UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | February 28 |

|

|

Date of reporting period: | August 31, 2020 |

Item 1.

Reports to Stockholders

Fidelity® Select Portfolios®

Consumer Discretionary Sector

Automotive Portfolio

Communication Services Portfolio

Construction and Housing Portfolio

Consumer Discretionary Portfolio

Leisure Portfolio

Retailing Portfolio

Semi-Annual Report

August 31, 2020

Includes Fidelity and Fidelity Advisor share classes

See the inside front cover for important information about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2020 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Automotive Portfolio

Investment Summary (Unaudited)

Top Ten Stocks as of August 31, 2020

| | % of fund's net assets |

| Tesla, Inc. | 11.8 |

| Toyota Motor Corp. sponsored ADR | 10.7 |

| General Motors Co. | 8.7 |

| Honda Motor Co. Ltd. sponsored ADR | 5.4 |

| O'Reilly Automotive, Inc. | 4.5 |

| Aptiv PLC | 4.3 |

| Copart, Inc. | 4.1 |

| AutoZone, Inc. | 4.1 |

| BorgWarner, Inc. | 3.6 |

| Ferrari NV | 3.3 |

| | 60.5 |

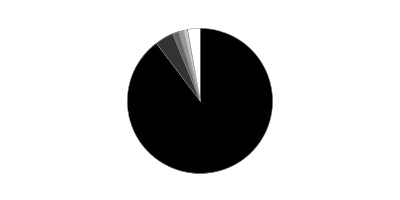

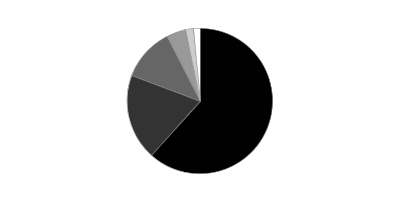

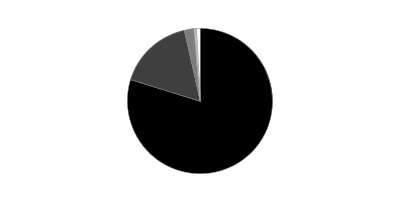

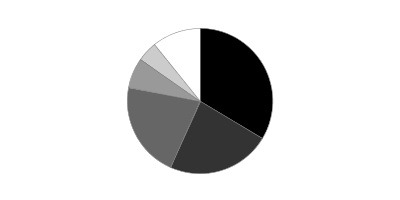

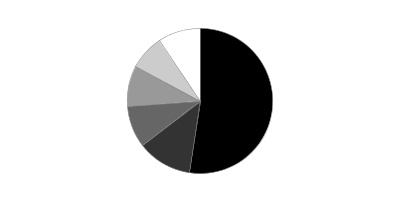

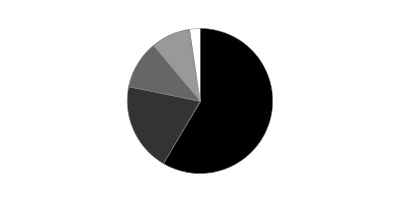

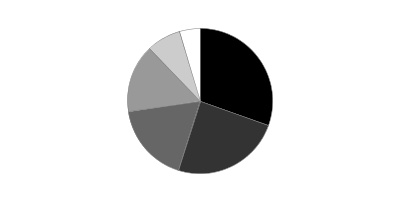

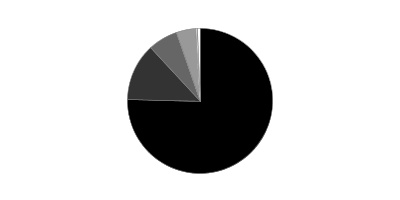

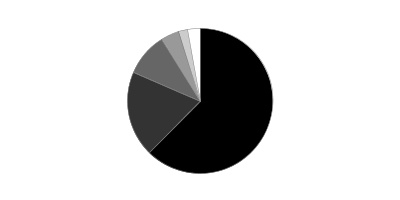

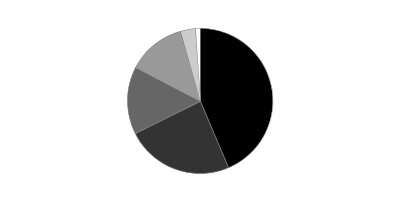

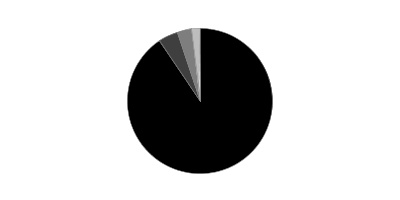

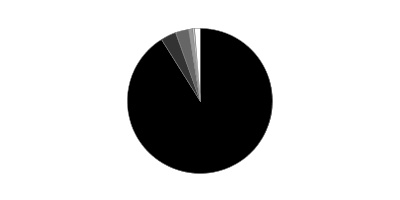

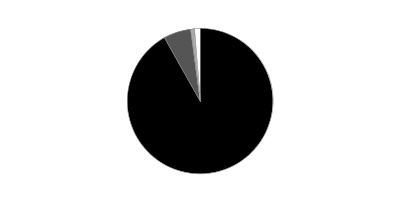

Top Industries (% of fund's net assets)

| As of August 31, 2020 |

| | Automobiles | 47.8% |

| | Specialty Retail | 19.3% |

| | Auto Components | 15.9% |

| | Commercial Services & Supplies | 5.9% |

| | Distributors | 4.2% |

| | All Others* | 6.9% |

* Includes short-term investments and net other assets (liabilities).

Automotive Portfolio

Schedule of Investments August 31, 2020 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 95.1% | | | |

| | | Shares | Value |

| Auto Components - 15.9% | | | |

| Auto Parts & Equipment - 15.9% | | | |

| Adient PLC (a) | | 36,234 | $628,298 |

| Aptiv PLC | | 27,440 | 2,363,133 |

| Autoliv, Inc. | | 2,793 | 218,804 |

| BorgWarner, Inc. | | 49,006 | 1,989,154 |

| Gentex Corp. | | 36,991 | 1,000,607 |

| Lear Corp. | | 13,350 | 1,520,966 |

| Magna International, Inc. Class A (sub. vtg.) | | 19,738 | 961,213 |

| | | | 8,682,175 |

| Automobiles - 46.8% | | | |

| Automobile Manufacturers - 46.2% | | | |

| Ferrari NV (b) | | 9,320 | 1,815,070 |

| Fiat Chrysler Automobiles NV (b) | | 57,484 | 634,049 |

| Ford Motor Co. | | 213,891 | 1,458,737 |

| General Motors Co. | | 159,883 | 4,737,333 |

| Honda Motor Co. Ltd. sponsored ADR | | 116,103 | 2,969,915 |

| Li Auto, Inc. ADR (a)(b) | | 700 | 11,410 |

| NIO, Inc. sponsored ADR (a)(b) | | 66,299 | 1,261,670 |

| Tesla, Inc. (a) | | 12,985 | 6,470,682 |

| Toyota Motor Corp. sponsored ADR | | 44,035 | 5,831,555 |

| XPeng, Inc. ADR (a) | | 3,900 | 79,950 |

| | | | 25,270,371 |

| Motorcycle Manufacturers - 0.6% | | | |

| Harley-Davidson, Inc. | | 11,100 | 307,581 |

|

| TOTAL AUTOMOBILES | | | 25,577,952 |

|

| Commercial Services & Supplies - 5.9% | | | |

| Diversified Support Services - 5.9% | | | |

| Copart, Inc. (a) | | 21,669 | 2,238,841 |

| IAA Spinco, Inc. (a) | | 17,416 | 911,205 |

| KAR Auction Services, Inc. | | 6,088 | 105,566 |

| | | | 3,255,612 |

| Distributors - 4.2% | | | |

| Distributors - 4.2% | | | |

| Genuine Parts Co. | | 10,051 | 949,216 |

| LKQ Corp. (a) | | 42,296 | 1,342,475 |

| | | | 2,291,691 |

| Machinery - 0.9% | | | |

| Construction Machinery & Heavy Trucks - 0.9% | | | |

| Allison Transmission Holdings, Inc. | | 13,657 | 489,877 |

| Road & Rail - 2.1% | | | |

| Trucking - 2.1% | | | |

| Lyft, Inc. (a) | | 11,796 | 349,987 |

| Uber Technologies, Inc. (a) | | 24,387 | 820,135 |

| | | | 1,170,122 |

| Specialty Retail - 19.3% | | | |

| Automotive Retail - 19.3% | | | |

| Advance Auto Parts, Inc. | | 9,920 | 1,550,595 |

| AutoZone, Inc. (a) | | 1,857 | 2,221,548 |

| CarMax, Inc. (a)(b) | | 11,744 | 1,255,786 |

| Carvana Co. Class A (a)(b) | | 7,636 | 1,649,071 |

| Lithia Motors, Inc. Class A (sub. vtg.) | | 4,373 | 1,088,702 |

| O'Reilly Automotive, Inc. (a) | | 5,278 | 2,457,595 |

| Sonic Automotive, Inc. Class A (sub. vtg.) | | 7,200 | 304,272 |

| | | | 10,527,569 |

| TOTAL COMMON STOCKS | | | |

| (Cost $35,308,535) | | | 51,994,998 |

|

| Nonconvertible Preferred Stocks - 1.0% | | | |

| Automobiles - 1.0% | | | |

| Automobile Manufacturers - 1.0% | | | |

| Volkswagen AG | | | |

| (Cost $452,360) | | 3,167 | 526,613 |

|

| Money Market Funds - 7.9% | | | |

| Fidelity Cash Central Fund 0.12% (c) | | 1,144,586 | 1,144,815 |

| Fidelity Securities Lending Cash Central Fund 0.11% (c)(d) | | 3,158,044 | 3,158,360 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $4,303,175) | | | 4,303,175 |

| TOTAL INVESTMENT IN SECURITIES - 104.0% | | | |

| (Cost $40,064,070) | | | 56,824,786 |

| NET OTHER ASSETS (LIABILITIES) - (4.0)% | | | (2,165,380) |

| NET ASSETS - 100% | | | $54,659,406 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $287 |

| Fidelity Securities Lending Cash Central Fund | 3,400 |

| Total | $3,687 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

The value, beginning of period, for the Fidelity Cash Central Fund was $535,945. Net realized gain (loss) and change in net unrealized appreciation (depreciation) was $110 and $0 respectively. Purchases and sales of the Fidelity Cash Central Fund were $17,519,399 and $14,896,874, respectively, during the period.

Investment Valuation

The following is a summary of the inputs used, as of August 31, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Common Stocks | $51,994,998 | $51,994,998 | $-- | $-- |

| Nonconvertible Preferred Stocks | 526,613 | 526,613 | -- | -- |

| Money Market Funds | 4,303,175 | 4,303,175 | -- | -- |

| Total Investments in Securities: | $56,824,786 | $56,824,786 | $-- | $-- |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 68.7% |

| Japan | 16.1% |

| Netherlands | 4.5% |

| Bailiwick of Jersey | 4.3% |

| Cayman Islands | 2.4% |

| Canada | 1.8% |

| Ireland | 1.2% |

| Germany | 1.0% |

| | 100.0% |

See accompanying notes which are an integral part of the financial statements.

Automotive Portfolio

Financial Statements

Statement of Assets and Liabilities

| | | August 31, 2020 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $3,070,526) — See accompanying schedule:

Unaffiliated issuers (cost $35,760,895) | $52,521,611 | |

| Fidelity Central Funds (cost $4,303,175) | 4,303,175 | |

| Total Investment in Securities (cost $40,064,070) | | $56,824,786 |

| Receivable for investments sold | | 4,980,115 |

| Receivable for fund shares sold | | 599,665 |

| Dividends receivable | | 37,083 |

| Distributions receivable from Fidelity Central Funds | | 1,287 |

| Prepaid expenses | | 396 |

| Other receivables | | 2,811 |

| Total assets | | 62,446,143 |

| Liabilities | | |

| Payable for investments purchased | $4,525,970 | |

| Payable for fund shares redeemed | 56,209 | |

| Accrued management fee | 20,940 | |

| Other affiliated payables | 9,089 | |

| Other payables and accrued expenses | 16,579 | |

| Collateral on securities loaned | 3,157,950 | |

| Total liabilities | | 7,786,737 |

| Net Assets | | $54,659,406 |

| Net Assets consist of: | | |

| Paid in capital | | $33,870,165 |

| Total accumulated earnings (loss) | | 20,789,241 |

| Net Assets | | $54,659,406 |

| Net Asset Value, offering price and redemption price per share ($54,659,406 ÷ 1,293,885 shares) | | $42.24 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended August 31, 2020 (Unaudited) |

| Investment Income | | |

| Dividends | | $221,629 |

| Income from Fidelity Central Funds (including $3,400 from security lending) | | 3,687 |

| Total income | | 225,316 |

| Expenses | | |

| Management fee | $93,671 | |

| Transfer agent fees | 41,742 | |

| Accounting fees | 6,852 | |

| Custodian fees and expenses | 2,460 | |

| Independent trustees' fees and expenses | 109 | |

| Registration fees | 13,591 | |

| Audit | 17,653 | |

| Legal | 25 | |

| Miscellaneous | 1,014 | |

| Total expenses before reductions | 177,117 | |

| Expense reductions | (944) | |

| Total expenses after reductions | | 176,173 |

| Net investment income (loss) | | 49,143 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 4,262,720 | |

| Fidelity Central Funds | (252) | |

| Foreign currency transactions | 706 | |

| Total net realized gain (loss) | | 4,263,174 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 7,732,062 | |

| Assets and liabilities in foreign currencies | 153 | |

| Total change in net unrealized appreciation (depreciation) | | 7,732,215 |

| Net gain (loss) | | 11,995,389 |

| Net increase (decrease) in net assets resulting from operations | | $12,044,532 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Six months ended August 31, 2020 (Unaudited) | Year ended February 29, 2020 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $49,143 | $493,545 |

| Net realized gain (loss) | 4,263,174 | 4,080,200 |

| Change in net unrealized appreciation (depreciation) | 7,732,215 | (1,479,820) |

| Net increase (decrease) in net assets resulting from operations | 12,044,532 | 3,093,925 |

| Distributions to shareholders | (2,839,507) | (1,655,954) |

| Share transactions | | |

| Proceeds from sales of shares | 16,909,732 | 14,390,055 |

| Reinvestment of distributions | 2,689,399 | 1,571,589 |

| Cost of shares redeemed | (10,624,530) | (21,701,036) |

| Net increase (decrease) in net assets resulting from share transactions | 8,974,601 | (5,739,392) |

| Total increase (decrease) in net assets | 18,179,626 | (4,301,421) |

| Net Assets | | |

| Beginning of period | 36,479,780 | 40,781,201 |

| End of period | $54,659,406 | $36,479,780 |

| Other Information | | |

| Shares | | |

| Sold | 483,639 | 396,128 |

| Issued in reinvestment of distributions | 104,362 | 42,404 |

| Redeemed | (339,130) | (618,672) |

| Net increase (decrease) | 248,871 | (180,140) |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Automotive Portfolio

| | Six months ended (Unaudited) August 31, | Years endedFebruary 28, | | | | |

| | 2020 | 2020 A | 2019 | 2018 | 2017 | 2016 A |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $34.91 | $33.29 | $37.52 | $36.78 | $33.72 | $48.82 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)B | .05 | .46C | .36 | .39D | .33 | .65 |

| Net realized and unrealized gain (loss) | 10.23 | 2.67E | (2.15) | 6.11 | 5.22 | (9.37) |

| Total from investment operations | 10.28 | 3.13 | (1.79) | 6.50 | 5.55 | (8.72) |

| Distributions from net investment income | – | (.49)F | (.38) | (.20) | (.52) | (.45) |

| Distributions from net realized gain | (2.95) | (1.02)F | (2.06) | (5.56) | (1.98) | (5.93) |

| Total distributions | (2.95) | (1.51) | (2.44) | (5.76) | (2.49)G | (6.38) |

| Redemption fees added to paid in capitalB | – | – | – | –H | –H | –H |

| Net asset value, end of period | $42.24 | $34.91 | $33.29 | $37.52 | $36.78 | $33.72 |

| Total ReturnI,J | 34.86% | 9.14%E | (4.66)% | 19.08% | 16.80% | (20.00)% |

| Ratios to Average Net AssetsK,L | | | | | | |

| Expenses before reductions | 1.00%M | 1.00% | .97% | .97% | .96% | .87% |

| Expenses net of fee waivers, if any | 1.00%M | 1.00% | .97% | .96% | .96% | .87% |

| Expenses net of all reductions | 1.00%M | .99% | .97% | .96% | .95% | .86% |

| Net investment income (loss) | .28%M | 1.33%C | 1.04% | 1.04%D | .92% | 1.49% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $54,659 | $36,480 | $40,781 | $56,139 | $54,069 | $65,745 |

| Portfolio turnover rateN | 64%M | 45% | 31% | 117% | 83% | 80% |

A For the year ended February 29.

B Calculated based on average shares outstanding during the period.

C Net investment income per share reflects a large, non-recurring dividend which amounted to $.09 per share. Excluding such non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.07%.

D Net investment income per share reflects a large, non-recurring dividend which amounted to $.08 per share. Excluding such non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .83%.

E Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.19 per share. Excluding these litigation proceeds, the total return would have been 8.58%.

F The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

G Total distributions of $2.49 per share is comprised of distributions from net investment income of $.515 and distributions from net realized gain of $1.975 per share.

H Amount represents less than $.005 per share.

I Total returns for periods of less than one year are not annualized.

J Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

K Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

L Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

M Annualized

N Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio

Investment Summary (Unaudited)

Top Ten Stocks as of August 31, 2020

| | % of fund's net assets |

| Alphabet, Inc. Class A | 22.7 |

| Facebook, Inc. Class A | 20.3 |

| T-Mobile U.S., Inc. | 6.5 |

| Netflix, Inc. | 4.5 |

| The Walt Disney Co. | 4.3 |

| Activision Blizzard, Inc. | 4.2 |

| Liberty Broadband Corp. Class A | 4.1 |

| Liberty Global PLC Class C | 4.0 |

| Comcast Corp. Class A | 3.4 |

| Electronic Arts, Inc. | 2.6 |

| | 76.6 |

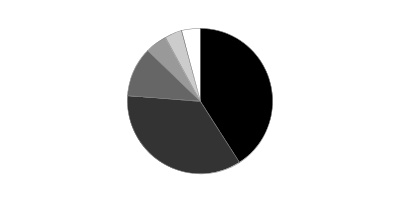

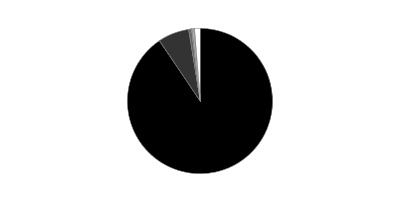

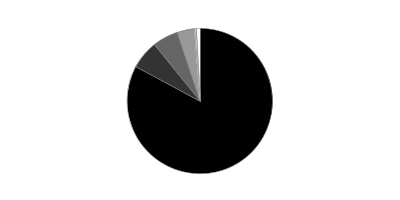

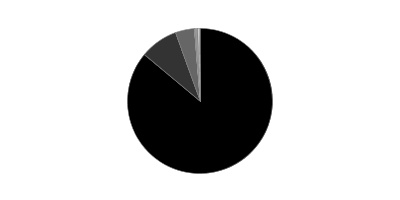

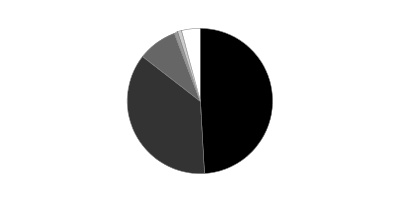

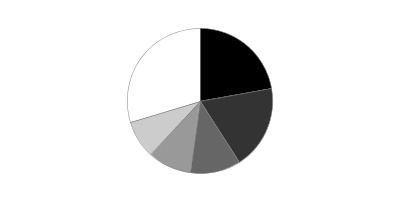

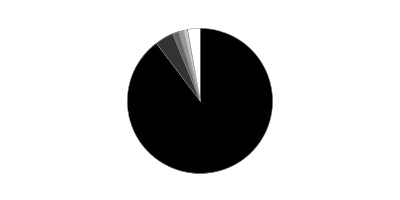

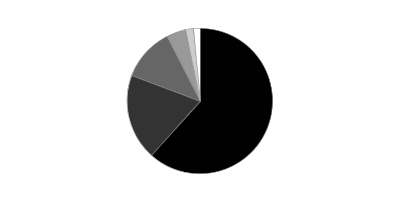

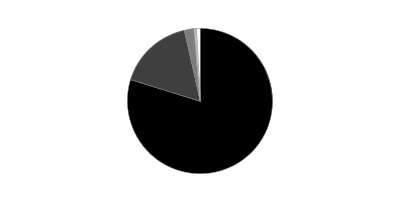

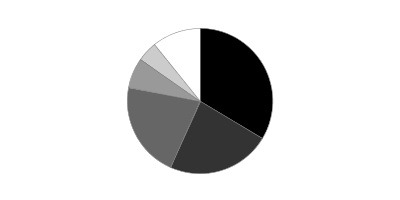

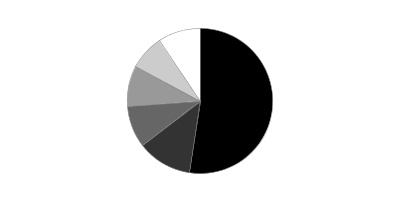

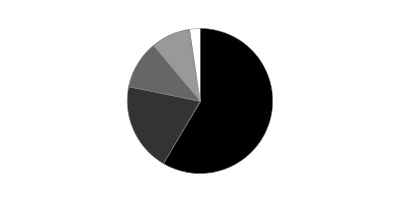

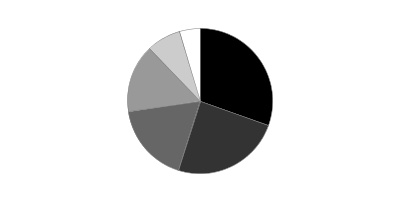

Top Industries (% of fund's net assets)

| As of August 31, 2020 |

| | Interactive Media & Services | 46.4% |

| | Entertainment | 21.2% |

| | Media | 12.6% |

| | Diversified Telecommunication Services | 8.1% |

| | Wireless Telecommunication Services | 7.5% |

| | All Others* | 4.2% |

* Includes short-term investments and net other assets (liabilities).

Communication Services Portfolio

Schedule of Investments August 31, 2020 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 98.4% | | | |

| | | Shares | Value |

| Communications Equipment - 0.7% | | | |

| Communications Equipment - 0.7% | | | |

| EchoStar Holding Corp. Class A (a) | | 182,400 | $5,358,912 |

| Diversified Telecommunication Services - 8.1% | | | |

| Alternative Carriers - 6.3% | | | |

| GCI Liberty, Inc. (a) | | 145,032 | 11,715,685 |

| Liberty Global PLC Class C (a) | | 1,337,900 | 30,785,079 |

| Liberty Latin America Ltd. Class C (a) | | 211,100 | 2,013,894 |

| Vonage Holdings Corp. (a) | | 306,300 | 3,507,135 |

| | | | 48,021,793 |

| Integrated Telecommunication Services - 1.8% | | | |

| Verizon Communications, Inc. | | 230,900 | 13,685,443 |

|

| TOTAL DIVERSIFIED TELECOMMUNICATION SERVICES | | | 61,707,236 |

|

| Entertainment - 21.2% | | | |

| Interactive Home Entertainment - 10.9% | | | |

| Activision Blizzard, Inc. | | 386,900 | 32,313,888 |

| DouYu International Holdings Ltd. ADR (a) | | 628,065 | 10,513,808 |

| Electronic Arts, Inc. (a) | | 140,500 | 19,595,535 |

| Take-Two Interactive Software, Inc. (a) | | 94,700 | 16,211,693 |

| Zynga, Inc. (a) | | 500,800 | 4,537,248 |

| | | | 83,172,172 |

| Movies & Entertainment - 10.3% | | | |

| Lions Gate Entertainment Corp.: | | | |

| Class A (a)(b) | | 34,500 | 336,030 |

| Class B (a) | | 309,934 | 2,808,002 |

| Netflix, Inc. (a) | | 64,200 | 33,997,752 |

| Spotify Technology SA (a)(b) | | 7,600 | 2,144,416 |

| The Walt Disney Co. | | 245,971 | 32,436,196 |

| Warner Music Group Corp. Class A | | 99,800 | 2,960,068 |

| World Wrestling Entertainment, Inc. Class A | | 75,600 | 3,331,692 |

| | | | 78,014,156 |

|

| TOTAL ENTERTAINMENT | | | 161,186,328 |

|

| Interactive Media & Services - 46.4% | | | |

| Interactive Media & Services - 46.4% | | | |

| Alphabet, Inc. Class A (a) | | 105,900 | 172,567,227 |

| ANGI Homeservices, Inc. Class A (a)(b) | | 497,200 | 6,898,650 |

| Facebook, Inc. Class A (a) | | 528,200 | 154,868,240 |

| InterActiveCorp (a) | | 13,700 | 1,821,963 |

| Match Group, Inc. (a) | | 112,970 | 12,616,490 |

| Zillow Group, Inc. Class A (a) | | 57,700 | 4,920,656 |

| | | | 353,693,226 |

| Media - 12.6% | | | |

| Advertising - 0.0% | | | |

| S4 Capital PLC (a) | | 65,900 | 315,369 |

| Broadcasting - 4.0% | | | |

| Liberty Media Corp.: | | | |

| Liberty Media Class A (a) | | 177,962 | 6,438,665 |

| Liberty SiriusXM Series A (a) | | 218,200 | 7,922,842 |

| Liberty SiriusXM Series C (a) | | 19,870 | 715,221 |

| Nexstar Broadcasting Group, Inc. Class A | | 41,400 | 3,974,814 |

| Sinclair Broadcast Group, Inc. Class A | | 14,400 | 299,664 |

| ViacomCBS, Inc. Class B | | 387,800 | 10,800,230 |

| | | | 30,151,436 |

| Cable & Satellite - 8.6% | | | |

| Altice U.S.A., Inc. Class A (a) | | 132,500 | 3,654,350 |

| Comcast Corp. Class A | | 577,300 | 25,868,813 |

| DISH Network Corp. Class A (a) | | 120,339 | 4,274,441 |

| Liberty Broadband Corp. Class A (a) | | 228,623 | 31,593,412 |

| | | | 65,391,016 |

|

| TOTAL MEDIA | | | 95,857,821 |

|

| Road & Rail - 1.9% | | | |

| Trucking - 1.9% | | | |

| Lyft, Inc. (a)(b) | | 485,200 | 14,395,884 |

| Wireless Telecommunication Services - 7.5% | | | |

| Wireless Telecommunication Services - 7.5% | | | |

| Millicom International Cellular SA | | 245,300 | 7,248,615 |

| T-Mobile U.S., Inc. | | 425,050 | 49,594,834 |

| | | | 56,843,449 |

| TOTAL COMMON STOCKS | | | |

| (Cost $474,763,266) | | | 749,042,856 |

|

| Money Market Funds - 4.3% | | | |

| Fidelity Cash Central Fund 0.12% (c) | | 9,093,729 | 9,095,547 |

| Fidelity Securities Lending Cash Central Fund 0.11% (c)(d) | | 23,853,259 | 23,855,644 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $32,951,427) | | | 32,951,191 |

| TOTAL INVESTMENT IN SECURITIES - 102.7% | | | |

| (Cost $507,714,693) | | | 781,994,047 |

| NET OTHER ASSETS (LIABILITIES) - (2.7)% | | | (20,498,543) |

| NET ASSETS - 100% | | | $761,495,504 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $4,787 |

| Fidelity Securities Lending Cash Central Fund | 224,614 |

| Total | $229,401 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of August 31, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Common Stocks | $749,042,856 | $749,042,856 | $-- | $-- |

| Money Market Funds | 32,951,191 | 32,951,191 | -- | -- |

| Total Investments in Securities: | $781,994,047 | $781,994,047 | $-- | $-- |

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio

Financial Statements

Statement of Assets and Liabilities

| | | August 31, 2020 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $22,776,389) — See accompanying schedule:

Unaffiliated issuers (cost $474,763,266) | $749,042,856 | |

| Fidelity Central Funds (cost $32,951,427) | 32,951,191 | |

| Total Investment in Securities (cost $507,714,693) | | $781,994,047 |

| Receivable for investments sold | | 3,865,609 |

| Receivable for fund shares sold | | 1,861,842 |

| Dividends receivable | | 14,856 |

| Distributions receivable from Fidelity Central Funds | | 13,802 |

| Prepaid expenses | | 4,299 |

| Other receivables | | 14,246 |

| Total assets | | 787,768,701 |

| Liabilities | | |

| Payable for fund shares redeemed | 1,945,505 | |

| Accrued management fee | 321,896 | |

| Distribution and service plan fees payable | 8,791 | |

| Other affiliated payables | 121,976 | |

| Other payables and accrued expenses | 20,279 | |

| Collateral on securities loaned | 23,854,750 | |

| Total liabilities | | 26,273,197 |

| Net Assets | | $761,495,504 |

| Net Assets consist of: | | |

| Paid in capital | | $489,887,784 |

| Total accumulated earnings (loss) | | 271,607,720 |

| Net Assets | | $761,495,504 |

| Net Asset Value and Maximum Offering Price | | |

| Class A: | | |

| Net Asset Value and redemption price per share ($20,278,399 ÷ 266,478 shares)(a) | | $76.10 |

| Maximum offering price per share (100/94.25 of $76.10) | | $80.74 |

| Class M: | | |

| Net Asset Value and redemption price per share ($4,669,666 ÷ 61,550 shares)(a) | | $75.87 |

| Maximum offering price per share (100/96.50 of $75.87) | | $78.62 |

| Class C: | | |

| Net Asset Value and offering price per share ($4,002,613 ÷ 53,170 shares)(a) | | $75.28 |

| Communication Services: | | |

| Net Asset Value, offering price and redemption price per share ($704,893,257 ÷ 9,218,439 shares) | | $76.47 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($17,628,039 ÷ 230,565 shares) | | $76.46 |

| Class Z: | | |

| Net Asset Value, offering price and redemption price per share ($10,023,530 ÷ 130,930 shares) | | $76.56 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended August 31, 2020 (Unaudited) |

| Investment Income | | |

| Dividends | | $1,053,922 |

| Income from Fidelity Central Funds (including $224,614 from security lending) | | 229,401 |

| Total income | | 1,283,323 |

| Expenses | | |

| Management fee | $1,647,190 | |

| Transfer agent fees | 566,703 | |

| Distribution and service plan fees | 36,681 | |

| Accounting fees | 113,671 | |

| Custodian fees and expenses | 3,160 | |

| Independent trustees' fees and expenses | 1,924 | |

| Registration fees | 54,872 | |

| Audit | 20,791 | |

| Legal | 432 | |

| Interest | 69 | |

| Miscellaneous | 12,701 | |

| Total expenses before reductions | 2,458,194 | |

| Expense reductions | (30,161) | |

| Total expenses after reductions | | 2,428,033 |

| Net investment income (loss) | | (1,144,710) |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 1,349,575 | |

| Fidelity Central Funds | (1,480) | |

| Foreign currency transactions | (1,498) | |

| Total net realized gain (loss) | | 1,346,597 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 164,497,429 | |

| Fidelity Central Funds | (236) | |

| Total change in net unrealized appreciation (depreciation) | | 164,497,193 |

| Net gain (loss) | | 165,843,790 |

| Net increase (decrease) in net assets resulting from operations | | $164,699,080 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Six months ended August 31, 2020 (Unaudited) | Year ended February 29, 2020 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $(1,144,710) | $(1,158,013) |

| Net realized gain (loss) | 1,346,597 | 57,254,598 |

| Change in net unrealized appreciation (depreciation) | 164,497,193 | 13,008,631 |

| Net increase (decrease) in net assets resulting from operations | 164,699,080 | 69,105,216 |

| Distributions to shareholders | (13,180,711) | (180,128,842) |

| Share transactions - net increase (decrease) | 14,301,887 | 141,718,647 |

| Total increase (decrease) in net assets | 165,820,256 | 30,695,021 |

| Net Assets | | |

| Beginning of period | 595,675,248 | 564,980,227 |

| End of period | $761,495,504 | $595,675,248 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Communication Services Portfolio Class A

| | Six months ended (Unaudited) August 31, | Years endedFebruary 28, | |

| | 2020 | 2020 A | 2019 B |

| Selected Per–Share Data | | | |

| Net asset value, beginning of period | $60.63 | $74.84 | $78.20 |

| Income from Investment Operations | | | |

| Net investment income (loss)C | (.21) | (.30) | (.12) |

| Net realized and unrealized gain (loss) | 17.08 | 8.78 | 2.68 |

| Total from investment operations | 16.87 | 8.48 | 2.56 |

| Distributions from net investment income | – | – | (.14) |

| Distributions from net realized gain | (1.40) | (22.69) | (5.77) |

| Total distributions | (1.40) | (22.69) | (5.91) |

| Net asset value, end of period | $76.10 | $60.63 | $74.85 |

| Total ReturnD,E,F | 28.77% | 11.90% | 3.83% |

| Ratios to Average Net AssetsG,H | | | |

| Expenses before reductions | 1.09%I | 1.07% | 1.13%I |

| Expenses net of fee waivers, if any | 1.09%I | 1.07% | 1.12%I |

| Expenses net of all reductions | 1.08%I | 1.06% | 1.11%I |

| Net investment income (loss) | (.67)%I | (.47)% | (.68)%I |

| Supplemental Data | | | |

| Net assets, end of period (000 omitted) | $20,278 | $9,947 | $715 |

| Portfolio turnover rateJ | 55%I | 73% | 107% |

A For the year ended February 29.

B For the period November 30, 2018 (commencement of sale of shares) to February 28, 2019.

C Calculated based on average shares outstanding during the period.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio Class M

| | Six months ended (Unaudited) August 31, | Years endedFebruary 28, | |

| | 2020 | 2020 A | 2019 B |

| Selected Per–Share Data | | | |

| Net asset value, beginning of period | $60.52 | $74.82 | $78.20 |

| Income from Investment Operations | | | |

| Net investment income (loss)C | (.29) | (.48) | (.16) |

| Net realized and unrealized gain (loss) | 17.04 | 8.75 | 2.67 |

| Total from investment operations | 16.75 | 8.27 | 2.51 |

| Distributions from net investment income | – | – | (.12) |

| Distributions from net realized gain | (1.40) | (22.57) | (5.77) |

| Total distributions | (1.40) | (22.57) | (5.89) |

| Net asset value, end of period | $75.87 | $60.52 | $74.82 |

| Total ReturnD,E,F | 28.62% | 11.58% | 3.76% |

| Ratios to Average Net AssetsG,H | | | |

| Expenses before reductions | 1.34%I | 1.35% | 1.36%I |

| Expenses net of fee waivers, if any | 1.34%I | 1.35% | 1.35%I |

| Expenses net of all reductions | 1.33%I | 1.34% | 1.34%I |

| Net investment income (loss) | (.92)%I | (.75)% | (.90)%I |

| Supplemental Data | | | |

| Net assets, end of period (000 omitted) | $4,670 | $2,264 | $485 |

| Portfolio turnover rateJ | 55%I | 73% | 107% |

A For the year ended February 29.

B For the period November 30, 2018 (commencement of sale of shares) to February 28, 2019.

C Calculated based on average shares outstanding during the period.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio Class C

| | Six months ended (Unaudited) August 31, | Years endedFebruary 28, | |

| | 2020 | 2020 A | 2019 B |

| Selected Per–Share Data | | | |

| Net asset value, beginning of period | $60.20 | $74.76 | $78.20 |

| Income from Investment Operations | | | |

| Net investment income (loss)C | (.43) | (.81) | (.25) |

| Net realized and unrealized gain (loss) | 16.91 | 8.74 | 2.67 |

| Total from investment operations | 16.48 | 7.93 | 2.42 |

| Distributions from net investment income | – | – | (.09) |

| Distributions from net realized gain | (1.40) | (22.49) | (5.77) |

| Total distributions | (1.40) | (22.49) | (5.86) |

| Net asset value, end of period | $75.28 | $60.20 | $74.76 |

| Total ReturnD,E,F | 28.32% | 11.01% | 3.63% |

| Ratios to Average Net AssetsG,H | | | |

| Expenses before reductions | 1.79%I | 1.86% | 1.87%I |

| Expenses net of fee waivers, if any | 1.79%I | 1.86% | 1.85%I |

| Expenses net of all reductions | 1.78%I | 1.85% | 1.84%I |

| Net investment income (loss) | (1.36)%I | (1.26)% | (1.37)%I |

| Supplemental Data | | | |

| Net assets, end of period (000 omitted) | $4,003 | $1,982 | $377 |

| Portfolio turnover rateJ | 55%I | 73% | 107% |

A For the year ended February 29.

B For the period November 30, 2018 (commencement of sale of shares) to February 28, 2019.

C Calculated based on average shares outstanding during the period.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the contingent deferred sales charge.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio

| | Six months ended (Unaudited) August 31, | Years endedFebruary 28, | | | | |

| | 2020 | 2020 A | 2019 | 2018 | 2017 | 2016 A |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $60.82 | $74.88 | $79.70 | $80.75 | $68.59 | $82.48 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)B | (.11) | (.12) | .13 | .21 | .22 | .27 |

| Net realized and unrealized gain (loss) | 17.16 | 8.79 | 5.31 | 3.14 | 17.53 | (8.82) |

| Total from investment operations | 17.05 | 8.67 | 5.44 | 3.35 | 17.75 | (8.55) |

| Distributions from net investment income | – | – | (.20) | (.16) | (.33) | (.23) |

| Distributions from net realized gain | (1.40) | (22.73) | (10.06) | (4.23) | (5.26) | (5.12) |

| Total distributions | (1.40) | (22.73) | (10.26) | (4.40)C | (5.59) | (5.34)D |

| Redemption fees added to paid in capitalB | – | – | – | –E | –E | –E |

| Net asset value, end of period | $76.47 | $60.82 | $74.88 | $79.70 | $80.75 | $68.59 |

| Total ReturnF,G | 28.98% | 12.22% | 8.12% | 4.16% | 26.85% | (10.88)% |

| Ratios to Average Net AssetsH,I | | | | | | |

| Expenses before reductions | .78%J | .78% | .82% | .80% | .82% | .81% |

| Expenses net of fee waivers, if any | .78%J | .78% | .81% | .80% | .82% | .81% |

| Expenses net of all reductions | .77%J | .77% | .80% | .79% | .82% | .80% |

| Net investment income (loss) | (.36)%J | (.18)% | .17% | .26% | .30% | .34% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $704,893 | $577,157 | $562,422 | $509,375 | $680,392 | $576,118 |

| Portfolio turnover rateK | 55%J | 73% | 107% | 22% | 33% | 42% |

A For the year ended February 29.

B Calculated based on average shares outstanding during the period.

C Total distributions of $4.40 per share is comprised of distributions from net investment income of $.163 and distributions from net realized gain of $4.233 per share.

D Total distributions of $5.34 per share is comprised of distributions from net investment income of $.227 and distributions from net realized gain of $5.115 per share.

E Amount represents less than $.005 per share.

F Total returns for periods of less than one year are not annualized.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

J Annualized

K Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio Class I

| | Six months ended (Unaudited) August 31, | Years endedFebruary 28, | |

| | 2020 | 2020 A | 2019 B |

| Selected Per–Share Data | | | |

| Net asset value, beginning of period | $60.80 | $74.88 | $78.20 |

| Income from Investment Operations | | | |

| Net investment income (loss)C | (.11) | (.11) | (.06) |

| Net realized and unrealized gain (loss) | 17.17 | 8.79 | 2.67 |

| Total from investment operations | 17.06 | 8.68 | 2.61 |

| Distributions from net investment income | – | – | (.15) |

| Distributions from net realized gain | (1.40) | (22.76) | (5.77) |

| Total distributions | (1.40) | (22.76) | (5.92) |

| Net asset value, end of period | $76.46 | $60.80 | $74.89 |

| Total ReturnD,E | 29.01% | 12.22% | 3.91% |

| Ratios to Average Net AssetsF,G | | | |

| Expenses before reductions | .76%H | .77% | .70%H |

| Expenses net of fee waivers, if any | .76%H | .77% | .69%H |

| Expenses net of all reductions | .75%H | .76% | .68%H |

| Net investment income (loss) | (.34)%H | (.17)% | (.30)%H |

| Supplemental Data | | | |

| Net assets, end of period (000 omitted) | $17,628 | $2,493 | $452 |

| Portfolio turnover rateI | 55%H | 73% | 107% |

A For the year ended February 29.

B For the period November 30, 2018 (commencement of sale of shares) to February 28, 2019.

C Calculated based on average shares outstanding during the period.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio Class Z

| | Six months ended (Unaudited) August 31, | Years endedFebruary 28, | |

| | 2020 | 2020 A | 2019 B |

| Selected Per–Share Data | | | |

| Net asset value, beginning of period | $60.85 | $74.89 | $78.20 |

| Income from Investment Operations | | | |

| Net investment income (loss)C | (.07) | (.03) | (.03) |

| Net realized and unrealized gain (loss) | 17.18 | 8.80 | 2.65 |

| Total from investment operations | 17.11 | 8.77 | 2.62 |

| Distributions from net investment income | – | – | (.16) |

| Distributions from net realized gain | (1.40) | (22.81) | (5.77) |

| Total distributions | (1.40) | (22.81) | (5.93) |

| Net asset value, end of period | $76.56 | $60.85 | $74.89 |

| Total ReturnD,E | 29.07% | 12.38% | 3.92% |

| Ratios to Average Net AssetsF,G | | | |

| Expenses before reductions | .64%H | .65% | .64%H |

| Expenses net of fee waivers, if any | .64%H | .65% | .62%H |

| Expenses net of all reductions | .63%H | .64% | .61%H |

| Net investment income (loss) | (.22)%H | (.05)% | (.16)%H |

| Supplemental Data | | | |

| Net assets, end of period (000 omitted) | $10,024 | $1,833 | $529 |

| Portfolio turnover rateI | 55%H | 73% | 107% |

A For the year ended February 29.

B For the period November 30, 2018 (commencement of sale of shares) to February 28, 2019.

C Calculated based on average shares outstanding during the period.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Construction and Housing Portfolio

Investment Summary (Unaudited)

Top Ten Stocks as of August 31, 2020

| | % of fund's net assets |

| Lowe's Companies, Inc. | 17.7 |

| The Home Depot, Inc. | 16.4 |

| Equity Residential (SBI) | 6.0 |

| Johnson Controls International PLC | 5.6 |

| Welltower, Inc. | 3.7 |

| D.R. Horton, Inc. | 3.4 |

| Toll Brothers, Inc. | 3.0 |

| Vulcan Materials Co. | 2.9 |

| Essex Property Trust, Inc. | 2.8 |

| Invitation Homes, Inc. | 2.5 |

| | 64.0 |

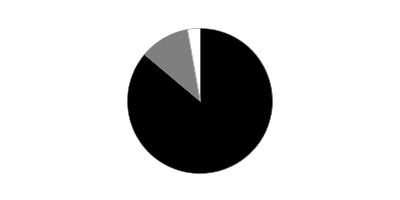

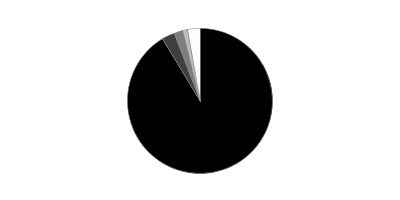

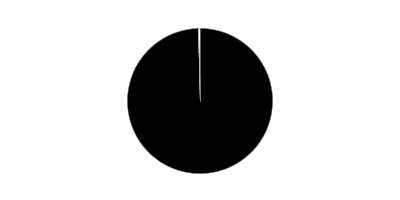

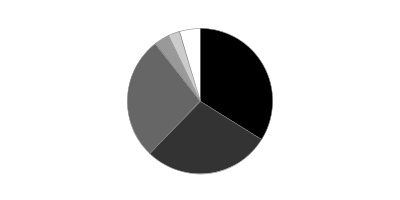

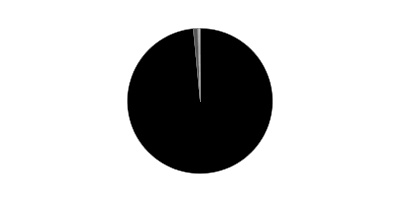

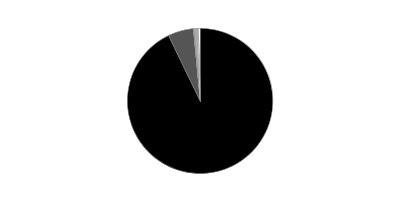

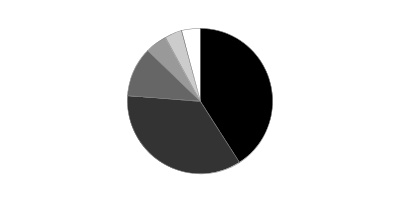

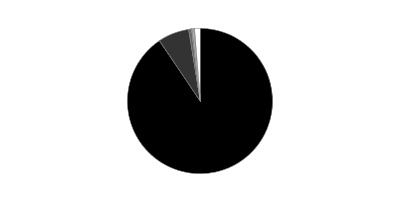

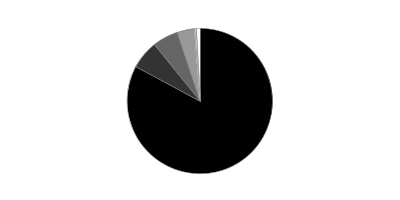

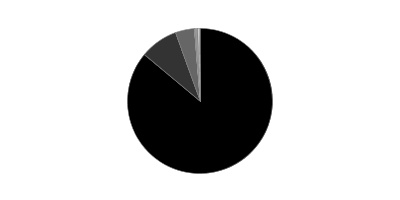

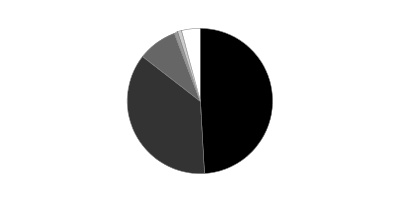

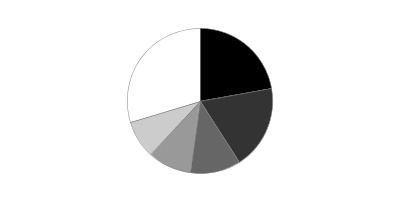

Top Industries (% of fund's net assets)

| As of August 31, 2020 |

| | Specialty Retail | 34.1% |

| | Building Products | 17.1% |

| | Equity Real Estate Investment Trusts (Reits) | 16.4% |

| | Household Durables | 13.5% |

| | Construction & Engineering | 6.9% |

| | All Others* | 12.0% |

* Includes short-term investments and net other assets (liabilities).

Construction and Housing Portfolio

Schedule of Investments August 31, 2020 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 99.5% | | | |

| | | Shares | Value |

| Building Products - 17.1% | | | |

| Building Products - 17.1% | | | |

| Allegion PLC | | 68,231 | $7,054,403 |

| Carrier Global Corp. | | 127,900 | 3,817,815 |

| Fortune Brands Home & Security, Inc. | | 89,487 | 7,524,067 |

| Johnson Controls International PLC | | 440,251 | 17,931,423 |

| Patrick Industries, Inc. | | 31,805 | 1,787,759 |

| Resideo Technologies, Inc. (a) | | 112,900 | 1,508,344 |

| The AZEK Co., Inc. | | 79,400 | 3,134,712 |

| Trane Technologies PLC | | 57,500 | 6,807,425 |

| Ufp Industries, Inc. | | 83,107 | 4,932,400 |

| | | | 54,498,348 |

| Commercial Services & Supplies - 0.4% | | | |

| Environmental & Facility Services - 0.4% | | | |

| ABM Industries, Inc. | | 33,097 | 1,262,320 |

| Construction & Engineering - 6.9% | | | |

| Construction & Engineering - 6.9% | | | |

| Comfort Systems U.S.A., Inc. | | 49,429 | 2,504,567 |

| Construction Partners, Inc. Class A (a) | | 108,907 | 2,035,472 |

| Dycom Industries, Inc. (a) | | 50,454 | 3,103,426 |

| EMCOR Group, Inc. | | 40,370 | 3,028,154 |

| Granite Construction, Inc. | | 44,418 | 825,731 |

| Quanta Services, Inc. | | 89,799 | 4,602,199 |

| Willscot Mobile Mini Holdings (a) | | 329,950 | 5,906,105 |

| | | | 22,005,654 |

| Construction Materials - 4.0% | | | |

| Construction Materials - 4.0% | | | |

| Forterra, Inc. (a) | | 60,780 | 805,335 |

| Summit Materials, Inc. (a) | | 183,814 | 2,736,990 |

| Vulcan Materials Co. | | 77,476 | 9,297,120 |

| | | | 12,839,445 |

| Electrical Equipment - 0.9% | | | |

| Electrical Components & Equipment - 0.9% | | | |

| Atkore International Group, Inc. (a) | | 111,401 | 2,977,749 |

| Equity Real Estate Investment Trusts (REITs) - 16.4% | | | |

| Health Care REITs - 3.7% | | | |

| Welltower, Inc. | | 202,700 | 11,659,304 |

| Hotel & Resort REITs - 0.8% | | | |

| MGM Growth Properties LLC | | 96,816 | 2,717,625 |

| Residential REITs - 11.9% | | | |

| Equity Lifestyle Properties, Inc. | | 27,703 | 1,836,432 |

| Equity Residential (SBI) | | 337,600 | 19,057,520 |

| Essex Property Trust, Inc. | | 40,972 | 8,870,848 |

| Invitation Homes, Inc. | | 283,900 | 8,128,057 |

| | | | 37,892,857 |

|

| TOTAL EQUITY REAL ESTATE INVESTMENT TRUSTS (REITS) | | | 52,269,786 |

|

| Household Durables - 13.5% | | | |

| Homebuilding - 13.5% | | | |

| Blu Investments LLC (b)(c) | | 11,990,913 | 3,717 |

| D.R. Horton, Inc. | | 149,956 | 10,702,360 |

| NVR, Inc. (a) | | 1,849 | 7,707,261 |

| PulteGroup, Inc. | | 144,785 | 6,455,963 |

| Skyline Champion Corp. (a) | | 70,113 | 2,001,025 |

| Taylor Morrison Home Corp. (a) | | 166,700 | 3,922,451 |

| Toll Brothers, Inc. | | 223,600 | 9,440,392 |

| TopBuild Corp. (a) | | 16,858 | 2,592,760 |

| | | | 42,825,929 |

| Paper & Forest Products - 0.7% | | | |

| Forest Products - 0.7% | | | |

| Louisiana-Pacific Corp. | | 66,541 | 2,191,861 |

| Real Estate Management & Development - 3.3% | | | |

| Diversified Real Estate Activities - 0.6% | | | |

| The RMR Group, Inc. | | 67,528 | 1,905,640 |

| Real Estate Development - 0.7% | | | |

| Howard Hughes Corp. (a) | | 37,700 | 2,228,447 |

| Real Estate Services - 2.0% | | | |

| CBRE Group, Inc. (a) | | 91,300 | 4,293,839 |

| Cushman & Wakefield PLC (a) | | 184,495 | 2,141,987 |

| | | | 6,435,826 |

|

| TOTAL REAL ESTATE MANAGEMENT & DEVELOPMENT | | | 10,569,913 |

|

| Specialty Retail - 34.1% | | | |

| Home Improvement Retail - 34.1% | | | |

| Lowe's Companies, Inc. | | 341,795 | 56,290,216 |

| The Home Depot, Inc. | | 183,190 | 52,216,478 |

| | | | 108,506,694 |

| Trading Companies & Distributors - 2.2% | | | |

| Trading Companies & Distributors - 2.2% | | | |

| Beacon Roofing Supply, Inc. (a) | | 86,803 | 2,941,754 |

| BMC Stock Holdings, Inc. (a) | | 99,700 | 3,980,024 |

| | | | 6,921,778 |

| TOTAL COMMON STOCKS | | | |

| (Cost $188,627,164) | | | 316,869,477 |

|

| Money Market Funds - 0.9% | | | |

| Fidelity Cash Central Fund 0.12% (d) | | | |

| (Cost $2,873,909) | | 2,873,334 | 2,873,909 |

| TOTAL INVESTMENT IN SECURITIES - 100.4% | | | |

| (Cost $191,501,073) | | | 319,743,386 |

| NET OTHER ASSETS (LIABILITIES) - (0.4)% | | | (1,197,914) |

| NET ASSETS - 100% | | | $318,545,472 |

Legend

(a) Non-income producing

(b) Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $3,717 or 0.0% of net assets.

(c) Level 3 security

(d) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost |

| Blu Investments LLC | 5/21/20 | $20,739 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $1,381 |

| Fidelity Securities Lending Cash Central Fund | 1,738 |

| Total | $3,119 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of August 31, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Common Stocks | $316,869,477 | $316,865,760 | $-- | $3,717 |

| Money Market Funds | 2,873,909 | 2,873,909 | -- | -- |

| Total Investments in Securities: | $319,743,386 | $319,739,669 | $-- | $3,717 |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 89.4% |

| Ireland | 9.9% |

| Others (Individually Less Than 1%) | 0.7% |

| | 100.0% |

See accompanying notes which are an integral part of the financial statements.

Construction and Housing Portfolio

Financial Statements

Statement of Assets and Liabilities

| | | August 31, 2020 (Unaudited) |

| Assets | | |

Investment in securities, at value — See accompanying schedule:

Unaffiliated issuers (cost $188,627,164) | $316,869,477 | |

| Fidelity Central Funds (cost $2,873,909) | 2,873,909 | |

| Total Investment in Securities (cost $191,501,073) | | $319,743,386 |

| Cash | | 139 |

| Receivable for investments sold | | 64,785 |

| Receivable for fund shares sold | | 781,856 |

| Dividends receivable | | 75,985 |

| Distributions receivable from Fidelity Central Funds | | 400 |

| Prepaid expenses | | 2,474 |

| Other receivables | | 17,806 |

| Total assets | | 320,686,831 |

| Liabilities | | |

| Payable for investments purchased | $1,267,119 | |

| Payable for fund shares redeemed | 666,465 | |

| Accrued management fee | 135,720 | |

| Other affiliated payables | 52,410 | |

| Other payables and accrued expenses | 19,645 | |

| Total liabilities | | 2,141,359 |

| Net Assets | | $318,545,472 |

| Net Assets consist of: | | |

| Paid in capital | | $202,837,766 |

| Total accumulated earnings (loss) | | 115,707,706 |

| Net Assets | | $318,545,472 |

| Net Asset Value, offering price and redemption price per share ($318,545,472 ÷ 4,731,682 shares) | | $67.32 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended August 31, 2020 (Unaudited) |

| Investment Income | | |

| Dividends | | $2,690,651 |

| Income from Fidelity Central Funds (including $1,738 from security lending) | | 3,119 |

| Total income | | 2,693,770 |

| Expenses | | |

| Management fee | $698,121 | |

| Transfer agent fees | 250,882 | |

| Accounting fees | 51,056 | |

| Custodian fees and expenses | 9,932 | |

| Independent trustees' fees and expenses | 907 | |

| Registration fees | 27,330 | |

| Audit | 17,391 | |

| Legal | 1,492 | |

| Interest | 1,551 | |

| Miscellaneous | 6,347 | |

| Total expenses before reductions | 1,065,009 | |

| Expense reductions | (46,673) | |

| Total expenses after reductions | | 1,018,336 |

| Net investment income (loss) | | 1,675,434 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | (12,318,415) | |

| Fidelity Central Funds | 119 | |

| Total net realized gain (loss) | | (12,318,296) |

| Change in net unrealized appreciation (depreciation) on investment securities | | 56,727,003 |

| Net gain (loss) | | 44,408,707 |

| Net increase (decrease) in net assets resulting from operations | | $46,084,141 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Six months ended August 31, 2020 (Unaudited) | Year ended February 29, 2020 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $1,675,434 | $2,713,972 |

| Net realized gain (loss) | (12,318,296) | 32,794,214 |

| Change in net unrealized appreciation (depreciation) | 56,727,003 | 3,334,280 |

| Net increase (decrease) in net assets resulting from operations | 46,084,141 | 38,842,466 |

| Distributions to shareholders | (13,100,539) | (24,490,216) |

| Share transactions | | |

| Proceeds from sales of shares | 57,177,433 | 299,727,079 |

| Reinvestment of distributions | 12,458,535 | 22,923,116 |

| Cost of shares redeemed | (102,979,469) | (243,352,371) |

| Net increase (decrease) in net assets resulting from share transactions | (33,343,501) | 79,297,824 |

| Total increase (decrease) in net assets | (359,899) | 93,650,074 |

| Net Assets | | |

| Beginning of period | 318,905,371 | 225,255,297 |

| End of period | $318,545,472 | $318,905,371 |

| Other Information | | |

| Shares | | |

| Sold | 976,030 | 4,813,223 |

| Issued in reinvestment of distributions | 270,192 | 383,278 |

| Redeemed | (1,960,078) | (3,905,073) |

| Net increase (decrease) | (713,856) | 1,291,428 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Construction and Housing Portfolio

| | Six months ended (Unaudited) August 31, | Years endedFebruary 28, | | | | |

| | 2020 | 2020 A | 2019 | 2018 | 2017 | 2016 A |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $58.56 | $54.22 | $59.88 | $61.70 | $53.16 | $59.74 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)B | .35 | .53 | .49 | .44 | .37 | .33 |

| Net realized and unrealized gain (loss) | 11.24 | 8.71 | 1.32 | 6.58 | 10.29 | (5.02) |

| Total from investment operations | 11.59 | 9.24 | 1.81 | 7.02 | 10.66 | (4.69) |

| Distributions from net investment income | – | (.60) | (.55) | (.30) | (.45) | (.23) |

| Distributions from net realized gain | (2.83) | (4.31) | (6.92) | (8.53) | (1.67) | (1.66) |

| Total distributions | (2.83) | (4.90)C | (7.47) | (8.84)D | (2.12) | (1.89) |

| Redemption fees added to paid in capitalB | – | – | – | –E | –E | –E |

| Net asset value, end of period | $67.32 | $58.56 | $54.22 | $59.88 | $61.70 | $53.16 |

| Total ReturnF,G | 22.02% | 17.10% | 4.03% | 11.07% | 20.23% | (8.11)% |

| Ratios to Average Net AssetsH,I | | | | | | |

| Expenses before reductions | .81%J | .79% | .80% | .80% | .80% | .81% |

| Expenses net of fee waivers, if any | .81%J | .79% | .80% | .80% | .80% | .80% |

| Expenses net of all reductions | .77%J | .79% | .79% | .79% | .79% | .80% |

| Net investment income (loss) | 1.27%J | .88% | .86% | .69% | .62% | .57% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $318,545 | $318,905 | $225,255 | $331,418 | $404,526 | $449,303 |

| Portfolio turnover rateK | 121%J | 161% | 90% | 56% | 87% | 80% |

A For the year ended February 29.

B Calculated based on average shares outstanding during the period.

C Total distributions of $4.90 per share is comprised of distributions from net investment income of $.598 and distributions from net realized gain of $4.306 per share.

D Total distributions of $8.84 per share is comprised of distributions from net investment income of $.303 and distributions from net realized gain of $8.534 per share.

E Amount represents less than $.005 per share.

F Total returns for periods of less than one year are not annualized.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

J Annualized

K Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Consumer Discretionary Portfolio

Investment Summary (Unaudited)

Top Ten Stocks as of August 31, 2020

| | % of fund's net assets |

| Amazon.com, Inc. | 25.5 |

| The Home Depot, Inc. | 9.0 |

| Lowe's Companies, Inc. | 5.2 |

| NIKE, Inc. Class B | 4.1 |

| Starbucks Corp. | 3.8 |

| McDonald's Corp. | 3.8 |

| Dollar General Corp. | 2.9 |

| Burlington Stores, Inc. | 2.9 |

| TJX Companies, Inc. | 2.8 |

| Dollar Tree, Inc. | 2.4 |

| | 62.4 |

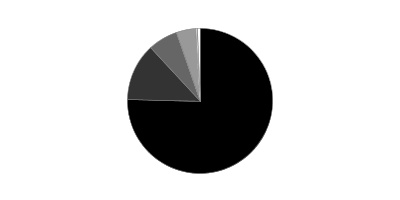

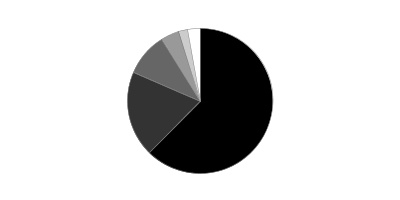

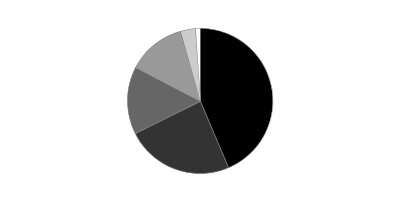

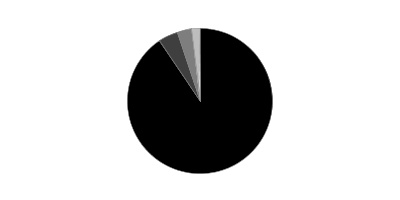

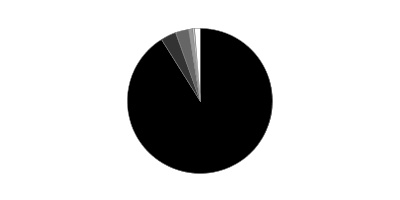

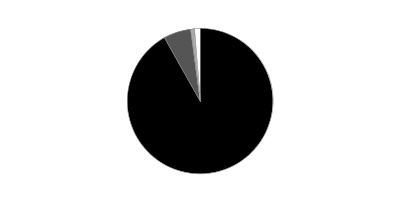

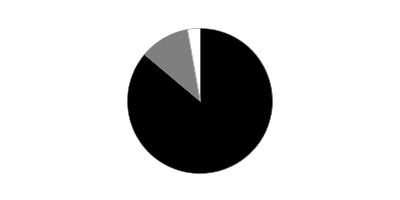

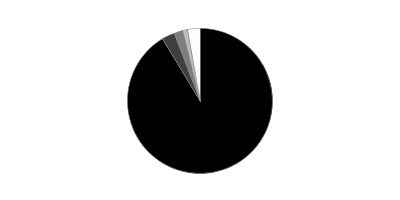

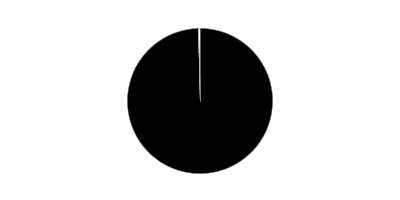

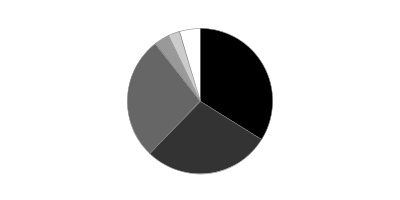

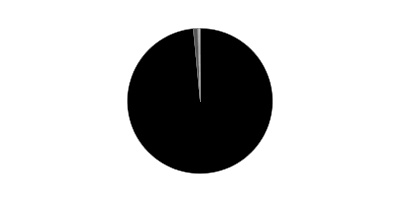

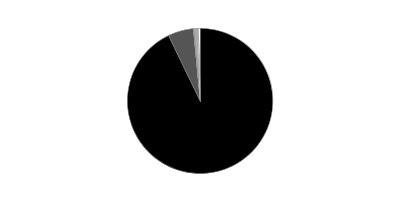

Top Industries (% of fund's net assets)

| As of August 31, 2020 |

| | Internet & Direct Marketing Retail | 30.4% |

| | Specialty Retail | 27.0% |

| | Hotels, Restaurants & Leisure | 17.4% |

| | Textiles, Apparel & Luxury Goods | 9.6% |

| | Multiline Retail | 7.1% |

| | All Others* | 8.5% |

* Includes short-term investments and net other assets (liabilities).

Consumer Discretionary Portfolio

Schedule of Investments August 31, 2020 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 100.6% | | | |

| | | Shares | Value |

| Automobiles - 0.7% | | | |

| Automobile Manufacturers - 0.7% | | | |

| Ferrari NV | | 10,097 | $1,966,391 |

| Tesla, Inc. (a) | | 3,000 | 1,494,960 |

| | | | 3,461,351 |

| Commercial Services & Supplies - 0.3% | | | |

| Diversified Support Services - 0.3% | | | |

| Copart, Inc. (a) | | 13,858 | 1,431,809 |

| Diversified Consumer Services - 1.4% | | | |

| Education Services - 1.4% | | | |

| Bright Horizons Family Solutions, Inc. (a) | | 10,200 | 1,356,702 |

| Grand Canyon Education, Inc. (a) | | 38,723 | 3,641,511 |

| New Oriental Education & Technology Group, Inc. sponsored ADR (a) | | 10,790 | 1,582,138 |

| | | | 6,580,351 |

| Food & Staples Retailing - 1.6% | | | |

| Food Distributors - 0.8% | | | |

| Performance Food Group Co. (a) | | 102,092 | 3,727,379 |

| Food Retail - 0.2% | | | |

| Kroger Co. | | 27,800 | 991,904 |

| Hypermarkets & Super Centers - 0.6% | | | |

| BJ's Wholesale Club Holdings, Inc. (a) | | 61,932 | 2,750,400 |

|

| TOTAL FOOD & STAPLES RETAILING | | | 7,469,683 |

|

| Food Products - 0.2% | | | |

| Packaged Foods & Meats - 0.2% | | | |

| JDE Peet's BV | | 19,300 | 850,098 |

| Hotels, Restaurants & Leisure - 17.4% | | | |

| Casinos & Gaming - 2.3% | | | |

| Caesars Entertainment, Inc. (a) | | 99,007 | 4,534,521 |

| Churchill Downs, Inc. | | 30,046 | 5,250,839 |

| Penn National Gaming, Inc. (a) | | 26,619 | 1,360,231 |

| | | | 11,145,591 |

| Hotels, Resorts & Cruise Lines - 2.3% | | | |

| Extended Stay America, Inc. unit | | 180,500 | 2,254,445 |

| Hilton Worldwide Holdings, Inc. | | 61,700 | 5,575,212 |

| Marriott Vacations Worldwide Corp. | | 33,378 | 3,159,895 |

| | | | 10,989,552 |

| Leisure Facilities - 1.8% | | | |

| Drive Shack, Inc. (a) | | 175,900 | 244,501 |

| Planet Fitness, Inc. (a) | | 63,096 | 3,835,606 |

| Vail Resorts, Inc. | | 19,712 | 4,290,711 |

| | | | 8,370,818 |

| Restaurants - 11.0% | | | |

| ARAMARK Holdings Corp. | | 99,768 | 2,749,606 |

| Chipotle Mexican Grill, Inc. (a) | | 7,072 | 9,266,300 |

| Darden Restaurants, Inc. | | 7,500 | 650,025 |

| McDonald's Corp. | | 84,416 | 18,024,504 |

| Noodles & Co. (a) | | 87,700 | 667,397 |

| Restaurant Brands International, Inc. | | 18,800 | 1,018,589 |

| Starbucks Corp. | | 217,387 | 18,362,680 |

| Wendy's Co. | | 100,300 | 2,100,282 |

| | | | 52,839,383 |

|

| TOTAL HOTELS, RESTAURANTS & LEISURE | | | 83,345,344 |

|

| Household Durables - 3.7% | | | |

| Homebuilding - 3.7% | | | |

| D.R. Horton, Inc. | | 107,281 | 7,656,645 |

| Lennar Corp. Class A | | 59,793 | 4,473,712 |

| NVR, Inc. (a) | | 1,367 | 5,698,121 |

| | | | 17,828,478 |

| Interactive Media & Services - 0.5% | | | |

| Interactive Media & Services - 0.5% | | | |

| Alphabet, Inc. Class A (a) | | 1,344 | 2,190,088 |

| Internet & Direct Marketing Retail - 30.4% | | | |

| Internet & Direct Marketing Retail - 30.4% | | | |

| Amazon.com, Inc. (a) | | 35,385 | 122,112,218 |

| Delivery Hero AG (a)(b) | | 3,900 | 418,959 |

| Expedia, Inc. | | 56,100 | 5,506,215 |

| MercadoLibre, Inc. (a) | | 2,300 | 2,687,757 |

| Ocado Group PLC (a) | | 35,500 | 1,184,942 |

| The Booking Holdings, Inc. (a) | | 5,731 | 10,948,789 |

| The RealReal, Inc. (a)(c) | | 77,800 | 1,249,468 |

| Wayfair LLC Class A (a) | | 4,412 | 1,308,423 |

| | | | 145,416,771 |

| IT Services - 0.6% | | | |

| Data Processing & Outsourced Services - 0.6% | | | |

| PayPal Holdings, Inc. (a) | | 9,937 | 2,028,539 |

| Visa, Inc. Class A | | 4,300 | 911,557 |

| | | | 2,940,096 |

| Multiline Retail - 7.1% | | | |

| General Merchandise Stores - 7.1% | | | |

| B&M European Value Retail SA | | 230,386 | 1,465,930 |

| Dollar General Corp. | | 70,142 | 14,160,267 |

| Dollar Tree, Inc. (a) | | 118,031 | 11,362,844 |

| Ollie's Bargain Outlet Holdings, Inc. (a) | | 48,302 | 4,614,773 |

| Target Corp. | | 16,200 | 2,449,602 |

| | | | 34,053,416 |

| Road & Rail - 0.1% | | | |

| Trucking - 0.1% | | | |

| Lyft, Inc. (a) | | 22,800 | 676,476 |

| Specialty Retail - 27.0% | | | |

| Apparel Retail - 7.3% | | | |

| Burlington Stores, Inc. (a) | | 70,300 | 13,844,179 |

| Ross Stores, Inc. | | 83,827 | 7,634,963 |

| TJX Companies, Inc. | | 244,113 | 13,374,951 |

| | | | 34,854,093 |

| Automotive Retail - 2.3% | | | |

| AutoZone, Inc. (a) | | 3,693 | 4,417,973 |

| O'Reilly Automotive, Inc. (a) | | 13,884 | 6,464,807 |

| | | | 10,882,780 |

| Computer & Electronics Retail - 1.0% | | | |

| Best Buy Co., Inc. | | 43,743 | 4,851,536 |

| Home Improvement Retail - 14.9% | | | |

| Floor & Decor Holdings, Inc. Class A (a) | | 45,106 | 3,303,563 |

| Lowe's Companies, Inc. | | 151,834 | 25,005,541 |

| The Home Depot, Inc. | | 151,917 | 43,302,422 |

| | | | 71,611,526 |

| Specialty Stores - 1.5% | | | |

| Dick's Sporting Goods, Inc. | | 36,300 | 1,964,556 |

| Five Below, Inc. (a) | | 31,379 | 3,434,432 |

| National Vision Holdings, Inc. (a) | | 30,753 | 1,155,390 |

| Sally Beauty Holdings, Inc. (a) | | 52,800 | 589,248 |

| | | | 7,143,626 |

|

| TOTAL SPECIALTY RETAIL | | | 129,343,561 |

|

| Textiles, Apparel & Luxury Goods - 9.6% | | | |

| Apparel, Accessories & Luxury Goods - 4.6% | | | |

| adidas AG | | 8,205 | 2,492,900 |

| Canada Goose Holdings, Inc. (a)(c) | | 20,434 | 501,157 |

| Capri Holdings Ltd. (a) | | 117,621 | 1,863,117 |

| G-III Apparel Group Ltd. (a) | | 20,097 | 222,273 |

| Hermes International SCA | | 984 | 844,760 |

| lululemon athletica, Inc. (a) | | 8,330 | 3,129,331 |

| LVMH Moet Hennessy Louis Vuitton SE | | 6,484 | 3,045,033 |

| PVH Corp. | | 82,606 | 4,606,111 |

| Tapestry, Inc. | | 191,682 | 2,823,476 |

| VF Corp. | | 37,266 | 2,450,240 |

| | | | 21,978,398 |

| Footwear - 5.0% | | | |

| Deckers Outdoor Corp. (a) | | 18,700 | 3,812,369 |

| NIKE, Inc. Class B | | 176,130 | 19,707,186 |