QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

Empire District Electric Company |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

THE EMPIRE DISTRICT ELECTRIC COMPANY

602 Joplin Street

Joplin, Missouri 64801

March 19, 2002

Dear Stockholder:

You are cordially invited to attend our Annual Meeting of Stockholders to be held at 10:30 a.m., Joplin time, on Thursday, April 25, 2002 at the Holiday Inn, 3615 South Range Line, Joplin, Missouri.

At the meeting, stockholders will be asked to elect three persons to our Board of Directors for three-year terms.

Your participation in this meeting, either in person or by proxy, is important. Even if you plan to attend the meeting, please promptly vote your proxy through the Internet, by telephone or by mail. At the meeting, if you desire to vote in person, you may withdraw your proxy.

| | | Sincerely, |

|

|

M.W. McKinney

President and Chief Executive Officer |

THE EMPIRE DISTRICT ELECTRIC COMPANY

602 Joplin Street

Joplin, Missouri 64801

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Holders of Common Stock:

Notice is hereby given that the Annual Meeting of Stockholders of The Empire District Electric Company will be held on Thursday the 25th of April, 2002, at 10:30 a.m., Joplin time, at the Holiday Inn, 3615 South Range Line, Joplin, Missouri, for the following purposes:

- 1.

- To elect three Directors for terms of three years.

- 2.

- To transact such other business as may properly come before the meeting or at any adjournment or adjournments thereof.

Any of the foregoing may be considered or acted upon at the first session of the meeting or at any adjournment or adjournments thereof.

Holders of Common Stock of record on the books of Empire at the close of business on March 1, 2002 will be entitled to vote on all matters, which may come before the meeting or any adjournment or adjournments thereof. A complete list of the stockholders entitled to vote at the meeting will be open at our office located at 602 Joplin Street, Joplin, Missouri, to examination by any stockholder for any purpose germane to the meeting, for a period of ten days prior to the meeting, and also at the meeting.

STOCKHOLDERS WHO DO NOT EXPECT TO ATTEND IN PERSON ARE REQUESTED, REGARDLESS OF THE NUMBER OF SHARES OF STOCK OWNED, TO EITHER VOTE THEIR PROXY THROUGH THE INTERNET OR BY TELEPHONE OR SIGN AND DATE THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE, TO WHICH NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES.

Joplin, Missouri

Dated: March 19, 2002

| | | J.S. Watson

Secretary-Treasurer |

THE EMPIRE DISTRICT ELECTRIC COMPANY

602 Joplin Street

Joplin, Missouri 64801

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

APRIL 25, 2002

This proxy statement is furnished in connection with the solicitation on behalf of the Board of Directors of The Empire District Electric Company, a Kansas corporation, of proxies to be voted at our Annual Meeting of Stockholders to be held on Thursday, April 25, 2002, and at any and all adjournments of the meeting.

A form of proxy is enclosed for execution by stockholders. The proxy reflects the number of shares registered in a stockholder's name directly. Any stockholder giving a proxy has the right to revoke it at any time before the proxy is exercised by written notice to the Secretary-Treasurer of Empire, or a duly executed proxy bearing a later date or voting in person at the meeting.

A copy of our Annual Report for the year ended December 31, 2001, has been mailed to each stockholder of record on the record date for the meeting. You are urged to read the entire Annual Report.

The entire cost of the solicitation of proxies will be borne by us. Solicitation, commencing on or about March 19, 2002, will be made by use of the mails, telephone and telegraph and by our regular employees without additional compensation therefore. We will request brokers or other persons holding stock in their names, or in the names of their nominees, to forward proxy material to the beneficial owners of stock or request authority for the execution of the proxies and will reimburse those brokers or other persons for their expense in so doing.

March 1, 2002 has been fixed as the record date for the determination of stockholders entitled to vote at the meeting and at any adjournment or adjournments thereof. The stock transfer books will not be closed. As of the record date, there were 19,721,085 shares of common stock outstanding. Holders of common stock will be entitled to one vote per share on all matters presented to the meeting.

1. ELECTION OF DIRECTORS

The Board of Directors is divided into three classes with the directors in each class serving for a term of three years. The term of office of one class of directors expires each year in rotation so that one class is elected at each Annual Meeting for a full three-year term. During 2001, the Board of Directors held 5 meetings, and with the exception of Mr. J. R. Herschend and Mr. R. E. Mayes, all of the members of the Board of Directors attended more than 75% of the aggregate of the Board meetings and meetings held by all committees of the Board on which the Director served during the periods that the Director served. Unless otherwise specified, the persons named in the accompanying proxy intend to vote the shares represented by proxies for the election of Mr. M. F. Chubb, Jr. and Mr. R. L. Lamb, who are members of the current Board of Directors, and Mr. W. L. Gipson as Class III Directors. Directors will be elected by a plurality of the votes of the stockholders present in person or represented by proxy at the meeting. Any shares not voted (whether by abstention, broker non-vote or votes withheld) are not counted as votes cast for those individuals and will be excluded from the vote.

While it is not expected that any of the nominees will be unable to qualify for or accept office, if for any reason one or more shall be unable to do so, proxies will be voted for nominees selected by the Board of Directors.

1

The name, age, principal occupation for the last five years, period of service as a Director of Empire and certain other directorships of each Director are set forth below.

CLASS I DIRECTORS

(Terms expire in 2003)

R.D. Hammons, 68, Chief Executive Officer, Chairman and Director of Hammons Products Company (food processing) until 1999 (retired). Director of Empire since 1983.

J.R. Herschend, 69, Co-Owner, Co-Founder and Chairmanemeritus of the Board of Directors of Silver Dollar City, Inc. (entertainment attractions). Director of Empire since January 1994. Director of Ozark Mountain Bank, Branson, Missouri; Director of Central Bancompany, Jefferson City, Missouri.

M.W. McKinney, 57, President and Chief Executive Officer of Empire since April 1, 1997. Mr. McKinney will retire as our President and Chief Executive Officer on April 30, 2002 and become Chairman of the Board effective May 1, 2002. Executive Vice President-Commercial Operations of Empire from 1995 to 1997. Executive Vice President of Empire from 1994 to 1995. Vice President-Customer Services of Empire from 1982 to 1994. Director of Empire since 1991.

M.M. Posner, 62, President and Principal of Posner McCleary Inc. (international advertising, marketing and financial relations firm). Director of Empire since 1991. Director of United Missouri Bank of Jefferson City, Jefferson City, Missouri. Director of United Missouri Bank of Columbia, Columbia, Missouri.

CLASS II DIRECTORS

(Terms expire in 2004)

R.C. Hartley, 54, Co-Founder and Director of National Information Consortium (electronic commerce). Director of Empire since 1988.

F.E. Jeffries, 71, Chairman and Director of Phoenix Duff & Phelps Corporation (financial services firm) until 1997 (retired). Director of Empire since 1984. Director of Duff & Phelps Utilities Income Inc., Chicago, Illinois; Duff & Phelps Utilities Tax-Free Income Inc., Chicago, Illinois; Duff & Phelps Utility and Corporate Bond Trust Inc., Chicago, Illinois.

J.S. Leon, 64, President of Missouri Southern State College since 1982. Director of Empire since 2001.

CLASS III DIRECTORS

(Terms expire in 2002, nominees for election

at the Annual Meeting of Stockholders for

terms to expire in 2005)

M.F. Chubb, Jr., 68, Senior Vice President of Eagle-Picher Industries Inc. (diversified industrial products) until 1996 (retired). Director of Empire since 1991. Director of Eagle-Picher Industries Inc., Cincinnati, Ohio until 1996 (retired).

R.L. Lamb, 69, President of Empire from 1982 to March 31, 1997 (retired). Executive Vice President of Empire from 1978 to 1982. Vice President-Customer Services of Empire from 1974 to 1978. Director of Empire since 1978.

W.L. Gipson, 45, Executive Vice President since February 1, 2001, Chief Operating Officer since October 25, 2001, Vice President-Commercial Operations from 1997 to 2001. Mr. Gipson will become President and Chief Executive Officer effective May 1, 2002. Nominated for election at the April 25, 2002 Annual Meeting of Shareholders.

2

Director Compensation

Each Director who is not an officer or full-time employee is paid a monthly retainer for his or her services as a Director at a rate of $15,000 per annum. In addition, a fee of $1,000 is paid to each Director for each day the Directors meet and for each meeting of a Committee of the Board (the chairman of each Committee receives an additional $250 for each Committee meeting) that the Director attends in person or by telephone. During 2001, the Board of Directors held six days of meetings. Our 1996 Stock Incentive Plan permits our Directors to receive shares of Common Stock in lieu of all or a portion of any cash payment for services rendered as a Director. In addition, a Director may defer all or part of any compensation payable for his or her services under the terms of our Deferred Compensation Plan for Directors. Amounts so deferred are credited to an account for the benefit of the Director and accrue an interest equivalent at a rate equal to the prime rate. A Director is entitled to receive all amounts deferred in a number of annual installments following retirement, as elected by him or her.

We maintain a Stock Unit Plan for Directors, which we refer to as the Directors Retirement Plan, to provide Directors the opportunity to accumulate retirement benefits in the form of common stock units in lieu of cash. The Directors Retirement Plan also provides Directors the opportunity to convert previously earned cash retirement benefits to common stock units. Each common stock unit earns dividends in the form of common stock units and can be redeemed for one share of common stock upon retirement or death of the Director. The number of units granted annually is computed by dividing the Director's retainer fee by the fair market value of our common stock on January 1 of the year the units are granted. Common stock unit dividends are computed based on the fair market value of our common stock on the dividend's record date. During 2001, 3,559 units were granted for services provided in 2001, and 3,404 units were granted pursuant to the provisions of the plan providing for the reinvestment of dividends on stock units in additional stock units.

Committees of the Board of Directors

Audit Committee

In accordance with its written charter the Audit Committee reviews, with our independent auditors, the scope and results of Empire's auditing procedures, meets with our internal auditors regarding internal auditing procedures and establishes procedures to assure the adequacy of our accounting practices and internal controls. The Audit Committee held three meetings during 2001. The members of the Audit Committee are Mrs. Posner and Messrs. Chubb, Hartley, Jeffries and Leon, each of whom is independent (as independence is defined in the New York Stock Exchange's listing standards). The report of the Audit Committee can be found below under the heading "Audit Committee Report."

Compensation Committee

We have a Compensation Committee of the Board of Directors. The Compensation Committee fixes the compensation of each of our senior officers and administers certain of our employee benefit plans. The Committee held three meetings during 2001. The members of the Compensation Committee are Mrs. Posner and Messrs. Herschend, Jeffries, Lamb and Mayes. The report of the Compensation Committee can be found below under the heading "Compensation Committee Report on Executive Compensation."

Nominating Committee

We have a Nominating Committee of the Board of Directors which meets to suggest to the Board nominees to fill vacancies on the Board when they occur. The Committee held three meetings in 2001. The members of the Nominating Committee are Messrs. Chubb, Hammons, Herschend and Mayes. The Nominating Committee will consider nominees recommended by stockholders for election to the Board of Directors. Recommendations of nominees for election should be submitted in writing to Empire's Secretary-Treasurer, in accordance with our charter and the rules under the Securities Exchange Act of 1934 relating to the solicitation of proxies. Any such recommendation should be accompanied by a written statement from the candidate of his or her consent to be considered as a candidate and, if nominated and elected, to serve as Director.

3

Stock Ownership of Directors and Officers

The following table shows information with respect to the number of shares of our common stock beneficially owned as of March 1, 2002 by each of our officers named in the Summary Compensation Table, each Director and our Directors and executive officers as a group. The shares reported as beneficially owned include (a) shares owned by certain relatives with whom the Directors or officers are presumed, for proxy statement reporting purposes, to share voting or investment power and (b) shares accrued for the benefit of certain officers under certain of our employee benefit plans.

Name

| | Position

| | Shares of Common

Stock Beneficially

Owned

|

|---|

| M.W. McKinney (1) | | President and Chief Executive Officer | | 27,925 |

| W.L. Gipson (2) | | Executive Vice President and Chief Operating Officer | | 14,133 |

| D.W. Gibson (3) | | Vice President-Finance and Chief Financial Officer | | 4,061 |

| M.E. Palmer | | Vice President-Commercial Operations | | 1,173 |

| C.A. Stark(4) | | Vice President-General Services | | 6,138 |

| M.F. Chubb, Jr. | | Director | | 7,591 |

| R.D. Hammons | | Director | | 3,466 |

| R.C. Hartley | | Director | | 13,052 |

| J.R. Herschend | | Director | | 1,500 |

| F.E. Jeffries | | Director | | 25,224 |

| R.L. Lamb | | Director | | 18,776 |

| J.S. Leon | | Director | | 1,532 |

| R.E. Mayes(5) | | Director | | 800 |

| M.M. Posner | | Director | | 9,600 |

| Directors and executive officers, as a group | | 134,971 |

- (1)

- Mr. McKinney will retire as our President and Chief Executive Officer on April 30, 2002 and become Chairman of the Board effective May 1, 2002

- (2)

- Mr. Gipson will become President and Chief Executive Officer effective May 1, 2002 and is standing for election as a Class III Director to replace Mr. Mayes on the Board.

- (3)

- Mr. Gibson became Vice President—Regulatory Services effective March 15, 2002.

- (4)

- Mr. Stark will retire effective June 30, 2002.

- (5)

- Mr. Mayes will retire as a Director effective April 25, 2002.

No Director or officer owns more than 0.5% of the outstanding shares of our common stock and the Directors and executive officers as a group own less than 1% of the outstanding shares of our common stock.

Other Stock Ownership The following table reflects the holdings of the only person known to the Company to own beneficially more than 5% of Common Stock of the Company.

Name and Address of Beneficial Owner

| | Amount and Nature of

Beneficial Ownership

| | Percent of Class on

March 1, 2002

| |

|---|

AXA Financial, Inc.

1290 Avenue of the Americas

New York, NY 10104 | | 1,050,202(1 | ) | 5.4 | % |

- (1)

- Based on a Schedule 13G dated February 11, 2002, filed jointly, pursuant to Rule 13d-1 (f) (1) of the Securities Exchange Act of 1934, with the Securities and Exchange Commission on behalf of AXA Financial, Inc.; four French mutual insurance companies, AXA Assurances I.A.R.D. Mutuelle, AXA Assurance Vie Mutuelle, AXA Conseil Vie Assurance Mutuelle and AXA Courtage Assurance Mutuelle, as a group; AXA: and their subsidiaries. According to this filing, a majority of the shares reported in the Schedule 13G are held by unaffiliated third-party client accounts managed by Alliance Capital Management L.P. (a majority-owned subsidiary of AXA Financial, Inc.), as investment adviser.

4

2. EXECUTIVE COMPENSATION

Set forth below is information concerning the various forms of compensation of each person who was (i) at any time during 2001 our Chief Executive Officer or (ii) at December 31, 2001, one of our four most highly compensated executive officers, other than the Chief Executive Officer.

SUMMARY COMPENSATION TABLE

| |

| | Annual Compensation

| | Long-Term

Compen-

sation

Awards

| |

|

|---|

Name and

Principal Position

| | Year

| | Salary

| | Bonus

| | Other Annual

Compensation

| | Restricted

Stock

Awards(1)

| | All Other

Compen-

sation(2)

|

|---|

M.W. McKinney(3)

President and Chief

Executive Officer | | 2001

2000

1999 | | $

| 255,000

227,875

206,750 | | $

| 70,161

73,964

70,544 | | $

| 296

1,939

1,447 | | $

| 20,155

23,935

20,537 | | $

| 5,710

5,463

5,671 |

W.L. Gipson(4)

Executive Vice President

and Chief Operating

Officer |

|

2001

2000

1999 |

|

|

172,039

123,650

112,200 |

|

|

23,198

18,267

12,405 |

|

|

401

1,350

105 |

|

|

8,174

8,253

6,386 |

|

|

4,957

3,526

3,352 |

C.A. Stark(5)

Vice President—

General Services |

|

2001

2000

1999 |

|

|

127,500

112,500

104,000 |

|

|

12,446

15,557

12,387 |

|

|

1,967

—

1,132 |

|

|

6,406

7,529

6,364 |

|

|

5,107

4,642

4,600 |

M.E. Palmer

Vice President —

Commercial Operations |

|

2001

2000

1999 |

|

|

106,739

85,760

78,019 |

|

|

10,411

4,000

2,964 |

|

|

—

—

— |

|

|

5,408

—

— |

|

|

3,385

2,807

2,515 |

D.W. Gibson(6)

Vice President — Finance

and Chief Financial

Officer |

|

2001

2000

1999 |

|

|

105,673

91,190

84,000 |

|

|

11,139

5,000

3,500 |

|

|

—

—

— |

|

|

5,138

—

— |

|

|

4,109

3,179

3,223 |

- (1)

- As of December 31, 2001, Messrs. McKinney, Gipson and Stark had been awarded 2,643, 857 and 799 shares, respectively, of unvested restricted stock which on such date had values of $55,503, $17,997 and $16,779 respectively. Messrs. McKinney, Gipson, Stark, Palmer and Gibson were awarded 969, 393, 308, 260 and 247 shares, respectively, of unvested restricted stock on January 31, 2002, with respect to their 2001 employment. Dividend equivalents are paid on such shares. All of the foregoing shares were awarded pursuant to our 1996 Stock Incentive Plan.

- (2)

- Included for 2001: (a) our matching contributions under our 401(k) Retirement Plan in the amounts of $3,985, $4,666, $3,704, $2,987 and $2,974 for Messrs. McKinney, Gipson, Stark, Palmer and Gibson, respectively, and (b) our payments of premiums for term life insurance on behalf of Messrs. McKinney, Gipson, Stark, Palmer and Gibson in the amounts of $1,724, $291, $1,403, $397, and $1,135, respectively.

- (3)

- Mr. McKinney will retire as our President and Chief Executive Officer on April 30, 2002 and become Chairman of the Board of Directors effective May 1, 2002.

- (4)

- Mr. Gipson will become President and Chief Executive Officer effective May 1, 2002 and is standing for election as a Class III Director.

- (5)

- Mr. Stark will retire effective June 30, 2002.

- (6)

- Mr. Gibson became Vice President-Regulatory Services effective March 15, 2002.

5

Retirement Plans

We maintain a Retirement Plan covering substantially all of our employees. The Retirement Plan is a noncontributory, trusteed pension plan designed to meet the requirements of Section 401(a) of the Internal Revenue Code. Each covered employee is eligible for retirement at normal retirement date (age 65), with early retirement permitted under certain conditions. We also maintain a Supplemental Executive Retirement Plan which covers our officers who are participants in the Retirement Plan. This Plan is intended to provide benefits which, except for the application of the limits of Section 415 and Section 401(a)(17) of the Internal Revenue Code, would have been payable under the Retirement Plan. This Plan is not qualified under the Internal Revenue Code and benefits payable under the plan are paid out of our general funds.

The following table shows estimated maximum annual benefits payable following retirement (assuming payments on a normal life annuity basis and not including any survivor benefit) to an employee in specified remuneration and Years of Credited Service classifications. These amounts are based on an assumed final rate of compensation and retirement at normal retirement age of 65 and are approximated without consideration of any reduction which would result from various options which may be elected prior to actual retirement.

PENSION PLAN TABLE

| | Years of Credited Service(b)

|

|---|

Average Annual

Earnings(a)

| | 15 Years

| | 20 Years

| | 25 Years

| | 30 Years

| | 35 Years

| | 40 Years

|

|---|

| 75,000 | | 16,088 | | 21,450 | | 26,813 | | 32,175 | | 37,538 | | 43,632 |

| 100,000 | | 22,182 | | 29,575 | | 36,969 | | 44,363 | | 51,757 | | 59,882 |

| 125,000 | | 28,276 | | 37,700 | | 47,126 | | 56,550 | | 65,976 | | 76,132 |

| 150,000 | | 34,369 | | 45,825 | | 57,282 | | 68,738 | | 80,194 | | 92,382 |

| 175,000 | | 40,463 | | 53,950 | | 67,438 | | 80,925 | | 94,413 | | 108,632 |

| 200,000 | | 46,557 | | 62,075 | | 77,594 | | 93,113 | | 108,632 | | 124,882 |

| 225,000 | | 52,651 | | 70,200 | | 87,751 | | 105,300 | | 122,851 | | 141,132 |

| 250,000 | | 58,744 | | 78,325 | | 97,907 | | 117,488 | | 137,069 | | 157,382 |

| 275,000 | | 64,838 | | 86,450 | | 108,063 | | 129,675 | | 151,288 | | 160,000 |

| 300,000 | | 70,932 | | 110,825 | | 138,532 | | 160,000 | | 160,000 | | 160,000 |

- (a)

- "Average Annual Earnings" is the average annual compensation over the five consecutive years within the ten-year period prior to termination of employment which produces the highest average. The compensation used to calculate this average for a salaried employee is the aggregate of the employee's annual compensation which generally corresponds with the employee's salary and incentive compensation. The earnings of Messrs. McKinney, Gipson, Stark, Palmer and Gibson covered by the Plans correspond substantially to such amounts shown for them in the Summary Compensation Table.

- (b)

- As of December 31, 2001, Messrs. McKinney, Gipson, Stark, Palmer and Gibson had accrued 34, 20, 21, 15 and 22 Years of Credited Service, respectively, under the Retirement Plan and the Supplemental Executive Retirement Plan.

Severance Pay Plan

We have a Change of Control Severance Pay Plan, referred to as the Severance Plan, which provides certain key employees with severance benefits following a change in control of Empire. A change in control generally includes: (i) specified events relating to the continued existence of Empire in its current form; (ii) an acquisition by any person of 10% or more of the securities entitled to vote in the election of Directors or (iii) the current Directors, or their approved successors, no longer constitute a majority of the Board of Directors. A change of control was deemed to occur on September 3, 1999 when our stockholders voted in favor of the proposed merger with UtiliCorp United Inc. Some of our executive officers and senior managers were selected by the Compensation Committee of the Board of Directors to enter into one-year agreements pursuant to the Severance Plan which are automatically extended for one-year terms unless we have given prior notice of termination.

6

A participant in the Severance Plan is entitled to receive specified benefits in the event of certain involuntary terminations of employment (including terminations by the employee following specified changes in duties, benefits, etc., that are treated as involuntary terminations) occurring within three years after a change in control, or a voluntary termination of employment occurring during a period of twelve to eighteen months after a change in control. The Compensation Committee extended this period until December 31, 2002, for M.W. McKinney and C.A. Stark in order to facilitate an orderly transition in senior management. A senior officer participant would be entitled to receive benefits of three times such participant's annual compensation. A participant who is not a senior officer would receive approximately two weeks of severance compensation for each full year of employment with us, with a minimum of 17 weeks. Payments to participants resulting from involuntary terminations are to be paid in a lump sum within 30 days following termination, while payments resulting from voluntary termination are paid in monthly installments and cease if the participant becomes otherwise employed. In addition, all restricted stock held by a participant vests upon voluntary or involuntary termination after a change of control (which occurred as noted above, on September 3, 1999). Also, participants who qualify for payments under the Severance Plan will continue to receive benefits for a specified period of time under health, insurance and our other employee benefit plans in existence at the time of the change in control. If any payments are subject to the excise tax on "excess parachute payments" under Section 4999 of the Code, senior officer participants are also entitled to an additional amount essentially designed to put them in the same after-tax position as if this excise tax had not been imposed.

As stated above, stockholder approval of the proposed merger effected a change in control under the Severance Plan. Certain key employees became eligible to receive compensation as specified under the terms of the Severance Plan as a result of the change of control. As of December 31, 2001, we had incurred approximately $1,430,000 of obligations under the Severance Plan to individuals electing voluntary termination or involuntarily terminated. Since that date, we have incurred additional obligations under the Severance Plan to Mr. McKinney (who will retire on April 30, 2002) and Mr. Stark (who will retire on June 30, 2002) aggregating approximately $1,524,000 payable monthly over three year periods.

Compensation Committee Report on Executive Compensation

Our executive compensation policies are designed to enable us to attract and retain high caliber individuals for key positions while at the same time linking their compensation to our financial performance and their own performance. The linkage between compensation and performance is accomplished by dividing executive compensation into two components: a base salary that is set at the beginning of the year and incentive compensation that is determined at the end of the year based on the extent to which specific, predetermined goals were achieved. Depending on the extent to which these goals are met, our senior executives can earn total compensation which is above, at, or below the level of senior executive compensation at comparable electric utilities.

At the beginning of each year, the Committee determines a target total compensation amount for each senior executive, including the President and Chief Executive Officer. To determine this amount for the President and Chief Executive Officer, the Committee first takes the mid-point of the range of total compensation paid to executives in positions comparable to that of the Company's President and Chief Executive Officer at other utilities of similar size. The Committee then determines a corresponding amount for each other senior officer based on a comparison of the officer's responsibilities with those of the President and Chief Executive Officer. The resulting amount is adjusted for each senior officer to reflect the officer's experience and performance. In determining the appropriate mid-point amounts in 2001, the Committee relied primarily upon an industry compensation study prepared by a management consulting firm and, in addition, took into account increases in compensation for businesses generally in 2001 predicted by various consulting firms and recent compensation increases received by our employees. A greater number of companies were included in the management consulting firm's study than are included in the Standard & Poor's Electric Companies Index used in the Performance Chart. The companies included in that study are, for the most part, either electric or electric and gas utilities.

7

Our total compensation package for senior executives, including the President and Chief Executive Officer, has an incentive compensation component. Executives can earn incentive compensation based on the extent to which Empire's and each senior executive's personal performance goals are met. In 2001, the areas in which performance was measured in determining incentive compensation and the relative weighting of each area were: (1) our return on common equity compared to that of all other electric utilities reported in an industry survey of approximately 52 electric and gas utilities over a five-year period (40%), (2) reduction of controllable expenses over a five-year period (20%), (3) control of fuel and purchased power expenses (20%) and (4) for each senior executive, the achievement of predetermined personal goals for the year (20%).

In each of these four areas, three performance levels, "threshold," "par" and "maximum," are set at the beginning of the year. For executives to receive any incentive compensation based on any particular performance measure, at least the "threshold" level of performance must have been achieved. Greater incentive compensation is payable if the "par" or "maximum" performance level is achieved. If the par level objective in each of the four performance areas is achieved, each senior executive would receive incentive compensation which, when added to base salary, would equal the individual's target total compensation. In 2001, we achieved a level below the threshold performance for return on equity and for reduction of controllable expenses, but did achieve the maximum level of performance for control of fuel and purchased power expenses.

Regardless of the extent to which the four performance criteria are met in any year, no incentive compensation is payable in any year in which we do not pay dividends per share of common stock at least equal to the dividends per share paid in the preceding year. In 2001, the dividends paid on each share of our common stock were equal to those paid in 2000.

Our incentive compensation policy also seeks to encourage senior executives to hold down our electric rates so that we can remain competitive with alternate energy suppliers by adjusting incentive compensation otherwise payable to reflect the level of our residential electric rates compared to those of the 12 other utilities in our geographic area. The adjustment ranges from a 10% increase in incentive compensation if we have the lowest rates in the comparison group to elimination of incentive compensation if we are one of the four companies in the comparison group with the highest rates. In 2001, Empire had the second lowest retail electric rates of the 13 utilities, which resulted in incentive compensation of 105% of full value.

Incentive compensation is typically paid one-half in cash at the end of the year and one-half in common stock. The common stock portion of incentive compensation is restricted stock that generally is not issued unless the recipient continues to be employed by us for three years after the stock is awarded. The three-year vesting period is intended to encourage continuity among our senior executives. In addition, by increasing the stock ownership of our senior management, we believe that these individuals will have an even greater incentive to advance the interests of our stockholders.

The senior executive officers are also eligible for lump sum incentive awards. During 2001, the incentive awards pertained to all non-bargaining unit employees including senior executive officers. The lump sum incentive awards are based on a "pay for results" approach and reward those employees who make significant contributions to the overall success of Empire. Base and incentive objectives are set each year by an employee and his supervisor, which in the case of the President and Chief Executive Officer was the Compensation Committee. Base objectives must be met to be eligible for the lump sum incentive awards, and employees accomplishing one or more of their incentive objectives are then awarded a lump sum incentive award which is allocated from an incentive pool. In 2001, all the senior executive officers received a lump sum incentive award.

In 2001, the President and Chief Executive Officer's base salary was increased 11.9% above its 2000 level to reflect market conditions. Mr. McKinney's incentive compensation is based on the same factors as the incentive compensation of the other senior executive officers, although a greater percentage of his target total compensation is comprised of incentive compensation. As a result of the level of attainment of performance goals, the sum of Mr. McKinney's base salary and his incentive compensation for 2001 was approximately 92.7% of his target total compensation. In addition, Mr. McKinney received a lump sum incentive award as a result of meeting his base and incentive objectives.

8

As of the date of this Proxy Statement, the Compensation Committee had not acted on the compensation to be provided to Mr. Gipson in his capacity as President and Chief Executive Officer.

Based on our current level of executive compensation, the Committee does not believe it necessary to adopt a policy with respect to Section 162(m) of the Internal Revenue Code at this time.

F.E. Jeffries, Chairman

J.R. Herschend

R.L. Lamb

R.E. Mayes

M.M. Posner

Audit Committee Report

The Audit Committee has reviewed and discussed our audited financial statements for the year ended December 31, 2001 with our management. The Audit Committee has discussed with our independent auditors the matters required to be discussed by SAS 61. The Audit Committee has received the written disclosures and letter from our independent accountants required by Independence Standards Board Standard No. 1, and the Audit Committee has discussed with such accountants the independence of such accountants.

Based on the foregoing review and discussions, the Audit Committee has recommended to our Board of Directors that our audited financial statements for the year ended December 31, 2001 be included in our Annual Report on Form 10-K for the year ended December 31, 2001.

M.M. Posner, Chairman

M.F. Chubb, Jr.

R.C. Hartley

F.E. Jeffries

J.S. Leon

Fees Billed by Our Independent Auditors

Audit Fees

The aggregate fees billed by our independent accountants for professional services rendered in connection with the audit of our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2001, as well as for the review of our financial statements included in our Quarterly Reports on Form 10-Q during the year ended December 31, 2001 totaled $131,000 (excluding expenses reimbursed by Empire).

Financial Information Systems Design and Implementation Fees

No fees were billed by our independent auditors for financial information systems design and implementation services rendered during the year ended December 31, 2001.

All Other Fees

The aggregate fees billed by our independent auditors for non-audit services during the year ended December 31, 2001 was $91,500, including tax-related services.

The Audit Committee has considered and determined that the provision of these services is compatible with maintaining the principal accountant's independence.

9

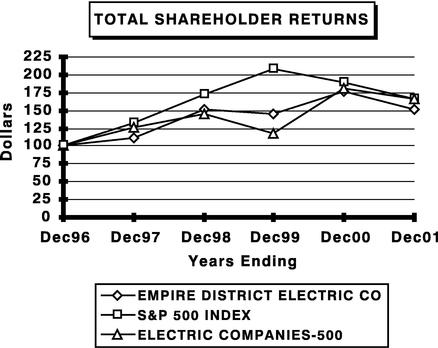

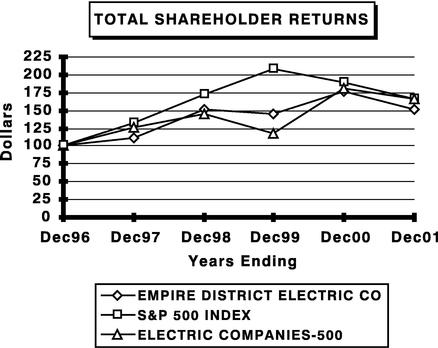

Comparison of Stockholder Returns

Set forth below is a graph and table indicating the value at the end of the specified years of a $100 investment made on December 31, 1996, in our common stock and similar investments made in the securities of the companies in the Standard & Poor's 500 Composite Index ("S&P 500 Composite") and the Standard & Poor's Electric Companies Index ("Electric Companies"). The graph and table assume that dividends were reinvested when received.

| | The Empire District

Electric Company

| | Electric

Companies

| | S&P 500

Composite

|

|---|

| 1996 | | $ | 100.00 | | $ | 100.00 | | $ | 100.00 |

| 1997 | | | 112.34 | | | 133.36 | | | 126.24 |

| 1998 | | | 150.57 | | | 171.48 | | | 145.78 |

| 1999 | | | 144.96 | | | 207.56 | | | 117.54 |

| 2000 | | | 177.55 | | | 188.66 | | | 180.34 |

| 2001 | | | 150.96 | | | 166.24 | | | 165.44 |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our Directors and executive officers to file reports of changes in ownership of our equity securities with the SEC and the New York Stock Exchange. SEC regulations require that Directors and executive officers furnish to us copies of all Section 16(a) forms they file. Except as set forth in the following paragraph, to our knowledge, based solely on review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended December 31, 2001, all our officers and directors complied with applicable Section 16(a) filing requirements.

An amendment to Mr. Hartley's Form 5 was filed in August 2001 to include a reportable Form 5 transaction which occurred in November 2000.

10

3. OTHER MATTERS

PricewaterhouseCoopers LLP have been our independent auditors since 1992. Representatives of PricewaterhouseCoopers LLP are expected to be present at the meeting for the purpose of answering questions which any stockholder may wish to ask, and such representatives will have an opportunity to make a statement at the meeting.

We know of no other matter to come before the meeting. If, however, any other matters properly come before the meeting, it is the intention of the persons named in the enclosed proxy to vote the same in accordance with their judgment on such other matters.

4. STOCKHOLDER PROPOSALS

The 2003 Annual Meeting is tentatively scheduled to be held on April 24, 2003. Specific proposals of stockholders intended to be presented at that meeting (1) must comply with the requirements of the Exchange Act and the rules and regulations promulgated thereunder and our Articles of Incorporation, and (2) if intended to be included in our proxy materials for the 2003 Annual Meeting, must be received at Empire's principal office not later than November 20, 2002. If the date of the 2003 Annual Meeting is changed by more than 30 days from April 24, 2003, stockholders will be advised of such change and of the new date for submission of proposals.

Dated: March 19, 2002

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. THEREFORE, STOCKHOLDERS WHO DO NOT EXPECT TO ATTEND IN PERSON ARE URGED TO EITHER VOTE THEIR PROXY THROUGH THE INTERNET OR BY TELEPHONE OR SIGN, DATE AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE, TO WHICH NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES.

11

| | | Please mark your votes as indicated in this example | | ý |

THIS PROXY SOLICITED ON BEHALF OF THE BOARD OF THE COMPANY. The Board of Directors

recommends a vote FOR item (1).

(1) The election of Directors. |

FOR the election of Directors in accordance with the provisions of the accompanying proxy statement (except as marked to the contrary below). |

|

WITHHOLD AUTHORITY to vote for all nominees listed below. |

| o | | o |

(INSTRUCTION: You may withhold authority to vote for any individual nominee by striking a line through the nominee's name below:)

Class III (to serve until the 2005 Annual Meeting): 01 M.F. Chubb, Jr., 02 R.L. Lamb and 03 W.L. Gipson.

|

| (2) | | Upon any other matter which may properly come before the meeting in their discretion.

| | Every properly signed proxy will be voted in the manner specified hereon and, in the absence of specification, will be voted FOR item (1). |

|

|

|

|

The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement annexed thereto and of the Company's Annual Report for 2001. |

|

|

|

|

By checking the box to the right, I consent to future access of Annual Reports, Proxy Statements, prospectuses and other communications electronically via the Internet. I understand that the Company may no longer distribute printed materials to me from any future stockholder meeting until such consent is revoked, but a notice of the meeting and the availability of the materials will be provided to me. I understand that I may revoke my consent at any time by contacting the Company's transfer agent, Mellon Investor Services LLC, Ridgefield Park, NJ and that costs normally associated with electronic access, such as usage and telephone charges, will be my responsibility. |

|

o |

NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such.

^ FOLD AND DETACH HERE ^

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and telephone voting is available through 4:00 PM Eastern Time the business day prior to annual meeting day.

Your Internet or telephone vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

Internet

http://www.eproxy.com/ede

Use the Internet to vote your proxy. Have your proxy card in hand when you access the web site. You will be prompted to enter your control number, located in the box below, to create and submit an electronic ballot.

OR

Telephone

1-800-435-6710

Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call. You will be prompted to enter your control number, located in the box below, and then follow the directions given.

OR

Mail

Mark, sign and date

your proxy card

and

return it in the

enclosed postage-paid

envelope.

If you vote your proxy by Internet or by telephone, you are acknowledging receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement and of the Company's Annual Report for 2001, and you do NOT need to mail back your proxy card.

[LOGO] EMPIRE

SERVICES YOU COUNT ON

PROXY

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS OF

THE EMPIRE DISTRICT ELECTRIC COMPANY

KNOW ALL MEN BY THESE PRESENTS, that the undersigned hereby constitutes and appoints M.W. McKINNEY, G.A. KNAPP and J.S. WATSON, or any one of them, with power of substitution, as attorneys and proxies to appear and vote all shares of Common Stock standing in the name of the undersigned, with all the powers the undersigned would possess if personally present, at the Annual Meeting of Stockholders of The Empire District Electric Company to be held at the Holiday Inn, 3615 South Range Line, in the City of Joplin, State of Missouri, on the 25th day of April, 2002 at 10:30 a.m., Joplin time, and at any and all adjournments and postponements thereof, in the manner indicated on the reverse thereof.

(Continued on the reverse side)

^ FOLD AND DETACH HERE ^

[LOGO] EMPIRE

SERVICES YOU COUNT ON

Dear Shareholder:

We will hold the 2002 Annual Meeting of Shareholders of The Empire District Electric Company on Thursday, April 25, 2002, at 10:30 a.m., at the Holiday Inn, 3615 South Range Line (Intersection of Highway 71 and Interstate 44), Joplin, Missouri. I cordially invite you to attend.

Whether or not you plan to attend the meeting, please either vote your proxy via the Internet, telephone or detach the proxy card above, complete it and return it in the envelope provided. Your vote is important to us.

|

Sincerely, |

|

/s/ Myron W. McKinney |

|

Myron W. McKinney

President and Chief Executive Officer |

QuickLinks

THE EMPIRE DISTRICT ELECTRIC COMPANY 602 Joplin Street Joplin, Missouri 64801THE EMPIRE DISTRICT ELECTRIC COMPANY 602 Joplin Street Joplin, Missouri 64801THE EMPIRE DISTRICT ELECTRIC COMPANY 602 Joplin Street Joplin, Missouri 648011. ELECTION OF DIRECTORSCLASS I DIRECTORS (Terms expire in 2003)CLASS II DIRECTORS (Terms expire in 2004)CLASS III DIRECTORS (Terms expire in 2002, nominees for election at the Annual Meeting of Stockholders for terms to expire in 2005)2. EXECUTIVE COMPENSATIONSUMMARY COMPENSATION TABLEPENSION PLAN TABLE3. OTHER MATTERS4. STOCKHOLDER PROPOSALS