UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | February 29 |

| |

Date of reporting period: | February 29, 2004 |

Item 1. Reports to Stockholders

Fidelity®

Select

Portfolios®

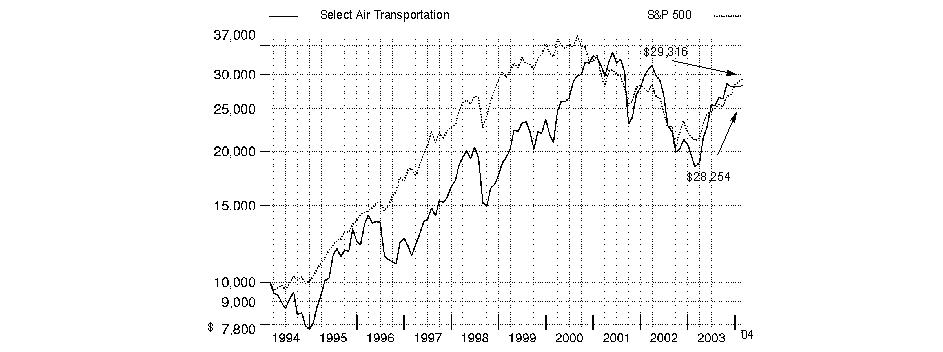

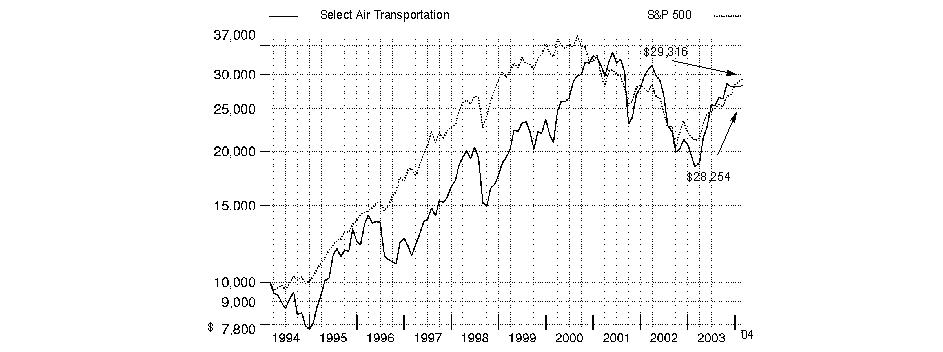

Air Transportation

Automotive

Banking

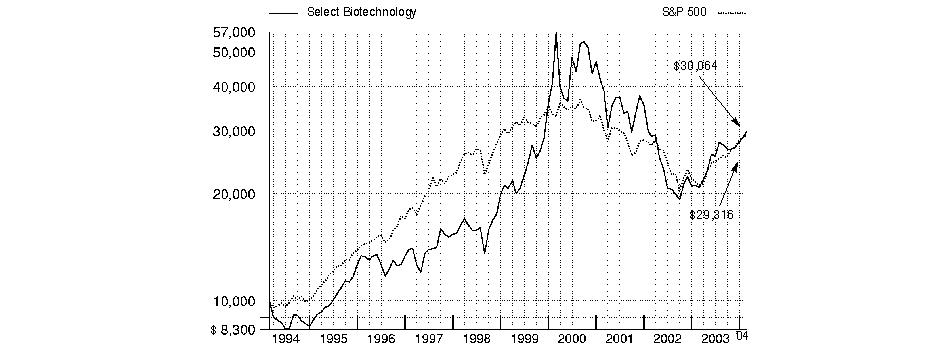

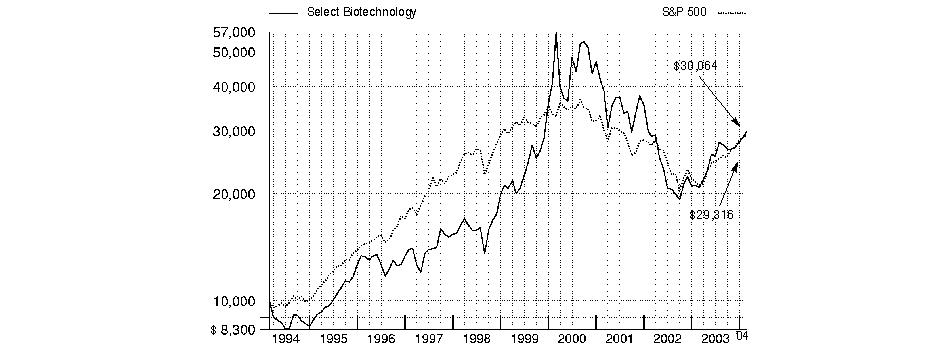

Biotechnology

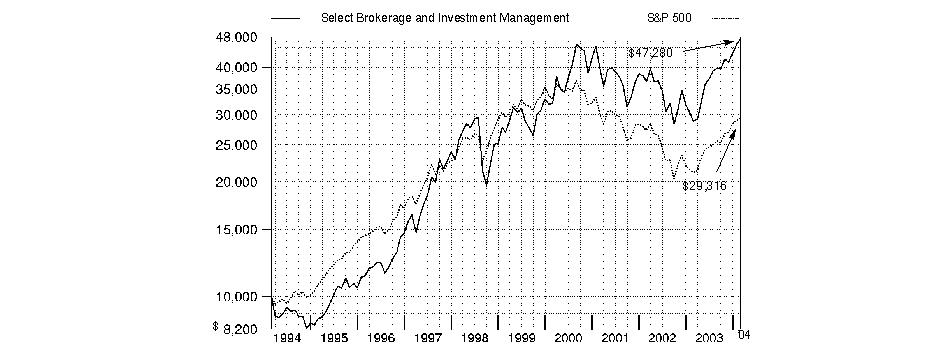

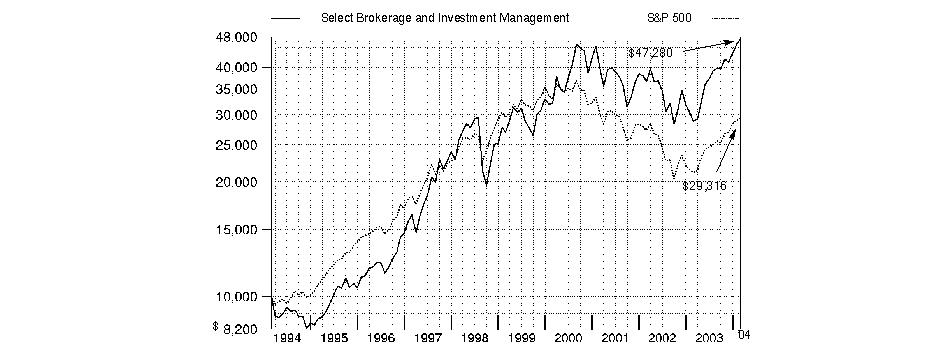

Brokerage and Investment Management

Business Services and Outsourcing

Chemicals

Computers

Construction and Housing

Consumer Industries

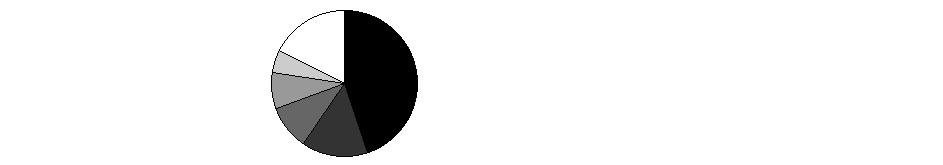

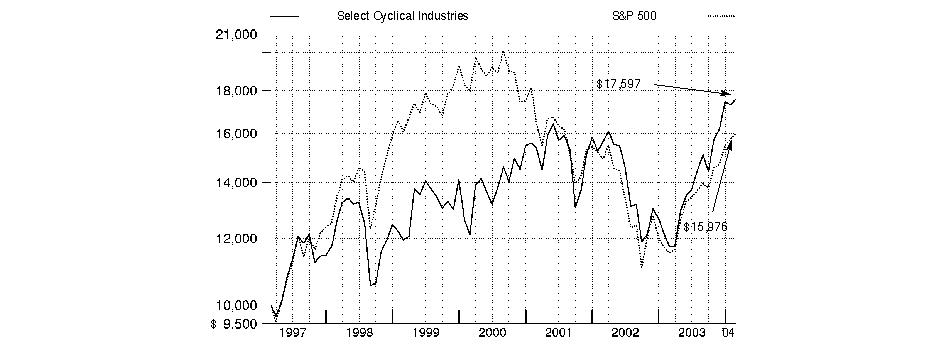

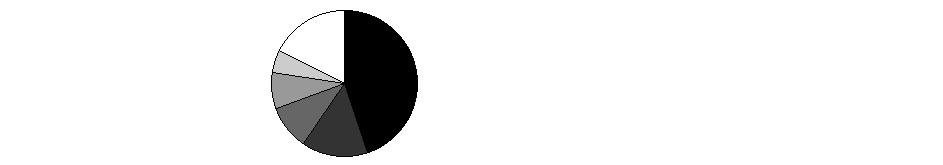

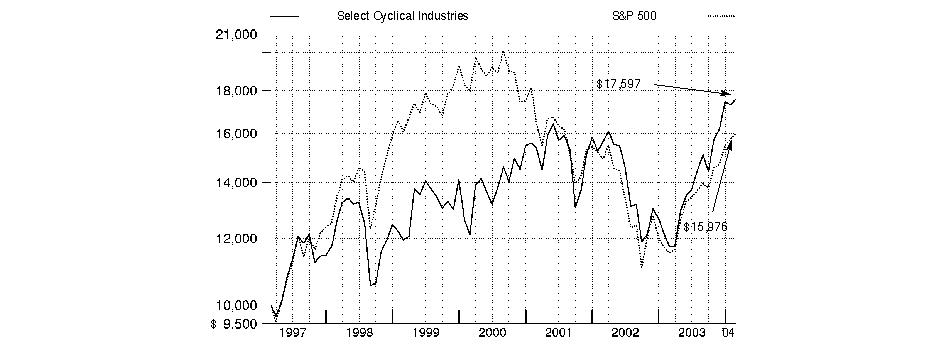

Cyclical Industries

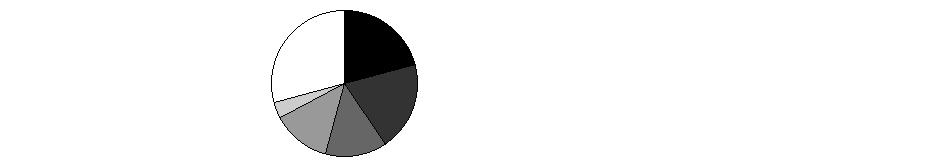

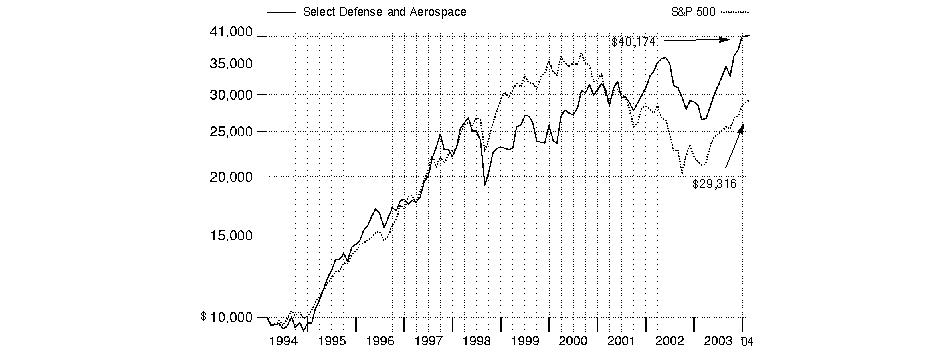

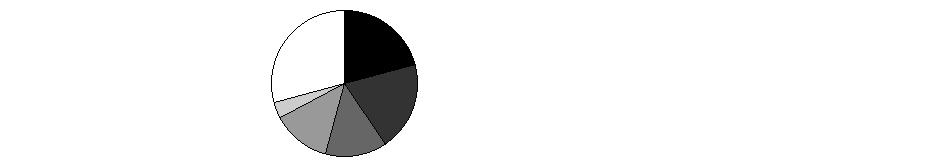

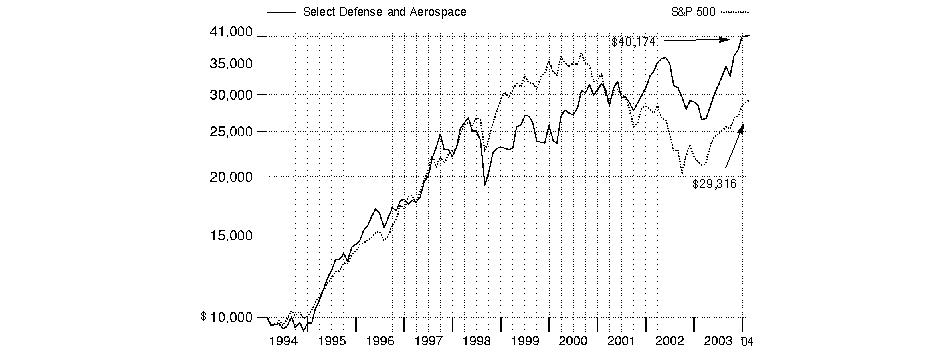

Defense and Aerospace

Developing Communications

Electronics

Energy

Energy Service

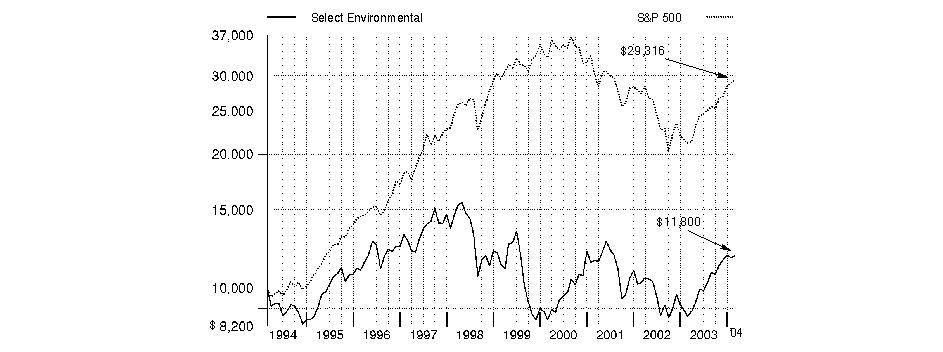

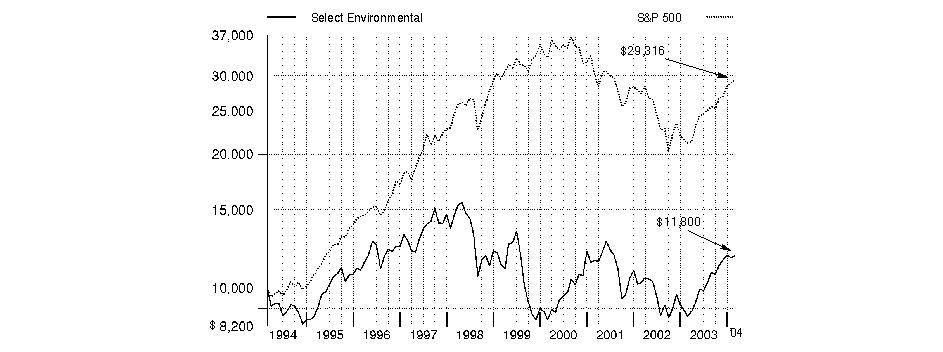

Environmental

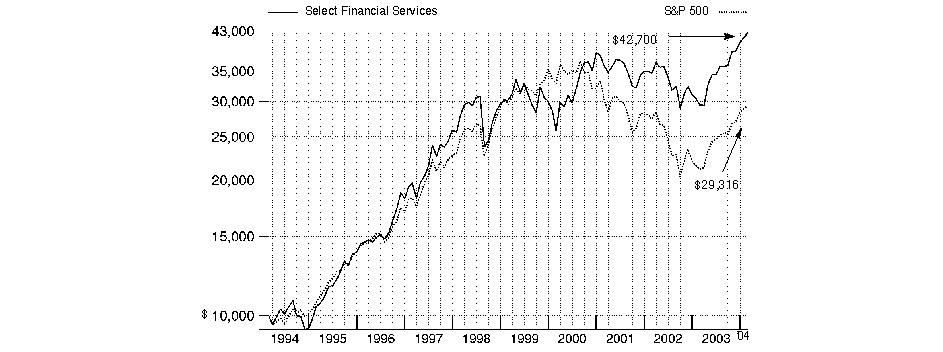

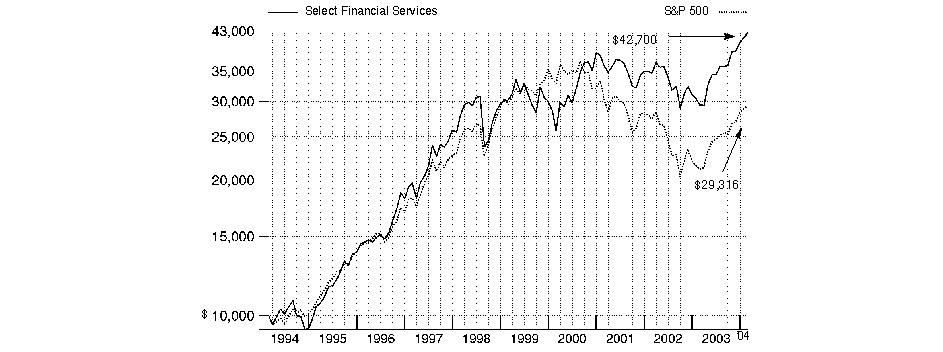

Financial Services

Food and Agriculture

Gold

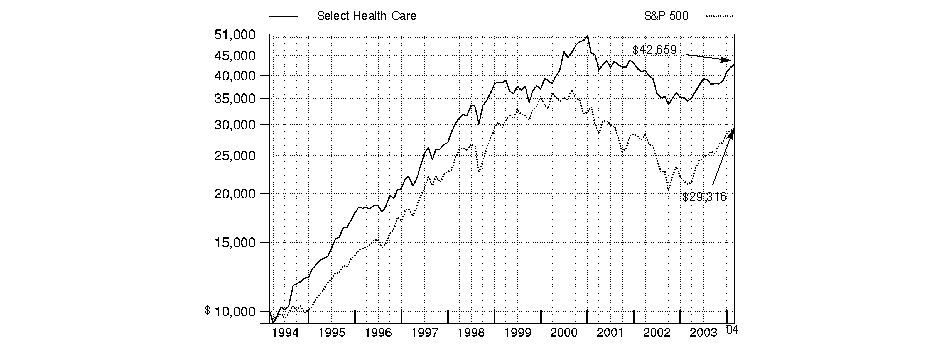

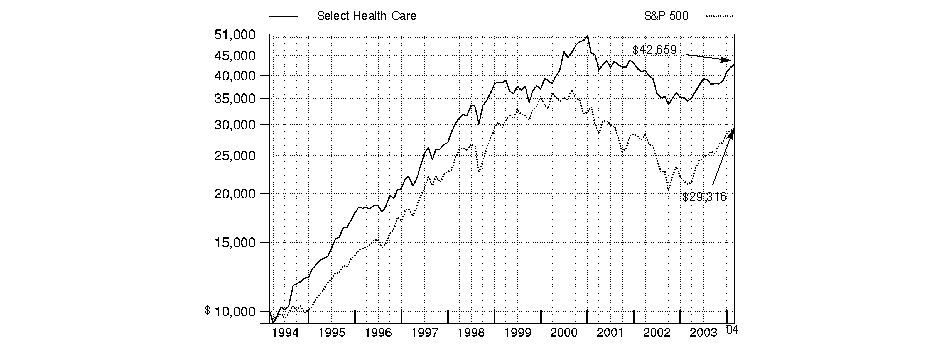

Health Care

Home Finance

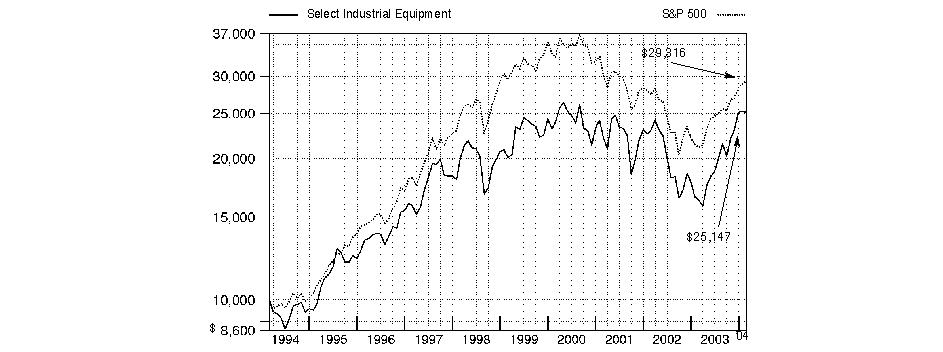

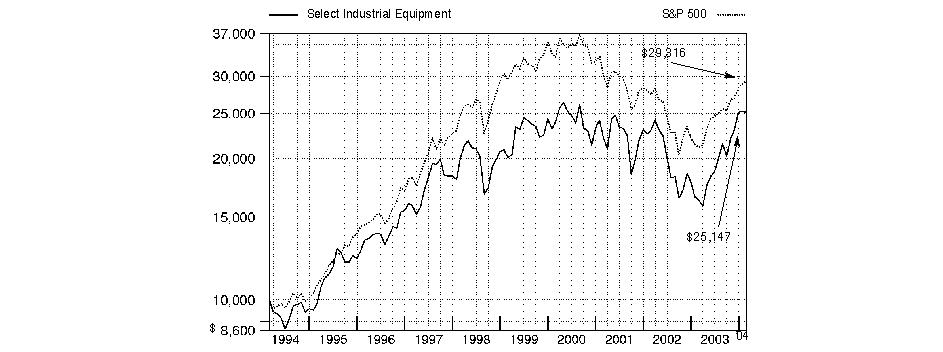

Industrial Equipment

Industrial Materials

Insurance

Leisure

Medical Delivery

Medical Equipment and Systems

Money Market

Multimedia

Natural Gas

Natural Resources

Networking and Infrastructure

Paper and Forest Products

Pharmaceuticals

Retailing

Software and Computer Services

Technology

Telecommunications

Transportation

Utilities Growth

Wireless

Annual Report

February 29, 2004

(2_fidelity_logos) (Registered_Trademark)

Contents

* Fund updates for each Select Portfolio include: Performance, Management's Discussion, Investment Summary, Investments, and Financial Statements.

Annual Report

For a free copy of the funds' proxy voting guidelines visit www.fidelity.com/goto/proxyguidelines, call 1-800-544-8544, or visit the Securities and Exchange Commission (SEC)'s website at www.sec.gov.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by

Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Consumer Industries Portfolio

Performance

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity a fund's total returns will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

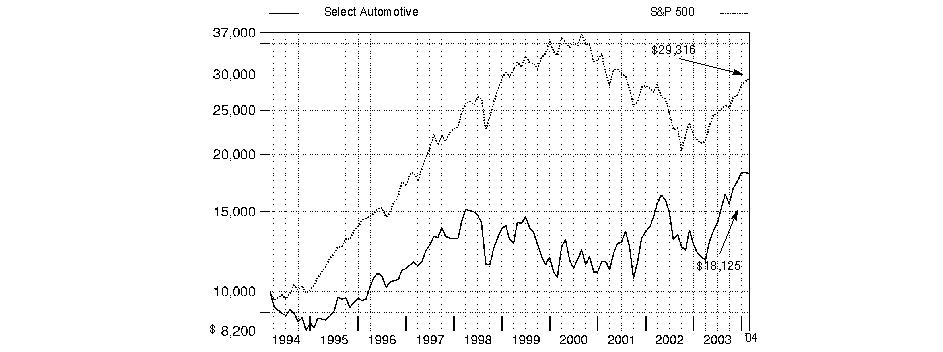

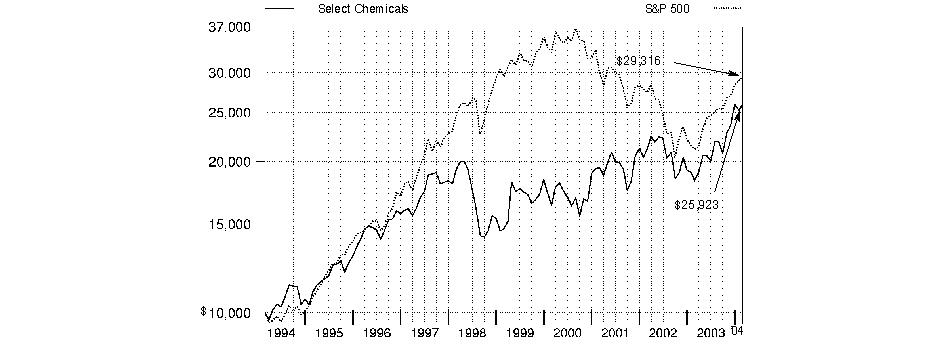

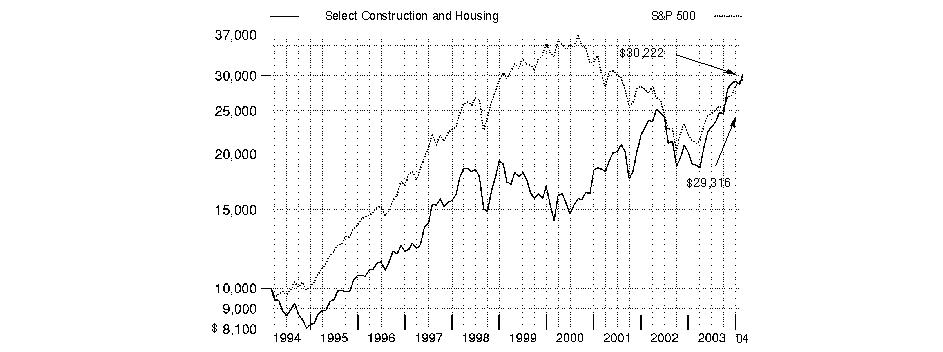

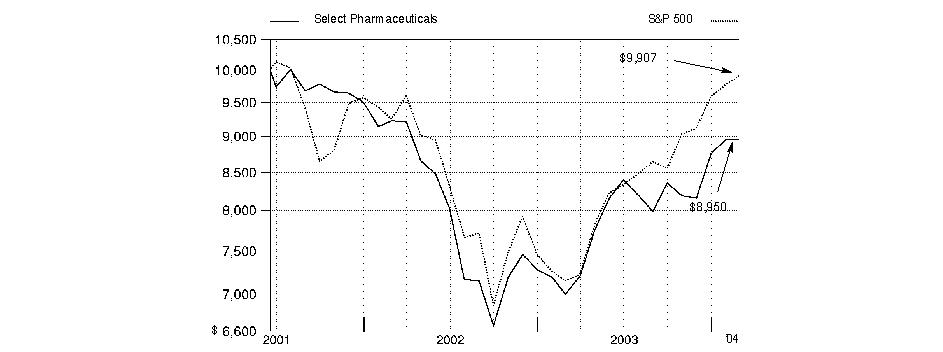

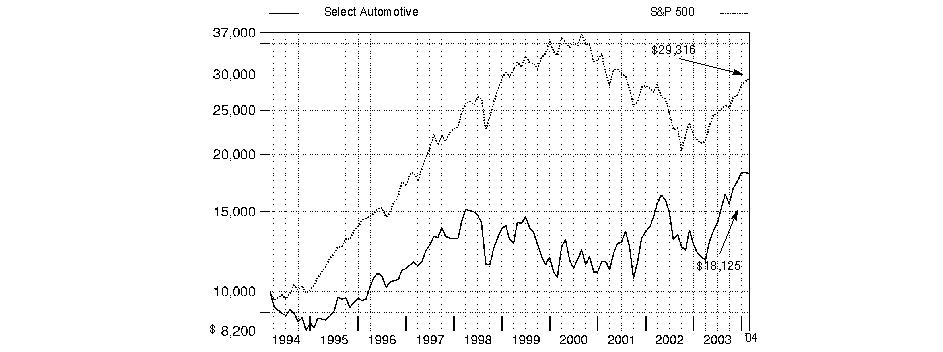

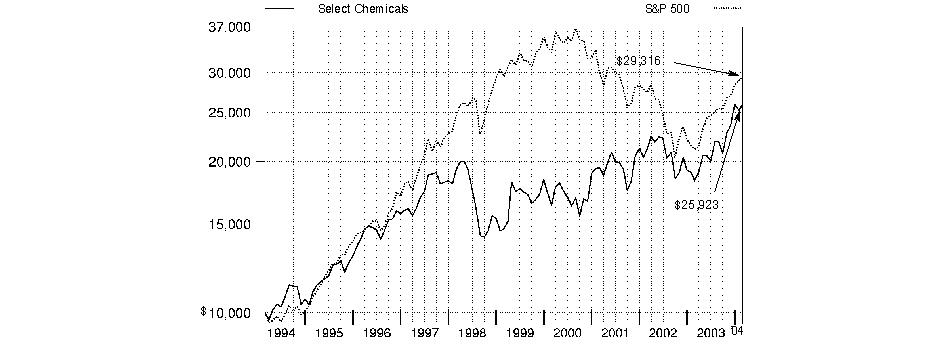

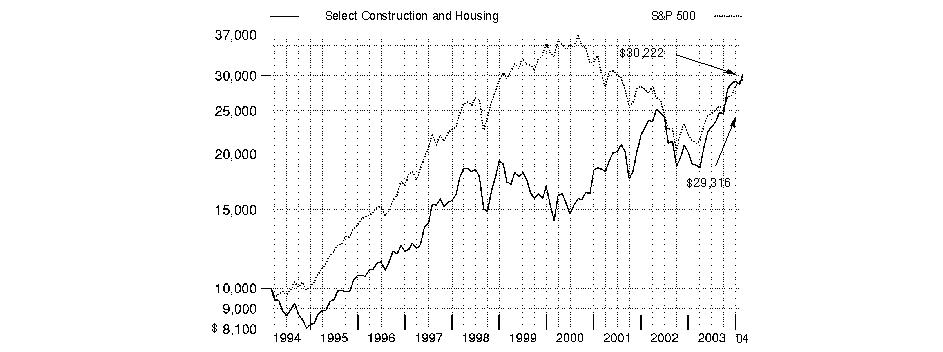

Average Annual Total Returns

Periods ended February 29, 2004 | Past 1

year | Past 5

years | Past 10

years |

Select Consumer Industries | 33.82% | 0.29% | 9.41% |

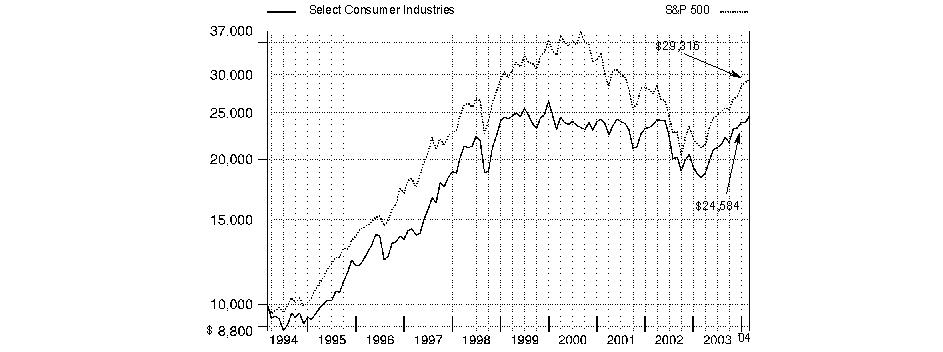

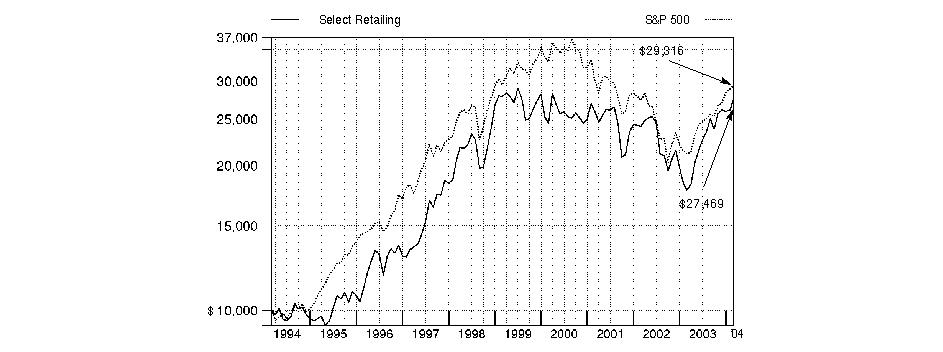

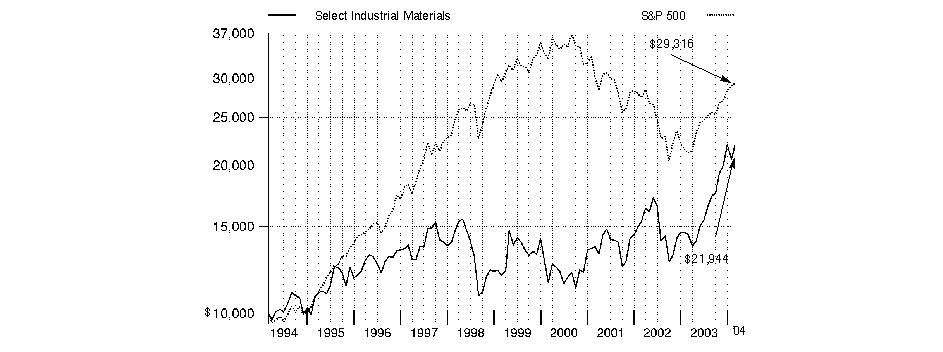

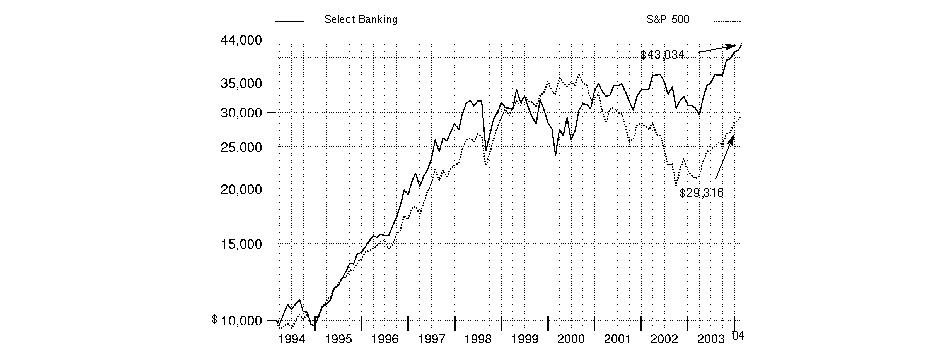

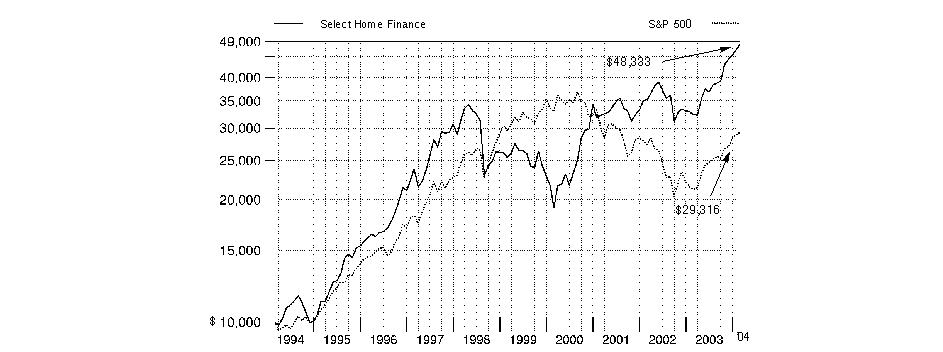

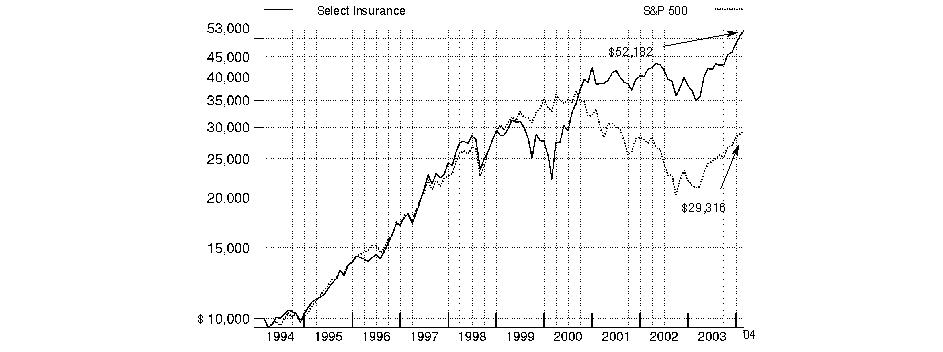

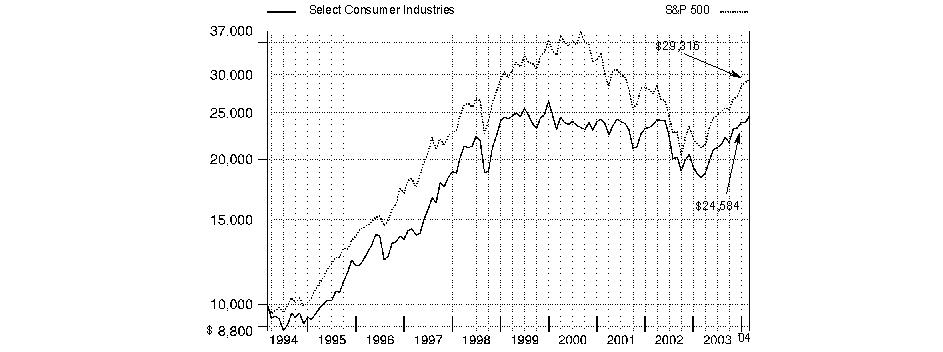

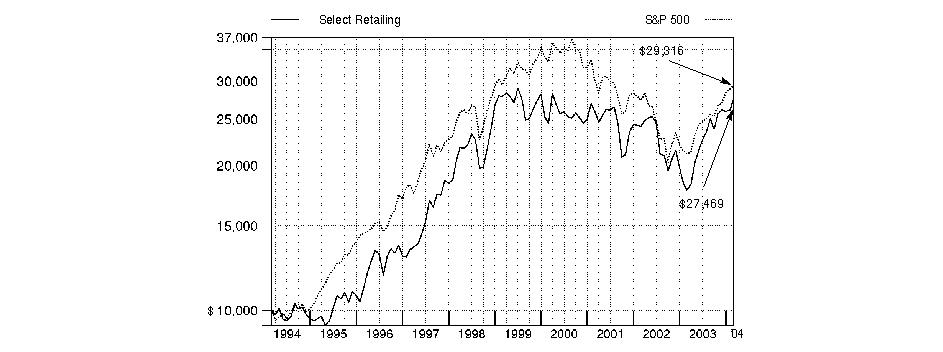

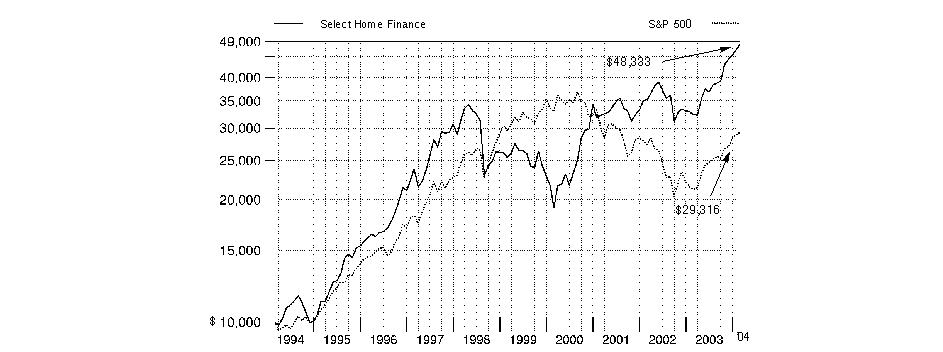

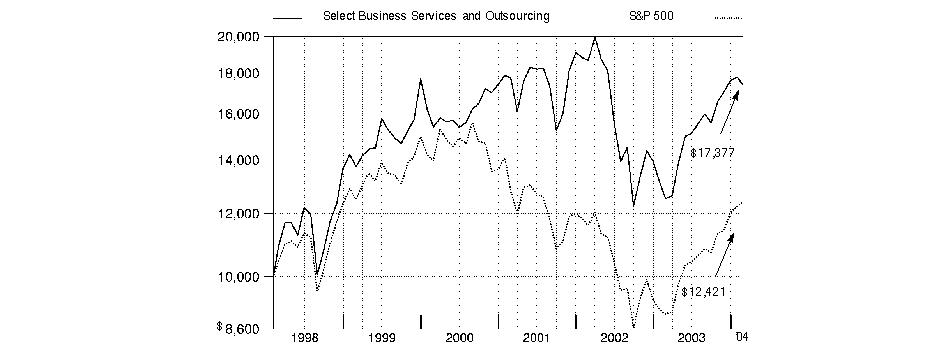

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Select Consumer Industries Portfolio on February 28, 1994. The chart shows how the value of your investment would have grown, and also shows how the S&P 500® Index did over the same period.

Annual Report

Consumer Industries Portfolio

Management's Discussion of Fund Performance

Comments from Joshua Spencer, who became Portfolio Manager of Fidelity® Select Consumer Industries Portfolio on January 12, 2004

From March 2003 through the end of February 2004, domestic stocks recovered dramatically from their prior three-year swoon, driven largely by a broad-based economic and corporate profit recovery. Most major equity benchmarks gained 35% or more during the 12-month period, led by the Russell 2000® Index - a measure of the overall small-cap universe - which advanced 64.41%. As investors grew more confident about the economy's vitality, small-cap stocks were bid up, particularly those with no current earnings. In comparison, the Wilshire 5000® Total Market Index, commonly used as a proxy for the entire U.S. stock market's performance, rose 42.47%. Every sector of the market posted a double-digit advance, with economically sensitive issues - especially technology stocks - leading the way. The tech-heavy NASDAQ Composite® Index returned 52.47% during the past year, despite a negative return in February as investors turned to the more value-oriented segments of the market. The broader Standard & Poor's 500SM Index climbed 38.52% during the year, slightly outperforming the 37.07% increase for the blue-chip Dow Jones Industrial AverageSM.

For the 12-month period that ended on February 29, 2004, Fidelity Select Consumer Industries Portfolio returned 33.82%, lagging the 37.04% return of the Goldman Sachs® Consumer Industries Index as well as that of the S&P 500®. The fund's underperformance versus these indexes was mostly attributable to two factors: first, not owning a large enough position in Altria Group, the parent company of consumer products giant Philip Morris, which performed much better than expected as a result of the favorable resolution of pending tobacco-related lawsuits; and second, holding too large an average cash position, thus missing out on some of the upside of the market's overall rebound during the period. The fund's large positions in such strong-performing stocks as Coca-Cola, Procter & Gamble and Yahoo! all helped absolute performance. Conversely, large positions in media companies Viacom and Fox Entertainment, whose advertising revenues did not meet expectations, held back the fund's overall return, as did our holdings in AutoZone and Wilson's Leather.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

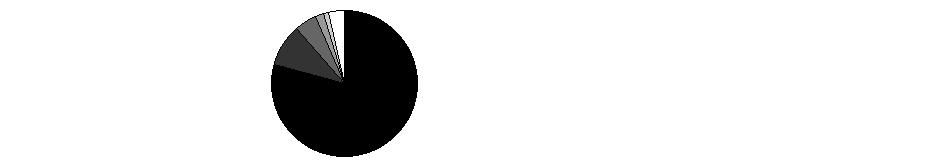

Consumer Industries Portfolio

Investment Summary

Top Ten Stocks as of February 29, 2004 |

| % of fund's

net assets |

Procter & Gamble Co. | 5.3 |

Clear Channel Communications, Inc. | 5.3 |

Univision Communications, Inc. Class A | 3.6 |

Home Depot, Inc. | 3.6 |

McDonald's Corp. | 3.3 |

PepsiCo, Inc. | 3.3 |

Viacom, Inc. Class B (non-vtg.) | 2.8 |

Citadel Broadcasting Corp. | 2.7 |

Yahoo!, Inc. | 2.5 |

Colgate-Palmolive Co. | 2.2 |

| 34.6 |

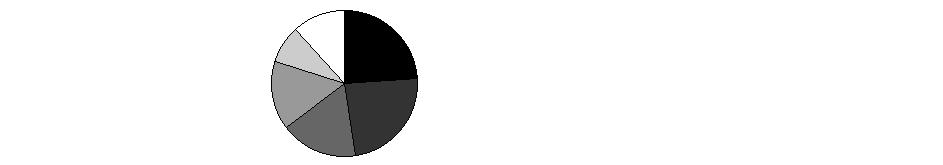

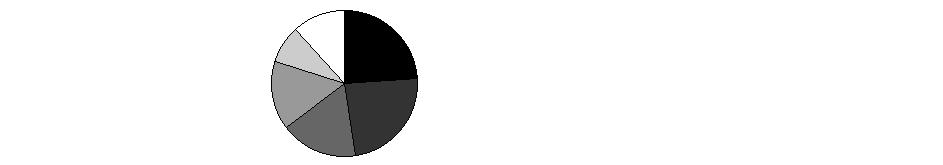

Top Industries as of February 29, 2004 |

% of fund's net assets |

| Media | 31.9% | |

| Hotels, Restaurants & Leisure | 12.0% | |

| Specialty Retail | 8.8% | |

| Household Products | 7.9% | |

| Food Products | 6.1% | |

| All Others* | 33.3% | |

* Includes short-term investments and net other assets. |

Annual Report

Consumer Industries Portfolio

Investments February 29, 2004

Showing Percentage of Net Assets

Common Stocks - 97.0% |

| Shares | | Value (Note 1) |

AUTOMOBILES - 2.7% |

Harley-Davidson, Inc. | 8,300 | | $ 440,896 |

Monaco Coach Corp. (a) | 9,200 | | 262,200 |

Thor Industries, Inc. | 8,300 | | 246,427 |

TOTAL AUTOMOBILES | | 949,523 |

BEVERAGES - 5.7% |

Anheuser-Busch Companies, Inc. | 3,700 | | 196,914 |

PepsiCo, Inc. | 22,600 | | 1,172,940 |

The Coca-Cola Co. | 13,500 | | 674,460 |

TOTAL BEVERAGES | | 2,044,314 |

COMMERCIAL SERVICES & SUPPLIES - 1.9% |

Cendant Corp. | 22,300 | | 506,210 |

Cintas Corp. | 100 | | 4,271 |

Manpower, Inc. | 3,300 | | 147,675 |

TOTAL COMMERCIAL SERVICES & SUPPLIES | | 658,156 |

FOOD & STAPLES RETAILING - 1.2% |

CVS Corp. | 10,400 | | 390,000 |

Sysco Corp. | 100 | | 3,965 |

Whole Foods Market, Inc. | 600 | | 46,410 |

TOTAL FOOD & STAPLES RETAILING | | 440,375 |

FOOD PRODUCTS - 6.1% |

Bunge Ltd. | 4,400 | | 171,820 |

Dean Foods Co. (a) | 9,040 | | 328,242 |

Fresh Del Monte Produce, Inc. | 6,400 | | 162,944 |

Hershey Foods Corp. | 1,900 | | 157,510 |

Kellogg Co. | 8,000 | | 315,920 |

McCormick & Co., Inc. (non-vtg.) | 2,300 | | 71,921 |

Smithfield Foods, Inc. (a) | 14,500 | | 370,910 |

SunOpta, Inc. (a) | 5,200 | | 53,112 |

The J.M. Smucker Co. | 1,400 | | 70,812 |

Unilever NV (NY Shares) | 6,500 | | 472,550 |

TOTAL FOOD PRODUCTS | | 2,175,741 |

HOTELS, RESTAURANTS & LEISURE - 12.0% |

Boyd Gaming Corp. | 100 | | 2,038 |

Brinker International, Inc. (a) | 6,270 | | 235,940 |

Carnival Corp. unit | 11,500 | | 510,255 |

CBRL Group, Inc. | 2,300 | | 87,354 |

McDonald's Corp. | 41,700 | | 1,180,110 |

MGM MIRAGE (a) | 8,200 | | 357,110 |

Outback Steakhouse, Inc. | 8,800 | | 425,832 |

Royal Caribbean Cruises Ltd. | 13,400 | | 592,950 |

Starwood Hotels & Resorts Worldwide, Inc. unit (a) | 8,400 | | 327,684 |

Wendy's International, Inc. | 2,270 | | 92,321 |

|

| Shares | | Value (Note 1) |

Wyndham International, Inc. Class A (a) | 163,900 | | $ 183,568 |

Yum! Brands, Inc. (a) | 7,300 | | 270,319 |

TOTAL HOTELS, RESTAURANTS & LEISURE | | 4,265,481 |

HOUSEHOLD DURABLES - 2.1% |

American Greetings Corp. Class A (a) | 3,700 | | 83,879 |

Newell Rubbermaid, Inc. | 13,200 | | 337,788 |

Pulte Homes, Inc. | 1,200 | | 63,312 |

Toll Brothers, Inc. (a) | 6,300 | | 276,570 |

TOTAL HOUSEHOLD DURABLES | | 761,549 |

HOUSEHOLD PRODUCTS - 7.9% |

Colgate-Palmolive Co. | 14,000 | | 776,300 |

Kimberly-Clark Corp. | 2,300 | | 148,764 |

Procter & Gamble Co. | 18,460 | | 1,892,333 |

TOTAL HOUSEHOLD PRODUCTS | | 2,817,397 |

INTERNET SOFTWARE & SERVICES - 4.3% |

Sina Corp. (a) | 6,700 | | 296,013 |

Sohu.com, Inc. (a) | 13,000 | | 365,300 |

Yahoo!, Inc. (a) | 19,948 | | 885,691 |

TOTAL INTERNET SOFTWARE & SERVICES | | 1,547,004 |

LEISURE EQUIPMENT & PRODUCTS - 2.0% |

Brunswick Corp. | 6,800 | | 267,648 |

MarineMax, Inc. (a) | 4,400 | | 116,908 |

Polaris Industries, Inc. | 3,800 | | 321,822 |

TOTAL LEISURE EQUIPMENT & PRODUCTS | | 706,378 |

MEDIA - 31.9% |

Belo Corp. Series A | 3,100 | | 86,490 |

Cablevision Systems Corp. - NY Group Class A (a) | 4,900 | | 124,852 |

Citadel Broadcasting Corp. | 52,000 | | 972,400 |

Clear Channel Communications, Inc. | 43,338 | | 1,865,268 |

Comcast Corp. Class A (special) (a) | 6,100 | | 178,242 |

Cumulus Media, Inc. Class A (a) | 18,300 | | 364,170 |

Dow Jones & Co., Inc. | 2,900 | | 141,230 |

E.W. Scripps Co. Class A | 1,950 | | 189,852 |

EchoStar Communications Corp.

Class A (a) | 9,800 | | 353,976 |

Emmis Communications Corp.

Class A (a) | 100 | | 2,530 |

Entercom Communications Corp.

Class A (a) | 100 | | 4,616 |

Fox Entertainment Group, Inc. Class A (a) | 12,500 | | 362,750 |

Gannett Co., Inc. | 5,900 | | 508,993 |

JC Decaux SA (a) | 9,900 | | 199,397 |

Journal Communications, Inc. Class A | 200 | | 3,666 |

Lamar Advertising Co. Class A (a) | 5,570 | | 221,129 |

Liberty Media Corp. Class A (a) | 25,600 | | 291,840 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

MEDIA - CONTINUED |

Meredith Corp. | 1,800 | | $ 90,540 |

News Corp. Ltd. sponsored ADR | 7,700 | | 252,021 |

Omnicom Group, Inc. | 4,300 | | 351,740 |

R.H. Donnelley Corp. (a) | 7,100 | | 307,785 |

Radio One, Inc. Class D (non-vtg.) (a) | 16,300 | | 296,986 |

Spanish Broadcasting System, Inc.

Class A (a) | 8,840 | | 99,008 |

Time Warner, Inc. (a) | 18,400 | | 317,400 |

Tribune Co. | 5,100 | | 254,694 |

Univision Communications, Inc.

Class A (a) | 35,900 | | 1,279,117 |

Viacom, Inc.: | | | |

Class A | 12,100 | | 468,996 |

Class B (non-vtg.) | 25,428 | | 977,961 |

Walt Disney Co. | 28,900 | | 766,717 |

TOTAL MEDIA | | 11,334,366 |

MULTILINE RETAIL - 2.7% |

Big Lots, Inc. (a) | 6,400 | | 92,160 |

Dollar General Corp. | 4,600 | | 100,694 |

Family Dollar Stores, Inc. | 5,600 | | 213,024 |

Federated Department Stores, Inc. | 3,400 | | 178,058 |

Nordstrom, Inc. | 6,900 | | 270,066 |

Saks, Inc. (a) | 2,100 | | 36,582 |

Tuesday Morning Corp. (a) | 1,800 | | 59,400 |

TOTAL MULTILINE RETAIL | | 949,984 |

PERSONAL PRODUCTS - 2.5% |

Avon Products, Inc. | 2,700 | | 190,620 |

Estee Lauder Companies, Inc. Class A | 3,300 | | 140,580 |

Gillette Co. | 14,300 | | 550,407 |

TOTAL PERSONAL PRODUCTS | | 881,607 |

SPECIALTY RETAIL - 8.8% |

American Eagle Outfitters, Inc. (a) | 8,000 | | 195,120 |

AnnTaylor Stores Corp. (a) | 2,000 | | 91,600 |

Foot Locker, Inc. | 5,500 | | 144,100 |

Gap, Inc. | 12,800 | | 266,240 |

Home Depot, Inc. | 35,060 | | 1,273,029 |

Hot Topic, Inc. (a) | 150 | | 4,355 |

Limited Brands, Inc. | 5,000 | | 98,750 |

Lowe's Companies, Inc. | 8,800 | | 492,800 |

Office Depot, Inc. (a) | 9,900 | | 172,557 |

PETsMART, Inc. | 3,300 | | 89,562 |

Select Comfort Corp. (a) | 5,900 | | 159,713 |

Staples, Inc. (a) | 1,200 | | 31,464 |

West Marine, Inc. (a) | 4,300 | | 127,925 |

TOTAL SPECIALTY RETAIL | | 3,147,215 |

|

| Shares | | Value (Note 1) |

TEXTILES APPAREL & LUXURY GOODS - 2.5% |

Coach, Inc. (a) | 2,800 | | $ 110,964 |

Kenneth Cole Productions, Inc. Class A | 2,000 | | 67,520 |

Liz Claiborne, Inc. | 5,700 | | 210,330 |

NIKE, Inc. Class B | 3,000 | | 219,750 |

Polo Ralph Lauren Corp. Class A | 2,200 | | 73,854 |

Reebok International Ltd. | 5,100 | | 203,031 |

TOTAL TEXTILES APPAREL & LUXURY GOODS | | 885,449 |

TOBACCO - 2.7% |

Altria Group, Inc. | 8,640 | | 497,232 |

UST, Inc. | 11,800 | | 449,344 |

TOTAL TOBACCO | | 946,576 |

TOTAL COMMON STOCKS (Cost $30,713,085) | 34,511,115 |

Money Market Funds - 2.7% |

| | | |

Fidelity Cash Central Fund, 1.08% (b) | 521,494 | | 521,494 |

Fidelity Securities Lending Cash Central Fund, 1.08% (b) | 436,000 | | 436,000 |

TOTAL MONEY MARKET FUNDS (Cost $957,494) | 957,494 |

TOTAL INVESTMENT PORTFOLIO - 99.7% (Cost $31,670,579) | | 35,468,609 |

NET OTHER ASSETS - 0.3% | | 104,840 |

NET ASSETS - 100% | $ 35,573,449 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

Other Information |

Purchases and sales of securities, other than short-term securities, aggregated $46,594,878 and $40,584,208, respectively. |

The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $3,600 for the period. |

Income Tax Information |

The fund hereby designates approximately $590,000 as a capital gain dividend for the purpose of the dividend paid deduction. |

See accompanying notes which are an integral part of the financial statements.

Consumer Sector

Consumer Industries Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 29, 2004 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $424,960) (cost $31,670,579) - See accompanying schedule | | $ 35,468,609 |

Receivable for investments sold | | 2,318,283 |

Receivable for fund shares sold | | 154,478 |

Dividends receivable | | 28,226 |

Interest receivable | | 544 |

Prepaid expenses | | 152 |

Other affiliated receivables | | 49 |

Other receivables | | 8,109 |

Total assets | | 37,978,450 |

| | |

Liabilities | | |

Payable to custodian bank | $ 17,302 | |

Payable for investments purchased | 1,837,359 | |

Payable for fund shares redeemed | 57,812 | |

Accrued management fee | 16,486 | |

Other affiliated payables | 13,021 | |

Other payables and accrued expenses | 27,021 | |

Collateral on securities loaned, at value | 436,000 | |

Total liabilities | | 2,405,001 |

| | |

Net Assets | | $ 35,573,449 |

Net Assets consist of: | | |

Paid in capital | | $ 30,471,079 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 1,304,340 |

Net unrealized appreciation (depreciation) on investments | | 3,798,030 |

Net Assets, for 1,469,315 shares outstanding | | $ 35,573,449 |

Net Asset Value, offering price and redemption price per share ($35,573,449 ÷ 1,469,315 shares) | | $ 24.21 |

Statement of Operations

| Year ended February 29, 2004 |

| | |

Investment Income | | |

Dividends | | $ 333,136 |

Interest | | 15,561 |

Security lending | | 1,215 |

Total income | | 349,912 |

| | |

Expenses | | |

Management fee | $ 177,247 | |

Transfer agent fees | 181,187 | |

Accounting and security lending fees | 55,512 | |

Non-interested trustees' compensation | 158 | |

Custodian fees and expenses | 11,779 | |

Registration fees | 14,065 | |

Audit | 43,848 | |

Legal | 337 | |

Miscellaneous | 482 | |

Total expenses before reductions | 484,615 | |

Expense reductions | (15,148) | 469,467 |

Net investment income (loss) | | (119,555) |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities | 4,330,503 | |

Foreign currency transactions | (106) | |

Total net realized gain (loss) | | 4,330,397 |

Change in net unrealized appreciation (depreciation) on investment securities | | 4,329,229 |

Net gain (loss) | | 8,659,626 |

Net increase (decrease) in net assets resulting from operations | | $ 8,540,071 |

Other Information | | |

Sales charges paid to FDC | | $ 16,685 |

Deferred sales charges withheld by FDC | | $ 119 |

Exchange fees withheld by

FSC | | $ 810 |

Annual Report

See accompanying notes which are an integral part of the financial statements.

Consumer Industries Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

February 29,

2004 | Year ended

February 28,

2003 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ (119,555) | $ (190,179) |

Net realized gain (loss) | 4,330,397 | (1,560,593) |

Change in net unrealized appreciation (depreciation) | 4,329,229 | (3,859,117) |

Net increase (decrease) in net assets resulting from operations | 8,540,071 | (5,609,889) |

Distributions to shareholders from net realized gain | (589,523) | - |

Share transactions

Net proceeds from sales of shares | 20,824,895 | 16,098,427 |

Reinvestment of distributions | 577,945 | - |

Cost of shares redeemed | (14,480,206) | (13,278,482) |

Net increase (decrease) in net assets resulting from share transactions | 6,922,634 | 2,819,945 |

Redemption fees | 7,160 | 12,450 |

Total increase (decrease) in net assets | 14,880,342 | (2,777,494) |

| | |

Net Assets | | |

Beginning of period | 20,693,107 | 23,470,601 |

End of period | $ 35,573,449 | $ 20,693,107 |

Other Information Shares | | |

Sold | 964,806 | 752,061 |

Issued in reinvestment of distributions | 25,128 | - |

Redeemed | (645,822) | (622,216) |

Net increase (decrease) | 344,112 | 129,845 |

Financial Highlights

Years ended February 28, | 2004 F | 2003 | 2002 | 2001 | 2000 F |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 18.39 | $ 23.58 | $ 25.31 | $ 28.46 | $ 31.81 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | (.09) | (.18) | (.07) | (.11) | .02 D |

Net realized and unrealized gain (loss) | 6.28 | (5.02) | (.25) | .68 | (1.29) |

Total from investment operations | 6.19 | (5.20) | (.32) | .57 | (1.27) |

Distributions from net investment income | - | - | - | - | (.02) |

Distributions from net realized gain | (.38) | - | (1.42) | (3.80) | (2.08) |

Total distributions | (.38) | - | (1.42) | (3.80) | (2.10) |

Redemption fees added to paid in capital C | .01 | .01 | .01 | .08 | .02 |

Net asset value, end of period | $ 24.21 | $ 18.39 | $ 23.58 | $ 25.31 | $ 28.46 |

Total Return A,B | 33.82% | (22.01)% | (.87)% | 2.74% | (4.55)% |

Ratios to Average Net Assets E | | | | | |

Expenses before expense reductions | 1.59% | 1.86% | 1.71% | 1.80% | 1.27% |

Expenses net of voluntary waivers, if any | 1.59% | 1.86% | 1.71% | 1.80% | 1.27% |

Expenses net of all reductions | 1.54% | 1.83% | 1.69% | 1.78% | 1.25% |

Net investment income (loss) | (.39)% | (.84)% | (.30)% | (.37)% | .06% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 35,573 | $ 20,693 | $ 23,471 | $ 20,483 | $ 63,331 |

Portfolio turnover rate | 138% | 116% | 110% | 92% | 96% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown. B Total returns do not include the effect of the former sales charges. C Calculated based on average shares outstanding during the period. D Investment income per share reflects a special dividend which amounted to $.04 per share. E Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund. F For the year ended February 29. |

See accompanying notes which are an integral part of the financial statements.

Consumer Sector

Food and Agriculture Portfolio

Performance

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity a fund's total returns will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 29, 2004 | Past 1

year | Past 5

years | Past 10

years |

Select Food and Agriculture | 30.94% | 4.00% | 10.83% |

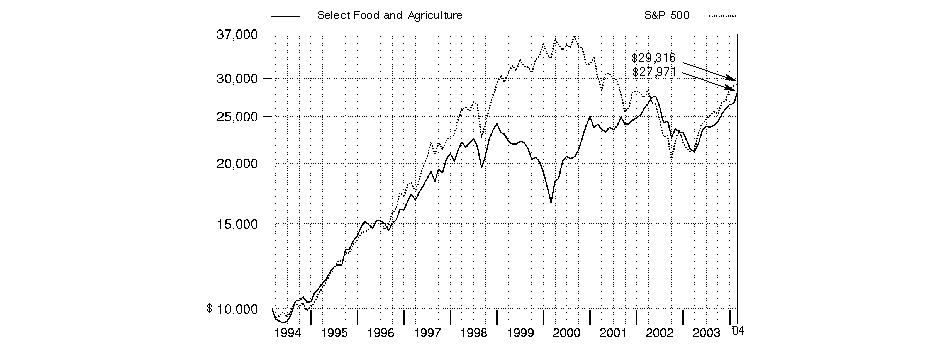

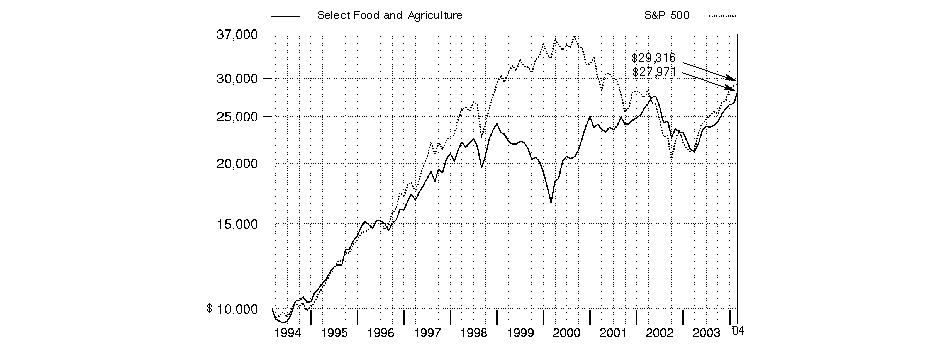

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Select Food and Agriculture Portfolio on February 28, 1994. The chart shows how the value of your investment would have grown, and also shows how the S&P 500 Index did over the same period.

Annual Report

Food and Agriculture Portfolio

Management's Discussion of Fund Performance

Comments from Valerie Friedholm, Portfolio Manager of Fidelity® Select Food and Agriculture Portfolio

From March 2003 through the end of February 2004, domestic stocks recovered dramatically from their prior three-year swoon, driven largely by a broad-based economic and corporate profit recovery. Most major equity benchmarks gained 35% or more during the 12-month period, led by the Russell 2000® Index - a measure of the overall small-cap universe - which advanced 64.41%. As investors grew more confident about the economy's vitality, small-cap stocks were bid up, particularly those with no current earnings. In comparison, the Wilshire 5000® Total Market Index, commonly used as a proxy for the entire U.S. stock market's performance, rose 42.47%. Every sector of the market posted a double-digit advance, with economically sensitive issues - especially technology stocks - leading the way. The tech-heavy NASDAQ Composite® Index returned 52.47% during the past year, despite a negative return in February as investors turned to the more value-oriented segments of the market. The broader Standard & Poor's 500SM Index climbed 38.52% during the year, slightly outperforming the 37.07% increase for the blue-chip Dow Jones Industrial AverageSM.

For the year ending February 29, 2004, the fund rose 30.94%, lagging the Goldman Sachs® Consumer Industries Index, which returned 37.04%, and the S&P 500®. While food stocks moved higher during the period, they failed to keep pace with the broader market and other consumer industries that tend to benefit more from cyclical upturns in the economy. I continued to favor leading companies with strong brands focused on fast-growing niche areas rather than the more diversified players, which I felt had less potential in an expanding economy. While this strategy worked reasonably well, our holdings still struggled relative to the sector benchmark. We lost the most ground in packaged foods, where several names, such as Wrigley and dairy giant Dean Foods, underperformed despite their strong and improving fundamentals. We also owned some companies whose businesses struggled, specifically General Mills, Kraft and Sara Lee. Elsewhere, the Atkins diet craze hurt same-store sales trends at Weight Watchers, which was the fund's biggest detractor. On the plus side, the fund was rewarded for heavily overweighting some of the more cyclical groups in its universe - namely restaurants and food distributors - that soundly outpaced the index. Within restaurants, performance was helped by a focus on casual-dining stocks - including McDonald's and Yum! Brands - that thrived amid a more favorable competitive environment. Coffee retailer Starbucks also boosted returns in this space, while Sysco led the way among food distributors.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Food and Agriculture Portfolio

Investment Summary

Top Ten Stocks as of February 29, 2004 |

| % of fund's

net assets |

McDonald's Corp. | 6.2 |

Anheuser-Busch Companies, Inc. | 5.1 |

Sysco Corp. | 4.8 |

Kraft Foods, Inc. Class A | 4.2 |

Procter & Gamble Co. | 4.1 |

PepsiCo, Inc. | 3.9 |

Kellogg Co. | 3.6 |

McCormick & Co., Inc. (non-vtg.) | 3.0 |

Hershey Foods Corp. | 3.0 |

Starbucks Corp. | 2.6 |

| 40.5 |

Top Industries as of February 29, 2004 |

% of fund's net assets |

| Food Products | 29.4% | |

| Hotels, Restaurants & Leisure | 22.2% | |

| Beverages | 13.2% | |

| Food & Staples Retailing | 9.3% | |

| Household Products | 6.7% | |

| All Others* | 19.2% | |

* Includes short-term investments and net other assets. |

Annual Report

Food and Agriculture Portfolio

Investments February 29, 2004

Showing Percentage of Net Assets

Common Stocks - 90.9% |

| Shares | | Value (Note 1) |

BEVERAGES - 13.2% |

Adolph Coors Co. Class B | 5,000 | | $ 338,900 |

Anheuser-Busch Companies, Inc. | 99,000 | | 5,268,780 |

Coca-Cola Enterprises, Inc. | 32,000 | | 745,920 |

Constellation Brands, Inc. Class A (a) | 7,600 | | 240,920 |

Pepsi Bottling Group, Inc. | 29,500 | | 853,435 |

PepsiAmericas, Inc. | 18,900 | | 362,502 |

PepsiCo, Inc. | 78,100 | | 4,053,390 |

The Coca-Cola Co. | 37,600 | | 1,878,496 |

TOTAL BEVERAGES | | 13,742,343 |

CHEMICALS - 0.8% |

Monsanto Co. | 5,600 | | 185,024 |

Sensient Technologies Corp. | 3,900 | | 77,025 |

The Scotts Co. Class A (a) | 9,500 | | 598,975 |

TOTAL CHEMICALS | | 861,024 |

COMMERCIAL SERVICES & SUPPLIES - 1.3% |

Aramark Corp. Class B | 36,000 | | 988,200 |

Cintas Corp. | 9,300 | | 397,203 |

TOTAL COMMERCIAL SERVICES & SUPPLIES | | 1,385,403 |

FOOD & STAPLES RETAILING - 9.3% |

Kroger Co. (a) | 35,700 | | 686,154 |

Performance Food Group Co. (a) | 6,300 | | 220,500 |

Safeway, Inc. (a) | 84,000 | | 1,921,080 |

Sysco Corp. | 127,600 | | 5,059,340 |

United Natural Foods, Inc. (a) | 12,600 | | 581,490 |

Whole Foods Market, Inc. | 15,800 | | 1,222,130 |

Winn-Dixie Stores, Inc. | 5,000 | | 30,600 |

TOTAL FOOD & STAPLES RETAILING | | 9,721,294 |

FOOD PRODUCTS - 29.4% |

American Italian Pasta Co. Class A | 500 | | 20,350 |

Archer-Daniels-Midland Co. | 34,000 | | 584,800 |

Bunge Ltd. | 12,500 | | 488,125 |

Campbell Soup Co. | 7,200 | | 201,312 |

ConAgra Foods, Inc. | 35,400 | | 962,526 |

Corn Products International, Inc. | 2,600 | | 98,540 |

Dean Foods Co. (a) | 71,250 | | 2,587,088 |

Delta & Pine Land Co. | 400 | | 10,200 |

Dreyer's Grand Ice Cream Holdings, Inc. | 7,500 | | 588,225 |

Fresh Del Monte Produce, Inc. | 34,200 | | 870,732 |

H.J. Heinz Co. | 32,400 | | 1,238,004 |

Hershey Foods Corp. | 37,300 | | 3,092,170 |

Hormel Foods Corp. | 26,600 | | 737,352 |

Interstate Bakeries Corp. | 600 | | 9,000 |

Kellogg Co. | 95,000 | | 3,751,550 |

Kraft Foods, Inc. Class A | 129,700 | | 4,382,563 |

|

| Shares | | Value (Note 1) |

McCormick & Co., Inc. (non-vtg.) | 101,400 | | $ 3,170,778 |

Nestle SA ADR | 23,300 | | 1,549,450 |

Sanderson Farms, Inc. | 2,400 | | 85,080 |

Sara Lee Corp. | 500 | | 10,910 |

Smithfield Foods, Inc. (a) | 23,800 | | 608,804 |

SunOpta, Inc. (a) | 3,900 | | 39,834 |

The J.M. Smucker Co. | 19,200 | | 971,136 |

Tootsie Roll Industries, Inc. | 5,092 | | 189,677 |

Unilever NV (NY Shares) | 31,000 | | 2,253,700 |

Wm. Wrigley Jr. Co. | 38,400 | | 2,159,616 |

TOTAL FOOD PRODUCTS | | 30,661,522 |

HOTELS, RESTAURANTS & LEISURE - 22.2% |

Applebee's International, Inc. | 15,950 | | 652,515 |

Bob Evans Farms, Inc. | 3,300 | | 111,639 |

Brinker International, Inc. (a) | 29,600 | | 1,113,848 |

Buffalo Wild Wings, Inc. | 37,400 | | 935,000 |

California Pizza Kitchen, Inc. (a) | 18,500 | | 339,475 |

CBRL Group, Inc. | 8,800 | | 334,224 |

Darden Restaurants, Inc. | 46,800 | | 1,141,920 |

Jack in the Box, Inc. (a) | 2,663 | | 66,229 |

Krispy Kreme Doughnuts, Inc. (a) | 5,386 | | 207,146 |

McDonald's Corp. | 230,000 | | 6,508,998 |

Outback Steakhouse, Inc. | 36,700 | | 1,775,913 |

P.F. Chang's China Bistro, Inc. (a) | 68 | | 3,310 |

Red Robin Gourmet Burgers, Inc. (a) | 55,700 | | 1,723,915 |

Ruby Tuesday, Inc. | 14,800 | | 468,864 |

Sonic Corp. (a) | 12,400 | | 420,484 |

Starbucks Corp. (a) | 72,900 | | 2,727,189 |

The Cheesecake Factory, Inc. (a) | 13,500 | | 637,605 |

Volume Services America Holdings, Inc. Income Deposit Security | 12,930 | | 223,689 |

Wendy's International, Inc. | 32,400 | | 1,317,708 |

Yum! Brands, Inc. (a) | 67,000 | | 2,481,010 |

TOTAL HOTELS, RESTAURANTS & LEISURE | | 23,190,681 |

HOUSEHOLD DURABLES - 0.3% |

Jarden Corp. (a) | 9,000 | | 319,500 |

HOUSEHOLD PRODUCTS - 6.7% |

Colgate-Palmolive Co. | 48,600 | | 2,694,870 |

Procter & Gamble Co. | 41,900 | | 4,295,169 |

TOTAL HOUSEHOLD PRODUCTS | | 6,990,039 |

PERSONAL PRODUCTS - 1.8% |

Alberto-Culver Co. | 45,450 | | 1,867,086 |

SPECIALTY RETAIL - 1.6% |

Select Comfort Corp. (a) | 24,100 | | 652,387 |

Weight Watchers International, Inc. (a) | 27,100 | | 1,016,792 |

TOTAL SPECIALTY RETAIL | | 1,669,179 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

TOBACCO - 4.3% |

Altria Group, Inc. | 43,700 | | $ 2,514,935 |

RJ Reynolds Tobacco Holdings, Inc. | 13,200 | | 814,836 |

Universal Corp. | 6,500 | | 327,730 |

UST, Inc. | 22,700 | | 864,416 |

TOTAL TOBACCO | | 4,521,917 |

TOTAL COMMON STOCKS (Cost $74,114,918) | 94,929,988 |

Money Market Funds - 17.9% |

Fidelity Cash Central Fund, 1.08% (b) | 8,991,461 | | 8,991,461 |

Fidelity Securities Lending Cash Central Fund, 1.08% (b) | 9,752,625 | | 9,752,625 |

TOTAL MONEY MARKET FUNDS (Cost $18,744,086) | 18,744,086 |

TOTAL INVESTMENT PORTFOLIO - 108.8% (Cost $92,859,004) | 113,674,074 |

NET OTHER ASSETS - (8.8)% | (9,237,720) |

NET ASSETS - 100% | $ 104,436,354 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

Other Information |

Purchases and sales of securities, other than short-term securities, aggregated $54,455,428 and $66,542,854, respectively. |

The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $4,465 for the period. |

Income Tax Information |

At February 29, 2004, the fund had a capital loss carryforward of approximately $7,186,000 of which $4,117,000 and $3,069,000 will expire on February 28, 2011 and February 29, 2012, respectively. |

See accompanying notes which are an integral part of the financial statements.

Consumer Sector

Food and Agriculture Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 29, 2004 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $9,607,772) (cost $92,859,004) - See accompanying schedule | | $ 113,674,074 |

Receivable for investments sold | | 7,227 |

Receivable for fund shares sold | | 738,951 |

Dividends receivable | | 79,425 |

Interest receivable | | 4,440 |

Prepaid expenses | | 441 |

Other affiliated receivables | | 76 |

Other receivables | | 5,758 |

Total assets | | 114,510,392 |

| | |

Liabilities | | |

Payable for investments purchased | $ 146,906 | |

Payable for fund shares redeemed | 67,656 | |

Accrued management fee | 46,759 | |

Other affiliated payables | 33,621 | |

Other payables and accrued expenses | 26,471 | |

Collateral on securities loaned, at value | 9,752,625 | |

Total liabilities | | 10,074,038 |

| | |

Net Assets | | $ 104,436,354 |

Net Assets consist of: | | |

Paid in capital | | $ 91,640,805 |

Accumulated undistributed net realized gain (loss) on investments | | (8,019,913) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 20,815,462 |

Net Assets, for 2,245,982 shares outstanding | | $ 104,436,354 |

Net Asset Value, offering price and redemption price per share ($104,436,354 ÷ 2,245,982 shares) | | $ 46.50 |

Statement of Operations

| Year ended February 29, 2004 |

| | |

Investment Income | | |

Dividends | | $ 1,594,365 |

Interest | | 34,932 |

Security lending | | 10,212 |

Total income | | 1,639,509 |

| | |

Expenses | | |

Management fee | $ 528,881 | |

Transfer agent fees | 491,546 | |

Accounting and security lending fees | 59,048 | |

Non-interested trustees' compensation | 480 | |

Custodian fees and expenses | 8,583 | |

Registration fees | 19,825 | |

Audit | 44,126 | |

Legal | 442 | |

Miscellaneous | 2,941 | |

Total expenses before reductions | 1,155,872 | |

Expense reductions | (20,419) | 1,135,453 |

Net investment income (loss) | | 504,056 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on investment securities | | 1,532,340 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 22,626,863 | |

Assets and liabilities in foreign currencies | 178 | |

Total change in net unrealized appreciation (depreciation) | | 22,627,041 |

Net gain (loss) | | 24,159,381 |

Net increase (decrease) in net assets resulting from operations | | $ 24,663,437 |

Other Information | | |

Sales charges paid to FDC | | $ 21,209 |

Deferred sales charges withheld by FDC | | $ 2,871 |

Exchange fees withheld by

FSC | | $ 2,100 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Food and Agriculture Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

February 29, 2004 | Year ended

February 28, 2003 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 504,056 | $ 676,621 |

Net realized gain (loss) | 1,532,340 | (7,877,487) |

Change in net unrealized appreciation (depreciation) | 22,627,041 | (16,044,426) |

Net increase (decrease) in net assets resulting from operations | 24,663,437 | (23,245,292) |

Distributions to shareholders from net investment income | (521,536) | (816,384) |

Distributions to shareholders from net realized gain | - | (2,364,916) |

Total distributions | (521,536) | (3,181,300) |

Share transactions

Net proceeds from sales of shares | 24,022,618 | 74,577,088 |

Reinvestment of distributions | 489,419 | 3,008,704 |

Cost of shares redeemed | (32,354,647) | (83,113,282) |

Net increase (decrease) in net assets resulting from share transactions | (7,842,610) | (5,527,490) |

Redemption fees | 13,977 | 97,097 |

Total increase (decrease) in net assets | 16,313,268 | (31,856,985) |

Net Assets | | |

Beginning of period | 88,123,086 | 119,980,071 |

End of period (including undistributed net investment income of $0 and $44,341, respectively) | $ 104,436,354 | $ 88,123,086 |

Other Information Shares | | |

Sold | 567,727 | 1,721,821 |

Issued in reinvestment of distributions | 11,371 | 69,302 |

Redeemed | (800,611) | (2,009,194) |

Net increase (decrease) | (221,513) | (218,071) |

Financial Highlights

Years ended February 28, | 2004 F | 2003 | 2002 | 2001 | 2000 F |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 35.71 | $ 44.68 | $ 46.01 | $ 31.88 | $ 46.92 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .22 | .25 | .34 | .44 | .42D |

Net realized and unrealized gain (loss) | 10.80 | (8.06) | 2.79 | 13.96 | (13.07) |

Total from investment operations | 11.02 | (7.81) | 3.13 | 14.40 | (12.65) |

Distributions from net investment income | (.24) | (.32) | (.21) | (.36) | (.42) |

Distributions from net realized gain | - | (.88) | (4.28) | - | (1.79) |

Distributions in excess of net realized gain | - | - | - | - | (.21) |

Total distributions | (.24) | (1.20) | (4.49) | (.36) | (2.42) |

Redemption fees added to paid in capitalC | .01 | .04 | .03 | .09 | .03 |

Net asset value, end of period | $ 46.50 | $ 35.71 | $ 44.68 | $ 46.01 | $ 31.88 |

Total ReturnA,B | 30.94% | (17.85)% | 7.76% | 45.47% | (27.86)% |

Ratios to Average Net AssetsE | | | | | |

Expenses before expense reductions | 1.27% | 1.25% | 1.24% | 1.28% | 1.31% |

Expenses net of voluntary waivers, if any | 1.27% | 1.25% | 1.24% | 1.28% | 1.31% |

Expenses net of all reductions | 1.25% | 1.17% | 1.14% | 1.24% | 1.29% |

Net investment income (loss) | .55% | .59% | .79% | 1.07% | 1.00% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 104,436 | $ 88,123 | $ 119,980 | $ 119,769 | $ 78,288 |

Portfolio turnover rate | 62% | 225% | 315% | 151% | 38% |

ATotal returns would have been lower had certain expenses not been reduced during the periods shown. BTotal returns do not include the effect of the former sales charges. CCalculated based on average shares outstanding during the period. DInvestment income per share reflects a special dividend which amounted to $.28 per share. EExpense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund FFor the year ended February 29.

See accompanying notes which are an integral part of the financial statements.

Consumer Sector

Leisure Portfolio

Performance

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity a fund's total returns will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 29, 2004 | Past 1

year | Past 5

years | Past 10

years |

Select Leisure | 53.09% | 2.39% | 12.23% |

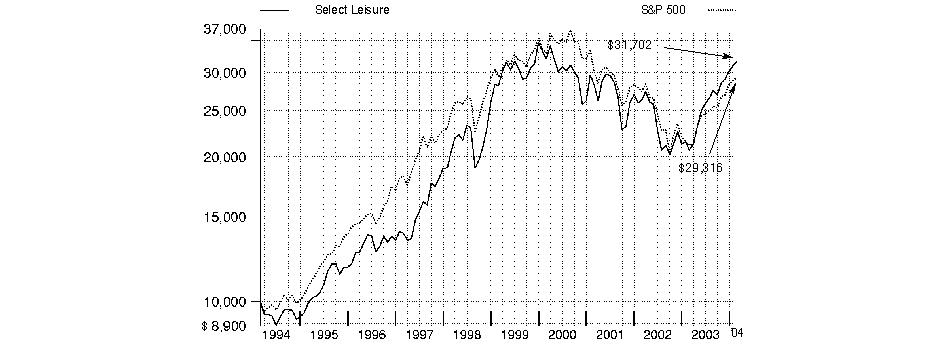

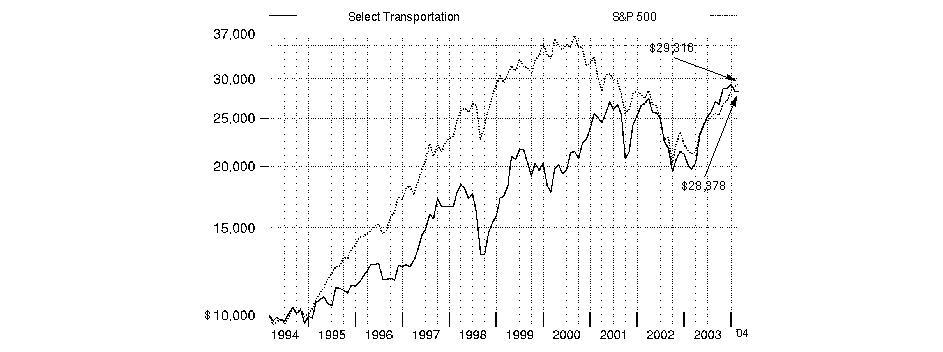

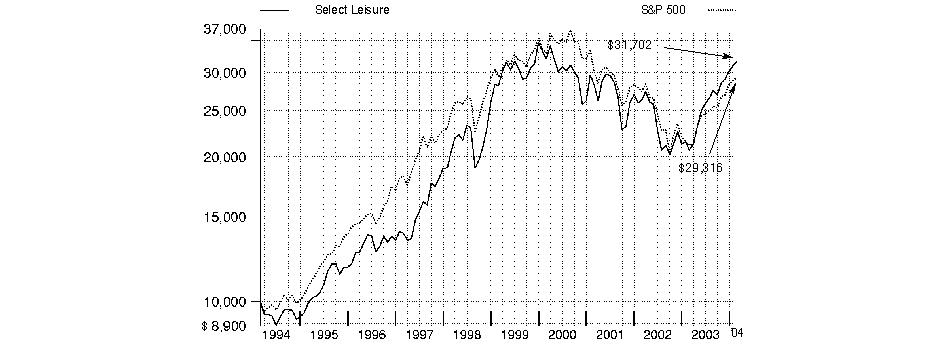

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Select Leisure Portfolio on February 28, 1994. The chart shows how the value of your investment would have grown, and also shows how the S&P 500 Index did over the same period.

Annual Report

Leisure Portfolio

Management's Discussion of Fund Performance

Comments from Joshua Spencer, Portfolio Manager of Fidelity® Select Leisure Portfolio

From March 2003 through the end of February 2004, domestic stocks recovered dramatically from their prior three-year swoon, driven largely by a broad-based economic and corporate profit recovery. Most major equity benchmarks gained 35% or more during the 12-month period, led by the Russell 2000® Index - a measure of the overall small-cap universe - which advanced 64.41%. As investors grew more confident about the economy's vitality, small-cap stocks were bid up, particularly those with no current earnings. In comparison, the Wilshire 5000® Total Market Index, commonly used as a proxy for the entire U.S. stock market's performance, rose 42.47%. Every sector of the market posted a double-digit advance, with economically sensitive issues - especially technology stocks - leading the way. The tech-heavy NASDAQ Composite® Index returned 52.47% during the past year, despite a negative return in February as investors turned to the more value-oriented segments of the market. The broader Standard & Poor's 500SM Index climbed 38.52% during the year, slightly outperforming the 37.07% increase for the blue-chip Dow Jones Industrial AverageSM.

For the 12-month period that ended on February 29, 2004, the fund posted a total return of 53.09%, outperforming both the Goldman Sachs® Consumer Industries Index, which returned 37.04%, and the S&P 500®. This strong performance - both in absolute terms and relative to the indexes - came as a result of a secular rebound from the chilling effects of the September 11 terrorist attacks. As leisure activities began to pick up pace, several companies in the casino and gaming, resort, air and cruise lines, and hotel and restaurant industries saw their earnings and profits begin to soar. Favorable stock picking - particularly in such names as JetBlue, McDonald's and video game maker Electronic Arts - also helped the fund outperform. Stocks that detracted from overall performance included InterActiveCorp, the Internet travel company, whose generally high stock valuation suffered as a result of competition from other online travel concerns. Media companies Viacom and Fox Entertainment also saw their stock prices fall, due to weaker-than-expected growth in corporate advertising revenues. I sold JetBlue and Electronic Arts prior to the end of the period.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Leisure Portfolio

Investment Summary

Top Ten Stocks as of February 29, 2004 |

| % of fund's

net assets |

McDonald's Corp. | 5.9 |

Yahoo!, Inc. | 5.6 |

Viacom, Inc. Class B (non-vtg.) | 5.0 |

Liberty Media Corp. Class A | 4.1 |

Clear Channel Communications, Inc. | 3.7 |

Carnival Corp. unit | 3.6 |

News Corp. Ltd. ADR | 3.5 |

Harley-Davidson, Inc. | 3.5 |

Cendant Corp. | 3.3 |

EchoStar Communications Corp. Class A | 3.2 |

| 41.4 |

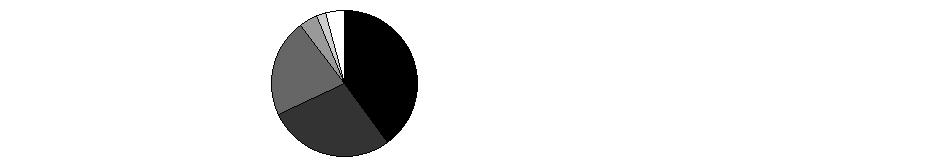

Top Industries as of February 29, 2004 |

% of fund's net assets |

| Media | 39.7% | |

| Hotels, Restaurants & Leisure | 34.3% | |

| Internet Software & Services | 7.9% | |

| Automobiles | 5.4% | |

| Leisure Equipment & Products | 4.6% | |

| All Others* | 8.1% | |

* Includes short-term investments and net other assets. |

Annual Report

Leisure Portfolio

Investments February 29, 2004

Showing Percentage of Net Assets

Common Stocks - 99.2% |

| Shares | | Value (Note 1) |

AUTOMOBILES - 5.4% |

Harley-Davidson, Inc. | 134,600 | | $ 7,149,952 |

Monaco Coach Corp. (a) | 71,500 | | 2,037,750 |

Thor Industries, Inc. | 65,000 | | 1,929,850 |

TOTAL AUTOMOBILES | | 11,117,552 |

COMMERCIAL SERVICES & SUPPLIES - 3.3% |

Cendant Corp. | 296,600 | | 6,732,820 |

COMMUNICATIONS EQUIPMENT - 0.5% |

Scientific-Atlanta, Inc. | 27,400 | | 906,940 |

HOTELS, RESTAURANTS & LEISURE - 34.3% |

Brinker International, Inc. (a) | 137,400 | | 5,170,362 |

Buffalo Wild Wings, Inc. | 6,100 | | 152,500 |

Carnival Corp. unit | 165,400 | | 7,338,798 |

GTECH Holdings Corp. | 24,500 | | 1,438,885 |

Harrah's Entertainment, Inc. | 12,400 | | 644,180 |

Hilton Hotels Corp. | 180,900 | | 2,899,827 |

International Game Technology | 51,100 | | 2,005,164 |

Kerzner International Ltd. (a) | 54,200 | | 2,086,700 |

Krispy Kreme Doughnuts, Inc. (a) | 43,200 | | 1,661,472 |

Mandalay Resort Group | 71,700 | | 3,685,380 |

Marriott International, Inc. Class A | 45,300 | | 2,021,739 |

McDonald's Corp. | 425,900 | | 12,052,971 |

MGM MIRAGE (a) | 50,000 | | 2,177,500 |

Outback Steakhouse, Inc. | 70,800 | | 3,426,012 |

Penn National Gaming, Inc. (a) | 33,600 | | 882,336 |

Royal Caribbean Cruises Ltd. | 137,500 | | 6,084,375 |

Six Flags, Inc. (a) | 213,500 | | 1,582,035 |

Sonic Corp. (a) | 37,500 | | 1,271,625 |

Starwood Hotels & Resorts Worldwide, Inc. unit (a) | 79,100 | | 3,085,691 |

Station Casinos, Inc. | 28,300 | | 1,064,080 |

Wendy's International, Inc. | 130,300 | | 5,299,301 |

Wyndham International, Inc. Class A (a) | 846,500 | | 948,080 |

Yum! Brands, Inc. (a) | 86,300 | | 3,195,689 |

TOTAL HOTELS, RESTAURANTS & LEISURE | | 70,174,702 |

HOUSEHOLD DURABLES - 0.9% |

Toll Brothers, Inc. (a) | 43,000 | | 1,887,700 |

INTERNET & CATALOG RETAIL - 0.7% |

Amazon.com, Inc. (a) | 17,400 | | 750,810 |

Overstock.com, Inc. (a) | 22,500 | | 659,250 |

TOTAL INTERNET & CATALOG RETAIL | | 1,410,060 |

|

| Shares | | Value (Note 1) |

INTERNET SOFTWARE & SERVICES - 7.9% |

Netease.com, Inc. sponsored ADR (a) | 12,500 | | $ 662,875 |

Sina Corp. (a) | 41,400 | | 1,829,093 |

Sohu.com, Inc. (a) | 76,300 | | 2,144,030 |

Yahoo!, Inc. (a) | 258,252 | | 11,466,389 |

TOTAL INTERNET SOFTWARE & SERVICES | | 16,102,387 |

LEISURE EQUIPMENT & PRODUCTS - 4.6% |

Brunswick Corp. | 138,600 | | 5,455,296 |

MarineMax, Inc. (a) | 22,300 | | 592,511 |

Polaris Industries, Inc. | 38,500 | | 3,260,565 |

TOTAL LEISURE EQUIPMENT & PRODUCTS | | 9,308,372 |

MEDIA - 39.7% |

Belo Corp. Series A | 16,000 | | 446,400 |

Cablevision Systems Corp. - NY Group Class A (a) | 114,100 | | 2,907,268 |

Citadel Broadcasting Corp. | 107,000 | | 2,000,900 |

Clear Channel Communications, Inc. | 177,241 | | 7,628,453 |

Cumulus Media, Inc. Class A (a) | 98,700 | | 1,964,130 |

E.W. Scripps Co. Class A | 12,500 | | 1,217,000 |

EchoStar Communications Corp. Class A (a) | 182,100 | | 6,577,452 |

Fox Entertainment Group, Inc. Class A (a) | 187,800 | | 5,449,956 |

Gannett Co., Inc. | 70,700 | | 6,099,289 |

Hughes Electronics Corp. (a) | 1,201 | | 20,825 |

Lamar Advertising Co. Class A (a) | 2,500 | | 99,250 |

Liberty Media Corp. Class A (a) | 734,068 | | 8,368,375 |

News Corp. Ltd.: | | | |

ADR | 191,400 | | 7,167,930 |

sponsored ADR | 27,448 | | 898,373 |

Omnicom Group, Inc. | 66,100 | | 5,406,980 |

Radio One, Inc. Class D (non-vtg.) (a) | 109,900 | | 2,002,378 |

Tribune Co. | 104,800 | | 5,233,712 |

Univision Communications, Inc. Class A (a) | 141,300 | | 5,034,519 |

Viacom, Inc. Class B (non-vtg.) | 268,196 | | 10,314,818 |

Washington Post Co. Class B | 1,500 | | 1,343,550 |

Westwood One, Inc. (a) | 32,900 | | 1,016,610 |

TOTAL MEDIA | | 81,198,168 |

SPECIALTY RETAIL - 1.9% |

Foot Locker, Inc. | 145,200 | | 3,804,240 |

Steiner Leisure Ltd. (a) | 100 | | 1,810 |

TOTAL SPECIALTY RETAIL | | 3,806,050 |

TOTAL COMMON STOCKS (Cost $175,753,748) | 202,644,751 |

Money Market Funds - 9.3% |

| Shares | | Value (Note 1) |

Fidelity Cash Central Fund,

1.08% (b) | 3,271,966 | | $ 3,271,966 |

Fidelity Securities Lending Cash

Central Fund, 1.08% (b) | 15,834,175 | | 15,834,175 |

TOTAL MONEY MARKET FUNDS (Cost $19,106,141) | 19,106,141 |

TOTAL INVESTMENT PORTFOLIO - 108.5% (Cost $194,859,889) | 221,750,892 |

NET OTHER ASSETS - (8.5)% | (17,397,372) |

NET ASSETS - 100% | $ 204,353,520 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

Other Information |

Purchases and sales of securities, other than short-term securities, aggregated $272,008,858 and $246,984,452, respectively. |

The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $18,043 for the period. |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: |

United States of America | 87.3% |

Australia | 3.9% |

Panama | 3.6% |

Liberia | 3.0% |

Bahamas (Nassau) | 1.0% |

Others (individually less than 1%) | 1.2% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Consumer Sector

Leisure Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 29, 2004 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $15,526,049) (cost $194,859,889) - See accompanying schedule | | $ 221,750,892 |

Receivable for investments sold | | 3,818,905 |

Receivable for fund shares sold | | 277,200 |

Dividends receivable | | 107,874 |

Interest receivable | | 2,845 |

Prepaid expenses | | 801 |

Other affiliated receivables | | 534 |

Other receivables | | 52,236 |

Total assets | | 226,011,287 |

| | |

Liabilities | | |

Payable for investments purchased | $ 5,342,949 | |

Payable for fund shares redeemed | 293,189 | |

Accrued management fee | 96,795 | |

Other affiliated payables | 63,643 | |

Other payables and accrued expenses | 27,016 | |

Collateral on securities loaned, at value | 15,834,175 | |

Total liabilities | | 21,657,767 |

| | |

Net Assets | | $ 204,353,520 |

Net Assets consist of: | | |

Paid in capital | | $ 168,930,801 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 8,531,716 |

Net unrealized appreciation (depreciation) on investments | | 26,891,003 |

Net Assets, for 2,746,551 shares outstanding | | $ 204,353,520 |

Net Asset Value, offering price and redemption price per share ($204,353,520 ÷ 2,746,551 shares) | | $ 74.40 |

Statement of Operations

| Year ended February 29, 2004 |

| | |

Investment Income | | |

Dividends | | $ 966,374 |

Interest | | 140,996 |

Security lending | | 57,356 |

Total income | | 1,164,726 |

| | |

Expenses | | |

Management fee | $ 946,814 | |

Transfer agent fees | 749,615 | |

Accounting and security lending fees | 104,599 | |

Non-interested trustees' compensation | 828 | |

Custodian fees and expenses | 11,565 | |

Registration fees | 18,068 | |

Audit | 44,411 | |

Legal | 762 | |

Miscellaneous | 3,404 | |

Total expenses before reductions | 1,880,066 | |

Expense reductions | (100,824) | 1,779,242 |

Net investment income (loss) | | (614,516) |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities | 41,415,857 | |

Foreign currency transactions | 1,666 | |

Total net realized gain (loss) | | 41,417,523 |

Change in net unrealized appreciation (depreciation) on investment securities | | 24,508,475 |

Net gain (loss) | | 65,925,998 |

Net increase (decrease) in net assets resulting from operations | | $ 65,311,482 |

Other Information | | |

Sales charges paid to FDC | | $ 94,557 |

Deferred sales charges withheld by FDC | | $ 9,187 |

Exchange fees withheld by

FSC | | $ 3,015 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Leisure Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

February 29, 2004 | Year ended

February 28, 2003 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ (614,516) | $ (876,053) |

Net realized gain (loss) | 41,417,523 | (8,789,717) |

Change in net unrealized appreciation (depreciation) | 24,508,475 | (24,755,586) |

Net increase (decrease) in net assets resulting from operations | 65,311,482 | (34,421,356) |

Share transactions

Net proceeds from sales of shares | 79,019,245 | 35,521,313 |

Cost of shares redeemed | (52,161,777) | (100,057,850) |

Net increase (decrease) in net assets resulting from share transactions | 26,857,468 | (64,536,537) |

Redemption fees | 37,107 | 50,793 |

Total increase (decrease) in net assets | 92,206,057 | (98,907,100) |

| | |

Net Assets | | |

Beginning of period | 112,147,463 | 211,054,563 |

End of period | $ 204,353,520 | $ 112,147,463 |

Other Information Shares | | |

Sold | 1,278,672 | 646,188 |

Redeemed | (839,593) | (1,766,686) |

Net increase (decrease) | 439,079 | (1,120,498) |

Financial Highlights

Years ended February 28, | 2004 F | 2003 | 2002 | 2001 | 2000 F |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 48.60 | $ 61.57 | $ 66.22 | $ 84.73 | $ 81.44 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | (.24) | (.33) | (.29) | (.11) | (.28) D |

Net realized and unrealized gain (loss) | 26.03 | (12.66) | (4.37) | (8.52) | 11.58 |

Total from investment operations | 25.79 | (12.99) | (4.66) | (8.63) | 11.30 |

Distributions from net realized gain | - | - | - | (9.92) | (8.15) |

Redemption fees added to paid in capital C | .01 | .02 | .01 | .04 | .14 |

Net asset value, end of period | $ 74.40 | $ 48.60 | $ 61.57 | $ 66.22 | $ 84.73 |

Total Return A,B | 53.09% | (21.07)% | (7.02)% | (12.04)% | 13.89% |

Ratios to Average Net Assets E | | | | | |

Expenses before expense reductions | 1.15% | 1.27% | 1.12% | 1.12% | 1.15% |

Expenses net of voluntary waivers, if any | 1.15% | 1.27% | 1.12% | 1.12% | 1.15% |

Expenses net of all reductions | 1.09% | 1.19% | 1.09% | 1.12% | 1.12% |

Net investment income (loss) | (.38)% | (.62)% | (.46)% | (.15)% | (.32)% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 204,354 | $ 112,147 | $ 211,055 | $ 269,848 | $ 314,348 |

Portfolio turnover rate | 156% | 124% | 60% | 71% | 120% |

ATotal returns would have been lower had certain expenses not been reduced during the periods shown. BTotal returns do not include the effect of the former sales charges. CCalculated based on average shares outstanding during the period. DInvestment income per share reflects a special dividend which amounted to $.04 per share. EExpense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund. FFor the year ended February 29.

See accompanying notes which are an integral part of the financial statements.

Consumer Sector

Multimedia Portfolio

Performance

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity a fund's total returns will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 29, 2004 | Past 1

year | Past 5

years | Past 10

years |

Select Multimedia | 50.99% | 4.89% | 13.04% |

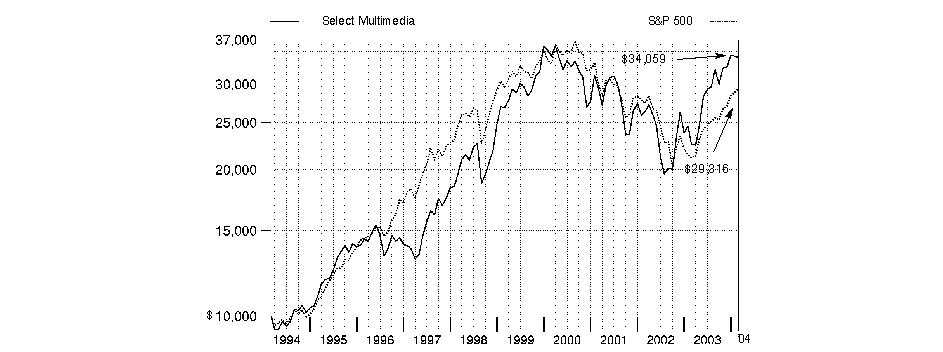

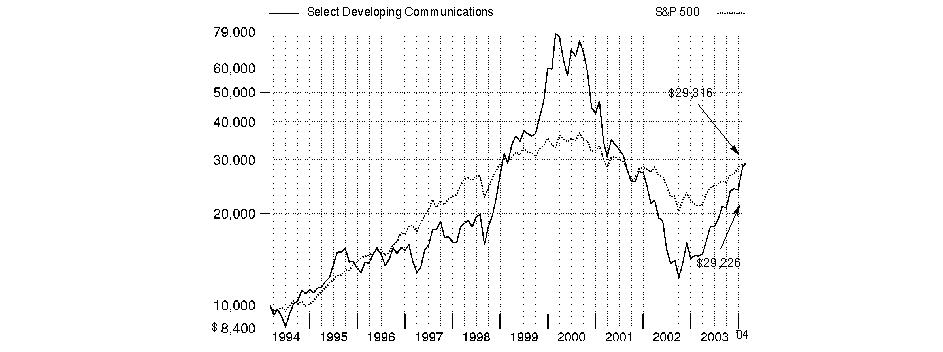

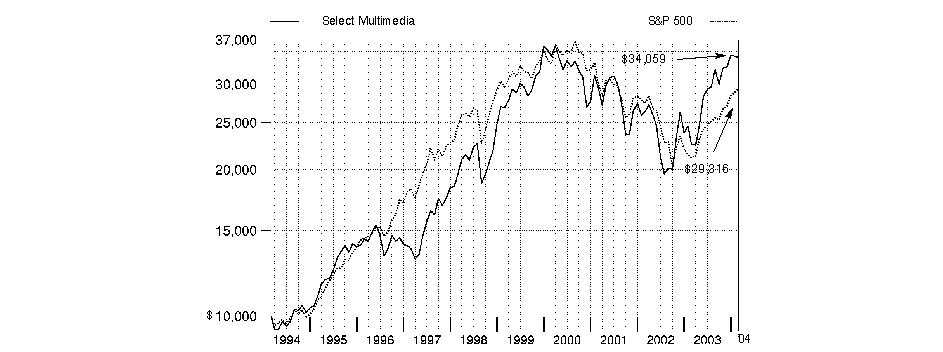

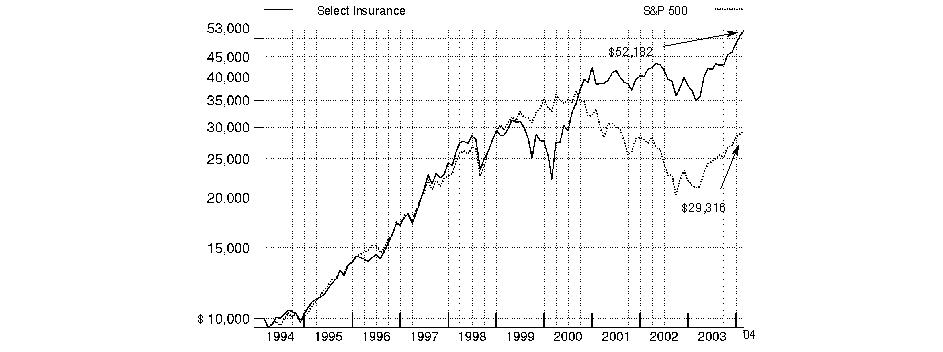

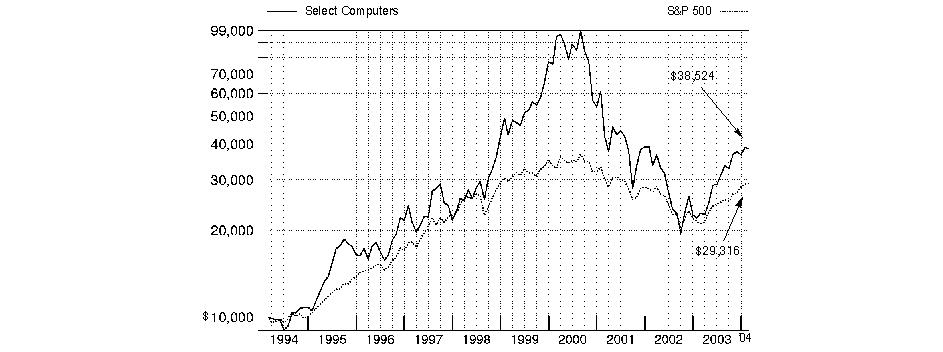

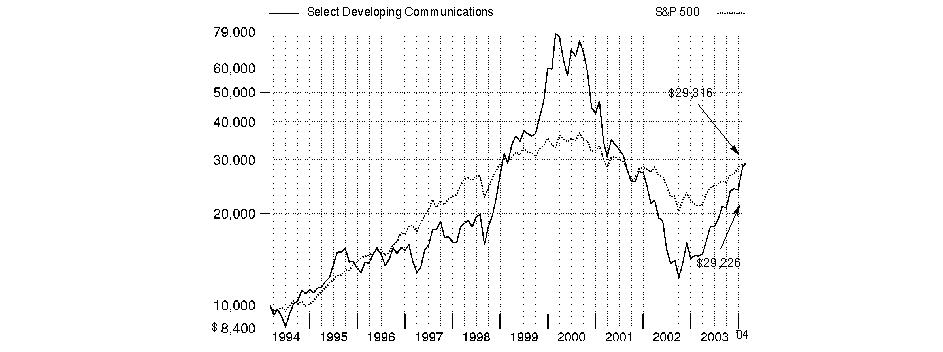

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Select Multimedia Portfolio on February 28, 1994. The chart shows how the value of your investment would have grown, and also shows how the S&P 500 Index did over the same period.

Annual Report

Multimedia Portfolio

Management's Discussion of Fund Performance

Comments from Matt Friedman, Portfolio Manager of Fidelity® Select Multimedia Portfolio

From March 2003 through the end of February 2004, domestic stocks recovered dramatically from their prior three-year swoon, driven largely by a broad-based economic and corporate profit recovery. Most major equity benchmarks gained 35% or more during the 12-month period, led by the Russell 2000® Index - a measure of the overall small-cap universe - which advanced 64.41%. As investors grew more confident about the economy's vitality, small-cap stocks were bid up, particularly those with no current earnings. In comparison, the Wilshire 5000® Total Market Index, commonly used as a proxy for the entire U.S. stock market's performance, rose 42.47%. Every sector of the market posted a double-digit advance, with economically sensitive issues - especially technology stocks - leading the way. The tech-heavy NASDAQ Composite® Index returned 52.47% during the past year, despite a negative return in February as investors turned to the more value-oriented segments of the market. The broader Standard & Poor's 500SM Index climbed 38.52% during the year, slightly outperforming the 37.07% increase for the blue-chip Dow Jones Industrial AverageSM.

For the 12 months that ended February 29, 2004, the fund returned 50.99%, outperforming the S&P 500® as well as the Goldman Sachs® Consumer Industries Index, which gained 37.04%. The fund was aided by investments in several strong performing media-related segments not represented in its sector benchmark, including Internet portals, alternative carriers and international media companies. For example, overweighted positions in two Internet-related advertising vehicles, Yahoo! and Overture, generated strong gains. Yahoo! continued to dominate online advertising, through traditional banner and pop-up ads, as well as paid search advertising via its acquisition of Overture Services during the period. AOL Time Warner benefited from resolving its balance sheet issues and stabilizing its dial-up business. Broadband provider Covad helped returns in response to positive regulatory rulings during the year. On the other hand, investments in Viacom and Clear Channel Communications were disappointing, as both companies suffered from weaker-than-expected radio advertising revenue. Fox Entertainment fell short when investors became concerned about lackluster ratings for several new shows.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Multimedia Portfolio

Investment Summary

Top Ten Stocks as of February 29, 2004 |

| % of fund's

net assets |

Viacom, Inc. Class B (non-vtg.) | 8.7 |

Yahoo!, Inc. | 7.8 |

Fox Entertainment Group, Inc. Class A | 6.5 |

EchoStar Communications Corp. Class A | 5.4 |

Liberty Media Corp. Class A | 5.2 |

Walt Disney Co. | 5.1 |

InterActiveCorp | 5.0 |

Omnicom Group, Inc. | 5.0 |

Cablevision Systems Corp. - NY Group Class A | 5.0 |

Clear Channel Communications, Inc. | 4.9 |

| 58.6 |

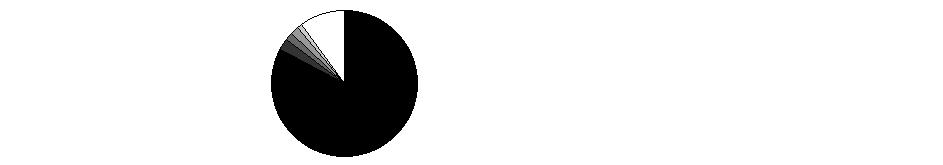

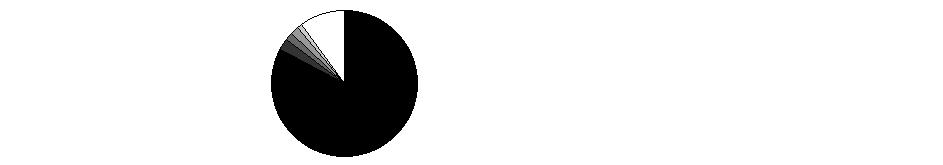

Top Industries as of February 29, 2004 |

% of fund's net assets |

| Media | 79.2% | |

| Internet Software & Services | 9.5% | |

| Internet & Catalog Retail | 5.0% | |

| Wireless Telecommunication Services | 1.9% | |

| Communications Equipment | 1.0% | |

| All Others * | 3.4% | |

* Includes short-term investments and net other assets. |

Annual Report

Multimedia Portfolio

Investments February 29, 2004

Showing Percentage of Net Assets

Common Stocks - 98.8% |

| Shares | | Value (Note 1) |

COMMERCIAL SERVICES & SUPPLIES - 0.8% |

Monster Worldwide, Inc. (a) | 28,900 | | $ 635,800 |

R.R. Donnelley & Sons Co. | 23,200 | | 736,832 |

TOTAL COMMERCIAL SERVICES & SUPPLIES | | 1,372,632 |

COMMUNICATIONS EQUIPMENT - 1.0% |

Scientific-Atlanta, Inc. | 48,300 | | 1,598,730 |

COMPUTERS & PERIPHERALS - 0.5% |

Concurrent Computer Corp. (a) | 190,000 | | 773,300 |

CONSTRUCTION & ENGINEERING - 0.8% |

Dycom Industries, Inc. (a) | 49,300 | | 1,277,856 |

INTERNET & CATALOG RETAIL - 5.0% |

InterActiveCorp (a) | 253,000 | | 8,240,210 |

Netflix, Inc. | 600 | | 20,640 |

TOTAL INTERNET & CATALOG RETAIL | | 8,260,850 |

INTERNET SOFTWARE & SERVICES - 9.5% |

United Online, Inc. (a) | 91,050 | | 1,567,881 |

Yahoo Japan Corp. (a) | 66 | | 1,217,455 |

Yahoo!, Inc. (a) | 287,600 | | 12,769,440 |

TOTAL INTERNET SOFTWARE & SERVICES | | 15,554,776 |

IT SERVICES - 0.0% |

infoUSA, Inc. (a) | 5,500 | | 56,100 |

MEDIA - 79.2% |

Belo Corp. Series A | 44,300 | | 1,235,970 |

British Sky Broadcasting Group PLC (BSkyB) sponsored ADR | 43,200 | | 2,340,144 |

Cablevision Systems Corp. - NY Group Class A (a) | 322,755 | | 8,223,797 |

Catalina Marketing Corp. (a) | 23,700 | | 414,039 |

Central European Media Enterprises Ltd. Class A (a) | 21,000 | | 410,970 |

Cheil Communications, Inc. | 3,000 | | 458,209 |

Cinram International, Inc. | 37,800 | | 765,652 |

Clear Channel Communications, Inc. | 188,026 | | 8,092,639 |

Dow Jones & Co., Inc. | 26,000 | | 1,266,200 |

E.W. Scripps Co. Class A | 21,100 | | 2,054,296 |

EchoStar Communications Corp. Class A (a) | 243,400 | | 8,791,608 |

EMI Group PLC | 4,200 | | 19,842 |

Emmis Communications Corp. Class A (a) | 600 | | 15,180 |

Entravision Communications Corp. Class A (a) | 200 | | 1,920 |

|

| Shares | | Value (Note 1) |

Fox Entertainment Group, Inc. Class A (a) | 369,300 | | $ 10,717,086 |

Gannett Co., Inc. | 39,200 | | 3,381,784 |

Gemstar-TV Guide International, Inc. (a) | 56,900 | | 411,956 |

Hughes Electronics Corp. (a) | 189,934 | | 3,293,456 |

ITV PLC (a) | 178,600 | | 461,910 |

JC Decaux SA (a) | 41,800 | | 841,899 |

Lamar Advertising Co. Class A (a) | 189,500 | | 7,523,150 |

Liberty Media Corp. Class A (a) | 742,704 | | 8,466,826 |

Lions Gate Entertainment Corp. (a) | 3,400 | | 21,462 |

McGraw-Hill Companies, Inc. | 23,500 | | 1,836,995 |

Meredith Corp. | 200 | | 10,060 |

News Corp. Ltd.: | | | |

ADR | 69,800 | | 2,614,010 |

sponsored ADR | 124,711 | | 4,081,791 |

NTL, Inc. (a) | 510 | | 34,966 |

Omnicom Group, Inc. | 100,600 | | 8,229,080 |

Pixar (a) | 20,900 | | 1,373,966 |

Playboy Enterprises, Inc. Class B (non-vtg.) (a) | 280,660 | | 4,296,905 |

Point.360 (a) | 19,400 | | 84,390 |

R.H. Donnelley Corp. (a) | 15,800 | | 684,930 |

Radio One, Inc. Class D (non-vtg.) (a) | 26,400 | | 481,008 |

SBS Broadcasting SA (a) | 32,900 | | 1,087,345 |

Sirius Satellite Radio, Inc. (a) | 39,600 | | 116,424 |

Sogecable SA (a) | 38,600 | | 1,796,039 |

Spanish Broadcasting System, Inc. Class A (a) | 7,400 | | 82,880 |

Time Warner, Inc. (a) | 293,725 | | 5,066,756 |

TiVo, Inc. (a) | 35,900 | | 383,771 |

Tribune Co. | 24,200 | | 1,208,548 |

Univision Communications, Inc. Class A (a) | 111,100 | | 3,958,493 |

Viacom, Inc. Class B (non-vtg.) | 372,096 | | 14,310,813 |

Walt Disney Co. | 313,300 | | 8,311,849 |

Washington Post Co. Class B | 300 | | 268,710 |

World Wrestling Entertainment, Inc. Class A | 6,400 | | 86,720 |

WPP Group PLC sponsored ADR | 1,200 | | 67,548 |

TOTAL MEDIA | | 129,683,992 |

SOFTWARE - 0.1% |

Electronic Arts, Inc. (a) | 400 | | 18,864 |

Macrovision Corp. (a) | 700 | | 13,664 |

NDS Group PLC sponsored ADR (a) | 5,300 | | 155,343 |

OpenTV Corp. Class A (a) | 5,200 | | 15,028 |

TOTAL SOFTWARE | | 202,899 |

WIRELESS TELECOMMUNICATION SERVICES - 1.9% |

SpectraSite, Inc. (a) | 84,800 | | 3,103,680 |

TOTAL COMMON STOCKS (Cost $139,823,843) | 161,884,815 |

Money Market Funds - 11.0% |

| Shares | | Value (Note 1) |

Fidelity Securities Lending Cash Central Fund, 1.08% (b)

(Cost $18,008,875) | 18,008,875 | | $ 18,008,875 |

TOTAL INVESTMENT PORTFOLIO - 109.8% (Cost $157,832,718) | | 179,893,690 |

NET OTHER ASSETS - (9.8)% | | (16,068,053) |

NET ASSETS - 100% | $ 163,825,637 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

Other Information |

Purchases and sales of securities, other than short-term securities, aggregated $312,552,652 and $308,319,849, respectively. |

The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $64,459 for the period. |

Income Tax Information |

The fund hereby designates approximately $1,425,000 as a capital gain dividend for the purpose of the dividend paid deduction. |

See accompanying notes which are an integral part of the financial statements.

Consumer Sector

Multimedia Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 29, 2004 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $17,954,178) (cost $157,832,718) - See accompanying schedule | | $ 179,893,690 |

Receivable for investments sold | | 4,955,372 |

Receivable for fund shares sold | | 67,510 |

Dividends receivable | | 60,079 |

Interest receivable | | 447 |

Prepaid expenses | | 796 |

Other affiliated receivables | | 383 |

Other receivables | | 32,797 |

Total assets | | 185,011,074 |

| | |

Liabilities | | |

Payable to custodian bank | $ 298,614 | |

Payable for investments purchased | 1,010,958 | |

Payable for fund shares redeemed | 1,702,707 | |

Accrued management fee | 81,605 | |

Other affiliated payables | 55,041 | |

Other payables and accrued expenses | 27,637 | |

Collateral on securities loaned, at value | 18,008,875 | |

Total liabilities | | 21,185,437 |

| | |

Net Assets | | $ 163,825,637 |

Net Assets consist of: | | |

Paid in capital | | $ 135,384,643 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 6,379,865 |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 22,061,129 |

Net Assets, for 3,654,126 shares outstanding | | $ 163,825,637 |

Net Asset Value, offering price and redemption price per share ($163,825,637 ÷ 3,654,126 shares) | | $ 44.83 |

Statement of Operations

| Year ended February 29, 2004 |

| | |

Investment Income | | |

Dividends | | $ 386,978 |

Interest | | 108,947 |

Security lending | | 37,705 |

Total income | | 533,630 |

| | |

Expenses | | |

Management fee | $ 897,880 | |

Transfer agent fees | 697,559 | |

Accounting and security lending fees | 99,129 | |

Non-interested trustees' compensation | 809 | |

Custodian fees and expenses | 30,423 | |

Registration fees | 31,289 | |

Audit | 44,388 | |

Legal | 919 | |

Miscellaneous | 2,468 | |

Total expenses before reductions | 1,804,864 | |

Expense reductions | (116,793) | 1,688,071 |

Net investment income (loss) | | (1,154,441) |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities | 35,916,718 | |

Foreign currency transactions | 9,721 | |

Total net realized gain (loss) | | 35,926,439 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 21,257,647 | |

Assets and liabilities in foreign currencies | 157 | |

Total change in net unrealized appreciation (depreciation) | | 21,257,804 |

Net gain (loss) | | 57,184,243 |

Net increase (decrease) in net assets resulting from operations | | $ 56,029,802 |

Other Information | | |

Sales charges paid to FDC | | $ 222,797 |

Deferred sales charges withheld by FDC | | $ 1,694 |

Exchange fees withheld by

FSC | | $ 3,675 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Multimedia Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

February 29,

2004 | Year ended

February 28,

2003 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ (1,154,441) | $ (651,154) |

Net realized gain (loss) | 35,926,439 | 3,092,917 |

Change in net unrealized appreciation (depreciation) | 21,257,804 | (17,822,917) |

Net increase (decrease) in net assets resulting from operations | 56,029,802 | (15,381,154) |

Distributions to shareholders from net realized gain | (12,358,836) | - |

Share transactions

Net proceeds from sales of shares | 137,479,179 | 138,813,149 |

Reinvestment of distributions | 11,930,736 | - |

Cost of shares redeemed | (129,433,118) | (163,593,387) |

Net increase (decrease) in net assets resulting from share transactions | 19,976,797 | (24,780,238) |

Redemption fees | 66,876 | 202,024 |

Total increase (decrease) in net assets | 63,714,639 | (39,959,368) |

| | |

Net Assets | | |

Beginning of period | 100,110,998 | 140,070,366 |

End of period (including undistributed net investment income of $0 and undistributed net investment

income of $23,586, respectively) | $ 163,825,637 | $ 100,110,998 |

Other Information Shares | | |

Sold | 3,290,473 | 4,158,091 |

Issued in reinvestment of distributions | 279,016 | - |

Redeemed | (3,033,755) | (4,786,847) |

Net increase (decrease) | 535,734 | (628,756) |

Financial Highlights

Years ended February 28, | 2004 E | 2003 | 2002 | 2001 | 2000 E |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 32.10 | $ 37.38 | $ 41.91 | $ 53.39 | $ 43.13 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | (.31) | (.20) | (.18) | (.06) | (.16) |

Net realized and unrealized gain (loss) | 16.49 | (5.14) | (4.36) | (7.29) | 11.90 |

Total from investment operations | 16.18 | (5.34) | (4.54) | (7.35) | 11.74 |

Distributions from net realized gain | (3.47) | - | - | (4.16) | (1.57) |

Redemption fees added to paid in capital C | .02 | .06 | .01 | .03 | .09 |

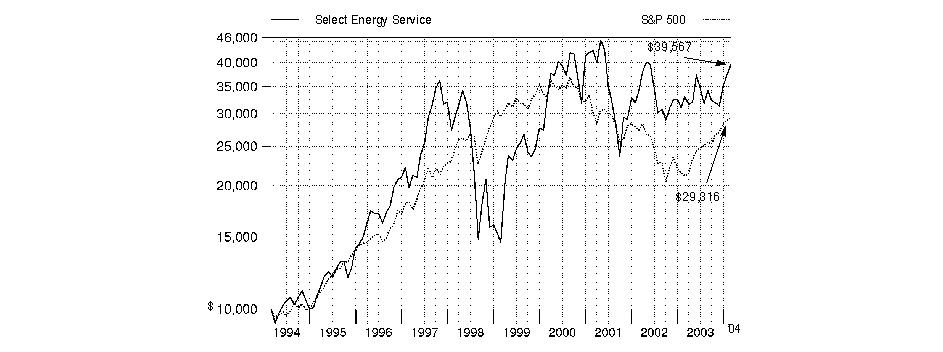

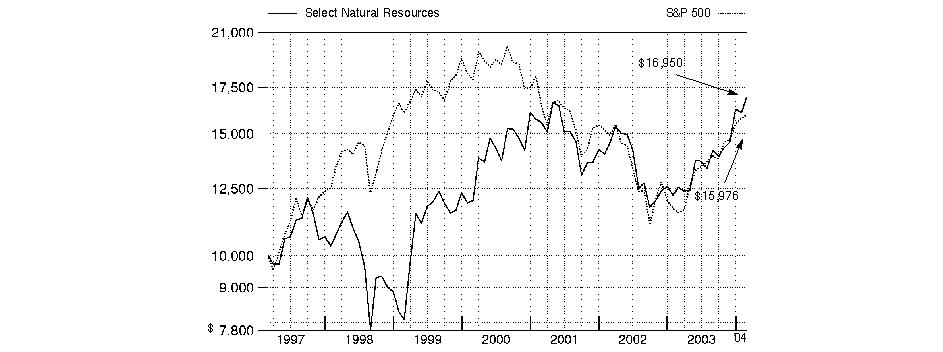

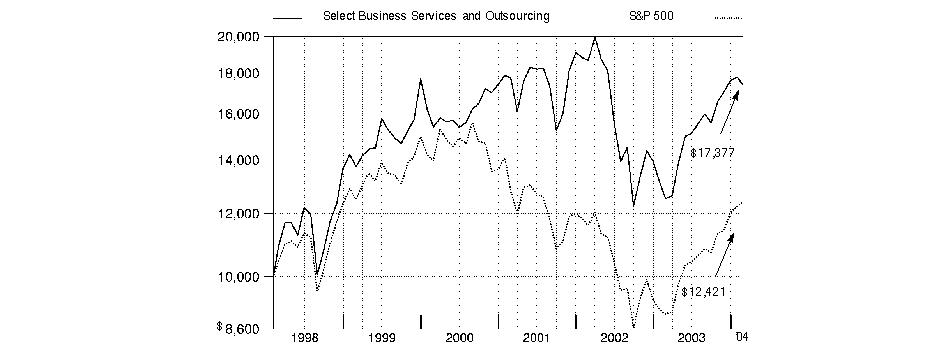

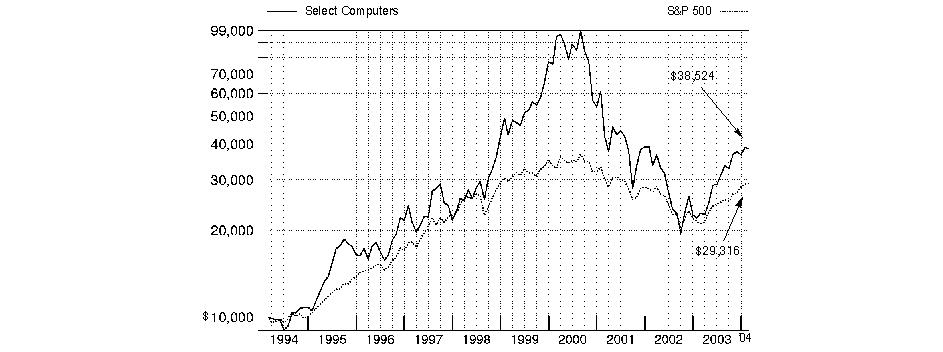

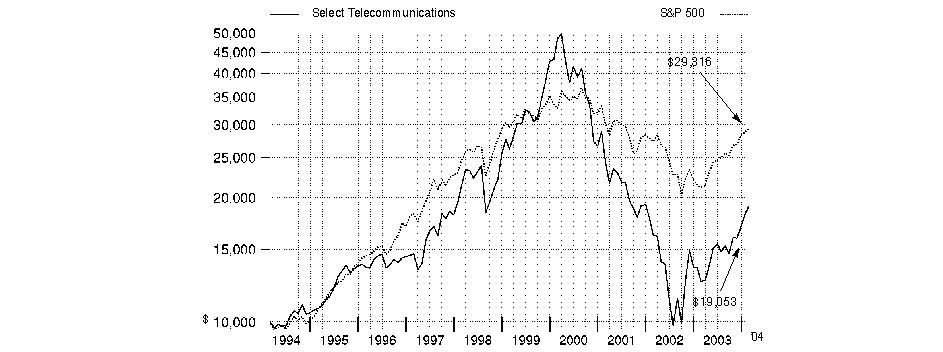

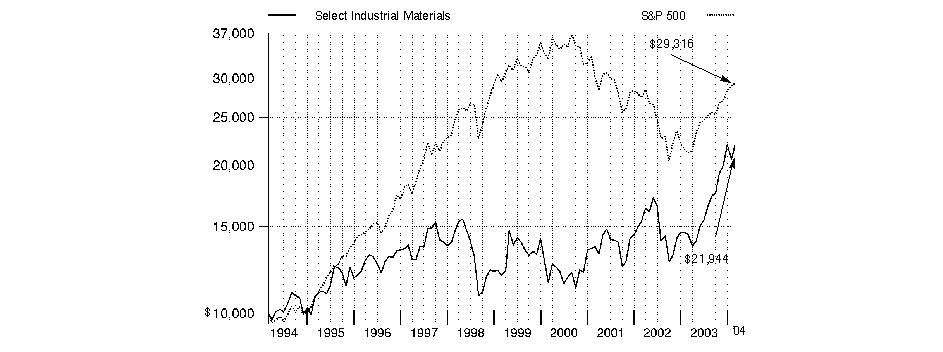

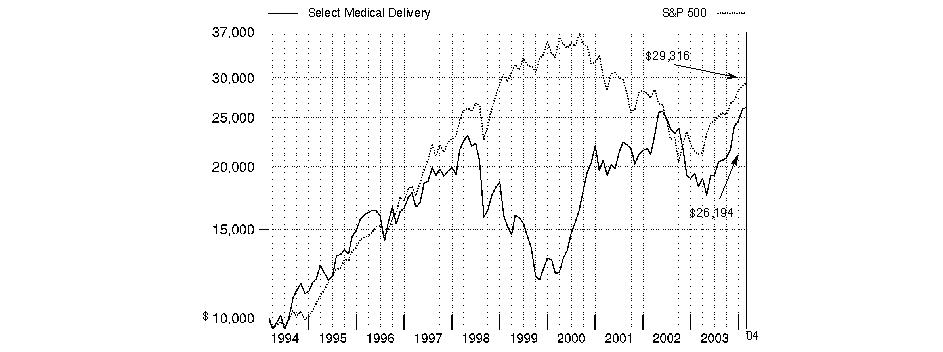

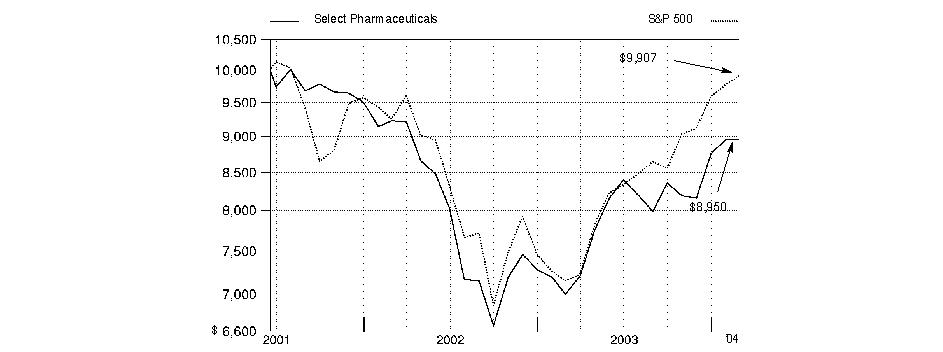

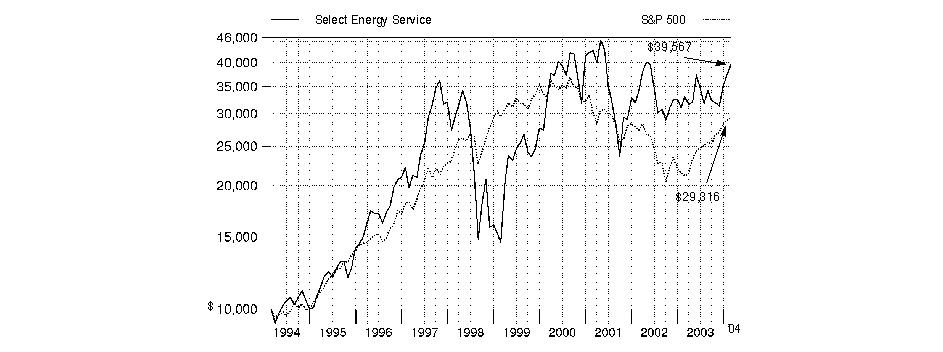

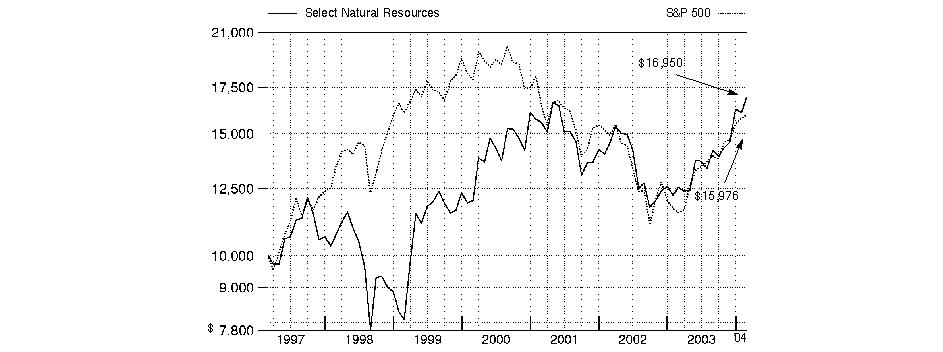

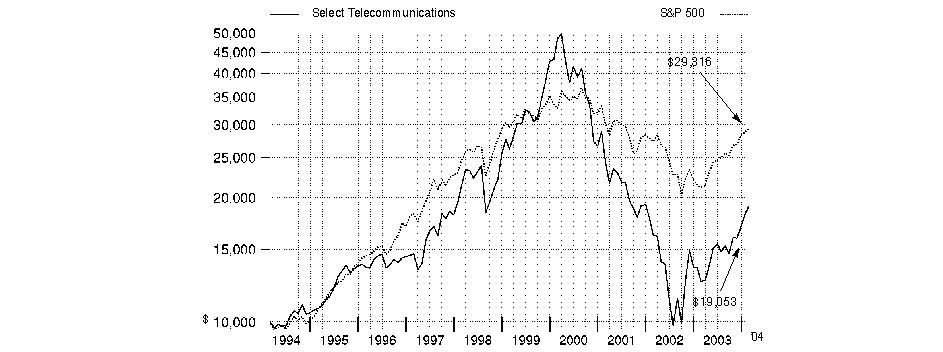

Net asset value, end of period | $ 44.83 | $ 32.10 | $ 37.38 | $ 41.91 | $ 53.39 |