UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | February 28 |

| |

Date of reporting period: | February 28, 2006 |

Item 1. Reports to Stockholders

Fidelity®

Select Portfolios®

Consumer Sector

Consumer Industries

Food and Agriculture

Leisure

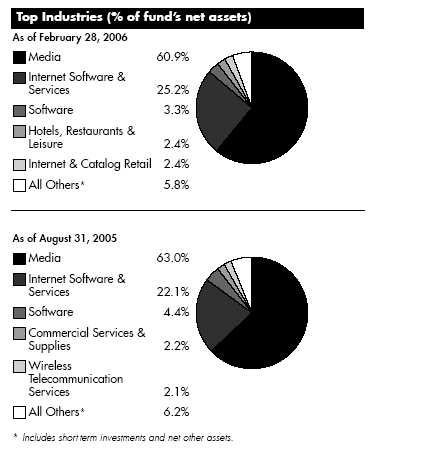

Multimedia

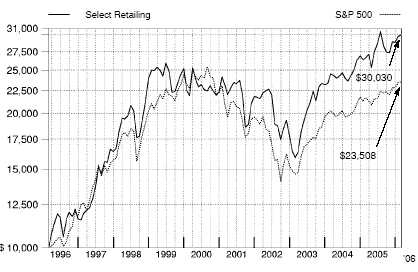

Retailing

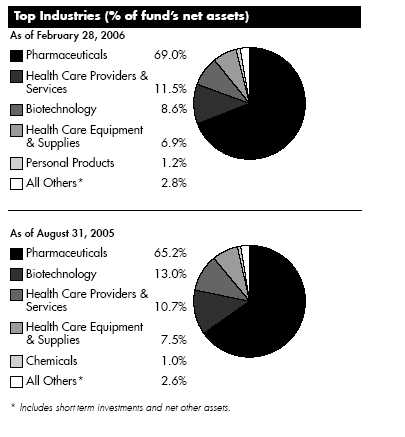

Annual Report

February 28, 2006

| Contents | | |

| |

| Chairman’s Message | | 3 |

| Shareholder Expense Example | | 4 |

| Fund Updates* | | |

| Consumer Sector | | |

| Consumer Industries | | 5 |

| Food and Agriculture | | 17 |

| Leisure | | 27 |

| Multimedia | | 38 |

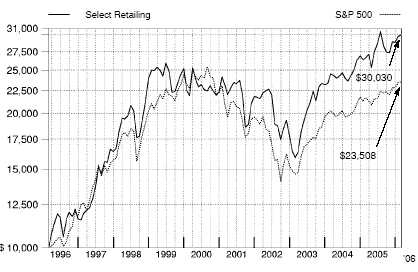

| Retailing | | 48 |

| Notes to Financial Statements | | 58 |

| Report of Independent Registered | | 63 |

| Public Accounting Firm | | |

| Trustees and Officers | | 64 |

| Distributions | | 69 |

| Board Approval of Investment | | 70 |

| Advisory Contracts and | | |

| Management Fees | | |

* Fund updates for each Select Portfolio include: Performance, Management’s Discussion of Fund Performance, Investment Changes, Investments, and Financial Statements.

To view a fund’s proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) website at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washing-ton, DC. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity’s web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

|

(Photograph of Edward C. Johnson 3d.)

Although many securities markets made gains in early 2006, there is only one certainty when it comes to investing: There is no sure thing. There are, however, a number of time-tested, fundamental investment principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets’ inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets’ best days can significantly diminish investor returns. Patience also affords the benefits of compounding — of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn’t eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio’s long-term success. The right mix of stocks, bonds and cash — aligned to your particular risk tolerance and investment objective — is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities — which historically have been the best performing asset class over time — is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third investment principle — investing regularly — can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won’t pay for all your shares at market highs. This strategy — known as dollar cost averaging — also reduces unconstructive “emotion” from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

3 Annual Report

Shareholder Expense Example

|

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2005 to Febru-ary 28, 2006).

The first line of the table below for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

|

The second line of the table below for each fund provides information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | |

Expenses Paid |

| | | Beginning | | Ending | | During Period* |

| | | Account Value | | Account Value | | September 1, 2005 to |

| | | September 1, 2005 | | February 28, 2006 | | February 28, 2006 |

| Consumer Industries Portfolio | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,060.00 | | $ | | 5.77 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,019.19 | | $ | | 5.66 |

| Food and Agriculture Portfolio | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,056.80 | | $ | | 5.15 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,019.79 | | $ | | 5.06 |

| Leisure Portfolio | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,104.00 | | $ | | 5.06 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,019.98 | | $ | | 4.86 |

| Multimedia Portfolio | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,060.30 | | $ | | 5.36 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,019.59 | | $ | | 5.26 |

| Retailing Portfolio | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,061.60 | | $ | | 5.37 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,019.59 | | $ | | 5.26 |

A 5% return per year before expenses

* Expenses are equal to each Fund’s annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| | | Annualized |

| | | Expense Ratio |

| Consumer Industries Portfolio | | 1.13% |

| Food and Agriculture Portfolio | | 1.01% |

| Leisure Portfolio | | 97% |

| Multimedia Portfolio | | 1.05% |

| Retailing Portfolio | | 1.05% |

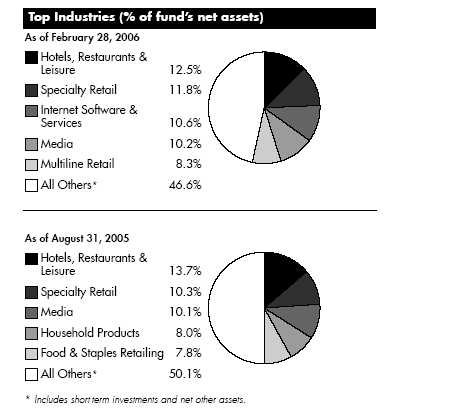

Consumer Industries Portfolio

Performance

|

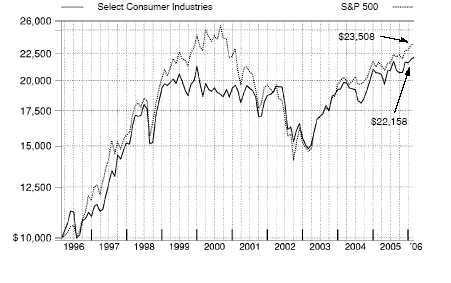

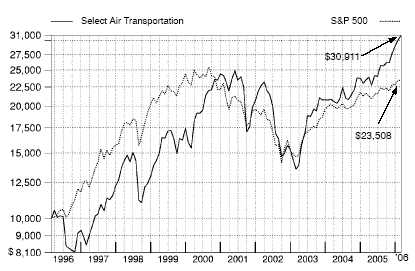

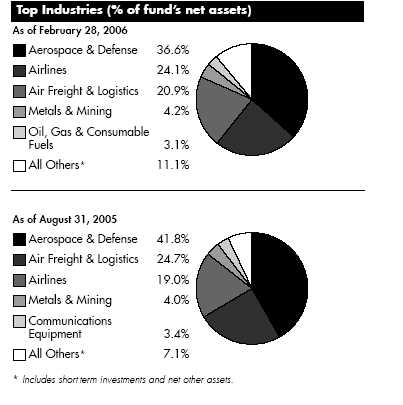

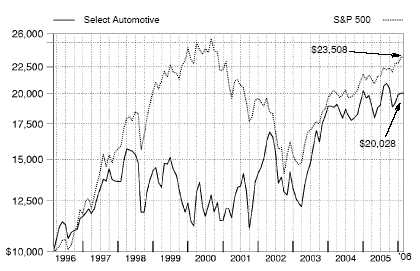

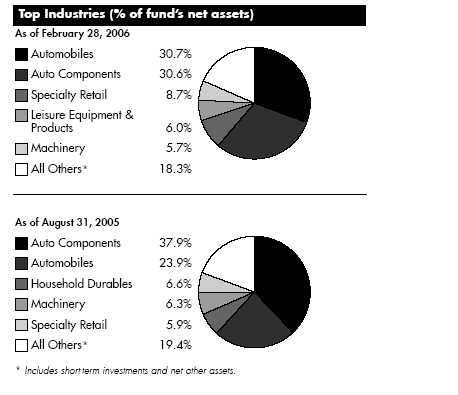

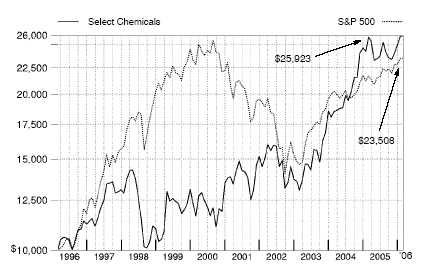

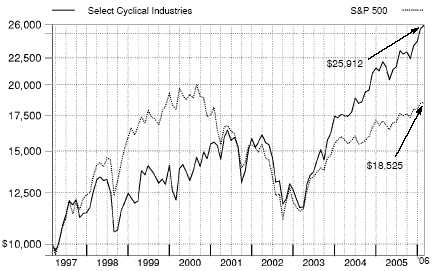

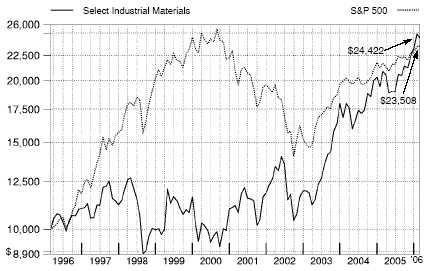

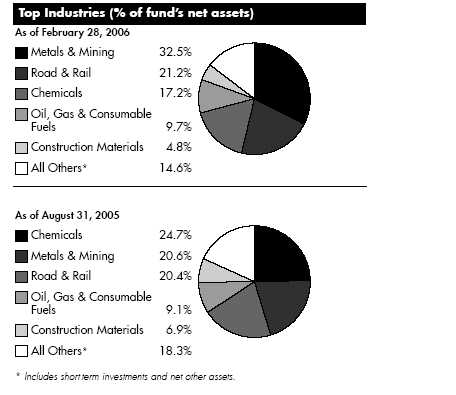

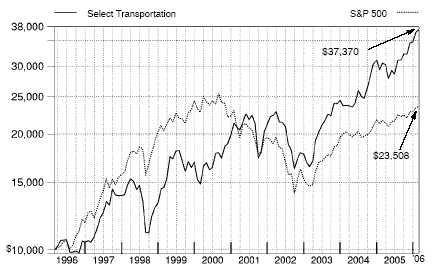

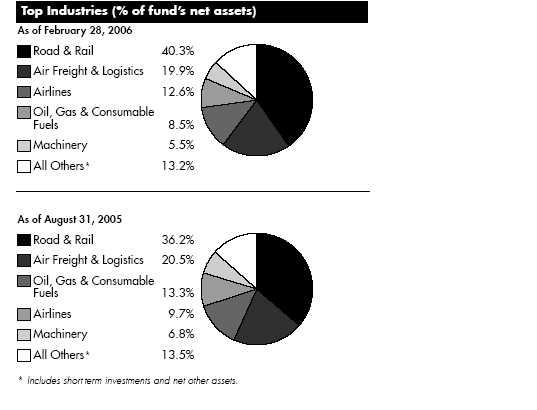

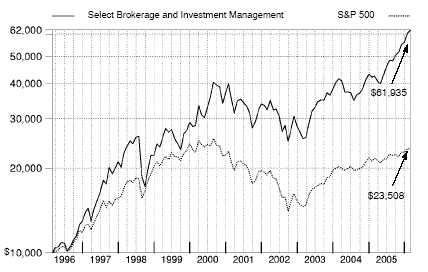

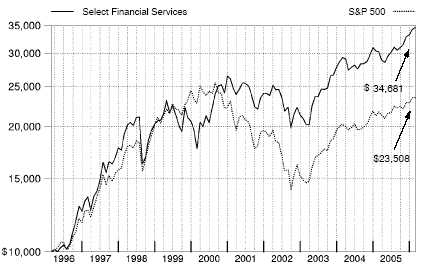

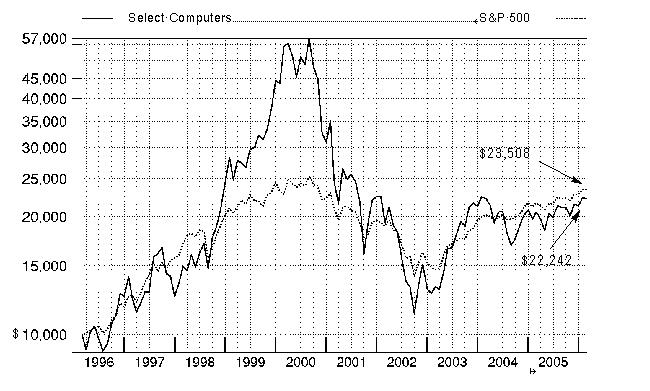

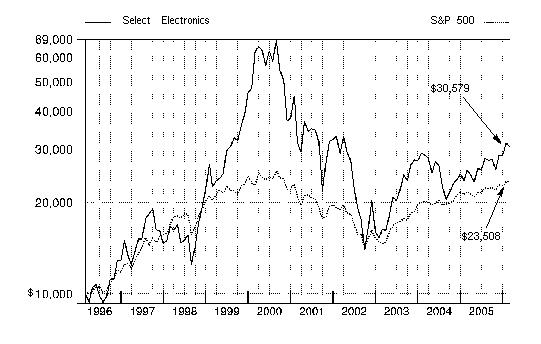

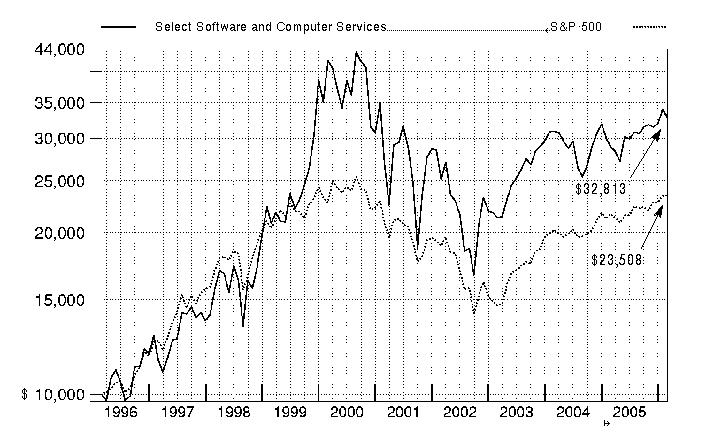

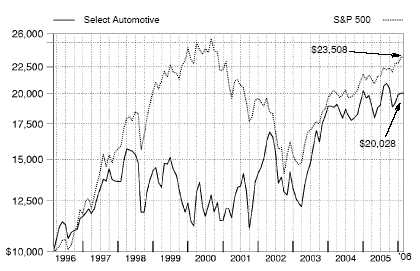

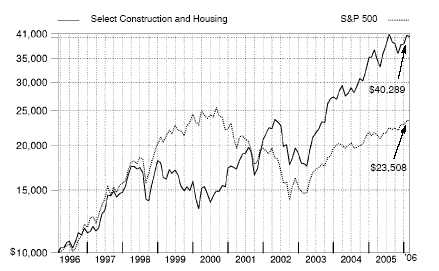

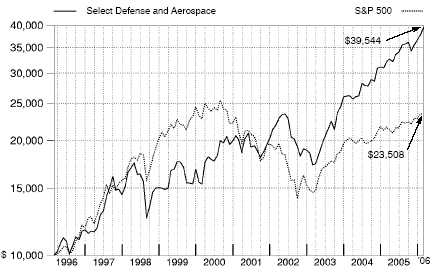

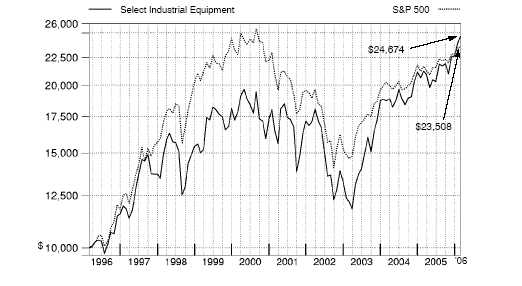

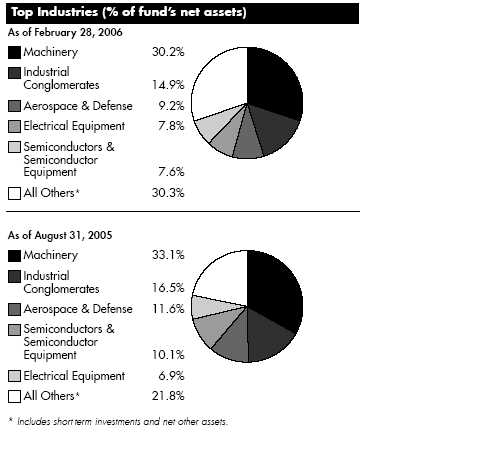

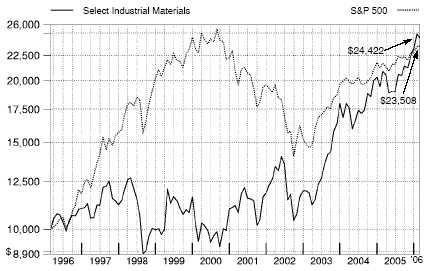

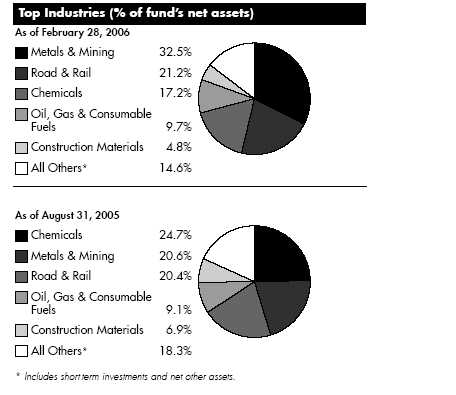

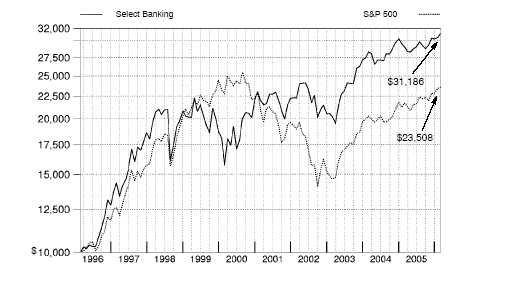

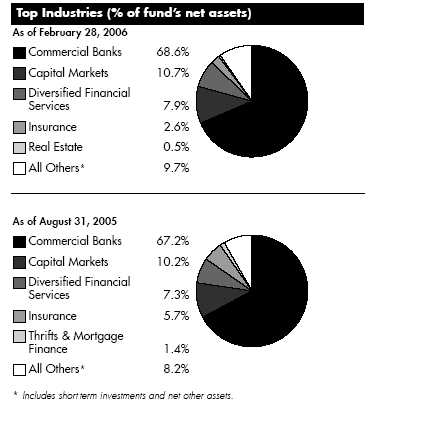

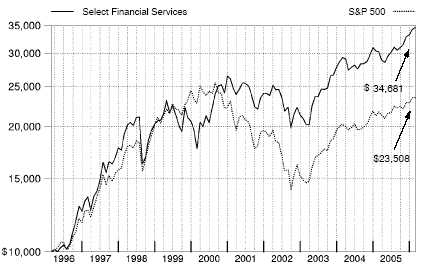

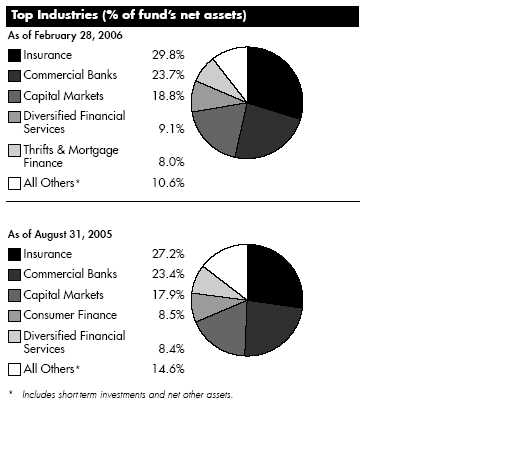

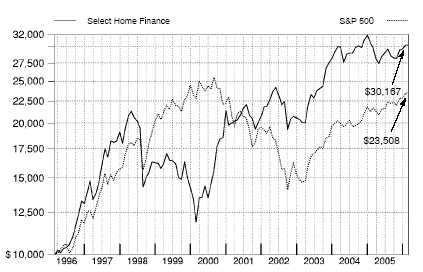

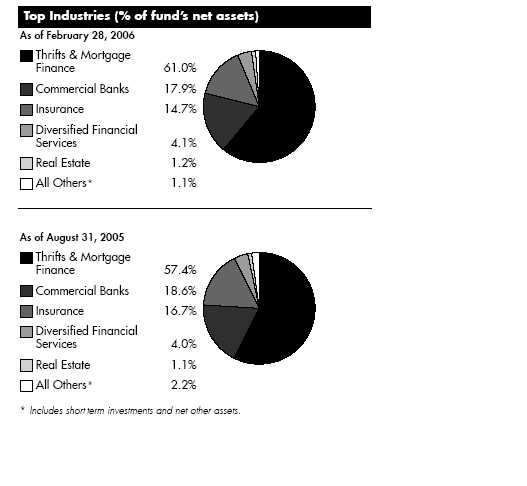

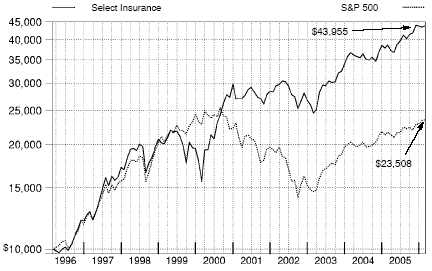

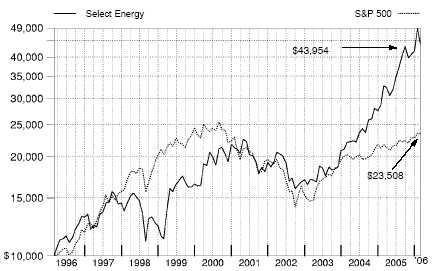

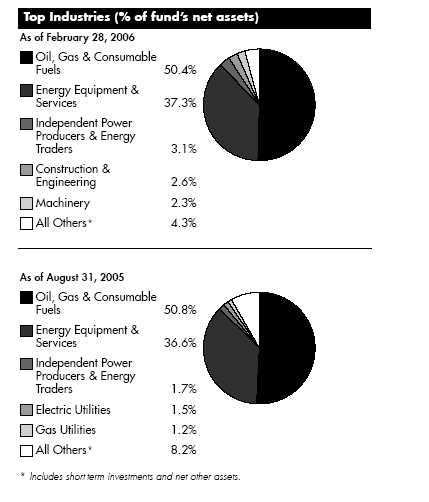

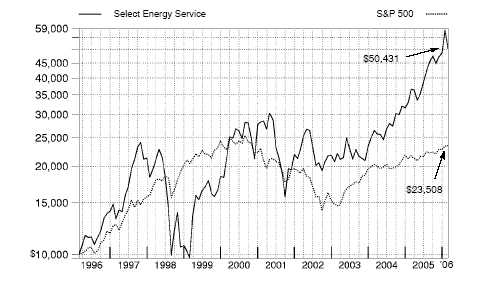

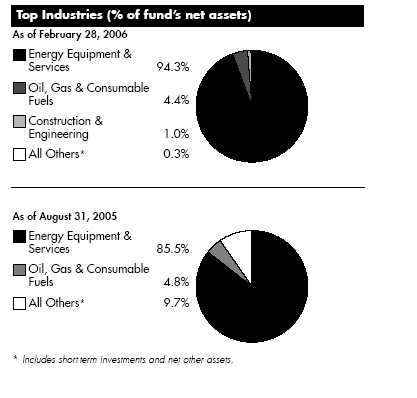

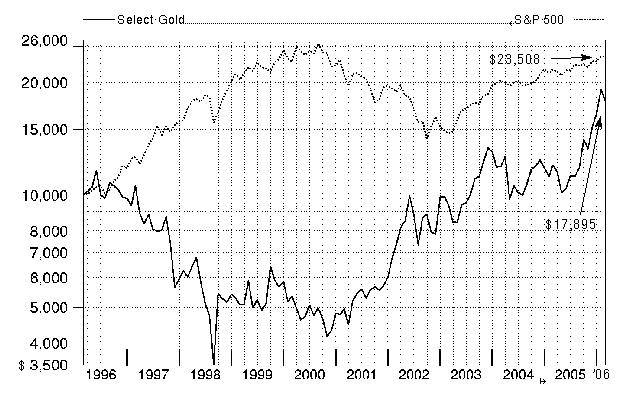

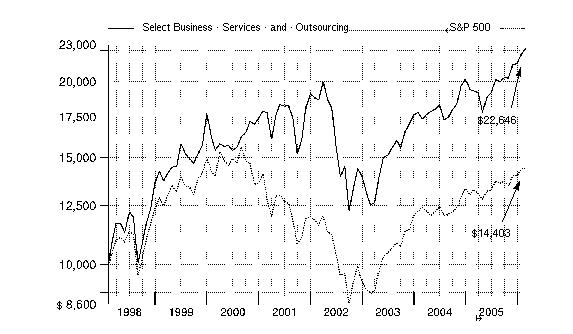

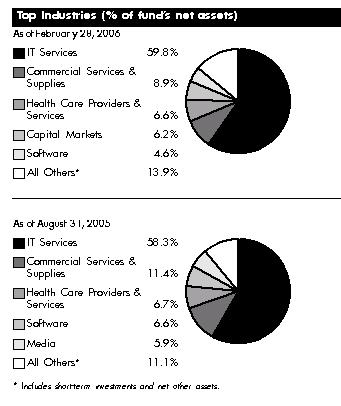

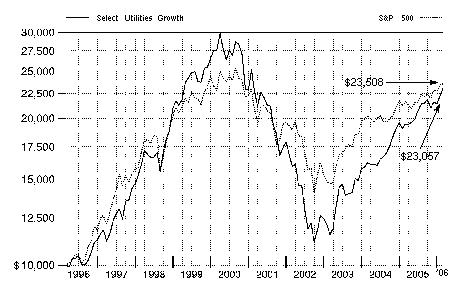

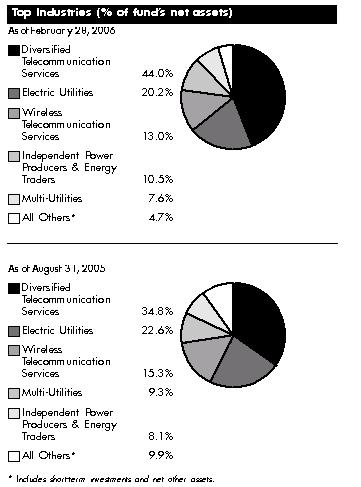

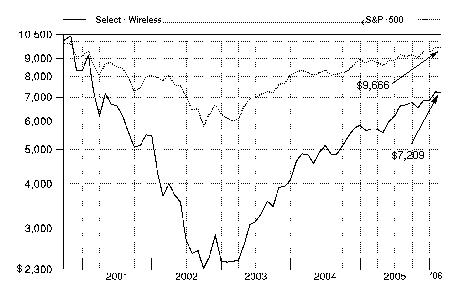

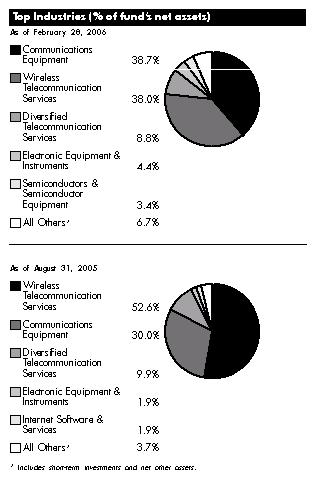

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund’s dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity a fund’s total returns will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns | | | | | | |

| Periods ended February 28, 2006 | | Past 1 | | Past 5 | | Past 10 |

| | | year | | years | | years |

| Select Consumer Industries | | 7.31% | | 2.95% | | 8.28% |

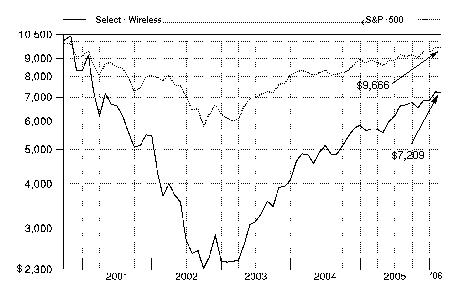

| |

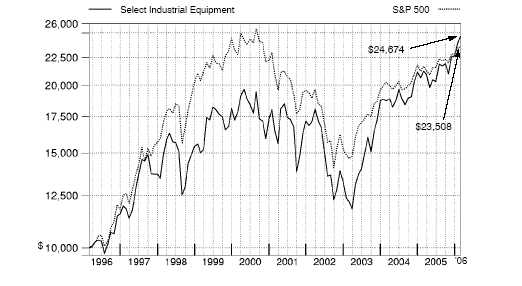

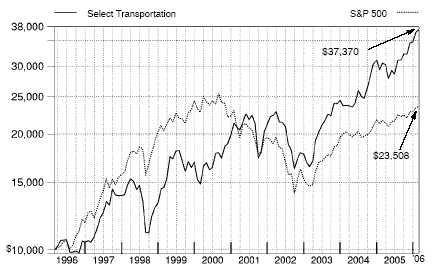

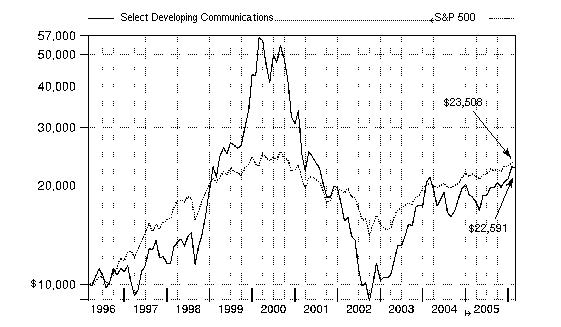

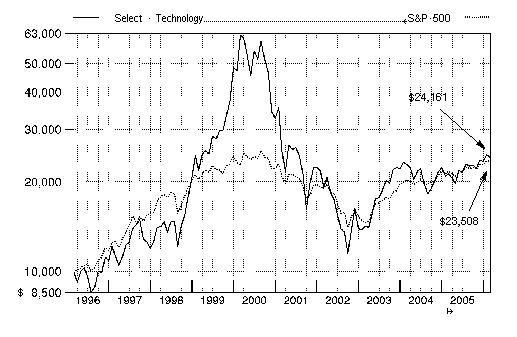

| $10,000 Over 10 Years | | | | | | |

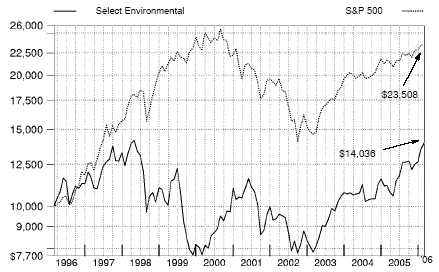

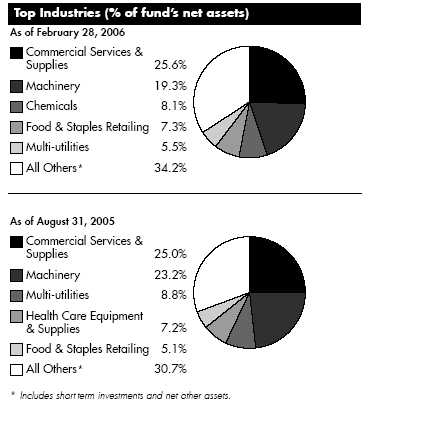

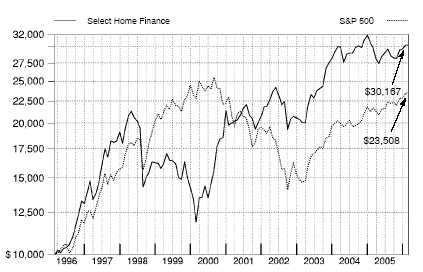

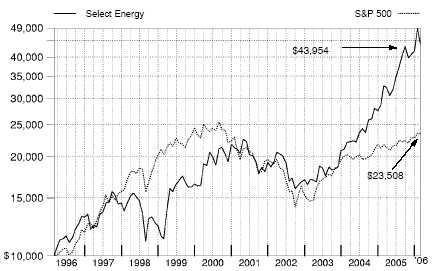

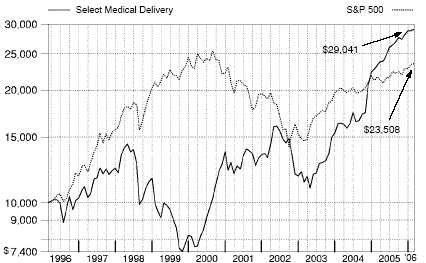

Let’s say hypothetically that $10,000 was invested in Fidelity® Select Consumer Industries Portfolio on February 29, 1996. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

5 Annual Report

Consumer Industries Portfolio

|

Management’s Discussion of Fund Performance

Comments from John Roth, Portfolio Manager of Fidelity® Select Consumer Industries Portfolio

With the exception of several popular large-cap stock performance measures, most major U.S. equity benchmarks had double-digit returns for the year ending February 28, 2006. For much of the period, market gains were driven largely by the energy sector, although utilities ultimately sneaked into the top spot for the year overall. Financials and telecommunication services also reached double figures, outperforming the 8.40% return of the broader market as measured by the large-cap-oriented Standard & Poor’s 500SM Index. The consumer discretionary segment — home to the weak performing automobile and media industries — was the biggest disappointment. Although the overall return for the S&P 500® beat the small-cap Russell 2000® Index in calendar year 2005 — the first time that’s happened in six years — small-caps stormed back in early 2006, leading to a 16.59% advance during the past 12 months, nearly twice the broader market’s gain. Mid-caps soared even higher, returning 17.67% according to the Russell Midcap® Index. The technology-heavy NASDAQ Composite® Index also fared well, climbing 12.13%, but the Dow Jones Industrial AverageSM, an index of 30 large-cap, blue-chip stocks, managed to rise only 4.52% .

For the 12-month period ending February 28, 2006, the fund returned 7.31%, outperforming the 3.31% return of the Goldman Sachs® Consumer Industries Index but lagging the S&P 500. Advertisers continued to shift spending out of traditional media such as radio, television and print, and into online media such as paid search and branded advertising. The fund benefited from that trend relative to the sector index by avoiding several traditional media firms, including Comcast and Liberty Media, while holding a sizable out-of-benchmark position in Internet firm Google, whose stock soared. Performance also was helped by positions in Evergreen Solar, maker of a key component of solar cells, and Chinese online travel firm Ctrip.com International. Conversely, I avoided tobacco and food conglomerate Altria, a large component of the Goldman Sachs index, because of the firm’s tobacco-related legal problems and concerns about its growth. That decision hurt relative results, as favorable court decisions gave Altria’s stock a strong boost. The fund’s positions in adult education firm Apollo Group, cosmetics retailer Avon Products and Brunswick, a maker of powerboats, hurt relative performance as well.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

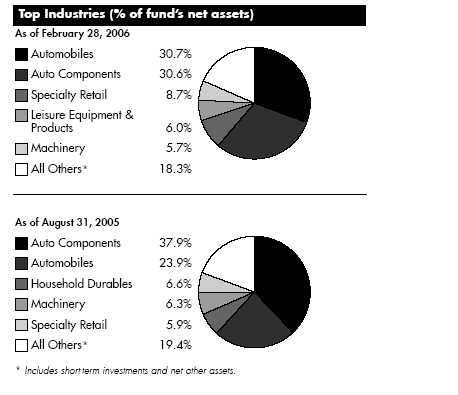

Consumer Industries Portfolio

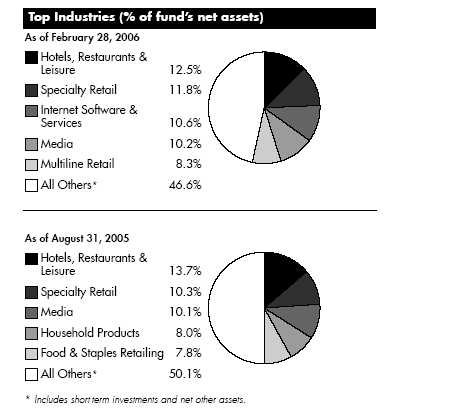

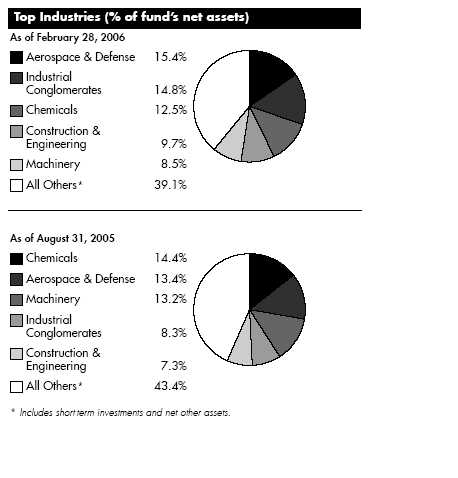

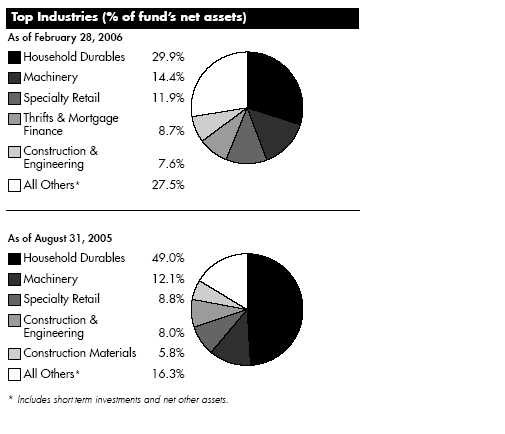

Investment Changes

| Top Ten Stocks as of February 28, 2006 |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Procter & Gamble Co. | | 6.7 | | 6.1 |

| Google, Inc. Class A (sub. vtg.) | | 5.0 | | 4.3 |

| PepsiCo, Inc. | | 3.7 | | 1.5 |

| Target Corp. | | 3.1 | | 3.0 |

| Wal-Mart Stores, Inc. | | 2.7 | | 3.3 |

| The Coca-Cola Co. | | 2.3 | | 3.3 |

| Walt Disney Co. | | 2.3 | | 1.9 |

| eBay, Inc. | | 2.1 | | 2.9 |

| Lowe’s Companies, Inc. | | 2.1 | | 1.9 |

| Nestle SA sponsored ADR | | 2.1 | | 1.0 |

| | | 32.1 | | |

7 Annual Report

| Consumer Industries Portfolio | | | | | | | | |

| Investments February 28, 2006 | | | | |

| Showing Percentage of Net Assets | | | | | | | | |

| |

| Common Stocks — 97.9% | | | | | | | | |

| | | | | | | Shares | | Value (Note 1) |

| |

| AUTOMOBILES – 0.8% | | | | | | | | |

| Motorcycle Manufacturers – 0.8% | | | | | | | | |

| Harley-Davidson, Inc. | | | | | | 7,600 | | $ 399,076 |

| BEVERAGES – 7.7% | | | | | | | | |

| Brewers – 0.5% | | | | | | | | |

| SABMiller PLC | | | | | | 12,400 | | 246,662 |

| Distillers & Vintners – 0.5% | | | | | | | | |

| Diageo PLC sponsored ADR | | | | | | 4,100 | | 252,970 |

| Soft Drinks – 6.7% | | | | | | | | |

| Coca-Cola Enterprises, Inc. | | | | | | 17,600 | | 345,840 |

| PepsiCo, Inc. | | | | | | 31,200 | | 1,844,232 |

| The Coca-Cola Co. | | | | | | 27,700 | | 1,162,569 |

| | | | | | | | | 3,352,641 |

| |

| TOTAL BEVERAGES | | | | | | | | 3,852,273 |

| |

| COMMERCIAL SERVICES & SUPPLIES – 1.3% | | | | | | | | |

| Human Resource & Employment Services – 1.3% | | | | | | | | |

| Monster Worldwide, Inc. (a) | | | | | | 8,100 | | 396,576 |

| Robert Half International, Inc. | | | | | | 6,700 | | 240,664 |

| | | | | | | | | 637,240 |

| |

| DISTRIBUTORS – 0.5% | | | | | | | | |

| Distributors – 0.5% | | | | | | | | |

| Li & Fung Ltd. | | | | | | 122,000 | | 247,683 |

| DIVERSIFIED CONSUMER SERVICES – 1.8% | | | | | | | | |

| Education Services – 1.1% | | | | | | | | |

| Apollo Group, Inc. Class A (a) | | | | | | 10,700 | | 528,366 |

| Specialized Consumer Services – 0.7% | | | | | | | | |

| Steiner Leisure Ltd. (a) | | | | | | 3,500 | | 149,205 |

| Weight Watchers International, Inc. (a) | | | | | | 4,300 | | 225,621 |

| | | | | | | | | 374,826 |

| |

| TOTAL DIVERSIFIED CONSUMER SERVICES | | | | | | | | 903,192 |

| |

| ELECTRICAL EQUIPMENT – 0.7% | | | | | | | | |

| Electrical Components & Equipment – 0.7% | | | | | | | | |

| Evergreen Solar, Inc. (a) | | | | | | 21,400 | | 333,626 |

| FOOD & STAPLES RETAILING – 7.6% | | | | | | | | |

| Drug Retail – 3.0% | | | | | | | | |

| CVS Corp. | | | | | | 20,000 | | 566,600 |

| Walgreen Co. | | | | | | 20,500 | | 919,630 |

| | | | | | | | | 1,486,230 |

| Food Retail – 0.7% | | | | | | | | |

| Whole Foods Market, Inc. | | | | | | 5,000 | | 319,400 |

See accompanying notes which are an integral part of the financial statements.

Annual Report 8

| | | Shares | | Value (Note 1) |

| Hypermarkets & Super Centers – 3.9% | | | | |

| Costco Wholesale Corp. | | 11,700 | | $ 599,976 |

| Wal-Mart Stores, Inc. | | 29,900 | | 1,356,264 |

| | | | | 1,956,240 |

| |

| TOTAL FOOD & STAPLES RETAILING | | | | 3,761,870 |

| |

| FOOD PRODUCTS – 3.9% | | | | |

| Packaged Foods & Meats – 3.9% | | | | |

| Diamond Foods, Inc. | | 6,900 | | 142,140 |

| Flowers Foods, Inc. | | 3,600 | | 99,000 |

| Green Mountain Coffee Roasters, Inc. (a) | | 2,600 | | 106,626 |

| Lindt & Spruengli AG (participation certificate) | | 290 | | 552,834 |

| Nestle SA sponsored ADR | | 13,800 | | 1,017,060 |

| | | | | 1,917,660 |

| |

| HOTELS, RESTAURANTS & LEISURE – 12.5% | | | | |

| Casinos & Gaming – 2.0% | | | | |

| Aristocrat Leisure Ltd. | | 21,800 | | 195,034 |

| International Game Technology | | 7,000 | | 250,390 |

| MGM MIRAGE (a) | | 9,800 | | 362,306 |

| Station Casinos, Inc. | | 1,600 | | 109,520 |

| WMS Industries, Inc. (a) | | 2,800 | | 81,340 |

| | | | | 998,590 |

| Hotels, Resorts & Cruise Lines – 5.5% | | | | |

| Carnival Corp. unit | | 15,200 | | 785,080 |

| Ctrip.com International Ltd. sponsored ADR | | 4,000 | | 310,200 |

| eLong, Inc. sponsored ADR (a) | | 24,800 | | 315,704 |

| Kerzner International Ltd. (a) | | 4,600 | | 309,534 |

| Royal Caribbean Cruises Ltd. | | 10,100 | | 445,006 |

| Starwood Hotels & Resorts Worldwide, Inc. unit | | 9,000 | | 571,500 |

| | | | | 2,737,024 |

| Leisure Facilities – 0.1% | | | | |

| International Speedway Corp. Class A | | 1,400 | | 66,304 |

| Restaurants – 4.9% | | | | |

| Buffalo Wild Wings, Inc. (a) | | 20,654 | | 783,406 |

| CBRL Group, Inc. | | 3,200 | | 142,176 |

| Domino’s Pizza, Inc. | | 7,250 | | 184,875 |

| McDonald’s Corp. | | 10,200 | | 356,082 |

| Outback Steakhouse, Inc. | | 13,100 | | 547,711 |

| Starbucks Corp. (a) | | 11,100 | | 403,152 |

| | | | | 2,417,402 |

| |

| TOTAL HOTELS, RESTAURANTS & LEISURE | | | | 6,219,320 |

| |

| HOUSEHOLD PRODUCTS – 7.7% | | | | |

| Household Products – 7.7% | | | | |

| Colgate-Palmolive Co. | | 9,400 | | 512,112 |

| Procter & Gamble Co. | | 55,300 | | 3,314,128 |

| | | | | 3,826,240 |

See accompanying notes which are an integral part of the financial statements.

|

9

| Consumer Industries Portfolio | | | | |

| Investments - continued | | | | |

| |

| |

| Common Stocks – continued | | | | |

| | | Shares | | Value (Note 1) |

| |

| INTERNET & CATALOG RETAIL – 1.2% | | | | |

| Catalog Retail – 0.6% | | | | |

| Coldwater Creek, Inc. (a) | | 13,500 | | $ 303,345 |

| Internet Retail – 0.6% | | | | |

| Priceline.com, Inc. (a) | | 12,200 | | 299,510 |

| |

| TOTAL INTERNET & CATALOG RETAIL | | | | 602,855 |

| |

| INTERNET SOFTWARE & SERVICES – 10.6% | | | | |

| Internet Software & Services – 10.6% | | | | |

| Digitas, Inc. (a) | | 10,900 | | 154,017 |

| eBay, Inc. (a) | | 26,200 | | 1,049,572 |

| Google, Inc. Class A (sub. vtg.) (a) | | 6,854 | | 2,485,397 |

| Homestore, Inc. (a) | | 32,162 | | 200,048 |

| iVillage, Inc. (a) | | 19,300 | | 157,295 |

| Sina Corp. (a) | | 5,300 | | 118,561 |

| Sohu.com, Inc. (a) | | 5,600 | | 117,768 |

| Yahoo!, Inc. (a) | | 30,296 | | 971,290 |

| | | | | 5,253,948 |

| |

| LEISURE EQUIPMENT & PRODUCTS – 3.3% | | | | |

| Leisure Products – 3.3% | | | | |

| Brunswick Corp. | | 10,700 | | 419,761 |

| K2, Inc. (a) | | 8,500 | | 96,900 |

| MarineMax, Inc. (a) | | 16,400 | | 506,104 |

| RC2 Corp. (a) | | 2,400 | | 86,472 |

| SCP Pool Corp. | | 11,700 | | 508,599 |

| | | | | 1,617,836 |

| |

| MEDIA – 10.2% | | | | |

| Advertising – 1.8% | | | | |

| Harte-Hanks, Inc. | | 6,000 | | 168,060 |

| Interpublic Group of Companies, Inc. (a) | | 24,956 | | 258,544 |

| Omnicom Group, Inc. | | 6,100 | | 486,902 |

| | | | | 913,506 |

| Broadcasting & Cable TV – 0.5% | | | | |

| Liberty Global, Inc. Class A | | 12,200 | | 247,782 |

| Movies & Entertainment – 5.2% | | | | |

| Carmike Cinemas, Inc. | | 5,200 | | 123,864 |

| News Corp. Class A | | 43,600 | | 709,808 |

| Viacom, Inc. Class B (non-vtg.) (a) | | 14,200 | | 567,432 |

| The Walt Disney Co. | | 41,300 | | 1,155,987 |

| | | | | 2,557,091 |

| Publishing – 2.7% | | | | |

| Dow Jones & Co., Inc. | | 3,300 | | 134,145 |

| Gannett Co., Inc. | | 6,000 | | 372,960 |

| McGraw-Hill Companies, Inc. | | 10,600 | | 562,754 |

| Media General, Inc. Class A | | 2,900 | | 145,290 |

| Reuters Group PLC sponsored ADR | | 3,300 | | 131,769 |

| | | | | 1,346,918 |

| |

| TOTAL MEDIA | | | | 5,065,297 |

See accompanying notes which are an integral part of the financial statements.

Annual Report 10

| | | Shares | | Value (Note |

| |

| MULTILINE RETAIL – 8.3% | | | | |

| Department Stores – 4.8% | | | | |

| Federated Department Stores, Inc. | | 8,300 | | $ 589,632 |

| JCPenney Co., Inc. | | 6,400 | | 375,296 |

| KarstadtQuelle AG (a)(d) | | 14,000 | | 342,800 |

| Nordstrom, Inc. | | 7,800 | | 296,400 |

| Saks, Inc. | | 8,400 | | 158,760 |

| Sears Holdings Corp. (a) | | 5,000 | | 602,250 |

| | | | | 2,365,138 |

| General Merchandise Stores – 3.5% | | | | |

| Family Dollar Stores, Inc. | | 7,500 | | 192,900 |

| Target Corp. | | 28,500 | | 1,550,400 |

| | | | | 1,743,300 |

| |

| TOTAL MULTILINE RETAIL | | | | 4,108,438 |

| |

| PERSONAL PRODUCTS – 1.3% | | | | |

| Personal Products – 1.3% | | | | |

| Avon Products, Inc. | | 19,200 | | 553,920 |

| Herbalife Ltd. (a) | | 2,800 | | 86,772 |

| | | | | 640,692 |

| |

| REAL ESTATE – 0.4% | | | | |

| Real Estate Investment Trusts – 0.4% | | | | |

| MeriStar Hospitality Corp. (a) | | 21,400 | | 220,634 |

| SOFTWARE – 0.6% | | | | |

| Home Entertainment Software – 0.6% | | | | |

| Activision, Inc. (a) | | 11,433 | | 142,913 |

| Electronic Arts, Inc. (a) | | 3,400 | | 176,698 |

| | | | | 319,611 |

| |

| SPECIALTY RETAIL – 11.8% | | | | |

| Apparel Retail – 3.7% | | | | |

| Aeropostale, Inc. (a) | | 7,000 | | 200,830 |

| American Eagle Outfitters, Inc. | | 5,600 | | 142,464 |

| Charlotte Russe Holding, Inc. (a) | | 5,700 | | 103,740 |

| Chico’s FAS, Inc. (a) | | 10,100 | | 475,205 |

| Esprit Holdings Ltd. | | 18,100 | | 139,170 |

| Foot Locker, Inc. | | 9,600 | | 221,856 |

| Gymboree Corp. (a) | | 7,100 | | 162,306 |

| Hot Topic, Inc. (a) | | 5,150 | | 67,877 |

| Urban Outfitters, Inc. (a) | | 12,300 | | 345,630 |

| | | | | 1,859,078 |

| Automotive Retail – 0.5% | | | | |

| AutoZone, Inc. (a) | | 2,500 | | 241,700 |

| Computer & Electronics Retail – 2.1% | | | | |

| Best Buy Co., Inc. | | 16,050 | | 864,453 |

| Gamestop Corp. Class B (a) | | 5,400 | | 197,154 |

| | | | | 1,061,607 |

| Home Improvement Retail – 2.1% | | | | |

| Lowe’s Companies, Inc. (d) | | 15,000 | | 1,022,700 |

| |

| |

| See accompanying notes which are an integral part of the financial statements. | | | | |

11 Annual Report

| Consumer Industries Portfolio | | | | |

| Investments - continued | | | | |

| |

| |

| Common Stocks – continued | | | | |

| | | Shares | | Value (Note 1) |

| |

| SPECIALTY RETAIL – CONTINUED | | | | |

| Specialty Stores – 3.4% | | | | |

| Guitar Center, Inc. (a) | | 4,400 | | $ 227,744 |

| Office Depot, Inc. (a) | | 13,500 | | 481,680 |

| OfficeMax, Inc. | | 3,400 | | 99,722 |

| PETsMART, Inc. | | 3,900 | | 101,244 |

| Sports Authority, Inc. (a) | | 962 | | 35,200 |

| Staples, Inc. | | 23,450 | | 575,463 |

| Tractor Supply Co. (a) | | 2,300 | | 145,314 |

| | | | | 1,666,367 |

| |

| TOTAL SPECIALTY RETAIL | | | | 5,851,452 |

| |

| TEXTILES, APPAREL & LUXURY GOODS – 5.7% | | | | |

| Apparel, Accessories & Luxury Goods – 4.0% | | | | |

| Carter’s, Inc. (a) | | 9,500 | | 607,905 |

| Coach, Inc. (a) | | 9,300 | | 332,196 |

| Kenneth Cole Productions, Inc. Class A (sub. vtg.) | | 2,800 | | 77,028 |

| Liz Claiborne, Inc. | | 9,200 | | 331,476 |

| Polo Ralph Lauren Corp. Class A | | 6,600 | | 382,536 |

| Ports Design Ltd. | | 109,000 | | 140,502 |

| Quiksilver, Inc. (a) | | 8,500 | | 123,250 |

| | | | | 1,994,893 |

| Footwear – 1.7% | | | | |

| Deckers Outdoor Corp. (a)(d) | | 4,300 | | 145,770 |

| NIKE, Inc. Class B | | 8,100 | | 702,918 |

| | | | | 848,688 |

| |

| TOTAL TEXTILES, APPAREL & LUXURY GOODS | | | | 2,843,581 |

| |

| TOTAL COMMON STOCKS | | | | |

| (Cost $42,185,808) | | | | 48,622,524 |

| |

| Money Market Funds — 5.0% | | | | |

| | | Shares | | Value (Note 1) |

| Fidelity Cash Central Fund, 4.57% (b) | | 1,140,985 $ | | 1,140,985 |

| Fidelity Securities Lending Cash Central Fund, 4.58% (b)(c) | | 1,346,000 | | 1,346,000 |

| TOTAL MONEY MARKET FUNDS | | | | |

| (Cost $2,486,985) | | | | 2,486,985 |

| |

| TOTAL INVESTMENT PORTFOLIO - 102.9% | | | | |

| (Cost $44,672,793) | | | | 51,109,509 |

| |

| NET OTHER ASSETS – (2.9)% | | | | (1,427,482) |

| NET ASSETS – 100% | | $ | | 49,682,027 |

(a) Non-income producing

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund’s holdings as of its most recent quarter end is available upon request.

(c) Investment made with cash collateral received from securities on loan. (d) Security or a portion of the security is on loan at period end.

See accompanying notes which are an integral part of the financial statements.

Annual Report 12

| Affiliated Central Funds | | | | |

| Information regarding fiscal year to date income earned by the fund from the affiliated Central funds is as follows: | | | | |

| |

| Fund | | Income earned |

| Fidelity Cash Central Fund | | $ | | 37,484 |

| Fidelity Securities Lending Cash Central Fund | | | | 7,629 |

| Total | | $ | | 45,113 |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows:

| United States of America | | 88.2% |

| Switzerland | | 3.2% |

| Panama | | 1.6% |

| Cayman Islands | | 1.4% |

| United Kingdom | | 1.3% |

| Others (individually less than 1%) | | 4.3% |

| | | 100.0% |

See accompanying notes which are an integral part of the financial statements.

|

13 Annual Report

13

| Consumer Industries Portfolio | | | | | | |

| |

| Financial Statements | | | | | | |

| |

| |

| Statement of Assets and Liabilities | | | | | | |

| | | | | | | February 28, 2006 |

| |

| Assets | | | | | | |

| Investment in securities, at value (including securities loaned of $1,267,310) — See accompanying schedule: | | | | | | |

| Unaffiliated issuers (cost $42,185,808) | | $ | | 48,622,524 | | |

| Affiliated Central Funds (cost $2,486,985) | | | | 2,486,985 | | |

| Total Investments (cost $44,672,793) | | | | $ | | 51,109,509 |

| Receivable for investments sold | | | | | | 7,912 |

| Receivable for fund shares sold | | | | | | 93,832 |

| Dividends receivable | | | | | | 24,983 |

| Interest receivable | | | | | | 2,968 |

| Prepaid expenses | | | | | | 168 |

| Other affiliated receivables | | | | | | 4 |

| Other receivables | | | | | | 2,864 |

| Total assets | | | | | | 51,242,240 |

| |

| Liabilities | | | | | | |

| Payable for fund shares redeemed | | $ | | 147,720 | | |

| Accrued management fee | | | | 23,306 | | |

| Other affiliated payables | | | | 15,446 | | |

| Other payables and accrued expenses | | | | 27,741 | | |

| Collateral on securities loaned, at value | | | | 1,346,000 | | |

| Total liabilities | | | | | | 1,560,213 |

| |

| Net Assets | | | | $ | | 49,682,027 |

| Net Assets consist of: | | | | | | |

| Paid in capital | | | | $ | | 41,989,850 |

| Accumulated net investment loss | | | | | | (14) |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | | | | | 1,255,475 |

| Net unrealized appreciation (depreciation) on investments | | | | | | 6,436,716 |

| Net Assets, for 1,930,124 shares outstanding | | | | $ | | 49,682,027 |

| Net Asset Value, offering price and redemption price per share ($49,682,027 ÷ 1,930,124 shares) | | | | $ | | 25.74 |

| |

| Statement of Operations | | | | | | |

| | | | | | | Year ended February 28, 2006 |

| |

| Investment Income | | | | | | |

| Dividends | | | | $ | | 392,834 |

| Interest | | | | | | 51 |

| Income from affiliated Central Funds (including $7,629 from security lending) | | | | | | 45,113 |

| Total income | | | | | | 437,998 |

| |

| Expenses | | | | | | |

| Management fee | | $ | | 244,492 | | |

| Transfer agent fees | | | | 158,780 | | |

| Accounting and security lending fees | | | | | | |

| | | | | 21,549 | | |

| Independent trustees’ compensation | | | | 182 | | |

| Custodian fees and expenses | | | | 15,775 | | |

| Registration fees | | | | 15,898 | | |

| Audit | | | | 33,517 | | |

| Legal | | | | 340 | | |

| Miscellaneous | | | | 1,446 | | |

| Total expenses before reductions | | | | 491,979 | | |

| Expense reductions | | | | (8,784) | | 483,195 |

| |

| Net investment income (loss) | | | | | | (45,197) |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

See accompanying notes which are an integral part of the financial statements.

Annual Report 14

| Unaffiliated issuers | | 1,978,609 | | | | |

| Foreign currency transactions | | 1,499 | | | | |

| Total net realized gain (loss) | | | | | | 1,980,108 |

| Change in net unrealized appreciation (depreciation) on investment securities | | | | | | 1,133,559 |

| Net gain (loss) | | | | | | 3,113,667 |

| Net increase (decrease) in net assets resulting from operations | | | | $ | | 3,068,470 |

See accompanying notes which are an integral part of the financial statements.

|

15 Annual Report

| Consumer Industries Portfolio | | | | | | | | | | | | | | | | | | |

| Financial Statements - continued | | | | | | | | | | | | | | | | | | |

| |

| |

| Statement of Changes in Net Assets | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Year ended | | Year ended |

| | | | | | | | | | | February 28, | | February 28, |

| | | | | | | | | | | 2006 | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | | | | | | | $ | | (45,197) | $ | | | (114,300) |

| Net realized gain (loss) | | | | | | | | | | | | 1,980,108 | | | | 28,900 |

| Change in net unrealized appreciation (depreciation) | | | | | | | | | | | | 1,133,559 | | | | 1,505,127 |

| Net increase (decrease) in net assets resulting from operations | | | | | | | | | | | | 3,068,470 | | | | 1,419,727 |

| Distributions to shareholders from net realized gain | | | | | | | | | | | | (484,881) | | (1,510,535) |

| Share transactions | | | | | | | | | | | | | | | | | | |

| Proceeds from sales of shares | | | | | | | | | | | | 26,870,735 | | 23,571,117 |

| Reinvestment of distributions | | | | | | | | | | | | 473,921 | | | | 1,475,744 |

| Cost of shares redeemed | | | | | | | | | | | | (20,002,209) | | (20,792,957) |

| Net increase (decrease) in net assets resulting from share transactions | | | | | | | | | | 7,342,447 | | | | 4,253,904 |

| Redemption fees | | | | | | | | | | | | | | 8,138 | | | | 11,308 |

| Total increase (decrease) in net assets | | | | | | | | | | | | 9,934,174 | | | | 4,174,404 |

| |

| Net Assets | | | | | | | | | | | | | | | | | | |

| Beginning of period | | | | | | | | | | | | 39,747,853 | | 35,573,449 |

| End of period (including accumulated net investment loss of $14 and accumulated net investment loss of $21, | | | | | | | | | | |

| respectively) | | | | | | | | | | $ | | 49,682,027 | $ | 39,747,853 |

| |

| Other Information | | | | | | | | | | | | | | | | | | |

| Shares | | | | | | | | | | | | | | | | | | |

| Sold | | | | | | | | | | | | 1,077,885 | | | | 1,007,148 |

| Issued in reinvestment of distributions | | | | | | | | | | | | | | 18,542 | | | | 62,267 |

| Redeemed | | | | | | | | | | | | (806,579) | | | | (898,454) |

| Net increase (decrease) | | | | | | | | | | | | 289,848 | | | | 170,961 |

| |

| Financial Highlights | | | | | | | | | | | | | | | | | | |

| Years ended February 28, | | | | 2006 | | | | 2005 | | 2004E | | | | 2003 | | | | 2002 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | | 24.23 | | $ | | 24.21 | | $ 18.39 | | $ | | 23.58 | | $ | | 25.31 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)C | | | | (.03) | | | | (.07) | | (.09) | | | | (.18) | | | | (.07) |

| Net realized and unrealized gain (loss) | | | | 1.80 | | | | 1.05 | | 6.28 | | | | (5.02) | | | | (.25) |

| Total from investment operations | | | | 1.77 | | | | .98 | | 6.19 | | | | (5.20) | | | | (.32) |

| Distributions from net realized gain | | | | (.26) | | | | (.97) | | (.38) | | | | — | | | | (1.42) |

| Redemption fees added to paid in capitalC | | | | —F | | | | .01 | | .01 | | | | .01 | | | | .01 |

| Net asset value, end of period | | $ | | 25.74 | | $ | | 24.23 | | $ 24.21 | | $ | | 18.39 | | $ | | 23.58 |

| Total ReturnA,B | | | | 7.31% | | | | 4.18% | | 33.82% | | | | (22.01)% | | | | (.87)% |

| Ratios to Average Net AssetsD | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | | | 1.15% | | | | 1.23% | | 1.59% | | | | 1.86% | | | | 1.71% |

| Expenses net of fee waivers, if any | | | | 1.15% | | | | 1.22% | | 1.59% | | | | 1.86% | | | | 1.71% |

| Expenses net of all reductions | | | | 1.13% | | | | 1.19% | | 1.54% | | | | 1.83% | | | | 1.69% |

| Net investment income (loss) | | | | (.11)% | | | | (.31)% | | (.39)% | | | | (.84)% | | | | (.30)% |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | | 49,682 | | $ | | 39,748 | | $ 35,573 | | $ | | 20,693 | | $ | | 23,471 |

| Portfolio turnover rate | | | | 71% | | | | 112% | | 138% | | | | 116% | | | | 110% |

| |

| | | | | |

A Total returns would have been lower had certain expenses not been reduced during the periods shown. B Total returns do not include the effect of the former sales charges. C Calculated based on average shares outstanding during the period. DExpense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund. EFor the year ended February 29. FAmount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report 16

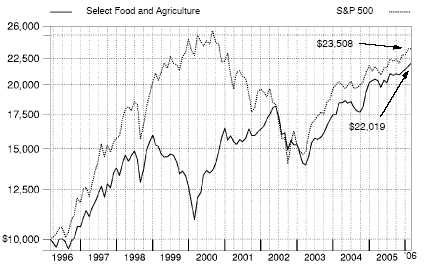

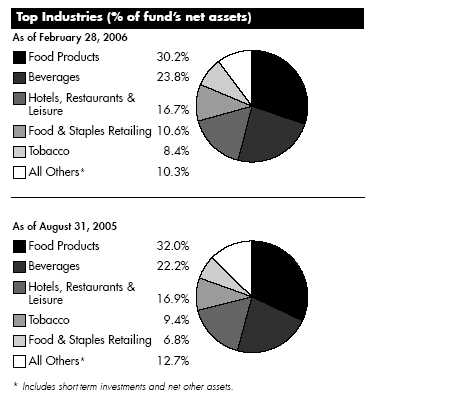

Food and Agriculture Portfolio

Performance

|

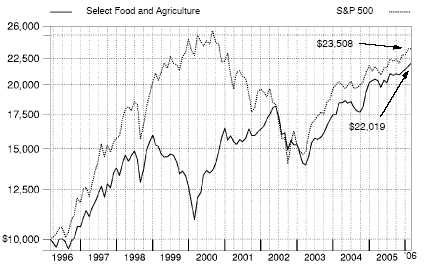

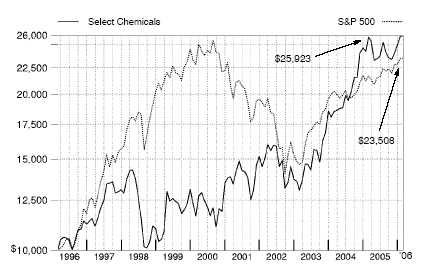

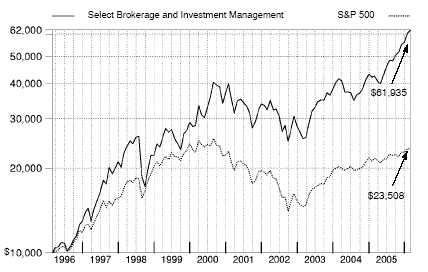

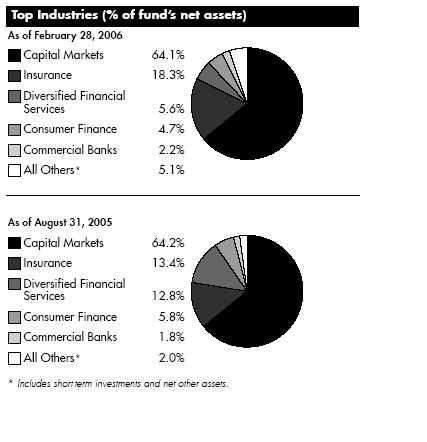

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund’s dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity a fund’s total returns will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns | | | | | | |

| Periods ended February 28, 2006 | | Past 1 | | Past 5 | | Past 10 |

| | | year | | years | | years |

| Select Food and Agriculture | | 7.50% | | 6.75% | | 8.21% |

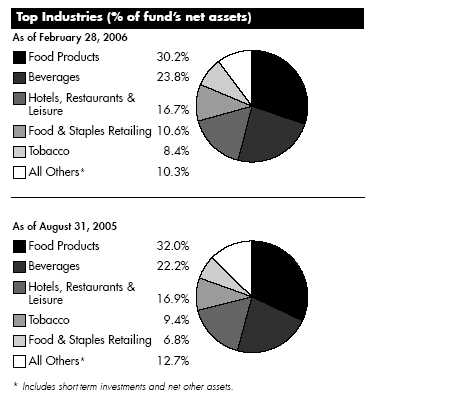

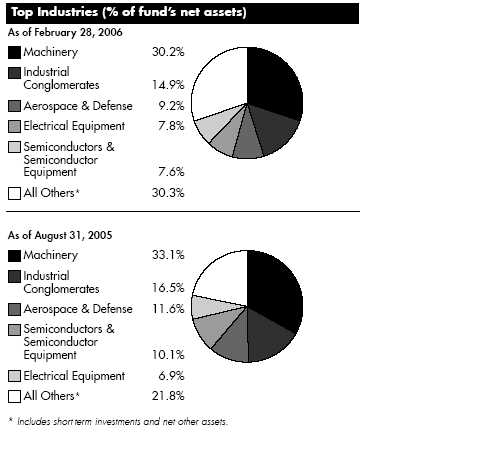

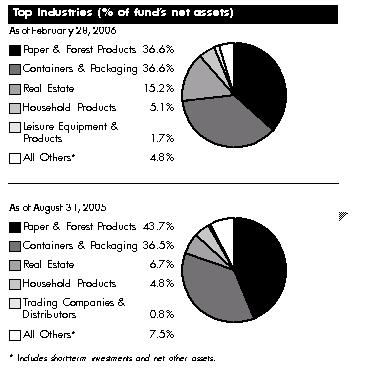

10,000 Over 10 Years

Let’s say hypothetically that $10,000 was invested in Fidelity Select Food and Agriculture Portfolio on February 29, 1996. The chart shows the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

17 Annual Report

Food and Agriculture Portfolio

|

Management’s Discussion of Fund Performance

Comments from Robert Lee, Portfolio Manager of Fidelity® Select Food and Agriculture Portfolio

With the exception of several popular large-cap stock performance measures, most major U.S. equity benchmarks had double-digit returns for the year ending February 28, 2006. For much of the period, market gains were driven largely by the energy sector, although utilities ultimately sneaked into the top spot for the year overall. Financials and telecommunication services also reached double figures, outperforming the 8.40% return of the broader market as measured by the large-cap-oriented Standard & Poor’s 500SM Index. The consumer discretionary segment — home to the weak performing automobile and media industries — was the biggest disappointment. Although the overall return for the S&P 500® beat the small-cap Russell 2000® Index in calendar year 2005 — the first time that’s happened in six years — small-caps stormed back in early 2006, leading to a 16.59% advance during the past 12 months, nearly twice the broader market’s gain. Mid-caps soared even higher, returning 17.67% according to the Russell Midcap® Index. The technology-heavy NASDAQ Composite® Index also fared well, climbing 12.13%, but the Dow Jones Industrial AverageSM, an index of 30 large-cap, blue-chip stocks, managed to rise only 4.52% .

The fund returned 7.50% during the past year, solidly ahead of the Goldman Sachs® Consumer Industries Index, which gained 3.31%, and slightly behind the S&P 500. Some of the fund’s outperformance of the Goldman Sachs index resulted from the strong showing of stocks in the food and agriculture space relative to other consumer industries represented in the index. For example, the fund benefited from not investing in media stocks —which were among the weakest performers within the benchmark — and having very little invested in hypermarkets and super centers — specifically Wal-Mart, a major index component that declined. Partially offsetting this, packaged foods stocks lagged the Goldman Sachs index, so our natural inclusion of some of these stocks — such as Wrigley — held back our relative return. Security selection was strong overall. Although packaged food stocks lagged as a group, we benefited from some good picks there. Overweightings in Swiss-based Nestle and Anglo-Dutch Unilever were notable contributors here. Additionally, we saw solid gains from restaurant holdings Wendy’s International and Domino’s Pizza, although Outback Steakhouse modestly detracted. Strong results from tobacco stocks — driven mostly by Altria Group — further aided performance, as did our showing in the fertilizers and agricultural chemicals area, where Monsanto was a standout. Among beverage companies, PepsiCo helped but bottler Coca-Cola Enterprises detracted. Meat processor Smithfield Foods was the biggest detractor versus the index, and underweighting strong performing food retailer Albertson’s also hurt. Some stocks I’ve mentioned were no longer held at period end.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

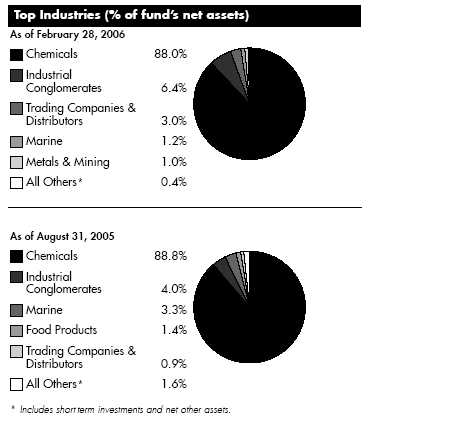

Food and Agriculture Portfolio

Investment Changes

| Top Ten Stocks as of February 28, 2006 |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Nestle SA sponsored ADR | | 8.4 | | 8.0 |

| Unilever NV (NY Shares) | | 6.5 | | 5.8 |

| PepsiCo, Inc. | | 6.5 | | 5.9 |

| Altria Group, Inc. | | 6.4 | | 7.5 |

| The Coca-Cola Co. | | 6.1 | | 5.9 |

| McDonald’s Corp. | | 5.8 | | 6.9 |

| Kellogg Co. | | 4.4 | | 4.2 |

| Coca-Cola Enterprises, Inc. | | 3.5 | | 3.7 |

| Kroger Co. | | 3.5 | | 1.6 |

| Starbucks Corp. | | 3.4 | | 1.1 |

| | | 54.5 | | |

19 Annual Report

| Food and Agriculture Portfolio | | | | | | |

| Investments February 28, 2006 | | | | |

| Showing Percentage of Net Assets | | | | | | |

| |

| Common Stocks — 99.6% | | | | | | |

| | | | | Shares | | Value (Note 1) |

| |

| BEVERAGES – 23.8% | | | | | | |

| Brewers – 2.8% | | | | | | |

| Anheuser-Busch Companies, Inc. | | | | 100 | | $ 4,154 |

| Efes Breweries International NV unit (a)(e) | | | | 8,000 | | 299,040 |

| InBev SA | | | | 33,800 | | 1,562,965 |

| SABMiller PLC | | | | 78,900 | | 1,569,484 |

| | | | | | | 3,435,643 |

| Distillers & Vintners – 3.6% | | | | | | |

| Constellation Brands, Inc. Class A (sub. vtg.) (a) | | | | 39,400 | | 1,037,796 |

| Diageo PLC sponsored ADR | | | | 30,500 | | 1,881,850 |

| Pernod Ricard SA | | | | 9,100 | | 1,557,789 |

| | | | | | | 4,477,435 |

| Soft Drinks – 17.4% | | | | | | |

| Coca-Cola Enterprises, Inc. | | | | 224,900 | | 4,419,285 |

| Coca-Cola Femsa SA de CV sponsored ADR | | | | 11,800 | | 360,844 |

| Coca-Cola Hellenic Bottling Co. SA sponsored ADR | | | | 20,300 | | 613,060 |

| Fomento Economico Mexicano SA de CV sponsored ADR | | | | 7,600 | | 661,124 |

| PepsiCo, Inc. | | | | 137,300 | | 8,115,803 |

| The Coca-Cola Co. | | | | 181,500 | | 7,617,555 |

| | | | | | | 21,787,671 |

| |

| TOTAL BEVERAGES | | | | | | 29,700,749 |

| |

| CHEMICALS – 4.8% | | | | | | |

| Fertilizers & Agricultural Chemicals – 4.5% | | | | | | |

| Agrium, Inc. | | | | 18,400 | | 458,320 |

| Bodisen Biotech, Inc. (a) | | | | 21,000 | | 325,500 |

| CF Industries Holdings, Inc. | | | | 100 | | 1,762 |

| Monsanto Co. | | | | 45,000 | | 3,774,600 |

| Mosaic Co. (a) | | | | 16,800 | | 267,120 |

| Potash Corp. of Saskatchewan | | | | 3,300 | | 316,566 |

| Syngenta AG sponsored ADR | | | | 19,000 | | 539,980 |

| | | | | | | 5,683,848 |

| Specialty Chemicals – 0.3% | | | | | | |

| Senomyx, Inc. (a) | | | | 21,800 | | 354,468 |

| |

| TOTAL CHEMICALS | | | | | | 6,038,316 |

| |

| COMMERCIAL SERVICES & SUPPLIES – 0.0% | | | | | | |

| Diversified Commercial & Professional Services – 0.0% | | | | | | |

| Aramark Corp. Class B | | | | 100 | | 2,846 |

| FOOD & STAPLES RETAILING – 10.6% | | | | | | |

| Food Distributors – 3.3% | | | | | | |

| Central European Distribution Corp. (a)(d) | | | | 8,000 | | 335,280 |

| Sysco Corp. | | | | 127,100 | | 3,824,439 |

| | | | | | | 4,159,719 |

| |

| |

| | | | | Shares | | Value (Note 1) |

| Food Retail – 6.4% | | | | | | |

| Kroger Co. (a) | | | | 217,400 | | $ 4,356,696 |

See accompanying notes which are an integral part of the financial statements.

Annual Report 20

| Safeway, Inc. | | 131,000 | | 3,184,610 |

| Whole Foods Market, Inc. | | 7,400 | | 472,712 |

| | | | | 8,014,018 |

| Hypermarkets & Super Centers – 0.9% | | | | |

| Wal-Mart Stores, Inc. | | 23,200 | | 1,052,352 |

| |

| TOTAL FOOD & STAPLES RETAILING | | | | 13,226,089 |

| |

| FOOD PRODUCTS – 30.2% | | | | |

| Agricultural Products – 4.1% | | | | |

| Archer-Daniels-Midland Co. | | 101,300 | | 3,213,236 |

| Bunge Ltd. | | 10,500 | | 595,245 |

| Corn Products International, Inc. | | 50,600 | | 1,364,176 |

| | | | | 5,172,657 |

| Packaged Foods & Meats – 26.1% | | | | |

| Cadbury Schweppes PLC sponsored ADR (d) | | 8,200 | | 335,544 |

| General Mills, Inc. | | 85,900 | | 4,230,575 |

| Groupe Danone | | 2,700 | | 312,211 |

| Hershey Co. | | 7,000 | | 358,050 |

| Kellogg Co. | | 124,700 | | 5,525,457 |

| Koninklijke Numico NV (a) | | 6,600 | �� | 285,839 |

| Kraft Foods, Inc. Class A | | 100 | | 3,009 |

| Lindt & Spruengli AG | | 30 | | 593,277 |

| Nestle SA sponsored ADR | | 143,000 | | 10,539,100 |

| People’s Food Holdings Ltd. | | 100 | | 71 |

| Tyson Foods, Inc. Class A | | 100 | | 1,353 |

| Unilever NV (NY Shares) | | 117,100 | | 8,148,989 |

| Wm. Wrigley Jr. Co. | | 36,200 | | 2,300,148 |

| | | | | 32,633,623 |

| |

| TOTAL FOOD PRODUCTS | | | | 37,806,280 |

| |

| HOTELS, RESTAURANTS & LEISURE – 16.7% | | | | |

| Restaurants – 16.7% | | | | |

| Applebee’s International, Inc. | | 9,300 | | 215,202 |

| Buffalo Wild Wings, Inc. (a) | | 88,314 | | 3,349,750 |

| California Pizza Kitchen, Inc. (a) | | 9,700 | | 291,582 |

| Chipotle Mexican Grill, Inc. Class A | | 100 | | 4,560 |

| Domino’s Pizza, Inc. | | 44,500 | | 1,134,750 |

| McCormick & Schmick’s Seafood Restaurants (a) | | 13,100 | | 306,933 |

| McDonald’s Corp. | | 207,700 | | 7,250,807 |

| Outback Steakhouse, Inc. | | 21,900 | | 915,639 |

| Red Robin Gourmet Burgers, Inc. (a) | | 45,500 | | 1,819,545 |

| Starbucks Corp. (a)(d) | | 117,600 | | 4,271,232 |

| Texas Roadhouse, Inc. Class A (a) | | 20,000 | | 307,200 |

| Yum! Brands, Inc. | | 21,600 | | 1,030,320 |

| | | | | 20,897,520 |

See accompanying notes which are an integral part of the financial statements.

|

21 Annual Report

21

| Food and Agriculture Portfolio | | | | |

| Investments - continued | | | | |

| |

| |

| Common Stocks – continued | | | | |

| | | Shares | | Value (Note 1) |

| |

| HOUSEHOLD PRODUCTS – 3.7% | | | | |

| Household Products – 3.7% | | | | |

| Colgate-Palmolive Co. | | 60,650 | | $ 3,304,212 |

| Procter & Gamble Co. | | 20,997 | | 1,258,350 |

| | | | | 4,562,562 |

| |

| MACHINERY – 1.1% | | | | |

| Construction & Farm Machinery & Heavy Trucks – 1.1% | | | | |

| AGCO Corp. (a) | | 19,500 | | 381,225 |

| Caterpillar, Inc. | | 4,500 | | 328,860 |

| CNH Global NV | | 10,100 | | 255,227 |

| Deere & Co. | | 5,300 | | 404,231 |

| | | | | 1,369,543 |

| |

| PERSONAL PRODUCTS – 0.3% | | | | |

| Personal Products – 0.3% | | | | |

| Avon Products, Inc. | | 11,200 | | 323,120 |

| TOBACCO – 8.4% | | | | |

| Tobacco – 8.4% | | | | |

| Altria Group, Inc. | | 110,600 | | 7,952,140 |

| British American Tobacco PLC sponsored ADR | | 13,500 | | 646,380 |

| Imperial Tobacco Group PLC | | 10,400 | | 312,870 |

| Loews Corp. – Carolina Group | | 8,100 | | 384,669 |

| Reynolds American, Inc. (d) | | 11,900 | | 1,263,185 |

| | | | | 10,559,244 |

| |

| TOTAL COMMON STOCKS | | | | |

| (Cost $101,462,391) | | | | 124,486,269 |

| |

| Money Market Funds — 1.4% | | | | |

| | | Shares | | Value (Note 1) |

| Fidelity Cash Central Fund, 4.57% (b) | | 1,173,874 $ | | 1,173,874 |

| Fidelity Securities Lending Cash Central Fund, 4.58% (b)(c) | | 600,975 | | 600,975 |

| TOTAL MONEY MARKET FUNDS | | | | |

| (Cost $1,774,849) | | | | 1,774,849 |

| |

| TOTAL INVESTMENT PORTFOLIO - 101.0% | | | | |

| (Cost $103,237,240) | | | | 126,261,118 |

| |

| NET OTHER ASSETS – (1.0)% | | | | (1,254,603) |

| NET ASSETS – 100% | | $ | | 125,006,515 |

(a) Non-income producing

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund’s holdings as of its most recent quarter end is available upon request.

(c) Investment made with cash collateral received from securities on loan. (d) Security or a portion of the security is on loan at period end.

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the period end, the value of these securities amounted to $299,040 or 0.2% of net assets.

See accompanying notes which are an integral part of the financial statements.

Annual Report 22

| Affiliated Central Funds | | | | |

| Information regarding fiscal year to date income earned by the fund from the affiliated Central funds is as follows: | | | | |

| |

| Fund | | Income earned |

| Fidelity Cash Central Fund | | $ | | 55,900 |

| Fidelity Securities Lending Cash Central Fund | | | | 42,021 |

| Total | | $ | | 97,921 |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows:

| United States of America | | 74.5% |

| Switzerland | | 9.3% |

| Netherlands | | 7.1% |

| United Kingdom | | 3.8% |

| France | | 1.6% |

| Belgium | | 1.3% |

| Others (individually less than 1%) | | 2.4% |

| | | 100.0% |

See accompanying notes which are an integral part of the financial statements.

|

23 Annual Report

23

| Food and Agriculture Portfolio | | | | | | | | |

| |

| Financial Statements | | | | | | | | |

| |

| |

| Statement of Assets and Liabilities | | | | | | | | |

| | | | | | | | | February 28, 2006 |

| |

| Assets | | | | | | | | |

| Investment in securities, at value (including securities loaned of $582,538) — See accompanying schedule: | | | | | | | | |

| Unaffiliated issuers (cost $101,462,391) | | $ | | 124,486,269 | | | | |

| Affiliated Central Funds (cost $1,774,849) | | | | 1,774,849 | | | | |

| Total Investments (cost $103,237,240) | | | | | | $ | | 126,261,118 |

| Receivable for investments sold | | | | | | | | 754,283 |

| Receivable for fund shares sold | | | | | | | | 99,680 |

| Dividends receivable | | | | | | | | 54,584 |

| Interest receivable | | | | | | | | 3,807 |

| Prepaid expenses | | | | | | | | 509 |

| Other receivables | | | | | | | | 3,127 |

| Total assets | | | | | | | | 127,177,108 |

| |

| Liabilities | | | | | | | | |

| Payable for investments purchased | | $ | | 918,448 | | | | |

| Payable for fund shares redeemed | | | | 523,892 | | | | |

| Accrued management fee | | | | 58,955 | | | | |

| Other affiliated payables | | | | 39,018 | | | | |

| Other payables and accrued expenses | | | | 29,305 | | | | |

| Collateral on securities loaned, at value | | | | 600,975 | | | | |

| Total liabilities | | | | | | | | 2,170,593 |

| |

| Net Assets | | | | | | $ | | 125,006,515 |

| Net Assets consist of: | | | | | | | | |

| Paid in capital | | | | | | $ | | 99,432,292 |

| Undistributed net investment income | | | | | | | | 237,173 |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | | | | | | | 2,313,431 |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | | | | | | | 23,023,619 |

| Net Assets, for 2,395,866 shares outstanding | | | | | | $ | | 125,006,515 |

| Net Asset Value, offering price and redemption price per share ($125,006,515 ÷ 2,395,866 shares) | | | | | | $ | | 52.18 |

| |

| Statement of Operations | | | | | | | | |

| | | | | | | | | Year ended February 28, 2006 |

| |

| Investment Income | | | | | | | | |

| Dividends | | | | | | $ | | 2,498,933 |

| Interest | | | | | | | | 96 |

| Income from affiliated Central Funds (including $42,021 from security lending) | | | | | | | | 97,921 |

| Total income | | | | | | | | 2,596,950 |

| |

| Expenses | | | | | | | | |

| Management fee | | $ | | 739,001 | | | | |

| Transfer agent fees | | | | 453,016 | | | | |

| Accounting and security lending fees | | | | | | | | |

| | | | | 66,312 | | | | |

| Independent trustees’ compensation | | | | 593 | | | | |

| Custodian fees and expenses | | | | 28,886 | | | | |

| Registration fees | | | | 26,177 | | | | |

| Audit | | | | 34,242 | | | | |

| Legal | | | | 777 | | | | |

| Miscellaneous | | | | 3,290 | | | | |

| Total expenses before reductions | | | | 1,352,294 | | | | |

| Expense reductions | | | | (18,675) | | | | 1,333,619 |

| |

| Net investment income (loss) | | | | | | | | 1,263,331 |

| | Realized and Unrealized Gain (Loss)

Net realized gain (loss) on:

Investment securities:

|

See accompanying notes which are an integral part of the financial statements.

Annual Report 24

| Unaffiliated issuers | | 8,287,528 | | |

| Foreign currency transactions | | 315 | | |

| Total net realized gain (loss) | | | | 8,287,843 |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment securities | | (384,822) | | |

| Assets and liabilities in foreign currencies | | (307) | | |

| Total change in net unrealized appreciation (depreciation) | | | | (385,129) |

| Net gain (loss) | | | | 7,902,714 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 9,166,045 |

See accompanying notes which are an integral part of the financial statements.

|

25 Annual Report

| Food and Agriculture Portfolio | | | | | | | | | | | | | | | | | | | | |

| Financial Statements - continued | | | | | | | | | | | | | | | | | | | | |

| |

| |

| Statement of Changes in Net Assets | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Year ended | | Year ended |

| | | | | | | | | | | February 28, | | February 28, |

| | | | | | | | | | | 2006 | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | | | | | | | $ | | 1,263,331 | | $ | | | | 712,640 |

| Net realized gain (loss) | | | | | | | | | | | | 8,287,843 | | | | | | 8,330,360 |

| Change in net unrealized appreciation (depreciation) | | | | | | | | | | | | (385,129) | | | | | | 2,593,286 |

| Net increase (decrease) in net assets resulting from operations | | | | | | | | | | | | 9,166,045 | | | | 11,636,286 |

| Distributions to shareholders from net investment income | | | | | | | | | | | | (1,049,605) | | | | | | (683,408) |

| Distributions to shareholders from net realized gain | | | | | | | | | | | | (6,158,772) | | | | | | — |

| Total distributions | | | | | | | | | | | | (7,208,377) | | | | | | (683,408) |

| Share transactions | | | | | | | | | | | | | | | | | | | | |

| Proceeds from sales of shares | | | | | | | | | | | | 47,926,666 | | | | 105,702,482 |

| Reinvestment of distributions | | | | | | | | | | | | 6,802,073 | | | | | | 642,326 |

| Cost of shares redeemed | | | | | | | | | | | | (71,028,865) | | | | (82,447,637) |

| Net increase (decrease) in net assets resulting from share transactions | | | | | | | | | | (16,300,126) | | | | 23,897,171 |

| Redemption fees | | | | | | | | | | | | | | 20,664 | | | | | | 41,906 |

| Total increase (decrease) in net assets | | | | | | | | | | | | (14,321,794) | | | | 34,891,955 |

| |

| Net Assets | | | | | | | | | | | | | | | | | | | | |

| Beginning of period | | | | | | | | | | | | 139,328,309 | | | | 104,436,354 |

| End of period (including undistributed net investment income of $237,173 and undistributed net investment income | | | | | | | | | | |

| of $28,038, respectively) | | | | | | | | | | $ | | 125,006,515 | | $ | | 139,328,309 |

| |

| Other Information | | | | | | | | | | | | | | | | | | | | |

| Shares | | | | | | | | | | | | | | | | | | | | |

| Sold | | | | | | | | | | | | 932,427 | | | | | | 2,217,961 |

| Issued in reinvestment of distributions | | | | | | | | | | | | 133,891 | | | | | | 13,111 |

| Redeemed | | | | | | | | | | | | (1,380,263) | | | | (1,767,243) |

| Net increase (decrease) | | | | | | | | | | | | (313,945) | | | | | | 463,829 |

| |

| Financial Highlights | | | | | | | | | | | | | | | | | | | | |

| Years ended February 28, | | | | 2006 | | | | 2005 | | 2004E | | | | 2003 | | | | 2002 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | | 51.42 | | $ | | 46.50 | | $ 35.71 | | $ | | 44.68 | | $ | | 46.01 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)C | | | | 50 | | | | .29 | | .22 | | | | .25 | | | | .34 |

| Net realized and unrealized gain (loss) | | | | 3.25 | | | | 4.90 | | 10.80 | | | | (8.06) | | | | 2.79 |

| Total from investment operations | | | | 3.75 | | | | 5.19 | | 11.02 | | | | (7.81) | | | | 3.13 |

| Distributions from net investment income | | | | (.44) | | | | (.29) | | (.24) | | | | (.32) | | | | (.21) |

| Distributions from net realized gain | | | | (2.56) | | | | — | | — | | | | (.88) | | | | (4.28) |

| Total distributions | | | | (3.00) | | | | (.29) | | (.24) | | | | (1.20) | | | | (4.49) |

| Redemption fees added to paid in capitalC | | | | 01 | | | | .02 | | .01 | | | | .04 | | | | .03 |

| Net asset value, end of period | | $ | | 52.18 | | $ | | 51.42 | | $ 46.50 | | $ | | 35.71 | | $ | | 44.68 |

| Total ReturnA,B | | | | 7.50% | | | | 11.24% | | 30.94% | | | | (17.85)% | | | | 7.76% |

| Ratios to Average Net AssetsD | | | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | | | 1.04% | | | | 1.06% | | 1.27% | | | | 1.25% | | | | 1.24% |

| Expenses net of fee waivers, if any | | | | 1.04% | | | | 1.06% | | 1.27% | | | | 1.25% | | | | 1.24% |

| Expenses net of all reductions | | | | 1.03% | | | | 1.05% | | 1.25% | | | | 1.17% | | | | 1.14% |

| Net investment income (loss) | | | | 97% | | | | .61% | | .55% | | | | .59% | | | | .79% |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | | 125,007 | | $ 139,328 | | $ 104,436 | | $ | | 88,123 | | $ | | 119,980 |

| Portfolio turnover rate | | | | 75% | | | | 86% | | 62% | | | | 225% | | | | 315% |

| |

| | | | | |

A Total returns would have been lower had certain expenses not been reduced during the periods shown. B Total returns do not include the effect of the former sales charges. C Calculated based on average shares outstanding during the period. DExpense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund. EFor the year ended February 29.

See accompanying notes which are an integral part of the financial statements.

Annual Report 26

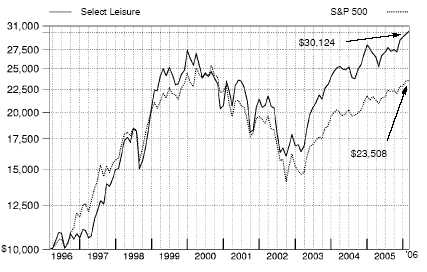

Leisure Portfolio

Performance

|

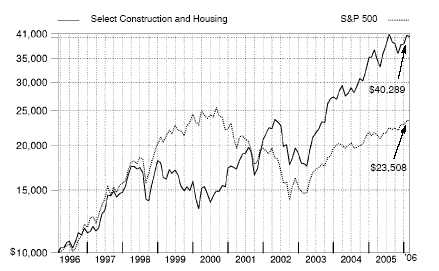

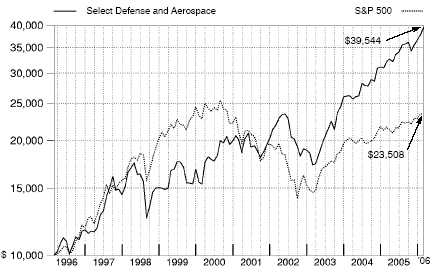

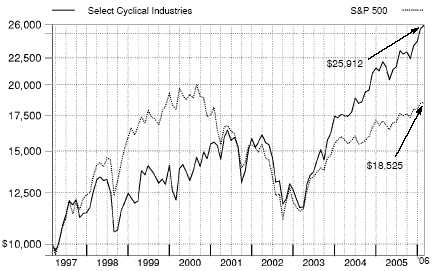

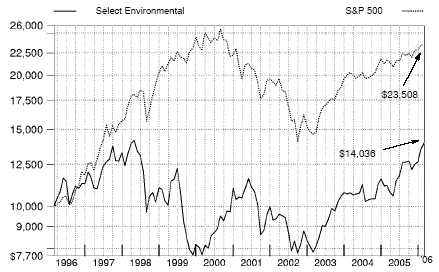

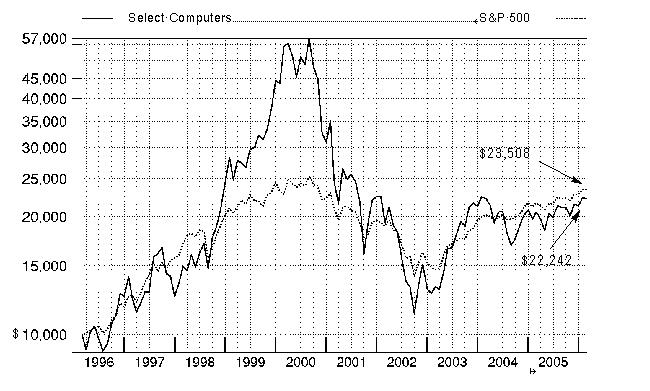

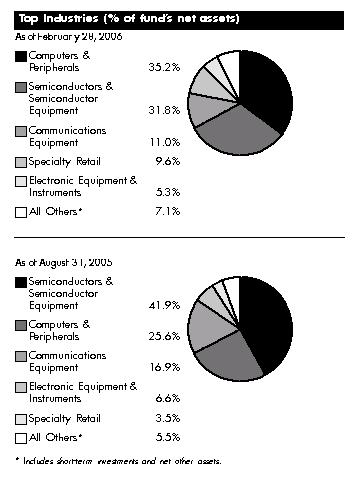

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund’s dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity a fund’s total returns will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns | | | | | | |

| Periods ended February 28, 2006 | | Past 1 | | Past 5 | | Past |

| | | year | | years | | years |

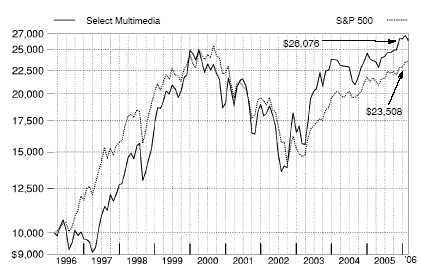

| Select Leisure | | 11.67% | | 6.15% | | 11.66% |

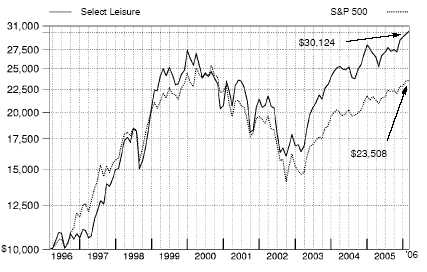

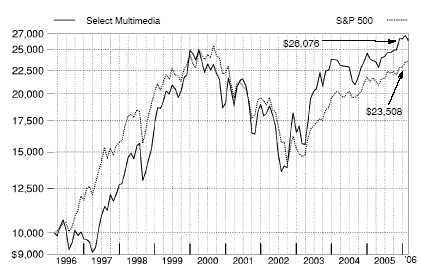

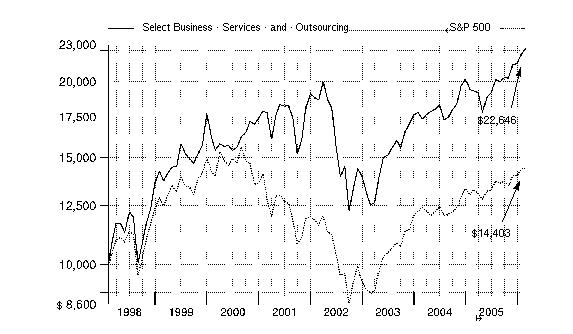

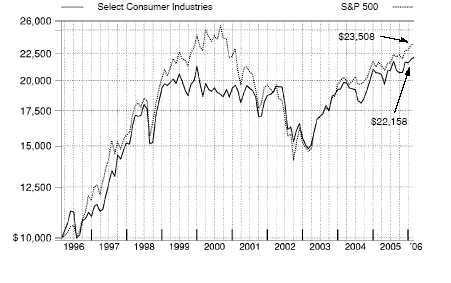

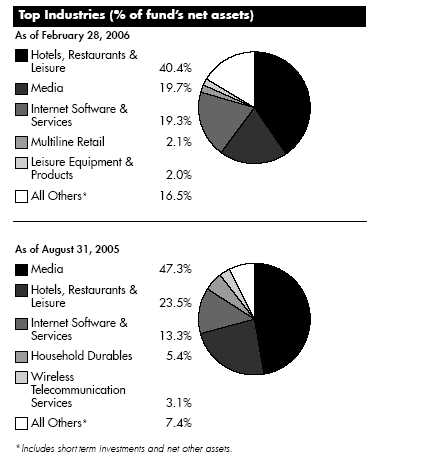

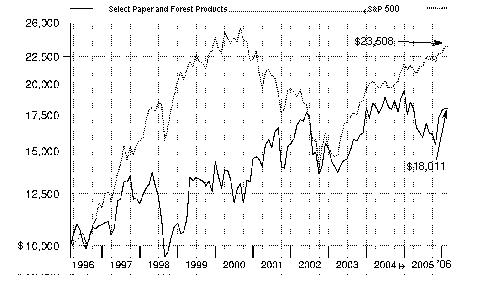

$10,000 Over 10 Years

Let’s say hypothetically that $10,000 was invested in Fidelity Select Leisure Portfolio on February 29, 1996. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

27 Annual Report

Management’s Discussion of Fund Performance

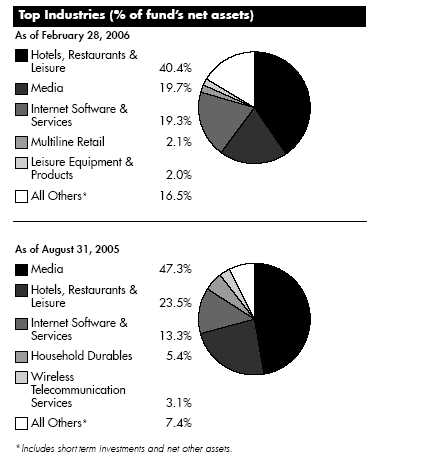

Comments from Gopal Reddy, who became Portfolio Manager of Fidelity® Select Leisure Portfolio on November 1, 2005

With the exception of several popular large-cap stock performance measures, most major U.S. equity benchmarks had double-digit returns for the year ending February 28, 2006. For much of the period, market gains were driven largely by the energy sector, although utilities ultimately sneaked into the top spot for the year overall. Financials and telecommunication services also reached double figures, outperforming the 8.40% return of the broader market as measured by the large-cap-oriented Standard & Poor’s 500SM Index. The consumer discretionary segment — home to the weak performing automobile and media industries — was the biggest disappointment. Although the overall return for the S&P 500® beat the small-cap Russell 2000® Index in calendar year 2005 — the first time that’s happened in six years — small-caps stormed back in early 2006, leading to a 16.59% advance during the past 12 months, nearly twice the broader market’s gain. Mid-caps soared even higher, returning 17.67% according to the Russell Midcap® Index. The technology-heavy NASDAQ Composite® Index also fared well, climbing 12.13%, but the Dow Jones Industrial AverageSM, an index of 30 large-cap, blue-chip stocks, managed to rise only 4.52% .

For the 12-month period ending February 28, 2006, Select Leisure Portfolio returned 11.67%, easily surpassing both the Goldman Sachs® Consumer Industries Index, which gained 3.31%, and the S&P 500. Good security selection, including large exposure to a handful of top-performing stocks, aided the fund’s performance relative to its sector index. Most of the fund’s success was in the Internet, casinos/gaming and restaurant segments. Weak results in the home entertainment software and consumer electronics areas curbed our gains a bit. Our strongest performer by far was Google, the Internet search engine whose soaring stock price continued to reflect its strong earnings as it reshapes the world of advertising. Other key contributors included American Tower, which builds and operates cellular transmitter towers, and Lamar Advertising, which owns and operates billboards, including popular and profitable new digital billboards. Both these stocks benefited from strong pricing power. Equinix, an Internet hosting company, and Melco, a Hong Kong restaurant and gaming firm, also contributed to performance. Omnicom, a diversified advertising company that provides one-stop media buying, was a disappointment, as was Internet portal Yahoo!, which fell short of expectations despite posting strong cash flow growth. Not owning consumer products giant Procter & Gamble, a benchmark component that did well, also hurt performance.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

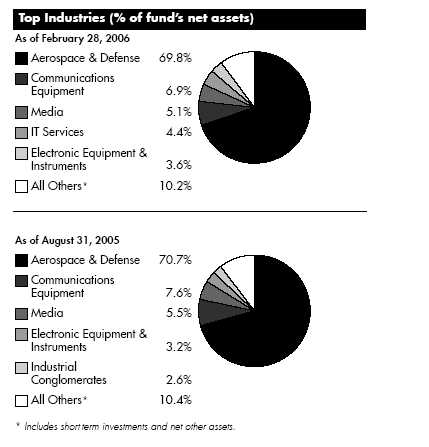

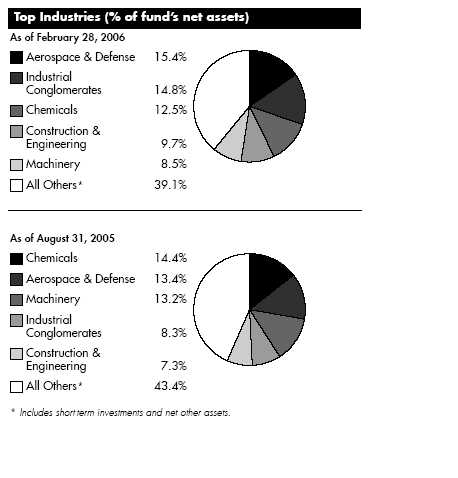

Leisure Portfolio

Investment Changes

| Top Ten Stocks as of February 28, 2006 |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Google, Inc. Class A (sub. vtg.) | | 7.5 | | 7.5 |

| Yahoo!, Inc. | | 7.3 | | 5.8 |

| Carnival Corp. unit | | 4.7 | | 3.7 |

| Equinix, Inc. | | 3.9 | | 0.0 |

| Walt Disney Co. | | 3.9 | | 4.6 |

| News Corp. Class A | | 3.8 | | 4.4 |

| Starwood Hotels & Resorts | | | | |

| Worldwide, Inc. unit | | 3.5 | | 1.0 |

| Kerzner International Ltd. | | 3.3 | | 1.4 |

| Penn National Gaming, Inc. | | 3.0 | | 1.4 |

| Lamar Advertising Co. Class A | | 2.5 | | 6.3 |

| | | 43.4 | | |

29 Annual Report

| Leisure Portfolio | | | | | | |

| Investments February 28, 2006 | | | | |

| Showing Percentage of Net Assets | | | | | | |

| |

| Common Stocks — 96.0% | | | | | | |

| | | | | Shares | | Value (Note 1) |

| |

| AUTOMOBILES – 0.3% | | | | | | |

| Motorcycle Manufacturers – 0.3% | | | | | | |

| Harley-Davidson, Inc. | | | | 14,000 | | $ 735,140 |

| BUILDING PRODUCTS – 0.7% | | | | | | |

| Building Products – 0.7% | | | | | | |

| Simpson Manufacturing Co. Ltd. | | | | 35,200 | | 1,375,968 |

| COMPUTERS & PERIPHERALS – 0.6% | | | | | | |

| Computer Hardware – 0.6% | | | | | | |

| Hewlett-Packard Co. | | | | 35,000 | | 1,148,350 |

| CONSTRUCTION & ENGINEERING – 0.3% | | | | | | |

| Construction & Engineering – 0.3% | | | | | | |

| Perini Corp. (a) | | | | 21,700 | | 659,463 |

| DIVERSIFIED CONSUMER SERVICES – 0.6% | | | | | | |

| Education Services – 0.6% | | | | | | |

| Corinthian Colleges, Inc. (a) | | | | 99,700 | | 1,292,112 |

| DIVERSIFIED FINANCIAL SERVICES – 0.4% | | | | | | |

| Specialized Finance – 0.4% | | | | | | |

| NETeller PLC (a) | | | | 56,200 | | 741,346 |

| DIVERSIFIED TELECOMMUNICATION SERVICES – 0.0% | | | | | | |

| Integrated Telecommunication Services – 0.0% | | | | | | |

| AT&T, Inc. | | | | 100 | | 2,759 |

| BellSouth Corp. | | | | 100 | | 3,158 |

| Verizon Communications, Inc. | | | | 100 | | 3,370 |

| | | | | | | 9,287 |

| |

| ELECTRONIC EQUIPMENT & INSTRUMENTS – 0.7% | | | | | | |

| Electronic Manufacturing Services – 0.5% | | | | | | |

| Merix Corp. (a) | | | | 100,500 | | 972,840 |

| Technology Distributors – 0.2% | | | | | | |

| PFSweb, Inc. (a) | | | | 244,800 | | 396,600 |

| TOTAL ELECTRONIC EQUIPMENT & INSTRUMENTS | | | | | | 1,369,440 |

| |

| FOOD PRODUCTS – 0.4% | | | | | | |

| Packaged Foods & Meats – 0.4% | | | | | | |

| Nestle SA sponsored ADR | | | | 11,000 | | 810,700 |

| HEALTH CARE EQUIPMENT & SUPPLIES – 0.3% | | | | | | |

| Health Care Supplies – 0.3% | | | | | | |

| Align Technology, Inc. (a)(d) | | | | 68,900 | | 562,224 |

| HEALTH CARE PROVIDERS & SERVICES – 0.1% | | | | | | |

| Health Care Services – 0.1% | | | | | | |

| Emdeon Corp. (a) | | | | 14,400 | | 151,776 |

| HOTELS, RESTAURANTS & LEISURE – 40.4% | | | | | | |

| Casinos & Gaming – 15.8% | | | | | | |

| Aristocrat Leisure Ltd. (d) | | | | 109,500 | | 979,644 |

| Boyd Gaming Corp. | | | | 98,300 | | 4,298,659 |

| FortuNet, Inc. | | | | 44,000 | | 418,000 |

| Harrah’s Entertainment, Inc. | | | | 23,900 | | 1,718,888 |

| Isle of Capri Casinos, Inc. (a) | | | | 78,900 | | 2,391,459 |

See accompanying notes which are an integral part of the financial statements.

Annual Report 30

| | | Shares | | Value (Note 1) |

| Las Vegas Sands Corp. (a) | | 44,600 | | $ 2,379,410 |

| MGM MIRAGE (a) | | 57,000 | | 2,107,290 |

| Penn National Gaming, Inc. (a) | | 180,700 | | 6,266,676 |

| Pinnacle Entertainment, Inc. (a) | | 50,200 | | 1,408,110 |

| Shuffle Master, Inc. (a)(d) | | 59,200 | | 1,546,896 |

| Station Casinos, Inc. | | 37,300 | | 2,553,185 |

| WMS Industries, Inc. (a) | | 74,400 | | 2,161,320 |

| Wynn Resorts Ltd. (a)(d) | | 64,800 | | 4,305,960 |

| | | | | 32,535,497 |

| Hotels, Resorts & Cruise Lines – 15.5% | | | | |

| Carnival Corp. unit | | 186,600 | | 9,637,890 |

| eLong, Inc. sponsored ADR (a) | | 1,100 | | 14,003 |

| Gaylord Entertainment Co. (a) | | 36,900 | | 1,647,585 |

| Kerzner International Ltd. (a) | | 99,300 | | 6,681,897 |

| Marriott International, Inc. Class A | | 27,900 | | 1,908,360 |

| Morgans Hotel Group Co. | | 7,400 | | 144,300 |

| Royal Caribbean Cruises Ltd. | | 103,900 | | 4,577,834 |

| Starwood Hotels & Resorts Worldwide, Inc. unit | | 113,100 | | 7,181,850 |

| | | | | 31,793,719 |

| Leisure Facilities – 2.5% | | | | |

| International Speedway Corp. Class A | | 17,300 | | 819,328 |

| Vail Resorts, Inc. (a) | | 127,500 | | 4,212,600 |

| | | | | 5,031,928 |

| Restaurants – 6.6% | | | | |

| Buffalo Wild Wings, Inc. (a) | | 63,015 | | 2,390,159 |

| McDonald’s Corp. | | 122,800 | | 4,286,948 |

| Melco International Development Ltd. | | 2,492,000 | | 3,774,346 |

| Outback Steakhouse, Inc. | | 14,800 | | 618,788 |

| Starbucks Corp. (a)(d) | | 67,100 | | 2,437,072 |

| | | | | 13,507,313 |

| |

| TOTAL HOTELS, RESTAURANTS & LEISURE | | | | 82,868,457 |

| |

| HOUSEHOLD DURABLES – 1.5% | | | | |

| Consumer Electronics – 1.1% | | | | |

| Harman International Industries, Inc. | | 21,200 | | 2,339,420 |

| Homebuilding – 0.4% | | | | |

| D.R. Horton, Inc. | | 25,200 | | 859,572 |

| |

| TOTAL HOUSEHOLD DURABLES | | | | 3,198,992 |

| |

| INTERNET & CATALOG RETAIL – 0.9% | | | | |

| Catalog Retail – 0.0% | | | | |

| dELiA*s, Inc. (a) | | 143 | | 1,274 |

| Internet Retail – 0.9% | | | | |

| Expedia, Inc. (a) | | 99,300 | | 1,883,721 |

| |

| TOTAL INTERNET & CATALOG RETAIL | | | | 1,884,995 |

| |

| INTERNET SOFTWARE & SERVICES – 19.3% | | | | |

| Internet Software & Services – 19.3% | | | | |

| China Lotsynergy Holding Ltd. (a) | | 354,000 | | 96,966 |

| |

| |

| See accompanying notes which are an integral part of the financial statements. | | | | |

31

31 Annual Report

| Leisure Portfolio | | | | |

| Investments - continued | | | | |

| |

| |

| Common Stocks – continued | | | | |

| | | Shares | | Value (Note 1) |

| |

| INTERNET SOFTWARE & SERVICES – CONTINUED | | | | |

| Internet Software & Services – continued | | | | |

| eBay, Inc. (a) | | 23,300 | | $ 933,398 |

| Equinix, Inc. (a) | | 154,200 | | 8,086,248 |

| Google, Inc. Class A (sub. vtg.) (a) | | 42,300 | | 15,338,826 |

| iVillage, Inc. (a) | | 10,100 | | 82,315 |

| Yahoo!, Inc. (a)(d) | | 470,304 | | 15,077,946 |

| | | | | 39,615,699 |

| |

| LEISURE EQUIPMENT & PRODUCTS – 2.0% | | | | |

| Leisure Products – 2.0% | | | | |

| Brunswick Corp. | | 26,700 | | 1,047,441 |

| MarineMax, Inc. (a) | | 36,000 | | 1,110,960 |

| Mattel, Inc. | | 103,400 | | 1,742,290 |

| Polaris Industries, Inc. | | 5,500 | | 275,275 |

| | | | | 4,175,966 |

| |

| MEDIA – 19.7% | | | | |

| Advertising – 3.1% | | | | |

| Interpublic Group of Companies, Inc. (a) | | 384 | | 3,978 |

| Lamar Advertising Co. Class A (a)(d) | | 102,500 | | 5,229,550 |

| Omnicom Group, Inc. | | 14,400 | | 1,149,408 |

| | | | | 6,382,936 |

| Broadcasting & Cable TV – 5.9% | | | | |

| Comcast Corp. Class A (a) | | 177,100 | | 4,751,593 |

| EchoStar Communications Corp. Class A (a) | | 127,800 | | 3,753,486 |

| Grupo Televisa SA de CV (CPO) sponsored ADR | | 13,500 | | 1,059,210 |

| Television Broadcasts Ltd. | | 112,000 | | 630,171 |

| The DIRECTV Group, Inc. (a) | | 87,401 | | 1,377,440 |

| Univision Communications, Inc. Class A (a) | | 500 | | 16,725 |

| XM Satellite Radio Holdings, Inc. Class A (a) | | 23,535 | | 519,888 |

| | | | | 12,108,513 |

| Movies & Entertainment – 7.7% | | | | |

| News Corp. Class A | | 480,996 | | 7,830,615 |

| The Walt Disney Co. (d) | | 281,800 | | 7,887,582 |

| | | | | 15,718,197 |

| Publishing – 3.0% | | | | |

| Gannett Co., Inc. | | 33,900 | | 2,107,224 |

| Getty Images, Inc. (a) | | 37,900 | | 3,071,037 |

| McGraw-Hill Companies, Inc. | | 19,500 | | 1,035,255 |

| | | | | 6,213,516 |

| |

| TOTAL MEDIA | | | | 40,423,162 |

| |

| MULTILINE RETAIL – 2.1% | | | | |

| General Merchandise Stores – 2.1% | | | | |

| 99 Cents Only Stores (a) | | 387,300 | | 4,407,474 |

See accompanying notes which are an integral part of the financial statements.

Annual Report 32

| | | Shares | | Value (Note |

| |

| PERSONAL PRODUCTS – 0.0% | | | | |

| Personal Products – 0.0% | | | | |

| Avon Products, Inc. | | 3,800 | | $ 109,630 |

| REAL ESTATE – 1.1% | | | | |

| Real Estate Investment Trusts – 0.3% | | | | |

| Host Marriott Corp. | | 33,000 | | 641,190 |

| Real Estate Management & Development – 0.8% | | | | |

| Emperor Entertainment Hotel Ltd. | | 2,125,000 | | 753,264 |

| Far East Consortium International Ltd. | | 1,925,000 | | 818,843 |

| | | | | 1,572,107 |

| |

| TOTAL REAL ESTATE | | | | 2,213,297 |

| |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT – 0.5% | | | | |

| Semiconductor Equipment – 0.5% | | | | |

| MEMC Electronic Materials, Inc. (a) | | 29,800 | | 998,002 |

| SOFTWARE – 1.5% | | | | |

| Application Software – 1.5% | | | | |

| NAVTEQ Corp. (a) | | 33,400 | | 1,546,754 |