Professional Division

Restructuring Department

| | 3.1. | Every term in this tax ruling shall bear the meaning and the definition determined therefor in Part E2 of the Ordinance, after Amendment 242 to the Ordinance, unless explicitly stated otherwise. |

| | 3.2. | For purposes of Section 104H of the Ordinance and for purposes of this chapter: |

“Transferred Company” – Orbotech.

“Surviving Company” – KLA, indirectly, through the Subsidiaries.

“Substitution Date” – The date of substitution of the shares in practice and no later than 180 days from the date of issuance of this tax ruling.

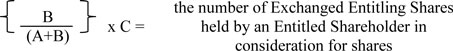

“Allotted Shares” – KLA shares which are allotted to the Transferring Shareholders against the Transferred Shares, all within the meaning thereof in Section 104H of the Ordinance, including all of the securities to be received in the context of a capital restructuring of KLA, including distribution of bonus shares, split and any right allotted by virtue thereof.

“Applying Rights Holders” or “Transferring Shareholders” –Interested Parties, residents of Israel only, who wish that the provisions of Section 104H of the Ordinance, that are specified inAnnex D to this tax ruling, will apply to them. A current version of Annex D shall be transferred shortly after the Closing Date, containing an updated list of Interested Parties who are Israel residents, in accordance with the provisions of the last part of Section 1.4.7 above.

“Deferment Period” – with regard to one half of the Allotted Shares which were allotted to the Applying Rights Holders and actually transferred to the Applying Rights Holders – 24 months from the share Substitution Date. With regard to the remaining Allotted Shares which were actually transferred to the Applying Rights Holders – 48 months from the share Substitution Date.

“Tax Arrangement” – an arrangement for the deferment of the tax event with respect to the equity component in accordance with Section 104H of the Ordinance, all as will be determined and stipulated below.

“Trustee” – IBI Trusts Management P.C. 515020428, withholding file no. 936080233.

The tax arrangement with respect to the equity component that is paid to Israel resident shareholders who are Interested Parties for Orbotech shares (the “Share Substitution Transaction”)

| | 3.3. | This tax ruling does not apply with regard to rights holders in the Transferred Company who are not among the Applying Rights Holders, with regard to whom the provisions of the Ordinance or the provisions ofInterested Public Tax Ruling (as defined in Section 1.19 above) shall apply. In addition, this tax ruling does not apply with regard to shareholders of the Transferred Company who were previously given a preliminary tax ruling from the Tax Authority that determines a tax arrangement pertaining to taxation of the shares held by them (if any). |

10