10

Professional Division

Restructuring Department

| | 1.33. | According to your declaration, the Company does not constitute a land association within the meaning thereof in the Land Taxation Law (Appreciation and Purchase), 5723-1963. |

| | 1.34. | The Subsidiaries of KLA and Orbotech are subject to the provisions of the Encouragement of Capital Investments Law, 5719-1959, as of the date of issuance of this tax ruling. It is noted that as of 2018 Orbotech reports its income within a preferred route. |

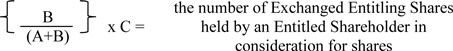

To confirm that the exchange of Orbotech shares by Public Shareholders who hold their shares through either TASE Members or through the Foreign Brokers or directly through the Transfer Agent, as well as by Public Shareholders whose holdings are registered in the Company’s register in Israel, with the exclusion of Public Shareholders who are exempt from tax due to their residency, who comply with the conditions specified in Section 3.5 of the Capital Market Tax Ruling (the “Interested Public”) and by 102 Capital Gains Rights Holders and 3(i) Rights Holders who are entitled to Stock Consideration – shall not be deemed as a sale at the exchange date but rather on the date of the actual sale of the allotted shares thereby.

| | 3.1. | Every term in this tax ruling shall bear the meaning and the definition determined therefor in Part E2 of the Ordinance, after Amendment 242 to the Ordinance, unless explicitly stated otherwise (in this respect, see,inter alia, the explicit reference highlighted in Section 1.12 above). |

| | 3.2. | For purposes of Section 104H of the Ordinance and for purposes of this chapter: |

“Transferring Shareholders”– The Interested Public.

“Transferred Company” – Orbotech.

“Transferred Shares” – Orbotech’s shares held by the Interested Public.

“Surviving Company” – KLA, indirectly, through the Subsidiaries.

“Exchange Date” – The exchange of the shares in practice and no later than 180 days from the date of issuance of this tax ruling.

“Allotted Shares” – KLA shares which are allotted to the Transferring Shareholders against the Transferred Shares, all within the meaning thereof in Section 104H of the Ordinance, including all of the securities to be received in the context of a capital restructuring of KLA, including distribution of bonus shares, split and any right allotted by virtue thereof.

125 Menachem Begin Road, Kiryat HaMemshalla, Tel Aviv 61070, P.O.B. 7008, Floor 18, Tel.: 03-7633060 Fax: 03-7633086