UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | February 29 |

Date of reporting period: | February 29, 2024 |

Item 1.

Reports to Stockholders

Contents

| Average Annual Total Returns | |||

Periods ended February 29, 2024 | Past 1 year | Past 5 years | Past 10 years |

Class A (incl. 5.75% sales charge) | -7.26% | 1.26% | 3.39% |

Class M (incl. 3.50% sales charge) | -5.28% | 1.47% | 3.32% |

Class C (incl. contingent deferred sales charge) | -3.28% | 1.72% | 3.40% |

| Telecommunications Portfolio | -1.33% | 2.79% | 4.34% |

| Class I | -1.25% | 2.81% | 4.34% |

| Class Z | -1.16% | 2.95% | 4.42% |

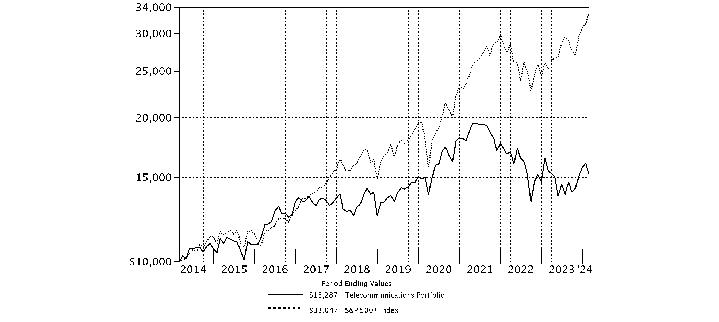

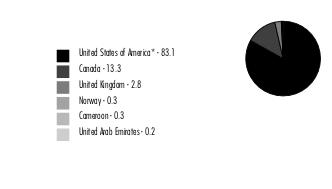

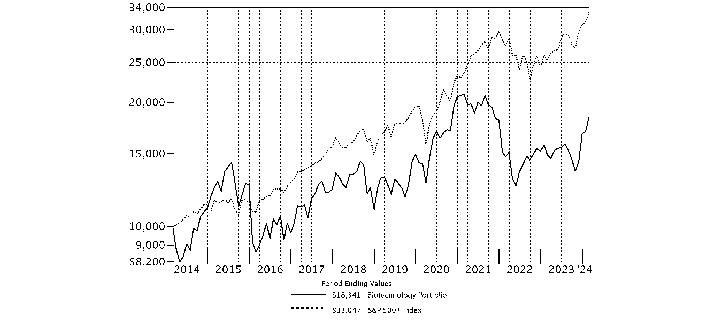

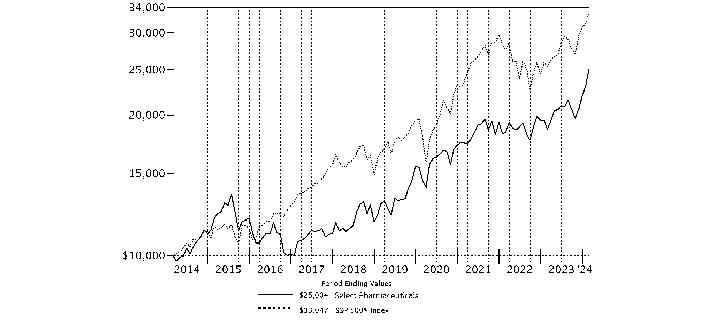

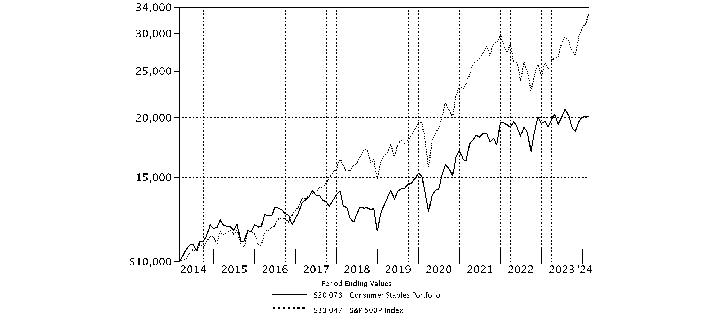

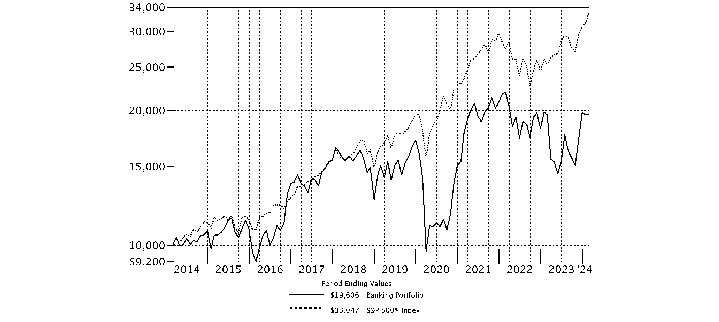

| $10,000 Over 10 Years |

Let's say hypothetically that $10,000 was invested in Telecommunications Portfolio, a class of the fund, on February 28, 2014. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period. |

|

Top Holdings (% of Fund's net assets) | ||

| Verizon Communications, Inc. | 23.7 | |

| AT&T, Inc. | 22.8 | |

| Cogent Communications Group, Inc. | 4.9 | |

| T-Mobile U.S., Inc. | 4.8 | |

| Liberty Global Ltd. Class C | 4.2 | |

| Iridium Communications, Inc. | 4.1 | |

| Liberty Latin America Ltd. Class C | 4.0 | |

| Frontier Communications Parent, Inc. | 3.5 | |

| Anterix, Inc. | 3.2 | |

| Telephone & Data Systems, Inc. | 3.0 | |

| 78.2 | ||

| Industries (% of Fund's net assets) | ||

| Diversified Telecommunication Services | 79.6 | |

| Wireless Telecommunication Services | 11.9 | |

| Media | 5.4 | |

| IT Services | 0.8 | |

| Construction & Engineering | 0.3 | |

| Common Stocks - 98.0% | |||

| Shares | Value ($) | ||

| Construction & Engineering - 0.3% | |||

| Construction & Engineering - 0.3% | |||

| Dycom Industries, Inc. (a) | 4,400 | 556,556 | |

| Diversified Telecommunication Services - 79.6% | |||

| Alternative Carriers - 24.7% | |||

| Anterix, Inc. (a) | 146,600 | 5,820,020 | |

| Bandwidth, Inc. (a) | 45,800 | 940,732 | |

| Cogent Communications Group, Inc. (b) | 109,739 | 8,878,982 | |

| GCI Liberty, Inc. Class A (Escrow) (c)(f) | 182,800 | 2 | |

| Globalstar, Inc. (a)(b) | 3,353,965 | 5,232,185 | |

| Iridium Communications, Inc. | 260,111 | 7,530,213 | |

| Liberty Global Ltd. Class C (b) | 407,836 | 7,565,358 | |

| Liberty Latin America Ltd. Class C (a) | 1,102,733 | 7,189,819 | |

| Lumen Technologies, Inc. (a)(b) | 972,400 | 1,575,288 | |

| 44,732,599 | |||

| Integrated Telecommunication Services - 54.9% | |||

| AT&T, Inc. | 2,442,220 | 41,346,785 | |

| ATN International, Inc. | 38,500 | 1,291,290 | |

| Consolidated Communications Holdings, Inc. (a) | 594,600 | 2,562,726 | |

| Frontier Communications Parent, Inc. (a)(b) | 266,200 | 6,303,616 | |

| IDT Corp. Class B (a) | 132,000 | 4,911,720 | |

| Shenandoah Telecommunications Co. | 5,623 | 104,925 | |

| Verizon Communications, Inc. | 1,074,897 | 43,017,380 | |

| 99,538,442 | |||

TOTAL DIVERSIFIED TELECOMMUNICATION SERVICES | 144,271,041 | ||

| IT Services - 0.8% | |||

| Internet Services & Infrastructure - 0.1% | |||

| Twilio, Inc. Class A (a) | 4,000 | 238,360 | |

| IT Consulting & Other Services - 0.7% | |||

| Amdocs Ltd. | 14,000 | 1,276,800 | |

TOTAL IT SERVICES | 1,515,160 | ||

| Media - 5.4% | |||

| Cable & Satellite - 5.4% | |||

| Charter Communications, Inc. Class A (a) | 7,300 | 2,145,689 | |

| Comcast Corp. Class A | 121,200 | 5,193,420 | |

| Liberty Broadband Corp. Class C (a) | 41,824 | 2,516,968 | |

| 9,856,077 | |||

| Wireless Telecommunication Services - 11.9% | |||

| Wireless Telecommunication Services - 11.9% | |||

| Gogo, Inc. (a) | 665,400 | 5,429,664 | |

| T-Mobile U.S., Inc. | 52,724 | 8,609,829 | |

| Telephone & Data Systems, Inc. | 355,164 | 5,434,009 | |

| U.S. Cellular Corp. (a) | 59,100 | 2,061,999 | |

| 21,535,501 | |||

| TOTAL COMMON STOCKS (Cost $174,408,698) | 177,734,335 | ||

| Money Market Funds - 11.1% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 5.39% (d) | 2,486,775 | 2,487,272 | |

| Fidelity Securities Lending Cash Central Fund 5.39% (d)(e) | 17,516,200 | 17,517,951 | |

| TOTAL MONEY MARKET FUNDS (Cost $20,005,223) | 20,005,223 | ||

| TOTAL INVESTMENT IN SECURITIES - 109.1% (Cost $194,413,921) | 197,739,558 |

NET OTHER ASSETS (LIABILITIES) - (9.1)% | (16,437,024) |

| NET ASSETS - 100.0% | 181,302,534 |

| (a) | Non-income producing |

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Level 3 security |

| (d) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (e) | Investment made with cash collateral received from securities on loan. |

| (f) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $2 or 0.0% of net assets. |

| Additional information on each restricted holding is as follows: | ||

| Security | Acquisition Date | Acquisition Cost ($) |

| GCI Liberty, Inc. Class A (Escrow) | 5/23/23 | 0 |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 10,884,272 | 34,229,008 | 42,626,008 | 89,677 | - | - | 2,487,272 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.39% | 9,165,924 | 139,866,787 | 131,514,760 | 9,224 | - | - | 17,517,951 | 0.1% |

| Total | 20,050,196 | 174,095,795 | 174,140,768 | 98,901 | - | - | 20,005,223 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Common Stocks | 177,734,335 | 177,734,333 | - | 2 |

| Money Market Funds | 20,005,223 | 20,005,223 | - | - |

| Total Investments in Securities: | 197,739,558 | 197,739,556 | - | 2 |

| Statement of Assets and Liabilities | ||||

| February 29, 2024 | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $16,928,821) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $174,408,698) | $ | 177,734,335 | ||

Fidelity Central Funds (cost $20,005,223) | 20,005,223 | |||

| Total Investment in Securities (cost $194,413,921) | $ | 197,739,558 | ||

| Foreign currency held at value (cost $21,712) | 23,805 | |||

| Receivable for investments sold | 3,788,929 | |||

| Receivable for fund shares sold | 50,103 | |||

| Dividends receivable | 34,270 | |||

| Distributions receivable from Fidelity Central Funds | 2,880 | |||

| Prepaid expenses | 577 | |||

| Other receivables | 5,969 | |||

Total assets | 201,646,091 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 2,564,752 | ||

| Payable for fund shares redeemed | 97,602 | |||

| Accrued management fee | 80,312 | |||

| Distribution and service plan fees payable | 8,340 | |||

| Other affiliated payables | 35,668 | |||

| Other payables and accrued expenses | 39,408 | |||

| Collateral on securities loaned | 17,517,475 | |||

| Total Liabilities | 20,343,557 | |||

| Net Assets | $ | 181,302,534 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 203,153,430 | ||

| Total accumulated earnings (loss) | (21,850,896) | |||

| Net Assets | $ | 181,302,534 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($16,322,599 ÷ 369,260 shares)(a) | $ | 44.20 | ||

| Maximum offering price per share (100/94.25 of $44.20) | $ | 46.90 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($6,380,271 ÷ 145,526 shares)(a) | $ | 43.84 | ||

| Maximum offering price per share (100/96.50 of $43.84) | $ | 45.43 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($2,546,783 ÷ 57,814 shares)(a) | $ | 44.05 | ||

| Telecommunications : | ||||

Net Asset Value, offering price and redemption price per share ($147,413,277 ÷ 3,305,904 shares) | $ | 44.59 | ||

| Class I : | ||||

Net Asset Value, offering price and redemption price per share ($6,343,626 ÷ 142,594 shares) | $ | 44.49 | ||

| Class Z : | ||||

Net Asset Value, offering price and redemption price per share ($2,295,978 ÷ 51,782 shares) | $ | 44.34 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

Year ended February 29, 2024 | ||||

| Investment Income | ||||

| Dividends | $ | 6,787,855 | ||

| Income from Fidelity Central Funds (including $9,224 from security lending) | 98,901 | |||

| Total Income | 6,886,756 | |||

| Expenses | ||||

| Management fee | $ | 1,001,334 | ||

| Transfer agent fees | 396,851 | |||

| Distribution and service plan fees | 102,790 | |||

| Accounting fees | 67,753 | |||

| Custodian fees and expenses | 8,024 | |||

| Independent trustees' fees and expenses | 1,276 | |||

| Registration fees | 84,711 | |||

| Audit | 56,196 | |||

| Legal | 1,025 | |||

| Interest | 9,099 | |||

| Miscellaneous | 1,257 | |||

| Total expenses before reductions | 1,730,316 | |||

| Expense reductions | (15,437) | |||

| Total expenses after reductions | 1,714,879 | |||

| Net Investment income (loss) | 5,171,877 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (25,059,062) | |||

| Foreign currency transactions | (3,022) | |||

| Total net realized gain (loss) | (25,062,084) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 13,379,225 | |||

| Assets and liabilities in foreign currencies | 2,080 | |||

| Total change in net unrealized appreciation (depreciation) | 13,381,305 | |||

| Net gain (loss) | (11,680,779) | |||

| Net increase (decrease) in net assets resulting from operations | $ | (6,508,902) | ||

| Statement of Changes in Net Assets | ||||

Year ended February 29, 2024 | Year ended February 28, 2023 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 5,171,877 | $ | 5,140,003 |

| Net realized gain (loss) | (25,062,084) | 7,530,927 | ||

| Change in net unrealized appreciation (depreciation) | 13,381,305 | (35,292,068) | ||

| Net increase (decrease) in net assets resulting from operations | (6,508,902) | (22,621,138) | ||

| Distributions to shareholders | (7,597,238) | (16,991,172) | ||

| Share transactions - net increase (decrease) | (37,569,762) | 20,395,222 | ||

| Total increase (decrease) in net assets | (51,675,902) | (19,217,088) | ||

| Net Assets | ||||

| Beginning of period | 232,978,436 | 252,195,524 | ||

| End of period | $ | 181,302,534 | $ | 232,978,436 |

| Fidelity Advisor® Telecommunications Fund Class A |

| Years ended February 28, | 2024 A | 2023 | 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 46.57 | $ | 54.28 | $ | 66.52 | $ | 60.60 | $ | 55.68 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | 1.06 | .93 | 1.51 D | .66 | .87 | |||||

| Net realized and unrealized gain (loss) | (1.85) E | (5.19) | (5.14) | 10.61 | 5.86 | |||||

| Total from investment operations | (.79) | (4.26) | (3.63) | 11.27 | 6.73 | |||||

| Distributions from net investment income | (1.10) | (.99) | (1.66) | (.39) | (.96) | |||||

| Distributions from net realized gain | (.48) | (2.46) | (6.95) | (4.96) | (.85) | |||||

| Total distributions | (1.58) | (3.45) | (8.61) | (5.35) | (1.81) | |||||

| Net asset value, end of period | $ | 44.20 | $ | 46.57 | $ | 54.28 | $ | 66.52 | $ | 60.60 |

Total Return F,G | (1.60)% E | (7.98)% | (6.28)% | 18.75% | 12.12% | |||||

Ratios to Average Net Assets C,H,I | ||||||||||

| Expenses before reductions | 1.13% | 1.13% | 1.09% | 1.11% | 1.18% | |||||

| Expenses net of fee waivers, if any | 1.13% | 1.13% | 1.09% | 1.11% | 1.17% | |||||

| Expenses net of all reductions | 1.12% | 1.13% | 1.09% | 1.10% | 1.17% | |||||

| Net investment income (loss) | 2.48% | 1.89% | 2.27% D | 1.01% | 1.47% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 16,323 | $ | 18,744 | $ | 22,023 | $ | 29,800 | $ | 21,376 |

Portfolio turnover rate J | 26% | 24% | 28% | 58% | 58% |

| Fidelity Advisor® Telecommunications Fund Class M |

| Years ended February 28, | 2024 A | 2023 | 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 46.21 | $ | 53.88 | $ | 66.09 | $ | 60.25 | $ | 55.40 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | .95 | .80 | 1.29 D | .46 | .70 | |||||

| Net realized and unrealized gain (loss) | (1.84) E | (5.14) | (5.08) | 10.54 | 5.83 | |||||

| Total from investment operations | (.89) | (4.34) | (3.79) | 11.00 | 6.53 | |||||

| Distributions from net investment income | (1.00) | (.86) | (1.48) | (.20) | (.83) | |||||

| Distributions from net realized gain | (.48) | (2.46) | (6.95) | (4.96) | (.85) | |||||

| Total distributions | (1.48) | (3.33) F | (8.42) F | (5.16) | (1.68) | |||||

| Net asset value, end of period | $ | 43.84 | $ | 46.21 | $ | 53.88 | $ | 66.09 | $ | 60.25 |

Total Return G,H | (1.84)% E | (8.21)% | (6.55)% | 18.39% | 11.81% | |||||

Ratios to Average Net Assets C,I,J | ||||||||||

| Expenses before reductions | 1.38% | 1.39% | 1.39% | 1.41% | 1.46% | |||||

| Expenses net of fee waivers, if any | 1.38% | 1.38% | 1.38% | 1.41% | 1.46% | |||||

| Expenses net of all reductions | 1.37% | 1.38% | 1.38% | 1.40% | 1.45% | |||||

| Net investment income (loss) | 2.23% | 1.64% | 1.97% D | .71% | 1.19% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 6,380 | $ | 7,301 | $ | 7,733 | $ | 9,038 | $ | 6,919 |

Portfolio turnover rate K | 26% | 24% | 28% | 58% | 58% |

| Fidelity Advisor® Telecommunications Fund Class C |

| Years ended February 28, | 2024 A | 2023 | 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 46.38 | $ | 54.04 | $ | 66.17 | $ | 60.32 | $ | 55.45 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | .74 | .56 | 1.01 D | .17 | .46 | |||||

| Net realized and unrealized gain (loss) | (1.85) E | (5.15) | (5.09) | 10.54 | 5.82 | |||||

| Total from investment operations | (1.11) | (4.59) | (4.08) | 10.71 | 6.28 | |||||

| Distributions from net investment income | (.75) | (.61) | (1.10) | (.07) | (.56) | |||||

| Distributions from net realized gain | (.48) | (2.46) | (6.95) | (4.79) | (.85) | |||||

| Total distributions | (1.22) F | (3.07) | (8.05) | (4.86) | (1.41) | |||||

| Net asset value, end of period | $ | 44.05 | $ | 46.38 | $ | 54.04 | $ | 66.17 | $ | 60.32 |

Total Return G,H | (2.33)% E | (8.66)% | (6.97)% | 17.88% | 11.34% | |||||

Ratios to Average Net Assets C,I,J | ||||||||||

| Expenses before reductions | 1.88% | 1.88% | 1.83% | 1.86% | 1.88% | |||||

| Expenses net of fee waivers, if any | 1.88% | 1.87% | 1.83% | 1.86% | 1.87% | |||||

| Expenses net of all reductions | 1.87% | 1.87% | 1.83% | 1.84% | 1.87% | |||||

| Net investment income (loss) | 1.73% | 1.15% | 1.52% D | .26% | .77% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 2,547 | $ | 3,923 | $ | 5,254 | $ | 7,801 | $ | 6,491 |

Portfolio turnover rate K | 26% | 24% | 28% | 58% | 58% |

| Telecommunications Portfolio |

| Years ended February 28, | 2024 A | 2023 | 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 46.97 | $ | 54.73 | $ | 67.04 | $ | 60.99 | $ | 56.04 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | 1.20 | 1.09 | 1.71 D | .86 | 1.09 | |||||

| Net realized and unrealized gain (loss) | (1.87) E | (5.24) | (5.18) | 10.71 | 5.90 | |||||

| Total from investment operations | (.67) | (4.15) | (3.47) | 11.57 | 6.99 | |||||

| Distributions from net investment income | (1.23) | (1.15) | (1.89) | (.57) | (1.19) | |||||

| Distributions from net realized gain | (.48) | (2.46) | (6.95) | (4.96) | (.85) | |||||

| Total distributions | (1.71) | (3.61) | (8.84) | (5.52) F | (2.04) | |||||

| Net asset value, end of period | $ | 44.59 | $ | 46.97 | $ | 54.73 | $ | 67.04 | $ | 60.99 |

Total Return G | (1.33)% E | (7.71)% | (5.99)% | 19.15% | 12.50% | |||||

Ratios to Average Net Assets C,H,I | ||||||||||

| Expenses before reductions | .85% | .82% | .79% | .81% | .83% | |||||

| Expenses net of fee waivers, if any | .84% | .82% | .79% | .81% | .82% | |||||

| Expenses net of all reductions | .84% | .82% | .79% | .79% | .82% | |||||

| Net investment income (loss) | 2.75% | 2.20% | 2.57% D | 1.31% | 1.82% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 147,413 | $ | 171,885 | $ | 199,560 | $ | 242,284 | $ | 219,854 |

Portfolio turnover rate J | 26% | 24% | 28% | 58% | 58% |

| Fidelity Advisor® Telecommunications Fund Class I |

| Years ended February 28, | 2024 A | 2023 | 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 46.84 | $ | 54.58 | $ | 66.84 | $ | 60.86 | $ | 55.84 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | 1.23 | 1.10 | 1.74 D | .88 | 1.04 | |||||

| Net realized and unrealized gain (loss) | (1.87) E | (5.21) | (5.18) | 10.66 | 5.91 | |||||

| Total from investment operations | (.64) | (4.11) | (3.44) | 11.54 | 6.95 | |||||

| Distributions from net investment income | (1.23) | (1.16) | (1.87) | (.60) | (1.08) | |||||

| Distributions from net realized gain | (.48) | (2.46) | (6.95) | (4.96) | (.85) | |||||

| Total distributions | (1.71) | (3.63) F | (8.82) | (5.56) | (1.93) | |||||

| Net asset value, end of period | $ | 44.49 | $ | 46.84 | $ | 54.58 | $ | 66.84 | $ | 60.86 |

Total Return G | (1.25)% E | (7.67)% | (5.97)% | 19.13% | 12.47% | |||||

Ratios to Average Net Assets C,H,I | ||||||||||

| Expenses before reductions | .80% | .78% | .77% | .79% | .88% | |||||

| Expenses net of fee waivers, if any | .79% | .78% | .77% | .79% | .88% | |||||

| Expenses net of all reductions | .79% | .78% | .77% | .78% | .88% | |||||

| Net investment income (loss) | 2.81% | 2.25% | 2.59% D | 1.33% | 1.76% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 6,344 | $ | 28,441 | $ | 12,038 | $ | 30,622 | $ | 12,428 |

Portfolio turnover rate J | 26% | 24% | 28% | 58% | 58% |

| Fidelity Advisor® Telecommunications Fund Class Z |

| Years ended February 28, | 2024 A | 2023 | 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 46.72 | $ | 54.46 | $ | 66.75 | $ | 60.75 | $ | 55.84 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | 1.26 | 1.18 | 1.83 D | .95 | 1.20 | |||||

| Net realized and unrealized gain (loss) | (1.86) E | (5.23) | (5.20) | 10.67 | 5.86 | |||||

| Total from investment operations | (.60) | (4.05) | (3.37) | 11.62 | 7.06 | |||||

| Distributions from net investment income | (1.31) | (1.22) | (1.98) | (.67) | (1.30) | |||||

| Distributions from net realized gain | (.48) | (2.46) | (6.95) | (4.96) | (.85) | |||||

| Total distributions | (1.78) F | (3.69) F | (8.92) F | (5.62) F | (2.15) | |||||

| Net asset value, end of period | $ | 44.34 | $ | 46.72 | $ | 54.46 | $ | 66.75 | $ | 60.75 |

Total Return G | (1.16)% E | (7.56)% | (5.87)% | 19.31% | 12.68% | |||||

Ratios to Average Net Assets C,H,I | ||||||||||

| Expenses before reductions | .69% | .67% | .65% | .67% | .68% | |||||

| Expenses net of fee waivers, if any | .68% | .66% | .65% | .67% | .67% | |||||

| Expenses net of all reductions | .68% | .66% | .65% | .65% | .67% | |||||

| Net investment income (loss) | 2.92% | 2.36% | 2.71% D | 1.45% | 1.97% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 2,296 | $ | 2,685 | $ | 5,587 | $ | 31,271 | $ | 25,223 |

Portfolio turnover rate J | 26% | 24% | 28% | 58% | 58% |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Gross unrealized appreciation | $26,454,151 |

| Gross unrealized depreciation | (24,566,427) |

| Net unrealized appreciation (depreciation) | $1,887,724 |

| Tax Cost | $195,851,834 |

| Undistributed tax-exempt income | $- |

| Undistributed ordinary income | $647,266 |

| Capital loss carryforward | $(24,383,431) |

| Net unrealized appreciation (depreciation) on securities and other investments | $1,885,273 |

Short-term | $(2,815,930) |

Long-term | (21,567,501) |

| Total capital loss carryforward | $(24,383,431) |

| February 29, 2024 | February 28, 2023 | |

| Ordinary Income | $5,255,215 | $ 5,364,741 |

| Long-term Capital Gains | 2,342,023 | 11,626,431 |

| Total | $7,597,238 | $ 16,991,172 |

| Purchases ($) | Sales ($) | |

| Telecommunications Portfolio | 50,113,160 | 84,581,317 |

| Distribution Fee | Service Fee | Total Fees | Retained by FDC | |

| Class A | - % | .25% | $41,163 | $1,006 |

| Class M | .25% | .25% | 32,480 | - |

| Class C | .75% | .25% | 29,147 | 1,643 |

| $102,790 | $2,649 |

| Retained by FDC | |

| Class A | $3,593 |

| Class M | 826 |

Class CA | 53 |

| $4,472 |

| % of Class-Level Average Net Assets | |

| Class A | .2000 |

| Class M | .2000 |

| Class C | .2000 |

| Telecommunications | .2000 |

| Class I | .1500 |

| Amount | % of Class-Level Average Net Assets | |

| Class A | $39,521 | .24 |

| Class M | 15,661 | .24 |

| Class C | 7,026 | .24 |

| Telecommunications | 314,104 | .21 |

| Class I | 19,456 | .16 |

| Class Z | 1,083 | .04 |

| $396,851 |

| % of Average Net Assets | |

| Telecommunications Portfolio | .0354% |

| % of Average Net Assets | |

| Telecommunications Portfolio | .04 |

| Maximum Management Fee Rate % | |

| Class A | 0.72% |

| Class M | 0.72% |

| Class C | 0.72% |

| Telecommunications | 0.72% |

| Class I | 0.67% |

| Class Z | 0.56% |

| Amount | |

| Telecommunications Portfolio | $6,856 |

| Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense | |

| Telecommunications Portfolio | Borrower | $ 4,077,133 | 5.34% | $9,068 |

| Purchases ($) | Sales ($) | Realized Gain (Loss) ($) | |

| Telecommunications Portfolio | 261,186 | 343,444 | (32,379) |

| Amount | |

| Telecommunications Portfolio | $352 |

| Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End | |

| Telecommunications Portfolio | $926 | $- | $- |

| Average Loan Balance | Weighted Average Interest Rate | Interest Expense | |

| Telecommunications Portfolio | $64,000 | 5.83% | $31 |

| Expense reduction | |

| Class A | $413 |

| Class M | 787 |

| Class C | 62 |

| $1,262 |

Year ended February 29, 2024 | Year ended February 28, 2023 | |

| Telecommunications Portfolio | ||

| Distributions to shareholders | ||

| Class A | $ 608,617 | $1,371,752 |

| Class M | 226,115 | 479,499 |

| Class C | 88,039 | 286,410 |

| Telecommunications | 5,963,168 | 13,019,579 |

| Class I | 598,796 | 1,515,681 |

| Class Z | 112,503 | 318,251 |

Total | $ 7,597,238 | $ 16,991,172 |

| Shares | Shares | Dollars | Dollars | |

Year ended February 29, 2024 | Year ended February 28, 2023 | Year ended February 29, 2024 | Year ended February 28, 2023 | |

| Telecommunications Portfolio | ||||

| Class A | ||||

| Shares sold | 43,001 | 78,714 | $1,846,776 | $3,917,123 |

| Reinvestment of distributions | 13,440 | 27,038 | 586,014 | 1,318,232 |

| Shares redeemed | (89,654) | (108,969) | (3,795,896) | (5,376,984) |

| Net increase (decrease) | (33,213) | (3,217) | $(1,363,106) | $(141,629) |

| Class M | ||||

| Shares sold | 29,602 | 34,367 | $1,262,425 | $1,663,349 |

| Reinvestment of distributions | 5,207 | 9,903 | 225,496 | 478,658 |

| Shares redeemed | (47,271) | (29,810) | (2,010,396) | (1,403,232) |

| Net increase (decrease) | (12,462) | 14,460 | $(522,475) | $738,775 |

| Class C | ||||

| Shares sold | 5,255 | 10,310 | $224,808 | $526,650 |

| Reinvestment of distributions | 1,964 | 5,729 | 86,122 | 280,668 |

| Shares redeemed | (33,986) | (28,682) | (1,431,291) | (1,415,361) |

| Net increase (decrease) | (26,767) | (12,643) | $(1,120,361) | $(608,043) |

| Telecommunications | ||||

| Shares sold | 643,117 | 538,813 | $27,478,363 | $26,964,598 |

| Reinvestment of distributions | 125,072 | 247,377 | 5,494,243 | 12,134,608 |

| Shares redeemed | (1,121,615) | (773,315) | (48,452,953) | (38,015,718) |

| Net increase (decrease) | (353,426) | 12,875 | $(15,480,347) | $1,083,488 |

| Class I | ||||

| Shares sold | 92,263 | 817,391 | $3,962,229 | $41,395,131 |

| Reinvestment of distributions | 13,260 | 29,024 | 594,502 | 1,455,032 |

| Shares redeemed | (570,092) | (459,823) | (23,438,458) | (21,772,889) |

| Net increase (decrease) | (464,569) | 386,592 | $(18,881,727) | $21,077,274 |

| Class Z | ||||

| Shares sold | 45,276 | 30,184 | $1,933,594 | $1,459,810 |

| Reinvestment of distributions | 1,463 | 4,499 | 63,497 | 231,168 |

| Shares redeemed | (52,424) | (79,794) | (2,198,837) | (3,445,621) |

| Net increase (decrease) | (5,685) | (45,111) | $(201,746) | $(1,754,643) |

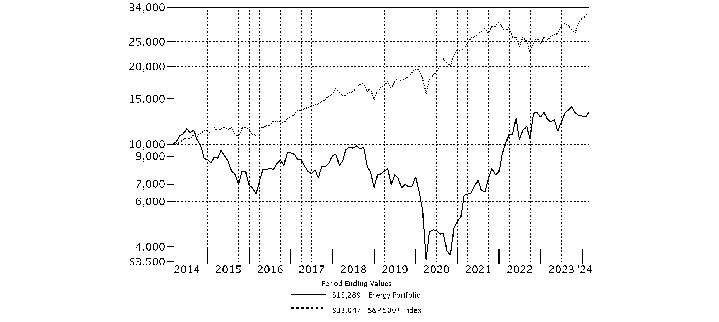

| Average Annual Total Returns | |||

Periods ended February 29, 2024 | Past 1 year | Past 5 years | Past 10 years |

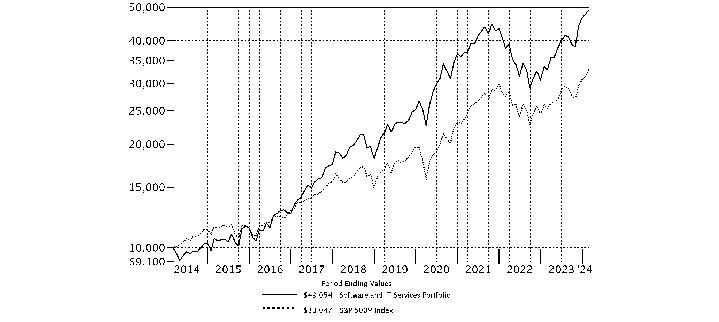

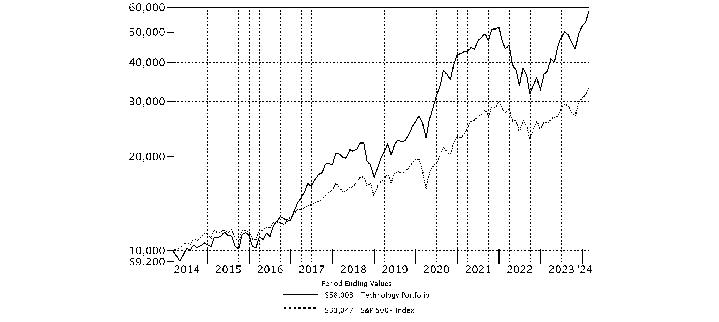

| Wireless Portfolio | 19.83% | 12.28% | 9.54% |

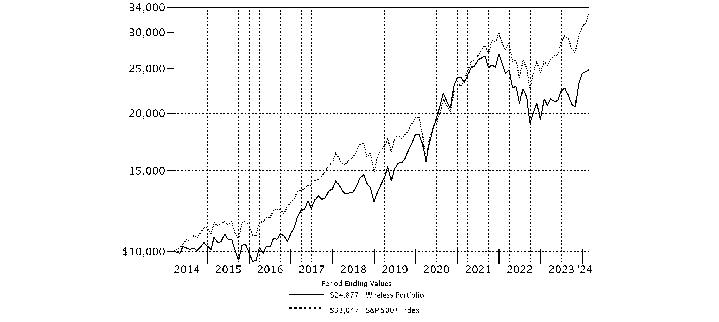

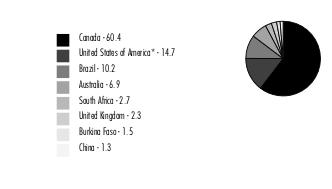

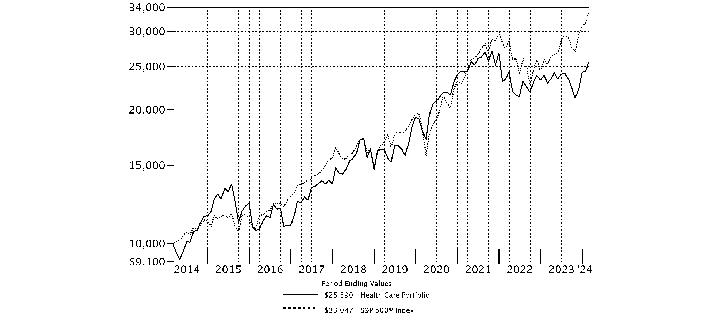

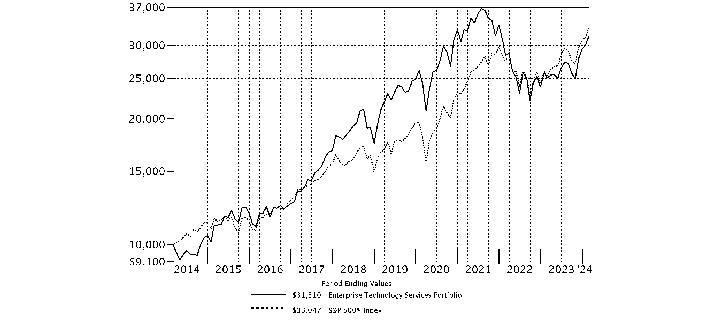

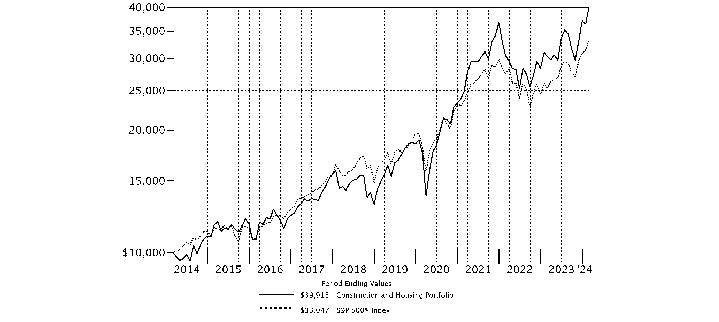

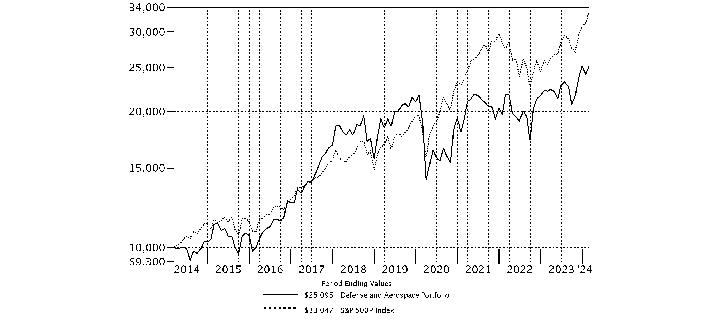

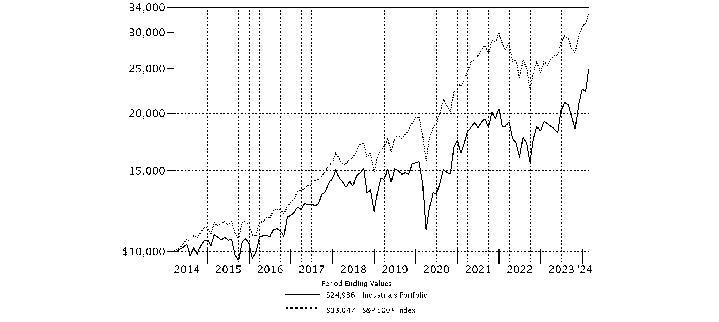

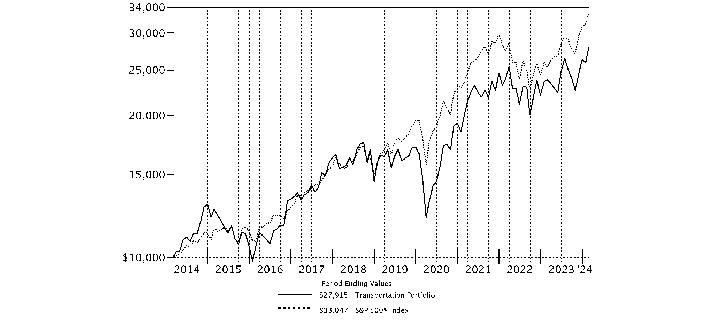

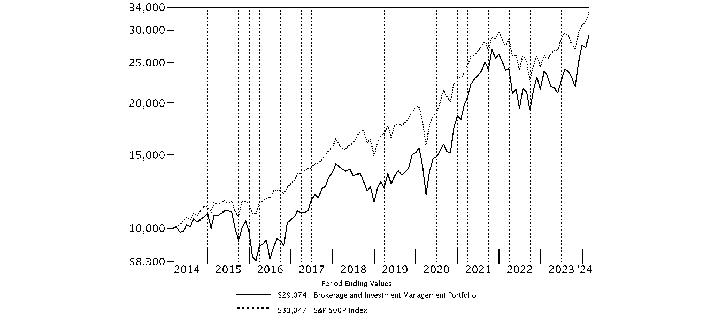

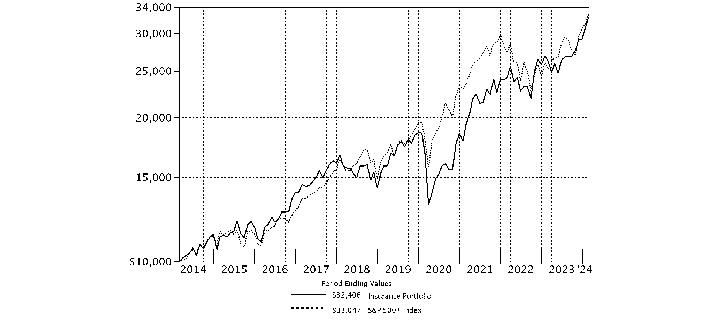

| $10,000 Over 10 Years |

Let's say hypothetically that $10,000 was invested in Wireless Portfolio on February 28, 2014. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period. |

|

Top Holdings (% of Fund's net assets) | ||

| Apple, Inc. | 10.1 | |

| AT&T, Inc. | 9.4 | |

| T-Mobile U.S., Inc. | 9.1 | |

| American Tower Corp. | 7.8 | |

| Marvell Technology, Inc. | 7.2 | |

| Qualcomm, Inc. | 5.6 | |

| Meta Platforms, Inc. Class A | 4.4 | |

| Amazon.com, Inc. | 2.9 | |

| Motorola Solutions, Inc. | 2.7 | |

| Rogers Communications, Inc. Class B (non-vtg.) | 2.5 | |

| 61.7 | ||

| Industries (% of Fund's net assets) | ||

| Semiconductors & Semiconductor Equipment | 18.6 | |

| Diversified Telecommunication Services | 18.1 | |

| Wireless Telecommunication Services | 17.0 | |

| Technology Hardware, Storage & Peripherals | 12.4 | |

| Equity Real Estate Investment Trusts (Reits) | 9.6 | |

| Interactive Media & Services | 5.9 | |

| Communications Equipment | 5.0 | |

| Broadline Retail | 2.9 | |

| Entertainment | 2.1 | |

| Software | 1.8 | |

| Ground Transportation | 1.7 | |

| Oil, Gas & Consumable Fuels | 1.2 | |

| IT Services | 0.6 | |

| Consumer Staples Distribution & Retail | 0.0 | |

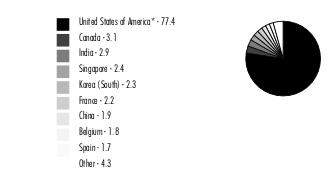

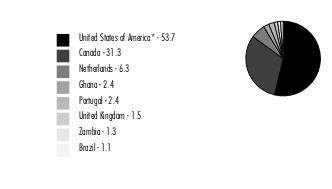

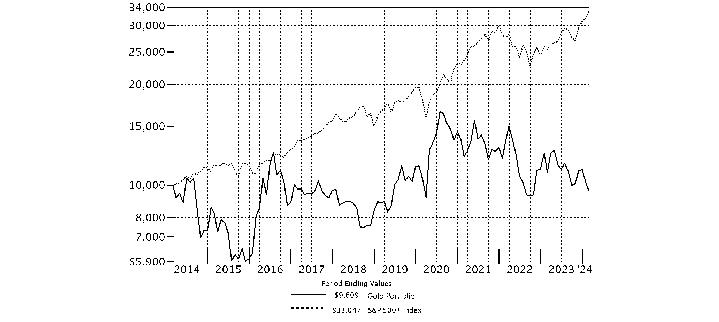

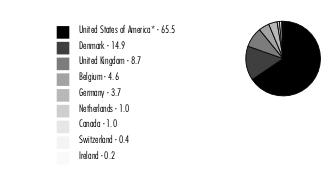

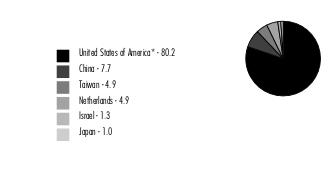

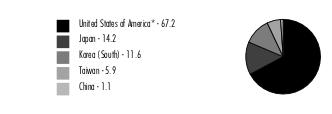

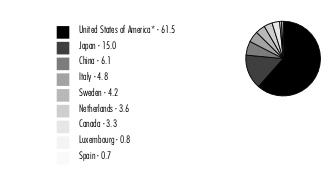

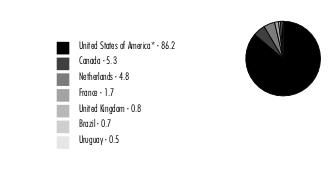

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| Common Stocks - 96.9% | |||

| Shares | Value ($) | ||

| Broadline Retail - 2.9% | |||

| Broadline Retail - 2.9% | |||

| Amazon.com, Inc. (a) | 53,600 | 9,474,336 | |

| Communications Equipment - 5.0% | |||

| Communications Equipment - 5.0% | |||

| Ericsson: | |||

| (B Shares) | 163,600 | 888,350 | |

| (B Shares) sponsored ADR (b) | 472,000 | 2,567,680 | |

| Motorola Solutions, Inc. | 26,568 | 8,777,802 | |

| Nokia Corp. sponsored ADR | 793,800 | 2,802,114 | |

| ViaSat, Inc. (a)(b) | 60,301 | 1,180,091 | |

| 16,216,037 | |||

| Consumer Staples Distribution & Retail - 0.0% | |||

| Food Retail - 0.0% | |||

| Maplebear, Inc. (NASDAQ) | 700 | 22,778 | |

| Diversified Telecommunication Services - 18.1% | |||

| Alternative Carriers - 2.7% | |||

| GCI Liberty, Inc. Class A (Escrow) (c)(g) | 112,300 | 1 | |

| Iridium Communications, Inc. | 47,400 | 1,372,230 | |

| Liberty Global Ltd. Class A | 337,800 | 5,911,500 | |

| Liberty Latin America Ltd. Class C (a) | 212,100 | 1,382,892 | |

| 8,666,623 | |||

| Integrated Telecommunication Services - 15.4% | |||

| AT&T, Inc. | 1,797,300 | 30,428,289 | |

| Cellnex Telecom SA (d) | 79,715 | 2,882,060 | |

| Orange SA ADR | 619,800 | 7,127,700 | |

| Shenandoah Telecommunications Co. | 300 | 5,598 | |

| Telefonica SA sponsored ADR (b) | 677,149 | 2,769,539 | |

| Verizon Communications, Inc. | 167,901 | 6,719,398 | |

| 49,932,584 | |||

TOTAL DIVERSIFIED TELECOMMUNICATION SERVICES | 58,599,207 | ||

| Entertainment - 2.1% | |||

| Movies & Entertainment - 2.1% | |||

| Spotify Technology SA (a) | 26,600 | 6,820,506 | |

| Equity Real Estate Investment Trusts (REITs) - 9.6% | |||

| Telecom Tower REITs - 9.6% | |||

| American Tower Corp. | 126,592 | 25,174,085 | |

| Crown Castle, Inc. | 12,201 | 1,341,378 | |

| SBA Communications Corp. Class A | 21,900 | 4,582,137 | |

| 31,097,600 | |||

| Ground Transportation - 1.7% | |||

| Passenger Ground Transportation - 1.7% | |||

| Uber Technologies, Inc. (a) | 69,200 | 5,501,400 | |

| Interactive Media & Services - 5.9% | |||

| Interactive Media & Services - 5.9% | |||

| Match Group, Inc. (a) | 37,000 | 1,333,480 | |

| Meta Platforms, Inc. Class A | 29,400 | 14,409,822 | |

| Snap, Inc. Class A (a) | 314,600 | 3,466,892 | |

| 19,210,194 | |||

| IT Services - 0.6% | |||

| Internet Services & Infrastructure - 0.6% | |||

| Shopify, Inc. Class A (a) | 26,200 | 2,000,894 | |

| Oil, Gas & Consumable Fuels - 1.2% | |||

| Oil & Gas Refining & Marketing - 1.2% | |||

| Reliance Industries Ltd. | 113,800 | 4,010,834 | |

| Semiconductors & Semiconductor Equipment - 18.6% | |||

| Semiconductors - 18.6% | |||

| Marvell Technology, Inc. | 327,200 | 23,447,152 | |

| NXP Semiconductors NV | 25,300 | 6,318,169 | |

| Qorvo, Inc. (a) | 42,000 | 4,811,100 | |

| Qualcomm, Inc. | 114,150 | 18,011,729 | |

| STMicroelectronics NV (depository receipt) (b) | 168,300 | 7,677,846 | |

| 60,265,996 | |||

| Software - 1.8% | |||

| Application Software - 1.8% | |||

| LivePerson, Inc. (a) | 84,000 | 106,680 | |

| RingCentral, Inc. (a)(b) | 169,200 | 5,654,664 | |

| Zoom Video Communications, Inc. Class A (a) | 300 | 21,219 | |

| 5,782,563 | |||

| Technology Hardware, Storage & Peripherals - 12.4% | |||

| Technology Hardware, Storage & Peripherals - 12.4% | |||

| Apple, Inc. | 180,020 | 32,538,613 | |

| Samsung Electronics Co. Ltd. (a) | 136,470 | 7,500,963 | |

| 40,039,576 | |||

| Wireless Telecommunication Services - 17.0% | |||

| Wireless Telecommunication Services - 17.0% | |||

| Bharti Airtel Ltd. | 386,000 | 5,230,872 | |

| Bharti Airtel Ltd. | 47,900 | 416,998 | |

| Millicom International Cellular SA (a)(b) | 177,680 | 3,313,732 | |

| Rogers Communications, Inc. Class B (non-vtg.) | 179,500 | 7,943,683 | |

| Spok Holdings, Inc. | 1 | 18 | |

| T-Mobile U.S., Inc. | 180,016 | 29,396,613 | |

| U.S. Cellular Corp. (a) | 179,100 | 6,248,799 | |

| Vodafone Group PLC sponsored ADR (b) | 280,581 | 2,508,394 | |

| 55,059,109 | |||

| TOTAL COMMON STOCKS (Cost $219,110,327) | 314,101,030 | ||

| Money Market Funds - 4.1% | |||

| Shares | Value ($) | ||

Fidelity Securities Lending Cash Central Fund 5.39% (e)(f) (Cost $13,115,605) | 13,114,294 | 13,115,605 | |

| TOTAL INVESTMENT IN SECURITIES - 101.0% (Cost $232,225,932) | 327,216,635 |

NET OTHER ASSETS (LIABILITIES) - (1.0)% | (3,110,015) |

| NET ASSETS - 100.0% | 324,106,620 |

| (a) | Non-income producing |

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Level 3 security |

| (d) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $2,882,060 or 0.9% of net assets. |

| (e) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (f) | Investment made with cash collateral received from securities on loan. |

| (g) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $1 or 0.0% of net assets. |

| Additional information on each restricted holding is as follows: | ||

| Security | Acquisition Date | Acquisition Cost ($) |

| GCI Liberty, Inc. Class A (Escrow) | 5/23/23 | 0 |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 2,912,303 | 60,718,633 | 63,630,936 | 69,670 | - | - | - | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.39% | 10,799,733 | 136,103,550 | 133,787,678 | 89,050 | - | - | 13,115,605 | 0.0% |

| Total | 13,712,036 | 196,822,183 | 197,418,614 | 158,720 | - | - | 13,115,605 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Common Stocks | 314,101,030 | 310,330,619 | 3,770,410 | 1 |

| Money Market Funds | 13,115,605 | 13,115,605 | - | - |

| Total Investments in Securities: | 327,216,635 | 323,446,224 | 3,770,410 | 1 |

| Statement of Assets and Liabilities | ||||

| February 29, 2024 | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $12,835,249) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $219,110,327) | $ | 314,101,030 | ||

Fidelity Central Funds (cost $13,115,605) | 13,115,605 | |||

| Total Investment in Securities (cost $232,225,932) | $ | 327,216,635 | ||

| Foreign currency held at value (cost $134,615) | 134,664 | |||

| Receivable for investments sold | 22,594,539 | |||

| Receivable for fund shares sold | 149,531 | |||

| Dividends receivable | 410,340 | |||

| Distributions receivable from Fidelity Central Funds | 4,619 | |||

| Prepaid expenses | 554 | |||

| Other receivables | 12,095 | |||

Total assets | 350,522,977 | |||

| Liabilities | ||||

| Payable to custodian bank | $ | 132,597 | ||

| Payable for investments purchased | 3,223,025 | |||

| Payable for fund shares redeemed | 128,488 | |||

| Accrued management fee | 144,803 | |||

| Notes payable to affiliates | 8,855,000 | |||

| Other affiliated payables | 65,372 | |||

| Other payables and accrued expenses | 751,397 | |||

| Collateral on securities loaned | 13,115,675 | |||

| Total Liabilities | 26,416,357 | |||

| Net Assets | $ | 324,106,620 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 223,116,156 | ||

| Total accumulated earnings (loss) | 100,990,464 | |||

| Net Assets | $ | 324,106,620 | ||

Net Asset Value, offering price and redemption price per share ($324,106,620 ÷ 27,229,325 shares) | $ | 11.90 | ||

| Statement of Operations | ||||

Year ended February 29, 2024 | ||||

| Investment Income | ||||

| Dividends | $ | 5,867,630 | ||

| Income from Fidelity Central Funds (including $89,050 from security lending) | 158,720 | |||

| Total Income | 6,026,350 | |||

| Expenses | ||||

| Management fee | $ | 1,611,636 | ||

| Transfer agent fees | 638,611 | |||

| Accounting fees | 108,986 | |||

| Custodian fees and expenses | 15,086 | |||

| Independent trustees' fees and expenses | 1,965 | |||

| Registration fees | 31,428 | |||

| Audit | 76,697 | |||

| Legal | 984 | |||

| Interest | 2,739 | |||

| Miscellaneous | 1,569 | |||

| Total expenses before reductions | 2,489,701 | |||

| Expense reductions | (22,764) | |||

| Total expenses after reductions | 2,466,937 | |||

| Net Investment income (loss) | 3,559,413 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers (net of foreign taxes of $130,049) | 13,401,584 | |||

| Foreign currency transactions | (3,452) | |||

| Total net realized gain (loss) | 13,398,132 | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers (net of increase in deferred foreign taxes of $288,050) | 39,059,203 | |||

| Assets and liabilities in foreign currencies | 1,365 | |||

| Total change in net unrealized appreciation (depreciation) | 39,060,568 | |||

| Net gain (loss) | 52,458,700 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 56,018,113 | ||

| Statement of Changes in Net Assets | ||||

Year ended February 29, 2024 | Year ended February 28, 2023 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 3,559,413 | $ | 2,866,892 |

| Net realized gain (loss) | 13,398,132 | 10,204,800 | ||

| Change in net unrealized appreciation (depreciation) | 39,060,568 | (72,760,166) | ||

| Net increase (decrease) in net assets resulting from operations | 56,018,113 | (59,688,474) | ||

| Distributions to shareholders | (7,837,214) | (26,743,653) | ||

| Share transactions | ||||

| Proceeds from sales of shares | 39,969,785 | 36,656,737 | ||

| Reinvestment of distributions | 7,189,424 | 24,990,417 | ||

| Cost of shares redeemed | (73,439,523) | (76,575,168) | ||

Net increase (decrease) in net assets resulting from share transactions | (26,280,314) | (14,928,014) | ||

| Total increase (decrease) in net assets | 21,900,585 | (101,360,141) | ||

| Net Assets | ||||

| Beginning of period | 302,206,035 | 403,566,176 | ||

| End of period | $ | 324,106,620 | $ | 302,206,035 |

| Other Information | ||||

| Shares | ||||

| Sold | 3,580,709 | 3,281,452 | ||

| Issued in reinvestment of distributions | 622,461 | 2,265,748 | ||

| Redeemed | (6,688,166) | (7,089,181) | ||

| Net increase (decrease) | (2,484,996) | (1,541,981) | ||

| Wireless Portfolio |

| Years ended February 28, | 2024 A | 2023 | 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 10.17 | $ | 12.91 | $ | 13.34 | $ | 10.69 | $ | 8.93 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | .12 | .09 | .10 | .10 | .14 | |||||

| Net realized and unrealized gain (loss) | 1.89 | (1.95) | .54 | 3.50 | 1.93 | |||||

| Total from investment operations | 2.01 | (1.86) | .64 | 3.60 | 2.07 | |||||

| Distributions from net investment income | (.11) | (.09) | (.09) | (.10) | (.12) | |||||

| Distributions from net realized gain | (.17) | (.79) | (.98) | (.86) | (.19) | |||||

| Total distributions | (.28) | (.88) | (1.07) | (.95) D | (.31) | |||||

| Net asset value, end of period | $ | 11.90 | $ | 10.17 | $ | 12.91 | $ | 13.34 | $ | 10.69 |

Total Return E | 19.83% | (14.79)% | 4.40% | 36.09% | 23.01% | |||||

Ratios to Average Net Assets C,F,G | ||||||||||

| Expenses before reductions | .81% | .79% | .77% | .79% | .81% | |||||

| Expenses net of fee waivers, if any | .80% | .79% | .77% | .79% | .81% | |||||

| Expenses net of all reductions | .80% | .79% | .77% | .78% | .81% | |||||

| Net investment income (loss) | 1.16% | .85% | .69% | .80% | 1.39% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 324,107 | $ | 302,206 | $ | 403,566 | $ | 440,296 | $ | 355,309 |

Portfolio turnover rate H | 22% | 11% | 30% | 55% | 78% |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Gross unrealized appreciation | $128,289,492 |

| Gross unrealized depreciation | (36,846,924) |

| Net unrealized appreciation (depreciation) | $91,442,568 |

| Tax Cost | $235,774,067 |

| Undistributed tax-exempt income | $- | ||

| Undistributed ordinary income | $426,423 | ||

| Undistributed long-term capital gain | $9,829,064 | ||

| Net unrealized appreciation (depreciation) on securities and other investments | $91,435,546 |

| February 29, 2024 | February 28, 2023 | |

| Ordinary Income | $3,157,438 | $2,921,826 |

| Long-term Capital Gains | 4,679,776 | 23,821,827 |

| Total | $7,837,214 | $ 26,743,653 |

| Purchases ($) | Sales ($) | |

| Wireless Portfolio | 66,941,172 | 105,069,003 |

| % of Average Net Assets | |

| Wireless Portfolio | 0.0353% |

| % of Average Net Assets | |

| Wireless Portfolio | .04 |

| Maximum Management Fee Rate % | |

| Wireless Portfolio | 0.72% |

| Amount | |

| Wireless Portfolio | $1,449 |

| Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense | |

| Wireless Portfolio | Borrower | $ 8,855,000 | 5.56% | $2,739 |

| Purchases ($) | Sales ($) | Realized Gain (Loss) ($) | |

| Wireless Portfolio | 561,937 | 9,807,651 | (6,099,885) |

| Amount | |

| Wireless Portfolio | $534 |

| Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End | |

| Wireless Portfolio | $9,303 | $- | $- |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2023 to February 29, 2024). |

Annualized Expense Ratio- A | Beginning Account Value September 1, 2023 | Ending Account Value February 29, 2024 | Expenses Paid During Period- C September 1, 2023 to February 29, 2024 | |||||||

| Telecommunications Portfolio | ||||||||||

Class A ** | 1.11% | |||||||||

| Actual | $ 1,000 | $ 1,042.30 | $ 5.64 | |||||||

Hypothetical-B | $ 1,000 | $ 1,019.34 | $ 5.57 | |||||||

Class M ** | 1.36% | |||||||||

| Actual | $ 1,000 | $ 1,041.10 | $ 6.90 | |||||||

Hypothetical-B | $ 1,000 | $ 1,018.10 | $ 6.82 | |||||||

| Class C | 1.86% | |||||||||

| Actual | $ 1,000 | $ 1,038.50 | $ 9.43 | |||||||

Hypothetical-B | $ 1,000 | $ 1,015.61 | $ 9.32 | |||||||

Telecommunications Portfolio ** | .84% | |||||||||

| Actual | $ 1,000 | $ 1,043.90 | $ 4.27 | |||||||

Hypothetical-B | $ 1,000 | $ 1,020.69 | $ 4.22 | |||||||

Class I ** | .79% | |||||||||

| Actual | $ 1,000 | $ 1,044.30 | $ 4.02 | |||||||

Hypothetical-B | $ 1,000 | $ 1,020.93 | $ 3.97 | |||||||

Class Z ** | .67% | |||||||||

| Actual | $ 1,000 | $ 1,044.60 | $ 3.41 | |||||||

Hypothetical-B | $ 1,000 | $ 1,021.53 | $ 3.37 | |||||||

Wireless Portfolio ** | .79% | |||||||||

| Actual | $ 1,000 | $ 1,138.90 | $ 4.20 | |||||||

Hypothetical-B | $ 1,000 | $ 1,020.93 | $ 3.97 | |||||||

Annualized Expense Ratio- A | Expenses Paid | |||||

| Telecommunications Portfolio | ||||||

| Class A | 1.03% | |||||

| Actual | $ 5.23 | |||||

Hypothetical- B | $ 5.17 | |||||

| Class M | 1.28% | |||||

| Actual | $ 6.50 | |||||

Hypothetical- B | $ 6.42 | |||||

| Telecommunications Portfolio | .71% | |||||

| Actual | $ 3.61 | |||||

Hypothetical- B | $ 3.57 | |||||

| Class I | .74% | |||||

| Actual | $ 3.76 | |||||

Hypothetical- B | $ 3.72 | |||||

| Class Z | .63% | |||||

| Actual | $ 3.20 | |||||

Hypothetical- B | $ 3.17 | |||||

| Wireless Portfolio | .71% | |||||

| Actual | $ 3.78 | |||||

Hypothetical- B | $ 3.57 | |||||

| A Annualized expense ratio reflects expenses net of applicable fee waivers. | ||||||

| B 5% return per year before expenses |

| Wireless Portfolio | $15,300,245 |

| Telecommunications Portfolio | 0.09% |

| Wireless Portfolio | $24,637 |

| April 2023 | July 2023 | October 2023 | December 2023 | |

| Telecommunications Portfolio | ||||

| Class A | 100% | 100% | 100% | 100% |

| Class M | 100% | 100% | 100% | 100% |

| Class C | 100% | 100% | 100% | 100% |

| Telecommunications | 100% | 100% | 100% | 100% |

| Class I | 100% | 100% | 100% | 100% |

| Class Z | 100% | 100% | 100% | 100% |

| Wireless Portfolio | ||||

| Wireless | 80% |

| April 2023 | July 2023 | October 2023 | December 2023 | |

| Telecommunications Portfolio | ||||

| Class A | 100% | 100% | 100% | 100% |

| Class M | 100% | 100% | 100% | 100% |

| Class C | 100% | 100% | 100% | 100% |

| Telecommunications | 100% | 100% | 100% | 100% |

| Class I | 100% | 100% | 100% | 100% |

| Class Z | 100% | 100% | 100% | 100% |

| Wireless Portfolio | ||||

| Wireless | 100% |

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

|

Contents

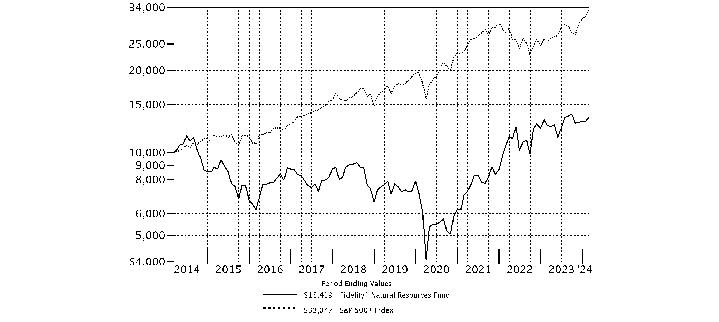

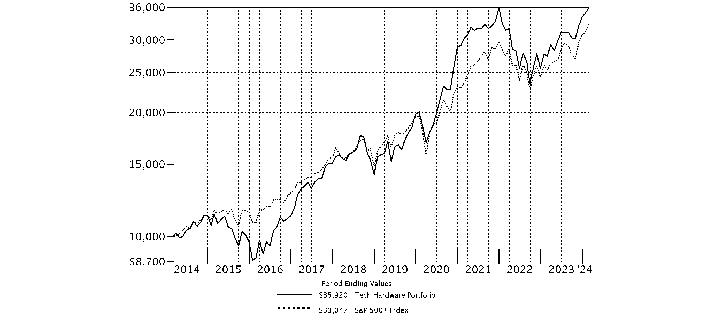

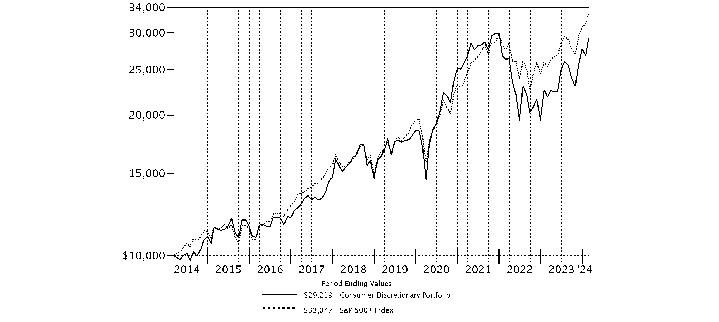

| Average Annual Total Returns | |||

Periods ended February 29, 2024 | Past 1 year | Past 5 years | Past 10 years |

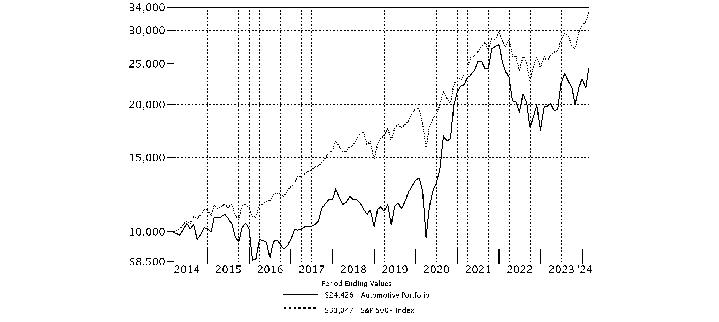

| Utilities Portfolio | 6.01% | 6.98% | 8.33% |

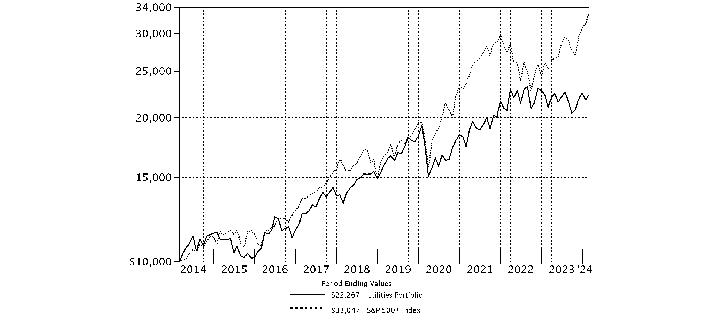

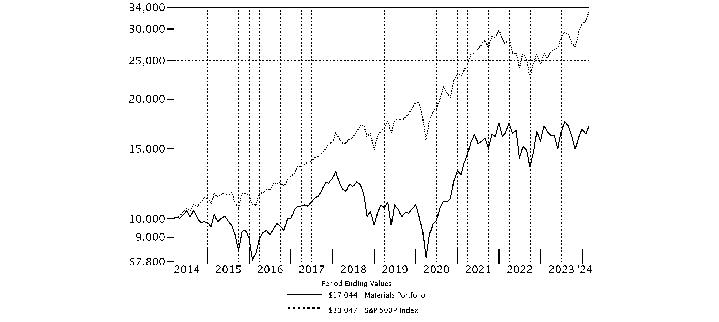

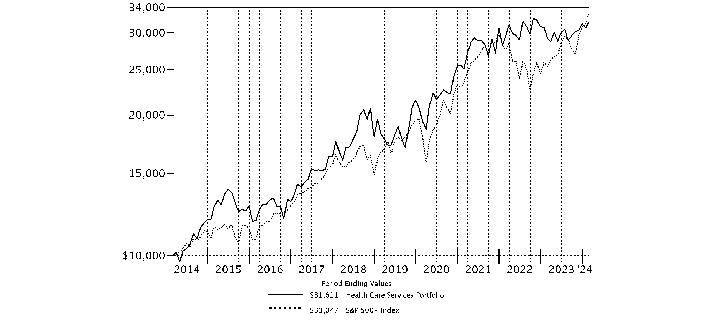

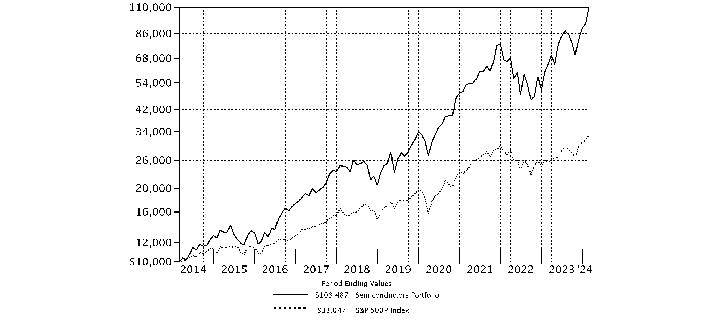

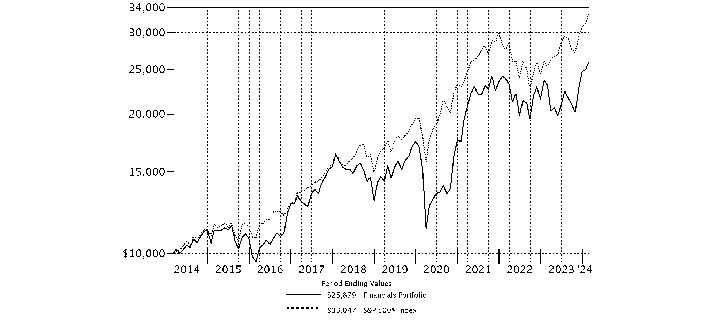

| $10,000 Over 10 Years |

Let's say hypothetically that $10,000 was invested in Utilities Portfolio on February 28, 2014. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period. |

|

Top Holdings (% of Fund's net assets) | ||

| NextEra Energy, Inc. | 13.0 | |

| Sempra | 8.9 | |

| Constellation Energy Corp. | 6.6 | |

| PG&E Corp. | 6.1 | |

| Edison International | 6.0 | |

| FirstEnergy Corp. | 5.5 | |

| American Electric Power Co., Inc. | 4.9 | |

| Entergy Corp. | 4.9 | |

| Southern Co. | 4.9 | |

| Eversource Energy | 4.8 | |

| 65.6 | ||

| Industries (% of Fund's net assets) | ||

| Electric Utilities | 68.8 | |

| Multi-Utilities | 17.5 | |

| Independent Power and Renewable Electricity Producers | 8.6 | |

| Electrical Equipment | 1.2 | |

| Gas Utilities | 1.2 | |

| Water Utilities | 1.0 | |

| Chemicals | 0.3 | |

| Common Stocks - 98.6% | |||

| Shares | Value ($) | ||

| Chemicals - 0.3% | |||

| Industrial Gases - 0.3% | |||

| Air Products & Chemicals, Inc. | 15,300 | 3,580,812 | |

| Electric Utilities - 68.8% | |||

| Electric Utilities - 68.8% | |||

| Allete, Inc. | 2,707 | 153,324 | |

| American Electric Power Co., Inc. (a) | 668,927 | 56,985,891 | |

| Constellation Energy Corp. | 451,474 | 76,050,795 | |

| Duke Energy Corp. | 177,447 | 16,294,958 | |

| Edison International | 1,017,721 | 69,225,382 | |

| Entergy Corp. | 555,963 | 56,469,162 | |

| Evergy, Inc. | 491,100 | 24,329,094 | |

| Eversource Energy | 956,499 | 56,146,491 | |

| Exelon Corp. | 627,100 | 22,475,264 | |

| FirstEnergy Corp. | 1,732,845 | 63,439,455 | |

| Fortum Corp. | 240,700 | 3,004,716 | |

| Kansai Electric Power Co., Inc. | 89,200 | 1,142,667 | |

| NextEra Energy, Inc. | 2,737,806 | 151,099,513 | |

| NRG Energy, Inc. | 108,099 | 5,980,037 | |

| PG&E Corp. | 4,213,492 | 70,323,181 | |

| Pinnacle West Capital Corp. | 152,800 | 10,440,824 | |

| PPL Corp. | 1,885,406 | 49,718,156 | |

| Southern Co. | 837,395 | 56,314,814 | |

| Xcel Energy, Inc. | 143,959 | 7,585,200 | |

| 797,178,924 | |||

| Electrical Equipment - 1.2% | |||

| Electrical Components & Equipment - 1.2% | |||

| Fluence Energy, Inc. (b) | 465,300 | 7,114,437 | |

| Nextracker, Inc. Class A | 61,900 | 3,481,256 | |

| Sunrun, Inc. (a)(b) | 232,700 | 2,801,708 | |

| 13,397,401 | |||

| Gas Utilities - 1.2% | |||

| Gas Utilities - 1.2% | |||

| Southwest Gas Holdings, Inc. | 87,534 | 5,965,442 | |

| UGI Corp. (a) | 316,295 | 7,742,902 | |

| 13,708,344 | |||

| Independent Power and Renewable Electricity Producers - 8.6% | |||

| Independent Power Producers & Energy Traders - 7.4% | |||

| Energy Harbor Corp. (b) | 231,300 | 19,429,200 | |

| The AES Corp. | 1,786,533 | 27,155,302 | |

| Vistra Corp. | 714,627 | 38,975,757 | |

| 85,560,259 | |||

| Renewable Electricity - 1.2% | |||

| Clearway Energy, Inc. Class A (a) | 166,124 | 3,365,672 | |

| NextEra Energy Partners LP | 338,012 | 9,285,190 | |

| Sunnova Energy International, Inc. (a)(b) | 139,933 | 1,018,712 | |

| 13,669,574 | |||

TOTAL INDEPENDENT POWER AND RENEWABLE ELECTRICITY PRODUCERS | 99,229,833 | ||

| Multi-Utilities - 17.5% | |||

| Multi-Utilities - 17.5% | |||

| DTE Energy Co. | 238,955 | 25,890,774 | |

| NiSource, Inc. | 1,498,176 | 39,042,467 | |

| Public Service Enterprise Group, Inc. | 555,252 | 34,647,725 | |

| Sempra | 1,465,508 | 103,464,865 | |

| 203,045,831 | |||

| Water Utilities - 1.0% | |||

| Water Utilities - 1.0% | |||

| Essential Utilities, Inc. (a) | 338,294 | 11,765,865 | |

| TOTAL COMMON STOCKS (Cost $981,829,058) | 1,141,907,010 | ||

| Money Market Funds - 4.1% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 5.39% (c) | 4,515,263 | 4,516,166 | |

| Fidelity Securities Lending Cash Central Fund 5.39% (c)(d) | 43,353,942 | 43,358,278 | |

| TOTAL MONEY MARKET FUNDS (Cost $47,874,444) | 47,874,444 | ||

| TOTAL INVESTMENT IN SECURITIES - 102.7% (Cost $1,029,703,502) | 1,189,781,454 |

NET OTHER ASSETS (LIABILITIES) - (2.7)% | (31,747,923) |

| NET ASSETS - 100.0% | 1,158,033,531 |

| (a) | Security or a portion of the security is on loan at period end. |

| (b) | Non-income producing |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 13,606,856 | 582,351,500 | 591,442,190 | 637,232 | - | - | 4,516,166 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.39% | 9,119,850 | 204,098,094 | 169,859,666 | 14,950 | - | - | 43,358,278 | 0.1% |

| Total | 22,726,706 | 786,449,594 | 761,301,856 | 652,182 | - | - | 47,874,444 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Common Stocks | 1,141,907,010 | 1,141,907,010 | - | - |

| Money Market Funds | 47,874,444 | 47,874,444 | - | - |

| Total Investments in Securities: | 1,189,781,454 | 1,189,781,454 | - | - |

| Statement of Assets and Liabilities | ||||

| February 29, 2024 | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $43,132,336) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $981,829,058) | $ | 1,141,907,010 | ||

Fidelity Central Funds (cost $47,874,444) | 47,874,444 | |||

| Total Investment in Securities (cost $1,029,703,502) | $ | 1,189,781,454 | ||

| Receivable for investments sold | 38,886,527 | |||

| Receivable for fund shares sold | 2,852,483 | |||

| Dividends receivable | 5,154,793 | |||

| Distributions receivable from Fidelity Central Funds | 31,228 | |||

| Prepaid expenses | 1,856 | |||

| Other receivables | 27,101 | |||

Total assets | 1,236,735,442 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 32,280,076 | ||

| Payable for fund shares redeemed | 2,337,429 | |||

| Accrued management fee | 496,379 | |||

| Other affiliated payables | 192,095 | |||

| Other payables and accrued expenses | 37,654 | |||

| Collateral on securities loaned | 43,358,278 | |||

| Total Liabilities | 78,701,911 | |||

| Net Assets | $ | 1,158,033,531 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 966,106,674 | ||

| Total accumulated earnings (loss) | 191,926,857 | |||

| Net Assets | $ | 1,158,033,531 | ||

Net Asset Value, offering price and redemption price per share ($1,158,033,531 ÷ 11,632,452 shares) | $ | 99.55 | ||

| Statement of Operations | ||||

Year ended February 29, 2024 | ||||

| Investment Income | ||||

| Dividends | $ | 37,577,905 | ||

| Income from Fidelity Central Funds (including $14,950 from security lending) | 652,182 | |||

| Total Income | 38,230,087 | |||

| Expenses | ||||

| Management fee | $ | 6,746,116 | ||

| Transfer agent fees | 2,267,986 | |||

| Accounting fees | 364,069 | |||

| Custodian fees and expenses | 12,127 | |||

| Independent trustees' fees and expenses | 8,146 | |||

| Registration fees | 68,804 | |||

| Audit | 40,789 | |||

| Legal | 1,213 | |||

| Interest | 12,236 | |||

| Miscellaneous | 7,133 | |||

| Total expenses before reductions | 9,528,619 | |||

| Expense reductions | (96,700) | |||

| Total expenses after reductions | 9,431,919 | |||

| Net Investment income (loss) | 28,798,168 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 38,799,030 | |||

| Foreign currency transactions | 73 | |||

| Total net realized gain (loss) | 38,799,103 | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 4,857,870 | |||

| Assets and liabilities in foreign currencies | 1,063 | |||

| Total change in net unrealized appreciation (depreciation) | 4,858,933 | |||

| Net gain (loss) | 43,658,036 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 72,456,204 | ||

| Statement of Changes in Net Assets | ||||

Year ended February 29, 2024 | Year ended February 28, 2023 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 28,798,168 | $ | 24,300,868 |

| Net realized gain (loss) | 38,799,103 | 32,167,095 | ||

| Change in net unrealized appreciation (depreciation) | 4,858,933 | (78,850,488) | ||

| Net increase (decrease) in net assets resulting from operations | 72,456,204 | (22,382,525) | ||

| Distributions to shareholders | (46,638,898) | (62,216,948) | ||

| Share transactions | ||||

| Proceeds from sales of shares | 299,175,604 | 921,832,942 | ||

| Reinvestment of distributions | 42,202,004 | 57,299,028 | ||

| Cost of shares redeemed | (561,927,330) | (613,822,146) | ||

Net increase (decrease) in net assets resulting from share transactions | (220,549,722) | 365,309,824 | ||

| Total increase (decrease) in net assets | (194,732,416) | 280,710,351 | ||

| Net Assets | ||||

| Beginning of period | 1,352,765,947 | 1,072,055,596 | ||

| End of period | $ | 1,158,033,531 | $ | 1,352,765,947 |

| Other Information | ||||

| Shares | ||||

| Sold | 3,004,338 | 8,651,956 | ||

| Issued in reinvestment of distributions | 425,669 | 535,973 | ||

| Redeemed | (5,699,536) | (5,965,477) | ||

| Net increase (decrease) | (2,269,529) | 3,222,452 | ||

| Utilities Portfolio |

| Years ended February 28, | 2024 A | 2023 | 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 97.31 | $ | 100.38 | $ | 86.55 | $ | 91.20 | $ | 85.32 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | 2.21 | 1.82 | 1.92 | 1.61 | 2.09 | |||||

| Net realized and unrealized gain (loss) | 3.57 | .04 D | 14.72 | (1.81) | 5.99 | |||||

| Total from investment operations | 5.78 | 1.86 | 16.64 | (.20) | 8.08 | |||||

| Distributions from net investment income | (2.13) | (1.75) | (1.71) | (2.12) | (1.94) | |||||

| Distributions from net realized gain | (1.42) | (3.18) | (1.10) | (2.34) | (.26) | |||||

| Total distributions | (3.54) E | (4.93) | (2.81) | (4.45) E | (2.20) | |||||

| Net asset value, end of period | $ | 99.55 | $ | 97.31 | $ | 100.38 | $ | 86.55 | $ | 91.20 |

Total Return F | 6.01% | 1.46% | 19.19% | (.05)% | 9.34% | |||||

Ratios to Average Net Assets C,G,H | ||||||||||

| Expenses before reductions | .74% | .74% | .74% | .76% | .75% | |||||

| Expenses net of fee waivers, if any | .73% | .74% | .73% | .76% | .75% | |||||

| Expenses net of all reductions | .73% | .74% | .73% | .75% | .74% | |||||

| Net investment income (loss) | 2.23% | 1.74% | 1.96% | 1.88% | 2.25% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 1,158,034 | $ | 1,352,766 | $ | 1,072,056 | $ | 896,285 | $ | 1,247,009 |

Portfolio turnover rate I | 83% | 53% | 37% | 64% | 65% J |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Gross unrealized appreciation | $204,449,057 |

| Gross unrealized depreciation | (53,606,910) |

| Net unrealized appreciation (depreciation) | $150,842,147 |

| Tax Cost | $1,038,939,307 |

| Undistributed tax-exempt income | $- |

| Undistributed ordinary income | $2,564,134 |

| Undistributed long-term capital gain | $38,520,487 |

| Net unrealized appreciation (depreciation) on securities and other investments | $150,842,236 |

| February 29, 2024 | February 28, 2023 | |

| Ordinary Income | $27,455,620 | $23,713,330 |

| Long-term Capital Gains | 19,183,278 | 38,503,618 |

| Total | $46,638,898 | $62,216,948 |

| Purchases ($) | Sales ($) | |

| Utilities Portfolio | 1,047,534,061 | 1,245,526,318 |

| % of Average Net Assets | |

| Utilities Portfolio | 0.0280% |

| % of Average Net Assets | |

| Utilities Portfolio | .03% |

| Maximum Management Fee Rate % | |

| Utilities Portfolio | 0.69% |

| Amount | |

| Utilities Portfolio | $11,798 |

| Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense | |

| Utilities Portfolio | Borrower | $ 8,120,400 | 5.42% | $12,236 |

| Purchases ($) | Sales ($) | Realized Gain (Loss) ($) | |

| Utilities Portfolio | 17,450,089 | 45,535,052 | 1,971,959 |

| Amount | |

| Utilities Portfolio | $2,367 |

| Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End | |

| Utilities Portfolio | $1,568 | $- | $- |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2023 to February 29, 2024). |

Annualized Expense Ratio- A | Beginning Account Value September 1, 2023 | Ending Account Value February 29, 2024 | Expenses Paid During Period- C September 1, 2023 to February 29, 2024 | |||||||

Utilities Portfolio ** | .73% | |||||||||

| Actual | $ 1,000 | $ 1,032.70 | $ 3.69 | |||||||

Hypothetical-B | $ 1,000 | $ 1,021.23 | $ 3.67 | |||||||

Annualized Expense Ratio- A | Expenses Paid | |||||

| Utilities Portfolio | .68% | |||||

| Actual | $ 3.44 | |||||

Hypothetical- B | $ 3.42 | |||||

| A Annualized expense ratio reflects expenses net of applicable fee waivers. | ||||||

| B 5% return per year before expenses |

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

|

Contents

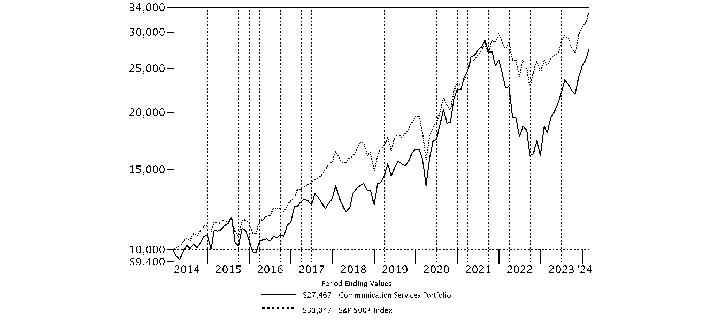

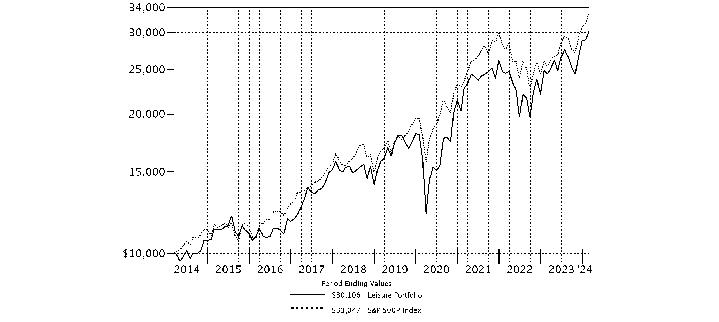

| Average Annual Total Returns | |||

Periods ended February 29, 2024 | Past 1 year | Past 5 years | Past 10 years |

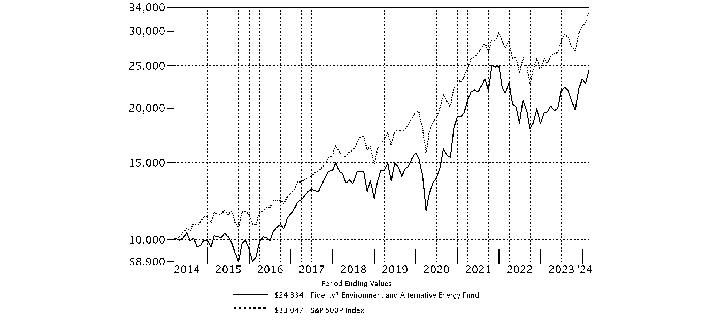

| Fidelity® Environment and Alternative Energy Fund | 24.26% | 11.13% | 9.30% |

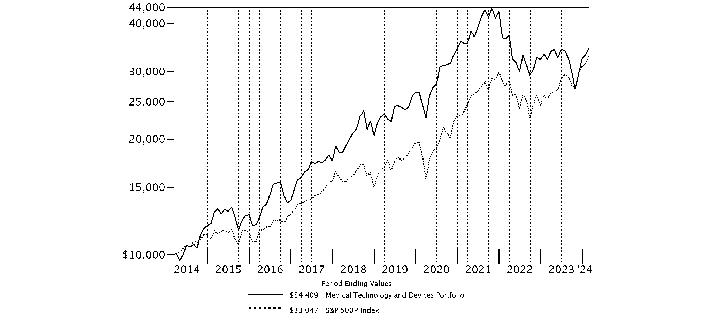

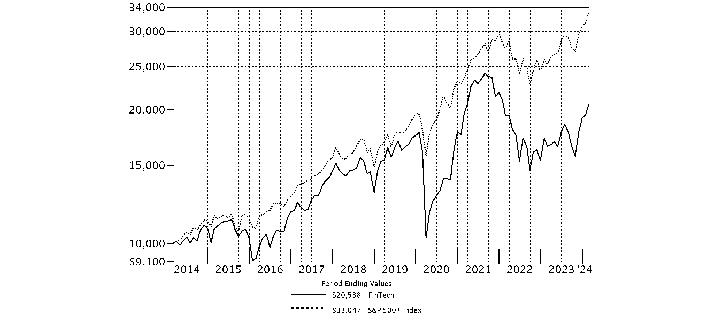

| $10,000 Over 10 Years |

Let's say hypothetically that $10,000 was invested in Fidelity® Environment and Alternative Energy Fund on February 28, 2014. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period. |

|

Top Holdings (% of Fund's net assets) | ||

| Microsoft Corp. | 13.3 | |

| Linde PLC | 8.3 | |

| Danaher Corp. | 6.3 | |

| IBM Corp. | 5.9 | |

| Eaton Corp. PLC | 5.5 | |

| Prologis, Inc. | 5.1 | |

| Union Pacific Corp. | 5.0 | |

| Tesla, Inc. | 4.8 | |

| Trane Technologies PLC | 3.4 | |

| Republic Services, Inc. | 3.2 | |

| 60.8 | ||

| Industries (% of Fund's net assets) | ||

| Software | 13.3 | |

| Chemicals | 9.9 | |

| Electrical Equipment | 8.9 | |

| Semiconductors & Semiconductor Equipment | 7.5 | |

| IT Services | 6.9 | |

| Life Sciences Tools & Services | 6.9 | |

| Equity Real Estate Investment Trusts (Reits) | 5.1 | |

| Ground Transportation | 5.0 | |

| Automobiles | 4.8 | |

| Commercial Services & Supplies | 4.6 | |

| Machinery | 4.5 | |

| Building Products | 4.3 | |

| Electric Utilities | 4.2 | |

| Communications Equipment | 3.2 | |

| Containers & Packaging | 2.1 | |

| Construction & Engineering | 2.1 | |

| Independent Power and Renewable Electricity Producers | 1.7 | |

| Professional Services | 1.4 | |

| Aerospace & Defense | 0.9 | |

| Electronic Equipment, Instruments & Components | 0.8 | |

| Energy Equipment & Services | 0.8 | |

| Oil, Gas & Consumable Fuels | 0.6 | |

| Common Stocks - 99.5% | |||

| Shares | Value ($) | ||

| Aerospace & Defense - 0.9% | |||

| Aerospace & Defense - 0.9% | |||

| BWX Technologies, Inc. | 17,430 | 1,757,467 | |

| Woodward, Inc. | 21,670 | 3,066,088 | |

| 4,823,555 | |||

| Automobiles - 4.8% | |||

| Automobile Manufacturers - 4.8% | |||

| Tesla, Inc. (a) | 125,290 | 25,293,545 | |

| Building Products - 4.3% | |||

| Building Products - 4.3% | |||

| The AZEK Co., Inc. (a) | 93,870 | 4,516,086 | |

| Trane Technologies PLC | 64,060 | 18,062,998 | |

| 22,579,084 | |||

| Chemicals - 9.9% | |||

| Commodity Chemicals - 0.2% | |||

| PureCycle Technologies, Inc. (a)(b) | 225,910 | 1,308,019 | |

| Diversified Chemicals - 0.3% | |||

| The Chemours Co. LLC | 67,600 | 1,329,692 | |

| Industrial Gases - 8.3% | |||

| Linde PLC | 97,420 | 43,724,044 | |

| Specialty Chemicals - 1.1% | |||

| Aspen Aerogels, Inc. (a)(b) | 276,690 | 4,753,534 | |

| PPG Industries, Inc. | 5,520 | 781,632 | |

| 5,535,166 | |||

TOTAL CHEMICALS | 51,896,921 | ||

| Commercial Services & Supplies - 4.6% | |||

| Environmental & Facilities Services - 4.6% | |||

| Clean Harbors, Inc. (a) | 9,040 | 1,646,184 | |

| Republic Services, Inc. | 90,820 | 16,674,552 | |

| Tetra Tech, Inc. | 22,710 | 4,026,937 | |

| Veralto Corp. | 17,036 | 1,472,251 | |

| 23,819,924 | |||

| Communications Equipment - 3.2% | |||

| Communications Equipment - 3.2% | |||

| Arista Networks, Inc. (a) | 59,950 | 16,638,523 | |

| Construction & Engineering - 2.1% | |||

| Construction & Engineering - 2.1% | |||

| AECOM | 51,340 | 4,560,532 | |

| Quanta Services, Inc. | 25,970 | 6,272,015 | |

| 10,832,547 | |||

| Containers & Packaging - 2.1% | |||

| Metal, Glass & Plastic Containers - 2.1% | |||

| Ball Corp. | 170,050 | 10,886,601 | |

| Electric Utilities - 4.2% | |||

| Electric Utilities - 4.2% | |||

| Kansai Electric Power Co., Inc. | 447,530 | 5,732,933 | |

| PG&E Corp. | 607,280 | 10,135,503 | |

| Southern Co. | 89,920 | 6,047,120 | |

| 21,915,556 | |||

| Electrical Equipment - 8.9% | |||

| Electrical Components & Equipment - 7.9% | |||

| Array Technologies, Inc. (a)(b) | 111,480 | 1,520,587 | |

| Eaton Corp. PLC | 99,830 | 28,850,870 | |

| Fluence Energy, Inc. (a)(b) | 101,170 | 1,546,889 | |

| Nextracker, Inc. Class A | 59,160 | 3,327,158 | |

| Sunrun, Inc. (a)(b) | 128,440 | 1,546,418 | |

| Vertiv Holdings Co. | 67,940 | 4,594,103 | |

| 41,386,025 | |||

| Heavy Electrical Equipment - 1.0% | |||

| Vestas Wind Systems A/S (a) | 194,740 | 5,427,022 | |

TOTAL ELECTRICAL EQUIPMENT | 46,813,047 | ||

| Electronic Equipment, Instruments & Components - 0.8% | |||

| Electronic Components - 0.8% | |||

| Coherent Corp. (a) | 72,020 | 4,283,750 | |

| Energy Equipment & Services - 0.8% | |||

| Oil & Gas Equipment & Services - 0.8% | |||

| Baker Hughes Co. Class A | 137,030 | 4,054,718 | |

| Equity Real Estate Investment Trusts (REITs) - 5.1% | |||

| Industrial REITs - 5.1% | |||

| Prologis, Inc. | 198,030 | 26,391,458 | |

| Ground Transportation - 5.0% | |||

| Rail Transportation - 5.0% | |||

| Union Pacific Corp. | 102,730 | 26,061,574 | |

| Independent Power and Renewable Electricity Producers - 1.7% | |||

| Independent Power Producers & Energy Traders - 1.7% | |||

| RWE AG | 146,580 | 4,910,043 | |

| The AES Corp. | 269,020 | 4,089,104 | |

| 8,999,147 | |||

| IT Services - 6.9% | |||

| IT Consulting & Other Services - 6.9% | |||

| Amdocs Ltd. | 58,750 | 5,358,000 | |

| IBM Corp. | 167,370 | 30,968,471 | |

| 36,326,471 | |||

| Life Sciences Tools & Services - 6.9% | |||

| Life Sciences Tools & Services - 6.9% | |||

| Agilent Technologies, Inc. | 24,600 | 3,379,056 | |

| Danaher Corp. | 129,800 | 32,857,572 | |

| 36,236,628 | |||

| Machinery - 4.5% | |||

| Agricultural & Farm Machinery - 0.7% | |||

| Deere & Co. | 9,290 | 3,391,315 | |

| Construction Machinery & Heavy Transportation Equipment - 2.5% | |||

| Cummins, Inc. | 48,332 | 12,982,459 | |

| Industrial Machinery & Supplies & Components - 1.3% | |||

| Parker Hannifin Corp. | 9,830 | 5,263,474 | |

| Timken Co. | 20,340 | 1,708,357 | |

| 6,971,831 | |||

TOTAL MACHINERY | 23,345,605 | ||

| Oil, Gas & Consumable Fuels - 0.6% | |||

| Coal & Consumable Fuels - 0.2% | |||

| Cameco Corp. | 32,320 | 1,309,930 | |

| Oil & Gas Refining & Marketing - 0.4% | |||

| Neste OYJ | 72,720 | 1,993,975 | |

TOTAL OIL, GAS & CONSUMABLE FUELS | 3,303,905 | ||

| Professional Services - 1.4% | |||

| Research & Consulting Services - 1.4% | |||

| KBR, Inc. | 124,000 | 7,443,720 | |

| Semiconductors & Semiconductor Equipment - 7.5% | |||

| Semiconductor Materials & Equipment - 0.9% | |||

| Enphase Energy, Inc. (a) | 36,300 | 4,610,463 | |

| Semiconductors - 6.6% | |||

| Analog Devices, Inc. | 40,750 | 7,816,665 | |

| First Solar, Inc. (a) | 43,080 | 6,629,581 | |

| NXP Semiconductors NV | 55,960 | 13,974,891 | |

| ON Semiconductor Corp. (a) | 79,740 | 6,293,081 | |

| 34,714,218 | |||

TOTAL SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT | 39,324,681 | ||

| Software - 13.3% | |||

| Systems Software - 13.3% | |||

| Microsoft Corp. | 168,900 | 69,863,795 | |

| TOTAL COMMON STOCKS (Cost $374,257,997) | 521,134,755 | ||

| Convertible Preferred Stocks - 0.0% | |||

| Shares | Value ($) | ||

| Electronic Equipment, Instruments & Components - 0.0% | |||

| Electronic Components - 0.0% | |||

CelLink Corp. Series D (a)(c)(d) (Cost $295,699) | 14,200 | 133,622 | |

| Money Market Funds - 1.7% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 5.39% (e) | 144,225 | 144,254 | |

| Fidelity Securities Lending Cash Central Fund 5.39% (e)(f) | 8,818,993 | 8,819,875 | |

| TOTAL MONEY MARKET FUNDS (Cost $8,964,129) | 8,964,129 | ||

| TOTAL INVESTMENT IN SECURITIES - 101.2% (Cost $383,517,825) | 530,232,506 |

NET OTHER ASSETS (LIABILITIES) - (1.2)% | (6,455,955) |

| NET ASSETS - 100.0% | 523,776,551 |

| (a) | Non-income producing |

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $133,622 or 0.0% of net assets. |

| (d) | Level 3 security |

| (e) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (f) | Investment made with cash collateral received from securities on loan. |

| Additional information on each restricted holding is as follows: | ||

| Security | Acquisition Date | Acquisition Cost ($) |

| CelLink Corp. Series D | 1/20/22 | 295,699 |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 480,638 | 57,406,147 | 57,742,531 | 77,916 | - | - | 144,254 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.39% | 5,110,325 | 89,534,503 | 85,824,953 | 77,765 | - | - | 8,819,875 | 0.0% |

| Total | 5,590,963 | 146,940,650 | 143,567,484 | 155,681 | - | - | 8,964,129 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Common Stocks | 521,134,755 | 510,797,690 | 10,337,065 | - |

| Convertible Preferred Stocks | 133,622 | - | - | 133,622 |

| Money Market Funds | 8,964,129 | 8,964,129 | - | - |

| Total Investments in Securities: | 530,232,506 | 519,761,819 | 10,337,065 | 133,622 |

| Statement of Assets and Liabilities | ||||

| February 29, 2024 | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $8,622,550) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $374,553,696) | $ | 521,268,377 | ||

Fidelity Central Funds (cost $8,964,129) | 8,964,129 | |||

| Total Investment in Securities (cost $383,517,825) | $ | 530,232,506 | ||

| Foreign currency held at value (cost $5,478) | 5,500 | |||

| Receivable for investments sold | 2,308,385 | |||

| Receivable for fund shares sold | 248,365 | |||

| Dividends receivable | 961,789 | |||

| Distributions receivable from Fidelity Central Funds | 21,969 | |||

| Prepaid expenses | 573 | |||

| Other receivables | 1,486 | |||

Total assets | 533,780,573 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 521,645 | ||

| Payable for fund shares redeemed | 301,493 | |||

| Accrued management fee | 223,993 | |||

| Other affiliated payables | 100,952 | |||

| Other payables and accrued expenses | 36,064 | |||

| Collateral on securities loaned | 8,819,875 | |||

| Total Liabilities | 10,004,022 | |||

| Net Assets | $ | 523,776,551 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 493,658,111 | ||

| Total accumulated earnings (loss) | 30,118,440 | |||

| Net Assets | $ | 523,776,551 | ||

Net Asset Value, offering price and redemption price per share ($523,776,551 ÷ 15,196,043 shares) | $ | 34.47 | ||

| Statement of Operations | ||||

Year ended February 29, 2024 | ||||