UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

[ ☒ ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

[ ☐ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-08052

GLOBE LIFE INC.

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Delaware | | 63-0780404 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 3700 South Stonebridge Drive, McKinney, TX | | 75070 |

| (Address of principal executive offices) | | (Zip Code) |

972-569-4000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 par value per share | GL | New York Stock Exchange |

| 4.250% Junior Subordinated Debentures | GL PRD | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | ¨ |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

| | | | Emerging growth company | | ¨ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ¨ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by checkmark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No x

As of June 30, 2024, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $7.4 billion based on the closing sale price as reported on the New York Stock Exchange.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. | | | | | | | | |

| Class | | Outstanding as of January 31, 2025 |

| Common Stock, $1.00 par value per share | | 83,848,424 shares |

DOCUMENTS INCORPORATED BY REFERENCE | | | | | | | | |

| Document | | Parts Into Which Incorporated |

| Proxy Statement for the Annual Meeting of Stockholders to be held on April 24, 2025 (Proxy Statement) | | Part III |

Globe Life Inc.

Table of Contents | | | | | | | | | | | |

| | | | Page |

| | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | |

| Item 5. | | |

| Item 6. | | |

| | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

| Item 15. | | |

| | | |

Part I

Item 1. Business

Globe Life and the Company refer to Globe Life Inc., an insurance holding company incorporated in Delaware in 1979, and its subsidiaries and affiliates. Its primary subsidiaries are Globe Life And Accident Insurance Company, American Income Life Insurance Company, Liberty National Life Insurance Company, Family Heritage Life Insurance Company of America, and United American Insurance Company.

Globe Life's website is: www.globelifeinsurance.com. Globe Life makes available free of charge through its website, its annual report on Form 10-K, its quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after they have been electronically filed with or furnished to the Securities and Exchange Commission. Other information included in Globe Life's website is not incorporated into this filing.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Primary Distribution Method | | Underwriting Company | | Products and Target Markets | | Distribution |

| | | | | | | | |

| | Direct to Consumer Division | | Globe Life And Accident Insurance Company

McKinney, Texas | | Individual life and supplemental health limited-benefit insurance including juvenile and senior life coverage and Medicare Supplement to lower middle-income to middle-income Americans. | | Nationwide distribution through direct to consumer channels: including direct mail, electronic media, and insert media. |

| | | | | | | | |

| | | | | | | | |

| | American Income Life Division | | American Income Life Insurance Company

Waco, Texas | | Individual life and supplemental health limited-benefit insurance marketed to working families. | | 11,741 average producing agents in the U.S., Canada, and New Zealand. |

| | | | | | | | |

| | | | | | | | |

| | Liberty National Division | | Liberty National Life Insurance Company

McKinney, Texas | | Life and supplemental health limited-benefit insurance distributed through in-home and worksite channels. | | 3,664 average producing agents in the U.S. |

| | | | | | | | |

| | | | | | | | |

| | Family Heritage Division | | Family Heritage Life Insurance Company of America

Cleveland, Ohio | | Supplemental limited-benefit health insurance to lower middle-income to middle-income families. | | 1,399 average producing agents in the U.S. |

| | | | | | | | |

| | | | | | | | |

| | United American Division | | United American Insurance Company

McKinney, Texas | | Supplemental health Medicare coverage to beneficiaries and, to a lesser extent, supplemental limited-benefit coverage to people under age 65. | | 3,355 independent producing agents in the U.S. |

Insurance

Life Insurance—The distribution channels for life insurance products include direct to consumer, exclusive agents, and independent agents. These methods are described in greater detail within the primary marketing distribution channel chart as shown above. The following table presents annualized premium in force for the three years ended December 31, 2024 by distribution method:

| | | | | | | | | | | | | | | | | |

| | Annualized Premium in Force(1) (Dollar amounts in thousands) |

| 2024 | | 2023 | | 2022 |

Direct to Consumer | $ | 922,508 | | | $ | 933,057 | | | $ | 936,507 | |

| Exclusive agents: | | | | | |

| American Income | 1,761,713 | | | 1,654,197 | | | 1,553,003 | |

| Liberty National | 410,912 | | | 390,693 | | | 360,963 | |

| Independent agents: | | | | | |

| United American | 6,499 | | | 6,958 | | | 7,609 | |

| Other | 197,629 | | | 200,840 | | | 203,438 | |

| $ | 3,299,261 | | | $ | 3,185,745 | | | $ | 3,061,520 | |

Globe Life's insurance subsidiaries write a variety of nonparticipating ordinary life insurance products. These include traditional whole life, term life, and other life insurance. The Company does not currently sell interest-sensitive whole life products. The following tables present selected information about Globe Life's life insurance products.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annualized Premium in Force (Dollar amounts in thousands) |

| | 2024 | | 2023 | | 2022 |

| Amount | | % of

Total | | Amount | | % of

Total | | Amount | | % of

Total |

| Whole life: | | | | | | | | | | | |

| Traditional | $ | 2,321,947 | | | 70 | | | $ | 2,213,816 | | | 69 | | | $ | 2,106,878 | | | 69 | |

| Interest-sensitive | 28,105 | | | 1 | | | 29,929 | | | 1 | | | 31,838 | | | 1 | |

Term | 745,231 | | | 23 | | | 753,261 | | | 24 | | | 756,471 | | | 25 | |

Other | 203,978 | | | 6 | | | 188,739 | | | 6 | | | 166,333 | | | 5 | |

| $ | 3,299,261 | | | 100 | | | $ | 3,185,745 | | | 100 | | | $ | 3,061,520 | | | 100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Policy Count and Average Face Amount Per Policy (Dollar amounts in thousands) |

| 2024 | | 2023 | | 2022 |

| Policy Count | | Average Face Amount per Policy | | Policy Count | | Average Face Amount per Policy | | Policy Count | | Average Face Amount per Policy |

| Whole life: | | | | | | | | | | | |

| Traditional | 9,092,122 | | | $ | 16.2 | | | 9,050,091 | | | $ | 16.0 | | | 9,011,227 | | | $ | 15.7 | |

| Interest-sensitive | 169,054 | | | 20.4 | | | 176,339 | | | 20.4 | | | 183,887 | | | 20.4 | |

Term | 4,600,839 | | | 15.2 | | | 4,680,364 | | | 15.1 | | | 4,720,870 | | | 15.3 | |

Other | 495,894 | | | 18.1 | | | 479,664 | | | 17.3 | | | 453,515 | | | 16.1 | |

| 14,357,909 | | | $ | 16.0 | | | 14,386,458 | | | $ | 15.8 | | | 14,369,499 | | | $ | 15.6 | |

Health Insurance—The following table presents Globe Life's health insurance annualized premium in force for the three years ended December 31, 2024 by distribution channel.

| | | | | | | | | | | | | | | | | |

| | Annualized Premium in Force (Dollar amounts in thousands) |

| 2024 | | 2023 | | 2022 |

Direct to Consumer | $ | 74,815 | | | $ | 70,249 | | | $ | 72,161 | |

| Exclusive agents: | | | | | |

| Liberty National | 201,874 | | | 200,160 | | | 196,336 | |

| American Income | 119,986 | | | 116,962 | | | 113,087 | |

| Family Heritage | 454,725 | | | 418,693 | | | 387,897 | |

| Independent agents: | | | | | |

| United American | 624,446 | | | 579,237 | | | 558,373 | |

| $ | 1,475,846 | | | $ | 1,385,301 | | | $ | 1,327,854 | |

Globe Life offers Medicare Supplement and limited-benefit supplemental health insurance products that include accident, cancer, critical illness, heart, intensive care, and other health products. These products are designed to supplement health coverage that applicants already own. Medicare Supplements are offered to enrollees in the traditional fee-for-service Medicare program. Medicare Supplement plans are standardized by federal regulation and are designed to pay deductibles and co-payments not paid by Medicare.

The following table presents supplemental health annualized premium in force information for the three years ended December 31, 2024 by product category.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Annualized Premium in Force (Dollar amounts in thousands) |

| 2024 | | 2023 | | 2022 |

| Amount | | % of

Total | | Amount | | % of

Total | | Amount | | % of

Total |

| Limited-benefit plans | $ | 824,844 | | | 56 | | | $ | 782,424 | | | 56 | | | $ | 735,858 | | | 55 | |

| Medicare Supplement | 651,002 | | | 44 | | | 602,877 | | | 44 | | | 591,996 | | | 45 | |

| $ | 1,475,846 | | | 100 | | | $ | 1,385,301 | | | 100 | | | $ | 1,327,854 | | | 100 | |

Pricing—Premium rates for life and health insurance products are established using assumptions as to future mortality, morbidity, persistency, investment income, expenses, and target profit margins. These assumptions are based on Company experience and projected investment earnings rates. Revenues for individual life and health insurance products are primarily derived from premium income, and, to a lesser extent, through policy charges to the policyholder account values on annuity products and certain individual life products. Profitability is affected by actual experience deviations from the established assumptions and to the extent investment income varies from that required for policy reserves.

Collections for certain life products are not recognized as revenues, but are added to policyholder account values. Revenues from these products are derived from charges to the account balances for insurance risk and administrative costs. Profits are earned to the extent these revenues exceed actual costs. Profits are also earned from investment income in excess of the amounts required for policy reserves.

Underwriting—The underwriting standards of Globe Life's insurance subsidiaries are established by management. Each subsidiary uses information obtained from the application, and in some cases additional information such as, telephone interviews with applicants, inspection reports, pharmacy data, motor vehicle records, responses to both medical and non-medical questions, doctors’ statements and/or medical records and examinations. This information is used to determine whether a policy should be issued in accordance with the application, with a different rating, with a rider, with reduced coverage, or rejected.

Reserves—The life insurance policy reserves reflected in Globe Life's consolidated financial statements as future policy benefits are calculated based on accounting principles generally accepted in the United States of America (GAAP). These reserves, with future premiums and the associated interest compounded at assumed rates, are expected to be sufficient to cover policy and contract obligations as they mature. Generally, the mortality and lapse

assumptions used in the calculations of reserves are based on Company experience. Similar reserves are held on most of the health insurance policies written by Globe Life's insurance subsidiaries, since these policies generally are issued on a guaranteed-renewable basis. The assumptions used in the calculation of Globe Life's reserves are reported in Note 1—Significant Accounting Policies. Reserves for certain life products consist of the policyholders’ account values and are increased by policyholder deposits and interest credited and are decreased by policy charges and benefit payments.

Investments—The nature, quality, and percentage mix of insurance company investments are regulated by state laws. The investments of Globe Life insurance subsidiaries consist predominantly of high-quality, investment-grade securities. Approximately 88% of our invested assets, at fair value, are fixed maturities at December 31, 2024 (see Note 4—Investments and Management’s Discussion and Analysis).

Competition—Globe Life competes with other life and health insurance carriers through policyholder service, price, product design, and sales efforts. While there are insurance companies competing with Globe Life, no individual company dominates any of Globe Life's life or health insurance markets.

Globe Life's health insurance products compete with, in addition to the products of other health insurance carriers, health maintenance organizations, preferred provider organizations, and other health care-related institutions which provide medical benefits based on contractual agreements.

The Company effectively competes with other carriers, in part, due to its ability to operate at lower policy acquisition and administrative expense levels than peer companies. This allows Globe Life to have competitive rates while maintaining higher underwriting margins.

Regulation

Insurance—Insurance companies are subject to regulation and supervision in the states in which they do business. The laws of the various states establish agencies with broad administrative and supervisory powers which include, among other things, granting and revoking licenses to transact business, regulating trade practices, licensing agents, approving policy forms, approving certain premium rates, setting minimum reserve and loss ratio requirements, determining the form and content of required financial statements, and prescribing the type and amount of investments permitted. Insurance companies are also required to file detailed annual reports with supervisory agencies, and records of their business are subject to examination at any time. Under the rules of the National Association of Insurance Commissioners (NAIC), insurance companies are examined periodically by one or more of the supervisory agencies.

Risk-Based Capital (RBC)—The NAIC requires that a risk-based capital formula be applied to all life and health insurers. The risk-based capital formula is a threshold formula rather than a target capital formula. It is designed only to identify companies that require regulatory attention and is not to be used to rate or rank companies that are adequately capitalized. All Globe Life's insurance subsidiaries are more than adequately capitalized under the risk-based capital formula. See further discussion of RBC in Capital Resources.

Holding Company—States have enacted legislation requiring registration and periodic reporting by insurance companies domiciled within their respective jurisdictions that control or are controlled by other corporations so as to constitute a holding company system. Globe Life Inc. and its subsidiaries have registered as a holding company system pursuant to such legislation in Indiana, Nebraska, Ohio, Texas, and New York.

Insurance holding company system statutes and regulations impose various limitations on investments in subsidiaries, and may require prior regulatory approval for material transactions between insurers and affiliates and for the payment of certain dividends and other distributions.

Sustainable Business Practices

Globe Life’s sustainable business practices are a driver of the success and longevity that our Company has experienced since its origin. We plan to advance our sustainable business practices by further developing the Company's sustainability strategy and have substantially aligned disclosures with the Sustainability Accounting Standards Board (SASB) standards and the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

Environmental responsibility and sustainability are key components of our overall corporate responsibility efforts. We strive to reduce our impact on the environment by placing a company-wide emphasis on recycling and reducing waste at our corporate facilities, focusing on efforts to reduce the use of paper and water. With respect to social matters, our focus continues to be on supporting a culture that is inclusive and attractive for all of our employees and independent sales agents. We are committed to maintaining a diverse workforce that reflects the communities in which we work. In addition, to enable the Company to appropriately respond to related challenges and opportunities, the Company has in place a Sustainability Committee, and the Board and its committees regularly engage with senior management on relevant and related issues.

Human Capital Management

Globe Life's talent base encompasses a broad range of experience that possesses the depth of critical skills to efficiently and effectively accomplish our business purpose and mission, serve our policyholders, and protect our shareholders' interests. Maintaining superior human capital is a key driver to the success and longevity that our Company has experienced since its origins dating back to the early 1900s. As of December 31, 2024, the Company had 3,732 full-time, part-time, and temporary employees, a 3% increase over the prior year. The increase in headcount in 2024 was primarily to support the increased growth in recent periods, as well as lower attrition levels than normal. The Company engages over 16,400 independently-contracted insurance agents. Refer to Management's Discussion & Analysis for exclusive agent counts.

People, Culture, and Community

At Globe Life, we are united by our mission to—Make Tomorrow Better1 and this starts with our employees and agents. Beyond providing insurance protection for millions of individuals, serving our policyholders and generating financial results for our shareholders, we focus on cultivating a healthy, positive culture and a thriving community within and among our campuses that is inclusive of and attractive for all. Globe Life promotes a diverse and inclusive work force to better enable our employees to consistently achieve outstanding individual and collective results. Our commitment to diversity starts at the top; of the 9 independent Board members, 56% are women and 33% are racial/ethnic minorities as of December 31, 2024.

As of December 31, 2024 and 2023, the Globe Life employees, (excluding independently-contracted agents) identify as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| 2024 |

| Ethnicity/Race | Gender | | Generations |

| White | 51 | % | | Female | 68 | % | | Baby Boomers (1946-1964) | 14 | % |

| Black or African American | 25 | | | Male | 32 | | | Gen X (1965-1977) | 29 | |

| Hispanic or Latino | 13 | | | | | | Millennials (1978-1995) | 44 | |

| Asian | 9 | | | | | | Gen Z (1996-2012) | 13 | |

| American Indian or Alaskan Native | 1 | | | | | | | |

| Native Hawaiian or Pacific Islander | — | | | | | | | |

| Other or Not Specified | 1 | | | | | | | |

| Total | 100 | % | | | 100 | % | | | 100 | % |

1Per the Globe Life Employee Handbook, the Globe Life mission statement is "We help families Make Tomorrow Better by working to protect their financial future."

| | | | | | | | | | | | | | | | | | | | | | | |

| 2023 |

| Ethnicity/Race | Gender | | Generations |

| White | 52 | % | | Female | 68 | % | | Baby Boomers (1946-1964) | 16 | % |

| Black or African American | 24 | | | Male | 32 | | | Gen X (1965-1977) | 29 | |

| Hispanic or Latino | 13 | | | | | | Millennials (1978-1995) | 45 | |

| Asian | 9 | | | | | | Gen Z (1996-2012) | 10 | |

| American Indian or Alaskan Native | 1 | | | | | | | |

| Native Hawaiian or Pacific Islander | — | | | | | | | |

| Other or Not Specified | 1 | | | | | | | |

| Total | 100 | % | | | 100 | % | | | 100 | % |

We conduct a confidential survey biennially to give our employees the opportunity to provide candid feedback about their experiences at the Company, including but not limited to, confidence in the Company and leadership, competitiveness of our compensation and benefit package, and departmental relationships. The results are shared with our employees, reviewed by senior leadership, and used to identify areas for improvement and create action plans based on the employee feedback received.

We strive to Make Tomorrow Better, in part by giving financial and service contributions to programs that provide hands-on assistance in the communities where we live, work, serve, and visit. We focus our charitable giving on organizations that support children, families, veterans, and seniors, as well as those that work to ensure people are able to live full, healthy lives. These categories align with our mission to help families Make Tomorrow Better by working to protect their financial future. In 2024, we provided financial support of more than $7 million to organizations within that focus, including charities that support underserved communities, provide scholarships to youth, and advance equity and diversity efforts.

Talent Development

At Globe Life, we believe investing in our employees through training and development is paramount to their success. We have developed a learning ecosystem that includes a multitude of professional development opportunities, including online, self-directed, and instructor-led courses on a variety of topics. An education assistance program is also offered to facilitate growth in an area related to one's current position with the Company.

Health, Safety, and Wellness

We strive to provide a safe and healthy work environment for every employee. We furnish employees with numerous tools and trainings throughout the year to help ensure they have, at their fingertips, the best information to safely engage with co-workers, customers, and third parties. In furtherance of our commitment to our employees, we offer a comprehensive employee benefits package that includes competitive monetary benefits, retirement benefits through a Section 401(k) plan and a qualified pension to eligible employees, fitness center reimbursement, paid-time-off (based on years of service), health insurance, dental and vision insurance, employee resource program, health savings and flexible spending accounts, family leave, and tuition assistance.

The Company remains committed to the well-being and safety of its employees, agents, customers, guests, vendors, and shareholders in our resolve to maintain a stable and secure business environment.

Item 1A. Risk Factors

Risks Related to Our Business

The following is a summary of the material risks and uncertainties that could adversely affect our business, financial condition, and results of operations.

Business and Operational Risks

The development and maintenance of our various distribution channels are critical to growth in product sales and profits.

Our future success depends, in substantial part, on our ability to recruit, hire, and motivate highly-skilled insurance personnel. Further, the development and retention of producing agents are critical to supporting sales growth in our agency operations because our insurance sales are primarily made to individuals.

A failure to effectively develop new methods of reaching consumers, realize cost efficiencies or generate an attractive value proposition in our Direct to Consumer Division business could result in reduced sales and profits. In addition, if we do not provide an attractive career opportunity with competitive compensation as well as motivation for producing agents to increase sales of our products, our growth could be impeded. Doing so may be difficult due to many factors, including but not limited to, fluctuations in economic and industry conditions and the effectiveness of our compensation programs and competition among other companies.

Our life insurance products are sold in niche markets. We are at risk should any of these markets diminish.

We have several life distribution channels that focus on distinct market niches, three of which are labor unions, affinity groups, and sales via Direct to Consumer solicitations. Deterioration of our relationships with either organized labor union groups or affinity groups, or adverse changes in the public’s receptivity to Direct to Consumer marketing initiatives could negatively affect our life insurance business.

Actual or alleged misclassification of independent contractors at our insurance subsidiaries could result in adverse legal, tax or financial consequences.

A significant portion of our sales agents are independent contractors. Although we believe we have properly classified such individuals, a risk nevertheless exists that a court, the Internal Revenue Service or other authority will take the position that our sales agents are employees. From time-to-time, we are subject to civil litigation, including class and collective action litigation, alleging that we have improperly classified certain of our sales agents as independent contractors. In September 2024, the Equal Employment Opportunity Commission (EEOC) notified us that it had determined that all sales agents affiliated with State General Agent Simon Arias were employees, not independent contractors, of Globe Life Inc. and/or AIL. Such determination is not binding but we expect any potential civil action brought by the EEOC would include such an allegation. A future adverse judgment in connection with any such civil litigation described above could result in substantial damages. Future changes in rules, regulations or interpretations of existing rules and regulations, or significant adverse judgments in litigation, could require us to reclassify all or a portion of our agents as employees and the impact could significantly increase our operating costs and negatively impact our insurance business.

The use of third-party vendors, including independent sales agents, to support the Company's operations makes the Company susceptible to the operational risk of those third parties, which could lower revenues, increase costs, reduce profits, disrupt business, or damage the Company’s reputation.

The Company utilizes third-party vendors, including independent sales agents, to provide certain business services and functions, which exposes the Company to risks outside the control of the Company. The reliance on these third-party vendors creates a number of business risks, such as the risk that the Company may not maintain service quality, control or effective management of the outsourced business operations and that the Company cannot control the data, information systems, facilities or networks of such third-party vendors. We employ controls and procedures designed to facilitate service quality of our third party vendors; however, such controls and procedures cannot be 100% effective in all cases. The Company may be adversely affected by a third-party vendor who

operates in a poorly controlled manner or fails to deliver contracted services, which could lower revenues, increase costs, reduce profits, disrupt business, or damage the Company’s reputation.

Extensive federal and state laws regulate our business, imposing certain requirements that independent sales agents must follow in dealing with clients. Misconduct of our independent sales agents could result in violations of law by, or claims against, us or our subsidiaries. From time to time, we are subject to private litigation as a result of alleged misconduct by independent agents. We employ controls and procedures designed to prevent and detect agent misconduct; however, such controls and procedures cannot be 100% effective in all cases. Instances of misconduct or non-compliance or violations of laws or regulations by our independent sales agents could result in adverse findings in either examinations or litigation and subject us to sanctions, monetary liabilities, restrictions on or loss of the operation of our business or reputational harm, any of which could have a material adverse effect on our business, financial condition or results of operations.

Additionally, the Company is at risk of being unable to meet legal, regulatory, financial or customer obligations if the data, information systems, facilities or networks of a third-party vendor are disrupted, damaged or fail, whether due to physical disruptions, such as fire, natural disaster, pandemic or power outage, or due to cybersecurity incidents, ransomware or other impacts to vendors, including labor strikes, political unrest and terrorist attacks.

Financial and Strategic Risks

Our investments are subject to market and credit risks. Significant downgrades, delinquencies and defaults in our investment portfolio could potentially result in lower net investment income and increased realized and unrealized investment losses.

Our invested assets are subject to the customary risks of defaults, downgrades, and changes in market values. Our investment portfolio consists predominately of fixed income investments, where we are exposed to the risk that individual issuers will not have the ability to make required interest or principal payments. A concentration of these investments in any particular issuer, industry, group of related industries or geographic areas could increase this risk. Factors that may affect both market and credit risks include interest rate levels (consisting of both treasury rate and credit spread), financial market performance, disruptions in credit markets, general economic conditions, legislative changes, particular circumstances affecting the businesses or industries of each issuer and other factors beyond our control.

Additionally, as the majority of our investments are long-term fixed maturities that we typically hold until maturity, a significant increase in interest rates and/or credit spreads could cause a material temporary decline in the fair value of our fixed investment portfolio, even with regard to performing assets. These declines could cause a material increase in unrealized losses in our investment portfolio. Significant unrealized losses could substantially reduce our capital position and shareholders’ equity. It is possible our investment in certain of these securities with unrealized losses could experience a credit event where an allowance for credit loss is recorded, reducing net income.

We cannot be assured that any particular issuer, regardless of industry, will be able to make required interest and principal payments on a timely basis or at all. Significant downgrades or defaults of issuers could negatively impact our risk-based capital ratios, leading to potential downgrades of the Company by rating agencies, potential reduction in future dividend capacity from our insurance subsidiaries, and/or higher financing costs at Globe Life Inc. (Parent Company) should additional statutory capital be required.

Changes in interest rates could negatively affect income.

Declines in interest rates expose insurance companies to the risk that they will fail to earn the level of interest on investments assumed in pricing products and in setting discount rates used to calculate policy liabilities, which could have a negative impact on income. Significant decreases in interest rates could result in calls by issuers of investments, where such features are available to issuers. Any such calls could result in a decline in our investment income, as reinvestment of the proceeds would likely be at lower interest rates.

An increase in interest rates could result in certain policyholders surrendering their life or annuity policies for cash, thereby potentially requiring our insurance subsidiaries to liquidate invested assets if other sources of liquidity are

not available to meet their obligations. In such a case, realized losses could result from the sale of the invested assets and could adversely affect our statutory income, required capital levels, and results of operations.

Our ability to fund operations is substantially dependent on available funds from our insurance subsidiaries.

As a holding company with no direct operations, our principal asset is the capital stock of our insurance subsidiaries, which periodically declare and distribute dividends on their capital stock. Moreover, our liquidity, including our ability to pay our operating expenses and to make principal and interest payments on debt securities or other indebtedness owed by us, as well as our ability to pay dividends on our common stock or any preferred stock, depends significantly upon the surplus and earnings of our insurance subsidiaries and the ability of these subsidiaries to pay dividends or to advance or repay funds to us.

The principal sources of our insurance subsidiaries’ liquidity are insurance premiums, as well as investment income, maturities, repayments, and other cash flow from our investment portfolio. Our insurance subsidiaries are subject to various state statutory and regulatory restrictions applicable to insurance companies that limit the amount of cash dividends, loans, and advances that those subsidiaries may pay to us, including laws establishing minimum solvency and liquidity thresholds. For example, in the states where our companies are domiciled, an insurance company generally may pay dividends only out of its unassigned surplus as reflected in its statutory financial statements filed in that state. Additionally, dividends paid by insurance subsidiaries are restricted based on regulations by their states of domicile. Accordingly, impairments in assets or disruptions in our insurance subsidiaries’ operations that reduce their capital or cash flow could limit or disallow the payment of dividends, a principal source of our cash flow, to us.

Other sources of liquidity include a variety of short-term and long-term instruments, including our credit facility, commercial paper, long-term debt, Federal Home Loan Bank (FHLB), intercompany financing and reinsurance.

Changes in laws or regulations in the states in which our companies are domiciled could constrain the ability of our insurance subsidiaries to pay dividends or to advance or repay funds to us in sufficient amounts and at times necessary to pay our debt obligations, corporate expenses, or dividends on our capital stock.

We are subject to liquidity risks associated with sourcing a concentration of our funding from the Federal Home Loan Bank (“FHLB”).

We use institutional funding agreements originating from FHLB, which from time to time serve as a significant source of our liquidity. Additionally, we use agreements with the FHLB to meet near-term liquidity needs. If the FHLB were to change its definition of eligible collateral, we could be required to post additional amounts of collateral in the form of cash or other assets. Additionally, if our creditworthiness falls below the FHLB’s requirements or if legislative or other political actions cause changes to the FHLB’s mandate or to the eligibility of life insurance companies to be members of the FHLB system, we could be required to find other sources to replace this funding, which may prove difficult and increase our liquidity risk.

Adverse capital and credit market conditions may significantly affect our ability to meet liquidity needs or access capital, as well as affect our cost of capital.

Should interest rates increase in the future, the higher interest expense on any newly issued debt may reduce net income. In addition, if the credit and capital markets were to experience significant disruption, uncertainty and instability, these conditions could adversely affect our access to capital. Such market conditions could limit our ability to replace maturing debt obligations in a timely manner, or at all, and/or access the capital necessary to grow our business and maintain required capital levels and credit ratings.

In the event that current sources of liquidity do not satisfy our needs, we may have to seek additional financing or raise capital. The availability and cost of additional financing or capital depend on a variety of factors such as market conditions, the general availability of credit or capital, the volume of trading activities, the overall availability of credit to the insurance industry, our credit ratings and credit capacity. Additionally, customers, lenders or investors could develop a negative perception of our financial prospects if we were to incur large investment losses or if the level of our business activity decreased due to a market downturn. Our access to funds may also be impaired if regulatory authorities or rating agencies take negative actions against us. If our internal sources of liquidity prove to

be insufficient, we may not be able to successfully obtain additional financing on favorable terms or at all. As such, we may be forced to delay raising capital, issue shorter term securities than we would prefer or bear an unattractive cost of capital which could decrease our profitability and significantly reduce our financial flexibility. If so, our results of operations, financial condition, consolidated RBC, and cash flows could be materially negatively affected.

We have become subject to, and may in the future be subject to, short selling strategies driving down the market price of our common stock.

Short selling is the practice of selling securities that the seller does not own but may have borrowed with the intention of buying identical securities back at a later date. A short seller hopes to profit from a decline in the value of the securities between the sale of the borrowed securities and the purchase of the replacement shares, as the short seller expects to pay less in that purchase than it received in the sale. Because it is in the short seller’s best interests for the price of the securities to decline, some short sellers publish, or arrange for the publication of, opinions or characterizations regarding the relevant issuer, its business prospects and similar matters calculated to or which may create negative market momentum, which may permit them to obtain profits for themselves as a result of selling the stock short. Companies, like us, that are subject to unfavorable allegations, even if untrue, may have to expend a significant amount of resources to investigate such allegations and/or defend themselves, including in connection with securityholder litigation against Globe Life Inc. or investigations by regulators related to or prompted by such allegations.

Since April 2024, we have been and continue to be the target of several short sellers who have published reports making allegations about the Company, which resulted in a significant decline in the price of our common stock. In addition, these reports resulted in significant negative publicity against us, damaged our reputation, and exposed us to securities class action litigation. We have already expended significant resources to defend and repair our reputation. We will continue to defend against any unfounded and unsubstantiated claims about our business, our disclosures, and the integrity of our financial statements, which may require us to expend significant resources.

We may be subject to additional short seller reports and activity in the future. The publication of any such commentary regarding us may bring about a temporary, or long term, decline in the market price of our common stock. No assurances can be made that similar declines in the market price of our common stock or negative publicity will not occur in the future, in connection with such commentary by short sellers or otherwise.

Industry Risks

Variations in actual-to-expected rates of mortality, morbidity and policyholder behavior could materially negatively affect our results of operations and financial condition.

We establish policy reserves to pay future policyholder benefits. These reserves do not represent an exact calculation of liability, but rather are actuarial estimates based on models and accounting requirements that include many assumptions and projections which are inherently uncertain. The reserve assumptions involve the exercise of significant judgment with respect to levels or trends of mortality, morbidity, lapses, and discount rates. Changes in assumptions could materially impact our financial condition and results of operations. Further, actual results may differ significantly from the levels assumed, which could result in increased policy obligations and expenses and thus negatively affect our profit margins and income.

A ratings downgrade or other negative action by a rating agency could materially affect our business, financial condition, and results of operations.

Various rating agencies review the financial performance and condition of insurers, including our insurance subsidiaries, and publish their financial strength ratings as indicators of an insurer’s ability to fulfill its contractual obligations. These ratings are important to maintaining public confidence in our insurance products. A downgrade or other negative action by a rating agency with respect to the financial strength ratings of our insurance subsidiaries could negatively affect us by limiting or restricting the ability of our insurance subsidiaries to pay dividends to us and reducing our sales by adversely affecting our ability to sell insurance products through independent insurance agencies.

Obtaining timely and appropriate premium rate increases for certain supplemental health insurance policies is critical.

A significant percentage of the supplemental health insurance premiums that our insurance subsidiaries earn is from Medicare Supplement insurance. Medicare Supplement insurance, including conditions under which the premiums for such policies may be increased, is highly regulated at both the state and federal level. As a result, Medicare Supplement business is characterized by lower profit margins than life insurance and requires strict administrative discipline and economies of scale for success. Since Medicare Supplement policies are coordinated with the federal Medicare program, which commonly experiences health care inflation every year, annual premium rate increases for the Medicare Supplement policies are typically necessary. Accordingly, the inability to obtain approval of appropriate premium rate increases for supplemental health insurance plans in a timely manner from state insurance regulatory authorities could adversely impact their profitability and thus our business, financial condition, and results of operations.

Our business is subject to the risk of the occurrence of catastrophic events that could adversely affect our financial condition or operations.

Our insurance policies are issued to and held by a large number of policyholders throughout the United States in relatively low-face amounts. Accordingly, it is unlikely that a large portion of our policyholder base would be affected by a single natural disaster. However, our insurance operations could be exposed to the risk of catastrophic mortality or morbidity caused by events such as a pandemic or other public health issues, hurricane, earthquake, or man-made catastrophes, including acts of terrorism or war, which may produce significant claims in larger areas, especially those that are heavily populated. Claims resulting from natural or man-made catastrophic events could cause substantial volatility in our financial results for any fiscal quarter or year and could materially reduce our profitability or harm our financial condition. In addition, government, business, and consumer reactions to public health events could result in material negative impacts to our business and operations.

Our life and health insurance products are particularly exposed to risks of catastrophic mortality, such as a pandemic or other events that result in a large number of deaths. In addition, the occurrence of such an event in a concentrated geographic area could have a severe disruptive effect on our workforce and business operations. The likelihood and severity of such events cannot be predicted and are difficult to estimate. In such an event, the impact to our operations could have a material adverse impact on our ability to conduct business and on our results of operations and financial condition, particularly if those problems affect our producing agents or our employees performing operational tasks and supporting computer-based data processing, or impair or destroy our capability to transmit, store, and retrieve valuable data. In addition, in the event that a significant number of our management were unavailable following a disaster, the achievement of our strategic objectives could be negatively impacted.

We are exposed to model risk, which is the risk of financial loss or reputational damage or adverse regulatory impacts caused by model errors or limitations, incorrect implementation of models, or misuse of or overreliance upon models.

Models are utilized by our businesses and corporate areas primarily to project future cash flows associated with pricing products, calculating reserves and valuing assets, as well as in evaluating risk and determining capital requirements, among other uses. These models may not operate properly and may rely on assumptions and projections that are inherently uncertain. As our businesses continue to grow and evolve, the number and complexity of models we utilize expands, increasing our exposure to error in the design, implementation or use of models, including the associated input data and assumptions.

Our business is subject to the risk of direct or indirect effects of climate change.

Climate change may increase the frequency and severity of weather-related events and natural disasters, which may adversely impact our mortality and morbidity rates and disrupt our business operations. In addition, climate change and climate change regulation may affect the prospects of companies and other entities whose securities we hold or our willingness to continue to hold their securities. Climate change may also influence investor sentiment with respect to the Company and investments in our portfolio.

Legal, Regulatory, and Compliance Risks

Recent volatility in the trading price of our common stock has and can be expected to result in securities class action litigation.

In April 2024, the trading price of our common stock dropped following the publication of certain short seller reports. As of the date of this Report, one putative securities class action has been filed against Globe Life Inc. and we expect that other putative class action claims may be filed as well. While we intend to defend such actions vigorously, any judgment against us or any future stockholder litigation could have a material adverse effect on our business, financial condition or results of operations.

Our businesses are heavily regulated and changes in regulation or regulatory scrutiny may have a material adverse impact on our business, financial condition or results of operation.

Insurance companies, including our insurance subsidiaries, are subject to extensive supervision and regulation in the states in which they conduct business. The primary purpose of this supervision and regulation is the protection of policyholders, not investors. Regulatory agencies have broad administrative power over numerous aspects of our business, including premium rates for our life, Medicare Supplement and other supplement health products, as well as other terms and conditions included in the insurance policies offered by our insurance subsidiaries, marketing practices, advertising, use of emerging technologies, agent licensing, independent agent practices, policy forms, capital adequacy, solvency, reserves and permitted investments.

Regulatory authorities also have the power to conduct investigations, and to bring administrative or judicial proceedings against us, which could result in suspension or revocation of our licenses, cease and desist orders, fines, civil penalties, disgorgement, criminal penalties or other disciplinary action that could have a material adverse impact on our business, financial condition or results of operation. Press coverage and other public statements that allege wrongdoing, even if untrue, can lead to increased regulatory inquiries or investigations including any that may arise in connection with the subpoenas from U.S. Attorney’s Office for the Western District of Pennsylvania seeking documents related to sales practices by certain of our independent sales agents contracted to sell American Income Life Insurance Company policies.

The insurance laws, regulations and policies currently affecting our companies may change at any time, possibly having an adverse effect on our business. Should regulatory changes occur, we may be unable to maintain all required licenses and approvals, or fully comply with the wide variety of applicable laws and regulations or the relevant authority’s interpretation of such laws and regulations. If we do not have the requisite licenses and approvals or do not comply with applicable regulatory requirements, the insurance regulatory authorities could preclude or temporarily suspend some or all of our business activities and/or impose substantial fines. Additionally, any violation or alleged violation of law or regulations could result in significant legal costs or in legal proceedings that may result in monetary and legal remedies being imposed against the Company, which could have a material adverse effect on our business, financial condition or results of operations.

Changes in accounting standards issued by accounting standard-setting bodies may affect our financial statements, reduce our reported profitability and change the timing of profit recognition.

Our financial statements are subject to the application of GAAP and accounting practices as promulgated by the National Association of Insurance Commissioners’ statutory accounting practices (NAIC SAP), which principles are periodically revised and/or expanded. Accordingly, from time to time we are required to adopt new or revised accounting standards or guidance issued by recognized authoritative bodies. Future accounting standards that we are required to adopt could change the current accounting treatment that we apply to our consolidated financial statements. These changes, including underlying assumptions, projections, estimates or judgments/interpretations by management, could have a material adverse effect on our business, financial condition, and results of operations. (Refer to Note 1—Significant Accounting Policies under the caption Accounting Pronouncements Yet to be Adopted)

Non-compliance with laws or regulations related to customer and consumer privacy and information security, including a failure to ensure that third parties with access to sensitive customer and consumer information maintain its confidentiality, could materially adversely affect our reputation and business operations.

The collection, maintenance, use, disclosure, and disposal of personally identifiable information by our insurance subsidiaries are regulated at the international, federal, and state levels. Applicable laws and rules are subject to change by legislation or administrative or judicial interpretation. We are subject to the privacy and security provisions of federal laws including, but not limited to, the Gramm-Leach-Biley Act of 1999 (GLBA), the Health Information Technology for Economic and Clinical Health Act (HITECH), and the Health Insurance Portability and Accountability Act of 1996 (HIPAA). HIPAA additionally requires that we impose privacy and security requirements on our third-party business associates. Various state laws also address the use and disclosure of personally identifiable information, to the extent they are more restrictive than these and other federal laws. Further, approximately half of the states have adopted a form of the National Association of Insurance Commissioners’ data security model law, which imposes security requirements. Noncompliance with these laws, whether by us or by one of our business associates, could have a material adverse effect on our business, reputation, and results of operations and could result in material fines and penalties, various forms of damages, consent orders regarding our privacy and security practices, adverse actions against our licenses to do business, and injunctive relief.

General Risk Factors

The failure to maintain effective and efficient information systems at the Company could adversely affect our financial condition and results of operations.

Our business is highly dependent upon the internet, third-party service providers, and information systems to operate in an efficient and resilient manner. We gather and maintain data for the purpose of conducting marketing, actuarial analysis, sales, and policy administration functions. Our ability to modernize and maintain our information technology systems and infrastructure requires us to commit significant resources and effective planning and execution. This modernization includes the responsible and secure use of emerging technologies like artificial intelligence.

Malicious third parties, employee or agent errors or disasters affecting our information systems could impair our business operations, regulatory compliance, and financial condition. Employee or agent malfeasance or errors in the handling of our information systems may result in unauthorized access to customer or proprietary information, or an inability to use our information systems to efficiently support business operations. As a result of more frequent and sophisticated cyberattacks and the highly regulated nature of the insurance industry, we must continually implement new, and maintain existing, technology or adapt existing technology to protect against security and privacy incidents and to meet compliance requirements of new and proposed regulations.

Any incident affecting confidential information systems resulting from the above factors could damage our reputation in the marketplace, deter potential customers from purchasing our products, result in the loss of existing customers, subject us to significant civil and criminal liability, constrain cash flows, or require us to incur significant technical, legal, or other expenses. In addition, should we be unable to implement or maintain our technology effectively, efficiently, or in a timely manner, it could result in poor customer experience, poor agent experience, additional expenses, reputational harm, legal and regulatory actions, and other adverse consequences. This could also result in the inability to effectively support business operations.

Changes in U.S. federal income tax law could increase our tax costs or negatively impact our insurance subsidiaries' capital.

Changes to the Internal Revenue Code, administrative rulings, or court decisions affecting the insurance industry, including the products insurers offer, could increase our effective tax rate and lower our net income, adversely impact our insurance subsidiaries' capital, or limit the ability of our insurance subsidiaries to sell certain of their products.

Damage to the brand and reputation of Globe Life or its subsidiaries could affect our ability to conduct business.

Negative publicity through traditional media, internet, social media, and other public forums, including short seller reports and allegations of independent agent misconduct could damage our brand or reputation, which could adversely impact our ability to recruit and retain agents, our ability to market our products, and the persistency of in-force policies. A reduction in the number of agents selling our products, or the rate of growth of the number of agents selling our products may have an adverse impact on product sales and profit, and such impact may be material.

We may fail to meet expectations relating to corporate responsibility and sustainability standards and practices.

Certain existing or potential investors, customers and regulators evaluate our business or other practices according to a variety of corporate responsibility and sustainability standards and expectations. Certain of our regulators have proposed or adopted, or may propose or adopt, certain corporate responsibility and sustainability rules or standards that would apply to our business. Our practices may be judged by these standards that are continually evolving and not always clear. Our decisions or priorities are made with the considerations of all stakeholders. Prevailing corporate responsibility and sustainability standards and expectations may also reflect contrasting or conflicting values or agendas.

We may fail to meet our corporate responsibility and sustainability expectations. Failure to meet, or achieve progress on, our expectations, on a timely basis, or at all, could adversely affect our reputation, business, financial performance, and growth. We may face adverse regulatory, investor, customer, media, or public scrutiny leading to business, reputational, or legal challenges. In addition, our policies, and processes to evaluate and manage these standards in coordination with other business priorities may not prove completely effective or satisfy investors, customers, regulators, or others.

Item 1B. Unresolved Staff Comments

As of December 31, 2024, Globe Life had no unresolved SEC staff comments.

Item 1C. Cybersecurity

Risk Management and Strategy

We have implemented a comprehensive Enterprise Risk Management (“ERM”) process to identify, assess and manage risks related to our overall organization, including material risks from cybersecurity threats. Our ERM process takes a holistic view of our specific risks and our strategy to anticipate and manage possible risks. Our Executive Vice President, General Counsel and Chief Risk Officer (“CRO”) oversees our ERM program and execution of our risk strategy, including as it relates to cyber risk. The Chief Information Security Officer ("CISO"), who reports to the General Counsel and CRO, leads our cyber risk management and strategy and the Information Security Department.

Our cyber risk management and information security strategy includes elements to identify threats, assess risks, implement protective controls, detect attempts from threat actors to compromise the confidentiality, integrity, and availability of information and information systems, respond to those events and ultimately recover from incidents. We use a threat-based approach to identify and assess cyber risks. This approach includes membership in threat intelligence organizations such as the FS-ISAC (Financial Services Information Sharing and Analysis Center) to identify standard and emerging cyber-threats to financial services organizations and specifically to insurance companies. We also monitor for threats through vendor alerts, manufacturer bulletins, and government advisories.

Identified threats are analyzed using a recognized risk assessment model to consistently assess the likelihood and impact of these threats. We then map these threats to a well-established industry model called MITRE ATT&CK to identify areas of vulnerability. This analysis produces a likelihood score that is used in conjunction with an impact analysis to calculate the preliminary level of risk. The impact analysis includes factors such as disruption to business operations, employee and customer data, legal issues, reputational harm, and regulatory compliance. Based on the preliminary level of risk, we also analyze compensating controls and other factors to arrive at a residual risk level. If appropriate, additional mitigations may be planned based on this risk level.

We manage identified cyber risks by designing and implementing information security policies and controls addressing a wide range of current cyber threats. These policies and associated standards are designed to comply with current applicable legal and regulatory requirements and align with recognized frameworks for cybersecurity risk management. We review and update these policies and controls regularly in order to confirm ongoing alignment with the constantly changing threat landscape and evolving compliance requirements.

We assess the effectiveness of our corporate policies and controls internally, as well as through the engagement of external advisors to conduct regular reviews, penetration tests, and vulnerability scans of Company information systems and applications. Results from these assessments help inform updates to risk assessments, changes to security controls and processes, and updates to policies and standards as appropriate. We employ a variety of internal measures to detect, prevent, and reduce the frequency and severity of cybersecurity incidents on the Company’s infrastructure, which may include, but are not limited to, the use of encryption, intrusion prevention, endpoint security, password protection, multi-factor authentication, internal phishing testing, security awareness training, and vulnerability scanning and penetration testing.

In addition, cybersecurity is incorporated into our third-party risk management program. We assess the ability of our vendors as appropriate to adequately protect information, which includes requiring agreements that address cybersecurity. We periodically review and assess vendors’ adherence to these agreements and review for information security (including cybersecurity) incidents experienced by our third-party vendors. With respect to our independent sales agents, we require each agent to execute an agent agreement containing terms governing the ownership, use and confidentiality of policyholder and proprietary information. We also engage with agency offices to support their use of measures and safeguards to protect information.

Due to the type and volume of information that we collect and store to support our business, including to provide insurance coverage to prospective, current and former policyholders, we are an attractive target for cyber threat actors seeking financial gain. Our failure to maintain the safety of our policyholder’s information could have a

material adverse effect on our reputation, financial condition and results of operations. To date, we have not experienced a cybersecurity incident that resulted in a material adverse effect on our business strategy, results of operations, or financial condition; however, we anticipate that our systems and data will continue to face attacks or other cybersecurity risks and there can be no guarantee that we will not experience such an incident in the future. Although we maintain cybersecurity insurance, the costs and expenses related to cybersecurity incidents may not be fully insured. We describe whether and how risks from identified cybersecurity threats, including as a result of previous cybersecurity incidents, have materially affected or are reasonably likely to materially affect us, including our business strategy, results of operations, or financial condition under Item 1A. Risk Factors, General Risk Factors, “The failure to maintain effective and efficient information systems at the Company could adversely affect our financial condition and results of operations.”

Governance

Our Board of Directors considers information security to be an enterprise-wide risk management issue and oversees material cybersecurity risks through the Audit Committee. The Audit Committee is designated with the responsibility to monitor and periodically report to the full Board regarding management’s risk management and information security processes. The ERM Committee and the Operational Risk Committee (“ORC”) are the senior management-level entities designated with the responsibility to oversee the execution of our risk strategy, including as it relates to cyber risk. These Committees are composed of an enterprise-wide representative group of the Company’s Executive and Senior Vice Presidents, as well as other essential directors and personnel. The ERM Committee is chaired by our CRO, and the ORC is chaired by our Chief Security Officer (“CSO”). The Chief Information Officer (“CIO”) and CISO serve on both Committees. Our CRO has over a decade of experience managing risks at the Company, including risks from cybersecurity threats. Our current CIO has over 15 years of experience managing risks, including risks from cybersecurity threats. Our current CSO has a Certified Information Systems Security Professional certification, a Certified Information Systems Auditor certification, a Certified in Risk and Information Systems Control certification, and over 20 years of experience in cybersecurity. The CISO serves on both Committees and leads cyber governance and strategy, as well as cyber risk and incident management. The current CISO holds a master’s degree in cybersecurity, has a Certified Information Systems Security Professional certification, and has over a decade of experience in cybersecurity.

The CISO assesses cyber risk and provides recommendations for management decision(s) by the ORC on a routine basis. The CISO briefs the Audit Committee on a quarterly basis. These updates include compliance measures designed to meet applicable regulations as well as current or planned changes to the regulations, an overview of the current cyber threats, risk management activities, and discussions of cyber incident investigations that warrant the attention of the Board. The CISO also provides an annual update to the entire Board of Directors on topics such as changes in cybersecurity, top threats facing the Company, key risks and mitigation efforts, and any potential material cybersecurity incidents. The Chair of the Audit Committee also provides a quarterly report to the Board on any information security topics presented to the Audit Committee by management.

Incident Management

The Company maintains and tests a cybersecurity incident response plan that outlines steps for the containment, investigation of, response to and recovery from cyber events. The plan also includes information pertaining to roles and responsibilities, escalation, third-party support, documentation, reporting, and law enforcement engagement. Escalation is designed to raise awareness of events that may require disclosure to help ensure assessments are performed without unreasonable delay. In alignment with our plan, we maintain playbooks that outline processes for responding to certain incidents commonly observed in the insurance industry. In addition, we have implemented a formal crisis management process, which outlines an incident response communication plan with executive leadership as well as criteria for communication with the chair of the Audit Committee and the Lead Director of the Board.

Item 2. Properties

Globe Life Inc., through its subsidiaries, owns or leases buildings that are used in the normal course of business. Globe Life Inc. owns and occupies approximately 480,000 combined square feet in McKinney, Texas (headquarters) and at the Waco, Texas and Oklahoma City, Oklahoma campuses. Additionally, the Company leases other buildings across the U.S.

Item 3. Legal Proceedings

Item 4. Mine Safety Disclosures

Not Applicable.

Part II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

The principal market in which Globe Life's common stock is traded is the New York Stock Exchange (NYSE: GL). There were 1,859 shareholders of record on December 31, 2024, excluding shareholder accounts held in nominee form.

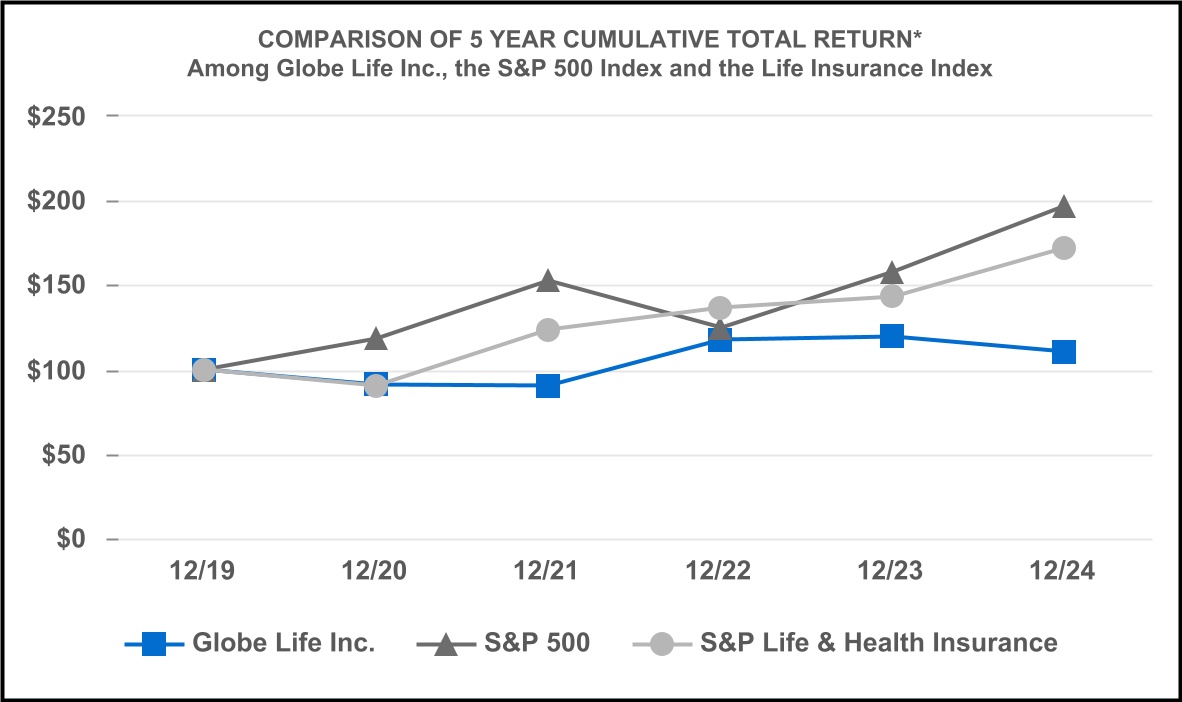

The line graph shown below compares Globe Life's cumulative total return on its common stock with the cumulative total returns of the Standard & Poor’s 500 Stock Index (S&P 500) and a Life Insurance Index. Globe Life's stock is included within the S&P 500 Index.

*$100 invested on 12/31/2019 in stock or index, including reinvestment of dividends. Fiscal year ended December 31.

Copyright© 2025 Standard & Poor's, a division of S&P Global. All rights reserved.

Purchases of Certain Equity Securities by the Issuer and affiliated purchasers for the Fourth Quarter 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | | (b) | | (c) | | (d) |

| Period | | Total Number

of Shares

Purchased | | Average

Price Paid

Per Share | | Total Number of

Shares Purchased

as Part of

Publicly Announced

Plans or Programs | | Maximum Number of

Shares (or Approximate Dollar

Amount) that May Yet Be

Purchased Under the

Plans or Programs |

| October 1-31, 2024 | | 374,567 | | | $ | 105.45 | | | 374,567 | | | — |

| November 1-30, 2024 | | — | | | — | | | — | | | — |

| December 1-31, 2024 | | 116,484 | | | 108.77 | | | 116,484 | | | — |

Item 6. [Reserved]

CAUTIONARY STATEMENTS

We caution readers regarding certain forward-looking statements contained in the foregoing discussion and elsewhere in this document, and in any other statements made by, or on behalf of Globe Life whether or not in future filings with the Securities and Exchange Commission. Any statement that is not a historical fact, or that might otherwise be considered an opinion or projection concerning the Company or its business, whether express or implied, is meant as and should be considered a forward-looking statement. Such statements represent management's opinions concerning future operations, strategies, financial results or other developments. We specifically disclaim any obligation to update or revise any forward-looking statement because of new information, future developments, or otherwise.

Forward-looking statements are based upon estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond our control, including uncertainties related to the impact of the recent pandemic and associated direct and indirect effects on our business operations, financial results, and financial condition. If these estimates or assumptions prove to be incorrect, the actual results of Globe Life may differ materially from the forward-looking statements made on the basis of such estimates or assumptions. Whether or not actual results differ materially from forward-looking statements may depend on numerous foreseeable and unforeseeable events or developments, which may be national in scope, related to the insurance industry generally, or applicable to the Company specifically. Such events or developments could include, but are not necessarily limited to:

1.Economic and other conditions, including the continued impact of inflation, geopolitical events, and the recent pandemic on the U.S. economy, leading to unexpected changes in lapse rates and/or sales of our policies, as well as levels of mortality, morbidity, and utilization of health care services that differ from Globe Life's assumptions;

2.Regulatory developments, including changes in accounting standards or governmental regulations (particularly those impacting taxes and changes to the Federal Medicare program that would affect Medicare Supplement);

3.Market trends in the senior-aged health care industry that provide alternatives to traditional Medicare (such as Health Maintenance Organizations and other managed care or private plans) and that could affect the sales of traditional Medicare Supplement insurance;

4.Interest rate changes that affect product sales, financing costs, and/or investment yields;

5.General economic, industry sector or individual debt issuers’ financial conditions (including developments and volatility arising from geopolitical events, particularly in certain industries that may comprise part of our investment portfolio) that may affect the current market value of securities we own, or that may impair an issuer’s ability to make principal and/or interest payments due on those securities;

6.Changes in the competitiveness of the Company's products and pricing;

7.Litigation results or regulatory actions against the Company;

8.Levels of administrative and operational efficiencies that differ from our assumptions (including any reduction in efficiencies resulting from increased costs arising from the impact of higher than anticipated inflation);

9.The ability to obtain timely and appropriate premium rate increases for health insurance policies from our regulators;

10.The customer response to new products and marketing initiatives;

11.Reported amounts in the consolidated financial statements which are based on management estimates and judgments which may differ from the actual amounts ultimately realized;

12.Compromise by a malicious actor or other event that causes a loss of secure data from, or inaccessibility to, our computer and other information technology systems;

13.The impact of reputational damage on the Company including the impact on the Company's ability to attract and retain agents;

14.The severity, magnitude, and impact of natural or man-made catastrophic events, including but not limited to pandemics, tornadoes, hurricanes, earthquakes, war and terrorism, on our operations and personnel, commercial activity, level of claims, and demand for our products; and

15.Globe Life's ability to access the commercial paper and debt markets, particularly if such markets become unpredictable or unstable for a certain period.

Readers are also directed to consider other risks and uncertainties described in other documents on file with the Securities and Exchange Commission.

GLOBE LIFE INC.

Management's Discussion & Analysis

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with Globe Life's Consolidated Financial Statements and Notes thereto appearing elsewhere in this report. The following management discussion will only include comparison to prior year. For discussion regarding activity from 2022, please refer to the prior filed Form 10-Ks at www.sec.gov.

"Globe Life" and the "Company" refer to Globe Life Inc. and its subsidiaries and affiliates.