UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-15477

MAXWELL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 95-2390133 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

3888 Calle Fortunada San Diego, California | | 92123 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (858) 503-3300

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.10 per share | | Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Annual Report on Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer ¨ | | Accelerated filer x | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of Common Stock held by non-affiliates as of June 30, 2015 based on the closing price of the common stock on the NASDAQ Global Market was $186,068,190.

The number of shares of the registrant’s Common Stock outstanding as of February 12, 2016, was 31,849,932 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the registrant’s annual meeting of stockholders (the “Proxy Statement”) are incorporated by reference in Part III of this Form 10-K to the extent stated herein. The Proxy Statement will be filed within 120 days of the registrant’s fiscal year ended December 31, 2015.

MAXWELL TECHNOLOGIES, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 31, 2015

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Unless the context otherwise requires, all references to “Maxwell,” “the Company,” “we,” “us,” and “our” refer to Maxwell Technologies, Inc. and its subsidiaries. All references to “Maxwell SA” refer to our Swiss Subsidiary, Maxwell Technologies, SA.

Some of the statements contained in this Annual Report on Form 10-K and incorporated herein by reference discuss our plans and strategies for our business or make other forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “may,” “could,” “will,” “continue,” “seek,” “should,” “would” and similar expressions are intended to identify these forward-looking statements, but are not the exclusive means of identifying them. These forward-looking statements reflect the current views and beliefs of our management; however, various risks, uncertainties and contingencies could cause our actual results, performance or achievements to differ materially from those expressed in, or implied by, our statements. Such risks, uncertainties and contingencies include, but are not limited to, the following:

| |

| • | our ability to remain competitive and stimulate customer demand through successful introduction of new products, and to educate our prospective customers on the products we offer; |

| |

| • | dependence upon the sale of products to a small number of customers and vertical markets, some of which are heavily dependent on government funding or government subsidies which may or may not continue in the future; |

| |

| • | dependence upon the sale of products into Asia and Europe, where macroeconomic factors outside our control may adversely affect our sales; |

| |

| • | downward pressures on product pricing from increased competition and potential shift in sales mix with respect to low margin and high margin business; |

| |

| • | risks related to our international operations including, but not limited to, our ability to adequately comply with the changing rules and regulations in countries where our business is conducted, our ability to oversee and control our foreign subsidiaries and their operations, our ability to effectively manage foreign currency exchange rate fluctuations arising from our international operations, and our ability to continue to comply with the U.S. Foreign Corrupt Practices Act as well as the anti-bribery laws of foreign jurisdictions; |

| |

| • | risk that activist stockholders attempt to effect changes to our company which could adversely affect our corporate governance; |

| |

| • | risk that our restructuring efforts may not be successful and that we may not be able to realize the anticipated cost savings and other benefits; |

| |

| • | successful acquisition, development and retention of key personnel; |

| |

| • | our ability to effectively manage our reliance upon certain suppliers of key component parts, specialty equipment and logistical services; |

| |

| • | our ability to match production volume to actual customer demand; |

| |

| • | our ability to manage product quality problems; |

| |

| • | our ability to protect our intellectual property rights and to defend claims against us; |

| |

| • | our ability to effectively identify, enter into, manage and benefit from strategic alliances; |

| |

| • | occurrence of a catastrophic event at any of our facilities; |

| |

| • | occurrence of a technology systems failure, network disruption, or breach in data security; |

| |

| • | our ability to obtain sufficient capital to meet our operating or other needs; and, |

| |

| • | our ability to manage and minimize the impact of unfavorable legal proceedings. |

Many of these factors are beyond our control. Additionally, there can be no assurance that we will not incur new or additional unforeseen costs or risks in connection with the ongoing conduct of our business. Accordingly, any forward-looking statements included herein do not purport to be predictions of future events or circumstances and may not be realized.

For a discussion of important risks associated with an investment in our securities, including factors that could cause actual results to differ materially from expectations referred to in the forward-looking statements, see Item 1A, Risk Factors, of this document. We do not have any obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

Introduction

Maxwell was incorporated under the name Maxwell Laboratories, Inc. in 1965. The Company made an initial public offering of common stock in 1983, and changed its name to Maxwell Technologies, Inc. in 1996. Today, we develop, manufacture and market energy storage and power delivery products for transportation, industrial, information technology and other applications and microelectronic products for space and satellite applications. Our products are designed and manufactured to perform reliably with minimal maintenance for the life of the applications into which they are integrated. We believe that this “life-of-the-application” reliability gives our products a competitive advantage and enables them to command higher profit margins than commodity products. We focus on the following lines of high-reliability products:

| |

| • | Ultracapacitors: Our primary focus, ultracapacitors, are energy storage devices that possess a unique combination of high power density, extremely long operational life and the ability to charge and discharge very rapidly. Our ultracapacitor cells, multi-cell packs and modules provide highly reliable energy storage and power delivery solutions for applications in multiple industries, including automotive, bus, rail and truck in transportation, and grid energy storage and wind in renewable energy. |

| |

| • | High-Voltage Capacitors: Our CONDIS® high-voltage capacitors are designed and manufactured to perform reliably for decades in all climates. These products include grading and coupling capacitors and electric voltage transformers that are used to ensure the safety and reliability of electric utility infrastructure and other applications involving transport, distribution and measurement of high-voltage electrical energy. |

| |

| • | Radiation-Hardened Microelectronic Products: Our radiation-hardened microelectronic products for satellites and spacecraft include single board computers and components, such as high-density memory and data conversion modules. Many of these products incorporate our proprietary RADPAK® packaging and shielding technology and novel architectures that enable them to withstand the effects of environmental radiation and perform reliably in space. |

General Product Line Overview

Ultracapacitors

Ultracapacitors enhance the efficiency and reliability of devices or systems that generate or consume electrical energy. They differ from other energy storage and power delivery products in that they combine rapid charge/discharge capabilities typically associated with film and electrolytic capacitors with energy storage capacity generally associated with batteries. Although batteries store significantly more electrical energy than ultracapacitors, they cannot charge and discharge as rapidly and efficiently as ultracapacitors. Conversely, although electrolytic capacitors can deliver bursts of high power very rapidly, they have extremely limited energy storage capacity, and therefore cannot sustain power delivery for as much as a full second. Also, unlike batteries, which store electrical energy by means of a chemical reaction and experience gradual depletion of their energy storage and power delivery capability over hundreds to a few thousand charge/discharge cycles, ultracapacitors’ energy storage and power delivery mechanisms involve no chemical reaction, so they can be charged and discharged hundreds of thousands to millions of times with minimal performance degradation. This ability to store energy, deliver bursts of power and perform reliably for many years with little or no maintenance makes ultracapacitors an attractive energy-efficiency option for a wide range of energy-consuming and generating devices and systems.

Based on potential volumes, we believe that the transportation industry represents the largest current market opportunity for ultracapacitors. Transportation applications include braking energy recuperation and torque-augmentation systems for hybrid-electric buses, trucks and autos and electric rail vehicles, vehicle power network smoothing and stabilization, engine starting systems for internal combustion vehicles and burst power for stop-start idle elimination systems.

Our ultracapacitor products have become a standard and often preferred energy storage solution for transportation applications such as hybrid-electric transit buses and electric rail systems and industrial electronics applications such as wind energy, automated utility meters in smart grid systems and backup power for telecommunications and information technology installations.

To reduce manufacturing cost and improve the performance of our ultracapacitor products, we developed a proprietary, solvent-free, process to produce the carbon film electrode material that enhances product performance and durability and enables a favorable cost position versus competitors. As part of our offerings, we market electrode material to other ultracapacitor manufacturers. We have licensed our proprietary cell architecture to manufacturers in China, Taiwan and Korea to expand and accelerate acceptance of ultracapacitor products in large and rapidly growing global markets.

High-Voltage Capacitors

High-voltage grading and coupling capacitors and electronic voltage transformers are used mainly in the electric utility industry. Grading and coupling capacitors are key components of circuit breakers that prevent high-voltage arcing that can damage switches, step-down transformers and other equipment that transmits or distributes high-voltage electrical energy within electricity network infrastructure and also within high-voltage laboratories. Electronic voltage transformers measure voltage and power levels within electric utility infrastructure. The market for these products consists of expansion, upgrades and maintenance of existing infrastructure and new infrastructure installations in developing countries. Such initiatives are capital-intensive and frequently are subject to regulation, availability of government funding and prevailing economic conditions. North America has a large installed base of fragmented electric utility infrastructure, and has experienced power interruptions and supply problems. Utility deregulation, government budget deficits, and other factors have limited recent capital spending in what historically has been a very large market for utility infrastructure components. We believe that consolidation and changes in market dynamics will generate new opportunities. Projects to increase the availability of electrical energy in developing countries as well as infrastructure modernization and renovation in already developed countries may continue to increase demand for our high-voltage products and solutions in the years to come.

Radiation-Hardened Microelectronics

Radiation-hardened microelectronic products are used almost exclusively in space and satellite applications. Because satellites and spacecraft are extremely expensive to manufacture and launch, and space missions typically span years or even decades, and because it is impractical or impossible to repair or replace malfunctioning parts, the industry demands electronic components that are virtually failure-free. As satellites and spacecraft routinely encounter ionizing radiation from solar flares and other natural sources, onboard microelectronic components must be able to withstand such radiation and continue to perform reliably. For that reason, suppliers of components for space applications historically used only special radiation-hardened silicon in the manufacture of such components. However, the space market is relatively small and the process of producing “rad-hard” silicon is long and very expensive. In addition, because it takes several years to produce a rad-hard version of a new semiconductor, components using rad-hard silicon many times are several generations behind their current commercial counterparts in terms of density, processing power and functionality.

To address the performance gap between rad-hard and commercial silicon and provide components with both increased functionality and significantly greater processing power, Maxwell and a few other specialty components suppliers have developed shielding, packaging, and other radiation mitigation techniques that allow sensitive commercial semiconductors to withstand space radiation effects and perform as reliably as components incorporating rad-hard semiconductors. Although this market is limited in size, the value proposition for high-performance, radiation-tolerant, components enables us to generate profit margins much higher than those for commodity electronic components.

We are exploring opportunities to sell the net assets associated with our microelectronics product line which, if successful, could provide us with a cash infusion to support ongoing operations as well as investments in our business.

Business Strategy

Our primary objective is to significantly increase our revenue and profit margins by creating and satisfying demand for ultracapacitor-based energy storage and power delivery solutions. To accomplish this, we are focusing on:

Establishing and expanding market opportunities for ultracapacitors by:

| |

| • | Collaborating with key existing and prospective customers to develop ultracapacitor-based solutions for high-volume and high-value applications; |

| |

| • | Demonstrating the efficiency, durability and safety of our ultracapacitor products through extensive internal and third-party testing; |

| |

| • | Integrating mathematical models for ultracapacitors into simulation software used by system designers; |

| |

| • | Participating in a broad array of working groups, consortia and industry standards committees to disseminate knowledge of, and promote the use of, ultracapacitors; |

| |

| • | Manufacturing products that are environmentally compatible; and |

| |

| • | Establishing technical and commercial relationships with value added partners within our target market segments and applications, including value added distributors, solution level integrators and tier 1 suppliers. |

Becoming a preferred ultracapacitor supplier by:

| |

| • | Being a low-cost producer and demonstrating ultracapacitors’ value proposition; |

| |

| • | Designing and manufacturing products with “life-of-the-application” durability; |

| |

| • | Building a robust supply chain through global sourcing; |

| |

| • | Achieving superior performance and manufacturing quality while reducing product and overall energy system cost; |

| |

| • | Developing and deploying enabling technologies and systems, including cell balancing and integrated charging systems, among others; |

| |

| • | Marketing high-performance, low-cost electrode material to other manufacturers; and |

| |

| • | Establishing and maintaining broad and deep protections of key intellectual property. |

We also seek to expand market opportunities and revenue for our high-voltage capacitors and radiation-hardened microelectronic products. While these products address highly specialized applications, we are a technology leader in the market niches they serve, and thus are able to sell our products at attractive profit margins. To maintain and expand this competitive position we are leveraging our technological expertise to develop new products that not only meet the demands of our current markets, but also address additional applications.

Products and Applications

Our products incorporate our know-how and proprietary energy storage and power delivery and microelectronics technologies at both the component and system levels for specialized, high-value applications that demand “life-of-the-application” reliability.

Ultracapacitors

Ultracapacitors, also known as electrochemical double-layer capacitors (“EDLC”) or supercapacitors, store energy electrostatically by polarizing an organic salt solution within a sealed package. Although ultracapacitors are electrochemical devices, no chemical reaction is involved in their energy storage mechanism. Their electrostatic energy storage mechanism is fully reversible, allowing ultracapacitors to be rapidly charged and discharged hundreds of thousands to millions of times with minimal performance degradation, even in the most demanding heavy charge/discharge applications.

Compared with electrolytic capacitors, which have very low energy storage capacity and discharge power overly rapidly to be suitable for many power delivery applications, ultracapacitors have much greater energy storage capacity and can deliver energy over time periods ranging from fractions of a second to several minutes.

Compared with batteries, which require minutes or hours to fully charge or discharge, ultracapacitors discharge and recharge in as little as fractions of a second. Although ultracapacitors store only about five to ten percent as much electrical energy as a battery of comparable size, they can deliver or absorb electric energy up to 100 times more rapidly than batteries. Because they operate reliably through hundreds of thousands to millions of deep discharge cycles, compared with only hundreds to a few thousand equivalent cycles for batteries, ultracapacitors have significantly higher lifetime energy throughput, which equates to significantly lower cost on a life cycle basis.

We link our ultracapacitor cells together in multi-cell modules to satisfy energy storage and power delivery requirements of varying voltages. Both individual cells and multi-cell products can be charged from any primary energy source, such as a battery, generator, fuel cell, solar panel, wind turbine or electrical outlet. Virtually any device or system whose intermittent peak power demands are greater than its average continuous power requirement is a candidate for an ultracapacitor-based energy storage and power delivery solution.

Our ultracapacitor products have significant advantages over batteries, including:

| |

| • | the ability to charge and discharge up to 100 times faster; |

| |

| • | significantly lower weight per unit of power delivery; |

| |

| • | higher charge/discharge turnaround efficiency, minimizing energy loss; |

| |

| • | the ability to operate reliably and continuously in extreme temperatures (-40º C to +65º C); |

| |

| • | minimal to no maintenance requirements; |

| |

| • | “life of the application” durability; and |

| |

| • | minimal environmental issues associated with disposal because they contain no heavy metals. |

With no moving parts and no chemical reactions involved in their energy storage mechanism, ultracapacitors provide a simple, highly reliable, “solid state-like” solution to buffer short-term mismatches between power available and power required. Additionally, ultracapacitors offer the advantage of storing energy in the same form in which it is used, as electricity.

Emerging applications, including electric power in vehicles, stabilization of renewable power including solar and wind, and highly reliable, maintenance-free, backup power for telecommunications, information technology and industrial installations, are creating significant opportunities for more efficient and reliable energy storage and power delivery products. In many applications, power demand varies widely from moment to moment, and peak power demand typically is much greater than the average power requirement. For example, automobiles require 10 times more power to accelerate than to maintain a constant speed, and forklifts require more power to lift a heavy pallet of material than to move from place to place within a warehouse.

Engineers historically have addressed transient peak power requirements by over-sizing the engine, battery or other primary energy source to satisfy all of a system’s power demands, including demands that occur infrequently and may last only fractions of a second. Sizing a primary power source to meet brief peak power requirements, rather than for average power requirements, is costly and inefficient. When a primary energy source is coupled with ultracapacitors, which can deliver or absorb brief bursts of high power on demand for periods of time ranging from fractions of a second to several minutes, the primary energy source can be smaller, lighter and less expensive.

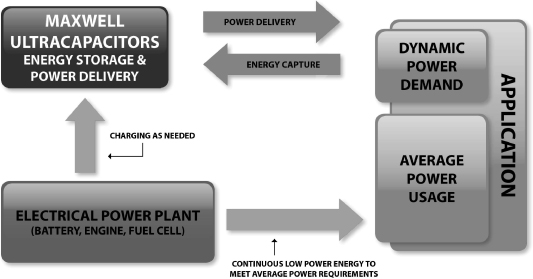

The following diagram depicts the separation of a primary energy storage source from a peak power delivery component to satisfy the requirements of a particular application. Components that enable this separation allow designers to optimize the size, efficiency and cost of the entire electrical power system.

Peak Power Application Model

Although batteries remain the most widely used component for both energy storage and peak power delivery, ultracapacitors, more advanced batteries and flywheels now enable system designers to separate and optimize these functions. Based in part on our ultracapacitor products’ declining cost, high performance and “life-of-the-application” durability, they are becoming a preferred solution for many energy storage and power delivery applications.

We offer our ultracapacitor cells with capacitances ranging from 1 to 3,400 farads. Applications such as hybrid-electric bus, truck and auto drive trains, electric rail systems , renewables stabilization and uninterruptible power supply systems require integrated energy storage systems consisting of up to hundreds of ultracapacitor cells. To facilitate adoption of ultracapacitors for these larger systems, we have developed integration technologies, including proprietary electrical balancing and thermal management systems and interconnect technologies. We hold patents for certain of these technologies. We offer a broad range of standard multi-cell modules. Our current standard multi-cell products each incorporate from 6 to 60 of our cells to provide “plug and play” solutions for applications requiring from 16 to 160 volts, and these modules are designed to be linked together for higher voltage and higher power applications.

High-Voltage Capacitors

Electric utility infrastructure includes switches, circuit breakers, step-down transformers and measurement instruments that transmit, distribute and measure high-voltage electrical energy. High-voltage capacitors are used to protect these systems from high-voltage arcing. With operational lifetimes measured in decades, these applications require high reliability and durability.

Through our acquisition in 2002 of Montena Components Ltd., now known as Maxwell Technologies SA, and its CONDIS® line of high-voltage capacitor products, Maxwell has more than 30 years of experience in this industry, and is the world’s largest producer of such products for use in utility infrastructure. Engineers with specific expertise in high-voltage systems develop, design and test our high-voltage capacitor products in our development and production facility in Rossens, Switzerland. Our high-voltage capacitors are produced through a proprietary assembly and automated winding and drying process to ensure consistent quality and reliability. Since our acquisition of this business, we have upgraded and expanded our high-voltage capacitor production facility and high end laboratory to double our output capacity and significantly shorten order-to-delivery intervals.

We sell our high-voltage capacitor products to large systems integrators, which install and service power plants and electrical utility infrastructure worldwide.

Radiation-Hardened Microelectronic Products

Manufacturers of satellites and other spacecraft require microelectronic components and sub-systems that meet specific functional requirements and can withstand exposure to gamma rays, hot electrons and protons and other environmental radiation encountered in space. In the past, microelectronic components and systems for such special applications used only specially fabricated radiation-hardened silicon. However, the process of designing and producing rad-hard silicon is lengthy and expensive, and there are only a few specialty semiconductor wafer fabricators, so supplies of rad-hard silicon are limited. Therefore, there is demand for space-qualified components made with higher-performance, lower-cost commercial silicon, protected by shielding and other radiation mitigation techniques. Producing our components and systems incorporating radiation-protected commercial silicon requires expertise in power electronics, circuit design, silicon selection, radiation shielding and quality assurance testing.

We design, manufacture and market radiation-hardened microelectronic products, including single-board computers and components such as memory and power modules, for the space and satellite markets. Using highly adaptable, proprietary, packaging and shielding technology and other radiation mitigation techniques, we design and manufacture products that allow satellite and spacecraft manufacturers to use powerful, low cost, commercial semiconductors that are protected with the level of radiation mitigation required for reliable performance in the specific orbit or environment in which they are to be deployed.

Manufacturing

Our internal manufacturing operations are conducted in production facilities located in San Diego, California; Peoria, Arizona; and Rossens, Switzerland. We have made substantial capital investments to outfit and expand our internal production facilities and incorporate mechanization and automation techniques and processes. We have trained our manufacturing personnel in advanced operational techniques, added information technology infrastructure and implemented new business processes and systems to increase our manufacturing capacity and improve efficiency, planning and product quality. Our ultracapacitor electrode material is produced at our Peoria facility. We outsource the assembly of our 60 mm diameter large cell ultracapacitors, and subsequently, assembly of large cell-based multi-cell modules to Belton Technology Group (“Belton”), a contract manufacturer with operations in Shenzhen, China. In 2011, Belton installed a new large cell assembly line that doubled its previous production capacity, and a third line was installed in 2013. In 2010, we outsourced assembly of our mid-size D-cell ultracapacitor products and D-cell-based multi-cell modules to Tianjin Lishen Battery Joint-Stock Co. Ltd. (“Lishen”), one of China’s largest producers of lithium-ion batteries, based in Tianjin. We believe that we have sufficient capacity to meet near-term demand for all of our product lines.

Ultracapacitors

We produce electrode material for our own ultracapacitor products, and for sale to other ultracapacitor manufacturers such as Yeong-Long Technologies Co., Ltd. (“YEC”) at our Peoria facility. In 2013, we completed a major electrode capacity expansion in our Peoria facility. This facility gives us sufficient capacity to support both our current ultracapacitor production requirements and external electrode demand in the near term. As demand increases, additional increments of electrode production capacity can be added within a year through the utilization of established equipment vendors.

We also produce our engine start module on production lines in our Peoria facility. As noted above, we have outsourced assembly of all other cell types and multi-cell modules to contract manufacturers in Asia. To reduce cost, simplify assembly and facilitate automation, we have designed our ultracapacitor products to incorporate lower-cost materials and to reduce both the number of parts in a finished cell and the number of manufacturing process steps required to produce them. We intend to continue using outsourced cell and module assembly in countries with low-cost labor, but plan to continue to produce our proprietary electrode material only in internal production facilities to ensure protection of our intellectual property.

High-Voltage Capacitors

We produce our high-voltage grading and coupling capacitors and electronic voltage transformers in our Rossens, Switzerland facility. We believe we are the only high-voltage capacitor producer that manufactures its products with stacking, assembly and automated winding processes. This enables us to produce consistent, high quality and highly reliable products, and gives us sufficient capacity to satisfy anticipated global customer demand. We operate the assembly portion of the manufacturing process using a “cell-based,” “just-in-time” design, allowing us to increase production capacity without adding direct labor, and significantly shortening order-to-delivery intervals.

Radiation-Hardened Microelectronics Products

We produce our radiation-hardened microelectronics products in our San Diego production facility. We have re-engineered our production processes for microelectronic products, resulting in substantial reductions in cycle time and a significant increase in yield. This facility maintains the QML-V and QML-Q certifications issued by the Department of Defense procurement agency.

Our microelectronics production operations include die characterization, packaging and electrical, environmental and life testing. As a result of manufacturing cycle time reductions and operator productivity increases achieved over the past several years, we believe that this facility is capable of significantly increasing its current output with minimal additional direct labor or capital expenditure, and therefore, that we have ample capacity to meet foreseeable demand in the space and satellite markets.

Suppliers

We generally purchase components and materials, such as carbon powder, certain electronic components, dielectric materials, silicon die, and ceramic insulators from a number of suppliers. For certain products, we rely on a limited number of suppliers or a single supplier for a number of reasons, including notably, the cost effectiveness of doing business with a single supplier. Although we believe there are alternative sources for some of the components and materials that we currently obtain from a single source, there can be no assurance that we will be able to identify and qualify alternative suppliers in a timely and cost effective manner. Therefore, for certain critical components, we utilize mitigation strategies such as, for example, maintaining an inventory of safety stock on our own premises in an effort to minimize the impact of an unforeseen disruption in supply from these outside parties.

Marketing and Sales

We market and sell our products worldwide through both direct and indirect sales channels for incorporation by integrators and OEM customers into a wide range of end products. Because the introduction of products based on emerging technologies requires customer acceptance of new and unfamiliar technical approaches, and because many OEM customers have rigorous vendor qualification processes, the design-in process and initial sale of our products often takes months or even years.

Our principal marketing strategy is to identify applications for which our products and technology offer a compelling value proposition, to become a preferred vendor on the basis of service and price, and to negotiate supply agreements that enable us to establish long-term relationships with key OEM and integrator customers. As these design-in sales tend to be technical and engineering-intensive, we organize market-specific teams composed of sales, applications engineering and other technical and operational personnel to work closely with our customers across multiple disciplines to satisfy their requirements for form, fit, function and environmental needs. As time-to-market often is a primary motivation for our customers to use our products, the initial sale and design-in process typically evolves into ongoing account management to ensure on-time delivery, responsive technical support and problem-solving.

We design and conduct discrete marketing programs intended to position and promote each of our product lines. These include trade shows, seminars, advertising, product publicity, distribution of product literature, internet websites and “social media.” We employ marketing communications specialists and outside consultants to develop and implement our marketing programs, design and develop marketing materials, negotiate advertising media purchases, write and place product press releases and manage our marketing websites.

We also have an alliance with YEC to assemble and market small cell ultracapacitor products. In addition, we sell electrode material to YEC, both for Maxwell-branded products and for incorporation into YEC’s own ultracapacitor products.

Competition

Each of our product lines has competitors, some of whom have longer operating histories, significantly greater financial, technical, marketing and other resources, greater name recognition and larger installed customer bases than we have. In some of the target markets for our emerging technologies, we face competition both from products utilizing well-established, existing technologies and other novel or emerging technologies.

Ultracapacitors

Our ultracapacitor products have two types of competitors: other ultracapacitor suppliers and purveyors of energy storage and power delivery solutions based on batteries or other technologies. Although a number of companies are developing ultracapacitor products and technology, our principal competitors in the supply of ultracapacitor or supercapacitor products are Panasonic, a division of Matsushita Electric Industrial Co., Ltd., NessCap Co., Ltd., LS Mtron, a unit of LS Cable, Supreme Power Solutions Co., Ltd., Vina Technology Company, Ltd., Samxon, a unit of Man Yue Technology Holdings, Ltd., Skeleton Technologies, Yunasko, Ltd., and Ioxus, Inc. The key competitive factors in the ultracapacitor industry are price, performance (energy stored and power delivered per unit volume), durability and reliability, operational lifetime and overall breadth of product offerings. We believe that our ultracapacitor products and electrode material compete favorably with respect to all of these competitive factors. However, the hybrid transit vehicle market for ultracapacitors in China, a region which has historically represented a significant portion of our sales, has recently become more competitive with respect to pricing which has caused us to lower our prices to remain competitive. In addition, the recent increase in the number of competitors in the hybrid transit vehicle market in China may drive down our market share.

Ultracapacitors also compete with products based on other technologies, including advanced batteries in power quality and peak power applications, as well as with flywheels, thermal storage and batteries in backup energy storage applications. We believe that ultracapacitors’ durability, long life, performance and value give them a competitive advantage over these alternative choices in many applications. In addition, integration of ultracapacitors with some of these competing products may provide optimized solutions that neither product can provide by itself. For example, tier 1 auto parts supplier Continental AG designed a combined solution incorporating ultracapacitors with a battery for engine starting in a stop-start idle elimination system for “micro hybrid” autos which was introduced in 2010 and installed in more than one million cars by French automaker PSA Peugeot Citroen and was more recently introduced by General Motors for several models under the Cadillac brand.

High-Voltage Capacitors

Maxwell, through its acquisition in 2002 of Montena Components Ltd., now known as Maxwell Technologies SA, with its CONDIS® line of high-voltage capacitor products, is the world’s largest producer of high-voltage capacitors for use in electric utility infrastructure. Our principal competitors in the high-voltage capacitor markets are in-house production groups of certain of our customers and other independent manufacturers, such as the Coil Product Division of Trench Limited in Canada and Europe and Hochspannungsgeräte Porz GmbH in Germany. We believe that we compete favorably, both as a consistent supplier of highly reliable high-voltage capacitors, and in terms of our expertise in high-voltage systems design. Over the last ten years, our largest customer has transitioned from producing its grading and coupling capacitors internally to outsourcing substantially all of its requirements to us.

Radiation-Hardened Microelectronic Products

Our radiation-hardened single-board computers and components compete with the products of traditional radiation-hardened integrated circuit suppliers such as Honeywell International Inc., BAE Systems plc and Cobham plc. We also compete with commercial integrated circuit suppliers with product lines that have inherent radiation tolerance characteristics, such as Texas Instruments Incorporated, Analog Devices, Inc. and Atmel Corporation in Europe. Our proprietary radiation-hardening technologies enable us to provide flexible, high function, cost-competitive, radiation-hardened products based on the most advanced commercial electronic circuits and processors. In addition, we compete with component product offerings from high reliability packaging houses such as Micross Components, Microsemi Corporation and Teledyne Microelectronics, a unit of Teledyne Technologies, Inc.

Research and Development

We maintain active research and development programs to improve existing products and to develop new products. For the year ended December 31, 2015, our research and development expenditures totaled approximately $24.7 million, compared with $26.3 million and $22.5 million in the years ended December 31, 2014 and December 31, 2013, respectively. In general, we focus our research and product development activities on:

| |

| • | designing and producing products that perform reliably for the life of the end products or systems into which they are integrated; |

| |

| • | making our products less expensive to produce so as to improve our profit margins and to enable us to reduce prices to allow our products to penetrate new, price-enabled applications; |

| |

| • | designing our products to have superior technical performance; |

| |

| • | designing our products to be compact and light; and |

| |

| • | designing new products that provide novel solutions to expand our market opportunities. |

Most of our current research, development and engineering activities are focused on material science, including activated carbon, electrolyte, electrically conductive and dielectric materials, ceramics and radiation-tolerant silicon and ceramic composites to reduce cost and improve performance, reliability and ease of manufacturing. Additional efforts are focused on product design and manufacturing processes for high-volume manufacturing.

Ultracapacitors

The principal focus of our ultracapacitor development activities is to increase power and energy density, reduce internal resistance, extend operational life and reduce manufacturing cost. Our ultracapacitor designs focus on low-cost, high-capacity cells in standard sizes ranging from 1 to 3,400 farads, and corresponding multi-cell modules based on various form factors.

High-Voltage Capacitors

The principal focus of our high-voltage capacitor development efforts is to enhance performance and reliability while reducing the size, weight and manufacturing cost of our products. We also are directing our design efforts to develop high-voltage capacitors for additional applications and solutions.

Microelectronic Products

The principal focus of our microelectronics product development activities is on circuit design, shielding and other radiation-hardening techniques that allow the use of powerful commercial silicon components in space and satellite applications that require ultra-high reliability. We also focus on creating system solutions that overcome the basic failure mechanisms of individual components through architectural approaches, including redundancy, mitigation and correction. This involves expertise in system architecture, including algorithm and microcode development, circuit design and the physics of radiation effects on silicon electronic components.

Intellectual Property

We place a strong emphasis on inventing, protecting and exploiting proprietary technologies, processes and designs which bring intrinsic value and uniqueness to our product portfolio. We place a high priority on obtaining patents to provide the broadest and strongest possible protection for our products, technologies and other strategic initiatives. Our continued success will depend in part on our ability to protect our existing patents and to secure patent protection on developing technologies. As of December 31, 2015, we held 91 issued U.S. patents and 22 published pending U.S. patent applications which relate to our core technologies, processes and designs. Of these issued patents, 64 relate to our ultracapacitor products and technology, 6 relate to our high-voltage capacitor products and technology, and 21 relate to our microelectronics products and technology.

Our pending and any future patent applications may not survive the challenges of patent prosecution in the jurisdictions in which we file throughout the world; however, our strategy is to focus on countries generating revenue as well as markets which we deem key to our business strategies and objectives. We routinely seek patent protection in the United States and the principal countries of Europe and Asia. At present, with the exception of microcode architectures within our radiation-hardened microelectronics product line, we do not rely on licenses from any third parties to produce our products.

Our existing patent portfolios and pending patent applications relate primarily to:

Ultracapacitors

| |

| • | compositions of the electrode, including its formulation, design and fabrication techniques; |

| |

| • | physical cell package designs as well as the affiliated processes used in cell assembly; |

| |

| • | cell-to-cell and module-to-module interconnect technologies that minimize equivalent series resistance and enhance the functionality, performance and longevity of ultracapacitor products including system level electronics; and |

| |

| • | module and system designs that facilitate applications of ultracapacitor technology. |

Microelectronics

| |

| • | system architectures that enable commercial silicon products to be used in radiation-intense space environments; |

| |

| • | technologies and designs that improve packaging densities while mitigating the effect of radiation on commercial silicon; |

| |

| • | radiation-mitigation techniques that improve performance while protecting sensitive commercial silicon from the effects of environmental radiation in space; and |

| |

| • | fault-tolerant computer systems with a plurality of processors which avoid deficiencies typically experienced by similar systems due to ionizing radiation. |

High-Voltage Capacitors

| |

| • | manufacture of capacitors in a manner which significantly reduces exposure of internal components to impurities, moisture and other undesirable materials in an effort to avoid longer manufacturing times and reduced performance characteristics without these technical advancements. |

Historically, our high-voltage capacitor products have been based on our know-how and trade secrets rather than on patents. We filed our first patent application covering our high-voltage capacitor technology in 2003, and we continue to pursue patent protection in addition to trade secret protection of certain aspects of our products’ design and production.

While our primary strategy for protecting our proprietary technologies, processes and designs is related to obtaining patents, we also apply for trademark registrations which identify us as the source of the products. Additionally, we promote our technologies, processes and designs in association with these registered trademarks to further distinguish our products from those of our competitors. As of December 31, 2015, we had 12 formal trademark registrations within the U.S.

Establishing and protecting proprietary products and technologies is a key element of our corporate strategy. Although we attempt to protect our intellectual property rights through patents, trademarks, copyrights, trade secrets and other measures, there can be no assurance that these steps will be adequate to prevent infringement, misappropriation or other misuse by third parties, or will be adequate under the laws of some foreign countries, which may not protect our intellectual property rights to the same extent as do the laws of the U.S.

We use employee and third-party confidentiality and nondisclosure agreements to protect our trade secrets and unpatented know-how. We require each of our employees to enter into a proprietary rights and nondisclosure agreement in which the employee agrees to maintain the confidentiality of all our proprietary information and, subject to certain exceptions, to assign to us all rights in any proprietary information or technology made or contributed by the employee during his or her employment with us. In addition, we regularly enter into nondisclosure agreements with third parties, such as potential product development partners and customers, to protect any information disclosed in the pursuit of securing possible fruitful business endeavors.

Financial Information by Geographic Areas

|

| | | | | | | | | | | | | | | | | | | | | |

| | | Years ended December 31, |

| | | 2015 | | 2014 | | 2013 |

| | | Amount | | Percent | | Amount | | Percent | | Amount | | Percent |

| | | (Dollars in thousands) |

| Revenues from external customers located in: | | | | | | | | | | | | |

| China | | $ | 87,856 |

| | 53 | % | | $ | 89,143 |

| | 48 | % | | $ | 92,817 |

| | 48 | % |

| United States | | 20,836 |

| | 12 | % | | 23,758 |

| | 13 | % | | 29,090 |

| | 15 | % |

| Germany | | 13,972 |

| | 8 | % | | 16,384 |

| | 9 | % | | 25,935 |

| | 13 | % |

All other countries (1) | | 44,708 |

| | 27 | % | | 57,301 |

| | 30 | % | | 45,692 |

| | 24 | % |

| Total | | $ | 167,372 |

| | 100 | % | | $ | 186,586 |

| | 100 | % | | $ | 193,534 |

| | 100 | % |

_____________

| |

| (1) | Revenue from external customers located in countries included in “All other countries” do not individually comprise more than 10% of total revenues for any of the years presented. |

|

| | | | | | | | | | | | | | | | | | | | | |

| | | Years ended December 31, |

| | | 2015 | | 2014 | | 2013 |

| | | Amount | | Percent | | Amount | | Percent | | Amount | | Percent |

| | | (Dollars in thousands) |

| Long-lived assets: | | | | | | | | | | | | |

| United States | | $ | 22,267 |

| | 69 | % | | $ | 28,013 |

| | 72 | % | | $ | 33,740 |

| | 74 | % |

| China | | 4,148 |

| | 13 | % | | 4,991 |

| | 13 | % | | 5,444 |

| | 12 | % |

| Switzerland | | 6,021 |

| | 18 | % | | 5,663 |

| | 15 | % | | 6,422 |

| | 14 | % |

| Total | | $ | 32,436 |

| | 100 | % | | $ | 38,667 |

| | 100 | % | | $ | 45,606 |

| | 100 | % |

Revenues by Product Line |

| | | | | | | | | | | | | | | | | | | | | |

| | | Years ended December 31, |

| | | 2015 | | 2014 | | 2013 |

| | | Amount | | Percent | | Amount | | Percent | | Amount | | Percent |

| | | (Dollars in thousands) |

| Ultracapacitors | | $ | 114,525 |

| | 68 | % | | $ | 135,637 |

| | 73 | % | | $ | 136,277 |

| | 71 | % |

| High-voltage capacitors | | 41,718 |

| | 25 | % | | 40,361 |

| | 21 | % | | 43,339 |

| | 22 | % |

| Microelectronic products | | 11,129 |

| | 7 | % | | 10,588 |

| | 6 | % | | 13,918 |

| | 7 | % |

| Total | | $ | 167,372 |

| | 100 | % | | $ | 186,586 |

| | 100 | % | | $ | 193,534 |

| | 100 | % |

Risks Attendant to Foreign Operations and Dependence

We have substantial operations in Switzerland, and we derive a significant portion of our revenues from sales to customers located outside the U.S. We expect our international sales to continue to represent a significant amount of our future revenues. As a result, our business will continue to be subject to certain risks, such as those imposed by domestic laws and regulations related to topics such as export controls and interactions with foreign officials as well as foreign government regulations, including, notably, changes in tax laws, tax treaties, tariffs and freight rates. To the extent that we are unable to respond effectively to political, economic and other conditions in the countries where we operate and do business, our results of operations and financial condition could be materially adversely affected. Some of our business partners also have international operations and are subject to the risks described above. Even if we are able to successfully manage the risks of international operations, our business may be adversely affected if our business partners are not able to successfully manage these risks as well.

Having substantial international operations also increases the complexity of managing our financial reporting and internal controls and procedures. Additionally, as a result of our extensive international operations and significant revenue generated outside the U.S., the dollar amount of our current and future revenues, expenses and debt may be materially affected by fluctuations in foreign currency exchange rates. Similarly, assets and liabilities of our Swiss subsidiary that are not denominated in its functional currency are subject to effects of currency fluctuations, which may affect our reported earnings. Also, changes in the mix of income from our domestic and foreign operations, expiration of tax holidays and changes in tax laws and regulations could increase our tax expense. If we are unable to manage these risks effectively, it could impair our ability to achieve our targets for revenues and profitability.

As a result of our status as a publicly traded company within the U.S., we are subject to the U.S. Foreign Corrupt Practices Act (“FCPA”), which prohibits companies from making improper payments to foreign officials for the purpose of obtaining or retaining business. Additionally, as a result of our international operations, we could also be subject to the anti-bribery laws of other jurisdictions which vary slightly from jurisdiction to jurisdiction and may be different than the FCPA. If we fail to comply with anti-bribery laws and regulations, we could be subject to civil and/or criminal penalties as well as expenses related to any internal investigation.

Backlog

Product backlog as of December 31, 2015 was approximately $18.1 million, compared with $18.9 million as of December 31, 2014. Backlog consists of firm orders for products that will be delivered within 12 months. The actual amount of backlog at any particular time may not be a meaningful indicator of future business prospects as this amount is impacted by a number of factors including potential cancellations of orders by our customers.

Significant Customers

One customer, Shenzhen Xinlikang Supply China Management Co. Ltd., accounted for 19%, 20% and 22% of total revenues in the years ended December 31, 2015, 2014 and 2013, respectively.

Government Regulation

Due to the nature of our operations, including, notably, the use of hazardous substances in some of our manufacturing and research and development activities, we are subject to stringent federal, state and local laws, rules, regulations and policies governing workplace safety and environmental protection. These include the use, generation, manufacture, storage, air emission, effluent discharge, handling and disposal of certain materials and wastes. In the course of our historical operations, materials or wastes may have spilled or been released from properties owned or leased by us or on or under other locations where these materials and wastes have been taken for disposal. These properties and the materials and wastes spilled, released, or disposed thereon are subject to environmental laws which may impose strict liability, without regard to fault of the original conduct, for remediation of contamination resulting from such releases. Under such laws and regulations, we could be required to remediate previously spilled, released, or disposed substances or wastes, or to make capital improvements to prevent future contamination. Failure to comply with such laws and regulations also could result in the assessment of substantial administrative, civil and criminal penalties and even the issuance of injunctions restricting or prohibiting our activities. It is also possible that implementation of stricter environmental laws and regulations in the future could result in additional costs or liabilities to us as well as the industry in general. While we believe we are in substantial compliance with existing environmental laws and regulations, we cannot be certain that we will not incur substantial costs in the future.

In addition, certain of our microelectronics products are subject to strict export regulations when they are sold to customers outside the U.S. We routinely obtain export licenses for such product shipments outside the U.S. In certain political situations, the U.S. agencies responsible for administering such export regulations may modify their policies regarding underlying licensing procedures, which could adversely affect our financial results.

Employees

As of December 31, 2015, we had 451 employees in five countries, as follows: 263 full-time, 2 part-time and 35 temporary employees in the U.S.; 84 full-time, 9 part-time and 15 temporary employees in Switzerland; 28 full-time and 4 temporary employees in China; 10 full-time employees in Germany, and 1 full-time employee in Korea. We are unable to estimate the percent of our Swiss employees that are members of a labor union, as Swiss law prohibits employers from inquiring into the union status of employees. We consider our relations with our employees to be amicable.

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available free of charge to the public over the Internet at the SEC’s website at http://www.sec.gov. Our SEC filings are also available free of charge on our website at http://www.maxwell.com as soon as reasonably practicable following the time that they are filed with the SEC. You may also read and copy any document we file with the SEC at the SEC’s Public Reference Room at 450 Fifth Street, NW, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The information found on our website is not part of this or any report that we file with the SEC.

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. Our business, financial condition and results of operations could be seriously harmed if potentially adverse developments, some of which are described below, materialize and cannot be resolved successfully. In any such case, the market price of our common stock could decline and you may lose all or part of your investment in our common stock.

The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties, including those not presently known to us or that we currently deem immaterial, may also result in decreased revenues, increased expenses or other adverse impacts that could result in a decline in the price of our common stock. You should also refer to the other information set forth in this Annual Report on Form 10-K, including our consolidated financial statements and the related notes.

Our restructuring activities could result in management distractions, operational disruptions and other difficulties.

We have initiated restructuring and other exit activities in an effort to reduce costs and improve operational efficiency, and such efforts are expected to continue in the future. Our restructuring plan includes reductions-in-force, a U.S. manufacturing facility consolidation, and the potential divestiture of a product line. These actions are intended to better align our cost structure with near-term revenue, and also to improve engineering and operational efficiencies throughout the organization. Additional reductions- in-force and senior level employee replacements may be required as we continue to realign our business organization, operations and product lines. Our efforts to consolidate U.S. manufacturing operations may not be successful. For example, we may encounter issues with the quality and performance of products which are manufactured in an alternate facility where certain key manufacturing processes have not been practiced or qualified. Such difficulties, even if managed correctly, could result in delays in the actual consolidation of our manufacturing operations and therefore a delay in realizing anticipated reductions in expenses. Any restructuring efforts could also disrupt our ability to supply products to customers, detriment relationships with customers and other business partners, divert the attention of management away from other priorities, harm our reputation, expose us to increased risk of legal claims by terminated employees, increase our expenses, increase the workload placed upon remaining employees and cause employees to lose confidence in our future performance and decide to leave. In addition, if we continue to reduce our workforce, it may adversely impact our ability to respond rapidly to new growth opportunities or to remain competitive. Further, employees whose positions were or will be eliminated in connection with these restructuring activities or who otherwise determine to leave may seek employment with our competitors, customers or suppliers. Although each of our employees is required to sign a confidentiality agreement with us at the time of employment, which agreement contains covenants prohibiting among other things the disclosure or use of our confidential information and the solicitation of our employees, we cannot guarantee that the confidential nature of our proprietary information will be maintained in the course of such future employment, or that our key continuing employees will not be solicited to terminate their employment with us. We cannot guarantee that any restructuring activities undertaken in the future will be successful, or that we will be able to realize the anticipated cost savings and other anticipated benefits from our restructuring plans.

Unfavorable results of legal proceedings could materially adversely affect us.

We are subject to various legal proceedings and claims that have arisen out of the ordinary conduct of our business and are not yet resolved, and additional claims may arise in the future. Results of legal proceedings cannot be predicted with certainty. Regardless of merit, litigation may be both time-consuming and disruptive to our operations and could cause significant expense and diversion of management attention. From time to time, we are involved in major lawsuits concerning intellectual property, torts, contracts, shareholder litigation, administrative and regulatory proceedings and other matters, as well as governmental inquiries and investigations, the outcomes of which may be significant to our results of operations and may limit our ability to engage in our business activities. In recognition of these considerations, we may enter into material settlements to avoid ongoing costs and efforts in defending or pursuing a matter. Should we fail to prevail in certain matters, or should several of these matters be resolved against us in the same reporting period, we may be faced with significant monetary damages or injunctive relief against us that could adversely affect our business, financial condition and operating results. While we have insurance related to our business operations, it may not apply to or fully cover any liabilities we incur as a result of these lawsuits. We record reserves for potential liabilities where we believe the liability to be probable and reasonably estimable. However, our actual costs may be materially different from these estimates.

For example, as articulated in Item 3 - Legal Proceedings, we have several pending legal matters in the form of both government and regulatory investigations. Notably, we received a subpoena from the SEC on June 11, 2015 relating to an investigation into the underlying causes prompting the restatement of our 2011 and 2012 financial statements in 2013. The subpoena requests a range of documents, including documents relating to our revenue recognition practices and associated transactions and business relationships. We are unable at this time to predict the outcome of the investigation. It is possible that the investigation could lead to claims or findings of violations of securities laws. We expect to incur substantial legal and administrative costs in connection with the investigation, and could incur other costs, damages or penalties, depending on the outcome. We are unable at this time to estimate the amount of the possible loss or range of loss that we may incur as a result of the investigation. Further, these lawsuits, including, notably the investigation by the SEC, could be both time-consuming and disruptive to our business and, our reputation could be harmed as a result of the allegations asserted in public statements and court documents throughout the course of the action. Consequently, our financial condition or operating results could be materially adversely affected.

Activist stockholders may attempt to effect changes to our company, which could adversely affect our corporate governance, results of operations and financial condition.

Stockholders may from time to time attempt to effect changes, engage in proxy solicitations or advance stockholder proposals. Responding to proxy contests and other actions by activist stockholders can generally be costly and time-consuming, disrupting our operations and diverting the attention of our board of directors and management from the pursuit of business strategies. Additionally, stockholder campaigns could result in corporate governance changes that could adversely affect our results of operations and financial condition. Any perceived uncertainties as to our future direction also could affect the market price and volatility of our securities.

A substantial percentage of our total revenue depends on the sale of products within a small number of vertical markets and a small number of geographic regions, and the decline in the size of a vertical market or reduction of consumption within a geographic region, could impede our growth and profitability.

Sales within a relatively small number of vertical markets and a small number of geographic regions make up a large portion of our revenues. Our ability to grow our sales within this limited number of markets and regions depends on our ability to compete on price, delivery and quality. If a particular market into which we sell experiences a decline, then our customers will decrease their own consumption of our products thereby reducing our revenues. For example, if consumers are no longer accepting of start-stop systems within passenger automobiles, then our direct customers will no longer consume products from us for incorporation into such applications. Additionally, a substantial portion of our revenues stems from sales to customers within a limited number of geographic regions including, notably, China and the United States. If certain factors were to arise including, for example, a catastrophic event or shift in economic health and stability within a particular region, then customers within these regions may reduce their consumption of our products resulting in reduced revenues for us.

Many of our customers are currently the benefactors of government funding or government subsidies.

Our products are currently sold into a limited number of vertical markets, some of which are either directly funded by or partially subsidized with government funding. Our ultracapacitor products provide numerous technology and environmental benefits for many of the applications in which our customers are using these products. As the use of our technology in certain applications is still relatively immature, the costs associated with producing the products is high as compared with the more mature solutions. However, many government entities have determined that they view certain prevailing interests, including, for example, reduction of pollution, to outweigh the economic costs associated with incorporating these clean technologies and therefore are willing to allocate government funding to encourage companies to produce goods which reduce pollution and energy consumption. For example, a large portion of our current ultracapacitor business is concentrated in the Chinese hybrid transit vehicle and wind energy markets, which are heavily dependent on government regulation and subsidy. These markets may experience slower rates of growth when there are changes or delays in government policies and subsidy programs that support our sales into these markets. At the end of 2015, the Chinese government subsidy program which provided subsidies for large diesel-electric hybrid buses was renewed for 2016, but at a reduced reimbursement rate. Additionally, in 2016, the Chinese government put into a place a new subsidy program for medium diesel-electric hybrid buses, however, we are unsure if we will be able to capture the benefit of this new program. For 2016, we may see variability in revenue as a result of uncertainty regarding how the new China government subsidy will impact our sales into the hybrid transit vehicle market.

Similarly, our microelectronics and high-voltage capacitor products are primarily consumed by markets which are either directly funded by or controlled by the respective government bodies in the jurisdictions where our customers do business. For example, our microelectronics products are used in the space community which is ultimately run by the space agencies of the respective governments. Likewise, our high-voltage capacitor products are largely used for electric utility infrastructures which are largely controlled by the respective governments supplying power and electricity to its populations. If these government entities elect to change their policies on government subsidies or decide to cancel or reduce certain government funding programs, then our customers could cancel or reduce orders for our products.

Downward pressures on product pricing or changes to our product mix could adversely impact our financial condition and operating results, and such pressures or changes could even result in loss of revenue in exchange for avoidance of gross margin pressures.

We strive to manage gross margin for the products we sell. There can be no assurance that targeted gross margin percentage levels will be achieved. In general, gross margins will remain under downward pressure due to increased competition as well as a potential shift in our sales mix to lower margin business. For example, if we increase sales of our products into markets which traditionally have lower margin rates than our current business, such as the automotive market, we may be forced to reduce our margins to remain competitive. Further, we are beginning to experience significant downward pricing pressure in the Chinese hybrid transit vehicle market, which has historically represented a significant portion of our sales, as a result of changes in the government subsidy program and other market factors. If our cost reduction efforts do not keep pace with these price pressures, or if we continue to pursue certain vertical markets and reduce our margins to maintain or increase sales, then we could experience degradation in our overall profit margins. In addition, gross margins could be negatively impacted by an increase in raw materials, components and labor costs, or by changes to our product mix.

Our business is subject to risks related to its international operations including the risk that we will be unable to adequately comply with the changing rules and regulations in countries where our business is conducted.

We derive a significant portion of our revenue and earnings from international operations. Such operations outside the U.S. are subject to special risks and restrictions, including: fluctuations in currency values and foreign currency exchange rates, import and export requirements and trade policy, anti-corruption laws, tax laws (including U.S. taxes on foreign subsidiaries), foreign exchange controls and cash repatriation restrictions, data privacy requirements, labor laws, anti-competition regulations, and other potentially detrimental domestic and foreign governmental practices or policies affecting U.S. companies doing business abroad. Compliance with these U.S. and foreign laws and regulations increases the costs of doing business in foreign jurisdictions and these costs may continue to increase in the future as a result of changes in such laws and regulations or in their interpretation. Furthermore, we have implemented policies and procedures designed to ensure compliance with these laws and regulations, but there can be no assurance that our employees, contractors, or agents will not violate such laws and regulations or our policies. For example, in 2014, based upon events occurring in the Ukraine, the U.S. Department of State and U.S. Department of Commerce instituted a policy to not issue export licenses for product shipments to Russia. Under this new policy, our products which require export licenses, including, notably, our microelectronics products, are restricted from being shipped to customers within Russia without such export licenses. Any violations of rules and regulations could individually or in the aggregate materially adversely affect our financial condition or operating results. Some of our business partners also have international operations and are subject to the risks described above. Even if we are able to successfully manage the risks of international operations, our business may be adversely affected if our business partners are not able to successfully manage these risks.

Our success could be negatively impacted if we fail to control, oversee and direct foreign subsidiaries and their operations.

We currently own foreign subsidiaries located within Europe and Asia where the employees and cultures represent certain vast differences from employees and cultures within the United States where our corporate headquarters is situated. While the cultural values and philosophies of the people located in Europe and portions of Asia are generally viewed to be in alignment with that of U.S. persons, there are still some significant differences. For example, the respective European data privacy laws take a harsher position regarding the protection of employee personal data and, consequently, there is less information shared with the U.S. parent corporation regarding employees working for our European subsidiaries. Additionally, the human resources and the systems our foreign entities use can be vastly different; notably, our Swiss, German, Korean, and Chinese subsidiaries utilize a primary language other than English for communications. Having substantial international operations also increases the complexity of managing our financial reporting and internal controls and procedures. If we are unable to manage these risks effectively, it could negatively impact our operating performance and our reputation.

Our exposure to fluctuations in foreign currency exchange rates arising from international operations could harm our financial condition and operating results.