UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | July 31 |

Date of reporting period: | July 31, 2024 |

Item 1.

Reports to Stockholders

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® International Real Estate Fund Fidelity Advisor® International Real Estate Fund Class A : FIRAX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class A | $ 120 | 1.20% |

Class A | $9,425 | $9,582 | $9,750 | $10,675 | $11,581 | $12,300 | $12,511 | $16,071 | $13,539 | $12,002 | $12,046 |

FTSE® EPRA℠/NAREIT® Developed ex North America Index | $10,000 | $9,831 | $10,363 | $10,710 | $11,550 | $12,008 | $10,537 | $13,594 | $11,122 | $10,055 | $10,502 |

MSCI EAFE Index | $10,000 | $9,986 | $9,252 | $10,918 | $11,642 | $11,365 | $11,197 | $14,617 | $12,552 | $14,692 | $16,376 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class A (incl. 5.75% sales charge) | -5.40% | -1.59% | 1.88% |

| Class A (without 5.75% sales charge) | 0.37% | -0.42% | 2.48% |

| FTSE® EPRA℠/NAREIT® Developed ex North America Index | 4.45% | -2.64% | 0.49% |

| MSCI EAFE Index | 11.46% | 7.58% | 5.06% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $485,725,289 | |

| Number of Holdings | 77 | |

| Total Advisory Fee | $3,520,499 | |

| Portfolio Turnover | 84% |

(as of July 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) | ||

| Real Estate Management & Development | 34.6 | |

| Industrial REITs | 15.7 | |

| Residential REITs | 11.9 | |

| Specialized REITs | 11.6 | |

| Health Care REITs | 5.6 | |

| Retail REITs | 3.6 | |

| Household Durables | 2.9 | |

| Office REITs | 2.0 | |

| Diversified REITs | 1.5 | |

| Others | 5.2 | |

| Common Stocks | 94.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Japan | 22.6 |

| United Kingdom | 13.5 |

| Australia | 12.6 |

| United States | 11.3 |

| Singapore | 8.4 |

| Hong Kong | 6.2 |

| Sweden | 5.4 |

| France | 4.8 |

| Spain | 4.1 |

| Others | 11.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Wing Tai Holdings Ltd | 4.6 | |

| Prologis Inc | 4.2 | |

| Nomura Real Estate Holdings Inc | 3.7 | |

| National Storage REIT unit | 3.5 | |

| Segro PLC | 3.2 | |

| Advance Residence Investment Corp | 2.9 | |

| Daiwa Securities Living Investment Corporation | 2.9 | |

| Ingenia Communities Group unit | 2.8 | |

| Arena REIT unit | 2.7 | |

| CK Asset Holdings Ltd | 2.6 | |

| 33.1 | ||

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913455.100 1851-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

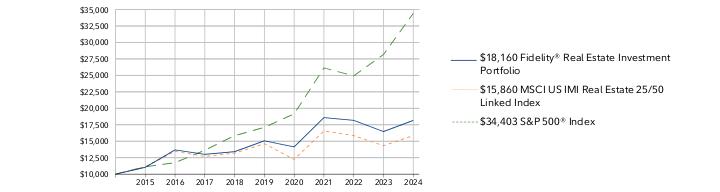

| | Fidelity® Real Estate Investment Portfolio Fidelity® Real Estate Investment Portfolio : FRESX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Real Estate Investment Portfolio | $ 73 | 0.69% |

Fidelity® Real Estate Investment Portfolio | $10,000 | $11,034 | $13,682 | $13,006 | $13,413 | $15,062 | $14,136 | $18,584 | $18,171 | $16,467 | $18,160 |

MSCI US IMI Real Estate 25/50 Linked Index | $10,000 | $11,129 | $13,457 | $12,695 | $13,185 | $14,621 | $12,238 | $16,556 | $15,854 | $14,323 | $15,860 |

S&P 500® Index | $10,000 | $11,121 | $11,745 | $13,629 | $15,843 | $17,108 | $19,153 | $26,134 | $24,921 | $28,165 | $34,403 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Fidelity® Real Estate Investment Portfolio | 10.28% | 3.81% | 6.15% |

| MSCI US IMI Real Estate 25/50 Linked Index | 10.73% | 1.64% | 4.72% |

| S&P 500® Index | 22.15% | 15.00% | 13.15% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $2,619,172,869 | |

| Number of Holdings | 42 | |

| Total Advisory Fee | $14,405,798 | |

| Portfolio Turnover | 34% |

(as of July 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) | ||

| Specialized REITs | 38.2 | |

| Residential REITs | 17.3 | |

| Industrial REITs | 15.0 | |

| Retail REITs | 12.8 | |

| Health Care REITs | 8.2 | |

| Real Estate Management & Development | 6.1 | |

| Hotel & Resort REITs | 1.4 | |

| Common Stocks | 99.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 100.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Prologis Inc | 11.0 | |

| American Tower Corp | 9.0 | |

| Equinix Inc | 6.7 | |

| Ventas Inc | 5.6 | |

| Public Storage Operating Co | 5.4 | |

| Kimco Realty Corp | 4.1 | |

| CBRE Group Inc Class A | 4.0 | |

| NNN REIT Inc | 3.6 | |

| Digital Realty Trust Inc | 3.5 | |

| CubeSmart | 3.4 | |

| 56.3 | ||

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913431.100 303-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® International Real Estate Fund Fidelity Advisor® International Real Estate Fund Class C : FIRCX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class C | $ 195 | 1.95% |

Class C | $10,000 | $10,097 | $10,191 | $11,077 | $11,929 | $12,593 | $12,701 | $16,185 | $13,531 | $11,994 | $12,038 |

FTSE® EPRA℠/NAREIT® Developed ex North America Index | $10,000 | $9,831 | $10,363 | $10,710 | $11,550 | $12,008 | $10,537 | $13,594 | $11,122 | $10,055 | $10,502 |

MSCI EAFE Index | $10,000 | $9,986 | $9,252 | $10,918 | $11,642 | $11,365 | $11,197 | $14,617 | $12,552 | $14,692 | $16,376 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class C (incl. contingent deferred sales charge) | -1.41% | -1.20% | 1.87% |

| Class C | -0.42% | -1.20% | 1.87% |

| FTSE® EPRA℠/NAREIT® Developed ex North America Index | 4.45% | -2.64% | 0.49% |

| MSCI EAFE Index | 11.46% | 7.58% | 5.06% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $485,725,289 | |

| Number of Holdings | 77 | |

| Total Advisory Fee | $3,520,499 | |

| Portfolio Turnover | 84% |

(as of July 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) | ||

| Real Estate Management & Development | 34.6 | |

| Industrial REITs | 15.7 | |

| Residential REITs | 11.9 | |

| Specialized REITs | 11.6 | |

| Health Care REITs | 5.6 | |

| Retail REITs | 3.6 | |

| Household Durables | 2.9 | |

| Office REITs | 2.0 | |

| Diversified REITs | 1.5 | |

| Others | 5.2 | |

| Common Stocks | 94.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Japan | 22.6 |

| United Kingdom | 13.5 |

| Australia | 12.6 |

| United States | 11.3 |

| Singapore | 8.4 |

| Hong Kong | 6.2 |

| Sweden | 5.4 |

| France | 4.8 |

| Spain | 4.1 |

| Others | 11.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Wing Tai Holdings Ltd | 4.6 | |

| Prologis Inc | 4.2 | |

| Nomura Real Estate Holdings Inc | 3.7 | |

| National Storage REIT unit | 3.5 | |

| Segro PLC | 3.2 | |

| Advance Residence Investment Corp | 2.9 | |

| Daiwa Securities Living Investment Corporation | 2.9 | |

| Ingenia Communities Group unit | 2.8 | |

| Arena REIT unit | 2.7 | |

| CK Asset Holdings Ltd | 2.6 | |

| 33.1 | ||

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913456.100 1853-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® International Real Estate Fund Fidelity® International Real Estate Fund : FIREX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® International Real Estate Fund | $ 95 | 0.94% |

Fidelity® International Real Estate Fund | $10,000 | $10,195 | $10,392 | $11,404 | $12,412 | $13,218 | $13,480 | $17,367 | $14,675 | $13,033 | $13,112 |

FTSE® EPRA℠/NAREIT® Developed ex North America Index | $10,000 | $9,831 | $10,363 | $10,710 | $11,550 | $12,008 | $10,537 | $13,594 | $11,122 | $10,055 | $10,502 |

MSCI EAFE Index | $10,000 | $9,986 | $9,252 | $10,918 | $11,642 | $11,365 | $11,197 | $14,617 | $12,552 | $14,692 | $16,376 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Fidelity® International Real Estate Fund | 0.60% | -0.16% | 2.75% |

| FTSE® EPRA℠/NAREIT® Developed ex North America Index | 4.45% | -2.64% | 0.49% |

| MSCI EAFE Index | 11.46% | 7.58% | 5.06% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $485,725,289 | |

| Number of Holdings | 77 | |

| Total Advisory Fee | $3,520,499 | |

| Portfolio Turnover | 84% |

(as of July 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) | ||

| Real Estate Management & Development | 34.6 | |

| Industrial REITs | 15.7 | |

| Residential REITs | 11.9 | |

| Specialized REITs | 11.6 | |

| Health Care REITs | 5.6 | |

| Retail REITs | 3.6 | |

| Household Durables | 2.9 | |

| Office REITs | 2.0 | |

| Diversified REITs | 1.5 | |

| Others | 5.2 | |

| Common Stocks | 94.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Japan | 22.6 |

| United Kingdom | 13.5 |

| Australia | 12.6 |

| United States | 11.3 |

| Singapore | 8.4 |

| Hong Kong | 6.2 |

| Sweden | 5.4 |

| France | 4.8 |

| Spain | 4.1 |

| Others | 11.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Wing Tai Holdings Ltd | 4.6 | |

| Prologis Inc | 4.2 | |

| Nomura Real Estate Holdings Inc | 3.7 | |

| National Storage REIT unit | 3.5 | |

| Segro PLC | 3.2 | |

| Advance Residence Investment Corp | 2.9 | |

| Daiwa Securities Living Investment Corporation | 2.9 | |

| Ingenia Communities Group unit | 2.8 | |

| Arena REIT unit | 2.7 | |

| CK Asset Holdings Ltd | 2.6 | |

| 33.1 | ||

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913454.100 1368-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

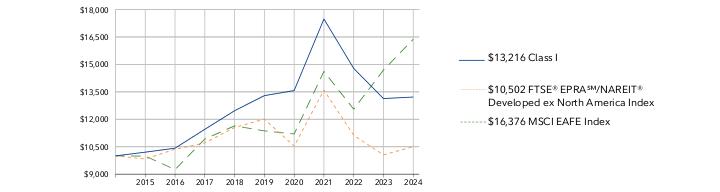

| | Fidelity® International Real Estate Fund Fidelity Advisor® International Real Estate Fund Class I : FIRIX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class I | $ 91 | 0.91% |

Class I | $10,000 | $10,201 | $10,421 | $11,451 | $12,468 | $13,292 | $13,569 | $17,482 | $14,780 | $13,132 | $13,216 |

FTSE® EPRA℠/NAREIT® Developed ex North America Index | $10,000 | $9,831 | $10,363 | $10,710 | $11,550 | $12,008 | $10,537 | $13,594 | $11,122 | $10,055 | $10,502 |

MSCI EAFE Index | $10,000 | $9,986 | $9,252 | $10,918 | $11,642 | $11,365 | $11,197 | $14,617 | $12,552 | $14,692 | $16,376 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class I | 0.64% | -0.11% | 2.83% |

| FTSE® EPRA℠/NAREIT® Developed ex North America Index | 4.45% | -2.64% | 0.49% |

| MSCI EAFE Index | 11.46% | 7.58% | 5.06% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $485,725,289 | |

| Number of Holdings | 77 | |

| Total Advisory Fee | $3,520,499 | |

| Portfolio Turnover | 84% |

(as of July 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) | ||

| Real Estate Management & Development | 34.6 | |

| Industrial REITs | 15.7 | |

| Residential REITs | 11.9 | |

| Specialized REITs | 11.6 | |

| Health Care REITs | 5.6 | |

| Retail REITs | 3.6 | |

| Household Durables | 2.9 | |

| Office REITs | 2.0 | |

| Diversified REITs | 1.5 | |

| Others | 5.2 | |

| Common Stocks | 94.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Japan | 22.6 |

| United Kingdom | 13.5 |

| Australia | 12.6 |

| United States | 11.3 |

| Singapore | 8.4 |

| Hong Kong | 6.2 |

| Sweden | 5.4 |

| France | 4.8 |

| Spain | 4.1 |

| Others | 11.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Wing Tai Holdings Ltd | 4.6 | |

| Prologis Inc | 4.2 | |

| Nomura Real Estate Holdings Inc | 3.7 | |

| National Storage REIT unit | 3.5 | |

| Segro PLC | 3.2 | |

| Advance Residence Investment Corp | 2.9 | |

| Daiwa Securities Living Investment Corporation | 2.9 | |

| Ingenia Communities Group unit | 2.8 | |

| Arena REIT unit | 2.7 | |

| CK Asset Holdings Ltd | 2.6 | |

| 33.1 | ||

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913458.100 1855-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® International Real Estate Fund Fidelity Advisor® International Real Estate Fund Class Z : FIKLX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class Z | $ 79 | 0.79% |

Class Z | $10,000 | $10,977 | $11,210 | $14,459 | $12,239 | $10,892 | $10,977 |

FTSE® EPRA℠/NAREIT® Developed ex North America Index | $10,000 | $10,809 | $9,486 | $12,237 | $10,013 | $9,052 | $9,454 |

MSCI EAFE Index | $10,000 | $9,930 | $9,782 | $12,771 | $10,966 | $12,836 | $14,307 |

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | Life of Fund A | |

| Class Z | 0.78% | 0.00% | 1.61% |

| FTSE® EPRA℠/NAREIT® Developed ex North America Index | 4.45% | -2.64% | -0.96% |

| MSCI EAFE Index | 11.46% | 7.58% | 6.33% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $485,725,289 | |

| Number of Holdings | 77 | |

| Total Advisory Fee | $3,520,499 | |

| Portfolio Turnover | 84% |

(as of July 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) | ||

| Real Estate Management & Development | 34.6 | |

| Industrial REITs | 15.7 | |

| Residential REITs | 11.9 | |

| Specialized REITs | 11.6 | |

| Health Care REITs | 5.6 | |

| Retail REITs | 3.6 | |

| Household Durables | 2.9 | |

| Office REITs | 2.0 | |

| Diversified REITs | 1.5 | |

| Others | 5.2 | |

| Common Stocks | 94.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Japan | 22.6 |

| United Kingdom | 13.5 |

| Australia | 12.6 |

| United States | 11.3 |

| Singapore | 8.4 |

| Hong Kong | 6.2 |

| Sweden | 5.4 |

| France | 4.8 |

| Spain | 4.1 |

| Others | 11.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Wing Tai Holdings Ltd | 4.6 | |

| Prologis Inc | 4.2 | |

| Nomura Real Estate Holdings Inc | 3.7 | |

| National Storage REIT unit | 3.5 | |

| Segro PLC | 3.2 | |

| Advance Residence Investment Corp | 2.9 | |

| Daiwa Securities Living Investment Corporation | 2.9 | |

| Ingenia Communities Group unit | 2.8 | |

| Arena REIT unit | 2.7 | |

| CK Asset Holdings Ltd | 2.6 | |

| 33.1 | ||

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913459.100 3301-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

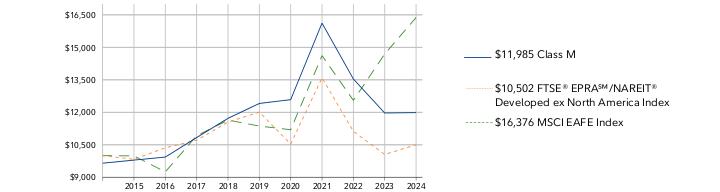

| | Fidelity® International Real Estate Fund Fidelity Advisor® International Real Estate Fund Class M : FIRTX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class M | $ 145 | 1.45% |

Class M | $9,650 | $9,794 | $9,934 | $10,835 | $11,722 | $12,409 | $12,584 | $16,118 | $13,538 | $11,968 | $11,985 |

FTSE® EPRA℠/NAREIT® Developed ex North America Index | $10,000 | $9,831 | $10,363 | $10,710 | $11,550 | $12,008 | $10,537 | $13,594 | $11,122 | $10,055 | $10,502 |

MSCI EAFE Index | $10,000 | $9,986 | $9,252 | $10,918 | $11,642 | $11,365 | $11,197 | $14,617 | $12,552 | $14,692 | $16,376 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class M (incl. 3.50% sales charge) | -3.36% | -1.40% | 1.83% |

| Class M (without 3.50% sales charge) | 0.15% | -0.69% | 2.19% |

| FTSE® EPRA℠/NAREIT® Developed ex North America Index | 4.45% | -2.64% | 0.49% |

| MSCI EAFE Index | 11.46% | 7.58% | 5.06% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $485,725,289 | |

| Number of Holdings | 77 | |

| Total Advisory Fee | $3,520,499 | |

| Portfolio Turnover | 84% |

(as of July 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) | ||

| Real Estate Management & Development | 34.6 | |

| Industrial REITs | 15.7 | |

| Residential REITs | 11.9 | |

| Specialized REITs | 11.6 | |

| Health Care REITs | 5.6 | |

| Retail REITs | 3.6 | |

| Household Durables | 2.9 | |

| Office REITs | 2.0 | |

| Diversified REITs | 1.5 | |

| Others | 5.2 | |

| Common Stocks | 94.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Japan | 22.6 |

| United Kingdom | 13.5 |

| Australia | 12.6 |

| United States | 11.3 |

| Singapore | 8.4 |

| Hong Kong | 6.2 |

| Sweden | 5.4 |

| France | 4.8 |

| Spain | 4.1 |

| Others | 11.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Wing Tai Holdings Ltd | 4.6 | |

| Prologis Inc | 4.2 | |

| Nomura Real Estate Holdings Inc | 3.7 | |

| National Storage REIT unit | 3.5 | |

| Segro PLC | 3.2 | |

| Advance Residence Investment Corp | 2.9 | |

| Daiwa Securities Living Investment Corporation | 2.9 | |

| Ingenia Communities Group unit | 2.8 | |

| Arena REIT unit | 2.7 | |

| CK Asset Holdings Ltd | 2.6 | |

| 33.1 | ||

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913457.100 1854-TSRA-0924 | |

Item 2.

Code of Ethics

As of the end of the period, July 31, 2024, Fidelity Select Portfolios (the trust) has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer and its Chief Financial Officer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3.

Audit Committee Financial Expert

The Board of Trustees of the trust has determined that Donald F. Donahue is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Donahue is independent for purposes of Item 3 of Form N-CSR.

Item 4.

Principal Accountant Fees and Services

Fees and Services

The following table presents fees billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte Entities”) in each of the last two fiscal years for services rendered to Fidelity International Real Estate Fund and Fidelity Real Estate Investment Portfolio (the “Funds”):

Services Billed by Deloitte Entities

July 31, 2024 FeesA

Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | |

Fidelity International Real Estate Fund | $43,600 | $- | $9,700 | $1,100 |

Fidelity Real Estate Investment Portfolio | $38,000 | $- | $9,100 | $1,000 |

July 31, 2023 FeesA

Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | |

Fidelity International Real Estate Fund | $43,800 | $- | $9,200 | $1,100 |

Fidelity Real Estate Investment Portfolio | $38,100 | $- | $8,600 | $1,000 |

A Amounts may reflect rounding.

The following table(s) present(s) fees billed by Deloitte Entities that were required to be approved by the Audit Committee for services that relate directly to the operations and financial reporting of the Fund(s) and that are rendered on behalf of Fidelity Management & Research Company LLC ("FMR") and entities controlling, controlled by, or under common control with FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund(s) (“Fund Service Providers”):

Services Billed by Deloitte Entities

July 31, 2024A | July 31, 2023A | |

Audit-Related Fees | $200,000 | $80,000 |

Tax Fees | $- | $- |

All Other Fees | $1,929,500 | $- |

A Amounts may reflect rounding.

“Audit-Related Fees” represent fees billed for assurance and related services that are reasonably related to the performance of the fund audit or the review of the fund's financial statements and that are not reported under Audit Fees.

“Tax Fees” represent fees billed for tax compliance, tax advice or tax planning that relate directly to the operations and financial reporting of the fund.

“All Other Fees” represent fees billed for services provided to the fund or Fund Service Provider, a significant portion of which are assurance related, that relate directly to the operations and financial reporting of the fund, excluding those services that are reported under Audit Fees, Audit-Related Fees or Tax Fees.

Assurance services must be performed by an independent public accountant.

* * *

The aggregate non-audit fees billed by Deloitte Entities for services rendered to the Fund(s), FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any Fund Service Provider for each of the last two fiscal years of the Fund(s) are as follows:

Billed By | July 31, 2024A | July 31, 2023A |

Deloitte Entities | $4,969,400 | $3,317,900 |

A Amounts may reflect rounding.

The trust's Audit Committee has considered non-audit services that were not pre-approved that were provided by Deloitte Entities to Fund Service Providers to be compatible with maintaining the independence of Deloitte Entities in its(their) audit of the Fund(s), taking into account representations from Deloitte Entities, in accordance with Public Company Accounting Oversight Board rules, regarding its independence from the Fund(s) and its(their) related entities and FMR’s review of the appropriateness and permissibility under applicable law of such non-audit services prior to their provision to the Fund(s) Service Providers.

Audit Committee Pre-Approval Policies and Procedures

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by a fund’s independent registered public accounting firm relating to the operations or financial reporting of the fund. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of non-audit services by the audit firms that audit the Fidelity funds. The policies and procedures require that any non-audit service provided by a fund audit firm to a Fidelity fund and any non-audit service provided by a fund auditor to a Fund Service Provider that relates directly to the operations and financial reporting of a Fidelity fund (“Covered Service”) are subject to approval by the Audit Committee before such service is provided.

All Covered Services must be approved in advance of provision of the service either: (i) by formal resolution of the Audit Committee, or (ii) by oral or written approval of the service by the Chair of the Audit Committee (or if the Chair is unavailable, such other member of the Audit Committee as may be designated by the Chair to act in the Chair’s absence). The approval contemplated by (ii) above is permitted where the Treasurer determines that action on such an engagement is necessary before the next meeting of the Audit Committee.

Non-audit services provided by a fund audit firm to a Fund Service Provider that do not relate directly to the operations and financial reporting of a Fidelity fund are reported to the Audit Committee periodically.

Non-Audit Services Approved Pursuant to Rule 2-01(c)(7)(i)(C) and (ii) of Regulation S-X (“De Minimis Exception”)

There were no non-audit services approved or required to be approved by the Audit Committee pursuant to the De Minimis Exception during the Fund’s(s’) last two fiscal

years relating to services provided to (i) the Fund(s) or (ii) any Fund Service Provider that relate directly to the operations and financial reporting of the Fund(s).

The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

The Registrant is not a “foreign issuer,” as defined in 17 CFR 240.3b-4.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable.

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Contents

| Common Stocks - 94.6% | |||

| Shares | Value ($) | ||

| Australia - 12.6% | |||

| Abacus Storage King | 8,002,513 | 6,672,385 | |

| Arena (REIT) unit | 5,107,440 | 12,892,440 | |

| Goodman Group unit | 476,443 | 10,936,103 | |

| Ingenia Communities Group unit | 3,913,319 | 13,435,354 | |

| National Storage REIT unit | 10,644,872 | 17,194,199 | |

TOTAL AUSTRALIA | 61,130,481 | ||

| Belgium - 2.6% | |||

| Inclusio SA | 241,840 | 3,755,845 | |

| Montea SICAFI SCA | 56,089 | 4,862,256 | |

| Warehouses de Pauw | 146,679 | 3,981,283 | |

TOTAL BELGIUM | 12,599,384 | ||

| Brazil - 0.4% | |||

| LOG Commercial Properties e Participacoes SA | 469,300 | 1,803,803 | |

| Canada - 0.8% | |||

| Sienna Senior Living, Inc. (a) | 227,800 | 2,560,719 | |

| StorageVault Canada, Inc. (a) | 338,800 | 1,150,887 | |

TOTAL CANADA | 3,711,606 | ||

| France - 4.8% | |||

| ARGAN SA | 102,604 | 8,383,760 | |

| Mercialys SA | 269,300 | 3,418,708 | |

| Unibail-Rodamco-Westfield NV | 151,500 | 11,362,489 | |

TOTAL FRANCE | 23,164,957 | ||

| Germany - 3.8% | |||

| Instone Real Estate Group BV (a)(b) | 380,243 | 3,884,730 | |

| LEG Immobilien AG (a) | 88,877 | 7,777,692 | |

| TAG Immobilien AG (c) | 450,800 | 6,805,902 | |

TOTAL GERMANY | 18,468,324 | ||

| Greece - 0.2% | |||

| Trade Estates Real Estate Investment SA | 434,406 | 767,262 | |

| Hong Kong - 6.2% | |||

| CK Asset Holdings Ltd. | 3,198,000 | 12,238,837 | |

| Great Eagle Holdings Ltd. (a) | 4,651,541 | 6,334,743 | |

| Link (REIT) | 147,800 | 624,279 | |

| Magnificent Hotel Investment Ltd. (c) | 140,513,000 | 1,348,864 | |

| Sun Hung Kai Properties Ltd. | 138,500 | 1,199,206 | |

| Sunevision Holdings Ltd. | 3,331,000 | 1,172,459 | |

| Tai Cheung Holdings Ltd. | 13,752,116 | 5,544,605 | |

| Wing Tai Properties Ltd. | 5,298,000 | 1,417,257 | |

TOTAL HONG KONG | 29,880,250 | ||

| Ireland - 1.2% | |||

| Glenveagh Properties PLC (b)(c) | 551,259 | 820,922 | |

| Irish Residential Properties REIT PLC | 4,927,200 | 4,905,865 | |

TOTAL IRELAND | 5,726,787 | ||

| Israel - 0.1% | |||

| Azorim Investment Development & Construction Co. Ltd. (c) | 137,200 | 621,327 | |

| Italy - 1.0% | |||

| Infrastrutture Wireless Italiane SpA (b) | 428,400 | 4,766,177 | |

| Japan - 22.6% | |||

| Advance Residence Investment Corp. (a) | 6,750 | 14,193,451 | |

| Daiwa Securities Living Invest | 20,451 | 13,911,130 | |

| Goldcrest Co. Ltd. | 52,000 | 1,003,171 | |

| Health Care & Medical Investment Corp. (a) | 14,587 | 12,113,233 | |

| Japan Logistics Fund, Inc. (a) | 3,667 | 6,271,389 | |

| JTOWER, Inc. (c) | 113,447 | 1,229,852 | |

| Katitas Co. Ltd. | 451,300 | 5,660,644 | |

| Kyoritsu Maintenance Co. Ltd. | 64,700 | 1,262,213 | |

| Mitsubishi Estate Co. Ltd. | 267,300 | 4,555,845 | |

| Mitsui Fudosan Co. Ltd. | 559,600 | 5,797,378 | |

| Mitsui Fudosan Logistics Park, Inc. (a) | 2,317 | 6,534,712 | |

| Nomura Real Estate Holdings, Inc. | 626,200 | 17,727,807 | |

| Sekisui House Ltd. (a) | 281,900 | 7,063,384 | |

| Sumitomo Realty & Development Co. Ltd. | 69,900 | 2,310,387 | |

| Tosei Corp. | 616,800 | 10,363,376 | |

TOTAL JAPAN | 109,997,972 | ||

| Netherlands - 0.2% | |||

| CTP BV (b) | 55,308 | 966,093 | |

| New Zealand - 0.9% | |||

| Arvida Group Ltd. | 3,298,007 | 3,179,750 | |

| Stride Property Group unit | 1,656,732 | 1,262,085 | |

TOTAL NEW ZEALAND | 4,441,835 | ||

| Singapore - 8.4% | |||

| Digital Core (REIT) | 374,700 | 213,579 | |

| Parkway Life REIT | 3,808,600 | 10,342,798 | |

| Singapore Land Group Ltd. | 6,125,000 | 8,110,459 | |

| Wing Tai Holdings Ltd. | 21,850,581 | 22,231,455 | |

TOTAL SINGAPORE | 40,898,291 | ||

| Spain - 4.1% | |||

| Aedas Homes SAU (b) | 193,900 | 4,857,988 | |

| Arima Real Estate SOCIMI SA (c) | 1,036,442 | 9,399,757 | |

| Cellnex Telecom SA (b) | 35,010 | 1,221,035 | |

| Lar Espana Real Estate Socimi SA | 132,885 | 1,170,652 | |

| Neinor Homes SLU (b) | 247,900 | 3,487,767 | |

TOTAL SPAIN | 20,137,199 | ||

| Sweden - 5.4% | |||

| Heba Fastighets AB (B Shares) | 2,725,243 | 8,321,392 | |

| Hemnet Group AB | 78,500 | 2,901,272 | |

| Nyfosa AB | 1,157,700 | 11,837,313 | |

| Swedish Logistic Property AB (c) | 947,421 | 3,361,782 | |

TOTAL SWEDEN | 26,421,759 | ||

| United Kingdom - 13.4% | |||

| Assura PLC | 8,935,700 | 4,675,327 | |

| Berkeley Group Holdings PLC | 37,400 | 2,441,562 | |

| Big Yellow Group PLC | 785,600 | 12,220,130 | |

| Grainger Trust PLC | 2,159,922 | 6,691,817 | |

| Harworth Group PLC | 631,497 | 1,347,623 | |

| Helical PLC | 56,993 | 164,119 | |

| Londonmetric Properity PLC | 2,525,336 | 6,538,342 | |

| Rightmove PLC | 339,000 | 2,511,088 | |

| Safestore Holdings PLC | 229,103 | 2,375,331 | |

| Segro PLC | 1,299,270 | 15,296,393 | |

| Unite Group PLC | 903,511 | 11,069,177 | |

TOTAL UNITED KINGDOM | 65,330,909 | ||

| United States of America - 5.9% | |||

| Airbnb, Inc. Class A (c) | 24,300 | 3,391,308 | |

| Equinix, Inc. | 6,500 | 5,136,560 | |

| Prologis, Inc. | 161,500 | 20,357,075 | |

TOTAL UNITED STATES OF AMERICA | 28,884,943 | ||

| TOTAL COMMON STOCKS (Cost $461,122,976) | 459,719,359 | ||

| Money Market Funds - 11.5% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 5.39% (d) | 20,397,284 | 20,401,364 | |

| Fidelity Securities Lending Cash Central Fund 5.39% (d)(e) | 35,455,829 | 35,459,374 | |

| TOTAL MONEY MARKET FUNDS (Cost $55,860,738) | 55,860,738 | ||

| TOTAL INVESTMENT IN SECURITIES - 106.1% (Cost $516,983,714) | 515,580,097 |

NET OTHER ASSETS (LIABILITIES) - (6.1)% | (29,854,808) |

| NET ASSETS - 100.0% | 485,725,289 |

| (a) | Security or a portion of the security is on loan at period end. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $20,004,712 or 4.1% of net assets. |

| (c) | Non-income producing |

| (d) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (e) | Investment made with cash collateral received from securities on loan. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 11,696,031 | 215,711,188 | 207,005,999 | 382,395 | 144 | - | 20,401,364 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.39% | 6,931,294 | 167,107,428 | 138,579,348 | 76,560 | - | - | 35,459,374 | 0.2% |

| Total | 18,627,325 | 382,818,616 | 345,585,347 | 458,955 | 144 | - | 55,860,738 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Communication Services | 12,629,424 | 11,408,389 | 1,221,035 | - |

Consumer Discretionary | 20,437,347 | 10,932,401 | 9,504,946 | - |

Health Care | 5,740,469 | 5,740,469 | - | - |

Information Technology | 1,172,459 | 1,172,459 | - | - |

Real Estate | 419,739,660 | 405,876,844 | 13,862,816 | - |

| Money Market Funds | 55,860,738 | 55,860,738 | - | - |

| Total Investments in Securities: | 515,580,097 | 490,991,300 | 24,588,797 | - |

| Statement of Assets and Liabilities | ||||

As of July 31, 2024 | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $33,737,512) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $461,122,976) | $ | 459,719,359 | ||

Fidelity Central Funds (cost $55,860,738) | 55,860,738 | |||

| Total Investment in Securities (cost $516,983,714) | $ | 515,580,097 | ||

| Foreign currency held at value (cost $591,912) | 591,912 | |||

| Receivable for investments sold | 10,506,913 | |||

| Receivable for fund shares sold | 26,010 | |||

| Dividends receivable | 2,113,390 | |||

| Reclaims receivable | 1,604,420 | |||

| Distributions receivable from Fidelity Central Funds | 49,623 | |||

| Prepaid expenses | 452 | |||

| Other receivables | 1,557 | |||

Total assets | 530,474,374 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 8,563,635 | ||

| Payable for fund shares redeemed | 342,293 | |||

| Accrued management fee | 308,213 | |||

| Distribution and service plan fees payable | 3,997 | |||

| Other payables and accrued expenses | 71,573 | |||

| Collateral on securities loaned | 35,459,374 | |||

| Total liabilities | 44,749,085 | |||

| Net Assets | $ | 485,725,289 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 677,196,721 | ||

| Total accumulated earnings (loss) | (191,471,432) | |||

| Net Assets | $ | 485,725,289 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($11,353,341 ÷ 1,136,840 shares)(a) | $ | 9.99 | ||

| Maximum offering price per share (100/94.25 of $9.99) | $ | 10.60 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($1,660,719 ÷ 167,779 shares)(a) | $ | 9.90 | ||

| Maximum offering price per share (100/96.50 of $9.90) | $ | 10.26 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($1,208,905 ÷ 124,572 shares)(a) | $ | 9.70 | ||

| International Real Estate : | ||||

Net Asset Value, offering price and redemption price per share ($167,627,337 ÷ 16,523,778 shares) | $ | 10.14 | ||

| Class I : | ||||

Net Asset Value, offering price and redemption price per share ($38,799,991 ÷ 3,847,876 shares) | $ | 10.08 | ||

| Class Z : | ||||

Net Asset Value, offering price and redemption price per share ($265,074,996 ÷ 26,357,343 shares) | $ | 10.06 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

| Year ended July 31, 2024 | ||||

| Investment Income | ||||

| Dividends | $ | 18,802,954 | ||

| Non-Cash dividends | 1,540,370 | |||

| Income from Fidelity Central Funds (including $76,560 from security lending) | 458,955 | |||

| Income before foreign taxes withheld | $ | 20,802,279 | ||

| Less foreign taxes withheld | (1,373,918) | |||

| Total income | 19,428,361 | |||

| Expenses | ||||

| Management fee | $ | 3,552,756 | ||

| Transfer agent fees | 380,300 | |||

| Distribution and service plan fees | 50,023 | |||

| Accounting fees | 145,883 | |||

| Custodian fees and expenses | 68,667 | |||

| Independent trustees' fees and expenses | 2,526 | |||

| Registration fees | 93,787 | |||

| Audit fees | 74,125 | |||

| Legal | 488 | |||

| Interest | 17,312 | |||

| Miscellaneous | 9,697 | |||

| Total expenses before reductions | 4,395,564 | |||

| Expense reductions | (34,335) | |||

| Total expenses after reductions | 4,361,229 | |||

| Net Investment income (loss) | 15,067,132 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (24,020,621) | |||

| Fidelity Central Funds | 144 | |||

| Foreign currency transactions | (252,215) | |||

| Total net realized gain (loss) | (24,272,692) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 9,772,501 | |||

| Assets and liabilities in foreign currencies | 35,906 | |||

| Total change in net unrealized appreciation (depreciation) | 9,808,407 | |||

| Net gain (loss) | (14,464,285) | |||

| Net increase (decrease) in net assets resulting from operations | $ | 602,847 | ||

| Statement of Changes in Net Assets | ||||

Year ended July 31, 2024 | Year ended July 31, 2023 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 15,067,132 | $ | 14,162,941 |

| Net realized gain (loss) | (24,272,692) | (140,724,118) | ||

| Change in net unrealized appreciation (depreciation) | 9,808,407 | 27,253,459 | ||

| Net increase (decrease) in net assets resulting from operations | 602,847 | (99,307,718) | ||

| Distributions to shareholders | (10,710,496) | (31,353,019) | ||

| Share transactions - net increase (decrease) | (66,075,665) | (152,565,247) | ||

| Total increase (decrease) in net assets | (76,183,314) | (283,225,984) | ||

| Net Assets | ||||

| Beginning of period | 561,908,603 | 845,134,587 | ||

| End of period | $ | 485,725,289 | $ | 561,908,603 |

Fidelity Advisor® International Real Estate Fund Class A |

| Years ended July 31, | 2024 | 2023 | 2022 | 2021 | 2020 | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 10.12 | $ | 11.88 | $ | 14.84 | $ | 11.74 | $ | 12.14 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) A,B | .26 | .19 | .18 | .22 | .17 | |||||

| Net realized and unrealized gain (loss) | (.23) | (1.52) | (2.39) | 3.08 | .05 | |||||

| Total from investment operations | .03 | (1.33) | (2.21) | 3.30 | .22 | |||||

| Distributions from net investment income | (.16) | (.03) | (.52) | (.20) | (.24) | |||||

| Distributions from net realized gain | - | (.40) | (.23) | - | (.38) | |||||

| Total distributions | (.16) | (.43) | (.75) | (.20) | (.62) | |||||

| Net asset value, end of period | $ | 9.99 | $ | 10.12 | $ | 11.88 | $ | 14.84 | $ | 11.74 |

Total Return C,D | .37 % | (11.35)% | (15.76)% | 28.46% | 1.71% | |||||

Ratios to Average Net Assets B,E,F | ||||||||||

| Expenses before reductions | 1.22% | 1.25% | 1.23% | 1.23% | 1.27% | |||||

| Expenses net of fee waivers, if any | 1.20 % | 1.20% | 1.22% | 1.23% | 1.27% | |||||

| Expenses net of all reductions | 1.20% | 1.19% | 1.22% | 1.23% | 1.26% | |||||

| Net investment income (loss) | 2.70% | 1.91% | 1.33% | 1.66% | 1.40% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 11,353 | $ | 12,875 | $ | 16,274 | $ | 17,071 | $ | 11,710 |

Portfolio turnover rate G | 84 % | 52% | 47% | 37% | 69% |

Fidelity Advisor® International Real Estate Fund Class M |

| Years ended July 31, | 2024 | 2023 | 2022 | 2021 | 2020 | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 10.01 | $ | 11.76 | $ | 14.71 | $ | 11.64 | $ | 12.02 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) A,B | .23 | .17 | .14 | .18 | .13 | |||||

| Net realized and unrealized gain (loss) | (.22) | (1.52) | (2.37) | 3.05 | .05 | |||||

| Total from investment operations | .01 | (1.35) | (2.23) | 3.23 | .18 | |||||

| Distributions from net investment income | (.12) | - | (.49) | (.16) | (.18) | |||||

| Distributions from net realized gain | - | (.40) | (.23) | - | (.38) | |||||

| Total distributions | (.12) | (.40) | (.72) | (.16) | (.56) | |||||

| Net asset value, end of period | $ | 9.90 | $ | 10.01 | $ | 11.76 | $ | 14.71 | $ | 11.64 |

Total Return C,D | .15 % | (11.60)% | (16.01)% | 28.08% | 1.41% | |||||

Ratios to Average Net Assets B,E,F | ||||||||||

| Expenses before reductions | 1.47% | 1.52% | 1.53% | 1.55% | 1.59% | |||||

| Expenses net of fee waivers, if any | 1.45 % | 1.45% | 1.51% | 1.55% | 1.58% | |||||

| Expenses net of all reductions | 1.45% | 1.43% | 1.51% | 1.54% | 1.58% | |||||

| Net investment income (loss) | 2.45% | 1.66% | 1.04% | 1.34% | 1.08% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 1,661 | $ | 1,967 | $ | 2,804 | $ | 3,488 | $ | 2,976 |

Portfolio turnover rate G | 84 % | 52% | 47% | 37% | 69% |

Fidelity Advisor® International Real Estate Fund Class C |

| Years ended July 31, | 2024 | 2023 | 2022 | 2021 | 2020 | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 9.75 | $ | 11.52 | $ | 14.43 | $ | 11.43 | $ | 11.80 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) A,B | .18 | .11 | .07 | .11 | .07 | |||||

| Net realized and unrealized gain (loss) | (.22) | (1.48) | (2.32) | 3.00 | .04 | |||||

| Total from investment operations | (.04) | (1.37) | (2.25) | 3.11 | .11 | |||||

| Distributions from net investment income | (.01) | - | (.43) | (.11) | (.10) | |||||

| Distributions from net realized gain | - | (.40) | (.23) | - | (.38) | |||||

| Total distributions | (.01) | (.40) | (.66) | (.11) | (.48) | |||||

| Net asset value, end of period | $ | 9.70 | $ | 9.75 | $ | 11.52 | $ | 14.43 | $ | 11.43 |

Total Return C,D | (.42) % | (12.03)% | (16.40)% | 27.44% | .85% | |||||

Ratios to Average Net Assets B,E,F | ||||||||||

| Expenses before reductions | 1.97% | 2.02% | 2.02% | 2.05% | 2.04% | |||||

| Expenses net of fee waivers, if any | 1.95 % | 1.95% | 2.01% | 2.05% | 2.03% | |||||

| Expenses net of all reductions | 1.95% | 1.94% | 2.01% | 2.04% | 2.03% | |||||

| Net investment income (loss) | 1.95% | 1.16% | .55% | .85% | .63% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 1,209 | $ | 1,487 | $ | 2,087 | $ | 3,036 | $ | 3,836 |

Portfolio turnover rate G | 84 % | 52% | 47% | 37% | 69% |

Fidelity® International Real Estate Fund |

| Years ended July 31, | 2024 | 2023 | 2022 | 2021 | 2020 | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 10.28 | $ | 12.06 | $ | 15.04 | $ | 11.90 | $ | 12.31 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) A,B | .29 | .22 | .22 | .26 | .20 | |||||

| Net realized and unrealized gain (loss) | (.24) | (1.55) | (2.42) | 3.12 | .05 | |||||

| Total from investment operations | .05 | (1.33) | (2.20) | 3.38 | .25 | |||||

| Distributions from net investment income | (.19) | (.04) | (.54) | (.24) | (.28) | |||||

| Distributions from net realized gain | - | (.40) | (.24) | - | (.38) | |||||

| Total distributions | (.19) | (.45) C | (.78) | (.24) | (.66) | |||||

| Net asset value, end of period | $ | 10.14 | $ | 10.28 | $ | 12.06 | $ | 15.04 | $ | 11.90 |

Total Return D | .60 % | (11.19)% | (15.50)% | 28.83% | 1.98% | |||||

Ratios to Average Net Assets B,E,F | ||||||||||

| Expenses before reductions | .95% | .98% | .95% | .97% | 1.00% | |||||

| Expenses net of fee waivers, if any | .94 % | .95% | .94% | .97% | 1.00% | |||||

| Expenses net of all reductions | .94% | .95% | .94% | .96% | .99% | |||||

| Net investment income (loss) | 2.95% | 2.15% | 1.61% | 1.92% | 1.67% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 167,627 | $ | 223,674 | $ | 316,203 | $ | 360,653 | $ | 224,266 |

Portfolio turnover rate G | 84 % | 52% | 47% | 37% | 69% |

Fidelity Advisor® International Real Estate Fund Class I |

| Years ended July 31, | 2024 | 2023 | 2022 | 2021 | 2020 | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 10.22 | $ | 11.98 | $ | 14.94 | $ | 11.83 | $ | 12.23 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) A,B | .29 | .22 | .22 | .27 | .21 | |||||

| Net realized and unrealized gain (loss) | (.24) | (1.54) | (2.40) | 3.09 | .06 | |||||

| Total from investment operations | .05 | (1.32) | (2.18) | 3.36 | .27 | |||||

| Distributions from net investment income | (.19) | (.04) | (.54) | (.25) | (.28) | |||||

| Distributions from net realized gain | - | (.40) | (.24) | - | (.38) | |||||

| Total distributions | (.19) | (.44) | (.78) | (.25) | (.67) C | |||||

| Net asset value, end of period | $ | 10.08 | $ | 10.22 | $ | 11.98 | $ | 14.94 | $ | 11.83 |

Total Return D | .64 % | (11.15)% | (15.46)% | 28.83% | 2.09% | |||||

Ratios to Average Net Assets A,E,F | ||||||||||

| Expenses before reductions | .92% | .92% | .92% | .90% | .93% | |||||

| Expenses net of fee waivers, if any | .91 % | .91% | .91% | .90% | .93% | |||||

| Expenses net of all reductions | .91% | .91% | .91% | .90% | .92% | |||||

| Net investment income (loss) | 2.99% | 2.19% | 1.64% | 1.99% | 1.73% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 38,800 | $ | 58,592 | $ | 95,002 | $ | 290,807 | $ | 145,964 |

Portfolio turnover rate G | 84 % | 52% | 47% | 37% | 69% |

Fidelity Advisor® International Real Estate Fund Class Z |

| Years ended July 31, | 2024 | 2023 | 2022 | 2021 | 2020 | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 10.21 | $ | 11.97 | $ | 14.93 | $ | 11.82 | $ | 12.25 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) A,B | .30 | .23 | .23 | .28 | .22 | |||||

| Net realized and unrealized gain (loss) | (.23) | (1.53) | (2.39) | 3.09 | .05 | |||||

| Total from investment operations | .07 | (1.30) | (2.16) | 3.37 | .27 | |||||

| Distributions from net investment income | (.22) | (.06) | (.55) | (.26) | (.32) | |||||

| Distributions from net realized gain | - | (.40) | (.25) | - | (.38) | |||||

| Total distributions | (.22) | (.46) | (.80) | (.26) | (.70) | |||||

| Net asset value, end of period | $ | 10.06 | $ | 10.21 | $ | 11.97 | $ | 14.93 | $ | 11.82 |

Total Return C | .78 % | (11.01)% | (15.35)% | 28.99% | 2.12% | |||||

Ratios to Average Net Assets B,D,E | ||||||||||

| Expenses before reductions | .80% | .80% | .79% | .81% | .83% | |||||

| Expenses net of fee waivers, if any | .79 % | .80% | .79% | .81% | .83% | |||||

| Expenses net of all reductions | .79% | .80% | .79% | .81% | .82% | |||||

| Net investment income (loss) | 3.11% | 2.30% | 1.76% | 2.08% | 1.83% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 265,075 | $ | 263,313 | $ | 412,765 | $ | 324,228 | $ | 110,808 |

Portfolio turnover rate F | 84 % | 52% | 47% | 37% | 69% |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Gross unrealized appreciation | $41,532,873 |

| Gross unrealized depreciation | (47,356,392) |

| Net unrealized appreciation (depreciation) | $(5,823,519) |

| Tax Cost | $521,403,616 |

| Undistributed ordinary income | $12,040,926 |

| Capital loss carryforward | $(197,745,984) |

| Net unrealized appreciation (depreciation) on securities and other investments | $(5,766,377) |

Short-term | $(53,124,096) |

Long-term | (144,621,889) |

| Total capital loss carryforward | $(197,745,985) |

| July 31, 2024 | July 31, 2023 | |

| Ordinary Income | $10,710,496 | $3,356,620 |

| Long-term Capital Gains | - | 27,996,399 |

| Total | $10,710,496 | $31,353,019 |

| Purchases ($) | Sales ($) | |

| Fidelity International Real Estate Fund | 409,793,136 | 485,027,184 |

| Maximum Management Fee Rate % | |

| Class A | .88 |

| Class M | .88 |

| Class C | .88 |

| International Real Estate | .88 |

| Class I | .84 |

| Class Z | .72 |

| Total Management Fee Rate % | |

| Class A | .87 |

| Class M | .87 |

| Class C | .87 |

| International Real Estate | .83 |

| Class I | .84 |

| Class Z | .72 |

| Distribution Fee | Service Fee | Total Fees ($) | Retained by FDC ($) | |

| Class A | -% | .25% | 28,801 | 21,629 |

| Class M | .25% | .25% | 8,610 | 2,382 |

| Class C | .75% | .25% | 12,612 | 10,319 |

| 50,023 | 34,330 |

| Retained by FDC ($) | |

| Class A | 4,591 |

| Class M | 104 |

Class CA | 13 |

4,708 |

| % of Class-Level Average Net Assets | |||

| Class A | .2000 | ||

| Class M | .2000 | ||

| Class C | .2000 | ||

| International Real Estate | .2000 | ||

| Class I | .1587 | ||

| Class Z | .0420 | ||

| Amount ($) | % of Class-Level Average Net Assets | |

| Class A | 15,567 | .23 |

| Class M | 2,366 | .23 |

| Class C | 1,750 | .23 |

| International Real Estate | 257,796 | .22 |

| Class I | 42,539 | .16 |

| Class Z | 60,282 | .04 |

380,300 |

| % of Average Net Assets | |

| Fidelity International Real Estate Fund | .0487 |

| % of Average Net Assets | |

| Fidelity International Real Estate Fund | .05 |

| Amount ($) | |

| Fidelity International Real Estate Fund | 336 |

| Borrower or Lender | Average Loan Balance ($) | Weighted Average Interest Rate | Interest Expense ($) | |

Fidelity International Real Estate Fund | Borrower | 5,885,895 | 5.57% | 17,312 |

| Purchases ($) | Sales ($) | Realized Gain (Loss) ($) | |

| Fidelity International Real Estate Fund | 7,248,579 | 9,762,613 | (628,892) |

| Amount ($) | |

| Fidelity International Real Estate Fund | 847 |

| Total Security Lending Fees Paid to NFS ($) | Security Lending Income From Securities Loaned to NFS ($) | Value of Securities Loaned to NFS at Period End ($) | |

| Fidelity International Real Estate Fund | 8,292 | - | - |

| Expense Limitations | Reimbursement ($) | |

| Class A | 1.20% | 1,591 |

| Class M | 1.45% | 260 |

| Class C | 1.95% | 178 |

| International Real Estate | .95% | - |

| Class I | .95% | - |

| Class Z | .80% | - |

2,029 |

| Expense reduction ($) | |

| Class A | 23 |

| Class M | 24 |

| Class C | 2 |

49 |

Year ended July 31, 2024 | Year ended July 31, 2023 | |

| Fidelity International Real Estate Fund | ||

| Distributions to shareholders | ||

| Class A | $197,335 | $589,083 |

| Class M | 22,744 | 95,765 |

| Class C | 1,260 | 71,168 |

| International Real Estate | 3,991,533 | 11,787,000 |

| Class I | 968,390 | 3,502,573 |

| Class Z | 5,529,234 | 15,307,430 |

Total | $10,710,496 | $31,353,019 |

| Shares | Shares | Dollars | Dollars | |

Year ended July 31, 2024 | Year ended July 31, 2023 | Year ended July 31, 2024 | Year ended July 31, 2023 | |

| Fidelity International Real Estate Fund | ||||

| Class A | ||||

| Shares sold | 149,127 | 220,957 | $1,428,737 | $2,249,865 |

| Reinvestment of distributions | 20,416 | 54,508 | 193,428 | 575,600 |

| Shares redeemed | (305,525) | (372,948) | (2,917,719) | (3,743,643) |

| Net increase (decrease) | (135,982) | (97,483) | $(1,295,554) | $(918,178) |

| Class M | ||||

| Shares sold | 7,276 | 12,145 | $68,938 | $122,424 |

| Reinvestment of distributions | 2,419 | 9,147 | 22,744 | 95,765 |

| Shares redeemed | (38,417) | (63,311) | (358,657) | (621,719) |

| Net increase (decrease) | (28,722) | (42,019) | $(266,975) | $(403,530) |

| Class C | ||||

| Shares sold | 24,850 | 38,043 | $230,021 | $370,214 |

| Reinvestment of distributions | 135 | 6,950 | 1,260 | 71,168 |

| Shares redeemed | (52,923) | (73,601) | (491,721) | (715,903) |

| Net increase (decrease) | (27,938) | (28,608) | $(260,440) | $(274,521) |

| International Real Estate | ||||

| Shares sold | 3,126,185 | 4,016,231 | $30,245,628 | $41,915,010 |

| Reinvestment of distributions | 376,168 | 1,034,325 | 3,615,993 | 11,077,624 |

| Shares redeemed | (8,729,414) | (9,529,052) | (84,573,131) | (97,458,769) |

| Net increase (decrease) | (5,227,061) | (4,478,496) | $(50,711,510) | $(44,466,135) |

| Class I | ||||

| Shares sold | 1,040,396 | 2,326,816 | $9,949,967 | $23,438,582 |

| Reinvestment of distributions | 96,829 | 318,645 | 924,857 | 3,390,384 |

| Shares redeemed | (3,021,341) | (4,845,879) | (28,769,275) | (48,317,844) |

| Net increase (decrease) | (1,884,116) | (2,200,418) | $(17,894,451) | $(21,488,878) |

| Class Z | ||||

| Shares sold | 7,081,914 | 9,920,994 | $67,663,154 | $99,887,715 |

| Reinvestment of distributions | 531,173 | 1,117,458 | 5,058,654 | 11,856,230 |

| Shares redeemed | (7,053,105) | (19,736,894) | (68,368,543) | (196,757,950) |

| Net increase (decrease) | 559,982 | (8,698,442) | $4,353,265 | $(85,014,005) |

| Strategic Advisers Fidelity International Fund | |

| Fidelity International Real Estate Fund | 16% |

| Pay Date | Income | Taxes | |

| Fidelity International Real Estate Fund | |||

| Class A | 09/11/2023 | $0.1264 | $0.0137 |

| 12/11/2023 | $0.0443 | $0.0084 | |

| Class M | 09/11/2023 | $0.0987 | $0.0137 |

| 12/11/2023 | $0.0340 | $0.0084 | |

| Class C | 09/11/2023 | $0.0000 | $0.0000 |

| 12/11/2023 | $0.0163 | $0.0084 | |

| International Real Estate | 09/11/2023 | $0.1492 | $0.0137 |

| 12/11/2023 | $0.0527 | $0.0084 | |

| Class I | 09/11/2023 | $0.1511 | $0.0137 |

| 12/11/2023 | $0.0537 | $0.0084 | |

| Class Z | 09/11/2023 | $0.1673 | $0.0137 |

| 12/11/2023 | $0.0583 | $0.0084 | |

| A special meeting of shareholders was held on July 16, 2024. The results of votes taken among shareholders on the proposal before them are reported below. Each vote reported represents one dollar of net asset value held on the record date for the meeting. | ||

| Proposal 1 | ||

| To elect a Board of Trustees. | ||

# of Votes | % of Votes | |

| Bettina Doulton | ||

| Affirmative | 50,178,154,296.75 | 92.38 |

| Withheld | 4,136,551,415.53 | 7.62 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| Robert A. Lawrence | ||

| Affirmative | 50,131,321,830.27 | 92.30 |

| Withheld | 4,183,383,882.00 | 7.70 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| Vijay C. Advani | ||

| Affirmative | 50,021,870,319.77 | 92.10 |

| Withheld | 4,292,835,392.50 | 7.90 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| Thomas P. Bostick | ||

| Affirmative | 50,057,248,681.17 | 92.16 |

| Withheld | 4,257,457,031.10 | 7.84 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| Donald F. Donahue | ||

| Affirmative | 49,998,023,290.27 | 92.05 |

| Withheld | 4,316,682,422.00 | 7.95 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| Vicki L. Fuller | ||

| Affirmative | 50,146,578,363.15 | 92.33 |

| Withheld | 4,168,127,349.12 | 7.67 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| Patricia L. Kampling | ||

| Affirmative | 50,227,895,949.71 | 92.48 |

| Withheld | 4,086,809,762.56 | 7.52 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| Thomas A. Kennedy | ||

| Affirmative | 50,080,160,698.34 | 92.20 |

| Withheld | 4,234,545,013.93 | 7.80 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| Oscar Munoz | ||

| Affirmative | 49,879,616,445.58 | 91.83 |

| Withheld | 4,435,089,266.69 | 8.17 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| Karen B. Peetz | ||

| Affirmative | 50,078,105,799.58 | 92.20 |

| Withheld | 4,236,599,912.69 | 7.80 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| David M. Thomas | ||

| Affirmative | 50,013,939,190.36 | 92.08 |

| Withheld | 4,300,766,521.91 | 7.92 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| Susan Tomasky | ||

| Affirmative | 50,109,134,188.50 | 92.26 |

| Withheld | 4,205,571,523.77 | 7.74 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| Michael E. Wiley | ||

| Affirmative | 50,016,526,096.47 | 92.09 |

| Withheld | 4,298,179,615.80 | 7.91 |

| TOTAL | 54,314,705,712.27 | 100.00 |

| Proposal 1 reflects trust-wide proposal and voting results. | ||

|

Contents

| Common Stocks - 98.9% | |||

| Shares | Value ($) (000s) | ||

| Equity Real Estate Investment Trusts (REITs) - 92.8% | |||

| REITs - Apartments - 13.4% | |||

| American Homes 4 Rent Class A | 1,483,200 | 53,529 | |

| Camden Property Trust (SBI) | 247,900 | 27,455 | |

| Equity Residential (SBI) | 1,023,000 | 71,231 | |

| Invitation Homes, Inc. | 1,141,600 | 40,264 | |

| Mid-America Apartment Communities, Inc. | 511,000 | 71,422 | |

| UDR, Inc. | 2,148,941 | 86,108 | |

| 350,009 | |||

| REITs - Diversified - 15.8% | |||

| Crown Castle, Inc. | 629,800 | 69,328 | |

| Digital Realty Trust, Inc. | 612,300 | 91,533 | |

| Elme Communities (SBI) | 694,700 | 11,435 | |

| Equinix, Inc. | 222,100 | 175,512 | |

| Lamar Advertising Co. Class A | 275,300 | 32,997 | |

| SBA Communications Corp. Class A | 153,083 | 33,608 | |

| 414,413 | |||

| REITs - Health Care - 8.2% | |||

| Ventas, Inc. | 2,706,554 | 147,345 | |

| Welltower, Inc. | 609,840 | 67,845 | |

| 215,190 | |||

| REITs - Hotels - 1.4% | |||

| DiamondRock Hospitality Co. | 2,841,100 | 23,382 | |

| Ryman Hospitality Properties, Inc. | 135,600 | 13,629 | |

| 37,011 | |||

| REITs - Industrial Buildings - 1.1% | |||

| STAG Industrial, Inc. | 671,300 | 27,396 | |

| REITs - Management/Investment - 13.2% | |||

| American Tower Corp. | 1,064,100 | 234,528 | |

| NNN (REIT), Inc. | 2,120,500 | 95,189 | |

| Weyerhaeuser Co. | 540,000 | 17,150 | |

| 346,867 | |||

| REITs - Manufactured Homes - 3.4% | |||

| Equity Lifestyle Properties, Inc. | 158,974 | 10,918 | |

| Sun Communities, Inc. | 622,063 | 78,834 | |

| 89,752 | |||

| REITs - Regional Malls - 0.7% | |||

| Tanger, Inc. | 586,500 | 16,950 | |

| REITs - Shopping Centers - 8.5% | |||

| Acadia Realty Trust (SBI) | 149,516 | 3,236 | |

| Kimco Realty Corp. | 4,795,390 | 104,204 | |

| Phillips Edison & Co., Inc. | 627,600 | 22,029 | |

| Regency Centers Corp. | 392,900 | 26,458 | |

| SITE Centers Corp. | 1,980,100 | 30,593 | |

| Urban Edge Properties | 1,826,000 | 37,068 | |

| 223,588 | |||

| REITs - Single Tenant - 0.8% | |||

| Four Corners Property Trust, Inc. | 775,200 | 21,039 | |

| REITs - Storage - 12.3% | |||

| CubeSmart | 1,863,800 | 88,680 | |

| Extra Space Storage, Inc. | 303,340 | 48,419 | |

| Iron Mountain, Inc. | 434,500 | 44,562 | |

| Public Storage Operating Co. | 478,500 | 141,598 | |

| 323,259 | |||

| REITs - Warehouse/Industrial - 14.0% | |||

| Americold Realty Trust | 1,375,700 | 41,120 | |

| Lineage, Inc. | 180,300 | 15,845 | |

| Prologis, Inc. | 2,279,215 | 287,294 | |

| Terreno Realty Corp. | 310,000 | 21,207 | |

| 365,466 | |||

TOTAL EQUITY REAL ESTATE INVESTMENT TRUSTS (REITS) | 2,430,940 | ||

| Real Estate Management & Development - 6.1% | |||

| Real Estate Services - 6.1% | |||

| CBRE Group, Inc. (a) | 937,200 | 105,632 | |

| Compass, Inc. (a) | 3,300,000 | 14,487 | |

| CoStar Group, Inc. (a) | 510,000 | 39,790 | |

| 159,909 | |||

| TOTAL COMMON STOCKS (Cost $1,764,747) | 2,590,849 | ||

| Money Market Funds - 1.1% | |||

| Shares | Value ($) (000s) | ||

Fidelity Cash Central Fund 5.39% (b) (Cost $27,028) | 27,022,731 | 27,028 | |

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $1,791,775) | 2,617,877 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | 1,296 |

| NET ASSETS - 100.0% | 2,619,173 |

| (a) | Non-income producing |

| (b) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| Affiliate (Amounts in thousands) | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 91,636 | 382,847 | 447,456 | 2,188 | 1 | - | 27,028 | 0.1% |

| Fidelity Securities Lending Cash Central Fund 5.39% | 44,244 | 164,218 | 208,462 | 20 | - | - | - | 0.0% |

| Total | 135,880 | 547,065 | 655,918 | 2,208 | 1 | - | 27,028 | |

| Valuation Inputs at Reporting Date: | ||||

Description (Amounts in thousands) | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Common Stocks | 2,590,849 | 2,590,849 | - | - |

| Money Market Funds | 27,028 | 27,028 | - | - |

| Total Investments in Securities: | 2,617,877 | 2,617,877 | - | - |

| Statement of Assets and Liabilities | ||||

As of July 31, 2024 Amounts in thousands (except per-share amount) | ||||

| Assets | ||||

| Investment in securities, at value - See accompanying schedule: | ||||

Unaffiliated issuers (cost $1,764,747) | $ | 2,590,849 | ||

Fidelity Central Funds (cost $27,028) | 27,028 | |||

| Total Investment in Securities (cost $1,791,775) | $ | 2,617,877 | ||

| Receivable for investments sold | 7,544 | |||

| Receivable for fund shares sold | 1,709 | |||

| Dividends receivable | 1,537 | |||

| Distributions receivable from Fidelity Central Funds | 121 | |||

| Prepaid expenses | 3 | |||

| Other receivables | 1,140 | |||

Total assets | 2,629,931 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 6,679 | ||

| Payable for fund shares redeemed | 2,081 | |||

| Accrued management fee | 1,358 | |||

| Deferred trustees payable | 540 | |||

| Other payables and accrued expenses | 100 | |||

| Total liabilities | 10,758 | |||

| Net Assets | $ | 2,619,173 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 1,761,203 | ||

| Total accumulated earnings (loss) | 857,970 | |||

| Net Assets | $ | 2,619,173 | ||

Net Asset Value, offering price and redemption price per share ($2,619,173 ÷ 65,251 shares) | $ | 40.14 | ||

| Statement of Operations | ||||

| Year ended July 31, 2024 Amounts in thousands | ||||

| Investment Income | ||||

| Dividends | $ | 78,359 | ||

| Income from Fidelity Central Funds (including $20 from security lending) | 2,208 | |||

| Total income | 80,567 | |||

| Expenses | ||||

| Management fee | $ | 14,573 | ||

| Transfer agent fees | 2,617 | |||

| Accounting fees | 396 | |||

| Custodian fees and expenses | 27 | |||

| Independent trustees' fees and expenses | 13 | |||

| Registration fees | 41 | |||

| Audit fees | 55 | |||

| Legal | 2 | |||

| Miscellaneous | 59 | |||

| Total expenses before reductions | 17,783 | |||

| Expense reductions | (167) | |||

| Total expenses after reductions | 17,616 | |||

| Net Investment income (loss) | 62,951 | |||