David J. Mazzo, PhD President & Chief Executive Of ficer M ay 2 3 , 2 0 2 2|Na s d aq : C L B S Developing Innovative Therapies to Treat or Reverse Disease Exhibit 99.2

Forward-Looking Statements This presentation contains “forward-looking statements” that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this communication regarding strategy, future operations, future financial position, future revenue, projected expenses, prospects, plans and objectives of management are forward-looking statements. In addition, when or if used in this communication, the words “may,” “could,” “should,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict” and similar expressions and their variants, as they relate to Caladrius, Cend or the management of either company, before or after the aforementioned merger, may identify forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements relating to the timing and completion of the proposed merger; Caladrius’s continued listing on the Nasdaq Capital Market until closing of the proposed merger; the combined company’s listing on the Nasdaq Capital Market after closing of the proposed merger; expectations regarding the capitalization, resources and ownership structure of the combined company; the approach Cend is taking to discover and develop novel therapeutics; the adequacy of the combined company’s capital to support its future operations and its ability to successfully initiate and complete clinical trials; the difficulty in predicting the time and cost of development of Cend’s product candidates; the nature, strategy and focus of the combined company; the executive and board structure of the combined company; and expectations regarding voting by Caladrius’s and Cend’s stockholders. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: the risk that the conditions to the closing of the transaction are not satisfied, including the failure to timely or at all obtain stockholder approval for the transaction; uncertainties as to the timing of the consummation of the transaction and the ability of each of Caladrius and Cend to consummate the transaction; risks related to Caladrius’s ability to correctly estimate its operating expenses and its expenses associated with the transaction; the ability of Caladrius or Cend to protect their respective intellectual property rights; unexpected costs, charges or expenses resulting from the transaction; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; and legislative, regulatory, political and economic developments. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors included in Caladrius’s Annual Report on Form 10-K filed with the SEC on March 22, 2022. Caladrius can give no assurance that the conditions to the transaction will be satisfied. Except as required by applicable law, Caladrius undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. No Offer or Solicitation This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the United States Securities Act of 1933, as amended. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction. Important Additional Information Will be Filed with the SEC In connection with the proposed transaction between Caladrius and Cend, Caladrius intends to file relevant materials with the SEC, including a registration statement that will contain a proxy statement and prospectus. CALADRIUS URGES INVESTORS AND STOCKHOLDERS TO READ THESE MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CALADRIUS, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the proxy statement, prospectus and other documents filed by Caladrius with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of the proxy statement, prospectus and other documents filed by Caladrius with the SEC by contacting Investor Relations by mail at Attn: Investor Relations, Caladrius Biosciences, Inc., 110 Allen Road, 2nd floor, Basking Ridge, NJ 07920. Investors and stockholders are urged to read the proxy statement, prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction. Participants in the Solicitation Caladrius and Cend, and each of their respective directors and executive officers and certain of their other members of management and employees, may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Caladrius’s directors and executive officers is included in Caladrius’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 22, 2022, and amended on April 21, 2022. Additional information regarding these persons and their interests in the transaction will be included in the proxy statement relating to the transaction when it is filed with the SEC. These documents can be obtained free of charge from the sources indicated below. Information regarding disclosures 2

Combination of Caladrius and Cend platforms provides Lisata with a multi-product development pipeline Proprietary field-leading technology in lucrative global indications backed by a strong IP portfolio Potential value creating events in the next 12-24 months based on milestones across the pipeline Seasoned management with domain expertise along with big pharma and emerging biotech experience Strong balance sheet [$88.5 million cash & investments (as of 3/31/2022) - no debt]; well-positioned for current development programs’ projected capital needs and cash balance target at merger closing Caladrius investment highlights 3 Pending merger with Cend Therapeutics, creating Lisata Therapeutics, which will be a financially sound publicly-traded company with clinical stage product candidates

4 Creating a new diversified therapeutics company, well-positioned for growth Lisata is derived from the Finnish for “augmented” or “enhanced” Public company with diverse development pipeline, strong existing & potential for future attractive partnerships Merger closing expected 3Q22 pending shareholder approvals and customary conditions Ownership divided as ~50% of outstanding shares owned by each of Caladrius and Cend shareholders 4 Board appointees from each of Caladrius and Cend + 1 jointly agreed new director Lisata Therapeutics (Nasdaq: LSTA) Focused on the development of therapies that reverse cardiovascular disease Focused on the development of more effective treatments for solid tumor cancers

Lisata Therapeutics overview Experienced Executive and Development Leadership with extensive domain-relevant expertise David J. Mazzo, Ph.D. – Chief Executive Officer David Slack, M.B.A. – President and Chief Business Officer Kristen K. Buck, M.D. – Executive Vice President of R&D and Chief Medical Officer World-renowned Technical Advisor Erkki Ruoslahti, M.D., Ph.D. – Scientific Founder of Cend technology Caladrius invested $10 million in Cend which includes a resource collaboration to maintain pipeline momentum Full, capital-efficient development and public company operational infrastructure (~30 people) Combined pipeline of multiple clinical stage assets in a variety of indications with milestones over the next 2 years ~$70 million in net cash* [no debt] projected as of transaction closing Existing Cend partnership with Qilu Pharmaceutical Qilu has exclusive rights to CEND-1 in China, Taiwan, Hong Kong, and Macau and assumes all development and commercialization responsibilities in the licensed territories Qilu will pay up to $225 million in milestones and tiered double-digit royalties on product sales in the region, if any 5*As defined in the Agreement and Plan of Merger and Reorganization dated as of April 26, 2022

Lisata Therapeutics strategic rationale 6 CendR Platform™ provides a targeted tissue penetration capability designed to specifically enhance drug delivery to solid tumors Converts tumor stroma from barrier to conduit for effective delivery via co-administration of a range of chemo-, targeted and immunotherapies Selectively depletes intratumoral immunosuppressive cells Tumor-Penetrating Nanocomplex (TPN) Platform™ with broad potential to enable nucleic acid-based therapies to effectively treat solid tumor cancers Development candidate identification expected in 2023 Strong patent protection beyond 2030 with patent term extension eligibility Proprietary Platform Technologies

Lisata Therapeutics strategic rationale 7 Lead product candidate, CEND-1, advancing in a variety of difficult-to-treat solid tumor applications CEND-1 is currently in multiple studies in first-line, metastatic pancreatic ductal adenocarcinoma (PDAC) in combination with standard-of-care chemotherapy CEND-1 development to expand to additional difficult-to-treat tumors (e.g., hepatocellular, gastric, breast cancers) and additional anti-cancer drug combinations, including immunotherapies CEND-1 has been granted Fast Track as well as Orphan Drug Designation by the U.S. FDA in PDAC Robust Clinical Stage Pipeline with Broad Therapeutic Reach

Lisata Therapeutics strategic rationale Existing Cend strategic partnership in China with Qilu Pharmaceutical with non-dilutive milestone payments, development collaboration and participation in downstream economics Potential for up to $225 million in milestones and royalties on potential sales in the region $10 million payment due for proceeding to Phase 3 in PDAC (could be as soon as 2023) Additional partnership opportunities for broad applications of CEND-1 and the CendR Platform™ Anticipated combined pipeline clinical & business development milestones over the next 24 months Experienced management team with extensive development expertise and leading scientific advisors 8 Compelling Value Proposition

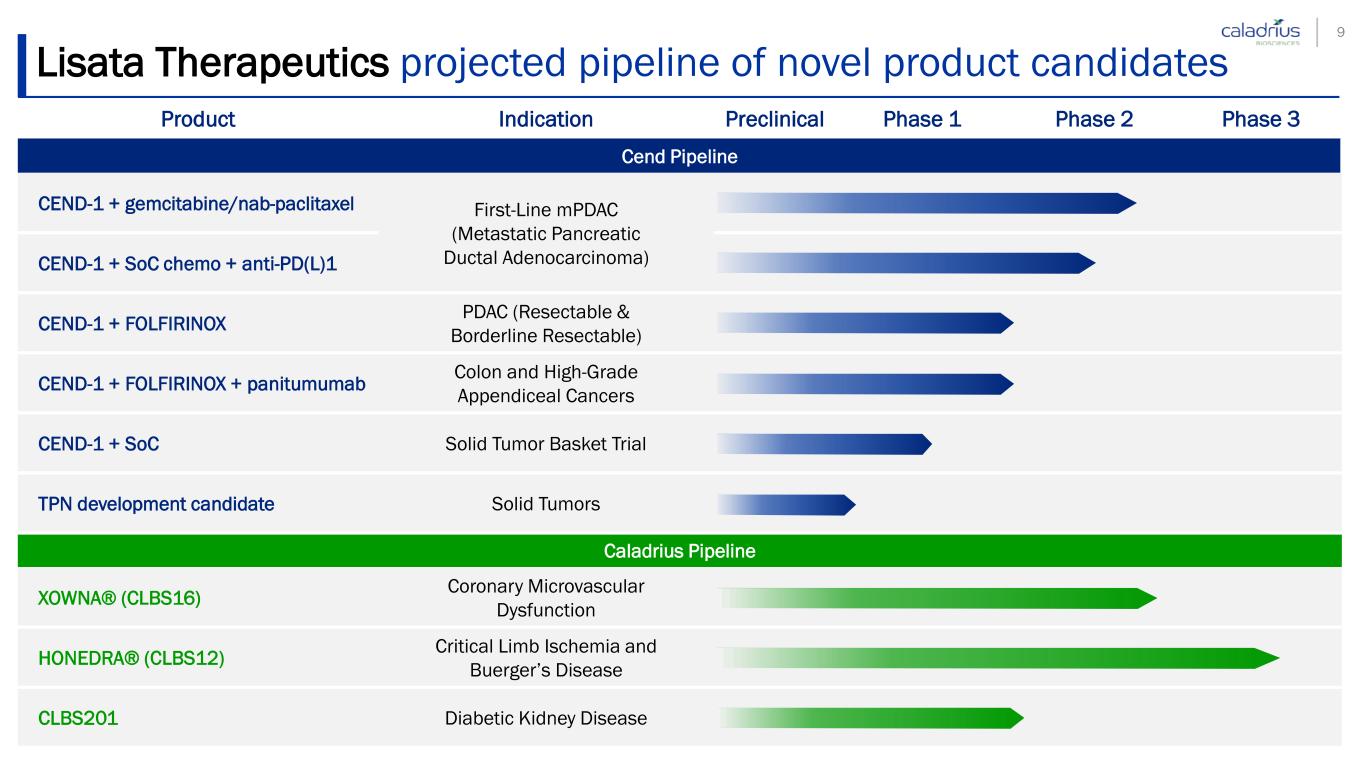

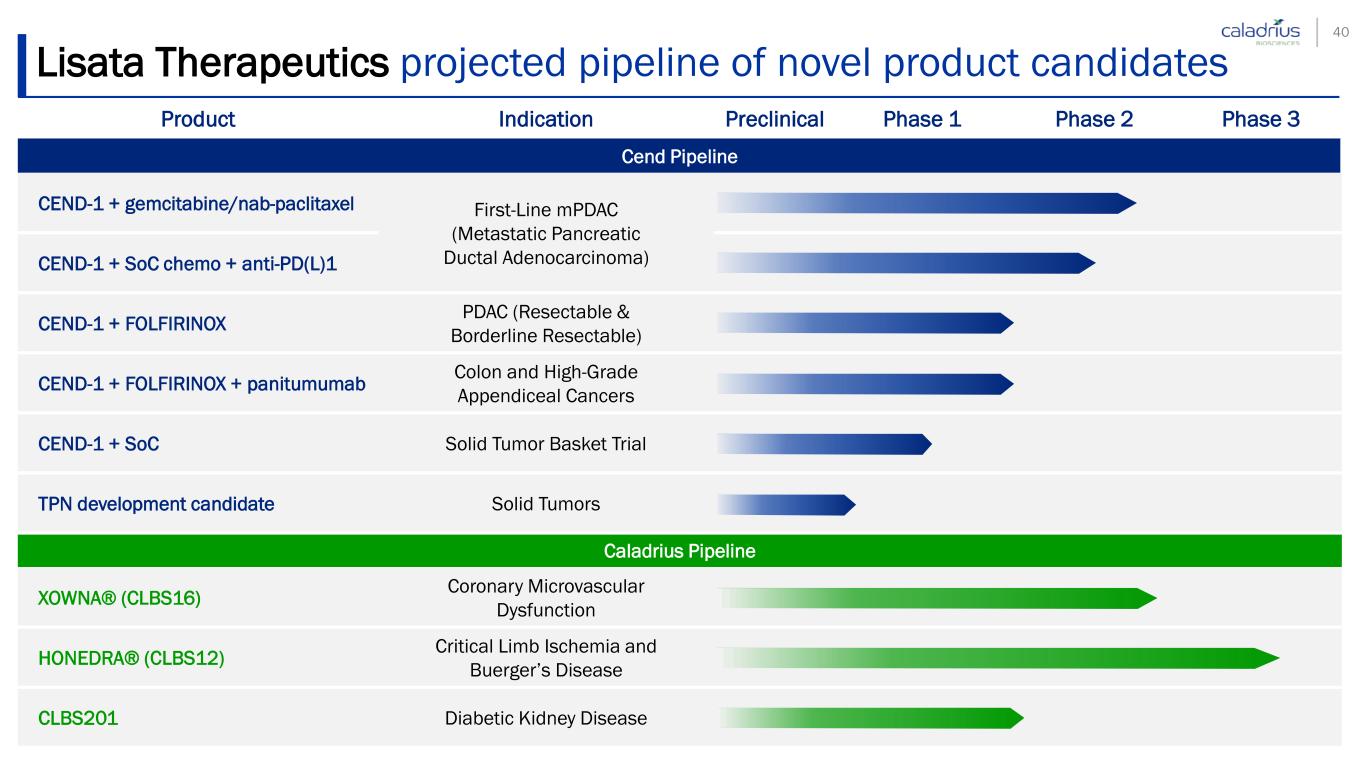

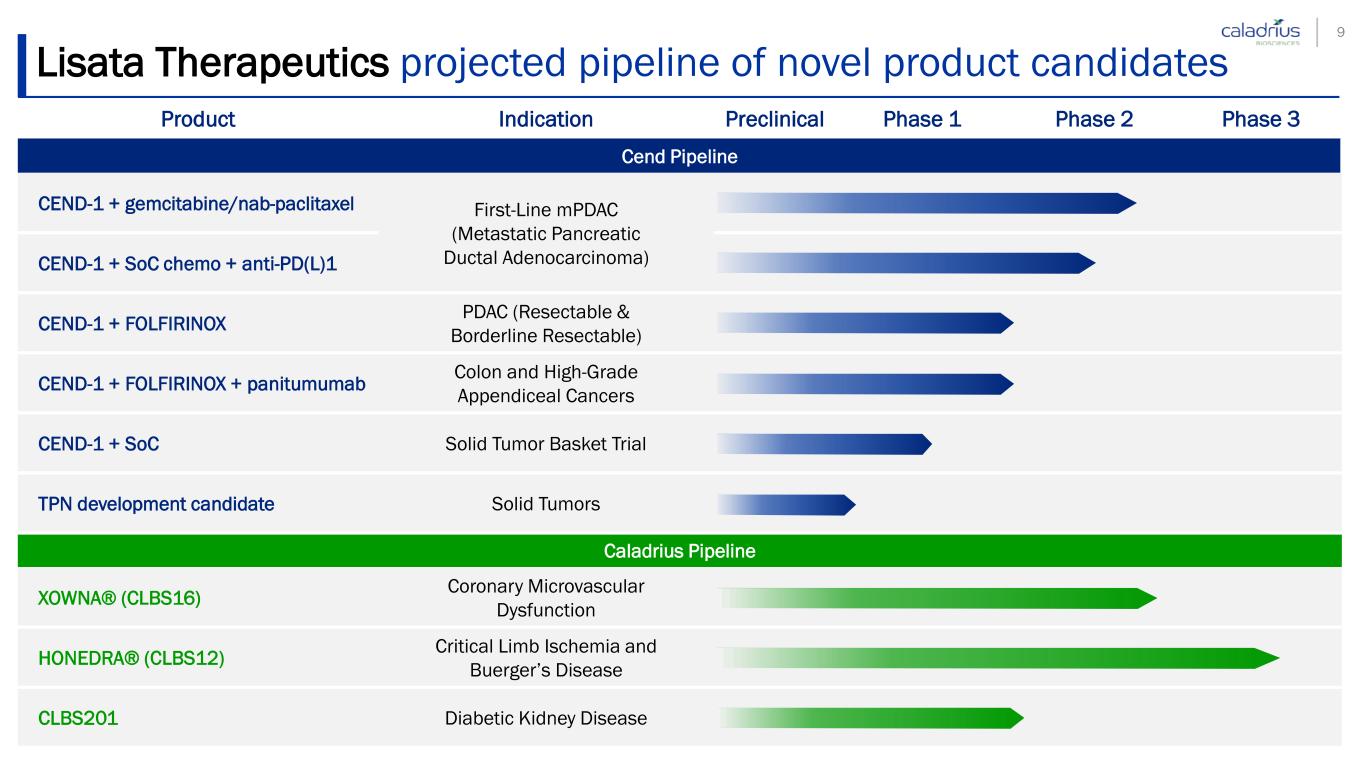

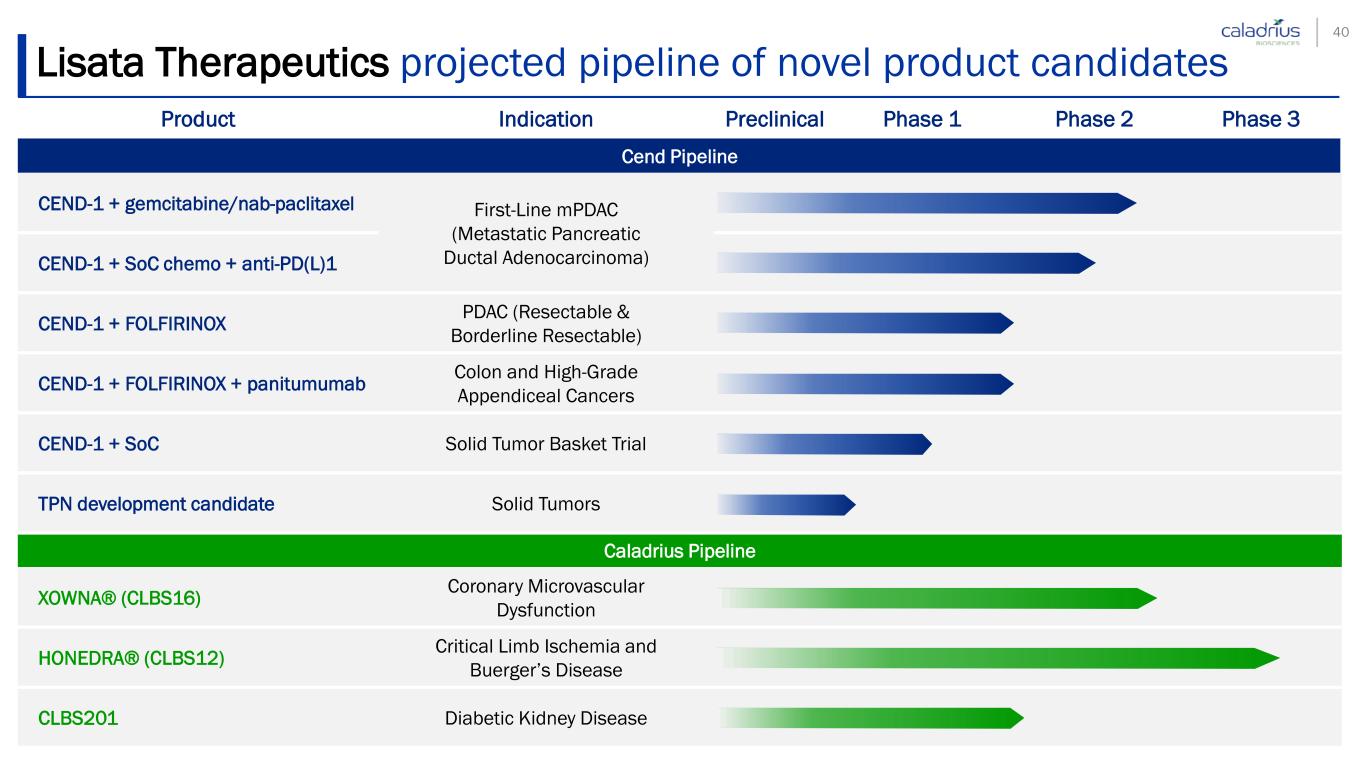

Lisata Therapeutics projected pipeline of novel product candidates Product Indication Preclinical Phase 1 Phase 2 Phase 3 Cend Pipeline CEND-1 + gemcitabine/nab-paclitaxel First-Line mPDAC (Metastatic Pancreatic Ductal Adenocarcinoma)CEND-1 + SoC chemo + anti-PD(L)1 CEND-1 + FOLFIRINOX PDAC (Resectable & Borderline Resectable) CEND-1 + FOLFIRINOX + panitumumab Colon and High-Grade Appendiceal Cancers CEND-1 + SoC Solid Tumor Basket Trial TPN development candidate Solid Tumors Caladrius Pipeline XOWNA® (CLBS16) Coronary Microvascular Dysfunction HONEDRA® (CLBS12) Critical Limb Ischemia and Buerger’s Disease CLBS201 Diabetic Kidney Disease 9

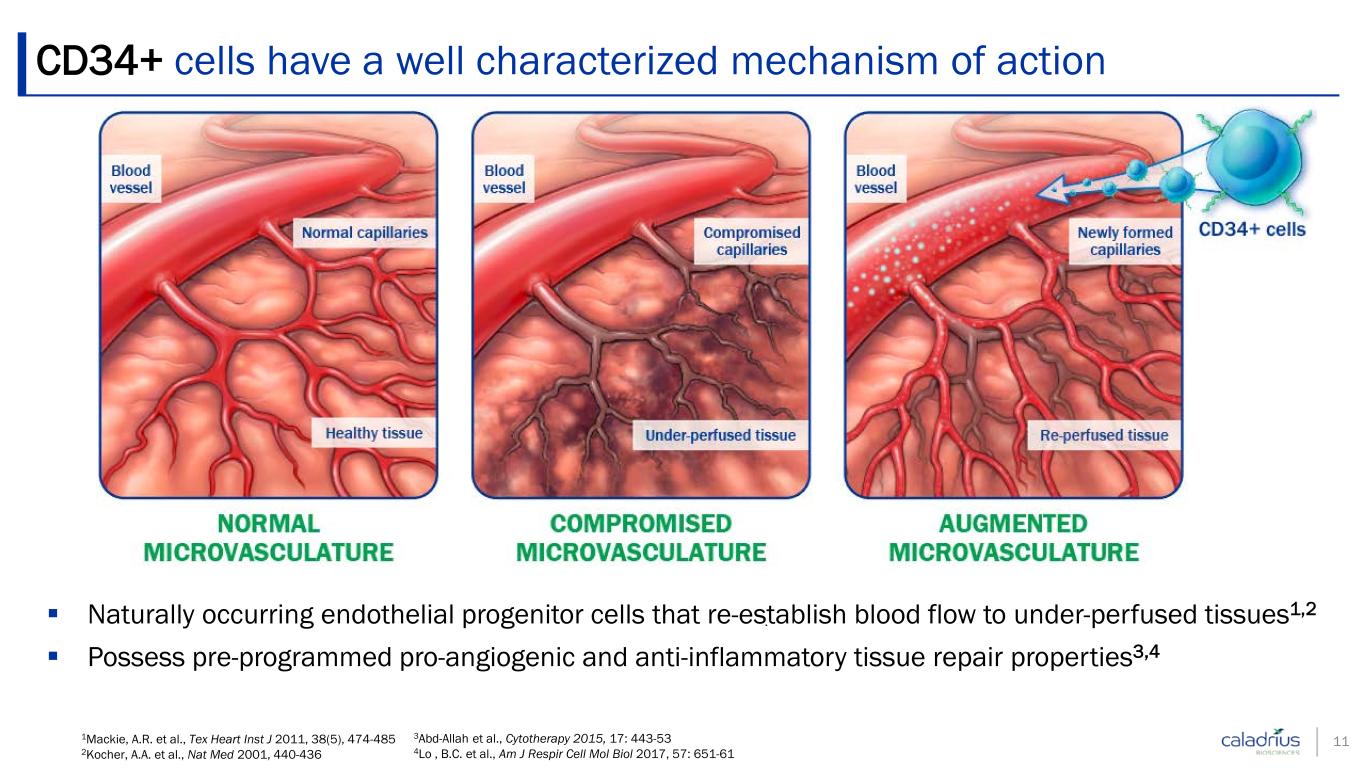

CD34+ Cell Therapy Technology Overview

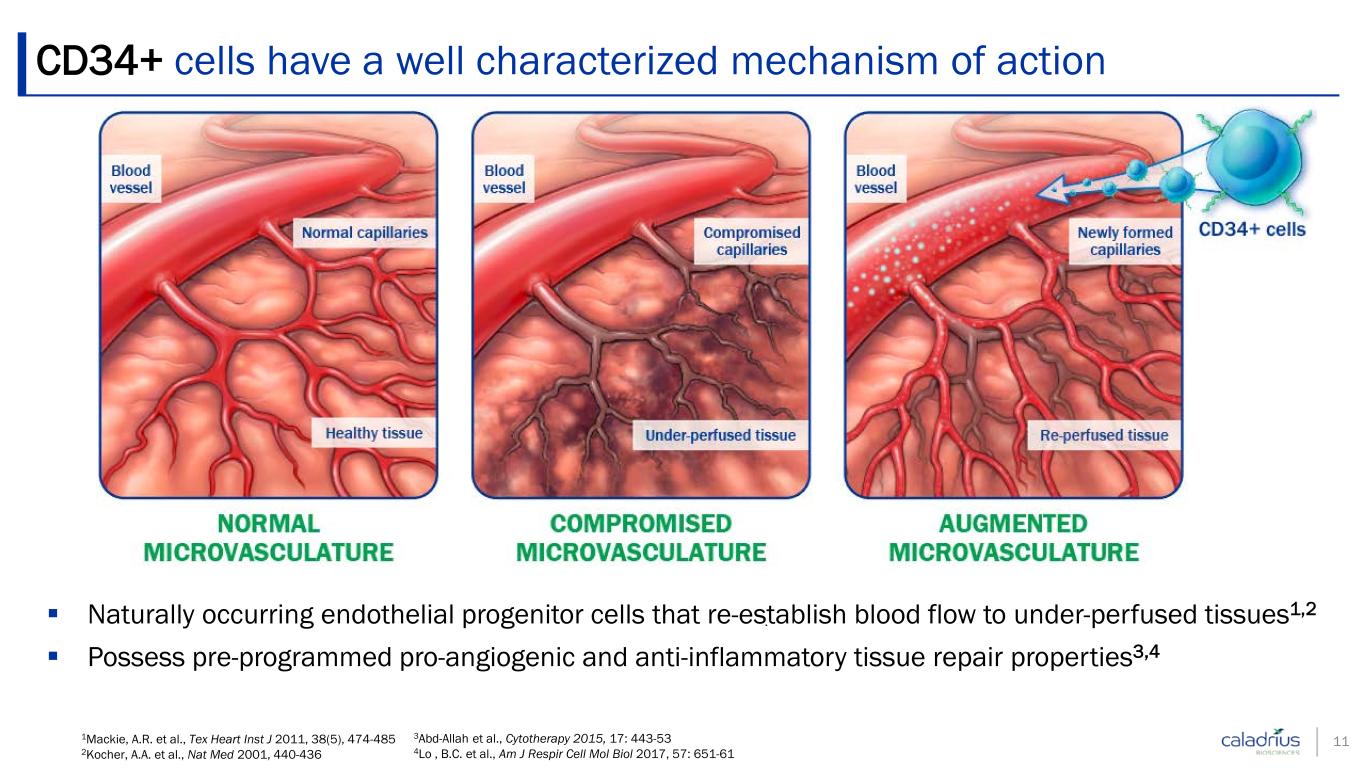

Naturally occurring endothelial progenitor cells that re-establish blood flow to under-perfused tissues1,2 Possess pre-programmed pro-angiogenic and anti-inflammatory tissue repair properties3,4 1Mackie, A.R. et al., Tex Heart Inst J 2011, 38(5), 474-485 2Kocher, A.A. et al., Nat Med 2001, 440-436 3Abd-Allah et al., Cytotherapy 2015, 17: 443-53 4Lo , B.C. et al., Am J Respir Cell Mol Biol 2017, 57: 651-61 CD34+ cells have a well characterized mechanism of action 11

CD34+ cells have been studied clinically in a variety of ischemic disease indications by numerous investigators across many sites and countries CD34+ cells repeatedly demonstrated vascular repair in multiple organs Consistent and compelling results of rigorous clinical studies comprising >1,000 patients have been published in peer reviewed journals1-4 Single treatments elicited durable therapeutic effects Treatment generally well-tolerated Strong patent protection beyond 2031 with 9 U.S. patents and 28 foreign patents granted Key patent claims: Pharmaceutical composition of non-expanded CD34+/CXCR4+ cells Therapeutic concentration range Stabilizing serum Repair of injury caused by vascular insufficiency 1 Povsic, T. et al. JACC Cardiovasc Interv, 2016, 9 (15) 1576-1585 2 Losordo, D.W. et al. Circ Cardiovasc Interv, 2012; 5:821–830 3 Velagapudi P, et al, Cardiovas Revasc Med, 2018, 20(3):215-219 4 Henry T.D., et al, European Heart Jour 2018, 2208–2216 CD34+ autologous cell therapy is extensively studied/clinically validated 12

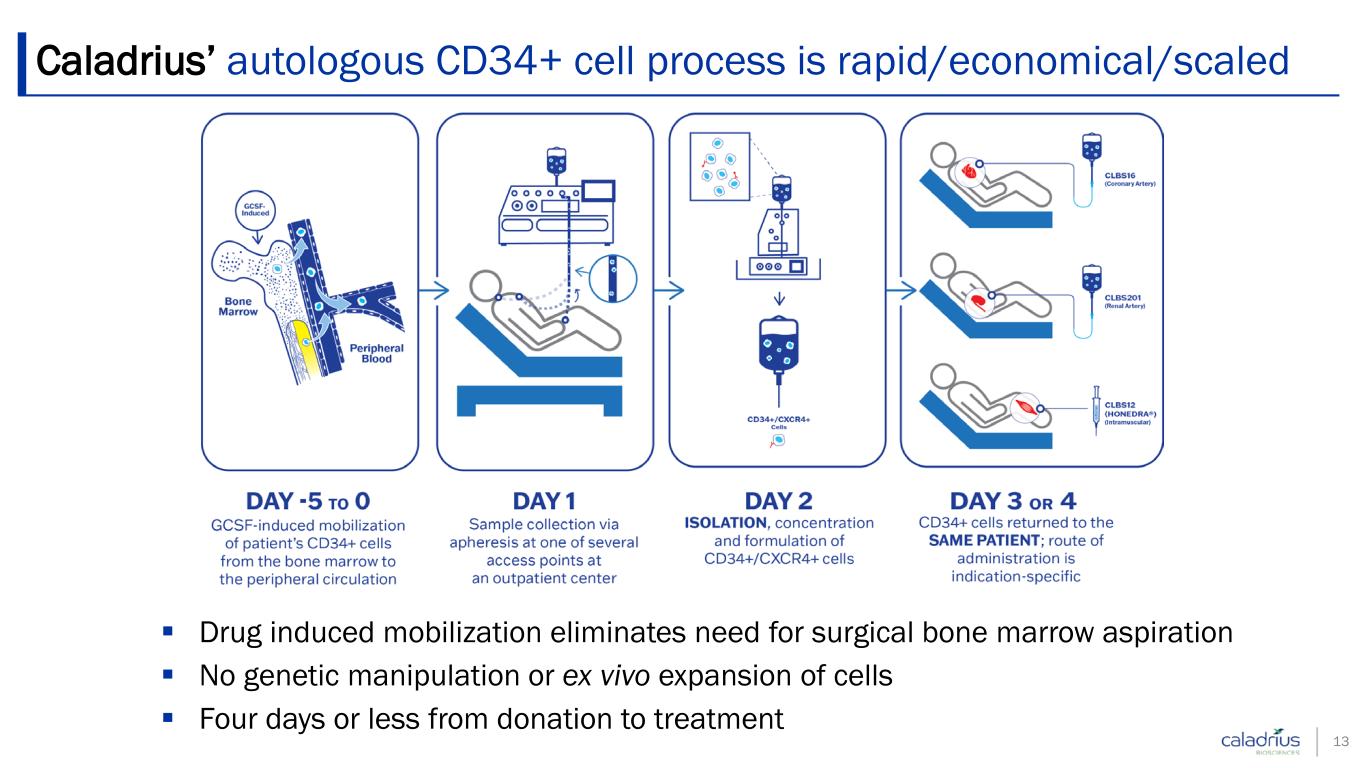

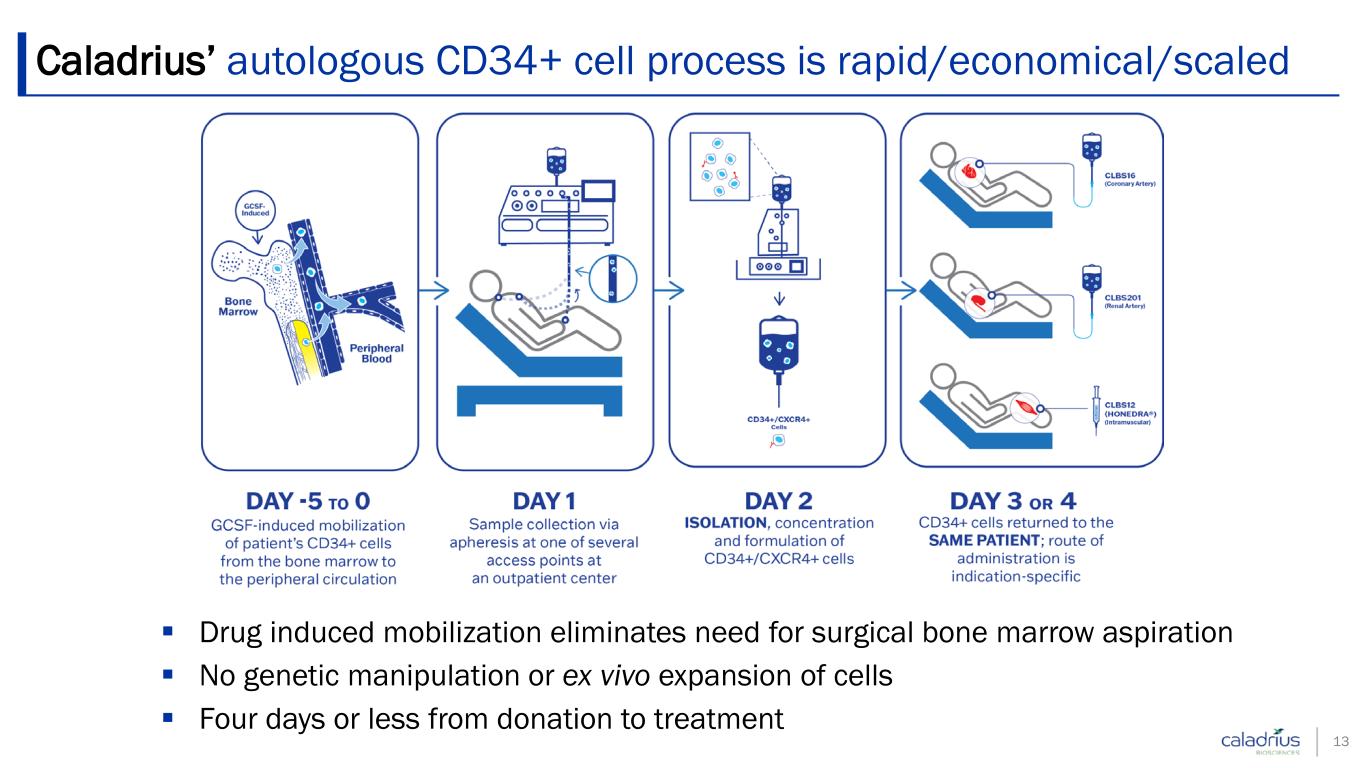

Drug induced mobilization eliminates need for surgical bone marrow aspiration No genetic manipulation or ex vivo expansion of cells Four days or less from donation to treatment Caladrius’ autologous CD34+ cell process is rapid/economical/scaled 13

XOWNA® (CLBS16) Coronary Microvascular Dysfunction (USA)

Deficient heart microvasculature without large vessel obstructive disease Causes frequent, debilitating chest pain; not treatable by stents or bypass; responds poorly or not at all to available pharmacotherapies Afflicts women more frequently (2:1 to 3:1), especially younger women1,2 Results in poor prognosis for patients3 Significantly elevated risk of all-cause mortality4 Clinically diagnosed based on symptoms and demonstrated absence of large vessel obstructive disease Quantitatively diagnosed using Coronary Flow Reserve (CFR)5 and image-techniques (cPET and cMRI) 50% - 65% of patients with angina without obstructive coronary artery disease (CAD) are believed to have CMD6 Applicable CMD population in the U.S. potentially treatable by XOWNA® ranges from ~415,000 to ~1.6 million patients7 1 Coronary Microvascular Disease. (2015, July 31). In American Heart Association 2 R. David Anderson, John W. Petersen, Puja K. Mehta, et al., Journal of Interventional Cardiology, 2019: 8 3 Loffler and Bourque, Curr Cardiol Rep. 2016 Jan; 18(1): 1 4 Kenkre, T.S. et al., Circ: CV Qual & Outcomes 2017, 10(12) 1-9 5 Collins, P., British heart journal (1993) 69(4), 279–281 6 Marinescu MA, et al. JACC Cardiovasc Imaging. 2015;8:210-220 7 Tunstall-Pedoe H. (ed.) WHO, Geneva, 2003, pp. 244, Swiss Fr 45, ISBN: 92-4-156223-4 Indication: Coronary microvascular dysfunction (CMD) 15

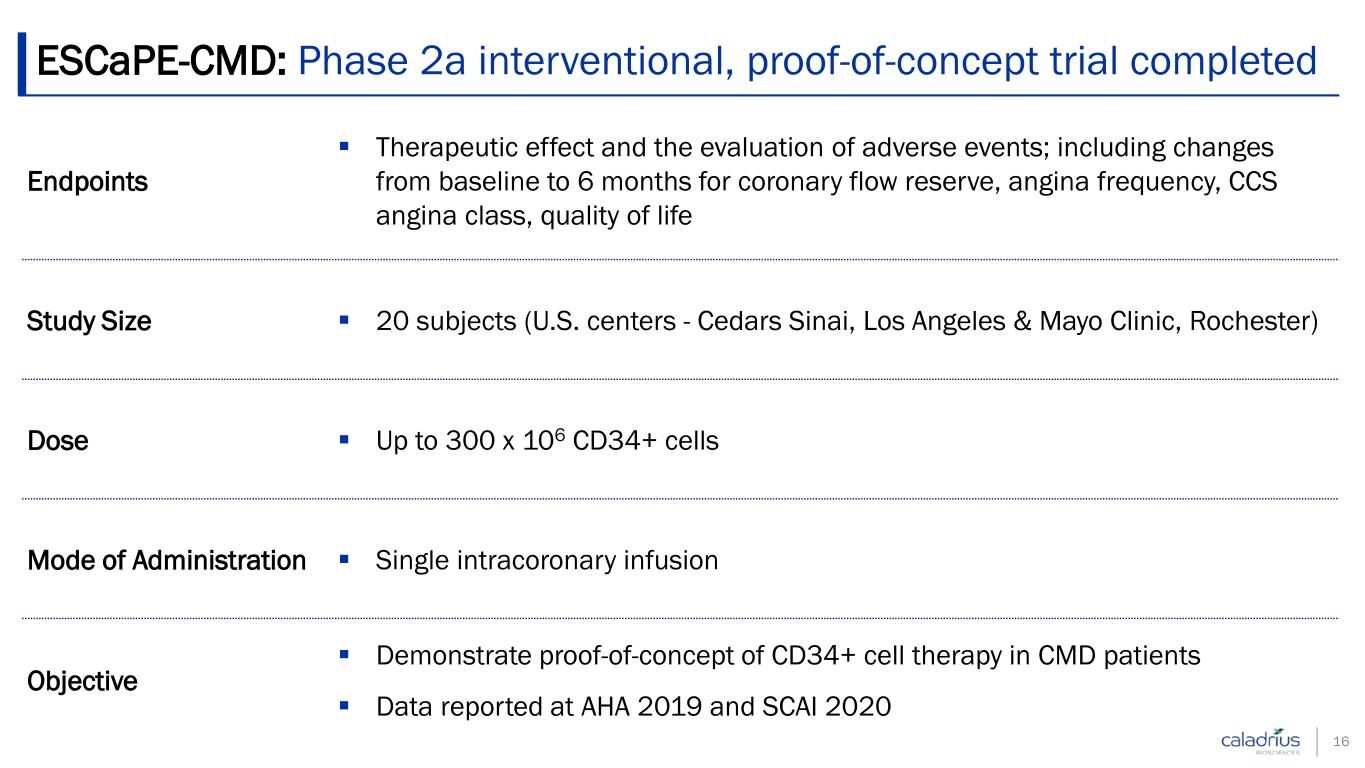

Endpoints Therapeutic effect and the evaluation of adverse events; including changes from baseline to 6 months for coronary flow reserve, angina frequency, CCS angina class, quality of life Study Size 20 subjects (U.S. centers - Cedars Sinai, Los Angeles & Mayo Clinic, Rochester) Dose Up to 300 x 106 CD34+ cells Mode of Administration Single intracoronary infusion Objective Demonstrate proof-of-concept of CD34+ cell therapy in CMD patients Data reported at AHA 2019 and SCAI 2020 ESCaPE-CMD: Phase 2a interventional, proof-of-concept trial completed 16

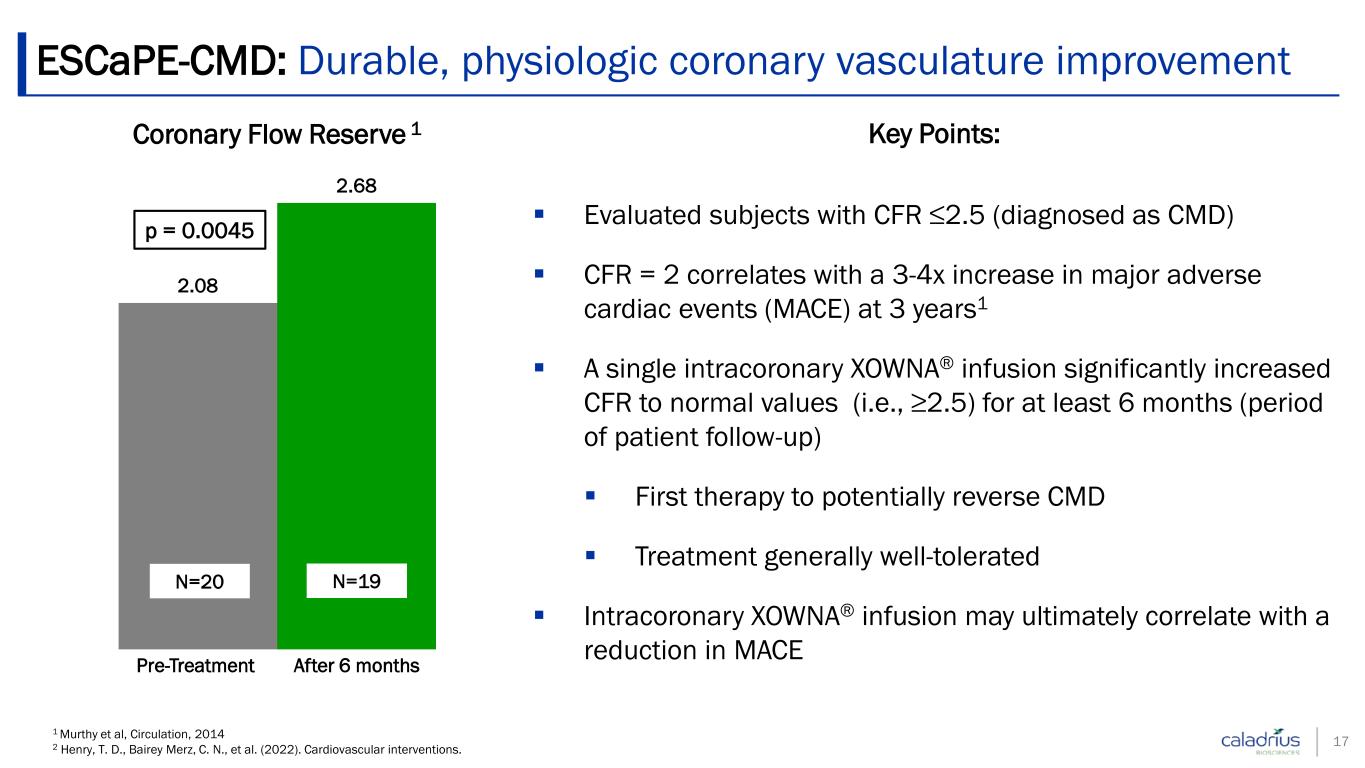

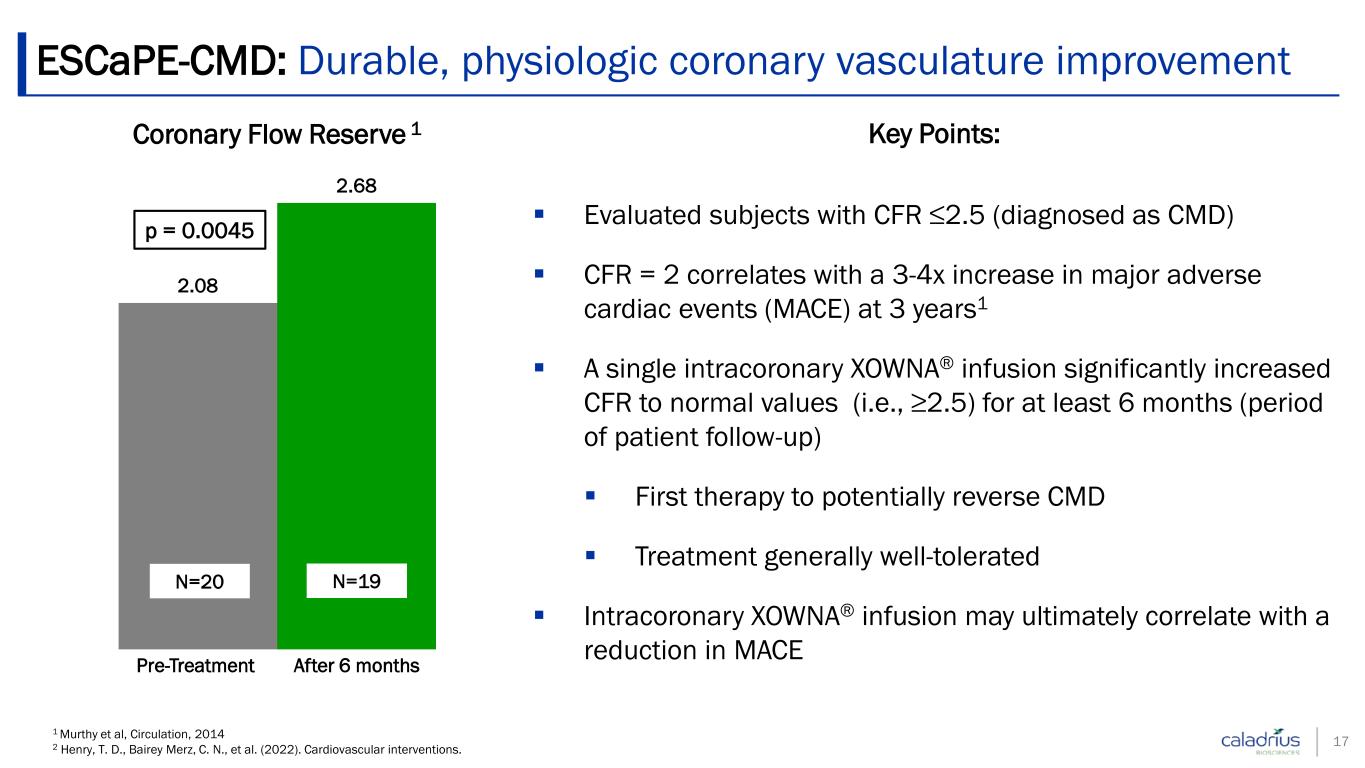

ESCaPE-CMD: Durable, physiologic coronary vasculature improvement 17 1 Murthy et al, Circulation, 2014 2 Henry, T. D., Bairey Merz, C. N., et al. (2022). Cardiovascular interventions. Coronary Flow Reserve 1 2.08 2.68 p = 0.0045 N=20 Pre-Treatment After 6 months N=19 Key Points: Evaluated subjects with CFR ≤2.5 (diagnosed as CMD) CFR = 2 correlates with a 3-4x increase in major adverse cardiac events (MACE) at 3 years1 A single intracoronary XOWNA® infusion significantly increased CFR to normal values (i.e., ≥2.5) for at least 6 months (period of patient follow-up) First therapy to potentially reverse CMD Treatment generally well-tolerated Intracoronary XOWNA® infusion may ultimately correlate with a reduction in MACE

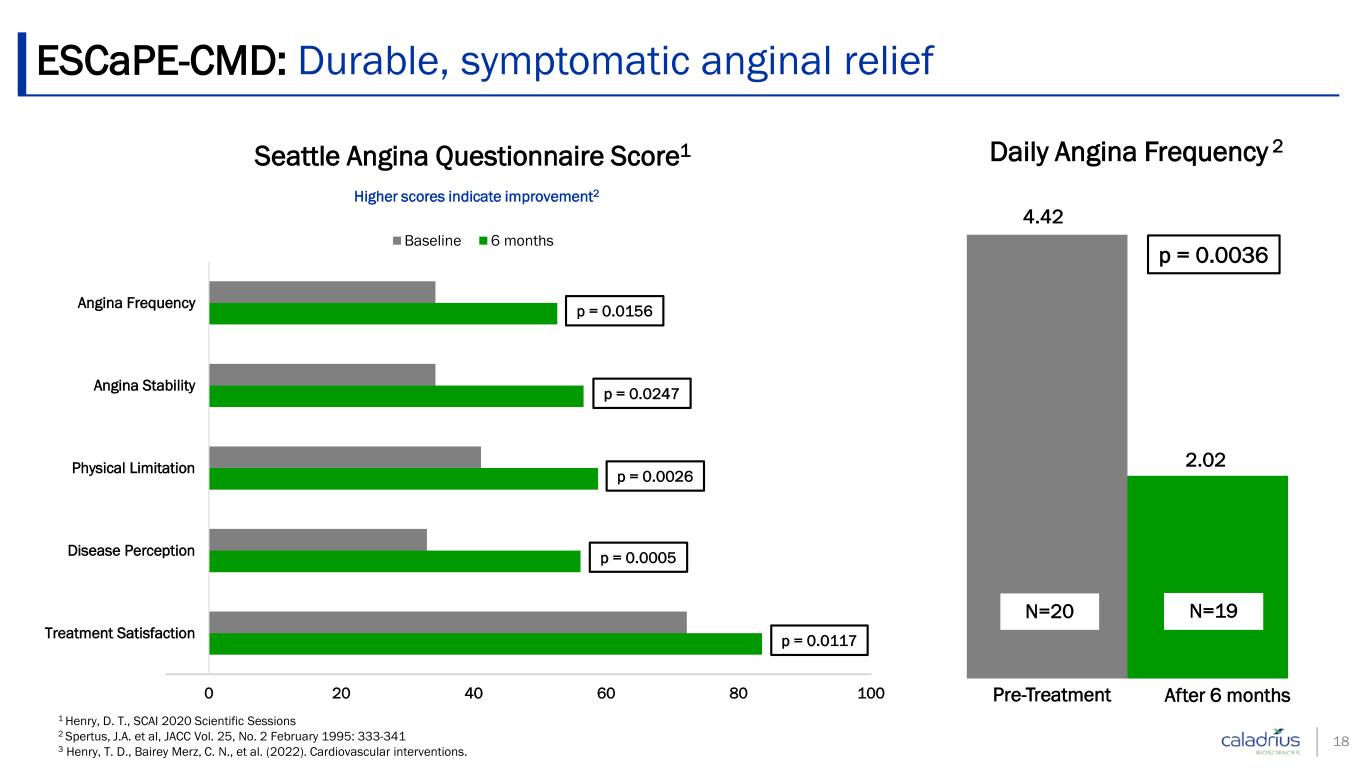

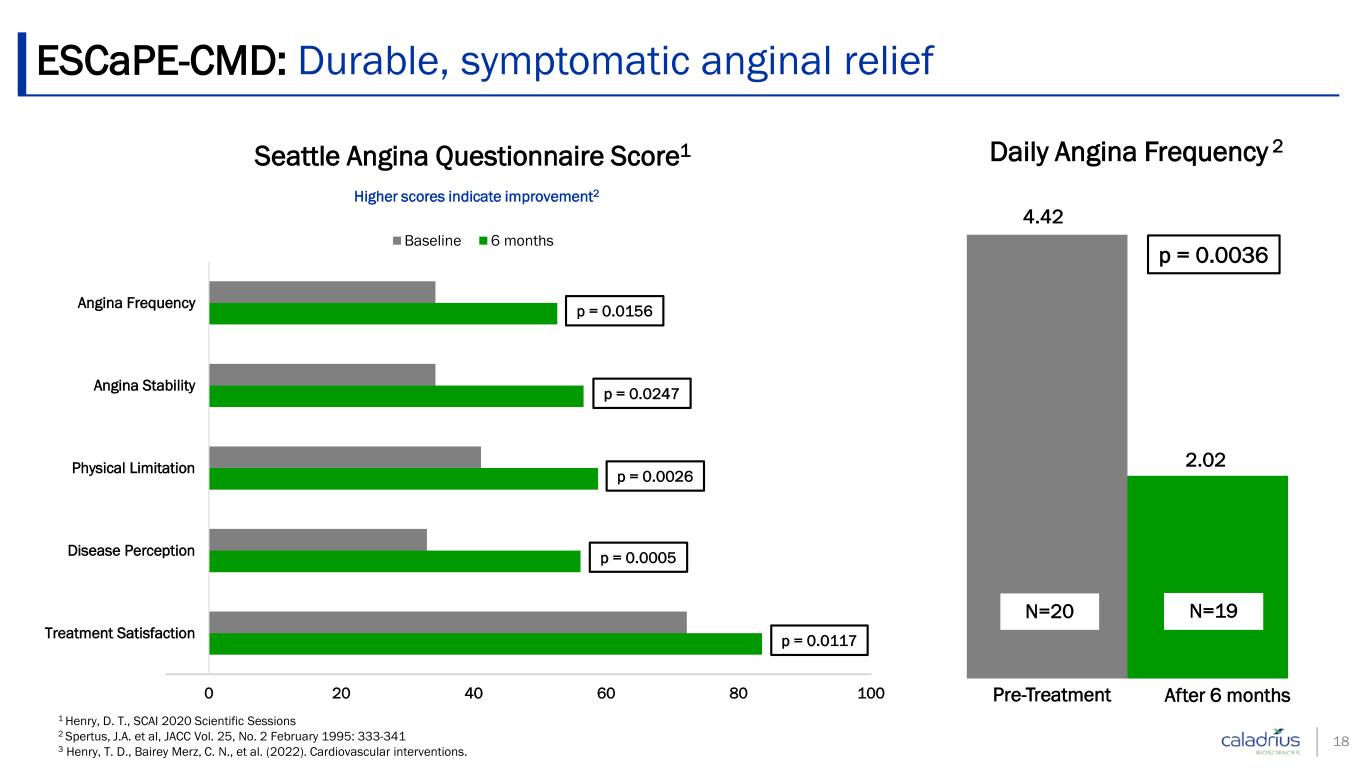

18 1 Henry, D. T., SCAI 2020 Scientific Sessions 2 Spertus, J.A. et al, JACC Vol. 25, No. 2 February 1995: 333-341 3 Henry, T. D., Bairey Merz, C. N., et al. (2022). Cardiovascular interventions. 0 20 40 60 80 100 Treatment Satisfaction Disease Perception Physical Limitation Angina Stability Angina Frequency Seattle Angina Questionnaire Score1 Baseline 6 months Higher scores indicate improvement2 p = 0.0026 p = 0.0247 p = 0.0156 p = 0.0005 Daily Angina Frequency 2 4.42 2.02 N=20 Pre-Treatment After 6 months p = 0.0036 N=19 ESCaPE-CMD: Durable, symptomatic anginal relief p = 0.0117

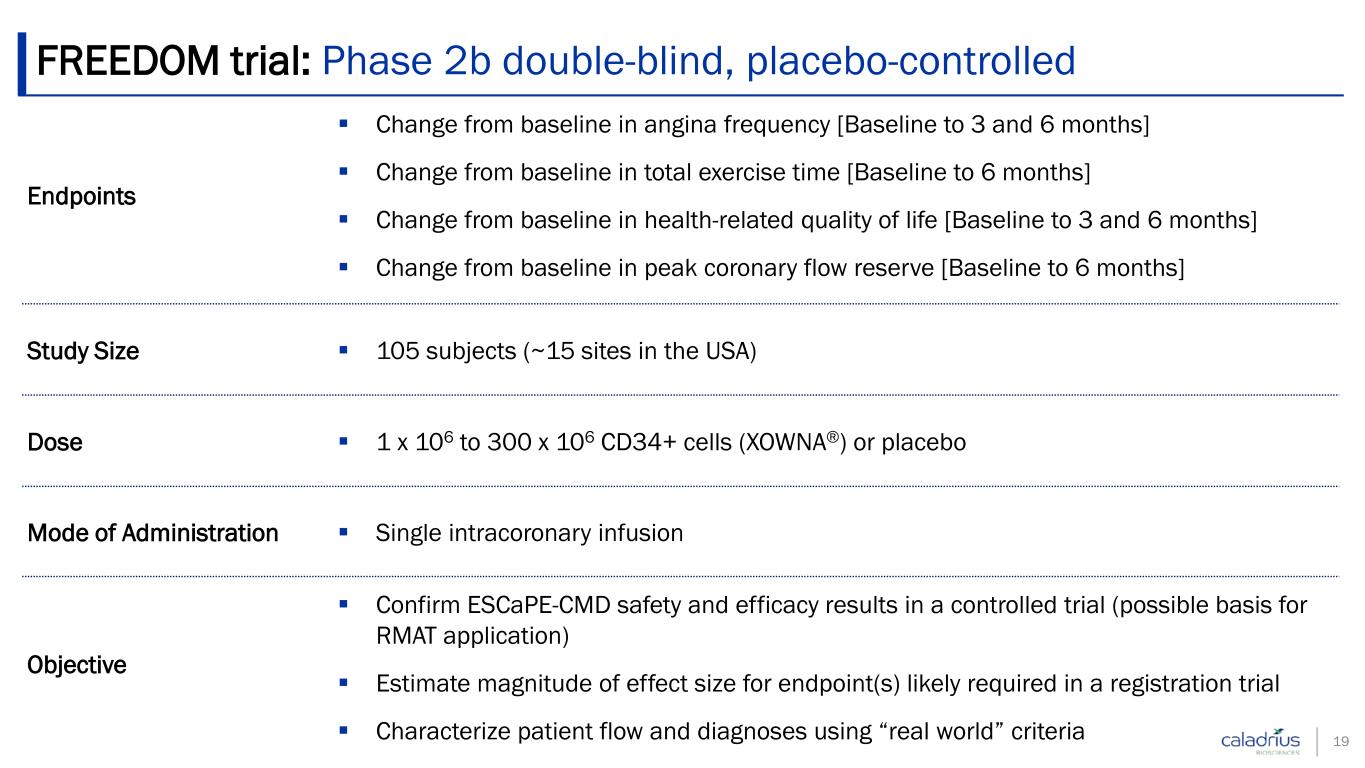

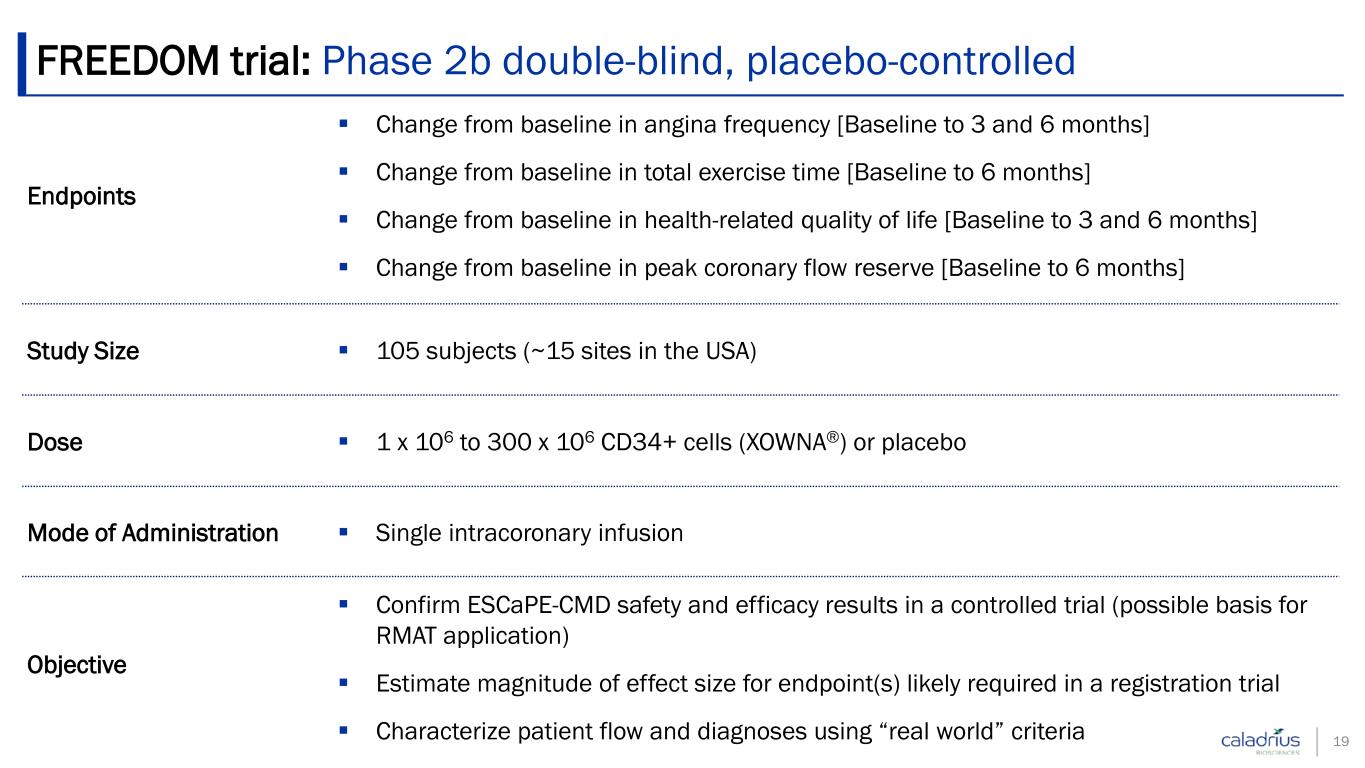

Endpoints Change from baseline in angina frequency [Baseline to 3 and 6 months] Change from baseline in total exercise time [Baseline to 6 months] Change from baseline in health-related quality of life [Baseline to 3 and 6 months] Change from baseline in peak coronary flow reserve [Baseline to 6 months] Study Size 105 subjects (~15 sites in the USA) Dose 1 x 106 to 300 x 106 CD34+ cells (XOWNA®) or placebo Mode of Administration Single intracoronary infusion Objective Confirm ESCaPE-CMD safety and efficacy results in a controlled trial (possible basis for RMAT application) Estimate magnitude of effect size for endpoint(s) likely required in a registration trial Characterize patient flow and diagnoses using “real world” criteria FREEDOM trial: Phase 2b double-blind, placebo-controlled 19

XOWNA®/FREEDOM trial status update Enrollment discontinued at ~1/3 of 105 originally stipulated patients due to COVID-19 pandemic related delays and other challenges Restricted accessibility of subjects to investigational sites Reduced availability of staff at the clinical sites Unexpected discontinuation of the catheter originally specified for the diagnosis of CMD Subjects testing positive for COVID-19 prior to treatment Competition for available apheresis resources Supply chain (i.e., out-of-stock) issues for some catheters FDA cleared for administration of XOWNA® Discontinuation of catheters cleared by FDA for administration of XOWNA® Supply chain (i.e., out-of-stock) issues associated with Omnipaque, a commonly used contrast agent Financial pressures of dramatically increased costs of personnel, materials and manufacturing 20

XOWNA®/FREEDOM trial status update Additional clinical data is not particularly useful for future regulatory and/or commercial use Revised projected recruitment timeline of >4 years to trial primary endpoint readout not viable for financial and commercial reasons Planned interim analysis of data from not fewer than 20 patients with 6-month follow up to address study objectives; results expected in August 2022 Next development steps will be based on interim analysis results, discussions with FDA, as appropriate, and a review of the cost and timeline of a revised development plan Decision expected by year-end 2022 21

SAKIGAKE designated – Japan Orphan Drug designated (Buerger’s disease) - USA Advanced Therapeutic Medicinal Product (ATMP) designated – EU HONEDRA® Critical Limb Ischemia (Japan) (CLBS12)

Severe arterial obstruction impeding blood flow in the lower extremities Often found as a co-morbidity in diabetes patients Includes severe rest pain and non-healing ulcers Buerger’s disease (BD = inflammation in small and medium arteries) a form of CLI associated with a history of heavy smoking (orphan population) Patients with no-option CLI have persistent symptoms even after bypass surgery, angioplasty, stenting and available pharmacotherapy CLI patients are at high risk of amputation and death Multi-hundred-million-dollar opportunity in Japan Indication: Critical limb ischemia (CLI) 23

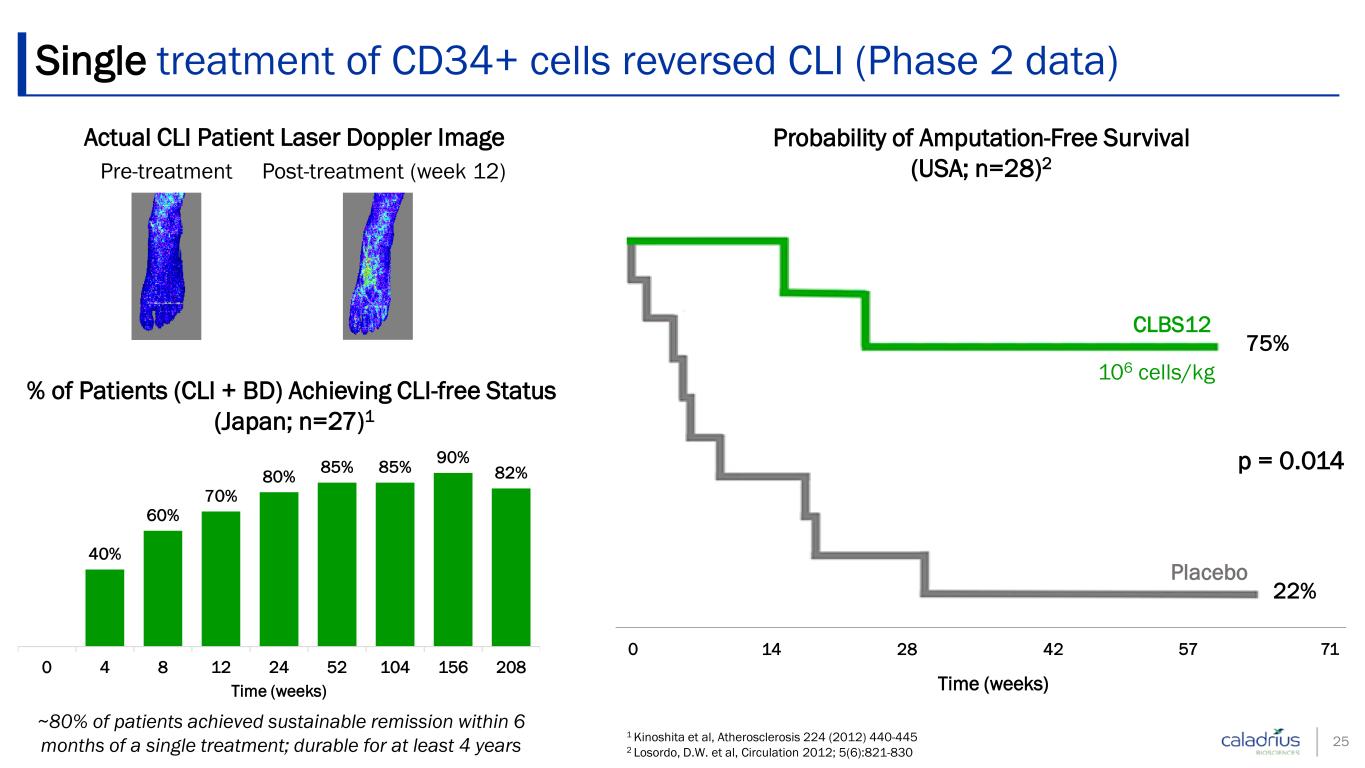

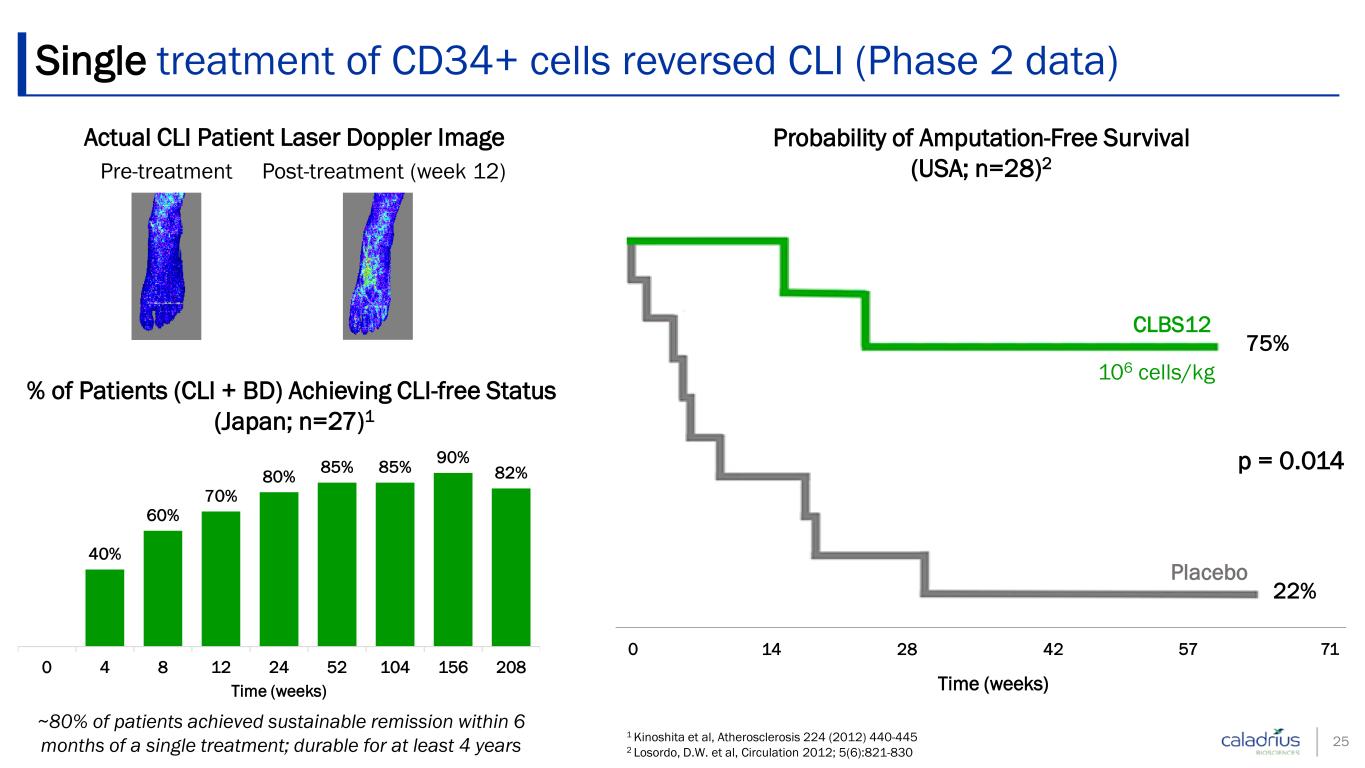

Single treatment of CD34+ cells reversed CLI (Phase 2 data) 25 Post-treatment (week 12) Pre-treatment Actual CLI Patient Laser Doppler Image 0 14 28 42 57 71 Time (weeks) CLBS12 Placebo 75% 22% p = 0.014 106 cells/kg Probability of Amputation-Free Survival (USA; n=28)2 ~80% of patients achieved sustainable remission within 6 months of a single treatment; durable for at least 4 years 40% 60% 70% 80% 85% 85% 90% 82% 0 4 8 12 24 52 104 156 208 Time (weeks) % of Patients (CLI + BD) Achieving CLI-free Status (Japan; n=27)1 1 Kinoshita et al, Atherosclerosis 224 (2012) 440-445 2 Losordo, D.W. et al, Circulation 2012; 5(6):821-830

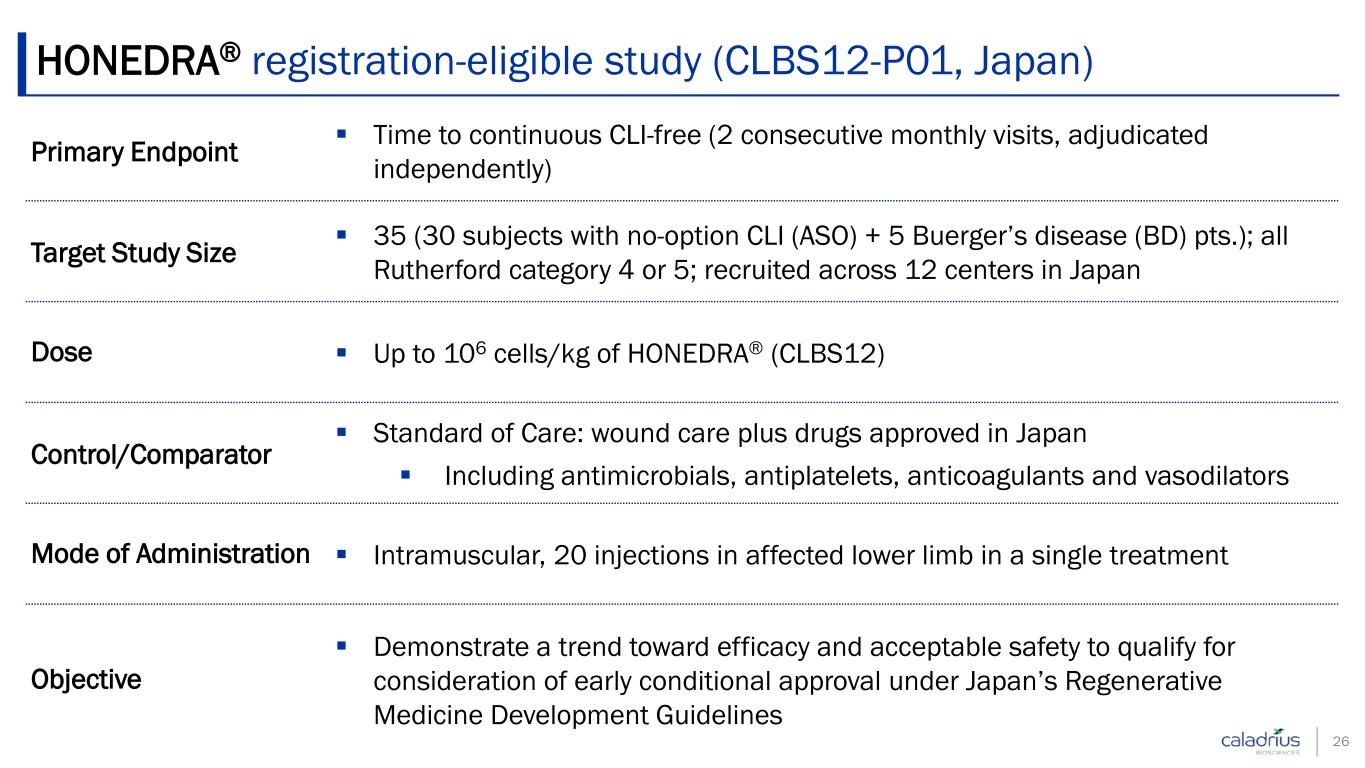

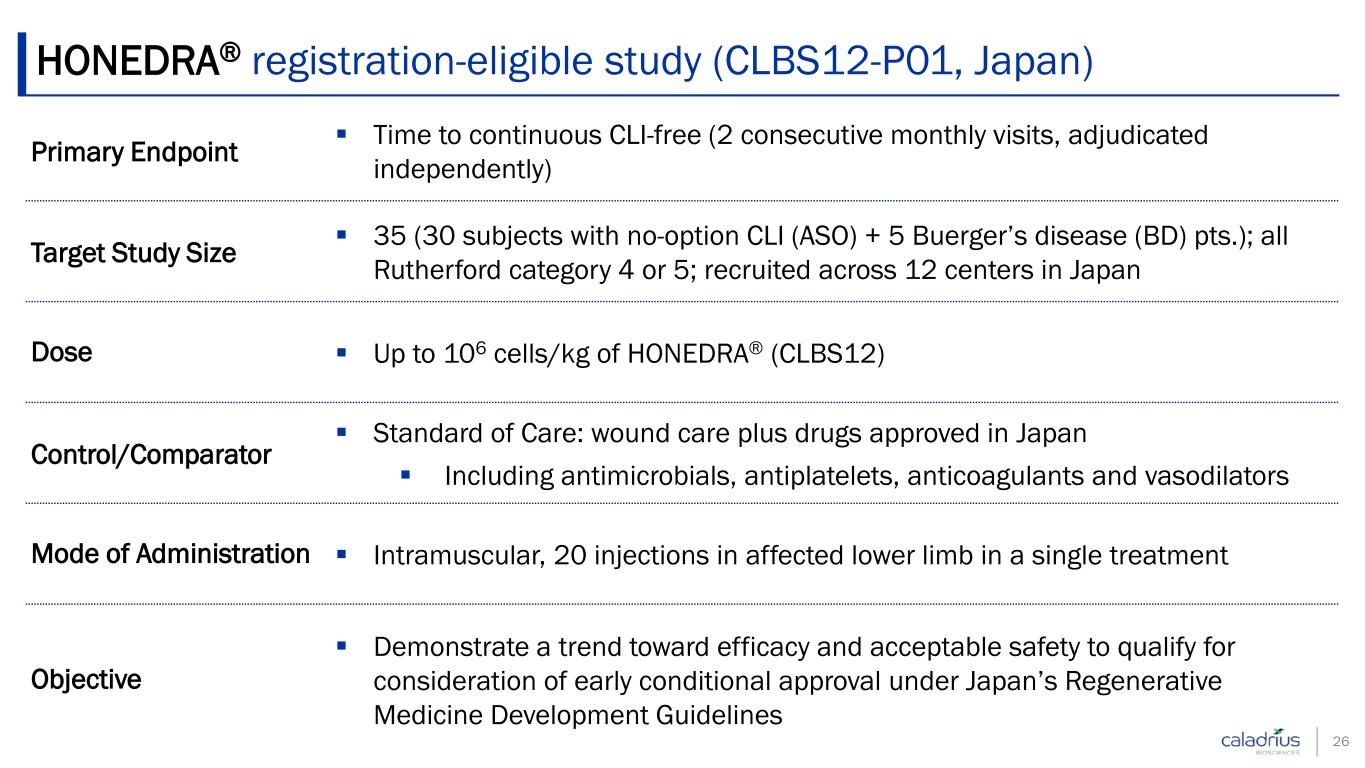

Primary Endpoint Time to continuous CLI-free (2 consecutive monthly visits, adjudicated independently) Target Study Size 35 (30 subjects with no-option CLI (ASO) + 5 Buerger’s disease (BD) pts.); all Rutherford category 4 or 5; recruited across 12 centers in Japan Dose Up to 106 cells/kg of HONEDRA® (CLBS12) Control/Comparator Standard of Care: wound care plus drugs approved in Japan Including antimicrobials, antiplatelets, anticoagulants and vasodilators Mode of Administration Intramuscular, 20 injections in affected lower limb in a single treatment Objective Demonstrate a trend toward efficacy and acceptable safety to qualify for consideration of early conditional approval under Japan’s Regenerative Medicine Development Guidelines HONEDRA® registration-eligible study (CLBS12-P01, Japan) 26

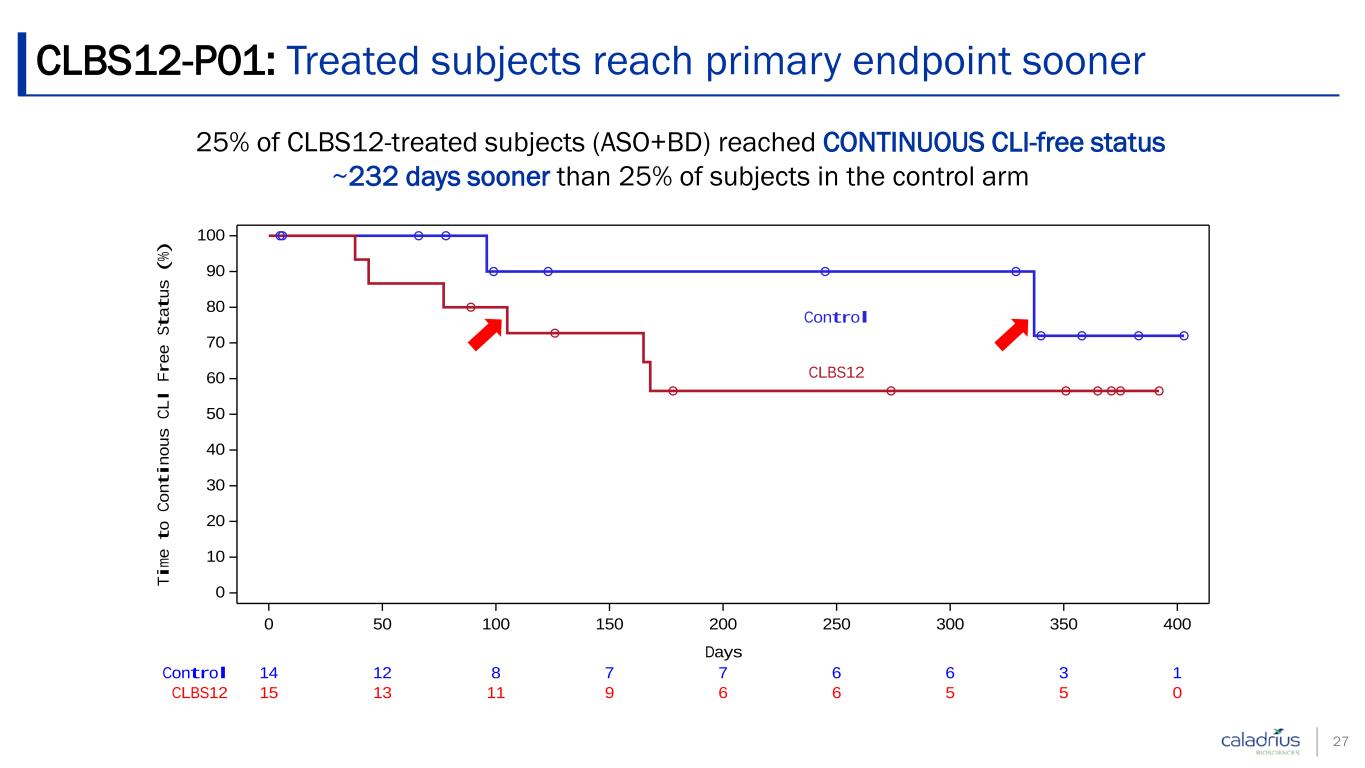

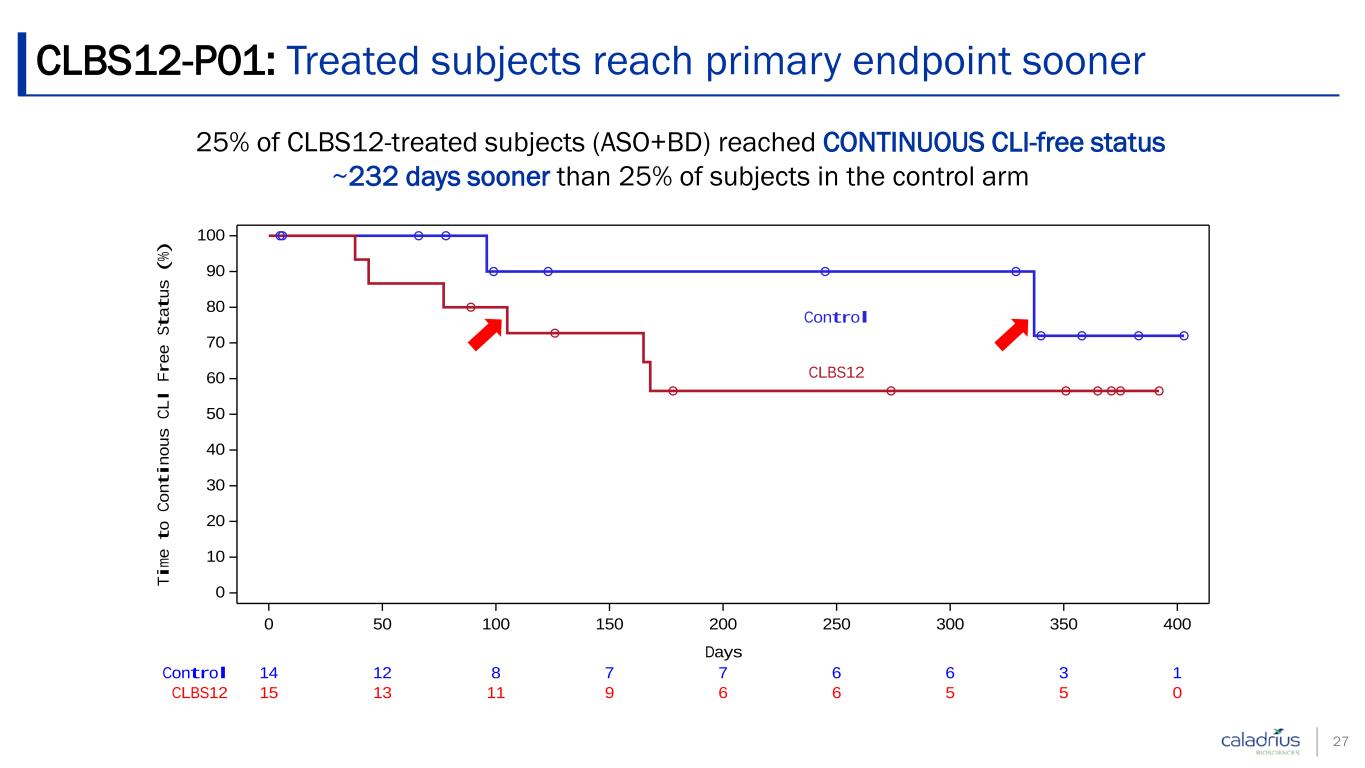

25% of CLBS12-treated subjects (ASO+BD) reached CONTINUOUS CLI-free status ~232 days sooner than 25% of subjects in the control arm CLBS12-P01: Treated subjects reach primary endpoint sooner 27 15 13 11 9 6 6 5 5 0CLBS12 14 12 8 7 7 6 6 3 1Control Control CLBS12 0 50 100 150 200 250 300 350 400 Days 0 10 20 30 40 50 60 70 80 90 100 Ti me t o Co nt in ou s CL I Fr ee S ta tu s (% )

CLBS12-P01: Treated subjects hit secondary endpoint sooner 28 25% of CLBS12-treated subjects (ASO+BD) reached FIRST CLI-free status ~260 days sooner than 25% of subjects in the control arm 15 13 10 9 6 6 5 5 0CLBS12 14 12 7 6 6 5 5 3 1Control Control CLBS12 0 50 100 150 200 250 300 350 400 Days 0 10 20 30 40 50 60 70 80 90 100 Ti me t o Fi rs t CL I Fr ee S ta tu s (% )

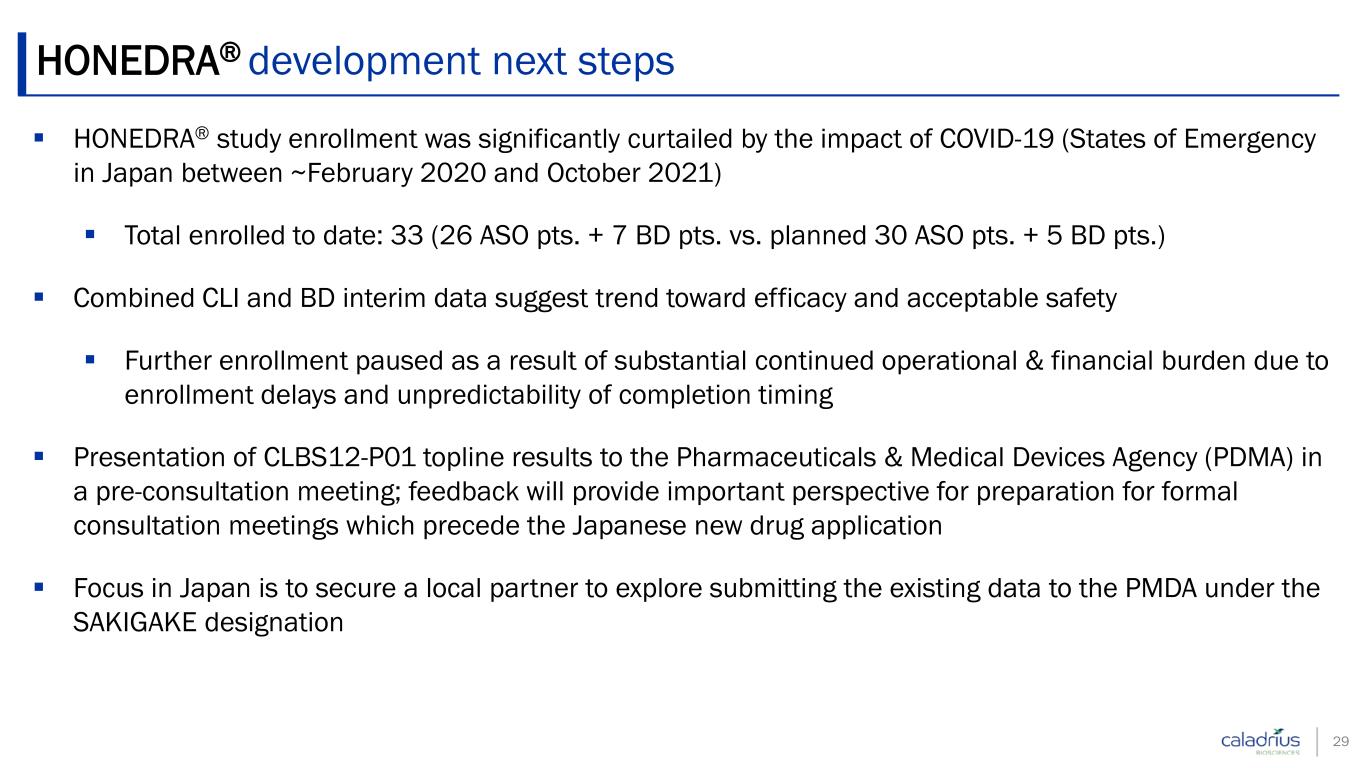

HONEDRA® study enrollment was significantly curtailed by the impact of COVID-19 (States of Emergency in Japan between ~February 2020 and October 2021) Total enrolled to date: 33 (26 ASO pts. + 7 BD pts. vs. planned 30 ASO pts. + 5 BD pts.) Combined CLI and BD interim data suggest trend toward efficacy and acceptable safety Further enrollment paused as a result of substantial continued operational & financial burden due to enrollment delays and unpredictability of completion timing Presentation of CLBS12-P01 topline results to the Pharmaceuticals & Medical Devices Agency (PDMA) in a pre-consultation meeting; feedback will provide important perspective for preparation for formal consultation meetings which precede the Japanese new drug application Focus in Japan is to secure a local partner to explore submitting the existing data to the PMDA under the SAKIGAKE designation 29 HONEDRA® development next steps

CLBS201 Diabetic Kidney Disease (USA)

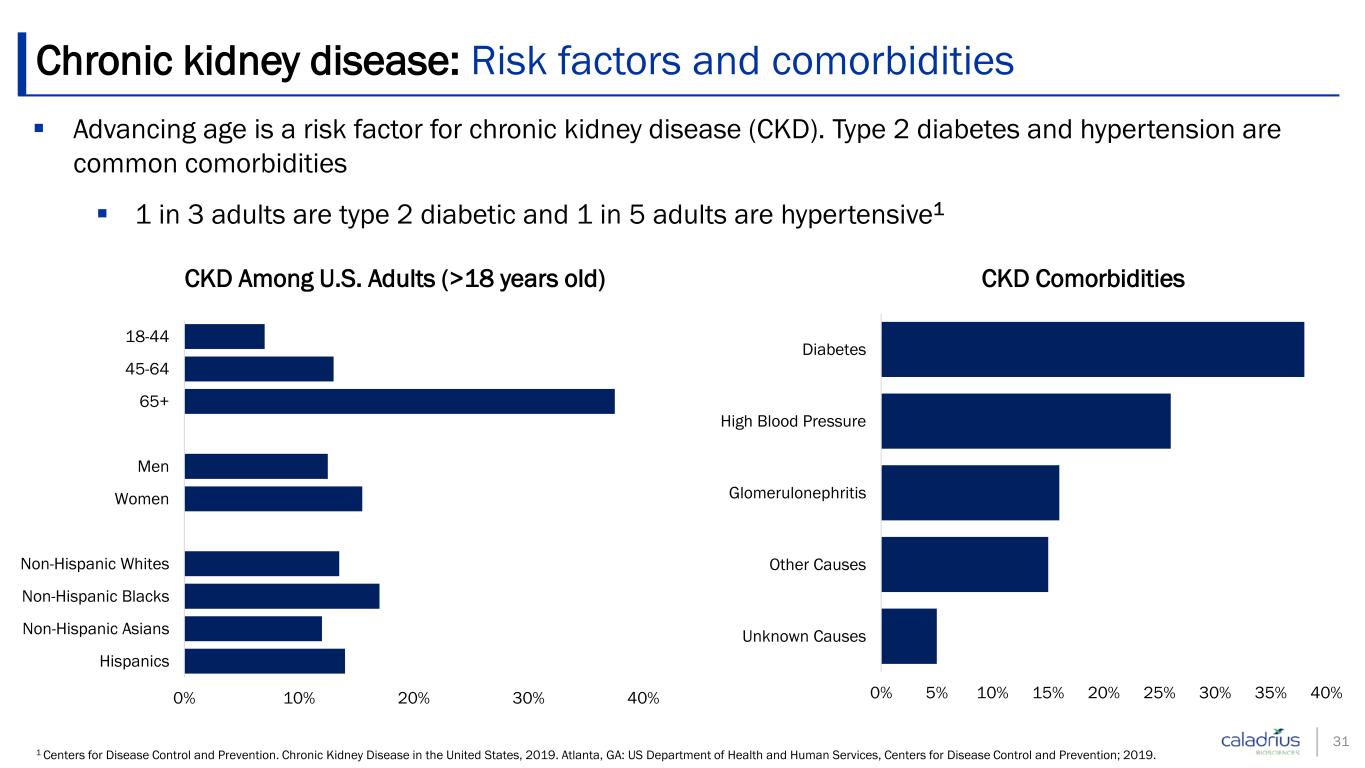

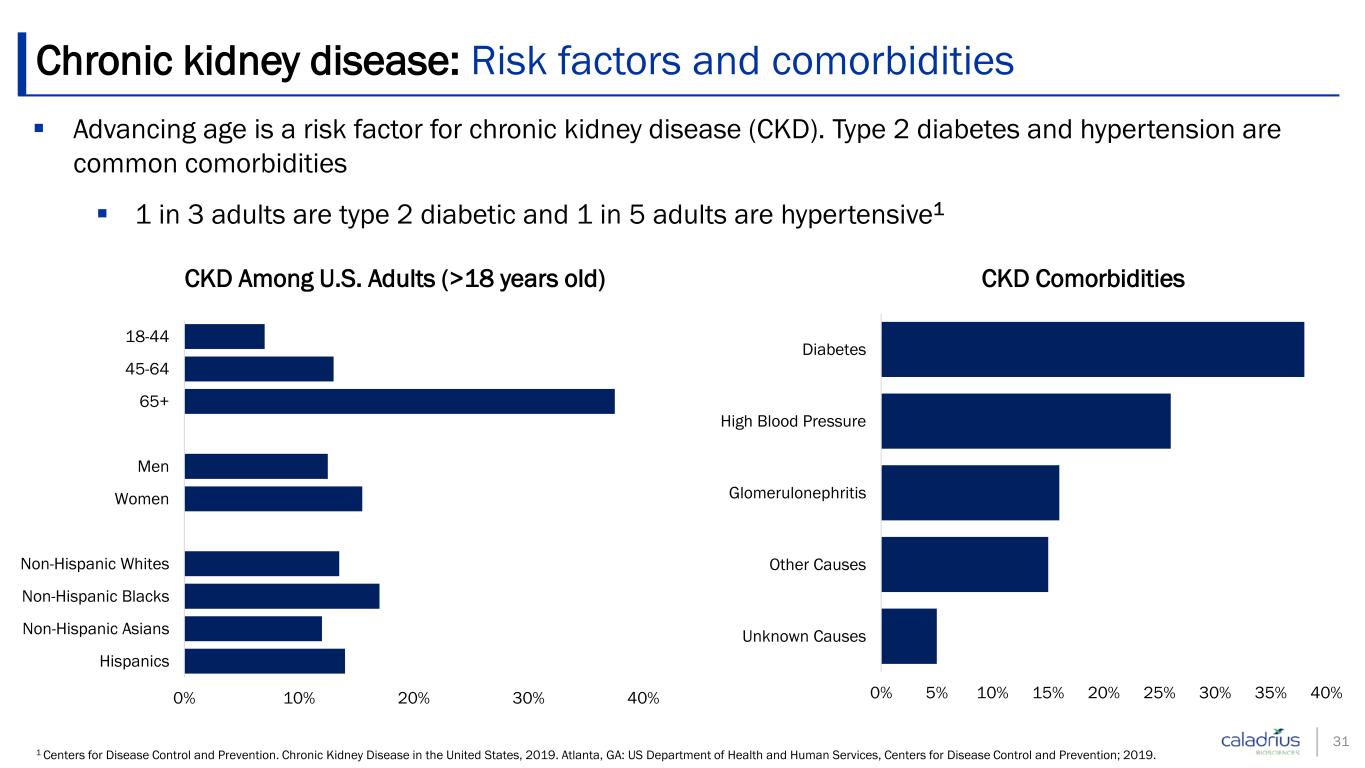

Advancing age is a risk factor for chronic kidney disease (CKD). Type 2 diabetes and hypertension are common comorbidities 1 in 3 adults are type 2 diabetic and 1 in 5 adults are hypertensive1 Chronic kidney disease: Risk factors and comorbidities 1 Centers for Disease Control and Prevention. Chronic Kidney Disease in the United States, 2019. Atlanta, GA: US Department of Health and Human Services, Centers for Disease Control and Prevention; 2019. 0% 10% 20% 30% 40% Hispanics Non-Hispanic Asians Non-Hispanic Blacks Non-Hispanic Whites Women Men 65+ 45-64 18-44 CKD Among U.S. Adults (>18 years old) 0% 5% 10% 15% 20% 25% 30% 35% 40% Unknown Causes Other Causes Glomerulonephritis High Blood Pressure Diabetes CKD Comorbidities 31

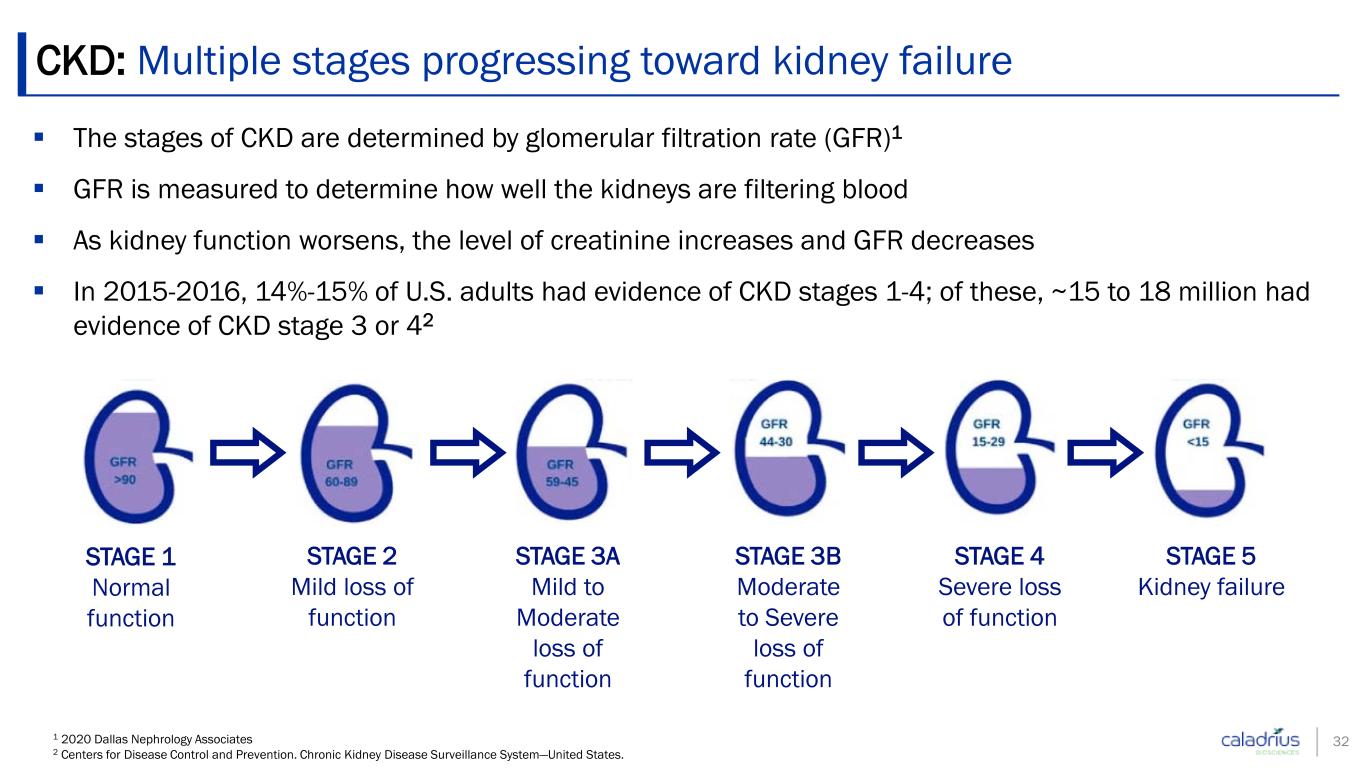

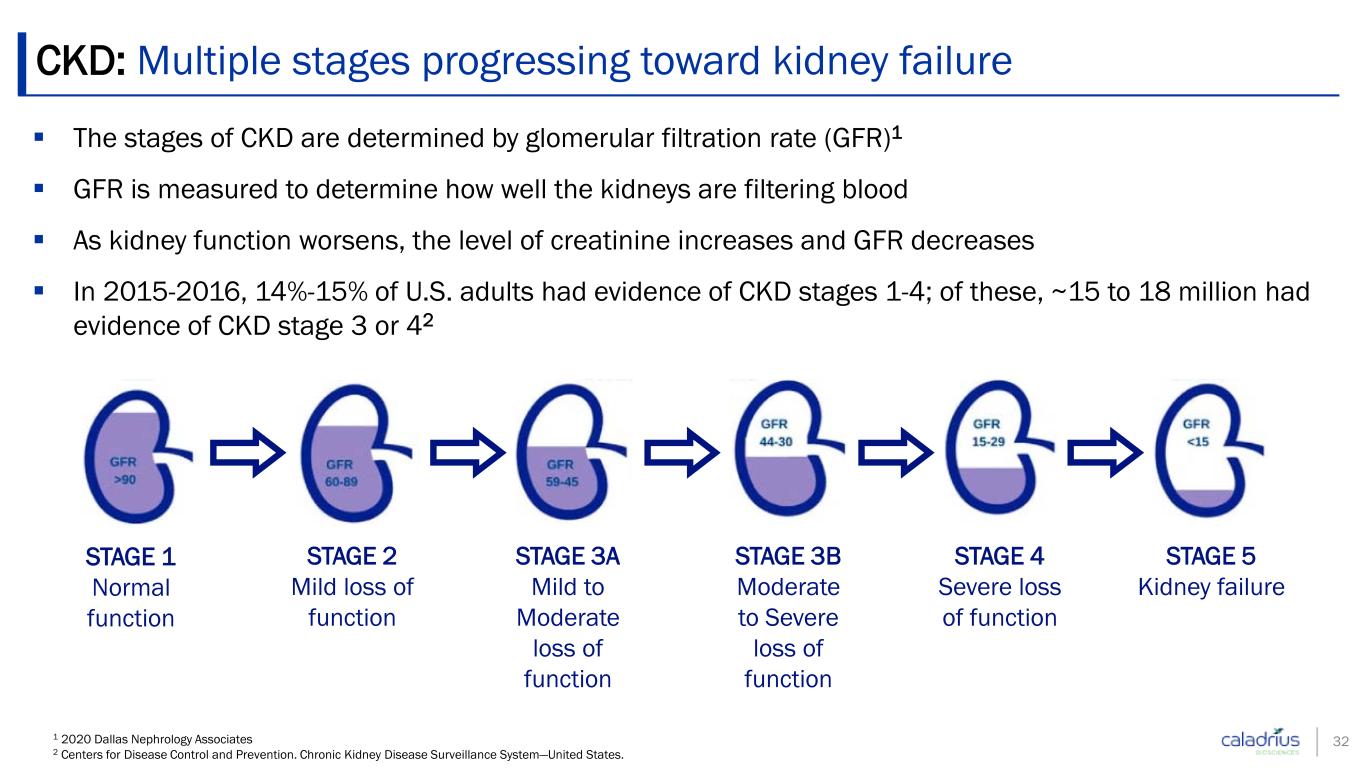

CKD: Multiple stages progressing toward kidney failure 1 2020 Dallas Nephrology Associates 2 Centers for Disease Control and Prevention. Chronic Kidney Disease Surveillance System—United States. The stages of CKD are determined by glomerular filtration rate (GFR)1 GFR is measured to determine how well the kidneys are filtering blood As kidney function worsens, the level of creatinine increases and GFR decreases In 2015-2016, 14%-15% of U.S. adults had evidence of CKD stages 1-4; of these, ~15 to 18 million had evidence of CKD stage 3 or 42 32 STAGE 4 Severe loss of function STAGE 5 Kidney failure STAGE 3B Moderate to Severe loss of function STAGE 1 Normal function STAGE 2 Mild loss of function STAGE 3A Mild to Moderate loss of function

CKD is often associated with progressive microvasculature damage and loss1,2 Preclinical studies show that microcirculation replenishment improves kidney function CD34+ cells are promoters of new capillary growth, improving the microvasculature Therapies currently available and/or expected to be available over the next 5–10 years will slow the progression of CKD/diabetic kidney disease (DKD) An effective regenerative DKD therapy (i.e., one that reverses the course of the disease) could represent a medical and pharmacoeconomic breakthrough 1 Chade AR. (2017) Small Vessels, Big Role: Renal Microcirculation and Progression of Renal Injury. Hypertension; 69(4):551-563. 2 Zuk, Anna & Bonventre, Joseph. (2016). Annual Review of Medicine. 67. 293-307. 10.1146/annurev-med-050214-013407. 33 Development rationale for CLBS201 CLBS201 clinical strategy To demonstrate that CD34+ cell therapy (mobilization, donation and administration) can be tolerated by patients with CKD with Type 2 Diabetes To demonstrate that regeneration of the kidney microcirculation using CD34+ cell therapy improves kidney function

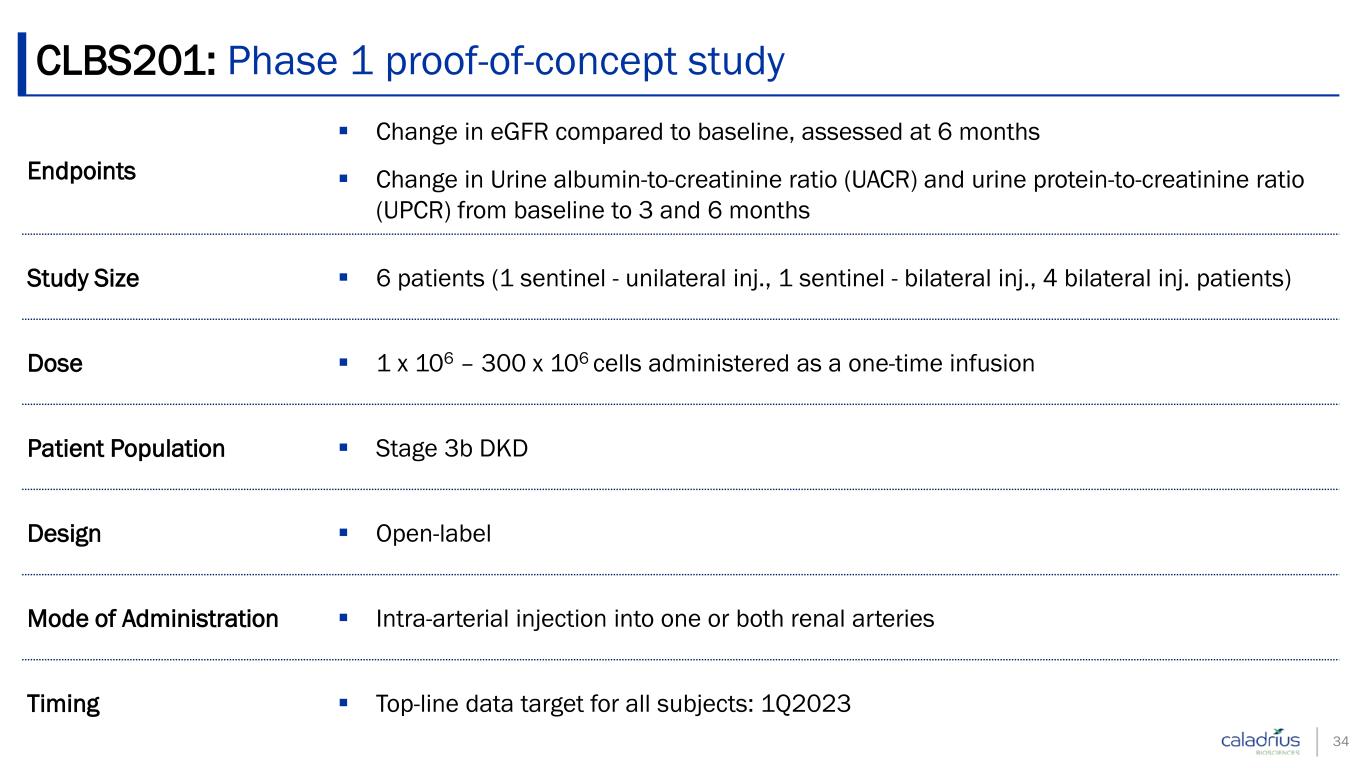

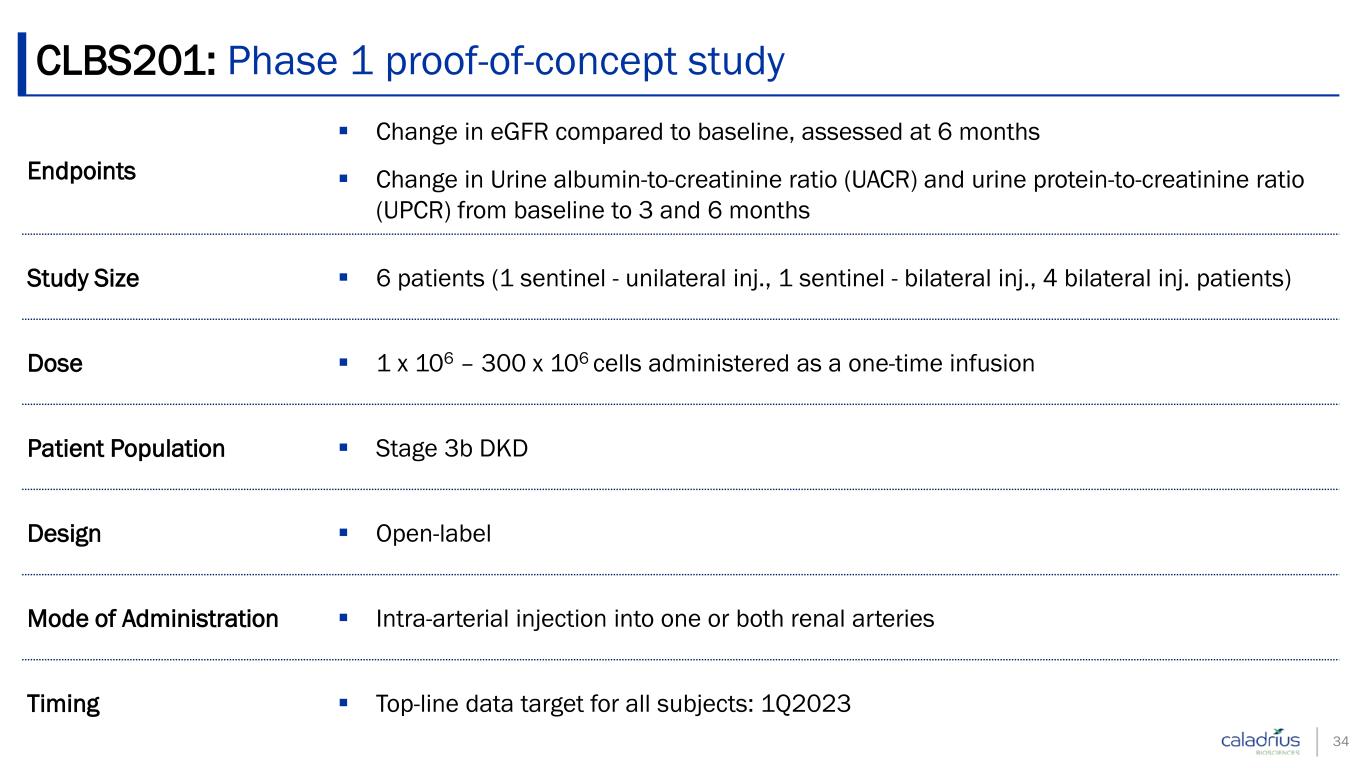

CLBS201: Phase 1 proof-of-concept study 34 Endpoints Change in eGFR compared to baseline, assessed at 6 months Change in Urine albumin-to-creatinine ratio (UACR) and urine protein-to-creatinine ratio (UPCR) from baseline to 3 and 6 months Study Size 6 patients (1 sentinel - unilateral inj., 1 sentinel - bilateral inj., 4 bilateral inj. patients) Dose 1 x 106 – 300 x 106 cells administered as a one-time infusion Patient Population Stage 3b DKD Design Open-label Mode of Administration Intra-arterial injection into one or both renal arteries Timing Top-line data target for all subjects: 1Q2023

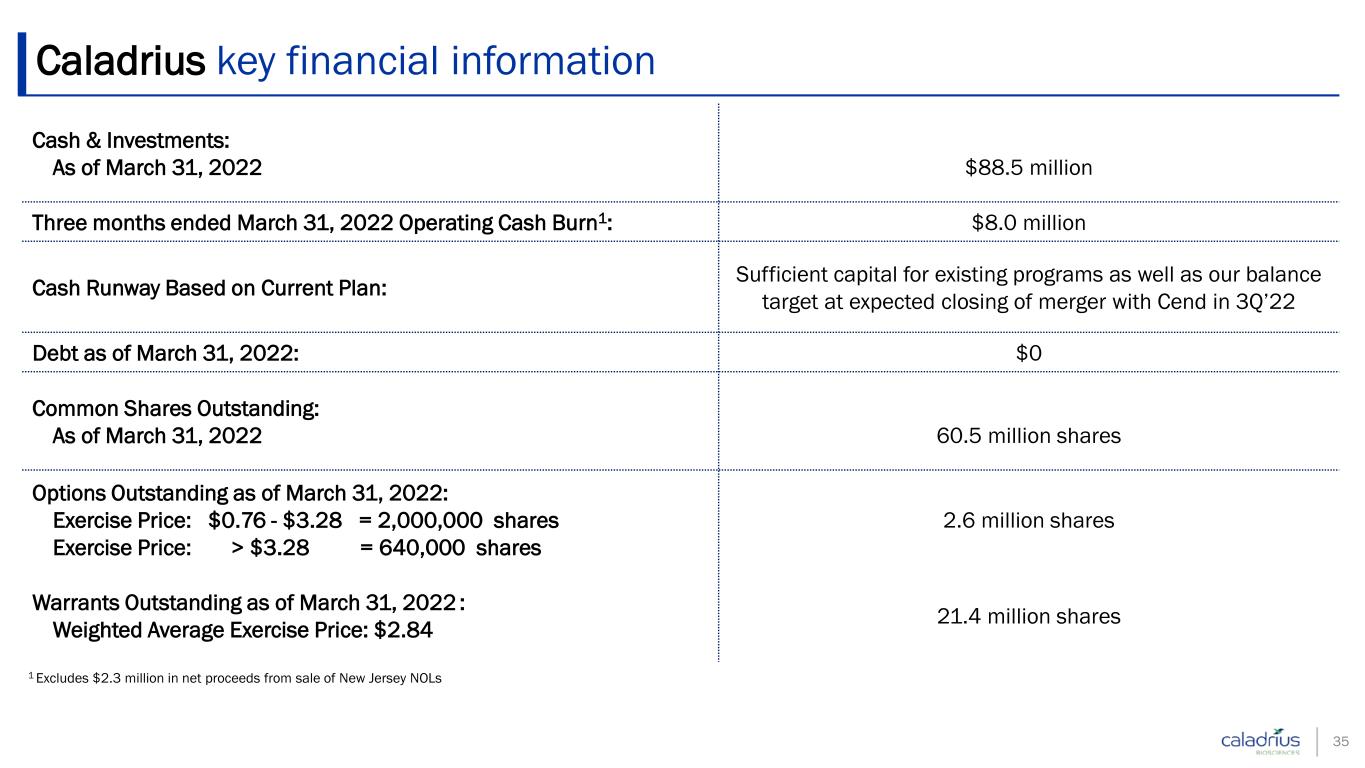

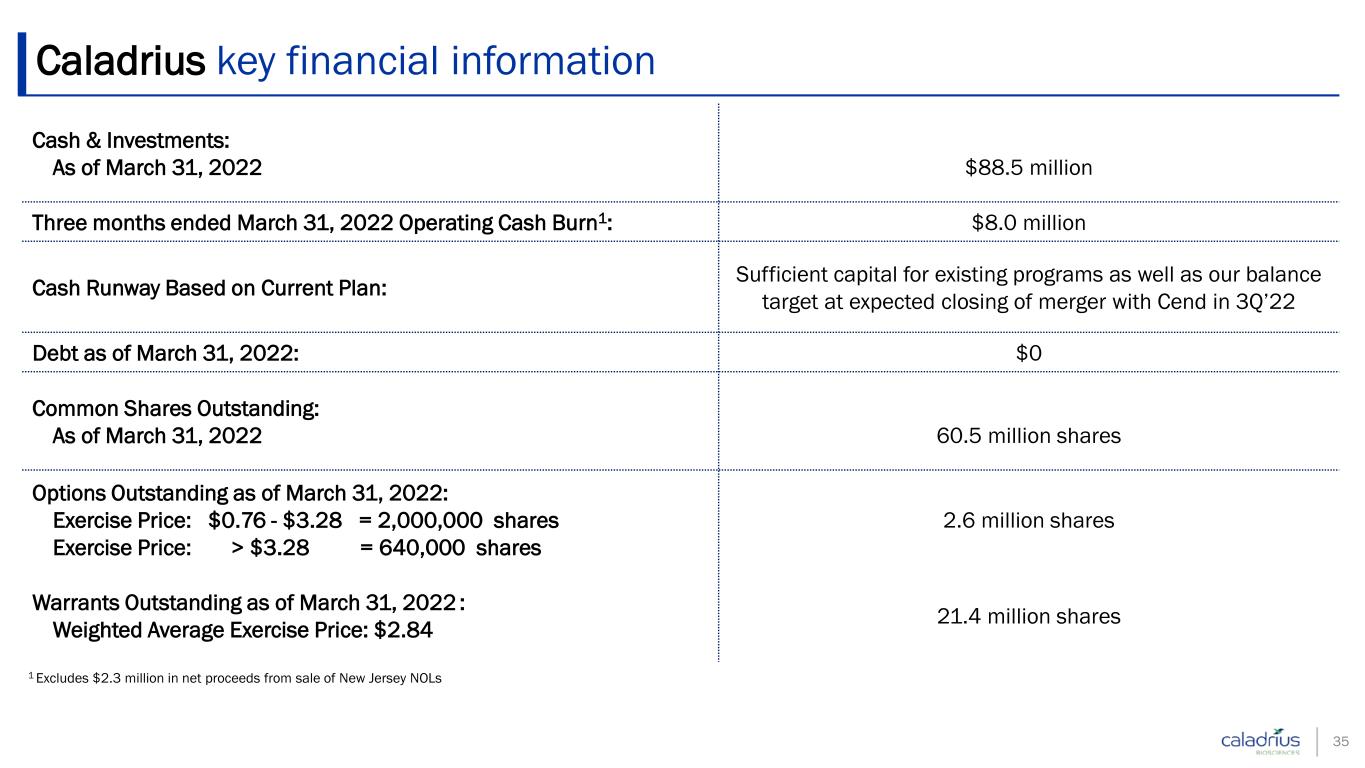

Caladrius key financial information 35 Cash & Investments: As of March 31, 2022 $88.5 million Three months ended March 31, 2022 Operating Cash Burn1: $8.0 million Cash Runway Based on Current Plan: Sufficient capital for existing programs as well as our balance target at expected closing of merger with Cend in 3Q’22 Debt as of March 31, 2022: $0 Common Shares Outstanding: As of March 31, 2022 60.5 million shares Options Outstanding as of March 31, 2022: Exercise Price: $0.76 - $3.28 = 2,000,000 shares Exercise Price: > $3.28 = 640,000 shares 2.6 million shares Warrants Outstanding as of March 31, 2022 : Weighted Average Exercise Price: $2.84 21.4 million shares 1 Excludes $2.3 million in net proceeds from sale of New Jersey NOLs

Lisata Therapeutics Emphasizing the development of more effective treatments for solid tumor cancers

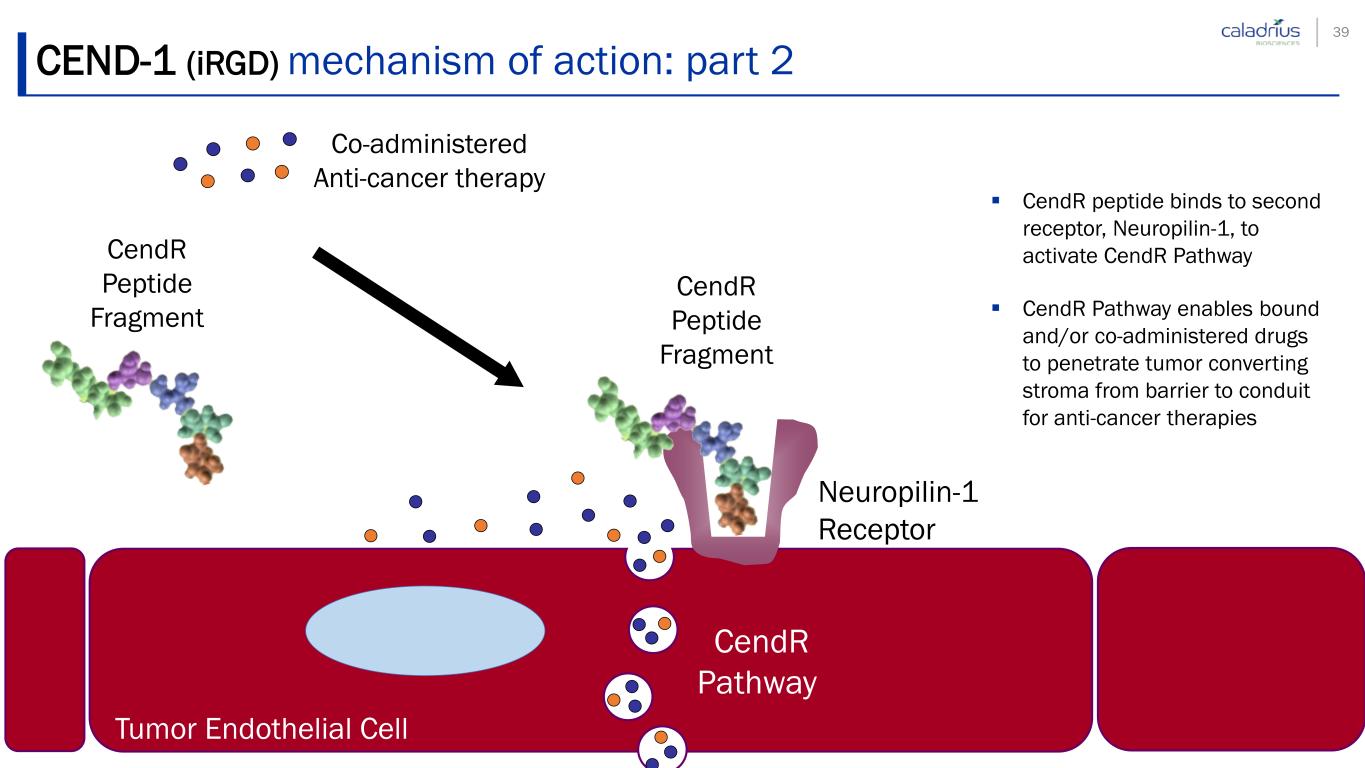

CEND-1 (iRGD) mechanism of action CEND-1, a cyclic peptide, targets tumors by binding to alpha-v (“αv”) integrins, which are selectively expressed on tumor vascular endothelium and not expressed on normal healthy vasculature αv integrins are also expressed on: Cancer-associated fibroblasts, a major component of tumor stroma, and on tumor cells themselves Intratumoral immunosuppressive cells which contribute to an immunotherapy-refractory or “cold” tumor microenvironment evident in pancreatic and other cancers Once bound to these integrins, CEND-1 is cleaved by proteases that are up-regulated in tumors, releasing a C-end Rule (CendR) linear peptide fragment The CendR fragment then binds to a second receptor, Neuropilin-1, to trigger activation of the CendR Pathway, a novel active transport pathway Enables the CendR peptide and co-administered and/or bound drugs to penetrate the tumor, essentially converting the tumor stroma from a barrier to a conduit to reach tumor cell targets 37

CEND-1 (iRGD) mechanism of action: part 1 38 αv β3/β5 Tumor Endothelial Cell Co- Admin Drug or Cargo Integrin CEND-1 Protease Peptide Cleaved CEND-1 targets tumor alpha-v integrins, which are selectively expressed on tumor vascular endothelium and not expressed on normal healthy vasculature and tumor stroma CEND-1 is cleaved by proteases that are up- regulated in tumors, releasing a C-end Rule (CendR) peptide fragment CendR Peptide Fragment 38

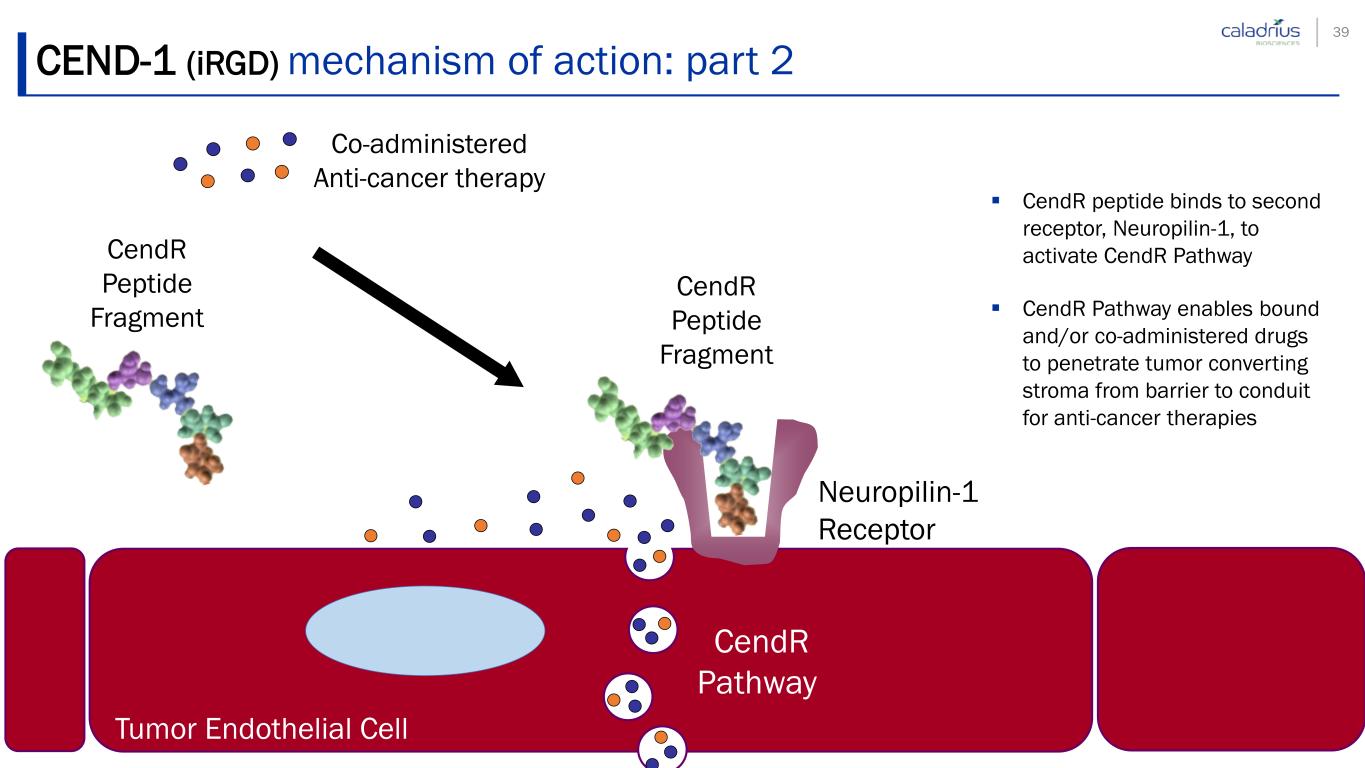

CEND-1 (iRGD) mechanism of action: part 2 Neuropilin-1 Receptor Tumor Endothelial Cell CendR Peptide Fragment Co-administered Anti-cancer therapy CendR Pathway CendR peptide binds to second receptor, Neuropilin-1, to activate CendR Pathway CendR Pathway enables bound and/or co-administered drugs to penetrate tumor converting stroma from barrier to conduit for anti-cancer therapies CendR Peptide Fragment 39

Lisata Therapeutics projected pipeline of novel product candidates Product Indication Preclinical Phase 1 Phase 2 Phase 3 Cend Pipeline CEND-1 + gemcitabine/nab-paclitaxel First-Line mPDAC (Metastatic Pancreatic Ductal Adenocarcinoma)CEND-1 + SoC chemo + anti-PD(L)1 CEND-1 + FOLFIRINOX PDAC (Resectable & Borderline Resectable) CEND-1 + FOLFIRINOX + panitumumab Colon and High-Grade Appendiceal Cancers CEND-1 + SoC Solid Tumor Basket Trial TPN development candidate Solid Tumors Caladrius Pipeline XOWNA® (CLBS16) Coronary Microvascular Dysfunction HONEDRA® (CLBS12) Critical Limb Ischemia and Buerger’s Disease CLBS201 Diabetic Kidney Disease 40

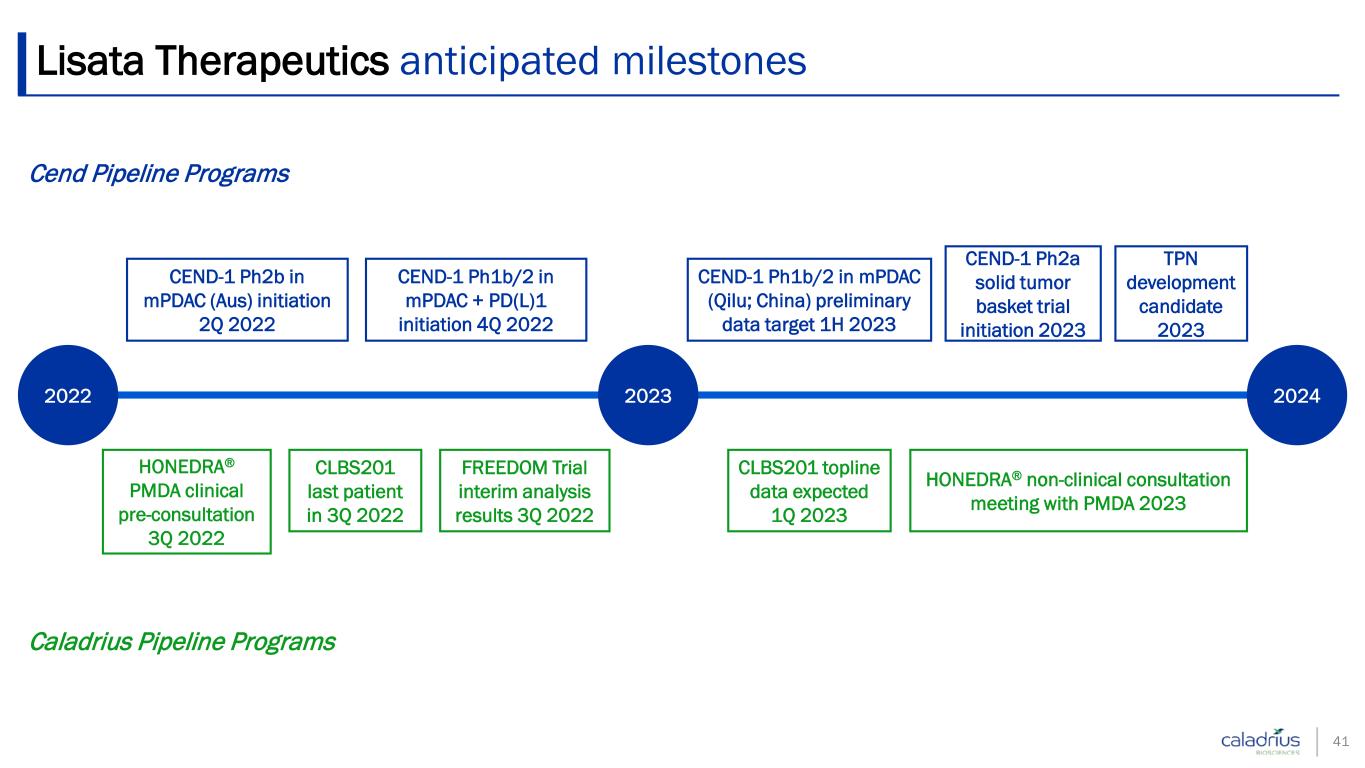

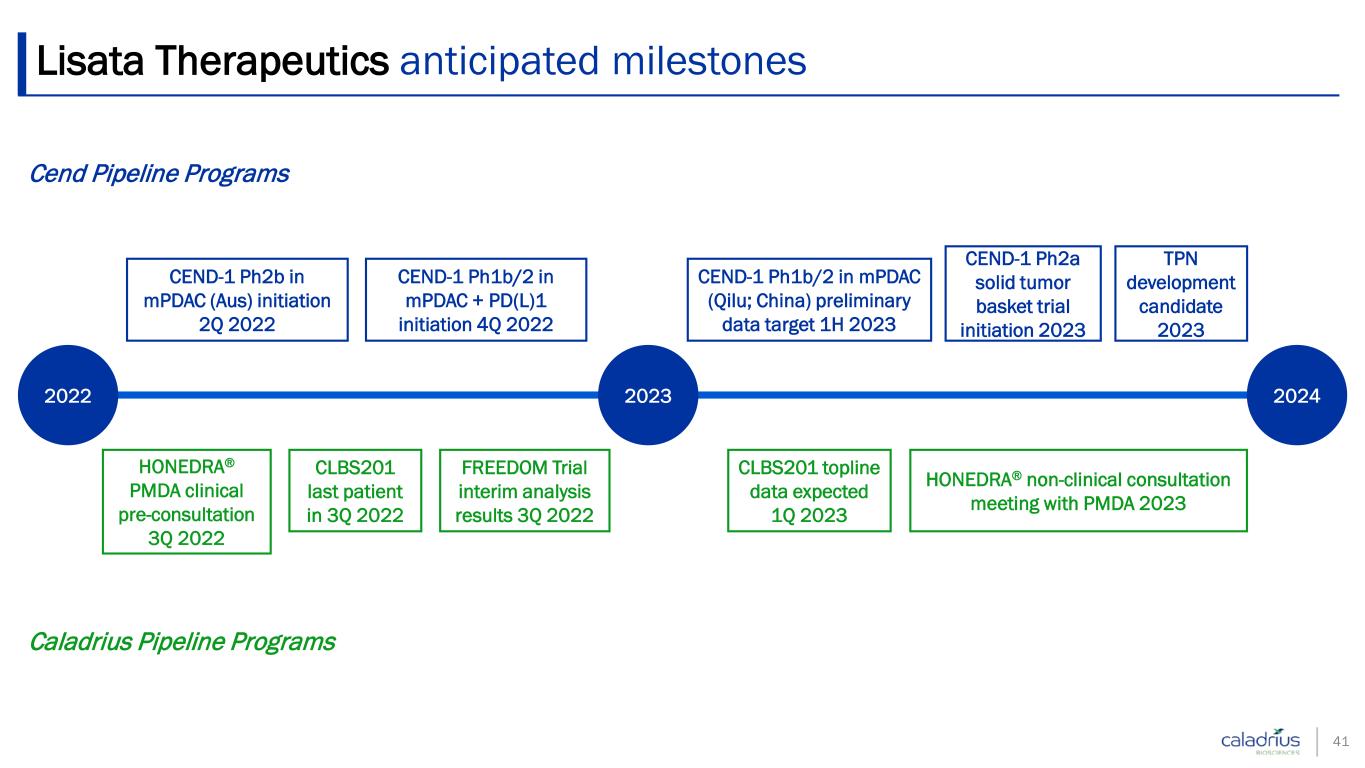

Lisata Therapeutics anticipated milestones 41 Cend Pipeline Programs Caladrius Pipeline Programs 2022 2023 2024 CEND-1 Ph2b in mPDAC (Aus) initiation 2Q 2022 CEND-1 Ph1b/2 in mPDAC + PD(L)1 initiation 4Q 2022 CEND-1 Ph1b/2 in mPDAC (Qilu; China) preliminary data target 1H 2023 CEND-1 Ph2a solid tumor basket trial initiation 2023 TPN development candidate 2023 HONEDRA® PMDA clinical pre-consultation 3Q 2022 CLBS201 last patient in 3Q 2022 CLBS201 topline data expected 1Q 2023 HONEDRA® non-clinical consultation meeting with PMDA 2023 FREEDOM Trial interim analysis results 3Q 2022

Combination of Caladrius and Cend platforms provides Lisata with a multi-product development pipeline Proprietary field-leading technology in lucrative global indications backed by a strong IP portfolio Potential value creating events in the next 12-24 months based on milestones across the pipeline Seasoned management with domain expertise along with big pharma and emerging biotech experience Strong balance sheet [$88.5 million cash & investments (as of 3/31/2022) - no debt]; well-positioned for current development programs’ projected capital needs and cash balance target at merger closing Caladrius investment highlights 42 Pending merger with Cend Therapeutics, creating Lisata Therapeutics, which will be a financially sound publicly-traded company with clinical stage product candidates

Developing Innovative Therapies that Treat or Reverse Disease Investor Relations Contact: John D. Menditto Tel: (908) 842-0084 jmenditto@caladrius.com M ay 2 3 , 2 0 2 2|Na s d aq : C L B S