UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number:811-03091

Name of Fund: BlackRock Series Fund, Inc.

BlackRock Advantage Large Cap Core Portfolio

BlackRock Balanced Capital Portfolio

BlackRock Capital Appreciation Portfolio

BlackRock Global Allocation Portfolio

BlackRock Government Money Market Portfolio

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Series Fund, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800)441-7762

Date of fiscal year end: 12/31/2018

Date of reporting period: 12/31/2018

| Item 1 – | Report to Stockholders |

DECEMBER 31, 2018

| | |

ANNUAL REPORT | |  |

BlackRock Series Fund, Inc.

| Ø | | BlackRock Advantage Large Cap Core Portfolio |

| Ø | | BlackRock Balanced Capital Portfolio |

| Ø | | BlackRock Capital Appreciation Portfolio |

| Ø | | BlackRock Global Allocation Portfolio |

| Ø | | BlackRock Government Money Market Portfolio |

BlackRock Series Fund II, Inc.

| Ø | | BlackRock High Yield Portfolio |

| Ø | | BlackRock U.S. Government Bond Portfolio |

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

In the 12 months ended December 31, 2018, concerns about a variety of political risks and a modest slowdown in global growth worked against the equity market despite solid corporate earnings, while rising interest rates constrained bond returns. Though the market’s appetite for risk remained healthy for most of the reporting period, risk-taking declined sharply later in the reporting period. As a result, bonds held their value better than stocks, which posted negative returns across the globe. Shorter-term, higher-quality securities led the bond market, and U.S. equities outperformed most international stock markets.

Volatility rose in emerging market stocks, as the rising U.S. dollar and higher interest rates in the U.S. disrupted economic growth abroad. U.S.-China trade relations and debt concerns adversely affected the Chinese stock market, while Turkey and Argentina became embroiled in currency crises, largely due to hyperinflation in both countries. An economic slowdown in Europe also led to negative performance for European equities.

In fixed income markets, short-term U.S. Treasury interest rates rose the fastest, while longer-term rates slightly increased. This led to a negative return for long-term U.S. Treasuries and a substantial flattening of the yield curve. Many investors are concerned with the flattening yield curve as a harbinger of recession. However, given the extraordinary monetary measures in the last decade, we believe a more accurate barometer for the economy is the returns along the risk spectrums in stock and bond markets. Although the fundamentals in credit markets remained relatively solid, investment-grade bonds posted flat returns, and high-yield bonds declined slightly. Recent sell-offs in risk assets have flattened asset returns along the risk spectrum somewhat, which bears further scrutiny in the months ahead.

In response to rising growth and inflation, the U.S. Federal Reserve (the “Fed”) increased short-term interest rates four times during the reporting period. The Fed also continued to reduce its balance sheet, gradually reversing the unprecedented stimulus measures it enacted after the financial crisis. By our estimation, the Fed’s neutral interest rate, or the theoretical rate that is neither stimulative nor restrictive to the economy, is approximately 3.0%. With that perspective, the Fed’s current policy is still mildly stimulative to the U.S. economy, which leaves room for further Fed rate hikes to arrive at monetary policy that is a neutral factor for economic growth.

Volatility in the U.S. equity market spiked in October, as a wide range of risks were brought to bear on markets, ranging from rising interest rates and slowing global growth to heightened trade tensions and political turmoil in several countries, including the United States. This was accompanied by a broad basedrisk-off in December — which was the worst December performance on record since 1931. Although fears of recession drove equity volatility higher at the end of 2018, we continue to believe the probability of recession in 2019 remains relatively low.

Economic growth and global earnings are likely to slow somewhat in 2019 — the tax cut stimulus will be less pronounced, and the Fed’s rate hikes in 2018 will gain traction in 2019. Trade frictions look more baked into asset prices than a year ago, but markets may be overlooking European political risks. Consequently, we are cautious on European equities, as European unity remains tenuous with a history offlare-ups. We continue to prefer to take risk in U.S. and emerging market equities. Within U.S. equities, we believe that companies with high-quality earnings and strong balance sheets offer the most attractive risk/rewardtrade-off. Going into 2019, we also favor short-term bonds over long-term bonds because they offer nearly equivalent yields with far lower volatility.

In this environment, investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visitblackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

| Total Returns as of December 31, 2018 |

| | | 6-month | | 12-month |

U.S. large cap equities

(S&P 500® Index) | | (6.85)% | | (4.38)% |

U.S. small cap equities

(Russell 2000® Index) | | (17.35) | | (11.01) |

International equities

(MSCI Europe, Australasia,

Far East Index) | | (11.35) | | (13.79) |

Emerging market equities

(MSCI Emerging Markets Index) | | (8.48) | | (14.57) |

3-month Treasury bills

(ICE BofAML3-Month

U.S. Treasury Bill Index) | | 1.06 | | 1.87 |

U.S. Treasury securities

(ICE BofAML10-Year

U.S. Treasury Index) | | 2.72 | | (0.03) |

U.S. investment grade bonds

(Bloomberg Barclays U.S.

Aggregate Bond Index) | | 1.65 | | 0.01 |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | 1.38 | | 1.36 |

U.S. high yield bonds

(Bloomberg Barclays

U.S. Corporate High Yield

2% Issuer Capped Index) | | (2.24) | | (2.08) |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | THIS PAGEISNOT PARTOF YOUR FUND REPORT |

Table of Contents

| | |

| Fund Summary as of December 31, 2018 | | BlackRock Advantage Large Cap Core Portfolio |

Investment Objective

BlackRock Advantage Large Cap Core Portfolio’s (the “Fund”) investment objective is to seek long-term capital appreciation.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended December 31, 2018, the Fund underperformed its benchmark, the Russell 1000® Index.

What factors influenced performance?

After beginning the year favoring growth stocks and trend-based strategies, investors later reversed course and sold out of more expensive, growth-oriented areas of the market on fears of expensive valuations and of approaching the end of the market cycle. As thesell-off was often disconnected with the broader sentiment of management and market participants, it created a difficult environment for sentiment-based signals and resulted in sentiment insights detracting from relative performance for the period. A signal that gauges company sentiment based on trends in online job postings was the largest detractor for the period. Identifying sentiment based on short positions of hedge funds acted as a drag on performance as well, largely due to significant hedge fundde-risking toward the end of the year. A signal that usesgeo-location data to determine consumer foot traffic patterns into variousbrick-and-mortar locations further detracted. Given a rotation out of growth positions, investors typically flock to pockets of attractive relative valuation. However, as value stocks showed some of the strongest earnings trends heading into the fourth quarter, theysold-off amid the rotation away from growth expectations. As a result, while fundamental signals held up well for the period, an insight that evaluates each stock based on forward sales relative to enterprise value hindered relative performance for the year.

As volatility and concerns about the approaching end of the current cycle increased, investors returned their focus to company fundamentals and to finding quality businesses offering sustainable growth prospects. In this vein, the Fund’s fundamental insights, particularly quality insights, were the primary drivers of positive relative return over the course of the year. Among the portfolio’s fundamental signals, identifying companies with attractive cash flow growth relative to operating assets was the top contributor. Identifying positive dividend growth trends as a measure of quality also proved beneficial. Although the portfolio’s sentiment insights overall were a drag on relative performance, sentiment insights that provide a more quality-based lens into companies contributed positively. Specifically, an insight that gauges sentiment from informed bond investors contributed significantly, given interest rate volatility. Text-based analyses of management conference calls to determine longer-term trends in company fundamentals proved beneficial as well. Both of these signals held up extremely well in the fourth quarter, in a market environment that was generally challenging for trend- and sentiment-based insights. Finally, thematic signals showed mixed results for the period, contributing marginally overall to relative performance.

Describe recent portfolio activity.

Over the course of the period, the portfolio maintained a balanced allocation of risk across all major return drivers. However, a number of new stock selection insights were added to the portfolio. Among these insights, a model that evaluates companies on the basis of governance and the ethics and sustainability of its business practices from a social and environmental perspective was added to the Fund’s bucket of quality signals. In addition, a new insight was added that captures the location of hotel booking trends and invests in related stocks most sensitive to those areas. A new macro thematic model that evaluates industries across various inputs such as labor costs and hiring activity was added as well.

Describe portfolio positioning at period end.

Relative to the Russell 1000® Index, the Fund was positioned essentially neutrally from a sector perspective. The Fund had slight overweight positions in health care and financials and slight underweight positions in communications services and consumer discretionary.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 4 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2018 (continued) | | BlackRock Advantage Large Cap Core Portfolio |

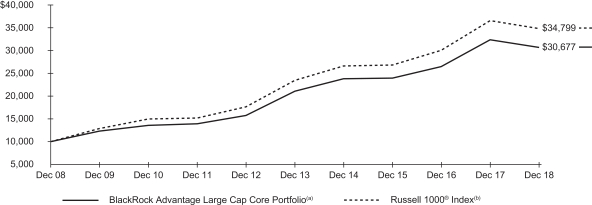

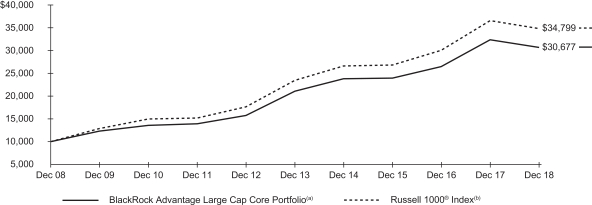

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming transaction costs and other operating expenses, including investment advisory fees, if any. Does not include insurance-related fees and expenses. Under normal circumstances, the Fund seeks to invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in large cap equity securities and derivatives that have similar economic characteristics to such securities. The Fund’s total returns prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Large Cap Core Portfolio. |

| (b) | The index measures the performance of the large cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership. The index represents approximately 92% of the total market capitalization of the Russell 3000® Index. |

Performance Summary for the Period Ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 6-Month

Total Returns (a) | | | | | | Average Annual Total Returns (a) | |

| | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

BlackRock Advantage Large Cap Core Portfolio | | | (8.50 | )% | | | | | | | (5.11 | )% | | | | | | | 7.81 | % | | | | | | | 11.86 | % |

Russell 1000® Index | | | (7.42 | ) | | | | | | | (4.78 | ) | | | | | | | 8.21 | | | | | | | | 13.28 | |

| | (a) | Cumulative and average annual total returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on theex-dividend date. Insurance-related fees and expenses are not reflected in these returns. The Fund’s total returns prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Large Cap Core Portfolio. | |

Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (a) | | | | |

| | | Beginning

Account Value

(07/01/18) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | | | | Beginning

Account Value

(07/01/18) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | Annualized

Expense

Ratio | |

BlackRock Advantage Large Cap Core Portfolio | | $ | 1,000.00 | | | $ | 915.00 | | | $ | 2.41 | | | | | | | $ | 1,000.00 | | | $ | 1,022.68 | | | $ | 2.55 | | | | 0.50 | % |

| | (a) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | (b) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period shown). | |

See “Disclosure of Expenses” on Page 18 for further information on how expenses were calculated.

| | |

| Fund Summary as of December 31, 2018 (continued) | | BlackRock Advantage Large Cap Core Portfolio |

Portfolio Information

SECTOR ALLOCATION

| | | | |

| Sector | | Percent of

Net Assets | |

Information Technology | | | 20 | % |

Health Care | | | 15 | |

Financials | | | 14 | |

Industrials | | | 10 | |

Consumer Discretionary | | | 10 | |

Communication Services | | | 9 | |

Consumer Staples | | | 6 | |

Energy | | | 5 | |

Real Estate | | | 4 | |

Utilities | | | 4 | |

Materials | | | 2 | |

Short-Term Securities | | | 4 | |

Liabilities in Excess of Other Assets | | | (3 | ) |

|

| For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sectorsub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine sector sub classifications for reporting ease. | |

| | |

| 6 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2018 | | BlackRock Balanced Capital Portfolio |

Investment Objective

BlackRock Balanced Capital Portfolio’s (the “Fund”) investment objective is to seek high total investment return.

Portfolio Management Commentary

How did the Fund perform?

For the12-month period ended December 31, 2018, the Fund returned (2.66)%, underperforming its blended benchmark (60% Russell 1000® Index/40% Bloomberg Barclays U.S. Aggregate Bond Index), which returned (2.59)% for the period. The Russell 1000® Index returned (4.78)%, while the Bloomberg Barclays U.S. Aggregate Bond Index returned 0.01%.

What factors influenced performance?

From an asset allocation perspective, a favorable stance on equities was the primary detractor from performance, namely an overweight position in both Japanese and U.S. equities held during the fourth quarter as global equity markets sold off. The Fund tilted to European equities in the first half of the year, which benefitted performance as a dovish European Central Bank stance boosted equity returns. However, these positive contributions were more than offset by our overweight equity position in the fourth quarter.

Within U.S. equities, sentiment insights detracted from performance for the period. A signal that gauges company sentiment based on trends in online job postings was the largest detractor for the period. Identifying sentiment based on short positions of hedge funds acted as a drag on performance as well, largely due to significant hedge fundde-risking towards the end of the year. A signal that usesgeo-location data to determine consumer foot traffic patterns into variousbrick-and-mortar locations further detracted. While fundamental signals held up well overall, an insight that evaluates each stock based on forward sales relative to enterprise value hindered performance.

Within fixed income, overweight positions to emerging market bonds, corporate credit in Europe and Asia, and U.S. investment grade corporate credit detracted from returns.

From an asset allocation standpoint, the largest positive contributor to performance over the year was an underweight stance with respect to U.S. duration (and corresponding sensitivity to interest rate changes). The duration underweight added significant value as yields moved higher early in 2018. The Fund ultimately closed the position at a profit as the U.S. Federal Reserve hiked rates again in late September.

Within the equity allocation, among the portfolio’s fundamental signals, identifying companies with good growth relative to operating assets was the top contributor. Identifying positive dividend growth trends as a measure of quality also proved beneficial. Although broadly speaking the portfolio’s sentiment insights were a drag on relative performance, an insight that gauges sentiment from informed bond investors contributed significantly, given interest rate volatility. Text-based analyses of management conference calls to determine longer-term trends in company fundamentals proved beneficial as well.

Within fixed income, allocations to securitized assets such asnon-agency mortgage-backed securities (“MBS”) and collateralized loan obligations (“CLOs”) contributed positively to return. Macro investment strategies, duration positioning and an overweight to municipal bonds also added to performance.

The Fund held derivatives primarily in financial futures contracts during the period as part of its investment strategy. Although the positions were small, the contribution to Fund performance was positive. Derivatives are used by the investment adviser as a means to manage risk and/or take outright views on equities, interest rates, credit risk and/or foreign exchange positions.

Describe recent portfolio activity.

From a broad asset allocation perspective, the Fund began the period with a modest preference for stocks over bonds, notably in international developed markets. The Fund reduced the magnitude of its underweight position in U.S. bonds over the period. During the period, the Fund initiated an overweight position in European equities, and closed this position as prices moved higher. The Fund retained a preference for Japanese equities versus U.S. equities. The Fund initiated an overweight position in U.S. equities late in the period on an expectation that continued inflationary pressures would benefit equities. Thesell-off in U.S. equities at the end of 2018 provided an attractive opportunity to add to this overweight, given a belief that market pricing of the growth outlook had become overly pessimistic.

Within U.S. equities, new stock selection insights were added including a model that evaluates companies on the basis of governance as well as the sustainability of their business practices from a social and environmental perspective. Also, a new insight was added that captures the location of hotel booking trends and invests in related stocks most sensitive to those areas.

Within fixed income, an underweight stance with respect to duration and corresponding interest rate sensitivity was maintained early in the period, but reduced as the first quarter of 2018 progressed. The Fund held a constructive view on emerging market bonds early in the period but decreased its allocation in the second quarter. The Fund also became more cautious on corporate credit, while adding exposure to agency MBS and municipal bonds. The Fund continued to favorfront-end Treasuries and securitized assets. During the third quarter, the portfolio moved to overweight duration as the rise in interest rates provided an attractive entry point. During the fourth quarter, the duration overweight was reduced and exposure was increased to sectors expected to benefit from more accommodative monetary policy such as agency MBS and municipal bonds, as well as local currency emerging market debt. The portfolio reduced bank loans in favor of high yield bonds while adding to investment grade credit for high quality income. The Fund took profits on its allocation to securitized assets.

At period end, the Fund held a slightly elevated allocation to cash at 7%. The cash position did not have a material impact on performance results for the period.

| | |

| Fund Summary as of December 31, 2018 (continued) | | BlackRock Balanced Capital Portfolio |

Describe portfolio positioning at period end.

The Fund ended the period with a preference for stocks over bonds, notably in the United States and Japan. Within U.S. equities, the Fund had slight overweight positions in health care and financials and slight underweight positions in communication services and consumer discretionary. Within fixed income, the Fund ended the period with a slightly overweight duration stance and a tilt toward higher quality, more liquid sectors such as agency MBS, investment grade corporate credit and municipals. The Fund maintained a small allocation to emerging market bonds.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These views are not intended to be a forecast of future events and are no guarantee of future results.

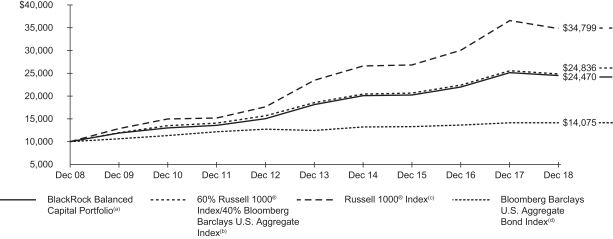

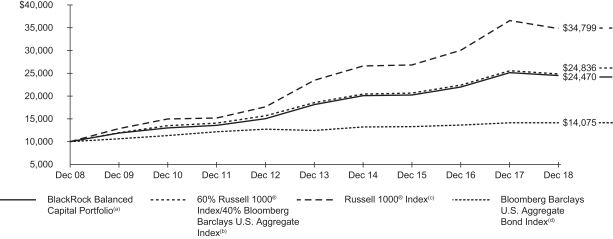

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming transaction costs and other operating expenses, including investment advisory fees, if any. Does not include insurance-related fees and expenses. The Fund invests in U.S. and foreign equity and fixed income securities of any maturity. |

| (b) | A widely recognized unmanaged market-weighted index comprised of investment-grade corporate bonds rated BBB or better, mortgages and U.S. Treasury and U.S. Government agency issues with at least one year to maturity. |

| (c) | The index measures the performance of the large cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership. The index represents approximately 92% of the total market capitalization of the Russell 3000® Index. |

| (d) | The Fund compares its performance to that of a customized weighted index comprised of the returns of the Russell 1000® Index (60%) and Bloomberg Barclays U.S. Aggregate Bond Index (40%). |

Performance Summary for the Period Ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 6-Month

Total Returns (a) | | | | | | Average Annual Total Returns (a) | |

| | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

BlackRock Balanced Capital Portfolio | | | (4.71 | )% | | | | | | | (2.66 | )% | | | | | | | 6.23 | % | | | | | | | 9.36 | % |

60% Russell 1000® Index/40% Bloomberg Barclays US Aggregate Bond Index | | | (3.67 | ) | | | | | | | (2.59 | ) | | | | | | | 6.07 | | | | | | | | 9.52 | |

Russell 1000® Index | | | (7.42 | ) | | | | | | | (4.78 | ) | | | | | | | 8.21 | | | | | | | | 13.28 | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 1.65 | | | | | | | | 0.01 | | | | | | | | 2.52 | | | | | | | | 3.48 | |

| | (a) | Cumulative and average annual total returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on theex-dividend date. Insurance-related fees and expenses are not reflected in these returns. | |

Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

| | |

| 8 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2018 (continued) | | BlackRock Balanced Capital Portfolio |

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (a) | |

| | | | | | | | | Including

interest

expense | | | Excluding

interest

expense | | | | | | | | | Including interest expense | | | Excluding interest expense | |

| | | Beginning

Account Value

(07/01/18) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | Expenses

Paid During

the Period (c) | | | Beginning

Account Value

(07/01/18) | | | | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (c) | |

BlackRock Balanced Capital Portfolio | | $ | 1,000.00 | | | $ | 952.90 | | | $ | 2.56 | | | $ | 2.46 | | | $ | 1,000.00 | | | | | | | $ | 1,022.58 | | | $ | 2.65 | | | $ | 1,022.68 | | | $ | 2.55 | |

| | (a) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | (b) | Expenses are equal to the annualized expense ratio (0.52%), multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period shown). | |

| | (c) | Expenses are equal to the annualized expense ratio (0.50%), multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period shown). | |

See “Disclosure of Expenses” on page 18 for further information on how expenses were calculated.

Portfolio Information

PORTFOLIO COMPOSITION

| | | | |

| Asset Type | | Percent of

Total Investments (a) | |

Common Stocks | | | 56 | % |

U.S. Government Sponsored Agency Securities | | | 17 | |

Corporate Bonds | | | 12 | |

U.S. Treasury Obligations | | | 5 | |

Asset-Backed Securities | | | 4 | |

Municipal Bonds | | | 3 | |

Non-Agency Mortgage-Backed Securities | | | 2 | |

Foreign Government Obligations | | | 1 | |

Investment Companies | | | — | (b) |

Capital Trusts | | | — | (b) |

Foreign Agency Obligations | | | — | (b) |

| | (a) | Total Investments exclude short-term securities, options purchased, options written, borrowed bonds, TBA sale commitments andInvestments Sold Short. | |

| | (b) | Representing less than 0.5% of the Fund’s total investments. | |

| | |

| Fund Summary as of December 31, 2018 | | BlackRock Capital Appreciation Portfolio |

Investment Objective

BlackRock Capital Appreciation Portfolio’s (the “Fund”) investment objective is to seek long term growth of capital.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended December 31, 2018, the Fund outperformed its benchmark, the Russell 1000® Growth Index, and the broad market S&P 500® Index. The following discussion of relative performance pertains to the Russell 1000® Growth Index.

What factors influenced performance?

On a sector basis, the largest contributor to relative performance was consumer discretionary where internet & direct marketing retail holdings had the most positive impact. Selection within hotels, restaurants & leisure and a lack of exposure to media also added value within the sector. Health care and industrials were additional sources of strength. Within health care, equipment & supplies and life sciences tools & services holdings drove gains, while positioning to machinery and zero exposure to air freight & logistics benefited performance in industrials.

The top individual contributors were Amazon.com Inc. and Netflix Inc. Amazon outperformed as the company delivered a series of strong earnings reports, with revenue acceleration in North America, International, Prime, Amazon Web Services (“AWS”) and advertising. In addition, Amazon’s operating margin expansion has been notable, driven by advertising, subscription services, AWS and shipping efficiencies. Netflix continued to outperform after a series of strong earnings reports. The company exceeded 23 million global net subscriber additions for 2017 and is on pace to exceed 28 million in 2018, ahead of forecasts.

Conversely, communication services detracted from performance with entertainment holdings hindering results. Consumer staples and materials also weighed on performance. Selection within beverages was a drag in consumer staples, while an overweight to construction materials was a weakness in materials (at period end the Fund had zero exposure to construction materials).

The top detractors over the annual period were Tencent Holdings Ltd. and Constellation Brands Inc. Tencent underperformed amid U.S./China trade tensions, weakness in the Chinese stock market, regulatory uncertainty and questions around timing of game launches and monetization. In addition, data showed a modest decline in Tencent’s share of mobile user time spent. Constellation has underperformed on investor concerns over sales growth for its Mexican import beers and overall beer profit margin growth, as well over reinvestment risk in cannabis and hemp company Canopy Growth. Constellation announced a $4 billion investment in Canopy Growth during the second quarter.

Describe recent portfolio activity.

Due to a combination of portfolio trading activity, market movement and sector reclassifications during the12-month period, the portfolio’s weighting in the communication services sector increased, particularly within entertainment and interactive media & services. Health care exposure also increased, namely within equipment & supplies and pharmaceuticals. Exposure to information technology decreased, largely with respect to internet software & services. Consumer discretionary exposure, namely within specialty retail, declined as well.

Describe portfolio positioning at period end.

As of period end, the Fund’s largest overweight relative to the Russell 1000® Growth Index was the health care sector, followed by communication services. Industrials was the largest sector underweight, followed by consumer staples.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 10 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2018 (continued) | | BlackRock Capital Appreciation Portfolio |

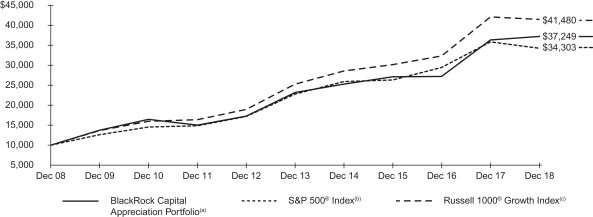

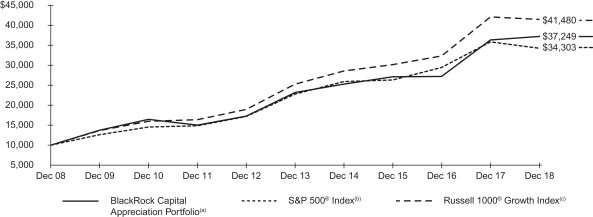

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming transaction costs and other operating expenses, including investment advisory fees, if any. Does not include insurance-related fees and expenses. The Fund invests primarily in a diversified portfolio consisting primarily of common stock of U.S. companies that the investment adviser believes have exhibited above-average growth rates in earnings over the long term. |

| (b) | This unmanaged index covers 500 leading companies and captures approximately 80% coverage of available market capitalization. |

| (c) | This unmanaged index measures the performance of the large cap growth segment of the U.S. equity universe and consists of those Russell 1000®securities with higherprice-to-book ratios and higher forecasted growth values. |

Performance Summary for the Period Ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 6-Month

Total Returns (a) | | | | | | Average Annual Total Returns (a) | |

| | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

BlackRock Capital Appreciation Portfolio | | | (10.78 | )% | | | | | | | 2.42 | % | | | | | | | 9.93 | % | | | | | | | 14.05 | % |

S&P 500® Index | | | (6.85 | ) | | | | | | | (4.38 | ) | | | | | | | 8.49 | | | | | | | | 13.12 | |

Russell 1000® Growth Index | | | (8.17 | ) | | | | | | | (1.51 | ) | | | | | | | 10.40 | | | | | | | | 15.29 | |

| | (a) | Cumulative and average annual total returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on theex-dividend date. Insurance-related fees and expenses are not reflected in these returns. | |

Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (a) | | | | |

| | | Beginning

Account Value

(07/01/18) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | | | | Beginning

Account Value

(07/01/18) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | Annualized

Expense

Ratio | |

BlackRock Capital Appreciation Portfolio | | $ | 1,000.00 | | | $ | 892.20 | | | $ | 2.34 | | | | | | | $ | 1,000.00 | | | $ | 1,022.74 | | | $ | 2.50 | | | | 0.49 | % |

| | (a) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | (b) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period shown). | |

See “Disclosure of Expenses” on Page 18 for further information on how expenses were calculated.

| | |

| Fund Summary as of December 31, 2018 (continued) | | BlackRock Capital Appreciation Portfolio |

Portfolio Information

SECTOR ALLOCATION

| | | | |

| Sector | | Percent of

Net Assets | |

Information Technology | | | 32 | % |

Health Care | | | 19 | |

Consumer Discretionary | | | 16 | |

Communication Services | | | 15 | |

Industrials | | | 6 | |

Financials | | | 5 | |

Consumer Staples | | | 2 | |

Real Estate | | | 2 | |

Materials | | | 1 | |

Short-Term Securities | | | 5 | |

Liabilities in Excess of Other Assets | | | (3 | ) |

|

| For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sectorsub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine sector sub classifications for reporting ease. | |

| | |

| 12 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2018 | | BlackRock Global Allocation Portfolio |

Investment Objective

BlackRock Global Allocation Portfolio’s (the “Fund”) investment objective is to seek high total investment return.

Portfolio Management Commentary

How did the Fund perform?

For the12-month period ended December 31, 2018, the Fund underperformed its Reference Benchmark and outperformed the broad-basedall-equity benchmark, the FTSE World Index. The Reference Benchmark is comprised as follows: 36% S&P 500® Index; 24% FTSE World(ex-U.S.) Index; 24% ICE BofAML Current5-Year U.S. Treasury Index; and 16% FTSENon-US Dollar World Government Bond Index. The Fund invests in both equities and bonds, and therefore, Fund management believes that the Reference Benchmark provides a more accurate representation of the Fund’s composition and a more comparable means for measurement. The following discussion of relative performance pertains to the Reference Benchmark. The following commentary (and referenced allocation percentages) are based on the economic exposures of the Fund, which reflect adjustments for futures, swaps and options (except with respect to fixed income securities), and convertible bonds, and may vary relative to the market value.

What factors influenced performance?

Within equities, the Fund’s overweight to Japan and underweight to the United States detracted from performance. In Europe, exposure to financials negatively influenced returns. From a sector perspective, an overweight to and stock selection within energy weighed on returns, as did stock selection within information technology (“IT”), health care, consumer discretionary, materials and real estate. Broadly speaking, an underweight to fixed income negatively impacted returns. Within fixed income, an overweight stance with respect to U.S. duration (and corresponding sensitivity to interest rate changes) weighed on performance, as did exposure to select emerging market government bonds. Exposure to commodity-related securities detracted as well. In terms of currency management, an overweight to the Indian rupee negatively impacted performance.

Within equities, an overweight to India positively impacted returns. From a sector perspective, overweight positions to health care and technology and underweights to consumer staples, financials and industrials contributed to performance. Stock selection within utilities and industrials was additive. The Fund’s performance also benefited from exposure to cash and cash equivalents. With respect to currency exposure, an underweight to the euro and an overweight to the U.S. dollar contributed to performance.

The Fund uses derivatives, which may include options, futures, swaps, and forward contracts both to seek to enhance returns of the Fund and to hedge (or protect) against adverse movements in currency exchange rates, interest rates, and movements in the securities markets. During the period, the Fund’s use of derivatives detracted from its performance.

Describe recent portfolio activity.

During the12-month period, the Fund’s overall equity allocation decreased from 62% to 58% of net assets. Within equities, the Fund decreased exposure to Europe, notably the United Kingdom, Germany and France, and increased exposure to Canada and Brazil. From a sector perspective, the Fund decreased exposure to IT, financials, industrials and consumer discretionary, and increased exposure to healthcare, consumer staples and communication services.

The Fund’s overall allocation to fixed income increased from 31% to 33% of net assets. Within fixed income, the Fund increased exposure to government bonds and corporate credit.

The Fund’s exposure to commodity-related securities decreased from 4% to 2% of net assets.

Reflecting the above changes, the Fund’s holdings of cash and cash equivalents increased from 3% to 7% of net assets. During the12-month period, the Fund’s cash position helped mitigate portfolio volatility and served as a source of funds for new investments and redemptions.

Describe portfolio positioning at period end.

Relative to its Reference Benchmark, the Fund was underweight in equities and fixed income, and overweight in commodity-related securities and cash. Within equities, the Fund was overweight in Asia and underweight in the United States and Europe. Within Asia, the Fund was overweight in Japan, China and India, and underweight in Australia. Within Europe, the Fund was overweight in the Netherlands and underweight in the United Kingdom, Germany and Switzerland. From a sector perspective, the Fund was overweight in communication services, energy and health care, and was underweight in financials, information technology, industrials and consumer discretionary. Within fixed income, the Fund was underweight in developed market government bonds and overweight in corporate debt. With respect to currency exposure, the Fund was overweight in the U.S. dollar, Indian rupee and Hong Kong dollar, and underweight in the euro, Australian dollar, Swiss franc and British pound.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Fund Summary as of December 31, 2018 (continued) | | BlackRock Global Allocation Portfolio |

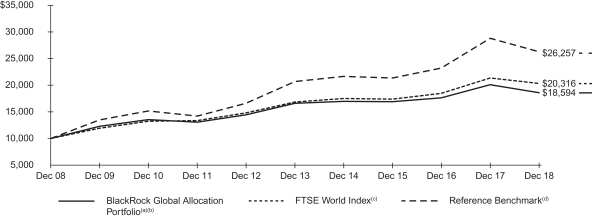

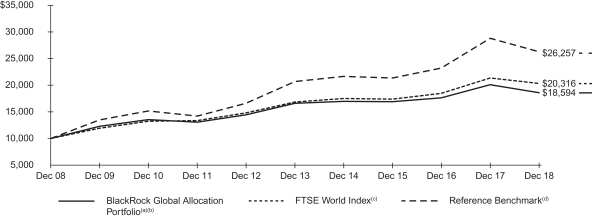

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming transaction costs, if any, and other operating expenses, including investment advisory fees. Does not include insurance-related fees and expenses. |

| (b) | The Fund invests in a portfolio of U.S. and foreign equity securities, debt and money market securities, the combination of which will be varied from time to time with respect to types of securities and markets in response to changing markets and economic trends. |

| (c) | This unmanaged capitalization-weighted index is comprised of 2,602 equities from 35 countries in 4 regions, including the United States. |

| (d) | The Reference Benchmark is an unmanaged weighted index comprised as follows: 36% S&P 500® Index; 24% FTSE World(ex-U.S.) Index; 24% ICE BofAML Current5-Year U.S. Treasury Index; and 16% FTSENon-U.S. Dollar World Government Bond Index. |

Performance Summary for the Period Ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns (a) | |

| | | 6-Month

Total Returns (a) | | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

BlackRock Global Allocation Portfolio | | | (5.89 | )% | | | | | | | (7.27 | )% | | | | | | | 2.31 | % | | | | | | | 6.40 | % |

FTSE World Index | | | (8.72 | ) | | | | | | | (8.77 | ) | | | | | | | 4.91 | | | | | | | | 10.13 | |

Reference Benchmark | | | (4.47 | ) | | | | | | | (4.68 | ) | | | | | | | 3.87 | | | | | | | | 7.35 | |

U.S. Stocks: S&P 500 Index(b) | | | (6.85 | ) | | | | | | | (4.38 | ) | | | | | | | 8.49 | | | | | | | | 13.12 | |

Non U.S. Stocks: FTSE World(ex-U.S.) Index(c) | | | (10.68 | ) | | | | | | | (13.81 | ) | | | | | | | 1.08 | | | | | | | | 7.05 | |

U.S. Bonds: ICE BofAML Current5-Year U.S. Treasury Index(d) | | | 2.56 | | | | | | | | 1.46 | | | | | | | | 1.42 | | | | | | | | 2.09 | |

Non U.S. Stocks: FTSE Non U.S. Dollar World Government Bond Index(e) | | | (0.91 | ) | | | | | | | (1.82 | ) | | | | | | | 0.28 | | | | | | | | 1.27 | |

| | (a) | Cumulative and average annual total returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on theex-dividend date. Insurance-related fees and expenses are not reflected in these returns. | |

| | (b) | This unmanaged index covers 500 leading companies and captures approximately 80% coverage of available market capitalization. | |

| | (c) | This unmanaged capitalization-weighted index comprised of 1,979 equities from 34 countries, excluding the United States. | |

| | (d) | This unmanaged index is designed to track the total return of the current coupon five-year U.S. Treasury bond. | |

| | (e) | This unmanaged market capitalization-weighted index tracks 22 government bond indexes, excluding the United States. | |

Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (a) | |

| | | | | | | | | Including

dividend

expense | | | Excluding

dividend

expense | | | | | | | | | Including dividend expense | | | Excluding dividend expense | |

| | | Beginning

Account Value

(07/01/18) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | Expenses

Paid During

the Period (c) | | | | | | Beginning

Account Value

(07/01/18) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (c) | |

BlackRock Global Allocation Portfolio | | $ | 1,000.00 | | | $ | 941.10 | | | $ | 2.84 | | | $ | 2.79 | | | | | | | $ | 1,000.00 | | | $ | 1,022.28 | | | $ | 2.96 | | | $ | 1,022.33 | | | $ | 2.91 | |

| | (a) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | (b) | Expenses are equal to the annualized expense ratio (0.58%), multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period shown). | |

| | (c) | Expenses are equal to the annualized expense ratio (0.57%), multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period shown). | |

See “Disclosure of Expenses” on page 18 for further information on how expenses were calculated.

| | |

| 14 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2018 (continued) | | BlackRock Global Allocation Portfolio |

OVERALL ASSET EXPOSURE

| | | | | | | | | | | | |

| | | Percent of Fund’s

Net Assets (a) | | | Reference

Benchmark (b) Percentage (Open) | |

| Portfolio Composition | | 12/31/2018 | | | 12/31/2017 | |

U.S. Equities | | | 31 | % | | | 32 | % | | | 35 | % |

European Equities | | | 9 | | | | 15 | | | | 12 | |

Asia Pacific Equities | | | 15 | | | | 14 | | | | 10 | |

Other Equities | | | 3 | | | | 1 | | | | 3 | |

| | | | | | | | | | | | |

Total Equities | | | 58 | | | | 62 | | | | 60 | |

| | | | | | | | | | | | |

U.S Dollar Denominated Fixed Income Securities | | | 31 | | | | 22 | | | | 24 | |

U.S. Issuers | | | 29 | | | | 19 | | | | — | |

Non-U.S. Issuers | | | 2 | | | | 3 | | | | — | |

Non-U.S Dollar Denominated Fixed Income Securities | | | 2 | | | | 9 | | | | 16 | |

| | | | | | | | | | | | |

Total Fixed Income Securities | | | 33 | | | | 31 | | | | 40 | |

| | | | | | | | | | | | |

Commodity-Related Securities | | | 2 | | | | 4 | | | | | |

| | | | | | | | | | | | |

Cash & Short-Term Securities | | | 7 | | | | 3 | | | | — | |

| | | | | | | | | | | | |

| | (a) | Exposure based on market value and adjusted for the economic value of futures, swaps and options (except with respect to fixed income securities), and convertible bonds. | |

| | (b) | The Reference Benchmark is an unmanaged weighted index comprised as follows: 36% of the S&P 500 Index®; 24% FTSE World (ex U.S.) Index; 24% ICE BofA Merrill Lynch Current5-Year U.S. Treasury Index; and 16% FTSENon-U.S. Dollar World Government Bond Index. Descriptions of these indexes are found on page 14 of this report to shareholders in the “Performance Summary” section. | |

| | |

| Money Market Overview For the 12-Month Period Ended December 31, 2018 | | BlackRock Government Money Market Portfolio |

Noteworthy market conditions during 2018 included the continued steady removal of monetary accommodation by the Federal Open Market Committee (“FOMC”), the ongoing gradual reduction of the Fed’s balance sheet, increased Treasury bill issuance and various geopolitical events including trade-tariffs, the Italian elections, and Brexit uncertainty. 2018 was generally a strong year for cash as an asset class in terms of return and flows, but a volatile year for the overall financial markets.

The FOMC continued on their path to normalize monetary policy by hiking the federal funds rate four times during 2018, bringing the target range to 2.25%-2.50%. In the final statement of the year released by the FOMC at their December meeting, the FOMC’s assessments of economic growth, labor market conditions, and inflation were largely unchanged. As was generally expected, the “forward guidance” part of their statement was altered to signifying greater emphasis on a more “data dependent” approach to monetary policy. In another significant change, at the last FOMC meeting of the year, the FOMC’s interest rate forecast was revised to reflect just two hikes in 2019 (as compared with three hikes projected in the prior forecast in September). The outlook included one additional hike for 2020, while the median “longer run” rate forecast came down 0.25% to 2.75%.

In an effort to promote trading in the federal funds market at rates that are comfortably within the target range, the interest on overnight excess reserves rate (“IOER”) was raised just 0.20% to 2.40% at the June 2018 meeting. This move was widely viewed as a “technical adjustment” by the FOMC. As was the case with the technical adjustment in June, the FOMC followed the same action in December when they hiked the IOER by 0.20% and the federal funds range by 0.25%. To conclude the year, the Fed’s Summary of Economic Projections was updated to reflect modest declines in the near-term outlook for economic growth, while the unemployment rate was left unchanged.

U.S. Treasury bill supply during the year was robust, hitting record levels for net new issuance of $384 billion. Furthermore in October, the U.S. Treasury introduced the two-month Treasury bill to the market with a $25 billion initial offering while moving the auctions for four-week and eight-week Treasury bills to Thursdays. This move helped the Treasury to ladder maturing debt. Also of note, government agencies issued floating rate notes indexed to the Secured Overnight Financing Rate (“SOFR”), which is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities, and is the reference rate eventually expected to replace the London Inter-Bank Offered Rate (“LIBOR”). In addition to the agency notes referenced to SOFR, some large financial institutions also issued certificates of deposit and commercial paper linked to this index, and demand for such obligations was generally strong.

Credit spreads were periodically elevated in 2018 for a multitude of reasons including the surge in Treasury bill issuance, a lack of clarity about repatriation related flows early in the year, and bank balance sheet and funding pressures toward the end of the period. For example, credit spreads as evidenced by the three-month LIBOR and overnight indexed swaps widened out to 0.60% in April. This measure later contracted to around 0.17% by early October, before subsequently rising to a high of 0.43% later in the fourth quarter.

In our view, the FOMC’s interest rate normalization campaign appears closer to winding down, although a few additional interest rate hikes remain possible in 2019, subject to further declines in the unemployment rate, upward pressure on inflation, and an easing in financial conditions. That said, we believe the bar for further action has materially risen. We also surmise that the timing of any additional hikes has become less certain and could occur outside of the quarterly meeting cycle that market participants have generally been accustomed to, given the FOMC’s emphasis on “data-dependence.” The implementation of a press conference after every FOMC meeting reinforces to us this possibility. The net new supply of Treasury bills is expected to contract during the first quarter of 2019 as the U.S. Treasury reduces its cash balance in advance of the expiration of the suspension of the debt ceiling in early March. In the event that Congress does not address the debt ceiling in a timely fashion, we anticipate that extraordinary measures would be used to provide additional borrowing authority until around the third quarter of 2019.

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

| | |

| 16 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2018 | | BlackRock Government Money Market Portfolio |

Investment Objective

BlackRock Government Money Market Portfolio’s (the “Fund”) investment objective is to seek to preserve capital, to maintain liquidity and achieve the highest possible current income consistent with the foregoing.

Portfolio Information

PORTFOLIO COMPOSITION

| | | | |

| Asset Type | | Percent of

Net Assets | |

U.S. Government Sponsored Agency Obligations | | | 47 | % |

Repurchase Agreements | | | 38 | |

U.S. Treasury Obligations | | | 11 | |

Other Assets Less Liabilities | | | 4 | |

CURRENTSEVEN-DAY YIELDS

| | | | | | | | |

| | | 7-Day

SEC Yield | | | 7-Day

Yield | |

BlackRock Government Money Market Portfolio | | | 1.99 | % | | | 1.99 | % |

The7-Day SEC Yield may differ from the7-Day Yield shown above due to the fact that the7-Day SEC Yield excludes distributed capital gains.

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (a) | | | | |

| | | Beginning

Account Value

(07/01/18) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | | | | Beginning

Account Value

(07/01/18) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | Annualized

Expense

Ratio | |

BlackRock Government Money Market Portfolio | | $ | 1,000.00 | | | $ | 1,008.40 | | | $ | 2.53 | | | | | | | $ | 1,000.00 | | | $ | 1,022.68 | | | $ | 2.55 | | | | 0.50 | % |

| | (a) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | (b) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period shown). | |

See “Disclosure of Expenses” on page 18 for further information on how expenses were calculated.

| | |

| Fund Summary as of December 31, 2018 | | BlackRock High Yield Portfolio |

Investment Objective

BlackRock High Yield Portfolio’s (the “Fund”) investment objective is to seek to maximize total return, consistent with income generation and prudent investment management.

Portfolio Management Commentary

How did the Fund perform?

During the12-month period ended December 31, 2018, the Fund underperformed the benchmark, the Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index.

What factors influenced performance?

The past year was a challenging time for the high yield market. After producing a modest gain through the end of September, the index declined 5.10% in the fourth quarter due to the combination of slowing economic growth, falling oil prices and heightened investor risk aversion. The index closed the year with a loss of 2.08% as a result.

Security selection in the wireless, independent energy and metals & mining industries detracted from Fund performance. Security selection in thenot-rated segment of the market, as well as an overweight allocation to CCC rated positions detracted, as well. Tactical allocations to equities and floating rate loan interests (“bank loans”) also detracted, largely due to their poor returns in the fourth quarter.

Security selection in the gaming and oilfield services contributed to performance, as did an underweight position in the midstream energy sector. Security selection in BB and B rated bonds also added value.

At period end, the Fund had a slightly above average cash balance. The cash balance did not have a material impact on Fund performance.

Describe recent portfolio activity.

The Fund actively managed risk throughout the annual period and ended the year with a beta of slightly less than 1.0. (Beta measures a security’s sensitivity to the movements of the market as a whole. A beta of greater than one indicates more volatility than the market, while a beta of less than one indicates lower volatility.)

The Fund added to its weighting in bank loans on the belief that these senior, secured assets provide attractive income with minimal interest-rate risk. The Fund held a steady credit positioning over the course of the year, with underweight positions in BB rated issues and overweights in the B and CCC credit tiers. The Fund maintained an underweight in consumer cyclicals on the belief that the industry faces fundamental headwinds. The portfolio was slightly underweight in energy, with a preference for the independent energy industry.

Describe portfolio positioning at period end.

The Fund’s general investment themes and core positions reflected the investment adviser’s views regarding issuer cash flows, firm or industry catalysts, and idiosyncratic factors.

The Fund was underweight in the market’s “tails” — both the higher-yielding segment that contains a larger concentration of stressed assets, as well as the portion that features higher quality and lower yields. With that said, the Fund maintained a position in select CCC rated issues with improving credit positions and/or attractive yields.

At the industry level, the Fund’s largest overweight positions were in technology, wireless and chemicals. Conversely, the Fund was underweight in the retail, automotive and consumer products industries. The Fund had an approximately 15% weighting in bank loans, coupled with smaller allocations to both preferred and common stocks.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 18 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2018 (continued) | | BlackRock High Yield Portfolio |

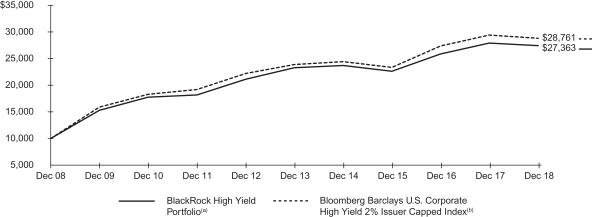

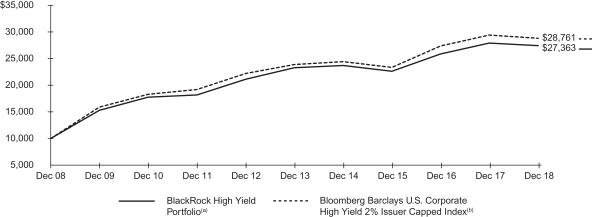

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming transaction costs and other operating expenses, including investment advisory fees, if any. Does not include insurance-related fees and expenses. The Fund invests primarily innon-investment grade bonds with maturities of ten years or less. On September 17, 2018, the Fund acquired all the assets, subject to the liabilities of BlackRock High Yield Portfolio (the “Predecessor Fund”), a series of BlackRock Series Fund, Inc., through a tax-free reorganization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization. The Fund’s total returns prior to October 1, 2011 are the returns of the Predecessor Fund when it followed a different investment objective and different investment strategies under the name “BlackRock High Income Portfolio”. |

| (b) | This unmanaged index is comprised of issues that meet the following criteria: at least $150 million par value outstanding; maximum credit rating of Ba1; at least one year to maturity; and no issuer represents more than 2% of the index. |

Performance Summary for the Period Ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Standardized

30-Day Yield (b) | | | Unsubsidized

30-Day Yield (b) | | | 6-Month Total Returns (a) | | | | | | Average Annual Total Returns (a) | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

BlackRock High Yield Portfolio | | | 7.04 | % | | | 5.54 | % | | | (3.00 | )% | | | | | | | (2.31 | )% | | | 3.23 | % | | | 10.59 | % |

Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index | | | — | | | | — | | | | (2.24 | ) | | | | | | | (2.08 | ) | | | 3.84 | | | | 11.14 | |

| | (a) | Cumulative and average annual total returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on theex-dividend/payable date. Insurance-related fees and expenses are not reflected in these returns. On September 17, 2018, the Fund acquired the assets, subject to the liabilities of BlackRock High Yield Portfolio (the “Predecessor Fund”), a series of BlackRock Series Fund, Inc., through a tax-free reorganization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization. The Fund’s total returns prior to October 1, 2011 are the returns of the Predecessor Fund when it followed a different investment objective and different investment strategies under the name “BlackRock High Income Portfolio”. | |

| | (b) | The standardized30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized30-day yield excludes the effects of any waivers and/or reimbursements. | |

Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (a) | | | | |

| | | Beginning

Account Value

(07/01/18) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | | | | Beginning

Account Value

(07/01/18) | | | Ending Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | Annualized

Expense Ratio | |

BlackRock High Yield Portfolio | | $ | 1,000.00 | | | $ | 970.00 | | | $ | 2.48 | | | | | | | $ | 1,000.00 | | | $ | 1,022.68 | | | $ | 2.55 | | | | 0.50 | % |

| | (a) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | (b) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period shown). | |

See “Disclosure of Expenses” on page 18 for further information on how expenses were calculated.

| | |

| Fund Summary as of December 31, 2018 (continued) | | BlackRock High Yield Portfolio |

Portfolio Information

CREDIT QUALITY ALLOCATION

| | | | |

| Credit Rating (a) | | Percent of Total Investments (b) | |

BBB/Baa | | | 6 | % |

BB/Ba | | | 35 | |

B | | | 46 | |

CCC/Caa | | | 10 | |

NR | | | 3 | |

| | (a) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. | |

| | (b) | Total investments exclude short-term securities. | |

| | |

| 20 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2018 | | BlackRock U.S. Government Bond Portfolio |

Investment Objective

BlackRock U.S. Government Bond Portfolio’s (the “Fund”) investment objective is to seek to maximize total return, consistent with income generation and prudent investment management.

Portfolio Management Commentary

How did the Fund perform?

For the12-month period ended December 31, 2018, the Fund underperformed its benchmark, the Bloomberg Barclays U.S. Government/Mortgage Index.

What factors influenced performance?

The largest detractors from performance relative to the benchmark included an allocation to Treasury inflation protected securities. Security selection within30-year agency mortgage-backed securities (“MBS”) and the Fund’s underweighting of15-year agency MBS also weighed on the Fund’s return.

Positive contributors to performance relative to the benchmark included the Fund’s stance with respect to U.S. interest rates. A below-benchmark stance with respect to duration (and corresponding interest rate sensitivity) aided return as rates rose. In addition, the Fund’s positioning along the U.S. Treasury yield curve added to performance. Allocations to securitized sectors including commercial mortgage-backed securities (“CMBS”), agency collateralized mortgage obligations (“CMOs”) and senior floating rate collateralized loan obligations (“CLOs”) also contributed positively. These segments continued to benefit from favorable fundamentals around the U.S. consumer, housing and commercial real estate. The Fund’s strategies with respect to both global interest rates and currencies added to relative performance as well.

Describe recent portfolio activity.

During the12-month period, the Fund decreased its allocation to U.S. government securities, while adding exposures in agency MBS, primarily in pass-throughs with a smaller increase to CMOs. The Fund kept itsout-of-benchmark allocation to securitized assets roughly unchanged during the period, adding some exposures in CMBS while trimming exposures in CLOs. The Fund maintained an underweight stance with respect to duration, with the degree of underweight decreasing over the period.

The Fund held a small percentage of assets in derivatives including options and futures contracts as a means to manage risk to allocations in MBS and securitized assets. The Fund’s use of derivatives provided a positive return to Fund performance.

Describe portfolio positioning at period end.

At period end, the Fund was slightly underweight in agency MBS relative to the benchmark, with exposures continuing to favor higher coupons relative to lower coupons, given valuations that appeared attractive relative to the underlying fundamentals. The Fund continued to hold a core allocation to agency CMBS and CMOs for carry (incremental income), while pursuing an increased allocation to CMBS owing to attractive valuations versus low coupon MBS. The Fund was modestly short U.S. duration. Outside of the United States, the Fund was tactically short at thelong-end of the German yield curve in anticipation of a heavy January supply calendar. The Fund was also positioned with a short real rate position in the United Kingdom on the belief that the market was pricing an overly negative outcome from Brexit negotiations. Lastly, the Fund had a short position in the middle of the Japanese curve on the view that valuations for that segment were stretched.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Information

PORTFOLIO COMPOSITION

| | | | |

| Asset Type | | Percent of

Total Investments (a) | |

U.S. Government Sponsored Agency Securities | | | 61 | % |

U.S. Treasury Obligations | | | 35 | |

Asset-Backed Securities | | | 2 | |

Non-Agency Mortgage-Backed Securities | | | 2 | |

Foreign Government Obligations | | | | —(b) |

| | (a) | Total investments exclude short-term securities, options purchased, options written and TBA sale commitments. | |

| | (b) | Representing less than 0.5% of the Fund’s total long investments. | |

| | |

| Fund Summary as of December 31, 2018 (continued) | | BlackRock U.S. Government Bond Portfolio |

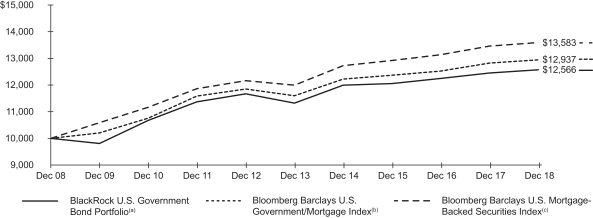

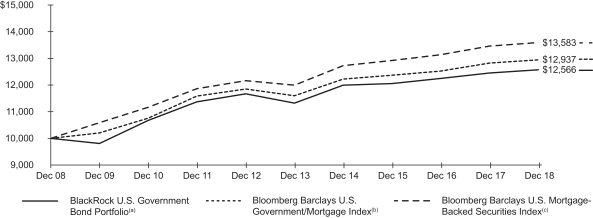

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming transaction costs and other operating expenses, including investment advisory fees, if any. Does not include insurance-related fees and expenses. The Fund, under normal circumstances, will invest at least 80% of its assets in bonds that are issued or guaranteed by the U.S. Government and its agencies. On September 17, 2018, the Fund acquired all of the assets, subject to the liabilities, of BlackRock U.S. Government Bond Portfolio (the “Predecessor Fund”), a series of BlackRock Series Fund, Inc., through a tax-free reorganization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization. The Predecessor Fund’s total returns prior to October 1, 2011 are the returns of the Fund when it followed a different investment objective and different investment strategies under the name “BlackRock Government Income Portfolio.” |

| (b) | This index measures debt issued by the U.S. Government, and its agencies, as well as mortgage-backed pass-through securities of Ginnie Mae, Fannie Mae and Freddie Mac. |

| (c) | This unmanaged index includes the mortgage-backed pass-through securities of Ginnie Mae, Fannie Mae and Freddie Mac that meet certain maturity and liquidity criteria. |

Performance Summary for the Period Ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Standardized

30-Day Yield (b) | | | Unsubsidized

30-Day Yield (b) | | | 6-Month

Total Returns (a) | | | | | | Average Annual Total Returns (a) | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

BlackRock U.S. Government Bond Portfolio | | | 2.72 | % | | | 2.15 | % | | | 1.46 | % | | | | | | | 0.77 | % | | | 2.09 | % | | | 2.31 | % |

Bloomberg Barclays U.S. Government/Mortgage Index | | | — | | | | — | | | | 1.96 | | | | | | | | 0.93 | | | | 2.22 | | | | 2.61 | |

Bloomberg Barclays U.S. Mortgage-Backed Securities Index | | | — | | | | — | | | | 1.96 | | | | | | | | 0.99 | | | | 2.53 | | | | 3.11 | |

| | (a) | Cumulative and average annual total returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on theex-dividend/payable date. Insurance-related fees and expenses are not reflected in these returns. On September 17, 2018, the Fund acquired all of the assets, subject to the liabilities, of BlackRock U.S. Government Bond Portfolio (the “Predecessor Fund”), a series of BlackRock Series Fund, Inc., through a tax-free reorganization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization. The Predecessor Fund’s total returns prior to October 1, 2011 are the returns of the Fund when it followed a different investment objective and different investment strategies under the name “BlackRock Government Income Portfolio.” | |

| | (b) | The standardized30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized30-day yield excludes the effects of any waivers and/or reimbursements | |

Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (a) | |

| | | | | | | | | Including

Interest

Expense | | | Excluding

Interest

Expense | | | | | | | | | Including

Interest

Expense | | | Excluding

Interest

Expense | |

| | | Beginning

Account Value

(07/01/18) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | Expenses

Paid During

the Period (c) | | | | | | Beginning

Account Value

(07/01/18) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (b) | | | Ending

Account Value

(12/31/18) | | | Expenses

Paid During

the Period (c) | |

BlackRock U.S. Government Bond Portfolio | | $ | 1,000.00 | | | $ | 1,014.60 | | | $ | 5.08 | | | $ | 2.54 | | | | | | | $ | 1,000.00 | | | $ | 1,020.16 | | | $ | 5.09 | | | $ | 1,022.68 | | | $ | 2.55 | |

| | (a) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | (b) | Expenses are equal to the annualized expense ratio (1.00%), multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period shown). | |

| | (c) | Expenses are equal to the annualized expense ratio (0.50%), multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period shown). | |

See “Disclosure of Expenses” on page 18 for further information on how expenses were calculated.

| | |

| 22 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

The Benefits and Risks of Leveraging

The Funds may utilize leverage to seek to enhance returns and net asset value (“NAV”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

The Funds may utilize leverage by entering into reverse repurchase agreements.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by each Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Funds’ shareholders benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from leverage is distributed to the Funds’ shareholders, and the value of these portfolio holdings is reflected in the Funds’ per share NAV. However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other ongoing costs of leverage exceed a Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if the Funds had not used leverage.

Furthermore, the value of each Fund’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can also influence the value of portfolio investments. As a result, changes in interest rates can influence each Fund’s NAV positively or negatively in addition to the impact on each Fund’s performance from leverage. Changes in the direction of interest rates are difficult to predict accurately, and there is no assurance that a Fund’s leveraging strategy will be successful.