independent Director”) is granted a stock option to purchase 25,000 shares of common stock upon first election to the Board. These options vest over four years, with the first 25% vesting one year from the grant date, and the remainder vesting monthly in equal increments during the 36-month period following the initial vesting date. In addition, each Independent Director is granted a stock option to purchase 10,000 shares of common stock of the Company upon a reelection to the Board. These options vest on a monthly basis in equal increments over a period of twelve months. The exercise price of any option granted to an Independent Director will be equal to the closing price of the common stock as reported in theWall Street Journalon the day of election or reelection, as applicable. Drs. Boyer, Richmond and Sanders, as Independent Directors, each received an option to purchase 10,000 shares of common stock upon reelection to the Board in 2001.

COMPENSATION OF EXECUTIVE OFFICERS

SUMMARY OF COMPENSATION

The table below shows the compensation paid by Genentech to the Named Executive Officers, including salary, bonuses, stock options and certain other compensation for the fiscal years ended December 31, 2001, 2000 and 1999:

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | Long Term | | |

| | | | Annual Compensation | | Compensation | | |

| | | |

| | Awards/Securities | | All Other |

| | | | | | Other Annual | | Underlying | | Compensation |

| Name and Principal Position | | Year | | Salary(1) | | Bonus | | Compensation (4) | | Options(7)(#) | | (9) |

| |

| |

| |

| |

| |

| |

|

| | | | | | | | | | | | | | |

| Arthur D. Levinson, Ph.D. | | | 2001 | | | $ | 780,000 | | | $ | 985,000 | | | | — | | | | 360,000 | | | | — | | | $ | 70,600 | |

| | Chairman, President and Chief | | | 2001 | | | | — | | | $ | 150,000 | (2) | | | — | | | | — | | | | — | | | | — | |

| | Executive Officer | | | 2000 | | | $ | 755,010 | | | $ | 985,000 | | | | — | | | | 360,000 | | | | — | | | $ | 69,400 | |

| | | | 1999 | | | $ | 750,000 | | | $ | 985,000 | | | | — | | | | 1,932,852 | | | | (1,450,000 | )(8) | | $ | 68,000 | |

| |

| Myrtle S. Potter(10) | | | 2001 | | | $ | 520,256 | | | $ | 425,000 | | | $ | 1,207,608 | (5) | | | 225,000 | | | | — | | | $ | 30,800 | |

| | Executive Vice President, | | | 2000 | | | $ | 315,169 | | | $ | 500,000 | (3) | | $ | 789,284 | (6) | | | 300,000 | | | | — | | | $ | 10,000 | |

| | Commercial Operations and | | | 1999 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | Chief Operating Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Susan D. Desmond-Hellmann, M.D., M.P.H | | | 2001 | | | $ | 500,491 | | | $ | 425,000 | | | | — | | | | 225,000 | | | | — | | | $ | 37,000 | |

| | Executive Vice President, | | | 2000 | | | $ | 452,918 | | | $ | 425,000 | | | | — | | | | 250,000 | | | | — | | | $ | 34,000 | |

| | Development and Product | | | 1999 | | | $ | 375,208 | | | $ | 400,000 | | | | — | | | | 933,104 | | | | (700,000 | )(8) | | $ | 27,400 | |

| | Operations and Chief Medical | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Louis J. Lavigne, Jr. | | | 2001 | | | $ | 379,282 | | | $ | 310,000 | | | | — | | | | 160,000 | | | | — | | | $ | 27,560 | |

| | Executive Vice President and | | | 2000 | | | $ | 372,709 | | | $ | 310,000 | | | | — | | | | 160,000 | | | | — | | | $ | 27,100 | |

| | Chief Financial Officer | | | 1999 | | | $ | 367,500 | | | $ | 310,000 | | | | — | | | | 839,792 | | | | (630,000 | )(8) | | $ | 27,100 | |

| |

| Stephen G. Juelsgaard | | | 2001 | | | $ | 322,400 | | | $ | 225,000 | | | | — | | | | 160,000 | | | | — | | | $ | 21,896 | |

| | Senior Vice President, General | | | 2000 | | | $ | 314,528 | | | $ | 225,000 | | | | — | | | | 160,000 | | | | — | | | $ | 21,400 | |

| | Counsel and Secretary | | | 1999 | | | $ | 295,000 | | | $ | 239,939 | | | | — | | | | 519,872 | | | | (390,000 | )(8) | | $ | 20,000 | |

| |

| (1) | Includes amounts earned but deferred at the election of the executive, such as salary deferrals under Genentech’s Tax Reduction Investment Plan (the “401(k) Plan”) established under Section 401(k) of the Internal Revenue Code. |

15

| |

| (2) | In addition to his regular bonus of $985,000, Dr. Levinson was granted an additional bonus of $150,000 to reflect both the significant success and achievements of Genentech in 2001 and the fact that Dr. Levinson’s bonus in 2000 was, at his request, the same as that awarded in 1999 even though the Company’s performance was significantly better in 2000 than in 1999, and that bonuses of Chief Executive Officers in comparable companies increased substantially in the same period. |

| |

| (3) | The amount disclosed for Ms. Potter includes payment by Genentech of a sign-on hiring bonus of $250,000. |

| |

| (4) | Under the rules promulgated by the Securities and Exchange Commission, the payment of “perquisites” (such as imputed interest on loans at below market value rates) to a Named Executive Officer is not required to be disclosed where such amounts paid do not exceed the lesser of (i) 10% of the sum of the amounts of Salary and Bonus for the Named Executive Officer, or (ii) $50,000. Other than the payment of “perquisites” to Ms. Potter as described in footnotes (5) and (6) below, no other Named Executive Officer received the payment of any “perquisite” from the Company. |

| |

| (5) | The amount disclosed for Ms. Potter for 2001 includes payment by Genentech of (a) $371,325 for the value of options to purchase stock of Bristol-Myers Squibb surrendered by Ms. Potter upon her resignation of employment with Bristol-Myers Squibb, (b) a relocation benefit valued at $67,789 (including a gross-up payment of $34,132 included therein to reimburse Ms. Potter for the estimated income taxes attributable to the payment of the relocation benefit), (c) an adjustment in the amount of $171,426 for taxes payable by Ms. Potter for the relocation benefit paid by Genentech in 2000 (such adjustment amount includes a gross-up payment of $59,913 to reimburse Ms. Potter for the estimated income taxes attributable to the adjustment), (d) imputed interest of $194,248 on Ms. Potter’s relocation home loan (including a gross-up payment of $59,354 included therein to reimburse Ms. Potter for the estimated income taxes attributable to the imputed interest), and (e) compensation in the amount of $402,820 (including forgiveness of $200,000 on Ms. Potter’s relocation home loan and a gross-up payment of $202,820 to reimburse Ms. Potter for the estimated income taxes attributable to the loan forgiveness). |

| |

| (6) | The amount disclosed for Ms. Potter for 2000 includes payment by Genentech of (a) a relocation benefit valued at $424,553 (including a gross-up payment of $147,885 included therein to reimburse Ms. Potter for the estimated income taxes attributable to the relocation benefit), (b) imputed interest of $71,610 on Ms. Potter’s relocation home loan, (c) a gross-up payment of $33,008 to reimburse Ms. Potter for the estimated income taxes attributable to the imputed interest on the forgivable portion of the home loan, and (d) a gross-up payment of $260,113 to reimburse Ms. Potter for the estimated income taxes attributable to the sign-on bonus disclosed in footnote (3) above. |

| |

| (7) | Genentech has awarded no stock appreciation rights (“SARs”). |

| |

| (8) | The options granted in 1999 were replacements for the unvested portion of options granted in prior years that were canceled in connection with Genentech’s redemption of its special common stock in June of 1999. In replacement of these canceled unvested options, Genentech granted replacement options in connection with Roche’s public offering of Genentech common stock in July of 1999. These replacement options were granted at a higher exercise price and for a longer vesting period than the canceled unvested options they replaced. The number of replacement options granted equaled the number of canceled options multiplied by 1.333. No new options other than these replacement options were granted to the Named Executive Officers in 1999. For each Named Executive Officer, the first number shown is the number of replacement options granted in 1999 and the second number shown in parenthesis is the portion of unvested options granted in prior years that were canceled prior to the time of the replacement grant. |

| |

| (9) | Consists of Genentech’s matching payments under its 401(k) Plan and Supplemental Plan for 2001, 2000 and 1999. Each of the Named Executive Officers received $6,800 in matching payments under the 401(k) Plan for 2001 and each of the Named Executive Officers other than Ms. Potter received $6,800 in matching payments under the 401(k) Plan for 2000 and $6,400 in matching payments under the 401(k) Plan for 1999. Under the Supplemental Plan, Dr. Levinson, Dr. Desmond-Hellmann, Mr. Lavigne, Ms. Potter and Mr. Juelsgaard received matching payments of $63,800, $30,200, $20,760, $24,000 and $15,096, respectively, for 2001 and $62,600, $27,200, $20,300, $10,000 and $14,600, respectively, for 2000. Dr. Levinson, Dr. Desmond-Hellmann and Messrs. Lavigne and Juelsgaard received matching payments of $61,600, $21,000, $20,700 and $13,600, respectively, for 1999. |

| |

| (10) | Ms. Potter began her employment with Genentech effective May 15, 2000. |

16

STOCK OPTION GRANTS AND EXERCISES

OPTION GRANTS IN LAST FISCAL YEAR

| | | | | | | | | | | | | | | | | | | | | |

| | |

| | Individual Grants |

| |

|

| | | | Percent of | | |

| | | | Total Options | | | | Grant Date |

| | Number of Securities | | Granted to | | Exercise or | | | | Present |

| | Underlying Options | | Employees in | | Base Price | | Expiration | | Value(5) |

| Name | | Granted (#)(1) | | Fiscal Year(2) | | ($/SH)(3) | | Date(4) | | (in millions) |

| |

| |

| |

| |

| |

|

| Arthur D. Levinson | | | 360,000 | | | | 3.36 | % | | $ | 41.80 | | | | 09/26/11 | | | $ | 8.5 | |

| Myrtle S. Potter | | | 225,000 | (6) | | | 2.10 | % | | $ | 43.70 | (6) | | | (6) | | | $ | 5.6 | (6) |

| Susan D. Desmond-Hellmann | | | 225,000 | | | | 2.10 | % | | $ | 41.80 | | | | 09/26/11 | | | $ | 5.3 | |

| Louis J. Lavigne, Jr. | | | 160,000 | | | | 1.49 | % | | $ | 41.80 | | | | 09/26/11 | | | $ | 3.8 | |

| Stephen G. Juelsgaard | | | 160,000 | | | | 1.49 | % | | $ | 41.80 | | | | 09/26/11 | | | $ | 3.8 | |

| |

| (1) | The options were granted pursuant to the Plan and vest over four years, with the first 25% vesting one year from the grant date, and the remainder vesting monthly during the 36-month period following the initial vesting date, unless otherwise indicated. |

| |

| (2) | Based on a total of approximately 11 million options granted in 2001 under our Plan to employees, including the Named Executive Officers. Approximately 89% of these options were granted to more than 4,600 employees, other than the Named Executive Officers, representing more than 95% of the eligible employee population. |

| |

| (3) | The exercise price of options granted represented the fair market value of the underlying shares of common stock as based on the closing price of the Company’s common stock on the date of grant. |

| |

| (4) | These options have a term of ten years subject to earlier termination upon the occurrence of certain events related to termination of employment with the Company. |

| |

| (5) | Option value was determined using the Black-Scholes option pricing model based on the following assumptions: expected volatility of 63% based on historical volatility for the year and implied volatility from traded options and a risk free rate of 3.99% for the vesting term of the option. Each option is valued at its exercise price, which is assumed to be equivalent to the market price at the date of grant. This valuation model was not adjusted for the vesting restrictions or the risk of forfeiture of the options. Under SFAS 123, forfeitures may be estimated or assumed to be zero; in this model, the forfeiture rate was assumed to be zero. Our use of this model in accordance with rules adopted by the Securities and Exchange Commission does not constitute an endorsement of the model nor an acknowledgment that such model can accurately determine the value of options. The valuation calculations do not necessarily represent the fair market value of individual options, and are not intended to forecast possible future appreciation, if any, of the price of our common stock on the date of exercise as compared to the exercise price of the option. |

| |

| (6) | All of these options were granted pursuant to the Plan and vest over four years, with the first 25% vesting as of September 26, 2002 and the remainder vesting monthly during the 36-month period following the initial vesting date. 150,000 of the options have an exercise price of $41.80 and an expiration date of September 26, 2011 and 75,000 of the options have an exercise price of $47.50 and an expiration date of October 23, 2011. The exercise price of $43.70 in the Exercise or Base Price column above and the present value of the options in the Grant Date Present Value column above were calculated as weighted averages. |

The table below shows for the fiscal year ended December 31, 2001 certain information regarding options exercised by, and held at year end by, the Named Executive Officers:

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FY-END OPTION VALUES(1)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | Number of Securities | | |

| | | | | | Underlying Unexercised | | Value of Unexercised in-the- |

| | Shares | | | | Options at FY-end(#) | | Money Options at FY-end(3) |

| | Acquired on | | Value | |

| |

|

| Name | | Exercise(#) | | Realized(2) | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

| |

| |

| |

| |

| |

| |

|

| Arthur D. Levinson | | | 10,000 | | | $ | 359,263 | | | | 1,669,518 | | | | 983,334 | | | $ | 46,710,552 | | | $ | 15,757,008 | |

| Myrtle S. Potter | | | 0 | | | $ | 0 | | | | 79,166 | | | | 445,834 | | | $ | 0 | | | $ | 2,373,750 | |

| Susan D. Desmond-Hellmann | | | 50,000 | | | $ | 1,499,750 | | | | 669,793 | | | | 578,311 | | | $ | 17,750,040 | | | $ | 8,244,330 | |

| Louis J. Lavigne, Jr. | | | 0 | | | $ | 0 | | | | 636,498 | | | | 433,294 | | | $ | 17,594,952 | | | $ | 6,890,808 | |

| Stephen G. Juelsgaard | | | 0 | | | $ | 0 | | | | 468,786 | | | | 371,086 | | | $ | 12,563,592 | | | $ | 5,024,568 | |

| |

| (1) | Genentech has awarded no SARs. |

| |

| (2) | Sale price of Genentech’s common stock on the date of exercise minus the exercise price. |

| |

| (3) | The value of the unexercised in-the-money options is based on the fair market value of Genentech’s common stock, $54.25, at the close of business on December 31, 2001, the last business day of 2001, minus the exercise price of the options. |

17

CHANGE IN CONTROL AGREEMENTS

Genentech and Ms. Potter, Executive Vice President, Commercial Operations and Chief Operating Officer, entered into a Change of Control Agreement on January 20, 2001 (the “Agreement”). The Agreement is effective through the earlier of May 15, 2005 or 24 months following a Change of Control (as that term is defined in the Agreement). The Agreement generally provides that, in the event Ms. Potter’s employment with Genentech is terminated following a Change of Control (i) by Genentech, except for Cause or (ii) by Ms. Potter with Good Reason (as these terms are defined in the Agreement), Genentech will pay Ms. Potter a lump sum severance payment equal to two times the sum of (i) Ms. Potter’s annual base salary and (ii) Ms. Potter’s average annual bonus and provide 24 months of health care and other insurance coverage. If the foregoing severance payments are subject to excise tax, then Genentech will pay Ms. Potter an additional amount to cover such tax.

LOANS AND OTHER COMPENSATION

For purposes of the discussion below, applicable federal rate refers to the minimum interest rate required to be charged on a loan to avoid the imputation of interest income under the Internal Revenue Code, unless an exception applies. The Internal Revenue Service publishes the applicable federal rate on a monthly basis.

In 1999, Genentech lent $250,000 to Dr. Stephen Dilly, Vice President, Medical Affairs, for the purchase of a home in connection with his relocation to the San Francisco Bay Area. $175,000 of this loan is due and payable in equal installments of $58,333 each on the fifth, sixth and seventh anniversary of the date of the loan or, if earlier, the remaining balance is due on the date of termination of Dr. Dilly’s employment with Genentech. The remaining $75,000 will be forgiven on April 12, 2004, if Dr. Dilly remains employed by Genentech. The largest amount outstanding under this loan during 2001 was $250,000. The amount of this loan outstanding as of December 31, 2001 was $250,000. The loan is interest-free to Dr. Dilly, and imputed interest on this loan was not required under the Internal Revenue Code.

In 1999, Genentech made two loans to Ms. Diane Parks, Vice President, Cardiovascular and Specialty Therapeutics, one in the amount of $250,000 and one in the amount of $200,000 for a total of $450,000 for the purchase of a home in connection with her relocation to the San Francisco Bay Area. In July 1999, Genentech extended to Ms. Parks the first loan for $250,000. $150,000 of this loan is due and payable on the earlier of the fifth anniversary of the date of the loan or the date of termination of Ms. Parks’ employment with Genentech. The remaining $100,000 will be forgiven in five equal installments of $20,000 on the anniversary date of the loan, provided that Ms. Parks is employed by Genentech on the forgiveness date. In November 1999, Genentech extended to Ms. Parks the second loan for $200,000, of which $175,000 was repaid in November 1999 and the remaining $25,000 was repaid in April 2001. The largest amount outstanding under all loans during 2001 was $255,000. The amount of the loans outstanding as of December 31, 2001 was $210,000. The loan is interest-free to Ms. Parks, but interest is required to be imputed under the Internal Revenue Code. Imputed interest in the amount of $17,643 was calculated using the applicable federal rate of 5.74% and reported as taxable compensation to Ms. Parks.